- Other Filters

- Ticker TCS:LI Exchange LSE More

- Industry Regional - Pacific Banks More

- Sector Financial More

- 10,000+ Employees

- Based in Moscow, Russia

Tinkoff reports have an aggregate usefulness score of 4.8 based on 76 reviews.

Most Recent Annual Report

View 2022 Sustainability Report

This company has a Sustainability Report available to view on our partner site, ResponsibilityReports.com

Older/Archived Annual Reports

Rate This Report

Thank you for your feedback!

English (USA)

English (UK)

English (Canada)

English (India)

Deutsch (Deutschland)

Deutsch (Österreich)

Deutsch (Schweiz)

Français (France)

Français (Suisse)

Nederlands (Nederland)

Nederlands (België)

- Top Capitalization

- United States

- North America

- Middle East

- Sector Research

- Earnings Calendar

- Equities Analysis

- Most popular

- NVIDIA CORPORATION

- AMD (ADVANCED MICRO DEVICES)

- MICROSOFT CORPORATION

- SINGAPORE AIRLINES LIMITED

- NIPPON ACTIVE VALUE FUND PLC

- Index Analysis

- Indexes News

- EURO STOXX 50

- Currency Cross Rate

- Currency Converter

- Forex Analysis

- Currencies News

- Precious metals

- Agriculture

- Industrial Metals

- Livestock and Cattle

- CRUDE OIL (WTI)

- CRUDE OIL (BRENT)

- Developed Nations

- Emerging Countries

- South America

- Analyst Reco.

- Capital Markets Transactions

- New Contracts

- Profit Warnings

- Appointments

- Press Releases

- Security Transactions

- Earnings reports

- New markets

- New products

- Corporate strategies

- Legal risks

- Share buybacks

- Mergers and acquisitions

- Call Transcripts

- Currency / Forex

- Commodities

- Cryptocurrencies

- Interest Rates

- Asset Management

- Climate and ESG

- Cybersecurity

- Geopolitics

- Central Banks

- Private Equity

- Business Leaders

- All our articles

- Most Read News

- All Analysis

- Satirical Cartoon

- Today's Editorial

- Crypto Recap

- Behind the numbers

- All our investments

- Asia, Pacific

- Virtual Portfolios

- USA Portfolio

- European Portfolio

- Asian Portfolio

- My previous session

- My most visited

- Growth stocks

- Undervalued stocks

- Quality stocks

- Dividend Kings

- Quality stocks at a reasonable price

- Europe's family businesses

- Israeli innovation

- Let's all cycle!

- Bionic engineering

- Unusual volumes

- New Historical Highs

- New Historical Lows

- Top Fundamentals

- Sales growth

- Earnings Growth

- Profitability

- Rankings Valuation

- Enterprise value

- Top Consensus

- Analyst Opinion

- Target price

- Estimates Revisions

- Top ranking ESG

- Environment

- Visibility Ranking

- Stock Screener Home

- Powerful brands

- Place your bets

- The food of tomorrow

- 3D Printing

- E-Commerce & Logistics

- Oversold stocks

- Overbought stocks

- Close to resistance

- Close to support

- Accumulation Phases

- Most volatile stocks

- Top Investor Rating

- Top Trading Rating

- Top Dividends

- Low valuations

- All my stocks

- Stock Screener

- Stock Screener PRO

- Portfolio Creator

- Event Screener

- Dynamic Chart

- Economic Calendar

- Our subscriptions

- Our Stock Picks

- Thematic Investment Lists

TCS Group Holding PLC London S.E.

Us87238u2033, investment holding companies, tcs : tinkoff investor presentation november 2020.

November 2020

INVESTOR PRESENTATION

Certain statements and/or other information included in this document may not be historical facts and may constitute "forward looking statements" within the meaning of Section 27A of the U.S. Securities Act and

Section 2(1)(e) of the U.S. Securities Exchange Act of 1934, as amended. The words "believe", "expect", "anticipate", "intend", "estimate", "plans", "forecast", "project", "will", "may", "should" and similar expressions

may identify forward looking statements but are not the exclusive means of identifying such statements.

Forward looking statements include statements concerning our plans, expectations, projections, objectives, targets, goals, strategies, future events, future revenues, operations or performance, capital expenditures, financing needs, our plans or intentions relating to the expansion or contraction of our business as well as specific acquisitions and dispositions, our competitive strengths and weaknesses, our plans or goals relating to forecasted production, reserves, financial position and future operations and development, our business strategy and the trends we anticipate in the industry and the political, economic, social and legal environment in which we operate, and other information that is not historical information, together with the assumptions

underlying these forward looking statements. By their very nature, forward looking statements involve inherent risks, uncertainties and other important factors that could cause our actual results, performance or achievements to be materially different from results, performance or achievements expressed or implied by such forward-looking statements. Such forward-looking statements are based on numerous assumptions regarding our present and future business strategies and the political, economic, social and legal environment in which we will operate in the future. We do not make any representation, warranty or prediction that the results anticipated by such forward-looking statements will be achieved, and such forward-looking statements

represent, in each case, only one of many possible scenarios and should not be viewed as the most likely or standard scenario. We expressly disclaim any obligation or undertaking to update any forward-looking statements to reflect actual results, changes in assumptions or in any other factors affecting such statements.

