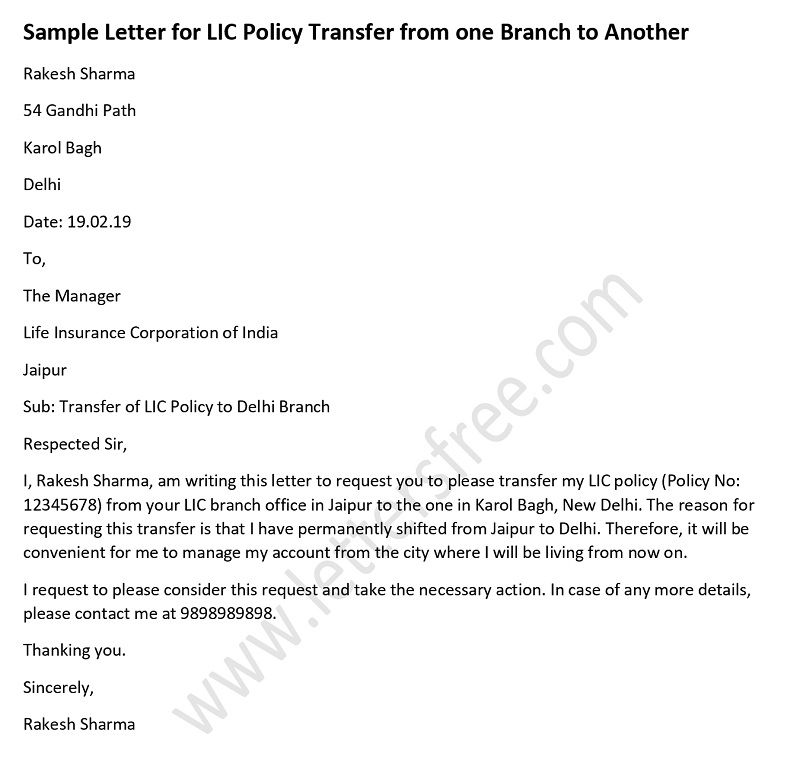

Sample Letter for LIC Policy Transfer from one Branch to Another

If you have a LIC policy in a particular branch and you wish to have it transferred to some other branch then in that case you have to write a formal LIC policy transfer application which can be drafted using LIC policy transfer letter format. This kind of insurance policy transfer letter contains all the important details along with reason for transfer making it a convenient way. There are various LIC policy transfer letter formats available online.

We have come up with a formal insurance policy transfer letter sample . Use this LIC policy transfer letter format which comes with ease of customization. Download and use LIC policy branch letter format in PDF format.

Letter Format for LIC Policy Transfer from one Branch to Another

Rakesh Sharma 54 Gandhi Path Karol Bagh Delhi

Date: 19.02.19

The Manager Life Insurance Corporation of India Jaipur

Sub: Transfer of LIC Policy to Delhi Branch

Respected Sir,

I, Rakesh Sharma, am writing this letter to request you to please transfer my LIC policy (Policy No: 12345678) from your LIC branch office in Jaipur to the one in Karol Bagh, New Delhi. The reason for requesting this transfer is that I have permanently shifted from Jaipur to Delhi. Therefore, it will be convenient for me to manage my account from the city where I will be living from now on.

I request to please consider this request and take the necessary action. In case of any more details, please contact me at 9898989898.

Thanking you. Sincerely, Rakesh Sharma

You May Also Like

Letter to Employees for Health Insurance Policy Letter for Correction of Date of Birth in LIC Policy Sample Insurance Surrender Letter Letter to Cancel an Insurance Policy Health Insurance Cancellation Letter Sample Business Insurance Cancellation Letter

Top Search:

- https://www lettersfree com/lic-policy-branch-transfer-letter-format/

View all contributions by Marisa

Related Posts

Randhir Koch September 27, 2020, 3:10 am

Transfer Branch

Chaudhari Hetalkumari Thakorbhai April 26, 2022, 3:45 am

Transfer branches ….

Manjunath March 31, 2021, 11:19 am

To which LIC branch need to submit the request. Can we submit to the branch where we stay? Please confrim

Thnx Manjunath

Chavda gopal Bhai July 10, 2021, 2:37 pm

Lic policy transfer lic to for dack

praveen stalin November 9, 2021, 1:58 pm

Very useful information. Thank you. Few LIC branch is acting fast with email responses.

Nitin Wanjare September 12, 2022, 6:39 am

I wish to transfer my LIC policy from my home branch in borivali to Byculla Brach close to where I stay . what is the process ( what documents needed ) and where do I submit my transfer letter request and documents

Leave a Comment

Next post: Letter Format for Surrender of Life Insurance Policy

Previous post: Complaint Letter to Police Station for Loss of Documents or Certificate

- Acceptance Letters

- Acknowledgement Letters

- Advice Letter

- Agreement Letter

- Announcement Letter

- Apology Letter

- Appeal Letter

- Application Letter

- Appointment Letter

- Appraisal Letter

- Appreciation Letter

- Approval Letter

- Authorization Letter

- Birthday Letter

- Breakup Letter

- Business Letter

- Cancellation Letter

- Certificate Format

- Certification Letter

- Charity Letter

- Claim Letter

- Collection Letter

- Complaint Letter

- Compliment Letter

- Condolence Letter

- Confirmation Letter

- Congratulations Letter

- Consent Letter

- Cover Letter

- Credit Letter

- Criticism Letter

- Delegation Letters

- Dismissal Letter

- Dispute Letter

- Donation Letter

- Employee Letter

- Encouragement Letters

- Endorsement Letter

- Evaluation Letter

- Farewell Letter

- Feedback Letter

- Follow Up Letter

- Friendly Letter

- Friendship Letter

- Fundraising Letter

- Get Well Letters

- Goodbye Letter

- Grievance Letter

- Inquiry Letter

- Internship Letter

- Interview Letter

- Introduction Letter

- Invitation Letter

- Leave Letter

- Love Letter

- Marketing Letter

- Memo Formats

- Miscellaneous Letter

- Notification Letters

- Order Letter

- Permission Letter

- Promotion Letter

- Proposal Letter

- Recommendation Letter

- Reference Letter

- Request Letter

- Resignation Letter

- Retirement Letter

- Romantic Letter

- Sales Letter

- Scholarship Letter

- Sorry Letter

- Sponsorship Letter

- Suggestion Letter

- Sympathy Letter

- Termination Letter

- Thank You Letter

- Transfer Letter

- Transmittal Letter

- Uncategorized

- Verification Letter

- Warning Letter

- Welcome Letter

- Withdrawal Letters

Recent Posts

- Letter Format Due to Late Fee by School

- Letter of Contract Agreement for Teachers Template

- Simple Letter of Consent for New Project Format

- Letter of Consent for Child to Travel with Grandparents

- Sample Letter Format to Judge Asking for Leniency by Wife

Popular Letters

- transfer request letter due to family problem

- goodbye letter to co-workers

- personal thank you letter appreciation

- self introduction letter

- apology letter to customer

- transfer request letter due to parent\s illness

- apology letter to teacher for not attending class

- application letter for teacher job for fresher

- Resignation Letter 2 Week Notice

- letter of interest for a job

Sample Donation Letter

School Donation Request Letter Template Sponsorship Thank You Letter Donation Letter for a Sick Person Donation Letter for Flood Victims Donation Request Letter for Cancer Patients Donation Thank You Letter How to Write a Donation Letter

Letter Writing Tips

Tips to Write a Wedding Welcome Letter Tips for Writing an Employee Warning Letter Tips for Writing a Transmittal Letter Tips for Writing a Employee Transfer Letter How to Write a Thank You Letter How to Write a Contract Termination Letter Tips for Writing an Effective Sponsorship Letter

Menu Display

Policy condition, policy conditions, various type of policy condition and their implication.

We welcome you as a policyholder and as a prospective customer to our customer service section. This section will guide you through the various intricacies of a life insurance contract and the facts that you must know to make the best out of your life insurance policy. Please read our guidelines immediately.

● Payment of Premiums

● non-forfeiture regulations, ● forfeiture in certain events, ● guaranteed surrender value, ● salary saving scheme, ● alterations, ● duplicate policy, ● age proof accepted by lic, ● alternative age proofs which are accepted, ● nomination, ● assignment, ● re-assignment, ● concessions for claims during the lapsed period, ● policy loans, ● claims settlement procedure, ● maturity claims, ● death claims, ● double accident benefit claims, ● disability benefit claims, ● claims review committees, ● insurance ombudsman, payment of premiums:.

A grace period of one month but not less than 30 days is allowed where the mode of payment is yearly, half-yearly or quarterly and 15 days for monthly payments. If death occurs within this period, the life assured is covered for full sum assured.

Non-forfeiture regulations:

If the policy has run for atleast 3 full years and subsequent premiums have not been paid the policy shall not be void but the sum assured will be reduced to a sum which will bear the same ratio as to the number of premiums paid bear to the total number of premiums payable.The concessions regarding claim in the above case is explained in the appropriate section.

Forfeiture in certain events:

In case of untrue or incorrect statement contained in the proposal, personal statement, declaration and connected documents or any material information with held, subject to the provision of Section 45 of the Insurance Act 1938, wherever applicable, the policy shall be declared void and all claims to any benefits in virtue thereof shall cease.

The policy shall be void, if the Life Assured commits suicide (whether sane or insane at the time) at any time or after the date on which the risk under the policy has commenced but before the expiry of one year from the date of commencement of the policy.

Guaranteed Surrender Value:

After payment of premiums for at least three years, the Surrender Value allowed under the policy is equal to 30% of the total premiums paid excluding premiums for the 1st year and all extra premiums.

Salary Saving Scheme:

The rate of installment premium shown in the schedule of the policy will remain constant as long as the employee continues with the employer given in the proposal. On leaving the employment of said employer the policyholder should intimate the Corporation. In case of the Salary Saving Scheme being withdrawn by the said employer, the Corporation will intimate the same to the policyholder. Thereafter the 5% rebate given under Salary Saving Scheme will be withdrawn.

Alterations:

After the policy is issued, the policyholder in a number of cases finds the terms not suitable to him and desires to change them. LIC allows certain types of alterations during the lifetime of the policy. However, no alteration is permitted within one year of the commencement of the policy with some exceptions. The following alterations are allowed.

- ● Alteration in class or term.

- ● Reduction in the Sum Assured

- ● Alteration in the mode of payment of premiums

- ● Removal of an extra premium

- ● Alteration from without profit plan to with profit plan

- ● Alternation in name

- ● Correction in policies

- ● Settlement option of payment of sum assured by installments

- ● Grant of accident benefit

- ● Grant of premium waiver benefit under CDA policies

- ● Alteration in currency and place of payment of policy monies

A fee for the change or alteration in the policy is charged by the Corporation called quotation fee and no additional fee is charged for giving effect to the alteration.

Duplicate Policy:

A duplicate policy confers on its owner the same rights and privileges as the original policy. The following are the requirements for issuing a duplicate policy: 1. Indemnity bond duly notarized as per requisite stamp value AND 2. Any one of the photo identity proof: Passport, PAN card, Voter’s identity card, Driving License, Personal identification card issued by Govt. organization or reputed commercial organization AND 3. Any one of the residence proof: Telephone bill, Bank A/C statement, Letter from any recognized public authority, Electricity Bill, ration Card, Valid lease agreement along with rent receipt which is not more than 3 months old, Certificate from employer as a proof of residence. 4. Requisite fee towards policy preparation charges to be paid at the Branch Cash counter.

However, in following cases Policyholder has to visit to Branch Office to know the requirements: 1. Policies under which absolute assignment is operational or 2. In death claim cases where the title is open and waiver of strict legal evidence of title is to be considered.

Age Proof accepted by LIC:

The Proofs of age, which are generally acceptable to the Corporation, are as under:

- ● Certified extract from Municipal or other records made at the time of birth.

- ● Certificate of Baptism or certified extract from family Bible if it contains age or date of birth.

- ● Certified extract from School or College if age or date of birth is stated therein.

- ● Certified extract from Service Register in case of Govt. employees and employees of Quasi-Govt. institutions including Public Limited Companies and Pass port issued by the Pass port Authorities in India.

Alternative Age Proofs which are accepted:

- ● Marriage certificate in the case of Roman Catholics issued by Roman Catholic Church.

- ● Certified extracts from the Service Registers of Commercial Institutions or Industrial Undertakings provided it is specifically mentioned in such extracts that conclusive evidence of age was produced at the time of recruitment of the employee.

- ● Certificate of Birth granted by Syedna v. Molana Badruddin Sahib of Baroda

- ● Identity Cards issued by Defence Department.

- ● A true copy of the University Certificate or of Matriculation/Higher Secondary Education, S.S.L. Certificate issued by a Board set up by a State/Central Government.

- ● Non- standard age proof like Horoscope, Service Record where age is not verified at the time of entry, E.S.I.S. Card, Marriage Certificate in case of Muslim Proposer, Elder’s Declaration, Self-declaration and Certificate by Village Panchayats are accepted subject to certain rules.

Nomination:

The nominee is statutorily recognized as a payee who can give a valid discharge to the Corporation for the payment of policy monies. Nomination will be incorporated in the text of the policy at the time of its issue. After the policy is prepared and issued and if no Nomination has been incorporated the assured can ordinarily affect the nomination only by an endorsement on the policy itself. A nomination made in this manner is required to be notified to the Corporation and registered by it in its records. A nomination is not required to be stamped. Any change or cancellation of nomination should be given in writing only by the Life Assured. Nomination under Joint Life Policy can only be a joint nomination. Nomination in favour of a stranger cannot be made as there is no insurable interest and moral hazard may be involved. Nomination in favour of wife and children as a class is not valid. Specific names of the existing wife and children should be mentioned. Where nomination is made in favour of successive nominees, i.e., nominee “A” failing him to nominee “B” failing whom nominee “C”, the nomination in favour of one individual in the order mentioned will be considered. Where the nominee is a minor, an appointee has to be appointed to receive the monies in the event of the assured’s death during the minority of the nominee. No nomination can be made under a policy financed from HUF funds. In the case of first endorsement of nomination the date of registration of nomination will be the date of receipt of the policy by the servicing office and in case of any other nomination or cancellation or change thereof, the date of receipt of the policy and/or of notice whichever is later, will be the date of registration.

Assignment:

An assignment has an effect of directly transferring the rights of the transferor in respect of the property transferred. Immediately on execution of an assignment of the Policy of life assurance the assignor forgoes all his rights, title and interest in the Policy to the assignee. The premium/loan interest notices etc. in such cases will be sent to the assignee. In case the assignment is made in favor of public bodies, institutions, trust etc., premium notices/receipts will be addressed to the official who has been designated by the institutions as a person to receive such notice An assignment of a life insurance policy once validly executed, cannot be cancelled or rendered in effectual by the assignor. Scoring of such assignments or super scribing words like 'cancelled' on such assignment does not annul the assignment. And the only way to cancel such assignment would be to get it re-assigned by the assignee in favor of the assignor. There are two types of assignments: 1. Conditional Assignment whereby the assignor and the assignee may agree that on the happening of a specified event which does not depend on the will of the assignor, the assignment will be suspended or revoked wholly or in part. 2. Absolute Assignment whereby all the rights, title and interest which the assignor has in the policy passes on to the assignee without reversion to the assignor or his estate in any event.

Re-assignment:

An assignee may during the term of policy reassign the interest in the policy to the assignor. Such reassignment would have the effect of cancelling the assignment in favour of assignee and after the reassignment is executed on policy document, the right, title and interest under the policy would revert to the assignor.

Concessions for claims during the lapsed period:

1. If the policyholder has paid premiums for atleast 3 full years and subsequently discontinued paying premiums, and in the event of death of the life assured within six months from the due date of the first unpaid premium, the policy money will be paid in full after deduction of the unpaid premiums, with interest upto date of the death. 2. If the policyholder has paid premiums for atleast 5 full years and subsequently discontinued paying premiums and in the event of death of the life assured within 12 months from the due date of first unpaid premium, the policy money will be paid in full after deducting the unpaid premiums, with interest upto date of the death.

If premiums under a policy are not paid within Days of Grace, the policy lapses. A lapsed policy can be revived as per the plan conditions on submission of proof of continued insurability to the satisfaction of the Corporation and payment of all arrears of premiums together with interest at such rate as fixed by the Corporation from time to time. The Corporation however reserves the right to accept at original terms, accept with modified terms or decline revival of a discontinued policy. The revival of the discontinued policy shall take effect only after the same is approved by the Corporation. The cost of Medical Reports, including Special Reports, if any, required for the purpose of Revival of the policy shall be borne by the Life Assured.

Policy Loans:

The Corporation can grant a loan to the policyholder against his policy as per the terms and conditions applicable to the policy. The requirements for granting a loan are as under : a) Application for loan with an endorsement of terms and conditions of the loan being placed on the policy. b) Policy to be assigned absolutely in favour of the Corporation c) A receipt for the loan amount The maximum loan amount available under the policy is 90% of the Surrender Value of the policy (85% in case of paid up policies) including cash value of bonus.

"Provision has also been made on Customer Portal for registration of request for Loan for the policyholders registered for Premier Services. After registration of request, the Loan documents can be submitted to any nearby LIC Branch Office."

- ● Loans are granted on policies as per Conditions and Privileges printed on the back of the Policy Bond.

- ● It is mentioned in the policy whether a particular policy is with or without loan facility.

- ● The rate of interest charged on policy loan is declared by the Corporation every year and they are plan specific.

- ● Interest on loan is payable half yearly.

The minimum period for which a loan can be granted is six months from the date of its payment. If repayment of loan is desired within this period the interest for the minimum period of six months will have to be paid. In case the policy becomes a claim either by maturity or death within six months from the date of loan interest will be charged only upto the date of maturity/death.

Claims settlement procedure:

The settlement of claims is a very important aspect of service to the policyholders. Hence, the Corporation has laid great emphasis on expeditious settlement of Maturity as well as Death Claims. The procedure for settlement of maturity and death claims is detailed below :

Maturity Claims:

1) In case of Endowment type of Policies, amount is payable at the end of the policy period. The Branch Office which services the policy sends out a letter informing the date on which the policy monies are payable to the policyholder at least two months before the due date of payment. The policyholder is requested to return the Discharge Form duly completed along with the Policy Document, NEFT Mandate Form (Bank A/c Particulars with supporting proof), KYC requirements etc. . On receipt of these documents payment is processed in advance so that maturity amount gets credited to the policyholder’s bank A/C on the due date. 2) Some Plans like Money Back Policies provide for periodical payments to the policyholders provided premium due under the policies are paid up to the anniversary due for Survival Benefit. In these cases where amount payable is up to Rs.500,000/-,payments are released without calling for the Discharge Receipt or Policy Document. Survival Benefit under Jeevan Anand policies up to Sum assured Rs. 200000/- is also released without calling for policy bond or discharge form. However, in case of higher amounts these two requirements are insisted upon.

Death Claims:

The death claim amount is payable in case of policies where premiums are paid up-to-date or where the death occurs within the days of grace. On receipt of intimation of death of the Life Assured the Branch Office calls for the following requirements: a) Claim form A – Claimant’s Statement giving details of the deceased and the claimant. b) Certified extract from Death Register c) Documentary proof of age, if age is not admitted d) Evidence of title to the deceased’s estate if the policy is not nominated, assigned or issued under M.W.P. Act. e) Original Policy Document The following additional forms are called for if death occurs within three years from the date of risk or from date of revival/reinstatement. a) Claim Form B – Medical Attendant’s Certificate to be completed by the Medical Attendant of the deceased during his/her last illness b) Claim Form B1 – if the life assured received treatment in a hospital c) Claim form B2 – to be completed by the Medical Attendant who treated the deceased life assured prior to his last illness. d) Claim Form C – Certificate of Identity and burial or cremation to be completed and signed by a person of known character and responsibility e) Claim form E – Certificate by Employer if the assured was employed person. f) Certified copies of the First Information Report, the Post-mortem report and Police Investigation Report if death was due to accident or unnatural cause. These additional forms are required to satisfy ourselves on the genuineness of the claim, i.e., no material information that would have affected our acceptance of proposal has been withheld by the deceased at the time of proposal. Further, these forms also help us at the time of investigation by the officials of the Corporation.

Double Accident Benefit Claims:

Double Accident Benefit is provided as an additional benefit to the life insurance cover. For this purpose an extra premium of Rs.1/- per Rs.1000/- S.A is charged. For claiming the benefits under the Accident Benefit the claimant has to produce the proof to the satisfaction of the Corporation that the accident is defined as per the policy conditions. Normally for claiming this benefit documents like FIR, Post-mortem Report are insisted upon.

Disability Benefit Claims:

Disability benefit claims consist of waiver of future premiums under the policy and extended disability benefit consisting in addition of a monthly benefit payment as per policy conditions. The essential condition for claiming this benefit is that the disability is total and permanent so as to preclude him from earning any wage/compensation or profit as a result of the accident

Claims Review Committees:

The Corporation settles a large number of Death Claims every year. Only in case of fraudulent suppression of material information is the liability repudiated. This is to ensure that claims are not paid to fraudulent persons at the cost of honest policyholders. The number of Death Claims repudiated is, however, very small. Even in these cases, an opportunity is given to the claimant to make a representation for consideration by the Review Committees of the Zonal office and the Central Office. As a result of such review, depending on the merits of each case, appropriate decisions are taken. The Claims Review Committees of the Central and Zonal Offices have among their Members, a retired High Court/District Court Judge. This has helped providing transparency and confidence in our operations and has resulted in greater satisfaction among claimants, policyholders and public.

Insurance Ombudsman

- ● The Grievance Redressal Machinery has been further expanded with the appointment of Insurance Ombudsman at different centers by the Government of India. At present there are 12 centres operating all over the country.

- ● Following type of complaints fall within the purview of the Ombdusman

a) any partial or total repudiation of claims by an insurer; b) any dispute in regard to premiums paid if payable in terms of the policy; c) any dispute on the legal construction of the policies in so far as such disputes relate to claims; d) delay in settlement of claims; e)non-issue of any insurance document to customers after receipt of premium.

- ● Policyholder can approach the Insurance Ombudsman for the redressal of their complaints free of cost.

- Foreign Units

- LIC Associates & Subsidiaries

- LIC Quick Tips

- Things you must know

- Why Life Insurance

- Last Updated on : 05/12/2023

- Anti-Bribery And Anti-Corruption Policy

- Anti Fraud Policy

- Citizens Charter

- Copyright Policy

- Customer Education

- Central Vigilance Commission Website Link

- Download Forms

+91-22-68276827

- Employees Corner

- Enquiry of Outstanding Claims for the Current Year

- Equal Opportunity Policy

- Frequently Asked Questions

- Golden Jubilee Foundation - Community Development

+91-8976862090

- Hyperlink Policy

- International Operations Associates

- Investee-AMRIT

- IRDAI Consumer Education

- Join Our Team

LIC on Social Media

Branch Locator

- Photo Gallery

- Policy for protection of interests of policyholders

- Press-Release

- Privacy Policy

- Rajbhasha Patrika

- Retired Employees Portal

- Stewardship Policy & Disclosure

- Swachh Bharat Campaign

- Tender –Award

- Terms & Conditions

- Unclaimed Amounts of Policyholders

- Underwriting Philosophy

- Welcome Kit

- LIC Pension Fund Limited

- LIC Cards Services Limited

- LIC Mutual Fund Trustee Private Limited

- LIC Mutual Fund Asset Management Limited

- LIC Housing Finance Limited

- LICHFL Asset Management Company Limited

404 Not found

13+ LIC Letter Format – Know How to Write & Check Examples Here

- Letter Format

- January 31, 2024

- Bank Letters , Cancellation Letters , Claim Letters , Credit Letters , Insurance Letters , Legal Letters , Loan Letters , Request Letters

LIC Letter Format : Life Insurance Corporation of India (LIC) is the largest life insurance company in India . It offers a range of life insurance policies to suit the needs of individuals, families, and businesses . As part of its communication with policyholders, LIC sends letters for various reasons. These letters are important as they contain valuable information related to policies, premium payments, claims, and other matters . In this article, we will discuss the LIC letter format and its various components.

Also Visit:

- Car Insurance Endorsement Letter Sample

- Bajaj Finance Loan Approval Letter PDF

How to Write LIC Letter Format

Content in this article

- Header: The letterhead of LIC includes its logo, name, and address. This information is printed at the top of the letter.

- Date: The date of the Insurance letter is mentioned below the header, on the right-hand side. It is important to mention the date as it helps in record-keeping and tracking of communication.

- Subject: The subject of the letter is mentioned below the date, in bold letters. It provides an overview of the purpose of the letter. For example, the subject could be “Premium payment reminder” or “Claim settlement update.”

- Salutation: The salutation or greeting is used to address the policyholder. It is usually “Dear Policyholder” or “Dear Mr./Ms. Last Name.”

- Body: The body of the LIC Letter Format contains the main message. It provides details related to the subject of the letter. For example, if the subject is premium payment reminder, the body of the letter would provide information related to the due date, amount, and payment options. The body of the letter may also contain instructions, explanations, and other relevant details.

- Complimentary Close: The complimentary close is a polite way of ending the letter. Commonly used complimentary closes include “Sincerely,” “Regards,” or “Yours faithfully.”

- Signature: The letter is signed by the authorized signatory of LIC. The name, designation, and contact details of the signatory are usually mentioned below the signature.

- Enclosures : If the LIC Letter Format requires any documents or forms to be submitted by the policyholder, the list of enclosures is mentioned at the end of the letter. For example, if the letter is related to claim settlement, the list of enclosures could include the claim form, death certificate, and policy documents.

LIC Letter Format – sample format

Below is a sample format of LIC Letter Format:

[Your Name] [Your Address] [City, State, Zip Code] [Your Email Address] [Your Phone Number] [Date]

[Recipient’s Name] [Recipient’s Position, if applicable] [Name of LIC Office or Branch] [Office Address] [City, State, Zip Code]

Subject: Request for [Specific Purpose: e.g., Policy Surrender, Policy Renewal, Policy Enquiry, etc.]

Dear [Recipient’s Name],

I hope this letter finds you well. I am writing to request [specific purpose: e.g., surrender my policy, renew my policy, inquire about my policy status, etc.].

I hold a policy with LIC under policy number [Policy Number], which was issued to me on [Date of Policy Issuance]. [Provide any relevant details about the policy, such as the type of policy or any specific terms.]

[If surrendering policy:] I regret to inform you that I am facing financial difficulties and need to surrender my policy. Kindly provide me with the necessary forms and procedures to initiate this process.

[If renewing policy:] I would like to renew my policy and ensure its continuation. Please provide me with the renewal options available and any documents or payments required for the renewal process.

[If inquiring about policy status:] I would like to inquire about the current status of my policy. Specifically, I would appreciate information regarding [mention specific details you wish to inquire about, such as premium payments, maturity benefits, etc.].

I kindly request your assistance in this matter and would appreciate a prompt response to my request. If there are any forms or documents I need to fill out, please provide them to me at your earliest convenience.

Thank you for your attention to this matter. I look forward to your prompt response.

Warm regards,

[Your Name]

Customize this letter according to your specific request or purpose when contacting LIC.

LIC Letter Format – samples

Have a look at a few sample formats of the LIC Letter Format. You can use any format given below.

LIC Letter Format – Example

Here’s an Example of LIC Letter Format:

[Manager’s Name] LIC Branch Office [Office Address] [City, State, Zip Code]

Subject: Policy Surrender Request

Dear Mr./Ms. [Manager’s Last Name],

I hope this letter finds you in good health. I am writing to request the surrender of my LIC policy with policy number XYZ123456.

Due to unforeseen financial circumstances, I find it necessary to surrender my policy. I understand the implications of this decision but believe it is the best course of action for my current situation.

I kindly request your assistance in guiding me through the surrender process and providing me with the necessary forms and instructions to proceed. Additionally, I would appreciate any information regarding the surrender value of my policy.

Please let me know if there are any documents I need to fill out or any other requirements for initiating the surrender process. Your prompt attention to this matter would be greatly appreciated.

Thank you for your understanding and assistance. I look forward to your prompt response.

This example is tailored specifically for a policy surrender request. Adjust the details and content as per your specific requirement when writing to LIC.

LIC Letter Format for Premium Payment Reminder

This is a LIC Letter Format For Premium Payment Reminder:

[Header: Logo, Name, and Address of LIC]

[Date: May 5, 2023]

[Subject: Premium Payment Reminder]

Dear Policyholder,

We would like to remind you that your premium payment for Policy No. 1234567 is due on May 31, 2023. The total premium amount due is INR 10,000.

To ensure the continuity of your policy benefits, we request you to make the payment on or before the due date. You can make the payment online through our website or mobile app or visit any of our nearest branches.

In case you have already made the payment, please ignore this letter.

Thank you for your continued trust in LIC.

[Signature]

Branch Manager

Enclosures: None

LIC Letter Format for Claim Settlement Update

Here is a LIC Letter Format for Claim Settlement Update:

[Subject: Claim Settlement Update]

Dear Mr. Sharma,

We would like to inform you that the claim submitted for Policy No. 7654321 has been processed and settled. The claim amount of INR 5,00,000 has been credited to your registered bank account on May 3, 2023.

We appreciate your cooperation and patience during the claim settlement process. If you have any further queries or concerns, please feel free to contact our customer care team at 1800-XXX-XXXX or visit our nearest branch.

Thank you for choosing LIC for your insurance needs.

Customer Service Manager

Enclosures:

- Copy of the settlement advice

LIC Letter format – Template

Here’s a Template of LIC Letter format:

[Recipient’s Name] LIC Branch Office [Office Address] [City, State, Zip Code]

Subject: [Brief Description of Purpose]

I am writing to [briefly explain the purpose of your letter, e.g., request information about a policy, update personal details, surrender a policy, etc.]. I hold a policy with LIC under policy number [Policy Number], and I require [mention specific requirements or information needed].

[Provide any relevant details or explanations related to your request.]

I kindly request your assistance in this matter and would appreciate your prompt attention to my request. If there are any forms or documents I need to fill out, please provide them to me at your earliest convenience.

This template can be used for various purposes when writing to LIC. Adjust the subject and content according to your specific request or inquiry.

LIC letter format for policy inquiry

This is a LIC letter format for policy inquiry:

[Your Address]

[City, State, Zip Code]

[Your Email Address]

[Your Phone Number]

[Manager’s Name]

LIC Branch Office

[Office Address]

Subject: Policy Inquiry

I hope this letter finds you well. I am writing to inquire about the status of my LIC policy with policy number XYZ123456.

I would like to request information regarding the following:

- Premium payment status and due dates.

- Policy benefits and coverage details.

- Maturity date and maturity benefits, if applicable.

- Any other relevant updates or changes to the policy.

I would appreciate it if you could provide me with the necessary details and updates regarding my policy. Additionally, if there are any documents or forms I need to fill out, please let me know.

LIC letter format for policy surrender

Here’s a LIC letter format for policy surrender:

LIC letter format for policy renewal

Here is a LIC letter format for policy renewal:

Subject: Policy Renewal Request

I hope this letter finds you well. I am writing to request the renewal of my LIC policy with policy number XYZ123456.

As my policy approaches its expiration date, I would like to ensure its continuation. Therefore, I kindly request your assistance in guiding me through the renewal process.

Please provide me with the necessary information regarding the renewal options available and any documents or payments required for the renewal process. Additionally, if there are any changes or updates to the policy terms, I would appreciate clarification on those as well.

Thank you for your attention to this matter. I look forward to your prompt response and assistance in renewing my policy.

Email Format about LIC Letter format

Here’s an Email Format of LIC Letter format:

Subject: [Policy No. or Subject of the Letter] – LIC Letter

Dear [Policyholder’s Name],

Greetings from Life Insurance Corporation of India (LIC)!

We hope this email finds you in good health and high spirits. This email is in reference to the letter sent to you by LIC regarding [Subject of the Letter], dated [Date of the Letter].

We would like to inform you that the letter has been dispatched to your registered mailing address on [Date of Dispatch]. In case you have not received the letter, please do let us know, and we will arrange for a copy of the same to be sent to you.

As the letter contains important information related to your policy, we request you to go through it carefully and take appropriate action, if required. In case you have any doubts or queries, please feel free to contact our customer care team at 1800-XXX-XXXX or visit our nearest branch.

Thank you for your continued trust in LIC. We look forward to serving you in the future.

[Your Name] Customer Service Representative Life Insurance Corporation of India

Enclosure: None

LIC letter format for updating nominee details

Here is a LIC letter format for updating nominee details:

Subject: Update of Nominee Details for Policy Number [Policy Number]

I hope this letter finds you well. I am writing to request the update of nominee details for my LIC policy with policy number XYZ123456.

I would like to make the following changes to the nominee details:

Old Nominee Details:

- Name: [Old Nominee Name]

- Relationship: [Old Nominee Relationship]

- Address: [Old Nominee Address]

New Nominee Details:

- Name: [New Nominee Name]

- Relationship: [New Nominee Relationship]

- Address: [New Nominee Address]

Please update the records accordingly and provide me with confirmation of the changes made. If there are any forms or documents that need to be filled out for this purpose, kindly provide them to me along with the necessary instructions.

Thank you for your attention to this matter. I appreciate your assistance in updating the nominee details for my policy.

LIC letter format for maturity benefits

This is a LIC letter format for maturity benefits:

Subject: Inquiry Regarding Maturity Benefits for Policy Number [Policy Number]

I hope this letter finds you well. I am writing to inquire about the maturity benefits for my LIC policy with policy number XYZ123456.

My policy is due to mature soon, and I would like to obtain information regarding the benefits that will be available to me upon maturity. Specifically, I would appreciate details regarding the maturity amount, any additional bonuses or benefits, and the process for receiving the maturity proceeds.

Furthermore, if there are any documents or forms that I need to complete to facilitate the maturity process, please provide me with guidance on how to proceed.

Thank you for your attention to this matter. I look forward to receiving the necessary information regarding the maturity benefits of my policy.

FAQS About LIC Letter Format – Know How to Write & Check Examples Here

How do i write a letter to lic for policy surrender.

To write a letter for policy surrender to LIC, start with your details, mention your policy number, state your intention to surrender the policy due to specific reasons, and request assistance from LIC for the surrender process.

What should be included in a letter to LIC for policy renewal?

In a letter to LIC for policy renewal, include your details, policy number, express your intention to renew the policy, request information about renewal options, and ask for guidance on the renewal process.

How do I inquire about my LIC policy through a letter?

To inquire about your LIC policy through a letter, include your details, policy number, state your inquiry regarding policy status or specific details, and request LIC to provide relevant information.

How can I request a change of address in my LIC policy through a letter?

When requesting a change of address in your LIC policy, include your details, policy number, state the current and new address, and request LIC to update their records accordingly.

What should I mention in a letter to LIC for updating nominee details?

In a letter to LIC for updating nominee details, include your details, policy number, mention the old and new nominee details, and request LIC to update their records with the new nominee information.

How do I inquire about maturity benefits for my LIC policy through a letter?

When inquiring about maturity benefits for your LIC policy through a letter, include your details, policy number, state your inquiry regarding maturity benefits, and request LIC to provide details about the benefits available upon maturity.

The LIC letter format is designed to provide clear and concise communication to policyholders . The various components of the letter, such as the header, date, subject, salutation, body, complimentary close, signature, and enclosures, ensure that the message is conveyed effectively. LIC Letter Format important for policyholders to read the letters carefully and take appropriate action, if required .

Related Posts

25+ Complaint Letter Format Class 11 – Email Template, Tips, Samples

24+ Car Parking Letter Format – How to Write, Email Templates

15+ Business Letter Format Class 12 – Explore Writing Tips, Examples

21+ Black Money Complaint Letter Format, How to Write, Examples

11+ Authorized Signatory Letter Format – Templates, Writing Tips

20+ Authorization Letter Format for ICEGATE Registration – Examples

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Name *

Email *

Add Comment

Save my name, email, and website in this browser for the next time I comment.

Post Comment

LIC POLICY SERVICE INFORMATION

LIC Agent & Policyholder can use this Blog

- How to make best use of this blog

- Medical & NM Chart

- Employer Employee Scheme

- Join Telegram Group

Friday, May 14, 2021

Reassignment.

In case you are raising a loan against your policy from any financial institution, your policy would have to be assigned to the financial institution. Assignment means the process of transferring the whole right of policy to other person (for love and affection) or organisation ( for loan)

When an LIC policy is used as a collateral against any Bank loan then, the original nominee in the policy loses all his claims (RIGHTS) to the policy .

The policy would be reassigned to you on the repayment of the loan. A fresh nomination should be done after reassignment of the policy .

Requirement for reassignment

1. Reassignment form No. 3857 to be signed by authorised person of the organisation with stamp

2. Notice of ressignment

3. Letter of authority on letterhead of the organisation from where you raised loan which is repaid by you

4. Original policy

5. Aadharcard

6. Processing fee Rs. 94.50 + GST ( You have to pay this amount at cash counter of LIC Branch office where your policy is being serviced . You can get challan for this from PS dept of LIC branch)

Download Reassignment form No. 3857

No comments:

Post a comment.

- [email protected]

- Monday - Saturday (10am - 05 pm)

- A3/24 Janakpuri New Delhi India 110058

Assignment in LIC Policy

The process of transferring the title rights, and interest on assets or property from one person to another person is known Assignment. Assignment is generally done to provide security against loan

Assignor : The person or policy holder who transfers the title on the assets or property is known as the assignor

Assignee : The person to whom the title on assets on property is transferred is known as the assignee.

Feature of Assignment in LIC Policy

- Assignment can be done only after purchase of a policy

- Assignment is applicable to all kinds of insurance plans except pension plans

- Assignor should have complete ownership of the policy. The life assured is minor of is not the policy holder or proposer, does not have any rights over the policy, hence cannot assign the policy

- After assignment the assignee gets complete ownership and rights over the policy including death benefit. He can even surrender the policy

- Assignment can be done towards a person or an institution

- Insurer has to record the fact of the assignment in their record

- Assignment once made cannot be cancelled. Policy can be re-assigned in the name of the life assured.

- The policy would be re-assigned to you and the repayment of the loan. A fresh nomination should be done after assignment of the policy

Types of Assignment

There are two types of assignment:

- Conditional Assignment: In this type of assignment, the rights, title and interest in the policy automatically revert back to the assignor:

The conditions are:

- On the death of the assignee before the death of the assignor

- The assignor survives the date of maturity of the insurance policy

- The loan is repaid

If the condition becomes effective it is automatic revert back to the assignor

- Absolute Assignment: In this type of assignment the rights, title and interest of the assignor passes completely to the assignee. Absolute assignment is generally done for valuable consideration the policy vests in the assignee absolutely and forms part of his estate on his death.

Documents Required:

- Original bond paper (for pasting endorsement)

- KYC Documents

- Assignment form 3855

- Re-assignment form 3848

Process of assignment in LIC Policy:

The assignment can be done by either of the following process:

- Making an endorsement on the LIC Policy document, In this process the stamp duty is not required. The assignment form along with the policy should be duly signed by the assignor, assignee & a witness.

- Execute a separate assignment deed in this case stamp duty needs to be paid.

- The assignment will be effective when the insurer only if it is registered with the insurer in their records. The date on which the notice of assignment is delivered to the insurer shall regulate the priority of all claims under a transfer or assignment.

LIC Child Plan Quote

- Letter Template

- Employment Verification Letter Template

Template for letter of reassignment or transfer

Template Categories

- Miscellaneous

Featured Categories

- Doctors Note

- Power of Attorney

- Rental Application

- Rent and Lease

- Certificate

- Business Proposal

About Dexform

- Terms of service

- Privacy policy

Celebrate Banking

Lic policies, assignment and bank loans.

Banks accept LIC policies assigned in their favour as security for loans to be sanctioned. A charge in favour of the bank over the LIC policy is created by assignment of LIC Policy.

Which are the types of LIC policies accepted by banks?

Banks normally accepts the following categories of policies:

a) Endowment Policies b) Whole Life Policies (limited payments or otherwise) c) Joint Life Policies

Some banks accept Children’s Deferred Assurance policies after the policies are adopted by the life assured on their attaining majority. Policies assured on the lives of minors are also accepted after the policies are assigned in favour of said minors on their attaining majority.

Which are the types of LIC policies not accepted by banks?

The following categories of L.I.C. policies are not accepted by banks, mainly because they are not assignable.

a) Children’s Endowment Policy b) Children’s Deferred Assurance c) Policies with nominations under “Married Women’s Property Act”. d) Policies taken out especially for the purpose of Estate Duty and the like.

Whether policies of New Private Sector Insurance companies acceptable?

The Policies issued by new Private Sector Insurance Companies approved by IRDA, are accepted by banks, if

1. The insurance company issue surrender value certificate and 2. The policy is assignable in favour of the bank.

What is meant by assignment?

Assignment means transfer of a right over a property existing or future, or debt by one person to another. Life insurance policies and book debts are two classes of securities, rights over which can be transferred by assignment. Nomination under the Insurance Act is automatically cancelled on assignment. Hence nominees need not join the assignment process.

When a policy is assigned in favour of a bank, it can enforce the right by surrendering the policy to the policy issuer and obtaining the surrender value. This is done after serving a notice of demand on the assignor on default.

What are the conditions to be satisfied for assignment of policy?

1. If there is any existing assignment on the policy, it should be reassigned in favour of the assured. 2. The assigner should assign the policy in favour of the bank by executing the assignment form/ notice of assignment. 3. The bank forwards the policy along with assignment form/ notice of assignment to the insurance company for registration of the assignment in their books. 4. Insurance company returns the policy to the bank after noting the details in their records and the bank keeps the assigned policy in its files.

What happens on the death of assured before settlement of liability?

When a policy is assigned in favour of another person or bank, the assured is transferring all future rights over the policy in favour of the assignee. Hence, in case of death of assured before settlement of the dues of the bank, bank lodges its claim before the insurance company supported by the death certificate and the assigned policy. The insurance company releases the amount in favour of the bank.

What is insurable interest?

Insurable interest arises if beneficiary happen to sustain monetary loss as a result of the death of the life assured. Insurable interest is of a pecuniary nature.

Husband has an insurable interest in the life of his wife and vice versa An employer has an insurable interest in his employee and vice versa.

What are the precautions taken by bank while accepting LIC policies?

1. The age of the assured is got admitted by the LIC. 2. The policy is an assignable policy and does not belong to the non – acceptable categories. 3. The surrender value and paid up amount of the policy is obtained. 4. The policy is in force and the premium is paid up to date by obtaining latest premium paid receipt. 5. No prior assignment exists/ all previous assignments are cancelled. 6. The assignment of policy in favour of the Bank is duly registered with the insurance company. 7. If the Insurance Policy offered as security is on the life of a person other than the borrower, the bank ensures that the borrower has an insurable interest in the life of the assured.

What is meant by re-assignment?

Share this:, related posts.

Lic Assignment Cancellation Form PDF Details

Do you need to cancel a Life Insurance Corporation of India (LIC) assignment? If so, it's essential that you complete the LIC Assignment Cancellation Form correctly. This form is used when policy holders want to withdraw their investments and surrender their policies. In this blog post, we'll outline the steps involved in completing an LIC Assignment Cancellation Form and discuss what happens after you submit it. We'll also go over important considerations for both term insurance plan cancellations as well as traditional plan reassignments. Read on to learn more about how to effectively manage your life insurance investments with an LIC cancellation form!

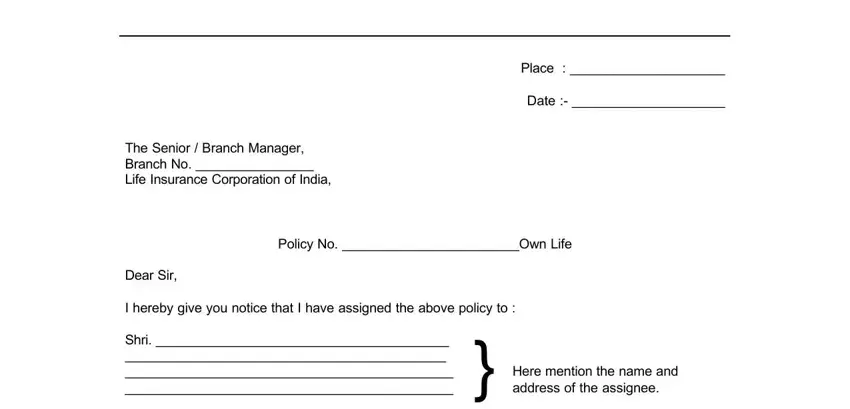

Form Preview Example

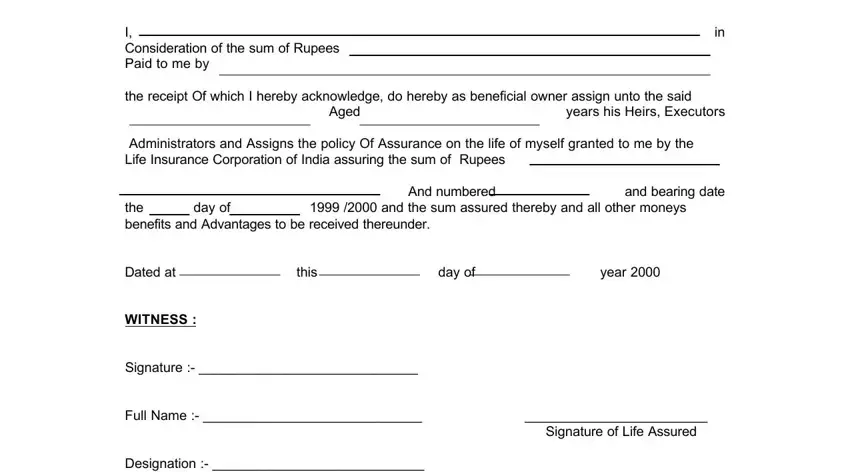

FORM OF ASSIGNMENT OF POLICY FOR VALUABLE CONSIDERATION

(Absolute Assignment)

Note : THIS FORM SHOULD NOT BE FILLED IN. The wording of the form, if found suitable, should be copied out either on the back of policy itself, or in the alternative, on a proper stamp paper of the requisite value.

(FOR INSTRUCTIONS RE: EXECUTION OF AN ASSIGNMENT SEE REVERSE)

Signature of Life Assured

Designation :- _____________________________

Address :- ________________________________

Place : _____________________

Date :- _____________________

The Senior / Branch Manager,

Branch No. ________________

Life Insurance Corporation of India,

Policy No. ________________________Own Life

I hereby give you notice that I have assigned the above policy to :

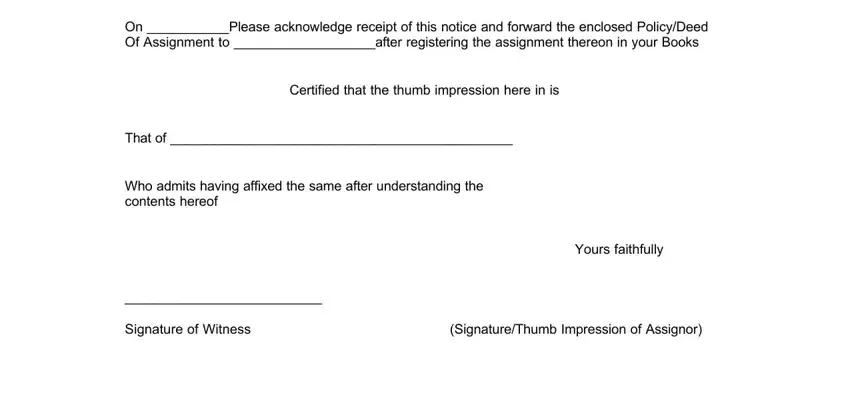

On ___________Please acknowledge receipt of this notice and forward the enclosed Policy/Deed

Of Assignment to ___________________after registering the assignment thereon in your Books

Certified that the thumb impression here in is

That of _______________________________________________

Who admits having affixed the same after understanding the contents hereof

?? Notice Should be given by assignor or his/her duly authorised Agent.

The assignor's thumb impression to the form should be attested by a Magistrate or justice of the Peace or a Gazetted Officer. An officer or Development officer of atleast 3 years standing or confirmed Development Officer recruited from the Agents, who were DM or BM club members before joining or Development officer recruited from agents who were ZM or Chairman's club members before joining Provided he / she is fully satisfied about the identity of the person. The attesting witness should certify as above

INSTRUCTIONS

(1) After making such alteration, if any as may be deemed necessary in the case under consideration, the form printed on the reverse should be copied either on the back of the policy, in which case no stamp duty will be payable or on a separate (Special adhesive or non-judicial ) Stamp paper of the appropriate value. Parties to the Assignment should satisfy themselves before forwarding the policy or the Deed of Assignment, as the case may be as regards proper Stamp duty having been paid thereon.

(2) The full name, and age, of the Assignee must be stated.

(3) The actual consideration for the assignment received from the assignee should be written in words, not in figures.

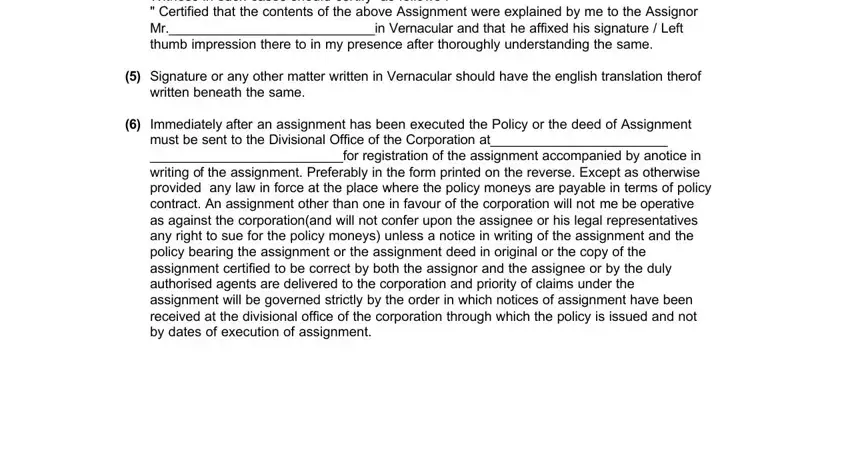

(4) The Assignor must affix his signature to the Assignment in the presence of a witness other than the Assignee. If the Assignor is not conversant with English, he must sign the Assignment before an English-knowing person and if he be illiterate, he must affix his thumb impression to the Assignment before a magistrate a justice of peace or Gazetted Officer. An Officer or Development Officer of Atleast 3 Years standing or confirmed Development Officer recruited from the Agents, who were DM or BM club members before joining or Development Officer recruited from Agency who were ZM chairmans club members before joining provided he/she is fully satisfied about the identity of the person executing the assignment. The Witness in such cases should certify as follows :-

" Certified that the contents of the above Assignment were explained by me to the Assignor Mr.____________________________in Vernacular and that he affixed his signature / Left thumb impression there to in my presence after thoroughly understanding the same.

(5) Signature or any other matter written in Vernacular should have the english translation therof written beneath the same.

(6) Immediately after an assignment has been executed the Policy or the deed of Assignment must be sent to the Divisional Office of the Corporation at________________________

__________________________for registration of the assignment accompanied by anotice in writing of the assignment. Preferably in the form printed on the reverse. Except as otherwise provided any law in force at the place where the policy moneys are payable in terms of policy contract. An assignment other than one in favour of the corporation will not me be operative as against the corporation(and will not confer upon the assignee or his legal representatives any right to sue for the policy moneys) unless a notice in writing of the assignment and the policy bearing the assignment or the assignment deed in original or the copy of the assignment certified to be correct by both the assignor and the assignee or by the duly authorised agents are delivered to the corporation and priority of claims under the assignment will be governed strictly by the order in which notices of assignment have been received at the divisional office of the corporation through which the policy is issued and not by dates of execution of assignment.

(7) When the policy is to be assigned by way of security or mortgage only and not absolutely it is advisable to consult a legal advisor as to form of assignment to be used, amount of stamp duty etc.

Form No. – 3848 p.i./15,000 f / 12-99

How to Edit Lic Assignment Cancellation Form Online for Free

Any time you intend to fill out reassignment form lic, you won't have to download any kind of applications - simply try using our online tool. The editor is continually maintained by our staff, receiving cool features and becoming greater. By taking a couple of simple steps, it is possible to begin your PDF editing:

Step 1: Click the "Get Form" button above. It's going to open our pdf tool so you can start filling out your form.

Step 2: As soon as you access the online editor, you will notice the form ready to be completed. Apart from filling out various blanks, you could also do some other things with the PDF, including adding any textual content, editing the original text, inserting graphics, putting your signature on the PDF, and much more.

This document requires specific info to be filled in, so make sure to take whatever time to enter exactly what is asked:

1. Fill out your reassignment form lic with a number of major blank fields. Note all of the required information and make sure nothing is omitted!

2. Right after this selection of blank fields is completed, go on to enter the suitable information in all these - I in Consideration of the sum of.

3. The third stage is normally straightforward - fill in every one of the form fields in Place Date, The Senior Branch Manager Branch, Policy No Own Life, Dear Sir I hereby give you notice, and Here mention the name and address in order to finish this segment.

4. Your next section will require your input in the following parts: Dear Sir I hereby give you notice, Certified that the thumb, That of Who admits having affixed, Yours faithfully, and SignatureThumb Impression of. Just be sure you provide all of the needed info to move further.

5. Since you approach the final parts of the file, you will find several extra things to complete. Specifically, than the Assignee If the Assignor, Signature or any other matter, written beneath the same, Immediately after an assignment, and for registration of the assignment must all be filled out.

Many people often make some mistakes while completing than the Assignee If the Assignor in this part. You need to reread whatever you enter here.

Step 3: Reread what you have entered into the form fields and then hit the "Done" button. Sign up with FormsPal right now and instantly gain access to reassignment form lic, available for download. Every last edit made is handily kept , which means you can modify the pdf at a later stage as needed. When you use FormsPal, you can easily complete documents without having to be concerned about information incidents or records being distributed. Our protected platform helps to ensure that your private information is maintained safe.

Lic Assignment Cancellation Form isn’t the one you’re looking for?

Related documents.

- Beachbody Coach Cancellation Form

- Form 242 For Listing Cancellation

- Nicop Cancellation Form

- Coach Cancellation Form

IMAGES

VIDEO

COMMENTS

after registering the assignment thereon in your books. Signature of witness. yours faithfully, (signature / thumb impression of assignor/ life assured) The wording of this form ,if found suitable should be copied out either on the back of the policy itself, or in the alternative, on a proper stamp paper of the requisite value.

Here are four templates for LIC Policy Transfer to Another Branch Letter Format: Template -1: Email Ideas About LIC Policy Transfer to Another Branch Letter Format. Subject: Request for Transfer of LIC Policy to [New Branch Name] Dear [Branch Manager's Name], I hope this email finds you well. I am writing to request the transfer of my LIC ...

Guidelines For Policy Holders. We welcome you as a policyholder and as a prospective customer to our customer service section. This section will guide you through the various intricacies of a life insurance contract and the facts that you must know to make the best out of your life insurance policy. Please read our guidelines carefully.

Access essential forms for LIC transactions effortlessly. Download a variety of forms for policy-related services and ensure a smooth experience with LIC India. ... If policy has run for 3 years or more from date or risk, claim form no.3783A may be used. ... 07. IPP-Letter of Indemnity Click here to download (Content is in English and Hindi)(58 ...

To, Sub: Transfer of LIC Policy to Delhi Branch. Respected Sir, I, Rakesh Sharma, am writing this letter to request you to please transfer my LIC policy (Policy No: 12345678) from your LIC branch office in Jaipur to the one in Karol Bagh, New Delhi. The reason for requesting this transfer is that I have permanently shifted from Jaipur to Delhi.

The Nominee Change Letter Format for LIC is a formal request letter that the policyholder needs to write and submit to LIC. The letter should contain all the relevant information, including the policyholder's name, policy number, and the details of the new nominee/s.The letter must be signed and dated by the policyholder to authenticate the request.

The Branch Office which services the policy sends out a letter informing the date on which the policy monies are payable to the policyholder at least two months before the due date of payment. The policyholder is requested to return the Discharge Form duly completed along with the Policy Document, NEFT Mandate Form (Bank A/c Particulars with ...

Enter: 19.02.19. To, Sub: Transfer of LICENT Policy to Delhi Branch. Respected Sir, I, Rakesh Sharma, am writing this letter to request you to please transfer my LIC policy (Policy No: 12345678) from your LIC branch office in Jaipur to the a in Karol Bagh, New Delhi. Who motive for requesting this transfer is which I possess permanently shifted ...

The letter for assignment of LIC policy should contain certain key elements to ensure clarity and validity. These include: 1. Contact Information: The letter should begin with the date and contact details of both the assignor and assignee. This includes their full names, addresses, phone numbers, and LIC policy numbers. 2.

Dear [Recipient's Name], I hope this letter finds you well. I am writing to request [specific purpose: e.g., surrender my policy, renew my policy, inquire about my policy status, etc.]. I hold a policy with LIC under policy number [Policy Number], which was issued to me on [Date of Policy Issuance].

India any Notice of assignment or reassignment in respect of the above POLICY/ POLICIES ... of their number, then a letter of Authority as under must be completed and signed by all of them except the authorised person before Magistrate or a Block Development Officer or Gazetted

absolute reassignment: 3: assignment questionnaire: 4: claim cancer cover form a2: 5: claim cancer cover form a3: 6: claim of cancer plan form a 1: 7: dab adding from: 8: disability claim form no 5279: 9: disability claim form no 5280 a: 10: ee conditional assignment: 11: form no. 3858 ( reassignment ) 12: form of assignment 3848: 13: loan form ...

A fresh nomination should be done after reassignment of the policy. 1. Reassignment form No. 3857 to be signed by authorised person of the organisation with stamp. 2. Notice of ressignment. 3. Letter of authority on letterhead of the organisation from where you raised loan which is repaid by you. 4. Original policy.

How to Edit Your Lic Reassignment Form 3857 Pdf Online Free of Hassle. Follow these steps to get your Lic Reassignment Form 3857 Pdf edited in no time: Hit the Get Form button on this page. You will go to our PDF editor. Make some changes to your document, like signing, highlighting, and other tools in the top toolbar.

Assignment in LIC Policy. The process of transferring the title rights, and interest on assets or property from one person to another person is known Assignment. Assignment is generally done to provide security against loan. Assignor : The person or policy holder who transfers the title on the assets or property is known as the assignor.

Template for letter of reassignment or transfer. 1. 2. Use t his lett er templa te i f y ou ar e rea ssign ing or transferring an employee, who remains in the. same classification, to another locati on, and/or diff erent supervisor. If the lay off unit is chan ging, please consult with your appropriate HR representative or.

The policy is an assignable policy and does not belong to the non - acceptable categories. 3. The surrender value and paid up amount of the policy is obtained. 4. The policy is in force and the premium is paid up to date by obtaining latest premium paid receipt. 5. No prior assignment exists/ all previous assignments are cancelled.

This form is used when policy holders want to withdraw their investments and surrender their policies. In this blog post, we'll outline the steps involved in completing an LIC Assignment Cancellation Form and discuss what happens after you submit it. ... lic reassignment letter, reassignment form of lic, lic form 3857, lic assignment form: 1 2 ...

1. Fill out the form with your full name, address, and contact information. 2. Specify the reason for the reassignment. For example, if you are giving the license to another person, list the name, address, and contact information of the recipient. 3. Provide a signature and date of signing. 4.

How to protect your lic reassignment form 3857 pdf when preparing it online. Guarding the data in your lic questionnaire form is rational and smart. Follow the recommendations below to shield your data: Password protect your device. Enable passcodes for each and every device that has access to your personal, payment, or document-connected ...

India any Notice of assignment or reassignment in respect of the above POLICY/ POLICIES ... of their number, then a letter of Authority as under must be completed and signed by all of them except the authorised person before Magistrate or a Block Development Officer or Gazetted

An enrollee will also be eligible for reassignment to another PCP under the following conditions: if they have not visited any PCP within the previous 12 months. If they are under 4 years of age and have not visited a PCP within the previous 6 months. If they have not visited a PCP within 6 months of giving birth.