How to Write the Management Team Section of a Business Plan + Examples

Written by Dave Lavinsky

Over the last 20+ years, we’ve written business plans for over 4,000 companies and hundreds of thousands of others have used the best business plan template and our other business planning materials.

From this vast experience, we’ve gained valuable insights on how to write a business plan effectively , specifically in the management section.

What is a Management Team Business Plan?

A management team business plan is a section in a comprehensive business plan that introduces and highlights the key members of the company’s management team. This part provides essential details about the individuals responsible for leading and running the business, including their backgrounds, skills, and experience.

It’s crucial for potential investors and stakeholders to evaluate the management team’s competence and qualifications, as a strong team can instill confidence in the company’s ability to succeed.

Why is the Management Team Section of a Business Plan Important?

Your management team plan has 3 goals:

- To prove to you that you have the right team to execute on the opportunity you have defined, and if not, to identify who you must hire to round out your current team

- To convince lenders and investors (e.g., angel investors, venture capitalists) to fund your company (if needed)

- To document how your Board (if applicable) can best help your team succeed

What to Include in Your Management Team Section

There are two key elements to include in your management team business plan as follows:

Management Team Members

For each key member of your team, document their name, title, and background.

Their backgrounds are most important in telling you and investors they are qualified to execute. Describe what positions each member has held in the past and what they accomplished in those positions. For example, if your VP of Sales was formerly the VP of Sales for another company in which they grew sales from zero to $10 million, that would be an important and compelling accomplishment to document.

Importantly, try to relate your team members’ past job experience with what you need them to accomplish at your company. For example, if a former high school principal was on your team, you could state that their vast experience working with both teenagers and their parents will help them succeed in their current position (particularly if the current position required them to work with both customer segments).

This is true for a management team for a small business, a medium-sized or large business.

Management Team Gaps

In this section, detail if your management team currently has any gaps or missing individuals. Not having a complete team at the time you develop your business plan. But, you must show your plan to complete your team.

As such, describe what positions are missing and who will fill the positions. For example, if you know you need to hire a VP of Marketing, state this. Further, state the job description of this person. For example, you might say that this hire will have 10 years of experience managing a marketing team, establishing new accounts, working with social media marketing, have startup experience, etc.

To give you a “checklist” of the employees you might want to include in your Management Team Members and/or Gaps sections, below are the most common management titles at a growing startup (note that many are specific to tech startups):

- Founder, CEO, and/or President

- Chief Operating Officer

- Chief Financial Officer

- VP of Sales

- VP of Marketing

- VP of Web Development and/or Engineering

- UX Designer/Manager

- Product Manager

- Digital Marketing Manager

- Business Development Manager

- Account Management/Customer Service Manager

- Sales Managers/Sales Staff

- Board Members

If you have a Board of Directors or Board of Advisors, you would include the bios of the members of your board in this section.

A Board of Directors is a paid group of individuals who help guide your company. Typically startups do not have such a board until they raise VC funding.

If your company is not at this stage, consider forming a Board of Advisors. Such a board is ideal particularly if your team is missing expertise and/or experience in certain areas. An advisory board includes 2 to 8 individuals who act as mentors to your business. Usually, you meet with them monthly or quarterly and they help answer questions and provide strategic guidance. You typically do not pay advisory board members with cash, but offering them options in your company is a best practice as it allows you to attract better board members and better motivate them.

Management Team Business Plan Example

Below are examples of how to include your management section in your business plan.

Key Team Members

Jim Smith, Founder & CEO

Jim has 15 years of experience in online software development, having co-founded two previous successful online businesses. His first company specialized in developing workflow automation software for government agencies and was sold to a public company in 2003. Jim’s second company developed a mobile app for parents to manage their children’s activities, which was sold to a large public company in 2014. Jim has a B.S. in computer science from MIT and an M.B.A from the University of Chicago

Bill Jones, COO

Bill has 20 years of sales and business development experience from working with several startups that he helped grow into large businesses. He has a B.S. in mechanical engineering from M.I.T., where he also played Division I lacrosse for four years.

We currently have no gaps in our management team, but we plan to expand our team by hiring a Vice President of Marketing to be responsible for all digital marketing efforts.

Vance Williamson, Founder & CEO

Prior to founding GoDoIt, Vance was the CIO of a major corporation with more than 100 retail locations. He oversaw all IT initiatives including software development, sales technology, mobile apps for customers and employees, security systems, customer databases/CRM platforms, etc. He has a B.S in computer science and an MBA in operations management from UCLA.

We currently have two gaps in our Management Team:

A VP of Sales with 10 years of experience managing sales teams, overseeing sales processes, working with manufacturers, establishing new accounts, working with digital marketing/advertising agencies to build brand awareness, etc.

In addition, we need to hire a VP of Marketing with experience creating online marketing campaigns that attract new customers to our site.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Click here to finish your business plan today.

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how Growthink’s professional business plan consulting services can create your business plan for you.

Other Resources for Writing Your Business Plan

- How to Write an Executive Summary

- How to Expertly Write the Company Description in Your Business Plan

- How to Write the Market Analysis Section of a Business Plan

- The Customer Analysis Section of Your Business Plan

- Completing the Competitive Analysis Section of Your Business Plan

- Financial Assumptions and Your Business Plan

- How to Create Financial Projections for Your Business Plan

- Everything You Need to Know about the Business Plan Appendix

- Business Plan Conclusion: Summary & Recap

Other Helpful Business Plan Articles & Templates

How Do You Draft the Personnel Section of the Business Plan? The Personnel Section of a Business Plan Explained.

Privacy Overview

Plan Smarter, Grow Faster:

25% Off Annual Plans! Save Now

0 results have been found for “”

Return to blog home

How to Create an Investor-Ready Personnel Plan and Forecast Employee Costs

Posted march 22, 2021 by noah parsons.

A personnel plan is a critical part of your business plan and financial forecast . In addition to helping you budget for current and future employees, your personnel plan enables you to think through who you should hire and when you should hire them.

If you’re pitching to angel investors or venture capitalists for funding, they will want to see why your team is uniquely suited to grow and scale your business, as well as your hiring plan.

Investors will want to know:

- What positions do you need to fill?

- When you plan on filling them?

- How much it’s going to cost to build the team you need??

What to include in the personnel section of your business plan

For many startups and small businesses, the people who do the work—your team—are both the most costly and most valuable asset. It makes sense that hiring the right person at the right time can have a significant impact on your ability to meet your company’s milestones and goals , not to mention your cash flow .

Thinking strategically about human resources — when to add positions, compensation levels, and whether to hire full-time or on a contract basis are all pieces of a healthy personnel plan.

So, whether you’re seeking investment or not, building a personnel plan and forecast is an essential part of business planning and strategic planning for the long-term viability of your company. Let’s dive right in and look at the five key steps to build an investor-ready personnel plan.

1. Describe your team

In the “team” section of your business plan, you will typically include an overview of the key positions in your company and the background of the people who will be in those critical roles. Usually, you’ll highlight each of the management positions in your company and then speak more generally about other departments and teams.

You don’t need to include full resumes for each team member—a quick summary of why each person is qualified to do the job is enough. Describe each person’s skills and experience and what they will be doing for the company.

