How to Plan out an Effective Working Capital Management Strategy

Updated on: 5 January 2023

Working capital refers to the capital or cash reserves of a business that is utilized to conduct its day-to-day operations. This is calculated by deducting the current liabilities against current assets. An effective working capital management strategy will help an organisation maximise profitability and liquidity. Inventories, trade receivables and cash (in hand and at the bank) are the main components of current assets. Trade payables, bank overdrafts and short-term loans are categorized under current liabilities.

Working Capital Management

An analysis done by the globally renowned auditing firm PwC on the impact of the COVID-19 outbreak states that in times of crisis, businesses should focus on liquidity rather than profitability in the short run. Therefore, an effective working capital management strategy is vital for a company’s survival.

Thriving Vs. Surviving

Whether an organization is thriving or surviving depends on profitability and liquidity. For instance, highly profitable and liquid companies thrive, while businesses that see a dip in profits but manage to maintain a healthy level of liquidity within their operations, survive. The key here is effective management of the working capital.

In certain instances, profitable organizations often experience setbacks as a result of inadequate funding to meet short-term obligations. Especially, in the current context where the global economy has been affected due to the COVID-19 pandemic, exercising a certain degree of discipline when it comes to strategic investments is prudent.

What is a Working Capital Management Strategy?

Broadly, there are three working capital management strategies – conservative, hedging and aggressive. The effectiveness of these three approaches depends on risk and profitability.

Conservative

The conservative strategy relies on long-term financial instruments to source funds for fixed assets, permanent working capital and part of the temporary working capital. Since long-term finances are impervious to the risk of interest rate fluctuations, these prove to be low risk. As there is “no pain, no gain,” such finances also have low profitability.

Hedging or maturity matching utilizes long term funding sources to finance long-term assets and a portion of the permanent working capital. Here, the temporary working capital will be funded by short term finances such as trade credit, short term loan. Financing of fixed assets such as machinery and infrastructure will be fulfilled through long term funding. This strategy poses moderate risk and profitability.

Where the aggressive strategy is concerned, long-term funds are used to finance fixed assets and part of the permanent working capital. The remaining portion of the permanent working capital and the temporary working capital will be financed through short term funding sources. This poses a high risk, but increased profitability since the finance cost of short-term funds are comparatively low, and at the same time those could be affected by market trends and interest rate fluctuations.

How to Plan an Effective Working Capital Management Strategy

Factors such as interest rates, market demand for business output, economic status, currency rate, and seasons (or market trends) greatly impact working capital management. Inter-connections between these aspects make managing working capital an intricate affair that requires a great deal of attention. For instance, the pandemic has pushed the global economy into a recession, resulting from border closures, the collapse of trade and travel bans.

Consequently, market demand, interest and currency rates too, have taken a hit as trading has come to a cease. As a result, companies are now navigating through uncharted territories to recover from this situation.

Let’s take a look at the steps that need to be followed to create a result-oriented working capital management strategy.

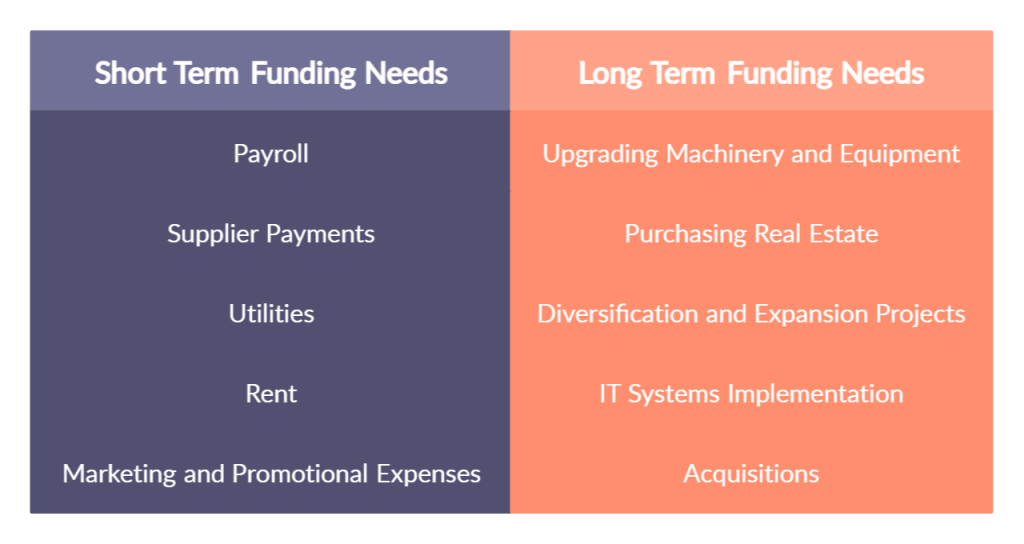

Analyze Current and Future Funding Requirements

The first step in building a successful working capital management plan is to analyze your future long and short term funding requirements. While rent, utilities, payroll, and supplier payments are classified under short term funding needs; upgrading of machinery and equipment, purchasing real estate for the company and other expansion activities require long term capital. Therefore, an analysis of your current and future funding needs is essential when preparing the organization’s working capital strategy.

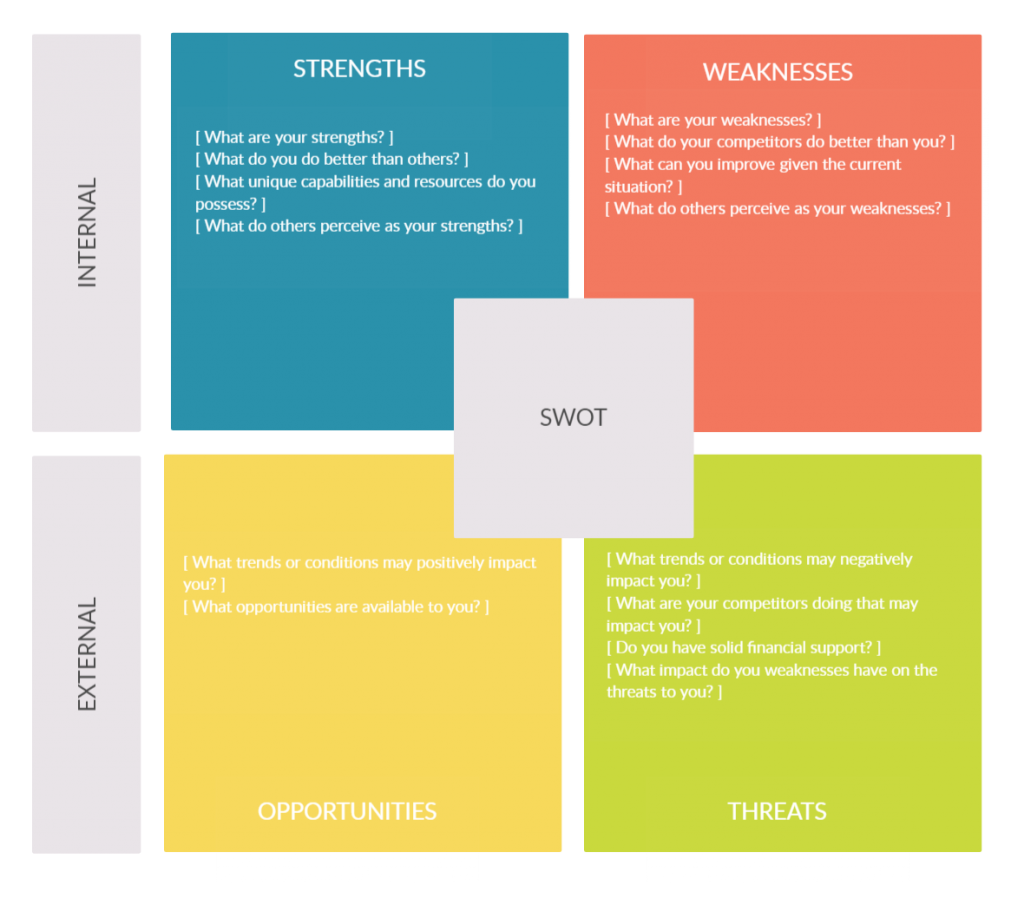

Imagine Scenarios and How Your Company Might Navigate Through Those

We are living in a Volatile, Uncertain, Complex and Ambiguous (VUCA) environment. Therefore, it is important to pay close attention to market trends and the status of the industry and economy. Perform a SWOT analysis to understand potential growth opportunities and threats. For instance, if the company had to halt operations due to a possible lockdown (due to pandemic or any other factor), are there sufficient funds available to meet payroll requirements and supplier payments? Or what available funding sources could power an expansion opportunity?

Once you have identified the opportunities and threats, you can conduct scenario and shock analysis to determine how well the organization would face such a circumstance.

Evaluate Your Working Capital Funding Sources

Review your current cash accounts, trade receivables and inventories to ensure that the funds at hand are adequate to meet the organization’s working capital requirements. Diversify where necessary; you may either opt for a short term loan to bridge capital shortfalls or short term investments to gain an additional income. It is also advisable to hold the company’s cash and investments in at least two different institutions to ensure access to credit in tough economic conditions.

Review Account Payables and Receivables

Go digital. Introduce online or electronic payment methods for your products or services to eliminate any delays in trade receivables. Enhancing customer convenience in terms of payment will also result in improving the demand and overall consumer satisfaction. Consider the 5Cs method before approving credit to a customer so that the chances of them being turned into bad debtors will be considerably less.

As for account payables, implement a process or schedule for cash and cheque payments to suppliers which will be subject to an approval process. This will eliminate ad hoc payments while streamlining the payment procedure.

Make Wise Strategic Management Decisions

What works best for a company obviously depends on the strategic decisions made by the organization with regards to its operations and assets. However, managing its working capital is an art that every business entity should master to survive in any industry.

Join over thousands of organizations that use Creately to brainstorm, plan, analyze, and execute their projects successfully.

More Related Articles

Leave a comment Cancel reply

Please enter an answer in digits: eleven + 7 =

Download our all-new eBook for tips on 50 powerful Business Diagrams for Strategic Planning.

- Small Business

- Credit Cards

- Personal Finance

- Business Loans

- Business Bank Accounts

- Free Business Bank Accounts

- Business Insurance

- Business Energy

- Business Water

- Accounting software

- How Do Business Loans Work?

- How To Get A Business Loan

- Do I Need A Business Bank Account?

- How To Open A Business Bank Account

- Do I Need Business Insurance?

- Types Of Business Insurance

- How To Switch Business Energy Supplier

- How To Start A Business

- What is an SME?

- How To Go Self-Employed

- How To Grow Your Business

Whether you’re an established business or start-up, see the latest offers from leading business bank account providers

- Personal Loans

- Secured Loans

- Bad Credit Loans

- Guarantor Loans

- Car Finance

- Unsecured Vs Secured Loans

- How to Get a Loan

- Why Can’t I Get A Loan?

- What Are Joint Loans?

- What Is A Bank Loan?

- Am I Eligible For A Personal Loan?

- What You Need To Know About APR

- Paying Off A Loan Early

- Loans For People On Benefits

Compare loans and check your eligibility from a range of leading loan providers

- Best Mortgage Lenders

- Mortgage Rates

- Commercial Mortgages

- Mortgage Calculator

- Stamp Duty Calculator

- Mortgage Eligibility

- What Is Stamp Duty?

- Fixed Vs Variable Rate Mortgages

- What Is A Buy-To-Let Mortgage?

- What Is A Joint Mortgage?

- How Remortgaging Works

- How To Pay Off Your Mortgage Early

- How Long Does A Mortgage Offer Last?

- What Is A Shared Ownership Mortgage?

- What Is A Guarantor Mortgage?

- UK House Prices

- How To Open A Bank Account

- Student Bank Accounts

- How Overdrafts Work

- Can I Open A Bank Account For My Child?

- Regular Savings Accounts

- What Is A Personal Pension?

- ISA Or Savings Account?

- How To Choose A Credit Card

- Do I Need A Credit Card?

- Credit Card Charges And Fees

- Debit Vs Credit Cards

- Breakdown Cover

- Car Insurance

- Home Insurance

- Travel Insurance

- Life Insurance

- Do I Need Breakdown Cover?

- Do I Need Life Insurance?

- Types Of Life Insurance

- What Is Home Emergency Cover?

- How To Maintain Your Vehicle

- Benefits Of Life Insurance

- Can You Have Multiple Life Insurance Policies?

- What Does Car Warranty Cover?

- Business Finance

What is Working Capital? Calculate and Manage it

The basic definition of working capital, also known as net working capital, is that it is a business’s current assets minus its current liabilities. It is a metric used to measure short-term liquidity and financial health, as it offers business owners an insight into how well equipped their company is to face upcoming obligations.

Below, we’ll explore the formula to calculate working capital, explain why it’s important for your business and detail some key ways in which you can manage your business’s working capital.

How to calculate your working capital

Working capital formula.

The formula for calculating working capital is simple and easy to understand:

Working capital = current assets – current liabilities

Of course, it is essential to understand what needs to be included in this formula in order to use it properly. So let’s dig into the terminology.

Understanding assets and liabilities

The term current assets refers to items that will be sold or otherwise converted into cash within the next year. As such, it can include the likes of:

- cash and cash equivalents

- accounts receivable

- notes receivable

- marketable securities

- prepaid expenses

- other liquid assets

Meanwhile, the term current liabilities is a mirror image. It refers to financial obligations that are to be fulfilled within the next year. So, current liabilities can be:

- accounts payable

- short-term debt

- un-earned revenue (pre-sold or pre-ordered goods or services)

- income tax and VAT

- accrued expenses

Working capital example

Below is an example of how a business can calculate its working capital.

Business X has cash and cash equivalents of £20,000, inventory worth £5,000 and accounts receivable of £2,500. The company has total current assets of £27,500.

For the next year, Business X’s financial obligations are comprised of wages worth £12,000, taxes worth £4,000 and short-term debts of £1,500. This means Business X has current liabilities of £17,500.

The company’s total current assets (£27,500) minus its current liabilities (£17,500) come to £10,000. As such, Business X has working capital of £10,000.

Why is working capital important?

Now we understand how to use the formula for working capital, it’s important to establish why working capital is important. Simply put, working capital is what keeps a business afloat, as it allows for the purchase of goods and services, paying staff and paying off debts.

Understanding working capital and the calculations surrounding it are just as essential.

That’s because they offer you insight into whether your business is equipped to meet its short-term obligations, and whether the company has sufficient excess capital to invest in expansion.

Crucially, third parties are often interested in the state of a business’s working capital too. Strong working capital makes a business look like a much more engaging proposition to lenders, investors and suppliers who you might be trying to attract. Being in good financial health sends positive signals.

But there are also ways to use working capital to examine the state of your business’s finances in even more detail.

What is a working capital ratio?

Your company’s working capital ratio, also known as the current ratio, is another important calculation to be aware of. The ratio allows a business to work out how many times over they could pay off their current liabilities with their current resources.

To calculate the ratio, you simply divide current assets by current liabilities rather than subtracting one from the other.

Working capital ratio = current assets / current liabilities

As such, the earlier example of Business X would have a working capital ratio of £27,500 divided by £17,500, which equals 1.57.

A working capital ratio of less than one is generally considered to be an indicator of financial insecurity, as it suggests a business will have trouble paying for upcoming expenses. Meanwhile, a ratio of more than two could mean a business is holding on to too much money when it could invest in growth or improvement.

Business X’s ratio of 1.57 is in the sweet spot, which is broadly agreed to be between 1.2 and 2.

» MORE: How to grow your business

How to manage working capital

Calculating your business’s working capital and working capital ratio is important, but it is also key to understand how to manage your capital.

It doesn’t matter how successful your business is if you don’t have enough cash to satisfy short-term obligations.

A proactive approach can ensure that your business is making the most efficient use of both its assets and its liabilities. This will allow a business to maintain a healthy working capital ratio over an extended period, creating long-term financial health and allowing a business to avoid running into trouble.

One crucial aspect of managing working capital is making the distinction between certain assets. While calculating working capital involves lumping all current assets together, it is worth considering how different assets’ liquidity varies.

For example, a business’s inventory (the goods and products you sell and the raw materials you have in stock) is a current asset, but what if consumer demand is not as strong as expected? The asset’s value is reliant on it selling for unit price, but it could sell at a lower value or fail to sell at all.

In short, inventory can be a risky asset to be overly reliant on as its conversion into cash is outside a business’s control. The good news is that a business can balance this risk with assets and liabilities it can control to better manage working capital.

For example, a business can decide when and how it pays for goods and services, as well as what proportion of cash to keep on hand. Make sure you use your assets AND liabilities wisely, so your business isn’t caught short.

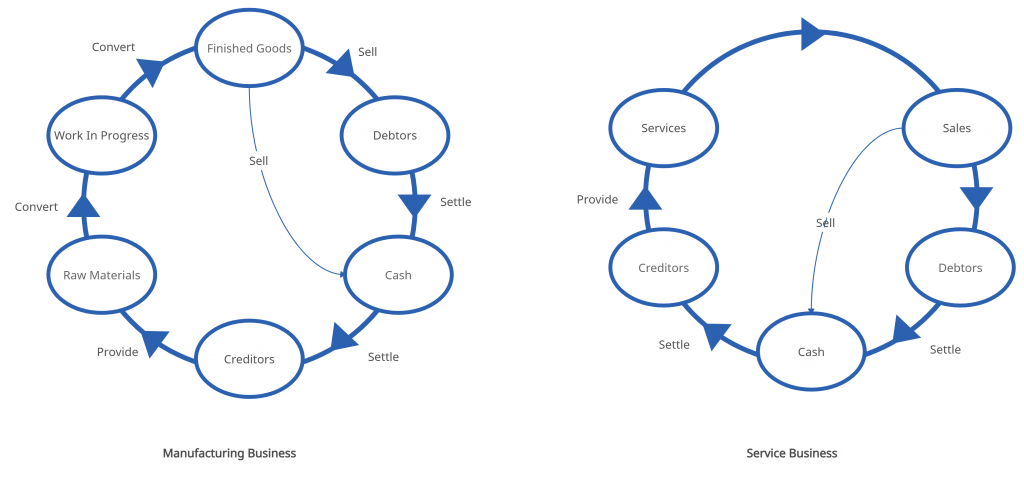

Another useful way to gain insight into your business’s working capital is the working capital cycle.

