Financial Assumptions and Your Business Plan

Written by Dave Lavinsky

Financial assumptions are an integral part of a well-written business plan. You can’t accurately forecast the future without them. Invest the time to write solid assumptions so you have a good foundation for your financial forecast.

Download our Ultimate Business Plan Template here

What are Financial Assumptions?

Financial assumptions are the guidelines you give your business plan to follow. They can range from financial forecasts about costs, revenue, return on investment, and operating and startup expenses. Basically, financial assumptions serve as a forecast of what your business will do in the future. You need to include them so that anyone reading your plan will have some idea of how accurate its projections may be.

Of course, your financial assumptions should accurately reflect the information you’ve given in your business plan and they should be reasonably accurate. You need to keep this in mind when you make them because if you make outlandish claims, it will make people less likely to believe any part of your business plan including other financial projections that may be accurate.

That’s why you always want to err on the side of caution when it comes to financial assumptions for your business plan. The more conservative your assumptions are the more likely you’ll be able to hit them, and the less likely you’ll be off by so much that people will ignore everything in your plan.

Why are Financial Assumptions Important?

Many investors skip straight to the financial section of your business plan. It is critical that your assumptions and projections in this section be realistic. Plans that show penetration, operating margin, and revenues per employee figures that are poorly reasoned; internally inconsistent, or simply unrealistic greatly damage the credibility of the entire business plan. In contrast, sober, well-reasoned financial assumptions and projections communicate operational maturity and credibility.

For instance, if the company is categorized as a networking infrastructure firm, and the business plan projects 80% operating margins, investors will raise a red flag. This is because investors can readily access the operating margins of publicly-traded networking infrastructure firms and find that none have operating margins this high.

As much as possible, the financial assumptions should be based on actual results from your or other firms. As the example above indicates, it is fairly easy to look at a public company’s operating margins and use these margins to approximate your own. Likewise, the business plan should base revenue growth on other firms.

Many firms find this impossible, since they believe they have a breakthrough product in their market, and no other company compares. In such a case, base revenue growth on companies in other industries that have had breakthrough products. If you expect to grow even faster than they did (maybe because of new technologies that those firms weren’t able to employ), you can include more aggressive assumptions in your business plan as long as you explain them in the text.

The financial assumptions can either enhance or significantly harm your business plan’s chances of assisting you in the capital-raising process. By doing the research to develop realistic assumptions, based on actual results of your or other companies, the financials can bolster your firm’s chances of winning investors. As importantly, the more realistic financials will also provide a better roadmap for your company’s success.

Finish Your Business Plan Today!

Financial assumptions vs projections.

Financial Assumptions – Estimates of future financial results that are based on historical data, an understanding of the business, and a company’s operational strategy.

Financial Projections – Estimates of future financial results that are calculated from the assumptions factored into the financial model.

The assumptions are your best guesses of what the future holds; the financial projections are numerical versions of those assumptions.

Key Assumptions By Financial Statement

Below you will find a list of the key business assumptions by the financial statement:

Income Statement

The income statement assumptions should include revenue, cost of goods sold, operating expenses, and depreciation/amortization, as well as any other line items that will impact the income statement.

When you are projecting future operating expenses, you should project these figures based on historical information and then adjust them as necessary with the intent to optimize and/or minimize them.

Balance Sheet

The balance sheet assumptions should include assets, liabilities, and owner’s equity, as well as any other line items that will impact the balance sheet. One of the most common mistakes is not including all cash inflows and outflows.

Cash Flow Statement

Cash flow assumptions should be made, but they do not impact the balance sheet or income statement until actually received or paid. You can include the cumulative cash flow assumption on the financial model to be sure it is included with each year’s projections.

The cumulative cash flow assumption is useful for showing your investors and potential investors how you will spend the money raised. This line item indicates how much of the initial investment will be spent each year, which allows you to control your spending over time.

Notes to Financial Statements

The notes to financial statements should explain assumptions made by management regarding accounting policies, carrying value of long-lived assets, goodwill impairment testing, contingencies, and income taxes. It is important not only to list these items within the notes but also to provide a brief explanation.

What are the Assumptions Needed in Preparing a Financial Model?

In our article on “ How to Create Financial Projections for Your Business Plan ,” we list the 25+ most common assumptions to include in your financial model. Below are a few of them:

For EACH key product or service you offer:

- What is the number of units you expect to sell each month?

- What is your expected monthly sales growth rate?

For EACH subscription/membership you offer:

- What is the monthly/quarterly/annual price of your membership?

- How many members do you have now or how many members do you expect to gain in the first month/quarter/year?

Cost Assumptions

- What is your monthly salary? What is the annual growth rate in your salary?

- What is your monthly salary for the rest of your team? What is the expected annual growth rate in your team’s salaries?

- What is your initial monthly marketing expense? What is the expected annual growth rate in your marketing expense?

Assumptions related to Capital Expenditures, Funding, Tax and Balance Sheet Items

- How much money do you need for capital expenditures in your first year (to buy computers, desks, equipment, space build-out, etc.)

- How much other funding do you need right now?

- What is the number of years in which your debt (loan) must be paid back

Properly Preparing Your Financial Assumptions

So how do you prepare your financial assumptions? It’s recommended that you use a spreadsheet program like Microsoft Excel. You’ll need to create separate columns for each line item and then fill in the cells with the example information described below.

Part 1 – Current Financials

Year to date (YTD) units sold and units forecast for next year. This is the same as YTD revenue, but you divide by the number of days in the period to get an average daily amount. If your plan includes a pro forma financial section, your financial assumptions will be projections that are consistent with the pro forma numbers.

Part 2 – Financial Assumptions

Estimated sales forecasts for next year by product or service line, along with the associated margin. List all major items in this section, not just products. For instance, you might include “Professional Services” as a separate item, with revenue and margin information.

List the number of employees needed to support this level of business, including yourself or key managers, along with your cost assumptions for compensation, equipment leasing (if applicable), professional services (accounting/legal/consultants), and other line items.

Part 3 – Projected Cash Flow Statement and Balance Sheet

List all key assumptions like: sources and uses of cash, capital expenditures, Planned and Unplanned D&A (depreciation & amortization), changes in operating assets and liabilities, along with those for investing activities. For example, you might list the assumptions as follows:

- Increases in accounts receivable from customers based on assumed sales levels

- Decreases in inventory due to increased sales

- Increases in accounts payable due to higher expenses for the year

- Decrease in unearned revenue as evidenced by billings received compared with those projected (if there is no change, enter 0)

- Increase/decrease in other current assets due to changes in business conditions

- Increase/decrease in other current liabilities due to changes in business conditions

- Increases in long term debt (if necessary)

- Cash acquired from financing activities (interest expense, dividends paid, etc.)

You make many of these assumptions based on your own experience. It is also helpful to look at the numbers for public companies and use those as a benchmark.

Part 4 – Future Financials

This section is for more aggressive financial projections that can be part of your plan, but which you cannot necessarily prove at the present time. This could include:

- A projection of earnings per share (EPS) using the assumptions above and additional information such as new products, new customer acquisition, expansion into new markets

- New product lines or services to be added in the second year. List the projected amount of revenue and margin associated with these items

- A change in your gross margins due to a specific initiative you are planning, such as moving from a high volume/low margin business to a low volume/high margin business

Part 5 – Calculations

Calculate all critical financial numbers like:

- Cash flow from operating activities (CFO)

- Operating income or loss (EBITDA) (earnings before interest, taxes, depreciation, and amortization)

- EBITDA margin (gross profits divided by revenue less cost of goods sold)

- Adjusted EBITDA (CFO plus other cash changes like capital expenditure, deferred taxes, non-cash stock compensation, and other items)

- Net income or loss before tax (EBT)

- Cash from financing activities (increase/decrease in debt and equity)

Part 6 – Sensitivity Analysis

If your assumptions are reasonably accurate, you will have a column for “base case” and a column for “worst case.” If you have a lot of variables with different possible outcomes, just list the potential range in one cell.

Calculate both EBITDA margins and EPS ranges at each level.

Part 7 – Section Highlights

Just list the two or three key points you want to make. If it is hard to distill them down, you need to go back and work on Part 3 until it makes sense.

