Online Focus Groups: 26 Paid Research Companies that Pay Up to $250 an Hour for Your Opinion

I recently participated in a paid focus group in San Francisco. You know, the kind with the one-way mirror on the wall.

We talked about travel habits and preferences for an hour and half, and I got paid $150 for my time and opinions. Not bad!

The whole thing was pretty quick and painless—and actually kind of interesting—which got me thinking that this could be a great side hustle . Especially if I could do it from home!

So down the rabbit hole I went, trying to find other companies that conduct paid research studies online .

And I should note before we get started that these aren’t the typical companies that pop up when you search for “online surveys.” Those companies, like Swagbucks and InboxDollars , are legit, but pay relatively little .

The companies I was after here were the ones that pay bigger sums to make it more worth your time. I earned $100 an hour for my little focus group adventure, and you can too.

Earn $50-150/hr, with thousands of new studies added each month.

Earn an average of $75 per project, and get notified of upcoming studies you may qualify for.

Patients and caregivers can earn $120/hour while helping advance medical research.

1. User Interviews

2. respondent, 3. rare patient voice, 4. survey junkie, too many choices, 5. product report card, 6. lightster, 7. pingpong, 8. fieldwork, 9. focusgroup.com, 10. experience dynamics, 11. american consumer opinion, 12. l&e opinions, 13. focusgroups.org, 14. findfocusgroups.com, 15. sis international, 16. surveyfeeds, 17. recruit and field, 18. field voices, 19. probe market research, 21. glg insights, 22. prolific, 23. watchlab, 24. mindswarms, 25. 20|20 panel, 26. focus insite, other online focus group and paid research study options, online focus groups alternatives, market research groups: your turn, serious about making extra money, frequently asked questions.

User Interviews facilitates in-person and online consumer conversations about products, websites, and services. The pay rates vary, but the average seems to be around $50-100 an hour.

I’ve earned $105 through the site so far, in exchange for about an hour a half.

In one of my studies, I earned a $10 Amazon gift card for completing a short online survey for bald guys! It said it should take 15 minutes, but all the questions were straight yes/no, so it probably only took 5.

User Interviews is a legit facilitator of online (and in-person) consumer research studies. Participants can get paid (generally $50-150/hr) to share their opinion and shape future products and services. While this won’t replace your day job, it can be a nice supplemental income.

- One of the best-paying survey companies I've found.

- Easy to sign-up.

- Lots of new studies added every week.

- Can be difficult to get selected.

Click here to join User Interviews .

Or check out our full User Interviews review .

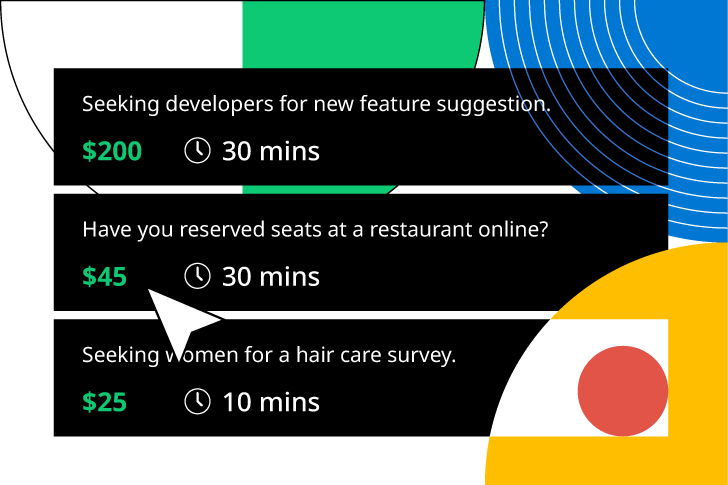

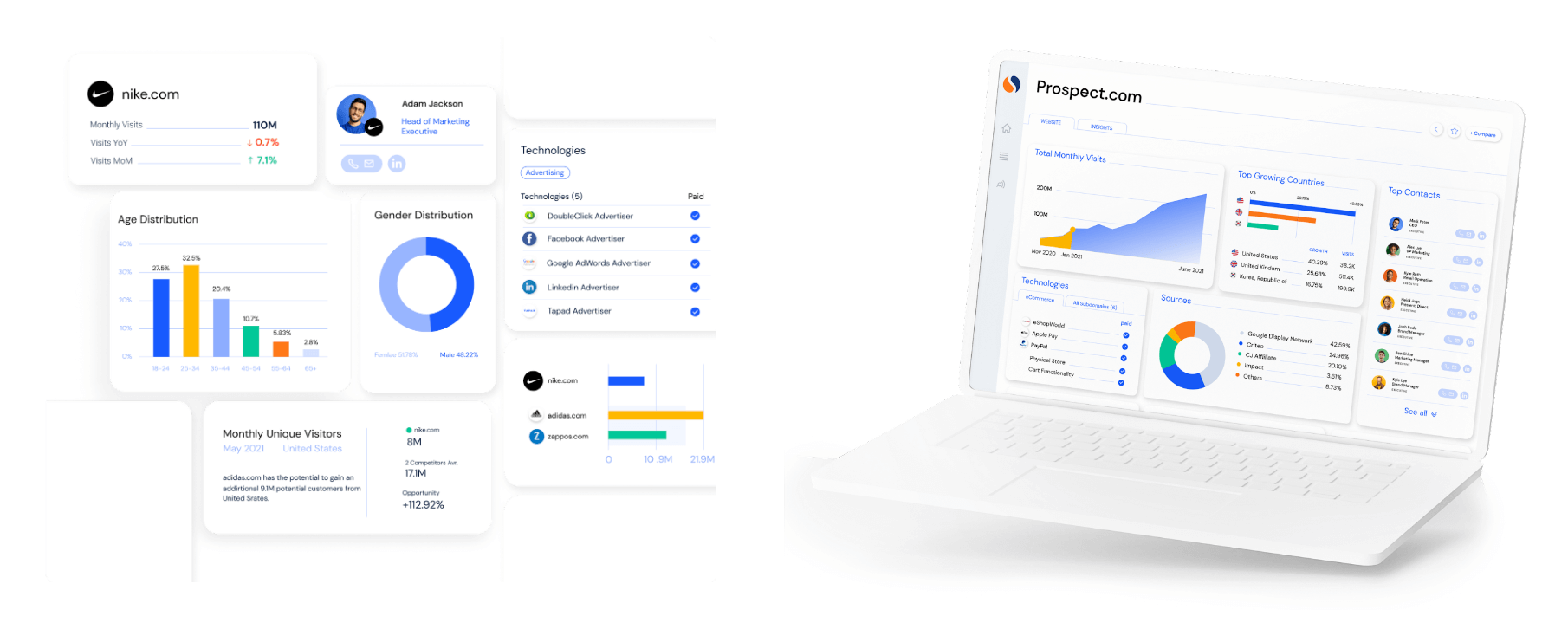

Respondent is a cool service that facilitates consumer research studies online—and often pays $100+ an hour !

Once you create your account, you’ll be able to browse all the open studies you might qualify for. The research brief shares the type of person the company is looking to connect with, the expected time commitment, and pay rate .

If it looks like a fit, answer the brief screener questionnaire to throw your hat in the ring. Don’t get discouraged if you don’t get selected right away—I’ve been selected for 5 studies out of 50 screeners so far.

While there are some “general population” studies, the best-paying opportunities are for industry professionals— up to $750 an hour!

The company takes a 5% processing fee, but the rest of the funds you earn will hit your PayPal account within 8-10 days of your study. (I’ve earned $395 through Respondent so far! )

Click here to join Respondent .

Read our full Respondent.io review here .

(Since recording, I’ve done a couple more studies.)

A leading source for medical research, Rare Patient Voice pays patients and caregivers $120 an hour. You can browse a full list of available studies on their site—nearly all of which are phone or webcam interviews.

If you suffer from any sort of medical condition (even if it’s not super rare), this one is worth a look.

The site is open to residents of United States, Canada, the United Kingdom, Italy, Spain, France, Germany, Australia, and New Zealand.

While most Survey Junkie earning opportunities don’t pay much, you’ll occasionally get emails for better-paying focus group and product testing studies.

These admittedly are pretty rare, but pay up to $75.

Still, power users of the regular Survey Junkie site/app report earning up to $40 a month.

The site boasts more than 20 million members and pays out more than $1 million every month.

Click here to sign up for Survey Junkie .

Start here instead. Punch in your name and email below I'll show you step-by-step how to add $500 to your bottom line.

Join the Free 5-Day $500 Challenge

You're in! Want to supercharge your challenge? Grab the companion workbook and earn $125 more (on average).

You'll also receive my best side hustle tips and weekly-ish newsletter. Opt-out anytime.

