Medical Practice Business Plan Template

Written by Dave Lavinsky

Medical Practice Business Plan

You’ve come to the right place to create your Medical Practice business plan.

We have helped over 10,000 entrepreneurs and business owners create business plans and many have used them to start or grow their Medical Practices.

Medical Practice Business Plan Example

Below is a template to help you create each section of your Medical Practice business plan.

Executive Summary

Business overview.

Fresno Medical is a new medical practice located in Fresno, California. Our goal is to provide affordable healthcare to individuals and families living in the area and surrounding communities. We offer general and preventative healthcare for all ages, including checkups, screening tests, and immunizations.

Our medical practitioners and supporting staff are well-trained and have a passion for improving the health and well-being of our clients. We serve our patients not just with our knowledge and skills but also with our hearts. We aim to help our patients experience the best healthcare possible while maintaining relationships that last a lifetime.

Service Offering

Fresno Medical practice will focus on providing primary care services to every family member, from infants to adults. Some of the general and primary care services we provide include:

- Immunizations: flu shots, COVID boosters, measles, mumps, polio, etc.

- Annual checkups

- Pediatrics: checkups, developmental screening, immunizations, etc.

- Health screenings: blood pressure, cholesterol, depression, diabetes, etc.

- General health counseling

Fresno Medical will work with local and national insurance companies to ensure that every patient can afford our services. If the patient’s insurance does not cover all of their medical costs, Fresno Medical will provide payment plan options so that they are not overwhelmed by their medical bills.

Customer Focus

Fresno Medical will primarily serve the community of Fresno, California. The community consists primarily of middle to lower income residents who need access to affordable medical care. Many of these residents are hesitant to go to hospitals or other medical facilities due to their costs. We will offer lower prices, flexible payment plans, and flexibility when working with insurance companies to accommodate this demographic.

Management Team

Fresno Medical is owned and operated by Jessica Wells, who has been working as a doctor at local hospitals for 15 years. Throughout her career, she has worked for hundreds of patients and families with all their general and preventative care needs. Though she has never run a medical practice herself, she has worked in the industry long enough to gain an in-depth knowledge of the business, including the operations side (e.g., running day-to-day operations) and the business management side (e.g., staffing, marketing, etc.).

Fresno Medical will also employ nurses, expert medical staff, and administrative assistants that are passionate about helping the local community.

Success Factors

Fresno Medical will be able to achieve success by offering the following competitive advantages:

- Location: Fresno Medical’s location is in a high-traffic area that is easily accessible to thousands of residents. It’s visible from the street with many people walking and driving to and from work on a daily basis.

- Patient-oriented service: Fresno Medical will have a staff that prioritizes the needs of the patients and educates them on the proper way to take care of themselves.

- Management: Jessica Wells has a genuine passion to help the community. Because of her previous experience and reputation in the medical community, she is fully equipped to open this practice.

- Relationships: Jessica Wells has developed strong connections with her patients and fellow staff throughout her career. Many patients have expressed interest in following Jessica to her new practice, and some former colleagues have shown interest in working for the clinic. Jessica also has relationships with medical equipment suppliers and insurance companies.

Financial Highlights

Fresno Medical is currently seeking $400,000 to launch. The capital will be used for funding capital expenditures, staffing, marketing expenses, and working capital.

The breakdown of the funding may be seen below:

- Clinic design/build: $100,000

- Medical supplies and equipment: $130,000

- Three months of overhead expenses (payroll, rent, utilities): $100,000

- Marketing and advertising: $50,000

- Working capital: $20,000

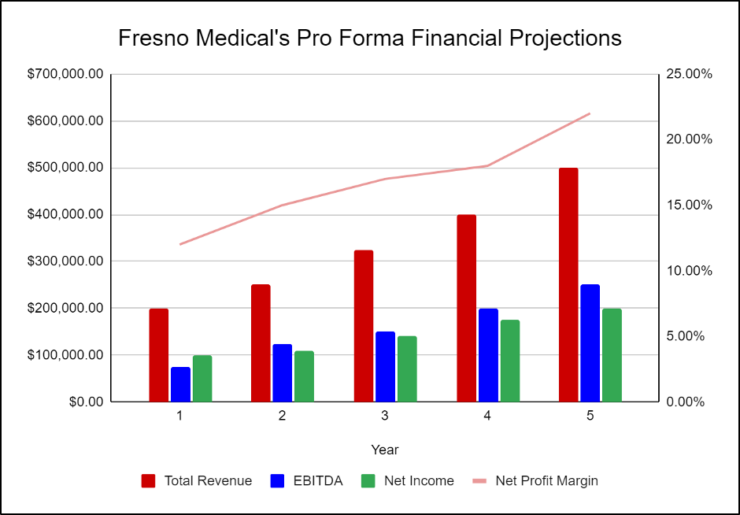

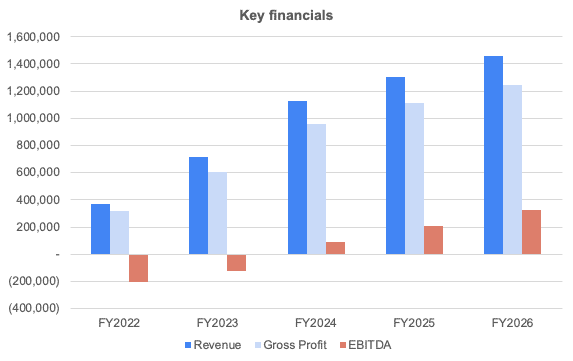

The following graph below outlines the pro forma financial projections for Fresno Medical.

Company Overview

Who is fresno medical.

Fresno Medical is a medical practice located in Fresno, California. We offer general and preventative health care for all ages. We offer immunizations, pediatrics, health screenings, and more. Our medical practitioners and supporting staff are well-trained to improve the health and well-being of our patients.

Fresno Medical is run and owned by Jessica Wells, who has been a doctor in the local medical community for 15 years. She has helped hundreds of patients and families with their general healthcare needs throughout her career. She also has gained knowledge and experience in the operations and marketing aspects of the medical business, which will prove indispensable for this private practice.

Fresno Medical’s History

After years of working with patients in hospital settings, Jessica Wells decided to establish a private practice. She wanted to develop a closer relationship with her patients, which was difficult to achieve while working in a large hospital. With this goal in mind, Jessica incorporated Fresno Medical as an S-corporation on March 15th, 2023.

Since its incorporation, the medical practice has achieved the following milestones:

- Found a clinic space and signed a Letter of Intent to lease it

- Developed the company’s name, logo, and website

- Hired a contractor for the office build-out

- Determined equipment and fixture requirements

- Began recruiting key employees with previous healthcare experience

- Drafted marketing campaigns to promote the practice

Fresno Medical’s Services

Fresno Medical will focus on providing primary care services to every family member, from infants to adults. The costs will depend upon the materials used, the physician’s time, and the amount designated for each procedure. Some of the general and primary care services we provide include:

- Immunizations: flu shots, measles, mumps, polio, etc.

Fresno Medical will maintain privacy according to HIPAA regulations. All patients will be welcome, including those without insurance. However, we expect most patients to utilize their insurance plans to pay their costs. The medical practice will work with local and national insurance companies to ensure that every family can afford our services. After billing insurance, Fresno Medical will provide flexible payment plan options so that no patient is overwhelmed by their medical bills.

