Official website of the U.S. government

- Priority 1: Workforce

- Priority 2: Customer Experience

- Priority 3: Business of Government

- PMA Learning Agenda

Small Businesses and the Federal Government: Working Together One Contract At A Time

By Performance.gov team

August 11, 2022

This is the fifth post in a series highlighting different aspects of strategic planning in the Federal Government. Today, we will meet the U.S. Small Business Administration and learn how they leverage their strategic planning initiatives to hit Government-wide objectives, including partnering with and growing disadvantaged small businesses.

When Douglas Craft retired from the military, he landed in New Mexico and started his own business: Crystal Clear Manufacturing, a company specializing in janitorial services, operations and maintenance, and landscaping.

Thanks to the support of the U.S. Small Business Administration (SBA), Croft’s company grew from a net worth of $80,000 to more than $25 million – more than a thirtyfold increase.

The SBA provides services to the business community by helping small business owners access mentoring, counseling, and training, capital, and government contracting assistance. Craft received support in all of these areas. The SBA helped him file for veteran benefits and enrolled him in their 8(a) program for socially and economically disadvantaged businesses. This opened the door for Crystal Clear Manufacturing to grow.

As a service-disabled veteran, Craft was also eligible for the 3% of federal contracting opportunities that are mandated by law to service-disabled veteran-owned companies. The first federal contract Craft was awarded was a $1.2 million contract to clean a federal building in Colorado. That was just the beginning for Craft and with the SBA’s continued support, he has received many federal contracts across the country.

Douglas Craft is a small business owner who receives support from the SBA.

An Ambitious Agency Priority Goal

Historically, about 10% of federal agencies’ total eligible contracting dollars typically go to small-disadvantaged businesses. Small-disadvantaged businesses (SDBs) are defined as a business where at least 51% is owned by one or more individuals who are both socially and economically disadvantaged; for example, Black and Latino-owned businesses are classified as SDBs.

President Biden’s Executive Order 13985 directed agencies to work to make contracting opportunities more readily available to all eligible firms and to remove barriers faced by underserved individuals and communities. In June 2021, President Biden reaffirmed his commitment by announcing a bold new goal to increase the share of contracts going to SDBs by 15% by 2025.

The SBA is determined to hit this goal. In their new strategic plan , they set an Agency Priority Goal (APG) that specifically focuses on increasing disadvantaged small business growth through federal procurement. This APG commits the SBA to increase federal contracting awards to SDBs to 12% by September 2023.

From a Strategic Plan to Real Results

Douglas Craft’s story is just one example of how the SBA supports small businesses. The SBA actively creates multiple opportunities for small businesses like Crystal Clear Manufacturing to work with and alongside the Federal Government.

While the 12% increase outlined in the SBA’s APG does not look large on paper, it represents billions of dollars in investments in small-disadvantaged businesses. That amount of growth and investment will have a positive effect on our economy by promoting diversity, equity, inclusion, and accessibility; closing the wealth disparity gap in the United States; and helping an increased number of Americans like Craft realize their entrepreneurial dreams.

The SBA is rigorously working to ensure they can deliver on this APG and best support small-disadvantaged businesses through technical assistance and business development services to businesses so that they can better compete for federal contracting awards.

Stay tuned as we explore the importance of strategy and performance in the Federal Government and share agency success stories.

Back to top

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

- How to Start a Business: A Comprehensive Guide and Essential Steps 1 of 25

- How to Do Market Research, Types, and Example 2 of 25

- Marketing Strategy: What It Is, How It Works, and How to Create One 3 of 25

- Marketing in Business: Strategies and Types Explained 4 of 25

- What Is a Marketing Plan? Types and How to Write One 5 of 25

- Business Development: Definition, Strategies, Steps & Skills 6 of 25

- Business Plan: What It Is, What's Included, and How to Write One 7 of 25

- Small Business Development Center (SBDC): Meaning, Types, Impact 8 of 25

- How to Write a Business Plan for a Loan 9 of 25

- Business Startup Costs: It’s in the Details 10 of 25

- Startup Capital Definition, Types, and Risks 11 of 25

- Bootstrapping Definition, Strategies, and Pros/Cons 12 of 25

- Crowdfunding: What It Is, How It Works, and Popular Websites 13 of 25

- Starting a Business with No Money: How to Begin 14 of 25

- A Comprehensive Guide to Establishing Business Credit 15 of 25

- Equity Financing: What It Is, How It Works, Pros and Cons 16 of 25

- Best Startup Business Loans 17 of 25

- Sole Proprietorship: What It Is, Pros and Cons, and Differences From an LLC 18 of 25

- Partnership: Definition, How It Works, Taxation, and Types 19 of 25

- What Is an LLC? Limited Liability Company Structure and Benefits Defined 20 of 25

- Corporation: What It Is and How to Form One 21 of 25

- Starting a Small Business: Your Complete How-to Guide 22 of 25

- Starting an Online Business: A Step-by-Step Guide 23 of 25

- How to Start Your Own Bookkeeping Business: Essential Tips 24 of 25

- How to Start a Successful Dropshipping Business: A Comprehensive Guide 25 of 25

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- 4k VA positions face potential pay downgrade

- Pathways Program gets overhaul

- 10+ years to build new FBI HQ

- Sports Schedule

Hubbard Radio Washington DC, LLC. All rights reserved. This website is not intended for users located within the European Economic Area.

5 strategies to help meet government-mandated small business contracting goals

Targeting SDBs emphasizes the worthy goals of promoting racial equity and assisting socio-economically disadvantaged businesses, but there is another motivation...

The Biden Administration has leaned into the longstanding commitment from the federal government to support small/disadvantaged businesses (SDBs) with new SDB contracting goals. This is welcome news for small business owners, who have faced significant challenges in the volatile economic environment of the pandemic. Targeting SDBs emphasizes the worthy goals of promoting racial equity and assisting socio-economically disadvantaged businesses, but there is another motivation for highlighting partnerships with SDBs: Doing so makes good business sense for the federal government.

SDBs are key to delivering agile innovation and localized service to our defense and federal agencies, national security efforts and agency missions. An executive order announced in December 2021 outlines key initiatives and asks agencies to agree with the Small Business Administration on an agency-specific SDB contracting goal for FY 2022 that will allow the federal government to cumulatively award at least 11% of federal contract spend to SDBs in FY 2022, which increases to 15% by 2025. Agencies need proven tools and new innovations to aid in the success of these initiatives.

Leveraging construction and real property projects

Particularly in the construction industry, which continues to navigate an uncertain rebound amid supply chain challenges, it is critical to nurture the small business pipeline to ensure that federal agency mission needs are met. The federal government has executed $15-17 billion in real property maintenance, repair and alteration annually for the last four years. Much of this work is very accessible to emergent firms and those first entering the federal market, making facilities construction and services a natural entry point for SDBs. But there are contracting and operational constraints that can be a barrier to getting this work in the hands of those businesses.

An entrepreneurial and hard-working individual can start a construction company with minimal investment, but entering the federal market is harder. A construction business owner must learn to navigate federal compliance requirements like certifying payroll, acquiring bonding, and building operational capacity with staffing and skill development while engaging in resource-intensive bidding cycles.

