- Career Blog

Payroll Manager Resume: Winning Examples for 2024

As an experienced payroll manager, you know that the role of a payroll manager is critical in any organization. However, with the job market growing increasingly competitive, you need more than just your skills and experience to set yourself apart from other potential candidates. Enter the professional resume – a key tool for any job seeker looking to land the perfect position.

First, let’s clarify what we mean by a payroll manager. In short, a payroll manager is responsible for overseeing the salaries, wages, and bonuses of an organization’s employees. This includes maintaining accurate records, calculating pay, and ensuring that all federal, state, and local payroll taxes are taken care of.

Importance of a Professional Resume

When it comes to landing a payroll manager position, having a well-crafted, professional resume is essential. Your resume serves as your introduction to potential employers, and it needs to make a strong first impression. It’s not enough to simply list your job titles and responsibilities – you need to showcase your value, experience, and accomplishments.

A strong payroll manager resume should highlight your expertise in payroll processing, tax compliance, and regulations. It should also showcase your experience with payroll software and other industry-specific tools. Beyond that, your resume should emphasize your leadership and communication skills, as well as your ability to work well in a team environment.

Key Qualifications of a Successful Payroll Manager Resume

When it comes to creating a winning resume for a payroll manager position, there are several key qualifications that should be highlighted. These qualifications not only showcase your expertise in the field but also demonstrate to potential employers that you have the skills necessary to effectively manage payroll operations.

Below are five key qualifications that should be included in a successful payroll manager resume:

A. Proficient in Payroll Processing Software

Today’s payroll operations are heavily reliant on technology, which is why it’s critical for payroll managers to have a strong understanding of payroll processing software. By listing proficiency in a specific payroll software system on your resume, you show potential employers that you have hands-on experience with tools that are essential to managing complex payroll processes. Be sure to include specifics such as the software name, modules or features used, and any relevant training or certifications acquired.

B. In-Depth Knowledge of Payroll Regulations and Laws

Processing payroll means adhering to a complex set of regulations and laws at both the state and federal level. As a payroll manager, it’s your responsibility to stay up-to-date on any changes to these regulations and ensure that your company remains in compliance. By highlighting your in-depth knowledge of payroll regulations and laws on your resume, you demonstrate to potential employers that you have the expertise necessary to avoid costly penalties and minimize risk.

C. Attention to Detail

The payroll process is incredibly detail-oriented, meaning that payroll managers must be able to carefully review and analyze information to ensure accuracy. Attention to detail is a critical qualification for payroll managers, and it should be prominently featured on your resume. Consider highlighting specific examples of how you have demonstrated attention to detail in your past work experiences, such as catching errors in employee pay data or developing processes to minimize errors.

D. Strong Communication Skills

As a bridge between executive leadership and employees, a payroll manager must have strong communication skills. This means not only the ability to effectively communicate payroll-related information to employees but also to clearly and concisely present payroll data to company leadership. Communication skills can be displayed in a resume through the use of action verbs and specific examples of how you’ve communicated complex data or resolved team conflicts.

E. Excellent Organizational and Management Skills

Payroll managers must be able to juggle multiple tasks and deadlines while ensuring that payroll operations continue to run smoothly. Strong organizational and management skills are key qualifications for this role, and they can be demonstrated in a resume through examples of how you’ve managed payroll teams or implemented new systems to streamline payroll processes.

A successful payroll manager resume should highlight not only your technical expertise but also your soft skills, showcasing your ability to effectively manage both people and processes. By including these key qualifications in your resume, you can increase your chances of landing the payroll manager job of your dreams.

Components of an Effective Payroll Manager Resume

When crafting your payroll manager resume, it’s important to include key components that will make it stand out from the rest. Here are six essential components to include:

A. Contact Information

First and foremost, make sure your contact information is prominently displayed at the top of your resume. Include your full name, phone number, email address, and city and state of residence. You can also include links to your professional social media profiles, such as LinkedIn.

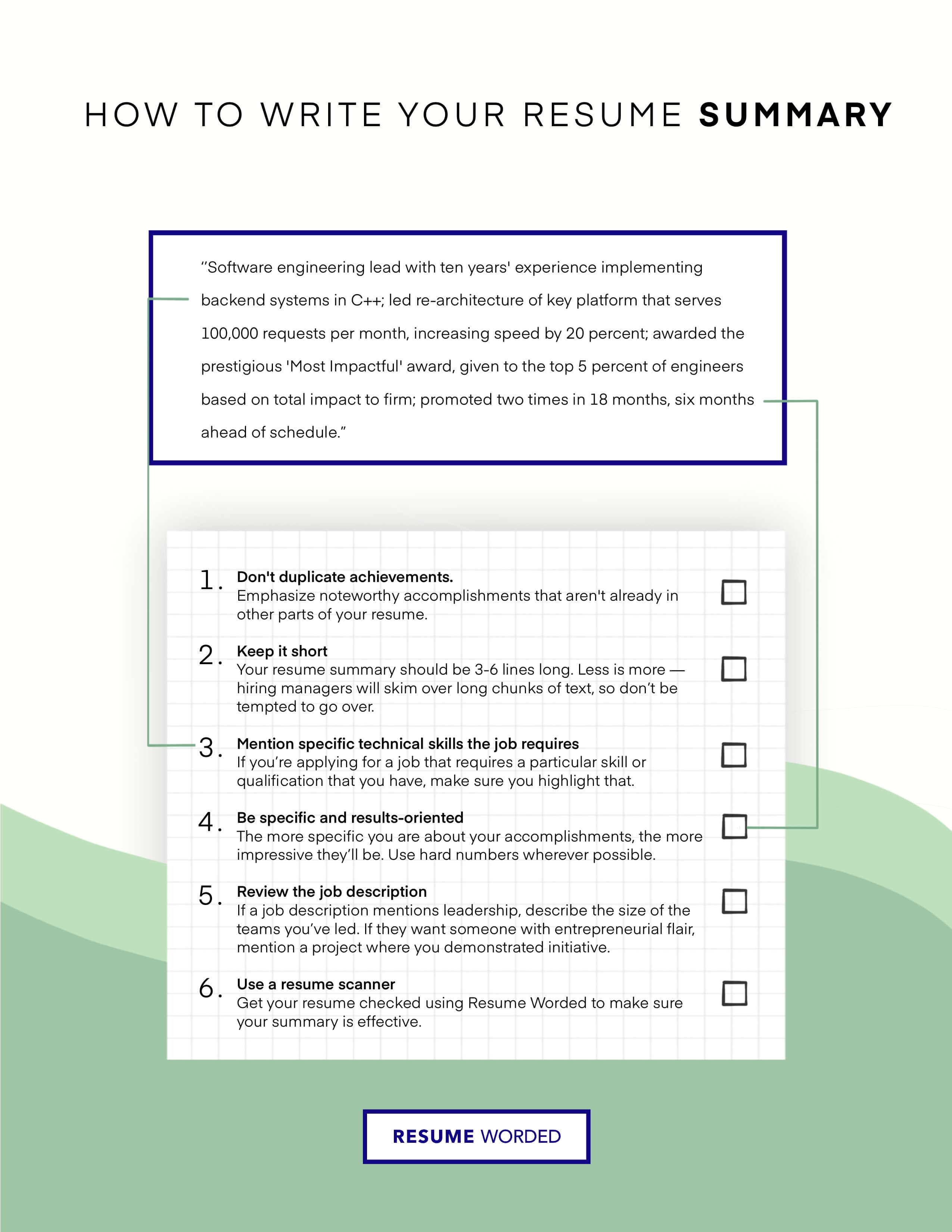

B. Professional Summary

Your professional summary is a brief statement that highlights your top skills and qualifications. It should be tailored to the specific job you’re applying for and focus on what you can bring to the role. Use this section to give the hiring manager a snapshot of your experience and expertise.

C. Core Competencies and Skills

In this section, you should highlight your key competencies and skills that are relevant to the payroll manager role. This might include experience with payroll software such as ADP or Paychex, knowledge of labor laws and regulations, and strong communication and team management skills.

D. Professional Experience

One of the most important parts of your resume is your professional experience section. In this section, you should list your previous work experience in reverse chronological order, starting with your most recent job. Be sure to include relevant details such as job title, company name, dates of employment, key responsibilities and achievements.

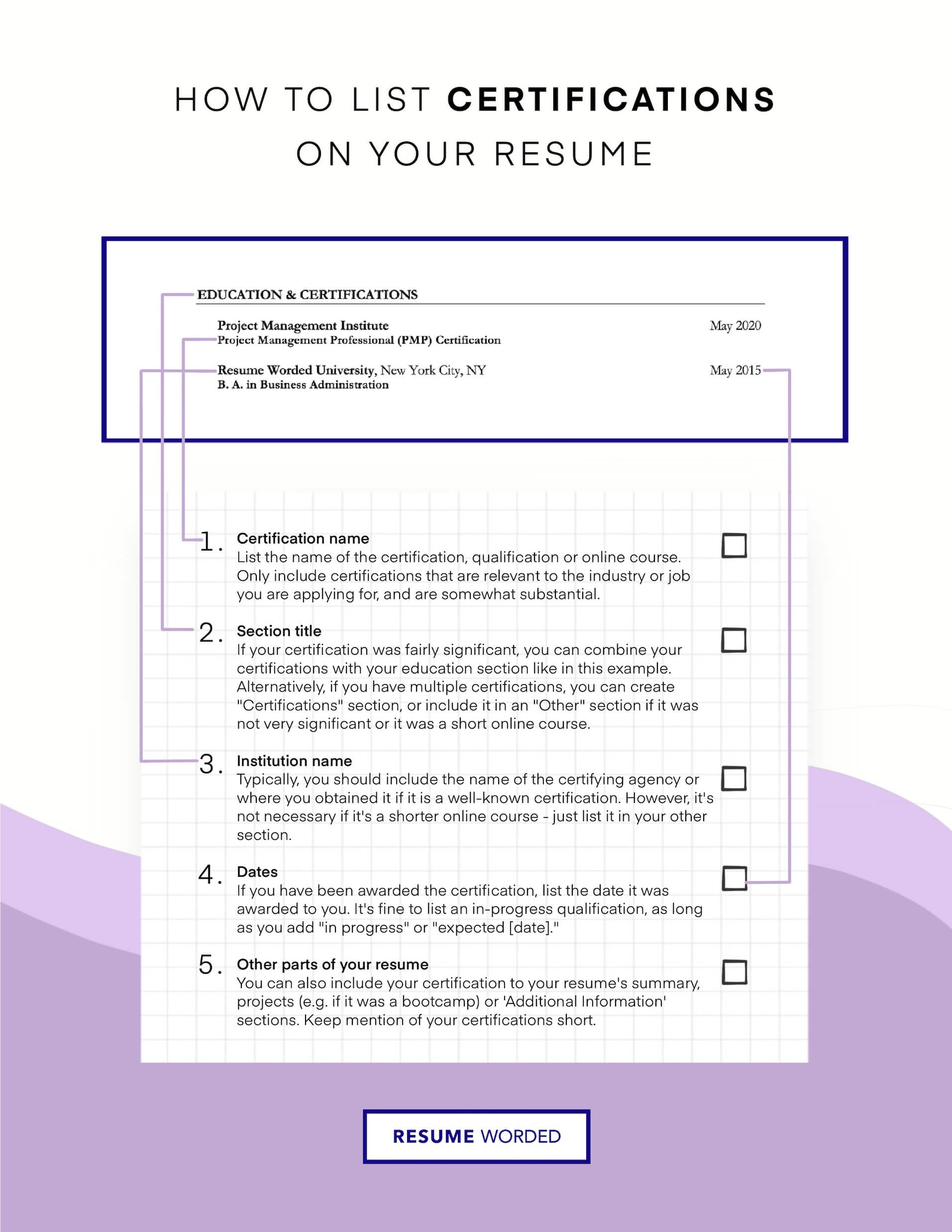

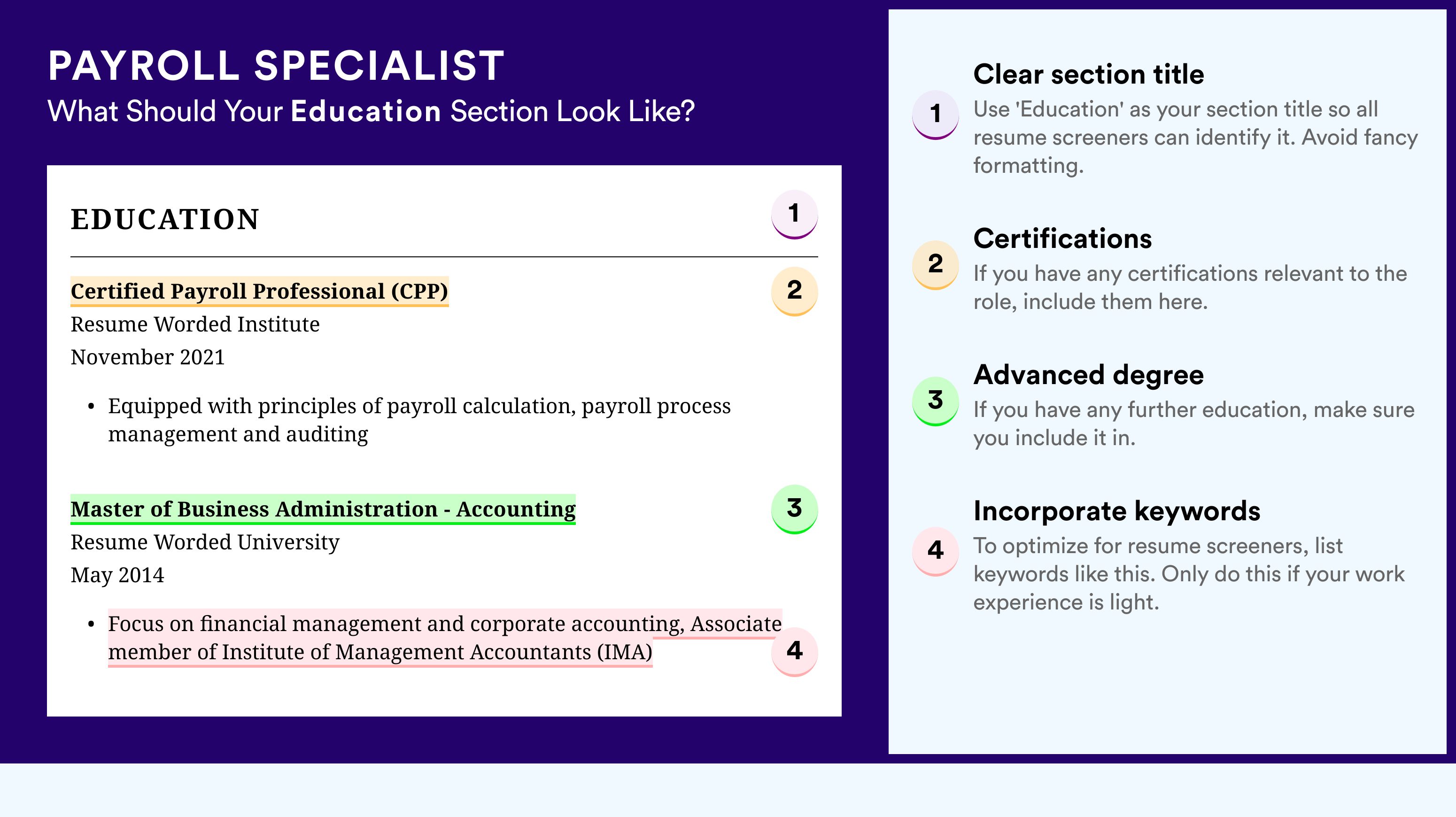

E. Education and Certification

In the education and certification section, you should list your highest level of education, including the degree earned and the institution attended. If you have any relevant certifications or licenses, such as the Certified Payroll Professional (CPP) designation, be sure to include them here.

F. Awards and Achievements

Finally, you should include any relevant awards or achievements that showcase your skills and abilities. This might include awards for outstanding performance or recognition for innovative payroll solutions. Including awards and achievements can also help your resume stand out from other candidates.

An effective payroll manager resume should include all of these components to showcase your experience, skills, and achievements in the best light possible. By tailoring your resume to the specific job you’re applying for, and highlighting your unique strengths, you’ll be well on your way to creating a winning resume.

Writing Tips for a Winning Payroll Manager Resume

As a payroll manager, you need to showcase your skills and achievements in your resume to win over hiring managers. Here are some writing tips for crafting a winning payroll manager resume:

A. Keyword Optimization

When writing your resume, be sure to include relevant keywords that are commonly used in the payroll industry. This will make it easier for recruiters and hiring managers to find your resume when they search for candidates.

Some relevant keywords for payroll manager resumes may include:

- Payroll processing

- Benefits administration

- Time and attendance

- Tax compliance

- Accounting software

- Data analysis

B. Highlighting Relevant Skills and Achievements

In addition to including relevant keywords, it’s important to highlight your key skills and achievements in your resume. This will help you stand out from other candidates and show hiring managers what you can bring to the table.

Some key skills and achievements for payroll managers may include:

- Knowledge of payroll laws and regulations

- Experience with payroll software and systems

- Strong communication and collaboration skills

- Ability to manage and prioritize tasks effectively

- Successful implementation of payroll-related projects or initiatives

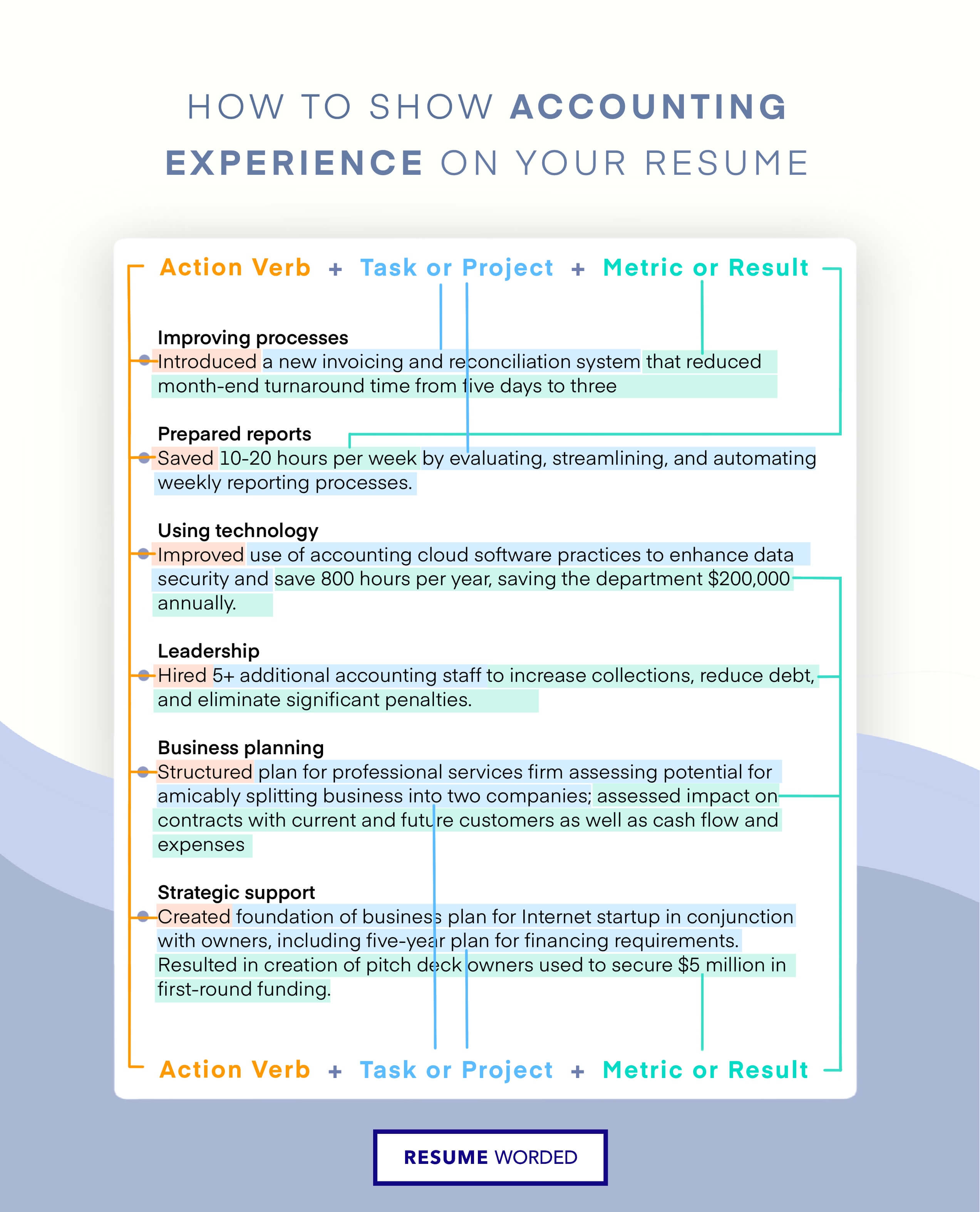

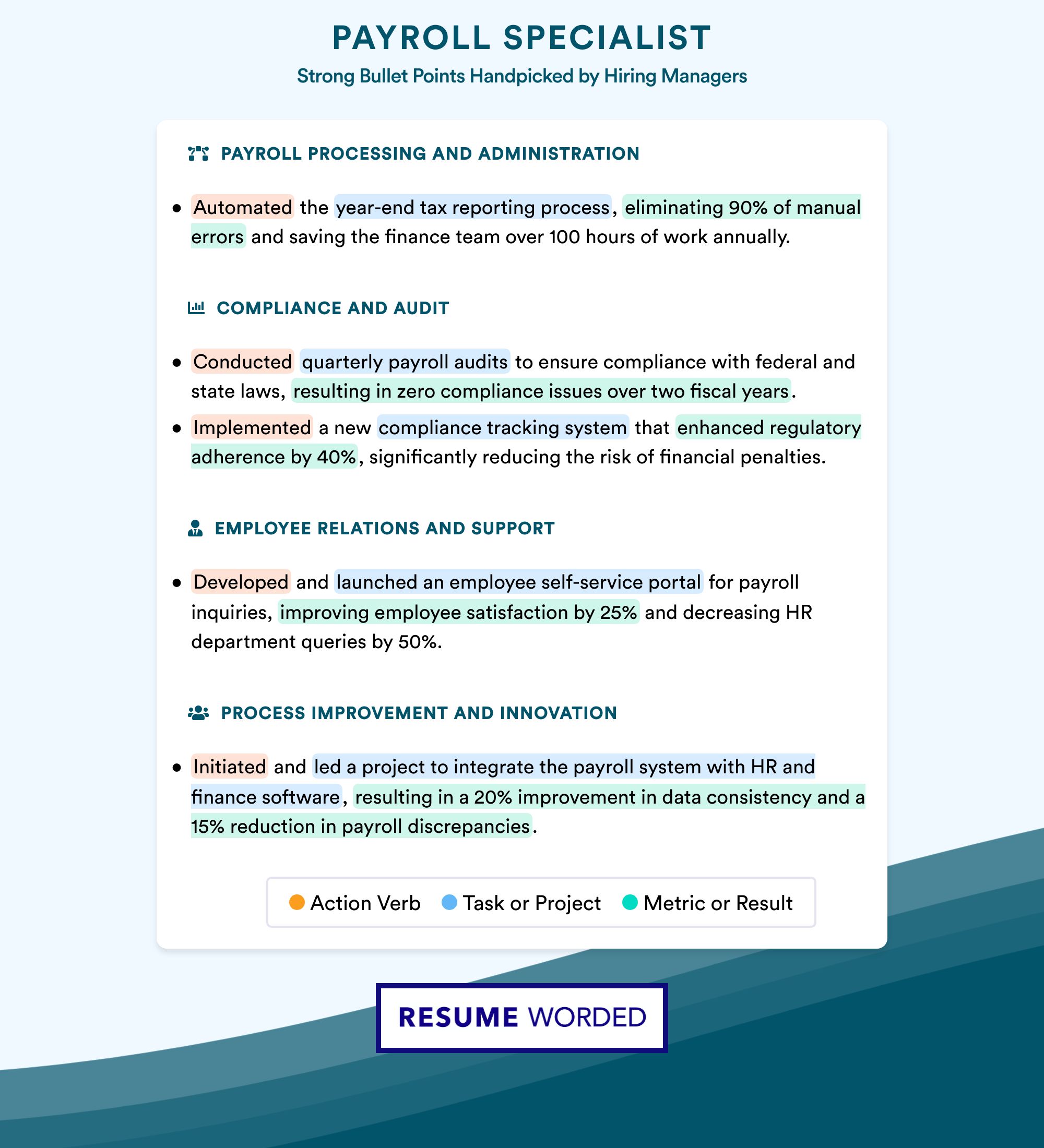

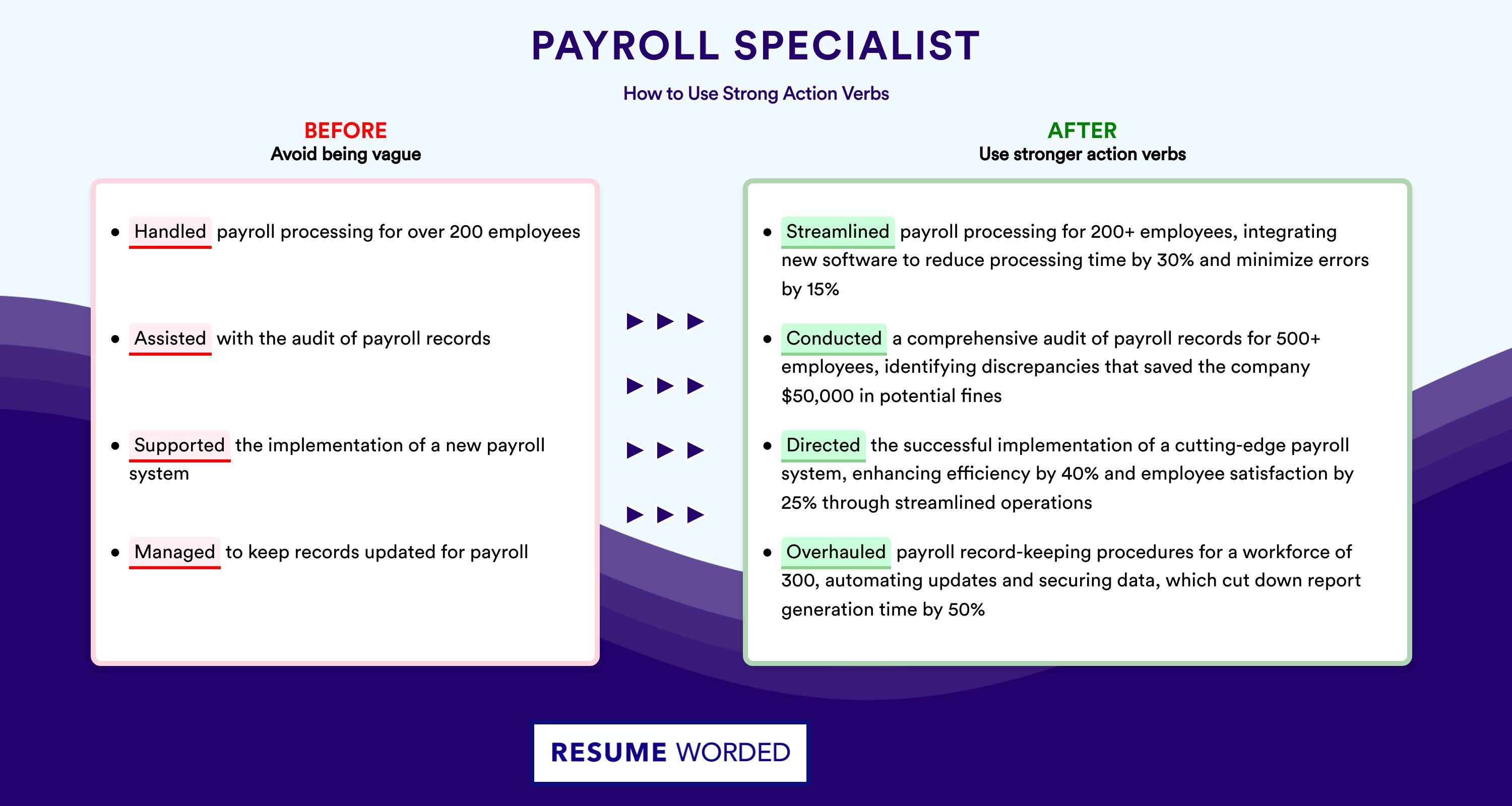

C. Utilizing Action Verbs

When describing your skills and achievements in your resume, try to use strong action verbs that demonstrate your impact and accomplishments. This will make your resume more compelling and engaging to read.

Some action verbs to consider for your payroll manager resume may include:

- Implemented

- Streamlined

D. Quantifying Accomplishments

To further demonstrate your impact as a payroll manager, consider quantifying your achievements wherever possible. This will give hiring managers a better sense of the results you can achieve in the role.

Some examples of quantifiable achievements for payroll managers may include:

- Reduced payroll processing time by X%

- Successfully processed X number of payrolls per month

- Implemented new benefits administration system resulting in X% increase in employee satisfaction

- Reduced payroll error rate to less than X%

E. Proper Formatting and Layout

Finally, be sure to pay attention to the formatting and layout of your resume. A clean, organized layout can make it easier for recruiters and hiring managers to read and understand your qualifications.

Some tips for proper formatting and layout may include:

- Use clear headings and subheadings to organize your resume

- Choose a readable font and font size

- Use bullet points to break up text and highlight key achievements

- Keep your resume to one or two pages maximum

By following these writing tips, you can create a winning payroll manager resume that showcases your skills, achievements, and qualifications to potential employers.

