- Browse All Articles

- Newsletter Sign-Up

- 15 Dec 2020

- Working Paper Summaries

Designing, Not Checking, for Policy Robustness: An Example with Optimal Taxation

The approach used by most economists to check academic research results is flawed for policymaking and evaluation. The authors propose an alternative method for designing economic policy analyses that might be applied to a wide range of economic policies.

- 31 Aug 2020

- Research & Ideas

State and Local Governments Peer Into the Pandemic Abyss

State and local governments that rely heavily on sales tax revenue face an increasing financial burden absent federal aid, says Daniel Green. Open for comment; 0 Comments.

- 12 May 2020

Elusive Safety: The New Geography of Capital Flows and Risk

Examining motives and incentives behind the growing international flows of US-denominated securities, this study finds that dollar-denominated capital flows are increasingly intermediated by tax haven financial centers and nonbank financial institutions.

- 01 Apr 2019

- What Do You Think?

Does Our Bias Against Federal Deficits Need Rethinking?

SUMMING UP. Readers lined up to comment on James Heskett's question on whether federal deficit spending as supported by Modern Monetary Theory is good or evil. Open for comment; 0 Comments.

- 20 Mar 2019

In the Shadows? Informal Enterprise in Non-Democracies

With the informal economy representing a third of the GDP in an average Middle East and North African country, why do chronically indebted regimes tolerate such a large and untaxed shadow economy? Among this study’s findings, higher rates of public sector employment correlate with greater permissibility of firm informality.

- 30 Jan 2019

Understanding Different Approaches to Benefit-Based Taxation

Benefit-based taxation—where taxes align with benefits from state activities—enjoys popular support and an illustrious history, but scholars are confused over how it should work, and confusion breeds neglect. To clear up this confusion and demonstrate its appeal, we provide novel graphical explanations of the main approaches to it and show its general applicability.

- 02 Jul 2018

Corporate Tax Cuts Don't Increase Middle Class Incomes

New research by Ethan Rouen and colleagues suggests that corporate tax cuts contribute to income inequality. Open for comment; 0 Comments.

- 13 May 2018

Corporate Tax Cuts Increase Income Inequality

This paper examines corporate tax reform by estimating the causal effect of state corporate tax cuts on top income inequality. Results suggest that, while corporate tax cuts increase investment, the gains from this investment are concentrated on top earners, who may also exploit additional strategies to increase the share of total income that accrues to the top 1 percent.

- 08 Feb 2018

What’s Missing From the Debate About Trump’s Tax Plan

At the end of the day, tax policy is more about values than dollars. And it's still not too late to have a real discussion over the Trump tax plan, says Matthew Weinzierl. Open for comment; 0 Comments.

- 24 Oct 2017

Tax Reform is on the Front Burner Again. Here’s Why You Should Care

As debate begins around the Republican tax reform proposal, Mihir Desai and Matt Weinzierl discuss the first significant tax legislation in 30 years. Open for comment; 0 Comments.

- 08 Aug 2017

The Role of Taxes in the Disconnect Between Corporate Performance and Economic Growth

This paper offers evidence of potential issues with the current United States system of taxation on foreign corporate profits. A reduction in the US tax rate and the move to a territorial tax system from a worldwide system could better align economic growth with growth in corporate profits by encouraging firms to invest domestically and repatriate foreign earnings.

- 07 Nov 2016

Corporate Tax Strategies Mirror Personal Returns of Top Execs

Top executives who are inclined to reduce personal taxes might also benefit shareholders in their companies, concludes research by Gerardo Pérez Cavazos and Andreya M. Silva. Open for comment; 0 Comments.

- 18 Apr 2016

Popular Acceptance of Morally Arbitrary Luck and Widespread Support for Classical Benefit-Based Taxation

This paper presents survey evidence that the normative views of most Americans appear to include ambivalence toward the egalitarianism that has been so influential in contemporary political philosophy and implicitly adopted by modern optimal tax theory. Insofar as this finding is valid, optimal tax theorists ought to consider capturing this ambivalence in their work, as well.

- 20 Nov 2015

Impact Evaluation Methods in Public Economics: A Brief Introduction to Randomized Evaluations and Comparison with Other Methods

Dina Pomeranz examines the use by public agencies of rigorous impact evaluations to test the effectiveness of citizen efforts.

- 07 May 2014

How Should Wealth Be Redistributed?

SUMMING UP James Heskett's readers weigh in on Thomas Piketty and how wealth disparity is burdening society. Closed for comment; 0 Comments.

- 08 Sep 2009

The Height Tax, and Other New Ways to Think about Taxation

The notion of levying higher taxes on tall people—an idea offered largely tongue in cheek—presents an ideal way to highlight the shortcomings of current tax policy and how to make it better. Harvard Business School professor Matthew C. Weinzierl looks at modern trends in taxation. Key concepts include: Studies show that each inch of height is associated with about a 2 percent higher wage among white males in the United States. If we as a society are uncomfortable taxing height, maybe we should reconsider our comfort level for taxing ability (as currently happens with the progressive income tax). For Weinzierl, the key to explaining the apparent disconnect between theory and intuition starts with the particular goal for tax policy assumed in the standard framework. That goal is to minimize the total sacrifice borne by those who pay taxes. Behind the scenes, important trends are evolving in tax policy. Value-added taxes, for example, are generally seen as efficient by tax economists, but such taxes can bear heavily on the poor if not balanced with other changes to the system. Closed for comment; 0 Comments.

- 02 Mar 2007

What Is the Government’s Role in US Health Care?

Healthcare will grab ever more headlines in the U.S. in the coming months, says Jim Heskett. Any service that is on track to consume 40 percent of the gross national product of the world's largest economy by the year 2050 will be hard to ignore. But are we addressing healthcare cost issues with the creativity they deserve? What do you think? Closed for comment; 0 Comments.

The Official Journal of the Pan-Pacific Association of Input-Output Studies (PAPAIOS)

- Open access

- Published: 09 May 2020

Tax structure and economic growth: a study of selected Indian states

- Yadawananda Neog ORCID: orcid.org/0000-0002-3578-0460 1 &

- Achal Kumar Gaur 1

Journal of Economic Structures volume 9 , Article number: 38 ( 2020 ) Cite this article

49k Accesses

26 Citations

3 Altmetric

Metrics details

The present study examines the long-run and short-run relationship between tax structure and state-level growth performance in India for the period 1991–2016. The analysis in this paper is based on the model of Acosta-Ormaechea and Yoo ( 2012 ), and for the verification of the relationship between taxation and economic growth the panel regression method is used. With the use of 14 Indian states data, Panel Pool mean group estimation indicates that income tax and commodity–service tax have negative effects whilst property and capital transaction tax have a significant positive effect on state economic growth. This study finds ‘U’ shape relationship between tax structure and growth performance. Based on the analysis, we conclude that for faster growth of Indian states, policymakers should give more focus on property taxes along with the reduction in income taxes.

1 Introduction

The study on the potential association between tax structure and growth performance has gathered a great deal of attention from policymakers, academicians and regulatory circles for several reasons. First, the developing and emerging economies require a large volume of tax revenues for the smooth and efficient functioning of the state at both the national and sub-national levels. Globalization has laid down the foundation for Goods and Service Tax (GST) in many developing countries (Mcnabb 2018 ). Due to competition, developing countries are also facing the difficulties to maintain existing tax revenues (Bird and Zolt 2011 ). Second, tax collection and structure of it create distortionary impacts in the economy through tax burden. Thus, the positive and negative impact of tax made the ‘tax–growth’ relationship more complex and the structure of taxation has a definite role in the development process of an economy.

In a budget constraint economy like India, investigation of tax–growth relationship enables us to formulate the suitable policy measure for the more inclusive and equitable growth process. The budget crisis is usually resolved through the cut-down of public spending or/and an increase in tax revenues (Macek 2014 ). Rapid reduction in spending or increase in taxes is harmful to long-run growth performance. Thus, the concern of the government lies with the problem of fiscal consolidation with sustainable growth performance where tax policies are vital.

Empirical evidence on the impact of tax structure on growth performance is not conclusive. India has adopted the Goods and Service Tax (GST) policy in 2017 intending to raise indirect tax collections and transform the indirect tax structure into a single market to avoid tax evasions and double taxation. GST is regarded as one of the major tax policy changes in independent India and economists are an optimist about its impact on revenue generations and growth performance. But this policy is not the only policy that shaped in independent India; other major policy changes also take place after independence. Footnote 1 Tax Reform Committee (TRC) report of 1991 regarded one of the productive and structured policy recommendations in the recent decade. At the state level, sales tax reform in the form of Value Added Tax (VAT) in 2005 becomes a fruitful policy initiative. However, the tax collections in both national and sub-national level are still low as compared to the international standards. Changes in tax policy also change in the tax structure in the economy and India witnessed these changes at both levels of governments. Recent studies proved that the changes in tax structure have decisive implication in the growth performance through work–leisure behaviour, investment decisions and overall productivity (Arnold et al. 2011 ; Gemmell et al. 2011 ; Macek 2014 ; Mdanat et al. 2018 ; Durusu-Ciftci 2018 ). In India, very few empirical studies are available which analyse the impact of these changes in tax structure on growth performance and this study will be first to investigate tax–growth nexus in India with the use of state-level data.

This analysis primarily concerned with tax structure rather than to tax levels (usually measured as a tax–GDP ratio). The main advantage of tax structure analysis is that it provides revenue-neutral tax policy changes which remove the difficulties related with the question of how aggregate tax revenue changes relates with expenditure changes (Arnold et al. 2011 ). The empirical results from linear panel regression suggest us that property and capital transection tax are positively affecting the state’s growth performance, where commodity and service tax effect negatively. However, the non-linear panel regression indicates that the positive effect is only visible for property taxes at a higher level where the negative effect of commodity and service taxes becomes positive after a threshold point. The effect of income tax is not significant in long run irrespective of panel regression models.

The structure of the paper is as follows: Sect. 2 deals with the theoretical framework and empirical literature, followed by a brief description of data and methodology in Sect. 3 . Empirical results and discussion are presented in Sect. 4 and our last Sect. 5 is for conclusions and recommendations.

2 Theoretical framework and empirical literature

Growth literature very recently acknowledges the role of taxation in the growth process of an economy. Until recently, growth models are more concerned with the steady-state process and exogenous changes. On the theoretical ground, taxation does not have any impact on growth (Myles 2000 ). Development of endogenous growth models creates the space for fiscal policy especially tax policy in determining the growth performance. Barro ( 1990 ), King and Rebello ( 1990 ) and Jones et al. ( 1993 ) were the pioneer in this regard. Tax level and tax structure have an impact on the saving behaviour of the household and investment in human capital. On the other hand, the firm also changes its investment decisions and innovations following tax policies (Johansson et al. 2008 ). These decisions and incentives in the accumulation of physical and human capital create the ‘Growth’ disparities amongst the countries and state economies.

A large body of literature available on “Tax-Growth” relationship is mostly dedicated to cross-country settings (Martin and Fardmanesh 1990 ; Karras 1999 ; Myles 2000 ; Tosun and Abizadeh 2005 ; Johansson et al. 2008 ; Vartia et al. 2008 ; Arnold 2011 ; Szarowska 2013; Macek 2014 ; Stoilova 2017 ; Safi et al. 2017 ; Durusu-Ciftci 2018 ) that investigates the effect of tax policy on economic performance. Income and corporation taxes are the major tax instruments for the governments irrespective of the level of developments of a country. The formation of tax structure with these two taxes has many implications in the growth performance. The study made by Arnold et al. ( 2011 ), Macek ( 2014 ) and Dackehag and Hansson ( 2012 ) has explored the negative relation of income and corporation tax with growth performance. Vartia et al. ( 2008 ) find the negative impact of corporation tax for OECD countries. If we consider the average and marginal tax rate, marginal tax is very influential than to average tax rate in investment decisions and labour supply. Empirical studies prove that marginal tax has a negative relation with growth, which indicate raising of marginal tax rate is associated with compromises with growth performance (Padovano and Galli 2001 ; Lee and Gordon 2005 ; Poulson and Kaplani 2008 ). Studies also established that other type of taxes also has a significant impact on growth performance, like consumption tax (Johansson et al. 2008 ; Durusu-Ciftci 2018 ), GST and Payroll (Tosun and Abizadeh 2005 ), property tax (Xing 2011 ), labour tax (Szarowska 2014 ), sales tax (Ojede and Yamarik 2012 ), excise (Reynolds 2006 ), etc.

However, looking at the single country’s perspective, we find very little evidence on the same. Stockey and Rebelo ( 1995 ) with the use of the endogenous growth model study the role of tax reforms on U.S. growth performance. They have found that tax reforms have very minor implication with economic outcomes. There are several studies exist for US economy where they empirically try to establish the link between tax and growth. Atems ( 2015 ) finds the spatial spillover effect of income taxes on the growth of 48 contiguous states. On the other hand, Ojede and Yamarik ( 2012 ) have not found any kind of impact of income taxes on growth in these states. Their panel pool mean group estimation indicates that property and sales tax has detrimental consequences in development. With the use of data for the U.S. covering the period of 1912–2006, Barro and Redlick ( 2009 ) find that average marginal income taxes were halting the economic growth. However, they have provided an interesting argument that in wartime, the tax does not have any kind of relation with growth. In search of an answer to the question that whether corporate tax rise destroys jobs in the U.S., Ljungqvist and Smolyansky ( 2016 ) use firm-level data for the period 1970–2010. The main conclusion of the paper is that a rise in corporate tax is not good for employment and income and has very little impact on economic activity. Using the error correction model, Mdanat et al. ( 2018 ) find for Jordan that income tax, corporation tax and personal tax negatively impact the growth. They suggest that irrespective of tax collection, the prime focus of the government should be social justice of the people. Dladla and Khobai ( 2018 ) also find similar results for South Africa where income taxes are coming out to be negative. For the case of Italy, Federici and Parisi ( 2015 ) used the 880 firms’ data and results show that corporation tax is bad for investments with the consideration of both effective average and marginal taxes rates.

Looking at the literature, the empirical relationship of tax structure with growth performance is still unclear for India. This study attempts to fill the gap by examining the effect of tax policy on economic performance in an emerging economy such as India at the state level. Second, with the use of panel Pool Mean Group (PMG) estimator which assumes slope homogeneity in the long run and heterogeneity in the short run, we can incorporate the dynamic behaviour of the variables which will be new to tax structure–growth study in India. Third, the tax–growth nexus may show a non-linear relationship due to the threshold effect. We consider this non-linearity in our panel regression model which will be a contribution to the existing literature.

3 Data and methodology

To study the effect of tax policy on economic performance in India, we employed three models and included each tax instruments in the models separately to avoid the problem of Multicollinearity. Following the works of Arnold et al. ( 2011 ) and Acosta-Ormaechea and Yoo ( 2012 ), the tax structure is measured by the share of individual tax to the total state tax revenues. We investigate the tax–growth relationship with the following equation.

Here, Y it is the growth rate of Per capita net state domestic product (NSDP), SGI is the state gross investment as a percentage of state domestic product, TAX is one of the tax shares (Property, Commodity & Services and Income), Tax Burden Footnote 2 is the ratio of total tax revenues to state domestic product and ϵ is the error term. Per the work of Acosta-Ormaechea and Yoo ( 2012 ), this study is more concerned with the impact of tax structure on growth rate rather than level effect. In model 1, we include property tax share, and in model 2 and model 3, we incorporate commodity & service tax and income tax, respectively. By following the approach of Arnold et al. ( 2011 ), we include total tax burden as a control variable which will reduce the biases that may occur from correlation in between tax mix and tax burden. We also included Secondary Enrollment Rate as a proxy variable for human capital in our model, but the inconsistent and insignificant results make us drop the variable from the final estimation model.

In search of a possible non-linear relationship, we introduce a separate panel regression by introducing the square of each tax share into the models.

If the coefficient of α 3 significant and carries an opposite sign to α 2 , then we can conclude that there is a non-linear relationship exist.

In this study, we included 14 Indian states for the period 1991 to 2016 and excluded North-Eastern states due to their relatively small tax revenue collections. Data have been taken from the Centre for Monitoring Indian Economy (CMIE) and Handbook of Statistics on the Indian States, published by Reserve Bank of India. The states that are included in this study are Andhra Pradesh (undivided), Footnote 3 Assam, Gujarat, Haryana, Himachal Pradesh, Jammu & Kashmir, Karnataka, Kerala, Maharashtra, Punjab, Tamil Nadu, Orissa, Rajasthan and West Bengal. All the states are included in model 1 and model 2. For model 3, due to the data availability, we include only seven states Footnote 4 namely Andhra Pradesh, Assam, Gujarat, Karnataka, Kerala, Maharashtra, and West Bengal.

The selection of the study period is primarily driven by the argument provided by Rao and Rao ( 2006 ) that after the market-oriented economic reform of 1991, more systematic and long-term goal-oriented tax reforms were initiated in state level for India. The economic reform also brings rapid growth in India and it becomes very interesting to look at the tax–growth nexus after the economic reform. The second restriction related to the use of long data span is the availability of data for each tax head for each of the states under this study.

3.1 Unit root

Pool Mean Group (PMG) specification is very fruitful and widely used model to capture the dynamic behaviour of policy variables. This model is very powerful as it can investigate both I (0) and I (1) variables in a single autoregressive distributive lag (ARDL) model setup. A necessary condition in the ARDL model is that the model cannot deal with the I(2) variables. Thus, the investigation of stationarity becomes a compulsion. We used popular panel unit root tests like LLC (Levin et al. 2002 ), the IPS (Im et al. 2003 ), the ADF-Fisher Chi square (Maddala and Wu 1999 ) and PP-Fisher Chi square (Choi 2001 ) in this study.

3.2 Panel PMG model

The Mean Group (MG) estimator was developed by Pesaran and Smith ( 1995 ) to solve the issue of bias related to heterogeneous slopes in dynamic panels. Traditional panel models like instrumental variables’ estimator of Anderson and Hsiao ( 1981 , 1982 ) and Arellano and Bond ( 1991 ) may produce inconsistent results in a dynamic panel framework (Pesaran et al. 1999 ). MG estimator takes the average value of every cross-section and provides the long-run estimate for ARDL or PMG. On the other hand, Pooled Mean Group (PMG) estimator developed by Pesaran et al. ( 1999 ) assumes slope homogeneity in the long run but heterogeneous slopes in the short run for cross-section units. Dynamic Fixed Effect (DFE) also works like PMG and restricts cointegrating vector to be equal across all panels and restricts the speed of adjustment to be equal.

Under these assumptions, PMG is more efficient estimator than to MG and DFE estimator. The prime requirement for PMG estimator is that T should be sufficiently large to N. Panel ARDL or PMG works through maximum likelihood. Our basic PMG begins with the following equation.

Here, x it is the vector explanatory variables and y i is the lag dependent variable. X it allows the inclusion of both I (0) and I (1) variables. State fixed effect is captured through μ i . Above equation can be re-parameterized to ARDL format.

ɸ i measures the state-specific speed of adjustment and known as Error Correction Term. Β i is the vector of long-run relationships and α ij and θ ij are the vectors of short-run dynamic relationships. Pesaran et al. ( 1999 ) did not provide any statistical test for checking long-run relationship but it can be concluded form sign and magnitude of Error Correction Term (ECT). If it is negative and less than − 2, a long-run relationship can be established.

4 Results and discussion

Panel unit root test results from Table 1 suggest that in the case of Model 1 & 2, the Growth rate of Per Capita Net State Domestic Product (PC-NSDP), Property tax and commodity taxes are stationary at level. Gross investment and total tax revenue share to GDP are stationary at the 1st difference in all models and income tax share is also stationary at the same order.

5 PMG model results

We have reported MG, PMG and DFE estimation in the Tables 2 and 3 . The Hausman test indicates that the PMG model is the best model for our data than to MG model. Negative and significant error correction terms in all the models show the long-run relationship in between variable. One major issue related to the tax–growth equation is the problem of endogeneity of the variables. As growth in per capita GDP is our dependent variables, there is a possibility that tax collections behave along with business cycles. Therefore, we tested the weak/strong exogeneity of the tax variables through the correlation analysis between business cycles and tax shares. Business cycles have been calculated using the Hodrick-Prescott (HP) Filter. We have found that all the tax instruments are very weakly related to the business cycles movement and thus, we conclude that variables are not truly endogenous.

The speed of adjustment in PMG model 1, 2 and 3 are 78.9%, 78.4% and 79.6%, respectively. For the sake of completeness, we have reported MG and DFE Footnote 5 model results also. But we are more concerned with the results of PMG estimator as Hausman test suggested that PMG is a better model than to MG. The sign of the property tax is positive and significant in the long run as well as in the short run. Results are in line with the findings of Acosta-Ormaechea and Yoo ( 2012 ). Property tax generally considered a good revenue source for state and municipal governments for providing economic and social services in the city. This tax is also able to establish cost–benefit linkages and feasible decisions for the citizens. The positive impact of property taxes indicates that the revenue generation and productive utilization of these revenues exceed the distortionary effect in these states. As we expected, the tax burden is negatively associated with growth performance in both long run and short run. The relationship is showing the distortionary effect of the tax collection in the state economy. In all models, gross investment enhancing the growth in per capita SDP in the long run. Signs are readily justified as enlargement of capital formation has a positive impact on output and employment which channelized to the development outcomes (Swan 1956 , Solow 1956 ).

Commodity and service taxes are negatively related to the growth in per-capita SDP in the long run as well as in short run and findings are similar to the work of Ojede and Yamarik ( 2012 ). Footnote 6 This tax now comes under the Goods & Services taxes, but in the pre-GST period, commodity and service taxes are reducing growth in per capita NSDP. Commodity taxes are indirect taxes and state own tax revenues mostly come from indirect taxes. As indirect taxes, it has certain disadvantages like inflationary pressure in the economy and regressive to the poor section of the society. Our results also support the same hypothesis that increased commodity tax share is harmful. In India, commodity and service tax includes central sale tax, state excise duty, vehicle tax, goods & passenger tax, electricity duty and entertainment tax. Central sale tax was imposed on interstate trade of commodities which is now transformed to Inter-State GST (IGST). According to Das ( 2017 ), if the IGST rate is high to the Revenue Neutral Rate, it will harm the aggregate demand in the economy through the reduction of disposable income. Heavy vehicle and passenger tax collections are creating an abysmal environment for industrial activities. The tax burden variable is also carrying a negative sign in both long run and short run and magnitude is very similar to model 1. Income tax share has become insignificant and positive in the long run and negative insignificant in the short run.

After examining the linear relationships, we extended our analysis to the examination of a non-linear relationship with the use of PMG estimation model. The result from Tables 4 and 5 indicates the existence of a non-linear relationship between tax structure and growth performance for Indian states. The linear coefficient for property taxes has now become negative and the square of it turns out to be positive. Thus, the property taxes show a ‘U’-shaped relationship with states’ growth performance which implies that a rise in property taxes is bad for growth initially and after a threshold point, it becomes growth enhancing. The threshold point for property taxes is 1.88 which indicates that more than 80.77% observation is more than to threshold point.

In the case of commodity and service taxes, both the linear and non-linear coefficients are significant with different signs. However, the coefficient magnitudes are abnormally large and this is due to the inclusion of both linear and quadratic terms into the single equation. The small commodity and service taxes are very bad for the state economy, whereas the large amount of it shows a positive relation. The threshold point for this tax is 4.45 which implies that 79.95% observation lies above the threshold. This is a very interesting result as high commodity and service taxes could lead to high inflation in the economy and high inflation regarded as atrocious for growth. Further investigation of these findings is highly recommendable. As like linear panel regression, the income tax shows no relation in our non-linear regression model also. However, the short-run coefficient for income tax is significant and shows a negative relationship. Income tax is considered to be distortionary tax to the economy in the presence of income and substitution effect (Kotlan 2011 ). Income tax mostly impacts the savings of the households and labour supply which is regarded as an engine of growth.

6 Conclusions and recommendations

In this study, we try to find out the long-run and short-run relationship between different tax structure and economic growth in states of India. Empirical evidence from linear regression suggests that the property tax enhancing growth and commodity & service taxes reduce it. The non-linear regression validates these findings for property taxes where high property taxes are good for growth. In the case of commodity & service taxes, the results become opposite after the threshold point and affecting the growth negatively. Interestingly, we do not find any significant impact of income taxes on growth in both linear and non-linear regressions in the long run.

As far as the total tax burden is concerned, negative relation with the growth performance is verified and results are in line with Arnold et al. ( 2011 ). The negative effect of commodity and service taxes in the short run is expected to be neutralized through the implementation of GST in India. Promotion of growth performance at the state level concerning income taxes is also very crucial. Income tax has a direct effect on individuals and their saving and investment behaviour. On the other side, tax revenues should be placed in productive investments. With the spending, the government can promote inclusive growth, equality and efficiency in the economy.

The most promising path emerged through this study for long-run growth performance in Indian states is to lower the total tax burden and shifting from income and commodity taxes to property tax for revenue generations. The conclusion may be debatable on various grounds as the studied variables do not take into account institutional quality, administrative efficiency in tax collection, fiscal balance and condition of the states and existence of informal sectors. Future research can be done to incorporate these issues.

Availability of data and materials

Dataset analysed in this study is available from the corresponding author on reasonable request.

One can see the writings of Rao and Rao ( 2006 ) for brief discussion.

This is the proxy for total tax burden in the economy with certain limitations. It does not include informal economy and expenditure policies.

Telangana state was established in 2014. We merged the data of Andhra Pradesh and Telangana to achieve aggregate data for undivided Andhra Pradesh.

Data for Income tax are available for ten states, but inclusion of these states made the model inconsistent due to huge fluctuations in tax revenue collections.

Most of the coefficients of PMG and DFE are in similar range and smaller than to MG estimator. This is due to MG estimator only takes the information of each state time series to estimate long-run and short-run coefficients.

They use sale tax, where our study takes aggregate revenue for commodity and services. However, inference can be drawn as sale tax and is one of the dominant contributors in total commodity and service tax revenue in India.

Abbreviations

Net state domestic product

Goods and service tax

Foreign direct investments

- Pool mean group

Dynamic fixed effect

Auto-regressive distributed lag

The organization for economic co-operation and development

Anderson TW, Hsiao C (1981) Estimation of dynamic models with error components. J Am Stat Assoc 76(375):598–606

Article Google Scholar

Anderson TW, Hsiao C (1982) Formulation and estimation of dynamic models using panel data. J Econom 18(1):47–82

Arellano M, Bond S (1991) Some tests of specification for panel data: monte carlo evidence and an application to employment equations. Rev Econ Stud 58(2):277–297

Arnold JM et al (2011) Tax policy for economic recovery and growth. Econ J 121:59–80. https://doi.org/10.1111/j.1468-0297.2010.02415.x

Atems B (2015) Another look at tax policy and state economic growth: the long and short run of it. Econ Lett 127(1):64–67

Barro RJ (1990) Government spending in a simple model of endogenous growth. J Politic Econ Univ Chicago Press 98(5):103–126

Barro RJ, Redlick CJ (2009) Macroeconomic effects from government purchases and taxes, ADB economics working paper series, No. 232

Bird RM, Zolt EM (2011) Dual income taxation: a promising path to tax reform for developing countries. World Dev 39(10):1691–1703

Choi I (2001) Unit root tests for panel data. J Int Money Fin. 20:249–272

Dackehag M, Hansson A (2012) Taxation of income and economic growth : an empirical analysis of 25 rich OECD countries

Das S (2017) Some concerns regarding the goods and services tax. Econ Polit Wkly 52(9)

Dladla K, Khobai H (2018) The impact of taxation on economic growth in South Africa, MPRA Paper No. 86219, 1–15

Durusu-çiftçi D, Gökmenoğlu KK, Yetkiner H (2018). The heterogeneous impact of taxation on economic development: new insights from a panel cointegration approach. Economic systems. Elsevier BV. https://doi.org/10.1016/j.ecosys.2018.01.001

Federici D, Parisi V (2015) Do corporate taxes reduce investments? Evidence from Italian firm level panel data. Cogent Econ Finance 3:1–14. https://doi.org/10.1080/23322039.2015.1012435

Gemmell N, Kneller R, Sanz I (2011) The timing and persistence of fiscal policy impacts ongrowth: evidence from OECD countries. Econ J 121(550):33–58

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econometrics. 115:53–74

Johansson Å et al (2008) Taxation and economic. Growth. https://doi.org/10.1787/241216205486OECD

Jones L, Manuelli R, Rossi P (1993) Optimal taxation in models of endogenous growth. J Polit Econ 101(3):485–517

Karras G (1999) Taxes and growth: testing the neoclassical and endogenous growth models. Contemporary Econ Policy. 17(2):177–188

King R, Rebelo S (1990) Public policy and economic growth: developing neoclassical implications. J Polit Econ 98(5):S126-50

Kotlán I, Machová Z, Janíčková L (2011) Vliv zdanění na dlouhodobý ekonomický růst. Politická ekonomie. 5:638–658

Lee Y, Gordon RH (2005) Tax structure and economic growth. J Public Econ 89(5–6):1027–1043. https://doi.org/10.1016/j.jpubeco.2004.07.002

Levin A, Lin CF, Chu CS (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econometrics. 108(1):1–24

Ljungqvist A, Smolyansky M (2016). To cut or not to cut? On the impact of corporate taxes on employment and income, Finance and economics discussion series 2016–006. Washington: Board of Governors of the Federal Reserve System, http://dx.doi.org/10.17016/FEDS.2016.006

Macek R (2014) The impact of taxation on economic growth: case study of OECD countries. Rev Econ Perspect. 14(4):309–328. https://doi.org/10.1515/revecp-2015-0002

Maddala GS, Wu S (1999) A comparative study of unit root tests with panel data and a new simple test. Oxford Bull Econ Stat 61:631–652

Martin R, Fardmanesh M (1990) Fiscal variables and growth: a cross-sectional analysis. Public Choice 64:239–251

Mcnabb K (2018) Tax structures and economic growth: new evidence from the government revenue dataset. J Int Dev 30:173–205. https://doi.org/10.1002/jid.3345

Mdanat MF et al (2018) Tax structure and economic growth in Jordan, 1980–2015. EuroMed J Bus 13(1):102–127. https://doi.org/10.1108/EMJB-11-2016-0030

Myles GD (2000) Taxation and economic growth. Fiscal Studies. 21(1):141–168. https://doi.org/10.1016/0264-9993(93)90021-7

Ojede A, Yamarik S (2012) Tax policy and state economic growth : the long-run and short-run of it, Economics Letters. Elsevier BV, 116, No.2, pp. 161–165. https://doi.org/10.1016/j.econlet.2012.02.023

Ormaechea AS, Yoo J (2012) Tax composition and growth: a broad cross-country perspective. IMF Working Papers. https://doi.org/10.5089/9781616355678.001

Padovano F, Galli E (2001) Tax rates and economic growth in the OECD countries (1950–1990). Econ Inq 39(1):44–57

Pesaran MH, Smith RP (1995) Estimating long-run relationships from dynamic heterogeneous panels. J Econometrics. 68:79–113

Pesaran MH, Shin Y, Smith RP (1999) Pooled mean group estimation of dynamic heterogeneous panels. J Am Stat Assoc. 94:621–634

Poulson BW, Kaplani JG (2008) State income taxes and economic growth. Cato J 28(1):53–71

Google Scholar

Rao MGR, Rao RK (2006) Trends and issues in tax policy and reform in India. INDIA POLICY FORUM

Reynolds S (2006) The impact of increasing excise duties on the economy. Working Paper Series 58069. PROVIDE Project

Saafi S, Mohamed MBH, Farhat A (2017) Untangling the causal relationship between tax burden distribution and economic growth in 23 OECD countries: fresh evidence from linear and non-linear Granger causality. Eur J Comp Econ. 14(2):265–301

Solow RM (1956) A contribution to the theory of economic growth. Q J Econ 70(1):65–94

Stoilova D (2017) Tax structure and economic growth: evidence from the European Union. Contaduría y Administración. 62:1041–1057. https://doi.org/10.1016/j.cya.2017.04.006

Stokey NL, Rebelo S (1995) Growth effects of flat-rate taxes. J Polit Econ 103(3):519–550

Swan TW (1956) Economic growth and capital accumulation. Econ Record 32:334–361. https://doi.org/10.1111/j.1475-4932.1956.tb00F434

Szarowska I (2014) Effects of taxation by economic functions on economic growth in the European Union. MPRA Paper No. 59781

Tosun MS, Abizadeh S (2005) Economic growth and tax components: an analysis of tax changes in OECD. Appl Econ 37:2251–2263. https://doi.org/10.1080/00036840500293813

Vartia L (2008) How do taxes affect investment and productivity ? An industry-level analysis of OECD countries. OECD Economics Department Working Papers 656

Xing J (2011) Does tax structure affect economic growth? Empirical evidence from OECD countries, Centre for Business Taxation, WP 11/20

Download references

Acknowledgements

Authors like to acknowledge the anonymous referee for his/her valuable comments.

Not applicable.

Author information

Authors and affiliations.

Department of Economics, Banaras Hindu University, Varanasi, India

Yadawananda Neog & Achal Kumar Gaur

You can also search for this author in PubMed Google Scholar

Contributions

Both the authors’ handled the data, analysed and contribute their part to write the manuscript. Both authors read and approved the final manuscript.

Corresponding author

Correspondence to Yadawananda Neog .

Ethics declarations

Competing interests.

The authors declare that they have no competing interests.

Additional information

Publisher's note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

See Tables 1 , 2 , 3 , 4 and 5 .

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/ .

Reprints and permissions

About this article

Cite this article.

Neog, Y., Gaur, A.K. Tax structure and economic growth: a study of selected Indian states. Economic Structures 9 , 38 (2020). https://doi.org/10.1186/s40008-020-00215-3

Download citation

Received : 26 November 2019

Revised : 16 March 2020

Accepted : 29 April 2020

Published : 09 May 2020

DOI : https://doi.org/10.1186/s40008-020-00215-3

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Tax structure

- How it works

Useful Links

How much will your dissertation cost?

Have an expert academic write your dissertation paper!

Dissertation Services

Get unlimited topic ideas and a dissertation plan for just £45.00

Order topics and plan

Get 1 free topic in your area of study with aim and justification

Yes I want the free topic

50 Focused Taxation Research Topics For Your Dissertation Paper

Published by Ellie Cross at December 29th, 2022 , Revised On August 15, 2023

A thorough understanding of taxation involves drawing from multiple sources to understand its goals, strategies, techniques, standards, applications, and many types. Tax dissertations require extensive research across a variety of areas and sources to reach a conclusive result. It is important to be able to understand and present tax dissertation themes well since they deal with technical matters.

Choosing the right topic in the area of taxation can assist students in understanding how much insight and knowledge they can contribute and the tools they will need to authenticate their study.

If you are not sure what to write about, here are a few top taxation dissertation topics to inspire you .

The Most Pertinent Taxation Topics & Ideas

- The effects of tax evasion and avoidance and the supporting data

- How does budgeting affect the management of tertiary institutions?

- How does intellectual capital affect the development and growth of huge companies, using Microsoft and Apple as examples?

- The importance and function of audit committees in South Africa and China: similarities and disparities

- How taxation can aid in closing the fiscal gap in the UK economy’s budget

- A UK study comparing modern taxation and the zakat system

- Is it appropriate to hold the UK government accountable for subpar services even after paying taxes?

- Taxation’s effects on both large and small businesses

- The impact of foreign currencies on the nation’s economy and labour market and their detrimental effects on the country’s tax burden

- A paper is explaining the importance of accounting in the taxes department

- To contribute to the crucial growth of the nation, do a thorough study on enhancing tax benefits among American residents

- A thorough comparison of current taxes and the Islamic zakat system is presented. Which one is more beneficial and effective for reducing poverty?

- According to the most recent academic study on tax law, what essential improvements are needed to implement tax laws in the UK?

- A thorough investigation of Australian tax department employees’ active role in assisting residents of all Commonwealth states to pay their taxes on time

- Why establishing a taxation system is essential for a country’s growth

- What is the tax system’s greatest benefit to the poor?

- Is it legitimate to lower the income tax so that more people begin paying it?

- What is the most significant investment made using tax revenue by the government?

- Is it feasible for the government to create diverse social welfare policies without having the people pay the appropriate taxes?

- How tax avoidance by people leads to an imbalance in the government budget

- What should deter people from trying to avoid paying taxes on time?

- Workers of the tax department’s role in facilitating tax evasion through corruption

- Investigate the changes that should be made to the current taxation system. A case study based on the most recent UK taxes studies

- Examine the variables that affect the amount of income tax UK people are required to pay

- An analysis of the effects of intellectual capital on the expansion and development of large businesses and multinationals. An Apple case study

- A comparison of the administration and policy of taxes in industrialised and emerging economies

- A detailed examination of the background and purposes of international tax treaties. How successful were they?

- An examination of the effects of taxation on small and medium-sized enterprises compared to giant corporations

- An examination of the effects of tax avoidance and evasion. An analysis of the worldwide Panama crisis and how tax fraud was carried out through offshore firms

- A critical analysis of how the administration of higher institutions is impacted by small business budgeting

- Recognising the importance of foreign currency in a nation’s economy. How can foreign exchange and remittances help a nation’s finances?

- An exploration of the best ways tax professionals may persuade customers to pay their taxes on time

- An investigation of the potential impact of tax and accounting education on the achievement of the nation’s leaders

- How the state might expand its revenue base by focusing on new taxing areas. Gaining knowledge of the digital content creation and freelance industries

- An evaluation of the negative impacts of income tax reduction. Will it prompt more people to begin paying taxes?

- A critical examination of the state’s use of tax revenue for human rights spending. A UK case study

- A review of the impact of income tax on new and small enterprises. Weighing the benefits and drawbacks

- A comprehensive study of managing costs so that money may flow into the national budget without interruption. A study of Norway as an example

- An overview of how effective taxes may contribute to a nation’s development of a welfare state. A study of Denmark as an example

- What are the existing problems that prevent the government systems from using the tax money they receive effectively and completely?

- What are people’s opinions of those who frequently avoid paying taxes?

- Explain the part tax officials play in facilitating tax fraud by accepting small bribes

- How do taxes finance the growth and financial assistance of the underprivileged in the UK?

- Is it appropriate to criticise the government for not providing adequate services when people and businesses fail to pay their taxes?

- A comprehensive comparison of current taxes and the Islamic zakat system is presented. Which one is more beneficial and effective for reducing poverty?

- A critical evaluation of the regulatory organisations was conducted to determine the tax percentage on different income groups in the UK

- An investigation into tax evasion: How do wealthy, influential people influence the entire system?

- To contribute to the crucial growth of the nation, do a thorough investigation on enhancing tax benefits among British nationals

- An assessment of the available research on the most effective ways to manage and maintain an uninterrupted flow of funds for a better economy

Hire an Expert Writer

Orders completed by our expert writers are

- Formally drafted in an academic style

- Free Amendments and 100% Plagiarism Free – or your money back!

- 100% Confidential and Timely Delivery!

- Free anti-plagiarism report

- Appreciated by thousands of clients. Check client reviews

We hope that you will be able to write a first-class dissertation or thesis on one of the issues identified above at your own pace and submit a solid draft. If you wish to use any of the above taxation dissertation topics directly, you may do so. Many people, however, prefer tailor-made topics that meet their specific needs. If you need help with topics or a taxation dissertation, you can also use our dissertation writing services . Place your order now !

Free Dissertation Topic

Phone Number

Academic Level Select Academic Level Undergraduate Graduate PHD

Academic Subject

Area of Research

Frequently Asked Questions

How to find taxation dissertation topics.

To find taxation dissertation topics:

- Study recent tax reforms.

- Analyze cross-border tax issues.

- Explore digital taxation challenges.

- Investigate tax evasion or avoidance.

- Examine environmental tax policies.

- Select a topic aligned with law, economics, or business interests.

You May Also Like

Family law dissertation topics are included in a section of UK law. This topic is more of a minor category in terms of your broader research. Family law dissertations are challenging.

Need interesting and manageable management dissertation topics or thesis? Here are the trending management dissertation titles so you can choose the most suitable one.

If you are having trouble finding an idea for your intellectual property law dissertation, here’s a list of 30 property law topics.

USEFUL LINKS

LEARNING RESOURCES

COMPANY DETAILS

- How It Works

A Systems View Across Time and Space

- Open access

- Published: 16 February 2021

Factors influencing taxpayers to engage in tax evasion: evidence from Woldia City administration micro, small, and large enterprise taxpayers

- Erstu Tarko Kassa ORCID: orcid.org/0000-0002-8199-4910 1

Journal of Innovation and Entrepreneurship volume 10 , Article number: 8 ( 2021 ) Cite this article

71k Accesses

15 Citations

6 Altmetric

Metrics details

The main purpose of this paper is to investigate factors that influence taxpayers to engage in tax evasion. The researcher used descriptive and explanatory research design and followed a quantitative research approach. To undertake this study, primary and secondary data has been utilized. From the target population of 4979, by using a stratified and simple random sampling technique, 370 respondents were selected. To verify the data quality, the exploratory factor analysis (EFA) was conducted for each variable measurements. After factor analysis has been done, the data were analyzed by using Pearson correlation and multiple regression analysis. The finding of the study revealed that the relationship between the study independent variables with the dependent variable was positive and statistically significant. The regression analysis also indicates that tax fairness, tax knowledge, and moral obligation significantly influence taxpayers to engage in tax evasion, and the remaining moral obligation and subjective norms were not statistically significant to influence taxpayers to engage in tax evasion.

Introduction

In developed and developing countries, business owners, government workers, service providers, and other organizations are forced by the government to pay a tax for a long period in human being history, and no one can escape from the tax of the country. To support this, there is an interesting statement mentioned by Benjamin Franklin “nothing is certain except death and taxes”. This statement confirmed that every citizen should be subjected to the law of tax, and they are obliged to pay the tax from their income. To build large dams, to construct transportation infrastructures, and to provide quality social services for the community, collecting a tax from citizens plays a significant role for the governments (Saxunova and Szarkova, 2018 ).

Tax is the benchmark and turning point of the country’s overall development and changing the livelihoods and enhancing per capital income of the individuals. The gross domestic product of the developed countries and average revenue ratio were 35% in the year 2005, whereas in developing countries the share was 15% and in third world countries also not more than 12% (Mughal, 2012 ).

In the developing world, countries have no system to collect a sufficient amount of tax from their taxpayers. The expected amount of revenue cannot be enhanced due to different reasons. Among the reasons tax operation of the system may not be smooth, tax evasion and lack of awareness creation for the taxpayers are common in the developing world, and citizens are not committed to paying the expected amount of tax for their countries (Fagbemi et al., 2010 ). In today’s world, this remains very much the same as persons now pay taxes to their governments. As the world has evolved, tax compliance has taken a back seat with tax avoidance and tax evasion being at the forefront of the taxpayer’s main objective. Tax avoidance is the use of legal means to reduce one’s tax liability while tax evasion is the use of illegal means to reduce that tax liability (Alleyne & Harris, 2017 ). Tax evasion is a danger to the community; the countries and international organizations have been making an effort to fight undesirable phenomena related to taxation, the tax evasion, or tax fraud (Saxunova and Szarkova, 2018 ).

Tax evasion may brings a devastating loss for the country's GDP at the micro level, and it became a debatable and a special concern for tax collector authorities (Aumeerun et al., 2016 ). The participants in tax evasion activity critized by different individuals and groups by considering the loss that brings to the country economy (Alleyne & Harris, 2017 ).

According to Dalu et al., ( 2012 ) state that in the Zimbabwe tax system there are identical devils tax evasion and tax avoidance that create a problem for the government to collect a tax from taxpayers. Like Zimbabwe, many nations have faced challenges to cover the annual budget and to construct different infrastructures due to the budget deficit created by tax evasion (Alleyne & Harris, 2017 ; Turner, 2010 ).

Scholars especially economists agreed that tax evasion may be considered a technical problem that exists in the tax collection system, whereas psychologists believed that tax evasion is a social problem for the countries (Terzić, 2017 ).

Tax evasion practices are more worsen in developing countries than when we compare against the developed countries. Tax evasion is like a pandemic for the countries because they are unable to control it. Therefore, governments were negatively affected by tax evasion to improve the life standard of its citizens and to allocate a budget for public expenditure, and it became a disease for the country’s economy and estimated to cost 20% of income tax revenue (Ameyaw et al., 2015 ; degl’Innocenti & Rablen, 2019 ; Palil et al., 2016 ).

Several factors may lead taxpayers to engage in tax evasion. Among the factors, tax knowledge, tax morale, tax system, tax fairness, compliance cost, attitudes toward the behavior, subjective norms, perceived behavioral control, and moral obligation are major factors (Alleyne & Harris, 2017 ; Rantelangi & Majid, 2018 ). Other factors have also a significant effect on taxpayers to engage in tax evasion practice such as capital intensity, leverage, fiscal loss, compensation, profitability, contextual tax awareness, interest rate, inflation, average tax rate, gender, and ethical tax awareness on tax evasion (Annan et al., 2014 ; AlAdham et al., 2016 ; Putra et al., 2018 ).

According to Woldia City Administration Revenue Office annual report ( 2019/2020 ) from July 1, 2019, to June 30, 2020, 232,757,512 birr was planned to be collected from taxpayers; however, the office was able to collect only 198,537,785.25 birr; however, the remaining 34,219,726.75 birr have not been collected by the office from the taxpayers. The reason behind this was there might be some factors that lead to taxpayers not to pay the annual tax from their annual income. Based on the review of the previous studies and by diagnosing the tax collection system in the city administration, the researcher identified the gaps. The first gap that motivated the researcher to undertake this study is that the prior studies did not address the factors that influence the tax collection system of Ethiopia, specifically, there is no research result that was able to show which factors influence taxpayers to engage in tax evasion in the Woldia city administration. The other gap is the previous study focused on the demographic, economic, social, and other factors. However, this study mainly focused on the behavioral and other factors that lead taxpayers to engage in tax evasion.

To indicate the benefit of this study, the study specifies on which critical factors the authority will focus on to enhance annual revenue and to aware tax payers of the devastating impact of tax evasion. Moreover, the paper may bring new insights on tax evasion influential non-economic factors that the researchers may give more emphasis on the upcoming researches. This paper will also contribute innovative ways to know the reasons why tax payers engage in tax evasion and inform the authority at which factors they will struggle to reduce their influence and to enhance revenue. The study can be an evidence that the tax authority should launch innovative techniques to control tax evasion practices. Moreover, applying fair tax system in the collectors’ side, the enterprises become innovative and will expand their business.

To sum up, in this study, the researcher examined which factor (tax knowledge, tax fairness, subjective norms, moral obligation, and attitude towards the behavior) influences taxpayers to engage in tax evasion activities. Based on the above discussion, the objective of the study is to examine factors that influence taxpayers to engage in tax evasion in Woldia city administration.

Literature review

Tax and tax evasion.

Tax is charged by the government to the business, governmental organization, and individual without any return forwarded from the authority. Tax can be categorized as direct tax which is collected from the profit of the companies and the incomes of individuals, and the other category of tax is an indirect tax collected from consumers’ payment (James and Nobes, 1999 ).

Tax evasion is a word explaining individuals, groups, and companies rejecting the expected amount of payment for the authority. It is a criminal offense on the view of law (Nangih & Dick, 2018 ). The overall procedure of tax collection faced different challenges especially tax evasion the most important one. Tax evasion is done intentionally by taxpayers by avoiding and hiding different documents that become evidence for the tax collection authorities. It is simply an illegal act to pay the true amount of the tax (Aumeerun et al., 2016 ; Storm, 2013 ). Tax evasion is a crime that is able to distort the overall economic, political, and social system of the country. The economic aspect of tax evasion affects fair distribution of wealth for the citizens. The social aspect also creates different social groups motivated by tax evasion discouraged by these individuals due to unfair competition (AlAdham et al., 2016 ). Tax evasion is a mal-activity that reduces the amount of tax paid by the payers. Perhaps the taxpayers who engaged in evasion activity may be supported by the legislative of the country (Kim, 2008 ; Putra et al., 2018 ; Allingham & Sandmo, 1972 ). According to Al Baaj et al. ( 2018 ) argument, there are two types of tax evasions. The first one is the legal evasion or tax avoidance which is supported by the legislation of the countries and the right is given for the taxpayer, but it is not constitutional (Gallemore & Labro, 2015 ; Zucman, 2014 ).

Theoretical reviews on factors affecting tax evasion

The illegal activity done by taxpayers has many determinants that lead them to engage in tax evasion. Among the factors that trigger taxpayers who participate in this activity are the economic factors. Under the economic factors, business sanctions, business stagnation, and the amount of tax burden are considered as influential factors. On the other hand, legal factors, social factors, demographic factors, mental factors, and moral factors are the most important factors (Saxunova and Szarkova, 2018 ). Many factors determine the taxpayers’ interest to engage in tax evasion. Among the factors, the following are considered under this review.

The factors that able to influence taxpayers to engage in tax evasion are moral obligation . It is a principle and a duty of taxpayers by paying a reasonable amount of tax for the tax authorities without the enforcement of others. It is an intrinsic motivation of payers paying the tax (Sadjiarto et al., 2020 ). When taxpayers have low tax morals, they will become negligent to pay their allotted tax, and they will engage in tax evasion (Alm & Torgler, 2006 ; Frey & Oberholzer-Gee, 1997 ; Torgler et al., 2008 ). According to Feld and Frey ( 2007 ), when tax officials are responsible and provide respect in their duties toward taxpayers, tax morale or the honesty of taxpayers will increase. Tax morals may be affected by a demographic and another factor like income level, marital status, and religion (Rantelangi & Majid, 2018 ). It is the determinant behavior of tax payers whether they participate or not. Tax morals can affect positively taxpayers to engage in tax evasion (Nangih & Dick, 2018 ; Terzić, 2017 ). It is known that taxes levied by the concerned authority are ethical. As cited by Ozili ( 2020 ), McGee ( 2006 ) argues that there are three basic views on the ethics and moral of tax evasion. The first view is tax evasion is unethical and should not be practice by any payer, the second argument deals that the state is illegal and has no moral authority to take anything from anyone, and the last argument is tax evasion can be ethical under some conditions and unethical under other situations; therefore, the decision to evade tax is an ethical dilemma which considers several factors (Robert, 2012 ). Therefore, the discussion leads to the following hypothesis:

H 1 . Moral obligation has a negative influence on taxpayers to engage in tax evasion.

The other factor that influences taxpayers to engage in tax evasion is tax fairness . Tax fairness is a non-economic factor that determines the tax collection of the country (Alkhatib et al., 2019 ). It is known that the tax collection procedures, principles, and implementation must be fair. Unethical behavior may happen due to the unfairness of the tax collection process. The fairness of tax may influence payers positively to pay the tax. When the tax rate is not reasonable and fair, the payers will regret to engage in the tax evasion practices and they will inform authorities their annual income without denying the exact amount. Considering the ability of paying or acceptable tax rates helps to maintain the fairness of the taxation system (Rantelangi & Majid, 2018 ). The governments choose to levy in what amounts and on whom will pay a high tax rate (Thu, 2017 ). The tax rate is a factor that induces taxpayers to pay less amount from their income. The rate of tax should be fair and reasonable for the payers (Ozili, 2020 ). As cited by Gandhi et al. ( 1995 ) the Allingham and Sandmo’s model, Allingham and Sandmo ( 1972 ) shows that the tax rate on payment can be positive, zero, or negative, which implies that an increase in the tax rate may cause the tax payment to increase, remain the same, or decrease. The theoretical literature could not evidence the claim that an increase in the tax rate will lead to an increase in tax evasion (Gandhi et al., 1995 ). The fairness of tax is controversial and argumentative because there may not happen a similar amount of tax for all payers (Abera, 2019 ). Thus, based on this ground the study hypothesis would be:

H 2 . Tax fairness has a positive influence on taxpayers to engage in tax evasion.

Tax knowledge is vital for taxpayers to know the cause and effect brought to them to engage in tax evasion. If tax payers are well informed about tax evasion, their participation in tax evasion would be infrequent; the reverse is true for a taxpayer who is not well informed. Tax-related information should give more emphasis to enhance the knowledge of taxpayers and experts of the authority (Poudel, 2017 ). Tax knowledge is a means to enhance the revenue of the country from the side of tax payers (Sadjiarto et al., 2020 ). If the authorities cascade different training for taxpayers about tax evasion and other tax-related issues, taxpayers become reluctant to engage in tax evasion (Rantelangi & Majid, 2018 ). Tax knowledge is a determinant factor for the taxpayer to engage and retain from the tax evasion activities (Abera, 2019 ). When taxpayers are undertaking their routine tasks without tax knowledge, they may involve in certain risks that expose them to engage in tax evasion (Thu, 2017 ). Thus, the discussion leads to the following hypothesis:

H 3 . Tax knowledge has a negative influence on taxpayers engaged in tax evasion.

The stakeholders, government experts, families, individuals, groups, and peers influence taxpayers whether they engaged in tax evasion or not (Alleyne & Harris, 2017 ). As cited by Alkhatib et al. ( 2019 ), the influence of peer groups on tax taxpayers is high, thus affecting the taxpayers’ preferences, personal values, and behaviors to engage in tax evasion (Puspitasari & Meiranto, 2014 ). The stakeholders around the taxpayers might be motivators to push taxpayers in the criminal act of tax evasion. This act called subjective norms meant that the payers are influenced by peers and other stakeholders. When the tax payer is reluctant to pay a tax for the authority, his/her friends are more likely to hide tax. As cited by Abera ( 2019 ), there is a strong relationship between social norms and subjective norms with tax evasion and affects the small business taxpayers (Nabaweesi, 2009 ). The above discussion can support the following hypothesis of the study:

H 4 . Subjective norms have a positive influence on taxpayers to engage in tax evasion.

The other factor that influences taxpayers to engage in tax evasion is an attitude towards the behavior of taxpayers. Attitude is a means of evaluating the activities whether they are positive or negative of any object. Many studies have been done by different scholars by defining and identifying the relationship between the attitudes of taxpayers with tax evasion (Alleyne & Harris, 2017 ). If the attitude of taxpayers towards taxation is negative, they will be reluctant to pay their obligation to the authority; the reverse is true when taxpayers have positive attitudes towards taxation (Abera, 2019 ). Based on the above discussion, the hypothesis of the study would be as follows:

H 5 . Tax payers’ attitude towards the behavior has a positive influence on taxpayers to engage in tax evasion.

Conceptual framework of the study

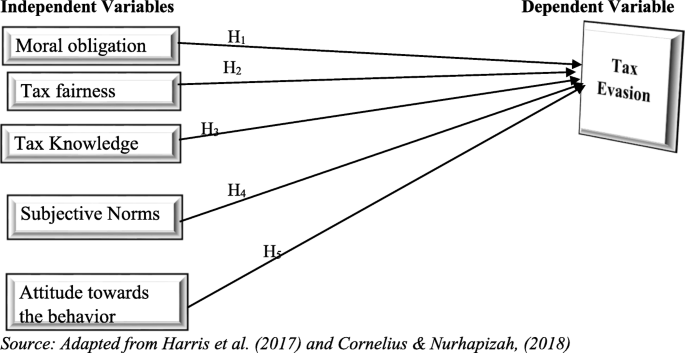

The researcher identified the variables and presented the relationship between independent and dependent variables as follows (Fig. 1 ):

Conceptual framework of the study. Adapted from Alleyne and Harris ( 2017 ) and Rantelangi and Majid ( 2018 )

Materials and methods

The researcher applied descriptive and explanatory research design to carry out this study. The explanatory research design enables the researcher to show the cause and effect relationship between independent and dependent variables, and the descriptive research also helps to describe the event as it is. The quantitative approach has been followed by the researcher to analyze and interpret the numerical data collected from the respondents. The researcher used primary and secondary data. The primary data was collected from the respondents by using questionnaires, and the secondary data was also collected from the reports, websites, and other sources.

The target population of the study was 4979 taxpayers (micro, small, and large enterprises). From the total taxpayers, 377 are categorized under level “A,” 207 are under level “B,” and the remaining 4395 taxpayers are categorized under level “C”. From the target population by using a stratified sampling technique, the respondents have been selected. The target population has been divided by the level of taxpayers; after dividing the population by level, the researcher applied a simple random sampling technique to select respondents. To identify the target participants or sample size in this study, the researcher used Yamane’s ( 1967 ) formula. Hence, the formula is described as follows:

where N = target population, n = sample size, e = error term

Based on the sample size, the respondents have participated proportionally as follows from each level. The total population was divided by strata based on the level categorized by the authorities. By using a simple random sampling technique, 28 respondents were from level “A,” 15 respondents from level “B,” and 327 respondents from level “C” have participated.

Regarding data collection instruments , the data was collected by self-administered standardized questionnaires. The variable of the study a moral obligation was measured by 4 items; after conducting factor analysis, the fourth variable or questionnaire has been removed and after that correlation and regression analysis has been done for 3 items; the value of Cronbach’s alpha was .711; the other factor attitude towards the behavior was measured by 4 items with a value of .804 Cronbach’s alpha; the third variable subjective norms was also measured by 4 items; the value of Cronbach’s Alpha was .887, and tax evasion was measured by 5 items; the Cronbach’s alpha value was .868. For the above-listed variables, the questionnaires were adapted from Alleyne and Harris ( 2017 ), and the remaining variable tax fairness was measured by 7 items, the Cronbach’s alpha value was .905, the items were adapted from Benk et al. ( 2012 ), and the last variable tax knowledge was measured by 5 items. However, after conducting factor analysis, the fifth item has been removed due to low value of the variable. After the removal of the fifth item, the Cronbach’s alpha value for the remaining items was .800, the items were adapted from Poudel ( 2017 ). For all variables, the researcher has used a five-point Likert scale from strongly agree to strongly disagree.

To analyze the collected data, the researcher used descriptive statistics analysis, factor analysis, correlation analysis, and multiple regression analysis to know the result of variables by using SPSS Version 22. Moreover, the model of the study is described as follows:

where Y = tax evasion, X 1 = moral obligation, X 2 = tax fairness, X 3 = tax knowledge, X 4 = subjective norms, and X 5 = attitude towards the behavior, β = beta coefficient, B 0 = constant, e = other factors not included in the study (0.05 random error).

Results and discussion

Level of respondents.

As indicated in Table 1 from the total respondents, 88.4% are categorized under level “C,” 4.1% are leveled under “B,” and the remaining 7.6% of respondents have been categorized under level “A”.

Factor analysis of the study variables

To undertake exploratory factor analysis, the data should fulfill the following assumptions. The first assumption is the variables should be ratio, interval, and ordinal; the second one is within the variables there should be linear associations; the third assumption is a simple size should range from 100 to 500; and the last assumption is the data without outliers. Thus, this study data have been checked by the researcher whether the data meets the assumption or not. After checking the assumptions, factor analysis was conducted as follows.

KMO and Bartlett’s test

Conducting KMO and Bartlett’s test is a precondition to conduct the factor analysis of the study measuring variables. KMO measures the adequacy of the sample of the study. In the result reported in Table 2 , the value was 0.883 and enough for the factor analysis. Related with Bartlett test as shown in Table 2 , the value is 5727.623 ( p < 0.001), which reveals the adequacy of data using factor analysis.

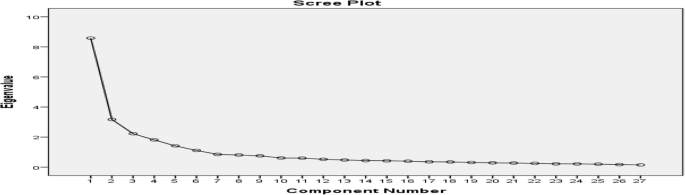

As shown in Table 3 , factors were extracted from study data; there was a linear relationship between variables. From the table, we can understand that 6 variables have more than one eigenvalue. The first factor scored the value 31.782 of the variance, the second value is 11.739 of the variance, the third factor scored 8.246 of the variance, the fourth factor accounts for 6.725 of the variance, the fifth factor also accounts for 5.233, and the last factor scored 4.123 of the variance. All six factors were explained cumulatively by 67.85% of the variance.

As shown in the Fig. 2 , the scree plot starts to turn down slowly at the low eigenvalue which is less than 1. The six factors eigenvalue is greater than one.

Scree plot. Source: own survey (2020)

The pattern matrix is shown in Table 4 which is able to show the loading of each variable and the relationship of variables in the study. The highest value among the factors measured the variable considerably. The cutoff point of loading was set at .35 and above. Based on the loading cutoff point except two factors, all are significant and analyzed under this study. From the six variables (five independent and one dependent) incorporated under this study, the identified factors show that how significantly enough to measure the situation. These factors have scored greater than 1 eigenvalue and able to explain 67.85% of the variance. In general, the detail variables and their factor are described as follows:

The first component tax fairness has 7 factors; the eigenvalue is 8.58 and able to explain 31.78 of the total variance. In this component, the highest contributed factor was item TF3 (weight = .925), TF5 (weight = .865), TF1 (weight = .859), TF2 (weight = .778), TF4 (.668), TF6 (weight = .614), and TF7 (weight = .568). The second component was tax evasion and has 5 items; the eigenvalue is 3.17 and explaining 11.73 of the variance. The factor weight of the items, TE4 (factor weight = .860), TE5 (factor weight = .810), TE3 (factor weight = .730), TE2 (factor weight = .650), and the last one is TE1 (factor weight = .606). The third component was subjective norms; it has 4 factors the weight of each factor described as follows. The first item SNS1 weight = .898, SNS2 factor weight = .887, SNS4 factor weight = .846, and SNS3 factor weight = .820. Moreover, the eigenvalue of this component is 2.226 and explained 8.246 of the variance of the study. The fourth component is an attitude towards the behavior. This variable has four factors that have 1.816 eigenvalue and explained 6.725 of the total variance. Among the items, ATB2 factor weight = .863, ATB1 factor weight = .792, ATB3 factor weight = .791 and the last factor is ATB4 factor weight = .500. The fifth component of the study is tax knowledge; at the very beginning of this variable, the researcher adapted five items. However, one item (TK5) was not significant and removed from this analysis. In this component, the highest value was scored by TK3 (factor weight = .866), the second highest TK2 (factor weight = .801), the third highest factor weight (weight = .700), and the last factor is TK4 (weight = .690). The eigenvalue of this component was 1.413 and explained 5.233% of the variance. The last component is a moral obligation; like tax knowledge, the researcher adapted for this variable 4 items, though, one item (MO4) was not significant and removed from the items list. The eigenvalue of this component was 1.113 and explained 4.123 of the variance. From the items, MO1 scored the highest factor weight of .891, the second highest weight in this component was MO3 with a factor weight of .854, and the third highest factor weight was scored by MO3 with a value of .508.

Association analysis of the study variables

To analyze the correlation between variables as shown in the Table 5 , the relation between subjective norms with taxpayers engaged in tax evasion is r = 0.240 ( p < 0.05); this indicates that there is a statistically significant relationship between the two variables. The relationship between ATB with TE, MO with TE, TK with TE, and TF with TE, the Pearson correlation result is r = 0.318 ( p < 0.05), r = 0.371 ( p < 0.05), .446, and r = 0.691 ( p < 0.05) respectively and statistically significant. It implies that the independent variables have a positive relationship with the dependent variable of the study with a statistically significant level of p < 0.05 and n = 370.

Effect analysis of the study variables

As shown in Table 6 , the study independent variables (SNS, ATB, MO, TK, and TF) explained the study dependent variable (TE) by 54.9%. This result indicates that there are other variables that explain the dependent variable by 45.1% which has not been investigated under this study.

Hypothesis test

The proposed hypothesis of the study has been tested based on the coefficient of regression and the “ p ” value of the study variables. The detail result is described as follows: