financial modeling Recently Published Documents

Total documents.

- Latest Documents

- Most Cited Documents

- Contributed Authors

- Related Sources

- Related Keywords

How deep is your model? Network topology selection from a model validation perspective

AbstractDeep learning is a powerful tool, which is becoming increasingly popular in financial modeling. However, model validation requirements such as SR 11-7 pose a significant obstacle to the deployment of neural networks in a bank’s production system. Their typically high number of (hyper-)parameters poses a particular challenge to model selection, benchmarking and documentation. We present a simple grid based method together with an open source implementation and show how this pragmatically satisfies model validation requirements. We illustrate the method by learning the option pricing formula in the Black–Scholes and the Heston model.

Financial modeling basics

Abstract on garch models: financial modeling, financial modeling: probability theoretic approaches.

Background. A large number of significant socio-economic events occur under the influence of unique factors. Formal application of probabilistic and statistical methods in such cases leads to analytical conclusions without sufficient scientific justification. Financial modeling reflects modern approaches to the probability interpretation, provides introduction and systematization of risk indicators, and the necessity of improving theoretical and probabilistic disciplines of economic orientation. Analysis of recent research and publications has shown that despite significant investigations, financial modeling is not theoretically complete scientific direction in terms of economic risk indicators and derivative characteristics, important scientific and practical problems remain unresolved in the analysis of socio-economic phenomena in uncertainty and implementation of modern achievements of scientists to the process. The aim of the article is to study theoretical and probabilistic concepts of socio-economic processes in conditions of uncertainty and uniqueness based on the financial modeling methods. Materials and methods. Analytical and statistical methods, methods of mathematical statistics and probability theory are used in the research process. Information database is data from trading sessions of world stock markets. Results. Theoretical and probabilistic concepts, including interpretations of probability and risk are considered through formalization of the analysis process by the subject of the socio-economic phenomenon in conditions of uncertainty. Models of typical stationary, dynamic, parity and dominant lotteries with introduced risk indicators are built. Risk is interpreted as the ratio of negative and favorable factors of the phenomenon information background. Relevant indicators are illustrated and calculated using various socio-economic and financial cases. Subjective-probabilistic modeling (SPM) in relation to decision-making in the financial market is studied as the development of Bayesian subjectivism. It has been shown that group consensus SPM-assessments of risk generate specific derivative financial instruments such as binary options, index derivatives, crypto-assets, etc. Conclusion. The results of the study showed the application effectiveness of financial modeling methods of risks assessment in financial markets, the prospects of relevant development in the field of financial engineering. Teaching economic disciplines, which are based on theoretical and probabilistic postulates, statistical and analytical-statistical procedures for calculating probabilistic indicators (probability, risk, prevention regulations, etc.), requires significant addition using the introduction of new methods of information analysis of social background, financial sphere to determine the optimal direction of development and investment activities. Keywords: risk ratio, probability interpretation, binary options, financial modeling, high-risk financial markets, subjective-probabilistic modeling.

On the convoluted gamma to length-biased inverse Gaussian distribution and application in financial modeling

Modeling the aggregate risk of common stockholder through the determined financial model.

Subject. The article focuses on methods for modeling and quantifying the risk associated with common stockholders. Objectives. We perform a critical analysis and study how the existing risk assessment methods can be modified. The article demonstrates strengths and advantages of the determined financial model. Methods. The study is based on methods of the discourse analysis, mathematical statistics, financial modeling. Results. If the entity receives payments out of net profit, we show the modified formula for assessing the aggregate leverage and suggest using the term financial leverage in Russian. The chi-squared comparison method reveals the need to respect aggregate leverage restrictions. We also present formulae for assessing its minimum and maximum. In this study, we provide a broader view of the financial mentality as a concept, quantify to what extent the decision-maker is prone to risk. Conclusions and Relevance. The advisable aggregate leverage fits in the interval, which should be specifically assessed for each entity, and can be determined by official reporting data through the proposed formulae. Managing common stockholders’ risk pursues to maintain the aggregate leverage ratio within its maximum and minimum. This task can be solved by modifying the structure and ratio of fixed and variable costs.

The Frozen Supply Chain Business Case: A Management Accounting Instructional Resource

This case guides students through the process of preparing a real-life business case. The business case involves capital expenditure analysis for a potential project in the Wally-Mart Supermarkets frozen supply chain. There are three parts to the business case: (1) prepare a financial model in Excel with a discounted cash flow method, to analyze relevant incremental capital expenditures, revenues, costs and profits; (2) concisely communicate the financial model and business case in a business style Word report, and (3) concisely communicate the financial model and business case in a business style PowerPoint presentation. The case materials include a practice financial modeling exercise. The case is suitable for use in undergraduate and graduate management accounting courses.

Financial modeling trends for production companies in the context of Industry 4.0

Over the years, technological progress has accelerated highly, and the speed, flexibility, human error reduction, and the ability to manage the process in real time have become more critical and required production companies to adapt production and business models according to the needs. The demand for real-time decision support systems adapted to these raising business needs is continuously growing. Nevertheless, businesses usually face challenges in identifying new indicators, data sources, and appropriate financial modeling methods to analyze them. This paper aims to define and summarize the main financial/economic forecasting methods for production companies in the context of Industry 4.0. Main findings show forecasting accuracy of up to 96% when combining economic and demand information, optimal forecasting period from 10 months to five years, more frequent use of soft indicators in forecasting, the relationship between company’s size and production planning. Four groups of indicators used in financial modeling, such as (I) production-related, (II) customers’ and demand-oriented, (III) industry-specific, and (IV) media information indicators, were separated. The analysis forms a suggestion for decision-makers to pay more attention to the forecasting object identification, indicators’ selection peculiarities, data collection possibilities, and the choice of appropriate methods of financial modeling. AcknowledgmentThis work was partly supported by Project No. 0121U100470 “Sustainable development and resource security: from disruptive technologies to digital transformation of Ukrainian economy”.

Financial Modeling in Commodity Markets

Basics of financial modeling, export citation format, share document.

Research Topics & Ideas: Finance

120+ Finance Research Topic Ideas To Fast-Track Your Project

If you’re just starting out exploring potential research topics for your finance-related dissertation, thesis or research project, you’ve come to the right place. In this post, we’ll help kickstart your research topic ideation process by providing a hearty list of finance-centric research topics and ideas.

PS – This is just the start…

We know it’s exciting to run through a list of research topics, but please keep in mind that this list is just a starting point . To develop a suitable education-related research topic, you’ll need to identify a clear and convincing research gap , and a viable plan of action to fill that gap.

If this sounds foreign to you, check out our free research topic webinar that explores how to find and refine a high-quality research topic, from scratch. Alternatively, if you’d like hands-on help, consider our 1-on-1 coaching service .

Overview: Finance Research Topics

- Corporate finance topics

- Investment banking topics

- Private equity & VC

- Asset management

- Hedge funds

- Financial planning & advisory

- Quantitative finance

- Treasury management

- Financial technology (FinTech)

- Commercial banking

- International finance

Corporate Finance

These research topic ideas explore a breadth of issues ranging from the examination of capital structure to the exploration of financial strategies in mergers and acquisitions.

- Evaluating the impact of capital structure on firm performance across different industries

- Assessing the effectiveness of financial management practices in emerging markets

- A comparative analysis of the cost of capital and financial structure in multinational corporations across different regulatory environments

- Examining how integrating sustainability and CSR initiatives affect a corporation’s financial performance and brand reputation

- Analysing how rigorous financial analysis informs strategic decisions and contributes to corporate growth

- Examining the relationship between corporate governance structures and financial performance

- A comparative analysis of financing strategies among mergers and acquisitions

- Evaluating the importance of financial transparency and its impact on investor relations and trust

- Investigating the role of financial flexibility in strategic investment decisions during economic downturns

- Investigating how different dividend policies affect shareholder value and the firm’s financial performance

Investment Banking

The list below presents a series of research topics exploring the multifaceted dimensions of investment banking, with a particular focus on its evolution following the 2008 financial crisis.

- Analysing the evolution and impact of regulatory frameworks in investment banking post-2008 financial crisis

- Investigating the challenges and opportunities associated with cross-border M&As facilitated by investment banks.

- Evaluating the role of investment banks in facilitating mergers and acquisitions in emerging markets

- Analysing the transformation brought about by digital technologies in the delivery of investment banking services and its effects on efficiency and client satisfaction.

- Evaluating the role of investment banks in promoting sustainable finance and the integration of Environmental, Social, and Governance (ESG) criteria in investment decisions.

- Assessing the impact of technology on the efficiency and effectiveness of investment banking services

- Examining the effectiveness of investment banks in pricing and marketing IPOs, and the subsequent performance of these IPOs in the stock market.

- A comparative analysis of different risk management strategies employed by investment banks

- Examining the relationship between investment banking fees and corporate performance

- A comparative analysis of competitive strategies employed by leading investment banks and their impact on market share and profitability

Private Equity & Venture Capital (VC)

These research topic ideas are centred on venture capital and private equity investments, with a focus on their impact on technological startups, emerging technologies, and broader economic ecosystems.

- Investigating the determinants of successful venture capital investments in tech startups

- Analysing the trends and outcomes of venture capital funding in emerging technologies such as artificial intelligence, blockchain, or clean energy

- Assessing the performance and return on investment of different exit strategies employed by venture capital firms

- Assessing the impact of private equity investments on the financial performance of SMEs

- Analysing the role of venture capital in fostering innovation and entrepreneurship

- Evaluating the exit strategies of private equity firms: A comparative analysis

- Exploring the ethical considerations in private equity and venture capital financing

- Investigating how private equity ownership influences operational efficiency and overall business performance

- Evaluating the effectiveness of corporate governance structures in companies backed by private equity investments

- Examining how the regulatory environment in different regions affects the operations, investments and performance of private equity and venture capital firms

Asset Management

This list includes a range of research topic ideas focused on asset management, probing into the effectiveness of various strategies, the integration of technology, and the alignment with ethical principles among other key dimensions.

- Analysing the effectiveness of different asset allocation strategies in diverse economic environments

- Analysing the methodologies and effectiveness of performance attribution in asset management firms

- Assessing the impact of environmental, social, and governance (ESG) criteria on fund performance

- Examining the role of robo-advisors in modern asset management

- Evaluating how advancements in technology are reshaping portfolio management strategies within asset management firms

- Evaluating the performance persistence of mutual funds and hedge funds

- Investigating the long-term performance of portfolios managed with ethical or socially responsible investing principles

- Investigating the behavioural biases in individual and institutional investment decisions

- Examining the asset allocation strategies employed by pension funds and their impact on long-term fund performance

- Assessing the operational efficiency of asset management firms and its correlation with fund performance

Hedge Funds

Here we explore research topics related to hedge fund operations and strategies, including their implications on corporate governance, financial market stability, and regulatory compliance among other critical facets.

- Assessing the impact of hedge fund activism on corporate governance and financial performance

- Analysing the effectiveness and implications of market-neutral strategies employed by hedge funds

- Investigating how different fee structures impact the performance and investor attraction to hedge funds

- Evaluating the contribution of hedge funds to financial market liquidity and the implications for market stability

- Analysing the risk-return profile of hedge fund strategies during financial crises

- Evaluating the influence of regulatory changes on hedge fund operations and performance

- Examining the level of transparency and disclosure practices in the hedge fund industry and its impact on investor trust and regulatory compliance

- Assessing the contribution of hedge funds to systemic risk in financial markets, and the effectiveness of regulatory measures in mitigating such risks

- Examining the role of hedge funds in financial market stability

- Investigating the determinants of hedge fund success: A comparative analysis

Financial Planning and Advisory

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors.

- Evaluating the impact of financial literacy on individual financial planning effectiveness

- Analysing how different taxation policies influence financial planning strategies among individuals and businesses

- Evaluating the effectiveness and user adoption of digital tools in modern financial planning practices

- Investigating the adequacy of long-term financial planning strategies in ensuring retirement security

- Assessing the role of financial education in shaping financial planning behaviour among different demographic groups

- Examining the impact of psychological biases on financial planning and decision-making, and strategies to mitigate these biases

- Assessing the behavioural factors influencing financial planning decisions

- Examining the role of financial advisors in managing retirement savings

- A comparative analysis of traditional versus robo-advisory in financial planning

- Investigating the ethics of financial advisory practices

The following list delves into research topics within the insurance sector, touching on the technological transformations, regulatory shifts, and evolving consumer behaviours among other pivotal aspects.

- Analysing the impact of technology adoption on insurance pricing and risk management

- Analysing the influence of Insurtech innovations on the competitive dynamics and consumer choices in insurance markets

- Investigating the factors affecting consumer behaviour in insurance product selection and the role of digital channels in influencing decisions

- Assessing the effect of regulatory changes on insurance product offerings

- Examining the determinants of insurance penetration in emerging markets

- Evaluating the operational efficiency of claims management processes in insurance companies and its impact on customer satisfaction

- Examining the evolution and effectiveness of risk assessment models used in insurance underwriting and their impact on pricing and coverage

- Evaluating the role of insurance in financial stability and economic development

- Investigating the impact of climate change on insurance models and products

- Exploring the challenges and opportunities in underwriting cyber insurance in the face of evolving cyber threats and regulations

Quantitative Finance

These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ethical implications among other pivotal areas.

- Developing and testing new quantitative models for asset pricing

- Analysing the effectiveness and limitations of machine learning algorithms in predicting financial market movements

- Assessing the effectiveness of various risk management techniques in quantitative finance

- Evaluating the advancements in portfolio optimisation techniques and their impact on risk-adjusted returns

- Evaluating the impact of high-frequency trading on market efficiency and stability

- Investigating the influence of algorithmic trading strategies on market efficiency and liquidity

- Examining the risk parity approach in asset allocation and its effectiveness in different market conditions

- Examining the application of machine learning and artificial intelligence in quantitative financial analysis

- Investigating the ethical implications of quantitative financial innovations

- Assessing the profitability and market impact of statistical arbitrage strategies considering different market microstructures

Treasury Management

The following topic ideas explore treasury management, focusing on modernisation through technological advancements, the impact on firm liquidity, and the intertwined relationship with corporate governance among other crucial areas.

- Analysing the impact of treasury management practices on firm liquidity and profitability

- Analysing the role of automation in enhancing operational efficiency and strategic decision-making in treasury management

- Evaluating the effectiveness of various cash management strategies in multinational corporations

- Investigating the potential of blockchain technology in streamlining treasury operations and enhancing transparency

- Examining the role of treasury management in mitigating financial risks

- Evaluating the accuracy and effectiveness of various cash flow forecasting techniques employed in treasury management

- Assessing the impact of technological advancements on treasury management operations

- Examining the effectiveness of different foreign exchange risk management strategies employed by treasury managers in multinational corporations

- Assessing the impact of regulatory compliance requirements on the operational and strategic aspects of treasury management

- Investigating the relationship between treasury management and corporate governance

Financial Technology (FinTech)

The following research topic ideas explore the transformative potential of blockchain, the rise of open banking, and the burgeoning landscape of peer-to-peer lending among other focal areas.

- Evaluating the impact of blockchain technology on financial services

- Investigating the implications of open banking on consumer data privacy and financial services competition

- Assessing the role of FinTech in financial inclusion in emerging markets

- Analysing the role of peer-to-peer lending platforms in promoting financial inclusion and their impact on traditional banking systems

- Examining the cybersecurity challenges faced by FinTech firms and the regulatory measures to ensure data protection and financial stability

- Examining the regulatory challenges and opportunities in the FinTech ecosystem

- Assessing the impact of artificial intelligence on the delivery of financial services, customer experience, and operational efficiency within FinTech firms

- Analysing the adoption and impact of cryptocurrencies on traditional financial systems

- Investigating the determinants of success for FinTech startups

Commercial Banking

These topic ideas span commercial banking, encompassing digital transformation, support for small and medium-sized enterprises (SMEs), and the evolving regulatory and competitive landscape among other key themes.

- Assessing the impact of digital transformation on commercial banking services and competitiveness

- Analysing the impact of digital transformation on customer experience and operational efficiency in commercial banking

- Evaluating the role of commercial banks in supporting small and medium-sized enterprises (SMEs)

- Investigating the effectiveness of credit risk management practices and their impact on bank profitability and financial stability

- Examining the relationship between commercial banking practices and financial stability

- Evaluating the implications of open banking frameworks on the competitive landscape and service innovation in commercial banking

- Assessing how regulatory changes affect lending practices and risk appetite of commercial banks

- Examining how commercial banks are adapting their strategies in response to competition from FinTech firms and changing consumer preferences

- Analysing the impact of regulatory compliance on commercial banking operations

- Investigating the determinants of customer satisfaction and loyalty in commercial banking

International Finance

The folowing research topic ideas are centred around international finance and global economic dynamics, delving into aspects like exchange rate fluctuations, international financial regulations, and the role of international financial institutions among other pivotal areas.

- Analysing the determinants of exchange rate fluctuations and their impact on international trade

- Analysing the influence of global trade agreements on international financial flows and foreign direct investments

- Evaluating the effectiveness of international portfolio diversification strategies in mitigating risks and enhancing returns

- Evaluating the role of international financial institutions in global financial stability

- Investigating the role and implications of offshore financial centres on international financial stability and regulatory harmonisation

- Examining the impact of global financial crises on emerging market economies

- Examining the challenges and regulatory frameworks associated with cross-border banking operations

- Assessing the effectiveness of international financial regulations

- Investigating the challenges and opportunities of cross-border mergers and acquisitions

Choosing A Research Topic

These finance-related research topic ideas are starting points to guide your thinking. They are intentionally very broad and open-ended. By engaging with the currently literature in your field of interest, you’ll be able to narrow down your focus to a specific research gap .

