- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Restaurant Business Plan

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

When starting a business—no matter what type of business that may be—a business plan is essential to map out your intentions and direction. That’s the same for a restaurant business plan, which will help you figure out where you fit in the landscape, how you’re going to differ from other establishments around you, how you’ll market your business, and even what you’re going to serve. A business plan for your restaurant can also help you later if you choose to apply for a business loan .

While opening a restaurant isn’t as risky as you’ve likely heard, you still want to ensure that you’re putting thought and research into your business venture to set it up for success. And that’s where a restaurant business plan comes in.

We’ll go through how to create a business plan for a restaurant and a few reasons why it’s so important. After you review the categories and the restaurant business plan examples, you can use the categories to make a restaurant business plan template and start your journey.

Why you shouldn’t skip a restaurant business plan

First-time restaurateurs and industry veterans alike all need to create a business plan when opening a new restaurant . That’s because, even if you deeply understand your business and its nuances (say, seasonal menu planning or how to order correct quantities), a restaurant is more than its operations. There’s marketing, financing, the competitive landscape, and more—and each of these things is unique to each door you open.

That’s why it’s so crucial to understand how to create a business plan for a restaurant. All of these things and more will be addressed in the document—which should run about 20 or 30 pages—so you’ll not only have a go-to-market strategy, but you’ll also likely figure out some things about your business that you haven’t even thought of yet.

Additionally, if you’re planning to apply for business funding down the line, some loans—including the highly desirable SBA loan —actually require you to submit your business plan to gain approval. In other words: Don’t skip this step!

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

How to write a restaurant business plan: Step by step

There’s no absolute format for a restaurant business plan that you can’t stray from—some of these sections might be more important than others, for example, or you might find that there’s a logical order that makes more sense than the one in the restaurant business plan example below. However, this business plan outline will serve as a good foundation, and you can use it as a restaurant business plan template for when you write your own.

Executive summary

Your executive summary is one to two pages that kick off your business plan and explain your vision. Even though this might seem like an introduction that no one will read, that isn’t the case. In fact, some investors only ask for the executive summary. So, you’ll want to spend a lot of time perfecting it.

Your restaurant business plan executive summary should include information on:

Mission statement: Your goals and objectives

General company information: Include your founding date, team roles (i.e. executive chef, sous chefs, sommeliers), and locations

Category and offerings: What category your restaurant fits into, what you’re planning to serve (i.e. farm-to-table or Korean), and why

Context for success: Any past success you’ve had, or any current financial data that’ll support that you are on the path to success

Financial requests: If you’re searching for investment or financing, include your plans and goals here and any financing you’ve raised or borrowed thus far

Future plans: Your vision for where you’re going in the next year, three years, and five years

When you’re done with your executive summary, you should feel like you’ve provided a bird’s eye view of your entire business plan. In fact, even though this section is first, you will likely write it last so you can take the highlights from each of the subsequent sections.

And once you’re done, read it on its own: Does it give a comprehensive, high-level overview of your restaurant, its current state, and your vision for the future? Remember, this may be the only part of your business plan potential investors or partners will read, so it should be able to stand on its own and be interesting enough to make them want to read the rest of your plan.

Company overview

This is where you’ll dive into the specifics of your company, detailing the kind of restaurant you’re looking to create, who’s helping you do it, and how you’re prepared to accomplish it.

Your restaurant business plan company overview should include:

Purpose: The type of restaurant you’re opening (fine dining, fast-casual, pop-up, etc.), type of food you’re serving, goals you have, and the niche you hope to fill in the market

Area: Information on the area in which you’re opening

Customers: Whom you’re hoping to target, their demographic information

Legal structure: Your business entity (i.e. LLC, LLP, etc.) and how many owners you have

Similar to your executive summary, you won’t be going into major detail here as the sections below will get into the nitty-gritty. You’ll want to look at this as an extended tear sheet that gives someone a good grip on your restaurant or concept, where it fits into the market, and why you’re starting it.

Team and management

Barely anything is as important for a restaurant as the team that runs it. You’ll want to create a section dedicated to the members of your staff—even the ones that aren’t yet hired. This will provide a sense of who is taking care of what, and how you need to structure and build out the team to get your restaurant operating at full steam.

Your restaurant business plan team and management section should have:

Management overview: Who is running the restaurant, what their experience and qualifications are, and what duties they’ll be responsible for

Staff: Other employees you’ve brought on and their bios, as well as other spots you anticipate needing to hire for

Ownership percentage: Which individuals own what percentage of the restaurant, or if you are an employee-owned establishment

Be sure to update this section with more information as your business changes and you continue to share this business plan—especially because who is on your team will change both your business and the way people look at it.

Sample menu

You’ll also want to include a sample menu in your restaurant business plan so readers have a sense of what they can expect from your operations, as well as what your diners can expect from you when they sit down. This will also force you to consider exactly what you want to serve your diners and how your menu will stand out from similar restaurants in the area. Although a sample menu is in some ways self-explanatory, consider the following:

Service : If your brunch is as important as your dinner, provide both menus; you also might want to consider including both a-la-carte and prix fixe menus if you plan to offer them.

Beverage/wine service: If you’ll have an emphasis on specialty beverages or wine, a separate drinks list could be important.

Seasonality: If you’re a highly seasonal restaurant, you might want to consider providing menus for multiple seasons to demonstrate how your dishes (and subsequent purchasing) will change.

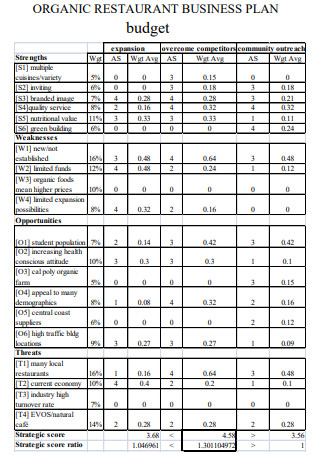

Market analysis

This is where you’ll begin to dive deeper. Although you’ve likely mentioned your market and the whitespace you hope to address, the market analysis section will enable you to prove your hypotheses.

Your restaurant business plan market analysis should include:

Industry information: Include a description of the restaurant industry, its size, growth trends, and other trends regarding things such as tastes, trends, demographics, structures, etc.

Target market: Zoom in on the area and neighborhood in which you’re opening your restaurant as well as the type of cuisine you’re serving.

Target market characteristics: Describe your customers and their needs, how/if their needs are currently being served, other important pieces about your specific location and customers.

Target market size and growth: Include a data-driven section on the size of your market, trends in its growth, how your target market fits into the industry as a whole, projected growth of your market, etc.

Market share potential: Share how much potential there is in the market, how much your presence will change the market, and how much your specific restaurant or restaurant locations can own of the open market; also touch on any barriers to growth or entry you might see.

Market pricing: Explain how you’ll be pricing your menu and where you’ll fall relative to your competitors or other restaurants in the market.

Competitive research: Include research on your closest competitors, how they are both succeeding and failing, how customers view them, etc.

If this section seems like it might be long, it should—it’s going to outline one of the most important parts of your strategy, and should feel comprehensive. Lack of demand is the number one reason why new businesses fail, so the goal of this section should be to prove that there is demand for your restaurant and show how you’ll capitalize on it.

Additionally, if market research isn’t your forte, don’t be shy to reach out to market research experts to help you compile the data, or at least read deeply on how to conduct effective research.

Marketing and sales

Your marketing and sales section should feel like a logical extension of your market analysis section, since all of the decisions you’ll make in this section should follow the data of the prior section.

The marketing and sales sections of your restaurant business plan should include:

Positioning: How you’ll describe your restaurant to potential customers, the brand identity and visuals you’ll use to do it, and how you’ll stand out in the market based on the brand you’re building

Promotion: The tools, tactics, and platforms you’ll use to market your business

Sales: How you’ll convert on certain items, and who/how you will facilitate any additional revenue streams (i.e. catering)

It’s likely that you’ll only have concepts for some of these elements, especially if you’re not yet open. Still, get to paper all of the ideas you have, and you can (and should) always update them later as your restaurant business becomes more fully formed.

Business operations

The business operations section should get to the heart of how you plan to run your business. It will highlight both internal factors as well as external forces that will dictate how you run the ship.

The business operations section should include:

Management team: Your management structure and hierarchy, and who is responsible for what

Hours: Your hours and days of operation

Location: What’s special about your location that will get people through the door

Relationships: Any advantageous relationships you have with fellow restaurateurs, places for sourcing and buying, business organizations, or consultants on your team

Add here anything you think could be helpful for illustrating how you’re going to do business and what will affect it.

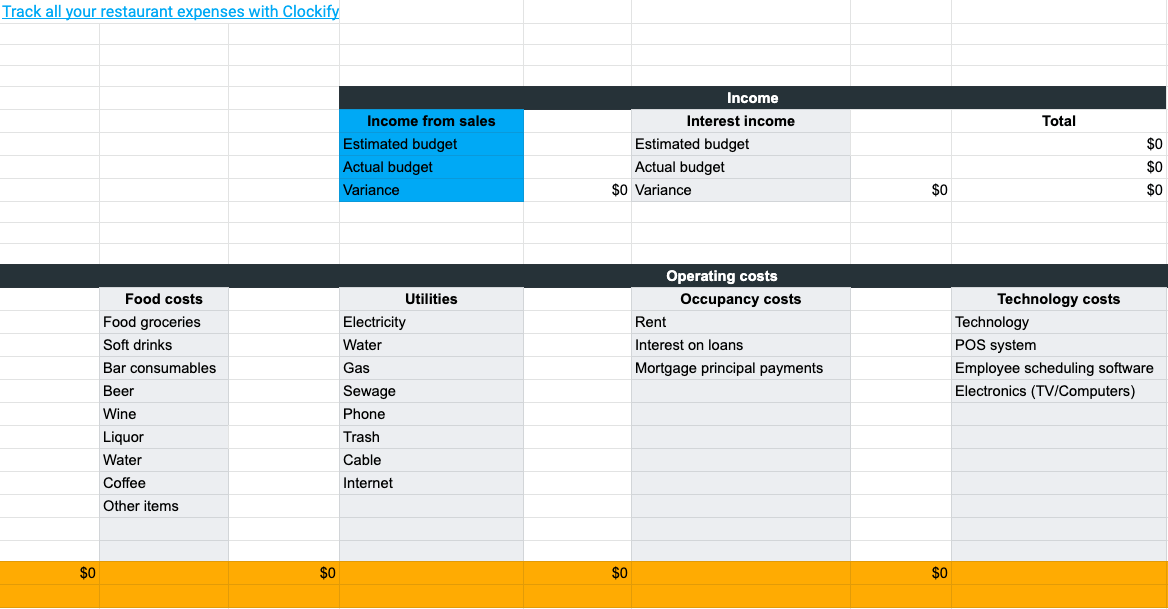

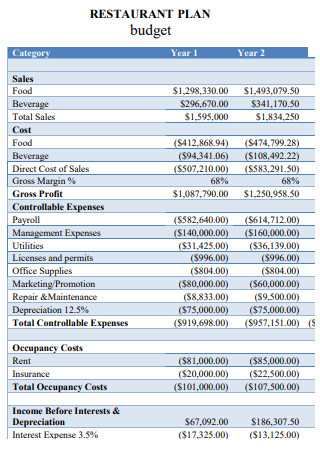

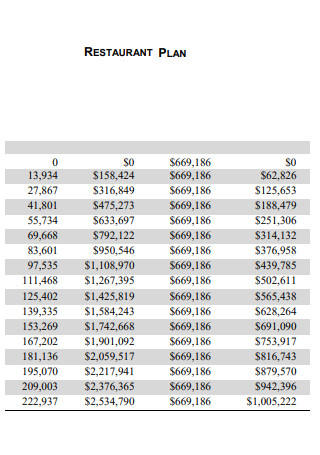

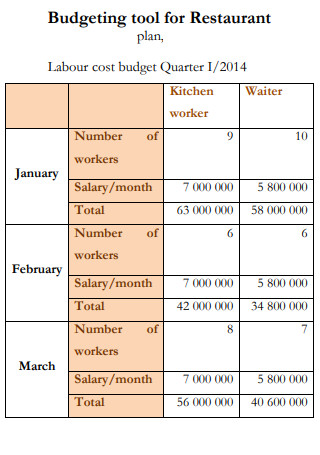

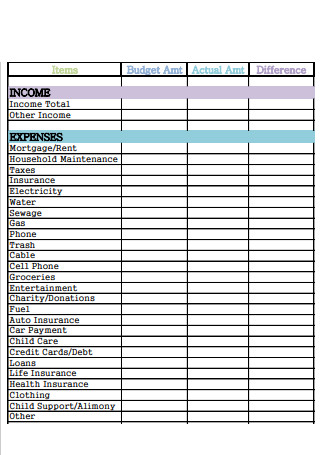

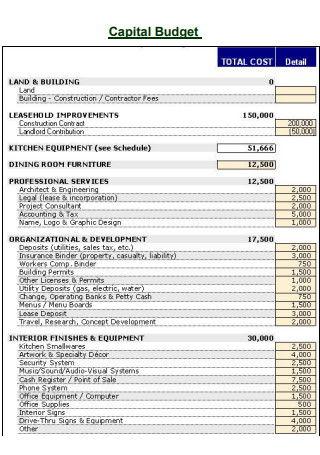

Here, you’ll detail the current state of your business finances and project where you hope to be in a year, three years, and five years. You’ll want to detail what you’ve spent, what you will spend, where you’ll get the money, costs you might incur, and returns you’ll hope to see—including when you can expect to break even and turn a profit.

Financial statements: If you’ve been in business for any amount of time, include existing financial statements (i.e. profit and loss, balance sheet, cash flow, etc.)

Budget: Your current budget or a general startup budget

Projections: Include revenue, cash flow, projected profit and loss, and other costs

Debt: Include liabilities if the business has any outstanding debt or loans

Funding request: If you’re requesting a loan or an investment, lay out how much capital you’re looking for, your company’s valuation (if applicable), and the purpose of the funding

Above all, as you’re putting your financials together, be realistic—even conservative. You want to give any potential investors a realistic picture of your business.

Feel like there are other important components but they don't quite fit in any of the other categories (or make them run too long)? That’s what the restaurant business plan appendix section is for. And although in, say, a book, an appendix can feel like an afterthought, don’t ignore it—this is another opportunity for you to include crucial information that can give anyone reading your plan some context. You may include additional data, graphs, marketing collateral (like logo mockups), and more.

Start Your Dream Business

The bottom line

Whether you’re writing a restaurant business plan for investors, lenders, or simply for yourself and your team, the most important thing to do is make sure your document is comprehensive. A good business plan for a restaurant will take time—and maybe a little sweat—to complete fully and correctly.

One other crucial thing to remember: a business plan is not a document set in stone. You should often look to it to make sure you’re keeping your vision and mission on track, but you should also feel prepared to update its components as you learn more about your business and individual restaurant.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

On a similar note...

How to Write a Small Restaurant Business Plan + Free Sample Plan PDF

Makenna Crocker

10 min. read

Updated March 18, 2024

Free Download: Sample Restaurant Business Plan Template

From greasy spoon diners to Michelin Star restaurants, food service has captured the hearts and imaginations of countless culinary entrepreneurs.

In the United States, 90% of restaurant owners operate small restaurants with fewer than 50 employees . And 70% operate in just one location.

If you’re passionate about food and dream of opening a restaurant, you have plenty of company. But cooking skills alone won’t cut it. You need a plan.

In this article, we’ll walk you through writing a small restaurant business plan, from conducting market research to developing promotional strategies and creating a financial forecast.

Need more guidance? Download our free small restaurant business plan template .

Why write a small restaurant business plan?

Starting a restaurant from scratch isn’t cheap. Startup costs range from $175,000 to $750,000 and include hefty upfront expenses like:

- Building lease

- Kitchen equipment

- Ingredient sourcing

The financials section of a business plan gives you space to compile these costs into an expense budget and compare them to your revenue projections . These will be invaluable in helping you determine if your restaurant concept is financially viable.

And if you need a bank loan or investor to help fund your restaurant , they’ll want to see a plan that includes financial projections (more on that later).

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- How to write a small restaurant business plan

The business plan is not only where you lay out your plan, vision, and goals for the restaurant – it pushes you to thoroughly research and understand your market , competitors , and customers to make informed decisions. It guides you through the intricacies of opening and running a small restaurant and helps you keep your finances in order.

Here are some tips for writing a small restaurant business plan that sets you up for success.

- Start with a company overview

A good place to start is to think about the big picture. What do you want your restaurant to be? Are you envisioning upscale dining in a candlelit, intimate setting? Or maybe you’re going for comfort food in a family-friendly atmosphere?

Capture the essence of your restaurant with a brief, attention-grabbing overview. Think of the start of your overview section as an elevator pitch. You’re introducing your concept and vision to highlight what will make your business unique .

Just keep it succinct.

You’ll need to include other important information about your business here, such as the legal structure of your business and the qualifications of you and your management team.

If you’re writing a business for an existing restaurant, you should also cover its history – when the restaurant was founded, who was involved, and milestones it has reached.

- Understand your target market

Conducting a thorough market analysis is key to the success of your small restaurant. In an industry as competitive as the restaurant business, you’ll need to have your finger on the pulse of your dining market if you hope to create a unique offering.

Defining your target market is essential when starting your restaurant, helping answer questions like:

- Is there demand in the local market for your food?

- Who are your primary competitors?

- Is there building space for lease near where your target customers live or work?

- What types of partnerships with food distributors (wholesalers, farmers, butchers, etc.) will be needed to ensure a steady flow of fresh ingredients?

The first step is to identify who your diners will be.

It’s unrealistic to try to appeal to every single customer. So, ask yourself who you envision walking through your doors. Are they:

- Adults aged 40 and over, with lots of disposable income and exotic culinary tastes.

- Children, young adults, and families looking for quick, convenient food that doesn’t stretch their budgets.

Of course, these aren’t the only two customer demographics for a restaurant. But you should get the sense that these customer segments have very different preferences.

Read more: Target market example

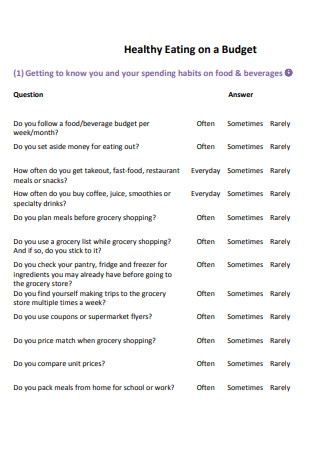

Understanding your target market involves more than just demographics. Consider their:

- Spending habits

- Daily routines

If you plan to operate in a busy city center, your target market might include working professionals seeking quick lunch options or upscale dining options after work. But if you’re opening in a less visible area near residential neighborhoods, you may be more likely to target families.

- Size up your competition

With a target customer in mind, you need to understand who you’ll be competing with for their dining budget.

Analyzing your competitors is about understanding their strengths, weaknesses, and strategies.

Start by identifying direct competitors (other small restaurants) and indirect competitors (like fast-food chains or food trucks). Observe how they attract customers, the ambiance they create, and the variety and pricing of their menus.

Get a feel for their operational strategies:

- How much staffing do they have?

- How fast (or slow) is their service?

- What kinds of supplier relationships do they seem to have?

And their marketing tactics :

- How do they engage with customers?

- What deals or promotions do they offer?

- What kind of reviews are they getting online?

Finally, think about their long-term position:

- Have they expanded or downsized recently?

- Have they changed their operating hours?

- Have they changed their menu?

As you observe these competitors and their customers, ask yourself what they are doing right and where they are coming up short.

This knowledge will help you identify gaps in the market and opportunities to offer a unique experience.

- Create a detailed operations plan

With so many moving pieces to manage as a restaurant owner, writing an operations plan is just as important as creating a market analysis.

The operations section of your business plan details how your restaurant will function daily.

It should briefly touch on every aspect of running the business–from staffing needs to how often you will need to buy new ingredients, kitchen equipment, or dining utensils.

Your operations plan will reflect the unique needs of your business, but a typical restaurant operations plan might include:

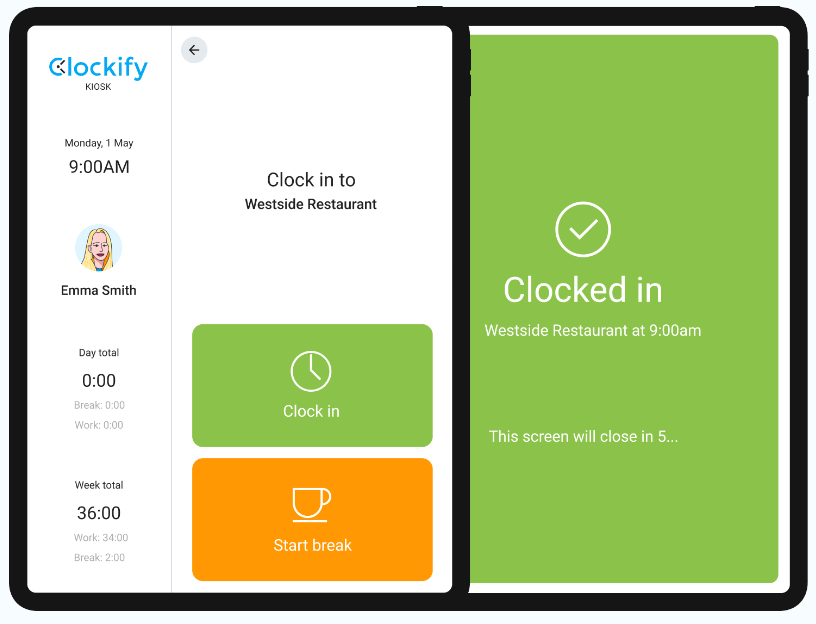

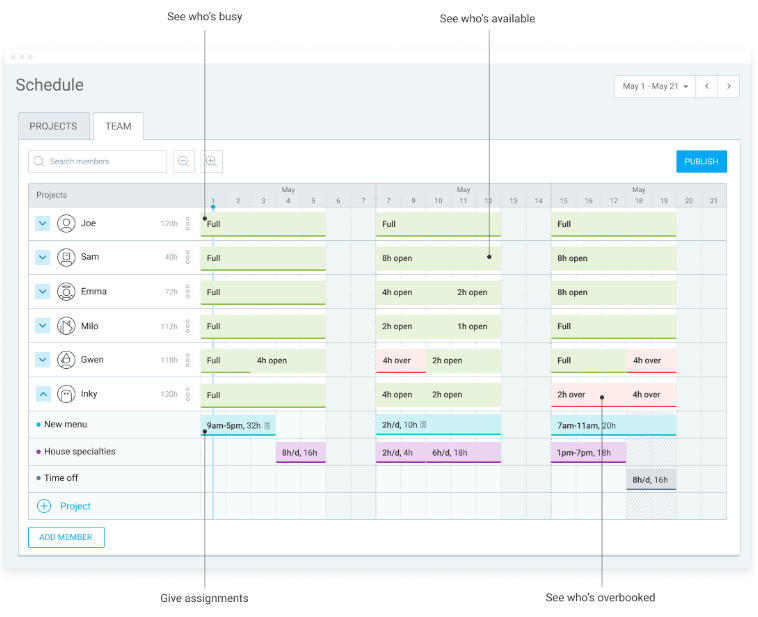

- Staffing and training: Lay out a staffing plan, with the roles and responsibilities of each team member. Include strategies for hiring, training, and employee retention.

- Equipment and technology: Outline your dining, kitchen, and technology needs, from tables and chairs to ovens and point-of-sale systems.

- Supply chain management: Explain your ingredient sourcing and inventory management strategies and your plan to build relationships with suppliers.

- Customer service policies: Describe how you manage customer service needs and feedback to ensure a positive dining experience.

- Health and safety protocols: Detail procedures for maintaining kitchen hygiene practices and food handling standards to ensure food safety and compliance with health regulations.

Without an operations plan, you’ll lack a documented strategy for managing your kitchen workflow, maintaining customer satisfaction, or even basic tasks like inventory or staffing.

And if you’re writing a business plan to get a bank loan or investment , they’ll want to see that you have a plan for successfully managing the restaurant.

- Actively market your restaurant

Your small restaurant may serve the most mouthwatering dishes in town, but no one will discover it without effective promotional strategies.

You need to develop a comprehensive marketing plan to showcase your culinary delights and entice customers through your doors.

Consider both traditional and digital marketing channels to reach your target audience. Traditional methods may include:

- Hosting special events

- Participating in local food festivals

- Partnering with complementary businesses in your community

Digital strategies may include:

- Creating an engaging website

- Building a strong presence on social media platforms

- Utilizing online review platforms to build credibility and foster positive word-of-mouth.

When developing your promotional strategies, consider the following tips:

Be smart about your online presence

Build a visually appealing and user-friendly website that showcases your restaurant’s ambiance, menu, and story.

Leverage social media platforms to engage with your audience, share enticing food photos, and run targeted advertising campaigns.

Consider promotions

Encourage repeat business by implementing a loyalty program that rewards customers for their patronage. Offer incentives such as discounts to certain customer segments, like seniors, veterans, or students.

Engage with the local community

Participate in community events, sponsor local sports teams or charity initiatives, and establish partnerships with neighboring businesses.

Becoming an active community member will build brand awareness and loyalty.

Don’t ignore your pricing and financial strategy

According to data from the National Restaurant Association , about 60% of restaurants fail in their first year, and 80% close within five years.

You need to understand your startup and ongoing operating expenses to run a successful small restaurant.

Start by estimating your startup costs , including:

- Site acquisition (down payment if owning the space, initial payment if leasing)

- Building improvements

- Equipment purchases

- Licenses and permits

- Initial inventory

- Menu creation

Then, account for ongoing operating expenses, such as:

- Employee wages

- Mortgage or rent payments

- Ingredient costs

Pricing your menu items strategically is essential to ensuring profitability. Analyze ingredient costs, consider portion sizes, and compare prices in your local market to determine competitive yet profitable pricing.

Conduct a break-even analysis to determine the number of customers you need to serve to cover costs and start generating profits. Regularly review your financials and adjust your pricing as needed to maintain a healthy bottom line.

Consider these financial aspects when developing your small restaurant business plan:

Budget Allocation

Determine how you will allocate your budget across different areas of your restaurant, such as kitchen equipment, interior design, marketing, and staff training.

Prioritize investments that will have a direct impact on customer experience and operational efficiency.

Revenue Streams

Identify multiple revenue streams for your restaurant. This may include revenue from food sales, catering services, private events, or partnerships with local businesses.

Diversifying your revenue sources can help stabilize your cash flow.

Cost Control

Develop strategies to control costs without compromising quality. Efficient inventory management, negotiation with suppliers, and staff training on waste reduction can contribute to cost savings.

Sales Forecasting

Create a sales forecast based on your market research, pricing strategy, and seating capacity. Consider seasonal fluctuations and special events that may impact your restaurant’s performance.

Other information to include in your small restaurant business plan

As a restaurant owner, a few components of your business plan are unique to your industry.

None of these fit neatly into any one section of a business plan. We suggest addressing them in additional sections or within the appendix .

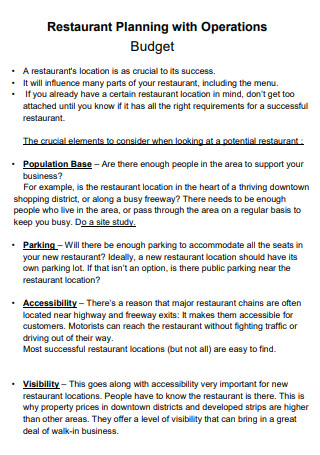

Restaurant location and layout

Include information about your restaurant’s location .

Some of this information will be included in your market analysis, but once you’ve secured a location, you should go deeper and analyze factors like:

- Rent and utilities

- Foot traffic

- Parking availability

- Nearby businesses

Explaining the layout of your restaurant – especially your kitchen – is also important. Consider adding photos or diagrams of each room to your plan.

Diagrams can be especially helpful. You can add in-depth details for seating arrangements in the dining room or how staff should move efficiently throughout the kitchen.

What do many people do before deciding whether to eat at a restaurant?

They look at the menu.

You can gain or lose customers on the strength of your menu. It affects numerous business areas, from marketing to pricing and operations.

For instance, if you’re running a family-friendly restaurant but your prices are too high, people will see that on your menu and may decide to eat somewhere cheaper.

On the other hand, if you’re running a fine dining restaurant , but your menu fails to describe your dishes in an appealing way, diners may go somewhere they perceive as having higher quality meals.

That makes the business plan a great place to create menu concepts.

You can experiment with different offerings, price points, and menu designs until you’re confident about sharing them with customers.

And since business plans are continuously updated as your business changes—you can see how your menu has changed over time and what’s been most successful.

Download your free small restaurant business plan template

If you’re ready to start a restaurant, you can download our free small restaurant business plan template from our library of over 550 sample business plans .

Get started today, and discover why businesses that plan grow 30% faster than those that don’t .

More restaurant business plan examples:

- Food truck business plan

- Coffee shop business plan

- Bakery business plan

- Brewery business plan

See why 1.2 million entrepreneurs have written their business plans with LivePlan

Makenna Crocker is the Social Brand Manager at Palo Alto Software. Her work focuses on market and social trends, educational content creation, and providing entrepreneurs with small business tips and tools. With a master’s degree in Advertising and Brand Responsibility from the University of Oregon, she specializes in generating a strong and responsible brand presence through social media and sharable content.

Table of Contents

- Why you need a plan

- Don’t ignore your pricing and financial strategy

- Additional info to include

- Free business plan template

Related Articles

6 Min. Read

Agriculture business plan

1 Min. Read

Accounting and bookkeeping business plan

Artist business plan

8 Min. Read

Auto repair shop business plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Eat App for

How it works.

How to Write a Restaurant Business Plan in 2024 (Step by Step Guide with Templates)

A comprehensive restaurant business plan is a framework that guides you to plan and forecast every element of restaurant management and operations.

This includes anything from your restaurant's menu design, location, financials, employee training, and a lot more.

Crafting a solid business plan is important, as it helps:

- Transform your restaurant ideas into reality.

- Boosts entrepreneurial success by 16% (Harvard Business Study) .

- Equips you to navigate challenges before they arise.

- Attracts potential investors.

“You have to show any potential investor that you have an actual plan, you know what you’re talking about, it looks professional, and you’re not just screwing around.” - Charles Bililies, owner of Souvla

Planning is key to restaurant success. Without a plan, you're more likely to join the 26% of restaurants that fail within a year.

Create a business plan to set yourself up for success.

Here's how to get started.

A step-by-step guide to writing a restaurant business plan

Embarking on a restaurant venture is an exciting prospect filled with endless possibilities.

However, the key to transforming your culinary dreams into reality lies in the foundation of a well-crafted restaurant business plan.

This guide will walk you through creating a winning restaurant business plan , from defining your niche to seeking expert advice.

So, are you ready to cook up some success? Let's get started.

Essential components of a restaurant business plan

A well-structured restaurant business plan typically consists of the following key components:

- Executive Summary

Company Description

- Market Analysis

- Restaurant Design

- Market Overview

- External help

- Financial Analysis

Delving into each section

Now, let's take a closer look at each section of your restaurant business plan and explore the key elements to consider:

1. Executive summary

A restaurant business plan should always begin with an executive summary. Why?

- 80% of venture capitalists say they read the executive summary first.

- 62% of investors say they would not continue reading a business plan if the executive summary did not capture their interest.

- A strong executive summary can increase the likelihood of securing funding by up to 40%.

An executive summary not only acts as the introduction to your restaurant business plan samples but also as a summary of the entire idea.

The main aim of an executive summary is to draw the reader (oftentimes an investor) into the rest of your business plan.

The executive summary also helps you envision the identity of your restaurant which essentially shapes the customer experience and sets you apart from competitors.

To establish a distinct identity, you need to focus on c ommon elements of an executive summary, including:

- A mission statement

- Proposed concept development

- Cuisine selection

- The overall execution

- The potential costs

- Expected return on investments (ROI)

Let's take a more in-depth look at the concept development, cuisine selection, and mission statement.

Further reading

- How to write a restaurant executive summary

Concept Development

Selecting the type of restaurant, service style, and atmosphere is the first step towards creating a unique dining experience. Whether you envision a sample menu for a:

- cozy, intimate bistro

- bustling quick-service deli

- fast-casual restaurant

- fine dining establishment

Your concept should reflect your passion and expertise in the industry.

With a broad range of options, it’s critical to scrutinize your target market and pinpoint the most suitable choice considering their preferences and your capabilities.

When planning your restaurant design, keep in mind that it should effectively complement your chosen theme and cuisine.

Additionally, consider the potential for patio seating and the involvement of your management team in making these critical decisions.

A well-thought-out concept will not only set the stage for an unforgettable dining experience but also pique the interest of potential investors.

Cuisine Selection

The cuisine you select for your restaurant can significantly influence its success.

Choosing the appropriate cuisine is vital for distinguishing your establishment from competitors and attracting your target market.

To make an informed decision, consider factors such as:

- Market demand

- Expertise and passion

- Ingredient availability

- Competition

- Profitability

- Cultural fit

- Seasonality

Dietary restrictions and trends

In the highly competitive restaurant industry, keeping track of current and emerging cuisine trends can be a significant advantage.

From regional delicacies to innovative fusion dishes, understanding what’s popular and in demand can help you tailor your offerings to the desires of your target audience.

By thoroughly analyzing the market and adapting to evolving tastes, your restaurant can remain relevant and successful in the long run.

Crafting a mission statement

A well-constructed mission statement communicates the purpose, values, and goals of your restaurant to potential investors and customers alike.

A mission statement serves as a guiding light for decision-makers and employees, fueling their efforts to achieve your restaurant’s objectives.

To create an impactful mission statement, consider the following steps:

- Identify the purpose of the restaurant.

- Contemplate the brand’s image.

- Account for the target audience.

- Incorporate company values.

- Ensure brevity and comprehensiveness.

Related content: How to Write a Restaurant Mission Statement

Remember, your mission statement should not only differentiate your restaurant from competitors but also resonate with your target market.

By articulating your restaurant’s unique values and vision, you’ll create a strong foundation upon which to build a thriving and successful business.

2. Company description

This is the part of the restaurant business plan where you fully introduce the company.

Start this section with the name of the restaurant you are opening along with the location, contacts, and other relevant information.

Also, include the owner’s details and a brief overview or description of their experience.

The second part of the company description should highlight the legal standing of the restaurant and outline the restaurant’s short and long-term goals.

Provide a brief market study showing that you understand the trends in the regional food industry and why the most independent restaurant investors will succeed in this market.

Here's an example of the page layout:

Restaurant Name: [Restaurant Name]

Location: [Restaurant Address]

Contact: [Restaurant Phone Number] | [Restaurant Email Address]

Owner: [Owner Name]

Experience: [Owner Name] has over [Number] years of experience in the restaurant industry. They have worked in various roles, including [List of Roles]. They are passionate about food and creating a memorable dining experience for their guests.

Legal Standing: [Restaurant Name] is a [Type of Legal Entity] registered in [State/Province].

Short-term Goals:

- Generate [Amount] in revenue within the first year of operation.

- Achieve a [Percentage] customer satisfaction rating within the first six months of operation.

Long-term Goals:

- Expand to a second location within five years.

- Become a recognized leader in the regional food industry.

Market Study:

The regional food industry is experiencing a number of trends, including:

- An increasing demand for fresh, local ingredients.

- A growing interest in ethnic cuisine.

- A preference for casual dining experiences.

3. Market analysis

The market analysis portion of the restaurant business plan is typically divided into three parts.

3.1 Industry analysis

What is your target market? What demographics will your restaurant cater to?

This section aims to explain your target market to investors and why you believe guests will choose your restaurant over others.

Comprehending your target market is key to customizing your restaurant offerings to their preferences and needs.

By diving into demographics, preferences, dining habits, and trends, you can fine-tune your concept and marketing strategy to reach and appeal to your target audience effectively.

An example of analyzing your target market

Comprehending your target market is key to customizing your restaurant offerings to their preferences and needs.

Demographics and preferences

Identifying your primary target market involves considering factors such as:

For example, a neighborhood with a high concentration of families might prefer a family-friendly restaurant with a diverse menu catering to various age groups and dietary preferences.

Conversely, a trendy urban area with a predominantly young and affluent population may gravitate towards upscale dining experiences and innovative cuisine.

Cultural and ethnic backgrounds also have a significant impact on restaurant preferences, with people from different backgrounds having distinctive tastes and customs that influence their dining choices.

By thoroughly understanding the demographics and preferences of your target market, you’ll be better equipped to create a restaurant concept that resonates with them and ultimately drives success.

Dining habits and trends

As the restaurant industry continues to evolve, staying informed about dining habits and trends is crucial for adapting your offerings and attracting customers.

For example, the rise of online ordering and delivery services has significantly influenced dining habits, with many consumers seeking the convenience of having their meals delivered to their doorstep.

Health trends have also had an impact on dining habits, with an increasing number of individuals seeking healthier options when dining out.

By staying abreast of current habits and trends, you can anticipate the needs and desires of your target market and tailor your restaurant’s offerings accordingly.

This forward-thinking approach will not only help you stay competitive but also foster long-term success in the ever-changing restaurant landscape.

- How to find your restaurant's target market

3.2 Competition analysis

It's easy to assume that everyone will visit your new restaurant first, so it is important to research your competition to make this a reality.

What restaurants have already established a customer base in the area?

Take note of everything from their prices, hours, and service style to menu design to the restaurant interior.

Then explain to your investors how your restaurant will be different.

3.3 Marketing analysis

Your investors are going to want to know how you plan to market your restaurant. How will your marketing campaigns differ from what is already being done by others in the restaurant industry?

How do you plan on securing your target market? What kind of offers will you provide your guests? Make sure to list everything.

The most important element to launching a successful restaurant is the menu . Without it, your restaurant has nothing to serve.

At this point, you probably don’t have a final version, but for a restaurant business plan, you should at least try to have a mock-up.

Add your logo to the mock-up and choose a design that you can see yourself actually using. If you are having trouble coming up with a menu design or don’t want to pay a designer, there are plenty of resources online to help.

The key element of your sample menu though should be pricing. Your prices should reflect the cost analysis you’ve done for investors. This will give them a better understanding of your restaurant’s target price point. You'll quickly see how important menu engineering can be, even early on.

5. Employees

The company description section of the restaurant business plan briefly introduces the owners of the restaurant with some information about each. This section should fully flesh out the restaurant's business plan and management team.

The investors don’t expect you to have your entire team selected at this point, but you should at least have a couple of people on board. Use the talent you have chosen thus far to highlight the combined work experience everyone is bringing to the table.

6. Restaurant design

The design portion of your restaurant business plan is where you can really show off your thoughts and ideas to the investors. If you don’t have professional mock-ups of your restaurant rendered, that’s fine.

Instead, put together a mood board to get your vision across. Find pictures of a similar aesthetic to what you are looking for in your restaurant.

The restaurant design extends beyond aesthetics alone and should include everything from restaurant software to kitchen equipment.

7. Location

The location you settle on for your restaurant should be well aligned with your target market (making it easier to cater to your ideal customer) and with your business plans.

At this stage in the process, its not uncommon to not have a specific location in mind - but you should at the very least have a few options to narrow down.

Tip: When you approach your investors about potential locations, make sure to include as much information as possible about each venue and why it would be ideal for your brand. Go into as much detail as possible - including everything from square footage to the demographics of the area.

Example for choosing an ideal location

Choosing the ideal location for your restaurant is a pivotal decision that can greatly influence your success.

To make the best choice, consider factors such as foot traffic, accessibility, and neighborhood demographics.

By carefully evaluating these factors, you’ll be better equipped to maximize visibility and attract your target market.

Foot traffic and accessibility

Foot traffic and accessibility are essential factors in selecting a location that will attract customers and ensure convenience.

A high-traffic area with ample parking and public transportation options can greatly increase the likelihood of drawing in potential customers.

Additionally, making your restaurant accessible to individuals with disabilities can further broaden your customer base and promote inclusivity.

It’s also important to consider the competition in the area and assess whether your restaurant can stand out among existing establishments.

By choosing a location with strong foot traffic and accessibility, you’ll be well on your way to creating a thriving restaurant that appeals to your target market.

Neighborhood demographics

Analyzing neighborhood demographics can help you determine if your restaurant’s concept and cuisine will appeal to the local population.

Factors such as income levels, family structures, and cultural diversity can all influence dining preferences and habits.

By understanding the unique characteristics of the neighborhood, you can tailor your offerings and marketing efforts to resonate with the local community.

Conducting a market analysis can be a valuable step in this process.

To gather demographic data for a particular neighborhood, you can utilize resources such as the U.S. Census Bureau’s American Community Survey and reference maps.

Armed with this information, you can make informed decisions about your restaurant’s concept, menu, and pricing, ensuring that your establishment is well-positioned for success within the community.

Conducting market research will further strengthen your understanding of the local demographic.

8. Market overview

The market overview section is heavily related to the market research and analysis portion of the restaurant business plan. In this section, go into detail about both the micro and macro conditions in the area you want to set up your restaurant.

Discuss the current economic conditions that could make opening a restaurant difficult, and how you aim to counteract that. Mention all the other restaurants that could prove to be competition and what your strategy is to set yourself apart.

9. Marketing

With restaurants opening left and ride nowadays, investors are going to want to know how you will get word of your restaurant to the world.

The next marketing strategy and publicity section should go into detail on how you plan to market your restaurant before and after opening. As well as any plans you may have to bring a PR company on board to help spread the word.

Read more: How to write a restaurant marketing plan from scratch

10. External help

To make your restaurant a reality, you are going to need a lot of help. List any external companies or software you plan on hiring to get your restaurant up and running.

This includes everything from accountants and designers to suppliers that help your restaurant perform better, like POS systems and restaurant reservation systems .

Explain to your other potential investors about the importance of each and what they will be doing for your restaurant.

11. Financial analysis

The most important part of your restaurant business plan is the financial section . We would recommend hiring professional help for this given its importance.

Hiring a trained accountant will not only help you get your own financial projections and estimates in order but also give you a realistic insight into owning a restaurant.

You should have some information prepared to make this step easier for the accountant.

He/she will want to know how many seats your restaurant has, what the check average per table will be, and how many guests you plan on seating per day.

In addition to this, doing rough food cost calculations for various menu items can help estimate your profit margin per dish. This can be achieved easily with a free food cost calculator.

- Important restaurant metrics to track

A well-crafted restaurant business plan serves as a roadmap to success, guiding every aspect of the venture from menu design to employee training.

By carefully considering each component of the plan, aspiring restaurateurs can increase their chances of securing funding, attracting customers, and achieving their long-term goals.

Remember, a restaurant business plan is not just a document to satisfy investors; it is a living tool that should be revisited and updated regularly as the business grows and evolves.

By staying committed to the plan and adapting it as needed, restaurateurs can ensure that their culinary dreams have a solid foundation for success.

Share this article!

Saif Alnasur used to work in his family restaurant, but now he is a food influencer and writes about the restaurant industry for Eat App.

How to Calculate Food Cost in:...

Whether you're putting together a menu for your...

The A to Z Guide to:...

86 that dish? Camper? Kill it? In the weeds?

OpenTable vs. Resy::...

When it comes to choosing an online restaurant...

Join restaurants in 70+ countries using Eat App

Empowering restaurants, one table at a time Discover seamless dining with Eat App

- Reservation system

- Table management

- CRM and guest profiles

- Reports & trends

- Integrations

- Privacy policy

- Terms of service

- The 16 Best Reservation Systems

- Guide to Restaurant Marketing

- Guide to Customer Service

- Guide to Making a Restaurant Website

- All articles

"> "> Compare us

- Seven Rooms

- Compare All

© Eat App. All rights reserved.

Restaurant Business Plan Template

Written by Dave Lavinsky

Restaurant Business Plan

You’ve come to the right place to create your restaurant business plan.

We have helped over 100,000 entrepreneurs and business owners with how to write a restaurant business plan to help them start or grow their restaurants.

Below is a restaurant business plan template to help you create each section of your business plan.

Restaurant Business Plan Example

Executive summary, business overview.

Bluehorn Restaurant & Steakhouse is a new restaurant and steakhouse located in Oklahoma City, Oklahoma. The menu of Bluehorn Restaurant & Steakhouse will include bistro-type dishes that are authentically created and crafted by acclaimed Chef Peter Logan. It will be located in the trendy part of town, known as the Plaza District. The restaurant will be surrounded by classy art galleries, live theater, high-end restaurants and bars, and expensive shopping.

Owned by emerging restaurant operators Chef Peter Logan and Anastasia Gillette, Bluehorn Restaurant & Steakhouse’s mission is to become Oklahoma City’s best, new restaurant for patrons to celebrate their next big event, have a nice date night, or gather with friends or family for a fun evening while dining over finely crafted entrees, desserts, and cocktails.

Products Served

The following are the menu items to be offered by Bluehorn Restaurant & Steakhouse:

- Soups & Salads

- Gourmet sides

- Wine, Beer & Spirits

Customer Focus

Bluehorn Restaurant & Steakhouse will target adult men and women between the ages of 21 – 65 with disposable income in Oklahoma City, Oklahoma. Within this demographic are millennials, young professionals, newlyweds, young families, more established families, and retirees. Because of the pricing structure of the menu, the patrons will likely be upper middle class to the wealthy population of Oklahoma City.

Management Team

Bluehorn Restaurant & Steakhouse is owned and operated by fellow Oklahoma City natives and culinary enthusiasts, Chef Peter Logan and Anastasia Gillette. Both come with a unique skill set and complement each other perfectly. They formerly worked together at another OKC fine dining establishment and made a great team for serving guests delectable food and wine while ensuring the highest level of customer service.

Chef Peter will manage the kitchen operations of Bluehorn Restaurant & Steakhouse, while Anastasia will oversee front of the house operations, maintain and ensure customer service, and manage all reservations.

Financial Highlights

Bluehorn Restaurant & Steakhouse is seeking $300,000 in debt financing to open its start-up restaurant. The funding will be dedicated for the build-out and design of the restaurant, kitchen, bar and lounge, as well as cooking supplies and equipment, working capital, three months worth of payroll expenses and opening inventory. The breakout of the funding is below:

- Restaurant Build-Out and Design – $100,000

- Kitchen supplies and equipment – $100,000

- Opening inventory – $25,000

- Working capital (to include 3 months of overhead expenses) – $25,000

- Marketing (advertising agency) – $25,000

- Accounting firm (3 months worth and establishment/permitting of business) – $25,000

Company Overview

Bluehorn Restaurant & Steakhouse is a new restaurant and steakhouse located in Oklahoma City, Oklahoma. Bluehorn Restaurant & Steakhouse will serve a wide variety of dishes and beverages and will cater to the upper middle class to wealthier population of Oklahoma City. The menu of Bluehorn Restaurant & Steakhouse will include bistro-type dishes that are authentically created and crafted by acclaimed Chef Peter Logan. It will be located in the trendy part of town, known as the Plaza District. The Plaza District is one of Oklahoma’s trendy neighborhoods and is considered the “it” area for newlyweds, millennials, professionals, and young singles. The restaurant will be surrounded by classy art galleries, live theater, high-end restaurants and bars, and expensive shopping.

Owned by emerging restaurant operators Chef Peter Logan and Anastasia Gillette, the restaurant’s mission statement is to become the best new steak restaurant in OKC. The following are the types of menu items Bluehorn Restaurant & Steakhouse will serve- shareables, steaks, soups, gourmet sides and salads.

Bluehorn Restaurant & Steakhouse History

Bluehorn Restaurant & Steakhouse is owned by two Oklahoma City natives, Chef Peter Logan and Anastasia Gillette. They have both worked around the country in fine dining establishments and have a combined twenty years in the restaurant industry. Upon working alongside each other at another fine dining establishment in Oklahoma City, the two of them became good friends and decided to venture into owning their own restaurant.

Chef Peter is the kitchen guru and critically acclaimed chef, while Anastasia manages the front of the house and is a certified Sommelier. Together, with both of their expertise and knowledge, Bluehorn Restaurant & Steakhouse is destined to become Oklahoma City’s next big restaurant.

Industry Analysis

The Restaurant industry is expected to grow to over $220 billion in the next five years.

Consumer spending is projected to grow. The Consumer Confidence Index, a leading indicator of spending patterns, is expected to also grow strongly, which will boost restaurant industry growth over the next five years. The growth in consumer confidence also suggests that more consumers may opt to segment their disposable income to eating outside the home.

Additionally, an increase in the number of households earning more than $100,000 annually further contributes to the industry growth, supporting industry operators that offer more niche, higher-end products. This group is expected to continue to grow in size over the next five years.

The urban population represents a large market for the industry. Specifically, time-strapped individuals living in urban areas will likely frequent industry establishments to save time on cooking. The urban population is expected to increase, representing a potential opportunity for the industry.

Customer Analysis

Demographic profile of target market, customer segmentation.

Bluehorn Restaurant & Steakhouse will primarily target the following customer profile:

- Upper middle class to wealthier population

- Millennials

- Young professionals

- Households with an average income of at least $75k

- Foodies and culture enthusiasts

Competitive Analysis

Direct and indirect competitors.

Bluehorn Restaurant & Steakhouse will be competing with other restaurants in Oklahoma City. A profile of each competitor is below. The Press Located in the trendy area known as the Plaza District, The Press has reimagined our favorite foods of the surrounding regions through the lens of home.

The menu consists of appetizers, soups, burgers and sandwiches, bowls, main dishes, sides, desserts, and a large selection of alcoholic beverages. The Press serves craft beer, domestic beer, wine spritzers, house cocktails, wine, and mimosas. They also offer brunch. The menu of The Press is affordable with the most expensive dish being $16. The wine menu is also not pretentious as the wine is sold either by the glass or bottle, with the most expensive bottle being $52 for the Gruet Sparkling Brut Rose. Oak & Ore Oak & Ore is a craft beer and restaurant in OKC’s Plaza District. They have a 36-tap beer selection and offer vegetarian, vegan, and gluten free dining options. Oak & Ore offers a rotating, 36-tap selection of their favorite brews from Oklahoma and around the world. Each beer is thoughtfully paired with a craft beer-inspired dining experience.

The food menu of Oak & Ore offers starters, salads, wings, fried chicken, sandwiches, tacos, banh mi, and sides. They also have a selection of kids dishes so the whole family can enjoy comfort food while sampling one of their delectable beers.

The Mule OKC The Mule is a casual, hip restaurant offering a large beer and cocktail menu plus sandwiches and more. Located in the constantly growing and buzzing hub that is the Plaza District, The Mule takes the timeless favorite and contorts it into a whole menu of wild offerings.

There is also a fantastic assortment of soups offered and The Mule shakes up a seasonal list of cocktails designed by their bar staff. During the winter months, patrons can stave off the cold with their versions of hot toddies and buttered rum. For the beer drinkers, they always have a reliable line-up of fresh cold brews on draft, as well as a wide selection of can.

Competitive Advantage

Bluehorn Restaurant & Steakhouse offers several advantages over its competition. Those advantages are:

- Gourmet dishes elegantly prepared to the finest standard.

- Selection of steaks sourced from local Oklahoma farms.

- An exclusive and unique wine menu that includes a wine selection of all price points.

- Highly sought after location: Bluehorn Restaurant & Steakhouse will be located in the trendy and attractive neighborhood known as The Plaza District.

- Trendy, welcoming, and energetic ambiance that will be perfect for a night out or a celebration.

Marketing Plan

Promotions strategy.

The marketing strategy for Bluehorn Restaurant & Steakhouse is as follows: Location Bluehorn Restaurant & Steakhouse’s location is a promotions strategy in itself. The Plaza District is a destination spot for locals, tourists, and anyone looking for the trendiest food fare in Oklahoma City. The Plaza District is home to OKC’s most popular bars and restaurants, art galleries, theaters, and boutique shopping. The millennials, young professionals, and foodies will frequent Bluehorn Restaurant & Steakhouse for the location itself.

Social Media Bluehorn Restaurant & Steakhouse will use social media to cater to the millennials and Oklahoma City residents. Chef Peter and Anastasia plan to hire an advertising agency to take professional photographs of the menu items and location to create appealing posts to reach a greater audience. The posts will include pictures of the menu items, as well as upcoming featured options. SEO Website Marketing Bluehorn Restaurant & Steakhouse plans to invest funds into maintaining a strong SEO presence on search engines like Google and Bing. When a person types in “local fine dining restaurant” or “Oklahoma City restaurant”, Bluehorn Restaurant & Steakhouse will appear in the top three choices. The website will include the full menu, location, hours, and lots of pictures of the food, drinks, and steaks. Third Party Delivery Sites Bluehorn Restaurant & Steakhouse will maintain a presence on sites like GrubHub, Uber Eats, Doordash, and Postmates so that people looking for local food to be delivered will see Bluehorn Restaurant & Steakhouse listed near the top.

Operations Plan

Operation functions:.

The company will hire the following:

- 4 sous chefs

- 2 bartenders

- 2 hostesses

- The company will hire an advertising agency and an accounting firm

Milestones:

Bluehorn Restaurant & Steakhouse aims to open in the next 6 months. The following are the milestones needed in order to obtain this goal.

7/1/202X – Execute lease for prime location in the Plaza District.

7/2/202X – Begin construction of restaurant build-out.

7/10/202X – Finalize menu.

7/17/202X – Hire advertising company to begin developing marketing efforts.

8/15/202X – Start of marketing campaign

8/22/202X – Final walk-thru of completed restaurant build-out.

8/25/202X – Hire team of sous chefs, servers, and bussers.

9/1/202X – Decoration and set up of restaurant.

9/15/202X – Grand Opening of Bluehorn Restaurant & Steakhouse

Bluehorn Restaurant & Steakhouse will be owned and operated by Chef Peter Logan and Anastasia Gillette. Each will have a 50% ownership stake in the restaurant.

Chef Peter Logan, Co-Owner

Chef Peter Logan is an Oklahoma City native and has been in the restaurant industry for over ten years. He was trained in a prestigious Le Cordon Bleu Culinary Academy in San Francisco and has worked in some of the nation’s most prestigious fine dining restaurants. His tenure has took him from the west coast to the east coast, and now he’s back doing what he loves in his hometown of Oklahoma City.

Chef Peter will manage the kitchen operations of Bluehorn Restaurant & Steakhouse. He will train and oversee the sous chefs, manage inventory, place food inventory orders, deal with the local food vendors, and ensure the highest customer satisfaction with the food.

Anastasia Gillette, Co-Owner

Anastasia Gillette was born and raised in Oklahoma City and has garnered over ten years in the restaurant industry as well. While in college, Anastasia worked as a hostess at one of the area’s most prestigious restaurant establishments. While there, she was eventually promoted to Front of the House Manager where she oversaw the hostesses, servers, bussers, bartenders, and reservations. Her passion always led to the beverage portion of the restaurant so she obtained her Sommelier certificate in 2019. With her wine education, Anastasia is able to cultivate an interesting and elegant wine selection for the restaurant.

Anastasia will oversee front of the house operations, maintain and ensure customer service, and manage all reservations. She will also be in charge of the bar and wine ordering, training of front of the house staff, and will manage the restaurant’s social media accounts once they are set up.

Financial Plan

Key revenue & costs.

The revenue drivers for Bluehorn Restaurant & Steakhouse will come from the food and drink menu items being offered daily.

The cost drivers will be the ingredients and products needed to make the menu items as well as the cooking materials. A significant cost driver is the fine dining equipment, serving dishes, and beer and wine glasses. Other cost drivers will be the overhead expenses of payroll for the employees, accounting firm, and cost of the advertising agency.

Funding Requirements and Use of Funds

Bluehorn Restaurant & Steakhouse is seeking $300,000 in debt financing to open its start-up restaurant. The breakout of the funding is below:

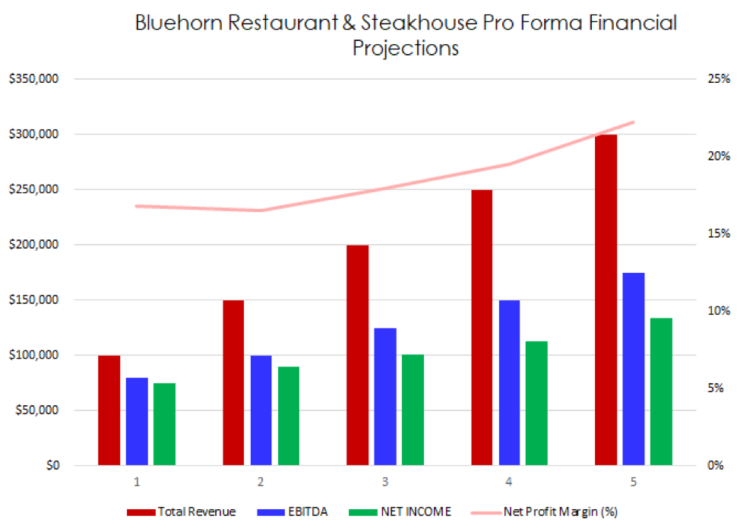

Financial Projections

Income Statement

Balance Sheet

Cash Flow Statement

Restaurant Business Plan FAQs

What is a restaurant business plan.

A restaurant business plan is a plan to start and/or grow your restaurant business. Among other things, it outlines your business concept, identifies your target customers, presents your marketing plan and details your financial projections.

You can easily complete your restaurant business plan using our Restaurant Business Plan Template here .

What Are the Main Types of Restaurants?

There are many types of restaurant businesses. Restaurants can range in type from fast food, fast casual, moderate casual, fine dining, and bar and restaurant types. Restaurants also come in a variety of different ethnic or themed categories, such as Mexican restaurants, Asian restaurants, American, etc. Some restaurants also go mobile and have food trucks.

How Do You Get Funding for Your Restaurant Business Plan?

Restaurant businesses are most likely to receive funding from banks. Typically you will find a local bank and present your business plan to them. Another option for a restaurant business is to obtain a small business loan. SBA loans are a popular option as they offer longer loan terms with lower interest rates.

What are the Steps To Start a Restaurant Business?

1. Develop A Restaurant Business Plan - The first step in starting a business is to create a detailed restaurant business plan that outlines all aspects of the venture. This should include potential market size and target customers, the services or products you will offer, pricing strategies and a detailed financial forecast.

2. Choose Your Legal Structure - It's important to select an appropriate legal entity for your restaurant business. This could be a limited liability company (LLC), corporation, partnership, or sole proprietorship. Each type has its own benefits and drawbacks so it’s important to do research and choose wisely so that your restaurant business is in compliance with local laws.

3. Register Your Restaurant Business - Once you have chosen a legal structure, the next step is to register your restaurant business with the government or state where you’re operating from. This includes obtaining licenses and permits as required by federal, state, and local laws.

4. Identify Financing Options - It’s likely that you’ll need some capital to start your restaurant business, so take some time to identify what financing options are available such as bank loans, investor funding, grants, or crowdfunding platforms.

5. Choose a Location - Whether you plan on operating out of a physical location or not, you should always have an idea of where you’ll be based should it become necessary in the future as well as what kind of space would be suitable for your operations.

6. Hire Employees - There are several ways to find qualified employees including job boards like LinkedIn or Indeed as well as hiring agencies if needed – depending on what type of employees you need it might also be more effective to reach out directly through networking events.

7. Acquire Necessary Restaurant Equipment & Supplies - In order to start your restaurant business, you'll need to purchase all of the necessary equipment and supplies to run a successful operation.

8. Market & Promote Your Business - Once you have all the necessary pieces in place, it’s time to start promoting and marketing your restaurant business. This includes creating a website, utilizing social media platforms like Facebook or Twitter, and having an effective Search Engine Optimization (SEO) strategy. You should also consider traditional marketing techniques such as radio or print advertising.

Learn more about how to start a successful restaurant business:

- How to Start a Restaurant Business

Where Can I Get a Restaurant Business Plan PDF?

You can download our free restaurant business plan template PDF here . This is a sample restaurant business plan template you can use in PDF format.

START A CONVERSATION

Get in touch to start cooking for delivery with CloudKitchens. Want a tour, or just have questions? We're here for that to.

+1 206-865-6298

Phone +1 206-865-6298

Email [email protected]

© 2024 City Storage Systems LLC.

Writing a Restaurant Business Plan: A Guide

Table of contents.

In many ways, a restaurant business plan is like a detailed recipe. But instead of listing ingredients and cooking methods, a restaurant business plan provides aspiring restaurant owners an overview of their proposed establishment—and it’s as crucial as a dish’s final dash of salt.

However, writing a strong restaurant business plan can be confusing. That’s why we’re here.

By diving into how to write a restaurant business plan, we’ll discuss the detailed information you should include so you know how to start a restaurant business successfully. That way, your business plan can be as well-built as your famous chicken club—if not as tasty. So, put on your apron, pick up your pen, and let’s get to work.

What is a restaurant business plan?

Nearly all new businesses need a business plan. That’s because a business plan details a business’s structure, operation, finances, marketing strategies, and more. Without this, your business may have difficulty attracting investors. A weak plan may even prevent you from obtaining the necessary licenses and permits.

A restaurant’s business plan is no exception. In fact, a restaurant’s business plan may be even more important than plans for other business types. That’s because restaurants are especially liable to fail within their first year.

According to some estimates, 30% of restaurants fail during their initial 12 months.

While a carefully considered plan alone may not help you stay afloat, a bad one can sink you faster than a vegetable in a pickling jar.

What to include in a restaurant business plan

Regardless of the business’s type, most business plans include the following:

- An executive summary

- A company description

- A market analysis

- A marketing strategy

- A financial strategy

In addition to these common sections, restaurant business plans typically include:

- A menu overview

- A design plan

- A location assessment

- An employee plan

Let’s unpack each of these sections in more detail.

1. Executive summary

Although the executive summary is normally at the top of restaurant business plans, it may be the last section you write. That’s because your executive summary summarizes what’s included in your restaurant business plan. In doing so, an executive summary functions like a book’s introduction, letting readers know exactly what to expect.

Writing a compelling, yet informative, executive summary is just as important as setting the right temperature on your sous vide. When investors are crunched for time, your executive summary may be the only section they read. As a result, your executive summary should be:

- Informative

- Well-written

When writing your executive summary, aim to include:

- Your concept

- How you intend to execute your concept

- An overview of costs and benefits

- Your expected profit margin

2. Company overview

Your company overview should be longer than your executive summary. Depending on the amount of detail you wish to include, your company overview may span several pages.

This is where you’ll describe your restaurant. Here are a few items to include in your company overview:

- The restaurant’s name

- The restaurant’s backstory

- The restaurant’s management structure

- Your goals and objectives

- Your food and concept

You should also include the location of your restaurant and any legal information about franchising and trademarking. Finally, it may be worthwhile to list your background as a restaurateur and your cooking experience.

3. Market analysis

A marketing plan, or industry analysis, looks at the market forces surrounding a new restaurant. This section is important because opening a new restaurant in an area with low demand or stiff competition could spell trouble. As a result, a strong market research analysis typically focuses on:

- The restaurant’s competition

- The state of the local restaurant industry

- The average revenue of similar restaurants

- The average rate of restaurant closures in the area

- The eating habits of the prospective customer base

You might also want to note current and expected meat and produce costs.

4. Marketing strategy

Before the internet changed the marketing landscape, many restaurants relied on word-of-mouth, radio, and newspapers to promote their eateries. Now, restaurant management teams have a wide range of marketing strategies—from billboards to social media accounts.

Providing an overview of your marketing strategy can help you set your budget. It can also keep you focused on the marketing strategies that work best for your target clientele. In addition to detailing how you’ll promote your restaurant, your marketing strategy might also discuss:

- Meal discounts

- Special promotions

- Community events

- In-kind donations

- Partnerships

5. Financial Strategy

So, how much does it cost to start a restaurant business ? Restaurants aren’t typically built on spare change. In fact, according to some estimates, the average restaurant startup cost is upwards of $250,000—and that’s just the initial investment.

Anyone who has ever worked in a restaurant knows that even fine-dining restaurants experience occasional equipment malfunctions. Some restaurants also have exorbitant food costs. As a result, knowing how you’ll pay for these expenses before they mount can give you peace of mind.

Your financial analysis should carefully outline the following:

- Potential investors

- Operating costs

- Equipment costs

- Employee costs

Your financial strategy might also include how you’ll save on expenses. For example, you could potentially minimize your upfront kitchen costs by opting for a ghost kitchen . Thus, your financial strategy could reflect how the ghost kitchen will impact your operating costs.

6. Menu overview

Your menu overview section might be the most exciting section you write. After all, your menu is often the focal point of your restaurant.

That said, your menu need not be totally complete. Instead, you can start menu engineering with just a general idea of your food and beverage concept. When constructing your sample menu overview section, consider the following:

- Restaurant logos

- An overview of the types of service

- Potential prices of each menu item

- A preliminary design

Once you have a firmer grasp of your menu’s general direction, you can tinker with it as your restaurant concept continues to grow.

7. Design Plan

Your restaurant’s layout can be just as important as your menu. Do you envision a central dining room flanked by smaller dining rooms? Do you prefer mostly two-top tables or community-style tables? Using your business plan to think through your restaurant idea’s design can help you budget for tables and chairs accordingly. It can also help you plan light fixtures and table decorations.

The best design plans may also include kitchen layouts. Since a successful restaurant’s efficiency is largely measured by its kitchen’s efficiency, a well-designed layout can boost productivity. When considering your kitchen’s layout and equipment , think about the following:

- Ovens and ranges

- Freezer space

- Dishwashing equipment

- Shelves and storage

- Office space

- Prep and hand sinks

8. Location assessment

Similar to a market analysis, a location assessment measures the profitability of your restaurant based on its area. However, its focus is different from that of a market analysis.

Instead of analyzing larger industry forces like supply and demand, location assessments look at the particular characteristics of a restaurant’s environment. These characteristics include:

- Available parking

- Population density

- Foot traffic

- Urban development

- Future zoning regulations

- Average rent

Location assessments can be particularly useful for restaurants in underdeveloped areas. They can give you an idea of an area’s expected growth or decline.

9. Employee plan

Finally, an employee plan is a valuable element to add to your restaurant business plan template. In short, an employee plan anticipates your staffing needs. A sample employee plan might include the following:

- Staffing needs

- Shifts and hours

- Back-of-house jobs

- Front-of-house jobs

- Employee pay