Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

- B2B Market Research

Try Qualtrics for free

The ultimate guide to b2b market research.

14 min read Knowing how your target customers are going to act and what they’re looking for can be the difference between business success and failure. Read our ultimate guide to B2B market research to understand how to carry out and use research to expand your business potential.

What is B2B market research?

B2B market research is the process of gathering data on what potential customers are looking for and what they need . The research can cover everything from brand perception , product fit, customer service requirements , sales and marketing strategies, and more.

It involves taking a sample of your target audience and understanding their motivations and preferences. By researching how your potential audience thinks, feels, and behaves , your strategic planning for attracting your target market will be more effective.

Not only that, but when you have them on board, you won’t risk creating an experience gap where your customers aren’t getting what they expect. You’ll be better able to predict future trends and tackle issues before they happen.

Download the market research eBook guide now

Differences between B2B and B2C market research

There are differences between B2B market research and B2C market research.

For example:

- B2B research might be looking at more complex and niche markets. Enterprise and other large businesses often have very focused or very complicated market audiences, whereas B2C might be a bit simpler in nature.

- B2B customers may need more convincing than B2C customers, which means research needs to be more in-depth. Your target audience will need greater incentives to choose you – so your research needs to be detailed enough that you can make the most attractive offer.

- B2B customers might be more scarce – meaning you need to have a competitive advantage. Understanding how your offering is perceived w hen compared to your competitors is more important when the customer pool is smaller.

What are the benefits of doing B2B market research?

With business research behind you, you can more effectively target customers and encourage engagement with your brand. The more tailored your offering is to what they want, the more they’ll spend with you.

Up-to-date insights on customers’ mindsets

Your potential customers’ needs and desires may change frequently, and keeping up can be tricky. Basing your future plans on past customer behavior might not be accurate. B2B market research can help you stay on top of any new developments and keep ahead of market fluctuations.

More significant customers

If you’re looking to target more than just small fry, you’ll need market research to understand exactly what your competitive advantage is – or what you have to do to get one.

Performance monitoring

Asking potential or current customers how you’re doing on a regular basis means that you can tailor your approach to fit their needs and expectations . Rather than guessing how you’re doing, you’ll have proof of your success (or failure).

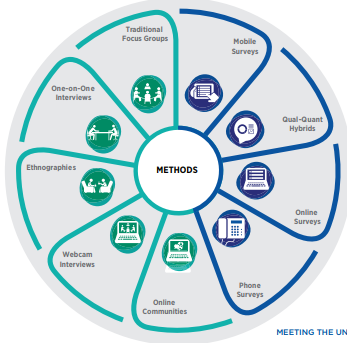

B2B market research methods

There are many different types of market research , so it’s worth doing your homework before launching any research campaign. However, there are some common research types and tips that can help you to get started.

Primary research methods: pros and cons

B2B marketing research is usually divided into two types of research: primary and secondary.

Primary research is where your brand speaks directly to the target audience to get data and insights. This type of research can be qualitative research or quantitative research (more on that shortly).

Pros: This type of research gets to the heart of your particular audience, and gets words directly from your participants’ mouths.

Cons: It can be costly and time-consuming to gather large amounts of data and analyze it. Your B2B participants may not have the time or the inclination to help you in your research, meaning you need to make the experience quick, easy, and engaging.

Secondary research methods: pros and cons

Secondary research is research that has been conducted by a third party and is publicly available.

Pros: This type of method is important, as it can yield information from outside your experience that can inform your results. For example, asking people directly for answers (primary research) might not actually reveal their real intentions. Sometimes, understanding audience behavior is easier when using secondary research.

Cons: You’ll have to evaluate what third-party data is actually useful for your needs. This research can also be biased, or be inaccurate – you need to check your sources thoroughly.

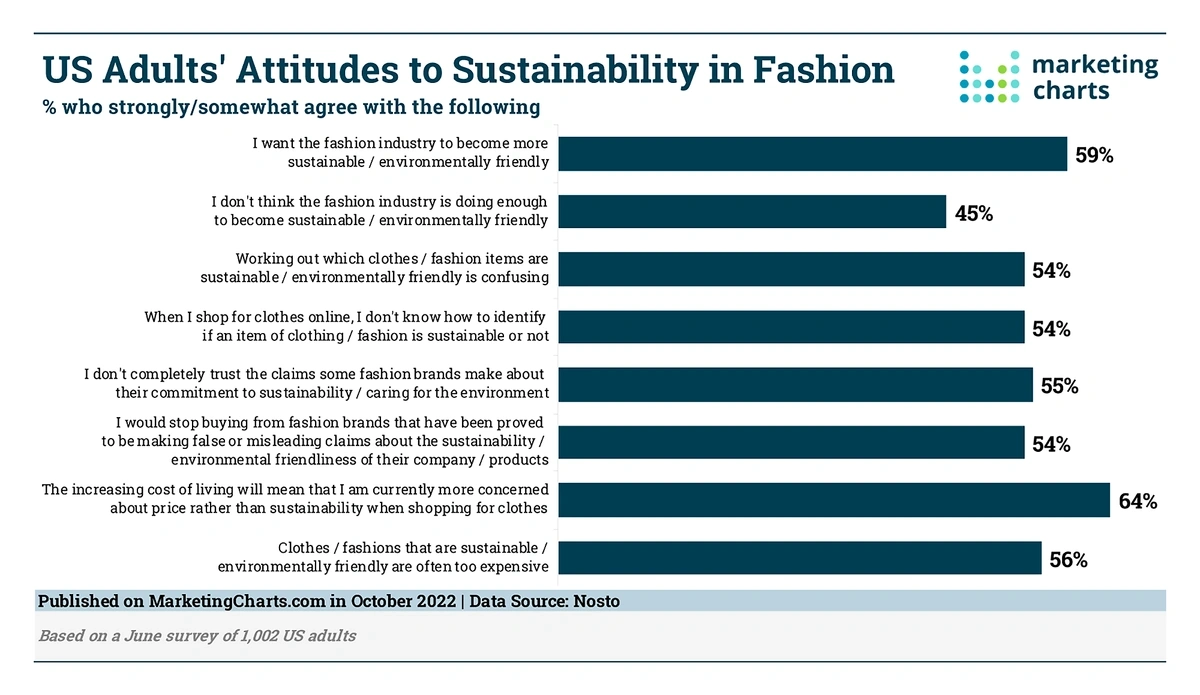

Qualitative research: pros and cons

Qualitative research involves the collation of data that can’t be summed up in numbers. It’s helpful for understanding potential explanations of behavior , rather than providing an exact explanation. Using this type of research, you’ll be able to form a hypothesis about your target market and potential customers.

You might use the following methods for qualitative research: :

- Focus groups

- Open-ended survey questions

Pros: This type of approach is specifically useful for B2B market research as you might not have a large enough target audience to get quantitative data. Given this market’s complexity, you might need in-depth, smaller discussions to get to the bottom of certain behaviors or perceptions.

B2B decision-makers are also likely to respond better to a personalized approach, rather than being quantified. You can build a closer relationship with your customers if you ask them questions in a more personalized setting.

Cons: This is a time-consuming approach to research, and it can be difficult to analyze insights for comparison. The interviewer can also skew results, making it difficult to maintain an unbiased approach. For groups, scheduling can be an issue.

Quantitative research: pros and cons

Quantitative research collects information that can be defined numerically. It’s much more definitive than qualitative data and is often used to prove a hypothesis with empirical evidence.

You might use the following approaches for quantitative research:

- Questionnaires

Pros: Using numerical data makes comparisons easy, and you can gather a greater number of responses in a more cost-effective way. It’s easier to reduce bias as there’s no interpersonal element. B2B decision-makers are also able to easily fit this into their likely busy schedules.

Cons: Though you will get concrete data using this approach, it’s hard to get nuance from structured results summarized in numbers. There might be less incentive to respond to a questionnaire or survey as it feels less personal, and answers might not be as in-depth.

How to carry out B2B market research

Identifying your research topic: exploratory vs specific research.

You might already know what you’re looking for when conducting your research, but sometimes you’re just looking for patterns and trends that you’re not aware of. This is where exploratory vs. specific research comes into play.

Exploratory research is generic and open, where you’re not looking for specific answers. You might use open-ended interviews with your panel or individual customers to get the lay of the land. Qualitative data is more helpful for this approach.

Specific research is for when you know the parameters of your research topic (a problem to solve, the success of a specific product). Your approach will likely be more structured and use quantitative data.

Choosing participants

Your participants are ideally formed of your target audience to get results that you can use to make informed strategic decisions. You’ll need a good sample size and a mix of participants to get useful results, and you should screen your participants for suitability before you carry out your research.

For B2B international market research, you might need to use a few different approaches to choosing participants. For example, you might:

- Ask your current or forthcoming customers: The best way to understand what attracts customers you want to your business is to ask the people who’ve already followed that path.

- Create your own research panel : This requires a lot of effort but can pay dividends, as you can access this panel repeatedly.

- Access an existing research panel or buy a list : This is a costly approach, and B2B customers are unlikely to participate – but in some cases, it can be a good start.

- Advertising on your website, a trade journal, or an industry community: Accessing participants may be easier if you advertise in spaces where potential customers might be.

- Sourcing competitors’ contacts : Your competitors’ clientele are a good source of information for competitive intelligence.

Engaging your participants

Our best tips for engaging your participants are:

- Personalizing your approach to each participant

- Offer multiple methods of response to allow for preferences and availability

- Avoid carrying out market research at peak times of the year or day

- Provide a good reason why they should take part in your research. This could be potential service improvements or tailored products, or a financial incentive to encourage them

Deciding on your B2B market research questions

The questions you decide to use can have a marked difference on the resulting information that you get. Choosing the right questions very much depends on what your goal is, and your questions will vary depending on whether they’re closed or open-ended .

Read our guide to market research questions to learn more

Choosing when to carry your research out

You might have a specific reason for carrying out your research at a certain time – a new product launch , for example – but market research is useful at all stages of a B2B business.

You do need to establish a timeframe in which to carry out your research, however. This helps you to tie your results to specific instances and narrow down reasons why particular data has been gathered.

Collecting and analyzing your data

The quantity of data you receive can be significant – so having a plan for how to analyze the information you get is key. This is where Qualtrics’ market research solutions, such as Qualtrics Core XM , can help.

How to use your B2B market research

Once you’ve completed your market research, it’s time to use the insights you’ve gained. It’s all well and good gathering information – taking action is where the true benefits of market research lie.

Here are a few ways in which you can leverage the data you’ve collected and get a good return on investment .

Create detailed market segments

You might use your B2B market research to create:

- Buyer personas : Who within each customer business are you aiming your efforts at?

- Customer segments : How can you create products and services that will fit the different types of customers you’re aiming to attract?

- Competitive intelligence : What can you offer that your competitors don’t?

Improve brand perception

Your research can help you to tackle:

- Brand perception : How do customers think of you? How aware of your presence are they ?

- USP : What is unique about your brand when compared to others?

- Customer retention : Why do customers continue to choose you over competitors?

- Marketing strategy: How can you leverage your brand perception in your marketing and inform sales strategy? How are your current efforts perceived?

Develop products and services

By undertaking market research, you can get feedback on:

- New product and service concepts : What do your customers want to buy?

- Current product and service development: What are customers currently keen on, and how could you improve?

- Pricing : How do customers currently feel about the prices of what you offer?

- Forecasts : What will the market for your products and services look like in the future?

Optimize the buying process

You can utilize your market research to understand more about:

- Decision-makers : Who makes the decisions about making a purchase, and how can you target them?

- Drivers : What makes a customer choose one brand over another?

- Wins and losses : Why did you win a pitch, or why did you lose a customer?

Measure success

Your research results can help you to track success across the following areas:

- Brand equit y : Does your target market think well of your brand? How aware are they of your existence?

- Customer satisfaction and loyalty: Are your customers happy and will they come back?

- Performance against decision-making factors: Are you successful in attracting customers with your price, ease of use, and more?

- Product and service success : How successful are you in selling your products and services?

How Qualtrics can help with your B2B market research

Qualtrics’ solutions can help you avoid pitfalls and develop market research reports that help you to actively improve your business success.

Business decisions are most accurate and cost-efficient when backed by data, meaning your B2B market research needs to be thorough and easily integrated into your business operations.

Rather than hiring a one-time B2B market research consultant, our solutions – such as Qualtrics Research Services – help you to create ongoing market research campaigns that provide you with valuable data that’s actionable.

Read our market research eBook guide for more insights.

Nail your market research with our all-encompassing market research eBook

Related resources

Market intelligence 10 min read, marketing insights 11 min read, ethnographic research 11 min read, qualitative vs quantitative research 13 min read, qualitative research questions 11 min read, qualitative research design 12 min read, primary vs secondary research 14 min read, request demo.

Ready to learn more about Qualtrics?

The B2B Market Research Company

We help the world's best B2B brands make smarter decisions driven by insights, empowering them to grow.

The world's most experienced B2B market research company. By far.

At B2B International, we've carried out more B2B market research studies, in more languages, and in more markets, than anyone. So, we have a unique understanding of the questions to ask, the people to talk to, and the decisions that need to be taken.

Our ability to reach hard-to-reach decision-makers and delve into specific areas within an industry highlights our effectiveness in conducting B2B market research.

Creating superior B2B experiences

In the business world, change is happening all around us, faster than ever - driven by digital transformation, evolving geo-political landscapes, and the global challenge of sustainability. Every opportunity is a multi-dimensional challenge. Every decision involves the heart and the head. And all of it is complex.

At B2B International we combine unique global experience, advanced B2B market research techniques, and a truly forward-thinking attitude to offer the multi-layered approach you need - to understand the dynamics of change.

Our Market Research Services

Brand & communication research.

Our specialist brand and marketing research solutions help clients to measure brand value and track brand health over time.

Customer Research & Segmentation

Our B2B-focused research approach combines active listening at every touchpoint with sophisticated analytical and segmentation techniques to bring the voice of the customer into the heart of your business.

Markets & Opportunities Research

Our market and opportunity research helps B2B firms develop a sustainable and profitable go-to-market plan.

Product & Proposition Research

Our end-to-end solution for product and pricing research is designed to help B2B businesses innovate successfully and profitably.

Thought Leadership Research

We help leading B2B brands to create compelling and evidence-based marketing content using market research.

Our B2B Industry Experience

We focus on researching complex and niche markets, and reaching hard-to-reach decision makers. We have covered every industry vertical in every corner of the world.

Our expertise is invaluable for clients looking for strategic guidance and detailed market insights, no matter their industry or location.

What Our Clients Are Saying

“B2B International did a great job in what was a specialist and difficult study to bring clarity and useful recommendations”

"B2B did a great job of finding specific groups of professionals to provide relevant insights. The quality of work from initial quote to final presentation was outstanding."

"Your B2B expertise was apparent and you delivered an excellent standard of deliverable. We were very happy and will use it as an integral part to our strategic planning."

"B2B were very knowledgeable, professional and responsive to our needs. This research has been a valuable input into generating good discussions and transformative actions."

International Reach

From the Americas to Asia-Pacific. As a leading B2B market research company, we have offices and business-to-business research experts in every major region of the world.

Featured Content

We surveyed over 3,600 buyers of B2B products and services and asked them to retrace their steps on their journeys for over 6,700 recent B2B purchase experiences. Find out how B2B brand experiences need to evolve to keep up with rising buyer expectations.

Read The Report

Privacy Overview

- Terms and conditions

- Adience privacy policy

B2B Market Research: Key Methods & Strategies (2023)

September 2, 2020

What is B2B market research?

B2B market research is the systematic and objective collecting and analysis of information connected to the business-to-business (B2B) market. This study assists businesses in better understanding their target consumers, the competitive environment, and general market dynamics.

B2B market research methodologies might include surveys, interviews, focus groups, and data analysis. The information gathered may be utilised to acquire insight into client demands, preferences, and habits, as well as discover market trends and opportunities. This data may then be utilised to guide strategic product development, pricing, marketing, and sales choices.

The purpose of B2B market research is to assist businesses in making educated decisions based on data-driven insights rather than assumptions or guesswork. Companies can better understand their consumers and the market if they first understand them.

Adience is a b2b market research agency . See more about them here.

Behind every good consumer product is a string of B2B transactions, involving multiple B2B products and services. Let’s take the example of a chocolate bar:

- The companies supplying the raw materials and ingredients to the chocolate bar manufacturer are B2B organizations

- The chocolate bar may be manufactured at a ‘co-packing facility’ rather than in a factory operated by the brand owner. That co-packing facility is a B2B organization

- The brand owner may get advice from professional services organizations such as marketing agencies. They are all B2B organizations

- The brand owner may sell to businesses as well as consumers. So they may themselves be a B2B organization

In short, B2B is big.

And B2B markets differ from consumer markets in several ways .

First, there are significant differences in terms of who is being sold to :

- In B2B, there are far fewer customers to sell to

- The gap between the highest spending and lowest spending customers tends to be higher

- Decision-making units are larger

- Decision-making units are also more volatile because people move roles/companies

- Decision-makers are harder to engage and locate

Second, there are differences in terms of what is being sold and where :

- Spend on products tends to be higher in B2B markets

- Products are more customized and complex

- Products are likely to be sold through multiple distribution channels

Third, there are differences in how B2B purchases are made :

- The B2B buying journey is long as it has more stages and stakeholders

- Buyers require more information throughout the buying process

- B2B purchases are (slightly) less emotionally driven

Business-to-business (B2B) marketing research is the practice of exploring B2B buyers’ attitudes, motivations, and behaviors. This knowledge is used to inform sales and marketing strategies for B2B organizations.

Why do businesses conduct B2B marketing research?

B2B organizations use B2B marketing research to achieve a variety of business objectives .

First, they use it to build market segmentations , including developing:

- Buyer personas

- Customer or market segments

- Competitor/marketplace maps

Second, they use it to better understand the buying process , including determining:

- Who influences and makes decisions (i.e., the decision-making unit)

- The inter-personal dynamics within the decision-making unit

- How and where customers find them

- What drives the target audience to select a provider (e.g., price)

- Finding out why they won or lost a sale

Third, they use it to develop their brand , including understanding:

- Perceptions of their brand

- What makes their brand unique versus competitors’

- What keeps customers coming back

- What the target audience thinks of potential new messages or straplines

- The optimal marcomms channels and messaging frameworks

- The optimal brand architecture

Fourth, they use it to track perceptions of their business , including measuring:

- Brand equity (e.g., awareness, consideration)

- Customer satisfaction and loyalty

- Performance in crucial decision-making criteria (e.g., price, ease of doing business)

- Which products or services are most appreciated

Fifth, they use it to develop products and services , including:

- Generating new ideas and opportunities

- Testing product and service ideas

- Developing go-to-market strategies

- Optimizing pricing

- Developing market forecasts

Finally, they use it to develop content and thought leadership , including:

- Developing content strategy and identifying key topics to engage your audience

- Developing research-based content and thought leadership reports

- Tweaking existing content and messaging to resonate more

Most businesses only have time or budget for a small number of projects each year. In our experience, there are a few projects that B2B organizations should prioritize :

- Exploring what matters to customers and identifying segments . Not all customers are the same. B2B organizations often segment their customer base by firmographic factors (e.g., size, sector). Segmenting by customers’ motivations, behaviors or ‘jobs to be done’ can help to set a foundation for all future research

- Monitoring performance. Once an organization knows what matters to customers, they then need to check that they are meeting customers’ expectations. Generally, agencies recommend measuring Net Promoter Score (NPS). NPS is not always relevant in B2B markets, as the nature of loyalty is different , so it should be used with caution if at all

- Identifying what is on the customer’s mind. Research can help businesses to keep on top of what keeps their customer up at night. For example, it can identify the trends and threats customers are responding to, which should inform product and service development. It can also inform the creation of content about how to respond to these trends and threats

What are the key methods for conducting B2B research?

