Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

- Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

- Experience Management

User Experience

- User Experience Research

See how XM for Customer Frontlines works

User experience (ux) research: definition and methodology.

17 min read To build outstanding products and services for your customers, you need a thorough understanding of who they are, what they need and where their pain points and priorities lie. UX research helps you fully step into your customers’ shoes.

What do we mean by user experience?

User experience (UX) is a customer’s-eye view of your business as it relates to completing tasks and using interactive platforms and services.

It’s closely tied to the idea of customer experience (CX) , but rather than being a holistic view of your brand, it’s more focused on utility and usability testing – the hands-on side of things. You can think of UX as a sub-discipline of CX .

For example, CX research might consider how customers perceive a company’s customer service levels and how confident they feel in having their issues resolved. Meanwhile, UX research would focus on how successfully those customers navigate a self-service website, whether the language on that site is clear and how easy it is to use.

Free eBook: The essential website experience & UX playbook

What is user experience (UX) research?

User experience (UX) research is about diving deep into how customers interact with your brand on a practical, functional level, and observing how easily they can complete their tasks and meet their goals.

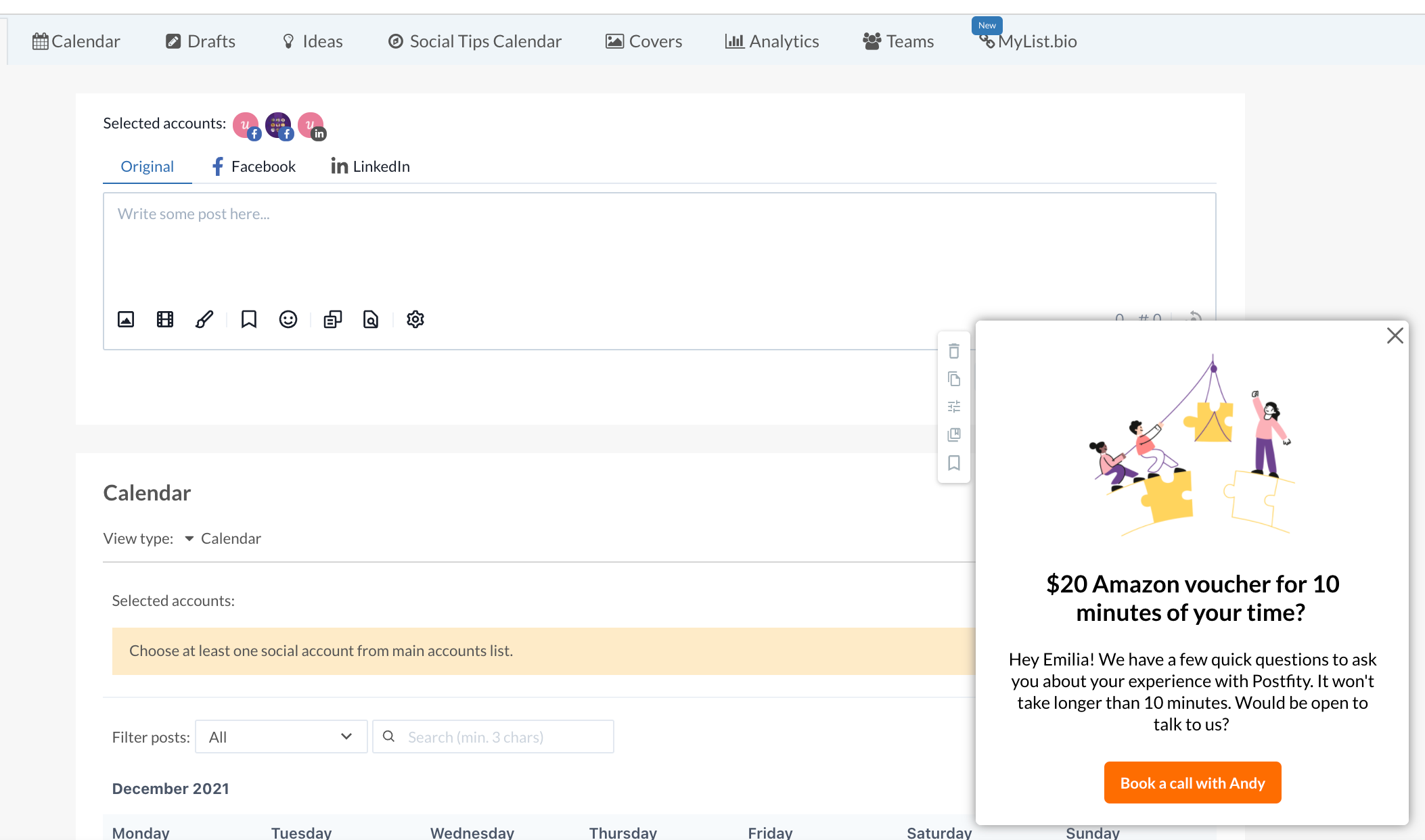

User research is the process of discovering the behaviors , motivations, and needs of your customers through observation, task analysis, and other types of user feedback . It can involve working directly with members of your target audience through UX testing sessions, remote session observation using digital tools, surveys to collect user feedback, and many more UX research methods and techniques.

Why is UX research important?

So what exactly is the value of user experience research? After all, you understand your business and its workings better than anyone. How can uninformed external users help you learn more?

The fresh perspective of your end-users is exactly why UX research is so valuable. Because they’re not already immersed in your language, processes, and systems, user testing participants are in the best position to help you see where things might be confusing to a newcomer who isn’t involved with your business.

Better yet, they can show you where confusion or frustration might lead a new or potential customer to miss out on product benefits, fail to convert, or even give up and look toward your competitors instead.

In areas like new product design and development , user research allows you to head off potential issues with products and services before they even hit the shelves. You can design the product correctly the first time, instead of having to fix it later when customers are unhappy.

Simply put, UX research is critical because it keeps you from wasting time, money, and effort designing the wrong product or solution. It’s valuable for all areas of your business and yields clear benefits for your product, your users, and your bottom line.

- Product benefits By asking your customers for direct feedback about a potential product, you can discover how and when customers prefer to use a product, what pain points your product will solve, and how to improve your product design .

- User benefits UX research is unbiased feedback, straight from the most valuable source: your customers. Because this type of research is not biased by investors, company leaders, or outside influences, it is the best resource for getting actionable product feedback.

- Business benefits Knowing what your users value helps you spend less time and money fixing flawed designs, speeds up the product development process , and increases customer satisfaction.

UX research helps brands and organizations to:

- Understand how users experience products, websites, mobile apps, and prototypes

- Evaluate and optimize prototypes and ideas based on UX research discoveries – and nail the design and experience early in a product’s life cycle

- Unearth new customer needs and business opportunities

- Find and fix hidden problems with products and services that arise in real-world use cases

- Make informed decisions through the product development process by testing various aspects of product designs

- Provide user experiences that outperform other businesses in your sector ( UX competitor research )

- Understand each user interaction across complete customer journeys

- Build a richer, more useful picture of your target audiences for better marketing and advertising

What’s the ROI of performing UX research?

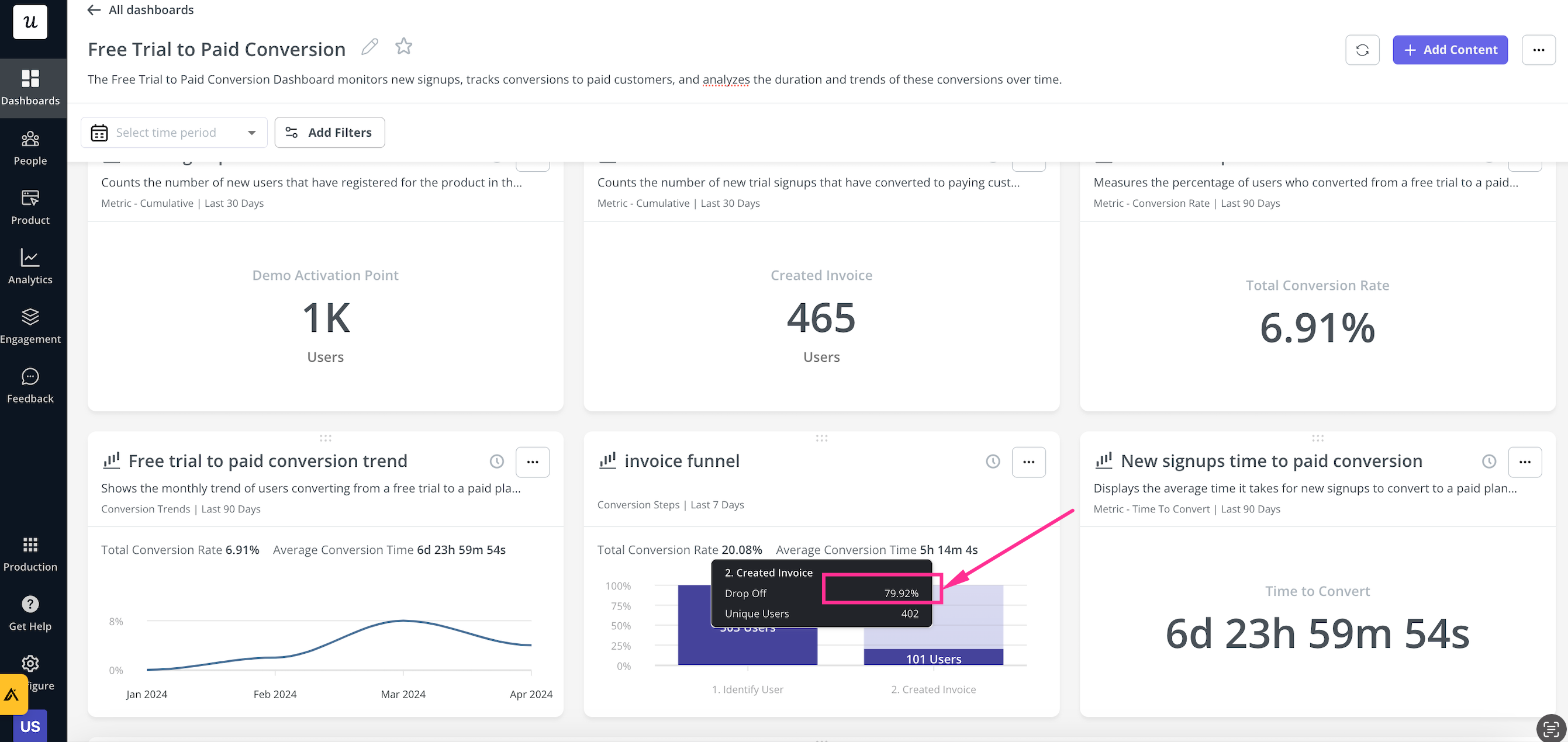

The ROI of UX research is tricky to pin down because there often isn’t a direct, easy-to-spot correlation between time spent on it and resulting revenue. UX research can and does drive revenue, but it more directly influences metrics that show customer satisfaction, customer retention, and behavioral goals like user signups.

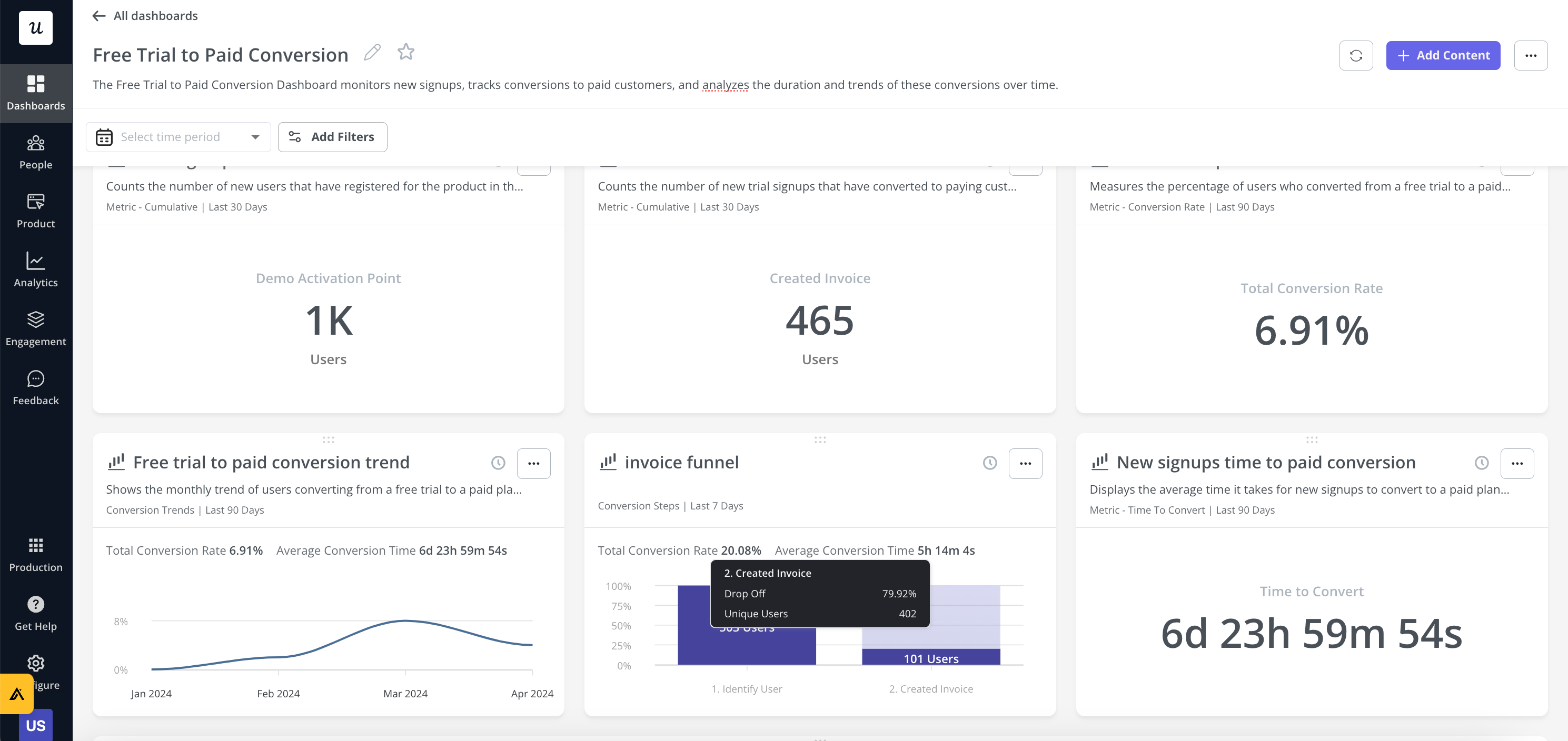

A simple way to draw a straight (if basic) line between UX research and its associated ROI is to calculate your conversion rate, where ‘conversion’ simply means completing the action you had in mind:

Number of people who took your desired action

————————————————————— x 100

Total visitors/users

That percentage can be calculated and revisited over time to see how UX changes resulting from your research are having an effect.

Generally, when we talk about ROI, we’re talking about the highest possible rates of return you can attribute to an investment. But – while PWC research suggests that ROI on UX research can rise to as high as 301% – it’s better not to get caught up in absolutes with operational data like revenue.

Instead, it’s worth thinking more about the benefits that come out of tracking human behavior associated with improving your UX in general.

For example, IBM research states that 3 out of 5 users think that a positive user experience is more influential than strong advertising, while Forrester Research estimates that as many as 50% of potential sales fall through because users can’t find the information they need.

Thorough UX research can also cut a project’s development time by up to 50% .

Ultimately, when trying to track the ROI of your time spent doing quantitative and qualitative research on UX, you want to look at behavior and sentiment. If your main goal is website use, you should notice a decline in bounce rate as a sign of positive ROI. If you sell services, run regular CSAT surveys to determine how satisfied customers are with everything.

You might also find that data in unusual places. For example, if you spot a decline in chatbot requests around how to do or perform certain actions, or for information, then you know your new UX implementations are working as desired.

Those kinds of behavioral data points will shine a light on how worthwhile your UX research has been more readily than changes in revenue.

User experience research methods

The type of UX research techniques you choose will depend on the type of research question you’re tackling, your deadline, the size of your UX research team, and your environment.

There are three research dimensions to consider as you decide which methods are best for your project:

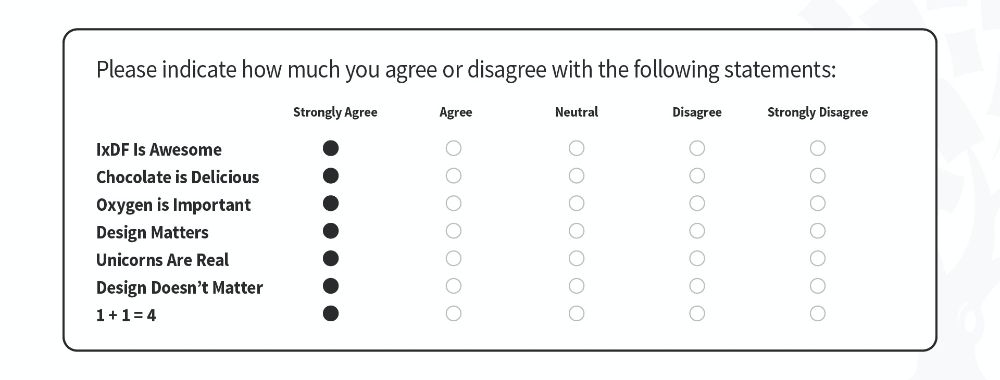

Attitudinal and behavioral

“Attitudinal” refers to what people say, while “ behavioral ” refers to what people actually do – and these are often very different. Attitudinal research is often used in marketing because it measures people’s stated beliefs and needs. However, in product design and user experience research, what people do tends to be more relevant.

For example, A/B testing shows visitors different versions of a site at random to track the effect of site design on conversion and behavior.

Another behavioral method is eye tracking, which helps researchers understand how users interact and visually engage with the design of an interface by following their gaze.

Qualitative and quantitative methods

Quantitative UX research studies collect and analyze results, then generalize findings from a sample to a population. They typically require large numbers of representative cases to work with and are structured in their approach.

Quantitative research uses measurement tools like surveys or analytics to gather data about how subjects use a product and are generally more mathematical in nature. This type of inquiry aims to answer questions like ‘what,’ ‘where’ and ‘when’.

Qualitative research methods, on the other hand, gather information about users by observing them directly, as in focus groups or field studies.

Qualitative research aims to understand the human side of data by gaining a sense of the underlying reasons and motivations surrounding consumer behavior. It tends to use small numbers of diverse (rather than representative) cases, and the data collection approach is less structured. Qualitative methods are best suited to address the ‘how’ or ‘why’ of consumer behavior.

Qualitative UX research methods

Several UX research methodologies can help UX researchers answer those big ‘how’ and ‘why’ questions, and influence the design process of any product or service you’ve got cooking. Here are just a few …

1. Participatory design

In participatory design, people are asked to draw or design their own best-case version of the tool, product, or service in question. This gives UX researchers the ability to ask qualitative questions about why specific choices have been made. If multiple participants make similar choices, it’s easy to spot patterns that should be adopted.

You might ask participants how they would redesign your website. While their responses will naturally vary, you might spot that several of them have moved your site’s navigation to a more prominent spot, or have moved the checkout from the left of the screen to the right.

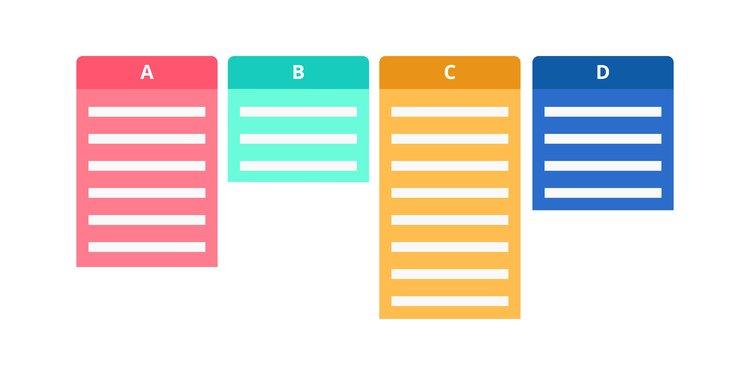

2. Card sorting

Card sorting involves giving participants a range of cards that represent business-specific topics and asking them how they would sort them into groups. UX researchers are then able to probe into why their audience might group certain things, and make changes to existing offerings as a result.

If you have a wide range of products and solutions, card sorting would be a useful way to gauge how your target audience would naturally bucket them on your website. A furniture seller, for example, might use this technique to find that people are naturally inclined to group items by room, rather than by furniture type.

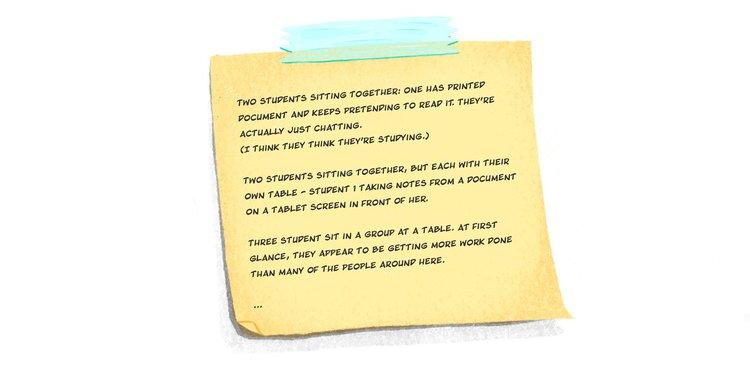

3. Diary studies

If you’d like to know how the UX of your product or service varies over time or throughout the length of its use, a diary study can help. Here, participants are given a way to record their thoughts as they set about using the product or service in question, noting things that occur to them as they go. This is useful as it provides real-world insight over a longer period than a one-off focus group.

Giving people access to an early build of an app and asking them to keep usability testing notes can highlight pain points in the user interface. In a one-off focus group, having to tap three times to get to an oft-used screen might seem fine – whereas participants are more likely to find it annoying in the day-to-day. This kind of longer-term usability test can provide really valuable insights.

Both quantitative and qualitative UX research methodologies can be useful when planning the design and development of your brand presence, as well as for usability testing when it comes to product and service design.

Context-of-use

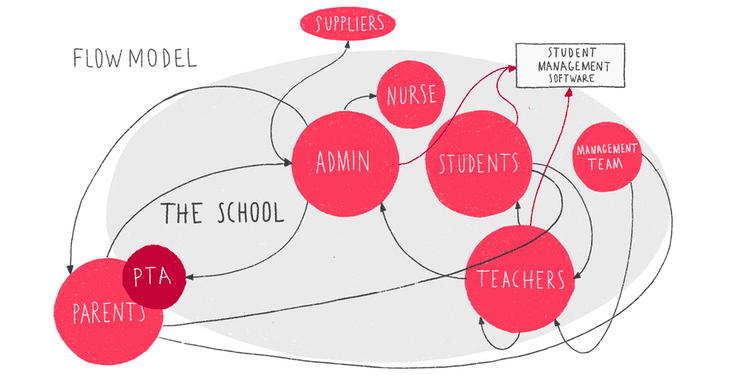

By collecting and analyzing information about users, the intended use of the application, the tasks they perform with the application, and the technical constraints presented by the application, context-of-use analysis allow UX researchers to better understand the overall experience.

Typically, context-of-use analysis data is collected through research surveys, focus groups, interviews, site visits, and observational studies.

Context-of use-analysis is one method for identifying the most important elements of an application or product in the context of using that application or product. This type of UX research is typically done early in the product lifecycle and continued as data identifies which components of the product and UX are most critical.

Types of user research tools

There are many types of user research methods for discovering data useful for product design and development. Below are some common examples of tools user experience researchers may use to gather information and draw insights into mental models, or users’ thought processes.

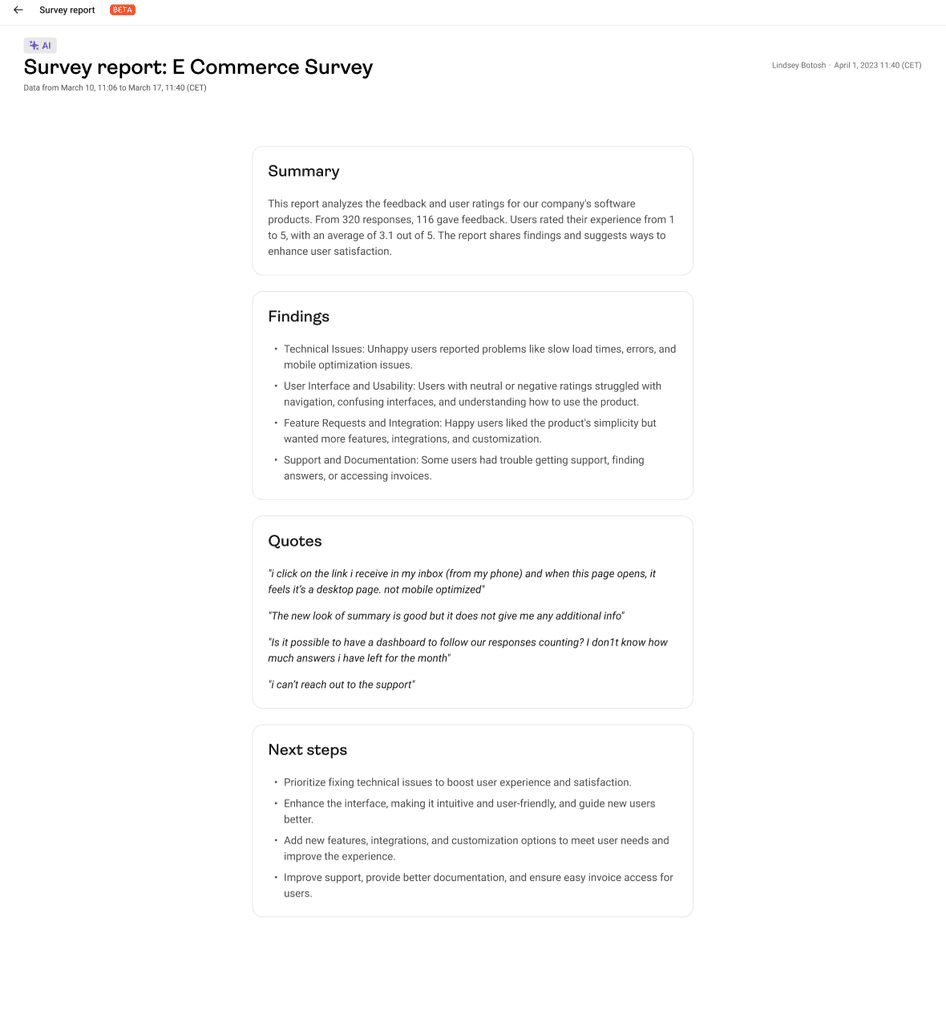

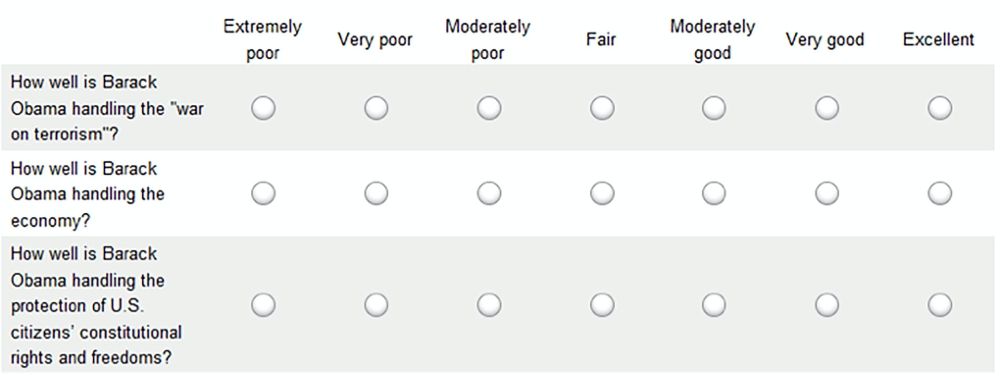

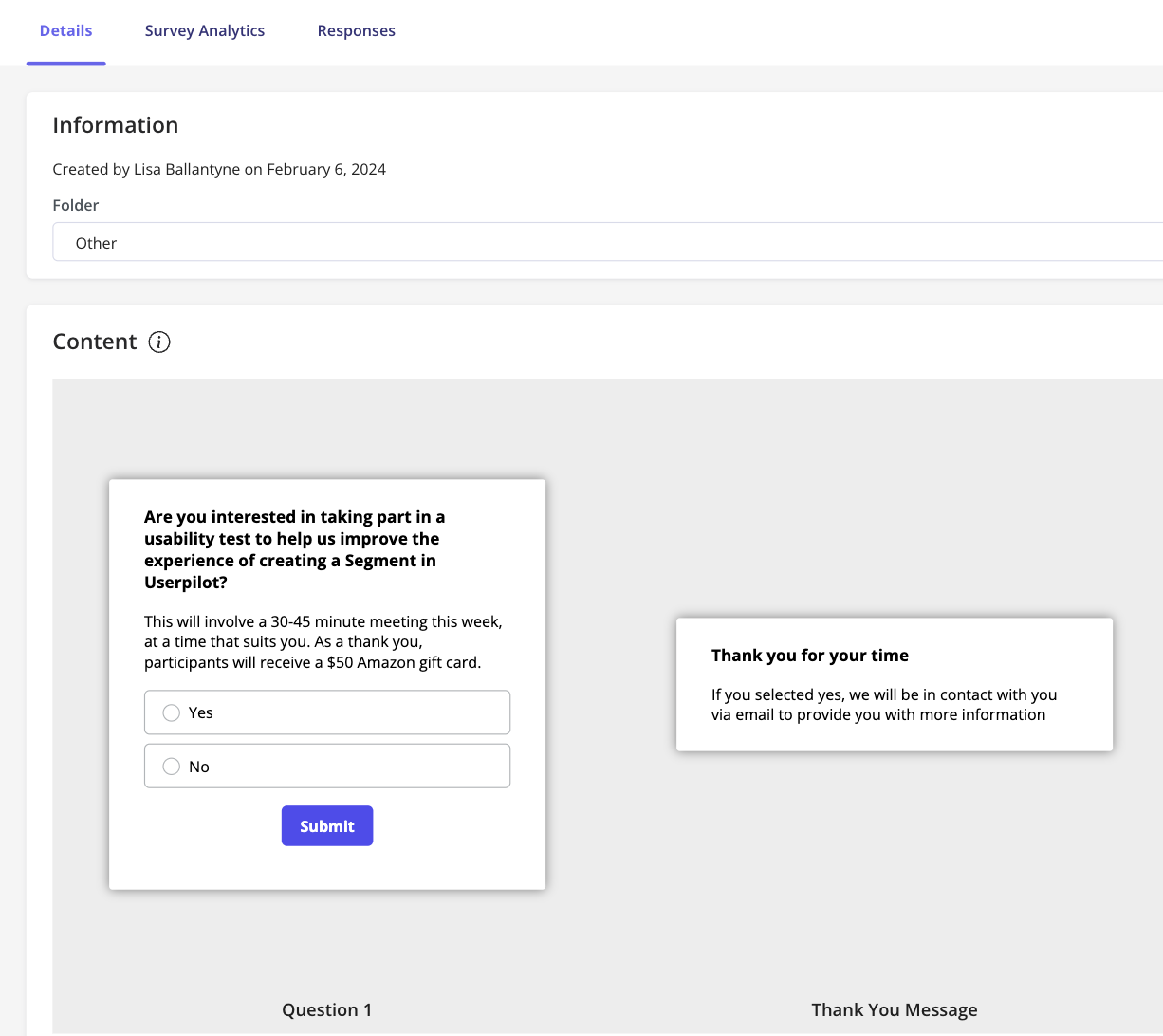

UX research surveys or questionnaires can discover data at scale through in-person or remote polling, with specific questions designed to collate useful information about user experience.

