Advertisement

How Is the Economy Doing?

By Ben Casselman and Lauren Leatherby Sept. 13, 2022

- Share full article

The U.S. economy is in a strange place right now. Job growth is slowing , but demand for workers is strong . Inflation is high (but not as high as last spring). Consumers are spending more in some areas, but cutting back in others. Job openings are high but falling, while layoffs are low and … well, it depends what indicator you watch.

This is one snapshot of where the economy stands, based on an analysis of how various indicators compare with their historical levels and whether they’ve been getting better or worse in recent months.

How conditions are faring for jobs, income, consumers and production :

Currently bad

Currently good

GETTING BETTER

GOOD AND GETTING BETTER

Capital goods

Unemployment

Manufacturing

and trade sales

earnings growth

GETTING WORSE

GOOD BUT GETTING WORSE

BAD BUT GETTING BETTER

There is no universally accepted definition of a “good” number of jobs or rate of wage growth, which means the exact placement of the various measures is somewhat subjective. Still, the patterns are revealing: The indicators are concentrated in the lower right-hand quadrant, meaning most of the economy is doing well, but slowing down.

Even in the best of times, it can be hard to get a handle on what’s happening in an economy with 150 million workers and $20 trillion worth of annual output. And these are far from the best of times. The pandemic and its ripple effects are continuing to disrupt global supply chains and keeping millions of Americans out of work . The war in Ukraine has pushed up gas and food prices, and added a new source of uncertainty. The Federal Reserve is trying to beat back the fastest inflation in decades — and threatening to cause a recession in the process.

By one common definition, the United States is already in a recession, because gross domestic product has declined for two consecutive quarters . Most economists consider that definition too simplistic , and prefer to look at a broader array of indicators across a variety of categories. They also say that to understand how the economy is doing, it is important to consider both levels and rates of change. It matters, for example, not only whether unemployment is low or high, but also whether it is rising or falling.

It also helps to consider the latest data in historical context. The graphics below show how this economic moment compares with recessions of the past 40 years, using the end of the second quarter as a benchmark. In most cases, the latest numbers don’t look much like the recessions of the past, although many show signs of a slowdown.

How current conditions compare with recessions over the last 40 years

Graphic shows year-over-year percentage change. Data for 2022 is presented as if a recession began in June, which marks the end of a second consecutive quarter of declines in gross domestic product. (An official designation of whether the United States is in a recession will be made in the future and will rely on several other indicators.)

If there is one part of the economy that is clearly doing well right now, it is the job market. Employers have added nearly six million jobs in the past year, and the unemployment rate recently matched a 50-year low. Employers would hire even more workers if they could find them: There were more than 11 million job openings at the end of July.

Still, not everything is rosy. The share of adults who are either working or actively looking for work is still well below its prepandemic level , which helps explain the frequent complaints from businesses that they can’t find enough workers. After months of strong gains, hiring slowed in August, and the total number of jobs remains millions below where it would be if the pandemic had never happened.

Layoffs, as measured through filings for unemployment claims, began rising earlier this year but have since edged back down; however, another measure, from a different survey, did not show a similar increase.

If layoffs pick up, watch out: In the past, when unemployment has increased even modestly, it has almost always meant the economy is in a recession.

Income and Prices

Graphic shows year-over-year percentage change. Data for 2022 is presented as if a recession began in June, which marks the end of a second consecutive quarter of declines in gross domestic product. Personal income data excludes transfer payments and is adjusted for inflation. Growth in hourly wages shows earnings for production and nonsupervisory employees.

Workers have seen their pay rise significantly in the past two years, as the hot labor market has given workers the leverage to demand raises. Other types of income, including from businesses and investments, have been rising too. The problem is, prices have been rising about as fast — or in some cases even faster.

The National Bureau of Economic Research, the semiofficial arbiter of recessions in the United States, focuses on personal income that is adjusted for inflation and excludes unemployment benefits and other government transfer payments. That indicator is still rising, in part because it measures income in the aggregate — meaning not how much the average person makes, but how much everyone, collectively, makes. When more people are working, overall incomes go up.

Many individuals, though, are falling behind. Inflation hit a four-decade high earlier this year, and though it has ebbed a bit in the past two months, no one is sure how long that will last. Even with the recent cooldown, average hourly earnings have risen more slowly than prices this year, although gains have been stronger among lower earners. Other measures of wages tell a similar story. And even without adjustments for inflation, wage gains have been slowing in recent months — a possible sign that workers’ rare moment of leverage may be nearing its end.

How current conditions compare to recessions over the last 40 years

Graphic shows year-over-year percentage change. Data for 2022 is presented as if a recession began in June, which marks the end of a second consecutive quarter of declines in gross domestic product. Consumer spending data and manufacturing and trade sales data are adjusted for inflation.

Economic indicators might be pointing in different directions, but this much is clear: Americans feel terrible about the economy right now. Consumer sentiment, as measured by a long-running survey from the University of Michigan, recently hit a record low — lower even than in the first weeks of the pandemic, when tens of millions of people lost their jobs overnight.

In the past, falling consumer sentiment has been a fairly reliable recession indicator. Consumer spending accounts for about 70 percent of G.D.P., so when people stop spending, the economy is almost guaranteed to run into hard times. So far, however, Americans haven’t acted on their dour mood by cutting back. Even in the face of high prices, people have continued to shell out for plane tickets, restaurant meals and other small luxuries. And now consumer sentiment is showing some signs of improvement as gas prices fall.

Interpreting the consumer economy is tough right now, however, because of how the pandemic disrupted spending patterns. Many people are eager to catch up on deferred travel and experiences, even if they have to pay more for them, which could cause spending on services like these to hold up even if the economy slows. Spending on goods, meanwhile, soared in the pandemic, as people traded gym memberships for home exercise equipment. Goods spending has now begun to slow. But supply-chain snarls have complicated the picture — rising car sales, for example, might mean that demand is strong, but it also might mean that production problems are easing and that there are finally more vehicles available to buy.

Graphic shows year-over-year percentage change. Data for 2022 is presented as if a recession began in June, which marks the end of a second consecutive quarter of declines in gross domestic product. Capital goods data excludes aircraft and military equipment.

Historically, one of the surest indicators of a coming recession has been a decline in orders for industrial equipment — companies don’t invest in so-called capital goods such as new machinery or delivery trucks when they’re worried that demand is about to fall sharply. Right now, though, those signals are being blurred by the same issues that make it hard to interpret consumer spending data. If manufacturers pull back now, is it because of falling demand, or because they can’t get the parts they need?

There is one sector that is, unequivocally, behaving as if we’re headed for a recession: housing. Ever since the Federal Reserve began raising interest rates this year, builders have been reducing construction, and would-be buyers have been pulling out of the market. So far, however, there is little sign of a surge in foreclosures or of the financial stresses caused by the last housing bust.

A slowdown that stays confined to one or two sectors doesn’t constitute a recession, which by definition involves a sustained decline in activity across a broad swath of the economy. It might not be obvious right away, but when a recession does hit, it will show up in virtually every major indicator.

Methodology

In the chart at the top of this story, the horizontal axis places indicators based on how they compare with their historical levels. For indicators that generally rise over time, such as payroll employment and consumer spending, the placement is based on how the current levels compare with their prepandemic path (specifically, the linear trend from 2017 to 2019). Employment, for example, is still somewhat below its previous trend line, so it is shown as slightly negative, while consumer spending is far above its trend, so it is most of the way to the positive (right) side of the chart.

For indicators with no long-run trend, placement is based on how current levels compare with their average from 2010 to 2019. The unemployment rate, for example, is substantially better than its long-run average, so it is shown as solidly positive.

The vertical axis is based on the change over the past three months. Employment growth has slowed but remains positive, so it is shown as positive, while the unemployment rate rose in August, so it is shown as slightly negative.

All indicators are converted to a consistent scale to allow for comparisons. So even though the unemployment rate is measured in percentage points and building permits are measured in thousands of units, we can see on the chart that the housing market is eroding faster than the labor market.

Sources: U.S. Bureau of Labor Statistics; U.S. Employment and Training Administration; U.S. Bureau of Economic Analysis; University of Michigan; U.S. Census Bureau; Board of Governors of the Federal Reserve System; Federal Reserve Bank of St. Louis

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

- Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

Inflation, Health Costs, Partisan Cooperation Among the Nation’s Top Problems

Democrats hold edge on many issues, but more americans agree with republicans on economy, crime, immigration, table of contents.

- More Americans agree with GOP on economic policy, crime and immigration policy, but Democrats have edge on several other issues

- Top problems facing the country

- Job ratings for Joe Biden, Kevin McCarthy, Chuck Schumer

- Acknowledgments

- Methodology

Pew Research Center conducted this study to better understand Americans’ views of the problems facing the country, Joe Biden’s job performance and more. For this analysis, we surveyed 5,115 adults from June 5-11, 2023. Everyone who took part in this survey is a member of the Center’s American Trends Panel (ATP), an online survey panel that is recruited through national, random sampling of residential addresses. This way nearly all U.S. adults have a chance of selection. The survey is weighted to be representative of the U.S. adult population by gender, race, ethnicity, partisan affiliation, education and other categories. Read more about the ATP’s methodology .