Emphasize your team’s strengths. How do they make your team stronger? What specific expertise and experience do they have in your (or a related) industry? Assuming your market research identified a great opportunity, why are you the right team to capitalize on it?

For potential investors, this section helps qualify why each team member is necessary for the success of the business. It acts as a justification for their salary and equity share if they are part owners of the company.

2. Describe your organizational structure

The organizational structure of your company is frequently represented as an “org chart” that shows who reports to whom and who is responsible for what.

You don’t have to create a visual org chart, though—describing your organization in the text is just fine. Just make sure to show that you have a clear structure for your company.

Is authority adequately distributed among the team? Do you have the resources to get everything done that you need to grow your company?

You’ll also want to mention the various teams your company is going to have in the future. These might include sales, customer service, product development, marketing, manufacturing, and so on.

You don’t need to plan on hiring all of these people right away. Think of this section as an outline of what you plan to do in the future with your company.

3. Explain the gaps

It’s alright to have gaps on your team, especially if you’re a startup. You may not have identified all the “right” team members yet, or you may not have the funds available yet to hire for essential roles . That’s okay.

The key is to know that you do have gaps on your team—this is how you figure out who you need to hire and when you need to hire them. Also, it’s much better to define and identify weaknesses in your team than to pretend that you have all the key roles that you need. In your business plan , explain where your organization is weak and what your plans are to correct the problem as you grow.

It might be tempting to hide your potential weaknesses from investors, but they’ll see through that right away. It’s much better to be open and honest about where you have management gaps and your plans to solve those problems. You want them to know you have identified and made plans to mitigate risks .

You also need to keep in mind that employees might wear a lot of hats in the early days of a company, but that specialization will happen as the company grows.

For example, initially, the CEO might also be the VP of Sales. But, eventually, the VP of Sales role should be filled by a specialist to take on that responsibility. Include these types of changes in your personnel plan to explain to investors that you understand how your company is going to grow and scale.

4. List your advisors, consultants, and board members

For some companies, external advisors, board members , and even consultants can play a crucial role in setting business strategy. These people might even fill key positions temporarily as your company grows. If this is the case, you’ll want to list these people in your business plan. Like your management team, provide a brief background on each principal advisor that explains the value they provide.

If your advisors don’t hold key roles or are not critical to your success, you don’t necessarily have to list them. But, do list anyone that is adding substantial value to the company by providing advice, connections, or operational expertise.

5. Forecast your personnel costs

Most business plans should include a personnel table to forecast the expense of your employees. Here are the expenses you’ll need to be aware of when forecasting.

Direct and indirect labor expenses

You’ll want to include both direct expenses , which usually comprise salaries, as well as indirect expenses which include:

- Paid time off

- Healthcare and insurance

- Payroll costs

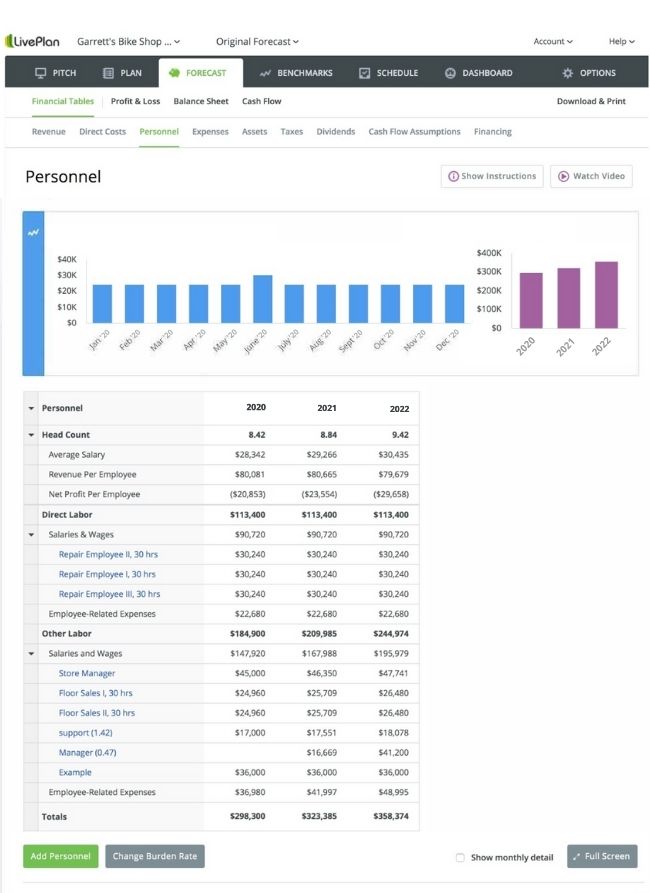

As well as any other costs you incur for each employee beyond their salary. Here’s an example of what a personnel forecast can look like using LivePlan .

Burden rate and employee-related expenses

There are different names for the indirect expenses of personnel. Still, I like to call it “burden rate” or “employee-related expenses,” which is an expense over and above the direct wages and salaries. These expenses typically include payroll taxes, worker’s compensation insurance, health insurance, and other benefits and taxes.

For business planning purposes, don’t stress about coming up with the exact figure for the burden rate. Instead, estimate it using a percentage of total monthly salaries. Somewhere between 15 percent and 25 percent usually makes sense, but it depends on what kind of benefits you plan on offering.

In your personnel plan, you can list both individual people as well as groups of people. You’ll probably want to list out key people and other highly paid employees, but group together other departments or groups of people. For example, you might list out your management team, but then group together departments like Marketing, Customer Service, and Manufacturing.

Then, add in your personnel burden to cover benefits and insurance. In the example personnel table above, this is called “Employee-Related Expenses.”

You’ll then take the total number of your salaries plus personnel burden and include this in your profit and loss forecast as an expense. Suppose you’re using LivePlan to build your personnel forecast. In that case, this how-to article on entering personnel shows where you’ll see personnel costs appear on your cash flow statement, profit and loss (income statement), and your balance sheet.

Do you need a personnel plan if you have no employees?

If you are a sole proprietor and don’t have employees, you should still include your own salary as part of the business plan. Make sure to include your salary as an expense in your Profit & Loss Statement . Even if you, the business owner, don’t take the salary, so you can keep the cash in your business, you’ll want to record what you should have been paid.

In the case of a sole proprietor, you probably don’t need a full table for the personnel plan, like in the example above. But, when you do start planning to hire a team, you should use the format I’ve described here.

Personnel planning is a valuable part of the business planning process because it forces you to think about what needs to get done in your business and who’s going to do it. Take the time to work through this part of your financial forecast, and you’ll have a much better sense of what it’s going to take to make your business successful.

*Editors Note: This article was initially written in 2019 and updated for 2021.

Like this post? Share with a friend!

Noah Parsons

Posted in business plan writing, join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How To Write the Management Section of a Business Plan

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

Ownership Structure

Internal management team, external management resources, human resources, frequently asked questions (faqs).

When developing a business plan , the 'management section' describes your management team, staff, resources, and how your business ownership is structured. This section should not only describe who's on your management team but how each person's skill set will contribute to your bottom line. In this article, we will detail exactly how to compose and best highlight your management team.

Key Takeaways

- The management section of a business plan helps show how your management team and company are structured.

- The first section shows the ownership structure, which might be a sole proprietorship, partnership, or corporation.

