- Search Search Please fill out this field.

- Personal Finance

Personal Financial Statement: Definition, Uses, and Example

:max_bytes(150000):strip_icc():format(webp)/cory1__cory_mitchell-5bfc262946e0fb005118b3b7.jpg)

What Is a Personal Financial Statement?

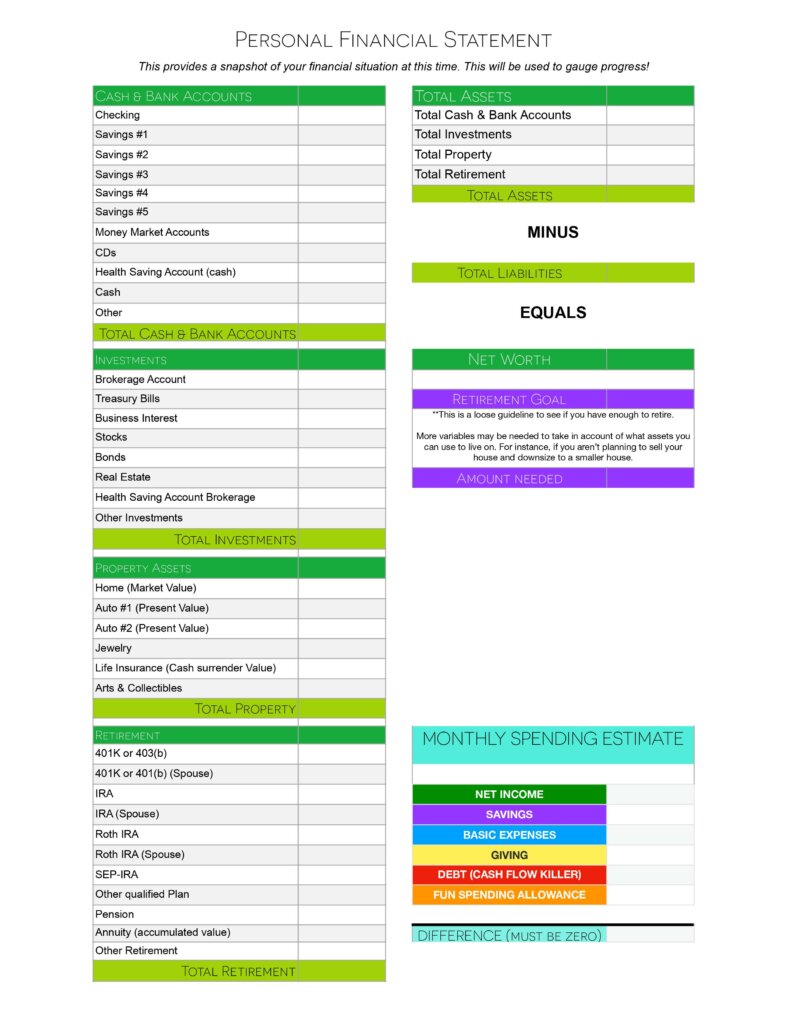

The term personal financial statement refers to a document or spreadsheet that outlines an individual's financial position at a given point in time. The statement typically includes general information about the individual, such as name and address, along with a breakdown of total assets and liabilities . The statement can help individuals track their financial goals and wealth, and can be used when they apply for credit .

Key Takeaways

- A personal financial statement lists all assets and liabilities of an individual or couple.

- An individual's net worth is determined by subtracting their liabilities from their assets—a positive net worth shows more assets than liabilities.

- Net worth can fluctuate over time as the values of assets and liabilities change.

- Personal financial statements are helpful for tracking wealth and goals, as well as applying for credit.

- Although they may be included in a personal financial statement, income and expenses are generally placed on a separate sheet called the income statement.

Understanding the Personal Financial Statement

Financial statements can be prepared for either companies or individuals. An individual’s financial statement is referred to as a personal financial statement and is a simpler version of corporate statements . Both are tools that can show the financial health of the subject.

A personal financial statement shows the individual's net worth —their assets minus their liabilities—which reflects what that person has in cash if they sell all their assets and pay off all their debts. If their liabilities are greater than their assets, the financial statement indicates a negative net worth. If the individual has more assets than liabilities, they end up with a positive net worth.

Keeping an updated personal financial statement allows an individual to track how their financial health improves or deteriorates over time. These can be invaluable tools when consumers want to change their financial situation or apply for credit such as a loan or a mortgage . Knowing where they stand financially allows consumers to avoid unnecessary inquiries on their credit reports and the hassles of declined credit applications.

The statement allows also credit officers to easily gain perspective into the applicant's financial situation in order to make an informed credit decision. In many cases, the individual or couple may be asked to provide a personal guarantee for part of the loan or they may be required to put up collateral to secure the loan.

Special Considerations

A personal financial statement is broken down into assets and liabilities. Assets include the value of securities and funds held in checking or savings accounts , retirement account balances, trading accounts , and real estate. Liabilities include any debts the individual may have including personal loans, credit cards, student loans, unpaid taxes , and mortgages. Debts that are jointly owned are also included. Married couples may create joint personal financial statements by combining their assets and liabilities.

Income and expenses are also included if the statement is used to attain credit or to show someone's overall financial position. This can be tracked on a separate sheet or an addendum, called the income statement . This includes all forms of income and expenses—typically expressed in the form of monthly or yearly amounts.

The following items are not included in a personal financial statement:

- Business-related assets and liabilities: These are excluded unless the individual is directly and personally responsible. So if someone personally guarantees a loan for their business—similar to cosigning —the loan is included in their personal financial statement.

- Rented items: Anything rented is not included in personal financial statements because the assets aren't owned. This changes if you own the property and rent it out to someone else. In this case, the value of the property is included in your asset list.

- Personal property: Items such as furniture and household goods are typically not included as assets on a personal balance sheet because these items can’t easily be sold to pay off a loan. Personal property with significant value, such as jewelry and antiques, may be included if their value can be verified with an appraisal .

Business liabilities are only included in a personal financial statement if an individual provides the creditor with a personal guarantee.

Keep in mind. Your credit report and credit history are big considerations when it comes to getting new credit and every lender has different requirements for issuing credit. So, even if you have a positive net worth—more assets than liabilities—you may still be refused a loan or credit card if you haven't paid your previous debts on time or have too many inquiries on file.

Example of a Personal Financial Statement

Let's assume that River wants to track their net worth as they move toward retirement . They have been paying off debts, saving money, investing , and are getting closer to owning their home. Each year, they update the statement to see the progress they have made.

Here's how they would break it down. They would list all their assets—$20,000 for a car, $200,000 for their house, $300,000 in investments, and $50,000 in cash and equivalents . They also own some highly collectible stamps and art valued at $20,000 that they can list. Their total assets are, therefore, $590,000. As for liabilities, River owes $5,000 on the car and $50,000 for their house. Although River makes all of their purchases with a credit card, they pay the balance off each month and never carry a balance. River cosigned a loan for their daughter and $10,000 remains on that. Even though it is not River's loan, they are still responsible, so it is included in the statement. River's liabilities are $65,000.

When we subtract their liabilities from their assets, River's net worth is $525,000. Although they use it mainly to track their financial health, River can use this information—and the statement as a whole—if they want to apply for any other credit.

Small Business Administration. “ Personal Financial Statement .” Pages 2-3.

Experian. “ What Happens If Your Loan Is Denied? ”

:max_bytes(150000):strip_icc():format(webp)/GettyImages-900973328-7d1f1f8001fb4579aa555b592ddf1c30.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Sample Personal Statement Accounting and Finance

by Talha Omer, MBA, M.Eng., Harvard & Cornell Grad

In personal statement samples by field.

The following personal statement is written by an applicant who got accepted to several top accounting and finance programs. Variations of this PS got accepted at the University of Michigan, Vanderbilt, and Indiana University. Read this personal statement to understand what a top essay in Accounting and Finance should look like.

Example Personal Statement Accounting and Finance

I have never made popular choices, whether academic or professional. Where high academic achievement irrefutably means pursuing a career in Medicine or STEM, I opted for a career in management. I was free to choose a path for myself, owing to my performance during an extensive pre-induction professional training program. Fortunately, I picked a path that everyone believed was insignificant.

My decision to move to a new city to pursue my path did not receive encouragement. Making my own decisions has given me the freedom to dream and make it a reality. It has strengthened my belief that I am the only one who can bring a difference for myself and those around me. Brazil’s institutions may seem frozen, yet, at the grassroots, Brazil is in perpetual motion with ceaseless creativity. To accelerate this motion, we need to bring better and more affordable solutions; I plan to do that.

Growing up in Brazil, I have constantly questioned why we are still not growing economically despite having abundant resources. I frequently discussed the economic factors affecting us with my father, leading me to work at local NGOs and attend voluntary programs. My interest intensified when I discovered during these experiences that the unequal distribution of resources was a major cause of our economic constriction.

Moreover, our medical, engineering and academic professionals would not work in rural areas due to a lack of facilities, further debilitating the imbalance. It made me realize that we could only reap the benefits of our efforts if there were a proportionate distribution of resources. Realizing how effective mobilization of resources can aid in eradicating social ills, I developed an interest in management. This equipped me with technical knowledge and provided room for opinion building.

Pursuing this path, I joined the leading undergraduate institution in the country. The zeal with which I made this decision led me to graduate summa cum laude. While studying, I taught communication skills to undergraduate business students from rural areas. Meeting these students compelled me to get involved even though I lacked formal teaching training. Through empathy and friendly get-togethers, I was able to help these students conveniently traverse in English. With this experience, I understood that my time and energy had been well spent and that as an agent of change, one does not necessarily need to be exceptional; instead, one requires creativity, patience, and emotional intelligence.

After graduation, I followed through with my goal of facilitating change by joining the banking sector as an accounting and finance trainee. By working in Brazil’s most vital financial sector, I was exposed to diversified experiences, from being as simple as issuing customer chequebooks to designing accounting and credit proposals to the tune of USD 1.2 billion. Furthermore, while working on individual projects, I developed an in-depth understanding of international accounting rules that regulated trade transactions; the learning opportunities were immense.

Two and a half years of experience in the finance sector brought me to work for the country’s central bank. The anxiety that accompanied moving away from home for the first time was overwhelmed by my professional and personal growth. Nine months of extensive training and on-the-job assignments exposed me to interminable learning opportunities. However, my real gain has been in the form of self-improvement and growth that accompanied my first experience living independently. Leaving the protective living that I enjoyed with my family is challenging, but it has developed and strengthened my capabilities of taking and owning my decisions. Above all, knowing that my family is not always around to guide me has instilled in me a greater sense of responsibility.

During the two a half years of experience in accounting and finance, I observed the financial exclusion experienced by some important yet financially constrained sectors of the economy. This exposure motivated me to join the Development Finance Department upon my appointment to the country’s central bank. Moreover, most of the firms operating in any country of the world are either small or medium enterprises. Thus, providing an enabling environment to such enterprises is significant for economic growth and employment generation.

In Brazil also, 90 percent of the enterprises are small and medium-sized, and lack of access to formal sources of finance is a significant impediment to these enterprises’ growth. Therefore, a huge room for improvement is available concerning the development of policy framework and market infrastructure for the financial inclusion of this sector. As a part of the central bank, I have been allowed to intervene in a system that is not effectively performing its role of financial intermediation. Innovation in financial products, development of accounting and risk mitigation strategies are requirements to alleviate this segment’s financial exclusion.

By broadening my exposure and enhancing my knowledge, I aim to equip myself better to address the shortcomings of one of the critical segments of the economy.

WANT MORE AMAZING ARTICLES ON GRAD SCHOOL PERSONAL STATEMENTS?

- 100+ Outstanding Examples of Personal Statements

- The Ultimate Guide to Writing a Winning Personal Statement

- Common Pitfalls to Avoid in Your Personal Statement

- Writing a Killer Opening Paragraph for Your Personal Statement

- Ideal Length for a Graduate School Personal Statement

- 100 Inspiring Quotes to Jumpstart Your Personal Statement

Sample Personal Statement for Masters in International Business

Sample Personal Statement for Masters in International Business My journey began amidst the kaleidoscope of Qatar's landscapes, setting the stage for a life attuned to cultural nuances. Transitioning to Riyadh in my teens, I absorbed a mosaic of traditions, sparking a...

Sample Personal Statement for Family Medicine Residency

Personal Statement Prompt: A personal letter is required. We are looking for mature, enthusiastic physicians who bring with them a broad range of life experiences, are committed to providing excellent patient care, and can embrace the depth and breadth of experiences...

[2024] 4 Law School Personal Statement Examples from Top Programs

In this article, I will discuss 4 law school personal statement samples. These statements have been written by successful applicants who gained admission to prestigious US Law schools like Yale, Harvard, and Stanford. The purpose of these examples is to demonstrate...

Sample Personal Statement Cybersecurity

In this article, I will be providing a sample grad school personal statement in the field of cybersecurity. This sample was written by an applicant who got admitted into George Mason, Northeastern and Arizona State University. This example aims to show how prospective...

100+ Grad School Personal Statement Examples

Introduction Importance of a Strong Personal Statement A personal statement is essential in the graduate school application process, as it plays a significant role in shaping the admissions committee's perception of you. In fact, a survey conducted by the Council of...

WANT AMAZING ARTICLES ON GRAD SCHOOL PERSONAL STATEMENTS?

- 100+ Personal Statement Templates

Student Good Guide

The best UK online resource for students

- Finance Personal Statement Examples

Here are two finance personal statement examples from some of the best students in undergraduate and postgraduate programmes. Both examples you can use as inspiration and motivation to write your own personal statement for university .

Finance Personal Statement

Ever since I discovered my passion for the finance industry at a young age, I have been determined to pursue a career as a financial consultant and advisor. It is this unwavering ambition that has led me to apply for the MSc course in Finance at the esteemed London School of Economics and Political Science (LSE). I firmly believe that this course will provide me with the necessary tools and knowledge to achieve my career goals by expanding my understanding of financial products, the intricate workings of financial markets, and investment banking.

The reputation of LSE as a university of academic excellence is one of the key reasons for my decision to apply. I am aware of the university’s ability to equip students with critical analysis skills that are essential for becoming leaders in their chosen sectors. Moreover, being located in the heart of London provides unparalleled opportunities for networking and professional development in the world of business and finance. The course’s comprehensive approach, which strikes a balance between theoretical and practical modules, is also highly appealing to me.

My educational background in accounting has laid a solid foundation for my advanced studies in finance. Through my coursework in accounting, I have developed strong numerical skills and gained practical experience in management accounting and reporting roles within financial firms. It was during my studies that I discovered a particular interest in Strategic Financial Management, where I was introduced to financial products such as equities, derivatives, fixed income, and bonds, along with their significance in financial markets. Building on this knowledge, I have become a qualified accountant and have gained valuable work experience as an Associate at Deloitte, where I am part of the project management team, responsible for decision support. This role has honed my ability to work under pressure and within tight time constraints, allowing me to meet urgent and conflicting deadlines.

