- Opportunities

- Alternative Assets

- Investment Themes

- Corporate Investing

- How to Invest

- Funded Portfolio

- Startup Application

- About OurCrowd

- Our Partners

- Startup News

- Our Co-Investors

- Knowledge Center

- Social Impact

- 2023 OurCrowd Global Investor Summit

- OurCrowd Virtual Events

- Summit Live

- Summit Agenda

- OurCrowd Jobs

- Portfolio Jobs

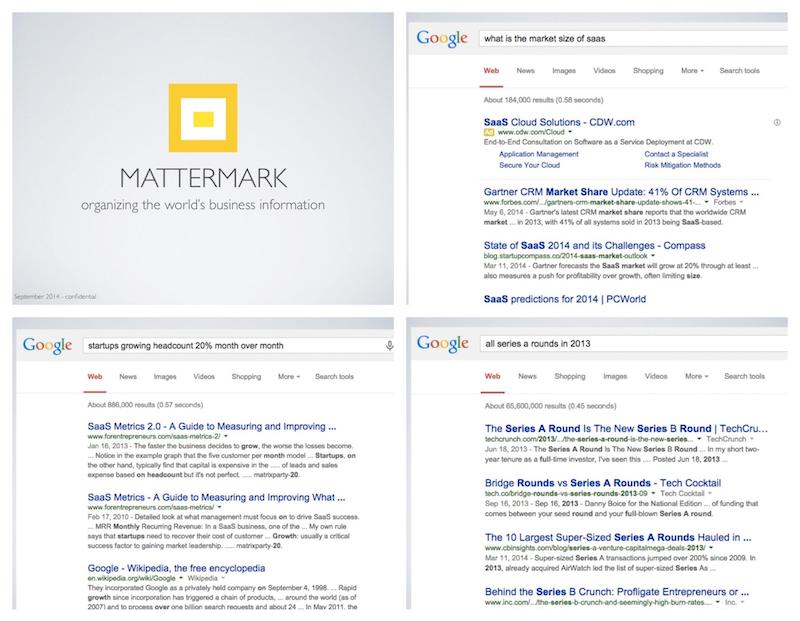

How to Prepare a Successful Investor Pitch Deck and Presentation

The investor pitch is one of the most important tools an entrepreneur has for raising capital. It is no secret that a successful investor pitch can make or break your chances of securing funding for your business venture.

As an entrepreneur, you only have a limited amount of time to make a good impression on potential investors. Unfortunately, many entrepreneurs fail to prepare a successful pitch, resulting in missed opportunities and wasted time.

In this guide, we will cover everything you need to know to prepare a successful investor pitch deck and presentation. We will discuss topics such as what information should be included in your pitch, how to structure your presentation, and how to effectively deliver your message. By following the advice in this guide, you will be well on your way to impressing potential investors and securing the funding you need for your business venture.

One of the most important aspects of a successful investor pitch is the content.

Your pitch should include information about your business model, your competitive landscape, and your financial projections. In addition, you will need to address any concerns that investors may have about your business. For example, if you are pitching a new technology product, you will need to explain why consumers will want to use it and how you plan on marketing it effectively. If you are pitching a new app or service, you need to explain what problem it solves and why people would be willing to pay for it.

The key is to provide enough information so that investors can understand your business and see the potential for growth but not so much that they get bogged down in the details. The best pitches strike a balance between being informative and concise.

Content Structure

A typical structure we recommend to entrepreneurs includes the following

- Executive summary : The executive summary should be a one-page overview of your business that includes your company’s mission statement, a brief description of your products or services, and an overview of your target market.

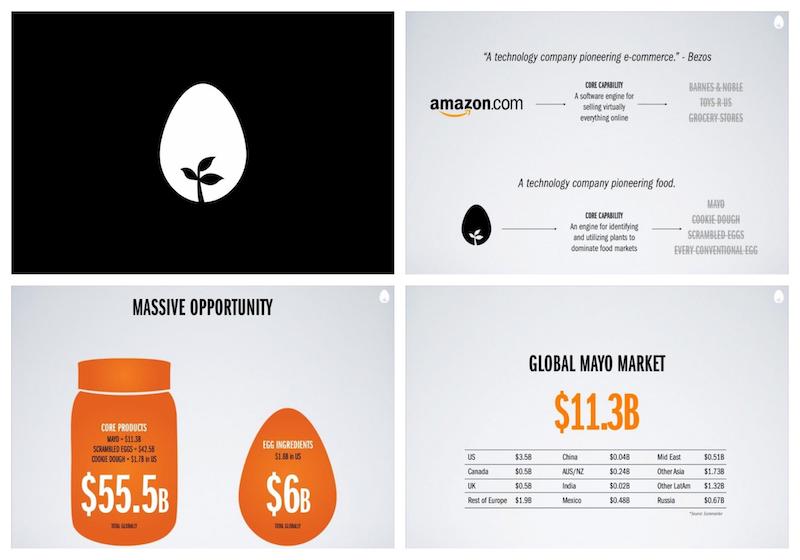

- The problem : This describes the issue that your product or service is attempting to solve. Also, you should describe who faces this problem,how it is currently being dealt with today, and the shortcomings and costs of existing solutions.

- Your solution : This is where you describe the solution you will offer for the problem your potential customers currently face.

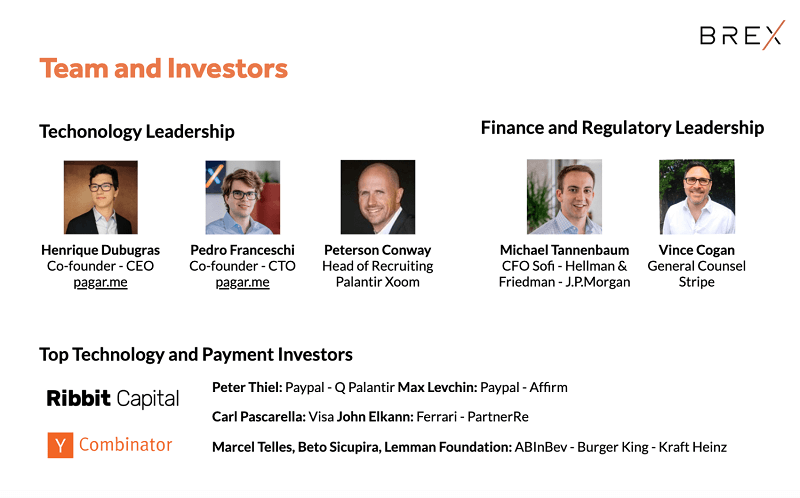

- Your team : Highlight the team behind your product and their qualifications to be trusted in handling your project.

- The market size : Talk about the size of the industry you’re serving and its projected growth.

- Traction : What milestones have you achieved so far? Traction is the measurable demonstration of your business’s ability to solve the problem combined with the proof of the business’s potential to grow over time.

- Competition: How does the competitive landscape. What are your strengths, weaknesses, opportunities and threats vis-a-vis your competitors?

- Financial statement : This is where you include your financial models, income statement, cash flow forecast, and balance sheet.

- Your long-term future plans : These are your next steps. It explains what your plans are for future funding and how these funds will be used to continue your business growth.

- FAQ : The final section should be reserved for frequently asked questions. This allows you to answer any lingering questions that the investors may have about your business venture.

Let's probe into each of these in more detail.

Executive Summary

This is a one-page overview of your business that includes your company’s mission statement, a brief description of your products or services, and an overview of your target market.

The purpose of the executive summary is to give investors a zoomed-out view of your business so that they can quickly decide if it is something they are interested in.

It should be clear, concise, and free from any unnecessary jargon or technical terms. The executive summary should be visually appealing and easy to read; bullet points are often helpful in this regard. Finally, you want to make sure it leaves potential investors wanting more by providing just enough information to pique their interest without giving away too much detail about your business plan.

Remember when crafting your own executive summary, the goal is to give investors a quick and easy way to understand what your business is all about. Keep it short, and free of any unnecessary fluff.

One great historic example of an executive summary is from Ronald Wayne, the third co-founder of Apple . In 1976, he wrote up a one-page agreement that summarized the key points about the new company. The document included information such as the name of the company (Apple Computer Company), its address (360 N Virginia St.), and its purpose (“To develop and sell personal computers.”)

It also listed out each founder’s roles and responsibilities within the company.

While this executive summary was short and to-the-point, it provided enough information for investors to understand what Apple was all about and see potential in investing in the young startup.

You, too, can use the executive summary to give investors a quick overview of your business and what makes it unique.

By including key information such as your company’s mission statement, a brief description of your products or services, and an overview of your target market, you will be well on your way to preparing a successful investor pitch.

The next piece of information you need to include in your investor pitch is the problem that your product or service is solving.

The Problem

This should describe the issue that your potential customers are facing and how it is currently being dealt with. In addition, you will want to show investors why your solution is better than any existing alternatives.

For example, if you are pitching a new app that helps people save money on groceries, you would want to describe the current methods people use for grocery shopping (such as clipping coupons or comparison shopping) and how they often fall short (such as not knowing which coupons are available or taking too much time comparing prices).

You would then explain how your app solves these problems by providing users with personalized recommendations for where they can find the best deals on groceries. By showing investors how your product solves a specific problem in a more effective way than existing solutions, you will be one step closer to impressing them and securing funding for your business venture.

When Peter Thiel was pitching PayPal to potential investors, he focused on the problem that people were facing with online payments. At the time, there were no safe and convenient ways to pay for goods and services online.

This created a major pain point for consumers as well as businesses who were trying to sell products or services online. Thiel’s solution was PayPal, which allowed users to securely send and receive money using only an email address. By focusing on the problem that people were facing with online payments, Thiel was able to show potential investors why his solution was needed and how it would revolutionize the way people interact with businesses online.

What problem is your product or service solving?

How does it compare to existing solutions?

By answering these questions, you will be able to craft a convincing argument for why investors should believe in your business and fund your venture.

When describing the problem your product or service solves, it can be helpful to use what is known as the “job-to-be-done” framework.

This framework was popularized by Harvard Business School professor Clayton Christensen and focuses on understanding the underlying reasons why people purchase a particular product or service.

For example, when someone buys a drill, they are not actually buying the drill itself but rather the “job” that they need to get done (such as drilling a hole in their wall).

By understanding the job that your potential customers are trying to get done, you will be better equipped to position your product or service as the best solution for them.

After describing the problem, now is your chance to show investors how your product or service solves the pain points that you have previously described.

The Solution

This is an opportunity for you to describe the solution to the problem your potential customers currently face.

So, if you are pitching a new money-saving app for those purchasing groceries, you would want to explain how your app provides users with personalized recommendations for where they can find the best deals on groceries.

When Mark Zuckerberg was pitching Facebook to potential investors, he focused on its unique ability to connect people online in a way that had never been done before. He explained how Facebook allows users to stay connected with their friends and family members no matter where they are in the world.

Zuckerberg also talked about how businesses could use Facebook as a platform to reach out directly to consumers and build relationships with them (something that was not possible with traditional advertising methods). By focusing on its unique ability to connect people online, he was able to highlight why Facebook deserved investment despite being just another social networking site at a time when there were already many established players such as MySpace.

Describe how your solution addresses the problem your potential customers currently face.

This is your chance to show investors how your product or service solves the pain points that you have previously described.

Two key questions to ask yourself (and answer) are: a) what makes my product or service unique? And b) how does it solve the problem in a better way than existing solutions?

Remember that when describing the solution, you want to focus on how your product or service is uniquely positioned to solve a specific problem.

Tips for Presenting your Solution:

- Keep it simple : The solution should be easy for investors to understand. Avoid using any technical jargon or terms that they may not be familiar with.

- Be specific : Describe exactly how your product or service solves the problem in a better way than existing solutions.

- Focus on the benefits : Explain how your product or service will make life easier for potential customers and why they would want to use it over existing alternatives.

- Paint a picture : Use visuals to help investors visualize how your product or service works. A demo video can be especially helpful in this regard. Make it tangible.

- Address any concerns : If there are any potential concerns that investors may have about your product or service, make sure to address them head-on. For example, if you are pitching a new technology product, you will need to explain how you will achieve the technological edge over your competitors, why consumers will want to use your solution and how you plan on marketing it effectively.

Let's now talk about the team behind your product and their qualifications to be trusted in handling your project.

This is your chance to show investors that you have assembled an A team of qualified individuals who are passionate about solving the problem that your product or service addresses.

For example, if you are pitching a new app that helps people save money on groceries, you would want to include information such as the experience of your team members in fields such as grocery-chain veterans, software development, user experience design, and marketing.

Some key points to keep in mind when crafting this part of your presentation include:

- Keep it short: You only have a limited amount of time to make an impression on potential investors so make sure not to bog them down with too many details about each team member’s background. Instead focus on highlighting their most important credentials and why those credentials make them well-suited for working on this particular project. 30 to 45 seconds for every key team member should suffice, and no more than 4 highlighted individuals.

- Focus on diverse backgrounds: Potential investors will often look favorably upon teams with diverse backgrounds as it shows that different perspectives are being represented

- Highlight Awards & Recognition: Be sure to mention any major awards or recognition

Take some time to think about the different backgrounds and skillsets that your team members bring to the table. Then, highlight why those credentials make them well-suited for working on this particular project.

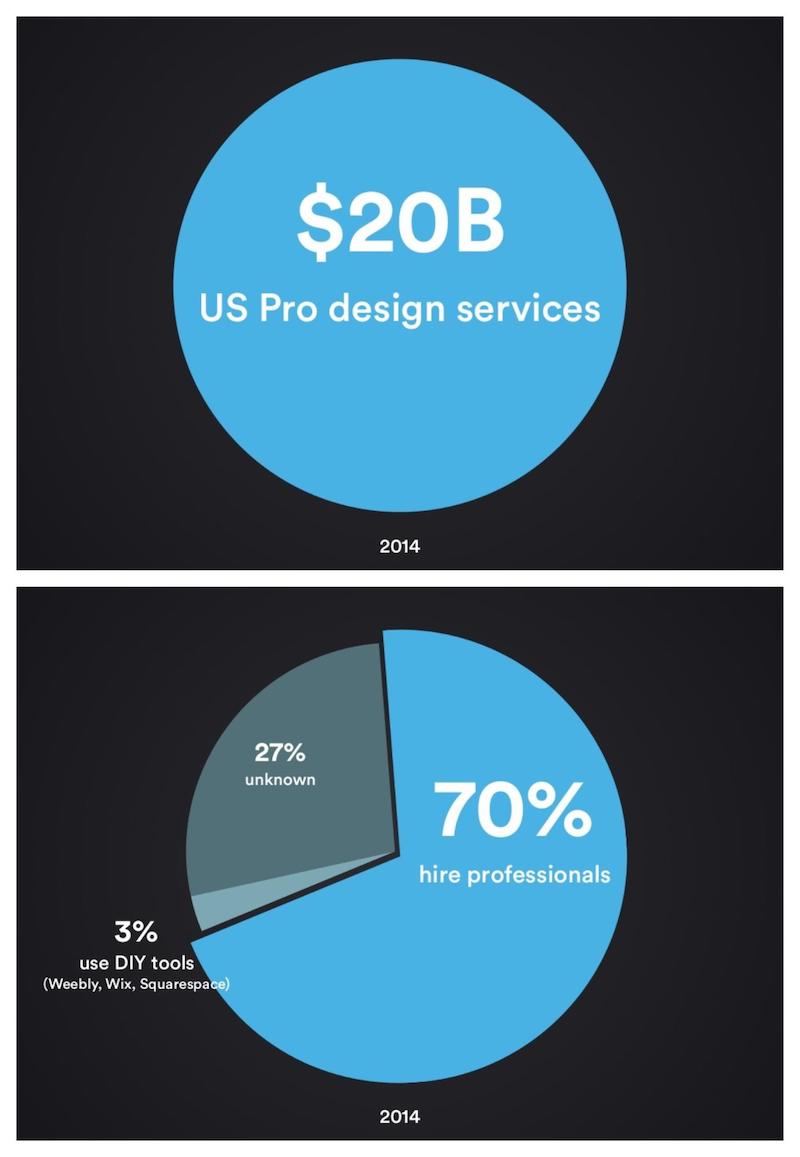

The Market Size

It can be helpful to provide some context around why this particular market is growing or changing. For example, an increase in online shopping due to Covid-19. Show investors that there is a large potential customer base for your product or service and explain why this market is attractive.

A couple of questions you should answer are:

- How big is the total addressable market for your product or service?

- Is this particular market growing or changing (and if so, why)?

Consider the following resources when researching the size of your market:

- Industry reports : These can be helpful in understanding the overall size and growth of a particular market. For example, if you are pitching a new app for pet owners, you could look at industry reports such as the American Pet Products Association’s “Pet Owners Survey” to learn more about this market. Also consider websites like statista.com, pewsocialtrends.org , edisonresearch.com

- Government data : Websites like census.gov can provide useful information on population trends that might impact the potential customer base for your product or service. Consider websites like census.gov and usa.gov/statistics

- Secondary research : In addition to industry reports and government data, there are a number of other sources that can provide helpful insights into the size of your target market. These include trade associations, market research firms, and business directories. Consider websites like nasdaq.com , www.dnb.com, marketsandmarkets.com , bcg.com

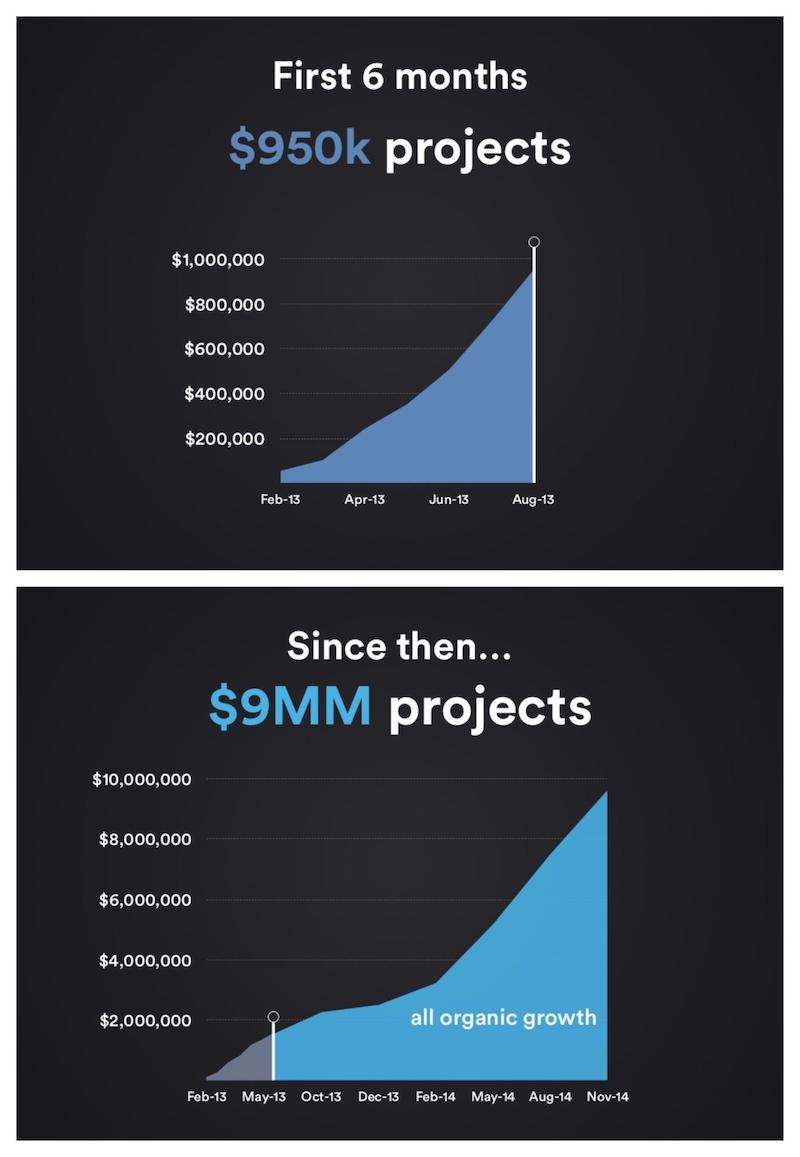

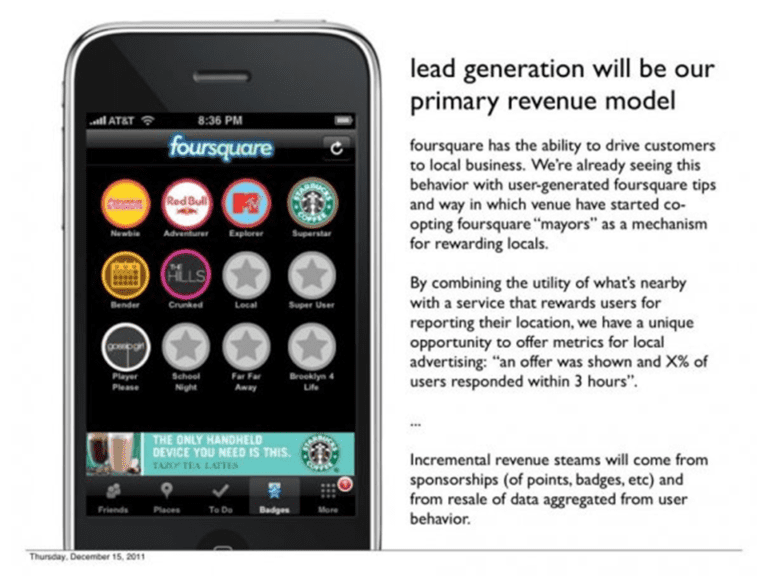

Traction is a measure of your business’s growth and momentum within the market you are addressing. It can be helpful to think of traction as the “proof” that your business is working and that there is customer demand for your product or service.

There are a number of different ways to measure traction, but some common metrics include pilots, numbers and names of customers, revenue growth, user growth, and engagement metrics.

Some other metrics could include marketing campaigns (and their success), press coverage (the more prestigious the media outlet - the better), brand mentions on tweets and big-shots that have tweeted about your idea or company, testimonials, subscribers, and more.

Including information about your business’s traction in your investor pitch can be helpful in convincing potential investors that now is the right time to invest in your company. After all, if you can show them that you have already achieved significant growth with limited resources, they will likely be more interested in supporting your venture moving forward.

How do you go about including this information in your presentation?

Start by focusing on one or two key metrics that best demonstrate the momentum behind your business. Then provide context around these numbers by explaining what they mean and why they are important. For example, if you are pitching a new app for pet owners and have seen strong revenue growth over the past six months, highlight this trend by showing investors a graph depicting this increase over time. You could then explain why this uptick is important (perhaps pet ownership has increased during Covid-19) and how it positions your company for continued success in the future.

Imagine you are pitching a new social media platform to potential investors.

One way to showcase the traction behind your business would be to include information about the number of users who have signed up for your platform, as well as how much time they are spending on the site each day.

You could also highlight any partnerships you have formed with other businesses or influencers and mention any press coverage you have received. All of this information will help show potential investors that your business is gaining momentum and has what it takes to be successful in the long run.

The Competition

Be sure to address the competition in your investor pitch. This will show that you have done your homework and are aware of the other companies in your industry. Reviewing your competition openly will give you an opportunity to discuss why you believe your company is better positioned for success than others. If you come to the conclusion that you don’t have any direct competitors, it may be that investors who hear this might decide that you have not performed your due diligence and will decline to back your business.

There are a few key points you’ll want to hit when discussing the competition in your investor pitch:

- Competitive landscape: Provide an overview of the competitive landscape. Consider all the products similar to yours in the market, and all the companies that solve similar problems to the one you are addressing. List your key competitors, and what they've done to succeed. Include a brief description of each competitor and their respective market share. Investors will be particularly interested in hearing customers' complaints about your competitors' products.

- Your uniqueness: Discuss what makes your company unique and better positioned for success than others. This could be anything from a new technology you have developed to a more efficient production process.

- Threats: Don’t forget to mention any potential threats that could impact your business down the road such as new entrants into the market or changes in consumer preferences.

Including this information in your presentation will show investors that you have taken the time to research the industry and understand where your company fits within it.

We recommend using a competitive analysis framework to help you organize your thoughts and gather the relevant information to include in your pitch. One great framework to use is known as the Five Forces framework.

The Five Forces is a tool created by economist Michael E. Porter that can be used to assess the competitive intensity of an industry and the corresponding attractiveness of opportunities within that industry. The five forces are:

- Threat of new entrants : How easy is it for new firms to enter the market and compete against existing firms? (e.g., high barriers to entry)

- Bargaining power of buyers : How much negotiating leverage do buyers have when purchasing products from suppliers in the industry? ( e. g., few buyers, switching costs)

- Bargaining power of suppliers : How much negotiating leverage do suppliers have when selling inputs to firms in the industry? ( e. g., many supplier options, differentiated products)

- The threat posed by substitute products : What alternatives do customers have if they decide not to purchase your product? (e.g., close substitutes, low switching costs)

- Intensity of competitive rivalry : How intense is competition among existing firms in this market?

The Five Forces framework can help you identify which areas of the industry are most attractive for opportunities and where there may be more competition. By taking the time to assess the competitive landscape prior to pitching your business, you will be better prepared to discuss why your company has what it takes to succeed in spite of any challenges that exist.

One critical question to address during this part of your investors deck is - what is your moat? A moat is a competitive advantage that makes it difficult for other companies to compete against you. This could be anything from a loyal customer base to patents or proprietary technology. When assessing your company’s moat, ask yourself the following questions:

- What does my company have that others don’t?

- How hard would it be for another firm to replicate what I have built?

- What are the costs associated with replicating my business model?

- What switching costs do my customers face if they decide to leave me for another supplier?

To assess your company’s moat, you will need to spend some time researching your industry and looking at what others are doing. Once you have a good understanding of the landscape, you can begin to identify areas where you may have an advantage over others.

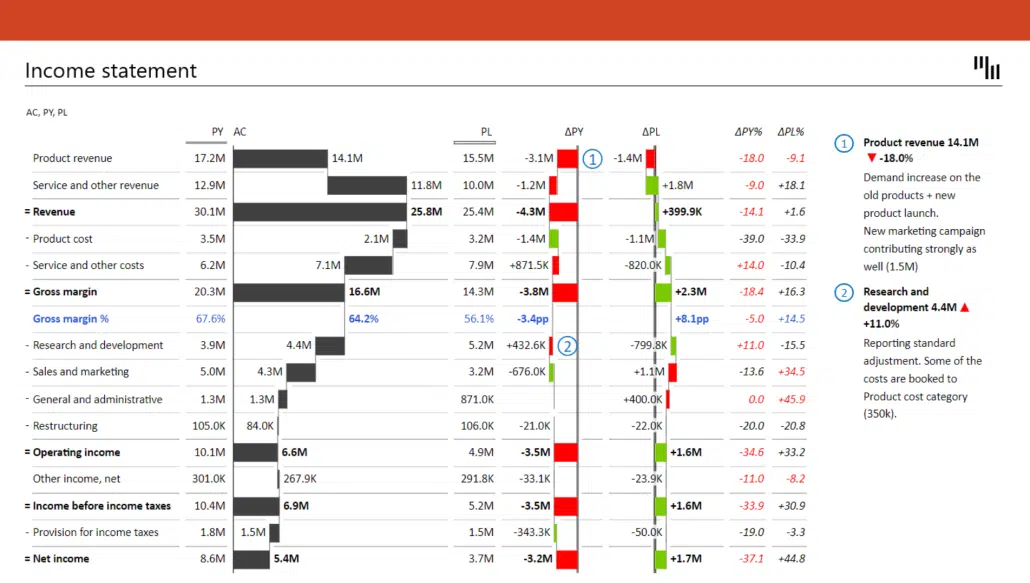

Financial Statement

The next step is to provide potential investors with an overview of your financial situation. This should include information such as your current revenue, expenses, and burn rate (the rate at which you are spending money).

In addition, it is often helpful to include a short-term and long-term forecast of your finances so that investors can see how you expect your business to grow over time.

Think of your financial statement as a snapshot of your company’s health. For example, if you are currently generating $1 million in annual revenue but anticipate doubling this figure within the next year, be sure to mention this on your financial statement slide.

By providing potential investors with a clear picture of your current financial situation as well as where you expect things to be in the future, they will be able to get a better sense of whether or not investing in your company is a wise decision.

Remember when crafting your financial statement that the goal is to provide potential investors with a clear picture of your current financial situation as well as where you expect things to be in the future. Warren Buffet is famously quoted as saying, “If you can’t write it down on one page, I don’t want to hear about it.” Buffett understands that by looking at the numbers, he can get a clear picture of a company’s financial health and make more informed investment decisions. As an entrepreneur, you should take a page out of Buffett’s book and make sure that your financial statement is clear, concise, and easy for potential investors to understand.

We suggest the following format for your financial statement:

- Income Statement : Showing revenues, expenses, and profits over a period of time

- Balance Sheet : Showing what the company owns (assets) and owes (liabilities) at a specific point in time

- Cash Flow Statement : Showing how cash is moving in and out of the business over a period of time.

Terms of the Round

The financial plan is a critical component of your investor pitch deck. This section will give investors a clear idea of your business’s financial situation, including your current revenues and expenses, as well as your projected revenues and expenses for the future.

In addition, the financial plan should include information on how you intend to use any funding that you are seeking from investors. For example, if you are looking for $1 million in funding, what specific purposes will this money be used for?

Will it be used to hire new employees? To launch a new marketing campaign? To open up a new office location? Be sure to include these details in your financial plan.

Some key elements you will want to include in your financial plan are:

- Amount you’re seeking, amount of equity you are giving away and conditions

- Use of proceeds: how you intend to use the investment money

- A detailed description of how you intend to generate revenue

- Your short-term and long-term business goals

- A breakdown of your costs and expenses

- A valuation assessment of your company

- Current cap table

- Shares outstanding pre-money and post-money

- Funding source for previous rounds

A well thought out financial plan will give investors confidence that you have a clear understanding of your business model and how you intend to generate revenue. It will also demonstrate that you have put serious thought into the feasibility of your business idea and its potential for long term success.

Your Long-term Future Plans

You will also want to include some information about your long-term plans for the company.

This is important because it shows investors that you are thinking ahead and have a vision for where you see the business going.

It can be helpful to include things such as long term product pipeline, milestone syou hope to achieve, projected financials (revenue, expenses, etc.)

We recommend addressing the following items when presenting your long-term plans:

- Plan of action

- Sources of revenue, projected sales, margins

- Profitability forecasts

- Balance sheet projection

- Growth and opportunity timeline

- Impact of team expansion on cash flow

- Exit strategy

Plan of Action

Your plan of action is a high-level overview of the steps you will take to achieve your long-term goals. It should include things such as when you plan on launching new products, expanding into new markets, or hiring additional staff.

Include information about your projected sales and margins for the next few years. This will give investors an idea of how much revenue you expect to generate and what kind of profit margin they can expect from investing in your company. It is also important to include any assumptions that you are making about future sales (e.g., market growth rate, product pricing). Being transparent about your projections will help build trust with your investors.

Exit Strategy

An exit strategy is a plan for how (and to whom) you may sell your company or when you plan to offer it on the public market. This information is important because it helps investors understand what they can expect from investing in your business. It shows that you have thought about the future of the company and have a plan in place for when it is time to capitalize on the initial investment. There are many different types of exit strategies, so be sure to include the one that makes the most sense for your business. Some common examples include selling the company to a larger company or taking it public through an IPO..

Discussing your exit strategy shows that you have thought about your investors’ interests and that their investment will generate more value down the road, and not just help you to keep the lights on for another month.

Frequently Asked Questions (FAQ)

Make time in your investors' pitch to allow for questions and be prepared to answer them, even if the question is not directly relevant. It shows that you're truly interested in what they think and care about their input. While it's nearly impossible to predict every question an investor may ask you, prepare for some of the most common questions that were not covered in your pitch:

- How did you come up with the idea for your business?

- Why do you believe your team is qualified to execute on this opportunity?

- What are your unit economics?

- How have you validated your market opportunity?

- Describe your competitive landscape and how you plan to differentiate yourself in the market.

- When do you anticipate reaching profitability?

- What are the biggest risks and challenges facing your business?

- How did you come up with your valuation?

- Have you had any conversations with potential acquirers?

- How much money are you looking to raise and for what purpose?

- Do you have any existing relationships with potential investors?

Consider these questions and prepare to answer them with confidence.

Now you know the critical ingredients you should prepare for your pitch.

Before we let you go, here are a few key tips to delivering an effective presentation. Remember - content is only half of the ingredients of a successful pitch.

Presentation Tips

If you were making a cake, the content would be the ingredients, and how you mix them together and bake them would be your presentation skills. Here are a few key tips:

- Practice, practice, practice - A successful investor pitch requires careful planning and execution in order to convince investors to provide funding for your startup. Knowing your material cold is not enough; it is important to rehearse your delivery daily so you come across as polished and professional. Preparing well will allow free you from the dreadful reading from your slides or notes.

- Start strongly - Grab investors' attention from the beginning with a compelling story or statistic that will make them want to hear more.

- Be clear and concise - Use simple language that can be understood by everyone in the room, and get to the point quickly without beating around the bush. Being concise is so important that, perhaps somewhat ironically, Y Combinator partner Kevin Hale speaks about the importance of this point for seven whole minutes in his outstanding lecture about pitching startups .

- Be passionate - Show excitement about your business and market opportunity; you're trying to convince others to believe in your vision!

- Visuals matter - Use high-quality visuals (e charts, graphs, photos) throughout your presentation to support your points; slides should complement what you're saying, not repeat it verbatim.

- Do not read off your slides - This is a surefire way to lose investors' attention. Instead, use your slides as a guide and speak extemporaneously about the topics you've prepared.

- Be prepared for questions - Have answers ready for commonly asked questions about your business and industry. Be sure to answer each question thoroughly but concisely; if you don't know the answer to a question, be honest and say so.

- Speak slowly and clearly - An investor presentation is not the time to speed up your talking or try out a new vocal fry.

- Make eye contact - With each person in the room, if possible. This will help you come across as sincere and trustworthy.

- Smile! - A genuine smile goes a long way in making a good impression; it makes you appear more likable and creates a positive association with your business in investors' minds.

- Avoid filler words such as “um” or “like“ - Using filler words makes you come across as nervous and unprepared, two qualities that will not instill confidence in investors.

- Dress the part - First impressions matter, so be sure to dress professionally in clothing that is clean and wrinkle-free. This shows that you're taking the pitch seriously and are respectful of investors' time.

- End on a strong note - Thank investors for their time and interest, then provide a brief overview of your key points to leave them with a lasting impression of your business.

One Final Tip...

Always follow up. After the pitch, be sure to send a thank-you note or email to each investor. You can use this interaction to send answers to questions you didn’t have the answer to during the presentation.

This not only shows your appreciation and professionalism, but also keeps you top of mind in case they have any additional questions or are interested in investing.

Follow these tips, and you'll be well on your way to delivering a successful investor pitch and securing the funding you need to grow your business.

Related stories

The Impact of Economic Conditions on Private Equity: Why Now is the Right Time to Invest in PE

Should You Invest in Cannabis Stocks in 2024?

What Is Biotechnology? An Overview for Beginners

What Is Private Credit? Breaking Down Its Role in Investments

Access exclusive deals.

Join for free and be notified of future investment opportunities

Join for free

- Intelligence hub

- Interactive investor hub

- Communications hub

- Investor relations

- Case studies

- Why InvestorHub?

- Security & privacy

- Community & articles

- D2I marketing

How to Create an Effective Investor Presentation

Investor presentations are a crucial tool for entrepreneurs and business owners seeking funding or investment opportunities. A well-crafted presentation can captivate potential investors, showcase your business's potential, and ultimately secure the financial support you need. To help you create an effective investor presentation that stands out from the crowd, we've compiled some essential tips and strategies.

Understanding Your Audience

Before diving into the details of your presentation, it's crucial to understand your audience. Investors have specific expectations and interests, so tailoring your pitch to their needs is essential. Research the individuals or firms you will be presenting to, and consider their investment preferences, industry focus, and track record. By understanding your audience, you can customize your presentation to resonate with their specific interests and increase your chances of success.

Crafting a Compelling Story

Every great investor presentation tells a compelling story. Start by clearly articulating your business's mission, vision, and unique value proposition. Describe the problem your product or service solves and how it addresses a market need. Use storytelling techniques to engage your audience emotionally and make your presentation memorable. By connecting with investors on a deeper level, you increase the likelihood of their investment in your business.

Presenting a Solid Business Plan

A well-structured and comprehensive business plan is the backbone of any investor presentation. Start with an executive summary that provides a concise overview of your business, highlighting key aspects such as market opportunity, competitive advantage, and financial projections. Then, dive into the details of your business model, target market, marketing strategy, and sales projections. Be prepared to answer questions and provide supporting data to back up your claims.

Creating Visually Engaging Slides

Investor presentations often rely heavily on visual aids, such as slides, to convey information effectively. When creating your slides, keep them clean, concise, and visually appealing. Use high-quality images, charts, and graphs to support your key points and make complex information more digestible. Avoid overcrowding your slides with text and opt for bullet points or short phrases instead. Remember, your slides should complement your presentation, not overshadow it.

Demonstrating Market Potential

Investors are often interested in the market potential of your business. Clearly articulate the size of your target market, its growth rate, and any emerging trends that support your business's viability. Use market research and industry data to back up your claims and demonstrate a thorough understanding of your industry's dynamics. Present a compelling case for why your business is well-positioned to capture a significant share of the market.

Highlighting Your Team's Expertise

Investors not only invest in ideas or products but also in the people behind them. Showcase your team's expertise, experience, and track record to instill confidence in potential investors. Highlight key team members and their accomplishments, emphasizing how their skills align with the business's goals. Demonstrating a strong and capable team can significantly enhance your presentation and increase investors' trust in your ability to execute your business plan successfully.

Addressing Potential Risks

No business is without risks, and investors understand that. Acknowledge and address any potential risks or challenges your business may face. Be transparent about your mitigation strategies and contingency plans, showing investors that you have considered potential obstacles and have a plan in place to overcome them. This demonstrates your preparedness and commitment to ensuring the long-term success of your venture.

Crafting an effective investor presentation requires careful planning, research, and attention to detail. By understanding your audience, telling a compelling story, presenting a solid business plan, creating visually engaging slides, demonstrating market potential, highlighting your team's expertise, and addressing potential risks, you can create a presentation that stands out and captures the attention of potential investors. Remember, practice makes perfect, so rehearse your presentation thoroughly to deliver a confident and impactful pitch. Good luck!

Become an expert at investor marketing.

Subscribe to receive regular investor marketing insights, how-to guides, and case studies.

By submitting your email you agree to be send marketing emails from and about InvestorHub

Cookie Settings

We use cookies to improve user experience. Choose what cookie categories you allow us to use. You can read more about our Cookie Policy by clicking on Cookie Policy below.

These cookies enable strictly necessary cookies for security, language support and verification of identity. These cookies can’t be disabled.

These cookies collect data to remember choices users make to improve and give a better user experience. Disabling can cause some parts of the site to not work properly.

These cookies help us to understand how visitors interact with our website, help us measure and analyze traffic to improve our service.

These cookies help us to better deliver marketing content and customized ads.

6 Powerful Tips for Crafting Outstanding Investor PowerPoint Presentations

In today's competitive business landscape, effectively communicating your company's potential to investors is crucial for securing funding and driving growth. Investor PowerPoint presentations play a significant role in conveying your vision, business model, financials, and growth prospects in a visually appealing and engaging manner. A well-prepared and compelling presentation can capture investors' attention and convince them to invest in your business.

This guide provides you with powerful tips and best practices for crafting outstanding investor PowerPoint presentations. By following these guidelines, you will be better equipped to create a presentation that clearly communicates your business's potential, showcases your achievements, and highlights the key information investors are looking for. This will ultimately increase your chances of securing investment and driving your business toward success.

Key Information Investors Look For

When creating investor PowerPoint presentations , it's essential to understand what information investors are typically looking for to make well-informed decisions. By focusing on these key aspects, you can ensure that your presentation effectively addresses investors' concerns and interests.

- Business Model and Market Opportunities: Investors need a clear understanding of your business model and market opportunities. This includes information about market saturation, market shares, and the overall size and growth potential of the industry. Additionally, they will want to know about your competitors, their strengths and weaknesses, and how you plan to differentiate your product or service. Any regulatory requirements or outstanding major lawsuits that could impact your business should also be addressed.

- Management Team and Key Employees: Investors want to meet the management team and recognize key employees. Including short CVs or bios in your PowerPoint presentations can help investors understand the team's capabilities, track record, and how they plan to lead the company to success.

- Financials and Key Metrics: Your investor PowerPoint presentations should include key financial data such as revenue, profit margins, working capital, debt position, and cash flow. Industry-specific key metrics, such as customer acquisition cost, lifetime value of a customer, and churn rate, should also be presented. These metrics help investors assess your company's financial performance and potential.

- Growth Prospects and Potential Returns: Investors want to see that your company has strong growth prospects and the potential to generate significant returns. Be sure to outline your growth plans and how you intend to achieve them in your investor PowerPoint presentations.

By incorporating these key aspects into your investor PowerPoint presentations, you can effectively address the information investors are most interested in and increase your chances of securing the funding you need.

Crafting a Compelling Story

A successful investor PowerPoint presentation tells a captivating story that highlights your business model, market opportunities, and investment benefits. By weaving together a compelling narrative, you can better engage your audience and provide a memorable context for the information you present. Here's how to craft a compelling story for your investor PowerPoint presentations:

- Start with a Strong Opening: Begin your presentation by clearly stating the problem your business is solving or the opportunity it is addressing. This sets the stage for your story and immediately captures your audience's attention.

- Showcase Your Business's Journey: Provide a brief overview of your company's history, including major milestones and achievements. This helps build credibility and demonstrates your team's ability to execute their vision.

- Highlight Your Unique Value Proposition: Clearly articulate what sets your product or service apart from the competition. Focus on the unique aspects of your business that give you a competitive advantage and support your success.

- Share Customer Success Stories: Including testimonials or case studies from satisfied customers can humanize your business and make your story more relatable. This also provides evidence of the value your product or service delivers to its users.

- Present Your Future Vision: Outline your company's goals and objectives for the future, and explain how you plan to achieve them. This demonstrates your ambition and commitment to growth, creating excitement and anticipation among investors.

- End with a Clear Call-to-Action: Conclude your investor PowerPoint presentation by summarizing the key points of your story and clearly stating what you want from investors. Be specific about the amount of funding you need and how it will be used to help your business achieve its goals.

By crafting a compelling story in your investor PowerPoint presentations, you can create an emotional connection with your audience and leave a lasting impression that can significantly impact their decision to invest in your business.

Want to skip all the fuss and create a professional PowerPoint side deck with only a few clicks?

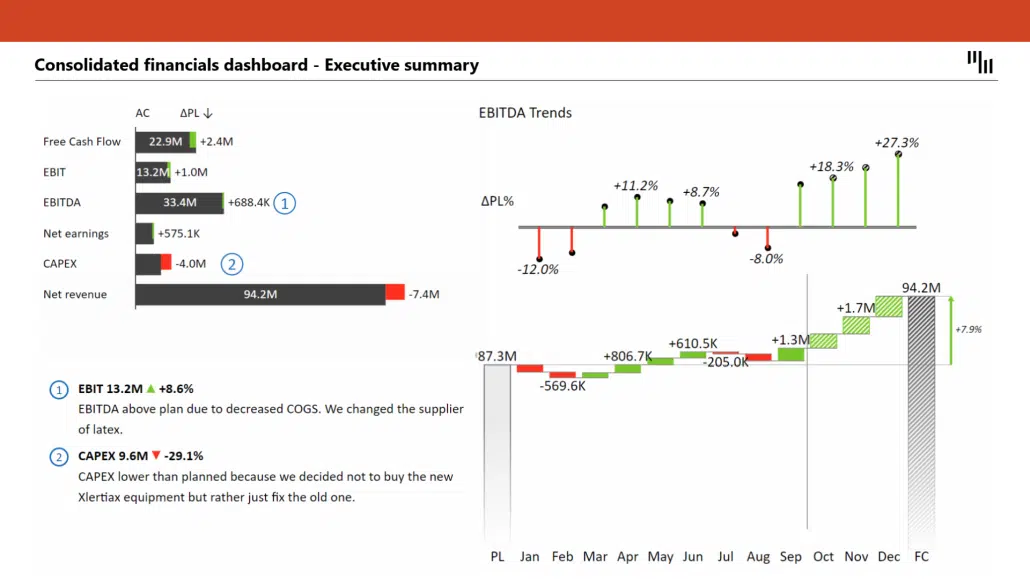

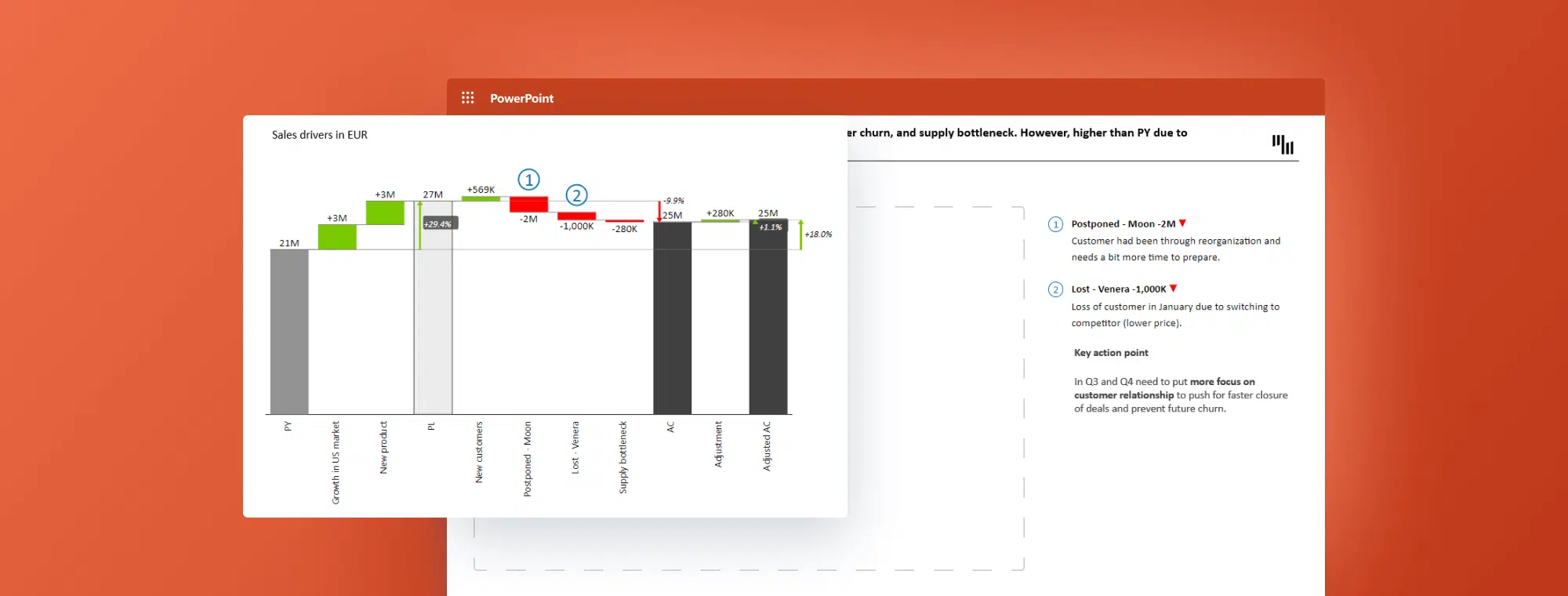

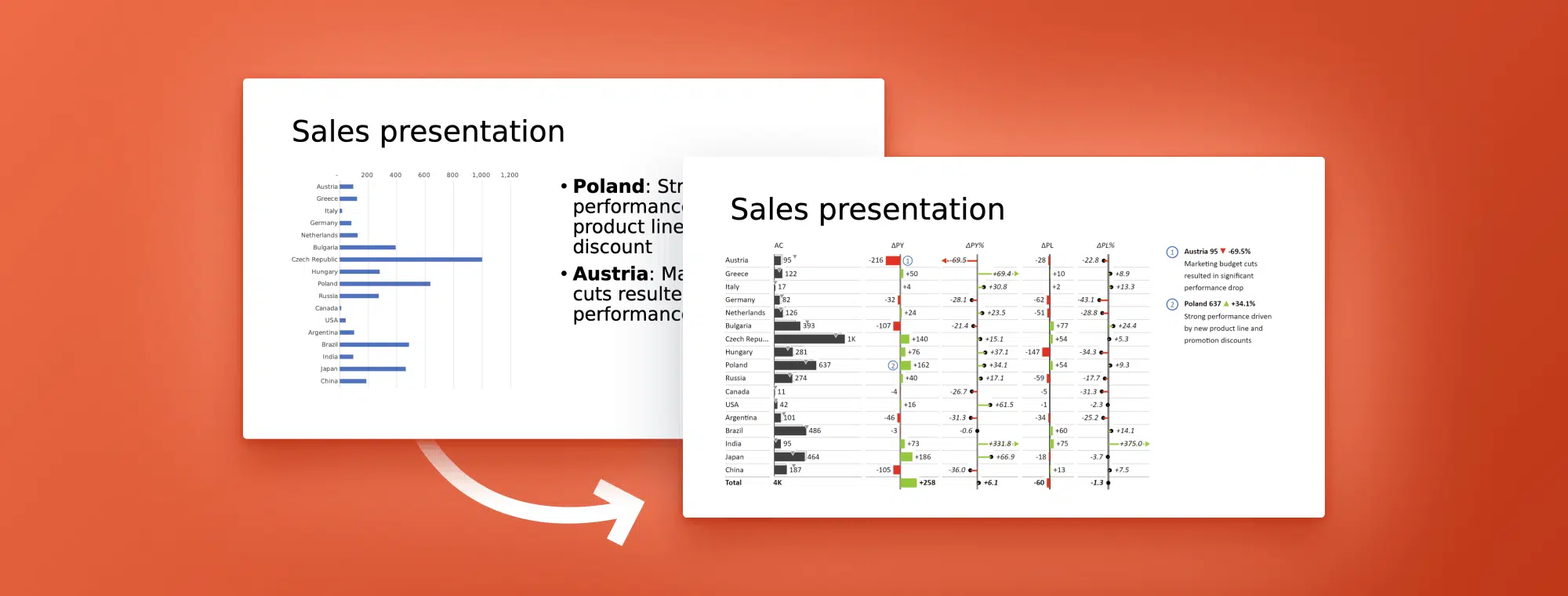

Try Zebra BI for Office and supercharge your slide deck with powerful visuals.

Keeping It Focused and Simple

Investor PowerPoint presentations should be concise and easy to understand, allowing investors to quickly grasp the essential information about your business. By keeping your presentation focused and simple, you can ensure that your audience remains engaged and retains the key points you want to convey. Here are some tips for maintaining focus and simplicity in your investor PowerPoint presentations:

- Prioritize Key Points: Identify the most crucial aspects of your business that investors need to understand, and prioritize those points in your presentation. By concentrating on the most relevant information, you can avoid overwhelming your audience with excessive detail.

- Use clear and concise language: Present your ideas using straightforward, concise language. Avoid jargon and complex terms that confuse your audience. Remember, not all investors will have an in-depth knowledge of your industry, so it's essential to make your presentation accessible to everyone.

- Limit the Number of Slides: Aim for a concise presentation with a limited number of slides. A general rule of thumb is to have no more than 10-15 slides for a typical investor PowerPoint presentation. This helps you maintain a focused narrative and ensures you don't lose your audience's attention.

- Keep Visuals Uncluttered: Use clean, minimalistic visuals that clearly illustrate your points without distracting from the message. Avoid cluttered slides with too much text or too many images. Instead, opt for simple charts, graphs, and images that effectively convey your message.

- Highlight One Idea per Slide: To keep your presentation focused, present only one main idea per slide. This approach ensures that each concept is given adequate attention and makes it easier for your audience to follow along and digest the information.

- Rehearse and Refine: Practice delivering your investor PowerPoint presentation and refine it based on feedback from peers or advisors. This process helps you identify areas where you can simplify or clarify your message, ensuring that the final version is as focused and easy to understand as possible.

By keeping your investor PowerPoint presentations focused and simple, you can effectively communicate your business's key information and make a strong impression on your audience, increasing your chances of securing investment.

Utilizing Visuals Effectively

Visuals play a crucial role in making investor PowerPoint presentations more engaging and impactful. When used effectively, visuals can illustrate complex ideas, support your narrative, and emphasize key points. Here are some tips for utilizing visuals effectively in your investor PowerPoint presentations:

- Choose the Right Visuals: Select visuals that accurately represent the information you want to convey. Use charts and graphs for presenting data , diagrams for illustrating processes or relationships, and images or icons for emphasizing key concepts.

- Maintain consistency: Use a consistent visual style throughout your presentation to create a cohesive look and feel. This includes using similar colors, fonts, and graphical elements that align with your company's branding.

- Simplify Data Visualization: When presenting data, opt for clear and straightforward charts or graphs that are easy to read and understand. Avoid overly complicated visuals that confuse your audience or obscure the main message.

- Balance Text and Visuals: Strive for a balance between text and visuals on each slide. Too much text can be overwhelming and difficult to read, while too many visuals can be distracting. Aim to create a harmonious blend of both elements that effectively convey your message.

- Use High-Quality Images: Ensure that all images, icons, and graphics used in your investor PowerPoint presentations are of high quality and resolution. Blurry or pixelated visuals can appear unprofessional and detract from your message.

- Opt for Readable Fonts and Colors: Choose fonts and colors that are easy to read and provide sufficient contrast between text and background. Avoid using excessively small font sizes or color combinations that strain the eyes.

- Animate with a Purpose: If you use animations or transitions, use them sparingly and for a clear purpose. Excessive or overly flashy animations can distract and detract from your presentation's overall message.

By utilizing visuals effectively in your investor PowerPoint presentations, you can create a more engaging and memorable experience for your audience, ultimately increasing your chances of securing investment and driving your business forward.

Highlighting Key Metrics and Data

Presenting key metrics and data in your investor PowerPoint presentations helps demonstrate your company's financial performance , growth potential, and overall viability. By effectively showcasing this information, you can provide investors with a clear understanding of your business's strengths and the potential return on their investment. Here are some tips for highlighting key metrics and data in your investor PowerPoint presentations:

- Identify the Most Important Metrics: Determine the most relevant and impactful metrics for your business and industry. These may include financial figures such as revenue growth, profit margins, and cash flow. In addition, they may include industry-specific metrics like customer acquisition cost, lifetime value of a customer, and churn rate.

- Use appropriate data visualization: Present your metrics and data using clear, easy-to-understand charts and graphs. Choose the most suitable visualization method for each data set. This includes line charts for displaying trends over time, bar charts for comparing values across categories, or pie charts for showing proportions.

- Emphasize Key Data Points: Draw attention to the most relevant data points or metrics by using bold colors, larger font sizes, or other visual elements. This helps ensure that investors can quickly identify and understand crucial information in your presentation.

- Provide Context for Your Metrics: When presenting metrics and data, provide context to help investors understand their significance. This may include comparing your figures to industry benchmarks, discussing historical trends, or explaining the impact of specific events on your numbers.

- Include Projections and Forecasts: Investors are interested in your company's future growth potential, so include projections and forecasts in your investor PowerPoint presentations. Clearly outline your assumptions and methodologies, and demonstrate how your plans align with these projections.

- Be transparent and honest: Present your data and metrics accurately and transparently. Be prepared to explain any discrepancies or anomalies, and avoid manipulating figures to create misleading impressions. Transparency and honesty help build trust with investors and support your presentation's credibility.

By effectively highlighting key metrics and data in your investor PowerPoint presentations, you can give investors the information they need to evaluate your business' potential. Enabling them to make informed investment decisions, in turn, increase your chances of securing the funding necessary to grow and succeed.

Polishing and Practicing Your Presentation

A polished and well-rehearsed investor PowerPoint presentation demonstrates professionalism but also helps you deliver your message confidently and effectively. Taking the time to refine and practice your presentation can significantly impact investors' impressions. Here are some tips for polishing and practicing your investor PowerPoint presentation:

- Review and Edit Your Content: Carefully read through your presentation, checking for errors in grammar, spelling, and punctuation. Ensure that your content is clear, concise, and easy to understand. Consider asking a colleague or advisor to review your presentation and provide feedback.

- Ensure Consistent Design and Branding: Check that your presentation's design elements, such as colors, fonts, and graphics, are consistent throughout and align with your company's branding. Consistency creates a cohesive and professional look, reinforcing your company's identity.

- Optimize Slide Transitions and Animations: Make sure that any slide transitions or animations you include are smooth and serve a purpose, such as emphasizing a point or guiding the audience's attention. Avoid excessive or overly flashy transitions that can distract or detract from your message.

- Test on Different Devices: To ensure that your investor PowerPoint presentation displays correctly on various screens and devices, test it on different monitors, projectors, or laptops. This helps identify and resolve any formatting or compatibility issues before presenting to investors.

- Practice Your Delivery: Rehearse your presentation multiple times, focusing on your pacing, tone, and body language. Practicing helps you become more comfortable with the material and enables you to speak confidently and clearly.

- Anticipate Questions and Prepare Answers: Think about potential questions investors might ask and prepare thoughtful, data-backed responses. This demonstrates your expertise and preparedness, building trust and credibility with your audience.

- Adjust Based on Audience Feedback: After practicing your presentation, consider any feedback or reactions from your test audience. Be open to adjustments to improve your presentation's clarity, engagement, and effectiveness.

By polishing and practicing your investor PowerPoint presentation, you can ensure a professional, engaging, and impactful presentation that effectively communicates your business's potential and increases your chances of securing investment.

Creating an effective investor PowerPoint presentation is crucial for capturing potential investors' attention and securing the funding needed to grow your business. By focusing on the key elements discussed in this guide, you can craft a compelling and engaging presentation that showcases your company's potential:

- Craft a compelling story that highlights your business model, market opportunities, and investment benefits.

- Keep your presentation focused and simple, prioritizing key points and using clear, concise language.

- Utilize visuals effectively to enhance your message and engage your audience.

- Highlight key metrics and data that demonstrate your company's financial performance and growth potential.

- Polish and practice your presentation to ensure professional and confident delivery.

By following these tips and putting in the necessary effort to create a well-structured, engaging, and data-driven investor PowerPoint presentation, you can significantly increase your chances of securing the investment needed to propel your business forward.

Ready to supercharge your PowerPoint presentations?

Try Zebra BI for Office for free. Don't miss the chance to create engaging presentations that drive results for free!

Related Resources

7 Tips for Creating Effective Financial PowerPoint Presentation: Best Practices and Techniques

Best practices for creating PowerPoint template for business presentations

5 Essential Steps to Mastering Your PowerPoint Consulting Presentation

How to use PowerPoint to create compelling sales presentations

Leave a comment cancel reply.

Want to join the discussion? Feel free to contribute!

Save my name, email, and website in this browser for the next time I comment.

Commentary Revolution: Transforming Power BI Dashboards with Dynamic Comments

Privacy Policy

Legal documentation

Try it in your Excel. For free.

" * " indicates required fields

We use essential cookies to make Venngage work. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Manage Cookies

Cookies and similar technologies collect certain information about how you’re using our website. Some of them are essential, and without them you wouldn’t be able to use Venngage. But others are optional, and you get to choose whether we use them or not.

Strictly Necessary Cookies

These cookies are always on, as they’re essential for making Venngage work, and making it safe. Without these cookies, services you’ve asked for can’t be provided.

Show cookie providers

- Google Login

Functionality Cookies

These cookies help us provide enhanced functionality and personalisation, and remember your settings. They may be set by us or by third party providers.

Performance Cookies

These cookies help us analyze how many people are using Venngage, where they come from and how they're using it. If you opt out of these cookies, we can’t get feedback to make Venngage better for you and all our users.

- Google Analytics

Targeting Cookies

These cookies are set by our advertising partners to track your activity and show you relevant Venngage ads on other sites as you browse the internet.

- Google Tag Manager

- Infographics

- Daily Infographics

- Graphic Design

- Graphs and Charts

- Data Visualization

- Human Resources

- Training and Development

- Beginner Guides

Blog Graphic Design

30+ Best Pitch Deck Examples, Tips & Templates

By Ryan McCready , Jul 04, 2023

A startup is, by definition, a fast-growing company. And to grow you need funding.

Enter the pitch deck.

Haven’t created a winning pitch deck before? No worries. You’ll find a ton of pre-made pitch deck templates and designs inspired by the examples throughout.

Then, use Venngage’s Presentation Maker to easily edit the templates — no technical expertise required.

A well-designed pitch deck is vital to convincing investors that your company has massive growth potential, so you can get the resources you need to scale.

In this post, we’ll look at the best startup pitch deck examples from heavy-hitters such as Guy Kawasaki, Airbnb, Uber and Facebook. We’ll also uncover the secrets of their successful startup pitch decks, and how you can leverage them to attract investor dollars, bring on new business partners and win new client contracts.

Table of contents (click to jump ahead):

- What is a pitch deck?

What is the purpose of a pitch deck?

What makes a good pitch deck, best pitch deck examples & sample pitch deck templates, what is the difference between a pitch deck vs business plan, pitch deck faq, create a pitch deck in 4 easy steps, what is a pitch deck .

A pitch deck is a presentation created to raise venture capital for your business. In order to gain buy-in and drum up financial support from potential investors, these presentations outline everything from why your business exists, to your business model, progress or milestones , your team, and a call-to-action.

The best startup pitch decks can help you:

- Prove the value of your business

- Simplify complex ideas so your audience can understand them (and get on board)

- Differentiate your business from competitors

- Tell the story behind your company to your target audience (and make that story exciting)

What is a pitch deck presentation?

A pitch deck presentation is a slideshow that introduces a business idea, product, or service to investors. Typically consisting of 10–20 slides, a pitch deck is used to persuade potential investors to provide funding for a business. It serves as a comprehensive overview of your company, outlining your business model, the problem you solve, the market opportunity you address, your key team members, and your financial projections.

The purpose of a pitch deck presentation can be to generate interest, secure funding, form partnerships or gain clients. A well-crafted pitch deck can greatly support a pitch deck presentation by effectively conveying the key messages, engaging the audience , and enhancing the overall impact of the presentation.

Great. Now let’s take a look at the elements of a good pitch deck.

To summarize, some of my favorite pitch deck design tips include:

- Adding icon headers to your most important insights

- Use similar charts and graphs for easy comparisons across slides

- For longer pitch decks, switch up the slide layouts

- Pick a consistent theme for your presentation background images

- Don’t just list your ideal users, create visual personas

- Use a timeline to show how your company has grown

- Always do the math for your audience

Now let’s take a look at some of the best startup pitch deck examples out there.

1. Sequoia capital pitch deck

How much did they raise? Sequoia Capital is actually a Venture Capital firm. According to TechCrunch , they’ve raised almost $1B for later-stage U.S. investments.

Key takeaway : “If you can’t tell the story of the company in five minutes, then you’re either overthinking it or you haven’t simplified it down enough.” – Mike Vernal, Sequoia Capital

VC firm Sequoia Capital has its own 10-slide pitch deck format to rival Guy Kawasaki’s famous example that we’ll take a look at a little later on. Its highly-curated, clarified format shines a spotlight on innovative ideas.

As the video above suggests, effectively communicating your mission, not just listing features, is key. Below is our take on the Sequoia Capital pitch deck example; you’ll find it clean, clear and easy to create.

Design tip : Click the blue background and select a new color from our color wheel (or one of your own brand colors via My Brand Kit, available with Venngage for Business ) to create a pitch deck with your branding.

Related: How to Make Successful Financial Pitch Decks For Startups

Blue and pink iconics pitch deck

Ready to try it for yourself? Add a pop of color to your version of the Sequoia pitch deck template with this pink and blue slide deck. The contrasting colors will make your information stand out.

2. Airbnb pitch deck

How much did they raise? $20k at three months and $600k at eight months (seed), according to Vator .

Key takeaway: A large marketplace, impressive rate of traction and a market ready for a new competitor are the factors which made Airbnb stand out early on, says Fast Company. The organization’s slide deck clearly demonstrates these points.

Your pitch deck should explain the core information in your business plan in a simple and straightforward way. Few startups have done this as well as Airbnb.

We’ve re-designed Airbnb’s famous deck as two light and airy sample pitch deck templates. The focus here is on engaging visuals, with minimal text used.

Airbnb fundraising slide deck

This type of deck is also called a demo day presentation . Since its going to be viewed from a distance by investors while you present, you don’t need lots of text to get your message across. The point is to complement your speech, not distract from it.

Another great thing about Airbnb’s fundraising slide deck format is that every slide has a maximum of three sections of information:

As one of the most popular presentation layouts , the rule of three design principle has been drilled into my head. And for good reason!

Here’s one of the slides that demonstrates why this pitch deck design tip works:

VIDEO TUTORIAL: Learn how to customize this pitch deck template by watching this quick 8-minute video.

Minimalist Airbnb pitch deck template

This simple sample pitch deck template is clean and incredibly easy to customize, making it perfect for presentation newbies.

Don’t forget to insert your own tagline instead of the famous “Book rooms with locals, rather than hotels” slogan. Hint: your tagline should similarly convey what your business offers. Airbnb’s pitch deck offers up tantalizing benefits: cost savings, an insider’s perspective on a location and new possibilities.

Design tip : Click the text boxes in our online editor and add your own words to the pitch decks. Duplicate slides you like, or delete the ones you don’t.

Related: How to Create an Effective Pitch Deck Design [+Examples]

3. Uber pitch deck

How much did they raise? $1.57M in seed funding in 2010, reports Business Insider .

Key takeaway : Successful pitch decks clearly highlight the key pain point (the inefficiency of cabs) and a tantalizing solution (fast, convenient 1-click ordering).

Uber co-founder Garrett Camp shared the company’s very first pitch deck from 2008 via a Medium post .

While there’s a surprising amount of text, it still manages to hit on every major part of their business plan succinctly — including key differentiators, use cases and best/worst-case scenarios.

Want something similar? We’ve updated the classic Uber pitch deck template with a sharp layout:

Uber investor deck

Many of the best pitch deck presentations out there are rather brief, only covering a few main points across a handful of slides. But sometimes your deck needs to provide more information.

There’s nothing wrong with having a longer investor pitch deck, as long as you switch up the slide layouts throughout — no one wants to see basically the same slide (just with different metrics or points) 25 times over.

This sample pitch deck template we created based on the infamous Uber deck has 20 or more slides and a diversity of layout options:

Design tip : Replace the photos with your own or browse our in-editor library with thousands of free professional stock images. To do so, double click any image to open our “replace” feature. Then, search for photos by keyword.

Blue Uber slide deck

In this navy version of the Uber pitch deck template, we’ve added bright colors and creative layouts.

Again, it’s easy to swap out the icons in our online editor. Choose from thousands of free icons in our in-editor library to make it your own.

Related : 9 Tips for Improving Your Presentation Skills For Your Next Meeting

4. Guy Kawasaki pitch deck

How much did they raise? Guy Kawasaki’s Garage Capital raised more than $315 million dollars for its clients, according to one estimate .

Key takeaway : Avoid in-depth technical discussions in your pitch deck. Focus on the pain point you’re solving, how you’ll solve it, how you’ll make money and how you’ll reach custvomers.

Guy Kawasaki’s 10 slide outline is famous for its laser focus. He’s renowned for coining the 10/20/30 rule : 10 slides, 20 minutes and no fonts smaller than 30 point.

While you may be tempted to include as much of your business plan as possible in your pitch deck, his outline forces you to tease out your most important content and engage investors or clients within a short time span.

We’re recreated his famous outline in two winning templates you can adapt and make your own:

Gradient Guy Kawasaki pitch deck

This clean pitch deck template has all the sections you need and nothing you don’t.

Kawasaki’s format steers you towards what venture capitalists really care about : problem/solution, technology, competition, marketing plan, your team, financial projections and timeline.

Read our blog post on persuasive presentations for more design and speaking tips.

Design tip : Quickly add in charts and graphs with our in-editor chart maker. You can even import data from Excel or Google sheets.

Blue Guy Kawasaki pitch deck

This more conservative pitch deck template design keeps all the focus on the core information.

Remember: opt for a 30-point font or larger. This will force you to stick to your key points and explain them clearly. Anything smaller, and you’ll risk losing your audience — especially if they’re busy reading while tuning out what you’re actually saying.

5. Buffer pitch deck

How much did they raise? $500k, according to Buffer’s co-founder Leo Widrich .

Key takeaway : The traction slide was key for Buffer: it showed they had a great product/market fit. If you have great traction, it’s much easier to raise funding.

What’s interesting about Buffer’s pitching process was the issue of competition, as that’s where many talks stalled. Investors became confused, since the social media landscape looked crowded and no one was sure how Buffer differed.

Eventually, they created this slide to clear the air:

To be frank, I’m still confused by this addition to the Buffer pitch deck, but perhaps their presentation would have cleared things up.

In any case, we’ve recreated Buffer’s pitch deck with its own traction, timeline and competitor slides, plus a clean new layout and some easy-to-customize icons:

Design tip : don’t forget to add a contact slide at the end of your pitch deck, like in the business pitch example below.

Because sometimes you’re going to pitch to a small room of investors. Other times, it will be to an auditorium full of random people in your industry. And I can guarantee that not everyone is going to know your brand off the top of their head.

You should make it extremely easy for people to find out more info or contact your team with any questions. I would recommend adding this to the last slide, as shown below.

Alternatively, you could add it to the slide that will be seen the longest in your pitch deck, like the title slide. This will help anyone interested write down your information as event organizers get things ready.

Related: Creating a Pitch Deck? 5 Ways to Design a Winner

6. Facebook pitch deck

How much did they raise? $500K in angel funding from venture capitalist Peter Thiel (first round).

Key takeaway : If you don’t have revenue traction yet, lean heavily on other metrics , like customer base, user engagement and growth. Use a timeline to tell a story about your company.

The best pitch decks tell the real story about your company or brand. You should not only want to sell the audience on your product but also on the hard work you’ve done building it from the ground up.

Design tip: Try data visualizations to relay a company or product timeline . Since people are familiar with the format and know how to read them quickly, you can convey the information impactfully and save room while you’re at it.

Here, Facebook’s classic pitch deck shows the incredible schools that’ve already signed on and describe when future launches will happen.

The sample pitch deck template featured below shows another example of a company or product timeline . This would have been a great fit in the Facebook pitch deck, don’t you think?

Plus you can summarize a ton of information about your brand on a single slide. Check out how well the timeline fits into this pitch deck template below:

If the designer wouldn’t have used a timeline, the same information could have been spread over five or six extra slides! Luckily, Venngage’s timeline maker can help you visualize progress across a period of time without any design experience required.

7. TikTok Pitch Deck

How much did they raise? $150.4M in funding in 2014 (back when TikTok was called Musical.ly), says Crunchbase .

Key takeaway : Use icons as visual anchors for written information.

(The full slide deck is available to Digiday subscribers , though you can view some of the key slides in this Medium post . Keep in mind: this TikTok pitch deck was created for potential advertisers, not investors. No other TikTok pitch decks are publicly available.)

What TikTok does really well in the above example is use icons as visual anchors for their stats. (I could write a whole article about using icons in your presentations correctly. There are so many ways you can use them to upgrade your slides.)

If you’re not sure what I’m talking about, just look at the slide deck template below.

Each of the main points has an icon that gives instant visual context about what the stat is about to the audience. These icons draw the eye immediately to these important facts and figures as well.

Design tip: Remember to use icons that have a similar style and color palette. Otherwise, you run the risk of them becoming a distraction.

8. Y Combinator pitch deck

How much did they raise? This startup accelerator has invested in over 3,500 startups to date, according to the company website . They state their combined valuation nears $1 trillion.

Key takeaway : Create clear, concise pitch deck slides that tell a story investors can understand in seconds.

The classic Y Combinator pitch deck is incredibly simple, and for good reason. Seed stage companies can’t provide much detail, so they should focus on telling a story about their company.

That means your slides should tell a story investors can immediately understand in a glance.

Note that one of Y Combinator’s key components is the problem (above) and solution (below) slides.

Explaining how your startup is going to solve a pain point is a vital part of any slide deck. According to Y Combinator , startups should use the problem slide to show the problem your business solves, and how this problem currently affects businesses and/or people. Additionally, if you’re starting a new startup, forming an LLC could be a great choice to launch your business in the right direction.

Without that information, investors are going to be left with more questions than answers.

The solution slide should show the real-world benefits of your product/service. I recommend using data visualization to show traction, like the chart above, with a couple of notes for context.

To ensure your problem and solutions slides are easily understood, use a similar layout for both, as shown below.

This will help the audience quickly recall the main problem you want to solve, and connect it to your solution (even if the slides are separated by a few other points or ideas).

9. Front pitch deck

How much did they raise ? $10M in Series A funding

Key takeaway : Use a simple flowchart to visualize a problem your product/service solves.

Not everyone is going to be able to explain their problem and solution as succinctly as the previous examples. Some will need to take a unique approach to get their point across.

That’s why I want to highlight how Front masterfully communicated the problem to be solved. They likely realized it would be a lot easier (and cleaner) to create a flow chart that visualizes the problem instead of text. (Did I mention you can make your own flowcharts with Venngage?)

Also, I really like how they distilled each down to a single phrase. That approach, combined with the visuals, will help it stick in investors’ minds as one of the best pitch decks.

Here’s another example pitch deck that uses a chart to convey their problem/solution:

It splits the competition slide right down the middle to illustrate the differences. It also shows exactly how the processes differ between the two entities using mini flowcharts.

Helping the audience make the right conclusions about your company should be an important part of your pitch deck strategy. Without saying a word, the visual choices you make can greatly impact your message.

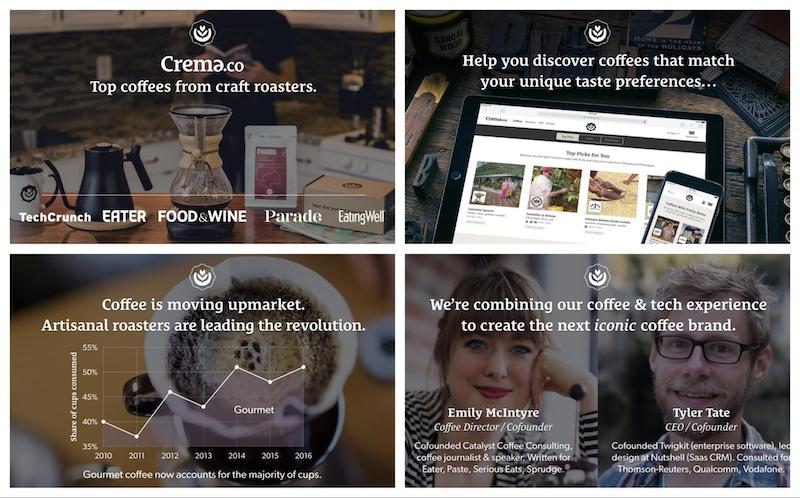

10. Crema pitch deck

How much did they raise? $175K in seed funding .

Key takeaway : Choose background images carefully — making sure they have a similar color palette.

The best pitch decks keep things consistent, mainly because there are so many moving parts in any presentation. You want each of your slides to feel like they’re connected by a singular feeling or theme. An out-of-place presentation background image can throw that off.

Keeping things consistent when you use a solid background color or pattern isn’t hard. But things can get tricky if you want to use different photos for your backgrounds.

However, if you pick presentation background images that have a similar color palette, you’ll be fine. Check out the images Crema used in their startup pitch deck below:

If you’re struggling to find exactly the same colored photos, you can use a color filter to make things more uniform.

11. WeWork pitch deck

How much did they raise? $6.9M in seed funding in 2011, says Crunchbase .

Key takeaway : Put your metrics on display.

The behemoths at WeWork still have one of the best software pitch decks, despite recent troubles (layoffs, and a valuation that dropped from $47 billion to $2.9 billion).

In fact, this investor pitch deck actually helped them raise money at a $5 billion valuation.

My favorite thing from this is how their key metrics are on the second slide. They waste no time getting down to business!

A lot of the time brands hide these metrics at the end of their presentation, but WeWork made sure to put it front and center in their slide deck.

This approach puts the audience in a positive state of mind, helping them be more receptive to the pitch.

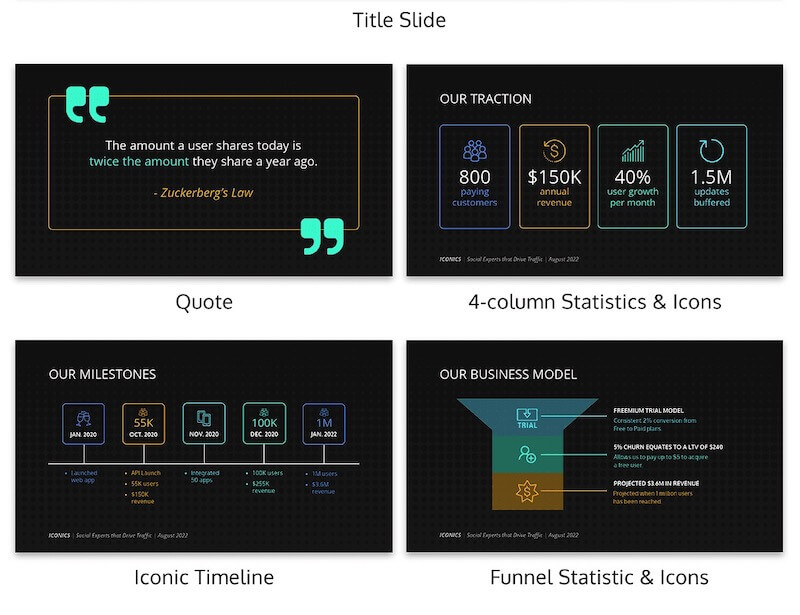

12. Crew (Dribble) pitch deck

How much did they raise? $2M in seed funding

Key takeaway : Start your presentation with a simple statement to set the tone.

Sometimes you have to set the mood of the room before you jump into your slide deck. A simple way to do this is by adding a powerful statement or famous quote at the beginning of your slides.

This may sound cliche, but the creatives over at Crew (now Dribbble ) used this approach well in their pitch presentation.

By claiming that every business is an online business, they instantly change the way that people think about the business sector.

Additionally, the designers used this straightforward statement to set up the rest of the presentation. In the next few slides, the potential market is explained. Without the statement, I don’t think these numbers would be as impactful.

Let’s take a look at the graphs and charts the Dribble team used in their slide deck. In the below business pitch example, you can see that the line charts use the same color palette, size, and typography.

One of my favorite tips from my presentation ideas roundup article states you should never make the audience do the math.

You can also use this mantra when you’re adding data visualizations to your slides. Make each slide extra easy to consume, as well as, easy to compare to other visualizations.

Below the pie charts use the exact same color palette, size, and typography as well:

If the designers would have used a different example, the audience would be distracted trying to decipher the information.

But consistent design across multiple visualizations will ensure your audience can make comparisons that lead to the right conclusions.

Pro Tip: You can use a comparison infographic to summarize key points you’re comparing.

13. Aspire Food Group pitch deck

How much did they raise? $1M from the Hult Prize in 2013 to scale their project.