UC Berkeley’s Premier Undergraduate Economics Journal

The Hidden Importance of Taxes: More Than Just a Nuisance for Taxpayers

ARDA TUNCTURK – MARCH 6TH, 2024

EDITOR: EVAN FREDERICK DAVIS

Imagine coming home from work. You sit down, grab something to eat and drink, and then turn on the TV. On the screen, you see the same old debate between politicians, normative philosophers, and social scientists: taxes. Should the rich be taxed more? Should the poor be given tax credits to help them survive? Among all of this, you ask a very simple yet profound question: What is the point of arguing over marginal tax rates anyway?

Unless you’re an athlete or very rich, you would arguably be completely right. For many people, the marginal tax rate does not affect their day-to-day lives. While you do have to pay some taxes when purchasing gasoline, many states do not have any taxes for groceries, and, barring economic anomalies such as the COVID-19 pandemic, the income tax rate you face yearly will probably never change. So, with that being said, is wondering about the marginal tax rate completely useless? No.

In economic theory, marginal tax rates are seen as a way of funding public projects and reducing income and wealth inequality, with a new and growing emphasis on the latter. So, rather than just thinking of taxes as the traditional mechanism with which the government amasses revenue that will be used to pay for various social, military, health, and development programs, one could also think of taxes as a way to combat wealth inequality and support the middle and lower classes in a given country. That said, while this article will mainly look into optimum taxes in terms of minimizing wealth inequality, it’s also worth looking at the optimum tax rate in terms of the maximization of government revenue. While minimizing economic inequality is certainly an admirable goal, it would not mean anything if everyone in the country had a low standard of living. In this case, although inequality would be very low since wealth is not unequally concentrated in a certain percentile of the population, since people have a low standard of living, this minimization of inequality is not really doing any good for the general welfare of the people. This is where looking at the maximization of government revenue comes in.

If one were to maximize government revenue, then the government could create more social programs, build more infrastructure, and provide more stimulus than it would under a non-optimum state. While we would not be minimizing economic inequality under this model, we would be increasing the standard of living in the country, which is another incredibly important goal and further highlights how important taxes are as a mechanism that the government can use to improve all facets of the economy.

Economic Growth, Productivity, and International Mobility

Two of the main talking points surrounding tax rates are the effect of increasing taxes on economic growth and productivity. Alinaghi and Reed ( 2020 ) find that a 10% increase in taxes in some cases produced a 0.2% decrease in GDP, and in other cases produced a 0.2% increase in GDP. That is to say that even a significant increase in the tax rates has only a moderate impact on a country’s GDP. In contrast, a paper by Romer and Romer (2010) found that the robust effect of a 1% increase in taxes corresponds to a roughly 2.5% decrease in a country’s GDP. An explanation for the differences in the findings between these two papers is that Alinaghi and Reed fail to account for the type of tax rate increases that are implemented. For example, a higher marginal tax rate (a progressive tax) on top innovators in the United States — who also, for the most part, make up the richest citizens in the United States — could decrease innovation within the United States, which in turn would cause a decrease in GDP.

This idea is exactly what Akcigit & Stantcheva ( 2018 ) found in their paper when analyzing the effects of U.S. state marginal tax rates on patent production. They noted that an increase in the marginal tax rate decreased patent production. Furthermore, Stantcheva ( 2020 ) further corroborated the idea that an increase in marginal tax rates for top earners could reduce innovation since the top earners are also the top innovators.

Along those lines, Akcigit & Stantcheva ( 2018 ) also analyzed the effects of an increase in taxes on international mobility — how investors choose to migrate to different countries based on each country’s given tax level. They analyzed the U.S. 1986 Tax Reform Act under the Reagan administration — which lowered the top tax rate on ordinary income from 50% to 28% — finding that the number of top 1% foreign investors in the U.S. increased after the act passed into law relative to a synthetic counterfactual country. A synthetic counterfactual country is a country that had the same trend in the number of foreign superstars as the U.S before the new tax code implementation in the U.S. This synthetic country is used as a control group in the experiment to see what would have happened to the number of foreign superstars in the U.S. if the tax change was not implemented. The difference between the synthetic country and the U.S. after the implementation is the treatment effect caused by the new law. These findings suggest that it may be beneficial to a country’s economy to decrease taxes if its goal is to increase innovation and economic growth. In terms of policy implications, if the U.S. were recovering from a recent recession, then decreasing taxes — on top of the regular monetary policy response — could lead to a quick recovery, as lower taxes would cause growth and productivity to increase, which would increase GDP.

Photo Credit: Akcigit & Stantcheva ( 2018 )

Taxes and Public Policy

Now that the effects of increasing the taxes have been talked about, what is even the point of increasing taxes in the first place? Over time, there has been a shift in economic discourse regarding social welfare. For many years, economists focused on income inequality as the driving force of evaluating how unequal a country’s economy is, and it, understandably, was a pretty good measure. Financial assets, such as stocks, were far from being the main makeup of a person’s wealth. However, throughout the last decade or so, wealth concentrated in the top 10% has grown a lot faster than income concentrated in the top 10% in the United States, according to the Realtime Inequality database by Thomas Blanchet, Emmanuel Saez, and Gabriel Zucman. This growing wealth inequality inside the United States has led to discussions about progressive policy measures, such as progressive wealth taxes, which are tax rates that increase as one’s wealth increases, with the tax rate depending on the wealth bucket that the economic agent is in.

Even if there is significant discourse about using wealth taxes to curb inequality between America’s rich, the middle class, and the poor, many economists have tried to utilize mathematical economic models to determine the “optimal” tax rate, where the optimal tax rate is defined as the one that maximizes the social welfare of society. This is typically measured in terms of monetary consumer and producer surplus, where consumer surplus is the benefit received by consumers for paying less for a good than what they value it, and producer surplus is profits for firms. This is referred to as the Utilitarian perspective on social welfare and is, for the most part, the most popular way of measuring it. There are also the Libertarian and Rawlsian perspectives. Libertarians reject the concept of measurable utility and instead focus on establishing a regulatory framework promoting free entrepreneurship, and Rawlsians conceive of social wellbeing as the utility of the person who is the worst off in society. Some possible reasons for why these two perspectives are not used in economics are that the Libertarian perspective does not allow for the consideration of public policy in the form of wealth transfers since it does not consider utility to be measurable, and the Rawlsian perspective focuses too much on the poorest individual’s situation at the expense of society as a whole.

With that being said, Piketty, Saez, and Stantcheva ( 2014 ) found a highest marginal tax rate of 83% for top labor incomes. Granted, there might be issues, such as international mobility effects or tax loopholes exploited by the rich, that change the marginal tax rate for behavioral reasons. Nevertheless, this is a significant finding and contributes to the idea that higher marginal tax rates on the top income brackets are in fact a way of reducing income inequality, which is in itself a significant societal and economic goal for any developed country. In addition, while the paper looked at marginal tax rates in the form of optimizing the level of income inequality rather than maximizing societal welfare, in a country like the U.S., which is already pretty rich across the board, the goal should be to minimize inequality between the rich and the poor rather than trying to increase what is already probably a high level of societal welfare.

Interestingly, when Piketty and Saez ( 2013 ) analyzed optimal inheritance taxes (an example of a wealth tax), they found an economically conflicting idea: people in the highest bequest percentiles should receive inheritance subsidies, whereas people in the lowest bequest percentiles should face an average inheritance tax of roughly 50% in the United States and a little more than 55% in France. Additionally, the paper also notes two studies — Chamley ( 1986 ) and Judd ( 1985 ) — that suggest that in an economy with zero stochastic shocks (i.e., random economic events), the optimal inheritance tax is 0% in the long run, since any nonzero tax would distort intertemporal economic choices by economic agents, which would in turn harm economic decision making due to complications in the short term decision-making process.

