To read this content please select one of the options below:

Please note you do not have access to teaching notes, the impact of research and development (r&d) on economic growth: new evidence from kernel-based regularized least squares.

Journal of Risk Finance

ISSN : 1526-5943

Article publication date: 25 July 2022

Issue publication date: 31 October 2022

Research and development (R&D) is increasingly considered to be a key driver of economic growth. The relationship between these variables is commonly examined using linear models and thus relies only on single-point estimates. Against this background, this paper provides new evidence on the impact of R&D on economic growth using a machine learning approach that makes it possible to go beyond single-point estimation.

Design/methodology/approach

The authors use the kernel regularized least squares (KRLS) approach, a machine learning method designed for tackling econometric models without imposing arbitrary functional forms on the relationship between the outcome variable and the covariates. The KRLS approach learns the functional form from the data and thus yields consistent estimates that are robust to functional form misspecification. It also provides pointwise marginal effects and captures non-linear relationships. The empirical analyses are conducted using a sample of 101 countries over the period 2000–2020.

The estimates indicate that R&D expenditure and high-tech exports positively and significantly influence economic growth in a non-linear manner. The authors also find a positive and statistically significant relationship between economic growth and greenhouse gas emissions. In both cases, the effects are higher for upper-middle-income and high-income countries. These results suggest that a substantial effort is needed to green economic growth. Internet access is found to be an important factor in supporting economic growth, especially in high-income and middle-income countries.

Practical implications

This paper contributes to underlining the importance of investing in R&D to support growth and shows that the disparity between countries is driven by the determinants of economic growth (human capital in R&D, high-tech exports, Internet access, economic freedom, unemployment rate and greenhouse gas emissions). Moreover, since the authors find that R&D expenditure and greenhouse gas emissions are positively associated with economic growth, technological progress with green characteristics may be an important pathway for green economic growth.

Originality/value

This paper uses an innovative machine learning method to provide new evidence that innovation supports economic growth.

- Research and development

- Economic growth

- KRLS estimates

- Greenhouse gas emissions

- Economic freedom

Acknowledgements

The authors thank the anonymous referees and the Editors for their constructive comments on an earlier version of the paper.

Minviel, J.-J. and Ben Bouheni, F. (2022), "The impact of research and development (R&D) on economic growth: new evidence from kernel-based regularized least squares", Journal of Risk Finance , Vol. 23 No. 5, pp. 583-604. https://doi.org/10.1108/JRF-11-2021-0177

Emerald Publishing Limited

Copyright © 2022, Emerald Publishing Limited

Related articles

We’re listening — tell us what you think, something didn’t work….

Report bugs here

All feedback is valuable

Please share your general feedback

Join us on our journey

Platform update page.

Visit emeraldpublishing.com/platformupdate to discover the latest news and updates

Questions & More Information

Answers to the most commonly asked questions here

This site uses cookies to optimize functionality and give you the best possible experience. If you continue to navigate this website beyond this page, cookies will be placed on your browser. To learn more about cookies, click here .

IMF: Why research and development is a crucial part of economic growth

Analysis suggests that the composition of R&D matters for growth. Image: Unsplash/Lucas Vasques

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Philip Barrett

Diaa noureldin, jean-marc natal, niels-jakob hansen.

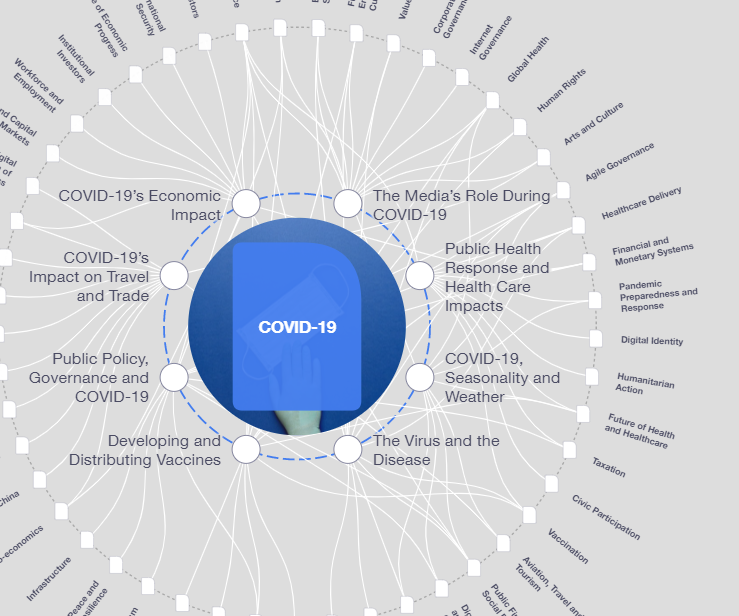

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} COVID-19 is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:, emerging technologies.

- Analysis by the IMF suggests that research and development are vital for economic progress.

- Cross-border collaboration is also crucial to help foster the innovation needed for long-term growth.

- COVID-19 vaccines are an example of innovation, helping save lives and bring forward the reopening of many economies.

The pandemic has rolled back decades of economic progress and wrought havoc on public finances. To build back better and fight climate change, sizable public investment needs to be sustainably financed. Boosting long-term growth—and thereby tax revenue—has rarely felt more pressing.

But what are the drivers of long-term growth? Productivity—the ability to create more outputs with the same inputs—is an important one. In our latest World Economic Outlook , we emphasize the role of innovation in stimulating long-term productivity growth . Surprisingly, productivity growth has been declining for decades in advanced economies despite steady increases in research and development (R&D), a proxy for innovation effort.

Knowledge transfer between countries is an important driver of innovation.

Our analysis suggests that the composition of R&D matters for growth. We find that basic scientific research affects more sectors, in more countries and for a longer time than applied research (commercially oriented R&D by firms), and that for emerging market and developing economies, access to foreign research is especially important. Easy technology transfer, cross-border scientific collaboration and policies that fund basic research can foster the kind of innovation we need for long-term growth.

Inventions draw on basic scientific knowledge

While applied research is important to bring innovations to market, basic research expands the knowledge base needed for breakthrough scientific progress. A striking example is the development of COVID-19 vaccines, which in addition to saving millions of lives has helped bring forward the reopening of many economies, potentially injecting trillions into the global economy . Like other major innovations, scientists drew on decades of accumulated knowledge in different fields to develop the mRNA vaccines.

Basic research is not tied to a particular product or country and can be combined in unpredictable ways and used in different fields. This means that it spreads more widely and remains relevant for a longer time than applied knowledge. This is evident from the difference in citations between scientific articles used for basic research, and patents (applied research). Citations for scientific articles peak at about eight years versus three years for patents.

Have you read?

How to find the best work-life balance for you, according to science, science denial: why it happens and 5 things you can do about it, this ‘citizen science’ project means anyone can help map the great barrier reef - from the comfort of home.

Spillovers are important for emerging markets and developing economies

While the bulk of basic research is conducted in advanced economies, our analysis suggests that knowledge transfer between countries is an important driver of innovation, especially in emerging market and developing economies.

