Hacking the Case Interview

Have an upcoming valuation case interview and don’t know how to prepare? We have you covered!

In this article, we’ll cover what a valuation case interview is, a step-by-step guide to solve any valuation case, and a comprehensive review of the major valuation methodologies.

If you’re looking for a step-by-step shortcut to learn case interviews quickly, enroll in our case interview course . These insider strategies from a former Bain interviewer helped 30,000+ land consulting offers while saving hundreds of hours of prep time.

What is a Valuation Case Interview?

A valuation case interview is a type of interview commonly used in management consulting and finance to assess a candidate's analytical, quantitative, and problem-solving skills.

In a valuation case interview, candidates are presented with a business scenario that involves determining the value of a company, an asset, or an investment opportunity.

The candidate is expected to use financial modeling, data analysis, and critical thinking to arrive at an appropriate valuation.

The case typically involves evaluating various factors such as financial statements, market trends, industry benchmarks, growth projections, and relevant economic indicators.

Candidates may be asked to perform calculations, create financial models, and provide a well-reasoned recommendation based on their analysis.

Valuation case interviews not only assess a candidate's ability to perform financial analysis but also evaluate their communication skills, as candidates are required to explain their thought process, assumptions, and findings to the interviewer.

These interviews are common in fields like investment banking, private equity, consulting, and corporate finance, where accurate valuation is crucial for decision-making.

How to Solve a Valuation Case Interview

There are eight major steps in a valuation case interview. Although these are the major steps, know that each valuation case interview can be slightly different.

Depending on your interviewer, they may spend more time on certain steps than others. They may also choose to skip certain steps that they feel are unnecessary for the discussion.

1. Understand the objective

This foundational step involves clarifying the scope of the valuation and its purpose within the context of the case.

Whether you are valuing a company, a project, an asset, or something else, it's crucial to define precisely what is being valued and the reasons behind the valuation.

This understanding serves as a guiding beacon for the rest of your analysis, helping you tailor your approach and focus on the most relevant data and methodologies.

A clear grasp of the valuation objective demonstrates your ability to extract critical information from the case prompt and ensures that your subsequent analysis is aligned with the intended outcome.

By establishing a solid foundation in this step, you set the stage for a well-structured and insightful valuation analysis that addresses the core challenges presented in the case.

2. Gather information

Once you've comprehended the valuation objective, you need to identify the key factors and variables that will influence your analysis.

This may include financial statements, industry benchmarks, market trends, growth projections, and more. Efficient data collection demonstrates your research skills and your ability to pinpoint the essential components driving the valuation.

As you accumulate data, you'll start forming an initial understanding of the company's financial health, competitive landscape, and potential risks.

This knowledge will be invaluable as you move forward to apply appropriate valuation methods.

3. Select a valuation method

The next step involves selecting the appropriate valuation method based on the nature of the business and the available data.

Common valuation methods include:

- Market Capitalization : Values the company based on its current stock price multiplied by the total number of outstanding shares.

- Discounted Cash Flow (DCF) Analysis : Calculates the present value of future cash flows generated by the company.

- Comparable Company Analysis (CCA) : Compares the company's financial metrics to similar publicly traded companies to estimate its value (e.g., using an earnings, revenue, EBITDA multiple)

- Precedent Transaction Analysis (PTA) : Examines the valuation multiples of similar companies based on their historical transactions.

- Book Value : Calculates the company's net worth by subtracting its liabilities from its assets.

- Liquidation Value : Estimates the value of the company's assets if it were to be liquidated.

- Replacement Cost : Determines the cost to replace the company's assets with equivalent new assets.

- Asset-based Approach : Calculates the company's value based on the fair market value of its assets.

Each method has its strengths and limitations, and your choice should align with the company's characteristics and the information you've gathered.

For instance, if you're valuing a stable and mature company with reliable cash flows, Discounted Cash Flow (DCF) might be suitable.

On the other hand, if market data for similar companies is readily available, Comparable Company Analysis (CCA) could be more relevant.

This step showcases your analytical acumen and ability to tailor your approach to the specific case. By justifying your method selection with clear reasoning, you'll demonstrate your expertise in translating theoretical concepts into practical decision-making tools.

4. Perform financial analysis and calculate the valuation

Afterwards, you'll apply the chosen valuation method to the company's financial data and industry benchmarks. This is where your quantitative skills come to the forefront.

For example, for a Discounted Cash Flow (DCF) analysis, you'll forecast the company's future cash flows, apply a discount rate to account for the time value of money, and calculate the present value of those cash flows.

As another example, for a Comparable Company Analysis (CCA), you'll identify publicly traded companies similar to the target company, gather their financial ratios, and apply those ratios to the target company's financial data.

This step showcases your ability to handle complex calculations and interpret financial metrics.

Precision, attention to detail, and a solid understanding of financial concepts are crucial to ensure accurate results that form the basis of your valuation.

5. Perform sensitivity analysis

Once you've derived your valuation estimate, it's crucial to assess its sensitivity to changes in key assumptions.

This step demonstrates your understanding of the potential risks and uncertainties that can impact the valuation.

By tweaking variables like growth rates, discount rates, or terminal values, you can gauge how different scenarios might influence the valuation outcome. This showcases your ability to think beyond the numbers and consider the broader business context.

It's a reflection of your analytical rigor and strategic mindset, as you'll be able to discuss how changes in market conditions, competitive dynamics, or industry trends could affect the valuation result.

Sensitivity analysis reveals your ability to anticipate challenges and make more informed decisions under various circumstances, a skill highly valued in consulting and financial roles.

6. Check reasonableness

It's essential to perform a reasonableness check on your calculated valuation.

This step involves using your business intuition and understanding of industry norms to ensure that the valuation result aligns with the reality of the company's performance and market conditions.

By comparing your valuation estimate to comparable companies' valuations, recent transactions, or industry benchmarks, you can identify any glaring discrepancies that might indicate errors in your assumptions or calculations.

Additionally, considering qualitative factors such as the company's competitive landscape, growth potential, and economic trends helps ensure that your valuation aligns with logical expectations.

Demonstrating your ability to critically evaluate your results and validate them against real-world context showcases your analytical rigor and ability to provide practical insights, both of which are highly valued in consulting and finance roles.

7. Present your findings

In the final step of solving a valuation case interview, you’ll present your findings.

It's crucial to effectively communicate your findings to the interviewer. Clear and concise communication is a key skill in consulting and other professional fields.

Begin by summarizing the key details of the case, including the company's background, the valuation method used, and the main assumptions made.

Present your calculated valuation and the reasoning behind it, highlighting the critical drivers that influenced the outcome.

Articulate any potential limitations or uncertainties in your analysis to show your awareness of the inherent complexities in valuation.

Delivering a well-structured and confident summary of your findings not only showcases your technical skills but also your capacity to translate insights into actionable recommendations, a quality highly valued in consulting roles.

8. Consider strategic implications

It can be helpful to go beyond just presenting your findings and talk through what the potential strategic implications are.

This is your opportunity to showcase your understanding of the broader business context and your capability to translate numerical findings into actionable insights.

Discuss how your valuation aligns with the company's current market position, growth prospects, and competitive landscape.

Highlight any potential areas of concern, such as overvaluation or undervaluation, and suggest strategies to address these issues.

Whether it's recommending expansion into new markets, optimizing operational efficiency, or considering potential mergers and acquisitions, your recommendations should be well-founded, innovative, and tailored to the company's unique circumstances.

This step allows you to demonstrate your ability to think strategically and provide value beyond numbers, qualities highly sought after in consulting and financial roles.

In addition to valuation case interviews, we also have additional step-by-step guides to: market entry case interviews , growth strategy case interviews , M&A case interviews , pricing case interviews , operations case interviews , marketing case interviews , and private equity case interviews .

Valuation Case Interview Examples

Valuation case interview example #1.

Your client, a private equity firm, is interested in investing in a technology startup. They have approached you to perform a valuation analysis of the startup. The startup operates in the e-commerce sector and has developed a cutting-edge platform that connects local artisans with customers seeking unique handmade products.

Your task is to determine the valuation of the startup using appropriate valuation methods and provide recommendations based on your analysis.

How to solve : The startup operates an e-commerce platform that connects local artisans with customers looking for unique handmade products. The platform aims to showcase artisanal craftsmanship and provide a marketplace for these products.

The startup provides the following financial information for the past year:

- Annual Gross Merchandise Value (GMV): $5 million

- Projected GMV Growth Rate: 25%

- Operating Expenses: $2 million

- Net Income: $1 million

- Estimated Discount Rate: 15%

We will use the Discounted Cash Flow (DCF) method and the Market Multiple method to determine the valuation of the startup.

After doing the analysis, suppose we get:

- DCF Valuation: $8.2 million

- Market Multiple Valuation: $7.5 million

Assess the reasonableness of the blended valuation estimate by comparing it with recent acquisitions or investments in the e-commerce sector.

Discuss the impact of variations in growth rates, discount rates, and key assumptions on the valuation. Highlight potential scenarios that could affect the valuation range.

Recommend a valuation range of $7.5 million to $8.2 million for the startup. Emphasize the startup's unique value proposition in connecting artisans with customers and the potential for growth in the e-commerce market.

Valuation Case Interview Example #2

Your client is a technology startup that is seeking investment from venture capitalists. They are looking to raise funds to expand their product line and market presence. As a consultant, your task is to perform a valuation analysis of the startup and recommend a valuation range for their company

How to solve : The startup is a technology company that has developed a cutting-edge software solution for streamlining supply chain operations. They provide real-time visibility into inventory levels, order status, and production schedules, helping companies optimize their supply chain efficiency.

- Annual Revenue: $2.5 million

- Projected Revenue Growth Rate: 30%

- Operating Expenses: $1.2 million

- Net Income: $800,000

- Estimated Discount Rate: 20%

We will use both the Discounted Cash Flow (DCF) method and the Comparable Company Analysis (CCA) method to determine the valuation of the startup.

- DCF Valuation: $6.8 million

- CCA Valuation: $7.5 million

Discuss the impact of changes in growth rates, discount rates, and key assumptions on the valuation. Highlight potential scenarios that could influence the valuation range.

Recommend a valuation range of $6.8 million to $7.5 million for the startup. Emphasize that the negotiation process with potential investors should consider the company's unique technology, growth prospects, and competitive landscape.

Valuation Case Interview Example #3

Your client is a manufacturing company interested in acquiring a competitor in the same industry. They have asked you to conduct a valuation of the target company to guide their acquisition strategy. The target company produces similar products and has a strong distribution network.

Your task is to determine the valuation of the target company and provide a recommendation for an offer price.

How to solve : The client, a manufacturing company, seeks to acquire a competitor with a similar product line and a robust distribution network. This acquisition would expand their market share and potentially provide operational synergies.

Collect financial data for both the client company and the target company:

- Client Company Revenue: $100 million

- Target Company Revenue: $60 million

- EBITDA Margin (both companies): 15%

- Industry Multiples: Average EV/EBITDA multiple of 8

We will use the Comparable Company Analysis (CCA) method and the precedent transaction method.

- Comparable Company Analysis Valuation: $72 million

- Precedent Transaction Valuation: $68 million

Discuss the sensitivity of the valuation to changes in EBITDA margin and industry multiples, as well as potential impacts on the acquisition strategy.

Recommend a valuation of $70.4 million for the target company. Emphasize that the acquisition aligns with the client's growth strategy and provides access to a stronger distribution network.

Recommended Case Interview Resources

Here are the resources we recommend to learn the most robust, effective case interview strategies in the least time-consuming way:

- Comprehensive Case Interview Course (our #1 recommendation): The only resource you need. Whether you have no business background, rusty math skills, or are short on time, this step-by-step course will transform you into a top 1% caser that lands multiple consulting offers.

- Hacking the Case Interview Book (available on Amazon): Perfect for beginners that are short on time. Transform yourself from a stressed-out case interview newbie to a confident intermediate in under a week. Some readers finish this book in a day and can already tackle tough cases.

- The Ultimate Case Interview Workbook (available on Amazon): Perfect for intermediates struggling with frameworks, case math, or generating business insights. No need to find a case partner – these drills, practice problems, and full-length cases can all be done by yourself.

- Case Interview Coaching : Personalized, one-on-one coaching with former consulting interviewers

- Behavioral & Fit Interview Course : Be prepared for 98% of behavioral and fit questions in just a few hours. We'll teach you exactly how to draft answers that will impress your interviewer

- Resume Review & Editing : Transform your resume into one that will get you multiple interviews

Land Multiple Consulting Offers

Complete, step-by-step case interview course. 30,000+ happy customers.

Valuation: the key to mergers and acquisitions

- Estimates and segmentation

- Profitability

- Competitive interaction

Example: Steel Producer Acquisition

Identify the problem, build a problem driven structure, lead the analysis and provide a recommendation.

Valuations are estimates of how much a company will be worth to a prospective buyer . The most important use for valuations in consulting interviews is in cases dealing with mergers and acquisitions . In order to weigh up our options in such scenarios, we need to be able to compare the potential gains or losses associated with various options - and this means we need to make valuations!

All the best resources in one place!

Risky business.

An important point to note straight off the bat is that valuations can only ever be estimates rather than absolute values. Because valuation fundamentally involves making predictions about the future, there will always be an element of uncertainly or risk . We address these sources of risk in some detail - as well as drilling down into many of the other issues here in more depth - in our full length lesson on valuation in the MCC Academy . Here, though, we will have to confine our briefer discussion to the more immediate nuts and bolts of how valuations are made.

We'll explore the theory around valuation through a reasonably straightforward case study which hinges on your valuing a company .

Let's say your interviewer gives you the following case prompt:

"Our client is a steel producer who wants to expand by acquiring their competitor. The competitor offers to sell their plant for $1M. Should our client accept the deal at this price or not?"

Working through this case will provide a great introduction to valuation!

As always, your first step in tackling a case should be to correctly identify the problem . This is quite straightforward given this case prompt. In order to work out whether the client should be willing to pay the $1m asking price, we ultimately need to work out what the steel producer is worth to them . That is, we have to establish the value of this second steel plant to our client, to see whether it is worth paying $1m for .

Varieties of value

This might seem simple enough - however, we have not quite narrowed down the specific problem to be addressed yet. There is an extra layer of complexity to consider when identifying the problem in the case dealing with valuation.

Prep the right way

This is because there is not one single "value" concept for us to reach for. Instead, the word "value" can refer to several distinct quantities, all of which might be of interest in different contexts. These various varieties of value can be somewhat bamboozling at first, as some are radically distinct from other, whilst some are subsets of one another,. We need to be clear exactly which kind of value we are trying to calculate!

In this case study, what we are interested in is the value which acquiring this second steel producer will offer for our specific client. This quantity is referred to as the Asset Value or the Total Enterprise Value (TEV) .

It's all relative...

Note that this value is inherently relative to a particular buyer and will be different for different individuals. In our case, the value of the steel producer will likely be very different for our client, whom is already involved in the industry, to the value which might be derived from a buyer with no existing interests in steel. What we are calculating here is the price which it makes sense for a certain individual to pay for the asset in question .

Now we know exactly which kind of value we are trying to figure out, it's time to get on and figure out how we are going to get to an answer. This means structuring our approach to the problem .

The TEV of the second steel producer can be calculated as the sum of the "standalone" or "market" value of that company plus any "synergies" which emerge when it is combined with our client's operation. Those synergies can be further divided into revenue synergies and cost synergies . Segmenting the problem in this manner yields the following structure:

That was quick enough, but now we need to turn our attention to what the contents of those boxes actually mean...

Standalone Value

We'll deal with synergies shortly, for now, let's focus on how we might calculate the standalone value of an asset - the second steel producer in our example. As per our remarks on the variety of valuations above, there are several ways in which we might go about estimating the standalone value of a company . Three of the most common are:

- Net Present Value This is generally the most robust method of company valuation and is the most commonly used in consulting interviews . This is the method we will use here and we will return to NPV below.

- Multiples This is a method of valuing a company based on the ratio between the company's value and some financial metric such as EBITDA - which stands for "Earnings Before Interest, Taxes, Depreciation and Amortisation", but which we can approximate as cash flow for the purpose of case interviews.

- Asset Based Valuation In some cases, the cash flow or similar of a company might misrepresent its value . This might be especially useful in cases concerning businesses like shipping or real estate companies, and especially any companies which might be loss-making, but hold a large volume of valuable assets . In such situations, an asset based valuation calculates the net present value associated with owning individual assets rather than for the company as a whole.

Net Present Value

Let's focus on the Net Present Value, which is more relevant to our example. The NPV represents the value today of the expected future cash flows of the company . This is often referred to as the value of cash flows in "perpetuity".

Join thousands of other candidates cracking cases like pros

Imagine you have the option to buy some bond which yields you a payment of $20 per year every year. The NPV of this bond is the amount which it would be sensible for you to pay today to receive this guarantee of $20 per year in perpetuity.

In our video lesson on valuation in the MCC Academy , we give a full explanation as to the rationale and mathematics underpinning NPV - which can be very important in tacking more complex case studies involving valuation . However, with limited space here, we'll skip straight to the payoff, and note that the NPV can be calculated via the following equation:

Discount rate

A crucial element of the Net Present Value equation is the discount rate (r). The discount rate effectively accounts for the intuitive fact that a dollar today is not worth the same as the guarantee of a dollar one year from now . In normal circumstances, having the same amount of money immediately will be more valuable than having the same amount at some later point in time. For instance, if you are given your dollar right away, you might deposit it in a savings account and earn interest , so you will have a dollar and a few cents more a year from now.

The discount rate will vary for different scenarios and you might be expected to make a reasonable estimation of its expected level for a case. Generally, the discount rate will be higher where a business venture is more risky . This reflects the higher interest rates which will be required by lenders or investors to entrust their money with a business has a higher risk of never managing to pay them back.

As a rule of thumb, you can think about a spectrum of discount rates ranging from 3% for a very safe business to 20% for a very risky venture .

Now, let's turn our gaze to synergies. The possibility of synergies is what will ultimately make our steel producer worth more or less to different buyers , as the new company may interact more or less beneficially with the companies or other assets they already own.

