- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Successful Business Plan for a Loan

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Table of Contents

What does a loan business plan include?

What lenders look for in a business plan, business plan for loan examples, resources for writing a business plan.

A comprehensive and well-written business plan can be used to persuade lenders that your business is worth investing in and hopefully, improve your chances of getting approved for a small-business loan . Many lenders will ask that you include a business plan along with other documents as part of your loan application.

When writing a business plan for a loan, you’ll want to highlight your abilities, justify your need for capital and prove your ability to repay the debt.

Here’s everything you need to know to get started.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

A successful business plan for a loan describes your financial goals and how you’ll achieve them. Although business plan components can vary from company to company, there are a few sections that are typically included in most plans.

These sections will help provide lenders with an overview of your business and explain why they should approve you for a loan.

Executive summary

The executive summary is used to spark interest in your business. It may include high-level information about you, your products and services, your management team, employees, business location and financial details. Your mission statement can be added here as well.

To help build a lender’s confidence in your business, you can also include a concise overview of your growth plans in this section.

Company overview

The company overview is an area to describe the strengths of your business. If you didn’t explain what problems your business will solve in the executive summary, do it here.

Highlight any experts on your team and what gives you a competitive advantage. You can also include specific details about your business such as when it was founded, your business entity type and history.

Products and services

Use this section to demonstrate the need for what you’re offering. Describe your products and services and explain how customers will benefit from having them.

Detail any equipment or materials that you need to provide your goods and services — this may be particularly helpful if you’re looking for equipment or inventory financing . You’ll also want to disclose any patents or copyrights in this section.

Market analysis

Here you can demonstrate that you’ve done your homework and showcase your understanding of your industry, current outlook, trends, target market and competitors.

You can add details about your target market that include where you’ll find customers, ways you plan to market to them and how your products and services will be delivered to them.

» MORE: How to write a market analysis for a business plan

Marketing and sales plan

Your marketing and sales plan provides details on how you intend to attract your customers and build a client base. You can also explain the steps involved in the sale and delivery of your product or service.

At a high level, this section should identify your sales goals and how you plan to achieve them — showing a lender how you’re going to make money to repay potential debt.

Operational plan

The operational plan section covers the physical requirements of operating your business on a day-to-day basis. Depending on your type of business, this may include location, facility requirements, equipment, vehicles, inventory needs and supplies. Production goals, timelines, quality control and customer service details may also be included.

Management team

This section illustrates how your business will be organized. You can list the management team, owners, board of directors and consultants with details about their experience and the role they will play at your company. This is also a good place to include an organizational chart .

From this section, a lender should understand why you and your team are qualified to run a business and why they should feel confident lending you money — even if you’re a startup.

Funding request

In this section, you’ll explain the amount of money you’re requesting from the lender and why you need it. You’ll describe how the funds will be used and how you intend to repay the loan.

You may also discuss any funding requirements you anticipate over the next five years and your strategic financial plans for the future.

» Need help writing? Learn about the best business plan software .

Financial statements

When you’re writing a business plan for a loan, this is one of the most important sections. The goal is to use your financial statements to prove to a lender that your business is stable and will be able to repay any potential debt.

In this section, you’ll want to include three to five years of income statements, cash flow statements and balance sheets. It can also be helpful to include an expense analysis, break-even analysis, capital expenditure budgets, projected income statements and projected cash flow statements. If you have collateral that you could put up to secure a loan, you should list it in this section as well.

If you’re a startup that doesn’t have much historical data to provide, you’ll want to include estimated costs, revenue and any other future projections you may have. Graphs and charts can be useful visual aids here.

In general, the more data you can use to show a lender your financial security, the better.

Finally, if necessary, supporting information and documents can be added in an appendix section. This may include credit histories, resumes, letters of reference, product pictures, licenses, permits, contracts and other legal documents.

Lenders will typically evaluate your loan application based on the five C’s — or characteristics — of credit : character, capacity, capital, conditions and collateral. Although your business plan won't contain everything a lender needs to complete its assessment, the document can highlight your strengths in each of these areas.

A lender will assess your character by reviewing your education, business experience and credit history. This assessment may also be extended to board members and your management team. Highlights of your strengths can be worked into the following sections of your business plan:

Executive summary.

Company overview.

Management team.

Capacity centers on your ability to repay the loan. Lenders will be looking at the revenue you plan to generate, your expenses, cash flow and your loan payment plan. This information can be included in the following sections:

Funding request.

Financial statements.

Capital is the amount of money you have invested in your business. Lenders can use it to judge your financial commitment to the business. You can use any of the following sections to highlight your financial commitment:

Operational plan.

Conditions refers to the purpose and market for your products and services. Lenders will be looking for information such as product demand, competition and industry trends. Information for this can be included in the following sections:

Market analysis.

Products and services.

Marketing and sales plan.

Collateral is an asset pledged to a lender to guarantee the repayment of a loan. This can be equipment, inventory, vehicles or something else of value. Use the following sections to include information on assets:

» MORE: How to get a business loan

Writing a business plan for a loan application can be intimidating, especially when you’re just getting started. It may be helpful to use a business plan template or refer to an existing sample as you’re going through the draft process.

Here are a few examples that you may find useful:

Business Plan Outline — Colorado Small Business Development Center

Business Plan Template — Iowa Small Business Development Center

Writing a Business Plan — Maine Small Business Development Center

Business Plan Workbook — Capital One

Looking for a business loan?

See our overall favorites, or narrow it down by category to find the best options for you.

on NerdWallet's secure site

U.S. Small Business Administration. The SBA offers a free self-paced course on writing a business plan. The course includes several videos, objectives for you to accomplish, as well as worksheets you can complete.

SCORE. SCORE, a nonprofit organization and resource partner of the SBA, offers free assistance that includes a step-by-step downloadable template to help startups create a business plan, and mentors who can review and refine your plan virtually or in person.

Small Business Development Centers. Similarly, your local SBDC can provide assistance with business planning and finding access to capital. These organizations also have virtual and in-person training courses, as well as opportunities to consult with business experts.

Business plan software. Although many business plan software platforms require a subscription, these tools can be useful if you want a templated approach that can break the process down for you step-by-step. Many of these services include a range of examples and templates, instruction videos and guides, and financial dashboards, among other features. You may also be able to use a free trial before committing to one of these software options.

