- Browse All Articles

- Newsletter Sign-Up

- 23 Jan 2024

More Than Memes: NFTs Could Be the Next Gen Deed for a Digital World

Non-fungible tokens might seem like a fad approach to selling memes, but the concept could help companies open new markets and build communities. Scott Duke Kominers and Steve Kaczynski go beyond the NFT hype in their book, The Everything Token.

- 12 Sep 2023

- Research & Ideas

How Can Financial Advisors Thrive in Shifting Markets? Diversify, Diversify, Diversify

Financial planners must find new ways to market to tech-savvy millennials and gen Z investors or risk irrelevancy. Research by Marco Di Maggio probes the generational challenges that advisory firms face as baby boomers retire. What will it take to compete in a fintech and crypto world?

- 17 Aug 2023

‘Not a Bunch of Weirdos’: Why Mainstream Investors Buy Crypto

Bitcoin might seem like the preferred tender of conspiracy theorists and criminals, but everyday investors are increasingly embracing crypto. A study of 59 million consumers by Marco Di Maggio and colleagues paints a shockingly ordinary picture of today's cryptocurrency buyer. What do they stand to gain?

- 17 Jul 2023

Money Isn’t Everything: The Dos and Don’ts of Motivating Employees

Dangling bonuses to checked-out employees might only be a Band-Aid solution. Brian Hall shares four research-based incentive strategies—and three perils to avoid—for leaders trying to engage the post-pandemic workforce.

- 20 Jun 2023

- Cold Call Podcast

Elon Musk’s Twitter Takeover: Lessons in Strategic Change

In late October 2022, Elon Musk officially took Twitter private and became the company’s majority shareholder, finally ending a months-long acquisition saga. He appointed himself CEO and brought in his own team to clean house. Musk needed to take decisive steps to succeed against the major opposition to his leadership from both inside and outside the company. Twitter employees circulated an open letter protesting expected layoffs, advertising agencies advised their clients to pause spending on Twitter, and EU officials considered a broader Twitter ban. What short-term actions should Musk take to stabilize the situation, and how should he approach long-term strategy to turn around Twitter? Harvard Business School assistant professor Andy Wu and co-author Goran Calic, associate professor at McMaster University’s DeGroote School of Business, discuss Twitter as a microcosm for the future of media and information in their case, “Twitter Turnaround and Elon Musk.”

- 06 Jun 2023

The Opioid Crisis, CEO Pay, and Shareholder Activism

In 2020, AmerisourceBergen Corporation, a Fortune 50 company in the drug distribution industry, agreed to settle thousands of lawsuits filed nationwide against the company for its opioid distribution practices, which critics alleged had contributed to the opioid crisis in the US. The $6.6 billion global settlement caused a net loss larger than the cumulative net income earned during the tenure of the company’s CEO, which began in 2011. In addition, AmerisourceBergen’s legal and financial troubles were accompanied by shareholder demands aimed at driving corporate governance changes in companies in the opioid supply chain. Determined to hold the company’s leadership accountable, the shareholders launched a campaign in early 2021 to reject the pay packages of executives. Should the board reduce the executives’ pay, as of means of improving accountability? Or does punishing the AmerisourceBergen executives for paying the settlement ignore the larger issue of a business’s responsibility to society? Harvard Business School professor Suraj Srinivasan discusses executive compensation and shareholder activism in the context of the US opioid crisis in his case, “The Opioid Settlement and Controversy Over CEO Pay at AmerisourceBergen.”

- 16 May 2023

- In Practice

After Silicon Valley Bank's Flameout, What's Next for Entrepreneurs?

Silicon Valley Bank's failure in the face of rising interest rates shook founders and funders across the country. Julia Austin, Jeffrey Bussgang, and Rembrand Koning share key insights for rattled entrepreneurs trying to make sense of the financing landscape.

- 27 Apr 2023

Equity Bank CEO James Mwangi: Transforming Lives with Access to Credit

James Mwangi, CEO of Equity Bank, has transformed lives and livelihoods throughout East and Central Africa by giving impoverished people access to banking accounts and micro loans. He’s been so successful that in 2020 Forbes coined the term “the Mwangi Model.” But can we really have both purpose and profit in a firm? Harvard Business School professor Caroline Elkins, who has spent decades studying Africa, explores how this model has become one that business leaders are seeking to replicate throughout the world in her case, “A Marshall Plan for Africa': James Mwangi and Equity Group Holdings.” As part of a new first-year MBA course at Harvard Business School, this case examines the central question: what is the social purpose of the firm?

- 25 Apr 2023

Using Design Thinking to Invent a Low-Cost Prosthesis for Land Mine Victims

Bhagwan Mahaveer Viklang Sahayata Samiti (BMVSS) is an Indian nonprofit famous for creating low-cost prosthetics, like the Jaipur Foot and the Stanford-Jaipur Knee. Known for its patient-centric culture and its focus on innovation, BMVSS has assisted more than one million people, including many land mine survivors. How can founder D.R. Mehta devise a strategy that will ensure the financial sustainability of BMVSS while sustaining its human impact well into the future? Harvard Business School Dean Srikant Datar discusses the importance of design thinking in ensuring a culture of innovation in his case, “BMVSS: Changing Lives, One Jaipur Limb at a Time.”

- 18 Apr 2023

What Happens When Banks Ditch Coal: The Impact Is 'More Than Anyone Thought'

Bank divestment policies that target coal reduced carbon dioxide emissions, says research by Boris Vallée and Daniel Green. Could the finance industry do even more to confront climate change?

The Best Person to Lead Your Company Doesn't Work There—Yet

Recruiting new executive talent to revive portfolio companies has helped private equity funds outperform major stock indexes, says research by Paul Gompers. Why don't more public companies go beyond their senior executives when looking for top leaders?

- 11 Apr 2023

A Rose by Any Other Name: Supply Chains and Carbon Emissions in the Flower Industry

Headquartered in Kitengela, Kenya, Sian Flowers exports roses to Europe. Because cut flowers have a limited shelf life and consumers want them to retain their appearance for as long as possible, Sian and its distributors used international air cargo to transport them to Amsterdam, where they were sold at auction and trucked to markets across Europe. But when the Covid-19 pandemic caused huge increases in shipping costs, Sian launched experiments to ship roses by ocean using refrigerated containers. The company reduced its costs and cut its carbon emissions, but is a flower that travels halfway around the world truly a “low-carbon rose”? Harvard Business School professors Willy Shih and Mike Toffel debate these questions and more in their case, “Sian Flowers: Fresher by Sea?”

Is Amazon a Retailer, a Tech Firm, or a Media Company? How AI Can Help Investors Decide

More companies are bringing seemingly unrelated businesses together in new ways, challenging traditional stock categories. MarcAntonio Awada and Suraj Srinivasan discuss how applying machine learning to regulatory data could reveal new opportunities for investors.

- 07 Apr 2023

When Celebrity ‘Crypto-Influencers’ Rake in Cash, Investors Lose Big

Kim Kardashian, Lindsay Lohan, and other entertainers have been accused of promoting crypto products on social media without disclosing conflicts. Research by Joseph Pacelli shows what can happen to eager investors who follow them.

- 31 Mar 2023

Can a ‘Basic Bundle’ of Health Insurance Cure Coverage Gaps and Spur Innovation?

One in 10 people in America lack health insurance, resulting in $40 billion of care that goes unpaid each year. Amitabh Chandra and colleagues say ensuring basic coverage for all residents, as other wealthy nations do, could address the most acute needs and unlock efficiency.

- 23 Mar 2023

As Climate Fears Mount, More Investors Turn to 'ESG' Funds Despite Few Rules

Regulations and ratings remain murky, but that's not deterring climate-conscious investors from paying more for funds with an ESG label. Research by Mark Egan and Malcolm Baker sizes up the premium these funds command. Is it time for more standards in impact investing?

- 14 Mar 2023

What Does the Failure of Silicon Valley Bank Say About the State of Finance?

Silicon Valley Bank wasn't ready for the Fed's interest rate hikes, but that's only part of the story. Victoria Ivashina and Erik Stafford probe the complex factors that led to the second-biggest bank failure ever.

- 13 Mar 2023

What Would It Take to Unlock Microfinance's Full Potential?

Microfinance has been seen as a vehicle for economic mobility in developing countries, but the results have been mixed. Research by Natalia Rigol and Ben Roth probes how different lending approaches might serve entrepreneurs better.

- 16 Feb 2023

ESG Activists Met the Moment at ExxonMobil, But Did They Succeed?

Engine No. 1, a small hedge fund on a mission to confront climate change, managed to do the impossible: Get dissident members on ExxonMobil's board. But lasting social impact has proved more elusive. Case studies by Mark Kramer, Shawn Cole, and Vikram Gandhi look at the complexities of shareholder activism.

- 07 Feb 2023

Supervisor of Sandwiches? More Companies Inflate Titles to Avoid Extra Pay

What does an assistant manager of bingo actually manage? Increasingly, companies are falsely classifying hourly workers as managers to avoid paying an estimated $4 billion a year in overtime, says research by Lauren Cohen.

External Sources of Finance

External sources of finance raise finance (money) from a third party. The finance can be used to fund large, long-term investments. However, external finance can be more costly, because loans usually charge interest (which isn't paid if a company funds growth with retained earnings). Some sources of external finance are:

Bank loans or mortgages

- Bank loans and mortgages are very important for many businesses. A business borrows money from a bank and then pays interest on the money borrowed.

- It is often harder for new businesses to get bank loans because banks see them as riskier.

Loans from family and friends

- Start-ups often use loans from family and friends. This is usually because the entrepreneur doesn’t have enough personal savings to finance the investment.

- If the entrepreneur gives up equity (a share of the business) then this is not a loan.

Hire purchases

- This is when a business buys something and instead of paying for it upfront pays for it in installments.

- When PSG bought Kylian Mbappe from Monaco, they didn’t pay the whole amount at the time and instead completed the purchase in different stages.

- This lets businesses buy things (like machinery) for the business that they otherwise wouldn’t be able to afford.

Trade credit

- Trade credit describes when businesses pay suppliers at a later date. It involves buying something now and paying for it later.

- Supermarkets use trade credit and trade creditors a lot, taking delivery of food and then paying the suppliers at a later date.

Government grants

- A government may give grants (money) to businesses to research things that the government is interested in.

- The Horizon 2020 fund is a set of grants given out by the countries in the European Union.

Share capital

- A business can sell share capital (some of its shares) to other people or businesses. They give away a percentage of the business in return for getting finance invested in the business.

- This is usually what happens on Dragon’s Den on the BBC. Public limited companies may do new share issues, creating shares and issuing them to investors through a stock market.

- Private limited companies can sell share capital (shares) to family, friends or even a private equity company.

External sources of finance raise finance (money) from a third party. The finance can be used to fund large, long-term investments. However, external finance is often more expensive because businesses pay interest on loans. There are several sources of external finance:

Debt factoring

- Debt factoring involves businesses selling their debt to a third party business.

- The business selling its debt will gain cash immediately rather than wait for debts to be settled although the business will sell its debt for less than its original value.

- The third party that buys this debt will then arrange and organise invoices and ensure that the debt money is collected. The third party business will retain a fee to cover the costs of its debt collection service.

- An overdraft is a service offered by banks allowing businesses to borrow an amount of money up to a limit which has been agreed in advance.

- Overdrafts are flexible as they allow a business to borrow as much as it wishes provided that the amount stays within an agreed limit.

- Businesses often pay for this flexibility through higher interest rates.

Venture capital

- Venture capital involves investors, or venture capitalists, providing a business with loans and share capital which is usually to support business growth.

- Venture capitalists will often ask for some control of the business they are investing in and this can be through the issue of shares or through the appointment of venture capitalists as non-executive directors of the business.

1 What is Business?

1.1 Understanding the Nature of Business

1.1.1 Why Businesses Exist

1.1.2 Business Aims & Objectives

1.1.3 Revenue & Costs

1.1.4 A-A* (AO3/4) - Cost Leadership

1.1.5 Profit

1.1.6 End of Topic Test - The Nature of Business

1.2 Understanding Different Business Forms

1.2.1 Sole Traders

1.2.2 Limited Liability

1.2.3 Non-Profit

1.2.4 Franchising

1.2.5 A-A* (AO3/4) - Franchising at Blockbuster

1.2.6 Key Business Terms

1.2.7 Shareholders

1.2.8 End of Topic Test - Different Businesses

1.3 External Environments

1.3.1 External Environments

2 Managers, Leadership & Decision Making

2.1 Understanding Management

2.1.1 Managers

2.1.2 (2024 EXAMS ONLY) Blake Mouton

2.1.3 Management Theories

2.1.4 End of Topic Test - Management

2.2 Understanding Management Decision Making

2.2.1 Scientific Decision Making

2.2.2 Intuition Decision Making

2.2.3 Influences on Decision Making

2.2.4 A-A* (AO3/4) - Taylorism & Jack Welch

2.2.5 End of Topic Test - Management Decisions

2.3 Understanding Stakeholders

2.3.1 Stakeholders

3 Decision Making to Improve Marketing Performance

3.1 Decision Making to Improve Marketing Performance

3.1.1 Setting Marketing Objectives

3.2 Understanding Markets & Customers

3.2.1 Market Calculations

3.2.2 Market Research

3.2.3 Market Mapping

3.2.4 Methods of Market Research

3.2.5 Interpreting PED & YED

3.3 Market Segmentation, Targeting & Positioning

3.3.1 Segmentation

3.3.2 Niche & Mass Markets

3.4 Marketing Mix

3.4.1 Marketing Mix

3.4.2 Product Decisions

3.4.3 Pricing Decisions & Price Skimming

3.4.4 Pricing Decisions & Price Penetration

3.4.5 A-A* (AO3/4) - Pricing & Competition

3.4.6 Promotional Decisions

3.4.7 Promotional Decisions 2

3.4.8 Promotional Decisions 3

3.4.9 Distribution Decisions

3.4.10 Distribution Decisions 2

3.4.11 Digital Marketing

3.4.12 Evaluating Digital Marketing

3.4.13 A-A* (AO3/4) - The Marketing Mix & Promotion

4 Decision Making to Improve Operational Performance

4.1 Setting Operational Objectives

4.1.1 Setting Operational Objectives

4.2 Analysing Operational Performance

4.2.1 Operations Data

4.2.2 A-A* (AO3/4) - The Problem with Operations Data

4.3 Increasing Efficiency & Productivity

4.3.1 Capacity

4.3.2 Productivity & Efficiency

4.3.3 Technology & Efficiency

4.4 Improving Quality

4.4.1 Importance of Quality

4.4.2 Measuring & Identifying Quality

4.4.3 Total Quality Management

4.4.4 Evaluating Total Quality Management

4.4.5 A-A* (AO3/4) - Toyota Production System

4.5 Managing Inventory & Supply Chains

4.5.1 Improving the Supply Chain

4.5.2 Inventory

4.5.3 Outsourcing

5 Decision Making to Improve Financial Performance

5.1 Financial Objectives

5.1.1 Setting Financial Objectives

5.1.2 Influences on Financial Objectives

5.2 Analysing Financial Performance

5.2.1 Cash-Flow & Budgets

5.2.2 Break-Even & Profitability Analysis

5.3 Sources of Finance

5.3.1 Internal Sources of Finance

5.3.2 External Sources of Finance

5.3.3 Factors for Financing

5.3.4 A/A* (AO3/4) - Debt

5.4 Improving Cash Flow & Profit

5.4.1 Improving Cash Flow & Profits

6 Improving Human Resource Performance

6.1 Human Resource Objectives

6.1.1 Setting Human Resource Objectives

6.1.2 Human Resource Management

6.2 Analysing Human Resource Performance

6.2.1 Analysing Human Resource Performance

6.2.2 Analysing Human Resource Performance 2

6.2.3 Analysing Human Resource Performance 3

6.3 Improving Organisational Design

6.3.1 Job Design

6.3.2 (2024 EXAMS ONLY) Hackman & Oldham's Model

6.3.3 Organisational Design

6.3.4 Human Resource Flow

6.3.5 A-A* (AO3/4) - Amazon & Netflix Org Design

6.4 Improving Motivation & Engagement

6.4.1 Motivating & Engaging Employees

6.4.2 Taylor's Theory

6.4.3 Maslow's Theory

6.4.4 Herzberg's Theory

6.4.5 Different Incentives

6.4.6 Evaluating Incentives

6.5 Improving Employer-Employee Relations

6.5.1 Improving Employer-Employee Relations

6.5.2 A-A* (AO3/4) - The Winter of Discontent

7 Analysing the Strategic Position of a Business

7.1 Mission, Corporate Objectives, Strategy

7.1.1 Business Mission & Corporate Objective

7.1.2 Mission, Corporate Objectives & Strategy

7.1.3 SWOT Analysis

7.1.4 A-A* (AO3/4) - SWOT Analysis

7.2 Financial Ratio Analysis

7.2.1 Financial Ratios

7.3 Overall Performance

7.3.1 Non-Financial Data

7.3.2 Core Competences

7.3.3 (2024 EXAMS ONLY) Kaplan and Norton's Balanced Sco

7.3.4 Assessing Business Performance

7.3.5 A-A* (AO3/4) - Assessing Financial Performance

7.4 Political & Legal Change

7.4.1 Political & Legal Change

7.5 Economic Change

7.5.1 Economic Environment

7.5.2 Business Considerations from Globalisation

7.5.3 A-A* (AO3/4) - Interest Rates in the UK

7.6 Social & Technological Environment

7.6.1 Social & Technological Environment

7.6.2 Lifestyle & Technological Environment

7.6.3 Corporate Social Responsibility

7.7 Competitive Environment

7.7.1 Porter's Five Forces

7.7.2 A-A* (AO3/4) - The 5 Forces

7.8 Investment Appraisal

7.8.1 Investment Appraisal

8 Choosing Strategic Direction

8.1 Choosing Areas of Competition

8.1.1 Choosing Areas of Competition

8.1.2 A-A* (AO3/4) - Diversification

8.2 Choosing How to Compete

8.2.1 Choosing How to Compete

8.2.2 (2024 EXAMS ONLY) Bowman's Strategic Clock

9 How to Pursue Strategies

9.1 Change in Scale

9.1.1 Growth & Retrenchment

9.1.2 Challenges of Growth

9.1.3 (2024 EXAMS ONLY) Growth Models

9.1.4 A-A* (AO3/4) - Diseconomies of Scale

9.2 Assessing Innovation

9.2.1 Assessing Innovation

9.3 Assessing Internationalisation

9.3.1 Internationalisation

9.3.2 Sourcing Resources & Entering Markets

9.3.3 A-A* (AO3/4) - Internationalisation in Guatemala

9.3.4 Managing Internationalisation

9.3.5 (2024 EXAMS ONLY) Bartlett & Ghosal's Model

9.3.6 Impact of Internationalisation

9.4 Digital Technology

9.4.1 Assessing Use of Digital Technology

9.4.2 Impact of Digital Technology

10 Managing Strategic Change

10.1 Managing Change

10.1.1 Managing Change

10.2 Managing Organisational Culture

10.2.1 Managing Organisational Culture

10.2.2 (2024 EXAMS ONLY) Hofstede's Model

10.2.3 Organisational Structures

10.3 Managing Strategic Implementation

10.3.1 Managing Strategic Implementation

10.4 Problems with Strategy

10.4.1 Problems with Strategy

10.4.2 A-A* (AO3/4) - Divorce of Ownership from Control

Jump to other topics

Unlock your full potential with GoStudent tutoring

Affordable 1:1 tutoring from the comfort of your home

Tutors are matched to your specific learning needs

30+ school subjects covered

Internal Sources of Finance

Factors for Financing

Sources of Finance Essay

Sources of Finance Essay.

In this assignment, I am going to look at different ways to finance a new start-up business and also for existing businesses who want to expand in the future. After reading this, you will learn the costs of different sources of finance and also their advantages and disadvantages. A source of finance is divided into two sections which are short term and long term. Short term is often referred to money that is borrowed for up to 12 months. Many businesses would use this to fund day to day activities such as utility bills or staff wages etc.

Long term is generally over one year and used for things such as buying property or expanding a business. In this assignment it is going to look at how existing businesses and new businesses will use these types of borrowing as a source of finance.

Long term finance

Owner’s capital refers to the amount of money the owner puts into the business themselves.

This is regarded as long term finance as the money will stay with the business as long as it exists. This could be savings, money received in result of a redundancy payment or money left to them in a will. The advantage of this source is that it doesn’t have any interest because it’s the owner’s money so you don’t need to pay anyone back unlike bank loans. In comparison to loans, this is generally more convenient because you don’t need to worry about paying back the bank and the interest rates. This source is more flexible than others because there is no restriction on the money so the owner can spend it on whatever they like. However, the disadvantage of this would be if the business fails then you are likely to lose your investment.

It also comes with an opportunity cost. This is defined as what you could have done with the money; for example, you were going to use it to buy a house but you contribute it to starting up a business, this is the opportunity cost. If businesses do not contribute the owner’s capital then it is unlikely they will receive any loans from banks or other investors. This is because if you were an investor and you saw a business that isn’t willing to take the risk and contribute their own money, you wouldn’t invest your own money in them.

Depending on how much the owner’s capital is going to be, this can be mixed with bank loans to go towards a business start-up. For example, I am going to open a Chinese take-away and invest £10,000 into the business but my priority is to buy utensils and refurbish the building. I could use my investment into refurbishing and since I contribute my own money I could get a loan from the bank to buy my utensils. This source of finance is suitable for new businesses to get them up and running however it can also be used for existing businesses who want to expand.

Venture capital is the money that is provided to businesses by investors. These investors are named venture capitalists who could either be a group of wealthy individuals or a company who make their money by investing on businesses. They are often seeking for new or growing businesses who they believe have potential and hope to develop them. There are some advantages for this source; it is a good option to new businesses especially for the ones who don’t have much operating history so it’s harder for them to secure a bank loan. The money the venture capitalists contribute is usually more than what banks are willing to lend. Businesses are also interested in but the contacts these wealthy people have which could help their business expand in many different ways.

For example, in Dragons Den, Peter Jones offers £50 000 to a business for 50% of the company which is 25% more than what the business was prepared to give away however with Peter being a wealthy and respectable entrepreneur they gave him what he wanted. They believe Peter has the contacts which could help their business expand rapidly. If a business could secure a venture capital, it is more beneficial than a bank loan because there are no interest rates however the disadvantage is you risk losing some independency to the investors.

They calculate how much money they are willing to invest and the percentage by considering the risk and reward. Usually, a new business is considered high risk because they have limited operating history but if they are believed to have potential then the investors will ask for a high percentage of the business for it to achieve a high profitable reward. It is likely the venture capitalists will make decisions for the company. If businesses are willing to sacrifice part of their business then this source is recommended because it could broaden the company.

Bank loans are regarded as long term finance because the money can be borrowed up to 25 years or longer in some circumstances. All loans have an interest rate attached to them. The interest rate is often calculated by how much the business borrows. The more you borrow the more interest you are going to pay. For example, if I borrow £9000 from Barclays bank, I will be charged 4.3% APR whereas if I borrow £30000 I will be charged at 6.9% APR. It could affect your loan if the interest rates go up so more businesses take out a loan on a fixed rate of interest where they won’t be charge any extra costs if the interest rates increase. If a variable rate loan is taking out, the interest rates can change which makes it harder to manage finance. Bank loans could be used by new and existing businesses; a new business can use it to buy equipment and an existing business could use it to expand the company for example, buying new premises.

An existing business will tend to be able to borrow more than a new business. This is because they have been operating for longer and banks generally find them more reputable. If these companies wish to borrow an excessive sum of money then extra security is needed to ensure the money is paid back. Often banks will ask the business to use their property as a security for the loan. It means if the business fails then the bank could recover the money from selling their property. This is usually referred as a second mortgage. Most businesses use this source to their advantage because it is convenient and the money could be borrowed for a lengthy period.

For some businesses, it could be looked at as a better option than securing a venture capital because you aren’t losing a share of the business for money but you also have decision on where the money could be spend; you have more independency with the money. The disadvantage is the interest rate could be quite high whereas if an owner’s capital was available, a repayment is not necessary. Also, if your business fails and you have taken out a second mortgage you could lose your property. Generally, bank loans work out quite expensive in the long run however it is a good way to raise finance for your business.

A mortgage is a loan used for purchasing a property and could be paid back in the space of 25 years or sometimes more. The property then becomes the borrower’s collateral which needs to be paid off as they agreed with the lenders. If there is a failure of payment then the lenders can repossess the property and sell it at an auction to recover the money. This source is common for both new and existing businesses that need a mortgage for their work premises. The advantage of mortgages is the fact they are usually more manageable and affordable than renting because the repayments are spread out over a lengthy period.

This also depends on the type of the property and other factors such as location and price. Here is an example, in 2008, house prices dropped in Northern Ireland; therefore buying a house was cheaper. In addition, getting a mortgage was easier and cheaper than renting. Also, once you have paid off your mortgage, you own the property and it could be worth far more than what you paid for it. Often, interest rates on mortgages are lower than a loan because the property is used as collateral. Mortgages fall into two main categories; fixed rate and various rates. Fixed rate is where the interest stays the same over a number of years and various rate means the interest can change.

This source also comes with many disadvantages; it is not as flexible as renting because if you want to move out of the property, it is not as easy as cancelling a contract with your landlord, you will have to sell the property which can be difficult. Maintenance is one of the problems for instance, if the roof leaks you will have to fix it yourself whereas a rented property it can be repaired for you. The main disadvantage is that you have to keep up with your repayments or you can end up losing your property.

For example, during the credit crunch there was many people made redundant and therefore they struggled to make repayments so their house was repossessed. Although the interest rate is lower on mortgages, it does carry high risk as you are repaying over a long period of time. For a new business it would be advisable to start off with a bank loan to establish a steady flow of finance into a business before considering a mortgage.

Retained profits are defined as capital which is kept in the business. The owner(s) can decide what they want to do with the companies’ profits. This could be for personal use, paid out to shareholders as a dividend or withdrawn as wages for sole trader’s also known as owner’s drawings. If the owner decides not to touch this money it is referred to as ploughing back the profits or organic growth. This is regarded as important long term finance but only relates to existing businesses. There are many advantages of retained profits; the money which is left in the business rather than paid out as a dividend is the opportunity cost for shareholders. The money is reinvested and helps the company expand and could be used for buying new equipment or machinery.

It is an advantageous source of finance because it doesn’t have any interest rates attached. It also has a lot of flexibility because the company has control of what is left in the business and what is paid out to dividends. This source of finance has some disadvantages. It could lead to the company getting criticized for restricting the value of dividends and holding on too much money for the business. If retained profits don’t result in higher profit then it could cause arguments amongst shareholders and you risk losing them. The shareholders may think the money would be better in their own hands rather than the business. In order to use this source accordingly, you must maintain good relationships with the shareholders and show that the business has potential to succeed. This is highly recommended for existing businesses because as long as the company exist while making profits, money will be reinvested each day and it could help with the growth of the business.

Selling assets is a common source of long term finance for an existing business. An asset is categorized as any item owned by a business or individual which could range from land to machinery. Business may sell some assets because they have no further need for them. By selling assets the company can raise money to fund other projects. For example; selling a JCB digger because there is limited work on in the construction site and it is taking up too much valuable space. These assets can turn into cash which could help the business with advertising or paying off debts. Often businesses sell a successful division of their business to another firm because they believe there is a declining market for their product or service. While it is still going good they will sell this in order to use the money to expand in a new and growing market.

The advantage of selling an asset is you get your money back straight away. Generally, this is a cheaper source of financing your business unlike bank loans where you have to worry about the high interest rates. For many, selling an asset is a good way to reduce or eliminate debt. Although, this seems like a convenient method, the cost of selling assets must be considered. In some cases, you won’t receive full market value for the goods but this depends on how quick you want to sell them. The assets could grow in value faster than what you can yield with the cash and also it could come with tax consequences. This means if you buy an asset and later sell it on for profit, you could be landed with what is called ‘Capital Gains Tax’.

You could end up with less money than you expected. This financing source mostly applies to existing businesses because they would have built more assets than new businesses starting up and would most likely have more debt on their hands. For new businesses, getting a bank loan or owner’s capital would be more suitable. Overall; this is a recommended source of finance for existing businesses as it carries little risk in the procedure. This benefits a lot of businesses because they are usually selling something they no longer require, in order to use the money on something which can help their company grow or eliminate debt. For example, you are investing on a delivering service for your company and plan to get a loan for a van. Your warehouse has several forklifts so you would plan to sell one in order to buy a van. To conclude, you aren’t losing money because you are using the money from the asset to start a new service; to expand your business.

Share capital is the capital of a company divided into equal amounts known as shares. There are two companies’ which share capital relate to which are private limited companies, (LTD’s) or public limited companies (PLC’s). In a private limited company, these shares are often sold to family firms but could be sold to family and friends. However, if they want to issue shares, they must go through an agreement with all the shareholders. On the other hand, a public limited company can sell shares on a stock exchange to members of the public. This means anyone could buy shares which results in them having a wider source of capital. A new business is usually classed as a private limited company and may have as little as two shareholders. However, if they expand over time and cannot issue any more shares they might consider about becoming a public limited company. This process is known as ‘floating the business’ which has to go through a number of administrative and legal procedures.

A public limited company can raise more because they can sell their shares on the stock exchange. If they want to expand their business but need £100 million then they can sell £100 million shares at the stock exchange for £1 each. This needs to come with a prospectus which is very important because it gives the investors a better understanding of the company before they commit to buying shares. You will tend to find information such as; how the business is managed, what does the business specialist in, etc. Businesses often use the services of a merchant bank such as Morgan Stanley or Merrill Lynch who specialize in share floatation. This means if all shares are not sold, they will buy them so the business can still raise the money they need. This is a type of insurance policy and you can imagine the cost it has attached to it.

Share capital is attractive and very helpful in raising long term finance for both new and existing businesses. The main advantages are; you will have commitment from your shareholders because like the owner they also want to see the business succeed. In terms where a plc becomes successful then they will most likely sell more shares to the public. However, if there comes a time when they want to raise more money, they can issue cheaper shares to existing shareholders through a rights issue’. If the company is doing well, and needs money for expansion, this is a quick and cheap way of raising finance. In comparison to loans, this source is cheaper; all you have to do is pay the shareholders their dividends each year instead of repaying high interest on bank loans.

This financing source is similar to venture capital; if you have the right business angels and venture capitalist, they can bring useful contacts, valuable skills and experience to your company. This could help with business strategy planning, new products ideas or expansion plans. Although, there are some disadvantages too. Depending on the investor, you may lose some independency of the decision making in your business.

For a potential investor to want a share of your business they will want to see reports and forecasts of the company; you may have to provide information for the investor(s) to monitor. This can be time consuming and may take management focus away from core business activities. Overall, share capital is a secure way to raise finance for your company. The money which is invested will stay within the company as long as the company exists and if it is a growing company then it could get a good reputation selling shares through the stock exchange.

Short term finance

A Bank overdraft is when someone makes an agreement with the bank to spend more than what they have in their account but the money will need to be paid back. This type of borrowing is common for both new and existing businesses that experience cash flow problems. The money a business receives from sales and the amount they spend is called cash flow. There are two types of overdrafts; authorized and unauthorized. An authorized overdraft is where you are allowed to borrow up to a limit agreed with the bank. An unauthorized overdraft is where you are exceeding your authorized overdraft limit or going below zero in your account without agreeing on an overdraft facility; this should be avoided at all costs. This source of finance does carry an interest rate but only for the amount overdrawn and the length of time overdrawn. For example, if an overdraft facility allows you to borrow up to £5000; you need £3000 on the 1st July to pay rent until you get a payment of £4000 from a customer on the 4th July, you will only be charged interest rates on the £3000 for 4 days you borrowed. Some banks will charge a fee for customers to use this facility.

A bank overdraft is suitable for companies that need the money for a short period of time whether it’s for paying staff wages or utility bills. Although, they must ensure they have money coming in to cover the cost of the overdraft as it can carry high interest rates; usually higher than bank loans. It can help avoid cheques bouncing and returned direct debit. This is where there are insufficient funds in the account to make a payment. If this happens, the business will have to pay bank charges and it can also damage relationships with suppliers as they will see the business as untrustworthy and they may not want to supply them with any more stock. The main advantage of a bank overdraft is the fact that is there when you need it and doesn’t cost anything (except for a small fee). You only need to borrow what you need.

It can also help maintain the cash flow within the company and allows the business to make essential payments while chasing their own payments. There are many disadvantages too, as mentioned before overdrafts can carry higher interest rates than bank loans which make them expensive for long term financing. In some cases, you may have to secure your business assets to get an overdraft and failing to make repayments can risk you losing your assets.

The main disadvantage and probably most important one is, if you find yourself going over the overdraft limit it would be classed as an unauthorized overdraft where you will be charged high interest rates and bank charges. If the business keeps using over their limit, it could damage their reputation with banks although they can get the limit raised but this is not advisable. If this is done repeatedly the banks will assume the business has financial issues and they can refuse further use of the overdraft service. This source of finance is useful if lending short term but a business should never rely on it.

Trade credit is the time given to a business from the supplier to pay for their stock. It is used in business to business (B2B) transactions. Trade credit is usually 30 days although this can be different depending on the organization. If you agreed 30 days credit with your supplier, you can sell the stock and have the money in your bank account before you pay the supplier. This means you are getting an interest free loan for 30 days. Usually small suppliers prefer to sell their products only to one big company instead of many small companies; this makes payments more manageable. An example is Cravendale farm only sells their milk to Asda so they will get one invoice from them at the end of the credit period. This is better than having multiple invoices from different supermarkets which can make cash flow more difficult. However, big companies like Asda often use this to their advantage and pay the supplier back late.

They usually get away with this because Cravendale farm know Asda are their only customers so they cannot afford to lose them. Trade credit is a very important source of finance and has many advantages. It does not carry any interest rates therefore it is better than using bank overdraft. It can save you from spending money in your account to buy stock and with that money you can use it elsewhere in the business. For new businesses it may be hard to get trade credit because they have limited operating history but if they shop around they might find a supplier that will offer them a small credit limit to begin with.

If they can make payments on time and prove to the suppliers they are reliable then it is possible the credit limit will increase. However the downfall of this source is, if you do not pay the supplier back on time you will get a bad reputation in the industry. If you constantly make late payments then the suppliers can withdraw this facility and ask for cash payments. It will also be hard for you to get new suppliers because they may be aware of your reputation of late payments; this should be avoided at all costs. Trade credit is a good source of finance being interest free and it can help you build good credit history. This will be useful for getting bank loans or using the overdraft facility.

Business credit cards are useful for short term borrowing. It is similar to using trade credit. If you pay for goods with a credit card, you will receive a statement once a month with the amounts spent in the last month. You will be given a time to pay for what you spent. If the amount is paid off in full you won’t have to pay any interest charges. Although, you do have the alternative of paying a minimum amount in which case you will have to pay interest on the remaining amount owed. This source of finance is recommended for new businesses as it gives them time to receive money from sales before they have to pay their expenses. It is also a good option for existing businesses but new businesses will tend to use it more to their advantage because it helps to maintain their cash flow and makes it easier for them to get started.

An example of this source is if I have just opened a Chinese take away then I can use my business credit card to buy stock. Once I have sold all my stock and I can pay the amount in full then I will get an interest free loan. Business credit cards have some advantages. It helps track purchases because you will get a statement each month which shows what the business has spent money on. You can get interest free credit if you pay the balance by the due date. With a business credit card being so convenient it does have its disadvantages. The card can be fixed with high interest rates and if you make late payments or failure to make a payments it can resolve in the interest rate to rise.

This can have a significant impact on the companies’ credit history and rating. This source is very useful although you should avoid making late payments because if you constantly have debt on the credit card, it can cost the business more money by paying interest rates. You will have to clear all debt before you can take advantage of the interest free credit again. You should always make payments on time to take advantage of this source. Failure to make payments can cause the business to get bad credit which means it will be harder to use other borrowing facilities in the future such as bank loans and it can harm the businesses’ reputation.

A business should take full advantage of trade credit and credit cards for short term financing. They are both very similar and suitable for new and existing businesses. However, I recommend using trade credit over credit cards because repayments are more flexible to a supplier than to a bank. I mean if you pay your credit card bills late you will be charged with interest but some suppliers are flexible with their payment and they can possibly excuse a late payment. Although, you should always try to make payments on time to avoid damaging company reputation and having bad credit history. Retained profits are considered to be a cheaper source of finance than bank loans and mortgages.

It is the best option available to help an existing company expand because it doesn’t carry any interest rates which means more capital for the business. If the business fails after taking out a bank loan and they can’t repay the loan, they can destroy their credit rating, making it difficult or impossible to get loans in the future. If retained profits are used and the business fails then it is just the companies’ investment that will be lost. For a new business, venture capital is considered to be the best source of long term finance. It is not only the investor’s money that is important but their skills and experience is crucial and could be the difference between a successful business and an unsuccessful one.

If you are planning to start up your own business you need an owner’s capital in order to secure a bank loan. Once the business starts operating it will be able to secure higher loans and take advantage of the retained profits. The retained profits can help the company expand without carrying any interest rates meaning more capital for the business. Trade credit comes in when the business is set up and you want to start selling products. You should shop around and find a good supplier that will offer you this source and if it’s used appropriately you will find it very convenient. These sources should help you succeed in your business.

Investopedia. (2014) Opportunity Cost. Available at: http://www.investopedia.com/terms/o/opportunitycost.asp Barclays. (2014) Your Loan Options. Available at: http://www.barclays.co.uk/Loans/P1242557963420 Money Supermarket. (2014) Advantages and disadvantages of mortgages. Available at: http://www.moneysupermarket.com/mortgages/advantages-and-disadvantages/ Gov.uk. (2014) Business finance explained. Loans. Available at: https://www.gov.uk/business-finance-explained/loans Tutor2u. (2012) Source of Finance – Retained Profits. Available at: http://tutor2u.net/business/finance/retained_profit.html eHow. (2014) Advantages and disadvantages of sale of assets. Available at: http://www.ehow.co.uk/info_8615419_advantages-disadvantages-sale-assets.html Tutor2u. (2012) What is share capital? Available at: http://www.tutor2u.net/blog/index.php/business-studies/comments/qa-what-is-share-capital NI Business Info. (2014) Advantages and disadvantages of equity finance. Available at: https://www.nibusinessinfo.co.uk/content/advantages-and-disadvantages-equity-finance Wikipedia. (2014) Trade Credit. Available at: http://en.wikipedia.org/wiki/Trade_credit Biz Help 24. (2014) Overdraft finance – Advantages and disadvantages. Available at: http://www.bizhelp24.com/money/business-finance/overdraft-finance-advantages-and-disadvantages.html Gov.uk (2014) Business finance explained. Overdrafts. Available at: https://www.gov.uk/business-finance-explained/overdrafts Money Supermarket. (2014) Advantages and disadvantages of credit cards. Available at: http://www.moneysupermarket.com/credit-cards/advantages-and-disadvantages/ Go Compare. (2014) Beginners guide to credit cards. Available at: http://www.gocompare.com/credit-cards/credit-cards-explained/

Place this order or similar order and get an amazing discount. USE Discount code “GET20” for 20% discount

Academic Writing Help

Dissertation Services

Admission Application Letters

Cheap Essays

Applied Sciences Custom Help

Professional Essay Writers

Biology Online Tutor

Business & Finance Online Tutor

Buy Customized Term Paper or Essay Online

Communication Assignment Help

Cheap Coursework

Become A Writer Contact Us FAQ

Write my Paper

Essay Writing Services

Computer Science Homework Help

Computer Science Online Tutor

Criminology Online Tutor

Economic Assignment Help

Dissertation Writing Service

Education Assignment Help

English Assignment Help

Environmental Science Online Tutor

Ethics Assignment Help

Financial Accounting Assistance

How Our Service is Used:

Our essays are NOT intended to be forwarded as finalized work as it is only strictly meant to be used for research and study purposes. We do not endorse or condone any type of plagiarism.

Geography Homework

Pay For Essay

History Help

Law Online Tutor

Type My Essay

International Law Online Tutor

Literature Homework Help

Write My Dissertation

Our Company

- Text on WhatsApp + (208) 408-0166

- Call or Text +1 (209) 264-9702

- We will be listed as ‘ Kendaall Enterprise ’ on your bank statement.

651 North Broad Street, Middletown, DE, United States, Delaware.

ESSAY SAUCE

FOR STUDENTS : ALL THE INGREDIENTS OF A GOOD ESSAY

Essay: Sources of Finance

Essay details and download:.

- Subject area(s): Accounting essays

- Reading time: 5 minutes

- Price: Free download

- Published: 21 June 2012*

- File format: Text

- Words: 1,207 (approx)

- Number of pages: 5 (approx)

Text preview of this essay:

This page of the essay has 1,207 words. Download the full version above.

Sources of Finance

Business Finance

How business finance works.

Whatever the business setting, the importance of financial resources are never far way. Many businesses, survive on external sources of funding: bank loans, commercial loans, investors, shareholders, and banking overdraft facilities to name just a few of the sources of finance.

However, before a business is able to secure finance, the ‘snapshot’ picture of either its’ previous trading accounts and/or its forecasting for growth and orders in the ensuing twelve months is a vital tool to be examined by external investors.

We will explore some of the important aspects of both: internal and external investments, financial incentives and other sources that are predominate in the UK and EU.

To start with, have a look at the diagram below; in which we can see a mapping of finance for a business – whatever, its size, shape or sector, all businesses will need to consider some, if not all, of these sources:-

External Sources

Shares: Limited companies could look to sell additional shares, to new or existing shareholders, in exchange for a return on their investment.

Loans: There are debenture loans, with fixed or variable interest, which are usually secured against the asset being invested in, so the loan company will have a legal shared interest in the investment. This means that the company would not be able to sell the asset without the lender’s prior agreement. In addition the lender will take priority over the owners and shareholders if the business should fail and the cost will have to be repaid even if a loss is made.

There are other types of loan for fixed amounts with fixed repayment schedules. These may be considered a little more flexible than debenture loans.

Overdraft: A bank overdraft may be a good source of short-term finance to help a business flatten seasonal dips in cash-flow, which would not justify or need a long-term solution. The advantage here is that interest is calculated daily and an overdraft is therefore cheaper than a loan.

Hire purchase: Hire purchase arrangements enable a firm to acquire an asset quickly without paying the full-price for it. The company will have exclusive use of the item for a set period of time and then have the option to either return it or buy it at a reduced price. This is often used to fund purchases of vehicles, machinery and ICT Products.

Credit from suppliers: Many invoices have payment terms of 30 days or longer. A company can take the maximum amount of time to pay and use the money in the interim period to finance other things. This method should be treated with caution to ensure that the invoice is still paid on time or else the firm might risk upsetting the supplier and jeopardise the future working relationship and terms of business. It should also be remembered that it’s not ‘found’ money but rather a careful balancing act of cash-flow.

Grants: Grants are often available from councils and other Government bodies for specific issues. For example there may be a council priority to regenerate a particular area of a town and who are happy to help fund refurbishment of buildings. Alternatively there may be an organisation that specialises in helping young entrepreneurs to launch new businesses. Assessment for grants can be very competitive, is very individual and not automatic.

Venture capital: This source is most often used in the early stages of developing a new business. There may be a huge risk of failure but the potential returns may also be big. This is a high risk source as the venture capitalist will be looking for a share in the firm’s equity and a strong return on their investment. However the significant experience these investors have in running businesses could prove valuable to the company. This is what the TV programme ‘Dragon’s Den’ is all about!

Factoring: This involves a company outsourcing its invoicing arrangements to an external organisation. It immediately allows the company to receive money based on the value of its outstanding invoices as well as to receive payment of future invoices more quickly. It works by the firm making a sale, sending the invoice to the customer, copying the invoice to the factoring company and the factoring company paying an agreed percentage of that invoice, usually 80% within 24 hours.

There are fees involved to cover credit management, administration charges, interest, and credit protection charges. This must be weighed up against the benefit gained in maximising cash flow, a reduction in the time spent chasing payments and access to a more sophisticated credit control system.

The downside is that customers may prefer to deal direct with the company selling the goods or services. In addition ending the relationship could be tricky as the sales ledger would have to be repurchased.

Internal Sources

Internal sources of finance are often from within the business and can be a large part of ‘personal investment’ by the business owner, their family members and perhaps even friends! Although this is often the; most easy form of, investment – it does come with a personal ‘price’.

- Personal savings: This is most often an option for small businesses where the owner has some savings available to use as they wish.

- Retained profit: This is profit already made that has been set aside to reinvest in the business. It could be used for new machinery, marketing and advertising, vehicles or a new IT system.

- Working capital: This is short-term money that is reserved for day-to-day expenses such as stationery, salaries, rent, bills and invoice payments.

- Sales of assets: There may be surplus fixed assets, such as buildings and machinery that could be sold to generate money for new areas. Decisions to sell items that are still used should be made carefully as it could affect capacity to deliver existing products and services.

The Scarce Resource: – Money!

Money is a scarce resource and each source has its own advantages and disadvantages. Lenders will be looking for a return on investment, the size of the risk and the flexibility with which they can get their money back when they want or need it. For the company seeking money, the decision as to the best source will ultimately depend on what the money is for, how long the money is needed for, the cost of borrowing and whether the firm can afford the repayments.

In a market driven economy which is the UK and EU, there is often a reluctance; by larger financial services to invest in smaller business ventures. Therefore, the first call on investment is often from the ‘personal’ pockets of the business owner.

Obtaining funding from external sources like the banking sector requires a large and varied set of criteria being met and managed by the business before a bank will release and invest its capital. All UK banks support business but at a variety of degree, therefore, all businesses, first point of financing is frequently itself.

Further reading …

The following website offers a very comprehensive overview of all sorts of business finance – why not, have a surf through its pages, to learn more about how, business finance is raised, managed and secured.

http://www.smallbusiness.co.uk/channels/small-business-finance/government-grants/

...(download the rest of the essay above)

About this essay:

If you use part of this page in your own work, you need to provide a citation, as follows:

Essay Sauce, Sources of Finance . Available from:<https://www.essaysauce.com/accounting-essays/sources-of-finance/> [Accessed 20-04-24].

These Accounting essays have been submitted to us by students in order to help you with your studies.

* This essay may have been previously published on Essay.uk.com at an earlier date.

Essay Categories:

- Accounting essays

- Architecture essays

- Business essays

- Computer science essays

- Criminology essays

- Economics essays

- Education essays

- Engineering essays

- English language essays

- Environmental studies essays

- Essay examples

- Finance essays

- Geography essays

- Health essays

- History essays

- Hospitality and tourism essays

- Human rights essays

- Information technology essays

- International relations

- Leadership essays

- Linguistics essays

- Literature essays

- Management essays

- Marketing essays

- Mathematics essays

- Media essays

- Medicine essays

- Military essays

- Miscellaneous essays

- Music Essays

- Nursing essays

- Philosophy essays

- Photography and arts essays

- Politics essays

- Project management essays

- Psychology essays

- Religious studies and theology essays

- Sample essays

- Science essays

- Social work essays

- Sociology essays

- Sports essays

- Types of essay

- Zoology essays

Essay on the Sources of Business Finance | Finance | Financial Management

After reading this essay you will learn about the long term and short term sources of business finance.

Essay on the Sources of Long Term Finance:

The sources of long-term finance include:

1. Issue of Equity and Preference Shares :

The share capital of a company is regarded as owned capital. A share is a unit of member’s interest in the company’s capital. The ‘equity share capital’ is the back bone of financial structure of any company.

The following are the features of equity shares:

ADVERTISEMENTS:

i. Risk Capital:

They provide the so-called ‘risk’ or ‘venture’ capital of the company. Their prospects rise and fall with the prosperity of the company and with the state of business conditions in general.

ii. Fluctuating Dividend:

The equity shareholders are the real owners of the company. If it does badly, they may get no dividend at all, if it does well, they may get good dividends. If losses continue, the owners may be unable to recover even their original investment after meeting the loan obligations.

iii. Changing Market Value:

The market value of equity shares depends on the profit earned by the company. The market value is determined by buyers and sellers who take into account earnings, prospects, the quality and calibre of management and general business outlook.

iv. Growth Prospects:

The equity share of a company may also act as ‘growth share’ that is, with prospects for further growth in case the company over a period of time has very good scope for quick expansion.

v. Protection against Inflation:

Equity shares represent the best hedging or insurance device, fully protecting investors against rising prices and against diminishing purchasing power of the currency. Investments in fixed income securities are poor hedges in an inflationary period.

vi. Voting Right:

Equity shareholders enjoy a statutory right to vote in the general meeting and thus exercise their voice in the management and affairs of the company.

‘Preference Shares’ are so called because the holders of such shares have preferential rights over equity shareholders.

These shares have three distinct characteristics:

i. They have the right to claim dividend out of profits at the fixed rate. However, payment of dividend is not legally compulsory. At the time of declaration of dividend, preference shareholders have a priority over equity shareholders.

ii. Preference shareholders have also the preferential right of claiming repayment of capital in the event of winding up of the company.

iii. Preference shares do not enjoy normal voting rights and voice in the management of the company’s affairs except when their interests are being directly affected.

Depending upon the terms and conditions of issue, different types of preference shares may be issued by a company to raise funds.

Preference shares may be issued as:

i. Cumulative or Non-Cumulative:

In case of cumulative preference shares, if dividend cannot be paid due to inadequate profits in a particular year the arrears of dividend will accumulate and become payable in subsequent years when profits are adequate. Others are non-cumulative preference shares.

ii. Participating or Non-Participating Shares:

If the shareholders, in addition to the fixed rate of dividend, are entitled to a further share in surplus after paying a reasonable dividend to equity shareholders, the shares are termed as participating, otherwise non-participating preference shares.

iii. Redeemable or Non-Redeemable Shares:

Redeemable shares are those which the company undertakes to repay after a certain specified period. Where such is not the case, the shares are called non-redeemable preference shares.

iv. Convertible Cumulative Preference Shares and Non-Cumulative Preference Shares:

A company may decide to issue cumulative preference shares with the additional provision that they will be convertible into equity shares, the preference shares are then known as convertible cumulative preference shares.

Merits and Demerits of Equity Shares:

The following are the advantages of equity share capital:

i. It provides risk capital.

ii. It is a source of permanent capital.

iii. It is the basis on which owners acquire their right of control over management.

iv. It does not require security of assets to be offered to raise ownership capital.

There are also certain limitations of ownership capital as a source of finance.

i. A company may find it difficult to raise additional ownership capital unless it has high profit-earning capacity, or growth prospects.

ii. Being a permanent source of capital, ownership funds cannot be reduced in the case of a company. A part of this fund may remain idle when there is no scope for expansion or fresh investment opportunities.

iii. Equity shareholders receive fluctuating dividends which may cause speculation and insider trading in these shares.

Merits and Demerits of Preference Shares:

Preference shares have the following merits:

i. It does not participate in the management of the affairs of the company.

ii. It helps to enlarge the sources of funds.

iii. Investors are inclined to invest in these shares due to the assurance of fixed return.

iv. Dividend is payable only when there are profits and the rate of preference dividend is fixed.

v. Trading on equity is possible.

The demerits of preference shares relate to some of its main characteristics:

i. They provided merely a fixed rate of return and that payment is also not legally compulsory. If it is not paid or accumulated as arrears, there is an adverse effect on the company’s credit.

ii. Investors seeking appreciation in value would not like to subscribe in preference shares.

iii. Dividend paid on preference shares is merely an appropriation of profits and not a charge, hence there is no tax-saving as in the case of interest payments.

2. Issue of Debentures :

It is a loan borrowed capital of the company. A debenture is the instrument of certificate issued by a company to acknowledge its debt.

Debentures have certain essential features:

i. They carry a fixed rate of interest.

ii. Generally they are repayable after a certain period as specified in the instrument itself.

iii. When debentures have to be retired, a huge amount is required. For this purpose a fund, known as ‘Sinking Fund’ is created so that the company does not find any difficulty in repaying the amount.

iv. Debentures may be converted into equity shares at the option of the debenture holders.

v. Usually debentures are secured over the immovable assets of the company.

Depending upon the terms and conditions of issue, there are different types of debentures:

(a) Secured or unsecured debentures;

(b) Convertible or non- convertible debentures.

The following are the merits of debentures:

i. It is a cheaper source of business finance since the rate of interest is lower than the rate of return on shares.

ii. Interest is a charge against profits of the company; so tax payable is reduced.

iii. Funds raised by the issue of debentures may be used in business to earn a much higher rate of return than the rate of interest (i.e., trading on equity is possible). As a result, the equity shareholders stand to gain.

iv. Issuing debentures during depression for raising finance is a convenient and easier source.

v. Debenture holders have no interference in the management of the company.

vi. Even financial institutions think it better to invest in debentures rather than to investment in shares of companies. This is due to the assurance of fixed return and repayment after a fixed period.

But it suffers from the following limitations also:

i. It involves a fixed financial commitment. The burden may be difficult to bear in case of falling profits.

ii. It is not possible to issue debentures beyond a certain limit due to the inadequacy of assets to be offered as security.

Shares and debentures can be made on the following grounds:

Distinction between:

a. Nature of Security:

A share indicates ownership while debentures indicate creditor ship.

b. Time of Issue:

Shares are issued by the company in the beginning to start a business while debentures are issued at a later stage to expend its business.

A Shareholder gets dividend when the company makes profit, and dividend may be fixed or fluctuating according to the nature of the share. A debenture holder gets interest at the fixed rate irrespective of profit or loss.

d. Repayment:

Equity shares can’t be purchased by a company. Redeemable preference shares are redeemable after the specified period. Amount of debenture is to be repaid usually at the end of a fixed period.

e. Rights and Privileges:

These are described in the Articles of Association whereas those of debenture-holders are defined in the debenture certificate.

f. Priority in Payment:

Priority in payment is available to debenture-holders at the time of winding up, but shareholders can get only if there is a surplus.

g. Debentures are profitable:

Debentures are profitable as under Income Tax Act., interest is a deductible item whereas dividend is an appropriation of profit, not a charge.

3. Loans from Financial Institutions :

A number of financial institutions have been set up by government with the main object of promoting industrial development. They play an important role as source of business finance.

Some of the important national level financial institutions are:

i. Industrial Credit and Investment Corporation of India (ICICI)

ii. Industrial Finance Corporation of India (IFICI)

iii. Industrial Development Bank of India (IDBI)

iv. Industrial Reconstruction Bank of India (IRBI)

v. National Industrial Development Corporation (NIDC)

vi. Unit Trust of India (UTI).

While financial institutions should play significant role in the financing of industry it is necessary to bear in mind very clearly that their contribution at best can be supplementary, marginal or subsidiary. Industries are expected to secure their capital requirements as far as possible directly through the open market approach. It is said that capital market institutions are not a resource of but a recourse to industrial finance, if open market approach is unable to satisfy their demands.

Apart from the national level institutions mentioned above, there are a number of similar Institutions set up in different states of India, viz.:

i. State Financial Corporations.

ii. State Industrial Development Corporations.

iii. State Industrial Investment Corporations.

The institutions operating in the capital market offer the following services:

i. Company Promotions.

ii. Company Underwriting.

iii. Company Finance.

iv. Institutional Investments:

Financial institutions at the national and state level provide long-and medium- term loans at reasonable rates of interest. They subscribe to the debenture issue of companies, and underwrite the public issue of shares and debentures. They also guarantee loans and deferred payments.

4. Retained Profits (Ploughing-Back of Profits) :

Retained profit is an internal source of business finance. It is a part of the ownership capital of the company. Successful companies make use of retained profits as much as possible for expansion of their business.

Since profits belong to the shareholders, the amount of retained profit is treated as ownership fund which serves the purpose of medium-and long-term finance.

It is better than other sources of business finance due to the following reasons:

i. There is no fixed commitment on this source since it is a part of risk capital like equity share capital. Use of retained profit does not involve any cost to be incurred for raising the funds.

ii. It does not require the security of assets which can be used for raising additional funds in the form of loan.

iii. Control over the management of the company remains unaffected. As an internal source, it is more dependable than external sources. It is not necessary to consider investor’s preference.

Limitations:

Limitations of self-financing or ploughing-back of profits are due to excessive resort t to this practice of internal financing.

i. Tendency towards monopoly due to over-investment.

ii. Accumulation of resources often attract competition in the market.

iii. With increased earning shareholders expect a higher rate of dividend to be paid.

iv. Danger of over-capitalisation due to frequent issue of bonus shares.

v. Growth of companies through internal financing may attract government restrictions as it leads to concentration of economic power.

5. Public Deposits :

Strictly speaking, it is a banking function, but it is performed by non-banking companies also. This is an important source of medium-term finance which companies make use of.

The following are the advantages of such non-bank deposits:

i. Public deposits are not secured loans.

ii. It is a cheaper source of business finance.

iii. If a company has public confidence and it has able and sincere top management, it is very simple, convenient and easy source of business finance.

iv. It enjoys tax exemption.

v. It is very profitable instrument of ‘trading on equity’, particularly for established enterprises.

But, it is an unreliable source of finance. It is an uncertain source of company finance and it is difficult to formulate the financial plan on the basis of public deposits. It is also an unsound source of finance. With the development of banking facility, it is generally losing its old glamour and importance.

Essay on the Sources of Short-Term Finance:

Sources of short-term finance are:

1. Trade Credit:

Trade credit is a common source of short-term finance available to all companies. It is readily available and is a flexible source. It refers to the amount payable to the suppliers of raw materials, goods etc. after an agreed period, which is generally less than a year. It is to be noted here that it is a legal commitment and must be honoured in all cases Payment has to be made regularly.

The more important advantages of trade credit as a source of short-term finance are the following:

i. It is an economical source of business finance.

ii. Time of payment is generally adjusted according to the continuity of dealings.

iii. Trade credit is readily available.

iv. Trade credit is a flexible source of finance. It can be easily adjusted to the changing needs for purchases.

2. Bank Loans and Advances:

Commercial banks are essentially dealers in short-term credit to finance current assets or circulating capital. Merchant banking institutions offer variety of services like promotion, syndication of projects, investment advice, management advisory services, acceptance credit and discount services, etc. Bank loans and advances are available in the form of cash credit and overdraft. Commercial banks also provide short-term finance by discounting bills of exchange.

The rate of interest on bank credit is fairly high. But the burden is not excessive because it is used for short periods and is compensated by profitable use of the funds.

3. Short-Term Loans from Finance Companies:

Short-term funds may be available from finance companies on the security of assets. Some finance companies also provide funds through leasing. Many finance companies like HDFC, Kotak Mahindra, Ross Murarka Finance, CEAT Finance, Escorts Finance, ITC Classic, SRF Finance and many other established finance companies are doing nice job in this sphere.

Related Articles:

- Sources of Finance: Internal and External | Industries

- Sources of Industrial Finance in India | Financial Management

- Capital Gearing: Concept and Factors Affecting It

- Essay on Financial Management: Top 5 Essays | Branches | Management

We use cookies

Privacy overview.

- Free Samples

- Premium Essays

- Editing Services Editing Proofreading Rewriting

- Extra Tools Essay Topic Generator Thesis Generator Citation Generator GPA Calculator Study Guides Donate Paper

- Essay Writing Help

- About Us About Us Testimonials FAQ

- Studentshare

- Finance & Accounting

- Sources of Finance

Sources of Finance - Essay Example

- Subject: Finance & Accounting

- Type: Essay

- Level: Ph.D.

- Pages: 3 (750 words)

- Downloads: 3

- Author: mekhistreich

Extract of sample "Sources of Finance"

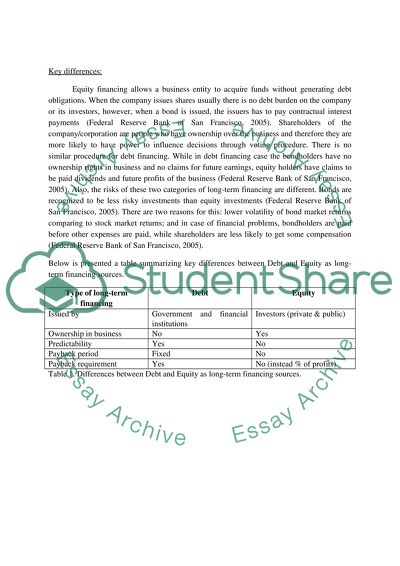

The equity market (also known as the stock market) is the market for trading equity instruments (Federal Reserve Bank of San Francisco, 2005). Shares are the securities issued to the general public and its ownership implies business ownership.There are two different types of shares: Equity shares and Preference shares (Finance.mapsofworld.com, 2013). One of the examples of the equity instrument is common stock shares, publicly traded on national and global Stock exchanges (Federal Reserve Bank of San Francisco, 2005).

Debts are the financial instruments traded for a long period of time. Example of debt instruments are mortgages and bonds (either corporate or government) (Federal Reserve Bank of San Francisco, 2005). Loans are granted by Banks, insurance companies or financial institutions in order to provide working capital or finance capital equipment (Term loan, 2006). Various banks including commercial banks, industrial development banks, and cooperative banks give medium-term loans for a period of 3-5 years (Finance.