- PRO Courses Guides New Tech Help Pro Expert Videos About wikiHow Pro Upgrade Sign In

- EDIT Edit this Article

- EXPLORE Tech Help Pro About Us Random Article Quizzes Request a New Article Community Dashboard This Or That Game Popular Categories Arts and Entertainment Artwork Books Movies Computers and Electronics Computers Phone Skills Technology Hacks Health Men's Health Mental Health Women's Health Relationships Dating Love Relationship Issues Hobbies and Crafts Crafts Drawing Games Education & Communication Communication Skills Personal Development Studying Personal Care and Style Fashion Hair Care Personal Hygiene Youth Personal Care School Stuff Dating All Categories Arts and Entertainment Finance and Business Home and Garden Relationship Quizzes Cars & Other Vehicles Food and Entertaining Personal Care and Style Sports and Fitness Computers and Electronics Health Pets and Animals Travel Education & Communication Hobbies and Crafts Philosophy and Religion Work World Family Life Holidays and Traditions Relationships Youth

- Browse Articles

- Learn Something New

- Quizzes Hot

- This Or That Game

- Train Your Brain

- Explore More

- Support wikiHow

- About wikiHow

- Log in / Sign up

- Education and Communications

- Journal Writing

How to Write a Journal Entry

Last Updated: February 21, 2024 Fact Checked

This article was co-authored by Nicolette Tura, MA and by wikiHow staff writer, Danielle Blinka, MA, MPA . Nicolette Tura is an Empowerment Expert based in the San Francisco Bay Area. She holds a decade of experience creating change in various non-profits then went on to operate her own wellness business for 10 years. Most recently, she worked as a Therapy Associate to a chiropractic neurologist for 15 months working hands-on with patients, helping them heal from neurological disorders like concussions, long covid, migraines, and more. Nicolette guides groups and individuals on transformative meditation journeys and game-changing mindset management workshops and retreats on empowering everyone to keep expanding beyond past conditioning and self-limiting beliefs. Nicolette is a 500-hour Registered Yoga Teacher with a Psychology & Mindfulness Major, a NASM certified Corrective Exercise Specialist, and an expert in psychophysiology with experience in nervous system regulation and breath work. She holds a BA in Sociology from the University of California, Berkeley, and a Master’s degree is Sociology from San Jose State University There are 16 references cited in this article, which can be found at the bottom of the page. This article has been fact-checked, ensuring the accuracy of any cited facts and confirming the authority of its sources. This article has been viewed 2,865,433 times.

Keeping a journal allows you to record what’s happening in your life and to work through your thoughts and feelings. Sometimes, you might write a journal for school to help you deepen your understanding of what you’re studying. Fortunately, writing a journal entry is a simple process. First, choose a topic to write about, like what's happening in your life. Then, write an opening for your entry and express your thoughts.

Choosing a Topic

- This is a great way to help you document things you want to remember.

- For instance, you might write about something funny that happened at lunch, scoring the winning goal in a soccer game, or a fight you had with your friend. The events can be positive or negative.

- Let’s say you’re feeling sad because you’re going through a breakup. You could write about how you feel and what you’ll miss about the relationship. This will help you release your feelings so you can start to feel better .

- Write about what you’d like to do this weekend.

- Discuss a place you’d like to visit.

- Pretend that you found a fantasy creature.

- Write about something you want to change.

- Write from the perspective of your favourite book or movie character.

- A summary of a reading or lecture.

- Your analysis of the course material.

- Connections between topics you’ve studied.

- Personal connections you made with the coursework.

- Questions you have about the text or lecture.

Tip: Keep a journal for school focused on studying and analyzing your course material. For instance, you might summarize your coursework, record your reflections on it, and write down questions you have. Leave out how you feel about what you’re reading or studying.

Opening Your Journal Entry

- Your instructor has assigned journaling to help you deepen your understanding of your coursework and to improve your writing skills . Following their instructions will help you best achieve these goals.

- For instance, you might write, “July 24, 2019,” “07-24-19,” or “24 July 2019.”

- For instance, you might write “Good Beans Coffee House,” “School,” “Paris,” or “My bedroom” for your location. For the time, you could write the actual time, such as “12:25 p.m.,” or the time of day, like “Early morning.”

Tip: You usually don’t include a salutation when you’re writing a journal for school.

Expressing Yourself in a Personal Journal

- If mistakes really bother you, it’s okay to go back and correct them after you finish writing your journal entry.

- Turn a memory into a story.

- Record what you dreamed last night.

- Write a list, such as what you did that day or what you’re grateful for.

- Doodle or paste pictures into your journal.

- Record song lyrics or quotes that mean something to you.

- Write your own lyrics or a poem.

- Write in stream of consciousness.

- For instance, you’d write, “I went to lunch with Sari today,” not “Amy had lunch with Sari today.”

- For instance, let’s say you’re on vacation at the beach. You might include details like, “sea spray hitting my face,” “the smell of burning wood from bonfires on the beach,” “the taste of salt on my lips,” “the sun glinting off the surface of the water,” and “the shouts from other beach goers having fun.”

- With journaling, it’s more important to write often than to write a lot.

Drafting an Academic Journal Entry

- If you’re telling a story, try to follow a narrative structure to give it a beginning, middle, and end.

- Read over your journal entry before your submit it to check that it makes sense.

- For handwritten journals, your instructor may require that you simply fill up a page. Make sure you know the exact requirements so you can do your assignment correctly.

- If you’re struggling to think of something to write, make a mind map about the topic to help you brainstorm some new ideas.

- If you’re struggling with your grammar, visit your school’s writing center or ask your instructor about tutoring options. Additionally, you can find online programs that help you with grammar.

- This is especially important if you’re keeping your journal as a graded assignment.

- If you’re typing your journal entries in an online portal, there may be a spellcheck tool you can use. However, you should still proofread the entry to look for other errors.

Journal Entry Template

Community Q&A

- It’s best to write regularly so that journaling becomes a habit. To help you remember, write in your journal at the same time everyday. [19] X Research source Thanks Helpful 2 Not Helpful 0

- You can write about anything you want, so don’t feel like you can only write about how you feel. You might instead prefer to write about your daily accomplishments or what you enjoyed that day. Thanks Helpful 25 Not Helpful 4

- While you can use a paper journal, there are journaling apps and websites you can try. Additionally, it’s okay to use a word processor like Google Docs or Microsoft Word for journaling. Thanks Helpful 16 Not Helpful 8

- Since your journal is private, prevent people from reading it by keeping it in a safe place. If it’s a digital journal, you might even password protect it. Thanks Helpful 26 Not Helpful 3

You Might Also Like

- ↑ https://libguides.usc.edu/writingguide/title

- ↑ Nicolette Tura, MA. Empowerment Expert. Expert Interview. 23 January 2020.

- ↑ https://positivepsychology.com/benefits-of-journaling/

- ↑ https://www.readingrockets.org/article/journal-writing

- ↑ https://www.hamilton.edu/academics/centers/writing/writing-resources/journal-writing

- ↑ https://writing.wisc.edu/handbook/assignments/writing-an-abstract-for-your-research-paper/

- ↑ https://www.niu.edu/citl/resources/guides/instructional-guide/reflective-journals-and-learning-logs.shtml

- ↑ https://psychcentral.com/blog/ready-set-journal-64-journaling-prompts-for-self-discovery

- ↑ https://psychcentral.com/lib/the-health-benefits-of-journaling

- ↑ https://www.bates.edu/biology/files/2010/06/How-to-Write-Guide-v10-2014.pdf

- ↑ https://files.eric.ed.gov/fulltext/EJ1081806.pdf

- ↑ https://writing.wisc.edu/handbook/style/connectingideas/

- ↑ https://positivepsychology.com/writing-therapy/

- ↑ https://apastyle.apa.org/style-grammar-guidelines/capitalization

- ↑ https://libguides.usc.edu/writingguide/proofreading

- ↑ https://www.psychologytoday.com/us/blog/modern-minds/202301/10-good-reasons-to-keep-a-journal

About This Article

To write a journal entry, first find a quiet, comfortable spot where you won’t be disturbed. Take a moment to brainstorm what you want to write about. You can journal about anything, like your day, your dreams, work, school, friends, or an upcoming project. If you’re not sure, choose a writing prompt for your entry, like “What was your earliest childhood memory?” or “What is your biggest secret?” Open to a new page in your journal and write the date at the top. Then, start writing. Let your thoughts flow and don’t edit yourself. Write whatever comes to mind. It’s okay to be honest since nobody else will be reading what you write. Draw pictures if specific images come to mind while you’re writing. Try to journal for somewhere between 5 and 20 minutes every day. The more you journal, the easier it will become! Keep reading to learn how to write a journal entry for school! Did this summary help you? Yes No

- Send fan mail to authors

Reader Success Stories

Sep 1, 2017

Did this article help you?

Enolisa Tigga

Sep 8, 2016

Nesma Mansour

Apr 9, 2016

Jun 23, 2017

Apr 25, 2017

Featured Articles

Trending Articles

Watch Articles

- Terms of Use

- Privacy Policy

- Do Not Sell or Share My Info

- Not Selling Info

wikiHow Tech Help Pro:

Develop the tech skills you need for work and life

Want to create or adapt books like this? Learn more about how Pressbooks supports open publishing practices.

4.4 Preparing Journal Entries

Learning objectives.

At the end of this section, students should be able to meet the following objectives:

- Describe the purpose and structure of a journal entry.

- Identify the purpose of a journal.

- Define “trial balance” and indicate the source of its monetary balances.

- Prepare journal entries to record the effect of acquiring inventory, paying salary, borrowing money, and selling merchandise.

- Define “accrual accounting” and list its two components.

- Explain the purpose of the revenue realization principle.

- Explain the purpose of the matching principle.

Question : In an accounting system , the impact of each transaction is analyzed and must then be recorded . Debits and credits are used for this purpose . How does the actual recording of a transaction take place?

Answer: The effects produced on the various accounts by a transaction should be entered into the accounting system as quickly as possible so that information is not lost and mistakes have less time to occur. After analyzing each event, the financial changes caused by a transaction are initially recorded as a journal entry . A list of all recorded journal entries is maintained in a journal (also referred to as a general journal ), which is one of the most important components within any accounting system. The journal is the diary of the company: the history of the impact of the financial events as they took place.

A journal entry is no more than an indication of the accounts and balances that were changed by a transaction.

Question : Debit and credit rules are best learned through practice . In order to grasp the use of debits and credits , how should the needed practice begin?

Answer: When faced with debits and credits, everyone has to practice at first. That is normal and to be expected. These rules can be learned quickly but only by investing a bit of effort. Earlier in this chapter, a number of transactions were analyzed to determine their impact on account balances. Assume now that these same transactions are to be recorded as journal entries. To provide a bit more information for this illustration, the reporting company will be a small farm supply store known as the Lawndale Company that is located in a rural area. For convenience, assume that the company incurs these transactions during the final few days of Year One, just prior to preparing financial statements.

Assume further that this company already has the account balances presented in Figure 4.3 “Balances Taken From T-accounts in Ledger” in its T-accounts before making this last group of journal entries. Note that the total of all the debit and credit balances do agree ($54,300) and that every account shows a positive balance. In other words, the figure being reported is either a debit or credit based on what makes that particular type of account increase. Few T-accounts contain negative balances.

This current listing of accounts is commonly referred to as a trial balance . Since T-accounts are kept together in a ledger (or general ledger), a trial balance reports the individual balances for each T-account maintained in the company’s ledger.

Figure 4.3 Balances Taken From T-accounts in Ledger

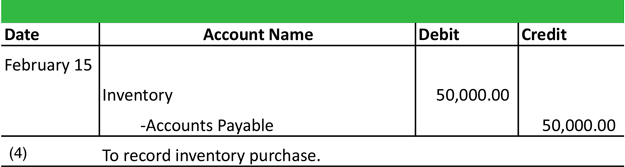

Question : Assume that after the above balances were determined , several additional transactions took place . The first transaction analyzed at the start of this chapter was the purchase of inventory on credit for $2,000 . This acquisition increases the record of the amount of inventory being held while also raising one of the company’s liabilities , accounts payable . How is the acquisition of inventory on credit recorded in the form of a journal entry?

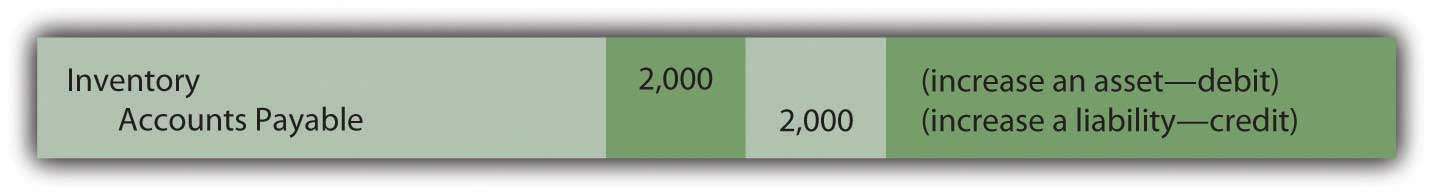

Answer: Following the transactional analysis, a journal entry is prepared to record the impact that the event has on the Lawndale Company. Inventory is an asset that always uses a debit to note an increase. Accounts payable is a liability so that a credit indicates that an increase has occurred. Thus, the following journal entry is appropriate 2 .

Figure 4.4 Journal Entry 1: Inventory Acquired on Credit

Notice that the word “inventory” is physically on the left of the journal entry and the words “accounts payable” are indented to the right. This positioning clearly shows which account is debited and which is credited. In the same way, the $2,000 numerical amount added to the inventory total appears on the left (debit) side whereas the $2,000 change in accounts payable is clearly on the right (credit) side.

Preparing journal entries is obviously a mechanical process but one that is fundamental to the gathering of information for financial reporting purposes. Any person familiar with accounting procedures could easily “read” the above entry: based on the debit and credit, both inventory and accounts payable have gone up so a purchase of merchandise for $2,000 on credit is indicated. Interestingly, with translation of the words, a Venetian merchant from the later part of the fifteenth century would be capable of understanding the information captured by this journal entry even if prepared by a modern company as large as Xerox or Kellogg.

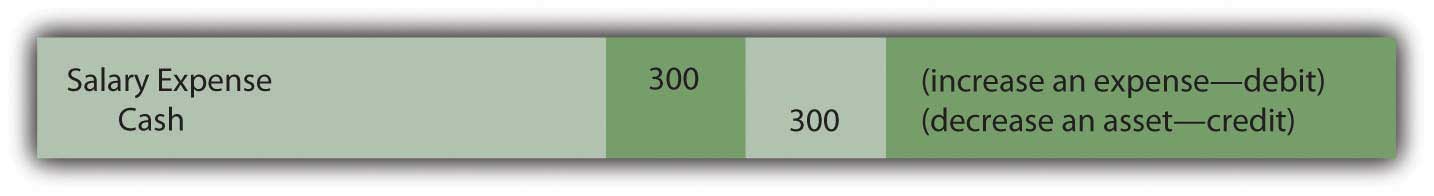

Question : As a second example , the Lawndale Company pays its employees their regular salary of $300 for work performed during the past week . If no entry has been recorded previously , what journal entry is appropriate when a salary payment is made?

Answer: Because no entry has yet been made, neither the $300 salary expense nor the related salary payable already exists in the accounting records. Apparently, the $1,000 salary expense appearing in the above trial balance reflects earlier payments made during the period by the company to its employees.

Payment is made here for past work so this cost represents an expense rather than an asset. Thus, the balance recorded as salary expense goes up by this amount while cash decreases. Increasing an expense is always shown by means of a debit; decreasing an asset is reflected through a credit.

Figure 4.5 Journal Entry 2: Salary Paid to Employees

In practice, the date of each transaction could also be included here. For illustration purposes, this extra information is not necessary.

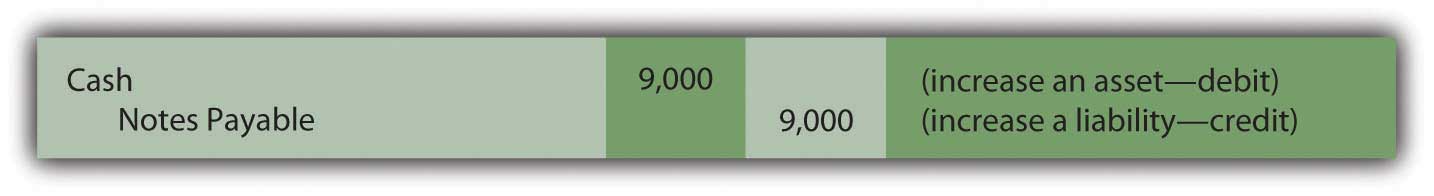

Question : Assume $9,000 is borrowed from a local bank when officials sign a new note payable that will have to be repaid in several years . What journal entry is prepared by a company’s accountant to reflect the inflow of cash received from a loan?

Answer: As always, recording begins with an analysis of the transaction. Here, cash increases as the result of the incurred debt (notes payable). Cash—an asset—increases $9,000, which is shown as a debit. The company’s notes payable balance also goes up by the same amount. As a liability, the increase is recorded through a credit. By using debits and credits in this way, the financial effects are entered into the accounting records.

Figure 4.6 Journal Entry 3: Money Borrowed from Bank

Link to multiple-choice question for practice purposes: http://www.quia.com/quiz/2092610.html

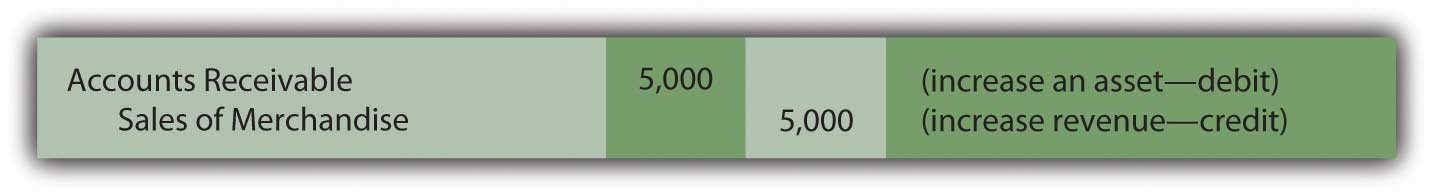

Question : In Transaction 1 , inventory was bought for $2,000 . That entry is recorded above . Assume now that these goods are sold for $5,000 to a customer on credit . How is the sale of merchandise on account recorded in journal entry form?

Answer: As discussed previously, two events really happen when inventory is sold. First, the sale is made and, second, the customer takes possession of the merchandise from the company. Assuming again that a perpetual inventory system is in use, both the sale and the related expense are recorded immediately. In the initial part of the transaction, the accounts receivable balance goes up $5,000 because the money from the customer will not be collected until a later date. The increase in this asset is shown by means of a debit. The new receivable resulted from a sale. Revenue is also recorded (by a credit) to indicate the cause of that effect.

Figure 4.7 Journal Entry 4A: Sale Made on Account

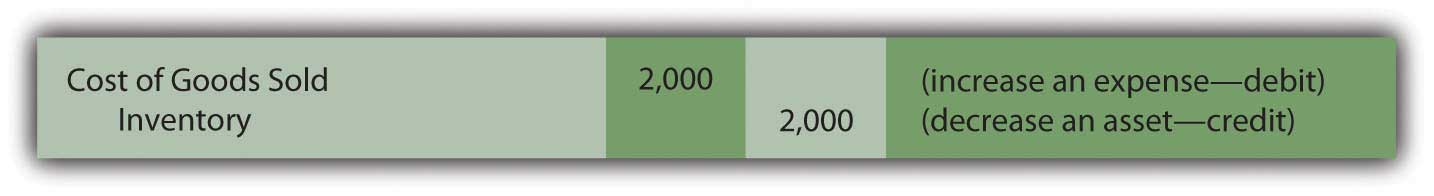

At the same time, inventory costing $2,000 is surrendered by the company. The reduction of any asset is recorded through a credit. The expense resulting from the asset outflow has been identified previously as “cost of goods sold.” Like any expense, it is entered into the accounting system through a debit.

Figure 4.8 Journal Entry 4B: Merchandise Acquired by Customers

Question : In the above transaction , the Lawndale Company made a sale but the cash will not be collected until some later date . Why is revenue reported at the time of sale rather than when the cash is eventually collected? Accounting is conservative . Thus , delaying recognition of sales revenue (and the resulting increase in net income) until the $5,000 is physically received might have been expected .

Answer: This question reflects a common misconception about the information conveyed through financial statements. As shown above in Journal Entry 4A, recognition of revenue is not tied directly to the receipt of cash. One of the most important elements comprising the structure of U.S. GAAP is accrual accounting , which serves as the basis for timing the reporting of revenues and expenses. Because of the direct impact on net income, such recognition issues are among the most complicated and controversial in accounting. The accountant must always determine the appropriate point in time for reporting each revenue and expense. Accrual accounting provides standard guidance (in the United States and throughout much of the world).

Accrual accounting is really made up of two distinct components. The revenue realization principle provides authoritative direction as to the proper timing for the recognition of revenue. The matching principle establishes guidelines for the reporting of expenses. These two principles have been utilized for decades in the application of U.S. GAAP. Their importance within financial accounting can hardly be overstated.

Revenue realization principle . Revenue is properly recognized at the point that (1) the earning process needed to generate the revenue is substantially complete and (2) the amount eventually to be received can be reasonably estimated. As the study of financial accounting progresses into more complex situations, both of these criteria will require careful analysis and understanding.

Matching principle . Expenses are recognized in the same time period as the revenue they help create. Thus, if specific revenue is to be recognized in the year 2019, any associated costs should be reported as expenses in that same time period. Expenses are matched with revenues. However, when a cost cannot be tied directly to identifiable revenue, matching is not possible. In those cases, the expense is recognized in the most logical time period, in some systematic fashion, or as incurred—depending on the situation.

For the revenue reported in Journal Entry 4A, assuming that the Lawndale Company has substantially completed the work required of this sale and $5,000 is a reasonable estimate of the amount that will be collected, recognition at the time of sale is appropriate. Because the revenue is recognized at that moment, the related expense (cost of goods sold) should also be recorded as can be seen in Journal Entry 4B.

Accrual accounting provides an excellent example of how U.S. GAAP guides the reporting process in order to produce fairly presented financial statements that can be understood by all decision makers around the world.

Link to multiple-choice question for practice purposes: http://www.quia.com/quiz/2092642.html

Key Takeaway

After the financial effects are analyzed, the impact of each transaction is recorded within a company’s accounting system through a journal entry. The purchase of inventory, payment of a salary, and borrowing of money are all typical transactions that are recorded by means of debits and credits. All journal entries are maintained within the company’s journal. The timing of this recognition is especially important in connection with revenues and expenses. Accrual accounting provides formal guidance within U.S. GAAP. Revenues are recognized when the earning process is substantially complete and the amount to be collected can be reasonably estimated. Expenses are recognized based on the matching principle, which holds that they should be reported in the same period as the revenue they help generate.

1 In larger organizations, similar transactions are often grouped, summed, and recorded together for efficiency. For example, all cash sales at one store might be totaled automatically and recorded at one time at the end of each day. To help focus on the mechanics of the accounting process, the journal entries recorded for the transactions in this textbook will be prepared individually.

2 The parenthetical information is included here only for clarification purposes and does not appear in a true journal entry.

Financial Accounting Copyright © 2015 by University of Minnesota is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License , except where otherwise noted.

3.5 Use Journal Entries to Record Transactions and Post to T-Accounts

When we introduced debits and credits, you learned about the usefulness of T-accounts as a graphic representation of any account in the general ledger. But before transactions are posted to the T-accounts, they are first recorded using special forms known as journals .

Accountants use special forms called journals to keep track of their business transactions. A journal is the first place information is entered into the accounting system. A journal is often referred to as the book of original entry because it is the place the information originally enters into the system. A journal keeps a historical account of all recordable transactions with which the company has engaged. In other words, a journal is similar to a diary for a business. When you enter information into a journal, we say you are journalizing the entry. Journaling the entry is the second step in the accounting cycle. Here is a picture of a journal.

You can see that a journal has columns labeled debit and credit. The debit is on the left side, and the credit is on the right. Let’s look at how we use a journal.

When filling in a journal, there are some rules you need to follow to improve journal entry organization.

Formatting When Recording Journal Entries

- Include a date of when the transaction occurred.

- The debit account title(s) always come first and on the left.

- The credit account title(s) always come after all debit titles are entered, and on the right.

- The titles of the credit accounts will be indented below the debit accounts.

- You will have at least one debit (possibly more).

- You will always have at least one credit (possibly more).

- The dollar value of the debits must equal the dollar value of the credits or else the equation will go out of balance.

- You will write a short description after each journal entry.

- Skip a space after the description before starting the next journal entry.

An example journal entry format is as follows. It is not taken from previous examples but is intended to stand alone.

Note that this example has only one debit account and one credit account, which is considered a simple entry . A compound entry is when there is more than one account listed under the debit and/or credit column of a journal entry (as seen in the following).

Notice that for this entry, the rules for recording journal entries have been followed. There is a date of April 1, 2018, the debit account titles are listed first with Cash and Supplies, the credit account title of Common Stock is indented after the debit account titles, there are at least one debit and one credit, the debit amounts equal the credit amount, and there is a short description of the transaction.

Let’s now look at a few transactions from Printing Plus and record their journal entries.

Recording Transactions

We now return to our company example of Printing Plus, Lynn Sanders’ printing service company. We will analyze and record each of the transactions for her business and discuss how this impacts the financial statements. Some of the listed transactions have been ones we have seen throughout this chapter. More detail for each of these transactions is provided, along with a few new transactions.

- On January 3, 2019, issues $20,000 shares of common stock for cash.

- On January 5, 2019, purchases equipment on account for $3,500, payment due within the month.

- On January 9, 2019, receives $4,000 cash in advance from a customer for services not yet rendered.

- On January 10, 2019, provides $5,500 in services to a customer who asks to be billed for the services.

- On January 12, 2019, pays a $300 utility bill with cash.

- On January 14, 2019, distributed $100 cash in dividends to stockholders.

- On January 17, 2019, receives $2,800 cash from a customer for services rendered.

- On January 18, 2019, paid in full, with cash, for the equipment purchase on January 5.

- On January 20, 2019, paid $3,600 cash in salaries expense to employees.

- On January 23, 2019, received cash payment in full from the customer on the January 10 transaction.

- On January 27, 2019, provides $1,200 in services to a customer who asks to be billed for the services.

- On January 30, 2019, purchases supplies on account for $500, payment due within three months.

Transaction 1: On January 3, 2019, issues $20,000 shares of common stock for cash.

- This is a transaction that needs to be recorded, as Printing Plus has received money, and the stockholders have invested in the firm.

- Printing Plus now has more cash. Cash is an asset, which in this case is increasing. Cash increases on the debit side.

- When the company issues stock, stockholders purchase common stock, yielding a higher common stock figure than before issuance. The common stock account is increasing and affects equity. Looking at the expanded accounting equation, we see that Common Stock increases on the credit side.

Impact on the financial statements: Both of these accounts are balance sheet accounts. You will see total assets increase and total stockholders’ equity will also increase, both by $20,000. With both totals increasing by $20,000, the accounting equation, and therefore our balance sheet, will be in balance. There is no effect on the income statement from this transaction as there were no revenues or expenses recorded.

Transaction 2: On January 5, 2019, purchases equipment on account for $3,500, payment due within the month.

- In this case, equipment is an asset that is increasing. It increases because Printing Plus now has more equipment than it did before. Assets increase on the debit side; therefore, the Equipment account would show a $3,500 debit.

- The company did not pay for the equipment immediately. Lynn asked to be sent a bill for payment at a future date. This creates a liability for Printing Plus, who owes the supplier money for the equipment. Accounts Payable is used to recognize this liability. This liability is increasing, as the company now owes money to the supplier. A liability account increases on the credit side; therefore, Accounts Payable will increase on the credit side in the amount of $3,500.

Impact on the financial statements: Since both accounts in the entry are balance sheet accounts, you will see no effect on the income statement.

Transaction 3: On January 9, 2019, receives $4,000 cash in advance from a customer for services not yet rendered.

- Cash was received, thus increasing the Cash account. Cash is an asset that increases on the debit side.

- Printing Plus has not yet provided the service, meaning it cannot recognize the revenue as earned. The company has a liability to the customer until it provides the service. The Unearned Revenue account would be used to recognize this liability. This is a liability the company did not have before, thus increasing this account. Liabilities increase on the credit side; thus, Unearned Revenue will recognize the $4,000 on the credit side.

Transaction 4: On January 10, 2019, provides $5,500 in services to a customer who asks to be billed for the services.

- The company provided service to the client; therefore, the company may recognize the revenue as earned (revenue recognition principle), which increases revenue. Service Revenue is a revenue account affecting equity. Revenue accounts increase on the credit side; thus, Service Revenue will show an increase of $5,500 on the credit side.

- The customer did not immediately pay for the services and owes Printing Plus payment. This money will be received in the future, increasing Accounts Receivable. Accounts Receivable is an asset account. Asset accounts increase on the debit side. Therefore, Accounts Receivable will increase for $5,500 on the debit side.

Impact on the financial statements: You have revenue of $5,500. Revenue is reported on your income statement. The more revenue you have, the more net income (earnings) you will have. The more earnings you have, the more retained earnings you will keep. Retained earnings is a stockholders’ equity account, so total equity will increase $5,500. Accounts receivable is going up so total assets will increase by $5,500. The accounting equation, and therefore the balance sheet, remain in balance.

Transaction 5: On January 12, 2019, pays a $300 utility bill with cash.

- Cash was used to pay the utility bill, which means cash is decreasing. Cash is an asset that decreases on the credit side.

- Paying a utility bill creates an expense for the company. Utility Expense increases, and does so on the debit side of the accounting equation.

Impact on the financial statements: You have an expense of $300. Expenses are reported on your income statement. More expenses lead to a decrease in net income (earnings). The fewer earnings you have, the fewer retained earnings you will end up with. Retained earnings is a stockholders’ equity account, so total equity will decrease by $300. Cash is decreasing, so total assets will decrease by $300, impacting the balance sheet.

Transaction 6: On January 14, 2019, distributed $100 cash in dividends to stockholders.

- Cash was used to pay the dividends, which means cash is decreasing. Cash is an asset that decreases on the credit side.

- Dividends distribution occurred, which increases the Dividends account. Dividends is a part of stockholder’s equity and is recorded on the debit side. This debit entry has the effect of reducing stockholder’s equity.

Impact on the financial statements: You have dividends of $100. An increase in dividends leads to a decrease in stockholders’ equity (retained earnings). Cash is decreasing, so total assets will decrease by $100, impacting the balance sheet.

Transaction 7: On January 17, 2019, receives $2,800 cash from a customer for services rendered.

- The customer used cash as the payment method, thus increasing the amount in the Cash account. Cash is an asset that is increasing, and it does so on the debit side.

- Printing Plus provided the services, which means the company can recognize revenue as earned in the Service Revenue account. Service Revenue increases equity; therefore, Service Revenue increases on the credit side.

Impact on the financial statements: Revenue is reported on the income statement. More revenue will increase net income (earnings), thus increasing retained earnings. Retained earnings is a stockholders’ equity account, so total equity will increase $2,800. Cash is increasing, which increases total assets on the balance sheet.

Transaction 8: On January 18, 2019, paid in full, with cash, for the equipment purchase on January 5.

- Cash is decreasing because it was used to pay for the outstanding liability created on January 5. Cash is an asset and will decrease on the credit side.

- Accounts Payable recognized the liability the company had to the supplier to pay for the equipment. Since the company is now paying off the debt it owes, this will decrease Accounts Payable. Liabilities decrease on the debit side; therefore, Accounts Payable will decrease on the debit side by $3,500.

Transaction 9: On January 20, 2019, paid $3,600 cash in salaries expense to employees.

- Cash was used to pay for salaries, which decreases the Cash account. Cash is an asset that decreases on the credit side.

- Salaries are an expense to the business for employee work. This will increase Salaries Expense, affecting equity. Expenses increase on the debit side; thus, Salaries Expense will increase on the debit side.

Impact on the financial statements: You have an expense of $3,600. Expenses are reported on the income statement. More expenses lead to a decrease in net income (earnings). The fewer earnings you have, the fewer retained earnings you will end up with. Retained earnings is a stockholders’ equity account, so total equity will decrease by $3,600. Cash is decreasing, so total assets will decrease by $3,600, impacting the balance sheet.

Transaction 10: On January 23, 2019, received cash payment in full from the customer on the January 10 transaction.

- Cash was received, thus increasing the Cash account. Cash is an asset, and assets increase on the debit side.

- Accounts Receivable was originally used to recognize the future customer payment; now that the customer has paid in full, Accounts Receivable will decrease. Accounts Receivable is an asset, and assets decrease on the credit side.

Impact on the financial statements: In this transaction, there was an increase to one asset (Cash) and a decrease to another asset (Accounts Receivable). This means total assets change by $0, because the increase and decrease to assets in the same amount cancel each other out. There are no changes to liabilities or stockholders’ equity, so the equation is still in balance. Since there are no revenues or expenses affected, there is no effect on the income statement.

Transaction 11: On January 27, 2019, provides $1,200 in services to a customer who asks to be billed for the services.

- The customer does not pay immediately for the services but is expected to pay at a future date. This creates an Accounts Receivable for Printing Plus. The customer owes the money, which increases Accounts Receivable. Accounts Receivable is an asset, and assets increase on the debit side.

- Printing Plus provided the service, thus earning revenue. Service Revenue would increase on the credit side.

Impact on the financial statements: Revenue is reported on the income statement. More revenue will increase net income (earnings), thus increasing retained earnings. Retained earnings is a stockholders’ equity account, so total equity will increase $1,200. Cash is increasing, which increases total assets on the balance sheet.

Transaction 12: On January 30, 2019, purchases supplies on account for $500, payment due within three months.

- The company purchased supplies, which are assets to the business until used. Supplies is increasing, because the company has more supplies than it did before. Supplies is an asset that is increasing on the debit side.

- Printing Plus did not pay immediately for the supplies and asked to be billed for the supplies, payable at a later date. This creates a liability for the company, Accounts Payable. This liability increases Accounts Payable; thus, Accounts Payable increases on the credit side.

Impact on the financial statements: There is an increase to a liability and an increase to assets. These accounts both impact the balance sheet but not the income statement.

The complete journal for these transactions is as follows:

We now look at the next step in the accounting cycle, step 3: post journal information to the ledger.

Continuing Application

Colfax market.

Colfax Market is a small corner grocery store that carries a variety of staple items such as meat, milk, eggs, bread, and so on. As a smaller grocery store, Colfax does not offer the variety of products found in a larger supermarket or chain. However, it records journal entries in a similar way.

Grocery stores of all sizes must purchase product and track inventory. While the number of entries might differ, the recording process does not. For example, Colfax might purchase food items in one large quantity at the beginning of each month, payable by the end of the month. Therefore, it might only have a few accounts payable and inventory journal entries each month. Larger grocery chains might have multiple deliveries a week, and multiple entries for purchases from a variety of vendors on their accounts payable weekly.

This similarity extends to other retailers, from clothing stores to sporting goods to hardware. No matter the size of a company and no matter the product a company sells, the fundamental accounting entries remain the same.

Posting to the General Ledger

Recall that the general ledger is a record of each account and its balance. Reviewing journal entries individually can be tedious and time consuming. The general ledger is helpful in that a company can easily extract account and balance information. Here is a small section of a general ledger.

You can see at the top is the name of the account “Cash,” as well as the assigned account number “101.” Remember, all asset accounts will start with the number 1. The date of each transaction related to this account is included, a possible description of the transaction, and a reference number if available. There are debit and credit columns, storing the financial figures for each transaction, and a balance column that keeps a running total of the balance in the account after every transaction.

Let’s look at one of the journal entries from Printing Plus and fill in the corresponding ledgers.

As you can see, there is one ledger account for Cash and another for Common Stock. Cash is labeled account number 101 because it is an asset account type. The date of January 3, 2019, is in the far left column, and a description of the transaction follows in the next column. Cash had a debit of $20,000 in the journal entry, so $20,000 is transferred to the general ledger in the debit column. The balance in this account is currently $20,000, because no other transactions have affected this account yet.

Common Stock has the same date and description. Common Stock had a credit of $20,000 in the journal entry, and that information is transferred to the general ledger account in the credit column. The balance at that time in the Common Stock ledger account is $20,000.

Another key element to understanding the general ledger, and the third step in the accounting cycle, is how to calculate balances in ledger accounts.

Link to Learning

It is a good idea to familiarize yourself with the type of information companies report each year. Peruse Best Buy ’s 2017 annual report to learn more about Best Buy . Take note of the company’s balance sheet on page 53 of the report and the income statement on page 54. These reports have much more information than the financial statements we have shown you; however, if you read through them you may notice some familiar items.

Calculating Account Balances

When calculating balances in ledger accounts, one must take into consideration which side of the account increases and which side decreases. To find the account balance, you must find the difference between the sum of all figures on the side that increases and the sum of all figures on the side that decreases.

For example, the Cash account is an asset. We know from the accounting equation that assets increase on the debit side and decrease on the credit side. If there was a debit of $5,000 and a credit of $3,000 in the Cash account, we would find the difference between the two, which is $2,000 (5,000 – 3,000). The debit is the larger of the two sides ($5,000 on the debit side as opposed to $3,000 on the credit side), so the Cash account has a debit balance of $2,000.

Another example is a liability account, such as Accounts Payable, which increases on the credit side and decreases on the debit side. If there were a $4,000 credit and a $2,500 debit, the difference between the two is $1,500. The credit is the larger of the two sides ($4,000 on the credit side as opposed to $2,500 on the debit side), so the Accounts Payable account has a credit balance of $1,500.

The following are selected journal entries from Printing Plus that affect the Cash account. We will use the Cash ledger account to calculate account balances.

The general ledger account for Cash would look like the following:

In the last column of the Cash ledger account is the running balance. This shows where the account stands after each transaction, as well as the final balance in the account. How do we know on which side, debit or credit, to input each of these balances? Let’s consider the general ledger for Cash.

On January 3, there was a debit balance of $20,000 in the Cash account. On January 9, a debit of $4,000 was included. Since both are on the debit side, they will be added together to get a balance on $24,000 (as is seen in the balance column on the January 9 row). On January 12, there was a credit of $300 included in the Cash ledger account. Since this figure is on the credit side, this $300 is subtracted from the previous balance of $24,000 to get a new balance of $23,700. The same process occurs for the rest of the entries in the ledger and their balances. The final balance in the account is $24,800.

Checking to make sure the final balance figure is correct; one can review the figures in the debit and credit columns. In the debit column for this cash account, we see that the total is $32,300 (20,000 + 4,000 + 2,800 + 5,500). The credit column totals $7,500 (300 + 100 + 3,500 + 3,600). The difference between the debit and credit totals is $24,800 (32,300 – 7,500). The balance in this Cash account is a debit of $24,800. Having a debit balance in the Cash account is the normal balance for that account.

Posting to the T-Accounts

The third step in the accounting cycle is to post journal information to the ledger. To do this we can use a T-account format. A company will take information from its journal and post to this general ledger. Posting refers to the process of transferring data from the journal to the general ledger. It is important to understand that T-accounts are only used for illustrative purposes in a textbook, classroom, or business discussion. They are not official accounting forms. Companies will use ledgers for their official books, not T-accounts.

Let’s look at the journal entries for Printing Plus and post each of those entries to their respective T-accounts.

The following are the journal entries recorded earlier for Printing Plus.

In the journal entry, Cash has a debit of $20,000. This is posted to the Cash T-account on the debit side (left side). Common Stock has a credit balance of $20,000. This is posted to the Common Stock T-account on the credit side (right side).

In the journal entry, Equipment has a debit of $3,500. This is posted to the Equipment T-account on the debit side. Accounts Payable has a credit balance of $3,500. This is posted to the Accounts Payable T-account on the credit side.

In the journal entry, Cash has a debit of $4,000. This is posted to the Cash T-account on the debit side. You will notice that the transaction from January 3 is listed already in this T-account. The next transaction figure of $4,000 is added directly below the $20,000 on the debit side. Unearned Revenue has a credit balance of $4,000. This is posted to the Unearned Revenue T-account on the credit side.

In the journal entry, Accounts Receivable has a debit of $5,500. This is posted to the Accounts Receivable T-account on the debit side. Service Revenue has a credit balance of $5,500. This is posted to the Service Revenue T-account on the credit side.

In the journal entry, Utility Expense has a debit balance of $300. This is posted to the Utility Expense T-account on the debit side. Cash has a credit of $300. This is posted to the Cash T-account on the credit side. You will notice that the transactions from January 3 and January 9 are listed already in this T-account. The next transaction figure of $300 is added on the credit side.

In the journal entry, Dividends has a debit balance of $100. This is posted to the Dividends T-account on the debit side. Cash has a credit of $100. This is posted to the Cash T-account on the credit side. You will notice that the transactions from January 3, January 9, and January 12 are listed already in this T-account. The next transaction figure of $100 is added directly below the January 12 record on the credit side.

In the journal entry, Cash has a debit of $2,800. This is posted to the Cash T-account on the debit side. You will notice that the transactions from January 3, January 9, January 12, and January 14 are listed already in this T-account. The next transaction figure of $2,800 is added directly below the January 9 record on the debit side. Service Revenue has a credit balance of $2,800. This too has a balance already from January 10. The new entry is recorded under the Jan 10 record, posted to the Service Revenue T-account on the credit side.

On this transaction, Cash has a credit of $3,500. This is posted to the Cash T-account on the credit side beneath the January 14 transaction. Accounts Payable has a debit of $3,500 (payment in full for the Jan. 5 purchase). You notice there is already a credit in Accounts Payable, and the new record is placed directly across from the January 5 record.

On this transaction, Cash has a credit of $3,600. This is posted to the Cash T-account on the credit side beneath the January 18 transaction. Salaries Expense has a debit of $3,600. This is placed on the debit side of the Salaries Expense T-account.

On this transaction, Cash has a debit of $5,500. This is posted to the Cash T-account on the debit side beneath the January 17 transaction. Accounts Receivable has a credit of $5,500 (from the Jan. 10 transaction). The record is placed on the credit side of the Accounts Receivable T-account across from the January 10 record.

On this transaction, Accounts Receivable has a debit of $1,200. The record is placed on the debit side of the Accounts Receivable T-account underneath the January 10 record. Service Revenue has a credit of $1,200. The record is placed on the credit side of the Service Revenue T-account underneath the January 17 record.

On this transaction, Supplies has a debit of $500. This will go on the debit side of the Supplies T-account. Accounts Payable has a credit of $500. You notice there are already figures in Accounts Payable, and the new record is placed directly underneath the January 5 record.

T-Accounts Summary

Once all journal entries have been posted to T-accounts, we can check to make sure the accounting equation remains balanced. A summary showing the T-accounts for Printing Plus is presented in Figure 3.10 .

The sum on the assets side of the accounting equation equals $30,000, found by adding together the final balances in each asset account (24,800 + 1,200 + 500 + 3,500). To find the total on the liabilities and equity side of the equation, we need to find the difference between debits and credits. Credits on the liabilities and equity side of the equation total $34,000 (500 + 4,000 + 20,000 + 9,500). Debits on the liabilities and equity side of the equation total $4,000 (100 + 3,600 + 300). The difference $34,000 – $4,000 = $30,000. Thus, the equation remains balanced with $30,000 on the asset side and $30,000 on the liabilities and equity side. Now that we have the T-account information, and have confirmed the accounting equation remains balanced, we can create the unadjusted trial balance.

Journalizing Transactions

You have the following transactions the last few days of April.

- Prepare the necessary journal entries for these four transactions.

- Explain why you debited and credited the accounts you did.

- What will be the new balance in each account used in these entries?

- You have incurred more gas expense. This means you have an increase in the total amount of gas expense for April. Expenses go up with debit entries. Therefore, you will debit gas expense.

- You purchased the gas on account. This will increase your liabilities. Liabilities increase with credit entries. Credit accounts payable to increase the total in the account.

- You have received more cash from customers, so you want the total cash to increase. Cash is an asset, and assets increase with debit entries, so debit cash.

- You also have more money owed to you by your customers. You have performed the services, your customers owe you the money, and you will receive the money in the future. Debit accounts receivable as asset accounts increase with debits.

- You have mowed lawns and earned more revenue. You want the total of your revenue account to increase to reflect this additional revenue. Revenue accounts increase with credit entries, so credit lawn-mowing revenue.

- Advertising is an expense of doing business. You have incurred more expenses, so you want to increase an expense account. Expense accounts increase with debit entries. Debit advertising expense.

- You paid cash for the advertising. You have less cash, so credit the cash account. Cash is an asset, and asset account totals decrease with credits.

- You paid “on account.” Remember that “on account” means a service was performed or an item was received without being paid for. The customer asked to be billed. You were the customer in this case. You made a purchase of gas on account earlier in the month, and at that time you increased accounts payable to show you had a liability to pay this amount sometime in the future. You are now paying down some of the money you owe on that account. Since you paid this money, you now have less of a liability so you want to see the liability account, accounts payable, decrease by the amount paid. Liability accounts decrease with debit entries.

- You paid, which means you gave cash (or wrote a check or electronically transferred) so you have less cash. To decrease the total cash, credit the account because asset accounts are reduced by recording credit entries.

Normal Account Balances

Calculate the balances in each of the following accounts. Do they all have the normal balance they should have? If not, which one? How do you know this?

Think It Through

Gift cards have become an important topic for managers of any company. Understanding who buys gift cards, why, and when can be important in business planning. Also, knowing when and how to determine that a gift card will not likely be redeemed will affect both the company’s balance sheet (in the liabilities section) and the income statement (in the revenues section).

According to a 2017 holiday shopping report from the National Retail Federation, gift cards are the most-requested presents for the eleventh year in a row, with 61% of people surveyed saying they are at the top of their wish lists. 6 CEB TowerGroup projects that total gift card volume will reach $160 billion by 2018. 7

How are all of these gift card sales affecting one of America’s favorite specialty coffee companies, Starbucks ?

In 2014 one in seven adults received a Starbucks gift card. On Christmas Eve alone $2.5 million gift cards were sold. This is a rate of 1,700 cards per minute. 8

The following discussion about gift cards is taken from Starbucks ’s 2016 annual report:

When an amount is loaded onto a stored value card we recognize a corresponding liability for the full amount loaded onto the card, which is recorded within stored value card liability on our consolidated balance sheets. When a stored value card is redeemed at a company-operated store or online, we recognize revenue by reducing the stored value card liability. When a stored value card is redeemed at a licensed store location, we reduce the corresponding stored value card liability and cash, which is reimbursed to the licensee. There are no expiration dates on our stored value cards, and in most markets, we do not charge service fees that cause a decrement to customer balances. While we will continue to honor all stored value cards presented for payment, management may determine the likelihood of redemption, based on historical experience, is deemed to be remote for certain cards due to long periods of inactivity. In these circumstances, unredeemed card balances may be recognized as breakage income. In fiscal 2016, 2015, and 2014, we recognized breakage income of $60.5 million, $39.3 million, and $38.3 million, respectively. 9

As of October 1, 2017, Starbucks had a total of $1,288,500,000 in stored value card liability.

- 6 National Retail Federation (NRF). “NRF Consumer Survey Points to Busy Holiday Season, Backs Up Economic Forecast and Import Numbers.” October 27, 2017. https://nrf.com/media-center/press-releases/nrf-consumer-survey-points-busy-holiday-season-backs-economic-forecast

- 7 CEB Tower Group. “2015 Gift Card Sales to Reach New Peak of $130 Billion.” PR Newswire. December 8, 2015. https://www.prnewswire.com/news-releases/2015-gift-card-sales-to-reach-new-peak-of-130-billion-300189615.html

- 8 Sara Haralson. “Last-Minute Shoppers Rejoice! Starbucks Has You Covered.” Fortune . December 22, 2015. http://fortune.com/video/2015/12/22/starbucks-gift-cards/

- 9 U.S. Securities and Exchange Commission. Communication from Starbucks Corporation regarding 2014 10-K Filing. November 14, 2014. https://www.sec.gov/Archives/edgar/data/829224/000082922415000020/filename1.htm

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution-NonCommercial-ShareAlike License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-financial-accounting/pages/1-why-it-matters

- Authors: Mitchell Franklin, Patty Graybeal, Dixon Cooper

- Publisher/website: OpenStax

- Book title: Principles of Accounting, Volume 1: Financial Accounting

- Publication date: Apr 11, 2019

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-financial-accounting/pages/1-why-it-matters

- Section URL: https://openstax.org/books/principles-financial-accounting/pages/3-5-use-journal-entries-to-record-transactions-and-post-to-t-accounts

© Dec 13, 2023 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

- Journal Entries

Home › Accounting › Accounting Cycle › Journal Entries

- What is a Journal Entry?

1. Identify Transactions

2. analyze transactions, 3. journalizing transactions, common journal entry questions.

Journal entries are the first step in the accounting cycle and are used to record all business transactions and events in the accounting system. As business events occur throughout the accounting period, journal entries are recorded in the general journal to show how the event changed in the accounting equation. For example, when the company spends cash to purchase a new vehicle, the cash account is decreased or credited and the vehicle account is increased or debited.

How to Make a Journal Entry

Here are the steps to making an accounting journal entry.

There are generally three steps to making a journal entry. First, the business transaction has to be identified. Obviously, if you don’t know a transaction occurred, you can’t record one. Using our vehicle example above, you must identify what transaction took place. In this case, the company purchased a vehicle. This means a new asset must be added to the accounting equation.

After an event is identified to have an economic impact on the accounting equation, the business event must be analyzed to see how the transaction changed the accounting equation. When the company purchased the vehicle, it spent cash and received a vehicle. Both of these accounts are asset accounts, so the overall accounting equation didn’t change. Total assets increased and decreased by the same amount, but an economic transaction still took place because the cash was essentially transferred into a vehicle.

After the business event is identified and analyzed, it can be recorded. Journal entries use debits and credits to record the changes of the accounting equation in the general journal. Traditional journal entry format dictates that debited accounts are listed before credited accounts. Each journal entry is also accompanied by the transaction date, title, and description of the event. Here is an example of how the vehicle purchase would be recorded.

Since there are so many different types of business transactions, accountants usually categorize them and record them in separate journal to help keep track of business events. For instance, cash was used to purchase this vehicle, so this transaction would most likely be recorded in the cash disbursements journal. There are numerous other journals like the sales journal, purchases journal, and accounts receivable journal.

We are following Paul around for the first year as he starts his guitar store called Paul’s Guitar Shop, Inc. Here are the events that take place.

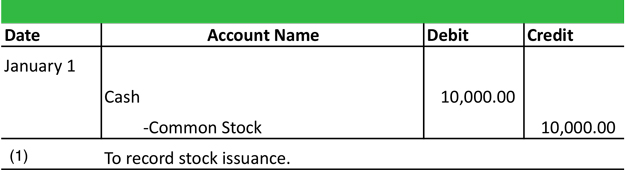

Entry #1 — Paul forms the corporation by purchasing 10,000 shares of $1 par stock.

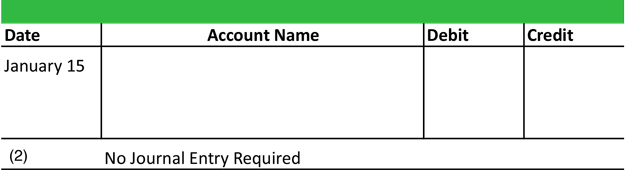

Entry #2 — Paul finds a nice retail storefront in the local mall and signs a lease for $500 a month.

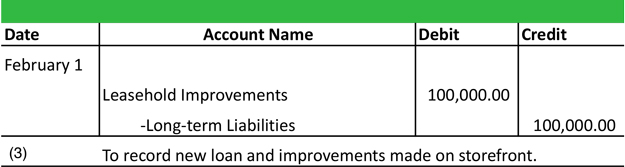

Entry #3 — PGS takes out a bank loan to renovate the new store location for $100,000 and agrees to pay $1,000 a month. He spends all of the money on improving and updating the store’s fixtures and looks.

Entry #4 — PGS purchases $50,000 worth of inventory to sell to customers on account with its vendors. He agrees to pay $1,000 a month.

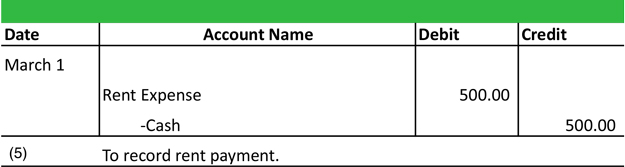

Entry #5 — PGS’s first rent payment is due.

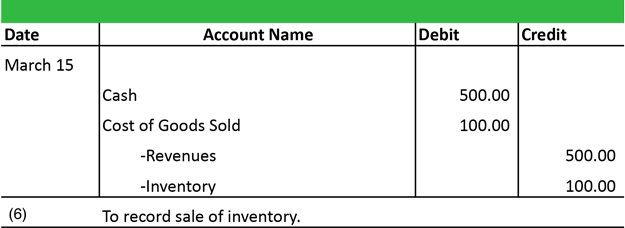

Entry #6 — PGS has a grand opening and makes it first sale. It sells a guitar for $500 that cost $100.

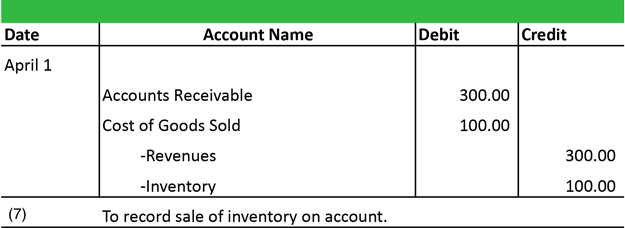

Entry #7 — PGS sells another guitar to a customer on account for $300. The cost of this guitar was $100.

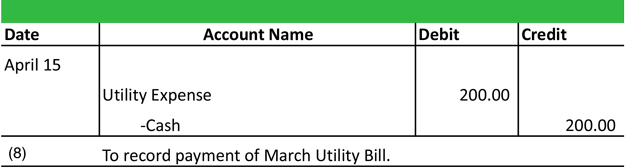

Entry #8 — PGS pays electric bill for $200.

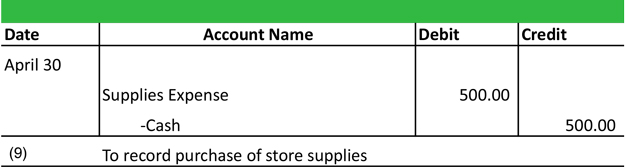

Entry #9 — PGS purchases supplies to use around the store.

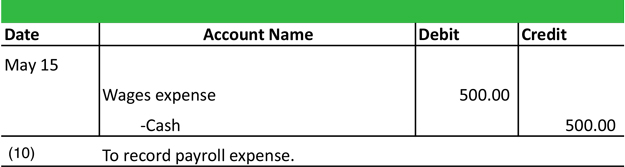

Entry #10 — Paul is getting so busy that he decides to hire an employee for $500 a week. Pay makes his first payroll payment.

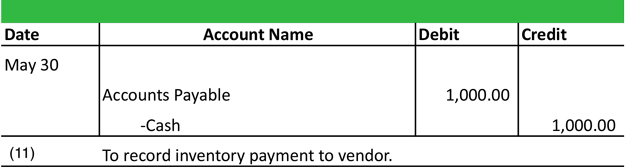

Entry #11 — PGS’s first vendor inventory payment is due of $1,000.

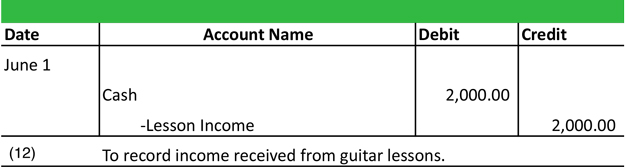

Entry #12 — Paul starts giving guitar lessons and receives $2,000 in lesson income.

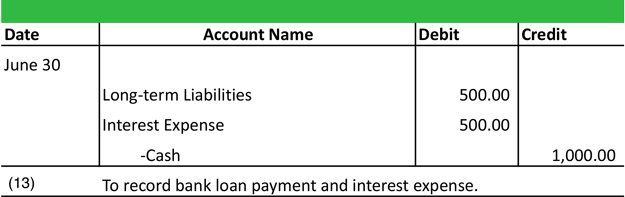

Entry #13 — PGS’s first bank loan payment is due.

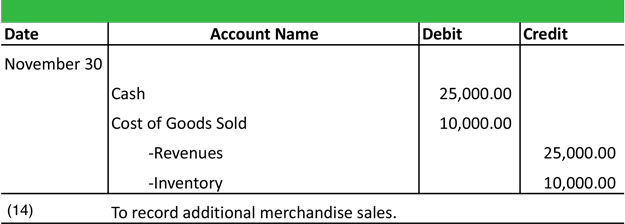

Entry #14 — PGS has more cash sales of $25,000 with cost of goods of $10,000.

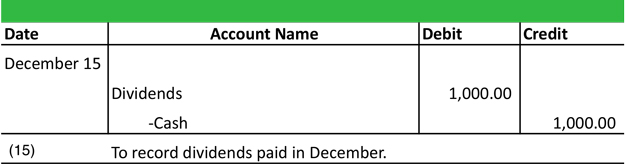

Entry #15 — In lieu of paying himself, Paul decides to declare a $1,000 dividend for the year.

Now that these transactions are recorded in their journals, they must be posted to the T-accounts or ledger accounts in the next step of the accounting cycle .

Here is an additional list of the most common business transactions and the journal entry examples to go with them.

- Depreciation Expense Entry

- Accumulated Depreciation Entry

- Accrued Expense Entry

What is a manual Journal Entry?

Manual journal entries were used before modern, computerized accounting systems were invented. The entries above would be manually written in a journal throughout the year as business transactions occurred. These entries would then be totaled at the end of the period and transferred to the ledger. Today, accounting systems do this automatically with computer systems.

What is a general journal entry in accounting?

An accounting journal entry is the written record of a business transaction in a double entry accounting system. Every entry contains an equal debit and credit along with the names of the accounts, description of the transaction, and date of the business event.

What is the purpose of a journal and ledger?

The purpose of an accounting journal is record business transactions and keep a record of all the company’s financial events that take place during the year. An accounting ledger, on the other hand, is a listing of all accounts in the accounting system along with their balances.

What is the purpose of a journal entry?

A journal entry records financial transactions that a business engages in throughout the accounting period. These entries are initially used to create ledgers and trial balances. Eventually, they are used to create a full set of financial statements of the company.

Accounting & CPA Exam Expert

Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- Financial Accounting Basics

- Accounting Principles

- Accounting Cycle

- Unadjusted Trial Balance

- Adjusting Entries

- Adjusted Trial Balance

- Financial Statement Prep

- Accounting Worksheet

- Closing Entries

- Income Summary Account

- Post Closing Trial Balance

- Reversing Entries

- Financial Statements

- Financial Ratios

Introduction

CDHE Nomination

AUCC Requirements

Course Description

Sample Policy Statements

Syllabus Sequencing Strategies

Sample Daily Syllabi

Lesson Plans

Reading Selection Recommendations

Assignments

Response Papers and Discussion Forums

Presentations

Discusssion, Group, WTL Questions

Variations, Misc.

Curbing Plagiarism

Additional Teaching & Course Design Resources

Guide Contributors

Basic Journal Assignment Example

Here is an example of a basic journal assignment:

Short writing assignments for a personal journal will be required for all readings. Additional assignments will be given frequently in class and for homework throughout the semester. In addition, it must be kept up to date. You may be asked to read journal entries for the class. Consequently, your journal must be brought to every class. Journal writings will not be graded for quality as a paper would be. If you have completed all assigned journal entries in a sincere manner, you will receive full credit for the journal in your final grade. That credit will be lessened only if you are lacking certain journal entries, or your entries are unacceptably brief or intentionally do not address the topic. The journal will not be judged negatively for unintentional errors in writing or punctuation. In other words, the journal is one place where a better writer will not necessarily get a better grade. The journal rewards effort and participation. It provides an opportunity to succeed no matter where you are starting from if you sincerely dedicate yourself.

Journal Writing

View in pdf format, common goals of a journal.

- To encourage regular writing

- To make connections between class material, lectures, and personal observations

- To raise questions and issues that can fuel classroom discussions

- To generate ideas for future paper topics

- To provide a forum for inquiry, analysis, and evaluation of ideas

- Write regularly

- Try to make concrete connections between journal entries

- Link personal reactions to the class material

- Approach the exercise with the intention of being challenged

- Present your ideas in a coherent and thought-provoking manner

- Ignore basic rules of grammar and punctuation

- Write to fill pages; the process is more important than the product

- Wait until the last minute to make your entries

- Confuse your journal with a personal diary. Although this is your journal, the main focus should be on class assignments and their connections. Try not to focus too much on your personal feelings, such as whether or not you liked the book or the film. Instead concentrate on why your professor assigned the material.

- Simply summarize — analyze. Avoid describing what you have read. Ask probing questions: are the points well-argued? Does the writer come to a logical conclusion? What other issues should be considered?

Take your journal seriously. Keeping a journal helps develop writing, reading, analytical and critical skills that are necessary in all disciplines.

Faculty Comments on the Value of Journal Writing

“I’ll be looking for evidence of thought and clarity of expression. The journal needn’t be polished to gem-like lustre, but it should be coherent and, I hope, thought-provoking.” — Richard Decker, Professor of Computer Science “Journals are ultimately very useful for developing good work habits by providing a venue and location for thinking through ideas in an ongoing and consistent way.” — Ella Gant, Professor of Art

by Molly Soule ’97 & Andresse St. Rose ’97

Tutor appointments.

Peer tutor and consultant appointments are managed through TracCloud (login required). Find resources and more information about the ALEX centers using the following links.

Office / Department Name

Nesbitt-Johnston Writing Center

Contact Name

Jennifer Ambrose

Writing Center Director

Help us provide an accessible education, offer innovative resources and programs, and foster intellectual exploration.

Site Search

- school Campus Bookshelves

- menu_book Bookshelves

- perm_media Learning Objects

- login Login

- how_to_reg Request Instructor Account

- hub Instructor Commons

Margin Size

- Download Page (PDF)

- Download Full Book (PDF)

- Periodic Table

- Physics Constants

- Scientific Calculator

- Reference & Cite

- Tools expand_more

- Readability

selected template will load here

This action is not available.

3.37: Assignment- Critical Thinking Journal Entry

- Last updated

- Save as PDF

- Page ID 59022

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

- Visit the Quia Critical Thinking Quiz page and click on Start Now (you don’t need to enter your name). Select the best answer for each question, and then click on Submit Answers. A score of 70 percent or better on this quiz is considering passing.

- Write a 200-400 word reflection on this activity. Based on the content of the questions, do you feel you use good critical thinking strategies in college? In what ways might you improve as a critical thinker?

Worked Example

Journal entry assignments tend to be more flexible than other types of writing assignments in college, and as a result they can be tailored to your own experiences as long as they answer the primary questions asked in the assignment.

One model of a successful entry about this topic can be found below. Feel free to include your own experiences and examples from real life as they pertain to the issue at hand.

Critical Thinking Journal Entry

by Sandy Brown

The thing I like about critical thinking is that is applies to everything. If you get better at using critical thinking in school, that means other things in life get easier, as well (at least that’s what I hope is true).

I didn’t do so great on the critical thinking quiz. I got a 50% the first time, but I think I would have done better if I had understood the questions more clearly. Question #9, the one about having autonomy, I got wrong because I thought it was saying it was important, rather than it wasn’t. Now that I think about it, I guess that’s an example of where I could be a better critical thinker—I could take the time to read these questions more closely, and be sure that my answer makes sense to what the question actually asks, rather than what I think it asks.

I was happy with parts of this, though. There were a couple of questions about fair-mindedness, and I got both those right, even though I didn’t remember seeing the words “fair-mindedness” in the textbook. That phrase makes a lot more sense to me than “first order” and “second order” thinking.

For me, I think that I’m a better thinker when I’m not in a rush. I tend to panic when I take tests, and then I answer questions too quickly. For things that don’t have a timer, like homework or out-of-class assignments, I tend to do a lot better because I can take as long as I need to figure out what exactly I’m supposed to do. So I guess one way to improve my critical thinking skills would be to practice going slower for timed tests, and giving myself time to check my answers before turning something in. I don’t want to make mistakes like the one I did on this quiz, when it counts against my actual grade.

- Try It: Critical Thinking. Authored by : Linda Bruce. Provided by : Lumen Learning. Located at : https://courses.candelalearning.com/lumencollegesuccess/chapter/critical-thinking-skills/ . License : CC BY: Attribution

- Revision and Adaptation. Provided by : Lumen Learning. License : CC BY: Attribution

- 101 Accounting Basics Strong foundation on fundamental concepts and the accounting process

- FIN Financial Accounting Financial accounting and reporting, financial statements, IFRS and GAAP

- MNG Managerial Accounting Managerial/management accounting topics to aid in decision-making

- DIC Accounting Dictionary Accounting terms defined and carefully explained

- MIS Misc Articles Miscellaneous topics about anything accounting

- References +

- 1 Analyzing business transactions

- 2 Rules of debit and credit

- 3 Chart of accounts

- 4 Journal entries

- 5 More journal entry examples

- 6 Posting to the ledger

- 7 Trial balance

- 8 Correcting entries

Journal entries: More examples

For additional practice in preparing journal entries, here are some more examples of business transactions along with explanations on how their journal entries are prepared.

A Few Things Before We Start

The transactions in this lesson pertain to Gray Electronic Repair Services, our imaginary small sole proprietorship business.

For account titles, we will be using the chart of accounts presented in an earlier lesson.

All transactions are assumed and simplified for illustration purposes.

Note: We will also be using this set of transactions and journal entries in later lessons when we discuss the other steps of the accounting process.

Alright! Let's start.

Transaction #1: On December 1, 2021, Mr. Donald Gray started Gray Electronic Repair Services by investing $10,000. The journal entry should increase the company's Cash, and increase (establish) the capital account of Mr. Gray; hence:

Transaction #2: On December 5, Gray Electronic Repair Services paid registration and licensing fees for the business, $370.

First, we will debit the expense (to increase an expense, you debit it); and then, credit Cash to record the decrease in cash as a result of the payment.

Transaction #3: On December 6, the company acquired tables, chairs, shelves, and other fixtures for a total of $3,000. The entire amount was paid in cash.

There is an increase in an asset account (Furniture and Fixtures) in exchange for a decrease in another asset (Cash).

Transaction #4: On December 7, the company acquired service equipment for $16,000. The company paid a 50% down payment and the balance will be paid after 60 days.

This will result in a compound journal entry. There is an increase in an asset account ( debit Service Equipment, $16,000), a decrease in another asset ( credit Cash, $8,000, the amount paid), and an increase in a liability account ( credit Accounts Payable, $8,000, the balance to be paid after 60 days).

Transaction #5: Also on December 7, Gray Electronic Repair Services purchased service supplies on account amounting to $1,500.

The company received supplies thus we will record a debit to increase supplies. By the terms "on account", it means that the amount has not yet been paid; and so, it is recorded as a liability of the company.

Transaction #6: On December 9, the company received $1,900 for services rendered. We will then record an increase in cash (debit the cash account) and increase in income (credit the income account).

Transaction #7: On December 12, the company rendered services on account, $4,250.00. As per agreement with the customer, the amount is to be collected after 10 days. Under the accrual basis of accounting , income is recorded when earned.

In this transaction, the services have been fully rendered (meaning, we made an income; we just haven't collected it yet.) Hence, we record an increase in income and an increase in a receivable account.

Transaction #8: On December 14, Mr. Gray invested an additional $3,200.00 into the business. The entry would be similar to what we did in transaction #1, i.e. increase cash and increase the capital account of the owner.

Transaction #9: Rendered services to a big corporation on December 15. As per agreement, the $3,400 amount due will be collected after 30 days.

Transaction #10: On December 22, the company collected from the customer in transaction #7. We will record an increase in cash by debiting it. Then, we will credit accounts receivable to decrease it. We are reducing the receivable since it has already been collected.

Actually, we simply transferred the amount from receivable to cash in the above entry.