14 Personal Finance Project Examples & Ideas

By: Author Amanda L. Grossman

Posted on Last updated: May 24, 2023

Want to introduce a money project to your students? Check out these personal finance project examples for middle and high school.

Every so often, I find a fun and interesting personal finance project example that I think should be passed on so that other educators can use it.

So today, I thought it’d be helpful to highlight them all in an article (that I update periodically with new ideas and examples as they come to me).

You can use these to round out your financial literacy class with an overall project due at the end of the semester, OR, squeeze one of these projects in for students to work on mainly at home if you don’t have a dedicated fin lit class.

Perhaps you are into project-based learning, and one of these could be the perfect anchor to your entire semester.

There’s lots of uses!

Personal Finance Project Examples

Below, you’ll find a mix of actual personal finance project examples from real classrooms and schools, as well as ideas for money projects that haven’t been done before.

I hope you get inspired.

Mr. Brennan’s Personal Finance Project

This teacher has created a personal finance project geared towards financial independence that accounts for 20% of his student’s grade in Economics.

Students are tasked with making a budget, finding an apartment, filling out a rental application, looking into utilities, meal planning, and all the things that go into getting that first apartment on their own.

He’s got a Part II, with tons of lessons around the theme of Staying Within Your Budget.

Project-Based Learning Finance Project

What a cool idea – in this PBL, students meet different families (adults pretending to be clients) and see what their financial needs and desires are.

They interview them to find out more about their lives, and what they’re looking for. They also get a printout of their financial situation.

It’s like they’re playing financial planner (in fact, the teacher had a financial planner come in to talk about her job and go through examples)!

11 Personal Finance Projects from Atlanta Fed (PDF)

The Atlanta Fed has this great resource with 10 different personal finance projects to use throughout the year (rubric included).

And…it’s available for free!

Author Julie Kornegay suggests that you have students complete 10 projects, with each being worth 20 points. Have them create a three-ring binder with each of their projects, and make it a large part of their final grade.

Working through each of the following projects will give your students a financial strategy to take with them:

- Expense tracking

- Setting financial goals

- Balance sheets and cash flow statements

- Creating a budget

- Credit reports

- Purchasing a vehicle

- Saving and investing for the long term

- Important financial documents

- Retirement savings

- Insurance inventory

Hint: she also gives several tips for how to keep everyone feeling safe doing these projects – since they’ll be sharing sensitive information at some point.

Youth Cash Transfer Program

40 students inside Rooted School Indianapolis were chosen to receive $50/week, for 40 weeks (adding up to $2,000 in total).

And here’s the kicker: they’re allowed to spend it however they’d like.

Talk about a bit of a fish bowl experiment, where teens can practice both receiving money and spending money without huge real-world consequences.

To be honest, I’m following this study because I want to see how things turn out ( researchers are going to be monitoring and studying the results of this program ).

Build a Classroom Food Pantry

Here’s a school that allowed a student to create and run a food pantry (as part of his Eagle Scout service project)…and now it runs continually as a grocery store experience for students that helps the community.

Unfortunately, there’s not a lot of information on this. But, could be a great project to develop at your own school now that you have the idea.

Psst: Want more? Don’t forget to check out these budget project for middle school students , and budget projects for high school students.

Mr. Saulino’s Personal Finance Webquest Project

If you’re in Mr. Saulino’s Social Studies course, then you’ll be completing a project called Personal Finance Webquest.

Each student pretends they are 22 years old, and they have $7,000 in their savings account to spend, or not spend, as they wish.

Students are required to stay within their budget while accomplishing the following:

- find an occupation

- set up and maintain a budget based upon your income

- rent and furnish an apartment or purchase a home

- purchase a car

- set up an investment portfolio

There are links provided in each section to help guide students in finding the information they need to complete their tasks.

Personal Finance Culminating Project

One teacher found her students were super bored with personal finance topics, so she decided to change things up.

Students need to pick 5 topics from a big list, and write a brief post about them (150-300 words) or a podcast summary.

Written pieces were posted to a classroom blog, and the quiz for the unit was for each student to read 5 others’ blogs, and summarize what they learned.

Apparently, this was quite the hit!

Included in that article are the Personal Finance Culminating Assignment, and Investigations Rubric.

Gen Z Money Project

Based on CNBC’s Millennial Money video series, this high school teacher developed an after school personal finance project where students plan what their life looks like at age 30.

Students complete a:

- Futures Thinking Activity

- Personal Values Activity

- Vision Board Activity

- Budget and Salary Activity

- Career Activity

And then students presented everything using Google Slides presentations.

Do you have a market day at your school? You know, where students come up with an idea for what to make or do in order to sell it to either their peers, the community, etc. on a Market Day at the school?

While it’s not entirely a personal finance project – it’s got more to do with entrepreneurship and running a business – I still thought it was worth mentioning here.

I've got an article on 22 Simple Market Day Ideas , and it's gotten a lot of attention.

My Pet Plan Project

Most kids, at some point, want to own a pet.

Take this desire, and let them learn some critical money lessons with it.

Have each of your students come up with a plan for buying and maintaining a pet for six months.

They get to decide things like:

- What type of pet to buy

- Where to buy their pet

- What accessories to purchase

- A feeding plan for their pet with costs

My First Car: The First Six Months

Many tweens and teens are looking to buy their first car in the coming few years.

But, how exactly are they supposed to do that? What are the steps? What are the estimated costs?

Then, how much does it cost to run their new car for the first six months?

You can also have them do things like calculate the cost of buying a new car each year for three years, versus paying one off and riding it another 7 years (also, opportunity costs).

Here's how to save up for a car as a teenager .

Buyer’s Remorse Project

Have your students save each of their receipts for one month leading up to this project (you can hand them a special envelope to remind them to do it).

When one month is up, have students do things like:

- Fill in a spending ledger

- Look at the totality of their spending over the entire period

- Divide it up by needs vs. wants

- Figure out percentages spent on needs vs. wants

- Figure out satisfaction for each purchase

- Categorize by days of week/types of stores to pinpoint/open their eyes to some of their spending habits

- Go through a tradeoffs exercise

- Run through a lesson on money values – shuffle anonymous sheets up and hand them out to ask others what their satisfaction level would be for the various spending (to find out that everyone prioritizes and values their money differently)

- Have them read through these 7 smart ways to spend your graduation money

Ask students things like “why might someone else’s buyer’s remorse not be yours? Did you have more buyer’s remorse when it was your money spent, than looking at how someone else spent their money? Why do you think that is?

I hope I've inspired you with some of these personal finance project examples. And I'd love to hear your own – please share in the comments to help other educators with ideas.

- Latest Posts

Amanda L. Grossman

Latest posts by amanda l. grossman ( see all ).

- 50 Banking Activities for Kids (Student Financial Literacy) - February 14, 2024

- 14 Christmas Activities for High School Students (they’ll Actually Find Cool) - December 1, 2023

- 3 Fun Selfie Scavenger Hunts for Teens (Christmas, Fin Lit, etc.) - November 27, 2023

CLIENT LOGIN HOURS OF OPERATION

- Debt Consolidation

- Debt Management

- Debt Settlement

- Credit Card Debt Forgiveness

- Debt Consolidation Programs

- Military & Veteran Debt Relief

- Credit Counseling

- Online Bankruptcy Classes

- Housing Counseling

- Foreclosure Prevention Counseling

- Eviction Prevention Help

- Credit Card Debt

- Student Loan Debt Relief

- Family Finances

- Credit Scores & Credit Reports

- Getting Out of Debt with Bad Credit

- Financial Literacy

- Financial Help

- Tools & Resources

- Budgeting Tips

- Military Money

- Hours of Operation

- Client Success Stories

- Partner With Us

- Financial Literacy for High School Students

Home » Financial Literacy » Resources for Teachers » Financial Literacy for High School Students

Are You Teaching Financial Literacy To High School Students?