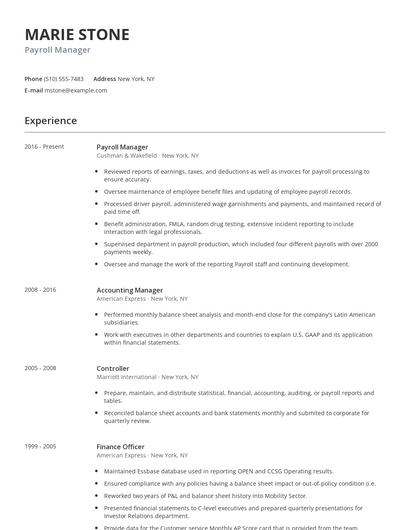

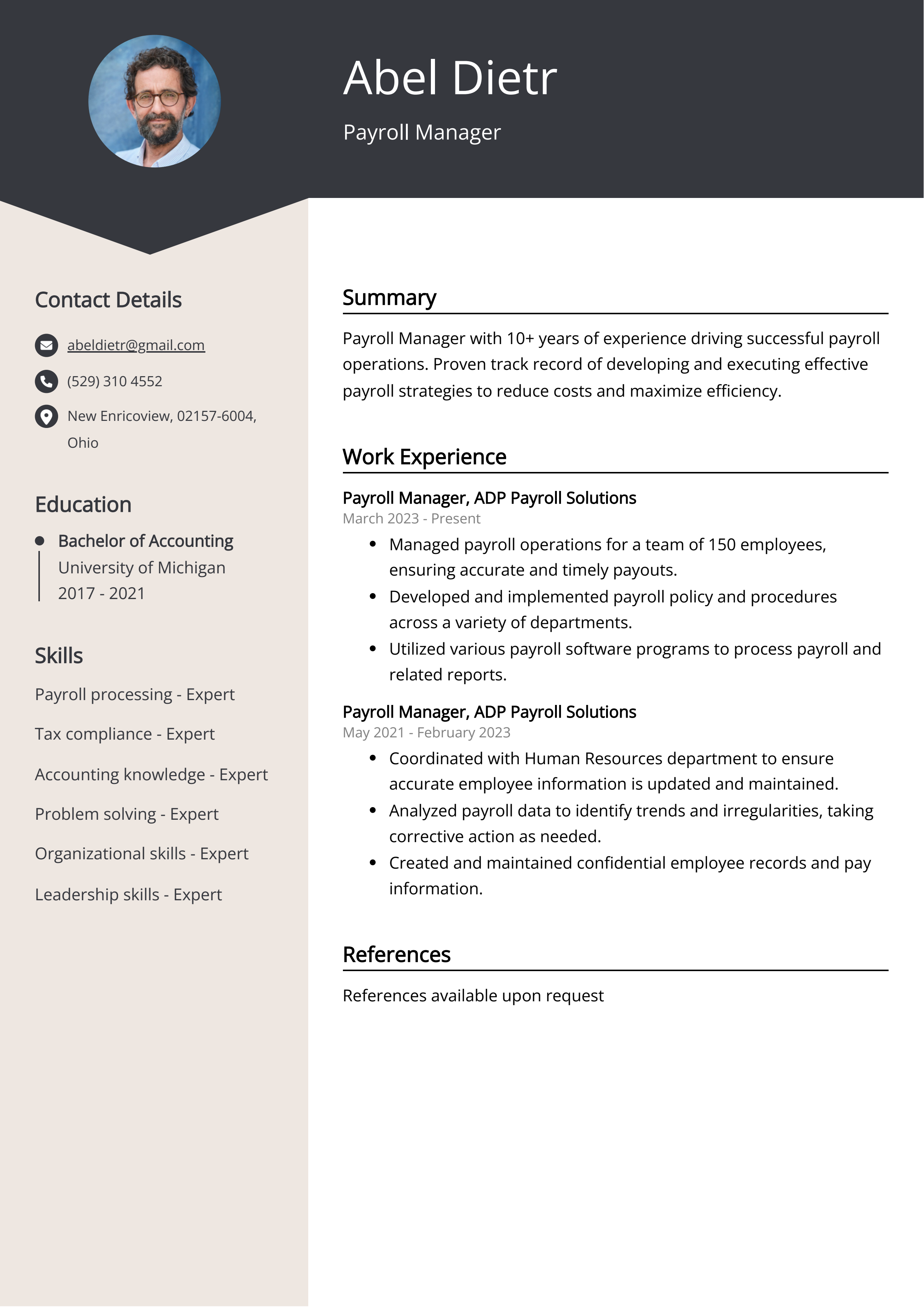

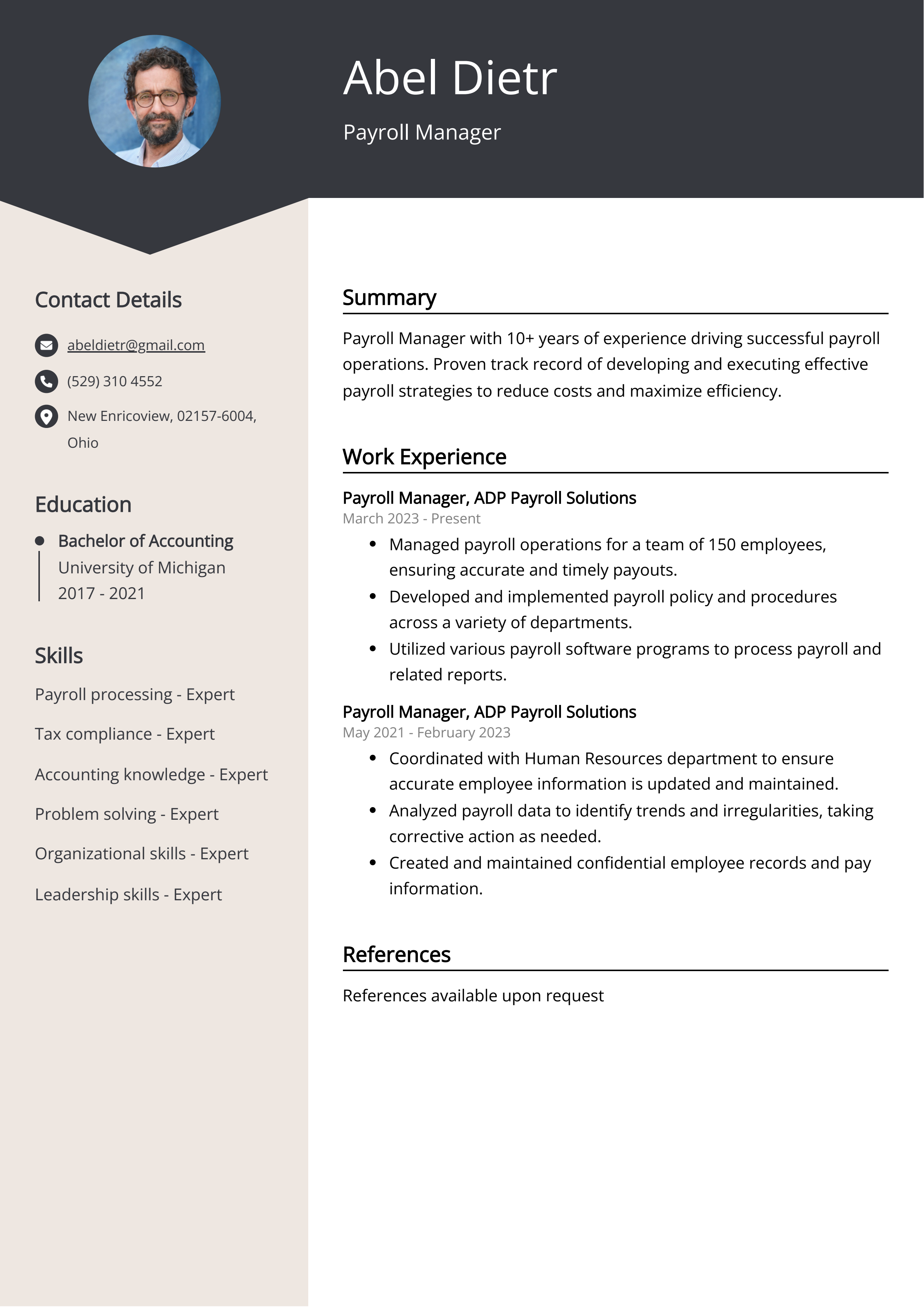

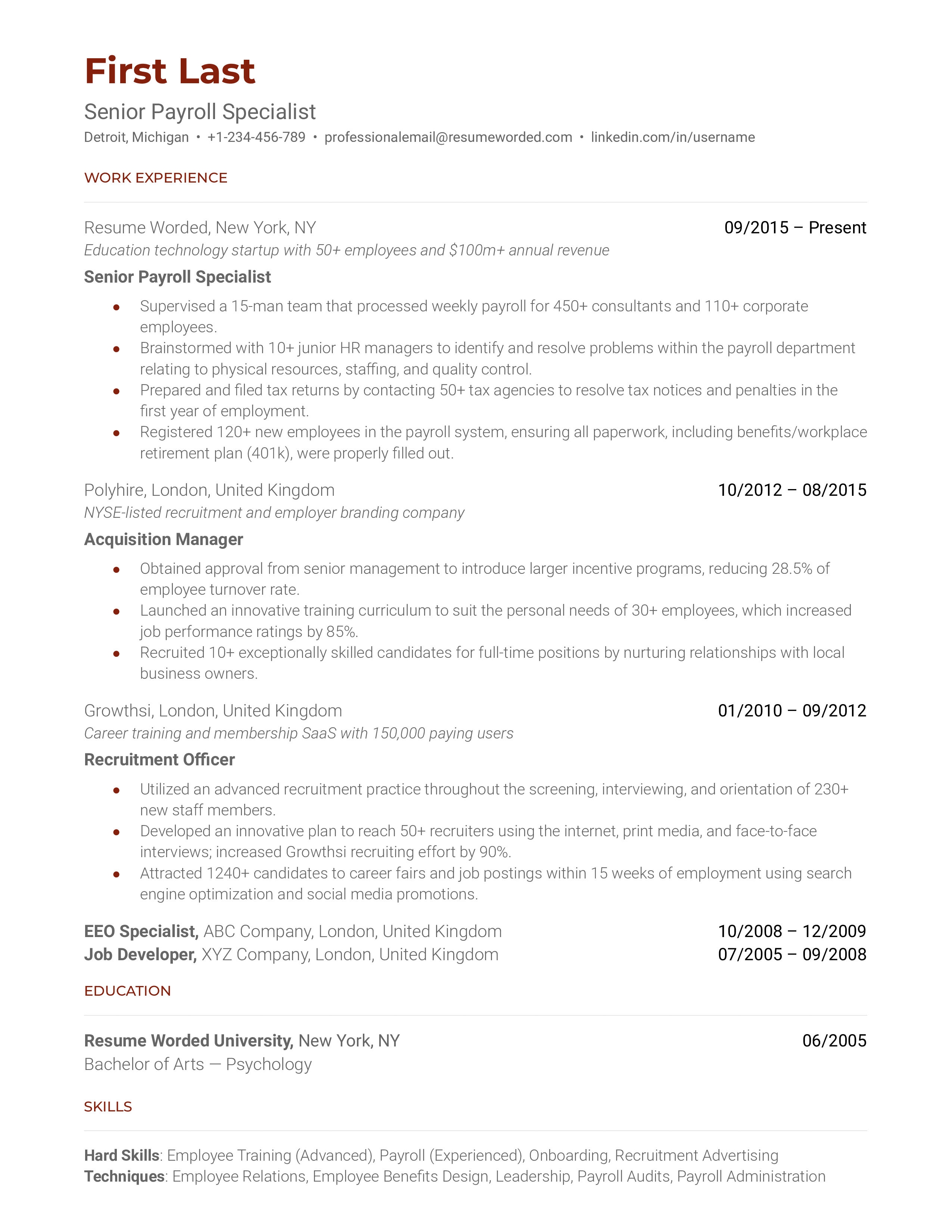

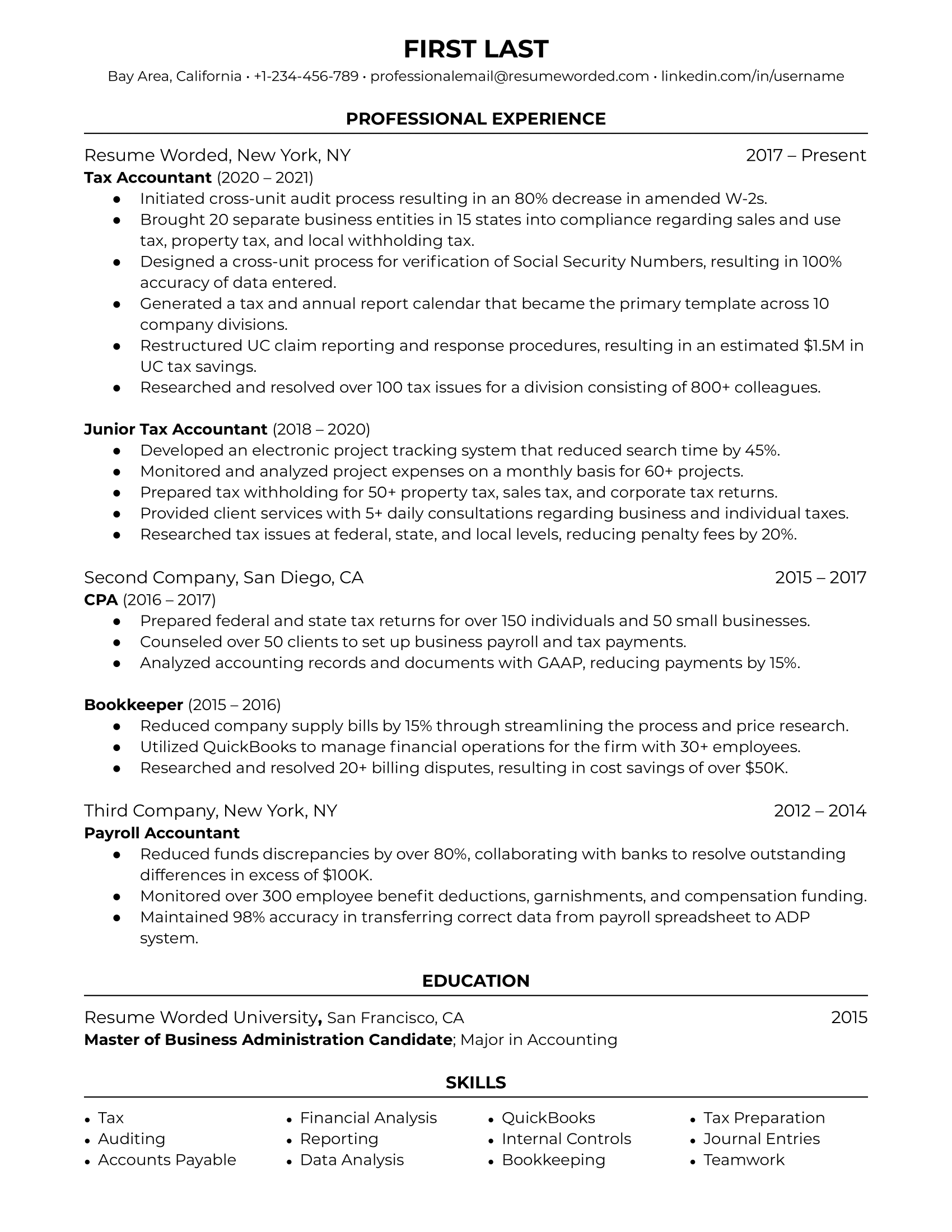

Sample Payroll Manager Resume Section by Section

When it comes to writing a winning payroll manager resume, there are a few key sections that you need to include to showcase your skills, experience, and accomplishments. In this section, we’ll break down the six most important sections of a payroll manager resume that job seekers should focus on.

At the top of your payroll manager resume, you should include your contact information. This includes your full name, phone number, professional email address, and current location. You should also include a link to your LinkedIn profile and any other relevant social media accounts that highlight your expertise in the payroll management field.

John Doe 1234 Main Street New York, NY 10001 (123) 456-7890 [email protected]

LinkedIn: linkedin.com/in/johndoe

Following your contact information, include a professional summary that provides a brief overview of your background, skills, and experience as a payroll manager. This section should capture the attention of hiring managers and entice them to continue reading your resume. Highlight your years of experience, areas of expertise, and notable achievements in payroll management.

Professional Summary:

Results-driven payroll manager with 8+ years of experience overseeing end-to-end payroll operations for large organizations. Skilled in payroll processing, tax compliance, and implementing streamlined payroll systems. Proven track record of accuracy and efficiency, reducing payroll errors by 20% and implementing cost-saving measures. Strong leadership abilities, adept at managing teams and ensuring timely payroll processing.

In the skills section, list the key skills and competencies that make you a strong candidate for a payroll manager position. Include both technical skills related to payroll processing, software, and tax regulations, as well as soft skills such as communication, problem-solving, and attention to detail. Tailor your skills to align with the requirements and responsibilities outlined in the job description.

- Payroll Processing

- Timekeeping Systems (ADP, Paychex)

- Tax Compliance

- Benefits Administration

- Auditing and Reporting

- HRIS and Payroll Software (SAP, Workday)

- Team Management

- Problem-solving

- Attention to Detail

- Communication

D. Work Experience

In the work experience section, provide a detailed overview of your previous roles and responsibilities as a payroll manager. Include the name of the company, your job title, and the dates of employment. Describe your key achievements and responsibilities, focusing on quantifiable results and specific contributions to payroll operations, process improvements, or cost savings.