To note, there is dissent from libertarian-leaning economic think tanks, such as the Cato Institute , who argue that the traditional derived optimal tax formulae produce too generous marginal tax rates (sometimes as high as 83%) due to flawed economic assumptions in producing said mathematical models. They also argue that there is a general lack of empirical substantiation for optimal tax claims, on top of incorrect assumptions that higher marginal tax rates on the top labor income brackets do not affect future taxable capital gains, corporate gains, and GDP.

The increasing concentration of individuals’ wealth — mainly in the form of financial assets, such as stocks — has led to a discussion about an optimal capital gains tax structure that minimizes wealth inequality. While research on this topic is sparse, a Joint Economic Committee study by the U.S. Congress, authored by James D. Gwartney and Randall G. Holcombe, does discuss an optimal (in terms of government revenue) marginal capital gains tax of 20%. While the paper does not analyze the optimum rate for wealth inequality, it does provide some estimate as to what optimum capital gains taxes could look like. Something interesting to note is that the suggested capital gains tax of 20% was actually lower than the tax rate at the time (1997) of 28%, which is consistent with the idea that a tax rate that is too high can decrease innovation and economic growth, which would decrease overall wealth taxable in the future. Thus, a higher tax rate does not necessarily suggest higher government tax revenues. This idea of an optimum tax rate in terms of government revenue maximization shows up in economics in the form of the Laffer curve, which is a curve where government revenue originally increases but later decreases as a function of the tax rate. Therefore, the optimum rate of tax is one that is neither too high nor too low based on the given curve. While the curve is critiqued as “too simple” by some economists, it is nevertheless a good illustration of how a tax rate that is too high disincentivizes innovators, which in turn decreases total taxable wealth.

Photo Credit: Investopedia

With taxes being seen as a “necessary evil” by many people, it can be difficult to remember the profound effects that taxes have on the economy as the whole. To think that taxes exist in an isolated echo chamber where they only affect government revenues would be sorely wrong. Taxes affect economic growth, innovation, and have significant effects on public policy in combating income and wealth inequality, along with bettering the standard of living in a given country. So, while it may be boring for some, it is a “necessary evil” for those bored by the effect of taxes to read up on all of the different outcomes caused by a change in the marginal tax rate, whether it be an inheritance tax, income tax, or something completely different.

Featured Image Source: Patriot Software

Disclaimer: The views published in this journal are those of the individual authors or speakers and do not necessarily reflect the position or policy of Berkeley Economic Review staff, the Undergraduate Economics Association, the UC Berkeley Economics Department and faculty, or the University of California, Berkeley in general.

Share this article:

Related Articles

Presidential Economics: A Series on Presidential Candidates’ Economic Proposals Part 3—Elizabeth Warren

The Pip in the Kiwi: An Analysis of the Automated Delivery Industry

Can you afford kids? The Rising Costs of Children

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

subscribe to our Monthly Newsletter!

- IELTS Scores

- Life Skills Test

- Find a Test Centre

- Alternatives to IELTS

- General Training

- Academic Word List

- Topic Vocabulary

- Collocation

- Phrasal Verbs

- Writing eBooks

- Reading eBook

- All eBooks & Courses

- Sample Essays

Paying Taxes Essay

This is an IELTS Paying Taxes Essay. In nearly all countries people have to pay some kind of taxes.

In this essay you have to decide whether you agree or disagree with the opinion that everyone should be able to keep their money rather than paying money to the government.

Here is the question:

Some people believe that they should be able to keep all the money they earn, and should not have to pay tax to the state.

To what extent do you agree or disagree?

Considering Both Sides

A good answer that looks at all the issues presented in the question would consider the following points:

- Why people may want to keep all the money they earn

- Why people should have to pay money to the state

Those are the two sides, so you should brainstorm some ideas around those two questions/opposing opinions before you start to write.

And of course it is very important to make sure you are very clear what your opinion is .

Now take a look at the paying taxes essay model answer.

You should spend about 40 minutes on this task.

Write about the following topic:

Give reasons for your answer and include any relevant examples from your own experience or knowledge.

Write at least 250 words.

Model Answer

People work hard and earn money which ideally they would like to retain for themselves. However, a significant portion of this usually has to be given to the state. In my view, it is right that people pay their fair share of taxes.

Money is everything in today’s world. This is because money is used to buy all the necessities such as food, water, and shelter. Money is also used to help a family’s children in the form of school fees and other activities. In addition to this, people do not only need money to cater for their necessities, but also for future investments. The more that people have to invest, the more they believe they can accumulate in the long term. As a result, many are reluctant to lose some of their income through the deduction of tax.

Nevertheless, citizens should be obliged to pay taxes to the government for a number of reasons. They should accept that the taxes they pay help the government offer them the public services all over the country. These public services are things such as the construction of roads, bridges, public hospitals, parks and other public services. The same tax money helps the country’s economy to be stable. Through taxes, the government can also pay off its debts. In short, money received through taxes is a way of ensuring that people have comfortable livelihoods.

In conclusion, even though many people think that they should not pay taxes, that money is useful to the stability of any country. Therefore, people should not avoid paying taxes as it may affect the country’s economy and services that it provides.

(272 Words)

Task Response

- The question is fully addressed so the essay would get a good score for task response.

- The first body paragraph explains the reasons why people may not want to pay tax and the second body paragraph explains why it is important to pay.

- Reasons and examples are given to support the ideas.

- The writer’s opinion is also very clear. It is presented in the thesis statement and repeated in the conclusion. It is explained in body paragraph two.

Coherence and Cohesion

- The paying taxes essay is well organized. Each of the main points is explained in a separate paragraph and a logical argument is presented to support the writer’s opinion.

- Cohesion is also maintained by good uses of linking words to join the ideas and paragraphs.

Lexical Resource

There is some good use of vocabulary and collocations and spelling and word forms are correct.

For example:

- a significant portion of

- necessities

- reluctant to

- deduction of tax

- be obliged to pay

- construction of

- the stability of

Grammatical Range and Accuracy

There is good accuracy in the grammar and a good range of sentence structures. For example:

- People work hard and earn money which ideally they would like to….

- This is because money is used to buy all the necessities such as…

- people do not only need money to cater for their necessities, but also for future investments.

- In conclusion, even though many people think that they should not pay taxes…

<<< Back

Next >>>

More Agree / Disagree Essays:

Extinction of Animals Essay: Should we prevent this from happening?

In this extinction of animals essay for IELTS you have to decide whether you think humans should do what they can to prevent the extinction of animal species.

Human Cloning Essay: Should we be scared of cloning humans?

Human cloning essay - this is on the topic of cloning humans to use their body parts. You are asked if you agree with human cloning to use their body parts, and what reservations (concerns) you have.

IELTS Sample Essay: Is alternative medicine ineffective & dangerous?

IELTS sample essay about alternative and conventional medicine - this shows you how to present a well-balanced argument. When you are asked whether you agree (or disagree), you can look at both sides of the argument if you want.

Multinational Organisations and Culture Essay

Multinational Organisations and Culture Essay: Improve you score for IELTS Essay writing by studying model essays. This Essay is about the extent to which working for a multinational organisation help you to understand other cultures.

Scientific Research Essay: Who should be responsible for its funding?

Scientific research essay model answer for Task 2 of the test. For this essay, you need to discuss whether the funding and controlling of scientific research should be the responsibility of the government or private organizations.

Internet vs Newspaper Essay: Which will be the best source of news?

A recent topic to write about in the IELTS exam was an Internet vs Newspaper Essay. The question was: Although more and more people read news on the internet, newspapers will remain the most important source of news. To what extent do you agree or disagree?

IELTS Internet Essay: Is the internet damaging social interaction?

Internet Essay for IELTS on the topic of the Internet and social interaction. Included is a model answer. The IELTS test usually focuses on topical issues. You have to discuss if you think that the Internet is damaging social interaction.

IELTS Vegetarianism Essay: Should we all be vegetarian to be healthy?

