- Search Search Please fill out this field.

- Corporate Finance

- Financial Analysis

What Is Business Forecasting? Definition, Methods, and Model

:max_bytes(150000):strip_icc():format(webp)/andy__andrew_beattie-5bfc262946e0fb005143d642.jpg)

What Is Business Forecasting?

Business forecasting involves making informed guesses about certain business metrics, regardless of whether they reflect the specifics of a business, such as sales growth, or predictions for the economy as a whole. Financial and operational decisions are made based on economic conditions and how the future looks, albeit uncertain.

Key Takeaways:

- Forecasting is valuable to businesses so that they can make informed business decisions.

- Financial forecasts are fundamentally informed guesses, and there are risks involved in relying on past data and methods that cannot include certain variables.

- Forecasting approaches include qualitative models and quantitative models.

Understanding Business Forecasting

Companies use forecasting to help them develop business strategies. Past data is collected and analyzed so that patterns can be found. Today, big data and artificial intelligence has transformed business forecasting methods. There are several different methods by which a business forecast is made. All the methods fall into one of two overarching approaches: qualitative and quantitative .

While there might be large variations on a practical level when it comes to business forecasting, on a conceptual level, most forecasts follow the same process:

- A problem or data point is chosen. This can be something like "will people buy a high-end coffee maker?" or "what will our sales be in March next year?"

- Theoretical variables and an ideal data set are chosen. This is where the forecaster identifies the relevant variables that need to be considered and decides how to collect the data.

- Assumption time. To cut down the time and data needed to make a forecast, the forecaster makes some explicit assumptions to simplify the process.

- A model is chosen. The forecaster picks the model that fits the dataset, selected variables, and assumptions.

- Analysis. Using the model, the data is analyzed, and a forecast is made from the analysis.

- Verification. The forecast is compared to what actually happens to identify problems, tweak some variables, or, in the rare case of an accurate forecast, pat themselves on the back.

Once the analysis has been verified, it must be condensed into an appropriate format to easily convey the results to stakeholders or decision-makers. Data visualization and presentation skills are helpful here.

Types of Business Forecasting

There are two key types of models used in business forecasting—qualitative and quantitative models.

Qualitative Models

Qualitative models have typically been successful with short-term predictions, where the scope of the forecast was limited. Qualitative forecasts can be thought of as expert-driven, in that they depend on market mavens or the market as a whole to weigh in with an informed consensus.

Qualitative models can be useful in predicting the short-term success of companies, products, and services, but they have limitations due to their reliance on opinion over measurable data. Qualitative models include:

- Market research : Polling a large number of people on a specific product or service to predict how many people will buy or use it once launched.

- Delphi method : Asking field experts for general opinions and then compiling them into a forecast.

Quantitative Models

Quantitative models discount the expert factor and try to remove the human element from the analysis. These approaches are concerned solely with data and avoid the fickleness of the people underlying the numbers. These approaches also try to predict where variables such as sales, gross domestic product , housing prices, and so on, will be in the long term, measured in months or years. Quantitative models include:

- The indicator approach : The indicator approach depends on the relationship between certain indicators, for example, GDP and the unemployment rate remaining relatively unchanged over time. By following the relationships and then following leading indicators, you can estimate the performance of the lagging indicators by using the leading indicator data.

- Econometric modeling : This is a more mathematically rigorous version of the indicator approach. Instead of assuming that relationships stay the same, econometric modeling tests the internal consistency of datasets over time and the significance or strength of the relationship between datasets. Econometric modeling is applied to create custom indicators for a more targeted approach. However, econometric models are more often used in academic fields to evaluate economic policies.

- Time series methods : Time series use past data to predict future events. The difference between the time series methodologies lies in the fine details, for example, giving more recent data more weight or discounting certain outlier points. By tracking what happened in the past, the forecaster hopes to get at least a better than average view of the future. This is one of the most common types of business forecasting because it is inexpensive and no better or worse than other methods.

Criticism of Forecasting

Forecasting can be dangerous. Forecasts become a focus for companies and governments mentally limiting their range of actions by presenting the short to long-term future as pre-determined. Moreover, forecasts can easily break down due to random elements that cannot be incorporated into a model, or they can be just plain wrong from the start.

But business forecasting is vital for businesses because it allows them to plan production, financing, and other strategies. However, there are three problems with relying on forecasts:

- The data is always going to be old. Historical data is all we have to go on, and there is no guarantee that the conditions in the past will continue in the future.

- It is impossible to factor in unique or unexpected events, or externalities . Assumptions are dangerous, such as the assumption that banks were properly screening borrowers prior to the subprime meltdown . Black swan events have become more common as our reliance on forecasts has grown.

- Forecasts cannot integrate their own impact. By having forecasts, accurate or inaccurate, the actions of businesses are influenced by a factor that cannot be included as a variable. This is a conceptual knot. In a worst-case scenario, management becomes a slave to historical data and trends rather than worrying about what the business is doing now.

Negatives aside, business forecasting is here to stay. Appropriately used, forecasting allows businesses to plan ahead for their needs, raising their chances of staying competitive in the markets. That's one function of business forecasting that all investors can appreciate.

Kesh, Someswar and Raja, M.K. "Development of a Qualitative Reasoning Model for Financial Forecasting." Information Management & Computer Security, vol. 13, no. 2, 2005, pp. 167-179.

Infiniti Research. " Business Forecasting: The Challenges in Knowing the Unknown ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-699097865-5914251597ff43a1b2e59a0c3cecc660.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

7 Financial Forecasting Methods to Predict Business Performance

- 21 Jun 2022

Much of accounting involves evaluating past performance. Financial results demonstrate business success to both shareholders and the public. Planning and preparing for the future, however, is just as important.

Shareholders must be reassured that a business has been, and will continue to be, successful. This requires financial forecasting.

Here's an overview of how to use pro forma statements to conduct financial forecasting, along with seven methods you can leverage to predict a business's future performance.

What Is Financial Forecasting?

Financial forecasting is predicting a company’s financial future by examining historical performance data, such as revenue, cash flow, expenses, or sales. This involves guesswork and assumptions, as many unforeseen factors can influence business performance.

Financial forecasting is important because it informs business decision-making regarding hiring, budgeting, predicting revenue, and strategic planning . It also helps you maintain a forward-focused mindset.

Each financial forecast plays a major role in determining how much attention is given to individual expense items. For example, if you forecast high-level trends for general planning purposes, you can rely more on broad assumptions than specific details. However, if your forecast is concerned with a business’s future, such as a pending merger or acquisition, it's important to be thorough and detailed.

Access your free e-book today.

Forecasting with Pro Forma Statements

A common type of forecasting in financial accounting involves using pro forma statements . Pro forma statements focus on a business's future reports, which are highly dependent on assumptions made during preparation, such as expected market conditions.

Because the term "pro forma" refers to projections or forecasts, pro forma statements apply to any financial document, including:

- Income statements

- Balance sheets

- Cash flow statements

These statements serve both internal and external purposes. Internally, you can use them for strategic planning. Identifying future revenues and expenses can greatly impact business decisions related to hiring and budgeting. Pro forma statements can also inform endeavors by creating multiple statements and interchanging variables to conduct side-by-side comparisons of potential outcomes.

Externally, pro forma statements can demonstrate the risk of investing in a business. While this is an effective form of forecasting, investors should know that pro forma statements don't typically comply with generally accepted accounting principles (GAAP) . This is because pro forma statements don't include one-time expenses—such as equipment purchases or company relocations—which allows for greater accuracy because those expenses don't reflect a company’s ongoing operations.

7 Financial Forecasting Methods

Pro forma statements are incredibly valuable when forecasting revenue, expenses, and sales. These findings are often further supported by one of seven financial forecasting methods that determine future income and growth rates.

There are two primary categories of forecasting: quantitative and qualitative.

Quantitative Methods

When producing accurate forecasts, business leaders typically turn to quantitative forecasts , or assumptions about the future based on historical data.

1. Percent of Sales

Internal pro forma statements are often created using percent of sales forecasting . This method calculates future metrics of financial line items as a percentage of sales. For example, the cost of goods sold is likely to increase proportionally with sales; therefore, it’s logical to apply the same growth rate estimate to each.

To forecast the percent of sales, examine the percentage of each account’s historical profits related to sales. To calculate this, divide each account by its sales, assuming the numbers will remain steady. For example, if the cost of goods sold has historically been 30 percent of sales, assume that trend will continue.

2. Straight Line

The straight-line method assumes a company's historical growth rate will remain constant. Forecasting future revenue involves multiplying a company’s previous year's revenue by its growth rate. For example, if the previous year's growth rate was 12 percent, straight-line forecasting assumes it'll continue to grow by 12 percent next year.

Although straight-line forecasting is an excellent starting point, it doesn't account for market fluctuations or supply chain issues.

3. Moving Average

Moving average involves taking the average—or weighted average—of previous periods to forecast the future. This method involves more closely examining a business’s high or low demands, so it’s often beneficial for short-term forecasting. For example, you can use it to forecast next month’s sales by averaging the previous quarter.

Moving average forecasting can help estimate several metrics. While it’s most commonly applied to future stock prices, it’s also used to estimate future revenue.

To calculate a moving average, use the following formula:

A1 + A2 + A3 … / N

Formula breakdown:

A = Average for a period

N = Total number of periods

Using weighted averages to emphasize recent periods can increase the accuracy of moving average forecasts.

4. Simple Linear Regression

Simple linear regression forecasts metrics based on a relationship between two variables: dependent and independent. The dependent variable represents the forecasted amount, while the independent variable is the factor that influences the dependent variable.

The equation for simple linear regression is:

Y = Dependent variable (the forecasted number)

B = Regression line's slope

X = Independent variable

A = Y-intercept

5. Multiple Linear Regression

If two or more variables directly impact a company's performance, business leaders might turn to multiple linear regression . This allows for a more accurate forecast, as it accounts for several variables that ultimately influence performance.

To forecast using multiple linear regression, a linear relationship must exist between the dependent and independent variables. Additionally, the independent variables can’t be so closely correlated that it’s impossible to tell which impacts the dependent variable.

Qualitative Methods

When it comes to forecasting, numbers don't always tell the whole story. There are additional factors that influence performance and can't be quantified. Qualitative forecasting relies on experts’ knowledge and experience to predict performance rather than historical numerical data.

These forecasting methods are often called into question, as they're more subjective than quantitative methods. Yet, they can provide valuable insight into forecasts and account for factors that can’t be predicted using historical data.

6. Delphi Method

The Delphi method of forecasting involves consulting experts who analyze market conditions to predict a company's performance.

A facilitator reaches out to those experts with questionnaires, requesting forecasts of business performance based on their experience and knowledge. The facilitator then compiles their analyses and sends them to other experts for comments. The goal is to continue circulating them until a consensus is reached.

7. Market Research

Market research is essential for organizational planning. It helps business leaders obtain a holistic market view based on competition, fluctuating conditions, and consumer patterns. It’s also critical for startups when historical data isn’t available. New businesses can benefit from financial forecasting because it’s essential for recruiting investors and budgeting during the first few months of operation.

When conducting market research, begin with a hypothesis and determine what methods are needed. Sending out consumer surveys is an excellent way to better understand consumer behavior when you don’t have numerical data to inform decisions.

Improve Your Forecasting Skills

Financial forecasting is never a guarantee, but it’s critical for decision-making. Regardless of your business’s industry or stage, it’s important to maintain a forward-thinking mindset—learning from past patterns is an excellent way to plan for the future.

If you’re interested in further exploring financial forecasting and its role in business, consider taking an online course, such as Financial Accounting , to discover how to use it alongside other financial tools to shape your business.

Do you want to take your financial accounting skills to the next level? Consider enrolling in Financial Accounting —one of three courses comprising our Credential of Readiness (CORe) program —to learn how to use financial principles to inform business decisions. Not sure which course is right for you? Download our free flowchart .

About the Author

Planning, budgeting and forecasting is typically a three-step process for determining and mapping out an organization’s short- and long-term financial goals.

- Planning provides a framework for a business’ financial objectives — typically for the next three to five years.

- Budgeting details how the plan will be carried out month to month and covers items such as revenue, expenses, potential cash flow and debt reduction. Traditionally, a company will designate a fiscal year and create a budget for the year. It may adjust the budget depending on actual revenues or compare actual financial statements to determine how close they are to meeting or exceeding the budget.

- Forecasting takes historical data and current market conditions and then makes predictions as to how much revenue an organization can expect to bring in over the next few months or years. Forecasts are usually adjusted as new information becomes available.

The process is usually managed by a chief financial officer (CFO) and the finance department. However, the definition can be expanded to include all areas of organizational planning including: financial planning and analysis , supply chain planning , sales planning , workforce planning and marketing planning .

Discover the power of integrating a data lakehouse strategy into your data architecture, including enhancements to scale AI and cost optimization opportunities.

Register for the ebook on generative AI

Basic business accounting practices date as far back as the 1400s, when Venetian investors kept track of their Asian trade expeditions using double-entry bookkeeping, income statements and balance sheets. The word “budget” is from the old French word “bougette,” meaning “small purse.” The British government began to use the phrase “open the budget” in the mid-1700s, when the chancellor presented the annual financial statements. Businesses began to regularly use the term “budget” for their finances by the late 1800s.

Modern business forecasting began in response to the economic devastation of the Great Depression of the 1930s. New types of statistics and statistical analyses were developed that could help business better predict the future. Consulting firms emerged to help companies use these new prediction tools.

Accounting and forecasting were difficult in the early 20th century because they depended on laborious hand-written equations, ledgers and spreadsheets. The emergence of mainframe computers in the 1960s and personal computers in the 1980s sped up the process. Software applications such as Microsoft Excel became widely popular for financial reporting. However, Excel programs and spreadsheets were prone to input errors and cumbersome when various departments or individuals needed to collaborate on a report.

By the start of the 2000s, companies gained access to ever-growing operational data sources, as well as information outside corporate transaction systems — such as weather, social sentiment and econometric data. The vast amounts of available data for forecasting created a need for more sophisticated software tools to process it.

Numerous planning software packages emerged to handle this data complexity, making planning, budgeting and forecasting faster and easier — both for processing and collaboration. With predictive insights drawn automatically from data, companies could identify evolving trends and guide decision making with foresight, not just hindsight.

Today, cloud-based systems are becoming the standard, providing more flexibility, security and cost savings — helping organizations generate accurate predictions and budgets with fewer errors.

But despite these advancements, businesses are still quite dependent on traditional spreadsheets. 1 Seventy percent of businesses say they rely heavily on spreadsheet reporting, with only 16 percent using on-premise specialist software — and only ten percent using cloud software for planning.

Many businesses still base their strategy on annual plans and budgets, which is a management technique developed over a century ago. But in today’s more competitive environment, organizations are realizing that plans, budgets and forecasts need to reflect current reality — not the reality of two, three or more quarters ago. Continuous planning and rolling forecasts are becoming widely used methodologies to update plans, budgets and forecasts frequently throughout the year, on a quarterly or even monthly basis. These approaches help managers spot trends before their competitors — helping them make better informed, more agile decisions about pricing, product mix, capital allocations and even staffing levels.

Creating and implementing a sound planning, budgeting and forecasting process helps organizations establish more accurate financial report and analytics — potentially leading to more accurate forecasting and ultimately revenue growth. Its importance is even more relevant in today’s business environment where disruptive competitors are entering even the most tradition-bound industries.

When companies embrace data and analytics in conjunction with well-established planning and forecasting best practices, they enhance strategic decision making and can be rewarded with more accurate plans and more timely forecasts. Overall, these tools and practices can save time, reduce errors, promote collaboration and foster a more disciplined management culture that delivers a true competitive advantage.

Specifically, companies are able to:

- Quickly update plans and forecasts in response to new threats and opportunities, identifying risk areas early enough to rectify issues before they are serious.

- Identify and analyze the impact of changes as they occur.

- Strengthen the links between operational and financial plans.

- Better plan and predict cash flows.

- Improve communication and collaboration among plan contributors.

- Consistently deliver timely, reliable plans and forecasts, plus contingency plans, for a range of possible events.

- Analyze variances and deviations from plans and promptly take corrective action.

- Create a budget specifically for growth and having confidence in how much can be spent.

- More accurately manage sales pipelines while tracking performance against targets.

- Make more confident strategic decisions based on hard data, instead of hopes or guesswork.

- Provide evidence of an organization’s future trajectory to potential investors and lending institutions based on multiple data sources and sophisticated analysis.

Budgeting, planning and forecasting software can be purchased as an off-the-shelf solution or as part of a larger integrated corporate performance management (CPM) solution.

Advanced software solutions enable organizations to:

- Measure and monitor performance through interactive, self-service dashboards and visualizations.

- Examine root-causes with high-fidelity analysis of dimensionally rich data.

- Evaluate trends and make predictions automatically from internal or external data.

- Perform rapid what-if scenario modelling and create timely, reliable plans and forecasts.

Planning is easier and more effective when practitioners follow well-established best practices. Software solutions that support these practices can enhance the timeliness and reliability of information and increase participation by key people throughout the organization; especially those at the front lines.

Leading companies have moved to solutions that address the full planning cycle — data collection, modeling, analytics and reporting — on a common planning platform with lean infrastructure requirements. Such platforms can handle a diverse range of business functions, from budget-focused finance tasks to, for example, supply chain-focused planning for retail environments with thousands of SKUs (stock keeping units).

Companies like IBM offer holistic, integrated software solutions to streamline the planning, budgeting and forecasting process. The logic is that to adapt to today's quickly changing business conditions, an organization needs one solution that creates a single source of truth and visibility into all its data. These solutions can extend well beyond the financial aspects of the business, becoming a powerful forecasting engine across the enterprise. With these agile planning and exploratory analytics software solutions — whether in the cloud or on-premises — companies can perform planning, budgeting and forecasting with greater speed, agility and foresight.

Evaluating and selecting planning, budgeting and forecasting software is a complex task. It requires careful consideration of the software’s functionality, its value to the planning process and its ability to support planning best practices. There are also factors such as vendor reliability and support, user community connections and commitment to customer success once the sale is complete.

IBM Analytics recently published a guide to help organizations evaluate planning, budgeting and forecasting software — identifying key qualities to look for:

- Adaptive . Can you rapidly change models and re-forecast frequently, based on input from business units? Can you update plans as often as necessary?

- Timely . Is your information always current because users contribute directly to a central planning database? Are your consolidations and rollups done automatically to easily meet deadlines?

- Integrated . Do your planning, analysis, workflow and reporting functions reside on one common platform, reducing the need to maintain “shadow” planning systems?

- Collaborative . Is your solution web-based? Does it enable participation anytime, from anywhere with a secure connection?

- Self-service . Are users able to access data and perform complex analysis without the assistance of IT? Are you able to use a familiar spreadsheet interface for faster user adoption and accelerate time to value?

- Enterprise-scale data capacity . Is your solution capable of handling very large data volumes without limiting cube size? Some solutions do not handle “data sparsity” well — forcing data to be split into multiple cubes for analysis, causing version control issues.

- Efficient . Are your managers able to spend less time managing data and more time managing the business?

- Relevant . Do you have the ability to customize views for different user roles, to help increase adoption and process ownership? Do you have formula capabilities that enable modeling of all relevant business drivers?

- Accurate . Do your plans contain errors because of broken links, stale data, improper rollups and missing components?

The key is not just evaluating product features and capabilities, but also evaluating how those features will be implemented by different users within the organization. It’s important to test any planning solution that will be used by a large variety of stakeholders such as finance, operations, HR and sales.

Discover how one of the largest operators of parking facilities in the Middle East used IBM Planning Analytics to deliver better automation and multidimensional analytical power along with cost advantages.

Learn how the real estate developer enhanced its core planning, forecasting and project management capabilities with IBM technology to drive even greater profitability.

Find out how the company used IBM planning analytics to provide monthly and weekly reporting for engineering, marketing, sales and operations.

IBM Planning Analytics provides a single solution to automate planning, budgeting and forecasting for your enterprise.

Gain the autonomy you crave to find, explore and share insights in the governed, trusted environment you need, with IBM Cognos Analytics.

A comprehensive solution that provides power and flexibility for streamlined, best-practice financial consolidation and reporting.

Transform your marketing organization across people, process and platforms to remove complexity, unlock efficiency, and drive growth.

Learn how companies are delivering dependable business forecasts and optimizing the allocation of resources.

Learn the five common drawbacks to spreadsheets as planning tools

Discover the benefits of embracing data and analytics in conjunction with well-established planning and forecasting best practices.

See how you can synthesize information, uncover trends and deliver insights to improve decision making throughout the enterprise.

Request a live, 10-minute demo and get hands-on experience with IBM Planning Analytics by building a revenue plan.

See how headcount planning is done with IBM Planning Analytics in a quick, click-through demo.

1 The Future of Planning, Budgeting and Forecasting Global Survey, Workday and FSN, 2017 (link resides outside ibm.com)

- Professional Services

- Creative & Design

- See all teams

- Project Management

- Workflow Management

- Task Management

- Resource Management

- See all use cases

Apps & Integrations

- Microsoft Teams

- See all integrations

Explore Wrike

- Book a Demo

- Take a Product Tour

- Start With Templates

- Customer Stories

- ROI Calculator

- Find a Reseller

- Mobile & Desktop Apps

- Cross-Tagging

- Kanban Boards

- Project Resource Planning

- Gantt Charts

- Custom Item Types

- Dynamic Request Forms

- Integrations

- See all features

Learn and connect

- Resource Hub

- Educational Guides

Become Wrike Pro

- Submit A Ticket

- Help Center

- Premium Support

- Community Topics

- Training Courses

- Facilitated Services

What Is Business Forecasting? Why It Matters

April 25, 2021 - 10 min read

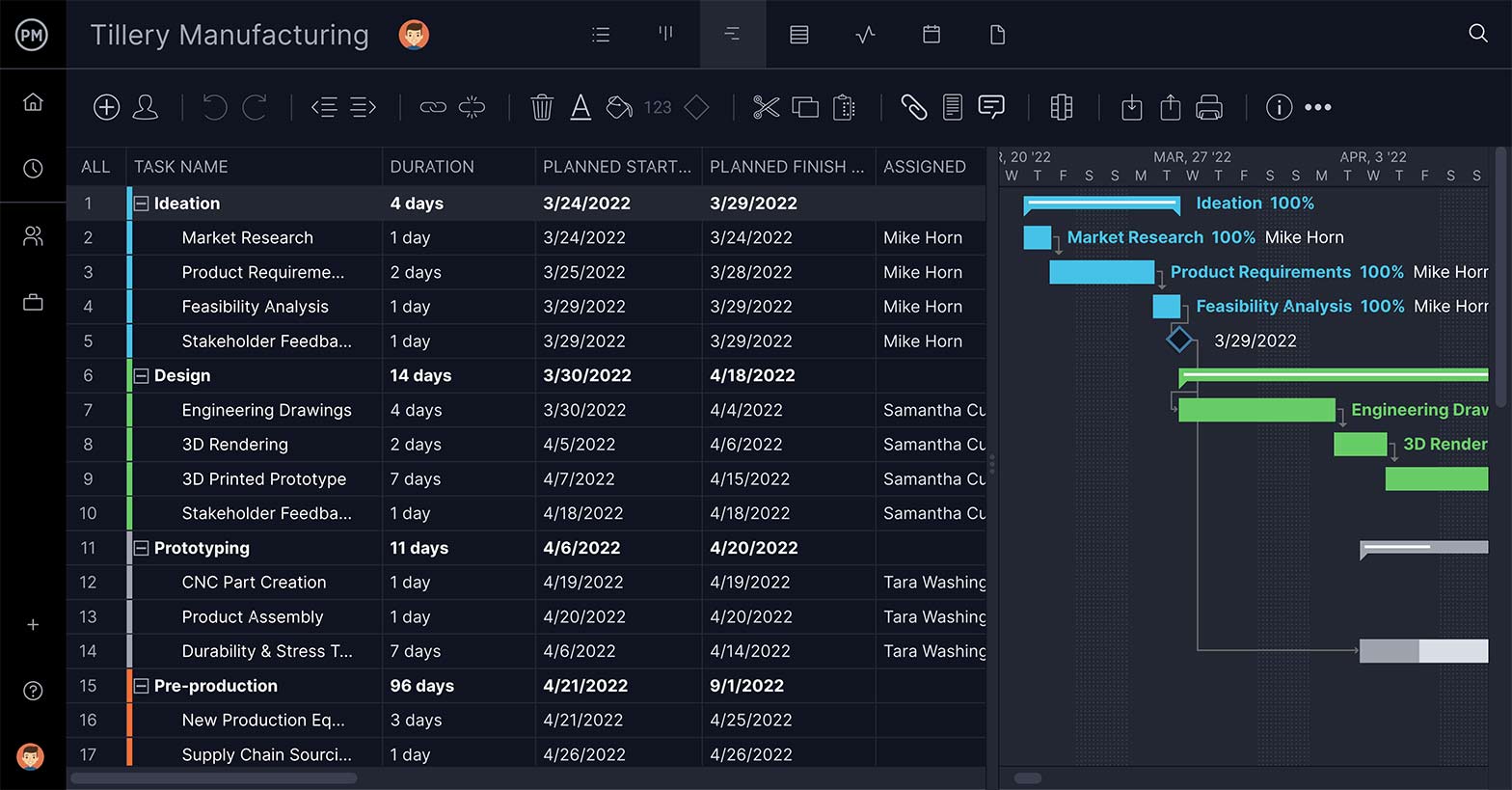

Companies conduct business forecasts to determine their goals, targets, and project plans for each new period, whether quarterly, annually, or even 2–5 year planning.

Forecasting helps managers guide strategy and make informed decisions about critical business operations such as sales, expenses, revenue, and resource allocation . When done right, forecasting adds a competitive advantage and can be the difference between successful and unsuccessful companies.

In this guide to business forecasting, we'll cover:

- What is business forecasting?

- What are the best forecasting techniques?

- Why forecasting in management is important

- How to conduct business forecasts

- A few forecasting examples for businesses

An introduction to business forecasting

What is business forecasting? Business forecasting is a projection of future developments of a business or industry based on trends and patterns of past and present data.

This business practice helps determine how to allocate resources and plan strategically for upcoming projects, activities, and costs. Forecasting enables organizations to manage resources , align their goals with present trends, and increase their chances of surviving and staying competitive.

The purpose of forecasts is to develop better strategies and project plans using available, relevant data from the past and present to secure your business's future . Good business forecasting allows organizations to gain unique, proprietary insights into likely future events, leverage their resources, set product team OKR , and become market leaders.

Managers conduct careful and detailed business forecasts to guarantee sound decision-making based on data and logic, not emotions or gut feelings.

What are important business forecasting methods?

There are several business forecasting methods. They fall into two main approaches:

- Quantitative forecasting

Qualitative forecasting

Quantitative and qualitative forecasting techniques use and provide different sets of data and are needed at different stages of a product's life cycle.

Note that significant changes in a company, such as new product focus, new competitors or competitive strategies, or changing compliance requirements diminish the connection between past and future trends. This makes choosing the right forecasting method even more important.

Quantitative business forecasting

Use quantitative forecasting when there is accurate past data available to analyze patterns and predict the probability of future events in your business or industry.

Quantitative forecasting extracts trends from existing data to determine the more probable results. It connects and analyzes different variables to establish cause and effect between events, elements, and outcomes. An example of data used in quantitative forecasting is past sales numbers.

Quantitative models work with data, numbers, and formulas. There is little human interference in quantitative analysis. Examples of quantitative models in business forecasting include:

- The indicator approach : This approach depends on the relationship between specific indicators being stable over time, e.g., GDP and the unemployment rate. By following the relationship between these two factors, forecasters can estimate a business's performance.

- The average approach : This approach infers that the predictions of future values are equal to the average of the past data. It is best to use this approach only when assuming that the future will resemble the past.

- Econometric modeling : Econometric modeling is a mathematically rigorous approach to forecasting. Forecasters assume the relationships between indicators stay the same and test the consistency and strength of the relationship between datasets.

- Time-series methods : Time-series methods use historical data to predict future outcomes. By tracking what happened in the past, forecasters expect to get a near-accurate view of the future.

Qualitative business forecasting is predictions and projections based on experts' and customers' opinions. This method is best when there is insufficient past data to analyze to reach a quantitative forecast. In these cases, industry experts and forecasters piece together available data to make qualitative predictions.

Qualitative models are most successful with short-term projections. They are expert-driven, bringing up contrasting opinions and reliance on judgment over calculable data. Examples of qualitative models in business forecasting include:

- Market research : This involves polling people – experts, customers, employees – to get their preferences, opinions, and feedback on a product or service.

- Delphi method : The Delphi method relies on asking a panel of experts for their opinions and recommendations and compiling them into a forecast.

How do you choose the right business forecasting technique?

- Choosing the right business forecasting technique depends on many factors. Some of these are:

- Context of the forecast

- Availability and relevance of past data

- Degree of accuracy required

- Allocated time to conduct the forecast

- Period to be forecast

- Costs and benefits of the forecast

- Stage of the product or business needing the forecast

Managers and forecasters must consider the stage of the product or business as this influences the availability of data and how you establish relationships between variables. A new startup with no previous revenue data would be unable to use quantitative methods in its forecast.

The more you understand the use, capabilities, and impact of different forecasting techniques, the more likely you will succeed in business forecasting.

Why is business forecasting important?

Any insight into the future puts your organization at an advantage. Forecasting helps you predict potential issues, make better decisions, and measure the impact of those decisions.

By combining quantitative and qualitative techniques, statistical and econometric models , and objectivity, forecasting becomes a formidable tool for your company.

Business forecasting helps managers develop the best strategies for current and future trends and events. Today, artificial intelligence, forecasting software, and big data make business forecasting easier, more accurate, and personalized to each organization.

Forecasting does not promise an accurate picture of the future or how your business will evolve, but it points in a direction informed by data, logic, and experiential reasoning.

What are the integral elements of business forecasting?

While there are different forecasting techniques and methods, all forecasts follow the same process on a conceptual level. Standard elements of business forecasting include:

- Prepare the stage : Before you begin, develop a system to investigate the current state of business.

- Choose a data point : An example for any business could be "What is our sales projection for next quarter?"

- Choose indicators and data sets : Identify the relevant indicators and data sets you need and decide how to collect the data.

- Make initial assumptions : To kickstart the forecasting process, forecasters may make some assumptions to measure against variables and indicators.

- Select forecasting technique : Pick the technique that fits your forecast best.

- Analyze data : Analyze available data using your selected forecasting technique.

- Estimate forecasts : Estimate future conditions based on data you've gathered to reach data-backed estimates.

- Verify forecasts : Compare your forecast to the eventual results. This helps you identify any problems, tweak errant variables, correct deviations, and continue to improve your forecasting technique.

- Review forecasting process : Review any deviations between your forecasts and actual performance data.

How do you do business forecasting?

Successful business forecasting begins with a collaboration between the manager and forecaster. They work together to answer the following questions:

- What is the purpose of the forecast? How will it be used?

- What are the components and dynamics of the system the forecast is focused on?

- How relevant is past data in estimating the future?

Once these answers are clear, choose the best forecasting methods based on the stage of the product or business life cycle, availability of past data, and skills of the forecasters and managers leading the project.

With the right forecasting method, you can develop your process using the integral elements of business forecasting mentioned above.

How do you get data for business forecasting?

A forecast is only as good as the data supplied. Before collecting data, ask:

- Why do you need it?

- What kind of data do you need?

- When will you collect it?

- Where will you gather it?

- Who is in charge of collecting it?

- How will you collect it?

- How will you analyze it?

When you have these answers, you can start collecting data from two main sources:

- Primary sources : These sources are gathered first-hand using reporting tools — you or members of your team source data through interviews, surveys, research, or observations.

- Secondary sources : Secondary sources are second-hand information or data that others have collected. Examples include government reports, publications, financial statements, competitors' annual reports, journals, and other periodicals.

Business forecasting examples

Some forecasting examples for business include:

- Calculating cash flow forecasts, i.e., predicting your financial needs within a timeframe

- Estimating the threat of new entrants into your market

- Measuring the opportunity of developing a new product or service

- Estimating the costs of recurring bills

- Predicting future sales growth based on past sales performance

- Analyzing relationships between variables, e.g., Facebook ads and potential revenue

- Budgeting contingencies and efficient allocation of resources

- Comparing customer acquisition costs and customer lifetime value over time

What are the limits of business forecasting?

You can follow the rules, use the right methods, and still get your business forecast wrong. It is, after all, an attempt to predict the future. Some limits to business forecasting include:

- Biases and errors by the forecasters or managers

- Incorrect information from employees, experts, or customers

- Inaccurate past numbers

- Sudden change in market conditions

- New industry regulations

How Wrike helps with business forecasting

The more accurate your business forecasting, the more effective your strategies and plans can be. While many things in business are out of your control, having an informed forecast of what lies ahead makes you prepared and confident about the future.

Wrike helps gather data in one central platform, extract insights, and communicate findings with forecasters and managers. Other benefits of Wrike include real-time data, integrations with other forecasting software, streamlined collaboration, and visibility into every business forecasting project.

Are you ready to make projections for your business, allocate your resources for the best results, and improve your business forecasting process? Get started with a two-week free trial of Wrike today.

Kelechi Udoagwu

Kelechi is a freelance writer and founder of Week of Saturdays, a platform for digital freelancers and remote workers living in Africa.

Related articles

Strengthen and Optimize Agency Resource Management

Improve your agency’s resource management processes and learn how Wrike boosts performance across the board with our robust project management software.

Release Management: Definition, Phases, and Benefits

What is release management and how can it improve software development strategy? In this guide, we talk about release management processes and their benefits.

The Definitive Guide to Data-Driven Marketing

Wondering what data-driven marketing is and how to reap its benefits for your business? Find out how to create your own data-driven strategy with our guide.

Get weekly updates in your inbox!

You are now subscribed to wrike news and updates.

Let us know what marketing emails you are interested in by updating your email preferences here .

Sorry, this content is unavailable due to your privacy settings. To view this content, click the “Cookie Preferences” button and accept Advertising Cookies there.

- Group Training

- Individual Training

- Individual Certification

- Corporate Certification

- Companies Certified

- Testimonial

- Companies w/ Certification

- Levels of Certification

- Certification Details

- Sample Exams

- Recertification

- Preparation Materials

- Exam Schedule

- CPF Prep/Review

- Research Reports

- Virtual Conference Recordings

- Cancellation Policy

- Refund Policy for Events

- Ambassador Program

- Member Companies

- Partnership

- Apply to Speak

- Subscription

- S&OP Self-Assessment

- Sponsored Content

- Become a Sponsor

- Exhibit at IBF Events

What Is Business Forecasting?

What exactly is business forecasting? To help answer this question, consider this. Whether you realize it or not, virtually every business decision and process is based on a forecast. Anything you plan is generally based on an assumption of something happening in the future which, by definition, is a forecast. Not all forecasts are derived from sophisticated methods, but an educated guess about the future is more valuable for the purposes of planning than no forecast at all.

It does not matter which industry you are in, whether your company manufactures products or offers services, or whether your company is small or large, you must have forecasts to plan effectively. Of course, the more accurate the forecasts, the better the plan. It stands to reason that if we know what happened in the past and why, or have insight into what may occur next, we can then predict what is likely to happen in the future. With this information, we can potentially alter the future to the company’s advantage.

Business Forecasting Drives Better Decision Making

Business Forecasting is the process of using analytics, data, insights, and experience to make predictions and respond to various business needs. The insight gained by Business Forecasting enables companies to automate and optimize their business processes. A Forecaster’s goal is to go beyond knowing what has happened and provide the best assessment of what will happen in the future to drive better decision making.

Many people think of a Business Forecast as how many of something we will sell next week. That is part of it, but Business Forecasting can encompass anything that identifies the likelihood of a future outcome, provides comparative information using analytics, or drives data-driven business decisions.

What Is Business Forecasting Used For?

Business Forecasting can be used for:

- Strategic planning and decision-making (long-term planning)

- Finance and accounting (budgets and cost controls)

- Marketing (consumer behavior, life cycle management, pricing)

- Operations and supply chain (resource planning, production, logistics, inventory)

Business Forecasting Techniques

At the heart of business process decision making is the forecast, which involves techniques including:

- Qualitative Forecasting : Refers to the use of opinion or educated guesses in developing forecasts.

- Quantitative Forecasting : Used to develop a future forecast using past data and, often, statistical or mathematical models.

These techniques, along with analyzing data and the use of statistical algorithms, can also be the foundation and input into a Demand Plan. For some companies, the forecast may be considered the Baseline Demand Forecast and is more statistically driven, and is a critical part of Demand Planning.

Get started

- Project management

- CRM and Sales

- Work management

- Product development life cycle

- Comparisons

- Construction management

- monday.com updates

What Business Forecasting Is and Why It Matters

As a business leader, you already understand that every decision you make impacts the overall success of the company. With this much at stake, it’s imperative that you make decisions with the most up-to-date facts and data possible. This step can be difficult when it comes to predicting future business statistics, such as sales data, inventory control, and budgetary figures. To help with this issue, many companies rely on business forecasting to make future projections based on high-level assumptions and historical data.

It’s crucial for your company to understand what business or demand forecasting is, why it matters and what methods to use to make these projections. This article defines these terms and delves into the types of forecast models you can use to learn more about your business and predict future trends.

“Business forecasting” is a part of our Project Management Glossary — check out the full list of terms and definitions!

What is business forecasting?

Business forecasting is a common practice companies of all sizes use frequently.

Business forecasting is the process of collecting and analyzing historical company data as well as marketing insights and trends to make projections regarding future business outcomes.

While the practice of business forecasting has been around for centuries, the combination of big data and advanced technologies, including machine learning and artificial intelligence, makes today’s predictions more accurate than ever before. Business leaders use this planning technique to predict everything from financial outcomes to future sales numbers. It’s important to note that there are numerous business forecasting methods you can use depending on the type of projections you need.

Types of business forecast methods

Business forecast methods typically fit into two primary categories: qualitative and quantitative.

Qualitative forecasting relies heavily on expert opinions and high-level assumptions. It’s an ideal planning tool for companies with less than three years of historic internal data or for when you’re forecasting during times of significant disruptions in the market. Quantitative forecasting, on the other hand, relies primarily on facts and numbers. These methods analyze current and past data to predict future outcomes.

Within these two categories, there are numerous types of business forecasting methods. Here’s a look at the top four.

- Delphi method : The Delphi method is a qualitative type of business forecasting that relies on expert opinions. Generally, project managers poll a panel of industry and field experts regarding relevant information, such as market trends and insights. Managers then compile and analyze this information to deliver data-driven forecasting results.

- Market research : The market research method involves polling users regarding specific products or features. This qualitative approach allows teams to obtain a general consensus as to the success or failures of these products and to determine future sales projections.

- Time-series method : The time-series method is a quantitative approach that relies heavily on the company’s past data points. This method uses the company’s historical data and advanced technology to analyze information and build models and other visuals that predict future outcomes.

- Econometric modeling : Econometric models use a mathematical approach that evaluates the company’s current and previous data to make strong projections regarding the company’s future. As a quantitative approach, it uses statistical analysis to predict future outcomes.

How to you know which of the forecasting techniques to use? It depends on several factors, including:

- Scope : The size of the project may limit the effectiveness of some forecasting methods. For example, the market research method may be difficult to complete for larger projects with many different steps and stages. In these cases, a quantitative approach, such as the time-series method may work better.

- Years in business : If your business is relatively new, a quantitative approach may not be possible. Typically, these methods require at least three years of hard data to deliver accurate results.

- Forecasting goals : The type of forecasting goals also determines the type of method you want to use. For instance, if you’re trying to identify shifts in the market, taking a quantitative approach that utilizes historical company data may not provide the results you need.

No matter which forecasting method you utilize, it plays a vital role in the project management process.

The role of business forecasting in project management

Accurate forecasting can help project managers set realistic goals and objectives, predict future outcomes, and conduct accurate risk assessments. These projections can help increase the project’s overall success and allow the team to meet tight deadlines.

Fortunately, advanced technology can help project managers track and manage company data to make business forecasting quick, easy, and effective. For example, monday.com allows project managers to store and view company data in one easy-to-use software. Our platform integrates with popular business platforms , such as Salesforce, Excel, Stripe, Zapier, and DropBox, which makes it easy to track business data, such as sales reports and financial information.

With the help of these digital tools, your company can reap the many benefits of business forecasting in project management.

Benefits of business forecasting in project management

Business forecasting offers organizations a variety of benefits, including those summarized below.

Gain valuable insights

Forecasting gives business leaders insights regarding the anticipated success of the company. While forecasting is not always 100% accurate, it does provide enough information to help companies with everything from managing cash flow to predicting inventory needs and setting realistic goals.

Make improvements

The business forecasting method, especially quantitative approaches, provides insights into the company’s past performance as well as future predictions. This visual representation can help your company identify problem areas, learn from past mistakes, and improve business operations.

Identify market shifts

Given today’s fast-paced market, it’s crucial for businesses to prepare for future changes. Forecasting — especially via qualitative methods — can help you understand future trends in the market, upcoming supply chain challenges, and changes in customer expectations. Having this knowledge in hand can help your organization prepare for the future and minimize the impact of any changes or shifts in the market.

Increase profits

The business forecasting process can improve your company’s long-term profitability in several ways:

- It allows your business leaders to develop budgets based on data-driven sales predictions .

- Accurate forecasting can help your organization secure the funding necessary to grow the business.

- Forecasting can help your company reduce waste by projecting shifts in the market.

The easiest way to understand the many benefits of business forecasting is to see this practice in action.

A few business forecasting examples and what they could mean for your team

To better understand how business forecasting can help your company prepare for the future, here’s a look at some forecasting examples and what they could mean for your team.

Sales forecasting

Suppose a shoe store wants to project next year’s sales numbers. Since this store has been in business for over five years, the time-series forecasting method is a good option. This method allows the business owner to use collected data to predict the future of the company. However, due to today’s fluctuating market, the shoe store owner may also want to take a qualitative approach, such as the Delphi method, to determine if any shifts in the market could impact future sales.

This forecasting data can help the shoe store owner with everything from planning next year’s budget to managing inventory to determining how many workers to hire.

Forecasting the success of a new product or service

Let’s look at a fashion design company that’s preparing for a new product launch. Knowing how much product to have on hand is crucial to the success of this launch. Too much inventory can impact profits, yet not enough inventory can affect customer satisfaction. In this case, the company can use market research to poll a number of potential customers to determine the likelihood of them making a purchase or referring this new product to others.

This forecasting data can help the company project future sales, set an appropriate price point, and have enough inventory in place to meet demand.

Frequently asked questions

What is forecasting in business.

Business forecasting is the process of analyzing big data, market insights, and expert opinions to make projections regarding future business outcomes. Business leaders use forecasting to set budgets, determine product offerings, oversee supply chain management, and manage projects.

How does forecasting help a business?

Forecasting is a critical tool for businesses of all sizes. While business planning is not 100% accurate every time, it does provide business leaders with data-driven insights. Leaders then use these insights to make informed decisions for the company, such as which products to sell, how many workers it needs, and how much inventory to secure.

What are the four basic forecasting methods?

There are dozens of business forecasting methods available, most of which are broken down into two categories, including qualitative and quantitative. The most popular qualitative methods are market research, which polls a panel of users to predict future outcomes, and the Delphi method, which involves gathering insights from industry experts. The most popular quantitative methods include the time-series method, which analyzes current and historical data to predict future outcomes, and econometric modeling, which uses mathematical models and statistical methods of analysis to make future projections.

Prepare for your company’s future with business forecasting

Don’t risk moving your company into the future without first understanding what to expect. Blindly leading your company into the upcoming weeks, months, and years can significantly impact the success of your business. Instead, rely on effective business forecasting techniques to help you project future outcomes, prepare for upcoming shifts and mitigate any possible risks.

monday.com’s seamless Work OS lets you gather data, work as a team to analyze it, and set goals and timelines so you can act on what you learn during forecasting.

Send this article to someone who’d like it.

What Is Business Forecasting? Predictions to Drive Success

November 29, 2021

by Alexandra Vazquez

In this post

Types of business forecasts, business forecasting methods, benefits of business forecasting, business forecasting challenges, business forecasting vs. scenario planning, business forecasting process, business forecasting examples.

It’s time to look inside your crystal ball and start forecasting. Forecasting gives you the tools you need to make reliable predictions about foreseeable events.

What is business forecasting?

Business forecasting is the process of analyzing data to predict future company needs and make insight-driven development decisions.

There’s really no downside to being prepared! Building a strong forecast prepares businesses for potential issues and identifies areas for profitable growth. Even if your predictions end up being inaccurate, you’ll have all the necessary data and information to get closer to the final forecast.

Some companies utilize predictive analytics software to collect and analyze the data necessary to make an accurate business forecast. Predictive analytics solutions give you the tools to store data, organize information into comprehensive datasets, develop predictive models to forecast business opportunities, adapt datasets to data changes, and allow import/export from other data channels.

Businesses can create various types of forecasts with business forecasting strategies. Because historical data and market trends affect so many aspects of business, comprehensive predictions can help prepare almost every element of your company.

- General business forecasting predicts overall market trends and external factors that affect your business’ success.

- Accounting forecasting creates projections of future business costs .

- Budget forecasting makes predictions for allocating the budget needed for future projects or addressing potential issues. Budgeting and forecasting software is an indispensable tool if you’re looking to forecast for budgeting your business activities.

- Financial forecasting projects a company’s monetary value as a whole. You can use the current assets and liabilities from your balance sheet to help you make a prediction.

- Demand forecasting predicts the future needs of your target customer base.

- Supply forecasting works with demand forecasting to allocate the necessary resources for fulfilling upcoming customer demands.

- Sales forecasting predicts the expected success of the company offerings and how it’ll affect future sales and cash flow.

- Capital forecasting makes predictions about a company’s future assets and liabilities.

There are two main types of business forecasting methods: quantitative and qualitative. While both have unique approaches, they’re similar in their goals and the information used to make predictions – company data and market knowledge.

Quantitative forecasting

The quantitative forecasting method relies on historical data to predict future needs and trends. The data can be from your own company, market activity, or both. It focuses on cold, hard numbers that can show clear courses of change and action. This method is beneficial for companies that have an extensive amount of data at their disposal.

There are four quantitative forecasting methods:

- Trend series method: Also referred to as time series analysis, this is the most common forecasting method. Trend series collects as much historical data as possible to identify common shifts over time. This method is useful if your company has a lot of past data that already shows reliable trends.

- The average approach: This method is also based on repetitive trends. The average approach assumes that the average of past metrics will predict future events. Companies most commonly use the average approach for inventory forecasting.

- Indicator approach: This approach follows different sets of indicator data that help predict potential influences on the general economic conditions, specific target markets, and supply chain. Some examples of indicators include changes in Gross Domestic Product (GDP), unemployment rate, and Consumer Price Index (CPI). By monitoring the applicable indicators, companies can easily predict how these changes may affect their own business needs and profitability by observing how they interact with each other. This approach would be the most effective for companies whose sales are heavily affected by specific economic factors.

- Econometric modeling: This method takes a mathematical approach using regression analysis to measure the consistency in company data over time. Regression analysis uses statistical equations to predict how variables of interest interact and affect a company. The data used in this analysis can be internal datasets or external factors that can affect a business, such as market trends, weather, GDP growth, political changes, and more. Econometric modeling observes the consistency in those datasets and factors to identify the potential for repeat scenarios in the future.

Qualitative forecasting

The qualitative forecasting method relies on the input of those who influence your company’s success. This includes your target customer base and even your leadership team. This method is beneficial for companies that don’t have enough complex data to conduct a quantitative forecast.

There are two approaches to qualitative forecasting:

- Market research: The process of collecting data points through direct correspondence with the market community. This includes conducting surveys, polls, and focus groups to gather real-time feedback and opinions from the target market. Market research looks at competitors to see how they adjust to market fluctuations and adapt to changing supply and demand . Companies commonly utilize market research to forecast expected sales for new product launches.

- Delphi method: This method collects forecasting data from company professionals. The company’s foreseeable needs are presented to a panel of experts, who then work together to forecast the expectations and business decisions that can be made with the derived insights. This method is used to create long-term business predictions and can also be applied to sales forecasts.

There are several benefits to making effective forecasts for your business. You gain valuable insights into its different aspects and the future of its success.

- Foresee upcoming changes with a heads up on potential market changes that can affect your business. With the right prediction, you can strategize the decisions to succeed in the face of the challenges ahead before they become costly surprises.

- Decrease the cost of unexpected demand by preparing ahead of time. Business forecasting is a great starting point for demand planning . If you plan to incorporate demand forecasting into your business processes, you’ll be prepared for upcoming market demands and avoid the extra costs associated with an influx of demand that you weren’t ready for.

- Increase customer satisfaction by giving them what they want, when they want it. Demand planning doesn’t just benefit you. With the right business forecast, your company can offer products or services to the target industry and meet their expectations. A company ready to serve its market is always met with customer satisfaction and loyalty.

- Set long- and short-term goals by tracking your progress. Business forecasting tools help you outline your future company objectives. Continuous predictions allow you to track the progress of your proposed goals as those future expectations become the present reality.

- Learn from the past by analyzing it. Forecasting enables you to collect and study extensive historical company data. Keeping a close eye on this data can help you identify where things may have gone wrong in the past. With this new information, your company can make the necessary adjustments to avoid similar mistakes in the future.

While the benefits of business forecasting highlight all of the amazing advantages it has to offer, it’s not a surefire way to prepare for the future. Companies who plan to forecast should also keep the challenges in mind and make sure that forecasting has more pros than cons for their business. Below are some of the notable challenges of business forecasting.

- You can’t always expect the unexpected. While old data can help you gain insights into company processes and learn from mistakes, history doesn’t always repeat itself. Business forecasting isn’t a perfect process, and although helpful, it may not precisely predict future trends or business matters using old company data alone. It operates on the assumption that what happened will most likely happen again. Unfortunately, this is not always the case, and the hard work put into preparing for a forecasted event may never come to fruition.

- It takes time to create an accurate forecast. Forecasting can be a lengthy process when started from scratch. Some companies find it challenging to gather the resources needed to begin predicting and allocate the time to do it correctly.

- Historical data will always be outdated. There’s no way to know what’ll happen next. Although historical information is very valuable, it’s forever considered “old”. Forecasts are never based on the present and, therefore, are only as accurate as the data you already collected.

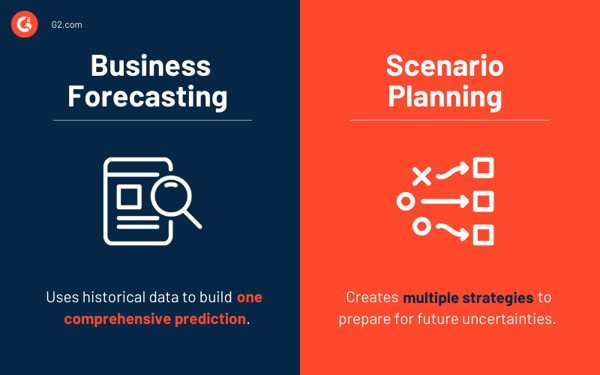

Business forecasting is often confused with scenario planning because of their shared goal of preparing for the future. Both rely on learning from past mistakes and reflecting on what decisions must be made to drive success. However, business forecasting and scenario planning differ in the preparation process.

Business forecasting focuses on a problem at hand and uses historical data to predict what might happen next. It emphasizes predictive analytics and the need to eliminate existing uncertainties. The problem can be as broad as the actual performance of the entire company, or as specific as how a single product might sell in the future based on past market trends.

While built on tangible data, forecasting is essentially a guess of the future and you need to make assumptions ahead of time to prepare for any predicted issues. Forecasting is an all-hands-on-deck approach that involves many departments, including analysts, economists, managers, and more.

Scenario planning creates multiple scenarios to help prepare for the future. With these scenarios in mind, a company can begin planning a course of action to achieve the desired outcome. This includes creating step-by-step strategies and timelines for achieving objectives.

While business forecasting focuses on past information, scenario planning takes the past, present, and future into consideration with learnings from the past, understanding the capabilities of the present, and aspiring for future success. Although a team’s input is important in scenario planning, company’s primary decision-makers carry out the bulk of the process.

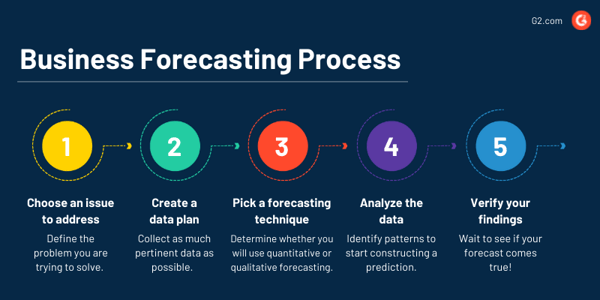

The way a company forecasts is always unique to its needs and resources, but the primary forecasting process can be summed up in five steps. These steps outline how business forecasting starts with a problem and ends with not only a solution but valuable learnings.

1. Choose an issue to address

The first step in predicting the future is choosing the problem you’re trying to solve or the question you’re trying to answer. This can be as simple as determining whether your audience will be interested in a new product your company is developing. Because this step doesn’t yet involve any data, it relies on internal considerations and decisions to define the problem at hand.

2. Create a data plan

The next step in forecasting is to collect as much data as possible and decide how to use it. This may require digging up some extensive historical company data and examining the past and present market trends. Suppose your company is trying to launch a new product. In this case, the gathered data can be a culmination of the performance of your previous product and the current performance of similar competing products in the target market.

3. Pick a forecasting technique

After collecting the necessary data, it’s time to choose a business forecasting technique that works with the available resources and the type of prediction. All the forecasting models are effective and get you on the right track, but one may be more favorable than others in creating a unique, comprehensive forecast.

For example, if you have extensive data on hand, quantitative forecasting is ideal for interpretation. Qualitative forecasting is best if you have less hard data available and are willing to invest in extensive market research.

4. Analyze the data

Once the ball starts rolling, you can begin identifying patterns in the past and predict the probability of their repetition. This information will help your company’s decision-makers determine what to do beforehand to prepare for the predicted scenarios.

5. Verify your findings

The end of business forecasting is simple. You wait to see if what you predicted actually happens. This step is especially important in determining not only the success of your forecast but also the effectiveness of the entire process. Having done some forecasting, you can compare the present experience with these forecasts to identify potential areas for growth.

When in doubt, never throw away “old” data. The final information of one forecasting process can also be used as the past data for another forecast. It’s like a life cycle of business development predictions.

With the different types of business forecasting come different potential use cases. A company may choose to utilize several elements of business forecasting to prepare for various situations. Here are some real-life examples where business forecasting would be valuable.

The seasoned veteran

Suppose you represent a company that has been in the market for a long time but has never tried business forecasting. Because of the long history of company data, you choose to try out quantitative business forecasting. Your aim is to make predictions using the most cost-effective and least time-consuming method. With those considerations, you may opt for the trend series method to manually identify common trends in old data, determine the likelihood of repeat instances, and forecast accordingly.

The new kid on the block

Imagine you are a new company that has entered the market to start selling your own brand of smartphones. You may think that business forecasting is impossible because you don’t have any historical company data to work off of. However, you can utilize qualitative business forecasting! Because the smartphone industry is a highly competitive one, you can use market research to take advantage of publicly available market data.

The one who wants the best of both worlds

Imagine you work for a recruiting company that has noticed that the country’s unemployment rate heavily affects company performance and has the data to prove it. As you have a clear indicator that directly impacts the potential for success, using the indicator approach to create long-term predictions would be the right call.

However, your company stresses the importance of integrating expert knowledge into the forecasting process. This extra note means that some qualitative forecasting can be used as well. You may choose to use the Delphi method to collect expert opinions and weigh that into the final forecasts as well.

What do the stars have in store for you?

Creating comprehensive predictions isn’t rocket science. With business forecasting, seeing the future is as easy as learning from the past. What you do with your findings is what will set you apart.

Want to start forecasting for your business? Learn more about business analytics and how it helps collect the necessary data and insights.

The future starts now

Automate business forecasting data analysis with predictive analytics software.

Alexandra Vazquez is a Senior Content Marketing Specialist at G2. She received her Business Administration degree from Florida International University and is a published playwright. Alexandra's expertise lies in writing for the Supply Chain and Commerce personas, with articles focusing on topics such as demand planning, inventory management, consumer behavior, and business forecasting. In her spare time, she enjoys collecting board games, playing karaoke, and watching trashy reality TV.

Recommended Articles

Contributor Network

A Guide to Choosing the Right Platform For Digital Business Cards

When was the last time you attended a business event and returned empty-handed? It's hard to...

by Mayuri Bangar

AI for Business Texting: Enhance Your Communication Strategy

AI's transformative impact has grown across all aspects of our lives. From anticipating retail...

by Jennifer Adler

5 Impactful Sustainable Business Practices

Sustainability is no longer a choice; it's a necessity.

by Lee Shields

Never miss a post.

Subscribe to keep your fingers on the tech pulse.

By submitting this form, you are agreeing to receive marketing communications from G2.

How Business Forecasting Works and Why You Should Use It

As you grow your small business, you need to plan and develop your long-term strategy. Well-run companies don’t just address things as they come up, they plan ahead. As a small business owner, it’s important to keep sight of the bigger picture through business forecasting.

With business forecasting, companies use different methods and data to predict market trends to help determine their short-term and long-term business outlook. This data is a vital part of helping companies grow, start new initiatives, and plan their finances for the quarter and year. It can also help you plan for potential seasonal dips in your cash flow or plan for future expansions.

Keep reading to find out more about the different types of and elements that make up business forecasting as well as why every small business should consider using forecasting methods.

What Is Business Forecasting?

Business forecasting is making informed predictions about business metrics. That can include specific aspects of a business, such as launching a new product, or cover the company as a whole. Often, financial, operational, and business decisions will be based on these forecasting techniques.

While no one can predict the future, business forecasting methods can help even small businesses develop strategies. With business forecasting, historical data is collected and analyzed to find potential patterns. Today, most forecasting includes some form of technology, such as artificial intelligence, to help develop models.

Why Should You Use Business Forecasting?