- Search Search Please fill out this field.

- Building Your Business

- Operations & Success

Financial Ratio Analysis Tutorial With Examples

:max_bytes(150000):strip_icc():format(webp)/KhadijaKhartit-4f144e2b63ee4dd4af60ac8a02233c50.jpg)

The Balance Sheet for Financial Ratio Analysis

The income statement for financial ratio analysis, analyzing the liquidity ratios, the current ratio, the quick ratio, analyzing the asset management ratios accounts receivable, receivables turnover, average collection period, inventory, fixed assets, total assets, inventory turnover ratio, fixed asset turnover, total asset turnover, analyzing the debt management ratios, debt-to-asset ratio, times interest earned ratio, fixed charge coverage, analyzing the profitability ratios, net profit margin, return on assets, return on equity, financial ratio analysis of xyz corporation.

While it may be more fun to work on marketing efforts, the financial management of a firm is a crucial aspect of owning a business. Financial ratios help break down complex financial information into key details and relationships. Financial ratio analysis involves studying these ratios to learn about the company's financial health.

Here are a few of the most important financial ratios for business owners to learn, what they tell you about the company's financial statements , and how to use them.

Key Takeaways

- Some of the most important financial ratios for business owners include the current ratio, the inventory turnover ratio, and the debt-to-asset ratio.

- These financial ratios quickly break down the complex information from financial statements.

- Financial ratios are snapshots, so it's important to compare the information to previous periods of data as well as competitors in the industry.

Here is the balance sheet we are going to use for our financial ratio tutorial. You will notice there are two years of data for this company so we can do a time-series (or trend) analysis and see how the firm is doing across time.

Here is the complete income statement for the firm for which we are doing financial ratio analysis. We are doing two years of financial ratio analysis for the firm so we can compare them.

Refer back to the income statement and balance sheet as you work through the tutorial.

The first ratios to use to start getting a financial picture of your firm measure your liquidity, or your ability to convert your current assets to cash quickly. They are two of the 13 ratios. Let's look at the current ratio and the quick (acid-test) ratio .

The current ratio measures how many times you can cover your current liabilities. The quick ratio measures how many times you can cover your current liabilities without selling any inventory and so is a more stringent measure of liquidity.

Remember that we are doing a time series analysis, so we will be calculating the ratios for each year.

Current Ratio : For 2020, take the Total Current Assets and divide them by the Total Current Liabilities. You will have: Current Ratio = 642/543 = 1.18X. This means that the company can pay for its current liabilities 1.18 times over. Practice calculating the current ratio for 2021.

Your answer for 2021 should be 1.31X. A quick analysis of the current ratio will tell you that the company's liquidity has gotten just a little bit better between 2020 and 2021 since it rose from 1.18X to 1.31X.

Quick Ratio : In order to calculate the quick ratio, take the Total Current Ratio for 2020 and subtract out Inventory. Divide the result by Total Current Liabilities. You will have: Quick Ratio = (642-393)/543 = 0.46X. For 2021, the answer is 0.52X.

Like the current ratio, the quick ratio is rising and is a little better in 2021 than in 2020. The firm's liquidity is getting a little better. The problem for this company, however, is that they have to sell inventory in order to pay their short-term liabilities and that is not a good position for any firm to be in. This is true in both 2020 and 2021.

This firm has two sources of current liabilities: accounts payable and notes payable. They have bills that they owe to their suppliers (accounts payable) plus they apparently have a bank loan or a loan from some alternative source of financing. We don't know how often they have to make a payment on the note.

Asset management ratios are the next group of financial ratios that should be analyzed. They tell the business owner how efficiently they employ their assets to generate sales. Assume all sales are on credit.

- Receivables Turnover = Credit Sales/Accounts Receivable = ___ X so:

- Receivables Turnover = 2,311/165 = 14X

A receivables turnover of 14X in 2020 means that all accounts receivable are cleaned up (paid off) 14 times during the 2020 year. For 2021, the receivables turnover is 15.28X. Look at 2020 and 2021 Sales in The Income Statement and Accounts Receivable in The Balance Sheet.

The receivables turnover is rising from 2020 to 2021. We can't tell if this is good or bad. We would really need to know what type of industry this firm is in and get some industry data to compare to.

Customers paying off receivables is, of course, good. But, if the receivables turnover is way above the industry's, then the firm's credit policy may be too restrictive.

Average collection period is also about accounts receivable. It is the number of days, on average, that it takes a firm's customers to pay their credit accounts. Together with receivables turnover, average collection helps the firm develop its credit and collections policy.

- Average Collection Period = Accounts Receivable/Average Daily Credit Sales*

- *To arrive at average daily credit sales, take credit sales and divide by 360

- Average Collection Period = $165/2311/360 = $165/6.42 = 25.7 days

- In 2021, the average collection period is 23.5 days

From 2020 to 2021, the average collection period is dropping. In other words, customers are paying their bills more quickly. Compare that to the receivables turnover ratio. Receivables turnover is rising and the average collection period is falling.

This makes sense because customers are paying their bills faster. The company needs to compare these two ratios to industry averages. In addition, the company should take a look at its credit and collections policy to be sure they are not too restrictive. Take a look at the image above and you can see where the numbers came from on the balance sheets and income statements.

Along with the accounts receivable ratios that we analyzed above, we also have to analyze how efficiently we generate sales with our other assets: inventory, plant and equipment, and our total asset base.

The inventory turnover ratio is one of the most important ratios a business owner can calculate and analyze. If your business sells products as opposed to services, then inventory is an important part of your equation for success.

Inventory Turnover = Sales/Inventory = ______ X

If your inventory turnover is rising, that means you are selling your products faster. If it is falling, you are in danger of holding obsolete inventory. A business owner has to find the optimal inventory turnover ratio where the ratio is not too high and there are no stockouts or too low where there is obsolete money. Both are costly to the firm.

For this company, their inventory turnover ratio for 2020 is:

Inventory Turnover Ratio = Sales/Inventory = 2311/393 = 5.9X

This means that this company completely sells and replaces its inventory 5.9 times every year. In 2021, the inventory turnover ratio is 6.8X. The firm's inventory turnover is rising. This is good in that they are selling more products. The business owner should compare the inventory turnover with the inventory turnover ratio with other firms in the same industry.

The fixed asset turnover ratio analyzes how well a business uses its plant and equipment to generate sales. A business firm does not want to have either too little or too much plant and equipment. For this firm for 2020:

Fixed Asset Turnover = Sales/Fixed Assets = 2311/2731 = 0.85X

For 2021, the fixed asset turnover is 1.00. The fixed asset turnover ratio is dragging down this company. They are not using their plant and equipment efficiently to generate sales as, in both years, fixed asset turnover is very low.

The total asset turnover ratio sums up all the other asset management ratios. If there are problems with any of the other total assets, it will show up here, in the total asset turnover ratio.

Total Asset Turnover = Sales/Total Asset Turnover = Sales/Total Assets = 2311/3373 = 0.69X for 2020. For 2021, the total asset turnover is 0.80. The total asset turnover ratio is somewhat concerning since it was not even 1X for either year.

This means that it was not very efficient. In other words, the total asset base was not very efficient in generating sales for this firm in 2020 or 2021. Why?

It seems to me that most of the problem lies in the firm's fixed assets. They have too much plant and equipment for their level of sales. They either need to find a way to increase their sales or sell off some of their plant and equipment. The fixed asset turnover ratio is dragging down the total asset turnover ratio and the firm's asset management in general.

There are three debt management ratios that help a business owner evaluate the company in light of its asset base and earning power. Those ratios are the debt-to-asset ratio, the times interest earned ratio , and the fixed charge coverage ratios. Other debt management ratios exist, but these help give business owners the first look at the debt position of the company and the prudence of that debt position.

The first debt ratio that is important for the business owner to understand is the debt-to-asset ratio ; in other words, how much of the total asset base of the firm is financed using debt financing. For example. the debt-to-asset ratio for 2020 is:

Total Liabilities/Total Assets = $1074/3373 = 31.8%. This means that 31.8% of the firm's assets are financed with debt. In 2021, the debt ratio is 27.8%. In 2021, the business is using more equity financing than debt financing to operate the company.

We don't know if this is good or bad since we do not know the debt-to-asset ratio for firms in this company's industry. However, we do know that the company has a problem with its fixed asset ratio which may be affecting the debt-to-asset ratio.

The times interest earned ratio tells a company how many times over a firm can pay the interest that it owes. Usually, the more times a firm can pay its interest expense the better. The times interest earned ratio for this firm for 2020 is:

- Times Interest Earned = Earnings Before Interest and Taxes/Interest = 276/141 = 1.96X

- For 2021, the times interest earned ratio is 3.35

The times interest earned ratio is very low in 2020 but better in 2021. This is because the debt-to-asset ratio dropped in 2021.

The fixed charge coverage ratio is very helpful for any company that has any fixed expenses they have to pay. One fixed charge (expense) is interest payments on debt, but that is covered by the times interest earned ratio.

Another fixed charge would be lease payments if the company leases any equipment, a building, land, or anything of that nature. Larger companies have other fixed charges which can be taken into account.

- Fixed charge coverage = Earnings Before Fixed Charges and Taxes/Fixed Charges = _____X

In both 2020 and 2021 for the company in our example, its only fixed charge is interest payments. So, the fixed charge coverage ratio and the times interest earned ratio would be exactly the same for each year for each ratio.

The last group of financial ratios that business owners usually tackle are the profitability ratios as they are the summary ratios of the 13 ratio group. They tell the business firm how they are doing on cost control, efficient use of assets, and debt management, which are three crucial areas of the business.

The net profit margin measures how much each dollar of sales contributes to profit and how much is used to pay expenses. For example, if a company has a net profit margin of 5%, this means that 5 cents of every sales dollar it takes in goes to profit and 95 cents goes to expenses. For 2020, here is XYZ, Inc's net profit margin:

Net Profit Margin = Net Income/Sales Revenue = 89.1/2311 = 3.9%

For 2021, the net profit margin is 6.5%, so there was quite an increase in their net profit margin. You can see that their sales took quite a jump but their cost of goods sold rose. It is the best of both worlds when sales rise and costs fall. Bear in mind, the company can still have problems even if this is the case.

The return on assets ratio, also called return on investment , relates to the firm's asset base and what kind of return they are getting on their investment in their assets. Look at the total asset turnover ratio and the return on asset ratio together. If total asset turnover is low, the return on assets is going to be low because the company is not efficiently using its assets.

Another way to look at the return on assets is in the context of the Dupont method of financial analysis. This method of analysis shows you how to look at the return on assets in the context of both the net profit margin and the total asset turnover ratio.

- To calculate the Return on Assets ratio for XYZ, Inc. for 2020, here's the formula:

- Return on Assets = Net Income/Total Assets = 2.6%

For 2021, the ROA is 5.2%. The increased return on assets in 2021 reflects the increased sales and much higher net income for that year.

The return on equity ratio is the one of most interest to the shareholders or investors in the firm. This ratio tells the business owner and the investors how much income per dollar of their investment the business is earning. This ratio can also be analyzed by using the Dupont method of financial ratio analysis. The company's return on equity for 2020 was:

Return on Equity = Net Income/Shareholder's Equity = 3.9%

For 2021, the return on equity was 7.2%. One reason for the increased return on equity was the increase in net income. When analyzing the return on equity ratio, the business owner also has to take into consideration how much of the firm is financed using debt and how much of the firm is financed using equity.

Now we have a summary of all 13 financial ratios for XYZ Corporation. The first thing that jumps out is the low liquidity of the company. We can look at the current and quick ratios for 2020 and 2021 and see that the liquidity is slightly increasing between 2020 and 2021, but it is still very low.

By looking at the quick ratio for both years, we can see that this company has to sell inventory in order to pay off short-term debt. The company does have short-term debt: accounts payable and notes payable, and we don't know when the notes payable will come due.

Let's move on to the asset management ratios. We can see that the firm's credit and collections policies might be a little restrictive by looking at the high receivable turnover and low average collection period. Customers must pay this company rapidly—perhaps too rapidly. There is nothing particularly remarkable about the inventory turnover ratio, but the fixed asset turnover ratio is remarkable.

The fixed asset turnover ratio measures the company's ability to generate sales from its fixed assets or plant and equipment. This ratio is very low for both 2020 and 2021. This means that XYZ has a lot of plant and equipment that is unproductive.

It is not being used efficiently to generate sales for the company. In addition, the company has to service the plant and equipment, pay for breakdowns, and perhaps pay interest on loans to buy it through long-term debt.

It seems that a very low fixed asset turnover ratio might be a major source of problems for XYZ. The company should sell some of this unproductive plant and equipment, keeping only what is absolutely necessary to produce their product.

The low fixed asset turnover ratio is dragging down total asset turnover. If you follow this analysis on through, you will see that it is also substantially lowering this firm's return on assets profitability ratio.

With this firm, it is hard to analyze the company's debt management ratios without industry data. We don't know if XYZ is a manufacturing firm or a different type of firm.

As a result, analyzing the debt-to-asset ratio is difficult. What we can see, however, is that the company is financed more with shareholder funds (equity) than it is with debt as the debt-to-asset ratio for both years is under 50% and dropping.

This fact means that the return on equity profitability ratio will be lower than if the firm was financed more with debt than with equity. On the other hand, the risk of bankruptcy will also be lower.

Unfortunately, you can see from the times interest earned ratio that the company does not have enough liquidity to be comfortable servicing its debt. The company's costs are high and liquidity is low. Fortunately, the company's net profit margin is increasing because their sales are increasing.

Hopefully, this is a trend that will continue. Return on Assets is impacted negatively due to the low fixed asset turnover ratio and, to some extent, by the receivables ratios. Return on Equity is increasing from 2020 to 2021, which will make investors happy.

As you can see, it is possible to do a cursory financial ratio analysis of a business firm with only 13 financial ratios, even though ratio analysis has inherent limitations.

Wells Fargo. " 5 Ways To Improve Your Liquidity Ratio ."

Julie Dahlquist, Rainford Knight. " Principles of Finance: 6.2 Operating Efficiency Ratios ." OpenStax, 2022.

U.S. Small Business Administration. " Calculate & Analyze Your Financial Ratios ," Pages 2, 4.

U.S. Small Business Administration. " Calculate & Analyze Your Financial Ratios ," Pages 3, 6.

Julie Dahlquist, Rainford Knight. " Principles of Finance: 6.4 Solvency Ratios ." OpenStax, 2022.

Nasdaq. " Fixed-Charge Coverage Ratio ."

U.S. Small Business Administration. " Calculate & Analyze Your Financial Ratios ," Pages 3, 5.

Julie Dahlquist, Rainford Knight. " Principles of Finance: 6.6 Profitability Ratios and the DuPont Method ." OpenStax, 2022.

Introduction: Ratio analysis is a powerful tool in financial analysis, providing insights into a company's performance. This guide will explore the applicati

Finance Health

Ratio Analysis

Invest Decision

Real Life Case

Invest Strategy

Business Metric

Finance Data

Exploring Ratio Analysis Through Real-Life Case Studies

Dec 4, 2023 5:54 AM - Parth Sanghvi

Image credit: Austin Distel

Introduction:.

Ratio analysis is a powerful tool in financial analysis, providing insights into a company's performance. This guide will explore the application of ratio analysis through diverse case studies, showcasing its significance and practical implications in decision-making.

Understanding Ratio Analysis:

Ratio analysis involves the examination of various financial ratios to evaluate a company's financial health, performance, and operational efficiency. Key ratios include liquidity, profitability, solvency, and efficiency ratios.

Importance of Case Studies in Ratio Analysis:

Real-life case studies offer practical demonstrations of how ratio analysis influences decision-making and provides actionable insights for investors, analysts, and businesses.

Case Study Examples:

Liquidity Ratio Impact on Small Business:

- Analyzing the current ratio and quick ratio of a small business to assess its ability to meet short-term obligations during a cash crunch.

Profitability Ratios in Tech Companies:

- Comparing net profit margin and ROE among tech giants to identify profitability leaders in the industry.

Solvency Ratio Impact in the Retail Sector:

- Analyzing debt-to-equity ratios in the retail sector during economic downturns to evaluate resilience and risk management strategies.

Efficiency Ratios and Manufacturing Operations:

- Assessing inventory turnover ratios and receivables turnover ratios in manufacturing firms to streamline operational efficiency.

Valuation Ratios in Investment Decisions:

- Using P/E ratios and P/B ratios to make informed investment decisions in different sectors based on market sentiment.

Lessons Learned from Case Studies:

Holistic Evaluation: How combining multiple ratios provides a comprehensive view of a company's performance.

Industry Benchmarking: The significance of benchmarking ratios against industry averages for accurate comparative analysis.

Impact on Decision-making: How ratio analysis influences investment, strategic, and operational decisions.

Leveraging Insights from Ratio Analysis:

Continuous Monitoring: Regularly reviewing ratios to detect trends and identify areas needing improvement.

Predictive Analysis: Using historical data from ratios to forecast future performance and trends.

Conclusion:

Ratio analysis case studies provide actionable insights and practical applications for businesses and investors. Learning from these real-life examples empowers stakeholders to make informed decisions based on a thorough understanding of financial ratios.

Other Blogs

Sep 11, 2023 1:38 PM - Rajnish Katharotiya

P/E Ratios Using Normalized Earnings

Price to Earnings is one of the key metrics use to value companies using multiples. The P/E ratio and other multiples are relative valuation metrics and they cannot be looked at in isolation. One of the problems with the P/E metric is the fact that if we are in the peak of a business cycle, earni...

Sep 11, 2023 1:49 PM - Rajnish Katharotiya

What is Price To Earnings Ratio and How to Calculate it using Python

Price-to-Earnings ratio is a relative valuation tool. It is used by investors to find great companies at low prices. In this post, we will build a Python script to calculate Price Earnings Ratio for comparable companies. Photo by Skitterphoto on Pexels Price Earnings Ratio and Comparable Compa...

Oct 17, 2023 3:09 PM - Davit Kirakosyan

VMware Stock Drops 12% as China May Hold Up the Broadcom Acquisition

Shares of VMware (NYSE:VMW) witnessed a sharp drop of 12% intra-day today due to rising concerns about China's review of the company's significant sale deal to Broadcom. Consequently, Broadcom's shares also saw a dip of around 4%. Even though there aren’t any apparent problems with the proposed solu...

- Search Search Please fill out this field.

What Is Ratio Analysis?

- What Does It Tell You?

- Application

The Bottom Line

- Corporate Finance

- Financial Ratios

Financial Ratio Analysis: Definition, Types, Examples, and How to Use

:max_bytes(150000):strip_icc():format(webp)/andrew_bloomenthal_bio_photo-5bfc262ec9e77c005199a327.png)

Ratio analysis is a quantitative method of gaining insight into a company's liquidity, operational efficiency, and profitability by studying its financial statements such as the balance sheet and income statement. Ratio analysis is a cornerstone of fundamental equity analysis .

Key Takeaways

- Ratio analysis compares line-item data from a company's financial statements to reveal insights regarding profitability, liquidity, operational efficiency, and solvency.

- Ratio analysis can mark how a company is performing over time, while comparing a company to another within the same industry or sector.

- Ratio analysis may also be required by external parties that set benchmarks often tied to risk.

- While ratios offer useful insight into a company, they should be paired with other metrics, to obtain a broader picture of a company's financial health.

- Examples of ratio analysis include current ratio, gross profit margin ratio, inventory turnover ratio.

Investopedia / Theresa Chiechi

What Does Ratio Analysis Tell You?

Investors and analysts employ ratio analysis to evaluate the financial health of companies by scrutinizing past and current financial statements. Comparative data can demonstrate how a company is performing over time and can be used to estimate likely future performance. This data can also compare a company's financial standing with industry averages while measuring how a company stacks up against others within the same sector.

Investors can use ratio analysis easily, and every figure needed to calculate the ratios is found on a company's financial statements.

Ratios are comparison points for companies. They evaluate stocks within an industry. Likewise, they measure a company today against its historical numbers. In most cases, it is also important to understand the variables driving ratios as management has the flexibility to, at times, alter its strategy to make it's stock and company ratios more attractive. Generally, ratios are typically not used in isolation but rather in combination with other ratios. Having a good idea of the ratios in each of the four previously mentioned categories will give you a comprehensive view of the company from different angles and help you spot potential red flags.

A ratio is the relation between two amounts showing the number of times one value contains or is contained within the other.

Types of Ratio Analysis

The various kinds of financial ratios available may be broadly grouped into the following six silos, based on the sets of data they provide:

1. Liquidity Ratios

Liquidity ratios measure a company's ability to pay off its short-term debts as they become due, using the company's current or quick assets. Liquidity ratios include the current ratio, quick ratio, and working capital ratio.

2. Solvency Ratios

Also called financial leverage ratios, solvency ratios compare a company's debt levels with its assets, equity, and earnings, to evaluate the likelihood of a company staying afloat over the long haul, by paying off its long-term debt as well as the interest on its debt. Examples of solvency ratios include: debt-equity ratios, debt-assets ratios, and interest coverage ratios.

3. Profitability Ratios

These ratios convey how well a company can generate profits from its operations. Profit margin, return on assets, return on equity, return on capital employed, and gross margin ratios are all examples of profitability ratios .

4. Efficiency Ratios

Also called activity ratios, efficiency ratios evaluate how efficiently a company uses its assets and liabilities to generate sales and maximize profits. Key efficiency ratios include: turnover ratio, inventory turnover, and days' sales in inventory.

5. Coverage Ratios

Coverage ratios measure a company's ability to make the interest payments and other obligations associated with its debts. Examples include the times interest earned ratio and the debt-service coverage ratio .

6. Market Prospect Ratios

These are the most commonly used ratios in fundamental analysis. They include dividend yield , P/E ratio , earnings per share (EPS), and dividend payout ratio . Investors use these metrics to predict earnings and future performance.

For example, if the average P/E ratio of all companies in the S&P 500 index is 20, and the majority of companies have P/Es between 15 and 25, a stock with a P/E ratio of seven would be considered undervalued. In contrast, one with a P/E ratio of 50 would be considered overvalued. The former may trend upwards in the future, while the latter may trend downwards until each aligns with its intrinsic value.

Most ratio analysis is only used for internal decision making. Though some benchmarks are set externally (discussed below), ratio analysis is often not a required aspect of budgeting or planning.

Application of Ratio Analysis

The fundamental basis of ratio analysis is to compare multiple figures and derive a calculated value. By itself, that value may hold little to no value. Instead, ratio analysis must often be applied to a comparable to determine whether or a company's financial health is strong, weak, improving, or deteriorating.

Ratio Analysis Over Time

A company can perform ratio analysis over time to get a better understanding of the trajectory of its company. Instead of being focused on where it is today, the company is more interested n how the company has performed over time, what changes have worked, and what risks still exist looking to the future. Performing ratio analysis is a central part in forming long-term decisions and strategic planning .

To perform ratio analysis over time, a company selects a single financial ratio, then calculates that ratio on a fixed cadence (i.e. calculating its quick ratio every month). Be mindful of seasonality and how temporarily fluctuations in account balances may impact month-over-month ratio calculations. Then, a company analyzes how the ratio has changed over time (whether it is improving, the rate at which it is changing, and whether the company wanted the ratio to change over time).

Ratio Analysis Across Companies

Imagine a company with a 10% gross profit margin. A company may be thrilled with this financial ratio until it learns that every competitor is achieving a gross profit margin of 25%. Ratio analysis is incredibly useful for a company to better stand how its performance compares to similar companies.

To correctly implement ratio analysis to compare different companies, consider only analyzing similar companies within the same industry . In addition, be mindful how different capital structures and company sizes may impact a company's ability to be efficient. In addition, consider how companies with varying product lines (i.e. some technology companies may offer products as well as services, two different product lines with varying impacts to ratio analysis).

Different industries simply have different ratio expectations. A debt-equity ratio that might be normal for a utility company that can obtain low-cost debt might be deemed unsustainably high for a technology company that relies more heavily on private investor funding.

Ratio Analysis Against Benchmarks

Companies may set internal targets for their financial ratios. These calculations may hold current levels steady or strive for operational growth. For example, a company's existing current ratio may be 1.1; if the company wants to become more liquid, it may set the internal target of having a current ratio of 1.2 by the end of the fiscal year.

Benchmarks are also frequently implemented by external parties such lenders. Lending institutions often set requirements for financial health as part of covenants in loan documents. Covenants form part of the loan's terms and conditions and companies must maintain certain metrics or the loan may be recalled.

If these benchmarks are not met, an entire loan may be callable or a company may be faced with an adjusted higher rate of interest to compensation for this risk. An example of a benchmark set by a lender is often the debt service coverage ratio which measures a company's cash flow against it's debt balances.

Examples of Ratio Analysis in Use

Ratio analysis can predict a company's future performance — for better or worse. Successful companies generally boast solid ratios in all areas, where any sudden hint of weakness in one area may spark a significant stock sell-off. Let's look at a few simple examples

Net profit margin , often referred to simply as profit margin or the bottom line, is a ratio that investors use to compare the profitability of companies within the same sector. It's calculated by dividing a company's net income by its revenues. Instead of dissecting financial statements to compare how profitable companies are, an investor can use this ratio instead. For example, suppose company ABC and company DEF are in the same sector with profit margins of 50% and 10%, respectively. An investor can easily compare the two companies and conclude that ABC converted 50% of its revenues into profits, while DEF only converted 10%.

Using the companies from the above example, suppose ABC has a P/E ratio of 100, while DEF has a P/E ratio of 10. An average investor concludes that investors are willing to pay $100 per $1 of earnings ABC generates and only $10 per $1 of earnings DEF generates.

What Are the Types of Ratio Analysis?

Financial ratio analysis is often broken into six different types: profitability, solvency, liquidity, turnover, coverage, and market prospects ratios. Other non-financial metrics may be scattered across various departments and industries. For example, a marketing department may use a conversion click ratio to analyze customer capture.

What Are the Uses of Ratio Analysis?

Ratio analysis serves three main uses. First, ratio analysis can be performed to track changes to a company over time to better understand the trajectory of operations. Second, ratio analysis can be performed to compare results with other similar companies to see how the company is doing compared to competitors. Third, ratio analysis can be performed to strive for specific internally-set or externally-set benchmarks.

Why Is Ratio Analysis Important?

Ratio analysis is important because it may portray a more accurate representation of the state of operations for a company. Consider a company that made $1 billion of revenue last quarter. Though this seems ideal, the company might have had a negative gross profit margin, a decrease in liquidity ratio metrics, and lower earnings compared to equity than in prior periods. Static numbers on their own may not fully explain how a company is performing.

What Is an Example of Ratio Analysis?

Consider the inventory turnover ratio that measures how quickly a company converts inventory to a sale. A company can track its inventory turnover over a full calendar year to see how quickly it converted goods to cash each month. Then, a company can explore the reasons certain months lagged or why certain months exceeded expectations.

There is often an overwhelming amount of data and information useful for a company to make decisions. To make better use of their information, a company may compare several numbers together. This process called ratio analysis allows a company to gain better insights to how it is performing over time, against competition, and against internal goals. Ratio analysis is usually rooted heavily with financial metrics, though ratio analysis can be performed with non-financial data.

- Valuing a Company: Business Valuation Defined With 6 Methods 1 of 37

- What Is Valuation? 2 of 37

- Valuation Analysis: Meaning, Examples and Use Cases 3 of 37

- Financial Statements: List of Types and How to Read Them 4 of 37

- Balance Sheet: Explanation, Components, and Examples 5 of 37

- Cash Flow Statement: How to Read and Understand It 6 of 37

- 6 Basic Financial Ratios and What They Reveal 7 of 37

- 5 Must-Have Metrics for Value Investors 8 of 37

- Earnings Per Share (EPS): What It Means and How to Calculate It 9 of 37

- P/E Ratio Definition: Price-to-Earnings Ratio Formula and Examples 10 of 37

- Price-to-Book (PB) Ratio: Meaning, Formula, and Example 11 of 37

- Price/Earnings-to-Growth (PEG) Ratio: What It Is and the Formula 12 of 37

- Fundamental Analysis: Principles, Types, and How to Use It 13 of 37

- Absolute Value: Definition, Calculation Methods, Example 14 of 37

- Relative Valuation Model: Definition, Steps, and Types of Models 15 of 37

- Intrinsic Value of a Stock: What It Is and Formulas to Calculate It 16 of 37

- Intrinsic Value vs. Current Market Value: What's the Difference? 17 of 37

- The Comparables Approach to Equity Valuation 18 of 37

- The 4 Basic Elements of Stock Value 19 of 37

- How to Become Your Own Stock Analyst 20 of 37

- Due Diligence in 10 Easy Steps 21 of 37

- Determining the Value of a Preferred Stock 22 of 37

- Qualitative Analysis 23 of 37

- How to Choose the Best Stock Valuation Method 24 of 37

- Bottom-Up Investing: Definition, Example, Vs. Top-Down 25 of 37

- Financial Ratio Analysis: Definition, Types, Examples, and How to Use 26 of 37

- What Book Value Means to Investors 27 of 37

- Liquidation Value: Definition, What's Excluded, and Example 28 of 37

- Market Capitalization: What It Means for Investors 29 of 37

- Discounted Cash Flow (DCF) Explained With Formula and Examples 30 of 37

- Enterprise Value (EV) Formula and What It Means 31 of 37

- How to Use Enterprise Value to Compare Companies 32 of 37

- How to Analyze Corporate Profit Margins 33 of 37

- Return on Equity (ROE) Calculation and What It Means 34 of 37

- Decoding DuPont Analysis 35 of 37

- How to Value Private Companies 36 of 37

- Valuing Startup Ventures 37 of 37

:max_bytes(150000):strip_icc():format(webp)/investing20-5bfc2b8f46e0fb00517be081.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Revolutionizing Digital Communication: The Power of Olly and AI

- AI-Powered Video Editing with Snapy.ai: The Future of Content Creation is Here

- Dawn of AI-Powered Video Editing: Transform Your Videos with Silence Remover Online

- The Dawn of Generative AI: Why and How to Adopt it for your Business

- Harnessing the Power of Generative AI for Business Innovation: An Exclusive Consultancy Approach

Original content with a single minded focus on value addition.

Financial Ratios Analysis with a live example

Financial statements give us an idea about a company’s performance and health but more often than not, investors, creditors, analysts, and competitors wish to know where the company stands in the industry, as compared to its competitors. The analysis of the company’s performance in isolation is misleading, therefore, financial ratios analysis is used to compare a company’s performance with that of its competitors.

This brings us to an important question: What are financial ratios? Well, they are simply ratios of line items found in the financial statement that give an idea about a company’s profitability, leverage, liquidity, and market value. For example, the Debt-to-Equity ratio is used to analyze the extent of leverage the company has.

But before we get into the details, let’s first see how the ratios are grouped. The following chart depicts the grouping of financial ratios in five categories.

Each of these ratios tells about a particular characteristic of the company. Let’s understand each group one by one now.

Profitability Ratios:

These ratios indicate a company’s ability to generate profit relative to its sales, assets and equity capital. They are extremely helpful when comparing the profitability of businesses of different sizes because the profitability of a medium enterprise cannot be compared with that of a large business in value terms. Let’s take a look at them, now.

- Gross Profit Margin: It is the ratio of a company’s gross profit to net sales. Gross profit is obtained after subtracting cost of goods sold (COGS) from net sales.

Gross Profit Margin = (Net Sales – COGS) / Net Sales

COGS is the cost related directly to the manufacturing of a product, such as raw materials cost and workers’ wages. Selling and distribution cost, office and administration cost, employees’ salaries, etc are not included in the calculation of COGS. Therefore, gross profit margin tells us about how efficiently is COGS managed.

- Operating Profit Margin: It is an indicator of how efficiently a company’s operations are being run and is the ratio of operating profit (EBITDA) and net sales.

Operating Profit Margin = Operating Profit (EBITDA) / Net Sales

EBITDA stands for Earnings before Interest, Tax, Depreciation, and Amortization. It is obtained after subtracting all the indirect costs such as selling and distribution cost, office and administration cost, and employees’ salaries from the gross profit. A high operating profit margin indicates high operating efficiency.

- Net Profit Margin: It is the ratio of a company’s net profit to net sales. It is also known as PAT (Profit After Tax) margin.

Net Profit Margin = Net Profit (PAT) / Net Sales

- Return on Assets (ROA): It is a measure of a company’s ability to utilize its assets efficiently and is the ratio of net profit to total assets.

ROA = Net Profit (PAT) / Total Assets

A high value of ROA indicates that a company is able to utilize its assets to generate profit efficiently.

- Return on Equity (ROE): It is ratio of net profit to shareholders’ equity. This number is crucial for equity investors as it measures the profit it can generate from the equity investments made.

ROE = Net Profit (PAT) / Shareholders’ Equity

Liquidity Ratios

These ratios give us an idea about a company’s ability to repay its short-term liabilities. Short-term or current liabilities are liabilities that have to be repaid within one year. Some of the important liquidity ratios are:

- Current ratio: It is the ratio of current assets of a company to its current liabilities. It is the measure of a company’s ability to repay all its short-term liabilities by liquidating current assets. Receivables, cash and cash equivalents, and inventory are considered current assets. If the value of current assets is higher than that of current liabilities, then the company is in a better position to repay its current liabilities.

Current Ratio = Current Assets/Current Liabilities

Although, a current ratio greater than 1 is considered good, too high a value may also indicate an inefficient working capital cycle. Let’s take an example. Consider the following for a company ABC Ltd:

In this case,

Current ratio = 6000/1500 = 4

It may look like a very good current ratio, but let’s take a look at the working capital before jumping onto conclusions.

Working Capital = Account Receivables + Inventory – Account = 4000

A negative working capital is considered good, but in this case, it comes out to be $4000, which is positive and quite high. This means that the company will need to borrow some amount to keep the working capital cycle running, which will further increase the company’s current liabilities.

- Quick ratio or Acid-test ratio: For some businesses, current ratio may not be relevant if their inventories are illiquid, as is in the case of the real estate sector. Therefore, another ratio called the quick-ratio is used in such as case. It is given by the following formula:

Quick Ratio = (Current Assets – Inventories) / Current Liabilities

By leaving out inventories in the calculation, an accurate picture about a firm’s ability to repay its short-term liabilities can be obtained. An ideal quick ratio is 1.

Leverage Ratios

To understand leverage ratios in the financial context, let’s understand leverage in literal terms. Leverage basically is deriving maximum benefit by using minimum resources. In the context of a business, the benefit is net profit and the resource is capital. We know that capital is of two types i.e. equity and debt capital. In concordance with the principal of higher risk, higher return, the cost of equity capital is higher than the cost of debt, as equity shareholders take a greater risk by not expecting repayment of their capital or consistent payment of dividends. Therefore, businesses are leveraged using debt for two reasons:

- The cost of debt i.e. the interest paid on it is lower as compared to dividends paid on equity shares

- Interest paid on debt is recorded as an expense in the profit and loss statement and is tax deductible

Due to these reasons, businesses are attracted towards debt as a source of capital. Now, let’s look at some of the leverage ratios.

- Debt-to-Equity Ratio: As the name suggests, it is the ratio of total debt or liabilities to shareholders’ equity.

Debt-to-Equity Ratio (DE) = Total Liabilities / Shareholders’ Equity

According to the argument made above, one would say that a very high DE ratio is advisable. However, high debt implies high risk of default. If the company fails to pay the interest and principal amount regularly, we might see the business in the bankruptcy court. On the contrary, a DE ratio lower than 1, shows that the company is really leveraging its potential to carry debt. This also brings us to a crucial point, which is that there is no ideal DE ratio. It varies with the industry in which a certain business works. A capital-intensive industry such as the steel industry will have a higher DE ratio as compared to that of the IT industry.

- Interest Coverage Ratio (ICR): This ratio indicates how effectively a business is able to meet its interest expenses.

Interest Coverage Ratio = Operating Profit (EBIT) / Interest Expenses

Generally, a high ICR is recommended as it shows that the business is able to repay its interest obligation easily, which is something a bank would be looking at.

- Debt Service Coverage Ratio (DSCR): It is the measure of a business’ ability to meet its debt obligations. Debt obligations include both interest and principal amount.

DSCR = Operating profit (EBITDA) / (Interest + Principal amount)

A business that has debt, has to pay not only interest but also the principal amount. Therefore, a high DSCR shows that a company can meet its debt obligations easily.

Turnover Ratios

These ratios give us an idea about the efficiency or effectiveness of a company’s management in managing its working capital cycle and utilizing its assets. Businesses often work on credit i.e. ‘Udhaar’. The business buys raw material from the suppliers on credit and in turn sell the final product to customers on credit but always, not all of the final products are sold. Some lie in the company’s warehouse till they are sold.

Therefore, the cash spent by the company on the manufacturing of the final product remains locked in the inventory and receivables from the customer. At the same time, the company has to pay cash to the raw material suppliers within the credit period. This entire cycle of converting the inventory, receivables and payables to suppliers in cash is called the working capital cycle.

Now, let’s take a look at these ratios.

- Inventory Turnover Ratio (ITR): This ratio is a measure of number of times a company is able sell its inventory in a specified period.

ITR = Cost of Goods Sold (COGS) / Average Inventory

Think of it this way: Final products worth $1000 arrive into the company’s warehouse. After some days, all of it is sold and a new batch of final products of the same amount arrives. The inventory turnover ratio basically tells us how many times the company repeats this process in a specified time period. A high ITR indicates that the inventory is being sold immediately and vice versa. A very high ITR is not always good because if there is an unusual spike in demand, the company will not be able to supply products to its customers and it may lose some of them.

- Receivables Turnover Ratio: It is the measure of the number of times a company is able to turn receivables into cash in a specified time period, which in simpler terms means how many times is the company able to ‘Vasool’ its ‘Udhaar’ from its debtors (read customers).

RTR = Credit Sales / Average Account Receivable

A high RTR indicates that a business is able to turn its receivables into cash frequently but it could also lead to losses, as customers may prefer to go to a competitor simply because it offers a longer credit period.

- Payables Turnover Ratio (PTR): It is the measure of the number of times a company is able to pay its payables in a specified time period i.e. how many times is the company able to pay its ‘Udhaar’ to its suppliers.

PTR = Credit Purchases / Average Accounts Payable

A low PTR indicates that the business is paying the suppliers less frequently, which gives the business sufficient time to convert inventory and receivables in to cash and pay the suppliers using the same cash. However, too long a credit period will affect the suppliers’ businesses and they may start supplying to a competitor.

- Fixed Asset Turnover Ratio (FATR): It is the measure of a business’ ability to utilize its fixed assets to generate revenues.

FATR = Net Revenue / Total Fixed Assets

A high FATR indicates that the company is able to generate large revenues from its fixed assets. It shows how efficiently the company is utilizing its fixed assets. A low FATR usually is characteristic of a capital-intensive business.

Market Value Ratios

These ratios are used to understand if the market price of a share is overvalued or undervalued relative to the underlying fundamentals of the company. Investors also compare companies within the same sector using these ratios. Therefore, they are also known as relative valuation ratios. Stock market investors keenly observe these ratios to find a stock that is undervalued. Now, let’s take a look at some of these ratios.

- Price-to-Earnings Ratio (PE): It is the ratio of current market price of a company’s share and its earnings per share (EPS). You might be wondering what EPS is, right? But don’t worry, it’s not at all complicated. It is the ratio of the net profit of the company to its total number of shares.

EPS = Net Profit (PAT) / Total No of Shares Outstanding

Once, we have the value of EPS, we can easily calculate the PE ratio for a company.

PE Ratio = Current Share Price / Earnings per Share (EPS)

Theoretically, a stock that has a PE ratio greater than 1 is considered overvalued and vice-versa but for all practical purposes PE ratio is used while comparing between competitors to see if the PE ratio of one company is overvalued or undervalued relative to its peers’ PE ratio.

- Price-to-Book Ratio (PB): It is the ratio of current market price of a share to the book value per share of a company. Book value is the amount that remains after all its assets are liquidated and its debt obligations are paid off.

Book Value per Share = (Total Assets – Total Liabilities) / Total No of Shares Outstanding

Book value per share is calculated using the above formula, following which the PB ratio can be easily calculated.

PB Ratio = Current Share Price / Book Value per Share

It is used in a similar way as the PE ratio is used by investors to compare multiple businesses, however, PB ratio is helpful only in capital-intensive businesses. In comparing service sector businesses, due to their low asset value, this ratio becomes irrelevant.

This piece has been penned down by Shivam Ghule , Finance Tolkien of CaseReads. If you want to understand the calculations of the above ratios, we have added a live example of a company. To access the file, click below:

We’ve uploaded 10+ MBA starter concepts to kick-start your MBA journey, directly click here .

Before you go, if you liked this piece, and if you have a friend starting their MBA; why not be a good friend and share this with them on WhatsApp ?

- Breaking down The Marketing Funnel – with examples

- Understanding the PESTLE Analysis with examples

You May Also Like

The 101 of Personal Branding

Understanding Gamification in Marketing with examples

What is Behavioral Economics? ft. Common Consumer Behaviour

2 thoughts on “ financial ratios analysis with a live example ”.

Pingback: AGR Dues Explained: A 17-year-old Bleeding Wound

Pingback: What Is ESG Investing? The Tri-cycle Of Businesses

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Brought to you by:

The Game of Financial Ratios

By: Pooja Gupta, Madhvi Sethi, Darroch A. Robertson

This exercise revolves around the rivalry between two financial analysts. Upset by their constant game of one-upmanship, an advisor to the governor of the Reserve Bank of India came up with a…

- Length: 3 page(s)

- Publication Date: Jan 16, 2017

- Discipline: Accounting

- Product #: W17015-PDF-ENG

What's included:

- Teaching Note

- Educator Copy

$4.95 per student

degree granting course

$8.95 per student

non-degree granting course

Get access to this material, plus much more with a free Educator Account:

- Access to world-famous HBS cases

- Up to 60% off materials for your students

- Resources for teaching online

- Tips and reviews from other Educators

Already registered? Sign in

- Student Registration

- Non-Academic Registration

- Included Materials

This exercise revolves around the rivalry between two financial analysts. Upset by their constant game of one-upmanship, an advisor to the governor of the Reserve Bank of India came up with a challenge for them to prove who was better. He provided them with financial data for the financial year ending March 2014 from 10 anonymous companies and asked them to match the financial data with specific industries given in a list. The challenge was timed, and the winner was to be determined on the basis of who could come up with the right combination first.

Pooja Gupta and Madhvi Sethi are affiliated with Symbiosis Institute of Business Management Bengaluru, Symbiosis International (Deemed University), Pune, India. Darroch A. Robertson is affiliated with Richard Ivey School of Business.

Learning Objectives

The case can be taught in a financial accounting or financial management course of an MBA program. It provides students with an exercise in which, with the help of ratio analysis, they identify the industries to which companies belong. It helps students identify unique patterns of operations and asset structures in different industries. After working through the case and the assignment question, students will be able to: understand and interpret financial data from different publicly listed firms in India; infer operating cycles and cash cycles of specific industries in India using information about business operations of different industries; and use financial ratios and pattern analysis to identify industries in India.

Jan 16, 2017

Discipline:

Geographies:

Ivey Publishing

W17015-PDF-ENG

We use cookies to understand how you use our site and to improve your experience, including personalizing content. Learn More . By continuing to use our site, you accept our use of cookies and revised Privacy Policy .

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Financial analysis

- Finance and investing

- Corporate finance

Strategic Analysis for More Profitable Acquisitions

- Alfred Rappaport

- From the July 1979 Issue

Do You Know Your Cost of Capital?

- Michael T. Jacobs

- Anil Shivdasani

- From the July–August 2012 Issue

Pitfalls in Evaluating Risky Projects

- James E. Hodder

- Henry E. Riggs

- From the January 1985 Issue

Get More Funding for Your R&D Initiatives

- Christoph Loch

- October 30, 2023

Today’s Options for Tomorrow’s Growth

- W. Carl Kester

- From the March 1984 Issue

What’s It Worth?: A General Manager’s Guide to Valuation

- Timothy A. Luehrman

- From the May–June 1997 Issue

How Much Should a Corporation Earn?

- John J. Scanlon

- From the January 1967 Issue

CEOs Don’t Care Enough About Capital Allocation

- José Antonio Marco-Izquierdo

- April 16, 2015

3 Strategies to Reduce Bias in Leadership Assessments

- Niels Van Quaquebeke

- Hannes Leroy

- May 24, 2021

Power Sharing Can Change Corporations for the Better

- Julie Battilana

- Tiziana Casciaro

- May 13, 2021

The Best-Performing CEOs in the World 2017

- Harvard Business Review

- From the November–December 2017 Issue

Using APV: A Better Tool for Valuing Operations

The Balanced Scorecard: Measures That Drive Performance

- Robert S. Kaplan

- David P. Norton

- From the July–August 2005 Issue

Are You Paying Too Much for That Acquisition?

- Robert G. Eccles

- Kersten L. Lanes

- Thomas C. Wilson

- From the July–August 1999 Issue

Putting the Service-Profit Chain to Work

- James L. Heskett

- Thomas O. Jones

- Gary W. Loveman

- W. Earl Sasser, Jr.

- Leonard A. Schlesinger

- From the March–April 1994 Issue

M&A Needn’t Be a Loser’s Game

- Larry Selden

- Geoffrey Colvin

- From the June 2003 Issue

How to Talk to Your CFO About Sustainability

- Tensie Whelan

- Elyse Douglas

- From the January–February 2021 Issue

“Showcase Projects” Can Deepen Your Relationships with Profitable Customers

- Jonathan Byrnes

- October 05, 2021

Does the Market Know Your Company’s Real Worth?

- James McNeill Stancill

- From the September 1982 Issue

It May Be Cheaper to Manufacture at Home

- Suzanne de Treville

- Lenos Trigeorgis

- From the October 2010 Issue

Edmonton Opera's Balanced Scorecard: The Art of Performance

- Natasha Khinkanina

- March 16, 2023

Conflicts of Interest at Uptown Bank

- Jonas Heese

- April 14, 2022

Financial Analytics Toolkit: Cash Flow Projections

- Marc Lipson

- September 24, 2019

Costco Wholesale Corp. Financial Statement Analysis (B)

- Maureen McNichols

- Brian Tayan

- June 19, 2003

Quality of Earnings Analysis

- David F. Hawkins

- November 15, 1993

Business Analysis and Valuation Model

- Krishna G. Palepu

- Jonathan Barnett

- Paul M. Healy

- September 01, 2004

The Financial Detective, 2016

- Kenneth Eades

- Jenelle Sirleaf

- October 12, 2016

Cash vs. Accruals: The Case of Revenue Recognition at Cantaloupe Systems

- Robert Siegel

- June 23, 2021

Quintiles IPO

- David P. Stowell

- Vishwas Setia

- November 19, 2014

Manufactured Homes, Inc.

- December 06, 1989

Vet Center: Investment Appraisal

- Ahmad Rahnema

- Juan Carlos Vazquez-Dodero de Bonifaz

- July 15, 1996

Expect the Unexpected: Risk Measurement and Management in Commercial Real Estate

- Craig Furfine

- August 28, 2017

Spreadsheet Modeling: Excel 2013: A Self-Paced Learning Program

- Wayne Winston

- Sarah Fairchild Sherry

- March 21, 2014

Murray Ohio Manufacturing Co.

- May 04, 1987

Deep Sight Technology, Inc.

- Henry B. Reiling

- Catherine Conneely

- February 23, 2000

Performance Goals at Tractors, Inc.

- Mark E. Haskins

- September 25, 2020

Financial Policy at Apple, 2013 (A)

- Mihir A. Desai

- Elizabeth A. Meyer

- June 19, 2014

Liquid Gold: Calambra Olive Oil (A)

- Phillip E. Pfeifer

- Dana Clyman

- Laura Kornish

- January 31, 2002

Upjohn Co.: The Upjohn - Pharmacia Merger

- Amy P. Hutton

- October 21, 1996

Becton Dickinson: Designing the New Strategic, Operational, and Financial Planning Process

- Robert Simons

- Antonio Davila

- Afroze Mohammed

- July 12, 1996

Edmonton Opera's Balanced Scorecard: The Art of Performance, Teaching Note

Big game: goldman sachs' elephant hunt in libya, teaching note: session 1 - options basics.

- Denis Gromb

- Joel Peress

- September 24, 2018

How Finance Works: The HBR Guide to Thinking Smart about the Numbers, 1. Financial Analysis, PowerPoint

- April 22, 2019

Popular Topics

Partner center.

Accounting For Managers - Ratio Analysis

Ratio analysis - case study and summary.

Summary Financial statements by themselves do not give the required information both for internal management and for outsiders. They must be analysed and interpreted to get meaningful information about the various aspects of the concern. Analysing financial statements is a process of evaluating the relationship between the component parts of the financial statements to obtain a proper understanding of a firm’s performance. Financial analysis may be external or internal analysis or horizontal or vertical analysis. Financial analysis can be carried out through a number of tools like ratio analysis, funds flow analysis, cash flow analysis etc. Among the various tools available for their analysis, ratio analysis is the most popularly used tool. The main purpose of ratio analysis is to measure past performance and project future trends. It is also used for inter-firm and intra-firm comparison as a measure of comparative productivity. The financial analyst x-rays the financial conditions of a concern by the use of various ratios and if the conditions are not found to be favourable, suitable steps can be taken to overcome the limitations.

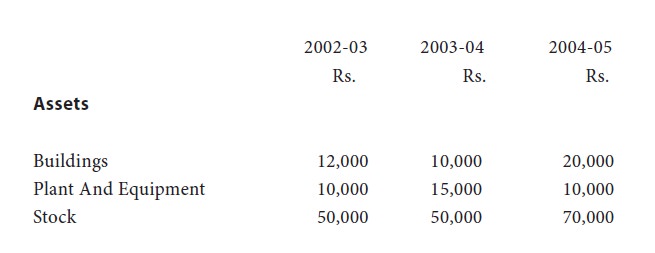

The following figures are extracted from the balance sheets of a Company:

The opening stock at the beginning of the year 2002-03 was rs.4,000. As a financial analyst comment on the comparative short-term, activity, solvency, profitability and financial position of the company during the three year period.

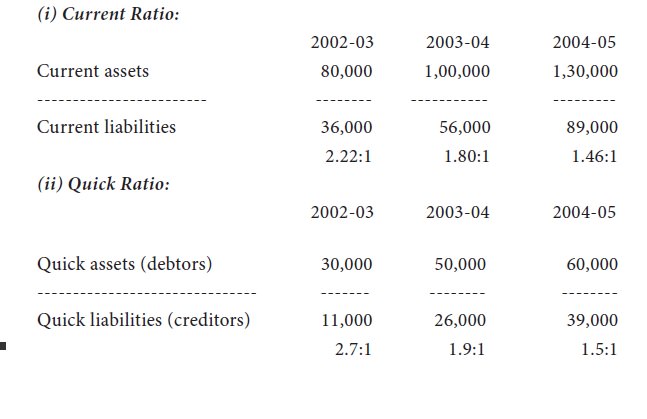

To test the short-term solvency the following ratios are calculated for three years:

I. Current ratio and

Ii. Quick ratio

As the standard for current ratio is 2:1 the working capital position of the company has weakened in the 2nd year and 3rd year. However the quick ratio for all the three years is well above the standard of 1:1. Thus it can be said that the short term solvency position of the company shows a mixed trend.

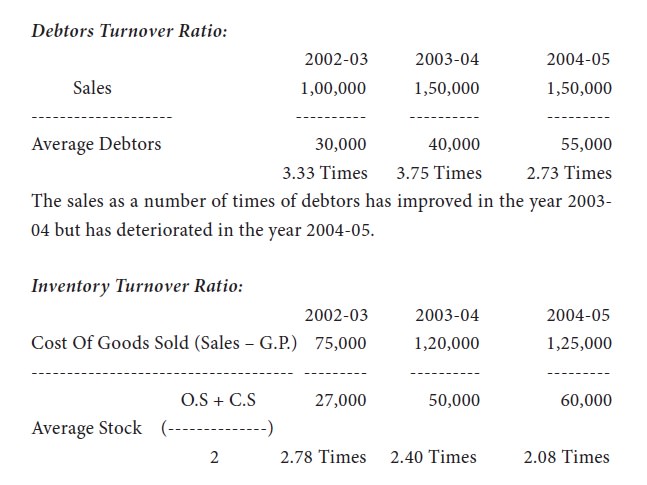

Activity Ratios:

To test the operational efficiency of the company the following ratios are calculated. Debtors turnover ratio and inventory turnover ratio.

