- 400+ Sample Business Plans

- WHY UPMETRICS?

Customer Success Stories

Business Plan Course

Strategic Planning Templates

E-books, Guides & More

- AI ASSISTANTS

Upmetrics AI Your go-to AI-powered business assistant

AI Writing Assist Write, translate, and refine your text with AI

AI Financial Assist Automated forecasts and AI recommendations

- TOP FEATURES

AI Business Plan Generator Create business plans faster with AI

Financial Forecasting Make accurate financial forecasts faster

Strategic Planning Develop actionable strategic plans on-the-go

AI Pitch Deck Generator Use AI to generate your investor deck

See how it works →

AI-powered business planning software

Very useful business plan software connected to AI. Saved a lot of time, money and energy. Their team is highly skilled and always here to help.

- Julien López

- BY USE CASE

Starting & Launching a Business Plan your business for launch and success

Validate Your Business Idea Discover the potential of your business idea

Secure Funding, Loans, Grants Create plans that get you funded

Business Consultant & Advisors Plan seamlessly with your team members and clients

Business Schools & Educators Simplify business plan education for students

Students & Learners Your e-tutor for business planning

- Sample Plans

Reviews See why customers love Upmetrics

Customer Success Stories Read our customer success stories

Blogs Latest business planning tips and strategies

Strategic Planning Templates Ready-to-use strategic plan templates

Business Plan Course A step-by-step business planning course

Ebooks & Guides A free resource hub on business planning

Business Tools Free business tools to help you grow

How to Prepare a Financial Plan for Startup Business (w/ example)

Free Financial Statements Template

Ajay Jagtap

- December 7, 2023

13 Min Read

If someone were to ask you about your business financials, could you give them a detailed answer?

Let’s say they ask—how do you allocate your operating expenses? What is your cash flow situation like? What is your exit strategy? And a series of similar other questions.

Instead of mumbling what to answer or shooting in the dark, as a founder, you must prepare yourself to answer this line of questioning—and creating a financial plan for your startup is the best way to do it.

A business plan’s financial plan section is no easy task—we get that.

But, you know what—this in-depth guide and financial plan example can make forecasting as simple as counting on your fingertips.

Ready to get started? Let’s begin by discussing startup financial planning.

What is Startup Financial Planning?

Startup financial planning, in simple terms, is a process of planning the financial aspects of a new business. It’s an integral part of a business plan and comprises its three major components: balance sheet, income statement, and cash-flow statement.

Apart from these statements, your financial section may also include revenue and sales forecasts, assets & liabilities, break-even analysis , and more. Your first financial plan may not be very detailed, but you can tweak and update it as your company grows.

Key Takeaways

- Realistic assumptions, thorough research, and a clear understanding of the market are the key to reliable financial projections.

- Cash flow projection, balance sheet, and income statement are three major components of a financial plan.

- Preparing a financial plan is easier and faster when you use a financial planning tool.

- Exploring “what-if” scenarios is an ideal method to understand the potential risks and opportunities involved in the business operations.

Why is Financial Planning Important to Your Startup?

Poor financial planning is one of the biggest reasons why most startups fail. In fact, a recent CNBC study reported that running out of cash was the reason behind 44% of startup failures in 2022.

A well-prepared financial plan provides a clear financial direction for your business, helps you set realistic financial objectives, create accurate forecasts, and shows your business is committed to its financial objectives.

It’s a key element of your business plan for winning potential investors. In fact, YC considered recent financial statements and projections to be critical elements of their Series A due diligence checklist .

Your financial plan demonstrates how your business manages expenses and generates revenue and helps them understand where your business stands today and in 5 years.

Makes sense why financial planning is important to your startup, doesn’t it? Let’s cut to the chase and discuss the key components of a startup’s financial plan.

Say goodbye to old-school excel sheets & templates

Make accurate financial plan faster with AI

Plans starting from $7/month

Key Components of a Startup Financial Plan

Whether creating a financial plan from scratch for a business venture or just modifying it for an existing one, here are the key components to consider including in your startup’s financial planning process.

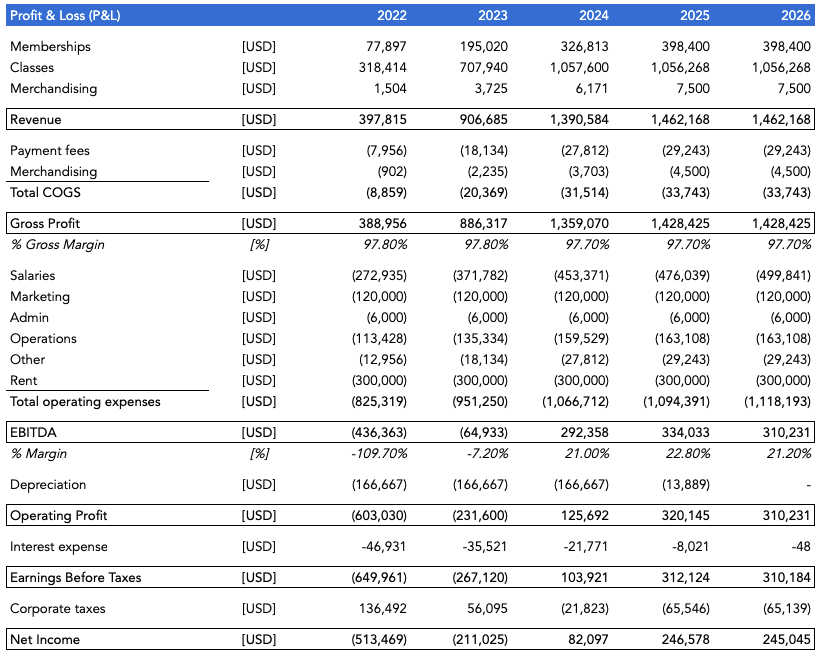

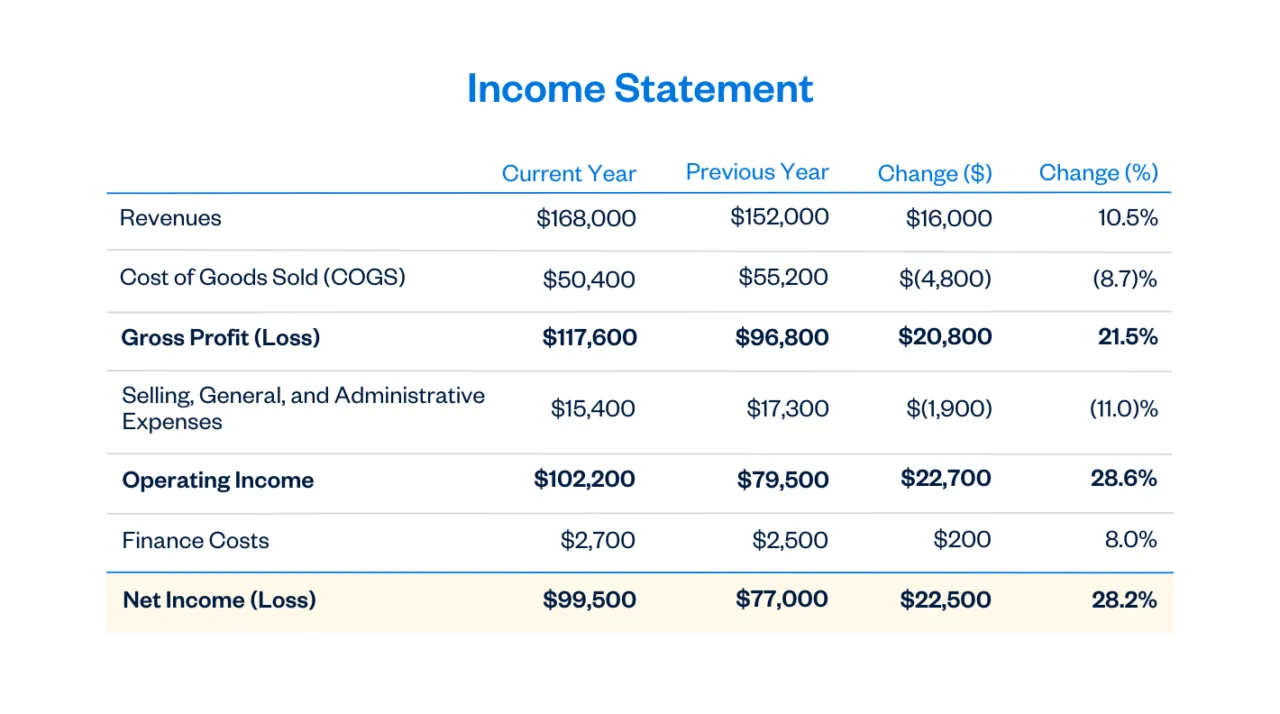

Income Statement

An Income statement , also known as a profit-and-loss statement(P&L), shows your company’s income and expenditures. It also demonstrates how your business experienced any profit or loss over a given time.

Consider it as a snapshot of your business that shows the feasibility of your business idea. An income statement can be generated considering three scenarios: worst, expected, and best.

Your income or P&L statement must list the following:

- Cost of goods or cost of sale

- Gross margin

- Operating expenses

- Revenue streams

- EBITDA (Earnings before interest, tax, depreciation , & amortization )

Established businesses can prepare annual income statements, whereas new businesses and startups should consider preparing monthly statements.

Cash flow Statement

A cash flow statement is one of the most critical financial statements for startups that summarize your business’s cash in-and-out flows over a given time.

This section provides details on the cash position of your business and its ability to meet monetary commitments on a timely basis.

Your cash flow projection consists of the following three components:

✅ Cash revenue projection: Here, you must enter each month’s estimated or expected sales figures.

✅ Cash disbursements: List expenditures that you expect to pay in cash for each month over one year.

✅ Cash flow reconciliation: Cash flow reconciliation is a process used to ensure the accuracy of cash flow projections. The adjusted amount is the cash flow balance carried over to the next month.

Furthermore, a company’s cash flow projections can be crucial while assessing liquidity, its ability to generate positive cash flows and pay off debts, and invest in growth initiatives.

Balance Sheet

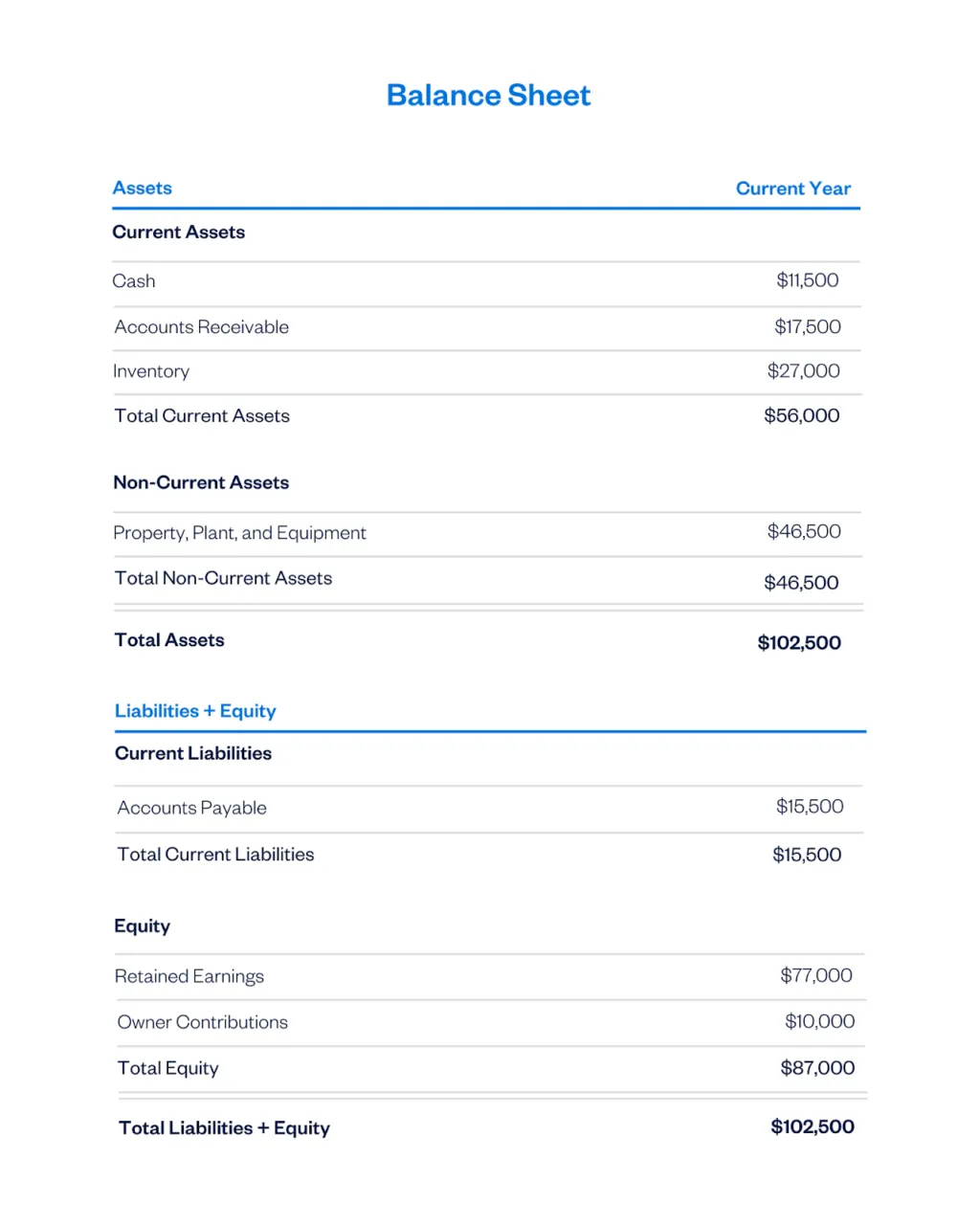

Your balance sheet is a financial statement that reports your company’s assets, liabilities, and shareholder equity at a given time.

Consider it as a snapshot of what your business owns and owes, as well as the amount invested by the shareholders.

This statement consists of three parts: assets , liabilities, and the balance calculated by the difference between the first two. The final numbers on this sheet reflect the business owner’s equity or value.

Balance sheets follow the following accounting equation with assets on one side and liabilities plus Owner’s equity on the other:

Here is what’s the core purpose of having a balance-sheet:

- Indicates the capital need of the business

- It helps to identify the allocation of resources

- It calculates the requirement of seed money you put up, and

- How much finance is required?

Since it helps investors understand the condition of your business on a given date, it’s a financial statement you can’t miss out on.

Break-even Analysis

Break-even analysis is a startup or small business accounting practice used to determine when a company, product, or service will become profitable.

For instance, a break-even analysis could help you understand how many candles you need to sell to cover your warehousing and manufacturing costs and start making profits.

Remember, anything you sell beyond the break-even point will result in profit.

You must be aware of your fixed and variable costs to accurately determine your startup’s break-even point.

- Fixed costs: fixed expenses that stay the same no matter what.

- Variable costs: expenses that fluctuate over time depending on production or sales.

A break-even point helps you smartly price your goods or services, cover fixed costs, catch missing expenses, and set sales targets while helping investors gain confidence in your business. No brainer—why it’s a key component of your startup’s financial plan.

Having covered all the key elements of a financial plan, let’s discuss how you can create a financial plan for your startup.

How to Create a Financial Section of a Startup Business Plan?

1. determine your financial needs.

You can’t start financial planning without understanding your financial requirements, can you? Get your notepad or simply open a notion doc; it’s time for some critical thinking.

Start by assessing your current situation by—calculating your income, expenses , assets, and liabilities, what the startup costs are, how much you have against them, and how much financing you need.

Assessing your current financial situation and health will help determine how much capital you need for your startup and help plan fundraising activities and outreach.

Furthermore, determining financial needs helps prioritize operational activities and expenses, effectively allocate resources, and increase the viability and sustainability of a business in the long run.

Having learned to determine financial needs, let’s head straight to setting financial goals.

2. Define Your Financial Goals

Setting realistic financial goals is fundamental in preparing an effective financial plan. So, it would help to outline your long-term strategies and goals at the beginning of your financial planning process.

Let’s understand it this way—if you are a SaaS startup pursuing VC financing rounds, you may ask investors about what matters to them the most and prepare your financial plan accordingly.

However, a coffee shop owner seeking a business loan may need to create a plan that appeals to banks, not investors. At the same time, an internal financial plan designed to offer financial direction and resource allocation may not be the same as previous examples, seeing its different use case.

Feeling overwhelmed? Just define your financial goals—you’ll be fine.

You can start by identifying your business KPIs (key performance indicators); it would be an ideal starting point.

3. Choose the Right Financial Planning Tool

Let’s face it—preparing a financial plan using Excel is no joke. One would only use this method if they had all the time in the world.

Having the right financial planning software will simplify and speed up the process and guide you through creating accurate financial forecasts.

Many financial planning software and tools claim to be the ideal solution, but it’s you who will identify and choose a tool that is best for your financial planning needs.

Create a Financial Plan with Upmetrics in no time

Enter your Financial Assumptions, and we’ll calculate your monthly/quarterly and yearly financial projections.

Start Forecasting

4. Make Assumptions Before Projecting Financials

Once you have a financial planning tool, you can move forward to the next step— making financial assumptions for your plan based on your company’s current performance and past financial records.

You’re just making predictions about your company’s financial future, so there’s no need to overthink or complicate the process.

You can gather your business’ historical financial data, market trends, and other relevant documents to help create a base for accurate financial projections.

After you have developed rough assumptions and a good understanding of your business finances, you can move forward to the next step—projecting financials.

5. Prepare Realistic Financial Projections

It’s a no-brainer—financial forecasting is the most critical yet challenging aspect of financial planning. However, it’s effortless if you’re using a financial planning software.

Upmetrics’ forecasting feature can help you project financials for up to 7 years. However, new startups usually consider planning for the next five years. Although it can be contradictory considering your financial goals and investor specifications.

Following are the two key aspects of your financial projections:

Revenue Projections

In simple terms, revenue projections help investors determine how much revenue your business plans to generate in years to come.

It generally involves conducting market research, determining pricing strategy , and cash flow analysis—which we’ve already discussed in the previous steps.

The following are the key components of an accurate revenue projection report:

- Market analysis

- Sales forecast

- Pricing strategy

- Growth assumptions

- Seasonal variations

This is a critical section for pre-revenue startups, so ensure your projections accurately align with your startup’s financial model and revenue goals.

Expense Projections

Both revenue and expense projections are correlated to each other. As revenue forecasts projected revenue assumptions, expense projections will estimate expenses associated with operating your business.

Accurately estimating your expenses will help in effective cash flow analysis and proper resource allocation.

These are the most common costs to consider while projecting expenses:

- Fixed costs

- Variable costs

- Employee costs or payroll expenses

- Operational expenses

- Marketing and advertising expenses

- Emergency fund

Remember, realistic assumptions, thorough research, and a clear understanding of your market are the key to reliable financial projections.

6. Consider “What if” Scenarios

After you project your financials, it’s time to test your assumptions with what-if analysis, also known as sensitivity analysis.

Using what-if analysis with different scenarios while projecting your financials will increase transparency and help investors better understand your startup’s future with its best, expected, and worst-case scenarios.

Exploring “what-if” scenarios is the best way to better understand the potential risks and opportunities involved in business operations. This proactive exercise will help you make strategic decisions and necessary adjustments to your financial plan.

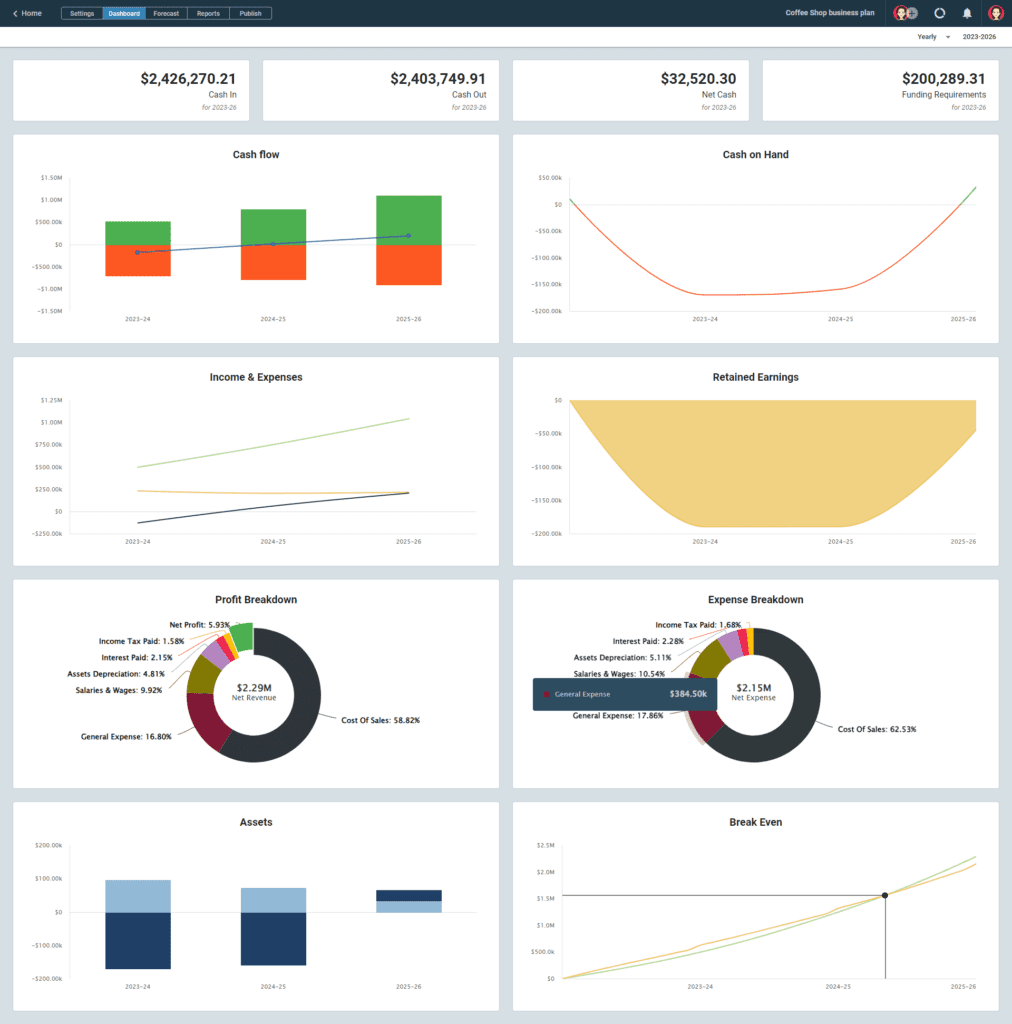

7. Build a Visual Report

If you’ve closely followed the steps leading to this, you know how to research for financial projections, create a financial plan, and test assumptions using “what-if” scenarios.

Now, we’ll prepare visual reports to present your numbers in a visually appealing and easily digestible format.

Don’t worry—it’s no extra effort. You’ve already made a visual report while creating your financial plan and forecasting financials.

Check the dashboard to see the visual presentation of your projections and reports, and use the necessary financial data, diagrams, and graphs in the final draft of your financial plan.

Here’s what Upmetrics’ dashboard looks like:

8. Monitor and Adjust Your Financial Plan

Even though it’s not a primary step in creating a good financial plan, it’s quite essential to regularly monitor and adjust your financial plan to ensure the assumptions you made are still relevant, and you are heading in the right direction.

There are multiple ways to monitor your financial plan.

For instance, you can compare your assumptions with actual results to ensure accurate projections based on metrics like new customers acquired and acquisition costs, net profit, and gross margin.

Consider making necessary adjustments if your assumptions are not resonating with actual numbers.

Also, keep an eye on whether the changes you’ve identified are having the desired effect by monitoring their implementation.

And that was the last step in our financial planning guide. However, it’s not the end. Have a look at this financial plan example.

Startup Financial Plan Example

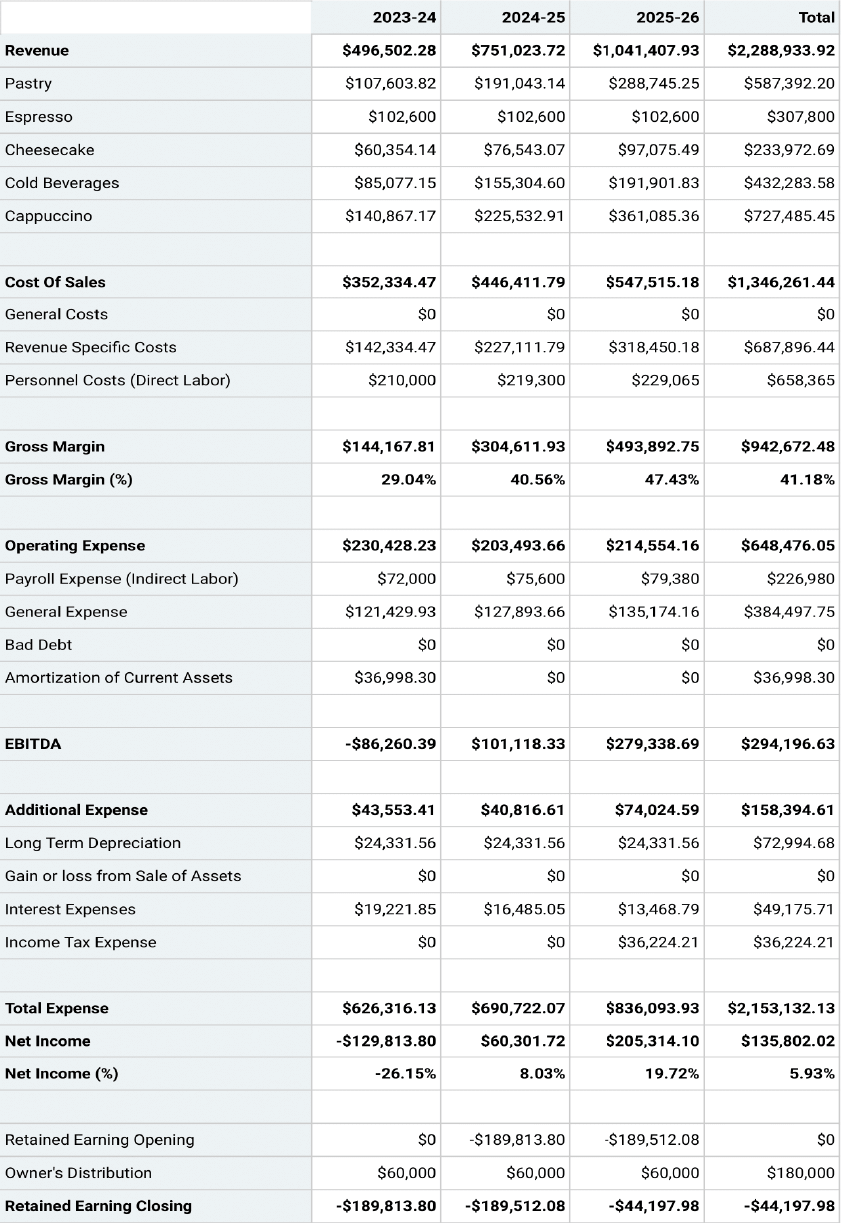

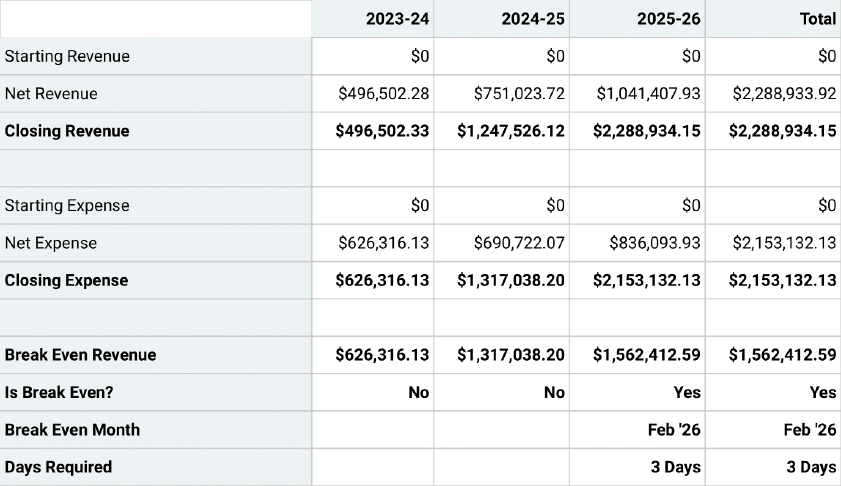

Having learned about financial planning, let’s quickly discuss a coffee shop startup financial plan example prepared using Upmetrics.

Important Assumptions

- The sales forecast is conservative and assumes a 5% increase in Year 2 and a 10% in Year 3.

- The analysis accounts for economic seasonality – wherein some months revenues peak (such as holidays ) and wanes in slower months.

- The analysis assumes the owner will not withdraw any salary till the 3rd year; at any time it is assumed that the owner’s withdrawal is available at his discretion.

- Sales are cash basis – nonaccrual accounting

- Moderate ramp- up in staff over the 5 years forecast

- Barista salary in the forecast is $36,000 in 2023.

- In general, most cafes have an 85% gross profit margin

- In general, most cafes have a 3% net profit margin

Projected Balance Sheet

Projected Cash-Flow Statement

Projected Profit & Loss Statement

Break Even Analysis

Start Preparing Your Financial Plan

We covered everything about financial planning in this guide, didn’t we? Although it doesn’t fulfill our objective to the fullest—we want you to finish your financial plan.

Sounds like a tough job? We have an easy way out for you—Upmetrics’ financial forecasting feature. Simply enter your financial assumptions, and let it do the rest.

So what are you waiting for? Try Upmetrics and create your financial plan in a snap.

Build your Business Plan Faster

with step-by-step Guidance & AI Assistance.

Frequently Asked Questions

How often should i update my financial projections.

Well, there is no particular rule about it. However, reviewing and updating your financial plan once a year is considered an ideal practice as it ensures that the financial aspirations you started and the projections you made are still relevant.

How do I estimate startup costs accurately?

You can estimate your startup costs by identifying and factoring various one-time, recurring, and hidden expenses. However, using a financial forecasting tool like Upmetrics will ensure accurate costs while speeding up the process.

What financial ratios should startups pay attention to?

Here’s a list of financial ratios every startup owner should keep an eye on:

- Net profit margin

- Current ratio

- Quick ratio

- Working capital

- Return on equity

- Debt-to-equity ratio

- Return on assets

- Debt-to-asset ratio

What are the 3 different scenarios in scenario analysis?

As discussed earlier, Scenario analysis is the process of ascertaining and analyzing possible events that can occur in the future. Startups or businesses often consider analyzing these three scenarios:

- base-case (expected) scenario

- Worst-case scenario

- best case scenario.

About the Author

Ajay is a SaaS writer and personal finance blogger who has been active in the space for over three years, writing about startups, business planning, budgeting, credit cards, and other topics related to personal finance. If not writing, he’s probably having a power nap. Read more

Reach Your Goals with Accurate Planning

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Popular Templates

Everything that you need to know to start your own business. From business ideas to researching the competition.

Practical and real-world advice on how to run your business — from managing employees to keeping the books.

Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

Entrepreneurs and industry leaders share their best advice on how to take your company to the next level.

- Business Ideas

- Human Resources

- Business Financing

- Growth Studio

- Ask the Board

Looking for your local chamber?

Interested in partnering with us?

Start » startup, business plan financials: 3 statements to include.

The finance section of your business plan is essential to securing investors and determining whether your idea is even viable. Here's what to include.

If your business plan is the blueprint of how to run your company, the financials section is the key to making it happen. The finance section of your business plan is essential to determining whether your idea is even viable in the long term. It’s also necessary to convince investors of this viability and subsequently secure the type and amount of funding you need. Here’s what to include in your business plan financials.

[Read: How to Write a One-Page Business Plan ]

What are business plan financials?

Business plan financials is the section of your business plan that outlines your past, current and projected financial state. This section includes all the numbers and hard data you’ll need to plan for your business’s future, and to make your case to potential investors. You will need to include supporting financial documents and any funding requests in this part of your business plan.

Business plan financials are vital because they allow you to budget for existing or future expenses, as well as forecast your business’s future finances. A strongly written finance section also helps you obtain necessary funding from investors, allowing you to grow your business.

Sections to include in your business plan financials

Here are the three statements to include in the finance section of your business plan:

Profit and loss statement

A profit and loss statement , also known as an income statement, identifies your business’s revenue (profit) and expenses (loss). This document describes your company’s overall financial health in a given time period. While profit and loss statements are typically prepared quarterly, you will need to do so at least annually before filing your business tax return with the IRS.

Common items to include on a profit and loss statement :

- Revenue: total sales and refunds, including any money gained from selling property or equipment.

- Expenditures: total expenses.

- Cost of goods sold (COGS): the cost of making products, including materials and time.

- Gross margin: revenue minus COGS.

- Operational expenditures (OPEX): the cost of running your business, including paying employees, rent, equipment and travel expenses.

- Depreciation: any loss of value over time, such as with equipment.

- Earnings before tax (EBT): revenue minus COGS, OPEX, interest, loan payments and depreciation.

- Profit: revenue minus all of your expenses.

Businesses that have not yet started should provide projected income statements in their financials section. Currently operational businesses should include past and present income statements, in addition to any future projections.

[Read: Top Small Business Planning Strategies ]

A strongly written finance section also helps you obtain necessary funding from investors, allowing you to grow your business.

Balance sheet

A balance sheet provides a snapshot of your company’s finances, allowing you to keep track of earnings and expenses. It includes what your business owns (assets) versus what it owes (liabilities), as well as how much your business is currently worth (equity).

On the assets side of your balance sheet, you will have three subsections: current assets, fixed assets and other assets. Current assets include cash or its equivalent value, while fixed assets refer to long-term investments like equipment or buildings. Any assets that do not fall within these categories, such as patents and copyrights, can be classified as other assets.

On the liabilities side of your balance sheet, include a total of what your business owes. These can be broken down into two parts: current liabilities (amounts to be paid within a year) and long-term liabilities (amounts due for longer than a year, including mortgages and employee benefits).

Once you’ve calculated your assets and liabilities, you can determine your business’s net worth, also known as equity. This can be calculated by subtracting what you owe from what you own, or assets minus liabilities.

Cash flow statement

A cash flow statement shows the exact amount of money coming into your business (inflow) and going out of it (outflow). Each cost incurred or amount earned should be documented on its own line, and categorized into one of the following three categories: operating activities, investment activities and financing activities. These three categories can all have inflow and outflow activities.

Operating activities involve any ongoing expenses necessary for day-to-day operations; these are likely to make up the majority of your cash flow statement. Investment activities, on the other hand, cover any long-term payments that are needed to start and run your business. Finally, financing activities include the money you’ve used to fund your business venture, including transactions with creditors or funders.

CO— aims to bring you inspiration from leading respected experts. However, before making any business decision, you should consult a professional who can advise you based on your individual situation.

Follow us on Instagram for more expert tips & business owners’ stories.

CO—is committed to helping you start, run and grow your small business. Learn more about the benefits of small business membership in the U.S. Chamber of Commerce, here .

Subscribe to our newsletter, Midnight Oil

Expert business advice, news, and trends, delivered weekly

By signing up you agree to the CO— Privacy Policy. You can opt out anytime.

More tips for your startup

How to change your ein, or how to fix an incorrect ein, micro-business vs. startup: what’s the difference, micro businesses: what are they and how do you start one.

By continuing on our website, you agree to our use of cookies for statistical and personalisation purposes. Know More

Welcome to CO—

Designed for business owners, CO— is a site that connects like minds and delivers actionable insights for next-level growth.

U.S. Chamber of Commerce 1615 H Street, NW Washington, DC 20062

Social links

Looking for local chamber, stay in touch.

Call Us (877) 968-7147

Most popular blog categories

- Payroll Tips

- Accounting Tips

- Accountant Professional Tips

How to Craft the Financial Section of Business Plan (Hint: It’s All About the Numbers)

Writing a small business plan takes time and effort … especially when you have to dive into the numbers for the financial section. But, working on the financial section of business plan could lead to a big payoff for your business.

Read on to learn what is the financial section of a business plan, why it matters, and how to write one for your company.

What is the financial section of business plan?

Generally, the financial section is one of the last sections in a business plan. It describes a business’s historical financial state (if applicable) and future financial projections. Businesses include supporting documents such as budgets and financial statements, as well as funding requests in this section of the plan.

The financial part of the business plan introduces numbers. It comes after the executive summary, company description , market analysis, organization structure, product information, and marketing and sales strategies.

Businesses that are trying to get financing from lenders or investors use the financial section to make their case. This section also acts as a financial roadmap so you can budget for your business’s future income and expenses.

Why it matters

The financial section of the business plan is critical for moving beyond wordy aspirations and into hard data and the wonderful world of numbers.

Through the financial section, you can:

- Forecast your business’s future finances

- Budget for expenses (e.g., startup costs)

- Get financing from lenders or investors

- Grow your business

- Growth : 64% of businesses with a business plan were able to grow their business, compared to 43% of businesses without a business plan.

- Financing : 36% of businesses with a business plan secured a loan, compared to 18% of businesses without a plan.

So, if you want to possibly double your chances of securing a business loan, consider putting in a little time and effort into your business plan’s financial section.

Writing your financial section

To write the financial section, you first need to gather some information. Keep in mind that the information you gather depends on whether you have historical financial information or if you’re a brand-new startup.

Your financial section should detail:

- Business expenses

Financial projections

Financial statements, break-even point, funding requests, exit strategy, business expenses.

Whether you’ve been in business for one day or 10 years, you have expenses. These expenses might simply be startup costs for new businesses or fixed and variable costs for veteran businesses.

Take a look at some common business expenses you may need to include in the financial section of business plan:

- Licenses and permits

- Cost of goods sold

- Rent or mortgage payments

- Payroll costs (e.g., salaries and taxes)

- Utilities

- Equipment

- Supplies

- Advertising

Write down each type of expense and amount you currently have as well as expenses you predict you’ll have. Use a consistent time period (e.g., monthly costs).

Indicate which expenses are fixed (unchanging month-to-month) and which are variable (subject to changes).

How much do you anticipate earning from sales each month?

If you operate an existing business, you can look at previous monthly revenue to make an educated estimate. Take factors into consideration, like seasonality and economic ups and downs, when basing projections on previous cash flow.

Coming up with your financial projections may be a bit trickier if you are a startup. After all, you have nothing to go off of. Come up with a reasonable monthly goal based on things like your industry, competitors, and the market. Hint : Look at your market analysis section of the business plan for guidance.

A financial statement details your business’s finances. The three main types of financial statements are income statements, cash flow statements, and balance sheets.

Income statements summarize your business’s income and expenses during a period of time (e.g., a month). This document shows whether your business had a net profit or loss during that time period.

Cash flow statements break down your business’s incoming and outgoing money. This document details whether your company has enough cash on hand to cover expenses.

The balance sheet summarizes your business’s assets, liabilities, and equity. Balance sheets help with debt management and business growth decisions.

If you run a startup, you can create “pro forma financial statements,” which are statements based on projections.

If you’ve been in business for a bit, you should have financial statements in your records. You can include these in your business plan. And, include forecasted financial statements.

You’re just in luck. Check out our FREE guide, Use Financial Statements to Assess the Health of Your Business , to learn more about the different types of financial statements for your business.

Potential investors want to know when your business will reach its break-even point. The break-even point is when your business’s sales equal its expenses.

Estimate when your company will reach its break-even point and detail it in the financial section of business plan.

If you’re looking for financing, detail your funding request here. Include how much you are looking for, list ideal terms (e.g., 10-year loan or 15% equity), and how long your request will cover.

Remember to discuss why you are requesting money and what you plan on using the money for (e.g., equipment).

Back up your funding request by emphasizing your financial projections.

Last but not least, your financial section should also discuss your business’s exit strategy. An exit strategy is a plan that outlines what you’ll do if you need to sell or close your business, retire, etc.

Investors and lenders want to know how their investment or loan is protected if your business doesn’t make it. The exit strategy does just that. It explains how your business will make ends meet even if it doesn’t make it.

When you’re working on the financial section of business plan, take advantage of your accounting records to make things easier on yourself. For organized books, try Patriot’s online accounting software . Get your free trial now!

Stay up to date on the latest accounting tips and training

You may also be interested in:

Need help with accounting? Easy peasy.

Business owners love Patriot’s accounting software.

But don’t just take our word…

Explore the Demo! Start My Free Trial

Relax—run payroll in just 3 easy steps!

Get up and running with free payroll setup, and enjoy free expert support. Try our payroll software in a free, no-obligation 30-day trial.

Relax—pay employees in just 3 steps with Patriot Payroll!

Business owners love Patriot’s award-winning payroll software.

Watch Video Demo!

Watch Video Demo

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How to Write the Financial Section of a Business Plan

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

Taking Stock of Expenses

The income statement, the cash flow projection, the balance sheet.

The financial section of your business plan determines whether or not your business idea is viable and will be the focus of any investors who may be attracted to your business idea. The financial section is composed of four financial statements: the income statement, the cash flow projection, the balance sheet, and the statement of shareholders' equity. It also should include a brief explanation and analysis of these four statements.

Think of your business expenses as two cost categories: your start-up expenses and your operating expenses. All the costs of getting your business up and running should be considered start-up expenses. These may include:

- Business registration fees

- Business licensing and permits

- Starting inventory

- Rent deposits

- Down payments on a property

- Down payments on equipment

- Utility setup fees

Your own list will expand as soon as you start to itemize them.

Operating expenses are the costs of keeping your business running . Think of these as your monthly expenses. Your list of operating expenses may include:

- Salaries (including your own)

- Rent or mortgage payments

- Telecommunication expenses

- Raw materials

- Distribution

- Loan payments

- Office supplies

- Maintenance

Once you have listed all of your operating expenses, the total will reflect the monthly cost of operating your business. Multiply this number by six, and you have a six-month estimate of your operating expenses. Adding this amount to your total startup expenses list, and you have a ballpark figure for your complete start-up costs.

Now you can begin to put together your financial statements for your business plan starting with the income statement.

The income statement shows your revenues, expenses, and profit for a particular period—a snapshot of your business that shows whether or not your business is profitable. Subtract expenses from your revenue to determine your profit or loss.

While established businesses normally produce an income statement each fiscal quarter or once each fiscal year, for the purposes of the business plan, an income statement should be generated monthly for the first year.

Not all of the categories in this income statement will apply to your business. Eliminate those that do not apply, and add categories where necessary to adapt this template to your business.

If you have a product-based business, the revenue section of the income statement will look different. Revenue will be called sales, and you should account for any inventory.

The cash flow projection shows how cash is expected to flow in and out of your business. It is an important tool for cash flow management because it indicates when your expenditures are too high or if you might need a short-term investment to deal with a cash flow surplus. As part of your business plan, the cash flow projection will show how much capital investment your business idea needs.

For investors, the cash flow projection shows whether your business is a good credit risk and if there is enough cash on hand to make your business a good candidate for a line of credit, a short-term loan , or a longer-term investment. You should include cash flow projections for each month over one year in the financial section of your business plan.

Do not confuse the cash flow projection with the cash flow statement. The cash flow statement shows the flow of cash in and out of your business. In other words, it describes the cash flow that has occurred in the past. The cash flow projection shows the cash that is anticipated to be generated or expended over a chosen period in the future.

There are three parts to the cash flow projection:

- Cash revenues: Enter your estimated sales figures for each month. Only enter the sales that are collectible in cash during each month you are detailing.

- Cash disbursements: Take the various expense categories from your ledger and list the cash expenditures you actually expect to pay for each month.

- Reconciliation of cash revenues to cash disbursements: This section shows an opening balance, which is the carryover from the previous month's operations. The current month's revenues are added to this balance, the current month's disbursements are subtracted, and the adjusted cash flow balance is carried over to the next month.

The balance sheet reports your business's net worth at a particular point in time. It summarizes all the financial data about your business in three categories:

- Assets : Tangible objects of financial value that are owned by the company.

- Liabilities: Debt owed to a creditor of the company.

- Equity: The net difference when the total liabilities are subtracted from the total assets.

The relationship between these elements of financial data is expressed with the equation: Assets = Liabilities + Equity .

For your business plan , you should create a pro forma balance sheet that summarizes the information in the income statement and cash flow projections. A business typically prepares a balance sheet once a year.

Once your balance sheet is complete, write a brief analysis for each of the three financial statements. The analysis should be short with highlights rather than in-depth analysis. The financial statements themselves should be placed in your business plan's appendices.

Simple Business Plan Template for Startups, Small Businesses & Entrepreneurs

Financial plan, what is a financial plan.

A business’ financial plan is the part of your business plan that details how your company will achieve its financial goals. It includes information on your company’s projected income, expenses, and cash flow in the form of a 5-Year Income Statement, Balance Sheet and Cash Flow Statement. The plan should also detail how much funding your company needs and the key uses of these funds.

The financial plan is an important part of the business plan, as it provides a framework for making financial decisions. It can be used to track progress and make adjustments as needed.

Why Your Financial Plan is Important

The financial section of your business plan details the financial implications of running your company. It is important for the following two reasons:

Making Informed Decisions

A financial plan provides a framework for making decisions about how to use your money. It can help you determine whether or not you can afford to make a major purchase, such as a new piece of equipment.

It can also help you decide how much money to reinvest in your business, and how much to save for paying taxes.

A financial plan is like a roadmap for your business. It can help you track your progress and make adjustments as needed. The plan can also help you identify potential problems before they arise.

For example, if your sales are below your projections, you may need to adjust your budget accordingly.

Your financial plan helps you understand how much outside funding is required, when your levels of cash might fall low, and what sales and other goals you need to hit to become financially viable.

Securing Funding

This section of your plan is absolutely critical if you are trying to secure funding. Your financial plan should include information on your revenue, expenses, and cash flow.

This information will help potential investors or lenders understand your business’s financial situation and decide whether or not to provide funding.

Include a detailed description of how you plan to use the funds you are requesting. For example, what are the key uses of the funds (e.g., purchasing equipment, paying staff, etc.) and what are the future timings of these financial outlays.

The financial information in your business plan should be realistic and accurate. Do not overstate your projected revenues or underestimate your expenses. This can lead to problems down the road.

Potential investors and lenders will be very interested in your future projections since it indicates whether you will be able to repay your loans and/or provide a nice return on investment (ROI) upon exit.

Financial Plan Template: 4 Components to Include in Your Financial Plan

The financial section of a business plan should have the following four sub-sections:

Revenue Model

Here you will detail how your company generates revenues. Oftentimes this is very straightforward, for instance, if you sell products. Other times, your answer might be more complex, such as if you’re selling subscriptions (particularly at different price/service levels) or if you are selling multiple products and services.

Financial Overview & Highlights

In developing your financial plan, you need to create full financial forecasts including the following financial statements.

5-Year Income Statement / Profit and Loss Statement

An income statement, also known as a profit and loss statement (P&L), shows how much revenue your business has generated over a specific period of time, and how much of that revenue has turned into profits. The statement includes your company’s revenues and expenses for a given time period, such as a month, quarter, or year. It can also show your company’s net income, which is the amount of money your company has made after all expenses have been paid.

5-Year Balance Sheet

A balance sheet shows a company’s financial position at a specific point in time. The balance sheet lists a company’s assets (what it owns), its liabilities (what it owes), and its equity (the difference between its assets and its liabilities).

The balance sheet is important because it shows a company’s financial health at a specific point in time. A strong balance sheet indicates that a company has the resources it needs to grow and expand. A weak balance sheet, on the other hand, may indicate that a company is struggling to pay its bills and may be at risk of bankruptcy.

5-Year Cash Flow Statement

A cash flow statement shows how much cash a company has on hand, as well as how much cash it is generating (or losing) over a specific period of time. The statement includes both operating and non-operating activities, such as revenue from sales, expenses, investing activities, and financing activities.

While your full financial projections will go in your Appendix, highlights of your financial projections will go in the Financial Plan section.

These highlights include your Total Revenue, Direct Expenses, Gross Profit, Other Expenses, EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization), and Net Income projections. Also include key assumptions used in creating these future projections such as revenue and cost growth rates.

Funding Requirements/Use of Funds

In this section, you will detail how much outside funding you require, if any, and the core uses of these funds.

For example, detail how much of the funding you need for:

- Product Development

- Product Manufacturing

- Rent or Office/Building Build-Out

Exit Strategy

If you are seeking equity capital, you need to explain your “exit strategy” here or how investors will “cash out” from their investment.

To add credibility to your exit strategy, conduct market research. Specifically, find other companies in your market who have exited in the past few years. Mention how they exited and the amounts of the exit (e.g., XYZ Corp. bought ABC Corp. for $Y).

Business Plan Financial Plan FAQs

What is a financial plan template.

A financial plan template is a pre-formatted spreadsheet that you can use to create your own financial plan. The financial plan template includes formulas that will automatically calculate your revenue, expenses, and cash flow projections.

How Can I Download a Financial Plan Template?

Download Growthink’s Ultimate Business Plan Template which includes a complete financial plan template and more to help you write a solid business plan in hours.

How Do You Make Realistic Assumptions in Your Business Plan?

When forecasting your company’s future, you need to make realistic assumptions. Conduct market research and speak with industry experts to get a better idea of the key trends affecting your business and realistic growth rates.

You should also use historical data to help inform your projections. For example, if you are launching a new product, use past sales data to estimate how many units you might sell in Year 1, Year 2, etc.

Learn more about how to make the appropriate financial assumptions for your business plan.

How Do You Make the Proper Financial Projections for Your Business Plan?

Your business plan’s financial projections should be based on your business model and your market research. The goal is to make as realistic and achievable projections as possible.

To create a good financial projection, you need to understand your revenue model and your target market. Once you have this information, you can develop assumptions around revenue growth, cost of goods sold, margins, expenses, and other key metrics.

Once you have your assumptions set, you can plug them into a financial model to generate your projections.

Learn more about how to make the proper financial projections for your business plan.

What Financials Should Be Included in a Business Plan?

There are a few key financials that should be included in a traditional business plan format. These include the Income Statement, Balance Sheet, and Cash Flow Statement.

Income Statements, also called Profit and Loss Statements, will show your company’s expected income and expense projections over a specific period of time (usually 1 year, 3 years, or 5 years). Balance Sheets will show your company’s assets, liabilities, and equity at a specific point in time. Cash Flow Statements will show how much cash your company has generated and used over a specific period of time.

Growthink's Ultimate Business Plan Template includes a complete financial plan template to easily create these financial statements and more so you can write a great business plan in hours.

BUSINESS PLAN TEMPLATE OUTLINE

- Business Plan Template Home

- 1. Executive Summary

- 2. Company Overview

- 3. Industry Analysis

- 4. Customer Analysis

- 5. Competitive Analysis

- 6. Marketing Plan

- 7. Operations Plan

- 8. Management Team

- 9. Financial Plan

- 10. Appendix

- Business Plan Summary

Other Helpful Business Planning Articles & Templates

What Is a Balance Sheet? Definition, Formulas, and Example

Trevor Betenson

10 min. read

Updated May 2, 2024

Business financial statements consist of three main components: the income statement , statement of cash flows , and balance sheet. The balance sheet is often the most misunderstood of these components—but also extremely beneficial if you understand how to use it.

Check out our free downloadable Balance Sheet Template for more, and keep reading to learn the different elements of a balance sheet, and why they matter.

- What is a balance sheet?

The balance sheet provides a snapshot of the overall financial condition of your company at a specific point in time. It lists all of the company’s assets, liabilities, and owner’s equity in one simple document.

A balance sheet always has to balance—hence the name. Assets are on one side of the equation, and liabilities plus owner’s equity are on the other side.

Assets = Liabilities + Equity

- What is the purpose of the balance sheet?

Put simply, a balance sheet shows what a company owns (assets), what it owes (liabilities), and how much owners and shareholders have invested (equity).

Including a balance sheet in your business plan is an essential part of your financial forecast , alongside the income statement and cash flow statement.

These statements give anyone looking over the numbers a solid idea of the overall state of the business financially. In the case of the balance sheet in particular, what it’s telling you is whether or not you’re in debt, and how much your assets are worth. This information is critical to managing your business and the creation of a business plan.

The balance sheet includes spending and income that isn’t in the income statement (also called a profit and loss statement). For example, the money you spend to repay a loan or buy new assets doesn’t show up in the income statement. And the money you take in as a new loan or a new investment doesn’t show up in the income statement either. The money you are waiting to receive from customers’ outstanding invoices shows up in the balance sheet, not the income statement.

Among other things, your balance sheet can be used to determine your company’s net worth. By subtracting liabilities from assets, you can determine your company’s net worth at any given point in time.

- Key components of the balance sheet

Typically, a balance sheet is divided into three main parts: Assets, liabilities, and owner’s equity.

Assets on a balance sheet or typically organized from top to bottom based on how easily the asset can be converted into cash. This is called “liquidity.” The most “liquid” assets are at the top of the list and the least liquid are at the bottom of the list.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

In the context of a balance sheet, cash means the money you currently have on hand. In business planning, the term “cash” represents the bank or checking account balance for the business, also sometimes referred to as “cash and cash equivalents” or “CCE.”

A cash equivalent is an asset that is liquid and can be converted to cash immediately, like a money market account or a treasury bill.

Accounts receivable

Accounts receivable is money people are supposed to pay you, but that you have not actually received yet (hence the “receivables”).

Usually, this money is sales on credit, often from business-to-business (or “B2B”) sales, where your business has invoiced a customer but has not received payment yet.

Inventory includes the value of all of the finished goods and ready materials that your business has on hand but hasn’t sold yet.

Current assets

Current assets are those that can be converted to cash within one year or less. Cash, accounts receivable, and inventory are all current assets, and these amounts accumulated are sometimes referenced on a balance sheet as “total current assets.”

Long-term assets

Long-term assets are also referred to as “fixed assets” and include things that will have a long-standing value, such as land or equipment. Long-term assets typically cannot be converted to cash quickly.

Accumulated depreciation

Accumulated depreciation reduces the value of assets over time. For example, if a business purchases a car, the car will lose value as time goes on.

Total long-term assets

Total long-term assets is used to describe long-term assets plus depreciation on a balance sheet.

Liabilities

Like assets, liabilities are ordered by how quickly a business needs to pay them off. Current liabilities are typically due within one year. Long-term liabilities are due at any point after one year.

Accounts payable

Accounts payable is the money that your business owes to other vendors, the other side of the coin to “accounts receivable.” Your accounts payable number is the regular bills that your business is expected to pay.

Pay attention to whether this number is exceedingly high, especially if your business doesn’t have enough to cover it.

Sales taxes payable

This only applies to businesses that don’t pay sales tax right away, for example, a business that pays its sales tax each quarter. That might not be your business, so if it doesn’t apply, skip it.

Short-term debt

This is debt that you have to pay back within a year—usually any short-term loan. This can also be referred to on a balance sheet as a line item called current liabilities or short-term loans. Your related interest expenses don’t go here or anywhere on the balance sheet; those should be included in the income statement.

Total current liabilities

The above numbers added together are considered the current liabilities of a business, meaning that the business is responsible for paying them within one year.

Long-term debt

These are the financial obligations that it takes more than a year to pay back. This is often a hefty number, and it doesn’t include interest. For example, this number reflects long-term loans on things like buildings or expensive pieces of equipment. It should be decreasing over time as the business makes payments and lowers the principal amount of the loan.

Total liabilities

Everything listed above that you have to pay out or back is added together.

This is the sum of all shareholder money invested in the business and accumulated business profits. Owner’s equity includes common stock, retained earnings, and paid-in-capital.

Paid-in capital

Money is paid into the company as investments. This is not to be confused with the par value or market value of stocks. This is actual money paid into the company as equity investments by owners.

Retained earnings

Earnings (or losses) that have been reinvested into the company, that have not been paid out as dividends to the owners. When retained earnings are negative, the company has accumulated losses. This can also be referred to as “shareholder’s equity.”

This doesn’t apply to all legal structures for a business; if you are a pass-through tax entity , then all profits or losses will be passed on to owners, and your balance sheet should reflect that.

Net earnings

This is an important number—the higher it is, the more profitable your company is. This line item can also be called income or net profit. Earnings are the proverbial “bottom line”: sales less costs of sales and expenses.

Total owner’s equity

Equity means business ownership, also called capital. Equity can be calculated as the difference between assets and liabilities. This can also be referred to as “shareholder’s equity” or “stockholder’s equity.”

Total liabilities and equity

This is the final equation I mentioned at the beginning of this post, assets = liabilities + equity.

- How to use the balance sheet

Your balance sheet can provide a wealth of useful information to help improve financial management. For example, you can determine your company’s net worth by subtracting your balance sheet liabilities from your assets, as noted above.

Overall, the balance sheet gives you insights into the health of your business. It’s a snapshot of what you have (assets) and what you owe (liabilities). Keeping tabs on these numbers will help you understand your financial position and if you have enough cash to make further investments in your business.

Perhaps the most useful aspect of your balance sheet is its ability to alert you to upcoming cash shortages. After a highly profitable month or quarter, for example, business owners sometimes get lulled into a sense of financial complacency if they don’t consider the impact of upcoming expenses on their cash flow .

There are two easy-to-figure ratios that can be computed from the balance sheet to help determine whether your company will have sufficient cash flow to meet current financial obligations:

Current ratio

This measures liquidity to show whether your company has enough current (i.e., liquid) assets on hand to pay bills on-time and run operations effectively. It is expressed as the number of times current assets exceeds current liabilities.

The higher the current ratio, the better. A current ratio of 2:1 is generally considered acceptable for inventory-carrying businesses, although industry standards can vary widely. The acceptable current ratio for a retail business, for example, is different from that of a manufacturer.

Current ratio formula

Current Assets / Current Liabilities

Quick ratio

This ratio is similar to the current ratio but excludes inventory. A quick ratio of 1.5:1 is generally desirable for non-inventory-carrying businesses, but—just as with current ratios—desirable quick ratios differ from industry to industry.

Quick ratio formula

Current Assets – Inventory / Current Liabilities

Knowing your industry’s standards is an important part of evaluating your business’s balance sheet effectively.

- The limits of the balance sheet

Remember, the balance sheet alone doesn’t give you a complete view of your business finances. You’ll want to keep tabs on your profit & loss statement (income statement) and cash flow as well.

Your profit & loss statement will show you the sales you are making and your business expenses and calculates your profitability. This is crucial for understanding the core economics of your business and if you’re building a profitable business, or not.

Your cash flow forecast shows how cash is moving in and out of your business and can help you predict your future cash balances. Fast growth can reduce cash quickly, especially for businesses that carry inventory, so this is a crucial statement to pay attention to as well.

The three statements all work together to provide you with a complete picture of your business. The balance sheet also helps illustrate how cash and profits are very different things .

- Example of a balance sheet

Large businesses will have longer and more complex balance sheets for their businesses, sometimes having separate balance sheets for different segments or departments of their business. A small business balance sheet will be more straightforward and have fewer line items.

Here is a balance sheet from Apple, for example. You’ll see that it includes a complex stockholder’s equity section and several specifically itemized types of long-term assets and liabilities.

Apple’s balance sheet .

You’ll also notice that it says “Period Ending” at the top; this indicates that these numbers are reflective of the time up until the date listed at the top of the column. This terminology is used when you are reporting actual values, not creating a financial forecast for the future.

- Get familiar with your balance sheet

Most companies should update their balance once a month, or whenever lenders ask for an updated balance sheet. Today’s accounting software programs will create your balance sheet for you, but it’s up to you to enter accurate information into the program to generate useful data to work from.

The balance sheet can be an extremely useful financial tool for businesses that understand how to use it properly. If you’re not as familiar with your balance sheet as you’d like to be, now might be a good time to learn more about the workings of your balance sheet and how it can help improve financial management.

Create your balance sheet easily by downloading our Balance Sheet Template , and check out our full guide to write your financial plan.

Trevor is the CFO of Palo Alto Software, where he is responsible for leading the company’s accounting and finance efforts.

Table of Contents

Related Articles

6 Min. Read

How to Forecast Sales for a Subscription Business

8 Min. Read

How to Forecast Personnel Costs in 3 Steps

5 Min. Read

How to Improve the Accuracy of Financial Forecasts

7 Min. Read

7 Financial Terms Small Business Owners Need to Know

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Financial Statements for Small Businesses: Tips & Samples

Regardless of your business’ size or the industry in which it operates, there are several financial statements you need to complete and update on a regular basis.

These financial statements will comprise a main part of your business plan, and that business plan will play an integral role in securing the investments or loans needed to grow your company. Financial statements will also help you understand how money flows into and out of your business, which leads to smarter decisions around which investments to make, which loans to pursue and more.

What Is a Financial Statement?

Financial statements provide a formal record of an organization’s financial activity, its current financial status and an idea of how well it may (or, may not) perform in the future. Financial statements can help to show business activity and financial performance. They are required for audits and are often used for tax, financing or investing purposes.

Financial statements are broken down into three main items: a current balance sheet, a profit and loss (P&L) statement , and a cash flow statement. Together, they provide an understanding of profits and a basis on which to make predictions about the company’s financial future. Here’s a look at each and the purpose it serves:

- The balance sheet shows assets and liabilities.

- The P&L statement, or income statement, records company revenues and expenses for a particular period.

- The cash flow statement demonstrates how much cash a company has on hand and its ability to manage its cash, as well its ability to meet current liabilities, pay operating expenses and fund any potential investments.

Key Takeaways

- Financial statements are an important part of running a profitable, financially-sound business.

- Financial statements comprise three individual items, all of which help both internal and external stakeholders make good decisions regarding the company.

- A financial plan is equally as important, and helps business owners chart their courses for the future based on their current and historical financial positions, resources and contingency plans.

Why Is a Financial Statement Important?

Financial statements (opens in new tab) include all of a small business’s operational results, its current financial position and its current cash flow. Financial statements are important because:

- They create a documented “paper trail” for a company’s financial activities.

- They summarize important financial accounting information about the company.

- They give both internal and external stakeholders an accurate picture of the organization’s current financial situation.

Financial statements are also used by lenders to determine an entity’s level of risk. These statements also include information that may be required by law and/or accounting standards. They also provide accountants with the data they need to be able to complete a company’s tax returns and other required documentation.

Individually, the three main financial statements for small businesses each serve a different purpose. The income statement, for example, shows whether a company is generating a profit, while the balance sheet reveals the current status of the business as of the date listed on that document (vs. for the year or quarter overall, as with the income statement). Finally, a company’s cash receipts and cash disbursements can be found on its cash flow statement.

Video: Understanding Financial Statements

What Should Be Included in a Financial Statement?

Business owners and their accountants use income statements, balance sheets and cash flow statements to analyze a company’s financial performance.

The income statement (opens in new tab) includes all of a company’s revenues, cost of goods (or cost of sales for services companies) sold and other expenses across a specified time period (e.g., a quarter or a year). Listed vertically, the entries on this statement typically appear in this order: revenue, expenses, and net income

The balance sheet includes all of a company’s assets, liabilities and shareholder equity. In most instances, these numbers are represented in two different columns.

Finally, the cash flow statement summarizes all of a company’s operating, financing and investment inflows and outflows, including but not limited to changes in the value of inventory, accounts receivable and payable and long-term debt.

How Do I Write a Financial Plan for my Business?

You can create a financial plan whether you’re just launching your business, preparing to expand it in some way or readying to pursue a new source of funding. Using the financial statements outlined in this article, you’ll create a financial plan that not only covers the organization’s progress and current status but also factors in future growth. This is an exercise you can do for yourself, potential investors including venture capitalists , or any other business stakeholder.

At minimum, the plan should include a sales forecast for the next three to four years, a budget for business expenses and overhead, a cash flow statement and a projection of anticipated net profits over time. The plan should also factor in the company’s assets and liabilities, an estimate of cash on-hand (and expected cash on-hand over the next few months) and current accounts payable .

Combined, these key data points will help you chart a course for the future by 1) assessing the company’s current financial status and 2) predicting a path forward based on historical performance. The plan will help you manage cash flow, prepare for potential cash shortages (e.g., due to industry or economic downturns) and set attainable goals for the next three to five years.

By putting a plan together and then reviewing and updating it annually, companies can readily pursue new opportunities, ride out the low points and achieve their short- and long-term goals.

#1 Cloud Accounting Software

5 Steps to Writing a Financial Plan for my Business

Here are the five steps you’ll want to take when writing a financial plan for your company:

Lay out your goals. Do you want to expand? Do you want to add new customer segments? Do you need more equipment? Do you need financing? The answers to these questions will help you kick off the financial plan writing process.

Create monthly financial projections. Small businesses don’t typically have the kind of reserves or business footprint to plan too far ahead. They need monthly projections. Calculate your anticipated income based (opens in new tab) on monthly projections for sales and expenses for items like labor, supplies and overhead, and then add in the costs for the goals you identified in the previous step.

Prepare a cash flow statement, income statement and balance sheet. Use these financial statements to create an accurate, current picture of your company’s financial health.

Calculate your business ratios. Used to rate the overall financial health of a small firm and decide whether its current operating model is viable, financial ratios are a key factor in assessing a company's basic financial health. In most cases, you will use either the current ratio or quick ratio.

Current ratio = Current assets / Current liabilities

Quick ratio = (Cash + Cash equivalents + Current Accounts Receivable) / Current liabilities

From these calculations, you can determine whether your company has the funds available to cover its short-term obligations.

Include contingency plans. You’ll want to have enough emergency sources of money before your business faces challenges that warrant using them. Maintain a cash reserve of three to six months, for example, or ensure that there’s money available on your line of credit. Like anything in life, the key is to not wait until it’s too late to secure these fund sources and ensure that they are there when you need them.

Financial Management

Building a Finance and Accounting Team for a Small Business

Every small business needs an accounting and finance function. How many people are on that team and what their jobs entail depends on the size of the business and the…

Trending Articles

Learn How NetSuite Can Streamline Your Business

NetSuite has packaged the experience gained from tens of thousands of worldwide deployments over two decades into a set of leading practices that pave a clear path to success and are proven to deliver rapid business value. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

Before you go...

Discover the products that 37,000+ customers depend on to fuel their growth.

Before you go. Talk with our team or check out these resources.

Want to set up a chat later? Let us do the lifting.

NetSuite ERP

Explore what NetSuite ERP can do for you.

Business Guide

Complete Guide to Cloud ERP Implementation

4 Key Financial Statements For Your Startup Business Plan

- September 12, 2022

- Fundraising

If you’re preparing a business plan for your startup, chances are that investors (or a bank) have also asked you to produce financial projections for your business. That’s absolutely normal: any startup business plan should at least include forecasts of the 3 financial statements.

The financial projections need to be presented clearly with charts and tables so potential investors understand where you are going, and how much money you need to get there .

In this article we explain you what are the 4 financial statements you should include in the business plan for your startup. Let’s dive in!

Financial Statement #1: Profit & Loss

The profit and loss (P&L) , also referred to as “income statement”, is a summary of all your revenues and expenses over a given time period .

By subtracting expenses from revenues, it gives a clear picture of whether your business is profitable, or loss-making. With the balance sheet and the cash flow statement, it is one of the 3 consolidated financial statements every startup must produce every fiscal year .

Most small businesses produce a P&L on a yearly basis with the help of their accountant. Yet it is good practice to keep track of all revenues and expenses on a monthly or quarterly basis as part of your budget instead.

When projecting your financials as part of your business plan, you must do so on a monthly basis. Usually, most startups project 3 years hence 36 months. If you have some historical performance (for instance you started your business 2 years ago), project 5 years instead.

Expert-built financial model templates for tech startups

Financial Statement #2: Cash Flow

Whilst your P&L includes all your business’ revenues and expenses in a given period, the cash flow statement records all cash inflows and outflows over that same period.

Some expenses are not necessarily recorded in your P&L but should be included in your cash flow statement instead. Why is that? There are 2 main reasons:

- Your P&L shows a picture of all the revenues you generated over a given period as well as the expenses you incurred to generate these revenues . If you sell $100 worth of products in July 2021 and incurred $50 cost to source them from your supplier, your P&L shows $100 revenues minus $50 expenses for that month. But what about if you bought a $15,000 car to deliver these products to your customers? The $15,000 should not be recorded as an expense in your P&L, but a cash outflow instead. Indeed, the car will help you generate revenues, say over the next 5 years, not just in July 2021

- Some expenses in your P&L are not necessarily cash outflows. Think depreciation and amortization expenses for instance: they are pure artificial expenses and aren’t really “spent”. As such, whilst your P&L might include a $100 depreciation expense, your cash flow remains the same.

Financial Statement #3: Balance Sheet

Whilst the P&L and cash flow statement are a summary of your financial performance over a given time period, the balance sheet is a picture of your financials at a given time.

The balance sheet lists all your business’ assets and liabilities at a given time (at end of year for instance). As such, it includes things such as:

- Assets: patents, buildings, equipments, customer receivables, tax credits etc. Assets can be either tangible (e.g. buildings) or intangible (e.g. customer receivables ).

- Liabilities: debt, suppliers payables, etc.

- Equity : the paid-in capital invested to date in the company (from you and any other potential investors). Equity also includes the cumulative result of your P&L: the sum of your profits and losses to date

Whilst P&L and cash flow statement are fairly simple to build when preparing your business plan, you might need help for your balance sheet.

Financial Statement #4: Use of Funds

The use of funds is not a mandatory financial statement your accountant will need to prepare every year. Instead, you shall include it in your startup business plan, along with the 3 key financial statements.

Indeed, the use of funds tells investors where you will spend your money over a given time frame. For instance, if you are raising $500k to open a retail shop, you might need $250k for the first year lease and another $250k for the inventory.

Use of funds should not be an invention from you: instead it is the direct result of your cash flow statement . If you are raising for your first year of business, and your projected cash flow statement result in a $500k loss (including all revenues and expenses), you will need to raise $500k.

For instance, using the example above, if you need $500k over the next 12 months, raise $600k or so instead. Indeed, better be on the safe side in case things do not go as expected!

Privacy Overview

SMALL BUSINESS MONTH. 50% Off for 6 Months. BUY NOW & SAVE

50% Off for 6 Months Buy Now & Save

Wow clients with professional invoices that take seconds to create

Quick and easy online, recurring, and invoice-free payment options

Automated, to accurately track time and easily log billable hours

Reports and tools to track money in and out, so you know where you stand

Easily log expenses and receipts to ensure your books are always tax-time ready

Tax time and business health reports keep you informed and tax-time ready

Automatically track your mileage and never miss a mileage deduction again

Time-saving all-in-one bookkeeping that your business can count on

Track project status and collaborate with clients and team members

Organized and professional, helping you stand out and win new clients

Set clear expectations with clients and organize your plans for each project

Client management made easy, with client info all in one place

Pay your employees and keep accurate books with Payroll software integrations

- Team Management

FreshBooks integrates with over 100 partners to help you simplify your workflows

Send invoices, track time, manage payments, and more…from anywhere.

- Freelancers

- Self-Employed Professionals

- Businesses With Employees

- Businesses With Contractors

- Marketing & Agencies

- Construction & Trades

- IT & Technology

- Business & Prof. Services