Call Us (877) 968-7147

Most popular blog categories

- Payroll Tips

- Accounting Tips

- Accountant Professional Tips

How to Craft the Financial Section of Business Plan (Hint: It’s All About the Numbers)

Writing a small business plan takes time and effort … especially when you have to dive into the numbers for the financial section. But, working on the financial section of business plan could lead to a big payoff for your business.

Read on to learn what is the financial section of a business plan, why it matters, and how to write one for your company.

What is the financial section of business plan?

Generally, the financial section is one of the last sections in a business plan. It describes a business’s historical financial state (if applicable) and future financial projections. Businesses include supporting documents such as budgets and financial statements, as well as funding requests in this section of the plan.

The financial part of the business plan introduces numbers. It comes after the executive summary, company description , market analysis, organization structure, product information, and marketing and sales strategies.

Businesses that are trying to get financing from lenders or investors use the financial section to make their case. This section also acts as a financial roadmap so you can budget for your business’s future income and expenses.

Why it matters

The financial section of the business plan is critical for moving beyond wordy aspirations and into hard data and the wonderful world of numbers.

Through the financial section, you can:

- Forecast your business’s future finances

- Budget for expenses (e.g., startup costs)

- Get financing from lenders or investors

- Grow your business

- Growth : 64% of businesses with a business plan were able to grow their business, compared to 43% of businesses without a business plan.

- Financing : 36% of businesses with a business plan secured a loan, compared to 18% of businesses without a plan.

So, if you want to possibly double your chances of securing a business loan, consider putting in a little time and effort into your business plan’s financial section.

Writing your financial section

To write the financial section, you first need to gather some information. Keep in mind that the information you gather depends on whether you have historical financial information or if you’re a brand-new startup.

Your financial section should detail:

- Business expenses

Financial projections

Financial statements, break-even point, funding requests, exit strategy, business expenses.

Whether you’ve been in business for one day or 10 years, you have expenses. These expenses might simply be startup costs for new businesses or fixed and variable costs for veteran businesses.

Take a look at some common business expenses you may need to include in the financial section of business plan:

- Licenses and permits

- Cost of goods sold

- Rent or mortgage payments

- Payroll costs (e.g., salaries and taxes)

- Utilities

- Equipment

- Supplies

- Advertising

Write down each type of expense and amount you currently have as well as expenses you predict you’ll have. Use a consistent time period (e.g., monthly costs).

Indicate which expenses are fixed (unchanging month-to-month) and which are variable (subject to changes).

How much do you anticipate earning from sales each month?

If you operate an existing business, you can look at previous monthly revenue to make an educated estimate. Take factors into consideration, like seasonality and economic ups and downs, when basing projections on previous cash flow.

Coming up with your financial projections may be a bit trickier if you are a startup. After all, you have nothing to go off of. Come up with a reasonable monthly goal based on things like your industry, competitors, and the market. Hint : Look at your market analysis section of the business plan for guidance.

A financial statement details your business’s finances. The three main types of financial statements are income statements, cash flow statements, and balance sheets.

Income statements summarize your business’s income and expenses during a period of time (e.g., a month). This document shows whether your business had a net profit or loss during that time period.

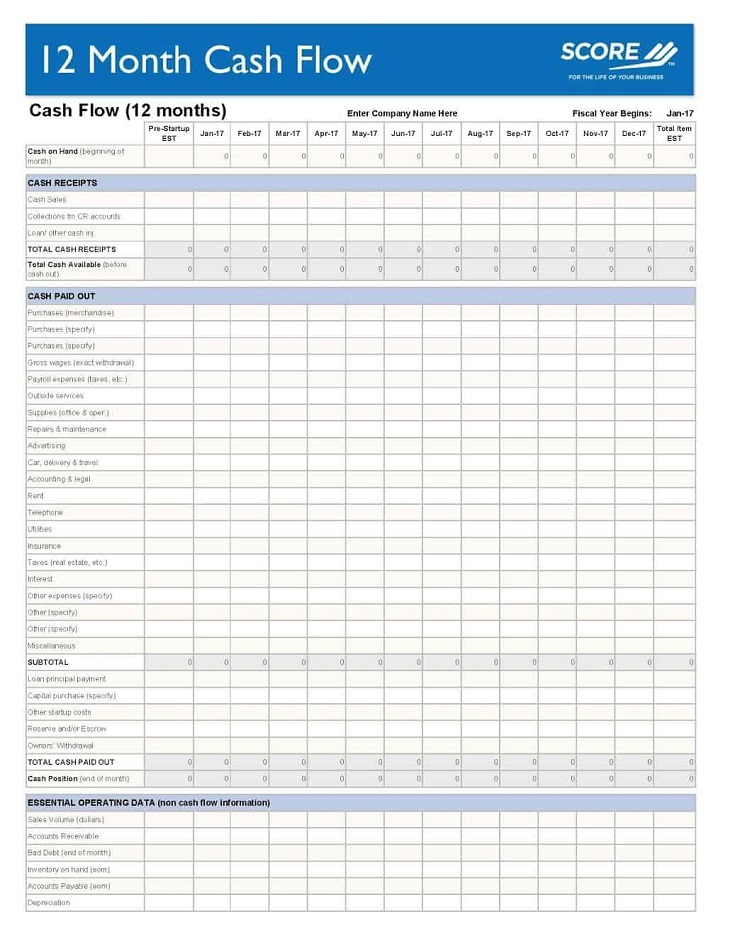

Cash flow statements break down your business’s incoming and outgoing money. This document details whether your company has enough cash on hand to cover expenses.

The balance sheet summarizes your business’s assets, liabilities, and equity. Balance sheets help with debt management and business growth decisions.

If you run a startup, you can create “pro forma financial statements,” which are statements based on projections.

If you’ve been in business for a bit, you should have financial statements in your records. You can include these in your business plan. And, include forecasted financial statements.

You’re just in luck. Check out our FREE guide, Use Financial Statements to Assess the Health of Your Business , to learn more about the different types of financial statements for your business.

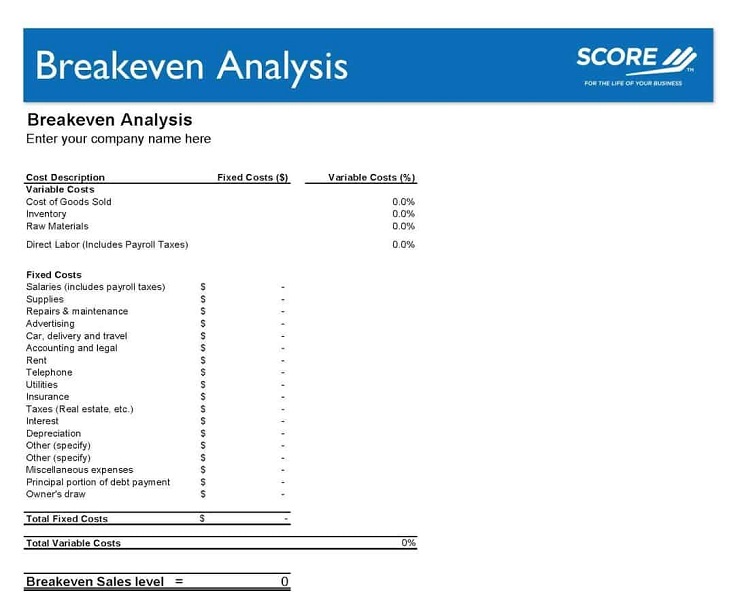

Potential investors want to know when your business will reach its break-even point. The break-even point is when your business’s sales equal its expenses.

Estimate when your company will reach its break-even point and detail it in the financial section of business plan.

If you’re looking for financing, detail your funding request here. Include how much you are looking for, list ideal terms (e.g., 10-year loan or 15% equity), and how long your request will cover.

Remember to discuss why you are requesting money and what you plan on using the money for (e.g., equipment).

Back up your funding request by emphasizing your financial projections.

Last but not least, your financial section should also discuss your business’s exit strategy. An exit strategy is a plan that outlines what you’ll do if you need to sell or close your business, retire, etc.

Investors and lenders want to know how their investment or loan is protected if your business doesn’t make it. The exit strategy does just that. It explains how your business will make ends meet even if it doesn’t make it.

When you’re working on the financial section of business plan, take advantage of your accounting records to make things easier on yourself. For organized books, try Patriot’s online accounting software . Get your free trial now!

Stay up to date on the latest accounting tips and training

You may also be interested in:

Need help with accounting? Easy peasy.

Business owners love Patriot’s accounting software.

But don’t just take our word…

Explore the Demo! Start My Free Trial

Relax—run payroll in just 3 easy steps!

Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial.

Relax—pay employees in just 3 steps with Patriot Payroll!

Business owners love Patriot’s award-winning payroll software.

Watch Video Demo!

Watch Video Demo

- 400+ Sample Business Plans

- WHY UPMETRICS?

Customer Success Stories

Business Plan Course

Strategic Planning Templates

E-books, Guides & More

Entrepreneurs & Small Business

Accelerators & Incubators

Business Consultants & Advisors

Educators & Business Schools

Students & Scholars

AI Business Plan Generator

Financial Forecasting

AI Assistance

Ai Pitch Deck Generator

Strategic Planning

See How Upmetrics Works →

- Sample Plans

Small Business Tools

How to Prepare a Financial Plan for Startup Business (w/ example)