Marketing research tends to use a mix of:

- Qualitative primary research – in-depth and exploratory techniques

- Quantitative primary research – structured techniques

- Secondary research methods – using publicly available data to answer questions about business decision-makers’ behavior and attitudes

Primary research methods engage directly with the target audience to elicit insights into their attitudes and behaviors. Most B2B marketing research projects include some element of primary research.

Our experience is that secondary research is also essential for each project. Behavioral datasets are a far better way to understand how people act or think than asking individuals for their opinions directly , so secondary research should be used in parallel with primary research to validate the results.

Looking at each technique in turn…

#1. Qualitative research

Qualitative methods are necessary for B2B research for four reasons:

- B2B markets are small, and the target audience can be niche. In some instances, quantitative research isn’t even possible

- B2B markets are more complex, and understanding them requires more detailed questions

- The B2B decision-making process tends to be more opaque, and qualitative techniques allow us to pick up non-verbal signs

- B2B decision-makers are accustomed to doing things on their terms, and tend to respond better to more open, exploratory techniques

Indeed, qualitative research is often the only way to achieve the following business objectives:

- Generate and develop new product and service ideas

- Obtain a detailed understanding of B2B decision-making processes

Qualitative research is also needed, in parallel with quantitative research, to:

- Evaluate reactions to websites and promotional materials

- Explore perceptions of a company, brand or product

- Identify the optimal brand positioning or marketing strategy

- Develop market segments

- Develop content marketing and thought leadership

There are a variety of different qualitative techniques that you can use when conducting research, including:

- In-depth interviews, which can be conducted face-to-face, by telephone or by videoconference

- Ethnography, which should be done in-person, but can be approximated using mobile apps

- Focus groups, which can be done face-to-face or online

Not all of these techniques are relevant to B2B marketing research due to the hard-to-find nature of the target audience.

In many projects, one-on-one interviews via telephone/videoconference are preferred. For specific audiences (e.g., junior decision-makers), it is sometimes preferable to conduct focus groups (online or in-person) or remote observation by mobile app.

Regardless of the qualitative technique used, it is essential to follow best practices:

- Don’t just speak to customers and prospects, make sure to interview internal stakeholders, who will have a wealth of insight into the target audience

- Use skilled (and independent) qualitative interviewers and moderators, who can limit bias and improve the quality of insights

- Use a range of techniques (e.g., projective questions, neuroscientific techniques) to dig deeper and elicit responses you wouldn’t get through direct questions

#2. Quantitative research

Quantitative techniques are necessary for B2B research for three reasons:

- You can conduct many interviews cost-effectively, which is useful when the research is going to inform critical business designs

- Quantitative research is more structured than qualitative research, which limits bias and makes it easier to compare responses between individuals or groups of individuals

- Quantitative data sets can be the foundation for some fascinating analysis (e.g., combining with CRM data or doing statistical analysis). It can also help to settle contentious internal issues

Indeed, quantitative research is the only way to achieve the following business objectives:

- Validate and test a product or service concept

- Identify the optimal pricing strategy

- Track and manage brand perceptions and levels of customer satisfaction

- Identify changes in market trends and patterns

Quantitative research is also needed, in parallel with qualitative research, to:

Quantitative research can be conducted online, face-to-face, or by telephone. In B2B marketing research, online surveys are typically preferred because they are more time- and cost-efficient.

However, online research is not always possible – for example, you may not be able to access a list of potential respondents’ emails. In those instances, the survey needs to be conducted via telephone. Face-to-face surveys are scarce in B2B due to the nature of the target audience.

Regardless of the quantitative technique used, it is essential to follow best practices:

- Be comfortable with smaller sample sizes than consumer surveys

- Be careful about where you are sourcing participants (see below)

- If you’ve done qualitative research, use it

- Don’t just speak to customers (or prospects)

- Use a range of techniques to dig deeper and unlock hidden insights

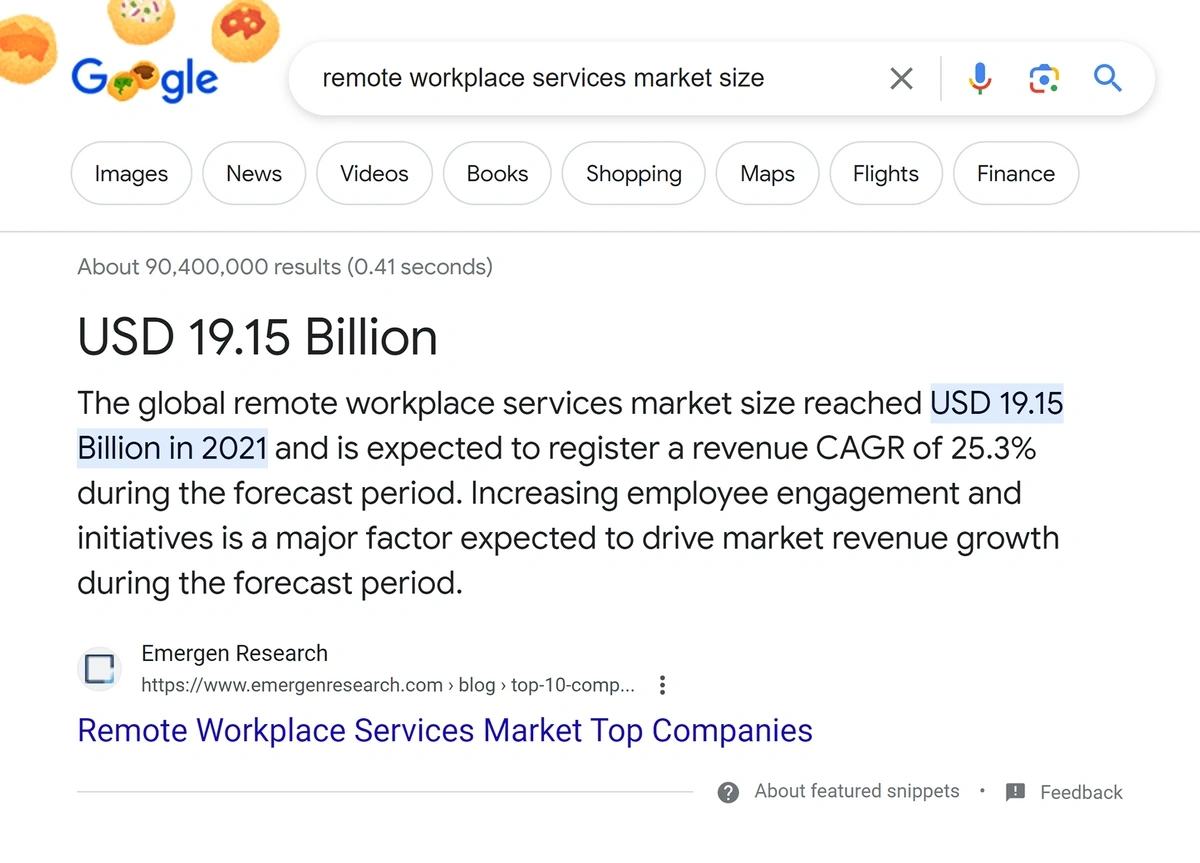

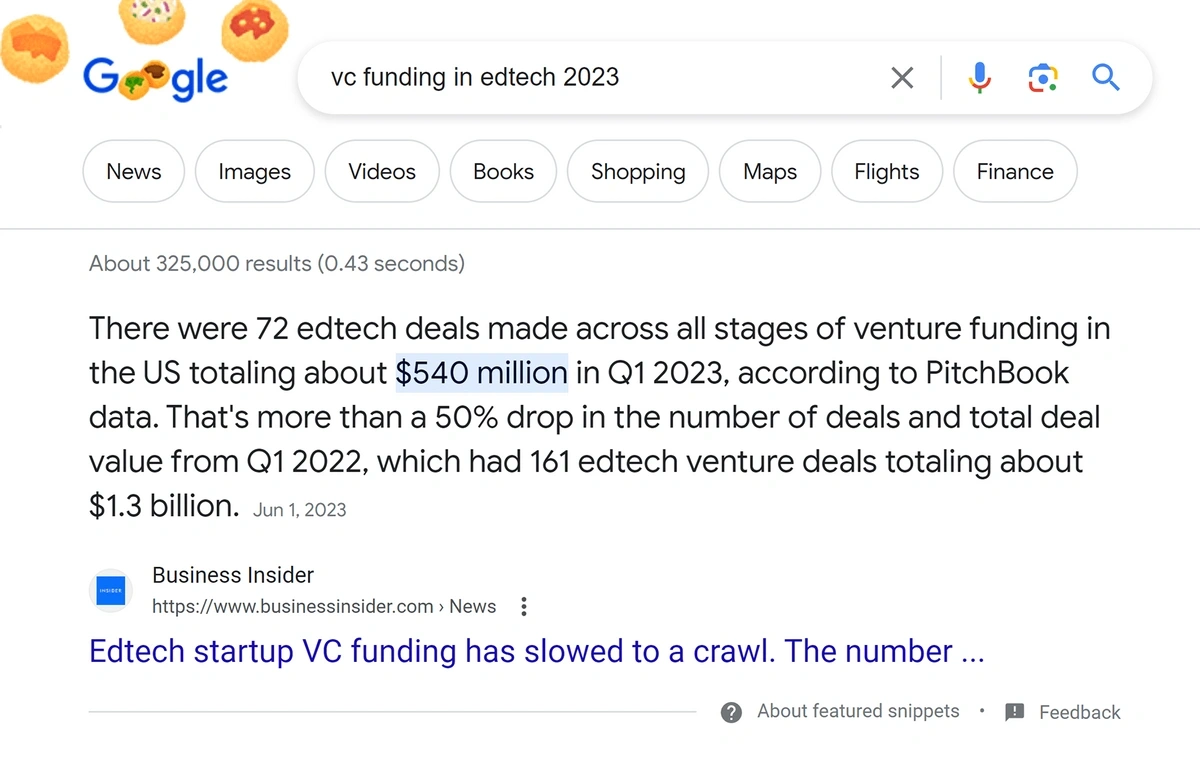

#3. Secondary research

Typically, qualitative or quantitative interviews tell only part of the story. Often there is additional information available, both online and offline, that could help us to obtain a better understanding of an issue.

Secondary research – also called ‘desk research’ – can be a cost-effective, easy, and quick way to access even more information.

Information gathered through secondary research is often used to help with the design of the primary research questions, e.g., coming up with a list of competitors to include in a survey. However, desk research can also help with some of the core objectives for a project.

So what are the benefits of secondary market research? In our experience, it can help with the following project objectives:

- Understanding the structure and size of a market

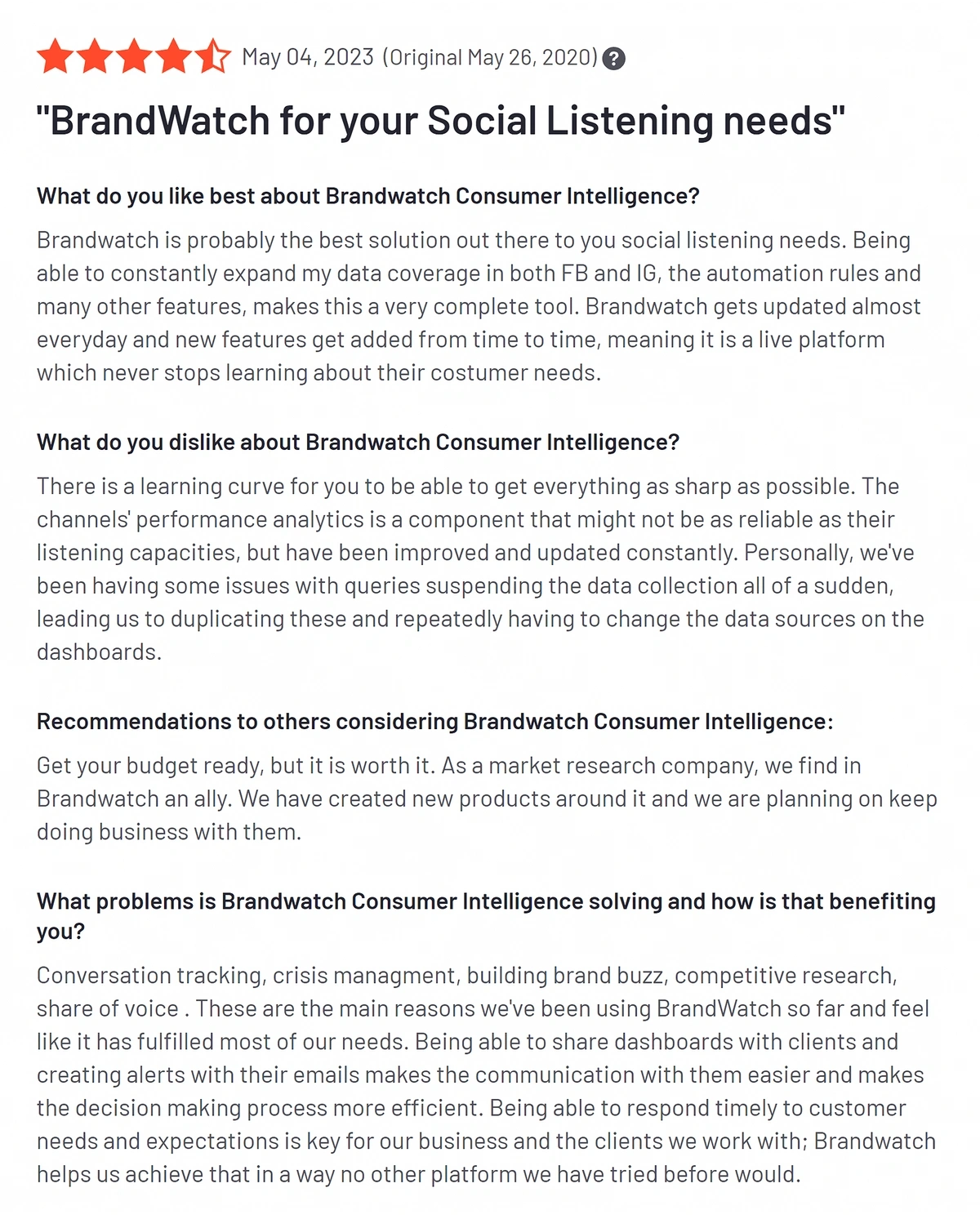

- Uncovering brand perceptions

- Gathering competitive or customer intelligence

- Building lists

- Developing an initial understanding of the buying process

- Informing content marketing strategy

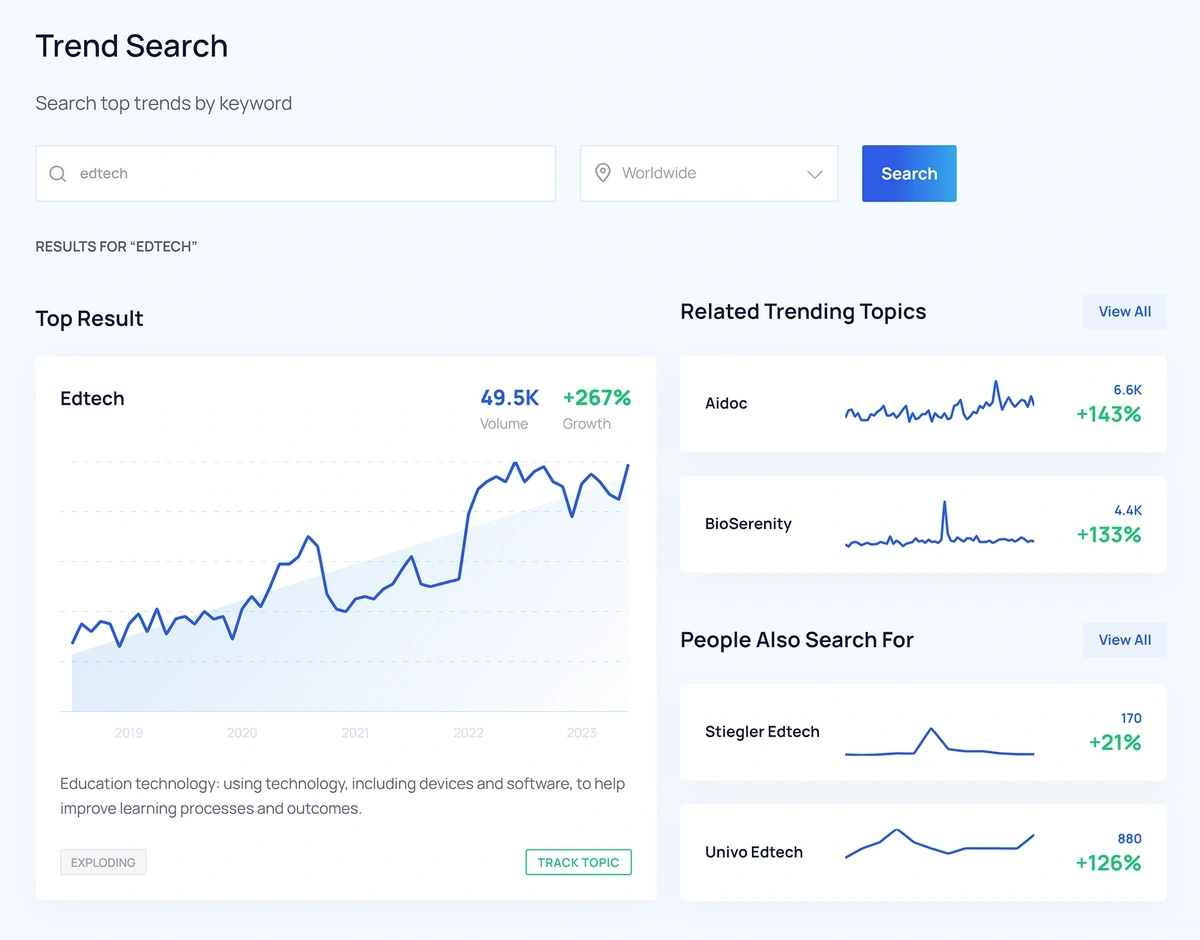

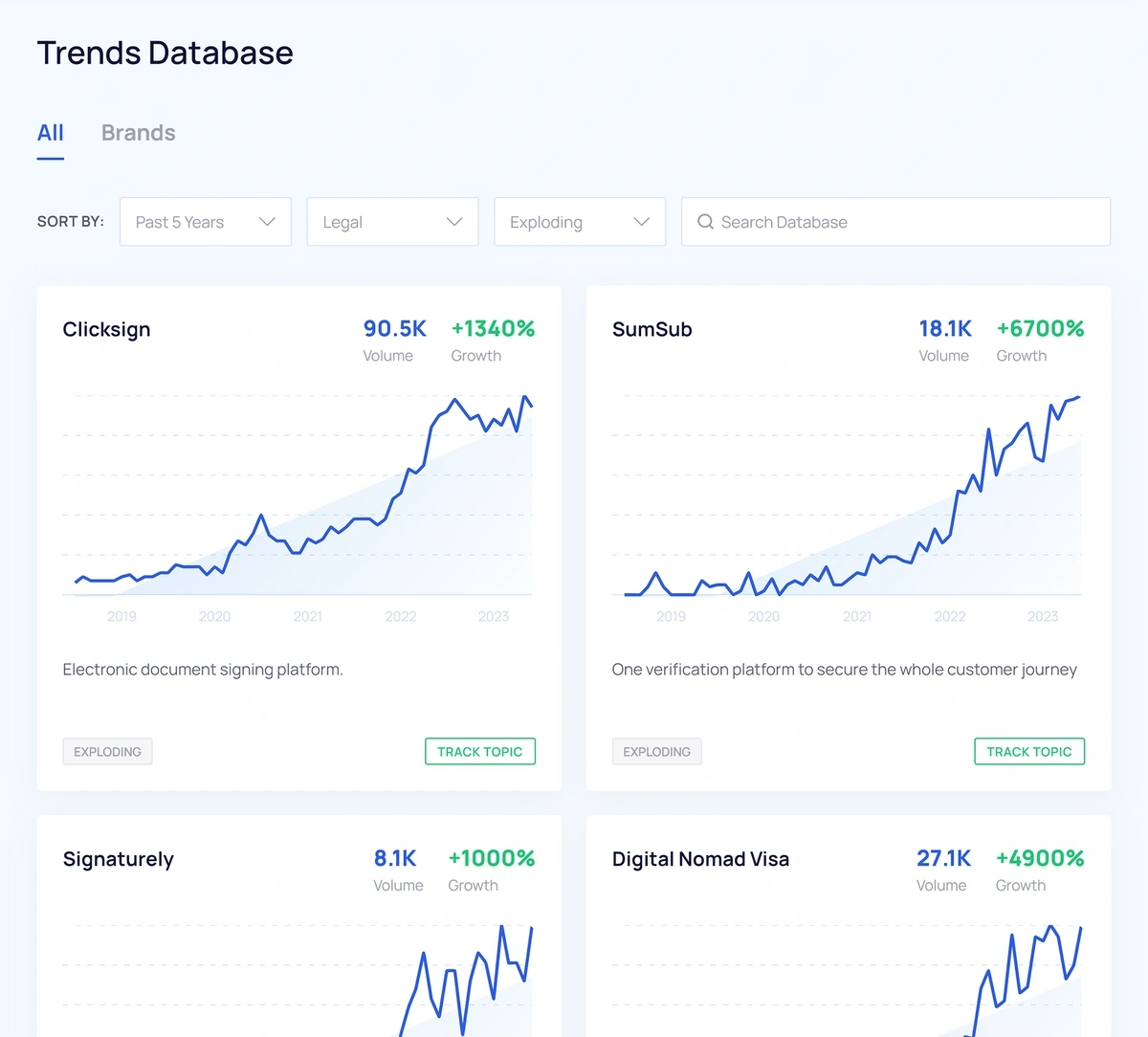

- Exploring industry trends

- Undertaking a risk analysis

Once you know what you are looking for, you need to know where to look. There tend to be ten types of information source that are useful in B2B secondary research:

- Government datasets of business (e.g., census.gov, Bureau of Labor Statistics)

- Special government reports (e.g., rulings by competition and consumer protection authorities such as the FTC)

- Company directories and databases

- Market research reports (e.g., marketresearch.com, Statista)

- Company websites, especially Investor Relations pages if they exist

- Online communities (e.g., LinkedIn groups, review sites, and specialist online communities)

- Business departments of academic institutions

- Trade associations

- General, business and trade press

- Social and search tools

Each source helps with specific objectives:

How do you find B2B research participants?

The target market for B2B research is small. Those within the target audience are hard to find and may not be willing to take part in a study.

To make the process easier, cast the net as wide as possible. It’s not a problem if you find contacts who are not relevant to the research. It is better to screen out irrelevant people than to miss relevant people.

There are 12 potential routes for finding relevant business decision-makers :

- Purchasing a list (or research panelists). Buying a list can be an effective but expensive way to acquire potential contacts. Panels and sampling marketplaces are even more costly, but unlike lists, they are notoriously unreliable for B2B research. Very few B2B decision-makers are likely to be on a research panel. And even when they are, the cost of recruitment can be prohibitive relative to other options

- Leveraging internal data or knowledge. A critical resource for B2B market research recruitment is a company’s database or CRM. This database is likely to contain customers that might be worth interviewing. There are also likely to be individuals in client-facing roles (e.g., sales) who can point you in the direction of prospects

- LinkedIn. LinkedIn is an excellent starting point for any project in which you need to recruit B2B decision-makers, especially if you cannot leverage internal lists or knowledge. Some decision-makers may not have profiles, and others may not log in regularly or have accurate data. Even then, in most industries, LinkedIn is likely to be the biggest and most up-to-date database for finding potential research participants

- Twitter. Twitter is not seen as a ‘B2B social network’, and it is far less structured, but it has its uses when you are trying to identify business decision-makers. Specifically, the Lists and Followers/Following functions can help you to find potential interviewees

- Industry events/conferences. Industry events bring together many people with similar job titles. In some instances, it can be useful to attend them to research the audience directly. But industry events can even be helpful if they happened in the past, or if you are unable to attend. That is because some conferences/events publish lists of attendees or exhibitors, which can be a useful source of potential research participants

- Industry associations/communities. Industry associations/groups are often an excellent recruiting resource for B2B research. They may allow you to attend meetings or advertise in publications. More importantly, you can take a look at group membership, attendance, or speaker lists to identify people who may be able to take part in your study

- Online forums. Online forums can be useful for the same reason as industry associations, i.e., you can search through membership lists. Many forums also allow you to post questions, or invite people to take part in research (or more accurately, to ask them to complete a screening questionnaire to check they are eligible)

- Trade journals and magazines. Trade publications tend to be targeted at specific verticals (i.e., industry) or horizontals (i.e., job function/role). For some B2B research projects, they can be a handy recruitment resource. You can pay to place a banner ad on a trade website/magazine/newsletter. In other situations, for example, if you are looking for thought leaders, lists of magazine contributors can be a great source of potential contact

- Competitor marketing materials + website. Competitors publish a lot of information about themselves that can be used in B2B research recruitment. Many companies talk about which companies they work with on their websites. Some also reveal their clients’ names and job titles, often through testimonials or case studies, which can be valuable if you are trying to gather competitive intelligence

