Uncovering Hidden Risks: A Comprehensive Guide to Business Plan Risk Analysis

A modern business plan that will lead your business on the road to success must have another critical element. That element is a part where you will need to cover possible risks related to your small business. So, you need to focus on managing risk and use risk management processes if you want to succeed as an entrepreneur.

How can you manage risks?

You can always plan and predict future things in a certain way that will happen, but your impact is not always in your hands. There are many external factors when it comes to the business world. They will always influence the realization of your plans. Not only the realization but also the results you will achieve in implementing the specific plan. Because of that, you need to look at these factors through the prism of the risk if you want to implement an appropriate management process while implementing your business plan.

By conducting a thorough risk analysis, you can manage risks by identifying potential threats and uncertainties that could impact your business. From market fluctuations and regulatory changes to competitive pressures and technological disruptions, no risk will go unnoticed. With these insights, you can develop contingency plans and implement risk mitigation strategies to safeguard your business’s interests.

This guide will provide practical tips and real-life examples to illustrate the importance of proper risk analysis. Whether you’re a startup founder preparing a business plan or a seasoned entrepreneur looking to reassess your risk management approach, this guide will equip you with the knowledge and tools to navigate the complex landscape of business risks.

Why is Risk Analysis Important for Business Planning?

Risk analysis is essential to business planning as it allows you to proactively identify and assess potential risks that could impact your business objectives. When you conduct a comprehensive risk analysis, you can gain a deeper understanding of the threats your business may face and can take proactive measures to mitigate them.

One of the key benefits of risk analysis is that it enables you to prioritize risks based on their potential impact and likelihood of occurrence . This helps you allocate resources effectively and develop contingency plans that address the most critical risks.

Additionally, risk analysis allows you to identify opportunities that may arise from certain risks , enabling you to capitalize on them and gain a competitive advantage.

It is important to adopt a systematic approach to effectively analyze risks in your business plan. This involves identifying risks across various market, operational, financial, and legal areas. By considering risks from multiple perspectives, you can develop a holistic understanding of your business’s potential challenges.

What is a Risk for Your Small Business?

In dictionaries, the risk is usually defined as:

The possibility of dangerous or bad consequences becomes true .

When it comes to businesses, entrepreneurs , or in this case, the business planning process, it is possible that some aspects of the business plan will not be implemented as planned. Such a situation could have dangerous or harmful consequences for your small business.

It is simple. If you don’t implement something you have in your business plan, there will be some negative consequences for your small business.

Here is how you can write the business plan in 30 steps .

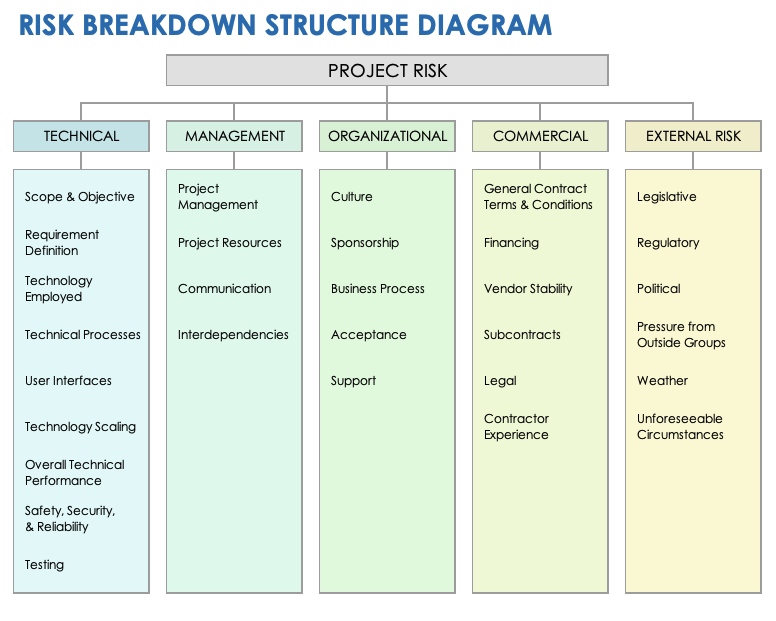

Types of Risks in Business Planning

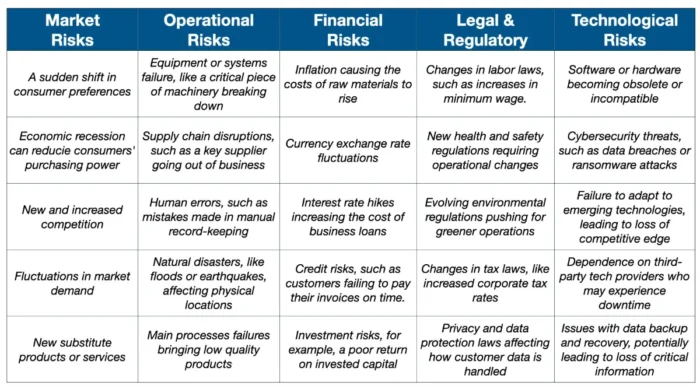

When conducting a business risk assessment for your business plan, it is essential to consider various types of risks that could impact your venture. Here are some common types of risks to be aware of:

1. Market risks

These risks arise from fluctuations in the market, including changes in consumer preferences, economic conditions, and industry trends. Market risks can impact your business’s demand, pricing, and market share.

2. Operational risk

Operational risk is associated with internal processes, systems, and human resources. These risks include equipment failure, supply chain disruptions, employee errors, and regulatory compliance issues.

3. Financial risks

Financial risks pertain to managing financial resources and include factors such as cash flow volatility, debt levels, currency fluctuations, and interest rate changes.

4. Legal and regulatory risks

Legal and regulatory risks arise from changes in laws, regulations, and compliance requirements. Failure to comply with legal and regulatory obligations can result in penalties, lawsuits, and reputational damage.

5. Technological risks

Technological risks arise from rapid technological advancements and the potential disruptions they can cause your business. These risks include cybersecurity threats, data breaches, and outdated technology infrastructure.

Basic Characteristics of Risk

Before you start with the development of your small business risk management process, you will need to know and consider the essential characteristics of the possible risk for your company.

What are the basic characteristics of a possible risk?

The risk for your company is partially unknown.

Your entrepreneurial work will be too easy if it is easy to predict possible risks for your company. The biggest problem is that the risk is partially unknown. Here we are talking about the future, and we want to prepare for that future. So, the risk is partially unknown because it will possibly appear in the future, not now.

The risk to your business will change over time.

Because your businesses operate in a highly dynamic environment, you cannot expect it to be something like the default. You cannot expect the risk to always exist in the same shape, form, or consequence for your company.

You can predict the risk.

It is something that, if we want, we can predict through a systematic process . You can easily predict the risk if you install an appropriate risk management process in your small business.

The risk can and should be managed.

You can always focus your resources on eliminating or reducing risk in the areas expected to appear.

Risk Management Process You Should Implement

The risk management process cannot be seen as static in your company. Instead of that, it must be seen as an interactive process in which information will continuously be updated and analyzed. You and your small business members will act on them, and you will review all risk elements in a specified period.

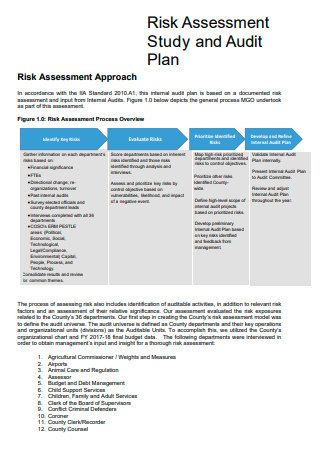

Adopting a systematic approach to identifying and assessing risks in your business plan is crucial. Here are some steps to consider:

1. Risk Identification

First, you must identify risk areas . Ask and respond to the following questions:

- What are my company’s most significant risks?

- What are the risk types I will need to follow?

In business, identifying risk areas is the process of pinpointing potential threats or hazards that could negatively impact your business’s ability to conduct operations, achieve business objectives, or fulfill strategic goals.

Just as meteorologists use data to predict potential storms and help us prepare, you can use risk identification to foresee possible challenges and create plans to deal with them.

Risk can arise from various sources, such as financial uncertainty, legal liabilities, strategic management errors, accidents, natural disasters, and even pandemic situations. Natural disasters can not be predicted or avoided, but you can prepare if they appear.

For example, a retail business might identify risks like fluctuating market trends, supply chain disruptions, cybersecurity threats, or changes in consumer behavior. As you can see, the main risk areas are related to types of risk: market, financial, operational, legal and regulatory, and technological risks.

You can also use business model elements to start with something concrete:

- Value proposition,

- Customers ,

- Customers relationships ,

- Distribution channels,

- Key resources and

- Key partners.

It is not necessarily that there will be risk in all areas and that the risk will be with the same intensity for all areas. So, based on your business environment, the industry in which your business operates, and the business model, you will need to determine in which of these areas there is a possible risk.

Also, you must stay informed about external factors impacting your business, such as industry trends, economic conditions, and regulatory changes. This will help you identify emerging risks and adapt your risk management strategies accordingly.

The idea for this step is to create a table where you will have identified potential risks in each important area of your business.

2. Risk Profiling

Conduct a detailed analysis of each identified risk, including its potential impact on your business objectives and the likelihood of occurrence. This will help you develop a comprehensive understanding of the risks you face.

