(844) 538-2937 or ( 416) 593-4357

Real Estate Assignment Sales – New Tax Rules

The Federal Budget for 2022 has made amendments to Part IX of the Excise Tax Act (“ETA”). Effective May 7, 2022, all assignment sales in respect of newly constructed or substantially renovated single unit residential complexes or residential condominium units are taxable.

For clarity, with respect to residential housing transactions, the purchaser (assignor) enters into an agreement of Purchase and Sale with the builder and then sells (assigns) their “rights and obligations” in the agreement of Purchase and Sale to another person (assignee).

Typically, the closing date for a pre-constructions residential property can take several months or even years. During this time, purchasers may decide to assign their rights outlined in the Purchase and Sale agreement to an assignee. The Federal Budget for 2022 now imposes GST/HST tax obligations on assignors and assignees. Essentially, an individual assignor of residential real estate now must collect GST/HST remit it to the CRA. This rule is applicable even to those who do not have a GST/HST number and believe that they are not purchasing and assigning in the course of commercial activity. In cases where the assignor is a non-resident, the assignee is obligated to self-assess the GST/HST. Prior to this amendment, the GST/HST liability depended on whether an individual purchased and assigned their rights in the course of commercial activity and if the purchaser’s true intentions were to live in and use the property, then there would be no GST/HST liability.

Deposit Portion of Assignments

Where an assignment agreement is entered into on or after May 7, 2022, the Budget confirms that GST/HST would not be applicable to the deposit portion of the assignment price. However, it must be indicated in writing that a part of the consideration is attributable to the reimbursement of a deposit paid by the assignor to the builder under the Purchase and Sale agreement. This means that an assignor would only be liable for GST/HST on the amount above the deposit. This also eliminates double taxation and is consistent with the holding from current caselaw, Casa Blanca Homes Ltd. v. The Queen , 2013 TCC 338 .

Where an assignment agreement is entered into before May 7, 2022, and the assignment sale is taxable, the total amount payable for the sale is subject to the GST/HST, this includes any amount paid by the assignor as a deposit to the builder, whether or not this amount is separately identified.

“Anti-flipping” Rule

Budget 2022 further proposes that sales of residential properties owned for less than 12 months are deemed to generate business income under the Income Tax Act (“ITA”). These are subject to limited exceptions such as divorce, or relocation for employment purposes. In terms of assignment sales, it has not yet been determined whether the proposed “anti-flipping” rules would apply since taxpayers do not technically “own” the properties. Tax practitioners are carefully monitoring this. For more information see our previous blog discussing this .

If you have questions about the new rules contact us today !

**Disclaimer

This article provides information of a general nature only. It does not provide legal advice nor can it or should it be relied upon. All tax situations are specific to their facts and will differ from the situations in this article. If you have specific legal questions, you should consult a lawyer.

Related posts:

- Withholding Tax for Non-Residents on Real Estate Sales

- Assigning Property and the GST/HST Implications

- How Real Estate Agents can Incorporate a Company

- Capital Gains – Canadians Selling U.S. Real Estate

- Business Expenses for Real Estate Agents

Jason Rosen

Rafia javaid, leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

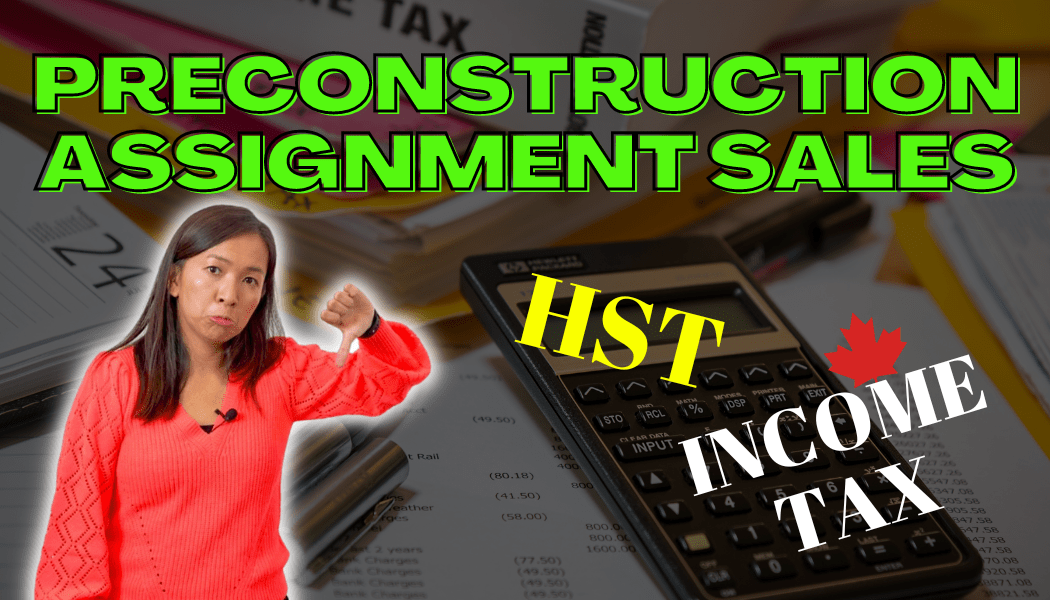

Everything you need to know about Preconstruction Assignment Sales

Have you sold pre-construction homes before closing on assignments?

Have you wondered about what are the tax implications on selling pre-construction homes before closing?

We often advise our clients to not to sell their pre-construction homes before closing if possible. It can trigger a series of tax implications – HST and income tax implications.

Before the announcement of Budget 2022, CRA had adopted the policies that HST would be applicable on not just the assignment fees, but also the deposit.

This could be a huge tax cost that most investors weren’t aware of.

Now, let’s use an example to explain .

Say you agree to purchase a pre-construction home for $700,000. You sign the agreement of purchase and sale and pay a deposit of $100,000 to the builder.

The new home is expected to be completed a few years later.

You decided to sell the property on assignment before it’s ready for closing for an additional $50,000.

Scenario 1: When you signed the agreement of purchase and sale, you intended to move into the property and use it as your primary residence.

Life circumstances change. You now decided to sell the property before closing. You sold it on assignment before May 6, 2022 .

HST: As your intention was to move into the property as your primary residence, you had no HST liability obligation.

Again, intention is subjective. If you’re questioned in court, you would have to provide evidence to prove your own intention.

Most clients thought that the CRA would have to prove that they were wrong. The truth however is that the taxpayers are the one who have the responsibility to prove to CRA their own filing position.

Make sure your have documentation proving your initial intention.

Income Tax: Assuming you have strong documentation proving that you did intend to purchase this pre-construction home as your primary residence, the $50,000 assignment fees could be reported as capital gain.

Scenario 2: When you signed the agreement of purchase and sale, you intended to move into the property and use it as your primary residence.

Life circumstances change. You now decided to sell the property before closing. You sold it on assignment after May 6, 2022 .

Budget 2022 changed the rule. For all assignment sales happened after May 6, 2022, regardless of your intention, you’re required to pay HST on the assignment sales.

HST implication:

This means that the $50,000 collected is no longer all yours. This $50,000 collected, if you don’t charge HST on top, is inclusive of HST.

You must remit the HST to CRA on sale on assignment. In this case, it would have been $5.8K.

Presumably, you would also be able to claim Input Tax Credit, which is the HST you paid on services that you used to allow you to sell the property. This includes the HST you paid on your legal cost and HST you paid on brokerage fees.

The net amount can be remitted to CRA.

Income Tax Implication:

Budget 2022 also made some rule changes when it comes down to sale of property. The sale of a property within one year of ownership is considered on income account, meaning 100% of the profit you make is taxable, with some exceptions allowed, effective Jan 1, 2023.

When you apply this new rule to this scenario, it is unknown as to whether an assignment sale is considered a flipped property. It’s difficult to say whether this rule is applicable to assignment sale at this point.