Here are the questions used for the report and its methodology .

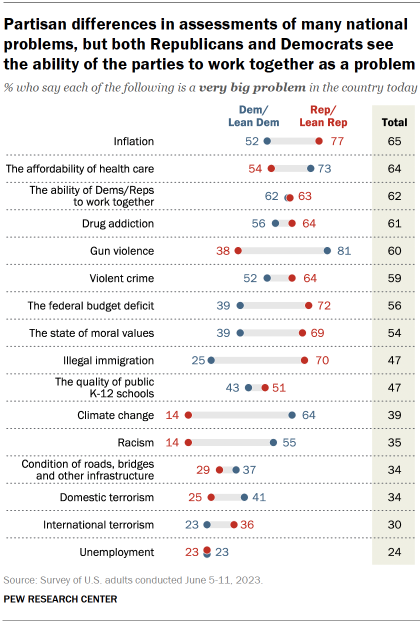

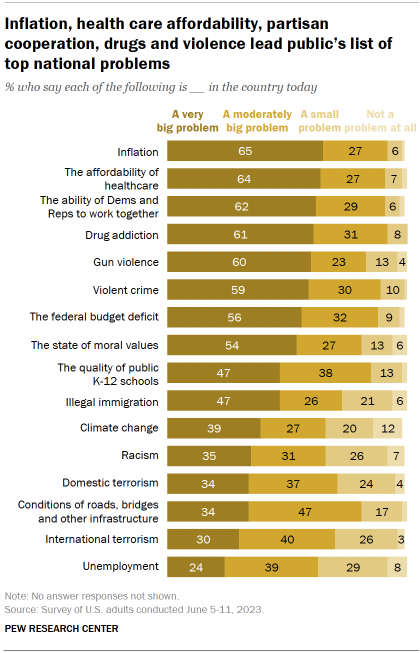

The public’s list of the top problems facing the nation includes inflation, health care affordability, drug addiction and gun violence.

Yet the ability of Republicans and Democrats to work together rates about as high on the problems list as these other concerns. And it is one of the few, among 16 problems included, on which there is no partisan divide.

The Pew Research Center survey, conducted June 5-11 among 5,115 members of the Center’s nationally representative American Trends Panel, finds wide differences in perceptions of most national problems.

Inflation remains the top concern for Republicans and Republican-leaning independents, with 77% saying it is a very big problem. The state of moral values, illegal immigration and the budget deficit also are seen as top problems by at least two-thirds of Republicans.

For Democrats and Democratic leaners, gun violence is the top concern, with about eight-in-ten (81%) saying it is a very big problem. The affordability of health care ranks second (73% say this).

Democrats are more than four times as likely as Republicans to say that climate change is a very big problem in the country (64% vs. 14%). Democrats are also much more likely to say gun violence and racism are very big problems.

By contrast, Republicans are more than twice as likely as Democrats to say that illegal immigration is a very big problem (70% vs. 25%). They are also about 30 percentage points more likely than Democrats to say that the state of moral values and the budget deficit are very big problems.

Among the other findings from the new survey:

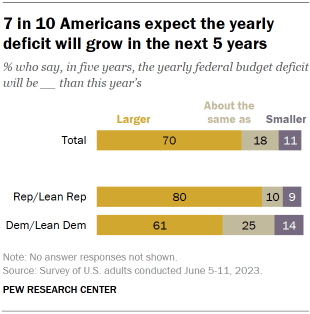

Most Americans expect the budget deficit to grow larger. The share of Americans who rate the budget deficit as a very big national problem has risen modestly since last year, from 51% to 56%.

Relatively few Americans expect the deficit to be lower in coming years: 70% say that, in about five years, it will be larger than it is today; 18% expect it to be about the same size as it is today, while just 11% say it will be smaller.

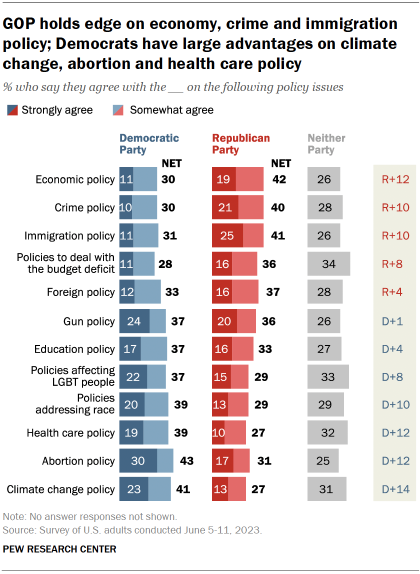

Democrats have sizable advantages on climate, health care policy; Republicans lead on economy, crime, immigration. The public is more likely to say they agree with the Democratic Party on a number of issues, including abortion policy, health care policy and climate change policy.

However, the Republican Party holds a 12-point advantage on economic policy: 42% say they agree with the GOP, 30% say they agree with the Democratic Party. The GOP holds similar leads on crime and immigration.

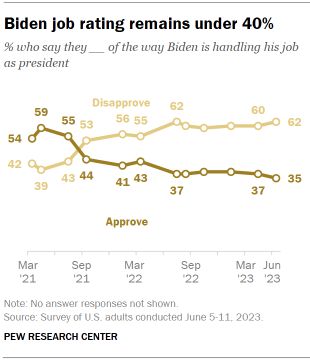

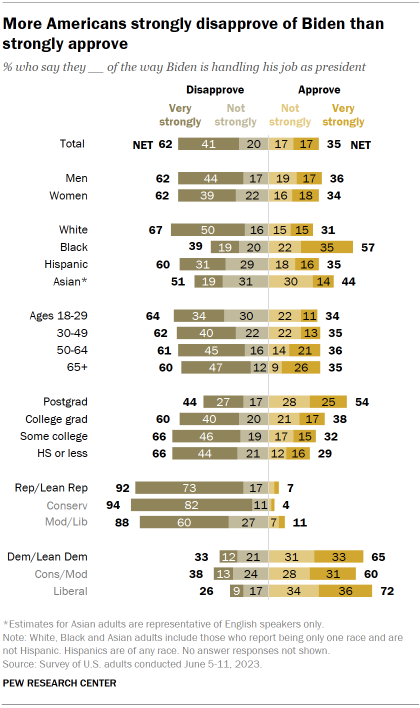

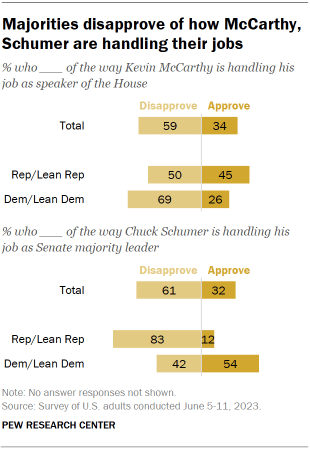

Biden job approval little changed. Currently, 35% of Americans approve of President Joe Biden’s job performance, while 62% disapprove. Biden’s job approval has changed little in the past year. The survey also finds low job ratings for House Speaker Kevin McCarthy (34% approve) and Senate Majority Leader Chuck Schumer (32%).

Please visit detailed tables for a current view of Biden’s approval rating among subgroups.

About four-in-ten Americans (41%) say they agree with the Democratic Party on climate change policy, while substantially fewer (27%) agree with the GOP; nearly a third (31%) say they agree with neither party.

The Democrats’ advantage is similar on abortion policy and health care policy (12 points each).

Republicans hold advantages on policies addressing the economy (12 points), crime (10 points), immigration (10 points) and the budget deficit (8 points).

Neither party has a significant edge on education policy, gun policy or foreign policy.

For the most part, the shares agreeing with each party on issues has not changed much over the past year.

However, the GOP’s 10-point advantage on immigration policy represents a shift since last July, when roughly equal shares of Americans say they agreed with each party (38% agree with GOP, 37% agree with Democrats).

In addition, while Democrats hold an 8-point advantage on policies affecting LGBT people (37% agree with the Democratic Party, 29% with the GOP and 33% with neither party), this is narrower than Democrats’ 20-point lead last July.

Majorities of Americans say 8 of the 16 issues included on the survey are “very big problems” facing the country. These range from economic concerns, such as inflation, affordability of health care and the budget deficit, to drug addiction, gun violence and violent crime.

Majorities also view the ability of Democrats and Republicans to work together (62%) and the state of moral values (54%) as very big national problems.

The share saying health care affordability is a very big problem is up 9 percentage points since May 2022, when 55% said this. The shares saying that gun violence and violent crime are very big problems have also increased since last year (by 9 percentage points and 5 points respectively).

Racism, domestic and international terrorism, unemployment, and the condition of infrastructure rate lower on the public’s list of very big national problems. Still, for these and other issues asked about on the survey, majorities rate each as at least moderately big problems.