Qualitative Risk Analysis

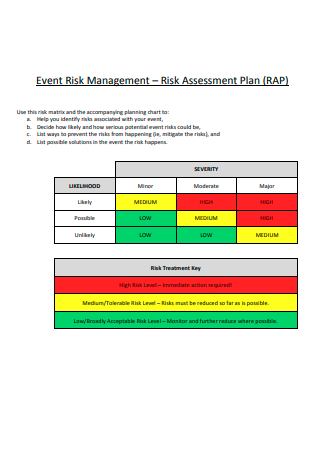

The qualitative risk analysis process involves assessing and prioritizing risks based on ranking or scoring systems to classify risks into low, medium, or high categories. For this analysis, you can use customer surveys or interviews.

Qualitative risk analysis is quick, straightforward, and doesn’t require specialized statistical knowledge to conduct a business risk assessment. The main negative side is its subjectivity, as it relies heavily on thinking about something or expert judgment.

This method is best suited for initial risk assessments or when there is insufficient quantitative analysis data .

For example, if we consider the previously identified risk of a sudden shift in consumer preferences, a qualitative analysis might rate its likelihood as 7 out of 10 and its impact as 8 out of 10, placing it in the high-priority quadrant of our risk matrix. But, qualitative analysis can also use surveys and interviews where you can ask open questions and use the qualitative research process to make this scaling. This is much better because you want to lower the subjectivism level when doing business risk assessment.

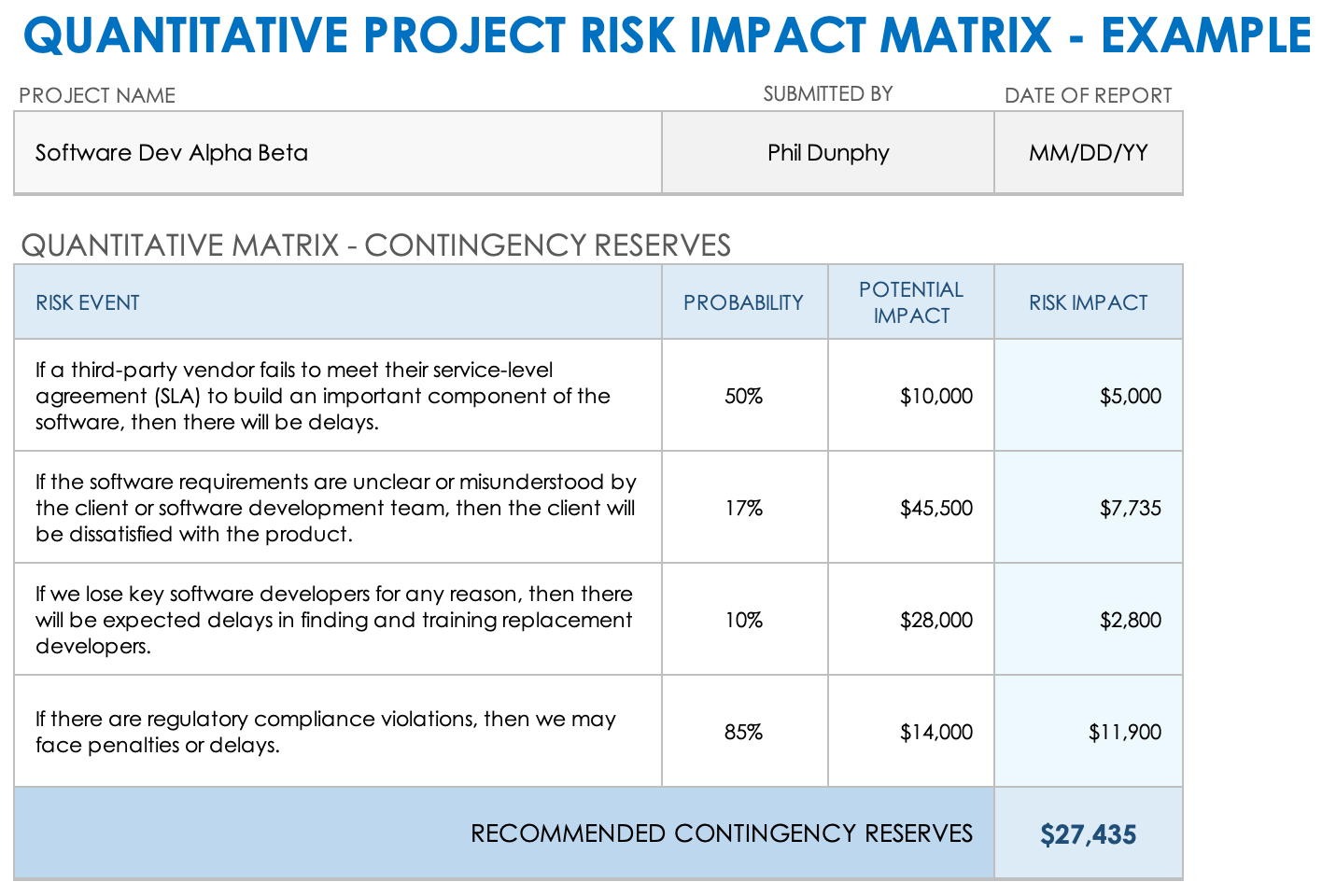

Quantitative Risk Analysis

On the other side, the quantitative risk analysis method involves numerical and statistical techniques to estimate the probability and potential impact of risks. It provides more objective and detailed information about risks.

Quantitative risk analysis can provide specific, data-driven insights, making it easier to make informed decisions and allocate resources effectively. The negative side of this method is that it can be time-consuming, complex, and requires sufficient data.

You can use this approachfor more complex projects or when you need precise data to inform decisions, especially after a qualitative analysis has identified high-priority risks.

For example , for the risk of currency exchange rate fluctuations, a quantitative analysis might involve analyzing historical exchange rate data to calculate the probability of a significant fluctuation and then using your financial data to estimate the potential monetary impact.

Both methods play crucial roles in effectively managing risks. Qualitative risk analysis helps to identify and prioritize risks quickly, while quantitative analysis provides detailed insights for informed decision-making.

