- Search Search Please fill out this field.

- Capital Asset Pricing Model (CAPM)

Cost of Equity CAPM Formula

What the capm can tell you.

- CAPM vs. WACC

Limitations of Using CAPM

The bottom line.

- Corporate Finance

How Do I Use the CAPM to Determine Cost of Equity?

:max_bytes(150000):strip_icc():format(webp)/andrew_bloomenthal_bio_photo-5bfc262ec9e77c005199a327.png)

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas' experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

:max_bytes(150000):strip_icc():format(webp)/P2-ThomasCatalano-d5607267f385443798ae950ece178afd.jpg)

What Is the Capital Asset Pricing Model (CAPM)?

Corporate accountants and financial analysts often use the capital asset pricing model (CAPM) in capital budgeting to estimate the cost of shareholder equity. Described as the relationship between systematic risk and expected return for assets, CAPM is widely used for the pricing of risky securities, generating expected returns for assets given the associated risk, and calculating costs of capital.

Key Takeaways

- The capital asset pricing model (CAPM) is used to calculate expected returns given the cost of capital and risk of assets.

- The CAPM formula requires the rate of return for the general market, the beta value of the stock, and the risk-free rate.

- The weighted average cost of capital (WACC) is calculated with the firm's cost of debt and cost of equity—which can be calculated via the CAPM.

- There are limitations to the CAPM, such as agreeing on the rate of return and which one to use and making various assumptions.

- There are online calculators for determining the cost of equity, but calculating the formula by hand or by using Excel is a relatively simple exercise.

The CAPM formula requires only the following three pieces of information: the rate of return for the general market, the beta value of the stock in question, and the risk-free rate.

CAPM Formula

Cost of Equity = Risk-Free Rate of Return + Beta * (Market Rate of Return - Risk-Free Rate of Return)

The risk-free rate of return is the theoretical return of an investment that has zero risk. It's considered theoretical because every investment carries some amount of risk, however small. It generally assumes the rate of return that's offered by short-term government debt.

The cost of equity is an integral part of the weighted average cost of capital (WACC). WACC is widely used to determine the total anticipated cost of all capital under different financing plans. WACC is often used to find the most cost-effective mix of debt and equity financing.

Assume Company ABC trades on the S&P 500 with a rate of return of 10%. The company's stock is slightly more volatile than the market with a beta of 1.2. The risk-free rate based on the three-month T-bill is 4.5%.

Based on this information, the cost of the company's equity financing is 11%: Cost of Equity = 4.5% + (1.2 * (10% - 4.5%)) .

Numerous online calculators can determine the CAPM cost of equity, but calculating the formula by hand or by using Microsoft Excel is a relatively simple exercise.

The Difference Between CAPM and WACC

The CAPM is a formula for calculating the cost of equity. The cost of equity is part of the equation used for calculating the WACC. The WACC is the firm's cost of capital. This includes the cost of equity and the cost of debt.

WACC Formula

WACC = [Cost of Equity * Percent of Firm's Capital in Equity] + [Cost of Debt * Percent of Firm's Capital in Debt * (1 - Tax Rate)]

WACC can be used as a hurdle rate against which to evaluate future funding sources. WACC can be used to discount cash flows with capital projects to determine net present value. A company's WACC will be higher if its stock is volatile or seen as riskier as investors will demand greater returns to compensate for additional risk.

There are some limitations to the CAPM, such as agreeing on the rate of return and which one to use. Beyond that, there’s also the market return, which assumes positive returns, while also using historical data. This includes the beta, which is only available for publicly traded companies. The beta also only calculates systematic risk, which doesn’t account for the risk companies face in various markets.

Various assumptions must be made including that investors can borrow money without limitations at the risk-free rate. The CAPM also assumes that no transaction fees occur, investors own a portfolio of assets, and investors are only interested in the rate of return for a single period—all of which are not always true.

Is CAPM the Same As Cost of Equity?

CAPM is a formula used to calculate the cost of equity—the rate of return a company pays to equity investors. For companies that pay dividends, the dividend capitalization model can be used to calculate the cost of equity.

How Do You Calculate Cost of Equity Using CAPM?

The CAPM formula can be used to calculate the cost of equity, where the formula used is: Cost of Equity = Risk-Free Rate of Return + Beta * (Market Rate of Return - Risk-Free Rate of Return) .

What Are Some Potential Problems When Estimating the Cost of Equity?

The biggest issues when estimating the cost of equity include measuring the market risk premium , finding appropriate beta information, and using short- or long-term rates for the risk-free rate.

How Are CAPM and WACC Related?

WACC is the total cost of all capital. CAPM is used to determine the estimated cost of shareholder equity. The cost of equity calculated from the CAPM can be added to the cost of debt to calculate the WACC.

For accountants and analysts, CAPM is a tried-and-true methodology for estimating the cost of shareholder equity. The model quantifies the relationship between systematic risk and expected return for assets and applies to a multitude of accounting and financial contexts.

Finance Strategists. " Capital Asset Pricing Model (CAPM) ."

CFA Institute. " Cost of Capital: Advanced Topics ."

:max_bytes(150000):strip_icc():format(webp)/shutterstock_112522391-5bfc2b9846e0fb0051bde2d3.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

These practice questions are not graded or timed.

Your data will be saved for the current session only and will be reset each time you reopen the tool.

- Undergraduate

- High School

- Architecture

- American History

- Asian History

- Antique Literature

- American Literature

- Asian Literature

- Classic English Literature

- World Literature

- Creative Writing

- Linguistics

- Criminal Justice

- Legal Issues

- Anthropology

- Archaeology

- Political Science

- World Affairs

- African-American Studies

- East European Studies

- Latin-American Studies

- Native-American Studies

- West European Studies

- Family and Consumer Science

- Social Issues

- Women and Gender Studies

- Social Work

- Natural Sciences

- Pharmacology

- Earth science

- Agriculture

- Agricultural Studies

- Computer Science

- IT Management

- Mathematics

- Investments

- Engineering and Technology

- Engineering

- Aeronautics

- Medicine and Health

- Alternative Medicine

- Communications and Media

- Advertising

- Communication Strategies

- Public Relations

- Educational Theories

- Teacher's Career

- Chicago/Turabian

- Company Analysis

- Education Theories

- Shakespeare

- Canadian Studies

- Food Safety

- Relation of Global Warming and Extreme Weather Condition

- Movie Review

- Admission Essay

- Annotated Bibliography

- Application Essay

- Article Critique

- Article Review

- Article Writing

- Book Review

- Business Plan

- Business Proposal

- Capstone Project

- Cover Letter

- Creative Essay

- Dissertation

- Dissertation - Abstract

- Dissertation - Conclusion

- Dissertation - Discussion

- Dissertation - Hypothesis

- Dissertation - Introduction

- Dissertation - Literature

- Dissertation - Methodology

- Dissertation - Results

- GCSE Coursework

- Grant Proposal

- Marketing Plan

- Multiple Choice Quiz

- Personal Statement

- Power Point Presentation

- Power Point Presentation With Speaker Notes

- Questionnaire

- Reaction Paper

- Research Paper

- Research Proposal

- SWOT analysis

- Thesis Paper

- Online Quiz

- Literature Review

- Movie Analysis

- Statistics problem

- Math Problem

- All papers examples

- How It Works

- Money Back Policy

- Terms of Use

- Privacy Policy

- We Are Hiring

Cost of Capital: Applications and Examples, Essay Example

Pages: 3

Words: 722

Hire a Writer for Custom Essay

Use 10% Off Discount: "custom10" in 1 Click 👇

You are free to use it as an inspiration or a source for your own work.

While investors need to know whether their investments are earning profits, the stock market proves to be very unpredictable. Consequently, they requires tools that enable them to measure the extent to which securities respond to the swing in the market. Beta is an important tool that has assisted shareholders to predict the volatility of their investments to the market. As a matter of fact, the reliability of a firm’s beta can be affected by several factors. A look at the recent trend in the global market indicates that the recent global financing had great impacts on firms’ beta, their equity and the cost of their capital. Additionally, implied some concepts for both the firms and their providers.

Firstly, financial flexibility of the firm is a factor that can affect the reliability the firms’ beta. A financially flexible company usually enjoy a more reliable beta that affect more investors to the company. Most of the companies experience negligible challenges in establishing a stable beta during when the sales are good. However, this overturns when the sales get lower and the firm is forced to borrow funds for maintenance. Firms suffer s from this problem especially when they extend their markets too wide during the period when the business is doing good. To maintain this market when sales declines, the firm is forced to get into debts in order to maintain the market. Consequently, its competitive ability declines.

Additionally, the growth rate of the company is influential in determining the reliability of the company’s beta. Slow growing firms have less stable betas because of the unreliable nature of their capital. Most of these companies have to depend on debts in order to maintain growth. Unstable beta exposes the company to losses and possibility of collapsing hence they cannot be relied upon. On the other hand, mature companies with stable growth rates requires less debts because their financial growth is stable. This makes them enjoy a stable cash flow that invites investors. Undoubtedly, the company enjoys a relatively reliable beta that makes it compete with the broader market positively.

Thirdly, Pratt and Grabowski (2010) polemicizes that the reliability of a firm’s beta is dependent on the market conditions at the time it is being measured. The volatility of the firm’s securities is measured against the condition of the market capital. Therefore, if the market is strong and the firm’s capital is weak, the beta will be unstable. On the other hand, both the capital market and the firm’s capital are stronger, the firm’s capital will be relatively balanced to the market, hence the beta will be stronger and reliable.

Undoubtedly, the financial crisis experienced in 2008 had intense impacts on the firms’ beta, the cost their equity and capital. For example, major companies in the USA lost large percentages of their value. This reflected to an increase in the strength of the firms’ beta, while the cost of their equity and capital declined (Poirson and Schmittann, 2013 p. 113). Banks lost trust in clients since they did not believe in their ability to repay the debts. As a result, firms were required to provide their own cash flow in the business, otherwise they could not do business. Share prices went down throughout the world, with company’s such as Dow Jones Industrial Average in the U.S. losing 33.8% of their value. The likely implications of this financial crisis to the firms and their capital providers was a large loss in profits. Companies lost most of their revenue due to decline in the share prices. Capital providers on the other hand lost a substantial part of their investments in the companies that they invested in.

Conclusively, it is evident that the reliability of a firm’s beta depends on the various factors such as financial flexibility, business growth and market conditions. The paper has explained how each of these variables affect the reliability of the beta. In addition, it is clear the financial crisis of 2008 had a great impact on firms’ betas, the cost of their equity and the capital. Firms and their providers lost a lot of capital and profits as a result.

Bibliography

Poirson HM and Schmittmann JM, 2013, Risk Exposures and Financial Spillovers in Tranquil and Crisis times: Bank-Level Evidence, International Monetary Fund.

Pratt SP and Grabowski RJ, 2010, Cost of Capital: Applications and Examples . New York, John Wiley & Sons.

Stuck with your Essay?

Get in touch with one of our experts for instant help!

Corporate Finance Project: Construction Industry, Term Paper Example

Pulling Up the Runaway, Essay Example

Time is precious

don’t waste it!

Plagiarism-free guarantee

Privacy guarantee

Secure checkout

Money back guarantee

Related Essay Samples & Examples

Voting as a civic responsibility, essay example.

Pages: 1

Words: 287

Utilitarianism and Its Applications, Essay Example

Words: 356

The Age-Related Changes of the Older Person, Essay Example

Pages: 2

Words: 448

The Problems ESOL Teachers Face, Essay Example

Pages: 8

Words: 2293

Should English Be the Primary Language? Essay Example

Pages: 4

Words: 999

The Term “Social Construction of Reality”, Essay Example

Words: 371

We use cookies to enhance our website for you. Proceed if you agree to this policy or learn more about it.

- Essay Database >

- Essay Examples >

- Essays Topics >

- Essay on Finance

The Cost Of Capital Essay Examples

Type of paper: Essay

Topic: Finance , Investment , Stock Market , Company , Risk , Taxes , Leadership , Debt

Published: 02/20/2020

ORDER PAPER LIKE THIS

Cost of capital refers to the rate of return which a company must earn or get on its investments to sustain its market value as well as attract funds (Miller, 2009). There are some factors beyond the control of a firm, yet affect its cost of capital. They include taxes and investor’s risk aversion. The level of interest rates can affect or impact the cost of debt as well as the cost of equity. For instance, if interest rate increases it causes an increase on the cost of debt, which leads to the increase on the cost of capital. In addition, tax rates affect or impact after-tax cost of debt. When the tax rates increase, it leads to decrease on the cost of debt, which decreases the cost of capital (Shubber & Alzafiri, 2008). Investor’s risk aversion is another factor beyond the control of a company but affect cost of capital. If investors may forecast variations within dividend growth, they price stocks at a low or high multiple of existing dividends based on whether the growth of dividend is projected to be low or high (Yuan & Chen, 2012). Weighted average cost of capital refers to the cost of capital utilized to complete a project (Miller, 2009). Rate of return can be defined as the earnings from an investment or a project (Shubber & Alzafiri, 2008). Suppose a company invested $100 in stock, this becomes cost of capital. A year later if this investment yields $120. Then the rate of return for this investment can be calculated by applying a formula proposed by Ramirez (2011): ((Return- Capital) ÷ Capital) × 100%

(($120- $100) ÷ 100% = 20% The rate of return is 20% and such an investment adds value. This company should expand because it increases the shareholder value. From a financial viewpoint, in case the return from an investment is greater than the cost of capital, it should be undertaken.

Miller, R. A. (2009). The weighted average cost of capital is not quite right: Reply to M. Pierru. The Quarterly Review of Economics and Finance, 6(2), 7. Ramirez, J. (2011). Handbook of corporate equity derivatives and equity capital markets. Chichester: Wiley. Shubber, K., & Alzafiri, E. (2008). Cost of capital of Islamic banking institutions: an empirical study of a special case. International Journal of Islamic and Middle Eastern Finance and Management, 4(1), 6. doi:10.1108/17538390810864223 Yuan, B., & Chen, K. (2012). Impact of investor’s varying risk aversion on the dynamics of asset price fluctuations. Journal of Economic Interaction and Coordination, 1(1), 3.

Cite this page

Share with friends using:

Removal Request

Finished papers: 422

This paper is created by writer with

ID 253756269

If you want your paper to be:

Well-researched, fact-checked, and accurate

Original, fresh, based on current data

Eloquently written and immaculately formatted

275 words = 1 page double-spaced

Get your papers done by pros!

Other Pages

Hate research proposals, immune system research proposals, cognition research proposals, cows research proposals, ambassador research proposals, countries college essays, fire department essays, dear essays, batch essays, hindenburg essays, lifeboat essays, big box essays, georgeanne essays, united states secret service essays, oklahoma city essays, diversion program essays, amendment protection essays, playtime essays, renton essays, education for girls essays, calo essays, mcdougal essays, tax consequences essays, blockchain essays, middle finger essays, base of operations essays, example of business plan on gandirk real estate group llc marketing plan, example of essay on e health in developing countries with a special focus on nigeria, music appreciation essay examples, microbiology article review article review examples, free case study on marketing 3, humansdorp district hospital essay examples, risk research paper examples, free criminal law essay example 3, good relation of the material to class topics and personal life term paper example, example of term paper on afghanistans drug addicted children, free research paper on the value of and utility of canadian content rules for television, good movie review on customer name, example of essay on mechanization steam power and hot metal, free essay about hang pham semancik, sample literature review on how providing nursery in workplace effect on emirati women worker, leadership and work place stress essay example, research paper on 2 b describe the role of qualitative research play in supporting the field of special education.

Password recovery email has been sent to [email protected]

Use your new password to log in

You are not register!

By clicking Register, you agree to our Terms of Service and that you have read our Privacy Policy .

Now you can download documents directly to your device!

Check your email! An email with your password has already been sent to you! Now you can download documents directly to your device.

or Use the QR code to Save this Paper to Your Phone

The sample is NOT original!

Short on a deadline?

Don't waste time. Get help with 11% off using code - GETWOWED

No, thanks! I'm fine with missing my deadline

Corporate Discount Rates Niels Joachim Gormsen and Kilian Huber – Working paper A new database of firms’ discount rates and costs of capital. The perceived cost of capital is related to the financial cost of capital, but the wedge between discount rates and the perceived cost of capital has grown substantially over the past decades. These dynamics have important implications for how interest rates and asset prices affect corporate investment.

Firms’ Perceived Cost of Capital Niels Joachim Gormsen and Kilian Huber – Working Paper Firms’ perceived cost of capital deviates substantially from the true cost of capital in financial markets. The deviations generate capital misallocation that substantially lowers TFP. The deviations also lead to a rejection of the Investment CAPM.

Climate Capitalists Niels Joachim Gormsen, Kilian Huber, and Sangmin Oh – Working Paper “Green investing” has real effects if green firms actually reduce their perceived cost of capital and discount rate in response to green investing. We find that the difference in the perceived cost of capital between the greenest and the brownest firms has fallen since 2016, concurrent with the rise of green investing. Discount rates followed a similar pattern. We also document within-firm variation in cost of capital and discount rates across green and brown projects.

Sticky Discount Rates Masao Fukui , Niels Joachim Gormsen and Kilian Huber – Working Paper Firms’ nominal discount rates are sticky with respect to expected inflation. As a result, real investment demand increases when inflation is high. This mechanism generates a distinct source of monetary non-neutrality and raises investment in response to government spending.

The Weighted Average Cost of Capital Essay

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment

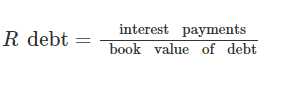

Calculating WACC is simple when a company has one source of capital. The components of WACC are more when there are many sources of financing. Debts and equity are its components when companies use them as the only sources of finance. In such cases, the firms’ analysts express the total cost of capital as a sum cost of debt and cost of equity (Moore, 2016). As shown in figure 1, those who calculate the cost of debts must know the interest payments and the principal amounts.

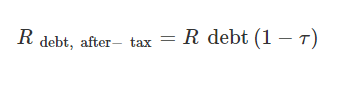

Analysts use the equation in figure 2 to obtain the cost of debt after tax.

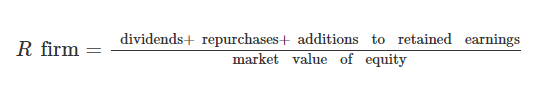

Figure 3 shows that cost of equity is a ratio of cash flows to equity’s market value.

Firms and investors utilize the weighted average cost of capital (WACC) to make crucial decisions. Moore (2016) suggested that firms use WACC to make project decisions while investors use it in valuation judgments. The cost of capital rises when WACC is high because investors demand more returns on their investment. For instance, when a firm has volatile stock, its WACC is high. Thus, investors must demand more returns because their confidence in the company is low. Similarly, the firm must analyze investment projects to determine whether they will generate profits that exceed the cost of capital. If the losses are more than the returns, the company will seek other projects.

Moore, D. J. (2016). A look at the actual cost of capital of US firms. Cogent Economics & Finance , 4 (1), 1233628.

- The Boeing 7E7 Project Management

- Alternatives or Other Complexities in Adjusting Discount Rates

- Apple Inc.: Statement of Cash Flows

- Tabby Versus Other Payments Gate Out

- Ratio, Vertical, and Horizontal Analysis: Pros & Cons

- Researching the Value of Credit Score

- A Step-By-Step Guide to Wellness

- Cryptocurrency and Its Instability Issues

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2023, February 14). The Weighted Average Cost of Capital. https://ivypanda.com/essays/the-weighted-average-cost-of-capital/

"The Weighted Average Cost of Capital." IvyPanda , 14 Feb. 2023, ivypanda.com/essays/the-weighted-average-cost-of-capital/.

IvyPanda . (2023) 'The Weighted Average Cost of Capital'. 14 February.

IvyPanda . 2023. "The Weighted Average Cost of Capital." February 14, 2023. https://ivypanda.com/essays/the-weighted-average-cost-of-capital/.

1. IvyPanda . "The Weighted Average Cost of Capital." February 14, 2023. https://ivypanda.com/essays/the-weighted-average-cost-of-capital/.

Bibliography

IvyPanda . "The Weighted Average Cost of Capital." February 14, 2023. https://ivypanda.com/essays/the-weighted-average-cost-of-capital/.

- StudyZoomer

Cost of Capital

Cost of Capital Student’s Name Institutional Affiliation

` The overall cost of capital is used for investment decision to pay for using the wealth of both debt holders and owners. It is the minimum rate of return that an organization earns to create value for the investors. Besides, the overall cost of capital is used to evaluate projects by, for instance, using the WACC as a hurdle rate with assumptions of having a similar risk in deciding on whether to enter into a plan or not. The cost of capital helps in evaluating a plan with provisions of having two valid underlying assumptions. To compute the rate of funds, we use the chronological value of equity and debt. The value of capital is determined by the multiplication of the value for every capital source with consideration of its relative weight. After that, the products are added together to settle on the WACC. This is because; the company finances its assets with consideration of either equity or debt. The cost of capital has a representation of compensating a market demand in exchange for bearing the risk of ownership and owning the asset. To determine the WACC, one has to evaluate what percentage of the company is financed by debt or by equity. The cost of retained earnings represent the company’s cumulative input since initiation (Huizinga, Voget & Wagner, 2018). However, the retained earnings can be pulled back to the firm for usage as capital structure and growth. The shareholders own the retained earnings as the effectual owners of the company.

Wait! Cost of Capital paper is just an example!

Besides, shareholders forfeit the opportunity cost for investment elsewhere instead of allowing the firm to fabricate capital. If the corporation has the prospect to earn a rate of return minus than its cost of capital with a profit rate, it should deem fit to invest. This is because, when the financial markets become unsettled, it is evident for an investor to settle for low-risk investments. It is achievable by looking for assets with a balance of high return with minimum risk.

Reference Huizinga, H., Voget, J., & Wagner, W. (2018). Capital gains taxation and the cost of capital: Evidence from unanticipated cross-border transfers of the tax base. Journal of Financial Economics.

Subscribe and get the full version of the document name

Get quality help now

Marissa Holloway

5,0 (324 reviews)

Recent reviews about this Writer

Absolutely incredible service! StudyZoomer delivered my cover letter within 24 hours so that I managed to submit my job application without delays.

Related Essays

( 275 words)

Copyright © 2024 StudyZoomer.com, All rights reserved

If you want to use the materials in your work, create a unique and discounted paper on this topic with our specialist.

Want to get a "Sanderberg Lean In" essay sample?

Please write your email to receive it right now

Cost Of Capital Essays

Article summary: the real value of china’s stock market, popular essay topics.

- American Dream

- Artificial Intelligence

- Black Lives Matter

- Bullying Essay

- Career Goals Essay

- Causes of the Civil War

- Child Abusing

- Civil Rights Movement

- Community Service

- Cultural Identity

- Cyber Bullying

- Death Penalty

- Depression Essay

- Domestic Violence

- Freedom of Speech

- Global Warming

- Gun Control

- Human Trafficking

- I Believe Essay

- Immigration

- Importance of Education

- Israel and Palestine Conflict

- Leadership Essay

- Legalizing Marijuanas

- Mental Health

- National Honor Society

- Police Brutality

- Pollution Essay

- Racism Essay

- Romeo and Juliet

- Same Sex Marriages

- Social Media

- The Great Gatsby

- The Yellow Wallpaper

- Time Management

- To Kill a Mockingbird

- Violent Video Games

- What Makes You Unique

- Why I Want to Be a Nurse

- Send us an e-mail

- Paper Writer Free >

- Essays Examples >

- Essay Topics >

Good The Cost Of Capital Essay Example

Type of paper: Essay

Topic: Cost , Finance , Company , Firm , Capital , Debt , Financing , Investment

Published: 2021/03/03

In this topic, the first issue that we discussed was to be introduced to the concept of cost of capital. We learnt that the cost of capital is usually the cost that a firm incurs in order to secure funding, either equity or debt. The cost capital tends to be applied in the area of assessing new projects that a firm intends to undertake. From the investor’s perspective, it is the amount of minimum return they expect to get from providing funds to a firm, thereby setting a certain benchmark which the new project in question must be able to meet. Primarily, the cost of capital can either be the one the firm occur in securing equity as a source financing project or debt as a means of financing various projects that a firm plan undertaking. In this introductory part, we learned that in calculating the cost of capital it is always important to consider the market risks as well as other factors related to the project in order to get a true picture of the actual cost of financing the project. Additionally, most of the firms make use both debt and equity in financing their investment activities. Therefore, in the case where the firm is using the two sources of financing, it should calculate the cost of capital using WACC formula. The second concept that we studied in this topic is the issue of cost of debt. The cost of debt is the interest that a firm pays for securing a loan from a financial institution or any other credit provider. When calculating the cost of debt, it is important to take into account the issue of risk, default premium, whereby the premium rises when the debt being secured increases. The formula that is used in calculating the cost of debt is (RF+the risk of credit) (1-t), where t represent the firm tax rate and in the case of RF it represent the rate of risk of securing the debt. Another important concept we discussed during the topic was the issue of cost of debt, which usually reflect the amount of return that investors expect to get from a firm by providing funds to a firm. It is calculated using the following formula; The last concept we discussed was the application of WACC in various financial situations. WACC is usually applied in measuring the cost that a company incurs in securing capital. WACC takes into account both the cost of debt and equity when calculating the cost of securing financing for a company. In practice, the following formula is applied when calculating cost of capital using WACC concept;. There are a number of things that I did learn from this topic on cost of capital, which I can apply in my life. To start with, I learned that in securing financing, a firm usually incurs some costs; therefore, when I start my business I expect to incur some cost when getting its capital. The cost incurred are usually determined by the risk that investors and creditors perceive the firm to be carrying. Secondly, in calculating the cost of capital it is always important to take into account the risk that is measured using the beta concept. Additionally, I did learn that from the investor’s perspective, the cost of capital reflects the returns they would be expecting from a firm by providing their money to the firm so that it can finance its different investment projects. Therefore, in the future when I will be financing an organization, the cost of capital plays a significant role in determining the ability of the firm to attract potential investors. Lastly, I did learn that the risk associated with the cost of securing debt increase when the amount of debt being secured increases.

Share with friends using:

- Desert Research Papers

- Ethics Reports

- Psychology Reports

- Success Reports

- Communication Reports

- Skills Reports

- Learning Reports

- University Reports

- Mind Reports

- Writing Reports

- Internet Reports

- Communication Skills Reports

- Listening Reports

- English Reports

- Teaching Reports

- Language Reports

- Ability Reports

- Speaking Reports

- Linguistics Reports

- Speaker Reports

- Grammar Reports

- Performance Reports

- Development Reports

- Community Reports

- Investment Reports

- Finance Reports

- Taxes Reports

- Company Reports

- Marketing Reports

- Commerce Reports

- Sales Reports

- Trade Reports

- Wealth Reports

- Accounting Reports

- Agreement Reports

- Revenue Reports

- Solvency Reports

- Margin Reports

- Income Reports

- Percentage Reports

- Basis Reports

- Outcome Reports

- Liquidity Reports

- Inventory Reports

- Equity Reports

- Audit Reports

- Inducing Essays

We use cookies to improve your experience with our site. Please accept before continuing or read our cookie policy here .

Wait, have you seen our prices?

IMAGES

VIDEO

COMMENTS

Cost Of Capital: The cost of funds used for financing a business. Cost of capital depends on the mode of financing used - it refers to the cost of equity if the business is financed solely ...

The cost of capital is the driving force behind investment decisions, as it is responsible for persuading investors to invest their funds in specific projects instead of others (Rossana 2011, p. 144). When confronted with two risky investment decisions to choose from, investors will always go for the one that promises high returns.

If what the CFO says regarding Treasury raising debt at 7 percent is true, the company's cost of capital must be above this figure. Therefore, the 6 per cent cost of capital as claimed is erroneous. Works Cited. Modigliani, Franco. The Cost of Capital, Corporation Finance and the Theory of Investment. New Jersey: Prentice Hall, 1998. Print ...

A capital market is a place where invest ors and consumers of capital (generally. companies or the government), raise long-term funds (longer than a year). Selling bonds. and stocks are two ways ...

The Mechanics. The cost of capital, in its most basic form, is a weighted average of the costs of raising funding for an investment or a business, with that funding taking the form of either debt or equity. The cost of equity will reflect the risk that equity investors see in the investment and the cost of debt will reflect the default risk ...

The cost of capital is a bridge between the firm's decision of investing in a long-term project and the assets owned by the stockholders. It plays a vital role to decide whether a proposed investment will push up or push down the firms' stock price. Gittman (2003) defines the term "cost of capital" in his book named "The Principle of ...

In the standard financi al textbooks, there is the weighted average cost of capital. method, which calculates cost of capital equal to a weighted average cost of debt. capital and equity: ( ) WACC ...

The cost of capital is the cost of a company's funds (both debt and equity), or, from an investors point of view "the expected return on a portfolio of all the company's existing sec

The cost of capital to a company is the minimum rate of return that is must earn on its investments in order to satisfy the various categories of investors, who have made investments in the form of shares , debentures and loans. The cost of capital in operational terms refers to the discount rate that would be used in determining the. 1479 Words.

The CAPM formula can be used to calculate the cost of equity, where the formula used is: Cost of Equity = Risk-Free Rate of Return + Beta * (Market Rate of Return - Risk-Free Rate of Return).

Comparing a company 's return on capital (ROIC) with its cost of capital (WACC) reveals whether invested capital was used effectively. From our spreadsheet calculations we see that using our estimated operating profit provides us with a 19.9% return on invested capital with only a 7.2% weighted average cost for that same capital.

Question. For a single year: Revenue = $3,000,000, cost of goods sold = $2,000,000, capital expenditures = $100,000, interest expense = $100,000, and selling and administrative costs = $200,000. Last year's net working capital (NWC) = $100,000 and this year's NWC = $100,000. Depreciation is $50,000.

For example, major companies in the USA lost large percentages of their value. This reflected to an increase in the strength of the firms' beta, while the cost of their equity and capital declined (Poirson and Schmittann, 2013 p. 113). Banks lost trust in clients since they did not believe in their ability to repay the debts.

Published: 02/20/2020. Cost of capital refers to the rate of return which a company must earn or get on its investments to sustain its market value as well as attract funds (Miller, 2009). There are some factors beyond the control of a firm, yet affect its cost of capital. They include taxes and investor's risk aversion.

Your first task is to estimate Harry Davis's cost of capital. Jones has provided you with the following data, which she believes may be relevant to your task. 1. The firm's tax rate is 40%. 2. The current price of Harry Davis's 12% coupon, …show more content…. What is the firm's cost of preferred stock? Kps = Dpn = 0.1 ($100) = $10 ...

Improved Essays. 1468 Words; 6 Pages; Open Document. Essay Sample Check Writing Quality. Show More. ... Cost of capital is market driven and forward based through focus on the expected return from the market for an asset, compared effectively with the market value. The cost of capital links the expected future returns of an asset with its ...

The perceived cost of capital is related to the financial cost of capital, but the wedge between discount rates and the perceived cost of capital has grown substantially over the past decades. These dynamics have important implications for how interest rates and asset prices affect corporate investment. Excess Dispersion in the Perceived Cost ...

The Weighted Average Cost of Capital Essay. Calculating WACC is simple when a company has one source of capital. The components of WACC are more when there are many sources of financing. Debts and equity are its components when companies use them as the only sources of finance. In such cases, the firms' analysts express the total cost of ...

For Exxon Mobil, as every business unit makes a consideration for investment prospects, it has to employ an interest rate that is the cost of capital to appraise and assess the impacts of expected cash flows in the different time-spans. Using a single company-wide cost of capital implies aggregating the risk of the whole company (California ...

Cost of Capital Student's Name Institutional Affiliation ` The overall cost of c. ... Use our writing tools and essay examples to get your paper started AND finished. Get an original paper. Get quality help now. Christine Whitehead . 5,0 (426 reviews) Recent reviews about this Writer ...

Cost Of Capital Essays. Article Summary: The Real Value of China's Stock Market. Brief Summary of the Article The summary below is based on the value of the stock market in China as derived from the journal of financial economics 2021. The main question addressed in the abstract is the role of China's capital allocation play in the stock ...

Cost of Debt. Weighted Average Cost of Capital. Q3 - Lodging Business Hurdle Rate. We determined the WACC of the Lodging business to be 9.70% by using the same method of analysis. Given or Pre-Determined Variables. Tax Rate = 44.1%. Capital Structure = 74% Debt, 24% Equity Cost of Equity. Cost of Debt.

In this topic, the first issue that we discussed was to be introduced to the concept of cost of capital. We learnt that the cost of capital is usually the cost that a firm incurs in order to secure funding, either equity or debt. The cost capital tends to be applied in the area of assessing new projects that a firm intends to undertake.

The best way to accomplish any business or personal goal is to write out every possible step it takes to achieve the goal. Then, order those steps by what needs to happen first. Some steps may ...

Cost cutting measures are essential in health care management in public sector without sacrificing the standards of care provision. ... Separate registers to record capital items and consumables are recommended to determine the diet cost in future and for the interventions to improve quality and reduce the cost. ... Search 218,749,691 papers ...