When choosing a topic , you’ll need to take into account its originality, relevance, feasibility, and the resources you have at your disposal. Make sure to align your interest and expertise in the subject with your university program’s specific requirements. Always consult your academic advisor to ensure that your chosen topic not only meets the academic criteria but also provides a valuable contribution to the field.

If you need a helping hand, feel free to check out our private coaching service here.

You Might Also Like:

thank you for suggest those topic, I want to ask you about the subjects related to the fintech, can i measure it and how?

Submit a Comment Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Print Friendly

Search form

- Travel & Maps

- Our Building

- Supporting Mathematics

- Art and Oxford Mathematics

- Equality, Diversity & Inclusion

- Undergraduate Study

- Postgraduate Study

- Current Students

- Research Groups

- Case Studies

- Faculty Books

- Oxford Mathematics Alphabet

- Oxford Online Maths Club

- Oxford Maths Festival 2023

- It All Adds Up

- Problem Solving Matters

- PROMYS Europe

- Oxfordshire Maths Masterclasses

- Outreach Information

- Mailing List

- Key Contacts

- People List

- A Global Department

- Research Fellowship Programmes

- Professional Services Teams

- Conference Facilities

- Public Lectures & Events

- Departmental Seminars & Events

- Special Lectures

- Conferences

- Summer Schools

- Past Events

- Alumni Newsletters

- Info for Event Organisers & Attendees

- Mathematical and Computational Finance @ Oxford

Research in Mathematical & Computational Finance

- MCF Working Papers 2024

- MCF Working Papers 2023

- MCF Working Papers 2022

- MCF Working Papers 2021

- MCF Working Papers 2020

- MCF Working Papers 2019

- MCF Working Papers 2018

The Oxford Mathematical and Computational Finance Group is one of the leading academic research groups in the world focused on mathematical modeling in finance and offers a thriving research environment, with experts covering multiple areas of quantitative finance. Our group maintains close links with the Data Science , Stochastic Analysis and Numerical Analysis groups as well as the Institute for New Economic Thinking (INET), the Alan Turing Institute (Machine Learning in Finance ) , DataSig , the Oxford-Man Institute of Quantitative Finance and the Oxford Probability Group , enabling cross-fertilisation of ideas and techniques.

Research activities of the group cover a wide spectrum of topics in Quantitative Finance , ranging from market microstructure and high-frequency modeling to macro-financial modeling and systemic risk, as well as more traditional topics such as portfolio optimisation, derivative pricing, credit risk modeling, using a variety of methods: stochastic analysis, probability, partial differential equations, optimisation, numerical simulation, statistics and machine learning.

Mathematical Foundations and Continuous-time finance

Positioned within Oxford's Mathematical Institute, the group has developed a unique expertise in the mathematical foundations underlying quantitative finance and pioneered new approaches in mathematical modeling.

Sam Cohen , Rama Cont , Ben Hambly , Blanka Horvath , Jan Obloj and Zhongmin Qian explore topics in stochastic analysis -stochastic calculus, backward stochastic differential equations, interacting particle systems, Malliavin calculus, Functional Ito calculus, rough path theory, pathwise methods in stochastic analysis, optimal transport- and their applications to the design of robust models for the pricing and hedging of derivatives in presence of model uncertainty. Michael Monoyios works on duality methods for optimal investment and consumption problems, and on valuation and hedging problems in incomplete markets. He has worked on models with transaction costs, and with partial and inside information on asset price evolution. He has interests in Fernholz's stochastic portfolio theory, and on the geometric interpretation of functionally generated portfolios that arise in this theory. Jan Obloj works on robust formulations of classical problems -- pricing, hedging, risk management, optimal investment – and seeks to understand and quantify the effects of model uncertainty. Blanka Horvath focusses on implied volatility modelling, rough volatility models, stochastic volterra equations and stochastic volatility models their short -time asymptotic properties as well as their numerical properties for pricing, hedging and simulation.

Statistical modeling and Machine Learning in Finance

Our group is one of the few academic research teams in the world with an active research agenda at the interface of machine learning and quantitative finance. Several group members are Fellows of the Alan Turing Institute. Hanqing Jin is Director of the Oxford-Nie Big Data Lab , where Ning Wang has developed algorithms for sentiment analysis based on social media data. Sam Cohen is exploring applications of Deep Learning to continuous-time finance as well as issues related to model robustness and its interaction with statistical modelling and optimal control. Rama Cont , Blanka Horvath and Justin Sirignano investigate the use of Deep Learning and data-driven modelling in finance. Terry Lyons and his team investigate the use of rough path signatures for machine learning. Jan Obloj employs tools from the optimal transport theory to develop data-driven estimators for risk measures, and to quantify robustness of deep neural networks to adversarial attacks. Blanka Horvath develops deep learning tools for option pricing, (deep) calibration and hedging and for data-driven simulation of asset price dynamics and data-driven portfolio choice problems.

Market microstructure and algorithmic finance

Álvaro Cartea focuses on mathematical models of algorithmic trading and the design of optimal trade execition strategies in electronic markets.

Rama Cont pioneered the analytical study of stochastic models for limit order books and intraday market modeling, and investigates the impact of algorithmic trading on market stability and liquidity.

Leandro Sanchez-Betancourt studies the equilibrium between makers and takers of liquidity with continuous-time models and tools from stochastic control and machine learning.

Macro-financial modeling: financial stability and systemic risk

Our group is actively engaged in the development of mathematical models of large-scale financial systems with the goal of providing quantitative insights on financial stability and systemic risk to regulators and policy makers. Rama Cont and Ben Hambly investigate the link between micro- and macro-behavior in stochastic models of direct and indirect contagion in financial markets, using network models and analogies with interacting particle systems.

Rama Cont ,Research Fellow at the Institute for New Economic Thinking (INET), have developed network models and simulation-based approaches for macro stress-testing and monitoring systemic risk in banking systems, in liaison with central banks and international organisations such as the Bank of England, the European Central Bank, IMF and Norges Bank.

Rama Cont is Director of the Oxford Martin Programme on Systemic Resilience , an interdisciplinary programme aimed at exploring solutions for managing stress scenarios with the potential for major and prolonged economic disruption, severe human or economic impacts, and contagion.

Computational Finance

Our group is a leader in the development of advanced numerical methods and high performance computiing for high-dimensional problems in finance: Mike Giles is a pioneer on multilevel Monte-Carlo methods and their applications in finance, and a leading expert on the use of GPU and high performance computing methods in finance. Raphael Hauser has developed robust numerical methods for portfolio optimisation and high-dimensional optimisation problems in finance. Jan Obloj develops numerical methods for martingale optimal transport problems which yield bounds for option prices and optimal transport techniques for model calibration. Justin Sirignano has pioneered the use of Deep Learning methods for various applications in finance ranging from credit risk modeling to limit order book modeling. Christoph Reisinger develops novel and efficient numerical methods for stochastic control problems and high-dimensional (S)PDEs and their applications in finance; Terry Lyons devised cubature methods in Wiener space for solving stochastic differential equations. Sam Howison and Jeff Dewynne were among the pioneers in the development of advanced partial differential equation methods in finance, the use of asymptotic methods for their solution and their application to various markets such as energy and commodities. Blanka Horvath develops numerical solutions for pricing, hedging and optimal investment problems and analytic- and asymptotic methods for a wide variety of stochastic models for equity, FX and interest rate modelling. The numerical methodologies explore path-dependent data-driven machine learning solutions as well as quantum machine learning algorithms.

Behavioural finance

Hanqing Jin develops quantitative models of investor behaviour, building on the fundamental work of Kahneman and Tversky's prospect theory and Lopes' SP/A theory. Ning Wang is working on sentiment analysis based on social media data, as well as on using data to establish metrics for learning and identification purposes. Jan Obloj works on optimal decision problems for cumulative prospect theory agents and understanding their actions in dynamic environments, such as casino gambling.

For more information on research activities of our group please visit the individual websites of group members .

- Langson Library

- Science Library

- Grunigen Medical Library

- Law Library

- Connect From Off-Campus

- Accessibility

- Gateway Study Center

Email this link

Entrepreneurship.

- Articles, Journals, & Cases

- Industry & Market Reports

- Market Size & Share

- Ratios, Averages, & Benchmarks

- Top 5 Ethical Research Guidelines

- Research Methods & Sample Size

- Customer Discovery

- Top 5 Survey Tips

- Primary Research Tools

- How-To eBooks

- Profiles & Overviews

- Lists of Companies

- NAICS / SIC Codes

- Company Strategy and M&A

- Supply Chain

- People & Contacts

- Funding Databases

- Funding Opportunities

- Books on Business Models, Plans, & Structures

- Examples & Templates

- Financial Modeling

- Patent Basics

- Patent Searching

- Trademark Basics

- Trademark Searching

- Copyright Basics & Searching

- Medical Devices

- Healthcare & Biotechnology

- Engineering

- IT & Technology

- Metaverse / AR / VR

- Ideation Resources

- Pitch Deck Resources

- New Venture Competition

- Entrepreneurship @ UCI

Usage policy & guidance

How to connect from off-campus

Test my UCI connection

Common VPN issues

Connecting FAQs

Financial modeling

Financial modeling templates

- Financial projections

- Balance sheet (projected)

- Break-even analysis

- 12-month cash flow statement

- 12-month profit and loss projection

- Financial history & ratios

Learn about financial modeling

- << Previous: Ratios, Averages, & Benchmarks

- Next: Intellectual Property Research >>

- Last Updated: May 13, 2024 11:33 AM

- URL: https://guides.lib.uci.edu/entrepreneurship

Off-campus? Please use the Software VPN and choose the group UCIFull to access licensed content. For more information, please Click here

Software VPN is not available for guests, so they may not have access to some content when connecting from off-campus.

- Frontiers in Applied Mathematics and Statistics

- Mathematical Finance

- Research Topics

Financial Modeling with Frictions

Total Downloads

Total Views and Downloads

About this Research Topic

Note for potential authors: please see the link on the right for further information on publishing fees , including fee discounts and how to apply for fee support . Most approaches in both academia and industry assume the absence of frictions as one of the main premises in modeling financial markets. However, both empirical evidence and the actual working mechanisms of markets show that this premise is far from being fulfilled. Market frictions can be categorized in a variety of ways, and comprise transaction costs, taxes, explicit or implicit regulatory costs, the indivisibility feature of assets, assets’ non-tradability and illiquidity, the presence of agency and information problems, different funding and adjustment rates, and discrete-time trading mechanisms. These frictions are responsible for the stochasticity of the state variables governing the market, the irregularity of the asset prices’ trajectories, the persistence (or otherwise) of the corresponding time series, and the presence of a long memory of the probability distributions representing them. Such considerations dictate the need to introduce more sophisticated mathematical models able to incorporate the above-mentioned features. In so doing, one of the basic assumptions of financial models – namely, market completeness – is missing. In mathematical terms, this translates into the non-uniqueness of the equivalent martingale measure, paving the way for the need of generalizations of the classical no-arbitrage principle. In terms of applications, market incompleteness acts on several levels, ranging from the need for derivatives traders to manage unhedgeable risk, to the complications investors face when they aim to choose optimal wealth allocation or consumption strategies. This Research Topic aims to provide solutions that are rigorous from a mathematical point of view and realistic from an economic perspective, to address classic problems in finance such as arbitrage-free derivative pricing and portfolio optimization. Topics of interest include, but are not limited to, the following: - Optimal control problems with frictions - Derivative pricing in non-frictionless markets - Decisions under partial information and asymmetric information - Risk management with frictions - Machine learning in non-frictionless markets - Market impact analysis - Optimal execution algorithms in the presence of market frictions - Fractal tools and roughness modeling in finance

Keywords : frictions, finance, insurance, pricing, trading, roughness, optimal control

Important Note : All contributions to this Research Topic must be within the scope of the section and journal to which they are submitted, as defined in their mission statements. Frontiers reserves the right to guide an out-of-scope manuscript to a more suitable section or journal at any stage of peer review.

Topic Editors

Topic coordinators, submission deadlines, participating journals.

Manuscripts can be submitted to this Research Topic via the following journals:

total views

- Demographics

No records found

total views article views downloads topic views

Top countries

Top referring sites, about frontiers research topics.

With their unique mixes of varied contributions from Original Research to Review Articles, Research Topics unify the most influential researchers, the latest key findings and historical advances in a hot research area! Find out more on how to host your own Frontiers Research Topic or contribute to one as an author.

Introduction to Topics in Modelling Financial and Macroeconomic Time Series

- Published: 01 July 2020

- Volume 56 , pages 1–3, ( 2020 )

Cite this article

- Fredj Jawadi 1

907 Accesses

2 Citations

Explore all metrics

This special issue of Computational Economics features recent and original studies, most of which were presented at the fourth International Workshop in Financial Markets and Nonlinear Dynamics (FMND), organized in Paris in June 2019 ( www.fmnd.fr ). The papers describe and apply recent developments in financial econometrics to model the properties of financial and macroeconomic data. They present different methodologies and provide interesting and original findings.

Avoid common mistakes on your manuscript.

Over the last few decades, there has been a growing body of literature on modelling financial and macroeconomic data, facilitated by easy access to a considerable amount of data as well as the availability of sophisticated machines which have helped scholars to datamine a large quantity of information. Further, since the aftermath of the global financial crisis in 2008–2009, many of the financial and macroeconomic models used in the past have been subject to criticism for yielding different back-testing results and extensions.

The current special issue of Computational Economics has published a series of twelve original research papers, presented at the fourth international workshop of financial markets and nonlinear dynamics organized in Paris in June 2019 ( www.fmnd.fr ). We briefly introduce and present these papers, grouping them by field of research.

We begin with two papers in the domain of portfolios. The first paper, by Detao Zhang and his co-authors, focuses on the selection of an optimal portfolio for investors under uncertain exit random time, with a focus on information costs and short sales constraints. Maximizing the ratio between the wealth and the value of fixed assets, the authors develop an optimal portfolio choice strategy and empirically validate it through simulations. Jean-Luc Prigent and his co-authors also determine an optimal financial portfolio under the assumption of ambiguity aversion. In particular, they adopt a framework that enables investors to invest in various risky assets. Formally, they investigate the CRRA framework, while introducing ambiguity using the entropy criterion. Accordingly, the authors show that ambiguity regarding the correlation between risky assets might impact the optimal payoff.

Modelling connectedness is the focus of the next two papers in this special issue. Paper 3 by Philip Franses applies non-parametric Dynamic Time Warping (DTW) to study similarities across economic time series. The author shows that DTW is able to capture alternations between lead-lag series relations. Through an application to US data, the author highlights further evidence of temporal alignments across state dynamics of the US business cycle around the great recession. He also shows state-varying recoveries from the recession. In paper 4 by Apostolos Serletis and his co-authors, the authors address the estimation of singular demand systems under the assumption of a time-varying matrix of errors for the demand system, while considering the constant conditional correlation (CCC) and dynamic conditional correlation (DCC) parameterizations of the variance model. The authors derive a number of important practical results and also provide an empirical application to support their methodology.

The next three papers in this special issue highlight the interest of using time-variation modelling. Paper 5, by Juan Sapena and his co-authors, develops a flexible state-space framework to model time series data to develop a mean-reverting panel time-series model. This econometric framework is particularly useful to capture further asymmetry and nonlinearity in the data. Applying the Feldstein-Horioka puzzle in a 17-country panel, the authors show the interest of their model, especially for solving complexities within macroeconomic data. Stephen Hall and his co-authors carried out a series of Monte Carlo Simulations to examine the performance of a time-varying-coefficient (TVC) procedure (paper 6) that deals with measurement errors, omitted variables, incorrect functional forms and simultaneity. In particular, the authors developed a new Bayesian search technique to set the appropriate driver variables for this TVC methodology. Paper 7 by Nabila Jawadi and her co-authors demonstrates the interest of time-varying modelling to compute the effects of investor attention on Islamic Stock returns. In particular, it appears that investor attention might drive investment is Islamic stock bonds, but this effect is time-varying and changes with the quantile under consideration.

The next three papers develop specific technical procedures that aim to optimize the datamining of financial time series. In particular, paper 8 by R. Neck develops a new OPTCON 3 algorithm to determine optimal policies for stochastic control problems with a quadratic objective function and nonlinear dynamic models. While including active learning and the dual effects of optimizing policies, the author points to the interest of an OPTCON3 approach to enhance our understanding of the adaptive economic policy problem under uncertainty. Carlos Rivero is the author of paper 9 which proposes a new procedure for Constant Parameters in a stochastic volatility model. In particular, the author proposes a new way to test the constancy of parameters in the stochastic volatility equation. He demonstrates the relevance and performance of his method using a Monte Carlo simulation. Paper 10 by Chengzhao Zhang introduces the kernel method into fuzzy c-mean algorithm (FCM) and synthetic minority over-sampling technique (SMOTE), combining them with a support vector machine (SVM) to propose a hybrid model of KFCM-KSMOTE-SVM for the Chinese stock market (China Securities Index 300). Empirically, the author shows that the KFCM-KSMOTE-SVM significantly outperforms various other prediction models, suggesting that KFCM-KSMOTE-SVM can solve the class imbalance problem in financial markets and predict extreme financial risks.

Finally, the two last papers in this issue deal with fascinating topics in banking and asset pricing. In paper 11, Sushanta Mallick and his co-author take bank ownership structures into consideration, while checking for improvements to efficiency in the convergence of banks in India during the post-reform period. Applying a nonparametric frontier estimator’s approach to a balanced panel of 73 banks, the authors compute time-dependent bank efficiency scores in order to examine the dynamics of the technological frontier and catch-up levels of Indian banks, pointing to the superiority of state-owned banks in India. In the last paper, by Jean-Luc Prigent and his co-author, the pricing process of a Bermuda swaption is explained from a computational point of view, and the process that provides a Bermuda swaption price is developed. Accordingly, using a 3-factor hybrid model based on the Libor market model that combines the domestic market, the foreign market and the foreign exchange market, they find further evidence of significant relationships between the cross-currency product and the volatility of each of the three markets under consideration.

Author information

Authors and affiliations.

University of Lille, Office B655, 104 Avenue du Peuple Belge, 59043, Lille Cedex, France

Fredj Jawadi

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Fredj Jawadi .

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Reprints and permissions

About this article

Jawadi, F. Introduction to Topics in Modelling Financial and Macroeconomic Time Series. Comput Econ 56 , 1–3 (2020). https://doi.org/10.1007/s10614-020-10011-7

Download citation

Published : 01 July 2020

Issue Date : June 2020

DOI : https://doi.org/10.1007/s10614-020-10011-7

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Time Series modelling

- Financial data

- Macroeconomic data

JEL Classifications

- Find a journal

- Publish with us

- Track your research

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

- Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

Support for legal abortion is widespread in many places, especially in Europe

Majorities in most of the 27 places around the world that Pew Research Center surveyed in 2023 and 2024 say abortion should be legal in all or most cases. But attitudes differ widely – even within places. Religiously unaffiliated adults, people on the ideological left and women are more likely to support legal abortion in many places.

This analysis focuses on public opinion of abortion in 27 places in North America, Europe, the Middle East, the Asia-Pacific, sub-Saharan Africa and Latin America.

This analysis draws on nationally representative surveys of 27,285 adults conducted from Feb. 20 to May 22, 2023. All surveys were conducted over the phone with adults in Canada, France, Germany, Greece, Italy, Japan, the Netherlands, South Korea, Spain, Sweden and the United Kingdom. Surveys were conducted face-to-face in Argentina, Brazil, Hungary, India, Indonesia, Israel, Kenya, Mexico, Nigeria, Poland and South Africa. In Australia, we used a mixed-mode probability-based online panel.

Data from Hong Kong, Taiwan and Vietnam comes from a survey of 6,544 adults conducted from June 6 to Sept. 17, 2023. All interviews in Hong Kong and Taiwan were conducted over the phone; those in Vietnam were conducted face-to-face.

In the United States, data comes from a survey of 8,709 U.S. adults conducted from April 8 to 14, 2024. Everyone who took part in this survey is a member of Pew Research Center’s American Trends Panel (ATP), an online survey panel that is recruited through national, random sampling of residential addresses. This way nearly all U.S. adults have a chance of selection. The survey is weighted to be representative of the U.S. adult population by gender, race, ethnicity, partisan affiliation, education and other categories. Read more about the ATP’s methodology .

Here are the questions used for this analysis , along with responses, and the survey methodology .

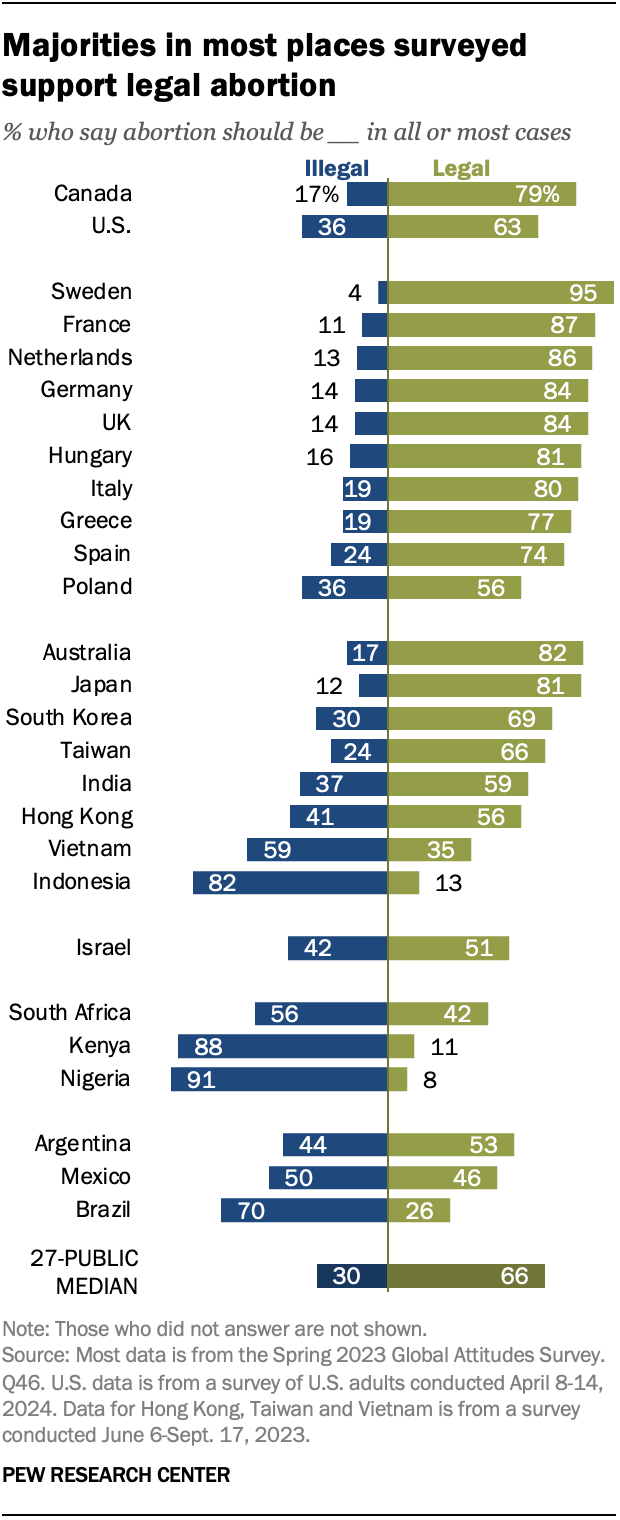

A median of 66% of adults across the 27 places surveyed believe abortion should be legal in all or most cases, while a median of 30% believe it should be illegal in all or most cases.

In the United States, where a Supreme Court decision ended the constitutional right to abortion in 2022, 63% of adults say abortion should be legal in all or most cases. U.S. support for legal abortion has not changed in recent years.

In Europe, there is widespread agreement that abortion should be legal. In nearly every European country surveyed, at least 75% of adults hold this view, including roughly 25% or more who say it should be legal in all cases.

Swedes are especially supportive: 95% say it should be legal, including 66% who say it should be legal in all cases.

Poland stands out among the European countries surveyed for its residents’ more restrictive views, at least compared with other Europeans. Over half of Poles (56%) say abortion should be legal in all or most cases, but 36% say it should be illegal in all or most cases.

Attitudes are more varied in the Asia-Pacific region. Majorities say abortion should be legal in all or most cases in Australia, Hong Kong, India, Japan, South Korea and Taiwan. But in Vietnam, a majority (59%) say it should be illegal in all or most cases, and 82% in Indonesia share this view.

In Israel, 51% of adults say abortion should be legal in all or most cases, while 42% say it should be illegal in all or most cases.

In all three African countries surveyed – Kenya, Nigeria and South Africa – majorities say abortion should be illegal in all or most cases. That includes 88% of adults in Kenya and 91% in Nigeria.

In South America, views about legal abortion are divided in Argentina and Mexico. But in Brazil, seven-in-ten adults say abortion should be illegal in all or most cases.

Abortion legislation and views of abortion

Abortion rules tend to be more restrictive in places where support for legal abortion is lower. Abortions in Brazil, Indonesia and Nigeria are only permitted when a woman’s life is at risk, according to the Center for Reproductive Rights . In Israel, Kenya and Poland, abortion is permitted to preserve a woman’s health. Most other places surveyed have more permissive regulations that allow abortions up to a specific point during the pregnancy.

Compared with Pew Research Center surveys over the past decade in Europe , India and Latin America , more people in many countries now say that abortion should be legal in all or most cases.

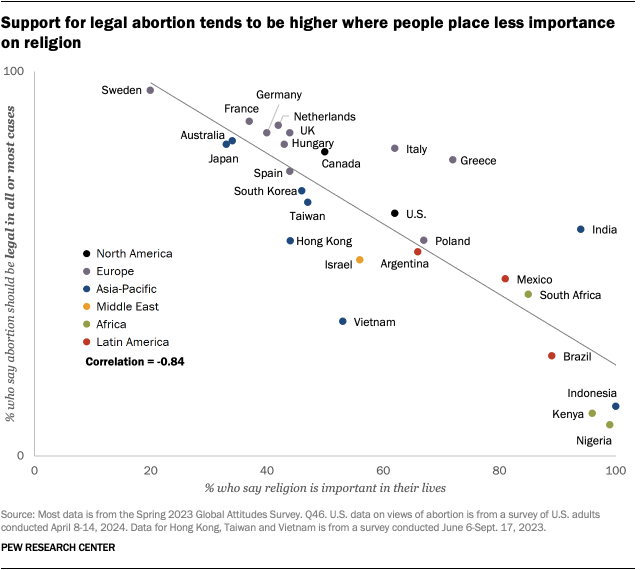

Importance of religion and attitudes toward abortion

Attitudes toward abortion are strongly tied to how important people say religion is in their lives. In places where a greater share of people say religion is at least somewhat important to them, much smaller shares think abortion should be legal.

For example, 99% of Nigerians say religion is important in their lives and only 8% say abortion should be legal in all or most cases. On the opposite end of the spectrum, 20% of Swedes see religion as important and 95% support legal abortion.

People in India are outliers: 94% view religion as important, but 59% also favor legal abortion.

How religious affiliation, GDP relate to abortion views

Economic development plays a role in this relationship, too. In places with lower gross domestic product (GDP) per capita , people tend to be more religious and have more restrictive attitudes about abortion.

But the U.S. stands apart in this regard: Among the advanced economies surveyed, Americans have the highest per capita GDP but are among the most likely to say religion is important to them. They are also among the least likely to say abortion should be legal in all or most cases.

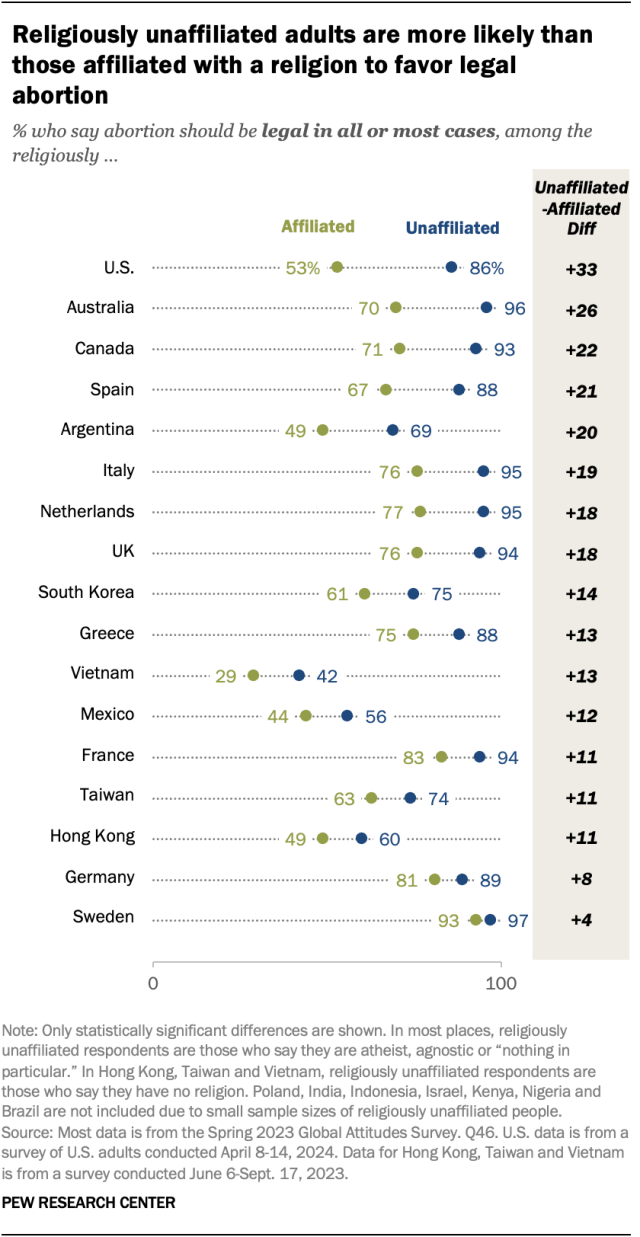

Religious affiliation is also an important factor when considering views of abortion in particular places.

On balance, adults who are religiously unaffiliated – self-identifying as atheist, agnostic or “nothing in particular” – are more likely to say abortion should be legal in all or most cases than are those who identify with a religion.

This difference is largest in the U.S., where 86% of religiously unaffiliated adults say abortion should be legal in all or most cases, compared with 53% of religiously affiliated Americans. Of course, differences also exist among religiously affiliated Americans. White evangelical Protestants are the least likely to favor legal abortion.

In countries where there are two dominant religions and negligible shares of religiously unaffiliated adults, there are often divides between the dominant religions.

Take Israel, for example, where 99% of adults affiliate with a religion. While 56% of Jewish adults say abortion should be legal in all or most cases, 23% of Muslims agree. And 89% of Jews who describe themselves as Hiloni (“secular”) favor legal abortion, compared with only 12% of Haredi (“ultra-orthodox”) or Dati (“religious”) Jews. Masorti (“traditional”) Jews fall in between, with 58% favoring legal abortion.

Views differ by religion in Nigeria, too, even as the vast majority of Nigerians oppose legal abortion. One-in-ten Nigerian Christians support legal abortion in all or most cases, compared with just 3% of Nigerian Muslims.

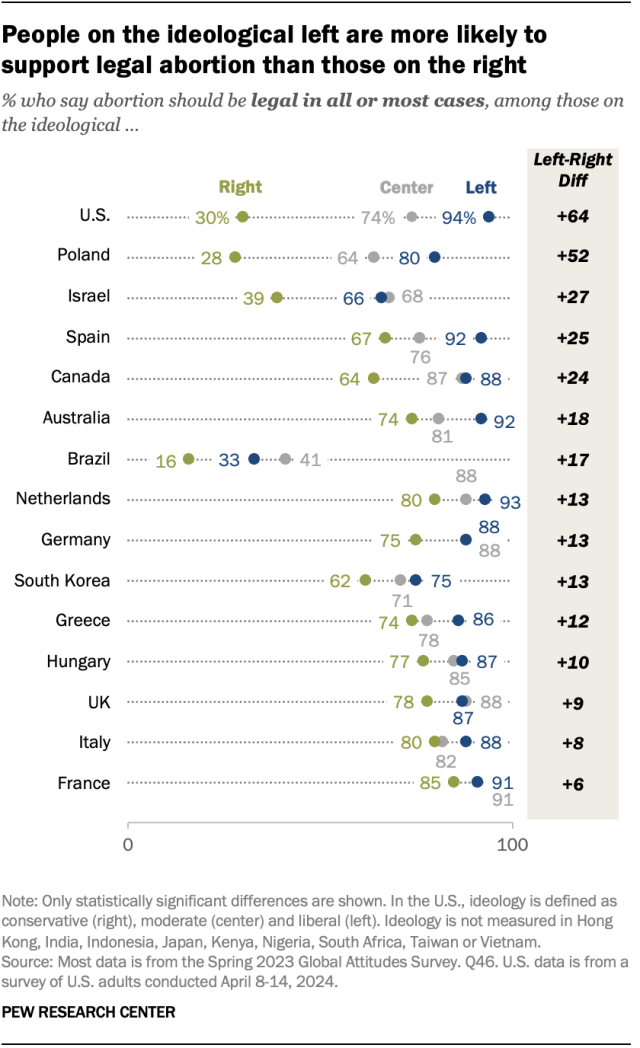

Differences in views by political ideology

In 15 of the 18 countries where the Center measures political ideology on a left-right scale, those on the left are more likely than those on the right to say abortion should be legal in all or most cases.

Again, Americans are the most divided in their views: 94% of liberals support legal abortion, compared with 30% of conservatives.

Opinions by gender

Gender also plays a role in views of abortion, though these differences are not as large or widespread as ideological and religious differences.

In seven countries surveyed – Australia, Israel, Japan, South Korea, Sweden, the UK and the U.S. – women are significantly more likely than men to say abortion should be legal in all or most cases.

In an additional six countries in Europe and North America, women are more likely than men to say abortion should be legal in all cases.

In Hong Kong, Hungary, India, Indonesia, Poland, Taiwan, Vietnam and all the African and Latin American countries surveyed, men and women have more similar views on abortion.

Note: Here are the questions used for this analysis , along with responses, and the survey methodology . This is an update of a post originally published June 20, 2023.

- Household Structure & Family Roles

- International Issues

- Religion & Abortion

Janell Fetterolf is a senior researcher focusing on global attitudes at Pew Research Center .

Laura Clancy is a research analyst focusing on global attitudes research at Pew Research Center .

Americans overwhelmingly say access to IVF is a good thing

Among parents with young adult children, some dads feel less connected to their kids than moms do, most east asian adults say men and women should share financial and caregiving duties, parents, young adult children and the transition to adulthood, public has mixed views on the modern american family, most popular.

1615 L St. NW, Suite 800 Washington, DC 20036 USA (+1) 202-419-4300 | Main (+1) 202-857-8562 | Fax (+1) 202-419-4372 | Media Inquiries

Research Topics

- Age & Generations

- Coronavirus (COVID-19)

- Economy & Work

- Family & Relationships

- Gender & LGBTQ

- Immigration & Migration

- International Affairs

- Internet & Technology

- Methodological Research

- News Habits & Media

- Non-U.S. Governments

- Other Topics

- Politics & Policy

- Race & Ethnicity

- Email Newsletters

ABOUT PEW RESEARCH CENTER Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions. It is a subsidiary of The Pew Charitable Trusts .

Copyright 2024 Pew Research Center

- Work & Careers

- Life & Arts

Become an FT subscriber

Try unlimited access Only $1 for 4 weeks

Then $75 per month. Complete digital access to quality FT journalism on any device. Cancel anytime during your trial.

- Global news & analysis

- Expert opinion

- Special features

- FirstFT newsletter

- Videos & Podcasts

- Android & iOS app

- FT Edit app

- 10 gift articles per month

Explore more offers.

Standard digital.

- FT Digital Edition

Premium Digital

Print + premium digital, ft professional, weekend print + standard digital, weekend print + premium digital.

Essential digital access to quality FT journalism on any device. Pay a year upfront and save 20%.

- Global news & analysis

- Exclusive FT analysis

- FT App on Android & iOS

- FirstFT: the day's biggest stories

- 20+ curated newsletters

- Follow topics & set alerts with myFT

- FT Videos & Podcasts

- 20 monthly gift articles to share

- Lex: FT's flagship investment column

- 15+ Premium newsletters by leading experts

- FT Digital Edition: our digitised print edition

- Weekday Print Edition

- Videos & Podcasts

- Premium newsletters

- 10 additional gift articles per month

- FT Weekend Print delivery

- Everything in Standard Digital

- Everything in Premium Digital

Complete digital access to quality FT journalism with expert analysis from industry leaders. Pay a year upfront and save 20%.

- 10 monthly gift articles to share

- Everything in Print

- Make and share highlights

- FT Workspace

- Markets data widget

- Subscription Manager

- Workflow integrations

- Occasional readers go free

- Volume discount

Terms & Conditions apply

Explore our full range of subscriptions.

Why the ft.

See why over a million readers pay to read the Financial Times.

International Edition

How Much Research Is Being Written by Large Language Models?

New studies show a marked spike in LLM usage in academia, especially in computer science. What does this mean for researchers and reviewers?

In March of this year, a tweet about an academic paper went viral for all the wrong reasons. The introduction section of the paper, published in Elsevier’s Surfaces and Interfaces , began with this line: Certainly, here is a possible introduction for your topic.

Look familiar?

It should, if you are a user of ChatGPT and have applied its talents for the purpose of content generation. LLMs are being increasingly used to assist with writing tasks, but examples like this in academia are largely anecdotal and had not been quantified before now.

“While this is an egregious example,” says James Zou , associate professor of biomedical data science and, by courtesy, of computer science and of electrical engineering at Stanford, “in many cases, it’s less obvious, and that’s why we need to develop more granular and robust statistical methods to estimate the frequency and magnitude of LLM usage. At this particular moment, people want to know what content around us is written by AI. This is especially important in the context of research, for the papers we author and read and the reviews we get on our papers. That’s why we wanted to study how much of those have been written with the help of AI.”

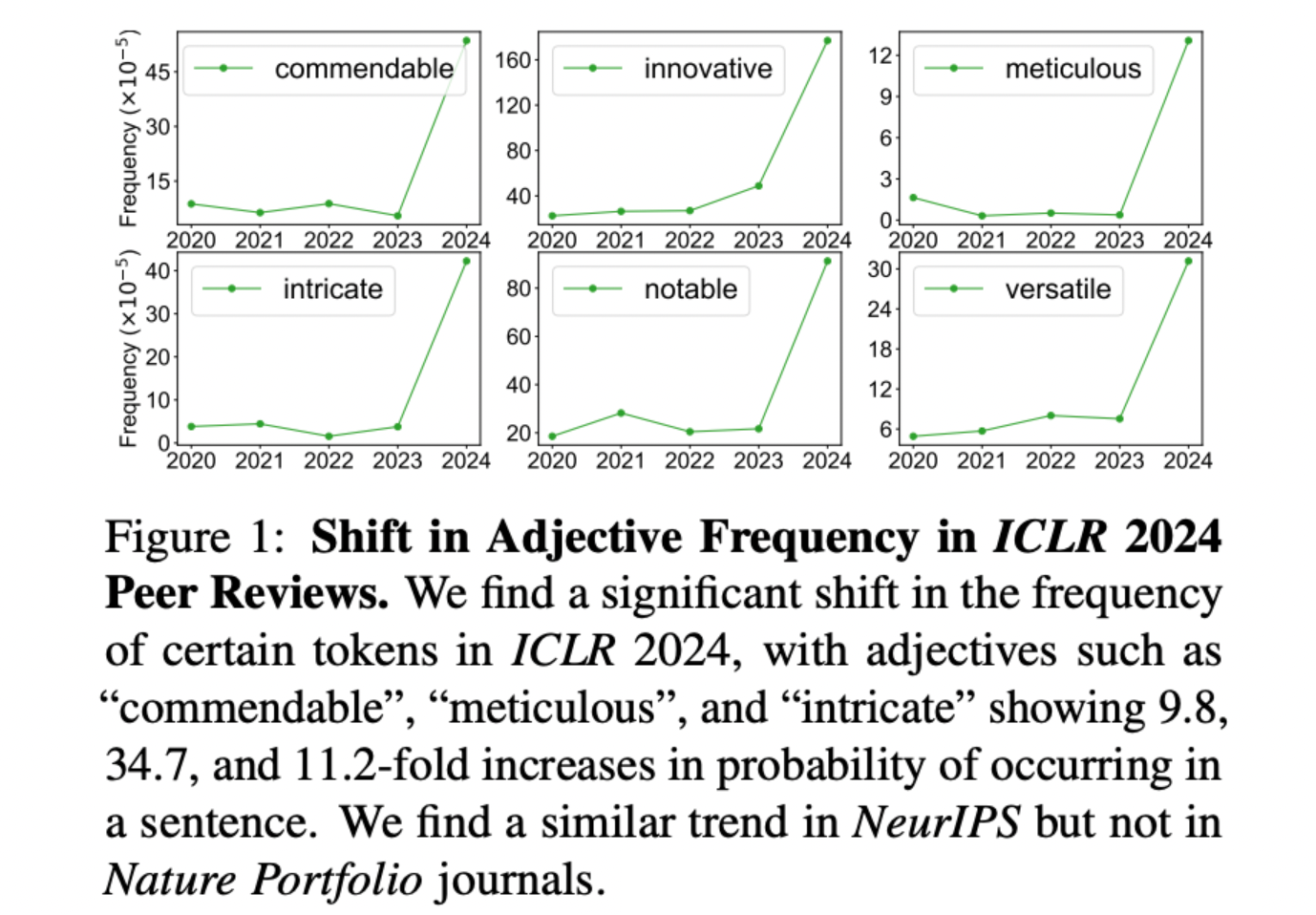

In two papers looking at LLM use in scientific publishings, Zou and his team* found that 17.5% of computer science papers and 16.9% of peer review text had at least some content drafted by AI. The paper on LLM usage in peer reviews will be presented at the International Conference on Machine Learning.

Read Mapping the Increasing Use of LLMs in Scientific Papers and Monitoring AI-Modified Content at Scale: A Case Study on the Impact of ChatGPT on AI Conference Peer Reviews

Here Zou discusses the findings and implications of this work, which was supported through a Stanford HAI Hoffman Yee Research Grant .

How did you determine whether AI wrote sections of a paper or a review?

We first saw that there are these specific worlds – like commendable, innovative, meticulous, pivotal, intricate, realm, and showcasing – whose frequency in reviews sharply spiked, coinciding with the release of ChatGPT. Additionally, we know that these words are much more likely to be used by LLMs than by humans. The reason we know this is that we actually did an experiment where we took many papers, used LLMs to write reviews of them, and compared those reviews to reviews written by human reviewers on the same papers. Then we quantified which words are more likely to be used by LLMs vs. humans, and those are exactly the words listed. The fact that they are more likely to be used by an LLM and that they have also seen a sharp spike coinciding with the release of LLMs is strong evidence.

Some journals permit the use of LLMs in academic writing, as long as it’s noted, while others, including Science and the ICML conference, prohibit it. How are the ethics perceived in academia?

This is an important and timely topic because the policies of various journals are changing very quickly. For example, Science said in the beginning that they would not allow authors to use language models in their submissions, but they later changed their policy and said that people could use language models, but authors have to explicitly note where the language model is being used. All the journals are struggling with how to define this and what’s the right way going forward.

You observed an increase in usage of LLMs in academic writing, particularly in computer science papers (up to 17.5%). Math and Nature family papers, meanwhile, used AI text about 6.3% of the time. What do you think accounts for the discrepancy between these disciplines?

Artificial intelligence and computer science disciplines have seen an explosion in the number of papers submitted to conferences like ICLR and NeurIPS. And I think that’s really caused a strong burden, in many ways, to reviewers and to authors. So now it’s increasingly difficult to find qualified reviewers who have time to review all these papers. And some authors may feel more competition that they need to keep up and keep writing more and faster.

You analyzed close to a million papers on arXiv, bioRxiv, and Nature from January 2020 to February 2024. Do any of these journals include humanities papers or anything in the social sciences?

We mostly wanted to focus more on CS and engineering and biomedical areas and interdisciplinary areas, like Nature family journals, which also publish some social science papers. Availability mattered in this case. So, it’s relatively easy for us to get data from arXiv, bioRxiv, and Nature . A lot of AI conferences also make reviews publicly available. That’s not the case for humanities journals.

Did any results surprise you?

A few months after ChatGPT’s launch, we started to see a rapid, linear increase in the usage pattern in academic writing. This tells us how quickly these LLM technologies diffuse into the community and become adopted by researchers. The most surprising finding is the magnitude and speed of the increase in language model usage. Nearly a fifth of papers and peer review text use LLM modification. We also found that peer reviews submitted closer to the deadline and those less likely to engage with author rebuttal were more likely to use LLMs.

This suggests a couple of things. Perhaps some of these reviewers are not as engaged with reviewing these papers, and that’s why they are offloading some of the work to AI to help. This could be problematic if reviewers are not fully involved. As one of the pillars of the scientific process, it is still necessary to have human experts providing objective and rigorous evaluations. If this is being diluted, that’s not great for the scientific community.

What do your findings mean for the broader research community?

LLMs are transforming how we do research. It’s clear from our work that many papers we read are written with the help of LLMs. There needs to be more transparency, and people should state explicitly how LLMs are used and if they are used substantially. I don’t think it’s always a bad thing for people to use LLMs. In many areas, this can be very useful. For someone who is not a native English speaker, having the model polish their writing can be helpful. There are constructive ways for people to use LLMs in the research process; for example, in earlier stages of their draft. You could get useful feedback from a LLM in real time instead of waiting weeks or months to get external feedback.

But I think it’s still very important for the human researchers to be accountable for everything that is submitted and presented. They should be able to say, “Yes, I will stand behind the statements that are written in this paper.”

*Collaborators include: Weixin Liang , Yaohui Zhang , Zhengxuan Wu , Haley Lepp , Wenlong Ji , Xuandong Zhao , Hancheng Cao , Sheng Liu , Siyu He , Zhi Huang , Diyi Yang , Christopher Potts , Christopher D. Manning , Zachary Izzo , Yaohui Zhang , Lingjiao Chen , Haotian Ye , and Daniel A. McFarland .

Stanford HAI’s mission is to advance AI research, education, policy and practice to improve the human condition. Learn more .

More News Topics

Green concrete recycling twice the coal ash is built to last

New modelling reveals that low-carbon concrete developed at RMIT University can recycle double the amount of coal ash compared to current standards, halve the amount of cement required and perform exceptionally well over time.

More than 1.2 billion tonnes of coal ash were produced by coal-fired power plants in 2022. In Australia, it accounts for nearly a fifth of all waste and will remain abundant for decades to come, even as we shift to renewables.

Meanwhile, cement production makes up 8% of global carbon emissions and demand for concrete -- which uses cement as a key ingredient -- is growing rapidly.

Addressing both challenges head-on, engineers at RMIT have partnered with AGL's Loy Yang Power Station and the Ash Development Association of Australia to substitute 80% of the cement in concrete with coal fly ash.

RMIT project lead Dr Chamila Gunasekara said this represents a significant advance as existing low-carbon concretes typically have no more than 40% of their cement replaced with fly ash.

"Our addition of nano additives to modify the concrete's chemistry allows more fly ash to be added without compromising engineering performance," said Gunasekara, from RMIT's School of Engineering.

Finding new opportunities in overlooked pond ash

Comprehensive lab studies have shown the team's approach is also capable of harvesting and repurposing lower grade and underutilised 'pond ash'- taken from coal slurry storage ponds at power plants -- with minimal pre-processing.

Large concrete beam prototypes have been created using both fly ash and pond ash and shown to meet Australian Standards for engineering performance and environmental requirements.

"It's exciting that preliminary results show similar performance with lower-grade pond ash, potentially opening a whole new hugely underutilised resource for cement replacement," Gunasekara said.

"Compared to fly ash, pond ash is underexploited in construction due to its different characteristics. There are hundreds of megatonnes of ash wastes sitting in dams around Australia, and much more globally."

"These ash ponds risk becoming an environmental hazard, and the ability to repurpose this ash in construction materials at scale would be a massive win."

New modelling technology shows low-carbon concrete's long-term resilience

A pilot computer modelling program developed by RMIT in partnership with Hokkaido University' Dr Yogarajah Elakneswaran has now been used to forecast the time-dependent performance of these new concrete mixtures.

According to Dr Yuguo Yu, an expert in virtual computational mechanics at RMIT, a longstanding challenge in the field has been to understand how newly developed materials will stand the test of time.

"We've now created a physics-based model to predict how the low-carbon concrete will perform over time, which offers us opportunities to reverse engineer and optimise mixes from numerical insights," Yu explained.

This pioneering approach -- recently unveiled in the journal Cement and Concrete Research -- reveals how various ingredients in the new low-carbon concrete interact over time.

"We're able to see, for example, how the quick-setting nano additives in the mix act as a performance booster during the early stages of setting, compensating for the large amounts of slower-setting fly ash and pond ash in our mixes," Gunasekara says.

"The inclusion of ultra-fine nano additives significantly enhances the material by increasing density and compactness."

This modelling, with its wide applicability to various materials, marks a crucial stride towards digitally assisted simulation in infrastructure design and construction.

By leveraging this technology, the team aims to instil confidence among local councils and communities in adopting novel low-carbon concrete for various applications.

This research was enabled by the ARC Industrial Transformation Research Hub for Transformation of Reclaimed Waste Resources to Engineered Materials and Solutions for a Circular Economy (TREMS). Led by RMIT's Professor Sujeeva Setunge, TREMS brings together top scientists, researchers and industry experts from nine Australian universities and 36 state, industry, and international partners to minimise landfill waste and repurpose reclaimed materials for construction and advanced manufacturing.

- Engineering and Construction

- Construction

- Civil Engineering

- Exotic Species

- Geochemistry

- Global Warming

- Activated carbon

- Electric power

- Fossil fuel

- Volcanic ash

Story Source:

Materials provided by RMIT University . Original written by Michael Quin. Note: Content may be edited for style and length.

Journal Reference :

- Yuguo Yu, Chamila Gunasekara, Yogarajah Elakneswaran, Dilan Robert, David W. Law, Sujeeva Setunge. Unified hydration model for multi-blend fly ash cementitious systems of wide-range replacement rates . Cement and Concrete Research , 2024; 180: 107487 DOI: 10.1016/j.cemconres.2024.107487

Cite This Page :

Explore More

- Autonomous Drones With Animal-Like 'Brains'

- How Practice Forms New Memory Pathways

- Reversing Brain Damage Caused by Ischemic Stroke

- Earth-Sized Planet Orbiting Ultra-Cool Dwarf

- Robots' Sense of Touch as Fast as Humans?

- Avian Flu Detected in NYC Wild Birds

- Metro-Area Quantum Computer Network Demo

- Iconic Baobab Tree's Origin Story

- 'Warm-Blooded' Dinos: 180 Million Years Ago

- Reaching 1,000 Degrees C With Solar Power

Trending Topics

Strange & offbeat.

IMAGES

VIDEO

COMMENTS

Explore the latest full-text research PDFs, articles, conference papers, preprints and more on FINANCIAL MODELLING. Find methods information, sources, references or conduct a literature review on ...

Subjective-probabilistic modeling (SPM) in relation to decision-making in the financial market is studied as the development of Bayesian subjectivism. It has been shown that group consensus SPM-assessments of risk generate specific derivative financial instruments such as binary options, index derivatives, crypto-assets, etc. Conclusion.

This list explores various research topic ideas related to financial planning, focusing on the effects of financial literacy, the adoption of digital tools, taxation policies, and the role of financial advisors. ... These topic ideas span the development of asset pricing models, evaluation of machine learning algorithms, and the exploration of ...

Abstract. Abstract: This study provides a holistic and quantitative overview of over 800 mathematical methods (e.g. financial and risk models, statistical tests, statistics and advanced algorithms) taken out of sampled scientific literature on financial and risk modelling by applying a bibliometric approach from 2008-2019 and a citation network analysis.

Research firms expect the user base to grow at an average annual rate of 17.5% over the next decade, with up to 28.1 billion IoT installed devices by 2020, and revenues exceeding 7 trillion USD the same year (2020). ... They formulate a model of financial contagion in a framework of incomplete information to estimate the width and length of the ...

This article is an introduction to machine learning for financial forecasting, planning and analysis (FP&A). Machine learning appears well suited to support FP&A with the highly automated extraction of information from large amounts of data. However, because most traditional machine learning techniques focus on forecasting (prediction), we discuss the particular care that must be taken to ...

Some things to remember. Financial modeling helps the analyst understand determinants of value creation, provides a means of assessing options and risks, and identifies how firm value is affected by different economic events. The estimation of firm value involves a three-step procedure: (1) analyze the target's historical statements to ...

Through a latent Dirichlet allocation topic modeling technique, we extract 15 coherent research topics that are the focus of 5942 academic studies from 1990 to 2020. We find that these topics can be grouped into four categories: Price-forecasting techniques, financial markets analysis, risk forecasting and financial perspectives.