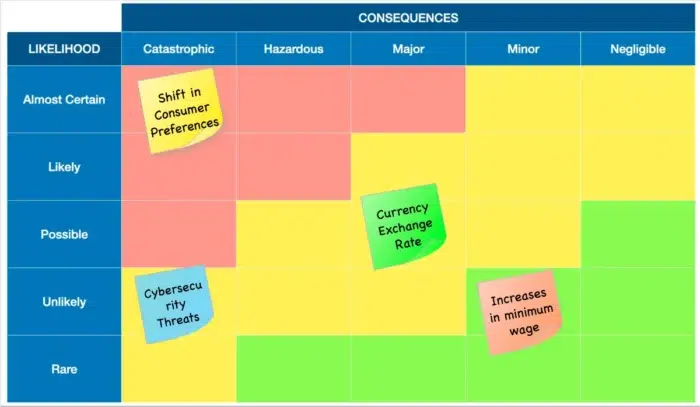

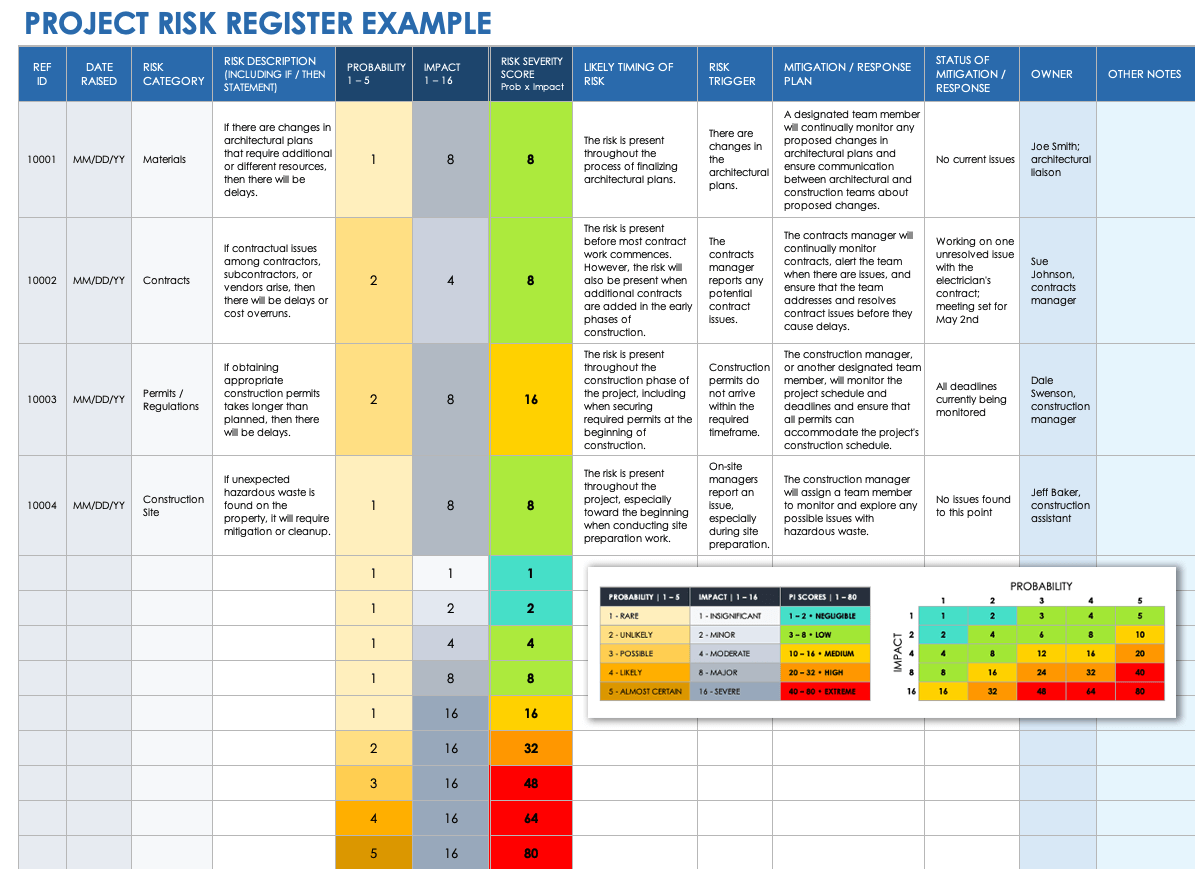

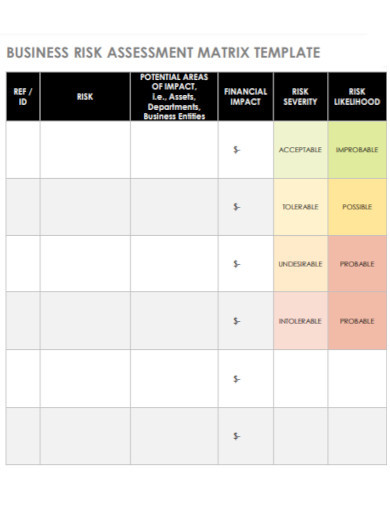

3. Business Risk Assessment Matrix

Once you have identified potential risks and analyzed their likelihood and potential impact, you can create a business risk assessment matrix to evaluate each risk’s likelihood and impact. This matrix will help you prioritize risks and allocate resources accordingly.

A business risk assessment matrix, sometimes called a probability and impact matrix, is a tool you can use to assess and prioritize different types of risks based on their likelihood (probability) and potential damage (impact). Here’s a step-by-step process to create one:

- Step 1: Begin by listing out your risks . For our example, let’s consider four of the risks we identified earlier: a sudden shift in consumer preferences (Market Risk), currency exchange rate fluctuations (Financial Risk), an increase in the minimum wage (Legal), and cybersecurity threats (Technological Risk).

- Step 2: Determine the likelihood of each risk occurring . In the process of risk profiling, we’ve determined that a sudden shift in consumer preferences is highly likely, currency exchange rate fluctuations are moderately likely, an increase in the minimum wage, and cybersecurity threats are less likely but still possible.

- Step 3: Assess the potential impact of each risk on your business if it were to occur . In our example, we might find that a sudden shift in consumer preferences could have a high impact, currency exchange rate fluctuations a moderate impact, an increase in minimum wage minor impact, and cybersecurity threats a high impact.

- Step 4: Plot these risks on your risk matrix . The vertical axis represents the likelihood (high to low), and the horizontal axis represents the consequences (high to low).

By visualizing these risks in a risk assessment matrix format, you can more easily identify which risks require immediate attention and which ones might need long-term strategies.

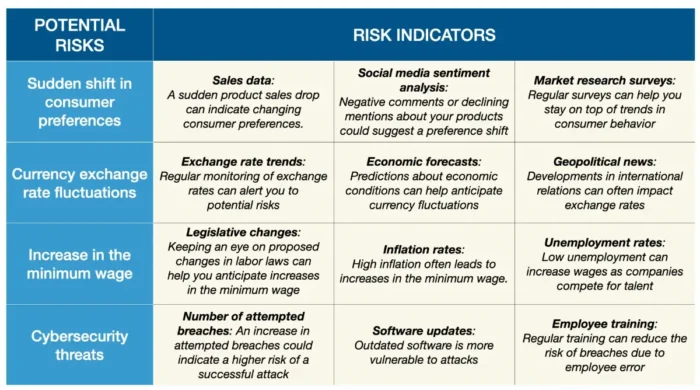

4. Develop Risk Indicators for Each Risk You Have Identified

The question is, how will you measure the business risks for your company?

Risk indicators are metrics used to measure and predict potential threats to your business. Simply, a risk indicator is a measure that should tell you whether the risk appears or not in a particular area you have defined previously. They act like a business’s early warning system. When these indicators change, it’s a signal that the risk level may be increasing.

For example, for distribution channels, an indicator can be a delay in delivery for a minimum of three days. This indicator will tell you something is wrong with that channel, and you must respond appropriately.

Now, let’s consider some risk indicators for the risks we have already identified and analyzed:

If you conduct all the steps until now, you can have a similar table with risk indicators in your business plan. You should monitor these indicators regularly, and if you notice a significant change, such as a drop in sales or an increase in attempted breaches, it’s time to investigate and take some action steps. This might involve updating your product line, hedging against currency risk, budgeting for higher wages, or improving your cybersecurity measures.

Remember, risk indicators can’t predict the future with certainty. But they can give you valuable insights that can help you prepare for potential threats.

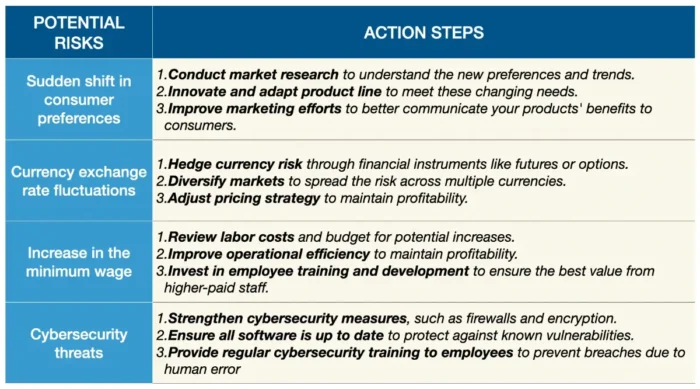

5. Define Possible Action Steps

The question is, what can you do regarding the risk if the risk indicator tells you that there is a potential risk?

Once the risk has appeared and is located, it is time to take concrete action steps. The goals of this step are not only to reduce or eliminate the impact of the risk for your company but also to prevent them in the future and reduce or eliminate their influence on the business operations or the execution of your business plan.

For example, for distribution channels with delivery delayed more than three days, possible activities can be the following:

- Apologizing to the customers for the delay,

- Determining the reasons for the delay,

- Analysis of the reasons,

- Removing the reasons,

- Consideration of alternative distribution channels, etc.

In this part of the business plan for each risk area and indicator, try to standardize all possible actions. You can not expect that they will be final. But, you can cover some basic guidelines that must be implemented if the risk appears. Here is an example of how this part will look in your business plan related to risks we have already identified through the risk assessment process.

6. Monitoring

Because this risk management process is dynamic , you must apply the monitoring process. In such a way, you can ensure the elimination of a specific kind of risk in the future, and you will allocate your resources to new possible risks.

After implementing the actions, you need to ask yourself the following questions:

- Are the actions taken regarding the risk the proper measures?

- Can you improve something regarding the risk management process? Is there a need for new risk indicators?

Techniques and Tools for Business Plan Risk Assessment

Various risk analysis methods, techniques, and tools are available to conduct an effective risk analysis for your business plan. Here are some commonly used ones:

1. SWOT analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis can help you identify internal strengths and weaknesses and external opportunities and threats. This analysis provides valuable insights into possible business risks and opportunities.

2. PESTEL analysis

A PESTEL (Political, Economic, Sociocultural, Technological, Environmental, Legal) analysis assesses the external factors that could impact your business. This analysis will help you identify risks and opportunities arising from these factors.

3. Scenario analysis

Consider different scenarios that could impact your business, such as best-case, worst-case, and most likely scenarios, as a part of your risk assessment process. You can anticipate potential risks and develop appropriate response strategies by analyzing these scenarios.

4. Monte Carlo simulation

Monte Carlo simulation uses random sampling and probability distributions to model various scenarios and assess their potential impact on your business. This technique provides you with a more accurate understanding of risk exposure.

5. Risk register

A risk register is a risk analysis tool that helps you record and track identified risks and their relevant details, such as impact, likelihood, mitigation strategies, and responsible parties. This tool ensures that risks are appropriately managed and monitored.

6. Business Impact Analysis (BIA)

Business impact analysis helps you understand the potential effects of various disruptions on your business operations and objectives. It’s about identifying what could go wrong and understanding how it could impact your bottom line. So, you can conduct business impact analysis as a part of your risk assessment inside your business plan.

7. Failure Mode and Effects Analysis (FMEA)

Using FMEA in your risk assessment process, you can proactively address potential problems, ensuring your business operations run as smoothly as you planned. It’s all about preparing for the worst while striving for the best.

8. Risk-Benefit Analysis (RBA)

The risk-benefit analysis allows you to make informed decisions, balancing the potential for gain against the potential for loss. It helps you choose the best path, even when the way forward isn’t entirely clear. This tool is a systematic approach to understanding the specific business risk and benefits associated with a decision, process, or project.

9. Cost-Benefit Analysis

By conducting a cost-benefit analysis as a part of your risk assessments, you can make data-driven decisions that consider both the possible risks (costs) and rewards (benefits). This approach provides a clear picture of the potential return on investment, enabling more effective and confident decision-making.

These techniques and tools allow you to conduct a comprehensive risk analysis for your business plan.

Mitigating and Managing Risks in a Business Plan

Identifying risks in your business plan is only the first step. To ensure the success of your venture, it is crucial to develop effective risk mitigation and management strategies. Here are some critical steps to consider:

- Risk avoidance : Some risks may be too high to justify taking. In such cases, consider avoiding these risks altogether by adjusting your business plan or exploring alternative strategies.

- Risk transfer : Transferring risks to third parties, such as insurance companies or outsourcing partners, can help mitigate their impact on your business. Evaluate opportunities for risk transfer and consider appropriate insurance coverage.

- Risk reduction : Implement measures to reduce the likelihood and impact of identified risks. This may involve improving internal processes, implementing safety protocols, or diversifying your supplier base .

- Risk acceptance : Some risks may be unavoidable or negatively impact your business. In such cases, accepting the risks and developing contingency plans can help minimize their impact.

In conclusion, a comprehensive risk analysis is essential for identifying, assessing, and managing different types of risk that could impact your success.

Conducting a thorough risk analysis can safeguard your business’s interests, capitalize on opportunities, and increase your chances of long-term success.

Related Posts

Risk Management Guide: Everything You Need to Know About Business Risk

Why Prioritizing Risk Management is Crucial for Healthcare Businesses

Start typing and press enter to search.

Strategic Risk Assessment Template, Examples, & Checklist for 2022

July 29, 2020

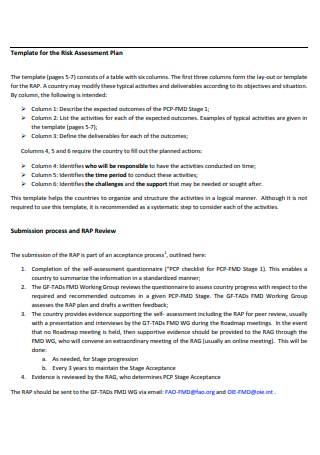

The first step in building a risk management plan is to conduct an initial risk assessment. What sets a strategic risk assessment apart from other risk assessment methods is that it is driven by the business’s core strategies. Get up to speed on strategic risk assessment with a checklist, template, and examples below.

What Is a Strategic Risk Assessment?

A strategic risk assessment is a systematic, continuous process for organizations to identify its strategic risks and understand how those risks are being managed across the business. “Strategic risks” are the risks that are most consequential to the organization’s ability to execute its strategy and achieve its objectives. They entail the risk exposures that can ultimately impact shareholder value or even threaten the business’s survival.

Planning a Strategic Risk Assessment

The strategic risk assessment process should be led by management, but receive input from and be reviewed in conjunction with the Board. The outcome of this risk assessment is to achieve consensus, among Board members and management, around the top key risks facing the organization. This process aligns with COSO’s 2017 ERM framework and is based on research by Dr. Mark Frigo, Director of the Center for Strategy, Execution, and Valuation at DePaul University, and Richard Anderson, a retired Partner at PwC and a clinical professor at the Strategic Risk Management Lab at DePaul.

Risk Assessment Checklist

Strategic Risk Assessment Template

1. understand the strategies of the organization.

The first step of the risk assessment is to develop an overview of the organization’s key strategies and business objectives. For some businesses, this data may already be well-developed and formally documented. If not, the risk assessment team can leverage examples such as The Return Driven Strategy model to understand and identify the strategies most critical to achieving the organization’s overall objectives. This is a crucial step in helping management and the Board eventually prioritize the potential risks to these strategies.

2. Collect data and views on strategic risks from the organization

The second step is to collect information from the organization regarding its strategic risks. This can be achieved by:

- Reviewing financial reports and investor presentations

- Interviewing key executive leaders regarding what they view as strategic risks

- Surveying business leaders and other personnel with views on risks, e.g. compliance, internal audit , and external audit teams

It can be helpful to use the information gathered on strategic risks in Step 1 to frame these interviews and surveys around the business’s key strategies. It can also be useful to interview key executive leaders regarding what they view as potential emerging risks in addition to gathering their feedback on strategic risks. This is a good time to consider incorporating risk assessment analytics to the data you gather on strategic risks.

3. Prepare a preliminary strategic risk profile

The next step is to utilize the results from steps 1 and 2 of the risk assessment planning to develop a preliminary profile of the organization’s strategic risks. The risk assessment team can use the Strategic Risk Management Model as a template to help assess the risks related to each of the top strategies identified. Ultimately, this profile should contain a list of the top risks to the organization’s strategy and objectives and their potential severity or ranking. How detailed this profile is, and how it will be presented, should be carefully catered to the culture of your organization. Color-coding risks and using visual heat maps may be helpful in presenting this information to management and the Board for review and discussion.

4. Validate and finalize the strategic risk profile with management and the Board

Upon presenting the preliminary strategic risk profile to leadership, the next step is for the risk assessment team to facilitate a discussion among key executives to help refine, validate, and finalize the risk profile. The ensuing cross-dialogue and conversations about risk and opportunity are among the most valuable conversations for shaping business strategy, as they unite executives across the organization to share their unique perspectives and collectively vet and prioritize the organization’s top key risks.

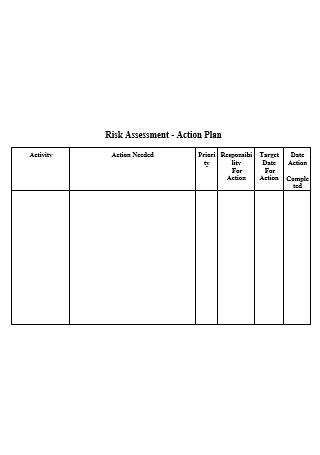

5. Develop a strategic risk management action plan

This step entails leveraging the results of the previous steps to produce a strategic risk management action plan to help manage and monitor the identified strategic risks. The action plan involves developing an appropriate risk response (accept, avoid, pursue, reduce, share) to each critical risk identified in accordance with the organization’s risk appetite. The consolidated action plan should prioritize these risk responses and allocate resources across them. Best practice indicates the action plan should also include a charter that:

- Has a formal statement on the organization’s risk appetite

- Assigns responsibilities and accountability for risk monitoring and actions among management, internal audit and compliance

6. Communicate the strategic risk profile and action plan

Once the strategic risk management action plan has been developed, it should be validated and finalized by management and the Board. Once finalized, this profile and plan must be communicated with the organization in order to help develop and build the organization’s risk culture.

7. Implement the enterprise risk management action plan

The value of performing a strategic risk assessment is realized when the organization implements the resulting action plan to manage and monitor its strategic risks. However, enterprise risk management should not be regarded as a one-time, annual procedure, but as a continual, ongoing process that can be built upon and strengthened. As such, these steps should be repeated as frequently as needed in response to significant external events that can affect the business, such as the 2008 financial crisis or the COVID-19 crisis. Furthermore, leveraging risk management software can help streamline and centralize the risk assessment process, creating the foundation for a mature ERM program. To learn how AuditBoard can help you manage your risk management plan from end to end, contact us by filling out the form below.

Related Articles

Call Us (877) 968-7147

Most popular blog categories

- Payroll Tips

- Accounting Tips

- Accountant Professional Tips

How to Conduct a Risk Analysis for Your Small Business

Small business owners take risks every day. But if you put too much at stake, your business bottom line could suffer. To make sure your decisions are sound, conduct a risk analysis for your small business.

What is a risk analysis in business?

A risk is a situation that can either have huge benefits or cause serious damage to a small business’s financial health. Sometimes a risk can result in the closure of a business. Before taking risks at your business, you should conduct a risk analysis.

A risk assessment for small business is a strategy that measures the potential outcomes of a risk. The assessment helps you make smart business decisions and avoid financial issues.

Jason Olsen, serial entrepreneur and founder of Studios 360, Prestman Auto, and Automobia, explained in his article :

The key is to not only use optimism for reasons to take action, but also to utilize risk factors you uncover to guide your decisions. Yes, you must have courage to bet on your ideas, but you must also have the ability to take a thoughtful, calculated approach. It’s nearly impossible to remove all risk in any scenario, but what’s important is to make sure these troublesome areas are always considered and understood.”

Internal vs. external risks

Usually, a risk is either internal or external. Internal risks occur inside of your operations, while external risks occur outside of your business.

Internal risks are often more specific to your business and easier to control than external risks. Examples of internal risks include:

- Financial risks

- Marketing risks

- Operational risks

- Workforce risks

Though you can project external risks, they are usually out of your control. You might need to take a reactive approach to managing external risks. These risks include:

- Changing economy

- New competitors

- Natural disasters

- Government regulations

- Consumer demand changes

How to do a risk assessment

There is no one way to assess business risk. The assessment is not 100% accurate when it comes to judging your level of risk. A small business risk analysis gives you a picture of the possible outcomes your business decisions could have. Use the following steps to do a financial risk assessment.

Step 1: Identify risks

The first step to managing business risks is to identify what situations pose a risk to your finances. Consider the damage a risk could have on your business. Then, think about your goals and the rewards that could come out of taking the risk. Depending on your business, location, and industry, risks will vary.

Step 2: Document risks

Once you have a list of potential business risks, define them in a document. Develop a process to weigh the effect of each risk. Look at how much damage the risk could potentially cause and how hard it would be to recover. Set up a scoring system for risks, from mild to severe.

Step 3: Appoint monitors

Identify individuals at your business who will keep an eye on and manage risks. The risk monitor might be you, a partner, or an employee. Decide how risks should be reported and handled. When you have procedures for risk management, issues can be taken care of smoothly.

Step 4: Determine controls

After understanding potential risks, figure out controls you can use to reduce them. Look at patterns over time to predict your income cycle. And, assess the impact risks have on your business. Look at the significance of a risk as well as its likelihood of occurring at your business.

Step 5: Review periodically

Your business risk assessment is not a one-time commitment. Review risk management processes annually to see how you handle risks. Also, look out for new risks that might not have been relevant in the previous assessment.

