Deed of Assignment or Deed of Novation: Key Differences and Legal Implications of Novation and Assignment Contracts

Novation and assignment stand out as pivotal processes for the transfer of contractual rights and obligations. These legal concepts allow a party to the contract to adapt to changing circumstances, ensuring that business arrangements remain relevant and effective. This article explores the nuances of novation and assignment, shedding light on their distinct legal implications, procedures, and practical applications. Whether you’re a business owner navigating the transfer of service contracts, or an individual looking to understand your rights and responsibilities in a contractual relationship, or a key stakeholder in a construction contract, this guide will equip you with the essential knowledge to navigate these complex legal processes.

Table of Contents

- What is a Deed of Novation?

- What is a Deed of Assignment?

Key Differences Between Novation and Assignment Deeds

Need a deed of novation or assignment key factors to consider, selecting the right assignment clause for your contract – helping you make the right choice, what is a deed of novation.

Novation is a legal process that allows a new party to a contract to take the place of an original party in a contract, thereby transferring both the responsibilities and benefits under the contract to a third party. In common law, transferring contractual obligations through novation requires the agreement of all original parties involved in the contract, as well as the new party. This is because novation effectively terminates the original contract and establishes a new one.

A novation clause typically specifies that a contract cannot be novated without the written consent of the current parties. The inclusion of such a clause aims to preclude the possibility of novation based on verbal consent or inferred from the actions of a continuing party. Nevertheless, courts will assess the actual events that transpired, and a novation clause may not always be enforceable. It’s possible for a novation clause to allow for future novation by one party acting alone to a party of their choosing. Courts will enforce a novation carried out in this manner if it is sanctioned by the correct interpretation of the original contract.

Novation is frequently encountered in business and contract law, offering a means for parties to transfer their contractual rights and duties to another, which can be useful if the original party cannot meet their obligations or wishes to transfer their contract rights. For novation to occur, there must be unanimous consent for the substitution of the new party for the original one, necessitating a three-way agreement among the original party, the new party, and the remaining contract party. Moreover, the novation agreement must be documented in writing and signed by all involved parties. Understanding novation is essential in the realms of contracts and business dealings, as it provides a way for parties to delegate their contractual rights and responsibilities while freeing themselves from the original agreement.

What is a Deed of Assignment?

A deed of assignment is a legal document that facilitates the transfer of a specific right or benefit from one party (the assignor) to another (the assignee). This process allows the assignee to step into the assignor’s position, taking over both the rights and obligations under the original contract. In construction, this might occur when a main contractor assigns rights under a subcontract to the employer, allowing the employer to enforce specific subcontractor duties directly if the contractor fails.

Key aspects of an assignment include:

- Continuation of the Original Contract: The initial agreement remains valid and enforceable, despite the transfer of rights or benefits.

- Assumption of Rights and Obligations: The assignee assumes the role of the assignor, adopting all associated rights and responsibilities as outlined in the original contract.

- Requirement for Written Form: The assignment must be documented in writing, signed by the assignor, and officially communicated to the obligor (the party obligated under the contract).

- Subject to Terms and Law: The ability to assign rights or benefits is governed by the specific terms of the contract and relevant legal statutes.

At common law, parties generally have the right to assign their contractual rights without needing consent from the other party involved in the contract. However, this does not apply if the rights are inherently personal or if the contract includes an assignment clause that restricts or modifies this general right. Many contracts contain a provision requiring the consent of the other party for an assignment to occur, ensuring that rights are not transferred without the other party’s knowledge.

Once an assignment of rights is made, the assignee gains the right to benefit from the contract and can initiate legal proceedings to enforce these rights. This enforcement can be done either independently or alongside the assignor, depending on whether the assignment is legal or equitable. It’s important to note that while rights under the contract can be assigned, the contractual obligations or burdens cannot be transferred in this manner. Therefore, the assignor remains liable for any obligations under the contract that are not yet fulfilled at the time of the assignment.

Choosing Between Assignment and Novation in a Construction Contract

Choosing between a deed of novation and an assignment agreement depends on the specific circumstances and objectives of the parties involved in a contract. Both options serve to transfer rights and obligations but in fundamentally different ways, each with its own legal implications, risks, and benefits. Understanding these differences and considering various factors can help in making an informed decision that aligns with your goals.

The choice between assignment and novation in a construction project scenario, where, for instance, an employer wishes to engage a subcontractor directly due to loss of confidence in the main contractor, hinges on several factors. These are:

- Nature of the Contract: The type of contract you’re dealing with (e.g., service, sales) can influence which option is more suitable. For instance, novation might be preferred for service contracts where obligations are personal and specific to the original parties.

- Parties Involved: Consent is a key factor. Novation requires the agreement of all original and new parties, making it a viable option only when such consent is attainable. Assignment might be more feasible if obtaining consent from all parties poses a challenge.

- Complexity of the Transaction: For transactions involving multiple parties and obligations, novation could be more appropriate as it ensures a clean transfer of all rights and obligations. Assignment might leave the original party with ongoing responsibilities.

- Time and Cost: Consider the practical aspects, such as the time and financial cost associated with each option. Novation typically involves more complex legal processes and might be more time-consuming and costly than an assignment.

If the intention is merely to transfer the rights of the subcontractor’s work to the employer without altering the subcontractor’s obligations under a contract, an assignment might suffice. However, if the goal is to completely transfer the main contractor’s contractual role and obligations to the employer or another entity, novation would be necessary, ensuring that all parties consent to this new arrangement and the original contractor is released from their obligations.

The legal interpretations and court decisions highlight the importance of the document’s substance over its label. Even if a document is titled a “Deed of Assignment,” it could function as a novation if it transfers obligations and responsibilities and involves the consent of all parties. The key is to clearly understand and define the objective behind changing the contractual relationships and to use a deed — assignment or novation — that best achieves the desired legal and practical outcomes, ensuring the continuity and successful completion of the construction project.

Understanding the distinction between assignment deeds and novation deeds is crucial for anyone involved in contractual agreements. Novation offers a clean slate by transferring both rights and obligations to a new party, requiring the consent of all involved. Assignment, conversely, allows for the transfer of contractual benefits without altering the original contract’s obligations. Each method serves different strategic purposes, from simplifying transitions to preserving original contractual duties. The choice between novation and assignment hinges on specific legal, financial, and practical considerations unique to each situation. At PBL Law Group, we specialise in providing comprehensive legal advice and support in contract law. Our team is dedicated to helping clients understand their options and make informed decisions that align with their legal and business objectives. Let’s discuss!

Authored By Raea Khan

Director Lawyer, PBL Law Group

Find what you need

Share this article, book a 15-min consultation, rated 5-star by our clients, latest insights & practical guides.

How to Deal with a Disputed Progress Claim: Procedure Under the NSW Security of Payment Act

Navigating the complexities of construction payments can be daunting, especially

How to Describe Construction Works in Payment Claims and Schedules: Ensuring Security of Payment in Construction Contracts

In the construction industry, the adherence to the Security of

How to Remove Strata Committee Members: Guide for NSW Strata Body Corporate

In New South Wales, the dynamics of strata management are

Speak to us Now or Request a Consultation.

How can our expert lawyers help.

Property and strata disputes, building defects claims, setting up new Owners Corporations and more…

Construction & Building Law

Construction and building disputes, building defects, delays and claims, debt recovery and more…

International Estate Planning

Cross-border estate planning, international wills and trusts, tax-efficient wealth transfer strategies and more…

Commercial & Business Law

Starting and scaling your business, banking and business financing, bankruptcy and insolvency and more…

Planning & Environment Law

Environment and planning regulation, land and environment court disputes, sub-divisions and more…

Wills & Estates

Creating, updating and contesting wills, estate planning and administration, probate applications and more…

Get In Touch

Helpful links, site information, how we can help.

Copyright © 2024 PBL Law Group. All Rights Reserved

Thank You For Your Request.

We’ve received your consultation request and will contact you within the next 24 hours (excluding weekends).

Assignment of loan | Practical Law

Assignment of loan

Practical law uk standard document 9-500-4767 (approx. 31 pages).

Deed of Assignment: Everything You Need to Know

A deed of assignment refers to a legal document that records the transfer of ownership of a real estate property from one party to another. 3 min read updated on January 01, 2024

Updated October 8,2020:

A deed of assignment refers to a legal document that records the transfer of ownership of a real estate property from one party to another. It states that a specific piece of property will belong to the assignee and no longer belong to the assignor starting from a specified date. In order to be valid, a deed of assignment must contain certain types of information and meet a number of requirements.

What Is an Assignment?

An assignment is similar to an outright transfer, but it is slightly different. It takes place when one of two parties who have entered into a contract decides to transfer all of his or her rights and obligations to a third party and completely remove himself or herself from the contract.

Also called the assignee, the third party effectively replaces the former contracting party and consequently assumes all of his or her rights and obligations. Unless it is stated in the original contract, both parties to the initial contract are typically required to express approval of an assignment before it can occur. When you sell a piece of property, you are making an assignment of it to the buyer through the paperwork you sign at closing.

What Is a Deed of Assignment?

A deed of assignment refers to a legal document that facilitates the legal transfer of ownership of real estate property. It is an important document that must be securely stored at all times, especially in the case of real estate.

In general, this document can be described as a document that is drafted and signed to promise or guarantee the transfer of ownership of a real estate property on a specified date. In other words, it serves as the evidence of the transfer of ownership of the property, with the stipulation that there is a certain timeframe in which actual ownership will begin.

The deed of assignment is the main document between the seller and buyer that proves ownership in favor of the seller. The party who is transferring his or her rights to the property is known as the “assignor,” while the party who is receiving the rights is called the “assignee.”

A deed of assignment is required in many different situations, the most common of which is the transfer of ownership of a property. For example, a developer of a new house has to sign a deed of assignment with a buyer, stating that the house will belong to him or her on a certain date. Nevertheless, the buyer may want to sell the house to someone else in the future, which will also require the signing of a deed of assignment.

This document is necessary because it serves as a temporary title deed in the event that the actual title deed for the house has not been issued. For every piece of property that will be sold before the issuance of a title deed, a deed of assignment will be required.

Requirements for a Deed of Assignment

In order to be legally enforceable, an absolute sale deed must provide a clear description of the property being transferred, such as its address or other information that distinguishes it from other properties. In addition, it must clearly identify the buyer and seller and state the date when the transfer will become legally effective, the purchase price, and other relevant information.

In today's real estate transactions, contracting parties usually use an ancillary real estate sale contract in an attempt to cram all the required information into a deed. Nonetheless, the information found in the contract must be referenced by the deed.

Information to Include in a Deed of Assignment

- Names of parties to the agreement

- Addresses of the parties and how they are binding on the parties' successors, friends, and other people who represent them in any capacity

- History of the property being transferred, from the time it was first acquired to the time it is about to be sold

- Agreed price of the property

- Size and description of the property

- Promises or covenants the parties will undertake to execute the deed

- Signatures of the parties

- Section for the Governors Consent or Commissioner of Oaths to sign and verify the agreement

If you need help understanding, drafting, or signing a deed of assignment, you can post your legal need on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Define a Deed

- Contract for Deed California

- Contract for Deed in Texas

- Assignment Law

- Deed Contract Agreement

- Assignment Of Contracts

- Legal Assignment

- Deed vs Agreement

- Assignment Legal Definition

- Contract for a Deed

- Practical Law

Assignment of loan

Practical law uk standard document 9-500-4767 (approx. 31 pages), get full access to this document with a free trial.

Try free and see for yourself how Practical Law resources can improve productivity, efficiency and response times.

About Practical Law

This document is from Thomson Reuters Practical Law, the legal know-how that goes beyond primary law and traditional legal research to give lawyers a better starting point. We provide standard documents, checklists, legal updates, how-to guides, and more.

650+ full-time experienced lawyer editors globally create and maintain timely, reliable and accurate resources across all major practice areas.

83% of customers are highly satisfied with Practical Law and would recommend to a colleague.

81% of customers agree that Practical Law saves them time.

- Lending - General

- Corporate lending

- Bankruptcy Basics

- Chapter 11 Bankruptcy

- Chapter 13 Bankruptcy

- Chapter 7 Bankruptcy

- Debt Collectors and Consumer Rights

- Divorce and Bankruptcy

- Going to Court

- Property & Exemptions

- Student Loans

- Taxes and Bankruptcy

- Wage Garnishment

Understanding the Assignment of Mortgages: What You Need To Know

3 minute read • Upsolve is a nonprofit that helps you get out of debt with education and free debt relief tools, like our bankruptcy filing tool. Think TurboTax for bankruptcy. Get free education, customer support, and community. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Explore our free tool

A mortgage is a legally binding agreement between a home buyer and a lender that dictates a borrower's ability to pay off a loan. Every mortgage has an interest rate, a term length, and specific fees attached to it.

Written by Attorney Todd Carney . Updated November 26, 2021

If you’re like most people who want to purchase a home, you’ll start by going to a bank or other lender to get a mortgage loan. Though you can choose your lender, after the mortgage loan is processed, your mortgage may be transferred to a different mortgage servicer . A transfer is also called an assignment of the mortgage.

No matter what it’s called, this change of hands may also change who you’re supposed to make your house payments to and how the foreclosure process works if you default on your loan. That’s why if you’re a homeowner, it’s important to know how this process works. This article will provide an in-depth look at what an assignment of a mortgage entails and what impact it can have on homeownership.

Assignment of Mortgage – The Basics

When your original lender transfers your mortgage account and their interests in it to a new lender, that’s called an assignment of mortgage. To do this, your lender must use an assignment of mortgage document. This document ensures the loan is legally transferred to the new owner. It’s common for mortgage lenders to sell the mortgages to other lenders. Most lenders assign the mortgages they originate to other lenders or mortgage buyers.

Home Loan Documents

When you get a loan for a home or real estate, there will usually be two mortgage documents. The first is a mortgage or, less commonly, a deed of trust . The other is a promissory note. The mortgage or deed of trust will state that the mortgaged property provides the security interest for the loan. This basically means that your home is serving as collateral for the loan. It also gives the loan servicer the right to foreclose if you don’t make your monthly payments. The promissory note provides proof of the debt and your promise to pay it.

When a lender assigns your mortgage, your interests as the mortgagor are given to another mortgagee or servicer. Mortgages and deeds of trust are usually recorded in the county recorder’s office. This office also keeps a record of any transfers. When a mortgage is transferred so is the promissory note. The note will be endorsed or signed over to the loan’s new owner. In some situations, a note will be endorsed in blank, which turns it into a bearer instrument. This means whoever holds the note is the presumed owner.

Using MERS To Track Transfers

Banks have collectively established the Mortgage Electronic Registration System , Inc. (MERS), which keeps track of who owns which loans. With MERS, lenders are no longer required to do a separate assignment every time a loan is transferred. That’s because MERS keeps track of the transfers. It’s crucial for MERS to maintain a record of assignments and endorsements because these land records can tell who actually owns the debt and has a legal right to start the foreclosure process.

Upsolve Member Experiences

Assignment of Mortgage Requirements and Effects

The assignment of mortgage needs to include the following:

The original information regarding the mortgage. Alternatively, it can include the county recorder office’s identification numbers.

The borrower’s name.

The mortgage loan’s original amount.

The date of the mortgage and when it was recorded.

Usually, there will also need to be a legal description of the real property the mortgage secures, but this is determined by state law and differs by state.

Notice Requirements

The original lender doesn’t need to provide notice to or get permission from the homeowner prior to assigning the mortgage. But the new lender (sometimes called the assignee) has to send the homeowner some form of notice of the loan assignment. The document will typically provide a disclaimer about who the new lender is, the lender’s contact information, and information about how to make your mortgage payment. You should make sure you have this information so you can avoid foreclosure.

Mortgage Terms

When an assignment occurs your loan is transferred, but the initial terms of your mortgage will stay the same. This means you’ll have the same interest rate, overall loan amount, monthly payment, and payment due date. If there are changes or adjustments to the escrow account, the new lender must do them under the terms of the original escrow agreement. The new lender can make some changes if you request them and the lender approves. For example, you may request your new lender to provide more payment methods.

Taxes and Insurance

If you have an escrow account and your mortgage is transferred, you may be worried about making sure your property taxes and homeowners insurance get paid. Though you can always verify the information, the original loan servicer is responsible for giving your local tax authority the new loan servicer’s address for tax billing purposes. The original lender is required to do this after the assignment is recorded. The servicer will also reach out to your property insurance company for this reason.

If you’ve received notice that your mortgage loan has been assigned, it’s a good idea to reach out to your loan servicer and verify this information. Verifying that all your mortgage information is correct, that you know who to contact if you have questions about your mortgage, and that you know how to make payments to the new servicer will help you avoid being scammed or making payments incorrectly.

Let's Summarize…

In a mortgage assignment, your original lender or servicer transfers your mortgage account to another loan servicer. When this occurs, the original mortgagee or lender’s interests go to the next lender. Even if your mortgage gets transferred or assigned, your mortgage’s terms should remain the same. Your interest rate, loan amount, monthly payment, and payment schedule shouldn’t change.

Your original lender isn’t required to notify you or get your permission prior to assigning your mortgage. But you should receive correspondence from the new lender after the assignment. It’s important to verify any change in assignment with your original loan servicer before you make your next mortgage payment, so you don’t fall victim to a scam.

Attorney Todd Carney

Attorney Todd Carney is a writer and graduate of Harvard Law School. While in law school, Todd worked in a clinic that helped pro-bono clients file for bankruptcy. Todd also studied several aspects of how the law impacts consumers. Todd has written over 40 articles for sites such... read more about Attorney Todd Carney

Continue reading and learning!

It's easy to get debt help

Choose one of the options below to get assistance with your debt:

Considering Bankruptcy?

Our free tool has helped 13,726+ families file bankruptcy on their own. We're funded by Harvard University and will never ask you for a credit card or payment.

Private Attorney

Get a free evaluation from an independent law firm.

Learning Center

Research and understand your options with our articles and guides.

Already an Upsolve user?

Bankruptcy Basics ➜

- What Is Bankruptcy?

- Every Type of Bankruptcy Explained

- How To File Bankruptcy for Free: A 10-Step Guide

- Can I File for Bankruptcy Online?

Chapter 7 Bankruptcy ➜

- What Are the Pros and Cons of Filing Chapter 7 Bankruptcy?

- What Is Chapter 7 Bankruptcy & When Should I File?

- Chapter 7 Means Test Calculator

Wage Garnishment ➜

- How To Stop Wage Garnishment Immediately

Property & Exemptions ➜

- What Are Bankruptcy Exemptions?

- Chapter 7 Bankruptcy: What Can You Keep?

- Yes! You Can Get a Mortgage After Bankruptcy

- How Long After Filing Bankruptcy Can I Buy a House?

- Can I Keep My Car If I File Chapter 7 Bankruptcy?

- Can I Buy a Car After Bankruptcy?

- Should I File for Bankruptcy for Credit Card Debt?

- How Much Debt Do I Need To File for Chapter 7 Bankruptcy?

- Can I Get Rid of my Medical Bills in Bankruptcy?

Student Loans ➜

- Can You File Bankruptcy on Student Loans?

- Can I Discharge Private Student Loans in Bankruptcy?

- Navigating Financial Aid During and After Bankruptcy: A Step-by-Step Guide

- Filing Bankruptcy to Deal With Your Student Loan Debt? Here Are 3 Things You Should Know!

Debt Collectors and Consumer Rights ➜

- 3 Steps To Take if a Debt Collector Sues You

- How To Deal With Debt Collectors (When You Can’t Pay)

Taxes and Bankruptcy ➜

- What Happens to My IRS Tax Debt if I File Bankruptcy?

- What Happens to Your Tax Refund in Bankruptcy

Chapter 13 Bankruptcy ➜

- Chapter 7 vs. Chapter 13 Bankruptcy: What’s the Difference?

- Why is Chapter 13 Probably A Bad Idea?

- How To File Chapter 13 Bankruptcy: A Step-by-Step Guide

- What Happens When a Chapter 13 Case Is Dismissed?

Going to Court ➜

- Do You Have to Go To Court to File Bankruptcy?

- Telephonic Hearings in Bankruptcy Court

Divorce and Bankruptcy ➜

- How to File Bankruptcy After a Divorce

- Chapter 13 and Divorce

Chapter 11 Bankruptcy ➜

- Chapter 7 vs. Chapter 11 Bankruptcy

- Reorganizing Your Debt? Chapter 11 or Chapter 13 Bankruptcy Can Help!

State Guides ➜

- Connecticut

- District Of Columbia

- Massachusetts

- Mississippi

- New Hampshire

- North Carolina

- North Dakota

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- West Virginia

Upsolve is a 501(c)(3) nonprofit that started in 2016. Our mission is to help low-income families resolve their debt and fix their credit using free software tools. Our team includes debt experts and engineers who care deeply about making the financial system accessible to everyone. We have world-class funders that include the U.S. government, former Google CEO Eric Schmidt, and leading foundations.

To learn more, read why we started Upsolve in 2016, our reviews from past users, and our press coverage from places like the New York Times and Wall Street Journal.

- Search Search Please fill out this field.

- Corporate Finance

- Corporate Debt

Debt Assignment: How They Work, Considerations and Benefits

Daniel Liberto is a journalist with over 10 years of experience working with publications such as the Financial Times, The Independent, and Investors Chronicle.

:max_bytes(150000):strip_icc():format(webp)/daniel_liberto-5bfc2715c9e77c0051432901.jpg)

Charlene Rhinehart is a CPA , CFE, chair of an Illinois CPA Society committee, and has a degree in accounting and finance from DePaul University.

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

Katrina Ávila Munichiello is an experienced editor, writer, fact-checker, and proofreader with more than fourteen years of experience working with print and online publications.

:max_bytes(150000):strip_icc():format(webp)/KatrinaAvilaMunichiellophoto-9d116d50f0874b61887d2d214d440889.jpg)

Investopedia / Ryan Oakley

What Is Debt Assignment?

The term debt assignment refers to a transfer of debt , and all the associated rights and obligations, from a creditor to a third party. The assignment is a legal transfer to the other party, who then becomes the owner of the debt. In most cases, a debt assignment is issued to a debt collector who then assumes responsibility to collect the debt.

Key Takeaways

- Debt assignment is a transfer of debt, and all the associated rights and obligations, from a creditor to a third party (often a debt collector).

- The company assigning the debt may do so to improve its liquidity and/or to reduce its risk exposure.

- The debtor must be notified when a debt is assigned so they know who to make payments to and where to send them.

- Third-party debt collectors are subject to the Fair Debt Collection Practices Act (FDCPA), a federal law overseen by the Federal Trade Commission (FTC).

How Debt Assignments Work

When a creditor lends an individual or business money, it does so with the confidence that the capital it lends out—as well as the interest payments charged for the privilege—is repaid in a timely fashion. The lender , or the extender of credit , will wait to recoup all the money owed according to the conditions and timeframe laid out in the contract.

In certain circumstances, the lender may decide it no longer wants to be responsible for servicing the loan and opt to sell the debt to a third party instead. Should that happen, a Notice of Assignment (NOA) is sent out to the debtor , the recipient of the loan, informing them that somebody else is now responsible for collecting any outstanding amount. This is referred to as a debt assignment.

The debtor must be notified when a debt is assigned to a third party so that they know who to make payments to and where to send them. If the debtor sends payments to the old creditor after the debt has been assigned, it is likely that the payments will not be accepted. This could cause the debtor to unintentionally default.

When a debtor receives such a notice, it's also generally a good idea for them to verify that the new creditor has recorded the correct total balance and monthly payment for the debt owed. In some cases, the new owner of the debt might even want to propose changes to the original terms of the loan. Should this path be pursued, the creditor is obligated to immediately notify the debtor and give them adequate time to respond.

The debtor still maintains the same legal rights and protections held with the original creditor after a debt assignment.

Special Considerations

Third-party debt collectors are subject to the Fair Debt Collection Practices Act (FDCPA). The FDCPA, a federal law overseen by the Federal Trade Commission (FTC), restricts the means and methods by which third-party debt collectors can contact debtors, the time of day they can make contact, and the number of times they are allowed to call debtors.

If the FDCPA is violated, a debtor may be able to file suit against the debt collection company and the individual debt collector for damages and attorney fees within one year. The terms of the FDCPA are available for review on the FTC's website .

Benefits of Debt Assignment

There are several reasons why a creditor may decide to assign its debt to someone else. This option is often exercised to improve liquidity and/or to reduce risk exposure. A lender may be urgently in need of a quick injection of capital. Alternatively, it might have accumulated lots of high-risk loans and be wary that many of them could default . In cases like these, creditors may be willing to get rid of them swiftly for pennies on the dollar if it means improving their financial outlook and appeasing worried investors. At other times, the creditor may decide the debt is too old to waste its resources on collections, or selling or assigning it to a third party to pick up the collection activity. In these instances, a company would not assign their debt to a third party.

Criticism of Debt Assignment

The process of assigning debt has drawn a fair bit of criticism, especially over the past few decades. Debt buyers have been accused of engaging in all kinds of unethical practices to get paid, including issuing threats and regularly harassing debtors. In some cases, they have also been charged with chasing up debts that have already been settled.

Federal Trade Commission. " Fair Debt Collection Practices Act ." Accessed June 29, 2021.

Federal Trade Commission. " Debt Collection FAQs ." Accessed June 29, 2021.

:max_bytes(150000):strip_icc():format(webp)/concernedman-ba55c714fbc94fc28f7fd6b7c7723894.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Legal Templates

Home Business Assignment Agreement

Assignment Agreement Template

Use our assignment agreement to transfer contractual obligations.

Updated February 1, 2024 Reviewed by Brooke Davis

An assignment agreement is a legal document that transfers rights, responsibilities, and benefits from one party (the “assignor”) to another (the “assignee”). You can use it to reassign debt, real estate, intellectual property, leases, insurance policies, and government contracts.

What Is an Assignment Agreement?

What to include in an assignment agreement, how to assign a contract, how to write an assignment agreement, assignment agreement sample.

Partnership Interest

An assignment agreement effectively transfers the rights and obligations of a person or entity under an initial contract to another. The original party is the assignor, and the assignee takes on the contract’s duties and benefits.

It’s often a requirement to let the other party in the original deal know the contract is being transferred. It’s essential to create this form thoughtfully, as a poorly written assignment agreement may leave the assignor obligated to certain aspects of the deal.

The most common use of an assignment agreement occurs when the assignor no longer can or wants to continue with a contract. Instead of leaving the initial party or breaking the agreement, the assignor can transfer the contract to another individual or entity.

For example, imagine a small residential trash collection service plans to close its operations. Before it closes, the business brokers a deal to send its accounts to a curbside pickup company providing similar services. After notifying account holders, the latter company continues the service while receiving payment.

Create a thorough assignment agreement by including the following information:

- Effective Date: The document must indicate when the transfer of rights and obligations occurs.

- Parties: Include the full name and address of the assignor, assignee, and obligor (if required).

- Assignment: Provide details that identify the original contract being assigned.

- Third-Party Approval: If the initial contract requires the approval of the obligor, note the date the approval was received.

- Signatures: Both parties must sign and date the printed assignment contract template once completed. If a notary is required, wait until you are in the presence of the official and present identification before signing. Failure to do so may result in having to redo the assignment contract.

Review the Contract Terms

Carefully review the terms of the existing contract. Some contracts may have specific provisions regarding assignment. Check for any restrictions or requirements related to assigning the contract.

Check for Anti-Assignment Clauses

Some contracts include anti-assignment clauses that prohibit or restrict the ability to assign the contract without the consent of the other party. If there’s such a clause, you may need the consent of the original parties to proceed.

Determine Assignability

Ensure that the contract is assignable. Some contracts, especially those involving personal services or unique skills, may not be assignable without the other party’s agreement.

Get Consent from the Other Party (if Required)

If the contract includes an anti-assignment clause or requires consent for assignment, seek written consent from the other party. This can often be done through a formal amendment to the contract.

Prepare an Assignment Agreement

Draft an assignment agreement that clearly outlines the transfer of rights and obligations from the assignor (the party assigning the contract) to the assignee (the party receiving the assignment). Include details such as the names of the parties, the effective date of the assignment, and the specific rights and obligations being transferred.

Include Original Contract Information

Attach a copy of the original contract or reference its key terms in the assignment agreement. This helps in clearly identifying the contract being assigned.

Execution of the Assignment Agreement

Both the assignor and assignee should sign the assignment agreement. Signatures should be notarized if required by the contract or local laws.

Notice to the Other Party

Provide notice of the assignment to the non-assigning party. This can be done formally through a letter or as specified in the contract.

File the Assignment

File the assignment agreement with the appropriate parties or entities as required. This may include filing with the original contracting party or relevant government authorities.

Communicate with Third Parties

Inform any relevant third parties, such as suppliers, customers, or service providers, about the assignment to ensure a smooth transition.

Keep Copies for Records

Keep copies of the assignment agreement, original contract, and any related communications for your records.

Here’s a list of steps on how to write an assignment agreement:

Step 1 – List the Assignor’s and Assignee’s Details

List all of the pertinent information regarding the parties involved in the transfer. This information includes their full names, addresses, phone numbers, and other relevant contact information.

This step clarifies who’s transferring the initial contract and who will take on its responsibilities.

Step 2 – Provide Original Contract Information

Describing and identifying the contract that is effectively being reassigned is essential. This step avoids any confusion after the transfer has been completed.

Step 3 – State the Consideration

Provide accurate information regarding the amount the assignee pays to assume the contract. This figure should include taxes and any relevant peripheral expenses. If the assignee will pay the consideration over a period, indicate the method and installments.

Step 4 – Provide Any Terms and Conditions

The terms and conditions of any agreement are crucial to a smooth transaction. You must cover issues such as dispute resolution, governing law, obligor approval, and any relevant clauses.

Step 5 – Obtain Signatures

Both parties must sign the agreement to ensure it is legally binding and that they have read and understood the contract. If a notary is required, wait to sign off in their presence.

Related Documents

- Purchase Agreement : Outlines the terms and conditions of an item sale.

- Business Contract : An agreement in which each party agrees to an exchange, typically involving money, goods, or services.

- Lease/Rental Agreement : A lease agreement is a written document that officially recognizes a legally binding relationship between two parties -- a landlord and a tenant.

- Legal Resources

- Partner With Us

- Terms of Use

- Privacy Policy

- Do Not Sell My Personal Information

The document above is a sample. Please note that the language you see here may change depending on your answers to the document questionnaire.

Thank you for downloading!

How would you rate your free template?

Click on a star to rate

Assignment Of Debt

Jump to section, what is an assignment of debt.

Assignment of debt is an agreement that transfer debt, rights, and obligations from a creditor to a third party. Assignment of debt agreements are commonly found when a creditor issues past due debt to a debt collection agency. The original lender will be relieved of all obligations and the agency will become the new owner of the debt. Debt assignment allows creditors to improve liquidity by reducing their financial risk. If a creditor has taken on a large amount of unsecured debt, an assignment of debt agreement is a quick way to transfer some of the unsecured loans to another party.

Common Sections in Assignments Of Debt

Below is a list of common sections included in Assignments Of Debt. These sections are linked to the below sample agreement for you to explore.

Assignment Of Debt Sample

Reference : Security Exchange Commission - Edgar Database, EX-10 19 ex107.htm ASSIGNMENT OF DEBT AND SECURITY , Viewed October 25, 2021, View Source on SEC .

Who Helps With Assignments Of Debt?

Lawyers with backgrounds working on assignments of debt work with clients to help. Do you need help with an assignment of debt?

Post a project in ContractsCounsel's marketplace to get free bids from lawyers to draft, review, or negotiate assignments of debt. All lawyers are vetted by our team and peer reviewed by our customers for you to explore before hiring.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Meet some of our Assignment Of Debt Lawyers

Matt Curry is a seasoned attorney specializing in real estate law and contract matters. With a deep understanding of contract law and extensive experience in negotiating and drafting contracts, Matt has earned a reputation for providing exceptional legal counsel to clients. As the founder and principal attorney at MPC LAW, Matt is committed to delivering tailored legal solutions. MPC LAW is renowned for its expertise in real estate transactions, lease agreements, contract negotiations, and dispute resolution. Matt's approach combines legal acumen with a client-centered focus, ensuring that every client receives personalized attention and strategic advice. Whether navigating complex real estate deals or resolving contractual disputes, Matt and his team at MPC LAW consistently achieve favorable outcomes for their clients. With a track record of success and a commitment to excellence, Matt Curry and MPC LAW are trusted partners for individuals and businesses seeking reliable legal counsel in real estate and contract matters.

Jared Fields is an experienced business lawyer and litigator with experience in diverse industries and practice areas. Prior to launching his own practice, he served as the chief legal officer for a group of privately-owned companies, including a real estate development group, construction companies, multiple franchisees, and a professional soccer team. As a result, he is experienced in real estate transactions, commercial agreements of varying degrees of sophistication, employment matters, and litigation, as well as general business legal advice. He was also an in-house attorney for a renewable energy company, where he was responsible for litigation, investigations, enforcement actions, and related securities filing disclosures. Mr. Fields also spent many years as a litigator in private practice, representing clients in matters ranging from securities litigation, to breach of contract, to cases involving real estate and financial services. Mr. Fields has particular experience in legal matters that may involve complex financial, accounting, valuation, and other quantitative issues.

Born in Cleveland, Ohio - 9/15/1974 Lived in Cleveland all my life went to college at Ohio Wesleyan University - graduated in 1996 went to law school at Cleveland Marshall College of Law - graduated in 2001 passed the OH bar exam in 2003 worked at the OH Atty General's office, at cuyahoga county prosecutor office and as a solo practitioner

I am a Swiss-American lawyer based in Florida and specialize in business, investments, and other civil matters. I have won many cases in both state and federal litigation, and arbitration. Before litigation or arbitration, however, I like to prevent these legal disputes by ensuring my clients base their business on strong concrete contracts that will protect them even decades down the road. My clients are my top priority, which is why they get my personal cell and can reach me anytime. My firm is also established on the extremely high standards of professionalism, transparent itemized billing, fast turnaround times and more. For more information, visit: https://www.transnationalmatters.com/

I am a Partner at Kashyap Partners (operating in California, New York and New Jersey), along with it's sister firm in India. I have been working as a technology, transactional and data privacy lawyer for 5 years with a specialisation in start-up law.

Ms. Melton-Mitchell is a seasoned executive that has obtained a law degree and is practicing law as a second career. She has spent over 25 years in the health care industry and is well versed in health law, contract law, financial law, trusts and estates, M&A and other types of transactional law. She maintains evening and weekend hours to allow clients flexibility in connecting with her around their schedule.

Robert McMillan Arthur is a collaborative attorney and mediator practicing across Wisconsin, with offices in the Metro Milwaukee area and Northeastern Wisconsin. He is a general practitioner, concentrating in Small Business Law, Entertainment Law, Intellectual Property Law, Nonprofit Law, Divorce and Family Law. Robert’s business law practice focuses on the needs of small, closely-held businesses and startups. As a veteran of a family owned business, Robert applies his extensive experience to advise his clients in a broad spectrum of legal issues, including contracts, licensing, trademark, copyright, employment, and business formation. With multidisciplinary qualifications and experiences, Robert chose his career in law to help people caught up in difficult situations in their personal or professional lives. His core principle of law practice is based on empowering and informing clients, advocating for their interests when appropriate, and guiding them in difficult problem solving.

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Financial lawyers by top cities

- Austin Financial Lawyers

- Boston Financial Lawyers

- Chicago Financial Lawyers

- Dallas Financial Lawyers

- Denver Financial Lawyers

- Houston Financial Lawyers

- Los Angeles Financial Lawyers

- New York Financial Lawyers

- Phoenix Financial Lawyers

- San Diego Financial Lawyers

- Tampa Financial Lawyers

Assignment Of Debt lawyers by city

- Austin Assignment Of Debt Lawyers

- Boston Assignment Of Debt Lawyers

- Chicago Assignment Of Debt Lawyers

- Dallas Assignment Of Debt Lawyers

- Denver Assignment Of Debt Lawyers

- Houston Assignment Of Debt Lawyers

- Los Angeles Assignment Of Debt Lawyers

- New York Assignment Of Debt Lawyers

- Phoenix Assignment Of Debt Lawyers

- San Diego Assignment Of Debt Lawyers

- Tampa Assignment Of Debt Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

- Insights & events

Assigning debts and other contractual claims - not as easy as first thought

Harking back to law school, we had a thirst for new black letter law. Section 136 of the Law of the Property Act 1925 kindly obliged. This lays down the conditions which need to be satisfied for an effective legal assignment of a chose in action (such as a debt). We won’t bore you with the detail, but suffice to say that what’s important is that a legal assignment must be in writing and signed by the assignor, must be absolute (i.e. no conditions attached) and crucially that written notice of the assignment must be given to the debtor.

When assigning debts, it’s worth remembering that you can’t legally assign part of a debt – any attempt to do so will take effect as an equitable assignment. The main practical difference between a legal and an equitable assignment is that the assignor will need to be joined in any legal proceedings in relation to the assigned debt (e.g. an attempt to recover that part of the debt).

Recent cases which tell another story

Why bother telling you the above? Aside from our delight in remembering the joys of debating the merits of legal and equitable assignments (ehem), it’s worth revisiting our textbooks in the context of three recent cases. Although at first blush the statutory conditions for a legal assignment seem quite straightforward, attempts to assign contractual claims such as debts continue to throw up legal disputes:

- In Sumitomo Mitsui Banking Corp Europe Ltd v Euler Hermes Europe SA (NV) [2019] EWHC 2250 (Comm), the High Court held that a performance bond issued under a construction contract was not effectively assigned despite the surety acknowledging a notice of assignment of the bond. Sadly, the notice of assignment failed to meet the requirements under the bond instrument that the assignee confirm its acceptance of a provision in the bond that required the employer to repay the surety in the event of an overpayment. This case highlights the importance of ensuring any purported assignment meets any conditions stipulated in the underlying documents.

- In Promontoria (Henrico) Ltd v Melton [2019] EWHC 2243 (Ch) (26 June 2019) , the High Court held that an assignment of a facility agreement and legal charges was valid, even though the debt assigned had to be identified by considering external evidence. The deed of assignment in question listed the assets subject to assignment, but was illegible to the extent that the debtor’s name could not be deciphered. The court got comfortable that there had been an effective assignment, given the following factors: (i) the lender had notified the borrower of its intention to assign the loan to the assignee; (ii) following the assignment, the lender had made no demand for repayment; (iii) a manager of the assignee had given a statement that the loan had been assigned and the borrower had accepted in evidence that he was aware of the assignment. Fortunately for the assignee, a second notice of assignment - which was invalid because it contained an incorrect date of assignment - did not invalidate the earlier assignment, which was found to be effective. The court took a practical and commercial view of the circumstances, although we recommend ensuring that your assignment documents clearly reflect what the parties intend!

- Finally, in Nicoll v Promontoria (Ram 2) Ltd [2019] EWHC 2410 (Ch), the High Court held that a notice of assignment of a debt given to a debtor was valid, even though the effective date of assignment stated in the notice could not be verified by the debtor. The case concerned a debt assigned by the Co-op Bank to Promontoria and a joint notice given by assignor and assignee to the debtor that the debt had been assigned “on and with effect from 29 July 2016”. A subsequent statutory demand served by Promontoria on the debtor for the outstanding sums was disputed on the basis that the notice of assignment was invalid because it contained an incorrect date of assignment. Whilst accepting that the documentation was incapable of verifying with certainty the date of assignment, the Court held that the joint notice clearly showed that both parties had agreed that an assignment had taken place and was valid. This decision suggests that mistakes as to the date of assignment in a notice of assignment may not necessarily be fatal, if it is otherwise clear that the debt has been assigned.

The conclusion from the above? Maybe it’s not quite as easy as first thought to get an assignment right. Make sure you follow all of the conditions for a legal assignment according to the underlying contract and ensure your assignment documentation is clear.

Contact our experts for further advice

Search our site

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

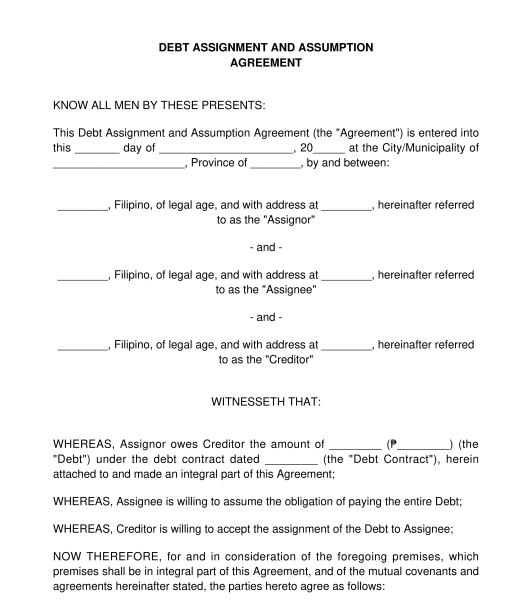

Debt Assignment and Assumption Agreement

Rating: 4.5 - 1 vote

A Debt Assignment and Assumption Agreement is a document whereby one party (the "assignor") assigns their debt to another party (the "assignee"), and the assignee agrees to pay the debt to the assignor's creditor.

A Debt Assignment and Assumption Agreement presumes that there is a debt that the assignor needs to pay to the creditor . This debt could arise from any circumstance, including a loan or maybe an unpaid contract of sale or services . In any case, this debt is then assigned (or transferred) to the assignee who will now have the obligation to pay the creditor . The parties may also choose whether the entire debt will be assigned or only a portion of it.

This document offers the option of having the debt transferred to the assignee completely or that the assignor and the assignee will be liable for the debt together . In the first option, the creditor will no longer have the right to ask for payment from the assignor even if the assignee fails to pay. In the second option, the creditor should first ask for payment from the assignee and, if the assignee fails to pay, they can ask for payment from the assignor. Either way, the creditor should sign and agree to the terms of the Debt Assignment and Assumption Agreement.

How to use this document

The user should enter all the information necessary to complete the document. This includes the names and addresses of the assignor, the assignee, and the creditor, the total amount of the debt, and, if only a portion of the debt will be transferred, the amount that will be transferred. Once the document is completed, it should be carefully reviewed by all the parties and, if the document is correct, it should be signed by all the parties.

Each party should keep a copy of the document for their records.

Notarizing the document

If the parties would want to notarize the Debt Assignment and Assumption Agreement, the document also includes an Acknowledgment portion. Notarization of the document converts the document from a private document to a public document so that it becomes admissible in court without need of further proof of its authenticity.

To notarize the document, the parties must print and sign an extra copy (for the notary public) of the document and bring all the copies to a notary public to acknowledge that they have signed the Debt Assignment and Assumption Agreement freely and voluntarily . They should also present a valid I.D. issued by an official agency bearing their photograph and signature such as a driver's license or a passport, among others.

Notarizing this document is optional .

Once notarized, the parties should each keep at least one (1) copy of the notarized document and the notary public will also keep one (1) copy for their notarial book.

Applicable law

The laws on contracts and obligations under the Civil Code of the Philippines apply.

How to modify the template

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Other names for the document:

Debt Assignment and Assumption Contract, Agreement to Assign Debt, Agreement to Assume Debt, Assignment and Assumption of Debt, Assumption and Assignment of Debt

Country: Philippines

General Business Documents - Other downloadable templates of legal documents

- Acknowledgement Receipt

- Minutes of the Meeting of the Stockholders

- Notice for Non-Renewal of Contract

- Loan Agreement

- Secretary's Certificate

- Minutes of the Meeting of the Board of Directors

- Monetary Demand Letter

- Notice of Meeting

- Deed of Assignment of Stock Subscription

- Letter of Consent of Nominee

- Business Name Change Letter

- Release, Waiver, and Quitclaim (One-Way)

- Notice of Dishonor for Bounced Check

- Withdrawal of Consent of Nominee

- Request to Alter Contract

- Subscription Agreement for Shares of Stock

- Breach of Contract Notice

- Affidavit of Closure of Business

- Notice of Death or Insolvency of a Partner

- Other downloadable templates of legal documents

IMAGES

VIDEO

COMMENTS

Under an assignment of loan, a lender (the assignor) assigns its rights relating to a loan agreement to a new lender (the assignee). Only the assignor's rights under the loan agreement are assigned. The assignor will still have to perform any obligations it has under the facility agreement. The debtor, the recipient of the loan, must be ...

Choosing between a deed of novation and an assignment agreement depends on the specific circumstances and objectives of the parties involved in a contract. Both options serve to transfer rights and obligations but in fundamentally different ways, each with its own legal implications, risks, and benefits. Understanding these differences and ...

A standard form deed of assignment under which a lender (the assignor) assigns its rights relating to a facility agreement (also known as a loan agreement) to a new lender (the assignee). Only the assignor's rights under the facility agreement (such as to receive repayment of the loan and to receive interest) are assigned. The assignor will still have to perform any obligations it may have ...

The deed of assignment is the main document between the seller and buyer that proves ownership in favor of the seller. The party who is transferring his or her rights to the property is known as the "assignor," while the party who is receiving the rights is called the "assignee.". A deed of assignment is required in many different ...

Virginia. Create Document. Updated October 04, 2021. A loan assignment agreement is when another entity agrees to take over the debt of someone else. This is when the debtor has changed for any type of event such as when a business or real estate is purchased. The new owner will agree to assume the debts of the past debtholder and release them ...

A standard form deed of assignment under which a lender (the assignor) assigns its rights relating to a facility agreement (also known as a loan agreement) to a new lender (the assignee). Only the assignor's rights under the facility agreement (such as to receive repayment of the loan and to receive interest) are assigned. The assignor will still have to perform any obligations it may have ...

Assignment of Mortgage - The Basics. When your original lender transfers your mortgage account and their interests in it to a new lender, that's called an assignment of mortgage. To do this, your lender must use an assignment of mortgage document. This document ensures the loan is legally transferred to the new owner.

An assignment transfers all the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it, and, if the mortgage is subsequently transferred, each assignment is recorded in the county land records.

Debt Assignment: A transfer of debt, and all the rights and obligations associated with it, from a creditor to a third party . Debt assignment may occur with both individual debts and business ...

Assignment Agreement Template. Use our assignment agreement to transfer contractual obligations. An assignment agreement is a legal document that transfers rights, responsibilities, and benefits from one party (the "assignor") to another (the "assignee"). You can use it to reassign debt, real estate, intellectual property, leases ...

Assignment of debt is an agreement that transfer debt, rights, and obligations from a creditor to a third party. Assignment of debt agreements are commonly found when a creditor issues past due debt to a debt collection agency. The original lender will be relieved of all obligations and the agency will become the new owner of the debt.

Fill out the template. A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor. The party that is assuming the debt is the new debtor; they ...

Sample Clauses. Deed of Assignment of Loan. Agreement means the deed ofassignment of loan agreement to be entered into as a deed between GBGL, the Borrower and the Original Lenders, pursuant to which GBGL will assign its rights under the Intra- Group Loan Agreement to the Lenders such that the Original Lenders will obtain an aggregate claim in ...

An assignment of trust deed is necessary if a lender sells a loan secured by a trust deed. It assigns the trust deed to whoever buys the loan (such as another lender), granting them all the rights ...

In Promontoria (Henrico) Ltd v Melton [2019] EWHC 2243 (Ch) (26 June 2019), the High Court held that an assignment of a facility agreement and legal charges was valid, even though the debt assigned had to be identified by considering external evidence. The deed of assignment in question listed the assets subject to assignment, but was illegible ...

Assignment means this deed of assignment and includes any variations thereto or hereto which may be made at any time and from time to time. Assignor means the person or persons named in Item 2(a) of the First Schedule hereto and includes his or their heirs personal representatives and permitted assigns.

If the individual title is issued when entering into a SPA: The stamp duty will be calculated based on the property purchase price (as stated in the Memorandum of Transfer and SPA), or the property's market value. If the individual title is not issued when entering into a SPA: Both the SPA and Deed of Assignment will bear a nominal stamp duty of RM10 on each copy of the documents.

This agreement must clearly establish the calendar date when the assignment of the debt to the Assuming Party becomes active. (2) Debtor Name And Mailing Address. The current Holder of the debt should be identified as the Debtor in this agreement. To this end, record the Debtor's name and address. (3) Assuming Party.

Document Overview. An assignment involves the transferal of some or all of the contractual rights or benefits by one party (the assignor) to a third party (the assignee). For example, a contractor may assign its right to payment of a sum of money but not its obligation to perform specific tasks such as construction or accounting.

Deed of Assignment means the deed of assignment of the Shareholder Loan in the agreed form set out in Schedule 6 (Deed of Assignment) to be entered into between the Seller and the Buyer upon Completion. Assignment of Management Agreement means the Assignment of Management Agreement and Subordination of Management Fees, dated the same date as ...

A Debt Assignment and Assumption Agreement presumes that there is a debt that the assignor needs to pay to the creditor. This debt could arise from any circumstance, including a loan or maybe an unpaid contract of sale or services. In any case, this debt is then assigned (or transferred) to the assignee who will now have the obligation to pay ...

ASSIGNMENT OF DEBT. It is known that the Debtor is indebted to the Creditor, under a separate agreement, for the current principal sum of $[CURRENT DEBT AMOUNT], plus any interest ("Debt"). Under this Agreement, the Assuming Party agrees to assume: (choose one) ☐ - All. of the Debt. ☐ - Portion. of the Debt.

Regardless of this Assignment, the Assignor will continue to be solely responsible for observing all the terms and conditions and obligations of the Assignor in the Sale Agreement. 3.2 Covenant to pay. The Borrower and/or the Assignor covenants and undertakes that it will on demand pay the Bank the Indebtedness.