Another well-established market research company is Product Report Card . They offer paid surveys, product testing and review gigs, and online focus groups.

The best-paying work is for in-home product tests and remote interviews and focus groups — often in the $75-$150/hour range.

Product Report Card will also give you a $5 welcome bonus for completing a short survey after you join. There’s a $25 minimum to cash-out.

Lightster is a unique money making app , where you get matched with brands and researchers based on your profile.

To get started, you’ll add some demographic information about yourself and answer some questions about your experience and interests.

After that, you may see some questions pop up in the app. Answer those to qualify for paid research conversations that pay $1 per minute.

I got invited to my first half hour session within a couple weeks of downloading the app, and got paid (via Amazon gift card) right away.

I was excited to discover PingPong as a newcomer to the online market research field. The service specializes in user experience testing for apps and websites, with pay rates ranging between €40 and €100 an hour. (Roughly $45-110.)

You might be curious—with the rates in euros—if this one is open to non-Europeans. PingPong let me join as an American and says they welcome testers from all over the world.

Since joining, I’ve received invites to several studies but haven’t been able to book one just yet.

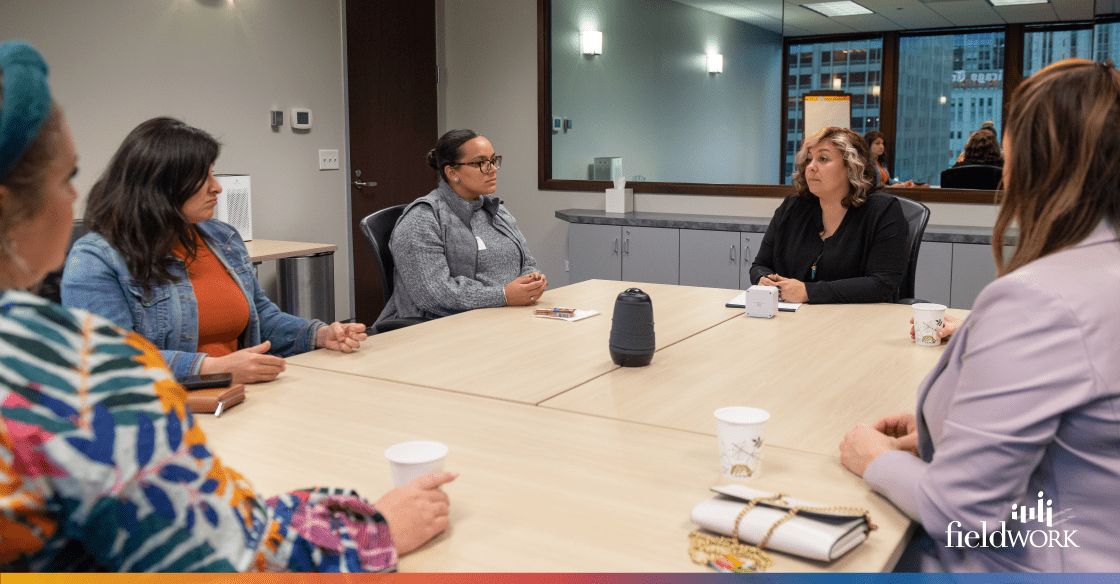

Fieldwork was the company that hosted the San Francisco focus group I participated in. They have locations throughout the US:

- Los Angeles (Orange County)

- Minneapolis

- San Francisco

Compensation starts at $75 for participating in focus groups, which usually last between 1-2 hours. The drawback was I got paid in Visa gift cards instead of cash, so I went to the grocery store and bought Amazon gift cards with them instead.

FocusGroup.com offers nationwide paid research opportunities. (The site is powered by Sago, a leading market research company.)

Be on the lookout for the “National” studies that pay between $75 and $200 . These are scheduled over the phone or webcam so you can take the calls from anywhere at times that are convenient to you.

It took a while, but I eventually earned $115 for an online study related to a well-known Seattle-area company.

The next one I did was an hour-long online focus group on credit cards that paid $100.

Other studies I saw were related to cars, technology, and banking.

I receive a few email notifications every month with studies. Those range from around $2 for 20-minute surveys, up to $150 for 90-minute in-person or online focus groups.

Check out my full FocusGroup.com review to learn more.

Experience Dynamics specializes in user experience and user interface testing (UX and UI). Corporate clients pay Experience Dynamics to help “make their users smile,” and they turn around and pay people like you for honest feedback on website designs and software applications.

According to the site, they recruit testers worldwide with all levels of technology experience. Most studies pay between $50-$150 dollars.

Experience Dynamics also facilitates:

- Field Studies, 1-2 hour interviews at your home or work.

- Diary Studies, where you to record your thoughts over 1-2 weeks.

- Phone Interviews

- Online Focus Groups

- Online Surveys

American Consumer Opinion is another market research company where you can qualify for several surveys a year.

Annoyingly, they insist on using their own “virtual currency” point system. Still, you can earn up to $50 worth of points for longer market research surveys.

There’s a $10 minimum to cash out and you can deposit your earnings directly into PayPal. To give you an incentive to complete the low-paying screener surveys, American Consumer Opinion will add your name to a monthly $50 drawing .

On L&E Opinions , I found nationwide studies paying $125-250. The company has been in business over 30 years and pays out millions of dollars in research incentives every year.

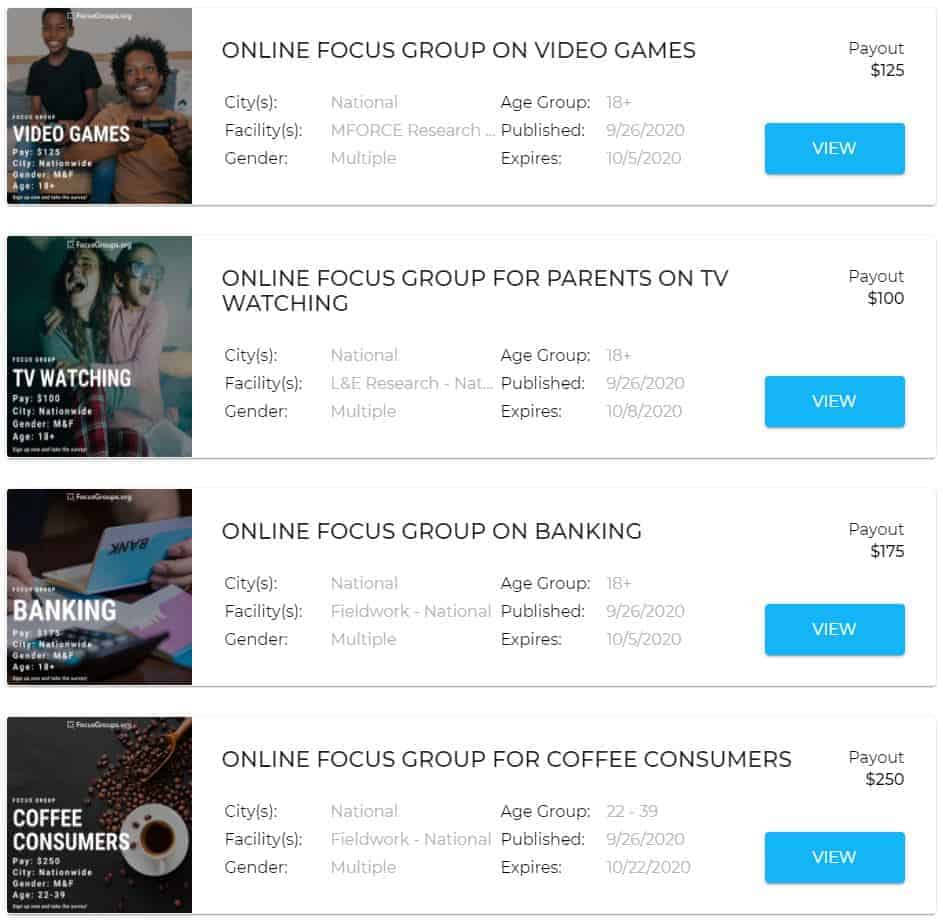

FocusGroups.org is an aggregator service that lists focus groups and paid research opportunities around the country. When I registered, I saw online focus group options that paid anywhere from $75 to $625!

Topics included pets, hygiene, cooking, luxury cars, and lots more. There are some handy filters you can use to select only online or “National” studies.

Another site that pulls in lots of different paid studies, FindFocusGroups.com was a great find.

At press time, they had the best-looking interface of most of these sites, but hadn’t been updated in several months.

When I checked, the compensation for these ranged from $50 to $200.

Through “compensated interviews” and focus groups, SIS helps brands figure out direction for their products. You can see a full list of available paid studies on this page .

