Don’t Confuse Change of Control and Assignment Terms

- David Tollen

- September 11, 2020

An assignment clause governs whether and when a party can transfer the contract to someone else. Often, it covers what happens in a change of control: whether a party can assign the contract to its buyer if it gets merged into a company or completely bought out. But that doesn’t make it a change of control clause. Change of control terms don’t address assignment. They say whether a party can terminate if the other party goes through a merger or other change of control. And they sometimes address other change of control consequences.

Don’t confuse the two. In a contract about software or other IT, you should think through the issues raised by each. (Also, don’t confuse assignment of contracts with assignment of IP .)

Here’s an assignment clause:

Assignment. Neither party may assign this Agreement or any of its rights or obligations hereunder without the other’s express written consent, except that either party may assign this Agreement to the surviving party in a merger of that party into another entity or in an acquisition of all or substantially all its assets. No assignment becomes effective unless and until the assignee agrees in writing to be bound by all the assigning party’s obligations in this Agreement. Except to the extent forbidden in this Section __, this Agreement will be binding upon and inure to the benefit of the parties’ respective successors and assigns.

As you can see, that clause says no assignment is allowed, with one exception:

- Assignment to Surviving Entity in M&A: Under the clause above, a party can assign the contract to its buyer — the “surviving entity” — if it gets merged into another company or otherwise bought — in other words, if it ceases to exist through an M&A deal (or becomes an irrelevant shell company).

Consider the following additional issues for assignment clauses:

- Assignment to Affiliates: Can a party assign the contract to its sister companies, parents, and/or subs — a.k.a. its “Affiliates”?

- Assignment to Divested Entities: If a party spins off its key department or other business unit involved in the contract, can it assign the contract to that spun-off company — a.k.a. the “divested entity”? That’s particularly important in technology outsourcing deals and similar contracts. They often leave a customer department highly dependent on the provider’s services. If the customer can’t assign the contract to the divested entity, the spin-off won’t work; the new/divested company won’t be viable.

- Assignment to Competitors: If a party does get any assignment rights, can it assign to the other party’s competitors ? (If so, you’ve got to define “Competitor,” since the word alone can refer to almost any company.)

- All Assignments or None: The contract should usually say something about assignments. Otherwise, the law might allow all assignments. (Check your jurisdiction.) If so, your contracting partner could assign your agreement to someone totally unacceptable. (Most likely, though, your contracting partner would remain liable.) If none of the assignments suggested above fits, forbid all assignments.

Change of Control

Here’s a change of control clause:

Change of Control. If a party undergoes a Change of Control, the other party may terminate this Agreement on 30 days’ written notice. (“Change of Control” means a transaction or series of transactions by which more than 50% of the outstanding shares of the target company or beneficial ownership thereof are acquired within a 1-year period, other than by a person or entity that owned or had beneficial ownership of more than 50% of such outstanding shares before the close of such transactions(s).)

- Termination on Change of Control: A party can terminate if controlling ownership of the other party changes hands.

Change of control and assignment terms actually address opposite ownership changes. If an assignment clause addresses change of control, it says what happens if a party goes through an M&A deal and no longer exists (or becomes a shell company). A change of control clause, on the other hand, matters when the party subject to M&A does still exist . That party just has new owners (shareholders, etc.).

Consider the following additional issues for change of control clauses:

- Smaller Change of Ownership: The clause above defines “Change of Control” as any 50%-plus ownership shift. Does that set the bar too high? Should a 25% change authorize termination by the other party, or even less? In public companies and some private ones, new bosses can take control by acquiring far less than half the stock.

- No Right to Terminate: Should a change of control give any right to terminate, and if so, why? (Keep in mind, all that’s changed is the party’s owners — possibly irrelevant shareholders.)

- Divested Entity Rights: What if, again, a party spins off the department or business until involved in the deal? If that party can’t assign the contract to the divested entity, per the above, can it at least “sublicense” its rights to products or service, if it’s the customer? Or can it subcontract its performance obligations to the divested entity, if it’s the provider? Or maybe the contract should require that the other party sign an identical contract with the divested entity, at least for a short term.

Some of this text comes from the 3rd edition of The Tech Contracts Handbook , available to order (and review) from Amazon here , or purchase directly from its publisher, the American Bar Association, here.

Want to do tech contracts better, faster, and with more confidence? Check out our training offerings here: https://www.techcontracts.com/training/ . Tech Contracts Academy has options to fit every need and schedule: Comprehensive Tech Contracts M aster Classes™ (four on-line classes, two hours each), topical webinars (typically about an hour), customized in-house training (for just your team). David Tollen is the founder of Tech Contracts Academy and our primary trainer. An attorney and also the founder of Sycamore Legal, P.C. , a boutique IT, IP, and privacy law firm in the San Francisco Bay Area, he also serves as an expert witness in litigation about software licenses, cloud computing agreements, and other IT contracts.

© 2020, 2022 by Tech Contracts Academy, LLC. All rights reserved.

Thank you to Pixabay.com for great, free stock images!

Related Posts

David tollen’s live webinars about technology contracting – april 16, may 21.

Join Tech Contracts Academy’s two remaining live webinars this spring: April 16 – The Indeminar: Indemnities in Contracts about Software, the Cloud, and AI May 21 – IP

Educational videos partnership with Briefly

Tech Contracts Academy and David Tollen have partnered with Adam Stofsky and Briefly Inc. to create a series of short, concise videos, covering contract basics. The videos are

Don’t grant a fault-based indemnity

I think it’s a mistake to indemnify against claims resulting from indemnitor negligence or other wrongdoing. Indemnities against 3rd party claims usually specify the claims

New AI Contracts Training Available On-Demand

David Tollen’s Tech Contracts Academy just released a new, updated version of our popular training: AI Contracts – Drafting and Negotiating. With 1 year’s access, you can use it for training and as a reference.

- What’s New on the Watch?

- COVID-19 Updates

- Private Equity Webinar Series

- Private Equity Finance

- Global PE Update

- Glenn West Musings

- Quarterly Private Funds Update

- Ancillary Agreements

- Co-investments

- Cybersecurity

- Going Privates

- Legal Developments

- Minority Investments

- Portfolio Company Matters

- Purchase Agreements

- R&W Insurance

- Secondaries

- Securities Laws

- Shareholder Agreements

- Specialist Areas

- Contributors

- Global Team

- Privacy Policy

Private Equity

Watch your inbox.

Get the latest views and developments in the private equity world from the Global Private Equity Watch team at Weil.

Spotting issues with assignment clauses in M&A Due Diligence

Written by: Kira Systems

January 19, 2016

6 minute read

Although not nearly as complex as change of control provisions , assignment provisions may still present a challenge in due diligence projects. We hope this blog post will help you navigate the ambiguities of assignment clauses with greater ease by explaining some of the common variations. (And, if you like it, please check out our full guide on Reviewing Change of Control and Assignment Provisions in Due Diligence. )

What is an Assignment Clause?

First, the basics:

Anti-assignment clauses are common because without them, generally, contracts are freely assignable. (The exceptions are (i) contracts that are subject to statutes or public policies prohibiting their assignment, such as intellectual property contracts, or (ii) contracts where an assignment without consent would cause material and adverse consequences to non-assigning counterparties, such as employment agreements and consulting agreements.) For all other contracts, parties may want an anti-assignment clause that allows them the opportunity to review and understand the impact of an assignment (or change of control) before deciding whether to continue or terminate the relationship.

In the mergers and acquisitions context, an assignment of a contract from a target company entity to the relevant acquirer entity is needed whenever a contract has to be placed in the name of an entity other than the existing target company entity after consummation of a transaction. This is why reviewing contracts for assignment clauses is so critical.

A simple anti-assignment provision provides that a party may not assign the agreement without the consent of the other party. Assignment provisions may also provide specific exclusions or inclusions to a counterparty’s right to consent to the assignment of a contract. Below are five common occurrences in which assignment provisions may provide exclusions or inclusions.

Common Exclusions and Inclusions

Exclusion for change of control transactions.

In negotiating an anti-assignment clause, a company would typically seek the exclusion of assignments undertaken in connection with change of control transactions, including mergers and sales of all or substantially all of the assets of the company. This allows a company to undertake a strategic transaction without worry. If an anti-assignment clause doesn’t exclude change of control transactions, a counterparty might materially affect a strategic transaction through delay and/or refusal of consent. Because there are many types of change of control transactions, there is no standard language for these. An example might be:

In the event of the sale or transfer by [Party B] of all or substantially all of its assets related to this Agreement to an Affiliate or to a third party, whether by sale, merger, or change of control, [Party B] would have the right to assign any or all rights and obligations contained herein and the Agreement to such Affiliate or third party without the consent of [Party A] and the Agreement shall be binding upon such acquirer and would remain in full force and effect, at least until the expiration of the then current Term.

Exclusion for Affiliate Transactions

A typical exclusion is one that allows a target company to assign a contract to an affiliate without needing the consent of the contract counterparty. This is much like an exclusion with respect to change of control, since in affiliate transfers or assignments, the ultimate actors and responsible parties under the contract remain essentially the same even though the nominal parties may change. For example:

Either party may assign its rights under this Agreement, including its right to receive payments hereunder, to a subsidiary, affiliate or any financial institution, but in such case the assigning party shall remain liable to the other party for the assigning party’s obligations hereunder. All or any portion of the rights and obligations of [Party A] under this Agreement may be transferred by [Party A] to any of its Affiliates without the consent of [Party B].

Assignment by Operation of Law

Assignments by operation of law typically occur in the context of transfers of rights and obligations in accordance with merger statutes and can be specifically included in or excluded from assignment provisions. An inclusion could be negotiated by the parties to broaden the anti-assignment clause and to ensure that an assignment occurring by operation of law requires counterparty approval:

[Party A] agrees that it will not assign, sublet or otherwise transfer its rights hereunder, either voluntarily or by operations of law, without the prior written consent of [Party B].

while an exclusion could be negotiated by a target company to make it clear that it has the right to assign the contract even though it might otherwise have that right as a matter of law:

This Guaranty shall be binding upon the successors and assigns of [Party A]; provided, that no transfer, assignment or delegation by [Party A], other than a transfer, assignment or delegation by operation of law, without the consent of [Party B], shall release [Party A] from its liabilities hereunder.

This helps settle any ambiguity regarding assignments and their effects under mergers statutes (particularly in forward triangular mergers and forward mergers since the target company ceases to exist upon consummation of the merger).

Direct or Indirect Assignment

More ambiguity can arise regarding which actions or transactions require a counterparty’s consent when assignment clauses prohibit both direct and indirect assignments without the consent of a counterparty. Transaction parties will typically choose to err on the side of over-inclusiveness in determining which contracts will require consent when dealing with material contracts. An example clause prohibiting direct or indirect assignment might be:

Except as provided hereunder or under the Merger Agreement, such Shareholder shall not, directly or indirectly, (i) transfer (which term shall include any sale, assignment, gift, pledge, hypothecation or other disposition), or consent to or permit any such transfer of, any or all of its Subject Shares, or any interest therein.

“Transfer” of Agreement vs. “Assignment” of Agreement

In some instances, assignment provisions prohibit “transfers” of agreements in addition to, or instead of, explicitly prohibiting “assignments”. Often, the word “transfer” is not defined in the agreement, in which case the governing law of the contract will determine the meaning of the term and whether prohibition on transfers are meant to prohibit a broader or narrower range of transactions than prohibitions on assignments. Note that the current jurisprudence on the meaning of an assignment is broader and deeper than it is on the meaning of a transfer. In the rarer case where “transfer” is defined, it might look like this:

As used in this Agreement, the term “transfer” includes the Franchisee’s voluntary, involuntary, direct or indirect assignment, sale, gift or other disposition of any interest in…

The examples listed above are only of five common occurrences in which an assignment provision may provide exclusions or inclusions. As you continue with due diligence review, you may find that assignment provisions offer greater variety beyond the factors discussed in this blog post. However, you now have a basic understand of the possible variations of assignment clauses. For a more in-depth discussion of reviewing change of control and assignment provisions in due diligence, please download our full guide on Reviewing Change of Control and Assignment Provisions in Due Diligence.

This site uses cookies. By continuing to browse this site you are agreeing to our use of cookies. Learn more about what we do with these cookies in our privacy policy .

Feldman & Feldman

Civil litigation law firm, what happens to existing contracts after a business is sold.

In many cases, a company’s contracts are one of the major reasons why a suitor wants to buy it. In most instances, the buyer of the business should be able to assume a contract the seller had. The question is usually what process the buyer will need to follow in order to substitute themselves into an existing contract.

Most Contracts Are Assignable, Meaning the Rights and Obligations Remain Intact

In the best-case scenario, a business’ existing contract will be freely assignable to a new party. The new party will inherit all of the rights and obligations under the contract. The mere fact that a sale took place is enough to allow for the assignment of a contract. Note that the party that sells the business may not be off the hook if the incoming party to the contract fails to perform in accordance with their contractual obligations. However, the seller of the business may be able to seek indemnification from the buyer in case of a breach of the contract or a lawsuit.

The original contract will often include a clause that states whether the agreement is assignable. If it is, the customer or counterparty does not have any say over who is on the other side of the agreement; but they can still sue the new party for breach of contract because they still maintain their rights under the agreement.

Assignment Can Make a Business Agreement More Efficient

If a contract is assignable, there is no new agreement necessary. When a transaction closes, the new company will simply take over performance as the successor-in-interest to the old company. The merger agreement will already assign the rights and obligations under existing contracts to the buyer without a new, specific process for each existing agreement. In general, the principle of assignment makes business transactions more efficient and saves the parties from a complex legal process.

The general rule is that a contract is assignable unless there is a provision in it to the contrary. An anti-assignment clause is generally enforceable; however, the clause must be in the agreement at the time of the business transaction in order to be enforceable. The counterparty to a contract cannot argue against assignment in court when there is no language in the contract concerning assignment just because they do not approve of the new business entity coming into the deal.

At the same time, the incoming business will still have an obligation to perform under the terms of existing contracts. If it fails to perform, it may be sued for breach of contract. Just because there is a new owner does not mean the counterparty forfeits its rights under the contract. The counterparty may not have a say in who performs the contract, but they can still file a lawsuit just the same.

Novation Is a More Complex and Less Certain Way of Transferring Contracts

The complex process that assignment saves parties to a contract from is called novation . This process requires a separate agreement for each contract where the substitution of a party is needed. While novation is not necessarily an anti-assignment process, it will keep a seller from automatically assigning agreements upon the completion of a deal. The original party to a contract must approve and agree to the substitution of a new party.

For example, contracts with a government entity often require novation when there is a merger or sale of the business. Novation is not automatic. There may be requirements that the new party must meet in order to take over an existing contract. The contractual counterparty may try to use a merger transaction and their consent as leverage to negotiate better terms. Never assume a contract will be novated just because a deal has taken place; however, if the counterparty refuses to novate the contract, it will give the other business the right to terminate the deal. If many contracts require novation, the merger process can be complex. The buyer of the company is assuming the risk that not all contracts can be novated because the process would happen after the deal closes.

Some contracts may not be able to survive a business merger. For example, some personal services contracts require the original party to perform. Additionally, some contracts may have specific provisions that prohibit assignment regardless of the circumstances. And, some leases may completely prohibit assignment. Finally, public policy may mandate that certain contracts are not assignable.

A party may not even need a full merger agreement in order to trigger the need for assignment or novation provisions. There may be a stock sale or other business transaction that results in a change of control over the company. In this case, there may be a need to assign or novate contracts, depending on their terms.

Pay Close Attention to the Language of Each Contract Before the Deal Closes

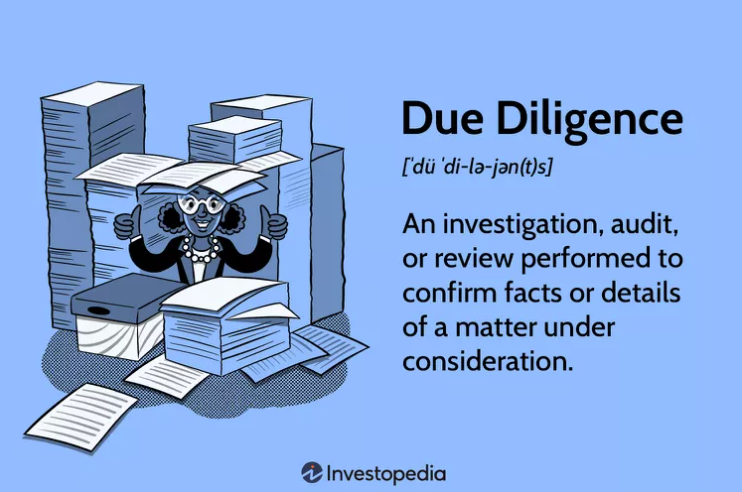

If you are considering purchasing a business, you will get the chance to review relevant contracts before the deal closes and after you have agreed to the terms. There is a due diligence period where you will be able to view corporate financials and agreements. During due diligence, you should scrutinize the terms of key contracts to determine locate any potential anti-assignment provisions. You should also review agreements to understand what your legal obligations may be after the deal closes. Determining which contracts are assignable is a necessary component of assessing the value of the business you’re contemplating purchasing.

If you are selling a business, you need to develop an in-depth understanding of the reliability and trustworthiness of your counterparty. You should contact a contract lawyer to ensure you have adequate protection from a potential lawsuit in case the buyer does not perform in accordance with the obligations in your company’s contracts.

720.306.1001 [email protected]

Assigning Contracts in a M&A Transactions

Often, one of the most valuable portions of a business is its contractual relationships. It could be with contracts with customers, a key supplier, vendors, or strategic partners. In such cases, when a seller decides to sell its business, the buyer may expect for those key contracts to be assigned to it at closing (so that the buyer can benefit from the contractual relationship).

Generally, contracts may address the issue of assignability in a few different ways, including:

The contract might be silent on the topic (in which case, state statutory or common law will dictate how the contract might be assigned) The contract might explicitly prohibit assignment without the other parties prior consent. The contract might be freely assignable (in which case, the assigning party may need to provide notice to the other party of the assignment). The contract might provide for assignment, provided certain conditions are met.

Often, in a M&A transaction, the buying and selling parties will need to obtain consents to the assignment from the other party to the contract. In fact, many times, obtaining certain consents may be a condition to close the transaction (i.e., if you can’t get the consent, the buyer may not close the transaction). We have seen deals fail to close because the other party to the contract would not consent to the assignment. Likewise, in many cases (unless there is a really strong relationship between the seller and the other party to the contract), the other party to the contract doesn’t have the same sense of urgency to provide it’s consent to the assignment. In such cases, we have seen closing be held up for months while the parties attempt to get consent to the assignment.

What can you do about this now?

This can be an easy thing to plan for, in many cases. You can start by changing your template contracts now and, going forward, use a contract with a more-favorable assignment clause to you. For example, you might want to provide that you can assign the contract upon a change of control (whether by asset, stock sale, merger, or otherwise) by providing notice to the other party. Having such a provision in your standard agreements can make the deal process “smooth sailing.” In addition, it takes out the “counterparty risk” (i.e., the risk that the party to the other contract doesn’t consent or takes a long time to do so).

Of course, this is easiest to implement when you have bargaining power. For example, if you have many customers, none of which make up a significant portion of your revenue (i.e., you don’t have high customer concentration), then you certainly want your customers to agree to this.

But, as you can imagine, this may be more difficult in cases where the other party to the contract has more bargaining power. For example, if the other party is a big company (and you are a small account to it), it may be difficult to negotiate these terms in. But, it’s always worth asking (especially if there’s a transaction anywhere in the (near) future.

Reevaluate Your Forms

Let us help. Doida Law Group understands the complexities and nuances that go into negotiating contracts among a variety of high-stakes business situations. We have proven processes in place that provide price certainty and optimal results for all parties. How can we help you today?

- Assignment Clause

Get free proposals from vetted lawyers in our marketplace.

Contract Clauses

- Acceleration Clause

- Arbitration Clause

- Cancellation Clause

- Choice of Law Clause

- Confidentiality Clause

- Consideration Clause

- Definitions Clause

- Dispute Resolution Clause

- Entire Agreement Clause

- Escalation Clause

- Exclusivity Clause

- Exculpatory Clause

- Force Majeure Clause

- Governing Law Clause

- Indemnification Clause

- Indemnity Clause

- Insurance Clause

- Integration Clause

- Merger Clause

- Non-Competition Clause

- Non-Disparagement Clause

- Non-Exclusivity Clause

- Non-Solicitation Clause

- Privacy Clause

- Release Clause

- Severability Clause

- Subordination Clause

- Subrogation Clause

- Survival Clause

- Termination Clause

- Time of Essence Clause

Jump to Section

Assignment clause defined.

Assignment clauses are legally binding provisions in contracts that give a party the chance to engage in a transfer of ownership or assign their contractual obligations and rights to a different contracting party.

In other words, an assignment clause can reassign contracts to another party. They can commonly be seen in contracts related to business purchases.

Here’s an article about assignment clauses.

Assignment Clause Explained

Assignment contracts are helpful when you need to maintain an ongoing obligation regardless of ownership. Some agreements have limitations or prohibitions on assignments, while other parties can freely enter into them.

Here’s another article about assignment clauses.

Purpose of Assignment Clause

The purpose of assignment clauses is to establish the terms around transferring contractual obligations. The Uniform Commercial Code (UCC) permits the enforceability of assignment clauses.

Assignment Clause Examples

Examples of assignment clauses include:

- Example 1 . A business closing or a change of control occurs

- Example 2 . New services providers taking over existing customer contracts

- Example 3 . Unique real estate obligations transferring to a new property owner as a condition of sale

- Example 4 . Many mergers and acquisitions transactions, such as insurance companies taking over customer policies during a merger

Here’s an article about the different types of assignment clauses.

Assignment Clause Samples

Sample 1 – sales contract.

Assignment; Survival . Neither party shall assign all or any portion of the Contract without the other party’s prior written consent, which consent shall not be unreasonably withheld; provided, however, that either party may, without such consent, assign this Agreement, in whole or in part, in connection with the transfer or sale of all or substantially all of the assets or business of such Party relating to the product(s) to which this Agreement relates. The Contract shall bind and inure to the benefit of the successors and permitted assigns of the respective parties. Any assignment or transfer not in accordance with this Contract shall be void. In order that the parties may fully exercise their rights and perform their obligations arising under the Contract, any provisions of the Contract that are required to ensure such exercise or performance (including any obligation accrued as of the termination date) shall survive the termination of the Contract.

Reference :

Security Exchange Commission - Edgar Database, EX-10.29 3 dex1029.htm SALES CONTRACT , Viewed May 10, 2021, < https://www.sec.gov/Archives/edgar/data/1492426/000119312510226984/dex1029.htm >.

Sample 2 – Purchase and Sale Agreement

Assignment . Purchaser shall not assign this Agreement or any interest therein to any Person, without the prior written consent of Seller, which consent may be withheld in Seller’s sole discretion. Notwithstanding the foregoing, upon prior written notice to Seller, Purchaser may designate any Affiliate as its nominee to receive title to the Property, or assign all of its right, title and interest in this Agreement to any Affiliate of Purchaser by providing written notice to Seller no later than five (5) Business Days prior to the Closing; provided, however, that (a) such Affiliate remains an Affiliate of Purchaser, (b) Purchaser shall not be released from any of its liabilities and obligations under this Agreement by reason of such designation or assignment, (c) such designation or assignment shall not be effective until Purchaser has provided Seller with a fully executed copy of such designation or assignment and assumption instrument, which shall (i) provide that Purchaser and such designee or assignee shall be jointly and severally liable for all liabilities and obligations of Purchaser under this Agreement, (ii) provide that Purchaser and its designee or assignee agree to pay any additional transfer tax as a result of such designation or assignment, (iii) include a representation and warranty in favor of Seller that all representations and warranties made by Purchaser in this Agreement are true and correct with respect to such designee or assignee as of the date of such designation or assignment, and will be true and correct as of the Closing, and (iv) otherwise be in form and substance satisfactory to Seller and (d) such Assignee is approved by Manager as an assignee of the Management Agreement under Article X of the Management Agreement. For purposes of this Section 16.4, “Affiliate” shall include any direct or indirect member or shareholder of the Person in question, in addition to any Person that would be deemed an Affiliate pursuant to the definition of “Affiliate” under Section 1.1 hereof and not by way of limitation of such definition.

Security Exchange Commission - Edgar Database, EX-10.8 3 dex108.htm PURCHASE AND SALE AGREEMENT , Viewed May 10, 2021, < https://www.sec.gov/Archives/edgar/data/1490985/000119312510160407/dex108.htm >.

Sample 3 – Share Purchase Agreement

Assignment . Neither this Agreement nor any right or obligation hereunder may be assigned by any Party without the prior written consent of the other Parties, and any attempted assignment without the required consents shall be void.

Security Exchange Commission - Edgar Database, EX-4.12 3 dex412.htm SHARE PURCHASE AGREEMENT , Viewed May 10, 2021, < https://www.sec.gov/Archives/edgar/data/1329394/000119312507148404/dex412.htm >.

Sample 4 – Asset Purchase Agreement

Assignment . This Agreement and any of the rights, interests, or obligations incurred hereunder, in part or as a whole, at any time after the Closing, are freely assignable by Buyer. This Agreement and any of the rights, interests, or obligations incurred hereunder, in part or as a whole, are assignable by Seller only upon the prior written consent of Buyer, which consent shall not be unreasonably withheld. This Agreement will be binding upon, inure to the benefit of and be enforceable by the parties and their respective successors and permitted assigns.

Security Exchange Commission - Edgar Database, EX-2.1 2 dex21.htm ASSET PURCHASE AGREEMENT , Viewed May 10, 2021, < https://www.sec.gov/Archives/edgar/data/1428669/000119312510013625/dex21.htm >.

Sample 5 – Asset Purchase Agreement

Assignment; Binding Effect; Severability

This Agreement may not be assigned by any party hereto without the other party’s written consent; provided, that Buyer may transfer or assign in whole or in part to one or more Buyer Designee its right to purchase all or a portion of the Purchased Assets, but no such transfer or assignment will relieve Buyer of its obligations hereunder. This Agreement shall be binding upon and inure to the benefit of and be enforceable by the successors, legal representatives and permitted assigns of each party hereto. The provisions of this Agreement are severable, and in the event that any one or more provisions are deemed illegal or unenforceable the remaining provisions shall remain in full force and effect unless the deletion of such provision shall cause this Agreement to become materially adverse to either party, in which event the parties shall use reasonable commercial efforts to arrive at an accommodation that best preserves for the parties the benefits and obligations of the offending provision.

Security Exchange Commission - Edgar Database, EX-2.4 2 dex24.htm ASSET PURCHASE AGREEMENT , Viewed May 10, 2021, < https://www.sec.gov/Archives/edgar/data/1002047/000119312511171858/dex24.htm >.

Common Contracts with Assignment Clauses

Common contracts with assignment clauses include:

- Real estate contracts

- Sales contract

- Asset purchase agreement

- Purchase and sale agreement

- Bill of sale

- Assignment and transaction financing agreement

Assignment Clause FAQs

Assignment clauses are powerful when used correctly. Check out the assignment clause FAQs below to learn more:

What is an assignment clause in real estate?

Assignment clauses in real estate transfer legal obligations from one owner to another party. They also allow house flippers to engage in a contract negotiation with a seller and then assign the real estate to the buyer while collecting a fee for their services. Real estate lawyers assist in the drafting of assignment clauses in real estate transactions.

What does no assignment clause mean?

No assignment clauses prohibit the transfer or assignment of contract obligations from one part to another.

What’s the purpose of the transfer and assignment clause in the purchase agreement?

The purpose of the transfer and assignment clause in the purchase agreement is to protect all involved parties’ rights and ensure that assignments are not to be unreasonably withheld. Contract lawyers can help you avoid legal mistakes when drafting your business contracts’ transfer and assignment clauses.

Benjamin W.

Meet some of our lawyers.

I am a solo-practitioner with a practice mostly consisting of serving as a fractional general counsel to growth stage companies. With a practical business background, I aim to bring real-world, economically driven solutions to my client's legal problems and pride myself on efficient yet effective work.

NJ and NY corporate contract lawyer and founder of a firm specializing in helping entrepreneurs. With a background in law firms, technology, and world class corporate departments, I've handled contracts and negotiations for everything from commercial leases and one-off sales agreements, to multi-million dollar asset sales. I love taking a customer-focused and business-minded approach to helping my clients achieve their goals. Other information: learning to surf, lover of travel, and one-time marathoner (NYC 2018) yulawlegal.com

Angelica M.

Angelica McDonald, Esq. has singlehandedly established an in-demand law firm, won several accolades for her incredible work in her community and has her sights set on building a bi-coastal law practice that serves clients from her hometown to Hollywood. She is putting her city of Raeford, North Carolina on the map as the birthplace of the next legal superstar. And she is just at the onset of her career. An astute attorney, Angelica is sought after for her razor-sharp business acumen and her relentless litigation style. With a diverse background in entertainment, media and sports law, as well as business, she represents entrepreneurs and athletes on everything from complex contract negotiation to intellectual property matters, ensuring anything they’ve built is protected.

Brittany S.

I am licensed in New York and New Jersey. I graduated with my J.D. from Touro University Law Center, Summa Cum Laude, in 2021. In 2018, I graduated from SUNY Farmingdale with a B.S. in Sport Management and a minor in Business Management. I have experience in real estate law and insurance defense, including employment law. Please note, I do not carry malpractice insurance.

Josh is a founding partner and the director of Art and Business Law for Twig, Trade, & Tribunal PLLC a local Fort Lauderdale law firm. His practice focuses on Art and Business law including art transactions, legal strategy, art leasing, due diligence, contract drafting, contract negotiations as well as other facets of Art Law including consulting for all market participants. He also advises clients regarding issues for Non-Fungible Tokens (NFTs) again focusing on contract drafting, strategic guidance, and other factors as it relates to art produced as NFTs having given numerous presentations on the subject.

If you're looking for an attorney who can help your business succeed, look no further! With my experience in the legal field, I can provide you with the legal advice you need with entity formation, contract drafting, business operations, and more, And because I'm committed to providing high quality service, you can be sure that your needs will always be met. Contact me today to learn more about how I can help your business thrive!

Find the best lawyer for your project

Contract lawyers by city.

- Atlanta Contract Lawyers

- Austin Contract Lawyers

- Boston Contract Lawyers

- Chicago Contract Lawyers

- Dallas Contract Lawyers

- Denver Contract Lawyers

- Fort Lauderdale Contract Lawyers

- Houston Contract Lawyers

- Las Vegas Contract Lawyers

- Los Angeles Contract Lawyers

- Memphis Contract Lawyers

- Miami Contract Lawyers

- New York Contract Lawyers

- Oklahoma City Contract Lawyers

- Orlando Contract Lawyers

- Philadelphia Contract Lawyers

- Phoenix Contract Lawyers

- Richmond Contract Lawyers

- Salt Lake City Contract Lawyers

- San Antonio Contract Lawyers

- San Diego Contract Lawyers

- San Francisco Contract Lawyers

- Seattle Contract Lawyers

- Tampa Contract Lawyers

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Find lawyers and attorneys by city

We use cookies and similar technologies on our website for collecting analytics, improving functionality and enhancing our services. Please see our Cookie Policy for more information and for details about how to disable cookies. By clicking "I agree" or continuing to use our website, you agree to our use of cookies and similar technologies.

Acquiring Contracts in an M&A Transaction

When acquiring a business, often a key component is the contracts to which the company is a party to. Ensuring the transfer of any such contracts can have significant impacts on the structure and timing of the acquisition of a business.

The General Rule and Exceptions

The general rule is that contracts are freely assignable and can be transferred from one party to another. There are, however, exceptions to this general rule. Contracts that are personal in nature, involving personal relations or personal skills, are not assignable. Also, an assignment of a contract cannot result in an increase of the burden on the remaining third party to the contract. Finally, contracts may expressly prohibit assignment of the contract or provide that an assignment can only occur under certain conditions. In the context of most M&A transactions, the relevant exception will be anti-assignment provisions in the contract itself.

Anti-Assignment Provisions

A standard assignment clause will prohibit the transfer of a contract without consent and may specify whether such consent can or cannot be unreasonably withheld. These provisions are typically included to ensure that each of the parties have control over who they engage in commercial arrangements and continue to do business with. A simple prohibition against assignment however, will not be triggered in the sale of a company by way of a share sale. Therefore, anti-assignment provisions are often include language that addresses the transfer of ownership on the sale of the shares of a company by prohibiting a change of control of a party to a contract without consent.

Asset Purchases

In an asset purchase transaction, the vendor is the company that owns the assets being sold. The resulting transfer of assets will include those desired contracts to which the company is a party to. Such transfer of contracts will be done by way of an assignment, thereby triggering any assignment provision and the corresponding need to obtain consent of the other party(ies) to such contract(s).

Share Purchases

In a share purchase transaction, the vendor is the shareholder(s) of the target company. The vendor sells the shares to the purchaser and there is no transfer of assets as they remain the assets of the target company. In this context, an assignment of a contract is not needed as the parties to the contract remain the same. The need to obtain consent would then only arise if the assignment provision specifically prohibited a change of control.

Seeking Consent

When proceeding with either an asset or share purchase where the consent of third parties is required, the timing of obtaining such consents must be considered. The contracts themselves may dictate when consent must be obtained and may require all costs be covered with respect to such consent. Obtaining the consent of third parties also raises issues with respect to the confidentiality of a transaction, where one or both parties wish to keep the proposed transaction confidential. The impact of not obtaining required consents should be considered, especially if such contracts are material to the business. Because of these various issues it is important to review any contracts that will be transferred or remain with the target company early in the process and discuss how any required consents will be obtained.

Assigning Contracts

To effect an assignment in the context of an asset purchase, the parties should enter into an assignment agreement whereby the vendor assigns and the purchaser assumes the contract and all rights, obligations and benefits thereunder. Often a contract will specify that the vendor will not be released of its obligations on an assignment. In such instances, the vendor and purchaser should address each of their obligations going forward. Typically, the purchaser will be solely responsible and will indemnify the vendor for any non-performance or breach by the purchaser under the contract from and after the date of assignment. If consent for the assignment is required from a third party, such party can either be made a party to the assignment agreement or its separate written consent can be obtained. If consent is not required, notice should be given to the third party that the assignment has or will occur. To effect an assignment in the context of a share purchase, only the documents effecting the sale and transfer of shares is needed as between the vendor and purchaser. Depending on the presence and content of any change of control provisions in each contract the target company is a party to, notice to or consent of the third party to each of the contracts may be necessary.

Although generally contracts are assignable, when contemplating the purchase or sale of a business consideration should be given to any contracts that will be assigned or remain with the target company. Each contract should be carefully reviewed in the context of the specific type of transaction so as to determine whether any consents or notices will be required before or after completion of the proposed transaction. Specifically, in the context of an asset purchase, only anti-assignment provisions will necessitate obtaining consent, and in the context of a share purchase, only change of control provisions will necessitate obtaining consent. Each party should also have regard to the timing and confidentiality issues that may arise in obtaining any necessary consents and all assignments or changes in control should be properly documented.

Subscribe to our newsletters

Stay current on business and legal news, topics and trends

Related Content

Is it Time to Restructure?

Discusses the benefits of restructuring a business in order to see capital gains exemptions

Buyer Beware: Employee Liabilities from a Business Purchase

Discusses the employee liabilities involved in business transactions and s. 97 of the ESA

Social Media and the M&A Transaction

Discusses all the relevant information needed around social media accounts when selling a business

Smart Intake Forms provide our clients with a secure program that generates a form to gather the necessary information from our clients to complete a request. This eliminates fees that would normally be spent on a lawyer’s time, collecting the data that can now be completed on your own time.

- Search Search Please fill out this field.

- Building Your Business

- Operations & Success

What Is an Assignment of Contract?

Assignment of Contract Explained

Hero Images / Getty Images

Assignment of contract allows one person to assign, or transfer, their rights, obligations, or property to another. An assignment of contract clause is often included in contracts to give either party the opportunity to transfer their part of the contract to someone else in the future. Many assignment clauses require that both parties agree to the assignment.

Learn more about assignment of contract and how it works.

What Is Assignment of Contract?

Assignment of contract means the contract and the property, rights, or obligations within it can be assigned to another party. An assignment of contract clause can typically be found in a business contract. This type of clause is common in contracts with suppliers or vendors and in intellectual property (patent, trademark , and copyright) agreements.

How Does Assignment of Contract Work?

An assignment may be made to anyone, but it is typically made to a subsidiary or a successor. A subsidiary is a business owned by another business, while a successor is the business that follows a sale, acquisition, or merger.

Let’s suppose Ken owns a lawn mowing service and he has a contract with a real estate firm to mow at each of their offices every week in the summer. The contract includes an assignment clause, so when Ken goes out of business, he assigns the contract to his sister-in-law Karrie, who also owns a lawn mowing service.

Before you try to assign something in a contract, check the contract to make sure it's allowed, and notify the other party in the contract.

Assignment usually is included in a specific clause in a contract. It typically includes transfer of both accountability and responsibility to another party, but liability usually remains with the assignor (the person doing the assigning) unless there is language to the contrary.

What Does Assignment of Contract Cover?

Generally, just about anything of value in a contract can be assigned, unless there is a specific law or public policy disallowing the assignment.

Rights and obligations of specific people can’t be assigned because special skills and abilities can’t be transferred. This is called specific performance. For example, Billy Joel wouldn't be able to transfer or assign a contract to perform at Madison Square Garden to someone else—they wouldn't have his special abilities.

Assignments won’t stand up in court if the assignment significantly changes the terms of the contract. For example, if Karrie’s business is tree trimming, not lawn mowing, the contract can’t be assigned to her.

Assigning Intellectual Property

Intellectual property (such as copyrights, patents, and trademarks) has value, and these assets are often assigned. The U.S. Patent and Trademark Office (USPTO) says patents are personal property and that patent rights can be assigned. Trademarks, too, can be assigned. The assignment must be registered with the USPTO's Electronic Trademark Assignment System (ETAS) .

The U.S. Copyright Office doesn't keep a database of copyright assignments, but they will record the document if you follow their procedure.

Alternatives to Assignment of Contract

There are other types of transfers that may be functional alternatives to assignment.

Licensing is an agreement whereby one party leases the rights to use a piece of property (for example, intellectual property) from another. For instance, a business that owns a patent may license another company to make products using that patent.

Delegation permits someone else to act on your behalf. For example, Ken’s lawn service might delegate Karrie to do mowing for him without assigning the entire contract to her. Ken would still receive the payment and control the work.

Do I Need an Assignment of Contract?

Assignment of contract can be a useful clause to include in a business agreement. The most common cases of assignment of contract in a business situation are:

- Assignment of a trademark, copyright, or patent

- Assignments to a successor company in the case of the sale of the business

- Assignment in a contract with a supplier or customer

- Assignment in an employment contract or work for hire agreement

Before you sign a contract, look to see if there is an assignment clause, and get the advice of an attorney if you want to assign something in a contract.

Key Takeaways

- Assignment of contract is the ability to transfer rights, property, or obligations to another.

- Assignment of contract is a clause often found in business contracts.

- A party may assign a contract to another party if the contract permits it and no law forbids it.

Legal Information Institute. " Assignment ." Accessed Jan. 2, 2021.

Legal Information Institute. " Specific Performance ." Accessed Jan. 2, 2021.

U.S. Patent and Trademark Office. " 301 Ownership/Assignability of Patents and Applications [R-10.2019] ." Accessed Jan. 2, 2021.

Licensing International. " What is Licensing ." Accessed Jan. 2, 2021.

Mastering M&A Contracts: A Comprehensive Guide

- Sep 13, 2023

- Justin Perkins

How to Master M&A Contracts: A Comprehensive Guide

Sept 13th, 2023.

A merger and acquisition (M&A) contract might be the largest agreement your company ever executes, both in size and stakes.

M&A contracts are high-stakes legal documents that can lead to the sale, partnership, or dissolution of an entire organization. Since the stakes are high, organizations take extra measures to mitigate risks—from using specialized software for contract lifecycle management to hiring legal and banking professionals in M&A contracts.

Acing an M&A contract involves preparing a sound contract with the right components, negotiating confidently and effectively, and using robust contract management software. This guide will explain all three steps and reveal the best contract management software for mergers or acquisitions.

Key Takeaways:

- Mergers and acquisitions are related but separate methods of transforming two distinct organizations into a single business entity.

- M&A contracts are complex and high-risk, so organizations take extra care to execute them correctly.

- Contract Logix offers a robust contract management software to help organizations mitigate M&A contract risks.

😉 Bonus: Learn more about how contract management software works here .

Key Components of M&A Contracts

To ace mergers and acquisition contracts, you need to first understand their key components.

What are Mergers and Acquisitions?

Mergers and acquisitions, while related, serve distinct purposes.

In a merger, two companies join forces to carry forward as a single business entity. In contrast, an acquisition sees one company taking ownership of another. Although both lead to the fusion of two entities, their structure differs significantly.

This difference in structure underscores the need for M&A contracts. Mergers and acquisitions involve many moving pieces, so a well-managed contract is essential.

Even for major companies like Amazon that regularly acquire other organizations, an M&A remains a significant undertaking. Coming prepared with the right research and software can make all the difference.

What’s in an M&A Contract?

A business contract contains comprehensive information about the terms and conditions of a business transaction. In an M&A contract, the transaction in question is a major one: a merger or acquisition. To excel in crafting an M&A contract, ensure it contains these key components:

- Price and terms: Clearly state the purchase price and payment terms, whether it’s a lump sum or structured installments. Since contracts are legally binding, include details like timeframes and currencies as well.

- Assets and liabilities: Two entities becoming one is a complicated endeavor. Your M&A contract should specify which assets and liabilities each company will transfer or assume. The contract must also specify what type of merger or acquisition will be taking place.

- Termination fees: Mergers and acquisitions can be costly and time-consuming, so organizations involved naturally want to avoid expending resources on a contract that will fall through. To act as a safety net, your M&A contract might include termination fees that establish a penalty if one party breaks off the agreement.

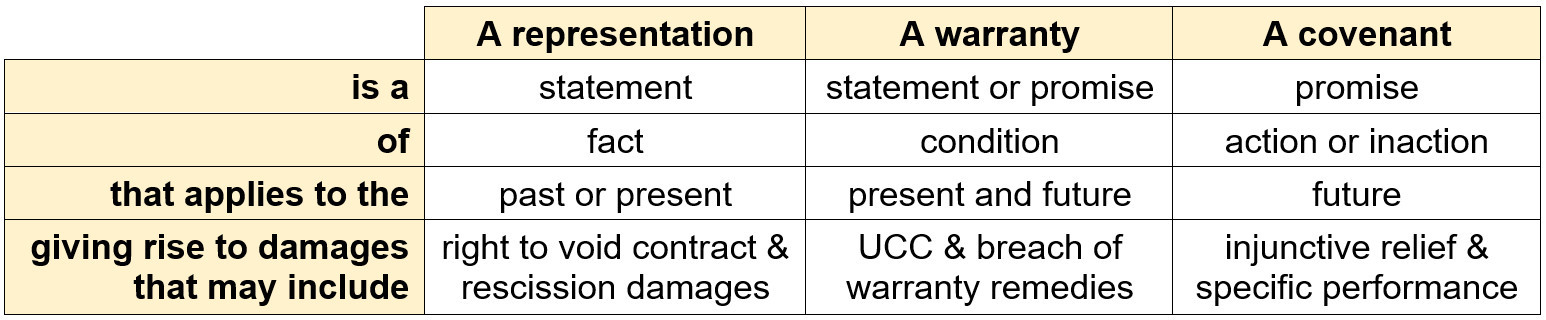

- Representations and warranties (R&W): These are statements a business makes about facets like its financials, ongoing lawsuits, or regulatory compliance. During due diligence, businesses verify these R&Ws for accuracy.

While these are some of the most important tentpoles of your M&A contracts, it’s by no means a comprehensive list. Collaborate with a legal professional that specializes in M&As to ensure your contract is sound and complete.

Negotiating Mergers and Acquisition Contracts

Once you’ve drafted your M&A contract with all key components, it’s time to enter into the negotiation phase. While M&A negotiations can be volatile and difficult, following these steps can ensure a successful outcome:

- Define your goals. What does success look like for your organization? Clearly define your goals, including any non-negotiables and potential deal-breakers the other party should be aware of.

- Do your due diligence: Think about the research you did before purchasing your home or car. Chances are, you conduct research before deciding where to buy gas or eat dinner, so you should take even more care researching a transaction as major as a merger or acquisition. Comprehensive due diligence uncovers hidden risks, identifies mistakes, and positions you to negotiate from an informed standpoint.

- Build rapport and trust: Harvard Law School’s Program on Negotiation warns that agreeableness can be both a blessing and a curse. Trying too hard to protect a business relationship can cause negotiators to claim less value for themselves, compromising their interests. However, likable negotiators often secure better deals, because people naturally favor those they like—this holds true in our friendships and relationships, but also in the boardroom.

- Anticipate challenges: While both parties generally benefit from an amicable negotiation, the purpose of negotiation is to maximize value. As such, enter negotiations expecting pushbacks and be prepared to assert your points.

Mitigating Contract Risk

Enterprise contracts inherently involve risk, and M&A agreements are no exception. Given the added stakes of dissolving or incorporating an entire organization, you need to mitigate your risks for these types of contracts.

Financial Risk

During due diligence, conduct a thorough research about the other organization’s finances and prospects. No amount of due diligence can completely ameliorate the risk of poor future performance, but the right mix of preparation and technology can help you mitigate other M&A contract risks.

These include overlooking payment terms, making uninformed financial commitments, or payment defaults. Contract management software such as Contract Logix can help organizations manage these risks by tracking financial information, logging dates, and automating workflows.

Even the most polished contracts can be open to interpretation. Legal disputes can arise from things like:

- Poorly defined terms in the contract

- Inaccurate representations or warranties

- Regulatory non-compliance

- Breach of contractual obligations

- Unclear Language

The cheapest and easiest way to resolve a legal dispute is to prevent it. That’s why companies involved in mergers and acquisitions use contract lifecycle management software to monitor contract language and terms, as well as compliance with regulations and ongoing obligations. This helps companies avoid costly legal disputes.

Reputational Risk

M&As can jeopardize your reputation. Oversights like missing a milestone, failing to adhere to the terms of your contract, or using unclear language that results in a major dispute can impact your reputation (in addition to your bottom line).

To safeguard your reputation, use software that helps you stay on top of your obligations by tracking important dates, monitoring contract terms, and even managing contract language.

M&A Contract Management Software

Whether you’re being acquired, merging, or doing the acquiring yourself, M&As are high-stakes endeavors.

Contract Logix supports organizations in mitigating contract risks throughout the contract lifecycle. From drafting and negotiation to execution and storage, Contract Logix ensures you meet your obligations and safeguard your interests in M&A contracts.

Experience the transformative impact of Contract Logix in your organization. Request a demo today.

Looking for more articles about Contract Management? Check out our previous article “ A 10-Point Checklist for Contract Renewals “.

Accelerate Your Digital Transformation With Contract Logix

Download our Data Extraction Product Brief to learn how you can automate the hard work using artificial intelligence

Contract Logix

What Are Merger and Acquisition Contracts?

Mergers and acquisitions (M&A) is a collective term used to describe the consolidation of companies into larger ones using different types of financial transactions. Transactions involved in M&A contracts include mergers, acquisitions, asset purchases, tender offers, and consolidations.

The terms “merger” and “acquisition” have slightly different meanings. Merger means that two companies have joined hands and decided to proceed as one firm. It indicates that the CEOs of both companies have mutually agreed to ally. The structure of mergers depends on the relationship between two parties, but they include vertical, horizontal, conglomerate, and rollup mergers.

Acquisition refers to a company acquiring another company as the new owner. In this scenario, an organization may not desire to become a part of another one, but it might not have a choice when the takeover is hostile.

- Purpose of merger and acqusition contracts

Merger and acquisition contracts generally contain several elements. They’re handy when it comes to communicating the terms and conditions of one company to another. Clarity is important in all clauses of these transactions, as M&A contracts are generally complex and lengthy.

Disputes tend to arise between parties during mergers and acquisitions. M&A contracts help manage these problems and protect the rights of both parties. They determine how the companies will share assets and information correctly. Moreover, M&A contracts perform process management functions to ensure a smooth consolidation or takeover.

These contracts are worth the hassle because a lot is at stake when consolidation occurs between companies. Buyers invest vast amounts of money into negotiations and asset purchases. Changes in ownership are extensive undertakings that require careful dealing. It involves more than just collecting money and assets — you’re essentially handing over your whole business to someone, or vice versa. Cautious, thorough handling is crucial.

M&A contracts also specify the prices of assets and make price adjustments. They help specify the terms and conditions of contract deals.

M&A contracts are useful for dealing with:

- Both the parties involved

- The deal structure — the asset purchases, stock purchases, and mergers

- The deal currency — stocks, debts, cash, and assets.

During consolidation, assets involved include real estate, intellectual property, contractual agreements, and more. The situation is stressful for both parties because so much is at stake. The successful sale of companies requires a dynamic understanding of all these scenarios.

- When do you need merger and acquisition contracts?

During a merger or acquisition, you’ll need to disclose the details of the terms before finalizing any arrangement. The contracts include all these details and allow you to negotiate appropriately.

Corporate statutes mandate that boards and shareholders approve mergers after the agreements have been submitted. M&A contracts will give a concise overview of these agreements between companies before the finalized takeover or consolidation.

Furthermore, M&A contracts give companies the chance to expand their market without heavy expenses and losses. This way, competition decreases, and companies get more market shares.

- Parts of merger and acquisition contracts

M&A contracts are divided into sections or articles, each containing different information. Sequentially, these articles consist of:

- Parties and recitals

- Price, currencies, and structure

- Representations and warranties

- Conditions

- Termination provisions

- Indemnification

- Defined terms and conditions

- Miscellaneous clauses

There’s a reason for the strategic sequence of these articles. The first items laid out in front of the opposing party are their areas of interest. Following this are the terms and conditions that both parties have to abide by. The covenants determine the conduct of the contract before its finalization. In case of undesirable outcomes, termination provisions provide all the required information.

The other articles, like taxes and indemnification, come after the formal closing of the contract. As discussed earlier, the finalization of mergers and acquisitions takes time. This is why it’s necessary for an M&A contract to cover all the details extensively.

- Drafting process of M&A contracts

Many M&A contract templates are available online for this purpose. You can choose the ones that suit your situation with all the necessary terms and conditions.

The first step is to come up with an efficient acquisition strategy . Then you can set up your M&A research criteria to identify the companies you want to partner with. A valuation analysis helps acquire financial data about the company. Negotiations will follow this step if all else goes well.

M&A due diligence aims to confirm whether the acquirer’s information about the company is valid. If no problems arise during due diligence, you can draw up a finalized purchase and sale contract. Lastly, financing details and integration of the acquisition are carried out.

The contract will also contain details of the two companies involved in the merger. The relevant contact information and names of the key people involved are included, along with the number of entities involved — dissolving, surviving, and final.

- Limitations of merger and acquisition contracts

Finding suitable M&A contract templates online can be tricky. Since so many options are available, companies face difficulty choosing the one that suits them best.

Such contracts also require much editing. Because mergers and acquisitions can take months and sometimes years, keeping track of these edits can seem impossible. Companies have to keep going back and forth for negotiations. This includes unnecessary emails and the use of outdated file servers to keep track of them.

The whole process is time-consuming and requires extensive paperwork. This takes attention away from strategizing suitable terms and conditions because legal departments are often held up by other commitments.

Furthermore, companies are forced to hire expensive attorneys outside of their legal departments for the whole process, incurring additional expenses. With a general lack of automation in contract workflows, progress becomes slow.

All the required documents for the contract are stored across multiple isolated systems. Tracking data is challenging, and it causes accessibility issues for the organization. Different teams within the company are unable to access the contracts. This decreases constructive participation and insight from other stakeholders. Without transparency in the contract lifecycle, managing it becomes a nuisance.

- Managing M&A contracts with templatable workflows

A company can opt for automated tools to lessen the time-consuming burden of managing M&A contracts.

Digital contract lifecycle management eases the burden of contract processing on organizations. With highly adaptive tools, this software supports all kinds of contracts . It allows deep integration with all the teams within a company, which is very useful during mergers and acquisitions.

Drafting M&A contracts is tiresome, but it doesn’t have to be. The Workflow Designer tool at Ironclad helps to manage these contracts efficiently.

Have you ever spent hours looking for a suitable template for your contracts? Mergers and acquisitions require particular templates due to the uniqueness of the companies involved. Each company has distinctive tangible and intangible assets and entities, and the required terms and conditions vary from one organization to another.

The Workflow Designer helps by providing a self-serve platform to generate editable workflows of your interest within minutes. Designing and creating your M&A contracts becomes much more straightforward. The templates are all customizable, too.

Instead of spending precious time on contract approval , you can develop intelligent strategies to negotiate good deals with the partner company.

The Workflow Designer also helps businesses ensure that their M&A contracts comply with legal requirements and policies.

Suppose the company you want to consolidate with asks you to handle its M&A contracts remotely. The time zone differences can cause stress and make you wonder how you’ll manage all the work. The Ironclad Clickwrap feature enables you to execute M&A contracts online from anywhere in the world. With both parties on the same platform, the execution and approval process will be seamless.

It will also reduce the inconvenience of emailing documents for signatures. You can instead get your contracts signed and approved on a single platform. The user-friendly interface means you won’t require IT specialists to do the job for you. You can control the contract workflows independently within the comfort of your home or office.

M&A contracts require much editing, which can waste plenty of time if done manually. Plus, the changes are hard to track. The Ironclad Editor provides tools to revise your contracts online.

Redlining is often done during the negotiation phases of M&A contracts. You can do this online and keep records of all your changes as well. Your colleagues are updated when contracts undergo edits, enabling everyone in your organization to stay on the same page. No more blaming legal teams for unnotified changes.

- The right tools for contract management

Merger and acquisition contracts enable smoother consolidation or takeover of companies. They can settle disputes and ensure a hassle-free process. Managing M&A contracts is a challenge that your business can now manage more easily using digital contract management platforms. With the right tools, these contracts can change your company’s dynamic and bring about immense growth.

Ironclad is not a law firm, and this post does not constitute or contain legal advice. To evaluate the accuracy, sufficiency, or reliability of the ideas and guidance reflected here, or the applicability of these materials to your business, you should consult with a licensed attorney. Use of and access to any of the resources contained within Ironclad’s site do not create an attorney-client relationship between the user and Ironclad.

Table of contents

Want more content like this? Sign up for our monthly newsletter.

Related topics

- Contracts and clauses

You might also like:

Considerations for International Contracts: Thriving in the Global Marketplace

Navigating Shareholder Agreements: A Guide for In-House Counsel

Navigating Options Contracts: Strategies for Success

- Drafting a Workable Contract

- Contract Tips

- Startup law

- Common Draft

- Choice of law

- Patent apps

- Marketing legal review

- Engagement agreement

- UH class notes

- Arbitration

Assignment provisions in contracts

Author’s note, Nov. 22, 2014: For a much-improved update of this page, see the Common Draft general provisions article .

(For more real-world stories like the ones below, see my PDF e-book, Signing a Business Contract? A Quick Checklist for Greater Peace of Mind , a compendium of tips and true stories to help you steer clear of various possible minefields. Learn more …. )

Table of Contents

Legal background: Contracts generally are freely assignable

When a party to a contract “ assigns ” the contract to someone else, it means that party, known as the assignor , has transferred its rights under the contract to someone else, known as the assignee , and also has delegated its obligations to the assignee.

Under U.S. law, most contract rights are freely assignable , and most contract duties are freely delegable, absent some special character of the duty, unless the agreement says otherwise. In some situations, however, the parties will not want their opposite numbers to be able to assign the agreement freely; contracts often include language to this effect.

Intellectual-property licenses are an exception to the general rule of assignability. Under U.S. law, an IP licensee may not assign its license rights, nor delegate its license obligations, without the licensor’s consent, even when the license agreement is silent. See, for example, In re XMH Corp. , 647 F.3d 690 (7th Cir. 2011) (Posner, J; trademark licenses); Cincom Sys., Inc. v. Novelis Corp. , 581 F.3d 431 (6th Cir. 2009) (copyright licenses); Rhone-Poulenc Agro, S.A. v. DeKalb Genetics Corp. , 284 F.3d 1323 (Fed. Cir. 2002) (patent licenses). For additional information, see this article by John Paul, Brian Kacedon, and Douglas W. Meier of the Finnegan Henderson firm.

Assignment consent requirements

Model language

[Party name] may not assign this Agreement to any other person without the express prior written consent of the other party or its successor in interest, as applicable, except as expressly provided otherwise in this Agreement. A putative assignment made without such required consent will have no effect.

Optional: Nor may [Party name] assign any right or interest arising out of this Agreement, in whole or in part, without such consent.

Alternative: For the avoidance of doubt, consent is not required for an assignment (absolute, collateral, or other) or pledge of, nor for any grant of a security interest in, a right to payment under this Agreement.

Optional: An assignment of this Agreement by operation of law, as a result of a merger, consolidation, amalgamation, or other transaction or series of transactions, requires consent to the same extent as would an assignment to the same assignee outside of such a transaction or series of transactions.

• An assignment-consent requirement like this can give the non-assigning party a chokehold on a future merger or corporate reorganization by the assigning party — see the case illustrations below.

• A party being asked to agree to an assignment-consent requirement should consider trying to negotiate one of the carve-out provisions below, for example, when the assignment is connection with a sale of substantially all the assets of the assignor’s business {Link} .

Case illustrations

The dubai port deal (ny times story and story ).

In 2006, a Dubai company that operated several U.S. ports agreed to sell those operations. (The agreement came about because of publicity and political pressure about the alleged national-security implications of having Middle-Eastern companies in charge of U.S. port operations.)

A complication arose in the case of the Port of Newark: The Dubai company’s lease agreement gave the Port Authority of New York and New Jersey the right to consent to any assignment of the agreement — and that agency initially demanded $84 million for its consent.

After harsh criticism from political leaders, the Port Authority backed down a bit: it gave consent in return for “only” a $10 million consent fee, plus $40 million investment commitment by the buyer.

Cincom Sys., Inc. v. Novelis Corp., No. 07-4142 (6th Cir. Sept. 25, 2009) (affirming summary judgment)

A customer of a software vendor did an internal reorganization. As a result, the vendor’s software ended up being used by a sister company of the original customer. The vendor demanded that the sister company buy a new license. The sister company refused.

The vendor sued, successfully, for copyright infringement, and received the price of a new license, more than $450,000 as its damages. The case is discussed in more detail in this blog posting.

The vendor’s behavior strikes me as extremely shortsighted, for a couple of reasons: First, I wouldn’t bet much on the likelihood the customer would ever buy anything again from that vendor. Second, I would bet that the word got around about what the vendor did, and that this didn’t do the vendor’s reputation any good.

Meso Scale Diagnostics, LLC v. Roche Diagnostics GmbH, No. 5589-VCP (Del. Ch. Apr. 8, 2011) (denying motion to dismiss).

The Delaware Chancery Court refused to rule out the possibility that a reverse triangular merger could act as an assignment of a contract, which under the contract terms would have required consent. See also the discussion of this opinion by Katherine Jones of the Sheppard Mullin law firm.

Assignment with transfer of business assets

Consent is not required for an assignment of this Agreement in connection with a sale or other disposition of substantially all the assets of the assigning party’s business.

Optional: Alternatively, the sale or other disposition may be of substantially all the assets of the assigning party’s business to which this Agreement specifically relates.

Optional: The assignee must not be a competitor of the non-assigning party.

• A prospective assigning party might argue that it needed to keep control of its own strategic destiny, for example by preserving its freedom to sell off a product line or division (or even the whole company) in an asset sale.

• A non-assigning party might argue that it could not permit the assignment of the agreement to one of its competitors, and that the only way to ensure this was to retain a veto over any assignment.

• Another approach might be to give the non-assigning party, instead of a veto over asset-disposition assignments, the right to terminate the contract for convenience . (Of course, the implications of termination would have to be carefully thought through.)

Assignment to affiliate

[Either party] may assign this Agreement without consent to its affiliate.

Optional: The assigning party must unconditionally guarantee the assignee’s performance.