- Training and professional development centers. Some companies provide continuing education to business professionals. In a small number of instances, they allow companies to invite their students to participate in research

- Your website or marketing materials. Just as you can purchase a banner ad on a trade magazine’s website or purchase space in a trade magazine’s newsletter, you can also publish content on your website or in your newsletter. The success of this approach depends on the level of engagement your customers have with your marketing efforts, but it can, in some instances, help to improve response rates. The downside of the approach is that it can require a lot of time to set-up, and it biases the responses towards site visitors. Therefore, you should combine it with other techniques

- Past research. At the end of research interviews, we tend to ask participants if they’d be open to taking part in future studies. Not everyone is open to the idea, but many consent as long as the request is reasonable. This approach makes it easier to identify potential interviewees when you are trying to target a similar target audience While this approach is cost-effective, there are potential pitfalls around data privacy (due to GDPR and CCPA), so you have to ensure you are getting consent to store and use the interviewees’ data

Each route’s effectiveness will vary depending on the specific audience or project, so you may need to experiment with several of them for each project.

How do you best engage business decision-makers during research recruitment?

Once you have identified potential interviewees, the next step is encouraging them to participate in research. Or, in the case of qualitative research, encouraging them to complete a screening questionnaire to make sure they meet the eligibility criteria (see next section).

In our experience, there are six things to consider when trying to engage business decision-makers:

- Personalize your outreach

- Use multiple methodologies (e.g., LinkedIn, phone call, email)

- Avoid peak business times

- Be patient – businesspeople are not always available when you engage them – and allocate more time for recruitment than you might for a consumer study

- Be open to revealing the research sponsor if necessary

- Make a case for why they should participate. A variety of ‘hard’ and ‘soft’ incentives can be used to explain to the decision-maker, or their gatekeeper, why the research may be of interest. For more information on the optimal approach for incentivization, click here

How do you screen business decision-makers to ensure they are relevant?

In both qualitative and quantitative research, a critical step is to ‘screen’ potential respondents to ensure they are the right person.

In quantitative research, this is conducted as part of the main questionnaire. In qualitative research, it is done separately, i.e., the individual is ‘screened,’ and then an interview is scheduled for a later date.

This screening questionnaire typically has two types of questions:

- Screening questions, which check that the individual meets specific eligibility criteria. For example, they are based in a country or sector that is in scope

- Profiling questions , which check that you are achieving a ‘mix’ of individuals. For example, you may be running a project that targets large businesses. Any industry vertical may be in scope, but you still need to ask a question about each company’s primary activity to make sure that you’re not just interviewing individuals who all work in the same sector

Here are a few things to consider when designing a screening questionnaire to ensure it is optimal:

- Avoid broad definitions

- Focus on job responsibilities, not job titles

- Check that they can speak knowledgeably and be articulate

- Keep it short. As a general rule, we suggest a maximum of 10 screening questions

How do you conduct B2B research projects to ensure they lead to action?

We have three guiding principles to ensure that insight always leads to action:

- Involve internal stakeholders – engage those who will approve or execute business decisions coming out of the research

- Go beyond the interviews/survey – use publicly available information, as well as information that is proprietary to the client, to give a more rounded view of the issue

- Tell a story – use story-telling and visualization techniques to make presentations memorable and easier to digest

Chris Wells

Chris Wells is a B2B marketing researcher and strategist. He was previously on the management team at B2B research specialist Circle Research, winners of the Best Research Agency at the 2016 MRS Awards. Chris has helped to deliver hundreds of research and strategy projects for B2B organizations.

Got a B2B market research project you’d like to discuss?

More from the blog.

December 13, 2023

We explain the benefits of a B2B market segmentation, the different types and data sources, plus how to do the primary research.

November 22, 2023

We explore key evaluation criteria for finding a research partner capable of delivering outstanding answers to your business questions.

October 6, 2023

B2B buyer journey mapping explores how customers and prospects make purchases – plus how your brand can perform better at each stage in the process.

Mastering B2B Market Research: A Step-by-Step Guide

Market research is pivotal to any business’s success in the digital world. You need it to understand your customers’ needs and preferences, identify threats from competitors, track market trends, reduce churn risk…the list goes on and on.

However, your business type will dictate how you conduct market research and which metrics are most important to meeting your goals. For example, if you’re a B2C company, you’ll aim to understand individual consumer behavior and preferences. But if you sell primarily to other businesses, you must conduct B2B market research. The nuances between the two are subtle but important.

Keep reading as we walk you through the basics of B2B market research, including different methods and tools, so you can make informed decisions and stay competitive in an ever-evolving digital environment.

What is B2B market research?

The core of market research is all about collecting and analyzing data about a target market or defined segment . It’s an intricate process that gives you the insights you need to make the best decisions for your business, including product launches, market expansions, marketing campaigns, budget allocation, and more.

But who you are researching depends on your target audience . Business-to-business (B2B) market research focuses on understanding businesses’ needs, preferences, and behaviors rather than individual customers. You define your consumer as the business itself.

Unlike B2C market research, which focuses on the interactions between a business and individual people, with B2B market analysis, you’re studying how different businesses work together, what they can offer each other, and how to create a mutually beneficial relationship. While most of the time, B2B market research methods will focus on how you can sell to another business; you may also use it to find new opportunities for partnerships and collaborations.

The importance of market research to B2B companies

Like traditional online market research , B2B analysis is crucial as it helps you understand where you stand vis-a-vis competitors. With it, you can identify your market position and better understand where new opportunities lie. It will also help you find new customers and better engage with existing ones so you see a greater return on your investments.

B2B user research will help you make well-informed, data-driven decisions , especially if you follow a systematic approach using a market research tool like Similarweb.

Here are some of the main benefits of B2B market research:

Define your target audience – In this case, your target audience is other businesses rather than individual customers. Like traditional audience analysis , you must define their pain points, preferences, and online behavior. Understanding their challenges is crucial for developing products and offering services that meet their needs.

Build loyal customer relationships – Customer satisfaction is important for any business, but for B2B businesses, it’s essential for retaining customers. You’ll be able to build strong relationships by continuously meeting their needs.

Pinpoint promising market opportunities – Which geos are you looking to go after primarily? Are there new areas that could increase your market share , or should you focus on a more niche audience with less competition? Determining where your book of business is largest will affect how you run campaigns and where you invest the most effort. B2B user research will also help you understand if there are any regulatory or cultural differences in the regions you’re hoping to expand to.

Conduct competitive analysis – Any good strategy starts with competitive analysis . Find out what your competitors are offering their customers and how your offering compares.

Optimize your pricing strategy – B2B research can help you understand how much your customers expect to pay for your service, given market conditions and competitor pricing. Make sure that the price you offer is comparable to the service you are providing.

Mitigate any risk – When launching a new product, entering a new market , or attempting to reach a new audience, you need reliable data and insights-driven research to mitigate risks.

Uncover industry trends – Detect, monitor, and analyze any trends in your industry that could affect what customers are looking for. This includes emerging players, new technologies, the state of the economy, and more.

And then innovate – Once you have a better idea of the trends shaping consumer behavior, you can improve your existing products or create new services to keep up with ever-changing demand.

Different types of B2B market research methods

There are a variety of methods you can use to conduct your research. We suggest using a mix so you’re not limited to only one strategy, as each will help you answer different questions.

Let’s take a look at the four main types of B2B market research :

Primary market research

Primary market research is the first-hand collection of data. This data can be obtained through a variety of B2B market research tools, but your main focus is looking directly at your customers’:

Web Metrics – Use website traffic analytics to understand how you perform online compared to your competitors. You should check if specific market segments outperform others and try to find out if it’s because of a specific offering or UX. Don’t forget to measure engagement metrics , such as bounce rate , pages per visit, and session duration , to understand how your audience interacts with your website.

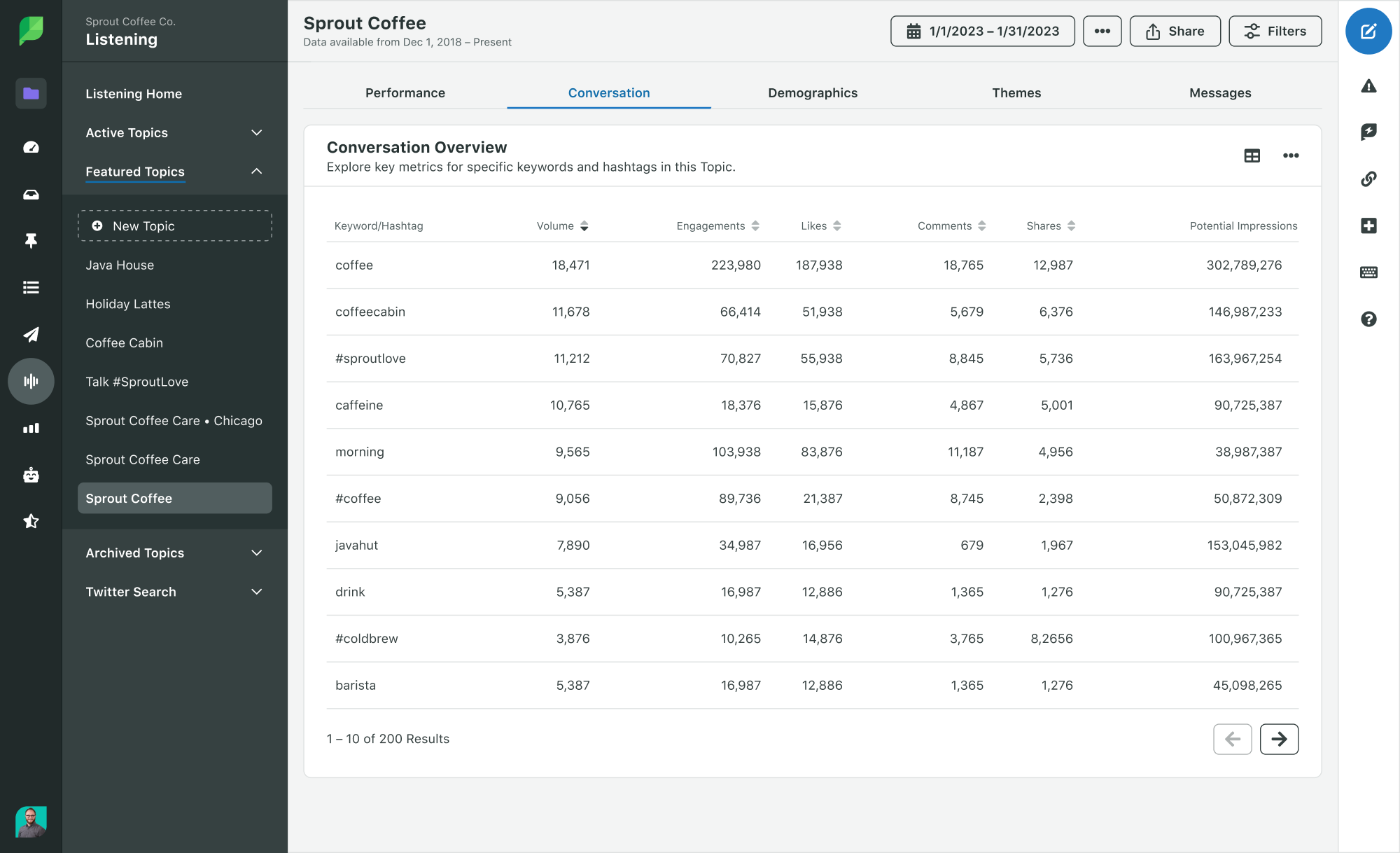

Web metrics analysis using the Similarweb platform.

Observation – Install software that records visits and creates heatmaps of your website so you can understand your user’s journey through your site. This type of research can work in parallel with website analytics, qualifying any findings that you make about user experience on certain pages.

What are you waiting for?

Start using digital intelligence and build a winning market research strategy.

Customer surveys – Surveys are an extremely effective form of B2B user research to help you learn more about your current customers. Distribute questionnaires and polls to your database via email, site chatbot, or social media. Ask questions that can give you qualitative data ( what type of business are they? ) and quantitative data ( how many employees do they currently have working for them? ). You should include both open-ended and multiple choice questions so you can get some personal feedback from your customer ( what’s a new product or feature you’d like to see us offer? ), as well as answers to important pre-determined questions ( how many people in your team currently use our product? ).

Focus groups – If you want to get even more personal, then focus groups are a great way to get a small group together to discuss your business. You can choose either customers or prospects depending on the questions you’d like to ask and the conclusions you want to make.

Secondary market research

Secondary market research uses data that has already been published. Unlike primary market research, which is for your eyes only, secondary market research is available to anyone. While it’s not exclusively yours, this data type is preferred for anyone hoping to keep costs low or have quick access to the information they need.

Government reports and census data – Government organizations frequently publish reports that are great high-level overviews, including the state of the economy and the conditions of financial markets. Most of these reports are published annually or quarterly, so check often for the most updated version to get the freshest data.

Competitor websites – Imitation is the highest form of flattery! A great source of secondary market research is to look at what your competitors are doing. Check out how they highlight competing features, cover blog topics, and target SEO keywords. You could also conduct a SWOT analysis to pinpoint your strengths, weaknesses, opportunities, and threats.

Competitor marketing channel mix using the Similarweb platform

Media outlets – Check the news and other media publications to see if any major events are affecting your industry. It’s a great way to keep up with current events impacting your customers.

Qualitative market research

Qualitative market research is one of the best ways to understand customers’ feelings about a brand, product, or service. It measures what comes to their mind whenever they hear your company’s name. It takes more time to analyze the results than other market research types, as it’s more about emotions- and opinions-based.

By understanding the sentiments of your customers, you will be able to shape and develop products, services, and digital strategies that are most important to them.

Here are a few methods for B2B qualitative research:

- Focus groups

- Case study or whitepaper

- Online forums

- Ethnography

Quantitative market research

Last on our list is quantitative market research , which focuses solely on collecting, analyzing, and comparing data. This is where you’re crunching the numbers. This data can forecast trends, size a new market , validate a market entry plan, or establish customer patterns.

