Published In: Applications

How to Write a Loan Application Letter (with Samples)

Sometimes we need financial assistance to push through with our business idea, education, medical emergencies, or any other personal project or goals that require a huge amount of money for its realization. Basically, it is for this reason that banks and other money lending institutions exist.

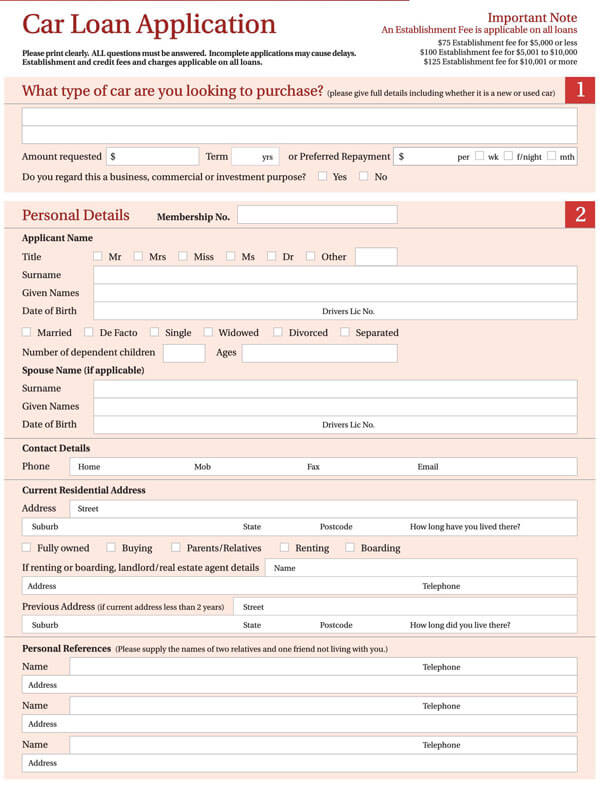

Applying for a loan from any lending institution requires the applicant to first fill out a form. Along with this form, the applicant can attach a loan application letter that provides more details on what he/she intends to do with the money and an overview of how the loan will be paid.

As a loan applicant, you need to learn how to write the loan request letter in a polite and convincing tone to appeal to your lender for your loan to be granted successfully.

What is a Loan Application Letter?

A Loan application letter is a document that informs the financial lending institution of the amount of money you are asking for, a clear outline of what you intend to do with the money, and convinces the bank why you are a good investment risk. Because it is a request, a loan application letter should be written in a polite tone, short and to the point.

The Loan Application Process

Based on the financial institution you choose, the process and time it takes for you to receive funding may vary. However, the typical loan application process may take on the following critical stages:

Pre-qualification stage

Prior to the loan contract, the potential borrower receives a list of items that they need to submit to the lender for them to get a loan. This may include Identification proof, credit score, current employment information, bank statements as well as previous loan statements.

Immediately this information is submitted, the lender reviews the documents and makes a pre-approval- meaning the borrower can move on to the next phase of the loan application process.

Loan application

In the second phase of the loan origination process, the borrower fills-in the loan application form either electronically- through mobile apps, websites, or paper-based. The data collected is then tailored to specific loan products.

The aspects that are included in the loan application form include the following;

The payment method- if it will be personal, through a check, or via online banking.

The payment frequency- There are several payment frequency methods, for example, Monthly installments, annually, or if the loan will be paid once.

The amount of interest accumulated on the loaned amount. This is the amount of money charged by the lender to the borrower on top of the amount which he/she has loaned.

The assets in the form of properties of the borrower will serve as collateral damage/guarantees in case the borrower defaults loan repayment or is unable to make his payments as per the agreed time.

Application processing

Once the application is received by the credit department, it is reviewed for accuracy, genuineness, and completeness. Lenders then use Loan Originating Systems to determine an applicant’s creditworthiness.

Underwriting process

This process only begins after an application is totally completed. In this stage, the lender checks the application in consideration of various accounts, such as an applicant’s credit score, risk scores, and other industry-based criteria. Today, this process is fully automated using Rule Engines and API integrations with credit scoring engines.

Credit Decision

Based on the results from the underwriting phase, the lender makes a credit decision. The loan is either approved, denied, or sent back to the originator for additional information. If the criteria used do not match with what is set in the engine system, there is an automatic change in the loan parameters, for instance, reduced loan amount or a different interest rate on the loaned amount.

Quality Check

Quality check of the loan application process is very critical since lending is highly regulated. The loan application is then sent to the Quality Control Team to analyze critical variables of the loan against internal and external regulations on loans. This is often the last step of the application process before funding is approved.

Loan funding

Once the loan documents are signed by both the borrower and the lender, funds are released shortly after. Nevertheless, business loans, loans on properties, and second mortgage loans may comparatively take more time to be approved due to legal and compliance reasons.

Essential Elements of a Loan Application Letter

Now that you have already understood the complex loan application process, it is important that you know the critical points to include in your loan request letter to convince your lender to give you a business loan.

Here is how to effectively write a loan application letter:

Header and greetings

The first and most important element of your business or personal loan application letter should be a header and an appropriate greeting.

In your header, include the following details:

- Your business names

- The physical address of your business

- Business telephone and cell phone numbers

- Lender’s contact details

- Lender’s or Loan Agent’s Name and Title

- A subject line stating the loan amount you are requesting for.

Once you have written your header, include a friendly but professional greeting to start off your loan application letter in a cordial tone.

Business Loan Request Summary

The body of your business or personal loan request letter should start with a brief summary of your loan request amount, why you need the loan, your basic business information, and why you are an ideal risk investment for the lender. This section should be brief and concise. Only include the relevant information to capture your loan agent’s interest and keep them reading the body of your loan application letter.

Basic Details about your Business

Ideally, this is the third paragraph of your loan application letter. Use a few short and concise sentences to give a clear outline of your business.

Be sure to include the details below:

- The legal name of your business and any DBA that your business uses

- Your business structure- if it is a corporation- partnership, individually owned, etc.

- A summary of what your business does.

- How long your business has been operational

- Total number of employees

- A brief description of your current annual revenue

Once you have provided your basic business information, it is time to write the meat of your business loan request letter- clearly explaining why you need the business loan and how you intend to recuperate the investment.

The purpose of the business loan

In the fourth paragraph of your loan application letter, explain succinctly how you will use the business loan. Additionally, tell the lender why your intended use of the business loan will be a wise business investment.

While detailing this section, be as specific as possible and demonstrate to the lender that you have carefully considered the kind of revenue generation this new debt will accomplish for your business. for instance, don’t just say that you intend to use the loan for working capital. Rather, say that you plan to increase your inventory by 45% or that you need to increase your Human Resources to 4 to generate more income by 6%.

In the same paragraph, inform the lender exactly how the loaned amount will help generate more profits necessary to cover repayment plus the interest accumulated on loan.

Proof that you’ll be able to fully repay the loan

In this section, you need to demonstrate to the lender that you can pay back the loaned amount together with interest as per the agreed repayment period. You will want to use any figures from your latest income statements or balance sheets to prove your business is financially healthy and that it is a low-risk investment decision for your lender. In case you have other existing debts, be sure to mention them and include a business debt schedule if possible. If your business is profitable, highlight that in your letter since it something that most lenders pretty much look for in successful loan applicants.

In addition to that, consider including specific cash flow projections to demonstrate to your lender how you plan to fit repayment of the loaned amount plus interest into your budget.

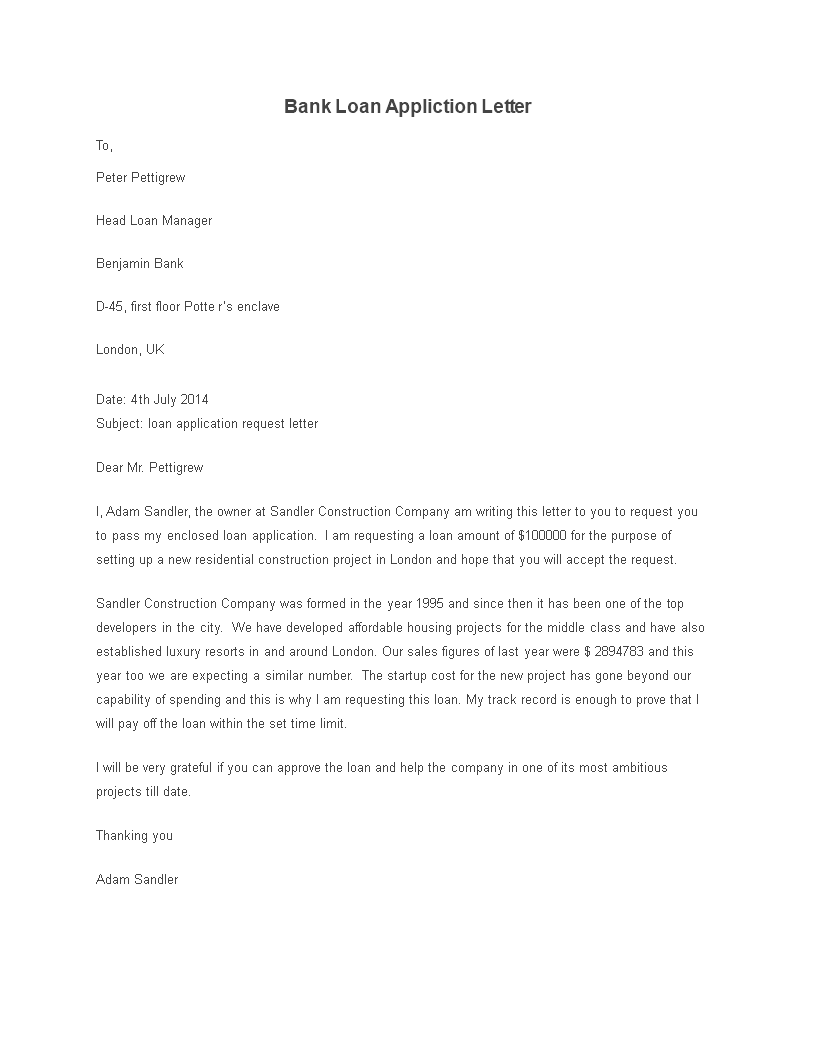

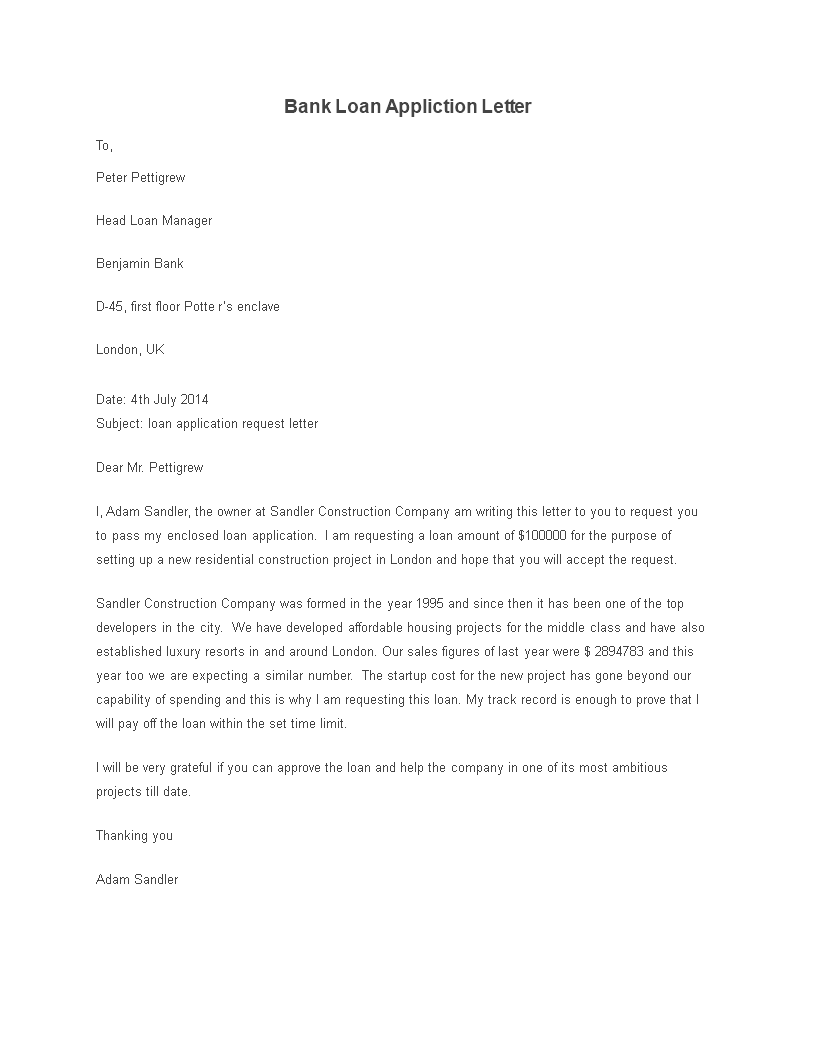

Sample: Loan Application Letter

Sample 1: business loan application letter.

Samira Mitchell,

Mitchell Face Masks Limited,

4680 Forest Road

939, New York.

January 17, 2021

Mr. Wesley Kingston

Guarantor Trust Bank

679, New York State

Ref: Loan Request for $10,000

Exactly two years ago, I started my small face mask vending business in our local market. Over the last two years, my business has picked up really well to an extent where I need to expand to a bigger face mask vending company.

It is for this reason that I am writing this letter. I am confident that there is a great market niche for face masks, especially due to the current worldwide Novel Covid-19 Pandemic. Thus far, I have had many repeat customers, new customer links through referrals, and my client base has grown rapidly. Generally, there is an increase in demand for my products; therefore, I am requesting for a loan amounting to $10,000 to be able to supply more and satisfy all my clients.

This money, along with the amount that I have saved up from my profits, will enable me to lease a large, modern storefront and to import supplies that will help me launch my business plan.

I have attached my business plan, my latest business balance sheets, current business schedules, as well as my credit history statements for your perusal and review. If you have any questions or need any further clarifications, please contact me directly on (111) 345 679 or email me at Mitchel.facemasksltd.co.ke. Thank you for your consideration.

Samira Mitchel.

Sample 2: Personal Loan Application Letter

Dear Michael,

It is common for everyone to face difficult situations and bitter realities in life. I am currently facing a situation where everything seems bleak, and there seems to be no way out of this difficult situation. I am in debt, and I need to pay at least 30% of my house’s mortgage will be taken over by the bank, and I am currently ailing and weak, I’ll not be able to survive such a nervewrecking situation.

The only way I can avoid such a fate is by paying the full amount that is needed by the bank. I can be able to do so if I am allowed to take out a loan from the office, which is a privilege that the company has granted to all the employees. I would be thankful if the company allows me to borrow the money against my monthly pay.

Mr Brandon Brown

Do’s and Don’ts of Writing a Loan Request Letter

A loan application letter may increase or break your chances of receiving funding from any lending institution. This is because it is the first thing that lenders look for in the underwriting process when you submit an application. That said, you must know the dos and don’ts of writing a winning loan request letter to help you receive the funding that you really need.

- Check your personal and business credit scores before sending a loan request letter and take the necessary steps to improve them.

- Have all your financial statements ready, including cash flow statements, business balance sheets, P$L statements, etc

- Make sure to submit all your relevant credentials along with your loan application request letter.

- Always provide the correct and factual information to avoid fraudulent consequences.

- Don’t make your letter too long and unnecessarily wordy

- Don’t use an informal format while writing the loan application letter. Instead, follow the proper rules on writing formal letters

- Don’t include any false information in your loan request letter- be it your business’s current financial health, assets, and liabilities that may be used as collateral damage in case you default payment or why you need the money.

Things to Remember When Writing a Loan Application Letter

Generally, you should always consider the following essential tips if you want to write a winning loan application letter:

- The loan application letter is a formal document. Therefore, observe the proper rules of writing a formal letter.

- Clearly state your intent to borrow a given amount of money

- Provide a vivid but brief description of why you need the money. Your explanation should be concise, genuine, and transparent. While at it, explain how you plan to use the loaned amount and be very sincere about it.

