Business Plan Development

Masterplans experts will help you create business plans for investor funding, bank/SBA lending and strategic direction

Investor Materials

A professionally designed pitch deck, lean plan, and cash burn overview will assist you in securing Pre-Seed and Seed Round funding

Immigration Business Plans

A USCIS-compliant business plan serves as the foundation for your E-2, L-1A, EB-5 or E-2 visa application

Customized consulting tailored to your startup's unique challenges and goals

Our team-based approach supports your project with personal communication and technical expertise.

Pricing that is competitive and scalable for early-stage business services regardless of industry or stage.

Client testimonials from just a few of the 18,000+ entrepreneurs we've worked with over the last 20 years

Free tools, research, and templates to help with business plans & pitch decks

Understanding The Distinction Between a Business Plan & Business Planning

In the dynamic world of entrepreneurship, our choice of words matters. Our vocabulary can often become a veritable alphabet soup of jargon, acronyms, and those buzzwords (I'm looking at you, "disrupt").

And let's not get started on business cliches – "circle back," "synergy," “deep-dive,” etc.

Yet sometimes, it's worth pausing to consider the words we casually sprinkle around in our business conversations. In a previous article, we explored the differences between strategic and tactical business planning , two related but distinct approaches to guiding a business. Now, we're going to delve into another pair of terms that often get used interchangeably but have unique implications: "business plan" (the noun) and "business planning" (the verb).

The business plan, a noun, is a tactical document. It's typically created for a specific purpose, such as securing a Small Business Administration (SBA) loan . Think of it as a road map – it outlines the route and the destination (in this case, the coveted bank loan). But once you've reached your tactical goal (in this case, getting the loan), it often gets shoved in the glove compartment, forgotten as part of the organization's action plan until the next road trip (i.e., additional funding ).

Business planning is not a static concept, but rather a dynamic verb. It's an ongoing process that necessitates continual adjustments. It's about creating a holistic, interconnected value-creating strategic plan that benefits all stakeholders. This includes attracting top-tier employees, ensuring a return on lending or investment, and making a positive impact on the community, whether online or in real life.

That being said, the customer remains at the heart of this process. Without customers, there are no sales, no revenue, and no value. Everything else is contingent on this key element.

If we were to compare the business plan to a map, then business planning would be the journey. It's a continuous process of making strategic decisions, adapting to new paths, and steering the business towards its goals. Sometimes, it even involves redefining objectives midway.

So, let's do a "deep-dive" (I couldn't resist) into these two terms, examining their application in the real world. Along the way, we'll uncover some tools that can aid us in the ever-evolving process of strategic business planning and the more finite task of crafting a winning business plan.

The Business Plan is a Document

Alright, let's take a closer look at a phrase we've all tossed around: the business plan. Imagine it as the detailed blueprint of your organization's goals, strategies, and tactics. It's like the North Star for your entrepreneurial ship, shedding light on the key questions: what, why, how, and when (speaking of questions, here are some FAQs about the business plan ).

Writing a solid business plan isn't easy , especially if you're just dipping your toes into the world of business planning. But don’t worry; we'll get to that (eventually).

So, let's break it down. What does a business plan document consist of, exactly?

- Executive Summary: Just as it sounds, this is a quick overview of the nitty-gritty that's in the rest of your business plan. It's the introduction to your organization, highlighting your mission statement and serving up the essential details like ownership, location, and structure.

- Company Overview: This is where you will detail your products and/or services, their pricing, and the operational plan. If you're opening a restaurant, this section is where you present your menu, and it's also where you talk about your ingredient sourcing, the type of service you'll provide, and the ambiance you're aiming for.

- Market Analysis Summary: This section demands a comprehensive analysis of your industry, target market, competitors, and your unique selling proposition. Without access to top-notch (and often not free) research tools, it can be challenging to find current industry data. Check out our guide on the best market research tools to get started.

- Strategy and Implementation Summary: Here, you'll lay out your short-term and long-term objectives along with the strategies you'll implement to attract and retain customers. This is where you’ll talk about all the different marketing and sales strategies you'll use to charm your future customers.

- Management Summary: This is your chance to spotlight your company's key personnel. Detail the profiles of your key leaders, their roles, and why they're perfect for it. Don't shy away from acknowledging talent gaps that need to be filled, and do share how you plan to fill them!

- Pro Forma Financials: This is where you get down to the dollars and cents with a detailed five-year revenue forecast along with crucial financial statements like the balance sheet and the profit & loss statement.

A business plan is an essential instrument, not just for securing funding, but also for communicating long-term goals and objectives to key stakeholders. But, while a business plan is essential for many circumstances, it's important to understand its scope and limitations. It's a tactical tool, an important one, but it's not the be-all and end-all of business strategy. Which brings us to our next point of discussion: business planning.

Business Planning is a Process

If we view the business plan as a blueprint, then business planning is the architect. But let's be clear: we're not building just any old house here. We're building the Winchester Mystery House of business. Just as the infamous Winchester House was constantly under construction , with new rooms being added and old ones revamped, so too is your business in a state of perpetual evolution. It's a dynamic, ongoing process, not a one-and-done event.

In the realm of business planning, we're always adding 'rooms' and 'corridors' – new products, services, and market strategies – to our 'house'. And just as Sarah Winchester reputedly consulted spirits in her Séance Room to guide her construction decisions, we consult our customers, market data, and strategic insights to guide our strategy. We're in a constant state of assessing, evolving, executing, and improving.

Business planning touches all corners of your venture. It includes areas such as product development, market research, and strategic management. It's not about predicting the future with absolute certainty – we’re planners, not fortune tellers. It's about setting a course and making calculated decisions, preparing to pivot when circumstances demand it (think global pandemics).

Business planning is not a 'set it and forget it' endeavor. It's akin to being your company's personal fitness coach, nudging it to continually strive for better. Much like physical fitness, if you stop the maintenance, you risk losing your hard-earned progress.

Business Planning Case Study: Solo Stove

Now that summer is here, my Solo Stove stands as a tangible testament to effective business planning.

For those unfamiliar, Solo Stove started with a simple yet innovative product – a smoke-limiting outdoor fire pit that garnered over $1.1 million on Kickstarter in 2016, far exceeding its original objective. Since then, it has expanded its portfolio with products tailored to outdoor enthusiasts. From flame screens and fire tools to color-changing flame additives, each product is designed to fit seamlessly into modern outdoor spaces, exuding a rugged elegance that resonates with their target audience.