To stay up-to-date with the dynamic financial market, I avidly follow financial news through subscriptions to reputable media platforms such as the Financial Times, the Economist, and Bloomberg. Additionally, I engage in various hobbies such as travelling, watching movies and documentaries, and reading to broaden my knowledge and stay informed about current affairs. As a sports enthusiast, I follow tennis, football, boxing, and Formula One racing. These diverse interests have cultivated qualities such as ambition, intuition, focus, and self-discipline, which drive me to excel in any endeavour. I value the input and opinions of others, making me an effective team player, while also possessing the independence and initiative to work autonomously. I firmly believe that these qualities will contribute to my success as a finance analyst and enable me to excel academically.

Looking toward the future, I aspire to establish a reputable financial consulting firm in my home country, Nigeria. This firm would provide a range of financial services to both companies and public institutions. I recognise that achieving this goal will require years of experience, cultivating the right connections, and personal determination. Pursuing an MSc in Finance from LSE will better equip me to manage corporate, strategic, and financial opportunities, while also providing the opportunity to learn from talented professors and compete with exceptional graduates. I am convinced that this course is a crucial step toward realizing my long-term aspirations.

The increasingly evident impact of financial risk on our world has captivated my interest like never before. The interplay between the financial sector, government, and the general public dominates news stories, emphasizing the significance of understanding the industry. With my passion for finance nurtured from an early age, I have dedicated myself to attaining a comprehensive understanding of both the theoretical and practical aspects of global finance through high-level studies and extensive work experience in diverse industrial and international contexts.

Currently, in my fourth year of a degree in Finance, Risk, and Investment at Caledonian University, I have developed a strong foundation of knowledge in the field. Moreover, I have delved deeper into specific areas

Finance Personal Statement Example

Since my early years, extensive international travel has shaped my perspective on the world, particularly the stark economic contrasts between the ‘Third World’ and the ‘Western World.’ Having the privilege of experiencing different cultures and economies through my parents, who have lived in Africa, Europe, and the USA, I have developed a deep curiosity about the mechanisms that drive global economies. This curiosity has led me to pursue Economics at A Level, as I believe it is at the core of world discussions and can provide a comprehensive understanding of current news articles and their correlation to the subject.

Through my readings, such as Tim Harford’s ‘The Undercover Economist,’ I have come to appreciate the analogy that economics is like engineering, offering insights into how things work and the consequences of changing them. I see economics as an intricate puzzle, requiring economists to integrate economic theories with government policies to solve complex economic problems. Attending conferences at prestigious institutions like the University of Warwick and Oxbridge has broadened my perspective on economics, with theories like Freakonomics intriguing me and sparking a desire to explore the unexpected links between seemingly unrelated phenomena.

My passion for economics is complemented by a strong affinity for mathematics , which has been nurtured since my childhood. From playing mental maths games to tackling complex problem-solving at A Level, I have developed analytical abilities that were put to the test during a taster day at Cass Business School. Through quick thinking and effective teamwork, I excelled in a trading shares simulation, resulting in my group being the most profitable. Furthermore, my participation in a business management enterprise day at the University of the West of England allowed me to showcase my skills, leading to the recognition of the ‘Best Business Idea.’

To gain practical experience in the finance sector, I sought work opportunities that would provide me with invaluable insights. My time at Britannia Building Society exposed me to the inner workings of retail banking, allowing me to shadow the branch manager, work closely with financial planning advisors, and handle transactions at the tills. This experience introduced me to financial assets, including options for investing in bonds, shares, and increasing savings. Additionally, working at Harrison’s Accountancy and Insolvency Agency gave me valuable knowledge about liquidations and insolvencies of businesses, further solidifying my interest in pursuing a career in finance.

Staying updated with current financial affairs is crucial to me, and I regularly read the economy sections of reputable sources such as the BBC website and The Economist. Subscribing to a weekly update from RBS provides me with topical developments in the financial markets. Alongside my commitment to academic and professional pursuits, I have also developed essential skills through my job at O2 Retail. This experience has sharpened my interpersonal skills and honed my ability to negotiate mutually beneficial deals for both customers and the company. As a captain of my football team, I have learned the value of leadership, motivation, and maintaining high team morale, skills that have translated into success in class debates and the trading shares simulation at Cass Business School.

During a recent trip to Switzerland, I had the opportunity to meet with the assistant vice president at Credit Suisse, who shared insights into exchange rate processes within a leading investment bank. These conversations further solidified my understanding of the close relationship between economics and the finance sector.

Through a comprehensive study of Level Economics and practical experiences, I have been able to bridge the gap between theory and real-world situations. Engaging with professionals in the field has deepened my appreciation for the vital connection between economics and finance. I am confident that pursuing a university education will equip me with the necessary knowledge and skills to navigate the dynamic and fast-paced world of financial markets.

My passion for finance and economics was sparked by the Lehman Brothers’ bankruptcy and the subsequent financial crisis when I was 21 years old. The events of that

Other Personal Statements

- Statistics Personal Statements

- PPE Oxford Personal Statement Example

- Classics Personal Statement Examples

- Theology Personal Statement Examples

- Physics Personal Statement Examples

- Chemical Engineering personal statement examples

- Oncology Personal Statement Examples

- Psychiatry Personal Statement Examples

- Earth Sciences Personal Statement Example

- History Personal Statement Examples

- Veterinary Personal Statement Examples For University

- Civil Engineering Personal Statement Examples

- User Experience Design Personal Statement Example

- Neuroscience Personal Statement Examples

- Graphic Design Personal Statement Examples

- Film Production Personal Statement Examples

- Events Management Personal Statement Examples

- Counselling Personal Statement Examples

- Forensic Science Personal Statement Examples

- Children’s Nursing Personal Statement Examples

- Chemistry Personal Statement Examples

- Sports Science Personal Statement Examples

- Mechanical Engineering Personal Statement Examples

- Electrical and Electronic Engineering Personal Statement Examples

- Quantity Surveying Personal Statement Examples

- Social Work Personal Statement Examples

- Physiotherapy Personal Statement Examples

- Journalism Personal Statement Examples

- English Literature Personal Statement Examples

- Marketing Personal Statement Examples

- Computer Science Personal Statement Examples

- Fashion Marketing Personal Statement Examples

- Dietetic Personal Statement Examples

- Product Design Personal Statement Examples

- Aerospace Engineering Personal Statement Examples

- Geography Personal Statement Examples

- Business Management Personal Statement Examples

- Politics Personal Statement Examples

- Psychology Personal Statement Examples

- Oxbridge Personal Statement Examples

- Zoology Personal Statement Example

- Sociology Personal Statement Example

- Fashion Personal Statement Example

- Mathematics Personal Statement Examples

- Software Engineering Personal Statement Examples

- Philosophy Personal Statement

- International Relations Personal Statement Example

- Biochemistry Personal Statement Example

- Dentistry Personal Statement Examples

- Midwifery Personal Statement

- Law Personal Statement Example

- Medicine Personal Statement for Cambridge

- ICT Personal Statement

- Primary Teacher PGCE Personal Statement

- PGCE Personal Statement Example

- Games Design Personal Statement

- Paramedic Science Personal Statement Examples

- Occupational Therapy Personal Statement

- Pharmacy Personal Statement Example

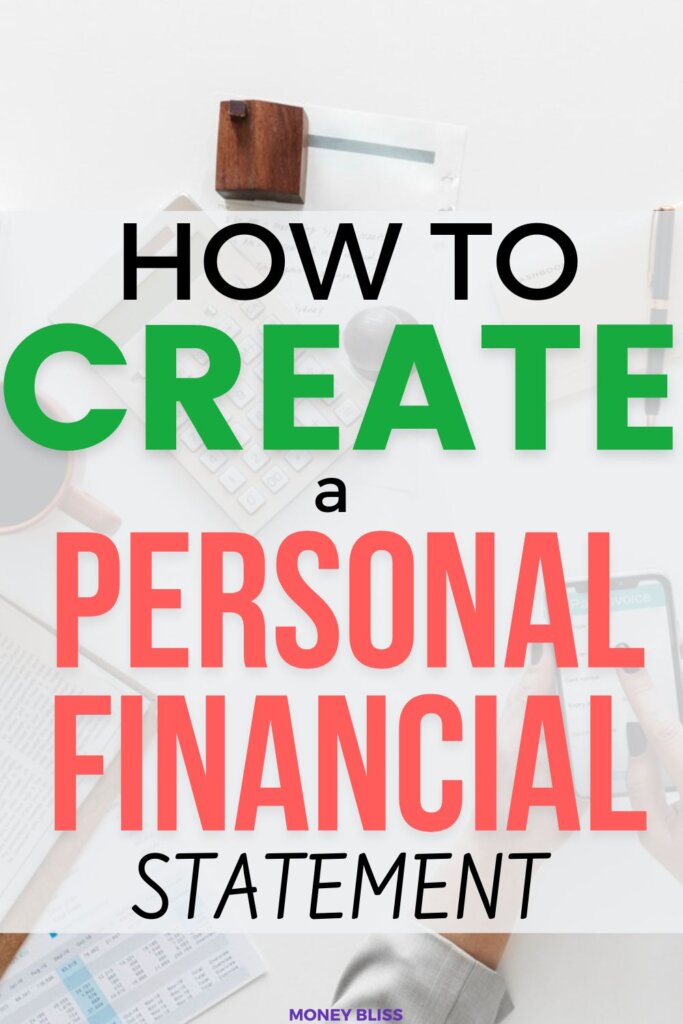

How to Create a Personal Financial Statement + [Free Template and Sample]

This post may contain affiliate links, which helps us to continue providing relevant content and we receive a small commission at no cost to you. As an Amazon Associate, I earn from qualifying purchases. Please read the full disclosure here .

Do you want to create a personal financial statement, but aren’t sure where to start?

According to Mint.com , over 65% of people have no clue how they spent money last month. So, you can probably be pretty sure even less know how their personal finance situation.

With rising costs for essentials like housing and education due to inflation, there is no better time to get an accurate picture of your current situation today.

If you’re wondering how your finances measure up, a Personal Financial Statement can be an invaluable tool in helping you understand where you stand financially and prepare for changes ahead.

This article will walk through creating a sample personal financial statement template with examples of what this document might look like based on your situation.

A personal financial statement isn’t just for your loan applications anymore, it’s an opportunity for transparency in your finances too!

What is a personal financial statement?

A personal financial statement is a document that summarizes your assets, liabilities, and net worth. A PFS can help you understand your financial health so you can make informed decisions about your money.

A personal financial statement template will typically include three sections:

- Assets: This section will list all of the money and property you own.

- Liabilities: This section will list all of the money you owe.

- Net Worth: This section will calculate your net worth by subtracting your total liabilities from your total assets.

Your personal financial statement should be updated on a regular basis, typically once a year. This will help you track your progress and make sure you’re on track to reach your financial goals.

What are the benefits of creating a personal financial statement?

There are many great benefits of a personal financial statement.

By creating a personal financial statement, you can see at a glance how much money you have coming in, going out, and what your net worth is. This information can be extremely helpful in making financial decisions and setting goals.

Benefit #1 – Understand Your Financial Situation

This is why you must spend the extra couple of minutes to create a personal financial statement form.

Most importantly, you get a better understanding of your financial situation. This includes seeing where your money is going each month and how much debt you have.

What we call around here at Money Bliss – the 1000-foot look from above. The outsider’s perspective of what is going on with your finances.

Benefit #2 – Helps you track your progress

When it comes to personal finance, one of the best things you can do is keep track of your progress.

Tracking your progress should be important to you! By seeing everything laid out in front of you, it becomes much easier to make informed financial decisions that will help improve your overall financial picture.

Benefit # 3- Find some areas of improvement

Since a personal financial statement is a document that summarizes your income, expenses, assets, and liabilities in one place it helps you see the financial big picture. Thus, spotting areas for improvement are easier.

For example, if you see that you are spending too much money on non-essential items, you can make changes to improve your financial health.

Benefit #4 – Useful Tool to Set Goals

Next, it can help you set goals. Once you see where you stand financially, you can set goals for paying off debt or saving more money each month.

This aids you to make better financial decisions by providing a clear picture of your financial situation.

Benefit #5 – Snapshot to help you stay motivated

Creating a personal financial statement can be incredibly helpful in staying motivated to save money and achieve your financial goals. Seeing your progress in black and white (or, more accurately, green and red) can be a strong motivator to keep going.

Using a personal finance statement is especially helpful if you’re working towards paying off debt or saving for a specific goal. It can be difficult to stay motivated when you’re not seeing progress, but seeing the numbers going down (or up) can give you the boost you need to keep going.

Benefit #6 – Monitor your financial health

Creating a personal financial statement can help you monitor your financial health and make informed decisions about your spending and saving habits.

- If you see that your expenses are consistently exceeding your income, for example, you may need to make some changes to ensure that you are able to meet your long-term financial goals.

- Easier to spot opportunities to save money or invest in assets that will grow in value over time.

Monitoring your financial health on a regular basis can help you avoid debt problems and keep track of your progress toward financial goals.

What are the types of personal financial statements?

A personal financial statement is a form or spreadsheet detailing a person’s overall financial health. This statement is typically used to apply for business loans or other forms of financing. There are two types of personal financial statements:

- The first type is the balance sheet, which lists a person’s assets and liabilities.

- The second type is the income statement, which details a person’s income and expenses.

The balance sheet provides an overview of a person’s financial situation at a particular point in time, while the income statement shows how much money a person has coming in and going out over a period of time.

Both types of statements are important in helping lenders evaluate a borrower’s ability to repay a loan. As well as for you to monitor your personal situation.

What are the components of a personal financial statement?

A personal financial statement is not just a document that shows how much money you have in your bank account. It also includes other important components to show a well-rounded picture.

Most people know that a personal finance statement includes income, assets, and liabilities. But did you know there are actually four main components of a personal financial statement?

A personal financial statement varies from a traditional balance sheet that is used for a company.

Your income is everything you earn in a year from all sources, including your job, investments, alimony, and more.

You should list all of your sources of income on your personal financial statement so you have a clear picture of what you’re bringing in each month.

- Include all sources of income, even if they are irregular or one-time payments.

- List after-tax income.

- If you are married or have a partner, include their income as well.

- Update your income regularly to reflect any changes (e.g., new job, raise, bonus).

This will help you make informed decisions about your spending and saving.

This is the money you spend each month on things like your mortgage or rent, car payments, groceries, and other necessary expenses.

Here are over 100 personal budget categories for various expenses.

Assets are everything you own like your home equity or the value of your car and can use to pay your debts. This includes cash, savings, investments, property, and possessions.

Calculate your total assets by adding up the value of all your cash, savings, investments, property, and possessions.

So, is a car an asset ? Well it depends if there is a loan against it.

Liabilities

Your liabilities are everything you owe money on. This includes, but is not limited to:

- Student loans

- Credit card debt

- Any other personal loans

Your liabilities also include any money you may owe in taxes.

How to create a personal financial statement – Part 1

There are a few key things you need to know in order to create a personal financial statement.

The first part includes what is needed for your net worth – assets and liabilities. The second part includes your current income, expenditures, and savings.

We will show you next how to collect all of this information, then you can start to work on creating a personal financial statement.

Step #1 – Determine your current assets and business profit

The first is your current assets. Your assets are everything you own and can use to pay your debts. This includes your savings, your home equity, and any investments you have. You will need to know the value of all of these things in order to create an accurate personal finance statement.

To determine the value of your assets, start by looking at your savings. This can be any money you have in the bank, including checking, savings, and money market accounts. Add up the total balance of all these accounts to get your total savings.

Next, determine the value of your home equity. This is the difference between what your home is worth and how much you still owe on it. To calculate this, look up the current value of your home and subtract any outstanding mortgage or other loan balances from it. This will give you an estimate of how much equity you have in your home.

Finally, add up the values of any investments you have. These can include stocks, bonds, mutual funds, and other types of investment accounts. Once you have all these values totaled up, this will give you an estimate of your current assets.

Step #2 – Determine your current liabilities

Your current liabilities are all of the debts and financial obligations that you currently have.

This can include things like credit card debt, car loans, student loans, and any other type of loan that you are currently paying off.

To get an accurate picture of your current liabilities, you will need to gather up all of your bills and statements so that you can see exactly how much you owe.

Step #3 – Determine your net worth

Your net worth is your assets – your savings, your home equity, and your stocks and investments – minus your liabilities. To calculate it, simply subtract your total liabilities from your total assets. This will give you your net worth.

Your net worth is a good indicator of your financial health.

It can help you make decisions about saving and investing, and it can also be a useful tool for budgeting. If you want to improve your financial health, focus on increasing your net worth by saving more money and investing in assets that will grow in value over time.

Your goal is to double your liquid net worth quickly.

How to create a personal financial statement – Part 2

Now, you have developed your next worth statement. The next step in creating a personal financial statement is to determine your monthly cash flow of money or annual cash flow.

This second part includes your current income, expenditures, and savings.

Step #1 – Determine your monthly income

Firstly, you will need your income flow section. This could come from your pay stubs, or if you are self-employed, your profit and loss statements.

Your monthly income includes all money that you earn in a month, including salary, wages, tips, commissions, child support, alimony, and any other regular payments that you receive.

Step #2 – Determine your monthly expenses

The next piece is to determine your monthly expenses. This includes things like your mortgage or rent, car payments, credit card bills, and any other regular expenses. You’ll also want to factor in occasional expenses, like doctor’s appointments or annual membership fees.

Your expenses can be divided into two categories: fixed and variable.

Fixed expenses are those that remain the same each month, such as rent or mortgage payments, car insurance, and minimum credit card payments. Variable expenses change from month to month and can include items such as groceries, utility bills, entertainment, and clothing.

Step #3 – Determine your monthly savings

Typically, most advice will leave out monthly savings. However, this. is a critical piece to learning how to FI – financial independence.

Once you have both your income and expense information, you can begin to calculate your monthly savings. To do this, simply take your total income and subtract your total expenses. The remaining amount is what you have available to save each month.

Maybe you just calculated this and realize you have a negative number (meaning you spend more than you earn each month), then you will need to make some changes in order to improve your financial situation.

It is important to note that a personal financial statement is not static.

Your income and expenses can change from month-to-month, so it is important to recalculate your statement on a regular basis. Additionally, as you begin to save more money each month, the amount available for savings will increase as well.

How to use a personal finance statement template

A personal financial statement is a snapshot of your financial health at a given point in time. It lists your assets, liabilities, and net worth so you can see the big picture of your finances.

You can use a personal finance statement template to track your progress over time and make changes to improve your financial health.

Here’s how to use a personal finance statement template:

- Enter your information into the template. This includes details about your income, expenses, debts, and assets.

- Review your numbers and calculate your net worth. This is the difference between your total assets and total liabilities.

- Watch for comparisons. Compare your net worth from one period to another to track your progress over time.

- Make tweaks. Make changes in areas where you want to improve, such as increasing savings or paying down debt.

- Repeat steps 1-4 periodically . Then you can see how well you’re doing and make necessary changes

How to interpret a personal finance statement

A personal financial statement is a document that shows your current financial health. It lists your assets and liabilities, giving you a clear picture of your net worth.

- Positive net worth means you have more assets than debt.

- Negative net worth means you have more debt than assets.

Your personal financial statement will help you to set financial goals and track your progress over time. For example, if you want to become debt-free within five years, you can use your statement to create a budget and track your progress each year.

If you have a negative net worth, don’t panic! You can improve your financial health by paying off debts and building up your savings.

Creating a budget will help you make the most of your income and make headway on your financial goals.

How to use a personal financial statement to make financial decisions?

This is the important piece of becoming a millionaire.

A personal financial statement can help you see where your money is going each month and make changes to ensure that you are saving enough for your future goals.

Way #1 – Look at your current financial situation

Your personal financial statement is a record of your income and expenses over a period of time. This information can be used to make financial decisions, such as whether to save money or invest in a new business venture.

If you are looking to save money, you will want to compare your total income to your total expenses. If your expenses are greater than your income, you will need to find ways to reduce your spending. You may also want to consider investing in a savings account or retirement fund.

If you are looking to invest in a new business venture, you will want to assess your current financial situation. You will need to determine how much money you can afford to invest and whether or not the venture is likely to be successful.

Doing this analysis before making any decisions can help you avoid making costly mistakes.

Way #2 – Determine your financial goals

There are a few key things to keep in mind when you’re determining your financial goals.

First, you need to think about your short-term and long-term goals.

- Your short-term goals might include things like saving up for a down payment on a house or car or paying off high-interest debt.

- Your long-term goals might include things like saving for retirement or sending your kids to college.

Once you’ve determined your goals, you need to think about how much money you’ll need to reach them. This is where a personal financial statement can come in handy.

This information can help you figure out how much money you have available to put towards your financial goals.

Once you have an idea of how much money you need to reach your financial goals, the next step is to develop a plan for how you’re going to save that money. This might involve setting up a budget and sticking to it, investing in a specific savings account or investment account, or taking advantage of employer matching programs if they’re available.

Making smart financial decisions is important for achieving both your short-term and long-term goals. A personal financial statement can help you determine how much money you need to reach your goals, and develop a plan for saving that money.

Way #3 – Make a budget

Your personal financial statement can be a helpful tool when you’re trying to make a budget. This document lists your income and expenses and can give you a clear picture of your financial situation.

To use your personal financial statement to make a budget:

- Look at your overall income and expenses. This will give you an idea of where your money is going each month.

- What are Necessary Expenses? Determine which expenses are necessary and which ones you can cut back on.

- Prioritize your List. Make a list of your monthly income and expenses, with the necessary expenses first. And drop the expenses at the bottom of the list.

- How Much is Left? Determine how much money you have left over each month after paying for necessities. This is the money you can use for savings or other goals.

- Adjust your budget as needed based on changes in your income or expenses.

Way #4 – Invest in yourself

There are a lot of things you can do to invest in yourself, but one of the smartest things you can do is to invest in your personal finance education.

In fact, one of the popular millionaire quotes from Warren Buffet is :

Invest in yourself as much as possible. Warren Buffet

Investing in yourself is one of the smartest things you can do.

Way #5 – Stay disciplined

Making financial decisions can be difficult, but if you have a personal financial statement, it can help you stay disciplined.

A personal financial statement is a document that shows your income, expenses, and assets. It can help you track your spending and see where you can save money. That my friend is black and white information.

Making financial decisions can be difficult, but if you have a personal financial statement, it can help you stay disciplined and on track.

What are some common mistakes to avoid when creating a personal finance statement?

There are many common mistakes people make when creating a personal financial statement. This can lead to an inaccurate picture of your financial situation and make it difficult to make informed decisions about your finances.

Any of these common mistakes can also lead to problems down the road because you will be unable to meet your financial obligations.

- Not including all sources of income

- Not including all debts and expenses

- Forgetting to track new sources of income

- Overstating or understating expenses

- Not properly categorizing expenses

- Forgetting to update (or review) the statement regularly

- Not tracking progress over time

- Too scared to seek professional help if needed.

By avoiding these common mistakes, you can create a personal financial statement that accurately reflects your financial situation and helps you make better decisions about your money.

How often should a personal finance statement be updated?

You should update your personal finance statement at least once a year.

However, you may want to update it more frequently if you have significant changes in your income or expenses. For example, you may want to update your personal finance statement after you get a raise or buy a new car.

A Personal Financial Statement Template Example

A personal financial statement is a document that summarizes your financial health.

It includes information about your income, expenses, debts, and assets. This information can be used to make informed decisions about your finances.

There are many personal finance statement templates available online. Some banks and financial institutions offer their own templates. You can also find templates in our free resource library. Once you find a template you like, you can download it and fill it out with your own information.

When filling out a personal financial statement template, be sure to include accurate and up-to-date information.

This will give you the most accurate picture of your financial health. Review your statements regularly to track your progress and make changes as needed.

Time to Create A Sample Personal Financial Statement

When creating a personal financial statement, it is important to include all sources of income, not just your salary. This includes any freelance work, investments, or other forms of passive income. Additionally, make sure to include any government benefits or assistance you receive.

Excluding all sources of income will give you an inaccurate picture of your financial situation and make it difficult to create a realistic budget.

This is something you need to spend dedicated time doing to create a personal financial statement worksheet.

Over time, this wealth management tool will help you to become the next millionaire.

Know someone else that needs this, too? Then, please share!!

Did the post resonate with you?

More importantly, did I answer the questions you have about this topic? Let me know in the comments if I can help in some other way!

Your comments are not just welcomed; they’re an integral part of our community. Let’s continue the conversation and explore how these ideas align with your journey towards Money Bliss.

There was a template offer that popped up when I first visited the page and then it disappeared. Could you please send me the spreadsheet?

You can go here to subscribe to our email list: https://moneybliss.org/email-subscribe/

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Original text

Why All Small Business Owners Need a Personal Financial Statement

Running a small business is exhilarating, demanding and often a blur of financial uncertainty. While most entrepreneurs focus on their business’s bottom line and keep their financial statements current, they often neglect to document their personal finances. That’s wrong. Every small business owner needs to create a personal financial statement (PFS), which serves as a personal balance sheet, documenting your assets, liabilities and net worth.

When do you need a personal financial statement?

Many small business owners may need a loan or other outside financing as they grow their companies. That usually requires providing a lot of documentation to the lender. But lenders don’t only want to see your business finances. Most require a personal financial statement as well.

If you decide to pledge personal assets as collateral, lenders definitely want to know the details about those assets. Financial institutions may wish to conduct a fiscal health evaluation of your personal finances so they can assess how well you manage money. For instance, if you have few assets and a lot of outstanding debt, it can indicate you would have trouble repaying a loan.

Are you thinking of buying an existing business or a franchise? The business owner, broker and/or franchisor will ask for a PFS as evidence that you’re financially able to purchase the business or franchise.

If you plan to rent a commercial office, retail space, or other types of business space, the landlord will likely request a personal financial statement before approving your lease.

As you can see, there are numerous reasons you need a PFS. It’s smart to prepare yours now (and keep it updated) so it will be ready when needed.

Personal financial statements are financial snapshots offering numerous benefits.

Beyond simply tracking your assets and liabilities, a PFS offers several vital benefits for entrepreneurs. Creating your PFS is like getting a checkup, except the result is a fiscal health evaluation rather than a physical one.

Some of the benefits of preparing a personal financial statement (sometimes called a personal financial summary):

- Securing funding: As we already noted, when seeking loans for business expansion, new equipment or company vehicles, lenders rely on your PFS to assess your creditworthiness and ability to repay. A strong PFS significantly increases your chances of securing favorable loan terms and interest rates.

- Understanding your net worth: Your PFS provides a clear picture of your overall financial standing, including your assets (cash, investments, property) and liabilities (debt, loans, mortgages). Seeing a comprehensive view helps you make informed decisions about investments, savings goals and risk management.

- Making prudent financial decisions: With a clear understanding of your income, expenses and debt obligations, you can make informed choices about spending, investments and financial planning. Your PFS empowers you to avoid impulsive decisions and build a solid financial foundation.

- Monitoring progress and adapting: Regularly reviewing your PFS allows you to track your progress toward your financial goals and identify areas for improvement. This ongoing review process enables you to pivot, adapt, and adjust your strategies as your business and personal circumstances evolve.

What's included in a personal financial statement?

A typical PFS is divided into two main sections—assets and liabilities.

List of assets

- Current Assets include cash, checking and savings accounts, certificates of deposit, short-term investments and accounts receivable.

- Investment Assets include stocks, bonds, mutual funds and retirement accounts (IRAs, 401(k)s).

- Fixed Assets include real estate holdings and personal property, such as jewelry, cars and other items of significant value (art collection, first editions of books, etc.)

List of liabilities

- Current Liabilities include credit card debt, outstanding bills and short-term loans.

- Long-term Liabilities include mortgages, car loans, student loans and personal loans.

Do not include business assets or liabilities in your personal financial statement.

Creating your financial snapshot

You don’t need to be a financial wizard to create a PFS. Here’s how:

- Gather your documents: Collect bank statements, investment account statements, loan documents and receipts for major purchases.

- Choose a format: You can use an online template, spreadsheet or pen and paper. Choose the best format for you and ensure consistency for future updates.

- List your assets: Identify and value all your assets using current market values for investments and real estate.

- List your liabilities: Include all your debts, noting the remaining balances and interest rates.

- Calculate your net worth: Subtract your total liabilities from your assets to determine your net worth. While this is part of your overall personal balance sheet, you should keep this calculation as a separate net worth statement.

- Review and update regularly: Your PFS is not static. Update it regularly, ideally quarterly, to reflect changes in your financial situation.

When creating your personal financial statement, it’s critical to be honest and accurate. This wealth assessment is for your own benefit to help you (and lenders) make informed decisions. No one is judging you.

A PFS helps you take ownership of your personal finances and equips you with the knowledge and confidence to navigate the challenges and reap the rewards of entrepreneurship. A healthy business rests on a solid personal financial foundation.

If navigating financial statements feels overwhelming, consider consulting with a financial advisor, accountant or SCORE mentor .

National Bankers Association Foundation

The National Bankers Association Foundation’s mission is to eliminate the racial wealth gap by ensuring underserved communities have fair access to transformative financial education, services, and resources. To accomplish this, we support the work of Minority Depository Institutions (MDIs) through our four strategic pillars, which include: Financial Education, Entrepreneurship and Small Business, Research and Impact, and Collaboration and Capacity Building.

Copyright © 2024 SCORE Association, SCORE.org

Funded, in part, through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

404 Not found

- AI Content Shield

- AI KW Research

- AI Assistant

- SEO Optimizer

- AI KW Clustering

- Customer reviews

- The NLO Revolution

- Press Center

- Help Center

- Content Resources

- Facebook Group

Guide to Better Finance Master’s Personal Statements

Table of Contents

A Finance master’s personal statement is an essay crafted by a prospective student applying for a master’s degree.

The statement’s purpose is to provide insight into the applicant’s personality and how they can contribute to the program. It also demonstrates their experience and expertise in the field.

Applicants should tailor their personal statements to each specific university and their unique requirements. This will help make it stand out from those of other applicants.

The Importance of a Personal Statement

Personal statements aren’t redundant. While applications and resumes already enumerate an applicant’s qualifications, the main advantage derived from personal statements lies in compelling exposition.

The exposition of your qualifications matters significantly. It can influence the impression you establish on readers. Moreover, it allows you to highlight specific skills and experiences to paint yourself as a prime candidate.

Personal statements are also a way to demonstrate a genuine dedication to mastering the subject or course .

The best thing about personal statements is that they are reasonably straightforward despite their value. The following section provides a few tips for crafting effective personal statements.

Tips for Writing a Finance Masters Personal Statement

Highlight Your Finance Accomplishments and Knowledge

Explain how your experience has given you a unique perspective on the subject. Showcase your achievements and competencies, such as internships or volunteer work related to Finance. These will show your passion for the industry and your dedication to learning.

Reference Research Experience

Referencing any related studies you’ve conducted or written about demonstrates your industry exposure. This will show that you are equipped to succeed in an advanced program and shows your hunger for knowledge.

Use Concrete Examples

Concrete examples are valuable because they are a reliable basis for your general performance. Include a few to support any skills, characteristics, and values you claim to possess.

Add an Opportunity Statement

Explain how a Finance Master’s degree can benefit your career, business, or academic life. Show your readers the allure that led you to pursue a Finance Master’s degree in the first place. This is valuable information because it gives admissions board representatives and recruiters a glimpse into your motivations.

Write With Clarity and Structure

To craft a clear, structured statement, you must use active language, well-rounded sentences, appropriate transition words, and utilize common English idioms when applicable. Avoid sounding overly robotic or overusing technical jargon. Let your personality shine through while demonstrating your mastery of the material.

This ensures you deliver a clear message and keeps your reader invested in your personal statement from the first sentence to the last.

If you’re still struggling with writing a Finance Masters personal statement , don’t fret. Here are a few examples you can gain inspiration from.

Sample Finance Masters Personal Statement

I am an experienced professional with a decade of experience in the financial industry. I have always been passionate about pursuing further education to ensure I stay at the highest level of the market. Last year, I pursued a Masters’s degree in Financial Management (M.Sc.) from an internationally renowned school.

I wanted to gain a better understanding of this area and expand my knowledge of economics and accounting principles. This will help me develop greater capability in dealing with processes in the ever-changing global environment.

By taking up this degree, I will also have the opportunity to sharpen my skills through various job roles. I will also gain access to professionals who can provide real-world insight into the area.

Moreover, My ability to apply within any business setting sets me apart from the rest of the market. I have a strong service orientation and focus on developing innovative solutions. These are qualities that are essential to excel within the management sector. After completing my M.Sc., I would be more than ready to take on future challenges and deliver excellent results.

I come from an international background and have been immersed in investment banking for the past six years. My work experience and Business undergraduate degree create a solid financial knowledge foundation. I want to build upon this foundation, so I seek an MSc in Finance. I recognize the need for more formal training to reach my long-term goals in the finance sector.

Through my experiences, I believe I understand the challenges faced in working within the global banking system. I have become adept at anticipating and dealing with potential problems as they arise. My current role requires that I be able to analyze different markets and predict outcomes accurately. I feel confident doing this after having undertaken significant research in this area.

Additionally, I manage portfolios and negotiate deals between clients and other businesses, a task further enhanced by my fluency in English and Spanish.

I relish the opportunity to further develop my understanding of Finance through a Master’s program. It will allow me to explore new topics like derivatives trading and financial engineering. I also look forward to pushing myself academically and developing professional connections. These networks could be vital when it comes time to pursue my career aspirations.

This course offers me the chance to gain the skills needed to do precisely that. Pursuing an MSc in Finance is the right decision for me.

I believe my qualifications in Financial Economics and varied work and activity exposure make me an ideal candidate for a Master’s Degree in Finance. During my time at school, I learned the fundamentals of business finance and economics as well. I build on this by reading content from some of the world’s leading financial institutions.

My success in these areas allowed me to skip a grade, giving me more time to pursue extra-curricular activities. I worked with a small company in India that specializes in financial consulting. This hands-on experience gave me great insight into corporate Finance’s complexities. It also helped me develop good communication skills and sharp problem-solving abilities.

I am excited to use my knowledge, expertise, and experiences to advance my understanding of the financial industry further. As a student, I will be committed to maximizing my potential by taking advantage of every opportunity the university offers. By working hard and combining real-life examples with classroom learning, I aim to establish myself as an engaged and capable student. Upon graduation, I can become a valuable asset to any financial organization or institution.

Personal statements are vital to Master’s applications and other selective ventures because they express your best qualities . Mastering the art of crafting compelling personal statements will help you go far in your academic and professional experiences. Make sure to apply our tips to maximize your chances of success. Good luck!

Abir Ghenaiet

Abir is a data analyst and researcher. Among her interests are artificial intelligence, machine learning, and natural language processing. As a humanitarian and educator, she actively supports women in tech and promotes diversity.

Explore All Write Personal Statement Articles

How to draft meaningful length of law school personal statement.

Are you confused on how to write a law school personal statement? One of the essential elements of your application…

- Write Personal Statement

Effective History and International Relations Personal Statement to Try

Are you considering studying history and international relations? Or you may be curious about what a degree in this field…

Guide to Quality Global Management Personal Statement

Are you applying for a global management program and want to stand out from the crowd? A well-written personal statement…

How to Draft Better Examples of Personal Statements for Residency

Achieving a residency can be a massive accomplishment for any aspiring medical professional. To secure your spot in one of…

Tips for Drafting a Free Example of Personal History Statement

A personal history statement can be crucial to many applications, from university admissions to job search processes. This blog will…

Writing Compelling Dietetic Internship Personal Statement

Applying for a dietetic internship is a rigorous process and requires submitting a personal statement, which is an essential part…

- Applying to Uni

- Apprenticeships

- Health & Relationships

- Money & Finance

Personal Statements

- Postgraduate

- U.S Universities

University Interviews

- Vocational Qualifications

- Accommodation

- Budgeting, Money & Finance

- Health & Relationships

- Jobs & Careers

- Socialising

Studying Abroad

- Studying & Revision

- Technology

- University & College Admissions

Guide to GCSE Results Day

Finding a job after school or college

Retaking GCSEs

In this section

Choosing GCSE Subjects

Post-GCSE Options

GCSE Work Experience

GCSE Revision Tips

Why take an Apprenticeship?

Applying for an Apprenticeship

Apprenticeships Interviews

Apprenticeship Wage

Engineering Apprenticeships

What is an Apprenticeship?

Choosing an Apprenticeship

Real Life Apprentices

Degree Apprenticeships

Higher Apprenticeships

A Level Results Day 2024

AS Levels 2024

Clearing Guide 2024

Applying to University

SQA Results Day Guide 2024

BTEC Results Day Guide

Vocational Qualifications Guide

Sixth Form or College

International Baccalaureate

Post 18 options

Finding a Job

Should I take a Gap Year?

Travel Planning

Volunteering

Gap Year Guide

Gap Year Blogs

Applying to Oxbridge

Applying to US Universities

Choosing a Degree

Choosing a University or College

Personal Statement Editing and Review Service

Guide to Freshers' Week

Student Guides

Student Cooking

Student Blogs

Top Rated Personal Statements

Personal Statement Examples

Writing Your Personal Statement

Postgraduate Personal Statements

International Student Personal Statements

Gap Year Personal Statements

Personal Statement Length Checker

Personal Statement Examples By University

Personal Statement Changes 2025

Personal Statement Template

Job Interviews

Types of Postgraduate Course

Writing a Postgraduate Personal Statement

Postgraduate Funding

Postgraduate Study

Internships

Choosing A College

Ivy League Universities

Common App Essay Examples

Universal College Application Guide

How To Write A College Admissions Essay

College Rankings

Admissions Tests

Fees & Funding

Scholarships

Budgeting For College

Online Degree

Platinum Express Editing and Review Service

Gold Editing and Review Service

Silver Express Editing and Review Service

UCAS Personal Statement Editing and Review Service

Oxbridge Personal Statement Editing and Review Service

Postgraduate Personal Statement Editing and Review Service

You are here

Business management and finance personal statement example.

Ever since the first implementation of money it has evolved to one of the main forces that abet our society in making progress in this highly commercialized age. As a result a whole new type of relationship between people has emerged, defined shortly nowadays as business and finance. The complexity and diversity of these disciplines have always fascinated me and instigated my critical thinking. Hence my immense willingness to pursue a degree in this field of study.

My persistence and diligence at school, coupled with the supportive attitude of my teachers have led me to brilliance in all of my school studies, maintaining an excellent overall grade throughout the years. Additionally, during my education in the English Language Medium School I managed to achieve proficiency in the English language certified by my excellent performance at the CAE and TOEFL tests. Moreover, my passion for mathematics encouraged by my parents from early childhood has developed my critical thinking faculties and analytical knacks. What is more, I have been ranked in the top 5 in several mathematical competitions. After assessing my qualities my teachers have chosen me to represent my class at the Student Council. Furthermore, I am an active member of the local Interact Club in which we organize various charity events and exhibitions.

As a part of my additional studies, last year I took up a course in rhetorics, which proved to be an exceptionally valuable experience. Through the debates we carried out, I improved my abilities to express my ideas clearly and concisely and learnt to think "out of the box". In my view, these are the vital skills without which no manager could achieve success in the constantly evolving world of business.

To gain a further insight of the world of finance and business, I've worked for 3 months in an accountancy company as a public relations assistant. Thus, I had the opportunity to grasp the feeling of working in a dynamic and competitive environment. Being perpetually pressured by deadlines helped me realize the actual value of concepts such as responsibility, time management and self-discipline. Additionally, I've been chosen to take part in several conferences and workshops connected to projects under the Leonardo da Vinci Programme, which I believe is a consequence of the flexibility, open-mindedness, and desire to learn that I've proven. There I met experts from a broad range of business related areas and managed to uncover the unique essence of their jobs.

Once I turned 18 I was finally able to realize my long lasting passion - trade at the FOREX market and put to a test my quick wits and decision making at the stock exchange. I had been preparing for that moment for quite a long time by taking an avid interest in financial news, reading specialized literature and researching thoroughly the trends and specifics of the market. Eventually, this established to be an invaluable experience and further fueled my desire to study relevant subjects at a university level.

As a summer job for the last two years I have been an Entertainer at hotels in a nearby resort. What I like about this job is that I can fully express my joyful nature and spread it among the guests. Since we had to prepare lots of dance, comedy and guest-orientated shows I have highly improved my ability to work as a part of a team and have had the chance to put to action my acting skills.

All the versatile hobbies and sports I've been involved in such as web designs, Photoshop graphics, karate, swimming and football have boosted my endurance, developed my mentality and made me more passionate about everything I do.

In the light of all this, I am positive with my decision to continue my education in business and finance related disciplines in which I will be able to fully expand my enthusiasm and potential for learning.

Profile info

This personal statement was written by Mitev for application in 2009.

Mitev's Comments

So far I have offers from: Manchester - International Business, Finance and Economics Aston University - International Business and Economics University of Essex - Financial Management

Still waiting for the offers from: University of Exeter - Economics and Finance University of Southampton - Economics and Management Sciences

I'll be happy to receive some feedback. Feel free to comment, criticize etc. :)

This personal statement is unrated

Related Personal Statements

Can you please send me email.

Mon, 14/11/2011 - 15:34

can you please send me email address, i need to know a few things. Thank You

Add new comment

Keep these 10 financial documents forever. Scan and shred the rest.

Always hold onto birth certificates and social security cards, but it’s okay to cast off those old bank statements.

No matter how digital we’ve become, we’re still a paper nation.

Are your financial documents stuffed in a closet, files, shopping bags or stacked up on the floor?

Get Michelle’s advice free in your inbox

You may prefer to view it as organized chaos. But isn’t it really just a manifestation of your inability to discern what you need and what you should let go?

When I look at the piles of paper in my office accumulated throughout the past year, I know it’s time for another document dump. It’s part of my spring cleaning ritual .

Sometimes we hold onto all that paper because we aren’t sure what to keep and what to toss. Here’s a rundown of what should be retained.

Forever documents

Certain papers should be kept in a safe location where they are protected from damage, loss and theft. Such original documents, which may be hard or costly to replace, include:

- Birth certificates and adoption papers

- Death certificates

- Marriage and divorce records

- Social Security cards. Yes, you know the number, but there may be an occasion where you have to produce the actual card.

- Military service records, including discharge documents. An honorably discharged service member is eligible to receive funeral and burial benefits.

- Loan payoff statements. Here’s something important: If you negotiated to pay less than what you owed on a debt, keep the original agreement in perpetuity. Often when debt is sold to debt collectors for pennies on the dollar, the sale doesn’t include a lot of information, including documentation proving a payoff.

- Year-end pay stubs. If a company goes out of business you may not be able to track down the information should you need it later.

- Retirement or pension records. Be sure to keep the records from previous jobs.

- Estate documents

- Funeral programs. Although many funeral homes will post an obituary online, they are often shortened versions of the program you might receive at the service. I have a folder of programs because they contain a wealth of information that can be helpful in estate planning, including maiden names and other family history you might need. (In this case, I like keeping the originals rather than a scanned version.)

Loan documents: Keep original loan documents and statements until you have paid off the loan. Then, save the paperwork verifying the balance was paid in full. My husband and I are coming up on one year of paying off our home . I may be a little paranoid, but I’m keeping the original documentation.

Vehicle title: Keep the original as long as you own the vehicle.

Receipts for big-ticket items: For insurance purposes, in case of fire or theft, save receipts for big-screen TVs, computers and other major purchases. Hold on to each receipt as long as you own the item. Personally, I like to keep the original, but a scanned copy should be fine.

Home improvement purchase orders, receipts, canceled checks: Keep proof of any upgrades until you sell the home. If you have a capital gain from selling your primary home, you may qualify to exclude as much as $250,000 from your income or as much as $500,000 if you file a joint return with your spouse.

If you exceed these limits, here’s where having proof of the capital improvements helps your tax situation: “When you make a home improvement, such as installing central air conditioning or replacing the roof, you can’t deduct the cost in the year you spend the money,” according to TurboTax. “But, if you keep track of those expenses, they may help you reduce your taxes in the year you sell your house.”

Investment statements: If they are available online, you do not need paper copies. The most important reason to maintain these records would be to establish your cost basis when selling an asset to make sure you claim the proper capital gain or loss on your tax return.

3 to 7 years

Tax records: Record-keeping guidelines are tied to statutes of limitations. That’s generally three years, but it’s seven years for worthless securities and bad debts, according to IRS spokesman Eric Smith.

“For most people, the tax-related statute of limitations is pretty straightforward,” he said.

But there are special circumstances that extend that time. For example, getting a tax-filing extension, serving in a combat zone, qualifying for a disaster-area deadline postponement or a financial disability.

You must keep records, such as receipts, canceled checks and other documents that support an item of income, a deduction or a credit appearing on a return, according to the IRS.

But it doesn’t have to be an original. Scan and shred. The agency will accept a legible digital copy of a document.

“Electronic storage is also fine, as long as they can be retrieved, if needed,” Smith said.

Why keep even a scanned version after several years?

Your past returns contain your financial history — employment, investments and charitable giving choices.

But you won’t have to worry about having a scanned copy if you have an IRS online account. With an account, you can access a transcript of your return.

Maintaining years of tax returns can help if you ever need to research payments made into Social Security .