- Explain why your business is a low-risk investment decision for the lender.

- Enumerate your assets and liabilities

- Include the time, date, manner, and method that you will use to make your payment.

Free Loan Application Letter Templates

Are you looking to get some financing for your business or personal emergency? Download our free, well-crafted Loan application letter templates to help you customize your loan request letter. Our Templates includes all the critical elements of a winning loan request letter that will successfully help convince your lender to grant you the funding you need. Download our templates today to help you get started!

Collateral is defined as something that helps secure a loan. Generally, based on the type of lending institution you pick, the lender will give you less than your pledged asset value. Lenders every so often quote an acceptable loan to value ratio, meaning that if you borrow against your house, for example, and it worth $400,000, you will be given a loan amounting to $380,000. Again, this depends on the bank.

The prepayment penalty is a fee that some lenders charge if you pay off all or part of your loan before the loan’s maturity date. These do not usually apply if you pay extra principal on your loaned amount in small amounts at a time. However, it is good that you counter check with your lender.

Every lender follows a different criterion to approve a business or personal loan. The application process depends on several factors; therefore, the time taken to receive funding in your account may take anywhere from a few minutes to several days. This depends on the type of institution you choose and the type of loan you are asking for.

Acquiring a loan is sometimes a necessity in one’s business or personal life. Nonetheless, it is not always easy to get a loan as lenders are wary of granting loans due to loan repayment defaults and fraudulent borrowers. This article has provided you with great insight on loan application letters, the loan application process, essential tips for writing a winning loan application letter, and the dos and don’ts of writing a convincing loan request letter. If you keep these things in mind every time you are thinking of applying for a loan, you are sure to get the funds you need to ensure the smooth running of your business and sort any personal emergency that may come your way.

Related Documents

Bank Loan Request Letter Sample: Free & Effective

In this article, I’ll share my insights and provide a step-by-step guide, including a practical template, to help you write an effective bank loan request letter.

Key Takeaways

- Understanding Loan Request Letters: Gain insight into the purpose and structure of effective bank loan request letters.

- Step-by-Step Guide: Follow a simple, structured approach to craft your loan request letter.

- Template Included: Use the provided template to create a personalized loan request letter.

- Real-Life Examples: Learn from actual experiences and examples to better understand what banks look for.

Understanding the Purpose of a Loan Request Letter

A bank loan request letter is your opportunity to present a compelling case to the lender. It’s not just about stating your need for funds but about showcasing your financial responsibility, business acumen, and planning skills.

Key Points:

- First Impression: The letter is often the first interaction with the lender.

- Information Conveyance: It conveys crucial information about your financial need and repayment plan.

- Persuasion Tool: A well-written letter can significantly influence the lender’s decision.

Crafting Your Letter: A Step-by-Step Guide

1. gather necessary information.

- Understand the loan requirements.

- Prepare financial statements and business plans.

2. Start with a Professional Format

- Use a formal business letter format.

- Include your contact information and the date.

3. Introduce Yourself and Your Business

- Briefly describe who you are and what your business does.

- Highlight your experience and achievements.

4. State the Purpose of the Loan

- Clearly define why you need the loan.

- Explain how the loan will benefit your business.

5. Detail Your Financial Information

- Include relevant financial statements.

- Showcase your ability to repay the loan.

6. Conclude with a Call to Action

- Politely request the bank to consider your loan application.

- Indicate your availability for further discussions.

7. Proofread and Edit

- Ensure there are no errors or omissions.

- Maintain a professional tone throughout.

Real-Life Example: Success Story

In my experience, one of my clients successfully secured a significant loan by clearly outlining their business growth plan, demonstrating past successes, and providing a detailed repayment strategy. The key was clarity, precision, and a touch of personal storytelling.

Loan Request Letter Template

[Your Name] [Your Address] [City, State, Zip Code] [Email Address] [Phone Number] [Date]

[Lender’s Name] [Bank’s Name] [Bank’s Address] [City, State, Zip Code]

Dear [Lender’s Name],

I am writing to request a loan of [Amount] for [Purpose of the Loan]. As the owner of [Your Business Name], I have outlined a detailed plan for how these funds will be used and the projected growth they will facilitate.

[Insert a brief description of your business, its history, and any notable achievements.]

The loan will be utilized for [specific use of the loan funds]. This investment is crucial for [reason for the loan], and I have attached a detailed business plan and financial projections to illustrate the potential return on investment.

[Include information about your financial situation, any collateral you are offering, and your plan for repayment.]

I am committed to the success of [Your Business Name] and have a robust plan in place to ensure the timely repayment of the loan. I am available to discuss this application in further detail at your convenience.

Thank you for considering my request. I look forward to the opportunity to discuss this further.

[Your Signature (if sending a hard copy)] [Your Printed Name]

Writing a bank loan request letter is a critical step in securing funding. It’s about presenting a clear, concise, and compelling narrative that aligns your needs with the lender’s requirements. Remember, it’s not just about the numbers; it’s about the story behind them.

I’d love to hear your thoughts and experiences with loan request letters. Have you tried writing one? What challenges did you face? Share your stories in the comments below!

Frequently Asked Questions (FAQs)

Q: What is the Most Important Aspect of a Bank Loan Request Letter?

Answer: The most crucial aspect of a bank loan request letter is clarity in communicating the purpose of the loan.

In my experience, a well-defined objective, backed by a solid business plan and clear financial projections, significantly increases the chances of approval. It’s essential to concisely convey why you need the loan, how you plan to use it, and how you intend to repay it.

Q: How Detailed Should Financial Information Be in the Letter?

Answer: Financial details should be comprehensive yet succinct. From my experience, including key financial statements like income statements, balance sheets, and cash flow projections is vital.

However, the trick is to balance detail with brevity. You want to provide enough information to assure the lender of your financial stability without overwhelming them with data.

Q: Is Personal Information Relevant in a Business Loan Request Letter?

Answer: Yes, to some extent. In my dealings, I’ve noticed that including a brief background about yourself, your experience, and your role in the business helps build a connection with the lender.

It adds a personal touch and can boost your credibility, especially if your personal journey reflects your business acumen and commitment.

Q: How Formal Should the Tone of the Letter Be?

Answer: The tone should be formally professional. In all my letters, I maintain a balance between professionalism and approachability. You want to come across as respectful and serious about your request, yet accessible and personable.

Avoid overly technical jargon or casual language; aim for clear, straightforward communication.

Q: Can Including a Repayment Plan Improve Chances of Loan Approval?

Answer: Absolutely. In my experience, outlining a clear and realistic repayment plan in your letter can significantly improve your chances of approval.

It demonstrates responsibility and foresight, showing the lender that you’ve thought through the financial implications of the loan and have a plan to manage your debts effectively.

Q: Should I Mention Collateral in the Loan Request Letter?

Answer: Yes, mentioning collateral can be beneficial. In my practice, I’ve found that specifying collateral not only increases the credibility of your loan request but also provides the lender with added security, making them more inclined to approve your loan. However, be clear and precise about what you are offering as collateral.

Q: How Long Should a Bank Loan Request Letter Be?

Answer: Ideally, keep it to one page. Throughout my career, I’ve learned that brevity is key. Lenders are busy, and a concise, well-organized letter is more likely to be read and appreciated.

Stick to the essentials and avoid unnecessary details. If more information is needed, the lender will ask for it.

Related Articles

Business request letter sample: free & effective, sample letter to a company requesting something: free & customizable, business plan cover letter sample: free & customizable, payment proposal letter sample: free & effective, congratulations job offer email sample: free & effective, sample request letter for confirmation after probation: free & effective, leave a comment cancel reply.

Your email address will not be published. Required fields are marked *

- Consumer Letters

- Bank Loan Request

How to Write a Bank Loan Application Letter: Example and Writing Tips

Last updated on January 02, 2023 - © Free-Sample-Letter.com

What is Bank Loan Application?

A bank loan application is a request made to a financial institution , such as a bank, to borrow a specific amount of money. The purpose of the loan can vary, such as to fund a business venture, pay for education expenses, or make a large purchase.

In order to apply for a loan, an individual or business must complete an application that includes personal and financial information, as well as details about the purpose of the loan and the requested amount . The lender will use this information to evaluate the borrower's creditworthiness and determine whether to approve the loan and at what terms.

Step-by-Step Guide: Crafting a Successful Loan Request Letter

Here are some tips on how to write a bank loan application letter:

- Identify the purpose of the loan and the amount you’re requesting . Be specific and clearly state your financial needs. For example: "I am writing to request a loan of $10,000 to cover the costs of my daughter's tuition at XYZ University." or "I am writing to request a loan of $50,000 to fund the expansion of my small business, XYZ Company."

- Explain your current financial situation and provide evidence of your ability to repay the loan. This may include income statements, tax returns, and other financial documents. For example: "I have been self-employed as the owner of XYZ Company for the past 5 years and have consistently earned a net profit of $30,000 per year / I have been employed as a software engineer at ABC Company for the past 8 years and have a stable income of $75,000 per year. Attached, you will find my tax returns and financial statements as evidence of my ability to repay the loan."

- Describe the specific use of the loan proceeds and how they will benefit you or your business. Be sure to include a detailed plan for how you will use the funds and how you will generate the income to repay the loan. For example: "The loan funds will be used solely for my daughter's tuition and other education-related expenses. I have a budget in place and am confident that I can make the monthly loan payments while still being able to cover my other financial obligations." or "The loan funds will be used to purchase additional inventory and hire two additional employees, which will allow us to increase our sales and profitability. I have a solid business plan in place and am confident that these investments will enable us to repay the loan within 3 years."

- Include any supporting documents that may help your case , such as financial statements or a business plan. For example: "In addition to the documents mentioned above, I have also included a copy of my budget plan, which shows my projected income and expenses for the next 3 years." or "In addition to the documents mentioned above, I have also included a copy of my detailed business plan, which outlines my marketing strategy and projected financial performance."

- Request a specific repayment plan and timeline. Be realistic and considerate of the lender's needs when proposing a repayment schedule . For example: "I am requesting a loan repayment period of 3 years, with monthly payments of $1,500. I understand that this may be negotiable and am open to discussing alternative repayment terms that work for both parties."

- Express your appreciation for the lender's consideration and provide contact information for follow-up. Thank the lender for their time and make it easy for them to get in touch with you if they have any questions. For example: "Thank you for considering my loan request. I am confident that this investment will help my business grow and thrive / I am confident that this investment in my daughter's education will pay off in the long run. If you have any questions or would like to discuss further, please don't hesitate to contact me at 555-555-5555 or by email at [email protected]."

➤ You May Also be Interested in Our Sample Letter to Request an Alternative Payment Plan from a Creditor

Need to Write a Bank Loan Request Letter? Use Our Free Templates for Success

For applying loan in a bank or financial institution.

Dear (mr/miss etc. + Loan manager name),

Following my visit to the bank yesterday where all necessary papers were filed regarding my loan request, here are a few more details pertaining to the loan.

I have been a long-standing customer with (name of bank) for over (number) years now and I recently applied for a (personal/company) loan of ($/€ amount). This loan will allow me to pay for (reason needed) which I have been planning for some time now.

My preferred loan structure, after much thought, is a (secured/unsecured) loan. I believe this is the best option for me and I also hope to be able to pay it off within (X years).

I prefer to take out a shorter loan period rather than the popular long term packages, and therefore hope that you will be able to see this as a positive factor in granting me this loan.

I am currently employed at (company name) and have been the (name of position) for (No. of years). Should you require any references or further information, please do not hesitate to contact (my boss/the HR Dept. etc.) at any time. They can be reached on (tel. no.) or via email on: ([email protected]).

As requested by (Mr./Miss X), please find (enclosed/attached) copies of my most recent bank statements for the last (3/6) months.

I am available to come in and speak with you at any time, I do hope that you will look favorably on my request and I very much look forward to hearing from you.

(name/signature)

Bank Loan Request Letter for Small Business (SBA)

Dear [Loan Manager's Name],

I am writing to request a loan of $50,000 from the Small Business Administration (SBA) to fund the expansion of my small business, XYZ Company.

I have been self-employed as the owner of XYZ Company for the past 5 years and have consistently earned a net profit of $30,000 per year. Attached, you will find my tax returns and financial statements as evidence of my ability to repay the loan.

The loan funds will be used to purchase additional inventory and hire two additional employees, which will allow us to increase our sales and profitability. I have a solid business plan in place and am confident that these investments will enable us to repay the loan within 3 years. In addition to the documents mentioned above, I have also included a copy of my detailed business plan, which outlines my marketing strategy and projected financial performance.

I am requesting a loan repayment period of 3 years, with monthly payments of $1,500. I understand that this may be negotiable and am open to discussing alternative repayment terms that work for both parties.

Thank you for considering my loan request. I am confident that this investment will help my business grow and thrive. If you have any questions or would like to discuss further, please don't hesitate to contact me at 555-555-5555 or by email at [email protected].

[Your Name]

You may also find these examples useful:

- Expert Advice: How to Write a Successful Administrative Letter

- Sample Bad Check Notice Letter: How to Request Payment for a Bounced Check

- Get Your Security Deposit Back: Use This Sample Letter for Claiming It

- Winning Grants: A Step-by-Step Guide to Crafting a Successful Request Letter

- Write a Winning Refund Request Letter with These Tips

- How to Write an IOU Letter (Writing Tips and Samples)

- How to Write a Successful Sponsorship Proposal Letter

- Email Template to Advise Customer of a Returned Check

We also recommend:

- IOU Template and Promissory Note - Sample & Free Download

- Payment Plan Request Letter - Sample & Free Download

- Bank Customer Service Representative Sample Cover Letter

- Banking Internship Sample Cover Letter

- Bank Teller Sample Cover Letter - Tips & Free Download

- Annual Leave Request Letter - Sample & Free Download

- Funeral Leave Request Letter - Sample & Free Download

- Refund Request Letter - Sample & Free Download

- Claiming Back a Security Deposit Letter (Tips & Samples)

Letters.org

The Number 1 Letter Writing Website in the world

Sample Loan Application Letter

Last Updated On December 25, 2019 By Letter Writing Leave a Comment

Loan application is written when the applicant wants to seek monetary assistance in the form of loan mostly on a mortgage of property. Since it is a request, the letter should be written in a polite tone.

Use the following tips and samples to write an effective loan application letter to a bank manager or a company.

Sample Loan Application Letter Writing Tips:

- As loan application letter is formal, the phrases and words should be chosen carefully.

- The language used should be simple and easy to understand

- The content of the letter should be short and straightforward.

Sample Loan Application Letter Template

__________ (Branch Manager’s name) __________ (Branch address) __________ __________

______________ (Your name) ______________ (Your address) __________________

Date __________ (date of writing letter)

Dear Mr. /Ms_____________ (name of the concerned person),

I have a savings account in your bank with account no._________ for the past …………… years. I want to apply for a ……………..(type of loan) loan for ………………….(state purpose) .

If you can inform me about the details and formalities required for seeking the loan, I shall make all the arrangements and meet you at the earliest.

Looking forward to meeting you,

Thanking you,

Yours Sincerely,

___________ (Your name)

Sample Loan Application Letter Sample, Email and Example/Format

Pavan Kumar 3214 Breeze apts Worli Hyderabad

The Branch Manager, Axis Bank, Station Road Branch, Hyderabad

30th September 2013

Subject: Loan application letter

Dear Sir/Madam,

I have a savings account in your bank for the last five years. I want to avail a home loan from your bank. I would like to know the details to seek a home loan from your bank.

I am a salaried employee, and I work for a central government organisation as a research scientist. You can verify my salary certificate and other details.

As the home loan interest rates have down, I would like to utilise this opportunity to buy a house. I have already booked a flat in Banjara Hills Hyderabad, and I need about Rs 35 lakhs as the loan amount. With my pay scale, I think I am eligible to seek a loan for this amount.

If you can send your representative to my place, we can discuss and finalise the loan. I shall keep all the documents ready so that there will not be a delay in processing the loan.

Looking forward to hearing from you,

_____________

Pavan Kumar

Email Format

A loan application letter is written to ask for financial credit service on some secured mortgage basis. As it is our requirement, the words should be so humble and sincere that the banker or the lender acquires total trust on the applicant. Loan application letter helps the loan applier to appeal for the various types of loans whichever he wishes to depend upon certain conditions.

I have sent this letter to you to explain my reasons behind requesting a loan modification on my mortgage. I wish to purchase a Mercedes Benz 300 Limousine costing Rs 56 lakhs. I am seeking an interest reduction down to 6.25% from my current 8.80%. I feel it is a fair percentage for you, and it is just within my means.

Without a reduction on the interest, I will not be able to afford the monthly payments. I have to choose between a loan modification and a foreclosure. I would far prefer the former, and you probably would as well. 6.25% is the most I will be able to manage, even if I cut all of my expenses out of the picture. Please consider my application seriously, and I hope to hear more from you on the matter.

Yours Faithfully,

____________

Jimmie Verna Melendez.

Related Letters:

- Sample Application Letter

- Sample Job Application Cover Letter

- Sample College Application Letter

- Sample Application Cover Letter

- Sample Scholarship Application Letter

- Job Application Letter

- Transfer Application

- Application Letter by Fresher

- Application Letter for Referral

- Business Application Letter

- College Application Letter

- Credit Application Letter

- General Application Letter

- Good Application Letter

- Grant Application Letter

- Letter Of Intend Application

- Job Application E-Mail Template

- Job Application Letter Format

- Job Application Letter Template

- Receptionist Application Letter

- Solicited Application Letter

- Summer Job Application Letter

- Work Application Letter

- Unsolicited Application Letter

- Corporation Application Letter

Leave a Reply Cancel reply

You must be logged in to post a comment.

Letter Solution

Welcome to "Letter Solution" Everything is about letter and application writing.

Bank Loan Application Letter Sample 8+ With Format

One format and 8 sample on bank loan letter.

Table of Contents

Bank Loan Application Letter Sample: Naturally, we take a loan from a bank when we fall into a money crisis. We talk to the branch manager about it. After that, he discussed everything and instructs us on all terms and conditions. Some bank managers tell to submit a request letter with the required documents. And then many people can not write a proper request letter. So I have written the post with a format and six samples that will clear your confusion and create a good idea about any type of bank loan application letter sample. Then you can write a new application in your own way. A well-written request letter for the loan can help you to be approved your application at the time of applying for a loan.

There are different types of loans in the bank. For example

- Business loan

- Personal loan

- Educational loan

- Two-wheeler loan

- Loan against property

When you will apply for a personal loan, eligibility is a must for you.

Personal loan eligibilit:

- You should be salaried person.

- You should have a job under government, public company.

- Your age should be between 25-50 years.

- You need to be an Indian citizen.

- The minimum salary should be 25000 but it depends on the city.

Application Format

Bank loan application letter.

The Bank Manager

[Name of the bank]

[Name of the branch]

[Address of the branch]

Date: …../ …../ ……

Sub: [Application for home loan]

Respected Sir/Madam,

I am ___________ [Your name]. I am a [savings/current] account holder with your branch for _____ years. I am a ______ service man. My monthly salary is deposited in my bank account. I always maintain a good balance in my account. But I need a loan for _____________ [Purpose of the loan].

I am requesting you for an amount Rs. __________ as a loan. I have enclosed all the required documents as you instructed earlier. I have read, got and agree with the term and condition of the bank.

I am waiting for positive response from you.

Thanking you

Yours sincerely

[Name of the applicant]

Contact details

Bank Loan Application Letter Sample

Bank of India

[Branch Name]

[Branch Address]

Date: 00/00/00

Sub: [Request for business loan]

Dear Sir/Madam,

With due respect, I beg to state that I have a current account with your branch. I am a businessman and run three restaurants. I need an amount of Rs. 100000/- as a loan for my business purpose.

I will be thankful to you if you will consider my request as early as possible.

Write A Letter To Bank Manager For Educational Loan

Gabgachi Branch

Delhi-700 071

Date: 12/11/2021

Sub: Application for educational loan

I, Ashutosh Kumar Saha, a permanent resident of Sukanta More, Gabgachi, would like to apply for an education loan for further studies. I have just appeared for my higher secondary board exams and would like to complete a course in B.TEC from a reputed institution in Delhi.

I can come to the branch at your convenience to discuss it required to get a loan in my favor. I will always be grateful to you if you look into the matter and approve my loan.

Ashutosh Kumar Saha

Application For Home Loan

Name of the bank

Name of the branch

Address of the branch

I am prakash saha. I am a savings account holder with your branch for ten years. I am a government serviceman. My monthly salary is deposited in my bank account. I always maintain a good balance in my account. But I need a loan for building my house.

I am requesting you for an amount of Rs. 200000/- [Two Lakh] as a loan. I have enclosed all the required documents as you instructed earlier. I have read, got and agree with the term and conditions of the bank.

I am waiting for a positive response from you.

Application For Personal Loan

It is stated that I would like to request you for a personal loan of Rs. 200000/-. I have a savings account for 15 years with your branch and save a good balance in the first week of the month. I have been working in an I.T company for 20 years and my salary is 25,000/-. I will pay the loan by deduction money by a savings account. I have read the term and conditions and got it. I have enclosed the necessary document as the instruction.

I am waiting for your positive response of hearing.

Yours faithfully

Sample of Bank Loan Application Letter

Sub: [Application for __________________ ]

With a lot of respect, I beg to state that I am an old account holder in your branch. My account number is XXXXXXXXX. Now I am a serviceman. I am doing my job in Malda Sonoscan Nursing Home. My salary is 12000/-. I need a loan amounting to Rs. 80000/- for buying a car. The deduction should be from my salary account.

Therefore I request you to grant me the loan and then I will be obliged to you.

Business Proposal For Bank Loan Sample

Sub: [Application of proposal of the business loan]

I am writing this letter to request a small business loan in the amount of Rs. 80,000/-for the purpose of business development. My current account number is XXXXXXXXX in your branch. I am an account holder for ten years and maintain a good balance in this account.

My company name is [XYZ]. It is a growing business that serves furniture to customers. You can follow our success online at [website name]. 25 workers work here daily.

I have attached all the required documents along with this application as you instructed earlier. So I earnestly request you for a small loan.

I am looking forward to hearing at your convenience.

FAQ’s On Requesting Loan

How do I write a letter requesting a loan?

Answer: It is not a hard matter. Just follow the structure and fill up the place with your right information.

Sub: [Application for_______ ]

Write first paragraph following the format.

Second paragraph

Third paragraph

That is enough for a letter of requesting loan.

What is the difference between application and letter?

Answer: There is a difference between application and letter. A letter is written for communication or giving information to anyone. On the other hand, an application is written to request for something.

How do you end an application letter?

Answer: You end an application letter with “Yours faithfully or your sincerely”. Besides it nowadays to write contact details at the end is very important.

Should I write thank you in advance?

Answer: Yes. You should write “Thank you” in advance for close connotation. It will express your politeness.

- Closing your bank account

- A new pass book

- New check-book

- Transfer bank account

- Opening a joint account

- Bank statement

- Hire a locker

- Change specimen signature

- Renewal of fixed deposit account

- Complaining non-receipt of pass-book

- Stop payment of a lost check

- Reopen account

- Change registered mobile number

I hope you have got the right information and chosen bank loan application letter sample . If you like the post, you can do a little help by sharing it with your friends, relatives and do comment in the below comment box.

- Stop Payment Cheque Letter With Format And Sample

- Closing Bank Account Letter With 20+ Sample

You May Also Like

Application For Opening Account In Bank With 10 Samples

Application For New Passbook With 6+ Sample

Application For Change Mobile Number In Bank With Sample

Bank Loan Application Letter template

Save, fill-In The Blanks, Print, Done!

Download Bank Loan Application Letter template

Or select the format you want and we convert it for you for free:

- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (13 kB)

- Language: English

- We recommend downloading this file onto your computer.

- Structured and written to highlight your strengths;

- Brief, preferably one page in length;

- Clean, error-free, and easy to read;

- Immediately clear about your name and the position you are seeking.

DISCLAIMER Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

How to get a personal loan with bad credit?

There are many reasons one may need to borrow money, but if you have bad credit, it can be a serious challenge. Some templates that can help you.

Related templates

- Loan Request Application Letter

- Vehicle Loan Application Letter

- Salary Transfer Letter To Bank

- Bank Job Application Letter Sample

Latest templates

- Hr Employee Exit Checklist

- Army Firefighter Job Description

- Nurse Job Description

- Handy Man Job Description

Latest topics

- GDPR Compliance Templates What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly...

- Easter Templates What is the true meaning of Easter? Check out some fun facts about the Easter Bunny and download nice Easter templates here.

- Google Docs How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs...

- Excel Templates Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly!

- Letter of interest How to write a letter of interest? What is a letter of interest? Check out and download here several professional and formal letters of interest:

You miss 100 percent of the shots you don’t take | Wayne Gretzky

ONLY TODAY!

Receive the template in another format, for free!

Home > Finance > Loans

How to Properly Write a Business Loan Request

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Have to submit a business loan request letter as part of your loan application? Not sure how to get started?

We don’t blame you. These kinds of letters aren’t as common as they used to be. While online lenders don’t usually ask for small-business loan requests, some traditional banks and credit unions still do. And if you apply for an SBA business loan (a loan backed by the US Small Business Administration), you’ll need a small-business loan request as part of your loan application package.

No matter which lender you’re applying with, this guide will help you write a strong business loan request letter―and to get the business loan you need.

How to write a business loan request letter

- Start with the easy stuff

- Write a brief summary

- Add information about your business

- Explain your financing needs

- Discuss your repayment plan

- Close the letter

1. Start with the easy stuff

Writing a loan request can feel overwhelming. After all, it’s not an everyday part of being a small-business owner. What do you say when applying for a bank loan? How do you write a business proposal for your loan application? What’s your lender even looking for in a business loan request letter?

That’s why we suggest starting your request writing process with the easy bits: formatting.

You’ll want to begin your business loan request with some pretty standardized formatting that includes your contact information, the date, your lender’s contact information, a subject line, and a greeting.

Typically, you’ll want to format the beginning of your small-business loan request roughly like this:

First and last name

Business’s name

Business’s phone number

Business’s address (this one is optional)

Lender name (or loan agent’s name and title, if you have one)

Contact information for your lender or loan agent

Subject line

Obviously you can simply plug in the relevant information for most of this. Easy peasy, right?

You’ll really only have to come up with your own subject line and greeting. But don’t overthink it. Something like this will work just fine for your subject line:

- Re: [Your business’s name] business loan request for [loan amount]

Likewise, keep your greeting simple. “Dear [lender]” or “Dear [loan agent]” will do quite nicely.

Got all that? Then you’re ready to get into the actual loan request.

By signing up I agree to the Terms of Use.

2. Write a brief summary

Before you dive into the meat of your loan request, you should give a brief summary of your letter. Just write a short paragraph that says why you’re writing and what you want.

So you’ll probably want to include the following details:

- Business name

- Business industry

- Desired loan amount

- What you’ll use the loan for

No need to get fancy with this. You’re trying to condense the most important information into one or two sentences.

For example, your summary might look something like this:

- I’m writing to request a [loan amount] loan for my small business in the [industry name] industry, [business name]. With this loan, [business name] would [describe your intended business loan use].

As you can see, you don’t need much detail here. You’re just giving the reader a quick overview of what’s to come.

And now that you’ve given them that preview, it’s time to get more in depth.

Remember, your lender isn’t here to grade your writing. Try to use good spelling, grammar, and punctuation―but don’t stress about crafting beautiful sentences.

3. Add information about your business

Your next section should add more detail about your business. You’ll want to include information like this:

- Business’s legal name (if different than name used)

- Business’s legal structure (LLC, partnership, S corp, sole proprietorship, etc.)

- Business’s purpose

- Business’s age (or date it began operating)

- Annual revenue

- Annual profit (if applicable)

- Number of employees

Now, keep in mind that you’re not trying to give your reader an encyclopedic history of your business. Instead, you’re trying to show that you have a well-established business―one that’s solid enough to deserve a business loan. So focus on relevant details that show your business’s maturity.

You can keep this section as short as a few sentences or as long as a few (brief) paragraphs. Just make sure you leave plenty of room for the next two sections.

4. Explain your financing needs

After discussing your business, it’s time to explain why you need a bank loan.

That means you’ll want to offer some details about how you plan to use your business financing. For example, you can talk about the employees you plan to hire, the building you want to expand, or whatever else you intend to do with your term loan .

Take note, though, that you also need to explain why your loan request makes sense. Because your lender doesn’t really care that you want a loan―it cares whether or not it makes sense to lend to you. You need to convince your lender that you have a good plan for your loan―one that will make it easy to repay the money you borrow.

Try to answer questions like these as you write this section:

- Why should your lender want to approve your loan application?

- What happens to your business if you get your small-business loan?

- What kind of growth will your business loan allow for?

Dig into your business plan and projections to find some good stats. Explain how hiring those additional employees will increase your revenue by a certain percentage or dollar amount. Break down how opening that add-on to your restaurant will allow you to seat a number of additional customers, and how much revenue you expect that to bring in.

The more specific you can get, the better. Because again, you’re trying to convince your lender that you’re borrowing as part of a thoughtful business plan ―not just because you want some cash.

And take your time with this part. In most cases, this section and the next one will form the meat of your business loan request letter.

As a rule, you should keep your business loan request letter to one page.

5. Discuss your repayment plan

By this point, your lender should understand what your business does and why a loan would help it grow. Now you need to prove to your lender that you can repay your small-business loan.

This doesn’t mean you have to show precise calculations breaking down your desired interest rate and monthly payment. (After all, your bank probably hasn’t even committed to a specific interest rate yet.)

Instead, talk about things like your business’s past finances, other existing debts, and any projections can you offer.

So if you have a profitable business, point that out, and discuss how that will free up cash flow to repay your loan. Offer summaries of profit-and-loss statements that show your business has been growing. Tell your lender how you’ll pay off that existing loan within a few months, so they don’t need to worry about it interfering with repayment of your new term loan.

Put simply, this is your chance to convince your lender of your creditworthiness. Especially if you have a slightly low credit score or some other concern, you want to use this section to show that you will absolutely repay your loan.

6. Close the letter

Finally, you can add a few finishing touches.

Usually you should close with a short paragraph or two that refers the reader to any attached documents (like financial statements) and asks them to review your loan application.

You may also want to include a sentence expressing willingness to answer any questions―or just saying you’re looking forward to hearing back.

Then end things with your signature, list any enclosed documents, and you’re done!

Well, sort of.

At this point, we strongly recommend you print off your business loan request letter and read it―out loud, if possible. This will help you catch any errors. Because no, your lender isn’t a writing teacher, but you still want to make a good impression.

Plus, if you make typos on something like your business name or desired loan amount, that inaccuracy could lead to confusion from your lender―slowing down your loan approval process.

Once you’ve proofread your loan request letter, you’re ready to submit it to your lender. With any luck, your thoughtful letter will help convince your lender to give you that loan you want.

Loan proposal letter template

So how do all those steps look when you put them together? Something like this:

First and last name

Business’s name

Business’s phone number

Business’s address (this one is optional)

Date

Lender name (or loan agent’s name and title, if you have one)

Contact information for your lender or loan agent

Subject line

Greeting

This first paragraph should summarize the rest of your letter. Keep it to just a couple sentences.

The next one to three paragraphs add more detail about your business. Include facts about its age, revenue, profit, employees, and other relevant information.

Then explain why you need financing and how you’ll use it to grow your business. This section can be a little longer (but remember your whole letter should fit on one page).

Next, talk about how your business will repay your loan. You may want to mention how financial documents show your business’s financial health, for example.

Finally, close with a short paragraph or two that list any enclosed documents and invite the lender to consider your loan application.

Printed name

List of enclosed financial documents

That’s not so hard, is it? With this basic business loan request letter template, you can easily write your own personalized business loan proposal.

The takeaway

So there you have it―that’s how to properly write a business loan request.

Get your formatting right, include a short summary, talk about your business, explain your loan needs, prove you can repay your loan, and close things off. (And don’t forget to proofread.)

We believe in you. You can write this thing.

And good luck getting your loan application approved!

Don’t just tell your lender you can repay your business loan―make sure you can with our business loan calculator .

Related reading

Best Small Business Loans

- How to Get a Small Business Loan in 7 Simple Steps

- 6 Most Important Business Loan Requirements

- How Long Does It Take To Get a Business Loan?

- Commercial Loan Calculator

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2023 All Rights Reserved.

25+ NOC Letter Format for Bank Loan – Writing Tips, Email Template

- Letter Format

- February 26, 2024

- Bank Letters , Legal Letters , Loan Letters , NOC Letters

NOC Letter Format for Bank Loan: When applying for a bank loan, the lender will typically require certain documents to assess the creditworthiness of the borrower . One of the documents that may be required is a NOC Letter Format for Bank Loan from the borrower’s employer. This Loan letter serves as proof that the employer has no objection to the borrower obtaining a loan and is often required for certain types of loans, such as a personal loan or a car loan .

- Car Insurance Endorsement Letter

- Bajaj Finance Loan Approval Letter

- Cheque Book Collection Authorization Letter

Tips for Noc Letter format for bank loan

Content in this article

A No Objection Certificate (NOC) is a document issued by an employer or organization that confirms their willingness to allow an individual to take a loan from a bank. Here are some tips for NOC Letter Format for Bank Loan:

- Use a formal tone: The NOC Letter Format for Bank Loan should be written in a formal tone, using proper grammar and punctuation. Use a professional font such as Times New Roman or Arial.

- Include all necessary details: The NOC Letter Format for Bank Loan should include the borrower’s name, date of birth, and account number. It should also mention the amount of loan that the borrower is applying for.

- Address the bank: The letter should be addressed to the bank or financial institution where the borrower is applying for a loan.

- State the purpose of the NOC: The NOC Letter Format for Bank Loan should clearly state that the organization has no objection to the employee taking a loan from the bank.

- Provide contact information: The letter should provide the organization’s contact information , including a phone number and email address, so that the bank can contact the organization if necessary.

- Include a signature: The NOC Letter Format for Bank Loan should be signed by an authorized representative of the organization, such as the HR manager or CEO.

- Use a standard format: The letter should follow a standard format, including a salutation, body, and closing.

NOC Letter Format for Bank Loan Sample format

An NOC (No Objection Certificate) letter for a bank loan is a formal document granting approval for a loan against a specific asset or property. Below is a sample format for a NOC Letter Format for Bank Loan:

[Your Name] [Your Address] [City, State, ZIP Code] [Date]

[Bank Name] [Bank Address] [City, State, ZIP Code]

Subject: No Objection Certificate (NOC) for [Your Full Name]

Dear [Bank Official/Bank Manager’s Name],

I, [Your Full Name], residing at [Your Address], hereby state that I have no objection to [Borrower’s Full Name], son/daughter of [Borrower’s Father’s Name], obtaining a loan from [Bank Name] for [Loan Purpose, e.g., home purchase, education, etc.].

I am the [relationship, e.g., parent/sibling/spouse] of the borrower, and I acknowledge and confirm that I have no claim, lien, or objection to the mortgaging of the property located at [Property Address, if applicable], which is being offered as security for the loan.

I understand that this No Objection Certificate (NOC) is being issued to facilitate the loan application process, and I hereby consent to the same. I also affirm that I have been informed of the terms and conditions of the loan.

Please feel free to contact me at [Your Contact Number] or [Your Email Address] for any further clarification or verification.

Thank you for your prompt attention to this matter.

[Your Full Name] [Your Signature]

[Enclosures: If any, such as copies of identification documents or property documents]

Please note that this is a general template, and you should customize it based on the specific details of your situation and the requirements of the bank. Always ensure that the information provided is accurate and up to date.

NOC Letter Format for Bank Loan Sample Format

NOC Letter Format for Bank Loan – Example

Here is an example of NOC Letter Format for Bank Loan:

[Your Name] [Your Address] [City, State ZIP Code] [Date]

[Bank Name] [Bank Address] [City, State ZIP Code]

Subject: NOC Letter for Bank Loan

Dear Sir/Madam,

I am writing this letter to inform you that I am an employee of [Your Company Name] and I have applied for a loan from your esteemed bank. As part of the loan application process, I have been informed that I need to submit a No Objection Certificate (NOC) from my employer.

Therefore, I kindly request you to issue me an NOC stating that [Your Company Name] has no objection to my loan application with your bank. Please find attached all the required documents related to my employment, and I assure you that I will fulfill all the necessary obligations related to the loan.

I would like to thank you for your cooperation and assistance in this matter. Please let me know if there is any further information that you require from my end.

[Your Name]

NOC letter format for loan application

This NOC letter affirms support for a loan application, expressing consent, understanding of terms, and willingness to offer collateral if applicable, in a concise and formal manner.

Subject: No Objection Certificate (NOC) for Loan Application of [Borrower’s Full Name]

I, [Your Full Name], residing at [Your Address], hereby provide this No Objection Certificate (NOC) in favor of [Borrower’s Full Name] who is applying for a loan from [Bank Name] for the purpose of [Loan Purpose, e.g., home purchase, education, etc.].

I am the [relationship, e.g., parent/sibling/spouse] of the borrower and declare that I have no objection to the loan application made by [Borrower’s Full Name]. I am aware that the loan is being sought for the purpose mentioned above, and I acknowledge that the property located at [Property Address, if applicable] may be mortgaged as security for the loan.

I understand the terms and conditions associated with the loan and confirm that I have no claim, lien, or objection against the property offered as collateral. I am providing this NOC willingly and to facilitate the loan application process.

Please feel free to contact me at [Your Contact Number] or [Your Email Address] if any further information or clarification is required.

Thank you for your attention to this matter.

Note: Customize the letter based on the specific details of your situation and the requirements of the bank. Ensure accuracy and completeness of information provided.

NOC Letter Format for Loan Application

NOC for loan from family member

This NOC expresses support for a family member’s loan application, confirming understanding of terms and indicating no objection to the borrowing process in a concise and formal manner.

[Family Member’s Name] [Family Member’s Address] [City, State, ZIP Code]

Subject: No Objection Certificate (NOC) for Loan Application

Dear [Family Member’s Name],

I hope this letter finds you well. I am writing to confirm that I have no objection to [Your Full Name], my [relationship, e.g., son/daughter], applying for a loan from [Lender’s Name] for [Loan Purpose, e.g., education, home purchase, etc.].

I understand that this loan is being sought for [mention the specific purpose] and that you will be responsible for the repayment. I am fully aware of the terms and conditions associated with the loan and have no objections to the same.

Please find attached any supporting documents required, and feel free to contact me if the lender needs any further information.

[Enclosures: If any, such as copies of identification documents or any other supporting documents]

Note: Customize the letter based on your specific situation and the requirements of the lender. Ensure accuracy and completeness of information provided.

NOC for Loan from Family Member

NOC Letter Format for Bank Loan – Template

Here’s a template of NOC Letter Format for Bank Loan:

I am an account holder of your bank and have recently applied for a loan from your esteemed institution. As part of the loan application process, I have been informed that I need to submit a No Objection Certificate (NOC) from my employer.

I am currently working with [Your Company Name], and I kindly request you to issue me an NOC stating that my employer has no objection to my loan application with your bank. I have attached all the necessary documents related to my employment and loan application, and I assure you that I will fulfill all the necessary obligations related to the loan.

Thank you for your cooperation in this matter. Please let me know if there is any further information that you require from my end.

NOC letter for property loan

This NOC affirms support for a property loan application, allowing the borrower to use the specified property as collateral, and expressing acknowledgment of the terms in a concise and formal manner.

Subject: No Objection Certificate (NOC) for Property Loan

I, [Your Full Name], hereby provide this No Objection Certificate (NOC) regarding the loan application of [Borrower’s Full Name] for the property located at [Property Address].

I confirm that I have no objection to the borrower mortgaging the aforementioned property as security for the loan from [Bank Name]. I am aware of the terms and conditions associated with the loan and understand that the property will serve as collateral.

Please find attached any necessary documents to support this NOC. Feel free to contact me at [Your Contact Number] or [Your Email Address] for any further clarification.

[Enclosures: If any, such as copies of property documents or identification]

Note: Customize the letter based on your specific situation and the requirements of the bank. Ensure accuracy and completeness of information provided.

NOC Letter for Property Loan

NOC letter format for personal loan

This NOC grants permission for a personal loan, confirming the absence of objections, understanding the purpose, and acknowledging the terms in a concise and formal manner.

Subject: No Objection Certificate (NOC) for Personal Loan

I, [Your Full Name], hereby provide this No Objection Certificate (NOC) regarding the personal loan application of [Borrower’s Full Name] for the amount of [Loan Amount].

I confirm that I have no objection to the borrower obtaining the mentioned personal loan from [Bank Name]. I am aware of the purpose for which the loan is sought and understand the terms and conditions associated with it.

Please feel free to contact me at [Your Contact Number] or [Your Email Address] for any further clarification.

[Enclosures: If any, such as copies of identification documents or any supporting documents]

NOC Letter Format for Personal Loan

NOC letter from co-applicant for bank loan

This NOC from a co-applicant affirms support for the primary borrower’s loan application, acknowledging terms and expressing consent in a brief and formal manner.

Subject: No Objection Certificate (NOC) for Loan Application of [Primary Borrower’s Full Name]

I, [Your Full Name], a co-applicant/co-borrower in the loan application of [Primary Borrower’s Full Name], hereby provide this No Objection Certificate (NOC).

I confirm that I have no objection to the loan application made by [Primary Borrower’s Full Name] for [Loan Purpose]. I am aware of the terms and conditions associated with the loan, and I acknowledge that [property or other assets, if applicable] may be mortgaged as security.

Please consider this letter as my consent for the loan application, and feel free to contact me at [Your Contact Number] or [Your Email Address] for any further clarification.

NOC Letter from Co-Applicant for Bank Loan

NOC Letter Format for Bank Loan – Email format

Here’s an Email Format of NOC Letter Format for Bank Loan:

Subject: Request for No Objection Certificate (NOC) for Bank Loan

Dear [Employer’s Name],

I hope this email finds you in good health and spirits. I am writing this email to request a No Objection Certificate (NOC) from [Your Company Name] for my bank loan application.

As part of the loan application process, I have been informed that I need to provide an NOC from my employer. Therefore, I kindly request you to issue me an NOC stating that [Your Company Name] has no objection to my loan application with [Bank Name]. I have attached all the necessary documents related to my employment and loan application, and I assure you that I will fulfill all the necessary obligations related to the loan.

I would be grateful if you could process my request as soon as possible as I am in urgent need of the loan. Please let me know if there is any further information that you require from my end.

Thank you for your cooperation in this matter.

[Your Name] [Your Designation] [Your Company Name] [Your Contact Information]

NOC letter for education loan

This NOC endorses a borrower’s education loan application, affirming no objections and expressing support for the loan’s purpose in a concise and formal manner.

Subject: No Objection Certificate (NOC) for Education Loan Application

I, [Your Full Name], hereby provide this No Objection Certificate (NOC) in support of the education loan application of [Borrower’s Full Name] for pursuing [Course/Program Name] at [Educational Institution’s Name].

I confirm that I have no objection to the borrower obtaining the mentioned education loan from [Bank Name]. I am aware of the purpose for which the loan is sought and understand the terms and conditions associated with it.

I understand that the loan will be utilized for educational expenses only and that [Borrower’s Full Name] will be responsible for repayment according to the terms agreed upon.

NOC Letter for Education Loan

NOC for loan from employer

This NOC seeks approval from the employer for a personal loan, assuring no impact on work and expressing commitment to maintaining job performance, concisely and formally.

[Employer’s Name] [Company Name] [Company Address] [City, State, ZIP Code]

I, [Your Full Name], an employee of [Company Name], request a No Objection Certificate (NOC) for obtaining a personal loan from [Lender’s Name] for [Loan Purpose].

I assure you that this loan will not interfere with my work responsibilities, and I am committed to managing the repayments without affecting my job performance. I am aware of the terms and conditions of the loan and understand that the loan is for personal use.

If required, I am willing to provide any additional information or documentation to facilitate the processing of this NOC.

Thank you for your understanding and cooperation.

[Your Full Name] [Your Employee ID] [Your Signature]

[Enclosures: If any, such as copies of identification documents or loan agreement]

Note: Customize the letter based on your specific situation, and ensure accuracy and completeness of information provided.

NOC for Loan from Employer

FAQS About NOC Letter Format for Bank Loan – Writing Tips, Email Template

How do i noc letter format for bank loan.

This NOC Letter Format for Bank Loan start with your name and address, followed by the date. Address the bank, state the subject, and include a clear body expressing consent. Sign off with your full name and signature.

What should I include in the body of an NOC Letter Format for Bank Loan?

This NOC Letter Format for Bank Loan clearly express your consent for the loan, mention the purpose, acknowledge any collateral if applicable, and assure cooperation. Include any necessary details like loan amount or property information.

Are there specific tips for writing an effective NOC Letter Format for Bank Loan?

This NOC Letter Format for Bank Loan keep it concise, be specific about your consent, provide accurate details, and use a formal tone. Double-check for clarity and completeness before submission.

Can you provide an email template for an NOC Letter Format for Bank Loan?

Certainly! This NOC Letter Format for Bank Loan Start with a formal greeting, state the purpose clearly, express consent, and provide necessary details. Conclude with a polite closing. Always attach any required documents.

Are there any key considerations when writing an NOC Letter Format for Bank Loan from family members?

Clearly state the relationship, confirm consent, and mention any collateral or terms involved. Keep the tone formal and ensure the NOC Letter Format for Bank Loan includes necessary details for the bank’s understanding.

A NOC Letter Format for Bank Loan from your employer is an important document when applying for a bank loan. By following the above format and including all the necessary details , you can ensure that your loan application is processed smoothly and without any unnecessary delays.

Overall, a well-written and properly NOC Letter Format for Bank Loan can help to streamline the process of obtaining a bank loan and provide assurance to the bank that the borrower has the support of their employer .

Related Posts

25+ Complaint Letter Format Class 11 – Email Template, Tips, Samples

15+ Business Letter Format Class 12 – Explore Writing Tips, Examples

21+ Black Money Complaint Letter Format, How to Write, Examples

11+ Authorized Signatory Letter Format – Templates, Writing Tips

20+ Authorization Letter Format for ICEGATE Registration – Examples

28+ Assurance Letter Format – How to Start, Examples, Email Template

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Name *

Email *

Add Comment

Save my name, email, and website in this browser for the next time I comment.

Post Comment

- Personal Personal Credit Card NRI Startup Solutions Wholesale MSME

- MD & CEO

- Our History

- MD & CEO Letter to Shareholders on the 1st Annual Report after Merger

- MD & CEO Letter to Shareholders on the 2nd Annual Report after Merger

- Board of Directors

- Awards & Accolades

- Investor Presentation (Q2-FY24)

- Investor Presentation – Q2 FY24 (In US$)

- Annual Report (FY 2022-23)

- View All Annual Reports

- Financial Documents

- IDFC FIRST Infrastructure Bonds

- Other Investor Information

- Fund Raising through QIP

- Composite Scheme of Amalgamation with IDFC Limited

- Come work with us

- Track job application

- CSR Activities

- IDFC FIRST Sustainability

Chat with IRA Your personal banking assistant

Help Center Support topics, Contact us, FAQs and more

Are you ready for an upgrade?

Login to the new experience with best features and services

For Loan Accounts

For Wholesale Accounts

- IDFC FIRST Bank Accounts

- IDFC FIRST Bank Deposits

- IDFC FIRST Bank Loans