You are using an outdated browser. Please upgrade your browser to improve your experience.

Trusted market research and industry insights

For your toughest business questions., media mentions, the boston globe: snow blower prices are piling up. do you need one, forbes: new jersey bag ban followed by increased use of plastic, wall street journal: new jersey plastic bag ban goes bust, smartbrief: how consumers are keeping their furry friends fed, forbes: the smallest pieces matter, market research by category, featured market research reports, on the market research blog.

Laundry Detergent Market to Reach $101 Billion by 2032

Middle East and Africa B2C E-Commerce Market Poised for Rapid Growth

The Future of Hospitality: IoT & Smart Technologies in Modern Hotels & Resorts

Helpful tools, research assistance, resource center.

What is a Marketing Research Report and How to Write It?

Table of contents

To see what Databox can do for you, including how it helps you track and visualize your performance data in real-time, check out our home page. Click here .

There is nothing more embarrassing for a marketer than to hear a client say “…this doesn’t quite address the business questions that we need to answer.” And unfortunately, this is a rather common occurrence in market research reporting that most marketers would care to admit.

So, why do most market research reports fail to meet client expectations? Well, in most cases, because there is more emphasis on methodology and analytic techniques used to craft the report rather than relying on data visualization, creative story-telling, and outlining actionable direction/steps.

Now, our next big question is, how do you avoid your client’s dreaded deer-in-the-headlights reaction when presenting such a report? This blog post will answer this and much more, as we go through the following:

What Is a Market Research Report?

Why is market research important, differences between primary and secondary market research, types of market research, market research reports advantages and disadvantages, how to do market research, how to prepare a market research report: 5 steps, marketing research report templates, marketing research reports best practices, bring your market research reports a step further with databox.

The purpose of creating a market research report is to make calculated decisions about business ideas. Market research is done to evaluate the feasibility of a new product or service, through research conducted with potential consumers. The information obtained from conducting market research is then documented in a formal report that should contain the following details:

- The characteristics of your ideal customers

- You customers buying habits

- The value your product or service can bring to those customers

- A list of your top competitors

Every business aims to provide the best possible product or service at the lowest cost possible. Simply said, market research is important because it helps you understand your customers and determine whether the product or service that you are about to launch is worth the effort.

Here is an example of a customer complaint that may result in more detailed market research:

Suppose you sell widgets, and you want your widget business to succeed over the long term. Over the years, you have developed many different ways of making widgets. But a couple of years ago, a customer complained that your widgets were made of a cheap kind of foam that fell apart after six months. You didn’t think at the time that this was a major problem, but now you know it.

The customer is someone you really want to keep. So, you decide to research this complaint. You set up a focus group of people who use widgets and ask them what they think about the specific problem. After the conducted survey you’ll get a better picture of customer opinions, so you can either decide to make the changes regarding widget design or just let it go.

PRO TIP: How Well Are Your Marketing KPIs Performing?

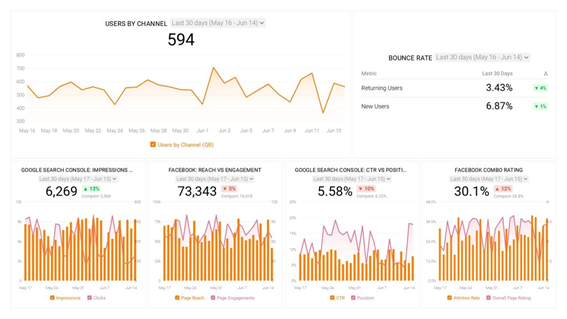

Like most marketers and marketing managers, you want to know how well your efforts are translating into results each month. How much traffic and new contact conversions do you get? How many new contacts do you get from organic sessions? How are your email campaigns performing? How well are your landing pages converting? You might have to scramble to put all of this together in a single report, but now you can have it all at your fingertips in a single Databox dashboard.

Our Marketing Overview Dashboard includes data from Google Analytics 4 and HubSpot Marketing with key performance metrics like:

- Sessions . The number of sessions can tell you how many times people are returning to your website. Obviously, the higher the better.

- New Contacts from Sessions . How well is your campaign driving new contacts and customers?

- Marketing Performance KPIs . Tracking the number of MQLs, SQLs, New Contacts and similar will help you identify how your marketing efforts contribute to sales.

- Email Performance . Measure the success of your email campaigns from HubSpot. Keep an eye on your most important email marketing metrics such as number of sent emails, number of opened emails, open rate, email click-through rate, and more.

- Blog Posts and Landing Pages . How many people have viewed your blog recently? How well are your landing pages performing?

Now you can benefit from the experience of our Google Analytics and HubSpot Marketing experts, who have put together a plug-and-play Databox template that contains all the essential metrics for monitoring your leads. It’s simple to implement and start using as a standalone dashboard or in marketing reports, and best of all, it’s free!

You can easily set it up in just a few clicks – no coding required.

To set up the dashboard, follow these 3 simple steps:

Step 1: Get the template

Step 2: Connect your HubSpot and Google Analytics 4 accounts with Databox.

Step 3: Watch your dashboard populate in seconds.

Marketing research requires both primary and secondary market research. But what does that mean and what are the main differences?

Primary market research takes in information directly from customers, usually as participants in surveys. Usually, it is consisted of:

- Exploratory Primary Research – This type of research helps to identify possible problem areas, and it’s not focused on discovering specific information about customers. As with any research, exploratory primary research should be conducted carefully. Researchers need to craft an interviewing or surveying plan, and gather enough respondents to ensure reasonable levels of statistical reliability.

- Specific Primary Research – This type of research is one of the best ways to approach a problem because it relies on existing customer data. Specific research provides a deeper, more thorough understanding of the problem and its potential solutions. The greatest advantage of specific research is that it lets you explore a very specific question, and focus on a specific problem or an opportunity.

Secondary market research collects information from other sources such as databases, trend reports, market or government statistics, industry content, etc. We can divide secondary market research into 3 categories:

- Public market data – Public sources range from academic journals and government reports to tax returns and court documents. These sources aren’t always easy to find. Many are available only in print in libraries and archives. You have to look beyond search engines like Google to find public source documents.

- Commercial data – Those are typically created by specialized agencies like Pew, Gartner or Forrester. the research agencies are quite expensive, but they provide a lot of useful information.

- Internal data – Your organization’s databases are gold mines for market research. In the best cases, your salespeople can tell you what they think about customers. Your salespeople are your direct sources of information about the market. Don’t underestimate your internal data.

In general, primary research is more reliable than secondary research, because researchers have to interview people directly. But primary research is expensive and time-consuming. Secondary research can be quicker and less expensive.

There are plenty of ways to conduct marketing research reports. Mostly, the type of research done will depend on your goals. Here are some types of market research often conducted by marketers.

Focus Groups

Product/service use research, observation-based research, buyer persona research, market segmentation research, pricing research, competitive analysis research, customer satisfaction and loyalty research, brand awareness research, campaign research.

An interview is an interactive process of asking and answering questions and observing your respondent’s responses. Interviews are one of the most commonly used tools in market research . An interview allows an organization to observe, in detail, how its consumers interact with its products and services. It also allows an organization to address specific questions.

A focus group is a group of people who get together to discuss a particular topic. A moderator leads the discussion and takes notes. The main benefit of focus groups is that they are quick and easy to conduct. You can gather a group of carefully-selected people, give them a product to try out, and get their feedback within a few hours/days.

Product or service use research helps you obtain useful information about your product or service such as:

- What your current customers do with the product/service

- Which features of the product/service are particularly important to your customers

- What they dislike about the product/service

- What they would change about the product/service

Observation-based research helps you to observe your target audience interacting with your product or service. You will see the interactions and which aspects work well and which could be improved. The main point is to directly experience the feedback from your target audience’s point of view.

Personas are an essential sales tool. By knowing your buyers’ pain points and the challenges they face, you can create better content, target messaging, and campaigns for them. Buyer persona research is based on market research, and it’s built around data that describes your customers’ demographics, behaviors, motivations, and concerns. Sales reporting software can significantly help you develop buyer personas when you gain insights after you collected all information.

Market segmentation research is carried out to better understand existing and potential market segments. The objective is to determine how to target different market segments and how they differ from each other. The three most important steps in writing a market segmentation research report are:

- Defining the problem

- Determining the solution [and]

- Defining the market

Related : 9 Customer Segmentation Tips to Personalize Ecommerce Marketing and Drive More Sales

A price that is too high, or too low, can kill a business. And without good market research, you don’t really know what is a good price for your product. Pricing research helps you define your pricing strategy.

In a competitive analysis, you define your “competition” as any other entity that competes with you in your market, whether you’re selling a widget or a piece of real estate. With competitive analysis research, you can find out things like:

- Who your competitors are

- What they’ve done in the past

- What’s working well for them

- Their weaknesses

- How they’re positioned in the market

- How they market themselves

- What they’re doing that you’re not

Related : How to Do an SEO Competitive Analysis: A Step-by-Step Guide

In today’s marketplace, companies are increasingly focused on customer loyalty. What your customers want is your product, but, more importantly, they want it delivered with a service that exceeds their expectations. Successful companies listen to their customers and respond accordingly. That’s why customer satisfaction and loyalty research is a critical component of that basic equation.

Related : 11 Tactics for Effectively Measuring Your Customer Service ROI

Who you are, what you stand for, what you offer, what you believe in, and what your audience thinks of you is all wrapped up in brand. Brand awareness research tells what your target audience knows about your brand and what’s their experience like.

A campaign research report is a detailed account of how your marketing campaign performed. It includes all the elements that went into creating the campaign: planning, implementation, and measurement.

Here are some of the top advantages and disadvantages of doing market research and crafting market research reports.

- Identify business opportunities – A market research report can be used to analyze potential markets and new products. It can give information about customer needs, preferences, and attitudes. Also, it compare products and services.

- A clear understanding of your customers – A market report gives company’s marketing department an in-depth picture about customers’ needs and wants. This knowledge can be used to improve products, prices, and advertising.

- Mitigates risks – 30% of small businesses fail within the first two years. Why is this so? The answer is that entrepreneurs are risk takers. However, there are risks that could be avoided. A good marketing research will help you identify those risks and allow you to mitigate them.

- Clear data-driven insights – Market research encompasses a wide range of activities, from determining market size and segment to forecasting demand, and from identifying competitors to monitoring pricing. All of these are quantified and measurable which means that gives you a clear path for building unique decisions based on numbers.

Disadvantages

- It’s not cheap – Although market research can be done for as little as $500, large markets like the United States can run into millions of dollars. If a research is done for a specific product, the budget may be even much higher. The budget also depends on the quality of the research. The more expensive it is, the more time the research will take.

- Some insights could be false – For example, if you are conducting a survey, data may be inadequate or inaccurate because respondents can, well, simply be dishonest and lie.

Here are the essential steps you need to take when doing market research:

Define your buyer persona

Identify a persona group to engage, prepare research questions for your market research participants, list your primary competitors, summarize your findings.

The job of a marketing persona is to describe your ideal customer and to tell you what they want, what motivates them, what frustrates them, and what limits them. Finding out these things means you have a better chance of designing your products, services, marketing messages, and brand around real customers. There is no one right way to create a buyer persona, though.

For example, if you’re in an industry focused on education, you could include things like:

- Educational level

- Education background

It’s recommended that you create 3-5 buyer personas for your products, based on your ideal customer.

This should be a representative sample of your target customers so you can better understand their behavior. You want to find people who fit both your target personas and who represent the broader demographic of your market. People who recently made a purchase or purposefully decided not to make one are a good sample to start with.

The questions you use determine the quality of your results. Of course, the quality of your results also depends on the quality of your participants.

Don’t ask questions that imply a yes or no answer. Instead, use open questions. For example, if you are researching customers about yogurt products, you could ask them: „ What have you heard about yogurt ?” or “ What do you think of yogurt ?“.

Avoid questions that use numbers, such as “ How many times a week do you eat yogurt ?”

Avoid questions that suggest a set of mutually exclusive answers, such as “ Do you like yogurt for breakfast, lunch, or dinner ?”

Avoid questions that imply a scale, such as “ Do you like chocolate-flavored yogurt ?”

Market researchers sometimes call one company the top competitor, another middle competitor, and the third one small competitor. However you classify them, you want to identify at least three companies in each category. Now, for each business on your list, list its key characteristics. For example, if your business sells running shoes, a key characteristic might be the product’s quality.

Next, make a list of your small business’s competitive advantages. These include the unique qualities or features of your business that make it the best choice of customers for the products or services it offers. Make a list of these competitive advantages and list them next to the key characteristics you listed for your business.

You have just finished writing your marketing research report. Everything is out there quantified or qualified. You just have to sum it up and focus on the most important details that are going to make a big impact on your decisions. Clear summary leads to a winning strategy!

Related : How to Prepare a Complete Marketing Report: The KPIs, Analysis, & Action Plan You Need

Here’s how to prepare a market research report in 5 simple steps:

Step 1: Cluster the data

Step 2: prepare an outline, step 3: mention the research methods, step 4: include visuals with narrative explanations, step 5: conclude the report with recommendations.

Your first step is to cluster all the available information into a manageable set. Clustering is the process of grouping information together in a way that emphasizes commonalities and minimizes differences. So, in market research, this will help to organize all the information you have about a product, service, or target market and identify your focus areas.

A marketing research report should be written so that other people can understand it:

- Include background information at the beginning to explain who your audience is and what problem you are trying to solve for them.

- In the body of the report, include a description of the methodology – Explain to the reader how your research was done, what was involved, and why you selected the methodology you used.

- Also in the body of the report, include the results of your market research. These may be quantitative or qualitative, but either way they should answer the questions you posed at the beginning.

- Include the executive summary – A summary of the entire report.

The market research methodology section includes details on the type of research, sample size, any limitations of the studies, research design, sample selection, data collection procedures, and statistical analyses used.

Visuals are an essential part of the presentation. Even the best-written text can be difficult to understand. Charts and graphs are easier to understand than text alone, and they help the reader see how the numbers fit the bigger picture.

But visuals are not the whole story. They are only one part of the presentation. Visuals are a cue for the reader. The narrative gives the story, not just the numbers.

Recommendations tend to follow logically from conclusions and are a response to a certain problem. The recommendation should always be relevant to the research rationale, that is, the recommendation should be based on the results of the research reported in the body of the report.

Now, let’s take a look at some dashboard reporting templates you could use to enhance your market research:

- Semrush (Position Tracking) Report

Brand Awareness Report

Sales pipeline performance report, customer success overview report, stripe (mrr & churn) report, semrush (position tracking) report template.

This free SEMRush dashboard template will help you monitor how your website’s search visibility on search engines evolves on a monthly basis. This dashboard contains all of the information you need to make changes and improve the ranking results of your business in Google Search.

This Brand Awareness Report will help you to get a sense of your brand awareness performance in Google Analytics, Google Organic Search, and Facebook. Use this dashboard to track brand awareness the same way you track other marketing campaigns.

Are your sales and marketing funnel healthy and growing? How is your sales and marketing funnel performing? What are the key conversion rates between your lifecycle stages? With a pipeline performance dashboard , you’ll get all of the answers quickly.

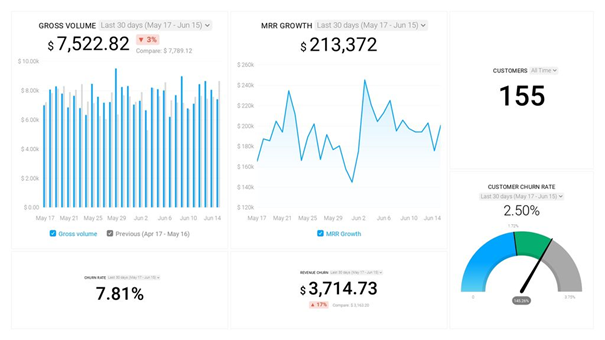

This Customer Success Overview Dashboard allows you to analyze how your customer service team’s responsiveness impacts your business. Use this dashboard to assess the correlation between your customer service performance and churn rate.

This Stripe dashboard tracks your churn rate and MRR growth in real-time and shows you which customers (and how many of them) you have at any given point in time. All you have to do to get started is to connect your Stripe account.

As we said earlier, there are no strict rules when it comes to writing marketing research reports. On the other hand, you must find your focus if you want to write a report that will make a difference. Here are some best practices you should keep in mind when writing a research report.

- Objectives – The objective of a market research report is to define the problems, identify key issues, and suggest recommendations for further research. If you answer them successfully, you’re on the right way.

- Don’t worry about the format – Be creative. The report could be in a form of a PowerPoint presentation, Excel sheet, interactive dashboard or even a video. Use the format that best fits your audience, but make sure to make it easy to read.

- Include an executive summary, scorecard , or a dashboard – This is really important because time is money, and most people don’t have time to waste. So, how to put everything important in a short role? Address all of the objectives and put them in a graphic dashboard or scorecard. Also, you can write an executive summary template (heart of the report) that can be easily updated and read by managers or CEOs.

- Use storytelling – A good story always makes a great point because it’s so memorable. Your research report results can double the effect with a catchy story.

- Keep it short – It’s not a secret that we are reading so little in the digital era. Use a lot of white space and bullet points. Too much text on a page means less focus for the reader.

- Be organized – Maintain the order of information. It’s important for the reader to navigate through the report easily. If they want to find some details or specific information it would be great to divide all sections with appropriate references.

- Methodological information – Methodological details could be boring. Include only the most important details that the reader needs to know to understand the big picture.

- Use images (or other visualizations) whenever you can – A good picture speaks for 1.000 words! If you can communicate the point visually, don’t hesitate to do it. It would be a lot easier for those who don’t like a lot of text to understand your results. But don’t push them where you can’t.

- Create readable graphs – The crown of marketing research reports is a comprehensive graph. Make sure to design precise and attractive graphs that will power up and round your story.

- Use the Appendix – You can include all secondary information such as methodological details and other miscellaneous data in the Appendix at the end of the report.

Market research reports are all about presenting your data in an easy-to-understand way and making calculated decisions about business ideas. But this is something easier said than done.

When busy stakeholders and executives grab a report, they need something that will give them an idea of the results – the big picture that addresses company wide-business goals.

Can a PowerPoint presentation or a PDF report meet those expectations? Most likely not. But a dashboard can.

Keep in mind that even with the best market analysis in the world, your market research report won’t be actionable if you don’t present the data efficiently and in a way that everyone understands what the next steps are. Databox is your key ally in the matter.

Databox dashboards are designed to help you present your market research data with clarity – from identifying what is influencing your business, and understanding where your brand is situated in the market, to gauging the temperature of your niche or industry before a new product/service launch.

Present your research results with efficient, interactive dashboards now by signing up for a free trial .

- Databox Benchmarks

- Future Value Calculator

- ROI Calculator

- Return On Ads Calculator

- Percentage Growth Rate Calculator

- Report Automation

- Client Reporting

- What is a KPI?

- Google Sheets KPIs

- Sales Analysis Report

- Shopify Reports

- Data Analysis Report

- Google Sheets Dashboard

- Best Dashboard Examples

- Analysing Data

- Marketing Agency KPIs

- Automate Agency Google Ads Report

- Marketing Research Report

- Social Media Dashboard Examples

- Ecom Dashboard Examples

Does Your Performance Stack Up?

Are you maximizing your business potential? Stop guessing and start comparing with companies like yours.

A Message From Our CEO

At Databox, we’re obsessed with helping companies more easily monitor, analyze, and report their results. Whether it’s the resources we put into building and maintaining integrations with 100+ popular marketing tools, enabling customizability of charts, dashboards, and reports, or building functionality to make analysis, benchmarking, and forecasting easier, we’re constantly trying to find ways to help our customers save time and deliver better results.

Do you want an All-in-One Analytics Platform?

Hey, we’re Databox. Our mission is to help businesses save time and grow faster. Click here to see our platform in action.

Grew up as a Copywriter. Evolved into the Content creator. Somewhere in between, I fell in love with numbers that can portray the world as well as words or pictures. A naive thinker who believes that the creative economy is the most powerful force in the world!

Get practical strategies that drive consistent growth

Streamlining Sales Processes with HubSpot and Databox

Marketing Reporting: The KPIs, Reports, & Dashboard Templates You Need to Get Started

12 Tips for Developing a Successful Data Analytics Strategy

Build your first dashboard in 5 minutes or less

Latest from our blog

- AI Adoption in SMBs: Key Trends, Benefits, and Challenges from 100+ Companies October 17, 2024

- Know What Social Content Resonates Most With Your Audience (w/ Darien Payton, Antidote) October 17, 2024

- Metrics & KPIs

- vs. Tableau

- vs. Looker Studio

- vs. Klipfolio

- vs. Power BI

- vs. Whatagraph

- vs. AgencyAnalytics

- vs. DashThis

- Product & Engineering

- Inside Databox

- Terms of Service

- Privacy Policy

- Talent Resources

- We're Hiring!

- Help Center

- API Documentation

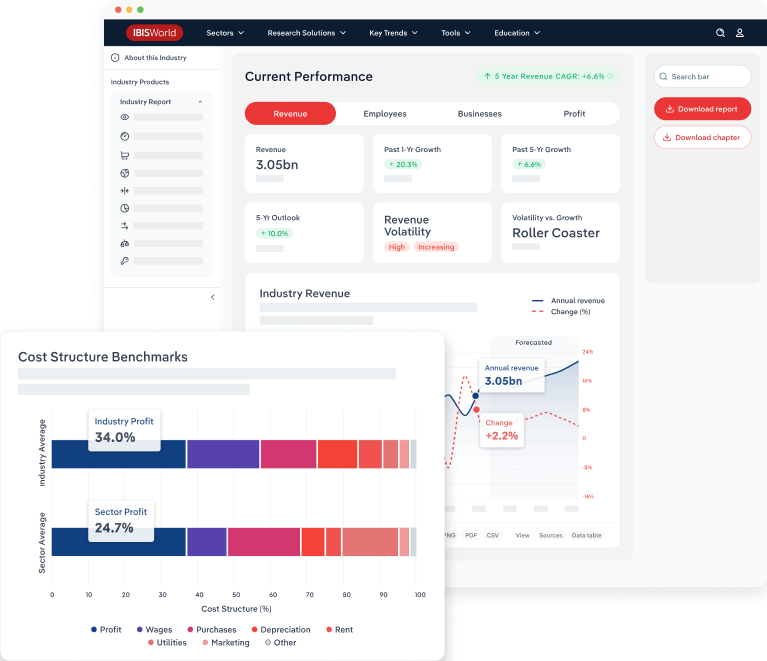

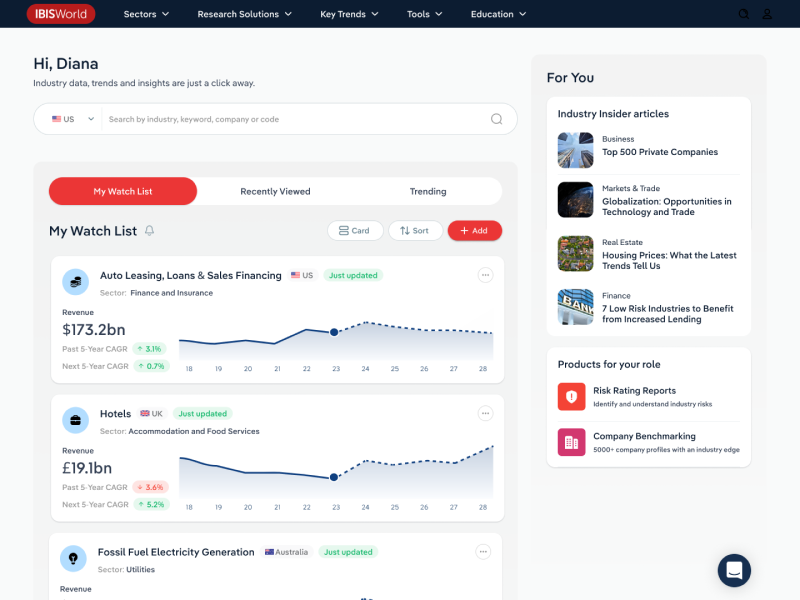

Industry research with unrivaled coverage.

The industry analysis and forecasts you need to make strategic decisions, backed by data..

Every sector of the economy, at your fingertips

No more scrambling for credible information. Fill knowledge gaps instantly with the largest collection of industry research reports.

Manufacturing

Construction, finance & insurance, real estate, healthcare & social assistance services, administration & business support services, information, retail trade, transportation & warehousing, professional, scientific & technical services, agriculture, forestry, fishing & hunting, accommodation & food services, educational services, industry analysis with an eye on the future.

Learn what’s behind today’s industry trends and where your market is headed next so you can future-proof your business decisions.

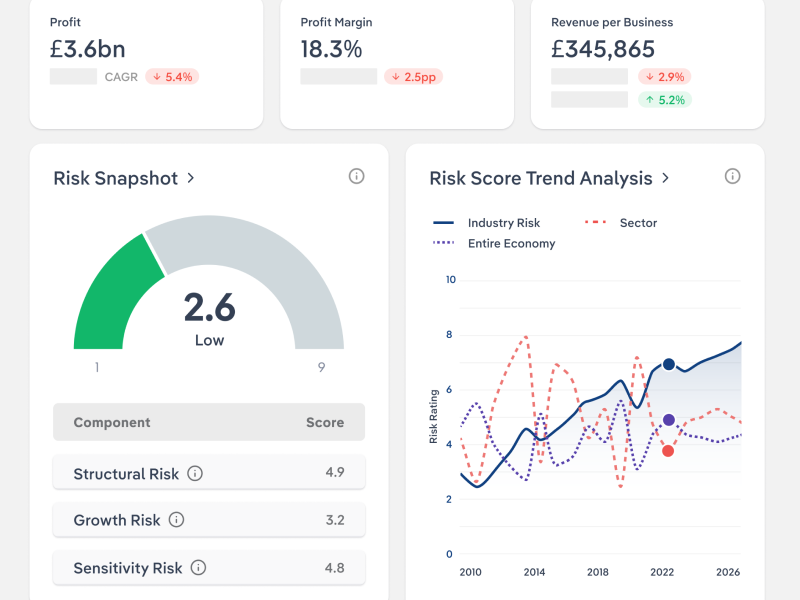

Mitigate risk with Industry research

Assess the industry from all sides to avoid blind spots and make smarter strategic decisions.

- check_circle_outline Leverage industry reports and risk ratings to mitigate the threats you can control and plan for the ones you can’t.

- check_circle_outline Compare industry financial ratios and benchmarks to help quantify the risk of doing business.

- check_circle_outline Identify opportunities and threats present in any industry to bolster your risk management frameworks.

Find your competitive edge

Discover the forces working for or against you in any industry to help you rise above the competition.

- check_circle_outline Understand which companies compete in the industry and the barriers to entry new businesses face.

- check_circle_outline Uncover geographic nuances and opportunities using business concentration and global trade data.

- check_circle_outline Ready your talking points with accessible key takeaways and call prep questions.

Understand market dynamics

Turn days of research into hours or minutes using actionable industry insights that paint a holistic picture of the market.

- check_circle_outline Discover the driving forces behind supply, demand, market size, risks and revenue trends.

- check_circle_outline Understand the growth trajectory of any industry with five-year data forecasts.

- check_circle_outline Present industry statistics, pain points and key success factors to help you gain credibility with your audience.

Need a closer look? Download a sample report?

Global coverage written by local analysts.

Streamline your research process with industry reports covering everything from established sectors to emerging markets across four continents.

Trusted by 7,000+ companies around the world

Independent, accurate and written by experienced analysts. Our industry analysis, company database and economic insights support businesses of all sizes, across all markets.

“IBISWorld delivers the crisp business knowledge we need to drive our business. Whether it be serving up our major clients, winning new business or educating people on industry issues, IBISWorld brings real value.”

“IBISWorld has revolutionised business information - which has proved commercially invaluable to exporters, investors and public policy professionals in Australia and overseas.”

“You could spend hours researching for the information that IBISWorld has at your fingertips. IBISWorld gives you far more than most resources do.”

Want industry statistics and news delivered to your inbox monthly?

And get full access to all statistics. Starting from $2,388 USD yearly

Empowering people with data

Insights and facts across 170 industries and 150+ countries, popular topics.

- Social media usage

- E-commerce worldwide

- Artificial intelligence (AI)

- Global inflation

- Electric vehicles

- Sustainability

- Fast fashion

Trusted by more than 23,000 companies

Trending statistics

Get facts and insights on topics that matter, oct 14, 2024 | climate change, global temperature anomalies in september 1979-2024.

In September 2024, the global average surface air temperature reached 16.17°C, which was 0.73°C above the 1991-2020 average for that month. This makes September 2024 the warmest on record globally.

Oct 16, 2024 | Banks

Leading banks worldwide 2023, by tier 1 capital.

In 2023, the Industrial and Commercial Bank of China (ICBC) ranked as the world's largest bank by Tier 1 capital, with approximately 523.4 billion U.S. dollars. ICBC was followed by three other Chinese banks. JPMorgan Chase secured fifth place, holding 277.31 billion U.S. dollars in Tier 1 capital.

Oct 16, 2024 | Fixed-Line Connections

Countries with the fastest average fixed broadband internet speed worldwide 2024.

As of August 2024, the United Arab Emirates (UAE) had the fastest average fixed broadband internet speed worldwide, with an average of 297.62 Mbps. Singapore ranked a close second at 297.57 Mbps, while Hong Kong followed in third. Fixed internet connections deliver broadband to a home, office, or other fixed location, with fiber connections offering the best quality service.

Oct 14, 2024 | Consumer Electronics

Leading tech companies' electricity consumption worldwide 2023.

Of the leading ten technology companies worldwide based on market capitalization, Samsung is the company consuming the most electricity at nearly 30 million megawatt-hours (MWh) based on the company's most recent 2023 figures. Google, Taiwan Semiconductor Manufacturing Company (TSMC), and Microsoft came in second, third, and fourth place in electricity consumption, respectively.

Oct 15, 2024 | E-Commerce

Depop app downloads per month worldwide 2021-2024.

Depop, a social shopping platform based in the United Kingdom, was downloaded a total of 641,000 times globally in September 2024. In the recorded time period, Depop's app downloads peaked in January 2021 when they reached over 780,000 that month.

Oct 15, 2024 | Online Advertising

B2b digital ad spend in the u.s. 2022-2026.

In 2024, business-to-business (B2B) digital advertising spending in the United States amounted to an estimated 18.3 billion U.S. dollars. The annual value was projected to reach 23 billion dollars by 2026.

Oct 15, 2024 | Economy

Projected gdp growth in china 2024.

According to a median projection in October 2024, China's GDP was expected to grow by 4.8 percent in 2024, missing the annual growth target of five percent set by the Chinese government. In the first quarter of 2020, the second-largest economy recorded the first contraction in decades due to the epidemic.

To curb the spread of the virus, the Chinese government imposed a lockdown in Wuhan, the epicenter, and other cities in Hubei province on January 23, 2020. A strict nationwide lockdown soon followed. Many factories remained closed in February, resulting in a plunge in manufacturing Purchasing Managers' Index (PMI). The shutdown of the “world’s factory” had severely disrupted global supply chains, especially automobile production. In March 2020, very few industrial sectors reported positive production growth. The pharmaceuticals sector recorded a production increase, which was mainly driven by the global demand for vital medical supplies. China had exported over seven billion yuan worth of face masks.

Apart from the manufacturing industry, the prolonged closures of business had caused significant losses in various sectors in China. The travel and tourism sector was massively affected by a drastic decline in flight ticket sales and hotel occupancy rates. The domestic tourism market expects a loss of 20 percent in revenues for 2020. Industry experts predicted that the global travel and tourism industry could lose about 2.5 trillion U.S. dollars in that year.

Oct 16, 2024 | Key Economic Indicators

Inflation rate in the uk 1989-2024.

The UK inflation rate was 1.7 percent in September 2024, down from 2.2 percent in the previous month. Between September 2022 and March 2023, the UK experienced seven months of double-digit inflation, which peaked at 11.1 percent in October 2022. As of the most recent month, alcohol and tobacco was the sector with the highest inflation rate. In general, the last time overall inflation was rising at comparable levels was in 1992, when inflation peaked at 8.4 percent. Between 1993 and 2021, the UK inflation rate never exceeded 5.4 percent and was usually at much lower levels.

There are various reasons for the elevated levels of inflation seen since 2021. After the COVID-19 pandemic, global supply chains struggled to meet the renewed demand for goods and services. Food and energy prices, which were already high, increased further in 2022. Russia's invasion of Ukraine in February 2022 brought an end to the era of cheap gas flowing to European markets from Russia. The war has also disrupted global food markets, with both Russia and Ukraine being major exporters of cereal crops. As a result of these factors, inflation is high across Europe and the rest of the world.

High inflation is one of the main factors behind the ongoing Cost of Living Crisis in the UK. With global energy prices spiralling, the UK's energy price cap has increased substantially. The cap, which limits what suppliers can charge consumers, reached 3,549 British pounds per year in October 2022, compared with 1,277 pounds a year earlier. Along with soaring food costs, high-energy bills have hit UK households hard, especially lower income ones that spend more of their earnings on housing costs. As a result of these factors, UK households experienced their biggest fall in living standards in decades in 2022/23, with household disposable income also expected to fall in 2023/24, and 2024/25.

Oct 17, 2024 | South Africa

Median age of the population in south africa 2020.

This statistic shows the median age of the population in South Africa from 1950 to 2100*.The median age is the age that divides a population into two numerically equal groups; that is, half the people are younger than this age and half are older. It is a single index that summarizes the age distribution of a population. In 2020, the median age of the South African population was 27.3 years.

Oct 16, 2024 | Wine & Champagne

Argentina: wine market revenue 2018-2029.

The wine market revenue in Argentina was forecast to continuously increase between 2024 and 2029 by in total 1.3 billion U.S. dollars (+45.94 percent). After the sixth consecutive increasing year, the indicator is estimated to reach 4.13 billion U.S. dollars and therefore a new peak in 2029.

Starting point of your research

- Agriculture

- Pharmaceuticals

- Advertising

- Video Games

- Virtual Reality

- European Union

- United Kingdom

- Market Insights

Discover data on your market

Gain access to valuable and comparable market data for over 190+ countries, territories, and regions with our Market Insights. Get deep insights into important figures, e.g., revenue metrics, key performance indicators, and much more.

All Market Insights topics at a glance

Statista accounts

Access all statistics starting from $2,388 usd yearly *.

* For commercial use only

Basic Account

- Free Statistics

Starter Account

- Free + Premium Statistics

Personal Account

Professional account, global stories vividly visualized, consumer insights, understand what drives consumers.

The Consumer Insights helps marketers, planners and product managers to understand consumer behavior and their interaction with brands. Explore consumption and media usage on a global basis.

Our Service

Save time & money with statista, trusted content.

With an increasing number of Statista-cited media articles, Statista has established itself as a reliable partner for the largest media companies of the world.

Industry expertise

Over 500 researchers and specialists gather and double-check every statistic we publish. Experts provide country and industry-based forecasts.

Flatrate access

With our solutions you find data that matters within minutes – ready to go in your favorite format.

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

1 All prices do not include sales tax. The account requires an annual contract and will renew after one year to the regular list price.

No results found.

The market research report guide for small business owners

While you may be unable to read your customer’s minds or predict with certainty how your next product launch will go, a market research report can get you close.

Clear and documented market analysis helps you get inside your customers’ heads, understand broader market trends and make accurate predictions about future business decisions.

In this article, you’ll learn how to write and use a market research report for your small business, what every good report should include and how you can leverage CRM data to expedite the report creation process.

What is a market research report?

A market research report documents findings and analyses of your business’s target audience and the broader market. It helps you understand your target audience, what they value and how wider macro-economic trends may impact their opinions and buying habits.

There is no prescribed format for reports. You can tailor your write-up to your audience’s needs and preferences, so a PDF, slide show or spreadsheet are all suitable mediums.

While reports can be as broad or as specific as necessary, most brands undertake market research to achieve a pre-defined goal such as assessing the viability of a new market or product.

Suppose you want to know whether a potential new product is feasible for mid-market B2B businesses . Customer surveys , group focus sessions and additional secondary research, such as market insights, can be potent combinations.

You could then use your CRM to identify relevant customer segments to survey and compile your findings into a market research report to share with stakeholders.

Your report will help them take the appropriate next steps, whether it’s proceeding with product development, commissioning further research or putting plans on hold.

Market research report vs. marketing research reports

Market research reports and marketing research reports sound synonymous, but it’s important to understand how they differ.

Market research reports are internal reports that analyze your market and customers. Anyone in your business can use them to make data-driven decisions about current and future strategies.

For example, marketing teams can consult your market research report when brainstorming creative routes. Product teams can refer to it when designing new software features.

On the other hand, marketing research reports are external-facing documents brands use to garner attention from their target market and win new business. These are also called white papers .

For instance, Pipedrive regularly publishes trend reports for marketing purposes, like The State of Sales and Marketing 2023/24 .

Meanwhile, McKinsey & Company releases market research reports regularly to aid companies in their decision-making. Below, its analysis of MSMEs (micro-, small- and medium-size enterprises) and various case studies shed light on the potential of small businesses worldwide:

It can be confusing to distinguish between the two report types since both involve conducting research.

To help clarify, the table below lists the key differences between market research reports and marketing research reports:

Now you know what a marketing research report involves, see why you’d want to spend time and money to create one for your small business.

Recommended reading

Marketing reporting: how to create reports that inform decisions

4 benefits of creating a market research report

Industry experience is invaluable when making critical business decisions. Industry insights are even more powerful when paired with data-backed research on your market and competitors.

Making calculated strategic decisions becomes much easier with an in-depth market research report that provides the following benefits.

1. Understand the business landscape

Broad market research reports can give you a holistic view of the market. Information like market size, brand awareness, consumer attitudes and economic factors such as purchasing power keeps you abreast of the latest industry trends .

A clear understanding of the business landscape can also lift the lid on your competitors’ strategies and consumer attitudes toward them, helping you gain a competitive advantage.

For instance, a research report shows consumers are unhappy about a competitor’s recent price rise. You could use this information to evaluate your pricing strategy and develop a marketing campaign that targets this customer pain point .

2. Know what your audience thinks

A market research report can tell you much about your target market, including their goals, pain points and attitudes toward products and brands.

You can use this research to create accurate and deep buyer personas that let your sales team find and prioritize ideal prospects . It can also inform future product lines or marketing strategies so they better align with the market's current needs.

3. Improve your messaging

If your creative team has a new campaign idea, a market research report can evaluate how much it will appeal to customers.

Using market research, you can test specific creative approaches. You can also gather a swipe file of opinions and pain points to ensure future campaigns resonate with your target audience and compel it to take action.

4. Uncover new business opportunities

It’s easier to brainstorm products that fill a gap in the market when you know what your customers think, want and need.

If you already have a new venture or small business idea in mind, market research can uncover whether there’s a genuine demand for your new product or service. You can gauge market size, potential price points, economic considerations and more.

Research methods: primary vs. secondary

You can collect two kinds of market research for your report: primary and secondary.

Primary research

Primary research is any data you collect to achieve your market research objective. It’s new, up to date and unique to you – ideal for guiding real-time decisions.

Primary research data can be expensive and time-consuming to collect and analyze. While it’s easy to download a finished report (secondary research) from an online database, organizing a dozen focus groups and collating the results will entail more work.

Some of the most common primary research methods include:

Face-to-face interviews

Focus groups

These methods can be broad and exploratory, such as uncovering general consumer attitudes. Alternatively, they can be specific, drilling down to learn what your audience thinks about a product, competitor or ad creative.

Who you approach for research will depend on your goals, but existing customers will likely be willing and approachable targets.

Your CRM is an excellent place to find your customers’ details. Records can also highlight which customers engage with your team the most. These are the people you’ll want to contact first.

How to Convince Your Team to Invest in a CRM

Secondary research

Secondary research is any data your company, governments or other businesses have compiled. While this research can be easier to obtain (since you don’t have to host a focus group or send out a questionnaire), it’s not as specific to your business or industry as primary research.

Many free secondary data resources exist, including the United States Census Bureau , YouGov and Data.gov .

Research companies like the Pew Research Center, Forrester and Gartner offer free and premium market data and research materials, including industry forecasts and economic benchmarks. The latter can be expensive for small business owners , with subscriptions costing over five figures.

You don’t have to turn to external sources for secondary research. Your business’s CRM system often contains ample data that can reveal much about your customers’ preferences and buying habits.

For example, you can run Pipedrive reports to determine:

Which customer segments have the highest lifetime value

Which products customers typically buy together (or one after the other)

Whether certain buyer personas favor a particular product or service

Observing your customers is critical to understanding your target market’s behavior and then using that knowledge to grow your small business accordingly.

6 steps to create a market research report

A detailed report makes your market research useful and actionable. Ensure you cover all applicable points and deliver a high-impact document by following the steps below.

Step 1: pick an objective

First, define the purpose of your market research industry report. Example objectives include:

Testing a new product

Understanding a market segment

Identifying industry trends

Running a competitor or market analysis

Examining customer satisfaction levels

Think about who will read your market research report so you can plan ahead to meet their needs. Different audiences require different styles, tones and information.

You’ll also need to decide whether your market research report will be exploratory or specific. Exploratory research requires longer, more meandering interviews and may make it more difficult to provide actionable takeaways.

Tips for choosing an objective for your market research report :

Align your objective with your business goals (e.g., is the purpose to launch a new product or strength-test an existing service in a fluctuating market?)

Ensure your objective is measurable (i.e., what metrics will you use to define success?)

Set general and specific objectives (e.g., general: learn whether adding AI to your tool will increase user sign-ups; specific: learn how much of segment A uses AI in non-competitive productivity tools)

Step 2: define your research subjects and data collection methods

Market research is time- and resource-intensive, so know who you’ll be speaking to and what you need to learn before you begin.

Buyer personas are an excellent place to start – especially if your objective is to determine what a particular customer segment thinks about a product or idea.

If you don’t already have well-defined personas, use Pipedrive’s buyer persona templates to create your own using sales and demographic data from your CRM.

Better understand your customers with our Buyer Persona Templates

Your data is processed according to our privacy notice . You may unsubscribe at any time.

For industry analysis or competitive analysis, make a list of your competitors. These include product and category competitors (think Adidas vs. Nike) and search competitors (brands who rank for the same keywords in Google).

Tips to define your audience and data collection methods:

Use your CRM to identify customers belonging to target segments and message them in advance

Look for customers who recently interacted with your team as these will often be the best research candidates

Run a SWOT analysis of competing brands before you start to identify threats and opportunities you can explore with respondents

Step 3: collect data using one or more of the above methods

Undertake the research stage of your report using one or more of the above methods.

Try to include one piece of primary, custom research – if your budget allows – to acquire a unique viewpoint that’s not accessible to competitors.

Aim to collect both qualitative and quantitative results, too. The latter provides empirical evidence, while the former adds color and depth to your findings.

For example, asking customers to rank brands on a scale of one to 10 is a form of quantitative research. Questioning them about what they think about the brands is qualitative research.

Tips for collecting market research :

Align your research methodology with your objectives. Broad exploratory discussions are better in a group session. One-to-one interviews tend to be preferable for researching specific questions.

Spend time fine-tuning questions before you begin. The quality of your questions will determine the quality of your results, so use open-ended questions that respondents can’t answer with a yes or no.

If you use a market research agency, you can elicit more honest feedback by keeping your brand secret from respondents

Step 4: analyze the research

Turn raw data into clear and actionable insights by centralizing it in a spreadsheet or your favorite presentation tool. Then look for themes and commonalities between data sets.

Depending on your objectives, there may be frameworks that accelerate this process – such as SWOT analysis.

You can use a SWOT analysis framework to analyze the competitor and product research you’ve compiled for your small business reporting.

Tips to analyze market research :

Several common programs are suitable for collating research, like PowerPoint and Excel. You can also use dedicated solutions like Miro to visualize your data.

Cluster large data sets to make them more manageable by looking for commonalities

Most businesses will find this the most challenging part of the market research report process, so reserve plenty of time for data analysis

Step 5: summarize findings

Draft your findings into a well-structured, detailed report that tells a story. Engaging and easy-to-follow stories will help employees, stakeholders and third parties digest your findings.

Develop a narrative during the data collection and analysis stages. It will make it easier to summarize your findings and craft actionable takeaways that stakeholders will appreciate.

A Pipedrive campaign performance report, for example, can illustrate customer sentiment as follows:

In this example, you could highlight an increase in email open rates (the Y-axis conversion metric) to demonstrate customer interest in a new product feature, assuming that feature appeared in the email subject line .

Tips to summarize your findings:

Use visuals to aid your storytelling and support your argument. Your CRM, for example, can generate graphics using internal data.

Process your findings to help you draw actionable takeaways that benefit your small business

Step 6: review your report and findings

Review your report and findings before sending it to colleagues and stakeholders. Ensure it makes sense and answers the objectives you chose at the start of the process.

Tips to review your findings:

Leave at least a day before proofreading your report and read through it multiple times

Focus on your argument on the first pass before moving on to spelling, grammar and other more technical aspects

Use tools like Grammarly and Hemingway to catch grammatical errors and improve clarity

What should you include in your market research report?

A market research report template is always a helpful jumping-off point. Alongside it, remember to include the following essential elements.

An executive summary

An executive summary is a concise roundup that helps time-restricted stakeholders to quickly understand your key findings.

Make your summary short and engaging. It will rarely be the only thing people read, but it should briefly summarize your arguments if it is.

A good executive summary can also set the course for the rest of the document, hinting at the argument you will make.

The healthcare-focused executive summary below from the Boston Consulting Group gives readers a brief overview of the arguments in the report.

An explanation of your research methods

Detailing your research methods gives context to your findings and highlights any limitations stakeholders should consider when implementing your suggestions.

Be specific here. Rather than mention you conducted a survey with customers, specify the number of customers you spoke to, detail each customer’s seniority or buying power and list the questions you asked. You want to prove your takeaways are based on the opinions of relevant buyers.

Examples to support your points

Great market research reports show rather than tell. Support your argument with customer examples, graphs or other visuals that allow readers to draw their own conclusions.

If you find that customers feel a certain way about a new product, include one or two quotes from a focus group demonstrating this attitude. Another strategy is to turn quantitative research (like the brand rankings mentioned earlier) into a chart or graph, like this illustrative visual in the McKinsey report on MSMEs:

End with takeaways

End your market research report with a takeaway section summarizing your key findings and recommendations. The goal is to make it as easy for colleagues and stakeholders to make decisions based on your research.

As such, ensure any takeaways are actionable and relate directly to the objectives you outlined at the start of the report.

If your goal was to test the viability of a new product, summarize consumer sentiment and outline how to proceed. That could be a go-to-market strategy if the opinion was favorable or a specific recommendation on how to improve the product if it wasn’t.

The state of sales and marketing 2024

4 best practices for writing insightful customer research reports.

Take your market research report from good to great by implementing the following best practices.

1. Be concise

Your research can (and should) be as detailed as you wish, but keep your report digestible for stakeholders or partners. While senior employees will welcome your hard work, they may not have time to read through a 50-page report.

There are several ways to keep your report on target:

Practice brevity. Only give the reader essential information. You don’t need to support your argument with dozens of examples – one or two will suffice.

Simplify your language. Avoid technical terms or industry jargon unless you’re speaking to knowledgeable readers. Don’t assume all your board members will understand.

Keep your structure. A logical flow will keep you on track and help you move swiftly from one point to the next.

48 essential sales terms that all salespeople and marketers should know

2. Tell a compelling story

Make your report memorable with a compellingly crafted story. Readers remember what they learn from stories, even if the story is a market research report.

You can create a narrative by:

Knowing your audience. Write with their goals in mind using an appropriate tone of voice.

Setting the scene. Outline the problem you’re going to solve. Refer to it frequently in your writing.

Using the active voice. It’s more direct and engaging.

3. Use images or other visuals as much as possible

Rather than confront readers with walls of text, use images, graphs and other visuals to deliver a more palatable reading experience.

These features will not only make your report more approachable but also improve your storytelling and support your arguments.

Even small icons and pull quotes like those in the report excerpt below are enough:

Keep in mind these tips when adding images to your report:

Use the right graph for the right data. Ensure your visual represents the data accurately and reports the information clearly.

Use annotations. Annotate graphs with snippets explaining what the data shows so it’s quick and easy to understand.

Keep file sizes manageable. Large images will slow down your presentation and bulk up your documents. Keep image sizes as minimal as possible without reducing the quality.

4. Use an appendix

While stakeholders may only have time to skim your research, others may devour it in full. Allow them to do so with an appendix that details all your findings.

A McKinsey report on generative AI ends with nine pages that outline the scope, objectives and relevant study overviews like this one:

Add footnotes and references to the main part of your presentation to make your appendix more usable, meaning those who want additional detail can quickly refer to the back of your document.

You can streamline your appendix by:

Labeling it clearly. If your report is long, you can separate your appendix into different sections, such as by charts and images.

Ordering the information. Ensure your appendix follows the report layout and sequencing. Even if you have multiple sections, your first graph could be the first in Appendix A and the first image could be the first in Appendix B.

Final thoughts

Whether you want to understand a new niche or get feedback on a new product for your small business, your market research report can help stakeholders across your organization to take informed and purposeful action.

Make things as easy as possible for yourself by leaning on the tools you already have at your disposal. Your CRM, for example, can unearth suitable research prospects, support your outreach efforts and even create graphics for your reports.

If you’re looking for comprehensive CRM features to help streamline and support all your business processes and more, try Pipedrive’s all-in-one solution for free .

Driving business growth

Full access. No credit card needed.

Recommended

Technographics: what it means and how to use technographic data

Technographics provide key insights to help you target the right customers. Learn what technographic data is and how to use it effectively.

Social media management for small businesses

Running multiple social channels doesn’t have to be a chore. Grow your online presence with these social media management tips and tools for small businesses.

The best tips and techniques for building an effective revenue report

Regular revenue reporting leads to better decision-making that drives up profitability. Find out how to create regular revenue reports and how to use them.

How to Do Market Research: The Complete Guide

Learn how to do market research with this step-by-step guide, complete with templates, tools and real-world examples.

Access best-in-class company data

Get trusted first-party funding data, revenue data and firmographics

Market research is the systematic process of gathering, analyzing and interpreting information about a specific market or industry.

What are your customers’ needs? How does your product compare to the competition? What are the emerging trends and opportunities in your industry? If these questions keep you up at night, it’s time to conduct market research.

Market research plays a pivotal role in your ability to stay competitive and relevant, helping you anticipate shifts in consumer behavior and industry dynamics. It involves gathering these insights using a wide range of techniques, from surveys and interviews to data analysis and observational studies.

In this guide, we’ll explore why market research is crucial, the various types of market research, the methods used in data collection, and how to effectively conduct market research to drive informed decision-making and success.

What is market research?

The purpose of market research is to offer valuable insight into the preferences and behaviors of your target audience, and anticipate shifts in market trends and the competitive landscape. This information helps you make data-driven decisions, develop effective strategies for your business, and maximize your chances of long-term growth.

Why is market research important?

By understanding the significance of market research, you can make sure you’re asking the right questions and using the process to your advantage. Some of the benefits of market research include:

- Informed decision-making: Market research provides you with the data and insights you need to make smart decisions for your business. It helps you identify opportunities, assess risks and tailor your strategies to meet the demands of the market. Without market research, decisions are often based on assumptions or guesswork, leading to costly mistakes.

- Customer-centric approach: A cornerstone of market research involves developing a deep understanding of customer needs and preferences. This gives you valuable insights into your target audience, helping you develop products, services and marketing campaigns that resonate with your customers.

- Competitive advantage: By conducting market research, you’ll gain a competitive edge. You’ll be able to identify gaps in the market, analyze competitor strengths and weaknesses, and position your business strategically. This enables you to create unique value propositions, differentiate yourself from competitors, and seize opportunities that others may overlook.

- Risk mitigation: Market research helps you anticipate market shifts and potential challenges. By identifying threats early, you can proactively adjust their strategies to mitigate risks and respond effectively to changing circumstances. This proactive approach is particularly valuable in volatile industries.

- Resource optimization: Conducting market research allows organizations to allocate their time, money and resources more efficiently. It ensures that investments are made in areas with the highest potential return on investment, reducing wasted resources and improving overall business performance.

- Adaptation to market trends: Markets evolve rapidly, driven by technological advancements, cultural shifts and changing consumer attitudes. Market research ensures that you stay ahead of these trends and adapt your offerings accordingly so you can avoid becoming obsolete.

As you can see, market research empowers businesses to make data-driven decisions, cater to customer needs, outperform competitors, mitigate risks, optimize resources and stay agile in a dynamic marketplace. These benefits make it a huge industry; the global market research services market is expected to grow from $76.37 billion in 2021 to $108.57 billion in 2026 . Now, let’s dig into the different types of market research that can help you achieve these benefits.

Types of market research

- Qualitative research

- Quantitative research

- Exploratory research

- Descriptive research

- Causal research

- Cross-sectional research

- Longitudinal research

Despite its advantages, 23% of organizations don’t have a clear market research strategy. Part of developing a strategy involves choosing the right type of market research for your business goals. The most commonly used approaches include:

1. Qualitative research

Qualitative research focuses on understanding the underlying motivations, attitudes and perceptions of individuals or groups. It is typically conducted through techniques like in-depth interviews, focus groups and content analysis — methods we’ll discuss further in the sections below. Qualitative research provides rich, nuanced insights that can inform product development, marketing strategies and brand positioning.

2. Quantitative research

Quantitative research, in contrast to qualitative research, involves the collection and analysis of numerical data, often through surveys, experiments and structured questionnaires. This approach allows for statistical analysis and the measurement of trends, making it suitable for large-scale market studies and hypothesis testing. While it’s worthwhile using a mix of qualitative and quantitative research, most businesses prioritize the latter because it is scientific, measurable and easily replicated across different experiments.

3. Exploratory research

Whether you’re conducting qualitative or quantitative research or a mix of both, exploratory research is often the first step. Its primary goal is to help you understand a market or problem so you can gain insights and identify potential issues or opportunities. This type of market research is less structured and is typically conducted through open-ended interviews, focus groups or secondary data analysis. Exploratory research is valuable when entering new markets or exploring new product ideas.

4. Descriptive research

As its name implies, descriptive research seeks to describe a market, population or phenomenon in detail. It involves collecting and summarizing data to answer questions about audience demographics and behaviors, market size, and current trends. Surveys, observational studies and content analysis are common methods used in descriptive research.

5. Causal research

Causal research aims to establish cause-and-effect relationships between variables. It investigates whether changes in one variable result in changes in another. Experimental designs, A/B testing and regression analysis are common causal research methods. This sheds light on how specific marketing strategies or product changes impact consumer behavior.

6. Cross-sectional research

Cross-sectional market research involves collecting data from a sample of the population at a single point in time. It is used to analyze differences, relationships or trends among various groups within a population. Cross-sectional studies are helpful for market segmentation, identifying target audiences and assessing market trends at a specific moment.

7. Longitudinal research

Longitudinal research, in contrast to cross-sectional research, collects data from the same subjects over an extended period. This allows for the analysis of trends, changes and developments over time. Longitudinal studies are useful for tracking long-term developments in consumer preferences, brand loyalty and market dynamics.

Each type of market research has its strengths and weaknesses, and the method you choose depends on your specific research goals and the depth of understanding you’re aiming to achieve. In the following sections, we’ll delve into primary and secondary research approaches and specific research methods.

Primary vs. secondary market research

Market research of all types can be broadly categorized into two main approaches: primary research and secondary research. By understanding the differences between these approaches, you can better determine the most appropriate research method for your specific goals.

Primary market research

Primary research involves the collection of original data straight from the source. Typically, this involves communicating directly with your target audience — through surveys, interviews, focus groups and more — to gather information. Here are some key attributes of primary market research:

- Customized data: Primary research provides data that is tailored to your research needs. You design a custom research study and gather information specific to your goals.

- Up-to-date insights: Because primary research involves communicating with customers, the data you collect reflects the most current market conditions and consumer behaviors.

- Time-consuming and resource-intensive: Despite its advantages, primary research can be labor-intensive and costly, especially when dealing with large sample sizes or complex study designs. Whether you hire a market research consultant, agency or use an in-house team, primary research studies consume a large amount of resources and time.

Secondary market research

Secondary research, on the other hand, involves analyzing data that has already been compiled by third-party sources, such as online research tools, databases, news sites, industry reports and academic studies.

Here are the main characteristics of secondary market research:

- Cost-effective: Secondary research is generally more cost-effective than primary research since it doesn’t require building a research plan from scratch. You and your team can look at databases, websites and publications on an ongoing basis, without needing to design a custom experiment or hire a consultant.

- Leverages multiple sources: Data tools and software extract data from multiple places across the web, and then consolidate that information within a single platform. This means you’ll get a greater amount of data and a wider scope from secondary research.

- Quick to access: You can access a wide range of information rapidly — often in seconds — if you’re using online research tools and databases. Because of this, you can act on insights sooner, rather than taking the time to develop an experiment.

So, when should you use primary vs. secondary research? In practice, many market research projects incorporate both primary and secondary research to take advantage of the strengths of each approach.

One rule of thumb is to focus on secondary research to obtain background information, market trends or industry benchmarks. It is especially valuable for conducting preliminary research, competitor analysis, or when time and budget constraints are tight. Then, if you still have knowledge gaps or need to answer specific questions unique to your business model, use primary research to create a custom experiment.

Market research methods

- Surveys and questionnaires

- Focus groups

- Observational research

- Online research tools

- Experiments

- Content analysis

- Ethnographic research

How do primary and secondary research approaches translate into specific research methods? Let’s take a look at the different ways you can gather data:

1. Surveys and questionnaires

Surveys and questionnaires are popular methods for collecting structured data from a large number of respondents. They involve a set of predetermined questions that participants answer. Surveys can be conducted through various channels, including online tools, telephone interviews and in-person or online questionnaires. They are useful for gathering quantitative data and assessing customer demographics, opinions, preferences and needs. On average, customer surveys have a 33% response rate , so keep that in mind as you consider your sample size.

2. Interviews

Interviews are in-depth conversations with individuals or groups to gather qualitative insights. They can be structured (with predefined questions) or unstructured (with open-ended discussions). Interviews are valuable for exploring complex topics, uncovering motivations and obtaining detailed feedback.

3. Focus groups

The most common primary research methods are in-depth webcam interviews and focus groups. Focus groups are a small gathering of participants who discuss a specific topic or product under the guidance of a moderator. These discussions are valuable for primary market research because they reveal insights into consumer attitudes, perceptions and emotions. Focus groups are especially useful for idea generation, concept testing and understanding group dynamics within your target audience.

4. Observational research

Observational research involves observing and recording participant behavior in a natural setting. This method is particularly valuable when studying consumer behavior in physical spaces, such as retail stores or public places. In some types of observational research, participants are aware you’re watching them; in other cases, you discreetly watch consumers without their knowledge, as they use your product. Either way, observational research provides firsthand insights into how people interact with products or environments.

5. Online research tools

You and your team can do your own secondary market research using online tools. These tools include data prospecting platforms and databases, as well as online surveys, social media listening, web analytics and sentiment analysis platforms. They help you gather data from online sources, monitor industry trends, track competitors, understand consumer preferences and keep tabs on online behavior. We’ll talk more about choosing the right market research tools in the sections that follow.

6. Experiments

Market research experiments are controlled tests of variables to determine causal relationships. While experiments are often associated with scientific research, they are also used in market research to assess the impact of specific marketing strategies, product features, or pricing and packaging changes.

7. Content analysis

Content analysis involves the systematic examination of textual, visual or audio content to identify patterns, themes and trends. It’s commonly applied to customer reviews, social media posts and other forms of online content to analyze consumer opinions and sentiments.

8. Ethnographic research

Ethnographic research immerses researchers into the daily lives of consumers to understand their behavior and culture. This method is particularly valuable when studying niche markets or exploring the cultural context of consumer choices.

How to do market research

- Set clear objectives

- Identify your target audience

- Choose your research methods

- Use the right market research tools

- Collect data

- Analyze data

- Interpret your findings

- Identify opportunities and challenges

- Make informed business decisions

- Monitor and adapt

Now that you have gained insights into the various market research methods at your disposal, let’s delve into the practical aspects of how to conduct market research effectively. Here’s a quick step-by-step overview, from defining objectives to monitoring market shifts.

1. Set clear objectives

When you set clear and specific goals, you’re essentially creating a compass to guide your research questions and methodology. Start by precisely defining what you want to achieve. Are you launching a new product and want to understand its viability in the market? Are you evaluating customer satisfaction with a product redesign?

Start by creating SMART goals — objectives that are specific, measurable, achievable, relevant and time-bound. Not only will this clarify your research focus from the outset, but it will also help you track progress and benchmark your success throughout the process.