Use a risk ratio to gauge risk

A risk ratio shows the relationship between your business’s debts and equity. Business debt creates risk. By comparing debt, or leverage, to equity, you get a better understanding of your business’s level of risk. This can help you set more targeted business debt management goals.

Debt-to-equity ratio

There are different kinds of financial leverage ratios. One common leverage ratio formula is the debt-to-equity ratio . For this ratio, divide your total debt by your total equity. Business equity is equal to your assets minus liabilities and shows your ownership in the business.

Debt-to-Equity Ratio = Total Debt / Total Equity

For example, you have $30,000 in debt and $15,000 in equity.

$30,000 / $15,000 = 2 times or 200%

This means for every dollar you have, you owe two dollars to creditors.

By finding the debt-to-equity ratio, you can see how much capital comes from debt. The more debt you have compared to equity, the bigger your risk level.

Purpose of risk assessments

Risk assessments are an important part of running your business. You can use your business risk assessment for making decisions and financing your business .

A simple risk analysis will help you avoid hazards that could damage your finances. The assessment informs you about the steps you need to take to protect your business. You can see what situations you need to address and avoid.

Beyond internal use, a financial risk assessment can help you prepare to talk with lenders. These individuals want to know your business’s level of risk before giving you money. They look at the likelihood of your business growing and how likely you are to pay back the loan.

Need help keeping track of your business debts, income, and expenses? Patriot’s online accounting software is easy to use and made for the non-accountant. We offer free, USA-based support. Try it for free today.

This article is updated from its original publication date of May 9, 2017.

Stay up to date on the latest accounting tips and training

You may also be interested in:

Need help with accounting? Easy peasy.

Business owners love Patriot’s accounting software.

But don’t just take our word…

Explore the Demo! Start My Free Trial

Relax—run payroll in just 3 easy steps!

Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial.

Relax—pay employees in just 3 steps with Patriot Payroll!

Business owners love Patriot’s award-winning payroll software.

Watch Video Demo!

Watch Video Demo

Contact us on 0208 290 4560

- Business insurance

- How to Write a...

How to Write a Risk Assessment: Templates & Examples

Dec 15, 2021

Does your business have to carry out risk assessments?

Yes, is the short answer. The Health and Safety Executive (HSE) state that as an employer, you’re required by law to protect your employees, and others, from harm.

The Management of Health and Safety at Work Regulations 1999 sets a minimum requirement that businesses must

- identify what could cause injury or illness in your business (hazards)

- decide how likely it is that someone could be harmed and how seriously (the risk)

- take action to eliminate the hazard, or if this isn’t possible, control the risk

To meet your duty of care, you will need to carry out and document a risk assessment.

Find out if the rules apply to you if you are self-employed .

Whilst not necessarily required by law, it also makes sense to carry out risk assessments linked to the running of your business. Knowing the possible risks that could threaten your businesses survival puts you in the best possible position to deal with them should they arise.

How to write a risk assessment

If you’ve not written a risk assessment before, it can seem like a daunting task. But it doesn’t need to be. The HSE suggest taking a 5-step approach to writing a risk assessment.

- Identify hazards

Hazards can be thought of as things in the workplace which may cause harm. Take a walk around your workplace and identify things which have the potential cause harm – this could be things which could injure, or things which could pose a long-term threat to health– manual handling, loud noise, or workplace stress for example.

When it comes to hazards think about working practices, processes, substances, and activities which could cause harm. And when identifying the hazards, think about how they could cause harm to employees, contractors, visitors, or members of the public.

- Assess the risks

Once you have identified your risks, then think about the likelihood of them happening and how serious it would be if they did.

The HSE recommends thinking about:

- who might be harmed and how

- what you’re already doing to control the risks

- what further action you need to take to control the risks

- who needs to carry out the action

- when the action is needed by

- Control the risks

Think about the steps you need to take to control the risks that you have identified.

The best possible outcome is that you can put controls in place which totally remove the identified risk. However, in many cases this just isn’t possible. So, you will need to think about the controls you can put in place to minimise the risks and the likelihood it will create harm.

Once you have identified the controls you need, put them into practice

- Record your findings

If you employ 5 or more people, then you must document the findings of your risk assessment.

You’ll need to include

- the hazards (things that may cause harm)

- what you are doing to control the risks

The HSE have created a risk assessment template to help you record your findings. And a quick Google search for ‘risk assessment template’ brings back multiple other template options which you may find useful and will mean you do not need to start from scratch.

- Review the controls

A risk assessment should not be thought of as a one time, box ticking exercise. It is important to that you review it on a regular basis. Make sure the controls you have identified remain appropriate and actually work in controlling the risks.

If anything changes in the way that you work (new staff, new processes, new premises etc) then make sure that you make a new assessment of the risks and work through the process listed above again.

COVID-19 is a good example of a new risk, requiring businesses to carry out COVID-19 specific risk assessments .

What type of risk assessment may your business need to carry out?

The obvious risk assessment that a business will need to carry out, and the one required by law referenced above, is linked to health and safety. Remember, you have a legal duty to protect your employees, and others, from harm

But there are also other risks which your business may face on a day-to-day basis, closely linked to your business success and survival.

So, you may need to carry out other risk assessments in areas such as:

- business continuity

- cyber security

- data security

You should be able to use the 5 principles above as a basis to writing any type of risk assessment.

Why your business should take risk seriously

Businesses face many risks in today’s environment. You just have to think of the shock which COVID-19 bought to the business world. And whilst it is one that we could not have foreseen, not giving enough time and effort to thinking about the risks your business faces and how you will respond if they should arise is a major risk to your business in itself.

At Anthony Jones we always say businesses should avoid falling into the trap of thinking ‘we would just….’ when it comes to risk management. The use of the word ‘just’ implies a level of simplicity in overcoming potential issues. But without prior thought, it is highly unlikely that you will have the answers to issues which may present themselves.

You also need to think about risk management when it comes to your insurance. Insurers are becoming increasingly selective, and we are seeing more requests for risk management information from insurers. They want to see how your business manages risk and how you are able to present this back can have a bearing on your ability to obtain the right insurance at the best possible price.

At Anthony Jones we focus on the areas of risk management with all of our clients. We work in partnership with Cardinus , a global risk and safety partner, to support our focus in this area. We can work with you to help you understand your business and attitude to risk and identify insurance covers which can offer protection. Get in touch with us on 020 8290 9080 or email us at [email protected] to discuss any of your business insurance requirements.

Get a Quote

You can call us during normal office hours, Monday to Friday, 9am to 5pm. Outside of office hours you can either email us or leave an answerphone message and we promise to get back to you the next working day.

General enquiries: 020 8290 4560 [email protected]

Sign up for news

Business Insurance Business Interruption Insurance Commercial Vehicle Insurance Cyber Insurance Fleet Management High Net Worth Insurance Intellectual Property Insurance Life & Critical Illness Cover Personal Insurance Transport & Logistics Vaping Insurance

ZenBusinessPlans

Home » Feasibility Study

A Sample Template for Conducting Business Risk Assessment

How do you conduct a risk assessment on an idea when writing a business plan? Or you need a sample business risk assessment template? I advice you read on. Every business involves some risks. This may be little or much depending on the type of business as well as many other market factors.

Identifying, outlining, and assessing the risks involved in a new business and developing strategies to manage those risks is an important, in fact indispensable step to take when planning a new business.

The Importance of Conducting Business Risk Assessment

By understanding potential risks to your business and outlining strategies to cushion their effects, you will help your business recover quickly if an unexpected incident occurs. For instance, a risk assessment will unveil workplace risks that you or your employees are exposed to. And it will help you meet your legal obligation for providing a safe workplace and reducing the likelihood of workplace mishaps that can impact negatively on your business.

Types of risk vary from business to business, but conducting a risk assessment and preparing a risk management plan involve a process that is common to all business. It goes without saying that the first step to take when conducting a risk assessment is to identify potential risks to your business. Understand the scope of potential risks will help you come up with realistic and cost-effective strategies for handling them.

When considering the types of risks that your business is prone to, it is very important that you think broadly. This is where many people go wrong in their risk assessment; they focus only on the obvious concerns like fire, theft, competition, etc. without paying attention to subtle but equally dangerous concerns.

Assessing your Business for Possible Risks

Only after assessing your business can you successfully identify the risks associated with it. Start by thinking about your critical business activities, which includes your main services, your resources, your employees and factors that could affect them or their work.

These factors include natural disasters, accidents, power failures, and illness. By assessing your business this way, you can work out those aspects that are indispensable to your business.

Conducting Business Risk Assessment – A Sample Template

After assessing your business to get a clear picture of it, you can start identifying the risks involved. Go through your business plan to see those things your business cannot do without, and list some possible risk factors that could cripple those indispensable things. Asking yourself the following questions will be of great help:

- How, why, when, and where are the risks likely to happen in my business?

- Are the risks coming from within or from external sources?

- Who might be affected if an incident occurs?

Don’t just think of what answers you have to these questions, write down your answers. Then start asking yourself as many “what if” questions as you can, using the various risks you have in your list? The following are examples of such questions:

- What if power supply ceases suddenly?

- What if key documents are destroyed?

- What if vital information gets lost due to hard disk crashes or virus attacks?

- What if an intruder gains access to confidential information?

- What if one of your best employees quit suddenly?

- What if your competitors reduced the prices of their products by half?

- What if your suppliers went out of business?

- What if the area you have your business in is affected by a natural disaster?

