Case Studies

Ready to talk.

- Full Name *

- Call Us Get Directions

- Name This field is for validation purposes and should be left unchanged.

We work alongside banks to create winning marketing strategies and execute those strategies with our full-service, in-house staff. To put it simply, we’re here to help you grow your bank.

Ready to talk?

Grand Savings Bank

The best banks don’t stop at accepting change, they embrace it. Grand Savings Bank knew they needed a new website to embody their approach to banking. Now, Grand Savings Bank shows how Life is Grand through an immersive customer experience built on a framework that can grow and evolve in this ever-changing industry.

Texana Bank

How does a 100+-year-old community bank reinvent itself to grow? Through dedication, hard work and collaboration. Texana Bank’s ownership embodies “marketing partner” through their approach to rebranding and reinvention.

Renasant Bank

Radical growth is possible in banking. Renasant Bank dedicated itself to intelligent expansion through organic growth, smart acquisitions, and timely de novo expansion. Mabus Agency has been there to support and enhance these efforts at every turn.

Great work comes from dedication.

Our work comes from an incredibly talented, full-time staff who cares about each bank who trusts us with its advancement. we work to make real connections with you and your staff. each mabus agency employee seeks to understand your institution’s needs, enhance your mission and reach your goals..

Meet Our Team. An Extension of Your Team.

- Phone This field is for validation purposes and should be left unchanged.

Getting personal: How banks can win with consumers

Key takeaways.

- Despite significant investment in AI, only 8 percent of banks are able to apply predictive insights from their machine-learning (ML) models to inform campaigns.

- Although banks know that time to insight matters, just 16 percent have standard protocols for algorithm development.

- By codifying, unifying, and centralizing key analytics and supporting processes, these organizations generate 5 to 15 percent higher revenue from their campaigns and launch them two-to-four times faster.

A large retail bank invested in ML technology to take its personalization initiatives to the next level. The goal was greater predictive power and efficiency in designing and automating customer campaigns. But two years later, the bank was still managing its personalization program much as it always had: manually and in silos. Although it had acquired a sophisticated analytics engine, the bank had overlooked the elements needed to turn that engine into a smoothly functioning “brain.” The result was a perpetual cycle of subscale efforts.

About the authors

This article is a collaborative effort by Jorge Ferreira, Lars Fiedler , Carlo Giovine , Louise Herring , and Megha Kansal , representing views from McKinsey’s Growth, Marketing & Sales Practice.

This bank is not alone. We see many well-intentioned personalization programs stumble from a mix of inconsistent data gathering, sluggish production models, and bespoke algorithms that are hard to update and share.

There are organizational issues as well. Too many businesses continue to view personalization as either a marketing initiative or an analytics initiative, when it needs to be managed as a joint initiative across the business. In the bank’s case, the marketing team was tasked with managing the program, but marketers had only sporadic access to analytics resources, forcing them to fall back on basic heuristics that were easier to manage but less effective at personalization. The bank’s aspiration also proved narrow, with a heavy focus on boosting click rates and conversions rather than on long-term drivers of customer value. As a result, the institution struggled to meet its retention and satisfaction targets for key segments.

There is a way to crack these challenges, and it starts by reframing them. We’ve seen organizations across the banking sector test a model that puts customer value at the center of personalization efforts. The outputs are individualized, but the inputs and algorithms that produce them are codified, unified, and centralized. Companies that have employed this model have generated 5 to 15 percent higher revenues from their enhanced campaigns and have halved or quartered their time to market. The bank referenced above, for example, learned to shift from equating value with mortgages sold and accounts opened to measuring it based on customer outcomes, such as retention and willingness to recommend. Instead of sales messaging such as “Try our zero percent introductory rate,” they developed journey-based communications, such as “Here’s how to make your holiday stress free.” Instead of monthly or quarterly campaign releases, they shifted to a daily or weekly tempo. Other companies can do the same.

Would you like to learn about our Growth, Marketing & Sales Insights Practice ?

Rather than creating an engine, most banks focus on parts.

Often banks claim to already work in an agile way or to have the analytical tools in place to drive personalization. But without effective mechanisms to coordinate and amplify customer initiatives across the organization, many end up with one-off use cases, hard-to-replicate models, and limited knowledge sharing—all of which run counter to scale. We’ve observed the following six common challenges that banks across segments face/have faced (Exhibit 1):

- Sporadic and inconsistent customer data: Our research suggests that only about 28 percent of banks today have the ability to rapidly integrate internal structured customer data into their AI models. 1 “ The state of AI in 2020: McKinsey Global Survey results ,” McKinsey, November 17, 2020. For many, a key struggle is that customer information is housed in different ways across the business and stove piped within functions, preventing the bank from gaining a complete view of the customer. To get around these constraints, some banks overindex on third-party analytics and unstructured data. But these can add cost and complexity while ignoring valuable customer data within a bank’s own systems.

- Narrow scope of machine-learning models: Only about 9 percent of banks have a full suite of ML models capable of driving personalized engagement at every touchpoint. Most are trained on isolated moments with short-term, product-driven aims, such as boosting mortgage applications or account openings, rather than on identifying drivers of customer lifetime value (CLV) and shaping their customer interactions based on those insights. As a result, they spend time, attention, and budget on interactions with only marginal returns and underspend in areas with higher potential.

- Subscale analytics development: Just 16 percent of data-science teams follow a standard protocol to develop AI tools. In the majority of cases, analytics are developed on a campaign basis, which slows build times and limits the number of personalization initiatives that can be launched.

- Poor campaign integration and tracking: ML models and campaign-management systems often lack feedback loops to connect them, with the result that a mere 8 percent of banks are able to apply predictive insights from their ML models to inform campaign execution and decision making.

- Inadequate AI risk management: Only 14 percent of banks have a specific AI governance framework. Instead, many AI risk-management practices are driven by traditional-model risk-management conventions such as those developed for know-your-customer and credit risk processes. But these conventions are poorly adapted to the iterative nature of the AI environment, which requires a more dynamic risk-management approach.

From hand crank to flywheel

At-scale personalization needs more than great analytics. It needs an integrated infrastructure with clear mission alignment around high-priority opportunities, use cases that cover the whole customer value lifecycle, an asset library equipped with ready-to-deploy case code, and a uniform set of practices to guide teaming and execution. We have outlined five core elements that make up this flywheel (Exhibit 2). Using this structure, initiatives flow across functions, forcing silos to collapse. Insights, tools, and practices are folded into playbooks that are deployed on successive campaigns, reducing launch times and continually improving outcomes. Equally important, the focus is on CLV rather than on purely transactional gains. Companies that have adopted this model have seen substantially improved customer outcomes.

- Identify high-value opportunities: Starting with one or two simple, high-impact journey use cases can help organizations roll out personalization initiatives faster while delivering value as they go. Those use cases should be determined based on customer and commercial impact and feasibility—taking into account the needs of high-value segments and microsegments, operational complexity, and the amount of new data or skills required. For example, a retail bank that was just starting out focused on the “deposits churn journey” within its affluent segment, then extended that to the “investments churn journey” for the affluent segment, and moved from there to the other segments. Once they were further up the maturity curve, the bank challenged its personalization teams to identify mass segment customers whose near-term value might be low but whose potential lifetime value was double or triple the average, making them good candidates to be upgraded to the affluent segment. Teams then developed campaigns targeting these new segments and developed relationship metrics to gauge whether the shift in segmentation strategies was effective.

The analytics factory within the personalization model

Understanding the factors that drive CLV requires massive amounts of historical data on multiple areas of customer behavior, from transaction histories to online footprints to demographic and psychographic characteristics. And it has to cover a sufficiently long period of time to enable pattern analysis. These needs alone explain why personalization programs cannot operate within discrete functions. Instead, organizations have to establish mechanisms to extract that data from their finance, marketing, channel, and product teams.

Even then, it can take months of trial and error to test thousands of different data combinations to arrive at a reliable algorithmic model. Once done, companies must figure out what actions they could take to drive CLV higher. Orchestrating these steps for a single major customer campaign can feel like a remarkable accomplishment, never mind doing it repeatedly and across all campaigns.

This is where the asset library comes into play. The library sits at the heart of a high-performing personalization model, centralizing, standardizing, and modularizing data and analytics and integrating decisioning and execution. It consists of four layers (exhibit).

The data layer takes inputs, known as data fields, from a company’s customer data and transforms them into a set of variables or features, such as a customer’s debt-to-asset ratios over a two-year timespan. These features are standardized with appropriate formatting, labeling, and categorization, and made available to serve as inputs to the machine-learning algorithms.

The analytics layer houses predictive intelligence. Algorithms (built with features from the data layer) test the strength and causality of different CLV factors and solve for customer questions, such as the risk of churn or propensity to buy. They are designed in a standardized, modular way and rigorously tested before being placed into the library to catch errors when they can be more easily addressed and enable greater sharing and reuse. Reuse, in turn, drives better campaign outcomes, since machine-learning analytics become “smarter” the more they are deployed in the field. For example, the retail bank mentioned earlier developed a sophisticated CLV forecast model in about a week by invoking routines that had been developed in their cross-selling, upselling, and value-reduction models. The model delivered better-than-expected accuracy in projecting a customer’s CLV growth because the algorithmic components had the benefit of prior rounds of field testing.

The decisioning layer tests which actions to take based on the predictive intelligence. But where heuristics and A/B testing may only be able to accommodate a handful of business rules, ML engines can test billions of parameters, enabling prescriptive interventions to be dialed in for a specific individual. The retail bank’s decision layer, for example, crunched through 50 billion parameters in different combinations, testing for the optimal channel, day, and time to send communications to specific high-value customers. The effort led to a 20 percent increase in the bank’s commission revenue across campaigns within the first eight months after implementation.

The execution-and-measurement layer takes these “decisions” and integrates them with relevant third-party tools to activate the campaign. Performance management is baked into this layer, creating a continuous information loop that feeds data from the field directly into the ML engine to refine subsequent analytics. Measurement and feedback requirements can vary significantly from one campaign to another, and even over time. So the modularity given by libraries is key to helping teams reuse previous components and speed delivery. After completing its first customer use case, for example, a bank had 1,500 features. While some elements were hyper-specific to the campaign, many others could be applied to new use cases—and because the algorithms underlying the features and data models are continually tested in the field, they became ever more predictive. Reusable models and interfaces can then be deployed to different parts of the business.

- Enable rapid activation: The asset library plays a vital role in helping personalization teams scale quickly (see sidebar, “The analytics factory within the personalization model”). The ready-to-deploy algorithms and automated decisioning and execution this structure enables make it easier and quicker to test new ideas, ingest data from the field, and issue ever-more-refined outputs. In addition to the advanced machine-learning “brain,” rich customer-data set, and marketing automation tools, organizations need a robust set of performance metrics. An Asian bank, for example, introduced a battery of AI protocols, processes and tooling that enabled them to cut implementation time by 50 percent for more than 150 analytics use cases. Creating playbooks of best practices can also shorten the learning curve. What goes into these guides can vary, but at minimum they should include campaign catalogs that document effective lead management and other tactics, triggers and performance metrics that have proven particularly predictive, and agile rituals such as how to break large projects into smaller cycles. They should also include recommendations on the ideal team size and composition and protocols for autonomous decision making. Organizations have to be willing to invest in building momentum around the activation effort and sustaining it over time. A European bank, for example, was committed to driving its personalization agenda forward aggressively. They brought in or trained several hundred data scientists to help with the effort. These experts huddled with counterparts from marketing and the product-and-channel organization to create granular profiles of their customers’ financial lives and isolate drivers of CLV. Initial use cases focused on adding rich media imagery to campaigns, with the selection and messaging tailored to customer profile data. Subsequent use cases sought to allow customers to stop and start an application with different devices. Over time, the bank developed more than 200 use cases, adding them to a common asset library and sharing playbooks with lessons learned. Since launching its factory model, the bank has improved conversion rates ninefold.

- Invest in fit-for-purpose martech enablement: An integrated technology stack is essential to orchestrate the insights loop that connects enterprise data to the ML models, feeding the resulting inputs into campaigns, then running the field data back through the engine until desired customer outcomes are achieved. Figuring out the best way to build this stack can get complicated quickly. Many companies fall into the trap of “throwing technology at the problem,” but instead of an integrated tech stack, they end up with a bloated one that adds cost and complexity. Best-in-class organizations let value dictate their spend. They align martech resources around their highest-priority use cases and tease apart the data, design, decisioning, distribution, and measurement dimensions they’ll need to meet their customer goals. This approach creates a martech road map based on value capture, which is more effective and sustainable. Given the expertise required to navigate the often-fluid martech environment, some companies find it helpful to collaborate with specialists, particularly when first building out their stack.

- Commit to creating a truly agile operating model: Many organizations apply agile development in pockets, but only a few manage their personalization efforts in a way that cross-cuts through the whole business. To help make that leap, some banks find it helpful to build integrated teams comprised of multiple agile pods, each tasked with a specific use case. One company, for example, broke campaign-related teams into “customer pods” and “enabling pods.” The customer pods served as the ideation center, responsible for capturing CLV insights and generating new ideas to test. The enabling pods took those insights and turned them into reusable assets and approaches. Both employed rapid test-and-learn practices and flexible teaming—pulling diverse talent together into specific project teams, then expanding, collapsing, and regrouping them as projects reached different milestones.

- Invest in talent and capability building: Leading banks take a data-driven approach to building their teams. They identify the skills needed to support personalization at scale within their business and train and hire for specific acumen, be it in advanced analytics, digital banking, digital marketing, and other areas. Given the high demand for talent, they also invest in developing knowledge champions who can carry lessons from team to team and raise the overall skill level. This train-and-scale approach helped the bank referenced earlier roll out its personalization model to six divisions, ultimately delivering over $120 million of value.

Breaking through data-architecture gridlock to scale AI

Leadership must also be in alignment.

Given the cross-cutting nature of the flywheel model, organizations will need to secure strong senior-leadership alignment and define a large enough scope for campaigns to have a material performance impact. Some have found it helpful to focus on an individual business line to start, then expand across the enterprise. One retail bank set up its personalization model within its personal-banking division. That domain was small enough to help teams manage the learning curve, but large enough to contain multiple customer segments and product categories around which to design customer outcomes and campaigns.

Senior leadership must also be open to leading the case for change. We recommend establishing a steering committee comprised of individuals from analytics, marketing, and major product divisions who together have joint accountability for delivering on agreed customer outcomes. Authorized delegates can manage the committee’s day-to-day responsibilities, but it’s important that these individuals have sufficient organizational clout and decision-making authority to ensure that needed changes take effect.

Tailoring to markets of one requires a bank to function as a collective rather than as a collection of functions. By focusing on the right building blocks and prioritizing integration and alignment, financial institutions can create the machinery to personalize at scale, gaining the breakthrough value that they have long sought.

Jorge Ferreira is an associate partner in McKinsey’s Madrid office, Lars Fiedler is a partner in the Hamburg office, Carlo Giovine , Louise Herring , and Megha Kansal are partners in the London office.

Explore a career with us

Related articles.

The value of getting personalization right—or wrong—is multiplying

How to build a data architecture to drive innovation—today and tomorrow

Designing data governance that delivers value

- Marketing Subscription

- Social Media

- Paid Social

- Facebook Ads

Influencer Marketing

- PR & Outreach

- Corporate Explainer Videos

- B2B Explainer Videos

- Tech Explainer Videos

- 3D Explainer Videos

- 2D Explainer Videos

- Educational Explainer Videos

- Healthcare Explainer Videos

- Real Estate Explainer Videos

- Motion Graphics Videos

- Animated Videos

- Corporate Video Production

- Branded Video Production

- Financial Video Production

- 3D Video Production

- 3D Animation

- Educational Video Production

- Healthcare Video Production

- Real Estate Video Production

- SaaS Explainer Videos

Video Marketing

- LinkedIn Lead Generation

- Community Management

- Website development

- Mobile App Development

- Unlimited Graphic Design

- Graphic Design Subscription

- Unlimited Web Design

- Flat Rate Graphic Design

- Mobile App Design

- NFT Game Development

- Play to Earn Game Development

- B2B Social Media

- B2B Lead Generation

- B2B Content Marketing

- B2B Inbound Marketing

- B2B Demand Generation

- B2B Influencer Marketing

- Fintech SEO

- Web3 GTM Strategy

- NFT Marketing

- Web3 Marketing

- Metaverse Marketing

- DeFi Marketing

- ICO Marketing

- IDO Marketing

- IEO Marketing

- STO Marketing

- Crypto Influencer Marketing

- Crypto Exchange Listing

- Crypto Market Making

- Blockchain PR

- Small Business

- Success Stories

Banking Marketing: 9 Best Marketing Strategies For Banks for 2024

Boost your client base and profits with our banking marketing services!

At NinjaPromo, we specialize in attracting and retaining clients in the finance sector. Our comprehensive solutions for banks and financial institutions ensure business growth. Our strategies are based on current trends and innovations, guaranteeing maximum efficiency and competitiveness for your brand. Click Here To Schedule Your Free Consultation Now

Bank marketing stands at a pivotal crossroads, especially as we approach 2024. A financial institution cannot keep interacting with its customers in the same way as new technologies emerge that shift the way we all do business. It may be hard to track changing consumer behaviors, but this guide will provide a comprehensive roadmap to help plan.

What is Bank Marketing?

Bank marketing encompasses a bank’s activities to learn more about customers, develop products to meet their needs, and plan/launch campaigns to reach them.

At its core, bank marketing is designed to achieve several pivotal objectives:

- Customer Acquisition and Retention: Effective marketing strategies for banks are tailored to catch the eye of potential clients and foster loyalty among current customers.

- Brand Building: Bank marketing helps build a brand that resonates with customers’ values and needs, boosting a bank’s reputation and credibility.

- Product Promotion: Bank marketing must showcase a bank’s products and inform customers as to their benefits and why they would be a good fit

- Market Analysis and Adaptation: Understanding market trends and customer behavior is vital. Bank marketing strategies involve constantly checking trends and staying up to date.

Bank marketing strategy is as vital as ever as new technologies and trends stand to shape 2024.

The Importance of Marketing for the Banking Industry in 2024

Marketing strategies for banks should consider Fintech innovations, changing regulatory environments, and evolving customer expectations to reshape marketing for banking services.

- Adapting to a Digitally Savvy Customer Base: Today’s consumers are more digitally connected and informed than ever before. They expect personalized, convenient, and seamless banking experiences. With this in mind, banks must focus on their digital banking services as part of their bank marketing strategies to find their target audience.

- Navigating the Competitive Landscape: The influx of fintech companies and digital-only banks has intensified competition amongst financial services providers. Most banks are more traditional and have to find the right way to strategically present their values and offerings to stand out in a crowded marketplace when they have historically faced little challenge.

- Brand Trust and Reputation Management: Marketing for banks must build and maintain a reputation for reliability, security, and customer-centricity. Effective communication and community engagement can help banks establish a positive brand and greater customer loyalty.

- Regulatory Compliance and Ethical Marketing for Banks: Crypto businesses stealing money have put the industry in a precarious position. Banks must be careful not to misrepresent anything in their marketing and ensure compliance with regulatory standards. This includes maintaining customer privacy and communicating honestly and transparently.

Why Traditional Marketing Strategies No Longer Work

Banking marketing is starting to shift away from traditional mediums, such as print and direct mail, as they offer lesser returns.

Shift in Consumer Behavior : The internet has dramatically changed how consumers interact with financial services. Customers often start searching for new products and services online and do not want to waste time during this process.

- Technological Evolution: Traditional tools take time to refine and execute, whereas digital options and those with AI can adapt and be released faster.

- Increased Competition and Market Saturation: The financial market has become more crowded and competitive. Traditional banking marketing strategies, often generic and broad, fail to cut through the noise and capture the attention of a diverse customer base.

- Demand for Measurable Results: Traditional marketing methods often require more work to measure regarding ROI and customer engagement.

- Sustainability and Environmental Concerns: Print advertisements and direct mail leave an environmental impact that modern consumers are less comfortable with. Banks are more mindful of the waste their projects create and steer away from anything that can be perceived negatively in light of environmental concerns.

Why Digital Marketing is the Future

Digital marketing for banks should be the focus of any major campaign in 2024. Digital marketing is the present and future direction, and here’s why:

- Alignment with Digital Consumer Behavior: A significant portion of financial decisions start online, and digital marketing aligns perfectly with the digital-first behavior of modern consumers. From researching financial products to comparing different banks, consumers are increasingly turning to digital channels for their banking needs .

- Greater Reach and Customization: Digital marketing can reach every intended demographic in a more personal way. Banks can tailor their messaging and offers based on individual customer data, preferences, and behaviors, something traditional marketing cannot.

- Data-Driven Insights and Strategies: Everything we do online leaves collected data behind. Banks can use this data for a more personalized outreach with a significantly higher success rate than would otherwise be possible.

Contact us for personalized solutions aimed at increasing your client base and profits. We specialize in creating effective marketing campaigns that make your bank more appealing to clients. Don’t settle for less – achieve more with NinjaPromo. Book intro call

- Cost-Effectiveness and ROI Measurement: Digital marketing is typically more cost-effective than traditional methods, offering a better return on investment. Digital analytics ensure that intended KPIs are being hit or methods are being pivoted to adjust.

- Enhanced Customer Engagement and Experience: Digital marketing opens up new avenues for customer engagement.

- Adaptability and Responsiveness: Digital marketing is continuously evolving. This allows banks to quickly adapt, ensuring their marketing strategies remain relevant and practical.

The Most Effective Digital Marketing Strategies for Banks in 2024

Banking marketing is no longer centered around printed billboards or expensive TV ads but rather digital marketing strategies more tailored to the reality of 2024.

Social Media Marketing

Instagram: Utilizing Visual Content to Capture the Attention of the Younger Demographic and Promote Financial Products

Instagram is a powerful platform for engaging with a younger audience. Banks can leverage Instagram’s visual nature to showcase their products and services creatively and with greater mass appeal than they would find otherwise.

- Visual Storytelling : Use high-quality images and videos to tell stories about your brand, products, and customer experiences.

- Interactive Features : Utilize Instagram Stories, polls, and Q&A sessions to engage directly with followers and gather feedback.

- Educational Content : Share informative content that simplifies complex financial concepts, catering to the financial literacy needs of younger users.

- Influencer Collaborations : Partner with influencers to reach wider audiences and add credibility to your bank marketing strategy.

LinkedIn: Building a Professional Image for the Bank and Attracting Corporate Clients

Most professionals are on Linkedin, so markers are keen on engaging customers with content. These ideal banking clients provide a greater lifetime value than most digital demographics. To reach them, banks can try:

- Content Marketing : Publish articles and posts that address the financial needs of businesses, showcasing your expertise in corporate finance solutions.

- Professional Networking : Engage with other businesses, join industry-related groups, and participate in discussions to increase visibility.

- Targeted Advertising : Use LinkedIn’s advanced targeting options to reach decision-makers in various industries with tailored advertising campaigns.

- Webinars and Events : Host webinars and online banking events focusing on business-related financial topics, demonstrating thought leadership.

Related Content: Top Fintech Events & Conferences in 2024

Search Engine Optimization (SEO)

SEO has been important in digital bank marketing for the past few years, and that is not changing anytime soon. Visibility online is as important as anything, and proper SEO ensures that a bank will appear higher in most search results. This is the case for both Local SEO and Content Marketing.

Local SEO: Optimizing for Local Search, Focusing on Services and Branch Locations

Attracting customers to their local bank involves optimizing online content to rank higher in local search results.

- Google My Business Optimization : Ensure your bank’s Google My Business listing is complete, accurate, and up-to-date with branch locations, hours, and services.

- Local Keywords : Incorporate local bank keywords into your website’s content, such as the names of cities or neighborhoods where your branches are located.

- Local Link Building : Establish links with local bank businesses and organizations, which can improve your local bank search rankings.

Content Marketing: Creating Relevant Financial Content to Improve Search Engine Rankings

Content marketing is about creating valuable and relevant content for your target audience. For banks, this can include:

- Educational Articles and Blogs : Write about financial topics, trends, and advice, positioning your bank as a knowledge leader in the industry.

- Keyword Optimization : Use relevant keywords throughout your content to improve its visibility in search engine results.

- Video Content : Produce content like tutorials or financial advice, which can benefit SEO and user engagement.

Effective SEO strategies help banks become more visible online, making it easier for potential customers to find their services.

Related Content: The Complete Guide to Financial SEO in 2024

Email Marketing

Email campaigns can be personalized and automated to keep customers aware of new offerings or special deals, enhancing their effectiveness.

Personalized Campaigns: Sending Personalized Offers and Financial Advice Based on Customer Behavior

Banks can use customer data to tailor their messages, making them more relevant and appealing.

- Segmentation : Divide your email list into segments based on customer behavior, preferences, and financial needs. Tailor your messages to each segment for greater relevance.

- Customized Offers : Use customer data to create personalized offers such as tailored loan rates, savings account options, or investment advice.

- Behavior-Based Content : Send content that aligns with the customer’s recent interactions with your services, like follow-up information after a significant transaction or inquiry.

Automated Campaigns: Using Triggers to Send Messages in Response to Specific Customer Actions

Automated email campaigns can be set up to trigger based on specific customer actions, providing timely and relevant information. Examples include:

- Welcome Emails : Automatically send a welcome email with helpful information when a new account is opened.

- Transactional Emails : Send confirmation emails for transactions, providing peace of mind and additional transaction-related information.

- Lifecycle Emails : Send emails with relevant messages or offers at different stages of the customer’s life cycle, such as on anniversaries of account openings or after a period of inactivity.

Customers want to feel that they matter, and personalized, automated emails can help. These campaigns can foster a better long-term relationship with clients than alternatives, leading to greater returns.

Elevate your bank’s recognition to new heights with digital marketing strategies tailored specifically for you by NinjaPromo. We offer creative solutions to help you stand out in the market, attract more clients, and reinforce your connection with your current audience. Start with us and achieve maximum success for your bank. Book intro call

Paid Advertising Campaigns

Although many digital marketing strategies have no direct cost, running paid advertisements offers a targeted way to reach potential customers as part of a digital bank marketing strategy.

Google Ads: Developing Targeted Campaigns to Attract Customers Searching for Financial Services

Google Ads allow banks to place advertisements in Google search results and on other websites, targeting potential customers based on their search queries and online behavior. Use these strategies for the best results:

- Keyword Targeting : Use specific keywords related to banking services and products to target users actively searching for these services.

- Ad Customization : Create relevant and engaging ads with clear calls to action. Tailor ad copy to match the search intent of the targeted keywords.

- Landing Page Optimization : Direct users to well-designed landing pages that provide detailed information about the advertised services and encourage further action, like signing up or inquiring.

Social Media Advertising: Launching Ads on Platforms Such as Facebook to Reach a Broad Audience Based on Interests

Social media platforms offer advertising tools that banks can utilize to target users based on demographics, interests, and behaviors. Try using the following methods:

- Audience Segmentation : Create different ad sets for various audience segments, such as young adults, families, or businesses, tailoring the messaging and offers to each group.

- Engaging Formats : Use a mix of formats like image, video, and carousel ads to showcase different aspects of your services.

- Retargeting Campaigns : Implement retargeting to re-engage users who have visited your website or interacted with your bank online but have yet to convert.

Google ads and social media have tremendous reach online, and a well-crafted campaign can be the most effective bank marketing strategy.

Mobile Applications (ASO)

Banking marketing plans have to include mobile apps. Everyone has a smartphone, and App Store Optimization (ASO) and in-app marketing are the ways to reach them. Mobile banking apps are often the primary way of interacting with a brand for modern consumers.

Developing User-Friendly Apps : Creating Mobile Apps with an Intuitive Interface for Managing Accounts and Conducting Transactions

Digital banking tools lose their value if mobile banking apps are not easy to use. Banking apps must have all the tools customers want but can’t be too complicated for the average person. Several things need to be considered:

- Intuitive Design : Ensure the app interface is clean, intuitive, and easy to navigate. Simplify the process for conducting transactions and accessing services.

- Personalization : Offer personalized features and content based on the user’s banking habits and preferences.

- Regular Updates : Continuously update the app with new features, security enhancements, and performance improvements based on user feedback and technological advancements.

In-App Marketing: Offering Personalized Promotions and Deals to Users Through the Mobile App

In-app marketing allows banks to engage with customers within the app, offering them relevant promotions and deals. Strategies include:

- Push Notifications : Use push notifications to inform users about new features, promotions, or financial tips, ensuring the content is relevant and not overly intrusive.

- In-App Offers : Provide special offers and discounts on banking products and services exclusively through the app.

- Customized Financial Insights : Offer personalized financial insights and advice based on the user’s transaction history and economic behavior.

Focusing on ASO and in-app bank marketing can ensure their mobile applications attract new users and provide ongoing value to existing customers.

Internet Banking

Internet banking is a significant aspect of the digital services offered by banks. Optimizing the online banking experience with advanced digital banking tools keeps the experience fast, easy, and safe for users.

Interface Optimization: Ensuring Ease of Use for Internet Banking to Enhance Customer Satisfaction

A user-friendly interface is key to a positive Internet banking experience. Banks should focus on the following aspects:

- Simplified Navigation : Design the Internet banking interface to be straightforward and intuitive. Ensure that customers can easily find and use standard banking features such as checking balances, transferring funds, and paying bills.

- Responsive Design : Ensure the internet banking platform is responsive and provides a seamless experience across all devices, including desktops, tablets, and smartphones.

- Personalization : Offer customization options, such as the ability to set up quick links to frequently used services or personalized dashboards that show relevant information at a glance.

Security: Emphasizing Transaction and Information Security to Strengthen Trust

Security is more critical for financial products than ever. Banks need to prioritize the following security measures:

- Robust Authentication Processes : Implement strong authentication methods, such as two-factor authentication, to enhance security for online banking transactions.

- Encryption and Data Protection : Advanced encryption technologies protect sensitive customer data and transactions from cyber threats.

- Continuous Monitoring and Updates : Regularly update security measures and monitor for potential threats. Keep customers informed about security features and best practices for safe online banking.

Video content allows banks the opportunity to simplify typically complex products and offers.

YouTube: Creating Informative Videos About the Bank’s Financial Products and Services

YouTube offers a massive platform for banks to reach a broad audience. Effective video marketing strategies include:

- Educational Content : Produce videos that explain financial products, offer financial advice, and demystify complex banking strategies.

- Customer Testimonials and Case Studies : Share stories of how customers have benefitted from the bank’s services, adding a human element to the bank’s offerings.

- Behind-the-Scenes Looks : Show the human side of the bank by featuring employee stories or glimpses into the bank’s operations and community involvement.

Webinars: Conducting Webinars to Educate Customers on Using New Financial Tools

Webinars are an excellent way for any financial institution to engage directly with customers. They can be used to:

- Introduce New Products or Services : Use webinars to launch and explain new banking products, providing a platform for customers to ask questions and get immediate responses.

- Financial Education : Digital banking services may include webinars on personal finance management, investment strategies, and navigating economic changes.

- Expert Panels : Banks can host webinars featuring financial institution experts or guest speakers to discuss relevant financial topics, providing value and direct communication to existing and potential customers.

Artificial Intelligence and Chatbots

In 2024, AI, particularly chatbots, is well-positioned to start impacting the banking experience .

Chatbots: Integrating Chatbots to Provide Quick Responses to Customer Queries

Customer service jobs are going to be nearly entirely replaced by AI because it can provide:

- Instant Customer Support : Chatbots don’t need to be connected to a customer to provide support. They can provide an immediate response without delay.

- 24/7 Availability : Instead of hiring or outsourcing support agents for all hours of the day, AI never shuts off and is always ready to help, unlike traditional customer service.

- Handling Routine Tasks : Customer inquiries are often for simple tasks that a chatbot can automate or help walkthrough, leaving agents assisting only with more complex banking strategies.

Personalized Experience: Using Artificial Intelligence to Analyze Data and Provide Customers with Personalized Recommendations

One of AI’s key features is its ability to “learn” and personalize itself to customers:

- Data Analysis for Personalization : When an AI is fed a customer’s data, it can provide personal recommendations for products and services and financial advice.

- Predictive Analytics : Humans are creatures of habit that routinely behave similarly. AI can notice when somebody changes their behavior, suggesting that something could be happening in their life that would trigger outreach for new products like a marriage or baby.

- Enhanced Security : AI algorithms can help detect and prevent fraudulent activities by analyzing transaction patterns and flagging unusual activities.

Customer service agents and FAQ pages can be slow, clunky, and frustrating. Chatbots can vastly improve this customer experience, improving an important point of contact for a bank.

Many young consumers focus their free time on personalities they follow, and tapping into these influencers can make a brand seem more relatable. Banks can build off of these relationships to position themselves in a more authentic and favorable way.

Strategies for Effective Influencer Marketing in Banking:

- Choosing the Right Influencers : Select influencers whose followers align with the bank’s target audience.

- Content Collaboration : Work with influencers to create content that naturally integrates the bank’s services or products. This could be through informative posts, stories about personal finance management, or experiences using the bank’s services.

- Long-Term Partnerships : Instead of one-off promotions, consider establishing long-term partnerships with influencers. This allows for a more authentic and sustained engagement with their audience.

- Diverse Influencer Portfolio : Collaborate with various influencers, from financial institution experts to lifestyle bloggers, to reach different audience segments effectively.

- Measuring Impact : Use analytics to track the performance of influencer campaigns, assessing metrics such as engagement rates, conversion rates, and audience growth.

Influencer marketing is the newest version of celebrity endorsement-based marketing, but with a more modern element that makes it seem less phony.

Entrust the Promotion of Your Financial Product to Professionals

Professional bank marketing services provide tremendous value in their years of experience and resources. They keep a finger on the pulse of what consumers are looking for and quickly adapt strategies.

Specialized Fintech Marketing Agency : For banks looking to fully capitalize on these advanced marketing strategies, partnering with Ninjapromo.io can be a game-changer.

Why Choose Professional Marketing Services for Your Bank?

- Expertise in Latest Trends and Technologies : Professional marketers stay in front of digital marketing trends and technologies, ensuring that your bank marketing strategies are current.

- Customized Marketing Solutions : They can offer tailored solutions that align with your overall bank marketing, unique goals, and target audience, maximizing the impact of your marketing efforts.

- Time and Resource Efficiency : Outsourcing your marketing needs allows your bank to focus on core business activities while the marketing experts handle the complexities of planning and executing bank marketing campaigns.

Bank marketing strategy was stagnant for many years but will not be in 2024. New technologies and consumer behavior give banks more tools to reach their customers. As the older, wealthier population ages, banks must reach the next generation that stands to inherit a tremendous amount of wealth.

Revolutionary banking marketing solutions from NinjaPromo!

Gain a competitive edge for your bank with our innovative marketing approaches. We offer unique strategies based on data and technology to enhance customer experience, increase brand recognition, and boost sales. Trust us to achieve your financial goals.

Let's Work Together

Did You Like This Article?

Average rating 4.6 / 5. Vote count: 54

No votes so far! Be the first to rate this post.

Our Other Articles

- How NinjaPromo works

- How you can do marketing at scale better, faster and cheaper

- How we’re different from agencies, freelancers and in-house marketing teams (hint: we’re 15x faster than hiring!)

- The most suitable subscription plan for your needs

BOOK A CALL WITH US

—Please choose an option— $1 - $5,000 $5,001 - $10,000 $10,001 - $30,000 $30,001 - $50,000 $50,001 - $100,000 $100,001+ Haven't decided yet —Please choose an option— North America Western Europe Middle East Asia Pacific (APAC) Other

By clicking next, you agree to receive communications from NinjaPromo in accordance with our Privacy Policy.

- Privacy Overview

- Strictly Necessary Cookies

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

- Commercial Lending

- Community Banking

- Compliance and Risk

- Cybersecurity

- Human Resources

- Mutual Funds

- Retail and Marketing

- Tax and Accounting

- Wealth Management

- Magazine Archive

- Newsletter Archive

- Sponsored Archive

- Podcast Archive

What’s On the Way for Bank Marketers in 2022

A s 2021 came to an anti-climactic close, and plans and budgets are submitted and approved, marketers everywhere took deep breaths before plowing into the new year. How will the COVID-19 virus and supply chain challenges continue to impact the economy and the banking industry in 2022? And what impact will economic challenges have on marketing priorities?

Capital Performance Group performed an informal survey of nearly a dozen of our strategic planning clients to gain an understanding of what the C-suite priorities are likely to be next year, and what the implications are today for bank marketers. So read on!

Marketers face four realities

As we spoke with members of bank C-suites, four themes rose to the top of the list:

Shift to growth. With margins shrinking and profits declining, many banks will be reducing marketing budgets for any activities that are not directly generating revenue growth.

Loans, loans, loans. While most institutions (and many businesses) are awash with deposits thanks to PPP and the stimulus payments, loan growth is projected to be tepid this year. All lines of business will need help generating loan demand.

Digital sales. The pandemic highlighted how vulnerable an institution can be without robust online account opening channels in place. This is not just a nice to have, it is as or even more imperative than having a convenient branch. Focusing marketing efforts on driving accounts through the digital channel will be key in 2022.

Measurement and attribution. Bank executives now expect marketers to be able to establish the linkage between your activities and the generation of business results.

Let’s take a look at each in a little more depth:

Growth as a top priority

Every bank marketing department has a ton of competing priorities—client events, sales campaigns, contributions and sponsorships, and social media posts, among others. Sometimes it’s a challenge to determine what to focus on. That is not likely to be the case next year.

Declining earnings usually means one thing for bank marketing—budgets will be under pressure. That’s why focusing on growth will likely be the top priority for bank marketers in 2022. Working with your line of business executives to understand their revenue goals, then crafting programs designed to help them reach those goals, will be the surest way to protect your budget from the chopping block.

Loans, loans, loans

Speaking about those revenue goals, it’s unlikely your executives are looking for deposits, since most institutions are swimming in excess funding. Rather, the prognosis for loan growth, especially on the business side, is very murky. This is due to a combination of factors, including the government stimulus programs, supply chain constraints impacting business sales, and the economic uncertainty that many businesses currently face. Unfortunately, one of the most attractive loan categories—commercial and industrial loans—has realized sharp declines in the rate of growth in the past year. (see chart below).

Banks need to grow loans in order to counteract shrinking margins, but many bankers expect loan demand to be uneven at in 2022. Enter marketing! How can you use data to determine which consumer or business segment is likely to borrow? What specific products will be in demand?

How can you craft a targeted campaign using third party data to find those prospects? How can you provide a flow of qualified home equity or business line of credit leads to your sales teams to supplement their calling efforts? These are important questions you will want to answer in order to deliver relevant value to your institution next year.

Digital sales

Deposit and loan product sales have been moving to the digital channel for years, but bankers were able to look at the (shrinking) majority of sales made through branches and convince themselves that consumers still preferred buying face-to-face. The year 2020 laid bare the fallacy of this thinking. As branches closed or limited service to appointments during the worst days of the pandemic, consumers flocked to open accounts online. Many large banks opened more deposit accounts online than in the branch. Unfortunately, many community banks and regionals discovered that their digital application user experience or marketing prowess was not up to the challenge.

“My digital account openings tripled, admittedly from a low base,” says the head of consumer banking of a $10 billion dollar institution. “But my branch sales plummeted 30 percent. The net was 1500 fewer new customers last year. That’s unsustainable.”

As a result, ramping up digital sales is near the top of the priority list for a large number of institutions. This doesn’t just require a fast, easy-to-use new account opening experience. There are many other pieces and parts involved in getting digital sales right, and Marketing needs to play a key role.

Let’s imagine you are helping generate loans for your business banking team. First, you need to work with them to understand exactly what kind of business they are likely to lend to. Then you can use third party data from providers like Dun and Bradstreet or ZoomInfo to identify those businesses. Next you need to develop and distribute a digital ad or content to capture their attention. And finally, once they visit your site or ask for more information, you need to nurture the lead and deliver it to your sales team, tracking whether it converts to a loan.

While other teams like the digital channel, IT, and the business line need to be involved in the process, it’s clear that marketing plays a pivotal role in bringing digital sales campaigns to life.

Measurement and attribution

There’s a good chance you’ve read up to this point and are saying to yourself, “We are doing all these things. We’ve got it covered!” That’s great news, but don’t get excited too soon. What we hear from too many C-suite executives is that their marketing team speaks a foreign language when it comes to results. While business line management is focused on growing new-to-bank households and deposit and loan balances, marketing talks about impressions, views and clicks. Not that those metrics aren’t important early indicators of business success. They are. But your internal clients generally don’t care about them. They care about moving the revenue dial.

In 2022, executives will either expect you to be able to demonstrate the linkage between your programs and business results, or they will redeploy your budget to activities that are known to drive business. That’s why it’s critical for you to build that framework and understanding with your business line clients and finance team now.

As we know, some activities like direct mail and digital media are easily measurable, while others such as traditional media or events are harder. That doesn’t mean you can’t do it, though! Remember, ‘perfect is the enemy of the good.’ In other words, just because you don’t have perfect attribution of each individual sale does not mean that you cannot take credit for it—if it’s reasonable to assume that marketing activity generated it.

Source: Courtesy of South Shore Bank, South Weymouth, Massachusetts.

By comparison, this bank actually calculated a ‘baseline,’ when no advertising was running, then identifies the week that important marketing activities like direct mail or advertising begin, to help demonstrate the correlation between marketing activities and business results.

It’s important to gain this level of understanding with your internal clients BEFORE you run the campaign, but if you do, and you measure your results carefully, you and your bank’s management team will begin to develop a clearer picture of the business results your marketing programs are having. And that understanding will be more important than ever this year.

Thriving in adversity

This year promises to be even more challenging than the past two for the financial industry. But that creates a golden opportunity for sharp marketers. Revenue generating departments will need more help than ever to hit their business goals. Translating your programs into language they can understand, helping drive meaningful volume through your on-line applications, and handing them qualified loan opportunities will position you and your department as an essential partner in 2022 and beyond.

Mark Gibson is senior consultant at Capital Performance Group , a strategic consulting firm that provides marketing performance and strategic planning services to the financial services industry. Email: [email protected]. LinkedIn .

Related Posts

Bank survey: Military families cite low income, inflation as financial product challenges

Roughly 30% of military families cite low income and lack of stability as a “primary challenge” they face with their current financial products and services, according to a new survey by the Fort Leavenworth, Kansas-based Armed Forces Bank.

Marketing Money Podcast: FDIC digital sign display rule

This episode provides important perspectives on compliance and optimizing marketing strategies.

The renewed focus on third-party risk management for banks

FDIC reminds banks that the competitive edge from partnering comes with caveats.

Rage against the machine thieves

Amid a spike in ATM crime, banks are rethinking and deepening security.

The art and science of data-driven personalization

Understanding account-holders as individuals, rather than segments or averages.

Marketing Money Podcast: Navigating the value of loyalty programs

From hotel upgrades to cashback bonuses, dissecting the nuances of rewards systems.

So you want to be a CRCM?

A monetary policy matrix, podcast: maximizing business, client value from sba loan programs, sponsored content.

Sealing The Deal: Learn About Electronic Notarization in This Comprehensive Webinar Series

Digital Account Opening Best Practices That Will Boost Your Deposit Game

Why It May Be Time for Your Bank to Expand into Dealer Commercial Lending

Legal notice, podcast: is it time to kill the paper check, podcast: how a georgia community bank engaged employees at 3x the national rate, podcast: tackling big goals for financial literacy month, podcast: the ceo view from main street, podcast: the points guy on why credit card rewards matter.

American Bankers Association 1333 New Hampshire Ave NW Washington, DC 20036 1-800-BANKERS (800-226-5377) www.aba.com About ABA Privacy Policy Contact ABA

© 2024 American Bankers Association. All rights reserved.

Case Studies

Value-added checking growth & attrition.

Read the Case Study: Value-Added Checking Growth & Attrition

Cost of Funds

Read the Case Study: Cost of Funds

Cost of Funds Peer Comparison

Read the Case Study: Cost of Funds Peer Comparison

Cultivate™ Difference

Read the Case Study: Cultivate™ Difference

Age Demographics Portfolio versus One-Year Openings

Read the Case Study: Age Demographics Portfolio versus One-Year Openings

Special Rates for Existing Products

Read the Case Study: Special Rates for Existing Products

Online & Mobile Banking Trends

Read the Case Study: Online & Mobile Banking Trends

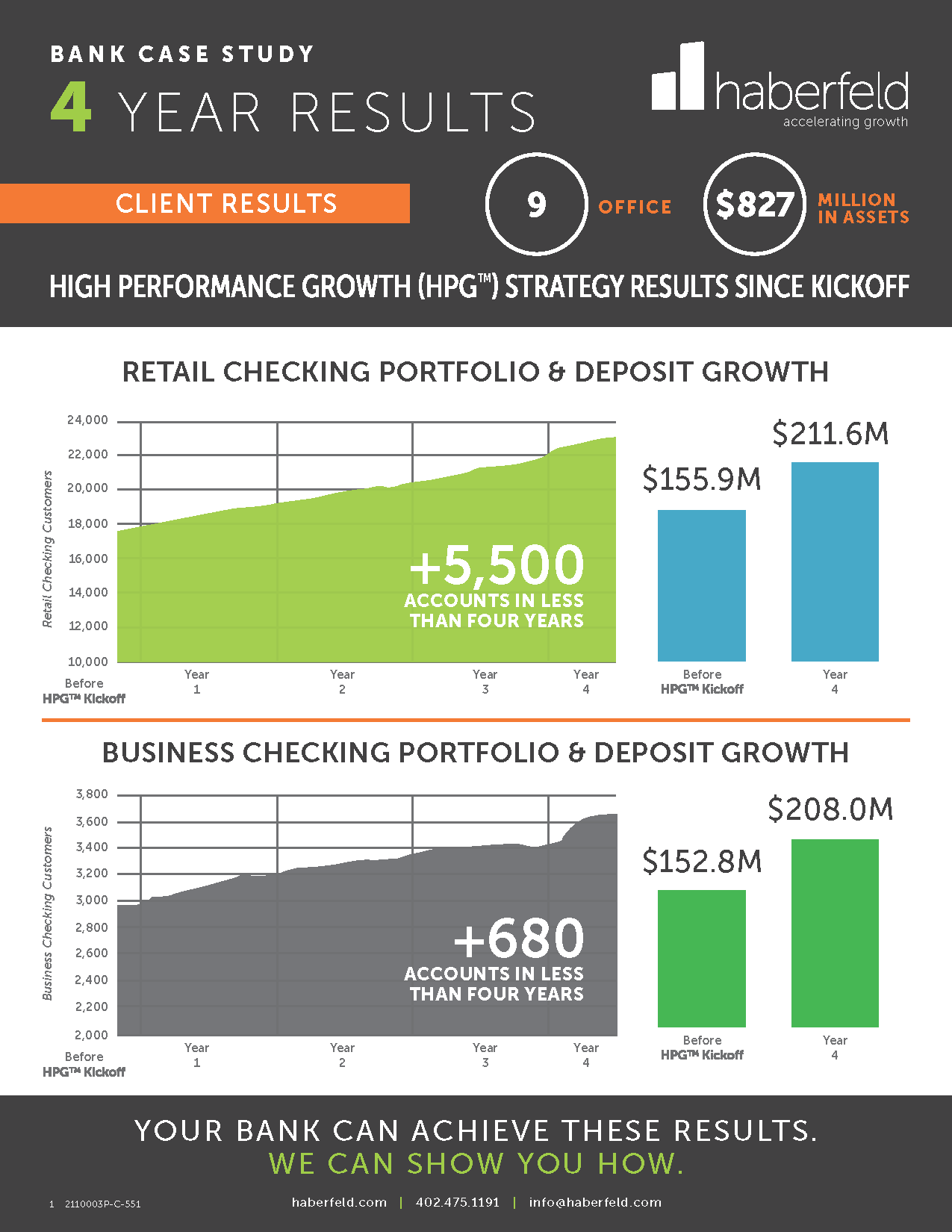

Big gains in account openings four years and counting

Read the Case Study: 9-branch bank with $827M in assets gains +5,500 new retail accounts

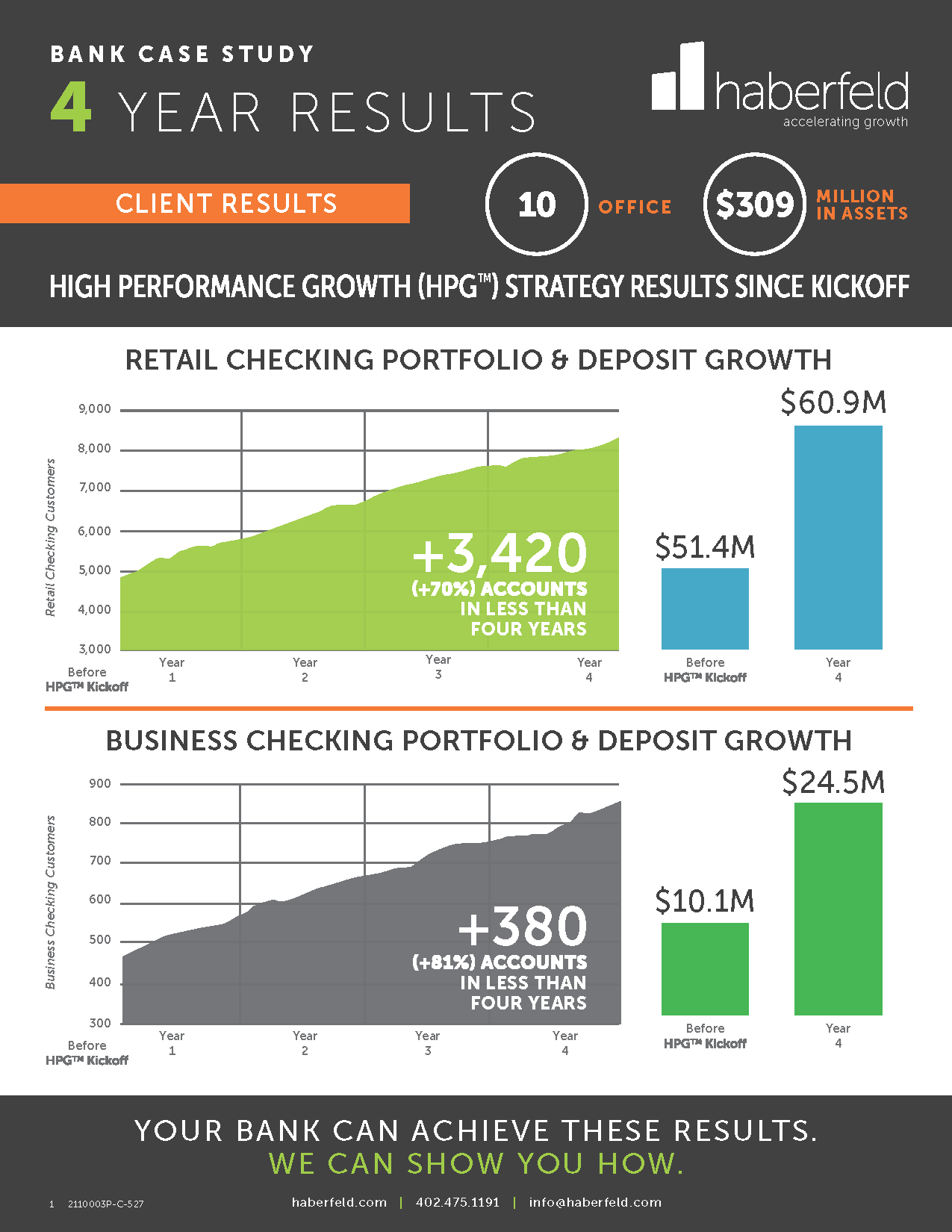

Explosive portfolio, deposit growth

Read the Case Study: 10-branch bank increases retail accounts more than 70%, business more than 80%, in less than four years

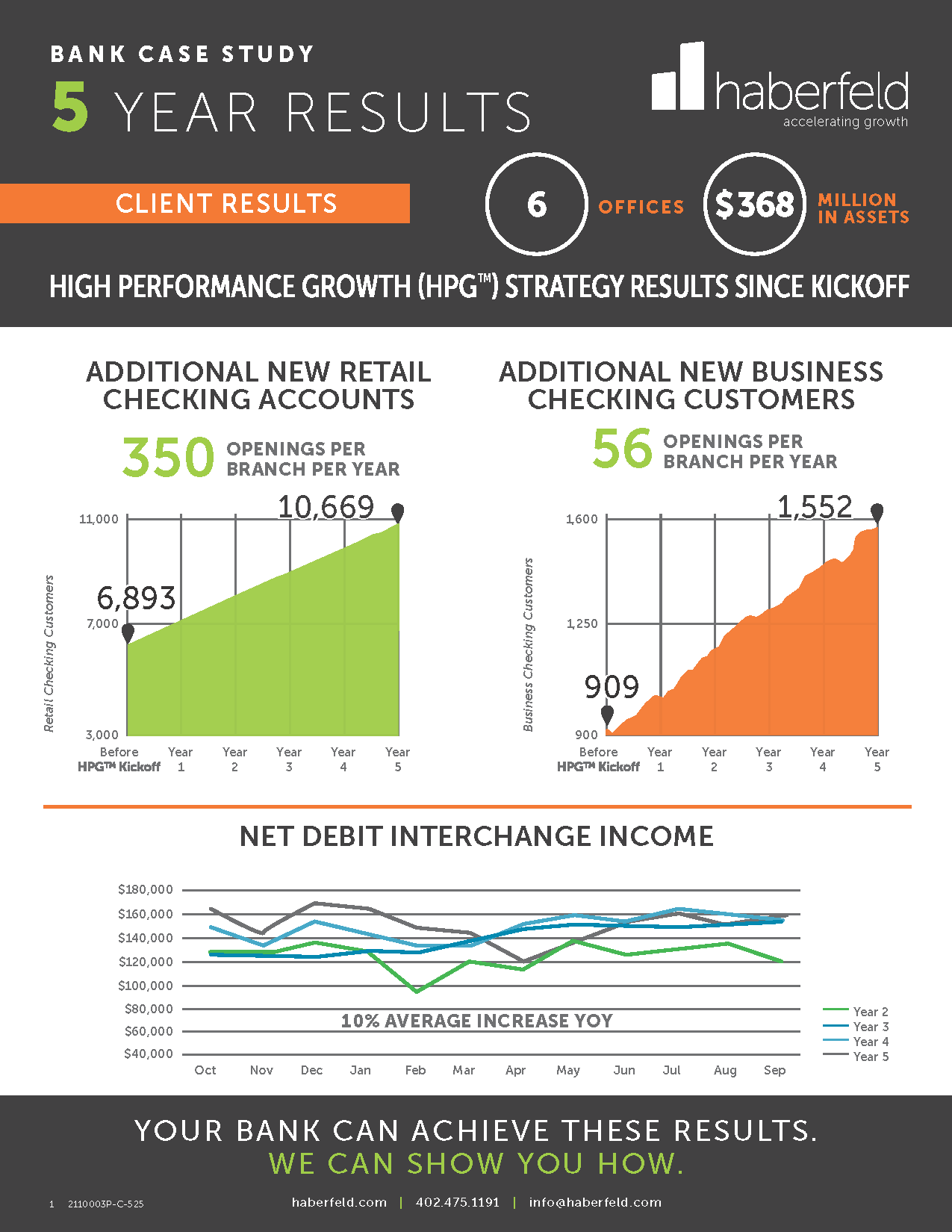

Incredible per-branch results in retail and business

Read the Case Study: 6-branch bank opens 350 retail checking accounts per location in just five years

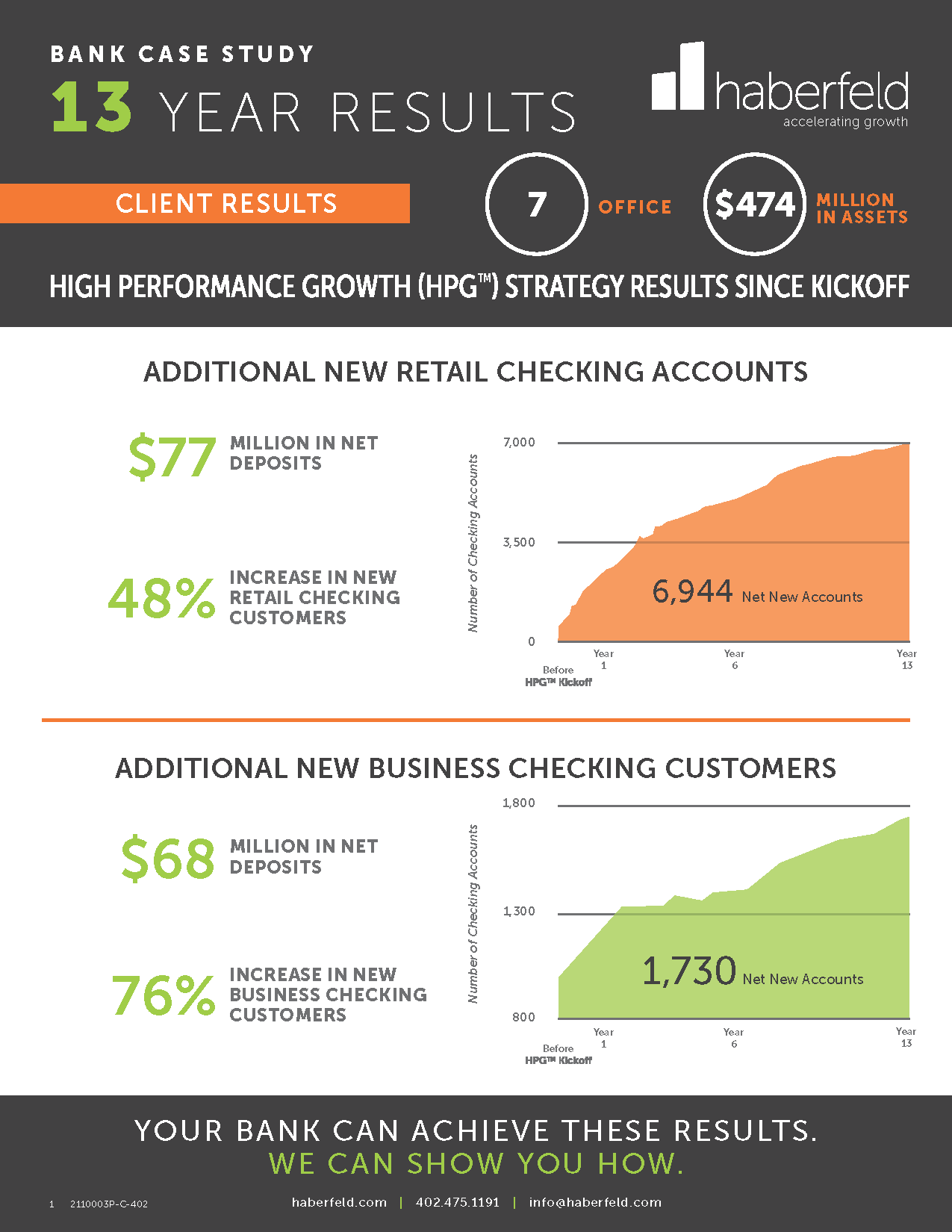

Growing retail, business accounts for more than 13 years

Read the Case Study: 7-branch bank sees sustained results in new accounts, net deposits

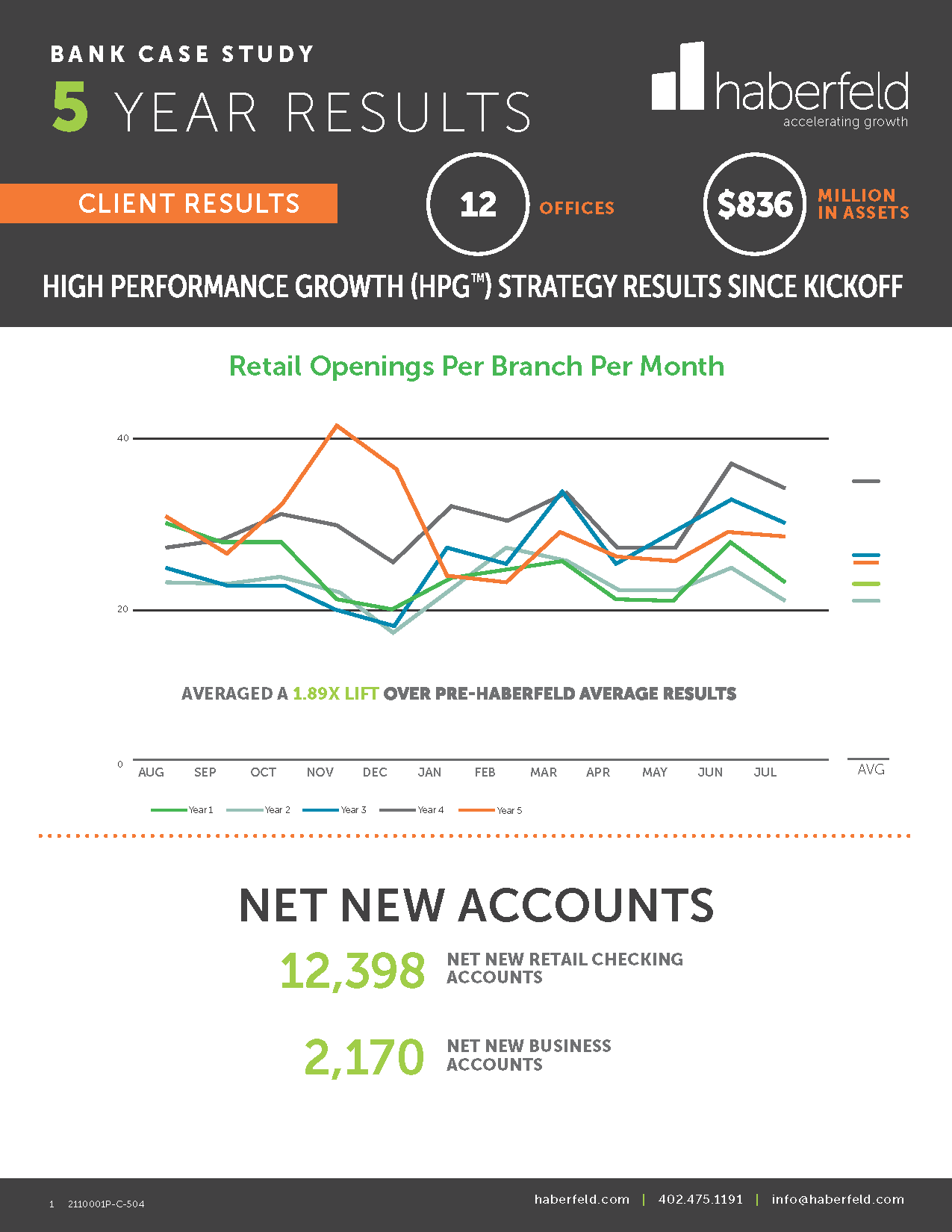

Average openings nearly double each year for more than 5 years

Read the Case Study: 12-branch bank with $836M in assets gains +12,000 net new retail accounts

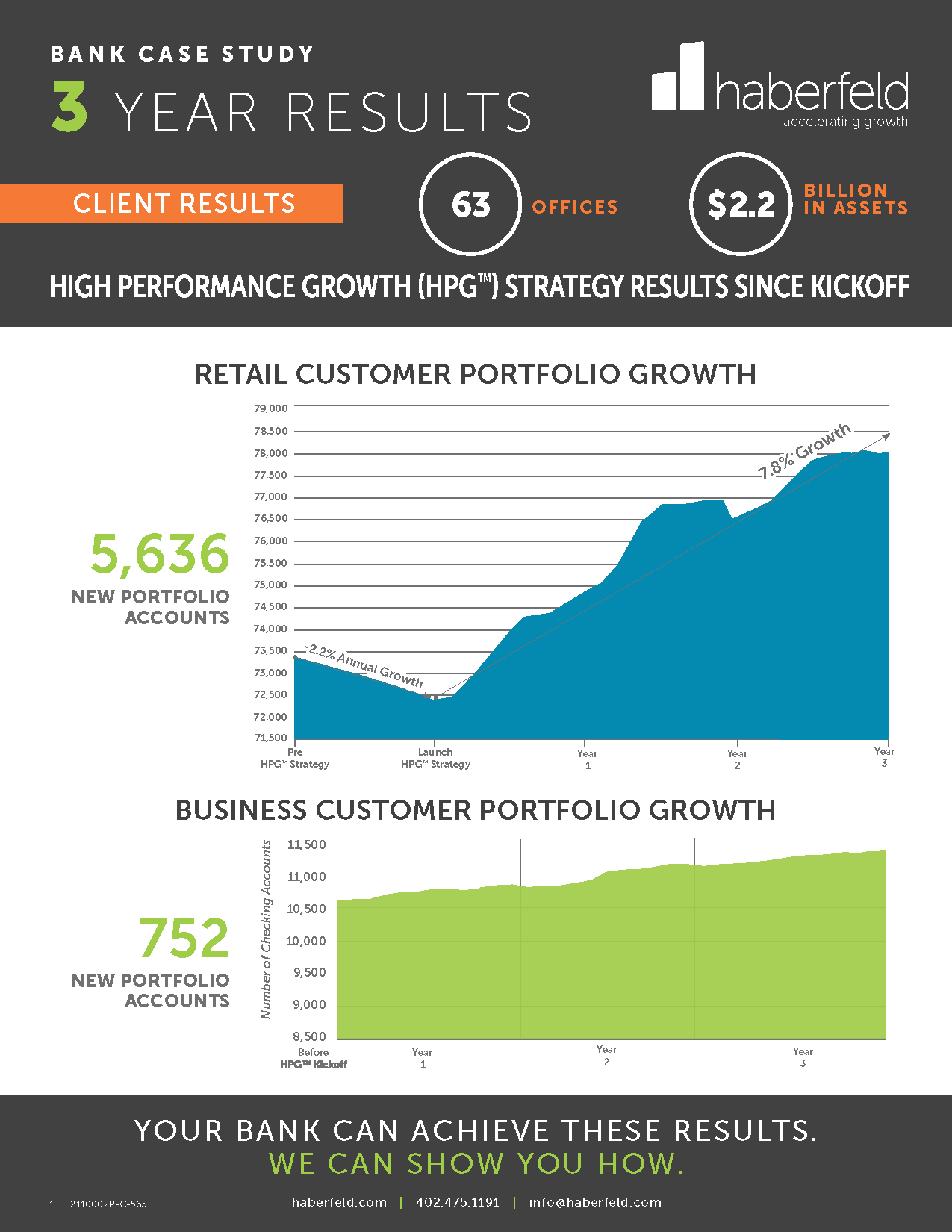

63-branch bank sees retail and business portfolio growth take off

Read the Case Study: In just 3 years, a community bank with $2.2 billion in assets adds almost 6,000 retail accounts

Credit Unions

One year, nearly $50m in total loan growth for 7-branch credit union.

Read the Case Study: A single year’s openings exceed 2,000 for credit union with $480M in assets

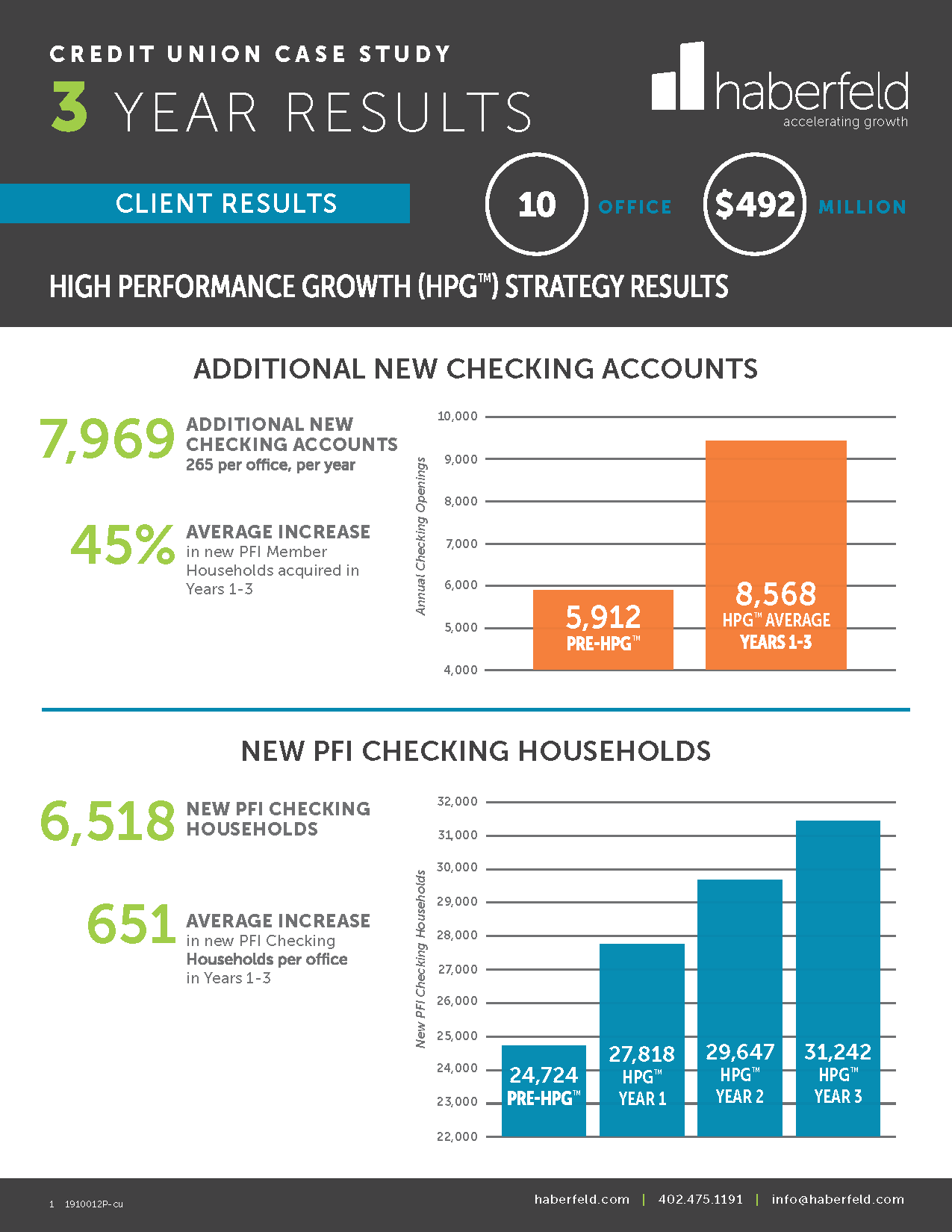

10-branch credit union averages 265 new accounts per branch, per year

Read the Case Study: In only 3 years, this credit union added almost 8,000 new retail account openings

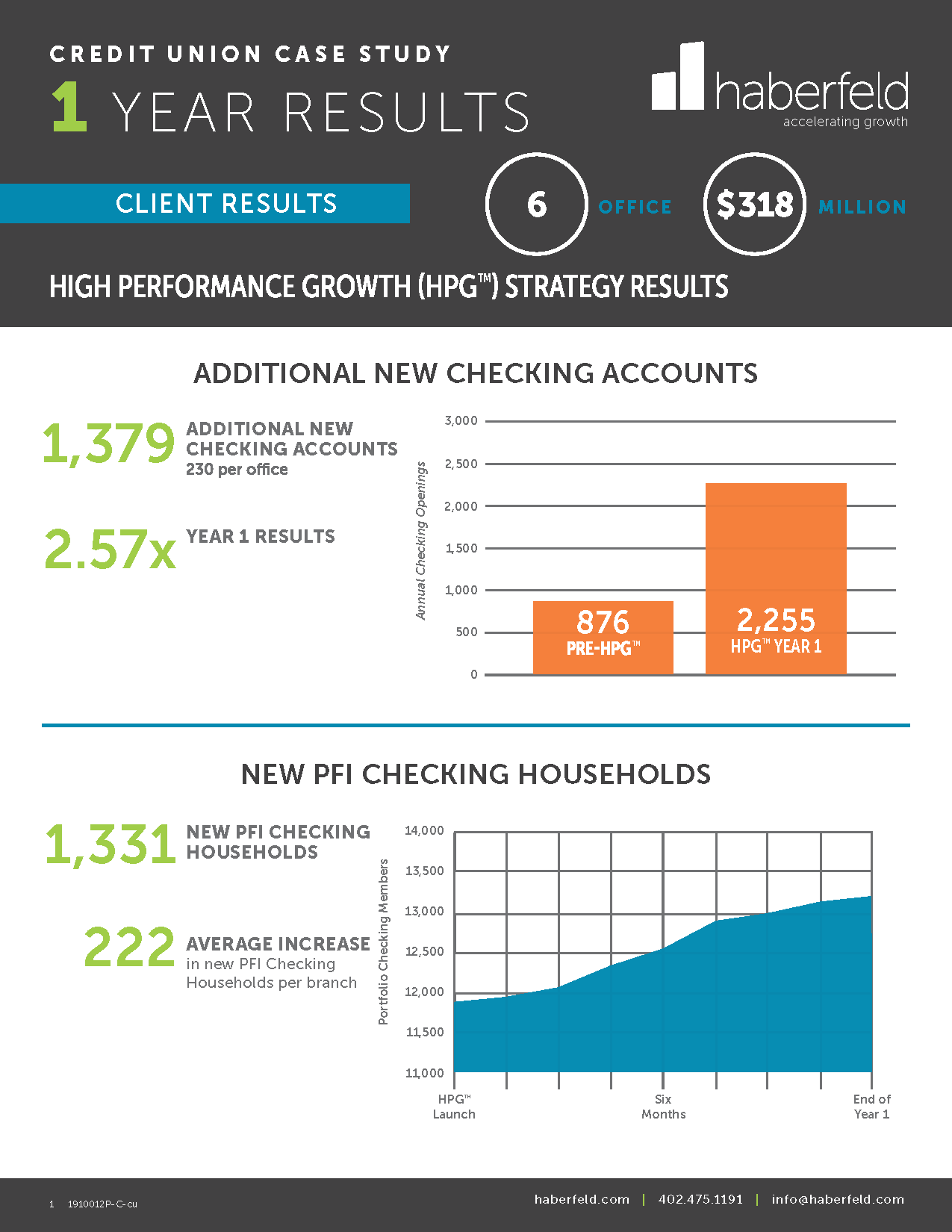

Additional new checking accounts grow 2.57x in one year

Read the Case Study: With just 6 branches, this $318M institution opens more than 2,600 accounts in one year

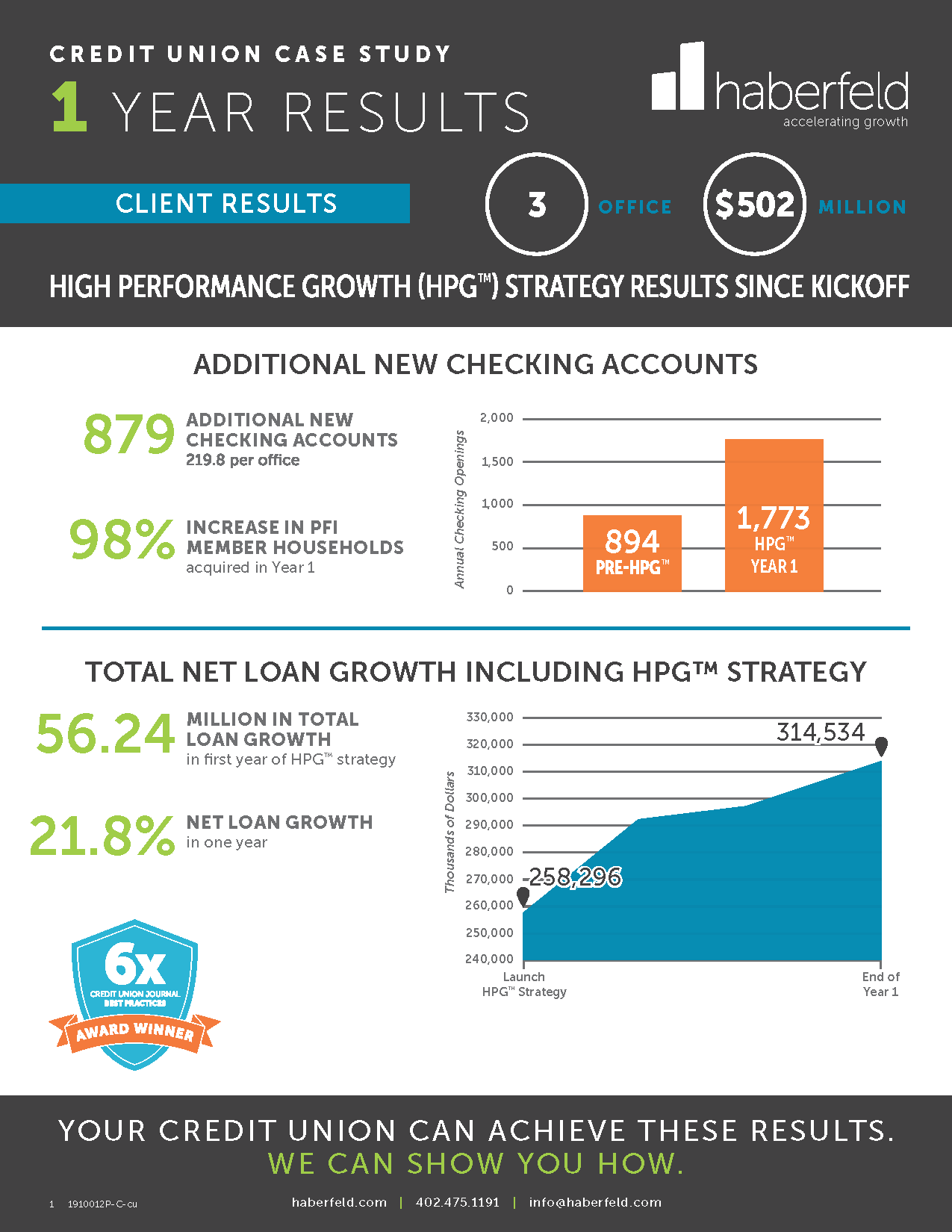

First-year results: 98 percent increase in new PFI households

Read the Case Study: A 3-branch credit union, with $502M in assets, opens 879 new accounts in one year

- Browse All Articles

- Newsletter Sign-Up

BanksandBanking →

No results found in working knowledge.

- Were any results found in one of the other content buckets on the left?

- Try removing some search filters.

- Use different search filters.

Regions Bank & Marketing Evolution

The Perfect Customer Journey with Unified Marketing Measurement

Regions Bank serves customers throughout the Southern and Midwest United States across 1,500 banking offices, 1,900 ATMs, and their website. One of the nation’s largest full-service providers of consumer and commercial banking, wealth management, mortgage and insurance products and services, it operates in a competitive marketplace with pressure from both large global brands and local disruptors.

When it came to understanding the ideal combinations of messaging, creative, and channel, however, Regions Bank struggled to find the correct mix to drive the highest return on their marketing investment.

To address this problem, Regions Bank chose Marketing Evolution and its advanced data analytics platform . Backed by unified marketing measurement capability, Regions Bank was able to effectively measure the impact of offline and online channels and tie those insights to online and offline conversions.

Additionally, the platform helped identify the best messages to deliver to the right consumers, and, ultimately, give them the ability to optimize their marketing while campaigns were live. The result? A 100% ROI increase using people-based marketing, and a 100% incremental revenue increase from new checking accounts.

Download the case study to learn how.

Get your copy of the case study

Fill out the form below.

About Marketing Evolution

Forward-looking brands rely on Marketing Evolution to deliver accurate person-level unified marketing measurement across both online and offline channels to maximize their media spend, creative rotation, brand impact, and, ultimately, their marketing ROI.

TymeBank Case Study: The Customer Impact of Inclusive Digital Banking

Full report.

This publication is also available in French and Spanish .

Executive Summary

This case study presents insights from customer research with TymeBank clients that bolsters CGAP’s hypotheses around how digital banks can support the mission of financial inclusion. As a fully digital South African bank that disproportionately serves low-income rural customers, TymeBank has created a suite of basic products that cater to the essential financial needs of those customers, namely a low-cost transactional account and a high-yield savings account. Judging from product uptake and client testimonials, these products add to a compelling value proposition that not only resonates with customers but improves their lives.

TymeBank’s distribution network, which is based on its partnerships with the nationwide Boxer and Pick n Pay (PnP) grocery store chains, helps to keep operational costs low and passes cost savings onto customers in the form of more affordable services. A clear majority of the bank’s customers cite affordability as a key source of value and the reason they opened a TymeBank account. The distribution network also extends the bank’s reach to areas that are underserved by traditional players. The affordability and accessibility likely explain why underserved segments, such as low-income women and rural customers, are over-represented in TymeBank’s (active) customer base as compared to the overall banked population in South Africa.

Despite having access to other banking options, TymeBank customers overwhelmingly see no compelling alternatives in the market. Crucially, the value customers see in the bank appears to be inversely related to income, with poorer customers reporting higher levels of satisfaction.

In today’s high-tech financial services landscape, which is often dominated by headlines about fintech startups and tech giants, it is easy to overlook the role banks can play in advancing financial inclusion. The high cost of running brick-and-mortar branch networks has traditionally inhibited banks from serving less profitable client segments, including the low-income groups that are the focus of financial inclusion. Banks have also been slow to adapt the digital innovations that have helped some newcomers reach these segments at lower cost. It is no surprise that some observers have questioned whether banks are even relevant to financial inclusion.

However, there are reasons to believe that banks can play an important role in financial inclusion if they overcome the challenges of their legacy systems and processes and digitize operations. In fact, banks have advantages over other types of financial services providers (FSPs) that may allow them to have an outsized impact on financial inclusion – if they are willing to expand down- market. Most importantly, banks do not face the same regulatory constraints as other providers. Whereas mobile money providers and fintechs generally cannot provide a wide array of financial products (ranging from savings to credit), banks can. License to intermediate retail deposits further plays to a bank’s advantage in the arena of digital credit. Banks can fund their lending portfolios with retail deposits that are typically cheaper than the other funding sources pure lenders use, which further reduces the cost of reaching low-income customers with credit.

CGAP previously presented three emerging business models in banking that we consider to be particularly promising for financial inclusion (Jeník and Zetterli 2020). These models are fully digital retail banks, marketplace banks, and Banking-as-a-Service (BaaS) (see Box 1). We conclude that they have the potential to deepen financial inclusion by:

- Lowering the cost of financial services;

- Improving access to a greater variety of services;

- Creating services that better meet the needs of various customer segments; and

- Improving the customer experience. 1

We analyzed several fully digital retail banks in a series of detailed case studies (Jeník, Flaming, and Salman 2020). One of these cases focused on TymeBank in South Africa. TymeBank is a fully digital retail bank founded with financial inclusion as a core business objective. Since its 2018 launch, the bank has onboarded over 4 million customers.

TymeBank offers low-income customers simple products at low prices, such as checking accounts, savings accounts, and debit cards – all through a distribution network that combines online and offline customer interaction based on partnerships with grocery store chains Boxer and PnP. In the area of credit products, TymeBank only offers a “buy now, pay later” option called MoreTyme. This case study provides a compelling example of how challenger banks can leverage digital technology to reach excluded customer segments with more affordable and useful products.

This paper builds on the TymeBank case study by examining the impact the bank’s services have had on low-income customers. By combining a quantitative analysis of TymeBank customer data with a phone-based survey of a randomly selected sample of low-income customers, the paper addresses the following questions:

- Does TymeBank serve low-income customers?

- Are its products relevant to low-income customers?

- What impact do the bank’s products have on low-income customers’ lives, in their own words?

The aim of this research is to shed light on the potential of digital banks to deepen financial inclusion in a way that improves the lives of low-income customers. CGAP is conducting additional research with other providers to better understand the impact of new financial services business models on customers. 2

TymeBank’s main value proposition consists of (i) simple, affordable, and accessible products; (ii) fast and automated onboarding; and (iii) incentive programs that appeal to target segments (e.g., the SmartShopper loyalty program). These are the qualities we would expect customers to point out when talking about the benefits of using TymeBank.

They are also important features that respond to three frequently cited barriers to financial inclusion: (i) expensive services, (ii) limited access points, and (iii) prohibitive know-your-customer (KYC) requirements. 3

Product affordability relies on TymeBank’s ability to maintain low operational costs and proportionally reduce them further as the bank grows. Current cost efficiency is due to the bank’s technology and microservice architecture (Flaming and Jeník 2020), its branchless model, and digitally facilitated onboarding. TymeBank onboards approximately 110,000 customers per month: about 93,500 through kiosks at an estimated cost of US$3 per customer, and about 16,500 via web at approximately US$0.60 per customer. 4

SOUTH AFRICA 5

South Africa enjoys relatively high levels of financial inclusion, including a banked adult population of approximately 85 percent in a market dominated by the country’s well-established commercial banks. However, many customers only use their bank account to receive government benefits; other use cases lag. There is little to no use of non-bank mobile money wallets.

Across demographic, socioeconomic, and geographic factors, financial inclusion levels positively corelate with higher age (people aged 18–29 are among those least included), urban areas, income level and regularity. Only 38 percent of individuals who reported having no income are banked, while 31 percent are entirely excluded.

METHODOLOGY

For the qualitative analysis based on customer interviews, 1,162 customers were screened from an overall sample of 10,000. The aim was to reach those TymeBank customers living in poverty (i.e., 70 percent or more likely to be living on less than US$5.50). Ultimately, 278 customers were identified for in-depth interviews. The screener surveys were conducted partly through interactive voice response (IVR) surveys and partly through live phone calls.

The quantitative analysis used customer data from TymeBank to assess the potential impact of the bank’s offering on its customer base, particularly individuals from groups that generally exhibit lower levels of financial inclusion. The data examined spanned a nine-month period from July 2020 to March 2021. The analyzed data correlated to active EveryDay account customers, defined as those who had performed a transaction within the past 30 days. Various sets of proxies were applied to estimate income level (e.g., onboarding location, outstanding balance, frequency of transactions, average size of transactions).

The analysis considered several important caveats:

a) We recognize that TymeBank is not representative of all fully digital retail banks in South Africa or elsewhere. The findings presented in this paper should not be interpreted as automatically applicable to other digital banks without careful consideration.

b) The research was conducted during the COVID-19 pandemic; some findings were or could be affected (e.g., as customer behavior changes in response to the pandemic).

c) Despite our best efforts to exclusively focus the analysis on low-income segments, we were unable to identify customers based on their stated income levels since TymeBank does not collect that information. Customer segmentation was performed through the previously mentioned set of proxies for the customer data analysis and through the screening questionnaire for the customer interviews. 6

d) The quantitative analysis focused on active customers with at least one transaction performed over the past 30 days, unless otherwise noted.

e) Where customers stated they had been financially excluded before opening a TymeBank account, we did not identify the underlying cause(s) of financial exclusion.

Key Findings

Does tymebank serve low-income customers.

Our research showed that TymeBank serves a higher proportion of low-income customers than the typical bank in South Africa, and a significantly higher portion of the most financially excluded segment.

Low-income customers in South Africa are relatively highly banked, although they are under-represented. South Africans earning US$200 per month or less constitute 47 percent of the population but only 41 percent of the banked population. 7 However, we estimate that this segment represents 48 percent of TymeBank’s active user base. 8

Among the three-quarters of TymeBank customers for whom data are available, 58 percent live in metropolitan areas and 42 percent in rural areas. This compares to South Africa’s rural population of 35 percent (as of 2016); we estimated this share to be even lower in 2021 (approximately 30 percent). 9 Hence, rural customers appeared to be noticeably overrepresented in the TymeBank user base.

Young, rural, low-income women comprise the most financially excluded and underserved segment in South Africa. This group forms 2.3 percent of South Africa’s banked population but 7 percent of TymeBank’s active base – nearly three times as much. 10 Finally, 13 percent of TymeBank’s active customers are first-time bank customers. 11

From a more general perspective, women in the low-income segment represent a higher-than- average share of the bank’s overall customer base sample (65 percent versus 57 percent),12 which suggests that low-income women particularly benefit from TymeBank’s services.

These findings lead us to conclude that TymeBank customers disproportionately seem to come from traditionally unbanked and underserved segments. In fact, the evidence suggests that the bank’s customer base may particularly skew toward the most underserved segments.

DOES TYMEBANK OFFER PRODUCTS THAT ARE RELEVANT TO LOW-INCOME CUSTOMERS?

Customers find TymeBank’s products useful and act upon features designed to promote certain behaviors.

The bank’s customers particularly value the low cost of its services and the convenience of access and usage. The lower their income, the more value customers seem to derive from its services. While the vast majority of TymeBank customers have previously held bank accounts, 67 percent say they see no good alternative to TymeBank (Figure 4). This response is despite the fact that, as of the time the research was conducted, the bank still only had a relatively modest payments and savings offering and had yet to launch credit products. (TymeBank has since launched MoreTyme, a “buy now, pay later” consumer credit product.) Customer endorsement seems driven by the strength of the bank’s value proposition and the low cost of its services. When asked, customers specifically appreciate the low fees (48 percent) and the high-yield savings account (38 percent).

Importantly, women make up a larger share of the total number of GoalSave (savings account) users compared to their representation in the overall customer base (3 percentage points higher). This finding suggests that female customers find value in the product, although they had slightly lower savings per user than men (US$58 versus US$59). The number of their deposits exceeds the number of withdrawals.

We did not find any significant differences in usage and product lifecycle patterns across income groups (aside from the frequency and size of transactions that correlate with income level), which suggests that TymeBank covers its customers’ essential needs across segments. The similarities in lifecycle (behavior patterns across products, such as most frequently performed type of transaction and their change over time) indicate that customers across income levels increase their engagement as they grow confident with the products.

However, important nuances do exist. For instance, the most excluded segment uses till machines for cash-in and cash-out transactions that are free-of-charge (and perhaps more accessible in certain areas), compared to the ATMs other segments prefer. This may be explained by price sensitivity that drives the preference for free till point withdrawals compared to ATM withdrawals, which are charged at US$0.61 per part of US$70.

The value generated for low(er) income customers will hopefully further expand as TymeBank expands its product offering (e.g., insurance and diverse credit products).

WHAT IMPACT DOES TYMEBANK HAVE ON CUSTOMERS’ LIVES?