Free Financial Statements Template

Ajay Jagtap

- December 7, 2023

13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

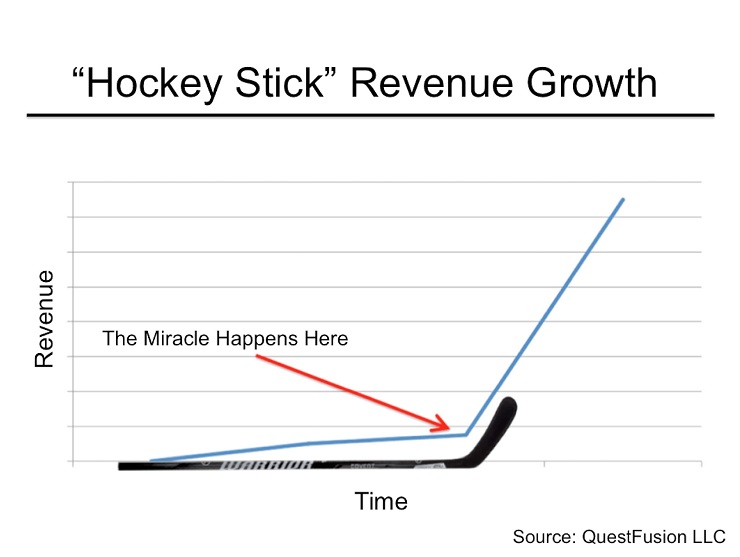

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

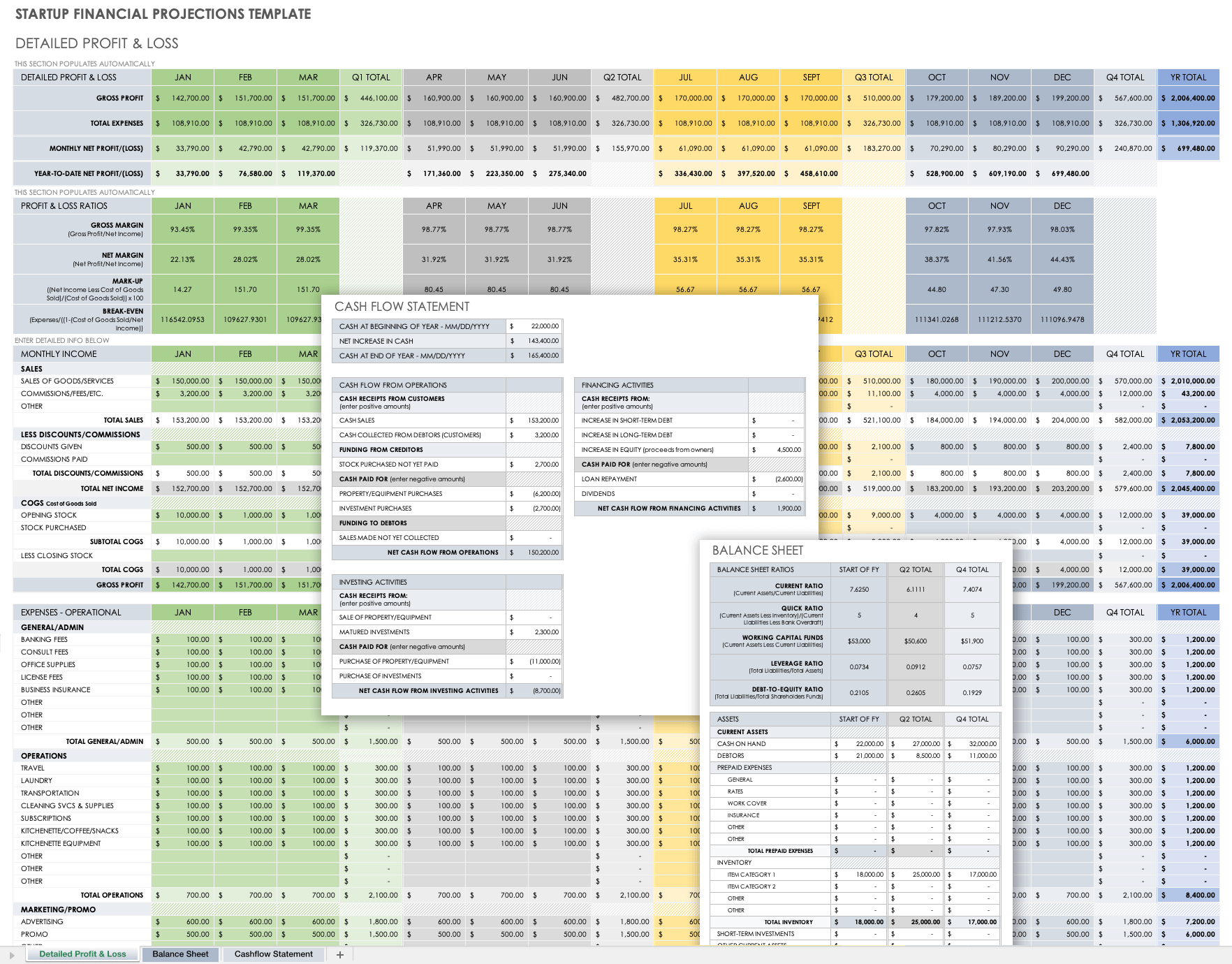

Income Statement

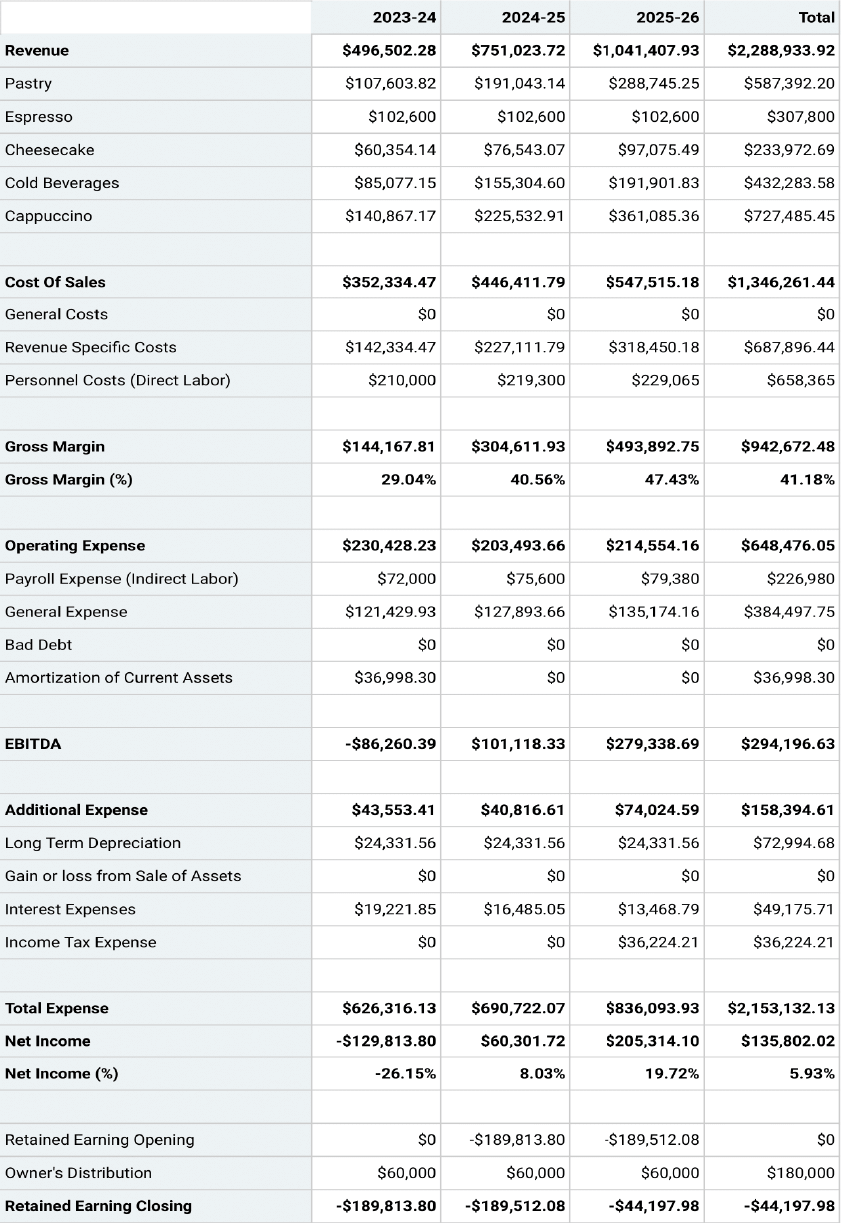

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

Balance Sheet

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

Break-even Analysis

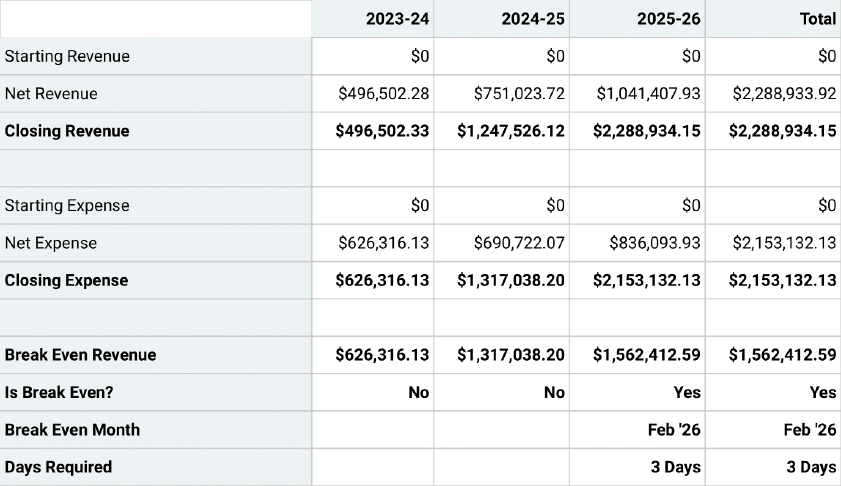

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your startup and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

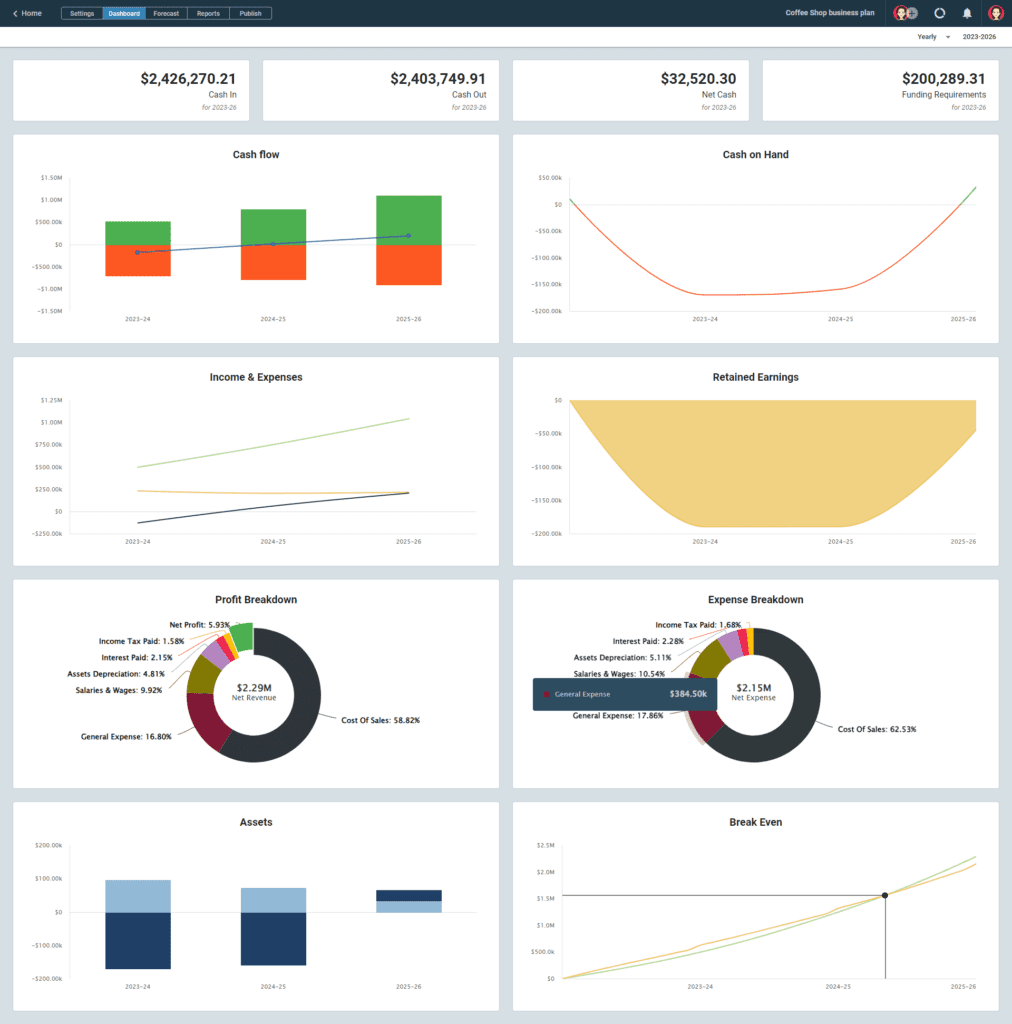

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

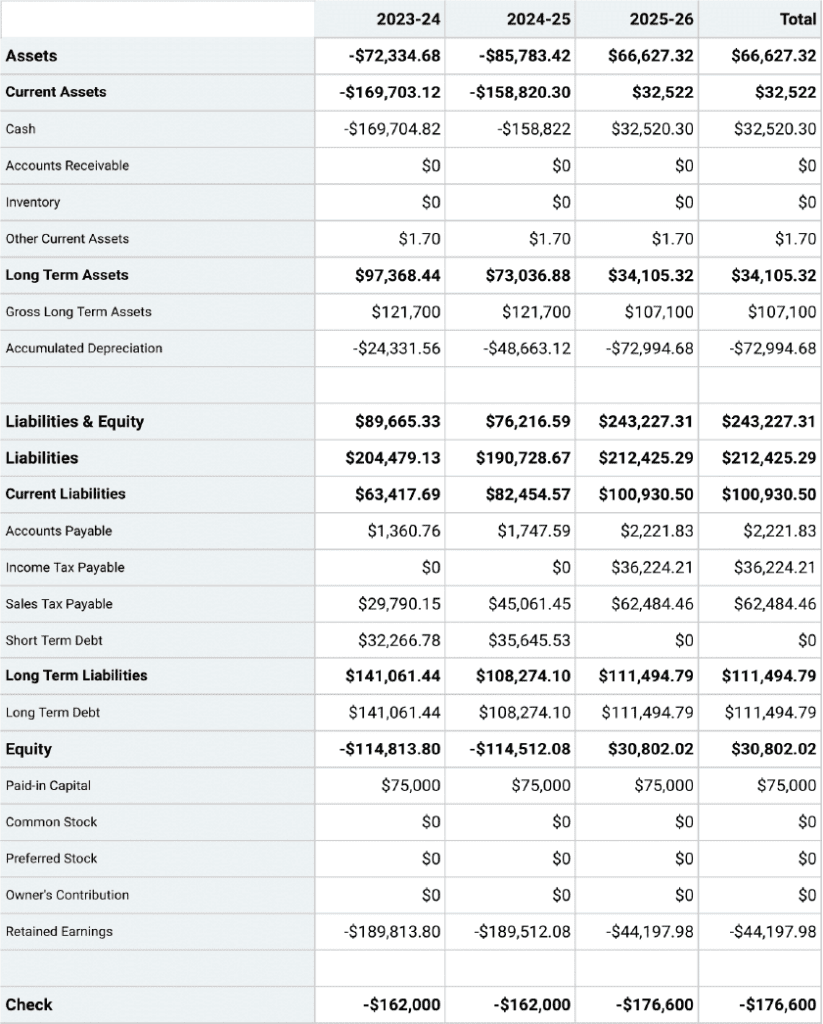

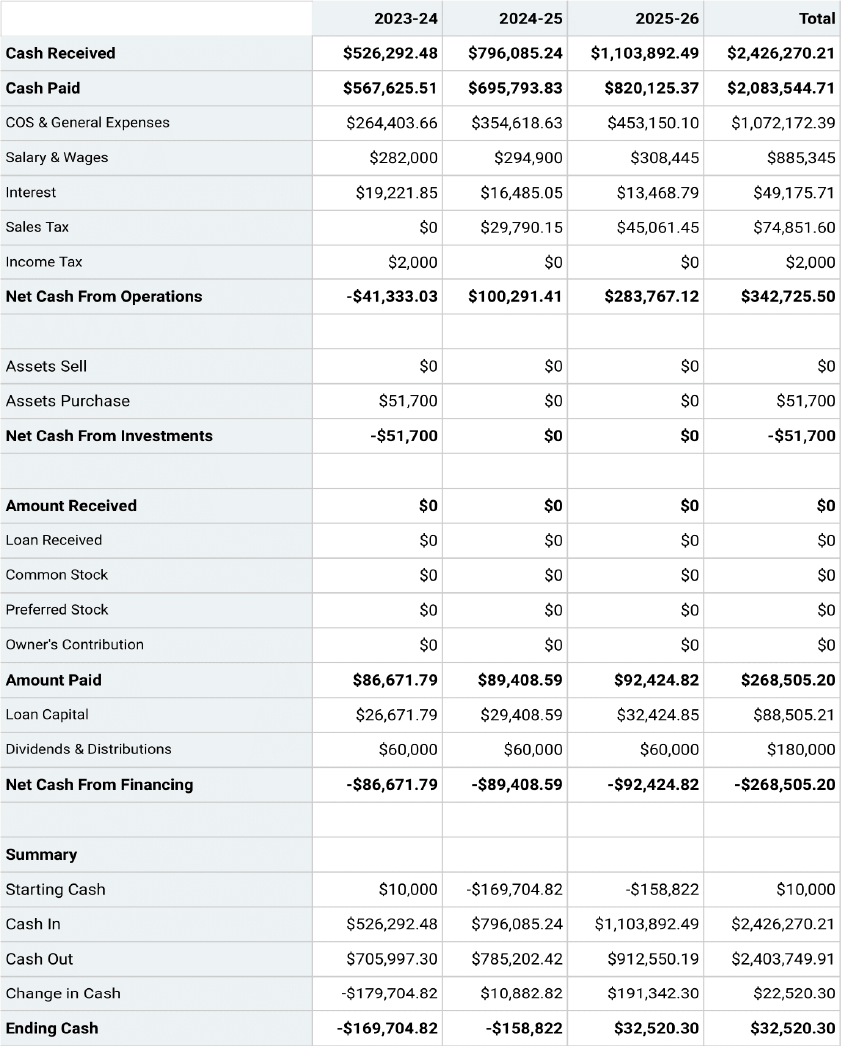

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

Projected Balance Sheet

Projected Cash-Flow Statement

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Reach Your Goals with Accurate Planning

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Free Financial Templates for a Business Plan

By Andy Marker | July 29, 2020

- Share on Facebook

- Share on LinkedIn

Link copied

In this article, we’ve rounded up expert-tested financial templates for your business plan, all of which are free to download in Excel, Google Sheets, and PDF formats.

Included on this page, you’ll find the essential financial statement templates, including income statement templates , cash flow statement templates , and balance sheet templates . Plus, we cover the key elements of the financial section of a business plan .

Financial Plan Templates

Download and prepare these financial plan templates to include in your business plan. Use historical data and future projections to produce an overview of the financial health of your organization to support your business plan and gain buy-in from stakeholders

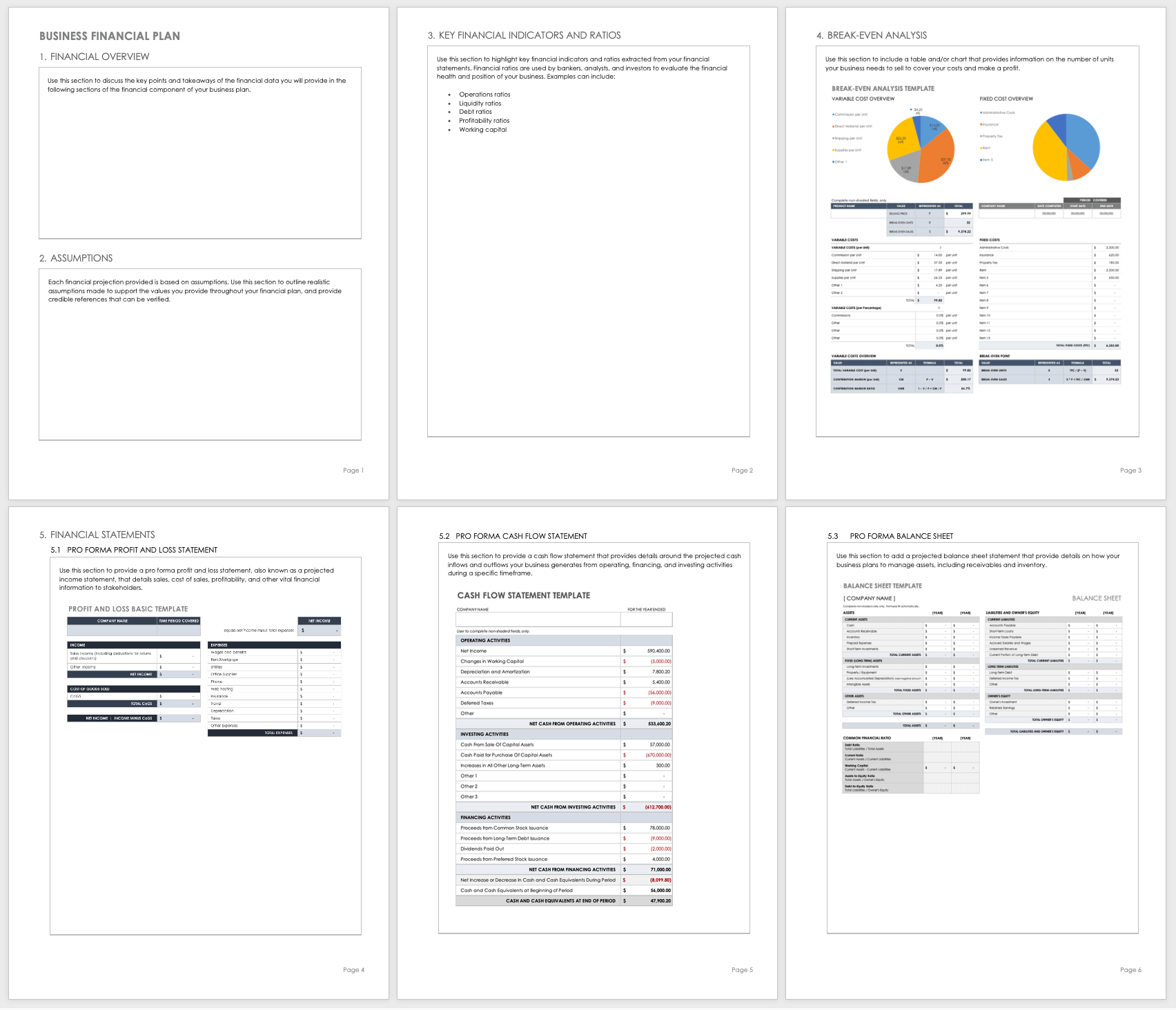

Business Financial Plan Template

Use this financial plan template to organize and prepare the financial section of your business plan. This customizable template has room to provide a financial overview, any important assumptions, key financial indicators and ratios, a break-even analysis, and pro forma financial statements to share key financial data with potential investors.

Download Financial Plan Template

Word | PDF | Smartsheet

Financial Plan Projections Template for Startups

This financial plan projections template comes as a set of pro forma templates designed to help startups. The template set includes a 12-month profit and loss statement, a balance sheet, and a cash flow statement for you to detail the current and projected financial position of a business.

Download Startup Financial Projections Template

Excel | Smartsheet

Income Statement Templates for Business Plan

Also called profit and loss statements , these income statement templates will empower you to make critical business decisions by providing insight into your company, as well as illustrating the projected profitability associated with business activities. The numbers prepared in your income statement directly influence the cash flow and balance sheet forecasts.

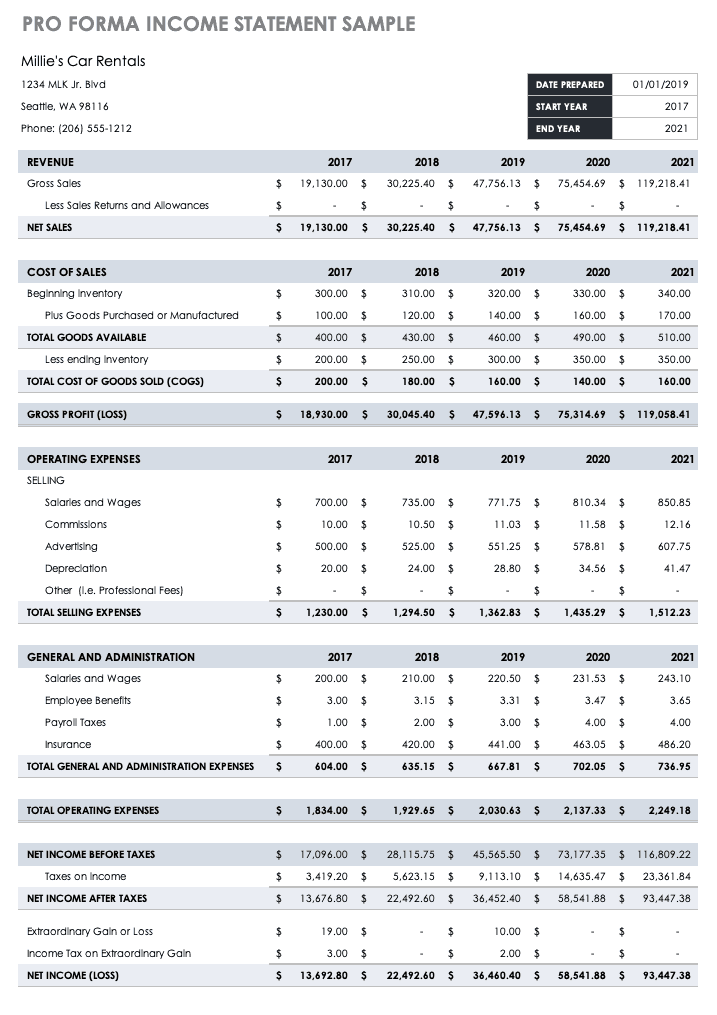

Pro Forma Income Statement/Profit and Loss Sample

Use this pro forma income statement template to project income and expenses over a three-year time period. Pro forma income statements consider historical or market analysis data to calculate the estimated sales, cost of sales, profits, and more.

Download Pro Forma Income Statement Sample - Excel

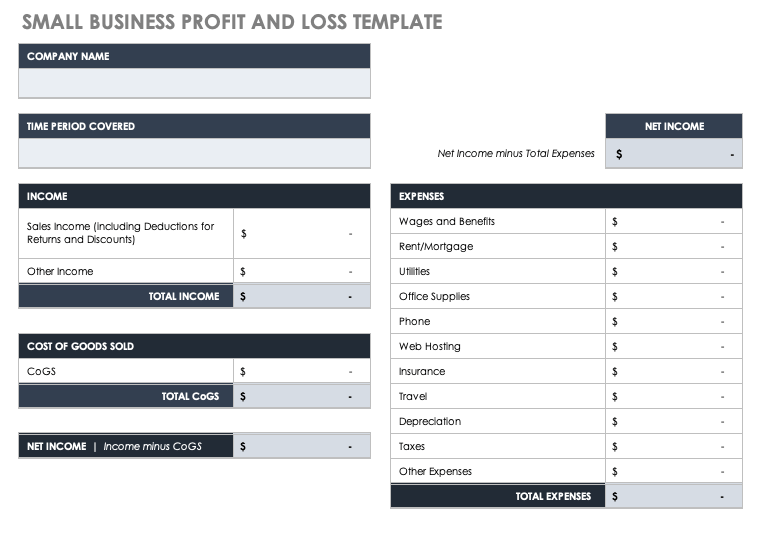

Small Business Profit and Loss Statement

Small businesses can use this simple profit and loss statement template to project income and expenses for a specific time period. Enter expected income, cost of goods sold, and business expenses, and the built-in formulas will automatically calculate the net income.

Download Small Business Profit and Loss Template - Excel

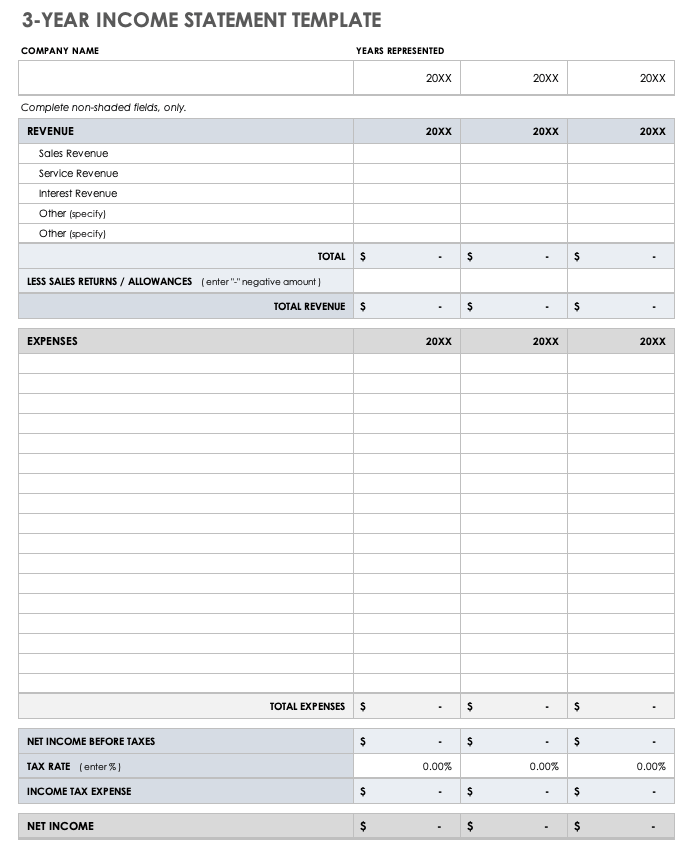

3-Year Income Statement Template

Use this income statement template to calculate and assess the profit and loss generated by your business over three years. This template provides room to enter revenue and expenses associated with operating your business and allows you to track performance over time.

Download 3-Year Income Statement Template

For additional resources, including how to use profit and loss statements, visit “ Download Free Profit and Loss Templates .”

Cash Flow Statement Templates for Business Plan

Use these free cash flow statement templates to convey how efficiently your company manages the inflow and outflow of money. Use a cash flow statement to analyze the availability of liquid assets and your company’s ability to grow and sustain itself long term.

Simple Cash Flow Template

Use this basic cash flow template to compare your business cash flows against different time periods. Enter the beginning balance of cash on hand, and then detail itemized cash receipts, payments, costs of goods sold, and expenses. Once you enter those values, the built-in formulas will calculate total cash payments, net cash change, and the month ending cash position.