Also write down your answers to these questions. By now, your risk assessment is gradually taking a good shape. But you are not done yet. After identifying the potential risks to your business, brainstorm with other people, such as your financial adviser, accountant, staff, and other interested parties. This will help you get many more perspectives on risks to your business.

Aside the ones you have listed, think about the events that have affected other businesses already in market, especially your competitors. What factors led to those events? What were the outcomes of those events? Don’t you see them happening to your business, too ? Answer these questions, and you will be able to identify even more risks that may be from external sources.

Don’t forget to identify each step involved in your work processes and outline the associated risks. Think of what factors could hamper each step and how this could affect the rest of the process. Once you have identified the risks associated with your business as explained above, you will need to analyze the likelihood and consequences of each, and come up with options for managing them.

After completing your rough draft, review it, and reproduce it in a better and more presentable format.

- Chapter 10: W riting a Marketing Plan

- Chapter 8: W riting your Company’s Profile

- Go Back to Introduction and Table of Content

More on Feasibility Study

Business risk assessment: what it is & why you need it

Updated 12 January 2024 • 6 min read

What is a business risk assessment?

A business risk assessment helps you identify, analyse and prioritise risks. Businesses use risk assessments to:

minimise or eliminate risks

protect against potential threats

improve decision-making.

Risk assessment for business plan

When you’re putting together a business plan , it’s important to include a business risk assessment. Completing this section helps business owners to:

understand what risks they face

develop strategies for minimising or eliminating those risks

allocate resources effectively to manage risks

monitor and review risks on an ongoing basis.

This means that the business owner has a documented strategy in place to handle when things can — and do — go wrong. This gives them better control over the business and its trajectory, while also giving potential investors assurance that the business is well managed and their investment is sound.

The different types of risks businesses face

While it may be difficult to catalogue every risk a business may face, you can do a risk assessment based on types of risk. These categories may include:

Hazard-based

These are risks from dangerous workplace situations that could cause harm to people, property or the environment. Examples include fires, floods and chemical spills.

Opportunity-based

This risk comes from choosing one opportunity over another. When you dedicate your resources to one opportunity, there’s always the chance that a better one will come along or the current one won’t go as planned. Examples include investing in a new product line or moving to a new location.

Uncertainty-based

This risk is present when the outcome of a situation is uncertain. Examples of business risks include legal action, damage from natural disasters, and the loss of important customers or suppliers.

Operational

This type of risk comes from the day-to-day running of your business. Examples of operational risk may include equipment failure, employee error or theft.

Reputational

A risk to your business' reputation can include negative media coverage, product recalls and data breaches.

Cyber security

Cyber security is a risk for all businesses, including small and medium-sized organisations. Any data loss, leak or compromise can cost a business severely — both financially and in reputational damage.

How to do a business risk assessment (plus template and example)

1. identify the different types of risks for your business..

To identify the risks to your business, consider what could go wrong and why that might happen. Consider holding brainstorming sessions with your employees or reviewing past incidents to get started.

2. Assess the likelihood and potential impact of each type of risk.

You’ll want to decide the likelihood and potential impact of each type of risk. For example, the risk may be unlikely to occur through to very likely to occur. Likewise, the impact of the risk may be negligible through to severe. Doing this assessment will help you decide what to prioritise and where to allocate resources.

3. Prioritise the risks and develop strategies for mitigating them.

Once you’ve identified and assessed your risks, you’ll need to develop strategies to mitigate them and lessen their potential negative impact. This could involve taking out adequate business insurance or putting business continuity plans in place.

Business risk assessment template

The Australian Taxation Office (ATO) has developed a business risk assessment template that you can use for your risk assessment.

The template includes questions to help you identify and assess risks.

Business risk assessment example

If you own a small business, you might not think you need to worry about conducting risk assessments. But all businesses can face risks that could significantly affect their operations. Consider the following example:

You own a small retail business with one store. Your primary source of income is from selling products online, but you also have a small number of customers who visit your store in person.

A customer tells you they see a mouse in your store. This is a reputational risk, as it could damage your business’ reputation if word gets out. It’s also an operational risk if it leads to damaged inventory.

In this case, you'd need to assess the likelihood of that risk and the potential damage it could do to your business reputation or operations. Based on this assessment, you can decide how best to deal with the risk.

This is just one example of the innumerable risks businesses can face. Conducting a thorough business risk assessment prepares you for just about anything that comes your way.

Tips for mitigating risk in your business

Risk is part of life — it can’t always be avoided, but there are strategies you can put in place to mitigate its impacts. Consider the following:

Have adequate insurance coverage to help mitigate the financial impact of risks such as fire, theft or liability.

Develop contingency plans so that you can continue operating if an incident, such as a natural disaster or power outage, occurs.

Implement risk management processes and procedures. This could involve anything from regular risk assessments to employee training on identifying and dealing with potential risks.

Regularly monitor and review risks and make sure you have effective mitigation strategies in place.

Maintain good relationships with suppliers and customers. This can help to minimise the impact of risks such as supply chain disruptions. Also, ask for feedback on their experience with your products or services, so you can identify potential risks before they become major problems.

Have strong internal financial controls and IT security measures.

Stay up to date on changes in laws and regulations. This will help you avoid compliance-related issues, including risks specific to your industry and general risks all businesses face.

Disclaimer: This is general advice not meant to replace professional guidance. When seeking out someone to help advise you on business decisions, find somebody with the accreditations to assist you.

Minimise your IT risk with MYOB

With MYOB’s business management platform , you can look after your finances, invoices , payroll and more, while maintaining compliance and data security at all times. Our cloud-based software is scalable and affordable, catering for sole traders through to mid-sized enterprises . With MYOB, your IT is future fit — so you have one less thing to worry about.

Sign up today and try FREE for 30 days .

Disclaimer: Information provided in this article is of a general nature and does not consider your personal situation. It does not constitute legal, financial, or other professional advice and should not be relied upon as a statement of law, policy or advice. You should consider whether this information is appropriate to your needs and, if necessary, seek independent advice. This information is only accurate at the time of publication. Although every effort has been made to verify the accuracy of the information contained on this webpage, MYOB disclaims, to the extent permitted by law, all liability for the information contained on this webpage or any loss or damage suffered by any person directly or indirectly through relying on this information.

Related Guides

How to define key performance indicators (kpis) for employees arrow right, how to perform a business gap analysis arrow right, business expenses guide for smbs arrow right.

Business Risk Assessment Template

Identify the business areas to be assessed, establish the context of each business area, identify potential risks in each business area, assess the severity and likelihood of each risk.

- 1 1. Negligible

- 3 3. Moderate

- 5 5. Catastrophic

- 2 2. Unlikely

- 3 3. Possible

- 4 4. Likely

- 5 5. Almost Certain

Approval: Risk Assessment

- Identify the business areas to be assessed Will be submitted

Identify potential impacts of each risk on the business

Determine risk tolerance levels.

- 2 2. Medium

Devise strategies to mitigate risks

Document risk information in a risk register.

- 1 1. Financial

- 2 2. Operational

- 3 3. Reputational

- 5 5. Environmental

Approval: Risk Mitigation Strategies

- Assess the severity and likelihood of each risk Will be submitted

Prepare a risk management plan

Approval: risk management plan.

- Determine risk tolerance levels Will be submitted

Communicate the risk management plan to stakeholders

Implement the risk management plan, monitor and review the effectiveness of risk mitigation strategies, revise and update risk management plan as required, approval: updated risk management plan.

- Revise and update risk management plan as required Will be submitted

Prepare a risk assessment report

Present the risk assessment report to management, approval: risk assessment report.

- Present the risk assessment report to management Will be submitted

Take control of your workflows today.

More templates like this.

What is business risk?

You know about death and taxes. What about risk? Yes, risk is just as much a part of life as the other two inevitabilities. This became all the more apparent during COVID-19, as each of us had to assess and reassess our personal risk calculations as each new wave of the pandemic— and pandemic-related disruptions —washed over us. It’s the same in business: executives and organizations have different comfort levels with risk and ways to prepare against it.

Where does business risk come from? To start with, external factors can wreak havoc on an organization’s best-laid plans. These can include things like inflation , supply chain disruptions, geopolitical upheavals , unpredictable force majeure events like a global pandemic or climate disaster, competitors, reputational issues, or even cyberattacks .

But sometimes, the call is coming from inside the house. Companies can be imperiled by their own executives’ decisions or by leaks of privileged information, but most damaging of all, perhaps, is the risk of missed opportunities. We’ve seen it often: when companies choose not to adopt disruptive innovation, they risk losing out to more nimble competitors.

The modern era is rife with increasingly frequent sociopolitical, economic, and climate-related shocks. In 2019 alone, for example, 40 weather disasters caused damages exceeding $1 billion each . To stay competitive, organizations should develop dynamic approaches to risk and resilience. That means predicting new threats, perceiving changes in existing threats, and developing comprehensive response plans. There’s no magic formula that can guarantee safe passage through a crisis. But in situations of threat, sometimes only a robust risk-management plan can protect an organization from interruptions to critical business processes. For more on how to assess and prepare for the inevitability of risk, read on.

Learn more about McKinsey’s Risk and Resilience Practice.

What is risk control?

Risk controls are measures taken to identify, manage, and eliminate threats. Companies can create these controls through a range of risk management strategies and exercises. Once a risk is identified and analyzed, risk controls can be designed to reduce the potential consequences. Eliminating a risk—always the preferable solution—is one method of risk control. Loss prevention and reduction are other risk controls that accept the risk but seek to minimize the potential loss (insurance is one method of loss prevention). A final method of risk control is duplication (also called redundancy). Backup servers or generators are a common example of duplication, ensuring that if a power outage occurs no data or productivity is lost.

But in order to develop appropriate risk controls, an organization should first understand the potential threats.

What are the three components to a robust risk management strategy?

A dynamic risk management plan can be broken down into three components : detecting potential new risks and weaknesses in existing risk controls, determining the organization’s appetite for risk taking, and deciding on the appropriate risk management approach. Here’s more information about each step and how to undertake them.

1. Detecting risks and controlling weaknesses

A static approach to risk is not an option, since an organization can be caught unprepared when an unlikely event, like a pandemic, strikes. So it pays to always be proactive. To keep pace with changing environments, companies should answer the following three questions for each of the risks that are relevant to their business.

- How will a risk play out over time? Risks can be slow moving or fast moving. They can be cyclical or permanent. Companies should analyze how known risks are likely to play out and reevaluate them on a regular basis.

- Are we prepared to respond to systemic risks? Increasingly, risks have longer-term reputational or regulatory consequences, with broad implications for an industry, the economy, or society at large. A risk management strategy should incorporate all risks, including systemic ones.

- What new risks lurk in the future? Organizations should develop new methods of identifying future risks. Traditional approaches that rely on reviews and assessments of historical realities are no longer sufficient.

2. Assessing risk appetite

How can companies develop a systematic way of deciding which risks to accept and which to avoid? Companies should set appetites for risk that align with their own values, strategies, capabilities, and competitive environments—as well as those of society as a whole. To that end, here are three questions companies should consider.

- How much risk should we take on? Companies should reevaluate their risk profiles frequently according to shifting customer behaviors, digital capabilities, competitive landscapes, and global trends.

- Are there any risks we should avoid entirely? Some risks are clear: companies should not tolerate criminal activity or sexual harassment. Others are murkier. How companies respond to risks like economic turmoil and climate change depend on their particular business, industry, and levels of risk tolerance.

- Does our risk appetite adequately reflect the effectiveness of our controls? Companies are typically more comfortable taking risks for which they have strong controls in place. But the increased threat of severe risks challenges traditional assumptions about risk control effectiveness. For instance, many businesses have relied on automation to increase speed and reduce manual error. But increased data breaches and privacy concerns can increase the risk of large-scale failures. Organizations, therefore, should evolve their risk profiles accordingly.

3. Deciding on a risk management approach

Finally, organizations should decide how they will respond when a new risk is identified. This decision-making process should be flexible and fast, actively engaging leaders from across the organization and honestly assessing what has and hasn’t worked in past scenarios. Here are three questions organizations should be able to answer.

- How should we mitigate the risks we are taking? Ultimately, people need to make these decisions and assess how their controls are working. But automated control systems should buttress human efforts. Controls guided, for example, by advanced analytics can help guard against quantifiable risks and minimize false positives.

- How would we respond if a risk event or control breakdown happens? If (or more likely, when) a threat occurs, companies should be able to switch to crisis management mode quickly, guided by an established playbook. Companies with well-rehearsed crisis management capabilities weather shocks better, as we saw with the COVID-19 pandemic.

- How can we build true resilience? Resilient companies not only better withstand threats—they emerge stronger. The most resilient firms can turn fallout from crises into a competitive advantage. True resilience stems from a diversity of skills and experience, innovation, creative problem solving, and the basic psychological safety that enables peak performance.

Change is constant. Just because a risk control plan made sense last year doesn’t mean it will next year. In addition to the above points, a good risk management strategy involves not only developing plans based on potential risk scenarios but also evaluating those plans on a regular basis.

Learn more about McKinsey’s Risk and Resilience Practice.

What are five actions organizations can take to build dynamic risk management?

In the past, some organizations have viewed risk management as a dull, dreary topic, uninteresting for the executive looking to create competitive advantage. But when the risk is particularly severe or sudden, a good risk strategy is about more than competitiveness—it can mean survival. Here are five actions leaders can take to establish risk management capabilities .

- Reset the aspiration for risk management. This requires clear objectives and clarity on risk levels and appetite. Risk managers should establish dialogues with business leaders to understand how people across the business think about risk, and share possible strategies to nurture informed risk-versus-return decision making—as well as the capabilities available for implementation.

- Establish agile risk management practices. As the risk environment becomes more unpredictable, the need for agile risk management grows. In practice, that means putting in place cross-functional teams empowered to make quick decisions about innovating and managing risk.

- Harness the power of data and analytics. The tools of the digital revolution can help companies improve risk management. Data streams from traditional and nontraditional sources can broaden and deepen companies’ understandings of risk, and algorithms can boost error detection and drive more accurate predictions.

- Develop risk talent for the future. Risk managers who are equipped to meet the challenges of the future will need new capabilities and expanded domain knowledge in model risk management , data, analytics, and technology. This will help support a true understanding of the changing risk landscape , which risk leaders can use to effectively counsel their organizations.

- Fortify risk culture. Risk culture includes the mindsets and behavioral norms that determine an organization’s relationship with risk. A good risk culture allows an organization to respond quickly when threats emerge.

How do scenarios help business leaders understand uncertainty?

Done properly, scenario planning prompts business leaders to convert abstract hypotheses about uncertainties into narratives about realistic visions of the future. Good scenario planning can help decision makers experience new realities in ways that are intellectual and sensory, as well as rational and emotional. Scenarios have four main features that can help organizations navigate uncertain times.

- Scenarios expand your thinking. By developing a range of possible outcomes, each backed with a sequence of events that could lead to them, it’s possible to broaden our thinking. This helps us become ready for the range of possibilities the future might hold—and accept the possibility that change might come more quickly than we expect.

- Scenarios uncover inevitable or likely futures. A broad scenario-building effort can also point to powerful drivers of change, which can help to predict potential outcomes. In other words, by illuminating critical events from the past, scenario building can point to outcomes that are very likely to happen in the future.

- Scenarios protect against groupthink. In some large corporations, employees can feel unsafe offering contrarian points of view for fear that they’ll be penalized by management. Scenarios can help companies break out of this trap by providing a “safe haven” for opinions that differ from those of senior leadership and that may run counter to established strategy.

- Scenarios allow people to challenge conventional wisdom. In large corporations in particular, there’s frequently a strong bias toward the status quo. Scenarios are a nonthreatening way to lay out alternative futures in which assumptions underpinning today’s strategy can be challenged.

Learn more about McKinsey’s Strategy & Corporate Finance Practice.

What’s the latest thinking on risk for financial institutions?

In late 2021, McKinsey conducted survey-based research with more than 30 chief risk officers (CROs), asking about the current banking environment, risk management practices, and priorities for the future.

According to CROs, banks in the current environment are especially exposed to accelerating market dynamics, climate change, and cybercrime . Sixty-seven percent of CROs surveyed cited the pandemic as having significant impact on employees and in the area of nonfinancial risk. Most believed that these effects would diminish in three years’ time.

Introducing McKinsey Explainers : Direct answers to complex questions

Climate change, on the other hand, is expected to become a larger issue over time. Nearly all respondents cited climate regulation as one of the five most important forces in the financial industry in the coming three years. And 75 percent were concerned about climate-related transition risk: financial and other risks arising from the transformation away from carbon-based energy systems.

And finally, cybercrime was assessed as one of the top risks by most executives, both now and in the future.

Learn more about the risk priorities of banking CROs here .

What is cyber risk?

Cyber risk is a form of business risk. More specifically, it’s the potential for business losses of all kinds in the digital domain—financial, reputational, operational, productivity related, and regulatory related. While cyber risk originates from threats in the digital realm, it can also cause losses in the physical world, such as damage to operational equipment.

Cyber risk is not the same as a cyberthreat. Cyberthreats are the particular dangers that create the potential for cyber risk. These include privilege escalation (the exploitation of a flaw in a system for the purpose of gaining unauthorized access to resources), vulnerability exploitation (an attack that uses detected vulnerabilities to exploit the host system), or phishing. The risk impact of cyberthreats includes loss of confidentiality, integrity, and availability of digital assets, as well as fraud, financial crime, data loss, or loss of system availability.

In the past, organizations have relied on maturity-based cybersecurity approaches to manage cyber risk. These approaches focus on achieving a particular level of cybersecurity maturity by building capabilities, like establishing a security operations center or implementing multifactor authentication across the organization. A maturity-based approach can still be helpful in some situations, such as for brand-new organizations. But for most institutions, a maturity-based approach can turn into an unmanageably large project, demanding that all aspects of an organization be monitored and analyzed. The reality is that, since some applications are more vulnerable than others, organizations would do better to measure and manage only their most critical vulnerabilities.

What is a risk-based cybersecurity approach?

A risk-based approach is a distinct evolution from a maturity-based approach. For one thing, a risk-based approach identifies risk reduction as the primary goal. This means an organization prioritizes investment based on a cybersecurity program’s effectiveness in reducing risk. Also, a risk-based approach breaks down risk-reduction targets into precise implementation programs with clear alignment all the way up and down an organization. Rather than building controls everywhere, a company can focus on building controls for the worst vulnerabilities.