The working capital cycle

To have a complete grasp of your working capital management, determining your working capital cycle can be useful. This is essentially a measure of how long it takes for your working capital to be translated into cash.

The formula for calculating your working capital cycle is:

Working capital cycle = Inventory days + Receivables days – Payables days

- Payables days: How long your business has to pay for the raw materials from which it makes its products.

- Inventory days: The average length of time it takes for raw materials to be transformed into your finished product and sold.

- Receivables days: The number of days it normally takes for your customers to pay.

A shorter cycle is generally viewed as most desirable, as it limits the amount of time in which working capital is inaccessible as cash.

Businesses can shorten the length of this cycle by taking measures, such as operating on a cash-only basis, chasing payments more aggressively or optimising manufacturing timelines.

If you need further help managing your working capital, it might be a good idea to contact a qualified accountant.

Image source: Getty Images

About the Author

Duncan Ferris is a business writer with expertise in pensions, investing and personal finance. Though he began his career as a pensions industry professional, he transitioned to journalism in 2017.…

Dive even deeper

4 Tips to Help Your Small Business Chase Unpaid Direct Debits

With the latest research suggesting that failure rates for direct debits are around their highest recorded levels, we explore why this payment system is becoming more popular and viable for small businesses, as well as what can be done to combat failed payments.

What is a VAT Loan?

The quarterly obligation of paying VAT returns to HMRC can be challenging for VAT-registered businesses for several reasons. VAT loans are a source of financing companies can use to avoid incurring late payment penalties by missing deadlines.

Top 6 Crowdfunding Sites UK

Raising money through crowdfunding could help you to start a business, launch a new project or expand the business to the next level. But determining the best crowdfunding platform for your business is a step that can turn crowdfunding failure into success.

How to Plan Your Business’s Working Capital Requirements

Managing working capital is the biggest challenge faced by businesses while running their operations. Many business owners feel that acquiring clients or increasing revenue can only help their business flourish. While it is partly true, what is equally important for a business to grow is how well it manages and strikes a balance between cash inflows and outflows.

The level of existing working capital available to a business is measured by comparing its current assets against current liabilities. It tells the business the short-term liquid assets remaining after paying short-term liabilities.

Working capital requirements might differ from business to business, but it is an important metric to assess the long-term financial health of a business. Effective working capital management also ensures that a business always maintains sufficient cash to meet its short-term commitments.

When working capital requirements are not managed efficiently, the business can suffer from cash flow problems, in turn, affecting its ability to expand, improve processes or even operate its operations. Therefore, a business owner needs to know how to plan his or her business’s working capital requirements effectively.

In this article, we will show you 6 steps that a business should follow to build a solid working capital plan. Meanwhile, if you’re interested in acquiring working capital for your businesses, click below:

Assess future fund requirements

An effective working capital plan should begin by evaluating the short-term funding needs of a business. These short-term funding needs include meeting payroll expenses, paying vendors, paying rent and taxes to the government.

The due date of cash outflows may not correspond to cash inflows, so a business owner must assess future fund requirements in order to meet various financial obligations.

An organisation might have long-term fund requirements too like acquiring new land or building or upgrading manufacturing machines. A business should aim to secure requisite long-term funding before executing a large capital investment plan.

Compute the working capital you will need

Every business should determine whether its current working capital is adequate under various growth scenarios.

To establish a reasonable expectation of growth opportunities available, the business has to consider the economy, its industry and competitions. For instance, how will the balance sheet get affected if current liabilities grew by 10%? Will the business still be able to pay salaries or rent on time?

Also, the business can perform a shock analysis by running the growth numbers above or below the expected rates. This will help the stakeholders to make a sound contingency plan for their business.

Suggested Read: 6 Tips to Rebuild Your Small Business after COVID-19

Evaluate your access to working capital and the alternatives

Businesses should review their current access to various funding sources, such as a line of credit , WC loan, account receivables, inventory, investment accounts and cash-in-hand. A business needs to ensure that these sources are sufficient to meet its strategic goals.

Many medium and large business enterprises consider holding cash and investments with at least two separate institutions. This diversification helps businesses protect themselves from losing access to credit during uncertain times.

Review your accounts receivables and payable processes

A business can employ several strategies and processes to maximise its working capital.

On the receivables side, a business can offer direct debit to customers, so the payments arrive on the scheduled date. This approach is used by the companies providing services that call for periodic scheduled payments like a utility service provider. Also, accepting credit card payments can help businesses improve their cash inflow.

While on the payable side, businesses can use controlled disbursement accounts to know every morning which issued cheques will hit its bank account that day. This will help the business maintain sufficient cash balance and maximise its working capital at the same time.

Don’t eat up cash, use borrowings or credit facilities

It is advisable for businesses to not use up the cash as they grow since a positive cash flow position improves the business’s access to capital and reduces its cost of capital as well. So, when the economy improves, and investments generate positive returns, the business will likely have access to credit at lower interest rates.

Test and update the plan regularly

Ideally, a business should update its working capital plan annually, supplemented with a quarterly or monthly financial position review to see if adjustments are needed.

For instance, if a business has downsized or has been merged with or taken over by another entity, its working capital requirements change drastically. This happens due to the changes in the level of current assets and current liabilities.

Therefore, a business should regularly access the state of the economy to test their access to credit facilities and improvise its plan accordingly.

Given the pandemic situation, many small and medium businesses are facing a lack of cash flow and are unable to manage their working capital requirements effectively. They are willing to take a working capital loan or open up a line of credit with banks or other sources. But, challenges in raising funds from formal sources have increased in this new-normal situation.

To disrupt the lending segment in India and provide capital to small businesses, Razorpay has built a product called Working Capital Loans .

Now businesses can get collateral-free working capital loans within 24 hours. The loans can be rapid in daily, weekly or monthly instalments as per the borrower’s convenience.

Just click on the ‘Loans’ tab to apply through our Razorpay dashboard, upload a few documents and receive a loan offer within 3 working days followed by a quick disbursal within a day. It’s that simple!

To summarise, while it is tough to predict the future, businesses must prepare their working capital plans and ensure access to capital when the economy bounces back to growth.

Also read: Razorpay Disrupts Working Capital Loan Processes for MSMEs

Liked this article? Subscribe to our weekly newsletter for more.

Writer-by-chance and overthinker-by-choice, raging a war against the Pineapple-on-pizza brigade

Related Posts

What is Enterprise Resource Planning (ERP)?

What is Strategic Cost Management?

Monthly Average Balance (MAB)

Recruitment Process

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

Type above and press Enter to search. Press Esc to cancel.

What is Working Capital?

What is working capital – and why is it important.

You may not talk about working capital every day, but this accounting term may hold the key to your company’s success. Working capital affects many aspects of your business, from paying your employees and vendors to keeping the lights on and planning for sustainable long-term growth. In short, working capital is the money available to meet your current, short-term obligations.

To make sure your working capital works for you, you’ll need to calculate your current levels, project your future needs and consider ways to make sure you always have enough cash.

How to calculate working capital

- You can get a sense of where you stand right now by determining your working capital ratio , a measurement of your company’s short-term financial health.

- Working capital formula: Current assets / Current liabilities = Working capital ratio

- If you have current assets of $1 million and current liabilities of $500,000, your working capital ratio is 2:1. That would generally be considered a healthy ratio, but in some industries or kinds of businesses, a ratio as low as 1.2:1 may be adequate.

Your net working capital tells you how much money you have readily available to meet current expenses.

- Net working capital formula: Current assets – Current liabilities = Net working capital

For these calculations, consider only short-term assets such as the cash in your business account and the accounts receivable — the money your customers owe you — and the inventory you expect to convert to cash within 12 months.

Short-term liabilities include accounts payable — money you owe vendors and other creditors — as well as other debts and accrued expenses for salary, taxes and other outlays.

Understanding your needs

Getting a true understanding of your working capital needs may involve plotting month-by-month inflows and outflows for your business. A landscaping company, for example, might find that its revenues spike in the spring, then cash flow is relatively steady through October before dropping almost to zero in late fall and winter. Yet on the other side of the ledger, the business may have many expenses that continue throughout the year.

Parts of these calculations could require making educated guesses about the future. While you can be guided by historical results, you’ll also need to factor in new contracts you expect to sign or the possible loss of important customers. It can be particularly challenging to make accurate projections if your company is growing rapidly.