Since the data you collect will be reliable, you can replicate and automate processes with a similar methodology. Often, there are fewer variables in data collection compared to qualitative research. There are three core methods of data collection that you’ll use to conduct quantitative research:

ABM campaigns

ABM stands for Account-Based Marketing. Although ABM campaigns can be considered more of a marketing tactic than traditional B2B research, it’s important to understand the high-value accounts that can drive the most impact for your business.

For example, let’s say you’re Hubspot , a software company that sells a content management platform for ecommerce businesses. With your platform, these companies can list inventory, track sales, follow up on deliveries, and even collect payments in one place. After conducting market research, you discover an up-and-coming ecommerce player that fits your target audience. This company has the chance to bring with it a substantial pipeline.

Finding up-and-coming ecommerce players for ABM using the Similarweb platform.

Rather than casting a wide net and launching a new marketing campaign in the hopes that someone at this company will click on your LinkedIn Ad or open an email, you run an ABM campaign.

Because ABM campaigns are more personalized, your marketing efforts will complement that company’s pain points, products, and even staff. For ABM campaigns to be effective, you want to make sure that you focus on strategic high-value accounts, use tailored messaging to build stronger relationships, and align your efforts with sales to nurture the relationship further.

How to conduct B2B market research using Similarweb

Now that you know the ins and outs, it’s time to learn how to do B2B market research.

You may not know where to begin or which metrics are the most important, but having a market research tool like Similarweb is invaluable.

The tools you’ll find inside help you make sense of all that data so you can solve the most complex business challenges with data-driven decisions. Although the uses are endless, here are four ways you can use Similarweb to conduct B2B market research:

1. Company research

Use the company research tool to understand how your customers are performing online while also pinpointing new potential prospects based on their digital footprint.

With Similarweb, you can uncover the digital strategies and tactics of any company by device, country, and marketing channel, compare full-funnel traffic , engagement, and conversion metrics.

This is an important step of B2B market research for two reasons. First, you can show your customers how your product or service directly impacts their growth online by monitoring changes in metrics from before and after they started working with you. Suppose you’re trying to find new prospects. In that case, you can use Similarweb Digital Research Intelligence to analyze the industry you’re targeting and discover the top-performing companies that would be lucrative business partners. Once you’ve identified these companies, you can also use Similarweb Sales Intelligence to validate and find the best leads.

2. Competitive benchmarking

While most of your B2B market research will look at your customers, you always want to watch the competition. That’s where business benchmarking comes in. Our Benchmarking tool compares and measures your business’s digital performance against competitors or the industry average. It’s a great way to determine industry best practices and identify opportunities for improvement.

You can use this data to pinpoint underperforming marketing or sales strategies , optimize your content , and even find areas for new market growth.

Here are some KPI ideas we recommend when benchmarking your business as part of your B2B research strategy:

- Increase web traffic by __%

- Launch x new products into a new target market within the next ½ year.

- Increase monthly active users on a mobile app by 5%

- Engage users – improve session duration or growth rate by __%

- Increase app store ranking by 5% on Android and/or iOS

- Reach top 2 results on ranking on (define keywords)

- Improve share of voice in ___ topic from __% to __%.

- Increase brand awareness – improve branded traffic share by __%

Benchmarking Traffic and Engagement metrics with Similarweb

3. Audience analysis

Knowing who you sell to is pivotal to your B2B market research strategy. That’s where audience analysis comes in. Understanding your target demographics allows you to build customized product offerings and personal marketing strategies.

Here’s an example of using Similarweb to conduct audience analysis. Unpack demographics for any site or industry you choose, including data on gender, age, location, interests, browsing habits, and more.

Using Similarweb to understand your audience’s demographics

4. Marketing channel performance

With insight into how different marketing channels are performing , you can find out the most effective ways to reach potential customers and ensure that you’re allocating the right budget for paid advertising.

Similarweb Marketing Intelligence makes this type of research easy. Look below at a snapshot from within our Marketing Channels tab, providing an overview of performance across direct , organic search, social media, email, paid search, and display ads. Check which convert the most and where the highest channel traffic comes from. For the ecommerce industry in the US, direct and organic search drive the most traffic to the top websites , whereas referrals and paid search are the most effective paid marketing channels.

Take the first step in acing B2B market research

B2B market analysis is key to staying ahead in the digital landscape. It will guide you through customer needs, competitor landscapes, and market trends.

Empower your business with comprehensive market insights and stay ahead of the curve with Similarweb Digital Research Intelligence. Whether you’re just starting or consider yourself a seasoned market research pro, we have all the necessary tools.

Take the next step in refining your B2B market strategy – sign up for Similarweb today.

Become a market research pro

Start using digital intelligence to grow your business online.

B2B market research is the process of studying a business’s needs, preferences, and behaviors as a whole rather than individual customers. You define your target customer as the business itself.

Why is B2B market research important?

B2B market research is important as it helps you understand where you stand vis-a-vis competitors. With it you can identify threats, get a better picture of new opportunities, and find out how to connect more with your customers. It will also help you find new prospects to increase ROI.

What are the four main types of B2B market research?

The four main types of B2B market research include primary, secondary, qualitative, and quantitative.

How can you use Similarweb to support your B2B market research?

You can use Similarweb Digital Research Intelligence in various ways to support your B2B market research, including company research, competitive benchmarking, audience analysis, marketing channel performance, and more.

Related Posts

US Financial Outlook: Top Trends to Watch in 2024

Top Economic Trends in Australia to Watch in 2024

What Is Data Management and Why Is It Important?

What is a Niche Market? And How to Find the Right One

The Future of UK Finance: Top Trends to Watch in 2024

From AI to Buy: The Role of Artificial Intelligence in Retail

Wondering what similarweb can do for your business.

Give it a try or talk to our insights team — don’t worry, it’s free!

Home • Knowledge hub • From Insights to Action: The Power of B2B Market Research in Decision Making.

From Insights to Action: The Power of B2B Market Research in Decision Making.

Making the right decisions in business is critical. For companies in the B2B sector, these choices can shape their future success or failure. So, how can businesses ensure they’re making the best decisions? The answer is clear: B2B market research.

Market research isn’t just about collecting data . It’s about understanding the market, knowing your competitors, and determining what your customers really want. It’s a tool that provides clarity in a complex business environment.

Every decision a company makes – from launching a new product to entering a new market – should be backed by solid research. It’s like having a roadmap in unfamiliar territory. As we dive into the importance of B2B market research, remember this: in a world full of information, understanding that information is what sets successful companies apart.

The Evolving Landscape of B2B Markets

The B2B market isn’t what it used to be. Like everything in the business world, it’s changing and evolving rapidly. A few years ago, businesses had the luxury of time. They could test the waters, make a decision, and then adapt based on the results. But those days are long gone.

Now, the market moves at lightning speed. New competitors are entering the scene almost daily, and they’re not just local businesses. Thanks to technology, even a tiny startup from halfway around the world can be a threat. This surge in competition means that companies can’t afford to rest on their laurels. They must be proactive, always on their toes, ready to adapt and innovate.

So, how do businesses keep up? The answer is data-driven strategies. In the past, many decisions were based on gut feelings or past experiences. While experience is valuable, it’s not enough in today’s dynamic market. Companies need hard facts, clear insights, and actionable data. This is where B2B market research comes into play. By understanding the market’s shifts and trends, businesses can make informed decisions that give them an edge over their competitors.

In short, the B2B market is more competitive and challenging than ever before. But with the right tools, like comprehensive market research, businesses can navigate these challenges and thrive.

What is B2B Market Research?

B2B market research is a systematic process that businesses use to gather, analyze, and interpret data about their target market, competitors, and the industry as a whole. While the core essence of market research remains consistent across different sectors, there are key differences when comparing B2B (Business-to-Business) and B2C (Business-to-Consumer) research.

As shown in the table above, B2B market research primarily focuses on businesses that are selling to other businesses. This means the considerations, challenges, and strategies will differ from those of B2C market research.

For instance, B2B market research often deals with longer sales cycles. Decisions in the B2B realm aren’t made on a whim; they often involve multiple stakeholders and can span weeks or even months. This contrasts with B2C, where individual consumers might make a purchase decision in minutes based on an emotional connection or a compelling advertisement.

Relationship-building is also more emphasized in B2B. Businesses are not just looking for a one-time sale; they’re aiming for long-term partnerships, which means understanding and catering to the specific needs and pain points of other businesses.

Another significant difference lies in the audience. B2B market research targets a smaller, more specific audience, often characterized by particular industry niches or specialized roles within companies. This is in stark contrast to B2C, where the audience is broader, encompassing a wide range of consumers with diverse preferences and behaviors.

Lastly, B2B market research requires a deeper understanding of industry jargon, complexities, and nuances. It’s not just about knowing what businesses want but understanding the intricacies of their operations, challenges, and industry trends.

While B2B and B2C market research aims to provide valuable business insights, the method, focus, and outcomes can vary considerably. Recognizing these differences is crucial for any company looking to gain a competitive edge in their respective markets.

Types of B2B Market Research

In B2B market research, different methodologies cater to distinct objectives and needs. Broadly, these methods can be categorized into three primary types: Quantitative Research, Qualitative Research, and Secondary Research. Let’s dive deeper into each category to understand their nuances and applications.

1. Quantitative Research

At its core, quantitative research seeks to quantify data and typically applies statistical analysis. This type of research is instrumental when businesses want to measure and analyze trends, patterns, or relationships within a market.

- Surveys: One of the most common tools in the quantitative research arsenal, surveys can be distributed widely to gather responses from a large sample size. These responses, often in the form of standardized closed-ended questions, provide a numerical representation of market opinions or behaviors.

- Structured Interviews: Unlike casual conversations, structured interviews involve a pre-defined set of questions asked in a specific order. They combine the rigor of surveys with the personal touch of interviews, ensuring consistent data collection across participants.

