- Technical Support

- Find My Rep

You are here

The Handbook of Marketing Research Uses, Misuses, and Future Advances

- Rajiv Grover - The University of Georgia, USA, University of Georgia, USA

- Marco Vriens - Microsoft Corporation

- Description

- Appeals to users as well as suppliers of marketing research: Comprehensive topics in marketing research (such as philosophy, techniques, and applications) are delivered in a reader-friendly, applications-oriented, and non-mathematical fashion.

- Covers many cutting-edge techniques of data collection and analysis: Traditional quantitative techniques, innovative qualitative techniques, and emerging online methods are presented.

- Provides a broad range of current ideas and applications: The contributors address models of the impact of marketing mix variables, segmentation, brand equity, satisfaction, customer lifetime value, and marketing ROI. Chapters on international marketing research and marketing management support systems are also included.

Talk to the author! http://www.terry.uga.edu/%7Ergrover/hb_main.html

See what’s new to this edition by selecting the Features tab on this page. Should you need additional information or have questions regarding the HEOA information provided for this title, including what is new to this edition, please email [email protected] . Please include your name, contact information, and the name of the title for which you would like more information. For information on the HEOA, please go to http://ed.gov/policy/highered/leg/hea08/index.html .

For assistance with your order: Please email us at [email protected] or connect with your SAGE representative.

SAGE 2455 Teller Road Thousand Oaks, CA 91320 www.sagepub.com

"This handbook comprehensively explores approaches for delivering market insights for fact-based decision-making in a market-oriented firm. Divided into four parts, it addresses: (1) the different nuances of delivering insights, (2) quantitative, qualitative, and online data gathering techniques, (3) basic and advanced data analysis methods, and (4) the substantial marketing issues that clients are interested in receiving through marketing research. It is a valuable resource for all studetns and instructors of marketing research."

"Grover and Vriens have blended the contributions of 48 well-qualified academics and professionals to produce a comprehensive, in-depth guide to modern market research. A unique feature of this work is its emphasis on the potential of market research as a generator of marketing insights, this positioning market research as a trusted adviser. This handbook can serve as an up-to-date reference for market research suppliers as well as a guide for users. Highly Recommended."

" In addition to discussing relevant content, the various contributors to the book are excellent communicators. Sentences are clear, paragraphs are coherent, and chapters fulfill the promise of their introductions, and readers will benefit from the diagrams, figures, and charts that are used to enhance the text. I enjoyed reading this book and recommend it highly. This book will be of particular interest to advanced students, academics, and practitioners. Although statistical background is necessary to comprehend the advanced analytical techniques, most readers are likely to benefit from the overviews provided in this well-written book."

— Guldem Gokcek, JOURNAL OF MARKETING

· The contents will be articulated in a very reader-friendly, applications-oriented and non-mathematical fashion.

· Promotes the current overarching business philosophy of customer/market focus by emphasizing the need for Market Research to provide the insights required for making decisions.

· Identifies such troubling current trends as biased sample answers on long questionnaires, and "professionals" whose job is to skew focus group responses.

· Will employ top flight international researchers from both academia and practice to provide a broad range of ideas and applications.

15+ Market Research Books for Free! [PDF]

Consumers ‘ consumption patterns and interests change over time. It is the responsibility of companies to keep abreast of these changes and orient their sales efforts towards them. This can best be achieved by consulting reliable sources such as our selection of market research books in PDF format , where you will find the perfect guide.

Markets are very dynamic and while some niches are stable in terms of sales, others can become history in a short period of time. Knowing the basics of how they work is essential in the decision making process regarding a product or service..

Market research is the process of collecting data that companies do to better understand their consumers and direct efforts in the right direction to offer them what they need. Market research can answer questions such as: What leads consumers to take certain types of actions? What conditions are the choice of one product or another?

To gather information, companies rely on statistical and analytical techniques and methods (such as surveys ) that allow them to be systematic in their research. At the end of the research, reports are produced which are used as a basis for customer satisfaction and also for developing marketing campaigns.

We invite you to get to know this collection with more than 15 market research books in PDF format that will help you meet the necessary goals to move your business forward and even start it successfully. Download them for free right now on any of your electronic devices.

Here is our complete selection of Market Research Books:

Market Research

Barry J. Babin, Steven D'Alessandro and others

MARKETING RESEARCH - Meaning and Importance (Article)

The Role of Marketing Research

A step-by-step guide to market research (Presentation)

IntoTheMinds

The Importance of Market Research (Article)

All Nations Trust Co

An Innovative Technique to Define Marketing Research Objective (Article)

Alla Starostina, Volodymyr Kravchenko and Mykola Petrovsky

Research in marketing strategy

Neil A. Morgan, Kimberly A. Whitler, Hui Feng and Simos Chari

Marketing Research

Pondicherry University

Do it Yourself Marketing Research And Data Analysis (Presentation)

marketing research and information

Market Analysis Framework

Parco de’ Medici

Market Analysis Instruments In The Development Of The Startup Marketing Strategy

Nicole Danilova and Yuliia Kuznetsova

Market Assessment and Analysis: Learner’s Notes

EU and the Food and Agriculture ONU

Market Analysis & Strategy (Presentation)

Conduct a Market Analysis (Article)

Here ends our selection of free Market Research Books in PDF format. We hope you liked it and already have your next book!

If you found this list useful, do not forget to share it on your social networks. Remember that “Sharing is Caring” .

Do you want more Business and Investment books in PDF format ?

Business Books

| Accounting Books

| Advertising Books

| Agribusiness Management Books

| Audit Books

| Books about Benchmarking

| Books about Corporate Image

| Books about Efficiency

| Books about Organizational Climate

| Books About Procedure Manuals

| Books about SWOT

| Books about Teamwork

| Books on Inflation

| Branding Books

| Budgeting Books

| Business Administration Books

| Business Plan Books

| Business Strategy Books

| Consulting Books

| Continuous Improvement Books

| Costs Books

| Cryptocurrency Books

| Digital Marketing Books

| Dropshipping Books

| Economics Books

| Entrepreneur Books

| Finances Books

| Financial Accounting Books

| Financial Management Books

| Forex Books

| Gastronomic Management Books

| Hospitality Industry Books

| Human Resources Books

| Innovation Books

| International Trade Books

| Inventory Books

| Investment Books

| Kaizen Books

| Logistics Books

| Manufacturing Processes Books

| Marketing Books

| Negotiation Books

| Networking Books

| Organizational Designs Books

| Organizational Development Books

| Personal Branding Books

| Project Management Books

| Public Relations Books

| Quality Control Books

| Real Estate Books

| Sales Books

| Six Sigma Books

| Supply Chains Books

| Trading Books

| Training Books

| Warehouse Books

Alternative Therapy

Art & Photography

Children's

Computer Science

Engineering

Esotericism

Food & Drinks

French Books

Mystery and Thriller

Portuguese Books

Self Improvement

Short Stories

Spanish Books

HELP US SPREAD THE HABIT OF READING!

InfoBooks is a website to download free books legally.

LINKS OF INTEREST:

Learn / Blog / Article

Back to blog

How to do market research in 4 steps: a lean approach to marketing research

From pinpointing your target audience and assessing your competitive advantage, to ongoing product development and customer satisfaction efforts, market research is a practice your business can only benefit from.

Learn how to conduct quick and effective market research using a lean approach in this article full of strategies and practical examples.

Last updated

Reading time.

A comprehensive (and successful) business strategy is not complete without some form of market research—you can’t make informed and profitable business decisions without truly understanding your customer base and the current market trends that drive your business.

In this article, you’ll learn how to conduct quick, effective market research using an approach called 'lean market research'. It’s easier than you might think, and it can be done at any stage in a product’s lifecycle.

How to conduct lean market research in 4 steps

What is market research, why is market research so valuable, advantages of lean market research, 4 common market research methods, 5 common market research questions, market research faqs.

We’ll jump right into our 4-step approach to lean market research. To show you how it’s done in the real world, each step includes a practical example from Smallpdf , a Swiss company that used lean market research to reduce their tool’s error rate by 75% and boost their Net Promoter Score® (NPS) by 1%.

Research your market the lean way...

From on-page surveys to user interviews, Hotjar has the tools to help you scope out your market and get to know your customers—without breaking the bank.

The following four steps and practical examples will give you a solid market research plan for understanding who your users are and what they want from a company like yours.

1. Create simple user personas

A user persona is a semi-fictional character based on psychographic and demographic data from people who use websites and products similar to your own. Start by defining broad user categories, then elaborate on them later to further segment your customer base and determine your ideal customer profile .

How to get the data: use on-page or emailed surveys and interviews to understand your users and what drives them to your business.

How to do it right: whatever survey or interview questions you ask, they should answer the following questions about the customer:

Who are they?

