Free Business Loan Proposal Template

This business loan proposal template managed to secure funds to over 16,000 clients! If you're unsure of how your business loan requests should look, simply use this completely customizable template and get ready to close the deal! You can change the text, images, colors, your logo - it's all 100% editable.

What's in this Business Loan Proposal Template

Visually attractive cover.

No matter which industry you're writing a business loan request for, the first impression always matters. In this business loan proposal template, the first thing your creditor sees is a nicely designed cover, fit for a world-class company like yours. From the text, logo, and background image, you can change everything to make it a better fit for your needs.

The best way to start your bank loan application is with a direct and straightforward cover letter or executive summary. Use this page to clearly and briefly describe who you are, your business background, the nature of your business or start-up, and how the loan will be used to help your company succeed.

Like everything else in this proposal, it's completely editable - the colors, the text, images, layout - everything.

Business profile

Explaining what your business does and the process of using and repaying the loan may sound a bit overwhelming to small business owners. That's why we created a business profile - a page dedicated to the history of your business, along with current activity and results.

It is a perfect place to highlight your business plan, leave some links to your brochures or any other documents that will help soft sell your business.

Management experience

The best way to show potential creditors how serious you are about your business is through management experience. Describing the experience, qualifications, and skills of key members of your management team gives you the perfect opportunity to show you understand exactly what your business needs to succeed.

In this business loan proposal template, we've created a whole section for management experience. All you need to do is fill it in!

Loan request and payment

This section in the business loan proposal template is all about the numbers. Show precisely why you need business financing, the amount you are requesting, the interest rate, as well as what you will use it for.

Whether you're looking for a small business loan or a large sum of money, this is the place to write it down. Like the rest of this template, every part is editable, from the text and logo to the background image.

Financial statements

This is the section the creditor will spend the most time looking at! It is also the perfect place to include your personal financial statements, balance sheets, credit history and reports, tax returns, and any other financial document you see fit for the cause.

Next steps and supporting documents

Once the hard part of writing the loan proposal is done, use this section to attach the proof behind the story you have told. If you're feeling optimistic, you can even add a digital signature box that will allow your creditors to approve your business loan right away!

Get paid straight from the proposal

No more messing around with invoices, no more waiting for checks to clear. This proposal template lets you take payments directly from the proposal, using the integrations with PayPal, Stripe, and GoCardless.

Don't take just our word for it

Here is what some of our 10,000 users across the globe have to say

Sara K. CEO & Founder

Shade O. Business Owner

Brent R. Marketing and Advertising

150+ other free proposal templates just like these are also available inside Better Proposals

Use this professional funding proposal template to reach out to possible donors and increase your organization's visibility and credibility! The funding proposal is pre-written and saves you time while offering great success.

If you’re in the iPhone mobile app development business, you know the value of an amazingly designed proposal. Our iPhone mobile app development proposal looks amazing on all screens and comes with all the needed sections included.

Need to write a product proposal, but not sure where to start? Use this template to create your own winning proposal.

Automate your sales process with our 50+ integration partners

Import your contacts from a CRM, receive payments, chat with prospects and manage projects. All in once place. See all integrations

Your questions, answered

Common questions about plans, designs and security

Start sending high conversion proposals today

Join 10,000+ happy customers and enjoy a simpler, faster, and more professional way to win more business.

No credit card required. Cancel anytime.

Proposal Template AI

Free proposal templates in word, powerpoint, pdf and more

Business Loan Proposal Template: A Comprehensive Guide + Free Template Download + How to Write it

A complete guide to writing a winning business loan proposal template.

When it comes to securing financing for your business, having a well-crafted loan proposal is key. A business loan proposal template serves as a framework for presenting your company’s financial needs, goals, and plans for the future to potential lenders. It’s a crucial tool for businesses of all sizes looking to secure the funding they need to grow and thrive.

What sets a business loan proposal template apart from a standard proposal is its focus on financial data , projections, and the specific use of funds . This type of proposal is tailored specifically to the needs of securing a business loan and provides lenders with a comprehensive understanding of your company’s financial health and potential for success. In this article, we’ll explore the essential elements of a business loan proposal template and provide tips for creating a compelling and effective document that can help you secure the funding your business needs.

Business Loan Proposal Template

Executive summary.

In the executive summary , provide a brief overview of your business, including its history, mission, and goals. Highlight the purpose of the loan and how it will benefit the business. Include key financial data such as revenue, expenses, and projected profit.

Our company, XYZ Inc., is a technology startup specializing in innovative software solutions. We are seeking a business loan to fund the expansion of our product line and increase our marketing efforts. With the loan, we aim to grow our customer base and increase revenue by 30% over the next year. Our financial data indicates a steady increase in sales and a strong potential for continued growth.

My advice on the executive summary is to focus on the most compelling aspects of your business and how the loan will drive its success.

Business Description

Provide a detailed description of your business, including its products or services, target market, competitive landscape , and strategic advantages. This section should demonstrate a strong understanding of your industry and showcase the potential for growth with the loan.

XYZ Inc. is a leader in providing cutting-edge software solutions for small and medium-sized businesses. Our products cater to a niche market that is currently underserved by major competitors. With the loan, we plan to expand our product line to meet the growing demand in this segment. Our strategic advantage lies in our ability to customize solutions for each client, giving us a competitive edge in a rapidly evolving market.

My advice on the business description is to emphasize your unique selling points and how the loan will help you capitalize on market opportunities.

Market Analysis

Conduct a thorough analysis of your target market, including its size, growth trends, and customer demographics. Identify key competitors and assess their strengths and weaknesses. This section should demonstrate a solid understanding of the market and how your business can capture a larger share with the help of the loan.

The market for small business software is projected to grow at a compound annual growth rate of 8% over the next five years. Our target market consists of small and medium-sized businesses in the retail and hospitality industries, which collectively represent a $10 billion opportunity. Major competitors in this space lack the customization and agility that we offer, giving us a significant advantage in capturing market share with the loan.

My advice on the market analysis is to present data-driven insights and articulate a clear strategy for market penetration with the loan.

Marketing Plan

Outline your marketing strategy to acquire new customers and retain existing ones. Describe your promotional tactics , advertising channels, and sales projections. This section should highlight how the loan will fuel your marketing efforts and drive business growth.

Our marketing plan includes targeted digital advertising, strategic partnerships with industry influencers, and a referral program to incentivize customer engagement. With the loan, we aim to increase our marketing budget by 50% to reach a wider audience and drive sales. We project a 20% increase in customer acquisition and a 10% improvement in customer retention within the first year of implementing the marketing plan.

My advice on the marketing plan is to be specific about your tactics and tie them directly to the loan’s impact on customer acquisition and retention.

Financial Projections

Present detailed financial projections , including income statements, balance sheets, and cash flow forecasts. Include assumptions and explanations for your projections, demonstrating a realistic and achievable financial plan with the loan.

Our financial projections show a 25% increase in revenue and a 15% improvement in gross margin with the loan. We have accounted for the increased expenses associated with product expansion and marketing activities, projecting a net profit increase of 30% over the next year. Our assumptions are based on historical sales data, market trends , and the anticipated impact of the loan on our business operations.

My advice on financial projections is to provide a clear rationale for your assumptions and demonstrate a solid understanding of your business’s financial performance with the loan.

Download free Business Loan Proposal Template in Word DocX, Powerpoint PPTX, and PDF. We included Business Loan Proposal Template examples as well.

Download Free Business Loan Proposal Template PDF and Examples Download Free Business Loan Proposal Template Word Document

Download Free Business Loan Proposal Template Powerpoint

Q: What is a business loan proposal template?

A: A business loan proposal template is a document that outlines the details of a business’s loan request, including the amount requested, the purpose of the loan, and the proposed repayment plan.

Q: Why is a business loan proposal template important?

A: A business loan proposal template is important because it provides a clear and organized outline of a business’s loan request, which can help lenders understand the business’s needs and make an informed decision.

Q: What should be included in a business loan proposal template?

A: A business loan proposal template should include the business’s background and financial information , the purpose of the loan, the amount requested, the proposed repayment plan, and any collateral or guarantors.

Q: How should a business loan proposal template be formatted?

A: A business loan proposal template should be formatted in a professional and organized manner, with clear headings and sections to clearly present the information to the lender.

Q: Where can I find a business loan proposal template?

A: Business loan proposal templates can be found online through financial institutions, business loan websites, and other business resources. It is important to use a reputable source to ensure the template is comprehensive and accurate.

Q: What should I consider when using a business loan proposal template?

A: When using a business loan proposal template, it is important to customize the template to fit the specific needs and circumstances of the business, and to ensure that all information provided is accurate and up to date.

Related Posts:

- Loan Proposal Template: A Comprehensive Guide + Free…

- Music Business Proposal Template: A Comprehensive…

- New Business Investment Proposal Template: A…

- Investor Proposal Template: A Comprehensive Guide +…

- Investment Proposal Template: A Comprehensive Guide…

- Small Business Proposal Template: A Comprehensive…

- Startup Investment Proposal Template: A…

- Real Estate Business Proposal Template: A…

How to write a business plan for a loan from a bank.

Learn how to increase your chances of securing a bank loan with these business proposal tips.

If you want a bank loan to start a new business or expand your existing one, you’ll need a thorough business proposal (also known as a loan proposal). It shows the bank (or lender) that you’ve got a plan that’s likely to succeed.

But loan proposals can also be tedious and complicated to draft. Use the following tips to learn how to write a business proposal for a bank loan and get a head start on success.

Why writing a business proposal for a bank loan is necessary.

When you’re considering getting a loan from a bank to support your business , one important step is creating a well-thought-out business proposal. This will not only help you explain your business plans but also play a big role in helping the bank decide whether to approve your loan request. Here are the main reasons why putting together a solid business proposal for a bank loan is so important:

- Clarity. A well-crafted business proposal helps you clearly articulate your business idea, goals, and objectives to the bank. This ensures that both you and the bank are on the same page regarding the purpose of the loan.

- Risk assessment. Banks need to assess the risk associated with lending you money. Your business proposal provides them with vital information about your business model, market analysis, and strategies, enabling them to gauge the level of risk involved.

- Repayment plan. Banks want to know how you plan to repay the loan. Your proposal should outline a clear and realistic repayment strategy, including cash flow projections and a timeline for repayment.

- Financial health. Lenders need to determine if your business is financially viable and can generate enough income to cover loan repayments. Your proposal should demonstrate the financial health of your business through financial statements, revenue projections, and profit margins.

- Legal requirements. Banks need to ensure that your business complies with all relevant laws and regulations. Your bank proposal letter for a business loan should address any legal considerations, licenses, permits, or certifications required.

What does a business plan proposal for a bank loan look like?

A business plan proposal for a bank loan is typically 20 to 30 pages long and follows a structured format:

- Cover sheet. A cover sheet is often included at the beginning of the proposal. It typically contains the business name, logo (if applicable), contact information, and the date of submission.

- Executive summary. This section provides a concise overview of the entire business proposal, summarizing key points such as the purpose of the loan, business description, financial projections, and the requested loan amount. It’s usually limited to one to two pages.

- Business description. This section offers a detailed explanation of the business, its history, mission, and vision. It also outlines the industry it operates in, its target market, and its competitive analysis.

- Market analysis. Includes market research findings, including market size, trends, and customer demographics. It should also detail your marketing and sales strategies.

- Management team. Describes the qualifications and experience of key members of your management team. Include their roles and responsibilities.

- Financial projections. Includes financial statements such as income statements, balance sheets, and cash flow projections. It should also outline how the loan will be used and how it will benefit the business.

- Loan request. Specifies the loan amount you are requesting from the bank, along with the purpose of the loan.

- Collateral and guarantees. If the loan requires collateral or personal guarantees, provide details about the assets or individuals involved.

- Repayment plan. Explains your proposed loan repayment strategy, including the terms, interest rate, and repayment schedule.

- Appendices. This section may include supporting documents, such as resumes of key team members, market research data, legal documents, and any other relevant information.

How to write a business proposal for a bank loan.

When it comes to securing a bank loan for your business, the quality of your business proposal can make all the difference. Let’s go through the process of how to write a business proposal for a bank loan.

Include critical details for the business plan in the proposal.

Your bank proposal should begin by introducing your business comprehensively. Cover essential aspects such as:

- Business overview. Introduce your business with its name, legal structure, and establishment date.

- Mission. Articulate your business’s purpose and long-term goals.

- Market analysis. Provide insights into your industry, target market, and current trends.

- Company history. Share key milestones and noteworthy achievements.

- Contact information. Include up-to-date contact details.

- Leadership team. Highlight key team members, their roles, qualifications, and relevant experience.

- Legal structure. Specify your business’s legal structure and ownership.

- Products/services. Describe your business offerings and emphasize their unique features.

Outline how you’ll pay the business loan back.

Every bank loan proposal should include some standard details like how much you need to borrow and how you’ll use the loan to advance your business.

More importantly, your business proposal should outline how you plan to pay the bank back. A few things you can write out to accomplish this include:

- Three-to-five-year sales forecasts

- Cash flow projections

- Expense estimates

The more detail you include, the better. But don’t crunch a bunch of numbers on the very first page — make sure your proposal is clearly outlined and all information is grouped logically.

Break down your backup loan repayment plan.

Part of your business proposal’s job is to convince the bank that you can pay them back, whether you meet your sales projections or not. To demonstrate this, show proof of collateral (or something that secures the loan) in case things don’t go as planned after you invest in assets like new real estate, equipment, or inventory for your business.

Simplify the business plan proposal for the bank loan process.

To enhance your business plan proposal’s effectiveness for a bank loan, consider simplifying it. Create your own business proposal and make sure you have the documents required for loan approval to jump-start your path to success. It’s easy to create a PDF online for your bank loan proposal, so it’s easily accessible to share with others for feedback.

Explore everything you can do with Adobe Acrobat today.

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

What Is a Business Loan Proposal?

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

Some lenders may require a business loan proposal be included in your application for a business loan . A business loan proposal should not be confused with a business plan. While some similar information is included in both documents, a business loan proposal is more streamlined to focus attention on the loan amount you want and your repayment plan.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

How is a business loan proposal different from a business plan?

While you may be asked to include a business plan with your loan application , its use is not limited to that. Think of your business plan as a broad, long-term document that can guide you through each stage of your business, from startup to expansion to sale or closure. It includes information on how your business is structured, how it operates and your plans for the future.

In contrast, a business loan proposal is a focused, short-term document with the purpose of securing funding for your business. The loan amount you're requesting, how it will be used and your ability to repay the loan will be of key interest to lenders.

>> MORE: What is a business loan?

What makes a good business loan proposal?

Like any document, it should be organized and well-written. The loan proposal itself can be relatively short, only a few pages, but additional documents will be added as attachments. The financial information you provide in your loan proposal should demonstrate that your business is financially sound.

Your loan proposal could be laid out in a number of ways. Before you begin, ask your lender if it has a preferred format. If it doesn't, you can use short sections to provide information and highlight specific details. Documents related to each section can be included at the end. This approach will provide a concise summary of your proposal upfront followed by attachments that can back up your statements.

Business loan proposal structure

The following are some typical sections of a loan proposal. If your lender doesn’t require a specific format, then you’ll have some flexibility in heading titles and the order of sections. After completing an executive summary and the business overview, you could rearrange the sections if appropriate for your business.

Executive summary or cover letter

Use the executive summary to briefly describe yourself and your background. Also, give an overview of your business and how you plan to use the loan funds. If you need more than a paragraph to adequately provide this information, then you can convert this section to a separate cover letter that contains a few paragraphs. However, remember that this is a summary and you'll provide more personal details and business information in other sections of the loan proposal.

Business overview

Provide the relevant history of your business, its legal structure, licenses required and a brief summary of its current activity. You can choose to cover your experience, qualifications and skills in this section. Or, if your business has multiple owners or team members who are major contributors to your operation, a separate section can be created to highlight their experience and skills. Add important details about your customers, the current market, industry trends and online marketing channels, if you use them.

Owner investment

The equity you have in your business can demonstrate your commitment to its success. Discuss the monetary investment you have in your business. This includes cash amounts you’ve invested and any retained earnings you’ve held on to.

Loan request

Be clear about the amount of money you're requesting and what it will be used for. Provide details about what will be purchased. Also, explain how you determined the loan amount you needed. Include quotes and estimates you used in your calculations.

Loan repayment plan

Using the loan terms you’ve been offered or quoted and the associated repayment schedule, explain how you’ll be able to make timely loan payments based on your projected sales and cash flow. If fluctuating sales and/or cash flow are normal in your business, explain how cash reserves or another option can be used to make payments during lean times.

>> MORE: Use NerdWallet's business loan calculator to figure out payments

Financial statements

You can provide an overview of both business and personal financial statements in this section and then include the actual statements as attachments.

Lenders will want to see business financial statements for the current period and three prior years. This list includes income statements, balance sheets and net worth reconciliations for your business. Projected income statements and balance sheets are OK if you’re a startup business.

Personal financial statements will be needed for any owner who has 20% or more equity in your business. These statements, which include personal assets, liabilities and net worth, should be current. Check with your lender to see if tax returns are also needed and the number of years.

>> MORE: Best startup business loans

Income and cash-flow projections

Explain the details of your projected income and cash-flow statements in this section. You may also want to discuss what changes you’ll make to your business if you don’t reach your projections. At a minimum provide one year of projections. Multiple years of projections will be needed if a positive cash flow can’t be achieved in the first year.

Pledged collateral

This section can be used to explain what recourse the lender will have if you can’t repay the loan, or the collateral you're pledging with the loan. Summarize the assets you're willing to use as collateral, which can be sold for cash to cover the loan debt. Provide a detailed list of these assets as an attachment.

Existing liabilities

Some lenders may request information on other debts you have. You can summarize the information here and include an attachment with details about whom you owe, their addresses, amounts owed and payment schedules.

Attachments

Finally, include any documents mentioned in the sections of your loan proposal as attachments.

Compare your business loan options

The best business loan is generally the one with the lowest rates and most ideal terms. But other factors — like time to fund and your business’s qualifications — can help determine which option you should choose. NerdWallet recommends comparing small-business loans to find the right fit for your business.

On a similar note...

What is a business loan proposal?

Advertiser disclosure.

We are an independent, advertising-supported comparison service. Our goal is to help you make smarter financial decisions by providing you with interactive tools and financial calculators, publishing original and objective content, by enabling you to conduct research and compare information for free - so that you can make financial decisions with confidence.

Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- Share this article on Facebook Facebook

- Share this article on Twitter Twitter

- Share this article on LinkedIn Linkedin

- Share this article via email Email

- • Personal finance

- • Homeownership

- • Small business loans

- • Funding inequality

- Connect with Emily Maracle on LinkedIn Linkedin

The Bankrate promise

At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Here's an explanation for how we make money .

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy.

Our banking reporters and editors focus on the points consumers care about most — the best banks, latest rates, different types of accounts, money-saving tips and more — so you can feel confident as you’re managing your money.

Editorial integrity

Bankrate follows a strict editorial policy , so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

Key Principles

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Editorial Independence

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How we make money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.

Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Starting a business can be the start of pursuing a lifelong dream. But turning a dream into reality requires putting your ideas on paper — especially if you want to secure a small business loan from a lender.

In most cases, lenders will request prospective business owners to present a business loan proposal. This relatively straightforward document informs the lender why you believe your business would be a good investment worthy of a loan. Think of it as a pitch for why you should get the loan and how you plan to repay it.

Key Takeaways

- A business loan proposal is a streamlined pitch to a lender that explains what you need the loan for and how you would pay it back

- A good business loan proposal should include financial information about your business, a high-level explanation of how your business operates and a loan repayment plan

- Business loan proposals are important documents for getting a lender to approve your loan request

Is a business loan proposal different from a business plan?

While a business plan and a business loan proposal may sound similar, they serve different goals. A business plan is more of a guide to your entire business. It takes you through the stages from start-up to operation, lays out how your company will be structured and considers your prospects and how they might affect your plans for the future.

By contrast, a business loan proposal has a simpler purpose: secure funds to start your business. This will typically be a shorter document and includes information most important to the lender, like how you plan to repay the loan in a timely manner.

Why would lenders want a business loan proposal?

Lenders typically want a business loan proposal and a business plan to better understand your business’s financial state and short-term prospects. This allows the lender to understand where your company stands in the market and how likely you are to succeed.

Lenders want to see available cash , projected revenues and other details relevant to your ability to generate profit. Lenders also want to know how much of a risk they are taking by lending you money and the likelihood that their loan will be repaid.

How to write a business loan proposal

A successful business loan proposal should be well-written and thoughtful. You will want to include essential financial documents as attachments in addition to the details about your business.

As for the format of your proposal, there are a few options, but it is best to ask the lender if there’s a preferred format. If the lender doesn’t provide guidance, you can create a document with several sections highlighting essential information for a potential lender.

1. Executive summary

Start by offering the lender information about you and your operation. Provide a brief background on yourself and an overview of your business. You can briefly explain how you want to use the funds, but keep it short as you will provide more details later on.

2. Overview of your business model

The overview should include a short history of operation, legal structure and essential details about operations, including any licensing and your company’s current revenue. You can also include information about the market that you operate in, including industry trends and details about your customer base.

3. Owner investments

Some lenders, like the SBA, require you to exhaust all other financing options before qualifying for a loan. In this section, you should show how much equity you have in your business, what you have invested or any profits. If there are other owners, lenders will also want to see what they’ve invested.

4. Loan request

Here you’ll outline the amount of money you need and how you plan to use it. Explain what you’ll purchase with the funds — like if you plan to use it for fixed assets or working capital — and how you believe it will impact the business. The loan request should also show how you determined the loan amount.

5. Loan repayment plan

The lender will want to know your plan for repaying the loan. Use this section to lay out a repayment schedule based on the loan terms. Make clear what your plan is to ensure payments are made on time and in full and how repaying the loan is likely to affect your overall cash flow. Also, explain how you would pay back the loan in case of a downturn in sales, such as cash reserves. You can include details about pledged collateral here as well.

6. Financial statements

While you’ll want to attach financial statements in full to your business loan proposal, you can provide a brief overview in this section. Provide insight into what your books look like over the last few quarters of operation, including income statements . If your business has any existing liabilities, you can also include those details here.

Additionally, you should include personal financial statements from major stakeholders in the company, usually anyone with 20 percent or more equity. These should be an overview of assets and liabilities and personal net worth for each stakeholder.

7. Income projections

In addition to past statements about your business’s operation, lenders will want to know what to expect from your business in the future. Include your projected income and cash flow statements. Include any details regarding changes you would make to your business if you fall short of projections, and provide at least one year of projections for the lender to consider.

The bottom line

Business loan proposals are important documents for business owners seeking financial support to present to a lender. They provide key details about the business as it currently operates and how a business loan would be used so that a lender can feel secure in providing funding and recouping its investment over time.

Frequently asked questions about business loan proposals

What’s the difference between a business plan and a business loan proposal, how do i write a business loan proposal.

Related Articles

How to get a business loan in 6 steps

SBA loan guide: Everything you need to know about SBA loans

How do business loans work?

What is a business line of credit and how does it work?

Proposal Templates > Loan Proposal Template

Loan Proposal Template

If you are looking to secure a new loan, a loan proposal might be your best bet. We’ve taken the guesswork out of putting together impressive looking proposals with our free and fillable loan proposal template that can be customized to your needs in minutes. Edit, deliver, and track your proposal, then get approval with built-in eSignatures.

Best proposal software ever!

I’ve tried soooo many proposal softwares and I’ll never try another one after Proposable. It’s so easy to use and it looks good, which all the others don’t.

Account Executive , Grow.com

Smart, reliable, and constantly improving.

Proposable just works. I can make visually interesting sales presentations, dynamically insert content, and execute agreements. Proposable powers our entire sales process.

CEO , Periodic

Related Templates:

Loan proposals or a loan purpose letter are formal documents that small business owners use when approaching lenders or investors. Imagine you’re a struggling baker, whose bakery is about to go belly up due to a financial crisis. In a situation like this, a loan might help you ride out these difficult days. To get a bank loan, you’d have to provide a company profile format. If you don ’ t know how to make one, check a business proposal sample doc.

A loan proposal letter typically includes the borrower ’ s name, a brief introduction of the company and the loan amount, along with the proposed method of payment and safety nets. The company introduction is supposed to help the lender understand the risk. For example, let’s say you wish to construct a small 7/11 mart. For that, you’d need a construction loan proposal sample. The lender will make a quick risk analysis to see how likely you are to return the money. The proposal also includes repayment terms, such as interest charged or the time within which the loan has to be paid back. It could include a payment schedule too, where the borrower has to pay back the loan in installments every month or three months.

Along with a loan proposal, sometimes the bank will ask for a business proposal. This usually happens when you might be looking for capital for your startup or business. Check out our business proposal sample pdf or business proposal template ppt to get a better idea.

It’s unlikely that you’ll attain a loan from the first company you approach. You ’ ll probably have to reach out to multiple banks or lenders and revise your loan plans several times. This can get hectic, so you should check out a loan proposal template or a sample request letter for working capital loans. A business proposal sample goes by many names. Some of these are bank loan proposal letter examples: business proposal format sample, or a loan proposal sample pdf. Head on over to Propsable.com; we have a huge variety of business proposal templates doc for you.

Before you apply for a loan, you need a business plan or a business idea. A business proposal is a perfect way to present your idea to lenders or investors. A business proposal usually follows a business proposal outline. If you don ’ t know what a business proposal looks like, look for a short business proposal sample or a business proposal template online. You can also find a business profile format for bank loans in word.

A good proposal will stand out and catch the eye of the lender. Discuss your business proposal ideas with an advisor to craft the perfect business proposal letter. At proposable.com, we have a large variety of business proposals that are guaranteed to suit your business. The best part is that we’re always growing! We ’ re adding new templates daily so that you never miss out on any opportunity because you’re busy crafting a proposal.

Researched by Consultants from Top-Tier Management Companies

Powerpoint Templates

Icon Bundle

Kpi Dashboard

Professional

Business Plans

Swot Analysis

Gantt Chart

Business Proposal

Marketing Plan

Project Management

Business Case

Business Model

Cyber Security

Business PPT

Digital Marketing

Digital Transformation

Human Resources

Product Management

Artificial Intelligence

Company Profile

Acknowledgement PPT

PPT Presentation

Reports Brochures

One Page Pitch

Interview PPT

All Categories

How to Write a Compelling Business Loan Proposal: A Step-by-Step Guide [Templates Included]

![business plan loan proposal template How to Write a Compelling Business Loan Proposal: A Step-by-Step Guide [Templates Included]](https://www.slideteam.net/wp/wp-content/uploads/2023/04/Business-Loan-Proposal-1013x441.jpg)

Mohammed Sameer

Billionaire Entrepreneur Mark Cuban once said, "The number one thing that small businesses need is capital.

Entrepreneurs, business owners, and startups are no strangers to this truth. Money is the lifeblood of any business, and, without it, even the most innovative idea can wither and die. Getting a business a loan is crucial for any business owner looking to expand their operations, increase production, or enter new markets. However, the harsh reality is that only 20-30% of small business loan applications are approved. In other words, you need to be in the top tier to get your hands on the funding you need to make your dreams a reality.

But don't worry; we've got you covered. In this blog, we'll walk you through the step-by-step process of creating a compelling business loan proposal that will catch the eyes of lenders and give your business the boost it needs. And to make things even better, we're also providing you with Business Loan Proposal Templates to help you create a visually stunning and professional presentation to support your proposal.

Let's get started!

Steps to Write a Compelling Business Loan Proposal to Secure Funding

Step 1: research and planning.

Research your industry, target audience, and competition to create a plan that sets your business apart. It should cover the following areas:

- Industry Trends: What are the current trends in your industry? What are the future prospects? How does your business fit into these trends?

- Target Audience: Who is your target audience? What are their needs and pain points? How can your business meet its needs?

- Competition: Who are your competitors? What are their strengths and weaknesses? How can you differentiate your business from them?

Once you've completed your research, it's time to create a plan that incorporates your findings.

Step 2: Executive Summary

It is the most critical part of your Business Loan Proposal. It's a summary of your proposal and should provide the stakeholders with a clear understanding of your business, financial needs, and future plans. Your executive summary should include the following:

- A brief introduction to your business

- A summary of your financial needs

- An overview of your future plans

- A description of how the loan will be used

Keep your executive summary concise, clear, and to the point. Remember, the reader should be able to understand your proposal within a few minutes of reading it.

Step 3: Financial Projections

The financial projections section is where you provide the reader with an overview of your company's financial performance. You'll need to provide financial projections for the next three to five years, including your income statement, balance sheet, and cash flow statement. Your financial projections should include the following:

- Revenue projections

- Expenses projections

- Profit and loss projections

- Cash flow projections

Be realistic with your projections and back them up with facts and figures.

Step 4: Marketing and Sales Strategy

The marketing and sales strategy section is where you explain how you plan to market and sell your product or service. Your marketing and sales strategy should include the following:

- Target market

- Product positioning

- Marketing channels

- Sales channels

- Sales forecasting

Be specific and provide details on how you plan to execute your marketing and sales strategy.

Step 5: Appendix

The appendix is where you include supporting documents that provide additional information about your business. Your appendix should include the following:

- Resumes of key team members

- Business licenses and permits

- Articles of incorporation

- Legal agreements

- Marketing materials

Make sure you label each document and include a table of contents for easy reference.

Step 6: Using Business Loan Proposal Templates

To make your task even easier, SlideTeam offers professionally designed Business Loan Proposal Templates that you can use as a starting point for creating your own compelling proposal.

The 100% customizable nature of the templates provides you with the desired flexibility to edit your presentations. The content-ready slides give you the much-needed structure.

Business Loan Proposal Templates We Bet On

Template 1: small business loan proposal ppt set.

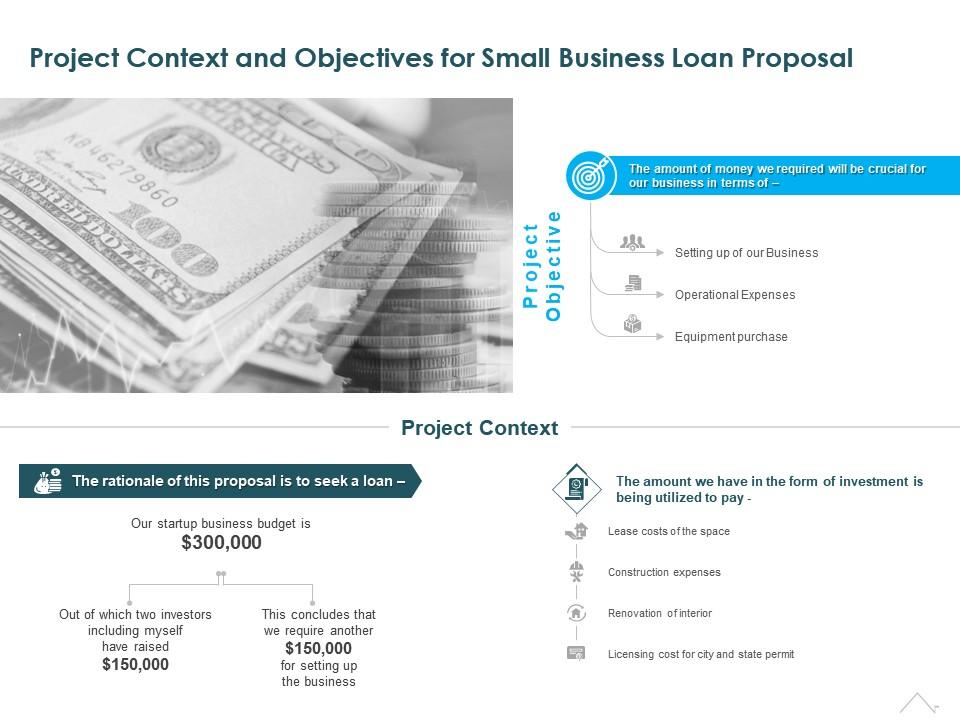

This PPT Bundle is your ticket to securing funding for your venture. With 30 sleek and modern slides, it covers the essentials of a loan proposal, including a cover letter, context and objectives, company profile, repayment plan, and operational and financial information. It also includes graphs and charts that make it easy to visualize and present complex data. Get it now.

Download this template

Template 2: Business Loan Proposal PPT Bundle

Whether you're a fledgling startup or a well-established enterprise, securing financial stability during lean times is crucial. Our PPT Set is indispensable in securing funding. It showcases your project objectives and context, highlighting challenges and solutions. With detailed budget allocation and repayment timelines, you'll impress lenders with your attention to detail. Plus, our PPT Layout covers everything from operational information to historical financial data, ensuring your proposal is comprehensive and convincing. Download now.

Template 3: Loan Proposal PPT Template

Pitch your startup business to investors and entrepreneurs with confidence using our PowerPoint Presentation. Impress your audience with a detailed company overview, showcasing your brand and current market statistics. Highlight your vision, mission, and achievements to prove your product's value. With our customizable PPT Graphic, you can present accurate cash flow data, salaries, business capacities, and outstanding debts. Back up your claims of genuineness and credibility by including a list of references. Download our PPT Set to map out your sources and uses of finance and provide a timeline for achieving your goals.

Grab this template

Template 4: Commercial Loan Proposal PPT Set

First impressions matter, especially when you're pitching a business loan proposal to a lender. Our PPT Bundle helps you streamline the process, highlighting your experience, plans, and budget allocation. You can reassure investors that their money will pay off by presenting a detailed project context and objectives. With operational information like management, marketing, and distribution, you can showcase your company's potential for growth. And by demonstrating your financial history and reputation, you can build trust and increase your chances of securing that all-important loan. Get it now.

Get this template

Template 5: Project Context and Objectives for Small Business Loan Proposal PPT Design

This exclusive PPT Slide offers valuable insights and strategic planning to secure the funding you need to fuel your growth. With a clear and concise layout, our PPT Design provides a well-structured proposal that divides your budget into two essential sections: the amount you have raised and the amount you need as a loan. It guides you in defining your plan to utilize this loan amount to further your business objectives, ensuring a compelling case for lenders or investors. Download now.

Craft a Winning Business Loan Proposal

Writing a compelling business loan proposal takes time and effort, but with the right approach, you can increase your chances of success. Use our step-by-step guide to create a professional and visually appealing proposal that showcases your business's strengths and potential. Remember, a business loan is a significant investment, and lenders want to be sure that they're making the right decision. By following our guide and using our business loan proposal PPT templates, you can create a proposal that stands out from the rest and demonstrates why your business is a good investment opportunity.

FAQs on Business Loan Proposal

What is a business loan proposal .

A business loan proposal is a document that outlines a company's financial needs, its repayment plan, and the intended use of the loan funds. The proposal provides a detailed description of the business, its market, and its operations, along with the requested amount of funding and the expected timeline for repayment. A well-written business loan proposal can help a company secure financing from investors, banks, or other lending institutions.

How do you write a business proposal request?

To write a business proposal request:

- Start by researching and identifying potential lenders or investors who may be interested in your business.

- Develop a detailed plan outlining your company's financial needs, the intended use of the funds, and your repayment plan. Your proposal should also provide information on your company's operations, target market, competition, and growth potential.

- Customize your proposal to the specific lender or investor you are targeting and provide any additional information or documentation they may require.

What are the five steps of writing a business proposal?

The five steps of writing a business proposal are as follows:

- Research: Conduct thorough research on the lender or investor you are targeting and their requirements for loan proposals.

- Outline: Develop an outline that includes key sections such as an executive summary, company overview, market analysis, funding request, and repayment plan.

- Draft: Use the outline to write the proposal, ensuring that it is well-organized, easy to read, and communicates the company's financial needs, potential, and repayment plan.

- Edit: Review the proposal for spelling and grammatical errors, clarity, and coherence.

- Submit: Submit the proposal to the targeted lender or investor, along with any additional documents they may require, and follow up promptly to answer any questions they may have.

Related posts:

- Top 10 Business Loan Proposal Templates to Ensure Funding (Free PDF Attached)

- Top 10 Conference Proposal Templates With Samples and Examples [Free PDF Attached]

- How to Design the Perfect Service Launch Presentation [Custom Launch Deck Included]

- Quarterly Business Review Presentation: All the Essential Slides You Need in Your Deck

Liked this blog? Please recommend us

Top 15 Business Proposal Cover Letter Templates With Samples and Examples

Top 10 Executive Summary Business Plan Templates with Samples and Examples

This form is protected by reCAPTCHA - the Google Privacy Policy and Terms of Service apply.

Digital revolution powerpoint presentation slides

Sales funnel results presentation layouts

3d men joinning circular jigsaw puzzles ppt graphics icons

Business Strategic Planning Template For Organizations Powerpoint Presentation Slides

Future plan powerpoint template slide

Project Management Team Powerpoint Presentation Slides

Brand marketing powerpoint presentation slides

Launching a new service powerpoint presentation with slides go to market

Agenda powerpoint slide show

Four key metrics donut chart with percentage

Engineering and technology ppt inspiration example introduction continuous process improvement

Meet our team representing in circular format

All Formats

Table of Contents

Proposal template bundle, 5 steps to draft a business loan proposal, 1. business loan proposal template, 2. restaurant loan proposal template, 3. sample loan proposal template, 4. business loan proposal example, 5. business loan proposal template, 6. business loan proposal in pdf, 7. sample loan proposal in pdf, 8. business loan proposal format, 9. printable business loan proposal template, 10. finance business loan proposal in pdf, 11. business loan proposal example, 12. printable loan proposal template, proposal templates, 11+ business loan proposal templates in google docs | word | pages | pdf.

Every business needs an adequate amount of capital to fund it’s startup expenses or pay for expansions. Business loans are taken by companies who seek to gain the financial assistance they need. This loan is like a debt that the company is obligated to repay according to the loan’s terms and conditions. Business loans are generally used for business purposes and these business loans can be of different types like bank loans, asset-based financing, invoice financing, microloans, and so on. By utilizing the proposal templates , propose any kind of business loan and get access to credit that can be repaid over a specific period.

- Google Docs

Step 1: Provide Information About Your Business

Step 2: describe your business plan, step 3: mention the purpose of the business loan, step 4: provide proof, step 5: add any supporting documents.

More in Proposal Templates

Sample business loan agreement template, 50+ business agreement template bundle, legal template loan agreement, business handbook template, transport and logistics loan application template, small business shareholder investment agreement template, equity loan investment agreement template, amendment to loan agreement template, legally binding loan agreement template, draft loan agreement template.

- Proposal Templates – 170+ Free Word, PDF, Format Download!

- 57+ Training Proposal Templates in PDF | Google Docs | MS Word | Pages

- 7+ Logistics Proposal Templates in PDF

- 13+ Recruitment Proposal Templates in Google Docs | MS Word | Pages | PDF | MS Excel

- 12+ Logistics Business Proposal Templates in PDF

- 67+ Project Proposal in PDF , Docs

- 39+ Sponsorship Proposal Templates – Free Word, Excel, PDF Format Download!

- 23+ Funding Proposal Templates – DOC, PDF, Excel, Apple Pages, Google Docs

- 22+ Bid Proposal Templates – Word, PDF, Google Docs, Apple Pages

- 16+ School Project Proposal Templates – Word, PDF

- 11+ Product Business Proposal Templates – Sample, Example

- 10+ Travel Insurance Document Templates in Google Docs | Google Sheets | Excel | Word | Numbers | Pages | PDF

- 10+ Longevity Insurance Document Templates in Google Docs | Word | Pages | PDF

- 10+ Auto Insurance Templates in Google Docs | Word | Pages | PDF

- 10+ Homeowners Insurance Templates in Google Docs | Word | Pages | PDF

File Formats

Word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates.

Financing | Templates

How To Write an SBA Business Plan [+Free Template]

Published June 13, 2023

Published Jun 13, 2023

REVIEWED BY: Tricia Jones

WRITTEN BY: Andrew Wan

This article is part of a larger series on Business Financing .

- 1. Write the Company Description

- 2. Identify Organization & Management

- 3. Specify the Market Analysis

- 4. Write Descriptions of the Products or Services

- 5. Indicate the Marketing & Sales Strategy

- 6. List Financial Data & Projections

- 7. Write the Financing Request

- 8. Fill In the Appendix & Supplemental Information

- 9. Complete the Executive Summary

- Additional Resources

Bottom Line

FILE TO DOWNLOAD OR INTEGRATE

SBA Business Plan Template Download

Thank you for downloading!

If you’re applying for a loan from the Small Business Administration (SBA), there’s a good chance that you’ll need a business plan to get approved. An SBA business plan provides a summary of the various aspects of your business, and we will guide you through the process of creating it, from writing your company description and marketing and sales strategies to completing financial data and projections and your executive summary.

Although there is no standard format, and to help you ensure nothing is overlooked, you can use our SBA business plan template above to ensure you cover the most important areas of your company. A well-prepared business plan can improve your chances of getting an SBA loan.

Step 1: Write the Company Description

This section should contain information about the purpose of your business. It should include a description of the problem or challenge your product or service aims to solve and what types of individuals or organizations will benefit.

A strong company description should also address the following questions:

- Why does your company exist?

- What problems does your business aim to address?

- What prompted you to start your business?

- What organizations or individuals will benefit from your company’s product or service?

- What makes your company different from others?

- What competitive advantages does your business offer?

- What would a successful product launch look like?

- Does your company have strategic partnerships with other vendors?

Step 2: Identify Organization & Management

Details about the legal and tax structure of your business should be included in this section. It can also be helpful to include an organizational chart of your company. You can include information about each team member’s background and experience and how it is relevant to your company:

- Highlight what business structure you have selected and why. Examples commonly include a sole proprietorship, limited liability company (LLC), partnership, S corporation (S-corp), and C corporation (C-corp)

- Include an organizational chart showing which team members are responsible for the various aspects of your company

- You can include resumes for members of your leadership team highlighting their experience and background

Step 3: Specify the Market Analysis

The market analysis section of your SBA business plan should look at who your competitors will be. Look at what they are doing well, what their weaknesses are, and how your company compares.

The SBA’s market analysis page contains information on how you can approach this. Questions you should also consider addressing should include:

- Who are the major competitors in the market?

- What are competitors doing well and are there areas for improvement?

- How does your company compare to the top competitors?

- How has the product or service evolved over time?

- Are there any trends for supply and demand throughout the year?

- What can your company do to stand apart from the top competitors?

Step 4: Write Descriptions of the Products or Services

In this section, you should detail the product or service offered by your business. You should explain what it does, how it helps your customers, and its expected lifecycle. You can also include things like any expected research and development costs, intellectual property concerns such as patents, what the lifecycle of your product looks like, and what is needed to manufacture or assemble it.

Here are some things to consider as you are working on this section:

- Description of what your product or service does

- How your product or service works

- How your customers will benefit from your product or service

- Illustration of the typical lifecycle

- Any patents or intellectual property you or your competitors have

- Pricing structure

- Plans for research and development

- Discuss plans for handling intellectual property, copyright, and patent filings

Step 5: Indicate the Marketing & Sales Strategy

Details of your marketing and sales strategy will be highly dependent on your business. It’s also something that may evolve and change over time in response to things like the overall economic environment, release of competitor’s products or services, and changes in pricing.

With that being said, here is a list of some items that should be addressed:

- Who is your target audience?

- How will you attract customers?

- How and where will sales be made?

- If applicable, what will the sales process look like?

- Where will you market and advertise your product or service?

- How does your marketing strategy compare to other companies in the industry?

- How much should you spend on marketing?

- What is the expected return on investment for marketing?

- Do you have any data showing the effect of marketing?

Step 6: List Financial Data & Projections

If your business has been running, you should include information about its finances. This should include all streams of revenue and expenses. Data for financial projections should also be included, along with a description of the methodology you used to reach those conclusions.

If available, you should be prepared to provide the following financial documents for at least the last three years to five years:

- Personal and business tax returns

- Balance sheets

- Profit and loss (P&L) statements

- Cash flow statements

- Hard and soft collateral owned by your business

- Business bank statements for the last six to 12 months

Financial projections should include enough data to offer some confidence that your business is viable and will succeed. It’s recommended that you provide monthly projections looking forward at least three years, with annual projections for years four and five.

- Projections for revenue and methodology used in arriving at these figures

- Expected shifts in revenue or expenses as a result of seasonality or other factors affecting supply and demand

- Expected expenses from loan payments, rent, lease payments, marketing and advertising fees, employee salaries, benefits, legal fees, warranty expenses, and more

You can use our SBA loan calculator to help you estimate monthly payments for the funding you’re currently looking for and projections for any additional loans you may need. Monthly payments can fluctuate depending on the terms of your loan. If you’re looking for accurate estimates, you can read our article on SBA loan rates .

Step 7: Write the Financing Request

This section is where you should specify how much funding you need, why you need it, what you’ll use it for, and the impact you expect it will have on your business. It’s also a good idea to indicate when you expect to use the funds over the course of the next three to five years.

Here is a checklist of some important items you should cover:

- How much funding you need and why

- When you will use the funds over the next three to five years

- What you will use the funds for

- The expected impact this will have on your business and how it will help reach your business goals

- The anticipation of any recurring needs for additional funding

- Your strategy for how you expect to pay off the loan

- Any future financial plans for your business

Step 8: Fill In the Appendix & Supplemental Information

This last section of your SBA business plan should include any additional information that may be helpful for lenders. This can include more detailed explanations or clarifications of data from other sections of your business plan.

Here are some examples of documents you can include:

- Business licenses

- Certifications or permits

- Letters of reference

- Photos of products

- Resumes of business owners

- Contractual agreements and other legal documents

Step 9: Complete the Executive Summary

The executive summary, which is the first section in a business plan, should be no more than one to two pages and provide a high-level overview of the items listed below. Since each section above is already detailed, a brief description of those sections will be sufficient:

- Your company’s mission statement

- The background and experience of your leadership team

- The product or service and what purpose it serves

- Your target market for the product or service

- Competitive analysis of other products and services

- Your competitive advantage or why your company will succeed

- Marketing and sales strategy

- Financial projections and funding needs

Depending on the type of SBA loan you’re applying for, certain areas of your business plan may be weighed more heavily than others. You can learn about the SBA loan options you can choose from in our guide on the different types of SBA loans .

Additional Resources for Writing an SBA Business Plan

If you’re looking for additional resources to help you write a business plan, you can consider the options below. Since a business plan is just one of many documents you’ll need, you can also read our guide on how to get an SBA loan if you need help with other areas of the loan process:

- SBA: SBA’s business guide contains information on how you can start a small business. It includes steps on creating a business plan, funding your company, and launching a business.

- SCORE: Through SCORE, you can request to be paired with a mentor and get business-related education. Educational courses come in several formats, including webinars, live events, and online courses.

- Small Business Development Center (SBDC): SBDCs provide training and counseling to small business owners. This can help with various aspects of your company such as getting access to working capital, business planning, financial management, and more. You can use the SBA’s tool to find your closest SBDC .

Having a strong SBA business plan can improve your chances of getting approved for an SBA loan. If you’re unsure where to start, you can use our guide and template to cover the most important aspects of your business. You can also see our tips on how to get a small business loan . To get even more ideas on creating a strong business plan, you can also utilize resources through organizations such as SCORE and the SBA itself.

About the Author

Find Andrew On LinkedIn

Andrew Wan is a staff writer at Fit Small Business, specializing in Small Business Finance. He has over a decade of experience in mortgage lending, having held roles as a loan officer, processor, and underwriter. He is experienced with various types of mortgage loans, including Federal Housing Administration government mortgages as a Direct Endorsement (DE) underwriter. Andrew received an M.B.A. from the University of California at Irvine, a Master of Studies in Law from the University of Southern California, and holds a California real estate broker license.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

Home > Finance > Loans

How to Properly Write a Business Loan Request

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Have to submit a business loan request letter as part of your loan application? Not sure how to get started?

We don’t blame you. These kinds of letters aren’t as common as they used to be. While online lenders don’t usually ask for small-business loan requests, some traditional banks and credit unions still do. And if you apply for an SBA business loan (a loan backed by the US Small Business Administration), you’ll need a small-business loan request as part of your loan application package.

No matter which lender you’re applying with, this guide will help you write a strong business loan request letter―and to get the business loan you need.

How to write a business loan request letter

- Start with the easy stuff

- Write a brief summary

- Add information about your business

- Explain your financing needs

- Discuss your repayment plan

- Close the letter

1. Start with the easy stuff

Writing a loan request can feel overwhelming. After all, it’s not an everyday part of being a small-business owner. What do you say when applying for a bank loan? How do you write a business proposal for your loan application? What’s your lender even looking for in a business loan request letter?

That’s why we suggest starting your request writing process with the easy bits: formatting.

You’ll want to begin your business loan request with some pretty standardized formatting that includes your contact information, the date, your lender’s contact information, a subject line, and a greeting.

Typically, you’ll want to format the beginning of your small-business loan request roughly like this:

First and last name

Business’s name

Business’s phone number

Business’s address (this one is optional)

Lender name (or loan agent’s name and title, if you have one)

Contact information for your lender or loan agent

Subject line

Obviously you can simply plug in the relevant information for most of this. Easy peasy, right?

You’ll really only have to come up with your own subject line and greeting. But don’t overthink it. Something like this will work just fine for your subject line:

- Re: [Your business’s name] business loan request for [loan amount]

Likewise, keep your greeting simple. “Dear [lender]” or “Dear [loan agent]” will do quite nicely.

Got all that? Then you’re ready to get into the actual loan request.

By signing up I agree to the Terms of Use.

2. Write a brief summary

Before you dive into the meat of your loan request, you should give a brief summary of your letter. Just write a short paragraph that says why you’re writing and what you want.

So you’ll probably want to include the following details:

- Business name

- Business industry

- Desired loan amount

- What you’ll use the loan for

No need to get fancy with this. You’re trying to condense the most important information into one or two sentences.

For example, your summary might look something like this:

- I’m writing to request a [loan amount] loan for my small business in the [industry name] industry, [business name]. With this loan, [business name] would [describe your intended business loan use].

As you can see, you don’t need much detail here. You’re just giving the reader a quick overview of what’s to come.

And now that you’ve given them that preview, it’s time to get more in depth.

Remember, your lender isn’t here to grade your writing. Try to use good spelling, grammar, and punctuation―but don’t stress about crafting beautiful sentences.

3. Add information about your business

Your next section should add more detail about your business. You’ll want to include information like this:

- Business’s legal name (if different than name used)

- Business’s legal structure (LLC, partnership, S corp, sole proprietorship, etc.)

- Business’s purpose

- Business’s age (or date it began operating)

- Annual revenue

- Annual profit (if applicable)

- Number of employees

Now, keep in mind that you’re not trying to give your reader an encyclopedic history of your business. Instead, you’re trying to show that you have a well-established business―one that’s solid enough to deserve a business loan. So focus on relevant details that show your business’s maturity.

You can keep this section as short as a few sentences or as long as a few (brief) paragraphs. Just make sure you leave plenty of room for the next two sections.

4. Explain your financing needs

After discussing your business, it’s time to explain why you need a bank loan.

That means you’ll want to offer some details about how you plan to use your business financing. For example, you can talk about the employees you plan to hire, the building you want to expand, or whatever else you intend to do with your term loan .

Take note, though, that you also need to explain why your loan request makes sense. Because your lender doesn’t really care that you want a loan―it cares whether or not it makes sense to lend to you. You need to convince your lender that you have a good plan for your loan―one that will make it easy to repay the money you borrow.

Try to answer questions like these as you write this section:

- Why should your lender want to approve your loan application?

- What happens to your business if you get your small-business loan?

- What kind of growth will your business loan allow for?

Dig into your business plan and projections to find some good stats. Explain how hiring those additional employees will increase your revenue by a certain percentage or dollar amount. Break down how opening that add-on to your restaurant will allow you to seat a number of additional customers, and how much revenue you expect that to bring in.

The more specific you can get, the better. Because again, you’re trying to convince your lender that you’re borrowing as part of a thoughtful business plan ―not just because you want some cash.

And take your time with this part. In most cases, this section and the next one will form the meat of your business loan request letter.

As a rule, you should keep your business loan request letter to one page.

5. Discuss your repayment plan

By this point, your lender should understand what your business does and why a loan would help it grow. Now you need to prove to your lender that you can repay your small-business loan.

This doesn’t mean you have to show precise calculations breaking down your desired interest rate and monthly payment. (After all, your bank probably hasn’t even committed to a specific interest rate yet.)

Instead, talk about things like your business’s past finances, other existing debts, and any projections can you offer.

So if you have a profitable business, point that out, and discuss how that will free up cash flow to repay your loan. Offer summaries of profit-and-loss statements that show your business has been growing. Tell your lender how you’ll pay off that existing loan within a few months, so they don’t need to worry about it interfering with repayment of your new term loan.