User groups or focus groups are a form of a structured interview that consults members of a target audience on their experience, views, and attitudes towards the product or solution. They usually involve neutral parties, such as a moderator and note-taker, and are led by a researcher who asks open-ended questions focused on specific aspects of an investigation.

User interviews are one-on-one structured interviews with a target audience member, led by a UX researcher to understand more about personal experiences with the product. These user interviews can be directed to compare and contrast answers between users, or non-directed, where users lead the conversation.

Ethnographic interviews take place within the target users’ typical environment to get a better context-of-use view. Field studies and site visits are similarly observational in nature, and take place in situ where the product or service is used, but may involve larger groups.

This is not a comprehensive list of research techniques but represents some of the main ways UX researchers might perform usability testing or trial UX design.

When to conduct user experience research

Before launching a new product or service, understanding user preferences that could impact your design or development is key to success. The earlier user experience research is performed, the more effective the end product or service will be, as it should encompass the insights learned about your target audience.

As a product and service’s use and value evolve over its lifecycle, the user experience will change over time. User research should be undertaken on an ongoing basis to determine how to adapt to users’ new needs and preferences.

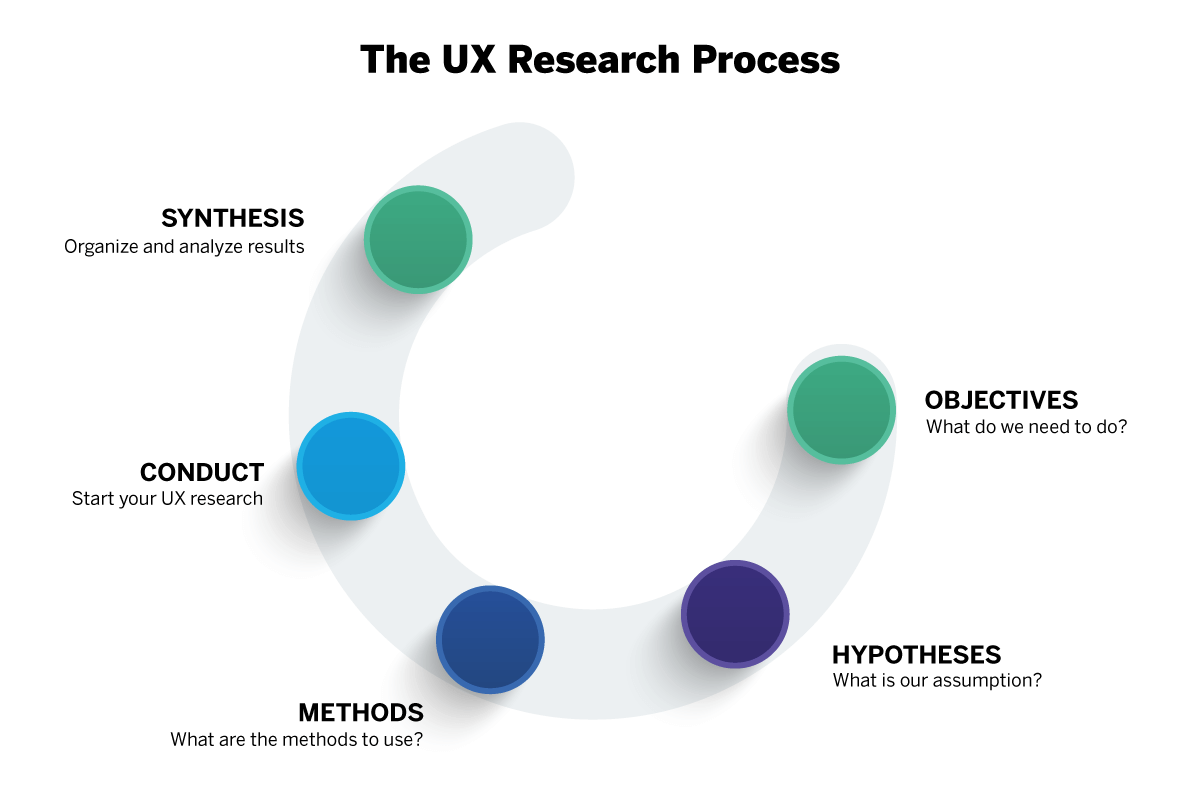

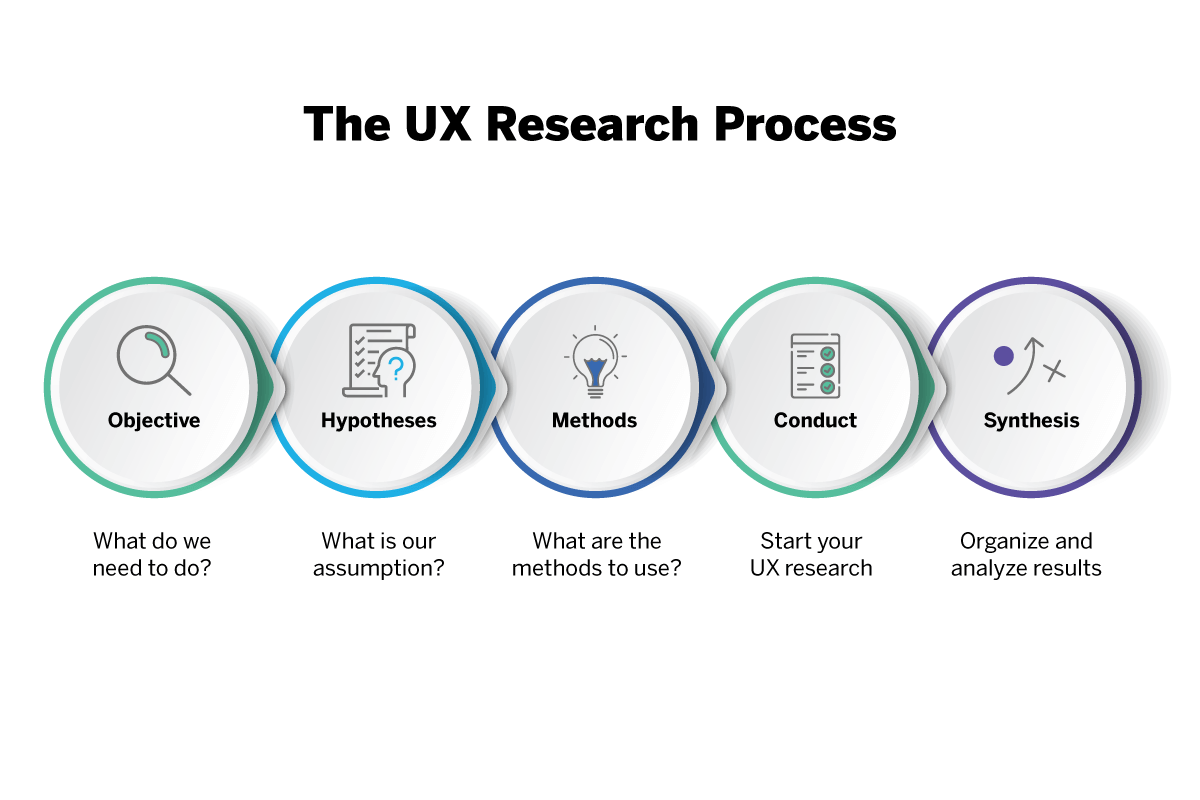

Five basic steps to conducting UX research

If you’re new to UX research, here’s a step-by-step list of what to consider before you begin your UX testing program:

- Objectives What do you need to find out about your users and their needs?

- Hypothesis What do you think you already know about your users?

- Methods Based on your deadline, project type, and the size of your research team, what UX research methods should you use?

- Process Using your selected UX research method(s), begin collecting data about your users, their preferences, and their needs.

- Synthesis Analyze the data you collected to fill in your knowledge gaps, address your hypothesis and create a plan to improve your product based on user feedback.

Qualtrics makes UX research simple and easy

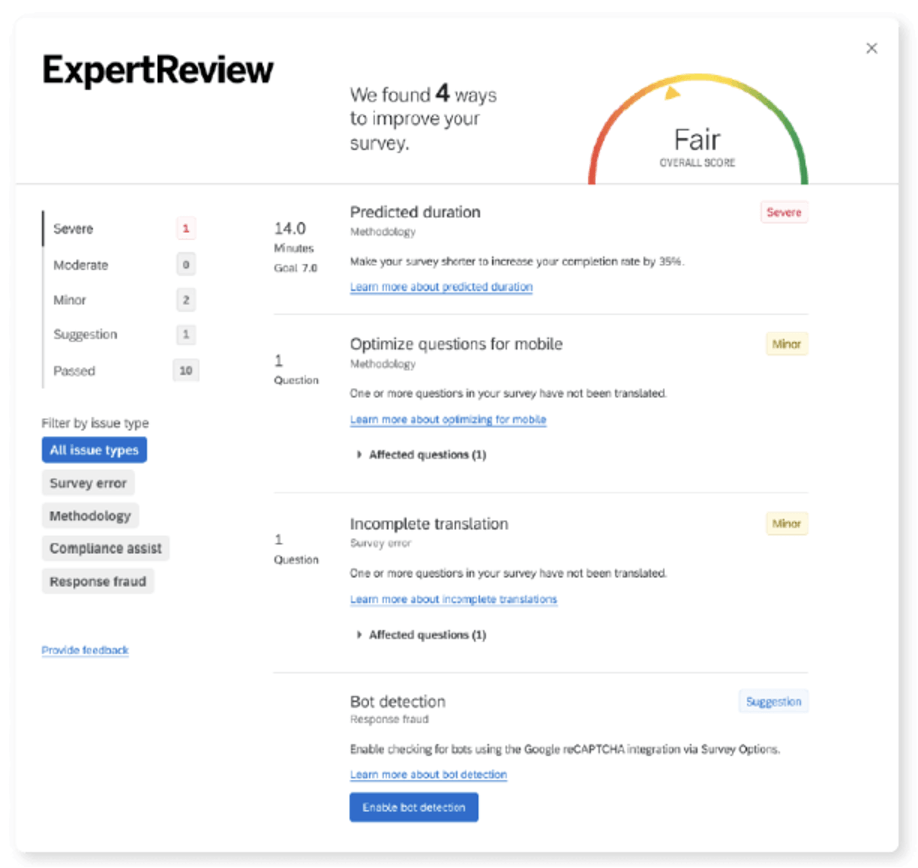

User experience research and user testing are multifaceted and can involve a lot of both quantitative and qualitative data. To ease the process and make sure it is efficient and scalable, it’s best conducted using a highly responsive platform that allows you to collect data, analyze trends and draw conclusions all in one place.

Whether you need attitudinal or behavioral insights, Qualtrics is your go-to solution for collecting all kinds of UX data and making use of it in the context of your wider CX program .

Conduct in-person studies or send beautifully designed surveys easily and quickly, and view your results via custom dashboards and reports using the most sophisticated research platform on the planet.

Free eBook: The essential website experience & UX playbook

Related resources

User experience 20 min read, user experience surveys 9 min read, ux research tools 8 min read, user analytics 11 min read, rage clicks 11 min read, user experience analytics 10 min read, website user experience 14 min read, request demo.

Ready to learn more about Qualtrics?

The Complete Guide to UX Research Methods

UX research provides invaluable insight into product users and what they need and value. Not only will research reduce the risk of a miscalculated guess, it will uncover new opportunities for innovation.

By Miklos Philips

Miklos is a UX designer, product design strategist, author, and speaker with more than 18 years of experience in the design field.

PREVIOUSLY AT

“Empathy is at the heart of design. Without the understanding of what others see, feel, and experience, design is a pointless task.” —Tim Brown, CEO of the innovation and design firm IDEO

User experience (UX) design is the process of designing products that are useful, easy to use, and a pleasure to engage. It’s about enhancing the entire experience people have while interacting with a product and making sure they find value, satisfaction, and delight. If a mountain peak represents that goal, employing various types of UX research is the path UX designers use to get to the top of the mountain.

User experience research is one of the most misunderstood yet critical steps in UX design. Sometimes treated as an afterthought or an unaffordable luxury, UX research, and user testing should inform every design decision.

Every product, service, or user interface designers create in the safety and comfort of their workplaces has to survive and prosper in the real world. Countless people will engage our creations in an unpredictable environment over which designers have no control. UX research is the key to grounding ideas in reality and improving the odds of success, but research can be a scary word. It may sound like money we don’t have, time we can’t spare, and expertise we have to seek.

In order to do UX research effectively—to get a clear picture of what users think and why they do what they do—e.g., to “walk a mile in the user’s shoes” as a favorite UX maxim goes, it is essential that user experience designers and product teams conduct user research often and regularly. Contingent upon time, resources, and budget, the deeper they can dive the better.

What Is UX Research?

There is a long, comprehensive list of UX design research methods employed by user researchers , but at its center is the user and how they think and behave —their needs and motivations. Typically, UX research does this through observation techniques, task analysis, and other feedback methodologies.

There are two main types of user research: quantitative (statistics: can be calculated and computed; focuses on numbers and mathematical calculations) and qualitative (insights: concerned with descriptions, which can be observed but cannot be computed).

Quantitative research is primarily exploratory research and is used to quantify the problem by way of generating numerical data or data that can be transformed into usable statistics. Some common data collection methods include various forms of surveys – online surveys , paper surveys , mobile surveys and kiosk surveys , longitudinal studies, website interceptors, online polls, and systematic observations.

This user research method may also include analytics, such as Google Analytics .

Google Analytics is part of a suite of interconnected tools that help interpret data on your site’s visitors including Data Studio , a powerful data-visualization tool, and Google Optimize, for running and analyzing dynamic A/B testing.

Quantitative data from analytics platforms should ideally be balanced with qualitative insights gathered from other UX testing methods , such as focus groups or usability testing. The analytical data will show patterns that may be useful for deciding what assumptions to test further.

Qualitative user research is a direct assessment of behavior based on observation. It’s about understanding people’s beliefs and practices on their terms. It can involve several different methods including contextual observation, ethnographic studies, interviews, field studies, and moderated usability tests.

Jakob Nielsen of the Nielsen Norman Group feels that in the case of UX research, it is better to emphasize insights (qualitative research) and that although quant has some advantages, qualitative research breaks down complicated information so it’s easy to understand, and overall delivers better results more cost effectively—in other words, it is much cheaper to find and fix problems during the design phase before you start to build. Often the most important information is not quantifiable, and he goes on to suggest that “quantitative studies are often too narrow to be useful and are sometimes directly misleading.”

Not everything that can be counted counts, and not everything that counts can be counted. William Bruce Cameron

Design research is not typical of traditional science with ethnography being its closest equivalent—effective usability is contextual and depends on a broad understanding of human behavior if it is going to work.

Nevertheless, the types of user research you can or should perform will depend on the type of site, system or app you are developing, your timeline, and your environment.

Top UX Research Methods and When to Use Them

Here are some examples of the types of user research performed at each phase of a project.

Card Sorting : Allows users to group and sort a site’s information into a logical structure that will typically drive navigation and the site’s information architecture. This helps ensure that the site structure matches the way users think.

Contextual Interviews : Enables the observation of users in their natural environment, giving you a better understanding of the way users work.

First Click Testing : A testing method focused on navigation, which can be performed on a functioning website, a prototype, or a wireframe.

Focus Groups : Moderated discussion with a group of users, allowing insight into user attitudes, ideas, and desires.

Heuristic Evaluation/Expert Review : A group of usability experts evaluating a website against a list of established guidelines .

Interviews : One-on-one discussions with users show how a particular user works. They enable you to get detailed information about a user’s attitudes, desires, and experiences.

Parallel Design : A design methodology that involves several designers pursuing the same effort simultaneously but independently, with the intention to combine the best aspects of each for the ultimate solution.

Personas : The creation of a representative user based on available data and user interviews. Though the personal details of the persona may be fictional, the information used to create the user type is not.

Prototyping : Allows the design team to explore ideas before implementing them by creating a mock-up of the site. A prototype can range from a paper mock-up to interactive HTML pages.