Here are eight actions that comprise a best practice for developing a risk-based cybersecurity approach:

- fully embed cybersecurity in the enterprise-risk-management framework

- define the sources of enterprise value across teams, processes, and technologies

- understand the organization’s enterprise-wide vulnerabilities—among people, processes, and technology—internally and for third parties

- understand the relevant “threat actors,” their capabilities, and their intent

- link the controls in “run” activities and “change” programs to the vulnerabilities that they address and determine what new efforts are needed

- map the enterprise risks from the enterprise-risk-management framework, accounting for the threat actors and their capabilities, the enterprise vulnerabilities they seek to exploit, and the security controls of the organization’s cybersecurity run activities and change program

- plot risks against the enterprise-risk appetite; report on how cyber efforts have reduced enterprise risk

- monitor risks and cyber efforts against risk appetite, key cyber risk indicators, and key performance indicators

How can leaders make the right investments in risk management?

Ignoring high-consequence, low-likelihood risks can be catastrophic to an organization—but preparing for everything is too costly. In the case of the COVID-19 crisis, the danger of a global pandemic on this scale was foreseeable, if unexpected. Nevertheless, the vast majority of companies were unprepared: among billion-dollar companies in the United States, more than 50 filed for bankruptcy in 2020.

McKinsey has described the decisions to act on these high-consequence, low-likelihood risks as “ big bets .” The number of these risks is far too large for decision makers to make big bets on all of them. To narrow the list down, the first thing a company can do is to determine which risks could hurt the business versus the risks that could destroy the company. Decision makers should prioritize the potential threats that would cause an existential crisis for their organization.

To identify these risks, McKinsey recommends using a two-by-two risk grid, situating the potential impact of an event on the whole company against the level of certainty about the impact. This way, risks can be measured against each other, rather than on an absolute scale.

Organizations sometimes survive existential crises. But it can’t be ignored that crises—and missed opportunities—can cause organizations to fail. By measuring the impact of high-impact, low-likelihood risks on core business, leaders can identify and mitigate risks that could imperil the company. What’s more, investing in protecting their value propositions can improve an organization’s overall resilience.

Articles referenced:

- “ Seizing the momentum to build resilience for a future of sustainable inclusive growth ,” February 23, 2023, Børge Brende and Bob Sternfels

- “ Data and analytics innovations to address emerging challenges in credit portfolio management ,” December 23, 2022, Abhishek Anand , Arvind Govindarajan , Luis Nario and Kirtiman Pathak

- “ Risk and resilience priorities, as told by chief risk officers ,” December 8, 2022, Marc Chiapolino , Filippo Mazzetto, Thomas Poppensieker , Cécile Prinsen, and Dan Williams

- “ What matters most? Six priorities for CEOs in turbulent times ,” November 17, 2022, Homayoun Hatami and Liz Hilton Segel

- “ Model risk management 2.0 evolves to address continued uncertainty of risk-related events ,” March 9, 2022, Pankaj Kumar, Marie-Paule Laurent, Christophe Rougeaux, and Maribel Tejada

- “ The disaster you could have stopped: Preparing for extraordinary risks ,” December 15, 2020, Fritz Nauck , Ophelia Usher, and Leigh Weiss

- “ Meeting the future: Dynamic risk management for uncertain times ,” November 17, 2020, Ritesh Jain, Fritz Nauck , Thomas Poppensieker , and Olivia White

- “ Risk, resilience, and rebalancing in global value chains ,” August 6, 2020, Susan Lund, James Manyika , Jonathan Woetzel , Edward Barriball , Mekala Krishnan , Knut Alicke , Michael Birshan , Katy George , Sven Smit , Daniel Swan , and Kyle Hutzler

- “ The risk-based approach to cybersecurity ,” October 8, 2019, Jim Boehm , Nick Curcio, Peter Merrath, Lucy Shenton, and Tobias Stähle

- “ Value and resilience through better risk management ,” October 1, 2018, Daniela Gius, Jean-Christophe Mieszala , Ernestos Panayiotou, and Thomas Poppensieker

Want to know more about business risk?

Related articles.

What matters most? Six priorities for CEOs in turbulent times

Creating a technology risk and cyber risk appetite framework

Risk and resilience priorities, as told by chief risk officers

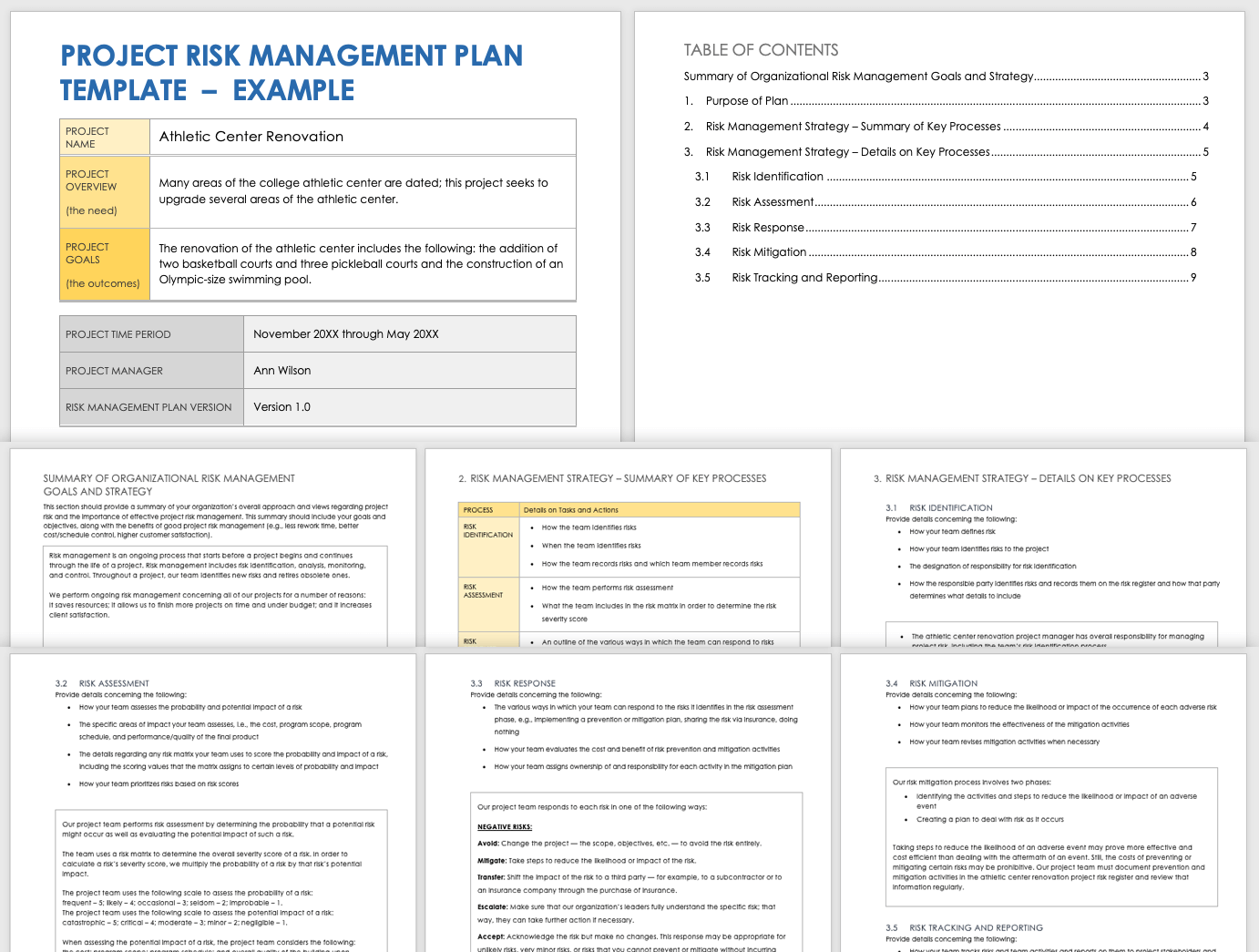

How to Create a Project Risk Management Plan

By Kate Eby | February 27, 2023

- Share on Facebook

- Share on LinkedIn

Link copied

Teams can use a project risk management plan to identify and assess the potential risks to a project. We’ve gathered expert tips on creating an effective risk management plan, as well as step-by-step instructions for creating an example plan.

On this page, you’ll find information on what to include in a project risk management plan and how to create a plan , as well as step-by-step instructions for completing an example project risk management plan .

What Is a Project Risk Management Plan?

Project teams create a project risk management plan , a document that helps identify and assess potential risks to a project. The plan outlines how your team will analyze and mitigate the potential risks to ensure project success.

The project risk management plan is one of the most important documents in project risk management . You can learn more about project risks in general — as well as specific types of project risks — in our comprehensive guides

What Does a Risk Management Plan Cover?

A risk management plan should cover a number of areas detailing potential project risks and how your team will deal with them. It will include a description of the project, along with how your team will identify and assess risk.

At a minimum, your project risk management plan should include the following details:

- Project description, including its purpose

- The team plan for identifying, logging, and assessing potential risks

- How the team will identify broad categories of risk

- How the team will evaluate the severity of each potential risk

- How your team will continue to monitor risks throughout the project

- How team members will be assigned as owners of various risks

- Your organization’s tolerance for certain risks, along with criteria for a risk being too large to accept

“A risk management plan defines how the risks for a project will be handled to ensure that the project can be completed within the set timeframe,” says Veniamin Simonov, Director of Product Management at NAKIVO , a backup and ransomware recovery software vendor. “The plan should cover methodology, risk categorization and prioritization, a response plan, staff roles, and responsibility areas and budgets.”

“The risk management plan will address ‘What are we going to do? How are we going to do it? What are the processes we're going to follow?’” says Alan Zucker, Founding Principal of Project Management Essentials . “It may include things such as what are the major categories you're going to use to define your risks. It might also include some guidelines for assessing risks.”

Components in a Project Risk Management Plan