The idea that what one owns already determines how much one is willing to pay for new items if pretty intuitive. Imagine you are selling a collectable item - say a novelty teapot, baseball card or the like. You will obviously get a lot more for it if you find a buyer who needs that item to complete their collection! Higher up the value scale, effects like this are known to cause interesting phenomena in the art market . In particular, there are cases where it makes sense for buyers to pay as much as possible for a painting at auction, as the new market value will increase the prices of the other works in their collection by the same artist by an amount that more than compensates their extra expenditure.

Looking for an all-inclusive, peace of mind program?

Returning to our example, we can divide the possible synergies for our client in acquiring the steel producer into two sides - cost synergies and revenue synergies. Let's look at each in turn.

Cost synergies

Cost synergies are realised when the merging of two companies allows for the reduction of costs . Such synergies might be achieved in a few different ways. For instance:

- Merging cost centres Combining two companies can allow for the removal of duplicated structures or staff . In our example, the newly merged company might make cuts to staff in supporting roles such as HR, management or R&D.

- Economies of scale Increasing the size of a business often allows for savings to be made by procuring goods or services in larger volumes - and thus for lower prices . For example, steel manufacture will require both raw materials and fuel/energy and a larger operation buying larger volumes of these might be able to negotiate lower prices. Similarly, the larger company might be able to negotiate lower shipping costs on their outgoing products.

Revenue Synergies

Revenue synergies are realised when combining two companies allows them to increase the revenue they generate . A typical way of deriving revenue synergies is via cross-selling , where two merged companies can sell their products to each other's customers.

In our example, cross-selling would be a strong possibility where our client and the acquired producer have previously specialised in different parts of a full spectrum of steel products which the same customers might be interested in buying. For instance, say our client's company has previously only offered large, unshaped ingots of raw steel and the new producer has specialised in smaller slabs or pre-formed items. The newly merged entity could cross-sell to existing customers who need both kinds of product.

Otherwise, revenue synergy could be obtained even if the two had already been selling the same products to the same customers as the newly combined operation might allow the merged company to fulfil larger orders and so access new customers dealing in larger volumes.

Not always a good thing...

Note that synergies will not always be positive . It might be that merging two companies would actually cause problems. For example, it would be highly damaging from a brand perspective for a health food company to acquire a processed food producer, and could cost them a lot in sales. Brand will likely not be a major concern in the steel industry, but will often be crucial in other case.

With our structure complete, we can proceed to lead the analysis as usual. This will mean asking the interviewer a few considered questions in order to estimate values for the various elements of the structure . Once you have these values, calculating the value of the company is straightforward.

Let's say that, in our example, we valued the steel producer as being worth $1.5m. If there are no other opportunities available with higher values, then we should recommend that our client goes ahead with the acquisition. However, if our client could invest the same $1m in another company or set of assets valued at over $1.5m, then we should advise that they do this instead. Valuation has given us a means to objectively choose between opportunities.

Impress your interviewer

This article is a good primer on valuation, helping you get to grips with the main concepts and walking you through a relatively simple example of a valuation-based case study. However, the problems in your case interview are likely to be somewhat more involved. To get across all aspects of valuation in the detail you will need to land an MBB consulting job, the best resource is the "building blocks" section of the MCC Academy . There, our full length video lesson explores more complex aspects of valuation - including things like a full discussion of risk as it pertains to case studies and of the mathematics around net present value. We do our best, but it simply isn't possible to cram all this material into an article of this size!

For now, though, you should certainly start applying what you have learnt here to practice case studies . Remember to also check out our other building block articles on estimates , profitability , pricing and competitive interaction to learn about more themes that come up again and again in consulting interviews!

Find out more in our case interview course

Ditch outdated guides and misleading frameworks and join the MCC Academy, the first comprehensive case interview course that teaches you how consultants approach case studies.

Discover our case interview coaching programmes

Discover our career advancement programme

Account not confirmed

Use Our Resources and Tools to Get Started With Your Preparation!

Valuation cases usually require estimating the price of a firm, patent, or service in the market .

This type of case can either be a subset of an M&A case, in which you need to know a company's worth before purchasing, or a standalone case (rare). For instance, “How much is Pfizer worth today?” In strategy consulting, these questions are rather rarely seen. However, cases where you do need to valuate something usually start with “ How much would you pay for… ”

The most common methods of valuating are the Discounted Cash Flow (DCF) and the industry multiple method

As these are still case studies meant to fit in an interview round, the interviewer will very likely not ask you to perform an exact and comprehensive valuation analysis. Instead, you may be required to estimate the worth of a product, patent, or a service. You may also have to judge if an offered price is reasonable.

Discounted Cash Flow method

The first valuation method is the Discounted Cash Flow method. This method shows how much money you would have in your savings account at a certain interest rate in order to provide you with the same annual cash flow generated by the company that is being evaluated. Here, you simply divide projected annual cash flows by a discounted rate (or interest rate). Of course, the discount rate of your savings account will be much lower than that of an investment in a company. This is so because the risk you take putting your money in a savings account is much lower than the risk of investing in a company.

Industry multiple method

The DCF method is limited since it does not take into account additional dimensions other than money (unless you quantify those dimensions into the future cash flows).

Football teams, for instance, are often overvalued compared to their generated returns. For such cases, there is another method called the industry multiple method.

This method allows you to valuate a firm by using a metric known to this company and multiplying it by the associated industry multiple. This can be done for similar players in the industry to assess their relative valuations using benchmarking .

An example of a multiple ratio is the price-to-book ratio (P/B). This multiple is the ratio of the actual firm valuation (based for example on M&A deals) and the book value of the same firm (value of its assets, which can be found in the balance sheet ). If a firm’s assets added up to 200 million, and it was sold for 100 million, the ratio is 0.5 (100 million/200 million). Do this for a set of representative industry players, take the average and you get the average industry multiple. Finally, you multiply the industry multiple with the value of the assets.

Other commonly used ratios are the price-earnings ratio (P/E ratio or PER) and the EBITDA ratio.

Since you will not be required to calculate the value of an investment on too high a level of detail, it is not necessary to learn values for different interest rates or industry multiples by heart. However, to give you an idea about orders of magnitude:

- A good guess for an industry multiple is EBITDA*10.

- Good guesses for interest rates would range from 3% (inflation) to up to 20% for highly speculative investments.

Key takeaways

- Use the Discounted Cash Flow (DCF) method to valuate a firm based solely on its expected profits.

- Use the industry multiple method to double-check if the DCF valuation is reasonable. Sometimes other aspects need to be factored in like brand value, customer loyalty, liabilities, etc.

- There are several types of industry multiples to choose from. For more precise valuation, choose more types of industry multiples.

Related Cases

EY-Parthenon Case: Nachhaltiges Geschäftsmodell

FTI-Andersch AG Case: Funkstille – Kommunikationstechnik in der Krise

Mazars Case: Prüfung der Carvermietungen GmbH

Smart meters.

Caribbean Island – MBB Final Round

Corporate Valuation

A Practical Approach with Case Studies

- © 2023

- Benedicto Kulwizira Lukanima 0

Department of Finance and Accounting, Universidad del Norte, Barranquilla, Colombia

You can also search for this author in PubMed Google Scholar

- Provides students with basic knowledge and advance skills for addressing some practical challenges in valuation

- Features case studies, practical, reflective and review questions, and web links

- Features slides, quizzes, Microsoft Excel illustrations, working data and sample syllabi online for download

Part of the book series: Classroom Companion: Business (CCB)

8924 Accesses

1 Citations

1 Altmetric

This is a preview of subscription content, log in via an institution to check access.

Access this book

- Available as EPUB and PDF

- Read on any device

- Instant download

- Own it forever

- Durable hardcover edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

Tax calculation will be finalised at checkout

Other ways to access

Licence this eBook for your library

Institutional subscriptions

Table of contents (22 chapters)

Front matter, the concept of value, existence of a firm, and the objective value maximization, an overview of corporate valuation.

Benedicto Kulwizira Lukanima

Corporate Value Creation

Time value of money, security markets and valuation, financial information as a source of valuation inputs, an overview of financial information, the basics of financial statement analysis, profitability analysis, financial leverage analysis, market perception analysis, free cash flows, the cost of capital, an overview of capital structure and cost of capital, the cost of equity, the cost of debt, intrinsic valuation, estimating growth rates, free cash flow discount models: cost of capital approach.

- Corporate finance

- Corporate valuation

- Value maximization

- Cost of capital

- Intrinsic valuation

- Equity valuation

- Firm valuation

- Investment decision

- Financial statement analysis

- Intrinsic value

- Relative value

- market value

- valuation challenges

- valuation techniques

- value creation

- free cash flow

About this book

This book provides students with basic knowledge and advance skills for addressing practical challenges in valuation. First, the book presents financial information as a vital ingredient for performing corporate valuation. Second, the book presents key concepts of value and valuation and basic techniques for cash flow discounting. Third, the book offers an understanding of the reality of valuation, not simply as a numerical subject, as most people tend to think, but as a combination of objective and subjective aspects. Finally, it examines valuation in relation to the linkage between a firm’s objective, management role in value creation, investors’ decisions, and the valuation role of financial information.

This book is designed and presented to make valuation easily accessible while also not diluting the nature of its complexity. To assist in the learning experience, the author provides illustrative case studies using real world data and review questions tocover all concepts. To assist professors, slides, Microsoft Excel illustrations, working data and sample syllabi are available online for download.

Authors and Affiliations

About the author.

Benedicto Kulwizira Lukanima is Assistant Professor in the Department of Finance and Accounting at Universidad del Norte (Barranquilla, Colombia).

Bibliographic Information

Book Title : Corporate Valuation

Book Subtitle : A Practical Approach with Case Studies

Authors : Benedicto Kulwizira Lukanima

Series Title : Classroom Companion: Business

DOI : https://doi.org/10.1007/978-3-031-28267-6

Publisher : Springer Cham

eBook Packages : Economics and Finance , Economics and Finance (R0)

Copyright Information : The Editor(s) (if applicable) and The Author(s), under exclusive license to Springer Nature Switzerland AG 2023

Hardcover ISBN : 978-3-031-28266-9 Published: 05 August 2023

Softcover ISBN : 978-3-031-28269-0 Due: 05 September 2023

eBook ISBN : 978-3-031-28267-6 Published: 04 August 2023

Series ISSN : 2662-2866

Series E-ISSN : 2662-2874

Edition Number : 1

Number of Pages : XXVI, 705

Number of Illustrations : 14 b/w illustrations, 166 illustrations in colour

Topics : Business Finance , Financial Accounting , Financial Services , Macroeconomics/Monetary Economics//Financial Economics

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Business growth

Marketing tips

16 case study examples (+ 3 templates to make your own)

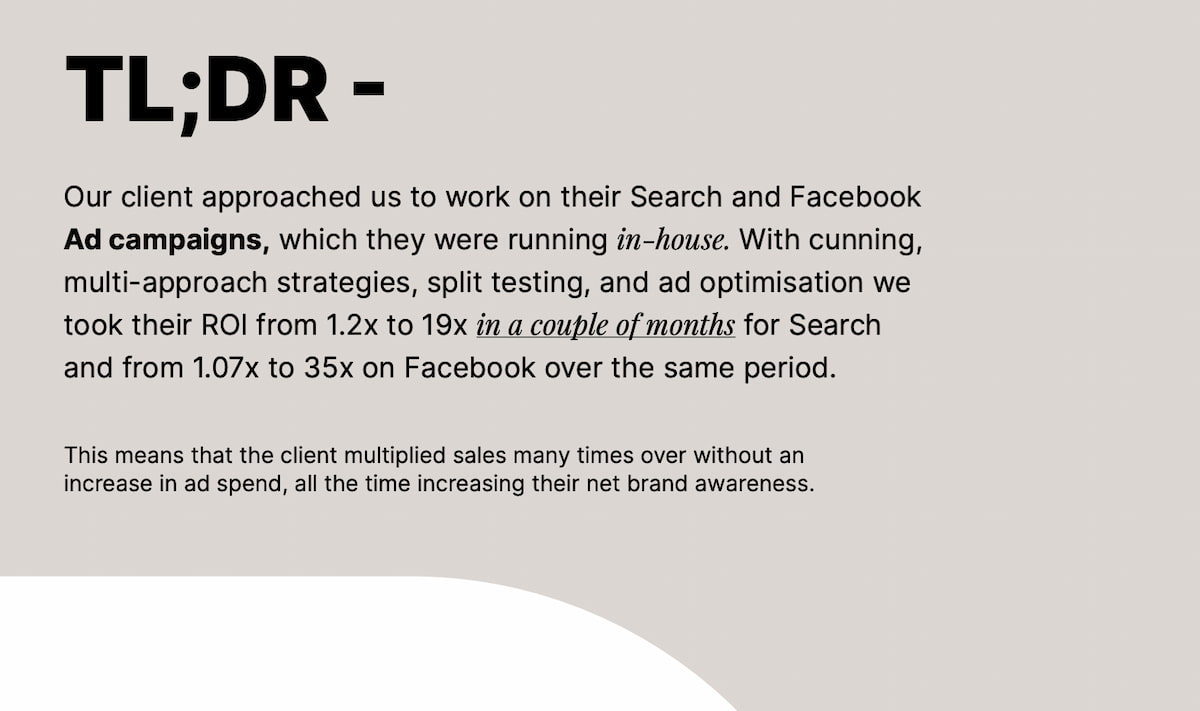

I like to think of case studies as a business's version of a resume. It highlights what the business can do, lends credibility to its offer, and contains only the positive bullet points that paint it in the best light possible.

Imagine if the guy running your favorite taco truck followed you home so that he could "really dig into how that burrito changed your life." I see the value in the practice. People naturally prefer a tried-and-true burrito just as they prefer tried-and-true products or services.

To help you showcase your success and flesh out your burrito questionnaire, I've put together some case study examples and key takeaways.

What is a case study?

A case study is an in-depth analysis of how your business, product, or service has helped past clients. It can be a document, a webpage, or a slide deck that showcases measurable, real-life results.

For example, if you're a SaaS company, you can analyze your customers' results after a few months of using your product to measure its effectiveness. You can then turn this analysis into a case study that further proves to potential customers what your product can do and how it can help them overcome their challenges.

It changes the narrative from "I promise that we can do X and Y for you" to "Here's what we've done for businesses like yours, and we can do it for you, too."

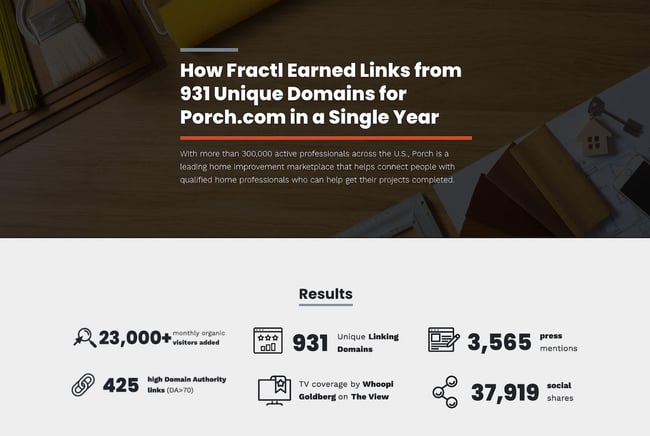

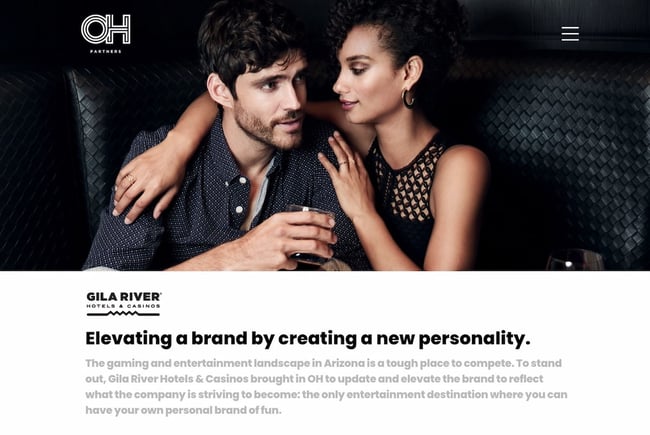

16 case study examples

While most case studies follow the same structure, quite a few try to break the mold and create something unique. Some businesses lean heavily on design and presentation, while others pursue a detailed, stat-oriented approach. Some businesses try to mix both.

There's no set formula to follow, but I've found that the best case studies utilize impactful design to engage readers and leverage statistics and case details to drive the point home. A case study typically highlights the companies, the challenges, the solution, and the results. The examples below will help inspire you to do it, too.

1. .css-1l9i3yq-Link[class][class][class][class][class]{all:unset;box-sizing:border-box;-webkit-text-fill-color:currentColor;cursor:pointer;}.css-1l9i3yq-Link[class][class][class][class][class]{all:unset;box-sizing:border-box;-webkit-text-decoration:underline;text-decoration:underline;cursor:pointer;-webkit-transition:all 300ms ease-in-out;transition:all 300ms ease-in-out;outline-offset:1px;-webkit-text-fill-color:currentColor;outline:1px solid transparent;}.css-1l9i3yq-Link[class][class][class][class][class][data-color='ocean']{color:#3d4592;}.css-1l9i3yq-Link[class][class][class][class][class][data-color='ocean']:hover{color:#2b2358;}.css-1l9i3yq-Link[class][class][class][class][class][data-color='ocean']:focus{color:#3d4592;outline-color:#3d4592;}.css-1l9i3yq-Link[class][class][class][class][class][data-color='white']{color:#fffdf9;}.css-1l9i3yq-Link[class][class][class][class][class][data-color='white']:hover{color:#a8a5a0;}.css-1l9i3yq-Link[class][class][class][class][class][data-color='white']:focus{color:#fffdf9;outline-color:#fffdf9;}.css-1l9i3yq-Link[class][class][class][class][class][data-color='primary']{color:#3d4592;}.css-1l9i3yq-Link[class][class][class][class][class][data-color='primary']:hover{color:#2b2358;}.css-1l9i3yq-Link[class][class][class][class][class][data-color='primary']:focus{color:#3d4592;outline-color:#3d4592;}.css-1l9i3yq-Link[class][class][class][class][class][data-color='secondary']{color:#fffdf9;}.css-1l9i3yq-Link[class][class][class][class][class][data-color='secondary']:hover{color:#a8a5a0;}.css-1l9i3yq-Link[class][class][class][class][class][data-color='secondary']:focus{color:#fffdf9;outline-color:#fffdf9;}.css-1l9i3yq-Link[class][class][class][class][class][data-weight='inherit']{font-weight:inherit;}.css-1l9i3yq-Link[class][class][class][class][class][data-weight='normal']{font-weight:400;}.css-1l9i3yq-Link[class][class][class][class][class][data-weight='bold']{font-weight:700;} Volcanica Coffee and AdRoll

People love a good farm-to-table coffee story, and boy am I one of them. But I've shared this case study with you for more reasons than my love of coffee. I enjoyed this study because it was written as though it was a letter.