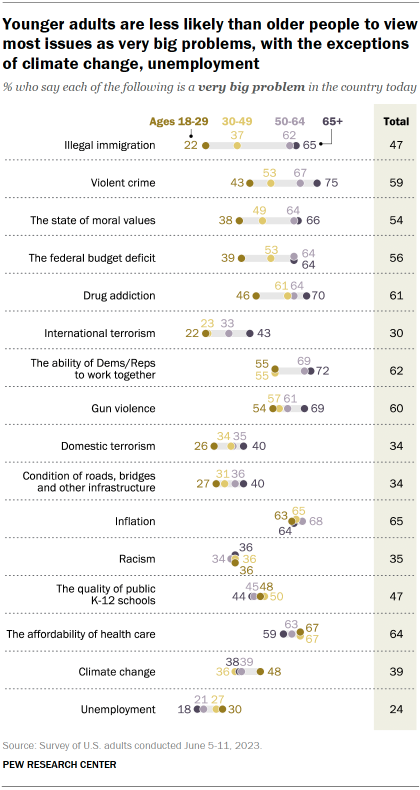

Older Americans remain more likely than younger Americans to say that a number of issues are very big problems in the country today. The starkest example of this is on illegal immigration: About two-thirds of adults ages 65 (65%) and over say that illegal immigration is a very big problem today. Around two-in-ten (22%) of adults under the age of 30 say the same.

However, this pattern is reversed on climate change. About half of adults ages 18-29 (48%) say that it is a very big problem, while 38% of adults ages 65 and over (and a similar share of adults 30-64) say this.

A majority of the public (62%) say they disapprove of Joe Biden’s job performance as president, with 41% who strongly disapprove. A much smaller share (35%) say they approve of Biden’s job performance, with only 17% who strongly approve.

Black adults are the only racial or ethnic group in which a majority says they approve of Biden’s job in office (57%). About half of Asian adults (51%) and six-in-ten Hispanic adults say they disapprove of Biden’s job performance.

Two-thirds of White adults (67%) say they disapprove of Biden’s job performance, including half who strongly disapprove.

While majorities across all age groups disapprove of Biden’s job performance, the share saying they strongly disapprove is much higher among adults ages 65 and over (47%) than those under 30 (34%).

Roughly two-thirds of Democrats and Democratic-leaning independents (65%) approve of Biden’s job performance, with a third strongly approving. An overwhelming majority of Republicans and Republican leaners disapprove (92%); nearly three-quarters (73%) strongly disapprove.

Please visit detailed tables for Biden’s approval rating among additional subgroups.

The job ratings for House Speaker Kevin McCarthy (34% approve) and Senate Majority Leader Chuck Schumer (32% approve) are comparable to Biden’s. Both congressional leaders get fairly mixed ratings from members of their own party and largely negative ratings from the opposing party.

Sign up for our weekly newsletter

Fresh data delivery Saturday mornings

Sign up for The Briefing

Weekly updates on the world of news & information

- Economic Conditions

- Government Spending & the Deficit

- Health Care

- Health Policy

- Issue Priorities

- National Conditions

- Partisanship & Issues

- Presidential Approval

- Unauthorized Immigration

A look at small businesses in the U.S.

State of the union 2024: where americans stand on the economy, immigration and other key issues, americans more upbeat on the economy; biden’s job rating remains very low, online shopping has grown rapidly in u.s., but most sales are still in stores, congress has long struggled to pass spending bills on time, most popular, report materials.

- June 2023 Biden Job Approval Detailed Tables

1615 L St. NW, Suite 800 Washington, DC 20036 USA (+1) 202-419-4300 | Main (+1) 202-857-8562 | Fax (+1) 202-419-4372 | Media Inquiries

Research Topics

- Age & Generations

- Coronavirus (COVID-19)

- Economy & Work

- Family & Relationships

- Gender & LGBTQ

- Immigration & Migration

- International Affairs

- Internet & Technology

- Methodological Research

- News Habits & Media

- Non-U.S. Governments

- Other Topics

- Politics & Policy

- Race & Ethnicity

- Email Newsletters

ABOUT PEW RESEARCH CENTER Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions. It is a subsidiary of The Pew Charitable Trusts .

Copyright 2024 Pew Research Center

Terms & Conditions

Privacy Policy

Cookie Settings

Reprints, Permissions & Use Policy

Featured Topics

Featured series.

A series of random questions answered by Harvard experts.

Explore the Gazette

Read the latest.

Lending a hand to a former student — Boston’s mayor

Where money isn’t cheap, misery follows

Larger lesson about tariffs in a move that helped Trump but not the country

We’ll gather together — even though everything seems so much more expensive.

Christina Pazzanese

Harvard Staff Writer

Economists explain why Americans feel inflation, economy are much, much worse than they actually are

Inflation and the economy will be front of mind for many Americans as they fork out more for Thanksgiving groceries than in recent years.

Recent polls show most Americans feel the U.S. economy is in tough shape and getting worse. In one, 76 percent rated economic conditions in the U.S. negatively, while 74 percent said rising food prices were having the greatest impact on their finances, according to a new poll from the Financial Times and the University of Michigan’s Ross School of Business.

This has experts scratching their heads, since most traditional indicators suggest the U.S. economy is on track to a post-pandemic recovery. The latest statistics from the Department of Labor show the overall inflation rate at 3.2 percent in October. While not quite the 2 percent rate the Federal Reserve would like to see, it’s part of a downward trendline since its 9 percent peak in June 2022.

So what exactly is driving this public pessimism?

The Gazette asked economists Karen Dynan , Ph.D. ’92, professor of the practice in Harvard’s Department of Economics and Harvard Kennedy School, and Jason Furman ’92, A.M. ’95, Ph.D. ’04, Aetna Professor of the Practice of Economic Policy at the Kennedy School and the Department of Economics. These interviews were edited for clarity and length.

Karen Dynan and Jason Furman

GAZETTE: Consumers are paying a lot more for groceries and eating out since the pandemic. Are higher food prices driving consumers’ negative view of the economy?

FURMAN: I think food is at the epicenter of this distinction between the way economists think about things, which is the rate of inflation, and the way the public thinks about things, which is the level of prices.

On average, food purchased for use at home is 25 percent more expensive than it was in February 2020. Turkey is up 37 percent; eggs are up 43 percent. There are a lot of items that are much more expensive than they were a few years ago.

What the Fed is focused on is what’s happening to food inflation — how much prices increased in the last year. And there, food at home prices over the last year have increased 2.1 percent. The Fed’s goal is 2 percent. So, from their perspective, they’ve done what they’re trying to do with respect to inflation in the food sector.

I think a lot of the public is really bothered by the price level, not by the recent rate of inflation. That’s a little bit of the disconnect: The rate of inflation has come down quite a lot, but the price level has not come down.

DYNAN: A key issue is what economists refer to as “salience,” meaning how much people notice something. The classic example is that gasoline prices seem to have a big influence on people’s answers when they’re asked about inflation. And that’s because gas prices are very salient: If you have a car, you probably fuel up on a regular basis, and you see the price right there on the pump.

The price of food is also very salient. Anyone who’s in the office and ordering lunch at a local salad and sandwich place is seeing it every day. It’s also the case that new technologies mean you are seeing the price more often. When you check out, it comes up on the screen. Sometimes you see it a few times, and then when you pay, and you add a tip, and you see an even higher price. I wonder whether that increases salience.

I should note that we don’t think the much higher prices relative to three years ago mean restaurants are that much more profitable. They had to raise wages a lot because of the worker shortage, and they may have higher costs generally because of pandemic-related protocols.

Graphic by Judy Blomquist/Harvard Staff; source: U.S. Bureau of Labor Statistics, Consumer Price Index, U.S. Department of Agriculture, King Arthur recipe for apple pie

GAZETTE: Why do so many people think the economy is in terrible shape? Most economists agree that GDP, unemployment, and wages look solid. And inflation, which is higher than optimal, is trending in a positive direction.

DYNAN: I think it’s probably a couple of things. One thing is that there has been this very sharp increase in interest rates that has resulted from the Fed’s tightening. And many forecasters are looking at that and thinking that these much tighter financial conditions are likely to drive the economy into recession over the coming year.

My personal view is that a recession is not the most likely outcome. But people are hearing a lot of talk from economists suggesting that the odds of a recession starting over the coming year are like 50 percent or higher. And so, people are essentially saying that even though things seem fine now, they’re worried about the future.

The other thing is the inflation story. The government emphasizes inflation measures that capture prices relative to where they were exactly a year ago. But people, in their heads, may be comparing prices to a different benchmark — for example, what they remember prices being around the time the pandemic set in, which they consider to be the last time the economy was normal. So even though the government statistics show year-over-year inflation moving in the right direction, people may be thinking about how much more expensive things are than they were three years ago.

GAZETTE: For decades, food prices climbed on average by 2 percent annually. In 2020, food went up 3.9 percent, 6.3 percent in 2021, and 10.4 percent in 2022. Other sectors that had big price increases because of the pandemic have since seen them start to decline. Food has not. Labor costs are up for every industry — is it fair to blame it entirely on the pandemic?