Regardless, you still would need to keep proper and relevant documentation supporting your intention that you were trying to move into the property as your primary residence. With proper documentation, you could still report the net income from assignment sale on capital account, meaning only 50% of the profit you make is taxable.

In our example, assuming client didn’t incur other cost of selling, the client would be reporting $44K of capital gain, 50% of which would be taxable.

Scenario 3: When you signed the agreement of purchase and sale, you intended to rent out your property.

Interest rate changed. You now decided to sell the property before closing. You sold it on assignment before May 6, 2022 .

Your intent was never to move into the property as your primary residence or have any of your family members moving in, as a result HST is applicable on assignment sale.

Assignment fees are subject to HST. $50,000 assignment fees you collected are subjected to HST.

CRA also adopted the position that the deposits $100K are also subject to HST as well. Ouch!

You thought you made $50,000 – but after considering the HST on assignment fees $5.8K and HST on deposits $11.5K, you really only net $33K.

This calculation hasn’t considered the brokerage fees as well as the lawyer fees yet. Yikes!

Income Tax implication:

The net amount profit of $33K (assuming there’s no brokerage fees or lawyer fees, if you have, the net profit is lower) would likely have to be reported as income, 100% of it is taxable.

If you own the property in your personal name, the entire amount is added to your job income or whatever income you have in your personal name. You’re taxed at the respective marginal tax rates, which can be as high as 53.5% in Ontario.

Triple Yikes!

If you own the property in the corporation, the profit is taxed as regular business income, most likely at 12.2% for qualified small businesses.

Scenario 4: When you signed the agreement of purchase and sale, you intended to rent out your property.

Interest rate changed. You now decided to sell the property before closing. You sold it on assignment AFTER May 12, 2022 .

The Government also recognized that charging HST on deposits were not right. Budget 2022 specified that HST would no longer be charged on deposits .

Assignment fees are subject to HST but deposits are not subject to HST anymore to avoid double taxation.

Assignment fees are reported as income 100% taxable.

So continuing with the same example, HST is applicable on the $50,000 assignment fees, meaning that you would incur HST liability of $5.8K as calculated above.

Again, you could offset the HST liability with the HST you pay on realtor commission as well as lawyer fees on closing.

The net amount would have to be paid to CRA.

The net profit of $44K (assuming there’s no brokerage fees or lawyer fees, if you have, the net profit is lower) would likely have to be reported as income, 100% of it is taxable.

Similar to Scenario 3, if you own the property in your personal name, the entire amount is added to your job income or whatever income you have in your personal name. You’re taxed at the respective marginal tax rates, which can be as high as 53.5% in Ontario.

Now that we’ve gone through the assignment sales tax implication in details – Are you still planning to sell your properties on assignment?

Let us know below.

Lastly, our team has been working tirelessly to prepare for the upcoming Wealth Hacker Conference on preparing everyone for the upcoming recession. We have experts such as Dalia sharing her insights on how to protect your portfolio and grow from this recession. If you are lost, join us at the upcoming Wealth Hacker Conference.

Visit WealthHacker.ca now to get your tickets.

Until next time, happy Canadian Real Estate Investing.

Cherry Chan, CPA, CA

Your Real Estate Accountant

Related Posts

How to Maneuver Through the Tax Hike in the Federal Budget

The Unfair 2024 Federal Budget

LP/GP Unraveled: Tax Efficiency and T5013 Clarifications for Investors

Your T1 Tax Roadmap: 8 Key Tips for a Smooth Journey

Hit enter to search or ESC to close

- My Guarantee To You

- Ultimate GTA Home Buyer Guide

- FIRST TIME BUYERS

- BUYER CLOSING COSTS

- Getting the right mortgage financing

- GTA Mortgage & Land Transfer Tax Calculators

- Etobicoke Condo Market Report

- Why sell with me?

- Free Home Evaluation

- Why is home staging important?

- How to price your property

- Featured listings

- Landlord’s guide

Everything you need to know about selling an assignment condo

Selling an assignment condo is not the same as dealing with a resale condo sale. You have to navigate many potential challenges and regardless of present market conditions, it can take time and skill to complete a deal. Depending on the contract you signed with the builder you may not even be allowed to sell the condo on assignment. If they do allow it, see below for a guide on everything you need to know about selling an assignment condo in the GTA.

What is an assignment sale?

An assignment sale is a transaction in which a buyer (the “Assignor”) has purchased a property and then sells their interest in that property to another buyer (the “Assignee”) prior to the property closing. Essentially, as the Assignor you are not actually selling the property; you are selling their contract along with the rights and obligations of the original agreement with the Builder or original seller. While it is possible to have an assignment sale of a pre-construction house or a resale property, assignment sales in Toronto are most common in pre-construction condos.

If you are looking to sell your condo prior to the building’s closing date you are the Assignor. In other words the original buyer of the condo unit in the pre-construction phase. In an assignment sale, the assignor is the seller.

The assignee is the buyer of the assigned condo and takes over all rights and responsibilities of the original contract.

Make sure that the agent you are working with is familiar with the process of selling an assignment condo. Most agents have no experience in assignment sales, so be careful who you choose to represent your best interests.

Cons of selling your condo on assignment

- The builder may have restrictions on how you can market your assignment condo. Your first step should be checking with the builder or reviewing your APS (agreement of purchase and sale) on what is allowed.

- The pool of buyers is limited due to the substantial amount of cash required.

- Due to the complex nature of an assignment condo sale, the legal fees will be higher than resale condos.

- (as of May 7th, 2022) New tax rules will severely cut into your profits, if any.

Pros of selling your condo on assignment

- Pre-con condos take years to complete and if your lifestyle changes it allows you to walk away, oftentimes with a profit.

- You avoid costs such as land transfer tax, occupancy fees, etc.

- You can get your deposit out earlier and you may even be able to negotiate the profits sooner than the building closing.

Looking to sell your investment property via assignment?

Get in touch for a free NO OBLIGATION consultation and see why others have put their trust in me . Don’t like forms? Call or text me at 647-830-5210 or email me at [email protected].

Your Name (required)

Your Email (required)

Your phone number (required)

Marketing an assignment condo

Some builders in Toronto and the GTA have restrictions on listing your assignment deal on TRREB’s MLS or online in general. Essentially they are making it hard to impossible to market the property. Ensure that the Realtor you are working with has access to a network of Realtors that work in pre-construction and assignments. I have done several transactions this way and while it is more difficult to market properties this way, as opposed to marketing it online to the masses, it is possible.

Holding onto the property until completion and selling it on the resale market.

This is becoming a more common solution for many since the NEW TAX RULES for assignments came into effect in May 2022 (see details below). Neither option is the clear winner as you will either have to share a large portion of the profit with the government or incur expenses to close the deal. If you decide to complete the deal with the builder, and then sell it on the resale market you will incur the following expenses.

- Monthly occupancy fees (these are charged from the beginning of occupancy to the builder completion date, usually between 3-12 months depending on varying circumstances).

- Development charges and levies. Fees vary, for GTA condos it’s typically capped at around $10,000 – $20,000.

- Legal fees – approximately $2,000

- Status certificate – $100

- Tarion fee – $700

- Reserve fund – $700

- Various admin fees – $2,000

FAQ’s

How does hst work on the builder purchase price.

If you are selling your property on assignment, the assignee (the buyer of the assignment condo) will assume all HST responsibilities for the original purchase price as they will be the ones doing the final closing on the unit. In most cases, HST is included in the builder’s price assuming that the buyer will use the property as a primary residence. Ensure that your Assignment purchase agreement has clear wording on who is responsible for which taxes.

When is the closing date?

In an assignment sale, there are two closing dates. The first closing date is when the sale has been approved by both lawyers and the builder. The second closing date is when the building is registered.

Who pays for the builder assignment fees?

Generally, the assignment fees, if any, are due to the builder upon the builder’s approval of the assignment sale.

When will I receive my profit?