In this case study, the founder of Volcanica Coffee talks about the journey from founding the company to personally struggling with learning and applying digital marketing to finding and enlisting AdRoll's services.

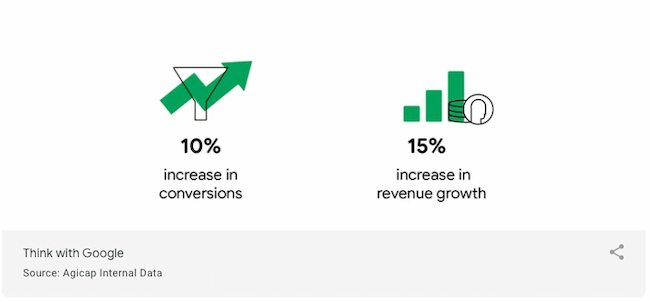

It felt more authentic, less about AdRoll showcasing their worth and more like a testimonial from a grateful and appreciative client. After the story, the case study wraps up with successes, milestones, and achievements. Note that quite a few percentages are prominently displayed at the top, providing supporting evidence that backs up an inspiring story.

Takeaway: Highlight your goals and measurable results to draw the reader in and provide concise, easily digestible information.

2. Taylor Guitars and Airtable

This Airtable case study on Taylor Guitars comes as close as one can to an optimal structure. It features a video that represents the artistic nature of the client, highlighting key achievements and dissecting each element of Airtable's influence.

It also supplements each section with a testimonial or quote from the client, using their insights as a catalyst for the case study's narrative. For example, the case study quotes the social media manager and project manager's insights regarding team-wide communication and access before explaining in greater detail.

Takeaway: Highlight pain points your business solves for its client, and explore that influence in greater detail.

3. EndeavourX and Figma

My favorite part of Figma's case study is highlighting why EndeavourX chose its solution. You'll notice an entire section on what Figma does for teams and then specifically for EndeavourX.

It also places a heavy emphasis on numbers and stats. The study, as brief as it is, still manages to pack in a lot of compelling statistics about what's possible with Figma.

Takeaway: Showcase the "how" and "why" of your product's differentiators and how they benefit your customers.

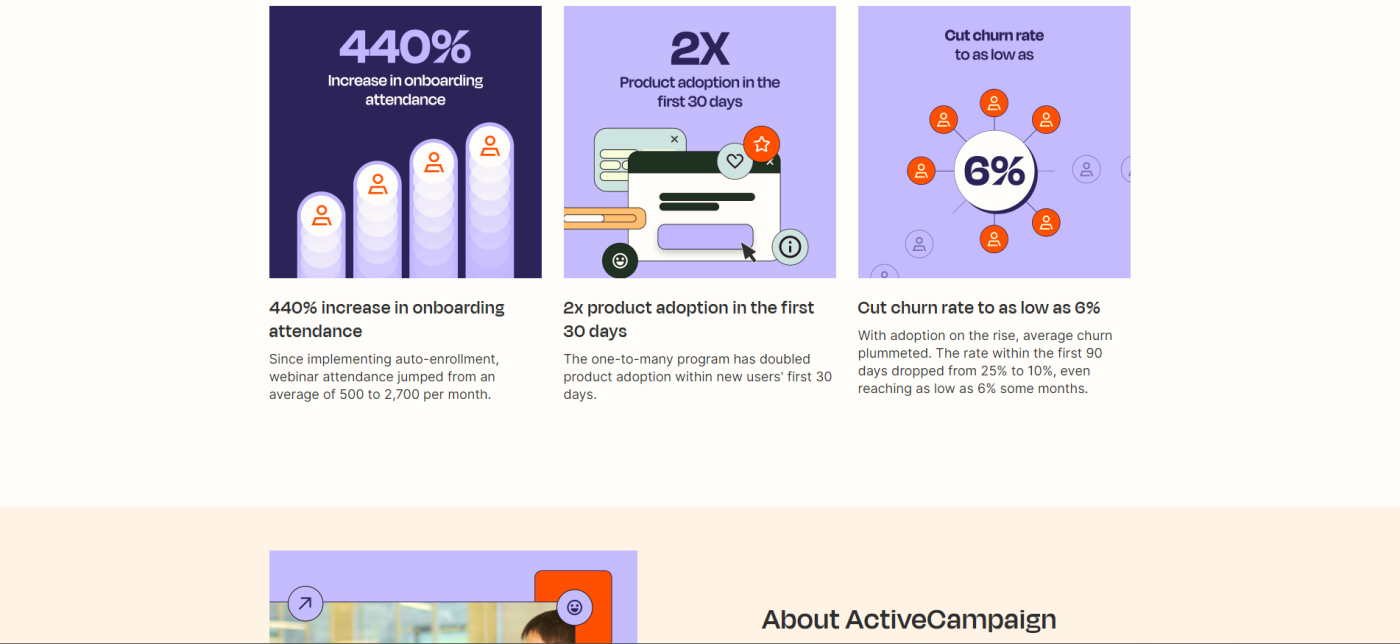

4. ActiveCampaign and Zapier

Zapier's case study leans heavily on design, using graphics to present statistics and goals in a manner that not only remains consistent with the branding but also actively pushes it forward, drawing users' eyes to the information most important to them.

The graphics, emphasis on branding elements, and cause/effect style tell the story without requiring long, drawn-out copy that risks boring readers. Instead, the cause and effect are concisely portrayed alongside the client company's information for a brief and easily scannable case study.

Takeaway: Lean on design to call attention to the most important elements of your case study, and make sure it stays consistent with your branding.

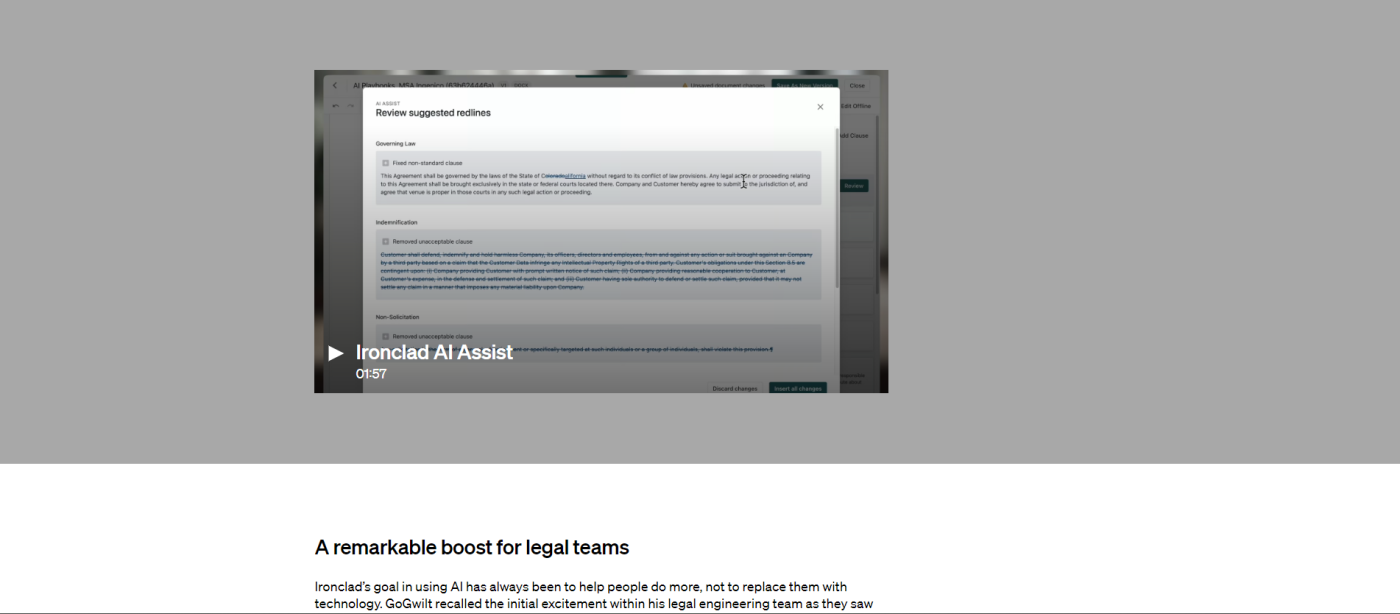

5. Ironclad and OpenAI

In true OpenAI fashion, this case study is a block of text. There's a distinct lack of imagery, but the study features a narrated video walking readers through the product.