2. Qualitative Research

Qualitative research, on the other hand, delves into the ‘why’ and ‘how’ behind data. It’s more exploratory in nature and aims to provide insights into market motivations, reasons, and underlying opinions.

- In-depth Interviews: In-depth Interviews (IDI) are one-on-one conversations between a researcher and a respondent. The goal is to explore detailed perspectives, experiences, and motivations. Such interviews are flexible and can be adapted based on the respondent’s answers.

- Focus Groups: Focus groups bring together a small group of participants to discuss a specific topic or set of topics. Guided by a moderator, these discussions can reveal shared experiences, common pain points, and collective insights that might not emerge in individual interviews.

3. Secondary Research

While quantitative and qualitative research involve primary data collection, secondary research leverages existing data. It involves analyzing information that has already been gathered, either internally by the company or externally by other organizations.

- Industry Reports: These are comprehensive documents that provide insights into a specific industry’s current state, trends, challenges, and opportunities. They’re invaluable for businesses looking to understand their market landscape.

- Publications: Articles, journals, whitepapers, and other published materials can offer a wealth of knowledge. They can provide historical context, expert opinions, and detailed analyses that can be instrumental in shaping a company’s strategies.

B2B market research isn’t a one-size-fits-all endeavor. Depending on the objectives, businesses can employ a mix of these research types to gain a holistic view of their market, make informed decisions, and chart a path to success.

From Insights to Action: The Process

The journey from raw data to actionable insights is a structured and meticulous process. At its heart, it’s about translating information into meaningful strategies that drive business growth. Let’s walk through the critical stages of this transformative journey.

1. Data Collection

Before making any informed decisions, businesses need a wealth of relevant data at their disposal. The key is to gather comprehensive and accurate data that truly reflects the market landscape.

- Identify Objectives: Begin by pinpointing what you aim to achieve. Whether it’s understanding customer behavior, gauging market demand, or assessing competitor strengths, having clear objectives will guide the data collection process.

- Choose the Right Tools: Depending on the research type (quantitative, qualitative, or secondary), employ appropriate tools. This could range from surveys and interviews to analyzing industry reports.

- Diverse Sources: Don’t rely on a single source. Collate data from multiple channels to ensure a well-rounded perspective. This could include customer feedback, online reviews, sales data, and more.

2. Data Analysis

Once you have a robust dataset, the next step is to sift through this information to derive meaningful insights.

- Data Cleaning: Start by filtering out any irrelevant or erroneous data points. This ensures that the analysis is based on accurate and pertinent information.

- Pattern Recognition: Use statistical tools and software to identify trends, correlations, and patterns within the data. For instance, is there a specific feature that most B2B customers value? Or a common pain point they face?

- Deep Dives: Don’t just skim the surface. Dive deep into the data to uncover underlying reasons, motivations, and triggers. This will provide a richer context and more nuanced insights.

3. Strategy Formation

With insights in hand, it’s time to translate them into actionable strategies.

- Align with Business Goals: Ensure that the derived strategies align with the company’s broader objectives. Whether expanding into a new market segment, refining product features, or optimizing pricing, the strategy should serve the larger business goals.

- Stakeholder Collaboration: Involve various departments and stakeholders in the strategy formation. A collaborative approach ensures the strategies are practical, feasible, and holistic.

- Continuous Iteration: The market landscape is dynamic. As such, strategies should be flexible and adaptable. Regularly revisit and refine them based on new data and changing market conditions.

In essence, the journey from insights to action is a systematic one, rooted in rigorous data collection, thoughtful analysis, and strategic planning. By adhering to this process, businesses can not only understand their market better but also carve out a distinct competitive edge.

How StellarTech Navigated Market Challenges with B2B Market Research

In the competitive world of enterprise software solutions, StellarTech, a fictional company, found itself at a crossroads. Despite having a robust product suite and a loyal client base, they witnessed stagnating sales and increased competition from emerging players. The company knew they had to pivot, but the direction was unclear.

The Challenge:

StellarTech’s primary product, an enterprise resource planning (ERP) software, was once a market leader. However, with the advent of cloud computing and niche software solutions, their offering seemed outdated. The company needed to decide whether to invest in a complete product overhaul, diversify its software suite, or explore untapped markets.

The B2B Market Research Approach:

StellarTech embarked on a comprehensive market research journey. They initiated a mix of quantitative and qualitative research methodologies:

- Surveys and Structured Interviews: Targeting their current client base, they aimed to understand the strengths and weaknesses of their existing product and what additional features or improvements were desired.

- Focus Groups: Bringing together IT heads from various industries, StellarTech sought to grasp the evolving needs of businesses and where their software could fit in.

- Industry Reports and Publications: A deep dive into secondary research provided insights into market trends, emerging technologies, and competitor offerings.

The Insights:

The research revealed a clear demand for cloud integration capabilities and industry-specific software solutions. Moreover, there was a significant market in small to mid-sized businesses that found current ERP solutions either too complex or too expensive.

The Strategy:

Armed with these insights, StellarTech decided on a three-pronged approach:

- Product Enhancement: They initiated the development of a cloud-integrated version of their ERP software, ensuring flexibility and scalability.

- Diversification: Recognizing the demand for industry-specific solutions, they began developing modules tailored for sectors like healthcare, manufacturing, and retail.

- Market Expansion: StellarTech launched a scaled-down, cost-effective version of its software targeting small to mid-sized businesses, filling a significant market gap.

The Outcome:

Within a year of implementing these strategies, StellarTech saw increased sales and successfully expanded its client base. Their tailored solutions became a hit in industries where they previously had a minimal presence.

This fictional tale of StellarTech underscores the transformative power of B2B market research. When approached methodically and acted upon strategically, market insights can pave the way for business rejuvenation and growth.

Navigating the Hurdles

B2B market research is a powerful tool, but like any tool, it has challenges. Understanding these challenges and proactively addressing them is crucial for any business aiming to harness the full potential of its research efforts.

1. Biased Data:

Challenge: One of the most common pitfalls in market research is data bias. This can stem from various sources – from leading questions in surveys to a non-representative sample group.

Solution: Ensure questionnaires are neutral and free from leading or loaded questions. It’s also essential to diversify the sample base, including various industries, company sizes, and demographics. Regularly review and update research methodologies to minimize bias.

2. Changing Market Dynamics:

Challenge: The business landscape is ever-evolving. What’s relevant today might be obsolete tomorrow. Relying on outdated data can lead to misguided strategies.

Solution: Adopt a continuous research approach. Instead of one-off research projects, regularly update your data, keeping an eye on industry trends, technological advancements, and shifting customer preferences. Utilize real-time data analytics tools to stay updated.

3. Over-reliance on Quantitative Data:

Challenge: While numbers and statistics provide a clear overview, they often miss the nuances and qualitative aspects of the market.

Solution: Balance quantitative research with qualitative methods. In-depth interviews, focus groups, and open-ended surveys can provide context, depth, and a more holistic understanding of the market.

4. Information Overload:

Challenge: In the age of big data, businesses often find themselves drowning in a sea of information, struggling to determine what’s relevant.

Solution: Prioritize data based on business objectives. Use data visualization tools and dashboards to sift through vast amounts of data, highlighting critical insights. Regularly review and declutter datasets, ensuring only pertinent information is retained.

5. Limited Internal Expertise:

Challenge: Not every company has in-house market research experts, which can lead to poorly designed research methodologies or misinterpretation of data.

Solution: Consider partnering with specialized market research agencies. They bring expertise, experience, and advanced tools to the table, ensuring research is comprehensive and insights are accurately derived.

6. Cultural and Regional Differences:

Challenge: For businesses operating globally, understanding cultural nuances and regional preferences is vital. Standard research methodologies might not be applicable across all regions.

Solution: Localize research efforts. Collaborate with local experts or agencies who understand the cultural and regional dynamics. Ensure research tools, like surveys, are translated and culturally adapted.

While B2B market research presents its set of challenges, they’re not insurmountable. By recognizing these potential obstacles and implementing best practices, businesses can ensure their research efforts are robust, relevant, and actionable.

The Horizon Ahead: The Future of B2B Market Research

The realm of B2B market research, like many industries, is poised for significant evolution in the coming years. Driven by technological advancements, changing business landscapes, and an ever-increasing demand for data-driven insights, the future holds exciting prospects. Let’s delve into some predictions and trends shaping the next chapter of B2B market research.

1. Integration of Artificial Intelligence (AI):

Forecast: AI will become a mainstay in market research processes. From data collection to analysis, AI-powered tools will offer deeper insights, faster results, and enhanced accuracy.

According to a report by the MIT Sloan Management Review, over 85% of companies believe AI will offer a competitive advantage in the future, with a significant portion of this advantage stemming from insights and analytics.

2. Real-time Data Analysis:

Forecast: The demand for real-time insights will grow exponentially. Businesses will no longer be content with periodic research reports but will seek continuous, up-to-the-minute data to make agile decisions.

A study by PwC revealed that 67% of business leaders believe real-time data analysis will be crucial to their operations within the next few years.

3. Predictive and Prescriptive Analytics:

Forecast: Beyond understanding current market dynamics, businesses will lean heavily on predictive analytics to forecast future trends. Furthermore, prescriptive analytics will guide businesses on the best course of action based on these predictions.

4. Increased Focus on Data Privacy:

Forecast: With regulations like GDPR and CCPA in place, the emphasis on data privacy will intensify. Market research methodologies will need to be adapted to ensure compliance while still gleaning valuable insights.

According to Cisco’s Annual Cybersecurity Report, 84% of businesses feel that data privacy is a competitive differentiator in today’s market.

5. Virtual Reality (VR) and Augmented Reality (AR) in Research:

Forecast: VR and AR will offer immersive research experiences. For instance, virtual focus groups or product testing in augmented reality environments will provide richer, more nuanced feedback.

6. Growth of DIY Research Tools: