Search site

Contact our office

- Telephone 01242 574244

- Fax 01242 221631

- Email [email protected]

Make an enquiry

- 01242 574244

- Get in touch

- Residential Property

- Top results

- News and Events

Charges when Selling or Buying Leasehold Property

When you buy, own or sell a Leasehold property, many of your rights and obligations will be set out in your lease. One of your obligations will be to make certain payments to the person or the organisation responsible for administering and managing your building. That person might be a landlord, a management company, or a managing agent instructed by the landlord or management company (referred to below as "the landlord"). The typed of payments or charges can be divided into three groups. They are:

Ground Rent

Your lease may provide for you to make regular payments of ground rent as well as service charges. Although the lease may initially oblige you to pay a fixed amount of ground rent, it may also contain a clause which allows the landlord to increase the rent in years to come. When buying a leasehold property you should always ask your conveyancer to explain if there are any rent review clauses in your lease and explain what this would mean to you in financial terms.

Service Charge

Service charges normally vary according to the amount that is spent by the landlord each year on the upkeep of the building as a whole, including for example, cleaning the communal areas, gardening, maintaining and renewing the structure of the building (including the roof), building insurance. Usually, the lease will oblige you to pay a fixed percentage or a "reasonable proportion" of that amount. You should ask your conveyancer how the service charge is calculated, what it covers and whether the landlord has any plans for expensive remedial works to be carried out to the building for which you will be responsible.

Administration Charges

The landlord is likely to make an administration charge if you ask for a service connected with the buying or selling of a leasehold property. The following are examples of these charges you may have to pay,

When you are selling

1. Sellers leasehold pack: When you are selling a leasehold property it will be your responsibility to pay the landlord's charge to provide a Sellers leasehold pack (usually in the form of a Form LPE1) to provide the leasehold information required by your buyer and their lender.

2. Licence to Assign: It is possible that your lease requires you to obtain a licence from the landlord to sell the property. This involves the landlord approving the buyer as a new owner of the property. You may have to pay both the landlord's and landlord's solicitors charges for consenting to the sale and providing the Licence.

3. Exit or Transfer Fee: A retirement flat lease may include an "exit" or "transfer fee" payable by you from the sale proceeds and expressed as a percentage of the property value.

When you are buying

1. Deed of Covenant: Some leases require a buyer to enter into a Deed with the landlord to confirm that you will be bound by the terms of the lease. The buyer has to pay this charge.

2. Notice of Assignment of Transfer and Charge: The landlord will require that a notice is sent to them notifying of the change of ownership and any mortgage lender. This is to ensure that the landlord has your contact details (these may be different from the address of the property you have purchased) for the purpose of sending you ground rent and service charge invoices, and details of works to be carried out to the building.

3. Certificate of Compliance: The landlord may be required to provide this to confirm to the Land Registry that the change of ownership requirements in the lease have been complied with.

4. Share or Membership Transfer Charge: If you are required to become a member of the Management Company then the landlord may make a charge to transfer the share or membership certificate into your name.

To ensure that you are aware of the above charges and procedures, when you are selling or buying leasehold property, you should ask your conveyancer to review the lease and property title at an early stage.

Hughes Paddison has an experienced residential property team who are able to advise on all aspects of leasehold conveyancing whether you are selling or buying. Please contact our residential property team, we will spend time discussing any queries you have concerning the leasehold property you are buying or selling, and provide you with a conveyancing quote.

The information contained on this page has been prepared for the purpose of this blog/article only. The content should not be regarded at any time as a substitute for taking legal advice.

- Call Us 01242 574244

- Email Us [email protected]

What our clients say

“Hughes Paddison have provided assistance on numerous occasions consistently acting in an exemplary fashion whilst dealing with all aspects of the issue at hand. It is extremely reassuring to know that our company is represented by such a competent and professional firm.” – Commercial Director, Ferroli Limited

““Jennifer was most helpful, frequently explaining the legal jargon with ease and doing so in an effective manner. This very much helped me follow along with what at times seemed like a daunting process - Jennifer’s ability to explain things clearly made the whole process much easier to deal with.”” – Anon

“Just a quick note to say a huge thankyou to both yourself and Jess for the service that you have given me over the last few months. It all seems to have been done with the minimum of fuss which has certainly taken away an element of stress that comes along with selling your house. I now see why you guys came as a recommendation and look forward to dealing with you both again when we purchase our new house next year.” – Anon

“Just a note to say thank you very much to you and your colleagues for dealing with the sale of our late Mum’s property. The service we received was excellent and you were able to resolve all the problems that cropped up!” – Anon

“Jennifer provided sound professional legal advice which I needed to help me to sort out the legal and financial aspects of a difficult personal situation. I wouldn't hesitate to go to her with any family legal matters I have in future.” – R

“Having the support of Marcus throughout what has been a very painful divorce has really helped me get through the last 18 months. Although this has personally been a very difficult process, I know that Marcus has done everything possible to make it as smooth as it can be. I really appreciate the honest, open feedback to all of my questions and also how quickly he responded to them. Above all else, Marcus really does seem to care about his clients and their families. I never had the feeling that this was just a job for Marcus, and I’m so grateful that I was fortunate enough to have had Marcus recommended to me when I did.” – R

“When you use a solicitor its usually in times of need, when you require expert advice and reassurance. This is exactly what our company has received from Hughes Paddison Solicitors and in particular Kimberly Whalen-Blake. Not only is Kimberly extremely well informed and professional; she is also personable and easy to communicate with. She responds to messages and emails promptly and goes over and above to assist. I would have no hesitation in recommending her services; and in the future, if necessary, I will definitely be calling on her expertise. ” – S - UK Parking Design

“ Hughes Paddison came highly recommended and they were not wrong. I am so glad I appointed Kim to represent me. It was a really difficult time and Kim swiftly and compassionately cut through to the crux of the issue and gave me such clear and great advice immediately. The outcome achieved was truly the best for myself and the organisation and avoided more stress for all parties involved, as it was solved very quickly. Most importantly for me, Kim handled the negotiations. The relief of handing this over to someone I completely trusted made a horrible situation much better. Many thanks to Kim and HP.” – Anon

We use essential cookies to make our site work. We'd also like to set analytics cookies that help us make improvements by measuring how you use the site. Clicking Reject All only enables essential cookies. For more detailed information about the cookies we use, see our Cookies page . For further control over which cookies are set, please click here

Our use of cookies.