The lack of imagery and color may not be the most inviting, but utilizing video format is commendable. It helps thoroughly communicate how OpenAI supported Ironclad in a way that allows the user to sit back, relax, listen, and be impressed.

Takeaway: Get creative with the media you implement in your case study. Videos can be a very powerful addition when a case study requires more detailed storytelling.

6. Shopify and GitHub

GitHub's case study on Shopify is a light read. It addresses client pain points and discusses the different aspects its product considers and improves for clients. It touches on workflow issues, internal systems, automation, and security. It does a great job of representing what one company can do with GitHub.

To drive the point home, the case study features colorful quote callouts from the Shopify team, sharing their insights and perspectives on the partnership, the key issues, and how they were addressed.

Takeaway: Leverage quotes to boost the authoritativeness and trustworthiness of your case study.

7 . Audible and Contentful

Contentful's case study on Audible features almost every element a case study should. It includes not one but two videos and clearly outlines the challenge, solution, and outcome before diving deeper into what Contentful did for Audible. The language is simple, and the writing is heavy with quotes and personal insights.

This case study is a uniquely original experience. The fact that the companies in question are perhaps two of the most creative brands out there may be the reason. I expected nothing short of a detailed analysis, a compelling story, and video content.

Takeaway: Inject some brand voice into the case study, and create assets that tell the story for you.

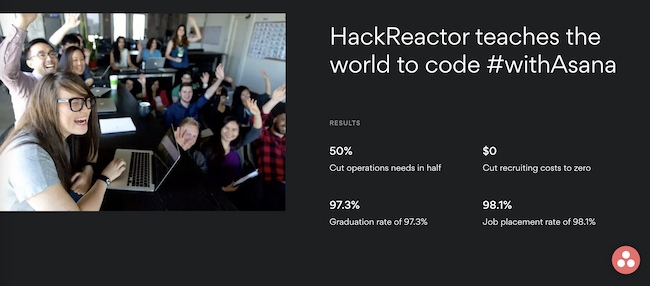

8 . Zoom and Asana

Asana's case study on Zoom is longer than the average piece and features detailed data on Zoom's growth since 2020. Instead of relying on imagery and graphics, it features several quotes and testimonials.

It's designed to be direct, informative, and promotional. At some point, the case study reads more like a feature list. There were a few sections that felt a tad too promotional for my liking, but to each their own burrito.

Takeaway: Maintain a balance between promotional and informative. You want to showcase the high-level goals your product helped achieve without losing the reader.

9 . Hickies and Mailchimp

I've always been a fan of Mailchimp's comic-like branding, and this case study does an excellent job of sticking to their tradition of making information easy to understand, casual, and inviting.

It features a short video that briefly covers Hickies as a company and Mailchimp's efforts to serve its needs for customer relationships and education processes. Overall, this case study is a concise overview of the partnership that manages to convey success data and tell a story at the same time. What sets it apart is that it does so in a uniquely colorful and brand-consistent manner.

Takeaway: Be concise to provide as much value in as little text as possible.

10. NVIDIA and Workday

The gaming industry is notoriously difficult to recruit for, as it requires a very specific set of skills and experience. This case study focuses on how Workday was able to help fill that recruitment gap for NVIDIA, one of the biggest names in the gaming world.

Though it doesn't feature videos or graphics, this case study stood out to me in how it structures information like "key products used" to give readers insight into which tools helped achieve these results.

Takeaway: If your company offers multiple products or services, outline exactly which ones were involved in your case study, so readers can assess each tool.

11. KFC and Contentful

I'm personally not a big KFC fan, but that's only because I refuse to eat out of a bucket. My aversion to the bucket format aside, Contentful follows its consistent case study format in this one, outlining challenges, solutions, and outcomes before diving into the nitty-gritty details of the project.

Say what you will about KFC, but their primary product (chicken) does present a unique opportunity for wordplay like "Continuing to march to the beat of a digital-first drum(stick)" or "Delivering deep-fried goodness to every channel."

Takeaway: Inject humor into your case study if there's room for it and if it fits your brand.

12. Intuit and Twilio

Twilio does an excellent job of delivering achievements at the very beginning of the case study and going into detail in this two-minute read. While there aren't many graphics, the way quotes from the Intuit team are implemented adds a certain flair to the study and breaks up the sections nicely.

It's simple, concise, and manages to fit a lot of information in easily digestible sections.

Takeaway: Make sure each section is long enough to inform but brief enough to avoid boring readers. Break down information for each section, and don't go into so much detail that you lose the reader halfway through.

13. Spotify and Salesforce

Salesforce created a video that accurately summarizes the key points of the case study. Beyond that, the page itself is very light on content, and sections are as short as one paragraph.

I especially like how information is broken down into "What you need to know," "Why it matters," and "What the difference looks like." I'm not ashamed of being spoon-fed information. When it's structured so well and so simply, it makes for an entertaining read.

Takeaway: Invest in videos that capture and promote your partnership with your case study subject. Video content plays a promotional role that extends beyond the case study in social media and marketing initiatives .

14. Benchling and Airtable

Benchling is an impressive entity in its own right. Biotech R&D and health care nuances go right over my head. But the research and digging I've been doing in the name of these burritos (case studies) revealed that these products are immensely complex.

And that's precisely why this case study deserves a read—it succeeds at explaining a complex project that readers outside the industry wouldn't know much about.

Takeaway: Simplify complex information, and walk readers through the company's operations and how your business helped streamline them.

15. Chipotle and Hubble

The concision of this case study is refreshing. It features two sections—the challenge and the solution—all in 316 words. This goes to show that your case study doesn't necessarily need to be a four-figure investment with video shoots and studio time.

Sometimes, the message is simple and short enough to convey in a handful of paragraphs.

Takeaway: Consider what you should include instead of what you can include. Assess the time, resources, and effort you're able and willing to invest in a case study, and choose which elements you want to include from there.

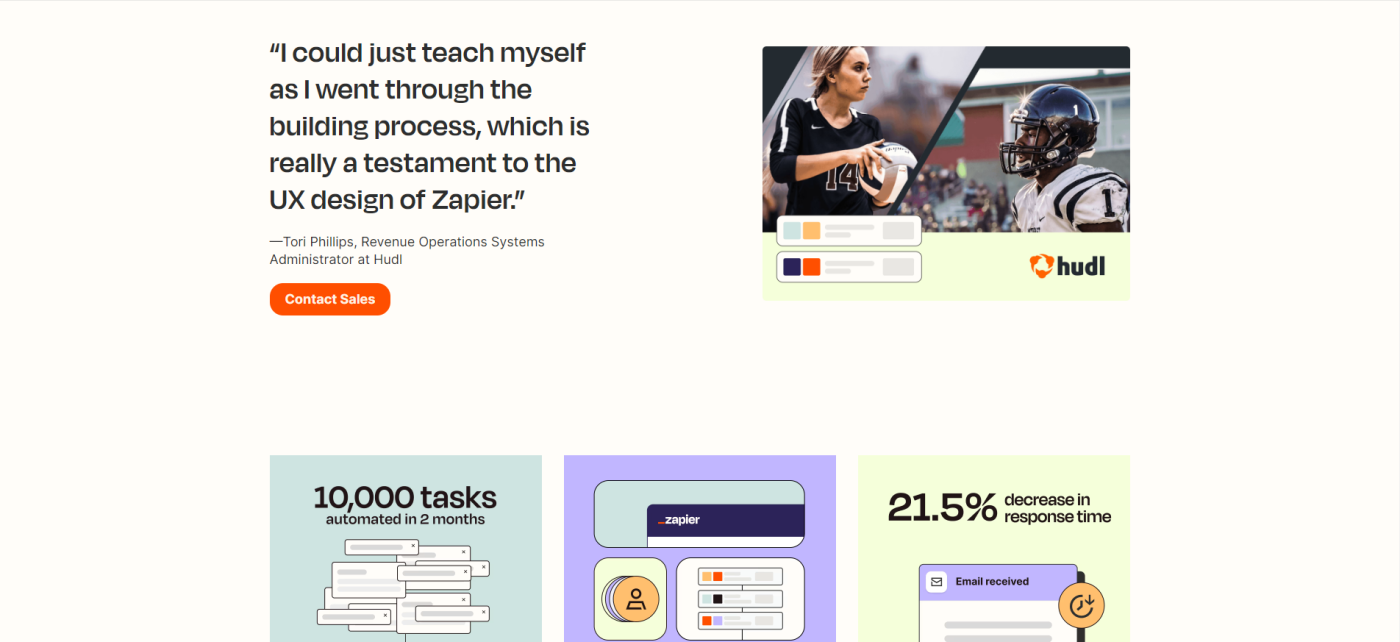

16. Hudl and Zapier

I may be biased, but I'm a big fan of seeing metrics and achievements represented in branded graphics. It can be a jarring experience to navigate a website, then visit a case study page and feel as though you've gone to a completely different website.

The Zapier format provides nuggets of high-level insights, milestones, and achievements, as well as the challenge, solution, and results. My favorite part of this case study is how it's supplemented with a blog post detailing how Hudl uses Zapier automation to build a seamless user experience.

The case study is essentially the summary, and the blog article is the detailed analysis that provides context beyond X achievement or Y goal.

Takeaway: Keep your case study concise and informative. Create other resources to provide context under your blog, media or press, and product pages.

3 case study templates

Now that you've had your fill of case studies (if that's possible), I've got just what you need: an infinite number of case studies, which you can create yourself with these case study templates.

Case study template 1

If you've got a quick hit of stats you want to show off, try this template. The opening section gives space for a short summary and three visually appealing stats you can highlight, followed by a headline and body where you can break the case study down more thoroughly. This one's pretty simple, with only sections for solutions and results, but you can easily continue the formatting to add more sections as needed.

Case study template 2

For a case study template with a little more detail, use this one. Opening with a striking cover page for a quick overview, this one goes on to include context, stakeholders, challenges, multiple quote callouts, and quick-hit stats.

Case study template 3

Whether you want a little structural variation or just like a nice dark green, this template has similar components to the last template but is designed to help tell a story. Move from the client overview through a description of your company before getting to the details of how you fixed said company's problems.

Tips for writing a case study

Examples are all well and good, but you don't learn how to make a burrito just by watching tutorials on YouTube without knowing what any of the ingredients are. You could , but it probably wouldn't be all that good.

Writing a good case study comes down to a mix of creativity, branding, and the capacity to invest in the project. With those details in mind, here are some case study tips to follow:

Have an objective: Define your objective by identifying the challenge, solution, and results. Assess your work with the client and focus on the most prominent wins. You're speaking to multiple businesses and industries through the case study, so make sure you know what you want to say to them.

Focus on persuasive data: Growth percentages and measurable results are your best friends. Extract your most compelling data and highlight it in your case study.

Use eye-grabbing graphics: Branded design goes a long way in accurately representing your brand and retaining readers as they review the study. Leverage unique and eye-catching graphics to keep readers engaged.

Simplify data presentation: Some industries are more complex than others, and sometimes, data can be difficult to understand at a glance. Make sure you present your data in the simplest way possible. Make it concise, informative, and easy to understand.

Use automation to drive results for your case study

A case study example is a source of inspiration you can leverage to determine how to best position your brand's work. Find your unique angle, and refine it over time to help your business stand out. Ask anyone: the best burrito in town doesn't just appear at the number one spot. They find their angle (usually the house sauce) and leverage it to stand out.

In fact, with the right technology, it can be refined to work better . Explore how Zapier's automation features can help drive results for your case study by making your case study a part of a developed workflow that creates a user journey through your website, your case studies, and into the pipeline.

Case study FAQ

Got your case study template? Great—it's time to gather the team for an awkward semi-vague data collection task. While you do that, here are some case study quick answers for you to skim through while you contemplate what to call your team meeting.

What is an example of a case study?

An example of a case study is when a software company analyzes its results from a client project and creates a webpage, presentation, or document that focuses on high-level results, challenges, and solutions in an attempt to showcase effectiveness and promote the software.

How do you write a case study?

To write a good case study, you should have an objective, identify persuasive and compelling data, leverage graphics, and simplify data. Case studies typically include an analysis of the challenge, solution, and results of the partnership.

What is the format of a case study?

While case studies don't have a set format, they're often portrayed as reports or essays that inform readers about the partnership and its results.

Related reading:

How Hudl uses automation to create a seamless user experience

How to make your case studies high-stakes—and why it matters

How experts write case studies that convert, not bore

Get productivity tips delivered straight to your inbox

We’ll email you 1-3 times per week—and never share your information.

Hachem Ramki

Hachem is a writer and digital marketer from Montreal. After graduating with a degree in English, Hachem spent seven years traveling around the world before moving to Canada. When he's not writing, he enjoys Basketball, Dungeons and Dragons, and playing music for friends and family.

- Content marketing

Related articles

14 types of email marketing to experiment with

14 types of email marketing to experiment...

8 business anniversary marketing ideas and examples worth celebrating

8 business anniversary marketing ideas and...

A guide to verticalization: What it is, when to try it, and how to get started

A guide to verticalization: What it is, when...

12 Facebook ad copy examples to learn from

Improve your productivity automatically. Use Zapier to get your apps working together.

Business Valuation Case Study: Cash Flow is King

Case Background

The business in question was a sole proprietorship that provided “sales, repair, and installation” services to homes and businesses. The business operated out of a 2,500 square foot shop located at the owner’s residence. The business did not pay rent for use of the facilities, did not pay a salary to the owner for his services, but did pay a small wage to the spouse. The business had a consistent revenue stream, but profitability varied year to year.

Approaches Used

The opposing valuation expert (Expert A) relied solely on the Privately Traded Guideline Company Method to determine the value of the business . Expert A used the Pratt’s Stat’s – Private Company Merger and Acquisition database to search for transactions involving companies deemed similar to the subject business. Using search criteria of similar NAICS codes, a comparable range of revenue, and a timeframe of the previous 10 years to the effective date of the valuation, Expert A found 38 transactions involving companies deemed comparable to the subject business. Using these 38 transactions, Expert A determined that the mean (average) sales multiple was 0.73. Expert A then multiplied this sales multiple by an average of the previous 3 years sales to arrive at the estimated enterprise value of the business of approximately $432,000.

I also used the Privately Traded Guideline Company Method in my valuation, and the same historical data as Expert A, but made normalization adjustments to the income statements to account for the market rate rent expense for the shop, estimated market level compensation of the owner based upon services performed, and removed compensation paid to the spouse which would not be required for operation of the business. I also used the Pratt’s Stat’s database and similar search criteria. My search resulted in 40 transactions which included all 38 transactions that Expert A used. In addition, I chose the Seller’s Discretionary Earnings (SDE) multiple and the sales multiple as the two multiples to use in my valuation. According to Pratt’s Stats FAQ, it defines SDE as Operating Profit (Earnings Before Interest and Taxes) + Owners Compensation + Depreciation/Amortization. I believe that SDE closely resembles the earnings stream available to a purchaser of the business and thus is the more relevant multiple.

By way of example, my report stated,

“If you have two similar companies that both generate $500,000 in net sales annually, but Company A produces cash flow available for distribution to an owner of $150,000 while Company B produces $25,000, Company A will be more valuable than Company B regardless of the top line revenue. Using a net sales multiple alone does not account for the differences in profitability of the companies in the sample, unless the revenue multiple selected represents comparable profitability to the subject company.”

I calculated the normalized SDE for the subject company (considering the normalization adjustments discussed previously) and then calculated the SDE as a % of sales for the subject company. This percentage was then compared to the SDE as a % of sales for the transactions in my search. The results were the subject company’s normalized SDE as a percentage of sales approximated the SDE as a % of sales in the 21st percentile of the transactions in my search. The SDE multiple for the 21 st percentile associated with the transactions was 1.93 times SDE. I also calculated the sales multiple for the 21 st percentile which was 0.41 times revenue. By using these two multiples to calculate the estimated enterprise value of the business, the end result was approximately $145,000.

My approach considered the bottom line cash flow available to a potential purchaser of the business and used multiples corresponding to transactions with similar levels of cash flow. My report highlighted that top line measures of profitability, such as revenue, should be supported with an analysis to show its relationship with bottom line cash flow measures. Simply put, if the “mean” multiple for revenue should be used, then the bottom line cash flow available to a purchaser of the business should approximate the “mean” cash flow of the data set. Within these transactions it did not, and I believed a different multiple should be used.

The judge on the case heard arguments from both sides and due to the disparity in results called for a 3 rd independent valuation expert to review both reports and state to the court which approach they believed was more credible. The 3 rd expert testified that they would have valued the company using a bottom line cash flow approach that considered normalization adjustments similar to ones used in my report. When asked if they would have used the “mean” revenue multiple, they stated that they would only have used it if the bottom line cash flow approximated the “mean” of the data set for the transactions considered. The judge ruled in favor of my valuation report.

Visit our webpage for more information on McKonly & Asbury’s Business Valuation Services . Should you have questions about the importance of the cash flow available to a purchaser of a business, or business valuation in general, don’t hesitate to contact me, T. Eric Blocher CPA, ASA, CVA at [email protected] .

About the Author

McKonly & Asbury is a Certified Public Accounting Firm serving companies across Pennsylvania including Camp Hill, Lancaster, Bloomsburg, and Philadelphia. We serve the needs of affordable housing, construction, family-owned businesses, healthcare, manufacturing and distribution, and nonprofit industries. We also assist service organizations with the full suite of SOC services (including SOC 2 reports), ERTC claims, internal audits, SOX compliance, and employee benefit plan audits.

Related Services

Subscribe to our newsletter.

Related Insights

Internal Audit’s Role in Managing Emerging Risks

The Basics of Partial Plan Terminations

TechSoup: Information Technology Solutions for Nonprofits

Independent v. Institutionalized Trust Companies: In Defense of the New Paradigm

Join 307,012+ Monthly Readers

Get Free and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Advice Already Downloaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write A Resume or Cover Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get A Job At A Hedge Fund

- Recent Posts

- Articles By Category

The Venture Capital Case Study: What to Expect and How to Survive

If you're new here, please click here to get my FREE 57-page investment banking recruiting guide - plus, get weekly updates so that you can break into investment banking . Thanks for visiting!