DYNAN: I think economists are still working out exactly what caused the surge in inflation. A big debate has been over the role of things that affect the supply of consumer goods and services and things that affect the demand for these items. We have a lot of evidence the pandemic created supply-related issues due to factory shutdowns, bottlenecks getting items into the country, and worker shortage. But demand has also been really strong because — between deferring spending and generous government support — people came out of the pandemic with a lot of money to spend. I think we don’t know the answer about the relative roles of these two factors. Probably, it’s a mix.

FURMAN: I think the way to think about it is prices as a whole are up 18 percent. That’s largely because of the amount of fiscal stimulus and expansionary monetary policy. There’s a long list of things. Food is up above and beyond that because of food-specific factors. The biggest increase in food prices is the cereal and grains category — bread, rice, stuff like that. Those commodity prices are up globally.

There has been a shift where people are eating more at home than in restaurants, so this relative spending on food at home has gone up. And so, it’s possible that that persistent change in the pattern of demand is playing a little bit of a role here as well.

GAZETTE: Despite the complaints, the data show consumers are still buying and paying the higher prices. With food being a necessity, is that keeping prices perhaps artificially high?

More like this

Retailers have been cutting costs, so why are prices still so high?

The economy keeps getting better. Our moods? Not so much.

Toomey doesn’t see recession looming

DYNAN: Economists like to think of this in terms of goods versus services. During the pandemic period, we saw a surge in demand for goods, and people really held off on many high-contact services. The resulting strong demand for goods did drive goods prices up. But since the pandemic, demand has pivoted back toward services because people are making up for the fact that they’d spent a year or two years without traveling, without going to concerts, without going to restaurants. So more recently we’ve seen price increases for services being larger than those for goods.

Another relevant consideration about the prices of goods versus services is that the cost of labor is more important when producing services. If you’re in the restaurant industry, your wage bill is a larger part of your total costs because you use a lot of labor relative to, say, a factory producing iPhones. Wage growth has started to come down, but it’s still elevated. I think that’s helping to keep services prices high.

GAZETTE: The USDA Economic Research Service predicts for 2023 groceries will have gone up 5.1 percent and eating out will be 7.1 percent. For 2024, it expects groceries will go up 1 percent, while eating out will be up 4.4 percent. Will consumers ever see a return to the days when food prices only went up 2 percent every year?

DYNAN: I think it’s a realistic outcome. If you look at inflation expectations broadly — for example, surveys of households about how much they expect inflation to be this year, next year, and so on — people do expect inflation to go back to levels that were nearly as low as what we saw prior to the pandemic. That’s what we would call “anchored inflation expectations.”

The fact that inflation expectations have come back to low levels is meaningful because those expectations (we think) reflect what workers have in mind when they’re going into wage negotiations, hoping to have their wages keep up with broader price trends.

And it’s what firms have in mind when they’re setting prices and trying to stay competitive with other firms. So those low expectations will help draw inflation down back to pre-pandemic norms or at least much closer to pre-pandemic norms.

FURMAN: A year ago, I was in discussions with some really good global food economists who thought there was going to be a major global food crisis, a big increase, driven by Russia-Ukraine being the most important part of it, coupled with a set of droughts and floods and other events around the world. And that didn’t happen. So, we did avert a worse scenario, and things are trending in the right direction. It’s just that the price level is never going to go back down. At some point, people will get used to it. But for a while, it will be pretty irritating.

Share this article

You might like.

Economist gathers group of Boston area academics to assess costs of creating tax incentives for developers to ease housing crunch

Student’s analysis of global attitudes called key contribution to research linking higher cost of borrowing to persistent consumer gloom

Researcher details findings on policy that failed to boost U.S. employment even as it scored political points

When math is the dream

Dora Woodruff was drawn to beauty of numbers as child. Next up: Ph.D. at MIT.

Seem like Lyme disease risk is getting worse? It is.

The risk of Lyme disease has increased due to climate change and warmer temperature. A rheumatologist offers advice on how to best avoid ticks while going outdoors.

Three will receive 2024 Harvard Medal

In recognition of their extraordinary service

10 Popular Posts on Economic Topics in 2021

What did people most want to know about the economy in 2021?

Inflation and COVID-19’s effects on the economy were top of mind, judging by the popularity of posts on those topics in our On the Economy blog, which offers frequent commentary, analysis and data from our economists and other St. Louis Fed experts. But examinations of longer-run trends, such as employment growth over 20 years, also attracted attention.

For readers of our Open Vault blog, which explains everyday economics and the Fed, the nuts and bolts of topical subjects like central bank digital currency and Fed “tapering” struck a chord, as did a post about the economic concept of externalities, explained with canine and pandemic examples.

Here’s a look at a few of the posts that were among the favorites published from January through Nov. 30.

Inflation Trends

How covid-19 may be affecting inflation.

The changing of U.S. consumer spending patterns during the pandemic may have affected the measurement of inflation, according to an On the Economy post published in February. The Bureau of Labor Statistics gathers information about prices in the U.S., weights the prices and aggregates them for the consumer price index, or CPI. Inflation is measured as the CPI’s rate of growth over a certain period.

But what happens if a certain category of goods or services becomes a bigger, or smaller, part of consumer spending? Based on spending habits in prior years, the official weights might not be the “true” weights in 2020, when social distancing led to more eating at home and less spending in restaurants.

What Are Risks for Future Inflation?

As U.S. inflation surged in 2021, an October On the Economy post identified some upside and downside risks for future inflation. A follow-up post examined whether higher inflation could “be attributed to a small group of goods and services or whether it is a more generalized event.” Looking at the overall price change over the period of the pandemic, “the role of outliers is greatly diminished, revealing that higher inflation is perhaps a broader phenomenon,” the post said.

Economic and Monetary Policy Explainers

Externalities: it’s what pandemics, pollution and puppies have in common.

Externalities are costs and benefits that impact or spill over to someone other than the producer or the consumer of a good or a service. As a June Open Vault post explained, that applies to everything from pandemics to puppies. In a pandemic, a lack of social distancing by one person creates an externality that is negative: a higher risk of infection for everyone. Puppies that only bark at strangers, meanwhile, could provide a positive externality for neighbors as a warning system.

A June Open Vault blog post highlighted the Economic Lowdown series video “Externalities.” What makes pollution a negative externality is explained in this clip.

Here’s What the Fed Means by Tapering

As anticipation built this fall for a Federal Open Market Committee decision to “taper,” so did curiosity about what tapering is. An Open Vault post answered that question: The Fed can turn to large-scale asset purchases when economic conditions warrant, and tapering means reducing the pace of those purchases. The post, published a week after the Nov. 3 announcement of the FOMC’s decision to start tapering, also explained how tapering works.

What Is the Federal Open Market Committee?

Readers curious about what tapering is could have learned earlier in the year about the committee that makes that and other monetary policy decisions. As a February Open Vault post explained, the FOMC is the main monetary policymaking body of the Federal Reserve and is comprised of leaders from around the Federal Reserve System.

People and Places

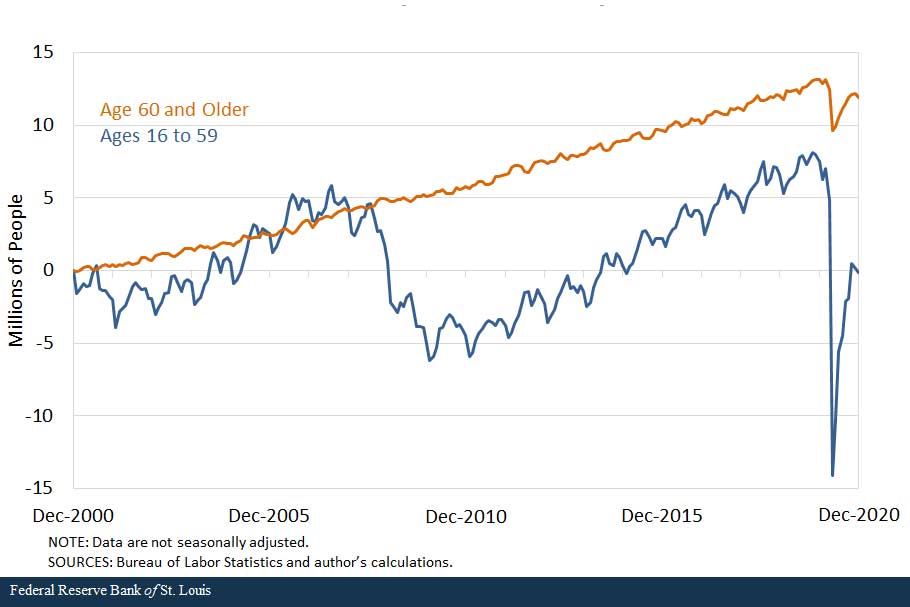

Older workers accounted for all net employment growth in past 20 years.

Before there was the “Great Resignation,” there was an employment increase: A February On the Economy post said that a rise in employment of people age 60 and older was responsible for U.S. employment growth of 11.8 million from December 2000 to December 2020. (See chart.) Among those workers, the increase in employment is attributed to the group’s population growth and increased employment-to-population ratio.

Cumulative Net Change in the Number of Employed People since December 2000

House Prices Surpass Housing-Bubble Peak on One Key Measure of Value

The steady increase of a house price-to-rent ratio “would imply increasing overvaluation” of houses, a May On the Economy post said. That was the case in early 2021 (using data available through March), when an index measuring the ratio of house prices to rent in the U.S. had risen rapidly over the course of a year and reached its highest level since at least 1975.

Sign up now for the free symposium, which has the theme, “Leading the Way in Challenging Times.” The event will run 6 to 8 p.m. CT on Feb. 23-24. Participants will hear insights from leading economists.

Inspiring Young Women to Pursue Economics

A January Open Vault post previewed a February 2021 event that is “designed to inspire young women and underrepresented minorities who may be interested in econ—and to encourage those pursuing a degree to persist.” The next Women in Economics Symposium is set for Feb. 23-24, 2022.

Money and Finance

Wealth gaps between white, black and hispanic families in 2019.

Across education, family structure and generations, gaps persist between the wealth of white families and that of Black and Hispanic families, the authors of a January On the Economy post found.

For instance, they wrote: “More education was associated with more wealth for all the racial and ethnic groups considered. However, wide gaps remain at every education level, with Black and Hispanic families having less median family wealth than white families with the same education.”

And Black and Hispanic families are less likely than white families to have financial and other assets like homes and businesses, and when they do, those assets were more likely to have lower values.

Navigating the ABCs of CBDCs—Central Bank Digital Currencies

“You’ve likely heard of Bitcoin, Ethereum, or even Dogecoin, but you may not have heard of ‘Fedcoin,’ an informal name some have used for the idea of a digital currency tied to a central bank, namely the Federal Reserve,” a June Open Vault post said. The post highlighted short videos in which a St. Louis Fed economist answered questions on central bank digital currencies, including about possible effects on privacy and bank lending.

Heather Hennerich is a senior editor with the St. Louis Fed External Engagement and Corporate Communications Division.

Related Topics

This blog explains everyday economics, consumer topics and the Fed. It also spotlights the people and programs that make the St. Louis Fed central to America’s economy. Views expressed are not necessarily those of the St. Louis Fed or Federal Reserve System.

Media questions

All other blog-related questions

Top Ten Global Economic Challenges: An Assessment of Global Risks and Priorities

Subscribe to global connection.

February 1, 2007

To learn more about the critical issues and challenges facing the world today, explore 11 Global Debates , a collections of essays celebrating 10 years of research by the Global Economy and Development program at Brookings.

The beginning of 2007 offers a conflicting picture of the global economy for those trying to discern trends, challenges and opportunities. Concerns about energy security and climate sustainability are converging-finally bringing consensus in sight on the need for action in the United States, but prospects for breaking the global stalemate are still years away. While some developing countries are succeeding in bringing hundreds of millions out of poverty, too many are still mired in a doom spiral of conflict, poverty, and disease- despite the entry of new philanthropists, advocates and global corporations into the field of development. China’s projected 9.6 percent growth rate is sending ripples to the farthest reaches of the planet-creating opportunities but also significant risks. The United States remains in the “goldilocks” zone, but this is premised on continued borrowing from abroad at historically unprecedented rates while many Americans fret about widening inequality and narrowing opportunity. While the United States concentrates on civil war in the Middle East, most leaders in the region are preoccupied with putting an outsized cohort of young people to work and on the road to becoming productive citizens.

What are the most important challenges we face and what are the potential solutions? In Washington, D.C., where short-term political wrangling too often crowds out the harder and more important long-term challenges, this inaugural publication of Brookings Global Economy and Development seeks to put the spotlight squarely back on the most consequential issues demanding action. It seeks to size these issues, offering policymakers and leaders a concise and clear view of the critical challenges as viewed by leading experts in the field. From economic exclusion of youth in the Middle East to a pragmatic approach to energy and environmental security, this “top 10” is intended to mark core issues and shed light on opportunities and challenges with a broader and longer-term perspective.

When we gather a year from now, we would expect many of these challenges to remain front and central, but we would hope this publication would elevate their visibility and help sustain a dialogue on their resolution.

1. Energy and Environmental Security Warwick McKibbin and Peter Wilcoxen

Energy and environmental security has emerged as the primary issue on the global agenda for 2007. Consensus has recently been forged on the potential for long-term economic, national security and societal damage from insecure energy supplies and environmental catastrophe, as well as the intense need for technological advances that can provide low-polluting and secure energy sources. Yet despite growing global momentum, there is still little agreement on the best set of actions required to reduce global dependency on fossil fuels and greenhouse gas emissions. Confounding the international policy challenge is the disproportionate impact of high oil prices and global warming across nations, insulating some countries from immediate concern while forcing others to press for more rapid change.

2. Conflict and Poverty

Lael Brainard, Derek Chollet, Jane Nelson, Ngozi Okonjo-Iweala, and Susan Rice

In a world where boundaries and borders have blurred, and where seemingly distant threats can metastasize into immediate problems, the fight against global poverty has become a fight for global security. American policymakers, who traditionally have viewed security threats as involving bullets and bombs, are increasingly focused on the link between poverty and conflict: the Pentagon’s 2006 Quadrennial Defense Review focuses on fighting the “long war,” declaring that the U.S. military has a humanitarian role in “alleviating suffering, ? [helping] prevent disorder from spiraling into wider conflict or crisis.”

3. Competing in a New Era of Globalization

Lael Brainard, Robert Litan, and Wing Thye Woo

Is the new episode of globalization just another wave or a seismic shift? While individual elements feel familiar, the combined contours are unprecedented in scale, speed, and scope.

4. Global Imbalances

Barry Bosworth, Lael Brainard, Peter Blair Henry, Warwick McKibbin, Kenneth Rogoff, And Wing Thye Woo

Today’s interconnected world is in uncharted territory: the world’s sole hegemonic power, the United States, nurses an addiction to foreign capital, while up-and-coming powers such as China and oil exporters sustain surpluses of increasing magnitudes. Some worry that the world is at a tipping point, where only a dramatic shift in economic policy can alter the looming trajectory. Others see underlying structural factors perpetuating gross imbalances for a sustained period.

5. Rise of New Powers

Chong-En Bai, Erik Berglöf, Barry Bosworth, David de Ferranti, Clifford Gaddy, Xiao Geng, Homi Kharas, Santiago Levy, Leonardo Martinez-Diaz, Urjit Patel, Shang-Jin Wei, Wing Thye Woo

The rise of “emerging powers”-a group that usually includes the so-called BRICs (Brazil, Russia, India, and China), but which sometimes is applied more broadly to include South Africa, Mexico and others-is reshaping the global economy and, more gradually, international politics. Growing much faster than the rest of the world, these economies are changing the structure of international production and trade, the nature and direction of capital flows, and the patterns of natural resource consumption. At the same time, the growth of these countries is beginning to shift the global distribution of power forcing the great powers to come to terms with the reality that they will need to share management of international rules and systems in the coming decades.

6. Economic Exclusion in the Middle East

Navtej Dhillon, Caroline Moser, and Tarik Yousef

The Middle East has before it what could be one of the greatest demographic gifts in modern history-a potential economic windfall arising from a young and economically active workforce. Today, young people aged 15- to 24- years old account for 22 percent of the region’s total population, the highest regional average worldwide. With the right mix of policies, this demographic opportunity could be tapped to spur economic growth and promote stability.

7. Global Corporations, Global Impact

David Caprara and Jane Nelson

The private sector is becoming a significant player-indeed some might say the dominant player-in shaping the global economic and development agenda. Multinational corporations with operations that span the globe, and in some cases capacities and networks that match those of governments, have a particularly important role to play in helping to spread the opportunities and mitigating some of the risks of globalization.

8. Global Health Crises

Maria-Luisa Escobar, David de Ferranti, Jacques Van Der Gaag, Amanda Glassman, Charles Griffin, and Michael Kremer

From responding to the threat of pandemic flu to efforts to control the spread of HIV/AIDS, the world has begun to realize that global health issues are relevant for any citizen, regardless of nationality, residence or status. Despite improvements in the world’s collective ability to battle disease with advances in medicine and technology, global health needs remain unmet, making the entire world vulnerable to health crises. In particular, the poor continue to suffer disproportionately from inadequate health services, exacerbating their struggle out of poverty.

9. Global Governance Stalemate

Colin Bradford, Ralph Bryant, and Johannes Linn

Today’s global challenges-nuclear proliferation, the deadlock of global trade negotiations, the threat of pandemic flu, and the fight against global poverty-cannot be solved by yesterday’s international institutions. To resolve the world’s most pressing problems, which touch all corners of the globe, we must adapt our global governance approaches to be more representative and thus more effective by encouraging and enabling the key affected countries to take an active role in generating solutions.

10. Global Poverty: New Actors, New Approaches

Lael Brainard, Raj Desai, David de Ferranti, Carol Graham, Homi Kharas, Santiago Levy, Caroline Moser, Joe O’Keefe

The challenge of global poverty is more urgent than ever: over half the world’s population-nearly 3 billion people-lives on less than $2 per day; nearly 30,000 children die each day-about 11 million per year -because they’re too poor to survive. With such a toll, addressing poverty in new and more effective ways must be a priority for the global policy agenda. Fortunately, a variety of new actors are bringing new perspectives, new approaches and new energy to the challenge.