Emerging market and developing economies rely much more on foreign than homegrown research (basic and applied) for innovation and growth. In countries where education systems are strong and financial markets deep, the estimated effect of foreign technology adoption on productivity growth—through trade, foreign direct investment or learning-by-doing—is particularly large. As such, emerging market and developing economies may find that policies to adapt foreign knowledge to local conditions are a better avenue for development than investing directly in homegrown basic research.

We gauge this by looking at data on research stocks —measures of accumulated knowledge through research expenditure. As the chart shows, a 1-percentage-point increase in foreign basic knowledge increases annual patenting in emerging market and developing economies by around 0.9 percentage point more than in advanced economies.

Innovation is a key driver of productivity growth

Why does patenting matter? It’s a proxy for measuring innovation. An increase in the stock of patents by 1 percent can increase productivity per worker by 0.04 percent. That may not sound like much, but it adds up. Small increases over time improve living standards.

We estimate that a 10 percent permanent increase in the stock of a country’s own basic research can increase productivity by 0.3 percent. The impact of the same increase in the stock of foreign basic research is larger. Productivity increases by 0.6 percent. Because these are average numbers only, the impact on emerging markets and developing economies is likely to be even bigger.

Basic science also plays a larger role in green innovation (including renewables) than in dirty technologies (such as gas turbines), suggesting that policies to boost basic research can help tackle climate change.

The Young Scientists Community , founded in 2008, brings together extraordinary rising-star scientists from various academic disciplines and geographies, all under the age of 40. Their mission is to help leaders engage with science and the role it plays in society.

The World Economic Forum trains and empowers Young Scientists to communicate cutting-edge research and champion evidence-based decision making, and in doing so, helps build a diverse global community of next-generation scientific leaders.

Each year, the Forum selects and onboards a new class of Young Scientists, adding to the growing 400+ alumni community. Meet the 2020 Young Scientists tackling the world’s most pressing challenges through scientific innovation. Get in touch to find out more about the community.

Policies for a more buoyant and inclusive future

Because private firms can only capture a small part of the uncertain financial reward of engaging in basic research, they tend to underinvest in it, providing a strong case for public policy intervention. But designing the right policies—including determining how you fund research—can be tricky. For example, funding basic research only at universities and public labs could be inefficient. Potentially important synergies between the private and public sector would be lost. It may also be difficult to disentangle basic and applied private research for the sake of subsidizing only the former.

Our analysis shows that an implementable hybrid policy that doubles subsidies to private research (basic and applied alike) and boosts public research expenditure by a third could increase productivity growth in advanced economies by 0.2 percentage point a year. Better targeting of subsidies to basic research and closer public‑private cooperation could boost this even further, at lower cost for public finances.

These investments would start to pay for themselves within about a decade and would have a sizeable impact on incomes. We estimate that per capita incomes would be about 12 percent higher than they are now had these investments been made between 1960 and 2018.

Finally, because of important spillovers to emerging markets, it is also key to ensure the free flow of ideas and collaboration across borders.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} weekly.

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Emerging Technologies .chakra .wef-17xejub{-webkit-flex:1;-ms-flex:1;flex:1;justify-self:stretch;-webkit-align-self:stretch;-ms-flex-item-align:stretch;align-self:stretch;} .chakra .wef-nr1rr4{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-nr1rr4{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-nr1rr4{font-size:1rem;}} See all

How venture capital is investing in AI in the top five global economies — and shaping the AI ecosystem

Piyush Gupta, Chirag Chopra and Ankit Kasare

May 24, 2024

What can we expect of next-generation generative AI models?

Andrea Willige

May 22, 2024

Solar storms hit tech equipment, and other technology news you need to know

Sebastian Buckup

May 17, 2024

Generative AI is trained on just a few of the world’s 7,000 languages. Here’s why that’s a problem – and what’s being done about it

Madeleine North

Critical minerals demand has doubled in the past five years – here are some solutions to the supply crunch

Emma Charlton

May 16, 2024

6 ways satellites are helping to monitor our changing planet from space

Localizing the economic impact of research and development

Fifty policy proposals for the trump administration and congress, stephen ezell and stephen ezell vice president, global innovation policy - the information technology and innovation foundation @itifdc scott andes scott andes former fellow - brookings centennial scholar initiative @scott_andes.

December 7, 2016

- 109 min read

The following paper is the product of a joint research effort between the Brookings Institution’s Anne T. and Robert M. Bass Initiative on Innovation and Placemaking and the Information Technology and Innovation Foundation .

The investments government and businesses make in basic and applied research and development (R&D) plant the seeds for the technologies, products, firms, and industries of tomorrow. They contribute substantially to the fact that at least one-half of America’s economic growth can be attributed to scientific and technological innovation. 1 But the increased complexity of technological innovation as well as the growing strength of America’s economic competitors mean that it’s no longer enough to simply fund scientific and engineering research and hope it gets translated into commercial results. The U.S. government needs to expand federal support for research and, just as important, it needs to improve the efficiency of the process by which federally funded knowledge creation leads to U.S. innovation and jobs. 2

This report provides 50 policy actions the Trump administration and Congress can take to bolster America’s technology transfer, commercialization, and innovation capacity, from the local to the national level. These recommendations include:

- Prioritize innovation districts within federal R&D outlays

- Task federal laboratories with a local economic development mission

- Create off-campus “microlabs” to provide a front door to labs

- Support technology clusters by assessing and managing local-level federal R&D investments

- Assess federal real estate holdings and reallocate physical research assets to innovation districts

- Allow labs to repurpose a small portion of existing funds for timely local collaboration

- Standardize research partnership contracts within cities

- Create NIH regional pre-competitive consortia to address national health concerns

- Allow DOE labs to engage in non-federal funding partnerships that do not require DOE approval

- Dismantle funding silos to support regional collaboration

- Incentivize cross-purpose funding based on the economic strength of cities

- Expand the national Regional Innovation Program

- Support the innovation potential of rural areas

- Facilitate regional makerspaces

- Introduce an “Open Commercialization Infrastructure Act”

Bolster institutions supporting tech transfer, commercialization, and innovation

- Establish a core of 20 “manufacturing universities”

- Complete the buildout of Manufacturing USA to 45 Institutes of Manufacturing Innovation (IMIs)

- Create a National Engineering and Innovation Foundation

- Create an Office of Innovation Review within the Office of Management and Budget

- Create a network of acquisition-oriented DoD labs based in regional technology clusters

- Establish manufacturing development facilities

- Establish a foundation for the national energy laboratories

Expand technology transfer and commercialization-related programs and investments

- Increase the importance of commercialization activities at federal labs/research institutes

- Allocate a share of federal funding to promote technology transfer and commercialization

- Develop a proof-of-concept, or “Phase Zero,” individual and institutional grant award program within major federal research agencies

- Fund pilot programs supporting experimental approaches to technology transfer and commercialization

- Support university-based technology accelerators/incubators to commercialize faculty and student research

- Allow a share of SBIR/STTR awards to be used for commercialization activities

- Increase the allocation of federal agencies’ SBIR project budgets to commercialization activities

- Modify the criteria and composition of SBIR review panels to make commercialization potential a more prominent factor in funding decisions