This strategic product development, a cornerstone of business planning, has allowed Solo Stove to evolve from a product to a lifestyle brand. By continually listening to their customers, probing their desires and needs, and innovating to meet those needs, they've built a brand that extends beyond the products they sell.

Their strategy also includes a primary "Direct To Consumer" (DTC) revenue model, executed via their e-commerce website. This model, while challenging due to increased customer acquisition costs, offers significant benefits, including higher margins since revenue isn’t split with a retailer or distributor, and direct interaction with the customer.

Through its primary business model, Solo Stove has amassed an email database of over 3.4 million customers . This competitive advantage allows for ongoing evaluation of customer needs, driving product innovation and improvement, and enabling effective marketing that strengthens their mission. The success of this approach is evident in the company's growth: from 2018 to 2020, Solo Stove’s revenue grew from $16 million to $130 million , a 185% CAGR.

While 85% of their revenue comes from online DTC channels, Solo Stove has also enhanced their strategic objectives by partnering with select retailers that align with their reputation, demographic, and commitment to showcasing Solo Brands’ product portfolio and providing superior customer service.

Solo Stove's success underscores how comprehensive business planning fosters regular assessment, constant evolution, and continual improvement. It's more than setting goals – it's about ceaselessly uncovering ways to deliver value to your customers and grow your business.

However, even successful businesses like Solo Stove can explore additional strategic initiatives for growth and diversification, aligning with their strategic direction and operational planning. For instance, a subscription model could provide regular deliveries of products or a service warranty, creating a consistent revenue stream and increasing customer loyalty. Alternatively, a B2B model could involve partnerships with adventure tourism operators, who could purchase Solo Stove products in bulk.

These complementary business models, when integrated into the operational plan, could support the primary DTC model by driving customer acquisition, providing ongoing revenue streams and expanding the customer base. This strategic direction ensures that Solo Stove continues to thrive in a competitive market.

The Interplay between the Business Plan (Noun) and Business Planning (Verb)

In the realm of business strategy, there's an intriguing chicken-and-egg conundrum: which comes first, the business plan or business planning? The answer is both straightforward and complex: they're two sides of the same coin, each indispensable in its own right and yet inextricably linked.

The process of business planning informs and modifies the business plan, just as the business plan provides a strategic foundation for the planning process. This interplay embodies the concept of Model-Based Planning™, where the business model serves as a guide, yet remains flexible to the insights and adaptations borne out of proactive business planning.

Let's revisit the Solo Stove story to elucidate this concept. Their business model, primarily direct-to-consumer, laid the groundwork for their strategy. Yet, it was through continuous business planning – the assessment of customer feedback, market trends, and sales performance – that they were able to refine their model, expand their product portfolio, and enhance their growth objectives. Their business plan wasn't a static document but a living entity, evolving through the insights gleaned from ongoing business planning.

So, how can you harness the power of both the tactical business plan and strategic business planning in your organization? Here are a few guiding principles:

- Embrace Model-Based Planning™: Start with a robust business model that outlines your strategic plan. But remember, this isn't set in stone—it's a guiding framework that will evolve over time as you gain insights from your strategic planning process.

- Make business planning a routine: Regularly review and update your business plan based on your findings from market research, customer feedback, and internal assessments. Use it as a living document that grows and adapts with your business.

- Foster open communication: Keep all stakeholders informed about updates to your business plan and the insights that informed these changes. This promotes alignment and ensures everyone is working towards the same goals.

- Be agile and adaptable: A key part of business planning is being ready to pivot when necessary . Whether it's a global pandemic or a shift in consumer preferences, your ability to respond swiftly and strategically to changing circumstances is crucial for long-term success.

Fanning the Flames: From Planning to Plan

The sparks truly ignite when you understand the symbiotic relationship between tactical business plans, strategic business planning, and the achievement of strategic goals. Crafting a tactical business plan (the noun) requires initial planning (the verb), but then you need to embark on continuous strategic planning (the verb) to review, refine, and realign your strategic business plan (the noun). It's a rhythm of planning, execution, review, and adjustment, all guided by key performance indicators.

Business planning, therefore, isn't a one-off event, but rather an active, ongoing process. A business plan needs constant nurturing and adjustment to stay relevant and guide your organization's path to success. This understanding frames your business plan not as a static document, but as a living, breathing entity, evolving with each step your business takes and each shift in the business landscape. It's a strategic roadmap, continually updated to reflect your organization's objectives and the ever-changing business environment.

How to Write a Management Summary for Your Business Plan

Entrepreneurs are often celebrated for their uncanny ability to understand others – their customers, the market, and the ever-evolving global...

Understanding Venture Debt vs Venture Capital

Despite growth in sectors like artificial intelligence, venture capital funding has seen better days. After peaking at $347.5 billion in 2021, there...

Going Beyond Writing: The Multifaceted Role of Business Plan Consultants

Most people think of a professional business plan company primarily as a "business plan writer." However, here at Masterplans, we choose to approach...

More Like this

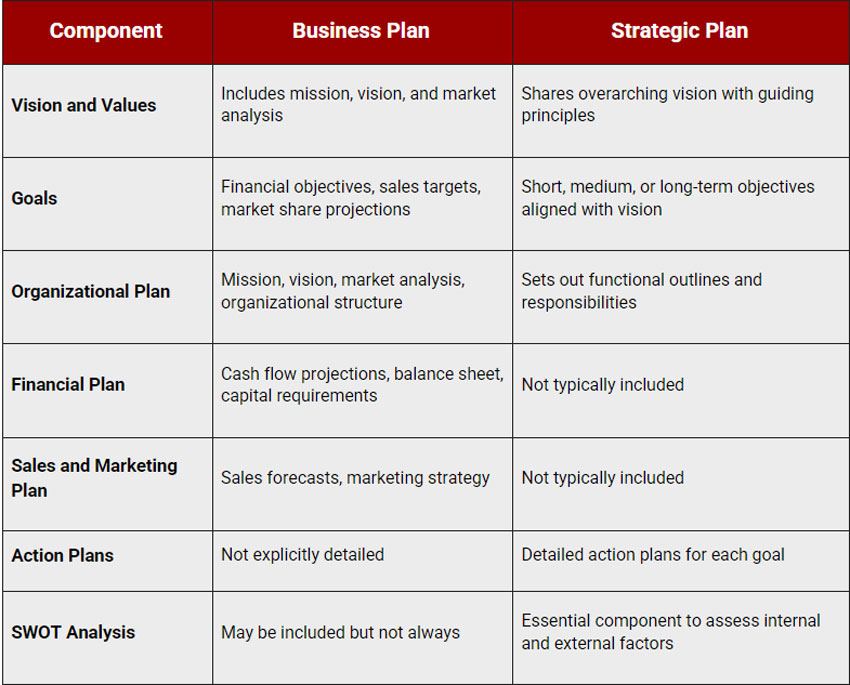

What is the difference between a business plan and a strategic plan.

It is not uncommon that the terms ‘strategic plan’ and ‘business plan’ get confused in the business world. While a strategic plan is a type of business plan, there are several important distinctions between the two types that are worth noting. Before beginning your strategic planning process or strategy implementation, look at the article below to learn the key difference between a business vs strategic plan and how each are important to your organization.

Definition of a business plan vs. a strategic plan

A strategic plan is essential for already established organizations looking for a way to manage and implement their strategic direction and future growth. Strategic planning is future-focused and serves as a roadmap to outline where the organization is going over the next 3-5 years (or more) and the steps it will take to get there.

Get the Free Guide for Setting OKRs that Work (with 100 examples!)

A strategic plan serves 6 functions for an organization that is striving to reach the next level of their growth:.

- Defines the purpose of the organization.

- Builds on an organization’s competitive advantages.

- Communicates the strategy to the staff.

- Prioritizes the financial needs of the organization.

- Directs the team to move from plan to action.

- Creates long-term sustainability and growth impact

Alternatively, a business plan is used by new businesses or organizations trying to get off the ground. The fundamentals of a business plan focus on setting the foundation for the business or organization. While it looks towards the future, the focus is set more on the immediate future (>1 year). Some of the functions of a business plan may overlap with a strategic plan. However, the focus and intentions diverge in a few key areas.

A business plan for new businesses, projects, or organizations serves these 5 functions:

- Simplifies or explains the objectives and goals of your organization.

- Coordinates human resource management and determines operational requirements.

- Secures funding for your organization.

- Evaluates potential business prospects.

- Creates a framework for conceptualizing ideas.

In other words, a strategic plan is utilized to direct the momentum and growth of an established company or organization. In contrast, a business plan is meant to set the foundation of a newly (or not quite) developed company by setting up its operational teams, strategizing ways to enter a new market, and obtaining funding.

A strategic plan focuses on long-term growth and the organization’s impact on the market and its customers. Meanwhile, a business plan must focus more on the short-term, day-to-day operational functions. Often, new businesses don’t have the capacity or resources to create a strategic plan, though developing a business plan with strategy elements is never a bad idea.

Business and strategic plans ultimately differ in several key areas–timeframe, target audience, focus, resource allocation, nature, and scalability.

While both a strategic and business plan is forward-facing and focused on future success, a business plan is focused on the more immediate future. A business plan normally looks ahead no further than one year. A business plan is set up to measure success within a 3- to 12-month timeframe and determines what steps a business owner needs to take now to succeed.

A strategic plan generally covers the organizational plan over 3 to 5+ years. It is set with future expansion and development in mind and sets up roadmaps for how the organization will reach its desired future state.

Pro Tip: While a vision statement could benefit a business plan, it is essential to a strategic plan.

Target Audience

A strategic plan is for established companies, businesses, organizations, and owners serious about growing their organizations. A strategic plan communicates the organization’s direction to the staff and stakeholders. The strategic plan is communicated to the essential change makers in the organization who will have a hand in making the progress happen.

A business plan could be for new businesses and entrepreneurs who are start-ups. The target audience for the business plan could also be stakeholders, partners, or investors. However, a business plan generally presents the entrepreneur’s ideas to a bank. It is meant to get the necessary people onboard to obtain the funding needed for the project.

A strategic plan provides focus, direction, and action to move the organization from where they are now to where they want to go. A strategic plan may consist of several months of studies, analyses, and other processes to gauge an organization’s current state. The strategy officers may conduct an internal and external analysis, determine competitive advantages, and create a strategy roadmap. They may take the time to redefine their mission, vision, and values statements.

Alternatively, a business plan provides a structure for ideas to define the business initially. It maps out the more tactical beginning stages of the plan.

Pro Tip: A mission statement is useful for business and strategic plans as it helps further define the enterprise’s value and purpose. If an organization never set its mission statement at the beginning stages of its business plan, it can create one for its strategic plan.

A strategic plan is critical to prioritizing resources (time, money, and people) to grow the revenue and increase the return on investment. The strategic plan may start with reallocating current financial resources already being utilized more strategically.

A business plan will focus on the resources the business still needs to obtain, such as vendors, investors, staff, and funding. A business plan is critical if new companies seek funding from banks or investors. It will add accountability and transparency for the organization and tell the funding channels how they plan to grow their business operations and ROI in the first year of the business.

The scalability of a business plan vs. strategic plan

Another way to grasp the difference is by understanding the difference in ‘scale’ between strategic and business plans. Larger organizations with multiple business units and a wide variety of products frequently start their annual planning process with a corporate-driven strategic plan. It is often followed by departmental and marketing plans that work from the Strategic Plan.

Smaller and start-up companies typically use only a business plan to develop all aspects of operations of the business on paper, obtain funding and then start the business.

Why understanding the differences between a business plan vs a strategic plan matters

It is important to know the key differences between the two terms, despite often being used interchangeably. But here’s a simple final explanation:

A business plan explains how a new business will get off the ground. A strategic plan answers where an established organization is going in the future and how they intend to reach that future state.

A strategic plan also focuses on building a sustainable competitive advantage and is futuristic. A business plan is used to assess the viability of a business opportunity and is more tactical.

10 Comments

I agree with your analysis about small companies, but they should do a strategic plan. Just check out how many of the INC 500 companies have an active strategic planning process and they started small. Its about 78%,

Strategic management is a key role of any organization even if belong to small business. it help in growth and also to steam line your values. im agree with kristin.

I agree with what you said, without strategic planning no organization can survive whether it is big or small. Without a clear strategic plan, it is like walking in the darkness.. Best Regards..