- The internal management section shows the department heads, including sales, marketing, administration, and production.

- The external management resources help back up your internal management and include an advisory board and consultants.

- The human resources section contains staffing requirements—part-time or full-time—skills needed for employees and the costs.

This section outlines the legal structure of your business. It may only be a single sentence if your business is a sole proprietorship. If your business is a partnership or a corporation, it can be longer. You want to be sure you explain who holds what percentage of ownership in the company.

The internal management section should describe the business management categories relevant to your business, identify who will have responsibility for each category, and then include a short profile highlighting each person's skills.

The primary business categories of sales, marketing , administration, and production usually work for many small businesses. If your business has employees, you will also need a human resources section. You may also find that your company needs additional management categories to fit your unique circumstances.

It's not necessary to have a different person in charge of each category; some key management people often fill more than one role. Identify the key managers in your business and explain what functions and experience each team member will serve. You may wish to present this as an organizational chart in your business plan, although the list format is also appropriate.

Along with this section, you should include the complete resumés of each management team member (including your own). Follow this with an explanation of how each member will be compensated and their benefits package, and describe any profit-sharing plans that may apply.

If there are any contracts that relate directly to your management team members, such as work contracts or non-competition agreements, you should include them in an Appendix to your business plan.

While external management resources are often overlooked when writing a business plan , using these resources effectively can make the difference between the success or failure of your managers. Think of these external resources as your internal management team's backup. They give your business credibility and an additional pool of expertise.

Advisory Board

An Advisory Board can increase consumer and investor confidence, attract talented employees by showing a commitment to company growth and bring a diversity of contributions. If you choose to have an Advisory Board , list all the board members in this section, and include a bio and all relevant specializations. If you choose your board members carefully, the group can compensate for the niche forms of expertise that your internal managers lack.

When selecting your board members, look for people who are genuinely interested in seeing your business do well and have the patience and time to provide sound advice.

Recently retired executives or managers, other successful entrepreneurs, and/or vendors would be good choices for an Advisory Board.

Professional Services

Professional Services should also be highlighted in the external management resources section. Describe all the external professional advisors that your business will use, such as accountants, bankers, lawyers, IT consultants, business consultants, and/or business coaches. These professionals provide a web of advice and support outside your internal management team that can be invaluable in making management decisions and your new business a success .

The last point you should address in the management section of your business plan is your human resources needs. The trick to writing about human resources is to be specific. To simply write, "We'll need more people once we get up and running," isn't sufficient. Follow this list:

- Detail how many employees your business will need at each stage and what they will cost.

- Describe exactly how your business's human resources needs can be met. Will it be best to have employees, or should you operate with contract workers or freelancers ? Do you need full-time or part-time staff or a mix of both?

- Outline your staffing requirements, including a description of the specific skills that the people working for you will need to possess.

- Calculate your labor costs. Decide the number of employees you will need and how many customers each employee can serve. For example, if it takes one employee to serve 150 customers, and you forecast 1,500 customers in your first year, your business will need 10 employees.

- Determine how much each employee will receive and total the salary cost for all your employees.

- Add to this the cost of Workers' Compensation Insurance (mandatory for most businesses) and the cost of any other employee benefits, such as company-sponsored medical and dental plans.

After you've listed the points above, describe how you will find the staff your business needs and how you will train them. Your description of staff recruitment should explain whether or not sufficient local labor is available and how you will recruit staff.

When you're writing about staff training, you'll want to include as many specifics as possible. What specific training will your staff undergo? What ongoing training opportunities will you provide your employees?

Even if the plan for your business is to start as a sole proprietorship, you should include a section on potential human resources demands as a way to demonstrate that you've thought about the staffing your business may require as it grows.

Business plans are about the future and the hypothetical challenges and successes that await. It's worth visualizing and documenting the details of your business so that the materials and network around your dream can begin to take shape.

What is the management section of a business plan?

The 'management section' describes your management team, staff, resources, and how your business ownership is structured.

What are the 5 sections of a business plan?

A business plan provides a road map showing your company's goals and how you'll achieve them. The five sections of a business plan are as follows:

- The market analysis outlines the demand for your product or service.

- The competitive analysis section shows your competition's strengths and weaknesses and your strategy for gaining market share.

- The management plan outlines your ownership structure, the management team, and staffing requirements.

- The operating plan details your business location and the facilities, equipment, and supplies needed to operate.

- The financial plan shows the map to financial success and the sources of funding, such as bank loans or investors.

SCORE. " Why Small Businesses Should Consider Workers’ Comp Insurance ."

The Secrets of a Great Personnel Plan

Investing in human resources (HR) is a key element of healthy personnel planning and strategy. A hallmark of effective leadership is efficient HR which means hiring employees in a cost-effective manner and mostly when needed. Your business plan should always include an informative and up-to-date personnel plan section to provide direction for the company and help entrepreneurs stay focused.

At the heart of every business owner is the desire to excel. The best way to excel is to define your plans and proceed with purpose. Your business plan comprises a business description , a competition analysis, a marketing plan, a personnel section, the HR section and key financial information.

The personnel plan is designed to help company owners put their plans into action. It helps to clarify objectives for the current and forthcoming year. Thus, a good understanding of personnel plan and how to implement it in your business is vital.

What is a personnel plan?

A personnel plan is a vital part of every company plan and financial forecast, which aids future and current budgeting and defines the type of employee to hire and when to hire such employees.

When you are seeking funding, venture capitalists and angel investors will want a breakdown of your team. Who are they? What talents and skills do they bring to the table? What is your hiring plan for the first year, second year, and so on? How will your team drive business growth and success?

All this information will include the positions you will need employees for, the period in which the management intends to fill the plan, and the financial implications of the implementation of the plan. Just as you would assess if your business is financially feasible , you’ll need to apply this same sentiment when hiring employees.

The personnel plan represents a consolidated strategy for hiring the best people for all company positions, while keeping an eye on future expansion.

Michael E. Gerber, the author of The E-Myth Revisited, posited that an effective personnel plan designed as an efficient workplace game will help employers prime employees for organizational goals while creating job satisfaction. This means that an effective hiring process is vital to an efficient process of personnel planning.

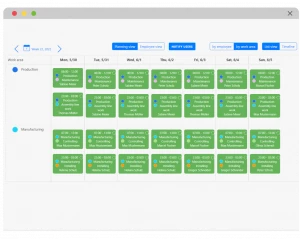

The majority of employers find personnel planning difficult especially those whose staff work in shifts. Organizational challenges like these can easily be taken care of with TimeTrack Duty Roster which helps employers create a suitable overview of their workforce and personalize shifts according to any number of criteria, including their location and skills.

Features of the TimeTrack Duty Roster

Key elements of a personnel plan

Each company’s needs may differ, but in general, these are common elements that should form part of every personnel plan.

Job description

- Clearly explained requirements of the various job functions. Use easy-to-understand language and phrases.

Organizational chart and type of hiring

- The chart of the organization should show who works for whom and provide a good overview of the overall management and employee structure of the company.

- The plan should be clear on whether employees are independent contractors or receive salaries. This is essential for labor compliance issues and the workers’ tax.

Remuneration (salary amount and assumptions)

- Details of hourly or yearly payments are defined, including relevant assumptions that comprise estimates of salary increases over time. You also need to account for company benefits, including health insurance. This may be a percentage of salary costs employers pay to staff.

Time of recruitment

- The hiring of employees is often done over time and staggered. Thus, your plan must include details about when an employee will start and the end date for temporary staff.

Incorporate key personnel into the business plan

Employees are the most valuable assets any company can have. This means that hiring the right person should always be a key priority for every company. Your staff will have a significant impact on revenue, customer experience/satisfaction and the success of the company.

Incorporating the personnel section into your business plan is an important part of strategic planning for long-term viability. The information below serves as guide on how to implement a personnel plan in your business.

Team dynamics

This presents an overview of all the key positions in your business and the backgrounds of staff in their critical roles and departments. Add the total number of staff and their experiences. Emphasize the strengths of individuals and how to upskill where necessary. A great team is typically the fulcrum of business success because they have the responsibility of and possess the ability to translate policies into business success.

Organizational structure

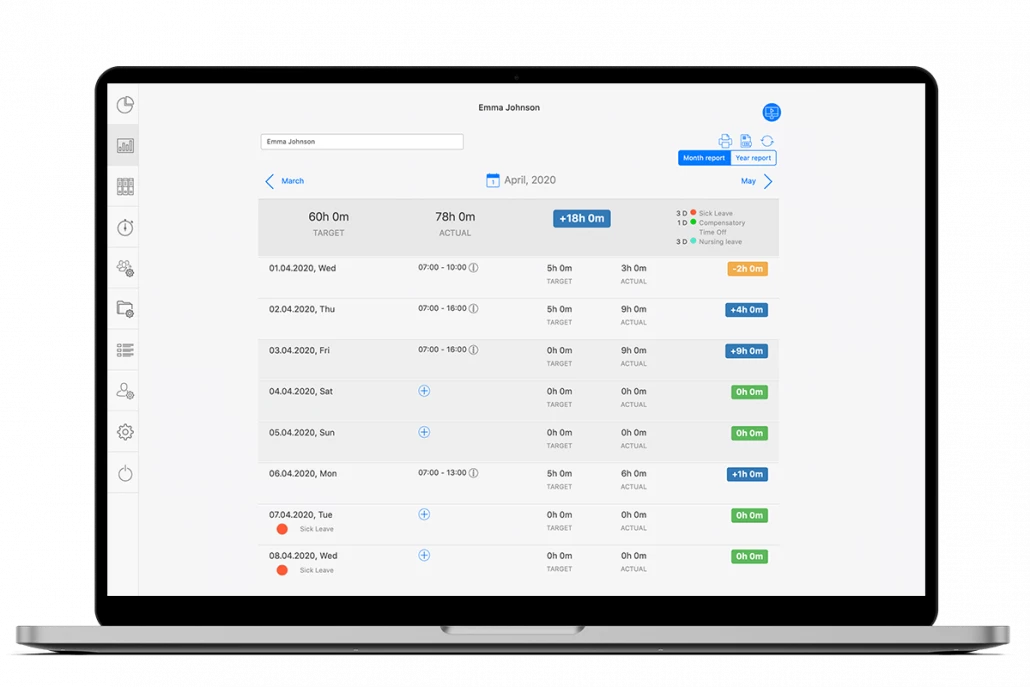

The structure of your company is represented in the company’s organizational chart, which shows the hierarchy of duties and management. Is authority finely distributed and are the various company teams properly mentioned? This includes customer service, product development, marketing, manufacturing and sales.

When planning the company’s organizational details, you will need a strategy to manage absences and leave. TimeTrack Leave Management feature helps you to finetune these details so you can easily (and quickly!) oversee employee absences, vacation time and keep track of working hours for compliance management.

TimeTrack Leave Management

Gaps and stumbling blocks

While it may be difficult to identify gaps in your team, chances are that if you look closely, you will observe a section of your company in need of quality talent. You need to figure out how to fill this gap. Don’t hide the weakness of your team from potential investors. Always remember that specialization will evolve as the company grows.

Where advisors, board members and consultants are applicable to your company, list them. Where they will fill key positions as the business grows, you need to list them and provide background on the value they provide.

The fine print

Every personnel plan needs to include a section addressing employment benefits , rights and conditions, especially for managers. Design your company’s management personnel plan and include a table of staff expenses, including both direct and indirect labor expenses, a burden rate and employee-related expenses, while adding payroll tax, workers’ compensation, salaries and health insurance.

Checklist for personnel planning

Personnel improvement

Improving conditions for personnel involve the identification of gaps, developing and implementing action plans and taking follow-up actions. Managers should develop a performance improvement plan before taking disciplinary action against employees.

Identify skills or performance gaps

A gap analysis is designed to help you identify potential and current issues and is an essential part of the personnel process. Incorporate characteristics of human resource planning into your business planning.

Provide proof of a skills gap or underperformance of the workforce using a consistent format across all employment cadres. Design your format, including employee information and a description of performance discrepancies using expected and actual performance criteria.

Have a face-to-face meeting with your employees to share observed issues or concerns and gain insights into causal factors of underperformance. Use your documentation to share insights on performance challenges. Let the affected employees know they have committed specific policy infractions. Focus only on the outcomes of behaviors to help affected staff understand how their behaviors affect company success.

Develop action plans

Establish specific and measurable improvement goals for your workforce. Avoid generalizations and focus on key goals. Setting bit-sized goals is an effective way of working while monitoring task on time .

Provide detailed resources, including advanced tools that can help employees improve. This also means providing the management with essential tools that will help with the efficient oversight of the workforce.

Create a timeline for achieving performance improvement goals. This will help keep the staff on track towards achieving expectations. Don’t forget to identify metrics for measuring progress. Be specific about what you want employees to achieve and define the intended consequences in the event of failure to complete performance improvement plan. Be specific about actions you will take whether or not targets are met.

Schedule regular appointments to review the performance improvement plan with your employees and implement their feedback.

Incorporating a personnel plan into your business strategy is a key factor for efficient planning. To maximize the opportunity presented by personnel planning, use any of the effective and reliable TimeTrack planning and absence management software tools.

I am a researcher, writer, and self-published author. Over the last 9 years, I have dedicated my time to delivering unique content to startups and non-governmental organizations and have covered several topics, including wellness, technology, and entrepreneurship. I am now passionate about how time efficiency affects productivity, business performance, and profitability.

Time Tracking

- Absence Management Software

- Clock In System

- Time Attendance System

- Auto Scheduling

- Duty Roster

- Shift Planning

- Appointment Planning

- Task Planning

- Info Center

- Timesheet Templates

- Rota Templates

- Promotional Program

- Affiliate Program

- Success Stories

Business Plan Section 3: Organization and Management

This section explains how your business runs and who’s on your team. Learn how to present the information in this section of your business plan.

This section of your business plan, Organization and Management, is where you’ll explain exactly how you’re set up to make your ideas happen, plus you’ll introduce the players on your team.

As always, remember your audience. If this is a plan for your internal use, you can be a little more general than if you’ll be presenting it to a potential lender or investor. No matter what its purpose, you’ll want to break the organization and management section into two segments: one describing the way you’ve set up the company to run (its organizational structure), and the other introducing the people involved (its management).

Business Organization

Having a solid plan for how your business will run is a key component of its smooth and successful operation. Of course, you need to surround yourself with good people, but you have to set things up to enable them to work well with each other and on their own.

It’s important to define the positions in the company, which job is responsible for what, and to whom everyone will report. Over time, the structure may grow and change and you can certainly keep tweaking it as you go along, but you need to have an initial plan.

If you’re applying for funding to start a business or expand one, you may not even have employees to fit all the roles in the organization. However, you can still list them in your plan for how the company will ideally operate once you have the ability to do so.

Obviously, for small businesses, the organization will be far more streamlined and less complicated than it is for larger ones, but your business plan still needs to demonstrate an understanding of how you’ll handle the workflow. At the very least, you’ll need to touch on sales and marketing, administration, and the production and distribution of your product or the execution of your service.

For larger companies, an organizational plan with well-thought-out procedures is even more important. This is the best way to make sure you’re not wasting time duplicating efforts or dealing with internal confusion about responsibilities. A smooth-running operation runs far more efficiently and cost-effectively than one flying by the seat of its pants, and this section of your business plan will be another indication that you know what you’re doing. A large company is also likely to need additional operational categories such as human resources and possibly research and development.

One way to explain your organizational structure in the business plan is graphically. A simple diagram or flowchart can easily demonstrate levels of management and the positions within them, clearly illustrating who reports to whom, and how different divisions of the company (such as sales and marketing) relate to each other.

Here is where you can also talk about the other levels of employees in your company. Your lower-level staff will carry out the day-to-day work, so it’s important to recognize the types of people you’ll need, how many, what their qualifications should be, where you’ll find them, and what they’ll cost.

If the business will use outside consultants, freelancers, or independent contractors, mention it here as well. And talk about positions you’d want to add in the future if you’re successful enough to expand.

Business Management

Now that we understand the structure of your business, we need to meet the people who’ll be running it. Who does what, and why are they onboard? This section is important even for a single practitioner or sole proprietorship, as it will introduce you and your qualifications to the readers of your plan.

Start at the top with the legal structure and ownership of the business. If you are incorporated, say so, and detail whether you are a C or S corporation. If you haven’t yet incorporated, make sure to discuss this with your attorney and tax advisor to figure out which way to go. Whether you’re in a partnership or are a sole owner, this is where to mention it.

List the names of the owners of the business, what percent of the company each of them owns, the form of ownership (common or preferred stock, general or limited partner), and what kind of involvement they’ll have with day-to-day operations; for example, if they’re an active or silent partner.

Here’s where you’ll list the names and profiles of your management team, along with what their responsibilities are. Especially if you’re looking for funding, make sure to highlight the proven track record of these key employees. Lenders and investors will be keenly interested in their previous successes, particularly in how they relate to this current venture.

Include each person’s name and position, along with a short description of what the individual’s main duties will be. Detail his or her education, and any unique skills or experience, especially if they’re relevant to the job at hand. Mention previous employment and any industry awards or recognition related to it, along with involvement with charities or other non-profit organizations.

Think of this section as a resume-in-a-nutshell, recapping the highlights and achievements of the people you’ve chosen to surround yourself with. Actual detailed resumes for you and your management team should go in the plan’s appendix, and you can cross-reference them here. You want your readers to feel like your top staff complements you and supplements your own particular skill set. You also want readers to understand why these people are so qualified to help make your business a success.

This section will spell out the compensation for management team members, such as salary, benefits, and any profit-sharing you might be offering. If any of the team will be under contract or bound by non-compete agreements, you would mention that here, as well.

If your company will have a Board of Directors, its members also need to be listed in the business plan. Introduce each person by name and the position they’ll hold on the board. Talk about how each might be involved with the business (in addition to board meetings.

Similar to what you did for your management team, give each member’s background information, including education, experience, special skills, etc., along with any contributions they may already have had to the success of the business. Include the full resumes for your board members in the appendix.

Alternately, if you don’t have a Board of Directors, include information about an Advisory Board you’ve put together, or a panel of experts you’ve convened to help you along the way. Having either of these, by the way, is something your company might want to consider whether or not you’re putting together the organization and management section or your business plan.

NEXT ARTICLE > Business Plan Section 4: Products and Services

Apply for a loan, get started.

Loans from $5,000 - $100,000 with transparent terms and no prepayment penalty. Tell us a little about yourself, your business and receive your quote in minutes without impacting your credit score.

Thanks for applying!

Loans are originated and funded through our lending arm, Accion Opportunity Fund Community Development. By clicking “Continue to Application,” you consent to, Accion Opportunity Fund Community Development’s Terms of Use and Privacy Policy ; and to receive emails, calls and texts , potentially for marketing purposes, including autodialed or pre-recorded calls. You may opt out of receiving certain communications as provided in our Privacy Policy .

- Business Planning

- Cash Flow Forecasting

- Scenario Planning

- Financial Reporting

- Financial Planning & Analysis

- For Enterprises

- For Franchises

- Case Studies

- Partnerships

- Software Integrations

- Templates & Downloads

A large update to Brixx has been released (15.04.24) - read about it here . Please clear cache/cookies in your browser if you encounter difficulties in loading the app.

How to Create a Personnel Plan for Investors

What is a personnel plan?

A personnel plan is a document that outlines an organization’s staffing needs, goals, and strategies for managing its workforce.

It is a key component of human resource management and provides a roadmap for the recruitment, selection, training, development, retention, and management of employees.

A personnel plan is critical within the business plan you would have created as a start-up or entrepreneur. It will help you in your financial forecasting, anticipating the right times to hire and expand.

What to include in the personnel section of your business plan

The personnel section of a business plan should include information about the management team and staff that will be involved in operating the business. The people who do the work are the most important asset, which of course comes with a cost. Understanding when to hire, when to think about human resources, and when to grow your business at the right time can be enormously important in meeting business objectives, setting yourself up for success with great personal benchmarks.

Building out a personnel plan within your business plan is going to be essential in planning for the long term success of your business. Forecasting this data can be the best way to ensure longevity.

Who is your management team?

This should include a brief introduction to the key members of the management team, including their backgrounds, experience, and relevant skills. It’s important to highlight their qualifications and how they will contribute to the success of the business.

This can be brief and doesn’t require a full resume for each member of the team. A simple explanation detailing qualifications and relevant experience applicable within the company is all that’s required.

What is the organizational structure?

This section should provide an overview of the organizational structure of the company, including who will be in charge of each department or functional area, as well as any outside consultants or advisors who will be involved.

In line with forecasting, you will want to illustrate the future of your company and who will be included. As you develop, you can anticipate your team growing from a just few employees into staff across multiple sectors, such as customer service, marketing, and support.

What are your staffing needs?

Outline the staffing needs of the business, including the number and types of employees needed to run the business successfully. This should also include the qualifications and skills required for each position.

Here you can identify the weaknesses and risks across your team, ensuring that you have a capable understanding of the roles and responsibilities that are important to the business in the future – though they may not be in place right now. Investors are quick to highlight “perfect” personnel plans, so you will want to embrace that you have identified risks in staffing.

As an example, your head of customer support may also be your head of sales, but in time these two roles will need to be separated.

What will recruitment and training look like?

This section should detail how the company plans to recruit and train employees, including any training programs or on-the-job training that will be provided.

What will the compensations and benefits be?

Outline the compensation and benefits packages that will be offered to employees, including salaries, bonuses, health benefits, retirement plans, and any other perks or incentives.

Outline the Human Resources policies

Detail the company’s policies on issues such as employee performance reviews, disciplinary procedures, and termination policies.

Does a business plan need personnel planning if I have no staff?

Even if you don’t have any employees right now, having a personnel plan is beneficial for your business in the long term.

Without a personnel plan, you may find it challenging to scale your business or adapt to changes in your industry or market. For example, if you suddenly need to hire someone to fill a critical role, you may not know where to start or what qualifications you should look for.

Creating a personnel plan can also help you to clarify your business goals and objectives. By determining the roles and responsibilities required to meet those goals, you can better prioritize and focus on the essential tasks that need to be done.

Therefore, even if you don’t have any employees currently, it’s still a good idea to develop a personnel plan to help you prepare for future growth and ensure that you have the right team in place to support your business objectives.

Is there an easy way to forecast a personnel plan?

Personnel planning is a long process as it requires dedicated thought as to what needs to happen in your business and where you want to take it. Typically, this require a lengthy process of spreadsheets and equations to figure out exactly who needs to be working with you, and at what cost.

Business planning software can ensure that this part of your business plan, alongside other key components, is created with ease – simply needing a few data entries to be entered throughout the software.

Related articles

- 10 Pitch Deck Mistakes to Avoid

- What are the Top 10 Business Plan Components?

- How To Find Potential Investors To Pitch To

- How to create financial projections for your business

Get started FREE with Brixx today

and take the first steps to planning your business’ future development

How To Write A Business Plan (2024 Guide)

Updated: Aug 20, 2022, 2:21am

Table of Contents

Brainstorm an executive summary, create a company description, brainstorm your business goals, describe your services or products, conduct market research, create financial plans, bottom line, frequently asked questions.

Every business starts with a vision, which is distilled and communicated through a business plan. In addition to your high-level hopes and dreams, a strong business plan outlines short-term and long-term goals, budget and whatever else you might need to get started. In this guide, we’ll walk you through how to write a business plan that you can stick to and help guide your operations as you get started.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

On LegalZoom's Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

Drafting the Summary

An executive summary is an extremely important first step in your business. You have to be able to put the basic facts of your business in an elevator pitch-style sentence to grab investors’ attention and keep their interest. This should communicate your business’s name, what the products or services you’re selling are and what marketplace you’re entering.

Ask for Help

When drafting the executive summary, you should have a few different options. Enlist a few thought partners to review your executive summary possibilities to determine which one is best.

After you have the executive summary in place, you can work on the company description, which contains more specific information. In the description, you’ll need to include your business’s registered name , your business address and any key employees involved in the business.

The business description should also include the structure of your business, such as sole proprietorship , limited liability company (LLC) , partnership or corporation. This is the time to specify how much of an ownership stake everyone has in the company. Finally, include a section that outlines the history of the company and how it has evolved over time.

Wherever you are on the business journey, you return to your goals and assess where you are in meeting your in-progress targets and setting new goals to work toward.

Numbers-based Goals

Goals can cover a variety of sections of your business. Financial and profit goals are a given for when you’re establishing your business, but there are other goals to take into account as well with regard to brand awareness and growth. For example, you might want to hit a certain number of followers across social channels or raise your engagement rates.

Another goal could be to attract new investors or find grants if you’re a nonprofit business. If you’re looking to grow, you’ll want to set revenue targets to make that happen as well.

Intangible Goals

Goals unrelated to traceable numbers are important as well. These can include seeing your business’s advertisement reach the general public or receiving a terrific client review. These goals are important for the direction you take your business and the direction you want it to go in the future.

The business plan should have a section that explains the services or products that you’re offering. This is the part where you can also describe how they fit in the current market or are providing something necessary or entirely new. If you have any patents or trademarks, this is where you can include those too.

If you have any visual aids, they should be included here as well. This would also be a good place to include pricing strategy and explain your materials.

This is the part of the business plan where you can explain your expertise and different approach in greater depth. Show how what you’re offering is vital to the market and fills an important gap.

You can also situate your business in your industry and compare it to other ones and how you have a competitive advantage in the marketplace.

Other than financial goals, you want to have a budget and set your planned weekly, monthly and annual spending. There are several different costs to consider, such as operational costs.

Business Operations Costs

Rent for your business is the first big cost to factor into your budget. If your business is remote, the cost that replaces rent will be the software that maintains your virtual operations.

Marketing and sales costs should be next on your list. Devoting money to making sure people know about your business is as important as making sure it functions.

Other Costs

Although you can’t anticipate disasters, there are likely to be unanticipated costs that come up at some point in your business’s existence. It’s important to factor these possible costs into your financial plans so you’re not caught totally unaware.

Business plans are important for businesses of all sizes so that you can define where your business is and where you want it to go. Growing your business requires a vision, and giving yourself a roadmap in the form of a business plan will set you up for success.

How do I write a simple business plan?

When you’re working on a business plan, make sure you have as much information as possible so that you can simplify it to the most relevant information. A simple business plan still needs all of the parts included in this article, but you can be very clear and direct.

What are some common mistakes in a business plan?

The most common mistakes in a business plan are common writing issues like grammar errors or misspellings. It’s important to be clear in your sentence structure and proofread your business plan before sending it to any investors or partners.

What basic items should be included in a business plan?

When writing out a business plan, you want to make sure that you cover everything related to your concept for the business, an analysis of the industry―including potential customers and an overview of the market for your goods or services―how you plan to execute your vision for the business, how you plan to grow the business if it becomes successful and all financial data around the business, including current cash on hand, potential investors and budget plans for the next few years.

- Best VPN Services

- Best Project Management Software

- Best Web Hosting Services

- Best Antivirus Software

- Best LLC Services

- Best POS Systems

- Best Business VOIP Services

- Best Credit Card Processing Companies

- Best CRM Software for Small Business

- Best Fleet Management Software

- Best Business Credit Cards

- Best Business Loans

- Best Business Software

- Best Business Apps

- Best Free Software For Business

- How to Start a Business

- How To Make A Small Business Website

- How To Trademark A Name

- What Is An LLC?

- How To Set Up An LLC In 7 Steps

- What is Project Management?

How To Get A Business License In North Dakota (2024)

How To Write An Effective Business Proposal

Best New Hampshire Registered Agent Services Of 2024

Employer Staffing Solutions Group Review 2024: Features, Pricing & More

How To Sell Clothes Online In 2024

2024 SEO Checklist

Julia is a writer in New York and started covering tech and business during the pandemic. She also covers books and the publishing industry.

Kelly Main is a Marketing Editor and Writer specializing in digital marketing, online advertising and web design and development. Before joining the team, she was a Content Producer at Fit Small Business where she served as an editor and strategist covering small business marketing content. She is a former Google Tech Entrepreneur and she holds an MSc in International Marketing from Edinburgh Napier University. Additionally, she is a Columnist at Inc. Magazine.

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

Create a Personal Business Plan That You'll Really Use Develop a customized tool that will serve to focus you on your most important objectives. Write it in user-friendly prose so you'll check it weekly.

By Marty Fukuda • Oct 7, 2014

Opinions expressed by Entrepreneur contributors are their own.

Every successful business leader I've encountered is in some way a prolific goal setter. For this reason, the single most important piece of advice I give any aspiring entrepreneur or business professional is to figure out exactly what you want, document it on paper and then attack it every day.

A personal business plan is something that I develop each year to help me put my own advice into action. Creating a plan can clarify your objectives for the coming year but don't just shove it in drawer. It is something that should become weekly, if not daily, reading material.

Related: Why Business Leaders Must Set a Personal Mission

1. Start with a simple brainstorming list.

Break down your role in the company into small parts and be sure it's comprehensive. This could mean taking each department that you oversee or are involved in, and breaking it down into further segments. For instance, for my company's graphic-design department, I would create separate objectives for its leadership development, equipment and software needs, anticipated hiring, the continued education plan and efficiency.

2. Prioritize objectives.

Your brainstorming list probably contains an overwhelming number of potential starting points. The key is narrowing them down into a manageable and realistic number of goals. Since you'll review the finished personal business plan often, don't write a novel.

I made the mistake of developing a massive 100-page personal business plan that I never looked at. The very thought of reviewing it was scary. A user-friendly one- to two-page document will do the trick.

Take your brainstorming list and organize it according to the biggest potential impact. You'll also have some must-dos (if not tackled business will fall apart). Then you'll have some items that aren't necessary or don't require much of your focus and perhaps can be delegated.

My company's CEO, Duane Hixon, does a wonderful job of narrowing down his list into what he refers to as his "rocks." These are the biggest areas of impact, the areas to which a person should offer most of his or her attention. These will make up the heart of the personal business plan.

Related: How to Build a Business Plan For Your Personal Brand

3. Be specific.

Once you've narrowed things down to a handful of rocks, be sure the plan includes specifics that will allow you to measure and track progress. For this year's plan, one of my rocks was maintaining company culture while building the team. Obviously, this is a broad, difficult-to-measure objective. For my plan, I developed a strategy for accomplishing the mission by including more details such as creating a company culture slide show and a plan for both current employees and new hires.

4. Set challenges but be realistic.

A goal that doesn't take much effort to accomplish isn't really a goal. Setting an objective that has a slim chance of realization, however, amounts to little more than a hope and can leave you feeling discouraged. Aim for a perfect balance between the two -- something that stretches you but doesn't break you.

Related: Write a Winning Business Plan With These 8 Key Elements

5. Set deadlines.

The beautiful thing about your personal business plan is that it's yours. You don't have to wait until the start of a new year to create one. While I create a plan annually, that doesn't mean that each objective has a deadline that's one year out. Set a deadline no matter what it is to keep you focused and provide a call to action (as opposed to adopting an open-ended objective).

6. Share the plan.

I recommend that you show your plan to a colleage whom you respect. Ask for feedback. This individual may think of an angle you have not. Equally important, this person will hold you accountable. It's a lot tougher to hit the eject button on a plan after you've shared it with someone you respect. And everyone can use a cheerleader in the workplace from time to time.

I personally love it when an employee shares a plan with me. It shows initiative and forward thinking. There are few things more impressive than when an employee has clear-cut objectives and works hard to meet them.

7. Revisit the plan weekly.

Creating the plan is just the first step. Put the plan in a prominent spot where you're going to remember to review it or place reminders in your calendar.If you've got a great plan, it can and will inspire you every time you see it.

Related: Your Mission Statement May Be Utterly Useless or a Gold Mine

Chief Operating Officer of N2 Publishing

Want to be an Entrepreneur Leadership Network contributor? Apply now to join.

Editor's Pick Red Arrow

- This 103-Year-Old Doctor Opened Her Medical Practice Before Women Could Have Bank Accounts — Here Are Her 6 Secrets to a Healthy, Successful Life

- Lock 5 Ways You Might Be Cheating on Your Taxes — And Why You Will Get Caught

- I've Had a Secret Side Hustle for Decades. It Keeps Tens of Thousands of Dollars in My Pocket — and Gets Me Into Places I Wouldn't Go Otherwise .

- Lock Here's How Steve Jobs Dealt With Negative Press and Avoided Brand Disasters

- One Factor Is Helping This Entrepreneur Tackle Business Ownership Later in Life. Now, She's Jumping Into a $20 Billion Industry .

- Lock Narcissism Can Help You Be Successful — Here's How to Harness It Without Going Too Far, According to an Ivy League-Trained Psychotherapist

Most Popular Red Arrow

Nike responds to criticism over u.s. women's olympic uniforms: 'everything's showing'.

The company is the official outfitter for the U.S. Olympic track and field athletes.

The 'Silver Tsunami' Meets 'Golden Handcuffs' as Past Low Mortgage Rates Lock in Homeowners — Whether They Like It or Not

The resulting lower supply of homes, and population growth outpacing construction, has led to a 7.2 million home shortage.

63 Small Business Ideas to Start in 2024

We put together a list of the best, most profitable small business ideas for entrepreneurs to pursue in 2024.

5 Entrepreneurial Mindsets That Drive Success

Here are the mindsets shared by the most successful entrepreneurs.

Elon Musk Informs Tesla Staff That Layoffs Will Affect at Least 14,000 Employees — Read the Leaked Email

The layoffs impact more than 10% of Tesla's 140,473-person workforce.

These Are the Busiest Airports in the World, According to a New Ranking

A surge in international and business travel has brought airports back to near pre-pandemic levels of passenger traffic.

Successfully copied link

- Sources of Business Finance

- Small Business Loans

- Small Business Grants

- Crowdfunding Sites

- How to Get a Business Loan

- Small Business Insurance Providers

- Best Factoring Companies

- Types of Bank Accounts

- Best Banks for Small Business

- Best Business Bank Accounts

- Open a Business Bank Account

- Bank Accounts for Small Businesses

- Free Business Checking Accounts

- Best Business Credit Cards

- Get a Business Credit Card

- Business Credit Cards for Bad Credit

- Build Business Credit Fast

- Business Loan Eligibility Criteria

- Small-Business Bookkeeping Basics

- How to Set Financial Goals

- Business Loan Calculators

- How to Calculate ROI

- Calculate Net Income

- Calculate Working Capital

- Calculate Operating Income

- Calculate Net Present Value (NPV)

- Calculate Payroll Tax

12 Key Elements of a Business Plan (Top Components Explained)

Starting and running a successful business requires proper planning and execution of effective business tactics and strategies .

You need to prepare many essential business documents when starting a business for maximum success; the business plan is one such document.

When creating a business, you want to achieve business objectives and financial goals like productivity, profitability, and business growth. You need an effective business plan to help you get to your desired business destination.

Even if you are already running a business, the proper understanding and review of the key elements of a business plan help you navigate potential crises and obstacles.

This article will teach you why the business document is at the core of any successful business and its key elements you can not avoid.

Let’s get started.

Why Are Business Plans Important?

Business plans are practical steps or guidelines that usually outline what companies need to do to reach their goals. They are essential documents for any business wanting to grow and thrive in a highly-competitive business environment .

1. Proves Your Business Viability

A business plan gives companies an idea of how viable they are and what actions they need to take to grow and reach their financial targets. With a well-written and clearly defined business plan, your business is better positioned to meet its goals.

2. Guides You Throughout the Business Cycle

A business plan is not just important at the start of a business. As a business owner, you must draw up a business plan to remain relevant throughout the business cycle .