I found rates from $25-200, depending on the time required and complexity of the topic. SIS recruits participants from all around the world, not just the US.

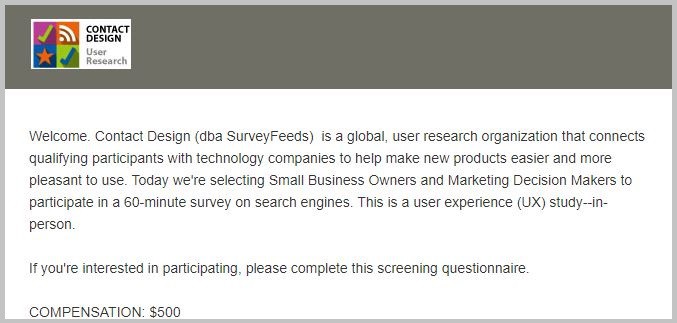

Similar to FindFocusGroups above, SurveyFeeds isn’t a market research company itself, but instead a promising “feed” of paid survey opportunities.

I found their Facebook page updated more frequently than their website, so it might be worthwhile to check there and see what you might qualify for.

The online studies I saw ranged from $75 to $300 .

Recruit and Field is one of the longest-running national market research companies. Since 1977, they’ve built up a participant database of over 300,000 consumers, business leaders, and medical professionals.

The company works with lots of name-brand clients and typically pays $100-275 for in-person and online surveys.

I recently earned $250 for a 1-hour call about business banking!

When I checked out Field Voices , I found a couple available studies to apply for. One was a neighborhood improvement interview that paid $150 for one hour, and the other was a group workshop on snacking habits that paid $300!

This firm works directly with companies as well, which means they’re not just pulling together lists of other research projects.

Consumers, medical professionals, and executives are in demand for Probe Market Research’s panels. Focus groups pay between $50 and $400, and you can often participate online or over the phone.

Major brands enlist Probe to conduct online surveys, mystery shopping gigs , mock juries, product trials, and more .

The popular and well-rated dscout app connects you with “engaging research missions.” Through those, you can get paid to share your feedback on a product or service.

Typical studies pay anywhere from $2 to $100 , paid out via PayPal. The biggest complaints from users are that the often in-depth screener surveys are unpaid.

Less of a market research firm and more of a consulting marketplace, GLG Insights aims to match you up with their clients looking for industry-specific expertise. Request to become a “Council Member” to get notified when relevant paid studies are available.

On GLG, you’ll be asked to connect your LinkedIn profile and upload a resume (or link to an online resume) to verify your career credentials. You can also name your own consulting rate — usually $100-150 and up .

After that, I answered a series of ethics questions based on GLG’s terms and conditions.

When academic and research institutions need opinions from the general population, they turn to Prolific . It’s easy to sign up and start completing online surveys.

The pay on Prolific is a bit lower — often in the $8-15/hr range. But in my Prolific review , I found plenty of quick and easy surveys available, and you can cash out to PayPal.

WatchLab has an obnoxiously inadequate website, but they claim to facilitate all sorts of focus groups, usability tests, interviews, mock juries, and more.

The pay varies depending on the research, and may be in the form of gift cards or cash. I saw ranges from $100 to $175 for 1-2 hour focus groups. WatchLab has locations in San Francisco and Chicago, as well as online options.

For in-person focus groups, you get paid on the spot — online may take 4-6 weeks.

Mindswarms is a unique video consumer research platform. They’ll pay you $50 via PayPal to answer 10 questions about a product or service.

These studies normally take around 10 minutes and can be recorded via your webcam or smartphone, but competition to get selected can be fierce.

To create your account you’ll need to record a 60-second video about one of your passions. Or you can do this through the Mindswarms app on iOS or Android .

Earn $50-150 for online focus groups and studies. While the website doesn’t necessarily inspire confidence, 20|20 Panel has been around for over 30 years.

I found several online focus groups paying $50-200 on Focus Insite . The company popped up in my Instagram feed, a signal they’re actively recruiting new participants.

You can join their panel database as a medical, technical, or business professional, or just as a general consumer. Alternatively, you can apply directly to the available market research studies listed.

The companies listed above certainly aren’t the only research companies around, and for this side hustle, it makes sense to join as many firms as you’re comfortable with.

That way, you’re presented with all the opportunities available, not just the projects managed by one company.

Here are a few more to consider:

- Ascendency Research — On average, studies pay $60-350. Many are local to the Twin Cities, MN, but they have some national studies, too.

- Elliott Benson — Conducting paid market research since 1995.

- PRC Market Research — You can browse upcoming projects (and their pay rate) before registering. Most studies pay $100-300/hour.

- NewtonX — Strictly for industry professionals to share their insight and get paid.

- Focus Forward — A unique aggregator of paid focus group and survey opportunities.

- UserTesting – Earn $10 for completing 20-minute online user tests of websites, apps, shopping portals, and more. This is pretty fun but you have to be fast because these tests get snatched up quickly.

- Pulse Labs – Earn up to $100 a week providing video feedback on products.

- Intellizoom – Get paid an average of $10 testing and reviewing websites.

- UserBrain – Receive new websites to test every week, an earn $5 for each 5-15 minute test.

- Google User Experience – Google pays gift cards for feedback on their products.

- Nelson Recruiting — Nationwide market research company established in 1980.

- Marketade – Specializes in remote usability testing, market validation, navigation research, and more.

- Engage Studies – Earn as much as $100 per focus group through this research company.

- Tell Us Your Opinion – Mainly operating in Tulsa but may have online/phone opportunities as well.

- Adler Weiner Research – In-person studies in Chicagoland and Southern California, plus remote studies nationwide.

- Advanced Focus – Hosts market research panels and focus groups in New York City.

- Nichols Research – Get paid to participate in in-person focus groups, primarily in Northern California.

- Herron Associates — In-person studies in Indianapolis, IN and Tampa, FL.

- PrizeRebel – Earn $10-12 an hour doing surveys or completing other tasks. (Just avoid the low-paying ones.)

As with any side hustle, there’s an opportunity cost. As in, what else could you be doing with your time?

I encourage you to check out our monster list of side hustle ideas , but here are a few that are similarly flexible.

Become a Bookkeeper

One of the first jobs that many companies hire out is “someone to keep the books.” If you have experience in this field, or just love numbers, becoming a remote bookkeeper could way to make extra money.

Most businesses don’t need a full-time bookkeeper so they’re open to hiring someone part-time. Most virtual bookkeepers charge $100-300 per client per month.

Network with business owners locally or online and let them know about your service. It might make sense to check out this free training on how to start a remote bookkeeping business .

Alternative Investments

If you’re after passive income , you might consider adding some alternative investments .

For example, Fundrise allows you to invest in professionally-vetted commercial real estate. This spreads your risk around with properties in multiple geographical locations–and minimums as low as $10 .

Disclosure: I’ve been a Fundrise investor since 2015, and earn a commission when you join through my referral link. Opinions are my own.

Resell Furniture Returns

Reselling furniture returns is a unique low-risk side hustle .

How it works is you join Sharetown as a local “reverse logistics” rep. Sharetown partners with direct-to-consumer mattress and furniture brands to handle their return requests.

When customers decide they don’t want to keep the item, you’ll get dispatched to go pick it up. After that, you’ll:

- clean it up

- photograph it

- list it for resale on sites like Facebook Marketplace

The Sharetown reps I’ve connected with target $150-250 per flip — and, importantly — you don’t have to pay Sharetown for the inventory until the item sells.

Check out my full Sharetown review to learn more.

Sharetown reps make money by reselling gently-used furniture and bed-in-a-box mattresses. Top reps earn $4000+ per month.

- Low startup costs

- Great earning power

- No hunting for inventory

- Requires a truck or SUV

- Bulky items to store

- Not available in all areas

Mobile Notary Service

Becoming a mobile notary loan signing agent is one of the most popular gigs among the Side Hustle Nation community. The flexible, part-time side hustle involves walking new homeowners through their stack of mortgage documents.

Appointments typically take around an hour and pay $75-150.

One big drawback to focus groups or online surveys is you’re limited in how much you can earn. It’s a great side hustle, but it’ll never be a full-time income.

Focus groups or paid research studies won’t pay your mortgage, but one or two a month will definitely help build your side hustle snowball .

Have you had any success in landing paid focus group studies? What do you think of this little supplemental side hustle?

Let me know in the comments below!

- Start Your Free $500 Challenge . My free 5-day email course shows you how to add $500 to your bottom line.

- Join the free Side Hustle Nation Community . The free Facebook group is the best place to connect with other side hustlers and get your questions answered.

- Download The Side Hustle Show . My free podcast shares how to make extra money with actionable weekly episodes.

The award-winning Side Hustle Show is a Top 10 Entrepreneurship podcast with over 1,200 5-star ratings!

Listen in your favorite podcast app or directly in your browser.

Is there such thing as an online focus group?

Yes! Several companies facilitate online consumer research focus groups, which is great because that means you can earn money from the comfort of your home or office. Check out our full list to learn more.

How much do focus groups pay?

The pay for focus groups depends on how long the session lasts. Most commonly, you’ll find rates average around $100 an hour.

Where can I find legit paid focus groups?

Companies like Respondent, Fieldwork, and FocusGroup.com are all legit facilitators of paid focus groups. Or, for the best results, you might try an aggregator service like FindFocusGroups.com, which pools together focus group opportunities from several sources. Be sure to check the list of providers on Side Hustle Nation as well.

How do online focus groups work?

Online focus groups work either via conference call or more commonly, through a group video chat to more closely mimic the in-person experience. A moderator will lead the group discussion and participants can chime in through their webcam and computer microphone or phone line.

********* Stock photo by Akhenaton Images via Shutterstock

Like That? There's More!

Join the 100,000 who get my best stuff via email.

I'll also send you my free guide: The 5 Fastest Ways to Make More Money .

You're in! Make sure to check your email (including spam/promotions) for your free welcome gift.

About the Author

Nick Loper is a side hustle expert who loves helping people earn more money and start businesses they care about. He hosts the award-winning Side Hustle Show, where he's interviewed over 500 successful entrepreneurs, and is the bestselling author of Buy Buttons , The Side Hustle , and $1,000 100 Ways .

His work has been featured in The New York Times, Entrepreneur, Forbes, TIME, Newsweek, Business Insider, MSN, Yahoo Finance, The Los Angeles Times, The San Francisco Chronicle, The Financial Times, Bankrate, Hubspot, Ahrefs, Shopify, Investopedia, VICE, Vox, Mashable, ChooseFI, Bigger Pockets, The Penny Hoarder, GoBankingRates, and more.

58 thoughts on “Online Focus Groups: 26 Paid Research Companies that Pay Up to $250 an Hour for Your Opinion”

Nice job, Nick! I have only ever been able to score low paying “mystery shopper” gigs. I get a free meal and $15 or $20 for my trouble. It usually takes about an hour, so am making $15 – $20 per hour. I have repeatedly mystery shopped a “Roy Rogers” restaurant that is on the NYS thruway. Almost every time I have had to travel to or from my daughter’s college campus I have been able to get a free meal, $10 or $15, and a portion of my tolls paid. I wouldn’t make the effort except that I am already driving by and there is a good chance that I would need a bathroom break anyway. Everybody wins. :>) I will be checking on a couple of the sites you provided to see if there is anything I qualify for.

Thanks Kevin. I’ve been half-heartedly attempting to find a mystery shopping expert to school me on how it really works :)

Hi Nick – If you are still reading these comments, I hope you will remove User Interviews from your list. After reading your article, I applied with them and was excited at first, but they have a serious flaw. They do not screen what the companies post for the surveys. First you have to take a questionnaire to see if you will be selected for the survey. Time after time you spend time answering the flawed questionnaire, and then not being selected, probably because of being forced to complete an answer that is not correct. Here’s an example that I just sent to Tabitha at User Interviews:

“I was applying for the Medical Injectibles survey, and the first several questions went well. Then there was the question “Do you care for a child with Juvenile Idiopathic Arthritis?” with the options of yes or no. I checked no, and I cannot imagine there are vast numbers of people who would have been able to check yes.

The next question was required, and it asked for the age of the person I care for, and had a box, also required, asking for the required medications.

Why was I prompted with that question when I had answered no?”

So that was yet another questionnaire that was flawed that completely wasted my time because I could not proceed. I have asked them to remove me from all further communication as I want nothing to do with them anymore, and I honestly don’t think you should be recommending them.

Hmm sorry for the trouble, Balinda. I agree, their conditional logic on the screener surveys could be better — or they could just advance to a “thanks but you’re not a fit” page. When those types of funky follow-up questions happen for me, I just back out and go back to the list since it’s clear I’m not going to qualify.

Nick, this list is AWESOME! I’ve been using User Interviews for about a month and a half and it seems like I hardly ever get selected for any of the surveys. In fact, I’ve only been selected for 1 so far (which literally took 10 minutes and I got a $30 Amazon gift card) and the second one I got approved for, by the time I got around to actually confirming my spot that evening, it was already fully booked up! I’m wondering with all the different options available if it would be feasible to make some decent side money – assuming the time commitment doesn’t get overwhelming. I’m gonna dig into this a little I think and see what I can come up with.

Hey Kyle, I hope you found some good “side jobs.” You mentioned that you used user interviews and only got 1 job. I’m so surprised by that. I have been using them for a few months and I have made a good bit of money. I had a 20 minute telephone survey and was paid $150! I had another that was in person. They came to my apt (they originally said to see my wardrobe in closet, but never did) they interviewed me on camera for about 10-15 minutes and then we went to a clothing store! They asked me if I liked the store, clothes, etc. In all I was with them about an hour. I got $350! I could have made another $100 for doing “homework,” but I was too busy. That’s just 2 of jobs I had from them. Anyway, I just wanted you to know, bcuz you should keep trying with them. I plan on hitting all these new ones, thanks to Nick! Good Luck!

It’s funny you bring this topic up. I LITERALLY started signing up for focus groups last Monday (going on two weeks) and I’ve already made $650. Most have came from respondent. I also signed up for the Reddit r/paidstudy group as well as the cool work ideas.com FB which posts multiple studies a day. I’m loving it so far!

Hi Nick, I’ve been using ACOP for a few years now it does take a long time to gather up money. I usually wait till I get up around $50 or so to cash in. The problem I find is it takes two to three months for it to show up in my Pay Pal account, very slow turn around.

Nick, I’ve been doing these for several years. I probably average about $1,000 per year doing these. This a great comprehensive list!

I tried Mindswarms. I had no trouble creating a profile video (though it really does not flatter me, nor had I trouble applying for studies. However, I have been on there for over a month, and I have been rejected for every. Single. Study. Besides that, they do not ever bother telling me, or giving me helpful suggestions. Their FAQ section is so useless as to be counterproductive. And I suspect that my mind and my interests are not average enough to make Mindswarms (or online studies/surveys in general) worth my while.

Here is a good rule of thumb: if you prefer the musical works of Vasily Kalinnikov (or just know who Vasily Kalinnikov was) over “Lady” Gaga, do not bother with surveys. Only the most average individuals with the most average minds can succeed with this rubbish. Or so my experiences would indicate.

Actually, the opposite is true. just regular surveys do kind of suck. However, the focus groups and interviews and so forth, all the ones that I’ve actually gotten into have been because I’m weird or different. That’s why so many people get declined. They look for people who don’t conform, mostly because they’re looking for new and innovative ideas. Why would you research the monotonous and mundane?

Thanks so much for the information. I signed up on Respondent today and have a 71% match on 1 survey. We’ll see how it goes.

I just tried to sign up with Respondent, and probably I’m the only one in the world with this problem of not having any social media sites. They want to verify your work on LinkedIn or your FB profile. I don’t have a FB account nor do I have a LinkedIn account. I know, I must be living in a cave, but the work I do does not allow me to use social media. What to do? I guess Respondent is out. Bummer.

This is pretty much the same for me too, Shari. Even if I had an account on social media I would only have my family and close friends on it. I wouldn’t want to give some site access. I also ran into one (can’t remember the name) where they wanted you to upload a video of yourself in order to get the surveys. I am also not comfortable with that. I’ve signed up with all that was listed above. We’ll see how it goes. Good luck to you!

Since I haven’t seen it noted in the comments or main blog anywhere I just wanted to put it out there that technically if you make over $600 with any single company like this they are supposed to issue a 1099 for your payouts. Normally if you accumulate that much over a year they may not bother BUT I was lucky enough to get into a study that paid $875 which immediately put me over that threshold. So then they issued a 1099 for all my earnings from them in that year. That hurt at tax time. This year I’m going to spread it out over as many companies as I can to hopefull get a lot but no single one over $600. And if you are lucky enough to get into a single high paying study, keep the tax implication in mind.

Very nice blog post. Thanks for sharing. On respondent I made $30 today. Not bad!

Thanks Nick, this list is AWESOME! I’ve been doing surveys and focus groups for about a year. I’ve had some great paying, easy jobs. I’ve also spent, what felt like like forever, time trying to qualify for them to no avail. However, from my experience, I can definitely say not to give up! Surveys are time consuming with little pay, for the most part. Focus groups, interviews, etc., is where the money is! I have been looking for more sites and you just gave me a bunch! I am gonna try them all! Keep the info coming! Thanks again!