Part 8 – Financial Summary

Include all the key numbers from your assumptions, section highlights, and calculations. In one place, you can add up CFO, EPS at different levels, and EBITDA margins under both base case and worst-case scenarios to give a complete range for each assumption.

The key to a successful business plan is being able to clearly communicate your financial assumptions. Be sure to include your assumptions in the narrative of your plan so you can clearly explain why you are making them. If you are using the business plan for financing or other purposes, it may also be helpful to include a separate “financials” section so people unfamiliar with your industry can quickly find and understand key information.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan and financial projections?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

It includes a full financial model. It lists all the key financial assumptions and you simply need to plug in answers to the assumptions and your complete financial projections (income statement, balance sheet, cash flow statement, charts and graphs) are automatically generated!

Click here to see how Growthink’s professional business plan consulting services can create your business plan for you.

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how our professional business plan writers can create your business plan for you.

If you just need a financial model for your business plan, learn more about our financial modeling services .

Other Resources for Writing Your Business Plan

- How to Write an Executive Summary

- How to Expertly Write the Company Description in Your Business Plan

- How to Write the Market Analysis Section of a Business Plan

- The Customer Analysis Section of Your Business Plan

- Completing the Competitive Analysis Section of Your Business Plan

- How to Write the Management Team Section of a Business Plan + Examples

- How to Create Financial Projections for Your Business Plan

- Everything You Need to Know about the Business Plan Appendix

- Business Plan Conclusion: Summary & Recap

Other Helpful Business Plan Articles & Templates

Plan Projections

ideas to numbers .. simple financial projections

Home > Business Plan > Business Plan Assumptions

Business Plan Assumptions

Financial projections business plan assumptions.

All financial projections are based on business plan assumptions. Listed below is a selection of the most important assumptions which need to be considered and decided upon when using the Financial Projections Template to produce the financials section of your business plan.

Business Plan Assumptions List

Inflation rates and foreign exchange rates, sales and marketing, cash collection, distribution, research and development, fixed assets, gross margin, operating expenses, depreciation.

You need to prepare a business plan assumptions sheet as part of your plan, however, the important point to remember is that the assumptions should be kept simple and to a minimum, to avoid over complicating the financial projection. Remember this is planning not accounting. The calculation of key assumptions is further discussed in our financial projection assumptions post.

About the Author

Chartered accountant Michael Brown is the founder and CEO of Plan Projections. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

You May Also Like

Free Assumption Templates: Project, Business and Financial

By Kate Eby | May 25, 2022

- Share on Facebook

- Share on LinkedIn

Link copied

We’ve collected free, downloadable assumption templates for project, business, and financial management needs. They can help you identify and track project constraints and assumptions during strategy development and project planning.

Included on this page, you will find a project assumptions and constraints template , an assumptions log template , an assumptions mapping template , and more.

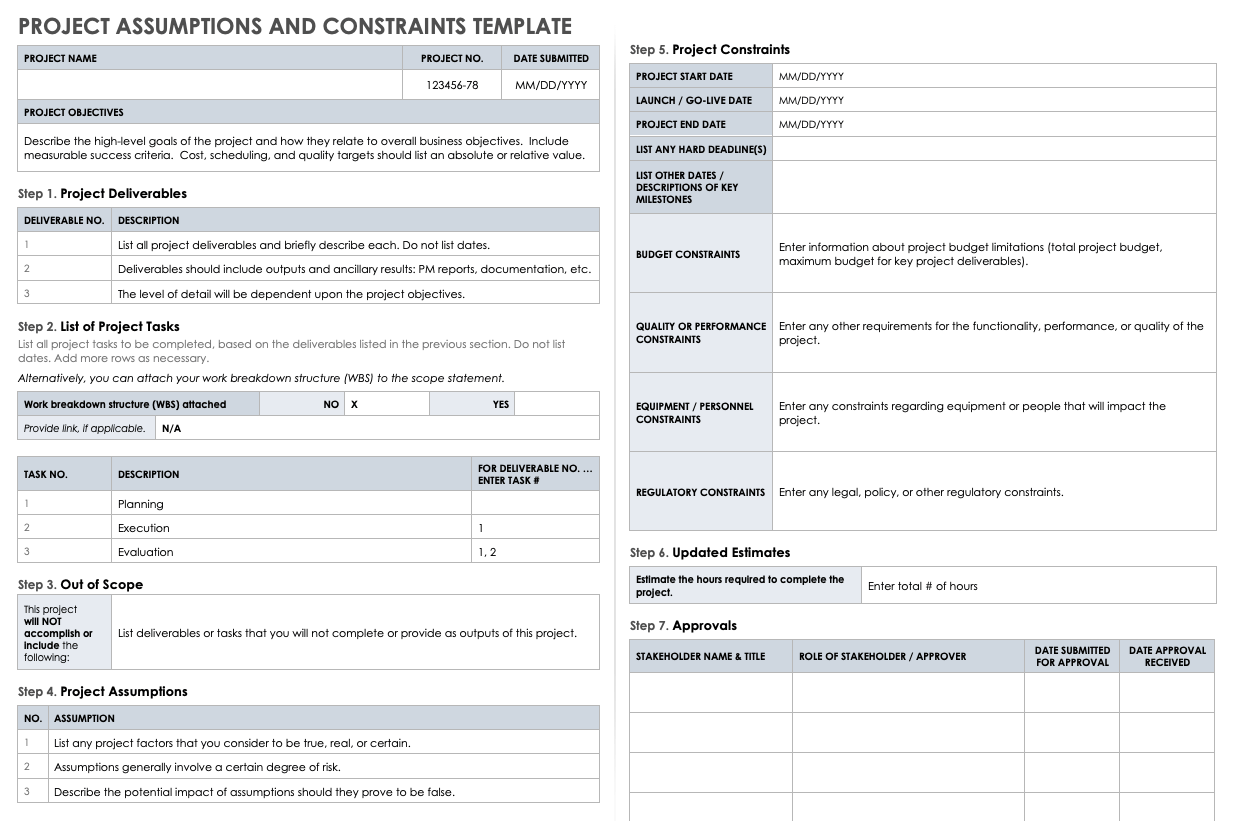

Project Assumptions and Constraints Template

Download Project Assumptions and Constraints Template Microsoft Excel | Microsoft Word

This assumptions and constraints template enables you to enter and track all objectives, assumptions, and constraints for your project. Each section comes pre-filled with explanatory text to help you correctly identify deliverables, tasks, scope, assumptions, constraints, and estimated time for project completion. The template is completely customizable and includes an approvals section for documenting signatures from key stakeholders.

For more project planning templates and resources, see this extensive collection of project scope management tools .

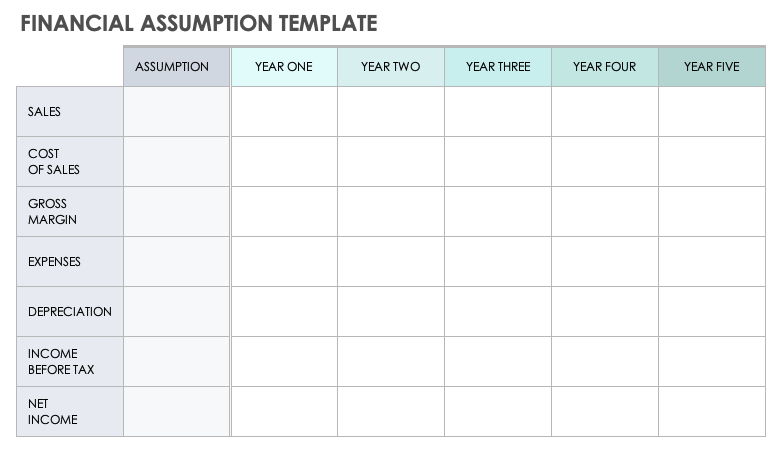

Financial Assumption Template

Download Financial Assumption Template Microsoft Excel | Microsoft Word

Use this financial assumption template to organize and visualize your financial projections on a yearly or monthly basis. Customize the items in the Particulars column to reflect your anticipated income sources and costs, and enter projected expenses and revenue for each month or year. This template includes a column that factors in financial assumptions, such as depreciation, financing costs, and income tax, so that your final financial projection is as accurate as possible.