There’s plenty of information online about case studies in finance interviews (IB, PE, etc.), but the venture capital case study remains a bit mysterious.

Depending on your source, a VC case study might consist of a “ cap table ” exercise where you calculate the company’s ownership over many investment rounds and the proceeds to each group upon exit…

…but it could also be a qualitative discussion of a market, an evaluation of a specific startup, or even a simple 3-statement model .

But if you’re interviewing at an early-stage VC fund (i.e., Seed and Series A investments), the most common type is the “Evaluate a startup and recommend investing or not investing” one.

The VC firm might give you a short investment memo or slide deck for the company, ask you to read it, and then say “yes” or “no” based on your analysis and interpretation.

We’ll go through a short example for a fictional startup called PitchBookGPT , which comes directly from our new Venture Capital & Growth Equity Modeling course .

This is a summary version, but it should be enough to give you some practice:

The Video Tutorial and the Files

If you prefer to watch or listen to this tutorial, you can get the 14-minute video walkthrough below:

If you prefer to read, you can continue with this article.

You can get the files, including the company’s pitch deck, here:

- PitchBookGPT – Seed Round Pitch Deck (PDF)

- Venture Capital Case Study Prompt (PDF)

- Venture Capital Case Study Solutions and Investment Recommendation (PDF)

- Case Study Walkthrough and Explanation – Slides (PDF)

- SaaS Valuation Multiples and Historical Data (PDF)

Video Table of Contents:

- 0:00: Introduction

- 1:58: Part 1: What to Expect in VC Case Studies

- 3:10: Part 2: What Do VCs Want in Early-Stage Investments?

- 4:51: Part 3: “The Numbers” for PitchBookGPT

- 8:16: Part 4: The Market, Product, and Team

- 11:45: Part 5: Recommendation and Counter-Factual

- 13:04: Recap and Summary

This Venture Capital Case Study Example: PitchBookGPT

In short, this startup is riding the AI hype train and plans to offer a subscription service that will automate parts of the pitch book creation process at investment banks.

It won’t replace Analysts or Associates because it can’t create entire presentations with all the correct details.

But it speeds up the process by generating slide templates based on your queries, presentation data, and free examples on the sec.gov site .

For example, if you type in “ SPAC vs. IPO ” or “Market overview slide with monetary and fiscal factors,” the software will generate sample slide images, and you can click the one you want to get an editable PowerPoint version:

The “artificial intelligence” part comes in because simple keyword searches do not work well when searching for specific slides; a slide’s purpose often differs from its text .

Also, machine learning could work well for a problem such as converting slide images into editable PowerPoint templates.

This is much trickier than it sounds for moderately complex slides, and a rules-based system is less efficient than using huge data sets for the image-to-slide translation.

This startup claims that its service can boost Analyst productivity by 30% and generate millions in extra fees for the average bank, and it plans to sell it to boutique banks for $2,000 per month.

They want a $2 million seed investment at a $20 million post-money valuation, meaning that we (the VCs) will own 10% if we invest.

So, should we do the deal?

What Do Venture Capitalists Look for in an Early-Stage Investment?

To answer this question, you need to think about what early-stage VCs look for in deals.

Most early-stage companies do not have revenue, but they do have markets and teams .

Since early-stage investing is so risky, VCs seek opportunities with the potential for very high cash-on-cash multiples , such as 10x in Series A rounds or 100x in Seed rounds.

To be clear, these are the targeted multiples.

Most startups fail, and even the ones that succeed do not come close to a 100x multiple in most cases.

Since this failure rate is so high, early-stage VCs need to aim high by finding companies with the potential to serve huge markets.

Here’s a summary of the different stages:

Since the asking valuation is $20 million, we can reframe this case study as:

“Could this company potentially reach 100x that valuation, or $2 billion? If not, what about something like 10 – 20x, for a $200 – $400 million valuation?”

You can answer this question by doing some quick math and qualitatively evaluating the market, product, and team.

Venture Capital Case Study, Part 1: The Numbers

In its slide deck, this company claims that there are ~4,000 boutique banks worldwide with 1 – 20 employees and that these banks alone can support a $100 million market size (since 4,000 * $2,000 / month * 12 months = $96 million).

They plan to target these smaller and mid-sized banks because they’re easier to reach and they have fewer resources for pitch book creation.

But this company makes a common mistake with this claim: it assumes it will capture 100% of this market.

That never happens in real life, even in a narrow niche like this one – because there are competitors and many firms that don’t need the product.

In large markets (tens or hundreds of billions of dollars), capturing even a tiny percentage might be a good result.

In a narrower market like this one, something like 10 – 20% might be plausible if the company executes well.

That means a more realistic revenue estimate is $10 – $20 million.

Startup / SaaS Valuation

Subscription software companies are usually valued based on a multiple of annual recurring revenue (ARR) , and this multiple is typically between 5x and 10x for public companies (more on SaaS accounting ):

If we apply these multiples to the company’s revenue estimates, we get a valuation range of $50 million (5x * $10 million) to $200 million (10x * $20 million).

This is a great result for the company, but it’s far below what most seed-stage VCs want.

A $50 million exit value would be a 2.5x multiple, while a $200 million exit value would be a 10.0x multiple.

And these numbers represent the potential outcomes and assume that everything goes well.

Also, these numbers do not account for the dilution in future funding rounds.

This 10% ownership will likely fall to 7%, 5%, or even 3% as the startup raises money in the Series A, B, and C rounds, which means even lower returns multiples.

You might say, “OK, but couldn’t this company’s revenue go much higher? They should charge per user , not per firm, for this service” (so the Average Revenue per User would be higher).

And that leads us to the next point about the qualitative evaluation of the market, product, and team.

Venture Capital Case Study, Part 2: The Market, Product, and Team

I wouldn’t say this company’s product is “terrible” – I’ve seen much worse startup ideas.

But it faces a “no man’s land problem” because the ideal customers differ from the reachable customers .

Boutique banks tend to be much more cost-conscious than large firms and don’t necessarily want to add a $2,000 monthly expense for multiple employees.

If a boutique bank needed this service for 5 Analysts, $2,000 per user per month would mean $120K per year , which is about the cost of hiring a full-time Analyst.

Many small banks would look at this and say, “OK, it speeds up presentations… but for that price, we could hire another Analyst and get client support, Excel work, and more.”

Also, small banks depend far less on long and detailed pitch books than large banks.

Most new deals come from longstanding relationships, not inbound inquiries or bake-offs / beauty pageants .

PitchBookGPT could target large banks ( the bulge brackets ) instead, as they are more willing to pay for training and productivity tools.

This service would be more useful for large firms because they tend to produce the 100+ slide pitch books where automation tools could save time.

However , it’s also much more difficult to close deals in this market, and compliance concerns mean these banks are less willing to share their data with external parties.

Could you imagine Goldman Sachs or Morgan Stanley uploading all their pitch books and slides to a VC-funded startup that may not even exist in a year?

Here’s my summary of the product/market fit problem:

Other Points in This Venture Capital Case Study

We don’t have time to analyze the team or the expected use of funds for this $2 million investment, but you would consider both in real life.

In short, they’re “fine but not amazing” – some of the budget numbers seem a bit too low (e.g., for the engineers), while others are on the high side (sales & marketing), but nothing seems completely crazy.

Similarly, the team (all fake names and bios) has relevant experience but looks a bit “junior,” so we’re neutral on them.

Our Final Decision

In short, we’d say no to this deal because we think a 100x multiple in any reasonable time frame – such as 5 or even 10 years – is implausible.

A 5 – 10x multiple might be feasible, but that’s not a great “stretch goal” for a seed-stage deal.

To reach a $1 – 2 billion valuation, the company would need hundreds of millions in annual revenue, and we don’t think that’s realistic for its business model and market.

The company could develop a different product or offer higher-end services to larger firms, but it doesn’t even have a “Version 1.0” yet, so that would be putting the cart before the horse.

You can view the full recommendation here .

What Would Change Our Mind?

If a few factors were different, we might be more inclined to recommend this deal:

- Per-Seat Pricing – Maybe they can’t charge $2,000 / user / month, but even something like $1,000 / user / month could increase potential revenue at many firms.

- Lower Asking Price – While a $2 million seed investment at a $20 million post-money valuation is not unheard of, it is aggressive. If the asking valuation were only $5 – 10 million, the deal math would be more feasible (maybe not for a 100x multiple, but something like 20 – 30x).

- Higher-End Product – For example, banks might be willing to pay more if this product could replace employees rather than just boost their productivity. But that would require far more capital to develop and might require technology that doesn’t exist.

The Venture Capital Case Study: Final Thoughts

In short, unlike many startups, this PitchBookGPT idea isn’t necessarily “bad.”

There are proven markets for productivity tools, slide templates, and reference models in both PowerPoint and Excel.

But the problem is that this isn’t a great early-stage VC idea – at least not for the deal terms the company wants.

That’s not great news for this fictional company, but it is reassuring if you’re a junior banker worried about getting replaced by AI anytime soon.

It probably won’t happen – and in the near term, these new tools might even improve your life.

If you liked this article, you might be interested in:

- The Growth Equity Case Study: Real-Life Example and Tutorial

- The Full Guide to Healthcare Private Equity, from Careers to Contradictions