You can learn more detailed information in our Privacy Policy

Some cookies are essential, whilst others help us improve your experience by providing insights into how the site is being used. The technology to maintain this privacy management relies on cookie identifiers. Removing or resetting your browser cookies will reset these preferences.

Essential Cookies

These cookies enable core website functionality, and can only be disabled by changing your browser preferences.

Google Analytics cookies help us to understand your experience of the website and do not store any personal data. Click here for a full list of Google Analytics cookies used on this site.

Third-Party cookies are set by our partners and help us to improve your experience of the website. Click here for a full list of third-party plugins used on this site.

- Bankruptcy Basics

- Chapter 11 Bankruptcy

- Chapter 13 Bankruptcy

- Chapter 7 Bankruptcy

- Debt Collectors and Consumer Rights

- Divorce and Bankruptcy

- Going to Court

- Property & Exemptions

- Student Loans

- Taxes and Bankruptcy

- Wage Garnishment

Understanding the Assignment of Mortgages: What You Need To Know

3 minute read • Upsolve is a nonprofit that helps you get out of debt with education and free debt relief tools, like our bankruptcy filing tool. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

A mortgage is a legally binding agreement between a home buyer and a lender that dictates a borrower's ability to pay off a loan. Every mortgage has an interest rate, a term length, and specific fees attached to it.

Written by Attorney Todd Carney . Updated November 26, 2021

If you’re like most people who want to purchase a home, you’ll start by going to a bank or other lender to get a mortgage loan. Though you can choose your lender, after the mortgage loan is processed, your mortgage may be transferred to a different mortgage servicer . A transfer is also called an assignment of the mortgage.

No matter what it’s called, this change of hands may also change who you’re supposed to make your house payments to and how the foreclosure process works if you default on your loan. That’s why if you’re a homeowner, it’s important to know how this process works. This article will provide an in-depth look at what an assignment of a mortgage entails and what impact it can have on homeownership.

Assignment of Mortgage – The Basics

When your original lender transfers your mortgage account and their interests in it to a new lender, that’s called an assignment of mortgage. To do this, your lender must use an assignment of mortgage document. This document ensures the loan is legally transferred to the new owner. It’s common for mortgage lenders to sell the mortgages to other lenders. Most lenders assign the mortgages they originate to other lenders or mortgage buyers.

Home Loan Documents

When you get a loan for a home or real estate, there will usually be two mortgage documents. The first is a mortgage or, less commonly, a deed of trust . The other is a promissory note. The mortgage or deed of trust will state that the mortgaged property provides the security interest for the loan. This basically means that your home is serving as collateral for the loan. It also gives the loan servicer the right to foreclose if you don’t make your monthly payments. The promissory note provides proof of the debt and your promise to pay it.

When a lender assigns your mortgage, your interests as the mortgagor are given to another mortgagee or servicer. Mortgages and deeds of trust are usually recorded in the county recorder’s office. This office also keeps a record of any transfers. When a mortgage is transferred so is the promissory note. The note will be endorsed or signed over to the loan’s new owner. In some situations, a note will be endorsed in blank, which turns it into a bearer instrument. This means whoever holds the note is the presumed owner.

Using MERS To Track Transfers

Banks have collectively established the Mortgage Electronic Registration System , Inc. (MERS), which keeps track of who owns which loans. With MERS, lenders are no longer required to do a separate assignment every time a loan is transferred. That’s because MERS keeps track of the transfers. It’s crucial for MERS to maintain a record of assignments and endorsements because these land records can tell who actually owns the debt and has a legal right to start the foreclosure process.

Upsolve Member Experiences

Assignment of Mortgage Requirements and Effects

The assignment of mortgage needs to include the following:

The original information regarding the mortgage. Alternatively, it can include the county recorder office’s identification numbers.

The borrower’s name.

The mortgage loan’s original amount.

The date of the mortgage and when it was recorded.

Usually, there will also need to be a legal description of the real property the mortgage secures, but this is determined by state law and differs by state.

Notice Requirements

The original lender doesn’t need to provide notice to or get permission from the homeowner prior to assigning the mortgage. But the new lender (sometimes called the assignee) has to send the homeowner some form of notice of the loan assignment. The document will typically provide a disclaimer about who the new lender is, the lender’s contact information, and information about how to make your mortgage payment. You should make sure you have this information so you can avoid foreclosure.

Mortgage Terms

When an assignment occurs your loan is transferred, but the initial terms of your mortgage will stay the same. This means you’ll have the same interest rate, overall loan amount, monthly payment, and payment due date. If there are changes or adjustments to the escrow account, the new lender must do them under the terms of the original escrow agreement. The new lender can make some changes if you request them and the lender approves. For example, you may request your new lender to provide more payment methods.

Taxes and Insurance

If you have an escrow account and your mortgage is transferred, you may be worried about making sure your property taxes and homeowners insurance get paid. Though you can always verify the information, the original loan servicer is responsible for giving your local tax authority the new loan servicer’s address for tax billing purposes. The original lender is required to do this after the assignment is recorded. The servicer will also reach out to your property insurance company for this reason.

If you’ve received notice that your mortgage loan has been assigned, it’s a good idea to reach out to your loan servicer and verify this information. Verifying that all your mortgage information is correct, that you know who to contact if you have questions about your mortgage, and that you know how to make payments to the new servicer will help you avoid being scammed or making payments incorrectly.

Let's Summarize…

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender’s interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage’s terms should remain the same. Your interest rate, loan amount, monthly payment, and payment schedule shouldn’t change.

Your original lender isn’t required to notify you or get your permission prior to assigning your mortgage. But you should receive correspondence from the new lender after the assignment. It’s important to verify any change in assignment with your original loan servicer before you make your next mortgage payment, so you don’t fall victim to a scam.

Attorney Todd Carney

Attorney Todd Carney is a writer and graduate of Harvard Law School. While in law school, Todd worked in a clinic that helped pro-bono clients file for bankruptcy. Todd also studied several aspects of how the law impacts consumers. Todd has written over 40 articles for sites such... read more about Attorney Todd Carney

Continue reading and learning!

It's easy to get debt help

Choose one of the options below to get assistance with your debt:

Considering Bankruptcy?

Our free tool has helped 13,590+ families file bankruptcy on their own. We're funded by Harvard University and will never ask you for a credit card or payment.

Private Attorney

Get a free evaluation from an independent law firm.

Learning Center

Research and understand your options with our articles and guides.

Already an Upsolve user?

Bankruptcy Basics ➜

- What Is Bankruptcy?

- Every Type of Bankruptcy Explained

- How To File Bankruptcy for Free: A 10-Step Guide

- Can I File for Bankruptcy Online?

Chapter 7 Bankruptcy ➜

- What Are the Pros and Cons of Filing Chapter 7 Bankruptcy?

- What Is Chapter 7 Bankruptcy & When Should I File?

- Chapter 7 Means Test Calculator

Wage Garnishment ➜

- How To Stop Wage Garnishment Immediately

Property & Exemptions ➜

- What Are Bankruptcy Exemptions?

- Chapter 7 Bankruptcy: What Can You Keep?

- Yes! You Can Get a Mortgage After Bankruptcy

- How Long After Filing Bankruptcy Can I Buy a House?

- Can I Keep My Car If I File Chapter 7 Bankruptcy?

- Can I Buy a Car After Bankruptcy?

- Should I File for Bankruptcy for Credit Card Debt?

- How Much Debt Do I Need To File for Chapter 7 Bankruptcy?

- Can I Get Rid of my Medical Bills in Bankruptcy?

Student Loans ➜

- Can You File Bankruptcy on Student Loans?

- Can I Discharge Private Student Loans in Bankruptcy?

- Navigating Financial Aid During and After Bankruptcy: A Step-by-Step Guide

- Filing Bankruptcy to Deal With Your Student Loan Debt? Here Are 3 Things You Should Know!

Debt Collectors and Consumer Rights ➜

- 3 Steps To Take if a Debt Collector Sues You

- How To Deal With Debt Collectors (When You Can’t Pay)

Taxes and Bankruptcy ➜

- What Happens to My IRS Tax Debt if I File Bankruptcy?

- What Happens to Your Tax Refund in Bankruptcy

Chapter 13 Bankruptcy ➜

- Chapter 7 vs. Chapter 13 Bankruptcy: What’s the Difference?

- Why is Chapter 13 Probably A Bad Idea?

- How To File Chapter 13 Bankruptcy: A Step-by-Step Guide

- What Happens When a Chapter 13 Case Is Dismissed?

Going to Court ➜

- Do You Have to Go To Court to File Bankruptcy?

- Telephonic Hearings in Bankruptcy Court

Divorce and Bankruptcy ➜

- How to File Bankruptcy After a Divorce

- Chapter 13 and Divorce

Chapter 11 Bankruptcy ➜

- Chapter 7 vs. Chapter 11 Bankruptcy

- Reorganizing Your Debt? Chapter 11 or Chapter 13 Bankruptcy Can Help!

State Guides ➜

- Connecticut

- District Of Columbia

- Massachusetts

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- West Virginia

Upsolve is a 501(c)(3) nonprofit that started in 2016. Our mission is to help low-income families resolve their debt and fix their credit using free software tools. Our team includes debt experts and engineers who care deeply about making the financial system accessible to everyone. We have world-class funders that include the U.S. government, former Google CEO Eric Schmidt, and leading foundations.

To learn more, read why we started Upsolve in 2016, our reviews from past users, and our press coverage from places like the New York Times and Wall Street Journal.

Assignments: why you need to serve a notice of assignment

It's the day of completion; security is taken, assignments are completed and funds move. Everyone breathes a sigh of relief. At this point, no-one wants to create unnecessary paperwork - not even the lawyers! Notices of assignment are, in some circumstances, optional. However, in other transactions they could be crucial to a lender's enforcement strategy. In the article below, we have given you the facts you need to consider when deciding whether or not you need to serve notice of assignment.

What issues are there with serving notice of assignment?

Assignments are useful tools for adding flexibility to banking transactions. They enable the transfer of one party's rights under a contract to a new party (for example, the right to receive an income stream or a debt) and allow security to be taken over intangible assets which might be unsuitable targets for a fixed charge. A lender's security net will often include assignments over contracts (such as insurance or material contracts), intellectual property rights, investments or receivables.

An assignment can be a legal assignment or an equitable assignment. If a legal assignment is required, the assignment must comply with a set of formalities set out in s136 of the Law of Property Act 1925, which include the requirement to give notice to the contract counterparty.

The main difference between legal and equitable assignments (other than the formalities required to create them) is that with a legal assignment, the assignee can usually bring an action against the contract counterparty in its own name following assignment. However, with an equitable assignment, the assignee will usually be required to join in proceedings with the assignor (unless the assignee has been granted specific powers to circumvent that). That may be problematic if the assignor is no longer available or interested in participating.

Why should we serve a notice of assignment?

The legal status of the assignment may affect the credit scoring that can be given to a particular class of assets. It may also affect a lender's ability to effect part of its exit strategy if that strategy requires the lender to be able to deal directly with the contract counterparty.

The case of General Nutrition Investment Company (GNIC) v Holland and Barrett International Ltd and another (H&B) provides an example of an equitable assignee being unable to deal directly with a contract counterparty as a result of a failure to provide a notice of assignment.

The case concerned the assignment of a trade mark licence to GNIC . The other party to the licence agreement was H&B. H&B had not received notice of the assignment. GNIC tried to terminate the licence agreement for breach by serving a notice of termination. H&B disputed the termination. By this point in time the original licensor had been dissolved and so was unable to assist.

At a hearing of preliminary issues, the High Court held that the notices of termination served by GNIC , as an equitable assignee, were invalid, because no notice of the assignment had been given to the licensee. Although only a High Court decision, this follows a Court of Appeal decision in the Warner Bros Records Inc v Rollgreen Ltd case, which was decided in the context of the attempt to exercise an option.

In both cases, an equitable assignee attempted to exercise a contractual right that would change the contractual relationship between the parties (i.e. by terminating the contractual relationship or exercising an option to extend the term of a licence). The judge in GNIC felt that "in each case, the counterparty (the recipient of the relevant notice) is entitled to see that the potential change in his contractual position is brought about by a person who is entitled, and whom he can see to be entitled, to bring about that change".

In a security context, this could hamper the ability of a lender to maximise the value of the secured assets but yet is a constraint that, in most transactions, could be easily avoided.

Why not serve notice?

Sometimes it's just not necessary or desirable. For example:

- If security is being taken over a large number of low value receivables or contracts, the time and cost involved in giving notice may be disproportionate to the additional value gained by obtaining a legal rather than an equitable assignment.

- If enforcement action were required, the equitable assignee typically has the option to join in the assignor to any proceedings (if it could not be waived by the court) and provision could be made in the assignment deed for the assignor to assist in such situations. Powers of attorney are also typically granted so that a lender can bring an action in the assignor's name.

- Enforcement is often not considered to be a significant issue given that the vast majority of assignees will never need to bring claims against the contract counterparty.

Care should however, be taken in all circumstances where the underlying contract contains a ban on assignment, as the contract counterparty would not have to recognise an assignment that is made in contravention of that ban. Furthermore, that contravention in itself may trigger termination and/or other rights in the assigned contract, that could affect the value of any underlying security.

What about acknowledgements of notices?

A simple acknowledgement of service of notice is simply evidence of the notice having been received. However, these documents often contain commitments or assurances by the contract counterparty which increase their value to the assignee.

Best practice for serving notice of assignment

Each transaction is different and the weighting given to each element of the security package will depend upon the nature of the debt and the borrower's business. The service of a notice of assignment may be a necessity or an optional extra. In each case, the question of whether to serve notice is best considered with your advisers at the start of a transaction to allow time for the lender's priorities to be highlighted to the borrowers and captured within the documents.

For further advice on serving notice of assignment please contact Kirsty Barnes or Catherine Phillips from our Banking & Finance team.

- [email protected]

- T: +44 (0)370 733 0605

- Download vCard for Catherine Phillips

Related Insights & Resources

Gowling WLG updates

Sign up to receive our updates on the latest legal trends and developments that matter most to you.

1.915-859-8900 Get a Free Quote

WE ARE CELEBRATING 25 YEARS OF EXCELLENCE! 🎉 JOIN US IN CELEBRATING THIS MILESTONE YEAR.

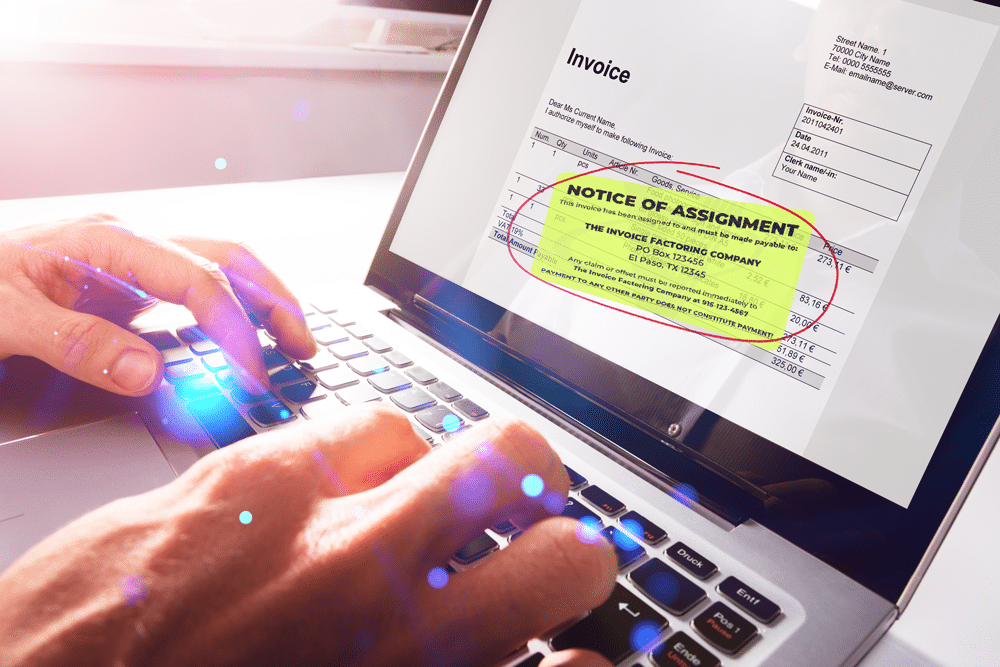

Factoring Notice of Assignment (NOA): Everything You Need to Know

A factoring notice of assignment (NOA) is usually required when you factor your invoices. Rest assured, NOAs are quite common in business and aren’t a cause for concern. However, it helps to understand what they are and how they work so that you can explain them to your customers as needed.

Assignment of Debt Explained

Companies transfer debt, along with all associated rights and obligations, to third parties all the time. One example of this occurs with collection companies. In these cases, the business, also referred to as the creditor, sells its uncollectable balances or assigns specific debts to the collection company. The collection company is then authorized to collect those specific balances on behalf of the creditor.

Assignment of debt may also come into play when businesses outsource their receivables and leverage certain types of funding, among other situations.

What Does Notice of Assignment Mean?

The customer, also referred to as the debtor, must be informed when a creditor assigns their debt to a third party. The document used in this process is referred to as a notice of assignment of debt.

What is a Notice of Assignment in Factoring?

When you leverage invoice factoring , you’re selling an unpaid B2B invoice to a factoring company at a discount. In exchange, you receive up to 98 percent of the invoice’s value right away and get the remaining sum minus a small factoring fee when your client pays. This means you’re not waiting 30, 60, or more days for payment. This cash flow acceleration helps businesses bridge cash flow gaps caused by slow-paying customers, seasonality, rapid growth, and more. Plus, the cash can be used for anything the business needs. This unique process means businesses can receive immediate funding without creating debt like other funding sources.

A notice of assignment is required in factoring because you’re assigning debt to a third party – the factoring company – and the customers involved need to know.

The Role of Notice of Assignment for Cash Flow

Invoice factoring stands out as a solution for businesses seeking to improve their cash flow. When a company decides to use invoice factoring, it enters into a factoring relationship, where accounts receivable and financial rights are handled differently than usual. This process involves the NOA, a pivotal document in factoring transactions. Essentially, NOA is a simple letter informing customers that the payment terms have changed and future payments should be made payable to the factoring company.

This notification ensures that there are no misdirected payments, which is a critical aspect when managing accounts payable and securing immediate cash. By using factoring, businesses can access working capital, which reduces the strain of slow-paying customers. It’s important for factoring clients to understand how factoring companies notify your customers and the implications of this process. The factoring contract typically outlines these details, ensuring that every party in a factoring transaction is aware of their responsibilities, especially regarding remittance addresses and payment information.

Factoring services offer an alternative to traditional lines of credit, providing businesses with high advances at low rates. This method is beneficial for companies that demand longer payment terms from their clients. By transferring the right to collect payments to the factoring company, the business can focus on its core operations while the finance company handles the receivables. Understanding the benefits of factoring and effectively communicating them to your customers may improve the factoring process and maintain healthy customer relationships, even when introducing new financial arrangements like invoice factoring.

The Importance of a Notice of Assignment in Factoring

Notice of Assignment in invoice factoring keeps your customers in the loop so they know who is collecting and why. It also lets them know where to send their payments. This streamlines the process and helps ensure there’s no confusion about where payments need to go.

Elements of a Factoring NOA Document

Each factoring company words its NOA a bit differently, but NOAs usually include:

- A statement that indicates the factoring company is now managing the invoice or invoices.

- A notice that payments should be made to the factoring company.

- Details on how payments can be made, including addresses, bank details, or payment portal information.

- What will occur if payments are sent to the business instead of the third party.

- A signature from someone at your business to show your customer that the NOA is authentic and a signature space for your customer to sign indicating that they’ve read and understand the document.

How Do Factoring Companies Notify Your Customers

A factoring notice of assignment is usually sent to customers by U.S. mail, though sometimes factoring companies use other delivery services or even digitize the NOA.

What Will Your Clients Think of You Factoring Your Invoices?

Sometimes, businesses that are new to invoice factoring have concerns about how customers will react to factoring or receiving an NOA. However, it’s usually not a cause for concern.

Although your factoring company isn’t an outsourcing company, it behaves quite similarly when collecting invoices. Nearly 40 percent of small businesses outsource at least one business process, Clutch reports. That means a significant portion of your customers already have some experience engaging with third parties. Furthermore, invoice factoring is growing in leaps and bounds and is expected to grow by eight percent in the coming years, per Grandview Research . Many of your customers already have experience with factoring or will very soon. Because most businesses have some exposure to factoring or will in the near future, it’s generally seen as an ordinary business practice – nothing more, nothing less.

However, even if factoring is entirely new to your customers, how they respond to your decision is often determined by how you present it. For instance, it accelerates payments without putting pressure on your customers to pay faster. It has benefits for them, too, and can help improve the relationship. This alone can actually help some businesses win bids or attract new customers. Explaining it to them this way can help soothe any concerns if customers come to you with questions.

How to Ensure Your Customer Relationships Are Protected

Most factoring companies will take good care of their customers because they are a reflection of you. Your repeat business helps ensure they’ll have repeat business. However, reviewing a factoring company’s testimonials and success stories is always a good idea to understand better how they operate before you sign up.

It’s also essential to work with a company like Viva that doesn’t send mass notifications to all its customers. We only notify those who are debtors on the invoices you’d like to factor to eliminate any confusion.

Lastly, it’s better to work with a company that provides you with 24/7 access to your account so you can see what’s paid and outstanding at a glance and can make decisions about orders using real-time data.

Request a Complimentary Invoice Factoring Quote

At Viva Capital, we always provide white glove care to the businesses we serve and their customers.As part of our service, we handle the Notice of Assignment with professionalism. Our collection experts make it easy for your customers to manage their bills and are happy to answer their questions. You’ll also have access to your personal Customer Account Portal so you can make informed decisions on the fly and always know what’s outstanding. To learn more or get started, request a complimentary invoice factoring quote .

- Recent Posts

- 10 Credit Crunch Business Strategies to Boost Your Resilience - March 21, 2024

- 5 Benefits Factoring Companies Offer Other Than Factoring - February 9, 2024

- Factoring Notice of Assignment (NOA): Everything You Need to Know - January 4, 2024

About Armando Armendariz

The Cost of Invoice Factoring: Is it Worth It?

Why Relying on Business Credit Cards is Dangerous

Comments are closed.

Request FREE Funding Estimate

Discover how we've helped businesses just like yours.

How Medlock Contractors has forged better relationships with their subcontractors with the help of Viva Capital Funding.

How R. Ramirez Express saves $5,000 per year in fuel costs with Viva Capital Funding.

How BelCon Logistics grew 1,000% in just 3.5 years with Viva Capital Funding.

How Top of the Line Healthcare Staffing boosted revenue 1,000% with Viva Capital Funding.

How Sun City Pallets boosted revenue 400% with Viva Capital Funding.

How DMI Industries Supplies grew and continued its global expansion plans with Viva Capital Funding.

How Cold Way Transportation boosted revenue 47% with Viva Capital Funding.

Industries we serve

- Transportation

- Manufacturing

- Service providers

- Construction

- Other Industries

Latest articles and insights

- Agile Business Transformation: Navigating Market Shifts for Long-Term Success April 8, 2024

- 10 Credit Crunch Business Strategies to Boost Your Resilience March 21, 2024

- What to Include in an Invoice to Get Paid Fast March 7, 2024

- Insurance for Business: Which Policies to Consider and Why February 21, 2024

- 5 Benefits Factoring Companies Offer Other Than Factoring February 9, 2024

- How to get a Russian Visa

- Getting started and what's the price

- About Visa House

- Tourist Visa

- Business Visa

- For a HQ Specialist

- Private Visa

- For a member of the family

- Transit Visa

- Visa-free entry

- Contact the Consulate

- Documents to be submitted

- Consular Questionnaire

- Consular Fee

- Check your Visa

- How to register your visa

- Migration Card

- Arrival Notification

- Before entering Russia

- Crossing the border

- Useful Hints

- Russian Visa News

- Tourist Visa Invitation

- Business Visa Invitation

- Travel Insurance

- Delivery of documents

- Flight tickets booking

- Hotel booking

- Notarized translation

- Additional Visa Services

- All about Russian visas

- General Info

- At the Consulate

- Visa Registration

- Russian Visa FAQs

- Russian Visa Types

- Russian Work Visa

- Procedure for obtaining

The procedure for receiving the work visa for foreign citizens

Obtaining a work visa for the foreign citizen is a multistage and long process. For example, it will take on the average 100 days and 15900 ₽ (only to pay the state fee) for the Company-employer registered in Moscow to hire a foreign worker. Since a work permit is valid maximum for 1 year, it is necessary to start processing a new work visa 6 months after receiving the current work visa.

Citizens of the CIS do not need a visa to enter Russia, and Work permit is issued for them in the simplified order for 10 working days and 4000 ₽ approximately.

Company – member of AmCham can process the documents in Moscow in “one window” mode for its foreign colleagues working not only in Moscow, but also in any other region of Russia.

Steps of the work visa getting procedure:

- Annual electronic application for foreign manpower need submitted to the Migration quotas automated information system.

- Placement of vacancy in the administration of Civil service of the employment of population.

- Permission to involve the foreign labor force in the Migration police.

- Work permit for foreigner (Plastic Card) in the Migration police.

- Accreditation at the local department of the Migration police.

- Work visa Invitation for foreigner.

- Receiving a single-entry work visa for 90 days at the Russian Consulate.

- Visa registration with the local department of the Migration police.

- Notification of the beginning of work of a foreigner submitted to the Migration Police.

- Re-issue of a single-entry work visa into a multiple-entry visa with the extension of its validity period.

Samples of documents

Detailed description of stages for the Company registered in Moscow and hiring foreign citizen to work in Moscow:

- Every year a Company is obliged to submit the application for foreign manpower need for the next year, so that the needs of the concrete company would be taken into account while the formation of quotas for the Russian Federation subjects and of all-Russian quota. Application includes a compulsory registration with the quick information center “Migration quota” at www.migrakvota.gov.ru . This rule does not apply to non-quota positions which list is renewed every year.

Required documents:

- Application form (PDF file, 48 KB) about the assignment to the employer of the state service of assistance in the selection of the required workers (1 copy);

- Information about the need of workers (PDF file, 50 KB), the presence of the unfilled vacancies (2 copies);

- Certificate from the Russian Federal Tax Service of “State registration of legal entities” and the introduction of record into the United state list of legal entities (1 notarized copy);

- Certificate from the Russian Federal Tax Service of “Registration of the legal entity with the Tax Authorities” (1 notarized copy);

- Codes of statistics (1 notarized copy);

- License to carry out activities (if needed) (1 notarized copy);

- Power of attorney (PDF file, 52 KB) to the authorized representative to submit and obtain statements of the Administration of civil service of the employment of population (UGSZN) of Moscow (1 copy).

- Conclusion of the Administration of civil service of the employment of population (UGSZN) of Moscow (copy with the assignment of the original);

- Request to the Administration of civil service of the employment of population (UGSZN) (PDF file, 73 KB) (2 copies);

- Application (PDF file, 44 KB) to the Migration police of Russia (3 copies);

- Application form of the organization (PDF file, 37 KB) (1 copy);

- Application (PDF file, 42 KB) to the Russian Migration police of Moscow (2 copies);

- Project of a labour contract or other documents confirming the preliminary agreement with foreign citizens or foreign partners about intention and conditions of employment of foreign workers (1 copy, signed and stamped by the employer);

- Certificate from the Russian Federal Tax Service of “The introduction of a record into the United state list of legal entities on the state registration of changes into the constitutive documents of a legal entity” (if changes were occurred) (2 notarized copies);

- Certificate from the Russian Federal Tax Service of “The introduction of a record into the United state list of legal entities on the state registration of changes which are not connected with constitutive documents of legal entity” (if changes were occurred) (2 notarized copies);

- Original of a billing document (stamped by bank) proving the payment of the state fee of 10000 ₽ for giving the company a “Permit to involve foreign labour force” for each foreign worker (properties).

- Copy of a “Permit to involve foreign labour force” (with the presentation of the original);

- Application (file PDF, 42 KB) to the Russian Migration police of Moscow (2 copies);

- Warrant to the authorized representative (file PDF, 52 KB) for the right to supply and obtain a work permit (plastic card) (2 copies);

- Application (file PDF, 102 KB) about issuing to foreign citizen or person without citizenship of work permit (1 copy);

- Letter of guarantee (file PDF, 55 KB) for the return of foreign worker (1 copy);

- Examination certificate for knowledge of Russian language;

- Form A30 – about absence of disease of Hansen (leprosy);

- Form A15-A19 – about absence of tuberculosis;

- Form A50-A53.9, A55, A57 – about absence of sexually transmitted infections (syphilis, lymphogranuloma (venereal), chancre);

- Form 086 – for the workers connected with physical labor;

- about absence of addiction;

- Notarized translation of passport of foreign citizen (1 copy);

- Colored photo of foreign citizen on the mat paper – 2 pieces;

- Copy of document with apostille about the vocational education with the translation into Russian (1 notarized copy); or a certificate of equivalency of such document to the Russian school certificate or diploma of professional education;

- Original of billing document (stamped by bank) about the payment of the state duty of 3500 ₽ for obtaining a “work permit for a foreign citizen or a person without citizenship” (properties).

- Application form (PDF file, 75 KB);

- Extract from the “United state list of legal entities” (remoteness of an extract should not exceed one month; 1 notarized copy);

- If the head (Director-General) is not Russian citizen, copies of Permit to involve foreign labour force and Work permit for foreign citizen (both notarized copies) are also required;

- Non-residential Lease Agreement (in case of sublease, copies of sublease agreement and non-residential lease agreement should be presented; 1 notarized copy);

- Certificate of “State registration of the property rights” of the non-residential premises (at owner of premises) occupied by organization (1 notarized copy);

- Letter of guarantee (file PDF, 41 КB).

- Organization Registration card in the Russian Migration police of Moscow;

- Application letter for invitation (file PDF, 116 KB) for Russian visa (1 copy);

- Letter of guarantee (file PDF, 45 KB) from organization (1 copy);

- Copy of “permit to employ foreign workers” (Permission) (1 copy);

- Copy of both sides of “Work permit of foreign citizen” (Plastic card) with the presentation of original;

- Copy of the page of passport of foreign citizen, which contains photo and specifications (1 copy);

- Copy of labor contract;

- Receipt for state fee payment.

- Application of foreign citizen to the Russian consulate with purpose of obtaining single work visa for 90 days.

- Notification of the beginning of work of the foreign national in the organization. After obtaining a work permit and a work visa, signing a labor contract with a foreign worker (or extending the existing labor contract for the new period), the Company- employer is obligated to send the notification of conclusion of the employment agreement with a foreign worker to the Migration police of Moscow in 3 days. Similar notification should be sent in case of cancellation of an employment agreement with a foreign worker.

- Registration of the work visa with the local department of the Migration police.

- Notification of arrival (Visa registration) (file XLSX, 130 KB) of foreign citizen to the place of stay (1 copy);

- Letter of guarantee (file PDF, 52 KB) from the inviting organization with the request to obtain a multiple entree work visa for foreign citizen (1 copy);

- Application with request to obtain a multiple entree work visa (file PDF, 55 KB) from a foreign citizen (1 copy);

- Passport copies of foreign citizen with the visa and migratory card, with the presentation of originals;

- Two photos (colored, mat paper, size of 3×4);

- Copy of “permit to employ foreign workers” (permission), with presentation of original;

- Copy of “work permit of foreign citizen” (Plastic card), with presentation of original.

- Russian Tourist Visa

- Russian Business Visa

- Russian Visa for Highly Qualified Specialists

- Russian Private Visa

- Russian Transit Visa

- Russian Visa for a family member

- Russian Consulates

- Russian Visa Centres

- Our Services

- Air tickets

- Clients Feedback

- Terms and Conditions

Contact information

Online consultation.

The Federal Register

The daily journal of the united states government, request access.

Due to aggressive automated scraping of FederalRegister.gov and eCFR.gov, programmatic access to these sites is limited to access to our extensive developer APIs.

If you are human user receiving this message, we can add your IP address to a set of IPs that can access FederalRegister.gov & eCFR.gov; complete the CAPTCHA (bot test) below and click "Request Access". This process will be necessary for each IP address you wish to access the site from, requests are valid for approximately one quarter (three months) after which the process may need to be repeated.

An official website of the United States government.

If you want to request a wider IP range, first request access for your current IP, and then use the "Site Feedback" button found in the lower left-hand side to make the request.

- Contact Contact Us How to contact HomeGround

- Services Consent for Alterations Sublet Registration Lease Extension Freehold Purchase

- Useful Resources

Administration charges: summary of tenants’ rights and obligations

(1) This summary, which briefly sets out your rights and obligations in relation to administration charges, must by law accompany a demand for administration charges. Unless a summary is sent to you with a demand, you may withhold the administration charge. The summary does not give a full interpretation of the law and if you are in any doubt about your rights and obligations you should seek independent advice.

(2) An administration charge is an amount which may be payable by you as part of or in addition to the rent directly or indirectly:

- for or in connection with the grant of an approval under your lease, or an application for such approval

- for or in connection with the provision of information or documents

- in respect of your failure to make any payment due under your lease or

- in connection with a breach of a covenant or condition of your lease.

If you are liable to pay an administration charge, it is payable only to the extent that the amount is reasonable.

(3) Any provision contained in a grant of a lease under the right to buy under the Housing Act 1985, which claims to allow the landlord to charge a sum for consent or approval, is void.

(4) You have the right to ask a First-tier Tribunal whether an administration charge is payable. You may make a request before or after you have paid the administration charge. If the tribunal determines the charge is payable, the tribunal may also determine:

- who should pay the administration charge and who it should be paid to

- the date it should be paid by and

- how it should be paid.

However, you do not have this right where:

- a matter has been agreed to or admitted by you

- a matter has been, or is to be, referred to arbitration or has been determined by arbitration and you agreed to go to arbitration after the disagreement about the administration charge arose or

- a matter has been decided by a court.

(5) You have the right to apply to a First-tier Tribunal for an order varying the lease on the grounds that any administration charge specified in the lease, or any formula specified in the lease for calculating an administration charge is unreasonable.

(6) Where you seek a determination or order from a First-tier Tribunal, you will have to pay an application fee and, where the matter proceeds to a hearing, a hearing fee, unless you qualify for a waiver or reduction. The total fees payable to the tribunal will not exceed £500, but making an application may incur additional costs, such as professional fees, which you may have to pay.

(7) A First-tier Tribunal has the power to award costs, not exceeding £500, against a party to any proceedings where:

- it dismisses a matter because it is frivolous, vexatious or an abuse of process or

- it considers that a party has acted frivolously, vexatiously, abusively, disruptively or unreasonably.

The Upper Tribunal (Lands Chamber) has similar powers when hearing an appeal against a decision of a First- tier Tribunal.

(8) Your lease may give your landlord a right of re-entry or forfeiture where you have failed to pay charges which are properly due under the lease. However, to exercise this right, the landlord must meet all the legal requirements and obtain a court order. A court order will only be granted if you have admitted you are liable to pay the amount or it is finally determined by a court, a tribunal or by arbitration that the amount is due. The court has a wide discretion in granting such an order and it will take into account all the circumstances of the case.

IMAGES

VIDEO

COMMENTS

I want to sell my property. As part of the sale process you may need to: give y our solicitor your landlord's details. provide proof that your ground rent has been paid. supply a seller's pack - also known as a management or assignment pack - please use our contact form. If we have been appointed to collect and organise your ground rent ...

Fees and Guidance HomeGround Management Limited ("HomeGround") acts as an agent for a large number of landlord ... fee when we are given both Notice of Transfer and Charge together 180.00 . 230117.V1.MW ... Rent Charge Assignment Fee Your title deeds will usually say that you have to tell us when the property has been

We charge a fee of £75 to review your consent to sublet form, which is paid during the application process. If your lease does not require landlord's consent and/or a notice of registration to be served, we will let you know and will refund you the £75.

3. Exit or Transfer Fee: A retirement flat lease may include an "exit" or "transfer fee" payable by you from the sale proceeds and expressed as a percentage of the property value. When you are buying. 1. Deed of Covenant: Some leases require a buyer to enter into a Deed with the landlord to confirm that you will be bound by the terms of the ...

If a legal assignment is required, the assignment must comply with a set of formalities set out in s136 of the Law of Property Act 1925, which include the requirement to give notice to the ...

A fee of £240.00 (inc VAT) is payable for providing a Consent for an Assignment Pack Request. Once we have received your request we will contact you to confirm whether consent is required and act on the landlord's behalf to provide it." Am I getting consent to ask for a assignment pack or am I getting the assignment pack, and has anyone else ...

HomeGround can also give you a quote for a price that the Landlord is willing to sell the freehold of your house to you informally, which may save some of the fees you would have to pay for advice from a surveyor and solicitors. The quote we would give you would include an allowance for the Landlord's costs.

When your original lender transfers your mortgage account and their interests in it to a new lender, that's called an assignment of mortgage. To do this, your lender must use an assignment of mortgage document. This document ensures the loan is legally transferred to the new owner. It's common for mortgage lenders to sell the mortgages to ...

HomeGround offers the following methods of payment. HomeGround Portal. View and pay your invoices online; successful payments appear on your account straight away. Automated payment line. Call 03300 887953 and follow the instructions. You will need your 12-digit customer reference number. Standard call rates apply.

An assignment can be a legal assignment or an equitable assignment. If a legal assignment is required, the assignment must comply with a set of formalities set out in s136 of the Law of Property Act 1925, which include the requirement to give notice to the contract counterparty.

A Notice of Assignment (NOA) is one of the most important parts of your factoring relationship. Find out what an NOA is and why it matters here. ... you receive up to 98 percent of the invoice's value right away and get the remaining sum minus a small factoring fee when your client pays. This means you're not waiting 30, 60, or more days ...

writing to us at HomeGround Management Ltd, PO Box 6433, London W1A 2UZ; If you wish to make a payment you can call our automated payment line directly on 03300 887953. Please remember to quote your 12-digit customer reference number on all correspondence, which you can find on HomeGround invoices.

For example, it will take on the average 100 days and 15900 ₽ (only to pay the state fee) for the Company-employer registered in Moscow to hire a foreign worker. Since a work permit is valid maximum for 1 year, it is necessary to start processing a new work visa 6 months after receiving the current work visa.

Search, browse and learn about the Federal Register. Federal Register 2.0 is the unofficial daily publication for rules, proposed rules, and notices of Federal agencies and organizations, as well as executive orders and other presidential documents.

The Moscow-based company Top Film Distribution released the film, starring Bill Murray, Kate Hudson and Bruce Willis, last year, but allegedly failed to make license payments.

The Ministry of Housing, Communities and Local Government's (formerly the Department for Communities and Local Government) job is to create great places to live and work, and to give more power to local people to shape what happens in their area. A collection of useful articles and resources to help explain how the leasehold system works.

May 2013 Notice of Privacy Practices Acknowledgment Moscow Pullman OB/GYN has a responsibility to protect the privacy of your health care information and to provide a ...

If you are liable to pay an administration charge, it is payable only to the extent that the amount is reasonable. (3) Any provision contained in a grant of a lease under the right to buy under the Housing Act 1985, which claims to allow the landlord to charge a sum for consent or approval, is void. (4) You have the right to ask a First-tier ...

Notice of Charge & Assignment Landlord Fees. I completed on a new leasehold flat just before Christmas whereby a lease extension was tied to the purchase. I have received a letter from the freeholder of the property stating they have not been formally notified of the change of ownership in accordance with the term of the lease.