- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Create a Business Budget for Your Small Business

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A business budget estimates future revenue and expenses in detail, so that you can see whether you’re on track to meet financial expectations for the month, quarter or year. Think of your budget as a point of comparison — you run your actual numbers against it to determine if you’re over or under budget.

From there, you can make informed business decisions and pivot accordingly. For example, maybe you find that your expenses are over budget for the quarter, so you may hold off on a large equipment purchase.

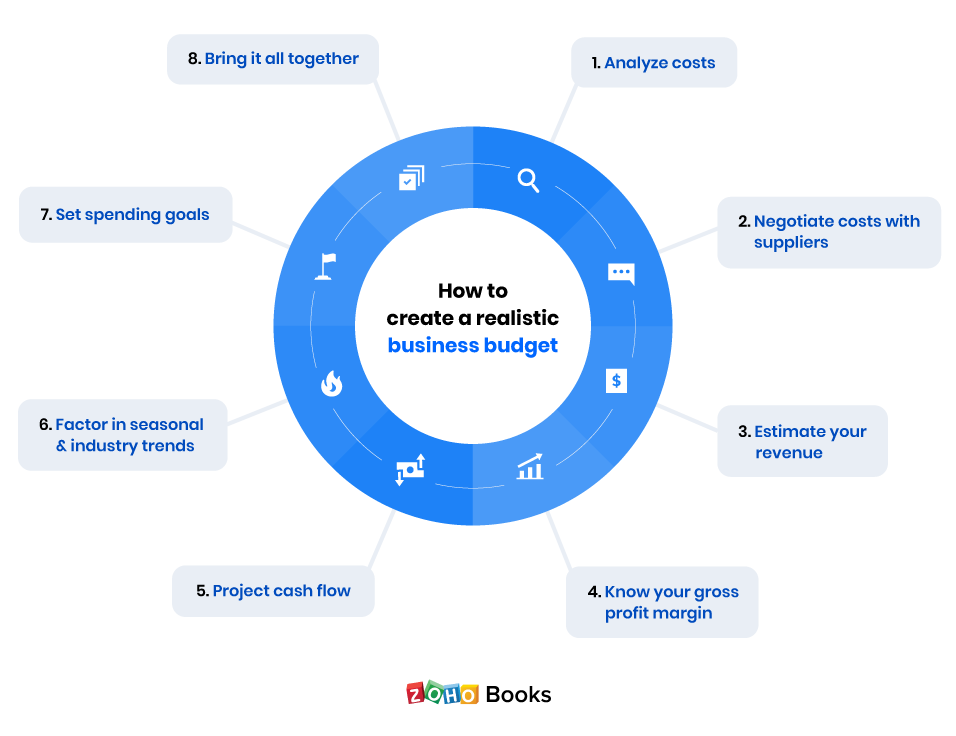

Here’s a step-by-step guide for creating a business budget, along with why budgets are crucial to running a successful business.

» MORE: What is accounting? Definition and basics, explained

QuickBooks Online

How does a business budget work?

Budgeting uses past months’ numbers to help you make financially conservative projections for the future and wiser business decisions for the present. If you’ve had a few bad months and predict another slow one, you can prepare to minimize expenses where possible. If business has been booming and you’re bringing in new customers, maybe you invest in buying more inventory to satisfy increased demand.

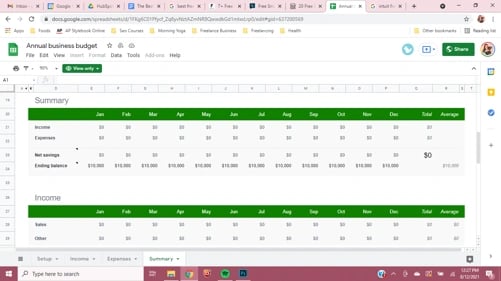

Creating a business budget from scratch can feel tedious, but you might already have access to tools that can help simplify the process. Your small-business accounting software is a good place to start, since it houses your business’s financial data and may offer basic budgeting reports.

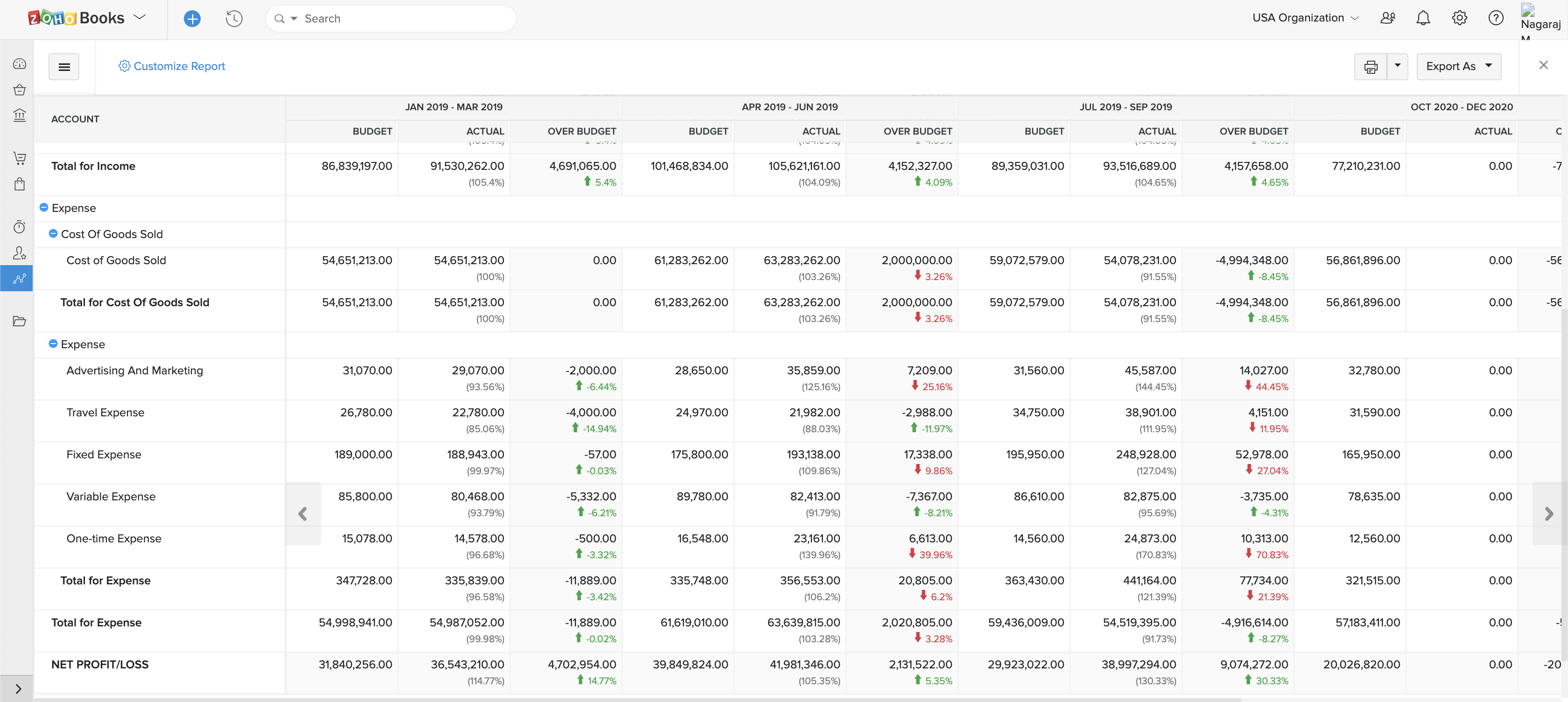

To create a budget in QuickBooks Online , for example, you break down your estimated income and expenses across each area of your business. Then, the software calculates figures like gross profit, net operating income and net income for you.

You can then compare actual versus projected figures side by side by running a Budget vs. Actuals report. Businesses that need more in-depth features, like cash flow forecasting or the ability to use different projection methods, might subscribe to business budgeting software in addition to accounting software.

If your small business doesn’t have access to these features or has simple financials, you can download free small-business budget templates to manually create and track your budget. Regardless of which option you choose, your business will likely benefit from hiring an accountant to help manage your budget, course-correct when the business gets off track, and make sure taxes are being paid correctly.

Why is a business budget important?

A business budget encourages you to look beyond next week and next month to next year, or even the next five years.

Creating a budget can help your business do the following:

Maximize efficiency.

Establish a financial plan that helps your business reach its goals.

Point out leftover funds that you can reinvest.

Predict slow months and keep you out of debt.

Estimate what it will take to become profitable.

Provide a window into the future so you can prepare accordingly.

Creating a business budget will make operating your business easier and more efficient. A business budget can also help ensure you’re spending money in the right places and at the right time to stay out of debt.

How to create a business budget in 6 steps

The longer you’ve been in business, the more data you’ll have to inform your forward-looking budget. If you run a startup, however, you’ll want to do extensive research into typical costs for businesses in your industry, so that you have working estimates for revenue and expenses.

From there, here’s how to put together your business budget:

1. Examine your revenue

One of the first steps in any budgeting exercise is to look at your existing business and find all of your revenue sources. Add all those income sources together to determine how much money comes into your business monthly. It’s important to do this for multiple months and preferably for at least the previous 12 months, provided you have that much data available.

Notice how your business’s monthly income changes over time and try to look for seasonal patterns. Your business might experience a slump after the holidays, for example, or during the summer months. Understanding these seasonal changes will help you prepare for the leaner months and give you time to build a financial cushion.

Then, you can use those historic numbers and trends to make revenue projections for future months. Make sure to calculate for revenue, not profit. Your revenue is the money generated by sales before expenses are deducted. Profit is what remains after expenses are deducted.

2. Subtract fixed costs

The second step for creating a business budget involves adding up all of your historic fixed costs and using them to reliably predict future ones. Fixed costs are those that stay the same no matter how much income your business is generating. They might occur daily, weekly, monthly or yearly, so make sure to get as much data as you can.

Examples of fixed costs within your business might include:

Debt repayment.

Employee salaries.

Depreciation of assets.

Property taxes.

Insurance .

Once you’ve identified your business’s fixed costs, you’ll subtract those from your income and move to the next step.

3. Subtract variable expenses

As you compile your fixed costs, you might notice other expenses that aren’t as consistent. Unlike fixed costs, variable expenses change alongside your business’s output or production. Look at how they’ve fluctuated over time in your business, and use that information to estimate future variable costs. These expenses get subtracted from your income, too.

Some examples of variable expenses are:

Hourly employee wages.

Owner’s salary (if it fluctuates with profit).

Raw materials.

Utility costs that change depending on business activity.

During lean months, you’ll probably want to lower your business’s variable expenses. During profitable months when there’s extra income, however, you may increase your spending on variable expenses for the long-term benefit of your business.

4. Set aside a contingency fund for unexpected costs

When you’re creating a business budget, make sure you put aside extra cash and plan for contingencies.

Although you might be tempted to spend surplus income on variable expenses, it’s smart to establish an emergency fund instead, if possible. That way, you’ll be ready when equipment breaks down and needs replacing, or if you have to quickly replace inventory that's damaged unexpectedly.

5. Determine your profit

Add up all of your projected revenue and expenses for each month. Then, subtract expenses from revenue. You may also see the resulting number referred to as net income . If you end up with a positive number, you can expect to make a profit. If not, that’s a loss — and that can be OK, too. Small businesses aren’t necessarily profitable every month, let alone every year. This is especially true when your business is just starting out. Compare your projected profits to past profits to confirm whether they’re realistic.

Looking for accounting software?

See our overall favorites, or choose a specific type of software to find the best options for you.

on NerdWallet's secure site

6. Finalize your business budget

Are the resulting profits enough to work with, or is your business overspending? This is your opportunity to set spending and earning goals for each month, quarter and year. These goals should be realistic and achievable. If they don’t line up with your projections, make sure to establish a strategy for making up the difference.

As time goes on, regularly compare your actual numbers to your budget to determine whether your business is meeting those goals, and course correct if necessary.

» MORE: Ways your small business can spend smarter

A business budget projects future revenue and expenses so you can create a smart, realistic spending plan. As the year progresses, comparing your actual numbers against your budget can help you hold your business accountable and make sure it reaches its financial goals.

A business budget includes projected revenue, fixed costs, variable costs and the resulting profits. You can also factor in contingency funds for unforeseen circumstances like equipment failure.

On a similar note...

Business growth

Business tips

7 free small business budget templates for future-proofing your finances

As a small business owner, you're likely balling with a lot more than your personal checking account. If you don't properly manage your business finances, there's more on the line than an overdraft fee—you now have an entire organization to account for.

Small business budgets are necessary to balance revenue, estimate how much you'll spend, and project financial forecasts, so you can stay out of the red and keep your business afloat.

But creating a small business budget template isn't a small task. Since I don't have a business to run, I did the heavy lifting for you—check out these free, downloadable templates for your small business budgeting.

Table of contents:

2. Overhead budget template

3. multiple-project budget template.

4. Startup budget template

5. Labor budget template

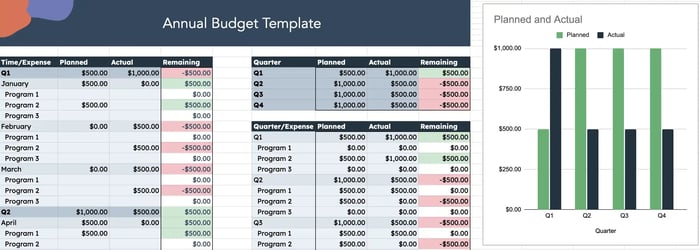

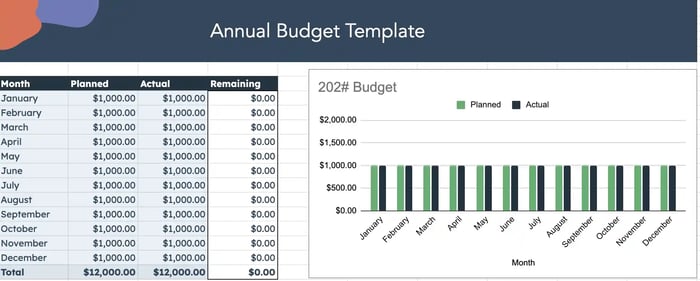

6. cash flow budget template, 7. administrative budget template, periodic budget reviews, how to design your small business budget plan, small business budget faq, 1. static budget template.