We want to hear from federal technology leaders about how you are addressing current cyber demands and how your agency is making the most of its resources to improve its cyber posture. | Take our quick survey

Fortunately, there are proven contracting methodologies that can support emergent construction businesses in this path. Catalyzed by new data and technology tools, they can be leveraged to accelerate fulfillment of the current aggressive SDB contracting goals.

Reconciling SDB support and category management

For many years, federal contracting offices have been tasked with optimizing spend — doing more with less by consolidating spend under category management principles. Those practices are frequently seen as being at odds with SDB support, and indeed they can be. But when work requirements are consolidated in the right way — into long-term multi-project contracts that can be tackled by small business — the result can be a small business growth engine for SDBs.

This method of category management frees SDBs from a constant bidding cycle. It also builds much-needed small business execution capacity during a volatile post-pandemic period when many small businesses are still recovering.

One example of how appropriately consolidated construction work requirements can support small business is through Job Order Contracting (JOC, also called SABER in Air Force and some agencies). Early government-funded studies demonstrated that the JOC methodology, which leverages a long-term contract based on a unit price guide and a coefficient or adjustment factor, resulted in fewer barriers to entry into the federal market for SDBs.

At the time, most of these programs funneled construction volume to SDBs through larger prime contractors, but contracting officers soon determined that SDBs could themselves be very successful at this type of small project execution program. Now, almost all JOC programs are set aside for SDBs.

Sole source awards with fair and reasonable pricing

To meet increased SDB award goals for 2022 and beyond, contracting officers will want to leverage sole source awards, which are enabled for 8(a) firms and, in certain circumstances, for women-owned small businesses, HUBZone and service-disabled veteran-owned small business firms. The maximum award value is $4.5M for individually owned firms, while tribally-owned entities have a cap of $100M in DoD.

These relatively small awards can be executed in weeks rather than the year-long timeline of many federal procurements. But arriving at fair and reasonable pricing in the absence of competition can be a challenge. Fortunately, construction pricing data can serve as a “single source of truth” to facilitate negotiations. While commercial, third-party price guides are sometimes used, a customized set of construction tasks with preset unit prices is the gold standard for governing pricing in a contractually precise way that ensures performance standards and covers DoD- and federal-specific work items.

By intersecting sole source awards and JOC, it is possible to award quick-execution multiple project vehicles. These are sometimes called “Mini-JOCs” or “Rapid-JOCs.” In the U.S. Army Corps of Engineers, they are sometimes called Performance-Oriented Construction Agreements (POCA). When properly planned and supported, they can serve as a good foundation for small businesses looking to enter the federal market, a key tenet of the recent executive order.

Read more: Commentary

By incentivizing SDBs with the potential for multiple small projects within a single contract vehicle, the government can introduce new companies into their ecosystem, reward performance and gain meaningful efficiencies in their procurement and management of projects. Many federal agencies are using sole source awards as a “quick start” to a larger, strategically planned multi-year JOC programs. It provides a way to prepare SDBs to competitively bid on the larger contract and serves as a pilot to ensure as they plan the larger acquisition.

Joint Base San Antonio (JBSA) — one of the largest DoD locations comprised of three main bases (Ft. Sam Houston, Lackland Air Force Base, and Randolph AFB) — recently awarded three 8(a) sole source contracts as part of a strategy to nurture an understanding of the JOC/SABER methodology in a location that hasn’t had one of these contracts in many years. The sole source contracts will provide much-needed federal fiscal year execution capacity and develop a competitive pool of SDBs while JBSA plans a long-term “SuperSABER” to serve all three bases.

Training and technology enablement for SDBs

There are a few challenges to fully realizing the potential of SDB execution of JOCs and sole source Mini-JOCs. The complexity of evaluating a vast set of unit prices and developing a coefficient can be daunting. The government must also fully understand the pricing to effectively negotiate a fair and reasonable coefficient.

Larger contracts can require a significant investment in data, software and training that can be a cash flow drain to emerging businesses. But turnkey, consumption-based JOC support systems can provide upfront program support in the form of technology enablement, and training can help SDBs to “demystify” JOC and engage in these programs with no up-front financial investment. Likewise, it is very low risk for the government to pilot these programs. The JOC consultant takes on a key role in coaching the SDB and ensuring success for all parties.

Leadership considerations

Accountability is a critical component of reaching any goal and it tends to start at the top of the organization. The onus should be placed on leadership to truly institutionalize achievement of small business contracting goals. Contracting offices are trained to focus on transparency and open competition, and some are wary of sole source awards.

OSDBUs, supported by contracting leadership, will need to bring into focus the value of sole source awards in developing the DoD and federal supplier base. They will also need to socialize the concept of ensuring fair and reasonable pricing through adept use of unit pricing tools, rather than direct competition.

To meet new SDB contracting goals, it will take the active support of the full federal marketplace to aid government contracting offices, 8(a)s, and other qualifying contractors in their pursuit of these awards. To continue to deliver agile innovation and localized service to our defense and federal agencies, national security efforts and agency missions, diverse small businesses must begin to thrive and stir up competition in the federal marketplace.

Want to stay up to date with the latest federal news and information from all your devices? Download the revamped Federal News Network app

Lisa Cooley serves as the vice president of federal sales at Gordian .

Copyright © 2024 Federal News Network. All rights reserved. This website is not intended for users located within the European Economic Area.

- Go Apple's Website to download the APP

- Go Google's Website to download the APP

Related Stories

New contracting goals for small disadvantaged businesses

DISA sends message to large companies: Meet small business goals or risk getting off-ramped

Did the government actually reach its annual small business contracting goals?

- New contracting goals for small disadvantaged businesses Federal Newscast

- DISA sends message to large companies: Meet small business goals or risk getting off-ramped Reporter's Notebook

- Did the government actually reach its annual small business contracting goals? Contracting

Top Stories

- GOP senators seek IG review to see if SBA office space remains underutilized Top Story

- DHA, AFGE cement workplace policies for 38K DoD health employees UNIONS

- HHS proves NOFOs can be less complex, easier for applicants MANAGEMENT

- CISA’s Connelly leaving federal service PEOPLE

- CISA directs agencies to investigate if Russian hackers stole Microsoft account details CYBERSECURITY

Programs submenu

Regions submenu, topics submenu, book event - we win, they lose: republican foreign policy & the new cold war, in conversation with yoichi iida: the hiroshima ai process & next steps for global governance, the impossible state live podcast: assessing south korea's national assembly election, quality education for security and economic growth.