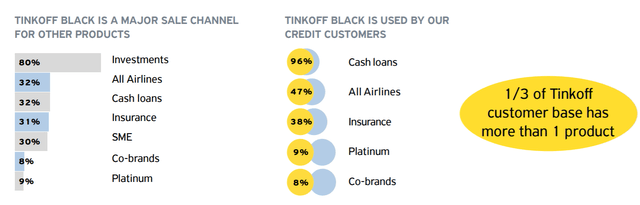

A digital financial & lifestyle ecosystem built around customer needs

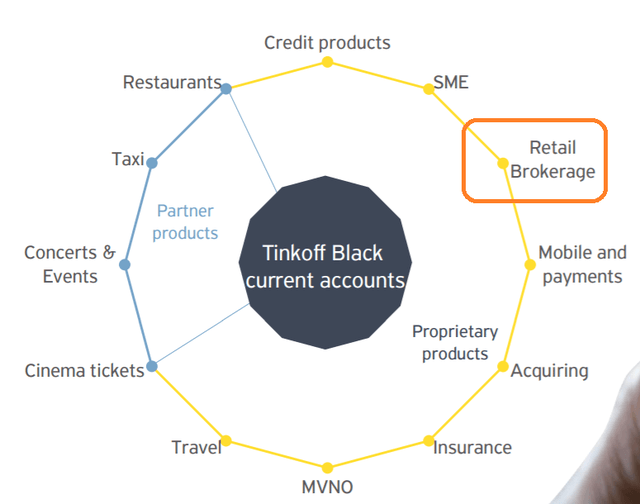

How Tinkoff Black drives cross-sell

TINKOFF BLACK IS A MAJOR SALE CHANNEL FOR OTHER PRODUCTS

80% 32% 32% 31% 30% 8% 9%

Investments All Airlines Cash loans Insurance SME Co-brands Platinum

TINKOFF BLACK IS USED BY OUR CREDIT CUSTOMERS

96% Cash loans

47% All Airlines

38% Insurance

9% Platinum

8% Co-brands

We also see positive cross-sell dynamics among other products

Lifestyle journey in your banking app

Restaurants 25%

Tinkoff Junior

Drives customers'

loyalty and stickiness

20.6 installs

150m sessions per month

1.5min session length

All currency data are in RUB bn unless otherwise stated

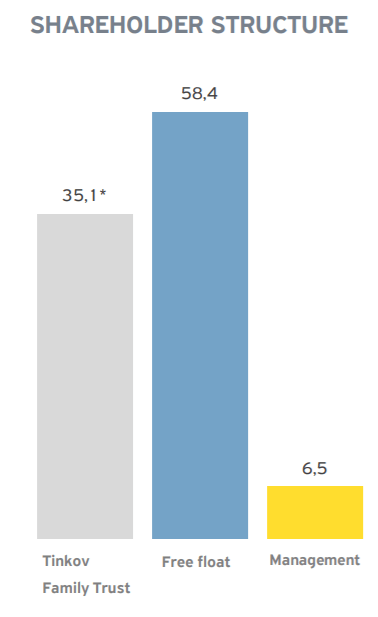

SHAREHOLDER STRUCTURE

Tinkov Family Trust Free float

Best Digital Bank

in Central and Eastern Europe, 2016

GROUP'S KEY FINANCIALS (IFRS)

Income statement

Interest income

Provision charge for loan impairment

Customer acquisition expense

Administrative and other operating expenses

Profit before tax

Profit for the period

Balance Sheet

Cash and treasury portfolio

Loans and advances to customers

Total assets

Customer accounts

Total liabilities

Total equity

Net interest margin

Cost/Income (incl. acquisition expenses)

Cost of risk

Most profitable bank

in Central and Eastern Europe, 2017

Best Internet Bank In Russia, 2018

Best Consumer Digital Bank in Russia, 2018

Best Digital Consumer Bank

In the World, 2020

350 300 250 200 150 100 50 0

* Market estimated as non-overdue portfolio from RAS reporting 101 form 455% and 457% accounts, including only loans with term up to 3 years

• Russian consumer finance crisis

• Macro weakness

• Low oil prices

• Geopolitics

80% 60% 40% 20% 0%

Profit (quarterly) ROE, rs

0% Cost of risk (wo macro) Cost of risk Average through the cycle

Premium debit/credit cards

Moscow & St. Petersburg: 51%

Black Edition

Max other region: 7%

Monthly income ( ₽ k): 197

Saint-Petersburg and Leningradskaya oblast'

Gender (M/F)

Average age

Monthly income ( ₽ k)

Moscow and Moscow Region

Every other region

Data shows weekly volumes as a % of the volumes during the first week of February (=100%)

Card Total Payment Volume (TPV)

SME clients' turnover

Offline Online

200% 175% 150% 125% 100% 75% 50%

Online Acquiring Total Payment Volume (TPV)

Retail brokerage transaction volumes

150% 125% 100% 75% 50%

350% 300% 250% 200% 150% 100% 50% 0%

Protecting health and safety of our employees, maintaining motivation, while ensuring business continuity

Supporting our communities Increase in restructuring /payment holiday requests from customers

Moving all non-critical and business essential functions to the cloud, equipping smart couriers with PPE. >95% of HQ employees are working from home. Offering more generous compensation packages for our smart couriers and employees still coming to the office (+15-20%). Increasing the number of employees included in the Long-Term Incentive Program.

Deploying Tinkoff cloud-based home call center (HCC) to assist the Moscow City Government and the People ' s Social Front (a consumer protection organization) with fielding calls from people beset by COVID-19 and related problems. Committing RUB 1bn to social initiatives, including support for hospitals.

Engaging with customers to find the optimal restructuring solution, including proprietary and government-sponsored payment holidays.

No loss in productivity and employee engagement Meaningful support for communities affected by COVID-19

Managed and controlled increase in restructured exposures, with limited impact on liquidity

Supporting SMEs given difficult revenue generating environment

Lowering acquiring and account fees, offering payment holidays on our small test loan portfolio, helping SMEs move online, launching 0% loans to pay salaries in partnership with the Russian Bank for SME support

Increasing loyalty of the customer base, minimizing negative impact on risk costs from the small test portfolio

Negative macro impact from COVID-19 related lockdowns and lower oil prices

Responding to significant increase in demand for Tinkoff Investments

Strengthening engagement with customers despite social distancing measures

Tightening origination standards (e.g. more manual verification, no issuance of second loans to existing customers), more proactive portfolio and credit limit management, shifting of resources from customer acquisition towards cloud-based pre-collection and collection activities. Gradual increase in approval rates following stabilization and improvement of high frequency internal asset quality metrics.

Investing in technology and system capability to deal with high volumes. Continuing the launch of new product features: a new process to onboard customers without the need for a physical meeting with our smart-couriers; a redesigned and enhanced web terminal; six new currencies that can traded at the interbank rate; online events, webinars, and shows for our customers.

Tinkoff introduced a cash-back offer called " Surviving quarantine " which allows customers to benefit from up to 75% discounts on online services, products, and subscriptions that are particularly in demand during isolation (online cinema, home fitness, books, language courses, etc.). Tinkoff Mobile implemented functions allowing customers to open accounts using virtual sim cards, to delay payment of mobile services by up to 2 weeks without charge, to waive certain roaming fees for customers not able to return to Russia, to record and store voice calls, and to use unlimited data for remote working apps like Zoom, Skype, Slack, etc. Introduced a new communication channel with Tinkoff support for Apple users through iMessage. Introduced 50% cashback on baby food expenditures for parents.

Temporary pause in loan growth in 2Q. Containing risk costs. Higher cash flow generation. Cost structure optimization.

#1 retail brokerage on MOEX by number of active customers for seven consecutive months with 2.4m customers

Continued growth in MAU (now 7.6m) and DAU (now 2.4m), continued growth in Tinkoff Black accounts

Experienced team and continued governance improvements

■ All members of the management board were present in 08-09 and 14-15 crises

■ Tinkoff Bank Board of Directors changes signal commitment to further corporate governance roadmap

Loyal, engaged customer base ■ 2.4m DAU, 7.6m MAU ■ 4.8 App rating on Apple Store and Google Play ■ Tinkoff Investments temporarily overtook the number of downloads of our main mobile banking app

Trust in the bank grew 2.4 times over 5 years (according to BrandZ poll)

Digital and flexible operating model

Conservative underwriting standards

■ High share of variable costs: Over 1/3 of total costs are customer acquisition costs

■ 30% hurdle rate ensures large buffer for eventual deteriorations

■ Lean organizational structure, with delegated decision making allowing each business to take swift decisions to relevant challenges

■ Low approval rates, gradually tightening underwriting standards since early 2019

■ Ability to shift resources (including HR) across different functions

■ Smaller than average loan tickets (Average credit card balance is 65k RUB, cash loan 260k RUB, POS loan 27k RUB, home equity 1050k RUB, car loan 550k RUB)

Diversified revenue structure

■ 41% of revenues from non-credit businesses (3Q20)

■ Net fee, commission, and insurance income covers 125% of administrative expenses and 77% of total expenses (3Q20)

■ Non-credit businesses are scaling up and driving customer growth

Abundant liquidity

■ Liquid balance sheet (cash, cash equivalents, and investments amounting to RUB 312bn, or 61% of customer accounts)

■ Short-term balance sheet (83% of financial assets expected to mature within 12 months)

■ Asset-liability matching (Current accounts fund cash, treasury, and very ST lending; deposits fund unsecured consumer lending; wholesale funding funds secured lending)

Adequate capital buffers

■ Current N1.1 buffer over minimum requirement equates to 126% of 2019 bank level profit

■ Highly capital generative business model, thanks to 30% internal hurdle rate

■ Profitable through the cycle, can easily and quickly slow down RWA growth

■ Flexible dividend policy (up to 30% of quarterly net income)

Total customers (m) Mobile App MAU (m) Mobile App DAU (m)

Several levers to defend returns: high margin credit business, growing non-credit businesses, high share of variable costs

ROA DRIVERS (as % of average assets)

Net interest income

F&C, Insurance income

Trading income, other

1Q Administrative Expenses

1Q Customer Acquisition Expenses

3Q Taxes ROA

Returning to growth

Credit business: Temporary pause in growth trajectory Transactional & Servicing business lines: reducing P&L volatility

+1.2mn new credit accounts acquired

+8.2% YTD gross loan growth

Diversified product and customer mix

Non-credit card products accounted for 40% of the loan book and secured loans grew to 18% of total portfolio

Conservative front loading of provisions

CoR at 6.5% in 3Q ' 20 and 11.6% in 9M ' 20 reflecting our conservative approach to risk assessment

NPLs (90d+) at 11.1% with coverage at 153%, gross loan coverage at 16.9%

Customer growth remains in focus

Current Accounts customers up to 10.7mn (+16% q-o-q and 70% y-o- y)

Investments customers grew to 2.4mn, providing us with record-high impact in fee and commission income

Important and less cyclical revenue and growth driver

41% of revenues coming from non-credit lines in 3Q ' 20

Tinkoff investments generated ₽ 2.1bn of fee income in 3Q ' 20 to become the second source of F&C income after Tinkoff Business ( ₽ 3.1bn)

Strong contributor to customer growth, leveraging on digital distribution channels

Superior profitability & capital position Strong business development effort

Net profit of ₽ 12.6bn in 3Q ' 20, up 29.8% y-o-y

ROE grew to 45.0% (ROA of 7.2%) in 3Q ' 20 returning to our longer-term levels

High statutory and Basel capital ratios throughout the crisis due to high profitability and declining risk weighted asset density on certain unsecured consumer loans

Tinkoff Business started opening accounts for foreign companies

Voice assistant Oleg added new skills, helping customers to set their spending limits, make recurring payments on time and pay their credit card bills Tinkoff Capital launched Russia ' s first exchange-traded fund (ETF) tracking the

Nasdaq ® -100 Technology Sector Index (NDXT)

In October, Tinkoff launched a financial messenger built into its super app for users to chat while making financial transactions

Launch of Tinkoff Pro - subscription offering that gives our customers all sorts of benefits within the Tinkoff ecosystems

ASSETS STRUCTURE

Cash and cash equivalents

Investments in debt securities

Total assets grew 8.4% q-o- q in 3Q'20 and 42.9% y-o-y

Our assets structure remains well balanced between loans and highly liquid investments and cash

Our large liquidity cushion enables to capture future growth opportunities

GROSS LOANS

NET LOANS BREAKDOWN

3Q'19 Net loans LLP

Gross loans grew 5.5% q-o-q, resuming the growth of the portfolio

The share of non-credit card loans grew slightly q-o-q to 40% as of 30-Sep-20

NPL coverage remained comfortable at 153% despite the expected uptick in total NPLs driven by the COVID-19 pandemic. We retain high recovery expectations for NPLs in courts.

The share of collateralized loans grew q-o-q to 18% as of 30-Sep-20

Total LLPs account for a conservative and comfortable 17% of our total gross loan balance

Provisioning rate Stage

Excellent Good

Monitor Sub standard NPL

Rose to (6.2%) due to macro factor adjustment

Does not include purchased originated credit impaired loans

(46%) (71%)

3.0% 2.1% 1.9% 2.2%

10.5% 10.9%

(6.3%) (44%) (69%)

Excellent: non-overdue credit cards with PD loans with early repayments

Sub-standard: 31-90 days overdue

NPL: 90+ days overdue

Good: other non-overdue loans

Current: non-overdue portfolio with low expected credit risk

Monitor: 1-30 days overdue or without first due date

Restructured loans fall into either Stage 1 or 2 depending on days overdue, on the probability of default level and deterioration, and on number of missed payments. Restructured loans in Stage 1 have higher provision coverage than current loans in Stage 1

" Credit holidays " government program

(Federal Law 106)

No payment over a 6 month period for customers with >30% decline in income

Interest accrues at rate of 2/3 of average market rate

Strict eligibility criteria and requires extensive documentation within 90 days of request

Tinkoff restructuring (>1 month)

Temporary relief (

Less stringent eligibility criteria

Flexible solutions with options to maintain a minimum monthly payment to encourage borrower discipline, positively impacting repayment rate and reducing probability of default

Customer allowed to decrease upcoming payment

Contractual interest rate unchanged

# of loans restructured during 20/03 - 31/10: 3,892 # of restructured loans outstanding as of 31/10: 1,795 Size of restructured loan portfolio as of 31/10:

As of 31-Oct-20, total outstanding restructured loans of RUB 4.6bn amounted to 1.1% of the gross loan portfolio, down from 4.5% as of 31-Jul-20

# of loans restructured during 20/03 - 31/10 139,431

# of restructured loans outstanding as of 31/10:

Size of restructured loan portfolio as of 31/10:

Data from management accounts

# of loans restructured during 20/03 - 31/10: 128,088 # of restructured loans outstanding as of 31/10: 1,608 Size of restructured loan portfolio as of 31/10:

Retail Deposits Legal entities

Debt securities in issue

2Q'20 3Q'20 Retail Cur.Acct. & Brokerage funds Subordinated debt

Due to banks (inc. Repo)

CUSTOMER ACCOUNTS

All currency data are in ₽ bn unless otherwise stated

WHOLESALE DEBT MATURITY PROFILE

% of retail accounts covered by DIA

Put option Put option Call option 33,9

Tier 1 Perpetual ECP

Local bonds

Customer funds' growth accelerated in 3Q, supported by the increasing popularity of our current account product. Our retail current account balances rose by 32bn in one quarter to 302bn, or a record 53% of total funding

FX position hedged on a long-term basis through a combination of natural hedge and long-dated currency swaps

We continue to deploy our retail current accounts in highly liquid securities and short duration loans

The share of RUB customer accounts has grown q-o-q

EXPECTED MATURITY OF FINANCIAL ASSETS (as of 31-Dec-19)

1-3 month Demand and

NET CASH FLOW PRODUCED BY CREDIT CARDS

CASH FLOW MANAGEMENT INSTRUMENTS

New utilized cards (RHS)

Monthly limit increase/decrease for utilized cards (LHS)

SHAREHOLDERS ' EQUITY

OF THE GROUP

Equity Basel III Tier 1 / Total CAR

Basel III CET1 ratio

Shareholders' equity rose 7.8% q -o-q given solid profit generation

Risk weighted assets rose 6.8% q-o-q

The negligible size of our FX-denominated assets and our USD-denominated AT1 perpetual bond ensure a small impact on our capital ratios from changes in the RUB/USD exchange rate

*According to Basel regulations **RWA/Total assets

RISK WEIGHTED ASSETS OF THE BANK

Retail loans

Credit + Market risk / Total assets

4Q'19 Credit risk

1Q'20 Market risk

2Q'20 Operational risk

STATUTORY RATIOS

Our statutory risk weighted assets declined 7.9% q-o-q due to the implementation of lower risk weights on certain unsecured consumer loans

Consequently, our risk weighted asset density declined q-o-q

Our statutory capital ratios remain well above the minimum requirements (currently 10.5%/8.5%/7.0% for N1.0/N1.2/N1.1)

Density calculated as risk-weighted retail portfolio divided by RAS retail loan book

F&C business

REVENUE STRUCTURE

Insurance premiums

9M'20 Credit

4Q'19 Treasury

1Q'20 2Q'20 Insurance premiums

NET F&C INCOME / OPEX

Net F&C and insurance income / Admin expenses Net F&C and insurance income / Total expenses

Total revenues grew 12% y-o- y in 3Q'20, driven by non -credit business lines

The share of non-credit revenues grew y-o-y from 32% to 41% - a record high

Our diversified revenue structure reduces the volatility of our P&L

Our non-credit revenue covers more than 100% of our admin expenses and almost 80% of our total expenses

STRUCTURE OF OPERATING EXPENSES

OPERATING EFFICIENCY

9M'20 Administrative staff

Other administrative

2Q'20 Acquisition

9M'20 3Q'19 C/I (incl. acquisition)

1Q'20 2Q'20 C/I (excl. acquisition)

Operating expenses rose 25% y-o-y, driven by acquisition costs as we returned to growth across all businesses

C/I returned to 2019 levels as we push on with our growth and customer acquisition plans

Rapid acquisition cost growth in 3Q20 compensated a temporary decrease in

2Q'20 caused by COVID

INTEREST INCOME

INTEREST EXPENSE

3Q'19 Credit portfolio

1Q'20 2Q'20

Credit portfolio Investment portfolio

29,7% 29,8%

COST OF BORROWING

4Q'19 1Q'20 Wholesale / interbank

4,3% 3,7% Customer accounts

Growth in interest income continues to outpace growth in interest expense in 2020

Credit portfolio yield declined in 3Q'20 as we returned to growth, especially in lower yielding categories

Interest expense declined 5% y-o-y despite a 45.7% y-o-y increase in the total funding base

Cost of borrowing reached a record low of 3.9%, continuing its decline driven by easing monetary policy, brand recognition, and customer loyalty

NET INTEREST INCOME

1Q'20 15,9% 9,9% 5,9 9,7

9M'20 3Q'19

COST OF RISK

Provision for loan impairment Reported Cost of risk

NET INTEREST MARGIN

Net interest margin (NIM)

18,3% 11,0% 9,9%

Risk-adjusted NIM 22,5%

3Q'19 4Q'19

WRITE-OFFS / SALE OF BAD DEBTS

Sale of bad debts Risk-adjusted NIM wo macro

% of gross loans (annualized)

4Q'19 1Q'20 2Q'20 3Q'20 Macro factor effect

Underlying CoR (w/o macro factor effect)

Reported cost of risk (incl. macro factor adjustments) declined q-o-q from 12.5% to 6.5%. As the economic situation turned out to be better than we had originally forecasted in 1Q'20, we reversed in 2Q and 3Q RUB 1.4bn out of the RUB 5.9bn macro factor adjustment made in 1Q'20.

Underlying cost of risk (excl. macro factor adjustments) significantly decreased q-o-q from 13.5% to 6.8%, driven by better performance of borrowers, including those who came out of restructuring programs

Risk adjusted NIM improved sequentially in 3Q'20 despite the q -o-q

NIM decline

NET UNSECURED LOANS

GROSS INTEREST YIELD

NPL (% OF GROSS LOANS)

3Q'19 4Q'19 1Q'20

COST OF RISK (UNSECURED LOANS)

Our unsecured loan portfolio returned to growth after a temporary slowdown in 2Q'20

Reported cost of risk declined q-o-q from 13.8% to 7.3%

Underlying cost of risk declined q-o-q from 14.9% to 7.7%.

Interest yields resumed their downward decline after temporary resilience in

4Q'19 - 2Q'20

NET COLLATERALIZED LOANS

Car loans Secured loans

Total Car loans Secured loans

15% 14% 13% 12% 11%

COST OF RISK (COLLATERALIZED LOANS)

In 3Q'20, car loans drove total collateralized loans portfolio growth

Underlying/Reported cost of risk changed in the following way in 3Q:

We remain optimistic about the prospects of this high margin, lower cost of risk portfolio

Secured loans: from 2.6%/2.1% to 1.0%/0.9%

Car loans: from 6.7%/5.4% to 4.6%/4.4%

Asset quality metrics continue to develop as the portfolio matures

Total collateralized portfolio: from 4.0%/3.2% to 2.4%/2.2%

FEE AND COMMISSION INCOME

INSURANCE PREMIUMS EARNED

9M'19 Credit-related

3Q'19 Debit cards

Merchant acquiring

2Q'20 Brokerage operations

4Q'19 Accident, other

Record-high quarterly revenue from SME, Investments and debit cards business lines lead to an impressive 39% y-o-y F&C income growth

More selective underwriting of insurance customers led to a temporary slowdown in insurance premiums growth

CUSTOMERS (m)

DEBIT CARDS TOTAL PAYMENT VOLUME (TPV)

Interchange

Cash withdrawal

3Q'20 Other

We purposely run this product line close to break-even as we see our current accounts business as the cornerstone of our customer relationship. Tinkoff Black customers are highly transactional, highly engaged, and more open to trying products and services in the Tinkoff suite

10,7m current accounts opened is cast-iron proof of our exceptional UX design, attractive tariffs and superb customer service

Customer base growth and ease of restrictive anti-pandemic measures led to the growth of interchange fees and as a result 16% y-o-y growth of fee and commission income

CUSTOMERS ( ' 000)

4Q'19 Transaction

2Q'20 Service

Despite lockdown measures, our SME business showed continued growth in customer number and fee and commission income y-o-y

We continue offering attractive terms and expanding the range of services for

SME customers to support the customer base growth During lockdown, Tinkoff SME clients benefitted from our ability to help them migrate to online payments, to do their accounting and tax reporting fully online through our cloud software, to build websites, to set up electronic documentation processes, to set up delivery services with partners, and to provide partner-financed credit lines to help companies through the crisis

ASSETS UNDER CUSTODY

TRANSACTION VOLUMES

In 2020, Tinkoff Investments sharply grew its customer base, its transaction volumes, and its revenue

Tinkoff Investments was named the winner in the Retail Brokerage

Company category of the Stock Market Elite 2019

#1 retail broker by the number of active users on MOEX throughout 2020, starting Dec 19

Product improvement continues: our asset manager Tinkoff Capital launched Russia's first ETF that tracks the Nasdaq 100 Technology

*Includes all revenues including fee and commissions, FX revenues, and interest on cash balances

Sector Index

TOTAL PAYMENT VOLUME (TPV)

MERCHANT ACQUIRING COMMISSION

GROSS ACQUIRING COMMISSION*

SHARE OF DIRECT-TO-MERCHANT

Steady business growth: turnover up 30% y-o-y along with revenue

Important source of revenue: in 3Q'20 internet acquiring brought ₽ 2.0bn of fee income

Direct share shows % of turnover generated by Tinkoff merchants without aggregators

On track to become Russia's second largest online acquirer

*Gross acquiring commission is total fee and commission income divided by turnover

RETURN ON ASSETS

RETURN ON EQUITY

Industry leading ROA of 7.2% and ROE of 45%

Net income of RUB 12.6bn rose 30% y-o-y, supported by continued customer acquisition and monetization

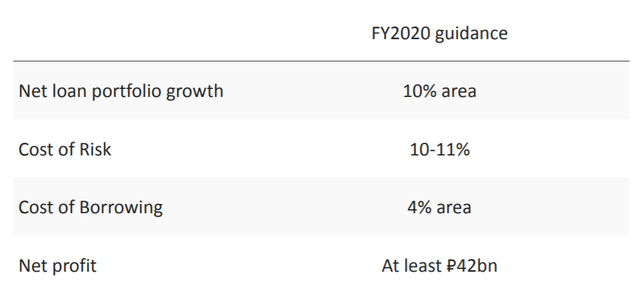

FY2020 guidance Net loan portfolio growth

Cost of Risk

10% area 10-11% 4% area

Time frame Implemented by Tinkoff

Customer support measures

Higher unemployment benefits and social security payments

Government retail borrower payment holiday scheme (see slide 11)

Reduction in interchange and merchant acquiring fees for certain online categories

Tax and debt holidays for SMEs

0% loans to SMEs to continue paying salaries

Bank support measures

Forbearance on revaluation of securities for capital calculation

Forbearance on use of FX rates for capital calculation

Forbearance on provisioning for restructured exposures and payment holidays

Lower deposit insurance charges from 0.15% to 0.10%

Reduced cost for existing CBR irrevocable credit lines

Interest on retail deposits and bond holdings above RUB 1 mn subject to 13% tax

Dividend withholding tax to offshore companies to increase to 15%

Issue in lombard

Issue not in lombard

Basic Materials

Consumer, Non-cyclical

Communications

Consumer, Cyclical

Provision charge for loan impairment Customer acquisition expense Administrative and other operating expenses Profit before tax

Cash and treasury portfolio Loans and advances to customers Total assets

Customer accounts Total liabilities Total equity

Cost/Income (incl. acquisition expenses) Cost of risk

RW for unsecured loans since 1-Sep-20

* SIFI means Systemically Important Financial Institution

LTM GROSS WRITTEN PREMIUMS

CAPITAL ADEQUACY*

*Actual capital / Regulatory capital

Ample capital buffers for our insurance business growth plans

TINKOFF BLACK DEBIT CARD

Everyday purchases

3.5% interest on balance 1% cashback on all purchases >5% cashback on special categories

Up to 30% cashback on selected merchants

Loyalty programmes and co-brands

Free cash withdrawal in any ATM worldwide

Convenient interface in the internet and mobile banks

Automatic and regular payments

Support of CB fast payments by phone number (NEW)

Payments to/from Sberbank by phone number (NEW)

Free ingoing and outgoing C2C transfers

Source: management accounts

Multicurrency support

Narrow FX spread (0,5%) and online exchange rate

Money transfers

Multicurrency cards (NEW) and deposits

Accounts in 30 currencies

Lifestyle banking

RETAIL TERM DEPOSITS

Opened and serviced online and via Tinkoff's smart couriers

Free withdrawals and top-ups via ATMs, terminals or bank transfers

Competitive interest rates and features, multiple currencies

Cashbacks for entertainment (NEW)

Restaurants

Tinkoff Travel Cashback

Tinkoff Junior (NEW)

Premium and Metal cards (NEW)

SAVINGS ACCOUNTS

3% interest

You can open a savings account and save for your personal goals

DEBIT CARDS TRANSACTIONS VOLUME

FEE AND COMMISSION I NCOME

10.7m million current accounts opened is cast-iron proof of our exceptional UX design, attractive tariffs and superb customer service

Fee & commission income rose y-o-y in spite of the impact of lockdown measures on transaction volumes

NEW CUSTOMERS ( '000 )

CAC ( ₽ '000 )

UNIT ECONOMICS

Revenue per customer ₽ '000

OPEX per customer ₽ '000

BUSINESS LINE P&L

Fee and commission income ₽ m Interest expense ₽ m Acquisition costs ₽ m

Interest income ₽ m

Transaction and service costs ₽ m Operating income ₽ m

HOME EQUITY LOANS

CREDIT CARDS

Flagship credit card product with premium features for mass and affluent customers

Co-brands and loyalty programmes 55-day grace period

Free repayments

Free 24/7 call centre coverage

International acceptance anywhere on the Mastercard or VISA networks

Regular limits reviews

Partner-based installment loans - 0% interest rate for up to 12 months. c.100 partner offers for all credit card customers

Just with one documents - a state registered ID

Cash-in on a debit card

Over 50% of issuance - to Tinkoff customer base

Cash loans secured by an apartment or a car

Programme loan size is up to RUB10mn, and tenor of 10 years max

Collateral - apartments in apartment blocks, housing property, car

Just one document - a state registered ID, partial loan amount directly debited on Tinkoff Black current account upon credit decision; following registration of collateral in RosReestr (Real Estate Register) the full amount of loan becomes available for a customer

Tinkoff fully conducts the origination process, including valuation, verification and registration of collateral. The involvement of customer in this process is nil

This is still a tiny segment of our overall credit business, we continue to test distribution, gather data and build our models

Point-of-sale unsecured lending for customers to pay for their purchases at online and offline retailers

Offered to both existing and new customers of Tinkoff

Up to RUB500k for non-Tinkoff customers and up to RUB2mn for

Tinkoff current account customers with positive track-record and risk profile

Low acquisition cost due to organic and cross-sell nature of growth

No cannibalization of credit cards traffic

Low loan size and short loan duration

P&L neutral product - the main goal of the product is a cross-sell to credit cards

c.20% of POS monthly issuance converted to credit cards

Two sales channels: dealers (launched 1H2018) and direct (launched in 2H2018)

Focus on second-hand car market with higher interest rates and lower competition vs new cars market

Loans through dealerships:

Our own exclusive and best in class IT solution of loan issuance through dealerships

Swift online verification

Synergy with Tinkoff Insurance

Direct car loans:

Partnerships with main classified sites - auto.ru, drom.ru and others

Own internet acquisition channels, including cross-sell to existing customer base

Tinkoff Business ecosystem

• SME-loan brokerage

• Loans for select clients

Start-up your business with Tinkoff

• Registration of new entities

• Start-up incubator (franchises)

• University of an entrepreneur

• HR agency

TINKOFF BUSINESS GROWTH DYNAMICS (# of accounts)**

700 600 500 400 300 200

TINKOFF MICRO SME'S IS A TOP -5 PLAYER

50 40 30 20 10 0

Small SME's Micro SME's Balance (RHS)

* Small SME (legal entities up to 20 employees), micro SME (individual entrepreneurs) ** Management accounts

Source: Bank's analytics based on CBR 101 form

3 Alfa-Bank

4 Rosselkhozbank

5 Tinkoff Bank

6 FC Otkritie

1-Oct-20 ₽ bn

CUSTOMERS ('000)

Transaction

We continue offering attractive terms and expanding the range of services for SME customers to support the customer base growth

During lockdown, Tinkoff SME clients benefitted from our ability to help them migrate to online payments, to do their accounting and tax reporting fully online through our cloud software, to build websites, to set up electronic documentation processes, to set up delivery services with partners, and to provide partner-financed credit lines to help companies through the crisis

For different type of investors :

Various investment instruments :

• Individual Investment Accounts

• Retail Brokerage Accounts

Investor - for passive investors

Trader - for active traders

Premium - for affluent customers

CUSTOMER ACCOUNTS ('000)

• Currency exchange

• Investment life insurance

• Roboadvisor

• Analytics

• Personal manager

• Direct debit/credit from/to current account

2019 snapshot

• #1 by number of newly opened accounts on MOEX (c.200k acc/mos)

• Average balance RUB285k

• MAU 1100k

* Management accounts

Avg. transaction fee rate

250 200 150 100 50 0

3Q'17 4Q'17 1Q'18 2Q'18 3Q'18 4Q'18 1Q'19 2Q'19 3Q'19 4Q'19 1Q'20 2Q'20 3Q'20

Revenue ₽ m Acquisition ₽ m Service ₽ m Operating income ₽ m

500 0 -500 -1 000

• Car insurance: OSAGO/KASKO

• Travel insurance

• Property insurance

Gross written premiums*

• Life insurance

Segment result

6,0 5,0 4,0

2,0 1,0 0,0

Total turnover and breakdown*

Direct share, rs

Fee and commission income

Attachments

- Original document

TCS Group Holding plc published this content on 02 December 2020 and is solely responsible for the information contained therein. Distributed by Public, unedited and unaltered, on 02 December 2020 13:08:05 UTC

Latest news about TCS Group Holding PLC

Chart tcs group holding plc.

Company Profile

Income statement evolution, annual profits - rate of surprise, sector other holding companies.

- Stock Market

Presentations

TCS Group (Tinkoff), Russian Fintech, Highly Profitable

- Steadily growing Russian neo bank. Not particularly fast as far as fintech bank go, but it's hugely profitable.

- Attractive here is that this neo bank is much more than just a banking platform. It has plently of ability to cross sell into its 13 million MAUs.

- The stock is priced at 14x this year's earnings.

Readers interested may also check out: Kaspi ( KAKZF )

Notes to readers:.

Tinkoff is a medium growth neo bank. Unlike some of its competitors, Tinkoff is not growing incredibly fast, at somewhere near 25% y/y. However, what it lacks in attractive fast growth rates, Tinkoff more than makes up with an incredibly profitable enterprise, with an attractive ROE.

I'll touch on some important investment risks of investing in this Russian bank lower down.

Also, I should note that these shares are listed on the London Stock Exchange and their share price is listed in USD. The shares are listed as TCS Group.

Investment Thesis

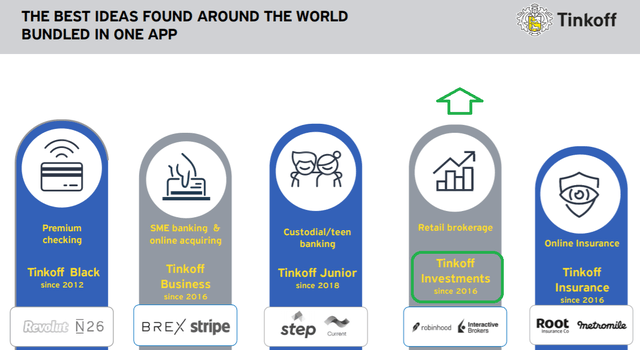

Tinkoff's shares trade on the London Stock Exchange as Tinkoff Group. It's much more than just a bank, it's a highly sticky ecosystem.

There are several avenues where Tinkoff generates revenues, but the one that's not fully monetized that interests me is its retail brokerage platform .

At the moment it's growing its operations at approximately 25% y/y and is being priced at 14x its 2020 earnings.

What's Tinkoff? Why is it Compelling?

As you can see below Tinkoff has a very sticky investment ecosystem and is now Russia's third-biggest bank with 12 million customers .

Source: Investor Presentation November 2020

However, it also acts as a platform for selling airline tickets and other verticals as you can see in the graphic above. Nonetheless, while those verticals are interesting, the aspect that I'm particularly attracted to here is Tinkoff's Investment ecosystem.

This business unit got started in 2016 and is now showing meaningful promise. In fact, Tinkoff Investments's assets under management were up 6x y/y as of Q3 2020 -- very attractive growth rates.

Incidentally, as a brief aside, you can see above, the shares are largely held by Tinkov and management, which together hold more than 40% of the company.

Guidance For FY 2020

Source: November 2020 Investor Presentation

For context, during 2019 Tinkoff's net income was RUB36.1 billion, hence given that its guidance is only for RUB42 billion ($560 million) for 2020, this implies that it's not quite growing its net income at to 25% y/y, but in fact closer to 16% y/y.

However, we have to keep in mind the effect that COVID had on Russia as well as the rest of the world.

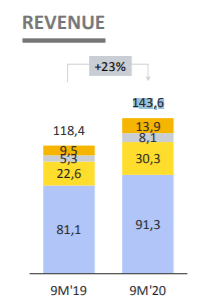

Having said that, below we can see that its revenue continues to tick along at close to 23% y/y during its trailing nine months.

Thus, it could be argued that Tinkoff is growing its top line faster than its bottom line because it's still investing for growth in the years ahead .

Valuation -- Appears to Carry a Margin of Safety

Assuming that Tinkoff hits RUB42 billion ($560 million) of net income in 2020 that puts the stock trading at about 14x earnings. In 2020, there are not too many neo banks that are both profitable and growing and likely to be valued anywhere near this valuation.

Obviously, it's difficult to compare with other peers given that most neo banks are publicly held. And I don't think comparisons with Square ( SQ ) are entirely valid as that company is much bigger and broader and US-focused (for the most part). Indeed, Square is playing a whole different game.

Several Investment Risks

Tinkoff is a bank with operations in Russia. Its country of operations has regular and large crises.

Russia's currency, Ruble, is steadily depreciating by about 10% to 15% per year. This is a huge headwind given that the shares are listed in USD.

For investors to be positively rewarded here Tinkoff has to continue growing its net income line at approximately 15% or higher. Otherwise, all considered, investors are probably asked to pay a premium right now.

The Bottom Line

This is an off-the-beaten-track investment. It carries substantial risk. However, I believe that this large bank still has plenty of potential and could be worthwhile considering.

The company is probably growing at somewhere around 25% on its top line, with a strong fiscal position and a broadening ecosystem. Meanwhile, for now, the stock is still trading at close to 14x earnings.

Analyst's Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Michael is LONG Tinkoff shares.

Seeking Alpha's Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Recommended For You

Trending analysis, trending news.

- S&P Dow Jones Indices

- S&P Global Market Intelligence

- S&P Global Mobility

- S&P Global Commodity Insights

- S&P Global Ratings

- S&P Global Sustainable1

- Investor Relations Overview

- Investor Presentations

- Investor Fact Book

- News Releases

- Quarterly Earnings

- SEC Filings & Reports

- Executive Committee

- Corporate Governance

- Merger Information

- Stock & Dividends

- Shareholder Services

- Contact Investor Relations

- Email Subscription Center

- Media Center

Tinkoff Bank to launch asset management unit by year-end

Managed Services Insights: The client lifecycle management solution

Technology & Automation Insights: Elevating KYC and onboarding efficiency

Banking Essentials Newsletter: May 15th Edition

Data Insights: Enhancing regulatory compliance and client lifecycle management.

- 7 Jun, 2019

- Author Beata Fojcik

- Theme Banking

Russia-based JSC Tinkoff Bank, which is part of TCS Group Holding PLC, plans to launch its own asset management company, hoping it will become operational in the fourth quarter.

The asset manager, called Tinkoff Capital, will initially offer clients its own exchange-traded funds, which customers will be able to manage fully online, the lender said June 6.

Tinkoff Capital is also exploring the possibility of offering individual asset management services and hopes to attract about 100,000 customers within a year, Vedomosti said the same day, citing the lender.

- Beata Fojcik

COMMENTS

FY2023 Presentation. PDF, 830 KB. Tinkoff provides regular on its business through investor presentations and results disclosures. Here you can find all of our recent presentations from meetings with investors as well as our quarterly IFRS results presentations.

TINKOFF tinkoff.ru TINKOFF . Market estimated as non-overdue portfolio from RAS reporting 101 form 455% and 457% accountss including only loans with term upto 3 years tinkoff.ru TINKOFF . tinkoff.ru ... PowerPoint Presentation Author: Amanov Arseniy Evgenyevich Created Date:

• In December 2022, Tinkoff introduced the Tinkoff Pay payment sticker, a new contactless payment method . • In 2022, Tinkoff Credit Broker issued 1 .4 million installment and POS loans for a total of RUB 57 billion, expanding its partner network by 40% . ESG developments • For the second year in a row, Tinkoff received platinum

• Tinkoff completed its debut mortgage securitisation • Tinkoff Named CEE's Best Digital Bank at Euromoney's Awards for Excellence 2021 • Tinkoff launched 9 development hubs • Tinkoff was recognized as Most Innovative Digital Bank by Global Finance 2020 44 .2 • Tinkoff becomes the largest player in the CBR's Faster

The Tinkoff management team will host an investor and analyst conference call at 14:00 UK time (16:00 Moscow time, 09:00 US Eastern Daylight Time), on Thursday, 26 August 2021. The press release, presentation and financial statements will be available on the Tinkoff website at ...

Tinkoff. Tinkoff is an online provider of retail financial services with over 7mln customers across Russia. Leveraging its high-tech proprietary online platform, Tinkoff has no branches and acquires and services its customers via online channels and its call centre. The bank was founded in 2006 by a Russian entrepreneur Oleg Tinkov.

November 2020 INVESTOR PRESENTATION 0 Disclaimer Certain statements and/or other information... a2fc45c4e661c38e303d6d666c2036.PZ_g9cp8BmYL0EKvz_9PAGA8o-_OBLCWhMei6q52J-M.CPiOoawfQj5Shw3YqZMnSQt1-t_7ZcrM9KrshsEDaKpzyJHEs1E_M1ufAw ... TCS : Tinkoff Investor Presentation November 2020 December 02, 2020 at 08:09 am EST Share November 2020 ...

RENAISSANCE CAPITAL'S 25th ANNUAL RUSSIA INVESTOR CONFERENCE pdf, 2.09 Мб. VTB Capital Investment Forum RUSSIA CALLING! 18 19 November 2020 pdf, 1.22 Мб. Презентация Tinkoff pdf, 1.59 Мб. Show more. 2023 IFRS Results pdf, 2.87 Мб. 1H 2023 IFRS Results pdf, 2.40 Мб. Instruction for voting at an EGM pdf, 1.11 Мб. Show more.

Tinkoff is an online financial ecosystem centred around the needs of customers. The Tinkoff ecosystem offers a full range of financial services for individuals and businesses. With a focus on lifestyle banking, the Tinkoff platform enables customers to analyse and plan personal spending, invest their savings, earn loyalty programme bonuses, book trips, buy movie tickets, make restaurant ...

Source: Investor Presentation November 2020 This business unit got started in 2016 and is now showing meaningful promise. In fact, Tinkoff Investments's assets under management were up 6x y/y as ...

Tinkoff Bank General Information Description. Provider of digital banking and online retail financial services intended to offer consumer lending facilities. The company's financial ecosystem offers a full range of financial and lifestyle services for individuals and businesses via its mobile app and web interface, enabling its clients to avail banking services such as savings, investments ...

TINKOFF . Market estimated as non-overdue portfolio from RAS reporting 101 form 455% and 457% accountss including only loans with term upto 3 years tinkoff.ru TINKOFF . tinkoff.ru TINKOFF . tinkoff.ru ... PowerPoint Presentation Author: Amanov Arseniy Evgenyevich Created Date:

Discover more about S&P Global's offerings. Investor Relations. Investor Relations Overview; Investor Presentations; Investor Fact Book

What is Tinkoff's current revenue? The current revenue for Tinkoff is 00000. How much funding has Tinkoff raised over time? Tinkoff has raised $10M. Who are Tinkoff's investors? Mint Capital has invested in Tinkoff. When was Tinkoff acquired? Tinkoff was acquired on 12-Nov-2010.

Presentations. Events. View All Events. Financial Results. SoFi Investor Relations. [email protected] (844) 422-7634 (SOFI) Quick Links. SEC Filings; Investor FAQs; Main Corporate Site; Investor Email Alerts. To opt-in for investor email alerts, please enter your email address in the field below and select at least one alert option. After submitting ...

The asset manager, called Tinkoff Capital, will initially offer clients its own exchange-traded funds, which customers will be able to manage fully online, the lender said June 6. Tinkoff Capital is also exploring the possibility of offering individual asset management services and hopes to attract about 100,000 customers within a year ...

The history of Tinkoff Bank. Tinkoff's active customer base reached 10 million on March 17. At YE2020, Tinkoff's active customer base was 9.1 million. Tinkoff history: evolution from a monoline bank to a full-fledged online ecosystem satisfying the full range of customers' financial and lifestyle needs.

Investor Presentation September 2021. 2 Certain information contained in this presentation and statements made orally during this presentation relate to or are based on studies, publications, surveys and other data obtained from third-party sources and Cortexyme's own internal estimates and research. While Cortexyme believes these third-party ...

tinkoff.ru TINKOFF . Market estimated as non-overdue portfolio from RAS reporting 101 form 455% and 457% accountss including only loans with term upto 3 years ... TINKOFF . tinkoff.ru TINKOFF . tinkoff.ru TINKOFF . tinkoff.ru TINKOFF . Title: PowerPoint Presentation Author: Amanov Arseniy Evgenyevich Created Date: 3/4/2022 11:38:03 AM ...

Moscow, Russia — 10 September 2021. Tinkoff has announced the launch of Tinkoff Private — a new offering in its ecosystem that will serve affluent customers. It is a digital private banking service that combines a wide range of both traditional and innovative services for affluent customers in the HNWI segment which is now available in the Tinkoff and Tinkoff Investments apps.