These projections can help you identify months when you have more money going out than coming in, and when that cash flow gap is widest.

4 reasons why your business might require additional working capital

- Seasonal differences in cash flow are typical of many businesses, which may need extra capital to gear up for a busy season or to keep the business operating when there’s less money coming in.

- Almost all businesses will have times when additional working capital is needed to fund obligations to suppliers, employees and the government while waiting for payments from customers.

- Extra working capital can help improve your business in other ways, for example: enabling you to take advantage of supplier discounts by purchasing in bulk.

- Working capital can also be used to pay temporary employees or to cover other project-related expenses.

Finding options to boost your working capital

An unsecured, revolving line of credit can be an effective tool for augmenting your working capital. Lines of credit are designed to finance temporary working capital needs, terms are more favorable than those for business credit cards and your business can draw only what it needs when it’s needed.

While a business credit card can be a convenient way for you and top employees to cover incidental expenses for travel, entertainment and other needs, it’s usually not the best solution for working capital purposes. Limitations include higher interest rates , higher fees for cash advances and the ease of running up excessive debt.

Qualifying for a working capital line of credit

When you apply for a line of credit, lenders will consider the overall health of your balance sheet, including your working capital ratio, net working capital, annual revenue and other factors. See what banks look for from businesses seeking financing .

Because small business owners’ business and personal finances tend to be closely intertwined, lenders will also examine your personal financial statements, credit score and tax returns. You’ll be asked for a personal guarantee of repayment.

Although many factors may affect the size of your working capital line of credit, a rule of thumb is that it shouldn’t exceed 10% of your company’s revenues.

2 working capital missteps to avoid

- Don’t confuse short-term working capital needs and longer-term, permanent requirements

- While it can be tempting to use a working capital line of credit to purchase machinery or real estate or to hire permanent employees, these expenditures call for different kinds of financing . If you tie up your working capital line of credit on these expenses, it won’t be available for its intended purpose.

Your small business banker can help you better understand your working capital needs and what steps you may need to prepare for any situation. While you can’t predict everything about running a company, a clear view of working capital can help you operate smoothly today — and set you up for long-term growth tomorrow.

You may also like

Tips for managing your cash flow

Establishing and maintaining good business credit

3 Reasons why liquidity is important for your business

« Back to small business lending resources

Get the funding your business needs

Our recommendation tool can help you find the right financing. Simply answer a few quick questions and we’ll recommend the best product for your business.

Connect with us

COVID-19 Resource Center

- Business Tips , On Demand Webinar

What is Working Capital? The Ultimate Guide for Small Businesses

- December 10, 2021

As a small business owner, you might be wondering, “what is working capital?” Working capital is the lifeblood of your business. It’s what keeps your business running and enables it to take on new growth opportunities .

No matter what stage your business is in, working capital is a crucial piece of your business’s health. This is because change is the only constant in the business world. The emergence of new competitors, new trends, and new consumer tastes likely make success in your industry a moving target. Even the top brands need to be receptive to a constantly changing market.

In this in-depth guide, you’ll learn what working capital is, why it’s important, and how much you need to start or keep a business running.

What is working capital and why do I need it?

Working capital is the total amount of capital you’ve invested in running your business. This is the money your business has available to meet your short-term (and sometimes long-term) obligations, typically within the next 12 months.

Your business can have either positive or negative working capital. Having positive working capital means your business can cover its day-to-day expenses and still have funds set aside for the unexpected. On the opposite side, having negative working capital means your business may not be able to cover key expenses like inventory, payroll, suppliers, and more.

Here’s another way to think of working capital: it’s the money that’s leftover if you paid off all your current liabilities with your current assets . The basic working capital formula is:

Working Capital = Current Assets – Current Liabilities

It can also be calculated and expressed as a ratio:

Working Capital Ratio = Current Assets / Current Liabilities

To make your working capital calculation even more actionable, you can determine how much working capital you have down to the number of days. To do so, divide your working capital by your daily operating expenses.

How much working capital do I need?

While there’s no magic number for working capital, It’s ideal to have a working capital ratio between 1.5 and 2.0. Find a happy medium that works for your business. You should be able to run your business comfortably, even during an unexpected event—without having too much extra working capital.

Having too much working capital shows that your business has more money than it needs to operate. These idle funds could be used to generate more revenue for your business or other growth opportunities.

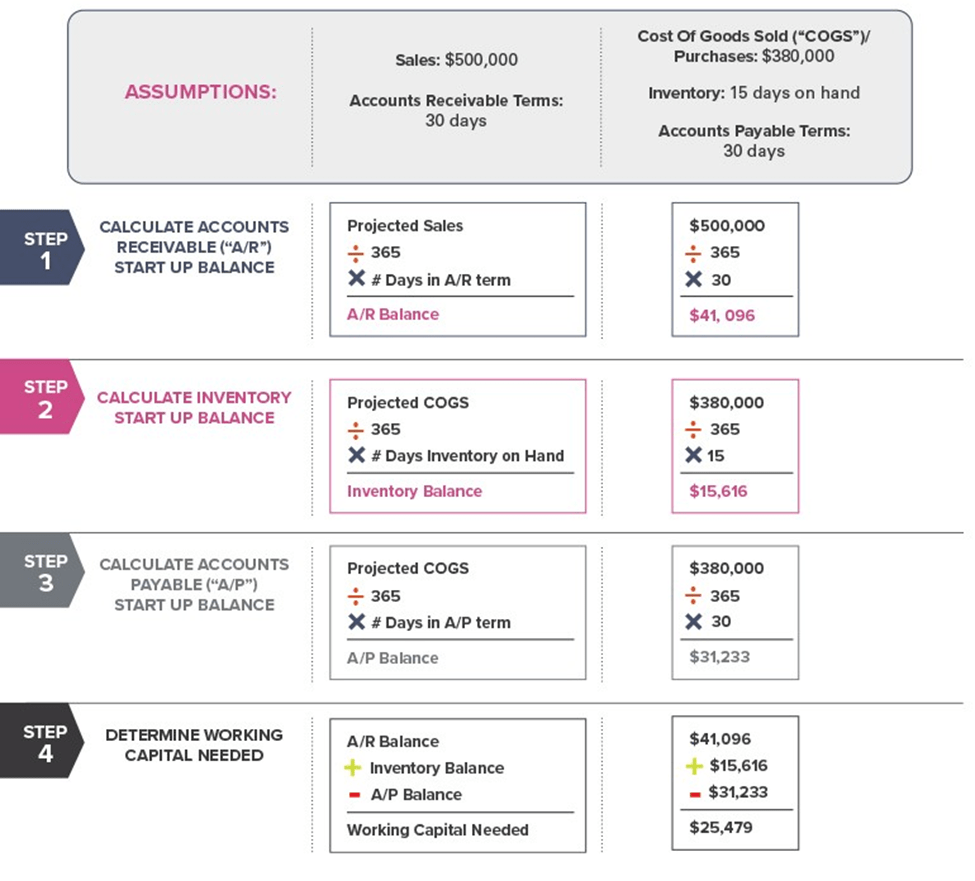

How much working capital do I need to start a business?

Is your business relatively new? Or are you looking to start a new business altogether? Let’s look at an example of how to calculate working capital for a new business .

From the above example, funds to cover your initial Accounts Receivable ($41,096) and inventory ($15,616) first come from Accounts Payable ($31,233). The remaining balance ($25,479) needs to be covered by working capital. To fund that amount, you can contribute your own equity, find outside sources for funding, or a combination of both.

Working capital varies by business and industry

As you probably know, working capital needs are based on how money flows through your business, which varies by industry. Some of the most common determining factors include:

Sales: Is your company profitable? If so, additional revenue will likely generate more working capital.

Length of operating cycle: How many days pass between paying suppliers and receiving cash from sales? The longer your operating cycle , the more working capital you’ll need to maintain your operations.

Inventory turnover: Faster inventory turnover means you can expect revenue to arrive reasonably quickly with each batch of inventory. This can reduce your working capital requirements, or even enable you to use your existing working capital in other areas.

Nature of your business: Some industries require more time turning raw materials into finished goods. Naturally, this will influence how you manage your debt, and how much working capital your business needs to support it.

Working capital: a potential revenue driver—and safety net

Since working capital directly affects your daily operations, it has strong implications for your business’s future. Suppose that you have low working capital, where the ratio between your assets and liabilities is less than one. If left unchecked, you can lose your ability to make longer-term investments in your business.

Are you looking to upgrade your equipment or planning to expand your operations? If you don’t have breathing room in your working capital, it’ll be very difficult to make or meet your long-term business goals. In certain situations, it may even put your business’s future at risk.

It pays to have a financial cushion for your business

Like having emergency savings for your personal finances, having sufficient working capital can be a lifeline for your business. Most of the time, your daily operations can be reasonably anticipated, but expenses can rapidly increase if an unexpected event takes place.

Imagine you run your own restaurant. During the pandemic, you’re required to immediately purchase personal protective equipment, thermometers, and make other changes to your business. Without working capital, this whirlwind of extra costs would require you to potentially take on high-cost debt to cover it.

Having ample working capital will enable you to pivot around emergency situations like this successfully. Otherwise, your only option is to sell assets or borrow to meet your inventory needs.

Common working capital mistakes

Remember, working capital needs vary by industry, business type, personal preferences, and more. However, it’s still important to avoid these common working capital pitfalls.

Too little working capital

Not having enough working capital can be a risky proposition. As we learned with the pandemic—or any unanticipated event—having enough capital to cover your day-to-day activities plus a little extra is a great foundation for your business’s future projects and goals.

Too much working capital

On the other hand, having too much working capital can also be problematic. If your working capital ratio is more than two, you have unused, excess capital. This is money that is just sitting idle and isn’t adding value to your profits, production, or generating investment returns.

Failure to think long-term

Without a reasonably solid foundation of working capital, your long-term planning ability is severely limited. A plan without working capital is just a business wish list.

Keys to consistent business growth

Now that you have an actionable understanding of the benefits of working capital, you can head into any business situation with confidence. Here are a few simple steps to keep in mind:

Take a second look at your business plan and financials

It’s a good idea to regularly take time to reassess your business plan and financials to ensure that they’re still aligned with your goals. Regular check-ins also make it easier to plan for the future.

Identify what works and what doesn’t

What is your working capital ratio? Are you comfortable with your rotation of debt payments, inventory costs, production costs, and other billables? Would adding more working capital put your mind at ease?

If you don’t believe your working capital calculations are sufficient, consider restructuring some of your debt payments, or taking on a working capital loan .

Think about your business’s future

Your goals can spearhead your best next steps. If you’re looking to expand your business, pay down your debt, or simply level-set after the pandemic, you can adjust your working capital accordingly. Working capital can have many uses, so it’s important to be very clear about how you’ll use your capital and how it will benefit your business.

Secure the working capital you need to reach your goals

As you think about your business’s future, remember that there are business loans available to meet your needs. Working capital loans are a great way to fuel your long-term growth. These loans can give you the capital needed to boost your revenue by launching a new product line or stepping up your marketing.

Many businesses have worked with Pursuit to meet their working capital needs. An affordable loan can be just what your business needs to reach the next level. Reach out to Purs uit today and see how we can help.

Key takeaways

- Working capital is the total amount of capital invested in your daily operations. It’s typically used for short-term obligations but can apply to long-term obligations as well.

- Working capital can be used to pursue new opportunities and protect your business from adverse events.

- Working capital varies depending on your business, industry, and a variety of other factors.

- A basic calculation of working capital is current assets divided by current liabilities.

- There’s no magic number for working capital, but a ratio between 1.5 and 2.0 can be a good starting point.

- A working capital loan has many uses and can be the lift your business needs.

Give your business a boost!

- First Name *

- Email Address *

- Email This field is for validation purposes and should be left unchanged.

By clicking "Subscribe" you agree to our terms and conditions .

Related articles

How to Build a Small Business Network

What are Business Credit Reports?

Je T’Aime Patisserie: A Parisian-Style Bakery Thrives with Help from Pursuit

How to Write a Small Business Plan

Find flexible, affordable business loan options

Headquarters

Business Loans

Service areas.

© 2024 Pursuit. All Rights Reserved.

Terms of Service | Privacy Policy | Machine Readable Files | Equal Opportunity Employment | Title VI, Section 504, the Age Discrimination Act, and Title IX

The 5-minute newsletter with fresh insights, guides and more!

- Comments This field is for validation purposes and should be left unchanged.

You are about to leave the Pursuit website

Pursuit provides links from this website to other websites for your information only. Pursuit does not recommend or endorse any product or service appearing on these third party sites, and disclaims all liability in connection with such products or services. We are not responsible for the privacy practices, security, confidentiality or the content of any website other than our own. Pursuit does not represent members or third parties should the two enter into an online transaction, and recommends that you appropriately investigate any products or services prior to purchase. Questions as appropriate to the content should be directed to the site owners.

Working Capital: Definitions, Formulas, Examples

Working capital is a vital concept in corporate finance and business management. It represents the liquid assets companies need to fund day-to-day operations and pay short-term obligations. Having adequate working capital ensures a company has sufficient cash flow to meet its current financial obligations and unforeseen expenses that may arise.

Article Contents

What is working capital, working capital formula, working capital ratios, financing strategies for working capital, working capital and liquidity ratios, case studies and examples for working capital, key takeaways.

Take our free course and Learn key competencies needed for investment banking careers

Working capital, also called net working capital, refers to a company’s current operating assets minus its current operating liabilities. Just calling it “Current assets less current liabilities” is too generic. For example, tax assets or liabilities are not operational and not included in working capital.

Think of it this way. If you set up a retail business, you would firstly have to invest in the Fixed Assets such as property, fixtures & fittings, even a website. This would require capital (borrowings or equity). But also, you would need to buy inventory – to keep on the shelves, and a stock in a warehouse / storeroom. Then, when the inventory is sold and starts to move, you need to invest to replace it. Yet if you have sold on credit to your customers, you still haven’t earned any cash. So inventory and receivables need funding! This is your working capital requirement. To the extent you have purchases on credit from your suppliers (accounts payable) this reduces the working capital requirement.

Monitoring and managing the working capital elements of a business help us evaluate its operational efficiency. Is inventory too high or rising out of line with revenue? Are receivables rising faster than revenue, indicating the business is not so efficient at collecting cash from its customers, or it is having to give extended credit terms to achieve sales growth?

Working assets need funding – being a use of cash. So, this is all a part of liquidity and efficiency analysis.

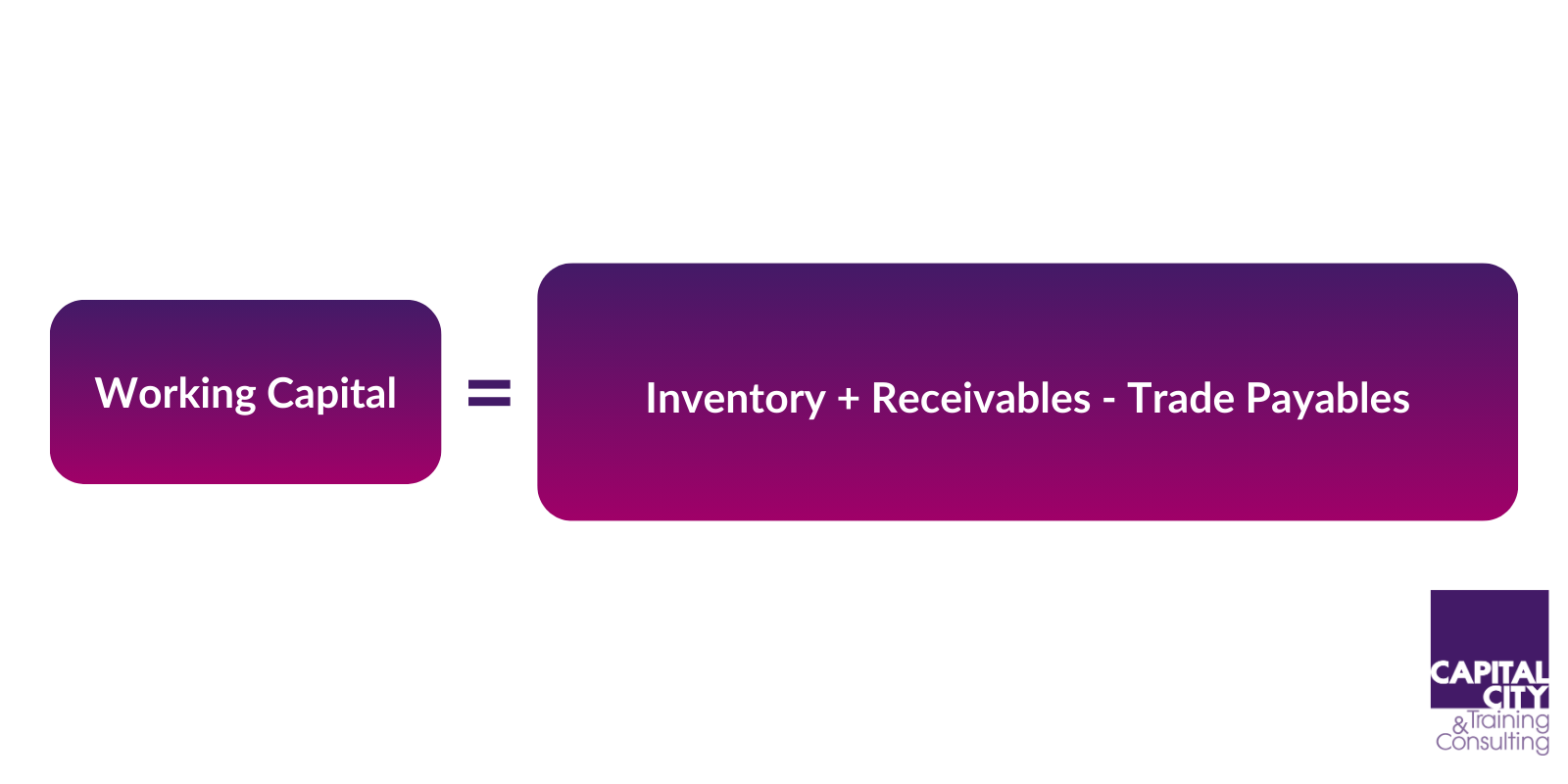

The formula for calculating Working Capital is:

Working capital = Inventory + Receivables – Trade Payables

For example:

- Inventory = £50,000

- Receivables = £40,000

- Trade Payables = £30,000

- Working Capital = £50,000 + £40,000 – £30,000 = £60,000

This company has £60,000 invested in ‘net working assets’ or working capital, Whether this is good or bad is a relative assessment – we need to compare to other companies with similar business models, as well as evaluating over time to see how the working capital has changed – and typically it should rise in line with revenue.

Working capital ratios can be used to assess the efficiency of a company’s investment in working assets and spot any anomalies that may need investigating.

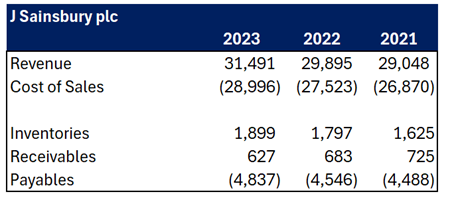

Take a supermarket as a little example – J Sainsbury plc. For a large, stable company such as this, there is an expectation that working capital investment would stay in line with Revenue and / or Cost of Sales. As revenue grows, receivables rise proportionally, as does inventory and payables. The only reason for changes would be a change in credit terms (for customers or suppliers), a change in the mix of products sold (for inventories) or some other questionable reason.

So, we should analyse the levels of working capital alongside changes in revenue:

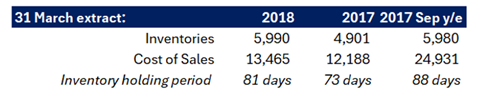

- When inventory is sold, the cost passes through the P&L as Cost of Sales. Cost of Sales in the annual report represents 1-year’s worth of inventory passing through the business. Inventory Days shows you how long the inventory takes to turn over if sales continue at a similar rate to that shown in the P&L

- Inventory Holding Period = Inventory / Cost of Sales *365 ( note below)

- This is an indicator that tells you how many days’ worth of sales are still to be collected from customers. Revenue shows a full year’s worth of sales, so receivables is how many days’ worth?

- DSO = Receivables / Revenue *365

- Similar to DSO but based on purchases. Purchases are not shown in the P&L, but Cost of Sales is a good proxy

- * Note: For a stable business model, Cost of Sales will be proportional to Revenue, so many analysts use Revenue as a base, rather than Cost of Sales.

For J Sainsbury plc, from the numbers above:

This shows a stable set of working capital ratios, with slightly higher inventory holdings, improving DSO and a pretty constant DPO.

As a cash-business (you cannot leave the supermarket without paying!) the DSO is low and should be. Sainsbury’s has some financial services business which distorts the numbers.

The slight rise in Inventory days might be due to slower moving inventory, or the company holding larger value items at the year end. (e.g. Sainsbury’s sells some simple electronic consumer goods, not just food and drinks e.g. TVs, microwave ovens)

Managing working capital involves both optimizing current assets and liabilities, as well as securing financing. The key is that working capital does require funding! It is cash tied up in the business. Common working capital financing options include:

- Overdraft facility – Allows a company to borrow needed amounts from its bank account, up to a set limit

- Credit cards – Provides access to revolving credit lines to fund purchases and operations

- Factoring – Selling receivables to a factoring company to immediately convert to cash

- Asset-based lending – Obtaining loans collateralized by assets like accounts receivable and inventory

- Short-term business loans – Borrowing needed working capital and repaying within 1-3 years

Choosing the optimal financing mix requires balancing costs, flexibility, and risk. Maintaining strong banking relationships and credit rating helps ensure access to cost-effective working capital financing.

From an analyst’s perspective, high working capital is a bit of a ‘red flag,’ and seeing companies accessing capital using factoring services might be seen as a cry for help when liquidity is squeezed. So analysing working capital goes hand in hand with liquidity analysis.

Key working capital ratios help assess a company’s liquidity and operational efficiency:

- Current ratio – Current assets / Current liabilities

- Quick ratio – (Current assets − Inventory) / Current liabilities

- Cash ratio – Cash and cash equivalents / Current liabilities

- Operating cash flow ratio – Operating cash flow / Current liabilities

- Days Sales Outstanding (DSO) – Receivables / Revenue *365

- Inventory holding period (Inventory days) – Inventory / Cost of Sales *365

- Days Payable Outstanding (DPO) – Payables / Cost of Sales *365

Benchmarking these ratios against historical trends and industry averages helps identify positive or negative working capital management tendencies.

Working capital analysis can give an indication of problems in a business, or a change in the business model that may be out of line with the strategy.

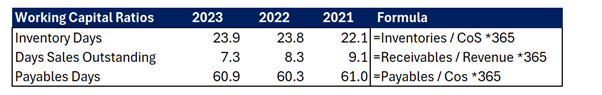

Case 1: Trexx

A decking materials supplier introduced an ‘early buy’ program to its customers to encourage buying its products. The evidence is in the DSO below. Key point: although revenue growth looks impressive, it has clearly offered extended credit to achieve this. This is not a sustainable growth strategy, purely a temporary ‘revenue boost.’ It puts a real strain on cash and will need permanent capital financing. Either that or it will soon run out of cash!

Case 2: Does this look ok? Patisserie Holdings

Patisserie Holdings was behind the infamous high-end Patisserie Valerie business which collapsed into administration in 2019. Have a look at its inventory holdings. Does it make sense to you?

Patisserie and cakes – with a holding period of nearly 3 months? Somethings up with their operating model, or their accounting! Working capital anomalies can be early warning signals for disrupted businesses. It was saved – on a smaller scale – with a management buyout backed by private equity.

Proper working capital management also ensures companies have reserves to withstand emergencies like recessions or supply chain disruptions. Overall, efficiently managing working capital is vital for healthy companies that want to sustain everyday operations while positioning for growth.

Working capital is the critical funding required to support routine business activities. Maintaining adequate working capital ensures liquidity, operational stability, and financial flexibility. But if it gets too high, it means the business is being inefficient and tying up unnecessary funding. Key elements of effective working capital management include optimizing current accounts, securing financing, and monitoring key ratios.

Develop Core Competencies for Analysing Financial Statements and Data

Working capital faqs, how do i calculate my working capital.

To calculate your working capital, subtract your current liabilities from your current assets. The formula is: Working Capital = Current Assets – Current Liabilities.

What are the 4 main components of working capital?

The 4 main components of working capital are:

- Cash and cash equivalents

- Accounts receivable

- Accounts payable

What is a good working capital ratio?

A good working capital ratio is generally considered to be between 1.2 and 2.0. This indicates that a business has enough current assets to cover its short-term obligations.

Is working capital and current ratio the same?

No, working capital and current ratio are not the same. Working capital is the difference between current assets and current liabilities, while the current ratio is the ratio of current assets to current liabilities.

Earnings Per Share (EPS): Definitions, Formulas, Examples

Earnings per share (EPS) is a key metric used to evaluate a company's profitability on a per-share basis. EPS indicates

The Thought That Counts

Through its recent publications, FCA is starting to tell us how it will handle Brexit in practice. Wisely they continue

Discounted Cash Flow Models (DCF): Guide and Examples

Discounted Cash Flow Models (DCF): Guide and Examples Discounted cash flow (DCF) analysis is a method used in

Share This Story, Choose Your Platform!

About the author: mark.

- My Account My Account

- Cards Cards

- Banking Banking

- Travel Travel

- Rewards & Benefits Rewards & Benefits

- Business Business

Advertisement

Related Content

The importance of a working capital plan.

Published: April 23, 2020

Updated: October 28, 2021

Adding a working capital plan to your financial routine can help you potentially increase your profits. Here's how.

Working capital is the lifeblood of a business. That’s why an effective working capital plan can help you free up more cash, increase your financial stability and potentially increase your profits. But business owners sometimes skip this type of planning because they don’t know what to look for on their financial statements. Read on to find out what it means to build a working capital plan and how to add one to your routine.

What is working capital?

Working capital is the amount of resources your business has to cover your upcoming expenses. It’s the difference between your short-term assets and your short-term liabilities. Short-term assets are cash, along with other assets that you expect to turn into cash within a year, like unpaid invoices (accounts receivable), inventory and marketable securities.

Short-term liabilities are any bills and other financial obligations that you’ll need to cover within the next year. Your balance sheet should list both categories. The difference between the two is your working capital.