Vegetarianism Essay for IELTS: In this vegetarianism essay, the candidate disagrees with the statement, and is thus arguing that everyone does not need to be a vegetarian.

Free University Education Essay: Should it be paid for or free?

Free university education Model IELTS essay. Learn how to write high-scoring IELTS essays. The issue of free university education is an essay topic that comes up in the IELTS test. This essay therefore provides you with some of the key arguments about this topic.

Return of Historical Objects and Artefacts Essay

This essay discusses the topic of returning historical objects and artefacts to their country of origin. It's an agree/disagree type IELTS question.

Sample IELTS Writing: Is spending on the Arts a waste of money?

Sample IELTS Writing: A common topic in IELTS is whether you think it is a good idea for government money to be spent on the arts. i.e. the visual arts, literary and the performing arts, or whether it should be spent elsewhere, usually on other public services.

Dying Languages Essay: Is a world with fewer languages a good thing?

Dying languages essays have appeared in IELTS on several occasions, an issue related to the spread of globalisation. Check out a sample question and model answer.

Technology Development Essay: Are earlier developments the best?

This technology development essay shows you a complex IELTS essay question that is easily misunderstood. There are tips on how to approach IELTS essay questions

Role of Schools Essay: How should schools help children develop?

This role of schools essay for IELTS is an agree disagree type essay where you have to discuss how schools should help children to develop.

Employing Older People Essay: Is the modern workplace suitable?

Employing Older People Essay. Examine model essays for IELTS Task 2 to improve your score. This essay tackles the issue of whether it it better for employers to hire younger staff rather than those who are older.

Examinations Essay: Formal Examinations or Continual Assessment?

Examinations Essay: This IELTS model essay deals with the issue of whether it is better to have formal examinations to assess student’s performance or continual assessment during term time such as course work and projects.

Essay for IELTS: Are some advertising methods unethical?

This is an agree / disagree type question. Your options are: 1. Agree 100% 2. Disagree 100% 3. Partly agree. In the answer below, the writer agrees 100% with the opinion. There is an analysis of the answer.

Ban Smoking in Public Places Essay: Should the government ban it?

Ban smoking in public places essay: The sample answer shows you how you can present the opposing argument first, that is not your opinion, and then present your opinion in the following paragraph.

Airline Tax Essay: Would taxing air travel reduce pollution?

Airline Tax Essay for IELTS. Practice an agree and disagree essay on the topic of taxing airlines to reduce low-cost air traffic. You are asked to decide if you agree or disagree with taxing airlines in order to reduce the problems caused.

Truthfulness in Relationships Essay: How important is it?

This truthfulness in relationships essay for IELTS is an agree / disagree type essay. You need to decide if it's the most important factor.

Any comments or questions about this page or about IELTS? Post them here. Your email will not be published or shared.

Before you go...

Check out the ielts buddy band 7+ ebooks & courses.

Would you prefer to share this page with others by linking to it?

- Click on the HTML link code below.

- Copy and paste it, adding a note of your own, into your blog, a Web page, forums, a blog comment, your Facebook account, or anywhere that someone would find this page valuable.

Band 7+ eBooks

"I think these eBooks are FANTASTIC!!! I know that's not academic language, but it's the truth!"

Linda, from Italy, Scored Band 7.5

IELTS Modules:

Other resources:.

- All Lessons

- Band Score Calculator

- Writing Feedback

- Speaking Feedback

- Teacher Resources

- Free Downloads

- Recent Essay Exam Questions

- Books for IELTS Prep

- Useful Links

Recent Articles

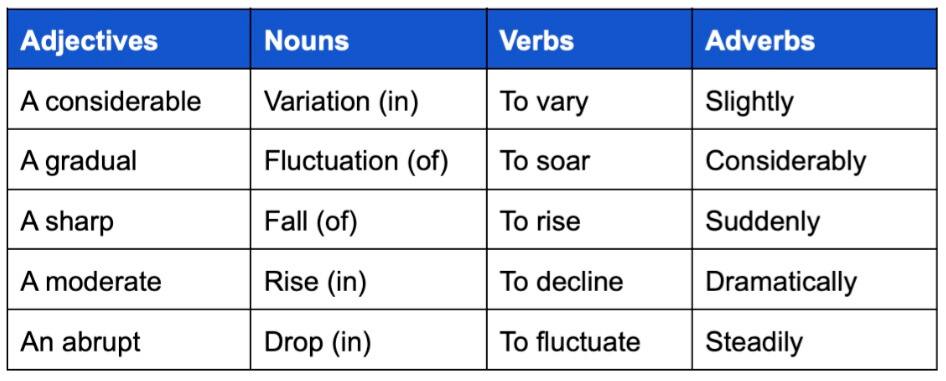

Useful Language for IELTS Graphs

May 16, 24 04:44 AM

Taking a Gap Year

May 14, 24 03:00 PM

IELTS Essay: Loving Wildlife and Nature

May 10, 24 02:36 AM

Important pages

IELTS Writing IELTS Speaking IELTS Listening IELTS Reading All Lessons Vocabulary Academic Task 1 Academic Task 2 Practice Tests

Connect with us

Copyright © 2022- IELTSbuddy All Rights Reserved

IELTS is a registered trademark of University of Cambridge, the British Council, and IDP Education Australia. This site and its owners are not affiliated, approved or endorsed by the University of Cambridge ESOL, the British Council, and IDP Education Australia.

Why do we pay taxes?

- Why do we pay federal taxes?

- Why do we pay state taxes?

- Why do we pay local taxes?

The bottom line

Why do we pay taxes federal income tax is the biggest source of government funding.

Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate tax products to write unbiased product reviews.

- The law obliges us to pay taxes, which in turn provide everything from health care and Social Security to education and defense.

- We pay taxes to the federal, state, and local governments, each of which uses the funds for different priorities.

- Taxes support the people and foster economic growth, giving government legitimacy.

- See Personal Finance Insider's picks for the best tax software.

Taxes, though not particularly popular, are key to fostering economic growth and development and to achieving the common goal of a prosperous and functional society.

While we usually think about them around the start of a new year when the federal income-tax season rolls around, we interact with them every day. In addition to our income, we are taxed on the purchases we make and the property we own. It all amounts to trillions of dollars a year in the US and pays for everything from Social Security and the military to trash removal and the upkeep of community greenspaces.

Total US federal spending for fiscal 2021 was about $10.1 trillion, according to data compiled by USAspending.gov . State government general fund spending, meanwhile, was $931.7 billion, according to a report from the National Association of State Budget Officers. All that money has to come from somewhere. That's why we pay taxes: to help fund governments at all levels.

The taxes collected by governments foster economic growth and development, paying for essential goods and services such as infrastructure, health care, and education in order to achieve the common goal of a prosperous, functional, and orderly society, says the World Bank, which provides development finance for collecting public revenue. Taxes are also a key ingredient in the social contract between citizens and the government. How they're collected and spent can determine a government's very legitimacy.

"At their most basic level, taxes address the 'free-rider' problem," says Poppy MacDonald, president at USAFacts , a not-for-profit and nonpartisan civic initiative that makes it easy to access and understand US government data. "If government didn't require citizens to pay for services, those services would be underfunded and, as a result, underprovided."

Each level of government uses the funds it raises in different ways, as each is responsible for different types of services. On the federal level, the government is tasked with large-scale programs, such as defending the country and providing social safety nets in the form of Social Security and Medicare. State spending is focused on things like education, transportation and public housing. Localities spend similarly to states, but tend to put more toward services including fire safety, sanitation, and parks and recreation.

Offers a high-quality user interface and access to experts and is especially valuable for self-employed filers who use QuickBooks integration.

$0 for Free Edition (~37% of filers qualify. Form 1040 and limited credits only), $69 for Deluxe, $129 for Premium

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Can be good for relatively complex tax situations that may require help navigating deductions and forms

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Offers step-by-step guidance

- Check mark icon A check mark. It indicates a confirmation of your intended interaction. Ability to upgrade for instant access to an expert

- con icon Two crossed lines that form an 'X'. Not all users will qualify for a $0 filing option

- con icon Two crossed lines that form an 'X'. Most expensive option for many tax situations

- con icon Two crossed lines that form an 'X'. No brick-and-mortar locations to meet with a tax pro

TurboTax is among the most expensive options for filing taxes online, but offers a high-quality user interface and access to experts. It's especially valuable for self-employed filers who use QuickBooks integration.

- Tell TurboTax about your life and it will guide you step by step. Jumpstart your taxes with last year’s info.

- Snap a photo of your W-2 or 1099-NEC and TurboTax will put your info in the right places.

- CompleteCheck™ scans your return so you can be confident it’s 100% accurate.

- You won’t pay for TurboTax until it’s time to file and you’re fully satisfied.

- TurboTax is committed to getting you your maximum refund, guaranteed.

Why do we pay federal taxes?

The federal government's right to impose taxes is enshrined in the Constitution. Article 1, Section 8, Clause 1, states: "The Congress shall have the Power to lay and collect Taxes, Duties, Imposts and Excises to pay the Debts and provide for the common Defense and general Welfare of the United States." However, people are probably more familiar with the specific tax provision established by the 16th Amendment, which was ratified in 1913, and reads: "The Congress shall have the power to lay and collect taxes on income, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration."

The federal individual income tax is one of the taxes withheld from your paycheck, and is more than likely the biggest item deducted. It's also the federal government's largest single source of revenue.

If you make money — however you make it — it's more than likely that income will be taxed. The federal income tax is progressive, meaning those with larger incomes pay a greater share. Rates range from as little as 10% on the lower end of the scale to as much as 37% on some income at the high end.

The Federal Insurance Contributions Act, better known as FICA, is the law that established the payroll tax that is deducted from each paycheck. It is separate from the federal income tax and helps fund both Social Security and Medicare programs, which provide benefits for retirees, the disabled, and children.

There are more federal taxes as well. For example, corporate income tax is levied on business profits. The estate tax is a tax on your right to transfer property when you die. Excise taxes are imposed on various goods, services and activities and may be imposed on the manufacturer, retailer or consumer, depending on the specific tax. Cigarettes, alcoholic beverages, and gasoline are among those items that are subject to an excise tax. Excise taxes also make up a relatively small and volatile portion of state and local tax collections, according to the non-profit Tax Foundation.

"At tax time, we are hyper focused on our income tax rates and how much income tax we will pay," says Gena Jones, founder and CEO of Jones Tax Group. "These other taxes should also be part of the tax conversation because they can be substantial."

So where does it all go? For fiscal 2021, the largest portion of the US government spending, almost 20%, was in the income security category, which includes programs ranging from unemployment compensation and military retirement to the earned income tax credit and nutrition assistance. Medicare accounted for 13.7%, Social Security was 11.8%, national defense was 11.1%, and health was 10%. The 2021 figures were heavily skewed by massive spending to address the economic impact of the COVID-19 pandemic.

Fiscal year 2021 federal spending by budget function

Source: USASpending.gov "We won't really appreciate some of the things our tax dollars pay for until our hair turns gray," says Jones. "Look at the bright side, some of the taxes you pay are put into your Social Security savings account, which you can begin to withdraw at retirement age."

Why do we pay state taxes?

As with the federal government, states need their residents to pay taxes in order to fund services. The way in which they do so differs from state to state, with some states choosing not to collect an income tax while others forgo sales tax. All states levy some form of property tax, with state-local tax burdens as of 2019 averaging 10.3% of national income. New Yorkers got hit the hardest at 14.1%, according to data compiled by the Tax Foundation.

Source: Tax Foundation * Does tax certain investment income. "Don't be fooled by states not imposing a certain type of tax. They are going to get the money necessary to operate," notes Jones. Where does the money from state taxes go? Spending on elementary and secondary education constitute the largest share of spending for states, accounting for almost 36% of costs in fiscal 2021, or about $483 billion, according to the National Association of State Budget Officers. Medicaid represented 27% of spending. Public university systems, community colleges, and other higher education institutions account for the third-biggest spending area, around 9%.

Other areas of state spending include transportation, corrections, and other public health programs.

Why do we pay local taxes?

Just like with state taxes, local taxes can vary. They can include taxes on property, sales, income, as well as miscellaneous items like water fees and parking meters. Local governments often get a significant portion of their revenue from sources such as grants from federal and state governments, and from charges for business-like entities that provide services like public utilities, hospitals, and public transit, MacDonald says.

Localities also collect revenue from licenses and sales taxes. Some also tax income or payrolls, such as New York City, which taxes some income at as much as 3.876%, the highest in the country, MacDonald says. Local taxes generally pay for services that people use daily, like K-12 public schools, transportation, police and fire services, and garbage removal.

We pay taxes to fund our federal, state and local governments so they can function properly and provide necessary services. Each particular government has its particular focus, with the big-picture spending on things like defense and Social Security placed in the hands of the federal government. States take on education and health, while local governments pay for things such as your garbage collection and child's school transportation.

- Main content

We sent you SMS, for complete subscription please reply.

You are using an outdated browser. Please upgrade your browser or activate Google Chrome Frame to improve your experience.

Wonder of the Day #194

Why Do You Have To Pay Taxes?

SOCIAL STUDIES — Money

Have You Ever Wondered...

- Why do you have to pay taxes?

- What is the IRS?

- How is tax money used by the government?

- Government ,

- Internal Revenue Service ,

- Social Studies ,

- United States ,

- Legislator ,

- Executive ,

- Percentage ,

- Requirement ,

- Firefighter ,

Today’s Wonder of the Day was inspired by Ainsley from IL. Ainsley Wonders , “ Why do we have to pay taxes? ” Thanks for WONDERing with us, Ainsley!

Every year around April 15, you'll hear adults of all ages groan about “tax day." That's because federal and state income tax forms are due around that time. But have you ever wondered why you have to pay taxes?

In the United States, we have governments at the local, state and national ( federal ) levels. These governments have various parts to them, including legislators (who make laws), executives (who enforce laws), judges , and many others. The money these government workers receive to do their jobs comes from taxes.

Taxes take many forms, too. When you work at a job to make money , you pay income taxes. Depending on how much money you make, a certain percentage (part) of the money you make is withheld (kept out of your paycheck and sent to the government).

When you buy things at a store, you also usually pay sales tax, which is a percentage of the cost of the item charged by the store. If you own property , you also pay property taxes on the value of your property .

Paying your taxes is considered a civic duty , although doing so is also a requirement of the law. If you do not pay your taxes, the government agency that oversees taxes — the Internal Revenue Service or IRS — will require you to pay your taxes or else face penalties, such as fines or going to jail.

The money you pay in taxes goes to many places. In addition to paying the salaries of government workers, your tax dollars also help to support common resources, such as police and firefighters .

Tax money helps to ensure the roads you travel on are safe and well-maintained. Taxes fund public libraries and parks. Taxes are also used to fund many types of government programs that help the poor and less fortunate , as well as many schools!

Each year when “tax day" rolls around, adults of all ages must report their income to the IRS, using special tax forms. There are many, many laws that set forth complicated rules about how much tax is owed and what kinds of special expenses can be used (“written off") to lower the amount of taxes you need to pay.

For the average worker, tax money has been withheld from paychecks throughout the year . On “tax day," each worker reports his or her income and expenses to the IRS.

Employers also report to the IRS how much they paid each worker. The IRS compares all these numbers to make sure that each person pays the correct amount of taxes.

If you haven't had enough tax money withheld from your checks throughout the year to cover the amount of tax you owe, you will have to send more money (“pay in") to the government. If, however, too much tax money was withheld from your paychecks, you will receive a check (get a “ refund ") from the government.

Wonder What's Next?

Tomorrow’s Wonder of the Day features a Japanese icon of breathtaking, but brief, blossoming beauty!

Are you ready to pay up? Be sure to check out the following activities with a friend or family member:

- Although you won't have to worry about paying income taxes until you have a job, there is one tax you're probably already familiar with: sales tax. The next time you head to the store, bring a calculator with you. As you travel the aisles of the store, look at the prices of products. Use the calculator to figure out how much each product would be if you purchased it. For example, if you see a toy truck for $2 and your local tax rate is 6% (six cents for every one dollar), you would multiply $2.00 by 0.06 to get the amount of sales tax you'd pay, which is $0.12. Then you would add $0.12 and $2 to get the total cost of the truck, $2.12. It's important to remember sales tax when you start saving up for an important purchase you want to make. Always remember to calculate how much an item will cost — after tax — so you'll be sure you have enough money when it's time to head to the store!

- Talk with an adult friend or family member about their views on taxes. Do they think they pay too much in taxes? Why or why not? What kinds of things do they think their tax money should be used for? Are there things that governments spend money on that they don't think is worth it? Ask for examples, if so. What kinds of avenues exist for objecting to the way your tax money is spent?

- Ask an adult friend or family member to go with you on a walk or take you for a drive around your hometown. Bring along a piece of paper and a pencil. As you walk or drive around, look for examples of your tax dollars at work. Do you see roads being repaired? Is there a public library in your town? What about police and firefighters? Try to come up with a list of at least 10 examples of your tax dollars at work. You might be surprised at how far your tax dollars go to provide services shared by everyone in your community!

Wonder Sources

- http://life.familyeducation.com/taxation/money-and-kids/47969.html

- http://en.wikipedia.org/wiki/Tax

Did you get it?

Wonder contributors.

We’d like to thank:

Jeniel , tejashree , diane , reyno and Erica from CT for contributing questions about today’s Wonder topic!

Keep WONDERing with us!

Wonder Words

The people who work for the government get paychecks, just like everyone who works! They also have to pay taxes.

supreet goyal

Great questions for a Wonder Journey--or a read through your textbook!

Great question, Tony. We think you'll find a ton of information at your local library or on the Internet. Enjoy your Wonder Journey!

You can cite Wondreopolis as the author and the date you accessed this Wonder. Thanks for checking!

?? Oh - verrrry clever, A! ?

Taxation IS theft. We pay over 50% of our income to the government in the form of taxes. It's oppressive.

Hi, Kj! Reading through this Wonder will provide you with some general information, but if you want a more detailed outline of the process, there are many tax services that can help!

I wish we never had to pay taxes but at the same time im happy we've had taxes so it's kinda in the middle for me...

We appreciate you sharing your thoughts with us, Alex!

We hope that reading through this Wonder will help answer your question, klk!

julia chungs

Thanks for sharing, julia!

Hi, B! April 15 is "tax day" - hope this helps!! ?

" During the middle decades of the fourteenth-century, the average tax-paying peasant would had to pay the equivalent of 32 grams of silver to the royal treasury. This would represent about 2% of the value of their farm, and if it was delivered as butter, it would be the equivalent of 16 kilograms."

Ref: http://www.medievalists.net/2015/07/how-much-taxes-did-a-medieval-peasant-pay-the-numbers-from-sweden/

Wow! That's some interesting research! Thanks for sharing!

Interesting! Did you already submit it to the Wonder Bank ?

Wenhua Chen

Well, no one likes paying taxes. But if you pay too little, the IRS can ask for more or do what's called an audit. Not fun. Thanks for WONDERing!

trident studios

No, but we CAN give you a new Wonder every day! ?

can u do more wonders about kyrie irving

Here's one: Who Has the Best Handles in the NBA? Answer: Steph Curry. ??

because the gover ment needs to pay police and firefighters and stuff

Well lynnea, most of us don't enjoy paying taxes but the article does explain why it benefits our society to pay them. Thanks for WONDERing with us!

Kaitlyn Galaydick

We're glad you stopped by Wonderopolis and asked, Kaitlyn! The author of this Wonder is Wonderopolis. :)

We just realized we missed this comment, chheee! We're sorry! Wonderopolis was created and is managed by the National Center for Families Learning, which is headquartered in Louisville, Kentucky. :)

i need help for a essay in school give me some reasons why take off taxes

Hi there, josh! We're glad you are WONDERing. We think it would be better if you researched your question rather than us just telling you. We encourage you to keep searching online or at your local library to find the information you need. :)

U have to pay a lot of money

Thanks for sharing your thoughts, Peppapig21! We're glad you are WONDERing with us! :)

Howdy, Tyson! We hope that smile means you are really enjoying WONDERing with us! :D

Hi, tyler! We hope this Wonder was helpful and informational! Always keep WONDERing! :)

The Grace Commission found that 0% of the income tax collected in the USA is spend on government services. ( & no, not 10%, 0)

Thank you for sharing, Serge! This article on CNN.com breaks down how income tax is spent. Interesting read!

Thanks for sharing your thoughts about taxes, Jackson! We're glad you're WONDERing! :)

I agree with your comment. I don't believe that everything in this article is facts. Maybe for some tax dollars benefit, but for others, there is no true benefit in paying taxes. The roads are still bad and filled with potholes, the libraries are old and filled with old outdated materials, you have schools that can't even ensure that every student will get a book, and the very people that we pay to protect and serve are killing "tax paying" citizens. How can you take money from someone who barely makes minimum wage to pay people who make twice if not more than them? There's no logic in that.

Thanks for sharing and joining the discussion, Kali!

Thanks for sharing your thoughts and opinions about taxes, Kayarrdee. We're glad you stopped by! :)

But what can we do about it? It comes out of our paychecks, when we buy stuff, etc. Then when the irs gets involved and the court of law. What can we really do?

Thanks for joining the discussion, Aryka! We appreciate you sharing your thoughts about taxes! :)

Loved this answer. Whether or not you know it but you don't even have to be in debt. Our government is so far into a debt spiral that they could triple our taxes and never pay it all back to the Federal Reserve! Matter of fact the could pay them back a dollar a second and it would take 440,000 years to pay it back. They are enslaving our future generations. And guess who pays this debt? It is made on the back of American people. Hence why every dollar bill is actually a promisary note to the Federal Reserve.

Thanks for joining the discussion, Kayarrdee! We appreciate you sharing your beliefs, too. This Wonder represents the common belief of the government behind taxes. If you want to learn more, we encourage you to check out the Wonder Sources where we found the information for this Wonder. :)

Thanks for sharing your opinion, Branson! We're glad you're WONDERing! :)

Thank YOU for WONDERing with us, Desiree! We're glad you stopped by! :)

We're sorry you didn't like this Wonder. Luckily, there are many more Wonders you can explore on the site! Just click on Explore Wonders at the top of the page! :)

Hi, Wonder Friend! We're glad you liked this Wonder and learning something new! :)

All these can be and have been funded privately, rather than by compulsory taxes (taxation is actually theft)

Thank you for saying this!

Thanks for stopping by Wonderopolis, Kayarrdee! Always keep WONDERing! :)

We appreciate you sharing your thoughts, Branson! Thanks for joining the conversation about taxes! :)

Hi, Jett! Thanks for sharing the additional information! You're right that taxes help pay for things in the community! :)

sauske uchiha

Hi, sauske! Thanks for sharing your thoughts and opinion about taxes. We appreciate your comment! :)

Great question, Cameron! We encourage you to keep WONDERing and researching about the history of taxes at your library and online! :)

why are yall not giving answers and just saying great question keep wondering and just leaving us hanging

Hi, alex! Thanks for asking! We like to encourage our Wonder Friends to embark on their own Wonder Journey to keep WONDERing and learning! Sometimes the Wonder of the Day is just the beginning! :)

We're glad you stopped by Wonderopolis to learn more for your project! We're sure you did GREAT! :)

WONDERSheep

Spread the word! The Federal Reserve is enslaving humanity!

We appreciate you sharing your opinion, Kayarrdee. Everyone believes different things and that's okay! :)

Exactly! Taxation is theft!

We appreciate hearing from our Wonder Friends, Branson! Visit again soon! :)

That is a very good point that you make. Maybe the government reads Wonderopolis? Hehe.

Hi, Mc6344! We appreciate you exploring the comments for this Wonder! :)

Thanks for sharing your opinion, Wonder Friend! Taxes are a heavily debated topic! We're glad you stopped by Wonderopolis! :)

Hi, Wonder Friend! You can use the search box at the top to look for Wonders about all kinds of topics! Always keep WONDERing! :)

Hi, Wonder Friend! Thanks for stopping by Wonderopolis! We're THRILLED you're WONDERing with us! :)

WONDERful, ajmeena! We're glad this Wonder was helpful! Thanks for stopping by! :)

What is the main idea of the passage

Hi, Kaden! It often helps to re-read text so that you understand the information better. Thank you for stopping by Wonderopolis! :)

Hi, andy! You're right, people often have disagreements over taxes. Thanks for WONDERing with us! :)

Hi, Wonder Friend! That's right. We encourage you to talk with an accountant for more information. Thanks for WONDERing with us! :)

hansy boo boo

Hello there, hansy boo boo! It's true, taxes aren't the most enjoyable way to spend money. If you were in charge, how would you do the tax system differently? If you didn't have taxes, what ways would you produce money to pay for things we all need, like trash removal and clean water? Have fun WONDERing about what you'd do differently! :)

Taxes should be voluntary! Less government less taxes!

Thanks for sharing your opinion, Wonder Friend! We hope you had fun exploring this Wonder! :)

Hey, hannah! It's great that you're WONDERing with us! We hope you are having a nice week! :)

Thanks for sharing your opinion, bradydog22! We appreciate you, Wonder Friend! :)

Wonderopolis

Hi, pooja! Some of the tax money is used to pay for road repairs and upkeep. However, it is hard to keep up with all the roads and city budgets are sometimes another issue to consider. Check out this related WONDER - Wonder #1147: What Is a Pothole? . Have a WONDERful day! :)

Hi monster! Policemen and Firemen are jobs and they need to be paid for their services to the community. They must also pay taxes to the government. Thanks for WONDERing with us and sharing your thoughts! :)

Hi Lucas! There were times in our country's history that the United States rebelled against taxes, such as the Boston Tea Party. Check out Wonder #619: Who Came to the Boston Tea Party? However, as this WONDER about taxes tells us, our taxes help pay for many things we are privileged to have in the United States, such as public education. You can find more information about our country's tax system at the U.S. Department of Treasury website. Always keep WONDERing! :)

Michael Redline

Thank you for sharing your opinion, Michael! By doing a little extra WONDERing, we found that there are different tax brackets so that people who make more money pay a higher tax percentage than those who make less. You can check it out here: http://www.taxact.com/tools/tax-bracket-calculator.asp Thanks for WONDERing with us, Wonder Friend! :)

SuperSmash22

That's a great question, SuperSmash22! Each time an employee gets paid, his or her employer electronically sends a portion of that money to a special accounting office located at their local, state and federal governments. Employers use banks to send money, just like individual people do. :)

Thanks for WONDERing with us, Iver! It's true, we do have to pay taxes - whether at the store, when we purchase things, or at work, when we get paid. It may not be our favorite thing to spend money on, but our dollars go towards helping pay for things we use everyday, like streets, public school, police and water. Paying taxes is pretty important, don't you think? Have a WONDERful day, Iver! :) :)

We are undergoing some spring clearing site maintenance and need to temporarily disable the commenting feature. Thanks for your patience.

Related Wonders for You to Explore

Who Was Lou Castro?

Who Was Dalip Singh Saund?

Who Was the Surfer of the Century?

Who Was Grace Lee Boggs?

How Did the British Save Children From the Nazis?

Drag a word to its definition

Select a Wonder Word:

Match its definition:

Congratulations!

You’ve matched all of the definitions correctly.

Share results

Question 1 of 3

If too much money was withheld from your paychecks throughout the year, what will you receive from the government after you file your taxes?

- a refund Correct!

- b bonus Not Quite!

- c bill Not Quite!

- d summons Not Quite!

Question 2 of 3

What does IRS stand for?

- a Internet Refund Subsidy Not Quite!

- b Illegal Ransom Service Not Quite!

- c Illinois Regulatory System Not Quite!

- d Internal Revenue Service Correct!

Question 3 of 3

When you pay tax on an item you purchase at a store, what type of tax are you paying?

- a property Not Quite!

- b income Not Quite!

- c sales Correct!

- d mercantile Not Quite!

Quiz Results

Share Results

Spread the joy of wonder, get your wonder daily.

Subscribe to Wonderopolis and receive the Wonder of the Day® via email or SMS

Join the Buzz

Don’t miss our special deals, gifts and promotions. Be the first to know!

Share with the World

Tell everybody about Wonderopolis and its wonders.

Share Wonderopolis

Wonderopolis widget.

Interested in sharing Wonderopolis® every day? Want to add a little wonder to your website? Help spread the wonder of families learning together.

You Got It!

http://wonderopolis.org/wonder/why-do-you-have-to-pay-taxes

© National Center for Families Learning (NCFL)

All about Finance » Tax » Why is it important to pay taxes?

Why is it important to pay taxes?

The Federal Income Tax is the largest source of revenue and funding for the U.S. government. It is key to a prosperous and functional society’s economic momentum and common development. But W hy is it important to pay taxes? Easily, so there is a good relationship between citizens and the economy.

Paying taxes allows the country to advance essential services such as health care, infrastructure, and education . How taxes are collected and invested or spent determines the legitimacy of a government.

At larger scales, the federal tax shifts larger tasks to the government, such as providing social safety nets through Social Security and Medicare and defending the country.

Reasons why we should pay taxes

Some consider taxes a large burden that takes up most of their salary. The question of whether it is really important to pay taxes arises when it is unknown where the money that’s collected ends up.

There are several reasons why it is necessary to assume the responsibility of paying taxes. They fall on the common good of the citizens and the country or region where they reside and are divided into two areas.

1. In a society

The government plans social projects, but the development force depends on the citizens. Without taxes, responding to people’s demands is impossible, especially regarding the most necessary public services.

- Education : Undoubtedly, education is one of the areas that most requires attention , and this is achieved with the payment of taxes. It is fundamental to the development of the country and human capital. Public schools are financed, equipped, and cared for thanks to tax money.

- Health : tax collection also helps the health sector . It especially finances health services such as medical research, social security, and social health care.

- Governance : governance is directly linked to the functioning of the country . The government manages the money collected through taxes and uses it profitably for all citizens. The money is also used to pay the police, public services, parliamentarians, postal system, among others.

- Other sectors : environmental protection, security, and scientific research are part of the different sectors necessary for the welfare of citizens. It is important to pay taxes because they allow you to finance projects such as unemployment benefits and pensions. Remember that taxes help stimulate a nation’s economic growth.

2. In business

The prosperity of businesses is linked to roads in excellent condition, good electricity and telephone service, and a good infrastructure. The government develops this infrastructure by collecting taxes while at the same time promoting economic activity.

The government can return the money paid by businesses through taxes to the economy in the form of loans or financing.

As already mentioned, taxes help improve the country’s quality of life. In that sense, consumption will be high as long as the standard of living rises. This favors companies as they will have more internal consumption.

What taxes are important to pay?

All taxes are necessary ; each one guarantees good services and the nation’s economic growth. To understand what taxes exist and why it is important to pay taxes, you need to know about each one.

The U.S. tax system is complex ; understanding the basics of the types of taxes can be valuable for financial planning. Especially for the first month of each year.

1. Income Tax

Income tax can be levied at the federal, state, and local levels . Payments at the national level will depend on several factors, including income and marital status. At the state level, they vary considerably.

Florida does not charge income tax. Some states use a flat income tax rate. While in others, different tax rates apply, depending on income.

2. Sales Taxes

These are taxes on goods and services purchased . They are generally calculated as a percentage of the price already paid. This type of tax varies according to the state or municipality of residence.

Some states do not charge sales taxes at the state or local level. Other states charge substantial amounts. Sales taxes, in some cases, are regressive; low-income households pay a large number of their earnings to cover taxes as opposed to higher-income individuals.

3. Excise taxes

Excise taxes are similar to sales taxes, the difference being that they are levied on specific goods. They are charged for sinful products such as beer, cigarettes, and gasoline.

These taxes are not only intended to raise money but also to discourage certain unhealthy behaviors. Sometimes excise taxes are combined with sales taxes on the same purchase.

4. Payroll taxes

This is made up of two taxes that employees and employers must pay. The Social Security tax is 6.2% of the employee’s salary; the employer matches the amount for 12.4%. The Medicare tax is 2.9%, which equals 1.45% for the employee and the employer to fund the program.

5. Property Taxes

Property taxes are based on the market value of the property . In most cases, it applies to real estate, although it may apply to other property, including a vehicle.

These taxes are generally deductible, but in cases where it is for the public welfare, not for improvements that increase the property’s value. Some people qualify for a mortgage interest deduction.

6. Estate Taxes

The IRS considers the estate tax a tax on the right to transfer property at death. Among the items considered estates are cash, insurance, real estate, securities, and business interests.

The federal government only taxes estates above $5.30 million, so most individuals are exempt from paying federal estate tax. A tax rate is charged, and the highest rate at the national level is 40%.

7. Gift Tax

It is similar to the inheritance tax since it is levied on the transferred wealth. It differs because it involves two living persons. Gifts of more than 14 thousand dollars must pay tax produced by the beneficiary.

It applies not only to cash but also to company shares and vehicles . The highest gift tax rate is 40% on the taxable amount of the gift or donation.

It is essential to know that not all taxes are paid simultaneously. Some taxes are deducted from the paycheck. Three types of taxes are reflected on an employee’s pay stub and are the most widespread: general income taxes, payroll taxes, and state income taxes.

It is important to pay taxes, whether federal, state, or local, to enjoy good public services and quality of life. To see a country’s economic growth, collecting taxes is essential.

For years I have studied American finance regulations. All the information in this blog is sourced from official or contrasted sources from reliable sites.

Salesforce Certified SALES & SERVICE Cloud Consultant in February 2020, Salesforce Certified Administrator (ADM-201), and Master degree in “Business Analytics & Big Data Strategy” with more than 13 years of experience in IT consulting.

- Investor Profile • Why it is so important to know your profile?

- Profit and loss statements why they are so important

- How to pay taxes according to UW Madison?

- 3 important truths about working for a hedge fund

- Are financial industry bloggers important?

- FedEx Hubs • How do they work and which are the most important ones in the USA?

- Employers Incur Operating Costs For Which Payroll Taxes

- When is the deadline to file taxes?

The Importance of Tax in Our Life Essay (Critical Writing)

Introduction, importance of tax.

Bibliography

Tax is one of the ways for authorities in the public sector to raise revenue to run their projects. Public administrations are charged with the development of sufficient revenue to finance programs that benefit the society; hence, they have to either raise the money through investments or apply levies on various commodities to generate the funds. The government can also introduce taxes with the aim of aligning the behavior of various entities with a given policy.

For instance, carbon taxes are used to compel different entities to reduce the impact of their business processes on the environment 1 . In the case under analysis, authorities in Cook County, Chicago, introduced a controversial tax on sweetened beverages in the soft drink field. Taxes are meant to generate revenue or to regulate the behavior of different entities; hence, the actual purpose of a new tax should be communicated to the public.

Lawmakers in the county responded to the pressure from citizens and various lobbying groups that had reviewed the nature and effects of the proposed tax. It is apparent that the tax was meant to reduce the consumption of sweetened soft drinks with the hope that consumers would be discouraged by the increased prices of the products 2 . However, the tax was not effective in attaining the intended health promotion objective because consumers could easily drive to the nearby towns outside the county and shop for the drinks.

A critical view of the tax reveals that its intention was not to boost health outcomes for the citizens of Cook County, but to help the administration in raising about $1.8 billion annually to increase its budget 3 . The government has been facing challenges in raising the required funds for the budget, and it is apparent that the only option it has is the development of new taxes that help in raising the deficit. Economic principles reveal that whenever an administration is facing deficits in its annual budget, there are some options that it may pursue to raise the required money 4 .

Taxes directly involve citizens in contributing to public programs run by the government 5 . However, the government is always limited by various policies when it comes to the introduction of taxes 6 . The policies are meant to ensure that the administration does not introduce laws that exploit the public in an unfair manner. For instance, in Cook County, the local government observes laws that dictate against the development of additional sales taxes on commodities 7 . The associated lawmakers had to introduce the tax at the point of sale, which was quite a bad choice because it would exempt all consumers using food stamps as stipulated by the law.

This case reveals that while taxes are necessary for boosting the capabilities of the government in meeting its obligations and plans, they have to be introduced in a manner that shows legitimacy and appropriate reasoning on the part of the proponents 8 . The tax on sweetened fizzy drinks was banned because its legitimacy was questionable. First, the administration did not have a solid reason for introducing the tax. Secondly, the intentions of the tax were concealed through the claim that the tax was meant to enhance health outcomes for the citizens of Cook County.

The Cook County administration demonstrated that it is always necessary for the authorities to look into introducing legitimate taxes. By introducing the tax, the government intended to raise more money to boost its budget, rather than promote health outcomes as the leaders claimed. Taxes are normally applied to finance government projects by raising revenue or regulating certain behaviors on the part of various entities.

Auerbach, Alan, Raj Chetty, Martin Feldstein, and Emmanuel Saez, eds. Handbook of Public Economics . Vol. 5. Boston: Newnes, 2013.

“ Chicago’s Soda Tax Is Repealed. ” The Economist , 2017. Web.

Lawton, Amy. “Green Taxation Theory in Practice: The 2012 Reform of the Carbon Reduction Commitment.” Environmental Law Review 18, no. 2 (2016): 126-141.

Lu, Xiaobo, and Kenneth Scheve. “Self-Centered Inequity Aversion and the Mass Politics of Taxation.” Comparative Political Studies 49, no. 14 (2016): 1965-1997.

Rood, Deborah K. “The Importance of Tax Quality Control.” Journal of Accountancy 219, no. 4 (2015): 24.

Saad, Natrah. “Tax Knowledge, Tax Complexity and Tax Compliance: Taxpayers’ View.” Procedia-Social and Behavioral Sciences 109, no.1 (2014):1069-1075.

- Amy Lawton, “Green Taxation Theory in Practice: The 2012 Reform of the Carbon Reduction Commitment,” Environmental Law Review 18, no. 2 (2016): 126-141.

- “Chicago’s Soda Tax Is Repealed,” The Economist , 2017. Web.

- “Chicago’s Soda Tax Is Repealed.”

- Natrah Saad, “Tax Knowledge, Tax Complexity and Tax Compliance: Taxpayers’ View,” Procedia-Social and Behavioral Sciences 109, no.1 (2014):1069-1075.

- Alan J. Auerbach et al., eds., Handbook of Public Economics , Vol. 5 (Boston: Newnes, 2013), 4.

- Deborah K. Rood, “The Importance of Tax Quality Control,” Journal of Accountancy 219, no. 4 (2015): 24.

- Xiaobo Lu and Kenneth Scheve, “Self-Centered Inequity Aversion and the Mass Politics of Taxation,” Comparative Political Studies 49, no. 14 (2016): 1965-1997.

- Feminist Perspective Influence on Canadian Laws and Lawmakers

- Childhood Obesity Scientific Studies

- Obesity and Its Challenges Analysis

- Fraud Examiners and the Panama Papers

- "Amazon Laws" and Taxation of Internet Sales

- Personal Income Tax: Arguments For and Against

- Canada Revenue Agency, Its Benefits and Limitations

- Section 179 of the International Revenue Code

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2020, October 31). The Importance of Tax in Our Life. https://ivypanda.com/essays/the-importance-of-tax-in-our-life/

"The Importance of Tax in Our Life." IvyPanda , 31 Oct. 2020, ivypanda.com/essays/the-importance-of-tax-in-our-life/.

IvyPanda . (2020) 'The Importance of Tax in Our Life'. 31 October.

IvyPanda . 2020. "The Importance of Tax in Our Life." October 31, 2020. https://ivypanda.com/essays/the-importance-of-tax-in-our-life/.

1. IvyPanda . "The Importance of Tax in Our Life." October 31, 2020. https://ivypanda.com/essays/the-importance-of-tax-in-our-life/.

IvyPanda . "The Importance of Tax in Our Life." October 31, 2020. https://ivypanda.com/essays/the-importance-of-tax-in-our-life/.

Theme 1: Your Role as a Taxpayer Lesson 1: Why Pay Taxes?

Educational Standards

State and National Standards

One to four hours

Curriculum Area(s)

- Civics/Government

- History/Social Studies

To help students understand the basic rationale, nature, and consequences of taxes

Students will be able to

- describe why governments need revenue to provide goods and services.

- identify taxes as an important source of governmental revenue.

- explain how taxes transfer the use of resources from the private sector to the government.

Taxes provide revenue for federal, local, and state governments to fund essential services--defense, highways, police, a justice system--that benefit all citizens, who could not provide such services very effectively for themselves. Taxes also fund programs and services that benefit only certain citizens, such as health, welfare, and social services; job training; schools; and parks.

Article 1 of the United States Constitution grants the U.S. government the power to establish and collect taxes. Congress delegated to the IRS the responsibility of administering and enforcing the Internal Revenue Code.

Taxes reduce taxpayers' income. As a result, taxpayers have less for personal goods and services, savings, and investments. The more services the government provides, the more taxpayers have to pay for them. Whenever new public goods and services are proposed that require new taxes, taxpayers must decide whether the additional benefits are worth the reduction in income.

public goods and services

Benefits that cannot be withheld from those who don't pay for them, and benefits that may be "consumed" by one person without reducing the amount of the product available for others. Examples include national defense, streetlights, and roads and highways. Public services include welfare programs, law enforcement, and monitoring and regulating trade and the economy.

Required payments of money to governments that are used to provide public goods and services for the benefit of the community as a whole.

Opening the Lesson

Ask students whether they know how the government pays for the goods it purchases and the services it provides. Show the Slide Show : Theme 1 Overview: Your Role as a Taxpayer . Then present the information from the background section above.

Developing the Lesson

On the board, list public programs and services such as:

- national defense

- police and fire protection

- public schools

- bank regulation

- job training

- air traffic controllers

- subsidized school lunches

- drug rehabilitation programs

- scientific research

Explain that each is funded by taxes. Ask students:

- Would you rather pay for each of these items with tax dollars or as each service is used? Students should be allowed to voice their opinions freely and differ on the value of specific programs. Try to build a consensus that items on the list are: public goods that benefit and are used by all in such a way that no one uses them up (highways, education, job training, libraries, defense); a public responsibility (nutrition, unemployment benefits, health care); and/or an investment in future productivity and human resources (job training, drug programs, research).

Online Activity

Direct students to Student Lesson: Why Pay Taxes?

Have students complete one or more of the following activities:

Activity 1: Your Federal Government -Check out the vast scope of the federal government.

Activity 2: Public Goods and Services -Get a bird's eye view of a typical community to see how many government services can be found.

Activity 3: Citizen's Guide to the Federal Budget -Learn how the federal government gets and spends its money.

Print Activity

Print and distribute Worksheet: Government Spending .

Worksheet Solutions: Government Spending .

Classroom Activity

Have students meet in small groups to compile a list of activities in which they or their family members have engaged within the last 48 hours. Then have students evaluate the activities to see what public goods or services they used for each activity. Using Info Sheet 1: Taxes Shift Resources , have students identify what resources were shifted from the private sector to the government to provide the public goods and services on their list. For example, students could explain that resources used to produce public education include the building, land, teachers, books, desks, electricity, and students. Have each group share its findings with the class.

To extend the lesson, use Info Sheet 2: Federal Revenues and Spending to show students how their tax dollars are spent. Ask what might happen if the only tax-supported program was national defense. Students should realize that individuals would have more money to spend each year, but none of the services typically provided by the government would be freely available. Ask students what they think might happen in the short term and in the long term. (Most students will probably predict that society in general would suffer.)

Concluding the Lesson

Ask students to think about why people pay taxes. Help students realize that certain functions are better performed collectively than individually.

Online Assessment

Direct students to complete Assessment: Why Pay Taxes? for this lesson.

Assessment Solutions: Why Pay Taxes?

Print Assessment

Print Assessment: Why Pay Taxes? and have students complete it on paper.

tell us what you think!

- Environmental Science

The Importance of Paying Taxes

15 Nov 2022

Format: APA

Academic level: College

Paper type: Essay (Any Type)

Downloads: 0

Electricity is the most used source of energy and with the rapid population and advancement in technology, there is a necessity of producing more electrical energy. Averagely, about $ 300 billion goes to conventional power sources each year. Out of the $300 billion, only thirty percent of it goes to renewable energy each year. This means that every year, 90 billion is spent on renewable energy (Buxbaum, 2014). Two reasons can explain the variance in the amount spent on renewable energy. Firstly, eighty percent of the investment decline came because of the decreasing cost of renewable energy technology, chief among them being solar panels. For instance, the cost of a rooftop solar system that is considered a good national trend barometer is reported to have fallen by almost a third. The other twenty percent was a result of a reduction in actual construction activity. This was influenced by subsidies from the government as well as general sluggishness in economics. With PTC, the cost of energy is significantly reduced. For this reason, businesspersons controlling other non-renewable energy, are using the media to convince people to stop using PTC because they are seeing it as a threat to their business. The majority of the citizens are gradually diverting to PTC products. The PTC is so important to the economy, and thus it must be saved. These tax credits are reported to have benefited many people by playing a significant role in the growth of the America economy, enhancing energy security, and job creation, and providing support to the new manufacturing process in the US among other benefits. Besides, PTC has to increase the production of wind energy which is clean and affordable (Roach, 2015). For proper regulation of energy, it is crucial to have an energy policy. This policy is essential since energy is a basic requirement for most social and economic activities in industrialized nations. The cost of energy has to be regulated because it affects production in industries as well as the living conditions of the citizens.

References

Buxbaum, R. (2014). Driving Renewable Energy Growth Through Effective Public Policy: A Financial and Policy Analysis of Cash Grants, Tax Credits and Pass-Through Tax Structures (MLPs and YieldCos).

Delegate your assignment to our experts and they will do the rest.

Roach, T. (2015). The effect of the production tax credit on wind energy production in deregulated electricity markets. Economics Letters , 127 , 86-88.

- Saudi Arabia to Invest in Nuclear Energy

- Lenticular and Cumulus Clouds

Select style:

StudyBounty. (2023, September 15). The Importance of Paying Taxes . https://studybounty.com/the-importance-of-paying-taxes-essay

Hire an expert to write you a 100% unique paper aligned to your needs.

Related essays

We post free essay examples for college on a regular basis. Stay in the know!

HACCP: A Systematic Approach to Food Safety

Sampling: the selection of a particular sample or group to represent an entire population, gis uses in national wildlife refuge management, factors that least affect the global environment.

Words: 1188

Restoration of the Chesapeake Bay

Hazard analysis techniques for system safety, running out of time .

Entrust your assignment to proficient writers and receive TOP-quality paper before the deadline is over.