Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

What’s in an Equity Research Report?

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

Even though you can easily find real equity research reports via the magical tool known as “Google,” we’ve continued to get questions on this topic.

Whenever I see the same question over and over again, you know what I do: I bash my head in repeatedly and contemplate jumping off a building…

…and then I write an article to answer the question.

To understand an equity research report, you must understand what goes into a stock pitch first.

The idea is similar, but an ER report is a “watered-down” version of a stock pitch.

But banks have some very solid reasons for publishing equity research reports:

Why Do Equity Research Reports Matter?

You might remember from previous articles that equity research teams do not spend that much time writing these reports .

Most of their time is spent speaking with management teams and institutional investors and sharing their views on sectors and companies.

However, equity research reports are still important because:

- You do still spend some time doing the required modeling work (~15%) and writing the reports (~20%).

- You might have to write a research report as part of the interview process.

For example, if you apply to an equity research role or an equity research internship , especially in an off-cycle process, you might be asked to draft a short report on a company.

And then in roles outside of ER, you need to know how to interpret reports quickly and extract the key information.

Equity Research Reports: Myth vs. Reality

If you want to understand equity research reports, you have to understand first why banks publish them: to earn higher commissions from trading activity.

A bank wants to encourage institutional investors to buy more shares of the companies it covers.

Doing so generates more trading volume and higher commissions for the bank.

This is why you rarely, if ever, see “Sell” ratings, and why “Hold” ratings are far less common than “Buy” ratings.

Different Types of Equity Research Reports

One last point before getting into the tutorial: There are many different types of research reports.

“Initiating Coverage” reports tend to be long – 50-100 pages or more – and have tons of industry research and data.

“Sector Reports” on entire industries are also very long. And there are other types, which you can read about here .

In this tutorial, we’re focusing on the “Company Update” or “Company Note”-type reports, which are the most common ones.

The Full Tutorial, Video, and Sample Equity Research Reports

For our full walk-through of equity research reports, please see the video below:

Table of Contents:

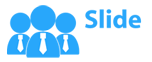

- 1:43: Part 1: Stock Pitches vs. Equity Research Reports

- 6:00: Part 2: The 4 Main Differences in Research Reports

- 12:46: Part 3: Sample Reports and the Typical Sections

- 20:53: Recap and Summary

You can get the reports and documents referenced in the video here:

- Equity Research Report – Jazz Pharmaceuticals [JAZZ] – OUTPERFORM [BUY] Recommendation [PDF]

- Equity Research Report – Shawbrook [SHAW] – NEUTRAL [HOLD] Recommendation [PDF]

- Equity Research Reports vs. Stock Pitches – Slides [PDF]

If you want the text version instead, keep reading:

Watered-Down Stock Pitches

You should think of equity research reports as “watered-down stock pitches.”

If you’ve forgotten, a hedge fund or asset management stock pitch ( sample stock pitch here ) has the following components:

- Part 1: Recommendation

- Part 2: Company Background

- Part 3: Investment Thesis

- Part 4: Catalysts

- Part 5: Valuation

- Part 6: Investment Risks and How to Mitigate Them

- Part 7: The Worst-Case Scenario and How to Avoid It

In a stock pitch, you’ll spend most of your time and energy on the Catalysts, Valuation, and Investment Risks because you want to express a VERY different view of the company .

For example, the company’s stock price is $100, but you believe it’s worth only $50 because it’s about to report earnings 80% lower than expectations.

Therefore, you recommend shorting the stock. You also recommend purchasing call options at an exercise price of $125 to limit your losses to 25% if the stock moves in the opposite direction.

In an equity research report, you’ll still express a view of the company that’s different from the consensus, but your view won’t be dramatically different.

You’ll spend more time on the Company Background and Valuation sections, and far less time and space on the Catalysts and Risk Factors. And you won’t even write a Worst-Case Scenario section.

If a company seems overvalued by 50%, a research analyst would probably write a “Hold” recommendation, say that there’s “uncertainty around several customers,” and claim that the company’s current market value is appropriate.

Oh, and by the way, one risk factor is that the company might report lower-than-expected earnings.

The Four Main Differences in Equity Research Reports

The main differences are as follows:

1) There’s More Emphasis on Recent Results and Announcements

For example, how does a recent product announcement, clinical trial result, or earnings report impact the company?

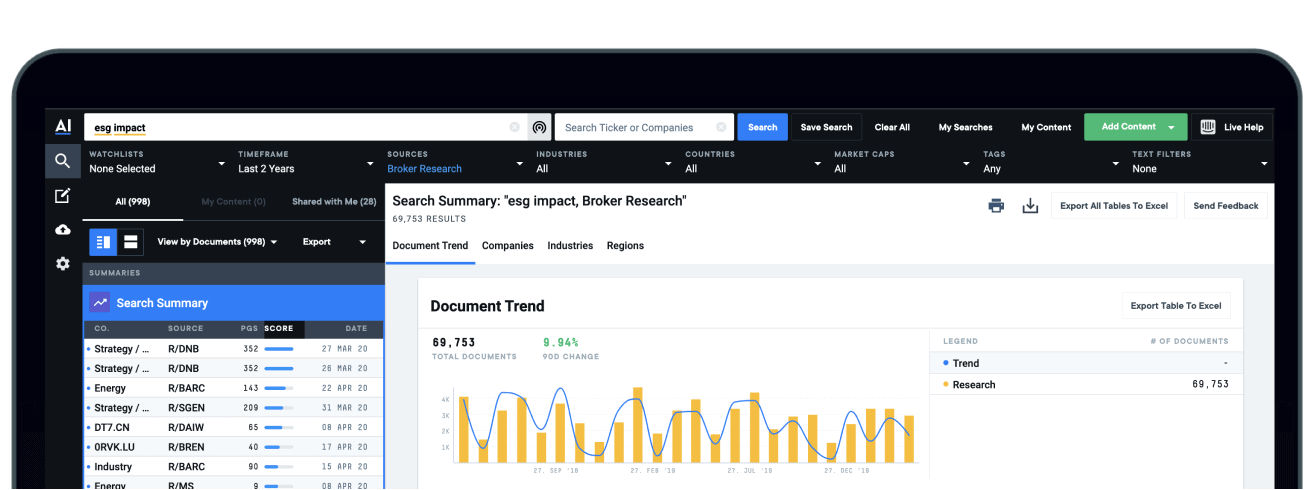

You’ll almost always see recent news and updates on the first page of a research report:

These factors may play a role in hedge fund stock pitches as well, but more so in short recommendations since timing is more important there.

2) Far-Outside-the-Mainstream Views Are Less Common

One comical example of this trend is how all 15 equity research analysts covering Enron rated it a “buy” right before it collapsed :

Sell-side analysts are far less likely to point out that the emperor has no clothes than buy-side analysts.

3) Research Reports Give “Target Prices” Rather Than Target Price Ranges

For example, the company is trading at $50.00 right now, but we expect its price to increase to exactly $75.00 in the next twelve months.

This idea is completely ridiculous because valuation is always about the range of possible outcomes, not a specific outcome.

Despite horrendously low accuracy , this practice continues.

To be fair, many analysts do give target prices in different cases, which is an improvement:

4) The Investment Thesis, Catalysts, and Risk Factors Are “Looser”

These sections tend to be “afterthoughts” in most reports.

For example, the bank might give a few reasons why it expects the company’s share price to rise: the company will capture more market share than expected, it will be able to increase its product prices more rapidly than expected, and a competitor is about to go bankrupt.

However, the sell-side analyst will not tie these factors to specific share-price impacts as a buy-side analyst would.

Similarly, the report might mention catalysts and investment risks, but there won’t be a link to a specific valuation impact from each factor.

So the typical stock pitch logic (“We think there’s a 50% chance of gaining 80% and a 50% chance of losing 20%”) won’t be spelled out explicitly:

Your Sample Equity Research Reports

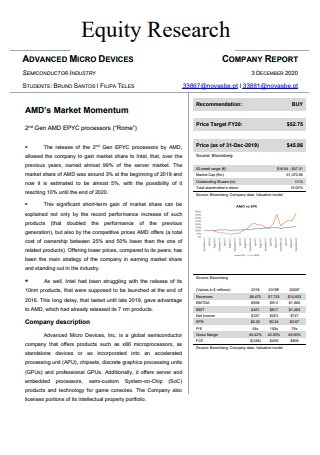

To illustrate these concepts, I’m sharing two equity research reports from our financial modeling courses :

The first one is from the valuation case study in our Advanced Financial Modeling course , and the second one is from the main case study in our Bank Modeling course .

These are comprehensive examples, backed by industry data and outside research, but if you want a shorter/simpler example you can recreate in a few hours, the Core Financial Modeling course has just that.

In each case, we started by creating traditional HF/AM stock pitches and valuations and then made our views weaker in the research reports.

The Typical Sections of an Equity Research Report

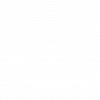

So let’s briefly go through the main sections of these reports, using the two examples above:

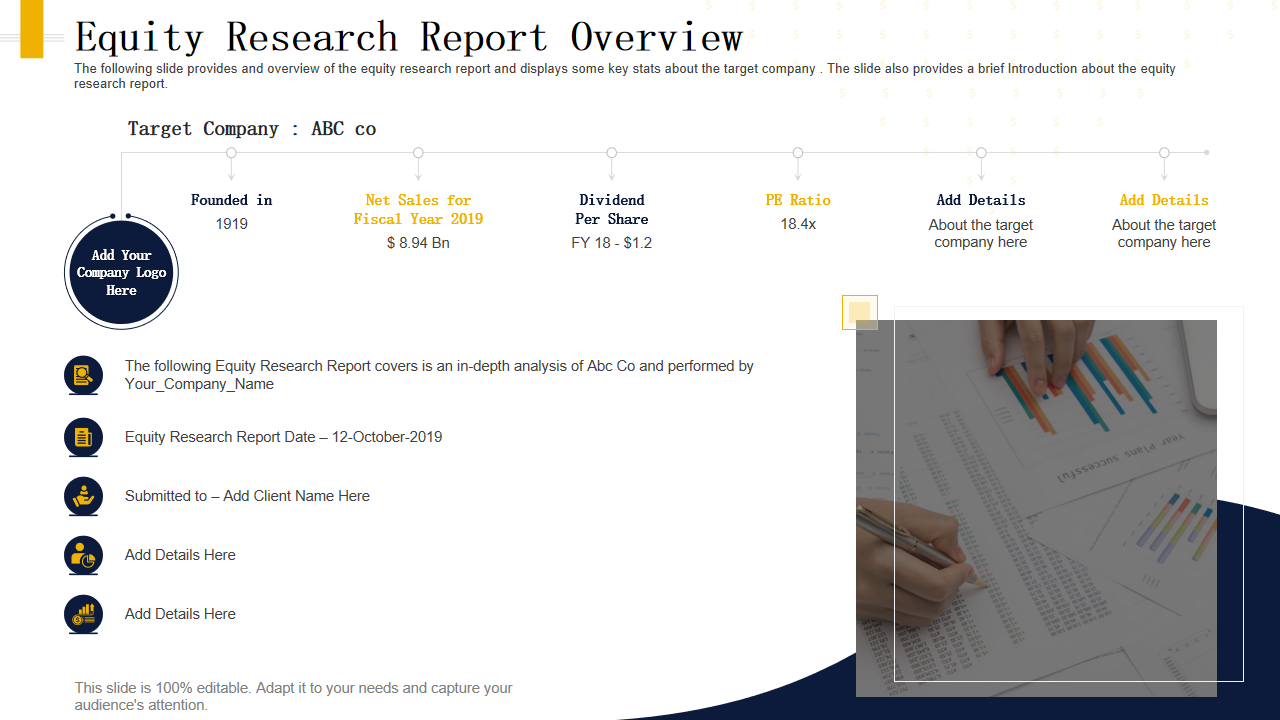

Page 1: Update, Rating, Price Target, and Recent Results

The first page of an “Update” report states the bank’s recommendation (Buy, Hold, or Sell, sometimes with slightly different terminology), and gives recent updates on the company.

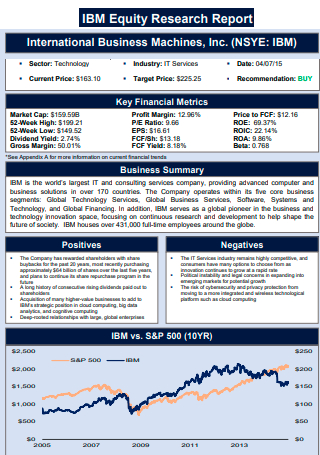

For example, in both these reports we reference recent earnings results from the companies and expectations for the next fiscal year:

We also give a “target price,” explain where it comes from, and give our estimates for the company’s key financial metrics.

We mention catalysts in both reports, but we don’t link anything to a specific valuation impact.

One problem with providing a specific “target price” is that it must be based on specific multiples and specific assumptions in a DCF or DDM.

So with Jazz, we explain that the $170.00 target is based on 20.7x and 15.3x EV/EBITDA multiples for the comps, and a discount rate of 8.07% and Terminal FCF growth rate of 0.3% in the DCF.

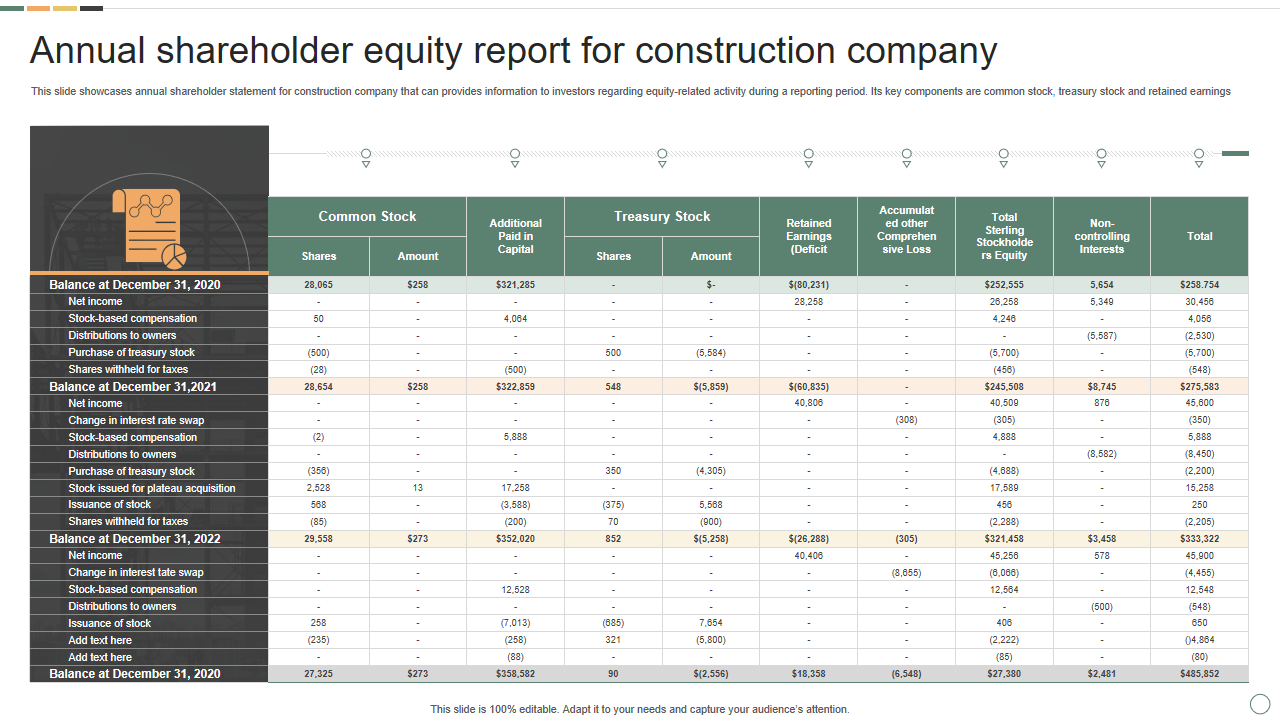

Next: Operations and Financial Summary

Next, you’ll see a section with lots of graphs and charts detailing the company’s financial performance, market share, and important metrics and ratios.

For a pharmaceutical company like Jazz, you might see revenue by product, pricing and # of patients per product per year, and EBITDA margins.

For a commercial bank like Shawbrook, you might see loan growth, interest rates, interest income and net income, and regulatory capital figures such as the Common Equity Tier 1 (CET 1) and Tangible Common Equity (TCE) ratios:

This section of the report explains how the analyst or equity research associate forecast the company’s performance and came up with the numbers used in the valuation.

The valuation section is the one that’s most similar in a research report and a stock pitch.

In both fields, you explain how you arrived at the company’s implied value, which usually involves pasting in a DCF or DDM analysis and comparable companies and transactions.

The methodologies are the same, but the assumptions might differ substantially.

In research, you’re also more likely to point to specific multiples, such as the 75 th percentile EV/EBITDA multiple, and explain why they are the most meaningful ones.

For example, you might argue that since the company’s growth rates and margins exceed the medians of the set, it deserves to be valued at the 75 th percentile multiples rather than the median multiples:

Investment Thesis, Catalysts, and Risks

This section is short, and it is more of an afterthought than anything else.

We do give reasons for why these companies might be mis-priced, but the reasoning isn’t that detailed.

For example, in the Shawbrook report we state that the U.K. mortgage market might slow down and that regulatory changes might reduce the market size and the company’s market share:

Those are legitimate catalysts, but the report doesn’t explain their share-price impact in the same way that a stock pitch would.

Finally, banks present Investment Risks mostly so they can say, “Well, we warned you there were risks and that our recommendation might be wrong.”

By contrast, buy-side analysts present Investment Risks so they can say, “There is a legitimate chance we could lose 50% – let’s hedge against that risk with options or other investments so that our fund does not collapse .”

How These Reports Both Differ from the Corresponding Stock Pitches

The Jazz equity research report corresponds to a “Long” pitch that’s much stronger:

- We estimate its intrinsic value as $180 – $220 / share , up from $170 in the report.

- We estimate the per-share impact of each catalyst: price increases add 15% to the share price, more patients from marketing efforts add 10%, and later-than-expected generics competition adds 15%.

- We also estimate the per-share impact from the risk factors and conclude that in the worst case , the company’s share price might decline from $130 to $75-$80. But in all likelihood, even if we’re wrong, the company is simply valued appropriately at $130.

- And then we explain how to hedge against these risks with put options.

The same differences apply to the Shawbrook research report vs. the stock pitch, but the stock pitch there is a “Short” recommendation where we claim that the company is overvalued by 30-50%.

And that sums up the differences perfectly: A Short recommendation with 30-50% downside in a stock pitch turns into a “Hold” recommendation with roughly equal upside and downside in a sell-side research report.

I’ve been harsh on equity research here, but I don’t want to disparage it too much.

There are many positives: You do get more creativity than in IB, it might be better for hedge fund or asset management exits, and it’s more fun to follow companies than to grind through grunt work on deals.

But no matter how you slice it, most equity research reports are watered-down stock pitches.

So, make sure you understand the “strong stuff” first before you downgrade – even if your long-term goal is equity research.

You might be interested in:

- The Equity Research Analyst Career Path: The Best Escape from a Ph.D. Program, or a Pathway into the Abyss?

- Private Equity Regulation : 2023 Changes and Impact on Finance Careers

- Stock Pitch Guide: How to Pitch a Stock in Interviews and Win Offers

About the Author

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street . In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.

Free Exclusive Report: 57-page guide with the action plan you need to break into investment banking - how to tell your story, network, craft a winning resume, and dominate your interviews

Read below or Add a comment

15 thoughts on “ What’s in an Equity Research Report? ”

Hi Brian, what softwares are available to publish Research Reports?

We use Word templates. Some large banks have specialized/custom programs, but not sure how common they are.

Is it possible if you can send me a template in word of an equity report? It will help the graduate stock management fund a lot at Umass Boston.

We only have PDF versions for these, but Word should be able to open any PDF reasonably well.

Do you also provide a pre constructed version of an ER in word?

We have editable examples of equity research reports in Word, but we generally only share PDF versions on this site.

Hey Brian Can you please help me with coverage initiated reports on oil companies. I could not find them on the net. I need to them to get equity research experience, after which only I will be able to get into the field. I searched but reports could not be found even for a price. Thanks

We have an example of an oil & gas stock pitch on this site… do a search…

https://mergersandinquisitions.com/oil-gas-stock-pitch/

Beyond that, sorry, we cannot look for reports and then share them with you or we’d be inundated with requests to do that every day.

No worries. Thanks!

Hi! Brian! Do u know how investment bankers design and layout an equity research? the software they use. like MS Word, Adobe Indesign or something…? And how to create and layout one? Thanks

where can I get free equity research report? I am a Chinese student and now study in Australia. Is the Morning Star a good resource for research report?

Get a TD Ameritrade to access free reports there for certain companies.

How do you view the ER industry since the trading commission has been down 50% since 2007. And there are new in coming regulation governing the ER reports have to explicitly priced and funds need to pay for the report explicity rather than as a service comes free with brokerage?

In addition the whole S&T environment is becoming highly automated.

People have been predicting the death of equity research for over a decade, but it’s still here. It may not be around in 100 years, but it will still be around in another 10 years, though it will be smaller and less relevant.

Yes, things are becoming more automated, but the actual job of an equity research analyst or associate hasn’t changed dramatically. A machine can’t speak with investors to assess their sentiment on a company – only humans can do that.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Learn Valuation and Financial Modeling

Get a crash course on accounting, 3-statement modeling, valuation, and M&A and LBO modeling with 10+ global case studies.

Here’s How to Write an Equity Research Report: The Best Guide

October 17, 2016

Equity Research is a rewarding career.

To keep up, you need a strong foundation with the judgment to think critically, act independently, and be relentlessly analytical.

That’s why I wrote this guide — to empower you with the equity research(ER) report writing skills to stay ahead in the equity research career.

There is almost NO guide available that teaches you how to write an equity research report.

From textbooks to online video tutorials, you can check and let me know if you find one.

And, I felt that I should write a detailed and step-by-step guide— a guide that really starts at the beginning to equip already-intelligent analysts with a healthy balance of conceptual and practical advice.

The Advanced Guide to Equity Research Report Writing takes your writing to the next level.

Who Is This Guide for?

I wrote this guide for an audience of equity research analysts , investment banking professionals, industry analysts, market research professionals, business management students, and freelance writers.

Most of all, I want you to walk away from this guide feeling confident about your equity report writing skill.

What Is an Equity Research Report

This chapter explains what exactly an ER report is.

The questions like—Who makes it? Who reads and uses it? What are the different types of equity research reports?—are answered clearly and elaborately.

It briefly talks about the various key contents of an ER report.

And lastly, it explains the need to provide a disclaimer at the end of an ER report.

So before understanding how to write an ER report, let’s try to understand what exactly an equity ER is.

FINRA , the Financial Industry Regulatory Authority, defines an equity research report, in Rule 2711 (a)(8) as,

“A written or electronic communication that includes an analysis of equity securities of individual companies or industries , and that provides information reasonably sufficient upon which to base an investment decision.

Readers of Equity Research, more so than anything else, identify trends that make investment decisions easier to justify.

In simpler words, equity research is a document written and published by a brokerage house or securities firm for its clients to help them to make better decisions regarding which stocks to choose for profitable investment.

The report should be such that it should convince the client to make a decision.

The report should be crisp; the point of view should be clearly structured and articulated concisely.

In the investment industry, equity reports usually refer to ‘sell-side’ research, or investment research created by brokerage houses.

Such research is circulated to the corporate and retail clients of the brokerage house that publishes it.

Research produced by the ‘buy-side’, which includes mutual funds, pension funds, and portfolio managers, is usually for internal use and is not distributed to outside parties.

a. Different types of equity reports

In the above paragraph, we saw terms such as ‘sell-side’ and ‘buy-side’.

Let’s quickly understand what these terms mean:

There are two main types of equity research reports:

i. Sell-Side reports

Sell-side reports are the most common type of equity research reports in circulation.

They are normally produced by investment banks , typically for their clients to guide their investment decisions.

A sell-side analyst works for a brokerage firm or bank which manages individual clients and makes investment recommendations to them.

Sell-side analysts issue the often-heard recommendations of “buy”, “hold”, “neutral”, or “sell”.

These recommendations help clients make decisions to buy or sell stocks.

This is favourable for the brokerage firm as each time a client takes a decision to trade; the brokerage firm gets a commission on the transactions.

Click here to see some examples of sell-side reports

ii. Buy-Side reports

The ‘buy-side’ reports are internal reports, produced for the bank itself, and are guided by differing perspectives and motivations.

A buy-side analyst generally works for a mutual fund or a pension fund company.

They perform research and make recommendations to the money managers of the fund that hires them.

Buy-side analysts will verify how promising an investment seems and how well it fits with the fund’s investment strategy.

These recommendations are made exclusively for the benefit of the fund that employs them and is not available to anyone outside the fund.

Within the buy/sell group, there are other types of reports like initiating coverage reports, standard reports, Issue reports, Investor notes, and sector reports.

iii. Initiating coverage reports

The initiating coverage reports are conducted on firms that the bank has begun following and are typically more comprehensive in nature.

Initiating coverage reports analyze a company’s historical financial information, order books, efficiency, SWOT, cash-flows, and future earning potential, basis which it estimates the future earnings of the company and its P/E multiples.

Click here to see some examples of initiating coverage reports

iv. Standard reports

After an initiating report is produced standard reports will follow for as long as the brokerage house continues to track the stock.

Stocks that are tracked are typically part of an index like the SENSEX or are amongst the top stocks in an industry as these are the stocks that investors care about and are traded in larger volumes.

v. Issue reports

These reports are issued when generally companies announce earnings each quarter (Quarterly earnings reports).

vi. Investor notes

These reports are published a few times in between for incremental information and news.

For example – investor conference companies hold a big M&A deal or a major new product announcement from a competitor.

These are usually short-run updates and are typically just quantitative in nature.

vii. Sector reports

A sector report is a document that evaluates a given industry and the companies involved in it.

It is often included as part of a business plan and typically seeks to establish how one company can gain an advantage in industry through detailed research on competition, products, and customers.

Click here to download the sector report

b. Contents of an equity research report

Now that we have understood the different types of equity research reports, let’s try to see the contents of an ER report.

An ER report should not be more than 10 to 15 pages long and should be very crisp and concise.

It should give the reader a clear understanding of the opinion of the analyst writing the report.

An ER report typically has the following contents:

1. Analyst opinion and summary

2. Key highlights of the company

3. A snapshot of the industry

4. Financial ratio analysis

5. Financial Modeling and Valuation analysis

6. Risk factors

7. Disclosure and rationale of rating

Usually, most of the equity research reports have this information; however, there is no hard and fast rule in which an ER report should be written.

We will study in detail (with examples) how to write each of these segments of an ER report in the forthcoming chapters.

c. Importance of Disclaimers in Analyst Reports

As every ER report is an investment document, and investors use it to make decisions for buying or selling securities based on it, it is important for the report to have certain disclaimers to show un-biases of the analyst writing the report.

Some typical disclaimers are as follows:

- Every ER report entirely reflects views and personal opinions of the analyst as on the date of publication

- The equity research analyst does not have an interest in the shares of the company

- Compensation of the analyst is not linked directly to any specific research recommendations contained in the report

Financial Analysts or equity research analysts working in brokerage firms or sell-side analysts write equity research reports.

Equity research report writing process

Equity Research Report writing

After completing the fundamental analysis, financial statement analysis, ratio analysis, and valuation, the last part of the equity research process is writing equity research reports.

As an equity research analyst, you need to analyze the industry and the company first and then write the stock research report.

This step is paramount in your equity research analysis career .

This is important to write the equity research reports in such a way that your clients understand every word of it.

It’s also important to include relevant analysis that you’ve done in the report.

How to write a report

Let’s see each step of writing an equity research report in detail.

1. Company fundamental analysis

a) Macroeconomic Analysis

b) Checking public information of the company

c) Discussion/ interviews with company management

d) Prepare a 5-year cash flow model and earnings forecast model

e) Review your operational and financial assumptions

f) Assess management and competitive environment, buyers, suppliers, substitutes, porter 5-forces model that tells you the competitive advantage of the company.

2. Company valuation analysis

1. Use intrinsic valuation—Discounted Cash Flow(DCF) method

2. Relative valuation

3. sum-of-the-parts valuation method, wherever required.

Pointers for writing equity research reports

I’ve created a list of pointers purely based on my experience and observations and a bit of research about dos and don’ts while writing an equity research report.

1. A clear view of the company

Before writing the report, have a clear view of the company in terms of—Investment rationale, risk assessment, key growth drivers, cost drivers, and revenue drivers.

2. Recommendation/Rating

Clearly write the company’s name at the top of the report and mention your recommendation—buy, sell, hold.

You can also use the words—outperform, underperform, neutral or accumulate based on your valuation.

Have an image of an equity research report in your mind, and so you won’t miss these details.

Usually, there are templates available in your company and you need to write the report using these templates.

3. Target price

You need to mention the target price based on your valuation along with the recommendation.

4. Investment rationale

Write clearly your investment rationale. Why do you think the share price will go up/down?

5. Share price chart

Include a price chart of the stock that will show the last 52-weeks’ share price movement.

6.Business model

Mention the analysis of the company’s business model and how will it perform in the next 2-3 years.

7. Key ratio analysis

Include important ratio analysis of the company and 52-week high-low share price on a stock exchange.

Include market capitalization, Enterprise Value(EV), Earnings Before Interest Tax and Depreciation (EBITDA), EV/EBITDA, and dividend yield (%)

8. Product profile and segments

Analyze the company’s product profile, its various segments, and brands. Include current sales and forecasted revenue figures, cost, market size, company’s market share, competition, the company’s performance in domestic and other markets.

9. Economy-Industry-Company (E-I-C) Analysis

Cover the company’s fundamental analysis with supportive data.

10. Intrinsic and relative valuation

Perform DCF analysis and relative valuation. Relative valuation should be done with the company’s peers on the basis of Price-Earnings ratio (P/E), Price to Book ratio (P/B), Price to Sales (P/S), Return on Equity (ROE) and Return on Capital Employed (ROCE).

11. Reasoning for recommendation

Write proper reasoning for your recommendation. For example—Why buy the stock or why not to buy the stock. So, your reasoning has to be strong.

12. Unlock the value

Write what can unlock/increase/reduce the value of the company .

13. Legal matters

If the company is battling any case, write what could be its effects on the stock price.

14. Common industry points

While writing industry reports, write the points which are common for all players in the industry, for example, regulatory limitation, excise duty, oil prices, etc.

15. Covering all the areas in an equity research report

While writing the equity research report, assume that the reader is new to the company and he doesn’t have any idea about its business.

So, your report should include precise information about—product, financials, management, market, future plans of the company, growth estimates, and the risk factors of the company.

In short, as an equity research analyst, your equity analysis report writing process should be structured and you should follow the dos and don’ts mentioned in this post.

Sample equity research reports (PDFs):

The Walt Disney Company

If you have any queries, Speak Your Mind.

Key Takeaways

- Equity research report writing is a skill . You need to build this skill to go to the next level in your career . Top-notch careers in finance–equity research, investment banking , asset management, financial research, Knowledge Process Outsourcing (KPO) units value this skill in high regard.

- There are different types of research reports–sell-side, buy-side, initiating coverage, standard, issue, investor notes, and sector reports. As an analyst, you should know all these reports.

- Contents of an equity research report include Analyst opinion and summary, Key highlights of the company, A snapshot of the industry, Financial and ratio analysis, Valuation analysis, Risk factors, and Disclosure and rationale of rating. I’m going to cover all these sections in detail with examples in the coming chapters.

Now You Try It

I hope you can see the potential of equity research report writing skills for your career.

Yes, it takes hard work to create something great.

But with this skill, you already know ahead of time that your hard work is going to pay off.

I want you to give the skill a try and let me know how it works for you.

If you have a question or thought, leave a comment below and I’ll get right to it.

- Download BIWS Course sample videos here .

- Read Students’ Testimonials here .

Avadhut is the Founder of FinanceWalk. He enjoys writing on Finance Careers topics. Check our Financial Modeling Courses . Contact us for Career Coaching based on Your Inner GPS.

View all posts

All FinanceWalk readers will get FREE $397 Bonus - FinanceWalk's Prime Membership.

If you want to build a long-term career in Financial Modeling, Investment Banking, Equity Research, and Private Equity, I’m confident these are the only courses you’ll need. Because Brian (BIWS) has created world-class online financial modeling training programs that will be with you FOREVER.

If you purchase BIWS courses through FinanceWalk links, I’ll give you a FREE Bonus of FinanceWalk's Prime Membership ($397 Value).

I see FinanceWalk's Prime Membership as a pretty perfect compliment to BIWS courses – BIWS helps you build financial modeling and investment banking skills and then I will help you build equity research and report writing skills.

To get the FREE $397 Bonus, please purchase ANY BIWS Course from the following link.

Breaking Into Wall Street Courses - Boost Your Financial Modeling and Investment Banking Career

To get your FREE Bonus, you must:

- Purchase the course through FinanceWalk links.

- Send me an email along with your full name and best email address to [email protected] so I can give you the Prime Bonus access.

Click Here to Check All BIWS Programs – Free $397 Bonus

Get new posts by email

Related post.

How To Do Equity Research: An Actionable Guide

ContentsWho Is This Guide for?What Is an Equity Research Reporta. Different types of equity reportsi. Sell-Side reportsii. Buy-Side reportsiii. Initiating coverage reportsiv. Standard reportsv. Issue reportsvi. Investor notesvii. Sector reportsb. Contents of an equity research reportc. Importance of Disclaimers in Analyst ReportsEquity research report writing processHow to write a report1. Company fundamental analysis2. Company valuation analysisPointers for writing equity research reports1. A clear view of the company2. Recommendation/Rating3. Target price4. Investment rationale5. Share price chart6.Business model7. Key ratio analysis8. Product profile ...

October 8, 2023

Equity Research Course: 10+ Lessons | Download XLS Free

September 22, 2023

Equity Research Interview Questions (Top 50 With Answers)

April 14, 2019

Equity Research Careers Guide – The Best Career Guide

January 24, 2019

How to Do Industry Analysis: Follow this 6-Step Process Model

Popular Post

$347 Free Bonus + Money-Back Guarantee

FinanceWalk

Reach out to us for a consultation. career coaching based on your inner gps., blog categories, navigations.

© 2007-2024 FinanceWalk - All rights reserved.

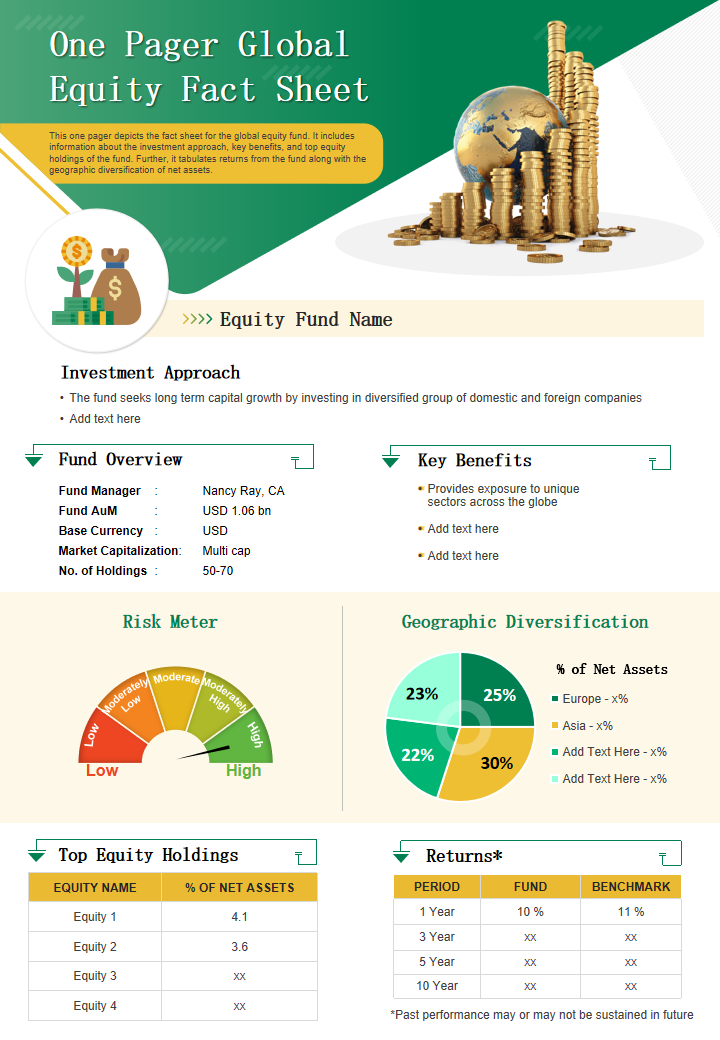

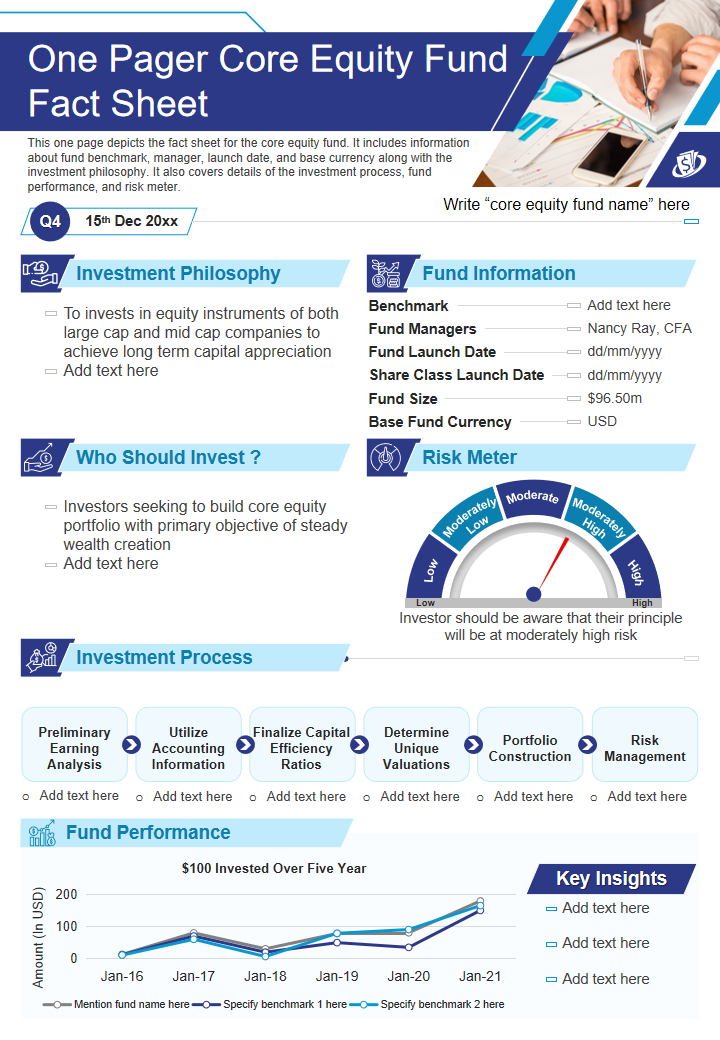

21+ SAMPLE Equity Research Report in PDF | Google Docs | Apple Pages | MS Word

Equity Research Report | Google Docs | Apple Pages | MS Word

21+ sample equity research report, what is an equity research report, types of equity research reports, components of an equity research report, how to write equity research reports, what should an equity research report include, where can i find equity research reports, who uses equity research reports.

Equity Research Report Template

Basic Buy Side Equity Research Report

Sample Currency Equity Research Report

Equity Stock Research Report Example

Printable Executive Summary Equity Research Report

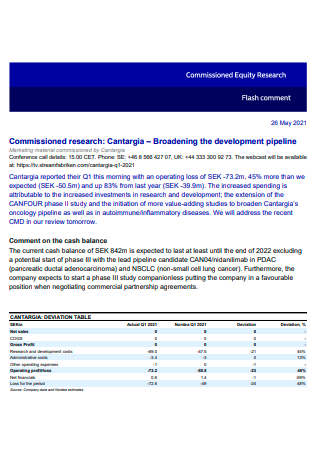

Commissioned Recommendation Equity Research Report

Corporation One Page Equity Research Report

First-Ever Equity Financial Research Report

Short Equity Research Report Format

Equity Analysis Research Report Modules

Equity Investment Recommendation Research Report in PDF

Global Equity Sector Research Report

Simple Equity Market Research Report

Private Equity Research Company Report

Quarterly Draft Equity Research Report

Technologies Equity Statement Research Report

Equity and Debt Industry Research Rules Report

Equity Analyst Disclosure Research Report

International Business Machine Equity Research Report

Equity Research Biotechnology Report

Formal Equity Research Report

1. possess a clear understanding of the company, 2. know about product and service profiles and segments, 3. understanding about the consumer market, 4. research and development capabilities, 5. familiarize yourself with the sector and industry, share this post on your network, file formats, word templates, google docs templates, excel templates, powerpoint templates, google sheets templates, google slides templates, pdf templates, publisher templates, psd templates, indesign templates, illustrator templates, pages templates, keynote templates, numbers templates, outlook templates, you may also like these articles, 12+ sample construction daily report in ms word | pdf.

Introducing our comprehensive sample Construction Daily Report the cornerstone of effective project management in the construction industry. With this easy-to-use report, you'll gain valuable insights into daily activities report,…

25+ SAMPLE Food Safety Reports in PDF | MS Word

Proper food handling ensures that the food we intake is clean and safe. If not, then we expose ourselves to illnesses and food poisoning. Which is why a thorough…

browse by categories

- Questionnaire

- Description

- Reconciliation

- Certificate

- Spreadsheet

Information

- privacy policy

- Terms & Conditions

Save 40% on Online Finance Courses

- The Investment Banker Micro-degree

- The Project Financier Micro-degree

- The Private Equity Associate Micro-degree

- The Research Analyst Micro-degree

- The Portfolio Manager Micro-degree

- The Restructurer Micro-degree

- Fundamental Series

- Asset Management

- Markets and Products

- Corporate Finance

- Mergers & Acquisitions

- Financial Statement Analysis

- Private Equity

- Financial Modeling

- Try for free

- Pricing Full access for individuals and teams

- View all plans

- Public Courses

- Investment Banking

- Investment Research

- Equity Research

- Professional Development for Finance

- Commercial Banking

- Data Analysis

- Team Training

- Felix Continued education, eLearning, and financial data analysis all in one subscription

- Learn more about felix

- Publications

- Online Courses

- Classroom Courses

- My Store Account

- Learning with Financial Edge

- Certification

- Masters in Investment Banking MSc

- Student Discount

- Find out more

- Diversity and Inclusion

- The Investment banker

- The Private Equity

- The Portfolio manager

- The real estate analyst

- The credit analyst

- Felix: Learn online

- Masters Degree

- Public courses

How to Write an Equity Research Report

By Brian Dzingai |

Reviewed By Rebecca Baldridge |

November 15, 2022

What is an Equity Research Report?

An equity research report may focus on a specific stock or industry sector, currency, commodity, or fixed-income instrument, or even on a geographic region or country, and generally make buy or sell recommendations. These reports are produced by a variety of sources, ranging from market research firms to in-house research departments at large financial institutions or boutique investment banks.

Key Learning Points

- An equity research report is a document prepared by an analyst that provides a recommendation to buy, hold, or sell shares of a public company.

- An equity research report is a document prepared by an analyst who is part of an investment research team in a brokerage firm or investment bank

- It provides an overview of the business, the industry it operates in, the management team, the company’s financial performance, and risks, and includes a target price and investment recommendation.

- It is intended to help an investor decide whether to invest in a stock.

Equity Research Report Structure

An equity research report can include varying levels of detail, and although there is no industry standard when it comes to formatting, there are common elements to all equity research reports. This guide includes some fundamental features and information that should be considered essential to any research report, as well as some tips for making your analysis and report as effective as possible.

Access the download to see a real-world example of an Equity Research Report, annotated to show each element discussed below.

Basic Information

The research report should begin with basic information about the firm, including the company’s ticker symbol, the primary exchange where its shares are traded, the primary sector and industry in which it operates, the current stock price and market capitalization, the target stock price, and the investment recommendation.

In addition, a security’s liquidity and float are important considerations for the equity analyst. The liquidity of a stock refers to the degree to which it can be purchased and sold without affecting the price. The analyst should understand that periods of financial stress can affect liquidity. A stock’s float refers to the number of shares that are publicly owned and available for trading and generally excludes restricted shares and insider holdings. The float of a stock can be significantly smaller than its market capitalization and thus is an important consideration for large institutional investors, especially when it comes to investing in companies with smaller market capitalizations. Consequently, a relatively small float deserves mention. Finally, it is good practice to identify the major shareholders of a firm.

Business Description

This section should include a detailed description of the company and its products and services. It should convey a clear understanding of the company’s economics, including a discussion of the key drivers of revenues and expenses. Much of this information can be sourced from the company itself and from its regulatory filings as well as from industry publications.

Industry Overview and Competitive Positioning

This section should include an overview of the industry dynamics, including a competitive analysis of the industry. Most firms’ annual reports include some discussion of the competitive environment. A group of peer companies should be developed for competitive analysis. The “Porter’s Five Forces” framework for industry analysis is an effective tool for examining the health and competitive intensity of an industry. Production capacity levels, pricing, distribution, and stability of market share are also important considerations.

It is important to note that there are different paths to success. Strength of brand, cost leadership, and access to protected technology or resources are just some of the ways in which companies set themselves apart from the competition. Famed investor Warren Buffett describes a firm’s competitive advantage as an economic “moat.” He says, “In business, I look for economic castles protected by unbreachable moats.”

Investment Summary

This section should include a brief description of the company, significant recent developments, an earnings forecast, a valuation summary, and the recommended investment action. If the purchase or sale of a security is being advised, there should be a clear and concise explanation as to why the security is deemed to be mispriced. That is, what is the market currently not properly discounting in the stock’s price, and what will prompt the market to re-price the security?

This section should include a thorough valuation of the company using conventional valuation metrics and formulas. Equity valuation models can derive either absolute or relative values. Absolute valuation models derive an asset’s intrinsic value and generally take the form of discounted cash flow models. Relative equity valuation models estimate a stock’s value relative to another stock and can be based on a number of different metrics, including price/sales, price/earnings, price/cash flow, and price/book value. Because model outputs can vary, more than one valuation model should be used.

Financial Analysis

This section should include a detailed analysis of the company’s historical financial performance and a forecast of future performance. Financial results are commonly manipulated to portray firms in the most favorable light. It is the responsibility of the analyst to understand the underlying financial reality. Accordingly, a careful reading of the footnotes of a company’s financial disclosures is an essential part of any examination of earnings quality. Non-recurring events, the use of off-balance-sheet financing, income and reserve recognition, and depreciation policies are all examples of items that can distort a firm’s financial results.

Financial modeling of future results helps to measure the effects of changes in certain inputs on the various financial statements. Analysts should be especially careful, however, about extrapolating past trends into the future. This is especially important in the case of cyclical firms. Projecting forward from the top or bottom of a business cycle is a common mistake.

Finally, it can be informative to use industry-specific financial ratios as part of the financial analysis. Examples include proven reserves/shares for oil companies, revenue/subscribers for cable or wireless companies, and revenue/available rooms for the hotel industry.

Investment Risks

This section should address potential negative industry and company developments that could pose a risk to the investment thesis. Risks can be operational or financial or related to regulatory issues or legal proceedings.

Although companies are generally obligated to discuss risks in their regulatory disclosures, risks are often subjective and hard to quantify (e.g., the threat of a competing technology). It is the job of the analyst to make these determinations. Of course, disclosures of “qualified opinions” from auditors and “material weakness in internal control over financial reporting” should be automatic red flags for analysts.

Environmental, Social & Governance (ESG)

This section should include information on how the company manages the relationships related to Environmental, Social, and Governance. Below are some examples within these three areas that can have a lasting impact on the company’s short- and long-term prospects:

- E nvironmental – how is the company working towards the conservation of the natural world? This can include climate change and carbon emissions, air and water pollution, energy efficiency, waste management, and more.

- S ocial – how does the company consider people and relationships? This can include community relations, human rights, gender and diversity, labor standards, customer satisfaction, and employee engagement.

- G overnance – what are the standards for running the company? This can include board composition, audit committee structure, executive compensation, succession planning, leadership experience, and bribery and corruption policies.

Enroll in our online ESG course and learn to identify the principles of ESG and how they are applied to investment strategies.

If you are interested in a career as an equity research analysts or in fixed income research, our online course covers all the key skills needed as either a sell side analyst in an investment bank or a buy side analyst working in an investment management firm.

Share this article

Example of an equity research report.

Sign up to access your free download and get new article notifications, exclusive offers and more.

Recommended Course

404 Not found

Start my free trial

Please fill out the form below and an AlphaSense team member will be in touch within 20 minutes to help set up your trial.

The Value of Equity Research

Equity research is an invaluable asset for anyone looking to stay up-to-date on market and industry trends. In this guide, you will learn about the type of information contained in equity research, the value it offers to corporate professionals, and how the most advanced teams are already leveraging the expertise of Wall Street’s top analysts to inform critical business decisions.

Get the guide

Introduction.

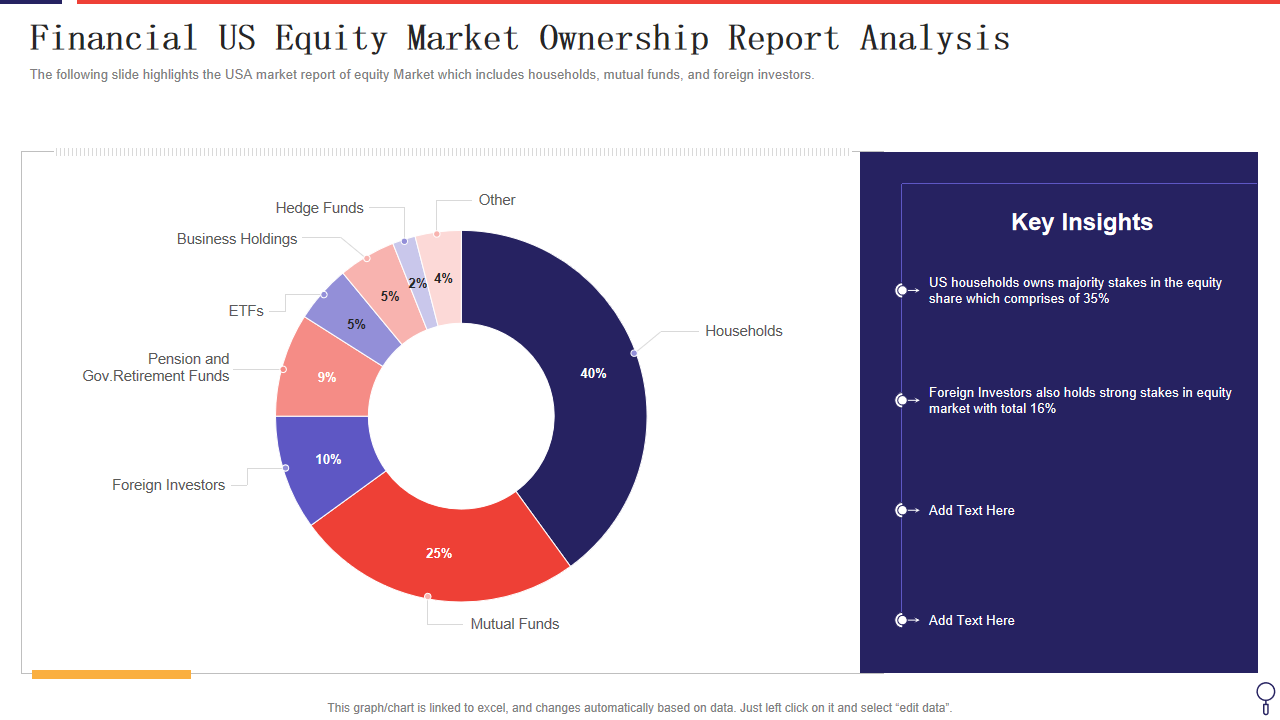

Equity research, which forms a multi-billion dollar industry for investment banks, is produced by thousands of analysts worldwide to provide the market with valuable information on companies, industries, and market trends. Today, over 90% of equity research is consumed by fund managers, who have the Wall Street relationships to acquire it and the analyst resources to mine it for insights. For corporate strategy professionals who lack this access, however, equity research has historically been challenging to obtain and navigate.

To help corporations circumvent these challenges, AlphaSense has introduced Wall Street Insights, the first and only equity research collection purpose-built for the corporate user. Through the AlphaSense platform, any business making strategic plans or product decisions, conducting competitive analysis, evaluating M&A, or engaging in investor relations can now tap into the deep industry expertise of Wall Street’s top analysts.

What is Equity Research?

Equity research is developed by sell-side firms to help investors and hedge fund managers discover market opportunities and make informed investment decisions. Increasingly, this expert analysis has also been identified by forward-looking corporations as a highly valuable tool to inform strategic decision-making.

There are thousands of sell-side firms that employ expert analysts around the globe to write equity research for the market. The majority of firms producing equity research are hyper-focused and only have one or two analysts developing reports on a specific industry. However, larger firms, such as Morgan Stanley and Bank of America, collectively employ thousands of analysts to write reports on thousands of public companies–covering everything from TMT giants to niche products.

Equity research analysts are deep subject matter experts who are often former executives, industry veterans, or academics. These analysts conduct in-depth research and publish reports on corporations, industries, and macro trends, offering an expert lens into a subject.

Historically, over 90% of equity research was consumed by buy-side fund managers, who had the Wall Street relationships to acquire it and the analyst resources to mine it for insights. For buy-side professionals, equity research is a critical tool to inform sound investment decisions backed by expert insights.

Today, equity research is increasingly relied upon by corporate teams as a high-value source of information. These teams leverage equity research to make strategic business plans, conduct competitive analysis, evaluate mergers and acquisitions, and make product and marketing decisions. For corporations, the value of equity research lies in the detailed coverage of their company, their competitors, and how they are performing related to the marketplace they are within.

What is an Equity Research Report?

An equity research report is a document prepared by an equity research analyst that often provides insight on whether investors should buy, hold, or sell shares of a public company. In an equity research report, an analyst lays out their recommendation, target price, investment thesis, valuation, and risks.

There are multiple forms of equity research, including (but not limited to):

An update report that highlights the latest news, company announcements, earnings reports, Buy Sell Hold ratings, M&A activity, anything that impacts the value of the company.

A comprehensive company report that is compiled when an analyst or firm initiates their coverage of a stock. Initiation reports cover all of the divisions and products of a company in-depth to provide a baseline of what the company is and how it is performing. Initiation reports can be tens to hundreds of pages long, depending on the complexity of a company.

General industry updates that cover a group of similar companies within a sector. Industry-specific reports typically dive into additional factors such as loan growth, interest rates, interest income, net income, and regulatory capital.

A report compiled by research firms either daily or weekly. These reports can often be a great place to get more in-depth insight on commodities and also get market opinions from commodity analysts or traders who write the reports.

A quick 1-2 page report that comments on a news release from a company or other quick information

What is Included in a Typical Equity Research Report?

Research reports don’t need to follow a specific formula. Analysts at different investment banks have some latitude in determining the look and feel of their reports. But more often than not, research reports follow a certain protocol of what investors expect them to look like.

A typical equity research report includes in-depth industry research, management analysis, financial histories, trends, forecasting, valuations, and recommendations for investors. Sometimes called broker research reports or investment research reports, equity research reports are designed to provide a comprehensive snapshot that investors or corporate leaders can leverage to make informed decisions.

Here’s a quick overview of what a standard equity research report covers:

This section covers events, such as quarterly results, guidance, and general company updates.

Upgrades/Downgrades are positive or negative changes in an analyst’s outlook of a particular stock valuation. These updates are usually triggered by qualitative and quantitative analysis that contributes to an increase or decrease in the financial valuation of that security.

Estimates are detailed projections of what a company will earn over the next several years. Valuations of those earnings estimates form price targets. The price target is based on assumptions about the asset’s future supply & demand and fundamentals.

Management Overview and Commentary helps potential investors understand the quality and makeup of a company’s management team. This section can also include a history of leadership within the company and their record with capital allocation, ESG, compensation, incentives, stock ownership. Plus, an overview of the company’s board of directors.

This section covers competitors, industry trends, and a company’s standing among its sector. Industry research includes everything from politics to economics, social trends, technological innovation, and more.

Historical Financial Results typically cover the history of a company’s stock, plus expectations based on the current market and events surrounding it. To determine if a company is at or above market expectations, Analysts must deeply understand the history of a specific industry and find patterns or trends to support their recommendations.

Based on the market analysis, historical financial results, etc., an analyst will run equity valuation models. In some cases, analysts will run more than one valuation model to determine the worth of company stock or asset.

Absolute valuation models : calculates a company’s or asset’s inherent value.

Relative equity valuation models : calculates a company’s or asset’s value relative to another company or asset. Relative valuations base their numbers on price/sales, price/earnings, price/cash flow.

An equity research analyst’s recommendation to buy, hold, or sell. The analyst also will have a target price that tells investors where they expect the stock to be in a year’s time.

What Does an Equity Research Analyst Do?

Equity research analysts exist on both the buy-side and the sell-side of the financial services market. Although these roles differ, both buy-side and sell-side analysts produce reports, projections, and recommendations for specific companies and stocks.

An equity research analyst specializes in a group of companies in a particular industry or country to develop high-level expertise and produce accurate projects and recommendations. Since ER analysts generally focus on a small set of stocks (5-20), they become specialists in those specific companies and industries that they evaluate or follow. These analysts monitor market data and news reports and speak to contacts within the companies/industries they study to update their research daily.

Analysts need to comprehend everything about their ‘coverage’ to give investment endorsements. Equity research analysts must be conversant with the business regulations and regime policies within the country to decide how it will affect the market environment and business in general. The more you understand the industries in detail, the easier it will be for you to decipher market dynamics.

One prevalent aspect of an equity research analyst’s job is building and maintaining valuable relationships with corporate leaders, clients, and peers. Equity research is largely about an analyst’s ability to service clients and provide insightful ideas that positively influence their investing strategy.

EQUITY RESEARCH ANALYSTS:

- Analyze stocks to help portfolio managers make better-informed investment decisions.

- Analyze a stock against market activity to predict a stock’s outlook.

- Develop investment models and provide trading strategies.

- Provide expertise on markets and industries based on their competitive analysis, business analysis, and market research.

- Use data to model and measure the financial risk associated with particular investment decisions.

- Understand the details of various markets to compare a company’s and sector’s stock

Buy-Side vs. Sell-Side Analysts

Although the roles of buy-side and sell-side analysts do overlap in some respects, the purpose of their research differs.

How Do Corporates Currently Access Equity Research?

If you were to Google “equity research reports,” you would not get access to equity research, earnings call transcripts or trade journals. You would, however, discover an unmanageable amount of noise to sift through.

Accessing equity research reports is highly dependent on relationships and entitlements, particularly for corporate teams. Unlike financial firms and investor relations teams, who can access equity research by procuring the right entitlements, corporate teams have a much harder time finding and purchasing high-quality equity research.

If you were to search online for equity research, for example, you would be presented with sub-par options such as:

Some websites allow you to search for research reports on companies or by firms. Some of the reports are free, but you must pay for most of them. Prices range from just $15 to thousands of dollars.

If you want just the bottom-line recommendations from analysts, many sites summarize the data. Nearly all the websites that provide stock quotes also compile analyst recommendations, however, you will only get the big picture and not any of the detailed analysis.

Some independent research providers sell their reports directly to investors. These reports typically include an overview of what a stock’s price could be, plus an analysis of the company’s earnings. These reports often cost less than $100 but can be more.

The majority of equity research is completely unsearchable, which is why AlphaSense’s Wall Street Insights is changing the game for corporations globally. Now, with WSI, corporations can leverage this high-quality research to augment their understanding of specific companies and industries; plus, AlphaSense’s corporate clients can now conduct more meaningful analysis and make more data-driven decisions.

Real-Time Research : Real-Time research is available to eligible users (based on an entitlement) immediately upon publication by the broker. Financial Services users with entitlements are the primary consumers of real-time research, while some Corporate professionals are also eligible. Payment for real-time research is made directly from clients to brokers through trading commissions or hard dollar agreements.

Aftermarket Research : Aftermarket research is a collection of many of the same documents as the real-time collection, but it is available after a zero to fifteen-day delay. Investment bankers, consultants, and corporate users are the primary consumers of Aftermarket research.

What is Wall Street Insights?

Wall Street Insights is the first and only equity research collection purpose-built for the corporate market, providing corporations unprecedented access to a deep pool of equity research reports from thousands of expert analysts.

Through partnerships with Morgan Stanley, Bank of America, Barclays, Bernstein, Bernstein Autonomous, Cowen, Deutsche Bank, Evercore ISI, HSBC, and others, corporate professionals can now access the world’s most revered equity research, indexed and searchable in the AlphaSense platform.

From macro market trends and industry analyses to company deep-dives, the Wall Street Insights content collection provides corporate professionals with a 360-degree view of every market. With the valuable expertise of thousands of analysts on your side, corporate teams can quickly compare insights, validate internal assumptions, and generate new ideas to guide critical business decisions and strategies.

In terms of search and accessibility, Wall Street Insights is the first of its kind. Not only does AlphaSense offer hard-to-find equity research reports, but we also provide a robust and seamless search experience.

What Research Do You Get Access to with WSI?

Get access to the world’s leading equity research with Wall Street Insights. Download the e-book to learn more about equity research from Morgan Stanley, Barclays, Bernstein, Deutsche Bank, and more.

“We are delighted to partner with AlphaSense to expand access to Morgan Stanley’s global research platform,” says Simon Bound, Global Head of Research at Morgan Stanley. We have over 600 publishing analysts covering companies, industries, commodities, and macroeconomic developments across more than 50 countries. Morgan Stanley will bring corporates a unique perspective from our best in class analysts, a global platform, and a collaborative culture that enables us to unravel the most complex market and industry trends.”

How Can Companies Leverage Equity Research?

Discover how the world’s most innovative companies leverage Wall Street Insights to make critical business decisions every day. Download the e-book to read real case studies from a Corporate Development team and a Corporate Strategy team.

“AlphaSense’s corporate users are typically Corporate Strategy, Corporate Development, and Investor Relations professionals. Today, thousands of enterprises rely on equity research to power data-driven decision making. These teams leverage equity research reports to:”

- Create investment ideas

- Monitor peers in real-time (and discover what equity research is being produced about them)

- Model and evaluate companies (for M&A or general benchmarking)

- Dive deep into customers, partners, and prospects

- Get up-to-speed quickly on specific industry trends

- Prepare for earnings season

Ready to explore the world’s leading equity research

How to Write an Equity Research Report

If you're interested in the financial industry or you're studying finance, you've probably heard of equity research reports. These documents are crucial for investment banking and trading firms that need to analyze and evaluate different strategics in the market. But what exactly are equity research reports, and how can you write one yourself? In this article, we'll guide you through the process of creating an equity research report, step-by-step.

Understanding the purpose of an equity research report.

The first step to writing a great equity research report is understanding its purpose. At its core, an equity research report is a document that provides in-depth analysis and valuation of a company's stock. The report is written for investors who want to understand whether the company is a good investment opportunity.

Equity research analysts spend countless hours researching and analyzing a company's financial statements, industry trends, and economic conditions before they write their report. They use a variety of analytical tools and techniques to evaluate a company's performance, including financial ratios, discounted cash flow analysis, and market multiples.

One of the key goals of an equity research report is to provide investors with an objective and unbiased assessment of a company's future prospects. Analysts are expected to be independent and free of conflicts of interest, so that investors can trust the information they provide.

What is an Equity Research Report?

An equity research report is a comprehensive document that contains detailed information on a particular company, industry, or asset. The report is prepared by an equity analyst, who works for an investment banking or trading firm.

Equity research reports typically include a variety of sections, including an executive summary, company overview, industry analysis, financial analysis, valuation , and investment recommendation. The executive summary provides a brief overview of the report's findings, while the company overview provides a detailed description of the company's business model, products, and services.

The industry analysis section provides an overview of the company's industry, including market size, growth prospects, and competitive landscape. The financial analysis section provides an in-depth analysis of the company's financial statements, including income statements, balance sheets, and cash flow statements.

The valuation section provides an estimate of the company's intrinsic value, based on a variety of factors, including earnings, cash flow, and assets. The investment recommendation section provides the analyst's opinion on whether the stock is a buy, hold, or sell, based on their analysis of the company's financial health and future prospects.

Importance of Equity Research Reports in the Financial Industry

Equity research reports are important in the financial industry because they help investors make informed decisions about which stocks to buy, hold or sell. These documents provide valuable information on a company's financial health, strategy, and overall performance.

Equity research reports are also important for companies, as they can help them attract new investors and improve their stock price. A positive equity research report can increase investor confidence in a company, leading to increased demand for its stock and a higher stock price.

However, equity research reports can also be controversial, as analysts may have conflicts of interest that can bias their recommendations. For example, an analyst may work for an investment bank that has a financial interest in the company being analyzed, which could lead to a biased report.

Overall, equity research reports play an important role in the financial industry, providing investors with valuable information that can help them make informed investment decisions.

Preparing to Write an Equity Research Report

Equity research reports are crucial in the world of finance as they help investors make informed decisions. These reports are written by equity research analysts, who analyze a company's financial performance and provide recommendations to investors. Before you start writing your equity research report, you need to gather relevant information and perform extensive research on the company you're analyzing. The following steps will help you prepare for your report:

Gathering Relevant Company Information

Before you start analyzing a company, you need to know everything about it. You must start by gathering information on the company you're analyzing. This includes the company's official name, primary business, history, management team, and more. You can find this information on the company's official website, annual reports, regulatory filings, and other relevant sources. It is important to ensure that the information you gather is accurate and up-to-date.

For instance, if you're analyzing a tech company, you need to know what products or services they offer. You also need to know how long they've been in business, who their key executives are, and what their mission statement is. This information will help you gain a better understanding of the company and its operations.

Analyzing Financial Statements

Once you have gathered information about the company, you need to analyze its financial statements. Financial statements are the company's official records that show its financial performance. These documents include the balance sheet, income statement, and cash flow statement. You can use financial ratios and financial modeling techniques to analyze the company's financial health.

For instance, you can use the price-to-earnings ratio (P/E ratio) to determine whether a company's stock is undervalued or overvalued. You can also use the debt-to-equity ratio to determine whether a company is financially stable or not. By analyzing a company's financial statements, you can gain insights into its profitability, liquidity, and solvency.

Conducting Industry and Competitor Analysis

Finally, you need to conduct industry and competitor analysis. This involves researching the industry in which the company operates, as well as analyzing its competitors. Understanding the competitive landscape can help you evaluate the company's strengths and weaknesses and identify future growth opportunities.

For instance, if you're analyzing a company in the retail industry, you need to know who its competitors are and what they're doing. This will help you identify the company's competitive advantage and determine whether it can sustain its growth in the long run. Industry analysis can also help you identify trends and changes in the market that may affect the company's performance.

Writing the Executive Summary

The executive summary is a crucial part of the equity research report. It provides a concise overview of the report's key findings and investment recommendations. In essence, it serves as a snapshot of the entire report, allowing investors to quickly grasp the main points and decide whether to read the full report.

However, writing a great executive summary can be a challenge. It requires the writer to condense a large amount of information into a few paragraphs while still conveying the most important details. Here are some tips for writing a great executive summary:

Key Components of an Executive Summary

A great executive summary should include the following components:

- Company Overview: This section should include a brief summary of the company you're analyzing. It should cover the company's history, its products or services, and its mission statement. This section should also include any recent news or developments that are relevant to the company's performance.

- Industry Analysis: This section provides an overview of the industry in which the company operates. It should cover the size of the industry, its growth prospects, and any major trends or challenges facing the industry. This section should also include an analysis of the company's position within the industry.

- Financial Analysis : This section provides an overview of the company's financial performance. It should cover the company's revenue, profitability, and cash flow. This section should also include an analysis of the company's financial ratios, such as its price-to-earnings ratio and its debt-to-equity ratio.

- Investment Recommendations: This section should include your buy, hold, or sell recommendations, along with the target price and time horizon. It should be based on your analysis of the company's financial performance, its position within the industry, and any other relevant factors.

Tips for Writing a Concise and Informative Executive Summary

When writing your executive summary, you should keep the following tips in mind:

- Keep it short and concise: Aim for a summary that is one or two paragraphs long. Remember that the purpose of the executive summary is to provide a quick overview of the report, so it should be brief and to the point.

- Focus on the most important information: Highlight the key findings and recommendations that are most relevant to investors. Avoid getting bogged down in details that are not essential to the investment decision.

- Use clear and concise language: Avoid using jargon or technical terms that investors may not understand. Use simple, straightforward language that is easy to understand.

- Include a call to action: End your executive summary with a clear call to action, such as "Buy," "Hold," or "Sell." This will help investors quickly understand your investment recommendation.

By following these tips, you can write an executive summary that effectively communicates your investment analysis and recommendations to investors. Remember that the executive summary is often the first thing investors will read, so it's important to make a strong first impression.

Assessing the Company's Business Model and Strategy

After writing your executive summary, the next step is to assess the company's business model and strategy. This is an important step in determining the company's strengths and weaknesses, and identifying areas for improvement.

When assessing the company's business model and strategy, it's important to consider a variety of factors. These may include the company's competitive advantage, growth strategy, and financial performance.

Evaluating the Company's Competitive Advantage

One key factor to consider when evaluating the company's competitive advantage is product differentiation. Does the company offer unique products or services that distinguish it from its competitors? This can be a major advantage, as it can help the company attract and retain customers.

Another important factor to consider is cost advantage. Does the company have lower production costs than its competitors? This can help the company maintain a competitive edge by offering lower prices or higher profit margins.

Brand recognition is also an important factor to consider. Is the company's brand well-known and respected? A strong brand can help the company build customer loyalty and increase its market share.

Analyzing the Company's Growth Strategy

Another key factor to consider when assessing the company's business model and strategy is its growth strategy. This includes the company's plans for expansion, research and development, and mergers and acquisitions.

Expansion can be a key driver of growth for a company, but it can also be risky. It's important to evaluate the company's expansion plans carefully to ensure that they are well thought out and have a high likelihood of success.

Research and development is another important factor to consider. Is the company investing in new products or technologies that could give it a competitive advantage in the future? If so, this could be a good sign for the company's long-term growth potential.

Mergers and acquisitions can also be a key part of a company's growth strategy. However, it's important to evaluate these deals carefully to ensure that they make strategic sense and will create value for the company's shareholders.

Performing Financial Analysis

Once you have gathered all the necessary financial data, the next step is to perform financial analysis to evaluate the company's financial health. This is a crucial step in the investment process, as it helps investors make informed decisions about whether or not to invest in a particular company.

Financial analysis involves using a variety of tools and techniques to analyze the company's financial statements, including financial ratios, cash flow analysis, and valuation methods.

Ratio Analysis

Ratio analysis is a popular method of financial analysis that involves comparing different financial ratios to evaluate the company's financial health. Financial ratios are useful because they allow investors to compare a company's performance over time, or against its competitors or industry benchmarks.

Some of the most common financial ratios used in ratio analysis include the debt-to-equity ratio, return on equity, and profit margin. These ratios can provide valuable insights into a company's financial health, including its ability to generate profits, manage debt, and create shareholder value.

Cash Flow Analysis

Cash flow analysis is another important tool for evaluating a company's financial health. This involves analyzing the company's cash flow statement to understand its ability to generate cash and fund operations.

When performing cash flow analysis, it's important to look at the company's operating cash flow, investing cash flow, and financing cash flow. By understanding how the company generates and uses cash, investors can gain a better understanding of its financial health and future prospects.

Valuation Methods

Valuation methods are used to determine a company's fair value. There are several different valuation methods that investors can use, including discounted cash flow analysis, multiples analysis, and precedent transactions analysis.

Discounted cash flow analysis involves estimating the future cash flows of a company and discounting them back to their present value. Multiples analysis involves comparing a company's financial ratios to those of its peers or industry benchmarks. Precedent transactions analysis involves looking at the prices paid for similar companies in the past to estimate the fair value of the company being analyzed.

By using a combination of financial analysis tools and techniques, investors can gain a comprehensive understanding of a company's financial health and make informed investment decisions.

Providing Investment Recommendations