- Abshire-Inamori Leadership Academy

- Aerospace Security Project

- Africa Program

- Americas Program

- Arleigh A. Burke Chair in Strategy

- Asia Maritime Transparency Initiative

- Asia Program

- Australia Chair

- Brzezinski Chair in Global Security and Geostrategy

- Brzezinski Institute on Geostrategy

- Chair in U.S.-India Policy Studies

- China Power Project

- Chinese Business and Economics

- Defending Democratic Institutions

- Defense-Industrial Initiatives Group

- Defense 360

- Defense Budget Analysis

- Diversity and Leadership in International Affairs Project

- Economics Program

- Emeritus Chair in Strategy

- Energy Security and Climate Change Program

- Europe, Russia, and Eurasia Program

- Freeman Chair in China Studies

- Futures Lab

- Geoeconomic Council of Advisers

- Global Food and Water Security Program

- Global Health Policy Center

- Hess Center for New Frontiers

- Human Rights Initiative

- Humanitarian Agenda

- Intelligence, National Security, and Technology Program

- International Security Program

- Japan Chair

- Kissinger Chair

- Korea Chair

- Langone Chair in American Leadership

- Middle East Program

- Missile Defense Project

- Project on Fragility and Mobility

- Project on Nuclear Issues

- Project on Prosperity and Development

- Project on Trade and Technology

- Renewing American Innovation Project

- Scholl Chair in International Business

- Smart Women, Smart Power

- Southeast Asia Program

- Stephenson Ocean Security Project

- Strategic Technologies Program

- Transnational Threats Project

- Wadhwani Center for AI and Advanced Technologies

- All Regions

- Australia, New Zealand & Pacific

- Middle East

- Russia and Eurasia

- American Innovation

- Civic Education

- Climate Change

- Cybersecurity

- Defense Budget and Acquisition

- Defense and Security

- Energy and Sustainability

- Food Security

- Gender and International Security

- Geopolitics

- Global Health

- Human Rights

- Humanitarian Assistance

- Intelligence

- International Development

- Maritime Issues and Oceans

- Missile Defense

- Nuclear Issues

- Transnational Threats

- Water Security

Updates on the Release of the U.S. National Action Plan on Responsible Business Conduct

Photo: Artinun/Adobe Stock

Critical Questions by Scott Busby and Lauren Burke

Published April 8, 2024

On March 20, 2024, the Biden administration released its updated National Action Plan on Responsible Business Conduct (NAP). Secretary of State Antony Blinken had promised the update in a statement on June 16, 2021, the 10th anniversary of the adoption of the UN Guiding Principles on Business and Human Rights (UNGPs) . The NAP is a framework for how the government, private sector companies, and other stakeholders can promote responsible business conduct (RBC), positively impact the communities in which they operate, and work with other stakeholders to support business practices that are transparent and accountable, respect human rights, and promote good governance. This updated version of the NAP is the culmination of numerous rounds of consultations with experts, inputs provided in response to a Federal Register Notice, and coordination across multiple government agencies.

Q1: What is a NAP, and how does it work?

A1: The UN Working Group on Business and Human Rights defines a NAP as an “evolving policy strategy developed by a State to protect against adverse human rights impacts by business enterprises in conformity with the UN Guiding Principles on Business and Human Rights.” Today, 26 countries have NAPs related to the UNGPs in place, showing a growing consensus around the importance of a clear business and human rights strategy. In addition to the UNGPs, the United States has incorporated into its NAP commitments relating to the Organization for Economic Cooperation and Development Guidelines for Multinational Enterprises on Responsible Business Conduct (OECD Guidelines), which are “recommendations jointly addressed by governments to multinational enterprises to enhance the business contribution to sustainable development and address adverse impacts associated with business activities on people, planet, and society.” Among other things, those guidelines call for corporate action to address corruption and promote protection of the environment.

As the name suggests, NAPs are not laws or regulations in themselves. Rather, NAPs present a roadmap that governments can use to announce commitments to develop laws, regulations, or guidance or undertake other efforts to enhance respect for human rights by the private sector and promote RBC. Germany, for example, committed in its 2016 NAP to explore the possibility of mandatory due diligence guidelines and followed up on that commitment by conducting a thorough assessment of how many German companies were undertaking due diligence efforts on their own. After the assessment determined that fewer than a quarter of German companies were doing so voluntarily, the German parliament adopted mandatory due diligence legislation in 2021.

The first U.S. NAP was released just weeks ahead of the end of the Obama administration in December 2016 and was largely made up of actions that U.S. agencies were already taking to advance RBC. While the Trump administration continued to take action on some of these commitments, such as the one by U.S. Customs and Border Protection (CBP) to enforce the prohibition on entry of goods made with forced labor, it basically ignored the NAP, meaning virtually all other NAP commitments were deprioritized.

Q2: How was the development of this NAP different from the Obama administration’s?

A2: The Obama administration’s NAP received mixed reviews on both process and substance. While supporters, for instance, praised the NAP’s commitment to increase enforcement of import prohibitions on goods made with forced labor, critics highlighted the lack of transparency in its development, its failure to go beyond preexisting policies and practices, and the “low bar” that it set by focusing on voluntary efforts by companies rather than proposing robust government requirements.

When Blinken announced that the Biden administration would revise and update the NAP in 2021, the process was intentionally designed to be more inclusive from the start. A Federal Register notice was issued to formally solicit input from the public, which generated 275 distinct policy recommendations. To develop those recommendations, outside organizations—including the CSIS Human Rights I nitiative—held numerous roundtable discussions with businesses, civil society organizations, academics, and other experts on specific areas of interest, resulting in robust discussions intended to help shape recommendations that were both reasonable and ambitious.

Q3: What is in the Biden administration’s NAP?

A3: Importantly, the Biden administration’s NAP articulates the general U.S. government expectation that businesses—regardless of their size, sector, operational context, ownership, or structure—conduct human rights due diligence (HRDD) in assessing the human rights–related risks in their operations and supply chains in line with the standards in the UNGPs, the OECD Guidelines, and the International Labor Organization’s Tripartite Declaration of Principles Concerning Multinational Enterprises and Social Policy . The NAP emphasizes that these standards should be treated as a floor, not a ceiling, and that HRDD “should be an integral part of decision-making and embedded into existing risk management systems with support from the highest levels of the business.” It also describes some elements of HRDD, including metrics to assess and address risks; ongoing assessment, monitoring, and evaluation; consistent stakeholder engagement; public communication; a grievance mechanism; and alignment with human rights instruments, although it does not expressly indicate that these are required or even recommended HRDD characteristics. In this regard, the NAP reflects the general voluntary approach that the U.S. government takes on HRDD, as compared to the mandatory approaches adopted in Germany and France and under consideration in the European Union .

The NAP identifies four priority areas for action: (1) establishing a Federal Advisory Committee on Responsible Business Conduct; (2) strengthening respect for human rights in federal procurement policies and processes; (3) strengthening access to remedy; and (4) providing resources to businesses. In each of these areas, the NAP lists specific commitments by relevant U.S. agencies. The NAP also includes commitments under the themes of technology; workers’ rights; environment, climate, just transitions; and anti-corruption, which reflect the broader character of the issues addressed in the OECD Guidelines.

Some of the NAP commitments describe concrete actions while others are more exploratory in nature without definite outcomes. The more concrete commitments include, for instance, the establishment of the RBC Federal Advisory Committee, which provides an ongoing, official forum for civil society, business, academics, and affected communities to raise concerns and make recommendations with relevant government officials. On procurement, the Department of State promises to develop a new human trafficking risk mapping process for high-risk and high-volume contracts to assist the acquisition workforce as well as federal contractors in conducting greater due diligence. (That said, some civil society advocates have expressed disappointment that the procurement commitments do not extend beyond the anti-trafficking restrictions in current law.) CBP, meanwhile, commits to drafting guidance to direct the proactive consideration of suspension and debarment whenever CBP issues a penalty under laws designed to prevent the importation of goods made with forced labor—a welcome addition to the penalties that might be imposed against those who try to import such goods. To strengthen access to remedy, the State Department commits to significant reforms to the National Contact Point process established under the OECD Guidelines, which is designed to provide aggrieved parties a vehicle to file complaints against companies allegedly responsible for acts contrary to those guidelines and then help to resolve those complaints. The Department of the Treasury also commits to advocate for effective remedy systems at multilateral development banks, while the U.S. International Development Finance Corporation promises to strengthen protections against reprisals for groups and individuals who raise concerns about DFC programs, and the U.S. Export-Import Bank commits to strengthening its remedy procedures—all of which will be important outcomes if they are achieved. And in providing resources to businesses, the Department of Labor commits to creating an RBC and Labor Rights Information Hub, a potentially useful online repository of all relevant U.S. government guidelines and information that businesses and others can turn to to get the information they need to conform their behavior to U.S law and policy.

Those NAP commitments with less clear outcomes include a State Department commitment to evaluate and assess the impact of potential approaches to implementing RBC Reporting Requirements. In the area of procurement, the Department of Defense (DOD) promises to conduct a review to evaluate the value of encouraging or requiring membership in the International Code of Conduct Association for Private Security Providers’ Association for its private security company vendors, a recommendation by advocates that has been pending for over a decade. And the Department of Labor commits to exploring the effects of the digitalization of the labor market on workers’ rights and identifying best practices for companies to address negative impacts—a worthy goal but with an uncertain result.

Q4: What impact is the NAP likely to have?

A4: Insofar as the Trump administration ignored the first NAP, the impact of the Biden administration’s NAP will hinge on whether President Biden remains in office for a second term. While some of this NAP’s commitments announce significant actions already taken or about to be taken, others will take time to carry out, especially those that entail reviews, consultations, or further internal U.S. government deliberations. Thus, as was the case with the Obama NAP, it is unfortunate that this updated NAP is being issued so late in the administration. That said, the updated NAP demonstrates the Biden administration’s commitment to bringing its policies and procedures regarding the private sector in line with international standards, which will help to reinforce those standards both domestically and abroad. While many of the updated NAP’s commitments, if carried out, would call only for voluntary action by companies (unlike the mandatory due diligence frameworks in Europe), they usefully supplement existing binding law and make clear what is expected of companies while allowing them to forge their own paths in enhancing their respect for human rights and RBC.

Scott Busby is a senior associate (non-resident) with the Human Rights Initiative at the Center for Strategic and International Studies (CSIS) in Washington, D.C. Lauren Burke is senior program manager with the CSIS Human Rights Initiative.

Critical Questions is produced by the Center for Strategic and International Studies (CSIS), a private, tax-exempt institution focusing on international public policy issues. Its research is nonpartisan and nonproprietary. CSIS does not take specific policy positions. Accordingly, all views, positions, and conclusions expressed in this publication should be understood to be solely those of the author(s).

© 2024 by the Center for Strategic and International Studies. All rights reserved.

Scott Busby

Lauren Burke

Programs & projects.

How to Optimize Your Federal Business Development Workflow

IN THIS ARTICLE

How to Define Your Federal Business Development Strategy

Difficulties in federal business development, tools and intelligence to streamline your workflow.

[Use Bloomberg Government’s focused data sets, proprietary tools, and expert analysis to fill your pipeline and grow your business now.]

Managing federal business development workflows can quickly become an unwieldy process, especially when it involves large government contracts that need input and coordination across multiple parties. Building and monitoring the entire opportunity pipeline, from the initial draft request for proposal to winning the final contract, often requires extensive research on information that’s fragmented across multiple platforms, spreadsheets, emails, and messages.

For business developers, this means a lot of time spent finding and gathering both quantitative and qualitative data on individual opportunities, market trends, government spending, networks and partnerships. Optimizing this workflow is essential to building robust pipelines, closing contracts, and growing your federal business.

Winning Federal Contracts on the Top 20 Contract Vehicles

With the right strategy in place, contractors can find and win new contracts for a predictable pipeline.

Before you’re able to optimize your workflow, you must first define your business development strategy. This is the plan of action your company will use to identify new opportunities, build out their pipeline, write the proposals, and ultimately win contracts. Accomplishing this goal requires a detailed plan and an immense amount of research into market conditions, government spending trends, and competitor analysis.

To define your company’s business development strategy and optimize your workflow, consider conducting both a Black Hat and White Hat review. These assessments provide valuable insights into the current market size, your company’s current position in it, and your competitors’ strengths and weaknesses.

The Data You Need

Gain the certainty you need for your business through key information on all federal budget, solicitation, and spending activities.

Black Hat Review

A Black Hat review is all about the competition. You’ll want to write a proposal from their point of view to gain a better understanding of how they would secure the deal. Make a note of any advantages your competitors might have, either in the products or services themselves or their opportunity funnels, and keep track of their weak points.

This exercise can help you determine how your company stacks up to the competition, the right competitive price point at which to market your solution, and whether or not you can win the contract. You’ll also gain key insights on how to position your company against your competitors while building customer relationships with program managers and contracting officers.

White Hat Review

Whereas a Black Hat review focuses on your competitors, a White Hat review targets your company’s capabilities and solutions. This is when you utilize the actionable information from research and assessments to improve your win probability.

Assess and minimize your own weak spots, and explore how your market solutions compare to the competition. It might reveal that you need a partner for a contract or that a niche is oversaturated. In any case, you can use this time to tackle any internal issues, adjust pipeline goals, and target competitor pitfalls with your solutions.

[Explore the tenth annual BGOV200 Federal Industry Leader rankings and download the full report.]

While it might be easy to say “define your business development strategy,” taking the necessary actions to create and implement a detailed pipeline plan is no simple feat. Business developers face many challenges throughout their workflows, from time-consuming research on opportunities to qualifying partnerships and contract leads.

Some common frustrations among business development teams include:

- Identifying areas of opportunity in a niche market.

- A shortage of pipeline opportunities and inaccurate information.

- Aggregating and analyzing accurate, reliable data and contracts to win work.

- Staying up-to-date on government spending trends and market conditions.

- Finding the right agency and vendor contacts.

- Facilitating calls or meetings to gain information and expand their networks.

- Clearly communicating with contracting officers.

- Ensuring accurate release dates for RFPs.

With information buried across a multitude of channels, business developers spend most of their time tracking it down or contacting people. These difficulties often hinder strategic growth planning, resulting in companies falling short of their pipeline goals. However, there are strategies and solutions that can help you overcome these hurdles with numerous added benefits.

Bloomberg Government offers a powerful suite of features designed to optimize your entire federal contracting workflow. With BGOV, business developers can easily create viable pipelines that win task orders on contracts and close deals.

Opportunity Search is the market’s most comprehensive search tool. With fast, accurate, and reliable information and access to a vast database of 31+ million contracts, BGOV provides business developers with the resources they need to save time while pursuing government contract opportunities.

BGOV Alerts offers proactive email updates on opportunities and markets of interest. Based on recompete data, machine learning algorithms can forecast which competitors might bid on the same project. BGOV Workspaces can also help you build your pipeline, qualify potential opportunities, and collaborate with team tools.