I’m wondering if the earning need to be claimed on our taxes? Is there a record that we are being paid? Do these companies ask for any personal information? Thanks

Try Jackson/Adept in Los Angeles. They have a Beverly Hills and Encino location.

Here are Metro Detroit Focus Groups and my reviews of them

Morpace Inc. 31700 Middlebelt Road Suite 200 Farmington Hills, MI 48334 Phone: (248) 737-5300 http://www.morpace.com Pays $80-$250 Focus Group Surveys (In Person). If they over fill the group which happened to me on one occassion then you get paid instantly without doing the survey. They pay by check or cash after the 1-2 hour in person survey. They offer surveys 1-2 times a year.

Shifrin Hayworth 26400 Lahser Rd #430, Southfield, MI 48033 Phone: (248) 223-0020 https://www.shifrin-hayworth.com/ Pays $50-$300 Focus Group Surveys (In Person). They pay by check or cash in person after the 1-2 hour survey. They offer surveys about 1-2 times a year.

I recently learned that you can only participate in 1 survey every 6 months which is why after being asked if you’ve done one recently you get disqualified.

I just did a study for them last week. They promised a $200 virtual gift card within 48 hours but it’s been a week and still nothing. They’ve stopped answering my emails and I can’t find a phone number for them, which seems pretty shady.

Did they ever get back to you/pay you?

So I have had really good luck with a lot of these companies you listed. I am a stay at home mom have been looking into all this and actively participating for about 6 weeks and made over 3000 dollars I have made 630 dollars on users interviews, 585 on respondents, 310 on user testing, 270 on validately usability studies , 250 on 20/20 panel, about 140 on intellizoom/ what users do Usability studies, 90 dollars on TrymyUI, and 50 on ping pong research. I have also made 375 dolars from focus point global. plus more companies that i got under 20 each from so there is money to be made here if you invest the time. I have done one on one studies with a web cam, phone interviews, product testing (shampoos, and even new cereal), online diary studies (usually about things you eat), and lots of usability studies. the key is knowing how to answer the screener questions. Thank you so much for your list I am going to check out the companies I have not uses yet

Whoa that’s awesome Casondra – thanks for sharing!

Hi Nick-I just found this post and thank you for “heads up”… I’m writing to share with you two top performers here in Seattle for in-person focus groups. In-Sight Space and Fieldwork / Seattle.

I’ve been fortunate enough to have had a few gigs with each of these company’s who conduct only focus groups. Most of the time the pay is cash on the spot and the groups range from 45 minutes to 2 hours. These two company’s have frequent remarkably high-paying gigs. It’s fairly common to attend a 90 minute focus group that pays anywhere from 150.00 – 350.00. On occasion I’ve landed one of their mock jury groups, sometimes held at one of Seattle’s finest hotels and lasts close to 8 hours. These mock jury groups have paid me between 300.00 to 550.00 for the gig and always provide a catered breakfast and lunch. Again, thanks for sharing your information and I hope you’re able to use my information and experience to help others.

Sincerely, Jason B.

Nice, Jason — thanks for sharing!

I’m registered with two companies for focus group and mock jury participation. I’ve done both and found them enjoyable and worthwhile. Usually payment was cash. One time it was a VISA gift card. The mock juries required more hours than the focus groups. One was Friday evening, all day Saturday, and Saturday evening. My experience has been food and beverages were provided when the event was more than 3 hours.

Participants were usually limited to one event in 6 months.

I’ve seen a large dropoff in opportunities since I reached a certain age. Sigh.

Very occasionally the local newspaper has a classified ad for focus group participants.

I need the mock jury site

Ok…I see several people are interested in Mystery Shopping so I thought I’d share a little info. I have done a lot of mystery shopping in the past and love it. Not amazing money but interesting and I enjoyed it. So…here are a few sites to start with…I hope this is OK…I see a few people said they would send information, but a lot of others requested info and I don’t know if they got what they needed. I hope this helps. So…first… this is the official website of the Mystery Shopping Professionals Association…it has a ton of good info and resources https://www.mspa-global.org/index.html Work available always depends on the type of job you are interested in and where you are located so the best companies to work with will vary for different people. Here are some other resources that may help… https://www.mysteryshopperjobfinder.com/members/resources/mspa-interview/ https://www.mysteryshopforum.com/ https://www.mysteryshoppermagazine.com/?source=forum-top-discussions and last but not least… https://www.shadowshopper.com Shadow Shopper…the first thing that pops up when you google Shadow Shopper will be scam alerts. I’m here to tell you it is not a scam. I have used them for years off and on. They do have a fee option, and to get anywhere, you probably will want to use it at least for a short time. But a lot of job boards charge a small fee. Basically it is where companies post work that they need to get done and shoppers go to find work. It’s a great way to see what is available in your area and skill set and interest and sign up with those companies offering that work. You can go out on your own and start just looking into shopping sites, but that sign up processing can be lengthy and if you pick one that doesn’t offer work in your area or jobs you want, you have wasted time and effort. Once you sign up with a few companies that you’ve found on Shadow Shopper, move on until you want to look for more. No need to keep your subscription if you have the work your want. Just my suggestion, but it has landed me several really good opportunities. One lasted years and was around made me around $2000/yr. Oh…and if you are wanting a list of companies…go here… it’s a tedious process to choose, but it’s an option… https://www.mysteryshopforum.com/companies/ Good luck and enjoy :)

Thank you Anna!

I’ve used Focus Pointe Global and Schlesinger in the Boston area for years. I’ve made really good money with them ($75-200 per session). People seem to over-estimate how difficult this all is. Sign up in the database, fill out a survey if you get an e-mail, if you pre-qualify for a study they call you to screen you again, you either qualify or you don’t on that phone call. If you’re picked, you go to their office and sit with the other people picked and just give your opinion for about 90 minutes. The hardest part for me is fighting traffic to get to the office in the city. These focus groups have been a lifesaver for me in periods of unemployment.

Will you get called every week about a survey? No, you definitely won’t, maybe not every month either. But if you sign up with 5-10 companies your chances of getting picked go up. And I agree that sites like Swagbucks are more or less a waste of time. It’s very small money.

Everyone is asking: How do I join? You have to go to the companies website and sign up for the panel (“Join the Panel”) and then wait. Also, the bigger companies post surveys on their Facebook pages so sign up for their notifications.

I do the best with Respondent, User Interviews and UTest.com. Also check out Affectiva’s job listings if you’re in the Boston area. I’ve made a lot helping to test out their automotive AI.

I have been doing focus groups online for prob 3 years or so. I have done a lot of them with watchlab and user interviews. Also accelerant research is a good one. Field work is another I’ve done them with. I’m sure there is more that I’ve used but i gotta tell u that these have been a life saver for me at times. I most recently did one that paid $400 which is the most I’ve made. I am signed up and in the databases of all that u listed plus a few others like accelerant research. Oh yeah another great place is Elliot Benson research.

Thanks for sharing Shelley!

you might try Mturk if you money to pay…

Great job on this article! I’ve been doing focus groups for many years. Probably made about $2,000 or so altogether.

I’d also recommend instapanel. I’ve been using them for several years to complete video surveys. They pay $20 for about 5-10 minutes of work. Here’s a link: https://instapanel.com/ .

I work for one of the market research companies that hire these focus group facilities/recruiters to get us the research we need. For in person focus groups (in facility) you can expect to get paid around $100 per hour, and more expensive if you’re in a specialty group (certain ailments, professionals such as tech). For online focus groups they run around $75 per hour.

If you want to know the panels to join around your area to join focus groups, I’d recommend going on Green Book (for research) and search on recruiters or facility around your neighborhood. This is where researchers go to find panels to do research with and you’ll get more opportunities with the facilities/recruiters there.

I don’t recommend online surveys bc you might terminate out of many surveys before you complete one and they won’t pay you more than $5 for one, and that’s on the rare end. Hope this helps!

Appreciate the insight — thanks Michelle!

I love love love all the great information I just obtained by reading your blog. OMG ! If anyone has any leads for Indiana specifically please let me know. I know of Herron Associates does a lot of research focus groups. Just go to their website and sign up. Ive done a few for them in the past and made anywhere from $50-150 for about an hour or so in person focus group. I think those are great and very interesting. If anyone wants to contact me to give me some tips on the mystery shopping I’d greatly appreciate it. TIA ( Thanks in Advance) Carrie

Thanks a bunch for the informative post! I signed up for several of the ones you have on this list and already got selected for a study. Just curious – most of the prescreen questions ask if you’ve recently participated in a study. If you have (I’ll fall into this bucket once I complete the study I just got picked for), does that greatly reduce your chances of being selected for another one?

Hi, are any of these open to people under 18?

All clinical trials are for ages 18-99.

Amalia, I apologize. I read your question to quickly & transposed the numbers. I thought you said 81.I’m rarely asked to prove my age, but they may have some way of checking. Product reviews are open to 16+, I believe. I’ve never had to show my ID online, only when I do things in person. Obviously medical care you’d show your ID.

Withpower.com is a great website to checkout medical trials. There are all sorts & bonus if you need medical care & don’t have the money to pay for it. Some just monitor or interview you…all the way up to getting medicated treatment for your condition. I even saw dental work on there.

Every clinical research compensated me for my time & travel. It’s always paid out very well for me & it’s definitely worth the time. I got $365 for downloading an app on my phone that I recorded how long I slept the night before.They sent a little survey with 4 questions every day to the app & I told them what time I went to bed, did I wake up during the night, how long did it take me to get back to sleep, and what time I woke up. I got paid in intervals at week 2, 6, 10, & 14. Super easy money.

I’m on #4 of this list now. User interviews has been fair to me. I’ve seen product reviews, online, and focus groups on there. If they let you know that you are qualified, act quickly!

Clinical research & focus groups are my favorite. I used to like doing product reviews & I still do. But once you really start getting into it, the rewards get better & better. Thank you so much, Nick. Yes, I referred you when signing up. You deserve it.

Hi Nick, this is a great job.

Many of these websites do not authorize participants from Nigeria and Africa. They have country-based restrictions. It sucks.

I have a master’s degree in business administration. I have a bachelor’s degree in mechanical engineering. I have a postgraduate diploma in economics, a postgraduate diploma in education and a professional diploma in early childhood education. I have a CEFR Level C1 in IELTS exam. I have done some surveys in my country, Nigeria and I performed well.

What survey sites do you recommend that do not have country-based restrictions? I am really curious Nick.

Leave a Comment Cancel reply

Usually hustling, occasionally social.

The Company About Contact Books Advertise Media 4580 Klahanie Dr SE #155 Sammamish, WA 98029 925-365-6671

Free Resources Blog Community $500 Challenge Personalized Playlists Side Hustle Quiz

The Fine Print Terms of Use Privacy How We Make Money CCPA Do Not Sell My Personal Information As an Amazon Associate, we earn from qualifying purchases.

Use Your Voice To Impact The World

Work with some of the world’s most influential brands to bring the best services and products to life.

Sign Up FAQs

Why Do We Want To Hear From You?

Simple – your opinion matters.

Use your voice so companies can provide the best services and products to the people who need them most. From consumers to business professionals, those working in the medical field to the patients they provide care for, kids to seniors – we want to hear from you!

Who Participates With Us… Anyone!

We welcome participants of all ages, including children, teenagers, moms, dads, and seniors. Our studies cover a wide range of topics, such as gaming, food, alcohol, and diapers.

Business Professionals

Many of our focus groups feature active participation from IT decision makers, business owners, C-Level professionals, human resource experts, contractors, and educators.

Those who utilize medications, treatments, and devices like injectables and wearables all play an integral role in research topics, such as rare diseases, weight management issues, diabetes, and cancer.

Healthcare Professionals

We have research opportunities for patient care managers, physicians, nurses, pharmacists, dentists, surgeons, veterinarians, hospital administrators, technicians, among others.

Had the opportunity to participate in my first focus group and I can say it was a great experience.

Everyone was so very nice and made the process so very easy. Will definitely participate again and recommend it to family and friends.

The Experience

Be Heard. Feel Appreciated.

Once you register for our Respondent Dashboard, you’re on your way to influencing the direction of game-changing products, services, and medical treatments.

From there, you’ll be contacted based on your responses and will be screened to ensure you’re participating in the appropriate market research study.

Create a profile to receive communication on potential opportunities.

Tell us more about yourself under the “More Information” tab in your profile. The more information we have, the more likely you are to be contacted.

Based on the preferences you’ve outlined in your profile, you will receive study opportunity information via email, phone, or a combination of the two.

4. Participate

Depending on the project, you may participate in a focus group, one-on-one interview, in-home discussion, or virtual session. Topics range from breakfast cereal to medical devices.

5. Be Rewarded

Your opinion matters. In appreciation, receive an incentive for your impact – it’s as easy as that!

Learn More About the Participant Experience

What’s a Mock Jury?

Ever wondered what it’s like to step into the shoes of a juror and weigh in on a legal case? In the intriguing world of mock trials, your opinions matter and your insights can shape the future.

We Want Your Opinion: How Focus Group Participants Help Brands Grow

You’ve heard of taste tests or seen commercials with a room full of people sharing their feedback. But on a large scale, how do so many companies get vital feedback from consumers to help them understand the market and make better products and services?

Partnering with Fieldwork: Jake Toohey

Jake was invited to participate in an in-person influencer event at our LA – Orange County office. Familiar with Fieldwork, Ben shares his experience participating in a focus group and at the Ambassador Event.

Who We’re Looking For

Sign Up For A Market Research Study Near You

Or participate online.

You’ll have the flexibility to participate in local market research studies or opt into our national database for virtual opportunities.

Are You a Content Creator?

Join our growing network of content creators, patient advocates, and influencers helping spread the word about Fieldwork focus groups.

Become a Fieldwork Ambassador

Frequently Asked Questions

What's a focus group.

A focus group is a round-table discussion on products and services that you use. The discussions are led by market research professionals and usually last between 1-2 hours. While focus groups are common types of research studies, we also do taste tests, product trials, in-home interviews, shop-along interviews, phone interviews, and online research.

When you’re done, you will receive an incentive for your contribution!

Fieldwork has focus group facilities across the United States. When you register, you will choose the one nearest you. If you do not live close to any, you can register for our national database, and you will be eligible for phone or online interviews.

What are my responsibilities as a focus group participant?

Fieldwork and its clients rely on the integrity of focus group respondents to conduct accurate and meaningful research. We ask that you:

- Be truthful in answering questions about yourself and your habits.

- Arrive for your appointment on time and ready to participate in the discussion.

- Notify fieldwork if you must cancel with as much advance notice as possible.

- Enjoy it. Focus Groups are fun!

How do I sign up for focus groups and other research studies?

Registering will add you to Fieldwork’s participant community, giving you access to various study opportunities. During the sign-up process, we will ask for contact information, demographic questions, and details about your household. This will be used to identify those who may qualify for a particular project. Additional screening will be needed to confirm qualification. Click here to register now.

Once I have registered, what happens?

Based on the details provided in your profile, you will receive study opportunity information via email, phone, or a combination of the two. During our initial outreach we will establish if you are available and interested in a particular study and a good candidate for the research.

If you qualify for a study, you will receive an email confirmation outlining the details such as location, what you will receive as an incentive, and any other details necessary to ensure you’re ready and prepared for your participation.

Once you’ve completed your participation, you will receive your incentive. Your voluntary participation in market research with Fieldwork constitutes an independent contractor relationship, not an employment relationship.

How and when will I receive my incentive?

We offer incentives in multiple forms. Depending on the project, but most commonly via an online, pre-paid solution. Incentives are typically sent out within 2 weeks of the date of participation.

If it’s been more than 2 weeks since participation, please reach out to [email protected] and include the following details:

- Name of participant

- Office where you participated

- Date of participation

- Study reference number

Why is my information being asked for multiple times?

We recognize things change and it’s important that we collect the most up to date information from each participant for each project. For this reason, you may be presented with questions you’ve answered previously. We thank you for your effort and patience with this process!

Why am I not qualifying for studies?

Our clients provide us with the specifications to ensure we get the right people for the project. You may not qualify for every study and that’s okay! This is no reflection on you, nor does it compromise your status in our system. It’s important to us that our participants engage in research topics that make sense for them and fit our clients’ needs!

I signed up but haven't heard from you. Why?

Phone and email communication are determined by the information provided in your Dashboard Profile. If your profile is complete, but you are not receiving calls or emails from Fieldwork, double check your email preferences and contact information on the “Edit Profile” tab when logged in. Also, double check that our email, [email protected] , is added to your contacts – our emails may be going to spam.

Is my information secure?

YES! Fieldwork adheres to the Insights Association Code of Standards and Ethics for Market Research and Data Analytics. That means your information is kept completely confidential. We do not sell or give your information to any third party. For more information, please visit the Insights Association website . See our privacy policy here .

I can't seem to log into my account. Can you help?

We’re here to help! Visit the login page to reset your password. Still having trouble? Send us an email at [email protected].

How do I unsubscribe?

If you would like to unsubscribe from our database and no longer receive calls or emails about upcoming focus groups, please click unsubscribe.

Join Our Community And Share Your Opinion

We’re looking for people from all walks of life to participate in market research studies that matter.

Get paid to participate in research studies

Find paid user research opportunities in topics you care about. Get paid to share feedback and influence the next generation of products and services.

new projects launch monthly

people participate worldwide

average project incentive

Getting started with paid research is quick and easy

1. create your profile.

Personalize your profile with your professional background, skills, and interests.

2. Get matched

Our matching algorithm will send research studies straight to your inbox based on your details.

3. Apply to studies

Answer a few screening questions online to help researchers know if you are a fit.

4. Get paid

Researchers invite participants to studies. Get paid quickly once your work is finished.

Get paid to influence the products you use daily

Choose from a wide variety of interesting paid research studies.

Unlock the power of your opinions in paid research projects. Influence tomorrow's products and services, from tech innovations to everyday items. Let your voice shape the future market.

Work with brands who value your opinion

Shape your daily tools, apps, and services through your insights. Make money by participating in paid studies, turning your experiences into influential feedback.

Earn money referring friends and colleagues.

When you sign up as a participant, you can make money by referring friends and colleagues.. Share studies with people in your network that are likely to be a good fit.

How do our participants feel about Respondent?

Rated 4.6 out of 200+ reviews on G2.com

Nareen Thompson

Property Manager - Real Estate

It's a cool way of spending quality time and earn some money as well as helping to shape decisions.

Eric Hollowaty

President - Energy, Oil and Gas

It's tangible - I know the feedback I'm providing is making a difference. Bonus points if it's for a product or service I already, or might in the future, use!

Almabelle Dorado

Regulatory Affairs Professional - Cosmetics

I enjoy contributing to a project and giving some of my insights. It gives me a sense of accomplishment when the product is successful.

Neels Minnaar

I like to share my experience and knowledge and being able to work remotely.

Jane Kimani

Licensed Agent - Insurance

I enjoy the fact that I can contribute to new innovations and/or improvement of products through my contributions and also get paid for it.

I like my voice being heard and talking about and trying out new things.

Get paid to share your opinions with interested brands.

Sign up to get started earning money with paid research today.

- Studies All Focus Groups App Installs Clinical Trials Online Surveys Product Testing

- Pollfish School

- Market Research

- Survey Guides

- Get started

What is a Focus Group and How to Use it in Your Market Research

Chances are, you’ve come across focus groups if you’ve looked into market research or other forms of research.

The term focus group is often used as one of the key methods to gather qualitative research , in the market research sphere. Although not quite an interview, this hands-on approach spurs discussions between research participants, which have the potential to go into great depth on a subject of study.

As such, using this technique allows businesses to gain critical insights into their target market, along with all of its segments.

These insights help you hone in on your marketing, branding, advertising and other business processes.

Focus groups can be conducted with other research methods , such as survey research and more.

That’s why you ought to familiarize yourself with this type of research technique. Luckily, this lengthy guide goes into the weeds of this form of research , allowing you to gain an exhaustive understanding and decide whether you should carry out this kind of research method.

This thorough guide explains what a focus group is, how to use it, how it works, its advantages and shortcomings, how it ranks against survey research and more.

Table of Contents: What is a Focus Group and How to Use it in Your Market Research

The role of the moderator, focus group size, the focus group approach, participant discussions, focus group participants, post-research document of findings.

- Data Democratization in Post-Focus Group Research

How long does a focus group last?

The environment of the study, the types of questions used in focus groups, when to use a focus group, how online surveys are superior.

- Benefits That Are Second to None

Reach the Masses and Conduct Quantitative Research

Quantitative + qualitative data = a complete market research experience, no need to worry about recruitment, granular respondent targeting, anonymity, privacy and no social pressures, focus groups vs. an online survey platform: the verdict, defining focus groups.

Let’s begin with the heart of the matter: what is a focus group ? A focus group is a small group of people selected based on their specific shared characteristics, to take part in a discussion for market research , or other types of research .

Focus groups are a kind of primary research . Unlike market research software , which is one of the most popular tools for conducting research in the present day, a focus group does not take place digitally—not before Covid, that is . Now, many events, whether they are research-related or otherwise, take place via online meetings.

At any rate, focus groups occur with all members in one conjoint session , whether it’s in-person or over the internet. Researchers can opt to include a single or multiple focus group sessions, should they require further studies on the same topic or group of participants.

Focus groups are one of the main techniques of qualitative research , which delves into a wide variety of phenomena. These include:

- Motivations

- Reasoning behind actions

- Sentiments

All of these aspects and topics of discussion can focus on the participants about various stimuli, such as current events, past events, plans, fears, culture, etc.

Unlike quantitative data, which works to find the “what” and generate statistics, qualitative data aims at understanding a topic in greater depth.

Focus groups are composed of a small number of people who take part in a studied conversation alongside a moderator. The moderator is one of the main researchers assigned to this kind of study.

The role of the moderator is to ask questions, manage the discussion, make sure everyone speaks up and take notes on the discourse, which are later used to analyze it . Essentially, the moderator is a kind of host in this scenario.

Their role is multi-pronged , as they wear different hats in the study. The degree of their involvement in the study may depend on the other actors involved, typically other researchers who are part of the focus group or the larger research study.

In addition, their roles may differ based on the other market research techniques their organization uses, whether it includes survey research , concept testing, experimental research , or others.

The following lists the different aspects of the role of the focus group moderator:

- Discussion driver

- Interviewer

- Post-session and on-site analyst

The typical size of a focus group ranges between 5-10 people. 5-7 is the ideal amount of focus group participants , as these groups are purposely kept small.

That’s because when there are more than seven people present, it is difficult for every member to speak about a topic , or issue, and especially, to answer a specific question. It would also be difficult for the moderator to control a larger group and ensure everyone provides their insights. Additionally, some topics become irrelevant to continue discussing after the seventh person weighs in.

This method provides an interactive approach for research participants to share their viewpoints and experiences and for researchers to collect critical data on their subjects.

In direct opposition to quantitative market research , focus groups do not involve crunching large numbers or making assumptions based on large quantities. Instead, they focus on a small group of participants who represent different market segments and customer personas .

In keeping with the qualitative research approach, the moderator uses open-ended questions. The moderator may also use multiple-choice questions, but those are almost always followed up with questions to explain the reasoning behind choosing a particular answe r.

Thus, these discussions are typically filled with questions that delve into the “why” and “how,” as they seek to uncover context and motivations.

The purpose of this qualitative research methodology is to gain a wealth of insights into customer behavior , customer preferences , attitudes, beliefs and more, by way of a hands-on approach.

As such, the focus group method is intended to reap key insights from the discussion generated among participants . During the discussion, the participants are not solely encouraged to respond to questions the moderator asks but to engage in conversations with other participants.

In doing so, participants are prompted to reflect on their memories and draw from their own experiences.

The discussion of the focus is based on a pre-selected topic . This is usually tied to a larger market research campaign , which may be part of another business campaign, such as the strategic planning process , a marketing objective, a consumer insights campaign and more.

In market research specifically, the participants of a focus group are members of a business’s or in broader studies, an industry’s target market . This is the broad range of customers who are most likely to buy from a business and are typically the targets of marketing campaigns.

The shared characteristics of the study can be based on demographics, psychographics, geographic location and firmographics . Firmographics characteristics are those that involve business, as such, they would be included in a B2B focus group. This is a study on other businesses, typically those who are clients of a business.

Demographic factors include characteristics such as gender, age range, ethnicity, income, education level, marital status, number of children and other such factors. These can include geographic locations, although geographical factors are considered a separate category in market segmentation .

Post-Focus Group Research

After the interview or set of interviews in this study, the moderator gathers the research and summarizes it. They may conduct their analysis or consult with other researchers on their team.

It is usually the other researchers who are better suited to understand and explain certain communication styles, and body language as well as to conduct further descriptive research . As such, there may be several rounds of analyses on the data from the focus group

Thus, in post-focus group research, which refers to post-interview research , there is usually a team of researchers involved in analyzing the group’s discussion and the data it produced.

After conducting an analysis, the researchers, including the moderator, will consult with one another to turn the raw data and analyzed research into a presentable document. This document should include the following:

- The purpose of the focus group study

- Demographics

- Psychographics

- Geographies

- Firmographics (if business personnel were studied)

- Key findings

- Explanations of key beliefs, sentiments, opinions, or thoughts

- This should include comparing them on a higher level, as each participant can represent a different segment of a target market.

- These can include statistics drawn from other market research methods, such as using an online survey tool , other non-focus group interviews and even sources of secondary research.

- This should include what the researchers plan to do next with the data, especially about other team members.

- After all, most data and research campaigns should be actionable. You wouldn’t want your efforts and highly-coveted data to sit idly and gather dust.

- This should be concise and round off the study.

- It should include a few of the most important findings, along with the plan of action and next steps.

They would then share it with other members of their organization . This often depends on the purpose of the focus group study.

For example, if it was for marketing purposes, the research would be primarily shared with the marketing team. If it was for customer development , it would be shared with the product team and so on.

Data Democratization in Post-Focus Group Research

There are going to be some cases in which the topic scrutinized in this kind of study doesn’t neatly correlate with a single department. This is perfectly fine, as certain business practices can be conducted cross-departmentally, or for the business at large.

This is where the democratization of data comes in. This concept refers to the practice and condition in which everybody in an organization has access to data. In such an environment there are no team members hindering access to the data. As such, there should be no bottlenecks preventing people from either using the data or understanding it.

This points to the need for the data to be both highly accessible and understandable . This underscores the i mportance of creating the post-research document mentioned in the previous section.

It is this document that serves as the go-to source for examining a business’s focus group study , and most importantly, putting the study to good use . This means the actions the focus group yields will go beyond those outlined in the plan of action section in the study’s main document.

Instead, in a democratized data environment, other team members, those who aren’t researchers or analysts, can analyze the data as well. This ability allows them to partake in the data for the decision-making process .

This is important for all companies, as data goes unused in too many businesses. Even though more companies are investing in customer data, up to 80% of all data goes unused . You wouldn’t want to waste your money and efforts on churning out data that goes unused.

As such, data democratization is a must in all market research campaigns, including docs groups.

How Focus Groups Work

Focus groups use a specific methodology to clear away any ambiguity. As aforementioned, the small group that makes up a focus group comprises 5-7 people .

The participants are pre-recruited, similar to the mechanism for gaining research participants used in survey panels . They are enlisted based on shared characteristics, which are considered the subject of market research.

To reiterate, these characteristics include demographics, psychographics, purchase history, shopping behaviors, and other factors.

The qualifications that researchers use to recruit participants often bind the participants to a brand’s target market. However, brands can also study people outside their target market to learn how other consumers think and possibly gain them as customers.

Focus group discussions vary; they can involve feedback on a product, experience, or marketing campaign . They can also be used to discuss consumers’ opinions on different matters, such as pop culture, news and politics, especially if they relate to a brand’s industry.

The discussions are led by a moderator , who prompts questions and talking points. The moderator sets the conversation in motion, along with acting as the researcher. As such, the moderator also notes their observations.

The length, both in terms of questions and the discussion of the interviews themselves will vary. It is up to the moderator to decide whether they’ve gleaned enough information from the participants or not before moving on to another question or topic or ending the session .

Typically, these discussions involve using 10-12 questions to draw out responses on key topics that underpin the overall market research campaign. The discussion takes about 30 to 90 minutes.

A focus group environment should be o pen-minded as participants can have varying and even oppositional opinions. No one should be made to feel threatened or silenced, as every insight matters.

Focus groups are NOT to be conducted in the same way as interviews . They are far more interactive, but most importantly, they are not carried out on a one-on-one basis . Instead, they are group-focused activities, in which participants speak with each other instead of solely with an interviewer.

As such, the participants may influence each other , possibly swaying the minds of some members, or reinforcing someone’s opinions. Some participants will draw opposition or even aversion to their responses from others, possibly from the moderators themselves.

This is because they’re in the same broader target market, they are all individuals who hold their own opinions and convictions.

Regardless , the moderator should not input any of their opinions or beliefs into the discussion and be as neutral as possible . They should assume this neutrality even if they severely disagree with any of the participants.

Since focus groups are small, researchers often conduct several (3-4) of them, which includes hosting several interviews per focus group, across different geographic locations. This way they can reap the maximum amount of insights and satisfy all of their research campaigns.

The Pros and Cons of Focus Groups

This market research method offers several advantages. These will help propel you to understand your customer base or subject matter much better. They will also help carry your research to completion. But, they have a few drawbacks as well. Researchers and businesses ought to consider both before choosing this research method.

- Researchers can probe the deep feelings, perceptions and beliefs of their intended subjects.

- When members are engaged, they provide invaluable information that removes any obscurities surrounding a topic.

- They generate results fairly quickly, as each session lasts no more than 90 minutes.

- Researchers can study body language, facial expressions and other non-verbal signs.

- Not all questions need to be premeditated, as they can be produced based on the direction of the conversation.

- Given that this is a discussion, you may discover even more insights than you had originally planned, including on other adjacent topics.

- The thoughts of a small group that fits a target market are useful but are not representative of a larger population.

- Recruitment will take a significant portion of the time.

- Traversing different geographic areas, if need be, is also time-consuming.

- Some members will be dominant while others will contribute less to the discussion.

- Certain participants can sway the discussion, even making it veer towards irrelevant territories.

- They can’t be used for quantitative research.

- They are therefore subject to social pressures and acquiescence bias , in which respondents tend to select positive responses or those with positive connotations.

- As such, there is a lack of accuracy, as these groups are not anonymous.

The moderator of a focus group should ask specialized questions to reap as much intelligence as possible. While this format is generally flexible, there are still certain question types that you should incorporate. These will help you hatch the questions you’ll need.

Here are the four types of questions that are most applicable to a focus group , along with question examples:

- Engagement questions

- These questions are designed to ease participants into the discussion by introducing themselves,

- These are easy questions posed early on to introduce the participants to each other, to make them more at ease, and to acquaint them with the main topic at hand.

- Tell us a bit about yourself.

- What do you generally think about ads in this industry?

- What do you think of this ad campaign?

- Exploration questions

- These questions probe deeper into the topic to get a feel of the participants’ feelings about it.

- These questions are to be asked after participants begin to ease into the conversation and become more active in it.

- Why do you feel that way?

- Have you seen better examples of this type of ad campaign?

- What would be a better way to go about it?

- Why do you feel this way about this [social] issue?

- Follow-up questions

- These are used to gain a better understanding of a previous question answered, or a previous topic addressed.

- These allow the moderator to get into the nitty-gritty of participants’ feelings and motivations.

- How do you go about this issue?

- Why do you feel this way?

- Is there anything that would change your mind about [this issue, method, way, etc]?

- How can this brand improve on serving [you, releasing a campaign, etc]?

- Exit questions

- These questions help conclude the session and should be asked when the moderator is certain that the group has expressed everything they can on the topic.

- They should be used to get confirmation on certain notions.

- Are you sure these are the best approaches?

- Is there anything else on this topic you’d like to add?

Do you need a focus group? If you do, you’ll need to know when to use them, which is rooted in the reason behind conducting them in the first place. As such, the when is closely tied to the why and how.

In short, knowing when to use a focus group depends on what you need it for. This will require you to turn to your research campaigns and needs. The following presents a few key moments and reasonings for when you should use this kind of research technique:

- To better understand the results of primary quantitative research or secondary quantitative data about qualitative aspects.

- Whenever you need to gain an explanation of something, whether it’s a phenomenon, a thing of the past, something current, something you still don’t understand.

- When you seek a more interactive research method as opposed to a textual or digitally-based one.

- When you require information about behaviors, motivations and other phenomena that are too complex for a questionnaire alone to reveal.

- In this case, the senior center already has a batch of possible participants to choose from, being the members of the center.

- In this case, the club can choose from a wide range of students at the college. They can promote their group via signs, a booth, email, etc.

Focus Groups Vs Online Surveys

Now that you’ve learned about the ins and outs of focus groups, it’s time to see how they stack up with another research method: online surveys . It’s key to compare them closely when you decide on the best research method you wish to conduct.

A focus group is a suitable method to garner qualitative research . It is far more interactive than seeking and providing written responses. So how do focus groups measure up against online surveys?

This method is useful for finding deep insights into a topic. It allows researchers to get as granular as possible, since they are speaking with the research subjects themselves and can ask anything that they didn’t include in a survey.

The following expounds on why online surveys provide researchers with more meaningful results and a more comprehensive market research experience. Use these insights to compare with the benefits of focus groups to determine the better option for your research needs.

Benefits that are second to none

An online survey platform , however, offers benefits that are second to no other market research method . That is because surveys offer more definitive results about a population since they are not limited to 10 or fewer research participants.

A potent online survey tool allows you to reach thousands of people — in just one survey alone.

This means surveys are the most apt tool for conducting quantitative research, something that a focus group cannot do .

What’s more, is that surveys can include open-ended questions and follow-up questions (depending on the online survey platform you use). This proves that surveys can also forge qualitative market research.

Thus , online survey platforms grant you the power to conduct both quantitative and qualitative research, giving you the most holistic research experience possible.

Additionally, there is no recruitment element. The survey platform is the recruiter in this case, as it allows only qualified respondents to take part in a survey .

You can create respondent requirements that are as granular as you wish, covering every minute detail of a customer profile and reaching any population.