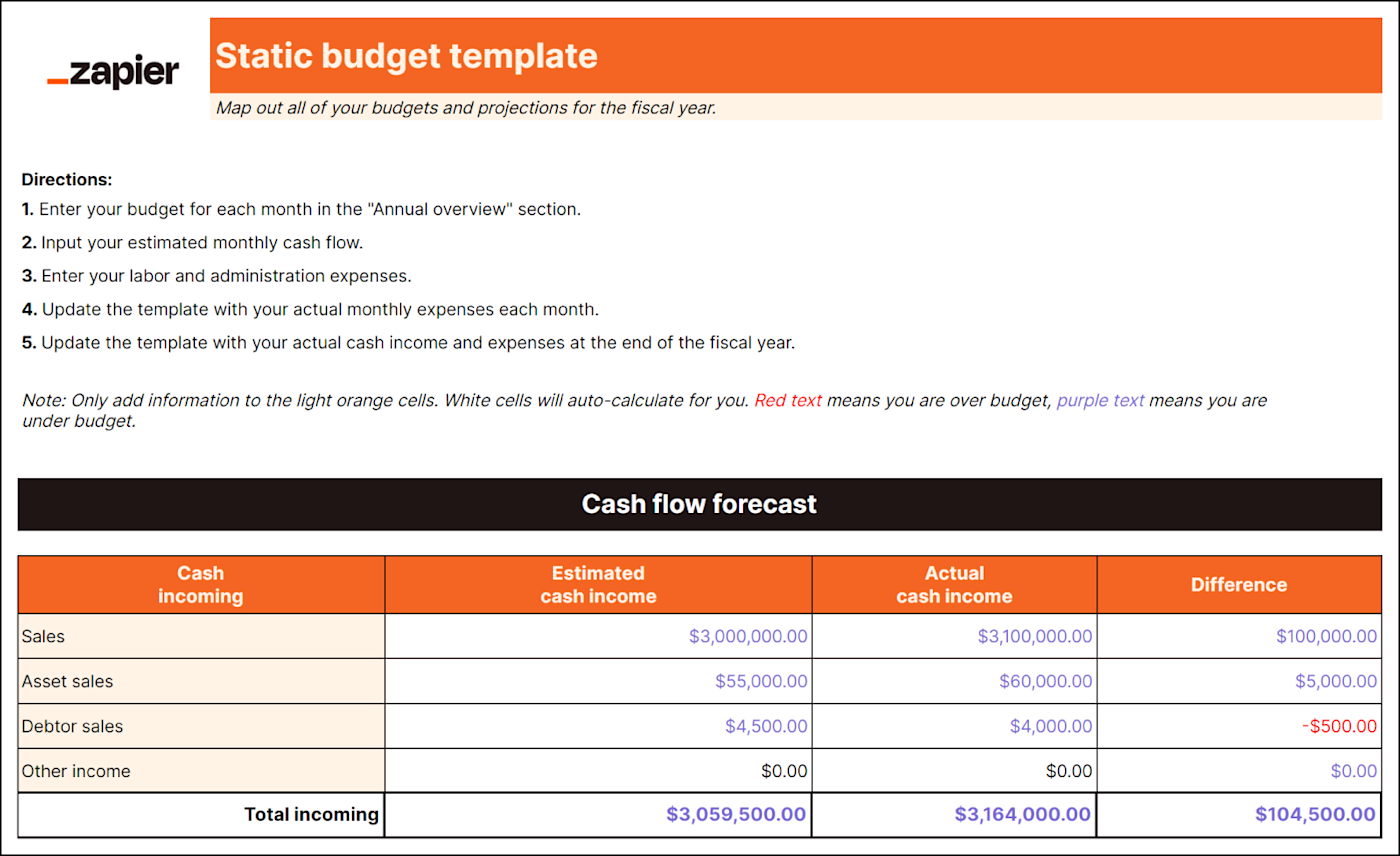

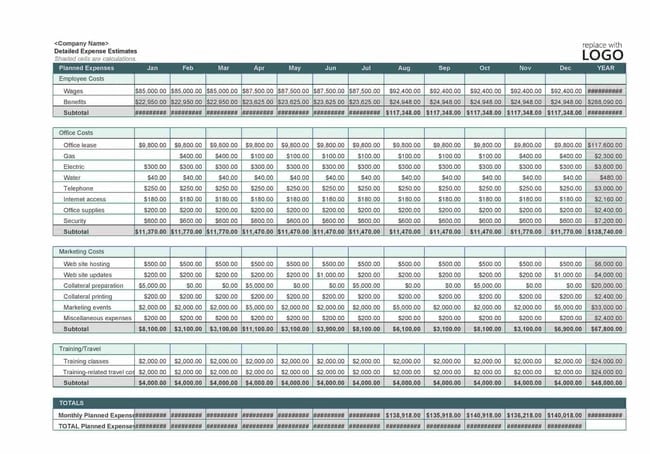

Best for: Multiple departments or revenue streams; Industries with complex operations

A static budget combines all the function-specific budgets a business uses into one. Typically, a static budget includes the following items (plus any other budgets your business might use):

Cash flow projections: Estimations of how much money will flow into and out of your business. They also help you decide when, how, and what you should spend money on.

Total expected spending: All estimated expenses, including labor and administrative costs.

By integrating all of your budgets and projections, the static budget provides a full picture of your business's estimated expenses and financial strategy for the upcoming fiscal year.

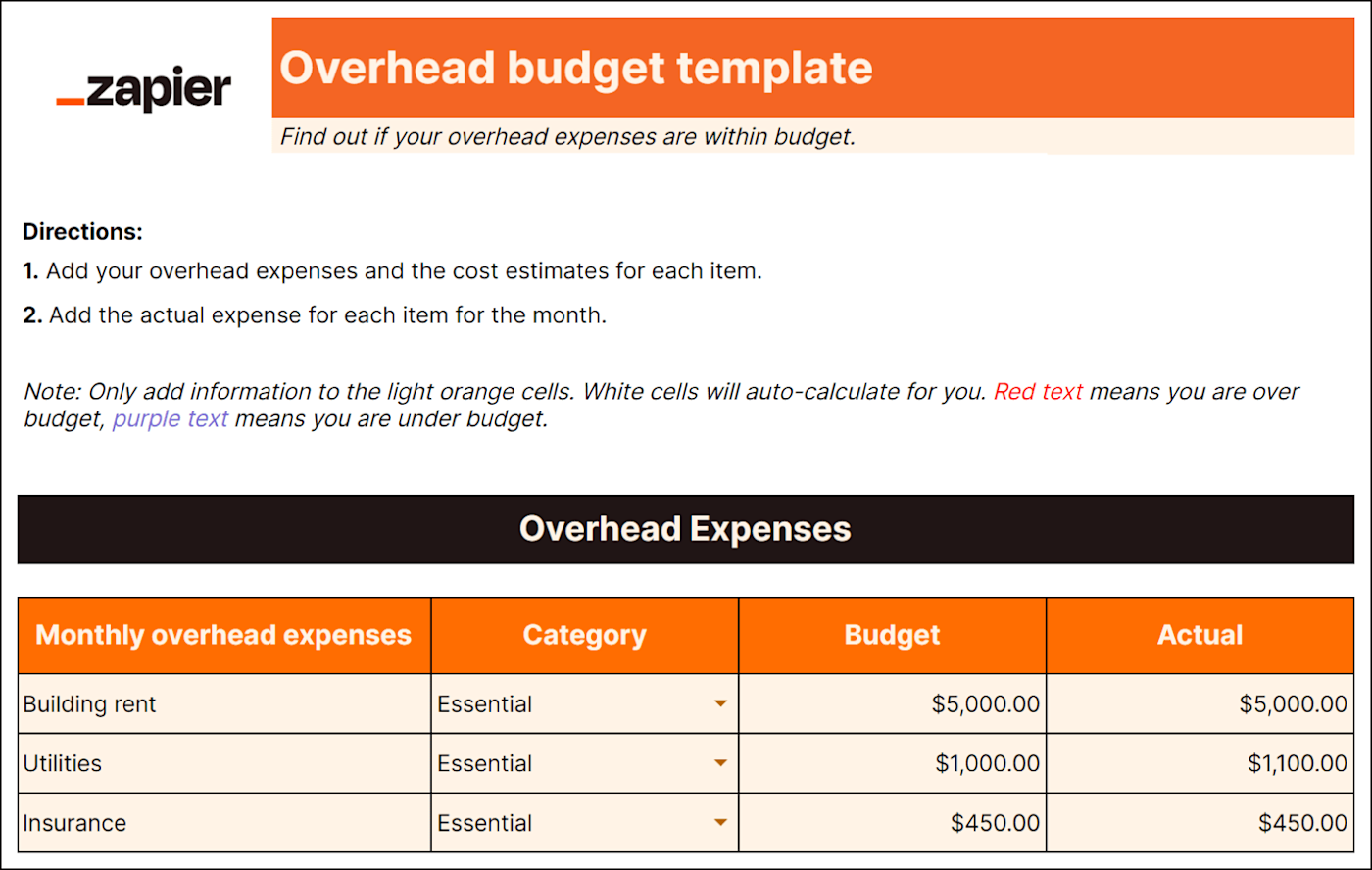

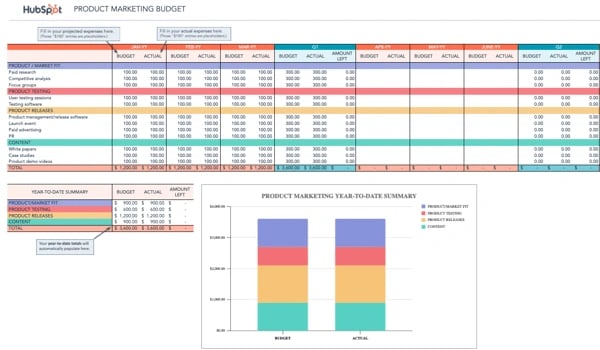

Best for: Service-based businesses

It's easy to forget about expenses that aren't directly tied to production, like delivery charges or utilities. But these costs exist (and can add up quickly), so you need an overhead budget. A detailed overhead budget template will include:

Administration expenses

It compares your budgeted amount to actual figures (warning: it may be a rude awakening) and can help improve accuracy for future financial planning.

Predicting overhead spending helps you plan how to use other funds more practically too—if you know how much you'll spend on overhead, you can make better business decisions. For example, you'd know whether you can afford to invest money into other initiatives like adding a delivery service or upgrading equipment.

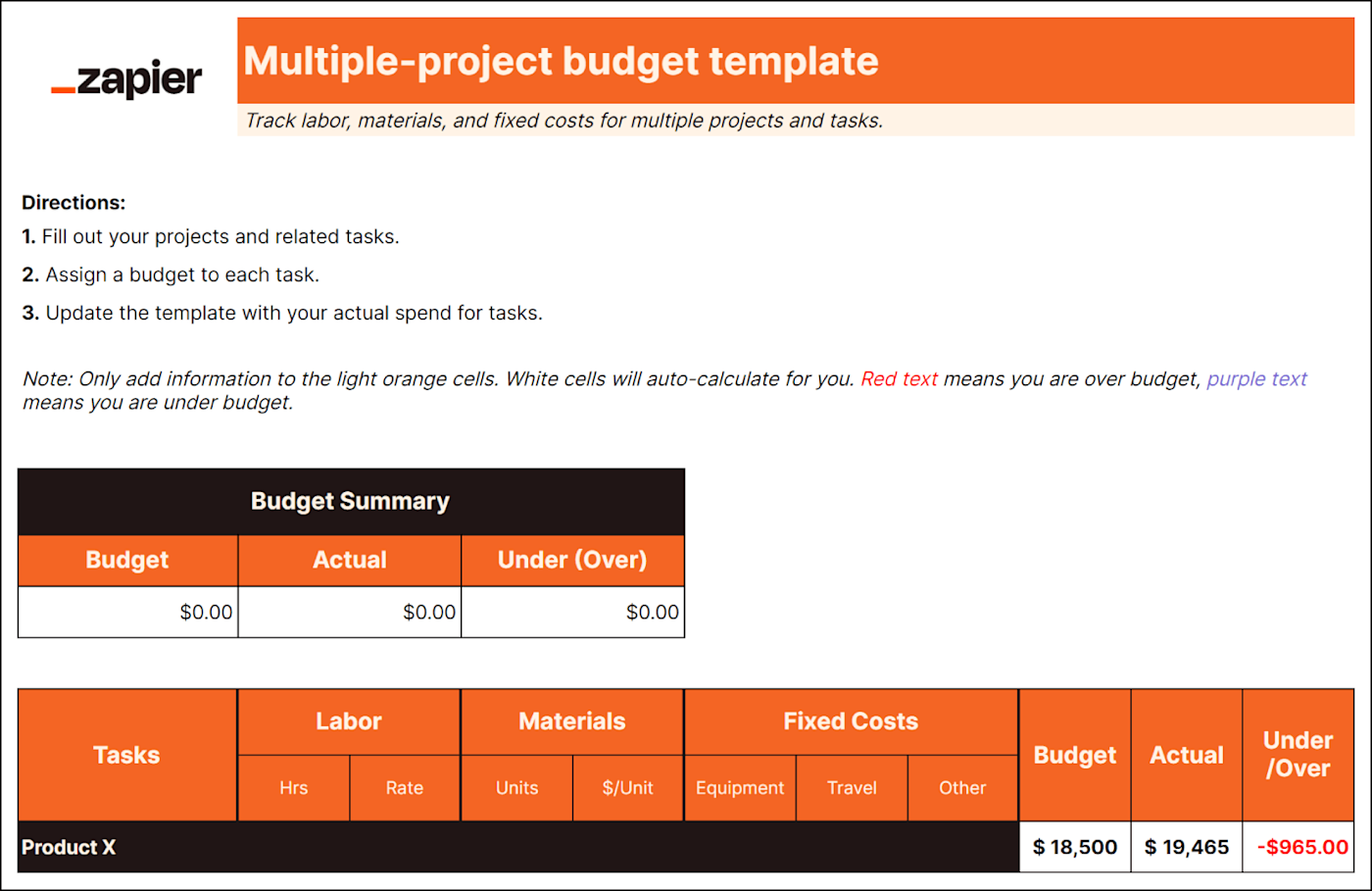

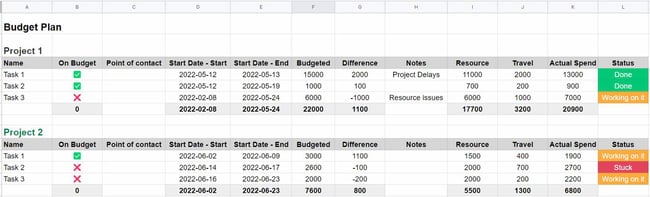

Best for: Project-based industries

If you're managing multiple projects like website development or event planning, each with its own budget and expenses, you need a multiple-project budget to help keep your head on straight. This type of budget will help you track the following items per project:

Product-by-product COGS (cost of goods sold)

Labor costs

Equipment and resource costs

Indirect project expenses like travel

A multiple-projects budget establishes estimates for everything you need to get projects across the finish line. It also lets you track costs to ensure you're not spending more than you accounted for in the budget.