Download Simple Cash Flow Template

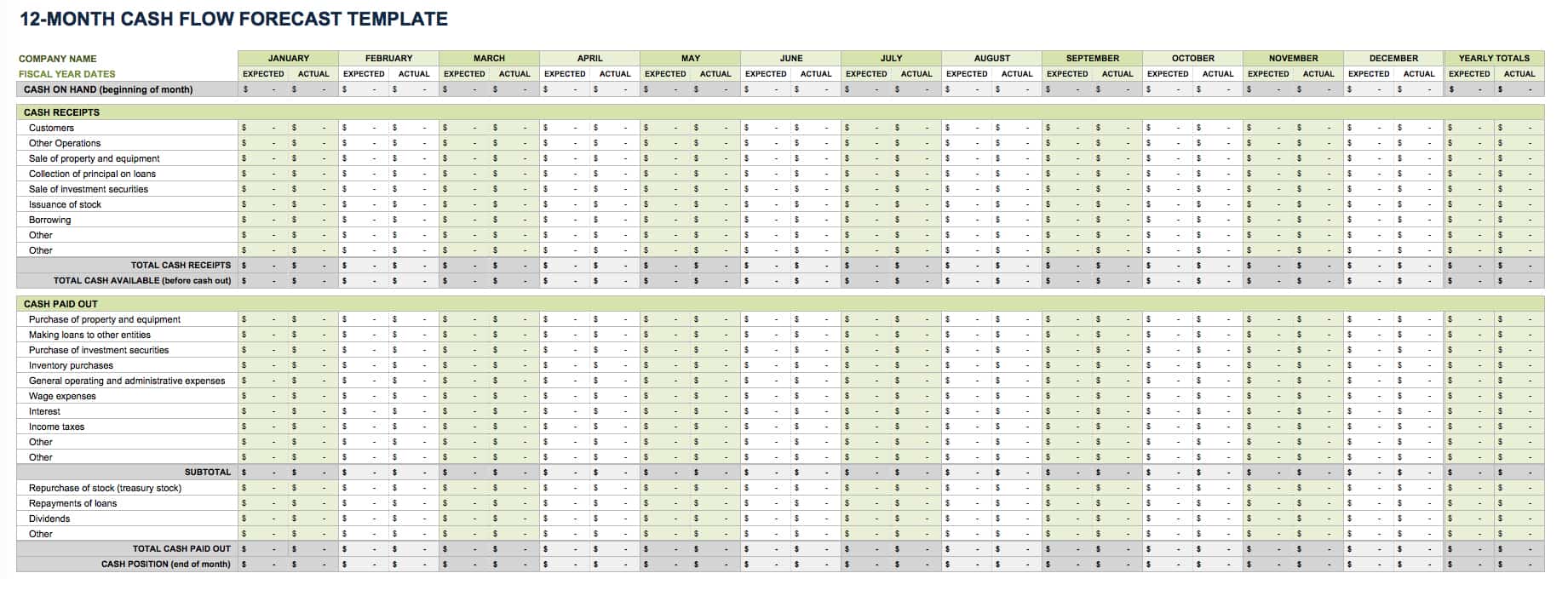

12-Month Cash Flow Forecast Template

Use this cash flow forecast template, also called a pro forma cash flow template, to track and compare expected and actual cash flow outcomes on a monthly and yearly basis. Enter the cash on hand at the beginning of each month, and then add the cash receipts (from customers, issuance of stock, and other operations). Finally, add the cash paid out (purchases made, wage expenses, and other cash outflow). Once you enter those values, the built-in formulas will calculate your cash position for each month with.

Download 12-Month Cash Flow Forecast

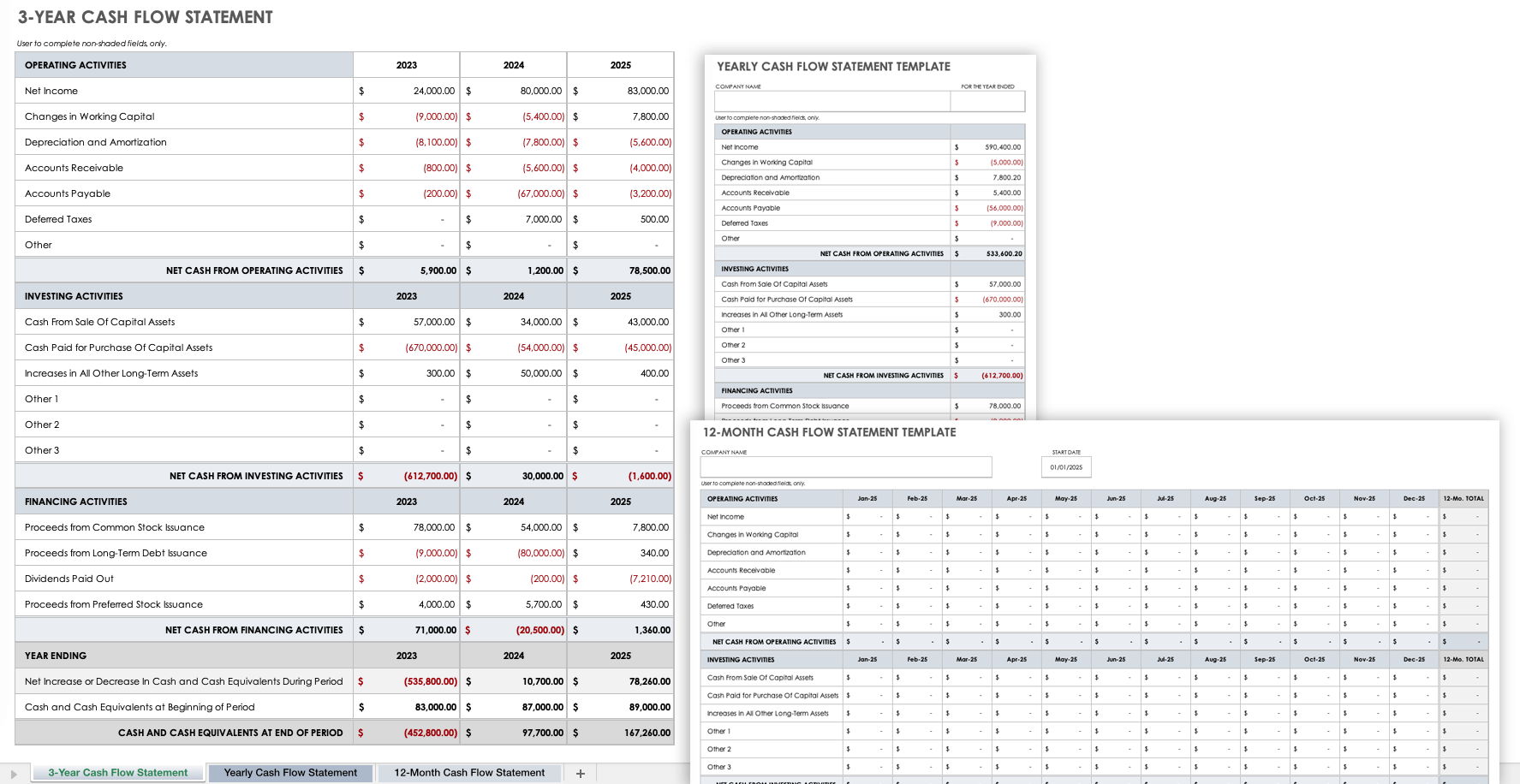

3-Year Cash Flow Statement Template Set

Use this cash flow statement template set to analyze the amount of cash your company has compared to its expenses and liabilities. This template set contains a tab to create a monthly cash flow statement, a yearly cash flow statement, and a three-year cash flow statement to track cash flow for the operating, investing, and financing activities of your business.

Download 3-Year Cash Flow Statement Template

For additional information on managing your cash flow, including how to create a cash flow forecast, visit “ Free Cash Flow Statement Templates .”

Balance Sheet Templates for a Business Plan

Use these free balance sheet templates to convey the financial position of your business during a specific time period to potential investors and stakeholders.

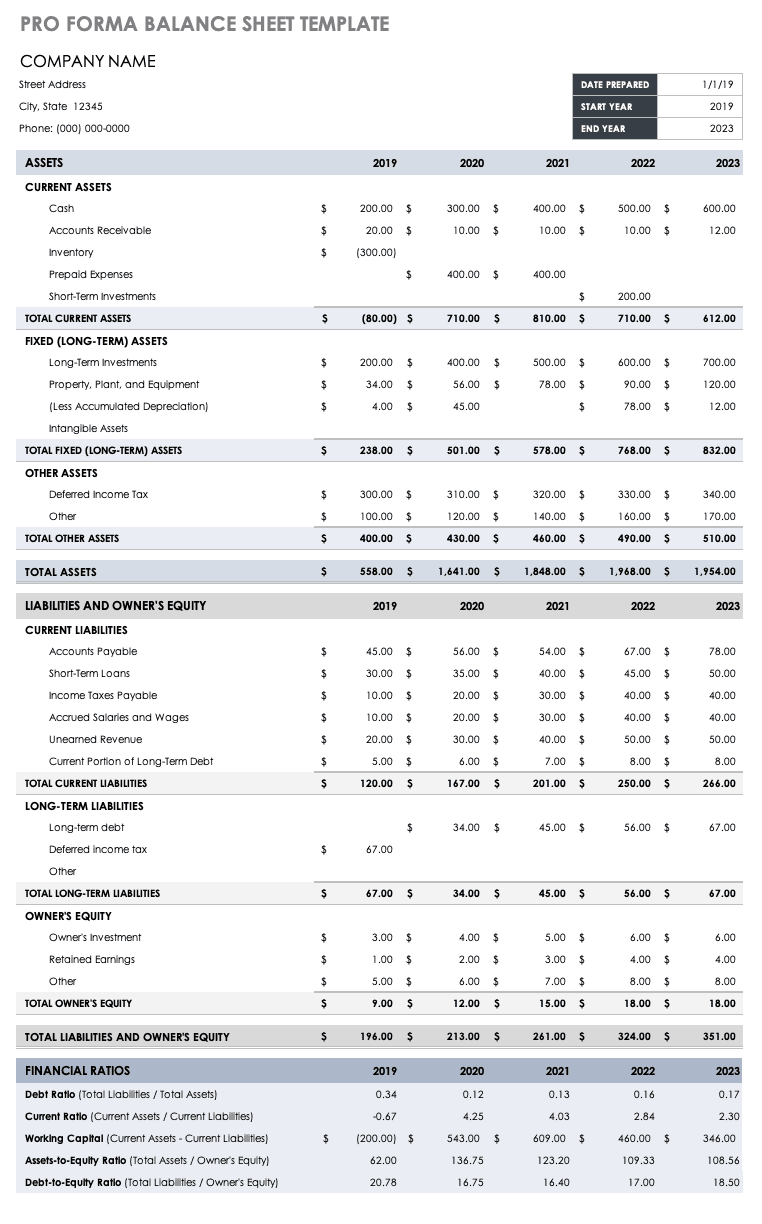

Small Business Pro Forma Balance Sheet

Small businesses can use this pro forma balance sheet template to project account balances for assets, liabilities, and equity for a designated period. Established businesses can use this template (and its built-in formulas) to calculate key financial ratios, including working capital.

Download Pro Forma Balance Sheet Template

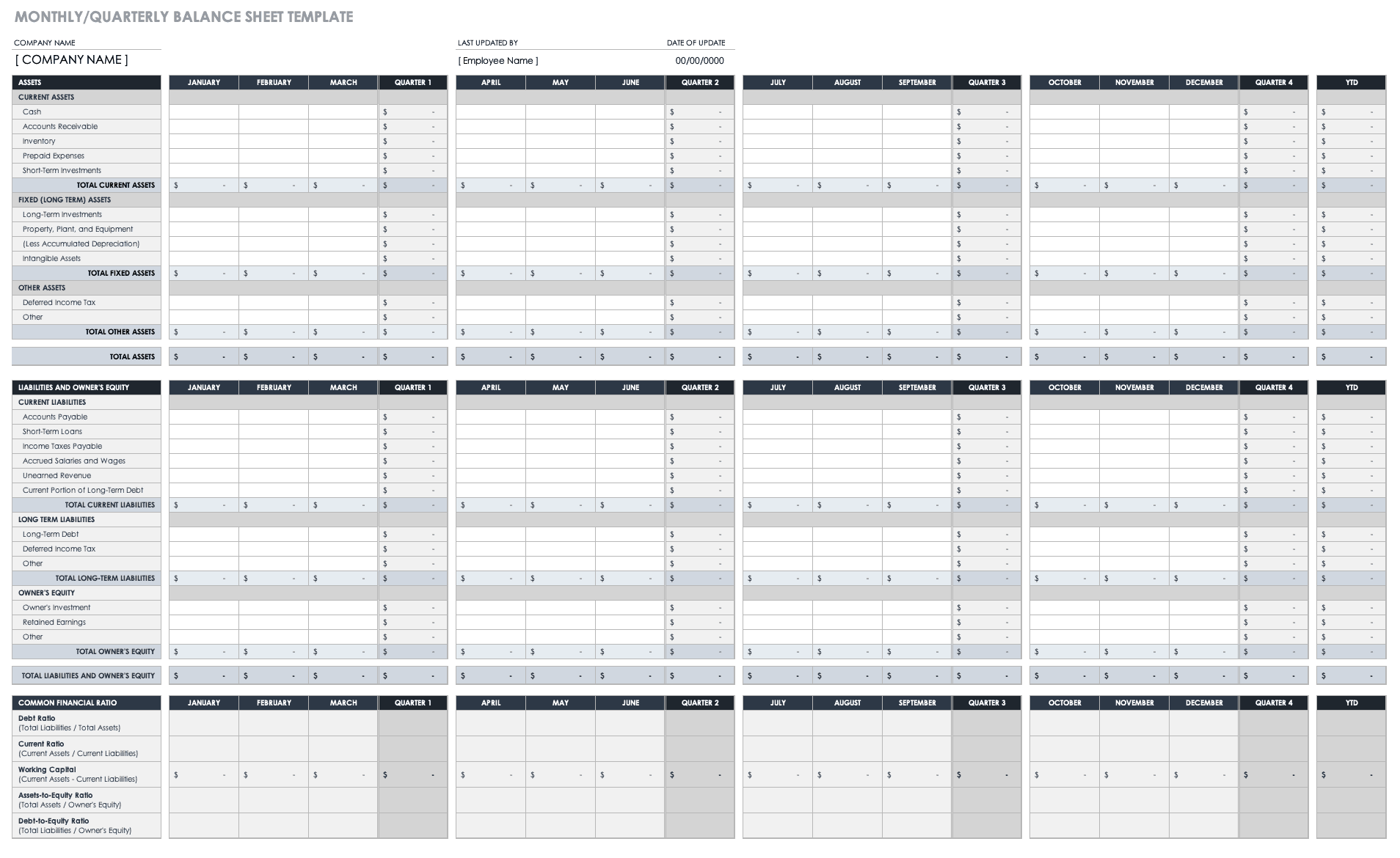

Monthly and Quarterly Balance Sheet Template

Use this balance sheet template to evaluate your company’s financial health on a monthly, quarterly, and annual basis. You can also use this template to project your financial position for a specified time in the future. Once you complete the balance sheet, you can compare and analyze your assets, liabilities, and equity on a quarter-over-quarter or year-over-year basis.

Download Monthly/Quarterly Balance Sheet Template - Excel

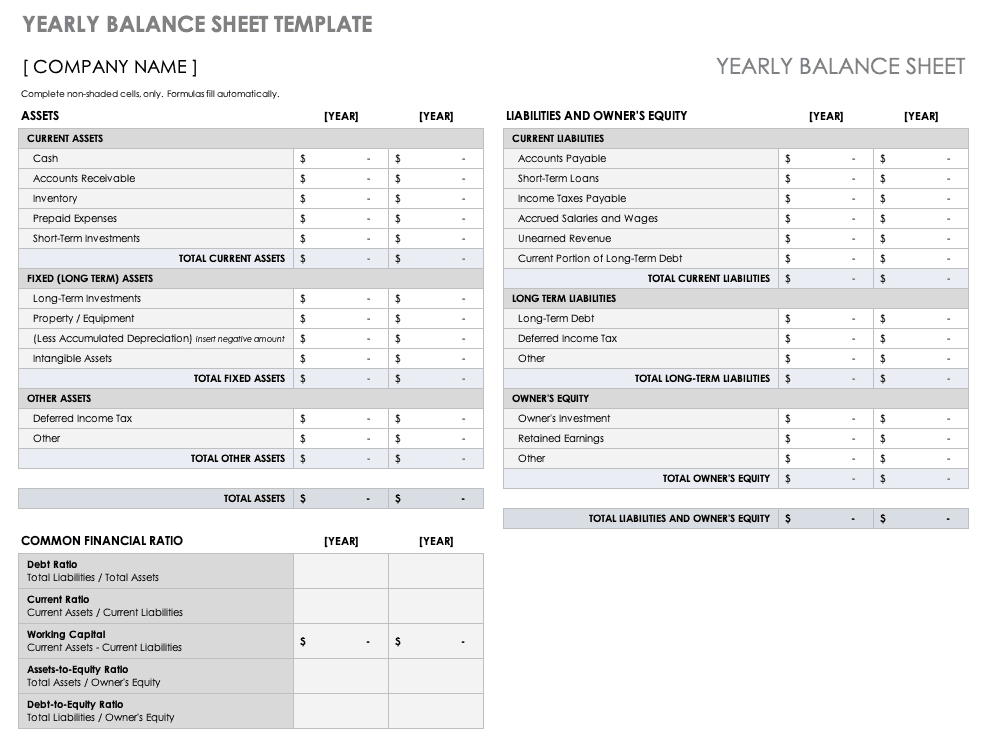

Yearly Balance Sheet Template

Use this balance sheet template to compare your company’s short and long-term assets, liabilities, and equity year-over-year. This template also provides calculations for common financial ratios with built-in formulas, so you can use it to evaluate account balances annually.

Download Yearly Balance Sheet Template - Excel

For more downloadable resources for a wide range of organizations, visit “ Free Balance Sheet Templates .”

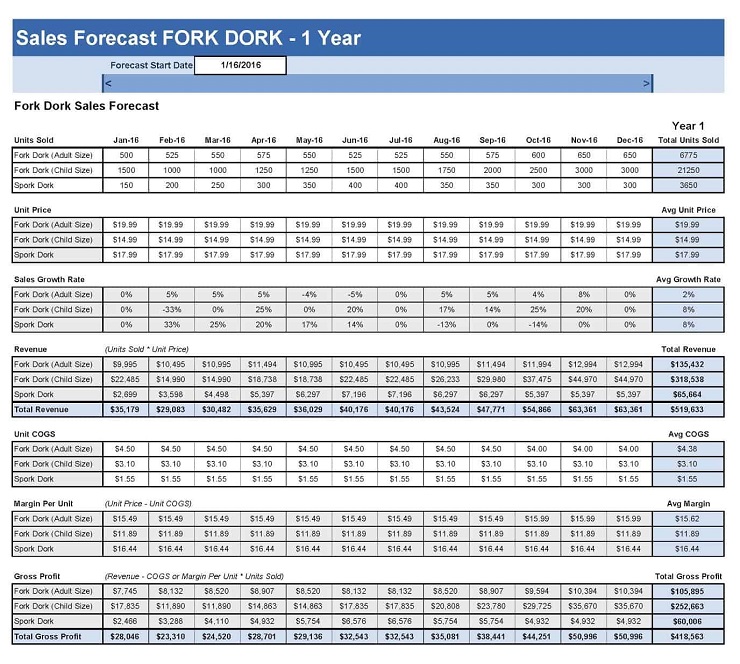

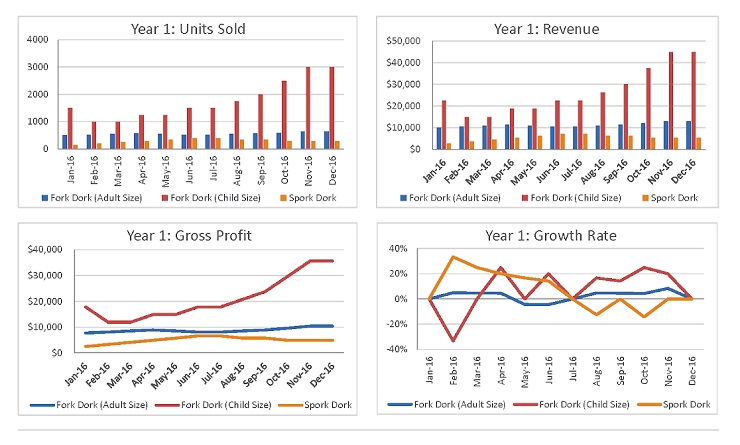

Sales Forecast Templates for Business Plan

Sales projections are a fundamental part of a business plan, and should support all other components of your plan, including your market analysis, product offerings, and marketing plan . Use these sales forecast templates to estimate future sales, and ensure the numbers align with the sales numbers provided in your income statement.

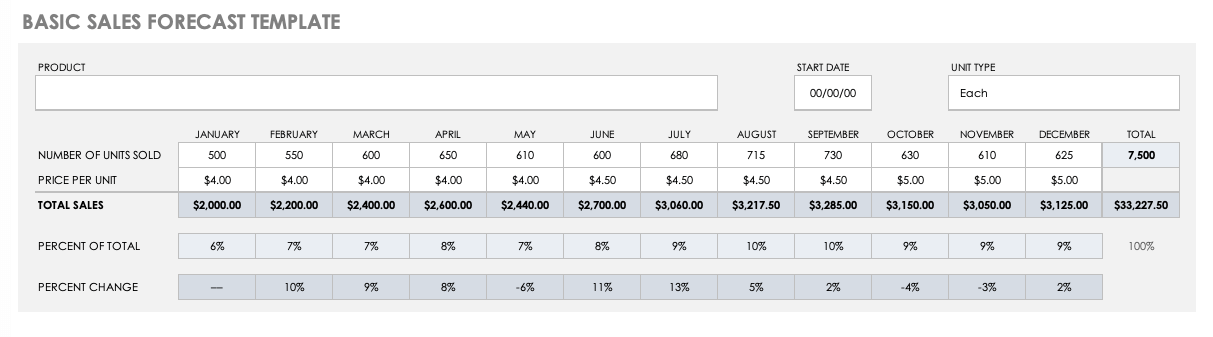

Basic Sales Forecast Sample Template

Use this basic forecast template to project the sales of a specific product. Gather historical and industry sales data to generate monthly and yearly estimates of the number of units sold and the price per unit. Then, the pre-built formulas will calculate percentages automatically. You’ll also find details about which months provide the highest sales percentage, and the percentage change in sales month-over-month.

Download Basic Sales Forecast Sample Template

12-Month Sales Forecast Template for Multiple Products

Use this sales forecast template to project the future sales of a business across multiple products or services over the course of a year. Enter your estimated monthly sales, and the built-in formulas will calculate annual totals. There is also space to record and track year-over-year sales, so you can pinpoint sales trends.

Download 12-Month Sales Forecasting Template for Multiple Products

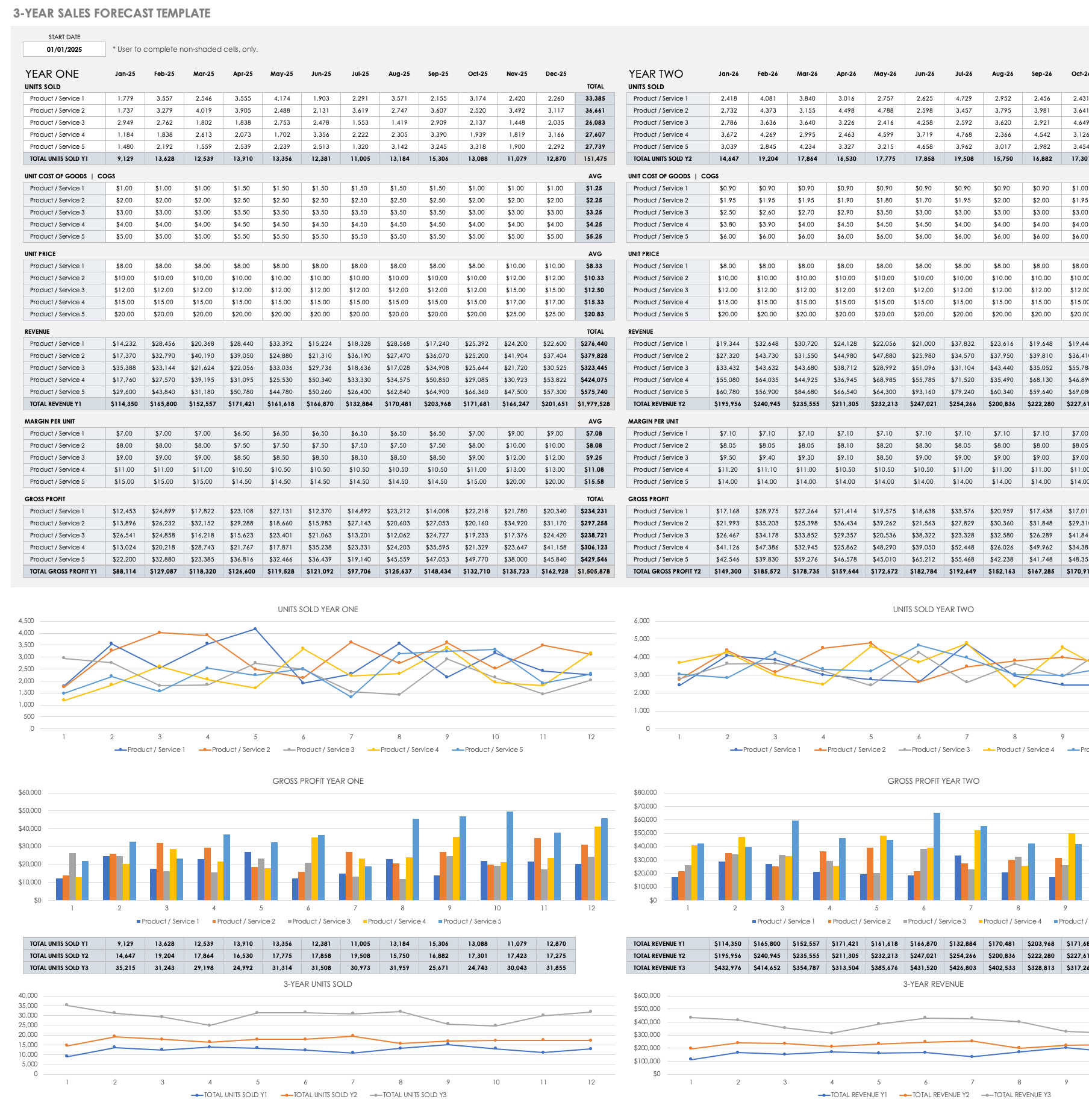

3-Year Sales Forecast Template for Multiple Products

Use this sales forecast template to estimate the monthly and yearly sales for multiple products over a three-year period. Enter the monthly units sold, unit costs, and unit price. Once you enter those values, built-in formulas will automatically calculate revenue, margin per unit, and gross profit. This template also provides bar charts and line graphs to visually display sales and gross profit year over year.

Download 3-Year Sales Forecast Template - Excel

For a wider selection of resources to project your sales, visit “ Free Sales Forecasting Templates .”

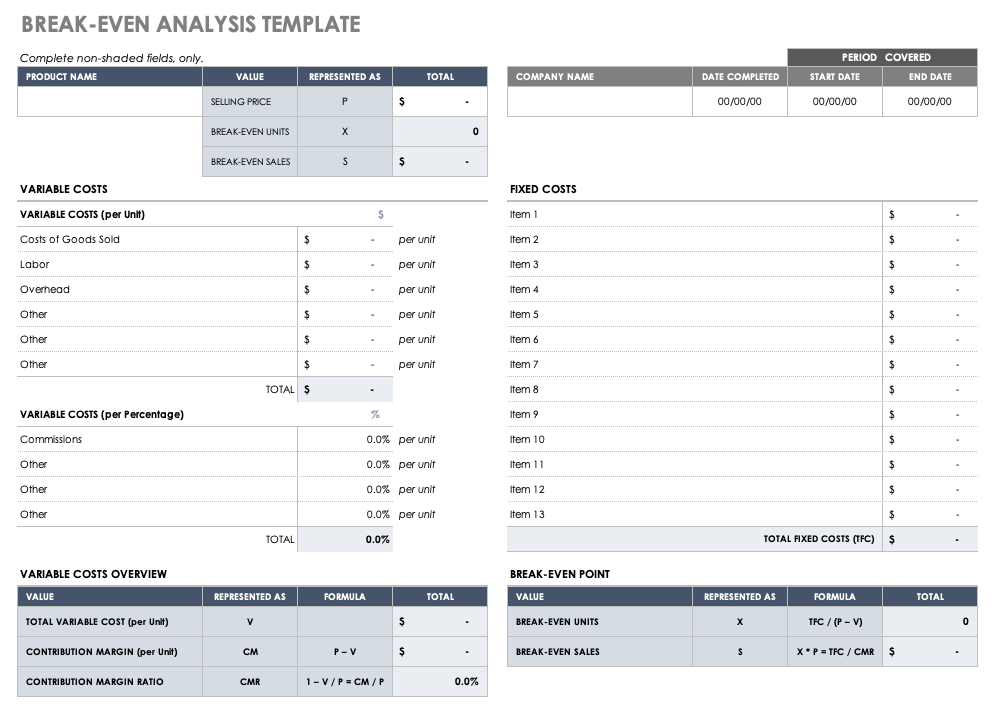

Break-Even Analysis Template for Business Plan

A break-even analysis will help you ascertain the point at which a business, product, or service will become profitable. This analysis uses a calculation to pinpoint the number of service or unit sales you need to make to cover costs and make a profit.

Break-Even Analysis Template

Use this break-even analysis template to calculate the number of sales needed to become profitable. Enter the product's selling price at the top of the template, and then add the fixed and variable costs. Once you enter those values, the built-in formulas will calculate the total variable cost, the contribution margin, and break-even units and sales values.

Download Break-Even Analysis Template

For additional resources, visit, “ Free Financial Planning Templates .”

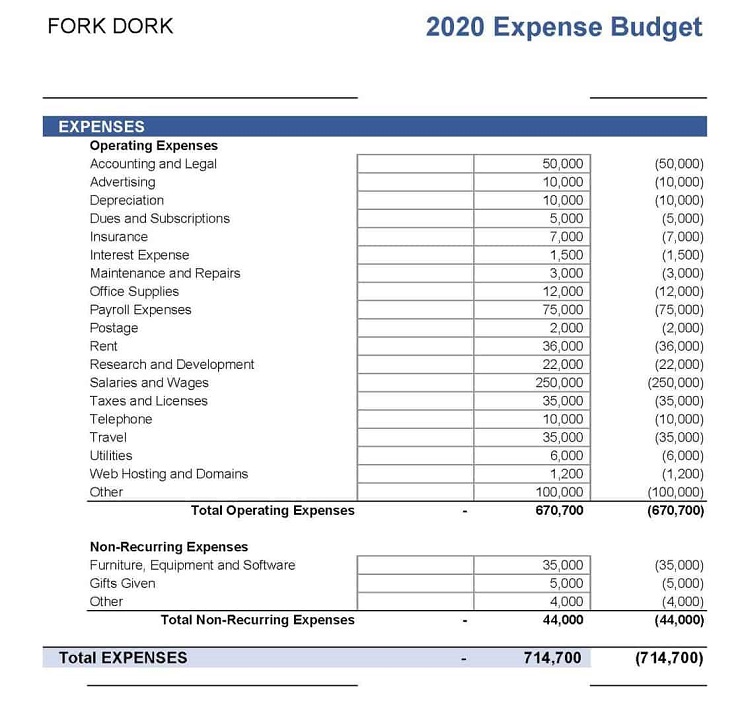

Business Budget Templates for Business Plan

These business budget templates will help you track costs (e.g., fixed and variable) and expenses (e.g., one-time and recurring) associated with starting and running a business. Having a detailed budget enables you to make sound strategic decisions, and should align with the expense values listed on your income statement.

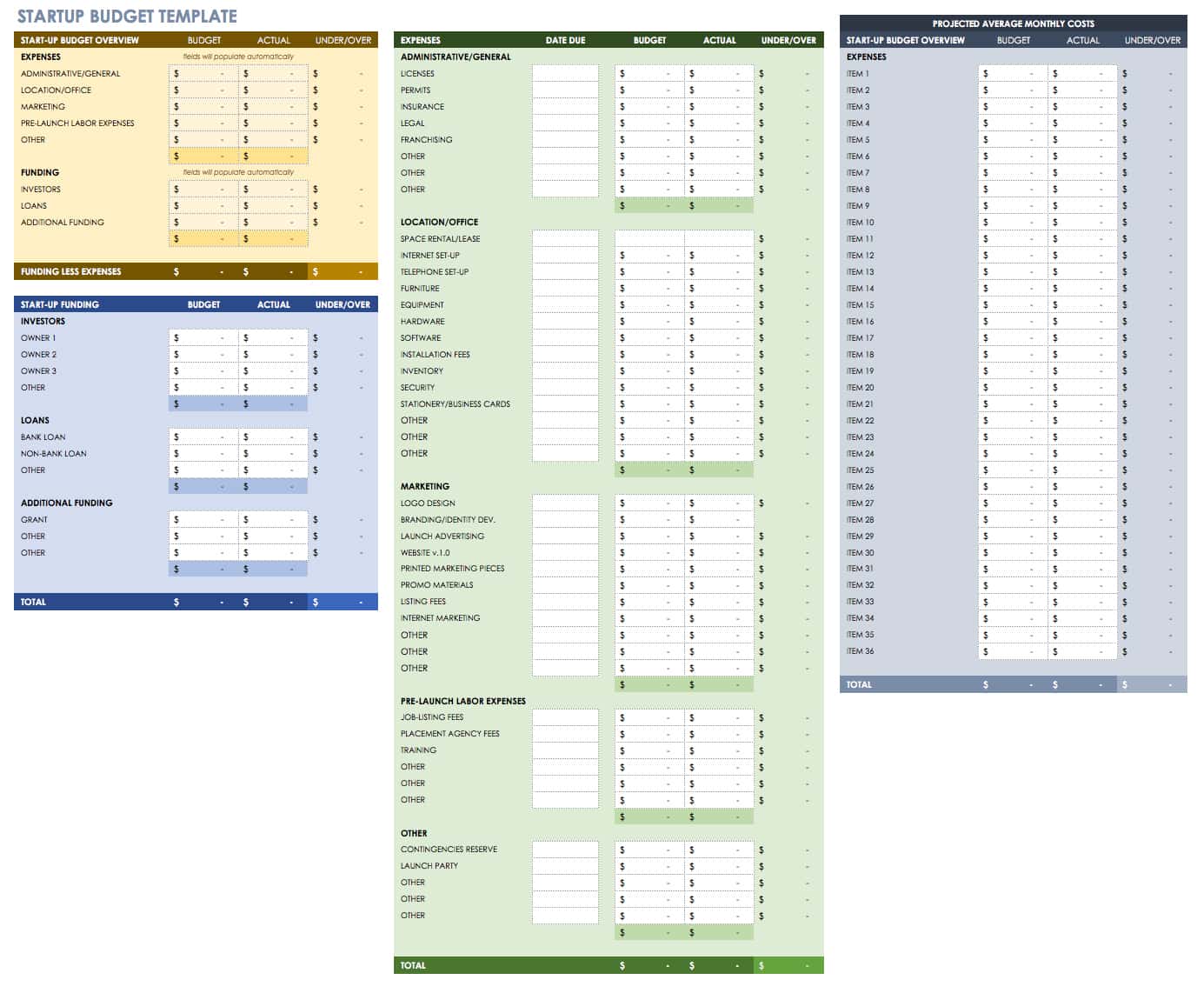

Startup Budget Template

Use this startup budget template to track estimated and actual costs and expenses for various business categories, including administrative, marketing, labor, and other office costs. There is also room to provide funding estimates from investors, banks, and other sources to get a detailed view of the resources you need to start and operate your business.

Download Startup Budget Template

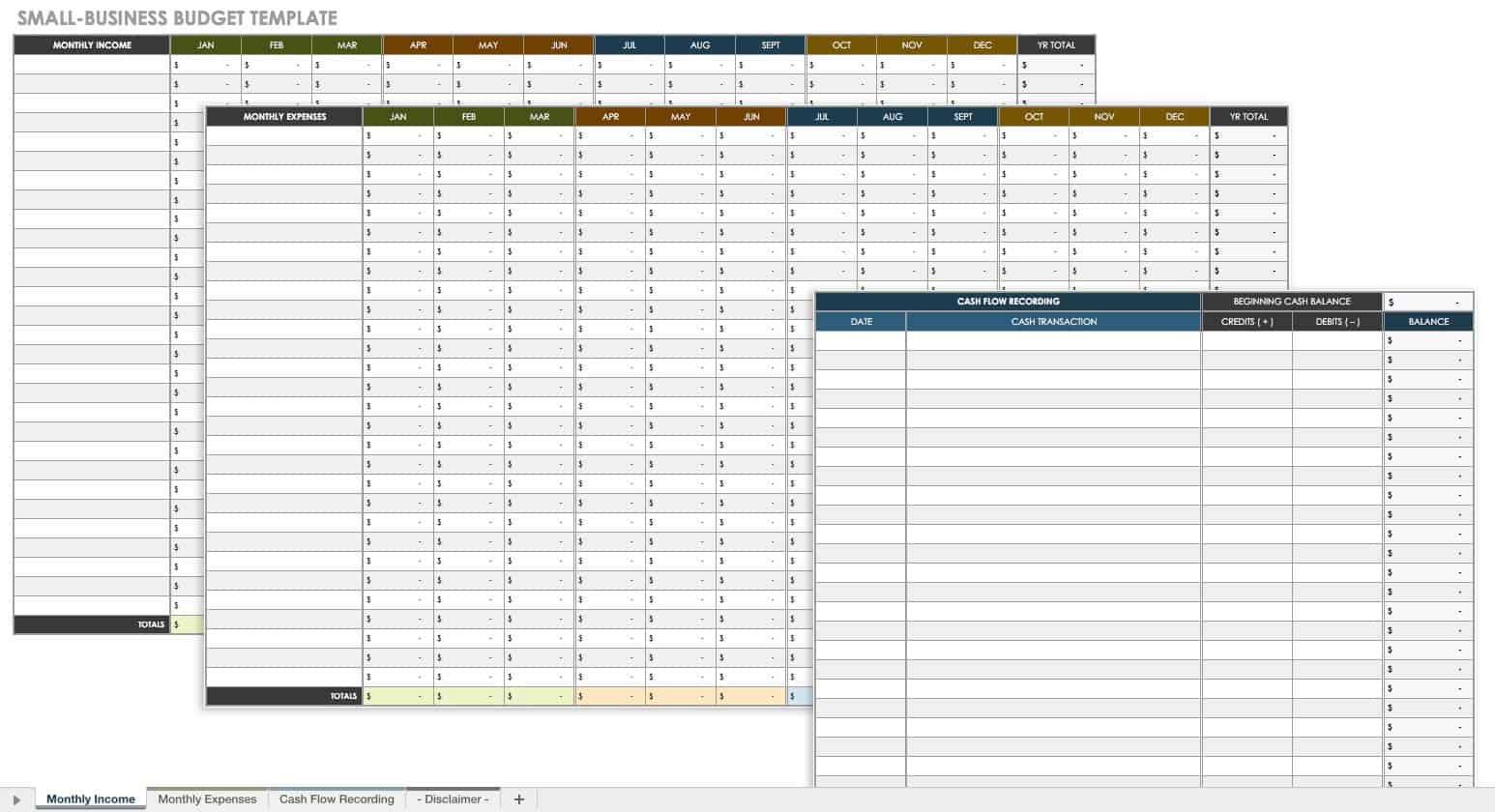

Small Business Budget Template

This business budget template is ideal for small businesses that want to record estimated revenue and expenditures on a monthly and yearly basis. This customizable template comes with a tab to list income, expenses, and a cash flow recording to track cash transactions and balances.

Download Small Business Budget Template

Professional Business Budget Template

Established organizations will appreciate this customizable business budget template, which contains a separate tab to track projected business expenses, actual business expenses, variances, and an expense analysis. Once you enter projected and actual expenses, the built-in formulas will automatically calculate expense variances and populate the included visual charts.

Download Professional Business Budget Template

For additional resources to plan and track your business costs and expenses, visit “ Free Business Budget Templates for Any Company .”

Other Financial Templates for Business Plan

In this section, you’ll find additional financial templates that you may want to include as part of your larger business plan.

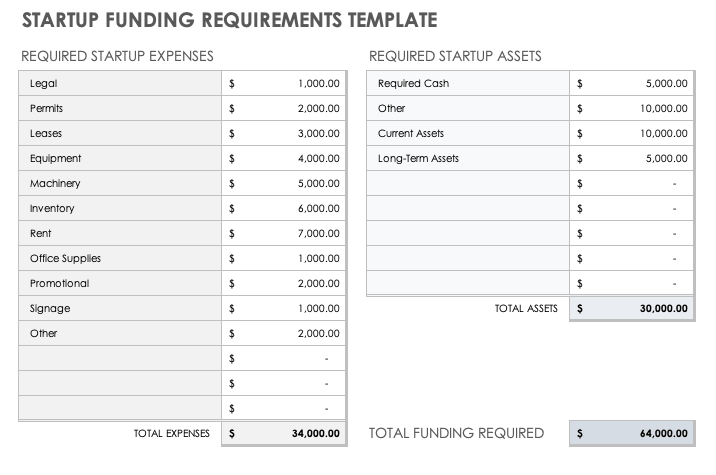

Startup Funding Requirements Template

This simple startup funding requirements template is useful for startups and small businesses that require funding to get business off the ground. The numbers generated in this template should align with those in your financial projections, and should detail the allocation of acquired capital to various startup expenses.

Download Startup Funding Requirements Template - Excel

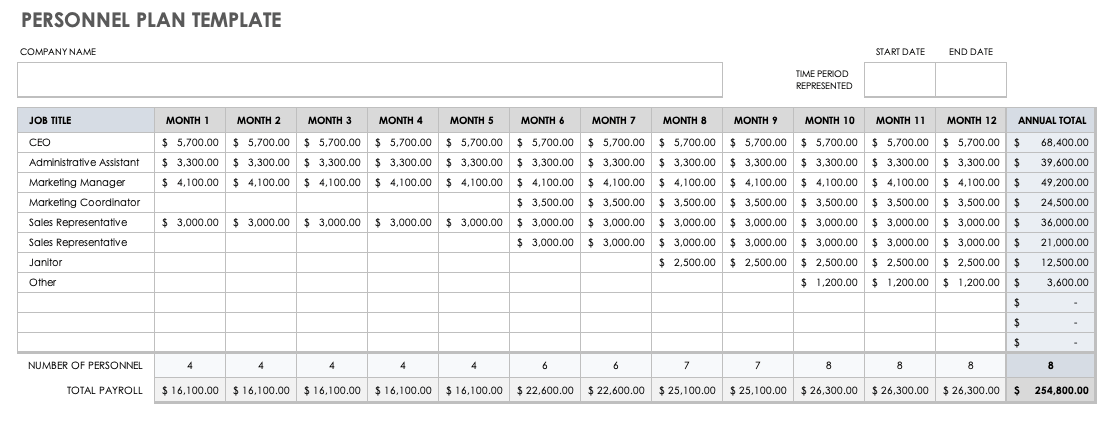

Personnel Plan Template

Use this customizable personnel plan template to map out the current and future staff needed to get — and keep — the business running. This information belongs in the personnel section of a business plan, and details the job title, amount of pay, and hiring timeline for each position. This template calculates the monthly and yearly expenses associated with each role using built-in formulas. Additionally, you can add an organizational chart to provide a visual overview of the company’s structure.

Download Personnel Plan Template - Excel

Elements of the Financial Section of a Business Plan

Whether your organization is a startup, a small business, or an enterprise, the financial plan is the cornerstone of any business plan. The financial section should demonstrate the feasibility and profitability of your idea and should support all other aspects of the business plan.

Below, you’ll find a quick overview of the components of a solid financial plan.

- Financial Overview: This section provides a brief summary of the financial section, and includes key takeaways of the financial statements. If you prefer, you can also add a brief description of each statement in the respective statement’s section.

- Key Assumptions: This component details the basis for your financial projections, including tax and interest rates, economic climate, and other critical, underlying factors.

- Break-Even Analysis: This calculation helps establish the selling price of a product or service, and determines when a product or service should become profitable.

- Pro Forma Income Statement: Also known as a profit and loss statement, this section details the sales, cost of sales, profitability, and other vital financial information to stakeholders.

- Pro Forma Cash Flow Statement: This area outlines the projected cash inflows and outflows the business expects to generate from operating, financing, and investing activities during a specific timeframe.

- Pro Forma Balance Sheet: This document conveys how your business plans to manage assets, including receivables and inventory.

- Key Financial Indicators and Ratios: In this section, highlight key financial indicators and ratios extracted from financial statements that bankers, analysts, and investors can use to evaluate the financial health and position of your business.

Need help putting together the rest of your business plan? Check out our free simple business plan templates to get started. You can learn how to write a successful simple business plan here .

Visit this free non-profit business plan template roundup or download a fill-in-the-blank business plan template to make things easy. If you are looking for a business plan template by file type, visit our pages dedicated specifically to Microsoft Excel , Microsoft Word , and Adobe PDF business plan templates. Read our articles offering startup business plan templates or free 30-60-90-day business plan templates to find more tailored options.

Discover a Better Way to Manage Business Plan Financials and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.

Discover why over 90% of Fortune 100 companies trust Smartsheet to get work done.

- Franchise Trends

- The Female Founder

- The Roadmap

- The Small Business Show

- U.S. Chamber of Commerce Small Business Update

- Company Culture

- Customer Experience

- Entrepreneurship

- Growth Strategy

- Recruitment

- Small Business Grants

- Social Media

- Contribute Content Request

- Show Appearance Request

Scott Mautz unveils the secrets to building mental strength

Unlocking the power of authenticity on social media – corey perlman, 5 simple steps to earn your sales prospect’s trust — ursula…, from intern to entrepreneur: the inspiring journey of gabrielle mills –….

- business plan

- small busienss

- balance sheet

How to Complete the Financial Section of Business Plan

A plan intends to explain the business, introduce critical contributors, products and, services and defines the goals for the future. It paints a picture of the founder’s expectations and helps others see their vision. The financial section of the plan provides the proof behind the story. It is the section that investors and lenders are most interested in, and often the first section they read, despite it being near the end of the plan. It also acts as a roadmap and a guide for the direction the company will take into the future.

Financial Section Elements

While it may sound complicated, the financial section of a business plan only contains three documents and a brief explanation of each. It is necessary to prepare an income statement, cash flow projection and a balance sheet either using spreadsheets, or software that does all of the calculations automatically. Before beginning this statement, it’s necessary to gather the following information:

Business Start-Up Expenses

This list of all of the costs associated with getting the business up and running comprises what primarily are one-time fees such as registering the company. Following is only a partial list of possible start-up costs, every business is unique, and the list may, or may not, contain these items and more.

- Business registration fees

- Licensing and permits

- Product inventory

- Deposit on rental property

- Down payment to purchase property

- Down payment on machines and equipment

- Set-up fees for utilities

Business Operating Costs

As the name implies, operating costs are the ongoing expenses that need to be paid to keep the business running. These expenses are usually monthly bills, and for a start-up, estimate six months worth of these costs. A company’s list of operating expenses might include:

- Monthly mortgage payment or rent

- Logistics and distribution

- Marketing and promotion

- Loan paymentsRaw materials

- Office supplies

- Building/vehicle maintenance

The Income Statement

This financial statement details the company’s revenues, expenses, and profit for a set period. Established businesses generated these annually, or semi-annually, based on actual performance. Start-ups with no previous years to look at have to use statistical data within the industry to make reasonable projections. A start-up will also produce monthly versions of this statement to show the forecast of growth. This section will include the data such as:

- Gross revenue (sales, interest income and sales of assets)

- General and administrative expenses (start-up and operating costs)

- Corporate tax rate (expected tax liabilities)

The math is simple here: subtract the expenditures from the revenue, and the remaining number is profit. When put into the proper format, an income statement gives a clear view of the financial viability of a company.

Cash-Flow Projection

This statement shows how you expect cash to flow in to, and out of, your business. It’s an essential internal cash management tool and a source of data that shows what your business’s capital needs will be in the near future. For investors and bank loan officers, it helps determine your creditworthiness and amount you can borrow. The cash-flow projection contains three parts:

- Cash revenues — This part details the incoming cash from sales for specific periods of time, usually monthly. It is an estimate, based upon past performance and future projections for current businesses, and industry averages for start-ups.

- Cash disbursements — Every monthly bill or other expense that is paid out in cash gets listed in this section. As with revenue, these are estimates, either based upon historical data, current data, or industry data.

- Cash flow projection — This merely is a reconciliation of the cash revenues to cash disbursements. Adding the current month’s revenues to the carried-over balance, then subtracting the month’s disbursements creates estimated cash flow.

The Balance Sheet

The final financial statement required for the business plan’s financial section is a balance sheet. This statement is a snapshot of the company’s net worth at a given point in time. Established businesses produce a balance sheet annually. Information from the income statement and cash flow projection are used to complete this statement. It summarizes the business’s financial data into three main categories:

- Assets — This is the total of all of the tangible items that the company owns that hold monetary value. That includes equipment, property, and cash-on-hand, for example.

- Liabilities — This is the total amount of debt that the company owes its creditors. You’ll include every debt, whether recurring, one-time, fixed, or variable.

- Equity — This is merely the difference between the company’s assets, including retained earnings and current earnings, and its liabilities.

Side-Notes and Details

In some cases, it may be necessary to explain details within the financial statements. Denote these instances within the statement and include a brief explanation sheet as an attachment. It may also be useful to add information on the process used to estimate revenues and expenses, which will show interested parties the intent and help them better understand the data.

Don’t Sweat the Process

It’s important to note that the order in which these financial statements is created may vary from the way they are presented here. This is to be expected. In fact, most business plan creators end up going back and forth with these statements as the numbers reveal the business’s financial reality. It paints a crystal clear picture of its economic viability, which can present to a lender, investor, or shareholder with confidence.

All of these financial documents can be created by using accounting and business software readily available online. Even so, some people aren’t entirely comfortable creating financial statements for their business plan, and outsource this critical task to a professional. Even the largest corporations struggle with financial planning and reporting, and they often hire the job out to someone more qualified. It’s merely a matter of making sure that the data is accurate, easy to track, and based on sound accounting practices.

Related Articles

5 ways to more effectively deal with unhappy customers.

- Terms of Use

- Privacy Policy

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

Writing a Business Plan—Financial Projections

Spell out your financial forecast in dollars and sense

Creating financial projections for your startup is both an art and a science. Although investors want to see cold, hard numbers, it can be difficult to predict your financial performance three years down the road, especially if you are still raising seed money. Regardless, short- and medium-term financial projections are a required part of your business plan if you want serious attention from investors.

The financial section of your business plan should include a sales forecast , expenses budget , cash flow statement , balance sheet , and a profit and loss statement . Be sure to follow the generally accepted accounting principles (GAAP) set forth by the Financial Accounting Standards Board , a private-sector organization responsible for setting financial accounting and reporting standards in the U.S. If financial reporting is new territory for you, have an accountant review your projections.

Sales Forecast

As a startup business, you do not have past results to review, which can make forecasting sales difficult. It can be done, though, if you have a good understanding of the market you are entering and industry trends as a whole. In fact, sales forecasts based on a solid understanding of industry and market trends will show potential investors that you've done your homework and your forecast is more than just guesswork.

In practical terms, your forecast should be broken down by monthly sales with entries showing which units are being sold, their price points, and how many you expect to sell. When getting into the second year of your business plan and beyond, it's acceptable to reduce the forecast to quarterly sales. In fact, that's the case for most items in your business plan.

Expenses Budget

What you're selling has to cost something, and this budget is where you need to show your expenses. These include the cost to your business of the units being sold in addition to overhead. It's a good idea to break down your expenses by fixed costs and variable costs. For example, certain expenses will be the same or close to the same every month, including rent, insurance, and others. Some costs likely will vary month by month such as advertising or seasonal sales help.

Cash Flow Statement

As with your sales forecast, cash flow statements for a startup require doing some homework since you do not have historical data to use as a reference. This statement, in short, breaks down how much cash is coming into your business on a monthly basis vs. how much is going out. By using your sales forecasts and your expenses budget, you can estimate your cash flow intelligently.

Keep in mind that revenue often will trail sales, depending on the type of business you are operating. For example, if you have contracts with clients, they may not be paying for items they purchase until the month following delivery. Some clients may carry balances 60 or 90 days beyond delivery. You need to account for this lag when calculating exactly when you expect to see your revenue.

Profit and Loss Statement

Your P&L statement should take the information from your sales projections, expenses budget, and cash flow statement to project how much you expect in profits or losses through the three years included in your business plan. You should have a figure for each individual year as well as a figure for the full three-year period.

Balance Sheet

You provide a breakdown of all of your assets and liabilities in the balances sheet. Many of these assets and liabilities are items that go beyond monthly sales and expenses. For example, any property, equipment, or unsold inventory you own is an asset with a value that can be assigned to it. The same goes for outstanding invoices owed to you that have not been paid. Even though you don't have the cash in hand, you can count those invoices as assets. The amount you owe on a business loan or the amount you owe others on invoices you've not paid would count as liabilities. The balance is the difference between the value of everything you own vs. the value of everything you owe.

Break-Even Projection

If you've done a good job projecting your sales and expenses and inputting the numbers into a spreadsheet, you should be able to identify a date when your business breaks even—in other words, the date when you become profitable, with more money coming in than going out. As a startup business, this is not expected to happen overnight, but potential investors want to see that you have a date in mind and that you can support that projection with the numbers you've supplied in the financial section of your business plan.

Additional Tips

When putting together your financial projections, keep some general tips in mind:

- Get comfortable with spreadsheet software if you aren't already. It is the starting point for all financial projections and offers flexibility, allowing you to quickly change assumptions or weigh alternative scenarios. Microsoft Excel is the most common, and chances are you already have it on your computer. You can also buy special software packages to help with financial projections.

- Prepare a five-year projection . Don’t include this one in the business plan, since the further into the future you project, the harder it is to predict. However, have the projection available in case an investor asks for it.

- Offer two scenarios only . Investors will want to see a best-case and worst-case scenario, but don’t inundate your business plan with myriad medium-case scenarios. They likely will just cause confusion.

- Be reasonable and clear . As mentioned before, financial forecasting is as much art as science. You’ll have to assume certain things, such as your revenue growth, how your raw material and administrative costs will grow, and how effective you’ll be at collecting on accounts receivable. It’s best to be realistic in your projections as you try to recruit investors. If your industry is going through a contraction period and you’re projecting revenue growth of 20 percent a month, expect investors to see red flags.

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » startup, business plan financials: 3 statements to include.

The finance section of your business plan is essential to securing investors and determining whether your idea is even viable. Here's what to include.

If your business plan is the blueprint of how to run your company, the financials section is the key to making it happen. The finance section of your business plan is essential to determining whether your idea is even viable in the long term. It’s also necessary to convince investors of this viability and subsequently secure the type and amount of funding you need. Here’s what to include in your business plan financials.

[Read: How to Write a One-Page Business Plan ]

What are business plan financials?

Business plan financials is the section of your business plan that outlines your past, current and projected financial state. This section includes all the numbers and hard data you’ll need to plan for your business’s future, and to make your case to potential investors. You will need to include supporting financial documents and any funding requests in this part of your business plan.

Business plan financials are vital because they allow you to budget for existing or future expenses, as well as forecast your business’s future finances. A strongly written finance section also helps you obtain necessary funding from investors, allowing you to grow your business.

Sections to include in your business plan financials

Here are the three statements to include in the finance section of your business plan:

Profit and loss statement

A profit and loss statement , also known as an income statement, identifies your business’s revenue (profit) and expenses (loss). This document describes your company’s overall financial health in a given time period. While profit and loss statements are typically prepared quarterly, you will need to do so at least annually before filing your business tax return with the IRS.

Common items to include on a profit and loss statement :

- Revenue: total sales and refunds, including any money gained from selling property or equipment.

- Expenditures: total expenses.

- Cost of goods sold (COGS): the cost of making products, including materials and time.

- Gross margin: revenue minus COGS.

- Operational expenditures (OPEX): the cost of running your business, including paying employees, rent, equipment and travel expenses.

- Depreciation: any loss of value over time, such as with equipment.

- Earnings before tax (EBT): revenue minus COGS, OPEX, interest, loan payments and depreciation.

- Profit: revenue minus all of your expenses.

Businesses that have not yet started should provide projected income statements in their financials section. Currently operational businesses should include past and present income statements, in addition to any future projections.

[Read: Top Small Business Planning Strategies ]

A strongly written finance section also helps you obtain necessary funding from investors, allowing you to grow your business.

Balance sheet

A balance sheet provides a snapshot of your company’s finances, allowing you to keep track of earnings and expenses. It includes what your business owns (assets) versus what it owes (liabilities), as well as how much your business is currently worth (equity).

On the assets side of your balance sheet, you will have three subsections: current assets, fixed assets and other assets. Current assets include cash or its equivalent value, while fixed assets refer to long-term investments like equipment or buildings. Any assets that do not fall within these categories, such as patents and copyrights, can be classified as other assets.

On the liabilities side of your balance sheet, include a total of what your business owes. These can be broken down into two parts: current liabilities (amounts to be paid within a year) and long-term liabilities (amounts due for longer than a year, including mortgages and employee benefits).

Once you’ve calculated your assets and liabilities, you can determine your business’s net worth, also known as equity. This can be calculated by subtracting what you owe from what you own, or assets minus liabilities.

Cash flow statement

A cash flow statement shows the exact amount of money coming into your business (inflow) and going out of it (outflow). Each cost incurred or amount earned should be documented on its own line, and categorized into one of the following three categories: operating activities, investment activities and financing activities. These three categories can all have inflow and outflow activities.

Operating activities involve any ongoing expenses necessary for day-to-day operations; these are likely to make up the majority of your cash flow statement. Investment activities, on the other hand, cover any long-term payments that are needed to start and run your business. Finally, financing activities include the money you’ve used to fund your business venture, including transactions with creditors or funders.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners’ stories.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Join us for our Small Business Day event!

Join us at our next event on Wednesday, May 1, at 12:00 p.m., where we’ll be kicking off Small Business Month alongside business experts and entrepreneurs. Register to attend in person at our Washington, D.C., headquarters, or join us virtually!

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

More tips for your startup

How to change your ein, or how to fix an incorrect ein, micro-business vs. startup: what’s the difference, micro businesses: what are they and how do you start one.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

Does your business plan need a push?

Writting a business plan can be a springboard exercise for your business, and it's not as difficult as people think. All it takes is a bit of method, and some efficient tools. The good news our free articles and paid course have you covered!

Resources on Business Plan Writing :

An article of the Accelerated MBA written by:

Antoine Martin (Ph.D) | Business coach

Is this article relevant? Share it & help someone!

In this article:

Financial projections: how to write the financial plan in business plan.

So, you’ve decided to write a business plan? Good for you! It’s an important document that will help you outline your business goals, strategies, and tactics.

But it’s not just a document for you, as the business owner in charge of everything – it’s also important for potential investors and lenders.

In particular, one of the most important sections of your business plan should be your financial plan or, in other words, your overall financial projections for the next few years – understand, three to five years – distilled in a specific and highly codified format.

Why? Because the financial projections in a business plan are the numbers’ version of your pitch – if something doesn’t add-up, that’s where you see it.

Now, we know that numbers can be impressive (not to say daunting), so in this post, we’ll explain to you how to write a financial plan in your business plan.

We’ll also explain the logic you are supposed to follow to do things right (because financiers expect you to follow a very specific logic).

And we’ll explain what your business plan absolutely needs to include from a financial standpoint.

If that makes sense to you, then let’s get going!

By the way…

Before we dig into the financial projections’ discussion, let us give you a tiny bit of background!

We are professional business coaches, and our job is to push entrepreneurs and business owners to their next steps.

Business planning and business plans are part of that, obviously, therefore we have written a series of free articles on how to write a business plan – of which this page is a part.

We are on a mission to make entrepreneurship fun and accessible, so we provide about 80 percent of our content for free – including a free business plan template to be downloaded down this page.

Still, in case that’s not sufficient, we’ve also created our Business Plan Builder Module , which has been designed to make your life super easy.

Shameless plug: it gives you access to:

- a complete and solid business plan writing work-frame tool

- automated financial tables that take the hassle away (yayyy!)

- two designer-made templates (comprehensive + pitch deck)

- and two hours of tutorial videos recorded with a business coach to explain all the logic you’ll need to master if you plan on writing a business plan that converts.

There’s simply no way to make things easier!

Now, having said that, let’s get going.

As a reminder, what is a business plan about?

To start the discussion, remember that a business plan is about much more than just numbers. As we’ve explained in our article What are Business Plans For? , the role of such a document is to show that beyond a nice business plan pdf nobody really cares about, you have a real business and a plan to get it somewhere.

First, a business plan’s purpose is to help you explain what your project is about. In that sense, the document you need to write should be written as a storytelling instrument, designed, and formulated to tell people a story they will want to read AND remember.

Second, it should give you a way to showcase your main business objectives for the next few years, as well as the strategy you will put into place to get there and deliver on your promises.

Third, your business plan should also provide a market analysis, and a description of your main target segment. That gives the reader a better understanding of your ecosystem’s potential, but more importantly the exercise forces you to look around, open your eyes and do some meaningful research.

You wouldn’t want to drive blindfolded, would you?

Of course, your document should also have a financial component – which is the topic of this article – and there the challenge is to ensure that your financial projections make sense, that they are clear, accurate and easy to follow.

Long things short, investors and bankers expect you to match a very specific business plan outline and format (there’s a code!) and you don’t have much wiggle room there – so be careful in your approach!

What is a Financial Plan & what should it include?

Now, let’s get into the core of this article: financial plans and financial projections. What are they, why are they important – there is a lot to explore.

First things first, what is a financial plan? How important is it in a business plan? And what type of elements is it made of? What are the projected financial statements you need to provide? Oh, and what do we mean by ‘financial projections’ in the first place, by the way?

What is the role of a financial plan in business plan?

A financial plan is the financial part of your business plan. Its purpose is simple: explain to the reader what should be the ins and outs of your project from a financial perspective, and help them see if their own business projections are aligned with yours.

On the one hand, the idea is to put numbers on your project, to make it tangible and show that your vision includes the end and the means.

On the other, it is also to show that you are capable of defending your big idea as well as the projected financials that need to come with it – something that many wannabe entrepreneurs are actually unable to do…

As a side note, and as silly as that might sound, this means that your business plan should include a lot more than just a financial plan and a smart cash flow projection!

That point brings us back to the one we made earlier when we said that a business plan should follow a specific structure (go read that article!), but we mention it again because we want things to be very clear: your business plan should be a matter of storytelling, not just a matter of financial projections!

Typically, we often see accountants work on business plans, and what they produce is rarely enough because they only deliver financial estimates that make no real sense to non-accountants (even less to the entrepreneurs at stake) and leave aside the rest of the topics – particularly the storytelling!

Said differently? The numbers are one aspect of the story, but you still have to come up with the pitch – which is where the rest of the business plan comes in handy.

Make sure to deliver an easy-to-read mix!

Your financial plan must provide your financial projections

To get into the technical part of the discussion, the financial plan in your business plan should include your financial projections, organized in a very formal format.

That makes two distinct points to consider!

On the one hand, you should be able to show with clear numbers what money should come in and when (that’s the income forecasts), for this year but also for the next, the ones after that for three to five years.

On the other, you should also be able to show what money needs to go out to make the business roll. What are the production costs, the fixed and variable expenses, the salaries, and of course the various marketing expenses needed to generate the development you are planning on getting to.

On that point, remember that your cost of client acquisition should also be part of the formalized projections – otherwise your numbers will be flawed (and doomed).

Ultimately, you need to be very clear as to when your new business (or existing business) should break even, as to when should profits be expected, as to when lenders and investors will get their money back, so forth and so on.

It must include specific financial documents people will expect to see

From a very formal perspective, you shouldn’t be trying to make one single projection sheet. Nope! Your readers will expect to see three important financial documents in the financial section of the business plan you will introduce to them.

- A profit and loss statement – also known as your P&L statement, or as an income statement

- A cash flow statement

- And a balance sheet.

First, the P&L table or income statement should show what money is expected to come in or go out, but it should also show if and when the business will make a profit or a loss, year by year, for the next five years.

The sales forecast and the operating expenses should be easy to understand at that stage, and you should also be able to provide your estimated gross profit, your gross margin, as well as your net profit and net margin.

In case you are wondering, your gross profit corresponds to your sales minus your cost of production. Your net profit corresponds to the gross profit minus all the remaining costs.

It’s okay to read that twice…

Not being profitable is also okay, by the way. That’s the game. However, you must be able to explain why you won’t be profitable in a given year, and how you plan on filling the gap in the bank – otherwise your business dies, right?

Second, the cashflow statement should explain your cash flow management strategy and indicate when you will need to fill the bank account in, and why.

For instance, important account receivables could justify a temporary cashflow need, but the gaps left from the previous years should also be visible. Obviously, the funding needs should also be there and aligned with the financial situation of the business.

Third, the balance sheet is a summary of the previous two tables, except that it shows the various elements in terms of assets or liabilities. For instance, the account receivables we mentioned just before would be an asset (because some money is owed to the business) while account payables would be a liability (since the business owes money to someone else).

Does all this sound a little complex?

That’s because it is.

No need to worry, though. We have you covered and will provide all the templates and tools you need further below. For now, just keep reading.

So, what’s the financial plan in a business plan for?

To conclude, the financial plan in business plan should act as a financial cartography of what you have in mind for that business of yours.

- The financial plan should illustrate the plan you have for the business in terms of numbers

- It should include precise financial projections of what you think can be achieved

- It should clearly illustrate your cashflow management strategy

- And it should summarize the information clearly

- All of this through highly standardized tables financiers will understand very easily

What documents should a financial business plan contain?

Getting your financial business plan right is a lot simpler than it seems.

Now, when you’re pitching that business of yours to potential partners, investors or lenders, you’ll need to provide them with a series of financial statements.

Yet, how to produce those documents without jumping into a living nightmare? How to come up with cash flow projections that make sense instead of being purely random?

Word of caution: financial planning for businesses is typically complex.

The question is not only fair, but it is also super-duper common and literally blocks tons of entrepreneurs and small business owners on a daily basis.

Because financial planning for businesses is typically complex.

Because most people aren’t comfortable with numbers.

And because the vast majority of small business owners simply don’t know where to start.

That’s probably why you were looking for either a financial plan pdf template or an example of financial plan for small business owners a few minutes ago, isn’t it?

Typically, here is what happens.

Some try and do their best, but then they don’t feel confident with pitching and defending their financial analysis, so they keep delaying and nothing happens.

Others end up having recourse to external help, even though external business plan consultants usually aren’t a good idea at that stage.

And the rest gives up.

That’s a shame, especially if consider that financial planning for a small business and building a financial plan for a business plan are only a matter of having access to the right method and tools!

Yes, a big (big) part of the work is to guestimate, but the rest is about trusting the process with the right logic, method and tools – and there’s nothing you can’t manage here.

Especially with the right tools!

How to build your financial forecasts?

Now that you understand the different sections of a financial plan, let us talk about how to build financial forecasting.

In plain English, this part of the exercise is where you’ll estimate your company’s income and expenses for the next few years. Therefore, you should keep a few things in mind.

One, you need to have a good understanding of your business in order to create realistic forecasts.

Sounds silly? Maybe, but this is a mistake people make way too much, and when they fail at justifying their financial projections, everything else goes down.

Two, you absolutely want to make sure that your projections can explore various trends, i.e. your pessimistic, optimistic, and most likely scenarios.

- If everything goes extremely well, we’ll get there.

- If everything goes wrong, we’ll get there.

- But… we should reasonably expect to achieve this and that if we obtain the funding we need…

Can you see the idea?

Be sure to also factor in any potential changes or risks that could affect your business.

For example, if you’re expecting a new competitor to enter the market, you’ll need to account for that in your projections. By being realistic and accounting for as many variables as possible, you’ll give yourself the best chance of success so give it some thought!

Pragmatically, how do I come up with reasonable financial forecasts for my business plan?

It’s all a question of common sense, really.

- How much do you plan on selling?

- What are your short, medium and long term financial goals?

- What would be the cost of production?

- What margin does that leave you with?

- What fixed costs would you expect?

- How about variable costs?

- Have you included transaction fees and credit card fees in your costs?

- What is the cost of insurance premiums?

- Will there be any debt to repay?

- What type of budget do you need for marketing purposes?

- What is the cost of acquisition of the client?

- What operational margin does it leave before the taxman comes in?

- What kind of money do you need to meet your long term goals?

- Have you planned for any emergency fund at all?