There are typically two options. You’ll either get the profits once the building closes (2nd closing) or when the builder approves the assignment sale. Depending on the market and your Realtor’s negotiating skill you should aim to get the profit as early as possible since the building closing could be a long time out.

New HST assignment rules

As of May 7, 2022, assignment sales in Ontario are subject to HST. When assigning a property to a buyer, the Assignor (seller) will have to pay HST on the profit portion of the proceeds regardless of what their initial intentions were when purchasing in the pre-construction phase. HST does not apply on deposits already made by the Assignor to the Builder, but you have to ensure that your Assignment Agreement of Purchase and Sale must include that the assignment price already includes the deposit.

New Income Tax on assignment sales

Assignment sales are now also subject to income tax. Pre-May 2022 you would only have to pay capital gains tax on the profit, which means you would only pay tax on 50% of the profit. Now 100% of the profit gets taxed and depending on your income that year you will likely fall into a higher tax bracket.

All assignment sales should be conditional upon your lawyer reviewing the entire assignment agreement. Part of that will be all of the contents and disclosures of the original Agreement of Purchase and Sale between the Assignor and the Builder.

You may also like:

- Bank of Canada maintains policy rate | February sees some buyers returning

What’s the right pricing strategy when selling my home?

Selling your tenanted condo in Toronto | A complete guide

Questions get in touch.

Don’t like filling out forms? Feel free to call, text, or email me. My cell phone number is 647-830-5210 and my email is [email protected]

Google Reviews

Reports, Guides, Resources & Much More

- 500 Wilson Ave | FOR SALE

- 65 Allegra Dr | FOR SALE

- 42 Castlebar Rd | SOLD

get monthly market insights. We’re not into spam. Promise!

Email address:

New Tax Rules for Real Estate Assignments and Flipping

Written by Sukhman Sandhu

Blog | real estate law, june 6, 2022.

To combat the sharp rise in real estate prices, the Canadian government has proposed new GST/HST rules in relation to Assignments (effective May 7, 2022) and Income Tax rules in relation to flipping real estate in general (effective January 1, 2023).

GST/HST to Apply for all Assignment Sales

As of May 7, 2022, where an individual sells an assignment of a new build or substantially renovated residential property, the transaction will be subject to HST, regardless of original intentions, as per the Canadian Excise Tax Act (“ETA”). Every individual assignor of residential real estate will now have to collect GST/HST on their assignment profit and remit it to the CRA.

Previously, if the original intention of entering the pre-construction Agreement of Purchase and Sale (APS) was for personal use, GST/HST did not apply to the assignment agreement. GST/HST previously only applied if the original intention was to sell for profit or flip the property. Effective May 7, 2022, whatever your intention, GST/HST will apply on the assignment profit.

Accompanied with some good news, the new rules do clarify that HST is no longer charged on recovered deposits. Prior to May 7, 2022, despite the court ruling against the CRA in a previous case dealing with this issue, the CRA continued to represent to tax payers that if the assignment is subject to GST/HST, the amount provided from the assignee (new buyer) to the assignor (original buyer) which reimburses the assignor for the assignor’s deposit to the builder is also subject to GST/HST. This created double taxation as the deposit that the assignor paid to the seller/builder is already subject to GST/HST.

For illustration purposes, envision Carrol purchased a new construction residential property for $1,200,000 and paid the builder’s lawyer a deposit of $200,000. Subsequently, Carrol entered into an assignment agreement for the assignment sale price of $1,500,000. Carrol in this situation is known as the ‘assignor’ and the individual who purchased from her is known as the ‘assignee’. The assignee must pay $500,000 to Carrol ($300,000 for the difference between assignment sale price of $1,500,000 and original purchase price of $1,200,000 + $200,000 to reimburse the assignor for assignor’s previous deposit to builder/builder’s lawyer) and $1,000,000 to the builder to complete the purchase (not including any closing/miscellaneous fees).

Prior to May 7, 2022, if Carrol’s original intention was to purchase for personal use, she would not be responsible to pay any HST/GST in relation to the assignment sale.

Prior to May 7, 2022, If Carrol’s original intention was not for personal use (i.e. investment property), then she would be liable to pay GST/HST on $500,000 (both the profit and deposit) which at the rate of 13% would have equaled $65,000. It is important to note that Carrol, on advise of her accountant, could have only paid GST/HST on $300,000 (avoiding any tax on deposit) by only remitting $39,000 and citing previous case ruling against double taxation on recovered deposit to the CRA.

As of May 7, 2022, regardless of Carrol’s original intention, she is liable to pay GST/HST on $300,000 which at the rate of 13% would equal $39,000.

Business Income instead of Capital Gains for Residential Property Flipping

Effective January 1, 2023, a new residential property flipping rule will classify the appreciation amount of all residential properties that are owned for less than 12 months to be business income under the Canadian Income Tax Act (“ITA”). This new legislation change will be subject to limited “life events” exceptions, such as the growth of a household, separation, a disability or illness, an employment change, insolvency, or an involuntary disposition.

Prior to January 1, 2023, investment properties (i.e. rentals) sold within or after 12 months of ownership are subject to capital gains tax which is 50% of business income tax and principal residence properties (owner-occupied) sold within or after 12 months of ownership are entirely exempt from tax.

Growing commentators believe that this proposed Residential Property Flipping Rule may also result in assignment sales treated as business income as opposed to capital gains. This would result in the assignor not only paying GST/HST on the portion of their assignment profit but also adding 100% of the assignment profit amount (minus remitted GST/HST) onto their annual personal income amount. We look forward to receiving further clarification in the near future.

If you are buying or selling investment properties, or have questions or concerns about residential or commercial real estate law in general, contact us at Sukh Law .

Sukh Law publishes articles for information purposes only and is not intended to constitute legal advice.

Related Resources…

Understanding the New Home HST Rebate in Ontario

Apr 30, 2024

When navigating the complexities of purchasing a new home in Ontario, understanding the nuances of the New Home HST...

Navigating Residency Requirements for Provincial and Canadian Corporations

Apr 25, 2024

Understanding the intricacies of corporate residency requirements is essential for any entrepreneur or investor...

Post-Closing Issues in Real Estate Transactions

Apr 18, 2024

Understanding the complexities of real estate transactions doesn't end at closing. In fact, issues that arise...

- [email protected]

- +1 877-SOFTRON

- Personal Tax Services

- Corporate Tax Services

- Estate Planning and Death Taxes

- US and Overseas Taxes

- Taxes on Sale of Property

- CRA Tax Help Videos

- Calculators

- Tax File Remotely

Here Are The Important Dates You Need To Know Regarding Recent Changes

Individuals : Federal & Quebec

Self-employed, trusts with a tax year end of dec 31, 2021, corporations, canadians with us tax filing.

Posted on 15 January 2024

The Lourantos Group

: 416-505-7975

A Comprehensive Guide To Selling Your Assignment Condo

Trying to resell your preconstruction condo before closing? This blog is for you. Assignment sales are more complicated compared to their resale counterparts, but with some guidance, the process is easy.

An assignment sale is a sale where the original buyers of a condo or home resell their contract to another buyer before closing. The most common type of assignment is a preconstruction condo assignment. Preconstruction condo assignments are prevalent because of the time lag between purchasing the home and the move-in date. While condo assignments might be the most popular type of assignment, any real estate contract is assignable. This blog is going to discuss condo assignments since they are the most prevalent, but *most* of the details apply to assigning a home or commercial preconstruction property as well.

In the GTA, our preconstruction market is booming. Toronto alone sees around 30,000 new home completions a year. Around 70% of preconstruction purchasers are investors. The remaining 30% of buyers are end-users who plan to use the property themselves. However, many investors, and end-users, might decide to sell the property before the final closing. Since there is no title to transfer, these buyers have to assign their contract to the next buyer.

What is a preconstruction condo assignment sale?

An assignment is when the original buyers of a preconstruction condo decide to sell their contract with the builder to another buyer before the home is complete. This differs from a regular real estate transaction because we are not buying or selling a home, rather we are buying or selling an interest in a contract to purchase a home once it’s complete. Essentially, the buyers are taking over the seller’s place in the contract with the builder. The new buyer pays the seller their deposits back, as well as any profit. In trying times, there might not be profit, and in extreme cases, the sellers might walk away from their deposits.

Assignments are like the wild-west equivalent of real estate. The buyers are called assignees, the sellers are called assignors, and there is no fixed closing date! You heard that right, the buyer purchases the contract not knowing whether it will close in 4 weeks, 6 weeks, or 8 weeks. In many cases, the buyers only have a rough estimate for the final closing of the property as well.

Every builder’s agreement of purchase and sale is different, so every assignment sale is different. You need legal and accounting advice before, during, and after an assignment sale. A real estate agent’s job in the transaction is to find a buyer, negotiate the contract, and coordinate the sale from start to finish. Your real estate agent might also connect you with accountants, and lawyers who can help make the necessary legal and tax declarations.

The Builder’s Role In Assignments:

Sellers often misinterpret their rights to assign in their purchase agreements with their builder. In the showroom, builders are quick to say their contract is assignable if you want to flip your contract before closing. However, builders can control when, how, and to whom you sell your contract.

It’s important to follow the rules set out by your builder when marketing your assignment. Deviating from the builder’s purchase contract can result in you losing your deposits!

Since all preconstruction home assignments require the builder’s consent, it’s important to prepare the file for their consent at your earliest convenience. The builder will want the same information they collected from you when you first purchased the home: full names, current address, sin, IDs (front and back), telephone number, emails, mortgage pre-approval letter, lawyer information… they will also want the buyer to replace all your cheques. Those could be cheques for future deposits, or cheques for interim occupancy fees. It’s important to advise the buyers to prepare all of this information before submitting the file to the builder, so there is limited delay assigning the property.

How do you sell an assignment condo?

The first step to selling your assignment is to review your original purchase agreement. The builder’s purchase agreement outlines restrictions and fees associated with assignments. An experienced realtor or lawyer can also review the contract with you. Next, email your builder’s customer service account and ask for permission to advertise the property for sale.

It’s important to thoroughly understand your preconstruction agreement, because some incentives offered to you might not be transferable to the buyer. Builders often offer incentives to direct buyers to stimulate sales. However, they sometimes make these incentives non-transferable. That could mean the free design dollars, or the capped development levies might not be available to the next buyer. It’s important not to advertise incentives that aren’t transferable.

The second step is to hire a Realtor to advise you on current market conditions. Your realtor will discuss marketing options as well as help you decide on a market price. There is a strong chance the builder will prohibit MLS listings of their properties. However, many builders will allow online marketing in places like Facebook, Instagram, WhatsApp, and brokerage websites.

While Realtor.ca is the best marketing platform out there, buyers looking for assignments know to look elsewhere. Don’t worry if you cannot market on realtor.ca. One of the advantages of Sotheby’s International Realty Canada is our vast marketing platform outside of Realtor.ca

Important Dates:

The first date you need to consider is the assignment closing date. This is the date the assignee officially takes over the contract from the assignor. On average, assignment closing happens within 3-6 weeks after an offer is accepted. This is when the assignee becomes the new owner of the property, and the assignee receives some of their deposit/profit back.

The second date to consider is the interim occupancy date. When buying preconstruction condos, there is usually a period between when the unit is ready for occupancy and before the building has registered with the city. Since no title exists yet, you cannot get a mortgage. Instead, during this time, you move in and pay the builder rent until final closing. Interim occupancy can last from months to years. During interim occupancy, buyers have the chance to view the unit which could help sell the home. Interim occupancy is when most assignment sales take place.

The third date you need to know is the final closing date. This is the date that the building registers with the city and the assignee pays the builder the balance of the purchase price, land transfer taxes, closing costs etc. Sometimes, assignees will negotiate to pay some of the assignors profit on final closing date, so they can roll it into the mortgage.

What Is Negotiable During An Assignment Sale:

Since the contract with the builder is already firm and binding, there can be no changes to that contract. The buyer is merely stepping into the seller’s shoes, in exchange for their deposits and profits. The assignment contract negotiates the purchase price and the deposit structure. The purchase price will indicate how much profit (or loss) the assignor receives in the transaction.

The payment schedule of an assignment is dependent on whether there is a profit or not. If the seller is making a profit or breaking even, then the buyers are expected to refund the full deposit paid-to-date by the sellers. In many cases, that is 20% of the original purchase price. If the seller is losing money on the assignment, then the buyers will bring a deposit for less than the deposits already paid to the seller. The deposit is due upon acceptance of the offer.

If there is profit, the assignee and assignor will negotiate when that profit is paid out. Remember when we mentioned the three important dates? the assignment closing, the interim occupancy date, and the final closing date? well, when it comes to negotiating when to pay the assignor their profit, we usually pick one of these dates to pay out the assignor’s profit.

The expected final closing is an important consideration for buyers when negotiating when to pay the assignor’s profit. The longer the final closing date, the more risk for the buyer. The reason? there is always a small risk the condo developer cancels the project. If a condo developer cancels the project, the buyers are returned their deposits paid-to-date. However, if a buyer has paid an assignor $100,000 in profit, that money is gone. So if there is a long closing, expect buyers to protect their final deposits by delaying it till interim occupancy, or final closing.

Conditions In Assignment Sales

After finding a buyer, the first hurdle to overcome is negotiating a fair deal. Once both parties are satisfied with the terms of the contract, we make the deal conditional on the lawyer’s review. This gives both the buyer and seller a chance to have the assignment contract, as well as the original purchase agreement, reviewed by a lawyer. Once both parties have spoken to their lawyers and are happy to continue, we put the deal to the developer to approve the new buyer. This condition usually lasts around 30 days. If the developer does not approve the new buyer within 30 days, the deal will become null and void, unless the buyer and seller both agree to extend that condition.

Once the developer accepts the buyer, the assignment will happen within a few days. Most contracts outline an assignment closing within 5 business days after the developer gives their consent. Some buyers will also include financing conditions in their assignment offer, so they have time to run the deal past their mortgage broker. However, most assignments are purchased with only lawyer review and developer consent conditions.

Here’s an example of selling an assignment for profit vs selling an assignment for a loss:

Below are four examples of the deposit/profit payment schedule for assignments.

Example 1 is a fantastic example of a preconstruction condo that appreciated $100,000. In this typical example, the assignee and assignor agreed to a deposit big enough to return all of the assignor’s deposits, as well as some extra profit to cover Realtor commissions. This deposit is usually transferred to the listing brokerage within 1 day of the offer being accepted and is released to the assignor on assignment closing. In this example, the assignor and assignee also agreed to pay the seller the rest of their profit at the final closing.

Example 2 shows the same conditions for the sale, except the assignee agreed to pay the assignor their full deposit and all their profit on the assignment closing date, instead of the final closing date.

Example 3 looks at an assignment where the assignor is taking a $100,000 loss. Instead of being paid their whole deposit on assignment closing, they are paid their deposit minus the difference between the purchase price and the sale price.

Example 4 is a rare case, where the market has turned significantly and the assignor is looking to transfer their assignment for $0. This means the assignor is walking away from all their deposits and will take no money to transfer their contract to the assignee.

What Does It Cost To Sell An Assignment condo:

The major fees when selling an assignment include the builder’s assignment fee, real estate commissions, and tax on the profit. Builder’s assignment fees usually range from $1500-$25,000 (in some extreme cases they go as high as $80,000). The assignor usually pays both the assignor and the assignee’s realtor commissions. The commission is something to negotiate with your agent. The total commission is usually 5% or less of the final sale price. There are likely taxes such as income tax, capital gains tax, or HST on the sale as well. Speak to your accountant about taxes due on the assignment sale.