Though there is no standard for inventory turnover ratio, higher the ratio, better is the activity level of the concern. From this angle the ratio has come down gradually during the three year period indicating slow moving of stock.

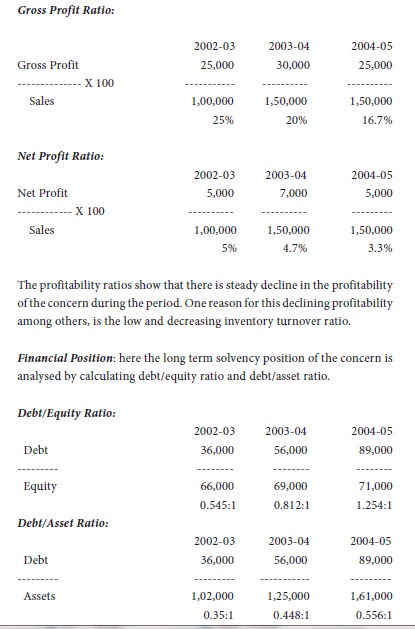

Profitability Ratios:

To analyse the profitability position of the company, gross profit ratio and net profit ratio are calculated.

Debt equity ratio expresses the existence of debt for every re.1 of equity. From this standpoint the share of debt in comparison to equity is increasing year after year and in the last year the debt is even more than equity. Debt asset ratio gives how much of assets have been acquired using debt funds. The calculation of this ratio reveals that in the 1st year 35% of assets were purchased using debt funds which has increased to 44.8% in the 2nd year and 55.6% in the 3rd year. Thus both the ratios reveal that the debt component in the capital structure is increasing which has far reaching consequences.

OTHER SUGEST TOPIC

IMAGES

VIDEO

COMMENTS

Financial Ratio Analysis Tutorial With Examples. Some of the most important financial ratios for business owners include the current ratio, the inventory turnover ratio, and the debt-to-asset ratio. These financial ratios quickly break down the complex information from financial statements. Financial ratios are snapshots, so it's important to ...

Ratio analysis case studies provide actionable insights and practical applications for businesses and investors. Learning from these real-life examples empowers stakeholders to make informed decisions based on a thorough understanding of financial ratios. Introduction: Ratio analysis is a powerful tool in financial analysis, providing insights ...

Table of contents. Financial Analysis Examples. Top 4 Financial Statement Analysis Examples. Example #1 - Liquidity Ratios. Current Ratio. Quick Ratio. Example #2 - Profitability Ratios. Operating Profitability Ratio. Net Profit Ratio.

This chapter presents four case studies which provide examples of financial information upon which liquidity, leverage, profitability, and causal calculations may be performed. The first two case studies also contain example ratio summary and analysis. Two discussion cases are also provided, followed by questions related to the financial ...

Ratio Analysis: A ratio analysis is a quantitative analysis of information contained in a company's financial statements. Ratio analysis is used to evaluate various aspects of a company's ...

Nestle Company has reported fluctuations in its cash ratio structure over the 4 years. In 2016, it had a be tter position as compared to the other three years. A higher value implies the. company ...

Financial ratio analysis is an important topic and is covered in all mainstream corporate finance textbooks. It is also a popular agenda item in investment club meetings. It is widely used to summarize the information in a company's financial statements in assessing its financial health. In today's information technology world, real time ...

Financial Statements Examples - Amazon Case Study. An in-depth look at Amazon's financial statements. Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets.

It may look like a very good current ratio, but let's take a look at the working capital before jumping onto conclusions. Working Capital = Account Receivables + Inventory - Account = 4000. A negative working capital is considered good, but in this case, it comes out to be $4000, which is positive and quite high.

In this free guide, we will break down the most important types and techniques of financial statement analysis. This guide is designed to be useful for both beginners and advanced finance professionals, with the main topics covering: (1) the income statement, (2) the balance sheet, (3) the cash flow statement, and (4) rates of return. 1.

contract with the student when the customer orders a beer and the bartender says. it will cost $5. Step 2: Identify the performance obligations in the contract: The performance. obligation in the contract is for the bartender to give the student a beer. Step 3: Determine the contract price: The contract price is $5.

Analysis of Financial Statements Using Ratios Henry J. Quesada, Associate Professor and Extension Specialist, Sustainable Biomaterials ... Current assets are related to the liquidity (ability to convert to cash) of the company. Some examples are cash, marketable securities (government bonds, common stock, or certificates of deposit), short-term ...

Abstract. This case study, "Liquidity Analysis of Sherwin-Williams Company," is about a top-ranked paint company around the globe. The analysis is based on data extracted from the company's annual ...

Thanks for watching this video. If you wish to learn more on this topic, check this comprehensive course Financial Management A Complete Study https://bit.ly...

This case study, "Liquidity Analysis of Sherwin-Williams Company," is about a top-ranked paint company around the globe. The analysis is based on data extracted from the company's annual report ...

The case can be taught in a financial accounting or financial management course of an MBA program. It provides students with an exercise in which, with the help of ratio analysis, they identify the industries to which companies belong. It helps students identify unique patterns of operations and asset structures in different industries.

Leverage Ratios in Financial Analysis. ... This case is meant to accompany Financial Policy at Apple, 2013 (A) and details the results of Apple's Q2 2013 earnings call. ... Finance & Accounting ...

In today's lesson, we're going to look at our case study company in performing financial analysis, exploring examples of performing vertical analysis, horizontal analysis, and ratio analysis. 2. Case Study: Vertical Analysis. The first piece of analysis we're going to perform is vertical analysis, starting with Legacy Clothing's income ...

Ratio Target 2003 2002 2001 Current Ratio 2 1 1 2. Although Caltron was able to improve operations and increase sales, by the installations of new equipment. However, it was unable to generate sufficient current asset to cover accounts payables, Line of credits and current portion of long term debt outstanding.

FINANCIAL RATIO ANALYSIS : CASE STUDIES 25 4.1 RATIO ANALYSIS 25 4.1.1 ACC Ltd. 25 4.1.1.1 Ratio Analysis for 2009 27 4.1.1.2 Ratio Analysis for 2008 30 4.1.1.3 Ratio Analysis for 2007 33 4.1.1.4 Summary for Balance Sheet and Profit & Loss Statement 36 4.1.2 Jindal Steel & Power Limited 37

Tel: (0)9432953985. 269. Financial Performance Analysis-A Case Study. 1 Amalendu Bhunia, 2 Sri Somnath Mukhuti and 2 Sri Gautam Roy. 1 Fakir Chand College Under University of Calcutta, Diamond ...

The main purpose of ratio analysis is to measure past performance and project future trends. It is also used for inter-firm and intra-firm comparison as a measure of comparative productivity. The financial analyst x-rays the financial conditions of a concern by the use of various ratios and if the conditions are not found to be favourable ...

Ratio analysis can reveal important relationships and be the basis of comparison in finding conditions and trends that are difficult to detect to study each component in the form of ratios. 4. Cash flow analysis (cash flow analysis), mainly used as a tool to evaluate the source and use of funds. 5.