- Search Search Please fill out this field.

- Financial Risk Definition

- For Businesses

- For Governments

- For the Market

- For Individuals

- Pros and Cons

- How to Control Financial Risk

- Financial Risk FAQs

The Bottom Line

- Corporate Finance

Understanding Financial Risk, Plus Tools to Control It

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Investopedia / Crea Taylor

What Is Financial Risk?

Financial risk is the possibility of losing money on an investment or business venture. Some more common and distinct financial risks include credit risk, liquidity risk, and operational risk.

Financial risk is a type of danger that can result in the loss of capital to interested parties. For governments, this can mean they are unable to control monetary policy and default on bonds or other debt issues. Corporations also face the possibility of default on debt they undertake but may also experience failure in an undertaking the causes a financial burden on the business.

Key Takeaways

- Financial risk generally relates to the odds of losing money.

- The financial risk most commonly referred to is the possibility that a company's cash flow will prove inadequate to meet its obligations.

- Financial risk can also apply to a government that defaults on its bonds.

- Credit risk, liquidity risk, asset-backed risk, foreign investment risk, equity risk, and currency risk are all common forms of financial risk.

- Investors can use a number of financial risk ratios to assess a company's prospects.

Understanding Financial Risks for Businesses

Financial markets face financial risk due to various macroeconomic forces, changes to the market interest rate, and the possibility of default by sectors or large corporations. Individuals face financial risk when they make decisions that may jeopardize their income or ability to pay a debt they have assumed.

Financial risks are everywhere and come in many shapes and sizes, affecting nearly everyone. You should be aware of the presence of financial risks. Knowing the dangers and how to protect yourself will not eliminate the risk, but it can mitigate their harm and reduce the chances of a negative outcome.

It is expensive to build a business from the ground up. At some point in any company's life the business may need to seek outside capital to grow. This need for funding creates a financial risk to both the business and to any investors or stakeholders invested in the company.

Credit risk —also known as default risk—is the danger associated with borrowing money. Should the borrower become unable to repay the loan, they will default. Investors affected by credit risk suffer from decreased income from loan repayments, as well as lost principal and interest. Creditors may also experience a rise in costs for the collection of debt.

When only one or a handful of companies are struggling it is known as a specific risk . This danger, related to a company or small group of companies, includes issues related to capital structure, financial transactions, and exposure to default. The term is typically used to reflect an investor's uncertainty about collecting returns and the accompanying potential for monetary loss.

Businesses can experience operational risk when they have poor management or flawed financial reasoning. Based on internal factors, this is the risk of failing to succeed in its undertakings.

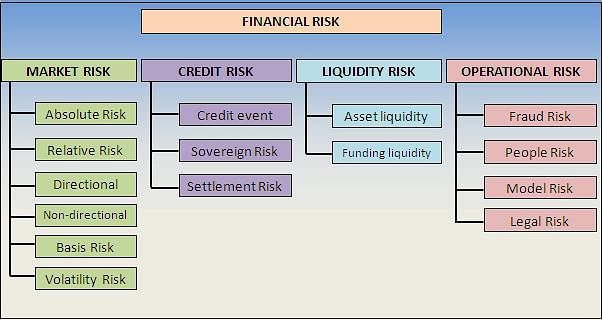

Many analysis identify at least five types of financial risk: market risk, credit risk, liquidity risk, operational risk, and legal risk.

How Governments Offset Financial Risk

Financial risk also refers to the possibility of a government losing control of its monetary policy and being unable or unwilling to control inflation and defaulting on its bonds or other debt issues.

Governments issue debt in the form of bonds and notes to fund wars, build bridges and other infrastructure and pay for their general day-to-day operations. The U.S. government's debt—known as Treasury bonds—is considered one of the safest investments in the world.

The list of governments that have defaulted on debt they issued includes Russia, Argentina, Greece, and Venezuela. Sometimes these entities only delay debt payments or pay less than the agreed-upon amount; either way, it causes financial risk to investors and other stakeholders.

The Impact of Financial Risks on Markets

Several types of financial risk are tied to financial markets. As mentioned earlier, many circumstances can impact the financial market. As demonstrated during the 2007 to 2008 global financial crisis, when a critical sector of the market struggles it can impact the monetary wellbeing of the entire marketplace. During this time, businesses closed, investors lost fortunes, and governments were forced to rethink their monetary policy. However, many other events also impact the market.

Volatility brings uncertainty about the fair value of market assets. Seen as a statistical measure, volatility reflects the confidence of the stakeholders that market returns match the actual valuation of individual assets and the marketplace as a whole. Measured as implied volatility (IV) and represented by a percentage, this statistical value indicates the bullish or bearish—market on the rise versus the market in decline—view of investments. Volatility or equity risk can cause abrupt price swings in shares of stock.

Default and changes in the market interest rate can also pose a financial risk. Defaults happen mainly in the debt or bond market as companies or other issuers fail to pay their debt obligations, harming investors. Changes in the market interest rate can push individual securities into being unprofitable for investors, forcing them into lower-paying debt securities or facing negative returns.

Asset-backed risk is the chance that asset-backed securities—pools of various types of loans—may become volatile if the underlying securities also change in value. Sub-categories of asset-backed risk involve the borrower paying off a debt early, thus ending the income stream from repayments and significant changes in interest rates.

In 2021, the U.S. high yield default rate finished at a record low 0.5%. 2022 and 2023 projections by Fitch Solutions anticipates continual lower than average default rates.

How Financial Risks Impact Individuals

Individuals can face financial risk when they make poor decisions. This hazard can have wide-ranging causes from taking an unnecessary day off of work to investing in highly speculative investments. Every undertaking has exposure to pure risk —dangers that cannot be controlled, but some are done without fully realizing the consequences.

Liquidity risk comes in two flavors for investors to fear. The first involves securities and assets that cannot be purchased or sold quickly enough to cut losses in a volatile market. Known as market liquidity risk this is a situation where there are few buyers but many sellers. The second risk is funding or cash flow liquidity risk. Funding liquidity risk is the possibility that a corporation will not have the capital to pay its debt, forcing it to default, and harming stakeholders.

Speculative risk is one where a profit or gain has an uncertain chance of success. Perhaps the investor did not conduct proper research before investing, reached too far for gains, or invested too large of a portion of their net worth into a single investment.

Investors holding foreign currencies are exposed to currency risk because different factors, such as interest rate changes and monetary policy changes, can alter the calculated worth or the value of their money. Meanwhile, changes in prices because of market differences, political changes, natural calamities, diplomatic changes, or economic conflicts may cause volatile foreign investment conditions that may expose businesses and individuals to foreign investment risk.

Pros and Cons of Financial Risk

Financial risk, in itself, is not inherently good or bad but only exists to different degrees. Of course, "risk" by its very nature has a negative connotation, and financial risk is no exception. A risk can spread from one business to affect an entire sector, market, or even the world. Risk can stem from uncontrollable outside sources or forces, and it is often difficult to overcome.

While it isn't exactly a positive attribute, understanding the possibility of financial risk can lead to better, more informed business or investment decisions. Assessing the degree of financial risk associated with a security or asset helps determine or set that investment's value. Risk is the flip side of the reward.

One could argue that no progress or growth can occur, be it in a business or a portfolio, without assuming some risk. Finally, while financial risk usually cannot be controlled, exposure to it can be limited or managed.

Financial Risk

Encourages more informed decisions

Helps assess value (risk-reward ratio)

Can be identified using analysis tools

Can arise from uncontrollable or unpredictable outside forces

Risks can be difficult to overcome

Ability to spread and affect entire sectors or markets

Tools to Control Financial Risk

Luckily there are many tools available to individuals, businesses, and governments that allow them to calculate the amount of financial risk they are taking on.

The most common methods that investment professionals use to analyze risks associated with long-term investments—or the stock market as a whole—include:

- Fundamental analysis , the process of measuring a security's intrinsic value by evaluating all aspects of the underlying business including the firm's assets and its earnings.

- Technical analysis , the process of evaluating securities through statistics and looking at historical returns, trade volume, share prices, and other performance data.

- Quantitative analysis , the evaluation of the historical performance of a company using specific financial ratio calculations.

For example, when evaluating businesses, the debt-to-capital ratio measures the proportion of debt used given the total capital structure of the company. A high proportion of debt indicates a risky investment. Another ratio, the capital expenditure ratio, divides cash flow from operations by capital expenditures to see how much money a company will have left to keep the business running after it services its debt.

In terms of action, professional money managers, traders, individual investors, and corporate investment officers use hedging techniques to reduce their exposure to various risks. Hedging against investment risk means strategically using instruments—such as options contracts—to offset the chance of any adverse price movements. In other words, you hedge one investment by making another.

Statistical and numerical analysis are great tools for identifying potential risk, but prior financial history is not indicative of a company's future performance. Make sure to analyze trends over a long period of time to better understand whether fluctuations (or lack thereof) are progress towards a financial goal or inconsistent operating activity.

Real-World Example of Financial Risk

Bloomberg and other financial commentators point to the June 2018 closure of retailer Toys "R" Us as proof of the immense financial risk associated with debt-heavy buyouts and capital structures, which inherently heighten the risk for creditors and investors.

In September 2017, Toys "R'" Us announced it had voluntarily filed for Chapter 11 bankruptcy. In a statement released alongside the announcement, the company's chair and CEO said the company was working with debtholders and other creditors to restructure the $5 billion of long-term debt on its balance sheet.

As reported in an article by CNN Money , much of this financial risk reportedly stemmed from a 2005 US $6.6 billion leveraged buyout (LBO) of Toys "R" Us by mammoth investment firms Bain Capital, KKR & Co., and Vornado Realty Trust. The purchase, which took the company private, left it with $5.3 billion in debt secured by its assets and it never really recovered, saddled as it was by $400 million worth of interest payments annually.

The Morgan-led syndicate commitment didn't work. In March 2018, after a disappointing holiday season, Toys "R" Us announced that it would be liquidating all of its 735 U.S. locations to offset the strain of dwindling revenue and cash amid looming financial obligations. Reports at the time also noted that Toys "R" Us was having difficulty selling many of the properties, an example of the liquidity risk that can be associated with real estate.

In November 2018, the hedge funds and Toys "R" Us' debt holders Solus Alternative Asset Management and Angelo Gordon took control of the bankrupt company and talked about reviving the chain. In February 2019, The Associated Press reported that a new company staffed with ex-Toys "R" Us execs, Tru Kids Brands, would relaunch the brand with new stores later in the year.

In late 2019, Tru Kids Brands opened two new stores—one in Paramus, New Jersey, and the other in Houston, Texas. Most recently, Macy's has partnered with WHP Global to bring back the Toys "R" Us brand. In 2022, Macy's plans to roll out approximately 400 physical toy store storefronts within existing Macy's locations.

How Do You Identify Financial Risks?

Identifying financial risks involves considering the risk factors a company faces. This entails reviewing corporate balance sheets and statements of financial positions, understanding weaknesses within the company's operating plan, and comparing metrics to other companies within the same industry. There are several statistical analysis techniques used to identify the risk areas of a company.

How Do You Handle Financial Risk?

Financial risk can often be mitigated, although it may be difficult or unnecessarily expensive for some to completely eliminate the risk. Financial risk can be neutralized by holding the right amount of insurance, diversifying your investments, holding sufficient funds for emergencies, and maintaining different income streams.

Why Is Financial Risk Important?

Understanding, measuring, and mitigating financial risk is critical for the long-term success of an organization. Financial risk may prevent a company from successfully accomplishing its finance-related objectives like paying loans on time, carrying a healthy amount of debt, or delivering goods on time. By understanding what causes financial risk and putting measures in place to prevent it, a company will likely experience stronger operating performance and yield better returns.

Is Financial Risk Systematic or Unsystematic?

Financial risk does impact every company. However, financial risk heavily depends on the operations and capital structure of an organization. Therefore, financial risk is an example of unsystematic risk because it is specific to each individual company.

Financial risk naturally occurs across businesses, markets, governments, and individual finance. These entities trade the opportunity to make profits and yield gains for the chance that they may lose money or face detrimental circumstances. These entities can use fundamental, technical, and quantitative analysis to not only forecast risk but make plans to reduce or mitigate it.

Fitch Solutions. " 2021 U.S. High-Yield Default Rate Ends at a Record 0.5% Low ."

Bloomberg. " Lessons Learned From the Downfall of Toys "R" Us ."

Barrons. " Toys ‘R’ Us Files for Bankruptcy ."

CNN Business. " How Toys 'R' Us Went From Big Kid on the Block to Bust ."

CNN Business. " Amazon Didn't Kill Toys 'R' Us. Here's What Did ."

CNN Money. " Toys 'R' Us Will Close or Sell All US Stores ."

Associated Press. " Toys R Us Plans Second Act By Holiday Season ."

CBS News. " Toys R Us Comeback Begins with Baby Steps: 2 New Stores to Open ."

Macy's. " Macy's & Toys "R" Us ."

:max_bytes(150000):strip_icc():format(webp)/operational_risk.asp-Final-4be32b4ee5c74958b22dfddd7262966f.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Table of Contents

What is financial risk, types of risks, types of financial risks, financial risks for businesses, financial risks for the market, financial risks for governments, financial risks for individuals, pros and cons of financial risk, tools to monitor financial risk, how to identify financial risks, how to handle financial risk, why is financial risk important, is financial risk systematic or unsystematic, real-world example of financial risk, what is financial risk and its types everything you need to know.

Financial Risk is one of the major concerns of every business across fields and geographies. This is the reason behind the Financial Risk Manager FRM Exam gaining huge recognition among financial experts across the globe. FRM is the top most credential offered to risk management professionals worldwide. Financial Risk again is the base concept of FRM Level 1 exam. Before understanding the techniques to control risk and perform risk management , it is very important to realize what risk is and what the types of risks are. Let's discuss different types of risk in this post.

Financial risk refers to the likelihood of losing money on a business or investment decision. Risks associated with finances can result in capital losses for individuals and businesses. There are several financial risks, such as credit, liquidity, and operational risks.

In other words, financial risk is a danger that can translate into the loss of capital. It relates to the odds of money loss.

In case of a financial risk, there is a possibility that a company’s cash flow might prove insufficient to satisfy its obligations. Some common financial risks are credit, operational, foreign investment, legal, equity, and liquidity risks.

In government sectors, financial risk implies the inability to control monetary policy and or other debt issues. Learn more about how financial risk is associated with different sectors, be it business, government, market, or individuals.

Check out the Simplilearn's video on Risk Management Fundamentals.

Learn for free! Subscribe to our YouTube Channel & Be a Part of 400k+ Happy Learners Community.

Risk can be referred to like the chances of having an unexpected or negative outcome. Any action or activity that leads to loss of any type can be termed as risk. There are different types of risks that a firm might face and needs to overcome . Widely, risks can be classified into three types: Business Risk, Non-Business Risk, and Financial Risk.

Business Risk

These types of risks are taken by business enterprises themselves in order to maximize shareholder value and profits. As for example, companies undertake high-cost risks in marketing to launch a new product in order to gain higher sales.

Non- Business Risk

These types of risks are not under the control of firms. Risks that arise out of political and economic imbalances can be termed as non-business risk.

Financial Risk

Financial Risk as the term suggests is the risk that involves financial loss to firms. Financial risk generally arises due to instability and losses in the financial market caused by movements in stock prices, currencies, interest rates and more.

Making a career in project management has never been this easy! Enroll in our Post Graduate Program in Project Management to get started today!

Risk Types: The different types of risks are categorized in several different ways. Risks are classified into some categories, including market risk, credit risk, operational risk, strategic risk, liquidity risk, and event risk.

Financial risk is one of the high-priority risk types for every business. Financial risk is caused due to market movements and market movements can include a host of factors. Based on this, financial risk can be classified into various types such as Market Risk, Credit Risk, Liquidity Risk, Operational Risk, and Legal Risk.

Market Risk:

Credit risk:, become a project management professional.

- 6% Growth In Jobs Of Project Management Profiles By 2024

- 22 Million Jobs Estimated For Project Management Professionals By 2027

PMP® Certification Training

- Access to Digital Materials from PMI

- 12 Full-Length Simulation Test Papers (180 Questions Each)

Post Graduate Program in Project Management

- Receive Post Graduate Program Certificate and Alumni Association Membership from UMass Amherst

- 8X higher live interaction in live online classes by industry experts

Here's what learners are saying regarding our programs:

Katrina Tanchoco

Shell - manila ,.

The interactive sessions make a huge difference as I'm able to ask for further clarifications. The training sessions are more engaging than the self-paced modules, it's easier now that i first decided to take up the online classroom training, and then followed it up with the self-paced learning (online and readings).

PHC Business Manager , Midlands and Lancashire Commissioning Support Unit

I wanted to transition into the Project Management field and wanted the right opportunity to do so. Thus, I took that leap forward and enrolled in this course. My learning experience was fantastic. It suited my learning style.

Liquidity Risk:

Operational risk:, legal risk:.

Why do businesses face financial risks? Financial risk may be due to several macroeconomic forces, fluctuating market interest rates, and the possibility of default by large organizations or sectors. When individuals run businesses, they face financial risk in making decisions that jeopardize their ability to pay debts or income. Building a business from the ground up is expensive. Often companies need to seek capital from outside sources for their steady growth. This funding requirement creates a financial risk for the company/ business seeking an amount and the investor/ stakeholder investing in the company’s business.

The danger associated with borrowing money is called credit risk or default risk. If the borrower cannot repay the loan (it becomes default), the investors suffer from reduced income from loan repayments, interests, and principal. Creditors often experience an increment in costs for debt collection.

Another term—specific risk, is used when only one or some companies struggle with financial situations. This type of danger that relates to a company or group of companies concerns capital structure, exposure to default, and financial transactions. Thus, specific risk reflects investors’ uncertainty about collecting returns and potential monetary loss.

Furthermore, businesses also experience operational risk. This type of risk is posed when businesses have flawed financial reasoning or poor management, i.e., they fail to succeed in their undertakings based on internal factors.

Financial risks affect businesses in different shapes and sizes. Financial risk awareness is a must. However, knowing the dangers and strategies to protect oneself does not eliminate the risk; it mitigates the harm and reduces the chances of negative outcomes.

Often financial markets are a hub of financial risks as several circumstances can impact them. When a critical market sector struggles with a financial crisis, it affects the monetary status of the entire marketplace. The 2007 -2008 global financial crisis bears testimony to marketplace risk. As the businesses closed, the investors lost fortunes, and the government was forced to reconsider its monetary policy.

Additionally, other events impact the market, too, such as volatility. It brings uncertainty regarding the fair value of market assets. Volatility is measured as implied volatility. This statistical value is represented as a percentage that reflects the stakeholders’ confidence that market returns match the marketplace’s valuation as a whole. It gives insights into the market on the rise vs the market in decline. So, volatility risk can lead to steep price swings in stock market shares.

Market interest rate changes and defaults can pose financial risks. Defaults occur mainly in the debt or bond market when issuers or companies fail to pay their debt obligations. Defaults harm investors severely. At the same time, changes in the market interest rate tend to push individual securities into unprofitability for investors. They are forced into lower-paying debt securities or negative returns.

Asset-backed risks arise when asset-backed securities become volatile when the value of the underlying securities also changes. A common category of asset-backed can be understood by the following example. A borrower who took money for a certain period pays off the debt early. This early payment ends the income stream from repayments. It also gets rid of the possible income from significant changes in interest rates.

Financial risk for a government arises in the following situations:

- government losing control of its monetary policy

- its inability or unwillingness to control inflation

- government defaulting on its bonds

- other debt issues

A government issues debt in the following form:

- Funding wars

- Building bridges

- Building infrastructure

- Paying for general day-to-day operations

For instance, the US government issues debts that are called treasury bonds. Several governments have defaulted on debt, including Venezuela, Russia, Argentina, and Greece. Some governments only delay debt payments, while some pay less than the agreed-upon amount. In both cases, it leads to financial risk for investors/stakeholders.

You, too, can fall prey to financial risks if you make poor decisions. A common cause of financial risk can be taking an unnecessary day off from work. Other causes include highly speculative investments. Individuals must understand that every undertaking has a potential risk attached. There are dangers beyond one’s control. Therefore, it is vital to fully realize the consequences.

Liquidity risk has the following two situations for investors:

- Market liquidity risk: Involves assets and securities that cannot be sold or purchased at a rate that compensates for the losses in a volatile market. It arises when there are many sellers but few buyers.

- Funding/ Cash flow liquidity risk: The possibility that a company might not have the necessary capital to pay its debt. Thereby it gets forced to default and harms stakeholders.

Individuals are also exposed to speculative risks wherein a profit or gain has uncertain success. An investor’s improper research before investing leads to chances of speculative risks. It happens when they reach too far for gains or invest a significantly large portion of their net worth into a particular investment.

Do you have an inflow of foreign currencies? You can also be exposed to currency financial risks as the following factors affect your calculated finances:

- Interest rate changes

- Monetary policy changes

- Changes in prices due to market differences

- Political changes

- Natural calamities

- Diplomatic changes

- Economic conflicts

Risk is the other side of the reward. Financial risk is a situation of uncertainty. It exists to different degrees. The term “risk” has a negative connotation, and financial risk has the ability to spread from one business to another or to an entire sector/ market/ world, making it all the more a serious issue. Therefore, understanding and assessing the degree of financial risk associated with an asset can lead to better and more informed business decisions. The pros and cons of knowledge of financial risks are as follows:

Several tools help individuals, governments, and businesses calculate the degree of financial risks they might encounter. Some commonly used methods to analyze financial risks associated with long-term investments are as follows:

- Fundamental analysis: Measures a security’s intrinsic value. It evaluates all aspects of the underlying business, such as the firm’s earnings and assets.

- Technical analysis: Evaluates securities via statistics. It considers historical returns, share prices, trade volumes, and other performance data.

- Quantitative analysis: Evaluates a company’s historical performance using specific financial ratio calculations.

- Statistical and numerical analysis: Identifies potential risks using statistical methods.

If you monitor financial risk via any of the analysis techniques mentioned above, ensure that you analyze trends over a long time. This way, you will better grasp the trends of fluctuations and progress towards a better financial goal. It is important to understand that a risk history does not always imply a future risk too.

The following practices help identify financial risks:

- Considering the risk factors a company might face is a prerequisite for identifying financial risks.

- Reviewing corporate balance sheets

- Studying statements of financial positions

- Exploring weaknesses within the company’s operating plan

- Comparing metrics to other companies of the same industry.

- Employing statistical analysis techniques to identify the company’s risk areas.

Completely eliminating financial risks can be difficult and expensive but mitigating the risks is easier and inexpensive. An individual or a company can neutralize financial risks by diversifying investments, holding the right amount of insurance or sufficient funds for emergencies. Different income streams are also a good option for tackling financial risks .

Understanding, evaluating, and mitigating financial risk is crucial for an organization’s long-term success. Financial risk often comes as a major hurdle in the path of accomplishing finance-related objectives such as paying loans timely, carrying a healthy debt amount, and delivering products on time. So, completely comprehending the causes of financial risks and adopting the right measures to prevent it can help a company yield better returns.

Financial risk is an unsystematic risk because it does not impact every company. It is specific to each company as it depends on an organization’s operations and capital structure.

Several companies have experienced some huge financial blows. An unfortunate popular history points to the June 2018 closure of Toys “R” Us. In September 2017, the company announced its bankruptcy. The company’s CEO also released a statement that the company was working with creditors to restructure the $5 billion of long-term debt. As per reports, much of the company’s financial risk originated from a 2005 US $6.6 billion leveraged buyout by investment firms— KKR & Co., Bain Capital, and Vornado Realty Trust.

In March 2018, Toys “R” Us announced that it would liquidate its 735 US locations to pull off from the dwindling revenue strain amid looming financial obligations after a disappointing holiday season. It also faced difficulty selling its properties. This situation is an example of the liquidity risk associated with real estate.

In November 2018, the debt holders Angelo Gordon and Solus Alternative Asset Management took control of the bankrupt company and created plans to revive the chain. In February 2019, a new company staffed with ex-Toys “R” Us execs, Tru Kids Brands, reported that it would relaunch the brand and opened two new stores that year. Recently, Macy’s has partnered with WHP Global, and together they are working on bringing back the Toys “R” Us brand.

If you have any questions regarding financial risks and types, drop them in the comment section below and we will get back to you. If you enjoy handling projects and evaluating risks, then you can become a project leader in this digital age with our Project Management Certification aligned with PMI-PMP® and IASSC-Lean Six Sigma. Attend live online interactive classes, masterclasses from UMass Amherst, Harvard Business Publishing case studies, and capstone projects.

Our Project Management Courses Duration And Fees

Project Management Courses typically range from a few weeks to several months, with fees varying based on program and institution.

Learn from Industry Experts with free Masterclasses

Project management.

How to Successfully Ace the PMP Exam on Your First Attempt in 2024

Career Masterclass: How to Successfully Ace the PMP Exam on Your First Attempt in 2024

Career Fast-track

Panel Discussion: The Startup Career Strategy - The Highs and Lows

Recommended Reads

Free eBook: Agile and Scrum Salary Report

Tackling Financial Risks in Everyday Life

Here’s All You Need to Know About MBA in Finance

Free eBook: Guide To The PMP Exam Changes

Financial Risk Manager (FRM) Part 1 Certification

Key Difference Between Product Management and Project Management

Get Affiliated Certifications with Live Class programs

- PMP, PMI, PMBOK, CAPM, PgMP, PfMP, ACP, PBA, RMP, SP, and OPM3 are registered marks of the Project Management Institute, Inc.

- Bibliography

- More Referencing guides Blog Automated transliteration Relevant bibliographies by topics

- Automated transliteration

- Relevant bibliographies by topics

- Referencing guides

Dissertations / Theses on the topic 'Financial risk management'

Create a spot-on reference in apa, mla, chicago, harvard, and other styles.

Consult the top 50 dissertations / theses for your research on the topic 'Financial risk management.'

Next to every source in the list of references, there is an 'Add to bibliography' button. Press on it, and we will generate automatically the bibliographic reference to the chosen work in the citation style you need: APA, MLA, Harvard, Chicago, Vancouver, etc.

You can also download the full text of the academic publication as pdf and read online its abstract whenever available in the metadata.

Browse dissertations / theses on a wide variety of disciplines and organise your bibliography correctly.

Laurent, Marie-Paule. "Essays in financial risk management." Doctoral thesis, Universite Libre de Bruxelles, 2003. http://hdl.handle.net/2013/ULB-DIPOT:oai:dipot.ulb.ac.be:2013/211221.

Zhang, Lequn. "Extreme Risk Forecast for Quantitative Financial Risk Management." Thesis, Curtin University, 2022. http://hdl.handle.net/20.500.11937/89362.

Gueye, Djibril. "Some contributions to financial risk management." Thesis, Strasbourg, 2021. http://www.theses.fr/2021STRAD027.

Wang, Mulong. "Financial derivatives in corporate risk management." Access restricted to users with UT Austin EID, 2001. http://wwwlib.umi.com/cr/utexas/fullcit?p3036610.

Schaumburg, Julia. "Quantile methods for financial risk management." Doctoral thesis, Humboldt-Universität zu Berlin, Wirtschaftswissenschaftliche Fakultät, 2013. http://dx.doi.org/10.18452/16675.

Genin, Adrien. "Asymptotic approaches in financial risk management." Thesis, Sorbonne Paris Cité, 2018. http://www.theses.fr/2018USPCC120/document.

Nikoci, Besjana <1989>. "Stress Testing for Financial Risk Management." Master's Degree Thesis, Università Ca' Foscari Venezia, 2015. http://hdl.handle.net/10579/6935.

Aas, Roar. "Risk management using derivatives." Thesis, Heriot-Watt University, 1993. http://ethos.bl.uk/OrderDetails.do?uin=uk.bl.ethos.262000.

Eriksson, Kristofer. "Risk Measures and Dependence Modeling in Financial Risk Management." Thesis, Umeå universitet, Institutionen för fysik, 2014. http://urn.kb.se/resolve?urn=urn:nbn:se:umu:diva-85185.

Paltalidis, Nikolaos. "Essays on applied financial econometrics and financial networks : reflections on systemic risk, financial stability & tail risk management." Thesis, University of Portsmouth, 2015. https://researchportal.port.ac.uk/portal/en/theses/essays-on-applied-financial-econometrics-and-financial-networks(3534970d-eeba-4748-9812-d18430925664).html.

Černák, Peter. "Risk Management." Master's thesis, Vysoká škola ekonomická v Praze, 2009. http://www.nusl.cz/ntk/nusl-76579.

Zou, Lin. "Essays in financial economics and risk management." Thesis, [College Station, Tex. : Texas A&M University, 2007. http://hdl.handle.net/1969.1/ETD-TAMU-1476.

Graf, Mario. "Financial Risk Management State-of-the-Art /." St. Gallen, 2005. http://www.biblio.unisg.ch/org/biblio/edoc.nsf/wwwDisplayIdentifier/01665710001/$FILE/01665710001.pdf.

Ewers, Robin B. "Enterprise Risk Management in Responsible Financial Reporting." Thesis, Walden University, 2017. http://pqdtopen.proquest.com/#viewpdf?dispub=10637579.

Despite regulatory guidelines, unreliable financial reporting exists in organizations, creating undue financial risk-harm for their stakeholders. Normal accident theory (NAT) identifies factors in highly complex integrated systems that can have unexpected, undetected, and uncorrected system failures. High-reliability organization (HRO) theory constructs promote reliability in complex, integrated systems prone to NAT factors. Enterprise risk management (ERM) integrates NAT factors and HRO constructs under a holistic framework to achieve organizational goals and mitigate the potential for stakeholder risk-harm. Literature on how HRO constructs promote ERM in responsible integrated financial systems has been limited. The purpose of this qualitative, grounded theory study was to use HRO constructs to identify and define the psychological factors involved in the effective ERM of responsible organizational financial reporting. Standardized, open-ended interviews were used to collect inductive data from a purposeful sample of 13 reporting agents stratifying different positions in organizations that have maintained consistent operational success while attenuating stakeholder risk-harm. The data were interpreted via transcription, and subsequent iterative open, axial, and narrative coding. Results showed that elements of culture and leadership found in the HRO construct of disaster foresightedness and mitigation fostered an internal environment of successful enterprise reporting risk management to ethically achieve organizational goals and abate third-party stakeholder risk-harm. The findings will contribute to positive social change by suggesting an approach for organizations to optimize strategic objectives while minimizing stakeholders’ financial risk-harm.

Siyi, Zhou. "Essays on financial and insurance risk management." Thesis, Imperial College London, 2012. http://ethos.bl.uk/OrderDetails.do?uin=uk.bl.ethos.586894.

Abbas, Sawsan. "Statistical methodologies for financial market risk management." Thesis, Lancaster University, 2010. http://ethos.bl.uk/OrderDetails.do?uin=uk.bl.ethos.547964.

Ben, Hadj Saifeddine. "Essays on risk management and financial stability." Thesis, Paris 1, 2017. http://www.theses.fr/2017PA01E003/document.

Pillay, Levina. "Risk practitioner experiences of enterprise risk management in financial institutions." Diss., University of Pretoria, 2015. http://hdl.handle.net/2263/52296.

Shedden, Jason Patrick. "A qualitative approach to financial risk." Pretoria : [s.n.], 2006. http://upetd.up.ac.za/thesis/available/etd-05092007-152751.

Yao, Rui. "Patterns of financial risk tolerance 1983-2001 /." Columbus, Ohio : Ohio State University, 2003. http://rave.ohiolink.edu/etdc/view?acc%5Fnum=osu1060624755.

Yang, Xi. "Applying stochastic programming models in financial risk management." Thesis, University of Edinburgh, 2010. http://hdl.handle.net/1842/4068.

MORAES, ALEX SANDRO MONTEIRO DE. "ESSAYS IN FINANCIAL RISK MANAGEMENT OF EMERGING COUNTRIES." PONTIFÍCIA UNIVERSIDADE CATÓLICA DO RIO DE JANEIRO, 2015. http://www.maxwell.vrac.puc-rio.br/Busca_etds.php?strSecao=resultado&nrSeq=26131@1.

Haar, Lawrence. "Business cycles and the management of financial risk." Thesis, University of Surrey, 2000. http://epubs.surrey.ac.uk/844543/.

Zabarankin, Michael Yurievich. "Optimization approaches in risk management and financial engineering." [Gainesville, Fla.] : University of Florida, 2003. http://purl.fcla.edu/fcla/etd/UFE0001048.

Hays, Douglas C. "Enterprise risk management solutions a case study /." Monterey, Calif. : Naval Postgraduate School, 2008. http://handle.dtic.mil/100.2/ADA483512.

Derrocks, Velda Charmaine. "Risk management." Thesis, Nelson Mandela Metropolitan University, 2010. http://hdl.handle.net/10948/1480.

Bedendo, Mascia. "Density forecasting in financial risk modelling." Thesis, University of Warwick, 2003. http://wrap.warwick.ac.uk/2661/.

HADJI, MISHEVA BRANKA. "Measuring Financial Risks: The Application of Network Theory in Fintech Risk Management." Doctoral thesis, Università degli studi di Pavia, 2020. http://hdl.handle.net/11571/1344336.

Chen, Hua. "Contingent Claim Pricing with Applications to Financial Risk Management." Digital Archive @ GSU, 2008. http://digitalarchive.gsu.edu/rmi_diss/22.

Baldwin, Sheena. "Extreme value theory : from a financial risk management perspective." Thesis, Stellenbosch : Stellenbosch University, 2004. http://hdl.handle.net/10019.1/53743.

Yamashita, Mamiko. "Three Essays on Financial Risk Management and Fat Tails." Thesis, Toulouse 1, 2020. http://www.theses.fr/2020TOU10056.

Simonson, Peter Douglas. "Limiting Financial Risk from Catastrophic Events in Project Management." Diss., North Dakota State University, 2020. https://hdl.handle.net/10365/31939.

Madaleno, Mara Teresa da Silva. "Essays on energy derivatives pricing and financial risk management." Doctoral thesis, Universidade de Aveiro, 2011. http://hdl.handle.net/10773/7302.

Yazid, Ahmad Shukri. "Perceptions and practices of financial risk management in Malaysia." Thesis, Glasgow Caledonian University, 2001. http://ethos.bl.uk/OrderDetails.do?uin=uk.bl.ethos.364743.

Masie, Desné Rentia. "Mediating markets : financial news media and reputation risk management." Thesis, University of Edinburgh, 2014. http://hdl.handle.net/1842/14196.

Holifield, Suzanne Marie. "Risk management and hedge accounting decisions at financial institutions." Connect to resource, 1995. http://rave.ohiolink.edu/etdc/view.cgi?acc%5Fnum=osu1267632084.

Awiszus, Kerstin [Verfasser]. "Actuarial and financial risk management in networks / Kerstin Awiszus." Hannover : Gottfried Wilhelm Leibniz Universität Hannover, 2020. http://d-nb.info/1215427298/34.

Vuillemey, Guillaume. "Derivatives markets : from bank risk management to financial stability." Thesis, Paris, Institut d'études politiques, 2015. http://www.theses.fr/2015IEPP0007/document.

Anastasio, Edoardo <1996>. "The relationship between financial risk management and shareholders value." Master's Degree Thesis, Università Ca' Foscari Venezia, 2022. http://hdl.handle.net/10579/20812.

Kwok, Ying-kit Tony. "A study on treasury risk control in financial institutions in Hong Kong /." Hong Kong : University of Hong Kong, 1995. http://sunzi.lib.hku.hk/hkuto/record.jsp?B14038912.

Siu, Kin-bong Bonny. "Expected shortfall and value-at-risk under a model with market risk and credit risk." Click to view the E-thesis via HKUTO, 2006. http://sunzi.lib.hku.hk/hkuto/record/B37727473.

Ye, Kang. "Knowledge level modeling for systemic risk management in financial institutions /." access full-text access abstract and table of contents, 2009. http://libweb.cityu.edu.hk/cgi-bin/ezdb/thesis.pl?phd-is-b30082274f.pdf.

Neis, Eric. "Three essays in financial economics." Diss., Restricted to subscribing institutions, 2006. http://proquest.umi.com/pqdweb?did=1158520261&sid=1&Fmt=2&clientId=1564&RQT=309&VName=PQD.

Weiss, Susan F. "Implications of Executive Succession Upon Financial Risk and Performance." ScholarWorks, 2011. https://scholarworks.waldenu.edu/dissertations/958.

Wang, Letian. "Global supply chain risk management through operational and financial hedges." Thesis, McGill University, 2010. http://digitool.Library.McGill.CA:80/R/?func=dbin-jump-full&object_id=95041.

Seidel, Henry [Verfasser], and Alexander [Akademischer Betreuer] Szimayer. "Essays in Financial Risk Management / Henry Seidel ; Betreuer: Alexander Szimayer." Hamburg : Staats- und Universitätsbibliothek Hamburg, 2017. http://d-nb.info/1148650563/34.

Reddy, Harry 1963. "Financial supply chain dynamics : operational risk management and RFID technologies." Thesis, Massachusetts Institute of Technology, 2005. http://hdl.handle.net/1721.1/33729.

Zhu, Yanhui. "Nature and management of financial risk in global stock markets." Thesis, Cardiff University, 2008. http://orca.cf.ac.uk/55720/.

Yousefi, Sepehr. "Credit Risk Management in Absence of Financial and Market Data." Thesis, KTH, Matematisk statistik, 2016. http://urn.kb.se/resolve?urn=urn:nbn:se:kth:diva-188800.

Seidel, Henry Verfasser], and Alexander [Akademischer Betreuer] [Szimayer. "Essays in Financial Risk Management / Henry Seidel ; Betreuer: Alexander Szimayer." Hamburg : Staats- und Universitätsbibliothek Hamburg, 2017. http://d-nb.info/1148650563/34.

Financial Risk Measurement for Financial Risk Management

Current practice largely follows restrictive approaches to market risk measurement, such as historical simulation or RiskMetrics. In contrast, we propose flexible methods that exploit recent developments in financial econometrics and are likely to produce more accurate risk assessments, treating both portfolio-level and asset-level analysis. Asset-level analysis is particularly challenging because the demands of real-world risk management in financial institutions - in particular, real-time risk tracking in very high-dimensional situations - impose strict limits on model complexity. Hence we stress powerful yet parsimonious models that are easily estimated. In addition, we emphasize the need for deeper understanding of the links between market risk and macroeconomic fundamentals, focusing primarily on links among equity return volatilities, real growth, and real growth volatilities. Throughout, we strive not only to deepen our scientific understanding of market risk, but also cross-fertilize the academic and practitioner communities, promoting improved market risk measurement technologies that draw on the best of both.

Forthcoming in Handbook of the Economics of Finance, Volume 2, North Holland, an imprint of Elsevier. For helpful comments we thank Hal Cole and Dongho Song. For research support, Andersen, Bollerslev and Diebold thank the National Science Foundation (U.S.), and Christoffersen thanks the Social Sciences and Humanities Research Council (Canada). We appreciate support from CREATES funded by the Danish National Science Foundation. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research.

MARC RIS BibTeΧ

Download Citation Data

More from NBER

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

Enter the email address you signed up with and we'll email you a reset link.

- We're Hiring!

- Help Center

Essay 4 - FINANCIAL RISK MANAGEMENT - EBOA EDOUBE SERGE CLAUDE.docx

Essay - Financial Risk Management

In the academic research we have been involved, at the extent to be rewarded a PhD degree in Financial Engineering including Developmental Finance, Risk Assessments and Financial Analysis, we are to study Financial Risk Management. As a critical discipline in our study programme, we have performed research in the aim of understanding all the insightful points that surround this course. In this light, we have organized our work into a series of chapters full of sections marked by various relevant issues. This implies undestanding the basics of Financial Risk Management through defining key words such as risk, financial risk, Financial Risk Management process, identifying the various components of Financial risks. In this mood, we have extended our reflection to understanding insightful issues of factors influencing major financial risks such as market risk, liquidity risk, operational risk, credit risk as well as business risk. Internal and external challenges surrounding financial risks and Financial risk measurement have also been examined in the angle of seeking ways to improve Financial Risk Management process. As far as risk measurement is concernced, some assessment tools or mathematical methods of financial risk measurement in companies have been presented namely Value at Risk, Rate of growth of real Assets, Equity ratio, Gearing ratio, Debt Equity Ratio, Net Present Value, etc… for quantification and assessment matters. Furthermore, we have attempted to come out with the relationship between Financial Risk Management and the financial industry. From this link, we have examined the various components of risk management theory bearing Financial Risk Management, Financial Risk Management and financial markets performance, Financial Risk Management and the banking industry. Examining Financial Risk Management also requires to take into account the issue of financial crisis through the critical contribution of Financial Risk Management in a preventive way and providing an addressing response in case of financial crisis reality. Before wrappig up our essay, we have found it relevant to identify internal and external Financial Risk Management perspectives. It is at the view of financial institutions as well as providing recommendations related to an effective Financial Risk Management throughout the overall components of a country’s global financial system and investors’ behaviour regarding Financial Risk Management as well. As long as this written essay is concerned, we consider Financial Risk Management as a prominent discipline in the overall financial industry.

Related Papers

Academia Letters

SERGE CLAUDE EBOA EDOUBE

Abdulhameed jastaniyah

Ireneusz Miciuła

Information about how to manage financial risk are made available because of the desire to show the stability and proper monitoring of the risks in order to fulfill the given economic tasks, which has a direct impact on the economic effects (financial result). Therefore the aim of article is classifies financial risk and main strategic components to manage it in order to maintain stable economic conditions.

Daniel Manate

The bubbles, either involving real or financial assets, previous to the subprime crisis bring at the investor’s community’s concern the elusive topic of risk mitigation. Funds industry need today, more than any time in the past, a clear, decisive and competent approach in risk management. A competitive financial investment company must take in consideration not only basic risk management measures,

khaldoun al-qaisi

The purpose of this paper is to provide a critical study over enterprise risk management. For this, the paper has reviewed theoretical and empirical literature in management of risk. Theoretical literature depicts that no theory can explain about the risk management techniques alone. While empirical literature providesthe importance of enterprise risk management to be used in the organization for managing the risk, exist in portfolio structure of the organization. The paper besides that also provides theoretical and empirical literature and depicts about the effect on working of the organization by implementing the enterprise risk management. The paper has discussed many theories on the implications on organization. The paper briefly discusses about how the performance of organization structure, firm value, default risk perspective, and disclosure requirement would be affected due to implication of enterprise risk management model. The paper has discussed the importance of technique...

Bojidar V Bojinov

The article clarifies the essence and nature of business risk and its manifestation in the banking sector. Discussed the main approaches for effective management in commercial banks.

iaeme iaeme

Smruti Rekha Das

The basic aim of risk management is to recognize, assess, and prioritize risk in order to assure that the uncertainty should not deviate from the intended purpose of the business goals. Risk can take place from various sources, which includes uncertainty in financial markets, recessions, inflation, interest rates, currency fluctuations, etc. Various methods used for this management of risk are faced with various decisions such as the market price, historical data, statistical methodologies, etc. For stock prices, the information derives from the historical data where the next price depends only upon the current price and some of the outside factors. Financial market is very risky to invest money, but the proper prediction with handling the risk will benefit a lot. Various types of risk in the financial market and the appropriate solutions to overcome the risk are analyzed in this study.

RELATED PAPERS

Physical Review A

Thomas Gorczyca

Gilberto Stefan

Jean-jacques Berthelier

Aline Rocha de Souza Ferreira de Castro

Isharyah Sunarno

Baginda Siagian

M.Farhan Asif

Leonardo Cervantes

Muhammad Muhammad Nura

American Journal of Pharmaceutical Education

Nkem Nonyel

Neuro-Oncology

Christof Kramm

International Journal of Clinical Medicine

Documents d'anàlisi geogràfica

Albert Arias

SOJ neurology

Muhammad Mullah

Biotechnology(Faisalabad)

Kalaivani K. Nadarajah

Cancer Medicine

Stefan Willems

Greenhouse Gases: Science and Technology

Ahmad salisu

Gautam Biswas

Separation Science and Technology

Dibakar Bhattacharyya

Suicide and Life-Threatening Behavior

Emanuela Leuci

Bulletin of the Graduate School of Education, Hiroshima University. Part. II, Arts and science education

Ryosuke Minamiura

Naval Postgraduate School (U.S.). Center for Homeland Defense and Security

Open Life Sciences

Dragan Velimirovic

See More Documents Like This

RELATED TOPICS

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

Home — Essay Samples — Business — Risk — Financial Risk in Insurance Industry

Financial Risk in Insurance Industry

- Categories: Risk Risk Management

About this sample

Words: 1899 |

10 min read

Published: Aug 30, 2022

Words: 1899 | Pages: 4 | 10 min read

Table of contents

Problem statement, risks and its types.

- What can go wrong or right?

- What can be done to avoid making mistakes and enjoying the good?

- What will happen if an error occurs?

- Insurance Risk: It is underwriting, the risk associated with the uncertainty of business written in the future

- Market Risk:- It is the risk associated with movements in interest rates, forcing exchange rates or asset prices to lead to an adverse movement in asset values

- Credit Risk: If another party fails to perform them in time i.e. if the party fails to pay the credit. So, allowance should be made for the financial effect of non-payment of reinsurance and of the non-payment of premium debtors.

- Liquidity Risk: It is the risk that a firm has insufficient financial resources to meet its obligation as they fall due or can only secure the resources at excessive cost.

- Operational Risk: It in the risk of direct or indirect loss resulting from inadequate or failed internal processes, people, and systems or from External events. These types where adopted from the literature review.

Research Question

- What are the current risk management practices of Jordanian insurance companies?

- How can Jordanian insurance companies properly improve and institutionalize risk management processes?

Research Importance

- Provide practical evidence of the importance of compatibility between priorities competitive and insurance companies' risks with its reflection in Institutional performance.

- Identify insurance companies' risks that affect the performance of the companies in Jordan and study the impact of each of them.

- Most studies have been conducted on companies operating in Europe and the United States. So the importance of the study lies in what will add to the concepts and frameworks of science to fill a gap.

Research Objectives

- Research on current risk management practices of Palestinian insurance companies.

- Identify the main risks of Palestinian insurance companies.

- Recognize risk management and its importance.

Research Limitations

- There are lots of studies on the field but few of them are implemented in Jordan.

- Some of the risks under study are out of control and could not be forecasted easily; which makes a huge limitation and gap in this study.

- Time limitations.

Cite this Essay

Let us write you an essay from scratch

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Get high-quality help

Prof. Kifaru

Verified writer

- Expert in: Business

+ 120 experts online

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Related Essays

3 pages / 1252 words

2 pages / 1116 words

7 pages / 2346 words

3 pages / 1343 words

Remember! This is just a sample.

You can get your custom paper by one of our expert writers.

121 writers online

Still can’t find what you need?

Browse our vast selection of original essay samples, each expertly formatted and styled

Related Essays on Risk

Life is full of uncertainties and challenges, but it is often said that the greatest rewards come to those who are willing to take risks. Whether it be in pursuing a new career path, starting a business, or even just trying a [...]

Outsourcing is a common practice in today's business environment, where companies delegate certain functions to specialized firms in order to cut costs and increase flexibility. However, this decision comes with its fair share [...]

Risk involves the chance an investment's actual return will differ from the expected return. Risk includes the possibility of losing some or all of the original investment. Different versions of risk are usually measured by [...]

Summary – Hip replacement is a surgical procedure in which the diseased cartilage and bone of the hip are replaced with a artificial prosthesis. This article discusses the few things to know before opting for a hip [...]

In crafting this leadership application essay, I am prompted to reflect on the formative experiences that have shaped my leadership abilities and underscore my aspiration to serve as a peer leader. As the oldest boy among four [...]

Introduction to the essay's focus on comparing Henry Moore's "Woman Seated in the Underground" and Pablo Picasso's "Bullfight Scene" Description of Picasso's artwork, including its medium, size, and subject [...]

Related Topics

By clicking “Send”, you agree to our Terms of service and Privacy statement . We will occasionally send you account related emails.

Where do you want us to send this sample?

By clicking “Continue”, you agree to our terms of service and privacy policy.

Be careful. This essay is not unique

This essay was donated by a student and is likely to have been used and submitted before

Download this Sample

Free samples may contain mistakes and not unique parts

Sorry, we could not paraphrase this essay. Our professional writers can rewrite it and get you a unique paper.

Please check your inbox.

We can write you a custom essay that will follow your exact instructions and meet the deadlines. Let's fix your grades together!

Get Your Personalized Essay in 3 Hours or Less!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

Financial Risk Essays

Analysis of financial risk in investment portfolios, the integration of esg in financial & reputational risk, bank of china report, risk management of international equity portfolios, popular essay topics.

- American Dream

- Artificial Intelligence

- Black Lives Matter

- Bullying Essay

- Career Goals Essay

- Causes of the Civil War

- Child Abusing

- Civil Rights Movement

- Community Service

- Cultural Identity

- Cyber Bullying

- Death Penalty

- Depression Essay

- Domestic Violence

- Freedom of Speech

- Global Warming

- Gun Control

- Human Trafficking

- I Believe Essay

- Immigration

- Importance of Education

- Israel and Palestine Conflict

- Leadership Essay

- Legalizing Marijuanas

- Mental Health

- National Honor Society

- Police Brutality

- Pollution Essay

- Racism Essay

- Romeo and Juliet

- Same Sex Marriages

- Social Media

- The Great Gatsby

- The Yellow Wallpaper

- Time Management

- To Kill a Mockingbird

- Violent Video Games

- What Makes You Unique

- Why I Want to Be a Nurse

- Send us an e-mail

- Contributors

- Mission and Values

- Submissions

- The Regulatory Review In Depth

Assessing Financial Risk Amid Climate Risk

Brian connor.

Scholars urge banks and regulators to adapt financial risk models to respond to climate change.

Climate change presents many challenges across the economy, including increased payout risk for insurers, heightened borrowing costs for vulnerable communities, and massive agricultural losses from drought.

Banks can be exposed to these risks by lending to businesses and investing in assets across different industries and geographies. Stress tests are simulation exercises through which bank management and financial regulators assess how banks are likely to fare when faced with serious risks.

In a recent report , Viral V. Acharya , a professor at the New York University Stern School of Business , and several coauthors discuss how a stress test design that considers climate risk can help assess climate change’s impact on financial stability.

Under Federal Reserve System regulations and the Dodd-Frank Act , large banks must regularly conduct stress tests and report the results of such tests. The Federal Reserve uses this data to set the stress capital buffer requirement, which is designed to ensure that banks hold enough assets to cushion against a downturn.

Although the Federal Reserve has not yet signaled an intention to consider climate risk when developing stress test regulations, the European Central Bank has committed to consider climate change in its financial affairs.

Acharya and his coauthors explore how regulators can adapt the design and implementation of stress tests to incorporate climate risk.

Typically, regulators and bank managers design stress test scenarios by choosing a combination of economic and financial calamities that are known to challenge the resilience of individual banks and the broader financial system. For example, the Federal Reserve uses a “severely adverse scenario” featuring a large hike in unemployment accompanied by a collapse in residential and commercial real estate prices.

But climate change presents a different set of risks.

The Acharya team divides these risks into two types: physical risks and transition risks. Physical risks are related to the direct effects of climate change, such as floods and wildfires. Transition risks are associated with the technological and policy changes governments adopt to shift to a cleaner economy, such as electric vehicle adoption or carbon taxes.

These risks, which are still somewhat speculative and unknown, present difficulties in designing realistic stress test scenarios.

For instance, Acharya and his coauthors describe how aggressive policy changes aimed at preventing disasters will translate to an increase in short-term transition risks but might lead to a decline in long-run physical risks.

To balance short-term and long-run risks, the authors suggest that policymakers consider a variety of risk combinations across a portfolio of different scenarios. The De Nederlandsche Bank , for example, presents one scenario with a technological breakthrough paving the way for more renewable energy, another with a global increase in carbon emissions prices due to public policy measures, and a third with a combination of those scenarios.

Acharya and his coauthors suggest that banks use climate-informed stress test scenarios to model how different climate risks could impact them, and banks can better confront those risks by using stress tests that incorporate climate change.

Consider wildfires. The property damage from wildfires, Acharya and his coauthors explain , might imperil homeowners’ ability to pay their mortgages. A stress test model informed by climate risk would therefore show an increase in credit risk for the bank that holds these mortgages. Homes near the wildfires might also decline in value. This decline would hurt local property tax revenues, which could make it harder for cities and towns to pay off their debts, thus increasing the default risk of the municipal bonds that banks hold. A normal stress test might not be granular enough to identify these specific risks, but a climate-targeted stress test would be.

Climate change can also increase liquidity risk for banks. Depositors often withdraw funds to pay for immediate needs after a natural disaster. As natural disasters increase in frequency, a climate stress test could predict that the bank may struggle to meet its regulatory capital requirements . If a bank’s deposits are concentrated in a particular geographic area—which is often the case—the outcome of the stress test could be even more grave. Knowledge of these risks would encourage banks to geographically diversify.

Finally, if carbon taxes and other transition policies curb growth in carbon-heavy industries, climate-informed stress tests would warn banks with exposure to depositors in these industries that they should account for future liquidity difficulties.

Acharya and his coauthors suggest that U.S. regulators should contribute to research on the climate risks that banks face. Policymakers should invest in developing better ways of estimating the relationships between different risks, which will improve stress test scenarios, Acharya and his coauthors argue .

Some central banks outside of the United States have begun doing this. The Australian Prudential Regulation Authority and the Bank of Canada have adopted and modified scenarios and predictions from the Network for Greening the Financial System , a consortium of central banks and supervisors.

Climate change presents new risks to many individuals and businesses across the economy. Through deposits, loans, and investments, large banks could find themselves exposed to a combination of risks in the future. By incorporating climate risk into their stress test exercises, regulators and banks will be better equipped to understand emerging threats to financial stability, Acharya and his coauthors conclude .

Related Essays

The Myth of Operation Choke Point

Scholar corrects the narrative that spawned laws prohibiting banks from cutting ties with the gun industry.

Securing Nations Against Climate Change

Scholars discuss regulatory climate change solutions in the context of national and global security.

Affordable Housing is Climate-Friendly Housing

States should prohibit local zoning ordinances that bar affordable, climate-friendly housing.

We use cookies to enhance our website for you. Proceed if you agree to this policy or learn more about it.

- Essay Database >

- Essay Examples >

- Essays Topics >

- Essay on Finance

Managing Financial Risk Essay

Type of paper: Essay

Topic: Finance , Investment , Company , Risk , Banking , Literature , Financial Risk , Value

Published: 02/23/2020

ORDER PAPER LIKE THIS

The chapter deals with discussion over ever increasing financial risk in today’s financial environment for the organizations. Author blames the end of Breton Woods System in 1972 that led to volatility of interest rates, exchange rates and commodity prices. However, post 1970 arena was a welcome for increasing financial risk as the CEO’s and CFO’s linked this volatility with higher profitability in response to large movements in interest rates and exchane rates and in recognition to this increased financial risk the top executives in an organization deals with following issues: - Extent to which their firm is exposed to interest rates, exchange rates or commodity prices. - Financial tools available as a solution for managing these risk exposures - How will the financial tools be helpful in managin these risks.

And the author deals with discussion over these issues only.

In terms of measuring the risk exposure, author cites the example of Saving and Loans which are negatively related to the interest rates. This is because Saving and Loans are used primarily for funding the long term lived assets with liabilitiesrepricing on frequent basis, thus when interest rates rises, value of Saving and Loans declines and with little affect on liabilties, it is the shareholder’s equity that falss substantially and vice-versa. Following graph depicts the relationship between Interest Rates and Saving and Loans:

Risk Profile

The graph depicts risk profile of Saving and Loans. As the actual interest rates rises above the expected rates, the value of Saving and Loans’s asset declines relative to the value of its liabilities and thus, the value of the firm declines. After discussing various aproaches of measuring the financial risk and available tools to counter these financial risks, author concludes the chapter by discussing as how the available tools will help in managing the financial risks, to which he states as: - Exposure can be managed in number of ways as individually using a financial instrument-for example by using interest rate swap to hedge against interest risk. - Using combinations of available tools to manage the financial risk-for example buying a call and selling a put to minimize the out of pocket costs to hedge.

Works Cited

Clifford Smith, C. S. Managing Financial Risk. In Risk Management (pp. 345-366).

Cite this page

Share with friends using:

Removal Request

Finished papers: 1037

This paper is created by writer with

If you want your paper to be:

Well-researched, fact-checked, and accurate

Original, fresh, based on current data

Eloquently written and immaculately formatted

275 words = 1 page double-spaced

Get your papers done by pros!

Other Pages

Civil rights argumentative essays, armed forces article reviews, tradition article reviews, dialect article reviews, american history article reviews, chivalry article reviews, jamaica article reviews, persuasion article reviews, strategies dissertation proposals, retreat critical thinkings, bilby essays, domine essays, narcosis essays, satori essays, checking account essays, sea slug essays, monotype essays, tax haven essays, dicotyledon essays, the melting pot essays, gods and generals essays, purpose in life essays, mpumalanga essays, bacterial transformation essay examples, administrative ethics essay example, social and moral impact of computer technology essay examples, coca cola company internal and swot analysis case study sample, work life balance gen x y and baby boomers course work, rhetorical appeals essay examples, global inequality sex and gender essay example, ethics in policing essay examples, essay on drug abuse and effects, effects of plastic on the human body essay example, sample presentation on would enable cost sensitive consumers to patronize their products, good article about effects of genocide on relationship between the maya and the guatemalan government, the religion of islam presentation sample, free presentation about secure training, free it support supervisor letter sample, free presentation about tuberculosis, reducing falls in a nursing home setting presentation example, good example of presentation on unemployment rates among minorities, example of gender and writing presentation.

Password recovery email has been sent to [email protected]

Use your new password to log in

You are not register!

By clicking Register, you agree to our Terms of Service and that you have read our Privacy Policy .

Now you can download documents directly to your device!

Check your email! An email with your password has already been sent to you! Now you can download documents directly to your device.

or Use the QR code to Save this Paper to Your Phone

The sample is NOT original!

Short on a deadline?

Don't waste time. Get help with 11% off using code - GETWOWED

No, thanks! I'm fine with missing my deadline

- Free Samples

- Premium Essays

- Editing Services Editing Proofreading Rewriting

- Extra Tools Essay Topic Generator Thesis Generator Citation Generator GPA Calculator Study Guides Donate Paper

- Essay Writing Help

- About Us About Us Testimonials FAQ

- Studentshare

- Finance & Accounting

Financial Risk Management

Financial risk management - essay example.

- Subject: Finance & Accounting

- Type: Essay

- Level: Masters

- Pages: 11 (2750 words)

- Downloads: 3

- Author: considinedoming

Extract of sample "Financial Risk Management"

- Cited: 0 times

- Copy Citation Citation is copied Copy Citation Citation is copied Copy Citation Citation is copied

CHECK THESE SAMPLES OF Financial Risk Management

Financial risk management in the financial institutions, corporate financial risk management, the process of identification, assessment and prioritization of risk in the organization, identifying and managing risk, financial risks in the telecom industry, financial risk management issues, financial risk management - goldman sachs bank during the financial crisis.

- TERMS & CONDITIONS

- PRIVACY POLICY

- COOKIES POLICY

- International edition

- Australia edition

- Europe edition

The UK is trapped in a cycle of political, social and financial turmoil. But there is a way out…

The Conservatives’ pernicious reign, defined by a toxic belief in self-organising markets, has brought Britain to its knees. But we now have an opportunity to turn things around – by reimagining the UK as a ‘we’ society rather than an ‘I’ society

I f there is any consensus in our otherwise fractured, toxic national debate it is that we cannot go on like this. Our economy is in crisis, exemplified by an annual £100bn shortfall in public and private investment, which must be lifted decisively for Britain to break out of today’s triple whammy of stagnant growth, productivity and living standards. Society reels from alarming gaps in the provision of crucial public services and the yawning unfairness in the distribution of income, wealth and opportunity. Our democracy and state seem incapable of acknowledging the full extent of these deformities, let alone adequately responding to them. Our international standing has plummeted at a time of geopolitical peril. A transformative response is an imperative. My new book, This Time No Mistakes: How to Remake Britain, tries to address the origins of this interlinked crisis – and offer a feasible way out. Nothing is immutable. We are agents of our own destiny.

The heart of the problem is a misconception about how capitalism and society work. Capitalism must be managed and regulated to work for the common good, just as society has to be curated to provide fairness and opportunity for all. Crucially, the vitality of the two are interdependent. Capitalism must be organised so it provides economic ladders that every individual can climb while a social contract must offer a floor below which they cannot fall. Britain’s problem is that the Conservative party, in power for all but 13 of the last 45 years, does not accept these truths or interdependencies. Worse, even if it did, neither the dominant culture and practise of our capitalism, nor the structure of our democracy, state and media would have made it easy to fashion the necessary responses.