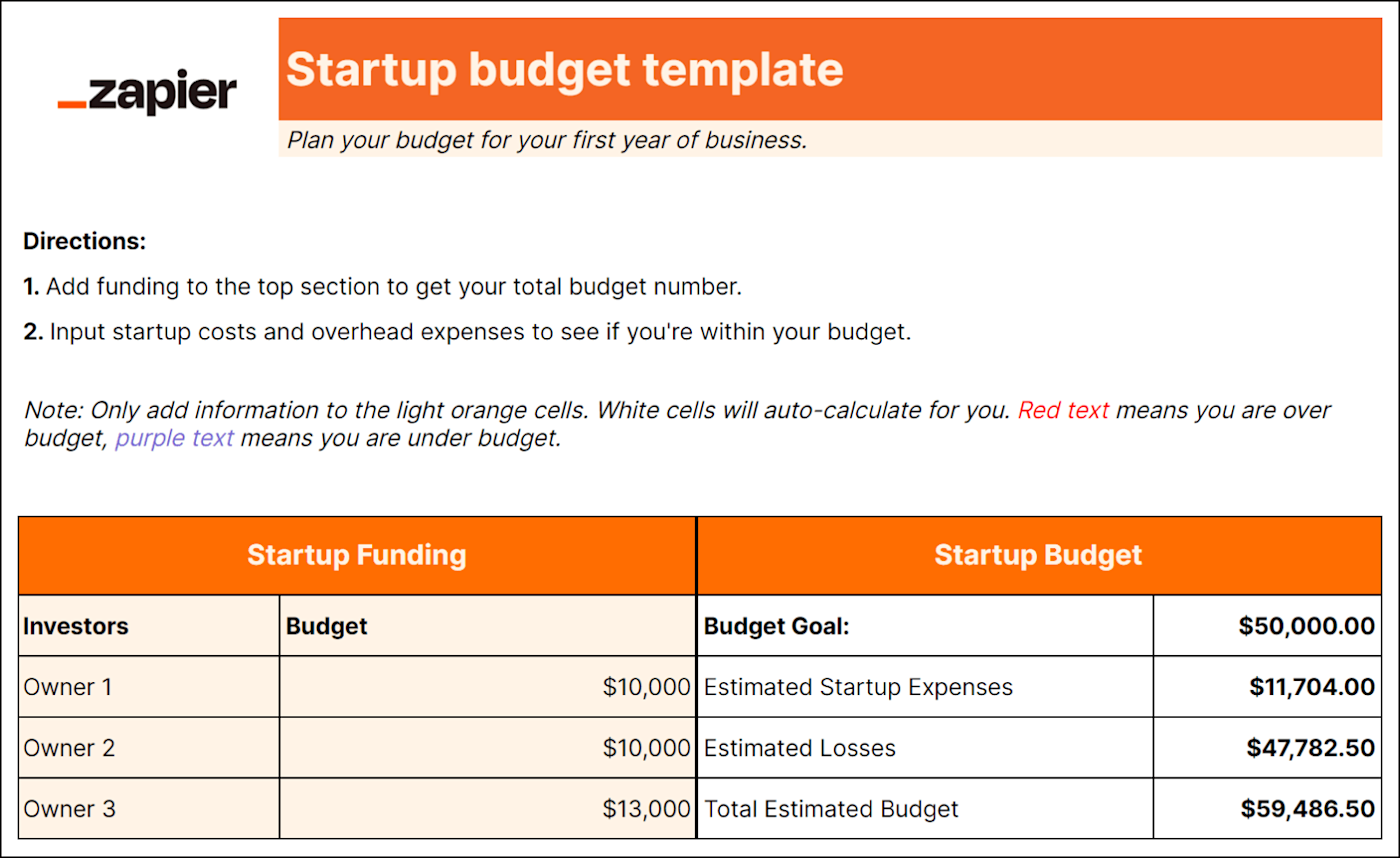

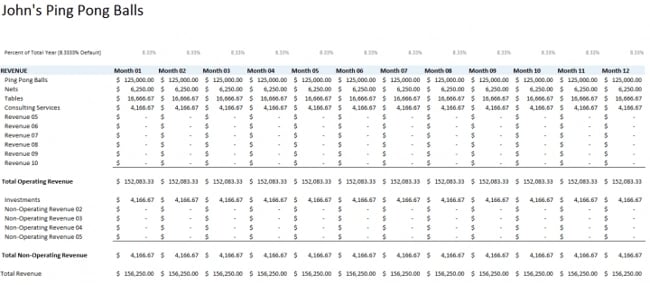

4. Startup budget template

Best for: New small businesses and startups

Startups need to ensure financial success from the get-go, so they can reinvest profit into the business and potentially attract more investors.

But unlike established small businesses, you don't have past financial data to base expenses on. That's why you need a startup budget to focus on expenses for your first year of business, including items like:

Funding from investors and loans

Licensing and permits

Logo and website design

Website domain

Business software

Security installation

Overhead expenses

Capital expenses

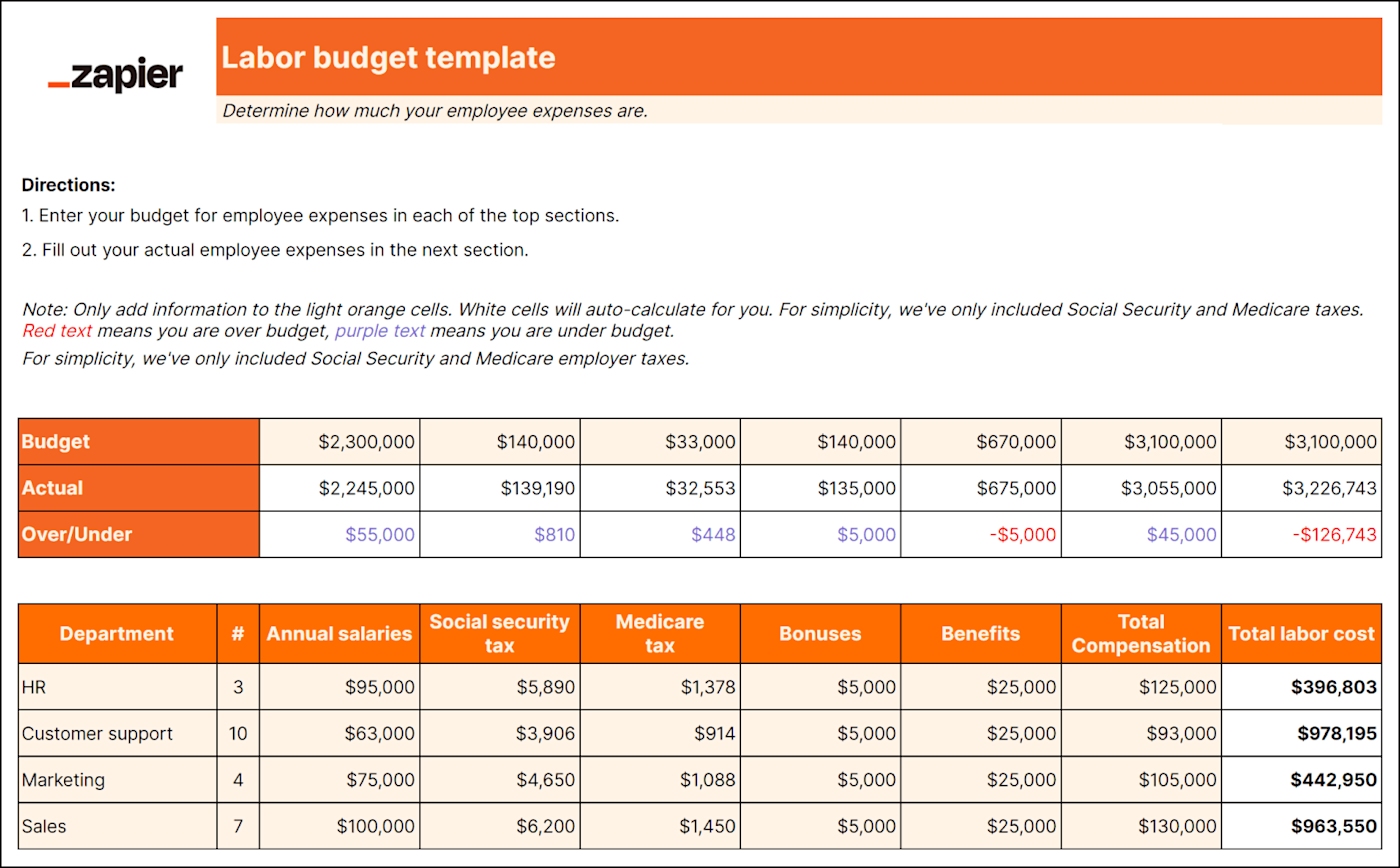

Best for: Larger businesses with lots of employees

Unless you're a one-person show, you'll need a labor budget. And even if you are a one-person show, it's good to know if you can afford to pay yourself. A labor budget breaks down all employee-related costs like:

Payroll taxes

Contract labor

Break down employee costs into direct, indirect, fixed, and variable categories to clarify how your company allocates its resources. You can also consider different scenarios more easily when you understand the breakdown of labor costs.

For example, you can simulate the impact of adding or reducing staff in specific departments or assess the effects of different compensation structures on different teams.

An accurate forecast of labor costs ensures you can sustainably meet your staffing needs and can help you make informed hiring decisions. Down the road, it can also help you determine if you can afford to give your staff raises, bonuses, or additional benefits.

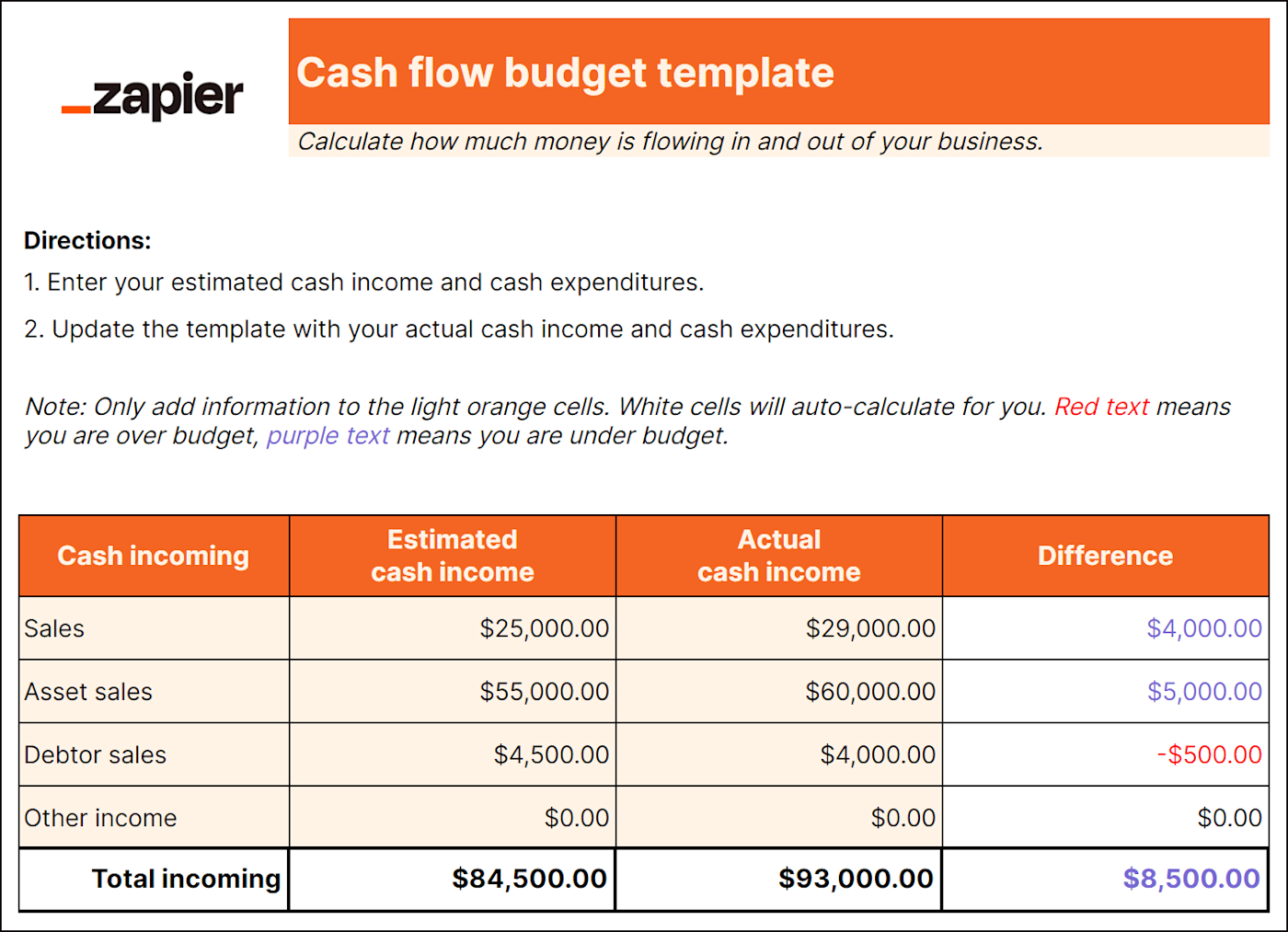

Best for: Businesses with fluctuating income and expenses; Seasonal businesses; Retail

As important as it is to be mindful of how much money you're spending, you should also track how much money you're making . A cash flow budget helps estimate how money is flowing in and out of your business. It includes:

Starting balance (set at the beginning of the month, quarter, or year)

Projected cash inflow from all revenue streams

Estimated cash expenditures

Ending balance (calculated at the end of the month, quarter, or year)

This type of budget lets you proactively manage your resources, anticipate potential cash shortages, and strategize for growth. For instance, if you know you're only going to break even this year, you may wait on expanding or making a large investment.

Best for: Businesses focused on streamlining operations

An administrative budget includes all those general expenses that the company as a whole needs to function. This type of budget accounts for:

Depreciation expenses

Training and development

Communication expenses

Accounting fees

While you could technically include administrative expenses in an overhead budget and call it a day, a separate administrative budget gives more of an eagle-eye view of how well your business is operating.

Without an eye on administrative costs, you may be spending unnecessarily or lose focus on areas where it'd be wiser to invest your money. In other words, you could be spending way too much on fancy pens when you should be saving up to upgrade your cash register.

A budget isn't a "set it and forget it" deal. Regular budget reviews can help you stay on track with your financial goals and respond proactively to changing market conditions.

You should compare your estimated budget to actual spending. Then you can see where you went over and where you can splurge more. Try to review your budget monthly, quarterly, and yearly.

Monthly: Compare actual performance against your budgeted figures for the month. Identify any deviations and look for insights into cash flow, sales trends, and expense management.

Quarterly: Dive deeper into performance over the last three months. Use trends to project revenue and expenses for the upcoming quarter and identify areas for improvement.

Yearly: Reflect on your long-term financial objectives for the fiscal year. Assess the effectiveness of your budgeting strategies, and set new budget targets for the upcoming year.

It's cliched but true: you gotta spend money to make money. But that's no excuse to start throwing cash at your business willy-nilly.

Budgeting forces you to prioritize your objectives, so you spend money on the things that matter most. Here's how to create a small business budget in four steps:

Identify your working capital for the budgeting period. Add up your current assets like cash, accounts receivable, and inventory. Then subtract current liabilities like accounts payable and short-term debt. The remaining amount is what you have left to cover your operational expenses during the budgeting period.

Separate business and personal expenses. If you haven't already, open a dedicated business bank account. This makes it easier to track, categorize, and analyze your finances.

Determine your fixed and variable costs. Make a list of costs that stay the same every month (fixed costs) and what changes (variable costs). These will change based on the purpose of the budget. For instance, a labor budget will only consider employee-related costs.

Calculate your total expenses. Add up all the costs for your business, including fixed costs, variable costs, labor, and any other applicable expenses. This total is how much your business needs to run. Any leftover money from your working capital can be allocated toward other business investments.

Budgeting methods

If you've budgeted before and hated it, you may just have been using an ineffective budgeting method for your preferences. Here are a few budgeting methods to try instead:

Traditional: This budget is set for a determined amount of time and uses last year's numbers as a benchmark. Once you set your budget, you don't change it unless you get approval for an adjustment.

Rolling: This dynamic approach spans a continuous time frame instead of a fixed time period. As each month or quarter passes, you add a new budget period and drop the oldest period. This lets businesses adjust projections based on real-time performance and market conditions.

Flexible: This budget changes along with your sales forecast. As real-time sales activity deviates from budgeted amounts, you recalculate the budget to reflect the new data.

Still don't know where to start with your small business budget? Check out the answers to these common questions before you open a new Google Sheet.

What should a business budget include?

A business budget should include all income sources and expenses. Income sources could include projected revenue from sales, loans, or potential investor funding. Expenses may include items like office space rent, employee salaries, insurance, and marketing. Add anything that helps paint a full picture of your finances.

How much does the average small business startup cost?

The average small business startup costs $40,000 in its first year of business. But this will absolutely vary depending on your type of business, unique expenses, and cash income. For instance, there are multiple types of businesses you can start with $10,000 or less.

What is the best free business budgeting software?

The best free budgeting business software will depend on what your business needs, but you can try apps like Mint or Wave. Or you can use a spreadsheet—scroll up for some free small business budget templates.

Automate your small business

Knowing when or where to invest money into your business is just one of the many tasks you have on your plate as a small business owner. Learn how automation for small businesses can help take some of those recurring tasks off your hands, so you can focus on growing your business.

Related reading:

The best free small business software

The best CRMs for small businesses

How to create effective document templates

21 free Google Sheets templates to boost productivity

Get productivity tips delivered straight to your inbox

We’ll email you 1-3 times per week—and never share your information.

Cecilia Gillen

Cecilia is a content marketer with a degree in Media and Journalism from the University of South Dakota. After graduating, Cecilia moved to Omaha, Nebraska where she enjoys reading (almost as much as book buying), decor hunting at garage sales, and spending time with her two cats.

- Small business

- Finance & accounting

Related articles

How to enrich lead data for personalized outreach

How to enrich lead data for personalized...

What is a proof of concept? And how to write one (with template)

What is a proof of concept? And how to write...

How to choose the best automation software

AI in customer service: 11 ways to automate support

AI in customer service: 11 ways to automate...

Improve your productivity automatically. Use Zapier to get your apps working together.

Accounting | How To

How To Create a Small Business Budget [+Free Template]

Published June 20, 2023

Published Jun 20, 2023

REVIEWED BY: Tim Yoder, Ph.D., CPA

WRITTEN BY: Eric Gerard Ruiz, CPA

This article is part of a larger series on Bookkeeping .

- 1. Create a Budget Process

- 2. Determine Key Assumptions in Budgeting

- 3. Create the Sales Budget

- 4. Create the Inventory and Purchases Budget

- 5. Create the COGS Budget

- 6. Create the Sales & Administrative Budget

- 7. Create the Capital Budget

- 8. Create the Cash Budget

- 9. Assemble Proforma Financial Statements

Common Problems in Budgeting

Bottom line.

Creating a business budget is an important step in planning. A small business budget starts with creating the budgeting process, the operating budgets, such as sales, inventory and purchases, cost of goods sold (COGS), and sales and administrative, and ends with the financial budgets, such as cash, capital, and proforma financial statements.

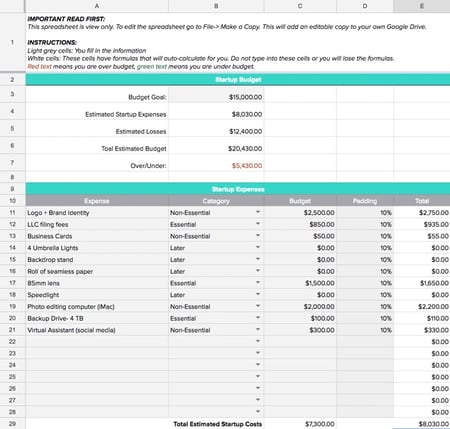

To help you get started, we’ve provided a very simplified version of a budget spreadsheet to illustrate how information from each area of your business is combined to form an annual budget. We’ll discuss how to use this spreadsheet throughout our article.

FILE TO DOWNLOAD OR INTEGRATE

FILE TO DOWNLOAD

Thank you for downloading!

Budgeting is an important subset of managerial accounting. Read our small business guide to managerial accounting and learn how managerial accounting concepts can be applied in a small business setup.

Step 1: Create a Budget Process

The budget process shows how the different departments of the business create a budget. Without a process, budgeting would be chaotic, and it would result in inefficiencies. In the budget process, you need to consider the following:

- Budget period: When are budgets created, reviewed, implemented, and evaluated against actual performance?

- Budgeting method: How are budgets created? Is it created from scratch (zero-based budgeting)? Is it based on actual results with adjustments (incremental budgeting)?

- Budget involvement: Who creates the budgets?

- Budget committee: Who oversees and approves the budgets?

- Budget manual: What are the guidelines for creating budgets?

Budget Period

The first thing to consider in the budget process is the budget period. How long should budgets be prepared? When will it be implemented? The budget period can be any time before the next business year begins. Hence, you can create next year’s budget three months prior to the end of the current year.

The crucial periods for budget planning are as follows:

- Budget preparation : The time at which managers and heads create a budget for their department.

- Budget review and approval : The time at which top management will review and approve all lower-level budgets.

- Budget implementation : The time at which all concerned parties will act upon planned activities stated in the budget. This phase runs until the effectiveness of the budget lasts.

- Budget accountability : The time at which top management will assess if the business is meeting its budgetary goals. This phase runs intermittently during the year, such as monthly, quarterly, or semiannually, especially during performance evaluation and review.

As a small business, you need not be particular about the phases. You can modify the phases depending on small business needs.

Budgeting Method

There are four different types of budgeting methods, but for small businesses, we picked only two, as they are the most appropriate for the setup:

- Zero-based budgeting : This is a budgeting technique that starts from scratch. It doesn’t use information from past budgets. Instead, departments and managers need to justify every dollar in the budget without referring to past performance or past budgeting practices.

- Incremental budgeting : This is a budgeting technique that uses actual figures from the past years and adjusts with a certain percentage. For example, if actual sales last year is $20,000, the incremental budgeted sales could be 10 percent more or $22,000.

Budget Involvement

Small businesses must consider what kind of involvement is needed during the budgeting process, given that budgets can be used to measure the performance of departments and managers. There are two kinds of budget involvement—for small businesses, authoritative budgeting is suitable if the small business owner is heavily involved in daily operations. Alternatively, participatory budgeting applies if the owner delegates decision-making to managers.

1. Authoritative budgeting

Also known as top-down budgeting, this budget involvement strategy only includes top management in the budgeting process, where operating personnel and lower-level employees have little to no say in the budget. It takes less time to create since there are fewer employees involved.

However, some operating personnel and lower-level employees may disagree with top management’s estimates in the budget. At the least, this strategy creates discord between top management and operating personnel due to conflicting views. But if prepared appropriately, authoritative budgeting reflects the business’ vision, mission, and goals better.

2. Participatory budgeting

This is also called bottom-up budgeting, and this budget involvement strategy includes operating personnel and lower-level employees in creating a budget. It is a budget co-created by everyone involved or affected by the budget being created.

It enhances the relationship between top management and operating personnel since everyone has a say in the budget. However, this strategy can take time since more employees are involved in the budgeting process. Also, some lower-level managers can use this opportunity to insert some budgetary slack so that they look good during performance.

Budget Committee

The budget committee is responsible for compiling all lower-level budgets and assembling them into one package called the master budget and reviewing and approving budgets from different departments. For small businesses, the composition of the budget committee can be the small business owners, chief executive officer (CEO), treasurer, budget coordinator, and chief accountant.

The role of the budget coordinator is to reach out to lower-level managers and communicate the wishes of the budget committee. If you’re a family-grown small business, family members, including the small business accountant or finance officer, can be committee members.

Budget Manual

The first order of business of the budget committee is to create a budget manual, which outlines the budgeting process. Lower-level managers and department heads will use the budget manual when creating lower-level budgets. The budget committee may also set specific budget formats and deadlines.

A budget manual standardizes the budgeting process—it ensures fairness and comparability among departments and managers. With this manual in place, you can prevent the instance of inserting unfamiliar line items in the budget or using different sources in forecasting budgeted figures.

The budget manual should include the following:

- Statements of budgetary purpose

- Budgetary activities, such as budget preparation, budget hearing and evaluation, budget approval, budget execution, and budget accountability

- Schedule of budgetary activities and deadlines

- Sample budgets

- Key assumptions used in budgeting

You can create a budget easily using QuickBooks Online. Its budgeting functions create budgets per account in the chart of accounts. Read our QuickBooks Online review for detailed information on our recommendation.

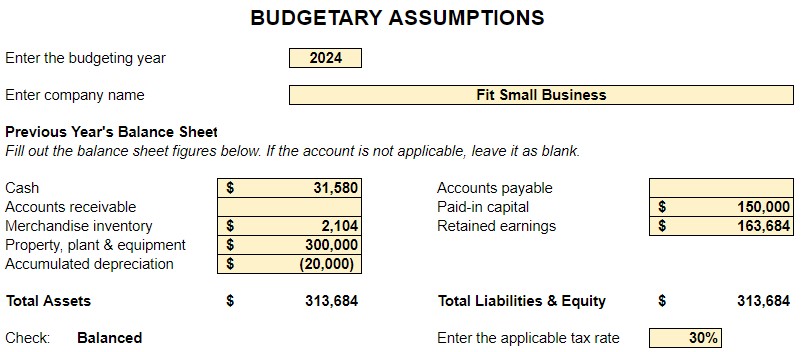

Step 2: Determine Key Assumptions in Budgeting

After performing the groundwork for budgeting, the next step is determining the key assumptions. These assumptions make it easy to prepare budgets since not all information is readily available until it happens. These assumptions are not arbitrary because they must be based on past experience and good business practices.

Examples of assumptions are:

- Sales forecast

- Selling price per unit

- Cost per unit

- Estimated discounts given to customers

- Estimated sales returns

- Desired ending inventory per month or quarter

- Number of raw materials used to produce one good unit

- Number of labor hours needed to produce one good unit

- Number of overhead hours (if any) needed to produce one good unit

- Inventory cost flow method used, such as first-in, first-out (FIFO), last-in, first-out (LIFO), or average cost

- Cash collection patterns

- Cash payments patterns

- Cash retention policies

Input your assumptions in the second tab of our downloadable spreadsheet. When done, all of the reports will automatically populate. It’s the quality of your assumptions that will determine if your budget is realistic. As you improve your budgeting process, you’ll come up with additional assumptions to include in the process.

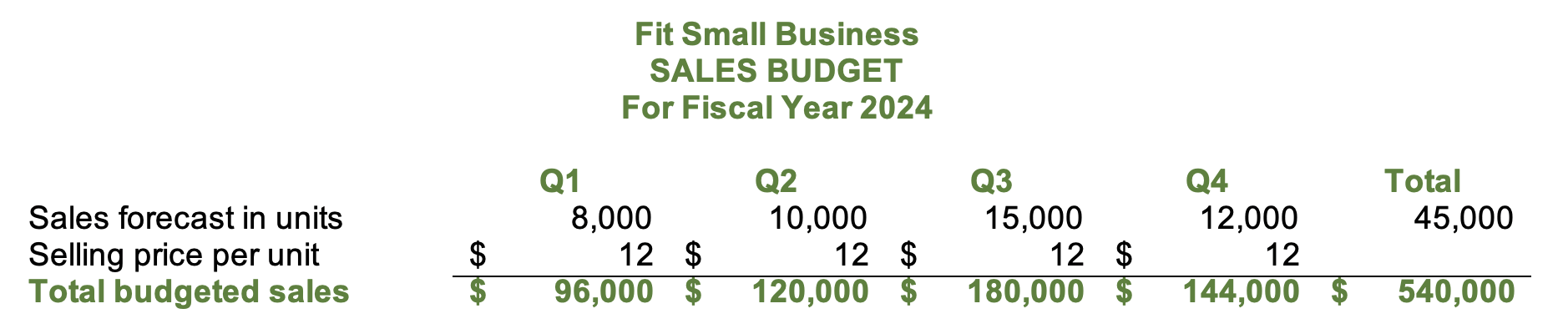

Step 3: Create the Sales Budget

The sales budget is the first budget that should be prepared because almost all budgets will depend on the information in it. It is the responsibility of the sales department to forecast and create the sales budget of the company, and it is crucial that the department forecast sales reasonably using the appropriate forecasting method. Our article about sales forecasting discusses the method of sales forecasting and shows how CRM software can help.

Below is an example of the sales budget taken from our small business master budget template.

Sales budget

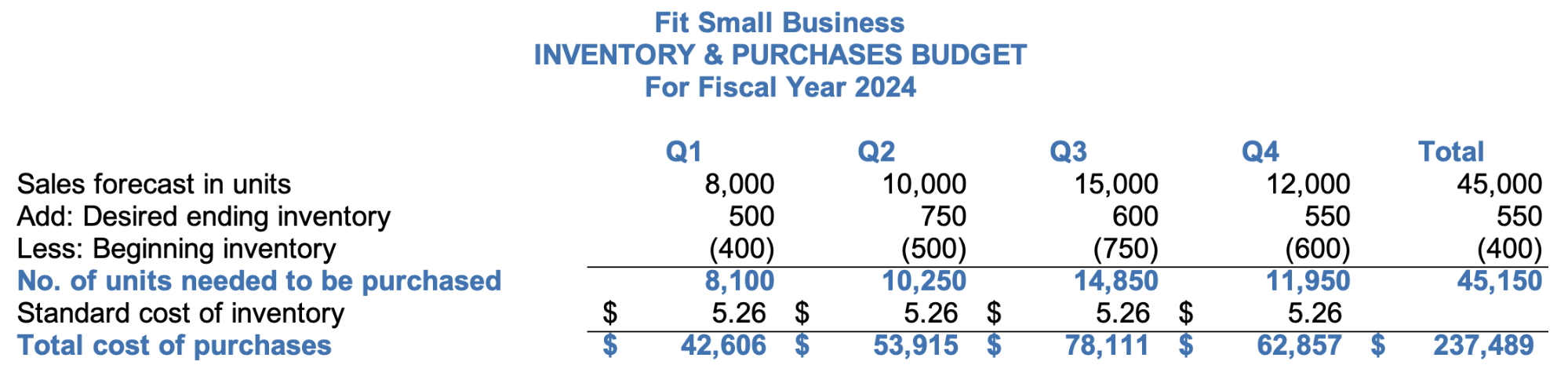

Step 4: Create the Inventory & Purchases Budget

There are two ways to call this budget: merchandising companies can call it inventory and purchases budget while manufacturing companies can call it production budget. However, the information shown in this budget remains the same. The inventory or production budget shows the number of units needed to meet the sales demand.

Inventory budget

The image above shows the sample inventory budget in our free template. One of our assumptions is that the business intends to keep 5% of next quarter’s sales forecast as current quarter’s ending inventory. In Q1, desired ending inventory is 500 units, which is 5% of 10,000 units of Q2’s sales forecast.

After determining the number of units needed, multiply them to the standard cost of inventory to get the total cost of inventory. The standard inventory cost is also the budgeted cost of inventory. Since some inventory prices fluctuate, setting standard costs makes it easy for us to budget.

When adding values in the total column, do not sum up the values in the beginning and desired ending inventory rows. Instead, the total beginning inventory in the total column should be the Q1 beginning inventory, while the total ending inventory should be the Q4 ending inventory.

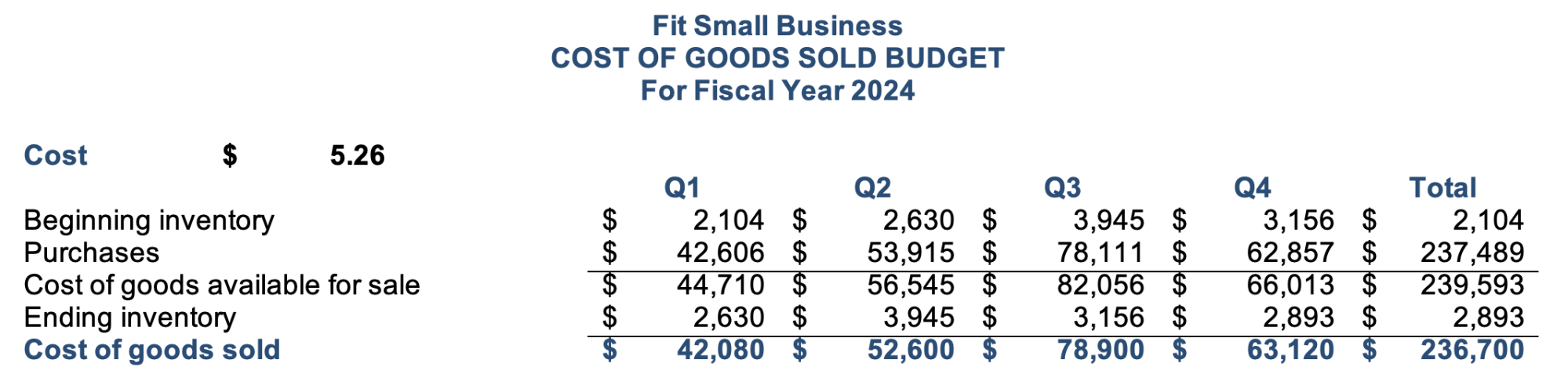

Step 5: Create the COGS Budget

The next logical step after budgeting inventory and purchases is to determine the COGS. Through the COGS budget, we can estimate the level of COGS per quarter. This budget is necessary for preparing the proforma income statement.

Below is the COGS budget from our small business budget template:

COGS budget

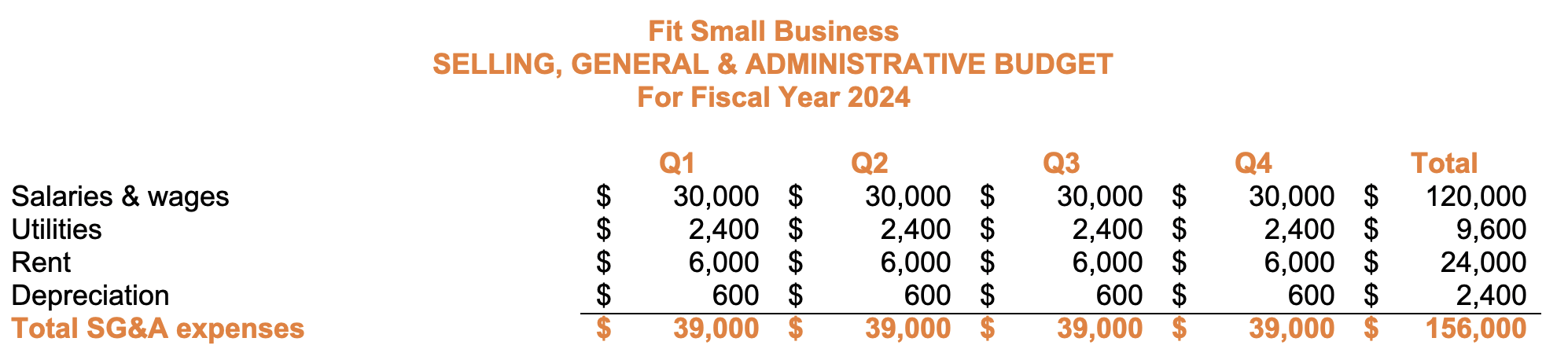

Step 6: Create the Sales & Administrative Budget

The sales and administrative (S&A) budget presents the budgeted costs for sales expenses, office expenses, and administrative expenses. This is necessary for budgeting the salaries of employees and other fixed expenses. The image below shows the sales and administrative budget from our template:

S&A budget

Most expenses in this budget are fixed costs. That’s why the amounts are the same for every quarter. Manufacturing companies may also call this budget a “fixed overhead budget.”

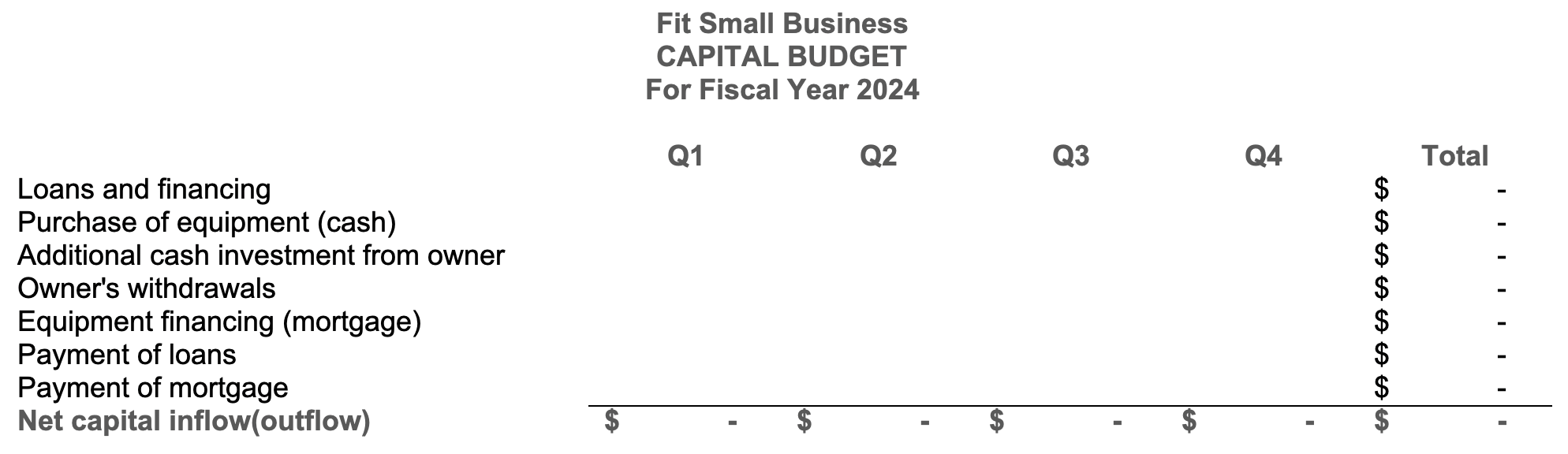

Step 7: Create the Capital Budget

A capital budget shows all the planned capital expenditures during the year. In our capital budget example below, there are no figures because the sample company didn’t plan any capital decisions for 2024. However, we’ve included common capital decisions for you to fill out when you use our template. For instance, a bank loan is a capital inflow while the purchase of equipment is a capital outflow.

Capital budget

The capital budget in our downloadable spreadsheet does not auto-populate from the assumptions tab. Instead, enter your budgeted loans and purchases directly in the report.

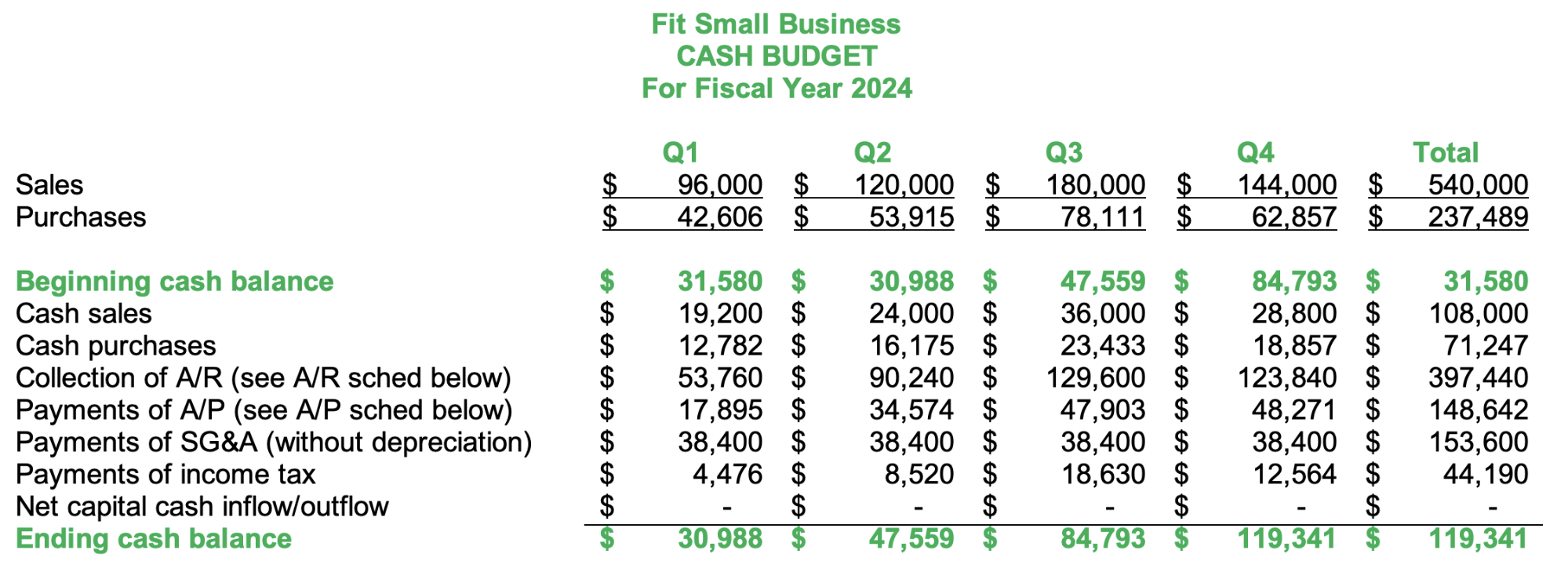

Step 8: Create the Cash Budget

The last budget that you need to prepare is the cash budget, which shows all the cash inflows and outflows from all budgets. Almost all budgets above affect cash flow. For example, the sales budget can show all cash inflows from cash sales and subsequent cash collections from credit sales.

Cash budget

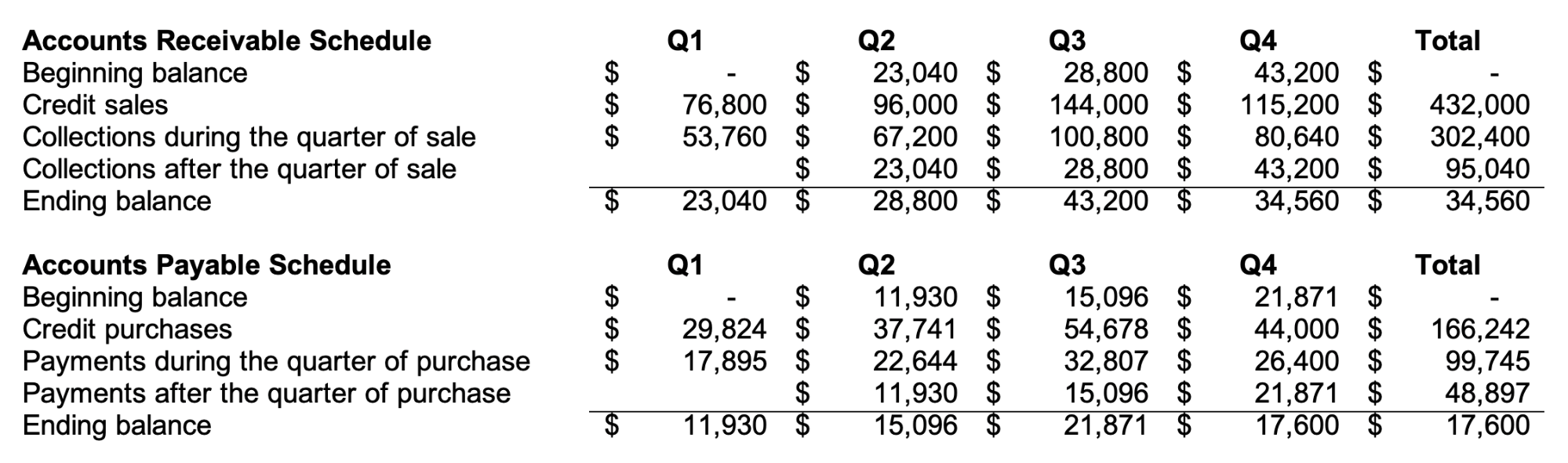

Accounts Receivable & Accounts Payable Schedule

Collections from accounts receivables (A/R) and payments of accounts payable (A/P) are integral parts of the cash budget. Creating the A/R and A/P schedules helps in computing the ending balance of A/R and A/P and the amount of cash collections and payments per quarter. Below are the supporting A/R and A/P schedules for our cash budget above:

A/R and A/P schedules

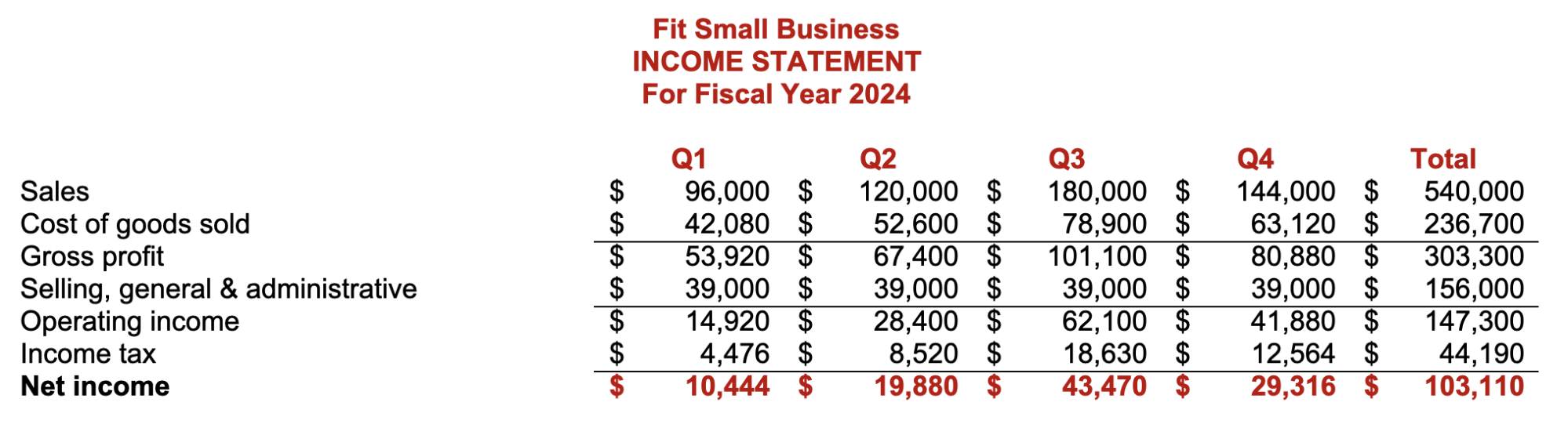

Step 9: Assemble the Proforma Financial Statements Based on Budgeted Figures

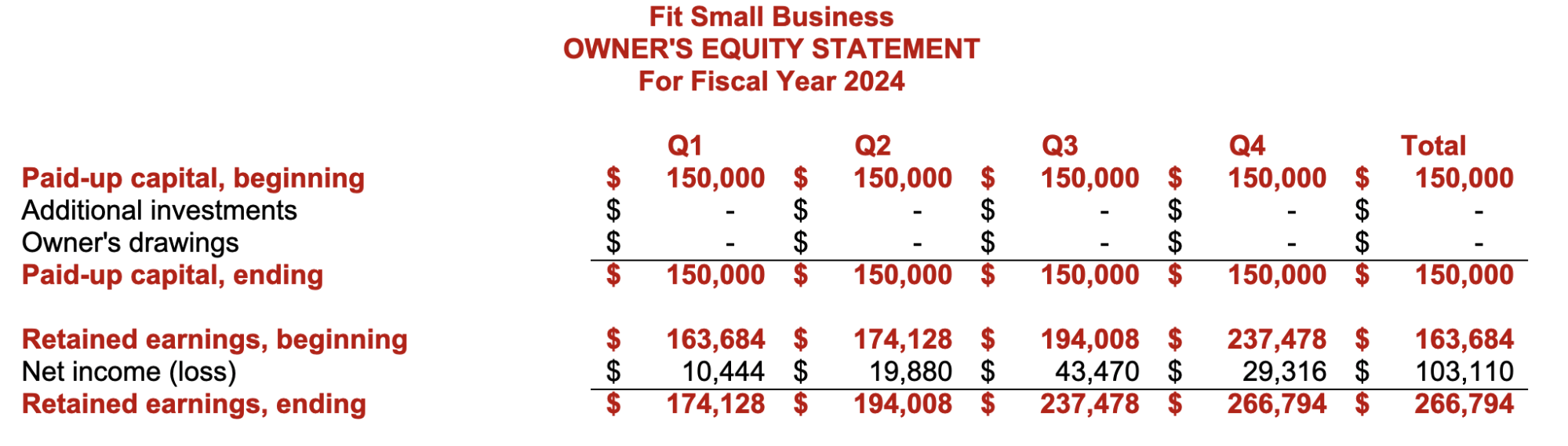

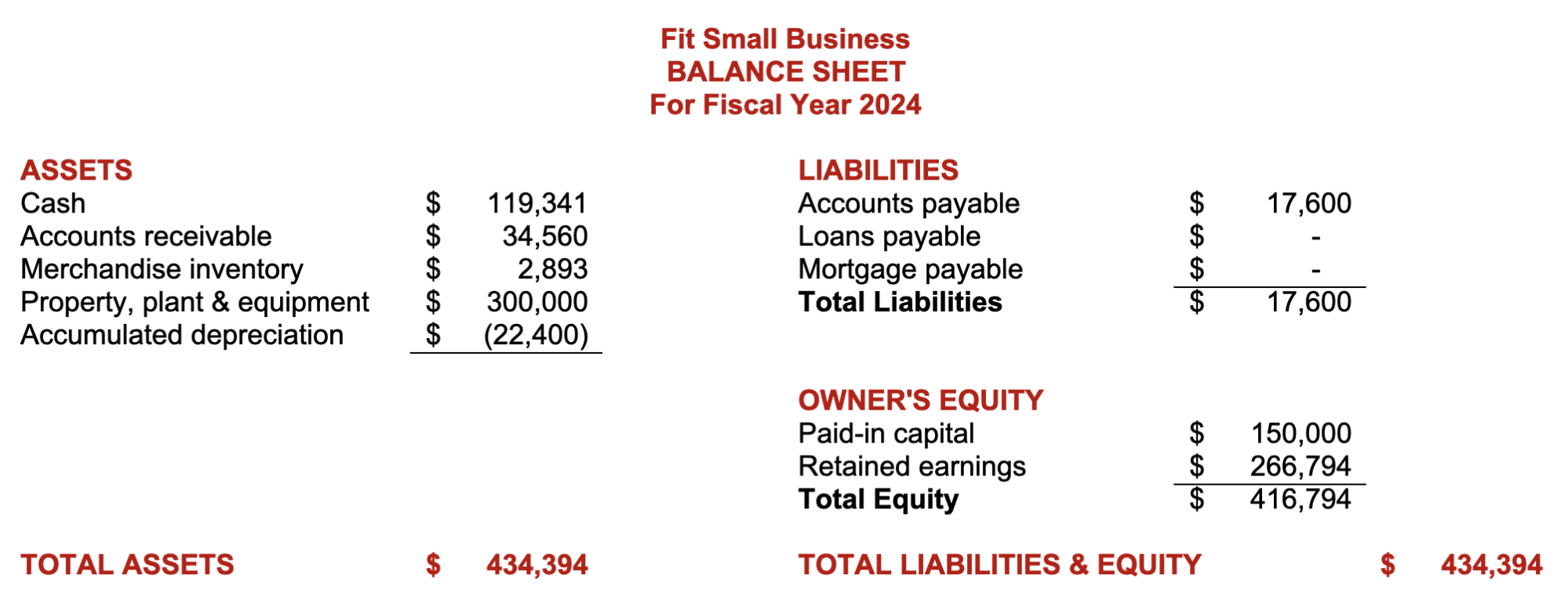

The ultimate result of the budgeting process is the proforma financial statements, which are the budgeted or projected results of planned activities. If the budget goes as planned, the actual financial statements should be near the proforma financial statements. Below are the proforma income statement and balance sheet in our small business budget template.

Proforma Income Statement

Proforma Owner’s Equity Statement

Proforma Balance Sheet

Budgeting helps businesses plan on future events and meet company goals. However, it is likely that you will experience difficulties and problems during the budgeting process. The four problems we’ll discuss are budgetary slack, goal incongruence, budget myopia, and standard setting.

Budgetary slack and goal incongruence occur when managers are not aligned with the business’s overall goals and objectives, while budget myopia happens when the business forgets to consider the impact of short-term decisions in the long run. Lastly, standard setting often poses a problem when standards are too high or ideal. Let’s discuss each of them in greater detail below.

Budgetary Slack

Sometimes, managers and heads can use budgets to preempt results to their favor. This unethical practice is called budgetary slack or budget padding. Budget slacks occur when managers underestimate revenue goals and overestimate expense goals and when the business follows the participatory budget involvement strategy.

When time for evaluation arrives, budget slacks will make the manager’s performance as exemplary. Managers tend to include budgetary slacks when top management is too strict and punitive whenever budgets aren’t met.

For example, the sales manager underestimates the sales forecast at $50,000 for the first quarter, knowing that they can achieve actual sales of $70,000. This example shows how budgetary slack can affect performance evaluation and create a false reflection of the company’s ability to generate revenue.

Goal Incongruence

Budgets are goals. When goals of management and employees don’t meet, the budget will not reflect the results that’s best for the business as a whole. Preventing goal incongruence enhances the quality of the budget. The goal of employees should be aligned with the business’s goals, and top management should provide opportunities for employees to pursue their career growth within the business.

Improper communication of business goals and ineffective leadership are the common causes of goal incongruence. As a small business owner or manager, you should show employees that you are committed to them with respect to their professional goals and that you expect them to align themselves with the business’s overall goals.

Budget Myopia

Budget myopia occurs when budgeting focuses only on short-term goals without considering how these goals will affect the company in the future. Managers become “myopic” in budgeting when they see budgets as measures for performance—they forget that the main objective of budgeting is to plan, organize, and manage the firm’s resources. As a result, budget realignments occur because there is a failure to plan future events.

Standard Setting

Another hurdle in budgeting is setting standards, which are tools for planning and controlling. If used inappropriately, they can cause problems in the budgeting process. It is important that you have to set your standards at a practical level.

Practical standards allow room for error or inefficiencies. It gives employees a chance to learn and improve their outputs without affecting performance. Unwise managers often impose ideal standards or standards that require optimum performance and perfection.

As a result, imposing ideal standards results in employee burnout, decreased productivity, and negative employee morale. Discouraged employees might also result in dysfunctional behavior that might be detrimental to the company.

Frequently Asked Questions (FAQs)

Why is budgeting important.

Budgets help in planning and managing business resources. Since plans and goals require an outflow of resources, budgets help the business determine the right amount of resources needed to achieve the goal.

Who should have an active participation in the budgeting process for small businesses?

The small business owner should have an active role in helping managers and supervisors craft their budgets. As the owner, you should guide your employees to align their goals with the business’ overall goals.

With our small business budget guide and template, you can create a small business master budget. We hope that the template will help you understand why budgeting is crucial to the planning, organizing, and controlling business operations.

About the Author

Find Eric Gerard On LinkedIn

Eric Gerard Ruiz, CPA

Eric is an accounting and bookkeeping expert for Fit Small Business. He has a CPA license in the Philippines and a BS in Accountancy graduate at Silliman University. Since joining FSB, Eric has used his expertise and authority in curating and writing content about small business accounting and bookkeeping, accounting software, financial accounting and reporting, managerial accounting, and financial management.

Join Fit Small Business

Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Select the newsletters you’re interested in below.

How to Create a Small Business Budget in 5 Simple Steps

Want to protect the financial health of your small business? You need a business budget. Here's how to create one.

When you build a business, there are a lot of things to stay on top of, from marketing and finding new clients to building a website and establishing your digital presence. But there’s one element that you want to stay on top of from the very beginning—and that’s your business budget.

Having a detailed and accurate budget is a must if you want to build a thriving, sustainable business. But how, exactly, do you create one? What are the steps for business budget planning?

As a small business owner, let’s take a look at how to create a business budget in five simple, straightforward steps.

What’s a Business Budget—and Why Is It Important?

Before we jump into creating a business budget, let’s quickly cover what a business budget is—and why it’s so important for small businesses.

A business budget is an overview of your business funds. It outlines key information on both the current state of your finances (including income and expenses) and your long-term financial goals. Because your budget will play a key role in making sound financial decisions for your business, it should be one of the first tasks you tackle to improve business success.

And, as a financially savvy owners, you’ll also want to have a budget in place to help you:

- Make sound financial decisions. In many ways, your business budgets are like a financial road map. It helps you evaluate where your business finances currently stand—and what you need to do to hit your financial goals in the future for business growth.

- Identify where to cut spending or grow revenue. Your business budgets can help you identify areas to decrease your spending or increase your revenue, which will increase your profitability in the process, outline unexpected costs, and help your sustain your business goals.

- Land funding to grow your business. If you’re planning to apply for a business loan or raise funding from investors, you’ll need to provide a detailed budget that outlines your income and expenses.

Now that you understand why budget creation is so important to your business decisions, let’s jump into how to do it.

Business Budget Step 1: Tally Your Income Sources

First things first. When building a small business budget, you need to figure out how much money your business is bringing in each month and where that money is coming from – this will hep create an operating budget based on your business income.

Your sales figures (which you can access using the Profit & Loss report function in FreshBooks) are a great place to start. From there, you can add any other sources of income for your business throughout the month.

Your total number of income sources will depend on your business model.

For example, if you run a freelance writing business, you might have multiple sources of income from:

- Freelance writing projects

- A writing course you sell on your website

- Consulting with other writers who are starting small businesses

Or, if you run a brick-and-mortar retail business, you may only have one source of income from your store sales.

However many income sources you have, make sure to account for any and all income that’s flowing into your business—then tally all those sources to get a clear picture of your total monthly income to build your master business budget template.

Business Budget Step 2: Determine Fixed Costs

Once you’ve got a handle on your income, it’s time to get a handle of your costs—starting with fixed costs.

Your fixed costs are any expenses that stay the same from month to month. This can include expenses like rent, certain utilities (like internet or phone plans), website hosting, and payroll costs.

Review your expenses (either via your bank statements or through your FreshBooks reports) and see which costs have stayed the same from month to month. These are the expenses you’re going to categorize as fixed costs.

Once these costs are determined, add them together to get your total fixed and variable costs expense for the month.

TIP: If you’re just starting your business and don’t have financial data to review, make sure to use projected costs. For example, if you’ve signed a lease for office space, use the monthly rent you will pay moving forward.

Business Budget Step 3: Include Variable Expenses

Related articles.

Variable costs don’t come with a fixed price tag—and will vary each month based on your business performance and activity. These can include things like usage-based utilities (like electricity or gas), shipping costs, sales commissions, or travel costs.

Variable expenses will, by definition, change from month to month. When your profits are higher than expected, you can spend more on the variables that will help your business scale faster. But when your profits are lower than expected, consider cutting these variable costs until you can get your profits up.

At the end of each month, tally these expenses. Over time, you’ll get a sense of how these expenses fluctuate with your business performance or during certain months, which can help you make more accurate financial projections and budget accordingly.

Business Budget Step 4: Predict One-Time Spends

Many of your business expenses will be regular expenses that you pay for each month, whether they’re fixed or variable costs. But there are also costs that will happen far less frequently. Just don’t forget to factor those expenses when you create a budget as well.

If you know you have one-time spends on the horizon (for example, an upcoming business course or a new laptop), adding them to your budget can help you set aside the financial resources necessary to cover those expenses—and protect your business from unexpected costs in the form of a sudden or large financial burden.

On top of adding planned one-time spends to your budget, you should also add a buffer to cover any unplanned purchases or expenses, like fixing a damaged cell phone or hiring an IT consultant to deal with a security breach. That way, when an unexpected expense pops up (and they always do), you’re prepared!

Business Budget Step 5: Pull It All Together

You’ve gathered all of your income sources and all of your revenue and expenses. What’s next? Pulling it all together to get a comprehensive view of your financial standing for the month.

On your businesses master budget, you’ll want to tally your total income and your total expenses (i.e., adding your total fixed costs, variable expenses, cost of goods, and one-time spends)—then compare cash flow in (income) to cash flow out (expenses) to determine your overall profitability.

Having a hard time visualizing what a business budget looks like in action? Here’s an operating budget example to give you an idea of what your new business budget might look like each month:

A Client Hourly Earnings: $5,000 B Client Hourly Earnings: $4,500 C Client Hourly Earnings: $6,000 Product Sales: $1,500 Loans: $1,000 Savings: $1,000 Investment Income: $500

Total Income: $19,500

Fixed Costs

Rent: $1,000 Internet: $50 Payroll costs: $5,000 Website hosting: $50 Insurance: $50 Government and bank fees: $25 Cell phone: $50 Accounting services : $100 Legal services: $100

Total Fixed Costs: $6,425

Variable Expenses

Sales commissions: $2,000 Contractor wages: $500 Electricity bill: $125 Gas bill: $75 Water bill: $125 Printing services: $300 Raw materials: $200 Digital advertising costs: $750 Travel and events: $0 Transportation: $50

Total Variable Expenses: $4,125

One-Time Spends

Office furniture: $450 Office supplies for new location: $300 December business retreat: $1,000 New time tracking software: $500 Client gifts : $100

One-Time Spends: $2,350

Expenses: $12,900

Total Income ($19,500) – Total Expenses ($12,900) = Total Net Income ($6,600)

Above all, once you have a clear sense of your profitability for the month, you can use it to make the right financial decisions for your small business moving forward.

For example, if you realize you’re in the red and spending more than you earn, you might cut your spending and focus on finding new clients . Alternatively, if your income is significantly higher than your expenses, you might consider investing your profits back into your business (like investing in new software or equipment).

Use Your Business Budget to Stay on Track

Putting in the work to create a budget for your small business may seem like a hassle. But while it takes a bit of time and energy, it’s worth the extra effort. Thorough business budgeting gives you the financial insights you need to make the right decisions for your business to grow, scale, and prosper in the future.

This post was updated in October 2023

Written by Deanna deBara , Freelance Contributor

Posted on June 20, 2017

Freshly picked for you

Thanks for subscribing to the FreshBooks Blog Newsletter.

Expect the first one to arrive in your inbox in the next two weeks. Happy reading!

- Search Search Please fill out this field.

- Small Business

6 Steps to a Better Business Budget

A top-notch budget can help propel your business success

:max_bytes(150000):strip_icc():format(webp)/100378251brianbeersheadshot__brian_beers-5bfc26274cedfd0026c00ebd.jpg)

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

You've just purchased or opened a small business and you know your trade. But when it comes to bookkeeping—and more specifically, budgeting —your skill set is lacking. The good news is that it is possible to come up with a budget (or at least a good estimation of what will be needed in terms of dollars and cents) fairly easily.

Estimating and matching expenses to revenue (real or anticipated) is important because it helps small business owners to determine whether they have enough money to fund operations, expand the business, and generate income for themselves. Without a budget or a plan, a business runs the risk of spending more money than it is taking in, or conversely, not spending enough money to grow the business and compete.

Key Takeaways

- A business budget helps owners determine if they have enough money to fund operations, expand, and generate income.

- Without a budget, a company runs the risk of spending money it doesn't have, not spending enough to compete, or failing to build a solid emergency fund.

- To create a budget, check industry standards to determine the average costs of doing business and create a spreadsheet estimating the amount of money you'll need to allocate toward your costs.

- Factor in some slack in your budget to cover unexpected costs and review areas where you could cut costs if times get tough.

- Review your budget every few months and shop around for new suppliers to save money on products or services for your business.

Getting Started With a Business Budget

Every small business owner tends to have a slightly different process, situation, or way of budgeting. However, there are some parameters found in nearly every budget that you can employ.

For example, many business owners must make rent or mortgage payments. They also have utility bills, payroll expenses, cost of goods sold (COGS) expenses (raw materials), interest, and tax payments. The point is every business owner should consider these items and any other costs specifically associated with the business when setting up shop or taking over an existing business.

With a business that is already up and running, you can make assumptions about future revenue based on recent trends in the business. If the business is a startup , you'll have to make assumptions based on your geographic area, hours of operation, and by researching other local businesses. Small business owners can often get a sense of what to expect by visiting other businesses that are for sale and asking questions about weekly revenue and traffic patterns.

After you've researched this information, you should then match the business's revenue with expenses. The goal is to figure out what an average weekly expense for overhead, utilities, labor, raw materials, etc. would look like. Based on this information, you may then be able to estimate or forecast whether you'll have enough extra money to expand the business or to tuck away some money into savings. On the flip side, owners may realize that in order to have three employees instead of two, the business will have to generate more in revenue each week.

These six simple tips will help you put together a top-notch small business budget:

1. Check Industry Standards

Not all businesses are alike, but there are similarities. Therefore, do some homework and peruse the internet for information about the industry , speak with local business owners, stop into the local library, and check the Internal Revenue Service (IRS) website to get an idea of what percentage of the revenue coming in will likely be allocated toward cost groupings.

Small businesses can be extremely volatile as they are more susceptible to industry downturns than larger, more diversified competitors. So, you only need to look for an average here, not specifics.

2. Make a Spreadsheet

Prior to buying or opening a business, construct a spreadsheet to estimate what total dollar amount and percentage of your revenue will need to be allocated toward raw materials and other costs. It's a good idea to contact any suppliers you'd have to work with before you continue on. Do the same thing for rent, taxes, insurance(s), etc. It's also important you understand the different types of budgets you'll need to set up for your small business and how to implement them.

3. Factor in Some Slack

Remember that although you may estimate that the business will generate a certain rate of revenue growth going forward or that certain expenses will be fixed or can be controlled, these are estimates and not set in stone. Because of this, it's wise to factor in some slack and make sure that you have more than enough money socked away (or coming in) before expanding the business or taking on new employees.

4. Look to Cut Costs

If times are tight and money must be found somewhere in order to pay a crucial bill, advertise, or otherwise capitalize on an opportunity, consider cost-cutting . Specifically, take a look at items that can be controlled to a large degree. Another tip is to wait to make purchases until the start of a new billing cycle or to take full advantage of payment terms offered by suppliers and any creditors. Some thoughtful maneuvering here could provide the business owner with much-needed breathing and expansion room.

5. Review the Business Periodically

While many firms draft a budget yearly, small business owners should do so more often. In fact, many small business owners find themselves planning just a month or two ahead because business can be quite volatile, and unexpected expenses can throw off revenue assumptions. Establishing a budget planning calendar can be an effective tool for business owners to ensure they have enough capital to meet their business needs.

6. Shop Around for Services/Suppliers

Don't be afraid to shop around for new suppliers or to save money on other services being performed for your business. This can and should be done at various stages, including when purchasing or starting up a business, when setting annual or monthly budgets, and during periodic business reviews.

The Bottom Line

Budgeting is an easy, but essential process that business owners use to forecast (and then match) current and future revenue to expenses. The goal is to make sure that enough money is available to keep the business up and running, to grow the business, to compete, and to ensure a solid emergency fund.

University of California, Irvine, Accounting & Fiscal Services. " Understanding Fiscal Years and Fiscal Periods ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-485221701-581f4df15f9b581c0b6e2256.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Get expert advice delivered straight to your inbox.

How to Create a Basic Business Budget

8 Min Read | Mar 13, 2024

You’d never intentionally set your business up to fail, right? But if you don’t know your numbers and how to make a business budget, that’s exactly what you’re doing. Money problems and bad accounting are two reasons why many small businesses don’t make it past their first five years. 1

Talking about budgets can feel overwhelming. We get it. For a lot of business leaders, it’s a lot more comfortable dreaming up big ideas and getting stuff done than digging into numbers. But you can’t set yourself up for steady growth until you have a handle on the money flowing in and out of your company. You also can’t enjoy financial peace in your business.

Not a numbers person? That’s okay. Follow the simple steps below to learn how to create a budget for a business and manage your finances with confidence. We’ll even give you a link to an easy-to-use small-business budget template in the EntreLeader’s Guide to Business Finances .

But before we get to that, let’s unpack what a budget is and why you need one.

Don't Let Your Numbers Intimidate You

With the EntreLeader’s Guide to Business Finances, you can grow your profits without debt—even if numbers aren’t your thing. Plus, get a free business budget template as part of the guide!

What Is a Business Budget?

A business budget is a plan for how you’ll use the money your business generates every month, quarter and year. It’s like looking through a windshield to see the expenses, revenue and profit coming down the road. Your business budget helps you decide what to do with business profit, when and where to cut spending and grow revenue, and how to invest for growth when the time comes. Leadership expert John Maxwell sums it up: “A budget is telling your money where to go instead of wondering where it went.”

But here’s what a business budget is not: a profit and loss (P&L) report you read at the end of the month. Your P&L is like a rearview mirror—it lets you look backward at what’s already happened. Your P&L statement and budget are meant to work together so you can see your financial problems and opportunities and use those findings to forecast your future, set educated goals, and stay on track.

Why Do I Need to Budget for My Business?

Creating a budget should be your very first accounting task because your business won’t survive without it. Sound dramatic? Check this out: There are 33.2 million small businesses in the United States. Out of the small businesses that opened from 1994 to 2020, 67.7% survived at least two years. But less than half survived past five years. 2 The top reasons these businesses went under? They hit a wall with cash-flow problems, faced pricing and cost issues, and failed to plan strategically . 3

As a business owner, one of the worst feelings in the world is wondering whether you’ll be able to make payroll and keep your doors open. That’s why we can’t say it enough: Make a business budget to stay more in control and have more financial peace in running your business.

A budget won’t help you earn more money, but it will help you:

- Maximize the money you’ve got

- Manage your cash flow

- Spend less than your business earns

- Stay on top of tax payments and other bills

- Know if you’re hitting your numbers so you can move at the true speed of cash

How to Create a Budget for a Business

Your ultimate goal is to create a 12–18-month business budget—and you will get there! But start by building out your first month. Don’t even worry about using a fancy accounting program yet. Good ol’ pen and paper or a simple computer document is fine. Just start! Plus, setting up a monthly budget could become a keystone habit that helps kick-start other smart business habits.

Here’s how to create your first budget for business:

1. Write down your revenue streams.

Your revenue is the money you earn in exchange for your products or services. You’ll start your small- business budget by listing all the ways you make money. Look at last month’s P&L—or even just your checking account statement—to help you account for all your revenue streams. You’re not filling in numbers yet. Just list what brings in revenue.

For example, if you run an HVAC business, your revenue streams could be:

- Maintenance service calls

- Repair services and sales

- New unit installation

- Insulation installation

- Air duct cleaning

2. Write down the cost of goods sold (if you have them).

Cost of goods is also called inventory. These expenses are directly related to producing your product or service. In the HVAC example, your cost of goods would be the price you pay for each furnace and air conditioning unit you sell and install. It could also include the cost of thermostats, insulation and new ductwork.

3. List your expense categories.

It’s crazy how much money can slip through the cracks when we’re not careful about putting it in the budget. Think through all your business expenses—down to the last shoe cover your technicians wear to protect your customers’ flooring during house calls. Here’s a list of common business budget categories for expenses to get you started:

- Office supplies and equipment

- Technology services

- Training and education

Related articles : Product Launch: 10 Questions to Ask Before You Launch a New Product New Product Launch: Your 10-Step Checklist

4. Fill in your own numbers.

Now that you have a solid list of revenue and expense categories, plug in your real (or projected) numbers associated with them. It’s okay if you’re not sure how much you’ll sell just yet or exactly how much you’ll spend. Make an educated guess if you’re just starting out. If your business has been earning money for a while, use past P&L statements to guide what you expect to bring in. Your first budget is about combining thoughtful guesswork with history and then getting a more realistic picture month over month.

5. Calculate your expected profit (or loss).

Now, number nerds and number haters alike—buckle in. We’re about to do some basic accounting so you know whether you have a profit or loss. This is your chance to figure out exactly how much you’re spending and making in your business.

Take your gross revenue (the total amount of money you expect to make this month) and subtract your expenses and cost of goods sold to find your profit or loss. Here’s what that calculation looks like:

Revenue - Expenses - Cost of Goods Sold = Profit or Loss

Don’t freak out if your first budget shows a loss. That actually happens a lot with your first few monthly budgets. You’re learning and getting context on what’s coming in and going out so you can make adjustments. Keep doing your budget, and before you know it, you’ll be a rock star at telling your money where to go, planning for emergencies , investments and opportunities , and building momentum.

6. Review your budget often.

Whew! Once you get that first business budget under your belt, take a deep breath and celebrate. You’ve just done something huge for your business! (You’ll also be happy to know, budgeting gets easier from here since you can copy and paste your first one and tweak your income and expenses each month.)

But here’s the thing: Your budget can’t just sit in a drawer or on your computer. You’ve got to look at it consistently to make sure you’re actually following it.

Weekly Review

At least once a week, someone in your business (whether it’s you, a qualified team member or a bookkeeper) needs to track your transactions so you know what’s happening with your money all month. Then you can make adjustments before you have more month than money.

Every time you review your budget, ask yourself these three questions:

- Are we on target to hit our revenue goal this month?

- If not, what we can change to get there?

- Are there any expenses we can cut or minimize?

Monthly Review

You also need to review your business budget when you close your books every month to compare it to your actuals—your P&L. Otherwise, how can you know how you’re doing?

7. Work toward a 12–18-month budget.

Now that you’ve created your first month’s budget, move on to the next one. You’ve got this! The more budget-building reps you get in, the better you’ll be at looking forward and planning for growth. In no time, you’ll reach that ultimate goal of a 12–18-month budget. Just keep adjusting as you go based on all you’re learning about getting an accurate road map for your finances.

As you start owning your numbers, remember: It’s okay if you’re a little intimidated by the process of accounting and making a budget for business. But it’s not okay to avoid the financial details that will make or break you. So just keep applying the basics we covered and keep moving forward.

Follow the steps above to create your budget, and review it often to stay on track.

Want a tool to make budget building simpler? Check out the EntreLeader’s Guide to Business Finances. It includes an easy-to-use small-business budget template in the extra resources section.

What are the benefits of budgeting?

A business budget will help you:

- Make informed, strategic decisions

- Invest in under-resourced areas

- Trim over-resourced areas

- Plan for the future

- Set goals and track your progress

Does using a small-business budget template save time?

Yes! Using a small-business budget template helps you plug in the numbers you need to operate with more confidence and fewer wrong turns. Check out the small-business-budget template inside our EntreLeader’s Guide to Business Finances .

How do I budget if I own a seasonal business?

Just like farmers put extra hay in the barn to cover leaner months, if you’re a seasonal business owner, you need to set aside resources in times of plenty to cover months your business turns down. Use your P&L statements to go back in time and look at financial performance year over year. Then, create your business budget based on what you learn and on any changes you see coming. You can also go to trade conferences to get an idea of your industry’s seasonal benchmarks.

Did you find this article helpful? Share it!

About the author

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books (including 12 national bestsellers) published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners. Learn More.

7 Tips for How to Run a Business Debt-Free

True or false: Running a business requires debt. The answer? False. The truth is, you can’t run a business if you’re broke—and debt increases your risk of going broke when a storm hits. Here’s how to run a business debt-free.

How to Create a Profit-Sharing Plan

It's easy to feel discouraged when trying to compete for top talent and keep your team happy. Learn how a profit-sharing plan can help you build and keep an awesome team even when the market shifts.

The Best Free Business Budget Templates

Published: October 12, 2023

Business budgets are a source of truth for your income and expenses. That includes all the money you spend — from A/B testing your marketing campaigns to your monthly office rent.

While organizing the numbers may sound difficult, using a business budget template makes the process simple. Plus, there are thousands of business budget templates for you to choose from.

We’ll share seven budget templates that can help organize your finances. But first, you’ll learn about different types of business budgets and how to create one.

What is a Business Budget?

A business budget is a spending plan that estimates the revenue and expenses of a business for a period of time, typically monthly, quarterly, or yearly.

The business budget follows a set template, which you can fill in with estimated revenues, plus any recurring or expected business expenses.

For example, say your business is planning a website redesign. You'd need to break down the costs by category: software, content and design, testing, and more.

Having a clear breakdown will help you estimate how much each category will cost and compare it with the actual costs.

Image Source

Types of Budgets for a Business

Master budget, operating budget, cash budget, static budget, departmental budget, capital budget, labor budget, project budget.

Business budgets aren’t one size fits all. In fact, there are many different types of budgets that serve various purposes. Let’s dive into some commonly used budgets:

Think of a master budget as the superhero of budgets — it brings together all the individual budgets from different parts of your company into one big, consolidated plan. It covers everything from sales and production to marketing and finances.

It includes details like projected revenues, expenses, and profitability for each department or business unit. It also considers important financial aspects like cash flow, capital expenditures, and even creates a budgeted balance sheet to show the organization's financial position.

The master budget acts as a guide for decision-making, helps with strategic planning, and gives a clear picture of the overall financial health and performance of your company. It's like the master plan that ties everything together and helps the organization move in the right direction.

Your operating budget helps your company figure out how much money it expects to make and spend during a specific period, usually a year. It not only predicts the revenue your business will bring in, but also outlines expenses it will need to cover, like salaries, rent, bills, and other operational costs.

By comparing your actual expenses and revenue to the budgeted amounts, your company can see how it's performing and make adjustments if needed. It helps keep things in check, allowing your business to make wise financial decisions and stay on track with its goals.

.png)

Free Business Budget Templates

Manage your business, personal, and program spend on an annual, quarterly, and monthly basis.

- Personal Budget Template

- Annual Budget Template

- Program Budget Template

You're all set!

Click this link to access this resource at any time.

A cash budget estimates the cash inflows and outflows of your business over a specific period, typically a month, quarter, or year. It provides a detailed projection of cash sources and uses, including revenue, expenses, and financing activities.

The cash budget helps you effectively manage your cash flow, plan for cash shortages or surpluses, evaluate the need for external financing, and make informed decisions about resource allocation.

By utilizing a cash budget, your business can ensure it has enough cash on hand to meet its financial obligations, navigate fluctuations, and seize growth opportunities.

A static budget is a financial plan that remains unchanged, regardless of actual sales or production volumes.

It’s typically created at the beginning of a budget period and doesn’t account for any fluctuations or changes in business conditions. It also assumes that all variables, such as sales, expenses, and production levels, will remain the same throughout the budget period.

While a static budget provides a baseline for comparison, it may not be realistic for businesses with fluctuating sales volumes or variable expenses.

A departmental budget focuses on the financial aspects of a specific department within your company, such as sales, marketing or human resources.

When creating a departmental budget, you may look at revenue sources like departmental sales, grants, and other sources of income. On the expense side, you consider costs such as salaries, supplies, equipment, and any other expenses unique to that department.

The goal of a departmental budget is to help the department manage its finances wisely. It acts as a guide for making decisions and allocating resources effectively. By comparing the actual numbers to the budgeted amounts, department heads can see if they're on track or if adjustments need to be made.

A capital budget is all about planning for big investments in the long term. It focuses on deciding where to spend money on things like upgrading equipment, maintaining facilities, developing new products, and hiring new employees.

The budget looks at the costs of buying new stuff, upgrading existing things, and even considers depreciation, which is when something loses value over time. It also considers the return on investment, like how much money these investments might bring in or how they could save costs in the future.

The budget also looks at different ways to finance these investments, whether it's through loans, leases, or other options. It's all about making smart decisions for the future, evaluating cash flow, and choosing investments that will help the company grow and succeed.

A labor budget helps you plan and manage the costs related to your employees. It involves figuring out how much your business will spend on wages, salaries, benefits, and other labor-related expenses.

To create a labor budget, you'll need to consider factors like how much work needs to be done, how many folks you'll need to get it done, and how much it'll all cost. This can help your business forecast and control labor-related expenses and ensure adequate staffing levels.

By having a labor budget in place, your business can monitor and analyze your labor costs to make informed decisions and optimize your resources effectively.

A project budget is the financial plan for a specific project.

Let's say you have an exciting new project you want to tackle. A project budget helps you figure out how much money you'll need and how it will be allocated. It covers everything from personnel to equipment and materials — basically, anything you'll need to make the project happen.

By creating a project budget, you can make sure the project is doable from a financial standpoint. It helps you keep track of how much you planned to spend versus how much you actually spend as you go along. That way, you have a clear idea of whether you're staying on track or if there are any financial challenges that need attention.

How to Create a Business Budget

While creating a business budget can be straightforward, the process may be more complex for larger companies with multiple revenue streams and expenses.

No matter the size of your business, here are the basic steps to creating a business budget.

1. Gather financial data.

Before you create a business budget, it’s important to gather insights from your past financial data. By looking at things like income statements, expense reports, and sales data, you can spot trends, learn from past experiences, and see where you can make improvements.

Going through your financial history helps you paint a true picture of your income and expenses. So, when you start creating your budget, you can set achievable targets and make sure your estimates match what's actually been happening in your business.

2. Find a template, or make a spreadsheet.

There are many free or paid budget templates online. You can start with an already existing budget template. We list a few helpful templates below.

You may also opt to make a spreadsheet with custom rows and columns based on your business.

3. Fill in revenues.

Once you have your template, start by listing all the sources of your business’ income. With a budget, you’re planning for the future, so you’ll also need to forecast revenue streams based on previous months or years. For a new small business budget, you’ll rely on your market research to estimate early revenue for your company.

When you estimate your revenue , you're essentially figuring out how much money you have to work with. This helps you decide where to allocate your resources and which expenses you can fund.

4. Subtract fixed costs for the time period.

Fixed costs are the recurring costs you have during each month, quarter, or year. Examples include insurance, rent for office space, website hosting, and internet.

The key thing to remember about fixed costs is that they stay relatively stable, regardless of changes in business activity. Even if your sales decrease or production slows down, these costs remain the same.

However, it's important to note that fixed costs can still change over the long term, such as when renegotiating lease agreements or adjusting employee salaries.

5. Consider variable costs.