What is their main goal?

What is their main barrier to achieving this goal?

Pitfalls to avoid:

Don’t ask too many questions! Keep it to five or less, otherwise you’ll inundate them and they’ll stop answering thoughtfully.

Don’t worry too much about typical demographic questions like age or background. Instead, focus on the role these people play (as it relates to your product) and their goals.

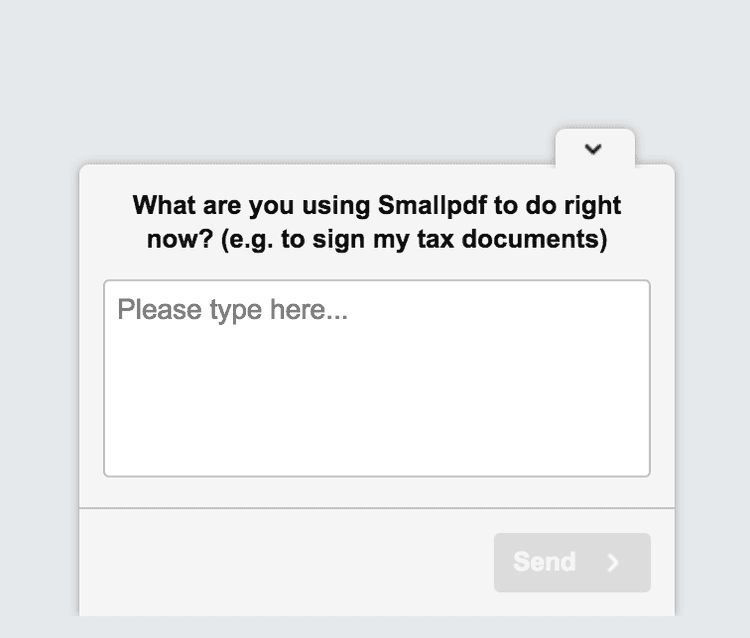

How Smallpdf did it: Smallpdf ran an on-page survey for a couple of weeks and received 1,000 replies. They learned that many of their users were administrative assistants, students, and teachers.

Next, they used the survey results to create simple user personas like this one for admins:

Who are they? Administrative Assistants.

What is their main goal? Creating Word documents from a scanned, hard-copy document or a PDF where the source file was lost.

What is their main barrier to achieving it? Converting a scanned PDF doc to a Word file.

💡Pro tip: Smallpdf used Hotjar Surveys to run their user persona survey. Our survey tool helped them avoid the pitfalls of guesswork and find out who their users really are, in their own words.

You can design a survey and start running it in minutes with our easy-to-use drag and drop builder. Customize your survey to fit your needs, from a sleek one-question pop-up survey to a fully branded questionnaire sent via email.

We've also created 40+ free survey templates that you can start collecting data with, including a user persona survey like the one Smallpdf used.

2. Conduct observational research

Observational research involves taking notes while watching someone use your product (or a similar product).

Overt vs. covert observation

Overt observation involves asking customers if they’ll let you watch them use your product. This method is often used for user testing and it provides a great opportunity for collecting live product or customer feedback .

Covert observation means studying users ‘in the wild’ without them knowing. This method works well if you sell a type of product that people use regularly, and it offers the purest observational data because people often behave differently when they know they’re being watched.

Tips to do it right:

Record an entry in your field notes, along with a timestamp, each time an action or event occurs.

Make note of the users' workflow, capturing the ‘what,’ ‘why,’ and ‘for whom’ of each action.

Don’t record identifiable video or audio data without consent. If recording people using your product is helpful for achieving your research goal, make sure all participants are informed and agree to the terms.

Don’t forget to explain why you’d like to observe them (for overt observation). People are more likely to cooperate if you tell them you want to improve the product.

💡Pro tip: while conducting field research out in the wild can wield rewarding results, you can also conduct observational research remotely. Hotjar Recordings is a tool that lets you capture anonymized user sessions of real people interacting with your website.

Observe how customers navigate your pages and products to gain an inside look into their user behavior . This method is great for conducting exploratory research with the purpose of identifying more specific issues to investigate further, like pain points along the customer journey and opportunities for optimizing conversion .

With Hotjar Recordings you can observe real people using your site without capturing their sensitive information

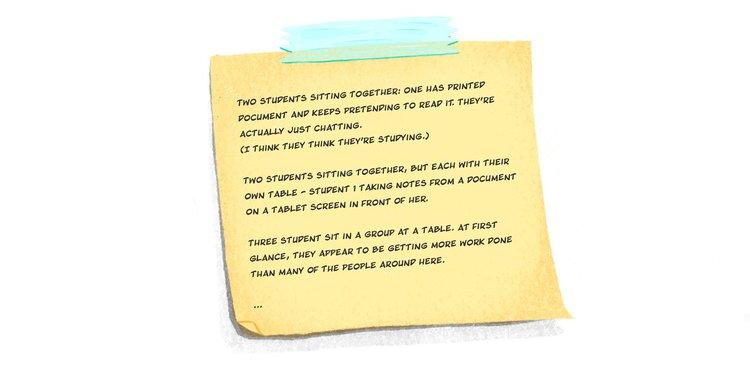

How Smallpdf did it: here’s how Smallpdf observed two different user personas both covertly and overtly.

Observing students (covert): Kristina Wagner, Principle Product Manager at Smallpdf, went to cafes and libraries at two local universities and waited until she saw students doing PDF-related activities. Then she watched and took notes from a distance. One thing that struck her was the difference between how students self-reported their activities vs. how they behaved (i.e, the self-reporting bias). Students, she found, spent hours talking, listening to music, or simply staring at a blank screen rather than working. When she did find students who were working, she recorded the task they were performing and the software they were using (if she recognized it).

Observing administrative assistants (overt): Kristina sent emails to admins explaining that she’d like to observe them at work, and she asked those who agreed to try to batch their PDF work for her observation day. While watching admins work, she learned that they frequently needed to scan documents into PDF-format and then convert those PDFs into Word docs. By observing the challenges admins faced, Smallpdf knew which products to target for improvement.

“Data is really good for discovery and validation, but there is a bit in the middle where you have to go and find the human.”

3. Conduct individual interviews

Interviews are one-on-one conversations with members of your target market. They allow you to dig deep and explore their concerns, which can lead to all sorts of revelations.

Listen more, talk less. Be curious.

Act like a journalist, not a salesperson. Rather than trying to talk your company up, ask people about their lives, their needs, their frustrations, and how a product like yours could help.

Ask "why?" so you can dig deeper. Get into the specifics and learn about their past behavior.

Record the conversation. Focus on the conversation and avoid relying solely on notes by recording the interview. There are plenty of services that will transcribe recorded conversations for a good price (including Hotjar!).

Avoid asking leading questions , which reveal bias on your part and pushes respondents to answer in a certain direction (e.g. “Have you taken advantage of the amazing new features we just released?).

Don't ask loaded questions , which sneak in an assumption which, if untrue, would make it impossible to answer honestly. For example, we can’t ask you, “What did you find most useful about this article?” without asking whether you found the article useful in the first place.

Be cautious when asking opinions about the future (or predictions of future behavior). Studies suggest that people aren’t very good at predicting their future behavior. This is due to several cognitive biases, from the misguided exceptionalism bias (we’re good at guessing what others will do, but we somehow think we’re different), to the optimism bias (which makes us see things with rose-colored glasses), to the ‘illusion of control’ (which makes us forget the role of randomness in future events).

How Smallpdf did it: Kristina explored her teacher user persona by speaking with university professors at a local graduate school. She learned that the school was mostly paperless and rarely used PDFs, so for the sake of time, she moved on to the admins.

A bit of a letdown? Sure. But this story highlights an important lesson: sometimes you follow a lead and come up short, so you have to make adjustments on the fly. Lean market research is about getting solid, actionable insights quickly so you can tweak things and see what works.

💡Pro tip: to save even more time, conduct remote interviews using an online user research service like Hotjar Engage , which automates the entire interview process, from recruitment and scheduling to hosting and recording.

You can interview your own customers or connect with people from our diverse pool of 200,000+ participants from 130+ countries and 25 industries. And no need to fret about taking meticulous notes—Engage will automatically transcribe the interview for you.

4. Analyze the data (without drowning in it)

The following techniques will help you wrap your head around the market data you collect without losing yourself in it. Remember, the point of lean market research is to find quick, actionable insights.

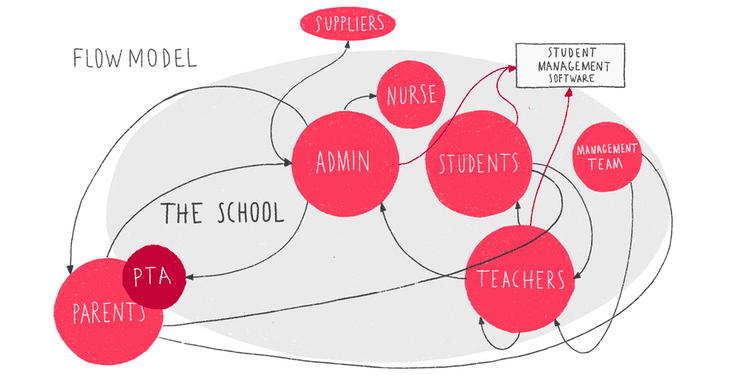

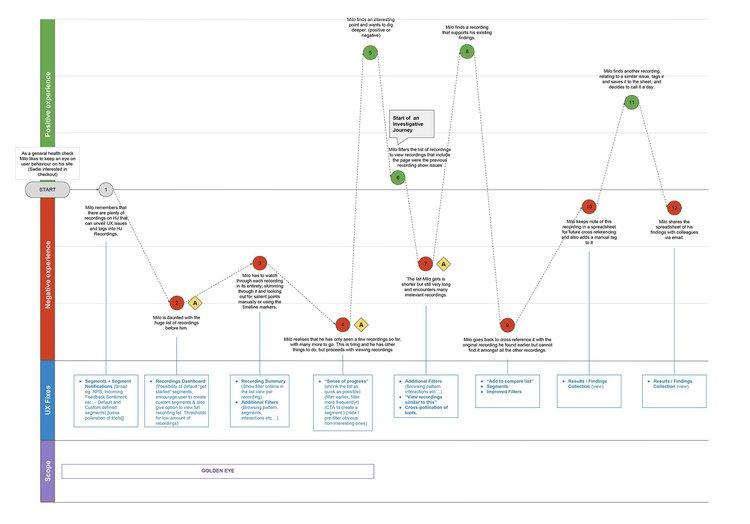

A flow model is a diagram that tracks the flow of information within a system. By creating a simple visual representation of how users interact with your product and each other, you can better assess their needs.

You’ll notice that admins are at the center of Smallpdf’s flow model, which represents the flow of PDF-related documents throughout a school. This flow model shows the challenges that admins face as they work to satisfy their own internal and external customers.

Affinity diagram

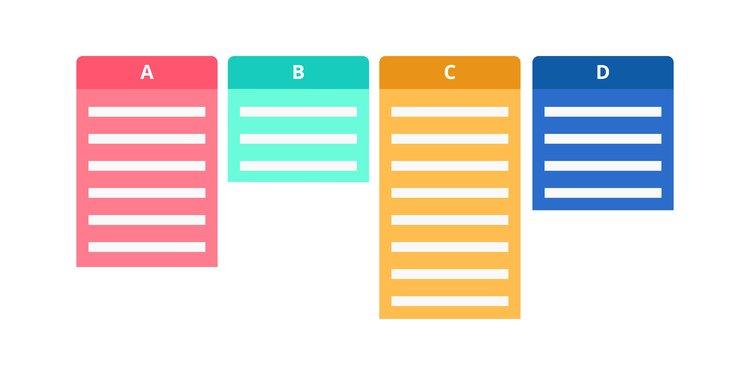

An affinity diagram is a way of sorting large amounts of data into groups to better understand the big picture. For example, if you ask your users about their profession, you’ll notice some general themes start to form, even though the individual responses differ. Depending on your needs, you could group them by profession, or more generally by industry.

We wrote a guide about how to analyze open-ended questions to help you sort through and categorize large volumes of response data. You can also do this by hand by clipping up survey responses or interview notes and grouping them (which is what Kristina does).

“For an interview, you will have somewhere between 30 and 60 notes, and those notes are usually direct phrases. And when you literally cut them up into separate pieces of paper and group them, they should make sense by themselves.”

Pro tip: if you’re conducting an online survey with Hotjar, keep your team in the loop by sharing survey responses automatically via our Slack and Microsoft Team integrations. Reading answers as they come in lets you digest the data in pieces and can help prepare you for identifying common themes when it comes time for analysis.

Hotjar lets you easily share survey responses with your team

Customer journey map

A customer journey map is a diagram that shows the way a typical prospect becomes a paying customer. It outlines their first interaction with your brand and every step in the sales cycle, from awareness to repurchase (and hopefully advocacy).

The above customer journey map , created by our team at Hotjar, shows many ways a customer might engage with our tool. Your map will be based on your own data and business model.

📚 Read more: if you’re new to customer journey maps, we wrote this step-by-step guide to creating your first customer journey map in 2 and 1/2 days with free templates you can download and start using immediately.

Next steps: from research to results

So, how do you turn market research insights into tangible business results? Let’s look at the actions Smallpdf took after conducting their lean market research: first they implemented changes, then measured the impact.

Implement changes

Based on what Smallpdf learned about the challenges that one key user segment (admins) face when trying to convert PDFs into Word files, they improved their ‘PDF to Word’ conversion tool.

We won’t go into the details here because it involves a lot of technical jargon, but they made the entire process simpler and more straightforward for users. Plus, they made it so that their system recognized when you drop a PDF file into their ‘Word to PDF’ converter instead of the ‘PDF to Word’ converter, so users wouldn’t have to redo the task when they made that mistake.

In other words: simple market segmentation for admins showed a business need that had to be accounted for, and customers are happier overall after Smallpdf implemented an informed change to their product.

Measure results

According to the Lean UX model, product and UX changes aren’t retained unless they achieve results.

Smallpdf’s changes produced:

A 75% reduction in error rate for the ‘PDF to Word’ converter

A 1% increase in NPS

Greater confidence in the team’s marketing efforts

"With all the changes said and done, we've cut our original error rate in four, which is huge. We increased our NPS by +1%, which isn't huge, but it means that of the users who received a file, they were still slightly happier than before, even if they didn't notice that anything special happened at all.”

Subscribe to fresh and free monthly insights.

Over 50,000 people interested in UX, product, digital empathy, and beyond, receive our newsletter every month. No spam, just thoughtful perspectives from a range of experts, new approaches to remote work, and loads more valuable insights. If that floats your boat, why not become a subscriber?

I have read and accepted the message outlined here: Hotjar uses the information you provide to us to send you relevant content, updates and offers from time to time. You can unsubscribe at any time by clicking the link at the bottom of any email.

Market research (or marketing research) is any set of techniques used to gather information and better understand a company’s target market. This might include primary research on brand awareness and customer satisfaction or secondary market research on market size and competitive analysis. Businesses use this information to design better products, improve user experience, and craft a marketing strategy that attracts quality leads and improves conversion rates.

David Darmanin, one of Hotjar’s founders, launched two startups before Hotjar took off—but both companies crashed and burned. Each time, he and his team spent months trying to design an amazing new product and user experience, but they failed because they didn’t have a clear understanding of what the market demanded.

With Hotjar, they did things differently . Long story short, they conducted market research in the early stages to figure out what consumers really wanted, and the team made (and continues to make) constant improvements based on market and user research.

Without market research, it’s impossible to understand your users. Sure, you might have a general idea of who they are and what they need, but you have to dig deep if you want to win their loyalty.

Here’s why research matters:

Obsessing over your users is the only way to win. If you don’t care deeply about them, you’ll lose potential customers to someone who does.

Analytics gives you the ‘what’, while research gives you the ‘why’. Big data, user analytics , and dashboards can tell you what people do at scale, but only research can tell you what they’re thinking and why they do what they do. For example, analytics can tell you that customers leave when they reach your pricing page, but only research can explain why.

Research beats assumptions, trends, and so-called best practices. Have you ever watched your colleagues rally behind a terrible decision? Bad ideas are often the result of guesswork, emotional reasoning, death by best practices , and defaulting to the Highest Paid Person’s Opinion (HiPPO). By listening to your users and focusing on their customer experience , you’re less likely to get pulled in the wrong direction.

Research keeps you from planning in a vacuum. Your team might be amazing, but you and your colleagues simply can’t experience your product the way your customers do. Customers might use your product in a way that surprises you, and product features that seem obvious to you might confuse them. Over-planning and refusing to test your assumptions is a waste of time, money, and effort because you’ll likely need to make changes once your untested business plan gets put into practice.

Lean User Experience (UX) design is a model for continuous improvement that relies on quick, efficient research to understand customer needs and test new product features.

Lean market research can help you become more...

Efficient: it gets you closer to your customers, faster.

Cost-effective: no need to hire an expensive marketing firm to get things started.

Competitive: quick, powerful insights can place your products on the cutting edge.

As a small business or sole proprietor, conducting lean market research is an attractive option when investing in a full-blown research project might seem out of scope or budget.

There are lots of different ways you could conduct market research and collect customer data, but you don’t have to limit yourself to just one research method. Four common types of market research techniques include surveys, interviews, focus groups, and customer observation.

Which method you use may vary based on your business type: ecommerce business owners have different goals from SaaS businesses, so it’s typically prudent to mix and match these methods based on your particular goals and what you need to know.

1. Surveys: the most commonly used

Surveys are a form of qualitative research that ask respondents a short series of open- or closed-ended questions, which can be delivered as an on-screen questionnaire or via email. When we asked 2,000 Customer Experience (CX) professionals about their company’s approach to research , surveys proved to be the most commonly used market research technique.

What makes online surveys so popular?

They’re easy and inexpensive to conduct, and you can do a lot of data collection quickly. Plus, the data is pretty straightforward to analyze, even when you have to analyze open-ended questions whose answers might initially appear difficult to categorize.

We've built a number of survey templates ready and waiting for you. Grab a template and share with your customers in just a few clicks.

💡 Pro tip: you can also get started with Hotjar AI for Surveys to create a survey in mere seconds . Just enter your market research goal and watch as the AI generates a survey and populates it with relevant questions.

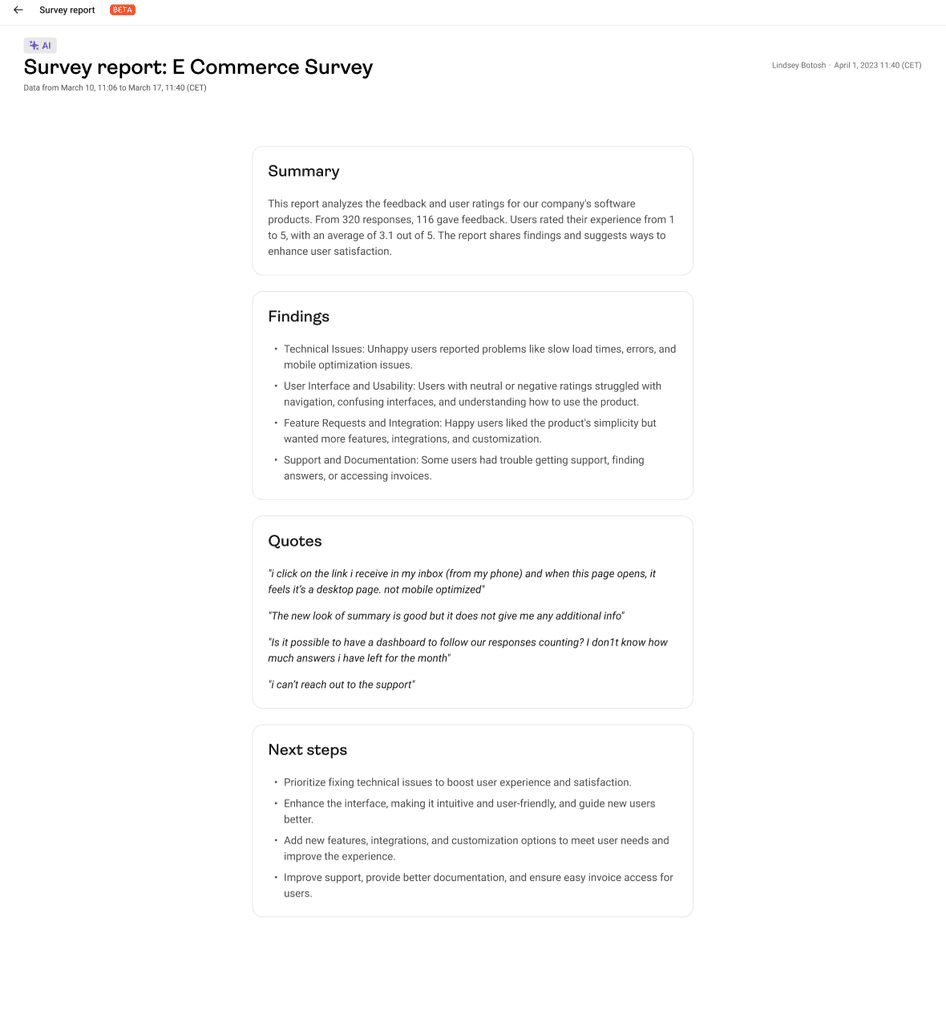

Once you’re ready for data analysis, the AI will prepare an automated research report that succinctly summarizes key findings, quotes, and suggested next steps.

An example research report generated by Hotjar AI for Surveys

2. Interviews: the most insightful

Interviews are one-on-one conversations with members of your target market. Nothing beats a face-to-face interview for diving deep (and reading non-verbal cues), but if an in-person meeting isn’t possible, video conferencing is a solid second choice.

Regardless of how you conduct it, any type of in-depth interview will produce big benefits in understanding your target customers.

What makes interviews so insightful?

By speaking directly with an ideal customer, you’ll gain greater empathy for their experience , and you can follow insightful threads that can produce plenty of 'Aha!' moments.

3. Focus groups: the most unreliable

Focus groups bring together a carefully selected group of people who fit a company’s target market. A trained moderator leads a conversation surrounding the product, user experience, or marketing message to gain deeper insights.

What makes focus groups so unreliable?

If you’re new to market research, we wouldn’t recommend starting with focus groups. Doing it right is expensive , and if you cut corners, your research could fall victim to all kinds of errors. Dominance bias (when a forceful participant influences the group) and moderator style bias (when different moderator personalities bring about different results in the same study) are two of the many ways your focus group data could get skewed.

4. Observation: the most powerful

During a customer observation session, someone from the company takes notes while they watch an ideal user engage with their product (or a similar product from a competitor).

What makes observation so clever and powerful?

‘Fly-on-the-wall’ observation is a great alternative to focus groups. It’s not only less expensive, but you’ll see people interact with your product in a natural setting without influencing each other. The only downside is that you can’t get inside their heads, so observation still isn't a recommended replacement for customer surveys and interviews.

The following questions will help you get to know your users on a deeper level when you interview them. They’re general questions, of course, so don’t be afraid to make them your own.

1. Who are you and what do you do?

How you ask this question, and what you want to know, will vary depending on your business model (e.g. business-to-business marketing is usually more focused on someone’s profession than business-to-consumer marketing).

It’s a great question to start with, and it’ll help you understand what’s relevant about your user demographics (age, race, gender, profession, education, etc.), but it’s not the be-all-end-all of market research. The more specific questions come later.

2. What does your day look like?

This question helps you understand your users’ day-to-day life and the challenges they face. It will help you gain empathy for them, and you may stumble across something relevant to their buying habits.

3. Do you ever purchase [product/service type]?

This is a ‘yes or no’ question. A ‘yes’ will lead you to the next question.

4. What problem were you trying to solve or what goal were you trying to achieve?

This question strikes to the core of what someone’s trying to accomplish and why they might be willing to pay for your solution.

5. Take me back to the day when you first decided you needed to solve this kind of problem or achieve this goal.

This is the golden question, and it comes from Adele Revella, Founder and CEO of Buyer Persona Institute . It helps you get in the heads of your users and figure out what they were thinking the day they decided to spend money to solve a problem.

If you take your time with this question, digging deeper where it makes sense, you should be able to answer all the relevant information you need to understand their perspective.

“The only scripted question I want you to ask them is this one: take me back to the day when you first decided that you needed to solve this kind of problem or achieve this kind of a goal. Not to buy my product, that’s not the day. We want to go back to the day that when you thought it was urgent and compelling to go spend money to solve a particular problem or achieve a goal. Just tell me what happened.”

— Adele Revella , Founder/CEO at Buyer Persona Institute

Bonus question: is there anything else you’d like to tell me?

This question isn’t just a nice way to wrap it up—it might just give participants the opportunity they need to tell you something you really need to know.

That’s why Sarah Doody, author of UX Notebook , adds it to the end of her written surveys.

“I always have a last question, which is just open-ended: “Is there anything else you would like to tell me?” And sometimes, that’s where you get four paragraphs of amazing content that you would never have gotten if it was just a Net Promoter Score [survey] or something like that.”

What is the difference between qualitative and quantitative research?

Qualitative research asks questions that can’t be reduced to a number, such as, “What is your job title?” or “What did you like most about your customer service experience?”

Quantitative research asks questions that can be answered with a numeric value, such as, “What is your annual salary?” or “How was your customer service experience on a scale of 1-5?”

→ Read more about the differences between qualitative and quantitative user research .

How do I do my own market research?

You can do your own quick and effective market research by

Surveying your customers

Building user personas

Studying your users through interviews and observation

Wrapping your head around your data with tools like flow models, affinity diagrams, and customer journey maps

What is the difference between market research and user research?

