View our Insights

- Featured Manufacturing Retail Health and wellness E-commerce Sustainability SMB Innovation Artificial Intelligence

- Assortment and Merchandising Consumer and shopper insights Market performance measurement Marketing, media and personalized offers Operations and supply chain BASES product offer management Revenue growth management Route-to-market

Small and medium-sized businesses (SMB)

Nielseniq partner network, who we serve, featured industries, featured industry resources.

- Company News

- Diversity, Equity, and Inclusion

Work with us

- Search Careers

- Early Careers

How can we help you?

How health-conscious consumers want to live in a healthy world, health & wellness.

All around the world, consumers are re-inventing how they approach health threats and wellness-related decisions. Our Global Health and Wellness report explores consumer sentiment across 17 diverse global markets to help understand the global state of health, wellness, and well-being. It showcases a universal hierarchy of needs that empowers a deeper understanding of how consumers are currently prioritizing their health and wellness needs.

This hierarchy, applied to the current state of health and wellness, brings to light a total view of consumer health needs. It highlights unique differences in the innate order to which consumers are prioritizing their health needs: those that are protective, preservation-focused, aspirational, evolving, and altruistic in nature.

Altruistic needs delve into selfless consumption that supports environmental, ethical, humanitarian or other philanthropic causes. This article explores the specific causes, product claims and exemplar brands that serve health-minded consumers who strive to live in a healthy world.

Am I helping the health of the planet & those around me?

67% of global consumers say that environmental health and how their choices impact the planet is important to them

of surveyed global consumers agree that environmental issues are having an adverse impact on their current and future health

of surveyed global consumers are more likely to buy products with sustainable credentials than 2 years ago

of surveyed global consumers are willing to pay more for products that support communities and vulnerable groups

Source: NielsenIQ Global Health & Wellness /study of 17 markets, September 2021

Globally unified through the impact of living alongside COVID-19, many consumers today feel awakened to how their individual purchase decisions and experiences can collectively affect us all. The realities of air pollution, supply chain disruptions and how supporting local origin can be good for the individual, their local community and the planet are just a few ways in which pandemic living has heightened attention around altruistic health and wellness needs.

From environmental challenges, to equal access to healthcare for all and protecting our most vulnerable, there are many ways in which consumers are prioritizing the idea of a healthy world, in addition to their own health.

Global measures of consumer sentiment indicate that while many prioritize altruistic needs less so than other needs, there is considerable willingness to pay more for products with certain altruistic attributes or features. For example, 72% of surveyed respondents around the world say they would be willing to pay a premium for products that claim to be sustainable – where, 52% would be willing to pay a little bit more, and 20% of global consumers would be willing to pay a lot more for sustainable products.

Mainstream values that produce a healthy world

The concept of altruistic health and wellness is no longer in its infancy. For many consumers, their baseline expectations are for products to have clean, simple and sustainable ingredients. This is driven by heightened consumer awareness of how their individual product consumption ladders towards living in a healthy world. U.S. measures of consumer searches and retail sales exemplify just how mainstream altruistic needs have become. There has been strong, double-digit growth in the number of searches for vegan and cruelty free products, meanwhile, the swift pace of sales among clean ingredients (complexly defined by NielsenIQ, but summarized as being free from parabens, sulfates, phthalates, artificial colors, artificial fragrances and 600+ other ingredients) has outpaced sales growth of the overall beauty and personal care category.

growth in searches for ‘vegan’

growth in searches for ‘cruelty free’

Source: Consumer Searches on Amazon from Oct. 2019 – Dec. 2020

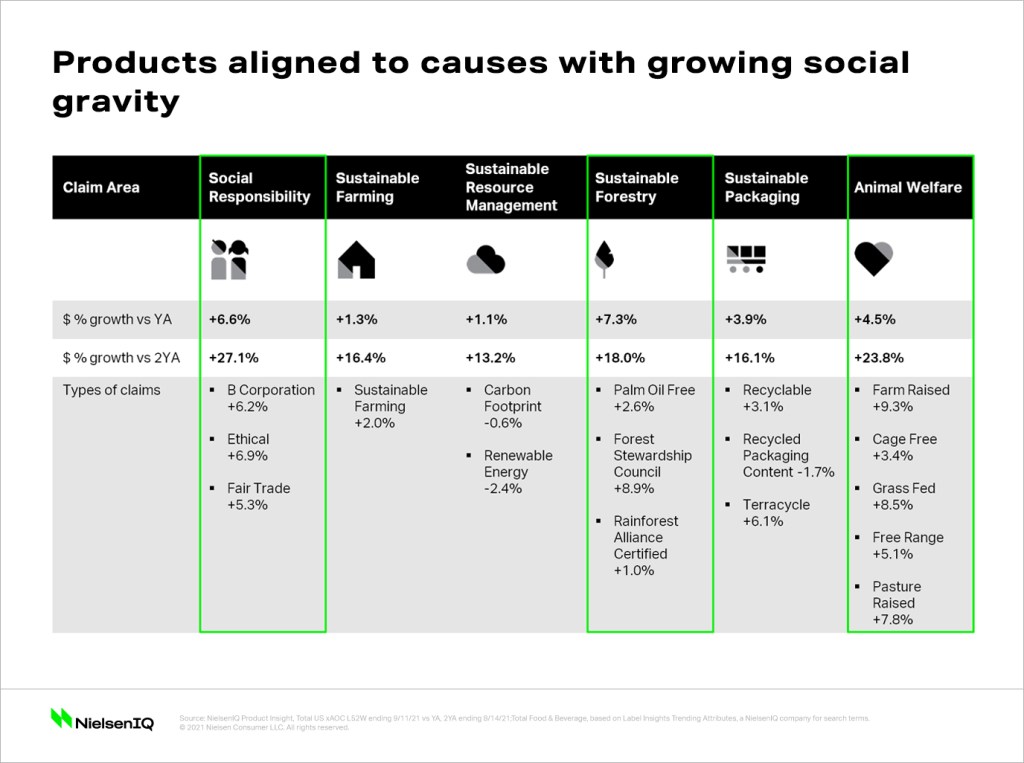

Beyond the scope of clean ingredients, there are many other pockets of growth within the sustainable product umbrella. From products backed by socially responsible organizations (+27% vs. 2019), to those that are manufactured with animal welfare in mind (+24% vs. 2019), there are many examples where products have aligned to causes with growing social gravity.

- How consumers arm themselves in the fight against health threats

- How consumers approach physical & mental well-being in 2021

- How consumers aspire to live healthy lives in 2021

- The changing face of global consumer health and wellness

All-in on clean label

Strong demand and continued growth have been constants in the world of clean label products. But interestingly enough, the leading “clean” brands today represent a mix of both old favorites and emerging up and comers. What unites these leaders is the common mission of producing products for healthy consumers who are striving to live in a healthy world.

Notably, Shea Moisture hair care products and Dr Bronners soaps both saw strong double-digit U.S. sales growth of 20% over the past year, likely driven by their long-term commitment to clean and sustainable beauty.

Some of the smaller brands that have made a splash include B.tan sunless tanner, and Sky organics personal care products, who have won with their commitment to clean ingredients without sacrificing performance.

Growth in clean for established brands as well as new

Shea moisture hair care $11.2MM, +20.8%

We strive to be sulfate free, paraben free and more, whenever possible. Tested on our family for four generations. Never on animals.

B. Tan suncare $2.8MM, +50.1%

We love animals, so we don’t test on them. And we love your bod so we keep all the nasties out of our products.

Dr. Bronners bath & shower $105MM, +19.9%

Only the purest organic and fair trade ingredients—most products vegan and certified to the same organic standards as food!

Sky organics HBL $3.8MM, +39.8%

Ours is a family deeply connected to nature and exploration, seeking travel and new experiences, always learning and engaged.

Source: NielsenIQ Retail Measurement Services, Product Insider, powered by Label Insight, Total US xAOC L52W ending 5/22/21; Beauty & Personal Care

Get ahead of the sustainability curve

While sustainability in and of itself is not new to the consumer packaged goods sector, the ways in which products are evolving to embody sustainable behaviors is constantly changing.

Take for example B.O.B. (Bars Over Bottles) a Brazilian beauty bar brand which touts water-less, plastic and chemical-free formulations that aim to reduce waste and preserve the world’s rivers and oceans. Low-waste products are commanding a swiftly growing spotlight with the U.S. haircare category as well. In fact, shampoo and conditioner bars, were the 9th most-searched hair care trend in early 2021 and offer a convenient and eco-friendly alternative to traditional bottled alternatives.

Similarly in Asia, Hong Kong skin care brand, Mono, has embodied a low-waste mentality of their own. Purchases include an empty bottle and soluble tablet that customers are instructed to combine with water in order to use. Leaving consumers to incorporate water to the product themselves results in a world of economical and environmental savings: fewer trucks and less packaging…even the wrapping of the product tablet is 100% recyclable.

Interest in low-waste hair care is growing

Shampoo and conditioner bars were the #9 most searched hair care trend in early 2021 with 135,000+ quarterly searches on Amazon alone.

+627% Plastic free hair care

+182% Zero waste hair care

+71% Refillable hair care

Source: Label Insight consumer search data from Amazon, Target & Walmart. April 2020-March 2021

Take a deeper look into the global consumer health and wellness revolution

Understanding how consumers’ altruistic health needs are being met is only part of the story. The opportunity for companies looking to meet and exceed the growing expectations of wellness-minded, conscious consumers is to figure out where your brand fits and sits along the entire hierarchy of health and wellness needs. Our Global Health and Wellness report takes a deep dive into how consumer needs have been reshaped around the world, what is trending, and what the budding opportunities are across the new, broadened spectrum of global well-being.

Stay one step ahead by staying up to date.

Don’t miss out on latest insights, offers and opportunities by NielsenIQ.

Related content

A Future without Plastic: Can the world really go plastic-free?

Discover On Premise consumer insights in Southeast Asia

Who is the Highball drinker in South Korea’s On Premise?

Wellness trends influencing consumers in 2024

This page does not exist in [x], feel free to read the page you are currently on or go to the [x] homepage.

- Search Menu

- Advance articles

- Author Interviews

- Research Curations

- Author Guidelines

- Open Access

- Submission Site

- Why Submit?

- About Journal of Consumer Research

- Editorial Board

- Advertising and Corporate Services

- Self-Archiving Policy

- Dispatch Dates

- Journals on Oxford Academic

- Books on Oxford Academic

Bernd Schmitt

June Cotte

Markus Giesler

Andrew Stephen

About the Journal

The Journal of Consumer Research publishes scholarly research that describes and explains consumer behavior.

Latest articles

Latest posts on x, visit the new jcr website.

The new JCR website highlights our community of consumer researchers and the important work we do. Visit consumerresearcher.com and find interviews with authors, resources for teachers, and much more.

Explore the website now

Why Publish with JCR ?

Award-winning articles.

Read our award-winning articles, including the Best Article Award winner as chosen by the members of the JCR Policy Board after receiving nominations from the Editorial Review Board. JCR also awards the Robert Ferber Award and Robert Ferber Honorable Mention. The Robert Ferber Award competition is held annually in honor of one of the founders and the second editor of the Journal of Consumer Research .

Read award-winning articles

High-Impact Articles

To highlight the impact of the journal, we have organized a collection of some of the most read, most cited, and most discussed articles from recent years.

Explore the collection

From the OUPblog

How drawing pictures can help us understand wine

Find out more

Why morning people seek more variety

The science behind ironic consumption

Read all posts from JCR on the OUPblog

Explore all past posts

Recommend to your library

Fill out our simple online form to recommend Journal of Consumer Research to your library.

Recommend now

Email alerts

Register to receive table of contents email alerts as soon as new issues of Journal of Consumer Research are published online.

Developing countries initiative

Your institution could be eligible to free or deeply discounted online access to Journal of Consumer Research through the Oxford Developing Countries Initiative.

Related Titles

- Recommend to your Library

Affiliations

- Online ISSN 1537-5277

- Print ISSN 0093-5301

- Copyright © 2024 Journal of Consumer Research Inc.

- About Oxford Academic

- Publish journals with us

- University press partners

- What we publish

- New features

- Open access

- Institutional account management

- Rights and permissions

- Get help with access

- Accessibility

- Advertising

- Media enquiries

- Oxford University Press

- Oxford Languages

- University of Oxford

Oxford University Press is a department of the University of Oxford. It furthers the University's objective of excellence in research, scholarship, and education by publishing worldwide

- Copyright © 2024 Oxford University Press

- Cookie settings

- Cookie policy

- Privacy policy

- Legal notice

This Feature Is Available To Subscribers Only

Sign In or Create an Account

This PDF is available to Subscribers Only

For full access to this pdf, sign in to an existing account, or purchase an annual subscription.

At the New York Fed, our mission is to make the U.S. economy stronger and the financial system more stable for all segments of society. We do this by executing monetary policy, providing financial services, supervising banks and conducting research and providing expertise on issues that impact the nation and communities we serve.

Introducing the New York Innovation Center: Delivering a central bank innovation execution

Do you have a Freedom of Information request? Learn how to submit it.

Learn about the history of the New York Fed and central banking in the United States through articles, speeches, photos and video.

Markets & Policy Implementation

- Effective Federal Funds Rate

- Overnight Bank Funding Rate

- Secured Overnight Financing Rate

- SOFR Averages & Index

- Broad General Collateral Rate

- Tri-Party General Collateral Rate

- Treasury Securities

- Agency Mortgage-Backed Securities

- Repos & Reverse Repos

- Securities Lending

- Central Bank Liquidity Swaps

- System Open Market Account Holdings

- Primary Dealer Statistics

- Historical Transaction Data

- Agency Commercial Mortgage-Backed Securities

- Agency Debt Securities

- Discount Window

- Treasury Debt Auctions & Buybacks as Fiscal Agent

- Foreign Exchange

- Foreign Reserves Management

- Central Bank Swap Arrangements

- ACROSS MARKETS

- Actions Related to COVID-19

- Statements & Operating Policies

- Survey of Primary Dealers

- Survey of Market Participants

- Annual Reports

- Primary Dealers

- Reverse Repo Counterparties

- Foreign Exchange Counterparties

- Foreign Reserves Management Counterparties

- Operational Readiness

- Central Bank & International Account Services

- Programs Archive

As part of our core mission, we supervise and regulate financial institutions in the Second District. Our primary objective is to maintain a safe and competitive U.S. and global banking system.

The Governance & Culture Reform hub is designed to foster discussion about corporate governance and the reform of culture and behavior in the financial services industry.

Need to file a report with the New York Fed? Here are all of the forms, instructions and other information related to regulatory and statistical reporting in one spot.

The New York Fed works to protect consumers as well as provides information and resources on how to avoid and report specific scams.

The Federal Reserve Bank of New York works to promote sound and well-functioning financial systems and markets through its provision of industry and payment services, advancement of infrastructure reform in key markets and training and educational support to international institutions.

The New York Fed provides a wide range of payment services for financial institutions and the U.S. government.

The New York Fed offers several specialized courses designed for central bankers and financial supervisors.

The New York Fed has been working with tri-party repo market participants to make changes to improve the resiliency of the market to financial stress.

- High School Fed Challenge

- College Fed Challenge

- Teacher Professional Development

- Classroom Visits

- Museum & Learning Center Visits

- Educational Comic Books

- Lesson Plans and Resources

- Economic Education Calendar

We are connecting emerging solutions with funding in three areas—health, household financial stability, and climate—to improve life for underserved communities. Learn more by reading our strategy.

The Economic Inequality & Equitable Growth hub is a collection of research, analysis and convenings to help better understand economic inequality.

This Economist Spotlight Series is created for middle school and high school students to spark curiosity and interest in economics as an area of study and a future career.

« How Has Treasury Market Liquidity Evolved in 2023? | Main | Borrower Expectations for the Return of Student Loan Repayment »

An Update on the Health of the U.S. Consumer

Andrew Haughwout, Donghoon Lee, Daniel Mangrum, Jonathan McCarthy, Davide Melcangi, Joelle Scally, and Wilbert van der Klaauw

The strength of consumer spending so far this year has surprised most private forecasters. In this post, we examine the factors behind this strength and the implications for consumption in the coming quarters. First, we revisit the measurement of “excess savings” that households have accumulated since 2020, finding that the estimates of remaining excess savings are very sensitive to assumptions about measurement, estimation period, and trend type, which renders them less useful. We thus broaden the discussion to other aspects of the household balance sheet. Using data from the New York Fed’s Consumer Credit Panel , we calculate the additional cash flows made available for consumption as a result of households’ adjustments to their debt holdings. To detect signs of stress in household financial positions, we examine recent trends in delinquencies and find the evidence to be mixed, suggesting that certain stresses have emerged for some households. In contrast, we find that the New York Fed’s Survey of Consumer Expectations still points to a solid outlook for consumer spending.

Surprising Consumption Strength

Real personal consumption expenditures (PCE) have been remarkably sturdy since the onset of the pandemic, to the surprise of many analysts over much of this period. The surprises have been especially notable over the first half of this year, as real PCE growth has held up in the face of ongoing monetary policy tightening and this spring’s banking system stress.

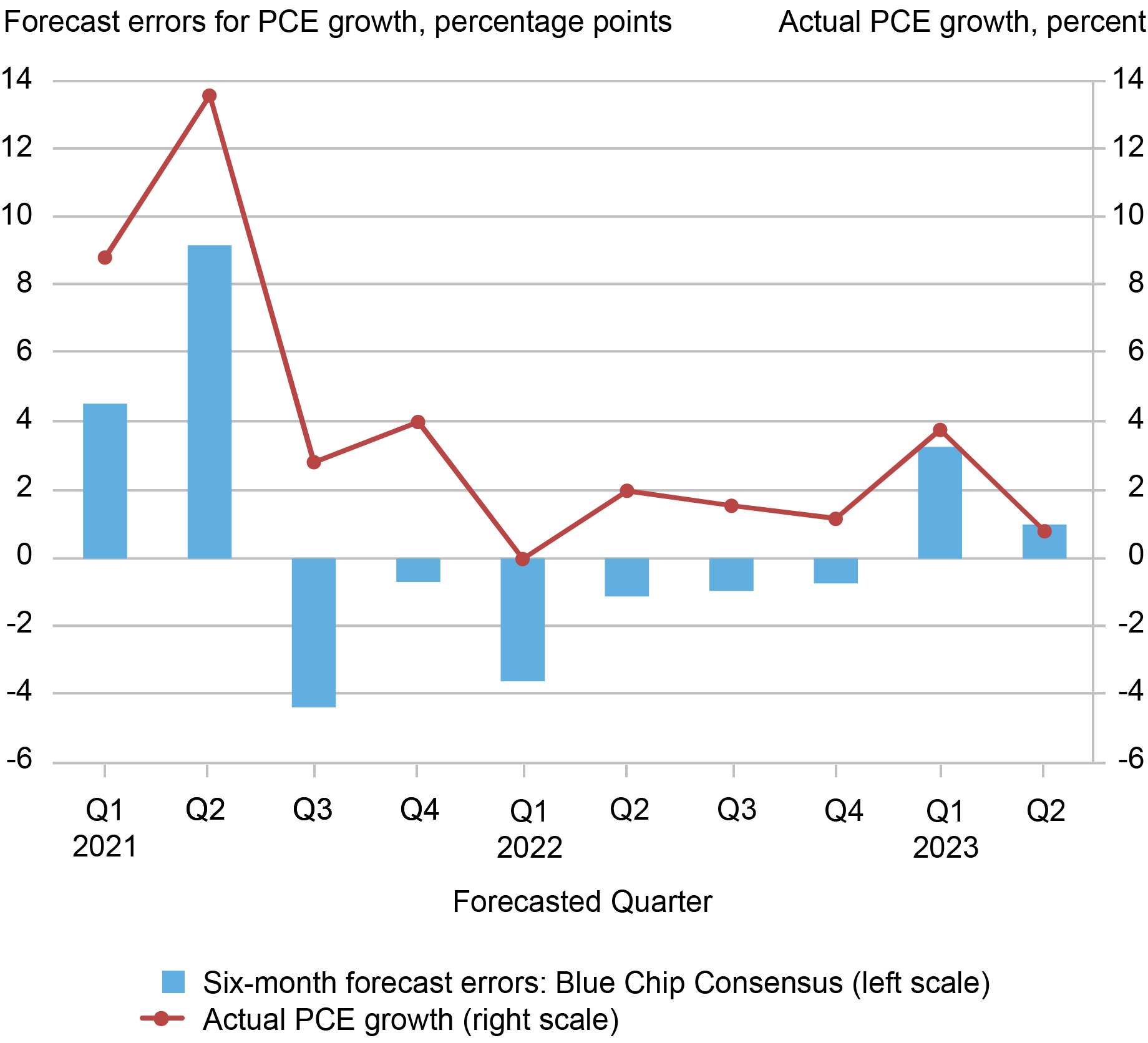

To quantify the extent of these surprises, we chart errors in the six-month-ahead Blue Chip Consensus forecasts of quarterly real PCE growth (measured at an annual rate). A positive forecast error (shown in the blue bars) at time t means that the realized growth rate (shown in red) was above the forecasts from six months earlier.

Consumption Has Surprised to the Upside, Especially in 2023

Sources: Bureau of Economic Analysis; Blue Chip Economic Indicators. Notes: The red line shows the real (inflation-adjusted) quarterly annualized rate of growth for personal consumption expenditures (PCE). The blue bars show the difference between realized PCE growth and the six-month-ahead Blue Chip Consensus forecasts, with positive values indicating that consumption growth was higher than expected.

In the first half of 2021, real PCE grew much faster than predicted, likely due to an unexpectedly fast rollout of vaccines and a larger-than-expected fiscal stimulus–in terms of both magnitude and multiplier effect on consumption. Throughout 2022, however, consumption was weaker than forecasted, probably due to a combination of higher-than-expected inflation, a larger effect on disposable income from the unwinding of pandemic-related fiscal support, and a faster-than-expected tightening of financial conditions.

But in 2023, we’ve seen upside surprises once again, particularly for the first quarter. Moreover, the most recent Blue Chip Consensus forecast for consumption growth in 2023:Q3 is higher than what was expected six months ago. This shift has occurred because many forecasters in the past few months have abandoned their projections of recession and negative consumption growth. We now attempt to understand these forecast errors.

Excess Savings

We begin our discussion with excess savings, which has received a lot of attention from economists and the business press . The idea is that large fiscal transfers and reduced consumption opportunities during the pandemic led households to save more than they otherwise would have done and now those savings may be available to support consumption. There is tremendous uncertainty, however, about how much excess savings still remain in the household sector.

While analysts generally agree that excess savings reached high levels over the course of 2021, significant differences about their recent level have developed; for example, see Aladangady et al. , de Soyres et al. , and Abdelrahman and Oliveira ( Higgins and Klitgaard study excess savings in the international context). The differences in estimates for the United States are attributable to technical factors like the assumed pre-pandemic trend, and different views about whether the savings rate or gross household saving (in dollars) is the appropriate way to think about any excess.

As we move further beyond the pandemic, measuring excess savings becomes increasingly fraught, since it relies heavily on assumptions about behavior in the absence of the pandemic. Consequently, in thinking about the recent resilience of consumption and the implications for the future, a broader assessment of households’ financial positions now seems a more important consideration than excess savings in isolation. In the remainder of the post, we focus on an important element of such an assessment: the role of debt in supporting households’ capacity to sustain consumption.

Household Debt

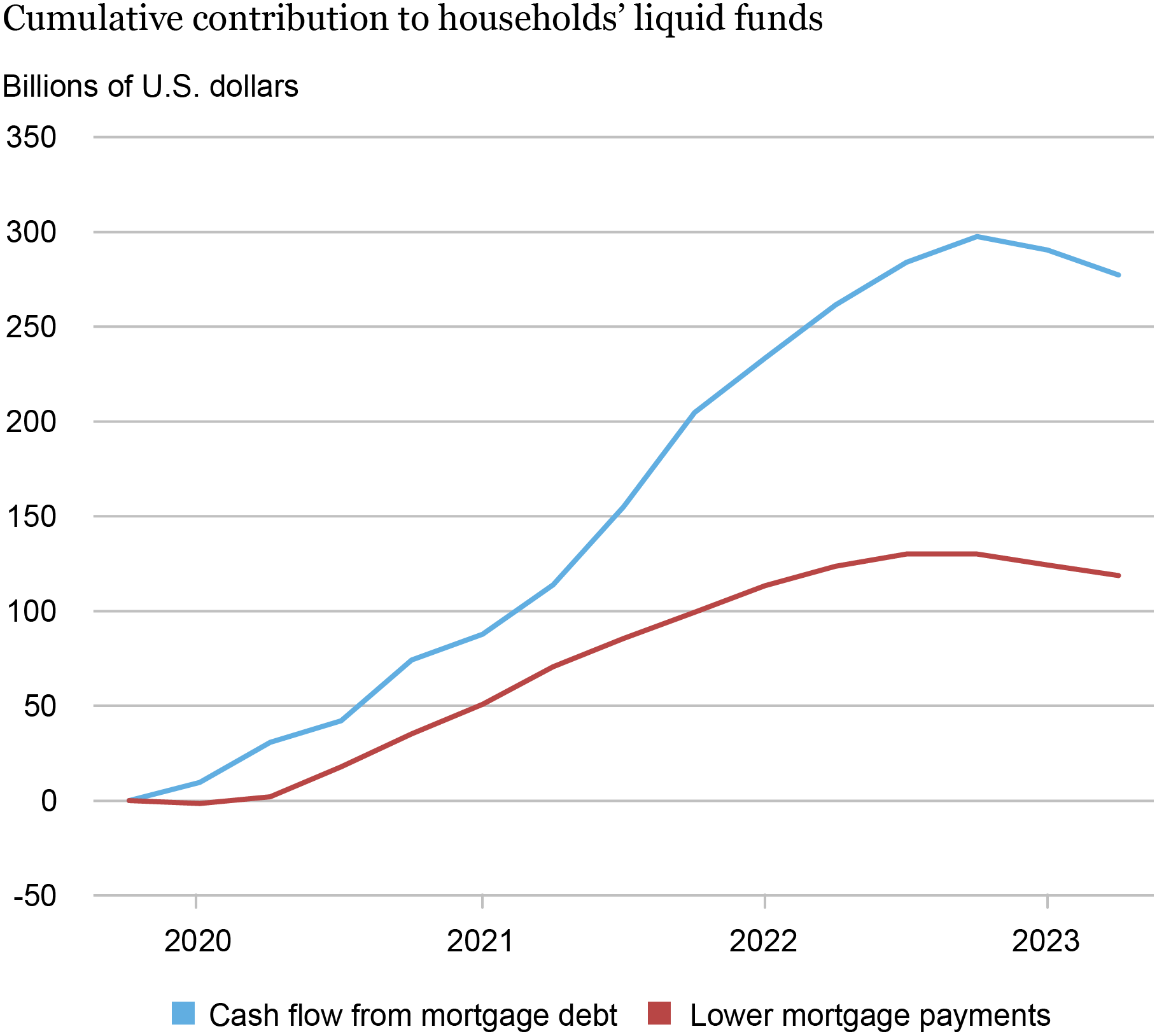

In addition to savings, households have relatively illiquid assets (like housing) and liabilities (like mortgages and credit card debts) on their balance sheets. The pandemic period featured forbearances on several types of debt, along with large fiscal transfers and very low interest rates, leading to significant improvements in household cash flows. For example, about 14 million households refinanced their mortgages, reducing their mortgage bill by $30 billion per year through 2021. The red line in the next chart shows that the cumulative savings from these lower payments stood at about $120 billion as of 2023:Q2, with recent quarters bringing declines as newer mortgages carry higher balances and higher interest rates.

In addition to these savings, homeowners withdrew unusually large amounts of home equity, primarily in the form of cash-out refinances during the period of low rates. These funds, shown in the blue line below, are also available for consumption and amount to $280 billion in 2023:Q2.

Equity Extraction and Mortgage Refinances Contributed to Liquid Funds Available for Consumption

Source: New York Fed Consumer Credit Panel / Equifax

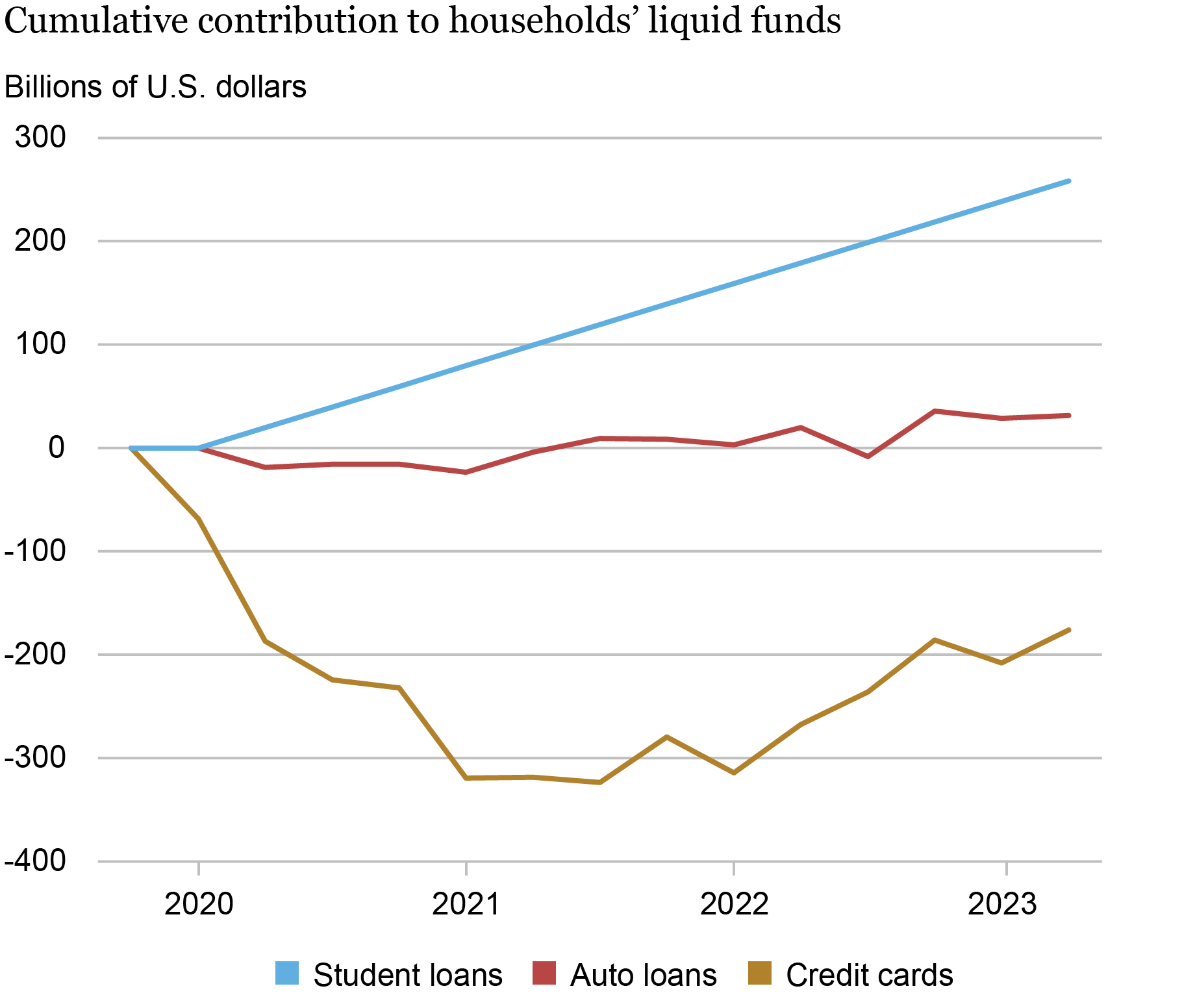

Other forms of household debt also supported consumption. Payments on student debt, which competes with auto loans to be the second largest household sector liability, have largely been in forbearance since the early stages of the pandemic. Payments on federal student loans prior to the payment moratorium totaled about $70 billion per year , meaning that through 2023:Q2 about $260 billion was left in the household sector; see the blue line in our next chart. By comparison, auto loans (red line) have made relatively small contributions to the funds available for consumption, while some of the funds that households saved have been reflected in reduced credit card balances (gold line).

Credit Card Paydowns Offset Student Loan Forbearance

Source: New York Fed Consumer Credit Panel / Equifax.

In total, mortgages—through equity extraction and lower interest payments—have provided about $400 billion of the excess savings since 2019, and nonmortgage debt has added about $110 billion as the positive cash flow from student loans is partly offset by the negative cash flow of credit cards. Of course, reduced credit card balances position households well for future consumption: since reduced balances typically mean that more credit is available for future use.

Other Indicators of Households’ Financial Health

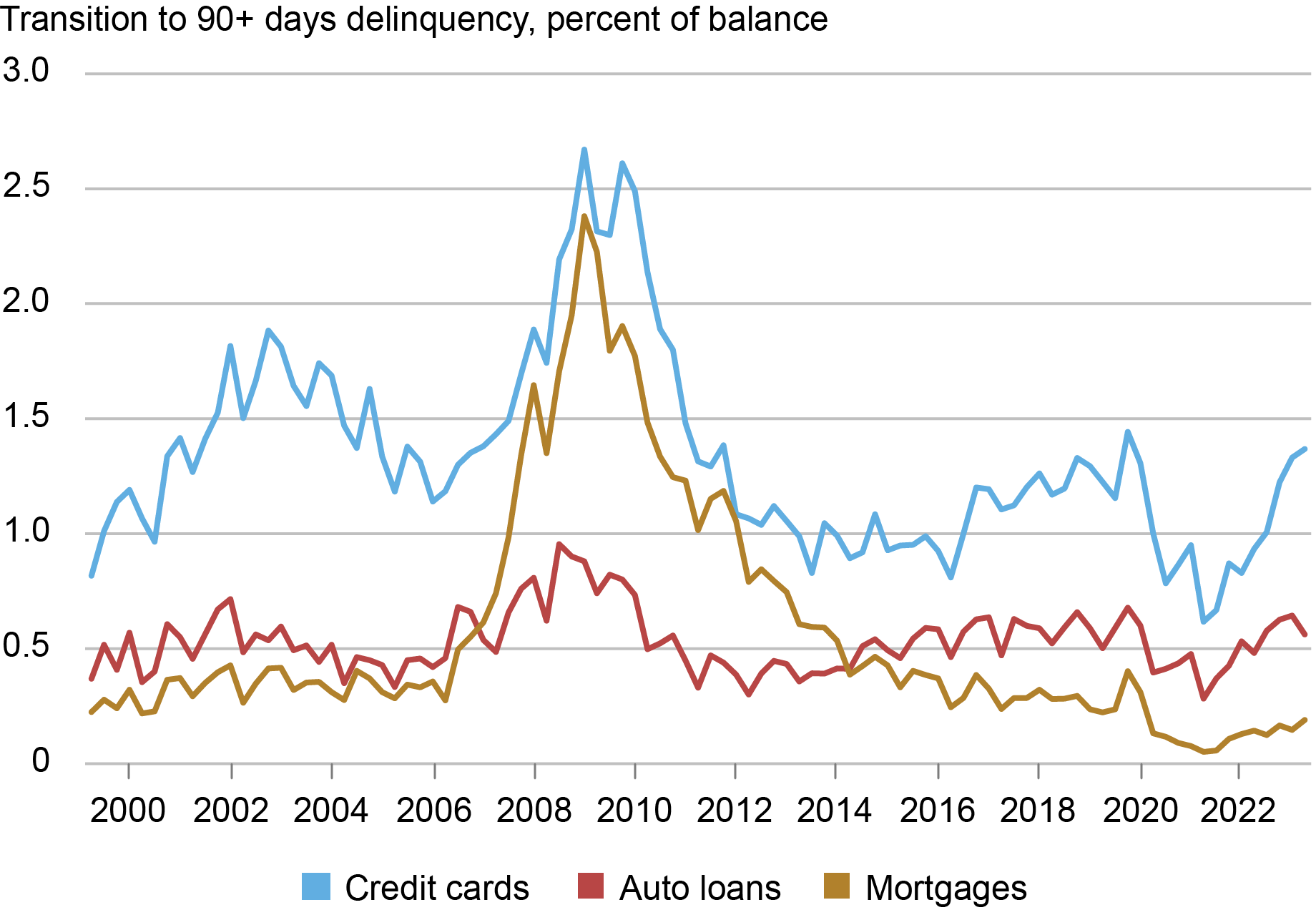

These positive cash flows from debt suggest that the household sector is in a strong position. Other indicators also support this assessment. Debt delinquencies are generally low, led by remarkably low mortgage delinquencies (shown in gold in the next chart). Auto loan and credit card delinquencies, on the other hand, have risen fairly sharply from their troughs during the pandemic and are now back to their 2019 levels. A key question going forward is whether these delinquency rates will level off or continue to rise. A further increase in delinquencies would indicate that, for at least some households, cash flow has become insufficient to support their financial obligations.

Will Delinquency Rates Continue to Rise?

As a second set of indicators, we use data from the New York Fed’s Survey of Consumer Expectations to assess households’ near-term expectations regarding their spending, debt delinquency, household income, and earnings growth. Median year-ahead expected spending growth has retreated somewhat from its high 2022 levels, but its current reading of 5.3 percent and six-month average of 5.4 percent remain well above its pre-pandemic level in February 2020 of 3.1 percent.

The same pattern is true for median expected household income growth and median expected earnings growth, which have averaged 3.2 percent and 2.9 percent, respectively, in recent months—well above their six-month averages going into the pandemic (2.7 percent and 2.4 percent, respectively). Consistent with these findings, the median probability of missing a debt payment over the next three months has been relatively low and stable over the past six months at an average of 11.3 percent, compared to a six-month average of 12.2 percent going into the pandemic.

What’s Next?

Overall, households report solid and stable expectations for spending growth, consistent with our evidence on the strength and liquidity of household balance sheets, including relatively low delinquencies. Of course, the period of very low interest rates that supported many of these developments is decidedly over, at least for now, suggesting that household finances will likely tighten further in the coming months. Additionally, the resumption of student loan payments could have substantial negative effects on vulnerable households. We will return to this important issue in our accompanying post .

Andrew F. Haughwout is the director of Household and Public Policy Research in the Federal Reserve Bank of New York’s Research and Statistics Group.

Donghoon Lee is an economic research advisor in Consumer Behavior Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Daniel Mangrum is a research economist in Equitable Growth Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Jonathan McCarthy is an economic research advisor in Macroeconomic and Monetary Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Davide Melcangi is a research economist in Labor and Product Market Studies in the Federal Reserve Bank of New York’s Research and Statistics Group.

Joelle Scally is a regional economic principal in the Federal Reserve Bank of New York’s Research and Statistics Group.

Wilbert van der Klaauw is the economic research advisor for Household and Public Policy Research in the Federal Reserve Bank of New York’s Research and Statistics Group.

How to cite this post: Andrew Haughwout, Donghoon Lee, Daniel Mangrum, Jonathan McCarthy, Davide Melcangi, Joelle Scally, and Wilbert van der Klaauw, “An Update on the Health of the U.S. Consumer,” Federal Reserve Bank of New York Liberty Street Economics , October 18, 2023, https://libertystreeteconomics.newyorkfed.org/2023/10/an-update-on-the-health-of-the-u-s-consumer/.

You may also be interested in:

Borrower Expectations for the Return of Student Loan Repayment

- Spending Down Pandemic Savings Is an “Only-in-the-U.S.” Phenomenon

Who Uses “Buy Now, Pay Later?”

Disclaimer The views expressed in this post are those of the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

Share this:

Liberty Street Economics features insight and analysis from New York Fed economists working at the intersection of research and policy. Launched in 2011, the blog takes its name from the Bank’s headquarters at 33 Liberty Street in Manhattan’s Financial District.

The editors are Michael Fleming, Andrew Haughwout, Thomas Klitgaard, and Asani Sarkar, all economists in the Bank’s Research Group.

Liberty Street Economics does not publish new posts during the blackout periods surrounding Federal Open Market Committee meetings.

The views expressed are those of the authors, and do not necessarily reflect the position of the New York Fed or the Federal Reserve System.

Economic Inequality

Most Read this Year

- Credit Card Delinquencies Continue to Rise—Who Is Missing Payments?

- Deposit Betas: Up, Up, and Away?

- The Great Pandemic Mortgage Refinance Boom

- The Post-Pandemic r*

- Economic Indicators Calendar

- FRED (Federal Reserve Economic Data)

- Economic Roundtable

- OECD Insights

- World Bank/All about Finance

We encourage your comments and queries on our posts and will publish them (below the post) subject to the following guidelines:

Please be brief : Comments are limited to 1,500 characters.

Please be aware: Comments submitted shortly before or during the FOMC blackout may not be published until after the blackout.

Please be relevant: Comments are moderated and will not appear until they have been reviewed to ensure that they are substantive and clearly related to the topic of the post.

Please be respectful: We reserve the right not to post any comment, and will not post comments that are abusive, harassing, obscene, or commercial in nature. No notice will be given regarding whether a submission will or will not be posted.

Comments with links: Please do not include any links in your comment, even if you feel the links will contribute to the discussion. Comments with links will not be posted.

Send Us Feedback

The LSE editors ask authors submitting a post to the blog to confirm that they have no conflicts of interest as defined by the American Economic Association in its Disclosure Policy. If an author has sources of financial support or other interests that could be perceived as influencing the research presented in the post, we disclose that fact in a statement prepared by the author and appended to the author information at the end of the post. If the author has no such interests to disclose, no statement is provided. Note, however, that we do indicate in all cases if a data vendor or other party has a right to review a post.

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- Request a Speaker

- International, Seminars & Training

- Governance & Culture Reform

- Data Visualization

- Economic Research Tracker

- Markets Data APIs

- Terms of Use

- Skip to main content

- Skip to FDA Search

- Skip to in this section menu

- Skip to footer links

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

U.S. Food and Drug Administration

- Search

- Menu

- Medical Devices

- Medical Devices News and Events

FDA Launches Health Care at Home Initiative to Help Advance Health Equity

Initiative aims to better position agency to address health care needs by moving care into the home setting

FOR IMMEDIATE RELEASE April 23, 2024

The following is attributed to Jeff Shuren, M.D., J.D., director of the FDA's Center for Devices and Radiological Health (CDRH) and Michelle Tarver, M.D., Ph.D., deputy director for transformation at CDRH

Clinical care is undergoing an evolution that has been accelerated over the last few years by the COVID-19 public health emergency. Health care has primarily been centered on health care systems and their components—hospitals, clinics, providers, and payers. However, many challenges persist, such as primary care physician and specialist shortages, significant increases in health care costs, higher chronic disease prevalence rates, and often the inability to meet the health care needs of millions of people who have no or limited access to health care systems. People from various racial and ethnic minority populations and those who live in rural communities and lower-income neighborhoods are impacted the most by these system challenges, which furthers health disparities across the nation.

Today, the U.S. Food and Drug Administration is announcing the launch of a new initiative, Home as a Health Care Hub, to help reimagine the home environment as an integral part of the health care system, with the goal of advancing health equity for all people in the U.S. While many care options are currently attempting to use the home as a virtual clinical site, very few have considered the structural and critical elements of the home that will be required to absorb this transference of care. Moreover, devices intended for use in the home tend to be designed to operate in isolation rather than as part of an integrated, holistic environment. As a result, patients may have to use several disparate medical devices, some never intended for the home environment, rather than interact with medical-grade, consumer-designed, customizable technologies that seamlessly integrate into an individual person's lifestyle.

The FDA's Center for Devices and Radiological Health (CDRH) has contracted with an architectural firm that intentionally designs innovative buildings with health and equity in mind, to consider the needs of variable models of a home and tailor solutions with opportunities to adapt and evolve in complexity and scale. The hub will be designed as an Augmented Reality/Virtual Reality (AR/VR)-enabled home prototype and is expected to be completed later this year.

This partnership includes collaboration with patient groups, health care providers, and the medical device industry to build the Home as a Health Care Hub. This prototype will serve as an idea lab, not only to connect with populations most affected by health inequity, but also for medical device developers, policy makers, and providers to begin developing home-based solutions that advance health equity. Existing models that have examined care delivery at home have found great patient satisfaction, good adherence, and potential cost savings to health care systems. By beginning with dwellings in rural locations and lower-income communities, the planned prototype will be intentionally designed with the goal of advancing health equity.

The FDA is using diabetes as an example health condition for the hub prototype given the impacts over the lifecycle of someone living with this condition. According to the Centers for Disease Control and Prevention ( CDC ), over $300 billion per year was spent on medical costs for diabetes in the U.S. in 2022. This is a 35% increase over the past decade, which is disproportionately borne by underserved communities and communities of color. Diabetes is a condition that impacts most major organs and can result in significant morbidity and early mortality, including cardiovascular disease, kidney failure, blindness, and amputations.

To increase access to health care and maximize health outcomes, it is critical that the delivery of personalized care has people at the center. By shifting the care model from systems to people, the health care system can triage scarce resources to those with the most urgent and critical needs and tailor personalized care for those managing chronic conditions. The Home as a Health Care Hub prototype is the beginning of the conversation—helping device developers consider novel design approaches, aiding providers to consider opportunities to educate patients and extend care options, generating discussions on value-based care paradigms, and opening opportunities to bring clinical trials and other evidence generation processes to underrepresented communities through the home.

As a part of CDRH's strategic priority to advance health equity , CDRH continues to support innovation that addresses health equity by moving care, as well as prevention and wellness, into the home setting. CDRH is committed to fostering innovation that improves public health by launching the Home as a Health Care Hub effort to enable solutions that seamlessly integrate medical devices and health care, prevention and wellness into people's lives, leading to a longer, higher quality life for all.

Additional Resources:

- CDRH Strategic Priorities and Updates

An official website of the United States government

Here’s how you know

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

Take action

- Report an antitrust violation

- File adjudicative documents

- Find banned debt collectors

- View competition guidance

- Competition Matters Blog

New HSR thresholds and filing fees for 2024

View all Competition Matters Blog posts

We work to advance government policies that protect consumers and promote competition.

View Policy

Search or browse the Legal Library

Find legal resources and guidance to understand your business responsibilities and comply with the law.

Browse legal resources

- Find policy statements

- Submit a public comment

Vision and Priorities

Memo from Chair Lina M. Khan to commission staff and commissioners regarding the vision and priorities for the FTC.

Technology Blog

Consumer facing applications: a quote book from the tech summit on ai.

View all Technology Blog posts

Advice and Guidance

Learn more about your rights as a consumer and how to spot and avoid scams. Find the resources you need to understand how consumer protection law impacts your business.

- Report fraud

- Report identity theft

- Register for Do Not Call

- Sign up for consumer alerts

- Get Business Blog updates

- Get your free credit report

- Find refund cases

- Order bulk publications

- Consumer Advice

- Shopping and Donating

- Credit, Loans, and Debt

- Jobs and Making Money

- Unwanted Calls, Emails, and Texts

- Identity Theft and Online Security

- Business Guidance

- Advertising and Marketing

- Credit and Finance

- Privacy and Security

- By Industry

- For Small Businesses

- Browse Business Guidance Resources

- Business Blog

Servicemembers: Your tool for financial readiness

Visit militaryconsumer.gov

Get consumer protection basics, plain and simple

Visit consumer.gov

Learn how the FTC protects free enterprise and consumers

Visit Competition Counts

Looking for competition guidance?

- Competition Guidance

News and Events

Latest news, williams-sonoma will pay record $3.17 million civil penalty for violating ftc made in usa order.

View News and Events

Upcoming Event

Older adults and fraud: what you need to know.

View more Events

Sign up for the latest news

Follow us on social media

--> --> --> --> -->

Playing it Safe: Explore the FTC's Top Video Game Cases

Learn about the FTC's notable video game cases and what our agency is doing to keep the public safe.

Latest Data Visualization

FTC Refunds to Consumers

Explore refund statistics including where refunds were sent and the dollar amounts refunded with this visualization.

About the FTC

Our mission is protecting the public from deceptive or unfair business practices and from unfair methods of competition through law enforcement, advocacy, research, and education.

Learn more about the FTC

Meet the Chair

Lina M. Khan was sworn in as Chair of the Federal Trade Commission on June 15, 2021.

Chair Lina M. Khan

Looking for legal documents or records? Search the Legal Library instead.

- Report Fraud

- Get Consumer Alerts

- Search the Legal Library

- Submit Public Comments

- Cases and Proceedings

- Premerger Notification Program

- Merger Review

- Anticompetitive Practices

- Competition and Consumer Protection Guidance Documents

- Warning Letters

- Consumer Sentinel Network

- Criminal Liaison Unit

- FTC Refund Programs

- Notices of Penalty Offenses

- Advocacy and Research

- Advisory Opinions

- Cooperation Agreements

- Federal Register Notices

- Public Comments

- Policy Statements

- International

- Office of Technology Blog

- Military Consumer

- Consumer.gov

- Bulk Publications

- Data and Visualizations

- Stay Connected

- Commissioners and Staff

- Bureaus and Offices

- Budget and Strategy

- Office of Inspector General

- Careers at the FTC

Fact Sheet on FTC’s Proposed Final Noncompete Rule

- Competition

- Office of Policy Planning

- Bureau of Competition

The following outline provides a high-level overview of the FTC’s proposed final rule :

- Specifically, the final rule provides that it is an unfair method of competition—and therefore a violation of Section 5 of the FTC Act—for employers to enter into noncompetes with workers after the effective date.

- Fewer than 1% of workers are estimated to be senior executives under the final rule.

- Specifically, the final rule defines the term “senior executive” to refer to workers earning more than $151,164 annually who are in a “policy-making position.”

- Reduced health care costs: $74-$194 billion in reduced spending on physician services over the next decade.

- New business formation: 2.7% increase in the rate of new firm formation, resulting in over 8,500 additional new businesses created each year.

- This reflects an estimated increase of about 3,000 to 5,000 new patents in the first year noncompetes are banned, rising to about 30,000-53,000 in the tenth year.

- This represents an estimated increase of 11-19% annually over a ten-year period.

- The average worker’s earnings will rise an estimated extra $524 per year.

The Federal Trade Commission develops policy initiatives on issues that affect competition, consumers, and the U.S. economy. The FTC will never demand money, make threats, tell you to transfer money, or promise you a prize. Follow the FTC on social media , read consumer alerts and the business blog , and sign up to get the latest FTC news and alerts .

Press Release Reference

Contact information, media contact.

Victoria Graham Office of Public Affairs 415-848-5121

Stop COVID Cohort: An Observational Study of 3480 Patients Admitted to the Sechenov University Hospital Network in Moscow City for Suspected Coronavirus Disease 2019 (COVID-19) Infection

Collaborators.

- Sechenov StopCOVID Research Team : Anna Berbenyuk , Polina Bobkova , Semyon Bordyugov , Aleksandra Borisenko , Ekaterina Bugaiskaya , Olesya Druzhkova , Dmitry Eliseev , Yasmin El-Taravi , Natalia Gorbova , Elizaveta Gribaleva , Rina Grigoryan , Shabnam Ibragimova , Khadizhat Kabieva , Alena Khrapkova , Natalia Kogut , Karina Kovygina , Margaret Kvaratskheliya , Maria Lobova , Anna Lunicheva , Anastasia Maystrenko , Daria Nikolaeva , Anna Pavlenko , Olga Perekosova , Olga Romanova , Olga Sokova , Veronika Solovieva , Olga Spasskaya , Ekaterina Spiridonova , Olga Sukhodolskaya , Shakir Suleimanov , Nailya Urmantaeva , Olga Usalka , Margarita Zaikina , Anastasia Zorina , Nadezhda Khitrina

Affiliations

- 1 Department of Pediatrics and Pediatric Infectious Diseases, Institute of Child's Health, Sechenov First Moscow State Medical University (Sechenov University), Moscow, Russia.

- 2 Inflammation, Repair, and Development Section, National Heart and Lung Institute, Faculty of Medicine, Imperial College London, London, United Kingdom.

- 3 Soloviev Research and Clinical Center for Neuropsychiatry, Moscow, Russia.

- 4 School of Physics, Astronomy, and Mathematics, University of Hertfordshire, Hatfield, United Kingdom.

- 5 Biobank, Institute for Regenerative Medicine, Sechenov First Moscow State Medical University (Sechenov University), Moscow, Russia.

- 6 Institute for Regenerative Medicine, Sechenov First Moscow State Medical University (Sechenov University), Moscow, Russia.

- 7 Chemistry Department, Lomonosov Moscow State University, Moscow, Russia.

- 8 Department of Polymers and Composites, N. N. Semenov Institute of Chemical Physics, Moscow, Russia.

- 9 Department of Clinical and Experimental Medicine, Section of Pediatrics, University of Pisa, Pisa, Italy.

- 10 Institute of Social Medicine and Health Systems Research, Faculty of Medicine, Otto von Guericke University Magdeburg, Magdeburg, Germany.

- 11 Institute for Urology and Reproductive Health, Sechenov First Moscow State Medical University (Sechenov University), Moscow, Russia.

- 12 Department of Intensive Care, Sechenov First Moscow State Medical University (Sechenov University), Moscow, Russia.

- 13 Clinic of Pulmonology, Sechenov First Moscow State Medical University (Sechenov University), Moscow, Russia.

- 14 Department of Internal Medicine No. 1, Institute of Clinical Medicine, Sechenov First Moscow State Medical University (Sechenov University), Moscow, Russia.

- 15 Department of Forensic Medicine, Sechenov First Moscow State Medical University (Sechenov University), Moscow, Russia.

- 16 Department of Statistics, University of Oxford, Oxford, United Kingdom.

- 17 Medical Research Council Population Health Research Unit, Nuffield Department of Population Health, University of Oxford, Oxford, United Kingdom.

- 18 Centre for Tropical Medicine and Global Health, Nuffield Department of Medicine, University of Oxford, Oxford, United Kingdom.

- 19 Oxford University Hospitals NHS Foundation Trust, John Radcliffe Hospital, Oxford, United Kingdom.

- 20 Sechenov First Moscow State Medical University (Sechenov University), Moscow, Russia.

- PMID: 33035307

- PMCID: PMC7665333

- DOI: 10.1093/cid/ciaa1535

Background: The epidemiology, clinical course, and outcomes of patients with coronavirus disease 2019 (COVID-19) in the Russian population are unknown. Information on the differences between laboratory-confirmed and clinically diagnosed COVID-19 in real-life settings is lacking.

Methods: We extracted data from the medical records of adult patients who were consecutively admitted for suspected COVID-19 infection in Moscow between 8 April and 28 May 2020.

Results: Of the 4261 patients hospitalized for suspected COVID-19, outcomes were available for 3480 patients (median age, 56 years; interquartile range, 45-66). The most common comorbidities were hypertension, obesity, chronic cardiovascular disease, and diabetes. Half of the patients (n = 1728) had a positive reverse transcriptase-polymerase chain reaction (RT-PCR), while 1748 had a negative RT-PCR but had clinical symptoms and characteristic computed tomography signs suggestive of COVID-19. No significant differences in frequency of symptoms, laboratory test results, and risk factors for in-hospital mortality were found between those exclusively clinically diagnosed or with positive severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) RT-PCR. In a multivariable logistic regression model the following were associated with in-hospital mortality: older age (per 1-year increase; odds ratio, 1.05; 95% confidence interval, 1.03-1.06), male sex (1.71; 1.24-2.37), chronic kidney disease (2.99; 1.89-4.64), diabetes (2.1; 1.46-2.99), chronic cardiovascular disease (1.78; 1.24-2.57), and dementia (2.73; 1.34-5.47).

Conclusions: Age, male sex, and chronic comorbidities were risk factors for in-hospital mortality. The combination of clinical features was sufficient to diagnose COVID-19 infection, indicating that laboratory testing is not critical in real-life clinical practice.

Keywords: COVID-19; Russia; SARS-CoV-2; cohort; mortality risk factors.

© The Author(s) 2020. Published by Oxford University Press for the Infectious Diseases Society of America. All rights reserved. For permissions, e-mail: [email protected].

Publication types

- Observational Study

- Research Support, Non-U.S. Gov't

- Hospitalization

- Middle Aged

Grants and funding

- 20-04-60063/Russian Foundation for Basic Research

An official website of the United States government

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

The site is secure. The https:// ensures that you are connecting to the official website and that any information you provide is encrypted and transmitted securely.

- Publications

- Account settings

Preview improvements coming to the PMC website in October 2024. Learn More or Try it out now .

- Advanced Search

- Journal List

- Epidemiol Psychiatr Sci

- v.25(5); 2016 Oct

Consumers’ role in mental health care: a research perspective

Guidelines by scientific associations and government policies in Europe, the USA and other countries over the past 30 years have promoted consumer participation in various aspects of mental health care. Although this can be viewed as an aspect of a widespread trend towards the public involvement in all sectors of healthcare (Brett et al . 2014 ), the specific characteristics of mental health consumers should not be overlooked, because their involvement is a challenging endeavour for a number of reasons: the power imbalance in relationships with providers is greater than in other sectors, people with mental disorders often belong to marginal groups and experience social exclusion, stigma and discrimination. Moreover, stigmatising attitudes can be found not only in general population, but also among health professionals (Nordt et al . 2006 ).

The growth of consumer-run services and consumer-led research represents a step forward and raises a number of key questions. Early models of consumer-run services arose in the wake of dissatisfaction with professional services and were based on the principles of exchange of experiences and mutual support. However, to what extent such services were able to meet the consumer expectations and to foster recovery more effectively than the traditional ones remained an open issue. Actually, the landmark Consumer Operated Service Programs study found modest differences in empowerment for people attending consumer-operated services in comparison with people attending mainstream services (Rogers et al . 2007 ). Should we conclude that the promise of alternative services has not been fulfilled? The editorial by Segal and Hayes in this issue of Epidemiology and Psychiatric Sciences addresses this problem (Segal & Hayes, 2016 ).

First of all, the authors point out a difference often neglected in scientific literature: consumer-operated service is an umbrella term covering a variety of organisations, not necessarily sharing the principles of self-help and peer support. In other words, not all consumer-run services are empowering agencies. In fact, such services can reproduce the hierarchical organization and the sharp distinction between users and providers considered as negative features of psychiatric care. Second, the authors call for a research agenda based on a careful description of the goals of consumer-run services, by looking at the content and the conceptual base of their activities. This is especially relevant, because the considerable increase in the number of consumer-run organisations has been coupled by an increase in their heterogeneity, resulting in large differences.

Consumer-operated services run the risk of becoming a source of cheap care for systems plagued by financial constraints and disappointing people looking for alternatives to mainstream care. The authors suggest that if consumer organisations are to retain a role as component of mental health care, they must keep a distinct profile, without losing their original mission. They conclude that assessment of fidelity to power sharing between staff and non-staff members, and focus on self-help should be used to describe consumer-run services and to evaluate their outcomes in terms of empowerment.

It is interesting to compare this perspective with the approach presented by Bramesfeld and Stegbauer in the second editorial of the same issue of Epidemiology and Psychiatric Sciences (Bramesfeld & Stegbauer, 2016 ). The authors support the concept of responsiveness as a central feature identified by users for quality of mental health services. It pertains to a non-medical dimension of any type of services and is therefore a universal characteristic, which applies to all human organisations. It claims for (apparently) very simple and primary things, such as respect, dignity and consideration for users’ values. Given the peculiar vulnerability of the population of mental health service users, these objectives seem more important and difficult to achieve than in other health services.

This non-psychiatric specific meaningfulness of indicators is connected to the difficulty in identifying hard outcome indicators, raised by Bramesfeld and Stegbauer. Indeed, consumer assessment of outcomes either in relationship to specific interventions and to quality of service performance is rare. As a possible reason for this, the authors mention the soft nature of parameters indicated by consumers and the difficulties to translate them into indicators to be used in quantitative studies. In the few studies of quality assessment conducted from the consumers’ standpoint, key indicators identified by consumers fall within the framework of responsiveness (Barbato et al . 2014 ). This is a serious challenge, still there are experiences where this has been tried and we should more seriously start with this. Segal & Hayes ( 2016 ) have shown in this issue that research can be built on consumer defined constructs.

Bramesfeld & Stegbauer ( 2016 ) warn that if we do not address the lack of representation of users’ views, this lack will continue to inform guidelines and shape quality monitoring, thus perpetuating quality standard not centred on consumers and, even more serious, eventually confirming that inclusion of their views is no worth. They suggest four ways to overcome this: use of key outcomes representing patient experiences (an example can be, again, empowerment, which is a core component of the experience of care of all individuals); a more convinced acceptance and appreciation of evidence from qualitative studies; focus on the patients’ pathways, i.e., the true relationship users have with services and professionals; use not only of surveys consisting of questions, but also more observational approaches, where facts, interactions, behaviour and procedures are observed and assessed according to their responsiveness.

We are persuaded that the way of evaluating service quality can change and improve through the four routes suggested here. Bramesfeld and Stegbauer also make a point of the systematic approach to quality of services evaluation. A more systematic framework for service evaluation and benchmarking would allow not only the full inclusion of users, but it would also define rules for their participation and the weight their participation should have in all the phases of the evaluation and improvement process. Active involvement of users has been often jeopardized by the initiative being in the hands of professionals who also establish participants’ roles and boundaries in the evaluation process – often even without making it explicit. Hence, we would need rules – to be shared – which have the responsiveness criteria integrated first of all in the co-produced service evaluation.

There are growing awareness of and sensitivity to these issues in research and several programs and initiatives are informing their own activities to the inclusion of consumers’ standpoint in evidence production. Whereas the GRADE model (Barbui et al . 2010 ) is aimed at integrating values and human rights into the process of translation of evidence into recommendations of mental health care, the WHO QualityRights project offers an assessment and improvement tool focused on human rights conditions in mental health and social care (WHO, 2012 ).

The constructs of empowerment and responsiveness should be used as outcome indicators in research in mental health services as crucial aspects of care. If we fail to systematically integrate these indicators into empirical research, the gap between evidence-based medicine and consumers’ experience is set to grow.

Acknowledgements

Financial support.

The authors received no specific grant for this research from any funding commercial or not-for profit agency.

Conflict of Interest

- Barbato A, Bajoni A, Rapisarda F, D'Anza V, Inglese C, De Luca F, Iapichino S, Mauriello F, D'Avanzo B (2014). Quality assessment of mental health care by people with severe mental disorders: a participatory research project . Community Mental Health Journal 50 , 402–408. [ PubMed ] [ Google Scholar ]

- Barbui C, Dua T, van Ommeren M, Yasamy MT, Fleischmann A, Clark N, Thornicroft G, Hill S, Saxena S (2010). Challenges in developing evidence-based recommendations using the GRADE approach: the case of mental, neurological, and substance use disorders . PLoS Med 7 , e1000322. [ PMC free article ] [ PubMed ] [ Google Scholar ]

- Bramesfeld A, Stegbauer C (2016). Assessing the performance of mental health service facilities for meeting patient priorities and health service responsiveness . Epidemiology and Psychiatric Sciences . 10.1017/S2045796016000354 [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- Brett J, Staniszewska S, Mockford C, Herron-Marx S, Hughes J, Tysall C, Suleman R (2014). Mapping the impact of patient and public involvement on health and social care research: a systematic review . Health Expectations 17 , 637–650. [ PMC free article ] [ PubMed ] [ Google Scholar ]

- Nordt C, Rössler W, Lauber C (2006). Attitudes of mental health professionals toward people with schizophrenia and major depression . Schizophrenia Bulletin 32 , 709–714. [ PMC free article ] [ PubMed ] [ Google Scholar ]

- Rogers ES, Teague GB, Lichenstein C, Campbell J, Lyass A, Chen R, Banks S (2007). Effects of participation in consumer-operated service programs on both personal and organizationally mediated empowerment: results of multisite study . Journal of Rehabilitation Research and Development 44 , 785–799. [ PubMed ] [ Google Scholar ]

- Segal SP, Hayes SL (2016). Consumer-run services research and implications for mental health care . Epidemiology and Psychiatric Sciences . 10.1017/S2045796016000287 [ PMC free article ] [ PubMed ] [ CrossRef ] [ Google Scholar ]

- WHO (2012). WHO QualityRights Tool Kit to Assess and Improve Quality and Human Rights in Mental Health and Social care Facilities . World Health Organization: Geneva. [ Google Scholar ]

Biden Says He Plans to Debate Trump

FILE PHOTO: Democratic presidential nominee Joe Biden gestures towards U.S. President Donald Trump as they participate in their second 2020 presidential campaign debate at Belmont University in Nashville, Tennessee, U.S., October 22, 2020. REUTERS/Jim Bourg/Pool/File Photo

By Jarrett Renshaw

NEW YORK (Reuters) -U.S. President Joe Biden said on Friday that he would participate in a debate with Donald Trump, his Republican opponent in November's election.

"I am, somewhere. I don't know when," the Democratic president said in an interview with broadcaster Howard Stern. "I'm happy to debate him."

The remarks were Biden's clearest yet on the prospect of a presidential debate. Biden had not previously committed to debate Trump, saying last month it would depend on the former president's behavior.

Trump, who refused to debate his rivals before winning the Republican primary race last month, has in recent weeks been challenging Biden to engage in a one-on-one match-up with him, offering to debate the incumbent Democrat "anytime, anywhere, anyplace."

Earlier this month, Trump's top two campaign advisers sent a letter to an independent commission that normally sanctions such events calling for an accelerated debates timetable, holding more than the usual three and starting them earlier in the campaign cycle.

A dozen leading U.S. news organizations have also urged the candidates to publicly commit to debating each other.

Their statement suggested that debates for the current race be sponsored, as they have every election cycle since 1988, by the nonpartisan Commission on Presidential Debates.

Biden's camp has been concerned that once on stage Trump will not abide by rules set by the Commission, and some Biden advisers say they would prefer not to elevate Trump by putting him on the same stage with the Democratic incumbent.

Biden has a lead among registered voters of 41% to 37% over Trump, a Reuters/Ipsos poll found earlier this month.

Asked during a trip to Las Vegas in early February about Trump calling for Biden to debate him, Biden said, "If I were him, I would want to debate me too. He's got nothing to do."

Biden and Trump faced each other in two televised presidential election debates during the 2020 campaign.

(Reporting by Jarrett Renshaw; Writing by Trevor Hunnicutt; Editing by Bill Berkrot)

Copyright 2024 Thomson Reuters .

Join the Conversation

Tags: United States

America 2024

Health News Bulletin

Stay informed on the latest news on health and COVID-19 from the editors at U.S. News & World Report.

Sign in to manage your newsletters »

Sign up to receive the latest updates from U.S News & World Report and our trusted partners and sponsors. By clicking submit, you are agreeing to our Terms and Conditions & Privacy Policy .

You May Also Like

The 10 worst presidents.

U.S. News Staff Feb. 23, 2024

Cartoons on President Donald Trump

Feb. 1, 2017, at 1:24 p.m.

Photos: Obama Behind the Scenes

April 8, 2022

Photos: Who Supports Joe Biden?

March 11, 2020

RFK Jr.: By the Numbers

Laura Mannweiler April 26, 2024

Biden’s Student Loan Chief to Step Down

Lauren Camera April 26, 2024

What to Know: Bird Flu Virus in Milk

Cecelia Smith-Schoenwalder April 26, 2024

Inflation a Stubborn Foe for the Fed

Tim Smart April 26, 2024

The Curse of the Modern Vice President

‘A Rule for the Ages’

Lauren Camera April 25, 2024

Futures Extend Gains After March PCE Data

FILE PHOTO: A street sign for Wall Street is seen outside the New York Stock Exchange (NYSE) in New York City, New York, U.S., July 19, 2021. REUTERS/Andrew Kelly/File Photo

(Reuters) - U.S. stock index futures extended gains on Friday, as fresh evidence of progress on the inflation front reignited hopes that the Federal Reserve could cut interest rates sometime this year.

The personal consumption expenditures (PCE) price index rose 0.3% in March, compared to a 0.3% increase forecast by economists polled by Reuters. In the 12 months through March, PCE inflation advanced 2.7% against expectations of 2.6%.

Excluding the volatile food and energy components, the PCE price index increased 0.3% last month against expectations of a 0.3% increase. Annually, it came in at 2.8% versus forecasts of 2.7%.

At 8:32 a.m. ET, Dow e-minis were up 122 points, or 0.32%, S&P 500 e-minis were up 46.75 points, or 0.92%, and Nasdaq 100 e-minis were up 197 points, or 1.12%.

(Reporting by Shashwat Chauhan in Bengaluru; Editing by Maju Samuel)

Copyright 2024 Thomson Reuters .

Tags: United States

The Best Financial Tools for You

Credit Cards

Personal Loans

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Subscribe to our daily newsletter to get investing advice, rankings and stock market news.

See a newsletter example .

You May Also Like

10 best growth stocks to buy for 2024.

Wayne Duggan April 26, 2024

7 High-Risk, High-Reward Stocks to Buy

Jeff Reeves April 26, 2024

5 Best Gold ETFs for 2024

Coryanne Hicks April 26, 2024

Green Hydrogen Stocks and ETFs

Matt Whittaker April 26, 2024

Best Tax-Free Muni Bond Funds

Tony Dong April 25, 2024

Bitcoin Runes 101: Bitcoin Meme Coins

Wayne Duggan April 25, 2024

7 Best High-Dividend ETFs to Buy Now

Glenn Fydenkevez April 25, 2024

What to Know About Sweep Accounts

Brian O'Connell April 24, 2024

Best Charles Schwab Mutual Funds

Tony Dong April 24, 2024

6 Best Airline Stocks to Buy

Coryanne Hicks April 24, 2024

7 Best Long-Term ETFs to Buy and Hold

Jeff Reeves April 24, 2024

7 Best Electric Vehicle ETFs to Buy

Tony Dong April 23, 2024

Best Beginner Investing Books

Julie Pinkerton April 23, 2024

Are There Any Tax-Free Investments?

Marguerita Cheng April 23, 2024

8 Best Defense Stocks to Buy Now

Wayne Duggan April 22, 2024

7 Best Energy ETFs to Buy Now

Tony Dong April 22, 2024

Small-Cap ETFs to Buy for Growth

Glenn Fydenkevez April 22, 2024

7 Best IPOs in 2024

Brian O'Connell April 22, 2024

Oil Stocks Tied to Crude Prices

Wayne Duggan April 19, 2024

7 Best Dividend ETFs to Buy Now

Jeff Reeves April 19, 2024

Healthcare consumerism today: Accelerating the consumer experience

The results of McKinsey’s 2018 Consumer Health Insights (CHI) Survey deliver a consistent message with important implications for payers, providers, and other industry stakeholders: consumer engagement is becoming increasingly important, but most stakeholders are still struggling to meet consumers’ needs. Four issues stood out:

Stay current on your favorite topics

- Personalization. The consumer experience should be tailored more closely to the needs of individuals.

- Access. The continuum of care should be improved so consumers have access when and where they need it.

- Incentives. Well-designed incentives hold promise of motivating consumers to make better choices.

- Innovation. New product concepts must be carefully designed to meet consumers’ needs and wants.

We will discuss these themes and their implications below. First, to put the themes in context, we will briefly describe the respondents to the 2018 CHI Survey.

Background on respondents

Almost 5,000 people participated in the 2018 CHI Survey. More than 95% of them indicated that they had obtained health insurance coverage, received medical care, or both in the past year. They were therefore defined as having engaged with the healthcare system during that time. This engagement often entailed a financial burden; 43% of the respondents said their out-of-pocket costs were higher than they had anticipated. The average amount respondents reported spending on healthcare in the past year varied depending on the coverage type:

- Group insurance: $3,300

- Individual insurance: $4,600

- Medicare: $2,700

- Medicaid: $700

- No insurance: $1,200

National health expenditures data supports our finding about financial impact, showing that consumers are responsible for nearly 30% of all healthcare spending. 1 National health expenditures by type of service and source of funds, CY 1960–2017. CMS.gov. The high spending may help explain why a significant number of consumers—nearly one-quarter of working age adults 2 Karpman M, Caswell KJ. Past-due medical debt among nonelderly adults, 2012–2015. Urban Institute. March 2017. —have past-due medical debt. In our survey, about half of the respondents said they are not satisfied with their ability to figure out the cost of a healthcare service or find lower-cost options.

Infographic

As member expectations rise, healthcare payers must fight to attract and retain members all while managing admin and medical costs.

Four themes from the research

Consumer engagement has become increasingly important for all healthcare industry stakeholders. Both payers and providers are now evaluated through rating systems that incorporate customer satisfaction, giving them a strong incentive to enhance the consumer experience. Four of the major national payers reported in their Q2 2018 earnings that they had identified consumer experience as a priority. 3 Q2 2018 earnings call transcripts from UnitedHealth Group, Anthem, Cigna, and Humana.

Nevertheless, many stakeholders are having difficulty meeting consumers’ needs. Our 2018 CHI Survey found that four areas are especially in need of improvement: personalization, access, incentives, and innovation.

Personalization

In healthcare, as in other industries, consumers are expecting more. But, not all healthcare consumers want the same things. The attitudes and behaviors expressed by this year’s survey respondents allowed us to refine the six healthcare consumer segments we’d previously identified (Exhibit 1). To illustrate how different these segments are, we will compare two: engaged traditionalists and busy convenience users.

Engaged traditionalists seek value and guidance. These consumers are disproportionately older and more likely to have health conditions, typically have an established relationship with a primary care provider (PCP), and rely on guidance from that provider when making healthcare decisions. Nevertheless, they are open to using digital tools and other services that could help support their relationship with their PCP.

Engaged traditionalists are also willing to make trade-offs to lower costs. In our survey, 45% of them said they had used generic drugs. Furthermore, 63% of them reported that they decide where to get care depending on what their insurance covers. (By comparison, only about 50% of the respondents in the other segments said that insurance coverage determined where they seek care.) Choosing the right health insurance plan is especially important to engaged traditionalists: 74% said they want to know what services will be covered and 70% want to know copayment amounts.

Would you like to learn more about our Healthcare Systems & Services Practice ?

Although engaged traditionalists regularly interact with payers and providers, the majority of them reported that they lack meaningful motivation to be healthier and want others to assist them with their health improvement goals.

In contrast, busy convenience users are typically of working age and in relatively good health; many have young children. In our survey, most of these consumers indicated they prioritize convenience over other factors and want to be able to make decisions quickly. Most also said they often delay seeking care for themselves until it is absolutely necessary and actively avoid going to doctors unless they have a serious health problem.

Compared with the other segments, busy convenience users were more likely to report that they do not have strong preferences about where they seek care for nonemergent health issues and that they visit urgent care centers when feeling unwell. However, almost 70% of these consumers, but only about 60% of the engaged traditionalists, said they want information on how much care costs before deciding where to seek treatment.

In addition, busy convenience users were more likely to indicate that they had used activity trackers and found them useful. They were also the segment most likely to report using mobile apps and mobile sites to schedule visits and manage other tasks with their routine care provider. Although 60% of this segment said they strongly believe they need to be better at taking care of themselves, 18% indicated they lack the time to do so.

Implications: Both payers and providers should consider how they can better meet the needs of specific consumer segments through personalized information, delivered when, how, and where consumers need it. In addition, these stakeholders should explore how they can better tailor the experiences they offer to the specific needs of each individual. Addressing each person’s needs remains a challenge for most payers and providers, but it is becoming somewhat easier because of the growing volume of consumer data and new techniques available to parse it. Developing the deep insights needed will require stakeholders to apply advanced analytics to multidimensional data.

Access to healthcare services has often been defined as the number of PCPs per 1,000 people, but this definition often appears insufficient, given consumers’ increasing demand for convenience (e.g., evening and weekend appointments, nearby locations) and the growing number of choices available to them. In all of the segments we identified, most respondents said they want convenient access to the care they need when they need it—if they cannot get convenient access to a PCP, they will go elsewhere. Results from the five CHI Surveys we conducted between 2014 and 2018 reveal that the percentage of respondents who said they had visited an urgent care center is rising. In contrast, the percentage of respondents who reported having visited a PCP within the past year is decreasing (Exhibit 2).

The increasing use of urgent care centers reflects the growing number of such centers, as well as consumers’ desire for convenience. 4 Stoimenoff L, Newman N. The essential role of the urgent care center in population health. Urgent Care Association of America. February 2018. Nevertheless, consumers still value their relationship with a PCP. When asked about the one place they preferred to receive care, most respondents selected their PCP’s office: 85% preferred that site for their annual exam, and 80% preferred it for routine care. Most respondents also said they want their PCP’s input for care decisions.

Given this preference, what would encourage more consumers to visit their PCP? We asked respondents to select their top three factors from a list of choices. Cost was the top response. As Exhibit 3 shows, the non-cost answers given most often were:

- Feeling that my physician cares more about me as a person: 36%

- Shorter wait times for appointments: 34%

- Quicker access to appointments: 28%

- More one-on-one time with the provider: 27%