Term Paper on Inflation: Top 6 Papers | Money | Economics

Here is a compilation of term papers on ‘Inflation’ for class 9, 10, 11 and 12. Find paragraphs, long and short term papers on ‘Inflation’ especially written for commerce students.

Term Paper on Inflation

Term Paper Contents:

- Term Paper on the Control of Inflation

Term Paper # 1. Meaning of Inflation:

A rise in price level or fall in the value of money is often the result of the excessive amount of money, or excessive issue of paper currency and this is commonly referred to as inflation.

ADVERTISEMENTS:

The various economists have defined inflation as follows:

“Inflation is a general and continuing increase in prices. This does not imply that all prices are increasing, some prices may even be falling, and the general trend must be upward. The rise in prices must also be continuing; once and for all price increases are excluded.” – Michael R. Edgmand

“We define inflation as rising prices, not as high prices. In some sense, then inflation is a disequilibrium state.” – Gardner Ackley

“By inflation we mean a time of generally rising prices for goods and factors production- rising prices for bread, cars, haircuts, rising wages, rents etc.” – Paul A. Samuelson

“Inflation is a state in which the value of money is falling or prices are rising.” – Crowther

“The obvious definition of inflation is that inflation is a rising price level” – Edward Shaoiro

“Inflation is a self-perpetuating and irreversible upward movement of prices caused by excess of demand over capacity to supply.” – Emile James

“Inflation consists of a process of rising prices.” – A.C.L. Day

The well-known English economist John Maynard Keynes has clearly distinguished between two types of rise in the price level in a country:

(a) Rise in prices followed by increase in production and employment; and

(b) Rise in prices not followed by such an increase in output and employment.

If a country is working with a large number of men unemployed, and a large number of factories, workshop etc. not fully utilised, any expansion of money and consequent increase in demand for goods and services will result in the rise in the price level and also rise in the production of goods and services.

This type of increase in production and in employment will continue so long as there are unemployed men and materials i.e., till the stage of full employment. Keynes states that the rise in the price level upto the stage of full employment is a good thing for the country since there is an increase in output and also in employment. Reynes uses the term reflation for such a rise in the price level.

The rise in the price level after the state of full employment is bad for the country since there is no corresponding increase in production and employment. Inflation is used to refer to such a rise in the price level after the economy has attained full employment in development countries like, India there may be heavy unemployment and under-employment and economic resources may not be fully employed.

In such economies, rise in the price level may not lead to increase in production and employment because of certain constraints in production as, for example, shortage of technical and managerial skill, shortage of power, transport etc. (known as bottle-necks). Hence, India can experience inflationary rise in prices even though it has not reached a stage of full employment.

Term Paper # 2. Kinds of Inflation :

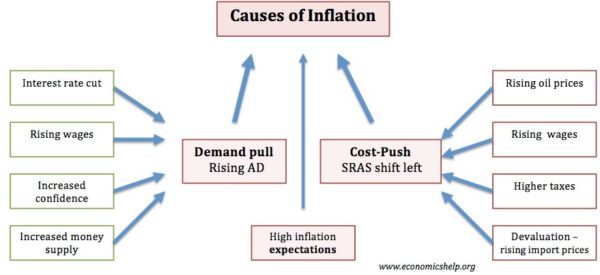

(i) demand pull inflation:.

This represents a situation where the basic factor at work is the increase in demand for resources either from the government or the entrepreneurs or the households. The result is that the pressure of demand is such that it cannot be met by the currently available supply of output. If, for example, in a situation of full employment, the government expenditure or private investment goes up this is bound to generate an inflationary pressure in the economy.

(ii) Cost Push Inflation:

In certain cases, prices may be pushed up by rise in wages or rise in profit margins. Often higher commodity taxes imposed by the government will raise the cost of production and therefore, raise the prices of goods and services. Thus, rise in wages, profit margins, and taxation all these are responsible for cost-push inflation.

(iii) Open or Suppressed Inflation:

A country might experience open or suppressed inflation. Open inflation refers to a situation where prices rise without any interruption. It is a situation where government does not make any attempt to stop rising prices. Suppressed inflation, on the other hand, is the one where government actively intervenes to check rising prices through price-ceiling, rationing or otherwise. Private holdings of cash and bank balances increase during the suppressed inflation. Prices will not rise in the controlled sector.

(iv) Money Inflation and Price Inflation:

Money inflation occurs in the initial stage. There is an expansion in the money supply during the initial stage leading to a sharp rise in the price level. Price inflation is the next stage when the rapid rise in demand leads to an enormous increase in the money supply. During this stage, the money supply fails to keep pace with the rate of increase of price level. Prices rise rapidly and the money supply lags behind in this stage of inflation.

(v) Wage Induced and Deficit Induced Inflation:

Inflation may also occur on account of the increase in money wages. Money wages have a tendency to increase whenever prices rise. Strong trade union may force employers to increase wages. This results in increased cost of production without any increase in output. This lead to further rise in price. Such type of price rise is called the wage induced inflation.

Deficit-induced inflation, on the other hand, occurs when the governments resort to deficit financing. Sometimes the government is not in a position to meet its expenditure by taxation i.e., its expenditure is more than income. The government then resorts to deficit financing. To finance deficit, government may increase the money supply by printing new currency notes. This results in rising prices. Wherever prices increase due to deficit financing, we call it deficit induced inflation.

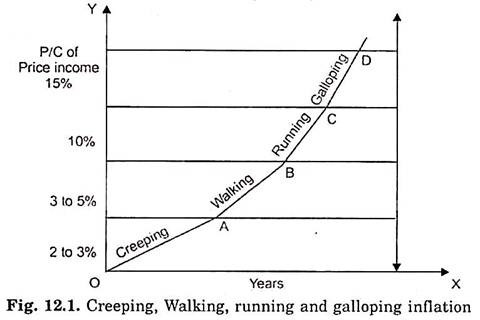

(vi) Creeping, Walking, Running and Galloping Inflation:

This classification is made on the basis of the extent to which prices rise. Creeping inflation is the mildest type of inflation. Prices rise very slowly. They increase by about 2 to 3% p.a. Such type of inflation is not at all dangerous to the economy. In fact, some economist Price income suggest that such type of inflation has 15% to be encouraged to make the economy dynamic.

But if the prices start rising 10% gradually at the rate of 3 to 5 per cent p.a., the situation is called the walking 3 to 5% inflation. If proper control is not exercised over this type of inflation, it 2 to 3% may turn into what is known as 0 Years running inflation. During running inflation, the rate of increase in the price level gets further accelerated. The price level under this type of inflation rises approximately by 10 per cent every year.

In case government fails to curb running inflation in time, it may easily develop into a galloping or hyperinflation. Hyperinflation is the most reverse type of inflation. Prices rise rapidly and perhaps there is no limit to which prices may rise. This type of inflation was experienced by India during the Janta Dal government regime (1989-91). At the time the rate of inflation was 17% approximately. The above classification of inflation into creeping, walking, running and galloping inflation can be better explained with the help of Fig. 12.1.

(vii) Comprehensive and Sporadic Inflation:

Inflation is also classified into comprehensive and sporadic inflation on the basis of coverage and scope. Comprehensive inflation is an economy-wide inflation. It occurs when the entire economy experiences inflationary pressures. Prices of all commodities rise in the economy. Price rise is not confined to any particular sector. It extends to every sector in the economy. It is normal inflationary phenomenon and refers to the rising prices of the general price level.

Sporadic inflation on the other hand is sectorial in nature. It refers to a situation wherein inflation is experienced by certain sector of the economy. It may occur on account of restricted supply of certain commodities due to certain specific reason like crop failure resulting in the price rise of food-grains or formation of a successful monopoly in the manufacturing sector causing price rise only in the manufacturing sector. Sporadic inflation is thus confined to only certain sectors in the economy.

Term Paper # 3. Nature, Features and Characteristic of Inflation :

Characteristics and features of inflation are as follows:

1. Inflation is an economic phenomenon. It is the result of economic forces.

2. Inflation is also a monetary phenomenon. Excess supply of money may cause inflation.

3. Cyclical movement is not inflation.

4. The hall mark of inflation is excess demand in relation to everything.

5. Inflation is a dynamic process which can be observed only over a long period of time.

6. It is always associated with an uninterrupted rise in prices.

7. Price rise is persistent and irreversible immediately. It is different from temporary price rise.

8. Pure inflation is a past full employment phenomenon.

Term Paper # 4. Causes of Inflation:

Inflation in an economy arises on account of number of factors. These factors relate mainly either to the demand or to the supply side. By demand we mean the demand of money income for goods and services and by supply we imply the available output for which the money income can be spent. Expectations also play an important role in causing inflationary pressures in the country.

Therefore, the factors that cause inflation may be divided into three groups:

(iii) Role of Expectation:

Inflation cannot be explained only in terms of excessive spending relative to available output. Expectations play an important role in the speed of inflation. Expectations regarding future movement of prices and wages result in the inflationary pressure in the economy. When prices are expected to increase, consumers will purchase more goods.

This will lead to an increase in the price level. Similarly, a rise in the expected income induces people to spend more. Expected wage increases also bring about inflation in the country. Expectations thus play a vital role in causing inflation in an economy.

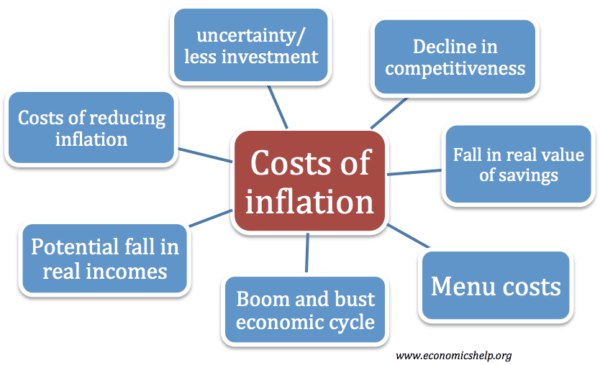

Term Paper # 5. Effects of Inflation :

Inflation indicates the rise in the price level and a fall in the value of money.

The effects of inflation can be broadly classified under following three categories:

(i) Political Effects of Inflation:

Inflation also leads to political upheavals. Political indiscipline grows and corrupt practices become common. Hitler became dictator of Germany only because of hyper-inflation during 1920s. Political revolutions are the outcome of inflationary rise in prices. Political and economic speculations are encouraged by inflation. Political stability is disturbed by inflation.

(ii) Economic Effects of Inflation:

Economic effects of inflation can be studied under following two heads:

(a) Effects on Distribution of Income:

Inflation redistributes income because prices of all factors do not rise in the same proportion. The effect of inflation on the incomes of different classes of earners is not uniform.

Following classes of people are affected by it:

1. Working Class:

Wages do not rise as fast as the prices rise during inflation. Naturally, workers tend to lose during the period of rising prices. The trade unions try to bargain with their employers for higher wages. Still the rise in wages is not corresponding to a rise in the prices. So, the workers are adversely affected during inflation. Salaried people have a more harsh effect of inflation than the wage-earners as they are not organised like the salaried people.

2. Consumers:

Inflation reduces the consumption of people. Rising price reduces private consumption by reducing the purchasing power in the hands of the people. The resources left unused can be secured by the government by printing new currency notes or raising the public debt. Thus, inflation can transfer the resources from the public to the government.

The reduced consumption of the public or increased savings is termed as the phenomenon of forced savings. Forced savings have been made use of by many countries for their economic development. However, consumers have to lead a low standard of living in the initial stages of development.

The effects of inflation have been nicely concluded by Kenneth K. Kurihara in the following manner:

“Inflation redistributed wealth and income in such a way as to hurt consumers, creditors, small investors and low and fixed income group, and benefits businessmen, debtors and farmers.”

3. Renteir Class:

People whose incomes are fixed (the rentier class) viz., pensioners, annuity holders, people living on past savings, etc., suffer the most during inflation. Inflation causes the real income of these people to fall due to rising prices. Falling real income reduces their standard of living. Inflation is thus harmful to the rentier class.

4. Debtors and Creditors:

Debtors as a group are benefitted during inflation whereas the creditors are put to loss. The debts are always fixed in terms of money in the modern economy. When a person borrows money before rise in the price level and repays later when prices have risen, he pays back the same amount of money but definitely having less purchasing power. Creditors are at a loss during inflation as they receive money having less purchasing power.

5. Farmers:

Farmers are benefitted during inflation because of two factors:

(a) The price of farm products increase; and

(b) Increase in the cost of production lags behind the rise in the prices.

Farmers who produce food-grains and other highly inflation-sensitive products are benefitted the most. Farmers in debts repayment repay their old debts along with the rate of interest as they get profits due to rising prices. They are further benefitted as debtors as they pay back lower purchasing power to the creditors. Inflation thus provides double advantages to the farmers.

6. Business Community:

The manufacturers, merchants and entrepreneurs stand to gain during inflation. The value of stocks held by the merchants increases during inflation. Business community sells commodities at better prices and earns high profits. Entrepreneurs earn huge profits as the rise in the price will be more than the rise in the cost of production. Producers try to increase the price in the cost of production instead of reducing their margin of profits. Inflation has favourable effect on the business community.

7. Investors:

Inflation is favourable to those who invest in equities, but is rather harsh to those who invest in fixed interest yielding bonds. Equity dividends increase during inflation due to increased corporate earnings and investors in equities are benefitted. Fixed interest yielding bonds bring the same income but less purchasing power.

Institutional investors safeguard their interest by diversifying their resources in profitable investments, but small and middle class investors lose much. In many countries small investors have experienced heavy losses because of the fall in the purchasing power of money. The fall in the value of money discourages saving and therefore, reduces the volume of funds available for investment in a free market economy.

(b) Effects on Production:

Keynes is of the opinion that a moderate rise in prices i.e., mild or creeping inflation has a favourable effect on production when there are utilised or underemployed resources in existence in an economy. Such a rise in prices creates optimism among the business community as they get more profits with increasing prices. They are induced to invest more and as a result employment, output and income will increase. The limit is set by the full employment level.

Once the full employment stage is reached in the economy, a further rise in the price will not stimulate production, employment and income due to physical limitations. So, till the level of full employment is reached, moderately rising prices are beneficial. The beneficial effects on production are possible only when inflation is moderate. A state of running or galloping inflation creates a lot of uncertainty which is harmful to production.

(iii) Social Effects of Inflation:

Inflation not only creates economic effects but also leads to certain social effects. It brings down the standards of business morality by encouraging a few rich persons. Black-marketing, anti-social activities dominate the society during inflationary rise in prices. Social peace is disturbed.

Frustration exists among poor people. It likely result in a social revolt. Social atmosphere gets totally spoiled as rich men try to exploit the situation and take undue advantage of inflation. Social stability is at stake. Unfair practices and social discontent become order of the day. Patriotic people are penalised.

Term Paper # 6. Control of Inflation :

Inflation is very complex phenomenon. There is no one sovereign remedy to combat it. On the other hand, measures have to be taken on several fronts, monetary and nonmonetary, to fight it. All these measures have one common aim. They aim at reducing aggregate monetary expenditure taking the available output as given.

Broadly speaking, the anti-inflationary measures can be classified as under:

(i) Monetary Measures:

According to some economists, inflation is a monetary phenomenon, i.e., it is caused by the monetary factors. These economists suggest that the control over the supply of money is the best measure to combat inflation.

The anti-inflationary monetary policy refers to the central banking operations of restricting credit. The Reserve Bank of India makes use of its weapons like the bank-rate policy, open market operations, variable reserve ratio and the selective credit controls to restrict credit. The monetary policy can successfully control inflation only when it is caused by the excess supply of money.

(ii) Fiscal Measures:

The two wings of fiscal policy are government revenues and government expenditure. The government’s fiscal policy can contribute to the control of inflation either expenditure, but decreasing government expenditure or combining both the elements. If private spending tends to excessive, the government can moderate the inflationary pressure by reducing its own reduction or postponement of government expenditure in modern times is not an easy task.

There may be projects already under construction and these obviously cannot be postponed. Similarly, other types of expenditure may be necessary to meet the normal requirements of the ‘collective consumption’ of the community-defence, police, justice etc. Then, there may be social expenditures on education, health etc., which are very difficult to cut because of undesirable political effects. Therefore, the major emphasis of fiscal policy in inflation has been a reducing private spending through increased taxation.

An increase in taxes tends to reduce private spending. If the rates of direct taxes on incomes and profits are raised, the private disposable income is reduced and this will tend to reduce private consumption spending. If the rates of commodity taxes are increased or fresh levies are made, the effect on consumption will be more immediate. An increase in the tax rates on a commodity will penalise spending directly by raising the cost of purchases.

Thus in period of inflation, the government should curb its own spending and increase the tax rates to reduce private spending. It is good thing to plan for a budget surplus during inflationary periods.

(iii) Other Measures:

There are also other physical measures to control inflation. For instance, government may try to increase output and thereby control inflation. In countries, like India where inflation is because of the shortage of agricultural commodities, it can be controlled by increasing the output of agricultural commodities.

Even in developed countries, by changing the techniques of production, the level of full employment output can itself be increased and be adjusted to the increased aggregate demand. There may be physical restraints on the increase in output and, therefore, we have to note the problems of technique, availability of factors of production in increasing output.

Inflation may also be due to the speculation activities, business expectations and hoardings. Under such circumstances, the government may try to restrict speculative activities to control inflation. In India, in order to protect the consumers from the evils of speculative activities, the government of India has given greater importance for the distribution of essential commodities through consumers’ co-operatives.

If the rise in the price confined only to some commodities the government may try to control their prices through price controls and rationing of the scare commodities. Rationing and price controls suffer from a severe limitation viz., coercion cannot be extensively made use of in a democratic country.

Lastly, if the inflation is due to the increase in cost (cost-push inflation), it can be controlled by wage freeze. The Government may try to put an end to the wage price spiral by freezing wages. This policy becomes effective if the trade unions do not object to the control over wages. Further, if the government wants to control wages, prices should not be allowed to rise, so that the standard of living of the consumers is not adversely affected.

Related Articles:

- Term Paper on Inflation | Money | Economics

- Term Paper on Deflation | Money | Economics

- Demand Pull Inflation and Cost Push Inflation | Money

- Cambridge Quantity Theory of Money | Term Paper | Theories | Economics

- Main navigation

- Main content

Center for Inflation Research

The Cleveland Fed is home to the Center for Inflation Research, a leading resource for “all things inflation.” Explore commentary, research, and analysis on inflationary trends from the Center, and find out about upcoming inflation-related events.

Our inflation resources

Inflation indicators and data, our center's latest news, our inflation research.

Economic Commentaries About Inflation

Economic Commentaries provide analysis of relevant economic issues and are written for an informed but nonspecialist audience. Browse the Economic Commentaries about inflation written by our economists.

Working Papers About Inflation

Working Papers are preliminary versions of technical papers containing results and discussions of current research. Written for eventual publication in professional economics journals. Browse the Working Papers about inflation written by our economists.

Our Inflation Resources

About the Center for Inflation Research

The Center for Inflation Research is guided by economists at the Federal Reserve Bank of Cleveland and an advisory council consisting of leading experts from the United States and abroad who provide external perspectives and input into the Center's projects and conferences.

Inflation 101

Here is your guide to understanding inflation. The Cleveland Fed's Center for Inflation Research provides inflation basics and explanations of inflation essentials for you to explore.

Conferences: Center for Inflation Research

Find information about our dedicated inflation conferences, papers presented at our past conferences, and our sponsorship of conference sessions.

Measures of Expected Inflation

We explain why expected inflation is important to consumers and the Federal Reserve and how it affects actual inflation. We explain the two basic approaches to measuring them, model-based and survey-based measures.

Consumer Price Data

We explain how measures of consumer prices are computed and what the differences are between the consumer price index (CPI) and the personal consumption expenditures (PCE) price index. We explain various measures used to gauge underlying inflation, or the long-term trend in prices, such as medians and other trimmed-mean measures and core measures of inflation.

Inflation Indicators and Data

The median CPI is a measure of inflation computed by the Federal Reserve Bank of Cleveland. It ranks the components of CPI inflation and picks the one in the middle. Its construction makes it less sensitive to short-lived price fluctuations, thereby better capturing the trend in prices. Released monthly.

Median PCE Inflation

Median PCE inflation is a measure of inflation computed by the Federal Reserve Bank of Cleveland. It ranks the components of PCE inflation and picks the one in the middle. Its construction makes it less sensitive to short-lived price fluctuations, thereby better capturing the trend in prices. Released monthly.

Inflation Nowcasting

The Federal Reserve Bank of Cleveland provides daily “nowcasts” of inflation for two popular price indexes, the price index for personal consumption expenditures (PCE) and the Consumer Price Index (CPI). These nowcasts give a sense of where inflation is today. Released each business day.

Inflation Expectations

We report average expected inflation rates over the next one through 30 years. Our estimates of expected inflation rates are calculated using a Federal Reserve Bank of Cleveland model that combines financial data and survey-based measures. Released monthly.

Survey of Firms' Inflation Expectations

The Survey of Firms’ Inflation Expectations (SoFIE) is a large quarterly representative panel of firms in the manufacturing and services sectors that was created to measure inflation expectations of chief executive officers (CEOs) in the United States. Released quarterly.

Inflation Charting

Examine and compare the behavior of various measures of total inflation and underlying inflation.

Center updates, direct to your inbox

Register to receive the Center for Inflation Research newsletter and other notifications by email. (Rest assured, we won’t share your information, and you can unsubscribe at any time.)

Read the most recent issue.

Learn more about our center

Lowering inflation: the who, what, and how.

CfIR leaders and experts from other Banks discuss how the Federal Reserve works to control inflation

https://youtu.be/qVgW2ozAKz8

Watch our leaders discuss what motivated the launch of our Center and the data and indicators available on this website.

Economic essays on inflation

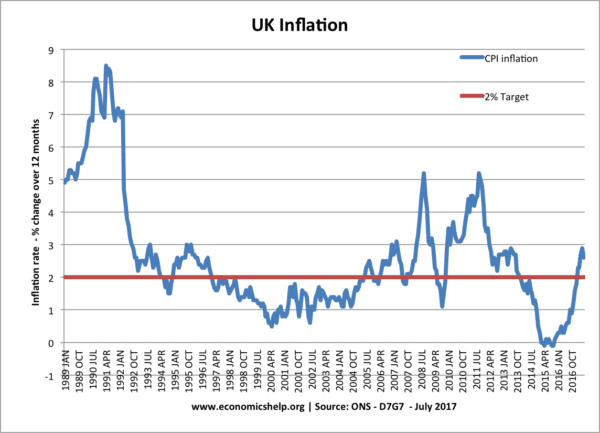

- Definition – Inflation – Inflation is a sustained rise in the cost of living and average price level.

- Causes Inflation – Inflation is caused by excess demand in the economy, a rise in costs of production, rapid growth in the money supply.

- Costs of Inflation – Inflation causes decline in value of savings, uncertainty, confusion and can lead to lower investment.

- Problems measuring inflation – why it can be hard to measure inflation with changing goods.

- Different types of inflation – cost-push inflation, demand-pull inflation, wage-price spiral,

- How to solve inflation . Policies to reduce inflation, including monetary policy, fiscal policy and supply-side policies.

- Trade off between inflation and unemployment . Is there a trade-off between the two, as Phillips Curve suggests?

- The relationship between inflation and the exchange rate – Why high inflation can lead to a depreciation in the exchange rate.

- What should the inflation target be? – Why do government typically target inflation of 2%

- Deflation – why falling prices can lead to negative economic growth.

- Monetarist Theory – Monetarist theory of inflation emphasises the role of the money supply.

- Criticisms of Monetarism – A look at whether the monetarist theory holds up to real-world scenarios.

- Money Supply – What the money supply is.

- Can we have economic growth without inflation?

- Predicting inflation

- Link between inflation and interest rates

- Should low inflation be the primary macroeconomic objective?

See also notes on Unemployment

Home — Essay Samples — Economics — Political Economy — Inflation

Essays on Inflation

Inflation essay topics and outline examples, essay title 1: understanding inflation: causes, effects, and economic policy responses.

Thesis Statement: This essay provides a comprehensive analysis of inflation, exploring its root causes, the economic and societal effects it generates, and the various policy measures employed by governments and central banks to manage and mitigate inflationary pressures.

- Introduction

- Defining Inflation: Concept and Measurement

- Causes of Inflation: Demand-Pull, Cost-Push, and Monetary Factors

- Effects of Inflation on Individuals, Businesses, and the Economy

- Inflationary Policies: Central Bank Actions and Government Interventions

- Case Studies: Historical Inflationary Periods and Their Consequences

- Challenges in Inflation Management: Balancing Growth and Price Stability

Essay Title 2: Inflation and Its Impact on Consumer Purchasing Power: A Closer Look at the Cost of Living

Thesis Statement: This essay focuses on the effects of inflation on consumer purchasing power, analyzing how rising prices affect the cost of living, household budgets, and the strategies individuals employ to cope with inflation-induced challenges.

- Inflation's Impact on Prices: Understanding the Cost of Living Index

- Consumer Behavior and Inflation: Adjustments in Spending Patterns

- Income Inequality and Inflation: Examining Disparities in Financial Resilience

- Financial Planning Strategies: Savings, Investments, and Inflation Hedges

- Government Interventions: Indexation, Wage Controls, and Social Programs

- The Global Perspective: Inflation in Different Economies and Regions

Essay Title 3: Hyperinflation and Economic Crises: Case Studies and Lessons from History

Thesis Statement: This essay explores hyperinflation as an extreme form of inflation, examines historical case studies of hyperinflationary crises, and draws lessons on the devastating economic and social consequences that result from unchecked inflationary pressures.

- Defining Hyperinflation: Thresholds and Characteristics

- Case Study 1: Weimar Republic (Germany) and the Hyperinflation of 1923

- Case Study 2: Zimbabwe's Hyperinflationary Collapse in the Late 2000s

- Impact on Society: Currency Devaluation, Poverty, and Social Unrest

- Responses and Recovery: Stabilizing Currencies and Rebuilding Economies

- Preventative Measures: Policies to Avoid Hyperinflationary Crises

Report on Inflation and Its Causes

The rise of inflation rate in the us, made-to-order essay as fast as you need it.

Each essay is customized to cater to your unique preferences

+ experts online

Iflation and Its Causes

Methods to control inflation, the grade inflation, inflation: a deceitful solution to debt, let us write you an essay from scratch.

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

How to Control Inflation in Pakistan

Main factors of inflation in singapore, effects of inflation on commercial banks’ lending: a case of kenya commercial bank limited, food inflation in the republic of india, get a personalized essay in under 3 hours.

Expert-written essays crafted with your exact needs in mind

The Issue of Unemployment and Inflation in Colombia

The theory and policy of macroeconomics on inflation rate, socio-economic conditions in 'what is poverty' by jo goodwin parker, non-accelerating inflation rate of unemployment (nairu), targeting zero inflation and increase of government spending as a way of curbing recession, howa spiraling inflation has impacted the venezuelan economy, how venezuela has been affected by inflation, effects of inflation on kenya commercial banks lending, exploring theories of inflation in economics, about fuel prices: factors, impacts, and solutions, analyzing the inflation reduction act, the oscillating tides of the american economy, exploring the implications of the inflation reduction act, inflation reduction act in the frame of macroeconomic challenges, the impact of inflation reduction act on the international economic stage, relevant topics.

- Unemployment

- Penny Debate

- American Dream

- Real Estate

- Supply and Demand

- Minimum Wage

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

The Long-term Effects of Inflation on Inflation Expectations

We study the long-term effects of inflation surges on inflation expectations. German households living in areas with higher local inflation during the hyperinflation of the 1920s expect higher inflation today, after partialling out determinants of historical inflation and current inflation expectations . Our evidence points towards transmission of inflation experiences from parents to children and through collective memory. Differential historical inflation also modulates the updating of expectations to current inflation, the response to economic policies affecting inflation, and financial decisions. We obtain similar results for Polish households residing in formerly German areas. Overall, our findings are consistent with inflationary shocks having a long-lasting impact on attitudes towards inflation.

Financial support from the Swiss National Science Foundation (grant number 207668) and the sponsors association of the Swiss Institute of Banking and Finance of the University of St. Gallen is gratefully acknowledged. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research.

MARC RIS BibTeΧ

Download Citation Data

Working Groups

Mentioned in the news, more from nber.

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

122 Inflation Essay Topic Ideas & Examples

🏆 best inflation topic ideas & essay examples, 👍 good essay topics on inflation, ⭐ simple & easy inflation essay titles, 💡 interesting topics to write about inflation.

- Increasing Inflation Impact on Individuals In simpler terms, inflation is the rise in the cost of living due to an exaggerated increase in commodity prices. This is because the rate of savings will be lower than the inflation resulting in […]

- Inflation and Unemployment in the United States In the 21st century, there are so many issues in the economy of the United States. This is increasing the demand for skilled workers by the day as opposed to the unskilled.

- The Current Impact of Inflation and Unemployment on Germany’s Political/Economic System It is notable to recognize the fact that the rate of savings in the nation is quite high causing a dip in the rate of inflation.

- The Price Deviations and Inflation Rates As seen from the table, the price deviations and inflation rates vary significantly depending on the item, season, and any global events that affect the economy.

- The Economic Disparity and Inflation It is essential to emphasize that the economic consequences of the pandemic are severe and are due in the main to inflation.

- US Economy: Navigating Debt, Inflation, and Recession Risks Today, the US is the world’s largest debtor and also the largest economy, market, and investor. Household debt can become a severe problem for the economy if exceeds their dead and accumulated wealth.

- Unemployment Rate: Impact on GDP and Inflation In such a way, the scenario shows it is vital to preserve the balance and avoid decisions focusing on only one aspect of the economy.

- The Inflation Dynamics in the Canadian Context According to the report, the economy only functions well when inflation is stable and predictable and is in an unhealthy state otherwise.inflation has been stable in the country over the last 25 years because of […]

- “Expected and Realized Inflation…” by Binder & Kamdar At the same time, the key focus of adaptive expectations is on the past rates of realized inflation and the factors that caused it.

- Inflation at the International Monetary Fund Anchoring inflation expectations, which is a condition in which inflation is regarded near the Central Bank target and typically matches what consumers anticipate, is one of the other possible measures. The pandemic appears to be […]

- How the Federal Reserve Controls Inflation According to the author of the article, the crisis became the impetus for developing new strategies for controlling the level of inflation.

- Fiscal Policy and Inflation in Canada According to the report, in order to protect the country from the long-lasting consequences of the COVID-19 pandemic and the recently emerged effects of the Russian-Ukraine war, Canadian policy-makers implemented fiscal policies, but their efficacy […]

- Walmart Has Been Negatively Impacted by Inflation The employment issues caused by the pandemic and increased prices for goods handling forced the company to consider the option of automation for business processes.

- “Inflation Hits the Fastest Pace Since 1981, at 8.5% Through March” by Koeze Further on, the predictions reveal that the inflation rate is expected to stabilize due to a decrease in the price of used cars and apparel.

- Inflation Rates and the Value of the Dollar Projected Social Security benefits at the retirement age of 65 years are 48,580 The current age is 25 years Retirement age is 65 years =40 years The annual inflation rate is at 3% Utilizing the […]

- Inflation and High-Interest Rates When a company borrows in a country with higher interest rates, the risk of inflation and currency depreciation grows, but the debt of this company is the same.

- Inflation’s Impact on Fixed Income By taking a diversified approach to fixed income investing, investors can better manage the risks associated with interest rates as well as inflation and increase the yield in their bond portfolios.

- How Economic Crises Affect Inflation Beliefs A feature of the article is the study by the authors of the consequences of inflationary crises and comparison with pre-existing crises to calculate the level of the crisis as a whole.

- Inflation: What Is It and Inflation in the USA Inflation is an increase in the general price level of goods, works, and services of the country’s population and businesses or an extended period. This kind of inflation is considered the best because it occurs […]

- Inflation Crisis in China for Financial Managers As a financial manager running my company, the rise in prices of commodities will decrease the purchasing power of the foreign currency used by investors and potential customers across the globe.

- Unemployment and Inflation Relation However, the level of unemployment and its prevailing types can differ significantly depending on the state of the economies of countries and the policies they use to combat unemployment.

- Unanticipated and Participated Inflation The first inflation outcome refers to income recipients hurt by inflation as there is a forcible price level increase that does not coincide with their income increase proportionally.

- Interest Rate and Inflation Impact on Exchange Rate The second observation point to be made pertains to the differences in the exchange rate of NZDUSD among the two viable.

- Inflation and Deflation Effects on the US and Saudi Stock Markets Inflation is traditionally defined as a consistent rise in the price rates within a specific industry or in the entire economy of the state, which is triggered by a rapid increase in demand: “Inflation is […]

- Treasury Inflation-Protected Security Refers This ensures that the real rate of interest is determined beforehand, and it adjusts automatically to the increase in the inflation rate.

- Significance of Inflation to Corporate Finance The argument goes on that with elevated inflation rates, there is always a chance to cut down on interest rates as compared to instances when the inflation rates are low and interest rates need to […]

- UAE and GCC Economic Analysis: Inflation and Unemployment This is explained by the fact that UAE is less dependent on oil trade, hence, the inflation and unemployment rate in the UAE is lower in comparison with the countries of GCC.

- Government Spending Stimulation in the Fight Against Inflation The equilibrium point is a point where the value of is money adjusted thereby creating an equilibrium in the quantity of money supplied and that of the quantity of money demanded.

- How the Inflation Gauge Was Faulty in the Past In other words, the goal of the CPI, when prices change, is to measure the percentage change if the spending by the consumers to be as well off as they were before.

- Inflation in the US Business Industry Inflation can be measured in the following ways; Monetary inflation; caused by increase in the increase in the amount of money in circulation in an economy.

- How Should Monetary Authorities React to Higher Inflation Therefore, the best alternative for monetary authorities to react to higher inflation is to reduce its regulatory influence in private enterprises and banks and limit the amount of money supply in the country. Therefore, the […]

- Gasoline Prices, Rates of Unemployment, Inflation, and Economic Growth The data which has been queried from the database are related to gasoline prices in California, the unemployment rate in the US, the inflation rate in the US, and Real GDP.

- Federal Reserve System: Inflation The article ‘Inflation and the Federal Reserve’ by Richard Cook; this source can be used to describe the central threat of inflation and identify the principal steps to be developed by central banks, government, and […]

- The US and the Philippines: Unemployment and Inflation In cyclical terms, this rising inflation is actually the product and not the cause of these record-high oil prices and the idea that the U.S.had failed to think of the above-discussed alternatives to the energy […]

- Interest Rate and Inflation in Netherlands As interest rate rises, demand for debt falls as cost of capital will increase and growth rate declined. As, more funds is shifting to Market B, central bank may raise the bank rate to stabilise […]

- Monetary Policy in an Economy: Inflation Inflation can be defined as a persistent rise in the general level of prices or alternatively, a persistent fall in the value of money.

- Dollarization the Main Tool to Reduce Inflation In general, wouldollarization’ means the substitution of hard currency for the domestic currency as the medium of exchange, and above all as the store of value, in a large part of the domestic economy, so […]

- Inflation Targeting in Emerging Countries Inflation Targeting is the public announcement of numerical targets for inflation for the year. Some emerging market countries that engage in inflation targeting have gone too far in the limitation of exchange rate flexibility, with […]

- Future Inflation and Growth Figures The increase in real GDP in the first half of 2007 was the same as that in the second half of 2006: at an annual rate of 2.25%.

- “Inflation Rise Hits US Consumers” BBC Article The main focus of the article’s concern is the inflation rise that US economics experiences now and the impact it has on US consumer spending.

- Inflation Dynamics: Mistakes in the Forecaster’s Behavior In this case, the authors of the article pay attention to the evaluation of the Phillips curve and understanding its advantages and drawbacks.

- Inflation Effect on Japan’s and Mexico’s Economies Thus, the study aimed to establish the influence of inflation and FDI on the GDP of a developed country, developing country, and the world.

- Inflation and Deflation and Their Outcomes That is the money in the hands of the consumers is more causing an increase in the aggregate demand. On the other side, the lender of the money loses some value of the money given […]

- Saudi Arabia and Inflation: Past, Present, Future What is the role of the Saudi Central Bank about inflation? What is the historical inflation trend in Saudi?

- Inflation Expectations: Households and Forecasters The New Keynesian formula that the authors of the paper were trying to create, in its turn was supposed to provide justification for the lack of forecast efficacy in determining the changes in inflation rates, […]

- Inflation Targeting in Emerging Economies Debates supporting the concept of inflation targeting are premised on the idea that recession remains as a greater challenge relative to the state of high inflation. The basis of inflation targeting is always to monitor […]

- The Federal Reserve and the Inflation Problem Louis in 2005, it was noted that the economic hero of the inflationary decades was the then chairman of the Fed, Paul Volcker.

- Asset Bubbles and Policy Response: A Historical View In the 1990s and the early years of the 21st century, the federal reserve policy makers opted to adopt the mop-up-after strategy-policy of letting the bubbles burst and then mopping up there after.

- Inflation Tradeoffs and the Phillips Curve In the findings, Lucas concluded that the there is a direct relationship and variance in the tradeoff between full employment and inflation rate at a particular level of input in the countries studied.

- Unemployment and Inflation Issues In most cases, if one is suffering structural unemployment, it is as a result of improvement in a certain area, or a change in the way things are done.

- Fluctuations in Inflation and Employment Debate surrounded what is termed the multiplier effect: are they higher for tax cuts or government spending, the differences in multiplier effect from different tax cuts, Incentive impact from tax cuts.

- Inflation in the 1970s In such a case, the reduced injections into the circular flow of the economy trim down the demand, which reduces inflation, and the general growth of the economy reduces significantly.

- Inflation Causes: Structuralism and Monetarism One of the features of this kind of inflation is a rapid rise in the price level with the currency loosing its value.

- The Relationship Between Money Supply and Inflation It is evidenced that changing the money supply through the central banks leads to a control of the inflationary situations in the same economy.

- The Effects of Inflation Targeting In theory inflation targeting is straightforward: the impending rate of inflation is predicted by the central bank, later on it is juxtaposed with the target rates which the government considers as appropriate for the economy […]

- The Euro Zone’s Rising Inflation and Unemployment Rate However, the euro zone found itself in a predicament from late 2009 after the economic downturns that faced some countries in the euro zone.

- Inflation Tax – Printing More Money to Cover the War Expenses The subsequent encroachment of inflation diminishes the value of money hence even if people had more money, the value of their cash was meaningless, a phenomenon similar to tax collection, which reduces the total amount […]

- Economic Condition of Singapore: Inflation Hits 5.2% in March Some of the effects of high inflation rate that has been felt in the economy are the increase of the housing prices, and cost of fuel increased by approximately 5%, thereby increasing the cost of […]

- Inflation Is Here to Stay, as Prices Will Always Go Up Monetary policy refers to the actions pursued by the central bank of a country to regulate the amount of money supply in the economy.

- Inflation in the United Kingdom According to the Bank of England, inflation occurs when the demand exceeds the ability by the economy’s capacity to produce goods and services.

- Effect of a Permanent Increase in Oil Price on Inflation and Output During the same year, the alterations in the price of oil were activated by a change in the supply of the same commodity in the market place.

- Consumer Price Index: Measuring Inflation In this case, the volumes of money being circulated exceeds the supply of goods and services in the same market thus leading to an upward adjustment of prices in order to absorb the extra monies […]

- The Cause of China’s Inflation The supply is affected by the increase of prices of food in the global market, whereby, the Chinese government finds it difficult to satisfy the food demand of the increasing population of the Chinese population.

- China’s Economic Growth and Inflation On the road to becoming the second largest economy, China has experienced growth rates of about 10% in the last 30 years making it to top the list of the fastest growing economies.

- Evaluate Government Policies to Reduce the Rate of Inflation The rate of inflation is the adjustment in the index of price in a single year to a new one expressed in percentages.

- Problem of China’s Inflation With the increase in oil prices, energy costs have increased, and this has resulted into an increase in the prices of products manufactured in the industries. In 2009 the government made a policy to increase […]

- Inflation in Saudi Arabia This paper, using the quarterly data from 1980 to 2010, examines the causes behind the inflation in Saudi, its effects, and the effectiveness of the counter-strategies and policies the Saudi government has put in place […]

- Inflation Rates in Sweden The recession of the early 1990s was largely responsible for the drop in inflation rates. As per the theoretical model of money supply and inflation, increases in money supply will lead to inflationary pressures.

- China Currency Policy and Inflation The sphere of inflation in China relates to the consumer price index which has recorded a rising orientation in the near past.

- Current News of Economics: The Global Inflation Inflation has affected the total demand for goods and services in the economy, thus exceeding the supply. This means that you would have to pay more for the same amount of goods and services you […]

- Analysis of Unemployment and Inflation in the United States This was at the height of the recession that continues to grapple the country with major negative implications in the economy.

- GDP, Unemployment, Inflation, and Economic Growth

- Absolute and Relative Anti-Inflation Reputation: Evidence From the Bond Markets

- World Inflation and Monetary Accommodation in Eight Countries

- Can Demography Improve Inflation Forecasts? The Case of Sweden

- Accounting for Post-Crisis Inflation and Employment: A Retro Analysis

- Unravelling India’s Inflation and Policy Puzzles

- Inflation and Financial Market Performance: What Have We Learned in the Past Ten Years?

- Administered Inflation and Business Pricing: Another Look

- The Historical Relationship Between Inflation and Political Rebellion: What It Might Teach Us About Neoliberalism

- America’s Only Peacetime Inflation: The 1970s

- Sectoral Inflation and the Phillips Curve: What Has Changed Since the Great Recession?

- Analyzing the Relationship Between Inflation Rate and Per Capita GDP Growth

- Banks, Lies, and Bricks: The Determinants of Home Value Inflation in Spain During the Housing Boom

- Capacity Utilization and Unemployment Rates: Are They Complements or Substitutes?

- Fast vs. Gradual Policies to Control Inflation

- Bond Market Inflation Expectations in Industrial Countries: Historical Comparisons

- Inflation and Monetary Velocity in Latin America

- What Drives the Relationship Between Inflation and Price Dispersion: Market Power vs. Price Rigidity

- How Much Did Speculation Contribute to the Recent Food Price Inflation?

- MAPI: Model for Analysis and Projection of Inflation in France

- Budget Deficit, Inflation, and Debt Sustainability: Evidence From Turkey

- Monetarism: Printing Money to Curb Inflation

- Capacity Constraints, Inflation, and the Transmission Mechanism: Forward-Looking vs. Myopic Policy Rules

- When Did Inflation Expectations in the Euro Area De-Anchor?

- Capturing the Link Between M3 Growth and Inflation in the Euro Zone

- Implementing Monetary Cooperation Through Inflation Targeting

- German Great Inflation: Summary & Analysis

- The Maastricht Inflation Criterion: On the Effect of the European Union Expansion

- What Unemployment Rates Tell Us About the Future Inflation

- Applying Foreign Exchange Interventions as an Additional Instrument Under Inflation Targeting: The Case of Ukraine

- China’s Economic Slowdown and International Inflation Dynamics

- The Impact of Inflation Targeting on the Real Economy of Developing and Emerging Countries

- Effects of Inflation on Business: The Good and the Bad

- U.S. Inflation Dynamics: What Drives Them Over Different Frequencies

- Structural Inflation and the 1994 ‘Monetary’ Crisis in China

- Macroeconomic Aggregate Model for Analysis of Inflation and Stabilization of the Russian Economy

- Cyclical vs. Acyclical Inflation: A Deeper Dive

- The Inflation-Output Nexus: Empirical Evidence From India, Brazil, and South Africa

- Forecasting Inflation Using Constant Gain Least Squares

- Stopping Hyperinflation: Lessons From the German Inflation Experience of the 1920s

- Modeling and Forecasting Inflation in Japan

- Globalization and Inflation Dynamics: The Impact of Increased Competition

- The Relationship Between Inflation and Economic Growth: A Multi-Country Empirical Analysis

- How Does Monetary Policy Influence Inflation and Employment?

- Assessing the Gap Between Observed and Perceived Inflation in the Euro Area

- Unanticipated Inflation, Devaluation, and Output in Latin America

- Inflation and Economic Growth Nexus in BRICS: Evidence From ARDL Bound Testing Approach

- Bootstrapping Covariate Unit Root Tests: An Application to Inflation Rates

- Fiscal Dominance and Inflation Targeting: Lessons From Brazil

- Inflation and the Gig Economy: E-Tailing and Self-Employment Rise in Disrupting the Phillips Curve

- Budget Ideas

- Accountancy Titles

- Cash Flow Paper Topics

- Monopolistic Competition Essay Titles

- Private Equity Research Ideas

- Auditing Paper Topics

- Economic Crisis Essay Titles

- Intangible Assets Essay Topics

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2024, February 25). 122 Inflation Essay Topic Ideas & Examples. https://ivypanda.com/essays/topic/inflation-essay-topics/

"122 Inflation Essay Topic Ideas & Examples." IvyPanda , 25 Feb. 2024, ivypanda.com/essays/topic/inflation-essay-topics/.

IvyPanda . (2024) '122 Inflation Essay Topic Ideas & Examples'. 25 February.

IvyPanda . 2024. "122 Inflation Essay Topic Ideas & Examples." February 25, 2024. https://ivypanda.com/essays/topic/inflation-essay-topics/.

1. IvyPanda . "122 Inflation Essay Topic Ideas & Examples." February 25, 2024. https://ivypanda.com/essays/topic/inflation-essay-topics/.

Bibliography

IvyPanda . "122 Inflation Essay Topic Ideas & Examples." February 25, 2024. https://ivypanda.com/essays/topic/inflation-essay-topics/.

The Great Inflation

![term paper on inflation Close-up of a "Whip Inflation Now" [WIN] button, President Ford's symbol of the fight against inflation.](https://www.federalreservehistory.org/-/media/images/essays/great-inflation/great_inflation_1_720x450.jpg)

The Great Inflation was the defining macroeconomic event of the second half of the twentieth century. Over the nearly two decades it lasted, the global monetary system established during World War II was abandoned, there were four economic recessions, two severe energy shortages, and the unprecedented peacetime implementation of wage and price controls. It was, according to one prominent economist, “the greatest failure of American macroeconomic policy in the postwar period” (Siegel 1994).

But that failure also brought a transformative change in macroeconomic theory and, ultimately, the rules that today guide the monetary policies of the Federal Reserve and other central banks around the world. If the Great Inflation was a consequence of a great failure of American macroeconomic policy, its conquest should be counted as a triumph.

Forensics of the Great Inflation

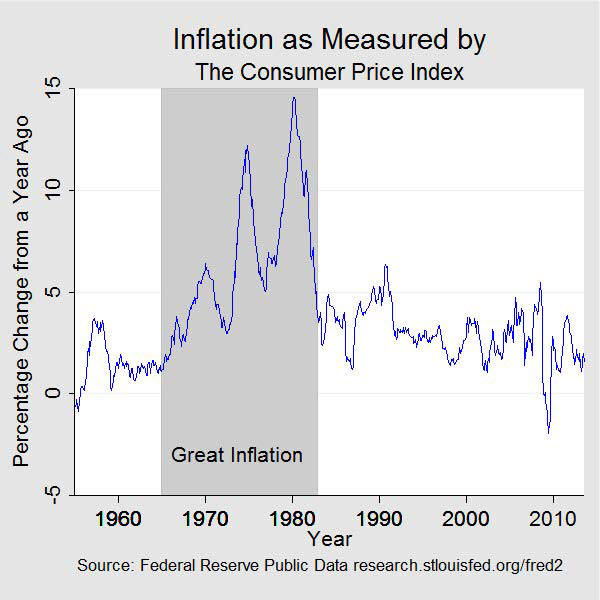

In 1964, inflation measured a little more than 1 percent per year. It had been in this vicinity over the preceding six years. Inflation began ratcheting upward in the mid-1960s and reached more than 14 percent in 1980. It eventually declined to average only 3.5 percent in the latter half of the 1980s.

While economists debate the relative importance of the factors that motivated and perpetuated inflation for more than a decade, there is little debate about its source. The origins of the Great Inflation were policies that allowed for an excessive growth in the supply of money—Federal Reserve policies.

To understand this episode of especially bad policy, and monetary policy in particular, it will be useful to tell the story in three distinct but related parts. This is a forensic investigation of sorts, examining the motive, means, and opportunity for the Great Inflation to occur.

The Motive: The Phillips Curve and the Pursuit of Full Employment

The first part of the story, the motive underlying the Great Inflation, dates back to the immediate aftermath of the Great Depression , an earlier and equally transformative period for macroeconomic theory and policy. At the conclusion of World War II, Congress turned its attention to policies it hoped would promote greater economic stability. Most notable among the laws that emerged was the Employment Act of 1946 . Among other things, the act declared it a responsibility of the federal government “to promote maximum employment, production, and purchasing power” and provided for greater coordination between fiscal and monetary policies. 1 This act is the seminal basis for the Federal Reserve’s current dual mandate to “maintain long run growth of the monetary and credit aggregates…so as to promote effectively the goals of maximum employment, stable prices and moderate long-term interest rates” (Steelman 2011).

The orthodoxy guiding policy in the post-WWII era was Keynesian stabilization policy, motivated in large part by the painful memory of the unprecedented high unemployment in the United States and around the world during the 1930s. The focal point of these policies was the management of aggregate spending (demand) by way of the spending and taxation policies of the fiscal authority and the monetary policies of the central bank. The idea that monetary policy can and should be used to manage aggregate spending and stabilize economic activity is still a generally accepted tenet that guides the policies of the Federal Reserve and other central banks today. But one critical and erroneous assumption to the implementation of stabilization policy of the 1960s and 1970s was that there existed a stable, exploitable relationship between unemployment and inflation. Specifically, it was generally believed that permanently lower rates of unemployment could be “bought” with modestly higher rates of inflation.

The idea that the “Phillips curve” represented a longer-term trade-off between unemployment, which was very damaging to economic well-being, and inflation, which was sometimes thought of as more of an inconvenience, was an attractive assumption for policymakers who hoped to forcefully pursue the dictates of the Employment Act. 2 But the stability of the Phillips curve was a fateful assumption, one that economists Edmund Phelps (1967) and Milton Friedman (1968) warned against. Said Phelps “[I]f the statical ‘optimum’ is chosen, it is reasonable to suppose that the participants in product and labour markets will learn to expect inflation…and that, as a consequence of their rational, anticipatory behaviour, the Phillips Curve will gradually shift upward...” (Phelps 1967; Friedman 1968). In other words, the trade-off between lower unemployment and more inflation that policymakers may have wanted to pursue would likely be a false bargain, requiring ever higher inflation to maintain .

The Means: The Collapse of Bretton Woods

Chasing the Phillips curve in pursuit of lower unemployment could not have occurred if the policies of the Federal Reserve were well-anchored. And in the 1960s, the US dollar was anchored—albeit very tenuously—to gold through the Bretton Woods agreement. So the story of the Great Inflation is in part also about the collapse of the Bretton Woods system and the separation of the US dollar from its last link to gold.

During World War II , the world’s industrial nations agreed to a global monetary system that they hoped would bring greater economic stability and peace by promoting global trade. That system, hashed out by forty-four nations in Bretton Woods, New Hampshire, during July 1944, provided for a fixed rate of exchange between the currencies of the world and the US dollar, and the US dollar was linked to gold. 3

But the Bretton Woods system had a number of flaws in its implementation, chief among them the attempt to maintain fixed parity between global currencies that was incompatible with their domestic economic goals. Many nations, it turned out, were pursing monetary policies that promised to march up the Phillips curve for a more favorable unemployment-inflation nexus.

As the world’s reserve currency, the US dollar had an additional problem. As global trade grew, so too did the demand for U.S. dollar reserves. For a time, the demand for US dollars was satisfied by an increasing balance of payments shortfall, and foreign central banks accumulated more and more dollar reserves. Eventually, the supply of dollar reserves held abroad exceeded the US stock of gold, implying that the United States could not maintain complete convertibility at the existing price of gold—a fact that would not go unnoticed by foreign governments and currency speculators.

As inflation drifted higher during the latter half of the 1960s, US dollars were increasingly converted to gold, and in the summer of 1971, President Nixon halted the exchange of dollars for gold by foreign central banks . Over the next two years, there was an attempt to salvage the global monetary system through the short-lived Smithsonian Agreement , but the new arrangement fared no better than Bretton Woods and it quickly broke down. The postwar global monetary system was finished.

With the last link to gold severed, most of the world’s currencies, including the US dollar, were now completely unanchored. Except during periods of global crisis, this was the first time in history that most of the monies of the industrialized world were on an irredeemable paper money standard.

The Opportunity: Fiscal Imbalances, Energy Shortages, and Bad Data

The late 1960s and the early 1970s were a turbulent time for the US economy. President Johnson’s Great Society legislation brought about major spending programs across a broad array of social initiatives at a time when the US fiscal situation was already being strained by the Vietnam War. These growing fiscal imbalances complicated monetary policy.

In order to avoid monetary policy actions that might interfere with the funding plans of the Treasury, the Federal Reserve followed a practice of conducting “even-keel” policies. In practical terms, this meant the central bank would not implement a change in policy and would hold interest rates steady during the period between the announcement of a Treasury issue and its sale to the market. Under ordinary conditions, Treasury issues were infrequent and the Fed’s even-keel policies didn’t significantly interfere with the implementation of monetary policy. But as debt issues became more prevalent, the Federal Reserve’s adherence to the even-keel principle increasingly constrained the conduct of monetary policy (Meltzer 2005).

A more disruptive force was the repeated energy crises that increased oil costs and sapped U.S. growth. The first crisis was an Arab oil embargo that began in October 1973 and lasted about five months. During this period, crude oil prices quadrupled to a plateau that held until the Iranian revolution brought a second energy crisis in 1979 . The second crisis tripled the cost of oil.

In the 1970s, economists and policymakers began to commonly categorize the rise in aggregate prices as different inflation types. “Demand-pull” inflation was the direct influence of macroeconomic policy, and monetary policy in particular. It resulted from policies that produced a level of spending in excess of what the economy could produce without pushing the economy beyond its ordinary productive capacity and pulling more expensive resources into play. But inflation could also be pushed higher from supply disruptions, notably originating in food and energy markets (Gordon 1975). 4 This “cost-push” inflation also got passed through the chain of production into higher retail prices.

From the perspective of the central bank, the inflation being caused by the rising price of oil was largely beyond the control of monetary policy. But the rise in unemployment that was occurring in response to the jump in oil prices was not.

Motivated by a mandate to create full employment with little or no anchor for the management of reserves, the Federal Reserve accommodated large and rising fiscal imbalances and leaned against the headwinds produced by energy costs. These policies accelerated the expansion of the money supply and raised overall prices without reducing unemployment.

Bad data (or at least a bad understanding of the data) also handicapped policymakers. Looking back at the information policymakers had in hand during the period leading up to and during the Great Inflation, economist Athanasios Orphanides has shown that the real-time estimate of potential output was significantly overstated, and the estimate of the rate of unemployment consistent with full employment was significantly understated. In other words, policymakers were also likely underestimating the inflationary effects of their policies. In fact, the policy path they were on simply wasn’t feasible without accelerating inflation (Orphanides 1997; Orphanides 2002).

And to make matters worse yet, the Phillips curve, the stability of which was an important guide to the policy decisions of the Federal Reserve, began to move.

From High Inflation to Inflation Targeting—The Conquest of US Inflation

Phelps and Friedman were right. The stable trade-off between inflation and unemployment proved unstable. The ability of policymakers to control any “real” variable was ephemeral. This truth included the rate of unemployment, which oscillated around its “natural” rate. The trade-off that policymakers hoped to exploit did not exist.

As businesses and households came to appreciate, indeed anticipate, rising prices, any trade-off between inflation and unemployment became a less favorable exchange until, in time, both inflation and unemployment became unacceptably high. This, then, became the era of “stagflation.” In 1964, when this story began, inflation was 1 percent and unemployment was 5 percent. Ten years later, inflation would be over 12 percent and unemployment was above 7 percent. By the summer of 1980, inflation was near 14.5 percent, and unemployment was over 7.5 percent.

Federal Reserve officials were not blind to the inflation that was occurring and were well aware of the dual mandate that required monetary policy to be calibrated so that it delivered full employment and price stability. Indeed, the Employment Act of 1946 was re-codified in 1978 by the Full Employment and Balanced Growth Act , more commonly known as the Humphrey-Hawkins Act after the bill’s authors. Humphrey-Hawkins explicitly charged the Federal Reserve to pursue full employment and price stability, required that the central bank establish targets for the growth of various monetary aggregates, and provide a semiannual Monetary Policy Report to Congress. 5 Nevertheless, the employment half of the mandate appears to have had the upper hand when full employment and inflation came into conflict. As Fed Chairman Arthur Burns would later claim, full employment was the first priority in the minds of the public and the government, if not also at the Federal Reserve (Meltzer 2005). But there was also a clear sense that addressing the inflation problem head-on would have been too costly to the economy and jobs.

There had been a few earlier attempts to control inflation without the costly side effect of higher unemployment. The Nixon administration introduced wage and price controls over three phases between 1971 and 1974. Those controls only temporarily slowed the rise in prices while exacerbating shortages, particularly for food and energy. The Ford administration fared no better in its efforts. After declaring inflation “enemy number one,” the president in 1974 introduced the Whip Inflation Now (WIN) program, which consisted of voluntary measures to encourage more thrift. It was a failure.

By the late 1970s, the public had come to expect an inflationary bias to monetary policy. And they were increasingly unhappy with inflation. Survey after survey showed a deteriorating public confidence over the economy and government policy in the latter half of the 1970s. And often, inflation was identified as a special evil. Interest rates appeared to be on a secular rise since 1965 and spiked sharply higher still as the 1970s came to a close. During this time, business investment slowed, productivity faltered, and the nation’s trade balance with the rest of the world worsened. And inflation was widely viewed as either a significant contributing factor to the economic malaise or its primary basis.

But once in the position of having unacceptably high inflation and high unemployment, policymakers faced an unhappy dilemma. Fighting high unemployment would almost certainly drive inflation higher still, while fighting inflation would just as certainly cause unemployment to spike even higher.

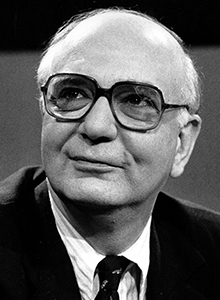

In 1979, Paul Volcker , formerly the president of the Federal Reserve Bank of New York, became chairman of the Federal Reserve Board. When he took office in August, year-over-year inflation was running above 11 percent, and national joblessness was just a shade under 6 percent. By this time, it was generally accepted that reducing inflation required greater control over the growth rate of reserves specifically, and broad money more generally. The Federal Open Market Committee (FOMC) had already begun establishing targets for the monetary aggregates as required by the Humphrey-Hawkins Act. But it was clear that sentiment was shifting with the new chairman and that stronger measures to control the growth of the money supply were required. In October 1979 , the FOMC announced its intention to target reserve growth rather than the fed funds rate as its policy instrument.

Fighting inflation was now seen as necessary to achieve both objectives of the dual mandate, even if it temporarily caused a disruption to economic activity and, for a time, a higher rate of joblessness. In early 1980, Volcker said, “[M]y basic philosophy is over time we have no choice but to deal with the inflationary situation because over time inflation and the unemployment rate go together.… Isn’t that the lesson of the 1970s?” (Meltzer 2009, 1034).

Over time, greater control of reserve and money growth, while less than perfect, produced a desired slowing in inflation. This tighter reserve management was augmented by the introduction of credit controls in early 1980 and with the Monetary Control Act . Over the course of 1980, interest rates spiked, fell briefly, and then spiked again. Lending activity fell, unemployment rose, and the economy entered a brief recession between January and July. Inflation fell but was still high even as the economy recovered in the second half of 1980.

But the Volcker Fed continued to press the fight against high inflation with a combination of higher interest rates and even slower reserve growth. The economy entered recession again in July 1981, and this proved to be more severe and protracted, lasting until November 1982 . Unemployment peaked at nearly 11 percent, but inflation continued to move lower and by recession’s end, year-over-year inflation was back under 5 percent. In time, as the Fed’s commitment to low inflation gained credibility, unemployment retreated and the economy entered a period of sustained growth and stability. The Great Inflation was over.

By this time, macroeconomic theory had undergone a transformation, in large part informed by the economic lessons of the era. The important role public expectations play in the interplay between economic policy and economic performance became de rigueur in macroeconomic models. The importance of time-consistent policy choices—policies that do not sacrifice longer-term prosperity for short-term gains—and policy credibility became widely appreciated as necessary for good macroeconomic results.

Today central banks understand that a commitment to price stability is essential for good monetary policy and most, including the Federal Reserve, have adopted specific numerical objectives for inflation. To the extent they are credible, these numerical inflation targets have reintroduced an anchor to monetary policy. And in so doing, they have enhanced the transparency of monetary policy decisions and reduced uncertainty, now also understood to be necessary antecedents to the achievement of long-term growth and maximum employment.

- 1 The act also created the president’s Council of Economic Advisers.

- 2 The Phillips curve is a negative, statistical relationship between inflation (or nominal wage growth) and the rate of unemployment. It is named after British economist A.W. Phillips, who is often credited with the revelation of the relations. Phillips, A.W. "The Relationship between Unemployment and the Rate of Change of Money Wages in the United Kingdom 1861–1957." Economica 25, no. 100 (1958): 283–99. http://www.jstor.org/stable/2550759 .

- 3 Dollars were convertible for gold by foreign governments and central banks. For domestic purposes, the US dollar was separated from gold in 1934 and has remained unconvertible since.

- 4 The concept of core inflation—the measurement of aggregate prices excluding food and energy goods—has its origin about this time.

- 5 The Humphrey-Hawkins Act expired in 2000; the Federal Reserve continues to provide its Monetary Policy Report to Congress on a semiannual basis.

Bibliography

Friedman, Milton. “The Role of Monetary Policy.” American Economic Review 58, no. 1 (March 1968): 1–17.

Gordon, Robert J. “Alternative Responses of Policy to External Supply Shocks.” Brookings Papers on Economic Activity 6, no. 1 (1975): 183–206.

Meltzer, Allan H., “ Origins of the Great Inflation ,” Federal Reserve Bank of St. Louis Review 87, no. 2, part 2 (March/April 2005): 145-75.

Meltzer, Allan H. A History of the Federal Reserve, Volume 2, Book 2, 1970-1986 . Chicago: University of Chicago Press, 2009.

Orphanides, Athanasios, “ Monetary Policy Rules Based on Real-Time Data ,” Finance and Economics Discussion Series 1998-03, Federal Reserve Board, Washington, DC, December 1997.

Orphanides, Athanasios, “ Monetary Policy Rules and the Great Inflation ,” Finance and Economics Discussion Series 2002-08, Federal Reserve Board, Washington, DC, January 2002.

Phelps, E.S. “ Phillips Curves, Expectations of Inflation and Optimal Unemployment Over Time .” Economica 34, no. 135 (August 1967): 254–81.

Phillips, A.W. " The Relation between Unemployment and the Rate of Change of Money Wage Rates in the United Kingdom 1861–1957 ." Economica 25, no. 100 (1958): 283–99.

Siegel, Jeremy J. Stocks for the Long Run: A Guide to Selecting Markets for Long-Term Growth , 2nd ed. New York: McGraw-Hill, 1994.

Steelman, Aaron. “ The Federal Reserve’s ‘Dual Mandate’: The Evolution of an Idea .” Federal Reserve Bank of Richmond Economic Brief no. 11-12 (December 2011).

Written as of November 22, 2013. See disclaimer .

Essays in this Time Period

- Launch of the Bretton Woods System

- Community Reinvestment Act of 1977

- Federal Reserve Reform Act of 1977

- Volcker's Announcement of Anti-Inflation Measures

- Full Employment and Balanced Growth Act of 1978 (Humphrey-Hawkins)

- Garn-St Germain Depository Institutions Act of 1982

- Nixon Ends Convertibility of U.S. Dollars to Gold and Announces Wage/Price Controls

- Depository Institutions Deregulation and Monetary Control Act of 1980

- Oil Shock of 1973–74

- Oil Shock of 1978–79

- Recession of 1981–82

- Savings and Loan Crisis

- The Smithsonian Agreement

Related People

Arthur F. Burns Chairman

Board of Governors

1970 – 1978

Paul A. Volcker Chairman

1979 – 1987

Related Links

- FRASER: Origins of the Great Inflation

Federal Reserve History

What is inflation?