For more financial planning resources, see this collection of business financial plan templates for more free, downloadable forms.

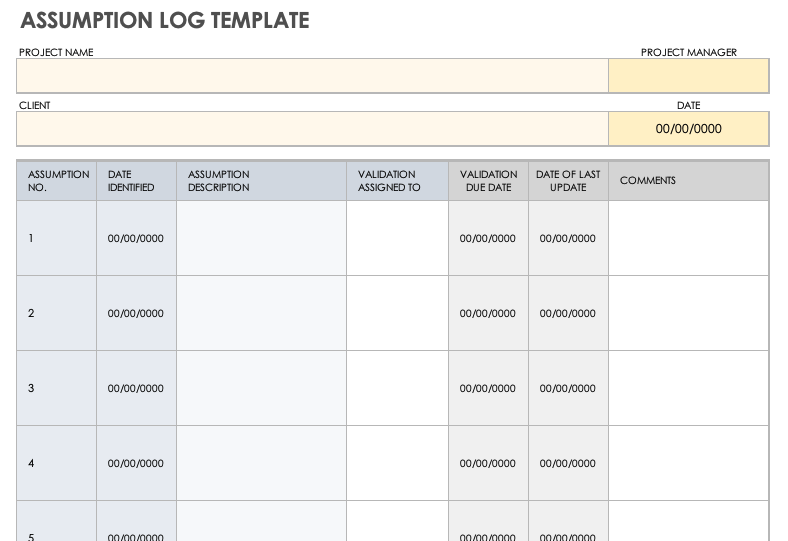

Assumption Log Template

Download Assumption Log Template Microsoft Excel | Microsoft Word

Record and track project assumptions through the entire lifecycle of your project with this assumption log template. Enter all assumptions into the log, and record the date, validation task assignments, and comments. By doing so, you can keep tabs on all aspects of your project as it develops.

See this comprehensive collection of project management plan templates to find the right project planning template for your project or business.

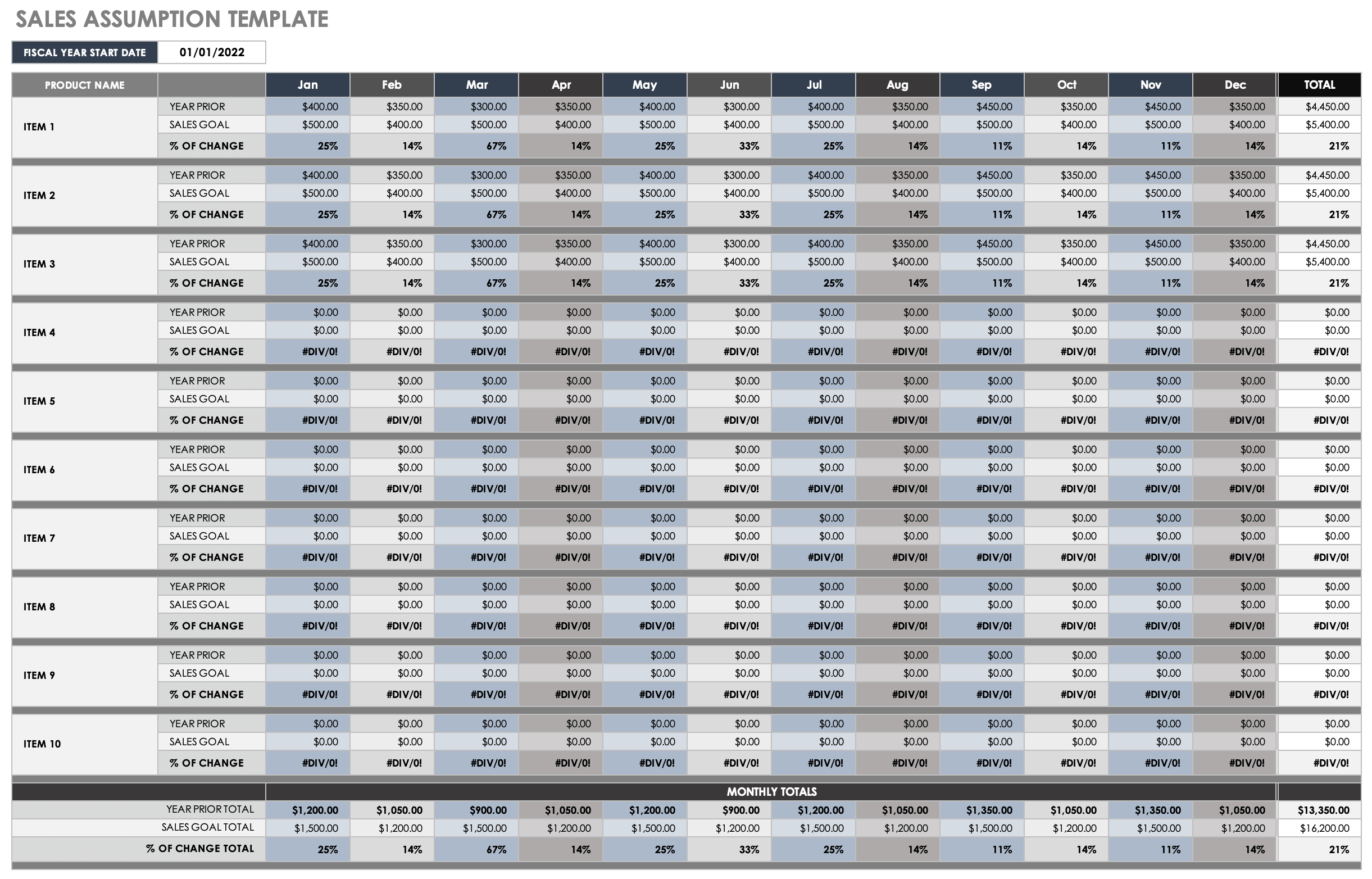

Sales Assumption Template

Download Sales Assumption Template Microsoft Excel | Smartsheet

Use this sales assumption template to track sales projections and assumptions while planning your monthly sales goals. The template includes 12 columns for recording monthly projections, as well as customizable rows where you can record projections for different product categories. The template also allows you to compare year-over-year performance against projections, which will help improve the accuracy of financial planning over time.

Assumptions Mapping Template

Download Assumptions Mapping Template Microsoft Word | Microsoft PowerPoint

An assumptions mapping template enables you to visualize, categorize, and communicate your assumptions clearly. The template divides assumptions into three, color-coded categories: desirable, feasible, and viable. On the second page, you will find a graph that enables you to plot assumptions based on their relative importance and certainty. Map each color-coded assumption onto the graph to create a dynamic visualization of your project assumptions.

For more resources and guidance on the project initiation process, see this comprehensive guide to project initiation .

Stay on Top of Project Constraints and Assumptions with Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Business Planning

Business Plan Financial Projections

Written by Dave Lavinsky

Financial projections are forecasted analyses of your business’ future that include income statements, balance sheets and cash flow statements. We have found them to be an crucial part of your business plan for the following reasons:

- They can help prove or disprove the viability of your business idea. For example, if your initial projections show your company will never make a sizable profit, your venture might not be feasible. Or, in such a case, you might figure out ways to raise prices, enter new markets, or streamline operations to make it profitable.

- Financial projections give investors and lenders an idea of how well your business is likely to do in the future. They can give lenders the confidence that you’ll be able to comfortably repay their loan with interest. And for equity investors, your projections can give them faith that you’ll earn them a solid return on investment. In both cases, your projections can help you secure the funding you need to launch or grow your business.

- Financial projections help you track your progress over time and ensure your business is on track to meet its goals. For example, if your financial projections show you should generate $500,000 in sales during the year, but you are not on track to accomplish that, you’ll know you need to take corrective action to achieve your goal.

Below you’ll learn more about the key components of financial projections and how to complete and include them in your business plan.

What Are Business Plan Financial Projections?

Financial projections are an estimate of your company’s future financial performance through financial forecasting. They are typically used by businesses to secure funding, but can also be useful for internal decision-making and planning purposes. There are three main financial statements that you will need to include in your business plan financial projections:

1. Income Statement Projection

The income statement projection is a forecast of your company’s future revenues and expenses. It should include line items for each type of income and expense, as well as a total at the end.