For example, if a small business has $1 million in cash, inventory and unpaid accounts receivables with $750,000 in current liabilities, their working capital is $250,000 ($1 million - $750,000).

What is a working capital plan?

A working capital plan looks for opportunities to either increase your short-term assets and/or reduce your liabilities. This can help put your business in a stronger financial position with more resources.

Another part of a working capital plan is to watch out for swings in the working capital cycle , especially the times when you may not have enough in liquid assets to cover your expenses. That way you can start tapping into other resources to get through the cycle, like taking out a loan or bringing on investors.

The benefits of a working capital plan may include:

- More positive cash flow, from increasing your assets and decreasing liabilities

- Less financial stress due to having more cash and liquidity to deal with swings

- A better credit score from having money on hand to keep up with your bills

- Fewer production delays, as you stay on good terms with your suppliers by paying them on time

- A more valuable company, as more working capital helps give your company the resources to grow, generate higher profits and expand

Strategies to Improve Your Working Capital

With the big picture in mind, here are a few common strategies that can help improve your working capital position.

Speed Up Collection for Accounts Receivable

The longer it takes for your business to get paid, the less cash you have on-hand. Plus, it increases the chance that a customer doesn’t pay at all, which is even worse for your working capital. To avoid trouble, set clear terms with clients for when you expect to get paid, consider scheduling earlier payment deadlines and follow up with clients that are behind on their invoices.

Reduce Accounts Payable

Whether it’s negotiating for improved terms with creditors, paying early to qualify for supplier discounts or just constantly searching for better vendors, anything you can do to reduce the amount owed for accounts payable will help your working capital.

Refinance Debt to Better Terms

If you’ve got outstanding debt and the monthly payments are a strain on your budget, refinancing could buy you some breathing room. This means replacing your current bills with another loan, at better terms. If your credit score and business income have improved since you first took out these loans, you’re in a good position to potentially qualify for a lower interest rate and lower payments.

Avoid Stockpiling Unnecessary Inventory

Even though inventory is technically a short-term asset, it’s not one you can immediately turn into cash during an emergency. That’s why you should avoid holding unnecessary stores of unsold inventory. An inventory management system could help you do that.

Maintain Financing Options

Sometimes working capital swings can still catch you off-guard. Having a business line of credit and/or credit cards available can help you manage your expenses during tight working capital stretches.

Managing Your Working Capital Plan

Even though there are many benefits to a working capital plan, it’s something that business owners might not develop as they focus on more obvious signs of their financial performance, like their profits and cash flow. This is your chance to get an edge by digging a little deeper into your balance sheet.

First, check what direction your working capital position is moving. Is it increasing or decreasing? Then, try to figure out what caused the change. If you’re losing working capital, is it intentional, like because you spent cash to buy new equipment? Or are sales falling and you need to tighten up expenses?

On the other hand, if you’re building working capital, that’s usually a good sign. But once again you want to figure out the root cause—like whether you built that extra cash from better operations or from a one-time infusion of funds from an outside investor. As you go over your working capital trends, look for opportunities to use the strategies mentioned earlier to help improve your current asset and liability positions.

It’s a good review to conduct regularly, once a month or quarter, along with a cash-flow statement analysis . This planning can help you better understand the financial health of your business and generate more working capital for the future.

Photo: Getty Images

The information contained herein is for generalized informational and educational purposes only and does not constitute investment, financial, tax, legal or other professional advice on any subject matter. THIS IS NOT A SUBSTITUTE FOR PROFESSIONAL BUSINESS ADVICE. Therefore, seek such advice in connection with any specific situation, as necessary. The views and opinions of third parties expressed herein represent the opinion of the author, speaker or participant (as the case may be) and do not necessarily represent the views, opinions and/or judgments of American Express Company or any of its affiliates, subsidiaries or divisions. American Express makes no representation as to, and is not responsible for, the accuracy, timeliness, completeness or reliability of any such opinion, advice or statement made herein.

Trending Content

- Search Search Please fill out this field.

- Fundamental Analysis

How Working Capital Works

:max_bytes(150000):strip_icc():format(webp)/Dr.JeFredaR.Brownheadshot-JeFredaBrown-1e8af368a1ea4533a21868d8a951895a.jpg)

Diane Costagliola is a researcher, librarian, instructor, and writer who has published articles on personal finance, home buying, and foreclosure.

:max_bytes(150000):strip_icc():format(webp)/_DianeCostagliola-8e8b0fa54fc946c282b909375b4184fe.jpg)

Cash is the lifeline of a company. If this lifeline deteriorates, so does the company's ability to fund operations, reinvest, and meet capital requirements and payments. Understanding a company's cash flow health is essential to making investment decisions. A good way to judge a company's cash flow prospects is to look at its working capital management (WCM).

Key Takeaways

- Working capital is the day-to-day cash that a company needs to run business operations. It is the difference between a company's current assets and its current liabilities.

- A company's working capital provides an indication of its short-term financial health and how liquid it is.

- All industries operate differently and therefore have different working capital requirements, such as retailers versus manufacturers.

- Assessing a company's supply chain management, inventory turnover, and its days sales outstanding (DSO) can provide an indication of its working capital management practices.

- The better a company's working capital, the less likely it needs to borrow money to fund operations.

What Is Working Capital?

Working capital refers to the cash a business requires for day-to-day operations, or, more specifically, for financing the conversion of raw materials into finished goods, which the company sells for payment. It is the difference between a company's current assets and its current liabilities, indicating its short-term financial health and liquidity.

Among the most important items of working capital are levels of inventory , accounts receivable , and accounts payable . Analysts look at these items for signs of a company's efficiency and financial strength.

Take a simplistic case: A small spaghetti sauce company uses $100 to build up its inventory of tomatoes, onions, garlic, spices, and so on. A week later, the company assembles the ingredients into sauce and ships it out. A week after that, the checks arrive from customers. That $100, which has been tied up for two weeks, is the company's working capital .

The quicker the company sells the spaghetti sauce, the sooner the company can go out and buy new ingredients, which will be made into more sauce sold at a profit. If the ingredients sit in inventory for a month, company cash is tied up and can't be used to grow the business. Even worse, the company can be left strapped for cash when it needs to pay its bills and make investments. Working capital also gets trapped when customers do not pay their invoices on time or suppliers get paid too quickly or not fast enough.

The better a company manages its working capital, the less it needs to borrow. Even companies with cash surpluses need to manage working capital to ensure that those surpluses are invested in ways that will generate suitable returns for investors.

Not All Companies Are the Same

Some companies are inherently better placed than others. Insurance companies, for instance, receive premium payments upfront before having to make any payments; however, insurance companies do have unpredictable cash outflows as claims come in.

Normally, a big retailer like Walmart ( WMT ) has little to worry about when it comes to accounts receivable: customers pay for goods on the spot. Inventories represent the biggest problem for retailers; as such, they must perform rigorous inventory forecasting or they risk being out of business in a short time.

Timing and lumpiness of payments can pose serious troubles. Manufacturing companies, for example, incur substantial upfront costs for materials and labor before receiving payment. Much of the time they eat more cash than they generate.

Evaluating Companies

Investors should favor companies that place emphasis on supply chain management to ensure that trade terms are optimized. Days sales outstanding , or DSO for short, is a good indication of working capital management practices. DSO provides a rough guide to the number of days that a company takes to collect payment after making a sale. Here is the simple formula:

DSO = Accounts Receivable Total Credit Sales × Number of Days \begin{aligned}&\text{DSO} = \frac { \text{Accounts Receivable} }{ \text{Total Credit Sales } } \times \text{Number of Days} \\ \end{aligned} DSO = Total Credit Sales Accounts Receivable × Number of Days

Rising DSO is a sign of trouble because it shows that a company is taking longer to collect its payments. It suggests that the company is not going to have enough cash to fund short-term obligations because the cash cycle is lengthening. A spike in DSO is even more worrisome, especially for companies that are already low on cash.

The inventory turnover ratio offers another good instrument for assessing the effectiveness of WCM. The inventory ratio shows how fast/often companies are able to get their goods completely off the shelves. The inventory ratio looks like this:

Inventory Turnover = Cost of Goods Sold Average Inventory where: Average Inventory = Beginning + Ending Inventory 2 \begin{aligned}&\text{Inventory Turnover} = \frac{ \text{Cost of Goods Sold} }{ \text{Average Inventory} } \\&\textbf{where:} \\&\text{Average Inventory} = \frac{ \text{Beginning} + \text{Ending Inventory} }{ 2 } \\\end{aligned} Inventory Turnover = Average Inventory Cost of Goods Sold where: Average Inventory = 2 Beginning + Ending Inventory

Broadly speaking, a high inventory turnover ratio is good for business. Products that sit on the shelf are not making money. Granted, an increase in the ratio can be a positive sign, indicating that management, expecting sales to increase, is building up inventory ahead of time.

For investors, a company's inventory turnover ratio is best seen in light of its competitors. In a given sector where, for instance, it is normal for a company to completely sell out and restock six times a year, a company that achieves a turnover ratio of four is an underperformer.

Software technology companies have low working capital needs because they do not sell any physical product, and therefore, have very little inventory expense.

Companies like computer giant Dell recognized early that a good way to bolster shareholder value was to notch up working capital management. The company's world-class supply-chain management system ensured that DSO stayed low. Improvements in inventory turnover increased cash flow, all but eliminating liquidity risk , leaving Dell with more cash on the balance sheet to distribute to shareholders or fund growth plans.

Dell's exceptional working capital management certainly exceeded those of the top executives who did not worry enough about the nitty-gritty of WCM. Some CEOs frequently see borrowing and raising equity as the only way to boost cash flow. Other times, when faced with a cash crunch, instead of setting straight inventory turnover levels and reducing DSO, these management teams pursue rampant cost cutting and restructuring that may later aggravate problems.

The Bottom Line

Cash is king; especially at times when fundraising can be difficult. Letting it slip away is an oversight that investors should not forgive. Analyzing a company's working capital can provide excellent insight into how well a company handles its cash, and whether it is likely to have any on hand to fund growth and contribute to shareholder value.

:max_bytes(150000):strip_icc():format(webp)/Cashconversioncycle-f39bee15fd174aae897c72466b2449ff.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Plan Projections

ideas to numbers .. simple financial projections

Home > Financial Projections > Working Capital

Working Capital

Working capital refers to a business’s current assets minus its current liabilities. It is a term often referred to by investors and lenders. The financial projections template cash flow statement refers to changes in working capital as part of the cash flow from operating activities, but what is working capital, what does it mean, and how does it affect cash flow?

Working Capital Cycle

Cash based business.

In an entirely cash based business, the cycle is one of cash flowing around the business without interruption. For example, suppose a business purchases a product costing 50, and immediately sells it for 120, making a profit of 70. In this case the 50 flows out of the bank account to pay for the product, and 120 is immediately received from the sale. To illustrate this is summarized in the diagram below. Expenses are also shown on the diagram but for simplicity are assumed to be nil in this example.

In this case the cash flow from operating actives section of the cash flow statement would look like this.

As can be seen in this simplified cash based business the cash and the profit are the same. In this case the cash in the bank account is now 70 being the 120 received from the sale less the 50 paid for the product. The profit is also 70 resulting from the sales of 120 less the costs of 50.

Credit Based Business

However, very few businesses operate in this manner, in most businesses purchases of goods are made and expenses are incurred on credit and a balance of monies due to suppliers is built up, additional purchases are made resulting in an inventory of goods held in the warehouse, and finally, when a sale is made, goods are dispatched to the customer on credit resulting in a balance of monies owed by the customer.

- Amounts due from customers – Accounts receivable

- Goods held for sale – Inventory

- Amount due to suppliers – Accounts payable

These three items (accounts receivable, inventory, and accounts payable) are continually changing throughout an accounting period as purchases and expenses are incurred and sales are made and are referred to as working capital, and the flow around the system is referred to as the working capital cycle

Credit Based Business Example

To illustrate, suppose in our credit based business we purchase goods on credit costing 80, hold 30 as inventory, and sell the balance (50) on credit for 120, as shown in the diagram below.

Again our profit is 70 which is the difference between the sales value (120) and the cost of the product sold (50), but what has happened to the cash?

It is important to realize that no cash has flowed in or out of the business. We have purchased goods of 80 on credit and we now owe the supplier 80 (accounts payable). Additionally we have made a sale on credit of 120 and our customers now owe us 120 (accounts receivable). And finally, since we only sold goods worth 50, the remaining product of 30 is sitting in our warehouse as inventory.

If we reconcile where the profit from the sale has gone we get the following:

As can be seen the cash from the sale has not yet flowed through to the business and has been used to increase the working capital of the business. Accordingly the extract from the cash flow statement would now be shown as follows:

The net cash flow into the business from operating activities is nil.

Net Change in Working Capital

In our simplified business, we assumed that the opening balances for accounts receivable, inventory, and accounts payable were zero. What affected the cash flow from one period to the next was the change in the working capital during the accounting period, summarized by the table below.

Additionally this can be summarized in the change in working capital formula below.

The minus sign is important as the effect on the cash flow is the exact opposite of the change in working capital.

Working Capital Equation

The working capital equation calculates the total working capital a business has at any point in time and can be stated as follows:

For example, if at the start of an accounting period, the balance sheet shows accounts receivable of 70,000, inventory of 40,000 and accounts payable of 30,000, then the working capital is.

Suppose the balance sheet at the end of the accounting period shows accounts receivable of 90,000, inventory of 55,000 and accounts payable of 35,000, then the working capital is.

The working capital has increased over the accounting period by 30,000 as summarized in the table below.

Assuming for example, the business has a net income of 70,000 for the period, then the extract from the cash flow statement would be as follows;

The business has net income of 70,000, but the net increase in working capital of 30,000 reduces the operating cash flow to 40,000.

Notice that the effect on the cash flow shown in the cash flow statement (-30,000) is the opposite of the change in working capital (+30,000).

To summarize, the operating cash flow of a business is affected by the changes in working capital during the period. If the working capital increases then the cash flow decreases, likewise if it decreases, then the cash flow increases.

Overtrading Working Capital

Overtrading occurs when a business does not have sufficient finance for the level of working capital needed to support its level of trading. It often occurs with start up businesses as they have do not have the financial resources and access to capital that more established businesses have.

Typically, a startup business will seek to expand rapidly and in doing so will create the need for additional working capital. The faster the business grows the more working capital and therefore the more cash it needs.

The additional working capital requirement comes from two main sources.

- Firstly inventory will need to increase to satisfy customer demand as the business grows.

- Secondly amounts outstanding from customers (accounts receivable) will increase as sales increase.

Of course this increase will be offset by an increase in amounts due to suppliers (accounts payable), but unfortunately for a new business, credit offered by suppliers does not normally increase as rapidly as the requirement to give credit to customers.

This increase in working capital needs to be financed. Without additional funding to match the growth in the business, the cash balance will start to fall until the business cannot pay its suppliers. At this point the business will not be able to get the supplies of inventory necessary to satisfy customer demand, and the business will start to fail.

Overtrading Symptoms

By carefully monitoring the following items a business can spot the signs that may lead to overtrading:

- Rapid sales growth

- Declining gross profit margins as prices are cut to stimulate growth

- Increasing inventory levels

- Increasing accounts receivable (amounts due from customers)

- Increasing accounts payable (amounts due to suppliers)

- Decreasing cash balances

How to Correct the Overtrading

- Reduce the amount of credit given to customers and speed up collections by cash settlement discounts in order to reduce accounts receivable.

- Obtain additional credit from suppliers in order to increase accounts payable.

- Reduce inventory levels.

- Seek additional working capital finance facilities which increase as the business grows such as invoice finance, invoice discounting, or asset finance

Working Capital and the Financial Projections

All businesses need working capital, however, the level of and the changes in working capital during an accounting period directly impact the cash flowing in or out of the business and the amount of funding required from investors and lenders.

When producing a financial projection for a business plan, it is important to calculate working capital levels correctly. In the financial projections template this is achieved by changing the following three parameters.

- Firstly accounts receivable – Days sales outstanding

- Secondly inventory – Days inventory outstanding

- Finally accounts payable – Days payable outstanding

The diagrams used in this tutorial are available for download in PDF format by following the link below.

About the Author

Chartered accountant Michael Brown is the founder and CEO of Plan Projections. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University.

You May Also Like

Check out our most Popular Searches

- Instant Personal Loan

- Collateral Free Business Loan

- Professional Loan for Doctors

- Check CIBIL Score for Free

- Loan for Medical Emergency

- Travel Loan

Choose The Product You Are Applying For

- Business Loan

- Professional Loan

- Personal Loan

- Pre-Owned Car Loan

- Medical Equipment Loan

- Loan Against Property

- Machinery Loan

Overview on Personal Loan

Personal Loan EMI Calculator

Personal Loan for CA

Personal Loan for CS

What is Working Capital? Its Meaning, Example and Importance

Loan up to 30 Lakhs | Attractive Interest Rate | Zero Foreclosure Charges

- What is Working Capital? Its Meaning, Formula, Example & Importance in Business

Table of Content

- What is Working Capital?

- How to Calculate Working Capital Requirement?

- What is working capital management?

Importance of Working Capital

Different types of working capital in business.

- Need for Additional Working Capital

What Happens If the Company Has Low Working Capital?

Frequently asked questions about working capital.

For a business to operate, it needs money. This money is often called the lifeblood of the business because it's essential to keep the business running. It's like the cash or deposits a business keeps on hand to pay for day-to-day operations. Working capital is a vital measure of a business's ability to pay its short-term debts. It's an important metric that shows how financially healthy a business is.

What is Working Capital - Meaning & Definition