During the starting phase of your business, a business plan helps bring your ideas into reality. A solid business plan can secure funding from lenders and investors.

After successfully setting up your business, the next phase is management. Your business plan still has a role to play in this phase, as it assists in communicating your business vision to employees and external partners.

Essentially, your business plan needs to be flexible enough to adapt to changes in the needs of your business.

3. Helps You Make Better Business Decisions

As a business owner, you are involved in an endless decision-making cycle. Your business plan helps you find answers to your most crucial business decisions.

A robust business plan helps you settle your major business components before you launch your product, such as your marketing and sales strategy and competitive advantage.

4. Eliminates Big Mistakes

Many small businesses fail within their first five years for several reasons: lack of financing, stiff competition, low market need, inadequate teams, and inefficient pricing strategy.

Creating an effective plan helps you eliminate these big mistakes that lead to businesses' decline. Every business plan element is crucial for helping you avoid potential mistakes before they happen.

5. Secures Financing and Attracts Top Talents

Having an effective plan increases your chances of securing business loans. One of the essential requirements many lenders ask for to grant your loan request is your business plan.

A business plan helps investors feel confident that your business can attract a significant return on investments ( ROI ).

You can attract and retain top-quality talents with a clear business plan. It inspires your employees and keeps them aligned to achieve your strategic business goals.

Key Elements of Business Plan

Starting and running a successful business requires well-laid actions and supporting documents that better position a company to achieve its business goals and maximize success.

A business plan is a written document with relevant information detailing business objectives and how it intends to achieve its goals.

With an effective business plan, investors, lenders, and potential partners understand your organizational structure and goals, usually around profitability, productivity, and growth.

Every successful business plan is made up of key components that help solidify the efficacy of the business plan in delivering on what it was created to do.

Here are some of the components of an effective business plan.

1. Executive Summary

One of the key elements of a business plan is the executive summary. Write the executive summary as part of the concluding topics in the business plan. Creating an executive summary with all the facts and information available is easier.

In the overall business plan document, the executive summary should be at the forefront of the business plan. It helps set the tone for readers on what to expect from the business plan.

A well-written executive summary includes all vital information about the organization's operations, making it easy for a reader to understand.

The key points that need to be acted upon are highlighted in the executive summary. They should be well spelled out to make decisions easy for the management team.

A good and compelling executive summary points out a company's mission statement and a brief description of its products and services.

An executive summary summarizes a business's expected value proposition to distinct customer segments. It highlights the other key elements to be discussed during the rest of the business plan.

Including your prior experiences as an entrepreneur is a good idea in drawing up an executive summary for your business. A brief but detailed explanation of why you decided to start the business in the first place is essential.

Adding your company's mission statement in your executive summary cannot be overemphasized. It creates a culture that defines how employees and all individuals associated with your company abide when carrying out its related processes and operations.

Your executive summary should be brief and detailed to catch readers' attention and encourage them to learn more about your company.

Components of an Executive Summary

Here are some of the information that makes up an executive summary:

- The name and location of your company

- Products and services offered by your company

- Mission and vision statements

- Success factors of your business plan

2. Business Description

Your business description needs to be exciting and captivating as it is the formal introduction a reader gets about your company.

What your company aims to provide, its products and services, goals and objectives, target audience , and potential customers it plans to serve need to be highlighted in your business description.

A company description helps point out notable qualities that make your company stand out from other businesses in the industry. It details its unique strengths and the competitive advantages that give it an edge to succeed over its direct and indirect competitors.

Spell out how your business aims to deliver on the particular needs and wants of identified customers in your company description, as well as the particular industry and target market of the particular focus of the company.

Include trends and significant competitors within your particular industry in your company description. Your business description should contain what sets your company apart from other businesses and provides it with the needed competitive advantage.

In essence, if there is any area in your business plan where you need to brag about your business, your company description provides that unique opportunity as readers look to get a high-level overview.

Components of a Business Description

Your business description needs to contain these categories of information.

- Business location

- The legal structure of your business

- Summary of your business’s short and long-term goals

3. Market Analysis

The market analysis section should be solely based on analytical research as it details trends particular to the market you want to penetrate.

Graphs, spreadsheets, and histograms are handy data and statistical tools you need to utilize in your market analysis. They make it easy to understand the relationship between your current ideas and the future goals you have for the business.

All details about the target customers you plan to sell products or services should be in the market analysis section. It helps readers with a helpful overview of the market.

In your market analysis, you provide the needed data and statistics about industry and market share, the identified strengths in your company description, and compare them against other businesses in the same industry.

The market analysis section aims to define your target audience and estimate how your product or service would fare with these identified audiences.

Market analysis helps visualize a target market by researching and identifying the primary target audience of your company and detailing steps and plans based on your audience location.

Obtaining this information through market research is essential as it helps shape how your business achieves its short-term and long-term goals.

Market Analysis Factors

Here are some of the factors to be included in your market analysis.

- The geographical location of your target market

- Needs of your target market and how your products and services can meet those needs

- Demographics of your target audience

Components of the Market Analysis Section

Here is some of the information to be included in your market analysis.

- Industry description and statistics

- Demographics and profile of target customers

- Marketing data for your products and services

- Detailed evaluation of your competitors

4. Marketing Plan

A marketing plan defines how your business aims to reach its target customers, generate sales leads, and, ultimately, make sales.

Promotion is at the center of any successful marketing plan. It is a series of steps to pitch a product or service to a larger audience to generate engagement. Note that the marketing strategy for a business should not be stagnant and must evolve depending on its outcome.

Include the budgetary requirement for successfully implementing your marketing plan in this section to make it easy for readers to measure your marketing plan's impact in terms of numbers.

The information to include in your marketing plan includes marketing and promotion strategies, pricing plans and strategies , and sales proposals. You need to include how you intend to get customers to return and make repeat purchases in your business plan.

5. Sales Strategy

Sales strategy defines how you intend to get your product or service to your target customers and works hand in hand with your business marketing strategy.

Your sales strategy approach should not be complex. Break it down into simple and understandable steps to promote your product or service to target customers.

Apart from the steps to promote your product or service, define the budget you need to implement your sales strategies and the number of sales reps needed to help the business assist in direct sales.

Your sales strategy should be specific on what you need and how you intend to deliver on your sales targets, where numbers are reflected to make it easier for readers to understand and relate better.

6. Competitive Analysis

Providing transparent and honest information, even with direct and indirect competitors, defines a good business plan. Provide the reader with a clear picture of your rank against major competitors.

Identifying your competitors' weaknesses and strengths is useful in drawing up a market analysis. It is one information investors look out for when assessing business plans.

The competitive analysis section clearly defines the notable differences between your company and your competitors as measured against their strengths and weaknesses.

This section should define the following:

- Your competitors' identified advantages in the market

- How do you plan to set up your company to challenge your competitors’ advantage and gain grounds from them?

- The standout qualities that distinguish you from other companies

- Potential bottlenecks you have identified that have plagued competitors in the same industry and how you intend to overcome these bottlenecks

In your business plan, you need to prove your industry knowledge to anyone who reads your business plan. The competitive analysis section is designed for that purpose.

7. Management and Organization

Management and organization are key components of a business plan. They define its structure and how it is positioned to run.