The teaching curriculum consists of fourteen lesson plans & worksheets designed to augment a semester course in life skills and personal finance management. The Teacher’s Guide, compiled in a separate, easy-to-use notebook, includes an outline of the curriculum:

- Lesson objectives

- Suggested resources

- Teaching notes

- Chart indicating appropriate age groups for the key learnings offered in each lesson

- Presentation slides

- Answer keys to worksheets (when necessary)

Introductory Overview to Financial Literacy for High School Students

Lesson one: making personal finance decisions.

Each day, we are faced with many decisions. While most decisions are simple, such as “what should I wear?” or “what should I eat?,” others are more complex, such as “should I buy a new or used car?” As decision-making skills are used and improved, a person’s quality of life is enhanced. Wiser choices result in better use of time, money, and other resources. This introductory lesson provides students with an opportunity to learn more about decision-making. The lesson starts with an overview of the decision-making process followed by a discussion of various internal and external factors that affect decisions.

Teacher’s Guide – Lesson One: Making Decisions

Student Guide – Lesson One: Making Decisions

Teacher’s Slide Presentation – Lesson One: Making Decisions

Teacher’s Power Point Presentation – Lesson One: Making Decisions

Lesson Two: Making Money

Building your career is one of the surest ways to increase income and make money. When planning for the future, one of the most critical financial decisions is determining your career path. In this lesson, students will be encouraged to consider various topics related to career planning and the financial aspects of employment. This variation of the decision-making process can help a person match personal abilities and interests with appropriate employment opportunities.

Teacher’s Guide – Lesson Two: Making Money

Student Guide – Lesson Two: Making Money

Teacher’s Slide Presentation – Lesson Two: Making Money

Teacher’s Power Point Presentation – Lesson Two: Making Money

Lesson Three: The Art of Budgeting

A personal budget is a financial plan that allocates future income toward expenses, savings, and debt repayment. “Where does the money go?” is a common dilemma faced by many individuals and households when it comes to budgeting and money management. Effective money management starts with a goal and a step-by-step plan for saving and spending. Financial goals should be realistic, be specific, have a timeframe, and imply an action to be taken. This lesson will encourage students to take the time and effort to develop their own personal financial goals and budget.

Teacher’s Guide – Lesson Three: The Art Of Budgeting

Student Guide – Lesson Three: The Art Of Budgeting

Teacher’s Slide Presentation – Lesson Three: The Art Of Budgeting

Teachers Power Point Presentation – Lesson Three: The Art Of Budgeting

Lesson Four: Living on Your Own

As young people grow up, a common goal is to live on their own. However, the challenges of independent living are often quite different from their expectations. This lesson provides a reality check for students as they investigate the costs associated with moving, obtaining furniture and appliances, and renting an apartment.

Teacher’s Guide – Lesson Four: Living On Your Own

Student Guide – Lesson Four: Living On Your Own

Teacher’s Slide Presentation – Lesson Four: Living On Your Own

Teacher’s Power Point Presentation – Lesson Four: Living On Your Own

Lesson Five: Buying a Home

For many, buying a home is the single most important financial decision they will make in their lifetime. However, the process of becoming a first-time homebuyer can be overwhelming, and requires a foundation for basic home-buying knowledge. This lesson will provide students with information on buying a home and where and how to begin the process. After comparing the differences between renting and buying, students will be introduced to a five-step process for home buying. This framework provides an overview for the activities involved with selecting and purchasing a home.

Teacher’s Guide – Lesson Five: Buying A Home

Student Guide – Lesson Five: Buying A Home

Teacher’s Slide Presentation – Lesson Five: Buying A Home

Teacher’s Power Point Presentation – Lesson Five: Buying A Home

Lesson Six: Banking Services

If the fee for an ATM transaction to withdraw money is $1 and a person withdraws money twice a week, the banking fees for that person will be $104 a year. Over a five-year period, those fees invested at five percent would grow to more than $570. Most students know that banks and other financial institutions (credit unions, savings and loan associations) offer a variety of services. However, few people know how to make wise choices when using financial services. In this lesson, students will learn about the different types of financial service products available and the features of each.

Teacher’s Guide – Lesson Six: Banking Services

Student Guide – Lesson Six: Banking Services

Teacher’s Slide Presentation – Lesson Six: Banking Services

Teacher’s Power Point Presentation – Lesson Six: Banking Services

Lesson Seven: Credit

In today’s world, credit is integrated into everyday life. From renting a car to reserving an airline ticket or hotel room, credit cards have become a necessary convenience. However, using credit wisely is critical to building a solid credit history and maintaining fiscal fitness. While most students have a general idea about the advantages and disadvantages of credit, this lesson provides an opportunity to discuss these issues in more detail.

Teachers Guide – Lesson Seven: Credit

Student Guide – Lesson Seven: Credit

Teacher’s Slide Presentation – Lesson Seven: Credit

Teacher’s Power Point Presentation – Lesson Seven: Credit

Lesson Eight: Credit Cards

What is APR? What is a grace period? What are transaction fees? These and other questions will be answered in this lesson as students learn about credit cards, and the different types of cards available and features of each, such as bank cards, store cards, and travel and entertainment cards.

As students start to shop for their first (or next) credit card, this lesson will make them aware of various costs and features. Included in this section is a discussion of the methods for calculating finance charges. Various federal laws protect our rights as we apply for and use credit cards, such as procedures for disputes and protection from card theft and fraud. In this lesson, students will also be given an opportunity to analyze the information contained on a credit card statement.

Teacher’s Guide – Lesson Eight: Credit Cards

Student Guide – Lesson Eight: Credit Cards

Teacher’s Slide Presentation – Lesson Eight: Credit Cards

Teacher’s Power Point Presentation – Lesson Eight: Credit Cards

Lesson Nine: Cars and Loans

“Should I buy a new car or a used car?” “Where is the best place to finance my automobile purchase?” “Is it better to take the rebate or the low-rate financing plan?” These are typical questions asked by people buying vehicles. In this lesson, students are asked to identify costs associated with owning and operating a motor vehicle. Since these costs are commonly underestimated, guidelines are provided on how much to spend when buying vehicles.

Teacher’s Guide – Lesson Nine: Cars And Loans

Student Guide – Lesson Nine: Cars And Loans

Teacher’s Slide Presentation – Lesson Nine: Cars And Loans

Teacher’s Power Point Presentation – Lesson Nine: Cars And Loans

Lesson Ten: The Influence of Advertising

In today’s modern world, advertising seems to be everywhere we look; online, television, billboards, magazines, newspapers, on buses, grocery carts, even cell phones. In addition, some forms of advertising can be subliminal, such as the strategically-placed soda can in a movie. We can’t help but be influenced and manipulated as consumers. In this lesson, students will become aware of the various techniques and appeals used to influence consumer behavior.

Teachers Guide – Lesson Ten: The Influence Of Advertising

Lesson 10: The Influence of Advertising – High School Student Guide

Teacher’s Slide Presentation – Lesson Ten: The Influence Of Advertising

Teacher’s Power Point Presentation – Lesson Ten: The Influence Of Advertising

Lesson Eleven: Consumer Awareness

Decisions, decisions. With so many choices available to us, how can we be sure we’re making the right decision? Wise consumer buying starts with a plan. Using a systematic purchasing strategy will provide students with an ability to make more effective purchases. Comparative shopping techniques will be discussed to encourage students to carefully consider price, product attributes, warranties, and store policies. Next, this lesson covers a variety of buying methods, such as buying clubs, shopping by phone, catalogs, online, and door-to-door selling.

Teacher’s Guide – Lesson Eleven: Consumer Awareness

Student Guide – Lesson Eleven: Consumer Awareness

Teacher’s Slide Presentation – Lesson Eleven: Consumer Awareness

Teacher’s Power Point Presentation – Lesson Eleven: Consumer Awareness

Lesson Twelve: Saving and Investing

Saving just 35 cents a day will result in more than $125 in a year. Small amounts saved and invested can easily grow into larger sums. However, a person must start to save. This lesson provides students with a basic knowledge of saving and investing. The process starts with setting financial goals. Next, a commitment to saving is discussed.

Teacher’s Guide – Lesson Twelve: Saving And Investing

Student Guide – Lesson Twelve: Saving And Investing

Teacher’s Slide Presentation – Lesson Twelve: Saving And Investing

Teacher’s Power Point Presentation – Lesson Twelve: Saving And Investing

Lesson Thirteen: In Trouble

The material in this lesson will help students become aware of the warning signs of financial difficulties. This lesson includes information on where to go for debt consolidation help and for nonprofit credit counseling .

Teacher’s Guide – Lesson Thirteen: In Trouble

Student Guide – Lesson Thirteen: In Trouble

Teacher’s Slide Presentation – Lesson Thirteen: In Trouble

Teacher’s Power Point Presentation – Lesson Thirteen: In Trouble

Lesson Fourteen: Consumer Privacy

In today’s information age, keeping your personal financial information private can be challenging. What you put on an application for a loan, your payment history, where you make purchases, and your account balances are but a few of the financial records that can be sold to third parties and other organizations. This lesson, with attached budgeting activities, will encourage high school students to take the time and effort to develop their own personal financial goals and spending behaviors.

Teacher’s Guide – Lesson Fourteen: Consumer Privacy

Student Guide – Lesson Fourteen: Consumer Privacy

Teacher’s Slide Presentation – Lesson Fourteen: Consumer Privacy

Teacher’s Power Point Presentation – Lesson Fourteen: Consumer Privacy

Supplementary Resources

In an effort to give you the most up-to-date information for teaching and making personal financial decisions, we’ve compiled the following lists of periodicals and organizations that can enhance your use of Practical Money Skills for Life.

More Resources for Students: The Cost of College

The cost to attend college has soared faster than almost any segment of the economy over the last 30 years. The average cost for students attending a public university is up 213% ($3,190 in 1988 to $9,970 in 2018), while private school is up 129% ($15,160 to $34,740) over the same time period.

That’s the primary reason Americans are $1.4 trillion in debt on student loans.

The good news is that are hundreds of online sites offering tips on not just what it will cost, but what you can do to pay for it. So, take a deep breath and check out these sites that should help you find a college you can afford to attend.

- www.collegedata.com : This is a wonderful resource for everything from cost factors to how to apply to how to pay your own way.

- www.trends.collegeboard.org : They specialize in providing historical data on college pricing, financial aid and what your degree will be worth when you graduate.

- https://studentaid.ed.gov/sa/prepare-for-college/choosing-schools/consider/costs : This is the site for the Department of Education, which provides approximately 67% of college financial aid. You will find detailed evaluation of costs and financial aid here.

- https://www.aie.org/ : This site offers answers on the cost of college, how to finance it and even how to manage money while you’re there.

- https://nces.ed.gov/ : This is a government site that collects and analyzes date from every college and provides accurate data on average cost of attendance.

- www.mykidscollegechoice.com : Very focused on finding a college you can afford and ways to pay for it.

- www.collegecountdown.com : Asks and answers questions about actual costs of college, school that fit you financially and how to evaluate offers you receive from colleges.

Other Resources for Teachers

- Debt Relief For Teachers

- Student Loan Forgiveness for Teachers

- Financial Literacy for Teachers

You will need Adobe Reader to view the PDF Download Adobe Reader

10 MINUTE READ

Financial Literacy Menu

- Financial Literacy Workshops & Webinars

- Financial Data

- Resources for Teachers

- Free Financial Literacy Resources for College Students

- Using Comic Books To Teach Financial Literacy

- How to Calculate Debt-To-Income Ratio

- Free Financial Literacy Workshops For Habitat For Humanity Homebuyers

- Free Personal Finance Workshops At Goodwill

- Financial Literacy Education Statistics from FINRA’s NFCS

- Financial Literacy for Kids

- Free Financial Literacy Program For Teachers: Teach Money

- How Much Are Americans Saving for College, Retirement and Emergencies?

- What Do Social Security Taxes Pay For?

- Life Insurance for Seniors

- Is Life Insurance Worth It?

- When Should I Get Life Insurance?

- Retirement Checklist

- High-Risk Loans

- What Is Check Cashing?

- Title Loans

- Should We Deduct Our Daughter’s Loan From Her Inheritance?

- Bonds 101: Bond Investment Basics

How to Create a Personal Financial Plan (And Reach Your Goals Faster)

We all have goals in life – things like starting a business , buying a house, getting married – but money problems often sneak in and prevent us from achieving these objectives.

And so we are left wishing we had done some financial planning to pay for the necessities and to cover any of life’s unexpected events … and we’d still have enough left to put towards our goals.

If any of this sounds familiar to you, then you probably don’t have a financial plan in place.

At its most basic, a financial plan helps you meet your current financial needs and offers a strategy to achieve future financial stability, so you’re able to move forward with your goals.

In this post, you’ll learn everything you need to know about financial plans. We’ll also share an eight-step process to help you create your own personal financial plan, plus a few templates that can help you save money and time.

Post Contents

What is a Financial Plan?

What is a personal financial plan, step 1: review your current situation, step 2: set short-term and long-term goals, step 3: create a plan for your debts, step 4: establish your emergency fund, step 5: start estate planning, step 6: begin investing in your future, step 7: get protected, step 8: keep track of your plan, daily successful living’s financial plan template, smartsheet’s one-page financial plan template, simply stacie’s printable financial planner, financial plan app options, want to learn more.

Start selling online now with Shopify

A financial plan is a roadmap for an individual or a company to reach its goals.

It takes into your account your existing financial situation and goals, then creates a detailed strategy based on your prioritized objectives, telling you exactly where to spend your money, and when to save.

→ Click Here to Launch Your Online Business with Shopify

Additionally, financial plans help you prepare for the unanticipated by having you set aside a pot of money. When an unexpected job loss , illness or economic downturn occurs, you can rely on these funds to cover your day-to-day expenses.

Essentially, you can use a financial plan to take control of your money such that you can achieve your goals and ease worries you may have about your wellbeing.

In the past, people had to hire a professional to create a financial planner for them. But with the advancements in technology, you should be able to create one on your own.

It’s pretty easy with a financial plan template, which you can modify to reflect your own goals, cash flow, etc. You’ll find some handy templates you can use, later in the article.

A personal financial plan is a documented analysis of your personal finances, including your earnings, liabilities, assets, and investments.

Its purpose is to help you assess the feasibility of your personal goals and to understand the steps that you will need to take – money-wise – to accomplish them.

Your personal financial plan can stretch over weeks, months or years, based on the estimated completion time of your goals.And you can adjust it at any time to reflect new or changing priorities.

How to Create a Personal Financial Plan in 8 Easy Steps

Making a financial plan could give you more confidence with your cash. Plus, it means fewer nights worrying about those pesky bills.

The trouble is many people don’t know where to get started. They worry about things like “how much does a financial plan cost?” and assume they need endless professional support.

The good news? It’s never too late (or too early) to start working on your financial plan. Even better – creating a financial plan isn’t as complicated as you’d think. You can even break it down into 8 easy steps, like this:

Before you start the actual “planning” part of the process, you need to know where your journey is going to start. That means checking out what your financial situation is like right now.

Honestly, everyone could benefit from investing in more frequent financial checkups, but it’s easy to put off looking at your bank statements.

Think about it – when’s the last time you actually looked at all of your payments for gas, electricity, broadband, and Netflix, and figured out what they add up to?

Grab your last 6 to 12 months of bank statements and highlight every regular outgoing expense in one color, then highlight your irregular expenses in another.

It might be helpful to categorize these costs into personal and “crucial” expenses. Once you’ve got all the right info in front of you, ask yourself:

- Where can I cut down on spending?

- How much could I save by switching to a different service?

- Do I really need all of my “optional” expenses?

Now you have a starting point for your journey to financial freedom.

The next step is figuring out where you’re going. This is an important component in your “financial plan for dummies” journey.

Setting solid goals gives you direction and clarity when making decisions about your finances. Your goals will show you if you’re moving in the right direction.

Ideally, you’ll need your goals to be S.M.A.R.T. This means they’re:

Don’t just say you want to have more money in your savings. Write down a statement that explains exactly what you want to accomplish, such as:

“I want to have at least $2,000 in my savings account by the end of next year.”

Short-term financial goals, like “I’ll put $100 in my savings next month”, keep you motivated by showing constant progress. Long-term goals give you a more consistent direction to move in.

No-one likes thinking about debts – but these are issues that you just can’t ignore if you want to be financially savvy. Personal financial plans can help.

You can’t make huge progress with your short and long-term goals if your interest and repayments are weighing you down. So figure out how to pay what you owe first.

Start by creating a plan to get rid of your most problematic debts. These are the expenses that cost the most due to excessive interest rates and fees. Get rid of those as fast as you can.

If you’re struggling to handle several debts at once, it might help to see whether you can consolidate everything into one, cheaper loan.

The bottom line is you need to take action and start working towards being debt-free. Remember, debts include everything from immediate issues, like credit cards, to long-term expenses, like student debt .

An emergency fund is like a financial safety blanket.

No matter how “prepared” you think you are, there’s always a chance that some unexpected cost will come and sweep you off your feet.

Emergency funds protect you against things like unexpected illness, suddenly losing your job, or even just a bill that you forgot to pay.

While the exact amount of emergency funding you have depends on you, it should generally cover about 3 to 6 months’ worth of your fixed expenses. You can also save enough to cover variable expenses like entertainment and food too.

Emergency funds are beneficial for anyone. However, they’re particularly important if you’re a freelancer , someone with a poor credit score, or someone with variable income.

When setting up your personal financial plans, make sure you have an emergency fund in place.

Estate planning is one of those complicated terms that most people ignore – assuming it only applies to wealthy people, or people approaching retirement .

However, it’s essential that you think about protecting your family when you’re not around. A proper estate plan gives you total peace of mind.

Estate plans include:

- Last will and testament

- Healthcare directives

- Power of attorney

- Trust information

This document might also include other clauses for things like final disposition instructions and guardianship nominations.

Estate planning might not be the best thing you can do with your Friday evening fun-wise, but it will ensure that you’re protected for anything.

The next step is building whatever wealth you already have, so you’re prepared for the future. You can begin focusing on your savings and making investments.

You might have different plans to suit your short-term and long-term goals. For instance, your short-term financial plan might cover the steps you’re going to take to build wealth now. Your 5-year financial plan might look at things like retirement.

Investing for retirement is one of the best ways to ensure that you’re ready to tackle the future. When you begin planning for retirement, you’ll need to consider a few variables like:

- Desired retirement age: When would you like to stop working (be realistic here)

- Desired lifestyle: What kind of lifestyle do you want? Do you want enough cash to do whatever you like? Then plan for that!

- Current health: Health is definitely a big contributor to wealth. If you know health problems are likely for you, make sure you’re ready to tackle the issue.

- Savings rate: How much are you saving towards the future right now?

If you’re brand-new to investing, seek out some extra support. There are wealth advisors out there that can introduce you to different kinds of investment accounts and vehicles.

Just as emergency funds protect you from unexpected surprises in life, insurance defends your cash from any unforeseen risks.

Having the right insurance means that you won’t need to constantly break into your savings every time something goes wrong. For instance, home insurance means that you’re properly protected from things like natural disasters and break-ins.

Car insurance ensures that if anything goes wrong with your car, you’re ready to jump in and fix the issue – without massive payments.

Having an emergency fund and making sure you’re insured properly means that you can stay on top of all your savings goals – even when the going gets tough.

Make a list of all the insurance you might need when planning financial plan components.

The importance of a financial plan is something you can’t afford to underestimate.

The more you know about your current financial situation and where you’re headed, the more confident you’ll be in your spending.

However, getting a financial plan example template and building your own strategy is just the first leg of the journey. You also need to commit to actively tracking your progress.

Check in every three months or so, and make sure you’re moving in the right direction. A lot can change in your financial situation within just a few weeks.

Remember to update your plan when significant events occur in your life too. Having a child, getting married, or purchasing a new home will all create new considerations for you to deal with.

Actively reviewing and updating your plan means that you can enjoy a bullet-proof strategy for reaching your financial goals.

Financial Plan Example [Templates]

While you can create a financial plan from scratch, it’s always easier and quicker with a template.

Many financial plan template options are available to help you set up a financial plan. All you need to do is enter the details in their fields. You can also edit or remove fields based on the information you have available.

Even if you don’t want to use templates, these financial plan examples are a good starting point to learn what real-world plans look like and the specific finances you have to include in the document.

Here are a few templates:

Daily Successful Living offers a simple template you can use to calculate your net worth.

You can do this by adding up your assets and then subtracting all of your liabilities.

Once you have estimated your net worth, you can move onto setting some personal goals.

Smartsheet’s free financial plan template lets you create a concise personal finance plan.

Use it to assess your current financial situation, create a strategy to reach your goals, and use the plan to track progress.

You can also include details for estate planning or life insurance if needed.

Simply Stacie’s financial planner allows you to lay it all out – month-to-month – to analyze your monthly spending habits compared to what you budgeted.

If you’re working towards a goal like, say, saving for retirement, it’ll help you find opportunities to cut back and put the money towards your objective.

Keeping track of your money is difficult, especially when you’re unsure of your spending.

Fortunately, there are budget apps you can use to stay on top of your finances.

- Mint : Mint, besides its pleasingly minimal UI, offers a good range of money management tools. These are set around a few different areas, namely expense tracking, credit health, and saving advice tailored to your goals.

- Pocketnest : Pocketnest teams up with your bank to take you through different themes of financial planning. After you answer a few questions about your financial hitch, the app walks you through each stage of your plan, giving you to-dos along the way to help address any gaps.

- YNAB : YNAB offers bank syncing, transaction matching, goal tracking, and more. It can help you prepare for the future by breaking up larger expenses into more manageable, bite-sized amounts. The best expenses are ones you can easily manage.

Each of these apps make creating a financial plan a lot more convenient. Being able to view your income, expenditures, investments, etc. at a glance helps you jot down details much faster than gathering information from individual accounts.

Financial plans aren’t just for people with high income. Anyone can utilize them to identify their goals and create a plan for achieving them.

If you create a financial plan today, you would be able to work on achieving your life’s goals strategically.

It doesn’t matter where you stand. The important thing is that you get to fulfill your ambitions while improving your financial stability.

Do you want to start a side hustle , go on a holiday, retire by 40? You decide and then create a personal financial plan for achieving your purpose.

P.S. Life’s going to throw you curveballs that can affect your financial situation. Rather than accepting them as your fate, battle through them. You have the most powerful weapon of them all – your financial plan!

- 10-Step Formula to Achieve Financial Freedom in 2021

- 30 Personal Finance Tips You Need to Know

- Money Blogs: The Best Personal Finance Blogs in 2021

- Economic Recession: What Steps Can You Take Now?

Oberlo uses cookies to provide necessary site functionality and improve your experience. By using our website, you agree to our privacy policy.

- Corporate Finance Assignment Help

- Stock Valuation Assignment Help

- Insurance Assignment Help

- Financial Planning Assignment Help

- Managerial Finance Assignment Help

- Econometrics Assignment Help

- Financial Engineering Assignment Help

- Quantitative Finance Assignment Help

- Financial Market Analysis Assignment Help

- Auditing and Assurance Assignment Help

- Capital Markets Assignment Help

- Bond Valuation Assignment Help

- Mergers and Acquisitions Assignment Help

- Financial Forecasting Assignment Help

- Financial Markets Assignment Help

- Investment Banking Assignment Help

- Portfolio Management Assignment Help

- Financial Modeling Assignment Help

- Financial Reporting Assignment Help

- Banking Assignment Help

- Financial Mathematics Assignment Help

- Public Finance Assignment Help

- Valuation Methods Assignment Help

- Applied Finance Assignment Help

- Corporate Taxation Assignment Help

- Capital Asset Pricing Model (CAPM) Assignment Help

- Financial Counselling Assignment Help

- Financial Technology Assignment Help

- Personal Investment Planning Assignment Help

- Financial Services Assignment Help

- Business Finance Assignment Help

The Ultimate Guide for Writing Personal Finance Assignments

Personal finance is important to our lives because it determines our financial health and shapes our future. Gaining a thorough understanding of personal finance and its guiding principles is crucial for students majoring in finance or other related fields. Writing assignments that explore different facets of personal finance is an effective way to improve our understanding of this subject. We'll walk you through the steps of writing a personal finance assignment successfully , in this blog, offering helpful advice along the way. Not only will learning how to write an engaging and educational personal finance assignment increase your knowledge, but it will also sharpen your analytical and critical thinking abilities. You will gain useful knowledge that can be applied to actual financial situations by studying topics like budgeting, investment strategies, and retirement planning. This blog will provide you with the tools you need to create a well-structured and thought-provoking personal finance assignment, regardless of your level of academic experience. Let's discuss how to write a compelling finance assignment that demonstrates your knowledge of this important subject.

Understanding the Assignment

First things first: make sure you have read and understood the assignment brief. As it lays the groundwork for your entire assignment, this step is essential. Spend some time reading through your professor's or the assignment brief's detailed instructions. Pay close attention to specifics like the assignment's scope, the area of personal finance it focuses on, and any given requirements or instructions. You'll be able to focus your writing and your research if you are aware of the assignment's parameters. Examine the assignment guidelines to find formatting preferences, citation styles, word limits, and any other specific expectations or guidelines. You can make sure you are on the right track and tailor your writing process accordingly by fully understanding the assignment brief. You will be able to tailor your approach and present a well-structured and pertinent assignment that meets the expectations of your professor or evaluator if you have a clear understanding of the learning objectives underlying the assignment. When comprehending the specifications of a personal finance assignment, keep the following three points in mind:

1.1 Define the Assignment Scope

The scope of the task must be specified when writing a personal finance assignment. Specify the area of personal finance that the assignment is focused on, such as debt management, retirement planning, investment strategies, or budgeting. Understanding the scope will help you focus your writing efforts and limit your research. This enables you to focus more intently on the particular ideas and tenets associated with the given subject, ensuring that your analysis is thorough and pertinent. You can avoid including irrelevant information and make sure you address the task's essential requirements by clearly defining the assignment's scope.

1.2 Analyze the Assignment Instructions

It is essential to analyze the assignment instructions if you want to finish the task successfully. Keep a close eye on the guidelines and instructions that your professor or the assignment brief provides. Find out the precise formatting requirements, citation requirements, word limits, and any other unique requirements for the assignment. You can structure your assignment appropriately and ensure that you meet all the requirements by fully understanding the instructions. In the end, this step will improve the readability and credibility of your assignment by assisting you in maintaining consistency and professionalism throughout your work.

1.3 Identify the Learning Objectives

For you to customize your approach and develop a well-structured assignment, you must first determine the learning objectives behind the assignment. Discover the assignment's fundamental goals. Is it intended to assess how well you comprehend particular ideas? Show evidence of critical thinking abilities. Apply theoretical understanding to practical situations. You can align your writing and analysis to serve the assignment's intended purpose by determining the learning objectives. This enables you to deliver a pertinent and concentrated discussion that addresses the main goals outlined by your professor or assessor. By prioritizing the material and focusing on the most crucial elements, you can ensure that your assignment effectively demonstrates your understanding and application of personal finance principles.

Conducting Research

It's time to gather information and do extensive research to back up your ideas and arguments once you have a firm grasp of the assignment. When writing a personal finance assignment, research is essential because it gives you the information and support for the argument that you need. Start by locating trustworthy sources, such as scholarly databases, books, reputable websites, and academic journals. You can get current and reliable information about personal finance from these sources. To ensure a thorough analysis, it's critical to strike a balance between primary and secondary sources. Take thorough notes while researching, and efficiently arrange the data you find. Make the writing process easier on yourself by organizing your notes based on important subtopics or themes. You can present a well-informed and well-supported assignment that demonstrates your understanding of personal finance concepts and their real-world applications by conducting in-depth research. Here are two crucial actions to think about:

2.1 Gather Reliable Sources

It's critical to compile trustworthy and credible sources to write an informed assignment on personal finance. To gather information that is both trustworthy and current, use scholarly databases, books, websites, and academic journals. Make sure the sources you select are pertinent to the subject of your assignment and have a solid track record of offering reliable data. Utilizing trustworthy sources will allow you to back up your claims and analyses with solid proof, improving the overall caliber and legitimacy of your assignment. To provide a thorough analysis that includes both theoretical frameworks and actual examples, keep the ratio of primary and secondary sources balanced.

2.2 Take Notes and Organize Information

It is essential to take thorough notes during the research process and efficiently arrange the information gathered. Make notes of important ideas, quotations, and references as you read through the different sources that are pertinent to your assignment. Make the writing process easier on yourself by organizing your notes based on important subtopics or themes. This strategy will keep you organized and guarantee that you have quick access to the data you require when drafting your assignment. You can prevent confusion and save time during the writing stage by organizing your notes. Furthermore, taking organized notes helps you keep track of the relationships between various ideas and concepts, facilitating a cogent and logical presentation in your assignment.

Structuring the Assignment

For your ideas and arguments to be effectively communicated, your assignment must be well-structured. The use of structure gives your readers a framework to follow your reasoning and understand the main ideas of your assignment. It's critical to divide your personal finance assignment into distinct sections, such as an introduction, body, and conclusion. Your assignment's context is established in the introduction, which also summarises the main goals. Your analysis, points, and supporting details are arranged logically into paragraphs or subsections in the main body. To ensure a seamless flow of ideas, each paragraph should concentrate on a particular subtopic or concept with clear transitions. The conclusion restates your main conclusions and summarises the major issues raised. You can effectively communicate your ideas, improve the readability of your assignment, and leave a lasting impression on your readers by adhering to a clearly defined structure. The following three points should be addressed in your personal finance assignment:

3.1 Introduction

Setting the scene and drawing readers in are both accomplished by the introduction to your assignment. Start with an attention-grabbing opening statement that sparks interest. Give a succinct explanation of the significance and application of personal finance in the modern world after this. Give a clear description of your assignment's goal and a schedule of the important topics you will address. This clarifies to your readers the assignment's structure and what to anticipate in the following sections. The introduction should give a summary of the subject, establish its importance, and lay a solid groundwork for the remainder of your assignment.

3.2 Main Body

You present your analysis, arguments, and supporting evidence in-depth in the assignment's main body. This section should be broken up into logical paragraphs, each of which should concentrate on a different aspect or idea of personal finance. Use transitional words and phrases to help your readers move easily between the various ideas and arguments in your paragraphs. Use pertinent information, examples, and scholarly references to support your arguments in the body. This enhances the validity of your analysis and reveals a thorough knowledge of the subject. The main idea of each paragraph should be introduced in a concise topic sentence, which should be followed by supporting details and analysis that elaborate on it.

3.3 Conclusion

The conclusion is the last part of your assignment, where you restate your main conclusions and summarise the most important ideas that were covered. Give a succinct summary of your arguments and restate your thesis. The conclusion should primarily serve as a recap and synthesis of your analysis; avoid adding new information or ideas there. Emphasize the importance of your findings and how they affect personal finance in this section. Share your knowledge, ideas, or suggestions for additional study or useful applications in the area of personal finance. You can leave a lasting impression on your readers and highlight the importance of your analysis and research by offering a thoughtful and compelling conclusion.

Polishing Your Assignment

Once you have finished the first draught, it is time to edit your work to improve its professionalism, coherence, and clarity. The crucial step of polishing your assignment entails going over and enhancing different facets of your work. To begin, thoroughly proofread your essay to catch any grammatical or spelling errors. Pay close attention to the grammar, punctuation, and writing style in general. Additionally, it's crucial to improve the coherence and clarity of your assignment by checking the way ideas flow and making sure paragraphs make sense together. Verify that your ideas are presented coherently and that your arguments are backed up by solid evidence. Pay close attention to the formatting and citation requirements, and make sure you follow them. Verify again that your citations are accurate and that your reference list is comprehensive. You can improve the quality and professionalism of your assignment by taking the time to polish it, which will ultimately leave a good impression on your readers and increase the overall impact of your work. Think about the following elements:

4.1 Proofread for Grammar and Spelling

It is essential to carefully proofread your assignment after you have finished the first draught to catch any grammatical or spelling errors. Even though grammar-checking software can be useful, it's still important to read your assignment out loud to ensure that all errors are caught. This makes it possible for you to spot any mistakes or awkward wording that automated tools might overlook. Pay close attention to the subject-verb agreement, punctuation, and sentence structure as you carefully read through each sentence and paragraph. Making grammar and spelling corrections improves your assignment's overall professionalism and clarity.

4.2 Enhance Clarity and Coherence

When you go over your assignment, concentrate on improving its coherence and clarity. To make it simple for your readers to understand your thought process, make sure your ideas flow logically from one point to the next. Verify that your points are backed up by solid evidence and that the transitions between paragraphs flow naturally. Use suitable transitional language to help your readers move through the text easily. This makes it easier to present your ideas and analysis in a coherent and well-organized manner. You can improve your audience's reading experience and effectively convey your ideas by improving the clarity and coherence of your assignment.

4.3 Formatting and Citations

Keep a close eye on the formatting requirements listed for your assignment. This includes details like font size, style, and line spacing as well as margins. The visual presentation of your work will be consistent and professional if you abide by these rules. Additionally, follow the guidelines for your assignment or your professor's recommended citation style, such as APA, MLA, or Harvard. Avoiding plagiarism and honoring the contributions of other researchers and authors requires accurate citation of all sources used. Verify your citations again for accuracy, and make sure your reference list is accurate and properly formatted. This dedication to proper formatting and citations shows your commitment to academic integrity and gives your assignment more credibility.

Writing a personal finance assignment requires a systematic approach that includes comprehension of the assignment, extensive research, effective work organization, and polishing for clarity and coherence. You will be prepared to write a thorough and well-organized assignment that demonstrates your understanding of personal finance concepts if you follow the instructions provided in this blog. Always start early, ask for clarification when necessary, and be proud of your work. Writing a personal finance assignment improves your subject knowledge while also honing your analytical and critical thinking abilities. You'll gain useful insights for your financial journey by applying the concepts of budgeting, investment strategies, and retirement planning to real-life scenarios. You can produce a compelling assignment that demonstrates your mastery of personal finance with commitment and effort. Good luck with this assignment, and may your finance endeavors bring you success and prosperity in the future.

Post a comment...

- Personal Budgeting Game

- Stock Market Game

- Our Platform

- Real-Time Stock Game

- Financial Literacy Resources

- Financial Literacy Certifications

- Market Insight Widgets

- Career Readiness

- Homeschool Resources

- K12 Schools

- School Districts

- Corporate Financial Literacy Program

- Employee Financial Education & Wellness

- Sponsor a School

- White Label Financial Education Solutions

- Teacher Test Drive

- Schedule a Demo

- Request a Quote

- Login Login -->

Personal Finance

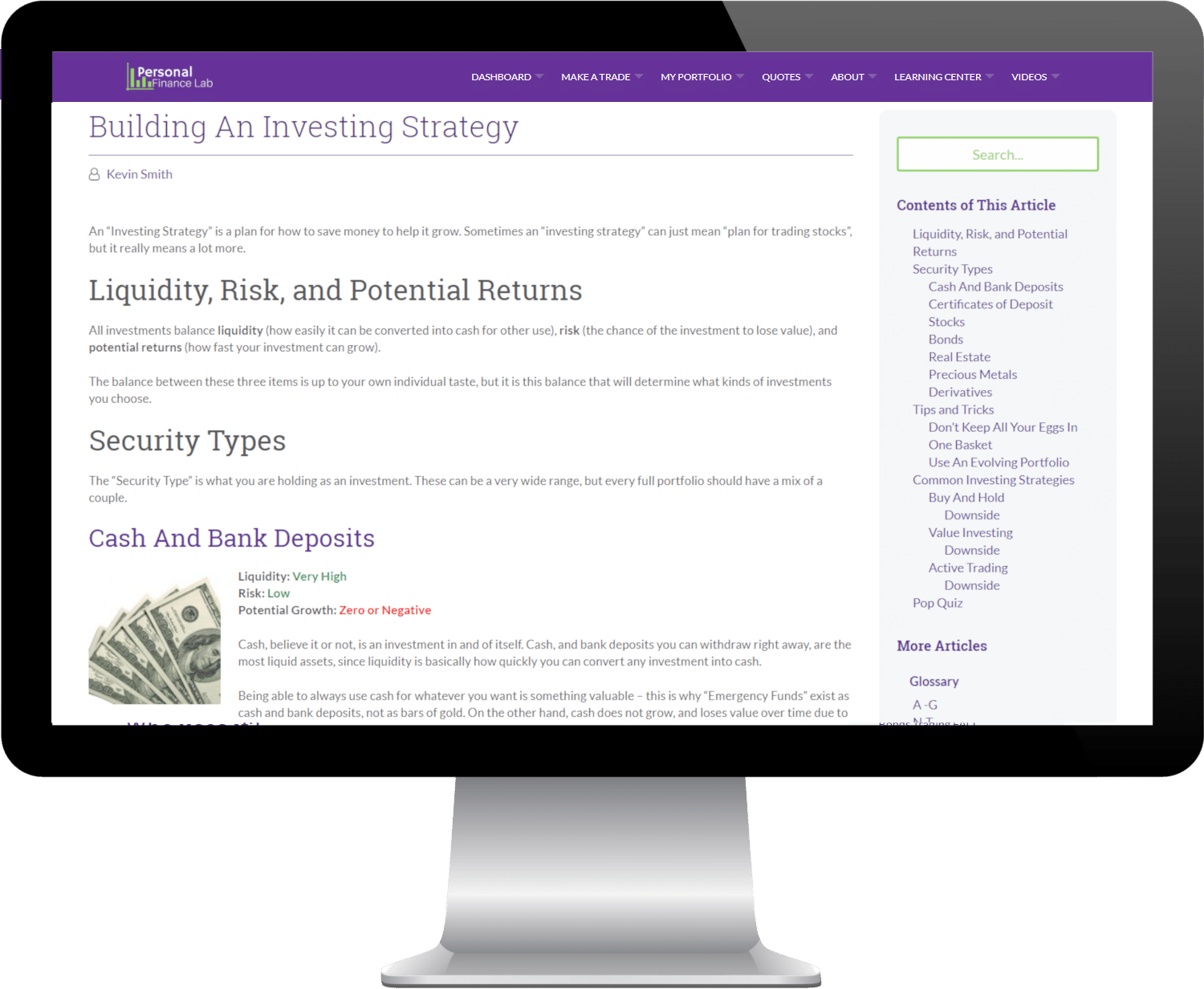

Using personalfinancelab.com in personal finance classes.

A quick look at why this is the coolest thing in education!

Why Use PersonalFinanceLab?

Real World Exercises, Aligned To Standards

Personal Finance Lab is anchored in our cutting-edge educational stock market game, developed with almost 30 years of collaboration with universities and high schools around the world. We combine the real-world excitement of the financial markets with our customizable financial literacy curriculum, aligned to both state and national standards.

This lets teachers mix and match lessons to perfectly compliment what they are already covering in class, all cemented with live data and examples from the real financial markets. This keeps students engaged, and reminded of the specifics of what was covered in class every time they see the news!

How It Works

Create A Stock Game

First, set up a stock market game for your class. You can pick all the settings, like what they can trade, how they need to diversify, and the window for the trading dates.

Choose Your Curriculum

Build “Assignments” by picking lessons from our library of over 300 activities. Mix and match depending on what you’re teaching in class – each assignment has its own start and due dates. You can borrow lessons from our Economics and Business curriculum libraries too, to build a completely customized course outline for your unique class!

Want your students to work in teams? You got it! Only let students trade mutual funds after week 4? No problem! Only let them invest half their portfolio in stocks, the rest in mutual funds or bonds? We built that right in!

Rankings Keep Students Engaged

Class rankings might not seem like much at first, but this is a proven way to get – and keep – your students’ attention. As they build their portfolio, they also complete your assignments and track their progress!

Match Your Class To The Real World

Students need to take notes every time they make a trade – letting you match their trading diary with the topics covered in class. This helps students connect your class to the world around them.

Integrates With Technology

We also work with schools to build Financial Literacy Labs – an amazing way to combine technology and curriculum! Get free posters, interactive LCD screens, and scrolling tickers to build the coolest room at your school.

Sample Lessons

- Budgeting and Spending Strategies

- Credit Cards

Click Here For More

- Search Search

From Our Blog

- Feature Highlight – Student Stock Comparison Tool

- Feature Highlight – Weekend Choices

- Feature Highlight – Trailing Stop Orders

- Feature Highlight – Economic Concepts Presentation Templates

- January 2024 Content Update

Personal Finance Lab

- Search Search Please fill out this field.

- Options and Derivatives

- Strategy & Education

Assignment: Definition in Finance, How It Works, and Examples

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

What Is an Assignment?

Assignment most often refers to one of two definitions in the financial world:

- The transfer of an individual's rights or property to another person or business. This concept exists in a variety of business transactions and is often spelled out contractually.

- In trading, assignment occurs when an option contract is exercised. The owner of the contract exercises the contract and assigns the option writer to an obligation to complete the requirements of the contract.

Key Takeaways

- Assignment is a transfer of rights or property from one party to another.

- Options assignments occur when option buyers exercise their rights to a position in a security.

- Other examples of assignments can be found in wages, mortgages, and leases.

Uses For Assignments

Assignment refers to the transfer of some or all property rights and obligations associated with an asset, property, contract, or other asset of value. to another entity through a written agreement.

Assignment rights happen every day in many different situations. A payee, like a utility or a merchant, assigns the right to collect payment from a written check to a bank. A merchant can assign the funds from a line of credit to a manufacturing third party that makes a product that the merchant will eventually sell. A trademark owner can transfer, sell, or give another person interest in the trademark or logo. A homeowner who sells their house assigns the deed to the new buyer.

To be effective, an assignment must involve parties with legal capacity, consideration, consent, and legality of the object.

A wage assignment is a forced payment of an obligation by automatic withholding from an employee’s pay. Courts issue wage assignments for people late with child or spousal support, taxes, loans, or other obligations. Money is automatically subtracted from a worker's paycheck without consent if they have a history of nonpayment. For example, a person delinquent on $100 monthly loan payments has a wage assignment deducting the money from their paycheck and sent to the lender. Wage assignments are helpful in paying back long-term debts.

Another instance can be found in a mortgage assignment. This is where a mortgage deed gives a lender interest in a mortgaged property in return for payments received. Lenders often sell mortgages to third parties, such as other lenders. A mortgage assignment document clarifies the assignment of contract and instructs the borrower in making future mortgage payments, and potentially modifies the mortgage terms.

A final example involves a lease assignment. This benefits a relocating tenant wanting to end a lease early or a landlord looking for rent payments to pay creditors. Once the new tenant signs the lease, taking over responsibility for rent payments and other obligations, the previous tenant is released from those responsibilities. In a separate lease assignment, a landlord agrees to pay a creditor through an assignment of rent due under rental property leases. The agreement is used to pay a mortgage lender if the landlord defaults on the loan or files for bankruptcy . Any rental income would then be paid directly to the lender.

Options Assignment

Options can be assigned when a buyer decides to exercise their right to buy (or sell) stock at a particular strike price . The corresponding seller of the option is not determined when a buyer opens an option trade, but only at the time that an option holder decides to exercise their right to buy stock. So an option seller with open positions is matched with the exercising buyer via automated lottery. The randomly selected seller is then assigned to fulfill the buyer's rights. This is known as an option assignment.

Once assigned, the writer (seller) of the option will have the obligation to sell (if a call option ) or buy (if a put option ) the designated number of shares of stock at the agreed-upon price (the strike price). For instance, if the writer sold calls they would be obligated to sell the stock, and the process is often referred to as having the stock called away . For puts, the buyer of the option sells stock (puts stock shares) to the writer in the form of a short-sold position.

Suppose a trader owns 100 call options on company ABC's stock with a strike price of $10 per share. The stock is now trading at $30 and ABC is due to pay a dividend shortly. As a result, the trader exercises the options early and receives 10,000 shares of ABC paid at $10. At the same time, the other side of the long call (the short call) is assigned the contract and must deliver the shares to the long.

:max_bytes(150000):strip_icc():format(webp)/novation.asp-final-f5904e1fe68047ba9d8b6feaf53c1736.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

PERSONAL FINANCE ASSIGNMENT

Definition of personal finance

Personal finance is the field that mainly deals with family finance or the financial calculations that people are doing on their own. It is required to estimate the cost and how the money will be spent in different expenditure sections in private life. Maintenance of profit and loss is also necessary for personal life. Self-budgeting is a vital tool for personal finance. Furthermore, it is noteworthy that personal financial planning and assessment allows one to identify the economic risk factors.

Various topics of personal finance

Various topics come under the head of personal finance. These topics are equally essential to take into consideration as these covers up a vast area. Those are enlisted below:

- Principles of Personal finance

- Statement of Personal income

- Health, Life and disability insurance

- Financial life management

- Separately managed account

- Money management

- Monitoring and reassessment

- Equity investment

- The process of personal financial planning

- Depreciating assets

Steps of personal financial planning personal finance

Personal finance can be planned by following several steps. It is noteworthy that personal financial planning is such a dynamic sector that cannot be progressed without a proper plan. The steps are stated below:

- Assessment: Assessment is the initial stage required for making a detailed assessment of the financial statements with the profit and loss statements.

- Goal setting: In the next step, it is essential to set goals. Moreover, the goal-setting process can be segmented into two separate heads, namely,

- Long-term goals

- Short term goals

- Creating a plan: After the goal is set, it is essential to develop a plan as per the requirement. Moreover, the program must be systematic so that the goals and objectives can be achieved positively.

- Execution: The personal finance section is all about execution after making the plan because if there is no execution, then the planning and goal setting will become futile.

- Monitoring and reassessment: In personal finance, there is a need for monitoring the execution process so that the current issues can be found through making the reassessments. Adults can make an idea regarding the cost estimation and make their further financial planning effectively.

Six critical areas of personal finance

There six different key areas that are of the personal-finance section. Those are as follows:

- Investment and accumulation of goals

- Adequate protection

- Estate planning

- Tax planning

- Financial position

- Retirement planning

Collateral assignment of life insurance

S ecured loans are often used by individuals needing financial resources for any reason, whether it’s to fund a business, remodel a home or pay medical bills. One asset that may be used for a secured loan is life insurance. Although there are pros and cons to this type of financial transaction, it can be an excellent way to access needed funding. Bankrate’s insurance editorial team discusses what a collateral assignment of life insurance is and when it might—or might not—be the best loan option for you.

What is collateral assignment of life insurance?

A collateral assignment of life insurance is a method of securing a loan by using a life insurance policy as collateral . If you pass away before the loan is repaid, the lender can collect the outstanding loan balance from the death benefit of your life insurance policy . Any remaining funds from the death benefit would then be disbursed to the policy’s designated beneficiary(ies).

Why use life insurance as collateral?

Collateral assignment of life insurance may be a useful option if you want to access funds without placing any of your assets, such as a car or house, at risk. If you already have a life insurance policy, it can be a simple process to assign it as collateral. You may even be able to use your policy as collateral for more than one loan, which is called cross-collateralization, if there is enough value in the policy.

Collateral assignment may also be a credible choice if your credit rating is not high, which can make it difficult to find attractive loan terms. Since your lender can rely on your policy’s death benefit to pay off the loan if necessary, they are more likely to give you favorable terms despite a low credit score.

Pros and cons of using life insurance as collateral

If you are considering collateral assignment, here are some pros and cons of this type of financial arrangement.

- It may be an affordable option, especially if your life insurance premiums are less than your payments would be for an unsecured loan with a higher interest rate.

- You will not need to place personal property, such as your home, as collateral, which you would need to do if you take out a secured loan. Instead, if you pass away before the loan is repaid, lenders will be paid from the policy’s death benefit. Any remaining payout goes to your named beneficiaries.

- You may find lenders who are eager to work with you since life insurance is generally considered a good choice for collateral.

- The amount that your beneficiaries would have received will be reduced if you pass away before the loan is paid off since the lender has first rights to death benefits.

- You may not be able to successfully purchase life insurance if you are older or in poor health.

- If you are using a permanent form of life insurance as collateral, there may be an impact on your ability to use the policy's cash value during the life of the loan. If the loan balance and interest payments exceed the cash value, it can erode the policy's value over time.

What types of life insurance can I use as collateral for a loan?

You may use either of the main types of life insurance— term and permanent —for collateral assignment. If you are using term life insurance, you will need a policy with a term length that is at least as long as the term of the loan. In other words, if you have 20 years to pay off the loan, the term insurance you need must have a term of at least 20 years.

Subcategories of permanent life insurance, such as whole life , universal life and variable life, may also be used. Depending on lender requirements, you may be able to use an existing policy or could purchase a new one for the loan. A permanent policy with cash value may be especially appealing to a lender, considering the added benefit of the cash reserves they could access if necessary.

How do I take out a loan using a collateral assignment of life insurance?

If you already have enough life insurance to use for collateral assignment, your next step is to find a lender who is willing to work with you. If you don’t yet have life insurance, or you don’t have enough, consider the amount of coverage you need and apply for a policy . You may need to undergo a medical exam and fill out an application .

Once your policy has been approved, ask your insurance company or agent for a collateral assignment form, which you will complete and submit with your loan application papers. The form names your lender as an assignee of the policy—meaning that they have a stake in its benefits for as long as the loan exists. You will also name beneficiaries or a single beneficiary, who will receive whatever is left over from the death benefits after the loan is repaid.

Note that you will need to stay current on your life insurance premium payments while the collateral assignment is active. This will be stated in the loan agreement, and failure to do so could have serious repercussions.

Alternatives to life insurance as collateral

If you are considering a collateral assignment of life insurance, there are a few alternative funding options that might be worth exploring. Since many factors determine each option, working with a financial advisor may be the best way to find the ideal solution for your situation.

Unsecured loan

Depending on your situation, an unsecured loan may be more affordable than a secured loan with life insurance as collateral. This is more likely to be the case if you have good enough credit to qualify for a low-interest rate without having to offer any type of collateral. There are many different types of unsecured loans, including credit cards and personal loans.

Secured loan

In addition to life insurance, there are other items you can use as collateral for a secured loan . Your home, a car or a boat, for example, could be used if you have enough equity in them. Typically, secured loans are easier to qualify for than unsecured, since they are not as risky for the lender, and you are likely to find a lower interest rate than you would with an unsecured loan. The flip side, of course, is that if you default on the loan, the lender can take the asset that you used to secure it and sell it to recoup their losses.

Life insurance loan

Some permanent life insurance policies accumulate cash value over time that you can use in different ways. If you have such a policy, you may be able to partially withdraw the cash value or take a loan against your cash value. However, there are implications to using the cash value in your life insurance policy, so be sure to discuss this solution with a life insurance agent or your financial advisor before making a decision.

Home equity line of credit (HELOC)

A home equity line of credit (HELOC) is a more flexible way to access funds than a standard secured loan. While HELOCs carry the downside of risking your home as collateral, you retain more control over the amount you borrow. Instead of receiving one lump sum, you will have access to a line of credit that you can withdraw from as needed. You will only have to pay interest on the actual amount borrowed.

Frequently asked questions

Finding the best life insurance company is important for you and your family. What works well for others might not fit your needs or current budget. First, find out how much life insurance you need by speaking with a financial advisor and using this life insurance calculator as a starting point. Similar to shopping for car insurance, you might want to look at customer service and claim reviews and the company’s financial stability ratings, then get quotes from several providers and ask for recommendations from people you trust.

Life insurance can be used as collateral for auto or home loans, but it is also commonly used for small business loans . Often small business owners have to use most of their private money to fund their businesses. When it is time to expand, upgrade technology or maybe hire more staff, they may need a loan to invest in their business that won’t put their remaining personal finances at risk.

It is typical for borrowers to put up their real estate or vehicles as collateral since they are usually our most valuable assets. Some loan companies may accept cash in the form of money market accounts or certificates of deposit (CD) , investments or valuable items such as jewelry, art and collectibles. Valuables are usually subject to an appraisal before they are accepted.

Although we have talked above about collateral assignment of your life insurance policy to secure a loan, there is another type of assignment called absolute assignment. With collateral assignment, you still exercise control over the policy, and the assignment only exists as long as the loan is active. Absolute assignment, however, transfers all policy rights to the lender, who becomes the new owner of the policy. The original policyholder gives up their right to name beneficiaries or access the policy’s cash value. This arrangement is more like a sale of the policy , with the new owner assuming all rights and responsibilities over it.

IMAGES

VIDEO

COMMENTS

Keep new credit card charges limited to what you can pay off, in full, each month. Hint: Create and follow a budget. Pay off existing credit card balances. Longer-term goals: Start saving at least ...

Study with Quizlet and memorize flashcards containing terms like 1. Describe two examples of important things that financial planning skills can help you do, and explain why these things are important to you personally. (4-6 sentences. 2.0 points)., 2. List two examples of goods you have purchased in the past or may purchase in the future. (Complete sentences are not necessary. 0.5 points), 3 ...

Tip: You can track your expenses using personal finance budgeting apps, which make budgeting more convenient than ever. Practical Money Skills Workbook 3 Six Saving Ideas If you find you are spending more than you make, now is the time to start spending less and setting aside more. Here are a few of the many ways you can save.

Included in that article are the Personal Finance Culminating Assignment, and Investigations Rubric. Gen Z Money Project. Based on CNBC's Millennial Money video series, this high school teacher developed an after school personal finance project where students plan what their life looks like at age 30. Students complete a: Futures Thinking ...