- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case NPS+ Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

Consumer Research: Examples, Process and Scope

What is Consumer Research?

Consumer research is a part of market research in which inclination, motivation and purchase behavior of the targeted customers are identified. Consumer research helps businesses or organizations understand customer psychology and create detailed purchasing behavior profiles.

It uses research techniques to provide systematic information about what customers need. Using this information brands can make changes in their products and services, making them more customer-centric thereby increasing customer satisfaction. This will in turn help to boost business.

LEARN ABOUT: Market research vs marketing research

An organization that has an in-depth understanding about the customer decision-making process, is most likely to design a product, put a certain price tag to it, establish distribution centers and promote a product based on consumer research insights such that it produces increased consumer interest and purchases.

For example, A consumer electronics company wants to understand, thought process of a consumer when purchasing an electronic device, which can help a company to launch new products, manage the supply of the stock, etc. Carrying out a Consumer electronics survey can be useful to understand the market demand, understand the flaws in their product and also find out research problems in the various processes that influence the purchase of their goods. A consumer electronics survey can be helpful to gather information about the shopping experiences of consumers when purchasing electronics. which can enable a company to make well-informed and wise decisions regarding their products and services.

LEARN ABOUT: Test Market Demand

Consumer Research Objectives

When a brand is developing a new product, consumer research is conducted to understand what consumers want or need in a product, what attributes are missing and what are they looking for? An efficient survey software really makes it easy for organizations to conduct efficient research.

Consumer research is conducted to improve brand equity. A brand needs to know what consumers think when buying a product or service offered by a brand. Every good business idea needs efficient consumer research for it to be successful. Consumer insights are essential to determine brand positioning among consumers.

Consumer research is conducted to boost sales. The objective of consumer research is to look into various territories of consumer psychology and understand their buying pattern, what kind of packaging they like and other similar attributes that help brands to sell their products and services better.

LEARN ABOUT: Brand health

Consumer Research Model

According to a study conducted, till a decade ago, researchers thought differently about the consumer psychology, where little or no emphasis was put on emotions, mood or the situation that could influence a customer’s buying decision.

Many believed marketing was applied economics. Consumers always took decisions based on statistics and math and evaluated goods and services rationally and then selected items from those brands that gave them the highest customer satisfaction at the lowest cost.

However, this is no longer the situation. Consumers are very well aware of brands and their competitors. A loyal customer is the one who would not only return to repeatedly purchase from a brand but also, recommend his/her family and friends to buy from the same brand even if the prices are slightly higher but provides an exceptional customer service for products purchased or services offered.

Here is where the Net Promoter Score (NPS) helps brands identify brand loyalty and customer satisfaction with their consumers. Net Promoter Score consumer survey uses a single question that is sent to customers to identify their brand loyalty and level of customer satisfaction. Response to this question is measured on a scale between 0-10 and based on this consumers can be identified as:

Detractors: Who have given a score between 0-6.

Passives: Who have given a score between 7-8.

Promoters: Who have given a score between 9-10.

Consumer market research is based on two types of research method:

1. Qualitative Consumer Research

Qualitative research is descriptive in nature, It’s a method that uses open-ended questions , to gain meaningful insights from respondents and heavily relies on the following market research methods:

Focus Groups: Focus groups as the name suggests is a small group of highly validated subject experts who come together to analyze a product or service. Focus group comprises of 6-10 respondents. A moderator is assigned to the focus group, who helps facilitate discussions among the members to draw meaningful insights

One-to-one Interview: This is a more conversational method, where the researcher asks open-ended questions to collect data from the respondents. This method heavily depends on the expertise of the researcher. How much the researcher is able to probe with relevant questions to get maximum insights. This is a time-consuming method and can take more than one attempt to gain the desired insights.

LEARN ABOUT: Qualitative Interview

Content/ Text Analysis: Text analysis is a qualitative research method where researchers analyze social life by decoding words and images from the documents available. Researchers analyze the context in which the images are used and draw conclusions from them. Social media is an example of text analysis. In the last decade or so, inferences are drawn based on consumer behavior on social media.

Learn More: How to conduct Qualitative Research

2.Quantitative Consumer Research

In the age of technology and information, meaningful data is more precious than platinum. Billion dollar companies have risen and fallen on how well they have been able to collect and analyze data, to draw validated insights.

Quantitative research is all about numbers and statistics. An evolved consumer who purchases regularly can vouch for how customer-centric businesses have become today. It’s all about customer satisfaction , to gain loyal customers. With just one questions companies are able to collect data, that has the power to make or break a company. Net Promoter Score question , “On a scale from 0-10 how likely are you to recommend our brand to your family or friends?”

How organic word-of-mouth is influencing consumer behavior and how they need to spend less on advertising and invest their time and resources to make sure they provide exceptional customer service.

LEARN ABOUT: Behavioral Targeting

Online surveys , questionnaires , and polls are the preferred data collection tools. Data that is obtained from consumers is then statistically, mathematically and numerically evaluated to understand consumer preference.

Learn more: How to carry out Quantitative Research

Consumer Research Process

The process of consumer research started as an extension of the process of market research . As the findings of market research is used to improve the decision-making capacity of an organization or business, similar is with consumer research.

LEARN ABOUT: Market research industry

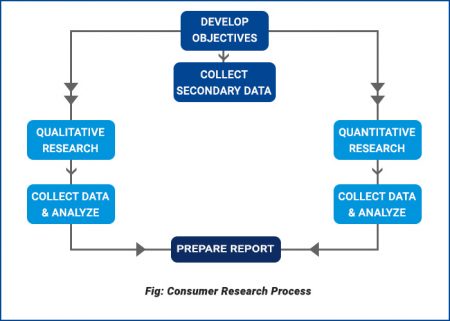

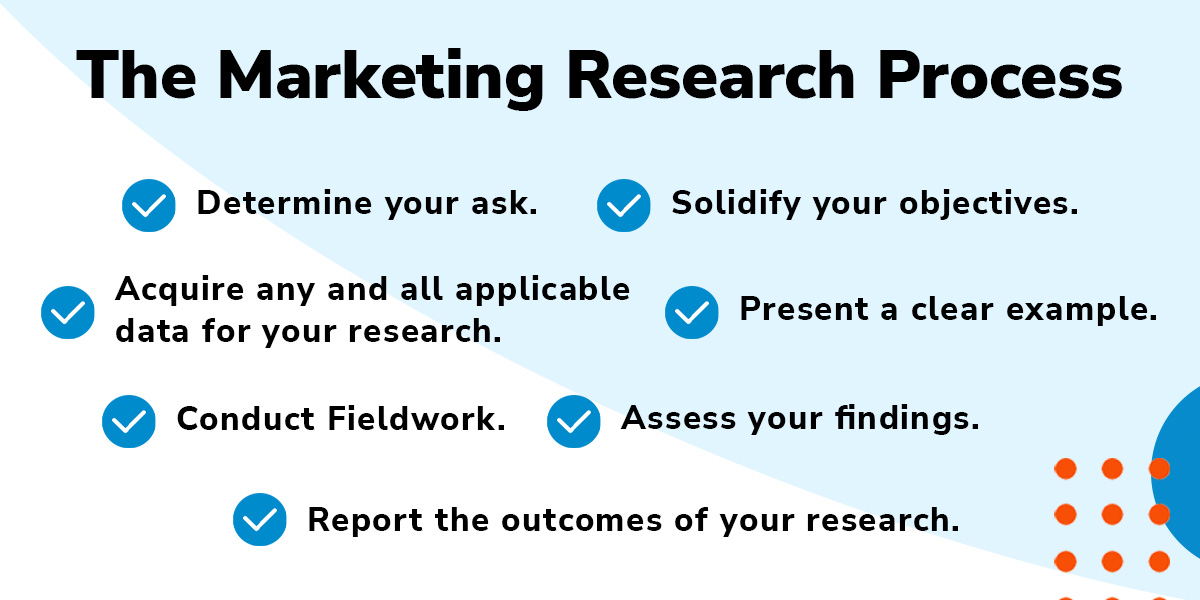

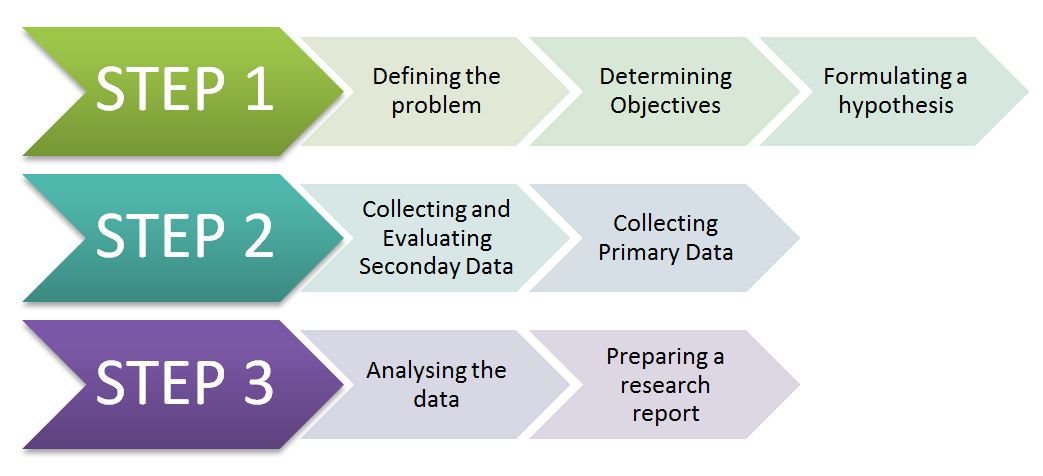

The consumer research process can be broken down into the following steps:

- Develop research objectives: The first step to the consumer research process is to clearly define the research objective, the purpose of research, why is the research being conducted, to understand what? A clear statement of purpose can help emphasize the purpose.

- Collect Secondary data: Collect secondary data first, it helps in understanding if research has been conducted earlier and if there are any pieces of evidence related to the subject matter that can be used by an organization to make informed decisions regarding consumers.

- Primary Research: In primary research organizations or businesses collect their own data or employ a third party to collect data on their behalf. This research makes use of various data collection methods ( qualitative and quantitative ) that helps researchers collect data first hand.

LEARN ABOUT: Best Data Collection Tools

- Collect and analyze data: Data is collected and analyzed and inference is drawn to understand consumer behavior and purchase pattern.

- Prepare report: Finally, a report is prepared for all the findings by analyzing data collected so that organizations are able to make informed decisions and think of all probabilities related to consumer behavior. By putting the study into practice, organizations can become customer-centric and manufacture products or render services that will help them achieve excellent customer satisfaction.

LEARN ABOUT: market research trends

After Consumer Research Process

Once you have been able to successfully carry out the consumer research process , investigate and break paradigms. What consumers need should be a part of market research design and should be carried out regularly. Consumer research provides more in-depth information about the needs, wants, expectations and behavior analytics of clients.

By identifying this information successfully, strategies that are used to attract consumers can be made better and businesses can make a profit by knowing what consumers want exactly. It is also important to understand and know thoroughly the buying behavior of consumers to know their attitude towards brands and products.

The identification of consumer needs, as well as their preferences, allows a business to adapt to new business and develop a detailed marketing plan that will surely work. The following pointers can help. Completing this process will help you:

- Attract more customers

- Set the best price for your products

- Create the right marketing message

- Increase the quantity that satisfies the demand of its clients

- Increase the frequency of visits to their clients

- Increase your sales

- Reduce costs

- Refine your approach to the customer service process .

LEARN ABOUT: Behavioral Research

Consumer Research Methods

Consumers are the reason for a business to run and flourish. Gathering enough information about consumers is never going to hurt any business, in fact, it will only add up to the information a business would need to associate with its consumers and manufacture products that will help their business refine and grow.

Following are consumer research methods that ensure you are in tandem with the consumers and understand their needs:

The studies of customer satisfaction

One can determine the degree of satisfaction of consumers in relation to the quality of products through:

- Informal methods such as conversations with staff about products and services according to the dashboards.

- Past and present questionnaires/ surveys that consumers might have filled that identify their needs.

T he investigation of the consumer decision process

It is very interesting to know the consumer’s needs, what motivates them to buy, and how is the decision-making process carried out, though:

- Deploying relevant surveys and receiving responses from a target intended audience .

Proof of concept

Businesses can test how well accepted their marketing ideas are by:

- The use of surveys to find out if current or potential consumer see your products as a rational and useful benefit.

- Conducting personal interviews or focus group sessions with clients to understand how they respond to marketing ideas.

Knowing your market position

You can find out how your current and potential consumers see your products, and how they compare it with your competitors by:

- Sales figures talk louder than any other aspect, once you get to know the comparison in the sales figures it is easy to understand your market position within the market segment.

- Attitudes of consumers while making a purchase also helps in understanding the market hold.

Branding tests and user experience

You can determine how your customers feel with their brands and product names by:

- The use of focus groups and surveys designed to assess emotional responses to your products and brands.

- The participation of researchers to study the performance of their brand in the market through existing and available brand measurement research.

Price changes

You can investigate how your customers accept or not the price changes by using formulas that measure the revenue – multiplying the number of items you sold, by the price of each item. These tests allow you to calculate if your total income increases or decreases after making the price changes by:

- Calculation of changes in the quantities of products demanded by their customers, together with changes in the price of the product.

- Measure the impact of the price on the demand of the product according to the needs of the client.

Social media monitoring

Another way to measure feedback and your customer service is by controlling your commitment to social media and feedback. Social networks (especially Facebook) are becoming a common element of the commercialization of many businesses and are increasingly used by their customers to provide information on customer needs, service experiences, share and file customer complaints . It can also be used to run surveys and test concepts. If handled well, it can be one of the most powerful research tools of the client management . I also recommend reading: How to conduct market research through social networks.

Customer Research Questions

Asking the right question is the most important part of conducting research. Moreover, if it’s consumer research, questions should be asked in a manner to gather maximum insights from consumers. Here are some consumer research questions for your next research:

- Who in your household takes purchasing decisions?

- Where do you go looking for ______________ (product)?

- How long does it take you to make a buying decision?

- How far are you willing to travel to buy ___________(product)?

- What features do you look for when you purchase ____________ (product)?

- What motivates you to buy_____________ (product)?

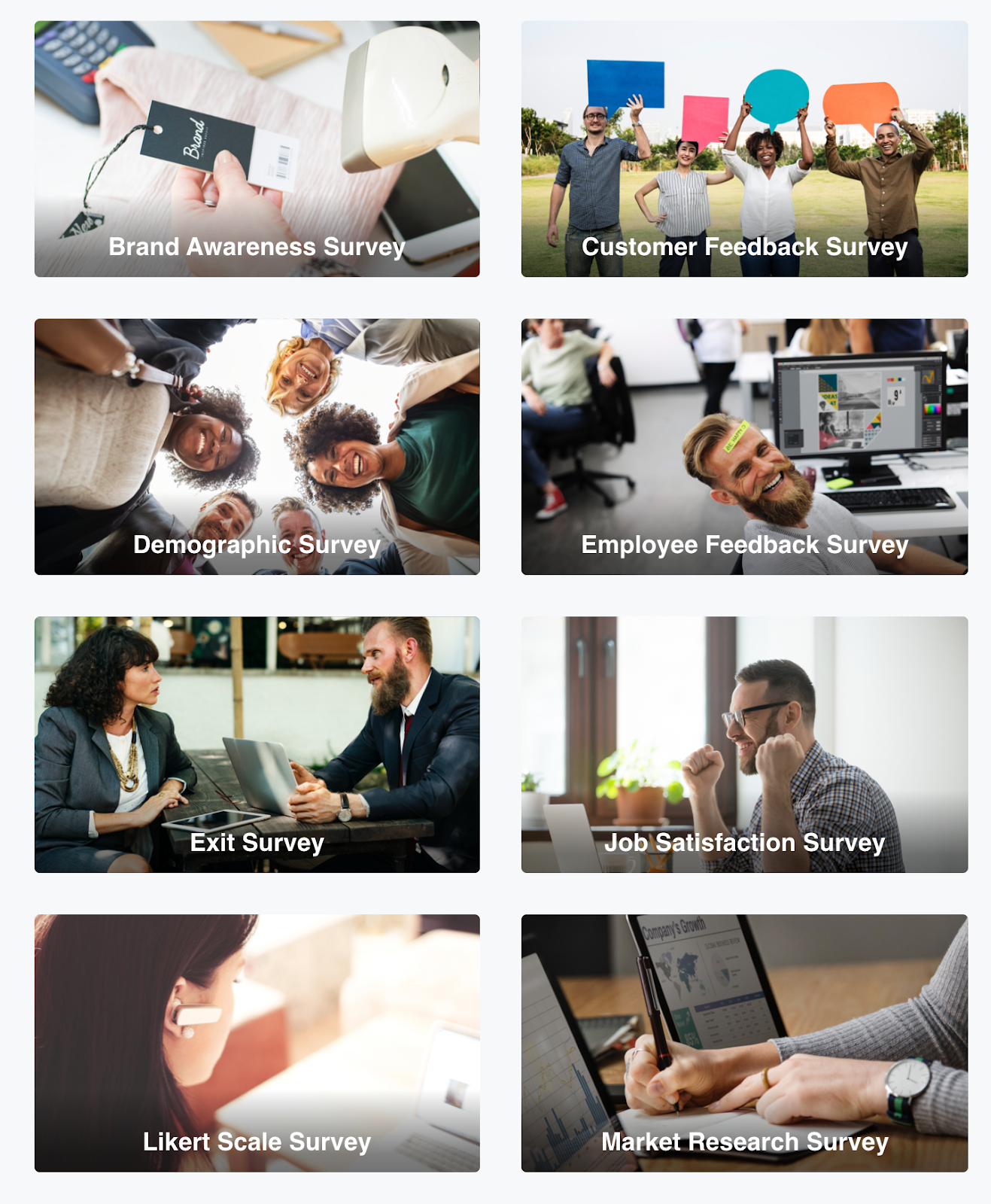

See more consumer research survey questions:

Customer satisfaction surveys

Voice of customer surveys

Product surveys

Service evaluation surveys

Mortgage Survey Questions

Importance of Consumer Research

Launching a product or offering new services can be quite an exciting time for a brand. However, there are a lot of aspects that need to be taken into consideration while a band has something new to offer to consumers.

LEARN ABOUT: User Experience Research

Here is where consumer research plays a pivotal role. The importance of consumer research cannot be emphasized more. Following points summarizes the importance of consumer research:

- To understand market readiness: However good a product or service may be, consumers have to be ready to accept it. Creating a product requires investments which in return expect ROI from product or service purchases. However, if a market is mature enough to accept this utility, it has a low chance of succeeding by tapping into market potential . Therefore, before launching a product or service, organizations need to conduct consumer research, to understand if people are ready to spend on the utility it provides.

- Identify target consumers: By conducting consumer research, brands and organizations can understand their target market based on geographic segmentation and know who exactly is interested in buying their products. According to the data or feedback received from the consumer, research brands can even customize their marketing and branding approach to better appeal to the specific consumer segment.

LEARN ABOUT: Marketing Insight

- Product/Service updates through feedback: Conducting consumer research, provides valuable feedback from consumers about the attributes and features of products and services. This feedback enables organizations to understand consumer perception and provide a more suitable solution based on actual market needs which helps them tweak their offering to perfection.

Explore more: 300 + FREE survey templates to use for your research

MORE LIKE THIS

The Power of AI in Customer Experience — Tuesday CX Thoughts

Apr 16, 2024

Employee Lifecycle Management Software: Top of 2024

Apr 15, 2024

Top 15 Sentiment Analysis Software That Should Be on Your List

Top 13 A/B Testing Software for Optimizing Your Website

Apr 12, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Uncategorized

- Video Learning Series

- What’s Coming Up

- Workforce Intelligence

The past, present, and future of consumer research

- Published: 13 June 2020

- Volume 31 , pages 137–149, ( 2020 )

Cite this article

- Maayan S. Malter ORCID: orcid.org/0000-0003-0383-7925 1 ,

- Morris B. Holbrook 1 ,

- Barbara E. Kahn 2 ,

- Jeffrey R. Parker 3 &

- Donald R. Lehmann 1

44k Accesses

35 Citations

3 Altmetric

Explore all metrics

In this article, we document the evolution of research trends (concepts, methods, and aims) within the field of consumer behavior, from the time of its early development to the present day, as a multidisciplinary area of research within marketing. We describe current changes in retailing and real-world consumption and offer suggestions on how to use observations of consumption phenomena to generate new and interesting consumer behavior research questions. Consumption continues to change with technological advancements and shifts in consumers’ values and goals. We cannot know the exact shape of things to come, but we polled a sample of leading scholars and summarize their predictions on where the field may be headed in the next twenty years.

Similar content being viewed by others

Online influencer marketing

Fine F. Leung, Flora F. Gu & Robert W. Palmatier

Social media influencer marketing: foundations, trends, and ways forward

Yatish Joshi, Weng Marc Lim, … Satish Kumar

Research in marketing strategy

Neil A. Morgan, Kimberly A. Whitler, … Simos Chari

Avoid common mistakes on your manuscript.

1 Introduction

Beginning in the late 1950s, business schools shifted from descriptive and practitioner-focused studies to more theoretically driven and academically rigorous research (Dahl et al. 1959 ). As the field expanded from an applied form of economics to embrace theories and methodologies from psychology, sociology, anthropology, and statistics, there was an increased emphasis on understanding the thoughts, desires, and experiences of individual consumers. For academic marketing, this meant that research not only focused on the decisions and strategies of marketing managers but also on the decisions and thought processes on the other side of the market—customers.

Since then, the academic study of consumer behavior has evolved and incorporated concepts and methods, not only from marketing at large but also from related social science disciplines, and from the ever-changing landscape of real-world consumption behavior. Its position as an area of study within a larger discipline that comprises researchers from diverse theoretical backgrounds and methodological training has stirred debates over its identity. One article describes consumer behavior as a multidisciplinary subdiscipline of marketing “characterized by the study of people operating in a consumer role involving acquisition, consumption, and disposition of marketplace products, services, and experiences” (MacInnis and Folkes 2009 , p. 900).

This article reviews the evolution of the field of consumer behavior over the past half century, describes its current status, and predicts how it may evolve over the next twenty years. Our review is by no means a comprehensive history of the field (see Schumann et al. 2008 ; Rapp and Hill 2015 ; Wang et al. 2015 ; Wilkie and Moore 2003 , to name a few) but rather focuses on a few key thematic developments. Though we observe many major shifts during this period, certain questions and debates have persisted: Does consumer behavior research need to be relevant to marketing managers or is there intrinsic value from studying the consumer as a project pursued for its own sake? What counts as consumption: only consumption from traditional marketplace transactions or also consumption in a broader sense of non-marketplace interactions? Which are the most appropriate theoretical traditions and methodological tools for addressing questions in consumer behavior research?

2 A brief history of consumer research over the past sixty years—1960 to 2020

In 1969, the Association for Consumer Research was founded and a yearly conference to share marketing research specifically from the consumer’s perspective was instituted. This event marked the culmination of the growing interest in the topic by formalizing it as an area of research within marketing (consumer psychology had become a formalized branch of psychology within the APA in 1960). So, what was consumer behavior before 1969? Scanning current consumer-behavior doctoral seminar syllabi reveals few works predating 1969, with most of those coming from psychology and economics, namely Herbert Simon’s A Behavioral Model of Rational Choice (1955), Abraham Maslow’s A Theory of Human Motivation (1943), and Ernest Dichter’s Handbook of Consumer Motivations (1964). In short, research that illuminated and informed our understanding of consumer behavior prior to 1969 rarely focused on marketing-specific topics, much less consumers or consumption (Dichter’s handbook being a notable exception). Yet, these works were crucial to the rise of consumer behavior research because, in the decades after 1969, there was a shift within academic marketing to thinking about research from a behavioral or decision science perspective (Wilkie and Moore 2003 ). The following section details some ways in which this shift occurred. We draw on a framework proposed by the philosopher Larry Laudan ( 1986 ), who distinguished among three inter-related aspects of scientific inquiry—namely, concepts (the relevant ideas, theories, hypotheses, and constructs); methods (the techniques employed to test and validate these concepts); and aims (the purposes or goals that motivate the investigation).

2.1 Key concepts in the late - 1960s

During the late-1960s, we tended to view the buyer as a computer-like machine for processing information according to various formal rules that embody economic rationality to form a preference for one or another option in order to arrive at a purchase decision. This view tended to manifest itself in a couple of conspicuous ways. The first was a model of buyer behavior introduced by John Howard in 1963 in the second edition of his marketing textbook and quickly adopted by virtually every theorist working in our field—including, Howard and Sheth (of course), Engel-Kollat-&-Blackwell, Franco Nicosia, Alan Andreasen, Jim Bettman, and Joel Cohen. Howard’s great innovation—which he based on a scheme that he had found in the work of Plato (namely, the linkages among Cognition, Affect, and Conation)—took the form of a boxes-and-arrows formulation heavily influenced by the approach to organizational behavior theory that Howard (University of Pittsburgh) had picked up from Herbert Simon (Carnegie Melon University). The model represented a chain of events

where I = inputs of information (from advertising, word-of-mouth, brand features, etc.); C = cognitions (beliefs or perceptions about a brand); A = Affect (liking or preference for the brand); B = behavior (purchase of the brand); and S = satisfaction (post-purchase evaluation of the brand that feeds back onto earlier stages of the sequence, according to a learning model in which reinforced behavior tends to be repeated). This formulation lay at the heart of Howard’s work, which he updated, elaborated on, and streamlined over the remainder of his career. Importantly, it informed virtually every buyer-behavior model that blossomed forth during the last half of the twentieth century.

To represent the link between cognitions and affect, buyer-behavior researchers used various forms of the multi-attribute attitude model (MAAM), originally proposed by psychologists such as Fishbein and Rosenberg as part of what Fishbein and Ajzen ( 1975 ) called the theory of reasoned action. Under MAAM, cognitions (beliefs about brand attributes) are weighted by their importance and summed to create an explanation or prediction of affect (liking for a brand or preference for one brand versus another), which in turn determines behavior (choice of a brand or intention to purchase a brand). This took the work of economist Kelvin Lancaster (with whom Howard interacted), which assumed attitude was based on objective attributes, and extended it to include subjective ones (Lancaster 1966 ; Ratchford 1975 ). Overall, the set of concepts that prevailed in the late-1960s assumed the buyer exhibited economic rationality and acted as a computer-like information-processing machine when making purchase decisions.

2.2 Favored methods in the late-1960s

The methods favored during the late-1960s tended to be almost exclusively neo-positivistic in nature. That is, buyer-behavior research adopted the kinds of methodological rigor that we associate with the physical sciences and the hypothetico-deductive approaches advocated by the neo-positivistic philosophers of science.

Thus, the accepted approaches tended to be either experimental or survey based. For example, numerous laboratory studies tested variations of the MAAM and focused on questions about how to measure beliefs, how to weight the beliefs, how to combine the weighted beliefs, and so forth (e.g., Beckwith and Lehmann 1973 ). Here again, these assumed a rational economic decision-maker who processed information something like a computer.

Seeking rigor, buyer-behavior studies tended to be quantitative in their analyses, employing multivariate statistics, structural equation models, multidimensional scaling, conjoint analysis, and other mathematically sophisticated techniques. For example, various attempts to test the ICABS formulation developed simultaneous (now called structural) equation models such as those deployed by Farley and Ring ( 1970 , 1974 ) to test the Howard and Sheth ( 1969 ) model and by Beckwith and Lehmann ( 1973 ) to measure halo effects.

2.3 Aims in the late-1960s

During this time period, buyer-behavior research was still considered a subdivision of marketing research, the purpose of which was to provide insights useful to marketing managers in making strategic decisions. Essentially, every paper concluded with a section on “Implications for Marketing Managers.” Authors who failed to conform to this expectation could generally count on having their work rejected by leading journals such as the Journal of Marketing Research ( JMR ) and the Journal of Marketing ( JM ).

2.4 Summary—the three R’s in the late-1960s

Starting in the late-1960s to the early-1980s, virtually every buyer-behavior researcher followed the traditional approach to concepts, methods, and aims, now encapsulated under what we might call the three R’s —namely, rationality , rigor , and relevance . However, as we transitioned into the 1980s and beyond, that changed as some (though by no means all) consumer researchers began to expand their approaches and to evolve different perspectives.

2.5 Concepts after 1980

In some circles, the traditional emphasis on the buyer’s rationality—that is, a view of the buyer as a rational-economic, decision-oriented, information-processing, computer-like machine for making choices—began to evolve in at least two primary ways.

First, behavioral economics (originally studied in marketing under the label Behavioral Decision Theory)—developed in psychology by Kahneman and Tversky, in economics by Thaler, and applied in marketing by a number of forward-thinking theorists (e.g., Eric Johnson, Jim Bettman, John Payne, Itamar Simonson, Jay Russo, Joel Huber, and more recently, Dan Ariely)—challenged the rationality of consumers as decision-makers. It was shown that numerous commonly used decision heuristics depart from rational choice and are exceptions to the traditional assumptions of economic rationality. This trend shed light on understanding consumer financial decision-making (Prelec and Loewenstein 1998 ; Gourville 1998 ; Lynch Jr 2011 ) and how to develop “nudges” to help consumers make better decisions for their personal finances (summarized in Johnson et al. 2012 ).

Second, the emerging experiential view (anticipated by Alderson, Levy, and others; developed by Holbrook and Hirschman, and embellished by Schmitt, Pine, and Gilmore, and countless followers) regarded consumers as flesh-and-blood human beings (rather than as information-processing computer-like machines), focused on hedonic aspects of consumption, and expanded the concepts embodied by ICABS (Table 1 ).

2.6 Methods after 1980

The two burgeoning areas of research—behavioral economics and experiential theories—differed in their methodological approaches. The former relied on controlled randomized experiments with a focus on decision strategies and behavioral outcomes. For example, experiments tested the process by which consumers evaluate options using information display boards and “Mouselab” matrices of aspects and attributes (Payne et al. 1988 ). This school of thought also focused on behavioral dependent measures, such as choice (Huber et al. 1982 ; Simonson 1989 ; Iyengar and Lepper 2000 ).

The latter was influenced by post-positivistic philosophers of science—such as Thomas Kuhn, Paul Feyerabend, and Richard Rorty—and approaches expanded to include various qualitative techniques (interpretive, ethnographic, humanistic, and even introspective methods) not previously prominent in the field of consumer research. These included:

Interpretive approaches —such as those drawing on semiotics and hermeneutics—in an effort to gain a richer understanding of the symbolic meanings involved in consumption experiences;

Ethnographic approaches — borrowed from cultural anthropology—such as those illustrated by the influential Consumer Behavior Odyssey (Belk et al. 1989 ) and its discoveries about phenomena related to sacred aspects of consumption or the deep meanings of collections and other possessions;

Humanistic approaches —such as those borrowed from cultural studies or from literary criticism and more recently gathered together under the general heading of consumer culture theory ( CCT );

Introspective or autoethnographic approaches —such as those associated with a method called subjective personal introspection ( SPI ) that various consumer researchers like Sidney Levy and Steve Gould have pursued to gain insights based on their own private lives.

These qualitative approaches tended not to appear in the more traditional journals such as the Journal of Marketing , Journal of Marketing Research , or Marketing Science . However, newer journals such as Consumption, Markets, & Culture and Marketing Theory began to publish papers that drew on the various interpretive, ethnographic, humanistic, or introspective methods.

2.7 Aims after 1980

In 1974, consumer research finally got its own journal with the launch of the Journal of Consumer Research ( JCR ). The early editors of JCR —especially Bob Ferber, Hal Kassarjian, and Jim Bettman—held a rather divergent attitude about the importance or even the desirability of managerial relevance as a key goal of consumer studies. Under their influence, some researchers began to believe that consumer behavior is a phenomenon worthy of study in its own right—purely for the purpose of understanding it better. The journal incorporated articles from an array of methodologies: quantitative (both secondary data analysis and experimental techniques) and qualitative. The “right” balance between theoretical insight and substantive relevance—which are not in inherent conflict—is a matter of debate to this day and will likely continue to be debated well into the future.

2.8 Summary—the three I’s after 1980

In sum, beginning in the early-1980s, consumer research branched out. Much of the work in consumer studies remained within the earlier tradition of the three R’s—that is, rationality (an information-processing decision-oriented buyer), rigor (neo-positivistic experimental designs and quantitative techniques), and relevance (usefulness to marketing managers). Nonetheless, many studies embraced enlarged views of the three major aspects that might be called the three I’s —that is, irrationality (broadened perspectives that incorporate illogical, heuristic, experiential, or hedonic aspects of consumption), interpretation (various qualitative or “postmodern” approaches), and intrinsic motivation (the joy of pursuing a managerially irrelevant consumer study purely for the sake of satisfying one’s own curiosity, without concern for whether it does or does not help a marketing practitioner make a bigger profit).

3 The present—the consumer behavior field today

3.1 present concepts.

In recent years, technological changes have significantly influenced the nature of consumption as the customer journey has transitioned to include more interaction on digital platforms that complements interaction in physical stores. This shift poses a major conceptual challenge in understanding if and how these technological changes affect consumption. Does the medium through which consumption occurs fundamentally alter the psychological and social processes identified in earlier research? In addition, this shift allows us to collect more data at different stages of the customer journey, which further allows us to analyze behavior in ways that were not previously available.

Revisiting the ICABS framework, many of the previous concepts are still present, but we are now addressing them through a lens of technological change (Table 2 )

. In recent years, a number of concepts (e.g., identity, beliefs/lay theories, affect as information, self-control, time, psychological ownership, search for meaning and happiness, social belonging, creativity, and status) have emerged as integral factors that influence and are influenced by consumption. To better understand these concepts, a number of influential theories from social psychology have been adopted into consumer behavior research. Self-construal (Markus and Kitayama 1991 ), regulatory focus (Higgins 1998 ), construal level (Trope and Liberman 2010 ), and goal systems (Kruglanski et al. 2002 ) all provide social-cognition frameworks through which consumer behavior researchers study the psychological processes behind consumer behavior. This “adoption” of social psychological theories into consumer behavior is a symbiotic relationship that further enhances the theories. Tory Higgins happily stated that he learned more about his own theories from the work of marketing academics (he cited Angela Lee and Michel Pham) in further testing and extending them.

3.2 Present Methods

Not only have technological advancements changed the nature of consumption but they have also significantly influenced the methods used in consumer research by adding both new sources of data and improved analytical tools (Ding et al. 2020 ). Researchers continue to use traditional methods from psychology in empirical research (scale development, laboratory experiments, quantitative analyses, etc.) and interpretive approaches in qualitative research. Additionally, online experiments using participants from panels such as Amazon Mechanical Turk and Prolific have become commonplace in the last decade. While they raise concerns about the quality of the data and about the external validity of the results, these online experiments have greatly increased the speed and decreased the cost of collecting data, so researchers continue to use them, albeit with some caution. Reminiscent of the discussion in the 1970s and 1980s about the use of student subjects, the projectability of the online responses and of an increasingly conditioned “professional” group of online respondents (MTurkers) is a major concern.

Technology has also changed research methodology. Currently, there is a large increase in the use of secondary data thanks to the availability of Big Data about online and offline behavior. Methods in computer science have advanced our ability to analyze large corpuses of unstructured data (text, voice, visual images) in an efficient and rigorous way and, thus, to tap into a wealth of nuanced thoughts, feelings, and behaviors heretofore only accessible to qualitative researchers through laboriously conducted content analyses. There are also new neuro-marketing techniques like eye-tracking, fMRI’s, body arousal measures (e.g., heart rate, sweat), and emotion detectors that allow us to measure automatic responses. Lastly, there has been an increase in large-scale field experiments that can be run in online B2C marketplaces.

3.3 Present Aims

Along with a focus on real-world observations and data, there is a renewed emphasis on managerial relevance. Countless conference addresses and editorials in JCR , JCP , and other journals have emphasized the importance of making consumer research useful outside of academia—that is, to help companies, policy makers, and consumers. For instance, understanding how the “new” consumer interacts over time with other consumers and companies in the current marketplace is a key area for future research. As global and social concerns become more salient in all aspects of life, issues of long-term sustainability, social equality, and ethical business practices have also become more central research topics. Fortunately, despite this emphasis on relevance, theoretical contributions and novel ideas are still highly valued. An appropriate balance of theory and practice has become the holy grail of consumer research.

The effects of the current trends in real-world consumption will increase in magnitude with time as more consumers are digitally native. Therefore, a better understanding of current consumer behavior can give us insights and help predict how it will continue to evolve in the years to come.

4 The future—the consumer behavior field in 2040

The other papers use 2030 as a target year but we asked our survey respondents to make predictions for 2040 and thus we have a different future target year.

Niels Bohr once said, “Prediction is very difficult, especially if it’s about the future.” Indeed, it would be a fool’s errand for a single person to hazard a guess about the state of the consumer behavior field twenty years from now. Therefore, predictions from 34 active consumer researchers were collected to address this task. Here, we briefly summarize those predictions.

4.1 Future Concepts

While few respondents proffered guesses regarding specific concepts that would be of interest twenty years from now, many suggested broad topics and trends they expected to see in the field. Expectations for topics could largely be grouped into three main areas. Many suspected that we will be examining essentially the same core topics, perhaps at a finer-grained level, from different perspectives or in ways that we currently cannot utilize due to methodological limitations (more on methods below). A second contingent predicted that much research would center on the impending crises the world faces today, most mentioning environmental and social issues (the COVID-19 pandemic had not yet begun when these predictions were collected and, unsurprisingly, was not anticipated by any of our respondents). The last group, citing the widely expected profound impact of AI on consumers’ lives, argued that AI and other technology-related topics will be dominant subjects in consumer research circa 2040.

While the topic of technology is likely to be focal in the field, our current expectations for the impact of technology on consumers’ lives are narrower than it should be. Rather than merely offering innumerable conveniences and experiences, it seems likely that technology will begin to be integrated into consumers’ thoughts, identities, and personal relationships—probably sooner than we collectively expect. The integration of machines into humans’ bodies and lives will present the field with an expanding list of research questions that do not exist today. For example, how will the concepts of the self, identity, privacy, and goal pursuit change when web-connected technology seamlessly integrates with human consciousness and cognition? Major questions will also need to be answered regarding philosophy of mind, ethics, and social inequality. We suspect that the impact of technology on consumers and consumer research will be far broader than most consumer-behavior researchers anticipate.

As for broader trends within consumer research, there were two camps: (1) those who expect (or hope) that dominant theories (both current and yet to be developed) will become more integrated and comprehensive and (2) those who expect theoretical contributions to become smaller and smaller, to the point of becoming trivial. Both groups felt that current researchers are filling smaller cracks than before, but disagreed on how this would ultimately be resolved.

4.2 Future Methods

As was the case with concepts, respondents’ expectations regarding consumer-research methodologies in 2030 can also be divided into three broad baskets. Unsurprisingly, many indicated that we would be using many technologies not currently available or in wide use. Perhaps more surprising was that most cited the use of technology such as AI, machine-learning algorithms, and robots in designing—as opposed to executing or analyzing—experiments. (Some did point to the use of technologies such as virtual reality in the actual execution of experiments.) The second camp indicated that a focus on reliable and replicable results (discussed further below) will encourage a greater tendency for pre-registering studies, more use of “Big Data,” and a demand for more studies per paper (versus more papers per topic, which some believe is a more fruitful direction). Finally, the third lot indicated that “real data” would be in high demand, thereby necessitating the use of incentive-compatible, consequential dependent variables and a greater prevalence of field studies in consumer research.

As a result, young scholars would benefit from developing a “toolkit” of methodologies for collecting and analyzing the abundant new data of interest to the field. This includes (but is not limited to) a deep understanding of designing and implementing field studies (Gerber and Green 2012 ), data analysis software (R, Python, etc.), text mining and analysis (Humphreys and Wang 2018 ), and analytical tools for other unstructured forms of data such as image and sound. The replication crisis in experimental research means that future scholars will also need to take a more critical approach to validity (internal, external, construct), statistical power, and significance in their work.

4.3 Future Aims

While there was an air of existential concern about the future of the field, most agreed that the trend will be toward increasing the relevance and reliability of consumer research. Specifically, echoing calls from journals and thought leaders, the respondents felt that papers will need to offer more actionable implications for consumers, managers, or policy makers. However, few thought that this increased focus would come at the expense of theoretical insights, suggesting a more demanding overall standard for consumer research in 2040. Likewise, most felt that methodological transparency, open access to data and materials, and study pre-registration will become the norm as the field seeks to allay concerns about the reliability and meaningfulness of its research findings.

4.4 Summary - Future research questions and directions

Despite some well-justified pessimism, the future of consumer research is as bright as ever. As we revised this paper amidst the COVID-19 pandemic, it was clear that many aspects of marketplace behavior, consumption, and life in general will change as a result of this unprecedented global crisis. Given this, and the radical technological, social, and environmental changes that loom on the horizon, consumer researchers will have a treasure trove of topics to tackle in the next ten years, many of which will carry profound substantive importance. While research approaches will evolve, the core goals will remain consistent—namely, to generate theoretically insightful, empirically supported, and substantively impactful research (Table 3 ).

5 Conclusion

At any given moment in time, the focal concepts, methods, and aims of consumer-behavior scholarship reflect both the prior development of the field and trends in the larger scientific community. However, despite shifting trends, the core of the field has remained constant—namely, to understand the motivations, thought processes, and experiences of individuals as they consume goods, services, information, and other offerings, and to use these insights to develop interventions to improve both marketing strategy for firms and consumer welfare for individuals and groups. Amidst the excitement of new technologies, social trends, and consumption experiences, it is important to look back and remind ourselves of the insights the field has already generated. Effectively integrating these past findings with new observations and fresh research will help the field advance our understanding of consumer behavior.

Beckwith, N. E., & Lehmann, D. R. (1973). The importance of differential weights in multiple attribute models of consumer attitude. Journal of Marketing Research, 10 (2), 141–145.

Article Google Scholar

Belk, R. W., Wallendorf, M., & Sherry Jr., J. F. (1989). The sacred and the profane in consumer behavior: theodicy on the odyssey. Journal of Consumer Research, 16 (1), 1–38.

Dahl, R. A., Haire, M., & Lazarsfeld, P. F. (1959). Social science research on business: product and potential . New York: Columbia University Press.

Ding, Y., DeSarbo, W. S., Hanssens, D. M., Jedidi, K., Lynch Jr., J. G., & Lehmann, D. R. (2020). The past, present, and future of measurements and methods in marketing analysis. Marketing Letters, https://doi.org/10.1007/s11002-020-09527-7 .

Farley, J. U., & Ring, L. W. (1970). An empirical test of the Howard-Sheth model of buyer behavior. Journal of Marketing Research, 7 (4), 427–438.

Farley, J. U., & Ring, L. W. (1974). “Empirical” specification of a buyer behavior model. Journal of Marketing Research, 11 (1), 89–96.

Google Scholar

Fishbein, M., & Ajzen, I. (1975). Belief, attitude, intention, and behavior: an introduction to theory and research . Reading: Addison-Wesley.

Gerber, A. S., & Green, D. P. (2012). Field experiments: design, analysis, and interpretation . New York: WW Norton.

Gourville, J. T. (1998). Pennies-a-day: the effect of temporal reframing on transaction evaluation. Journal of Consumer Research, 24 (4), 395–408.

Higgins, E. T. (1998). Promotion and prevention: regulatory focus as a motivational principle. Advances in Experimental Social Psychology, 30 , 1–46.

Howard, J. A., & Sheth, J. (1969). The theory of buyer behavior . New York: Wiley.

Huber, J., Payne, J. W., & Puto, C. (1982). Adding asymmetrically dominated alternatives: violations of regularity and the similarity hypothesis. Journal of Consumer Research, 9 (1), 90–98.

Humphreys, A., & Wang, R. J. H. (2018). Automated text analysis for consumer research. Journal of Consumer Research, 44 (6), 1274–1306.

Iyengar, S. S., & Lepper, M. R. (2000). When choice is demotivating: can one desire too much of a good thing? Journal of Personality and Social Psychology, 79 (6), 995–1006.

Johnson, E. J., Shu, S. B., Dellaert, B. G., Fox, C., Goldstein, D. G., Häubl, G., et al. (2012). Beyond nudges: tools of a choice architecture. Marketing Letters, 23 (2), 487–504.

Kruglanski, A. W., Shah, J. Y., Fishbach, A., Friedman, R., Chun, W. Y., & Sleeth-Keppler, D. (2002). A theory of goal systems. Advances in Experimental Social Psychology, 34 , 311–378.

Lancaster, K. (1966). A new theory of consumer behavior. Journal of Political Economy, 74 , 132–157.

Laudan, L. (1986). Methodology’s prospects. In PSA: Proceedings of the Biennial Meeting of the Philosophy of Science Association, 1986 (2), 347–354.

Lynch Jr., J. G. (2011). Introduction to the journal of marketing research special interdisciplinary issue on consumer financial decision making. Journal of Marketing Research, 48 (SPL) Siv–Sviii.

MacInnis, D. J., & Folkes, V. S. (2009). The disciplinary status of consumer behavior: a sociology of science perspective on key controversies. Journal of Consumer Research, 36 (6), 899–914.

Markus, H. R., & Kitayama, S. (1991). Culture and the self: implications for cognition, emotion, and motivation. Psychological Review, 98 (2), 224–253.

Payne, J. W., Bettman, J. R., & Johnson, E. J. (1988). Adaptive strategy selection in decision making. Journal of Experimental Psychology: Learning, Memory, and Cognition, 14 (3), 534–552.

Prelec, D., & Loewenstein, G. (1998). The red and the black: mental accounting of savings and debt. Marketing Science, 17 (1), 4–28.

Rapp, J. M., & Hill, R. P. (2015). Lordy, Lordy, look who’s 40! The Journal of Consumer Research reaches a milestone. Journal of Consumer Research, 42 (1), 19–29.

Ratchford, B. T. (1975). The new economic theory of consumer behavior: an interpretive essay. Journal of Consumer Research, 2 (2), 65–75.

Schumann, D. W., Haugtvedt, C. P., & Davidson, E. (2008). History of consumer psychology. In Haugtvedt, C. P., Herr, P. M., & Kardes, F. R. eds. Handbook of consumer psychology (pp. 3-28). New York: Erlbaum.

Simonson, I. (1989). Choice based on reasons: the case of attraction and compromise effects. Journal of Consumer Research, 16 (2), 158–174.

Trope, Y., & Liberman, N. (2010). Construal-level theory of psychological distance. Psychological Review, 117 (2), 440–463.

Wang, X., Bendle, N. T., Mai, F., & Cotte, J. (2015). The journal of consumer research at 40: a historical analysis. Journal of Consumer Research, 42 (1), 5–18.

Wilkie, W. L., & Moore, E. S. (2003). Scholarly research in marketing: exploring the “4 eras” of thought development. Journal of Public Policy & Marketing, 22 (2), 116–146.

Download references

Author information

Authors and affiliations.

Columbia Business School, Columbia University, New York, NY, USA

Maayan S. Malter, Morris B. Holbrook & Donald R. Lehmann

The Wharton School, University of Pennsylvania, Philadelphia, PA, USA

Barbara E. Kahn

Department of Marketing, University of Illinois at Chicago, Chicago, IL, USA

Jeffrey R. Parker

You can also search for this author in PubMed Google Scholar

Corresponding author

Correspondence to Maayan S. Malter .

Additional information

Publisher’s note.

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Reprints and permissions

About this article

Malter, M.S., Holbrook, M.B., Kahn, B.E. et al. The past, present, and future of consumer research. Mark Lett 31 , 137–149 (2020). https://doi.org/10.1007/s11002-020-09526-8

Download citation

Published : 13 June 2020

Issue Date : September 2020

DOI : https://doi.org/10.1007/s11002-020-09526-8

Share this article

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Consumer behavior

- Information processing

- Judgement and decision-making

- Consumer culture theory

- Find a journal

- Publish with us

- Track your research

Just one more step to your free trial.

.surveysparrow.com

Already using SurveySparrow? Login

By clicking on "Get Started", I agree to the Privacy Policy and Terms of Service .

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Don't miss the future of CX at RefineCX USA! Register Now

Enterprise Survey Software

Enterprise Survey Software to thrive in your business ecosystem

NPS® Software

Turn customers into promoters

Offline Survey

Real-time data collection, on the move. Go internet-independent.

360 Assessment

Conduct omnidirectional employee assessments. Increase productivity, grow together.

Reputation Management

Turn your existing customers into raving promoters by monitoring online reviews.

Ticket Management

Build loyalty and advocacy by delivering personalized support experiences that matter.

Chatbot for Website

Collect feedback smartly from your website visitors with the engaging Chatbot for website.

Swift, easy, secure. Scalable for your organization.

Executive Dashboard

Customer journey map, craft beautiful surveys, share surveys, gain rich insights, recurring surveys, white label surveys, embedded surveys, conversational forms, mobile-first surveys, audience management, smart surveys, video surveys, secure surveys, api, webhooks, integrations, survey themes, accept payments, custom workflows, all features, customer experience, employee experience, product experience, marketing experience, sales experience, hospitality & travel, market research, saas startup programs, wall of love, success stories, sparrowcast, nps® benchmarks, learning centre, apps & integrations, testimonials.

Our surveys come with superpowers ⚡

Blog Best Of

Customer Research 101: Definition, Types, and Methods

12 February 2024

Table Of Contents

What is Customer Research?

Why is customer research important, types of customer research.

- 6 Customer Research Methods

- How SurveySparrow Can Help

Do you want to improve your marketing or product? Then, customer research can help.

Your customer is at the heart of all your business decisions. In fact, everything revolves around a customer. A business is about having a paying customer, and it wouldn’t exist without one.

The effectiveness of your product or marketing depends on how well you know your customers. When you know your customers better, you can make better product or marketing decisions.

In this article, we break down:

- What customer research is

- Why it’s valuable for your business

- Different types of customer research

- Six customer research methods you can use to refine and grow your business

Customer research (or consumer research ) is a set of techniques used to identify the needs, preferences, behaviors, and motivations of your current or potential customers.

Simply put, the consumer research process is a way for businesses to collect information and learn from their customers so they can serve them better.

Businesses typically conduct customer research to uncover new insights on their customers. They then use these newly uncovered insights to improve their product, craft an effective marketing strategy, and more.

Here are 2 key questions customer research helps you answer:

- Who are my ideal customers? Who is the best fit (or worst fit) for our product?

- What channels can I use to find and communicate with my ideal customers?

Online survey tools like SurveySparrow can help you answer these questions. With omnichannel survey distribution, snazzy data visualization, and 1,500+ integrations with your favorite tools, SurveySparrow simplifies customer research for your GTM and product teams.

Looking for a Full-Fledged Customer Research Tool?

Discover Deeper Insights With SurveySparrow. Sign Up for Free.

Please enter a valid Email ID.

- 14-Day Free Trial

- • Cancel Anytime

- • No Credit Card Required

- • Need a Demo?

A. How well do you know your customers? Not knowing enough about your customers can cost you time and money.

For example, a recent survey revealed that 46% of customers broke up with a brand because they received irrelevant content pushes.

Successful marketers realize that research is necessary to understand and cater to the ever-changing needs of today’s customers. According to a study by Coschedule:

- Successful marketers are 242% more likely to conduct audience research at least once every quarter.

- 56% of the study’s most elite marketers research at least once a month.

B. You shouldn’t make assumptions about your customers’ preferences or needs. You have to go out there and get opinions from real customers.

C. You need to go beyond your general idea about your customers. The more you understand your customers, the better you’ll be able to serve them with your product or service.

D. If you want to make your product the best in the market, you need to identify any unmet needs and learn how well your product serves the needs of your current customers.

E. Customer research helps you learn more about your customers, both the potential and existing ones. Serving your customers better than the alternatives starts with understanding them better and more deeply.

F. Here are other key reasons why you should research customers:

- Know the Why : Your analytics dashboard merely tells you what your customers do. Only research can help you understand why they do that.

- Validate Assumptions and Best Practices : In most cases, guesswork leads to terrible decisions. Your customers might not need what you think they need. And what works for most businesses might not work for you. The only real way to know is to talk to your customers.

Customer research can be done in two distinct ways: primary and secondary.

Primary research

Primary research is research you conduct yourself. In other words, in primary research, you collect the data yourself. Some examples of primary research are face-to-face interviews, surveys, and social media interactions.

Secondary research

Secondary research (or desk research ) is done by someone else. In secondary research, you make use of data that’s been collected by other people. A few examples of secondary research are forums or communities, industry reports, and online databases.

Primary and secondary research can be further broken down into two kinds of data: qualitative and quantitative.

Qualitative data

Qualitative data is descriptive and conceptual. And the nature of the data makes it subjective and interpretive. Examples of qualitative data include descriptions of certain attributes, such as blue eyes or chocolate-flavored ice cream .

Quantitative data

Quantitative data can be expressed using numbers, which means it can be counted or measured. As opposed to qualitative data, it’s objective and conclusive. Examples of quantitative data include numerical values such as measurements , length , cost , or weight .

Customer Research Methods that Work in 2024 (and Beyond)

Now that you know what customer research is and why it’s important, read on to learn the different consumer research methods you can use to make the most of it.

In a survey, you ask a series of questions to your customers regarding a subject or concept.

You can conduct a survey in person, over the phone, through emails, or online forms.

Here are some advantages of conducting customer research through surveys:

- Quickly collect a ton of insightful data without the high costs.

- The data you collect using surveys is simple to analyze.

- You can ask various questions since you get a wide range of question formats.

When it comes to surveys, it’s all about how you ask. Clear and concise questions can help you get reliable information.

An online survey tool is your best bet for quickly gathering customer information. All you need to do is create a survey with a ready-to-use template and send your customers a link to take it.

If you’re in need of a cost-free and easy-to-use solution for conducting customer research surveys and beyond, consider exploring SurveySparrow . This tool aids in gathering essential data by enabling you to conduct thorough data analysis via its user-friendly and conversational survey format.

Check Out SurveySparrow for Free here!

14-Day Free Trial • No Credit Card Required • No Strings Attached

In an interview, you speak directly to your customers and ask them open-ended questions.

- Interviews allow you to have deep, one-on-one conversations with your customers and explore a topic in-depth.

- You can go into the details, obtain data beyond surface-level information, and gather deeper insights.

While interviews allow you to probe deeper into a subject, success depends on the expertise and skills of the researcher (or interviewer) conducting the interviews.

Conducting interviews isn’t easy. It’s time-consuming and costly. However, the information you collect can be invaluable for your company’s growth.

You can meet your customers in person to conduct your interviews. Or you can use video conferencing tools such as Google Meet or Zoom to converse with your customers online.

Your analytics dashboard lets you in on your customers’ actions within your product.

Just a glance at it and you’ll know what your customers do and how they engage with your product.

The irony is that customers don’t know what they want or why. They might think they need something but that might not be the case.

What they say they need doesn’t equate to what they do.

The point is that customer-reported behavior is different from actual behavior. That’s why it pays to track and observe your customers’ behavior.

You can use heatmaps, click tracking, scroll mapping, and user-recorded sessions to gain insights into your users’ actions and behavior.

Focus Groups

In this method, you combine a small group based on certain criteria such as demographic, firmographic, or behavioral attributes.

And you ask this group about whatever topic or concept. It could be about your product, marketing message, or something else that’s related to your customers or business.

The idea is to get them to talk to each other and have meaningful conversations.

A moderator helps facilitate the conversations between the individuals in this group. The moderator will try to draw meaningful insights from these conversations and discussions.

You mainly use this technique to understand a certain topic or subject better.

Competitive Analysis

Studying your competitors’ strategies and tactics is a great way to learn more about the target market and the existing solutions.

You can analyze both your direct and indirect competitors depending on the needs you address and the customers you cater to.

You can conduct a competitive analysis from a marketing or product perspective.

If you conduct your analysis from a marketing perspective, you study your competition’s SEO strategy , landing page copy, blog content, PR coverage, social media presence, etc.

You can also conduct your competitive analysis from a product perspective and analyze your competitors’ user experience, features, pricing structure, etc.

Review Mining

The reviews of you and your competitors are another great way to get inside your customer’s head. This method can be especially valuable if you are a SAAS company.

It helps you better understand your competitor’s strengths and weaknesses as well as your own. This understanding helps you improve your own products and better address the needs of your ideal customers.

This kind of data is easy to acquire as it’s publicly available, and you can get them on:

- Review sites such as G2Crowd and Capterra.

- Forums and niche communities such as ProductHunt, Reddit, Quora, etc.

Why SurveySparrow is the Best Customer Research Tool

SurveySparrow facilitates comprehensive customer research by enabling businesses to efficiently collect, analyze, and act on customer feedback, leading to better informed and customer-centric decisions.

- Collect Feedback Easily : Create simple surveys to find out what customers think about your products or services.

- Understand Satisfaction : Use surveys to figure out how happy customers are with what you offer.

- Learn Buying Habits : Find out why customers buy certain products, which helps in planning what to sell.

- Get Product Opinions : Ask customers what they like or don’t like about your products to make improvements.

- See How People View Your Brand : Understand how customers see your brand, which is important for your marketing.

- Keep Up with Trends : Regular surveys help you stay updated on what your customers want or need.

- Group Customers : Identify different types of customers to target them more effectively with your marketing.

- Improve Customer Experience : Learn where you can make the buying process better for your customers.

- Test New Ideas : Before launching new products, check if your customers would be interested.

- Check Customer Loyalty : Find out if customers would keep using your products or recommend them to others.

Sign up for a free trial.

please enter a valid email id. signup for free 14-day free trial • no credit card required • no strings attached, final thoughts.

Businesses that deeply understand their customers have a huge advantage over the ones that don’t. Period.

Whatever you’re looking to learn or achieve, it becomes a lot clearer with a little research.

When done right, customer research can be your competitive advantage.

Be sure to pick a method that’s right for your situation. What are you looking to learn and achieve? Think through each research method carefully and pick the one that works best for you.

Have you conducted customer research? What did you learn? And how did it go? Tell us about that in the comment section below.

And if you’re looking to conduct customer research through surveys, feel free to check out SurveySparrow .

I'm a developer turned marketer, working as a Product Marketer at SurveySparrow — A survey tool that lets anyone create beautiful, conversational surveys people love to answer.

You Might Also Like

Top 10 data analytics tools: insights with advanced analytical solutions, crunchy leaves and frosty winds… hello, mr. november, smiley face rating scale: everything you need to know, cherry-picked blog posts. the best of the best..

Leave us your email, we wont spam. Promise!

Start your free trial today

No Credit Card Required. 14-Day Free Trial

Request a Demo

Want to learn more about SurveySparrow? We'll be in touch soon!

Research Your Customers with Conversational Surveys!

Create beautiful surveys that your customers will love to answer boost your response rates by 40%.

14-Day Free Trial • No Credit card required • 40% more completion rate

Hi there, we use cookies to offer you a better browsing experience and to analyze site traffic. By continuing to use our website, you consent to the use of these cookies. Learn More

- Guide to consumer research

An Introductory Guide to Consumer Research And How to Conduct One

Consumer research is used across industries in order to gain key insights into consumer behavior and needs. In this article, we will explore the key aspects of consumer research, namely what it is and how to do it.

What Is Consumer Research?

Consumer research is research undertaken to gain an idea of customers' preferences, attitudes, motivations, and buying behaviors. This information can enable you to categorize customers into groups or segments, and tailor marketing efforts (or other aspects of the business, such as product development) to those who are most likely to spend their money on your product or service.

Research can take many different forms - such as surveys, questionnaires, and interviews. All of which enable you to gain answers to questions that your business is struggling to find through other means.

For example, most businesses have some kind of customer service department. Through consumer research, you can find out what methods of customer service are most preferred by your customers and invest more in these methods resulting in greater customer satisfaction.

Consumer research enables you to group customers into customer segments. A customer segment is simply a collection of individuals with similar consumer data - possibly in terms of the personal demographics such as age, gender, or location, or it could be that their spending habits, AOV , and preferences are similar.

These customer segments can be targeted in different ways, enabling you to maximize revenue from each individual.

2 Types of Consumer Research

There are two basic types of research, both of which apply to consumer research.

Quantitative Research

Quantitative research produces quantifiable data. This means that it can be considered directly in numbers and percentages and, as a result, is usually easier to analyze.

For example, perhaps you want to evaluate your quality assurance strategies . In order to gain quantitative data for this, you might ask yes/no questions or ask customers to rank statements on a scale from 1 to 10, such as “I frequently come across bugs in X software”. 10 would indicate all the time, and 1 would be never. The responses can then be added together to create a percentage.

Qualitative Research

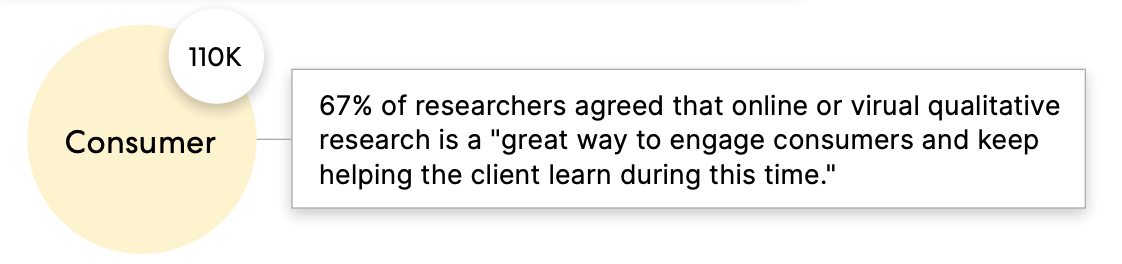

Qualitative research is often more in-depth, and questions enable responders to explore their answers in full detail. In 2021, 67% of researchers agreed that online or virtual qualitative research is helpful to consumer research. Qualitative research enables a much deeper understanding of the customer experience and opinion but is harder to analyze.

For example, returning to our example of experiencing bugs in software, a qualitative researcher may approach this question as follows:

Q: How often do you experience bugs when using our software? Explain in detail when and where this occurs.

A: I only experience bugs when using the accounting tool of the application. Whenever I try to export a report of my accounts, the app glitches and deletes my data.

This answer provides specific examples to the researcher and would make solving the problem much simpler. This is reflected in how business practices and software development intersect, as business needs are shaping new technology, a response that is driven through research.

However, if you are dealing with hundreds of responses, getting through them all can be challenging.

3 Benefits of Consumer Research

1. provides valuable market insight.

Consumer research provides insights that you cannot get from analytics alone, as it gives you insight into the thoughts and feelings of the consumers. These insights are extremely valuable, as if you know how to use customer analytics , you can apply these skills to implementing the data gathered from your consumer research.

2. Improve Marketing and Business Decisions

Once you have gained these insights, consumer research can actually be used to inform your marketing and business decisions and can even help the creation of brand marketing reports . For example, your research could suggest that your business lacks organization across its teams. This could lead to your business investing in WFM tools and ultimately revolutionizing its reputation.

3. Assists in Determining Market Position

Another benefit of consumer research is that it can provide insights into where your business sits within the market. You can find out whether you are preferred to your competition or vice versa, and why. It helps your business define its market position and make adjustments to improve this or solidify its brand identity.

5 Methods of Consumer Research

There are many different methods of conducting customer research. In this section, we will go through some of the key options available.

Interviews are a great way to conduct consumer research. The nature of spoken conversation often enables previously unconsidered ideas to come up naturally and opens up opportunities for discussions that reveal deeper insights. Furthermore, if you have access to software offering a free video call online , these interviews no longer need to be done in person.

- Focus Groups

Interviews can be conducted in focus groups where a select group of individuals discuss and offer their opinions on a matter together. These individuals might be from the same customer sectors or may represent different perspectives. How you choose to structure these is up to you.

- One-on-one Interviews

Alternatively, you may prefer to approach these with one-on-one interviews. This form of interview can often lead to a more in-depth conversation but, for logical reasons, are less time-efficient and can miss out on the group dynamic spurring new ideas.

Surveys are a written alternative to interviews and do not require a researcher to be present at the time of research. They can also be sent to a much larger group of respondents (meaning a more detailed set of data) and can be a combination of quantitative and qualitative responses.

Analytics is nothing new to anyone working in marketing, and it can be an excellent tool for conducting consumer research. Analytics will provide quantitative insights into consumer behavior, such as conversion rates and average sale values, and can contribute to consumer research.

Review Mining

Review mining can be a great way to gain consumer insights, and it doesn’t involve actively pursuing new research.

Previous reviews can often provide a mixture of quantitative and qualitative research through written descriptions and “star” system reviews. However, this method limits you to what is already available, and these reviews may not specifically target areas you are keen to research.

Secondary Research

Secondary research refers to looking at previously created research in your industry. Lots of this can be accessed online, and even if this isn’t the method you primarily choose to use, it can be a great starting point to guide your own research.

5 Steps to Conduct Consumer Research

1. set smart research goals and objectives.

SMART goals should be set before any business pursuit. Standing for specific, measurable, agreed, realistic, and time-bounded, these goals can help guide your research and avoid going off topic.

2. Determine the Research Methodology and Audience

As previously mentioned, there are several different methods of conducting consumer research. Choosing from the list above (and you are not limited to only one method), you should cover both quantitative and qualitative data for the best insight.

Develop a Buyer Persona

Develop a buyer persona in order to determine who your audience will be for the research. Buyer personas can be seen somewhat like “characters” in a story. They have certain wants, motivations, and behavior patterns. They make up your customer segments and who the research will target.

3. Conduct Research and Compile Data Findings

Put the research into action: send out surveys, schedule interviews, review your google analytics. Put all your findings into a spreadsheet, and begin to group responses logically. With qualitative data, it may be useful to identify “themes” in responses and categorize them according to these.

Once data is compiled, it is recommended to present it in a visually effective report , including charts or graphs depending on the content.

4. Analyze and Interpret Data Results

Take your data and consider what the information is telling you. Are you seeing frequent negative responses in one area? Do customers feel like you are overpricing your service? Interpret the data and come to conclusions as to what your business may need to do.

5. Take Action in Response to the Findings

Put your findings into action! If you are seeing consistent weaknesses in one area, this is a great time to bring the team together and brainstorm ideas to work around this and improve your business. When you implement changes that benefit the customers, you will see results coming back around to you in the form of increased engagement.

Key Takeaway

Consumer research is a brilliant way to ensure the success of any business. Enabling you to see how your customers view your company and gain key insights into how your business can improve. Provided your research has clear goals and gathers in-depth data, there is no reason your research shouldn’t be a raging success!