- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Budget Money in 5 Steps

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

If you have take-home pay of, say, $3,000 a month, how can you pay for housing, food, insurance, health care, debt repayment and fun without running out of money? That’s a lot to cover with a limited amount.

The answer is to make a budget.

What is a budget? A budget is a plan for every dollar you have. It represents more financial freedom and a life with much less stress.

How to budget money

It’s easy to get overwhelmed by the many details included in the budgeting process. Here are five steps to follow.

Step 1. Figure out your after-tax income

If you get a regular paycheck, the amount you receive is probably your after-tax income, but if you have automatic deductions for a 401(k) , savings, and health and life insurance, add those back in to give yourself a true picture of your savings and expenditures. If you have other types of money coming in — such as from side gigs — subtract anything that reduces that income, such as taxes and business expenses.

Step 2. Choose a budgeting system

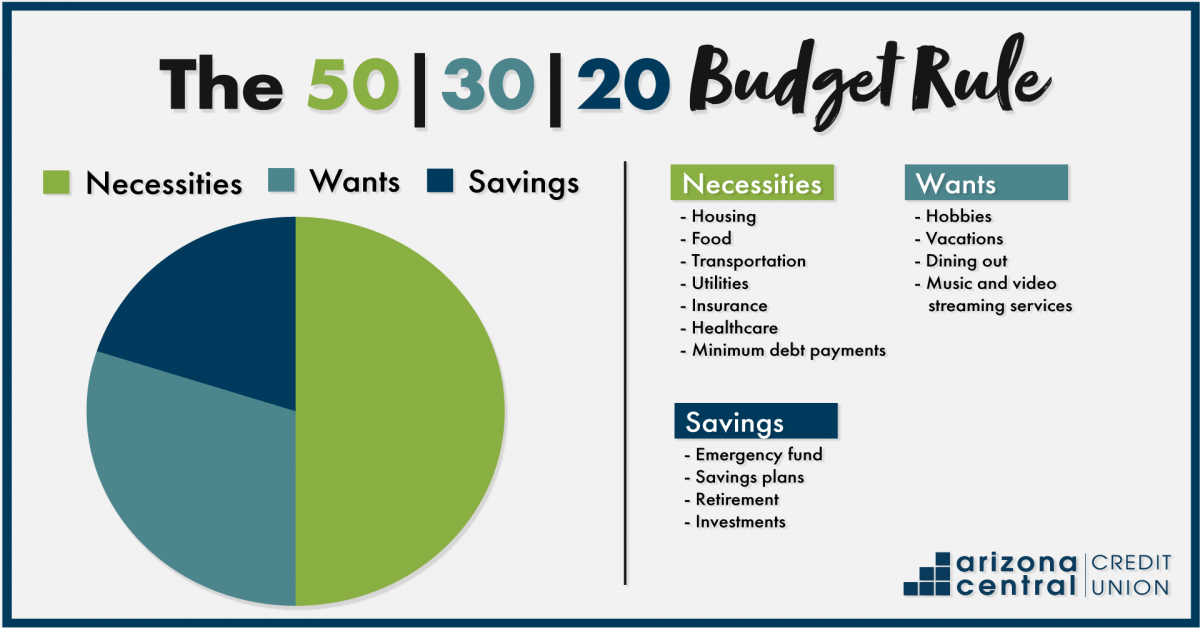

A budgeting system is a framework for how you budget. Everyone has different habits, personality types and approaches to managing money, and there are systems that can fit your lifestyle. Any budget must cover all of your needs, some of your wants and — this is key — savings for emergencies and the future. Budgeting system examples include the envelope system, the zero-based budget, and the 50/30/20 budget , which we’ll discuss more below.

Step 3. Track your progress

Record your spending or use online budgeting and savings tools . During this step, it’s important to pay attention to where your money is going. If you notice areas where you’re overspending, consider cutting those costs. The money you notice slipping through the cracks could go toward debt repayment, savings or another financial priority.

Step 4. Automate your savings

Automate as much as possible so the money you’ve allocated for a specific purpose gets there with minimal effort on your part. If your employer permits, set up automatic payments from your paycheck to your emergency savings , investment and retirement accounts. An accountability partner or online support group can help, so that you're held accountable for choices that don't fit the budget.

Step 5. Practice budget management

Your income, expenses and priorities will change over time, so manage your budget by revisiting it regularly, perhaps once a quarter. If you find that the initial budgeting system you choose isn’t working for you, consider trying a different strategy.

Determine priorities in your budget

When budgeting, it can be difficult to determine which items are most urgent. Should you prioritize your credit card debt, student loan repayments or retirement savings? Here is a list of potential priorities from most to least urgent.

Many experts recommend you try to build up several months of bare-bones living expenses. We suggest you start with an emergency fund of at least $500 — enough to cover small emergencies and repairs — and build from there.

You can’t get out of debt without a way to avoid more debt every time something unexpected happens. And you’ll sleep better knowing you have a financial cushion.

Get the easy money first. For most people, that means tax-advantaged accounts such as a 401(k). If your employer offers a match, consider contributing at least enough to grab the maximum. It's free money.

Why do we make capturing an employer match a higher priority than debt? Because you won’t get another chance this big at free money, tax breaks and compound interest. Ultimately, you have a better shot at building wealth by getting in the habit of regular long-term savings.

You don’t get a second chance at capturing the power of compound interest . Every $1,000 you don’t put away when you’re in your 20s could be $20,000 less you have at retirement.

If you have any extra cash available, go after the toxic debt in your life. High-interest credit card debt, personal and payday loans, title loans and rent-to-own payments all carry interest rates so high that you end up repaying two or three times what you borrowed.

If either of the following situations applies to you, investigate options for debt relief , which can include bankruptcy or debt management plans .

You can't repay your unsecured debt — credit cards, medical bills, personal loans — within five years, even with drastic spending cuts.

Your total unsecured debt equals half or more of your gross income.

Once you’ve knocked off any toxic debt, the next task is to get yourself on track for retirement. Financial professionals suggest saving 15% of your gross income for retirement, and; that includes your company match, if there is one.

If you’re young, consider funding a Roth individual retirement account after you capture the company match. Once you hit the contribution limit on the IRA, consider returning to your 401(k) and maximize your contribution there.

Regular contributions can help you build up three to six months' worth of essential living expenses — not your full budget, just the must-pay basics. You shouldn’t expect steady progress because emergencies happen, and that's when you should pull money from this fund. Just focus on replacing what you use and increasing your savings over time.

These are payments beyond the minimum required to pay off your remaining debt .

If you’ve already paid off your most toxic debt, what’s left is probably lower-rate, often tax-deductible debt (such as your mortgage). Tackle these when the goals listed above are covered.

Any wiggle room you have here comes from the money available for wants or from saving on your necessities, not your emergency fund and retirement savings.

Congratulations! You’re in a great position — a really great position — if you’ve built an emergency fund, paid off toxic debt and are socking away 15% toward a retirement nest egg. You’ve built a habit of saving that gives you immense financial flexibility. Don’t give up now. Consider saving for irregular expenses that aren’t emergencies, such as a new roof or your next car. Those expenses will come no matter what, and it’s better to save for them than borrow. You may also choose to use any disposable income you have to build wealth faster by putting more money in your retirement pot.

Try a simple budgeting plan

We recommend the popular 50/30/20 budget to maximize your money. Over the long term, someone who follows these guidelines will have manageable debt, room to indulge occasionally, and savings to pay irregular or unexpected expenses and retire comfortably.

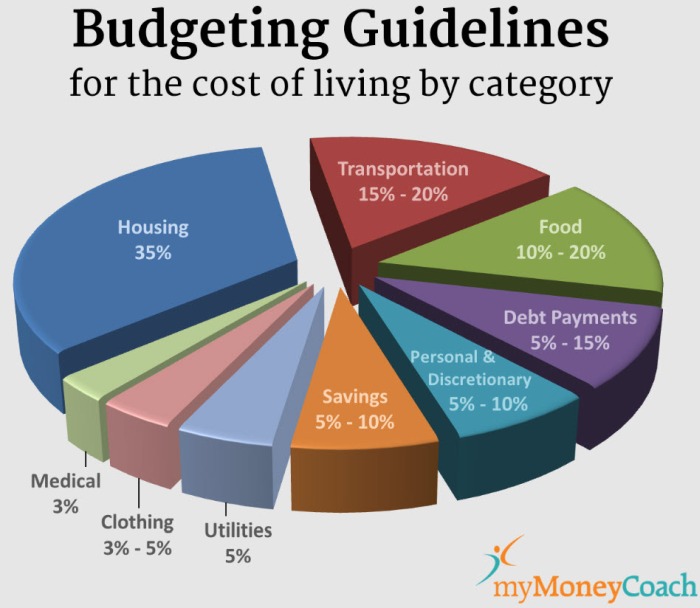

Allow up to 50% of your income for needs

Your needs — about 50% of your after-tax income — should include:

Basic utilities.

Transportation.

Minimum loan and credit card payments. Anything beyond the minimum goes into the savings and debt repayment category.

Child care or other expenses you need so you can work.

If your absolute essentials overshoot the 50% mark, you may need to dip into the “wants” portion of your budget for a while. It’s not the end of the world, but you'll have to adjust your spending.

Even if your necessities fall under the 50% cap, revisiting these fixed expenses occasionally is smart. You may find a better cell phone plan , an opportunity to refinance your mortgage or an opportunity for less expensive car insurance . That leaves you more to work with elsewhere.

Leave 30% of your income for wants

Separating wants from needs can be difficult. In general, though, needs are essential for you to live and work. Typical wants include dinners out, gifts, travel and entertainment.

It’s not always easy to decide. Are restorative spa visits (including tips for a massage ) a want or a need? How about organic groceries? Decisions vary from person to person.

If you're eager to get out of debt as fast as you can, you may decide your wants can wait until you have some savings or your debts are under control. But your budget shouldn't be so austere that you can never buy anything just for fun.

Every budget needs wiggle room — maybe you forgot about an expense or one was bigger than you anticipated — and some money to spend as you wish. If there's no money for fun, you'll be less likely to stick with your budget.

Commit 20% of your income to savings and debt paydown

Use 20% of your after-tax income to put something away for the unexpected, save for the future and pay off debt balances (paying more than minimums). Make sure you think of the bigger financial picture; that may mean two-stepping between savings and debt repayment to accomplish your most pressing goals.

Frequently Asked Questions

How do you make a budget spreadsheet.

Start by determining your take-home (net) income, then take a pulse on your current spending. Finally, apply the 50/30/20 budget principles : 50% toward needs, 30% toward wants and 20% toward savings and debt repayment.

How do you keep a budget?

The key to keeping a budget is to track your spending on a regular basis so you can get an accurate picture of where your money is going and where you’d like it to go instead. Here’s how to get started: 1. Check your account statements. 2. Categorize your expenses. 3. Keep your tracking consistent. 4. Explore other options. 5. Identify room for change. Free online spreadsheets and templates can make budgeting easier.

How do you figure out a budget?

Start with a financial self-assessment. Once you know where you stand and what you hope to accomplish, pick a budgeting system that works for you. We recommend the 50/30/20 system, which splits your income across three major categories: 50% goes to necessities, 30% to wants and 20% to savings and debt repayment.

Ready to learn more about budgeting? Watch this video.

On a similar note...

on Capitalize's website

Download the app

Disclaimer: NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product's site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution's Terms and Conditions. Pre-qualified offers are not binding. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

NerdUp by NerdWallet credit card: NerdWallet is not a bank. Bank services provided by Evolve Bank & Trust, member FDIC. The NerdUp by NerdWallet Credit Card is issued by Evolve Bank & Trust pursuant to a license from MasterCard International Inc.

Impact on your credit may vary, as credit scores are independently determined by credit bureaus based on a number of factors including the financial decisions you make with other financial services organizations.

NerdWallet Compare, Inc. NMLS ID# 1617539

NMLS Consumer Access | Licenses and Disclosures

California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License #60DBO-74812

Insurance Services offered through NerdWallet Insurance Services, Inc. (CA resident license no.OK92033) Insurance Licenses

NerdWallet has an engagement with Atomic Invest, LLC (“Atomic Invest”), an SEC-registered investment adviser, to bring you the opportunity to open an investment advisory account (“Atomic Treasury account”). Investment advisory services are provided by Atomic Invest. Companies which are engaged by Atomic Invest receive compensation of 0% to 0.85% annualized, payable monthly, based upon assets under management for each referred client who establishes an account with Atomic Invest (i.e., exact payment will differ). Atomic Invest also shares a percentage of compensation received from margin interest and free cash interest earned by customers with NerdWallet. NerdWallet is not a client of Atomic Invest, but our engagement with Atomic invest gives us an incentive to refer you to Atomic Invest instead of another investment adviser. This conflict of interest affects our ability to provide you with unbiased, objective information about the services of Atomic Invest. This could mean that the services of another investment adviser with whom we are not engaged could be more appropriate for you than Atomic Invest. Advisory services through Atomic Invest are designed to assist clients in achieving a favorable outcome in their investment portfolio. They are not intended to provide tax advice or financial planning with respect to every aspect of a client’s financial situation and do not include investments that clients may hold outside of Atomic Invest. For more details about Atomic Invest, please see the Form CRS , Form ADV Part 2A , the Privacy Policy , and other disclosures.

Brokerage services for Atomic Invest are provided by Atomic Brokerage LLC, a registered broker-dealer and member of FINRA and SIPC and an affiliate of Atomic Invest. Due to the relationship between Atomic Brokerage and Atomic Invest, there is a conflict of interest due to Atomic Invest directing orders to Atomic Brokerage. For additional information regarding conflicts, please see Items 5, 12 and 14 of Atomic Invest's Form ADV Part 2A . For more details about Atomic Brokerage, please see the Form CRS , the Atomic Brokerage General Disclosures , and the Privacy Policy . Check the background of Atomic Brokerage on FINRA's BrokerCheck . Fees such as regulatory fees, transaction fees, fund expenses, brokerage commissions and services fees may apply to your brokerage account.

Budgeting Unit

New to ngpf.

Save time, increase engagement, and teach life-changing financial skills with NGPF’s free curriculum

Start with a FREE Teacher Account to unlock NGPF's teachers-only materials!

Get started in 4 easy steps:.

1. Register for a free Teacher Account

2. Explore Semester Course

3. Find student favorites

4. Leverage NGPF Academy

Or, take a shortcut…

Spin the wheel to find a new favorite activity, your result:.

MOVE: Paycheck Scavenger Hunt

Unit 10: Unit Plan & Assessments

Unit assessment, lesson 1: budgeting strategies.

Students will be able to:

- List the different categories of expenses

- Explain how four different budgeting strategies work

- Weigh the pros and cons of each budgeting strategy

Lesson 2: Budgeting for Rent and Food

Students will be able to

- Understand how consumers allocate their average annual budget across different spending categories

- Prioritize multiple factors when deciding where to live

- Identify ways to reduce expenses associated with renting

- Explain how to save money when shopping at a grocery store

- Compare the unit prices of grocery items before making a spending decision

- Create a roommate agreement to share the costs associated with living together

Lesson 3: Budgeting for Transportation

- Compare the popularity of various transportation methods in the United States

- Explore how access to different transportation options can vary based on geographic location

- Identify ways to reduce their transportation costs

- Understand the financial implications and overall tradeoffs of using different transportation options

Lesson 4: Build Your Budget

- Create a budget on a salaried adult’s income and adjust it as required

- Research and choose appropriate budgeting apps to meet specific needs

Lesson 1: Budgeting Basics

- Describe the purpose of a budget

- Classify expenses as needs and wants

- Explain the difference between gross pay and net pay

Lesson 2: Budgeting Strategies

Lesson 3: budgeting for housing.

- Prioritize many factors when deciding where to live

- List important considerations before signing a lease

- Determine whether they are prepared to purchase a home

- Factor in how utilities will affect their budget

Lesson 4: Budgeting for Transportation

Lesson 5: budgeting for food.

- Estimate the costs of buying food

- Detail strategies for lowering a dining out budget

- Explain how inflation affects one’s ability to budget for food

Lesson 6: Build Your Budget

Lesson 6: budgeting challenges.

- Understand the various challenges people may face when trying to stick to their budgets

- Explain how a minimum wage is different from a living wage

- Identify ways people can budget with a limited or variable income

- Explore government benefits offered to help people meet their basic living expenses

Lesson 7: Build Your Budget

- COMPARE: Find an Apartment

- COMPARE: Needs vs. Wants

- COMPARE: Select Your Utilities

- COMPARE: Select a City to Live In

- CREATE: A Salary-Based Budget

- CREATE: Prom Pitch Showdown

- ECON: Demand Shifters

- ECON: Exchange Rates

- ECON: Inflation, Spending, and Wages

- ECON: Shortages and Surpluses

- ECON: Shrinkflation

- ECON: What is the Consumer Price Index (CPI)?

- FINE PRINT: Electricity Bill

- FINE PRINT: Residential Lease

- INTERACTIVE: Living Paycheck to Paycheck

- INTERACTIVE: Money Magic

- MOVE: Build Your Budget

- MOVE: Inflation Over Time

- MOVE: Making Transportation Decisions

- MOVE: The Average American Budget

- MOVE: The Real Relationship Test

- PLAY: Budget Frenzy!

- PLAY: Organize Budget Expenses

- PLAY: The Bean Game

- PROJECT: Budgeting with Roommates

- PROJECT: Plan a Friendsgiving Dinner

- PROJECT: Plan a Spring Break Trip

- PROJECT: Rein In Your Wants

- READ: Gig Workers: How are You Managing Your Money?

- RESEARCH: Monthly Cost of Car Ownership

- RESEARCH: Online Tools and Apps

CASE STUDIES

- CASE STUDY: Budget or Bust?

- CASE STUDY: How Do I Budget?

FINCAP FRIDAYS

- Budgeting Gets Loud

- Save a Dime on Valentine's

- Prices Have Grown for Food at Home

- Food Waste Due to Expiration Dates

- Cash Flash from the Past

- Average American Budget

- Protective Parents

- Nike Eyes Growing Feet

- Famous and Frugal

QUESTIONS OF THE DAY

- Groceries or Restaurants: Where are Americans spending more money?

- How Much Money Does The Average Person Spend On Video Games and Accessories?

- How much does the average American household spend on transportation per year?

- How much does the average consumer spend per month on subscription services?

- How much does the average pet owning household spend on their pets each year?

- How much money did Americans spend on video games in 2020?

- What are the top 3 types of products/services Gen Z is most likely to splurge on?

- What is the top-selling fast food category: Snacks, Burgers or Pizza?

- What matters most to teens when making a clothing purchase: Brand, Price or Quality?

- What percent of 18-24 year olds live with their parents?

- What percent of Americans earning more than $250,000 are living paycheck to paycheck?

- What percent of high school seniors have a driver's license?

- What percent of the U.S. food supply is wasted?

- What percentage of gig-workers say they're living comfortably?

- What’s the real value of $100 in each state?

DATA CRUNCH + MATH

- DATA CRUNCH: Has Income Kept Up with the Cost of Living?

- DATA CRUNCH: How Does Spending Differ Across Generations?

- DATA CRUNCH: How Does the Minimum Wage Compare to the Living Wage?

- DATA CRUNCH: How Have Prices For Consumer Goods Changed Over the Past 20 Years?

- DATA CRUNCH: What Does The Average Household Spend Money On?

- MATH: Calculating Percentages

- MATH: Discounts and Composite Functions

- MATH: Graphing a Budget Equation

- MATH: Unit Price

Assessments and Answer Keys

Sending form..., one more thing.

Before your subscription to our newsletter is active, you need to confirm your email address by clicking the link in the email we just sent you. It may take a couple minutes to arrive, and we suggest checking your spam folders just in case!

Great! Success message here

Teacher Account Log In

Not a member? Sign Up

Forgot Password?

Thank you for registering for an NGPF Teacher Account!

Your new account will provide you with access to NGPF Assessments and Answer Keys. It may take up to 1 business day for your Teacher Account to be activated; we will notify you once the process is complete.

Thanks for joining our community!

The NGPF Team

Want a daily question of the day?

Subscribe to our blog and have one delivered to your inbox each morning, create a free teacher account.

Complete the form below to access exclusive resources for teachers. Our team will review your account and send you a follow up email within 24 hours.

Your Information

School lookup, add your school information.

To speed up your verification process, please submit proof of status to gain access to answer keys & assessments.

Acceptable information includes:

- a picture of you (think selfie!) holding your teacher/employee badge

- screenshots of your online learning portal or grade book

- screenshots to a staff directory page that lists your e-mail address

- any other means that can prove you are not a student attempting to gain access to the answer keys and assessments.

Acceptable file types: .png, .jpg, .pdf.

Create a Username & Password

Once you submit this form, our team will review your account and send you a follow up email within 24 hours. We may need additional information to verify your teacher status before you have full access to NGPF.

Already a member? Log In

Welcome to NGPF!

Take the quiz to quickly find the best resources for you!

ANSWER KEY ACCESS

Budget Planning and Budgeting Lessons

Budgeting teaching budget lesson plans learning worksheet household family planning exercises classroom unit teacher resources activity free tutorial curriculum basics.

Lessons appropriate for: 1st 2nd 3rd 4th 5th 6th 7th 8th 9th 10th 11th 12th Graders.

First Grade - Second Grade - Third Grade - Fourth Grade - Fifth Grade - Sixth Grade - Seventh Grade - Eighth Grade - Ninth Grade - Tenth Grade - Eleventh Grade - Twelfth Grade - K12 - Middle School - High School Students - Adults - Special Education - Secondary Education - Teens - Teenagers - Kids - Children - Homeschool - Young People

Teaching Special Needs - Adult Education - Budgeting for Kids - Children - Young Adults

Our Budgeting section delivers an array of educational tools. Dive into our collection that comprises lesson plans, printable worksheets, instructive videos, detailed articles, and more. Our lesson plans and printable worksheets are crafted to guide educators in imparting knowledge about the principles of budgeting and the importance of financial planning. Tailored to fit various learning environments, these resources are adaptable for both group lessons and self-paced studies. Our instructive videos provide a vibrant approach to understanding budgeting, bringing to life the nuances of financial planning with compelling animations and lucid breakdowns of intricate topics. Meanwhile, our detailed articles delve into the finer points of budgeting, offering expert commentary and profound insights into managing personal finances effectively. Whether you're a visual learner, a reading enthusiast, or someone in search of structured lessons, the Budgeting section of Money Instructor is equipped with resources to ensure you grasp the essentials of financial planning and lead a financially sound life.

Lessons and worksheets.

|

Use these budgeting worksheets with our lesson plan or for teaching your own budget lesson plans. Monthly and daily student budget sheets. Personal budget form. | |||||

| ||||||

|

Printable budget lesson starter worksheets for a lesson introducing budgeting. Includes creating a personal budget for yourself, and earning money while prioritizing needs and wants. | |||||

| ||||||

|

A lesson about budgets, what they are, and why we use them.

| |||||

| ||||||

|

Students learn what a budget is, why they should budget, and how to set up a simple budget. | |||||

| ||||||

|

This is an introductory worksheet. Students learn and identify fixed and variable expenses to help understand how to create a budget. | |||||

: | ||||||

|

Use these worksheets to teach basic budget concepts. Even a child should understand basic personal finance concepts. | |||||

| ||||||

|

Students practice their skills at estimation while shopping for groceries. | |||||

| ||||||

|

An important budgeting money concept is understanding the difference between needs and wants. | |||||

| ||||||

|

Understanding the basic difference, between needs and wants, is crucial to good financial decision making. Students learn how to determine and prioritize their needs and wants and will also learn how to decide whether certain items are a necessity or a desire so they may demonstrate how different people interpret their own needs and wants.

| |||||

| ||||||

|

In this lesson, students learn to understand and identify what are their money habits. Every money decision you make either reinforces good or bad money habits. The first step toward creating good money habits is to first identify the money habits you currently have. | |||||

| ||||||

|

In this lesson, students keep a log of all their spending for products and services for a week to help identify their spending habits and patterns. | |||||

| ||||||

|

Learn about comparison shopping with this word problem worksheet. | |||||

| ||||||

|

This is a word problem worksheet for a lesson in basic budget concepts. | |||||

| ||||||

|

| |||||

| ||||||

| *

| |||||

| ||||||

| * Put together and categorize a budget. This is a good introductory worksheet showing what a simple one looks like. This worksheet is random, so every time you choose the link, a new worksheet is created. | |||||

| ||||||

| * This worksheet takes a predetermined budget and the student is asked to fill in the monthly items and determine if they are above or below their estimates. It also teaches and reinforces basic math skills. | |||||

| ||||||

|

A lesson for students on budgeting for school supplies, focusing on understanding financial priorities, tracking expenses, and implementing cost-saving strategies. They begin by identifying their financial starting point, recognizing income sources such as allowances, savings, and part-time jobs. From there, they delve into the significance of categorizing items into must-haves, luxuries, and intermediate essentials. The lesson concludes with the realization that budgeting transcends school preparation; it’s a lifelong skill that refines over time. | |||||

| ||||||

| * Test basic math skills while answering related questions. | |||||

| ||||||

|

Students will use given information to create a monthly spending plan, also known as a budget. In this lesson, they will develop the abilities needed to make an effective plan to budget monthly spending goals. | |||||

| ||||||

|

Use the coupons and answer the questions about grocery shopping with coupons. An introduction lesson on using coupons and discounts. Basic money math. | |||||

| ||||||

| Students learn about creating a realistic budget. | |||||

| ||||||

|

A lesson for students on how to build wealth and navigate your financial future by setting solid and achievable goals with our step-by-step guide. Covers everything from prioritizing objectives and creating SMART goals to budgeting and progress tracking. The tutorial covers various topics such as prioritizing individual financial objectives, whether that involves paying off student loans, purchasing a home, or embarking on investments. The lesson demystifies seemingly daunting financial goals, breaking them down into manageable tasks and highlighting the importance of creating realistic budgets. Students will understand how to allocate funds properly to avoid financial pitfalls, enabling them to take control of their financial destinies.

In this lesson, students learn to figure out their desired financial objectives by planning smart and effective financial goals that will help them achieve their goals. They will set financial goals that are specific, measurable, attainable, relevant, and time-bound.

A lesson on how to balance and prioritize between short-term and long-term financial goals, laying a foundation for a stable and independent financial future. Students learn about setting and prioritizing financial goals through a video lesson. Topics discussed include defining short-term and long-term goals, along with providing real-world examples of each. Students are guided through a step-by-step process of assessing their financial situations, listing, categorizing, and prioritizing goals, as well as developing actionable plans to achieve them. Strategies such as creating budgets, allocating income, and utilizing appropriate financial tools like high-yield savings accounts or tax-advantaged accounts like IRAs or 401(k)s are covered to facilitate understanding of the pathway to financial freedom. | |||||

| ||||||

|

A lesson for students on cash envelope budgeting, commonly known as cash stuffing or envelope stuffing, and how it can transform your financial habits and help you save effectively. Students learn about cash envelope budgeting, a method that involves allocating cash to different spending categories such as groceries, entertainment, and dining out. The lesson covers the fundamentals of setting up a cash envelope system, the psychological impact of spending physical cash versus using cards, and how this method can improve spending habits by encouraging mindfulness and discipline. | |||||

| ||||||

|

Students learn the significance of financial transparency and responsibility through "Loud Budgeting," a trend made popular on TikTok and social media. This personal finance approach involves openly discussing financial constraints and balancing savings with joyful activities. Utilizing budgeting apps and specific-goal savings accounts, students learn effective money management and challenge luxury spending trends. While not new, loud budgeting has gained attention for its blend of humor and seriousness in financial decision-making. By adopting this method, students embrace financial honesty, overcome spending stigmas, and pursue financial stability, inspiring a redefinition of success. | |||||

| ||||||

|

Many college students discover too late that they need to learn how to budget their money. Use this budget lesson plan and worksheet on the subject of college budgeting to help teach related principles. | |||||

| ||||||

|

A car is often one of the more expensive items we purchase. Read the car advertisements and answer the questions about taking a car loan with this loan worksheet. Learn about down payments and finance charges.

| |||||

| ||||||

|

Learn about purchasing and financing a car by filling in the missing financing calculations. | |||||

| ||||||

|

An introductory lesson on basic car insurance terminology. Learn about car insurance monthly premiums and answer the questions about choosing car insurance. Teaching lesson focus is on price comparison, and early understanding of basic liability insurance. | |||||

| ||||||

|

Learn to read the apartment advertisements and answer the questions about choosing an apartment to rent. Lesson focus is on rent comparison. | |||||

| ||||||

|

A worksheet introducing students to the concept of a mortgage loan. Also introduces the concepts of down payment and closing costs. | |||||

| ||||||

|

Students assess their own financial management skills by taking the money management self-assessment. This assessment will help students identify their current knowledge or money management as well as areas that need instruction regarding money and finances. | |||||

| ||||||

|

Credit cards, credit, and paying interest. A fundamental understanding of credit cards is important since people often exceed their budget by overspending on their credit card. Use these lessons to help with your understanding of credit and credit cards. | |||||

| ||||||

|

Students must design a cottage and stay within the specified budget. Practice real-word budgeting problems, while actively applying logic and algebraic knowledge. Students must understand evaluating alternatives, cost/benefit analysis, work with a budget, and substantiate their analysis. | |||||

| ||||||

|

Costs for vacation and travel can often be more than we anticipate. Use this lesson to help teach and learn about budgeting and spending for vacation travel. | |||||

| ||||||

|

Worksheets and Lessons with a spending money theme. Learn about spending money issues to help with budgeting lessons. | |||||

| ||||||

|

A lesson on how to prepare for a recession, economic loss, or potential job loss. Learn important steps and tips to help prepare and protect yourself for a decline in the economy, a layoff, job loss, unemployment, or other related event.

| |||||

| ||||||

|

Lessons designed to provide an in-depth understanding of the fundamentals of money management. This field entails strategic planning and effective oversight of budgeting, saving, investing, and spending to optimize financial resources. It encompasses key financial practices, including setting clear financial goals, developing and adhering to a practical budget, managing debt efficiently, and proactively planning for future financial needs. These lessons are crafted to equip individuals with the essential knowledge and skills for sound financial decision-making. | |||||

| ||||||

|

This lesson explores the Supplemental Nutrition Assistance Program (SNAP), focusing on its eligibility, benefits, and how it aids Americans in maintaining a healthy diet affordably. It introduces the Electronic Benefits Transfer (EBT) card for essential purchases and addresses the stigma associated with SNAP. Highlighting SNAP's crucial role in ensuring access to nutritious food, the lesson underscores its importance in providing security and supporting personal aspirations during challenging times. | |||||

| ||||||

This lesson introduces students to the concept of being responsible for managing money through accurate record-keeping.

This lesson begins with dispelling common myths about millionaires. Students then have an opportunity to give their opinions of wealth in a brainstorming activity that culminates in a formalizing of the definition of wealth through the equation of “assets – liabilities = net worth.”

With financial goals in mind, students work in pairs to complete a budget analysis for a fictitious high school senior who needs to save money. The lesson concludes with a personal budget development activity that uses the information on expenditures that was collected during the two-week data gathering period.

Students work in pairs to participate in a “Track Star” game that illustrates positive and negative spending behaviors. Each pair analyzes the game results, identifies effective and ineffective budgeting behaviors, and generates a list of budgeting principles.

| ||||||

| ||||||

The first step towards creating a budget is monitoring and categorizing your spending. A sample monthly household budget.

| ||||||

SUGGESTIONS OR NEED HELP?

Do you have a recommendation for an enhancement to this budgeting money lesson page, or do you have an idea for a new lesson? Then leave us a suggestion .

More Teaching Earning and Spending Money Worksheets and Lessons

To teach and learn money skills, personal finance, money management, business, careers, and life skills please go to the Money Instructor home page .

Teach and learn money skills, personal finance, money management, business, careers, real life skills, and more.... MoneyInstructor ®

- New Member Registration

- Teaching Lessons

© Copyright 2002-2024 Money Instructor® All Rights Reserved.

- Grades 6-12

- School Leaders

Get our mega Halloween worksheets bundle! 👻

25 Meaningful Saving and Budgeting Activities for High School Students

Teach teens financial fitness now so they have a prosperous future.

If we let students graduate high school without learning key skills like saving and budgeting, we’re doing them a real disservice. These budgeting activities are terrific for a life-skills class, morning meeting discussion, or advisory group unit. Give teens the knowledge they need to make smart financial choices now and in the future!

Classroom Saving and Budgeting Activities

Try the Jellybean Game

Before you get into the nitty-gritty of numbers, start with this clever activity that gives kids practice allocating assets in a low-stakes way. They’ll use jellybeans to decide what they need, want, and can truly afford.

Learn more: The Jellybean Game

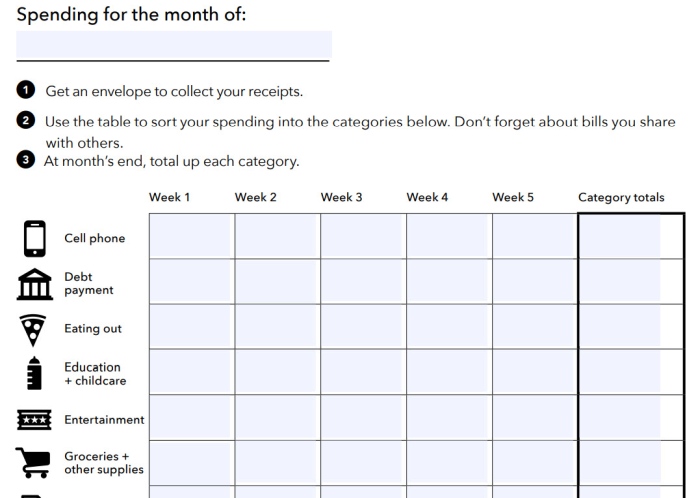

Use budget-planning worksheets

The Consumer Financial Protection Bureau has developed lots of tools to help teens and adults learn to manage money. Show kids how to use their Income Tracker, Spending Tracker, Bill Calendar, and Budget Worksheet (all at the link below). Start by having kids consider their current financial situation. Then, give them hypothetical “adult” situations to plan for, with income and expenses drawn from typical people in your area.

Learn more: Budgeting Worksheet Tools

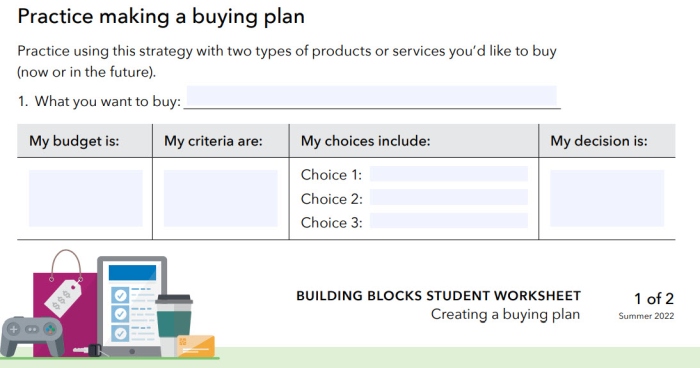

Create a buying plan

This activity encourages kids to think about purchases, especially major ones. Saving money is just one part of the process—they also need to consider what makes a good purchase and whether they should pay up front or borrow the money instead.

Learn more: Creating a Buying Plan

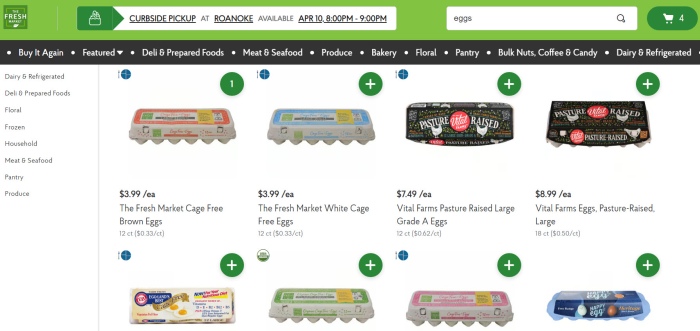

Practice grocery shopping

Most kids probably have no idea how much groceries cost. Use grocery store websites to your advantage, and have kids take a virtual shopping trip. They can plan meals and determine what they’ll need to buy. Or have them start with a weekly food budget and work backwards from there. Either way, remind them to make sure their menus include healthy options.

Learn more: Make a Great Grocery List at WebMD

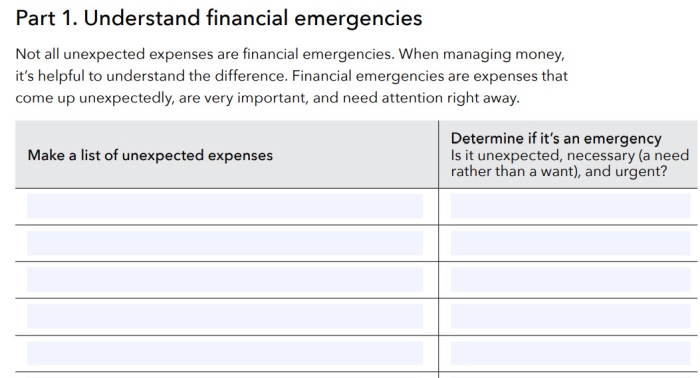

Build a savings “first-aid kit”

It’s no secret that things can and do go wrong. Budgeting activities like this one help students learn what to do when unexpected expenses crop up. Students learn about real-world costs and come up with ways to save in advance and adjust on the fly.

Learn more: Savings First Aid Kit

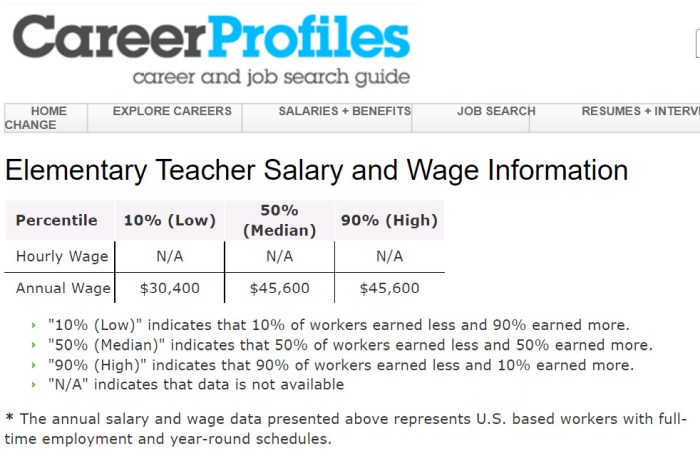

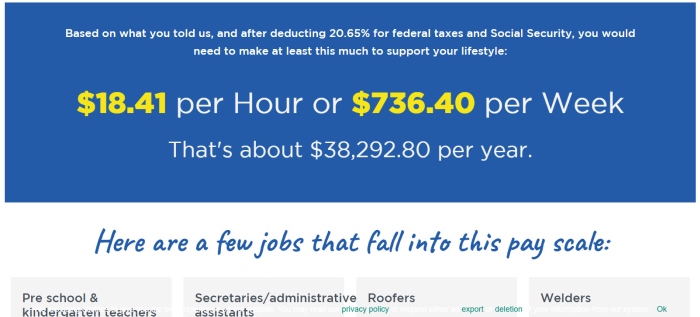

Discover what jobs actually pay

Ask students to list some jobs they think they’d like to do someday. Then, have them research average salaries for those jobs. Encourage them to factor in where they plan to live (salary ranges can be dramatically different across the country). Plus, ask them to think about the education they’ll need to land those jobs, and how long it will take them to earn the money to pay back any loans they’ll have to take.

Learn more: Job Salaries by Field

Find out how credit cards work

These days, most people pay with plastic instead of cash. Sometimes they use debit cards, but often they’re credit cards. If you’re going to use them, you need to know how they work. Divide your class into groups, and ask each to research a different question about credit cards, like how they work, what interest they charge, and how to use them safely.

Learn more: Best Credit Cards at Money Under 30

Experiment with different budget models

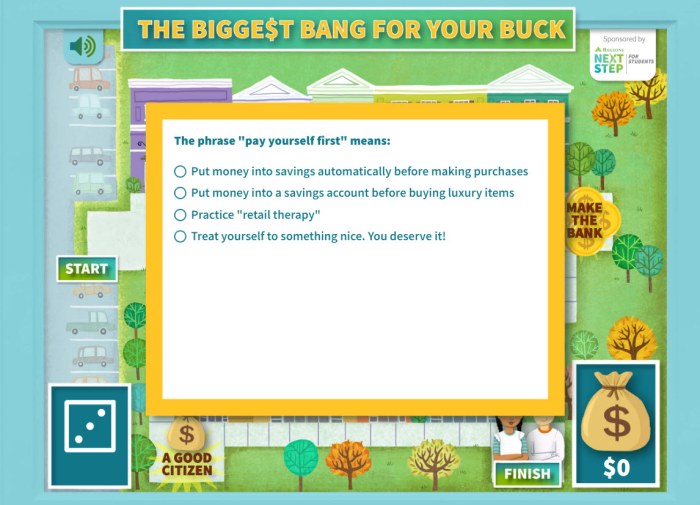

There’s no one right way to set up a budget. Expose students to a variety of models, like proportional budgets, the “pay yourself first” model, the envelope budget, and more. Ask them to think about which kind of person each model works best for and which one they’d choose.

Learn more: 6 Different Ways To Budget Your Money at Young Adult Money

Explore Budgeting Apps

Teens are usually pretty attached to their phones, so show them one way to make really good use of screen time: budgeting apps. Learn how to choose a good one in this video.

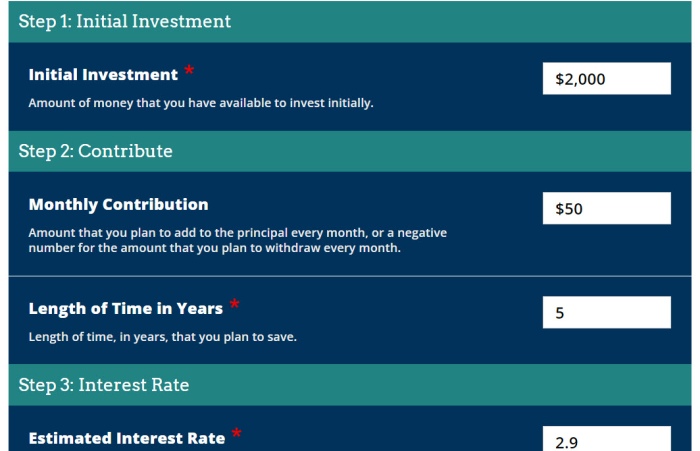

Calculate compound interest

When you invest your money in an interest-bearing account, it earns money just by sitting there! That money can really grow over time too. Have students complete budgeting activities like looking up current interest rates and then calculating the potential interest from using those accounts for short and long periods of time. Explore local bank offerings, and take into account things like fees too.

Learn more: Compound Interest Calculator

Learn what “living expenses” means

Kids generally don’t think about all the costs of daily living. Start by brainstorming a big list as a class of all the things people need to spend money on each month: rent or mortgage, car payments, credit card payments, food, entertainment, utilities, Internet access, and more. Break kids into groups and have each group research the average costs of those items in your area. Come back together as a class and add up their findings to see what “living expenses” can really be.

Learn more: Monthly Expenses at Inspired Budget

Get a reality check

Everybody’s got dreams, but how realistic are they? That’s where the Jump$tart Reality Check program comes in. By making choices about the future they want, teens will learn what they’ll need to earn to make it happen. The answers might really surprise them.

Learn more: Reality Check—Online Tool for Students

Reflect on needs vs. wants

Ask students to reflect on what they truly need to survive vs. things that just make life easier or more fun. Budgeting activities like this can help them identify items they can eliminate when funds get really tight.

Learn more: Needs vs. Wants

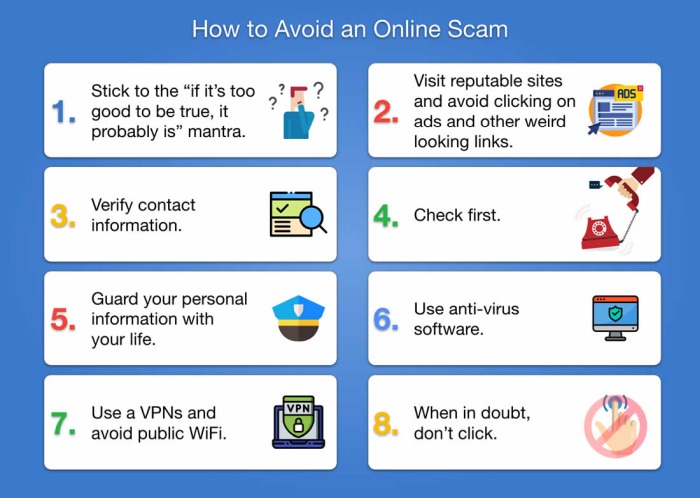

Learn to protect your money

If teens don’t learn smart skills like avoiding phishing scams, how to choose good passwords, or identifying fraudulent sites, they can lose everything they save. Take time to learn about the most common fraud issues, and teach them how to be responsible online.

Learn more: 8 Ways To Protect Your Money That All Students Should Know at We Are Teachers

Savings and Budgeting Online Games

How Not To Suck at Money

The title pretty much says at it all: By playing this game, students learn how to manage their money and use it responsibly.

Learn more: How Not To Suck at Money

The Uber Game

Let students imagine life as an Uber driver. This game is based on actual Uber driver experiences and can be a real eye-opener.

Learn more: The Uber Game

Hit the Road

Think of this like Oregon Trail for the modern age. A group of friends is setting off on a cross-country trip, but they’ve got to manage their funds to get where they want to go. Try this one as a group activity so kids have to work together to make smart choices.

Learn more: Hit the Road

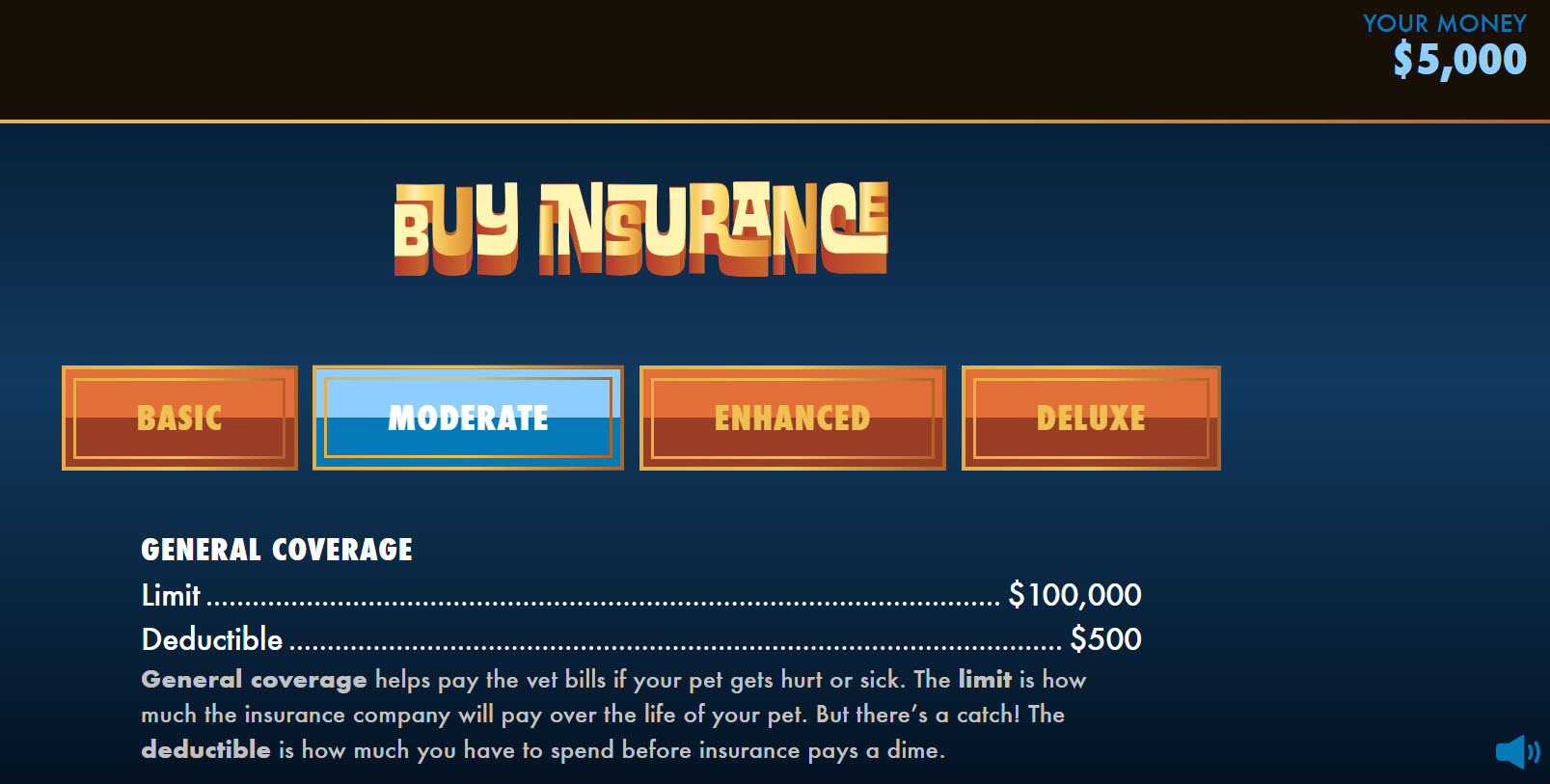

Budgeting and saving is important, but students should also learn about the importance of having the right kind of insurance. Because sometimes life really is just a bummer!

Learn more: Bummer

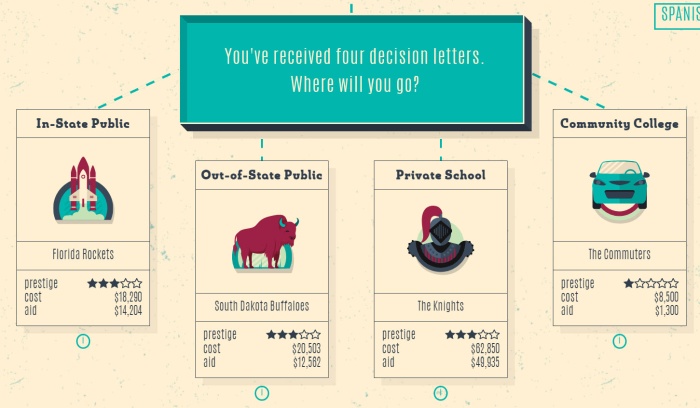

College-bound kids might figure they’ll take loans now and figure out how to pay them back later, but do they really have a handle on the true costs? These interesting online simulations let you pick your school, then walk through four years of potential expenses and income opportunities to find out how you fare in the end.

Learn more: Payback

Misadventures in Money Management

This online game feels a bit like a graphic novel, and it helps kids learn the basics of budgeting and money management. Explore multiple topics and complete missions to learn valuable skills.

Learn more: Misadventures in Money Management

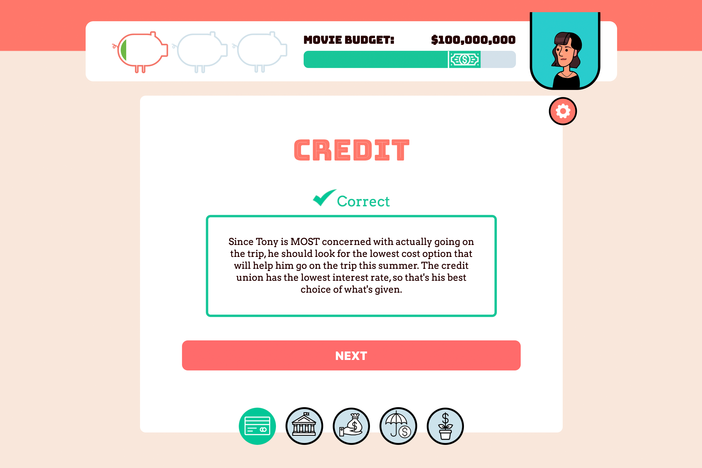

Lights, Camera, Budget!

Managing your own money can feel a little dull, so why not try your hand at managing a multimillion-dollar movie budget instead? This one has levels for both middle and high school students too.

Learn more: Lights, Camera, Budget!

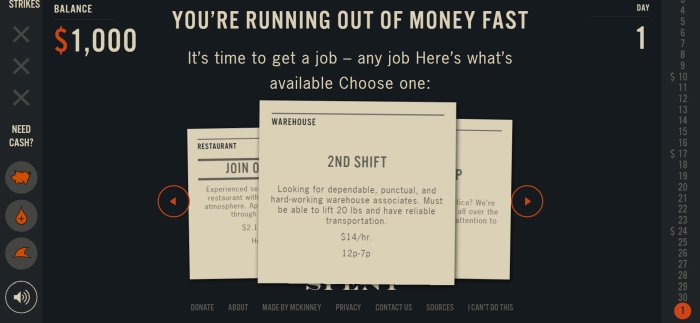

Living on the financial edge is a sad reality for so many people. Show kids what that can feel like with this online simulation. When the game starts, you have no housing and no job and just $1,000 in the bank. Can you get a job and make it to the end of the month?

Learn more: Spent

Claim Your Future

This cool online game assigns you a career (or lets you choose one) and tailors your experience to your location. You get to make choices about housing and other expenses, and the game calculates how those things fit into a responsible budget.

Learn more: Claim Your Future

The Biggest Bang for Your Buck

This online game guides kids through a shopping trip with financial literacy questions along the way. It’s simple but a terrific way to introduce a discussion on spending, saving, and budgeting.

Learn more: The Biggest Bang for Your Buck

For kids who are sure they can make enough money to live on with their social media accounts, this game might be a bit of a reality check.

Learn more: Influenc’d

Budgeting activities are just the start! Check out these life skills every teen should learn .

Plus, get all the best teaching tips and ideas straight to your inbox when you sign up for our free newsletters .

You Might Also Like

Let’s Change the Way We Talk About Finances: Free Money Myths Lesson and Activity

This print-and-go bundle comes with an activity, worksheet, and discussion questions. Continue Reading

Copyright © 2024. All rights reserved. 5335 Gate Parkway, Jacksonville, FL 32256

- Debt Consolidation

- Debt Management

- Debt Settlement

- Credit Card Debt Forgiveness

- Debt Consolidation Programs

- Military & Veteran Debt Relief

- Credit Counseling

- Online Bankruptcy Classes

- Housing Counseling

- Foreclosure Prevention Counseling

- Eviction Prevention Help

- Credit Card Debt

- Student Loan Debt Relief

- Family Finances

- Credit Scores & Credit Reports

- Getting Out of Debt with Bad Credit

- Financial Literacy

- Financial Help

- Tools & Resources

- Budgeting Tips

- Military Money

- Your Dream Team

- Hours of Operation

- Client Success Stories

- Partner With Us

- Financial Literacy for High School Students

Home » Financial Literacy » Resources for Teachers » Financial Literacy for High School Students

Are You Teaching Financial Literacy To High School Students?

The teaching curriculum consists of fourteen lesson plans & worksheets designed to augment a semester course in life skills and personal finance management. The Teacher’s Guide, compiled in a separate, easy-to-use notebook, includes an outline of the curriculum:

- Lesson objectives

- Suggested resources

- Teaching notes

- Chart indicating appropriate age groups for the key learnings offered in each lesson

- Presentation slides

- Answer keys to worksheets (when necessary)

Introductory Overview to Financial Literacy for High School Students

Lesson one: making personal finance decisions.

Each day, we are faced with many decisions. While most decisions are simple, such as “what should I wear?” or “what should I eat?,” others are more complex, such as “should I buy a new or used car?” As decision-making skills are used and improved, a person’s quality of life is enhanced. Wiser choices result in better use of time, money, and other resources. This introductory lesson provides students with an opportunity to learn more about decision-making. The lesson starts with an overview of the decision-making process followed by a discussion of various internal and external factors that affect decisions.

Teacher’s Guide – Lesson One: Making Decisions

Student Guide – Lesson One: Making Decisions

Teacher’s Slide Presentation – Lesson One: Making Decisions

Teacher’s Power Point Presentation – Lesson One: Making Decisions

Lesson Two: Making Money

Building your career is one of the surest ways to increase income and make money. When planning for the future, one of the most critical financial decisions is determining your career path. In this lesson, students will be encouraged to consider various topics related to career planning and the financial aspects of employment. This variation of the decision-making process can help a person match personal abilities and interests with appropriate employment opportunities.

Teacher’s Guide – Lesson Two: Making Money

Student Guide – Lesson Two: Making Money

Teacher’s Slide Presentation – Lesson Two: Making Money

Teacher’s Power Point Presentation – Lesson Two: Making Money

Lesson Three: The Art of Budgeting

A personal budget is a financial plan that allocates future income toward expenses, savings, and debt repayment. “Where does the money go?” is a common dilemma faced by many individuals and households when it comes to budgeting and money management. Effective money management starts with a goal and a step-by-step plan for saving and spending. Financial goals should be realistic, be specific, have a timeframe, and imply an action to be taken. This lesson will encourage students to take the time and effort to develop their own personal financial goals and budget.

Teacher’s Guide – Lesson Three: The Art Of Budgeting

Student Guide – Lesson Three: The Art Of Budgeting

Teacher’s Slide Presentation – Lesson Three: The Art Of Budgeting

Teachers Power Point Presentation – Lesson Three: The Art Of Budgeting

Lesson Four: Living on Your Own

As young people grow up, a common goal is to live on their own. However, the challenges of independent living are often quite different from their expectations. This lesson provides a reality check for students as they investigate the costs associated with moving, obtaining furniture and appliances, and renting an apartment.

Teacher’s Guide – Lesson Four: Living On Your Own

Student Guide – Lesson Four: Living On Your Own

Teacher’s Slide Presentation – Lesson Four: Living On Your Own

Teacher’s Power Point Presentation – Lesson Four: Living On Your Own

Lesson Five: Buying a Home

For many, buying a home is the single most important financial decision they will make in their lifetime. However, the process of becoming a first-time homebuyer can be overwhelming, and requires a foundation for basic home-buying knowledge. This lesson will provide students with information on buying a home and where and how to begin the process. After comparing the differences between renting and buying, students will be introduced to a five-step process for home buying. This framework provides an overview for the activities involved with selecting and purchasing a home.

Teacher’s Guide – Lesson Five: Buying A Home

Student Guide – Lesson Five: Buying A Home

Teacher’s Slide Presentation – Lesson Five: Buying A Home

Teacher’s Power Point Presentation – Lesson Five: Buying A Home

Lesson Six: Banking Services

If the fee for an ATM transaction to withdraw money is $1 and a person withdraws money twice a week, the banking fees for that person will be $104 a year. Over a five-year period, those fees invested at five percent would grow to more than $570. Most students know that banks and other financial institutions (credit unions, savings and loan associations) offer a variety of services. However, few people know how to make wise choices when using financial services. In this lesson, students will learn about the different types of financial service products available and the features of each.

Teacher’s Guide – Lesson Six: Banking Services

Student Guide – Lesson Six: Banking Services

Teacher’s Slide Presentation – Lesson Six: Banking Services

Teacher’s Power Point Presentation – Lesson Six: Banking Services

Lesson Seven: Credit

In today’s world, credit is integrated into everyday life. From renting a car to reserving an airline ticket or hotel room, credit cards have become a necessary convenience. However, using credit wisely is critical to building a solid credit history and maintaining fiscal fitness. While most students have a general idea about the advantages and disadvantages of credit, this lesson provides an opportunity to discuss these issues in more detail.

Teachers Guide – Lesson Seven: Credit

Student Guide – Lesson Seven: Credit

Teacher’s Slide Presentation – Lesson Seven: Credit

Teacher’s Power Point Presentation – Lesson Seven: Credit

Lesson Eight: Credit Cards

What is APR? What is a grace period? What are transaction fees? These and other questions will be answered in this lesson as students learn about credit cards, and the different types of cards available and features of each, such as bank cards, store cards, and travel and entertainment cards.

As students start to shop for their first (or next) credit card, this lesson will make them aware of various costs and features. Included in this section is a discussion of the methods for calculating finance charges. Various federal laws protect our rights as we apply for and use credit cards, such as procedures for disputes and protection from card theft and fraud. In this lesson, students will also be given an opportunity to analyze the information contained on a credit card statement.

Teacher’s Guide – Lesson Eight: Credit Cards

Student Guide – Lesson Eight: Credit Cards

Teacher’s Slide Presentation – Lesson Eight: Credit Cards

Teacher’s Power Point Presentation – Lesson Eight: Credit Cards

Lesson Nine: Cars and Loans

“Should I buy a new car or a used car?” “Where is the best place to finance my automobile purchase?” “Is it better to take the rebate or the low-rate financing plan?” These are typical questions asked by people buying vehicles. In this lesson, students are asked to identify costs associated with owning and operating a motor vehicle. Since these costs are commonly underestimated, guidelines are provided on how much to spend when buying vehicles.

Teacher’s Guide – Lesson Nine: Cars And Loans

Student Guide – Lesson Nine: Cars And Loans

Teacher’s Slide Presentation – Lesson Nine: Cars And Loans

Teacher’s Power Point Presentation – Lesson Nine: Cars And Loans

Lesson Ten: The Influence of Advertising

In today’s modern world, advertising seems to be everywhere we look; online, television, billboards, magazines, newspapers, on buses, grocery carts, even cell phones. In addition, some forms of advertising can be subliminal, such as the strategically-placed soda can in a movie. We can’t help but be influenced and manipulated as consumers. In this lesson, students will become aware of the various techniques and appeals used to influence consumer behavior.

Teachers Guide – Lesson Ten: The Influence Of Advertising

Lesson 10: The Influence of Advertising – High School Student Guide

Teacher’s Slide Presentation – Lesson Ten: The Influence Of Advertising

Teacher’s Power Point Presentation – Lesson Ten: The Influence Of Advertising

Lesson Eleven: Consumer Awareness

Decisions, decisions. With so many choices available to us, how can we be sure we’re making the right decision? Wise consumer buying starts with a plan. Using a systematic purchasing strategy will provide students with an ability to make more effective purchases. Comparative shopping techniques will be discussed to encourage students to carefully consider price, product attributes, warranties, and store policies. Next, this lesson covers a variety of buying methods, such as buying clubs, shopping by phone, catalogs, online, and door-to-door selling.

Teacher’s Guide – Lesson Eleven: Consumer Awareness

Student Guide – Lesson Eleven: Consumer Awareness

Teacher’s Slide Presentation – Lesson Eleven: Consumer Awareness

Teacher’s Power Point Presentation – Lesson Eleven: Consumer Awareness

Lesson Twelve: Saving and Investing

Saving just 35 cents a day will result in more than $125 in a year. Small amounts saved and invested can easily grow into larger sums. However, a person must start to save. This lesson provides students with a basic knowledge of saving and investing. The process starts with setting financial goals. Next, a commitment to saving is discussed.

Teacher’s Guide – Lesson Twelve: Saving And Investing

Student Guide – Lesson Twelve: Saving And Investing

Teacher’s Slide Presentation – Lesson Twelve: Saving And Investing

Teacher’s Power Point Presentation – Lesson Twelve: Saving And Investing

Lesson Thirteen: In Trouble

The material in this lesson will help students become aware of the warning signs of financial difficulties. This lesson includes information on where to go for debt consolidation help and for nonprofit credit counseling .

Teacher’s Guide – Lesson Thirteen: In Trouble

Student Guide – Lesson Thirteen: In Trouble

Teacher’s Slide Presentation – Lesson Thirteen: In Trouble

Teacher’s Power Point Presentation – Lesson Thirteen: In Trouble

Lesson Fourteen: Consumer Privacy

In today’s information age, keeping your personal financial information private can be challenging. What you put on an application for a loan, your payment history, where you make purchases, and your account balances are but a few of the financial records that can be sold to third parties and other organizations. This lesson, with attached budgeting activities, will encourage high school students to take the time and effort to develop their own personal financial goals and spending behaviors.

Teacher’s Guide – Lesson Fourteen: Consumer Privacy

Student Guide – Lesson Fourteen: Consumer Privacy

Teacher’s Slide Presentation – Lesson Fourteen: Consumer Privacy

Teacher’s Power Point Presentation – Lesson Fourteen: Consumer Privacy

Supplementary Resources

In an effort to give you the most up-to-date information for teaching and making personal financial decisions, we’ve compiled the following lists of periodicals and organizations that can enhance your use of Practical Money Skills for Life.

More Resources for Students: The Cost of College

The cost to attend college has soared faster than almost any segment of the economy over the last 30 years. The average cost for students attending a public university is up 213% ($3,190 in 1988 to $9,970 in 2018), while private school is up 129% ($15,160 to $34,740) over the same time period.

That’s the primary reason Americans are $1.4 trillion in debt on student loans.

The good news is that are hundreds of online sites offering tips on not just what it will cost, but what you can do to pay for it. So, take a deep breath and check out these sites that should help you find a college you can afford to attend.

- www.collegedata.com : This is a wonderful resource for everything from cost factors to how to apply to how to pay your own way.

- www.trends.collegeboard.org : They specialize in providing historical data on college pricing, financial aid and what your degree will be worth when you graduate.

- https://studentaid.ed.gov/sa/prepare-for-college/choosing-schools/consider/costs : This is the site for the Department of Education, which provides approximately 67% of college financial aid. You will find detailed evaluation of costs and financial aid here.

- https://www.aie.org/ : This site offers answers on the cost of college, how to finance it and even how to manage money while you’re there.

- https://nces.ed.gov/ : This is a government site that collects and analyzes date from every college and provides accurate data on average cost of attendance.

- www.mykidscollegechoice.com : Very focused on finding a college you can afford and ways to pay for it.

- www.collegecountdown.com : Asks and answers questions about actual costs of college, school that fit you financially and how to evaluate offers you receive from colleges.

Other Resources for Teachers

- Debt Relief For Teachers

- Student Loan Forgiveness for Teachers

- Financial Literacy for Teachers

You will need Adobe Reader to view the PDF Download Adobe Reader

10 MINUTE READ

Financial Literacy Menu

- Financial Literacy Workshops & Webinars

- Financial Data

- Resources for Teachers

- Free Financial Literacy Resources for College Students

- Using Comic Books To Teach Financial Literacy

- How to Calculate Debt-To-Income Ratio

- Free Financial Literacy Workshops For Habitat For Humanity Homebuyers

- Free Personal Finance Workshops At Goodwill

- Financial Literacy Education Statistics from FINRA’s NFCS

- Financial Literacy for Kids

- Free Financial Literacy Program For Teachers: Teach Money

- How Much Are Americans Saving for College, Retirement and Emergencies?

- What Do Social Security Taxes Pay For?

- Life Insurance for Seniors

- Is Life Insurance Worth It?

- When Should I Get Life Insurance?

- Retirement Checklist

- High-Risk Loans

- What Is Check Cashing?

- Title Loans

- Should We Deduct Our Daughter’s Loan From Her Inheritance?

- Bonds 101: Bond Investment Basics

David McMillin

David McMillin writes about credit cards, mortgages, banking, taxes and travel. Based in Chicago, he writes with one objective in mind: Help readers figure out how to save more and stress less. He is also a musician, which means he has spent a lot of time worrying about money. He applies the lessons he's learned from that financial balancing act to offer practical advice for personal spending decisions.

Kelly Ernst

Kelly is an editor for CNET Money focusing on banking. She has over 10 years of experience in personal finance and previously wrote for CBS MoneyWatch covering banking, investing, insurance and home equity products. She is passionate about arming consumers with the tools they need to take control of their financial lives. In her free time, she enjoys binging podcasts, scouring thrift stores for unique home décor and spoiling the heck out of her dogs.

CNET staff -- not advertisers, partners or business interests -- determine how we review the products and services we cover. If you buy through our links, we may get paid.

CNET editors independently choose every product and service we cover. Though we can’t review every available financial company or offer, we strive to make comprehensive, rigorous comparisons in order to highlight the best of them. For many of these products and services, we earn a commission. The compensation we receive may impact how products and links appear on our site.

Writers and editors and produce editorial content with the objective to provide accurate and unbiased information. A separate team is responsible for placing paid links and advertisements, creating a firewall between our affiliate partners and our editorial team. Our editorial team does not receive direct compensation from advertisers.

CNET Money is an advertising-supported publisher and comparison service. We’re compensated in exchange for placement of sponsored products and services, or when you click on certain links posted on our site. Therefore, this compensation may impact where and in what order affiliate links appear within advertising units. While we strive to provide a wide range of products and services, CNET Money does not include information about every financial or credit product or service.

4 Budget Projects High School Students Will Have Fun Learning From

By: Author Amanda L. Grossman

Posted on Last updated: May 9, 2024

- Pinterest 37

- Flipboard 0

These are budget projects high school students will get excited about – both fun and a great learning experience to understand money better.

Need a project-based way to teach your teens about managing a limited set of money?

These budget projects for high school students will help them to self-discover some pretty important money lessons, such as:

- How to prioritize and track bill payment

- How a person’s job and life choices can affect their money obligations

- How to do real-world money math in various scenarios

- How a teen can improve their budget

And I’m starting the list off with my favorite budget project!

Budget Projects for High School Students

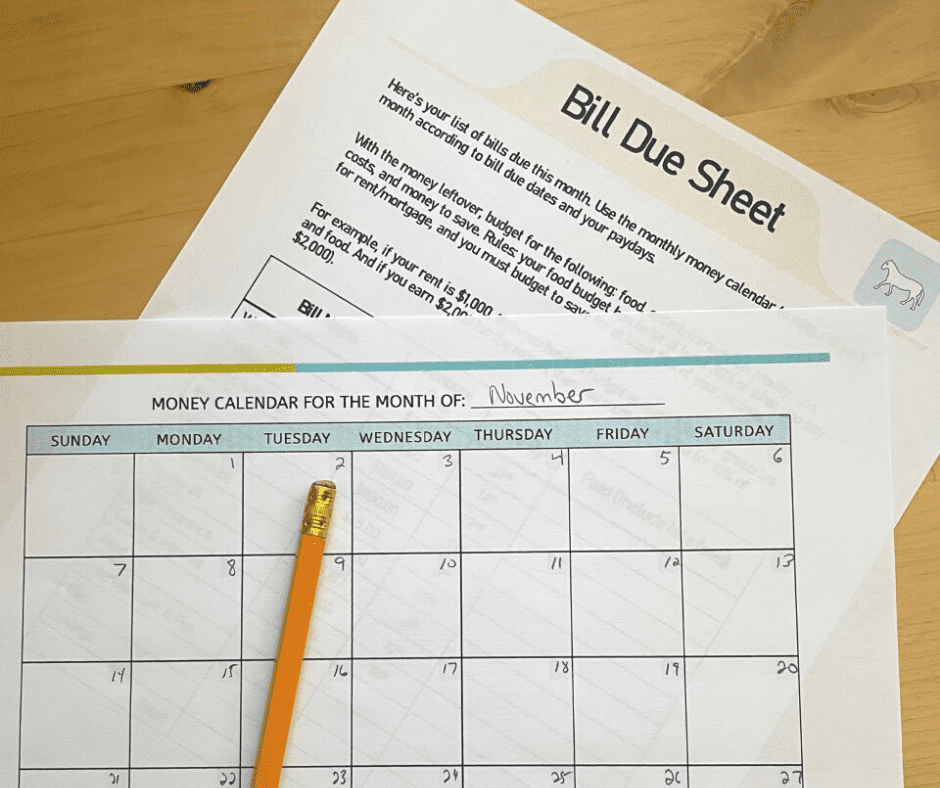

We’re going to start off these budget projects with my very new one, a bill-paying budget project scenario.

Stick around for the other three, too!

Hint: you'll also want to check out my article on how to teach budgeting , from beginner to advanced levels.

1. Bill-Paying Budget Project

Bill-paying is not something we’re born knowing how to do.

And it can feel like a slap in the face when you hit the real world and suddenly must be able to:

- Keep track of varying bill due dates

- Manage paydays, which usually come on different dates of the month than when bills are due

- Track what was already paid, and what hasn’t been paid yet, so that you recognize if a bill is missing (bills are due regardless of whether or not they got lost in the mail)

Most teenagers never deal with a monthly bill due date until they hit the real world – and at that point, slipping up can mean late fees, services turned off, lower credit scores, etc.

Why not give them a heads-up by working on a bill-paying budget project ahead of time?

Here’s a 30-day budget project, including a printable pack I created and am giving away for free for now (yes, I have plans on charging for this in the future – so go ahead and grab a copy!).

Step #1: Assign a Job + Bills with Due Dates

At the beginning of the month, assign your high school students one of four jobs. Based on the job they get, they’ll be assigned a list of bills with due dates, and a blank monthly money calendar.

Let your students know they’ll be paying bills over the course of the next month, according to when they are due. Also, tell the students there will be two paydays for the month, and that they’ll be paid pretend money on these days (here is free printable money for kids ).

They’ll take their bills sheet, and correctly fill in their monthly money calendar with each of the due dates, plus their paydays. They are then responsible for paying each of these bills by the due date (or face a late fee).

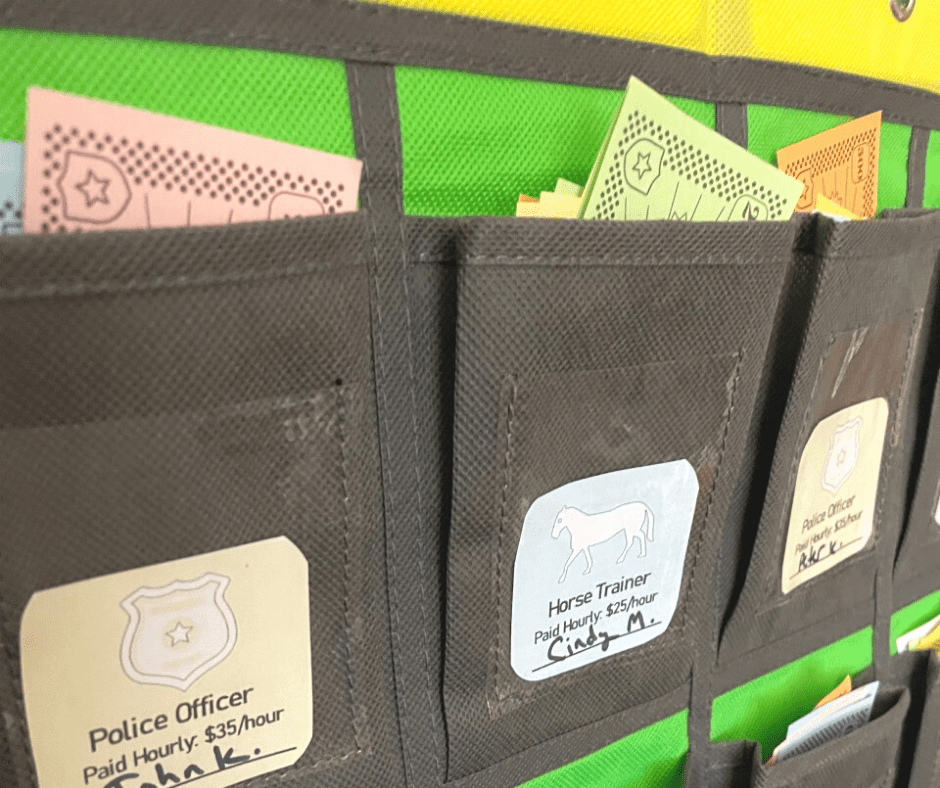

You can choose how to keep track of everything, but I would recommend a bill pay pocket chart.

Here’s how I set mine up to test everything out:

These two items were enough for a class of 30 students:

- Pocket Chart

- Pretend Money

Step #2: Set Up a Bill Paying Station

You’ll need an area of the classroom to collect their money and to sign off on their bill-paying sheet to show they’ve paid.

The person in charge of this can be a teacher, teacher’s aide, or student treasurer (you can switch out each week who fulfills this role).

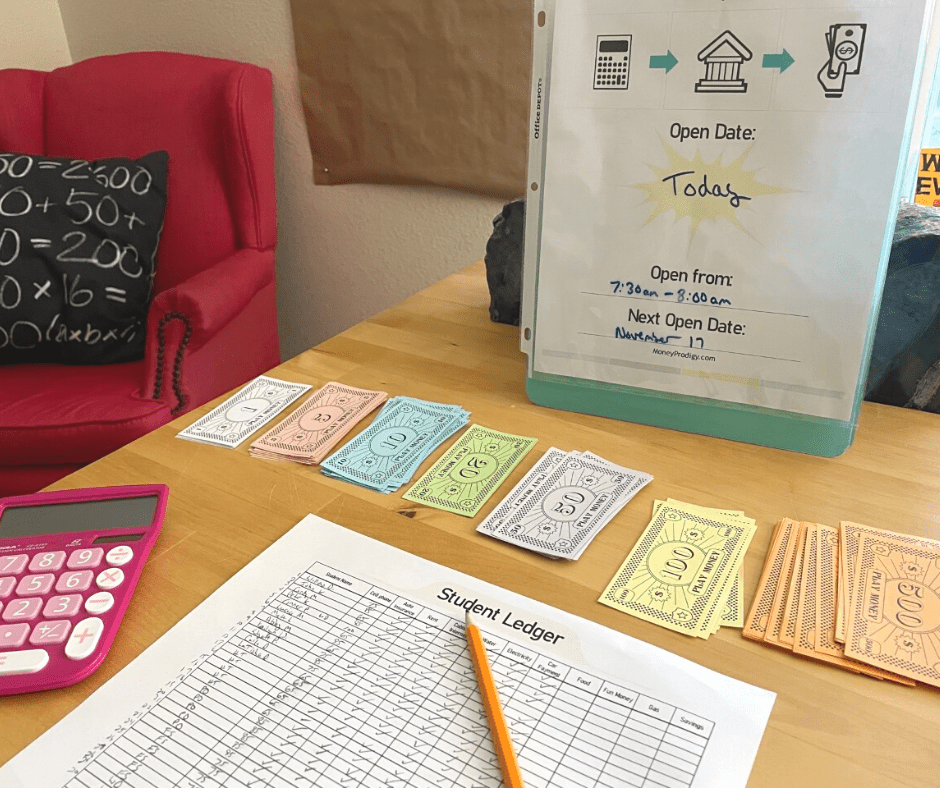

Choose what schedule the bill-paying station will be open, and use the printable bill-pay chart to communicate times/dates.

Step #3: Run the Month-Long Simulation

Students are now in charge of paying their bills, as they become due (or ahead of time). The treasurer/banker is in charge of keeping the bill-paying station running, as well as filling in the one-sheet student ledger for when each person pays and how much they end up paying.

And someone else (perhaps the teacher) is in charge of paying the students on each of the two paydays.

At the end of the month, there is a set of reflection questions for students to fill out.

Bonus: Tradeoffs and Prioritizing Money

To increase the “budgeting” part of this, you could come up with things that pretend money can buy.

This would mean that the students need to prioritize their money and make sure they have enough of it left to pay for each bill by its deadline.

For tight budgets, you can use privileges.

- $10 buys you 5 extra minutes on an educational computer game

- $15 buys you one late homework pass

- $XX buys you XXX

- Etc.

Could make things more interesting!

Hint: you'll also want to check out my article on how to teach budgeting .

2. Three-Budget-Scenarios Project

Have you checked out my article on sample budgets for an 18-year-old ?

One of the things I stress is a teen should create a budget for more than one scenario for their next step in life since an older teen’s life opportunities can change so quickly.

Hint: you could show one of these free financial literacy movies for students as to why they need backup plans.

You can take your own high school students through this, as a project.

Step #1: Download a Teen Budget Worksheet

Choose a teen budget worksheet for your students (you can get mine, for free, below), and print out three copies each.

Step #2: Brainstorm Next-Step Scenarios in Teen’s Lives

Get your students to help you brainstorm some common (and not-so-common) next steps that can happen in a teen’s life.

- Getting a first apartment alone

- Getting a first apartment with a roommate

- Going to college

- Going to a trade school

- Living with parents with new money responsibilities (like paying rent)

- Taking a gap year/traveling for a while

Step #3: Pick 3 Scenarios to Create a Budget Around

Either pick three scenarios from the brainstormed list that every student in your entire class will work on, or let your students pick three different scenarios they’re thinking about living out after they graduate.

Hint: one of the scenarios can be to create a teen budget for their life right now. Then, they can choose their ideal scenario to budget around, and finally, their backup plan scenario to budget around.

Help your students to first brainstorm the budget line items for each scenario.

For example, for a first-apartment scenario, they would want to include:

- Utilities (water, electricity, natural gas, trash pick-up, etc.)

- Transportation costs

Step #4: Compare and Discuss Pros/Cons

Ultimately, you want your teen students to see how much they’ll need to earn in order to survive on each of three different scenarios.

You’ll then want to guide discussion on the pros and cons, from a financial perspective to each of the three different paths post-high school.

3. End-of-Year Class Party Budget Project

Decide to throw an end-of-year party for your class, and let them not only handle most of the logistics but also handle the budgeting for it.

You’ll need to have a budget for this, which can be gained from fundraising, donations, etc.

Have each student in the class be in charge of something, perhaps broken up into groups. Then, have the entire class be in charge of the big budget decisions.

Budget decisions to be made:

- How to raise the money (if it’s not provided)

- What percentage of money to spend in each category (food, decorations, entertainment, etc.)

- Any rules or limitations when spending the money, as well as basic party setup (also great for teachers to provide their own rules and limitations – but you already knew that!)

- This or That scenario, where the class must decide on budgeting priorities (for example, would they rather have decorations or more money spent on the food?)

There are also some great budgeting decisions that need to be made at the group level.

Group budget decisions to be made:

- Specific items to purchase with the overall budget

- Amount of money to spend on each item

- Research the cost of an item online vs. in-store, and weigh which one is better to purchase (take into consideration the cost of gas and cost of shipping to get the item, whether or not you can find an online coupon or regular coupon to use, quality of product and how many times it’ll get used, etc.)

4. Fun Budgeting Simulation

Did you know I have a free, fun budget activity PDF for high school students?

Students use a fun fortune teller to be assigned one of 4 avatars, with a backstory that includes:

- Career stage

- Lifestyle stage

- Salary info

- Budgeting info

They’re asked to fill in a budget worksheet based on their brief. Then, they’re thrown a few budgeting scenarios where they need to think on their feet (based on the budget info they filled out) about how to handle it.

Things like:

- New job/lost job

- Hurricane soaks your belongings

It’s pretty fun!

Psst: you'll also want to check out these personal finance project examples .

I hope I’ve shown you some budget projects high school students can really get behind because they’re at least a bit fun, they teach real-life information, and they’ll make them think. I’d love to hear from you as far as how it goes!

- Latest Posts

Amanda L. Grossman

Latest posts by amanda l. grossman ( see all ).

- 11 Easy Things Kids Can Make and Sell at School (Non-Food) - September 10, 2024

- 7 Fun Halloween Candy Games for Kids (from Dollar Tree) - September 5, 2024

- 7 Simple Market Day Food Ideas (from Dollar Tree) - August 27, 2024

IMAGES

VIDEO

COMMENTS

This teacher has created a personal finance project geared towards financial independence that accounts for 20% of his student's grades in Economics. Students are tasked with making a budget, finding an apartment, filling out a rental application, looking into utilities, meal planning, and all the things that go into getting that first ...

Budgeting is a critical skill in personal finance, and the more practice your students get in making a budget, the better. Teachers and homeschoolers will encounter a variety of resources to teach this concept, but worksheets are a proven way to give your kids hands-on, practical experience. Here are the best budgeting worksheets for students.

Fact Checked. A budget planner is a tool, such as a worksheet or template, that you can use to design your budget. A successful budget planner helps you decide how to best spend your money while ...

Making Finance Personal: Project 5: Creating a Budget (Updated 2020) Permission is granted to reprint or photocopy this lesson in its entirety for educational purposes provided the user credits the Federal Reserve Bank of Atlanta.

Making Finance Personal: Project-Based Learning for the Personal Finance Classroom (Updated 2022) ... the budget project later in the semester. • Remind students each class meeting about the assignment. You may also want to do an expense-track-

Scenario 2: Planning for family goals. Derek and his wife Diana have two children under 4 years of age. Derek works as a school security officer and earns $20/hour, or $41,600 per year. Diana is an assistant manager for a hotel and earns a yearly salary of $46,200. Their net.

See full bio. Step 1. Figure out your after-tax income Step 2. Choose a budgeting system Step 3. Track your progress Step 4. Automate your savings Step 5. Practice budget management.

Teach budgeting skills with free Budgeting Lesson Plans, Projects and more. ... MISSION: By 2030, all U.S. high schoolers will take at least one-semester course in Personal Finance before graduation. STATE OF FINANCIAL EDUCATION REPORT. Read NGPF's school-by-school analysis of financial education in America today ... PROJECT: Budgeting with ...

Budgeting Assignment: Creating a Personal Budget Considering your current financial situation, goal(s), spending habits, and career pathway(s), create two realistic budgets for yourself. Create one budget based on your circumstances now and one budget based ... Identify your financial SMART Goals (ie. complete university debt free, have $2000 in

Psst: you might want to check out my comprehensive article on budgeting for kids, and the best teen budget worksheets. 1. Next Gen Personal Finance's Bean Game. Suggested Age Range: Not given. I just love this - every student receives 20 beans, as well as a game board that shows a cost (in beans) for different spending and saving categories.