Industry Analysis

Healthcare is a human right that everyone deserves access to. The medical industry will always be a necessity as it is the industry keeping society alive and well. Therefore, the medical industry is expected to continue to grow as the population grows. This is especially true for private practices, as there is a rising demand for small, patient-focused clinics that provide top-tier medical services.

Furthermore, the demand for private physicians has been on the rise. Hospitals have been low on rooms and beds the past few years, and nurses and doctors have been overworked. This has led to an increased demand for more medical professionals and private practices that can help lessen the load of larger hospitals.

Moreover, the pandemic instilled the importance of quality healthcare and practices in the general population. We expect that people all around the world will now put in more effort towards taking care of their health and getting the care and screenings they need.

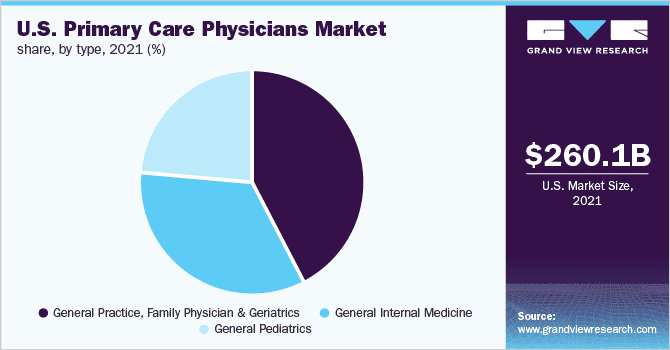

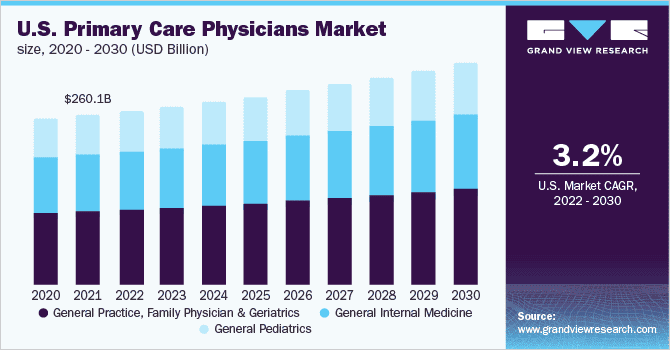

According to Facts & Factors, the global private medical market is expected to experience a compound annual growth rate (CAGR) of 12.5% over the next five years. This is enormous growth that is rarely seen in other industries. Furthermore, there is a growing demand for more primary care physicians as the general population aims to prevent developing chronic and preventable diseases. According to Grand View Research, the primary care market will experience a CAGR of 3.2% over the next 10 years, which is also moderate growth.

With such a demand for more medical practices and a greater emphasis on general health, we believe that Fresno Medical is starting at the right time and will see great success.

Customer Analysis

Demographic profile of target market.

Fresno Medical will serve the community residents of Fresno, California, and its surrounding areas. The community of Fresno, California has thousands of middle-class individuals and families seeking an affordable medical practice to take care of all their health concerns.

The demographics of Fresno, California are as follows:

Customer Segmentation

The company will primarily target the following customer segments:

- Middle-class individuals

- Hospital patients

Competitive Analysis

Direct and indirect competitors.

Fresno Medical will face competition from other companies with similar business profiles. A description of each competitor company is below.

City Metro Hospital

Founded in 1968, City Metro Hospital is one of the most popular hospitals in the area. Thousands of residents get all their primary care and emergency care needs taken care of with City Metro. It provides almost every service you can think of and enlists the help of thousands of doctors, nurses, and other expert medical professionals.

Though City Metro Hospital will continue to thrive, it does not foster an environment designed for long-lasting relationships. Since the pandemic, the hospital has been overwhelmed with patients and a staff shortage. This has led to doctors seeing thousands of patients and a tremendous increase in wait times. Fresno Medical will offer a more intimate setting where patients and doctors can create a long-lasting relationship that spans decades.

Quality Doctors

Quality Doctors is a private medical practice that provides highly personalized medical care. Quality Doctors includes a team of dedicated healthcare professionals with dual residency in emergency medicine and internal medicine. The practice offers same-day/next-day appointments, telemedicine, office visits, and home visits. Services offered by Quality Doctors include primary care, urgent care, and virtual visits.

Like City Metro Hospital, Quality Doctors is a large care system that cares for thousands of patients. This means that patients also do not get a close relationship with their doctor, which many crave. Furthermore, Quality Doctors has put much of its money and services toward emergency care in recent years and reduced its primary care services. Patients who want a lasting relationship with a primary care doctor will feel more welcome with Fresno Medical.

Johnson Community Care

Established in 1949, Johnson Community Care is a private medical practice with multiple locations. Patients all around the state can receive care at any location near them. Each site provides primary care services, emergency care, pharmacy services, and lab testing. Instead of heading to multiple locations to get all of these services, patients can get all their healthcare needs taken care of in one building.

Though Johnson is a highly successful medical practice, its major downfall is that it only provides services to those with its unique insurance plan. Therefore, anyone who has insurance through another company or plans provided by their employer cannot receive care at Johnson without paying out-of-network prices. Fresno Medical will partner with many insurance companies and provide flexible payment plans to help as many patients as possible.

Competitive Advantage

Fresno Medical enjoys several advantages over its competitors. These advantages include:

- Relationships: Jessica Wells has developed strong connections with her patients and fellow staff during her career. Many patients have expressed interest in following Jessica to her new practice, and some former colleagues have shown interest in working for the clinic. Jessica also has relationships with medical equipment suppliers and insurance companies.

Marketing Plan

Brand & value proposition.

The Fresno Medical brand will focus on the company’s unique value proposition:

- Client-focused healthcare services, where the company’s interests are aligned with the customer

- Service built on long-term relationships

- Big-hospital expertise in a small-clinic environment

- Moderate pricing for all preventative and general health services

Promotions Strategy

The promotions strategy for Fresno Medical is as follows:

Fresno Medical understands that the best promotion comes from satisfied patients. The clinic will encourage its patients to refer their friends and family by providing healthcare benefits for every new client produced. This strategy will increase in effectiveness after the business has already been established.

Social Media

We will maintain a social media presence to attract local clients looking for a new doctor or medical practice. We will post information about our team, services, and general health tips for better wellness. To create a genuine connection with our patients, we will also use social media to engage with them and answer any questions they may have about our practice.

Fresno Medical will have an informative and attractive website featuring all its services and referrals from other satisfied patients. The website will be highly informative and be designed in a way that is friendly and eye-catching.

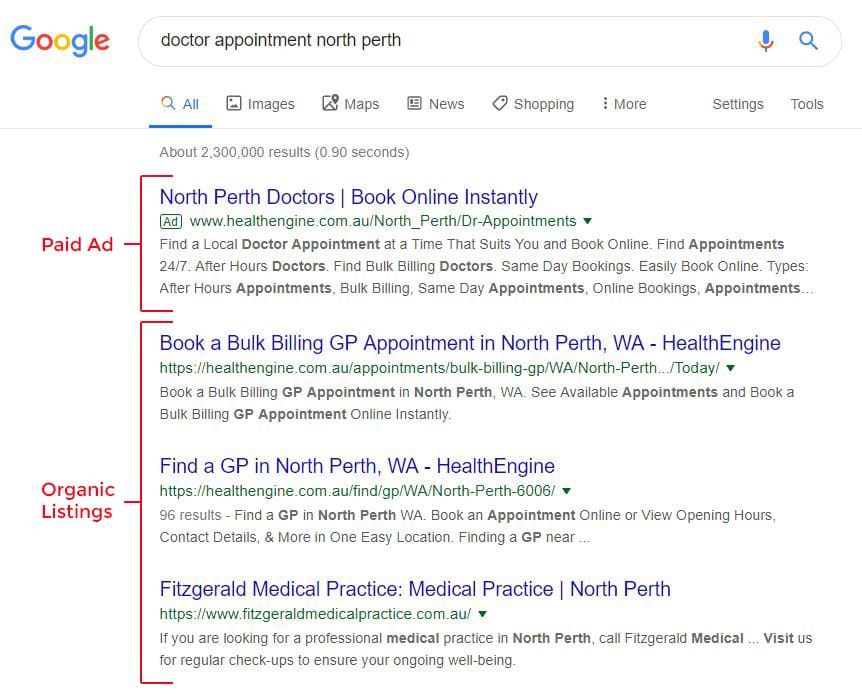

Fresno Medical will invest in a high SEO presence so that the clinic is listed at the top of the Google or Bing search engine when a potential patient is researching private medical practices in Fresno, California.

Fresno Medical’s pricing will be significantly lower than big hospitals. We will partner with as many insurance companies as possible to ensure that our patients’ medical care is covered. For services not fully covered by insurance, we offer a flexible payment program so patients are not overwhelmed by their medical bills.

Operations Plan

The following will be the operations plan for Fresno Medical.

Operation Functions:

- Jessica Wells will operate as the CEO of Fresno Medical. She will run all the general operations and executive functions of the company. She will also provide basic medical care for patients until she can hire a full medical staff.

- Jessica is joined by Mindy Keller, who will serve as the Marketing Manager and run all of the marketing and advertising efforts.

- Jessica is also joined by Rhonda Smith, who will work as the Receptionist of the clinic and the Administrative Assistant for the company.

- Jessica is also joined by Cindy Nguyen who will be the company’s Head Nurse. She will manage and train incoming nurses and provide medical treatment to patients.

- Jessica will continue to hire a team of medical staff to treat the medical practice’s growing patient list. The team will consist of doctors, nurses, physicians, and other necessary medical staff.

Milestones:

Fresno Medical expects to achieve the following milestones in the following six months:

- 4/202X Finalize lease agreement

- 5/202X Design and build out Fresno Medical

- 6/202X Hire and train initial staff

- 7/202X Kickoff of promotional campaign

- 8/202X Launch Fresno Medical

- 9/202X Reach break-even

Fresno Medical is owned and operated by Jessica Wells, who has been working as a doctor at local hospitals for 15 years. Throughout her career, she has worked with hundreds of patients and families and taken care of all their general and preventative care needs. Though she has never run a private medical practice herself, she has worked in the industry long enough to gain an in-depth knowledge of the business, including the operations side (e.g., running day-to-day operations) and the business management side (e.g., staffing, marketing, etc.).

The medical practice will also employ nurses, expert medical staff, and administrative assistants that are passionate about helping the local community.

Financial Plan

Key revenue & costs.

The revenues for the medical practice will come from the fees it will charge the patients and their insurance for the health care services it provides.

The cost drivers for the company will include the payroll of the staff, lease on the office building, medical supplies and equipment, and marketing costs.

Funding Requirements and Use of Funds

Key assumptions.

The following outlines the key assumptions required in order to achieve the revenue and cost numbers in the financials and to pay off the startup business loan.

- Year 4: 100

- Year 5: 125

- Annual lease costs: $40,000

Financial Projections

Income statement, balance sheet, cash flow statement, medical practice business plan faqs, what is a medical practice business plan.

A medical practice business plan is a plan to start and/or grow your medical practice business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your Medical Practice business plan using our Medical Practice Business Plan Template here .

What are the Main Types of Medical Practices?

There are a number of different kinds of medical practices , some examples include: Group medical practice, Private medical practice, and Hospital-based medical practice.

How Do You Get Funding for Your Medical Practice Business Plan?

Medical Practice businesses are often funded through small business loans. Personal savings, credit card financing and angel investors are also popular forms of funding.

A well-crafted medical practice business plan is key to securing any type of funding.

What are the Steps To Start a Medical Practice Business?

Starting a medical practice business can be an exciting endeavor. Having a clear roadmap of the steps to start a business will help you stay focused on your goals and get started faster.

1. Develop A Medical Practice Business Plan - The first step in starting a business is to create a detailed medical practice business plan that outlines all aspects of the venture. This should include market research on the medical industry and potential target market size, information the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your medical practice business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your medical practice business is in compliance with local laws.

3. Register Your Medical Practice Business - Once you have chosen a legal structure, the next step is to register your medical practice business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your medical practice business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Medical Practice Equipment & Supplies - In order to start your medical practice business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your medical practice business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful medical practice business:

- How to Open a Medical Practice

Medical Practice Business Plan Template

Written by Dave Lavinsky

Medical Practice Business Plan

Over the past 20+ years, we have helped over 500 entrepreneurs and business owners create business plans to start and grow their medical practices. On this page, we will first give you some background information with regards to the importance of business planning. We will then go through a medical practice business plan template step-by-step so you can create your plan today.

Download our Ultimate Medical Practice Business Plan Template here >

What is a Medical Practice Business Plan?

A business plan provides a snapshot of your medical office as it stands today, and lays out your growth plan for the next five years. It explains your business goals and your strategy for reaching them. It also includes market research to support your plans.

Why You Need a Business Plan for a Medical Office

If you’re looking to start a medical practice, or grow your existing medical practice, you need a business plan. A business plan will help you raise funding, if needed, and plan out the growth of your medical practice in order to improve your chances of success. Your business plan is a living document that should be updated annually as your company grows and changes.

Sources of Funding for Medical Practices

With regards to funding, the main sources of funding for a medical office are personal savings, credit cards, bank loans and angel investors. With regards to bank loans, banks will want to review your business plan and gain confidence that you will be able to repay your loan and interest. To acquire this confidence, the loan officer will not only want to confirm that your financials are reasonable, but they will also want to see a professional plan. Such a plan will give them the confidence that you can successfully and professionally operate a business. Personal savings and bank loans are the most common funding paths for medical practices.

Finish Your Business Plan Today!

How to write a business plan for a medical business.

If you want to start a medical private practice or expand your current one, you need a business plan. Below we detail what should be included in each section of your business plan.

Executive Summary

Your executive summary provides an introduction to your business plan, but it is normally the last section you write because it provides a summary of each key section of your plan.

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of medical office you are operating and the status. For example, are you a startup, do you have a practice that you would like to grow, or are you operating practices in multiple markets?

Next, provide an overview of each of the subsequent sections of your plan. For example, give a brief overview of the industry. Discuss the type of practice you are operating. Detail your direct competitors. Give an overview of your target customers. Provide a snapshot of your marketing plan. Identify the key members of your team. And offer an overview of your financial plan.

Company Analysis

In your company analysis, you will detail the type of medical office you are operating.

For example, you might operate one of the following types of medical practices:

- Group medical practice : this type of medical practice consists of two or more physicians providing medical care in the same facility. The physicians typically have different specialties, which allow them to collaborate and consult with each other.

- Private medical practice: this type of medical practice involves only one physician working along. A private practice usually serves a limited number of patients and operates with a small staff.

- Hospital-based medical practice: this type of medical practice is an ancillary medical office that is owned by a nearby hospital. The hospital will manage the practice and employ the doctors and nurses to work in their facilities and ancillary clinics.

In addition to explaining the type of medical practice you will operate, the Company Analysis section of your business plan needs to provide background on the business.

Include answers to question such as:

- When and why did you start the business?

- What is your business model?

- What is your mission statement?

- What milestones have you achieved to date? Milestones could include the number of patients served, number of positive reviews, reaching X amount of patients served, etc.

- Your legal structure. Are you incorporated as an S-Corp? An LLC? A sole proprietorship? Explain your business structure here.

Industry Analysis

In your industry analysis, you need to provide an overview of the medical industry.

While this may seem unnecessary, it serves multiple purposes.

First, researching the medical industry educates you. It helps you understand the market in which you are operating.

Secondly, market research can improve your strategy, particularly if your research identifies market trends.

The third reason for market research is to prove to readers that you are an expert in your industry. By conducting the research and presenting it in your plan, you achieve just that.

The following questions should be answered in the industry analysis section:

- How big is the medical industry (in dollars)?

- Is the market declining or increasing?

- Who are the key competitors in the market?

- Who are the key suppliers in the market?

- What trends are affecting the industry?

- What is the industry’s growth forecast over the next 5 – 10 years?

- What is the relevant market size? That is, how big is the potential market for your medical office? You can extrapolate such a figure by assessing the size of the market in the entire country and then applying that figure to your local population.

Customer Analysis

The customer analysis section must detail the customers you serve and/or expect to serve.

The following are examples of customer segments: individuals, families, seniors, and anyone needing a type of medical service.

As you can imagine, the customer segment(s) you choose will have a great impact on the type of medical office you operate. Clearly, families would respond to different marketing promotions than seniors, for example.

Try to break out your target customers in terms of their demographic and psychographic profiles. With regards to demographics, include a discussion of the ages, genders, locations and income levels of the customers you seek to serve.

Psychographic profiles explain the wants and needs of your target customers. The more you can understand and define these needs, the better you will do in attracting and retaining your customers.

Finish Your Medical Practice Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Medical Practice Business Plan Template you can finish your plan in just 8 hours or less!

Competitive Analysis

Your competitive analysis should identify the indirect and direct competitors your business faces and then focus on the latter.

Direct competitors are other medical offices.

Indirect competitors are other options that customers have to purchase from that aren’t direct competitors. This includes hospitals, clinics, teledocs, and online health forums.

With regards to direct competition, you want to describe the other practices with which you compete. Most likely, your direct competitors will be other practices located very close to your business location.

For each such competitor, provide an overview of their businesses and document their strengths and weaknesses. Unless you once worked at your competitors’ businesses, it will be impossible to know everything about them. But you should be able to find out key things about them such as:

- What types of medical services do they provide?

- What areas do they serve?

- What types of patients do they serve?

- What is their pricing (premium, low, etc.)?

- What are they good at?

- What are their weaknesses?

With regards to the last two questions, think about your answers from the customers’ perspective. And don’t be afraid to ask your competitors’ customers what they like most and least about them.

The final part of your competitive analysis section is to document your areas of competitive advantage. For example:

- Will you provide services that your competitors don’t offer?

- Will you provide faster patient waiting time?

- Will you provide better patient service?

- Will you offer better pricing?

Think about ways you will outperform your competition and document them in this section of your plan.

Marketing Plan

Traditionally, a marketing plan includes the four P’s: Product, Price, Place, and Promotion. For a medical office, your marketing plan should include the following:

Product : In the product section, you should reiterate the type of practice that you documented in your Company Analysis. Then, detail the specific services you will be offering. For example, in addition to medical services, will you provide nutrition and diet guidelines, insurance claim processing, family and loved one communication, and any other services?

Price : Document the prices you will offer and how they compare to your competitors. Essentially in the product and price sub-sections of your marketing plan, you are presenting the services you offer and their prices.

Place : Place refers to the location of your practice. Document your location and mention how the location will impact your success. For example, is your medical office located near a school, a busy neighborhood, an office complex, or an urban setting, etc.? Discuss how your location might be the ideal location for your patients.

Promotions : The final part of your marketing plan is the promotions section. Here you will document how you will drive customers to your location(s). The following are some promotional methods you might consider:

- Advertising in local papers and magazines

- Commercials

- Social media marketing

- Local radio advertising

- Word-of-mouth

Operations Plan

While the earlier sections of your business plan explained your goals, your operations plan describes how you will meet them. It should have two distinct sections as follows.

Everyday short-term processes include all of the tasks involved in running your practice, including patient and family communication and scheduling, managing appointments, inventory of medical supplies, accounting, billing, payroll, etc.

Long-term goals are the milestones you hope to achieve. These could include the dates when you expect to obtain your XXth patient, or when you hope to reach $X in revenue. It could also be when you expect to expand your medical practice to a new location.

Management Team

To demonstrate your practice’s ability to succeed, a strong management team is essential. Highlight your key players’ backgrounds, emphasizing those skills and experiences that prove their ability to grow a company.

Ideally you and/or your management team members have direct experience in managing medical practices. If so, highlight this experience and expertise. But also highlight any experience that you think will help your business succeed.

If your team is lacking, consider assembling an advisory board. An advisory board would include 2 to 8 individuals who would act like mentors to your business. They would help answer questions and provide strategic guidance. If needed, look for advisory board members with experience in managing a medical practice or a physician or nurse in the local medical field.

Financial Plan

Your financial plan should include your 5-year financial statement broken out both monthly or quarterly for the first year and then annually. Your financial statements include your income statement, balance sheet and cash flow statements.

Income Statement

An income statement is more commonly called a Profit and Loss statement or P&L. It shows your revenues and then subtracts your costs to show whether you turned a profit or not.

In developing your income statement, you need to devise assumptions. For example, will you take on one new patient at a time or multiple new patients offering a variety of medical services ? And will sales grow by 2% or 10% per year? As you can imagine, your choice of assumptions will greatly impact the financial forecasts for your business. As much as possible, conduct research to try to root your assumptions in reality.

Balance Sheets

Balance sheets show your assets and liabilities. While balance sheets can include much information, try to simplify them to the key items you need to know about. For instance, if you spend $50,000 on building out your medical practice, this will not give you immediate profits. Rather it is an asset that will hopefully help you generate profits for years to come. Likewise, if a bank writes you a check for $50,000, you don’t need to pay it back immediately. Rather, that is a liability you will pay back over time.

Cash Flow Statement

: Your cash flow statement will help determine how much money you need to start or grow your business, and make sure you never run out of money. What most entrepreneurs and business owners don’t realize is that you can turn a profit but run out of money and go bankrupt.

In developing your Income Statement and Balance Sheets be sure to include several of the key costs needed in starting or growing a medical practice:

- Cost of furniture and build-out

- Cost of medical supplies and equipment

- Payroll or salaries paid to staff

- Business and medical malpractice insurance

- Taxes and permits

- Legal expenses

Attach your full financial projections in the appendix of your plan along with any supporting documents that make your plan more compelling. For example, you might include your list of medical services your practice will offer, types of patients you will be targeting, and the areas your practice will serve.

Putting together a business plan for your medical practice is a worthwhile endeavor. If you follow the template above, by the time you are done, you will truly be an expert. You will really understand the industry, your competition, and your customers. You will have developed a marketing plan and will really understand what it takes to launch and grow a successful medical practice.

Medical Practice Business Plan FAQs

What is the easiest way to complete my medical practice business plan.

Growthink's Ultimate Medical Practice Business Plan Template allows you to quickly and easily complete your Medical Practice Business Plan.

Where Can I Download a Medical Clinic Business Plan PDF?

You can download our medical clinic business plan PDF here. This is a business plan template you can use in PDF format.

What is the Goal of a Business Plan's Executive Summary?

The goal of your Executive Summary is to quickly engage the reader. Explain to them the type of medical practice business you are operating and the status; for example, are you a startup, do you have a medical practice business that you would like to grow, or are you operating a chain of medical practice businesses?

Don’t you wish there was a faster, easier way to finish your Medical Practice business plan?

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success. Click here to see how Growthink’s business plan advisors can give you a winning business plan.

Other Helpful Business Plan Articles & Templates

- Sample Business Plans

- Medical & Health Care

Medical Practice Business Plan

Considering starting a new medical clinic? Great. Medical practice is one of the most rewarding and profitable entrepreneurial ventures for any medical professional.

You can easily start a medical clinic, but you need a detailed business plan when it comes to staying competitive in the market, raising funds, applying for loans, and scaling it like a pro.

Need help writing a business plan for your medical practice business? You’re at the right place. Our medical practice business plan template will help you get started.

Free Business Plan Template

Download our Free Business Plan Template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write a Medical Practice Business Plan?

Writing a medical practice business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

Introduce your business:

- This section may include the name of your medical clinic, its location when it was founded, the type of medical practice (E.g., solo practice, group practice, multi-specialty practice.), etc.

Market opportunity:

Mention your services:, medical services:, marketing & sales strategies:, financial highlights:, call to action:.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your clinic. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

Business description:

- Primary care practice

- Specialty practice

- Surgical practice

- Pediatrics practice

- Geriatrics practice, And more.

- Describe the legal structure of your medical practice, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

Mission statement:

Business history:.

- Additionally, If you have received any awards or recognition for excellent work, describe them.

Future goals:

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

Target market:

- For instance, a primary healthcare clinic may target individuals and families seeking routine health check-ups.

Market size and growth potential:

Competitive analysis:, market trends:.

- For instance, Artificial Intelligence (AI) and machine learning technologies are transforming the medical industry; explain how you plan on implementing these technologies in your business operations.

Regulatory environment:

Here are a few tips for writing the market analysis section of your medical clinic business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

Medical treatment:

services: Mention the medical services your business will offer. This list may include services like,

- General medical care

- Specialty care

- Chronic disease management

- Wellness and preventive care

- Treatment and diagnosis of illness and injuries, And more.

Describe each service:

- For instance, the process of chronic disease management may include treatment planning, patient education, medication management, patient engagement, care coordination, regular monitoring, and follow-up appointments.

Insurance & payment options:

- In addition to these payment options, describe if your medical practice offers regular patients discounts or any membership plans.

Additional services:

In short, this section of your medical practice plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

Unique selling proposition (USP):

- For example, advanced technology, specialized services, and emergency medical care could be some of the great USPs for a general medical clinic.

Pricing strategy:

Marketing strategies:, sales strategies:, patient retention:.

Overall, this section of your medical practice business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your medical clinic, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

Staffing & Training:

Operational process:, safety and infection control:.

- These protocols may include waste management, disinfection, sterilization, infection surveillance, etc.

Equipment & Technology:

- In addition, provide details on the sourcing and maintenance of these instruments and equipment. Explain how these technologies benefit your patients and help you stand out as a medical service provider.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your medical practice’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

Founder/CEO:

Key managers:.

- It should include, Medical director, department/division heads, committees, and other doctors involved in the medical operations, including their education, specialization, professional background, and years of experience in the medical industry.

Organizational structure:

Compensation plan:, advisors/consultants:.

- So, if you have any advisors or consultants, include them with their names and brief information about roles and years of experience.

This section should describe the key personnel for your medical practice services, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

Profit & loss statement:

Cash flow statement:, balance sheet:, break-even point:.

- This exercise will help you understand how much revenue you need to generate to sustain or be profitable.

Financing needs:

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more.These statements must be the latest and offer financial projections for at least the first three or five years of business operations.

- Provide data derived from market research, including stats about the medical practice industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your medical practice business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample medical practice business plan will provide an idea for writing a successful medical practice plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our medical practice business plan pdf .

Related Posts

Medical Lab Business Plan

Medical Billing Business Plan

Write a Appendix Section for Business Plan

Telemedicine Business Plan

How to Create Business Plan

Top 10 AI Tools for Startup

Frequently asked questions, why do you need a medical practice business plan.

A business plan is an essential tool for anyone looking to start or run a successful medical practice. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your medical practice.

How to get funding for your medical practice business?

There are several ways to get funding for your medical office, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

Small Business Administration (SBA) loan

Crowdfunding, angel investors.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your medical practice business?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your general practice business plan and outline your vision as you have in your mind.

What is the easiest way to write your medical practice business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any medical practice business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

Get the newsletter

Insights for those starting, managing, and growing independent healthcare practices

Get expert tips, guides, and valuable insights for your medical practice

July 26, 2023

10 min read

Practice Growth

Starting a Practice

Free template: How to create a business plan for your new practice

Your medical practice business plan is a living document that evolves as your practice grows. Here’s how to build it from scratch.

Most Popular

At a glance.

- A medical practice business plan is crucial for establishing direction, estimating finances, and evaluating competition.

- Creating an effective business plan involves gathering relevant data, making conservative financial projections, seeking expert input, and planning for risks.

- The 8 essential sections of a thorough medical practice business plan include the executive summary, business model details, market research, staffing model, 12-month budget, and more.

Medical schools and residencies prepare doctors to provide quality patient care but not to create a medical practice business plan. Yet a business plan is a key part of reaching new patients and supporting existing ones.

An effective medical practice business plan will:

- Establish a roadmap for your practice

- Estimate your revenue and expenses

- Evaluate the competition

Creating a thorough business plan may feel like an onerous roadblock to moving forward. However, plotting your direction in advance will keep you on track later on, and will set you up to effectively serve your patients.

Why you need a business plan for your medical practice

Whether you plan to start your own practice or take over someone else’s, a robust business plan is necessary. When you develop a comprehensive business plan full of intention, clear thought processes, and fine details, you demonstrate your commitment to your practice, community, and discipline.

A solid business plan effectively positions you to prevent surprises that could completely derail your practice and reputation.

“ A solid business plan effectively positions you to prevent surprises that could completely derail your practice and reputation. ”

If you plan to seek investors or business partners for your practice, a thorough business plan demonstrates that you have both a vision and the empirical data and financial goals required to back it up. It also establishes and communicates the direction you intend to take your practice.

If you do not plan to seek outside investors, your medical practice business plan is still a key tool for the most important investor: you. Working through the 8 parts of a plan will help you evaluate the landscape, establish your foundation, and move forward with your practice.

That said, writing your business plan is not the same as establishing your budget. However, you will need to create a detailed budget so you can incorporate some of that information into your comprehensive business plan.

What is involved in developing a healthcare business plan?

As you develop your medical practice business plan, think of how you approach diagnosing a patient: a systematic process. While it may vary by practitioner, you typically:

- Get to know your patient

- Ask about symptoms and history

- Dig deeper into factors that are relevant to the current issue

- Collect data from tests

- Develop an initial diagnosis

- Seek additional counsel when appropriate

- Revisit the diagnosis if needed

- Discuss the findings and prognosis with your patient

- Schedule treatment and follow-up

The business plan creation process is similar.

Translating the process to your medical practice’s business plan

Getting to know your patient translates into defining your mission and vision. What do you want to accomplish? What is your role in your community?

Asking about symptoms and history will lead you to gather relevant documents, certifications, and professional memberships; research other local practitioners; and investigate why your practice’s focus is needed. Just as you need to know how the body’s systems fit together, you need to know how your practice will fit into the market.

Digging deeper into factors relevant to the current issue involves getting into the numbers. Evaluate:

- Your selected location

- Fee structure

- Insurance company partners, if any

- Target patient volume

- Staffing needs

- Services, whether legal, financial, or practice growth

- Equipment, medical, and office

- Maintenance and upkeep cost estimates

- Ongoing costs, including rent or property taxes

Collecting data requires gathering facts. Avoid using more lucrative or optimistic numbers. Build your plan based on conservative estimates to set your practice up for success. Determine what benchmarks to establish and measure success.

Develop an initial diagnosis by evaluating whether you’ve made inaccurate assumptions or missed key components. Revisit areas you need to and gather new information.

Seek additional counsel in this process. Your legal and financial advisors are an important resource as you create your plan, not just as you execute it. You may also consult your staff about parts of your plan in which they have expertise. Finally, partnering practitioners should agree with the plan’s approach and direction.

“ Your legal and financial advisors are an important resource as you create your plan, not just as you execute it. ”

Revisit the diagnosis. Consider the input and adjust your assumptions, numbers, and benchmarks.

Discuss the diagnosis and prognosis with your investor(s). In this step, share your completed business plan with the individual(s) with whom you are working.

Set a follow-up plan to evaluate your progress after certain periods of time.

How to build your medical practice business plan document

It’s one thing to theoretically know how to approach your medical practice business plan and another to sit down and create it. This 8-section outline will give you an idea of the crucial parts of your document.

Make a copy of this sample business plan template that you can customize and use for your practice.

1. Executive summary

In the executive summary, summarize your business model. Incorporate the information you developed while getting to know your practice.

Include an overview of information such as the practice location, services, target patient, local demographics overview, any relevant business history associated with the practice, and your mission and vision for your practice and its community impact. This is also where you will define any existing barriers to moving forward.

“ Your executive summary is an understanding and compelling argument for why the community needs your services. ”

Your executive summary is an understanding and compelling argument for why the community needs your services. It will highlight how you will fill a need that is not met in the current environment.

This is the section that will get you invited to the investor’s table, as it were. It is the bait on the hook of your argument.

Pro tip: Save the executive summary for last. Once you have the information from the other areas you will research and develop, it will quickly come together.

2. Detailed business model

Define your services and how you’ll manage prospects who fall within and outside those services. Specify your hours of operation. Define and describe your physical office space.

If you intend to offer telehealth , describe how. Define the number of staff you’ll employ, their roles, and how you plan to add staff as your practice grows. Detail the equipment you’ll use and why it’s essential.

Determine which vendors you’ll use for a variety of functions, including office cleaning; non-office hours emergency call management; office, medical, and exam equipment and furniture; office and medical supplies, software; marketing; and physical and digital security .

3. Comprehensive market research and positioning

Provide hard data on the demographics of your local geographic area and how they support your practice. For example, do enough people in your area need your services? What is the median income in the area, and how has that influenced your target fee structure?

“ Define your insurance partners, how their fee structures align with yours, and how competitive your proposed fees are. ”

Define your insurance partners , how their fee structures align with yours, and how competitive your proposed fees are.

Outline your local competition, the reasons you can be sure there is enough market availability for your new practice, and why your practice is positioned for success above your competition.

4. Detailed staffing model

Even if you plan to be the only provider in your practice, you will still need a plan to answer calls, file insurance claims, maintain files, manage billing , process payroll, and order supplies, among a host of other tasks to keep your practice running smoothly.

In this section of your medical practice business plan, list what positions you will fill and how many people you will need in each. Include compensation, along with any budgeted overtime, as well as benefits and tax considerations. Also, note when you will target hiring each throughout the year.

5. Projected 12-month income and budget

Show the math regarding how many patients you will serve for each service you will offer, your projected fee for each service, and your anticipated overhead expenses.

Your overhead will include items such as:

- Staffing expenses based on the total number of staff and projected salaries.

- All office-related expenses for equipment, supplies, maintenance, utilities, software, marketing, staff recruitment, and temporary services.

- Anticipated vendor expenses such as off-hours call service, telehealth subscriptions, lab processing fees, janitorial services, etc.

- Maintaining licensure, subscribing to professional journals, and attending conferences to stay current.

Make sure to account for one-time or short-term expenses, such as an extra administrative position to cover a known busy month, as well as for ongoing expenses.

6. Potential risks and mitigation

What risks can you anticipate as you open your practice? This is the section where you will think of worst-case scenarios and what you would do were they to become a reality.

Consider scenarios such as:

- A patient sues you. The United States is a very litigious society. What sort of malpractice insurance or bonds do you need to obtain?

- A staff member gets injured at work. In addition to the mandatory worker’s comp, how else would you support them? And what does your insurance cover?

- You get injured at work. How can you protect the longevity of your well-being and that of your practice?

- Another global pandemic hits. How will you staff and maintain patient treatment protocols, what specialized supplies will you need to purchase, what type of insurance rate hikes could you anticipate based on the last pandemic’s model, etc.

- A natural disaster hits. Depending on your geography, are you likely to experience a flood, fire, earthquake, tornado, hurricane, or blizzard? Are there emergency supplies you can keep on hand? Are there specific ways you can shore up your facility to make it more stable — and when would you make those changes? What specialized insurance do you need to purchase?

Talk to a seasoned physician who can provide some mentorship. Ask what they’ve faced during their years of practice and what you need to know to be prepared. Then take that information into meetings with your lawyer and insurance broker.

7. Implementation plan

In your project implementation plan, outline the steps you need to take to open your practice, what milestones you will hit, and an associated date for each major and sub-task. Whether you use formal project management software or create a project plan in a spreadsheet or other document, include that detailed information in this section.

8. Exit strategy

You’re just opening or growing your practice — why would you plan to leave it? Plans change, retirement becomes attractive, large conglomerates buy smaller practices, or a host of other scenarios could happen.

“ Just as you worked through the risks section, there is value in thinking ahead to determine your plan when you are ready for something different. ”

Just as you worked through the risks section, there is value in thinking ahead to determine your plan when you are ready for something different. Will you sell your practice? How will you transition your patients? What will happen with valuable equipment and supplies?

Identifying these items and addressing what you feel will be the best way to step away from what you are currently creating will make the process more manageable later.

How detailed is an effective business plan?

You know what process to use and the broad sections to include in your business plan, but how detailed should you get?

While you don’t want your business plan development goal to be a target length, a solid business plan typically ends up being somewhere between 30 to 40 pages. This information will include graphs and charts that demonstrate your demographic research, specific equipment needs for positive community impact, budget numbers, etc.

Your business summary and exit strategy sections should not exceed 20% of your overall business plan. Both will provide a high-level overview; neither is the section where you will get into excruciating details.

However, the other 6 sections of your business plan will get into the fine details. Each section should provide narrative information as well as specific numbers that are itemized by topic and category.

Keep your business plan alive

Even though your medical practice business plan can provide information for potential investors, partners, and financiers, it is ultimately the mirror of what you want your business to become. This should be a living document you update and change as your priorities and focus evolve.

“ As you move forward and grow your practice, set yourself up for a larger vision. ”

As you move forward and grow your practice, set yourself up for a larger vision. Adding 3- and 5-year projections to your 12-month business plan will help refine your sense of your purpose and direction.

By creating a medical practice business plan, you create confidence in not only your ability to attract patients, but also your ability to run the business that serves them long term.

Further Reading

You Might Also Be Interested In

Optimize your independent practice for growth. Get actionable strategies to create a superior patient experience, retain patients, and support your staff while growing your medical practice sustainably and profitably.

Subscribe to The Intake: A weekly check-up for your independent practice

Karmin Gentili

Karmin Gentili has been a freelance writer and editor since 2016. She has over 25 years of experience in corporate HR and compliance consulting. She has worked to further elevate her skills by pursuing and receiving multiple certifications, including copywriting, video scriptwriting, effective content positioning, case study writing, and SEO. Her love of writing motivates her to use those skills to develop content for the medical field that ensures others can work toward achieving their goals.

Reviewed by

Lauren Wheeler, BCPA, MD

Dr. Lauren Wheeler, MD, BCPA, is a former family medicine physician who currently works as an independent healthcare advocate as well as a medical editor and writer. You can get in touch with her about anything writing or advocacy at her website www.lostcoastadvocacy.com .

Suggested for you

Licenses you need to start your own medical practice

Strategic tips for naming your healthcare practice

How choosing a location for your medical office can ensure practice growth

What to know about insurance credentialing when starting your own practice

Get expert tips, guides, and valuable insights for your healthcare practice, subscribe to the intake.

A weekly check-up for your independent practice — right in your inbox

How to Write a Business Plan for a General Practice

- January 3, 2023

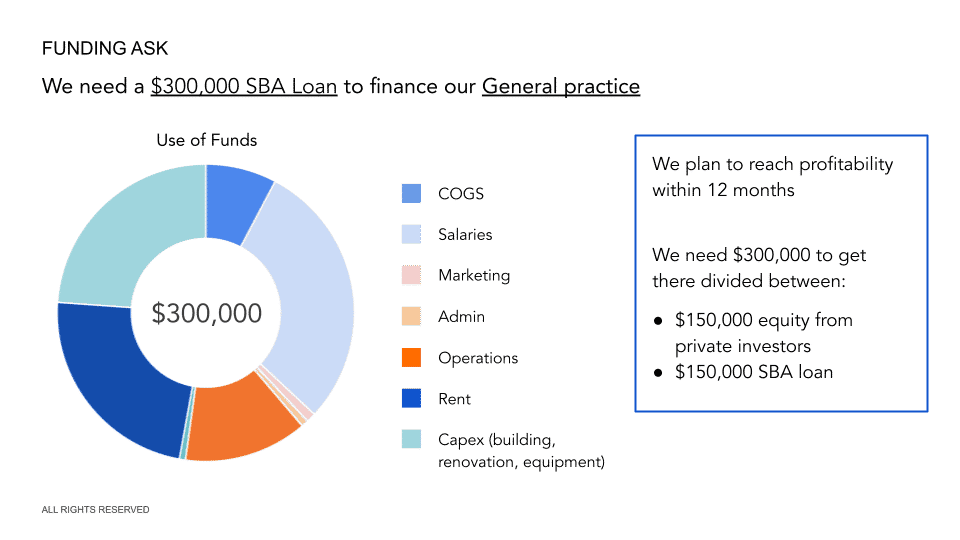

Whether you’re looking to raise funding from private investors or to get a loan from a bank (like a SBA loan) for your general practice, you will first need to prepare a solid business plan.

In this article we go through, step-by-step, all the different sections you need in the business plan of your general practice . Use this template to create a complete, clear and solid business plan that get you funded.

1. Executive Summary

The executive summary of a business plan gives a sneak peek of the information about your business plan to lenders and/or investors.

Though the executive summary is the first and the most important section, it should normally be the last section you write as it’s the summary of your business plan.

Why do you need a business plan for a general practice?

The purpose of a business plan is to secure funding through one of the following channels:

- Obtain bank financing or secure a loan from other lenders (such as a SBA loan )

- Obtain private investments from investment funds, angel investors, etc.

- Obtain a public or a private grant

How to write your general practice’s executive summary?

Provide a precise and high-level summary of every section that you have included in the business plan of your general practice. The information and the data you include in this segment should grab the attention of potential investors and lenders immediately.

Also make sure that the executive summary doesn’t exceed 2 pages in total: it’s supposed to be a summary for investors and lenders who don’t have time to scroll through 40-50 pages, so keep it short and brief.

The executive summary usually consists of 5 major sub-sections:

- Business overview : introduce the general practice that you want to open and mention the type of patients you will accept. Provide a brief of the pricing structure and facility capacity (that is, the number of patients you can accommodate at once) so that lenders can understand the scale of your business.

- Market overview : summarise the market where you will operate and provide a brief about your target audience , the total market size , competitors, etc.

- Management & people : hiring goes beyond the medical staff for a general practice. Indeed, if you open a private practice, you may also need a receptionist and other support staff. And if you are partnering with other doctors to form a joint partnership, mention every partner’s role in the setup as well as their experience

- Financial plan : how much profit and revenue do you expect in the next 5 years? When will you reach the break-even point and start making profits? You can include here a chart with your key financials (revenue, gross profit, net profit )

- Funding ask : what loan/investment/grant are you seeking? How much do you need? How long will this last?

General Practice Financial Model

Download an expert-built 5-year Excel financial model for your business plan

2. Business Overview

Here you must clarify the business model that you want to adopt for your general practice. Some of the important questions that you must address include:

- What’s the general practice’s location and why did you select that location?

- Will you start an independent practice or partner with an existing general practice?

- Will you specialise in a few medicine (OB, PEDs, Surgery, Adult Medicine, etc.)?

Let’s look at different subsections that you must include:

a) Business Model

This is where you need to explain the business model you want to adopt. Some of the common models that you can choose from include:

- Single Ownership (or Sole Proprietorship) : this format requires a single personal tax return, allowing for easy operation and maintenance of the business.

- Single Owner Professional Corporation : you may decide to incorporate your general practice clinic. The benefits include lower tax rates, faster debt clearance, etc.

- Joint Ownership : you partner with another general physician to start a general practice. This will require you and your partner to have the same goal. Joint ownership reduces startup costs and distributes administrative responsibilities. Two physicians can collectively attend to more patients and proportionately distribute the revenue.

- Cost Sharing : two physicians only share a few expenses, but they maintain their independence. Some expenses that they usually share include administrative costs, equipment costs, rent, utilities, etc.

b) Pricing Strategy

In this segment, you will need to provide your pricing strategy . Indeed, the prices will vary depending on the services that you are offering.

The golden rule is to maintain a pricing strategy that is aligned with the other general practices in the area.

Generally, the average price for primary care is $25 on average for people with insurance and $107 on average for people without insurance.

Also, clearly mention the insurance companies you will work with. Providing your pricing strategy will provide a fair idea to lenders and investors of your target audience (patients) which they will also tie into your financial projections later on.

c) Legal Structure

Finally, your business overview section should specify what type of business structure you want.

- Is this a corporation or a partnership (LLC)?

- Who are the investors?

- How much equity percentage do they own?

- Is there a Board of Directors? If so, whom? Do they have experience in the industry?

3. Market Overview

Before you start a business, you must get a clear understanding of the market. This knowledge helps to understand the viability of the business and the marketing strategies required to compete with other players.

You must cover 3 important areas in the market overview or market analysis section of your business plan:

- Industry Size & Growth : how big is the primary care or general practice industry in your area? What is its growth rate (or decline rate) and what are the factors contributing to its growth or decline?

- Competitive Landscape : how many competitors are there? How do they compare vs. your business? How can you differentiate yourself from them?

- Patients Overview: who is your target audience? What type of healthcare services do they need the most? What percentage of the target population has insurance?

a) Industry Size & Growth

How big is the primary care industry in the us.

The primary care market in the US was worth $266 billion in 2022 , and is estimated to grow to $342 billion in 2030 (3.2% CAGR).

There are over 140,600 general practice s in the US in 2022. This number increased by 1.1% CAGR from 2017 to 2022.

How big is the Primary Care industry in your area?

Once you provide the overall picture of the US, divert your attention to the area where you want to operate. It might not be possible to find region or area-specific studies, and hence, you must estimate the size. Read our article on how to estimate TAM, SAM and SOM for your business.

For example, we know there are 140,600 general practices in the country with total annual revenue of $266 billion in 2022: that’s an average annual revenue of $1.9 million per general practice .

Therefore, if the area where you want to open your general practice has already 10 competitors, you can safely assume that the primary care industry in your area is worth approximately $19 million.

b) Competitive Landscape

Studying your competitors’ business models is vital. You need to understand what makes them successful or why they fail. A clear understanding of their area of specialization, service offerings, marketing strategies, etc., will allow you to provide a better service.

You must perform proper research (of course, you will have a clear idea of the type of services a general physician can offer depending on specialization) so you can create a competitive chart summarizing their business model, services offered, pricing, etc.

Here is a sample table that you can use:

The table you will create will depend on what information you need and want to include based on your proposed business model.

General Practice SWOT Analysis

Try to provide a SWOT analysis . Here is a sample that you can use as a reference:

- Strengths : 5 years of experience as a GP in a reputed hospital

- Weaknesses : Startup cost, zero reputation

- Opportunities : High percentage of families with children, ageing population in the area

- Threats : 2 big hospitals in the vicinity that offer the same services

A clear understanding of your strengths and weakness along with opportunities and threats in the real market can help you to design your marketing strategy . It also helps potential investors to assess the risk and reward profile of your general practice.

c) Patients Overview

This is the section of your business plan where you should provide a detailed analysis of your target audience.

Some important points that you must include in your customer analysis include:

- Age and gender distribution (you can get local demographic data from census.gov )

- Per capita expenditure on primary healthcare

- Frequency of primary care clinic visits

- Average monthly income and disposable income

- Percentage of insured people vs uninsured people

If possible, include certain additional data points such as climate (that can cause seasonal recurrence of certain health issues) and eating habits (that can be responsible for things like diabetes, obesity, etc.).

4. Sales & Marketing

This section of your general practice business plan summarizes your strategy for acquiring and retaining new patients.

So, here are a few questions to help you stand out when shaping your marketing strategy:

- What are the different marketing strategies you will use?

- How do you intend to track the success of your marketing strategy?

- What is your customer acquisition cost (CAC)?

- What is your marketing budget?

- What are your Unique Selling Points (USPs)?

What marketing channels do general practices typically use?

A few marketing channels used by general practices include;

- Signage (especially if you’re close to a busy street)

- Word-of-mouth, recommendations

- Online local listing (Google Business)

- PPC ads, Facebook ads, etc.

- Email, SMS marketing (to remind existing customers of regular checkups for example)

- Content marketing on social media and blogs

5. Management & People

You must address two things here:

- The management team and their experience/track record

- The organization structure : different team members and who reports to whom?

Small businesses often fail because of managerial weaknesses. Thus, having a strong management team is vital. Highlight the experience and education of other general physicians (partners or not).

No need to provide extra details for general administrative staff such as receptionists, assistants, accountants, etc.

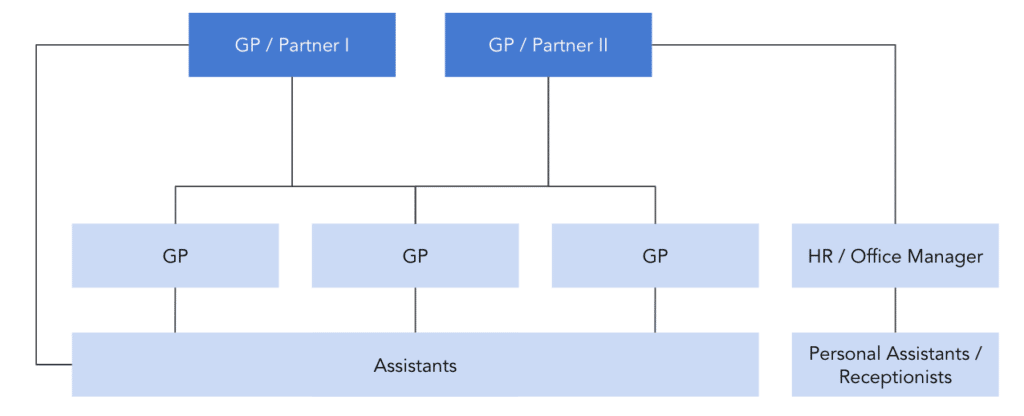

Organization Structure

Even if you haven’t already hired any other GPs, nurses, assistants, accountants, receptionists, and other relevant staff, you must provide a chart of the organization structure defining the hierarchy of reporting as shown below.

6. Financial Plan

The financial plan is perhaps, with the executive summary, the most important section of any business plan for a general practice.

Indeed, a solid financial plan tells lenders that your business is viable and can repay the loan you need from them. If you’re looking to raise equity from private investors, a solid financial plan will prove them your general practice is an attractive investment.

There should be 2 sections to your financial plan section: