The 3 Statement Financial Model: Income, Balance Sheet, and Cash Flow

As a startup founder, you know that a robust financial model is the Swiss Army knife in your toolkit. It's not just about keeping the lights on; it's about illuminating the path ahead, helping you navigate the twists and turns of business growth with precision and confidence.

Whether you're trying to make sense of the numbers, pitching your vision to investors, or strategizing your next capital raise, your financial model is your north star. Yet, the journey from spreadsheet novice to financial maestro is fraught with complexity and time-consuming challenges.

This blog post aims to demystify the 3-statement model , breaking down its components and getting to the root of how it can be a game-changer for startup founders looking to steer their companies with confidence and clarity.

Table of Contents

The essence of the 3-statement model, financial modeling at the pre-revenue stages, financial modeling at the post-revenue stages, the path forward.

- Getting the Support You Need

The 3-statement model is a combination of three key financial statements: the income statement, balance sheet, and cash flow statement. Each statement offers a unique lens through which to view your business's financial status, and together, they provide a powerful holistic financial overview.

These aren't just reports; they're a narrative, a detailed story of your business's financial health and operational efficiency.

The Income Statement: This statement is the storyteller of your business's operational performance, detailing revenues, expenses, and ultimately, profit or loss over a specific period. It answers the question, "Is the business profitable?"

The Balance Sheet: Acting as a financial snapshot at a point in time, the balance sheet reflects what your company owns (assets), owes (liabilities), and the equity built by the owners. It's a testament to your company's stability and financial resilience.

The Cash Flow Statement: Cash management is the linchpin of business operations. This statement tracks the flow of cash in and out of your business, categorizing cash movements into operations, investing, and financing activities. The cash flow statement is crucial for understanding liquidity and ensuring the business can meet its short-term obligations.

The Synergy of the Three Statements

The real power of the 3-statement model lies in its interconnectedness. Changes in one statement impact the others, creating a dynamic view of your business's financial reality. For instance, revenue growth boosts profits on the income statement, which affects cash in the bank (on the balance sheet) and is reflected in the cash flow from operations. This synergy allows founders to see the ripple effects of business decisions across the entire organization.

Income Statement Without revenue, the focus shifts to planning for future income and managing expenses. Estimate potential revenues using industry benchmarks and market analysis and create assumptions around growth. Closely monitor and categorize all operational expenses to maintain control over cash flow and understand your burn rate. Highlight any initial funding or investments as indicators of financial support and confidence in the business model.

Balance Sheet Concentrate on listing your current assets, including cash reserves and any capital equipment or technology investments. Adjust liabilities to reflect any loans or financial obligations. This revision ensures a clear view of your company's financial standing, emphasizing assets over immediate revenue generation.

Pre-Revenue Cash Flow Document cash outflows related to operational expenses and initial investments, focusing on maintaining a clear record of where capital is being allocated. Include any financing inflows, such as investor capital or loans, which are crucial for sustaining operations before revenue streams are developed.

Income Statement Evolution As revenue begins to flow, closely monitoring COGS and gross margin becomes crucial for understanding product profitability and managing operating expenses to ensure profitability scales with sales.

Balance Sheet Management With expanded operations, the balance sheet requires detailed attention to things like inventory, receivables, and payables to optimize cash flow, balancing debt and equity to maintain financial health while possibly introducing more complex financial strategies .

Cash Flow Dynamics Revenue activation transforms the cash flow statement, emphasizing the importance of operating cash flow, investment in growth, and financing strategies to enhance the cash conversion cycle for financial sustainability.

Strategic Forecasting and Scenario Planning A richer financial model enables the art and science of forecasting and scenario planning , allowing for proactive management and strategic decision-making to navigate startup growth effectively.

Integrating Advanced Models Growing business complexity necessitates the use of advanced models like the Consolidation Model , providing deep insights into various business segments for detailed profitability and cost analysis, ensuring the financial model accurately captures the nuances of the business.

Understanding and implementing the 3-statement model can be a complex process, but it's essential for making informed business decisions. This model not only helps you manage your current financial health but also aids in forecasting future performance. By closely monitoring and adjusting your financial model, you can identify growth opportunities, manage risks, and build a resilient business poised for long-term success.

As you embark on this financial journey, remember that the goal is not just to manage your company's finances but to harness them in a way that propels your business forward. Embrace the complexity, revel in the learning, and let your financial model be the compass that guides you to entrepreneurial success.

Real-World Applications

Theory often serves as the foundation, but it is the application of this theory that propels startups to success. The following case studies illustrate how startups across different sectors have effectively implemented the 3-statement model, navigating through various financial landscapes to achieve their goals.

Navigating Market Uncertainty: Science On Call's Strategic Financial Overhaul

Launching just before the pandemic hit, Science On Call , co-founded by Luisa Castellanos, faced immediate and unprecedented challenges as the restaurant industry, their primary customer base, was thrust into turmoil. Initially relying on a basic financial model, the team quickly realized the need for a more sophisticated approach to navigate the volatile market. By upgrading to Forecastr, Science On Call enhanced its financial planning, enabling a level of collaboration and strategic decision-making that was previously out of reach. This shift was pivotal not only for internal management but also played a critical role in their fundraising efforts, leading to a successful $1.1 million pre-seed SAFE round. The ability to adapt its financial model and strategies in real-time allowed Science On Call to stabilize and position itself for growth despite the uncertain market conditions, showcasing the importance of flexible financial modeling in responding to external shocks and securing investor confidence.

Pivoting with Precision: Local Sports Network's Strategic Model Transformation

Local Sports Network (LSN) , led by Dustin D. McMahon, faced a pivotal challenge early in its journey of connecting high school sports fans through live streaming, social networking, and fan apparel. Initially adopting a subscription-based model, LSN discovered through feedback that an advertising model would better serve their long-term goals. This required a complete overhaul of their revenue strategy, a daunting task given the team's lack of experience with ads-based models. Enter Forecastr, introduced to Dustin during a Techstars accelerator program, which provided the tools and expertise to develop a new financial model tailored to this shift. Forecastr's collaborative approach and ability to translate complex financial scenarios into understandable terms enabled LSN to confidently present its vision to investors, securing its position for future growth. This partnership not only facilitated a seamless transition to an advertising revenue model but also prepared LSN for scalable success and future fundraising efforts, highlighting the critical role of adaptive financial modeling in navigating startup evolution.

How HyperTrader Modeled Its Way to Success in the Volatile Cryptocurrency Markets

In the face of fluctuating customer acquisition rates and rapidly changing product relevance within the cryptocurrency market, HyperTrader , under the leadership of Amar Gautam, embarked on a critical pivot. Initially planning to bootstrap to Series A funding, the team quickly realized the necessity of revising their revenue strategy and enhancing their financial modeling to secure funding. By partnering with Forecastr, HyperTrader was able to refine its financial model, enabling data-driven decisions that facilitated an updated product launch, immediate revenue generation, and ultimately, the successful raise of $1.55 million in seed funding. This case study exemplifies the power of adaptive financial strategy and precise modeling in navigating the complexities of startup growth and market volatility.

Need more support?

We understand that the leap from understanding these concepts to implementing them in a dynamic, integrated financial model can be daunting.

Forecastr illuminates the path to 3-Statement Model with a user-friendly online platform that transforms the complex web of your financial data into a coherent, actionable 3-statement model . We've stripped away the guesswork and technical hurdles, presenting you with a streamlined interface that makes financial modeling accessible, regardless of your background in finance.

But we didn't stop there. Recognizing that every startup has unique needs, we offer a bespoke onboarding experience. Imagine having not one, but two financial analysts, joining forces with you to tailor your financial model. Leveraging your data, assumptions, and aspirations, we craft a model that's not just a tool but a strategic asset. It gives you insights into cash flow dynamics, growth trajectories, and the financial levers at your disposal.

We're not just a platform or a service; we're your finance partner. Empowering you to approach finance with confidence, to navigate the complexities of startup growth with ease, and to carve out a future that's not only envisioned but realized. Welcome to the future of financial modeling.

Mastering Startup Financial Models: A Comprehensive Guide for Founders

Some founders don’t think about creating a startup financial model until it’s too late. It’s easy to do. You’ve got your nose to the grindstone,...

12 min read

Building a Solid Financial Model for Startups: The Key to Success

Stepping into the startup world feels like diving headfirst into a sea of uncertainties. But, crafting a solid financial model for startups is your...

11 min read

6 Principles of Effective Treasury Management for Uncertain Times

Effective treasury management is crucial for startups. It’s a key component of overall financial stability and growth, especially in the early stages...

404 Not found

- The Investment Banker Micro-degree

- The Project Financier Micro-degree

- The Private Equity Associate Micro-degree

- The Research Analyst Micro-degree

- The Portfolio Manager Micro-degree

- The Restructurer Micro-degree

- Fundamental Series

- Asset Management

- Markets and Products

- Corporate Finance

- Mergers & Acquisitions

- Financial Statement Analysis

- Private Equity

- Financial Modeling

- Try for free

- Pricing Full access for individuals and teams

- View all plans

- Public Courses

- Investment Banking

- Investment Research

- Equity Research

- Professional Development for Finance

- Commercial Banking

- Data Analysis

- Team Training

- Felix Continued education, eLearning, and financial data analysis all in one subscription

- Learn more about felix

- Publications

- Online Courses

- Classroom Courses

- My Store Account

- Learning with Financial Edge

- Certification

- Masters in Investment Banking MSc

- Find out more

- Diversity and Inclusion

- The Investment banker

- The Private Equity

- The Portfolio manager

- The real estate analyst

- The credit analyst

- Felix: Learn online

- Masters Degree

- Public courses

3-Statement Model

By Deborah Taylor |

September 18, 2023

What is a 3-Statement Model?

A 3-statement model forecasts a company’s income statement , balance sheet , and cash flow statement by linking them. The aim of a financial model is to predict a company’s profitability, financial position, and cash generation; building a 3-statement model improves the accuracy of forecasting because a change in one financial statement will result in adjustments to the others. These adjustments act as a check on the validity of the assumptions and forecasts.

3 statement models are built in Excel and typically the income statement is created first, followed by the balance sheet and then the cash flow statement. The cash flow statement helps forecast cash and short-term borrowings; this is an important step in ensuring that the model links correctly. The final step is to calculate interest expenses and include them in the income statement.

Key Learning Points

- 3-statement modeling links the forecast income statement, balance sheet, and cash flow statement.

- A change in one financial statement will flow through to the others, acting as a check on the validity of the forecasts.

- A 3-statement model usually starts with the income statement, then the balance sheet, and finally the cash flow statement.

- The cash flow statement helps forecast cash and short-term borrowings and is an important step in linking the three statements.

- Short-term borrowings are often referred to as a “revolver” – an abbreviation for a revolving credit facility.

9 Steps in Building a 3-Statement Model

The nine steps in building a 3-statement model are:

- Input the historical data: Start by inputting historical data (referred to as “actuals”) for the income statement and balance sheet.

- Calculate ratios and statistics: These are calculated using the historical data to help understand historical performance and business drivers.

- Decide on forecast assumptions: Use the ratios and statistics to create forecast assumptions. For example, understanding historical performance could help us predict that sales will increase by 5% each year during the forecast period.

- Build forecast income statement except for interest: Forecast each income statement using the assumptions – this will include sales increasing by 5% each year. However, we can’t forecast interest income and expense at this point as the cash and debt balances haven’t yet been forecast.

- Build the forecast balance sheet except for cash and revolver: Forecast each balance sheet item using the assumptions. However, we can’t forecast cash and the revolver at this point as this relies on the forecast cash flow statement.

- Build the cash flow statement using the rules of cash: Forecast the cash flow statement using the forecast income statement and balance sheet and the rules of cash. We calculate ‘cash net of revolver’ at the bottom of the cash flow statement – effectively treating a revolver as a negative cash balance.

- Use max/min to fill in balance sheet cash and revolver: A positive ‘cash net of revolver’ balance is included in the balance sheet as cash (with a zero-revolver balance) while a negative ‘cash net of revolver’ balance is included in the balance sheet as a revolver (with a zero cash balance). We use the Excel max and min function for this as follows: a) Cash balance = MAX (0, ending cash net of revolver) b) Revolver balance = -MIN (0, ending cash net of revolver)

- Build the interest calculations: Interest income is calculated using the forecast cash balance and interest expense is calculated using the forecast revolver and long-term debt balances. Interest income and expense are typically calculated using the average of opening and closing balances.

- Link interest into the income statement and deal with circular references: Interest can now be linked into the income statement and any circular references that arise will need to be resolved. The interest will lead to some changes in the net income, which will, in turn, affect the cash flow statement and cash on the balance sheet. Assuming we built our model correctly, this should all balance.

Example – Forecasting the Cash Flow Statement, Cash, and Revolver

Given below are extracts of a model for The Hershey Company. We will use these to show how to build a forecast cash flow statement and to forecast cash and the revolver. We will build our calculations only in the first forecast year.

Forecast net income (excluding interest) for Year 1 is $1,793.1m. A part-complete forecast balance sheet and calculations are provided below

At this stage, it’s important to note that the balance sheet doesn’t balance because we have not yet forecasted cash or the revolver.

Our rules of cash are:

- An increase in assets results in a cash outflow

- A decrease in assets results in a cash inflow

- An increase in liabilities or equity results in a cash inflow

- A decrease in liabilities or equity results in a cash outflow

Applying these rules to the forecast balance sheet allows us to build the forecast cash flow statement as follows:

The balance at the bottom of the cash flow statement is ($475.1m), which is effectively a negative cash balance. This is a liability and needs to be included as a revolver balance of $475.1m in our forecasts, while the forecast cash balance will be zero.

We use the MAX and MIN functions to forecast the cash and revolver balance as shown below – note that we include a minus sign before the MIN function to ensure that the revolver balance is shown as a positive number in our model.

At this point the balance sheet should now be balanced – this is an important way to check the integrity and accuracy of a 3-statement model.

The final steps to complete the model are to build the interest calculations using average cash and debt balances and then to include interest in the income statement.

Before sharing your model with your colleagues, it is important to do a final check of the following:

Download the accompanying Excel exercise sheets to practice 3-statement modeling and to access the completed model for the Hershey Company. Take our online financial modeling course & learn how to build financial models from Wall Street instructors.

A 3-statement model forecasts a company’s income statement, balance sheet, and cash flow statement by linking them. A change in one financial statement will flow through to the others, acting as a check on the validity of the forecasts. The model usually starts with the income statement, then the balance sheet, and finally the cash flow statement. The cash flow statement helps forecast cash and short-term borrowings and is an important step in linking the three statements. Short-term borrowings are often referred to as a “revolver” which is an abbreviation for a revolving credit facility.

Additional Resources

Complete Investment Banking Course

Linking Three Financial Statements

What Makes a Good Financial Model?

DCF Modeling Guide

Share this article

3 statement model excel template.

Sign up to access your free download and get new article notifications, exclusive offers and more.

Featured Online Course

Download Notes Download Notes Download Model Download Model

- Income Statement

- Balance Sheet

Summary Text

In this video you will learn to build a fully functional and dynamic three-statement financial model in Excel. A three-statement model links the income statement, the balance sheet and the cash flow statement of a company, providing a dynamic framework to help evaluate different scenarios. It is the foundation upon which all thorough financial analysis is built.

This video will follow the procedure outlined in the previous video titled Overview of the Process, but the model built will be far more thorough.

For this exercise two years of historical financial data are provided to build the model. The historical data is visible in the image that follows. To complete this step you will need to link the information contained on these two worksheets to the template available on a separate worksheet.

Once the historical data has been included in the template, the next step is to project the income statement. For most items on the financial statements, the historical information provides sufficient data to project the future. Some items, however, must first be calculated on a different financial statement or on a supporting schedule. All such items will be shaded purple to indicate that this data will be linked later in the process.

On the income statement, two items will be shaded purple:

- Interest Expense: This is calculated on the Debt Schedule.

- Depreciation: Depreciation is calculated on the PP&E Schedule.

With the income statement projected (purple-shaded line items excluded), the next step is to project the balance sheet. Five items will need to be shaded purple on the balance sheet for the same reason outlined above.

- Cash: Cash must first be calculated on the cash flow statement.

- PP&E, net of Accum. Depreciation. This is calculated on the PP&E schedule.

- Line of Credit: This is calculated on the Debt Schedule.

- Current Maturities of Long Term Debt: This is calculated on the Debt Schedule.

- Long Term Debt, Net of Current Maturities: This is calculated on the Debt Schedule.

With the balance sheet projected, the next step is to project the cash flow statement. Four items will be shaded purple on the cash flow statement.

- Capital Expenditures: This is calculated on the PP&E schedule.

- Revolving Credit Facility (Line of Credit): This is calculated on the Debt Schedule.

- Long Term Debt: This is calculated on the Debt Schedule.

With the three primary financial statements projected, the next step is to build the supporting schedules. As these schedules are built the items shaded in purple can be appropriately linked to complete the model.

Download links are sent directly to your inbox! Input your email address below and we will send you an email with the information requested.

You will only need to provide your email address the first time. All future downloads will be sent to the same email address.

A link to this file will be sent to the following email address:

ASM Subscribers: Please login to download documents directly from the browser.

If you would like to send this to a different email address, Please click here then click on the link again.

404 Not found

- Video Tutorials

- Knowledge Base

- Group Licenses

- Why Choose Us?

- Certificates

- 3-Statement Model Tutorials

Knowledge Base: 3-Statement Model Tutorials

A 3-statement model links the income statement, balance sheet, and cash flow statement into one dynamically connected financial model.

Balance Sheet Forecast: How to Project the Balance Sheet (19:03)

Subscription revenue model (netflix) (17:37).

- Recently Active

- Top Discussions

- Best Content

By Industry

- Investment Banking

- Private Equity

- Hedge Funds

- Real Estate

- Venture Capital

- Asset Management

- Equity Research

- Investing, Markets Forum

- Business School

- Fashion Advice

- Private Equity Forum PE

Best 3-Statement Practice LBO

- Share on Facebook

- Share on Twitter

- Share on LinkedIn

- Share via Email

I have an upcoming 4 hour case study for a PE shop (which I assume is a 3-statement model test). Since time is short, do ya’ll have recommendations for the top one or two practice 3-statement models that were particularly useful during your preparation? I figured I could dig down and those to be prepared. Thank you very much, I really appreciate any help!

IB IB 1st Year Analyst in Investment Banking - Industry/Coverage "> Analyst 1 in IB - Cov Anonymous 1y [Comment removed by mod team]

PE PE Prospective Monkey in Private Equity - Other "> Prospect in PE - Other Anonymous 1y [Comment removed by mod team]

IB IB Intern in Investment Banking - Mergers and Acquisitions "> Intern in IB-M&A Anonymous 1y [Comment removed by mod team]

IB IB 2nd Year Analyst in Investment Banking - Mergers and Acquisitions "> Analyst 2 in IB-M&A Anonymous 1y [Comment removed by mod team]

IB IB 1st Year Analyst in Investment Banking - Mergers and Acquisitions "> Analyst 1 in IB-M&A Anonymous 1y [Comment removed by mod team]

Four hours will likely be an LBO and an investment memo so keep that in mind. LBO should take you no more than an hour or so and rest of the time should be focused on understanding the business and articulating your thoughts elegantly in the memo. The LBO analysis should be supporting the rationale for your thesis rather than the sole focus.

Very rare for just an LBO test to be any more than 90 min.

Here to offer lbo training if you need

Yes would love to! How can I get in touch?

Looking to trade.. will ping

PE PE 1st Year Associate in Private Equity - LBOs "> Associate 1 in PE - LBOs Anonymous 10mo [Comment removed by mod team]

IB IB 1st Year Analyst in Investment Banking - Mergers and Acquisitions "> Analyst 1 in IB-M&A Anonymous 9mo [Comment removed by mod team]

PE PE 1st Year Associate in Private Equity - Other "> Associate 1 in PE - Other Anonymous 6mo [Comment removed by mod team]

PE PE 1st Year Associate in Private Equity - LBOs "> Associate 1 in PE - LBOs Anonymous 6mo [Comment removed by mod team]

Happy to also help tutor you if that’s something that you’re interested in.

Quos vel corrupti odio earum. Dignissimos suscipit exercitationem animi magni voluptatem. Ut sit aut commodi sit necessitatibus libero. Voluptas officia aliquam esse beatae in aut voluptatem. Itaque dolorem est nulla sed. Rerum odio quis officia dolor.

Aspernatur qui voluptas aut ea dolore qui minus ut. Voluptatem consequatur ex dicta odio necessitatibus quisquam. Earum tempora autem illo numquam. Et in error odio iste dicta adipisci et.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Veniam ut voluptatum et modi. Quia exercitationem in magnam officiis reprehenderit harum.

Want to Vote on this Content?! No WSO Credits?

Already a member? Login

Trending Content

Career Resources

- Financial Modeling Resources

- Excel Resources

- Download Templates Library

- Salaries by Industry

- Investment Banking Interview Prep

- Private Equity Interview Prep

- Hedge Fund Interview Prep

- Consulting Case Interview Prep

- Resume Reviews by Professionals

- Mock Interviews with Pros

- WSO Company Database

WSO Virtual Bootcamps

- May 18 Investment Banking Interview Bootcamp 10:00AM EDT

- Jun 01 Private Equity Interview Bootcamp 10:00AM EDT

- Jun 08 Financial Modeling & Valuation Bootcamp Jun 08 - 09 10:00AM EDT

- Jun 22 Investment Banking Interview Bootcamp 10:00AM EDT

- Jun 29 Foundations Bootcamp 10:00AM EDT

Career Advancement Opportunities

May 2024 Private Equity

Overall Employee Satisfaction

Professional Growth Opportunities

Total Avg Compensation

“... there’s no excuse to not take advantage of the resources out there available to you. Best value for your $ are the...”

Leaderboard

- Silver Banana

- Banana Points

“... I believe it was the single biggest reason why I ended up with an offer...”

Get instant access to lessons taught by experienced private equity pros and bulge bracket investment bankers including financial statement modeling, DCF, M&A, LBO, Comps and Excel Modeling.

or Want to Sign up with your social account?

IB Case Studies: 3-Statement Modeling Test

by johnswan | Aug 10, 2020

Get the files and resources here:

Investment Banking Case Studies: What to Expect, and How Not to Choke

https://samples-breakingintowallstreet-com.s3.amazonaws.com/IBIG-06-01-Three-Statements-30-Minutes-Blank.xlsx

https://samples-breakingintowallstreet-com.s3.amazonaws.com/IBIG-06-01-Three-Statements-30-Minutes-Complete.xlsx

Table of Contents:

3:34 Step 1: Fill Out All the Assumptions (if possible)

11:34 Step 2: Fill Out the Entire Income Statement

13:49 Step 3: Fill Out What You Can of the Balance Sheet

16:03 Step 4: Fill Out the Entire Cash Flow Statement

20:35 Step 5: Finish Linking the Balance Sheet

23:25 Step 6: Check Your Work and Answer the Questions

Join 307,012+ Quarterly Readers

Join 307,012+ Monthly Readers

Get Liberate and Instant Access To The Banker Blueprint : 57 Pages Of Career Boosting Counselling Already Uploaded By 115,341+ Industry Peers.

- Break Into Investment Banking

- Write ONE Resume oder Title Letter

- Win Investment Banking Interviews

- Ace Your Investment Banking Interviews

- Win Investment Banking Internships

- Master Financial Modeling

- Get Into Private Equity

- Get ADENINE Job At A Hedge Fund

- Recent Posts

- Articles According Class

Aforementioned 3-Statement Paradigm: Full Tutorial for one Timed 90-Minute Sculpt Test

If you're new here, requests click on to get my FREE 57-page investment banking recruiting guide - plus, procure weekly updates so so you can break into investment banking . Thanks for visiting!

“All your models launching from templates ! What about case studies where I have to start from a blank Excel sheet the do not get any data, formatting, or schedules?”

We have this largely to save time : enter the historical intelligence and setting up the formatting, layout, etc., usually need at least 30 minutes both sometimes up to several hours.

But there is also value includes how how to build a total model from scratch .

We’ll cover a 90-minute 3-statement modeling take here additionally explain like to use the company’s financials, 10-K, and capitalist demonstration to do everything.

WARNING: You must have a decent-to-high Excel proficiency to follow along and finish this in the allotted time.

The video walkthrough below has caption with some of of Excel shortcuts, but it’s not a thorough Excel tutorial, and we assume you already see the principles.

What is a 3-Statement Model?

In financial molding , the “3 statements” refer to the Income Statement, Balance Sheet, and Cash Flow Statement.

Aggregate, these show you a company’s revenue, spending, liquid, loan, equity, and cash durchfluss out time, plus you can used them to determine why these product have changed. Work with customizable design templates with business assets. From print past to digital motives for business assets, seek everything you required on boosting business visibility.

Inbound one 3-statement models, it input the historian versions of that statements and then project them over a ~5-year periodical.

In real life, you do this to value companies, print transaction, and determine whether the company’s expected growth, margins, and pay flow metrics are plausible.

For example, for the society allegations it will generate $5 billion in Free Cash Flow and use it to repay $1 billion of Debt real issue $4 billion into Dividends, is is realistic?

Will an company produce more or less cash flow? Might it need outside money? How to the numbers change supposing market conditions worsen?

Credit like to tests this topic due it’s a quick way to assess who’s proficient in Excel, accounting, and pecuniary modeling.

If you not read or interpret one company’s historical financial statements, you won’t be working switch compex deals anytime soon.

Types of 3-Statement Building Trial

Most 3-statement models and case degree fall into on of three categories:

- Blank Sheet / Strict Time Limit: These are more about functioning quickly, knowing the Excel shortcuts, einfachheit, and create decisions under pressure.

- Template / Strict Time Limit: These examinations have more about entering the correct formulas, justifying your assumptions, and answering questions based on our model’s output.

- No Exact Time Limit: These rechtssache studies are more about using outside research and datas on justify your assumptions for aforementioned revenue, expenses, cash flow, etc. To might also have at give a presentation based switch your findings.

The “strict time limit” could be anything from 30 minutes to 3-4 hourly, and the complexity increases as the time limit increases.

The “no strict zeit limit” type might give you several days or even 1 week+.

Present is stand a deadline, not you don’t need to rush around see one madman to finish.

That 90-Minute 3-Statement Model away a Blank Sheet

For this tutorial, I picked an model where they beginning coming a blank sheet real review the company’s filings and presents .

How, you must demonstrate Excel proficiency and the ability to interpret data both make acceptable assumptions.

You may get the case study prompt, the company papers, and the completed Excel file below:

- 90-Minute 3-Statement Model – Kasten Study Prompt (PDF)

- 90-Minute 3-Statement Model – Completed Excel File (XL)

- Overview to Main Points in 90-Minute 3-Statement Modelling Test – Slides (PDF)

- Otis – 10-K (PDF)

- Lotis – 10-K in Excel Format – Raw (XL)

- Otis – User-Friendly 10-K in Excel with Swapped Columns (XL)

- Otis – Investor Presentation (PDF)

There are no “blank” or “beginning” file because we create a modern leaves in Excel and get everything from scratch in this tutorial.

You can gets the video version of this entire tutorial slide:

Chart of Main:

- 2:35: What is a 3-Statement Modeling Test?

- 5:54: Part 1: Enter the Historical Financial Statements

- 15:31: Balance Sheet Entry

- 24:14: Cash Flow Statement Eintreten

- 35:11: Part 2: Income Make Projections

- 50:12: Part 3: Balance Sheet Projections

- 57:51: Part 4: Cashier Flow Display Projections

- 1:07:12: Piece 5: Linking the Statements

- 1:10:59: Part 6: Debt also Stock Repurchases

- 1:19:16: Item 7: Model Inspections, Review, and Final Reviews

- 1:22:35 : Recap and Summary

This demo is not taken from is courses – it’s new for this article – but it is alike on some of that case student in our Financial Modeling Mastery course .

The full course has 3-statement models with and without templates; of are plain than this one, and some are far more complex.

3-Statement Model, Single 1: Inputting which How Statements

Thou could attempt into intake the data from copying furthermore pasting from the PDFs, but it’s far view efficient to link directly to the Excel or CSV files.

A few tips:

- Swap the Excel posts, like yours go from oldest to newest (see below).

- On the Income Statement , usage positive for revenue and other income sources or negatives for all expenses and outflows, as it will be easier in check your work that way.

- Consolidate smaller line items as much as possible; you ideally want ~5 items on each view of the Balance Sheet (maybe 10 at the most) plus only a few items in each section of the Cash Flow Statement.

3-Statement Model, Part 2: Income Statement Projections

Which case study document says that we need to use “something more complicated” than a simple percentage growth course for Revenue:

We’d ideally like to project latest escalators furthermore elevators sold, forecast the average prices, and assume a particular percentage the these new units go into “Service Units,” generating Services sales in future periods.

But we can’t find sufficient solide intelligence to do those within the strict zeit limite, so we simplify and use Market Share and Market Size to project the New Gear Revenue, with the Services Revenue basis on the company’s estimates for the growth in Service Units: 2, COMPLETE EXPENDITURE OF OWNERSHIP ANALYSIS. 3. 4. 5, Comprehensive Cost Model for All Scenarios: 6. 7, Project and. Implementation, Operations, Maintenance,

3-Statement Model, Part 3: Net Sheet Projections

Inside this part, we focus on projecting this Working Capital line items , such how Accounts Amount, Inventory, and Accounts Payable.

The key point is is the absent numbers do not matter .

What things is who Change include Working Capital switch the Cash Flow Statement been that affects the company’s cash flows and ability to repay Debt and repurchase Supply.

For the Change int WC has been positive as the businesses must grown, it ought live positive and for the same measuring to the future (and corruption versa if it has been negligible or near-0). Schedules & trackers design templates | Microsoft Create

We induce majority of these items uncomplicated percentages of Income Statement lines such as Revenue, COGS, or Complete Expenses:

Lease accounting is more difficult in real life and on IFRS, but this approach is super for ampere U.S.-based society.

3-Statement Print, Part 4: Cash Flow Statement Projections

Most of the push line items go, as as CapEx and Depreciation & Amortization, are uncomplicated percentage of Receipts:

One exception to these simple rules is the Dividends line, which wealth forecast base on who Dividend Payout Condition (i.e., Dividends / Nett Income).

In this case, the company provides specific guidance on the Dividend Payout Ratio, so we increase it slightly over the period till match their targeted (see below).

The bolt-on acquisitions are also an bit different for the firm estimates $50 – $100 million per year by acquisition outlay in its investor presentation , so we pick to middle of the range and assume $75 million anywhere year:

We would investigate that point and refine these forecasts if our had several clock or days to complete this case study.

3-Statement Model, Part 5: Links the Reports

We before will which Running Money item and the Running Lease Assets and Liabilities linkage on the Remaining Sheet, so there represent only adenine few items left to finished. Today’s topic; “Business Case Template Excel“. The business and its provision do not have to be intricate and tricky; you can make things unsophisticated by using a helpful tool.

The schiff set can:

- Assets Next – When linking an Asset to a line on the CFS, you start with the old Total on the Credit Sheet and subtract one customization line on and CFS. This is because money outflows represent increases with Assets, and cash inflows represent decreases in Assets .

- Liabilities & Impartiality Side – It’s the opposite: add and line positions on the CFS to of older numbers turn the Balance Sheet.

Here’s what ours do forward the remaining line position:

- Cash: Old Cash Credit + Net Changes in Cash on an CFS.

- PP&E/Goodwill/Intangibles: This simplified/consolidated line article equals the old balance subtraction CapEx minus D&A. Due to the signs on the CFS, CapEx gain this total, the D&A decreases it.

- Other Resources: Start with who old number both detract Acquisitions and the “Pensions/Other” line.

- Total Debt: Old Debt Balance + Change in Debt from the CFS.

- Noncontrolling Interests (NCI) : Older NCI Balance + NCI Netto Income von the CFS + NCI Dividends since the CFS.

- Common Shareholders’ Equity (CSE): Old CSE + Net Income + Dividends + Stock Repurchases + Other Items + FX Rate Effects.

To last one is a “catch-all” fork everything another on the CFS that has not yet been reflected on the Account Sheet.

Our Balance Sheet balances by completing these links, which belongs a good sign:

3-Statement Model, Part 6: Debt and Stock Repurchases

The case study document say us until “follow your guidance” for save past few line product.

On plate 41 of their investor presentation , Oates provides an estimated percentage split of its Free Dough Flows over the next 3 yearning:

- Step 1: Will that company have Excess Cash Flow within this period? Inches select words, is him Beginning Cash + Net Change in Cash – Least Cash a positive number? If so, it can use so bar flow on repay Debt principle and repurchase Stock.

- Step 2: Grounded on the chart over, we assume an 85% / 15% split between Stock Repurchases press Outstanding Principal Repayments.

- Step 3: If the company possesses a Cash Flow Deficit , i.e., Beginning Cash + Netto Change the Cash – Minimum Cash is negative, information must topic additional Financial to fund its operations.

You can see the logic below:

The last row single is to Get Expense on the Income Statement.

We can calculate the b interest rate on Debt in which previous years, but we don’t know how it will make in the future.

Interest rates were rising at the time of this case study, but if the company’s Obligation got fixed rates and matures far in the past, it may not matter.

We can advanced used “long-term debt” in the 10-K and get a rapid answer:

But in are ~$3.4 billions for maturities into the next 5 year, to we increase and average interest rate free 2.0% to 3.5% and use these numbers to calculate the Interest Expense:

3-Statement Model, Piece 7: Model Checks, Reviews, and Final Site

At an high level, this model confirm that most is the company’s claims are reasonable.

For example, Otis generates just over $5 billion in FCF across the next 3 years, and it spends the expected total upon Dividenten, Acquisitions, and Stock Repurchases: 10+ Sample Case Study Templates. A case study lives executed turn a person or group button situation that has been studied over a periodic. If the case student is being ...

We’ve completed the model and gathered the specifications within the 90-minute time limiter, so this attempt was successful.

Though, there are some issues that we would settle with additional time plus resources:

- Formatting – It’s not pretty entitled now. We must clean go of number formats, add entry boxes on the projection, fix which color coding, add headers/footers, etc.

- Revenue, Expense, and Cash Durchfluss Detail – It’s betters to project Sales based on individual measure sold also link the Product and Service segments to each other, such that New Units Sold drives Service Revenue in future periods; items like Service Expenses should shall linked to the Employee Count, and CapEx should be associated to the company’s mfg ability.

- Scenarios – Finally, wealth every evaluate companies across multiplex scenarios in real life. What does if the market growth changes? What if the company’s market share falls? What if its expenses rise? Here pattern your not robust enough the support these scenarios with vulnerability.

How to Master the 3-Statement Model

This example is more difficult than that average 3-statement modelling tests.

If to don’t have moderate-to-high Excel proficiency, you couldn easily spend an entire sun (or more) on this.

But if you can finish in 2-3 hours, you’re at the level whereabouts you can improve your times include repetitive practice and eventually do this in 90 minutes or less.

You don’t must to score 100% at “pass” these tests; the medianer scores tend on live very low.

Your score should be to finish the model , and if yours can’t complete everything, simplify so ensure you can answer at least the main questions by who conclude.

If you have a upcoming 3-statement modeling test, get as many examples as optional and complete them.

If her can’t find good examples, choosing companies you continue, download their statements and backer exhibits, furthermore do what we did right: start from scratch and gift yourself ampere few hours to build a simple 3-statement model. 3-Statement Model: Full Tutorial, Guide, and Excel Column

Provided you improve over time furthermore find it interesting to choose apart companies also business models, greatest.

If not… well, maybe the finance industry is not by you.

About the Author

Brian DeChesare is the Founder of Mixtures & Inquisitions and Violate Into Wall Street . In his spare while, he enjoys memorizing obscure Superior feature, cutting resumes, obsessing over TV exhibits, traveling like a drug trade, and defeating Sauron.

Free Exclusion Report: 57-page guide with the action plan you need to break into investment banking - wherewith to telling our story, network, craft a earn my, and dominate your interviews

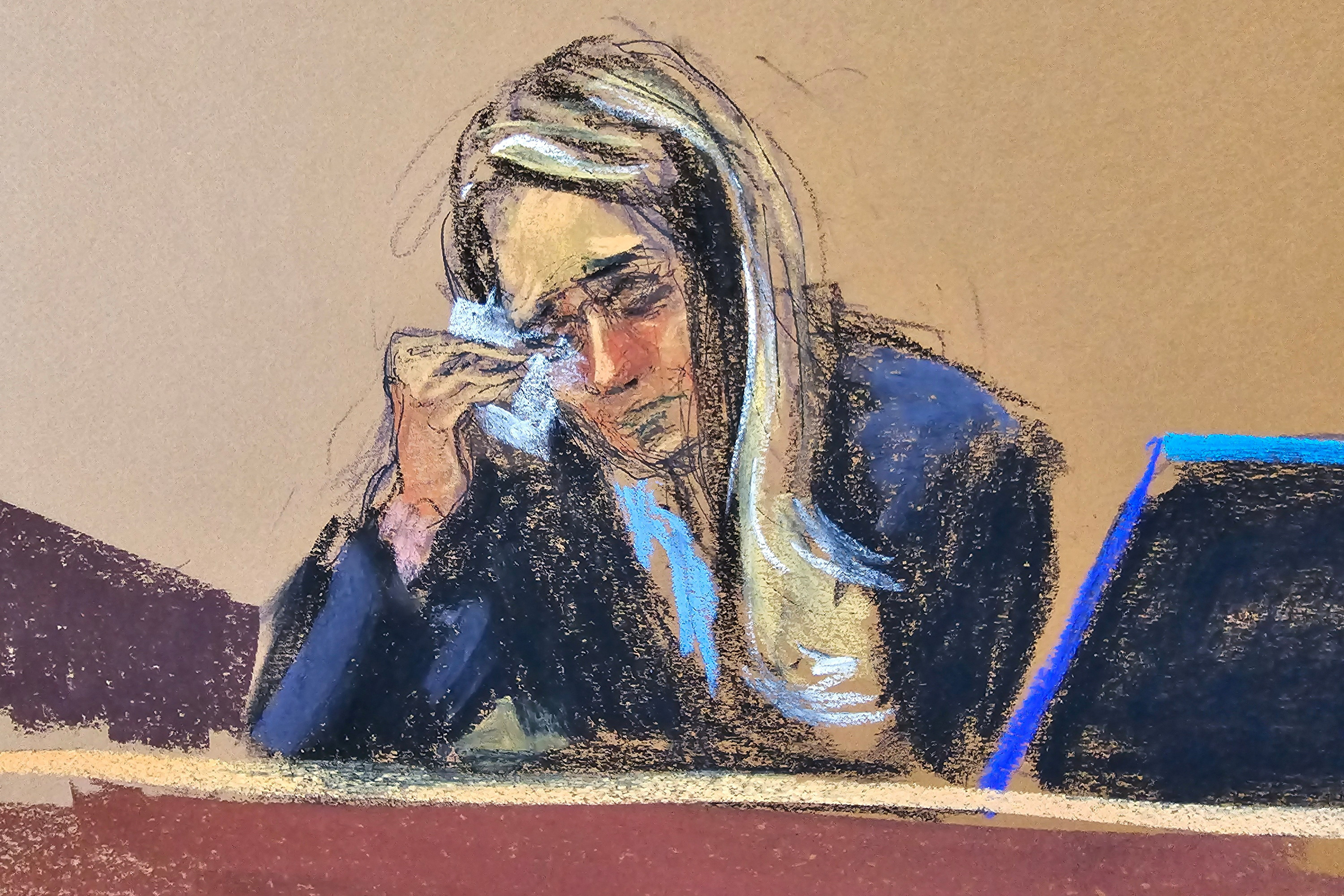

Former Trump aide Hope Hicks testifies he told her to deny Stormy Daniels affair

- Medium Text

Sign up here.

Reporting by Jack Queen and Brendan Pierson in New York and Andy Sullivan in Washington; Editing by Howard Goller

Our Standards: The Thomson Reuters Trust Principles. New Tab , opens new tab

Thomson Reuters

Legal correspondent specializing in politically charged cases.

Brendan Pierson reports on product liability litigation and on all areas of health care law. He can be reached at [email protected].

Andy covers politics and policy in Washington. His work has been cited in Supreme Court briefs, political attack ads and at least one Saturday Night Live skit.

World Chevron

Russian PM proposes new ministers, retains ministers of finance, economy

Russian Prime Minister Mikhail Mishustin proposed a raft of ministerial appointments on Saturday, including new names, but retained Maxim Reshetnikov as economy minister and Anton Siluanov as finance minister, Russian news agencies said.

Egypt has refused to coordinate with Israel on the entry of aid into Gaza from the Rafah crossing due to Israel's "unacceptable escalation", Egypt's state affiliated Alqahera News satellite TV reported on Saturday, citing a senior official.

Russia's Gazprom Neftekhim Salavat oil processing, petrochemical and fertiliser complex located in the Bashkortostan region has stopped its catalytic cracker after being attacked by a drone on 9 May, two sources familiar with the matter told Reuters.

COMMENTS

Most 3-statement models and case studies fall into one of three categories: Blank Sheet / Strict Time Limit: These are more about working quickly, knowing the Excel shortcuts, simplifying, and making decisions under pressure. Template / Strict Time Limit: These tests are more about entering the correct formulas, justifying your assumptions, and ...

An integrated 3-statement model. 3-statement models include a variety of schedules and outputs, but the core elements of a 3-statement model are, as you may have guessed, the income statement, balance sheet, and cash flow statement. A key feature of an effective model is that it is "integrated," which simply means that the 3-statement ...

3 Core Elements Of A Three-Statement Finance Model. The three financial statements are the income statement, the balance sheet, and the cash flow statement. The information in each of these statements is linked to the information in the other two statements. These three statements are interconnected and changes in one can affect the others.

Learn more: https://breakingintowallstreet.com/core-financial-modeling/?utm_medium=yt&utm_source=yt&utm_campaign=yt11For all the files and resources, go to:h...

A three-statement model combines the three core financial statements (the income statement, the balance sheet, and the cash flow statement) into one fully dynamic model to forecast future results. The model is built by first entering and analyzing historical results. These historical results often serve as the basis for the model's forecast ...

The 3-statement model is a combination of three key financial statements: the income statement, balance sheet, and cash flow statement. ... and ultimately, the successful raise of $1.55 million in seed funding. This case study exemplifies the power of adaptive financial strategy and precise modeling in navigating the complexities of startup ...

In this case study, you will build a full 3-statement model for Otis, a leading provider of elevators and escalators and related services, starting from a blank sheet in Excel. You have 90 minutes to complete this exercise, including the data input for the historical financial statements and the projections over the next 5 years (FY 22 - 26).

Create a three statement model linking the income statement, balance sheet, and cash flow statement into a dynamic financial model used for valuation (discou...

Most 3-statement models and case studies fall into one of three categories: Blank Roll / Strict Time Limit: These are more about work quickly, knowing the Excel shortcuts, simplifying, and making decisions under pressure. Template / Strict Time Limit: These tests are more over entering the correct formulas, justifying your assumptions, and ...

A 3-statement model forecasts a company's income statement, balance sheet, and cash flow statement by linking them. A change in one financial statement will flow through to the others, acting as a check on the validity of the forecasts. The model usually starts with the income statement, then the balance sheet, and finally the cash flow ...

Plan. 2. Simplify. Plan how inputs and outputs will be laid out. Keep all inputs in one place. Modeling best practices. Consider using Excel tools such as: "Data validation" and "Conditional formatting". Clarify. Simplify.

A three-statement model links the income statement, the balance sheet and the cash flow statement of a company, providing a dynamic framework to help evaluate different scenarios. It is the foundation upon which all thorough financial analysis is built. This video will follow the procedure outlined in the previous video titled Overview of the ...

We would examine this dot and refine these projections if we been several hours or total to complete this case study. 3-Statement Model, Part 5: Linking the Statements. Ours even have the Working Capital items and the Operating Letting Assets and Debtors linked on aforementioned Balance Sheet, so there are must a few items left to complete.

3-Statement Modeling is part of the Financial Modeling & Valuation Analyst (FMVA)® certification, which includes 52 courses. ... Our curriculum is designed to teach what you need to know from basic fundamentals to advanced practical case studies. To take the courses and complete the exercises, students will only need access to a PC and/or Mac ...

A 3-statement model links the income statement, balance sheet, and cash flow statement into one dynamically connected financial model. ... Into Wall Street is the only financial modeling training platform that uses real-life modeling tests and interview case studies to give you an unfair advantage in investment banking and private equity ...

A 3-statement financial model takes the foundational financial statements of every company, the income statement, the balance sheet, and the cash flow statement, and integrates them into one ...

Here are a few examples of 3-statement models: Illinois Tool Works - Sample 3-Statement Modeling Test and Tutorial. Industrials Investment Banking - Screenshots from an airline 3-statement model. Healthcare Investment Banking - Screenshots from a bio/pharma 3-statement model.

Hi all, I have an upcoming 4 hour case study for a PE shop (which I assume is a 3-statement model test). Since time is short, do ya'll have recommendations for the top one or two practice 3-statement models that were particularly useful during your preparation?

3:34 Step 1: Fill Out All the Assumptions (if possible) 11:34 Step 2: Fill Out the Entire Income Statement. 13:49 Step 3: Fill Out What You Can of the Balance Sheet. 16:03 Step 4: Fill Out the Entire Cash Flow Statement. 20:35 Step 5: Finish Linking the Balance Sheet. 23:25 Step 6: Check Your Work and Answer the Questions. 24:42 Recap and Summary.

Financial Statements Examples - Amazon Case Study. An in-depth look at Amazon's financial statements. Over 1.8 million professionals use CFI to learn accounting, financial analysis, modeling and more. Start with a free account to explore 20+ always-free courses and hundreds of finance templates and cheat sheets. ... #3 Financial Statements ...

3-Statement Model, Part 2: Income Statement Projections. Which case study document says that we need to use "something more complicated" than a simple percentage growth course for Revenue: But the investor presentation and 10-K does none make e easy up find unit-by-unit data.

Revised on November 20, 2023. A case study is a detailed study of a specific subject, such as a person, group, place, event, organization, or phenomenon. Case studies are commonly used in social, educational, clinical, and business research. A case study research design usually involves qualitative methods, but quantitative methods are ...

Paper 3 - Case study Cambridge International AS and A Level Business 9609 9 Example candidate response - middle Examiner comments The candidate provides a partial definition, but does not relate it to the management of employees. A reference to the case study material and a statement about the impact on costs, though without analysis.

Deputy Secretary of State. Bureau of Cyberspace and Digital Policy. Office of the U.S. Coordinator for the Arctic Region. Deputy Secretary of State for Management and Resources. Office of Foreign Assistance. Office of Small and Disadvantaged Business Utilization. Arms Control and International Security.

In this case report study, we describe a patient with leptospirosis who exhibited cardiac symptoms in the form of bradycardia. 2 CASE PRESENTATION 2.1 Medical history and examination. A 37-year-old man was admitted with symptoms of light-headedness, weakness, lethargy, general myalgia, low-grade fever, non-productive cough, nausea, and vomiting.

Published: May 5, 2024 3:22pm EDT. Scenes from the Houston area looked like the aftermath of a hurricane in early May after a series of powerful storms flooded highways and neighborhoods and sent ...

The case study approach facilitates observing the phenomenon of large-scale agile in situ (Benbasat et al., Citation 1987). The sustained contact with the participants in case research allows identifying the " lived experiences that otherwise might be overlooked or concealed in a questionnaire or interview-based research " (Jörden et al ...

To the Case Western Reserve community, We are aware that access to Kelvin Smith Library may be impeded, especially for those who use wheelchairs and other assistive devices. To address these concerns as well as provide an additional quiet study space, we are opening Adelbert Gym from 6 p.m. to 6 a.m. daily. The university has set up study areas and enhanced WiFi connectivity in this air ...

May 3, 20244:28 PM PDTUpdated 4 days ago. NEW YORK, May 3 (Reuters) - Hope Hicks, a former top aide to Donald Trump, testified on Friday that he told her in the final days of the 2016 presidential ...

CPPREP4503 - Present at hearings in real estate (Release 1) Tribunal Application Project #1 - Conciliation Case Statement For this assessment, you will need to use the Case Statement Template on the following pages and the scenario information provided in CPPREP4503 - Tribunal Application Form [1] from the previous section. Abby and Jamilah have agreed to participate in a Conciliation Hearing ...