- Office: (321)-224-1111

- [email protected]

- Consumer Protection History

- Our Consumer Protection Lawyers

- Meet Our Founder

- Class Action

- Resort Fraud (by Resort Name)

- Rescission Timeline by State

- State Timeshare Laws

- Timeshare Lies – The Abrams Firm

- What is a Timeshare?

- Find Your Answers – Timeshare Glossary

- Timeshare Complaints

- Timeshare Fraud – Value Resort Sales Scams

- Timeshare Fraud Laws

- Timeshare Scams

- Timeshare Lawyer – The Abrams Firm

- Timeshare Help

- Consumer Protection Attorney

- How to Get out of my Timeshare

- Cancel a Timeshare Contract

- Timeshare Exit Scams

- Timeshare Law Firm Clients

- Unauthorized Practice of Law By State

- Get Started

Timeshare Laws by State

Timeshare laws are state specific, so in every state your rights regarding your timeshare, or your purchase of one will vary greatly. Some states like Florida, Nevada, South Carolina, and California see a lot of timeshare usage and thus have more extensive timeshare laws. While other states like Michigan, Missouri and Wyoming do not have any timeshare specific rules and instead refer to real property, condominium, or consumer protection law. It is important to look at where the state chooses to address timeshare law. Depending on the area it is covered in you can get a clear idea of what your rights may be regarding your timeshare. If it is in consumer protection likely your rights are based on fraudulent activity by the managers, if it is in contract your rights probably have more options available for pursuing your case. You rights matter and it is important to know going in what your rights are and what remedies may be available to you and your family. This state list is designed to give you just a snapshot of how your state deals with timeshare laws and where to find it. Importantly most states give you a couple days to outright cancel a timeshare after signing on for it. If you are wanting out now and you just bought check out the cancellation list to see if you are within your rights. If you have any questions or concerns about how these laws might affect you, please reach out to us and we can review your case with a free consultation (360) 918-8196.

Alabama Timeshare law is codified in this statute but is generally regulated through the Alabama Real Estate Commission. Because it is done by the commission most of the timeshare law is governed by the professional standards placed on real estate agents, rather than timeshares as parts of real property. It is also designed to be focused on punishing agents who violate the rules, rather than just governing the sale of timeshares.

Required Licensure and Registration

In Alabama to sell vacation or timeshare plans the seller is required to be specifically licensed for it. Unlike a general real estate license Alabama imposes a separate ‘vacation time-share sales exam’ to be able to sell, lease, or convey timeshares. Failure to be licensed constitutes a violation of the rule and is could cost licensure ability plus fines.

Alaskan timeshare law is governed under their real property statute, more specifically in their common interest ownership act . Which governs not only timeshares but condominiums and any sort of shared development. Since the law is not specific to just timeshares its often more difficult to know how the rules will look at it. In situations like this it is invaluable to have a lawyer who specializes in timeshare law to review your unique case.

Extended Recission Period

A rather rare thing about Alaska’s timeshare law is that it gives an unusually long ‘cool off’ or rescission period to get out of your contract. In Alaska, the right to cancel your contract extends for 15 days from receiving your statutory required disclosure documents. In many states it can be as short as 72 hours, but Alaska gives you a full two weeks to decide if you want to get out.

Arizona timeshare law is governed under the timeshare owners’ association and management act. Which is enumerated in AZ Rev Stat § 33-2201-2211 (2020). The statute has specific authority over any other laws in Arizona for timeshare property and associations but focuses on the responsibility of the managing entity as opposed to the owners use.

Duties of the Managers

The timeshares owner’s association laws in Arizona are set up to give the owners some favor. It specifically lays out the obligations and responsibilities that managers of timeshares are required to give to their owners. While many of these relate to the duties of the manage, some like 33-2206 (5) encourage managers to extend an owner’s benefits if they are unable to use their timeshare for any reason. It also puts the responsibility on the mangers to disclose the relevant information to owners even prior to purchase.

Arkansas timeshare law falls under the Arkansas Time-share Act which explains each part of creation, administration, and financing protections of timeshares. It also states that timeshares in Arkansas will be governed under general real property law in anything that may exceed the statute. This differs from many states who treat timeshares as a special type of property, or simply as an expansion of camping or condominiums.

How Long to Sue

Arkansas provides a short right to address any major issues in your timeshare contract. You have four years after the date of the purchase to bring any cases against your developer for issues that arose in violation of the statute. This includes any of the areas specific to the statute: terms of the contract, required disclosures, administration of the managers duties, or how it was advertised to you.

California California timeshare law is generally applied through the California Vacation Ownership and Time-Share Act of 2004 . It governs general management of timeshares as well as sale, creation, and enforcement of timeshare laws. Unlike many states California restricts timeshare management to the state as the enforcer rather than delegating it to a real estate agency acting on behalf of the state. CA Bus & Prof Code § 11280 (2019).

Public Reporting

In California you are required to be given a public report that discloses many elements of the timeshare when you contract for a timeshare. Those timeshare reports are only valid for 5 years. Importantly the original report you may have been given during your initial signing has to be updated with any material changes to the complex. Make sure you know what is going on with your timeshare and the changes to it, they are required to inform you.

In Colorado timeshare law is scarce, there are no statutes that speak to specifically to timeshares. Usually in instances where there is nothing that directly speaks to timeshare it will be governed by property, real estate and contract law depending on how the timeshare interest was made. Because it is such a difficult state to determine your timeshare rights it is important to have a lawyer who has looked at this before to review your case.

Connecticut

Connecticut treats timeshare law a bit differently. Rather than governing the property or contract itself Connecticut looks at potential damage that might occur to consumers. Naturally, they codify their timeshare laws under consumer protection .

Protecting Consumers

With Connecticut’s focus on consumer protection for its timeshare law it makes sense that it puts most of the burden on the organization to provide and disclose anything to the owners. Timeshares are required to create a yearly report for the annual expenses of the timeshare fees and expenses. It is required by law timeshare owners have a right to get these annual expense reports provided to them to see how your timeshare is being managed.

Timeshare law in Delaware is governed under the Uniform Common Interest Ownership Act , while it does speak specifically to timeshares it generally governs any shared property such as condominiums.

Cool off Period

There is an unusually long ‘cool off period’ in Delaware, in fact one of the longest in the United States. A buyer of a timeshare has 15 days from the date of purchase to cancel the contract after receiving the required disclosure documents. This gives owners an entire two weeks to read over the documents and decide if they really want to stick with their timeshare purchase.

Orlando Florida is home to one of the largest number of timeshares in the US and houses some the biggest timeshare corporations. As you can expect from an industry that is largely built on timeshares the law is detailed. Florida timeshare law is housed in the Vacation and Timeshare Plan statute under Title XL real and personal property.

Timeshare Games

Florida speaks specifically to advertisement restrictions for timeshares. It has become somewhat common for advertisements to lure potential owners with the potential winning of a timeshare in a sweepstakes, or promotion that then will latter need to be upgraded. The law requires that in Florida promotional offers be honest and limited to the number of winners when dealing with timeshares. It forces timeshare companies to follow through on their promised sweepstakes. While you personally may not be the winner, someone must be.

Georgia timeshare law falls under title 44 of their property statute in the Regulation of Specialized Land Transactions, specifically article 5 governs timeshares.

Criminal Offense

Georgia rather uniquely treats violations of their time statute as a criminal offense up to a felony. Most states use civil law when it comes to the management and punishment of timeshares, mostly through fines, or contract cancellations. Georgia takes a much stricter approach and any violation of its timeshare statute under $5000 is a misdemeanor and any over $5000 is a felony with an up to three-year sentence. It can act as a good deterrence for scamming activity when companies can get slammed with more than just some fines, but someone can go to prison.

As you could imagine Hawaii is a premier spot for timeshares to be located. Hawaii reflects this in having one of the most comprehensive timeshare laws. Hawaii timeshare law falls into their property law in article 514E .

Required Disclosures

Most states require that certain things be discussed before purchasing a timeshare. In most states these disclosures are stated in their public offering statement. Hawaii however uses a different term and document more directly to its point. In Hawaii purchasers are usually given a document in the form of a ‘ disclosure statement ’ that summarizes the relevant changes and facts about the timeshare purchase contract.

Timeshare law in Idaho falls under property in general title 55. Weirdly the title of the statute is ‘ land located outside the state ’ but has previously been known as the subdivided land act. It essentially governs any land that has a division of property rights, which includes timeshares. Idaho’s timeshare is also further extended by their Consumer Protection act. It states specifically that violations of the Land Act will also be punishable under consumer protection law, as well as a felony under the statute.

Indiana timeshare law is governed under their property statute 32-32 . The statute is set up to govern both timeshares and campground memberships. The use of timeshares in Indiana is limited but campgrounds reflect a similar division of owner’s interest.

Unavailable Bookings

Timeshare, or campground managers in Indiana have a responsibility to owners to maintain their rights in scheduling and booking their reservations. If the managers are unable to meet the reservation of an owner and they are responsible for it, they are entitled to correct the mistake by giving the owner a similar site for the period or paying for the loss.

Iowa timeshares law is under a state specific statute real property code XIV . While Iowa does not have a huge share of timeshares property, they do have large share of timeshare law. The Iowa code is specific to some of the more important timeshare rights, such as disclosures, liens, sale, development, and management.

Exchange Program Disclosures

While in most states developers are required to disclose certain facts about the timeshare rental property itself Iowa takes it a step further by requiring additional disclosures if the program is a part of an exchange program . While not always called exchange programs, generally they are like point systems where instead of getting a contract to use a specific property you are instead put into a program with a company that makes you bargain for the use of property. Iowa raises the bar on what a potential owner is required to know when getting into not just a timeshare but an exchange program as well. It is important to know your rights before you give them away.

There is no timeshare specific law in Kansas. Instead, timeshares would likely be held under their real property , condominium and consumer protection law. Kansas specifically protects materially false statements about the nature of property and would protect consumers from getting scammed into timeshares. However, since there is no law on point for timeshares it would be a difficult case to make. In these cases, it is important to have a timeshare attorney who can thoroughly review your case to see your rights.

Kentucky timeshare specific laws are codified under their consumer protection . As you could expect from this most of these laws are targeted at the misuse of timeshares and vacation clubs by developers.

Must Disclose

Consumer protection law in Kentucky focuses on a few burdens that are placed on developers. Notably that they are required to disclose certain facts to purchasers. These include but are not limited to, the right to rescind a contract, the amount of time given to rescind and the duty of a refund for goods provided in the contract.

Louisiana timeshare law is assumed under Title XX of the Louisiana Civil Code Part II-A. The statute falls as a subpart of the Louisiana condominium act.

Fraudulent Representation

In Louisiana they have strict restrictions on what can be said when it comes to advertising timeshares. For most material misrepresentations it is considered a violation of the statute and punishable by law. This includes solicitations via radio, telephone, or just a pamphlet they may give out to you on vacation.

Maine timeshare law is carved out in a section of property law for timeshares it is a subpart of their unit ownership law. The statute is fairly limited in what it covers about timeshares, mostly just disclosure, finances, and foreclosure.

Foreclosure

In Main timeshare owners are given a 30-day period from the date of receiving notice to fix a default before the owner is permitted to open a foreclosure on the timeshare. Foreclosure generally applies to real property though. So, if your timeshare contract is for a point system as opposed to a share of time at a specific location foreclosure can get a lot trickier, since there is no property to foreclose on. If you are not sure of your companies’ rights regarding your inability to pay for your timeshare it is important to reach out to a timeshare lawyer to learn your rights.

Maryland timeshare law falls into their real property statute and is a subpart of their condominium law MD Real Prop Code § 11A . Maryland puts stricter requirements on the sale of timeshare estates than most other states. Particularly focusing on the licensing requirements of brokers.

Licensing Requirements

Maryland requires two separate forms of licensing to conduct timeshare sales in their state. First the person selling the timeshare is required to be a licensed real estate broker. Second, the timeshare sale is required to be overseen by a ‘project broker’. Which is essentially someone who oversees the specific sales of timeshares as a separate feature from standard real estate. If you think that you may have been sold a timeshare but someone who was unlicensed, or who did not disclose their licensure you should talk to a lawyer who specializes in timeshare law to review your case.

Massachusetts

Massachusetts timeshare laws are governed under the General Laws in real property referred to as the “ Real Estate Time-Share Act ”. The act falls into a subpart of 183 the alienation act and includes governance of condominiums as well as predatory lending practices (imposing unfair, or abusive lending like an obscene interest rate).

Owner Protections

Massachusetts timeshare law is set up to favor owners when it comes to a case. They included among more common fraud defenses to timeshares unconscionable and good-faith obligations to the sellers of timeshares. If you were intentionally ripped off you may have an unconscionable contract, or the seller was trying to scam you in its execution the probably acted in bad faith. In any case Massachusetts laws are set up to protect you if you think your case could be brought in Massachusetts its likely one a lawyer could help you with.

Michigan law does no speak specifically to timeshares. They have one major statute that governs the use of condominiums , but even this is somewhat limited in its ability to be applied to a timeshare because it does not specifically reference them. It would ultimately be up to a court to what kind of law they wanted to apply to your timeshare to decide your case. Because it is so sparing in the realm of timeshares it is recommended that you seek legal council to review your case for a timeshare in Michigan.

Timeshare law in Minnesota is administered under Minnesota Subdivided Land Sales Practice Act . It governs any type of land that divides shares over a series of people, think condominiums and timeshares. Because it is not specific to timeshares most of the law is more generalized to any concerns over shares of property interest, but it is administered through their real estate statute so is more focused on the creation and division of land.

Licensing Requirement

In the state of Minnesota anyone who wants to sell a share of subdivided land is required to be licensed as a real estate broker, or salesperson in the state. They also must have a current registration for the sale of the land. Generally, this means that before anything is shown to you it must be registered with the state first and they were required to be licensed in the state to be showing it or selling it you in the first place.

Mississippi

Mississippi governs its timeshare law through the real estate commission. It is enumerated in Chapter 8 of the commissions created rules. Since the statute is originally put forth by the real estate commission it naturally has a focus on the creation and management of timeshare interest.

Advertising

Mississippi law directly targets misleading information that can be given through advertisements for timeshares. It specifically states that no advertisement should state that the timeshare will increase in price during the timeshare period. This distinction is important because timeshares are not assets, they are simply use contracts. While many salespeople try to sell them as an asset like a house, this is directly misleading and illegal under Mississippi code. Miss Code R.§ 1601.8.11 (A)(2) (2019)

Missouri law does not spell out much regulation regarding timeshares specifically. There is some mention of it in their trade regulations. Title XXVI of their trade and commerce statute chapter 407.600 has a short 3-page statute for Time-sharing Regulation . The statute has not been updated in sometime, but it focuses on the notice requirements to both consumers and the state for timeshares.

Exchange Rights

Importantly as a consumer with a timeshare in Missouri the law favors your position. Often the purchase of a timeshare is coupled with entry into an exchange program. These programs allow you to exchange your timeshare in Missouri for another location, or time period you may like to see other than the one you purchased. Exchange companies are required to disclose limitations that they may impose on exchanges to you prior to the purchase. Notable ones include: if exchanges are subject to available space limitations, seasonal limits for locations, fees for certain exchanges, and many more. It is important to know that these must have been disclosed to you prior to obtaining the contract and should you be attempting to exchange you are required to have been given this info. If you need help understanding your rights regarding changing your timeshare or wish to get out of it contact our office at (360) 918-8196.

Montana centralizes its timeshare law around licensing and requirements of brokers/salespersons. The statute was heavily amended in 2009 to expand the scope and clarity of it. Since the statute is under an occupational rule of law it focuses heavily on requirements of the brokers who sell the timeshares and the documents that they submit to do so.

In Montana salesperson who sell or offer the sale of a timeshare are required to meet two things . First that they are currently registered with a timeshare project. This means there must be an overall real estate entity that is overlooking their attempted sale of timeshares and that overlooker is required to follow other valid real estate statutes. Second, they must be licensed as a timeshare salesperson. Licensure is simple in Montana and primarily just requires that they complete a course on the timeshare industry approved by the board.

The Nebraska Time-Share Act governs timeshare law in Nebraska, and it falls under their real property chapter 76 . Nebraska treats timeshares like it generally would real property, except it constitutes a separate estate or interest apart from other real property (like your home).

Timeshare Enforcement

Nebraska is specific about how an issue with a timeshare contract can be enforced in the state. Owners have four years to bring a claim in Nebraska from most issues relating to their timeshare contract, including its rescission period, or disclosure. Unfortunately, the Nebraska statute here is strict and your time starts ticking from when you purchase your timeshare. However, in many instances signing a separate contract, or a new one for your timeshare can reignite your claim. If you are afraid your time has ticked, or you want to be sure about your rights contact a lawyer to review your case (360)918-8196.

Nevada timeshare law has some of the most inclusive statutes in the US. It falls under their property statute under a subpart of the subdivide land section 119A . While the statute is expansive it focuses primarily on the licensing requirements of sellers with a few parts carved out for sale, resale, rights, management, and litigation. One big area to its credit is that it has several sections spelled out specifically for bringing cases and how that can be done.

Scam Protection

While many states address the sale of timeshares as real property, not many are interested in resale as a place that gets statutory protection. Nevada is the exception and has four parts that are spelled out just for the attempted resale of a timeshare. Resale is especially important because it is where most of the fraud occurs. Timeshares are notoriously difficult to get out of, so many companies come along claiming to be able to resell them and just take an advance fee from owners and disappear into the ether. Nevada has a specific protection for this. Under their law resellers if they take an advance fee are required to keep 80% of that fee in an escrow account until they can sell the timeshare. If they are unable to sell it the owners are entitled to get that money back.

New Hampshire

New Hampshire does not have a timeshare statute. It instead combines laws that govern timeshares with laws that govern condominiums. It also supplements these laws with some areas of consumer protection. All of it can be found in chapter 356 of title XXXI. Since the statute is set in a trade statute (Trade and Commerce) many of the laws focus around protecting consumers and guarding their rights. While the law might want to help you in New Hampshire it is important to have an attorney who knows timeshare law to make sure they can get those consumer protections extended to your timeshare. Call for a free consultation at (360)918-8196.

Interestingly New Jersey timeshare law is governed under their professions and occupations section. While most of the statute speaks to how to practice in a business the timeshare section is called the New Jersey Real Estate Timeshare Act and focuses mostly on property type law.

Burden on the Developer

Many timeshares are built and subsequently purchased, or rented by a major timeshare company like Hilton, or Wyndham. In New Jersey, the law is set out so that the primary burden falls on the developer of the timeshare units regardless of who does the wrong act. If the sales agent, marketing entity, or manager of the timeshare does something in violation of the statute the developer will also be on the hook for that behavior. This builds in an incentive on developers when they are building up to sell the timeshares to make sure that who they are handing it off to is not going to misuse it, or more likely scam people because they could be on the hook.

New Mexico timeshare law statute is under its property laws NM Stat § 47-11 (2019) . While the timeshare statute alone is not expansive it does deem that all timeshare interest in real estate will be treated as real estate. Essentially that all of the real estate law applies to timeshares as well even outside of the specific timeshare statute.

License to Sell

Timeshare salespersons in New Mexico are all required to either be a real estate broker, or to have a specific salesperson license under New Mexico law . They also require that developers must certify the registration of the project with the state. Generally, New Mexico law is more focused on timeshares as pieces of property and their proper certification and sale. If you are trying to bring a case in New Mexico, you should have an attorney review your case to make sure that you are also getting those property protections extended to your timeshare. Call now for a free consultation (360)918-8196 and see if you case qualifies.

North Carolina

North Carolina’s timeshare law is housed in their real estate and licensing section 93A article 4. The statute also specifically allows the use of security law and real estate law for any sections that might not be included in the timeshare statute. It is generally trying to expand the scope of timeshares so that it gets the same kind of protections regular real estate would. It also specifically states that timeshares are to be considered real estate.

Statute of Limitations

Unfortunately, in North Carolina the timeshare statute gives a short window in which you can bring a case under its statute. Owners only get one year from the date of execution of the contract to bring actions for violation of the timeshare statute. However, because in North Carolina timeshare is specifically considered real estate even if you are outside your time to bring a claim under timeshare law you may likely still have options in the area of real estate law. In cases like this where your rights may be up to a court to interpret it is important to have an attorney who specializes in timeshare law to give you the best chance at getting out of your timeshare. Call now at 360-918-8196 for a free consultation to see if your case qualifies.

North Dakota

North Dakota has some of the weakest timeshare law in the US. It does not have a statute that specifically speaks to timeshare and in addition timeshare is not even included as a sub term under their subdivided land, or condominium law. However, the real estate commission is responsible for the Subdivided Lands Disposition Act and would likely extend it to apply to timeshares along with other real property law, but it is the act that most closely mirrors a timeshare interest.

Ohio has a unique way of dealing with timeshare law. For timeshares purchased where the property is in Ohio it falls under standard real estate law and there are standard restrictions on real estate agents, the property itself and consumer protection. There is condominium law in Ohio under their real property statute chapter 5311 , condominium law is often insightful, but not absolute when looking at timeshare properties. It is important to have a lawyer review your case who knows how to find and apply the right laws to your situation and if needed argue on your behalf for why you should get the benefit of the most favorable Ohio property laws.

‘Foreign’ Real Estate

Ohio has a unique statute for dealing with property the foreign real estate statute. While it might sound like it applies to purchases outside of the US, it actually means any interest purchased outside of Ohio itself. This is valuable for timeshares because often the place where the timeshare is purchased is not the place where the timeshare is located. People in Ohio could purchase a sunny timeshare in Florida, or Hawaii and in these instances, it would fall under the foreign real estate statute.

Oklahoma is one of the few states that governs its timeshare laws under its securities statute. A security for purposes of the statute is basically just an investment and the laws that surround securities usually deal with making sure that they are fair and honest to the public. While the security statute does not reference timeshares by name, it is where land that is subdivided is handled and is aptly called the Oklahoma Subdivided Land Sales Code .

Complete Cancellation

Oklahoma has one huge protection to purchasers of subdivided land. That is that if the purchaser never received a public offering statement in compliance with § 71-626 the purchase is voidable by the purchaser (you). Voidable does not mean void it just means that you may have a good case for getting out of your timeshare. Oklahoma gives purchasers a huge protection with this as timeshare companies often try to hide the ball with public offering statement disclosure. If you think you may have a good case in a timeshare purchase in Oklahoma, please reach out to our firm at 360-918-8196 to confirm.

Timeshare law in Oregon was set up with the specific intent of protecting purchasers of timeshares while still providing regulations enough to allow the timeshare industry to grow. They do this through their real property statute with a portion [OR Rev Stat § 94.800 (2019)] designated for ‘ timeshare estates ’ as it calls them.

You Cannot Waive Your Rights

Oregon has an express provision to protect purchasers from unfair sales practices. Often sellers of timeshare interest due to their inherently fraudulent nature will try to get buyers to ‘contract out’ of any sort of defense. Basically, signing away their right to come back at the seller for scamming them. In Oregon sellers cannot waive or stipulate to waive any legal right that a purchaser has in the contract. If you are required to have 5 days to rescind the purchase and they do not give it, your contract is void.

Pennsylvania

Pennsylvania does not have a on point timeshare statute. They instead govern timeshares through the real estate commission and laws on condominium and planned community management. It is generally all held in their real and personal property title 68 . Their property laws are sub divided into the different types of interest you might expect in shared land ownership, creation, management and then protection. The statute reads easily as each one of these areas of law is set into its own chapter, but all housed inside the same real and personal property title.

Rhode Island

Rhode Island’s timeshare law falls under chapter 34-41 the Rhode Island Real Estate Time Share Act . The act hits on all the major elements of timeshare law, creation, management, coverage, report and perhaps most importantly remedies. Timeshare law in Rhode Island closely resembles standard contracts law. Instead of timeshares being treated like real estate as in most states, Rhode Island looks at them like contracts and gives many more contract defenses that are not always easy to get in real estate. A major portion of the Road Island timeshare statute is dedicated to spelling out what these defenses are and actions you may have to get out of your contract. If you think that you have a bad timeshare contract, or just want to get out of one reach out to our firm at 360-918-8196 for a free consultation.

Defense to Contracts

There are two big defenses to timeshares in Rhode Island that are not easily brought in other states. First is the defense of unconscionability of the contract. It basically means that the contract is just blatantly unfair to you in some way. This can be because the terms of the contract are obscene (like a crazy high interest rate), or because when you signed you were under too much pressure (think high pressure sales presentations). Second is a breach of warranty . There are certain promises that if they are implied to be a part of the timeshare or expressly said by the purchaser a person would believe them, they will be considered a part of it even if not in writing. If they then subsequently come back and say those promises are not real, or that they were never supposed to be a part of the contract you may have an action against them for a breach of warranty.

South Carolina

South Carolina timeshare law falls under their property and conveyance statute Title 27 chapter 32 . It is primarily focused on the creation of timeshare plans, with subparts dedicated to foreclosure of timeshares and transactions for timeshares. Uniquely South Carolina had a history of old timeshares. Timeshares that the person actually owned a deed to a property for a specific time each year. The laws of the South Carolina statute are designed in part to transition those old-style timeshares into the newer system which is often more based on contract point plans than real property.

Unfair Sales Tactics

It is extremely common for timeshares to use harsh tactics to get people into buying timeshares. These often involve getting vacationers, or prior owners into meetings at the offer of some free stuff and then hold them there for hours until they are worn down enough to commit to buying a timeshare. South Carolina offers some timeshare protection law for this under SC Code § 27-32-110 (2019) . It mostly protects users from deception, sellers are not allowed to lie about how the timeshare would work, or what types of accommodations the purchaser would get.

South Dakota

South Dakota timeshare law is focused in a mini statute Title 43 of Chapter 15B . Since it is short it focuses on just the general property elements of a timeshare. Like creation of a plan, how the state requires it to be inspected and generally closing on one. As such there are not a lot of protections that naturally fall in timeshare law in South Dakota. As a consumer or purchaser here, it is important to have a lawyer skilled in timeshare law to be able to support your case here where there is not much law in your favor. Contact us at 360-918-8196 for a free consultation.

Tennessee timeshare law falls under the Time-Share Act of 1981 , the statute is in Tennessee property law title. Much of the statute is dedicated to consumer protection laws in the form of advertising and resale restrictions. Generally making it harder for a seller, or reseller to get money out of owners without violating at least some laws.

Resale Protection

It has become a common practice to scam timeshare owners in alleged ‘resale’. Timeshares have a virtually non-existent resale value, so resellers will contact owners about having a buyer ‘lined up’, or just require you to pay the ‘listing fees’ in advance of the actual sale. Then they vanish without a trace and your money is gone. Tennessee has gotten wise to this type of scam along with some other states. In its statute it is illegal to require an advance fee to be paid for a timeshare resale and the contract must be in writing and tell the user that there are no guarantees for timeshare resale. Probably because they are nearly impossible to actually resell.

Texas timeshare law falls under the Texas Timeshare Act , it is under Texas property law in their Miscellaneous Shared Real Property Interest. Timeshares are just another form of shared property in the eyes of the law like condominiums or subdivided lands. Texas being no exception. Texas law focuses on the property interest of the timeshare and mostly governs its creation, cancellation, and management, with a minor carve out for consumer protection.

Deceptive Trade Practices

One segment of the timeshare statute in Texas is dedicated towards protecting consumers specifically from as it states, “Deceptive Trade Practices”. What this means in the timeshare market is mostly lies about what a timeshare is and what its interest represents. Where this is most often seen is about where they can book, what that booking includes accommodation wise and about the relative value of their timeshare. Texas hits all of these with their statute and if you feel you have been lied to about your timeshare you may have a case. Contact us at 360-918-8196 to have an attorney freely review your potential case.

Utah timeshare law is governed under the Timeshare and Camp Resort Act . Since the law extends to more than just timeshares it reads more broadly than many other state timeshare laws. It has a focus on consumer protection with some strict and harsh penalties for sellers if they violate the statute.

Penalties

Under Utah law if a seller violates section 4 (selling unregistered land), or section 14 (unregistered salesperson) the purchaser can not only void the agreement but can also recover all the money they paid for it, with interest and attorneys fees. Basically, Utah’s way of saying they do not take violations here lightly. Beyond just that strict rule Utah also specifically expands its timeshare laws, so that violations of it are also considered under consumer protection law and it is possible to bring in more action against them.

Vermont does not have a timeshare law statute. However, it does have a condominium act and Vermont has generally taken a more liberal approach when applying laws to timeshares. They tend to favor consumer protection and can use various sources of law to draw from when protecting consumer interest in timeshare purchases. Because there is no law directly on point it is important to have a qualified lawyer who understands timeshare law to be able to make your strongest case. Call now at 360-918-8196 and schedule an appointment to speak to one of our timeshare attorneys 1-on-1.

Washington timeshare law is governed by The Timeshare Act and stated in Chapter 64.36 of the real property interest and conveyance title of Washington’s code. The laws read a bit complex, but they are primarily focused on what disclosures are required in timeshare purchases and what a seller cannot do.

Cannot Escape Washington Law

A unique feature of Washington’s timeshare law is that it will apply to all timeshare cases that could be brought in Washington. Regardless of how the contract reads, or where the location of the contract is for (you bought a timeshare in Cancun, but purchased it in Washington) Washington law will govern. This provision is to stop sellers from trying to get cases moved to a jurisdiction (like Florida) where the laws would be more favorable to them and easier to litigate. If you have a Washington timeshare case, it is important to have a Washington timeshare lawyer because we know how these laws will work.

West Virginia

West Virginia timeshare law is governed in their estates and property Article 9, under the West Virginia time-sharing act . The laws in West Virginia for timeshares are straightforward and hold a lot of what you would expect. Protections for purchasers, obtaining timeshares, selling timeshares, and generally managing the interesting.

License Requirement

West Virginia has a licensing requirement for all timeshare sellers. A salesperson or broker must be licensed under the Real Estate Commission to make sales of timeshares.

Wisconsin timeshare law falls under statute 707 in their property section Time-share ownership . Right from the start of the statute Wisconsin law protects consumers. It treats timeshares not only as property, but also and more likely as a contract. Expanding timeshares to include contracts give the consumer much more protection than and rights than just real property.

Consumer Protections

While there are several defenses to contracts that are not available in property law. Wisconsin focuses on some of these defenses in its statute, but likely most all contract defenses would be available. Most notably is the unconscionable defense that they list right in opening section of the law. Wisconsin creates an unconscionable contract defense. If the contract is so unreasonable that it could not possibly be enforced (which timeshares often are considering their negative value) the court can essentially void the contract. Making it unenforceable. They can also do this for specific provisions of the contract, like if an interest rate on a mortgage is obscene the courts can choose to remove that provision while keeping the contract intact.

Wyoming does not have a specific timeshare statute. There is however a statute that governs condominiums . While it is an extremely short statute it does give some insight into where Wyoming’s focus is regarding subdivided land: property. The act treats condos as real property and would likely see timeshares the same way. In states where the law is unclear it is important to have an attorney skilled in timeshare law who knows how to make your case relevant. Call today to set up a free consultation with one of our attorneys 361-918-8196.

The Abrams Firm The Timeshare Law Firm

3270 S Highway A1A

Melbourne Beach, FL 32951

321-224-1111

This website does not provide legal advisement. To obtain legal representation a fully signed Attorney-Client Agreement is required.

- Book Travel

- Credit Cards

Timeshare Presentations: How to Get Cheap & Free Vacations

If you’re planning to visit some of the world’s most popular destinations, you can run into some hurdles if award availability is scarce and cash prices are high.

Sure, points can help offset the cost, but that means it will cost you a lot of points. What if I told you there’s a way to save those points and snag an awesome deal on your accommodation?

Well, there is – welcome to the world of timeshare presentation packages.

What Is a Timeshare?

In a nutshell, a timeshare is a shared ownership program in which you may use a vacation property for a set time period every year.

Timeshare properties can range from resorts to condominiums to campsites. They can be a good option for travellers who have a favourite destination they like to vacation at every year.

With timeshares, these travellers will have familiar accommodations to return to each time without the hassle of having to manage a fully-owned property while they are away.

Most of the big hotel brands that we’re familiar with have their own affiliated timeshare division. A few well-known examples include the Marriott Vacation Club, Hilton Grand Vacations, Holiday Inn Vacation Club, Hyatt Residence Club, and even Disney has their own Disney Vacation Club.

Generally speaking, there are two types of timeshares: those that are points-based and those that give you deeded weeks.

- In a points-based program, you have a certain number of points each year that can be redeemed against nights at your timeshare.

- In a deeded-week program, every year, you have a “week” of the year that you can use your timeshare.

You do not necessarily need to stick with your timeshare property either. Usually, there is a system or program for owners to swap their property for another destination or property for any given year, building some flexibility into the program.

Despite the perks of timeshares, many people choose not invest in one, as they can be a money drain if you don’t make good use of them.

There are annual maintenance fees for the upkeep of the property that have to be paid, the process of swapping properties can be quite complicated, and it can be a pain to get rid of them or resell them as they don’t hold much value in the reseller’s market.

What Is a Timeshare Presentation?

Whether you feel like timeshares may be a good fit for your travel patterns or not, you should consider attending a timeshare preview presentation.

The timeshare market is a competitive one, and most timeshare vacation clubs will offer some form of incentive for an opportunity to introduce you to their program in the hopes of enticing you to purchase one.

What is offered as part of the package varies by the club and even the property, and it can be anywhere from tickets to a theme park or a show, to accommodations at one of their properties for several days at a huge discount, plus maybe even some bonus points for their respective hotel award programs.

If it’s the accommodation you’re after, keep in mind that usually the package will cover a “standard” room; however, there is a possibility for upgrading, as we’ll discuss later.

What’s the Catch with Timeshare Presentations?

To take advantage of these fantastic offers, you (and your spouse, if you’re married) need to attend a 1.5- to two-hour sales pitch about the timeshare program while you’re vacationing on your timeshare package.

During that time, they’ll introduce you to their program, how easy it is to use the timeshare, the flexibility it provides, the years of enjoyment you will get out of it, and even give you a tour of a potential timeshare unit.

Easy enough, right? Most of the time, yes.

Some sales representatives can be pushy and will pull out all the stops to get you to sign on, because that’s how they earn their commission. You may feel pressured to buy, and they may spend a lot of time negotiating a better offer for you.

Most sales reps, however, are quite reasonable. If you’ve put in your time and made it clear you’re not ready to buy, they’ll send you along your merry way. And if you do happen to cave under the pressure and buy the timeshare, it’s not the end of the world (more on this later).

During the pandemic, some timeshares like the Marriott Vacation Club opted to do virtual sales presentations, and in lieu of a vacation deal, you’d earn Bonvoy points instead.

There have been recent offers of up to 20,000–25,000 Bonvoy points; however, you have to be a US resident to take advantage. For the in-person presentation packages, there are no US residency requirements.

How to Book a Timeshare Presentation

Now that you might be considering taking advantage of a timeshare presentation, let’s go over how you find these offers and sign up for them.

The easiest way is through each respective club’s website. Usually, there is a phone number or online form to complete for additional information.

Hyatt even allows you to book the package online if you reside in the USA.

Once you purchase the package, there is quite a bit of flexibility when it comes to booking. Although the terms specifically say that the timeshare has to be booked within 12 months of purchase, it is not uncommon for them to extend this deadline. I have done this on a couple of occasions myself, even prior to the pandemic.

Once you book your package, you can still change the dates, although some programs will charge a change fee. During the pandemic, there was even more leniency (I rescheduled a Marriott preview package no less than four times), although this may tighten up a bit as travel opens up.

Unfortunately, once you purchase a preview package, they are generally considered non-refundable. There have been scattered reports of people receiving refunds if they no longer fulfill the eligibility for the package, but as always, your mileage may vary and this should not be the expectation.

My Experiences with Hilton Grand Vacations

Hilton Grand Vacations (HGV) has over 50 properties spread across the United States. Their properties differ from the regular Hilton-branded hotels in that they generally offer accommodations with more space, larger and a greater number of bedrooms, and ensuite kitchen and laundry amenities.

Note that not all HGV properties are bookable through timeshare presentations, and some properties are only made available at certain times.

Thus far, I’ve done a couple of packages with Hilton Grand Vacations in Orlando , and another in Honolulu . Here’s a recap of my experiences so far with HGV.

Parc Soleil by Hilton Grand Vacations

View on the Hilton Grand Vacations website.

2017 Package Deal: Three nights / four days for US$199 and a US$200 “Stay a Night On Us” rebate voucher; upgraded to a two-bedroom suite for an additional US$50

A few years back, I had to call Hilton reservations to change an existing hotel booking I had. At the end of the call, they thanked me for being a loyal Hilton Honors member and asked if I would be interested in hearing about a “great offer” they currently had. I accepted, and so began my journey down the rabbit hole of timeshare packages.

I was forwarded to another agent, who offered me the above timeshare package. I was considering a trip to Disney for my son’s fifth birthday anyway, and this would definitely help bring down the trip’s cost, so I bought the package.

When we decided on our dates, I called back, and they confirmed availability and booked our accommodation and the timeshare presentation to be done during our stay – and that was it!

At the time of booking, my youngest was only a few months old and wasn’t the greatest sleeper, and so extra space to accommodate her sleeping situation was desirable. When I inquired whether our one-bedroom suite could be upgraded to a two-bedroom suite, the agent advised that we could do that for an additional US$50, which seemed more than reasonable to me, bringing our grand total to US$249 plus tax.

We stayed at the HGV Parc Soleil, which is a 15-minute drive into Disney. Other than being a bit further out from Disney, it was a fantastic accommodation option for families.

It had two beautiful outdoor pools, one that was zero-entry with a water slide and another for adults only. They had a kids activity centre and some organized activities throughout the day. There was also a basketball court, tennis court, and outdoor playground for the kids.

The suite itself was spacious, modern and clean with a full kitchen and an in-suite washer and dryer. There was also a paid shuttle service ($10 round trip per person) to the surrounding amusement parks, but times were rather limited.

We attended the timeshare presentation on the second day. It was located at the Parc Soleil, which made it convenient.

At check-in, they ask for your ID and credit card, then invite you to enjoy snacks and non-alcoholic drinks while you wait for your sales representative. You can also drop off your kids at a small, supervised children’s room (with toys, colouring, and a TV) while you attend the presentation.

Since it was our first timeshare presentation experience, we did not know what to expect. We were also genuinely interested in learning more about timeshares, which didn’t work in our favour.

They started off with some general questions about our travel habits and destinations we wanted to visit, and then went onto discuss how HGV could make it all happen at a fraction of the cost.

Once the sales representative realized we actually had some interest, he turned the pressure on. He would show us how he had booked various destinations at fantastic rates and began negotiating on the amount of initial investment required to purchase, while offering additional Hilton Honors points to sweeten the deal.

Each time we declined, he would go back to his manager and come back with a better deal.

This went on for a bit until he finally came back with what seemed to be a decent offer at the time, and we actually signed the papers and walked out with a timeshare after the two and half hours.

The agent offered to refund our US$199 package cost, probably as a kind gesture given that we had just bought a timeshare with him, and then sent us to the front desk to obtain our US$200 “Stay a Night On Us” rebate voucher.

Suffice to say, purchasing a time share was not our initial game plan. Luckily for us, there is a cooling-off period built into the contracts, whereby you have 10 days to rescind a timeshare purchase agreement.

With some time and space to actually think about our impulsive decision, we decided it really wasn’t for us and the next day, we rescinded.

The staff were very kind about it and it was an easy enough process, but lesson learned: do not show any interest in a timeshare if you are in it only for the cheap accommodations.

Hilton Grand Vacations at Tuscany Village

2019 Package Deal: Four nights / five days in a one bedroom suite for US$299, refunded after presentation, one $200 “Stay A Night On Us” rebate voucher OR 10,000 Hilton Honors points

A year later, my husband had a conference in Chicago at the Hilton. HGV had set up a booth in the lobby, where they offered everyone 1,000 Hilton Honors points just for listening to what they had to offer.

Jon took them up on the offer, and this time he was offered packages to either New York City, Las Vegas, Myrtle Beach, or Orlando. They were two- to four-night packages ranging from US$199 to US$399.

Now, you might be wondering: how often you can purchase a timeshare presentation package? As per HGV’s terms, as long as you have not attended another presentation in the last 12 months, you are eligible to purchase another.

We were just over a year since our first package, so we bought another, back to Orlando. This time around, the offer was four nights for US$299 plus tax, so we were a little hesitant as our previous offer was better.

The sales agent, sensing the hesitancy, sweetened the package by offering either a US$200 “Stay a Night On Us” rebate voucher or 10,000 Hilton Honors points, and to refund the US$299 after the presentation. That sealed the deal for us.

This time, we chose to stay at the Tuscany Village, located about 15 minutes from Disney once again. The décor was a bit more dated, but it still had an outdoor playground and a few pools that would satisfy most young kids.

There were also complimentary DVD rentals and a children’s activity centre, albeit a bit smaller than the one at Parc Soleil.

I enjoyed the fact that it was right beside the Orlando Vineland Premium Outlets, which meant some retail therapy for me between theme park days. They also had a paid shuttle going to the amusement parks, but once again, the times were limited.

Our presentation was back at the Parc Soleil. This time, my husband and I had a different game plan: we would tell them that we weren’t ready to buy a timeshare and to let them know early on.

This was working well for us initially, and at the one-hour mark the agent was pretty much finishing up. As we were just about to leave, he advised us that his manager had one last offer for us, which got us our third package…

The Grand Islander by Hilton Grand Vacations

The manager came out and offered us a trial membership to the HGV program. Now this was different.

There was no set destination for the package; instead, for $1,599 (USD), we would be given enough points to redeem for seven nights in up to a two-bedroom suite at any of the HGV properties in North America, including Hawaii.

We did the math and worked out that it would be less than $230 (USD) a night. If it were any other destination, we would have left it. After looking at the current rates for Hawaii for a Hilton property in Honolulu for March Break, we came to see that it was a great deal.

Keep in mind that these are rates for two adults and two children. If you have more than four in your family, like myself, either you’re paying more, or you’ll find that most hotels won’t even be able to accommodate. The fact that we could book a two-bedroom suite was a big selling point for us.

HGV has quite a few properties in Hawaii, with the Grand Islander by HGV being one of the newer ones. We booked at the Grand Islander for four nights in Honolulu over March Break .

That leaves us with three nights remaining, which we could have used to extend reservation to seven nights…

…or book three nights at their New York property, West 57th Street by Hilton Club at the south end of Central Park, another otherwise pricey accommodation option.

Either way, you can see that our $230 (USD) per night beats the above rates by a long shot.

An Even Better Offer…

Sticking with Hawaii as our theme destination, HGV currently has an offer on their website for five nights in Honolulu or Waikoloa for $799 (USD) in a standard room, which brings the nightly rate to $160 (USD) – an incredible deal for a night in Hawaii.

Granted, it’s for a standard room, but I’m pretty sure you can request an upgrade offer to a bigger suite at a decent cost when you call in.

My Experience with Marriott Vacation Club

We originally purchased our Marriott Vacation Club Preview Package back in 2019. This package offered a five nights at Marriott’s Maui Ocean Club for $799 (USD).

After numerous delays and postponements due to the COVID-19 pandemic, we finally enjoyed our stay in March 2022 .

We rescheduled our timeshare presentation after our arrival, and there were no issues with moving it to a different day. When it came time for the actual presentation, it took place in a cubicle in their outdoor Sales Centre.

We wound up going over the 90-minute allotment, and spent closer to two hours there. I was genuinely interested in the program, so it was more my fault than theirs.

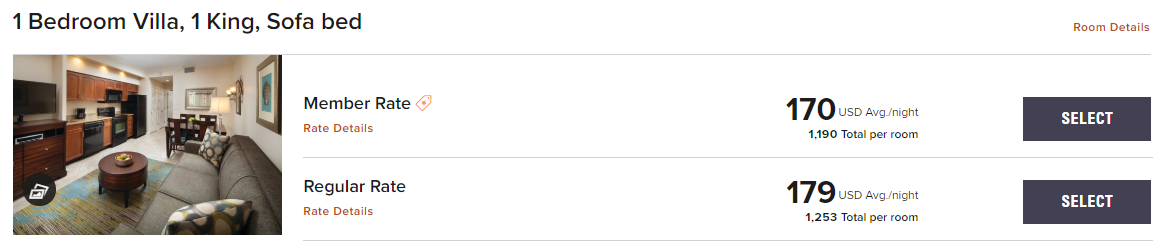

Marriott Vacation Club uses a points-based system. Our sales agent offered us the base-level 1,500 points at $15.84 (USD) per point, totalling $23,760 (USD).

As a signup bonus, they were willing to throw in another 3,000 points for the first year.

To put things into perspective, a one-bedroom villa in Maui at peak season could cost up to 4,500 points per week.

We didn’t show much interest in this, and they tried to sweeten the deal with some more offers, but we kindly declined. As we had an exit interview, another sales agent came in to offer us yet another timeshare presentation package.

The first offer, which was good for the next two years, was five nights at the same property for $1,295 (USD). We weren’t sure when we would be back to Maui again, so, again, we declined.

They approached us with one last offer: $995 (USD) for four nights at any of their North American properties, including another property in Hawaii for a $300 (USD) add-on fee.

Our family wanted to visit Kauai in the near future, and after a quick check for a four-night stay in the winter revealed prices at around $2,600 (USD) for four nights, we accepted this last offer.

It goes to show that sticking around for more offers can result in some pretty great rates!

If you’re not familiar with timeshare presentation packages, now’s the time to take a look at them as a means to very cheap accommodations in many popular vacation spots.

Timeshare presentations are a great option in areas where points redemptions are either not worth it (e.g., Orlando, where hotels are generally quite cheap to begin with), or in places where redemptions are difficult to make (e.g., Hawaii where the cost of redemptions are high).

It does require a small time commitment and perhaps a bit of finesse in talking down a sales representative, but in my mind, the savings are definitely worth it.

- Earn 80,000 MR points upon spending $15,000 in the first three months

- Plus, earn 40,000 MR points upon making a purchase in months 14–17 as a cardholder

- And, earn 1.25x MR points on all purchases

- Also, receive a $200 annual travel credit

- Transfer MR points to Aeroplan and other frequent flyer programs for premium flights

- Unlimited airport lounge access for you and one guest at Priority Pass, Plaza Premium, Centurion, and other lounges

- Credits and rebates for business expenses throughout the year with Amex Offers

- Bonus MR points for referring family and friends

- Qualify for the card as a sole proprietor

- Annual fee: $799

30 Comments

Amy, please clarify — you said “no” to buying the timeshare BUT they offered you another timeshare presentation elsewhere?

That’s correct!

Thanks for the great information!! Do any of them ask for income verification?

No, they didn’t.

Thank you VERY much, not even the fancier ones like Wyndham or Marriott presentations?

As a previous owner of timeshares and an attendee at multiple presentations I’ll add some comments which may be helpful: -if you buy, it is difficult to recover your purchase price because of the heavy marketing costs built into the price -I have sold my timeshares and currently have some fractional ownership properties to which I have title, which may not be subject to the same haircut on sale -my trading options (including my Hyatt property) are through Interval International which has a network of thousands of properties around the world -Resorts Condominiums International is another trading network, so you are not stuck with a specific hotel program -if you go to a place like Puerto Vallarta or Cabo San Lucas, you are swarmed at the airport, sometimes car rental places or Walmart, by sellers of these packages -I have a friend who used to fill her PV trips with different presentations, and she was often able to negotiate improved perks for the presentations themselves; she did this for a fair number of years, without buying, before they caught on to her -If you decide to buy, wait, wait, wait; I’ve seen people buy in the initial large presentation with cheers and champagne, only to see deals offered that were a fraction of the cost in later iterations -often you have to see multiple people before you escape, the deals keep getting better, but the original 90 minutes is substantially exceeded -the last one I went to took about 4 hours and I finally walked away abandoning my promised perks

Thanks for the article Amy. I was attempting to book an Orlando offer in my Hilton App yesterday but they only permit USA addresses. When I went to the International website the offers weren’t as good. Do you know of a way to get the same offers advertised on the App?

I’m not sure but you can try calling in and requesting.

Amy, do they ask to see both adult’s ID or license? We are common law marriage different last names. Can we just show 1 ID card?

When you sign up for the package they will usually ask if you are married, etc. If so, they will ask for your partners name. It doesn’t matter if the last names are different. At Hilton, they checked both ID’s but Marriott only checked my husbands (not sure if that was intentional though).

Hi Amy, thanks for the article (and love the family-geared content!). When I click through the link for the current HGV Hawaii offer and put in my zip code, I get a message basically telling me this offer is not available to me. Any idea why?

Hmm that’s interesting. I’m not entirely sure why. Perhaps certain states have different offers/restrictions.

My family has an Embarc timeshare bought maybe 20 years ago… from our experience… currently there is not enough money and points in the world to suffer the presentation. Long story but about 8 years ago, had to lawyer up to deal with them.

I have reached on Marriott Vacation Club for further information and was told there is no timeshare deal for canadian résidents at the moment but if I visit à proporty I can ask over there… not really convenient

Hi Amy, great article and tips! Just a question: is there a limitation on the number of times you can book (the rules seem to say once per year but is this per individual or per family (so a family of 2 adults could do this twice per year))? Thank you!

Hi Amy, Thank you for the great information. You mentioned you were given a trial membership of HGV. Is the $1599 USD a yearly fee? Are there any other fees associated with owning HGV timeshare? Do you plan on continuing with the HGV membership or will you likely cancel. Thanks!

It was $1599 one time fee for 7 nights. Once you use up the 7 nights, the trial is done.

I have used this strategy successfully. As a family of four, we will only stay in a one bedroom or two bedroom if it’s for any stretch of time. Having a kitchen to cook your own meals is a cost savings and easier than having to coordinate eating out all the time. In November 2019 we stayed in a one-bedroom at Maui Ocean Club Napili for only 450,000 bonvoy points. My wife and I attended a 1.5 hour timeshare presentation and received 40,000 bonvoy. The retail value of the room was $7,500 USD. Unfortunately, any type of room at Maui Ocean Club is very difficult to book on points.

I will likely have to cancel due to Australia’s continued strict lockdown, but I booked two 2 bedroom suites at the Surfers Paradise Marriot Vacation Club this December for seven days and 292,000 points each (total 584,000 points). The retail value was 14,500 Australian Dollars. You have to really hunt but can find some gems occasionally.

Thanks for the info Amy! Is there a website for all the Hilton offers available? I was able to find Orlando/Las Vegas by searching on their site, but could only find the Hawaii deal by using the link in your article. And similarly for Marriott, do they have a webpage that describes their offers? I was recently invited by a Marriott CSR to call a 1-800 number to get a similar deal, but would much rather check it out first on a website rather than have it described over the phone by a salesperson.

Unfortunately there’s no central page where all the offers are located for HGV. If you click on the various destinations they have you may see a banner at the top with an offer for whichever destination you selected. If you can’t find a particular destination offer, best to call or email them. Same applies for Marriott.

While staying at an Hilton in Washington DC 3 years ago, we were offred a timeshare presentation and visit for 10k HHONORS points. I said I wasn’t interested unless it was for 30k points which they agreed. The visit went smoothly and interesting, when we sat down to discussed the prices at one point I said it wouldn’t work out since I’m earning lots of miles and points from business travels. And that was it a total of 90 minutes of our time.

Hi Amy, how can you book the Grand Islanders by HGV in Maui? It is opening in September but I cannot find it is available to book yet. I’m looking 5 day accommodation in Maui next year. I really hope we can have the Honolulu’s deal in Maui.

I apologize, we have Grand Islander booked for Honolulu and Marriott booked for Maui. You are correct, the new HGV property opening in Maui is not bookable yet.

Hi Amy, how can you access the HGV in Honolulu? I entered my information and the site says I’m not eligible for the Hawaii deal and instead directed me to Orlando and Las Vegas only.

I would try calling in and requesting. Sometimes they do have eligibility restrictions based on where you’re located or your income. Actually, for my current one with Marriott in Maui, i had to go through a couple of agents before they gave me the offer I was looking for.

Hi Amy – Great article and timely as we’re looking to book a family trip to Hawaii this coming year. What offer did you end up getting for the Marriott presentation?

Hey Mark! $799 usd for 5 nights 🙂

Which property? Offers for me were between $799 and $999 for 5 nights depending on which island.

It’s at Marriott’s Maui Ocean Club 🙂

Nice score! Thanks

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Prince of Travel is Canada’s leading resource for using frequent flyer miles, credit card points, and loyalty programs to travel the world at a fraction of the price.

Join our Sunday newsletter below to get weekly updates delivered straight to your inbox.

Have a question? Just ask.

Business Platinum Card from American Express

120,000 MR points

American Express Aeroplan Reserve Card

85,000 Aeroplan points

American Express Platinum Card

100,000 MR points

TD® Aeroplan® Visa Infinite Privilege* Card

Up to 85,000 Aeroplan points†

Latest News

Hilton Honors Summer 2024 Global Promotion: Earn Double Points

Deals Apr 17, 2024

Lufthansa to Debut Allegris Business Class on Canadian Routes

News Apr 16, 2024

Singapore Airlines KrisFlyer: Spontaneous Escapes for May 2024

Deals Apr 16, 2024

Recent Discussion

Rbc changes earning rates on the rbc® british airways visa infinite†, how to use air canada same-day airport changes, american express referral program: refer friends, earn points, christopher, mbna rewards world elite® mastercard®, looking ahead to 2024 in the miles & points landscape, prince of travel elites.

Points Consulting

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

When Is a Timeshare Presentation Offer a Good Deal?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Would you sit through a two-hour timeshare sales presentation to get three nights at a hotel in Orlando, plus 15,000 Hilton Honors points — all for $199? How about for dinner or a spa voucher at a Marriott hotel in Dubai? Would three nights in Tahoe plus 10,000 IHG points for $249 be worth enduring a long sales pitch?

Companies dangle generous perks to try to sell you a timeshare, with offers ranging from free parking to free hotel nights to deeply discounted hotel stays — provided you sit through a timeshare sales presentation of 90 minutes or more.

Here’s what you need to know if you’re considering a timeshare sales presentation offer.

How timeshares work

What is a timeshare.

A timeshare is a fractional ownership of a vacation property or vacation property lease — usually at a popular travel destination or resort. It’s a lifetime commitment, although it’s possible to resell it. You’re basically investing in the opportunity to spend a week or more at select properties every year.

Many hotel chains have timeshares, including Hilton , Marriott and IHG .

The question "Is a timeshare a good deal?" is different from the question "Is this timeshare presentation offer a good deal?" Timeshares are often pitched as ways to save money on future vacations. Depending on your travel habits, it’s possible the timeshare pros and cons could tilt in your favor. But in most cases, collecting points and miles redeemable for travel is a better way to save.

But even if you know the timeshare route isn’t for you, that doesn’t necessarily mean you should skip out on the timeshare presentation offer. The perks could be well worth your time.

» Learn more: Are timeshares worth it? Possibly, if you buy smart

Timeshare presentation offers

A timeshare presentation offer is any benefit or discount — like free or reduced hotel stays, bonus points or free spa treatments — that you can receive by agreeing to sit through a timeshare sales presentation. These offers can include things like free parking at a resort where you’re staying, free hotel nights or deeply discounted hotel stays and resort experiences.

To determine whether it’s worth sitting through a presentation, consider the value of the perk being offered. In the case of free parking, you would probably be better off spending $50 to self-park and skip the sales pitch.

Can attending timeshare presentations offer a good deal?

Even still, there are times when sitting through a timeshare presentation can be worth your while. You can find good timeshare deals on offers for discounted stays, free nights and more online — or get offers through phone calls or targeted emails. In some cases, you might decide the savings are worth it.

Tip: Watch out for blackout dates, hidden charges and more

Depending on the hotel chain, your offer could be subject to blackout dates, high-season charges and package expiration dates. Read the terms and conditions carefully.

» Learn more: Find the best hotel credit card for you

Worthwhile timeshare offers, by chain

Here are a few offers from major hotel chains that, depending on how you feel about sitting through a sales pitch, might be worth grabbing.

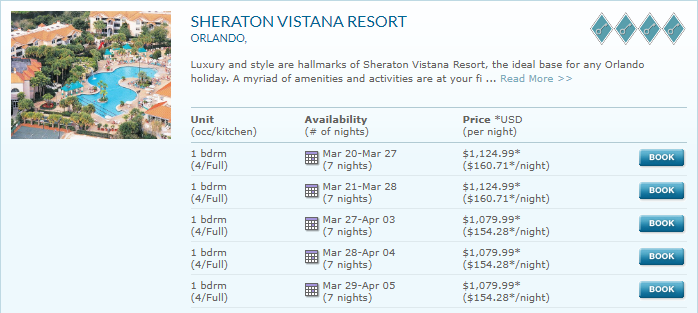

Hilton has a timeshare presentation offer that gets you a three-night stay in Orlando or Las Vegas, plus 15,000 Hilton points for $199. That’s a pretty decent deal considering that rooms normally cost $175 to $500 per night.

This offer is good at several hotels, including the Hilton Orlando Lake Buena Vista — an official Walt Disney World hotel. This means it gives its guests additional benefits, such as extra magic hours and access to FastPass. (Note that both services are currently on hold).

Other Hilton offers include a five-night stay at a resort in Hawaii for $649 plus taxes. The online offer includes 15,000 points. But a recent phone call to Hilton proved that sales representatives have some leeway to negotiate, in this case switching the offer to 5,000 Hilton points and a $200 Hilton gift certificate.

There are two different Hilton packages available for Hawaii — you can pick either Honolulu or the Big Island. Considering room rates here often hover around $500 per night, you can save a bundle by sitting through a timeshare presentation. For example, five nights in September 2021 at the Ocean Tower at the Hilton Waikoloa Village cost about $1,891.

That’s a big discount, not counting that $200 gift certificate and the value of those points, at a sprawling oceanfront resort featuring a saltwater lagoon.

Marriott Vacation Club has a number of specials for travelers willing to attend a timeshare presentation. In Dubai, for example, you can score two free nights at a number of hotels throughout the Middle East.

You can also participate in timeshare presentation in exchange for a dinner or spa voucher at select Marriott hotels in Dubai.

IHG’s vacation club is extending offers for properties in Gatlinburg, Tennessee; New Orleans; Myrtle Beach, South Carolina; and Lake Tahoe, Nevada; among others.

At the Lake Tahoe resort, you can pay $249 plus tax and get three nights in a one-bedroom villa at the Holiday Inn Club Vacations: Tahoe Ridge Resort, as well as 10,000 IHG points .

Considering three nights at that resort can cost upward of $1,000, the timeshare presentation offer may be well worth it.

Some IHG hotels cost as little as 8,000 points per night, which means you can turn those 10,000 points into another free night.

Who qualifies for timeshare presentation offers?

Not everyone will qualify for these offers. Requirements vary by chain, so check the details of your offer before committing to one of these packages.

In the case of Hilton, you must not have attended a timeshare presentation within the past year at the property where you’ll be staying or within the last six months at any other properties. You’ll also need to meet certain other criteria, though they don’t publish details about what these are.

For Marriott’s Vacation Club offer in Dubai, you must be a married couple 30 to 65 years old with a joint income of over $130,000 who has traveled to Europe at least once in the past three years.

IHG’s Holiday Inn Club, meanwhile, requires that you be older than 25 with a minimum income of $50,000.

If you’re tempted by a timeshare presentation offer

Are all timeshare presentation offers a good deal? No, especially if you’re staying somewhere cheap or they’re just handing out free parking. But if you do some research, you can score serious discounts in truly exciting locations.

How to maximize your rewards

You want a travel credit card that prioritizes what’s important to you. Here are our picks for the best travel credit cards of 2024 , including those best for:

Flexibility, point transfers and a large bonus: Chase Sapphire Preferred® Card

No annual fee: Bank of America® Travel Rewards credit card

Flat-rate travel rewards: Capital One Venture Rewards Credit Card

Bonus travel rewards and high-end perks: Chase Sapphire Reserve®

Luxury perks: The Platinum Card® from American Express

Business travelers: Ink Business Preferred® Credit Card

on Citibank's application

1%-5% Earn 5% cash back on purchases in your top eligible spend category each billing cycle, up to the first $500 spent, 1% cash back thereafter. Also, earn unlimited 1% cash back on all other purchases.