Backed by the power of Bloomberg News and proprietary expert analytics combined with powerful market intelligence tools provide business developers with a centralized platform for reliable information on current market conditions, government spending trends, and new contract opportunities. Not only does this present valuable context for current strategies and business decisions, it also saves time researching information by organizing disparate data stored on separate systems platforms.

With enhanced pipeline visibility and access to key market insights and information, BGOV enables business developers to produce accurate forecasting and strong opportunity pipelines. This translates into more contracts won and deals closed, growing your federal contracting business and network.

Market Intelligence to Inform Business Development

Bloomberg Government is your source for news, analysis, and data that covers mission-critical developments. From purchasing trends to supply chain, with BGOV, you’re always a step ahead.

Bloomberg Government helps you streamline the process of taking an opportunity search result from potential to pipeline – and proposal ready. Unparalleled document search capabilities allow you to seek out undiscovered opportunities, gaining a competitive advantage. Track these solicitations and perform competitive analysis to better understand your current market position. Competitive and contract intelligence provides you with accurate, up-to-date information so you can save time on research and focus on business development.

With Bloomberg Government, you receive reliable, actionable data that can propel your opportunities through your pipeline and deliver results. To learn more about how BGOV can help optimize your business development workflows, request a demo .

Find the right opportunities with BGOV’s unmatched data sets.Enhance your view of the market. Opportunity Search enables you to find and exclude keywords in documents attached to solicitation notices to surface relevant opportunities in no time at all.

Request a demo

Reference Shelf

- Report: BGOV200 Federal Industry Leader rankings

- Webinar: Contracts to Watch: GWACs & MACs

- Article: Partnering with 8(a) companies as a large contracting firm

- Article: The Top 10 IT Contractors

- Article: Federal Contract Spending Trends in Five Charts

- Article: How to Build Your Pipeline With the Right Federal Contracts

- Article: How to Size Your Market to Strategically Grow Your Federal Business

How Lobbying Firms are Changing their Structures and Advocacy Strategy

Contractor impacts: fy24 defense appropriations, artificial intelligence market profile.

Why are States Beginning to Mandate Small Business Retirement Plans?

For many people, reaching a financially secure retirement may seem more like an unrealistic daydream than a future reality. Too few people are adequately saving for their retirement, too many are relying on Social Security to fund their golden years, and too often, employees don't have a savings plan available through their employer to help. If we continue down this path, the future (and the economy) may look drastically different than what we envision today.

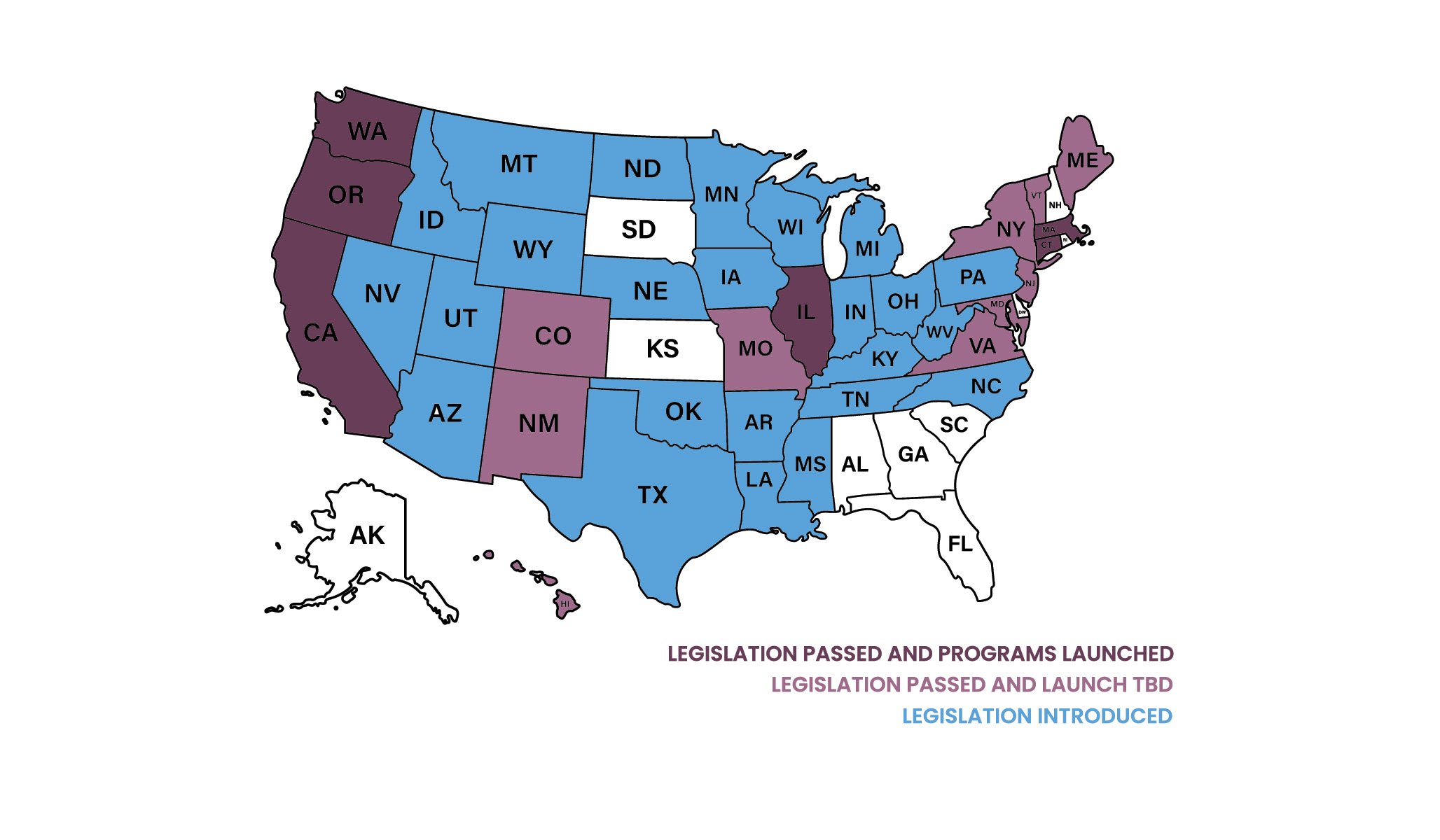

As a result, state governments are stepping in. To help today’s workforce more adequately prepare for a financially secure future, state governments across the country have started outlining legislation that requires all types of employers to offer some type of retirement plan for their employees to save in. In the last ten years, over half of the states have introduced legislation at the state level to implement or study options for state-sponsored retirement savings plans—but is this really necessary?

Why retirement state mandates are necessary

A declining number of Americans are confident in their ability to live comfortably throughout retirement—and among those who don't feel confident , 40 percent say their lack of confidence is due to having little to no savings. 1 Pair that with the fact that people have the potential to live longer today than in the past, and it’s easy to see why so few people are confident they can fund their entire retirement.

Adding to the problem is that once-reliable defined benefit plans (such as pensions) became increasingly rare for employers to offer, meaning the burden of obtaining a financially-secure retirement is falling on employees—rather than their employer—now more than ever before. As we've seen, insufficient savings—coupled with subpar economic growth, rising household debt, and an increasing cost of living—have all contributed to preventing today’s workers from achieving the retirement they always envisioned.

Employees clearly need a little bit of help from their employers to reach maximum retirement readiness, but reality is, the current retirement landscape doesn’t exactly have a level playing field. In reality, there are large discrepancies between employees who have access to a retirement savings plan based on their employer’s size, industry, their own education level, and the like. The state-run retirement programs require all employers—regardless of size—to offer some type of savings plan to employees, allowing workers who would otherwise not have access to a plan to begin putting away money.

Furthermore, and perhaps most importantly, states aren't just worried about the current climate in the retirement industry and among their citizenry—they’re thinking years into the future. Employees who aren’t saving enough for retirement right now and plan to live off Social Security in the future are setting themselves up to need support as they age. When a large number of people retire and don’t have adequate savings to cover things like healthcare, housing costs, and other everyday essentials, it’s the state government that ends up paying more money—both earlier and longer—than the federal government.

The root of the problem is this: people aren't as likely to save for retirement if they don’t have an easy, readymade option to do so. More than 30 percent of employees in the private sector are not offered access to a retirement savings plan through their employer. 2 How can we set today’s workforce up for a successful future when so many workers don’t even have access to a savings program? How can we realistically expect workers to own their retirement readiness if we don’t give them a way to do so?

Cue the state mandates.

How does a state mandated retirement plan help employees save more?

As we mentioned earlier, the state mandates were designed to level the retirement plan access playing field, so to speak, by providing all employees with a plan to save in, regardless of sector, company size, employee education level, etc.

To put it simply, many Americans aren’t actively engaged in saving for their future—let alone their retirement. Why would they think about something so far off in the distant future, when student loans, housing costs, and bills are piling up today ?

Providing access to an employer-sponsored plan may be just the kick workers need to get in gear and begin properly preparing for their future. In fact, 88 percent of employees who are offered a 401(k) or similar plan through their employer are saving for their retirement—but in stark contrast, less than half of workers who don’t have access to an employer-sponsored plan are saving for retirement. 3

The necessity seems obvious.

How state mandates could affect small business owners

The mandates will help today's workers prepare for a more secure retirement in the future, but how will the business owners, who are now being mandated to offer a retirement plan to employees, be affected? Cost may be an initial concern for some—but in reality, the mandates aren't going to take funds out of small business owners’ pockets since the plan will be state-funded and state-run.

Additionally, the state mandates will allow business owners to save for their own retirement—which may not have been an option before if no plan was offered through the business and the owner never opened an Individual Retirement Account (IRA) for themselves.

Types of state-sponsored retirement programs

While the goals of the state mandated retirement programs all center around helping workers reach retirement readiness and future financial independence, the specifics of the mandates themselves vary by state. The local state governments were tasked with maximizing effectiveness to safeguard our collective future as a society, while minimizing cost and financial risk to the employers the mandates are required for. To help accomplish this, state legislations have outlined four retirement program models.

- Mandatory auto-IRA programs

- Voluntary retirement plan marketplace

- Voluntary state-based open multiple employer plans (MEPs)

- Voluntary payroll deduction IRA programs

Click on the map below to learn more about the program details and guidelines for each state's mandated retirement program.

It's important for employers to note that while these four program models would satisfy the mandate within their specific state, there are additional options that would do so as well.

What options do business owners have to satisfy retirement state mandates?

Business owners have a variety of options to satisfy the retirement mandate in their state; they can choose the state-sponsored program or decide to offer a different type of qualified plan instead—like a 401(k) or a pooled employer plan (PEP).

Ascensus offers a variety of retirement plan options that satisfy state mandate regulations and are designed with business owners and their financial advisors in mind.

To learn more, contact our retirement specialists today at 800-345-6363.

1" 2023 Retirement Confidence Survey." Accessed June 28, 2023. https://www.ebri.org/docs/default-source/rcs/2023-rcs/2023-rcs-short-report.pdf?sfvrsn=7c8d392f_6 .

2 "Retirement plans for workers in private industry and state and local government in 2022." Accessed June 29, 2023. https://www.bls.gov/opub/ted/2023/retirement-plans-for-workers-in-private-industry-and-state-and-local-government-in-2022.htm .

3 "Post-Pandemic Realities: The Retirement Outlook of the Multigenerational Workforce." Accessed July 11, 2023. https://transamericainstitute.org/docs/default-source/research/post-pandemic-retirement-realities-multigenerational-workforce-report-july-2023.pdf

Need help finding something?

States With Retirement Plan Mandates: Guide for Small Businesses

Discover the states with retirement plan mandates and understand the impact on businesses. Learn about the requirements and penalties for non-compliance.

Published on Jan 05, 2024

Penelope team.

While employer-sponsored retirement plans are largely voluntary across much of the country, in some places that reality is changing.

In the absence of any federal laws requiring that employers offer retirement plans, a growing number of states are passing legislation mandating that businesses provide these types of benefits for employees.

While the number of states that already have such programs in place remains small at 16 states, the good news is that over the past decade, some 47 states have begun working on this issue, either taking steps toward adopting a mandated retirement program or introducing related legislation, which is substantial progress, according to Georgetown University’s McCourt School of Public Policy Center for Retirement Initiatives (CRI).

With these mandates becoming more common, it’s important to understand whether your business is impacted by such requirements and what steps are needed to comply. Here’s a closer look.

What is a State-Mandated Retirement Plan and Who is Impacted?

A state-mandated retirement plan is a retirement savings program that is mandated by the state government for private-sector employees who do not have access to an employer-sponsored retirement plan. These programs are designed to make it easier for small businesses to offer retirement savings options to their employees.

Several states in the U.S have implemented these state-mandated retirement plans, also known as auto-IRA programs. In these programs, employers who do not offer a workplace retirement plan are required to automatically enroll their employees into a Roth Individual Retirement Account (IRA) managed by the state. The employees can then contribute a portion of their paycheck to this account.

Each state's program varies in terms of the specific rules and regulations, but the general idea is to increase retirement savings among workers who may not otherwise have the opportunity to save through an employer-sponsored plan. It's important to note that while these programs are state-mandated, participation for employees is usually voluntary.

Remember that while these plans can offer a solution for some businesses, they might not be the best fit for everyone. Depending on the specifics of your business and your employees' needs, other options like 401(k) plans might be more beneficial. Reach out to our team for a complimentary call if you want to compare your retirement options.

Penalties for Non-Compliance with Your States Mandated Retirement Plans

Equally important to understand as a business owner, states with retirement plan mandates may charge steep penalties for not providing employees with access to a retirement plan.

In California, for instance, the current guidelines stipulate that employers with an average of four or fewer employees will be able to participate and will be required to join CalSavers by December 31, 2025, if they do not sponsor a retirement plan. Employers that fail to do this are subject to a penalty of $250 per eligible employee for the first non-compliance notice and an additional $500 per eligible employee if the non-compliance continues another 180 days or more after notice.

However, penalties and requirements vary by state, so it’s important to do your research and understand the local laws.

Why are States Adopting Retirement Plan Mandates?

There’s a retirement savings crisis in the United States. A report from the Federal Reserve reveals that one in four Americans have no retirement savings. A separate report , this one from the Employee Benefit Research Institute (EBRI), found that the aggregate retirement savings shortfall for all U.S. households ages 35 to 64 as of January 1, 2020, was $3.68 trillion.

State-mandated retirement plans are an attempt to help address these types of troubling statistics. Oregon was the first state in the nation to start enrolling private sector employees in a state-operated retirement plan. The state initiated OregonSaves back in 2017, according to the Pew Charitable Trusts. Some of the other early leaders included California, which initiated CalSavers in 2019, and Illinois, which kicked-off its plan in 2018.

Which States Already Have Retirement Plan Mandates?

The number of states actively considering mandated retirement plans is rapidly growing. Below is an update on which states have mandated retirement plans as of January 2024.

California

Under state legislation, businesses that do not provide a retirement plan of their own must facilitate the CalSavers program. If your business, in the preceding calendar year, employed on average a minimum of five employees based in California, with at least one being 18 years old or more, and does not sponsor a qualified retirement plan, it is obligated to register for CalSavers .

Colorado

In accordance with Colorado law, all businesses that have been operational for a minimum of two years and employ five or more individuals are obligated to facilitate the Colorado SecureSavings program . This mandate applies specifically to those businesses that currently do not offer a qualified retirement plan for their employees.

Connecticut

In Connecticut, state law mandates that employers, regardless of whether they are for profit or not-for-profit, must facilitate the state's retirement savings program, MyCTSavings , under certain conditions. This applies if the employer had five or more employees in Connecticut as of October 1st of the previous calendar year and paid at least five of those employees a minimum of $5,000 in taxable wages in that same year. Furthermore, this requirement is applicable to those employers who currently do not offer a qualified, employer-sponsored retirement savings plan.

Under Delaware law, businesses employing more than five employees that do not currently offer a retirement plan are required to participate in the DE EARNS program. The goal of this program is to facilitate retirement savings for their workers and increase access to retirement savings plans. The program is set to be implemented with a proposed launch date of January 1, 2025.

The Illinois Secure Choice program is their state-initiated retirement savings plan designed for employees within the state. It is mandatory for employers who have five or more employees in Illinois and do not already offer a retirement plan, to either introduce one or enroll in the Illinois Secure Choice program.

Under Maryland law, most employers are required to offer some sort of retirement savings to their employees. This can either be a traditional pension or through the MarylandSaves program. The MarylandSaves program requires workers to be at least 18 years old to participate. Importantly, it is intended for those who do not have access to an employer-sponsored retirement plan.

Massachusetts

The Massachusetts state-mandated retirement plan is the Massachusetts Defined Contribution CORE Plan . This 401(k) program has been designed specifically for non-profit organizations with 20 employees or less. It offers both tax-deferred and post-tax savings options. The CORE Plan is developed to provide a retirement savings solution for employees of eligible small non-profit organizations that might not have access to employer-sponsored retirement plans.

New York

New York's state-mandated retirement plan is known as the New York State Secure Choice Savings Program (SCSP) . This program is still under development but if you are a business owner in New York, be aware that a state mandate is underway.

Nevada

Nevada's state-mandated retirement plan is known as the Nevada Employee Savings Trust. This program was created under Senate Bill No. 305 and passed into law in June 2023. The law mandates that employers who don't currently offer retirement plans must register their employees in the Nevada Employee Savings Trust Program or an equivalent program provided by a trade association or chamber of commerce. Businesses with a staff of more than five and have been operating for a minimum of 36 months are obliged to provide access to this program or a comparable one to their employees. As of now, the program will be up and running by July 2025 and accepting contributions.

The Oregon state-mandated retirement plan is known as OregonSaves . This program is designed to provide an easy and automatic way for Oregonians to save for their future. Launched as a pilot program in 2017, OregonSaves became the nation's first state-mandated retirement savings program.

Under Oregon law, all employers are required to facilitate OregonSaves if they don't offer a retirement plan for their employees. The program is facilitated by employers and funded by employee investments. That means that businesses of all sizes, whether they employ hundreds or just one or two individuals, must either enroll their employees in the OregonSaves program or sponsor a qualifying retirement plan.

Virginia's state-mandated retirement plan is known as RetirePath Virginia . Under Virginia law, businesses with more than 25 employees, have been operating for two or more years, and does not provide a retirement plan option must to enroll in RetirePath Virginia.

The Washington Retirement Marketplace is an online portal where businesses with fewer than 100 workers and their employees can compare and enroll in retirement savings plans. The marketplace offers a variety of plans including Traditional Individual Retirement Accounts (IRA), Roth IRA, and Traditional 401(k).

While Washington State does not mandate businesses to offer a retirement plan, it provides the Retirement Marketplace as a resource for those businesses that choose to do so. Therefore, any business in Washington State can choose to use the Retirement Marketplace to facilitate retirement savings for their employees, but they are not required by law to do so.

Choosing Between a State Mandated Retirement Plan or Adopting Your Own

Businesses that operate in a state where retirement plans are mandated will need to decide whether to use the state-run plan or find an independent provider. Often, the best choice for your business will depend on your financial and administrative capabilities, as well as your short- and long-term goals.

State-run plans are inexpensive (they typically do not involve any upfront or set-up costs) and they also have minimal administrative requirements. However, state-run retirement plans can also be very limited in terms of how much they allow employees to save for retirement. Many states, for instance, offer Roth IRA programs. The annual contribution limit associated with this type of account by the IRS is just $7,000 for 2024 ($8,000 if you’re 50 or older). Additionally, there’s a limited number of investment providers available for state run investment plans and the investment funds, which are chosen by the government, may not always be the best options or even the most cost-effective options..

Opting to offer a private 401(k) plan, by comparison, allows for annual contributions of up to $23,000, according to 2024 IRS rules.

Most state-mandated IRA plans also do not allow employer contributions, which can be a drawback to consider. (Massachusetts is the exception to this rule, as it allows Safe Harbor contributions).

Additionally, there are no tax credits available to your business when utilizing a state-mandated retirement plan, but this type of benefit is available when offering a startup 401(k) plan. Eligible businesses may qualify for tax credits for the start-up or administration costs associated with a private, employer-sponsored plan. Read our article about employer tax credits to find out more.

Find the Right Retirement Plan for Your Business

As a business owner, it’s important to understand whether you’re required by state laws to offer a retirement plan for employees. An increasing number of states are implementing such mandates and for good reason. Significant numbers of Americans are vastly underprepared for retirement.

The key question to consider is whether your business and its employees would be best served by a state-run plan or a private retirement plan.

With the right plan and partner, businesses can benefit from improved employee engagement and loyalty while helping them build their retirement savings. Get started today by answering these four questions about your business and get a recommendation from our 401(k) retirement specialist.

Latest Articles

The Difference Between Roth and Pre-tax Retirement Contributions

Learn the key differences between Roth and pre-tax retirement contri...

What is the Automatic IRA Act of 2024? Small Business Retirement News

The Automatic IRA Act of 2024 would require employers to automatical...

Retirement Plans for Nonprofit Organizations

Explore a variety of retirement plans for nonprofits. Understand 403...

FAC Number: 2024-03 Effective Date: 02/23/2024

52.219-9 Small Business Subcontracting Plan.

As prescribed in 19.708 (b) , insert the following clause:

Small Business Subcontracting Plan (Sep 2023)

(a) This clause does not apply to small business concerns.

(b) Definitions . As used in this clause—

Alaska Native Corporation (ANC) means any Regional Corporation, Village Corporation, Urban Corporation, or Group Corporation organized under the laws of the State of Alaska in accordance with the Alaska Native Claims Settlement Act, as amended ( 43 U.S.C. 1601 , et seq. ) and which is considered a minority and economically disadvantaged concern under the criteria at 43 U.S.C. 1626(e)(1) . This definition also includes ANC direct and indirect subsidiary corporations, joint ventures, and partnerships that meet the requirements of 43 U.S.C. 1626(e)(2) .

Commercial plan means a subcontracting plan (including goals) that covers the offeror’s fiscal year and that applies to the entire production of commercial products and commercial services sold by either the entire company or a portion thereof ( e.g., division, plant, or product line).

Commercial product means a product that satisfies the definition of “commercial product” in Federal Acquisition Regulation (FAR) 2.101 .

Commercial service means a service that satisfies the definition of “commercial service” in FAR 2.101 .

Electronic Subcontracting Reporting System (eSRS) means the Governmentwide, electronic, web-based system for small business subcontracting program reporting. The eSRS is located at http://www.esrs.gov .

Indian tribe means any Indian tribe, band, group, pueblo, or community, including native villages and native groups (including corporations organized by Kenai, Juneau, Sitka, and Kodiak) as defined in the Alaska Native Claims Settlement Act ( 43 U.S.C. 1601 et seq.), that is recognized by the Federal Government as eligible for services from the Bureau of Indian Affairs in accordance with 25 U.S.C. 1452(c) . This definition also includes Indian-owned economic enterprises that meet the requirements of 25 U.S.C. 1452(e) .

Individual subcontracting plan means a subcontracting plan that covers the entire contract period (including option periods), applies to a specific contract, and has goals that are based on the offeror's planned subcontracting in support of the specific contract, except that indirect costs incurred for common or joint purposes may be allocated on a prorated basis to the contract.

Master subcontracting plan means a subcontracting plan that contains all the required elements of an individual subcontracting plan, except goals, and may be incorporated into individual subcontracting plans, provided the master subcontracting plan has been approved.

Reduced payment means a payment that is for less than the amount agreed upon in a subcontract in accordance with its terms and conditions, for supplies and services for which the Government has paid the prime contractor.

Subcontract means any agreement (other than one involving an employer-employee relationship) entered into by a Federal Government prime Contractor or subcontractor calling for supplies or services required for performance of the contract or subcontract.

Total contract dollars means the final anticipated dollar value, including the dollar value of all options.

Untimely payment means a payment to a subcontractor that is more than 90 days past due under the terms and conditions of a subcontract for supplies and services for which the Government has paid the prime contractor.

(1) The Offeror, upon request by the Contracting Officer, shall submit and negotiate a subcontracting plan, where applicable, that separately addresses subcontracting with small business, veteran-owned small business, service-disabled veteran-owned small business, HUBZone small business, small disadvantaged business, and women-owned small business concerns. If the Offeror is submitting an individual subcontracting plan, the plan must separately address subcontracting with small business, veteran-owned small business, service-disabled veteran-owned small business, HUBZone small business, small disadvantaged business, and women-owned small business concerns, with a separate part for the basic contract and separate parts for each option (if any). The subcontracting plan shall be included in and made a part of the resultant contract. The subcontracting plan shall be negotiated within the time specified by the Contracting Officer. Failure to submit and negotiate the subcontracting plan shall make the Offeror ineligible for award of a contract.

(i) The Contractor may accept a subcontractor's written representations of its size and socioeconomic status as a small business, small disadvantaged business, veteran-owned small business, service-disabled veteran-owned small business, or a women-owned small business if the subcontractor represents that the size and socioeconomic status representations with its offer are current, accurate, and complete as of the date of the offer for the subcontract.

(ii) The Contractor may accept a subcontractor's representations of its size and socioeconomic status as a small business, small disadvantaged business, veteran-owned small business, service-disabled veteran-owned small business, or a women-owned small business in the System for Award Management (SAM) if–

(A) The subcontractor is registered in SAM; and

(B) The subcontractor represents that the size and socioeconomic status representations made in SAM are current, accurate and complete as of the date of the offer for the subcontract.

(iii) The Contractor may not require the use of SAM for the purposes of representing size or socioeconomic status in connection with a subcontract.

(iv) In accordance with 13 CFR 121.411, 126.900, 127.700, and 128.600, a contractor acting in good faith is not liable for misrepresentations made by its subcontractors regarding the subcontractor's size or socioeconomic status.

(d) The Offeror’s subcontracting plan shall include the following:

(1) Separate goals, expressed in terms of total dollars subcontracted, and as a percentage of total planned subcontracting dollars, for the use of small business, veteran-owned small business, service-disabled veteran-owned small business, HUBZone small business, small disadvantaged business, and women-owned small business concerns as subcontractors. For individual subcontracting plans, and if required by the Contracting Officer, goals shall also be expressed in terms of percentage of total contract dollars, in addition to the goals expressed as a percentage of total subcontract dollars. The Offeror shall include all subcontracts that contribute to contract performance, and may include a proportionate share of products and services that are normally allocated as indirect costs. In accordance with 43 U.S.C. 1626 :

(i) Subcontracts awarded to an ANC or Indian tribe shall be counted towards the subcontracting goals for small business and small disadvantaged business concerns, regardless of the size or Small Business Administration certification status of the ANC or Indian tribe; and

(ii) Where one or more subcontractors are in the subcontract tier between the prime Contractor and the ANC or Indian tribe, the ANC or Indian tribe shall designate the appropriate Contractor(s) to count the subcontract towards its small business and small disadvantaged business subcontracting goals.

(A) In most cases, the appropriate Contractor is the Contractor that awarded the subcontract to the ANC or Indian tribe.

(B) If the ANC or Indian tribe designates more than one Contractor to count the subcontract toward its goals, the ANC or Indian tribe shall designate only a portion of the total subcontract award to each Contractor. The sum of the amounts designated to various Contractors cannot exceed the total value of the subcontract.

(C) The ANC or Indian tribe shall give a copy of the written designation to the Contracting Officer, the prime Contractor, and the subcontractors in between the prime Contractor and the ANC or Indian tribe within 30 days of the date of the subcontract award.

(D) If the Contracting Officer does not receive a copy of the ANC’s or the Indian tribe’s written designation within 30 days of the subcontract award, the Contractor that awarded the subcontract to the ANC or Indian tribe will be considered the designated Contractor.

(2) A statement of–

(i) Total dollars planned to be subcontracted for an individual subcontracting plan; or the Offeror's total projected sales, expressed in dollars, and the total value of projected subcontracts, including all indirect costs except as described in paragraph (g) of this clause, to support the sales for a commercial plan;