There are a few key items you will need to include in your projection:

- Revenue: Your revenue projection should break down your expected sales by product or service, as well as by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Expenses: Your expense projection should include a breakdown of your expected costs by category, such as marketing, salaries, and rent. Again, it is important to be realistic in your estimates.

- Net Income: The net income projection is the difference between your revenue and expenses. This number tells you how much profit your company is expected to make.

Sample Income Statement

2. cash flow statement & projection.

The cash flow statement and projection are a forecast of your company’s future cash inflows and outflows. It is important to include a cash flow projection in your business plan, as it will give investors and lenders an idea of your company’s ability to generate cash.

There are a few key items you will need to include in your cash flow projection:

- The cash flow statement shows a breakdown of your expected cash inflows and outflows by month. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

- Cash inflows should include items such as sales revenue, interest income, and capital gains. Cash outflows should include items such as salaries, rent, and marketing expenses.

- It is important to track your company’s cash flow over time to ensure that it is healthy. A healthy cash flow is necessary for a successful business.

Sample Cash Flow Statements

3. balance sheet projection.

The balance sheet projection is a forecast of your company’s future financial position. It should include line items for each type of asset and liability, as well as a total at the end.

A projection should include a breakdown of your company’s assets and liabilities by category. It is important to be realistic in your projections, so make sure to account for any seasonal variations in your business.

It is important to track your company’s financial position over time to ensure that it is healthy. A healthy balance is necessary for a successful business.

Sample Balance Sheet

How to create financial projections.

Creating financial projections for your business plan can be a daunting task, but it’s important to put together accurate and realistic financial projections in order to give your business the best chance for success.

Cost Assumptions

When you create financial projections, it is important to be realistic about the costs your business will incur, using historical financial data can help with this. You will need to make assumptions about the cost of goods sold, operational costs, and capital expenditures.

It is important to track your company’s expenses over time to ensure that it is staying within its budget. A healthy bottom line is necessary for a successful business.

Capital Expenditures, Funding, Tax, and Balance Sheet Items

You will also need to make assumptions about capital expenditures, funding, tax, and balance sheet items. These assumptions will help you to create a realistic financial picture of your business.

Capital Expenditures

When projecting your company’s capital expenditures, you will need to make a number of assumptions about the type of equipment or property your business will purchase. You will also need to estimate the cost of the purchase.

When projecting your company’s funding needs, you will need to make a number of assumptions about where the money will come from. This might include assumptions about bank loans, venture capital, or angel investors.

When projecting your company’s tax liability, you will need to make a number of assumptions about the tax rates that will apply to your business. You will also need to estimate the amount of taxes your company will owe.

Balance Sheet Items

When projecting your company’s balance, you will need to make a number of assumptions about the type and amount of debt your business will have. You will also need to estimate the value of your company’s assets and liabilities.

Financial Projection Scenarios

Write two financial scenarios when creating your financial projections, a best-case scenario, and a worst-case scenario. Use your list of assumptions to come up with realistic numbers for each scenario.

Presuming that you have already generated a list of assumptions, the creation of best and worst-case scenarios should be relatively simple. For each assumption, generate a high and low estimate. For example, if you are assuming that your company will have $100,000 in revenue, your high estimate might be $120,000 and your low estimate might be $80,000.

Once you have generated high and low estimates for all of your assumptions, you can create two scenarios: a best case scenario and a worst-case scenario. Simply plug the high estimates into your financial projections for the best-case scenario and the low estimates into your financial projections for the worst-case scenario.

Conduct a Ratio Analysis

A ratio analysis is a useful tool that can be used to evaluate a company’s financial health. Ratios can be used to compare a company’s performance to its industry average or to its own historical performance.

There are a number of different ratios that can be used in ratio analysis. Some of the more popular ones include the following:

- Gross margin ratio

- Operating margin ratio

- Return on assets (ROA)

- Return on equity (ROE)

To conduct a ratio analysis, you will need financial statements for your company and for its competitors. You will also need industry average ratios. These can be found in industry reports or on financial websites.

Once you have the necessary information, you can calculate the ratios for your company and compare them to the industry averages or to your own historical performance. If your company’s ratios are significantly different from the industry averages, it might be indicative of a problem.

Be Realistic

When creating your financial projections, it is important to be realistic. Your projections should be based on your list of assumptions and should reflect your best estimate of what your company’s future financial performance will be. This includes projected operating income, a projected income statement, and a profit and loss statement.

Your goal should be to create a realistic set of financial projections that can be used to guide your company’s future decision-making.

Sales Forecast

One of the most important aspects of your financial projections is your sales forecast. Your sales forecast should be based on your list of assumptions and should reflect your best estimate of what your company’s future sales will be.

Your sales forecast should be realistic and achievable. Do not try to “game” the system by creating an overly optimistic or pessimistic forecast. Your goal should be to create a realistic sales forecast that can be used to guide your company’s future decision-making.

Creating a sales forecast is not an exact science, but there are a number of methods that can be used to generate realistic estimates. Some common methods include market analysis, competitor analysis, and customer surveys.

Create Multi-Year Financial Projections

When creating financial projections, it is important to generate projections for multiple years. This will give you a better sense of how your company’s financial performance is likely to change over time.

It is also important to remember that your financial projections are just that: projections. They are based on a number of assumptions and are not guaranteed to be accurate. As such, you should review and update your projections on a regular basis to ensure that they remain relevant.

Creating financial projections is an important part of any business plan. However, it’s important to remember that these projections are just estimates. They are not guarantees of future success.

Business Plan Financial Projections FAQs

What is a business plan financial projection.

A business plan financial projection is a forecast of your company's future financial performance. It should include line items for each type of asset and liability, as well as a total at the end.

What are annual income statements?

The Annual income statement is a financial document and a financial model that summarize a company's revenues and expenses over the course of a fiscal year. They provide a snapshot of a company's financial health and performance and can be used to track trends and make comparisons with other businesses.

What are the necessary financial statements?

The necessary financial statements for a business plan are an income statement, cash flow statement, and balance sheet.

How do I create financial projections?

You can create financial projections by making a list of assumptions, creating two scenarios (best case and worst case), conducting a ratio analysis, and being realistic.

Planning, Startups, Stories

Tim berry on business planning, starting and growing your business, and having a life in the meantime., the value of business plan assumptions.

Identifying assumptions is extremely important for getting real business benefits from your business planning. Planning is about managing change, and in today’s world, change happens very fast. Assumptions solve the dilemma about managing consistency over time, without banging your head against a brick wall.

Assumptions might be different for each company. There is no set list. What’s best is to think about those assumptions as you build your twin action plans.

If you can, highlight product-related and marketing-related assumptions. Keep them in separate groups or separate lists.

The key here is to be able to identify and distinguish, later (during your regular reviews and revisions, in Section 3), between changed assumptions and the difference between planned and actual performance. You don’t truly build accountability into a planning process until you have a good list of assumptions that might change.

Some of these assumptions go into a table, with numbers, if you want. For example, you might have a table with interest rates if you’re paying off debt, or tax rates, and so on.

Many assumptions deserve special attention. Maybe in bullet points. Maybe in slides. Maybe just a simple list. Keep them on top of your mind, where they’ll come up quickly at review meetings.

Maybe you’re assuming starting dates of one project or another, and these affect other projects. Contingencies pile up. Maybe you’re assuming product release, or seeking a liquor license, or finding a location, or winning the dealership, or choosing a partner, or finding the missing link on the team.

Maybe you’re assuming some technology coming on line at a certain time. You’re probably assuming some factors in your sales forecast, or your expense budget; if they change, note it, and deal with them as changed assumptions. You may be assuming something about competition. How long do you have before the competition does something unexpected? Do you have that on your assumptions list?

The illustration below shows the simple assumptions in a bicycle shop sample business plan.

Sample List of Assumptions

Thanks for the good read, Tim. This will be helpful to small businesses to minimize and manage future risks.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

How Financial Assumptions Can Make Or Break Your Business Plan

May 9, 2022

Adam Hoeksema

A business plan is only as good as its financial assumptions. These are the key input data that your financial projections will extrapolate from and will form a picture of the future of your company. With a robust method of researching for these assumptions, and then the corresponding analysis of the available data, you’re left with more accurate assumptions, leading to a more realistic picture of your financial future.

Conversely, with weak assumptions from lack of sufficient research or bad analysis, you can get a dramatically different output that doesn’t remotely reflect reality. When looking for outside investment, these are the skills a savvy investor is going to value in an entrepreneur. So how best to improve your assumptions? Keep reading for the answer.

Financial Assumptions

Any entrepreneur, startup founder, or young company is going to need to form detailed financial reports, including forecasts and projections of the financial situation to come. These documents rely entirely on input data to extrapolate from, and these data are based on historical records and key assumptions .

The accuracy of these financial assumptions determines the accuracy of the output of these projections, and since the divergence from reality increases over time, it’s important for them to be as accurate as possible to precisely depict a realistic situation in the future.

The importance of these assumptions comes into play significantly when trying to attract capital from outside. These investors or lenders will be looking closely at your assumptions as a metric of your credibility; strong assumptions show you’ve done your due diligence and you know what you’re talking about. Weak ones will greatly harm your chances of success.

Here we’re going to go over the basics of financial assumptions, what they’re for, and common mistakes people make with them.

The Role of Financial Assumptions in Forecasting

In business planning, forecasting is a crucial step in visualizing how a company will perform in the future. Companies forecast future outcomes based on past and current data, using assumptions.

Forecasted elements of a financial plan include revenue, margin, and expenses, among others. When done accurately, these forecasts allow businesses to:

- Predict future expenses

- Make budgets

- Make informed decisions about the direction of the company

- Plan growth and financing options

However, accuracy requires more than just historical data; it’s important to input the rate of change over time correctly, and this is where assumptions come in.

Essentially, assumptions are educated guesses about the nature of your business and its market, and how these will affect future outcomes in your forecasts. As projections reach further into the future, the need for accuracy of the input assumptions increases. Small mistakes become significantly larger over time, and this skews projections to the point of making them worthless.

For investors to take notice, you’ll need accurate and well-thought-out assumptions that aren’t plucked from thin air. We’ll go into more detail about how to find these assumptions shortly, but first, let’s consider why accuracy is so important.

The Importance of Accuracy in Financial Assumptions

The financial statements of a business plan are an indication of the company’s profitability. They are the strongest display of the worthiness of investment that your company has, therefore, they’re going to need to be founded on accurate assumptions.

Even with relatively accurate initial figures, long-term projections can still be way off the mark. Essentially, any forecast is a calculation with decreasing accuracy over time, which is why they usually don’t project out past time frames of longer than around five years. Take the following example:

Let’s say you’ve done the research into the market, into the reducing costs of production over time, the rapid expected growth of your company, and the increase in value you’re going to make to your product or service over the next few years. What comes out is an assumed increase in revenue projected into the future.

If you assume your total revenue will increase by 20% over 5 years with a starting revenue of $20,000, the first-year outcome will be $24,000, an increase of four thousand dollars. The fifth-year outcome will be $49,767; an increase of almost thirty thousand dollars.

If your initial assumption is off by only 5% in either direction, the first year will show a difference from the above forecast of $1000 , either returning $23,000 or $25,000 at the low and high ends, respectively.

This isn’t a huge amount of money at this stage, so a misjudgment of 5% seems reasonable. However, if we extend this effect to the fifth year, an error of 5% brings a difference of either $9,500 or $11,268 to what you had projected, depending on whether your assumption was low or high.

If you’re smart or lucky enough to have made a conservative assumption, you’re now $11k better off. On the other hand, if you were too hasty and overestimated in your assumption, you may now owe somebody over $9k.

So, the effect of an assumption is greater with distance from the starting point. This means that when you’re designing a business plan to show to potential investors, they’re going to be very critical of your assumptions in order to assess the chances of their ROI in your company.

Regardless of whether you assumed low or high, if there’s a discrepancy that becomes obvious to investors, it will make them question the rest of your estimates and how accurate you will be in future calculations.

Therefore, accurate assumptions are critically Important to not only the precise understanding of the state of your company in the future but any chances of investors taking you seriously. Without good assumptions there is no forecast. Without a forecast, there’s not going to be any investment.

If your business is going to be relying on VC or other investors helping out, you’re going to find yourself out of luck. So, with that in mind, let’s take a look at some of the classic assumptions you’ll need to make when designing your forecasts and projections.

Key Financial Assumptions Examples

Building a business plan relies on numerous assumptions. These are the where, when, and how’s of your company, and will create projections in order for you to know where to direct your energy. The most important assumptions are called key assumptions, and without these, it’s going to be impossible to make informed decisions on the direction of your company.

Changes in assumptions can dramatically alter the outcomes of your forecasts. If you assume, for example, that your product or service is going to have a decreasing churn rate - or loss of customers - over the coming years of service improvement, you have to know what that rate is going to decrease by each year for your forecast to be of any use.

It’s worth thinking about these assumptions in terms of how you will persuade investors to commit. Here is a list of some of the areas in which key assumptions are needed for financial planning, for use as financial assumptions examples:

- Market – There’s no business without a market. This assumption isn’t so much a financial one as a general business one, but it has strong financial implications.

By the time you come to financial planning for your startup, you should know who your ideal customer is and how you’re addressing their pain points.

You should also know how much they’re willing to spend on your product or service, which will come in handy for your income statement and cash flow projections.

- Cost of production - Production cost changes over time. Even if it’s simply an increase in outgoings to match an increase in demand, this needs to be assumed. Usually, production costs can be reduced as economies of scale come into play, but regardless, it’s easy to overlook some data here.

Calculating production costs involves covering rent for manufacturing spaces, materials, utilities such as power and water, and essentially every little thing that goes into the manufacture of your product or provision of your service. Obviously, these will be more or less complicated depending on the type of business you’re running.

This step is crucial for the following revenue and costs to be accurate.

- Cost of Sales – This one is closely related to the cost of production and there may be some overlap in these costs such as labor, so separate them as you wish, however, make sure to calculate the cost of distribution; shipping, handling, marketing, etc. it’s possible to combine these assumptions under production and sales for convenience.

- Cost of Administration – This is a monthly expenditure covering all the outgoings related to your workforce and company maintenance. Payroll needs to be financially covered by any income or capital funding you’re expecting and this includes any bonuses you’re expecting to put out. One key assumption regarding bonuses will be in their timing, should you choose to pay them, and this needs to be factored into projections for costs.

- Pricing – This assumption should be made with detailed research backing it up. Since pricing alone can make or break your company, investors are going to want to see how you came up with your figures here. The costs of sales and production are going to determine your range of pricing options.

To accurately calculate prices, you’re going to need to understand how much value your product or service has to your customers, which is where the key assumptions from the Market section above come in. Pricing needs to match the value of what you’re offering, so this is the opposing force to the production and distribution costs, since it will always be pulling your price down towards its value, while costs of production and distribution will be pushing it up.

- Sales Forecast – For every different service or product that you’re offering, a sales forecast needs to be calculated. For an accurate sales forecast, you’re going to need to know the desired sales funnel in detail and how long the conversion process will take. These assumptions need to be backed up by your market research.

Further, you’re going to have to make assumptions on when your sales will complete; this means how long banking processes will take, etc. These assumptions will be critical to accurately forecast your profits in your financial plan.

- Cash Flow – This section will involve numerous key assumptions. Capital will hopefully be flowing into the company from numerous streams, and these need to be calculated well in order to project financial coverage of the aforementioned costs.

Timings of loan payments, loan repayments, cash equity, and others need to be reliably assumed to make sound predictions in these cases. Interest adjustments or early repayment fees are also things to take into consideration, and if you will be offering customer credit, this will create more complexities to look into in terms of when you’ll see that capital again.

These are some of the major areas in which financial assumptions are necessary, and their need for accuracy is obvious. An accurate assumption comes down to reliable and robust research and analysis practices, and for these, it’s important to follow the best practices of business planning, and consider expert help where needed.

Of course, the specifics of these areas and their significance to your company will depend entirely on the type of service, product, business, or market you’re involved with. As such, there’s no standard template, but there are some key practices worth following.

Find Your Industry Specific Projections Template to Help Create Assumptions:

Why There are no one-size-fits-all Financial Assumptions

Startup founders and entrepreneurs need to provide convincing projections of the financial state of the company over the following years to reassure investors that their capital will be returned. They do this by creating robust assessments of their current state and the state of company and market metrics as accurately as possible and factoring them into projection calculations as assumptions.

The best way to begin building your financial assumptions is to consider them from the perspective of an investor. If you’re looking to put down a significant investment in a project you’re going to want to guarantee your ROI, and to do that, you need to be persuaded of the project’s profitability.

Every company is different, and every market has its own needs and challenges. This is why there’s no strict financial assumptions template to follow, but by following these four basic principles, you’ll be closer to developing more accurate assumptions.

At the planning stage of a company, the historical financial data simply won’t exist. This reduces the power of the financial assumptions, and even further necessitates their precision. The trouble is, this is a lengthy process. AQPC showed that even financial analysts spend almost half their time collecting and validating data, and they’re experts at it.

This means you have to expect a grind. If you’re going it alone with this process, make sure to get a handle on your research methods, and which areas to focus on and in the right order. This is a topic for its very own article, but the point is, expect to dedicate and schedule a lot of time for this part of the process.

So we know the research is important, but how do you go about it? For costs of manufacturing, meeting with suppliers is essential to get written quotes for supplies covering any wholesale discounts that might be available. Then, for marketing and distribution, studying your market in depth is crucial to making accurate assumptions about the value of what you’re offering and how much it’ll cost to get it out there.

Find out exactly where and how to look, and gather the necessary data on all the elements your company needs to be able to predict. From this, you will work on the analysis.

Outsourcing

There are definitely ways to go this alone, especially if this relates to a field you’re familiar with, but the option to use outside help shouldn’t be overlooked. ProjectionHub offers a range of services that can help with the financial planning process. From basic projection templates to detailed, expert guidance and tailored forecasting spreadsheets specifically designed for your business, there are a lot of useful options that can help speed up the process and improve your accuracy.

Demonstration

Finally, show your workings! If you’ve spent the due time and energy collecting and analyzing the data, it’s not going to matter if you can’t demonstrate how you came to the conclusions you did. Putting in the work is how you get accurate assumptions, but describing your process is how you persuade others to trust them.

Financial forecasts are the backbone of a business plan for investors. They’re a demonstration that you’ve done your homework and you know what you’re doing, and with bold claims, there comes the need for strong evidence.

Making assumptions is the key to any projection. Assumptions about change over time, consistency over time, and any other incomings and outgoings that you anticipate as part of the process. The accuracy of these assumptions is what makes or breaks a business plan, as they hold the key to future, long-term investment as well as countless other business choices made by decision-makers.

If this seems like a daunting task, don’t’ worry. There are countless opportunities to take advantage of expert help with services like ours at ProjectionHub , which provides templates and expert advice to get you started.

Accurate assumptions should not be underestimated. Putting in the work at this stage of your financial projections will pay dividends and command great respect from investors.

About the Author

Adam is the Co-founder of ProjectionHub which helps entrepreneurs create financial projections for potential investors, lenders and internal business planning. Since 2012, over 40,000 entrepreneurs from around the world have used ProjectionHub to help create financial projections.

Other Stories to Check out

How to finance a small business acquisition.

In this article we are going to walk through how to finance a small business acquisition and answer some key questions related to financing options.

How to Acquire a Business in 11 Steps

Many people don't realize that acquiring a business can be a great way to become a business owner if they prefer not to start one from scratch. But the acquisition process can be a little intimidating so here is a guide helping you through it!

How to Buy a Business with No Money Down

Learn the rare scenarios enabling the purchase of a business with no money down and delve into the complexities of selling via seller notes, highlighting the balance of expanded opportunities and inherent risks in these unique financial transactions.

Have some questions? Let us know and we'll be in touch.

404 Not found

Lean Business Planning

Get what you want from your business.

List Business Plan Assumptions

Identify and list business plan assumptions. You will get real business benefits from the assumptions list in your business plan. Planning is about managing change, and in today’s world, change happens very fast. Assumptions solve the dilemma about managing consistency over time, without banging your head against a brick wall.

Assumptions might be different for each company. There is no set list. What’s best is to think about those assumptions as you build your twin action plans.

If you can, highlight product-related and marketing-related assumptions. Keep them in separate groups or separate lists.

You will use your business plan assumptions often

The key here is to be able to identify and distinguish, later (during your regular reviews and revisions, in Section 3), between changed assumptions and the difference between planned and actual performance. You don’t truly build accountability into a planning process until you have a good list of assumptions that might change.

Some of these business plan assumptions assumptions go into a table, with numbers, if you want. For example, you might have a table with interest rates if you’re paying off debt, or tax rates, and so on.

Many assumptions deserve special attention. Have a bullet point list. Maybe in slides. Maybe just a simple list. Keep them on top of your mind, where they’ll come up quickly at review meetings.

Maybe you’re assuming starting dates of one project or another, and these affect other projects. Contingencies pile up. Maybe you’re assuming product release, or seeking a liquor license, or finding a location, or winning the dealership, or choosing a partner, or finding the missing link on the team.

Maybe you’re assuming some technology coming on line at a certain time. You’re probably assuming some factors in your sales forecast, or your expense budget; if they change, note it, and deal with them as changed assumptions. You may be assuming something about competition. How long do you have before the competition does something unexpected? Do you have that on your assumptions list?

An Assumptions Example

The illustration below shows the simple assumptions in the bicycle shop sample business plan.

Share this:

Leave a comment cancel reply, discover more from lean business planning.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

Financial Plan Assumptions

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on July 11, 2023

Get Any Financial Question Answered

Table of contents, what are financial plan assumptions.

Financial plan assumptions are the key variables, estimates, and predictions used to develop a company's financial projections and strategy. They serve as the foundation for forecasting revenues , costs, investments, and taxes , among other elements.

Assumptions are critical in financial planning because they help businesses set realistic goals, allocate resources efficiently, and identify potential risks and opportunities. They also enable management to make informed decisions based on the best available data and industry insights.

Financial plan assumptions aim to create a comprehensive picture of a company's future financial performance by incorporating a range of factors.

These assumptions are designed to be flexible and adaptable, allowing for adjustments as new information becomes available or market conditions change.

Key Financial Plan Assumptions

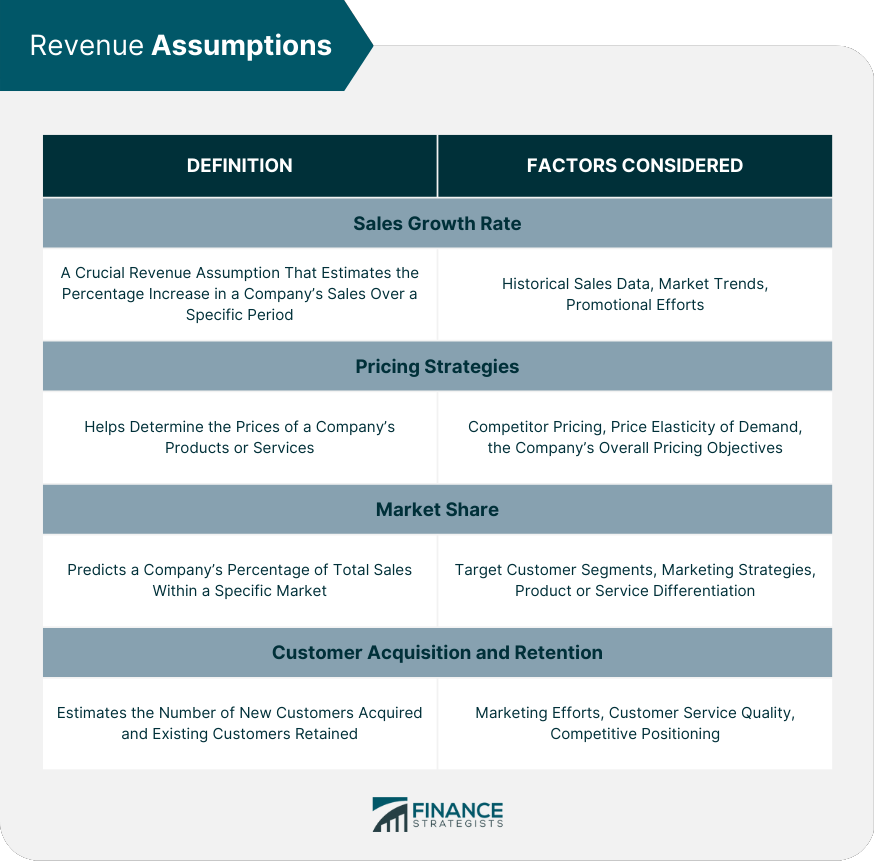

Revenue assumptions, sales growth rate.

The sales growth rate is a crucial revenue assumption that estimates the percentage increase in a company's sales over a specific period. This rate takes into account factors such as historical sales data, market trends, and promotional efforts.

Pricing Strategies

Pricing strategies help determine the prices of a company's products or services. Assumptions related to pricing may include competitor pricing, price elasticity of demand, and the company's overall pricing objectives.

Market Share

Market share assumptions predict a company's percentage of total sales within a specific market. Estimations consider factors such as target customer segments, marketing strategies, and product or service differentiation.

Customer Acquisition and Retention

Customer acquisition and retention assumptions estimate the number of new customers acquired and existing customers retained. These assumptions depend on factors such as marketing efforts, customer service quality, and competitive positioning.

Cost Assumptions

Fixed and variable costs.

Fixed and variable costs are essential components of a company's financial plan . Fixed costs include expenses that remain constant, regardless of production levels or sales, such as rent and salaries. Variable costs vary with production or sales, including raw materials and shipping costs.

Cost of Goods Sold (COGS)

COGS is the total cost of producing goods or services sold by a company. Key assumptions for COGS may include production costs , labor costs, and manufacturing overheads.

Operating Expenses

Operating expenses are the costs associated with running a business, excluding COGS. Assumptions for operating expenses may include marketing costs, administrative expenses, and research and development expenditures .

Inflation Rate

The inflation rate assumption estimates the increase in the general price level over time. This assumption affects various cost projections, such as wages, raw materials, and utilities.

Investment Assumptions

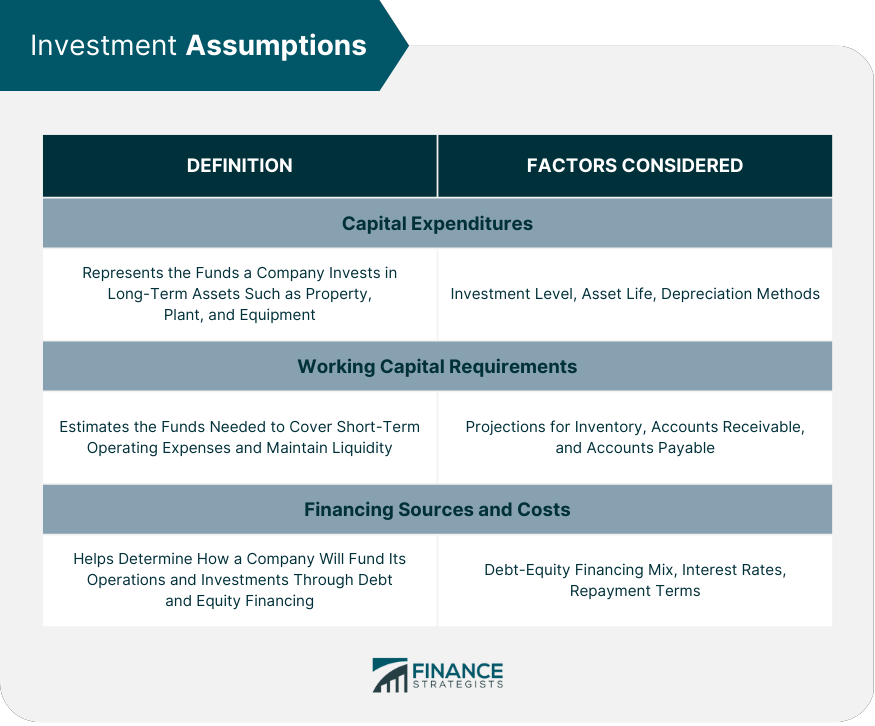

Capital expenditures.

Capital expenditures represent the funds a company invests in long-term assets, such as property, plant, and equipment. Assumptions for capital expenditures may include the anticipated level of investment , the useful life of assets , and depreciation methods.

Working Capital Requirements

Working capital assumptions estimate the funds needed to cover short-term operating expenses and maintain sufficient liquidity . These assumptions may include projections for inventory levels, accounts receivable , and accounts payable .

Financing Sources and Costs

Financing assumptions help determine how a company will fund its operations and investments. These assumptions include the mix of debt and equity financing, interest rates , and repayment terms.

Tax Assumptions

Corporate tax rates.

Corporate tax rate assumptions estimate the percentage of a company's profits subject to taxation. These assumptions take into account federal, state, and local tax rates, as well as any changes to tax laws.

Tax Credits and Incentives

Tax credits and incentives are reductions in tax liability offered by governments to encourage specific business activities. Assumptions related to tax credits may include eligibility criteria, application deadlines, and the expected amount of tax savings.

Tax Planning Strategies

Tax planning strategies are methods used by companies to minimize their tax liabilities. Assumptions related to tax planning may include the use of tax-efficient structures, deductions, and loss carryforwards.

Economic and Industry Assumptions

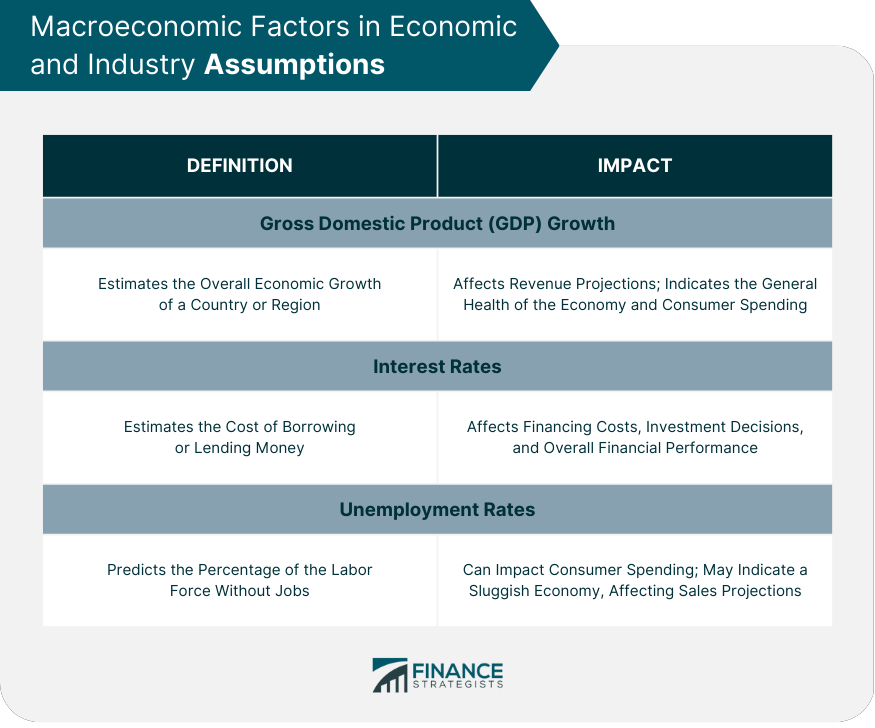

Macroeconomic factors.

Gross domestic product (GDP) growth rate assumptions estimate the overall economic growth of a country or region. These assumptions impact a company's revenue projections, as they help gauge the general health of the economy and consumer spending.

Interest Rates

Interest rate assumptions estimate the cost of borrowing or lending money. These rates affect a company's financing costs, investment decisions, and overall financial performance.

Unemployment Rates

Unemployment rate assumptions predict the percentage of the labor force without jobs. High unemployment rates can impact consumer spending and may indicate a sluggish economy, affecting a company's sales projections.

Industry Trends and Competition

Market size and growth.

Market size and growth assumptions help estimate the overall potential of an industry and the opportunities it presents for a company. Factors considered may include historical data, demographic trends, and technological advancements.

Technological Advancements

Technological advancements can disrupt industries and create new markets. Assumptions related to technology may include the adoption of new technologies, the impact of innovations on the market, and the potential for competitive advantage.

Regulatory Changes

Regulatory changes can significantly impact a company's operations and financial performance. Assumptions related to regulation may include potential changes in laws, compliance requirements, and the effects on the industry landscape.

Competitive Landscape

Competitive landscape assumptions evaluate a company's position within its industry and the level of competition it faces. These assumptions may consider factors such as market share, competitor strategies, and barriers to entry.

Sensitivity Analysis and Scenario Planning

Identifying key variables and uncertainties.

Sensitivity analysis and scenario planning involve identifying key variables and uncertainties in a company's financial plan. These variables may include economic factors, industry trends, or company-specific factors.

Developing Scenarios and Assumptions

Scenario planning involves creating alternative future scenarios based on varying assumptions. Companies develop multiple scenarios to explore the potential impact of different events, trends, and risks on their financial performance.

Analyzing the Impact on Financial Performance

Companies analyze the impact of different scenarios on their financial performance to identify potential risks and opportunities. This analysis helps management make informed decisions and adapt their strategies as needed.

Risk Mitigation and Contingency Planning

Based on the results of sensitivity analysis and scenario planning, companies develop risk mitigation and contingency plans. These plans help companies prepare for potential challenges and capitalize on emerging opportunities.

Regular Review and Update of Assumptions

Importance of ongoing monitoring.

Regularly reviewing and updating financial plan assumptions is essential to ensure their continued relevance and accuracy. Ongoing monitoring helps companies stay informed of market changes and adapt their strategies accordingly.

Frequency of Assumption Updates

The frequency of assumption updates depends on the nature of the company and its industry. Companies operating in rapidly changing environments may need to update their assumptions more frequently than those in more stable industries.

Incorporating New Information and Data

As new information and data become available, companies should incorporate them into their financial plan assumptions. This ensures that the assumptions remain relevant and provide an accurate basis for decision-making.

Adjusting Financial Plans as Needed

Based on updated assumptions, companies may need to adjust their financial plans to reflect changes in market conditions, industry trends, or company-specific factors. Regular adjustments help maintain the accuracy and relevance of financial projections.

Financial plan assumptions play a crucial role in the development of a company's financial strategy and projections. By incorporating a wide range of factors and estimates, assumptions help create a comprehensive picture of a company's future financial performance.

Regularly reviewing and updating financial plan assumptions is essential for ensuring their continued relevance and accuracy. As new information becomes available or market conditions change, companies must adapt their assumptions and adjust their financial plans accordingly.

Sensitivity analysis and scenario planning are valuable tools for managing risks and identifying potential opportunities.

By analyzing the impact of different scenarios on a company's financial performance, management can make informed decisions and develop risk mitigation and contingency plans.

In conclusion, financial plan assumptions are critical components of a company's financial planning process.

By incorporating a wide range of factors and regularly reviewing and updating these assumptions, companies can create accurate financial projections, identify potential risks and opportunities, and make informed decisions that drive their long-term success.

Financial Plan Assumptions FAQs

What are financial plan assumptions, and why are they important.

Financial plan assumptions are the underlying estimates and predictions that a financial plan is based upon. They are essential because they provide the framework for determining how much money you need to save, how much you can expect to earn on your investments, and how long your money will last in retirement.

How do I choose the right financial plan assumptions for my personal financial plan?

The right financial plan assumptions will depend on your personal circumstances, financial goals, and risk tolerance. You should consider your current income, expenses, debts, and assets when selecting your assumptions. Additionally, you should consider factors such as inflation, investment returns, and life expectancy.

What are some common financial plan assumptions used by financial planners?

Common financial plan assumptions used by financial planners include assumptions about inflation rates, investment returns, life expectancy, and tax rates. Other assumptions may include future expenses such as college tuition or medical costs, changes in income or employment, and changes in interest rates.

How often should I review and update my financial plan assumptions?

You should review and update your financial plan assumptions regularly, at least annually, and whenever there are significant changes in your life circumstances, such as a new job, a significant change in income or expenses, or a change in your investment portfolio.

What are the potential risks of relying on incorrect financial plan assumptions?

Relying on incorrect financial plan assumptions can lead to a variety of risks, including not saving enough for retirement, running out of money in retirement, or being unable to meet other financial goals. Additionally, incorrect assumptions can lead to poor investment decisions, resulting in lower investment returns and higher taxes. It is essential to ensure that your financial plan assumptions are as accurate as possible to help you achieve your financial goals.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Affordable Care Act's (ACA) Medicaid

- Brick and Mortar

- Burning Cryptocurrency

- Cryptocurrency Airdrop

- Cryptocurrency Alerting

- Cryptocurrency Analysis Tool

- Cryptocurrency Cloud Mining

- Cryptocurrency Taxes

- Depreciation Recapture

- Fannie Mae Home Price Index

- Fannie Mae Manufactured Community Housing Loan

- Fannie Mae Multifamily Loan

- Fannie Mae Senior Housing Loan

- Fannie Mae Short Sale

- Fannie Mae Student Housing Loan

- Financial Planning for Military Families

- Frozen Bank Account

- Gold-Backed Cryptocurrency

- IRA Rollover

- IRA Rollover Form

- Lieutenant Colonel Pension Plans

- Loss Mitigation

- Medicaid Asset Protection Trust

- Medical Lines of Credit

- Medicare Appeal

- Multi-Family Line of Credit

- Pension Pillar

- Pension Scheme

Ask a Financial Professional Any Question

Meet top certified financial advisors near you, find advisor near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

Hey, did we answer your financial question.

We want to make sure that all of our readers get their questions answered.

Great, Want to Test Your Knowledge of This Lesson?

Create an Account to Test Your Knowledge of This Topic and Thousands of Others.

Get Your Question Answered by a Financial Professional

Create a free account and submit your question. We'll make sure a financial professional gets back to you shortly.

Business Assumptions: Understanding Key Predictions in Entrepreneurship

✅ All InspiredEconomist articles and guides have been fact-checked and reviewed for accuracy. Please refer to our editorial policy for additional information.

Business Assumptions Definition

Business assumptions refer to the expected financial and operational projections a business makes about future market conditions, business environment, and internal company dynamics that influence business decisions and strategy. They are yet-to-be-proven elements considered true for the purposes of planning and budgeting.

Types of Business Assumptions

Some key types of business assumptions that can play a significant role in shaping an entrepreneur’s business model and strategy include revenue assumptions, market size assumptions, and operational expense assumptions.

Revenue Assumptions

Revenue assumptions guide a company’s sales expectations, based on factors like pricing strategies and the volume of products or services they expect to sell. For instance, an ecommerce business may anticipate selling 1,000 units of a product every month, priced at $50 each. This results in a monthly revenue assumption of $50,000. It’s crucial to note that revenue assumptions should be realistic, grounded in market research and business analytics.

Market Size Assumptions

Market size is a critical factor in business forecasting. Market size assumptions can help a company estimate the total demand for their product or service within the target market. For companies launching a new product or venture, this might involve assuming the population size and demographic that will use their product. Similarly, for companies expanding into a new region, market size assumptions would include the potential customer base in that area. Misjudging the market size can lead to either overestimating or underestimating the potential for sales, both of which can negatively affect business planning and financial projections.

Operational Expense Assumptions

Operational expense assumptions encompass the anticipated costs required to maintain business operations, including rent, utilities, wages and salaries, maintenance, and technological infrastructure costs. These assumptions are crucial to controlling costs, planning for growth, and ensuring profitability. For example, a startup in the tech industry may anticipate needing large sums of capital for software development, tech hardware, and skilled personnel. On the other hand, a small retail business would focus more on rent and product costs. Understanding these operational costs will contribute to more accurate financial planning and prevent budget overruns.

The Role of Business Assumptions in Financial Planning

Business assumptions play a pivotal role in the entire financial planning process. They form the backbone of the strategic decision-making process and significantly impact budgeting, forecasting, and strategic planning initiatives of any business.