Surveys : A series of questions asked to multiple users of your website that help you learn about the people who visit your site.

System Usability Scale (SUS) : SUS is a technology-independent ten-item scale for subjective evaluation of the usability.

Task Analysis : Involves learning about user goals, including what users want to do on your website, and helps you understand the tasks that users will perform on your site.

Usability Testing : Identifies user frustrations and problems with a site through one-on-one sessions where a “real-life” user performs tasks on the site being studied.

Use Cases : Provide a description of how users use a particular feature of your website. They provide a detailed look at how users interact with the site, including the steps users take to accomplish each task.

You can do user research at all stages or whatever stage you are in currently. However, the Nielsen Norman Group advises that most of it be done during the earlier phases when it will have the biggest impact. They also suggest it’s a good idea to save some of your budget for additional research that may become necessary (or helpful) later in the project.

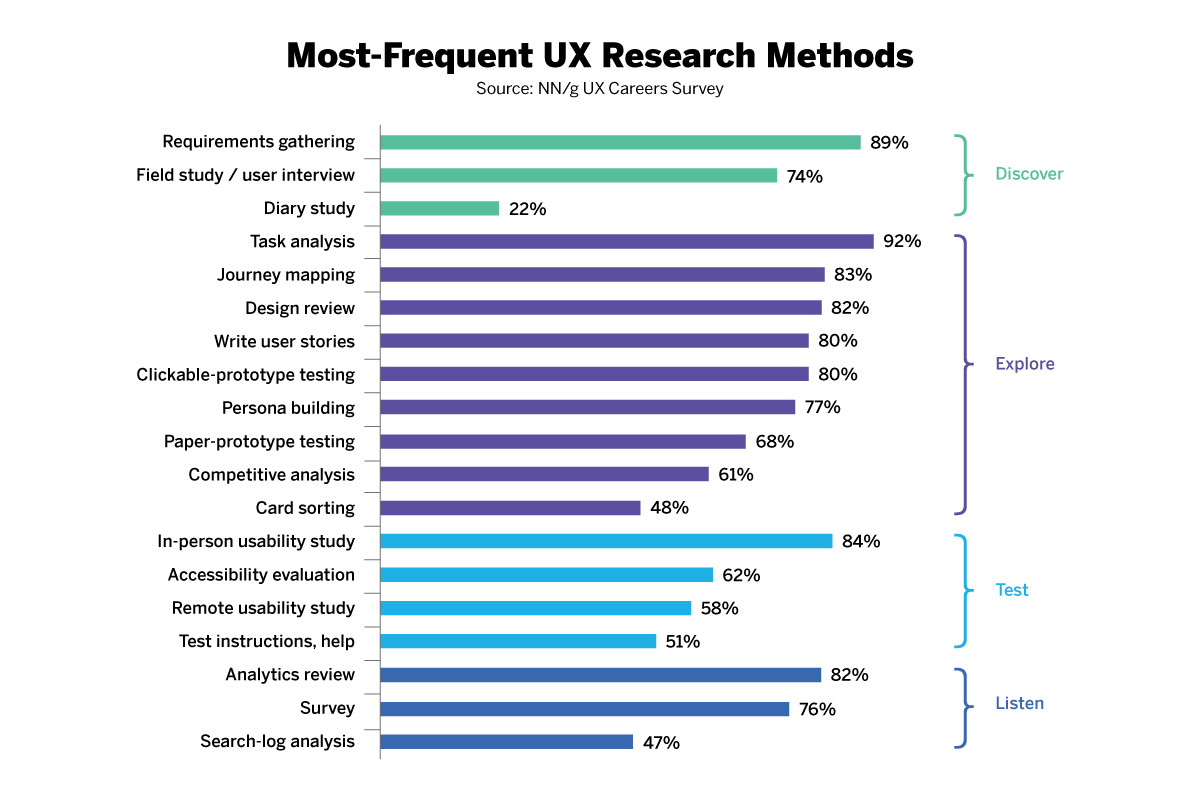

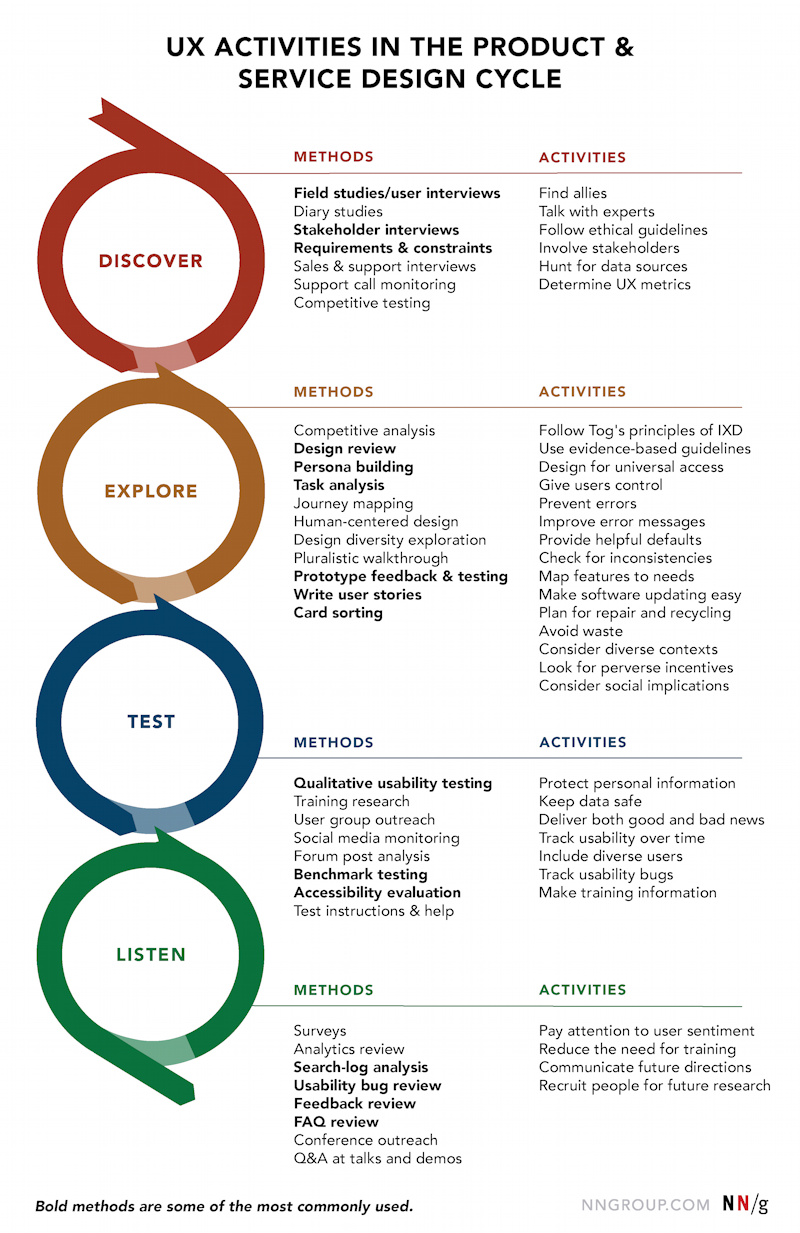

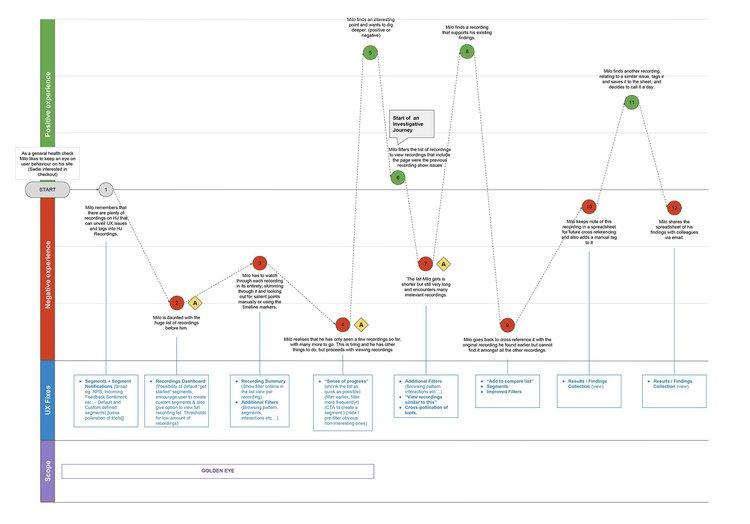

Here is a diagram listing recommended options that can be done as a project moves through the design stages. The process will vary, and may only include a few things on the list during each phase. The most frequently used methods are shown in bold.

Reasons for Doing UX Research

Here are three great reasons for doing user research :

To create a product that is truly relevant to users

- If you don’t have a clear understanding of your users and their mental models, you have no way of knowing whether your design will be relevant. A design that is not relevant to its target audience will never be a success.

To create a product that is easy and pleasurable to use

- A favorite quote from Steve Jobs: “ If the user is having a problem, it’s our problem .” If your user experience is not optimal, chances are that people will move on to another product.

To have the return on investment (ROI) of user experience design validated and be able to show:

- An improvement in performance and credibility

- Increased exposure and sales—growth in customer base

- A reduced burden on resources—more efficient work processes

Aside from the reasons mentioned above, doing user research gives insight into which features to prioritize, and in general, helps develop clarity around a project.

What Results Can I Expect from UX Research?

In the words of Mike Kuniaysky, user research is “ the process of understanding the impact of design on an audience. ”

User research has been essential to the success of behemoths like USAA and Amazon ; Joe Gebbia, CEO of Airbnb is an enthusiastic proponent, testifying that its implementation helped turn things around for the company when it was floundering as an early startup.

Some of the results generated through UX research confirm that improving the usability of a site or app will:

- Increase conversion rates

- Increase sign-ups

- Increase NPS (net promoter score)

- Increase customer satisfaction

- Increase purchase rates

- Boost loyalty to the brand

- Reduce customer service calls

Additionally, and aside from benefiting the overall user experience, the integration of UX research into the development process can:

- Minimize development time

- Reduce production costs

- Uncover valuable insights about your audience

- Give an in-depth view into users’ mental models, pain points, and goals

User research is at the core of every exceptional user experience. As the name suggests, UX is subjective—the experience that a person goes through while using a product. Therefore, it is necessary to understand the needs and goals of potential users, the context, and their tasks which are unique for each product. By selecting appropriate UX research methods and applying them rigorously, designers can shape a product’s design and can come up with products that serve both customers and businesses more effectively.

Further Reading on the Toptal Blog:

- How to Conduct Effective UX Research: A Guide

- The Value of User Research

- UX Research Methods and the Path to User Empathy

- Design Talks: Research in Action with UX Researcher Caitria O'Neill

- Swipe Right: 3 Ways to Boost Safety in Dating App Design

- How to Avoid 5 Types of Cognitive Bias in User Research

Understanding the basics

How do you do user research in ux.

UX research includes two main types: quantitative (statistical data) and qualitative (insights that can be observed but not computed), done through observation techniques, task analysis, and other feedback methodologies. The UX research methods used depend on the type of site, system, or app being developed.

What are UX methods?

There is a long list of methods employed by user research, but at its center is the user and how they think, behave—their needs and motivations. Typically, UX research does this through observation techniques, task analysis, and other UX methodologies.

What is the best research methodology for user experience design?

The type of UX methodology depends on the type of site, system or app being developed, its timeline, and environment. There are 2 main types: quantitative (statistics) and qualitative (insights).

What does a UX researcher do?

A user researcher removes the need for false assumptions and guesswork by using observation techniques, task analysis, and other feedback methodologies to understand a user’s motivation, behavior, and needs.

Why is UX research important?

UX research will help create a product that is relevant to users and is easy and pleasurable to use while boosting a product’s ROI. Aside from these reasons, user research gives insight into which features to prioritize, and in general, helps develop clarity around a project.

- UserResearch

Miklos Philips

London, United Kingdom

Member since May 20, 2016

About the author

World-class articles, delivered weekly.

By entering your email, you are agreeing to our privacy policy .

Toptal Designers

- Adobe Creative Suite Experts

- Agile Designers

- AI Designers

- Art Direction Experts

- Augmented Reality Designers

- Axure Experts

- Brand Designers

- Creative Directors

- Dashboard Designers

- Digital Product Designers

- E-commerce Website Designers

- Full-Stack Designers

- Information Architecture Experts

- Interactive Designers

- Mobile App Designers

- Mockup Designers

- Presentation Designers

- Prototype Designers

- SaaS Designers

- Sketch Experts

- Squarespace Designers

- User Flow Designers

- User Research Designers

- Virtual Reality Designers

- Visual Designers

- Wireframing Experts

- View More Freelance Designers

Join the Toptal ® community.

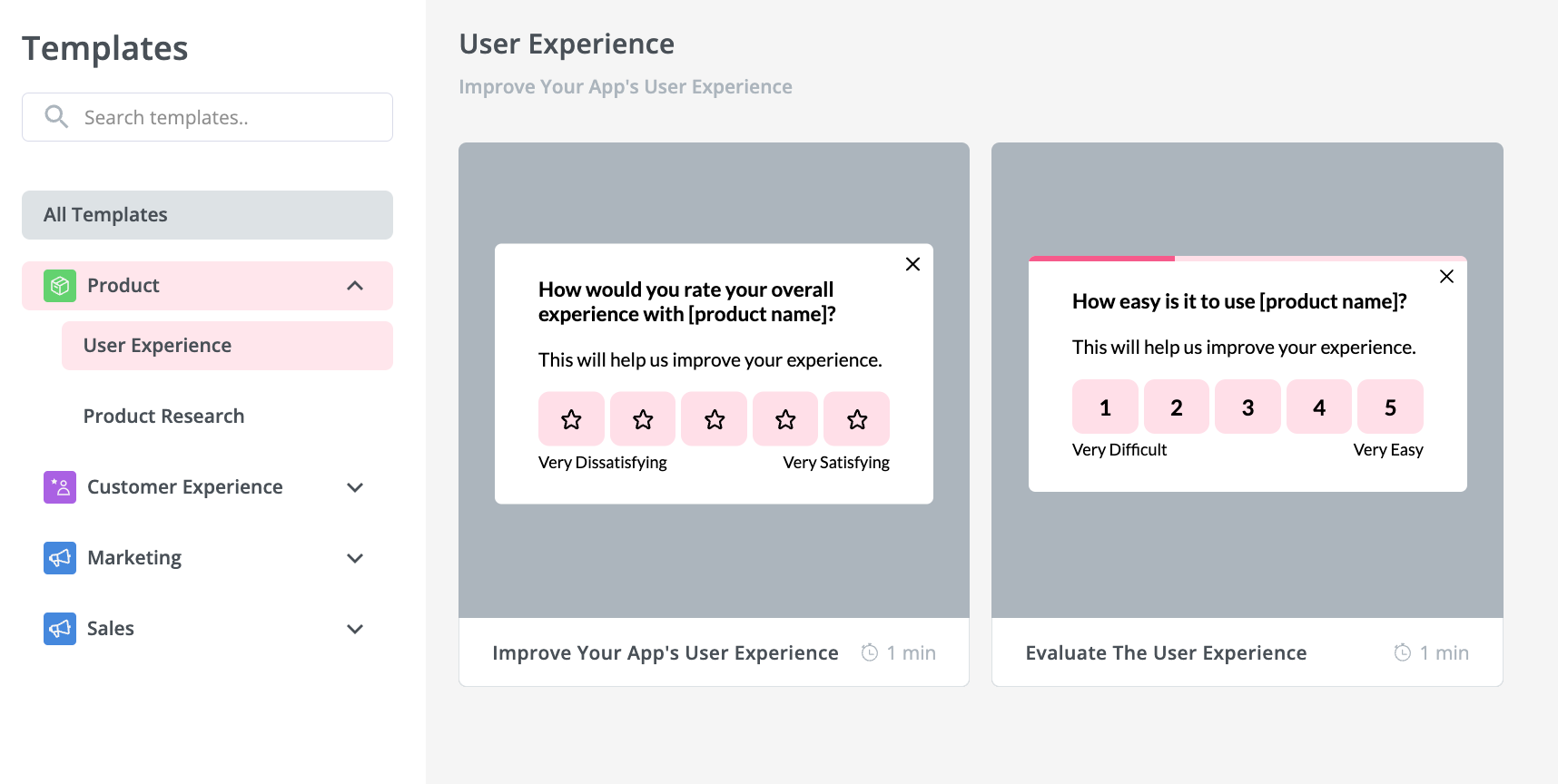

Integrations

What's new?

Prototype Testing

Live Website Testing

Feedback Surveys

Interview Studies

Card Sorting

Tree Testing

In-Product Prompts

Participant Management

Automated Reports

Templates Gallery

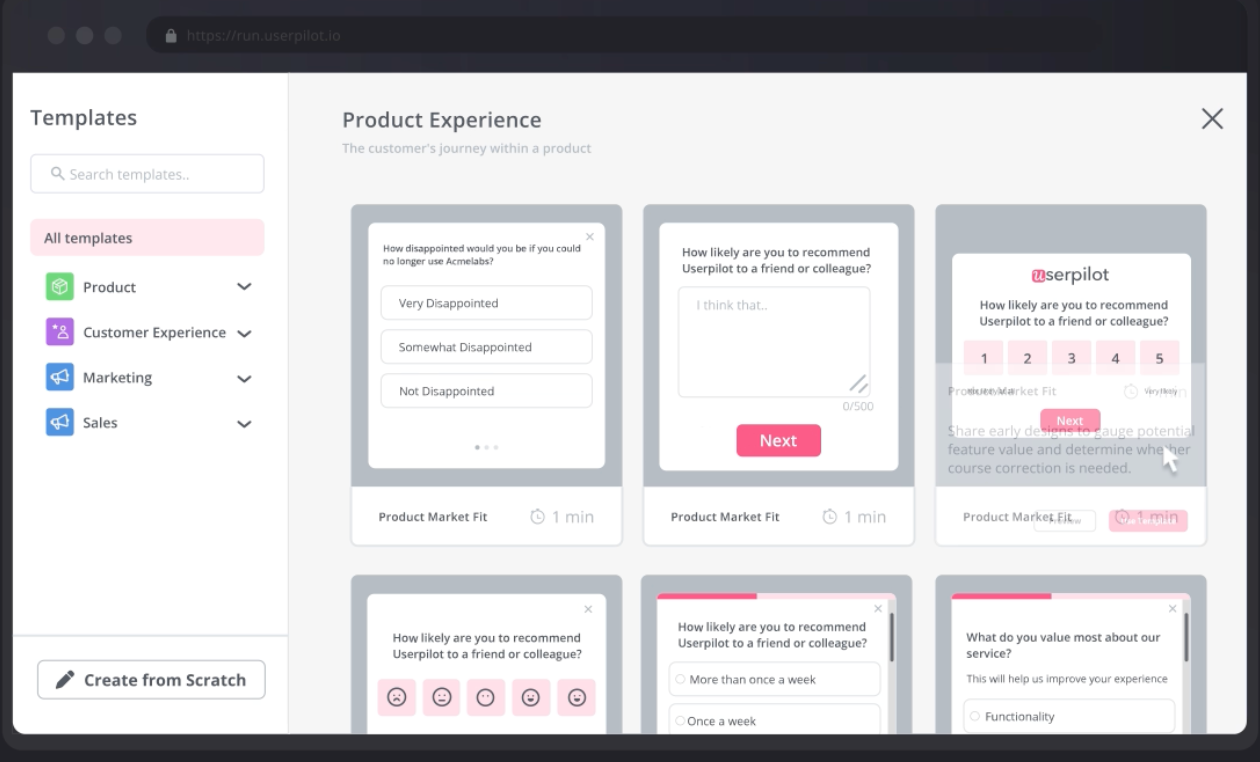

Choose from our library of pre-built mazes to copy, customize, and share with your own users

Browse all templates

Financial Services

Tech & Software

Product Designers

Product Managers

User Researchers

By use case

Concept & Idea Validation

Wireframe & Usability Test

Content & Copy Testing

Feedback & Satisfaction

Content Hub

Educational resources for product, research and design teams

Explore all resources

Question Bank

Research Maturity Model

Guides & Reports

Help Center

Future of User Research Report

The Optimal Path Podcast

Maze Guides | Resources Hub

What is UX Research: The Ultimate Guide for UX Researchers

0% complete

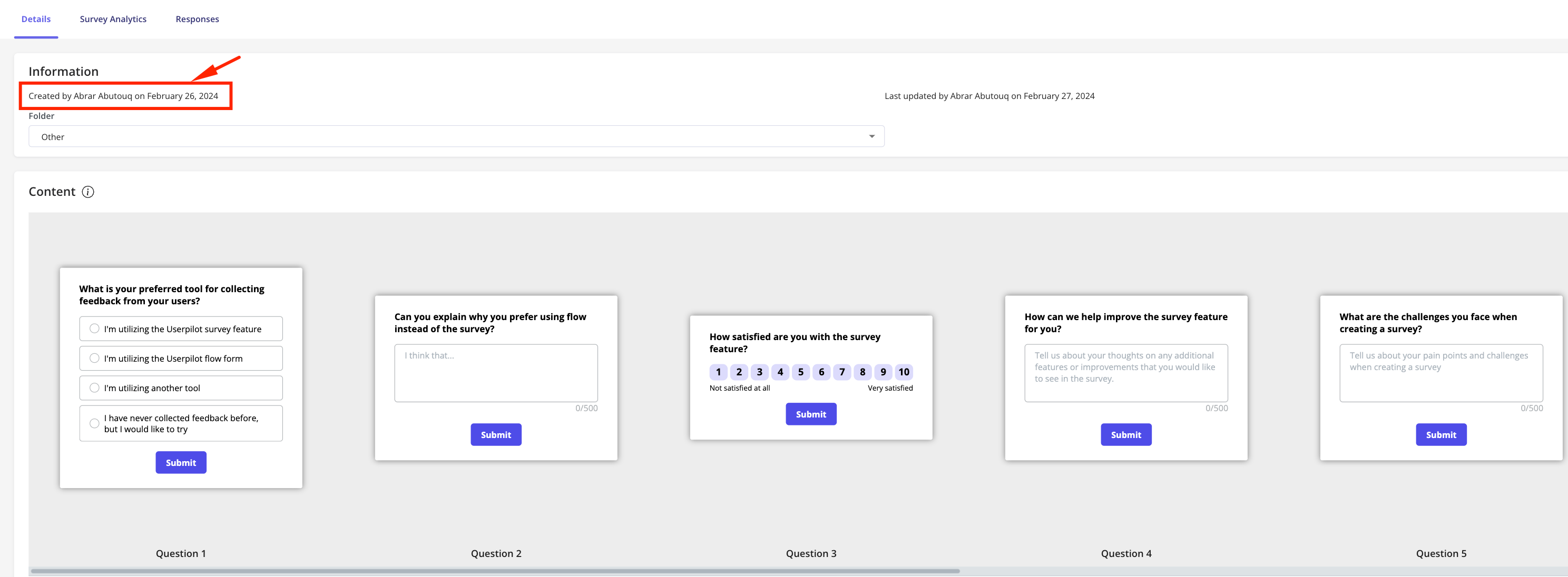

User experience research is a crucial component of the human-centered design process and an essential part of creating solutions that meet user expectations and deliver value to customers. This comprehensive guide to UX research dives into the fundamentals of research and its various methods and includes tips and best practices from leading industry experts.

Make informed design decisions with user research

Validate ideas, test prototypes, assess usability, and deliver real, actionable insights to your product team.

UX research: Your ultimate guide to nailing user experience and exceeding expectation

User experience research, or UX research , is the process of gathering insights about users' behaviors, needs, and pain points through observation techniques and feedback methodologies. It’s a form of user research that looks at how users interact with your product, helping bridge the gaps between what you think users need, what users say they need—and what they actually need.

The goal of UX research is to understand your users and gain context and perspectives to help make informed decisions and build user-centered products. It’s an essential part of designing, developing, and launching a product that will be an instant hit—but it should also be used throughout the product’s lifecycle post-launch to keep updated, and ensure new features are relevant to your audience.

As Sinéad Davis Cochrane , UX Manager at Workday, explains: “UX research represents insights gathered directly from users and customers, that helps you make product decisions at every stage of the development process.”

Is UX research the same as user research?

The terms ‘user research’ and ‘UX research’ are often used interchangeably, but they do differ. User research is the parent of UX research; it’s a broader research effort that aims to understand the demographics, behaviors, and sentiments of your users and personas.

UX research, on the other hand, is a type of user research that’s specific to your product or platform. Where user research focuses on the user as a whole, UX research considers how they interact with, respond to, and feel about your product or concept itself.

In both cases, the overarching goal is to get to know your users, understand what they need from your product, gain context to help make informed decisions, and build human-centered experiences.

Involve your users at every stage of your design process

Create research projects with Maze using customizable templates, and start making data-informed product decisions

Why is conducting UX research important?

In an ideal world, users would find your product easy to navigate, your net promoter score (NPS) would be off the charts, and you’d see adoption and activation rates skyrocket. In reality, however, this can be a challenging dream to achieve—but it is possible. The only way to build a product that users really resonate with is by involving them throughout the development process and building with them.

UX research is more than just a single ‘step’ in the development process: it should happen continuously, throughout the product lifecycle—so whether you’re building new products or iterating on existing ones, every decision is informed by user insights.

Here’s what you can achieve with continuous UX research:

Make informed decisions based on data

Our 2023 Continuous Research Report shows that 74% of people who do research (PWDR) believe research is crucial to guiding product decisions. Plus, 60% of respondents find that user recommendations inspire new product ideas.

Getting stakeholder buy-in to product decisions can be challenging, but when you suggest changes based on UX research, you have data to back up your suggestions. Your users inform your product, becoming the decision-makers as well as the customer.

UX research helps reduce and mitigate the risk of building the wrong thing—or building the right thing in the wrong way.

Sinéad Davis Cochrane , UX Manager at Workday

Reduce bias in the UX design process

There are hundreds of cognitive biases identified by psychologists, many of which unknowingly influence our decisions and the products we build. But a key principle of great UX design is to put aside existing beliefs, and learn from your users.

“You have to be humble, optimistic, and open-minded,” says Bertrand Berlureau , Senior Product Designer at iMSA. Using effective UX research, you can root out bias or assumptions, and follow real human behavior to inform product decisions.

According to Sinéad, you should consider these questions early in the design process:

- “What are your assumptions?”

- “What are some of the assumptions you’ve been making about your end-users and product without any evidence?”

- “What are the anecdotes or coincidental pieces of information that you hold, and how can you challenge them?”

Biases can subconsciously affect research and UX design, and it can be tricky to identify them. The first step to overcoming cognitive biases is by being aware of them. Head to chapter three of our cognitive biases guide to discover how.

Test and validate concepts

The power of UX research is that it can prove you right or wrong—but either way, you’ll end up knowing more and creating a product that provides a better user experience. For Bertrand, an idea without a test is just an idea. So, before the design process, his team starts with these user research methods:

- Face-to-face and remote user interviews

- Focus groups

- Co-creativity sessions through design sprints, quick prototyping, and hypothesis concepts

- User testing

UX research is the only way to unequivocally confirm your product is solving the right problem, in the right way. By speaking directly to real users, you can pinpoint what ideas to focus on, then validate your proposed solution, before investing too much time or money into the wrong concept.

Work on solutions that bring real value to customers

Another main benefit of UX research is that it allows product teams to mitigate risk and come up with products users want to use. “One of the main risks we need to control is whether users actually want to use a solution we've implemented,” explains Luke Vella , Group Product Manager at Maze. “UX research helps us reduce this risk, allowing us to build solutions that our customers see as valuable and make sure that they know how to unlock that value.”

Luke works on pricing and packaging, an area that requires constant user research. On one hand, he and his team want to understand which problems their users are facing and come up with plans to satisfy those different needs. On the other hand, they need to make sure they can monetize in a sustainable way to further invest in the product. You can only get this perfect balance by speaking to users to inform each step of the decision.

Market your product internally and externally

UX research also plays a crucial role in helping product marketers understand the customer and effectively communicate a product's value to the market—after all, a product can only help those who know about it.

For example, Naomi Francis , Senior Product Marketing Manager at Maze, uses different research methods to inform marketing strategy. Naomi conducts user interviews to build personas, using user research to collect insights on messaging drafts, product naming, and running surveys to gather user feedback on beta products and onboarding.

Understanding how and why customers need and use our product pushes marketing launches to the next level—you can get a steer on everything from messaging to language and approach.

Naomi Francis , Senior Product Marketing Manager at Maze

Types of UX research

All UX research methods fit into broader UX research techniques that drive different goals, and provide different types of insight. You can skip to chapter seven for a rundown of the top 9 UX research methods , or keep reading for a deep dive on the main types of UX research:

- Moderated and unmoderated

- Remote and in-person

- Generate and evaluate

- Qualitative and quantitative

- Behavioral and attitudinal

Where moderated/unmoderated and remote/in-person refer to the way research is conducted , the other types of UX research reflect the type of data they gather.

The most powerful insights come from a mixture of testing types—e.g. attitudinal and behavioral, generative and evaluative, and quantitative and qualitative. You don’t need to run all types of research at all times, but you’ll benefit from gathering multiple types of data throughout different stages of product development.

Moderated research

Moderated research is any research conducted with a facilitator or researcher present. A moderator may observe research sessions and take notes, ask questions, or provide instruction to participants where needed.

Like all research, it’s crucial a moderator doesn’t overly guide participants or influence results. Due to certain types of cognitive biases , people may behave differently while being observed, so researchers often opt for unmoderated methods to avoid results being impacted.

UX research methods for moderated research

- User interviews to speak directly with your target user face-to-face

- Focus groups to gather feedback on a variety of topics

- Moderated usability testing to hear the thought process behind the actions

Unmoderated research

As the name suggests, unmoderated research refers to the lack of a moderator. Often used in tandem with remote research , users complete tasks independently, guided by pre-written instructions.

Unmoderated research is helpful to ensure users are acting entirely of their own volition, and it has a lower cost and quicker turnaround than moderated research—however it does require efficient planning and preparation, to ensure users can navigate the tasks unaided.

UX research methods for unmoderated research

- Unmoderated usability testing to see how easily users navigate your product

- Live website testing to witness users interacting with your product in real time

- Surveys to have users answer specific questions and rate design elements

Remote research

An incredibly flexible approach, remote research is often favored due to its time-to-results and cost savings. Remote research can be moderated or unmoderated, and is conducted using UX research tools which record user behavior, feedback, and screen recordings.

Another key benefit is its reach and accessibility—by moving research to a virtual platform, you can access users from anywhere in the world, and ensure research is inclusive of those with different abilities or requirements, who may otherwise be unable to take part in traditional in-person research.

UX research methods for remote research

- Usability testing to evaluate how accessible your product is

- Card sorting to understand how users categorize and group topics

- Concept testing to assess what ideas users are drawn to

- Wireframe or prototype testing to invite users to test a rough version of the design

In-person research

Research conducted in-person is typically more expensive, as it may require travel, accommodation, or equipment. Many traditionally in-person research methods can easily be performed remotely, so in-person research is often reserved for if there’s additional needs for accessibility, or if your product requires physical testing, safety considerations or supervision while being tested.

UX research methods for in-person research

- Guerrilla research to speak to random users and gather feedback

- User interviews to connect with users and read body language

- Field studies to gauge how your product fits into a real world environment

Generative research

Generative research provides a deep understanding of your target audience’s motivations, challenges, and behaviors. Broadly speaking, it pinpoints a problem statement, identifies the problem to be solved, and collects enough data to move forward.

It should happen before you even begin designing, as it helps you identify what to build, the types of problems your user is facing, and how you can solve them with your product or service.

UX research methods for generative research

- Field studies to get familiar with users in their authentic environment

- User interviews to ask open-ended questions about pain points

- Diary research to keep a log of users’ behaviors, activities, and beliefs over time

- Open card sorting to have users define and name their own categories

Evaluative research

Evaluative research focuses on evaluating a product or concept in order to collect data that will improve the solution. Evaluative research usually happens early on and is used in a continuous, iterative way throughout the design process and following launch. You can use this type of UX research to assess an idea, check navigation, or see if your prototype meets your user’s needs.

UX research methods for evaluative research

- Usability testing to see if your platform is easy and intuitive to use

- A/B testing two versions of a design to see which one works best

- Tree testing to assess if your website’s information architecture (IA) makes sense

- Five-second tests to collect first impressions

Behavioral research

This type of research refers to observation—it’s human nature that sometimes what we say, or what we think we’ll do doesn’t match up to what we actually do in a situation. Behavioral research is about observing how users interact with your product or how they behave in certain situations, without any intervention.

UX research methods for behavioral research

- Observation in labs or real environments to witness behavior in real time

- Tree testing to view which paths users take on a website

- Diary research to see how users interact with your product in real life

Attitudinal research

Attitudinal research is the companion to behavioral research—it’s about what people say, and how they feel. In attitudinal research, you ask users to share their own experiences and opinions; this may be about your product, a concept, or specific design element. With a mix of attitudinal and behavioral research, you can get a broader picture of what your user truly needs.

UX research methods for attitudinal research

- Focus groups to understand users’ perspectives on your product

- User interviews to ask people questions about your product directly

- Surveys to gather insights on user preferences and opinions

Quantitative research

Quantitative and qualitative research methods are two types of research that can be used in unison or separately. Quantitative research comes from data and statistics, and results in numerical data.

It allows you to identify patterns, make predictions, and generalize findings about a target audience or topic. “[At iMSA] We analyze a lot of metrics and specific data like traffic analytics, chatbot feedback, user surveys, user testing, etc. to make decisions,” explains Bertrand. “The convergence of all the data, our user’s needs, governs the choices we make.”

Types of quantitative results you can find through UX research include:

- Time spent on tasks

- Net promoter score (NPS)

- System usability score (SUS)

- Number of clicks taken to complete a task

- Preference percentage on A/B tests

UX research methods for quantitative research

- A/B testing to see which option your users likes best

- Tree testing to get data on which paths users follow on your website

- Usability testing to get a score on system usability

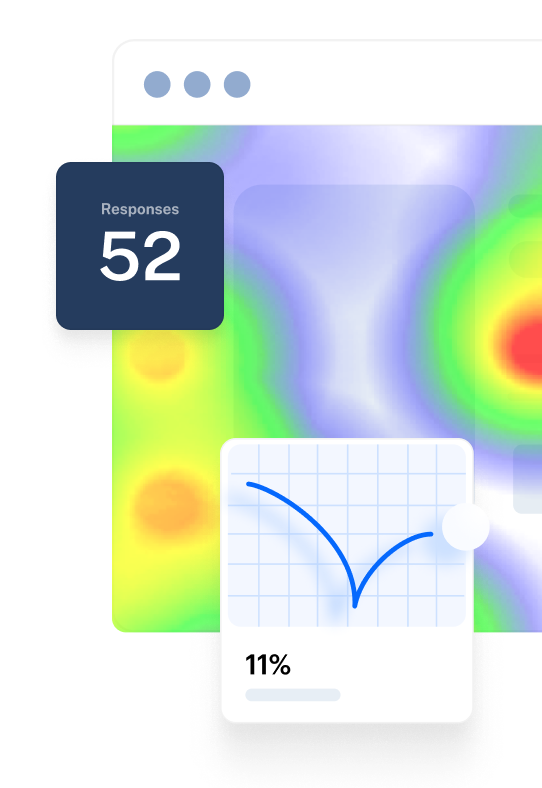

- Heatmaps to spot where users spend most of their session time

Qualitative research

Qualitative research is about understanding the why behind the data. It comes from comments, opinions, and observations—this type of research answers why and how users think or act in a certain way. Qualitative data helps you understand the underlying motivations, thoughts, and attitudes of target users. For this reason, attitudinal research is often qualitative (though not always).

UX research methods for qualitative research

- Interviews to discover your users’ motivations and frustrations

- Open question surveys to learn users’ pain points in their own words

- Focus groups to observe users’ interacting with your product

- Think aloud usability tests to hear commentary behind each user decision

💡 Product tip:

Maze allows you to record your participants' screen, audio, and video with Clips, so you can collect qualitative and quantitative insights simultaneously.

When should you conduct UX research?

The truth is, you should always be researching. When NASA wants to send a new shuttle into space, they don't build a rocket and launch it right away. They develop a design, test it in simulations and lab environments, and iterate between each stage. Only once they’ve run all the foreseeable scenarios do they put a person on the ship. Why should your product be any different?

With an overwhelming 83% of product professionals surveyed in our 2023 Continuous Research Report believing research should happen at all stages, it’s surprising that just 36% run tests after launch. While time and budget can make continuous research a challenge, testing at different stages gives you access to unique insights about your users and how they interact with your product.

That being said, if you can only afford to research a few times throughout the development process , here are some key moments to focus on:

Before developing the product

This is when you need to conduct the most extensive and detailed part of your research. During this phase, you’ll want to conduct generative research to get to know exactly:

- Who your user is

- The types of problems they’re facing (and what kind of product they want to solve them)

- What their expectations on a product or service like yours are

- What they like or dislike about your competitors

- Where they currently go to solve the mentioned problems

- What needs to happen for them to change companies (if they’re using a different product)

You can use a variety of UX research methods like focus groups and surveys to gather insights during this stage.

Remember: This step applies even if your product is already live, if you’re thinking of introducing a new feature. Validate your idea and investigate potential alternatives before you spend time and money developing and designing new functionality.

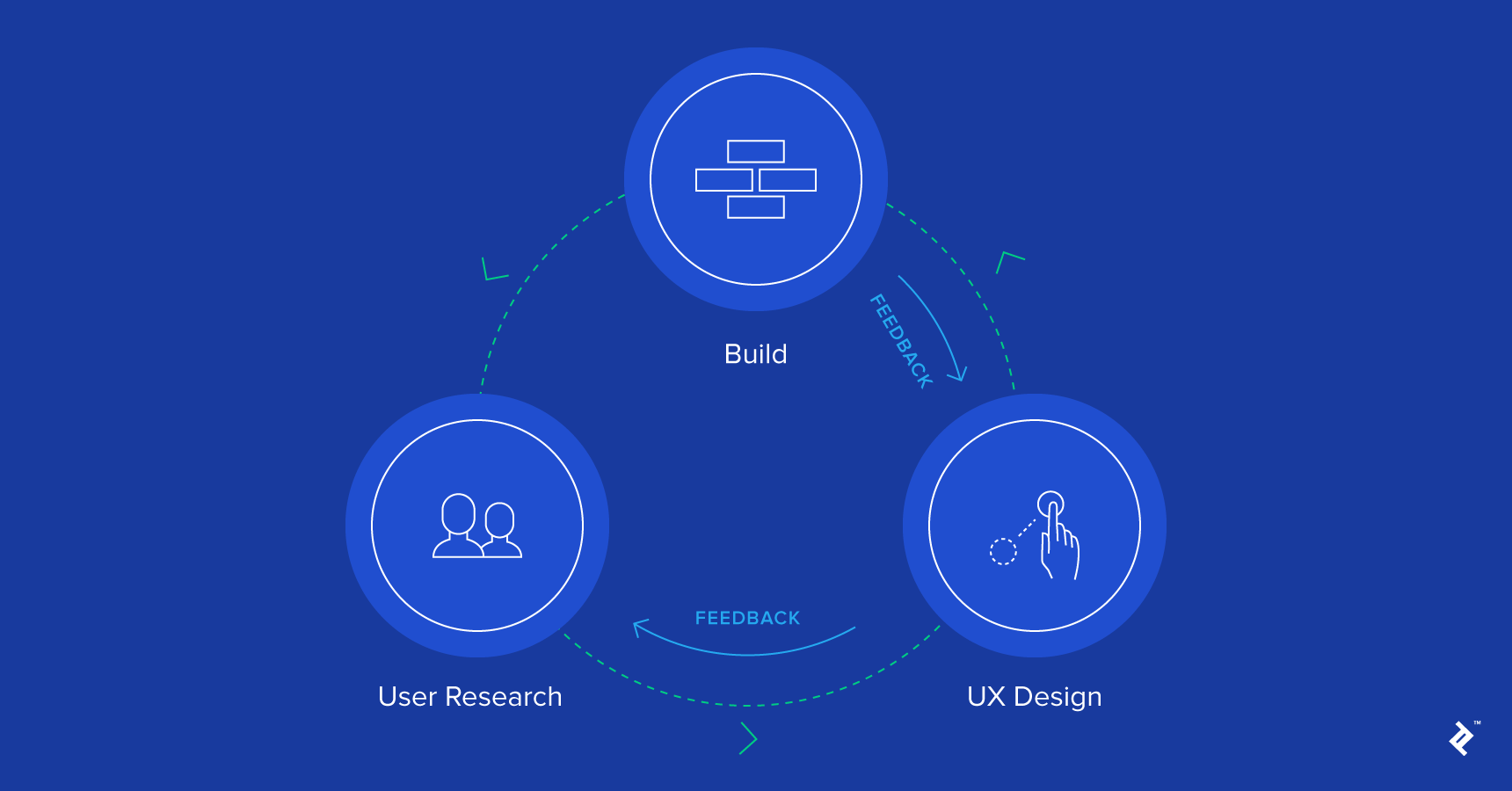

When you want to validate your decisions

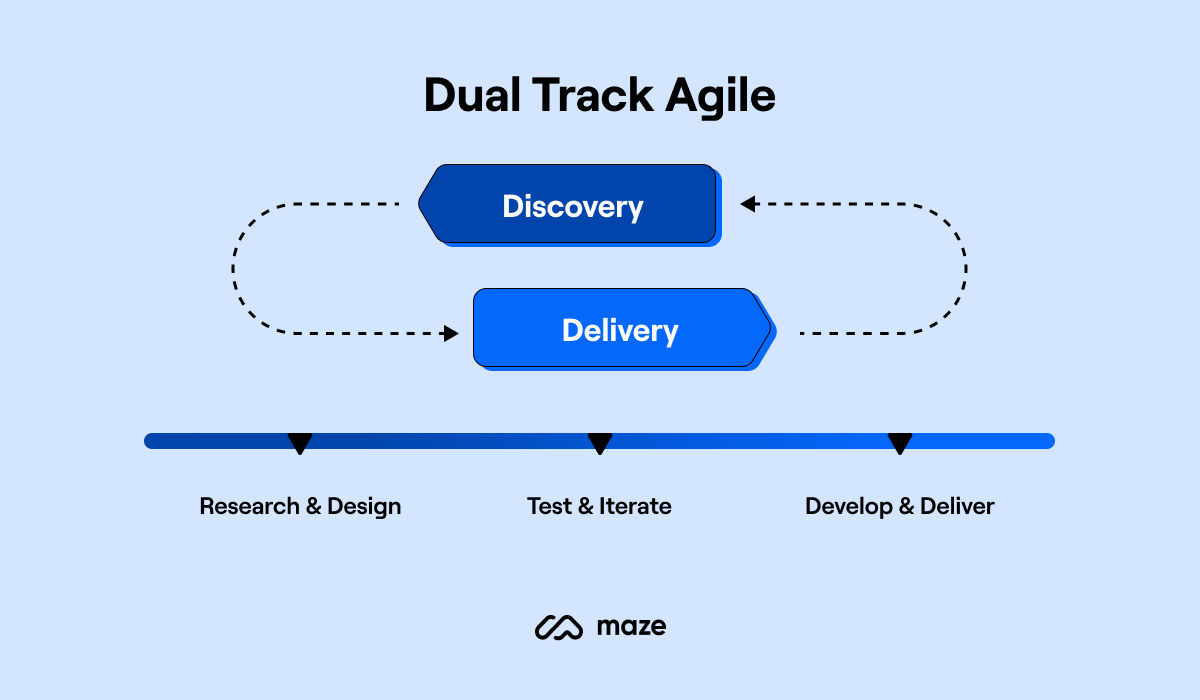

This is the point where you’ll run through a few cycles of researching, building, and iterating, before launching your product. The Maze Product team does this through continuous product discovery, via a dual-track habit:

Conduct research regularly while developing and building your product to see if you’re headed in the right direction. Let the research findings feed your deliverables.

Gather qualitative insights on user sentiment through surveys or focus groups. Test your wireframe or sketches to get quantitative answers in the form of clicks, heatmaps, or SUS. Use card sorting to generate ideas, tree testing to assess IA, or prototype testing to assess the usability of a beta version. The options are endless, so there’s no reason to miss maximizing your research at this stage and gather insights to power product decisions.

To evaluate product accessibility

Your product will be used by a multitude of diverse, unique users. Your research participants should be representative of your real audience, which means including all usage scenarios and user personas. Usability testing is one form of UX research that can be used here to ensure your product works for all its users, regardless of ability or need.

There are many ways to ensure your design is inclusive and accessible , including:

- Testing alt-texts, screen-reading capabilities, and color combinations

- Avoiding screen flashes or sudden pop-ups that may be triggering for certain conditions

- Being intentional in what language and imagery is used

Once your product is live

Research doesn’t end once you push your platform to production. Conduct Live Website Testing to evaluate how well your product is meeting your users' expectations and needs. This type of research invites you to answer the question: did we nail it?

Testing your live website also allows you to see how your users interact with your design in a real environment, so you can identify and solve mistakes fast. Pay close attention to loading times, error messages, and other quantitative data that may indicate bugs. You can also conduct regular sentiment checks by embedding feedback surveys into your product itself, to assess user satisfaction and NPS in a few clicks.

TL;DR: Why, how, and when to conduct UX research

The more you understand your customers, the better you can create products that meet expectations, tailor your strategy to their specific needs, and increase your chances for success. Plus, UX research allows you to create unbiased products that put your customers at the center of your business.

To conduct UX research, you’ll need to mix the stage of your product lifecycle with the right research type and methods. Meaning, while you need to conduct UX research continuously, you should look for different types of insights depending on the development stage you’re at and what your current objective is.

For example, if you want to test your live product, you should conduct a mix of quantitative and qualitative evaluative research. That means you might want to perform:

- Usability tests

- Feedback surveys

- Five-second tests

- Prototype testing

Now we’ve covered the what and why of UX research, let’s get into the how. Continue to the next chapter to learn how to create a UX research strategy that blows your competitors away.

Frequently asked questions

What are some examples of UX research?

Some examples of UX research include:

- A/B testing

- Prototype or wireframe testing

- Card sorting

- User interviews

- Tree testing

- 5-second testing

- Usability testing

What are the basics of UX research?

The basics of UX research are simple: you just need a clear goal in mind and a mix of quantitative and qualitative tests. Then, it's a case of:

- Determining the right testing methods

- Testing on an audience that’s an accurate representation of your real users

- Doing continuous product discovery

- Performing unbiased research to build an unbiased design

- Iterating and building user-centric products

UX research gets easier when you use a product discovery platform like Maze. This tool allows you to run multiple types of product research such as usability, prototype, card sorting, and wireframe tests—and get answers within hours.

Is UX research hard?

UX research isn’t hard, especially when you use an intuitive tool for product discovery—like Maze. Maze allows you to build tests using its multiple available templates. It also lets you bring your own users or recruit from its panel and creates an automated, ready-to-share metrics report. Maze gives you answers to tests within hours so you can improve your UX based on real user feedback fast.

Building a UX research strategy

What is UX Research? Methods, Process, Tools, Examples

Appinio Research · 15.02.2024 · 40min read

Ever wondered how successful products and services are meticulously crafted to cater to your needs and preferences? User Experience (UX) research is the key that unlocks the secrets behind creating user-centered designs. In this guide, we will delve deep into UX research, uncovering its methods, strategies, and practical applications. Whether you're a designer, developer, product manager, or simply curious about the science of user satisfaction, this guide will empower you with the knowledge and tools to understand, implement, and benefit from UX research principles.

What is UX Research?

User Experience (UX) Research is a systematic process of understanding and evaluating how users interact with a product, service, or system. It encompasses a wide range of research methods and techniques to gain insights into user behaviors, preferences, needs, and pain points. The ultimate goal of UX research is to inform and improve the design and functionality of products and services to enhance user satisfaction and usability.

Importance of UX Research

Effective UX research plays a pivotal role in shaping user-centered design and development processes. Its significance can be understood through several key points:

- User-Centered Design : UX research places users at the forefront of design decisions, ensuring that products and services are tailored to meet their needs and preferences.

- Enhanced Usability : Research findings lead to improvements that enhance the overall usability of products, reducing user frustration and increasing engagement.

- Cost Reduction : Identifying and addressing usability issues early in the design process can save time and resources by avoiding costly redesigns or post-launch fixes.

- Competitive Advantage : Organizations prioritizing UX research gain a competitive edge by delivering superior user experiences that attract and retain customers.

- Improved Customer Satisfaction : User satisfaction is closely linked to loyalty and positive word-of-mouth, making UX research an investment in long-term customer relationships.

- Data-Driven Decision-Making : Research data provides valuable insights that inform strategic decisions, reducing the guesswork and subjectivity in design choices.

UX Research Goals and Objectives

The primary goals and objectives of UX research revolve around understanding user needs, improving usability, and driving user-centered design. Here are the key objectives that guide UX research efforts:

- User Understanding : Gain a deep understanding of the target audience, including their demographics, behaviors, motivations, and pain points.

- Usability Evaluation : Identify usability issues and challenges users encounter during interactions with a product or service.

- Task Efficiency : Determine how efficiently users can accomplish tasks within a system, with a focus on minimizing friction and errors.

- User Satisfaction : Measure user satisfaction and gather feedback to uncover areas where improvements can enhance overall user experience.

- Feature Prioritization : Assess which features or functionalities are most valuable to users, guiding feature prioritization in development.

- Validation and Iteration : Validate design decisions through testing and iteration, ensuring that changes align with user expectations and preferences.

- Benchmarking : Establish benchmarks to track improvements over time and compare performance to industry standards.

- Evidence-Based Design : Base design decisions on empirical data and user insights, fostering a user-centered and data-driven design culture.

- Accessibility and Inclusivity : Ensure that products and services are accessible to a diverse range of users, including those with disabilities.

- Risk Mitigation : Identify and mitigate potential risks and challenges early in the design process, reducing the likelihood of post-launch issues.

- Continuous Improvement : Embrace a culture of constant improvement, where UX research is an ongoing process that informs product enhancements and updates.

By aligning research efforts with these objectives, organizations can create products and services that resonate with users, leading to increased user satisfaction and business success.

How to Plan UX Research?

Planning is the foundation of any successful UX research project. It sets the direction, defines your objectives, and ensures that your efforts are focused on achieving meaningful outcomes.

Setting Clear Objectives

Setting clear objectives is the first and most crucial step in planning UX research. Your objectives guide the entire research process, helping you stay on track and measure success effectively. When defining objectives, consider the following:

- Specificity : Objectives should be clear and specific. Vague goals can lead to ambiguous research outcomes.

- Relevance : Ensure that your objectives align with the overall goals of your product or project. How will the research contribute to the success of the endeavor?

- Measurability : Define objectives that are measurable. You should be able to determine whether you've achieved them or not.

- Timeframe : Consider the timeline for your research. Are your objectives achievable within the given time frame?

A well-defined objective might look something like this: "To identify pain points in our mobile app's onboarding process by conducting usability testing with 15 participants, with the aim of reducing drop-off rates by 20% within the next quarter."

Identifying Target Audience

Understanding your target audience is fundamental to effective UX research. Your product or service is designed for specific users, and knowing them intimately is essential. When identifying your target audience, keep the following in mind:

- Demographics : Who are your users? What are their age, gender, location, and other relevant demographics?

- Psychographics : Dig deeper into their lifestyles, values, interests, and behaviors. What motivates them, and what are their pain points?

- User Personas : Create user personas to visualize your target audience. Personas help in humanizing and empathizing with your users.

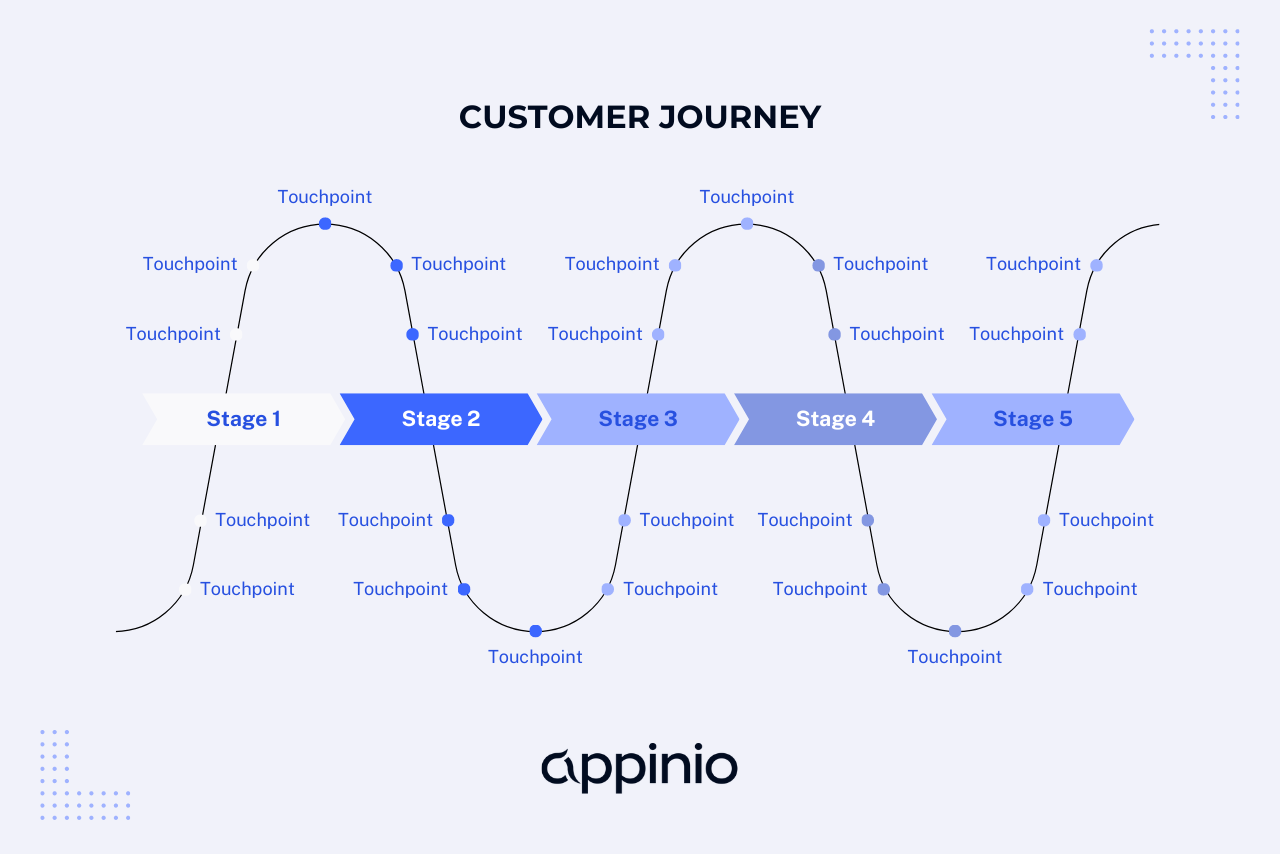

- User Journeys : Map out the typical user journeys to understand the various touchpoints and interactions users have with your product.

Defining Research Questions

Research questions act as the compass that guides your journey through the UX research landscape. They should be well-crafted and directly tied to your objectives. When defining research questions, consider the following:

- Open-Endedness : Craft questions that allow for open-ended responses . Closed-ended questions with yes/no answers can limit the depth of insights.

- Unbiased Language : Ensure that your questions are phrased in a neutral and impartial manner. Biased questions can lead to skewed results.

- Relevance : Are your research questions directly related to your objectives? Avoid asking questions that do not contribute to your research goals.

- User-Centered : Frame questions from the user's perspective. What would users want to know or share about their experience?

For instance, if your objective is to improve the checkout process of an e-commerce website, a research question could be: "What challenges do users encounter during the checkout process, and how can we simplify it to enhance their experience?"

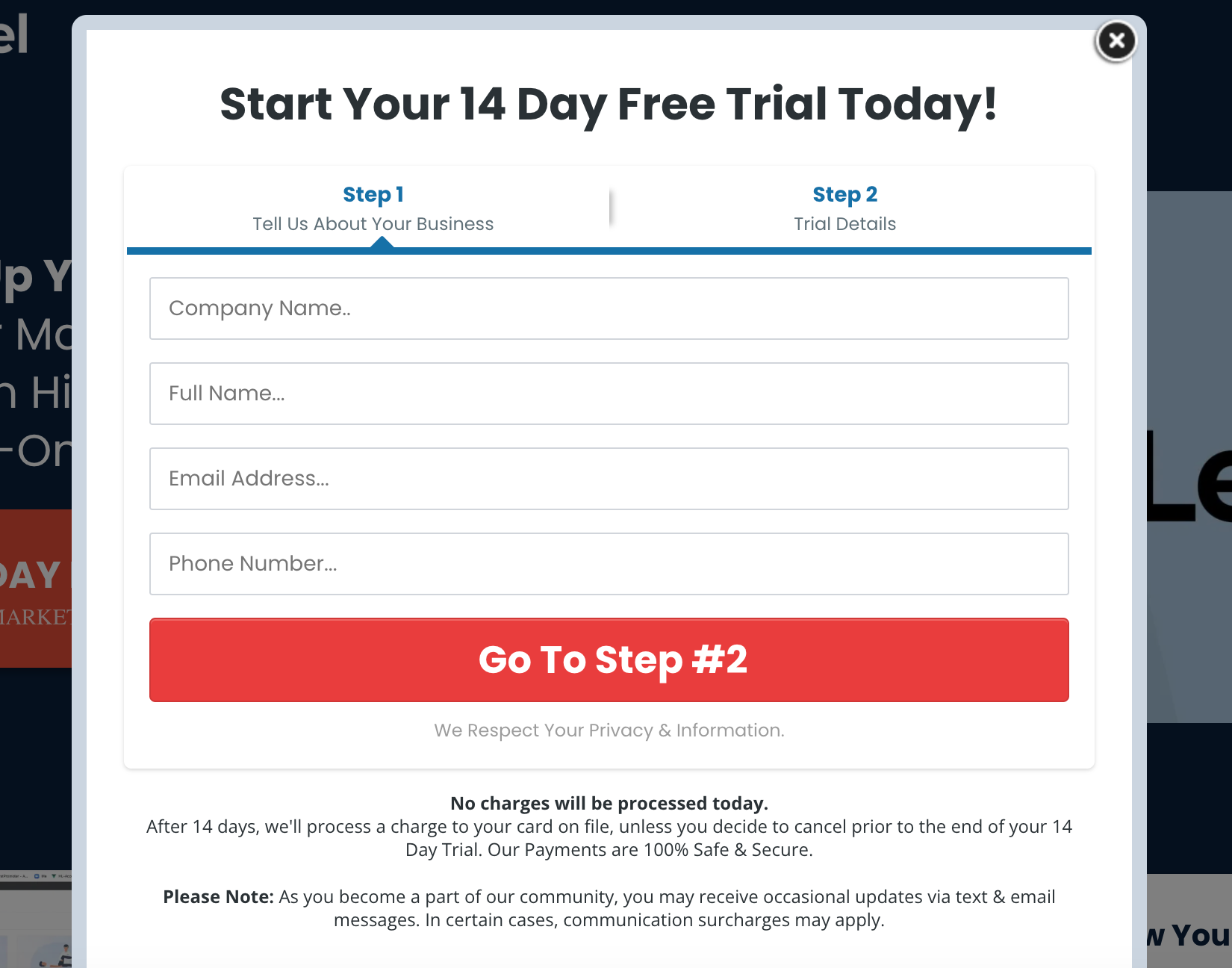

Budgeting and Resource Allocation

Effective UX research requires proper allocation of resources, both in terms of budget and personnel. Before embarking on your research journey:

- Financial Resources : Determine the budget available for your research project. This budget should cover participant incentives, research tools, and any other associated costs.

- Time Allocation : Allocate time appropriately for each phase of the research process, including recruitment, data collection, analysis, and reporting.

- Human Resources : Identify the team members or researchers responsible for conducting the research. Ensure they have the necessary skills and expertise.

- Tools and Software : Assess whether you have access to the required research tools, such as usability testing software, survey platforms, or analytics tools.

Proper budgeting and resource allocation prevent unexpected obstacles and ensure a seamless research process. Remember that investing in UX research is an investment in the overall success of your product or service.

Types of UX Research

When it comes to User Experience (UX) research, understanding the different types of research methodologies is crucial. Each type has its own strengths and applications, allowing you to gather specific insights into user behavior, preferences, and interactions. These are the three primary types of UX research.

Quantitative Research

Quantitative research focuses on collecting numerical data to quantify user behaviors, preferences, or attitudes. It involves systematic data collection and statistical analysis. Here's a deeper look into quantitative research:

- Data Collection : Quantitative research relies on structured data collection methods, such as surveys, questionnaires, or data analytics tools. These methods yield data in numerical form.

- Objective Measurement : It aims to provide objective and measurable data. This is particularly useful for answering questions like "How many users performed a specific action?" or "What percentage of users prefer feature A over feature B?"

- Large Sample Sizes : Quantitative research often involves larger sample sizes to ensure statistical significance. This allows for generalizable findings.

- Statistical Analysis : Statistical analysis plays a central role in quantitative research. It helps identify trends, correlations, and patterns within the data.

- A/B Testing : A common application of quantitative research is A/B testing, where two versions of a design or feature are compared to determine which performs better based on quantifiable metrics.

Quantitative research provides valuable insights when you need to make data-driven decisions and understand the broader user trends and preferences within your target audience.

Qualitative Research

Qualitative research dives deep into the subjective aspects of the user experience. It seeks to understand the "why" behind user behaviors and motivations. Here's a closer look at qualitative research:

- Data Collection : Qualitative research relies on methods such as user interviews, usability testing, focus groups , and ethnographic studies. These methods capture rich, non-numerical data.

- Subjective Insights : Qualitative research aims to uncover subjective insights. It helps answer questions like "Why do users find a particular feature frustrating?" or "What emotions do users experience during a specific interaction?"

- Small Sample Sizes : Qualitative research typically involves smaller sample sizes but offers in-depth insights into individual experiences.

- Contextual Understanding : Researchers often engage with users in their natural environment or within the context of product use. This provides a holistic understanding of user behaviors.

- Thematic Analysis : Qualitative data is analyzed through techniques like thematic coding, where common themes and patterns in user feedback are identified.

Qualitative research is particularly valuable when you want to gain a deeper understanding of user needs, pain points, and the emotional aspects of their interactions with your product or service.

Mixed-Methods Research

Mixed-methods research combines elements of both quantitative and qualitative research approaches. It offers a comprehensive view of the user experience by leveraging the strengths of both methodologies. Here's what you need to know about mixed-methods research:

- Data Variety : Mixed-methods research involves collecting both numerical and non-numerical data. This includes quantitative data from surveys and qualitative data from interviews or observations.

- Holistic Insights : By combining quantitative and qualitative data, researchers can gain a more complete and nuanced understanding of user behavior and preferences.

- Sequential or Concurrent : Mixed-methods research can be conducted sequentially (first quantitative, then qualitative) or concurrently (simultaneously collecting both types of data).

- Data Integration : Researchers must carefully integrate and analyze the data from both sources to draw comprehensive conclusions.

- Complementary Insights : The aim is to complement the strengths of one method with the weaknesses of the other, providing a more well-rounded perspective.