Related Content

Nancy Lindborg

July 31, 2017

October 5, 2016

Bruce Jones, Thomas Wright, Jeremy Shapiro, Robert Keane

February 25, 2014

Related Books

Lael Brainard, Abigail Jones, Nigel Purvis

July 15, 2009

Laurence Chandy, Hiroshi Kato, Homi Kharas

July 20, 2015

Nora Claudia Lustig

September 1, 1995

Development Financing Emerging Markets & Developing Economies Global Trade

Global Economy and Development

Middle East & North Africa

Climate and Energy Economics Project

Indermit Gill, M. Ayhan Kose

January 17, 2024

1:00 pm - 12:45 pm EDT

October 10, 2008

Examples of economic problems

The fundamental economic problem is the issue of scarcity but unlimited wants. Scarcity implies there is only a limited quantity of resources, e.g. finite fossil fuels. Because of scarcity, there is a constant opportunity cost – if you use resources to consume one good, you cannot consume another. Therefore, an underlying feature of economics is concerned with dealing how to allocate resources in society to make the most efficient and fair use of resources. The main issues are:

- What to produce?

- How to produce?

- For whom to produce?

Examples of economic problems include

- How to deal with external costs/pollution , e.g. pollution from production.

- How to redistribute income to reduce poverty , without causing loss of economic incentives.

- How to provide public goods (e.g. street-lighting) which are usually not provided in a free market.

- How should we measure economic welfare? Is it wrong to focus on ouptut and income? (as economics has in the past) – New measures of economic welfare try to include broader range of factors, such as environment, education, health care.

Video summary

Micro economic problems

1. The problem of externalities

The economic problem of pollution

One of the most frequent problems is that economic decisions can have external effects on other people not involved in the transaction. For example, if you produce power from coal, the pollution affects people all over the world (acid rain, global warming). This is a particular problem because we cannot rely on the free market to provide the most efficient outcome. If we create negative externalities , we don’t take them into account when deciding how much to consume. This is why we can get overconsumption of driving a car into a city centre at peak hour. If everyone maximises their utility, it doesn’t lead to the most efficient outcome – but gridlock and wasted resources.

Externalities, usually need some kind of government intervention. For example, taxes on negative externalities (e.g. sugar tax) or subsidies on positive externalities (e.g. free public education) even banning cars in city centres.

But, even the solution to market failure (e.g. taxes), creates its own potential problems, such as how much to tax? will there be tax evasion? The administration costs of collecting tax.

Environmental issues

Economics is traditionally concerned with utility maximisation – allowing individuals to aim at increasing their economic welfare. However, this can ignore long-term considerations of environmental sustainability. If we have over-consumption in this century, it could cause serious problems for future generations – e.g. global warming, loss of non-renewable resources. The difficulty is that the price mechanism doesn’t take into account these future costs, and policies to reduce consumption may prove politically unpopular.

– How to deal with potential future environmental costs?

Monopoly was an economic problem that Adam Smith was concerned about in his influential book of economics “A Wealth of Nations.” For various reasons firms can gain monopoly power – and therefore the ability to set high prices to consumers. Given a lack of alternatives, monopolies can make high profits at the expense of consumers, causing inequality within society. Monopoly power can also be seen through monopsony employers who pay lower wages to their workers.

How to deal with the problem of monopoly? – A government may seek to encourage competition, e.g. rail franchising, or price regulation to prevent excessive prices.

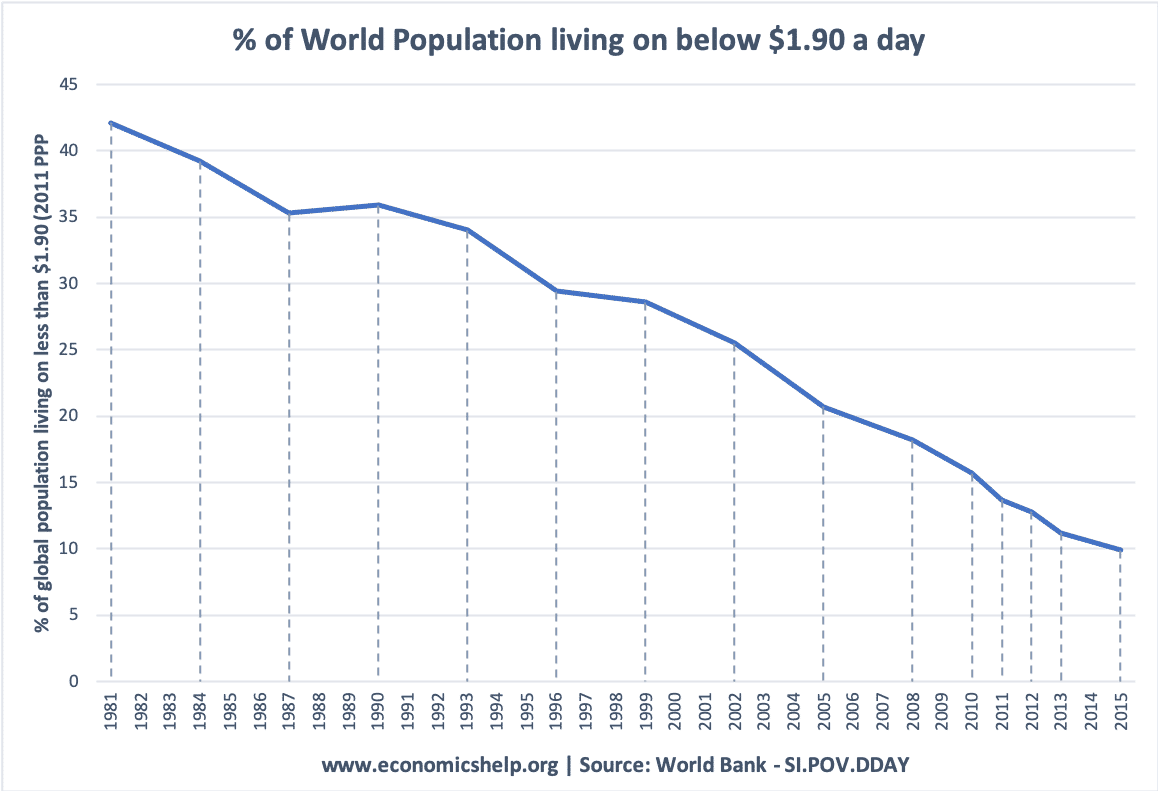

Inequality/poverty

This shows that 10% of the world population still live on below $1.90 a day – though the figure has reduced in past three decades.

Inequality is considered a problem because of normative opinions such as – it is an unfair distribution of resources. Also, you could argue there is a diminishing marginal utility of wealth . If all wealth is owned by a small percentage of the population, this reduces net welfare. Redistributing the money to the very poor would enable a greater net utility to society.

Five of the world’s largest companies Apple, Microsoft, Alphabet, Cisco and Oracle, have a total of $504bn cash savings (2015) This is money unused, whilst people around the world have insufficient food.

Inequality is a problem. However, it is also a problem to know how much we should seek to reduce poverty. Many will agree on the necessity of reducing absolute poverty – but how far should we take it? Should we aim for perfect equality (Communism) or should we aim for equality of opportunity?

Another issue with reducing poverty is that measures to reduce poverty may cause unintended consequences – e.g. higher income tax on high earners may create disincentives to work. Giving benefits to the low paid may reduce incentives to work.

Volatile prices

Some agricultural markets can have volatile prices. A glut in supply can be bad news because the fall in price can lead to lower revenue for farmers. It could even cause some to go out of business because of a bad year. These volatile markets can cause swings in economic fortunes.

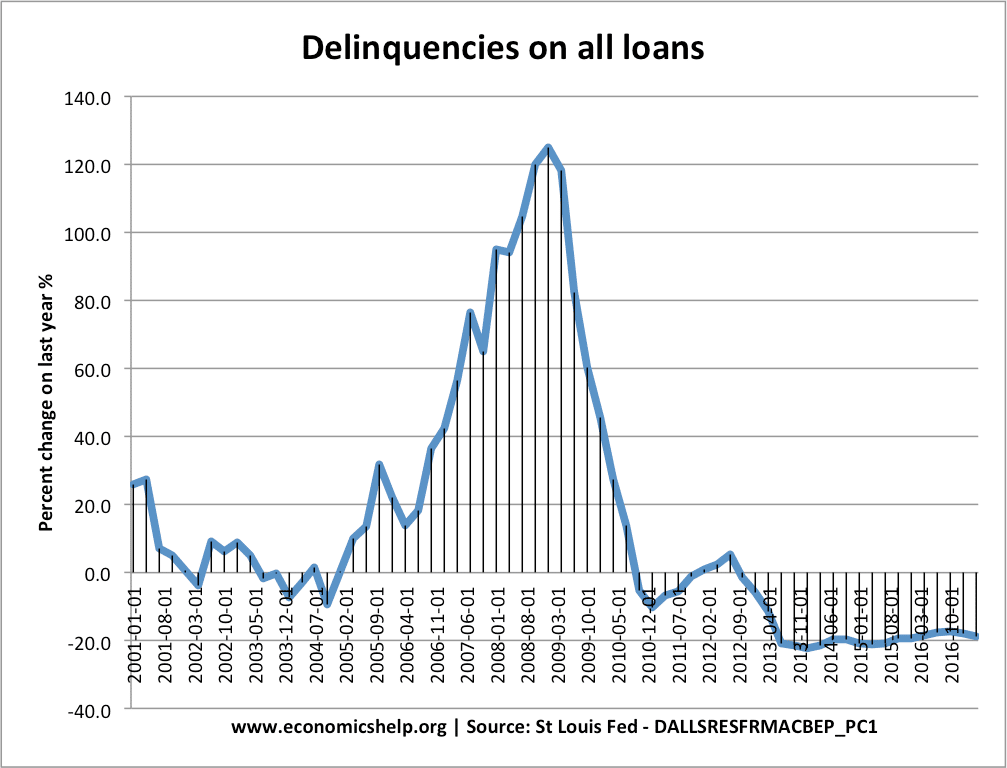

Irrational behaviour

In some asset markets, we have seen volatile prices exacerbated by irrational exuberance . Consumers have often been caught up in a market frenzy – hoping that rising prices will make them richer – and expecting prices to keep rising. We can see this in issues such as tulip mania , the South Sea Bubble, railway mania, and the recent property bubbles.

Macroeconomic problems

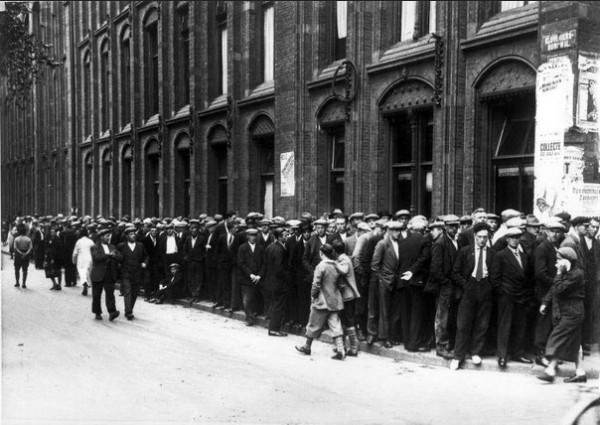

Mass unemployment 1933

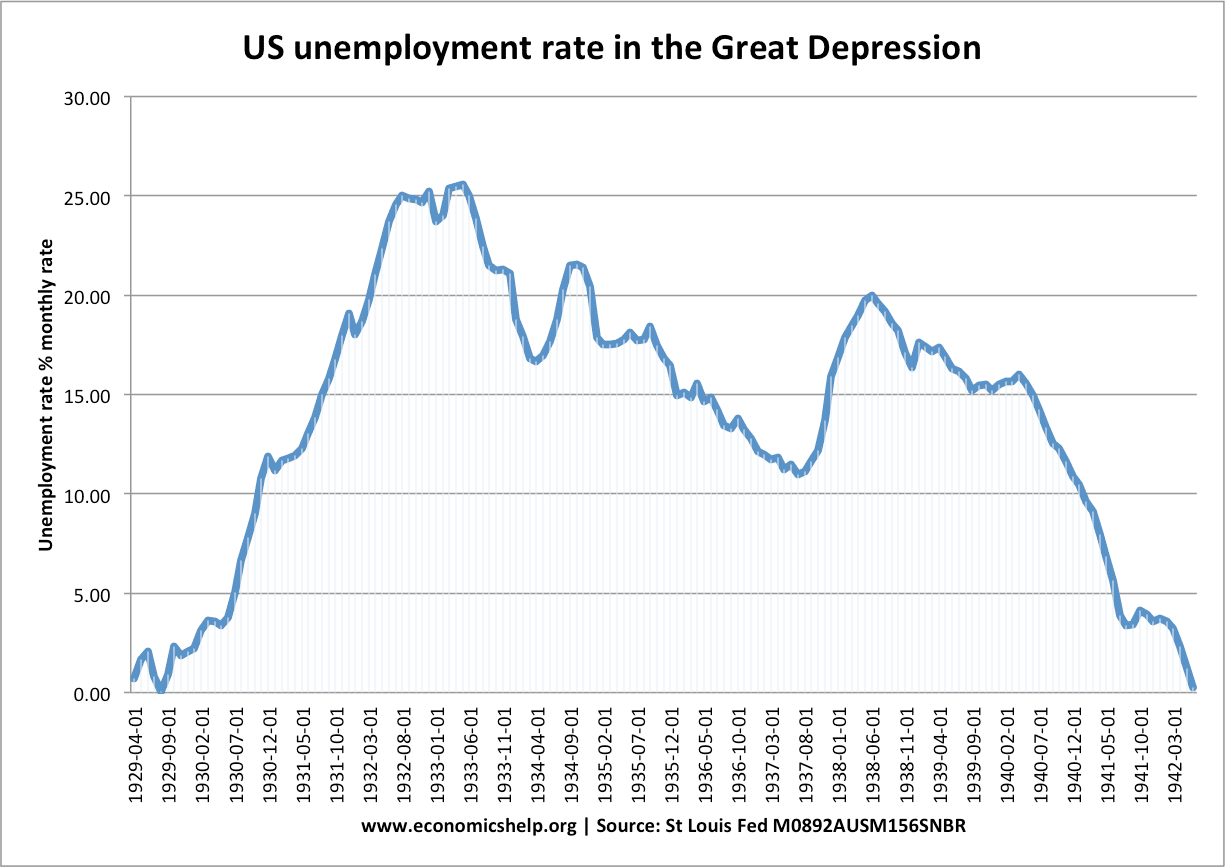

Unemployment has been a major economic problem in advanced economies. One of the principal causes of unemployment is swings in the business cycle. A fall in demand for goods during a recession, causes people to be laid off. Because of the depressed state of the economy, there is an imbalance between demand and supply of workers.

Unemployment can also be caused by rapid changes in labour markets, for examples, unskilled workers unable to gain employment in a high tech economy. Unemployment is a problem because it is a waste of resources, but more importantly, it leads to very high personal costs, such as stress, alienation, low income and feelings of failure.

A recession is a period of negative economic growth – a decline in the size of the economy. It exacerbates problems of inequality and unemployment. A problem of recession is that it can create a negative spiral. When demand falls, firms lay off workers. The unemployed have less money to spend causing further falls in demand.

In the great depression, unemployment rose to over 20% – the unemployed also had little support and relied on soup kitchens.

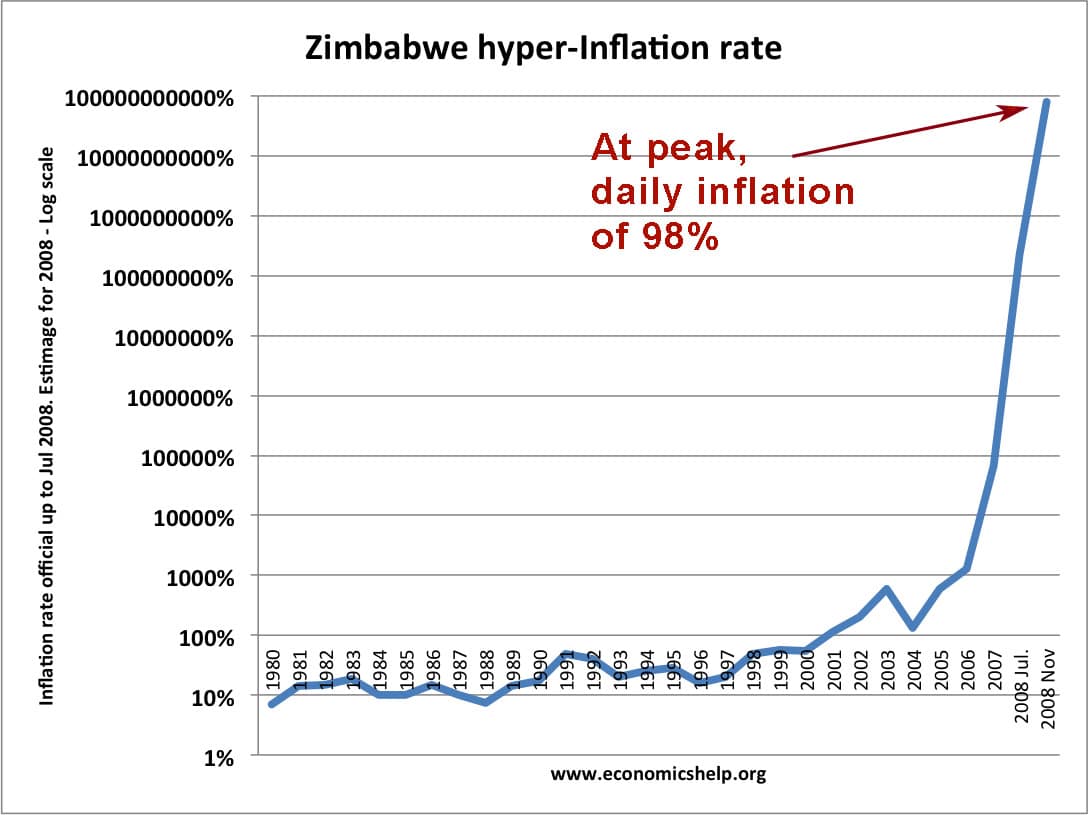

High inflation can be a serious problem if prices rise faster than wages and nominal interest rates. In periods of rapidly rising prices, people with savings will see a decline in their real wealth. If prices rise faster than wages, then people’s spending power will decline. Also, rapidly rising prices creates confusion and uncertainty and can cause firms to cut back on investment and spending.

Countries which have experienced hyperinflation , have seen it as a very traumatic period because all the economic certainty is washed away, leaving people without any certainty. Hyper inflation can cause not just economic turmoil but political turmoil as people lose confidence in the economic situation of the economy.

Balance of payments/current account deficit

A current account deficit on the balance of payments means an economy is importing more goods and services than it is exporting. To finance this current account deficit, they need a surplus on the financial/capital account. For many modern economies, a small current account deficit is not a problem. However, some developing economies have experienced a balance of payments crisis – where the large deficit has to be financed by borrowing, and this situation usually leads to a rapid devaluation of the currency. But, this devaluation increases the price of imports, reduces living standards and causes inflation.

Exchange rate volatility

In some cases, the exchange rate can cause economic problems. For example, countries in the Euro were not able to change the value of their currency against other Eurozone members. Because countries like Greece and Portugal had higher inflation rates, they became uncompetitive. Exports fell, and they developed a large current account deficit. The overvalued exchange rate caused a fall in economic growth.

On the other hand, a rapid devaluation can cause different problems. For example, when the price of oil fell, oil exporting countries saw a decline in export revenues, leading to a fall in the value of the currency. A rapid devaluation causes the price of imports to rise and causes both higher inflation and lower growth. A difficult problem for policymakers to deal with.

Development economics

Developing economies face similar economic problems, but any issue is magnified by low GDP and high levels of poverty. For example, unemployment in a developing economy is more serious because there is unlikely to be any government insurance to give a minimum standard of living.

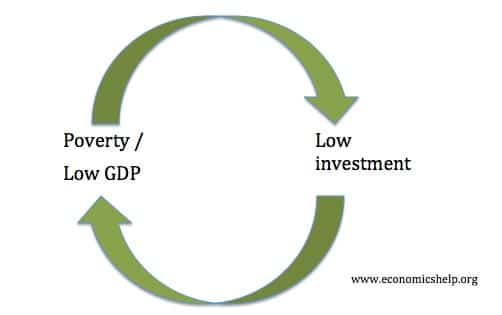

Poverty cycle . Some developing economies may be stuck in a poverty trap. Low growth and low saving ratios lead to low levels of investment and therefore low economic growth. This low growth and poverty cause the low savings and investment to be continued.

More examples

- Problems facing UK economy in 2015

- Economic problems of EU

Last updated: 17th November 2019, Tejvan Pettinger , www.economicshelp.org, Oxford, UK

28 thoughts on “Examples of economic problems”

Scarcity in resource is all over. It could be jobs, skills, capital, land, medicines, equipment, hospitals, universities, schools, houses, food, water etc

Sorry…it is not yet….

Enjoyed the lesson

what does economic mean

That is economic factors are addressed

Can I buy printed materials of this article Economic problems

Hi, Pettinger!

Really nice article, thank you. However, I am not sure I’ve got something you stated: isn’t inequality a macroeconomics issue? Because, you see, the scope of microeconomics is restricted to the individual actions of the economic agents (i.e., the “invisible hand science”) and inequality can only be properly handled by a macroeconomics perspective – or, at least, that’s the way I see it. Can you clarify that, please?

P.S.: if you are interested, I’ve answered this same question at stackexchange ( https://economics.stackexchange.com/questions/41448/is-inequality-a-micro-or-macro-economics-issue )

Govt.is also responsible for inequality , unemployment and low GDP growth by not taking efficient decisions in order to boost the economy.

Comments are closed.

Home — Essay Samples — Economics — Economic Issues — Economic Problem

Essays on Economic Problem

The relationship between money and love, turkey's economic development and challenges: a comprehensive analysis, made-to-order essay as fast as you need it.

Each essay is customized to cater to your unique preferences

+ experts online

Socio-economic Conditions in 'What is Poverty' by Jo Goodwin Parker

Economic policy of the international monetary fund in rwanda, analysis of bernie sanders’ speech on the well-being and financial issues of the us population, impact of recession in india, let us write you an essay from scratch.

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

The Strategies to Reduce Youth Unemployment

The relationship between economic growth and income inequality, the issues and methods of economics, raise of minimum wage and its effects on prices, get a personalized essay in under 3 hours.

Expert-written essays crafted with your exact needs in mind

The Journey of Economic Reforms During

The call to increase minimum wage, spanish economic crisis in 2008, the effectiveness of raising minimum wage policy, the great recession, possible effects of an economic decline in east-asia on the rest of the world, political, social and economic problem in tunisia, economic inequality in the united states, the problem of increasing economic inequality in america: evaluation of the works of joseph e. stiglitz, robert rector, and rachel sheffield, the political consequences of rising economic inequality, dynamic pricing technology at coca cola, homelessness, its history in the us, and effects on people, overview of the issue of poverty in uganda, the state of monopolies in the usa, issues in management of forest resources in african countries, the essential asset of the underdevelopment country, personal reflection on the topic of economic inequality, how foreign aid affects the economy of underdeveloped countries, the issue of economic inequality in the usa, the growth of economics in africa, relevant topics.

- Minimum Wage

- Income Inequality

- Economic Inequality

- Price Gouging

- Income Wealth Gap

- Unemployment

- Penny Debate

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Bibliography

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

Home / Essay Samples / Economics / Economic Problem

Economic Problem Essay Examples

Effects of war on economy.

War has a profound impact on the economy of any nation involved. The economic consequences of war can be far-reaching and long-lasting, affecting various sectors and aspects of a country's financial well-being. In this essay, we will explore the effects of war on the economy...

The Global Economic Crisis: Ripples and Repercussions

A global economic crisis is a daunting and far-reaching event that brings severe downturns in the world's economic activity, affecting numerous countries and industries simultaneously. In this essay, we will delve into the defining features of a global economic crisis, its underlying causes, and the...

Understanding the Dynamics of an Economic Crisis

An economic crisis is a severe and prolonged downturn in the economy of a country or region, characterized by a sharp decline in economic activity, widespread unemployment, and financial instability. It is a situation that disrupts the normal functioning of an economy and can have...

Persuading Society to Address Poverty: a Call to Action

Did you know that nearly half of the world population – which is more than 3 million people live on less than $2.50 a day? What can you buy with this amount? It is insufficient to feed their entire family, find a safe house or...

Navigating the Complexities of the Philippine Economy

To start with, this is economy of the Philippines essay in which I will briefly reveal this topic and discuss the main issues. Our economy today have facing different problems or issues regarding the most important thing in stimulating the Philippine national economy, thrusts spotlighting...

Arguments for Rising Minimum Wage

This is minimum wage argumentative essay where I want share my viewpoint due to this topic. I feel raising the minimum wage is a great idea. There are many theories and ideas which help confirm this. I have several supporting arguments that justify my theory...

Minimun Wage: the Exposition of International and National Forms

Minimun wage - have you heard this words combination before? So in this "Minimum wage essay thesis statement" the definition of the concept and its forms are given. To date, several definitions of minimum wages have been formulated internationally, but none are directly enshrined in...

Reasons Why Minimum Wage Should Be Raised and Its Possibilities

In addition to helping the economy, the minimum wage law was intended to be a humanitarian act. Most agree that full-time employees should be paid a fair wage in order to meet the basic needs of those who do not meet the current minimum wage....

Analysis of the Reasons Why Minimum Wage Should Be Raised

Increasing the minimum wage for the United States has been an area that recently has had many questions sprouting into existence such as showing reasons why minimum wage should be raised. The essay reveals this debate as it is going on for several years. In...

Sustainability as the Key for Supporting Global Food Security - Essay

Sustainability is common sense, survival of the fittest. Every creature fights to live, to sustain its life. And gloval food security exists when all people, at all times, have physical and economic access to sufficient, safe and nutritious food that meets their dietary needs and...

Trying to find an excellent essay sample but no results?

Don’t waste your time and get a professional writer to help!

You may also like

- Materialism

- Cost Benefit

- Construction

- Capitalism Essays

- Consumerism Essays

- Income Inequality Essays

- Microeconomics Essays

- Retailing Essays

- Fair Trade Essays

- Competitive Advantage Essays

- Opportunity Cost Essays

- Housing Market Essays

- International Monetary Fund Essays

samplius.com uses cookies to offer you the best service possible.By continuing we’ll assume you board with our cookie policy .--> -->