A loan business plan outlines your business’s objectives, products or services, funding needs and finances. The goal of this document is to convince lenders that they should approve you for a business loan.

Not all lenders will require a business plan, but you’ll likely need one for bank and SBA loans. Even if it isn’t required, however, a lean business plan can be used to bolster your loan application.

Lenders ask for a business plan because they want to know that your business is and will continue to be financially stable. They want to know how you make money, spend money and plan to achieve your financial goals. All of this information allows them to assess whether you’ll be able to repay a loan and decide if they should approve your application.

On a similar note...

- Search Search Please fill out this field.

Why Do I Need a Business Plan?

Sections of a business plan, the bottom line.

- Small Business

How to Write a Business Plan for a Loan

How to secure business financing

Matt Webber is an experienced personal finance writer, researcher, and editor. He has published widely on personal finance, marketing, and the impact of technology on contemporary arts and culture.

:max_bytes(150000):strip_icc():format(webp)/smda1_crop-f0c167dd2b2144f68f352c63d17f7db5.jpg)

A business plan is a document that explains what a company’s objectives are and how it will achieve them. It contains a road map for the company from a marketing, financial, and operational standpoint. Some business plans are more detailed than others, but they are used by all types of businesses, from large, established companies to small startups.

If you are applying for a business loan , your lender may want to see your business plan. Your plan can prove that you understand your market and your business model and that you are realistic about your goals. Even if you don’t need a business plan to apply for a loan, writing one can improve your chances of securing finance.

Key Takeaways

- Many lenders will require you to write a business plan to support your loan application.

- Though every business plan is different, there are a number of sections that appear in every business plan.

- A good business plan will define your company’s strategic priorities for the coming years and explain how you will try to achieve growth.

- Lenders will assess your plan against the “five Cs”: character, capacity, capital, conditions, and collateral.

There are many reasons why all businesses should have a business plan . A business plan can improve the way that your company operates, but a well-written plan is also invaluable for attracting investment.

On an operational level, a well-written business plan has several advantages. A good plan will explain how a company is going to develop over time and will lay out the risks and contingencies that it may encounter along the way.

A business plan can act as a valuable strategic guide, reminding executives of their long-term goals amid the chaos of day-to-day business. It also allows businesses to measure their own success—without a plan, it can be difficult to determine whether a business is moving in the right direction.

A business plan is also valuable when it comes to dealing with external organizations. Indeed, banks and venture capital firms often require a viable business plan before considering whether they’ll provide capital to new businesses.

Even if a business is well-established, lenders may want to see a solid business plan before providing financing. Lenders want to reduce their risk, so they want to see that a business has a serious and realistic plan in place to generate income and repay the loan.

Every business is different, and so is every business plan. Nevertheless, most business plans contain a number of generic sections. Common sections are: executive summary, company overview, products and services, market analysis, marketing and sales plan, operational plan, and management team. If you are applying for a loan, you should also include a funding request and financial statements.

Let’s look at each section in more detail.

Executive Summary

The executive summary is a summary of the information in the rest of your business plan, but it’s also where you can create interest in your business.

You should include basic information about your business, including what you do, where you are based, your products, and how long you’ve been in business. You can also mention what inspired you to start your business, your key successes so far, and your growth plans.

Company Overview

In this section, focus on the core strengths of your business, the problem you want to solve, and how you plan to address it.

Here, you should also mention any key advantages that your business has over your competitors, whether this is operating in a new market or a unique approach to an existing one. You should also include key statistics in this section, such as your annual turnover and number of employees.

Products and Services

In this section, provide some details of what you sell. A lender doesn’t need to know all the technical details of your products but will want to see that they are desirable.

You can also include information on how you make your products, or how you provide your services. This information will be useful to a lender if you are looking for financing to grow your business.

Market Analysis

A market analysis is a core section of your business plan. Here, you need to demonstrate that you understand the market you are operating in, and how you are different from your competitors. If you can find statistics on your market, and particularly on how it is projected to grow over the next few years, put them in this section.

Marketing and Sales Plan

Your marketing and sales plan gives details on what kind of new customers you are looking to attract, and how you are going to connect with them. This section should contain your sales goals and link these to marketing or advertising that you are planning.

If you are looking to expand into a new market, or to reach customers that you haven’t before, you should explain the risks and opportunities of doing so.

Operational Plan

This section explains the basic requirements of running your business on a day-to-day basis. Your exact requirements will vary depending on the type of business you run, but be as specific as possible.

If you need to rent office space, for example, you should include the cost in your operational plan. You should also include the cost of staff, equipment, and any raw materials required to run your business.

Management Team

The management team section is one of the most important sections in your business plan if you are applying for a loan. Your lender will want reassurance that you have a skilled, experienced, competent, and reliable senior management team in place.

Even if you have a small team, you should explain what makes each person qualified for their position. If you have a large team, you should include an organizational chart to explain how your team is structured.

Funding Request

If you are applying for a loan, you should add a funding request. This is where you explain how much money you are looking to borrow, and explain in detail how you are going to use it.

The most important part of the funding-request section is to explain how the loan you are asking for would improve the profitability of your business, and therefore allow you to repay your loan.

Financial Statements

Most lenders will also ask you to provide evidence of your business finances as part of your application. Graphs and charts are often a useful addition to this section, because they allow your lender to understand your finances at a glance.

The overall goal of providing financial statements is to show that your business is profitable and stable. Include three to five years of income statements, cash flow statements, and balance sheets. It can also be useful to provide further analysis, as well as projections of how your business will grow in the coming years.

What Do Lenders Look for in a Business Plan?

Lenders want to see that your business is stable, that you understand the market you are operating in, and that you have realistic plans for growth.

Your lender will base their decision on what are known as the “five Cs.” These are:

- Character : You can stress your good character in your executive summary, company overview, and your management team section.

- Capacity : This is, essentially, your ability to repay the loan. Your lender will look at your growth plans, your funding request, and your financial statements in order to assess this.

- Capital : This is the amount of money you already have in your business. The larger and more established your business is, the more likely you are to be approved for finance, so highlight your capital throughout your business plan.

- Conditions : Conditions refer to market conditions. In your market analysis, you should be able to prove that your business is well-positioned in relation to your target market and competitors.

- Collateral : Depending on your loan, you may be asked to provide collateral , so you should provide information on the assets you own in your operational plan.

How Long Does It Take to Write a Business Plan?

The length of time it takes to write a business plan depends on your business, but you should take your time to ensure it is thorough and correct. A business plan has advantages beyond applying for a loan, providing a strategic focus for your business.

What Should You Avoid When Writing a Business Plan?

The most common mistake that business owners make when writing a business plan is to be unrealistic about their growth potential. Your lender is likely to spot overly optimistic growth projections, so try to keep it reasonable.

Should I Hire Someone to Write a Business Plan for My Business?

You can hire someone to write a business plan for your business, but it can often be better to write it yourself. You are likely to understand your business better than an external consultant.

Writing a business plan can benefit your business, whether you are applying for a loan or not. A good business plan can help you develop strategic priorities and stick to them. It describes how you are going to grow your business, which can be valuable to lenders, who will want to see that you are able to repay a loan that you are applying for.

U.S. Small Business Administration. “ Write Your Business Plan .”

U.S. Small Business Administration. “ Market Research and Competitive Analysis .”

U.S. Small Business Administration. “ Fund Your Business .”

Navy Federal Credit Union. “ The 5 Cs of Credit .”

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans for May 2024 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How To Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

How to Write a Business Plan for a Loan

Business plans are often required when applying for funds from venture capitalists or other private investors, but even if you are seeking a bank loan for your company it is very helpful to prepare one since the lender wants to be confident that he is taking on an investment with growth potential so that you can repay the loan.

In this article, you will learn about the types of business loans, the importance of the business plan in your application for a loan, and how to write a business plan that will help you get the funding you need for your company.

Download our Ultimate Business Plan Template here

What Is a Business Loan?

A business loan is funding that is provided by a financial institution to a company for it to carry out its day-to-day operational activities. It also supports the purchase of equipment, refinancing of debt, and other purposes. Small businesses might need these loans because they may not have enough funds to buy equipment, refinance debt, or because they encounter financial difficulties.

Your Loan Application

You can apply for a commercial loan with your local bank, credit union, Small Business Administration (SBA) lender, or community development financial institution like Capital Impact. You should expect that the lender will ask you detailed questions about all aspects of your business to ensure that he or she is lending you money that will be repaid.

In addition, if you are looking to purchase a business or commercial real estate, the lender may ask for additional information and documentation to assess your qualifications and ability to repay the loan.

Before applying for a business loan it can be helpful to research different types of loans so you understand what is available and what you will need to pay attention to in your loan proposal.

Common Types of Business Loans

There are many types of loans for small businesses, including:

- lines of credit

- commercial mortgages

- equipment financing

Contact different lenders in your area to see what kind of loan terms they offer and if their interest rates are within your budget.

What is a Business Plan?

A traditional business plan is a document that provides an analysis of the present situation and future financial projections for a company. It includes details about the owners, management team, customers, location of the business, finances, marketing plan, and other information.

A comprehensive and well-researched business plan will help lenders make informed decisions about providing a loan for your business.

To help you get started, you can download our sample business plan for bank loan pdf .

Why Do You Need a Business Plan to Get a Business Loan?

A loan proposal business plan is your opportunity to show the lender you understand your business, its capabilities, and how it operates within the industry in which it competes. By putting together a clear and concise document that outlines all of this information, the lender should have a much easier time understanding how you have arrived at your numbers and where you are going in the future.

A business plan is also helpful to the lender because it provides an opportunity for him or her to ask you questions, further clarifying details that might not be clear from your application materials alone. This way the lender can walk away from the meeting with a good understanding of what he or she is loaning money to and how likely it is he or she will see the loan repaid.

How to Write a Business Plan to Get Approved for a Loan

Different lenders may ask for different sections of your business plan, but most require some combination of the following key elements.

1. Executive Summary

The Executive Summary is the first section of your business plan that a lender will read, but typically the last section written. It is very important because it acts as a snapshot of your business plan and allows the person reading to get an overview of what you are proposing.

The summary should include:

- A statement about why you need the business loan

- Details on how much money you want to borrow, when you will repay it, and interest rates

- A description of how the proceeds from the loan will be used

- Your business’s historical and projected financial information (again)

- The expected impact on your company and the industry as a whole if you are successful.

2. Company Description

In the Company Description, you should include basic facts about your company such as:

- What is the business structure (corporation, partnership, limited liability company (LLC), etc.)?

- How long has your company been in operation?

- What is the size of your workforce?

- What accomplishments or milestones have you achieved within the last year?

This section should also include information about your future business plans.

- How do you plan to expand, if at all?

- Who are your main competitors and how is your company different from them?

- What changes will you make to excel against these competitors?

3. Industry Analysis

In the Industry or Market Analysis, you should include information about your industry in general.

- What are the strengths and weaknesses of your industry?

- How will your company compete in it?

- What trends within the industry affect its future success or potential struggles?

You may also include information about your specific niche in the market. If your company operates in a very specific area of the industry, be sure to highlight it.

4. Customer Analysis

The Customer Analysis section of your business plan helps a lender understand who your customers are and why they will buy from you.

In this section, you should include information on the following:

- Your target audience and the individual customer segments

- How many potential customers you have within your target market

- How much your customers typically spend, and how much you expect them to spend in the future

- What has caused these changes or trends to occur and how they will impact your business

5. Competitive Analysis

This section should show the competitive landscape and how you plan to compete against your competitors.

- What are their strengths?

- Where do they fall short?

- What changes will you implement to get ahead of them?

- What are your company’s competitive advantages over these competitors?

6. Marketing Plan

This section should include a detailed description of the marketing strategy you plan to implement.

- What is your customer acquisition cost? How much will it cost you to bring in one new customer?

- How will you reach these potential customers? Be specific about your marketing strategy, advertising methods and costs.

- Who is responsible for implementing each part of the marketing plan and how much it is expected to cost?

7. Operations Plan

Your Operations Analysis should describe the way your company currently operates and how it will operate with the help of the loan.

- What are your company’s strengths? Weaknesses?

- What have you implemented in the past 12 months that has led to increased revenue, decreased costs, or improved efficiency?

- How will you continue to operate efficiently with the proceeds?

8. Management Team

In the management section, you should describe your business in terms of its personnel structure.

- What are the responsibilities of each person on your team?

- Who are they? What are their qualifications?

- How will their roles change when you receive the loan proceeds?

9. Financial Plan

This section should include your company’s financial statements include the projected income statements, projected balance sheet, and cash flow statements for the next 3 – 5 years.

You can assume that you will receive loan proceeds in 20XX, so plan accordingly.

Include a five-year break-even analysis and an explanation of how you arrived at your income statement and cash flow projections. Don’t forget to include interest and loan payments in your financial projections.

10. Appendix

In this section, you will include the supporting documents for the claims within your business plan. This section should include:

- A loan agreement

- A list of all applicable business licenses, permits, etc. that your company holds or has applied for

You may also include:

- An organizational chart for your company

- The resumes of the members of your management team

- The resumes of any employees who will be making a significant impact on your business with the loan money

- Copies of contracts, leases, and other agreements that are relevant to your business plan

- Complete financial statements and projections if you only include a summary in the Financial Plan section

These documents should be attached to your business plan in a separate file if they are not included and may need to be submitted with the final small business loan application.

Tips for Writing a Business Plan for a Loan

To have a successful business plan and loan application, you need to know exactly what information your loan officer is looking for and how to find it.

- Before you submit your application, be sure to carefully edit and proofread it for errors. Errors in a business plan may lead a lender to question your attention to detail, so make sure it is polished and error-free.

- Always be sure to include an executive summary of the main points of your plan at the beginning, as some loan officers may not read all of the details.

- Be sure to keep your tone professional and business-like.

- Include detailed financials, market analysis, and other crucial information.

- Remember that any omission or inaccuracies will be carefully scrutinized by a lending officer, so be sure you have all of the necessary documents before submission.

- Finally, remember that lenders often appreciate creativity and outside-the-box thinking when it comes to business plans, but don’t let it distract from the necessary information for your application.

Writing a good business plan is one of the most important and necessary steps toward securing a loan or other source of capital.

Use our proven business plan template provided below, and you’ll be able to give your lender all of the information they need to make an informed decision.

The key is to do it right. By following the steps outlined above and including all of the necessary documents (and editing/proofing your application), you should significantly improve your chance of securing a loan for your business.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Other Helpful Business Plan Articles & Templates

Home > Finance > Loans

How to Get a Small Business Loan in 7 Simple Steps

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Sooner or later, many small-business owners consider taking out a loan to supplement their business's growth. But small-business loans can be tricky lines of capital to obtain, especially if you don't know much about the application process. And with the broader banking system still reeling from the collapse of Silicon Valley Bank and Signature Bank, you’ll need a rock-solid plan and squeaky-clean paperwork before you even approach a bank.

That preparation begins here with these seven crucial steps for nailing down a business loan.

- Establish your reason for the loan

- Learn how lenders assess you

- Determine which type of loan you need

- Decide on a lender

- Gather the right financial documents

- Apply for the loan

- Keep building your financial profile

Lendio partners with over 75 lenders, which improves your odds and efficiency to get the funding you need.

Qualifications:

$50k in revenue

6 mos. in business

560 credit score

1. Establish your reason for the loan

The lender is going to hand over a significant amount of money to your business, and they’re going to want to know how and why it’s being spent. It’s a valid concern: how you invest the loan will affect your business’s income and ability to pay it back. Stocking up inventory or covering payroll are valid reasons banks and other traditional lenders would consider your loan application. (Purchasing a recreational 3D printer for the breakroom . . . not so much.)

General rationales for small businesses seeking loans include managing daily expenses, expanding or purchasing equipment, building a cash buffer against possible future shortfalls, or just starting a business. Also, determine exactly how much money you’ll need to borrow—don’t ballpark it and end up with too much to pay back or too little to cover expenses. A loan calculator can help you determine how much you can afford to take out, interest rates and all.

2. Learn how lenders assess you

Banks and lenders have their own formulas to determine if a loan will likely be paid back. In the case of small businesses, the formula usually involves—but isn’t limited to—five factors for consideration. Since small businesses also tend to be newer operations, they’re probably not going to excel in every area, but if they’re strong in at least three of the five, that can help level the bank’s assessment. Factors to pay attention to include the following:

- Credit score and history. If you’ve repaid loans responsibly in the past, the potential lender will find out—and they’ll also find out if you haven’t. Banks can assess business and personal financial histories through a variety of avenues, but most loan processes begin with a credit review .

- Collateral. What do you own that could cover the loan in case of default? Most banks and lenders will require something of value to shield the lender. Typical business items that qualify as collateral include real estate, buildings, vehicles, equipment, inventory, and accounts receivable.

- Cash flow. The more money your business is currently making, the less of a loan risk it’ll be to the lender. Banks and lenders will not only look at the amount of profit you’re bringing in but also examine how you’re managing it.

- Time in business. If you’ve been functioning as a business for several years, you’re probably doing something right. Startups and newer businesses won’t have time on their side, but a solid, executable business plan for reaching milestones will go a long way toward evening the odds in the lenders’ eyes.

- Industry. What’s the forecast for your line of business? For instance, if you had a successful local brewery last year but six more are fermenting in the area this year, your competitors might start to cut into your business's profits. Lenders might take current industry trends into consideration when deciding whether or not to approval your loan request.

By signing up I agree to the Terms of Use and Privacy Policy .

3. Determine which type of loan you need

Most traditional small-business lenders have strict requirements about your business's time in business and revenue. If you’re just launching your business and haven't started earning revenue, you'll have an easier time qualifying for a personal loan over a traditional small-business loan.

But there are multiple types of loans beyond traditional personal and business loans. Here are some of the most popular options.

Common loan types overview

We've overviewed the main types of loans—now let's look at a few more details.

- Term loans. With term loans , business owners receive a lump sum of money from their lender, which they’ll repay over an agreed-upon time. Along with repaying the principal loan amount, borrowers will repay interest accrued on the loan. Term loans are best for established businesses with solid credit that need expansion cash quickly.

- SBA loans. The U.S. Small Business Administration backs bank loans that meet strict borrower guidelines. This backing instills the confidence in banks and lenders to take chances on applicants who’ve previously been turned down. SBA loan interest rates are typically low, but the approval process can take months.

- Business lines of credit. Less rigid than a bank loan, a business line of credit gives you access to as much capital as your credit limit will allow, but you pay interest only on the cash drawn. Business lines of credit work well for covering short-term expenses or annual downtime for seasonal businesses.

- Business credit cards . Like business lines of credit, business credit cards give business owners near-instant access to a revolving line of credit. Business credit cards often come with rewards and even sign-up bonuses, which you won't get with lines of credit, but the repayment terms are typically stricter and the APR much higher.

- Commercial real estate loans. As the name implies, commercial real estate loans are for the purchase, development, and construction of business structures—offices, storefronts, hotels, etc.—typically for lease or rent to other businesses. Terms for these loans range from less than five years up to twenty.

- Invoice factoring and financing. With invoice factoring , you sell your business’s as-yet unpaid invoices to a factoring company, which then becomes responsible for collection from your customers. Conversely, invoice financing uses those invoices as collateral for a loan. Both generate cash fast.

- Equipment financing. When you take out a loan to buy business-related equipment , the equipment itself becomes the collateral, and the terms of the loan are determined by the expected lifespan and value of the equipment. As long as it doesn’t become outdated, owning it is good for building equity.

- Microfinancing. Microloans , or short-term loans under $50,000, can help business owners build their credit score as well as their cash flow.

- Merchant cash advances. If your business makes considerable and consistent credit card sales, a merchant cash advance can be a quick source of capital. After the lump-sum loan is made, it’s paid back through a daily withholding of your credit and debit card sales or weekly bank account withdrawals. Merchant cash advances are quite risky, and the repayment terms and interest rates are brutal if you miss a payment. Typically, we recommend merchant cash advances only as a last resort, and only if you're sure you can pay them back immediately.

4. Decide on a lender

After settling on which type of loan you need, it's time to choose a lender. Not all business financing venues, or even traditional lenders, are the same. If you're not sure where to start looking for lenders, here are a few of our favorites.

Recommended lenders

Data as of 2/8/23. Offers and availability may vary by location and are subject to change. *Does not represent the typical rate for every borrower, and other fees may apply.

Main types of lenders

Banks are typically seen as the traditional place to get a loan—but as you can tell from the table above, you have quite a few options to get a loan apart from going directly to a bank. Here are some of the main types of lenders you can choose from as you consider loan applications.

Direct lenders usually include banks, wealthy investors, asset-management firms, credit unions, and other traditional lenders. These types of lenders deal one-to-one with borrowers—you don't go through a third party to acquire a direct loan.

At Business.org, we recommend direct lenders Kabbage , OnDeck , and Accion for small businesses in dealing with financial institutions.

A lending marketplace collects loan options from networks of business funders, including traditional banks. Online lenders typically have a fast turnaround but require decent credit scores. Business.org's favorite lending marketplace is Lendio , which partners with 75 or so lenders and matches you with the best loan offers after you submit your application.

Peer-to-peer lending is a form of direct lending that lives almost exclusively online. Investors browse borrower profiles and choose businesses they’d take a chance on. (You've probably funded a few small businesses, projects, or individuals on platforms like Kickstarter and GoFundMe.) A peer-to-peer loan can come from one or several investors.

If you're interested in finding a peer-to-peer loan, we recommend looking at Lending Club and Funding Circle .

5. Gather the right financial documents

Whichever type of lender you go with or type of loan you apply for, you’ll need to present financial documents that explain where your business stands financially.

Of course, lenders will typically look at your credit score (including your FICO score, if you're taking out a personal loan to fund your business). But your credit score isn't enough information for lenders to determine whether or not you're loan-worthy ("lendable"), which is why lenders typically require an assortment of the following documents:

- Financial statements, such as profit and loss statements , cash flow statements, and balance sheets

- Business and personal credit reports

- Business and personal tax returns for at least the last year

- Business plan

- Business forecast

- State registrations and licenses

- Legal documentation, such as articles of incorporation, commercial leases, franchise agreements, etc.

6. Apply for the loan

If you’re applying for a substantial amount of money, you’ll want to allow your business plan plenty of lead time. Depending on the loan and lender, the loan application process can take months. Using some avenues, like lending marketplaces, can speed up the application and approval course, but in most cases, actually getting the money isn’t an overnight proposition for startup business loans.

Beyond the loan amount itself, tacked-on fees can take you by surprise if you’re not paying attention. Keep an eye on loan application fees, SBA loan guarantee fees, early repayment fees, and late repayment fees, as they’ll eventually affect your annual percentage rate (APR). By the time you apply, you should have a reasonable level of comfort with your ability to repay the loan on time and with the payment schedule, the APR, and the included fees.

Remember, you want to know how much the loan will ultimately cost, interest and all. As you're getting your documents in order and starting the application process, use a loan calculator to ensure you're taking out the right amount of money.

7. Keep building your financial profile

Improving personal credit, establishing business credit , paying down existing debts, maximizing income, expanding assets—these are all ways to build up your financial profile for future growth. It may seem backward, but banks prefer lending to businesses that don’t desperately need the money. It’s in your best interest to negotiate from a position of capital power.

While running your own operation doesn’t necessarily get easier, your future small-business loan processes will become more painless going forward, now that you’ve begun building your financial profile. Establish and build your business credit, and then you’ll be able to rely upon yourself instead of playing the economic odds.

Alternatives to business loans

Personal loans.

Newer businesses may not qualify for many small business loans — that’s where personal loans come in. Personal loans are authorized based primarily on your personal credit score .

Some personal lenders, like Upstart , will approve loans to individuals whose credit scores are as low as 300. But most personal loan providers require at least a 580 credit score.

Personal loans can range from $1,000 to $100,000 with an interest rate span of 5.99% to 35.95%. In order to qualify for higher amounts, you’ll likely need to secure the loan with some kind of collateral .

Your personal credit and assets are liable in the event of defaulting on a personal loan. With many business loans, only business assets will be at stake. But, as long as you’re comfortable with the risks, a personal loan can be another way to secure financing.

Personal credit cards

Personal credit cards are a great way to build credit in pursuit of a wider variety of lending options. Credit card APR ranges from 15.16% to 24%+ depending on your credit score.

If you have a credit score below 579, your lender may only offer a secured credit card where you make a cash deposit as collateral. You won’t have as much borrowing power because your credit limit will be a percentage of your collateral. Still, a secured credit card can help you build credit.

Your lender will decide your credit limit, but the average limit is around $13,000. The key to building credit — no matter your limit — is to consistently make your payments on time. Keep up with that and you’ll be able to apply for better lending products in no time.

The takeaway

Depending on if you have an established business or are just starting out, there are many attainable ways to get funding via small-business loans, including personal loans for first-time small-business owners.

Take a look at your financial wellbeing, documentation, and consider applying for a loan through your local bank, the SBA, or the multitude of online lenders—keeping in mind their specific fees and borrowing terms.

Wherever you’re at in your business journey, there are multiple options available for a first-time business loan.

Want to learn more about small business loans and financing? Check out our ultimate guide to small-business loans.

Related reading

- SBA Loan Rates Explained

Best Small Business Loans

- How to Apply for a Business Credit Card

- How to Build Business Credit: 5 Steps for Improving Your Business Credit Score

Small Business Loan FAQs

Some business lenders require around $10,000 of revenue per month while many require $30,000 or more per month. Your business revenue requirements depend on where you apply and what kind of loan you’re applying for. Be sure to check your lender requirements before you apply.

Yes. There are a few ways to approach securing a loan with bad credit . You can apply for a secure or collateralized loan or apply for a lending product that isn’t related to your credit score — something like an invoice factoring loan .

You can also apply for microloans , some of which have no minimum requirements. Additionally, there are lending marketplaces like Lendio that send your application to multiple lenders.

No. Many small businesses loans are easy to obtain. Take Lendio’s small business loans , for example. You fill out a 15-minute loan application and Lendio sends your request to a marketplace of lenders who will make you offers. Just like that, you have business loans available to you.

That said, there are some factors that may make securing a loan for your business more difficult. If you have poor business credit or your business is relatively new, for example, it may be difficult to get approved for a loan.

You may still be able to apply for a personal loan if your business credentials aren’t solid yet.

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2024 All Rights Reserved.

How to get a business loan from a bank

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Personal finance

- • Personal loans

- • Auto loans

- Connect with Pippin Wilbers on LinkedIn Linkedin

- Get in contact with Pippin Wilbers via Email Email

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Key takeways

- Compared to other types of lenders, banks may offer larger loan amounts and lower rates

- Banks typically require a credit score of at least 670 for a small business loan

- Bad credit and subprime borrowers may have better luck applying for a loan with online or alternative lenders

If your business is ready to grow, you may be considering applying for a small business loan at a bank. Many small business owners lean toward bank loans because they may offer larger amounts, lower rates and more hands-on support than online lenders.

According to the 2024 Report on Employer Firms from the Federal Reserve Banks, small businesses looking for financing were likelier to seek financing at a bank. Of the credit sources applicants applied to, 44 percent chose a large bank, while 28 percent chose a small bank.

Banks approve a majority of the loans applied for, but small banks are the most likely to approve you. According to the Federal Reserve’s Small Business Lending Survey , small banks approved 88 percent of applications in Q3 of 2023. Mid-sized banks approved 68 percent, and large banks approved about 52 percent.

As your business needs to meet certain requirements for a bank small business loan, you’ll want to find the right bank to be your lender. Here’s everything you need to know about how to get a business loan from a bank.

1. Check your business and personal credit scores

The bank will likely check your business credit score and the personal credit scores of any business owners when you apply for a loan. Because they will look into your credit, it’s a good idea to check your credit score ahead of time. Three main business credit bureaus assess your business credit: Dun & Bradstreet, Equifax and Experian.

If your score is too low, consider taking time to improve your credit score before applying for a business loan from a bank. You could consider opening a business credit card or secured line of credit to start building a positive payment history to boost your score.

Most lenders look at your FICO score to assess your personal credit history. Typically, banks like Wells Fargo set strict credit requirements to apply, usually requiring a FICO score of at least 670. However, online lenders may grant certain loan types to businesses with personal credit scores as low as 550.

You can also find banks with loan programs that don’t focus on credit scores and consider other factors to assess your creditworthiness. For example, Bank of America offers a cash-secured business line of credit that approves startup businesses as long as you can put down a $1,000 security deposit. Huntington Bank ’s Lift Local Business loan is another option that doesn’t solely focus on credit score.

2. Calculate how much money you need — and how much you can afford to repay

When you apply, the bank will want to know how much funding you want. Calculate your business needs to determine the right loan size.

Think about how much you can afford to repay as well. You will have a monthly payment until you pay off the loan, so you should be able to budget for the monthly payment each month from your business finances. The monthly payment will include both interest and principal payments.

3. Choose a loan type

There are many small business loan types . Research and choose the best option for your needs.

4. For secured loans, choose your collateral

Any secured loan requires collateral to back the loan. Term loans and credit lines often have both secured and unsecured options. Just be aware that unsecured loans often have higher interest rates.

SBA loans usually have specific collateral requirements, though small loans under $50,000 may not require collateral. Equipment and commercial real estate loans are usually backed by the equipment or real estate purchased.

Your lender may allow you to choose your collateral. You can use any business asset to back the loan — some will even let you use personal assets. It could be a vehicle, property, equipment, cash or investments.

It’s not always needed, but sometimes you may want to get the collateral appraised. If you are in the midst of a business merger, acquisition or bankruptcy, the value of the collateral you use may be debatable. An appraisal can help you get an accurate value for your collateral. In addition, certain SBA loans have specific appraisal requirements. You can talk to your lender to find out more about these. Lightbulb Bankrate insight When getting a small business loan from a bank, you may be required to sign a personal guarantee . This statement guarantees that you will repay the loan from personal assets if you default on the loan.

5. Compare lenders

It’s a good idea to consider multiple lenders when looking at bank business loans. You want to consider the lender requirements for a small business loan to make sure your business qualifies. You may also want to consider whether you want to work with a large national bank or a small bank.

Small banks offer more personalized service, which can help you get approved for a loan based on your character and relationship with the bank. Yet, large banks can often provide the most competitive rates and large loan amounts.

When comparing lenders, you’ll want to assess each lender and the features of the loan offered. Compare interest rates and any fees charged and repayment terms offered. Some lenders also offer discounts if you pay off the loan early.

- Bank of America

- Wells Fargo

- Live Oak Bank

6. Meet the requirements and prepare any documentation

Every bank lender sets its own requirements that you need to meet at a minimum in order to qualify for its loan. Bank lenders tend to keep stricter requirements than other types of lenders, such as fintech companies.

Lenders will look at your personal and business credit score, time in business and revenue. Bank lenders often require at least a 670 FICO score, 2 years in business and $150,000 to $250,000 in revenue annually. These factors assess whether your business can handle the loan payments.

Once you meet the bank’s minimum requirements, you can apply and send in the correct documentation. Each loan application will have different documentation requirements , but typically, you will need to fill out or provide the following:

Required documents

- Resume of all business owners

- Business plan

- Bank statements

- Income tax returns from the last three years

- Business tax ID number

- Financial statement

- Accounts receivable and accounts payable statements

- Collateral (if the loan is secured

- Business license and registration

- Any lease agreements the business has

7. Apply online or make an appointment

Once you’ve made all your preparations, you are ready to apply for a small business loan. Find out the best way to apply from your lender. You may be able to apply online, by phone or in person. Some lenders offer all of these options, while some may only offer one.

Before you start the application, it’s a good idea to review your documents. Make sure everything is there and scan for typos. If you apply in person, dress professionally to make a good impression. Be prepared to answer questions from the loan officer about your documents or application.

What to do if your bank loan is denied

Once you submit your application, you may get an answer immediately, or the lender may take some time to decide. Even if you did everything right, the answer could be no. If your business loan is denied , you can take a few steps to apply again and attempt to get approved.

First, think about asking the lender why they denied your application so you can build a better application the next time. Look for other lenders who have a similar loan offering and have minimum requirements that your business meets. For example, you could try to find a lender that approves businesses with little time in business if you’re a startup.

It can take a few tries to get a lender to approve your small business loan application. But if you’re persistent and willing to shop around with different lenders, you can find lenders willing to accept businesses with less-than-ideal finances. In some cases, you may need to look into alternative business loans rather than getting a loan from a traditional bank.

If you don’t qualify for a bank loan, consider:

- Business credit cards

- Business lines of credit

- Small business loans from alternative lenders

Bottom line

Small business loans from a bank allow businesses to get the funds needed for expansion, working capital, equipment purchases, inventory management and more. Banks may offer larger amounts, lower rates and a more personalized lending experience than other lenders, but expect stringent eligibility requirements.

If applying for a small business loan at a bank doesn’t seem like the best fit for your business, exploring alternative options can be beneficial.

Frequently asked questions

What do i need to get a business loan from my bank, how easy is it to get a business loan from a bank, how much of a business loan will a bank give me.

Article sources

We use primary sources to support our work. Bankrate’s authors, reporters and editors are subject-matter experts who thoroughly fact-check editorial content to ensure the information you’re reading is accurate, timely and relevant.

2024 Report on Employer Firms: Findings from the 2022 Small Business Credit Survey . Fed Small Business. Accessed on March 20, 2024.

Small Business Lending Survey . Federal Reserve Bank of Kansas City. Accessed on March 12, 2024.

Related Articles

How to get an SBA startup loan

How to get a small business loan when self employed

Where to get a business loan

First-time small business loan: 6 things to know

7 Steps to Form an LLC

1. check what requirements your state has, 2. name your business, 3. pick a registered agent, 4. file your articles of organization, 5. create an operating agreement, 6. plan for the future, 7. consider using a professional, 7 steps to start an llc for your small business.

Affiliate links for the products on this page are from partners that compensate us and terms apply to offers listed (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate products and services to help you make smart decisions with your money.

- The exact steps for forming an LLC vary by state, but it's a similar process in most states.

- You'll need a business name, a registered agent, articles of organization, and an operating agreement in certain states.

- Save $25 when using Block Advisors to form your LLC today. Discount applied in cart.

If you're working on setting up your own business, there's a good chance you're looking to open a limited liability company, or LLC. This business structure gives you limited liability protection similar to a corporation, plus the flexibility of a sole proprietorship or partnership, making it a popular choice for small business owners.

The main perk of an LLC is that it generally can protect your personal assets (like the money you're saving up to buy a home or retire) from certain liabilities or debt that come with owning your business. In other words, in many cases, a creditor you owe money to through your business usually won't be able to come for the money in your personal accounts. Having an LLC can also legitimize your business, which may be a benefit to many small business owners.

If that sounds good, follow these steps to open your LLC.

- Check what requirements your state has

- Name your business

- Pick a registered agent

- File your articles of organization

- Create an operating agreement

- Plan for the future

- Consider a professional service

LLCs are regulated by states, which means that you'll have to meet the specific requirements outlined by the state where you're registering the LLC. You'll find this information easily on your Secretary of State's website.

While most steps necessary to establish an LLC will need to be done no matter which state you live in, the specific guidance for how to do each step — like naming your business and picking a registered agent — can vary.

Now that you have a business, it's time to choose a name for it. While you'll want something catchy and easy to market, it's also important to make sure that the name you choose meets your specific state's requirements.

First, you'll need to ensure that the name you choose isn't being used by another LLC in your state. You can typically do a name search on the Secretary of State's website ( here's Illinois' search tool , for example).

In general, you'll need to have certain words in the name that make it clear your business is an LLC, such as "Limited Liability Company," "LLC," or "L.L.C." Many states will also prohibit you from including certain words in the name. In New York, for instance, you can't include the words "academy," "bank," "finance," "union" and many more .

Every LLC has to have a registered agent who acts as the point person for any legal matters that may come up and for the Secretary of State to send any official paperwork to. Generally, that person (or business) must have a physical address in the state where your LLC is registered and be available to receive mail there during working hours. They also have to be at least 18 years old.

You can name yourself as the registered agent, but it may not be the best idea. If you're worried you might not be available to serve as the point person or might not be able to keep up with important mail, it might be best to outsource this role. There are registered agent services you can use, though they'll come at a cost.

Next, head back to the Secretary of State's website to find the articles of organization that you'll need to file. You can also meet with someone in the department in person or by phone if you prefer.

The exact information you'll have to fill out for the articles of organization will vary by state. Still, you can expect to be asked for basic information like your LLC's name, address, services, and how you expect it to be managed. You'll also need to pay a filing fee.

Keep in mind that the articles of an organization may be called something different, depending on the state. Alabama and Texas, for example, call it a "certificate of formation." Some states also have publication requirements, which means you need to publish an announcement of your new business in a newspaper.

While you'll likely divvy up responsibilities for anyone in your business on your own, you may also be required to do so via an operating agreement. These agreements outline how your business will be run and delegate roles and power to different members. That may include voting procedures, rules around daily operations, and ownership rights within the company.

Only some states require you to create this type of agreement, but it is a good idea to do so even if you don't technically have to.

Opening an LLC may be your first priority, but there are other tasks to take care of during the process, like getting your employer identification number (EIN). An EIN is an identifying number that the IRS will use for tax reasons, but it's not always required for opening an LLC.

You may also want to open a business bank account to ensure you keep your personal and business assets separate for bookkeeping and tax purposes. Plus, look into what exactly you need to keep your LLC active in your state, which may include filing an annual report.

A lot goes into opening and operating your own business, but you don't have to take care of everything on your own. Block Advisors , part of H&R Block, can help you decide which type of business structure is best for you, such as an LLC, and help you open that business. Using an online service to incorporate your business will help ensure that you submit all of the necessary paperwork required in your state of incorporation. This could save you time now and headaches later.

With Block Advisors, you're not on your own once your business is up and running. The service provides tax help, including filing your taxes with a professional or on your own with help from a live expert. You can also opt for one of its bookkeeping services , which range from a step-by-step guide to doing your own bookkeeping to working with your own dedicated accountant.

If you're looking to scale, Block Advisors also offers payroll services, which help you pay your employees each pay cycle and can make sure you stay compliant. There are three tiers to choose from — the basic service comes with a dedicated accountant, up to the premium service, which includes timekeeping, human resources assistance, and more.

*This article is for informational purposes only and should not be construed as legal advice. You may want to seek the advice of an attorney to evaluate all relevant considerations in forming a business entity.

**Block Advisors discount may not be combined with any other offer or promotion. Void if transferred and where prohibited. Discount will appear in your cart automatically when you use the link. No cash value. Expires June 30, 2024.

Watch: AI expert explains how to incorporate generative AI into your business strategy

- Main content

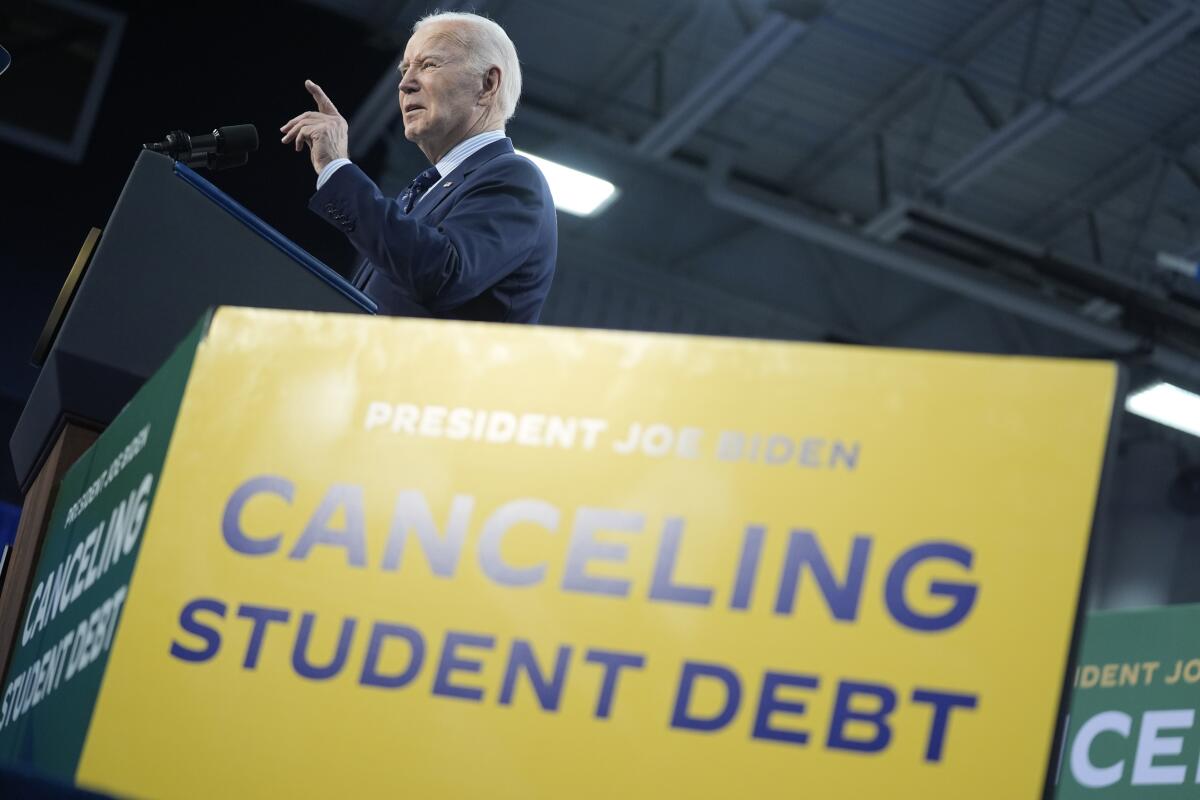

The deadline to consolidate some student loans to receive forgiveness is here. Here's what to know

N EW YORK (AP) — Borrowers with some types of federal student loans have until today to consolidate their loans to qualify for full student loan cancellation or credit toward cancellation. The Education Department is expected to conduct a one-time adjustment in the summer but borrowers who want to be considered for the adjustment have to submit a request to consolidate their loans by Tuesday.

This one-time adjustment is meant to show a more accurate payment count for student loan borrowers.

Here's what you need to know:

Borrowers with these types of loans must consolidate first to take advantage of this one-time adjustment:

— Commercially managed Federal Family Education Loan (FFEL) loans

— Parent PLUS loans

— Perkins loans

— Health Education Assistance Loan (HEAL) Program loans

You can learn more about the one-time adjustment at studentaid.gov .

The deadline to consolidate your loans is Tuesday.

If you have multiple federal student loans, you can combine them into one loan with fixed interest. If you decide to consolidate your loans into a Direct Consolidation Loan, you can do so for free. Once you have consolidated your loans, you will have one monthly payment instead of multiple payments a month.

You can apply to consolidate your loans at studentaid.gov/loan-consolidation . The consolidation process typically takes around 60 days to complete. Once you consolidate your loans, you will be eligible for the adjustment.

The Education Department is currently adjusting borrowers' accounts and expects to finish by July 1.

The Associated Press receives support from Charles Schwab Foundation for educational and explanatory reporting to improve financial literacy. The independent foundation is separate from Charles Schwab and Co. Inc. The AP is solely responsible for its journalism.

More student loan forgiveness available, but April 30 deadline looms

- Show more sharing options

- Copy Link URL Copied!

Californians who obtained federally backed student loans from private banks can have some or all of their remaining debt forgiven by the Biden administration, but they need to act fast: The deadline for qualifying is Tuesday.