Mixed-methods research is valuable when you want to explore complex user experiences, understand the reasons behind quantitative trends, or validate findings from one method with the other. It offers a holistic approach to UX research that can lead to more informed design decisions.

How to Conduct UX Research?

Now that you've laid the groundwork and explored the types of UX research, it's time to delve into the practical aspects of conducting UX research.

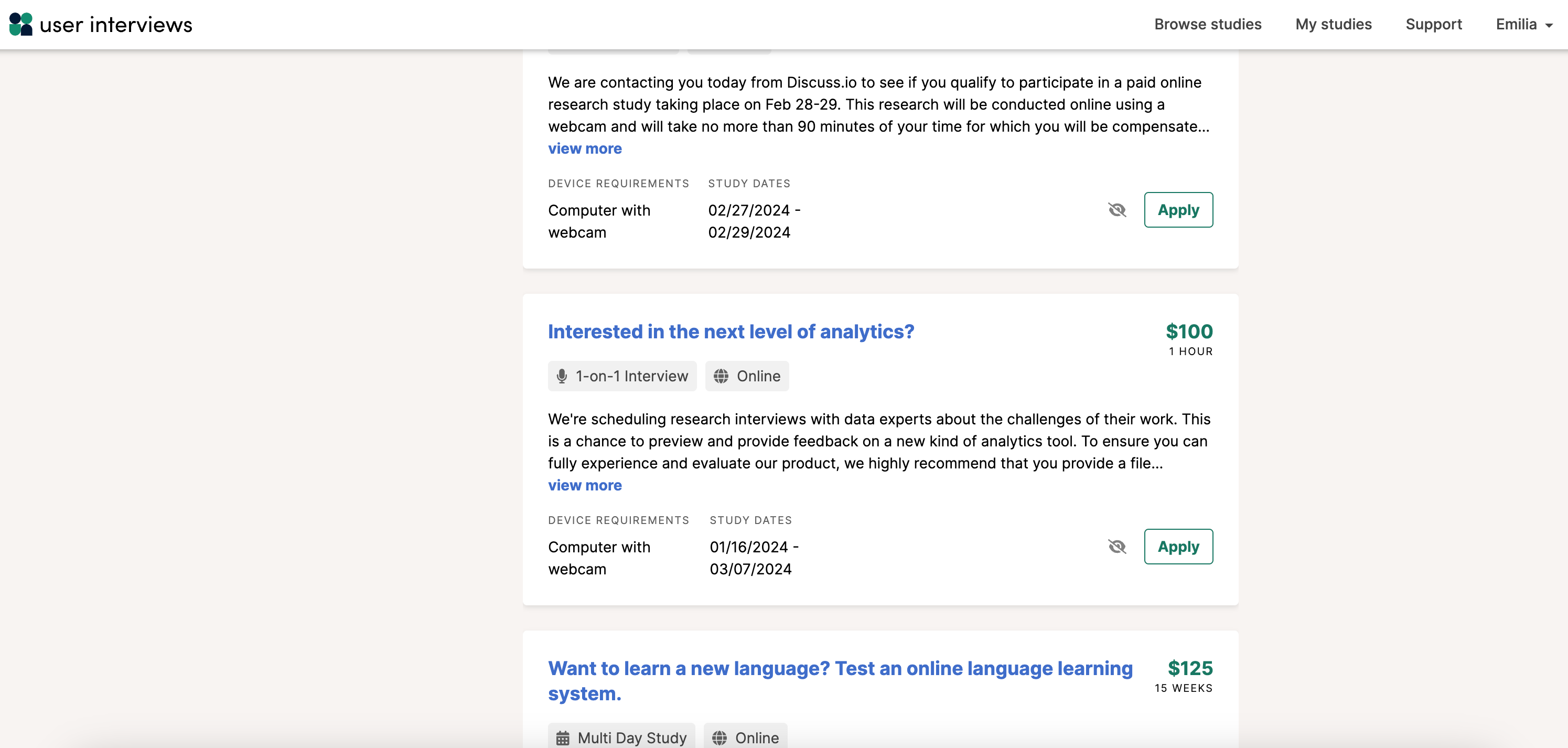

Recruitment: Finding the Right Participants

Recruiting participants is a crucial step in UX research. The quality of your research outcomes depends on selecting the right participants who represent your target audience. Here's how to do it effectively:

- Define Participant Criteria : Begin by defining specific criteria for your participants. These criteria should align with your research objectives. For instance, if you're testing a healthcare app, you might require participants who have experience with healthcare services.

- Recruitment Channels : Determine where and how you will find participants. Common recruitment channels include online platforms, user testing services, or in-house databases.

- Incentives : Consider offering incentives to motivate participants. This could be monetary compensation, gift cards, or access to your product or service.

- Screening : Screen potential participants to ensure they meet your criteria. Conducting a screening interview or questionnaire can help filter out inappropriate candidates.

Sampling: Choosing the Right Sample Size

Sampling involves selecting a subset of your target audience for research. The size and representativeness of your sample are critical for obtaining reliable results:

- Sample Size : Determine the appropriate sample size based on your research goals and statistical requirements. Larger samples enhance the reliability of your findings.

- Random Sampling : Whenever possible, aim for random sampling to reduce bias. Randomly selecting participants from your target population increases the likelihood of obtaining a representative sample.

- Stratified Sampling : In cases where certain user segments are essential, consider stratified sampling. This ensures that each segment is adequately represented in your sample.

Recruitment and sampling are foundational elements of UX research, ensuring that the data collected accurately reflects the perspectives of your intended user base.

Choosing the Right Data Collection Methods

Selecting the most suitable data collection methods is vital for gathering relevant and meaningful information. Depending on your research objectives, you can utilize various methods:

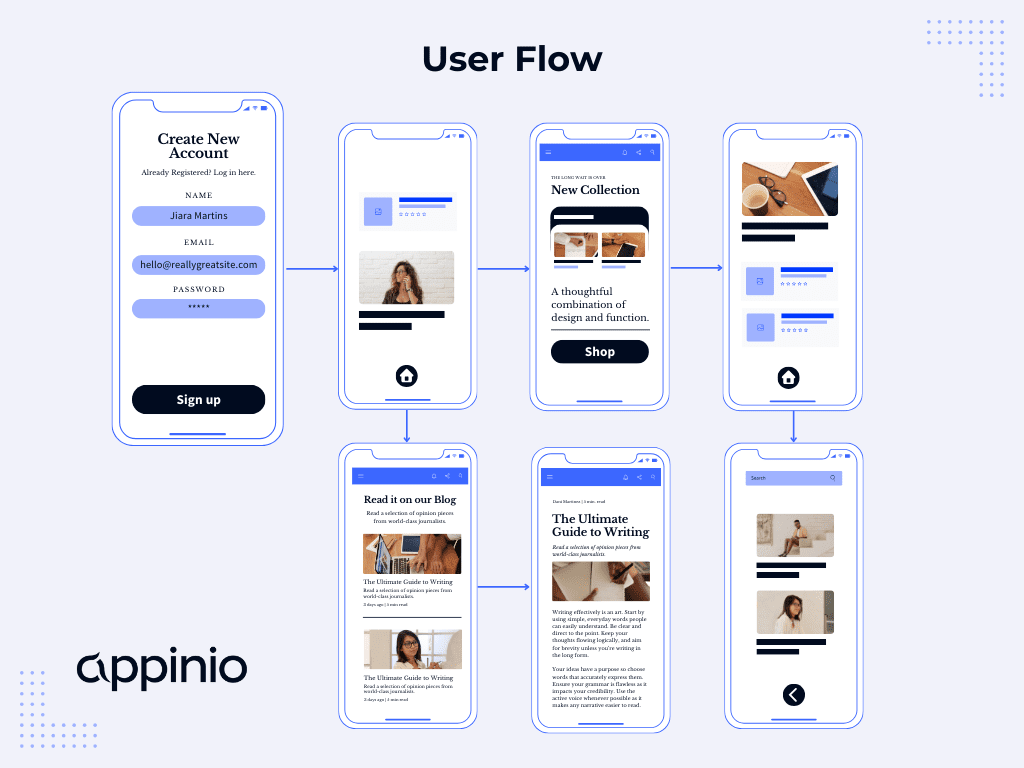

- Usability Testing : Usability testing involves observing users as they interact with your product or prototype. It provides direct insights into how users navigate and use your design.

- Surveys and Questionnaires : Surveys are useful for gathering structured, quantitative data. They allow you to collect responses from a large number of participants quickly.

- Interviews : Interviews offer a deeper understanding of user experiences by engaging participants in open-ended conversations. They are particularly effective for uncovering motivations and pain points.

- Observations : Observational studies involve watching users in their natural context, providing insights into real-world behavior.

- Eye-Tracking : Eye-tracking technology can reveal where users focus their attention within your design, helping to optimize layouts and content placement.

- Heatmaps : Heatmaps display aggregated user interactions, highlighting areas of interest and interaction intensity within your design.

- Card Sorting : Card sorting exercises help organize information and navigation structures based on how users group and label items.

Choosing the proper data collection methods depends on your research goals, the type of insights you seek, and the available resources. When it comes to data collection, Appinio offers a streamlined solution that simplifies the process and ensures actionable results.

With Appinio , you can effortlessly design surveys, target specific demographics, and gather insights from a diverse pool of respondents. Whether you're conducting usability testing, administering surveys, or conducting interviews, Appinio provides the tools you need to make informed decisions quickly and efficiently.

Ready to elevate your UX research? Book a demo with Appinio today and experience the power of real-time consumer insights firsthand!

Book a Demo

Making Sense of Collected Data

Once data is collected, the next step is to analyze it effectively. Proper data analysis is critical for drawing meaningful insights and conclusions:

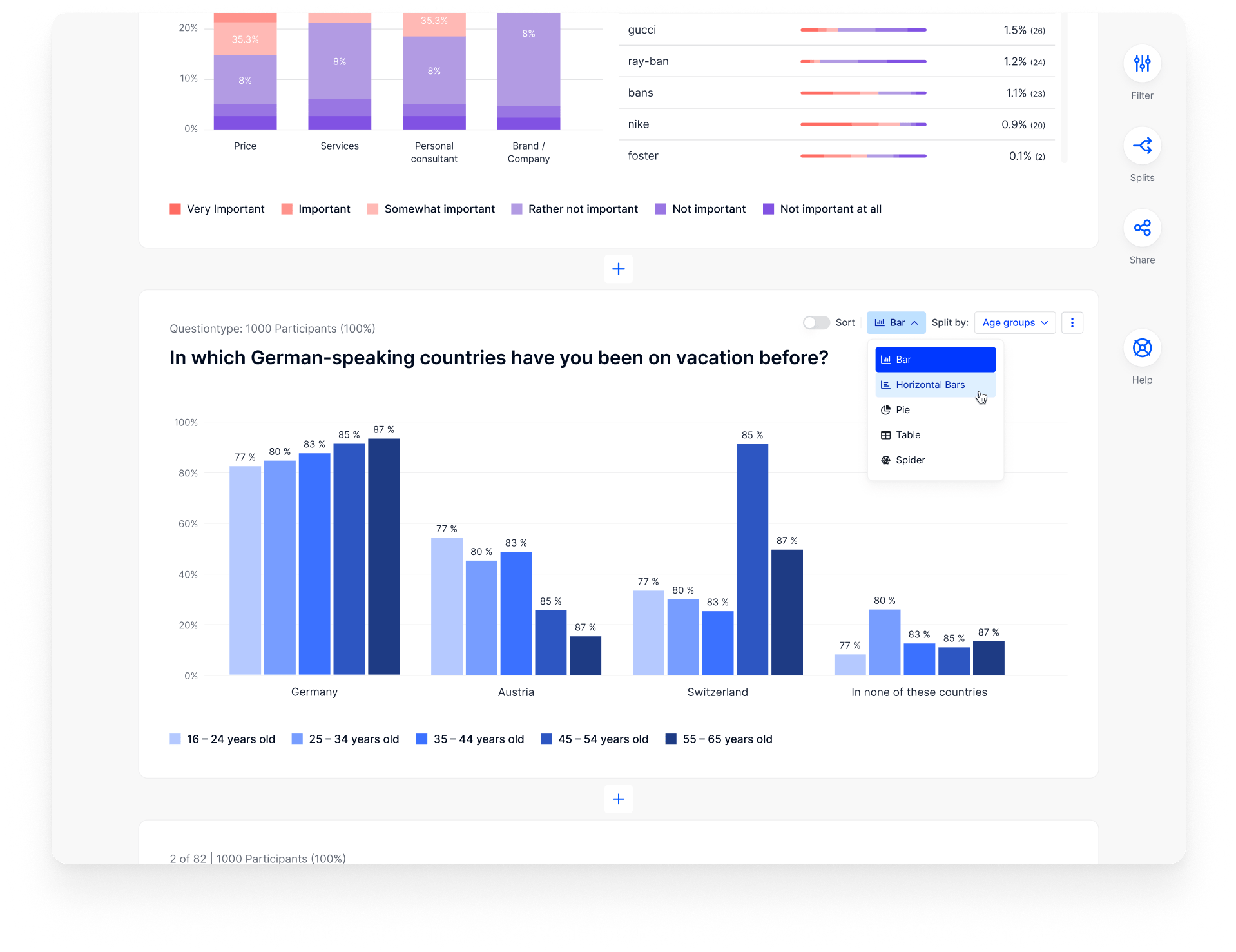

- Quantitative Analysis : For quantitative data collected through surveys or analytics, use statistical analysis techniques to identify patterns, correlations, and statistically significant findings.

- Qualitative Analysis : Qualitative data, such as interview transcripts or open-ended survey responses, requires thematic coding and content analysis to uncover themes, trends, and user sentiments.

- Mixed-Methods Integration : In mixed-methods research, integrate both quantitative and qualitative data to provide a comprehensive understanding of the user experience.

- Usability Metrics : When conducting usability testing, use established usability metrics such as task completion rates, time on task, and error rates to evaluate user performance.

- Data Visualization : Visualize your data using charts, graphs, and diagrams to make complex information more accessible and understandable.

Data analysis transforms raw data into actionable insights that inform design improvements and decision-making.

Improving User Experience Through Testing

Usability testing is a fundamental UX research method that involves observing users as they interact with your product or prototype. It helps identify usability issues and gather direct feedback for improvement:

- Test Planning : Begin by creating test scenarios and tasks that align with your research objectives. Determine what you want participants to accomplish during the test.

- Recruitment : Recruit participants who match your target audience and meet your criteria. Ensure they represent the diversity of your user base.

- Moderated vs. Unmoderated Testing : Choose between moderated (where a facilitator guides participants) and unmoderated (participants complete tasks independently) usability testing, depending on your needs and resources.

- Task Observation : Observe participants as they navigate your design, paying attention to their interactions, struggles, and feedback.

- Think-Aloud Protocol : Encourage participants to vocalize their thoughts and feelings during the test. This provides insights into their cognitive processes.

- Post-Test Interviews : Conduct post-test interviews to gather deeper insights. Ask participants about their overall experience, pain points, and suggestions for improvement.

- Iterative Testing : Usability testing is often an iterative process. After making design changes based on feedback, conduct additional tests to validate improvements.

Usability testing helps uncover issues that may not be apparent through other research methods, leading to improved user satisfaction and product usability.

Collecting Quantitative Insights

Surveys and questionnaires are valuable tools for collecting structured, quantitative data from a large number of participants. They can provide insights into user preferences, satisfaction, and demographics:

- Survey Design : Carefully design your survey or questionnaire , ensuring questions are clear, concise, and relevant to your research objectives.

- Sampling : Distribute your survey to a representative sample of your target audience to obtain meaningful results.

- Response Scale : Choose an appropriate response scale, such as Likert scales or multiple-choice questions, depending on the type of data you want to collect.

- Pre-Testing : Before launching your survey, conduct pre-testing to identify and address any potential issues with question wording or survey flow.

- Data Analysis : Once survey responses are collected, perform statistical analysis to uncover patterns and correlations within the data.

Surveys and questionnaires are efficient tools for gathering quantitative data, making them ideal for measuring user satisfaction, preferences, and trends.

Interviews and Observations