Vision, Mission in Business Plan VS Strategic Plan ?

you made a good analysis on strategic plan and Business plan the difference is quite clear now. But on the other hand, it seems that strategic plan and strategic management are similar which I think not correct. Please can you tell us the difference between these two?. Thanks

Thank you. I get points to work on it

super answer Thanking you

Hi. I went through all the discussions, comments and replies. Thanks! I got a very preliminary idea about functions and necessity of Strategic Planning in Business. But currently I am looking for a brief nice, flowery, juicy definition of “Business Strategic Planning” as a whole, which will give anyone a fun and interesting way to understand. Can anyone help me out please? Awaiting replies…… 🙂

that was easy to understand,

Developing a strategic plan either big or small company or organization mostly can’t achieve its goal. A strategic plan or formulation is the first stage of the strategic management plan, therefore, we should be encouraged to develop a strategic management plan. We can develop the best strategic plan but without a clear plan of implementation and evaluation, it will be difficult to achieve goals.

Comments Cancel

Join 60,000 other leaders engaged in transforming their organizations., subscribe to get the latest agile strategy best practices, free guides, case studies, and videos in your inbox every week..

Leading strategy? Join our FREE community.

Become a member of the chief strategy officer collaborative..

Free monthly sessions and exclusive content.

Do you want to 2x your impact.

The magazine of Glion Institute of Higher Education

- Strategic planning vs business planning: how they’re both key to success

Any thriving hospitality business needs thorough planning to make sure it succeeds. If you’ve heard the terms business planning and strategic planning, you might think they’re interchangeable, but they’re actually two distinct things companies need at different times for continued success.

The biggest difference is that business plans are mostly used when you are starting to build a business so you can quickly and smoothly create your vision. Strategic planning is what existing companies use to grow and improve their businesses.

If you’re looking for a career in hospitality management, it’s important to know the difference between the two and how to use them to best effect. In this article, we’ll go over what strategic planning and business planning are and how they are important to running a successful hospitality business.

We’ll also look at how you can learn to harness different planning methods and get the skills needed to develop your career.

Business planning

A business plan is one of the first things a fledgling business will draft. Alternatively, it can be used to set business goals when launching a new product or service.

The business plan will usually look at short-term details and focus on how things should run for around a year or less. This will include looking at concepts such as:

- What the business idea is

- Short-term goals

- Who your customers are

- What your customers need

- What investment or financing you will need to start your business

- How you make revenue

- What profitability to expect

- How you can appeal to potential shareholders

- What the short-term operational needs of the business are

- What the company’s values are

- What the budget is for different parts of the business

This means market analysis and research are vital when you are making a business plan.

What are the objectives of business planning?

The primary objective of a business plan is to have all the main details of your business worked out before you start. This will give you a roadmap to use when you launch your business or when you start offering a different product or service.

For example, if you wanted to become an event planner and open your own event planning business, your plan might include how to get funds to rent an office and pay staff.

Strategic planning

A strategic plan is where you set out the company’s goals and define the steps you will need to take to reach those goals.

A strategic plan would include:

- What current capabilities the company has

- Making measurable goals

- A full strategy for business growth

- How the company’s values, mission and vision tie in with the services and products the company intends to offer

- Who in the organization will handle certain roles

- What the timeline is for reaching certain goals

- A SWOT analysis, looking at the strengths, weaknesses, opportunities and threats in the company

- Examining the external environment for factors that will affect your company using a PEST (political, economic, social and technological) analysis

A strategic plan can be a long-term blueprint. You might find you use basically the same strategic plan for several years.

What is the objective and strategy of planning?

The aim of a strategic plan is to provide a tool that allows you to improve your business, grow the company, streamline processes or make other changes for the health of your business. Strategy implementation and meeting strategic objectives should generally lead to growth.

What is the difference between business planning and strategic planning?

There are a few major differences between strategic planning and business planning, which are outlined below.

Scope and time frame

A strategic plan is usually long-term, typically covering at least two to five years. By contrast, a business plan usually covers a year or less, since this is roughly how long it usually takes for a business to become established.

A business plan focuses on starting a business in its early stages. A strategic plan is used to guide the company through later stages. Put simply, the business plan is about direction and vision, while the strategic plan focuses on operations and specific tactics for business growth.

Stakeholders

A strategic plan will be presented to stakeholders and employees to make sure everyone knows what is going on in the company. This will help reassure everyone with a stake or role in the business.

By comparison, a business plan will often be shown to investors or lenders to help show the business idea is worth funding.

Flexibility and adaptability

A strategic plan typically has more flexibility. This is because it is meant to be in place for a longer period of time and the company should already be established. There is more leeway for refining strategy evolution, while your business plan should remain stable.

Similarities between business planning and strategic planning

Both of these activities will require some of the same analytical components, such as market analysis, financial projections and setting objectives you can track. Of course, both also require you to be highly organized and focused to ensure your business model or strategy development is appropriate for your business.

When to use strategic planning vs business planning

As we’ve already mentioned, you’ll generally use a business plan when you’re setting up a business or moving in a new direction. This will dictate much of the day-to-day running of a business. You would use strategic planning when you want to work on growth and drive innovation.

Can a business plan be used for strategic planning?

No, a business plan and a strategic plan are two different concepts with specific goals. While a business plan outlines short or mid-term goals and steps to achieve them, a strategic plan focuses on a company’s mid to long-term mission and how to accomplish this.

If you want to prepare for success, you need to make sure you are using the right type of plan.

Integrating strategic planning and business planning

While the two plans are different, you may end up using them together to ensure optimal success. As with any type of management role, such as hotel management , strategic and business plan management requires effective communication between different departments.

This includes different strategy managers as well as strategic and operational teams. You also need to make sure that, when you are using either plan, you find the right balance between flexibility and strict adherence to the plan. With strategic planning, this means constant strategy evaluation to assess your tactics and success.

Can strategic planning and business planning be used simultaneously?

In many hospitality careers , you’ll want to juggle growth and new directions, so you could end up using both planning types. However, it’s most common for the two to be distinct. This is because you’ll generally be using a business plan only when you are starting a new venture.

What are the career prospects in strategic and business planning?

There are plenty of options for what you can do if you have skills in strategic planning and business planning. Almost every management role will require these planning skills, including how to write strategic planning documents and measure success.

If you want to work in the hospitality sector, you could look into hotel planning and other careers with a business management degree . These will enable you to grow and nurture a business, but there is also a lot of scope to start your own business. Great planning skills can give you a real competitive advantage.

World-class degrees for making your mark in business

If you want the skills and insider knowledge to guide a business from inception to expansion, our courses provide expert teaching and real-world experience.

What skills do I need for a career in planning?

If you want to work in planning and management, you should work on various skills, such as:

- Decision-making

- Analytical skills

- Risk assessment knowledge

- Market analysis and forecasting

- Team management

- Communication, both written and verbal

- Organization

What qualifications can help with a career in strategic planning or business planning?

If you want to work in hotel planning and management, the most common route is to get a hospitality degree from a well-respected hospitality school in Switzerland . This will help you get the skills and knowledge you need to properly plan businesses as well as handle the execution of these plans.

Business degrees also teach you many transferable skills, such as good communication with your strategy team or data analysis, that you can use in almost any role in hospitality. They can also reduce the need to work your way up through the hospitality industry.

How can hospitality school help with planning careers?

Attending hospitality school can help you learn skills dedicated to hospitality as well as more general management, business and planning skills. This includes everything from how to handle a team to specifics such as hotel revenue management strategies .

If you find a hospitality school offering professional hospitality internships , you’ll also get experience in managing hotels and hospitality venues, helping you leap ahead in your career.

Hospitality degrees to kickstart your career

Our international business course combines leading industry expertise with essential internships to provide an exceptional foundation for a thriving career in the hospitality industry.

Both strategic and business planning are vital to build and grow a business. While business planning focuses on setting up the business and handling investment, vision and overall goals, strategic planning concentrates on growing the business and processing operational efficiency and resource allocation on a longer-term basis.

If you want to learn how to develop a hotel business plan or manage a hospitality venue, one of the best ways to get started is to study for a hospitality degree. This will give you hands-on experience of the strategic planning process or business management as well as the skills you need to succeed.

Photo credits Main image: Westend61/Westend61via Getty Images

LISTENING TO LEADERS

BUSINESS OF LUXURY

HOSPITALITY UNCOVERED

GLION SPIRIT

WELCOME TO GLION.

This site uses cookies. Some are used for statistical purposes and others are set up by third party services. By clicking ‘Accept all’, you accept the use of cookies

Privacy Overview

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

Share Podcast

The Difference Between a Plan and a Strategy

Setting strategy should push your organization outside its comfort zone.

- Apple Podcasts

- Google Podcasts

Planning is comforting but it’s a terrible way to make strategy, says Roger Martin , former dean of the Rotman School of Management at the University of Toronto. In contrast, setting strategy should push your organization outside its comfort zone – if you’re doing it right.

“Plans typically have to do with the resources you’re going to spend. Those are more comfortable because you control them,” Martin explains. “A strategy, on the other hand, specifies a competitive outcome that you wish to achieve, which involves customers wanting your product or service. The tricky thing about that is that you don’t control them.”

Key topics include: strategic planning, competitive strategy, risk management, innovation, and travel and tourism industry.

HBR On Strategy curates the best case studies and conversations with the world’s top business and management experts, to help you unlock new ways of doing business. New episodes every week.

- Watch the original HBR Quick Study episode: A Plan Is Not a Strategy (June 2022)

- Find more episodes of the HBR Quick Study series on YouTube .

- Discover 100 years of Harvard Business Review articles, case studies, podcasts, and more at HBR.org

ANNOUNCER: HBR On Strategy .

HANNAH BATES: Welcome to HBR On Strategy , case studies and conversations with the world’s top business and management experts, hand-selected to help you unlock new ways of doing business. Today, we bring you a conversation with one of the world’s leading thinkers on strategy – Roger Martin, former dean of the Rotman School of Management at the University of Toronto. In this episode, you’ll learn the difference between strategy and planning AND how to escape the common traps of strategic planning. Martin says starting with a plan is comforting to many of us, but it’s a terrible way to make strategy. His episode, called “A Plan is Not A Strategy,” originally aired as part of the HBR Quick Study video series in June 2022. Here it is.

ROGER MARTIN: This thing called planning has been around for a long, long time. People would plan out the activities they’re going to engage in. More recently, has been a discipline called strategy. People have put those two things together to call something strategic planning. Unfortunately, those things are not the same, strategy and planning. So, just putting them together and calling it strategic planning doesn’t help. What most strategic planning is in the world of business has nothing to do with strategy. It’s got the word, but it’s not. It’s a set of activities that the company says it’s going to do.

We’re going to improve customer experience. We’re going to open this new plant. We’re going to start a new talent development program. A whole list of them, and they all sound good, but the results of all of those are not going to make the company happy because they didn’t have a strategy. So, what’s a strategy? A strategy is an integrative set of choices that positions you on a playing field of your choice in a way that you win. So, there’s a theory. Strategy has a theory. Here’s why we should be on this playing field, not this other one, and here’s how, on that playing field, we’re going to be better than anybody else at serving the customers on that playing field. That theory has to be coherent. It has to be doable. You have to be able to translate that into actions for it to be a great strategy. Planning does not have to have any such coherence, and it typically is what people in manufacturing want– the few things they want, to build a new plant, and the marketing people want to launch a new brand, and the talent people want to hire more people– that tends to be a list that has no internal coherence to it and no specification of a way that that is going to accomplish collectively some goal for the company.

See, planning is quite comforting. Plans typically have to do with the resources you’re going to spend. So we’re going to build a plan. We’re going to hire some people. We’re going to launch a new product. Those are all things that are on the cost side of businesses. Who controls your costs? Who’s the customer of your costs? The answer is, you are. You decide how many square feet to lease, how many raw materials to buy, how many people to hire. Those are more comfortable because you control them. A strategy, on the other hand, specifies an outcome, a competitive outcome that you wish to achieve, which involves customers wanting your product or service enough that they will buy enough of it to make the profitability that you’d like to make. The tricky thing about that is that you don’t control them. You might wish you could, but you can’t. They decide, not you. That’s a harder trick. So that means putting yourself out and saying, here’s what we believe will happen. We can’t prove it in advance, we can’t guarantee it, but this is what we want to have happen and that we believe will happen. It’s much easier to say, I’ll build a factory, I will hire more people, et cetera, than I will have customers end up liking our offering more than those of competitors.

The tricky thing about planning is that while you’re planning, chances are at least one competitor is figuring out how to win. When US air carriers were busily planning what routes to fly and da-da-da, there was this little company in Texas called Southwest that had a strategy for winning. And at first, that looked largely irrelevant because it was tiny. What Southwest Airlines was aiming for was an outcome.

What they wanted to be is a substitute for Greyhound, a way more convenient way to get around at a price that wasn’t extraordinarily much greater than a Greyhound bus. Southwest said, everybody else is flying hub and spoke. They have hubs, and they fly hub and spoke. We’re going to fly point to point so that we don’t have aircraft waiting on the ground because you only make money when you’re in the air.

We’re going to only fly 737s, one kind of aircraft, so that our gates are set up for those, our systems are set up for those, our training, our simulations are set up. We’re not going to offer meals on the flights because we’re going to specialize in short flights. We’re not going to book through travel agents. We’re going to encourage people to book online because that’s less expensive for everybody and more convenient. So, their strategy ended up having a substantially lower cost than any of the major carriers so that they could offer substantially lower prices.

Because it had a way of winning, it got bigger and then bigger and then bigger and then bigger and bigger and bigger and bigger until it flies the most passenger seat miles in America. The major carriers were not trying to win against one another. They were all playing to play, as I say. They were playing to participate, maybe buy more planes, get more gates, maybe grow some, not having a theory of here’s how we could be better than our competitors.

And that was fine until somebody came along and said, here’s a way to be better than everybody else for this segment. And so that segment then goes. It’s gone. And the main playing to play players have to share a smaller pie that’s left over after Southwest takes whatever share it wants.

If you’re trying to escape this planning trap, this comfort trap of doing something that’s comfortable but not good for you, how do you start? The most important thing to recognize is that strategy will have angst associated with it. It’ll make you feel somewhat nervous because as a manager, chances are you’ve been taught you should do things that you can prove in advance.

You can’t prove in advance that your strategy will succeed. You can look at a plan and say, well, all of these things are doable. Let’s just do those because they’re within our control. But they won’t add up to much. In strategy, you have to say, if our theory is right about what we can do and how the market will react, this will position us in an excellent way.

Just accept the fact that you can’t be perfect on that, and you can’t know for sure. And that is not being a bad manager. That is being a great leader because you’re giving your organization the chance to do something great. The second thing I do is say, lay out the logic of your strategy clearly. What would have to be true about ourselves, about the industry, about competition, about customers for this strategy to work?

Why do you do that? It’s because you can then watch the world unfold. And if something that you say is in the logic that would have to be true for this to work is not working out quite the way you hoped, it’ll allow you to tweak your strategy. And strategy is a journey, what you want to have as a mechanism for tweaking it, honing it, and refining it so it gets better and better as you go along.

Another thing that helps with strategy is not letting it get overcomplicated. It’s great if you can write your strategy on a single page. Here’s where we’re choosing to play. Here’s how we’re choosing to win. Here are the capabilities we need to have in place.

Here are the management systems. And that’s why it’s going to achieve this goal, this aspiration that we have. Then you lay out the logic, what must be true for that all to work out the way we hope. Go do it, and watch and tweak as you go along.

That may feel somewhat more worry-making, angst-making than planning, but I would tell you that if you plan, that’s a way to guarantee losing. If you do strategy, it gives you the best possible chance of winning.

HANNAH BATES: That was Roger Martin — Professor Emeritus and former Dean of the Rotman School of Management at the University of Toronto. That video is part of the HBR Quick Study YouTube series – short takes on big topics in business and work. It was edited and produced by Scott LaPierre, with video and animation by Dave Di Iulio, Elie Honein, and Alex Belser. More HBR Quick Study videos can be found on YouTube or HBR.org. HBR On Strategy will be back next Wednesday with another hand-picked conversation about business strategy from the Harvard Business Review. In the meantime, we have another curated feed that you should check out: HBR On Leadership . And visit us any time at HBR.org, where you can subscribe to Harvard Business Review and explore articles, videos, case studies, books, and of course, podcasts, that will help you manage yourself, your teams, and your career. This episode of HBR On Strategy was produced by Anne Saini, and me, Hannah Bates. The show was created by Anne Saini, Ian Fox, and me. Special thanks to Maureen Hoch, Adi Ignatius, Karen Player, Anne Bartholomew, and you – our listener. See you next week.

- Subscribe On:

Latest in this series

This article is about strategy.

- Strategy formulation

- Risk management

Partner Center

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Certifications

- Associate Business Strategy Professional

- Senior Business Strategy Professional

- Examination

- Partnership

- For Academic Affiliation

- For Training Companies

- For Corporates

- Help Center

- Associate Business Strategy Professional (ABSP™)

- Senior Business Strategy Professional (SBSP™)

- Certification Process

- TSI Certification Examination

- Get your Institution TSI Affiliated

- Become a Corporate Education Partner

- Become a Strategy Educator

- Frequently Asked Questions

Business plan vs Strategic Plan - What You Must Know

Like everything else in life, the nature of business needs a plan in place to follow and measure. Crafting a strategic roadmap isn't just a suggestion—it's a necessity.

This is one of the key elements of a startup or even a business division within an organization that is expanding or diversifying. It has every resource element and needs to be mapped out for the business, including projected milestones for the future.

However, every business strategist needs to know that there are some subtle differences between what constitutes a business plan, and the several differences it has with a strategic plan. Let’s walk through the different elements that comprise each and understand the outcome each aims to achieve.

Introducing The Business Plan

A business plan is exactly what the name suggests— a plan to start and run a business or a new entity of an existing business; usually either an expansion in a newer region or a diversification into a new market. Business plans are mainly created for internal reference purposes or external funding purposes, with the latter being the common usage. They form the basis of all business strategies and decisions made at the ownership level in an organization. The most essential components of a business plan include:

Organizational Plan - This is the core of a business plan, and it includes the mission and vision statement, along with the market in which the company plans to operate. This plan also encompasses thorough market research to gauge the potential of the business, crucial for securing funding or sponsorship. It articulates the rationale behind the business's growth trajectory, outlining clear timelines for achieving milestones along the way.

Financial Plan - A robust financial plan is the bedrock of any successful business venture, where cash flow reigns supreme, and a meticulously crafted balance sheet serves as the ultimate scorecard. A financial plan includes some of the most important elements of the entire business plan and includes elements like projected cash flow statements, capital requirements, a summary of projected overheads, a projected balance sheet including assets and liabilities, and income and expense statements.

Remember to regard this as the central nervous system, for it permeates and influences almost every aspiration the enterprise hopes to attain.

Sales and Marketing Plan - We mentioned “almost” everything above for this very reason. Sales and marketing form the other significant component of the business plan. These include sales forecasts and overheads, marketing and brand management summaries, and market share projections that the business hopes to achieve within a time frame.

Business plans are indeed comprehensive and all-encompassing. They form the basis of the business's existence or the rationale for investments in it. But what about translating these plans into action? How do we ensure that the sky-high goals set forth are actually achievable?

The Actionables- A Strategic Plan

Strategic plans constitute the basis of operations and responsibilities within the business. These plans lay the paths out for each member of the organization to follow and define the functional outline and the key outcomes for every project and process within the business. A strategic plan goes on to define the operations and their outcomes within the organization, its departments, and its employees. The single thread connecting strategic planning with the business plan is the vision of the organization, and for obvious reasons— vision serves as the guiding light for strategy formation, which, in turn, directs the day-to-day operations of the business.

Why A Strategic Plan is Crucial to The Organization

In a word— synchronization. A robust and well-laid-out strategic plan establishes the much-needed sync between teams and their objectives. Not only that, it also provides a guide for daily operations alongside the focus and direction that teams often need to get the job done, on time and within budget. When all these components are integrated into a cohesive network, the true value of a strategic plan emerges—a seamless and grand orchestration of departments, teams, and individuals using the resources allocated to them to achieve the key performance indicator that they are responsible for.

Elements to Consider in a Strategic Plan

When tasked with creating a strategic plan for your business, you will need to incorporate certain components that will ensure that the stakeholders are aligned completely with the organization’s goals and objectives. These include:

Vision and Values - The vision statement is the most important component of the strategic plan and the most overarching. It propels the organization towards established goals and the values that every employee and stakeholder must incorporate.

Goals - These are short, medium, or long-term, depending on the scope of the strategic plan. They provide the much-needed context for the organization to undertake initiatives that meet the vision while maintaining the values.

Guiding Principles - Often, organizations face crossroads where they must decide which steps to take next, to reach their vision. Principles are included in strategic plans to align teams towards the vision when faced with a dilemma and form a critical part of strategic planning.

Action Plans - A sum of key initiatives, processes, and projects that are required to be performed on a pre-determined periodic basis for the goal to be accomplished. These also include the time frames for each stakeholder responsible for each option. They usually follow the DACI format for each action (Driver, Approver, Contributor, Informed)

SWOT Analysis - The quintessential component, the Strength, Weaknesses, Opportunities, and Threats analysis of the strategic plan lends context to all business actions vis-a-vis the external environment. This includes competitors, market forces and conditions, identification of internal and external threats, and several other factors.

Read This - SWOT Analysis: How to Strengthen Your Business Plan

Here’s a table highlighting the main differences between a Business Plan and a Strategic Plan with a focus on the key components of each—

Learning All About Strategic Planning

In all businesses, a strategic plan serves as the foundational blueprint, akin to a meticulously drawn map for a general. It provides the essential guidance and direction needed for the entire organization to navigate toward success. It is crucial, therefore, to acquire the necessary skills and certifications for employment as a business strategist who would be entrusted with creating it. Know more about how to become a successful and sought-after business strategist today!

Recent Posts

How Data Analytics Can Revolutionize Your Business - A Strategist's Guide

Download this Strategist's Guide to empower yourself with resourceful insights:

- Roadblocks to Data Usage

- Advantages that Data Analytics offer for businesses

- Elements of a Data Analytics Strategy

- Top reasons why businesses must adopt a Data Analytics Strategy

- Case studies, Scenarios, and more

CredBadge™ is a proprietary, secure, digital badging platform that provides for seamless authentication and verification of credentials across digital media worldwide.

CredBadge™ powered credentials ensure that professionals can showcase and verify their qualifications and credentials across all digital platforms, and at any time, across the planet.

Verify A Credential

Please enter the License Number/Unique Credential Code of the certificant. Results will be displayed if the person holds an active credential from TSI.

Stay Informed!

Keep yourself informed on the latest updates and information about business strategy by subscribing to our newsletter.

Start Your Journey with The Strategy Institute by Creating Your myTSI Account Today.

- Manage your professional profile conveniently.

- Manage your credentials anytime.

- Share your experiences and ideas with The Strategy Institute.

Account Login

- Remember Password

- Forgot Password?

Forgot Password

- Meet The Team

- Partnerships

- Testimonials

Strategic Plan vs Business Plan – Which Matters More for Leaders?

By Jibility Co-Founder Chuen Seet

In the world of business, strategic planning and business planning are two terms that are often used interchangeably. However, they are not the same thing . Strategic planning is a long-term planning process that helps a company define its vision, mission, and objectives. Business planning, on the other hand, is a short-term planning process that helps a company define its goals and strategies to achieve those goals.

Both strategic planning and business planning are important for leaders, but which one matters more? In this blog post, we will explore the differences between strategic planning and business planning and why strategic planning should be a top priority for leaders.

What is a Strategic Plan?

A strategic plan is a long-term plan that outlines a company’s vision, mission, and objectives. It is a comprehensive plan that guides a company’s actions over the next three to five years. A strategic plan helps a company identify its strengths, weaknesses, opportunities, and threats ( SWOT ) and develop strategies to capitalize on its strengths and opportunities while mitigating its weaknesses and threats.

A strategic plan helps a company create a roadmap for the future. It outlines the company’s goals and objectives, the strategies it will use to achieve those goals, and the metrics it will use to measure its progress. A strategic plan helps a company stay focused and aligned with its vision and mission.

What is a Business Plan?

A business plan is a short-term plan that outlines a company’s goals and strategies for the next year or two. A business plan helps a company define its products or services, target market, competition, marketing strategy, sales strategy, and financial projections. It is a tactical plan that helps a company achieve its goals in the short term.

A business plan helps a company allocate its resources effectively. It outlines the company’s budget, cash flow, and profit and loss projections. A business plan helps a company make informed decisions about its operations and investments.

Strategic Plan vs Business Plan: Which Matters More for Leaders?

Both strategic planning and business planning are important for leaders. However, strategic planning takes priority because it provides the long-term vision for the company. A strategic plan helps a company stay focused on its mission and vision and guides its decisions over the long term.

Business planning is important for day-to-day operations, but it is not a substitute for strategic planning. A company that only focuses on short-term goals and tactics may miss out on long-term opportunities.

If you are a leader, it is important to have a strategic plan in place to help you stay focused on your mission and vision, and guide your decisions over the long term. It will help you anticipate future trends and challenges and prepare for them. So, invest the time and resources to create a comprehensive strategic plan for your company and ensure that it is regularly updated and reviewed. By doing so, you will be able to steer your company towards success and stay ahead of the competition.

More on Strategic Planning

Capability-based planning vs Traditional Project Planning Approaches How to Create an Agile Strategic Planning Process 10 Tips for Conducting a Successful Strategic Planning Session 6 Steps to Create an Effective Implementation Plan

Jibility Helps Business Leader Close the Strategy Execution Gap

When you are ready to implement your strategy, Jibility can help you formulate a proven strategic roadmap by stepping you through our unique 6-step method to create a strategic roadmap that actually works. Try Jibility for free today.

Get started for free

Privacy overview.

Strategic Planning vs. Business Planning. Yes, There’s a Difference.

Too often when companies embark on a strategic plan, the results are disappointing. A common error involves assembling a long-term business plan, calling it a strategic plan, and complaining about how the exercise is mostly ‘financial,’ with limited use beyond the one-time rollup. In fact, a 2018 Chief Strategy Officer Survey noted, “Despite the vast effort put into the strategic planning process – 82% of survey participants say that it is a ‘very important’ area – most CSOs are dissatisfied with its output.”

So, what’s causing these frequent unsatisfactory results?

In “ Strategic Planning: You’re Probably Doing It Wrong ,” I outline five common pitfalls of flawed strategic planning efforts. As important as avoiding these pitfalls is understanding there is a significant difference between a strategic plan and a business plan.

Strategic plans center on choice around a company’s most critical go-forward imperatives, with resource tradeoffs inherent in those choices. They are about saying No more than saying Yes to business-as-usual funding and selective investments. Because of their very mechanics, business plans cannot contemplate these tradeoffs.

But first, what is Business Planning and its purpose?

Business Planning

Business planning processes – whether one-year Annual Operating Plan processes or longer-term three-to-five-year plans – are financial vantage points by product and service line, by market. They answer the What for a business: What financial outcomes are you targeting or projecting? Yet, they do little to answer the How , beyond calling out clear expectations and gaps.

As an FP&A discipline, business planning is useful for several purposes:

- Topline and Profit Targeting: Painting an aspirational and more realistic targeted revenue and profit trajectory by business segment and by market. Such targets are assigned to leadership incentive plans, both on one-year and three-year (as in LTIP) bases.

- Gap Identification: Highlighting, with current information, where certain business segments or markets will have a significant gap vs. aspiration or recent history. These gaps elevate critical operational and marketplace challenges.

- New Product Lines/New Market Expectations: Bringing attention to larger unknowns within the core business, such as new product line launch expectations or emerging market revenue trajectory. While uncertain projections, their identification is helpful in revealing higher-volatility aspects of a business.

- Margin and Profit Mix : With segment-level profitability assumptions, the above margin-weighted aspirational targets and more realistic projections can highlight where natural business evolution will enhance or pressure targeted profitability. Typically, a growing, subscale emerging market presence, as well as new product launches, will pressure profit mix and highlight the need for higher profitability in the incumbent core business.

- Long-Term Overhead Budgeting: The above topline projection and profit mix analysis can appropriately shape the scope and scale of a business’ total budget. However, business planning exercises rarely solve how this budget should be allocated between core and adjacent business opportunities, a common frustration of business planning.

With all the framing benefits above, misunderstanding a business plan as a strategic plan can yield damaging outcomes. For example:

- Multiplication rather than Real Choice among strategic imperatives : Frequently, the financial exercise in a business plan paints an aspiration, and business segment owners know a business-as-usual approach will not realize the intended revenue and profit outcomes of that aspiration. This causes business owners to launch more product lines or services, adding multiplicative complexity to the enterprise. Instead, more strategic, enterprise-wide discussions are required to appropriately callout why the core business-as-usual will not generate the aspiration, and what choices must be made to address challenges and change the trajectory, including drawing resources away from business-as-usual pools. Launching more offerings in more markets is not typically an optimal answer.

- Perpetuation of Misalignment : Like an Annual Operating Plan, multi-year business plans tend to engage the commercial P&L owners of the business on inputs within their respective business segment siloes. Functionally, they fail to force cross-business tradeoffs and choices. Worse, they may reinforce a business segment owner’s perception that they have their multi-year budgets as a given reflection of their numbers submission, without a transcendent view on funding and reallocation around decisive imperatives.

Spotlight Example : Nearly all branded consumer businesses are wrestling with how to grow their owned omnichannel differently in the 3-5 year horizon, to offset the pressure from wholesale channel consolidation, and from the Amazon price-matching, profit pool compression effect. Many of these businesses construct multi-year business plans annually without addressing the difficulties of the ‘How:’

- What new capabilities are required to build a different omnichannel approach,

- With what upstream product development to reinforce one’s own omnichannel offering,

- With what re-prioritization and de-prioritization of wholesale partners, and

- With what reallocation of funding from the core business?

When businesses do plan for bolder omnichannel plays, they often do so without a choice-driven reallocation. Real, sustainable choices come in reallocating product development, field sales, and marketing funding from traditional wholesale channels, amplifying select product line offerings to align with consumer shifts and to drive traffic to preferred channels, including owned and more advantageous omnichannel endpoints than where that traffic will otherwise naturally migrate.

None of the above challenges get solved in a business plan, and business planning in the absence of strategic planning may make certain outcomes worse .

How do organizations move from Business Plan to decisive Strategic Planning outcome?

Initially, divorce the Business Plan entirely and attack the top three to four-year enterprise challenges.

Decouple the strategic plan from a multi-year business planning exercise. Instead, ask each of your business leaders to address corporately defined (by the CEO management team or CSO consortium) top strategic questions facing the company over the next three to five years. Don’t ask for more than a handful of areas; even three to four is a heavy ask. Their considerations should contemplate the a) magnitude of the challenge, b) likely solutions, c) magnitude of the response, and d) potential capability build/partnerships and funding requirements inherent in that response. With that thought pattern, assemble your business leaders in an effort that begins with enterprise-wide trade-offs and debate, rather than within silo business plan projections and incremental solutions.

Crystallize solutions to enterprise challenges, translating them into strategic imperatives.

There are a variety of approaches to ensure the core leadership team is informed, derives realistic solutions, and makes hard decisions against the top enterprise challenges, whether with mutual presentation, small-group forums, facilitated debates, outside support, or other mechanisms. Whatever the strategic planning methodology, aligning executives around strategic choices is not only a necessity for strong strategic planning, but also a pre-requisite for linking any business plan process to a decisive strategic direction.

With strategic imperatives in place, re-visit the Business Plan and link for accountability .