Taxes due on an assignment sale:

The taxes on assignments are simple, however, buyers and sellers often confuse the HST taxes. That’s because there are two different HST taxes when talking about preconstruction assignments. Let’s clarify this! All new homes are subject to HST, however, end-users don’t notice the HST tax because the builder pays it and claims a $24,000 rebate on the end-user’s behalf. Alternatively, investors who purchase a pre-construction home are charged around $24,000 in HST, and are then able to claim a rebate for the HST they paid, if they rent the property out for one year. There are situations where an assignment will lose its eligibility for the HST rebate. If someone has lived in the home during interim occupancy, it will no longer be eligible for the end-user HST rebate.

The second HST tax we discuss when selling an assignment is the HST due on the profit. In many cases, the profit is subject to a 13% HST tax. In some cases, even the return of deposits is subject to HST.

The third tax is the income or capital gains tax on the profit. Any real estate property that is not your primary residence, as well as any business venture, is taxable as either a capital gain or as income. It’s really important to speak to an accountant before selling your assignment. Only an accountant can advise you whether you owe HST, capital taxes, or income taxes on your assignment sale.

Is it better to sell an assignment or wait till the condo is ready?

The pros to assigning a condo:

- Receive your deposits and profit sooner

- Avoid market risks. Savvy investors might look to assign their property if they sense the market might depreciate in the coming months/years.

- Avoid paying closing costs (land transfer taxes, development levies, utility hookups, and more). These usually come to a little more than 5.5% of the purchase price

- No mortgage or financing required

- Minimize holding costs (if you sell before interim occupancy or before final closing, there are no property taxes, maintenance fees, utility fees, insurance, mortgage, etc)

Cons to assigning a condo

- Developer restrictions (limiting the marketing of the property, limiting when they are accepting assignments)

- Market perception and buyer’s hesitancy when buying a property sight-unseen

- Market fluctuations suppressing buyer demand

- Limited buyer pool and most of the buyers are investors who want a good deal

- Usually sell for a lower price than comparable resale properties

- Financing challenges for the buyer if the property does not appraise at the new purchase price

- Potentially more taxes compared to closing and reselling

The most common mistakes when selling an assignment:

Hiring the wrong representation, or not relying on professional advice:.

As active realtors in the assignment market, we come across quite a few mistakes. But most of them could be avoided if the buyers and sellers were represented by experienced realtors and lawyers. The agreement of purchase and sale for an assignment is very different compared to an agreement of purchase and sale for a resale home. One of the most common mistakes we see from buyers and sellers is assuming the paperwork their realtors drafted is correct, and forgoeing their right to have their lawyer review the assignment paperwork.

Poor communication/understanding:

This happened to my assignment buyers recently. They purchased a home where the seller’s representative told us the finishes had not been chosen yet. We protected our buyers by including clauses to that degree. However, a few days after the assignment closing, we learned the sellers chose the finishes a few days before closing. Luckily, the developer allowed the buyer to make changes to the finishes at an additional fee.

Ignoring deadlines or dragging your feet:

Assignments come with a lot of moving deadlines, and there are a lot more parties involved compared to a resale property. Always return paperwork and signatures as soon as possible. Compared to a resale property where the only parties are the buyer, seller, and their agents and lawyers, an assignment involves the developer, the developer’s lawyers, the buyer and seller agents, and the buyer and seller lawyers. If everyone took 3 days to return paperwork, the conditional period would lapse and the deal would become null and void.

Incomplete Buyer Vetting:

Buying an assignment requires the assignee to have their mortgage preapproval, as well as their purchase funds available very shortly. If the assignee does not have a mortgage preapproval on hand, it could delay the developer accepting the assignment. If they do not have their funds available it could delay the quick closing as well.

It’s important to thoroughly vet buyers because some builders require the assignor to close in the rare chance the assignee cannot close.

Misunderstanding fees:

Builder’s contracts are not standard forms, and their deposit structures and closing fees can vary from site to site. There are a lot of potential fees when buying and selling assignments and they include, but are not limited to: deposits, seller’s profits, upgrades, lawyer’s fees, interim occupancy rent, utility set-up fees, development levies, realtor commissions, accountant fees, HST, and income taxes. These fees can vary from deal to deal, and when they are payable is different in every assignment. For example, some developers require the homeowner to pay for upgrades when they are chosen, and others charge for the upgrades at final closing.

If you have a preconstruction condo or home that you are thinking of assigning. Feel free to reach out to us for some advice and insight.

Related posts.

Everything you need to know to sell your preconstruction condo assignment

6 important facts to consider when selling a preconstruction condo.

Greater Toronto Area Real Estate

Toronto | Mississauga | Hamilton | Durham

Call Us Anytime: 416-274-2068

Prefer Text? 416-568-0427

Looking for Bspoke Realty?

10 Essential Things to Know About Real Estate Assignment Sales (for Sellers)

— We take our content seriously. This article was written by a real person at BREL.

What’s an assignment?

An assignment is when a Seller sells their interest in a property before they take possession – in other words, they sell the contract they have with the Builder to a new purchaser. When a Seller assigns a property, they aren’t actually selling the property (because they don’t own it yet) – they are selling their promise to purchase it, along with the rights and obligations of their Agreement of Purchase and Sale contract. The Buyer of an assignment is essentially stepping into the shoes of the original purchaser.

The original purchaser is considered to be the Assignor; the new Buyer is the Assignee. The Assignee is the one who will complete the final sale with the Builder.

Do assignments only happen with pre-construction condos?

It’s possible to assign any type of property, pre-construction or resale, provided there aren’t restrictions against assignment in the original contract. An assignment allows a Buyer of a any kind of home to sell their interest in that property before they take possession of it.

Why would someone want to assign a condo?

Often with pre-construction sales, there’s a long time lag between when the original contract is entered into, when the Buyer can move in (the interim occupancy period) and the final closing. It’s not uncommon for a Buyer’s circumstances to change during that time…new job out of the city, new husband or wife, new set of twins, etc. What worked for a Buyer’s lifestyle 4 years ago doesn’t always work come closing time.

Another common reason why people want to assign a contract is financial. Sometimes, the original purchaser doesn’t have the funds or can’t get the financing to complete the sale, and it’s cheaper to assign the contract to a new purchaser, than it is to renege on the sale.

Lastly, assignment sales are also common with speculative investors who buy pre-construction properties with no intention of closing on them. In these cases, the investors are banking on quick price appreciation and are eager to lock in a profit now, vs. waiting for the original closing date.

What can be negotiated in an assignment sale?

Because the Assignee is taking over the original purchaser’s contract, they can’t renegotiate the price or terms of the contract with the Builder – they are simply taking over the contract as it already exists, and as you negotiated it.

In most cases, the Assignee will mirror the deposit that you made to the Builder…so if you made a 20% deposit, you can expect the new purchaser to do the same.

Most Sellers of assignments are looking to make a profit, and part of an assignment sale negotiation is agreeing on price. Your real estate agent can guide you on price, which will determine your profit (or loss).

Builder Approval and Fees

Remember that huge legal document you signed when you made an offer to buy a pre-construction condo? It’s time to take it out and actually read it.

Your Agreement of Purchase & Sale stipulated your rights to assign the contract. While most builders allow assignments, there is usually an assignment fee that must be paid to the Builder (we’ve seen everything from $750 to $7,000).

There may be additional requirements as well, the most common being that the Builder has to approve the assignment.

Marketing Restrictions

Most pre-construction Agreements of Purchase & Sale from Toronto Builders do not allow the marketing of an assignment…so while the Builder may give you the right to assign your contract, they restrict you from posting it to the MLS or advertising it online. This makes selling an assignment extremely difficult…if people don’t know it’s available for sale, how they can possibly buy it?

While it may be very tempting to flout the no-marketing rule, BE VERY CAREFUL. Buyers guilty of marketing an assignment against the rules can be considered to have breached the Agreement, and the Builder can cancel your contract and keep your deposit.

We don’t recommend advertising an assignment for sale if it’s against the rules in your contract.

So how the heck can I find a Buyer?

There are REALTORS who specialize in assignment sales and have a database of potential Buyers and investors looking for assignments. If you want to be connected with an agent who knows the ins and outs of assignment sales, get in touch…we know some of the best assignment agents in Toronto.

What are the tax implications of real estate assignment?

Always get tax advice from a certified accountant, not from the internet (lol).

But in general, any profit made from an assignment is taxable (and any loss can be written off). The new Buyer or Assignee will be responsible for paying land transfer taxes and any HST that might be due.

How much does it cost to assign a pre-construction condo?

In addition to the Builder assignment fees, you will likely have to pay a real estate commission (unless you find the Buyer yourself) and legal fees. Because assignments are more complicated, you can expect to pay higher legal fees than you would for a resale property.

How does the closing of an assignment work?

With assignment sales, there are essentially 2 closings: the closing between the Assignor and the Assignee, and the closing between the Assignee and the Builder. With the first closing (the assignment closing) the original purchaser receives their deposit + any profit (or their deposit less any loss) from the Assignee. On the second closing (between the Builder and the Assignee), the Assignee pays the remaining amount to the Builder (usually with the help of a mortgage), and pays land transfer taxes. Title of the property transfers from the Builder to the Assignee at this point.

I suppose it could be said that there is a third closing too, when the Buyer takes possession of the property but doesn’t yet own it…this is known as the interim occupancy period. The interim occupancy occurs when the unit is ready to be occupied, but not ready to be registered with the city. Interim occupancy periods in Toronto range from a few months to a few years. During the interim occupancy period, the Buyer occupies the unit and pays the Builder an amount roughly equal to what their mortgage payment + condo fees + taxes would be. The timing of the assignment will dictate who completes the interim occupancy.

Assignments vs. Resale: Which is Better?

We often get calls from people who are debating whether they should assign a condo they bought, or wait for the building to register and then sell it as a typical resale condo.

Pros of Assigning vs. Waiting

- Get your deposit back and lock in your profit sooner

- Avoid paying land transfer taxes

- Avoid paying HST

- Maximize your return if prices are declining and you expect them to continue to decline

- Lifestyle – sometimes it just makes sense to move on

Cons of Assigning vs Waiting

- The pool of Buyers for assignment sales is much smaller than the pool of Buyers for resale properties, which could result in the sale taking a long time, getting a lower price than you would if you waited, or both.

- Marketing restrictions are annoying and reduce the chances of finding a Buyer

- Price – What is market value? If the condo building hasn’t registered and there haven’t been any resales yet, it can be difficult to determine how much the property is now worth. Assignment sales tend to sell for less than resale.

- Assignment sales can be complicated, so you want to make sure that you’re working with an agent who is experienced with assignment sales, and a good lawyer.

Still thinking of assignment your condo or house ? Get in touch and we’ll connect you with someone who specializes in assignment sales and can take you through the process.

Search by keyword or select a category below.

- Market Updates

- First Time Buyers

- 65+ Real Estate

- Aging in Place

- Mississauga

- Real Estate Crushes

- For Realtors

Raj Singh says:

What can be things to look for, especially determining market value for an assigned condo? I’m the assignee.

Sydonia Moton says:

Y would u need a lawyer when u buy a assignment property

Gideon Gyohannes says:

Good clear information!

Who pays the assignment fee to the developer? Assignor or Assignee?

Thanks Gideon 416 4591919

Melanie Piche says:

It’s almost always the Seller (though I suppose could be a point of negotiation).

Fiona Rourke says:

If there are 2 names on the agreement and 1 wants to leave and the other wants to remain… does the removing of 1 purchaser constitute an assignment

Brendan Powell says:

An assignment is one way to add or remove people from a contract, but not the only way…and not the simplest. Speak to your lawyer for advice on what makes the most sense for your specific situation. For a straightforward resale purchase you could probably just do an amendment signed by all parties. If it’s a preconstruction purchase with various deposits paid, etc it could be more complicated.

Katerina says:

Depends on the Developer. Some of them remove names via assignments only.

Haroon says:

Is there any difference in transaction process If assigner or seller of a pre constructio condo is a non resident ? Is seller required to get a clearance certificate from cRA to complete the transaction ?

Nathalie says:

Hello , i would like to know the exact steps for reassignment property please.

Amazing info. Thanks team. I may just touch base with you when my property in Stoney Creek is completed in. 2020. I may need to reassign it to someone Thanks

Victoria Bachlowa says:

If an assignor renegs on the deal and refuses to close because they figured out they could get more money and the assignment was already approved by the builder and all conditions fulfilled what can the Assignee do. I have $33,000 dollars in trust in the real estate’s trust fund. They sent me a mutual release which I have not signed. The interim occupancy is Feb. 1 and the closing is schedule for Mar. 1, 2019. I have financing in place, was ready to move in Feb. 1 and I have no where to live.

Definitely talk to your lawyer right away. They’ll want to look at your agreement of purchase and sale and will be able to advise you.

With assignment sales, there are essentially 2 closings: the closing between the Assignor and the Assignee, and the closing between the Assignee and the Builder. With the first closing (the assignment closing) the original purchaser receives their deposit + any profit (or their deposit less any loss) from the Assignee. Can I assume that these closing happen at the same time? I’m not sure how and when I would be paid as the Assignor.

What happens to the deposits or any profits already paid if the developer cancels the project after an assignment?

Hi, Did you get answer to this? I did an assignment sale last year and now the builder is not completing apparently and they are asking for their money back. Can they do that? After legal transactions, the lawyer simply said “the deal didn’t go through”. Apparently builder and the person who assumed the assignment agreed on taking out the deal. What do I have to pay back after it was done a year ago

This is definitely a question for your lawyer – as realtors we are not involved in that part of the transaction. I would expect that just as the builder would have to refund your deposits, you would likely need to do the same…but talk to your lawyer. As to whether the builder can cancel a project, yes they always reserve that right (but the details of how and under what circumstances would be in your original purchase agreement). It’s one of the annoying risks in buying preconstruction!

I completed the sale of my assignment in Dec 2015 however the CRA says I should be reporting the capital income in 2016 when the assignee closed his deal with the developer in July 2016. That makes no sense to me since I got all my money in Dec 2015. Can you supply any clarification on that CRA policy please?

You’d have to talk to the CRA or an accountant – we’re real estate agents,so we can’t give tax advice.

Hassan says:

Hello, You said that there are two closings. The first one between the assignor and the assignee and the second one between the builder and the new buyer (assignee). My question is that in the first closing does the assignee have to pay the assignor the deposit they have paid and any profit in cash or will the bank add this to the assignee’s mortgage?

The person doing the assigning usually gets their money at the first closing.

Kathy says:

What is the typical real estate free to assign your contract with the builder ?

Hi Kathy While we do few assignments (as they are rarely successful, and builders do not make it easy), in past we have charged more or less the same as we do for a typical resale listing. While there are elements to assignments that should be easier than a resale (eg staging), many other aspects of assignments are much MORE time-consuming, and the risk much higher since attempts to find a buyer for assignments are often unsuccessful. It’s also important to note that due to the extra complication, lawyer’s fees to assign are typically higher than resale as well–although more $ for the purchase side vs the sale side.

Mitul Patel says:

If assignee has paid small amount of deposit plus the original 25% deposit that the assignor has paid to the builder and gets the Keys to the unit since interim possession has been completed, when the condo registration is done and assignee is getting mortgage from the Bank or Pays the remaining balance to the Builder using his savings and decides not to pay the Balance of the Profit amount to Assignor, what are the possibilities in this kind of scenario?

You’d need to talk to a lawyer to find out the options.

David says:

How much exactly do brokers get paid at sale of Assignment? i.e. Would the broker’s fee be a % of your assignment selling price or your home’s selling price? I’m really looking for a clear answer.

I am using this website’s calculator associated with selling your home in Ontario. But there is no information on selling assignments. https://wowa.ca/calculators/commission-calculator-ontario

Realtors set their own commission, so there is no set fee- that website is likely the commission that that agent offers. We often see commissions of 4-5% for assignments. The fee is a % of the price of the assignment – for example, you originally bought for $500K; you’re now assigning for $600K – commission would be payable on the $600K.

Candace says:

Question: if i bought a pre construction condo, can i sell it as soon as it closes or do i have to live in it for 1 year after closing in order to avoid capital gains taxes?

Or does the 1 year start as soon as you move in?

I would suggest you talk to your accountant re: HST credit implications and capital gains, but if you sell it for more than you paid for it, capital gains usually apply.

You mention avoid paying HST when you assign your property. What is the HST based on? It’s not a commercial property that you would pay HST. Explain. Thanks.

HST and assignments are complex and this question is best answered specific to your situation by your accountant and real estate lawyer. In some cases HST is applicable on assignment profits – more details can be found on the CRA website here:

https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/gi-120/assignment-a-purchase-sale-agreement-a-new-house-condominium-unit.html

If you are a podcast listener, the true condos podcast is also a great resource.

https://truecondos.com/cra-cracking-down-on-assignments/

heres one for your comment, purchase pre construction from builder beginning of 2021, to be finished end of 2021, (semi detached) here we are end of 2022, both units are now ready. Had one assigned but because builder didnt accept within certain time frame(they also had a 90 day clause wherein we couldnt assign prior to 90 less firm closing date (WHICH MOVED 4 TIMES). Anyrate now we have a new assinor but the builder says we are in default from the first one and wants 50k to do the assignment (the agreement lists the possibility of assigning for 12k) Also this deal would include us loosing our whole deposit and paying the 12k(plus fees) would be in addition too the 130k we are already loosing. The second property we are trying to close but interest rates are riducous, together with closing costs(currently mortgage company is asking that my wife be added to that one, afraid to even ask this builder. Any advice on how to deal with this asshole greedy builder? We are simply asking for assignment as per contract and a small extension for the new buyer(week or two) Appreciate any advice. Thank you

Dealing with builders/developers can be extremely painful, much worse than resale transactions in our experience. Their contracts are written to protect THEM. Unfortunately all I can say is follow the advice of your lawyer.

Leave A Comment Cancel Reply

Your email address will not be published. Required fields are marked *

Like What You're Reading?

- Email This field is for validation purposes and should be left unchanged.

- Toronto Tax Lawyer

- Articling Program

- Canadian Tax Lawyers

- Case Results

- Case Studies

- Certified Specialists in Taxation

- Company Profile

- Leadership Team

- Articles & tips

- Canadian Accountant Articles

- Definitions

- Media Appearances

- News Releases

- Related Links

- CRA Tax Audits

- Unfiled Taxes

- Net Worth Audits

- Taxes Owing & Liens

- Tax Minimization

- CRA & Bitcoin Taxation

- Unreported Offshore Assets

- Unreported Offshore Income

- Unreported Foreign Pension

- Unreported Internet Income

- Unfiled GST/HST returns

- Individual & Family Income Tax Planning

- Succession Will, Estate and Tax Planning Ontario

- Tax Problems & Representation

- Tax Shelters

- Corporate Reorganizations

- Butterfly Transactions

- Incorporations

- Business Agreements

- Business Startup Planning

- Tax Consulting & Planning

- CEWS Tax Audit Services

- CERB Tax Audit Services

- CEBA Tax Audit Services

- Contact a Tax Lawyer

Tax Guidance for Assignors in Real Estate Assignment Transactions

Published: November 13, 2020

Last Updated: April 26, 2021

Tax Guidance for Assignors in a Real Estate Assignment Transaction – a Toronto Tax Lawyer Analysis

Introduction – what is real estate assignment.

Buying and Selling real estate assignments is a common form of transaction in the real estate market. An assignment is a transaction of the rights to a property before the legal ownership of the actual property is transferred. In the real estate context, the buyer of an assignment (the “assignee”) would purchase the rights to a real estate property, typically but not always a condo, that is being built under a Purchase and Sale Agreement, between the assignment seller and the builder, from the seller of the assignment (the “assignor”). This transaction would take place before the closing date of the property, and the ownership of the property legally remained with a third party, the builder, throughout the assignment transaction. Hence only contractual rights to a piece of property were assigned from one party to another in an assignment transaction and not the property itself.

Tax Guidance to Reporting Profits from an Assignment Sale – Capital Gains and GST/HST

The two main tax issues associated with the assignor in an assignment transaction are whether the profits from the sales are to be characterized as business income or taxable capital gain and whether the sales of assignments give rise to the obligation for the assignor to collect and remit GST/HST.

While many assignors would report their profits as taxable capital gains as well as taking the position that assignors are exempt from collecting and remitting GST/HST for sales of the assignments, over the past few years, the CRA has been aggressively going after assignment transactions, often auditing Canadian taxpayers for both unreported taxable business income and unremitted excise tax.

Whether a particular assignment sale will give rise to taxable business income will depend on the facts involved in the case. Similarly, whether the assignor has an obligation to collect and remit GST/HST will also depend on the facts. In short, there is no single answer and simple tax guidance as to how to report your taxes on every assignment transaction. We will breakdown the relevant tax factors below

Taxable Capital Gain vs. Taxable Income

The determination of income versus capital gain is a complex tax topic in which the Income Tax Act itself provides no tax guidance. This means the Tax Court will look to case law for a holistic set of relevant tax factors to determine taxable income vs. taxable capital gains. Please see our article on this general topic for a detailed breakdown (https://taxpage.com/articles-and-tips/a-canadian-tax-lawyers-introduction-to-business-income-vs-capital-gains/).

In the leading case on this issue, Happy Valley Farms Ltd v MNR, the Federal Court chose a set of holistic factors based on the principle of circumstantially determining the taxpayer’s intention at the time of the acquisition of the property. When a taxpayer acquired a property with the intention to resell at a higher value, such intention would strongly suggest the taxpayer has been carrying out business. Therefore, the taxpayer’s income should be characterized as taxable business income.

However, the mere fact an assignor ended up selling his or her legal interest in a piece of real estate property does not evidence that he or she had an intention to resell when he or she initially acquired the property. Usually, CRA has to prove an intention to resell through circumstantial evidence to make an inference that the taxpayer had an intention to resell upon acquisition. In the Happy Valley Farm case itself, the Federal Court determined the intention of the taxpayer by looking at his conduct while holding the property as well as his relevant past conducts.

Factors such as frequency or number of other similar transactions by the taxpayer and circumstances that were responsible for the sale of the property are ultimately tools to help the court to determine the taxpayer’s intention at the time of acquisition. No single Happy Valley Farms factor outside the motive factor is determinative, and the determination of taxable business income versus taxable capital gains in assignment transactions will depend on a holistic assessment of the facts.

GST/HST on Assignment Sales

Unlike the income tax implications of assignment sales, the GST/HST implication of assignment transactions is more clear. The seller in an assignment transaction can often be deemed as a “builder” under the Excise Tax Act, which gives rise to the obligation to collect and remit GST/HST upon the sales of the transaction.

However, even if the seller is not deemed to be a builder, an assignment sale is at the very least a transaction involving a “chose in action” which is considered an enforceable legal right in the property itself. A chose in action is specifically mentioned in the definition of “property” under section 123(1) of the Excise Tax Act

property means any property, whether real or personal, movable or immovable, tangible or intangible, corporeal or incorporeal, and includes a right or interest of any kind, a share and a chose in action, but does not include money; On the other hand, the seller of an assignment transaction can also claim Input Tax Credits for his or her initial purchase of the assignment rights from the builder. Since many buyers and sellers of real estate assignments are likely unaware of the GST/HST implications of assignment transactions, a crucial issue to keep in mind is the deadline and extension mechanism for claiming Input Tax Credit under subsection 225(5) of the Excise Tax Act.

Pro Tax Tips – Prepare for Different Tax Implication for Each Assignment Transaction

The tax implication of an assignment transaction for the assignor will depend on whether the assignor was legally engaging in business activities in the course of buying and selling his or her real estate property interest. Such determination will involve holistically looking at all the relevant facts surrounding the transaction. The nature of an assignment sale itself does not determine whether the profit from such sales should be reported as taxable income or taxable capital gains.

As CRA has been going after assignment transactions aggressively and will likely to continue doing so in the foreseeable future, it is important for Canadian taxpayers to be aware of his or her rights to objection under the Income Tax Act in order to make sure his or her right to file a notice of objection is preserved upon being audited by the CRA .

If you have been contacted by the CRA regarding your past assignment transactions or you have questions regarding a specific assignment transaction that you are contemplating and whether (or not) it constitutes a business transaction, please contact our office to speaking with one of our experienced Canadian tax lawyers.

Related Post

Disclaimer:.

"This article provides information of a general nature only. It is only current at the posting date. It is not updated and it may no longer be current. It does not provide legal advice nor can it or should it be relied upon. All tax situations are specific to their facts and will differ from the situations in the articles. If you have specific legal questions you should consult a lawyer."

About the Author

David j. rotfleisch.

David J. Rotfleisch, a leading Canadian tax lawyer, is not only a certified specialist in taxation but also a chartered professional accountant. Most recently, David is a pioneer in Canadian crypto taxation.

As of April 2020, he was one of 12 Ontario Certified Specialists In Taxation™.

Subscribe to our Newsletter

Looking for tax assistance.

Fill the form and we’ll get back to you.

Additional Areas Served

- Brampton Tax Lawyer

- Hamilton Tax Lawyer

- London Tax Lawyer

- Mississauga Tax Lawyer

- Montreal Tax Lawyer

- Ottawa Tax Lawyer

- Tax Lawyer Calgary

- Vancouver Tax Lawyer

- Winnipeg Tax Lawyer

- Edmonton Tax Lawyer

We are a Toronto tax law firm with a Canada wide full service income tax law practice.

Tax Solutions

- Tax Appeals

- Taxes Owning & Liens

Voluntary Disclosure

- Offshore Assets

- Offshore Income

- Offshore Pension

- Internet Income

Corporate Planning

- Tax Reorganizations

Get your CRA tax issue solved

Address: Rotfleisch & Samulovitch P.C. 2822 Danforth Avenue Toronto, Ontario M4C 1M1

416-367-4222 OR SCHEDULE ASSESSMENT

Copyright © 2024 Rotfleisch & Samulovitch Professional Corporation, Taxpage

Language selection

- Français fr

Proposed GST/HST Treatment of Assignment Sales

GST/HST Notices - Notice 323 May 2022

On April 7, 2022, the Minister of Finance Canada tabled Budget 2022 which proposed an amendment to Part IX of the Excise Tax Act. The proposed amendment would make all assignment sales in respect of a newly constructed or substantially renovated single unit residential complex or residential condominium unit taxable.

This publication provides questions and answers regarding the proposed amendment. Any commentary in this publication should not be taken as a statement by the Canada Revenue Agency that the proposed amendment will become law in its current form.

Except as otherwise noted, all statutory references in this publication are to the provisions of the Excise Tax Act (ETA). The information in this publication does not replace the law found in the ETA and its regulations.

If this information does not completely address your particular situation, you may wish to refer to the ETA or relevant regulation, or call GST/HST Rulings at 1‑800‑959‑8287 for additional information. If you require certainty with respect to any particular GST/HST matter, you may request a ruling. GST/HST Memorandum 1-4, Excise and GST/HST Rulings and Interpretations Service , explains how to obtain a ruling or an interpretation and lists the GST/HST rulings centres.

If you are located in Quebec and wish to request a ruling related to the GST/HST, please call Revenu Québec at 1‑800‑567‑4692. You may also visit the Revenu Québec website at revenuquebec.ca to obtain general information.

For listed financial institutions that are selected listed financial institutions (SLFIs) for GST/HST or Quebec sales tax (QST) purposes or both, whether or not they are located in Quebec, the CRA administers the GST/HST and the QST. If you wish to make a technical GST/HST or QST enquiry related to SLFIs, please call 1‑855‑666‑5166.

GST/HST rates

Reference in this publication is made to supplies that are subject to the GST or the HST. The HST applies in the participating provinces at the following rates: 13% in Ontario and 15% in New Brunswick, Newfoundland and Labrador, Nova Scotia and Prince Edward Island. The GST applies in the rest of Canada at the rate of 5%. If you are uncertain as to whether a supply is made in a participating province, refer to GST/HST Technical Information Bulletin B-103, Harmonized Sales Tax – Place of Supply Rules for Determining Whether a Supply is Made in a Province .

Table of Contents

Proposed amendment, definitions, questions and answers.

An assignment sale in respect of residential housing is a transaction in which a purchaser (an assignor) that has entered into an agreement of purchase and sale with a builder of a new house sells (assigns) their rights and obligations under the agreement of purchase and sale to another person (an assignee). The agreement that details the terms of the assignment of an agreement of purchase and sale (the assignment sale) is generally referred to as the assignment agreement.

For purposes of this notice, a house includes a detached or semi-detached house, a duplex, a condominium unit, a townhouse, a unit in a co-operative housing corporation, a mobile home (including a modular home) and a floating home.

Under the current GST/HST rules, an assignment sale made by a person that is not an individual in respect of newly constructed or substantially renovated residential housing is generally taxable, whereas an assignment sale made by an individual may be either taxable or exempt. An assignment sale made by an individual is generally taxable if the individual had originally entered into the agreement of purchase and sale with the builder for the primary purpose of selling their interest in the real property. If, on the other hand, the individual had originally entered into the agreement of purchase and sale for another primary purpose (for example, to occupy the house as a place of residence), the assignment sale is generally exempt. Any amount an assignor paid as a deposit to a builder is included in the consideration for a taxable assignment sale. For more information on the current GST/HST rules, refer to GST/HST Info Sheet GI-120, Assignment of a Purchase and Sale Agreement for a New House or Condominium Unit .

The proposed amendment to the ETA would make all assignment sales, including those made by individuals, in respect of newly constructed or substantially renovated residential housing taxable for GST/HST purposes. Furthermore, the proposed amendment would exclude any amount attributable to a deposit paid by an assignor to a builder from the consideration for a taxable assignment sale, when certain conditions are met. The proposed amendment would apply to all assignment agreements entered into after May 6, 2022.

The proposed amendment adds section 192.1 to the ETA. Proposed section 192.1 states that if a taxable supply by way of sale of a single unit residential complex (as defined in subsection 254(1)) or of a residential condominium unit is made in Canada under an agreement of purchase and sale (in this section, referred to as the purchase agreement) entered into with a builder of the single unit residential complex or of the residential condominium unit and if another supply by way of assignment of the purchase agreement is made by a person (other than the builder) under another agreement, then the following rules apply:

- the other supply is deemed to be a taxable supply, by way of sale, of real property that is an interest in the single unit residential complex or residential condominium unit

- the consideration for the other supply is deemed to be equal to the amount determined by the formula:

Proposed section 192.1 applies in respect of any supply by way of assignment of an agreement of purchase and sale if the supply is made after May 6, 2022.

Proposed section 192.1 applies to a single unit residential complex or a residential condominium unit.

Single unit residential complex means a residential complex that does not contain more than one residential unit, but does not include a residential condominium unit.

For the purposes of the proposed amendment, a single unit residential complex also includes:

- a multiple unit residential complex that does not contain more than two residential units (for example, a duplex)

- any other multiple unit residential complex if it is described by paragraph (c) of the definition of residential complex in subsection 123(1) and contains one or more residential units that are for supply as rooms in a hotel, motel, inn, boarding house, lodging house or similar premises and that would be excluded from being part of the residential complex if the complex were a residential complex not described by that paragraph (for example, a bed and breakfast establishment)