Work Experience:

Payroll Manager, XYZ Company, New York, NY June 2016 – Present

- Oversee payroll operations for a workforce of 2,000+ employees, ensuring accurate and timely processing of bi-weekly payroll.

- Implemented a new payroll software system, reducing processing time by 30% and improving payroll accuracy by 15%.

- Led a team of 5 payroll specialists, providing training and guidance on payroll procedures, tax regulations, and compliance.

- Collaborated with HR and Finance departments to streamline benefits administration, resulting in a 25% reduction in errors and improved employee satisfaction.

- Conducted regular audits to ensure payroll data integrity and compliance with federal and state regulations.

- Prepared and filed quarterly and year-end payroll tax reports, ensuring compliance with all tax obligations.

E. Education

In the education section, include your academic qualifications related to payroll management. List your degree, the name of the institution, and the dates of attendance. If you have any relevant certifications or additional training, mention them here as well.

Bachelor of Science in Accounting ABC University, New York, NY September 2012 – May 2016

F. Professional Associations and Certifications

If you are a member of any professional associations or hold relevant certifications in payroll management, include this information in a dedicated section. This demonstrates your commitment to professional development and staying updated on industry best practices.

Professional Associations and Certifications:

- Certified Payroll Professional (CPP)

- Member, American Payroll Association (APA)

- Member, Society for Human Resource Management (SHRM)

A well-crafted payroll manager resume should include the essential sections of contact information, professional summary, skills, work experience, education, and professional associations/certifications. Tailor each section to highlight your specific qualifications and achievements, showcasing your expertise in payroll management and positioning yourself as a strong candidate for the role.

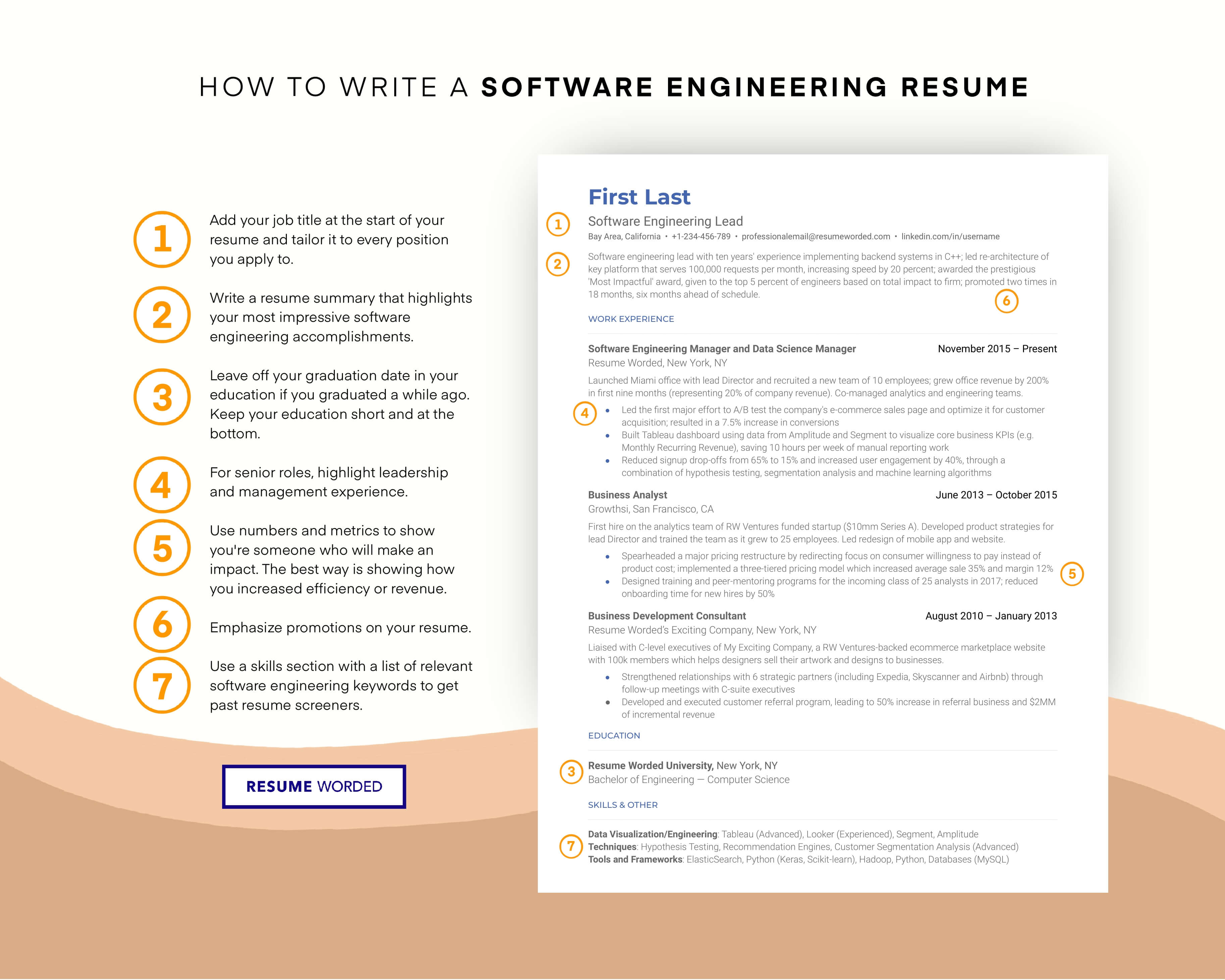

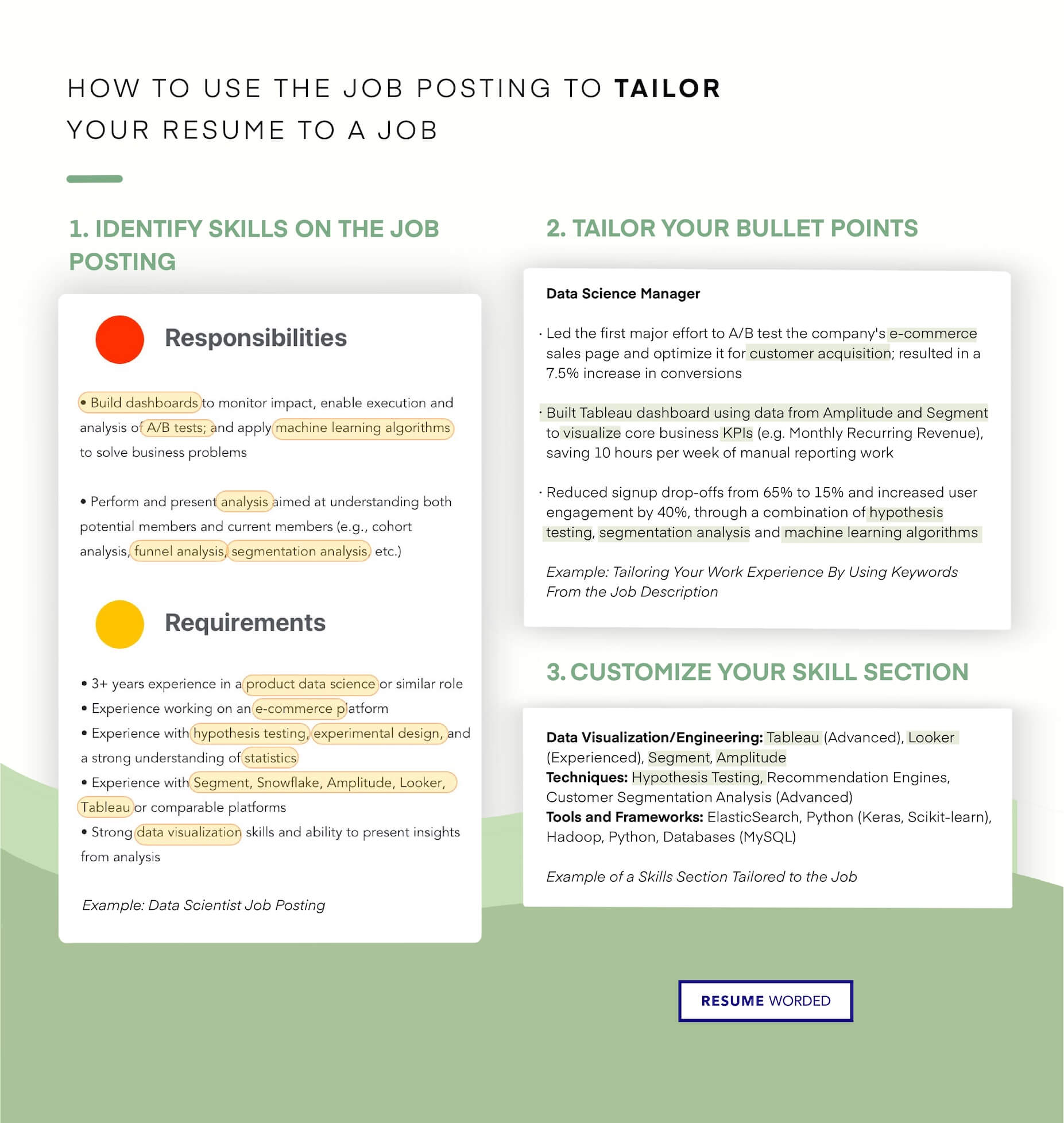

How to Tailor Your Payroll Manager Resume to a Job Posting

As an experienced payroll manager, you likely have a lot of skills and experience that could qualify you for any number of positions. However, if you want to increase your chances of landing a specific job, it’s important to tailor your resume to match the job posting. Here are some tips to help you do just that:

A. Analyzing the Job Posting

Before you start customizing your resume, take the time to thoroughly analyze the job posting. Look for keywords that the employer uses to describe the position, as well as any specific requirements or qualifications they mention. Pay attention to the language they use and try to reflect it in your resume.

B. Customizing Your Resume

Once you have a good understanding of the job posting, you can start customizing your resume. Start by highlighting your most relevant experience, accomplishments, and skills. Use bullet points to make it easy for the employer to scan your resume quickly.

C. Highlighting Relevant Experience

When it comes to highlighting your experience, focus on the tasks and responsibilities that are most relevant to the position you’re applying for. Use specific examples to demonstrate how you’ve handled similar challenges in the past. If you have experience working in a similar industry or with similar software, make sure to highlight that as well.

D. Incorporating Keywords

One of the most important aspects of tailoring your resume is incorporating keywords from the job posting. Many employers use Applicant Tracking Systems (ATS) to scan resumes for specific keywords before they ever reach a human reviewer. If your resume doesn’t contain those keywords, it may get filtered out before it ever gets seen by a real person.

To incorporate keywords into your resume, start by looking for the most important ones in the job posting. Make sure to include those keywords throughout your resume, especially in your skills and experience sections. However, be careful not to overuse keywords or use them in a way that doesn’t make sense. Your resume should still sound natural and professional.

By following these tips, you can create a winning payroll manager resume that’s tailored to a specific job posting. With the right combination of skills, experience, and keywords, you can increase your chances of getting noticed and landing the job you want.

Common Mistakes to Avoid in a Payroll Manager Resume

As a payroll manager, it’s crucial to present yourself in the best possible light on your resume. However, certain common mistakes can undermine your credibility and prevent you from standing out as a top candidate. Here are five common mistakes to avoid when preparing your payroll manager resume:

A. Spelling and Grammatical Errors

Spelling and grammatical errors can quickly undermine your credibility as a payroll manager. Simple typos, misspelled words, or improper use of grammar can signal to prospective employers that you lack attention to detail and may not be capable of performing the duties required of a payroll manager. To avoid these errors, proofread your resume carefully or have someone else read it for you.

B. Too General or Vague

When presenting your skills and accomplishments, it’s easy to fall into the trap of being too general or vague. Statements like “managed payroll operations” or “developed efficient payroll processes” don’t provide enough detail to showcase your expertise. Instead, focus on specific examples that highlight your skills and accomplishments clearly and concisely.

C. Focusing on Duties Instead of Accomplishments

One common pitfall in resume writing is focusing too much on job duties rather than accomplishments. While it’s important to outline your responsibilities as a payroll manager, it’s equally important to highlight your achievements in the role. For example, instead of simply stating that you “processed payroll,” you could say that you “implemented a new system that reduced payroll errors by 50% and saved the company $10,000 per year.”

D. Neglecting Professional Development

Payroll managers are expected to stay current with new technology, regulations, and best practices in their field. Neglecting to mention professional development activities on your resume can signal to prospective employers that you may not be up-to-date on industry trends and may not be a good fit for the role. Be sure to include any relevant certifications, training courses, or industry conferences you’ve attended.

E. Including Irrelevant Information

Finally, it’s important to avoid including irrelevant information on your payroll manager resume. While it’s tempting to showcase every accomplishment, skill, or hobby you’ve ever had, doing so can make your resume cluttered and difficult to read. Stick to the relevant information that showcases your skills and accomplishments as a payroll manager, and leave out anything that doesn’t add value.

By avoiding these common mistakes, you can create a winning payroll manager resume that showcases your expertise and sets you apart from other candidates. Remember to keep your resume clear, concise, and tailored to the specific job you’re applying for.

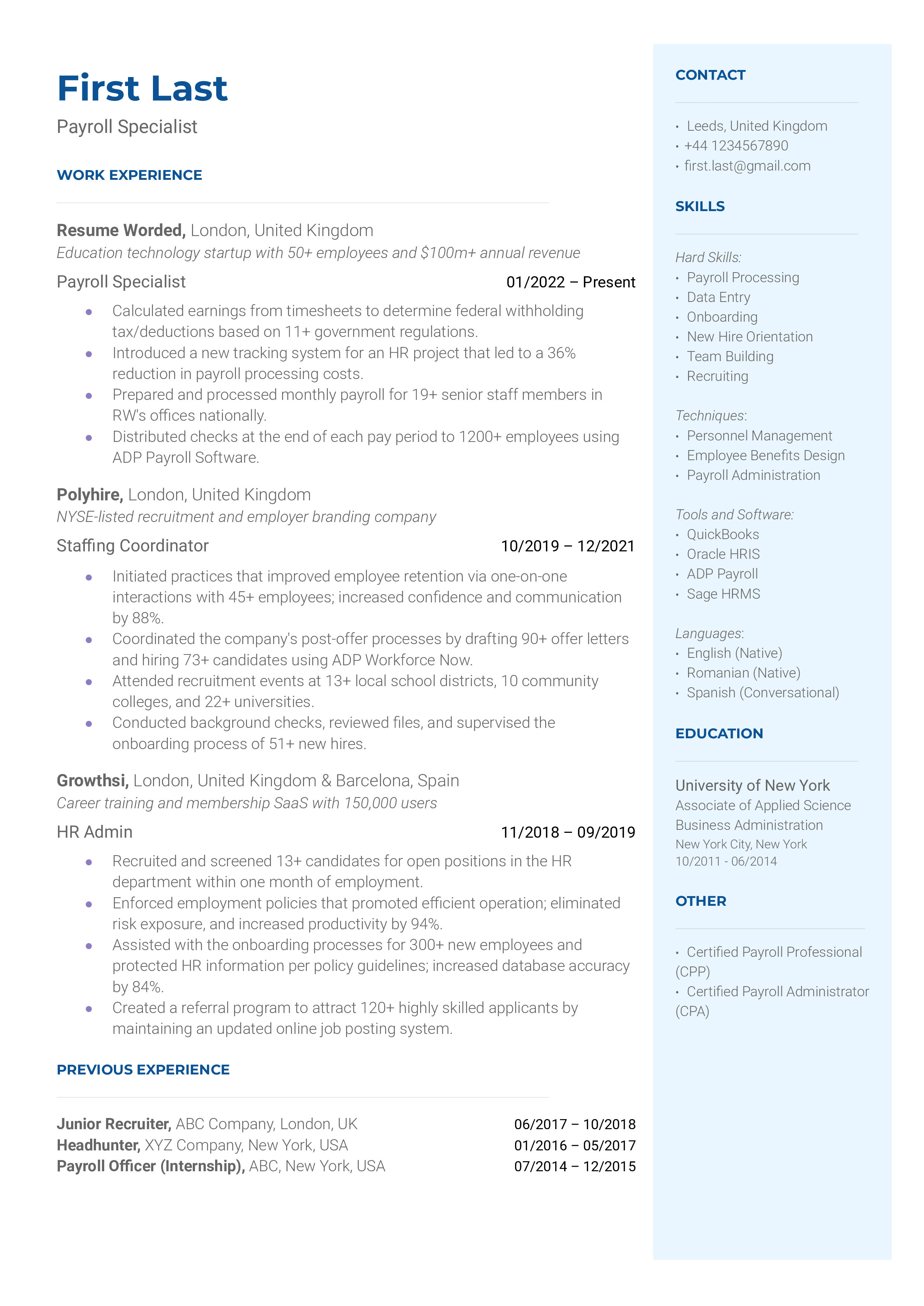

Payroll Manager Resume Example – Entry-Level

If you are just starting out in your career as a Payroll Manager, it is important to create a well-crafted resume that will catch the eye of potential employers. Here is a winning example of an entry-level Payroll Manager resume:

- Full Name: [Insert Name]

- Email: [Insert Email]

- Phone: [Insert Phone Number]

- LinkedIn: [Insert LinkedIn Profile URL]

Dedicated and detail-oriented professional seeking an entry-level Payroll Manager position. Strong foundation in payroll administration and a commitment to accuracy and compliance. Proficient in payroll software and eager to contribute to the success of an organization by ensuring timely and accurate payroll processing.

- Proficient in using payroll software, such as [mention specific software]

- Solid understanding of payroll processes, tax regulations, and compliance

- Strong analytical and problem-solving skills for resolving payroll discrepancies

- Excellent attention to detail and ability to maintain accurate payroll records

- Effective communication and interpersonal skills for collaborating with employees and stakeholders

Payroll Intern | [Insert Company Name], [Insert Location] [Insert Employment Dates]

- Assisted the payroll team with processing employee timesheets and calculating wages.

- Verified accuracy of payroll data, including deductions, benefits, and taxes.

- Conducted audits on payroll records to identify discrepancies and resolve issues.

- Assisted in preparing payroll reports and distributing pay stubs to employees.

E. Education and Certifications

Certified Payroll Professional (CPP) – In Progress

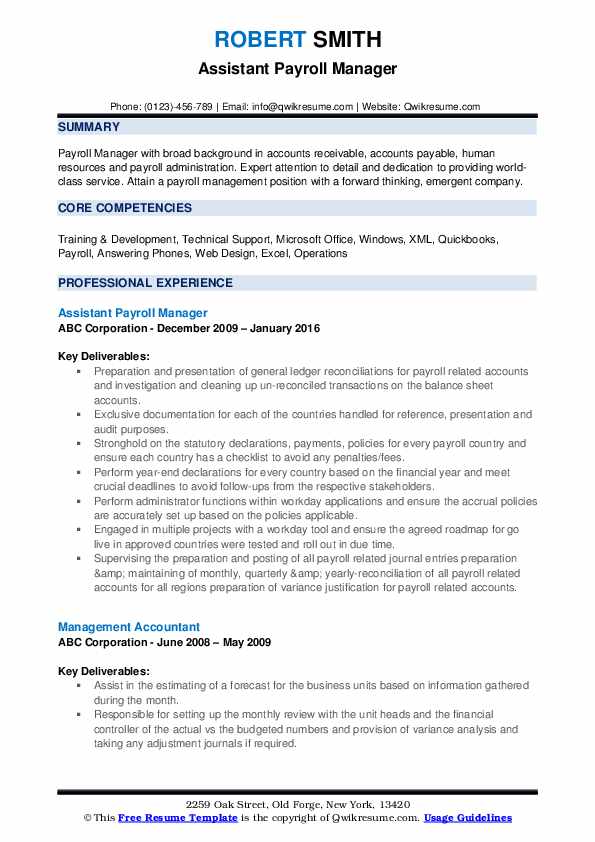

Payroll Manager Resume Example – Experienced

As an experienced payroll manager with [insert number] years of expertise, I have successfully managed complex payroll processes, ensuring timely and accurate payments for employees. With a proven track record of executing payroll strategies that minimize errors and increase efficiency, I am passionate about delivering results-driven payroll services that exceed expectations.

- Expert knowledge of payroll systems, procedures, and regulations

- Proficient in handling multiple payroll accounts with high-volume transactions

- Excellent analytical and problem-solving skills

- Strong communication and interpersonal skills

- In-depth understanding of tax laws and compliance requirements

- Ability to identify process improvements that enhance efficiency and accuracy

- Proficient in Microsoft Office Suite

Payroll Manager

[Insert Company Name], [Insert Location] [Insert Employment Dates]

- Oversaw the payroll process for over [insert number] employees in multiple locations

- Managed a team of [insert number] payroll specialists to ensure accurate and timely processing and delivery of payroll

- Analyzed payroll data and identified discrepancies to prevent errors and ensure compliance with state and federal regulations

- Developed and implemented payroll procedures and policies to improve efficiency and reduce costs

- Provided guidance and support to employees regarding payroll-related inquiries

- Prepared and filed tax-related documents and reports, such as W-2s and 1099s, in compliance with state and federal regulations

Senior Payroll Specialist

- Managed payroll transactions for over [insert number] employees

- Conducted audits and reconciliations of payroll data to identify and resolve discrepancies

- Responded to employee inquiries related to payroll, benefits, and taxes

- Prepared and filed tax reports and documents, such as quarterly and year-end payroll tax returns

- Developed and maintained accurate and secure payroll records and files

- [Insert Degree], [Insert University], [Insert Graduation Year]

- Certified Payroll Professional (CPP), [Insert Year]

Cover Letter Example for a Payroll Manager Position

A. introduction.

Dear Hiring Manager,

I am writing to express my interest in the Payroll Manager position at [Company Name]. As an experienced payroll professional with [number] years of experience, I believe that I have the necessary qualifications to contribute to the success of your team.

Throughout my career, I have developed a deep understanding and expertise in all aspects of payroll management, including compliance, tax regulations, and benefits administration. I have successfully led teams of payroll specialists, using my strong communication and leadership skills to effectively manage payroll operations.

As a payroll manager, I possess a unique combination of technical and soft skills that allow me to excel in my job. My proficiency in payroll software, such as ADP and Paychex, enables me to navigate complex payroll systems with ease. I am also skilled in employee relations, conflict resolution, and problem-solving, allowing me to effectively manage difficult situations in a professional and courteous manner.

In my previous role as a Payroll Manager at [Company Name], I successfully implemented a new payroll system, reducing errors by [percentage]. I also oversaw the processing of payroll for a team of over [number] employees, ensuring compliance with all relevant regulations and laws. In addition, I developed and implemented new policies and procedures, leading to increased efficiency and productivity.

I hold a Bachelor’s degree in Accounting from [University Name], and I am a certified payroll professional (CPP) with the American Payroll Association. These qualifications demonstrate my commitment to ongoing education and development within the payroll management field.

I am confident that my experience and expertise make me a strong candidate for the Payroll Manager position at [Company Name]. Thank you for considering my application. I look forward to discussing my qualifications with you further.

Related Articles

- Dishwasher Resume Example: Guide & Useful Tips

- 20 SQL Data Analyst Resume Examples

- 23 Highest Paying Engineering Jobs: A Complete Guide

- Marketing Project Manager: Job Description & Career Outlook

- Machine Learning Resume: Samples and Writing Guide

Rate this article

0 / 5. Reviews: 0

More from ResumeHead

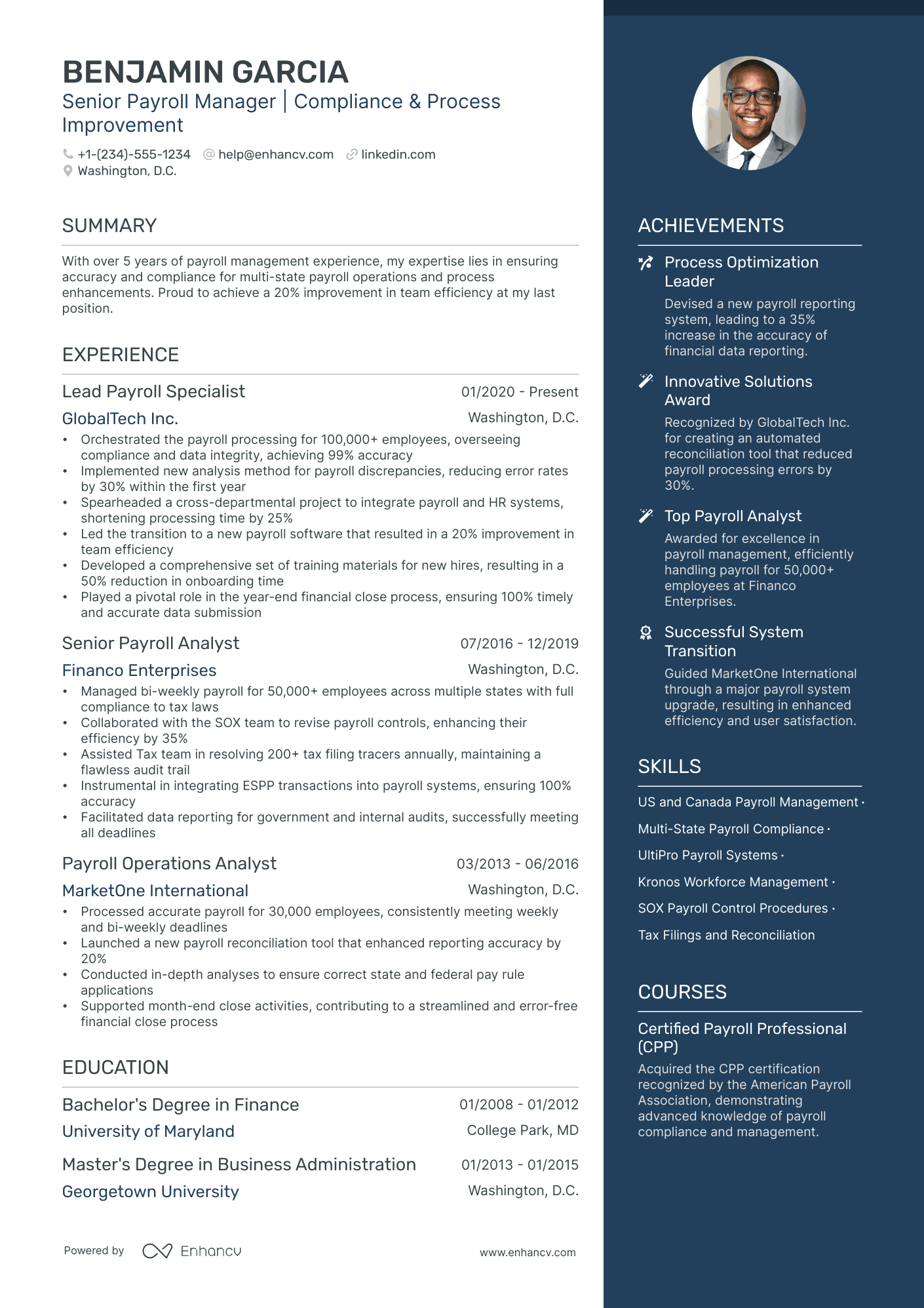

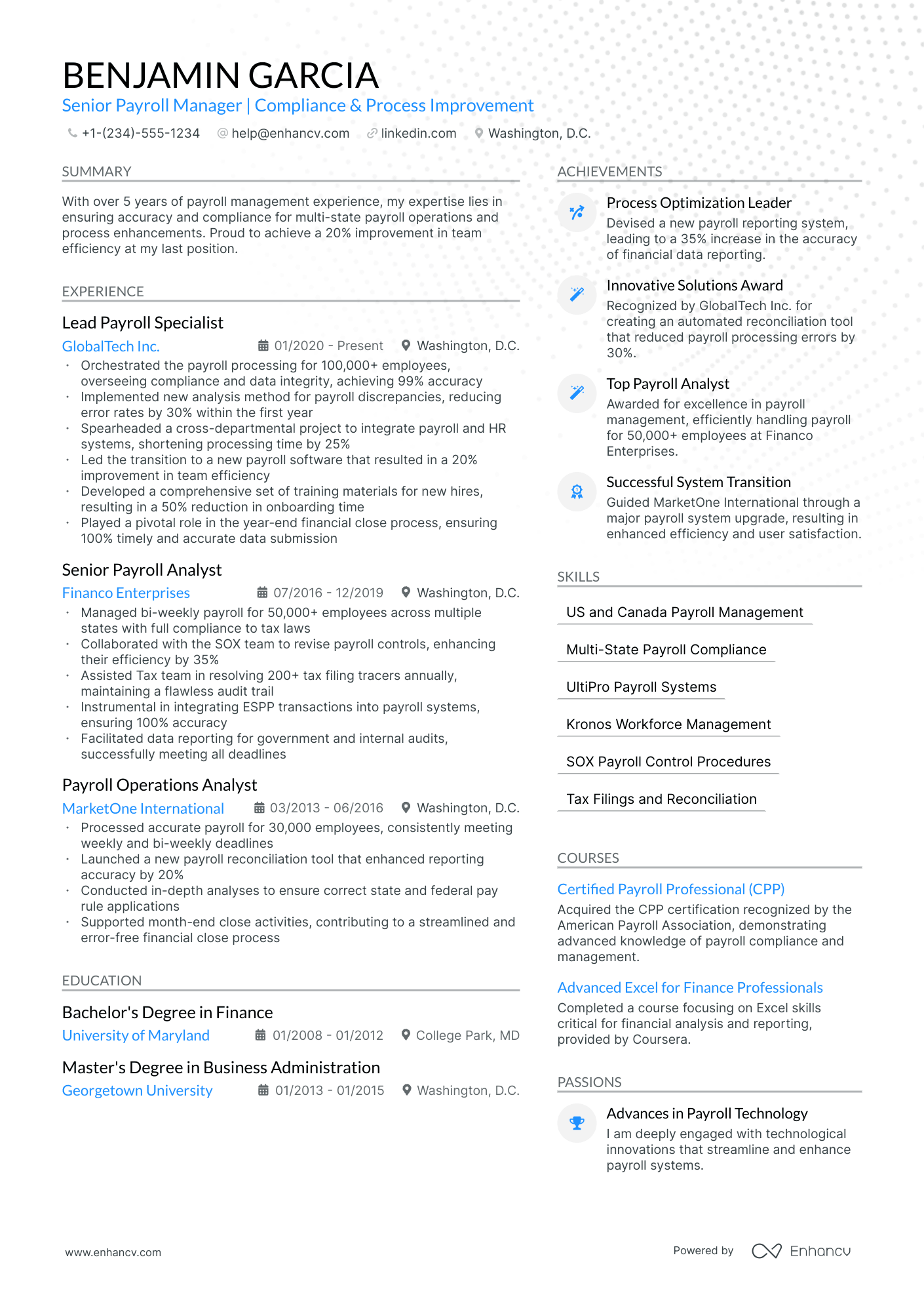

- • Orchestrated the payroll processing for 100,000+ employees, overseeing compliance and data integrity, achieving 99% accuracy

- • Implemented new analysis method for payroll discrepancies, reducing error rates by 30% within the first year

- • Spearheaded a cross-departmental project to integrate payroll and HR systems, shortening processing time by 25%

- • Led the transition to a new payroll software that resulted in a 20% improvement in team efficiency

- • Developed a comprehensive set of training materials for new hires, resulting in a 50% reduction in onboarding time

- • Played a pivotal role in the year-end financial close process, ensuring 100% timely and accurate data submission

- • Managed bi-weekly payroll for 50,000+ employees across multiple states with full compliance to tax laws

- • Collaborated with the SOX team to revise payroll controls, enhancing their efficiency by 35%

- • Assisted Tax team in resolving 200+ tax filing tracers annually, maintaining a flawless audit trail

- • Instrumental in integrating ESPP transactions into payroll systems, ensuring 100% accuracy

- • Facilitated data reporting for government and internal audits, successfully meeting all deadlines

- • Processed accurate payroll for 30,000 employees, consistently meeting weekly and bi-weekly deadlines

- • Launched a new payroll reconciliation tool that enhanced reporting accuracy by 20%

- • Conducted in-depth analyses to ensure correct state and federal pay rule applications

- • Supported month-end close activities, contributing to a streamlined and error-free financial close process

5 Payroll Manager Resume Examples & Guide for 2024

Your payroll manager resume must clearly highlight your experience with payroll systems and compliance. Demonstrate your proficiency in various payroll software platforms and your up-to-date knowledge of tax laws. Showcase your ability to manage and lead a payroll team effectively. Prove your track record in processing payroll accurately and ensuring timely disbursement of salaries.

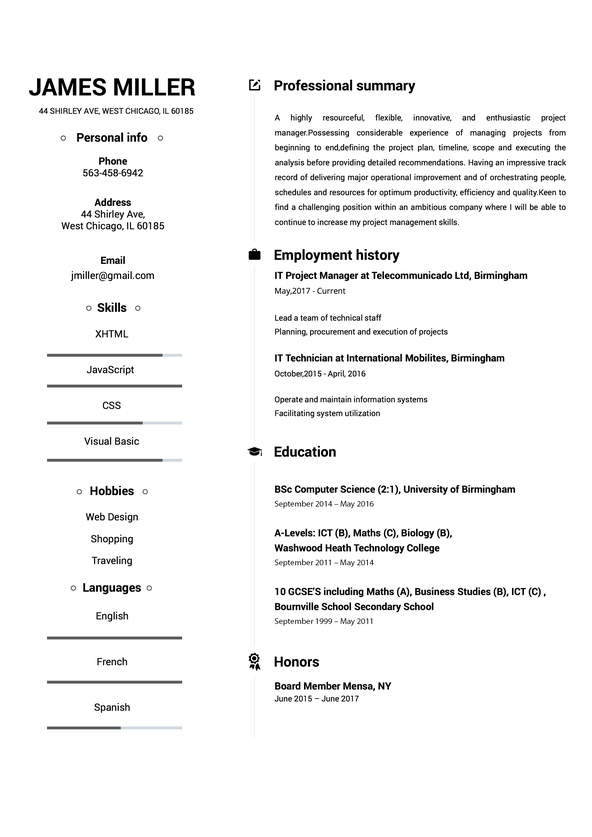

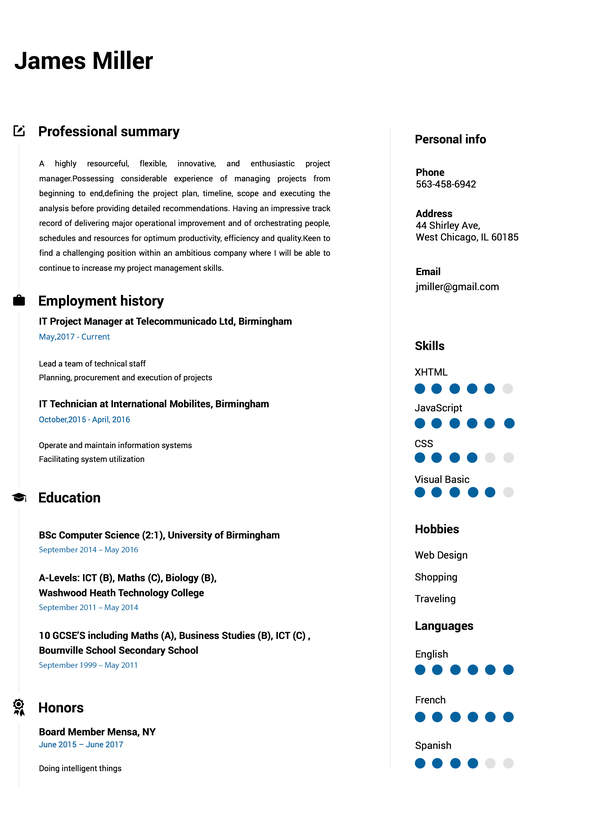

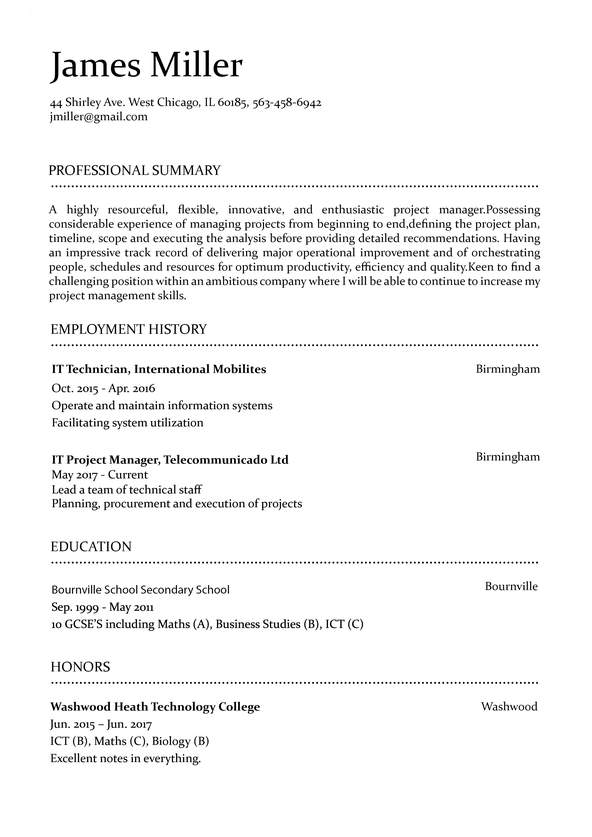

All resume examples in this guide

Traditional

Resume Guide

Resume Format Tips

Resume Experience

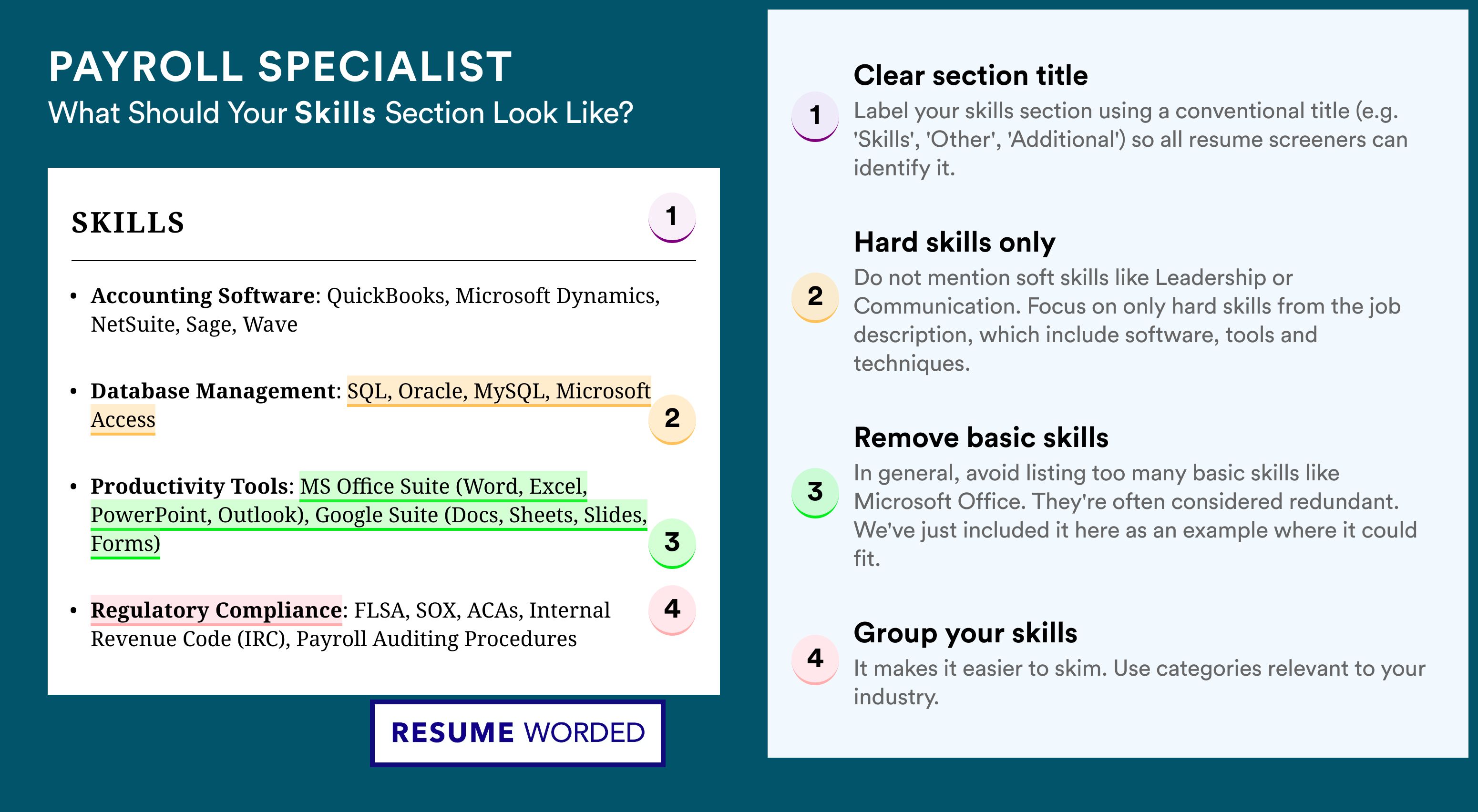

Skills on Resume

Education & Certifications

Resume Summary Tips

Additional Resume Sections

Key Takeaways

As a payroll manager, articulating your complex understanding of payroll systems and legislation in a concise resume can pose a significant challenge. Our guide provides insights and strategies to showcase your expertise effectively, ensuring that your resume stands out in a crowded field of professionals.

- payroll manager resumes that are tailored to the role are more likely to catch recruiters' attention.

- Most sought-out payroll manager skills that should make your resume.

- Styling the layout of your professional resume: take a page from payroll manager resume examples.

How to write about your payroll manager achievements in various resume sections (e.g. summary, experience, and education).

- Big 4 Accounting Resume Example

- Financial Reporting Manager Resume Example

- Oracle Project Accounting Resume Example

- Night Auditor Resume Example

- Phone Banking Resume Example

- Purchasing Director Resume Example

- General Ledger Accounting Resume Example

- Finance Associate Resume Example

- Audit Manager Resume Example

- Credit Manager Resume Example

Professional payroll manager resume format advice

Achieving the most suitable resume format can at times seem like a daunting task at hand.

Which elements are most important to recruiters?

In which format should you submit your resume?

How should you list your experience?

Unless specified otherwise, here's how to achieve a professional look and feel for your resume.

- Present your experience following the reverse-chronological resume format . It showcases your most recent jobs first and can help recruiters attain a quick glance at how your career has progressed.

- The header is the must-have element for your resume. Apart from your contact details, you could also include your portfolio and a headline, that reflects on your current role or a distinguishable achievement.

- Select relevant information to the role, that should encompass no more than two pages of your resume.

- Download your resume in PDF to ensure that its formatting stays intact.

Upload & Check Your Resume

Drop your resume here or choose a file . PDF & DOCX only. Max 2MB file size.

Mention specific courses or projects that are pertinent to the job you're applying for.

Traditional sections, appreciated by recruiters, for your payroll manager resume:

- Clear and concise header with relevant links and contact details

- Summary or objective with precise snapshot of our career highlights and why you're a suitable candidate for the payroll manager role

- Experience that goes into the nuts and bolts of your professional qualifications and success

- Skills section(-s) for more in-depth talent-alignment between job keywords and your own profile

- Education and certifications sections to further show your commitment for growth in the specific niche

What recruiters want to see on your resume:

- Demonstrated knowledge of payroll regulations and compliance with federal, state, and local laws.

- Proficiency with payroll software systems and technology like ADP, Paychex, or QuickBooks.

- Strong numerical aptitude and attention to detail for accurate payroll processing.

- Experience with benefits administration and understanding of various compensation structures.

- Proven track record of successfully managing a payroll team and improving departmental processes.

Quick guide to your payroll manager resume experience section

After deciding on the format of your resume, it's time to organize your experience within the dedicated section.

It's common for payroll manager professionals to be confused in this part of the process, as they may have too much or little expertise.

Follow the general rules of thumb to be successful when writing this part of your resume:

- The perfect number of bullets you should have under each experience item is no more than six;

- Select not merely your responsibilities, but the most noteworthy achievements for each role that match the job requirements;

- List any certificates or technical expertise you've gained on the job and how they've helped you progress as a professional;

- Carefully select the power verbs to go along with each bullet to avoid generic ones like "managed" and instead substitute those with the actuality of your particular responsibility;

- Integrate valuable keywords from the job advert in the form of achievements under each role you list.

If you're on the search for further advice on how to write your payroll manager experience section, get some ideas from real-world professional resumes:

- Led the transition to a new payroll system for over 1,500 employees, improving process efficiency by 25%.

- Negotiated with new payroll software providers to secure a contract that resulted in a 20% cost savings for the company.

- Developed and implemented strict payroll audit procedures that reduced payroll discrepancies by 95% within the first year.

- Managed payroll operations across 5 countries, ensuring full legal compliance and improving processing time by 10 days.

- Spearheaded a project to automate year-end tax reporting, reducing man-hours by 300 annually.

- Collaborated with HR to integrate payroll with employee benefits, increasing data accuracy and employee satisfaction.

- Oversaw bi-weekly payroll processing for over 800 employees, maintaining a 99.9% accuracy rate.

- Initiated a payroll self-service portal that was adopted by 80% of the workforce in the first year.

- Implemented a new payroll policy that streamlined overtime payouts and saved the company over $50,000 annually.

- Upgraded payroll software to enhance reporting functions, which provided executives with better decision-making data.

- Conducted comprehensive training for payroll staff, increasing team productivity by 40%.

- Reviewed and processed salary increases and bonuses with a total distributed value exceeding $2 million.

- Enhanced the payroll process using a lean methodology approach, resulting in the reduction of payroll cycle time by 15%.

- Led a task force to manage the payroll integration of two merging companies, including 1,200 new employees.

- Increased payroll processing accuracy to 99.98% by introducing new double-check mechanisms.

- Supervised the payroll team during a software upgrade, ensuring a smooth transition with no major disruptions to payroll processing.

- Cultivated a culture of continuous improvement in payroll processes, which facilitated a 10% reduction in payroll errors.

- Represented payroll in inter-departmental meetings, ensuring payroll considerations were factored into broader company financial strategies.

- Created a comprehensive set of payroll reports that provided leadership with insights, which drove a 5% decrease in labor costs.

- Built strong relationships with department leaders to ensure payroll needs were met promptly and efficiently.

- Coordinated with IT to launch a mobile application for timesheet submission, which was used by over 1,000 field employees.

- Oversaw the company-wide payroll compliance initiative to address new regulatory requirements, which was completed 1 month ahead of schedule.

- Initiated and led quarterly payroll forums to address stakeholder questions and concerns, improving inter-departmental communication.

- Managed payroll for expatriate employees, ensuring accurate withholding and reporting to respective countries' tax authorities.

- Directed a payroll department of 10 staff, handling payroll for over 2,000 employees across multiple sites.

- Enhanced the direct deposit enrollment to 98%, reducing paper checks and related costs by 75%.

- Successfully managed the year-end payroll reconciliation and W2 issuance with zero penalties.

- Orchestrated a significant overhaul of the payroll system that supported a workforce of 1,200 employees, catapulting system reliability and user satisfaction.

- Introduced an employee payroll education program, resulting in a substantial decrease in individual payroll queries.

- Managed salary benchmarking and payroll budgeting to align with company financial targets.

Quantifying impact on your resume

- Include the total number of employees for whom you've managed payroll to show the scale of your experience.

- List the percentage of accuracy you've maintained in payroll processing to demonstrate your attention to detail.

- Mention any reduction in payroll errors under your management to highlight your improvement initiatives.

- Quantify any cost savings achieved through efficient payroll management or vendor negotiations.

- Detail the number of payroll-related audits you have successfully passed to establish your compliance knowledge.

- Specify the size of your team if you have leadership experience to show management capabilities.

- Include any time you've saved for the company through streamlining or automating payroll processes.

- Note the number of payroll systems you are proficient in to showcase your technical skills and adaptability.

Action verbs for your payroll manager resume

Remember these four tips when writing your payroll manager resume with no experience

You've done the work - auditing the job requirements for keywords and have a pretty good idea of the skill set the ideal candidate must possess.

Yet, your professional experience amounts to a summer internship .

Even if you have limited or no professional expertise that matches the role you're applying for, you can use the resume experience section to:

- List extracurricular activities that are relevant to the job requirements. Let's say you were editor-in-chief of your college newspaper or part of the engineering society. Both activities have taught you invaluable, transferrable skills (e.g. communication or leadership) that can be crucial for the job;

- Substitute jobs with volunteer experience. Participating in charity projects has probably helped you develop an array of soft skills (e.g. meeting deadlines and interpersonal communications). On the other hand, volunteering shows potential employers more about you: who you are and what are the causes you care about;

- Align job applications with your projects. Even your final-year thesis work could be seen as relevant experience, if it's in the same industry as the job you're applying for. Ensure you've listed the key skills your project has taught you, alongside tangible outcomes or your project success;

- Shift the focus to your transferrable skills. We've said it before, but recruiters will assess your profile upon both job requirements and the skills you possess. Consider what your current experience - both academic and life - has taught you and how you've been able to develop your talents.

Recommended reads:

- How To List Certifications On A Resume (Examples Included)

- When You Should (And Not) Add Dean's List On Your Resume

If the certificate you've obtained is especially vital for the industry or company, include it as part of your name within the resume headline.

Payroll Manager skills and achievements section: must-have hard and soft skills

A key principle for your Payroll Manager resume is to prominently feature your hard skills, or the technologies you excel in , within the skills section. Aim to list several hard skills that are in line with the job's requirements.

When it comes to soft skills, like interpersonal communication abilities and talents , they're trickier to quantify.

Claiming to be a good communicator is one thing, but how can you substantiate this claim?

Consider creating a dedicated "Strengths" or "Achievements" section. Here, you can describe how specific soft skills (such as leadership, negotiation, problem-solving) have led to concrete achievements.

Your Payroll Manager resume should reflect a balanced combination of both hard and soft skills, just as job requirements often do.

Top skills for your payroll manager resume:

Payroll processing

Knowledge of payroll software

Tax law proficiency

Accounting principles

Data analysis

Financial reporting

Compliance management

Benefits administration

HRIS systems expertise

Audit preparation

Attention to detail

Problem-solving

Communication

Time management

Confidentiality

Strategic thinking

Adaptability

Customer service orientation

If you failed to obtain one of the certificates, as listed in the requirements, but decide to include it on your resume, make sure to include a note somewhere that you have the "relevant training, but are planning to re-take the exams". Support this statement with the actual date you're planning to be re-examined. Always be honest on your resume.

Payroll Manager-specific certifications and education for your resume

Place emphasis on your resume education section . It can suggest a plethora of skills and experiences that are apt for the role.

- Feature only higher-level qualifications, with details about the institution and tenure.

- If your degree is in progress, state your projected graduation date.

- Think about excluding degrees that don't fit the job's context.

- Elaborate on your education if it accentuates your accomplishments in a research-driven setting.

On the other hand, showcasing your unique and applicable industry know-how can be a literal walk in the park, even if you don't have a lot of work experience.

Include your accreditation in the certification and education sections as so:

- Important industry certificates should be listed towards the top of your resume in a separate section

- If your accreditation is really noteworthy, you could include it in the top one-third of your resume following your name or in the header, summary, or objective

- Potentially include details about your certificates or degrees (within the description) to show further alignment to the role with the skills you've attained

- The more recent your professional certificate is, the more prominence it should have within your certification sections. This shows recruiters you have recent knowledge and expertise

At the end of the day, both the education and certification sections hint at the initial and continuous progress you've made in the field.

And, honestly - that's important for any company.

Below, discover some of the most recent and popular Payroll Manager certificates to make your resume even more prominent in the applicant pool:

The top 5 certifications for your payroll manager resume:

- Certified Payroll Professional (CPP) - American Payroll Association (APA)

- Fundamental Payroll Certification (FPC) - American Payroll Association (APA)

- Certified Payroll Manager (CPM) - Canadian Payroll Association (CPA)

- Payroll Compliance Practitioner (PCP) - Canadian Payroll Association (CPA)

- Chartered Institute of Payroll Professionals (CIPP) - The Chartered Institute of Payroll Professionals

Listing your relevant degrees or certificates on your payroll manager resume is a win-win situation. Not only does it hint at your technical capabilities in the industry, but an array of soft skills, like perseverance, adaptability, and motivation.

- How to Put Cum Laude on Your Resume

- How To Include Your Relevant Coursework On A Resume

Adding a summary or objective to your payroll manager resume

One of the most crucial elements of your professional presentation is your resume's top one-third. This most often includes:

- Either a resume summary - your career highlights at a glance. Select the summary if you have plenty of relevant experience (and achievements), you'd like recruiters to remember about your application.

- Or, a resume objective - to showcase your determination for growth. The perfect choice for candidates with less experience, who are looking to grow their career in the field.

If you want to go above and beyond with your payroll manager resume summary or resume objective, make sure to answer precisely why recruiters need to hire you. What is the additional value you'd provide to the company or organization? Now here are examples from real-life payroll manager professionals, whose resumes have helped them land their dream jobs:

Resume summaries for a payroll manager job

- With 10+ years of expertise, I am a seasoned Payroll Manager adept in the latest payroll systems and compliance regulations. At my current role at a Fortune 500 company, I successfully managed payroll for over 5,000 employees, reducing processing errors by 25% through strategic process improvement initiatives.

- Dedicated Payroll Professional transitioning from a highly successful 7-year career in accounting, eager to leverage in-depth knowledge of financial reconciliations and tax planning to expertly manage payroll systems, ensuring accuracy and compliance at a multinational corporation.

- Accomplished Human Resources Specialist with a passion for numbers and details, seeking to transfer 8 years of benefits administration and compliance management experience to excel in payroll management, and contribute to the streamlined financial operations of a progressive tech startup.

- Boasting a 12-year tenure as a Payroll Manager for a leading retail chain, my career is highlighted by introducing an automated payroll system that bolstered efficiency by 40% and was replicated across regional outlets, indicative of my commitment to operational excellence and innovation in payroll administration.

- Desire to embark on a career as a Payroll Manager, offering my recent certification in payroll processing and a fresh perspective from my academic background in Business Administration. I am enthusiastic about applying analytical skills and meticulous attention to achieve excellence in payroll operations for a dynamic financial services firm.

- Eager to commence a Payroll Manager career with a focus on bringing my strong work ethic, quick learning ability, and a degree in finance to contribute effectively to the financial team of a high-growth tech company, ensuring accurate and timely compensation for its diverse employee base.

More sections to ensure your payroll manager resume stands out

If you're looking for additional ways to ensure your payroll manager application gets noticed, then invest in supplementing your resume with extra sections, like:

- Publications;

These supplementary resume sections show your technical aptitude (with particular technologies and software) and your people skills (gained even outside of work).

Key takeaways

- The logic of your resume presentation should follow your career highlights and alignment with the role;

- Curate information within different sections (e.g. summary, experience, etc.) that helps highlight your strengths;

- Exclude from your resume irrelevant experience items - that way you'd ensure it stays no longer than two pages and is easy to read;

- Dedicate space within the summary, experience, and/or achievements to highlight precisely why you're the best candidate for the role via your previous success;

- Both your technical and people capabilities should also play a crucial role in building up your payroll manager application. Prove your skill set in various resume sections.

Looking to build your own Payroll Manager resume?

- Resume Examples

How to Put Your Thesis on a Resume

How to write a cover letter for a job with no experience in that field, how to answer the “what type of work environment do you prefer” interview question, ace your next interview with the correct body language, how to email a cover letter – pro emailing tips for job hunters, should you use first person in a resume – a quick guide.

- Create Resume

- Terms of Service

- Privacy Policy

- Cookie Preferences

- Resume Templates

- AI Resume Builder

- Resume Summary Generator

- Resume Formats

- Resume Checker

- Resume Skills

- How to Write a Resume

- Modern Resume Templates

- Simple Resume Templates

- Cover Letter Builder

- Cover Letter Examples

- Cover Letter Templates

- Cover Letter Formats

- How to Write a Cover Letter

- Resume Guides

- Cover Letter Guides

- Job Interview Guides

- Job Interview Questions

- Career Resources

- Meet our customers

- Career resources

- English (UK)

- French (FR)

- German (DE)

- Spanish (ES)

- Swedish (SE)

© 2024 . All rights reserved.

Made with love by people who care.

- Payroll Manager Resume Example

Resume Examples

- Common Tasks & Responsibilities

- Top Hard & Soft Skills

- Action Verbs & Keywords

- Resume FAQs

- Similar Resumes

Common Responsibilities Listed on Payroll Manager Resumes:

- Manage the payroll process, including the calculation, preparation, and distribution of employee paychecks

- Ensure accurate and timely processing of payroll transactions, including new hires, terminations, salary changes, and deductions

- Maintain payroll records and ensure compliance with applicable laws and regulations

- Reconcile payroll accounts and prepare and submit payroll tax returns

- Respond to employee inquiries regarding payroll issues

- Develop and implement payroll policies and procedures

- Prepare reports for management on payroll costs, taxes, and other related topics

- Maintain up-to-date knowledge of payroll laws and regulations

- Assist with the preparation of the annual budget

- Monitor and audit employee time and attendance records

- Coordinate with other departments to ensure accurate payroll processing

- Develop and maintain positive relationships with employees and external vendors

Speed up your resume creation process with the AI-Powered Resume Builder . Generate tailored achievements in seconds for every role you apply to.

Payroll Manager Resume Example:

- Implemented automated payroll system, reducing processing time by 50% and minimizing errors by 25%.

- Developed and implemented payroll policies and procedures, ensuring compliance with all federal and state regulations.

- Reduced payroll costs by 15% through effective management of overtime and payroll deductions.

- Managed the successful integration of a new payroll software system, resulting in a 30% increase in efficiency and accuracy.

- Implemented a time and attendance tracking system, reducing payroll discrepancies by 20% and improving employee accountability.

- Developed and delivered comprehensive payroll training programs, resulting in a 25% decrease in payroll-related inquiries and errors.

- Implemented a streamlined payroll process, reducing processing time by 40% and improving payroll accuracy by 20%.

- Developed and maintained positive relationships with external vendors, resulting in cost savings of 10% through negotiation of favorable contracts.

- Implemented payroll analytics and reporting tools, providing management with real-time insights on payroll costs and trends.

- Proficiency in payroll software

- Knowledge of federal and state payroll regulations

- Strong analytical skills

- Ability to implement and manage automated payroll systems

- Experience in payroll cost reduction strategies

- Proficiency in time and attendance tracking systems

- Ability to develop and deliver comprehensive payroll training programs

- Strong negotiation skills for vendor contracts

- Experience in implementing streamlined payroll processes

- Ability to develop and maintain positive relationships with external vendors

- Proficiency in payroll analytics and reporting tools

- Strong management and leadership skills

- Excellent problem-solving abilities

- Strong attention to detail

- Excellent communication skills

- Ability to handle confidential information

- Strong organizational and multitasking abilities

- Knowledge of overtime and payroll deductions management

- Ability to work under pressure and meet deadlines

- Proficiency in Microsoft Office Suite (Excel, Word, PowerPoint)

- Knowledge of HRIS systems and databases.

Top Skills & Keywords for Payroll Manager Resumes:

Hard skills.

- Payroll Processing

- Payroll Tax Compliance

- Time and Attendance Management

- Benefits Administration

- HRIS (Human Resources Information System)

- Payroll Software (e.g., ADP, Paychex)

- Labor Laws and Regulations

- Auditing and Compliance

- Data Analysis and Reporting

- Problem-solving and Troubleshooting

- Team Management and Leadership

- Communication and Interpersonal Skills

Soft Skills

- Attention to Detail

- Analytical Thinking

- Problem Solving

- Time Management

- Organization

- Communication

- Collaboration

- Adaptability

- Confidentiality

- Customer Service

Resume Action Verbs for Payroll Managers:

- Implemented

- Streamlined

- Coordinated

- Collaborated

- Communicated

Generate Your Resume Summary

Resume FAQs for Payroll Managers:

How long should i make my payroll manager resume, what is the best way to format a payroll manager resume, which keywords are important to highlight in a payroll manager resume, how should i write my resume if i have no experience as a payroll manager, compare your payroll manager resume to a job description:.

- Identify opportunities to further tailor your resume to the Payroll Manager job

- Improve your keyword usage to align your experience and skills with the position

- Uncover and address potential gaps in your resume that may be important to the hiring manager

Complete the steps below to generate your free resume analysis.

Related Resumes for Payroll Managers:

Payroll accountant, payroll analyst, finance manager, staff accountant, general ledger accountant, senior accountant, tax manager.

Build my resume

- Resume builder

- Build a better resume in minutes

- Resume examples

- 2,000+ examples that work in 2024

- Resume templates

- 184 free templates for all levels

- Cover letters

- Cover letter generator

- It's like magic, we promise

- Cover letter examples

- Free downloads in Word & Docs

5 Payroll Resume Examples + Complete Guide

Payroll Resume

- Payroll Specialist

- Payroll Manager

- Payroll Clerk

- Payroll Administrator

- Write Your Payroll Resume

You blend precision, diligence, and expertise to effortlessly navigate the complexities of managing the payroll side of your company. You maintain near-constant oversight of employee finances, making sure everyone gets paid correctly, and on time.

Whatever your particular niche within payroll, you’ll need to craft a top-notch resume and write a cover letter that effectively summarizes your strengths before you can push your career forward.

We’re here to help. Our payroll resume examples and tips are tailor-made for professionals across all aspects of payroll. Read on to start advancing your career!

or download as PDF

Why this resume works

- Look at how Sylvia highlights her track record in saving costs. It’s an example you can emulate and boost chances of being hired.

Payroll Specialist Resume

- Highlighting how you leveraged Gusto, GAAP, Kronos, and more to boost efficiency and improve workers’ satisfaction would get you noticed by the hiring team.

Payroll Manager Resume

- To stand out from the rest, including your bachelors of science labor and employment relations not only gives you credibility but also underscores your insider’s knowledge of the industry.

Payroll Clerk Resume

- Choosing a professional resume template and formatting your piece to make it easy for recruiters to read and follow your career journey is a powerful expression of your professionalism.

Payroll Administrator Resume

- When you look closely, there is a tactical use of relevant software and tools to get things done and meet job expectations. Likewise, you can follow this script by highlighting your competencies in tools such as IRS Publication 15, Zenefits, BambooHR, and more to underscore your suitability for the advertised job.

Related resume examples

- Bank teller

- Accounting clerk

Tweak Your Payroll Resume to Match the Job

Thanks to your experience in payroll, you’ve developed a unique skill set that makes you the ideal candidate. With the help of tools like Paychex, ADP, and QuickBooks, payroll operations are seamless, and everyone’s happy.

Your job is pretty specialized, so focus your resume on the things that matter most in your particular branch of payroll.

Highlight that you’re a pro at crucial payroll tools, such as Excel, Paychex, and Kronos. If you’re applying for a specialized niche within payroll, such as compliance, emphasize your tax and legal regulatory knowledge, too.

Need some ideas?

15 top payroll skills

- ADP Workforce Now

- Paychex Flex

- QuickBooks Payroll

- Sage Payroll

- Microsoft Excel

- Ceridian Dayforce

- SAP SuccessFactors

- Oracle Payroll

Your payroll work experience bullet points

Regardless of your niche within payroll, your work is crucial—after all, you make sure payroll operations are running smoothly, all the while adhering strictly to the ever-changing tax laws and regulations.

Your daily responsibilities are key, but your resume should, instead, highlight your greatest successes. Harness the power of data and back them up with concrete metrics and figures to amplify your impact.

As an example, discuss how you streamlined payroll processes using ADP, leading to a reduction in total errors by 24%.

- Spotlight how you improved processes and reduced occurrences of payroll and benefit-related errors.

- Highlight the top-notch quality of your work by including improvements to data accuracy or meeting crucial deadlines.

- Showcase the scale of your work by mentioning the sheer volume of employees you oversaw payroll processes for.

- Emphasize your financial impact by outlining cost-savings that your work led to.

See what we mean?

- Implemented TSheets time tracking system, resulting in a 21% improvement in timekeeping accuracy and a $13,243 reduction in overtime costs

- Utilized QuickBooks Payroll to automate tax calculations, resulting in a 17% reduction in payroll tax errors and saving an estimated $5,348 annually in penalties

- Processed payroll for a team of 1,112 employees, ensuring accuracy and compliance with all federal and state regulations

- Achieved a 99.6% accuracy rate in payroll calculations, reducing errors and discrepancies

9 active verbs to start your payroll work experience bullet points

- Implemented

- Streamlined

3 Tips for Writing a Payroll Resume When You’re Just Starting Out

- Certifications won’t always be required, but can go a long way toward showing your commitment early in your career. If you have certs like the FPC, CPP, or specialized payroll qualifications, display them with pride.

- You know full well that accuracy and precision are key in payroll, so highlight your attention to detail. For instance, mention how you prevented errors and ensured smooth operations in tasks like calculating wages, deductions, and taxes.

- Showcase your familiarity with payroll software to set yourself apart and assure employers you can hit the ground running. Mention any payroll management tools you’ve used during your education or personal projects, such as ADP or QuickBooks.

3 Tips for Writing a Payroll Resume if You’re Already Experienced

- Your payroll strategies often have an impact on the broader business strategy—spotlight that in your resume. Detail how your initiatives saved expenses and time, leading to improved decision-making for senior management.

- If you’re specialized in a niche such as international payroll, compliance, or advanced reporting, flaunt that expertise. Highlight any certifications, training, and work experience that reaffirm it.

- Optimization is a crucial part of payroll. Show that you know that by talking about things like the strategies you used to streamline payroll workflows, implement new technologies, or introduce practices that boosted efficiency.

Use your cover letter to elaborate on the achievements you listed in your resume. For instance, detail why you opted to use Gusto to implement time-saving measures that led to significant drops in processing time.

If you’ve just started out, a career objective can be a great way to tailor your resume to each role. Mention each company and job title specifically, and include a long-term career trajectory you’d like to follow within the company—for example, setting your sights on a payroll lead role.

To distinguish your resume, tailor it to include the most relevant keywords for each job description . If a role emphasizes TurboTax and Kronos, list these skills at the top of your list.

Explore Jobs

- Jobs Near Me

- Remote Jobs

- Full Time Jobs

- Part Time Jobs

- Entry Level Jobs

- Work From Home Jobs

Find Specific Jobs

- $15 Per Hour Jobs

- $20 Per Hour Jobs

- Hiring Immediately Jobs

- High School Jobs

- H1b Visa Jobs

Explore Careers

- Business And Financial

- Architecture And Engineering

- Computer And Mathematical

Explore Professions

- What They Do

- Certifications

- Demographics

Best Companies

- Health Care

- Fortune 500

Explore Companies

- CEO And Executies

- Resume Builder

- Career Advice

- Explore Majors

- Questions And Answers

- Interview Questions

Payroll Manager resume examples for 2024

Payroll managers require a range of skills, from customer service and human resources to payroll systems and internal controls. They must process payroll tax, perform reconciliations, and manage multi-state payroll operations. They also need to maintain excellent organizational skills and handle accruals. Payroll managers must stay up-to-date with SOX regulations and handle payroll issues. As one expert put it, "the payroll manager is responsible for the accuracy and integrity of the payroll system."

Payroll Manager resume example

How to format your payroll manager resume:.

- Use the same job title on your resume as the job you're applying for,"

- Highlight achievements in your work experience section, such as cost savings or improved processes,"

- Aim to fit your resume on one page, focusing on relevant experience and accomplishments.

Choose from 10+ customizable payroll manager resume templates

Choose from a variety of easy-to-use payroll manager resume templates and get expert advice from Zippia’s AI resume writer along the way. Using pre-approved templates, you can rest assured that the structure and format of your payroll manager resume is top notch. Choose a template with the colors, fonts & text sizes that are appropriate for your industry.

Payroll Manager resume format and sections

1. add contact information to your payroll manager resume.

Payroll Manager Resume Contact Information Example # 1

Dhruv Johnson

[email protected] | 333-111-2222 | www.linkedin.com/in/dhruv-johnson

2. Add relevant education to your payroll manager resume

Your resume's education section should include:

- The name of your school

- The date you graduated ( Month, Year or Year are both appropriate)

- The name of your degree

If you graduated more than 15 years ago, you should consider dropping your graduation date to avoid age discrimination.

Optional subsections for your education section include:

- Academic awards (Dean's List, Latin honors, etc. )

- GPA (if you're a recent graduate and your GPA was 3.5+)

- Extra certifications

- Academic projects (thesis, dissertation, etc. )

Other tips to consider when writing your education section include:

- If you're a recent graduate, you might opt to place your education section above your experience section

- The more work experience you get, the shorter your education section should be

- List your education in reverse chronological order, with your most recent and high-ranking degrees first

- If you haven't graduated yet, you can include "Expected graduation date" to the entry for that school

Check More About Payroll Manager Education

Payroll Manager Resume Relevant Education Example # 1

Bachelor's Degree In Liberal Arts 1999 - 2002

Bellevue College Bellevue, WA

Payroll Manager Resume Relevant Education Example # 2

Bachelor's Degree In Accounting 2004 - 2007

University of Maryland - College Park College Park, MD

3. Next, create a payroll manager skills section on your resume

Your resume's skills section should include the most important keywords from the job description, as long as you actually have those skills. If you haven't started your job search yet, you can look over resumes to get an idea of what skills are the most important.

Here are some tips to keep in mind when writing your resume's skills section:

- Include 6-12 skills, in bullet point form

- List mostly hard skills ; soft skills are hard to test

- Emphasize the skills that are most important for the job

Hard skills are generally more important to hiring managers because they relate to on-the-job knowledge and specific experience with a certain technology or process.

Soft skills are also valuable, as they're highly transferable and make you a great person to work alongside, but they're impossible to prove on a resume.

Example of skills to include on an payroll manager resume

Customer service is the process of offering assistance to all the current and potential customers -- answering questions, fixing problems, and providing excellent service. The main goal of customer service is to build a strong relationship with the customers so that they keep coming back for more business.

Human resources is a set of people in a business or a corporation that are designated to locate, interview, and recruit new employees into the company. They are also responsible to maintain the integrity of the employees and help them sort their problems out. They try to introduce and manage employee-benefit programs.

A W-2 form is also known as the Wage and Tax Statement. An employer is required to send this document to each employee and the IRS (Internal Revenue Service) yearly. A W-2 details the employee's annual wages and the taxes deducted from their paychecks. This does not include self-employed or contracted workers, who file taxes with separate forms.

Kronos is an employee time tracking software popular in the US.

Paid time off or often referred to as PTO , is given in most companies or agencies intended for their employees. Although there are many benefits and time offs given for employees such as vacation leave, sick leave, maternity or paternity leave, bereavement leave , PTO is when the worker is given time to have a break or not go to work for essential purposes. This kind of agreement happens every year, wherein the workers are paid to have a break from work. Not all employers give such an offer, depending on the status of the company.

Top Skills for a Payroll Manager

- Customer Service , 7.7%

- Human Resources , 5.1%

- Payroll System , 5.1%

- Payroll Tax , 4.8%

- Other Skills , 77.3%

4. List your payroll manager experience

The most important part of any resume for a payroll manager is the experience section. Recruiters and hiring managers expect to see your experience listed in reverse chronological order, meaning that you should begin with your most recent experience and then work backwards.

Don't just list your job duties below each job entry. Instead, make sure most of your bullet points discuss impressive achievements from your past positions. Whenever you can, use numbers to contextualize your accomplishments for the hiring manager reading your resume.

It's okay if you can't include exact percentages or dollar figures. There's a big difference even between saying "Managed a team of payroll managers" and "Managed a team of 6 payroll managers over a 9-month project. "

Most importantly, make sure that the experience you include is relevant to the job you're applying for. Use the job description to ensure that each bullet point on your resume is appropriate and helpful.

5. Highlight payroll manager certifications on your resume

Specific payroll manager certifications can be a powerful tool to show employers you've developed the appropriate skills.

If you have any of these certifications, make sure to put them on your payroll manager resume:

- Certified Payroll Professional (CPP)

- Certified Management Accountant (CMA)

- Payroll Certification

- International Accredited Business Accountant (IABA)

- Fundamental Payroll Certification (FPC)

- Society for Human Resource Management Certified Professional (SHRM-CP)

- Senior Professional in Human Resources (SPHR)

- Certified Manager Certification (CM)

- Certified Security Supervision & Management (CSS)

- Certified in Financial Management

6. Finally, add an payroll manager resume summary or objective statement

A resume summary statement consists of 1-3 sentences at the top of your payroll manager resume that quickly summarizes who you are and what you have to offer. The summary statement should include your job title, years of experience (if it's 3+), and an impressive accomplishment, if you have space for it.

Remember to emphasize skills and experiences that feature in the job description.

Common payroll manager resume skills

- Customer Service

- Human Resources

- Payroll System

- Payroll Tax

- Reconciliations

- Payroll Operations

- Multi-State Payroll

- Process Payroll

- Payroll Data

- Timekeeping

- Internal Controls

- Calculation

- Payroll Issues

- Excellent Organizational

- General Ledger Accounts

- Workers Compensation

- Process Improvement

- ADP Workforce

- Payroll Functions

- Shared Services

- External Auditors

- Strong Analytical

- Payroll Policies

- Financial Statements

- Payroll Journal Entries

- Payroll Procedures

- Tax Filings

- Payroll Accounts

- Tax Returns

- Direct Reports

- Benefit Deductions

- Manual Checks

- Payroll Deductions

- Payroll Checks

- Payroll Reports

- Payroll Software

- Review Payroll

- Tax Payments

Payroll Manager Jobs

Links to help optimize your payroll manager resume.

- How To Write A Resume

- List Of Skills For Your Resume

- How To Write A Resume Summary Statement

- Action Words For Your Resume

- How To List References On Your Resume

Updated March 14, 2024

Editorial Staff

The Zippia Research Team has spent countless hours reviewing resumes, job postings, and government data to determine what goes into getting a job in each phase of life. Professional writers and data scientists comprise the Zippia Research Team.

Payroll Manager Related Resumes

- Payroll Analyst Resume

- Payroll Assistant Resume

- Payroll Clerk Resume

- Payroll Processor Resume

- Payroll Specialist Resume

- Payroll Supervisor Resume

- Payroll/Human Resource Manager Resume

Payroll Manager Related Careers

- Accounting Manager

- Benefits Clerk

- Commission Clerk

- Payroll & Human Resources Assistant

- Payroll Administrator

- Payroll Analyst

- Payroll Assistant

- Payroll Associate

- Payroll Bookkeeper

- Payroll Clerk

- Payroll Officer

- Payroll Processor

- Payroll Representative

- Payroll Specialist

Payroll Manager Related Jobs

What similar roles do.

- What Does an Accounting Manager Do

- What Does a Benefits Clerk Do

- What Does a Payroll & Human Resources Assistant Do

- What Does a Payroll Administrator Do

- What Does a Payroll Analyst Do

- What Does a Payroll Assistant Do

- What Does a Payroll Associate Do

- What Does a Payroll Clerk Do

- What Does a Payroll Processor Do

- What Does a Payroll Representative Do

- What Does a Payroll Specialist Do

- What Does a Payroll Supervisor Do

- What Does a Payroll Technician Do

- What Does a Senior Payroll Specialist Do

- Zippia Careers

- Office and Administrative Industry

- Payroll Manager

- Payroll Manager Resume

Browse office and administrative jobs

- ResumeBuild

- Payroll Manager

5 Amazing payroll manager Resume Examples (Updated 2023) + Skills & Job Descriptions

Build your resume in 15 minutes, payroll manager: resume samples & writing guide, harry nelson, professional summary, employment history.

- Analyze and reconcile payroll data, including salaries, wages, deductions, and other withholdings

- Prepare and distribute payroll reports and other related documents

- Assist with the preparation of the annual budget and forecasting

- Develop and maintain relationships with external payroll vendors

- Respond to inquiries from employees and HR staff regarding payroll matters

- Develop and implement payroll policies and procedures

- Research and resolve payroll discrepancies

Do you already have a resume? Use our PDF converter and edit your resume.

Richard Wilson

- Assist with audits and other payroll related inquiries

- Assist in the implementation and maintenance of payroll systems

- Manage payroll processing and ensure accurate and timely payroll processing

Quinn Wilson

- Maintain payroll records and ensure compliance with applicable laws and regulations

- Oversee payroll tax filing, garnishment processing and other related activities

- Prepare and submit payroll and related reports to management

- Perform other duties as assigned

Yolie Jackson

- Ensure compliance with all applicable laws and regulations

Not in love with this template? Browse our full library of resume templates

Table of Content

- Introduction

- Resume Samples & Writing Guide

- Resume Example 1

- Resume Example 2

- Resume Example 3

- Resume Example 4

- Resume Example 5

- Jobs Description

- Jobs Skills

- Technical Skills

- Soft Skills

- How to Improve Your Resume

- How to Optimize Your Resume

- Cover Letter Example

payroll manager Job Descriptions; Explained

If you're applying for an payroll manager position, it's important to tailor your resume to the specific job requirements in order to differentiate yourself from other candidates. Including accurate and relevant information that directly aligns with the job description can greatly increase your chances of securing an interview with potential employers. When crafting your resume, be sure to use action verbs and a clear, concise format to highlight your relevant skills and experience. Remember, the job description is your first opportunity to make an impression on recruiters, so pay close attention to the details and make sure you're presenting yourself in the best possible light.

payroll manager

- Headquarters’ payroll calculation including overseas Sales Rep..

- Provide information to employees and managers on payroll matters and tax issues.

- Process hiring procedures for foreign professionals.

- Enforce legal documents and contract writing for overseas Sales Representatives.

- Verifying and maintain payroll records of the branch offices.

payroll manager/implementation specialist

- In alliance with ADP implementation solutions for ADP clients payroll, time and attendance, HR and benefits, reporting, software training, etc.

- Specialize in processing multi state payrolls, taxes, open enrollments, employee maintenance, audits and time keeping

- Under contract with multiple clients’ biweekly/semi-monthly payrolls ranging from 50 – 600+ employees during tenure

- Working remotely or onsite with client when necessary

payroll manager/billing manager

- Manage 80+ employees

- Resolve problems concerning client and caregiver concerns