- Encourage engagement of intermediary organizations in supporting the development of startups

- Expand the NSF I-Corps program to additional federal agencies

- Authorize and extend the Lab-Corps program

- Provide federal matching funds for state and regional technology transfer and commercialization efforts

- Incentivize universities to focus more on commercialization activities

- Establish stronger university entrepreneurship metrics

- Expand the collaborative R&D tax credit to spur research collaboration between industry and universities and labs

- Increase funding for cooperative industry/university research programs at universities

- Establish an International Patent Consortium

Promote high-growth, tech-based entrepreneurship

- Encourage student entrepreneurship

- Help nascent high-growth startups secure needed capital

- Establish an entrepreneur-in-residence program with NIH

- Implement immigration policies that advantage high-skill talent

- Implement a research investor’s visa

Stimulate private-sector innovation

- Implement innovation vouchers

- Incentivize “megafunds” around high-risk research and development

- Increase R&D tax credit generosity

- Ensure that small and medium-sized enterprises are familiar with available R&D tax credits

- Implement an innovation box to spur enterprises’ efforts to commercialize technologies

- Revise the tax code to support innovation by research-intensive, pre-revenue companies

Introduction

Innovation is key to increasing economic growth and wages in the moderate to long run. Yet innovation does not fall like “manna from heaven,” as economists once suggested. It is the product of intentional human action, and, to have more of it, we must enact public policies that connect research and development investments to firms and inventors in the communities where they are located.

After seven years of growth following the end of the Great Recession and after over 70 straight months of employment growth, there is a case to be made that the country has rebounded and the main thrust of economic policy should focus on those who have been left behind. But the reason so many Americans aren’t seeing their wages rise fast enough isn’t just because they’ve been left behind, it’s because the country as a whole isn’t moving ahead fast enough.

It’s certainly true the labor market has begun to inch closer to full employment (in fact, in December 2016 the unemployment rate dropped to 4.6 percent), but that’s far from a leading indicator of the health of the U.S. economy. For the reality is the economy still has a long way to go to return to its full potential. Employment growth in the 36 months following the trough of the recession was the slowest of the 11 post-World War II recoveries, and average productivity growth was twice as high in the four decades following World War II as it has been since the end of the Great Recession. 3 Brookings economists Martin Baily and Nicholas Montalbano describe the country’s productivity growth as “weak since 2004 and dismal since 2010.” 4 And as the Information Technology and Innovation Foundation (ITIF) reports, U.S. productivity growth over the last decade is the lowest since the government started recording the data in the late 1940s. 5 Yet if the United States could boost its productivity levels by even just one percentage point, it could make the economy $2.3 trillion bigger than it is otherwise projected to be in 10 years while shrinking the federal budget deficit by more than $400 billion. 6

America’s innovation economy exists at three levels: technological, industrial, and spatial.

Meanwhile, other countries are increasing their technological sophistication, capturing crowded international markets and pushing U.S. firms—and, by extension, U.S. workers—behind. And whereas once America’s leading technology competitors were largely isolated to Western Europe and Japan, today many developing nations are crafting innovation strategies designed to wrest leadership in advanced technology categories such as life sciences, clean energy, new materials, flexible electronics, computing and the internet, and advanced manufacturing. As evidence of these trends, the United States has run a trade deficit in advanced technology products every year since 2002; the cumulative deficit since 2010 is $580 billion. 7 Improving America’s capacity to innovate is a key step toward confronting these challenges.

America’s innovation economy exists at three levels: technological, industrial, and spatial. Much innovation occurs in particular technology areas, for example life science innovation funded by the National Institutes of Health (NIH), additive manufacturing supported by America Makes, and composite and lightweight materials supported by the Institute for Advanced Composites Manufacturing Innovation (IACMI) and the Lightweight Innovations for Tomorrow (LIFT) Institutes for Manufacturing Innovation, respectively. Innovation also occurs across firms in the same industries that collaborate to drive technology advancements (e.g., aerospace and automotive). For this reason, sector- and technology-based innovation policies and programs like Manufacturing USA’s Institutes of Manufacturing Innovation and the Advanced Research Projects Agency-Energy do an effective job targeting R&D dollars.

The spatial level of innovation includes not just hot spots like Silicon Valley; Austin, Texas; or Boston, but also scores of communities throughout the country in places like Chattanooga, Tenn.; Denver; Minneapolis; Mobile, Ala.; and Pittsburgh, Pa. which are intensively developing their innovation ecosystems at the regional level. Indeed, as ITIF has shown, innovation occurs in all of America’s 435 congressional districts. 8

This dispersion matters because regional technology clusters engender concentrated knowledge flows and spillovers, workers with specialized skills, and dense supply chains that improve firm productivity. Many R&D-intensive firms benefit from proximity to innovation resources such as universities and federal laboratories, and this closeness produces myriad “ecosystem” benefits. 9

This is particularly the case for knowledge spillovers—the ability of workers and firms to learn from one another without incurring costs. Recent research shows that the value of proximity for firms and workers to share ideas attenuates extremely quickly with distance. For example, Rosenthal and Strange find that, for software companies, the spillover benefits are 10 times greater when firms are within one mile of each other than when they are two and five miles apart, and by 10 miles there are no more within-city localization benefits. 10

In other words, to be effective, technology policy needs to focus not just on the first two levels, technology and industry, but also on the spatial—the regional. Thus, if America’s innovation economy is to function maximally, Washington needs to promulgate smart policies and initiatives that effectively work in concert at the city, regional, state, and national levels.

The central component of an effective national technology policy system is robust government funding of scientific and engineering research. But in that respect, the United States is failing. If the federal government invested as much in R&D today as a share of GDP as it did in 1983, we would be investing over $65 billion more per year. 11 Unfortunately, given budget and political constraints, the Trump administration and the forthcoming 115th Congress may find it difficult to significantly increase overall federal investment in science and technology. This despite the fact that doing so would be a wise investment, as economists estimate that a 1 percent increase in the U.S. R&D capital stock improves GDP by 0.13 percent. 12 But regardless, one thing on which America should be able to achieve bipartisan consensus is the need to find ways to increase the return on investment from existing resources and programs.

What follows are 50 policy recommendations President Trump and Congress can enact to improve the economic impact of existing resources (with some modest additional investments). Many of these recommendations could be added to the COMPETES-related reauthorization legislation currently being considered in both the House and Senate. The recommendations are divided into five categories: strengthening innovation districts and regional technology clusters; launching or extending institutions supporting America’s innovation economy; facilitating technology transfer and commercialization activities; promoting the formation of high-growth firms; and stimulating private-sector innovation. These recommendations are the output of a joint research effort between the Brookings Institution and ITIF.

Why and how federal R&D policy impacts local economies

The federal government invests $146 billion a year in R&D, and whether these dollars are directed to military bases, federal laboratories, universities, or small technology firms, they come to ground in communities and play a critical role in local technological capacity. Federal investments often drive high-skilled employment, fund local universities and hospitals, support high-tech entrepreneurs, and lead to exports from large companies—all of which bring outside dollars and jobs into a region.

To maximize and capture the benefits of R&D within regional economies, mayors, regional economic developers, and philanthropic and private-sector leaders should understand their federal research portfolio. Indeed, regions should take stock of their portfolios as they would any other asset class. To do so, regional leaders need to understand how the federal government funds research.

The government allocates R&D through federal agencies. While most agencies have some level of R&D budget, 84 percent of funding flow from the Department of Defense (DoD), the Department of Health and Human Services (DHHS), the Department of Energy (DoE), and the National Science Foundation (NSF). These agencies have different areas of investment and different funding vehicles that impact local economies.

The Department of Defense: With 49 percent of all federal R&D, DoD represents the largest federal investor in research. But DoD’s size is not the only reason the department matters for local communities. No other federal agency has such a quasi-fiduciary relationship with the commercial outcomes of its own R&D funding. DoD pursues basic and applied research through its dozens of labs located in 22 states and then transfers that research to firms that create products and services for the military. For regions, DoD funding often implies near-to-market engineering, computer science, and material research that local firms can utilize to meet defense and civilian needs. Yet research partnerships are conducted predominantly through large defense contractors and less often with small and medium-sized firms. 13

The Department of Health and Human Services : DHHS invests over $32 billion every year in research, the vast majority of which is conducted by and through the National Institutes of Health. The primary vehicle for NIH R&D is competitive grants: currently more than 80 percent of NIH funding is awarded through 50,000 grants to more than 300,000 researchers at universities, medical schools, and other research institutions. NIH research dollars touch every state and almost every city, and so the agency is ideally situated to play an important role in improving the return on investment of federal R&D at the local level. Also, because the lion’s share of investment comes from NIH’s grants to research universities and medical schools, as opposed to being spent at its own labs, NIH is in a unique position to incentivize commercialization across the U.S. university system. Finally, through its investments in teaching hospitals, NIH represents a critical employment driver for local communities.

The Department of Energy: DoE invests heavily in its 17 federal laboratories across the country. Though the labs are not located in dense regional technology clusters, they exist at the frontiers of science and often partner with universities, firms, and other research institutions to improve product development in industries such as aerospace, automobiles, battery storage, and information technology. Regions with companies and institutions that have DoE partnerships are often at the cutting edge of technology and are ideally situated for high-value technology exports.

The National Science Foundation: NSF is an independent federal agency that invests specifically in basic science and engineering and scientific education. Unlike other agencies that focus on specific missions (e.g., defense, health, energy), NSF has a broad mandate to fund discovery, learning, and the research infrastructure across scientific domains. Like NIH, the primary funding vehicle for NSF is its competitive grants that are distributed across the nation’s educational, training, and research institutions. NSF represents roughly one-quarter of federal investments in basic science at U.S. universities and colleges

By understanding what government funding flows to their respective regions and then how to leverage agencies’ distinct funding vehicles, leaders can better maximize the local influence of R&D.

Strengthen innovation districts and regional technology clusters

Regional technology clusters are a key driver of economic growth and should be viewed by the incoming administration and Congress as a critical component of innovation policy. Large-scale manufacturing clusters can be found in suburban research parks and key agriculture technology clusters in many rural areas throughout the United States.

In many technology sectors—particularly life sciences, software and digital design, and robotics—the geography of innovation is changing. Firms in these industries are now beginning to relocate research activities into employment-dense areas of cities (generally the downtowns and midtowns) to be in greater proximity to other firms, universities, and research labs. 14 Companies are also realizing that attracting and retaining talented workers increasingly means situating themselves in amenity-rich places where their workers want to live. The result has been a rise of “innovation districts,” defined by the Brookings Institution as “geographic areas where leading anchor institutions and companies cluster and connect with entrepreneurs. They are physically compact, transit- and broadband-accessible, and offer mixed-use housing, office, and retail. 15

Innovation districts are critical to the nation’s innovation capacity because they are home to some of the country’s leading universities, research labs, and high-value companies and they generate outsized economic output. For example, research universities located within employment-dense areas of cities outperform their rural and suburban peers in terms of number of patents, invention disclosures, licensing revenue, and startups per student. 16 But federal laboratories built in the shadow of World War II are often located far from firms and cities and have difficulty impacting regional economies. And too often cluster policy receives lip service from Washington, with little actual attention paid to how the federal government can accelerate the economic capacity of regional economies. Reconfiguring the federal government’s $146 billion annual R&D investment portfolio to achieve greater economic outcomes should therefore be a prime objective of national policy.

In order to strengthen innovation districts and other regional technology clusters, the next administration should work with Congress on the following goals:

1. Prioritize innovation districts within federal R&D outlays

Federal agencies that fund R&D should prioritize innovation districts because the density of corporate research centers and entrepreneurs increases the likelihood that research will lead to commercial outcomes. Moreover, Federally Funded R&D Centers (FFRDCs) and University Affiliated Research Centers (UARCs) should be assessed in part based on their proximity to corporate research and employment density, and federal grants in engineering, computer science, life sciences, and other similar fields should prioritize academic institutions located within innovation districts. Of course, the geographic location of research assets is not the ultimate determinant of economic impact, but co-location and density are important and should be a consideration for all funding agencies.

Back to top

2. Task federal laboratories with a local economic development mission

Federal agencies such as DoD, DoE, DHHS, and the NSF that own and fund federal laboratories and FFRDCs should adopt an explicit mission to support the regional economies in which they are located. Many lab managers and agencies approach regional economic development as mutually exclusive from their core missions; this is especially true for weapons labs located within the Departments of Defense and Energy. But defense and weapons labs like Sandia and Los Alamos in New Mexico have successfully integrated regional economic development programs within their broader research objectives.

For example, both labs have partnered with the state of New Mexico on the New Mexico Small Business Assistance Program, which connects small businesses seeking technical assistance with lab researchers. 17 Every federal agency and federal lab should view regional economic development as part of its overarching mission. Moreover, increasing the technical capacity of the regions in which labs are located is mutually beneficial for the labs and the local economy. Moreover, given the mobility of the scientific workforce, creating homegrown talent helps labs address attrition.

3. Create off-campus “microlabs” to provide a front door to labs

Federal funding agencies, state governments, and regional consortia that utilize the lab system should work together to create and co-fund a number of off-campus, small-scale “microlabs”—co-located within or near universities or private-sector clusters—that would cultivate strategic alliances with regional innovation clusters. Microlabs would help overcome the problems that most labs are located outside of technology clusters and that most lab research occurs behind the walls of main campuses. These microlabs could take the form of additional joint research institutes or new facilities that allow access to lab expertise for untapped regional economic clusters. Accessible, off-campus lab space would also help labs engage with small to medium-sized enterprises (SMEs). The next administration should work to create microlabs and require state buy-in, or state governments or regional consortia could create voucher programs in concert with DoE and particular labs.

Several federal labs are already creating microlabs in cities; for example, Argonne National Laboratory has created office space in the Chicago Innovation Exchange, located on the University of Chicago’s Hyde Park campus. Another example is Cyclotron Road, a program of Lawrence Berkeley National Laboratory funded by the DOE EERE Advanced Manufacturing Office, which provides assistance to entrepreneurial researchers to advance technologies until they can succeed beyond the research lab. Cyclotron Road plays a pivotal role in providing entrepreneurs with technology development support (often leveraging technologies coming directly out of the Lawrence Berkeley laboratory) and helps them with identifying the most suitable business models, partners, and financing mechanisms for long-term impact. 18 Beyond external offices, microlabs can serve as funding gateways to align multiple public and private research dollars to meet industry needs.

4. Support technology clusters by assessing and managing local-level federal R&D investments

The $146 billion invested by the federal government in R&D takes place within specific institutions within communities, and these resources often dwarf the research investments and research-driven employment of non-federal companies and institutions. But federal research dollars do not necessarily pass through local political, civic, or private-sector leadership. As such, mayors, chambers of commerce, and philanthropies are often unaware of the innovation portfolio of their regions. The issue is most pronounced in large cities that can have over a billion dollars flowing annually from Washington. Without understanding their regional innovation portfolios, regions cannot coordinate and maximize federal investment for local economic growth.

To address this knowledge barrier, the federal government should help regions understand their research inflows by packaging their federal dollars by institution, areas of science, connections to global markets, and other data points. However, the federal government will never be able to whole cloth catalog what regions need to know about their innovation assets. Therefore, the government should also fund and advise regional innovation asset inventory and management assessments that are tailored to the specific economic development goals of individual communities.

5. Assess federal real estate holdings and reallocate physical research assets to innovation districts

The federal government owns billions of dollars’ worth of real estate that houses operations from post offices to federal laboratories. There is no national registry of these holdings and little information regarding their commercial value. Many of these physical operations were created before innovation districts and other technology clusters came into existence and are poorly placed to take advantage of the agglomeration benefits of cities.

The Trump administration should task the General Services Administration with identifying federally owned real estate parcels and strategically move research-intensive activities into existing federal buildings in cities. Agencies should also be able to register unused space within their own research institutions to identify and allocate vacant space for regional entrepreneurship and private-sector use. Congressional appropriation committees have traditionally been skeptical of allowing federal labs discretion on the use of space, but allowing lab managers to contract out unused space would increase the flexibility and regional responsiveness of the lab system. For example, Amtrak operates an office building in the heart of the Philadelphia innovation district, just a few blocks from Drexel University and the University of Pennsylvania. Amtrak does no research and extracts little benefit from being near major research universities; on the other hand, NIH, DoD, and NSF operate or fund numerous facilities that would greatly benefit from such a location. One mechanism for better allocating physical assets would be to create an intra-governmental auction whereby agencies could identify strategically located federal buildings and bid on these parcels. Agencies like Amtrak that don’t value their legacy locations in cities could sell such buildings to agencies that would benefit, creating a market dynamic within the federal government.

6. Allow labs to repurpose a small portion of existing funds for timely local collaboration

Increasing collaboration between regional universities and tech-based entrepreneurs and corporate partners requires greater flexibility in funding contracts. The next administration should allow federal labs to set aside a small amount—perhaps 5 percent—of fiscal year funding for unexpected research partnerships that may emerge throughout the year and that clearly align with lab mission and research goals. Labs would not be required to reserve these funds, nor be required to invest in regional partnerships, but interested labs would have the option. Similar repurposing rules should be encouraged for all federal funding opportunity announcements (FOAs) intended for federal labs.

7. Standardize research partnership contracts within cities

Virtually all innovation districts cluster numerous research institutions, but each one has its own rules relating to the commercialization of research. Cities should work to develop standardized partnership contracts that all research facilities can adopt to help researchers access the full spectrum of activity within a city. For example, in Philadelphia, the Wistar Institute—a National Cancer Institute-designated Cancer Center—has created a simple, standard contract for research partnerships that has been adopted by a number of medical schools in the city. The federal government should incentivize cities with multiple academic medical centers, federal labs, universities, and research institutions to develop standardized, simple research partnership agreements. Their development could either occur through pilot grants from the Economic Development Agency or directly through federal R&D funding agencies, such as NIH. The latter may be particularly effective given that in many cities research institutions with similar areas of expertise receive federal funding from the same federal agencies.

8. Create NIH regional pre-competitive consortia to address national health concerns

Given that over 80 percent of NIH R&D funding is allocated through its more than 50,000 grants across the country, the agency is ideally situated to support regional technology development. However, most NIH research grants don’t directly incentivize partnerships that lead to collaboration—particularly at the institutional-leadership level (e.g., for universities, the provost of research or president level). Rather, most collaboration around NIH grants occurs at the principal investigator level. While partnerships between researchers are important, more can be done to stimulate research-based partnerships between the public, civic, and private sectors.

To improve the commercial impact of research grants, the next administration should support regional pre-competitive consortia to address national health concerns. When applying for NIH grants, research institutions should be incentivized to coordinate with peers in their region. Making the consortia pre-competitive (i.e., uninvolved in patent development) will help to avoid intellectual property disputes and allow the efforts of its members to dovetail more closely with the academic missions of NIH research grants. One way to further incentivize partnerships would be to give grant proposals extra weight if multiple technology transfer offices, private-sector actors, and others within a city are designated as principal investigators. NIH already supports some pre-competitive consortia at the national level, such as the Accelerating Medicines Partnership and within its Clinical and Translational Science Awards, but doing so even more within technology clusters at the local level would enable research institutions to take advantage of proximity to form more long-lasting partnerships. 19

9. Allow DOE labs to engage in non-federal funding partnerships that do not require DOE approval

Currently, DoE must approve all non-DoE lab funding; this model is out of date, given that external funding is not trivial. For example, Oak Ridge National laboratory (ORNL) and Pacific Northwest National laboratory (PNNL) already receive 50 percent and 80 percent of their respective budgets from outside their DoE offices (though the majority of funding still comes from the federal government from agencies such as DoD). DoE should acknowledge that today’s multidisciplinary lab work requires varied funding sources. As labs increase their relevance to regional technology clusters, DoE should allow non-federal funding partnerships at lab managers’ discretion. Initially, DoE could specify a minimum amount of regional funding to be drawn from non-federal sources without its approval, and then gradually expand the minimum. 20

10. Dismantle funding silos to support regional collaboration

Stove-piped appropriations keep lab research projects unnecessarily compartmentalized and hinder lab managers from responding to regional demands. Labs should be funded to encourage broad, flexible engagements with numerous public- and private-sector actors. To this end, Congress and DoE should reorganize lab funding to mimic the financial design of Manufacturing USA (formerly known as the National Network for Manufacturing Innovation) or DoE’s energy hubs, institutions through which large, unencumbered appropriations are directed to complex, multidisciplinary regional technology and economic issues.

11. Incentivize cross-purpose funding based on the economic strength of cities

Like countries, cities and states specialize in technologies and industries. However, federal R&D funding agencies often ignore the potential interplay between seemingly discrete technologies, and doing so dampens the innovative potential of innovation districts. For example, Houston is an epicenter of the oil and gas and the health care industry, but little of the $160 million DHHS invests annually in the University of Texas MD Anderson Cancer Center considers what the health care field can learn from oil and gas. On the ground, researchers, medical professionals, and industry leaders in Houston recognized the potential for cross-pollination between these two areas of specialization and created “Pumps & Pipes,” an association of medical, energy, aerospace, and academic professions with the stated goal of problem solving through “using the other guy’s toolkit.” 21

Federal agencies should map the research and industrial comparative advantages of cities and create cross-agency funding opportunities in those areas. They should seek similar synergies with state-based technology-based economic development organizations, through which individual states focus on a few core technologies for economic development advantage.

12. Expand the national Regional Innovation Program

Regional innovation programs have proven a highly successful form of economic development for communities across the United States. 22 Programs such as the i6 Challenge and the Jobs and Innovation Accelerator Challenge have helped local, regional, and state entities leverage existing resources, spur regional collaboration, and support economic recovery and job creation in high-growth industries. The Regional Innovation Program operated by the Economic Development Administration identifies and supports regional innovation clusters, convenes relevant stakeholders, creates a cluster support framework, disseminates information, and provides targeted capital investments to spur economic growth. 23 There is great demand for this program from regions all around the nation, but in 2015 just $15 million in grants were awarded. More funding is needed, and more needs to be done to support regional innovation programs in the United States. Accordingly, the next administration and Congress should expand funding for the Regional Innovation Program to as much as $75 million. 24

13. Support the innovation potential of rural areas

While the vast majority of technology development, commercialization, and innovation occurs in cities and metropolitan regions, the innovation potential of more rural areas should not be neglected, both for these areas’ own economic growth prospects and for the contributions they can make to America’s innovation system. For example, consider the Natural Resources Research Institute (NRRI) located at the University of Minnesota Duluth. NRRI is a non-profit applied research organization, chartered by the Minnesota legislature, that works to develop and deliver the understanding and tools needed to better utilize Minnesota’s mineral, forest, energy, and water resources in a way that expands value-added and jobs in rural communities. 25 Other programs that support rural technology entrepreneurship and manufacturing include the Ben Franklin Technology Partners of Central and Northern Pennsylvania, which funds young companies and provides professional assistance in areas like prototype development and customer site visits. 26

But the next administration could support a network of institutes such as NRRI nationwide across more sectors, including aquaculture, agriculture, wind and water energy, and mining. One idea would be to have the U.S. Department of Agriculture (USDA) lead a major technology initiative around getting more value-added out of rural communities, whether from fish, fiber, food, wind, water, etc. Such a program, perhaps in coordination with the U.S. Department of Commerce’s Manufacturing Extension Partnership (MEP), could also build on and support existing rural manufacturing clusters, such as snowmobiles in northern Minnesota, wine in Western New York, or shipbuilding in Michigan. One aspect of this could be supporting rural Internet of Things projects, such as pilot programs for farms and vineyards. 27

14. Facilitate regional makerspaces

Makerspaces are community centers that combine manufacturing equipment and education for the purposes of enabling community members to design, prototype, and create manufactured works that couldn’t be created with the resources available to individuals working alone. 28 But well-staffed and programmed makerspaces are located disproportionately in large cities.

To more fully realize regional innovation potential, especially in manufacturing, the federal government should support a Public Library Makerspace grant program that enables the use of libraries not only for public education but also for economic development. Such a program would democratize the maker movement into communities that are traditional laggards in technology infrastructure, like broadband. This approach would make more widely available so-called lower-level innovation infrastructure (e.g., 3-D printing capability) that could seed innovations that ultimately feed into universities or federal labs. Another proposal to expand access to makerspaces is proposed legislation (in the House, H.R. 1622, in the Senate, S. 1705) that calls for a federal charter to launch a non-profit “National Fab Lab Network” (NFLN). 29 NFLN would act as a public-private partnership whose purpose is to facilitate the creation of a national network of fabrication labs and serve as a resource to assist stakeholders with their operations. The network would be comprised of local digital fabrication facilities providing community access to advanced manufacturing tools for learning skills, developing inventions, creating businesses, and producing personalized products. 30

15. Introduce an “Open Commercialization Infrastructure Act”

Another way to increase the use of America’s national R&D infrastructure would be through an Open Innovation Infrastructure Act, which would permit the private use of public-funded equipment and facilities—including universities, federal labs, and public libraries—for certain activities related to entrepreneurial education and training as well as for economic development and job creation. At present, buildings financed through tax-exempt bonds are not permitted to develop private programming within the facility, even though many private operations—such as incubators, accelerators, and training programs—that benefit entrepreneurs and others are important for broader economic development. For example, a small business that would like to use a 3-D printer in a makerspace at a public library to develop a commercial product is restricted from doing so. Such an Open Innovation Infrastructure Act would remove many such barriers.

Some worry the concept of innovation districts is just the latest urban fad, but there is nothing new about the economics of clusters and agglomeration; they have been studied by economists for over a century. Just as research parks defined much of the geography of innovation over the last half of the 20th century, innovation districts and other technology clusters are becoming emblematic of this century’s spatial science and technology research. The next administration should consider innovation districts and other regional clusters of technology generation (rural, suburban, and urban)—as strategic assets in the same vein as federal laboratories, military research facilities, and the university system. These institutions would not exist as they do without longstanding, substantial support from the federal government. The new president should add innovation districts to the list of national treasures that are supported and nurtured by the federal government, in partnership both with cities and with state technology-based economic development organizations.

In the private sector, firms need to innovate to respond to competition. Likewise, the competition for innovation leadership among nations has only grown fiercer. 31 Throughout its history, the United States has responded to international economic competition by chartering new institutions to bolster its innovation economy. For instance, the Morrill Act of 1862 chartered new universities in the agricultural and mechanical arts. 32 In the 1980s, the United States launched Sematech (a semiconductor research consortium) and the Manufacturing Extension Partnership in part as a response to heighted German and Japanese economic competition. The Obama administration launched Manufacturing USA in part to address the erosion of America’s industrial commons. Meanwhile, America’s global competitors have launched new institutions of their own, as documented in ITIF’s report, The Global Flourishing of National Innovation Foundations, which catalogued the efforts of almost 50 nations in chartering national innovation foundations and articulating national innovation strategies. 33 Yet the United States still lacks a national innovation foundation. Addressing that need and other proposals to expand the institutions underpinning America’s innovation economy are considered below.

16. Establish a core of 20 “manufacturing universities”

Across many American universities, the focus on engineering as a science has increasingly moved university engineering education away from a focus on real-world problem solving toward more abstract engineering questions, leaving university engineering departments more concerned with producing pure knowledge than working with industry to help it solve problems. To address this, the United Sates should designate a core of at least 20 “manufacturing universities” that revamp their engineering programs to focus more on manufacturing engineering and on work that is relevant to industry. 34 This effort would include more joint industry-university research projects, more student training that incorporates manufacturing experiences through co-ops or other programs, and a Ph.D. program focused on turning out more engineering graduates who work in industry.

At these manufacturing universities, criteria for faculty tenure would consider professors’ work with or in industry as much as their number of scholarly publications. In addition, these universities’ business schools would integrate closely with engineering and focus on manufacturing issues, including management of production. The schools would also appoint a chief manufacturing officer, as Georgia Tech has done, to oversee universities’ interdisciplinary manufacturing programs and ascertain how they can maximize their impact on regional economic development. A good model for these manufacturing universities is the Olin College of Engineering in Massachusetts, which reimagined engineering education and curricula to prepare students “to become exemplary engineering innovators who recognize needs, design solutions, and engage in creative enterprises for the good of the world.” Olin’s students now launch more startups per graduate than even MIT.

The Manufacturing Universities Act seeks to establish a competitive grant program for universities that propose to revamp their engineering programs and to focus much more on manufacturing engineering and in particular work that is more relevant to industry. Academic institutions receiving a manufacturing university designation would be eligible for an annual award of up to $5 million for up to four years. 35 The Manufacturing Universities Act of 2015 was incorporated into the 2017 National Defense Authorization Act (NDAA) passed by the Senate in June 2016, but it was not included in the House’s version of the NDAA. Ideally, the conference version of the NDAA that comes out of committee would include the manufacturing universities legislative text. The next administration should make implementation of the manufacturing universities legislation a top priority, directing relevant agencies (notably NSF and the National Institute of Standards and Technology) to implement it swiftly and effectively.

17. Complete the buildout of Manufacturing USA to 45 Institutes of Manufacturing Innovation (IMIs)

Manufacturing USA, launched in 2013 as the National Network for Manufacturing Innovation by the Obama administration and endorsed on a bipartisan basis by Congress through the Revitalizing American Manufacturing Innovation Act, has played a pivotal role in revitalizing America’s industrial commons and helping ensure U.S. leadership across a range of advanced manufacturing process and product technologies. 36 Thus far, nine Institutes of Manufacturing Innovation have been launched, focused on additive manufacturing, digital manufacturing and design innovation, lightweight and modern metals, power electronics, advanced composites, integrated photonics, flexible hybrid electronics, clean energy smart manufacturing, and revolutionary fibers and textiles.

As of December 2016, six more IMIs are under development, including two in a competition to be overseen by DoE (focused on Chemical Process Intensification and Sustainable Manufacturing), two expected to be led by the Department of Defense (focused on Regenerative Medicine and Assistive and Soft Robotics), and two more open topic competitions to be spearheaded by the Department of Commerce. The Obama administration has articulated a vision for a total of 45 IMIs. The Trump administration should collaborate with Congress to provide funding and authorization to build out the 45-institute network of industry-led Manufacturing USA institutes.

18. Create a National Engineering and Innovation Foundation

Science-based discoveries without a commercialization component mute the potential impact of R&D. Connecting discovery with production requires engineering-based innovation, an appropriable activity through which U.S. establishments can add and capture value. 37 And this requires the United States getting better at generating pathways that turn science into U.S.-made high-technology products. Engineering is not science; the two have distinctly different purposes. As Sridhar Kota, formerly assistant director for advanced manufacturing at the Office of Science and Technology Policy, writes, “Science is about analysis and discovery and dissemination of knowledge. Engineering is about synthesis and invention and turning ideas into reality through a process called innovation and through translational research and entrepreneurship.” 38 Both science and engineering are instrumental if American firms are to introduce successful innovations over the long term.

Yet the United States invests significantly more in scientific research than it does in engineering. For example, of the total federal research investments in science and engineering in 2008, approximately 14 percent were allocated to engineering development and the remainder to other scientific fields. 39 NSF invests roughly one-tenth on engineering education as it does on science and mathematics education.

Accordingly, it’s time to raise the profile of engineering within our national innovation system. While NSF supports phenomenal work, its primary mission is funding scientific research while its engineering support programs get short shrift. Therefore, the next administration should work with Congress to create a National Engineering and Innovation Foundation as a separate entity operating alongside the National Science Foundation. 40 The new National Engineering and Innovation Foundation would consolidate the current Engineering Directorate within NSF including the ERC and I/UCRC programs, the tech commercialization parts of the National Institute of Standards and Technology (e.g., including MEP and the Advanced Manufacturing Technology Consortia (AMTech) program), DoD’s Manufacturing Technology (ManTech) program, and DoE’s Advanced Manufacturing office into a single entity with an engineering and innovation focus.

19. Create an Office of Innovation Review within the Office of Management and Budget

Because federal agencies often propose regulations with little consideration given to their effect on innovation, Congress should task the Office of Management and Budget’s Office of Information and Regulatory Affairs with creating an Office of Innovation Review (OIR) to review proposed regulations to determine their effect not just on costs in the short term but also on innovation over the long term. OIR would have the specific mission of being the “innovation champion” within agency rule-making processes. 41 It would have authority to push agencies to either affirmatively promote innovation or to achieve a particular regula¨tory objective in a manner least damaging to innova¨tion. OIR would be authorized to propose new agency actions and to respond to existing ones, and could incorporate a “competitiveness screen” in its review of federal regulations that affect globally traded industries.

20. Create a network of acquisition-oriented DoD labs based in regional technology clusters

The Department of Defense is uniquely positioned to commercialize research from its over $70 billion of R&D investments annually because it invests with the intent of deploying R&D outcomes throughout its own operations. According to its own accounting, between 2000 and 2014 DoD paid private companies that had licensing arrangements with its labs $3.4 billion for military technology; during the same period, companies that licensed technology from DoD labs generated $20 billion in sales outside of DoD. 42 This is a positive outcome, because it suggests that even the licensing arrangements companies have with DoD that don’t end in procurement still generate broader economic impact. In other words, companies pay to use technology generated by DoD and then develop products and services around the technological discovery to meet defense as well as market needs.

This continuous cycle of development well positions the department’s R&D to impact the broader economy in general and regional clusters in particular. But the same report finds that the majority of licensing agreements are signed with a few large defense contractors, leaving many regions without such firms out of the game. 43 Moreover, as DoD seeks to acquire technologies beyond munitions, moving into areas such as software, material science, autonomous systems and vehicles, energy, and medical devices, it will need a broader scope of suppliers.

To increase the breadth of R&D-based procurement, the Trump administration should create a network of applied defense R&D facilities around regional technology clusters. 44 The network would be similar to Manufacturing USA but with numerous smaller centers that are highly focused around the virtuous cycle of firms working with DoD labs and creating products and services that meet military needs. DoD is already moving in this direction, in accordance with Secretary of Defense Ash Carter’s Third Offset strategy, which seeks to counter declining force sizes with the development of novel capabilities and concepts. 45 For example, the Defense Innovation Unit Experimental (DIUx) seeks to create bridges between the Pentagon and the commercial technology sector. It currently has locations in Silicon Valley, Boston, and Austin, Texas; last year it awarded 12 contracts worth $36.3 million. While DIUx is a good start, its budget is tiny compared to the changing demands for new technologies within the military. Accordingly, DoD should invest $500 million to develop 50 similar centers as technology platforms across the country. Given that DoD already operates dozens of laboratories across 22 states, in many cases existing labs could shift their research and commercialization strategies to better align with adjacent technology clusters. In other regions, the department would need to develop new assets.

21. Establish manufacturing development facilities

Oak Ridge National Laboratory in Tennessee operates the Department of Energy’s first manufacturing development facility (MDF), which focuses on assisting industry’s adoption of new manufacturing technologies that can lower production costs, speed time to market, and reduce energy consumption in manufacturing processes. The facility focuses on additive manufacturing (3D printing), carbon fiber and other composites, and new battery technologies and is also the location of the Institute for Advanced Composites Manufacturing Innovation, part of Manufacturing USA. 46 The MDF helps bridge basic research at Oak Ridge and the real-time commercial needs of industry. Also, because East Tennessee has historical technical strengths in composites and advanced manufacturing, the MDF is strategically positioned to amplify the region’s economy.

The next administration should create 20 additional manufacturing development facilities to bring to market the fruits of scientific and technical research discoveries made by federal laboratories run by DoD, DHHS, DoE, and other federal agencies. It is important to note that MDFs are not the same thing as manufacturing institutes; rather, they are specific lab departments, offices, or facilities that are either currently located behind the fence or new facilities that would traditionally be developed behind the fence. Therefore, relocating these assets would require less funding than developing new manufacturing institutes (which are also intended to meet different needs).

22. Establish a foundation for the national energy laboratories

A number of agencies—including USDA, the Department of Veterans Affairs, the Department of the Interior, NIH, the Food and Drug Administration, and DoD—have established foundations to provide them with more flexibility to accomplish their missions. These foundations are legally chartered to accept donations from alumni inventors and scientists, philanthropists, and high-wealth individuals to support research efforts in ways that federal and private funding alone cannot. Foundations are often highly capitalized, for example the foundation for the National Institutes of Health has a $100 million endowment and a $500,000 operating budget. Based off of the success of existing research foundations, the next administration should create a foundation for the national energy laboratories. Because many philanthropies are forbidden by their charters to fund overhead, and the federal lab system is congressionally mandated to charge overhead from donations, a foundation for the national energy labs could serve as a funding intermediary between the civic sector and federal labs. The foundation could also endow research chairs around areas of national interest, help support moving translational research to market, and even fund and take equity in startups.

If the United States wishes to keep pace in the increasingly intense competition for global innovation leadership, it will need to evaluate its existing base of institutions underpinning America’s innovation system and consider new ones that can play important roles in bolstering the country’s levels of technology transfer, commercialization, and innovation. In launching the Manufacturing USA network of Institutes of Manufacturing Innovation, the United States has shown a commendable ability to do so, but it alone is not enough and continued institutional innovation will be needed going forward.

Publicly funded research institutions—federal laboratories, universities, academic hospitals, military and space laboratories, and non-profit research centers—represent core assets in the U.S. innovation system. Not only do these institutions push the frontiers of science, they are anchors of regional economic growth. While the charters of many of these facilities are related to mission-oriented, non-economic public priorities, their activities are deeply tied to the future of the American economy. Strong R&D in defense supports aerospace and materials science industries, clean energy research promotes clean technologies such as wind turbines and new batteries, and scientific advances in public health lead to drug discoveries and health information technology platforms, to name but a few examples. These institutions also train and employ current and future generations of scientists and engineers. However, realizing the economic potential of R&D activities is no sure thing. In order for university and lab research to reach the market, these institutions must be supported by strong policies, incentives, and funding streams that collectively make commercialization a priority.

To date, the efficacy of technology transfer mechanisms at federal laboratories and federally supported universities is mixed. 47 Some labs and universities have elevated the importance of technology transfer and put in place creative and impactful policies to promote commercialization in their economic regions. For example, in 2015 the Oak Ridge National Laboratory established an innovation voucher program to enable technical assistance to small and medium-sized manufacturers in the state. And universities such as MIT, Pepperdine, and Carnegie Mellon have strong track records of implementing flexible, business-friendly technology transfer agreements. Unfortunately, as the report Innovation U 2.0: Reinventing University Roles in a Knowledge Economy documents, there is little consistency and insufficient adoption of best practices across universities, federal laboratories, and funding agencies. 48

As the largest funder of federal laboratory and university research, the executive branch has an enormous opportunity to incentivize the commercialization of research. President Obama’s Lab-to-Market Initiative was a step in the right direction, but there is more to be done. In order to unleash the full economic power of federally funded universities and laboratories, the incoming administration should work with Congress in the following areas:

23. Increase the importance of commercialization activities at federal labs/research institutes

America’s federal laboratories are insufficiently incentivized to invest time, energy, and resources in facilitating technology transfer, in large part because technology transfer is not even one of the eight main criteria in the Performance Evaluation and Management Plan (PEMP), a kind of annual report card for the federal labs. 49 Rather, PEMP treats successful transfers of technology to market as an afterthought. Elevating this important function to its own category would have significant impacts on the management of the labs and help to reverse the buildup of decades of skepticism and intransigence toward commercialization. Adding a ninth category to the PEMP for “Technology Impact” would create a mechanism to evaluate the economic impact of lab-developed technology, creating a stronger incentive for lab managers to focus on market implementation of valuable government intellectual property assets and technical capabilities. 50

24. Allocate a share of federal funding to promote technology transfer and commercialization

The current federal system for funding research pays little attention to the commercialization of technology, and is based instead on the linear model of research that assumes that basic research gets easily translated into commercial activity. Yet the reality is that the innovation process is choked with barriers, including institutional inertia, coordination and communication challenges, and lack of funding for proof of concept research and other “valley of death” activities. Accordingly, federal policy should explicitly address this challenge and allocate more funding toward commercialization activities.

The incoming administration should work with Congress to establish an automatic set-aside program that takes a modest percentage of federal research budgets and allocates this money to technology commercialization activities. 51 For instance, the Information Technology and Innovation Foundation has suggested that Congress allocate 0.15 percent of agency research budgets (about $110 million per year) to fund university, federal laboratory, and state government technology commercialization and innovation efforts. 52

Such funds could be used to provide “commercialization capacity-building grants” to organizations pursuing specific innovative initiatives to improve an institution’s capacity to commercialize faculty research as well as “commercialization accelerator grants” to support institutions of higher education pursuing initiatives that allow faculty to directly commercialize research. 53 These funds could also support a variety of different initiatives, including mentoring programs for researcher entrepreneurs, student entrepreneurship clubs and entrepreneurship curricula, industry outreach programs, and seed grants for researchers to develop commercialization plans.

In addition, the incoming administration should broaden beyond universities the number of institutions that are eligible for commercialization funds. At the state and regional levels many organizations outside the university play a critical role in assisting faculty and students in the commercialization of research. Institutions like BioCrossroads in Indiana and TEDCO in Maryland offer mentorship, funding, and access to customers for research entrepreneurs. These organizations should be eligible for federal research dollars specifically aimed at technology transfer.

25. Develop a proof-of-concept, or “Phase Zero,” individual and institutional grant award program within major federal research agencies

The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs support innovation, but both SBIR and STTR approval are a high bar for early-stage companies. There is often insufficient funding available at universities (or from other sources) to push nascent technologies to the point where these companies are positioned to receive an SBIR or STTR grant. The problem is essentially that researchers and universities do not have the resources available to support the proof-of-concept work, market analysis, and mentoring needed to translate ideas and nascent technologies from the university laboratory into a commercial product.