Market research takes a broad look at potential customers—what problems they’re trying to solve, their buying experience, and overall demand. User research, on the other hand, is more narrowly focused on the use (and usability ) of specific products.

What are the main criticisms of market research?

Many marketing professionals are critical of market research because it can be expensive and time-consuming. It’s often easier to convince your CEO or CMO to let you do lean market research rather than something more extensive because you can do it yourself. It also gives you quick answers so you can stay ahead of the competition.

Do I need a market research firm to get reliable data?

Absolutely not! In fact, we recommend that you start small and do it yourself in the beginning. By following a lean market research strategy, you can uncover some solid insights about your clients. Then you can make changes, test them out, and see whether the results are positive. This is an excellent strategy for making quick changes and remaining competitive.

Net Promoter, Net Promoter System, Net Promoter Score, NPS, and the NPS-related emoticons are registered trademarks of Bain & Company, Inc., Fred Reichheld, and Satmetrix Systems, Inc.

Related articles

6 traits of top marketing leaders (and how to cultivate them in yourself)

Stepping into a marketing leadership role can stir up a mix of emotions: excitement, optimism, and, often, a gnawing doubt. "Do I have the right skills to truly lead and inspire?" If you've ever wrestled with these uncertainties, you're not alone.

Hotjar team

The 7 best BI tools for marketers in 2024 (and how to use them)

Whether you're sifting through campaign attribution data or reviewing performance reports from different sources, extracting meaningful business insights from vast amounts of data is an often daunting—yet critical—task many marketers face. So how do you efficiently evaluate your results and communicate key learnings?

This is where business intelligence (BI) tools come in, transforming raw data into actionable insights that drive informed, customer-centric decisions.

6 marketing trends that will shape the future of ecommerce in 2023

Today, marketing trends evolve at the speed of technology. Ecommerce businesses that fail to update their marketing strategies to meet consumers where they are in 2023 will be left out of the conversations that drive brand success.

Geoff Whiting

Before accessing the site, please choose from the following options.

If you are an Individual Investor and you have queries in respect of your investment in Morgan Stanley Investment Management products, you should contact your Financial Adviser. If you are unable to contact your Financial Advisor and require assistance, please send an email to [email protected]

Stock Market Concentration: How Much Is Too Much?

- Stock market concentration has increased sharply over the past decade, creating a challenging environment for active managers and also raising unease about the loss of diversification, the valuations of the largest stocks, and the effect of flows into index funds.

- In this report, we look at concentration over the past 75 years to see where we stand today and to reflect on what it means for active equity managers.

- We examine which companies have had the largest stock market capitalizations and how that population has changed.

- We ask whether there is a correct level of concentration, both by comparing the U.S. to other global markets and by presenting the possibility that concentration was too low in the past.

- We then seek to determine whether fundamental corporate performance supports the current increase in concentration.

Subscribe to Counterpoint Global Insights - Consilient Observer

Please enter the code sent to your email address.

Valid for 10 minutes only

Invalid Otp

Resend Code

Thank you for Subscribing to Counterpoint Global Insights - Consilient Observer.</p> "> Thank you for Subscribing to Counterpoint Global Insights - Consilient Observer.

DEFINITIONS Market Capitalization is the total dollar market value of all of a company's outstanding shares.

IMPORTANT INFORMATION The views and opinions are those of the author as of the date of publication and are subject to change at any time due to market or economic conditions and may not necessarily come to pass. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

This material is for the benefit of persons whom the Firm reasonably believes it is permitted to communicate to and should not be forwarded to any other person without the consent of the Firm. It is not addressed to any other person and may not be used by them for any purpose whatsoever. It is the responsibility of every person reading this material to fully observe the laws of any relevant country, including obtaining any governmental or other consent which may be required or observing any other formality which needs to be observed in that country.

This material is a general communication, which is not impartial, is for informational and educational purposes only, not a recommendation to purchase or sell specific securities, or to adopt any particular investment strategy. Information does not address financial objectives, situation or specific needs of individual investors.

Any charts and graphs provided are for illustrative purposes only. Any performance quoted represents past performance. Past performance does not guarantee future results. All investments involve risks, including the possible loss of principal.

For the complete content and important disclosures, refer to the article pdf .

Introduction to Market Research

- First Online: 20 July 2018

Cite this chapter

- Marko Sarstedt 3 &

- Erik Mooi 4

Part of the book series: Springer Texts in Business and Economics ((STBE))

140k Accesses

10 Citations

Market research is key to understanding markets and requires the systematic gathering and interpreting of information about individuals and organizations. This will give you an essential understanding of your customers’ needs, a head start on your competitors, allow you to spot potential problems, and future growth. Drawing on real examples, we show the value of market research, describe its main purposes, and explain how market research differs from marketing research. We explain what makes, or breaks, a successful market research study and describe when market research is most needed. We also provide a description of the different types of market research providers.

Electronic supplementary material

The online version of this chapter ( https://doi.org/10.1007/978-3-662-56707-4_1 ) contains additional material that is available to authorized users. You can also download the “Springer Nature More Media App” from the iOS or Android App Store to stream the videos and scan the image containing the “Play button”.

This is a preview of subscription content, log in via an institution to check access.

Access this chapter

- Available as PDF

- Read on any device

- Instant download

- Own it forever

- Available as EPUB and PDF

- Compact, lightweight edition

- Dispatched in 3 to 5 business days

- Free shipping worldwide - see info

- Durable hardcover edition

Tax calculation will be finalised at checkout

Purchases are for personal use only

Institutional subscriptions

Roberts et al. ( 2014 ) and Hauser ( 2017 ) discuss the impact of marketing science tools on marketing practice.

AMA Definition of Marketing. (2004). http://www.Marketingpower.com/AboutAMA/pages/definitionofmarketing.aspx

Hauser, J. R. (2017). Phenomena, theory, application, data, and methods all have impact. Journal of the Academy of Marketing Science , 45 (1), 7–9.

Article Google Scholar

Homburg, C., Vomberg, A., Enke, M., & Grimm, P. H. (2015). The loss of the marketing department’s influence: Is it happening? And why worry? Journal of the Academy of Marketing Science , 43 (1), 1–13.

Honomichl, J. (2016). 2016 Honomichl Gold Top 50. https://www.ama.org/publications/MarketingNews/Pages/2016-ama-gold-top-50-report.aspx . Accessed 03 May 2018.

Iaccobucci, D., & Churchill, G. A. (2015). Marketing research: Methodological foundations (11th ed.). Nashville, TN: CreateSpace Independent Publishing Platform.

Google Scholar

ICC/ESOMAR (2016). ICC/ESOMAR international code on market, opinion, and social research and data analytics. https://www.esomar.org/uploads/public/knowledge-and-standards/codes-and-guidelines/ICCESOMAR_Code_English_.pdf . Accessed 03 May 2018.

Lee, N., & Greenley, G. (2010). The theory-practice divide: Thoughts from the editors and senior advisory board of EJM. European Journal of Marketing , 44 (1/2), 5–20.

Reibstein, D. J., Day, G., & Wind, J. (2009). Guest editorial: Is marketing academia losing its way? Journal of Marketing , 73 (4), 1–3.

Roberts, J. H., Kayand, U., & Stremersch, S. (2014). From academic research to marketing practice: Exploring the marketing science value chain. International Journal of Research in Marketing , 31 (2), 128–140.

Rouziès, D., & Hulland, J. (2014). Does marketing and sales integration always pay off? Evidence from a social capital perspective. Journal of the Academy of Marketing Science , 42 (5), 511–527.

Sheth, J. N., Sisodia, R. S. (Eds.). (2006). Does marketing need reform? In J. N. Sheth, & R. S. Sisodia (Eds.), Does marketing need reform? Fresh perspective on the future (pp. 3–12). Armonk, NY: M.E. Sharpe.

Tellis, G. J. (2017). Interesting and impactful research: On phenomena, theory, and writing. Journal of the Academy of Marketing Science , 45 (1), 1–6.

Further Reading

American Marketing Association at http://www.marketingpower.com

British Market Research Society at http://www.mrs.org.uk

ESOMAR at http://www.esomar.org

GreenBook Directory at http://www.greenbook.org

Insights Association at http://www.insightsassociation.org/

Download references

Author information

Authors and affiliations.

Faculty of Economics and Management, Otto-von-Guericke- University Magdeburg, Magdeburg, Germany

Marko Sarstedt

Department of Management and Marketing, The University of Melbourne, Parkville, VIC, Australia

You can also search for this author in PubMed Google Scholar

Rights and permissions

Reprints and permissions

Copyright information

© 2019 Springer-Verlag GmbH Germany, part of Springer Nature

About this chapter

Sarstedt, M., Mooi, E. (2019). Introduction to Market Research. In: A Concise Guide to Market Research. Springer Texts in Business and Economics. Springer, Berlin, Heidelberg. https://doi.org/10.1007/978-3-662-56707-4_1

Download citation

DOI : https://doi.org/10.1007/978-3-662-56707-4_1

Published : 20 July 2018

Publisher Name : Springer, Berlin, Heidelberg

Print ISBN : 978-3-662-56706-7

Online ISBN : 978-3-662-56707-4

eBook Packages : Business and Management Business and Management (R0)

Share this chapter

Anyone you share the following link with will be able to read this content:

Sorry, a shareable link is not currently available for this article.

Provided by the Springer Nature SharedIt content-sharing initiative

- Publish with us

Policies and ethics

- Find a journal

- Track your research

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

Internet & Technology

6 facts about americans and tiktok.

62% of U.S. adults under 30 say they use TikTok, compared with 39% of those ages 30 to 49, 24% of those 50 to 64, and 10% of those 65 and older.

Many Americans think generative AI programs should credit the sources they rely on

Americans’ use of chatgpt is ticking up, but few trust its election information, whatsapp and facebook dominate the social media landscape in middle-income nations, sign up for our internet, science, and tech newsletter.

New findings, delivered monthly

Electric Vehicle Charging Infrastructure in the U.S.

64% of Americans live within 2 miles of a public electric vehicle charging station, and those who live closest to chargers view EVs more positively.

When Online Content Disappears

A quarter of all webpages that existed at one point between 2013 and 2023 are no longer accessible.

A quarter of U.S. teachers say AI tools do more harm than good in K-12 education

High school teachers are more likely than elementary and middle school teachers to hold negative views about AI tools in education.

Teens and Video Games Today

85% of U.S. teens say they play video games. They see both positive and negative sides, from making friends to harassment and sleep loss.

Americans’ Views of Technology Companies

Most Americans are wary of social media’s role in politics and its overall impact on the country, and these concerns are ticking up among Democrats. Still, Republicans stand out on several measures, with a majority believing major technology companies are biased toward liberals.

22% of Americans say they interact with artificial intelligence almost constantly or several times a day. 27% say they do this about once a day or several times a week.

About one-in-five U.S. adults have used ChatGPT to learn something new (17%) or for entertainment (17%).

Across eight countries surveyed in Latin America, Africa and South Asia, a median of 73% of adults say they use WhatsApp and 62% say they use Facebook.

5 facts about Americans and sports

About half of Americans (48%) say they took part in organized, competitive sports in high school or college.

REFINE YOUR SELECTION

Research teams, signature reports.

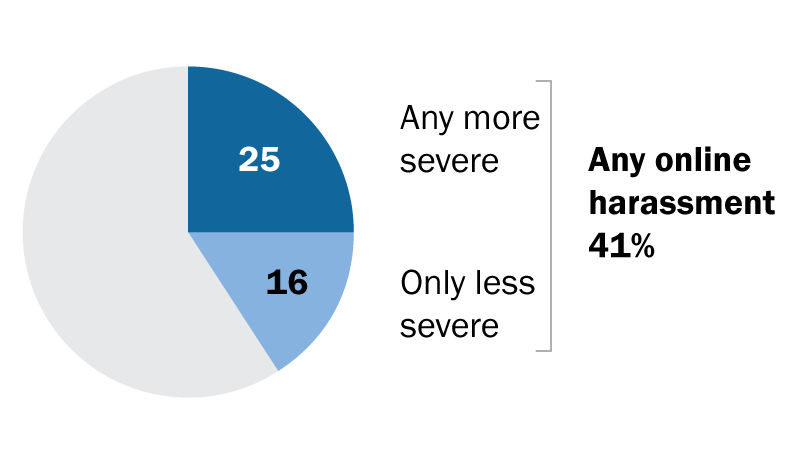

The State of Online Harassment

Roughly four-in-ten Americans have experienced online harassment, with half of this group citing politics as the reason they think they were targeted. Growing shares face more severe online abuse such as sexual harassment or stalking

Parenting Children in the Age of Screens

Two-thirds of parents in the U.S. say parenting is harder today than it was 20 years ago, with many citing technologies – like social media or smartphones – as a reason.

Dating and Relationships in the Digital Age

From distractions to jealousy, how Americans navigate cellphones and social media in their romantic relationships.

Americans and Privacy: Concerned, Confused and Feeling Lack of Control Over Their Personal Information

Majorities of U.S. adults believe their personal data is less secure now, that data collection poses more risks than benefits, and that it is not possible to go through daily life without being tracked.

Americans and ‘Cancel Culture’: Where Some See Calls for Accountability, Others See Censorship, Punishment

Social media fact sheet, digital knowledge quiz, video: how do americans define online harassment.

1615 L St. NW, Suite 800 Washington, DC 20036 USA (+1) 202-419-4300 | Main (+1) 202-857-8562 | Fax (+1) 202-419-4372 | Media Inquiries

Research Topics

- Email Newsletters

ABOUT PEW RESEARCH CENTER Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions. It is a subsidiary of The Pew Charitable Trusts .

© 2024 Pew Research Center

The state of AI in early 2024: Gen AI adoption spikes and starts to generate value

If 2023 was the year the world discovered generative AI (gen AI) , 2024 is the year organizations truly began using—and deriving business value from—this new technology. In the latest McKinsey Global Survey on AI, 65 percent of respondents report that their organizations are regularly using gen AI, nearly double the percentage from our previous survey just ten months ago. Respondents’ expectations for gen AI’s impact remain as high as they were last year , with three-quarters predicting that gen AI will lead to significant or disruptive change in their industries in the years ahead.

About the authors

This article is a collaborative effort by Alex Singla , Alexander Sukharevsky , Lareina Yee , and Michael Chui , with Bryce Hall , representing views from QuantumBlack, AI by McKinsey, and McKinsey Digital.

Organizations are already seeing material benefits from gen AI use, reporting both cost decreases and revenue jumps in the business units deploying the technology. The survey also provides insights into the kinds of risks presented by gen AI—most notably, inaccuracy—as well as the emerging practices of top performers to mitigate those challenges and capture value.

AI adoption surges

Interest in generative AI has also brightened the spotlight on a broader set of AI capabilities. For the past six years, AI adoption by respondents’ organizations has hovered at about 50 percent. This year, the survey finds that adoption has jumped to 72 percent (Exhibit 1). And the interest is truly global in scope. Our 2023 survey found that AI adoption did not reach 66 percent in any region; however, this year more than two-thirds of respondents in nearly every region say their organizations are using AI. 1 Organizations based in Central and South America are the exception, with 58 percent of respondents working for organizations based in Central and South America reporting AI adoption. Looking by industry, the biggest increase in adoption can be found in professional services. 2 Includes respondents working for organizations focused on human resources, legal services, management consulting, market research, R&D, tax preparation, and training.

Also, responses suggest that companies are now using AI in more parts of the business. Half of respondents say their organizations have adopted AI in two or more business functions, up from less than a third of respondents in 2023 (Exhibit 2).

Gen AI adoption is most common in the functions where it can create the most value

Most respondents now report that their organizations—and they as individuals—are using gen AI. Sixty-five percent of respondents say their organizations are regularly using gen AI in at least one business function, up from one-third last year. The average organization using gen AI is doing so in two functions, most often in marketing and sales and in product and service development—two functions in which previous research determined that gen AI adoption could generate the most value 3 “ The economic potential of generative AI: The next productivity frontier ,” McKinsey, June 14, 2023. —as well as in IT (Exhibit 3). The biggest increase from 2023 is found in marketing and sales, where reported adoption has more than doubled. Yet across functions, only two use cases, both within marketing and sales, are reported by 15 percent or more of respondents.

Gen AI also is weaving its way into respondents’ personal lives. Compared with 2023, respondents are much more likely to be using gen AI at work and even more likely to be using gen AI both at work and in their personal lives (Exhibit 4). The survey finds upticks in gen AI use across all regions, with the largest increases in Asia–Pacific and Greater China. Respondents at the highest seniority levels, meanwhile, show larger jumps in the use of gen Al tools for work and outside of work compared with their midlevel-management peers. Looking at specific industries, respondents working in energy and materials and in professional services report the largest increase in gen AI use.

Investments in gen AI and analytical AI are beginning to create value

The latest survey also shows how different industries are budgeting for gen AI. Responses suggest that, in many industries, organizations are about equally as likely to be investing more than 5 percent of their digital budgets in gen AI as they are in nongenerative, analytical-AI solutions (Exhibit 5). Yet in most industries, larger shares of respondents report that their organizations spend more than 20 percent on analytical AI than on gen AI. Looking ahead, most respondents—67 percent—expect their organizations to invest more in AI over the next three years.

Where are those investments paying off? For the first time, our latest survey explored the value created by gen AI use by business function. The function in which the largest share of respondents report seeing cost decreases is human resources. Respondents most commonly report meaningful revenue increases (of more than 5 percent) in supply chain and inventory management (Exhibit 6). For analytical AI, respondents most often report seeing cost benefits in service operations—in line with what we found last year —as well as meaningful revenue increases from AI use in marketing and sales.

Inaccuracy: The most recognized and experienced risk of gen AI use

As businesses begin to see the benefits of gen AI, they’re also recognizing the diverse risks associated with the technology. These can range from data management risks such as data privacy, bias, or intellectual property (IP) infringement to model management risks, which tend to focus on inaccurate output or lack of explainability. A third big risk category is security and incorrect use.

Respondents to the latest survey are more likely than they were last year to say their organizations consider inaccuracy and IP infringement to be relevant to their use of gen AI, and about half continue to view cybersecurity as a risk (Exhibit 7).

Conversely, respondents are less likely than they were last year to say their organizations consider workforce and labor displacement to be relevant risks and are not increasing efforts to mitigate them.

In fact, inaccuracy— which can affect use cases across the gen AI value chain , ranging from customer journeys and summarization to coding and creative content—is the only risk that respondents are significantly more likely than last year to say their organizations are actively working to mitigate.

Some organizations have already experienced negative consequences from the use of gen AI, with 44 percent of respondents saying their organizations have experienced at least one consequence (Exhibit 8). Respondents most often report inaccuracy as a risk that has affected their organizations, followed by cybersecurity and explainability.

Our previous research has found that there are several elements of governance that can help in scaling gen AI use responsibly, yet few respondents report having these risk-related practices in place. 4 “ Implementing generative AI with speed and safety ,” McKinsey Quarterly , March 13, 2024. For example, just 18 percent say their organizations have an enterprise-wide council or board with the authority to make decisions involving responsible AI governance, and only one-third say gen AI risk awareness and risk mitigation controls are required skill sets for technical talent.

Bringing gen AI capabilities to bear

The latest survey also sought to understand how, and how quickly, organizations are deploying these new gen AI tools. We have found three archetypes for implementing gen AI solutions : takers use off-the-shelf, publicly available solutions; shapers customize those tools with proprietary data and systems; and makers develop their own foundation models from scratch. 5 “ Technology’s generational moment with generative AI: A CIO and CTO guide ,” McKinsey, July 11, 2023. Across most industries, the survey results suggest that organizations are finding off-the-shelf offerings applicable to their business needs—though many are pursuing opportunities to customize models or even develop their own (Exhibit 9). About half of reported gen AI uses within respondents’ business functions are utilizing off-the-shelf, publicly available models or tools, with little or no customization. Respondents in energy and materials, technology, and media and telecommunications are more likely to report significant customization or tuning of publicly available models or developing their own proprietary models to address specific business needs.

Respondents most often report that their organizations required one to four months from the start of a project to put gen AI into production, though the time it takes varies by business function (Exhibit 10). It also depends upon the approach for acquiring those capabilities. Not surprisingly, reported uses of highly customized or proprietary models are 1.5 times more likely than off-the-shelf, publicly available models to take five months or more to implement.

Gen AI high performers are excelling despite facing challenges

Gen AI is a new technology, and organizations are still early in the journey of pursuing its opportunities and scaling it across functions. So it’s little surprise that only a small subset of respondents (46 out of 876) report that a meaningful share of their organizations’ EBIT can be attributed to their deployment of gen AI. Still, these gen AI leaders are worth examining closely. These, after all, are the early movers, who already attribute more than 10 percent of their organizations’ EBIT to their use of gen AI. Forty-two percent of these high performers say more than 20 percent of their EBIT is attributable to their use of nongenerative, analytical AI, and they span industries and regions—though most are at organizations with less than $1 billion in annual revenue. The AI-related practices at these organizations can offer guidance to those looking to create value from gen AI adoption at their own organizations.

To start, gen AI high performers are using gen AI in more business functions—an average of three functions, while others average two. They, like other organizations, are most likely to use gen AI in marketing and sales and product or service development, but they’re much more likely than others to use gen AI solutions in risk, legal, and compliance; in strategy and corporate finance; and in supply chain and inventory management. They’re more than three times as likely as others to be using gen AI in activities ranging from processing of accounting documents and risk assessment to R&D testing and pricing and promotions. While, overall, about half of reported gen AI applications within business functions are utilizing publicly available models or tools, gen AI high performers are less likely to use those off-the-shelf options than to either implement significantly customized versions of those tools or to develop their own proprietary foundation models.

What else are these high performers doing differently? For one thing, they are paying more attention to gen-AI-related risks. Perhaps because they are further along on their journeys, they are more likely than others to say their organizations have experienced every negative consequence from gen AI we asked about, from cybersecurity and personal privacy to explainability and IP infringement. Given that, they are more likely than others to report that their organizations consider those risks, as well as regulatory compliance, environmental impacts, and political stability, to be relevant to their gen AI use, and they say they take steps to mitigate more risks than others do.

Gen AI high performers are also much more likely to say their organizations follow a set of risk-related best practices (Exhibit 11). For example, they are nearly twice as likely as others to involve the legal function and embed risk reviews early on in the development of gen AI solutions—that is, to “ shift left .” They’re also much more likely than others to employ a wide range of other best practices, from strategy-related practices to those related to scaling.

In addition to experiencing the risks of gen AI adoption, high performers have encountered other challenges that can serve as warnings to others (Exhibit 12). Seventy percent say they have experienced difficulties with data, including defining processes for data governance, developing the ability to quickly integrate data into AI models, and an insufficient amount of training data, highlighting the essential role that data play in capturing value. High performers are also more likely than others to report experiencing challenges with their operating models, such as implementing agile ways of working and effective sprint performance management.

About the research

The online survey was in the field from February 22 to March 5, 2024, and garnered responses from 1,363 participants representing the full range of regions, industries, company sizes, functional specialties, and tenures. Of those respondents, 981 said their organizations had adopted AI in at least one business function, and 878 said their organizations were regularly using gen AI in at least one function. To adjust for differences in response rates, the data are weighted by the contribution of each respondent’s nation to global GDP.

Alex Singla and Alexander Sukharevsky are global coleaders of QuantumBlack, AI by McKinsey, and senior partners in McKinsey’s Chicago and London offices, respectively; Lareina Yee is a senior partner in the Bay Area office, where Michael Chui , a McKinsey Global Institute partner, is a partner; and Bryce Hall is an associate partner in the Washington, DC, office.

They wish to thank Kaitlin Noe, Larry Kanter, Mallika Jhamb, and Shinjini Srivastava for their contributions to this work.

This article was edited by Heather Hanselman, a senior editor in McKinsey’s Atlanta office.

Explore a career with us

Related articles.

Moving past gen AI’s honeymoon phase: Seven hard truths for CIOs to get from pilot to scale

A generative AI reset: Rewiring to turn potential into value in 2024

Implementing generative AI with speed and safety

Why the Pandemic Probably Started in a Lab, in 5 Key Points

By Alina Chan

Dr. Chan is a molecular biologist at the Broad Institute of M.I.T. and Harvard, and a co-author of “Viral: The Search for the Origin of Covid-19.”

This article has been updated to reflect news developments.

On Monday, Dr. Anthony Fauci returned to the halls of Congress and testified before the House subcommittee investigating the Covid-19 pandemic. He was questioned about several topics related to the government’s handling of Covid-19, including how the National Institute of Allergy and Infectious Diseases, which he directed until retiring in 2022, supported risky virus work at a Chinese institute whose research may have caused the pandemic.

For more than four years, reflexive partisan politics have derailed the search for the truth about a catastrophe that has touched us all. It has been estimated that at least 25 million people around the world have died because of Covid-19, with over a million of those deaths in the United States.

Although how the pandemic started has been hotly debated, a growing volume of evidence — gleaned from public records released under the Freedom of Information Act, digital sleuthing through online databases, scientific papers analyzing the virus and its spread, and leaks from within the U.S. government — suggests that the pandemic most likely occurred because a virus escaped from a research lab in Wuhan, China. If so, it would be the most costly accident in the history of science.

Here’s what we now know:

1 The SARS-like virus that caused the pandemic emerged in Wuhan, the city where the world’s foremost research lab for SARS-like viruses is located.

- At the Wuhan Institute of Virology, a team of scientists had been hunting for SARS-like viruses for over a decade, led by Shi Zhengli.

- Their research showed that the viruses most similar to SARS‑CoV‑2, the virus that caused the pandemic, circulate in bats that live r oughly 1,000 miles away from Wuhan. Scientists from Dr. Shi’s team traveled repeatedly to Yunnan province to collect these viruses and had expanded their search to Southeast Asia. Bats in other parts of China have not been found to carry viruses that are as closely related to SARS-CoV-2.

The closest known relatives to SARS-CoV-2 were found in southwestern China and in Laos.

Large cities

Mine in Yunnan province

Cave in Laos

South China Sea

The closest known relatives to SARS-CoV-2

were found in southwestern China and in Laos.

philippines

The closest known relatives to SARS-CoV-2 were found

in southwestern China and Laos.

Sources: Sarah Temmam et al., Nature; SimpleMaps

Note: Cities shown have a population of at least 200,000.

There are hundreds of large cities in China and Southeast Asia.

There are hundreds of large cities in China

and Southeast Asia.

The pandemic started roughly 1,000 miles away, in Wuhan, home to the world’s foremost SARS-like virus research lab.

The pandemic started roughly 1,000 miles away,

in Wuhan, home to the world’s foremost SARS-like virus research lab.

The pandemic started roughly 1,000 miles away, in Wuhan,

home to the world’s foremost SARS-like virus research lab.

- Even at hot spots where these viruses exist naturally near the cave bats of southwestern China and Southeast Asia, the scientists argued, as recently as 2019 , that bat coronavirus spillover into humans is rare .

- When the Covid-19 outbreak was detected, Dr. Shi initially wondered if the novel coronavirus had come from her laboratory , saying she had never expected such an outbreak to occur in Wuhan.

- The SARS‑CoV‑2 virus is exceptionally contagious and can jump from species to species like wildfire . Yet it left no known trace of infection at its source or anywhere along what would have been a thousand-mile journey before emerging in Wuhan.

2 The year before the outbreak, the Wuhan institute, working with U.S. partners, had proposed creating viruses with SARS‑CoV‑2’s defining feature.

- Dr. Shi’s group was fascinated by how coronaviruses jump from species to species. To find viruses, they took samples from bats and other animals , as well as from sick people living near animals carrying these viruses or associated with the wildlife trade. Much of this work was conducted in partnership with the EcoHealth Alliance, a U.S.-based scientific organization that, since 2002, has been awarded over $80 million in federal funding to research the risks of emerging infectious diseases.

- The laboratory pursued risky research that resulted in viruses becoming more infectious : Coronaviruses were grown from samples from infected animals and genetically reconstructed and recombined to create new viruses unknown in nature. These new viruses were passed through cells from bats, pigs, primates and humans and were used to infect civets and humanized mice (mice modified with human genes). In essence, this process forced these viruses to adapt to new host species, and the viruses with mutations that allowed them to thrive emerged as victors.

- By 2019, Dr. Shi’s group had published a database describing more than 22,000 collected wildlife samples. But external access was shut off in the fall of 2019, and the database was not shared with American collaborators even after the pandemic started , when such a rich virus collection would have been most useful in tracking the origin of SARS‑CoV‑2. It remains unclear whether the Wuhan institute possessed a precursor of the pandemic virus.

- In 2021, The Intercept published a leaked 2018 grant proposal for a research project named Defuse , which had been written as a collaboration between EcoHealth, the Wuhan institute and Ralph Baric at the University of North Carolina, who had been on the cutting edge of coronavirus research for years. The proposal described plans to create viruses strikingly similar to SARS‑CoV‑2.

- Coronaviruses bear their name because their surface is studded with protein spikes, like a spiky crown, which they use to enter animal cells. T he Defuse project proposed to search for and create SARS-like viruses carrying spikes with a unique feature: a furin cleavage site — the same feature that enhances SARS‑CoV‑2’s infectiousness in humans, making it capable of causing a pandemic. Defuse was never funded by the United States . However, in his testimony on Monday, Dr. Fauci explained that the Wuhan institute would not need to rely on U.S. funding to pursue research independently.

The Wuhan lab ran risky experiments to learn about how SARS-like viruses might infect humans.

1. Collect SARS-like viruses from bats and other wild animals, as well as from people exposed to them.

2. Identify high-risk viruses by screening for spike proteins that facilitate infection of human cells.

2. Identify high-risk viruses by screening for spike proteins that facilitate infection of

human cells.

In Defuse, the scientists proposed to add a furin cleavage site to the spike protein.

3. Create new coronaviruses by inserting spike proteins or other features that could make the viruses more infectious in humans.

4. Infect human cells, civets and humanized mice with the new coronaviruses, to determine how dangerous they might be.

- While it’s possible that the furin cleavage site could have evolved naturally (as seen in some distantly related coronaviruses), out of the hundreds of SARS-like viruses cataloged by scientists, SARS‑CoV‑2 is the only one known to possess a furin cleavage site in its spike. And the genetic data suggest that the virus had only recently gained the furin cleavage site before it started the pandemic.

- Ultimately, a never-before-seen SARS-like virus with a newly introduced furin cleavage site, matching the description in the Wuhan institute’s Defuse proposal, caused an outbreak in Wuhan less than two years after the proposal was drafted.

- When the Wuhan scientists published their seminal paper about Covid-19 as the pandemic roared to life in 2020, they did not mention the virus’s furin cleavage site — a feature they should have been on the lookout for, according to their own grant proposal, and a feature quickly recognized by other scientists.

- Worse still, as the pandemic raged, their American collaborators failed to publicly reveal the existence of the Defuse proposal. The president of EcoHealth, Peter Daszak, recently admitted to Congress that he doesn’t know about virus samples collected by the Wuhan institute after 2015 and never asked the lab’s scientists if they had started the work described in Defuse. In May, citing failures in EcoHealth’s monitoring of risky experiments conducted at the Wuhan lab, the Biden administration suspended all federal funding for the organization and Dr. Daszak, and initiated proceedings to bar them from receiving future grants. In his testimony on Monday, Dr. Fauci said that he supported the decision to suspend and bar EcoHealth.

- Separately, Dr. Baric described the competitive dynamic between his research group and the institute when he told Congress that the Wuhan scientists would probably not have shared their most interesting newly discovered viruses with him . Documents and email correspondence between the institute and Dr. Baric are still being withheld from the public while their release is fiercely contested in litigation.

- In the end, American partners very likely knew of only a fraction of the research done in Wuhan. According to U.S. intelligence sources, some of the institute’s virus research was classified or conducted with or on behalf of the Chinese military . In the congressional hearing on Monday, Dr. Fauci repeatedly acknowledged the lack of visibility into experiments conducted at the Wuhan institute, saying, “None of us can know everything that’s going on in China, or in Wuhan, or what have you. And that’s the reason why — I say today, and I’ve said at the T.I.,” referring to his transcribed interview with the subcommittee, “I keep an open mind as to what the origin is.”

3 The Wuhan lab pursued this type of work under low biosafety conditions that could not have contained an airborne virus as infectious as SARS‑CoV‑2.

- Labs working with live viruses generally operate at one of four biosafety levels (known in ascending order of stringency as BSL-1, 2, 3 and 4) that describe the work practices that are considered sufficiently safe depending on the characteristics of each pathogen. The Wuhan institute’s scientists worked with SARS-like viruses under inappropriately low biosafety conditions .

In the United States, virologists generally use stricter Biosafety Level 3 protocols when working with SARS-like viruses.

Biosafety cabinets prevent

viral particles from escaping.

Viral particles

Personal respirators provide

a second layer of defense against breathing in the virus.

DIRECT CONTACT

Gloves prevent skin contact.

Disposable wraparound

gowns cover much of the rest of the body.

Personal respirators provide a second layer of defense against breathing in the virus.

Disposable wraparound gowns

cover much of the rest of the body.

Note: Biosafety levels are not internationally standardized, and some countries use more permissive protocols than others.

The Wuhan lab had been regularly working with SARS-like viruses under Biosafety Level 2 conditions, which could not prevent a highly infectious virus like SARS-CoV-2 from escaping.

Some work is done in the open air, and masks are not required.

Less protective equipment provides more opportunities

for contamination.

Some work is done in the open air,

and masks are not required.

Less protective equipment provides more opportunities for contamination.

- In one experiment, Dr. Shi’s group genetically engineered an unexpectedly deadly SARS-like virus (not closely related to SARS‑CoV‑2) that exhibited a 10,000-fold increase in the quantity of virus in the lungs and brains of humanized mice . Wuhan institute scientists handled these live viruses at low biosafet y levels , including BSL-2.

- Even the much more stringent containment at BSL-3 cannot fully prevent SARS‑CoV‑2 from escaping . Two years into the pandemic, the virus infected a scientist in a BSL-3 laboratory in Taiwan, which was, at the time, a zero-Covid country. The scientist had been vaccinated and was tested only after losing the sense of smell. By then, more than 100 close contacts had been exposed. Human error is a source of exposure even at the highest biosafety levels , and the risks are much greater for scientists working with infectious pathogens at low biosafety.