Educational Tax Credits and Deductions You Can Claim for Tax Year 2023

Several tax breaks can help you cover the high costs of education, future college expenses and interest you pay on student loans.

Tax Breaks for Education

Getty Images

If you're going to grad school or taking any continuing education classes – even if you aren't working toward a degree – you may be eligible for the lifetime learning credit.

Key Takeaways

- The American opportunity credit can reduce your tax liability by up to $2,500 if you’re paying college tuition and fees.

- Continuing education, part-time classes and graduate school costs can be eligible for the lifetime learning credit, which can lower your tax bill by up to $2,000.

- Now that student loan payments have resumed, the tax break for student loan interest is even more attractive.

- You can withdraw money tax-free from a 529 college-savings plan for a wide range of education expenses, and a new rule lets you roll unused money over to a Roth IRA.

College is expensive, but there are several valuable tax breaks that can help ease the pain.

You may be able to cut your tax bill by up to $2,500 if you're paying college tuition, and you may even be eligible for tax credits that can help cover the cost of continuing education classes to improve your job skills.

Interest you pay on student loans might also be tax deductible – which is especially timely now that payments have resumed. You can use tax-advantaged savings accounts to pay for college costs, and new rules let you roll over unused money in a 529 college-savings plan into a Roth IRA.

Here's how families can make the most of these tax breaks to stretch their savings :

American Opportunity Credit for College Costs

The American opportunity credit can cut your tax liability by up to $2,500 if you're paying for the first four years of higher education for yourself, your spouse or a dependent you claim on your tax return.

To qualify for this credit, the student must be enrolled at least half time and be pursuing a degree or other recognized educational credential at a college, university, vocational school or other eligible postsecondary educational institution.

To claim the full credit, your modified adjusted gross income, or MAGI, must be $80,000 or less if you're filing as single or head of household – or $160,000 or less for married couples filing jointly .

You can claim a partial credit if your MAGI is more than $80,000 but less than $90,000 if you're filing as single or head of household – or more than $160,000 but less than $180,000 if you're married and filing jointly. The credit is calculated as 100% of the first $2,000 of qualifying expenses, plus 25% of the next $2,000 – making the maximum credit $2,500 per student.

Eligible expenses include tuition and fees, plus books, supplies and equipment.

"The expenses must be paid during the tax year for you to qualify for the tax credit, but you can pay for expenses in 2023 for an academic period that begins during the first three months of 2024,” says financial aid expert Mark Kantrowitz, author of “How to Appeal for More College Financial Aid.”

You'll usually receive Form 1098-T from the college reporting the qualified expenses you paid. To claim the credit, use IRS Form 8863 . For more information, see IRS Publication 970 Tax Benefits for Education .

Lifetime Learning Credit for Grad School and Continuing Education

If you're going to grad school or taking any continuing education classes – even if you aren't working toward a degree – you may be eligible for the lifetime learning credit. It's worth 20% of up to $10,000 in eligible expenses, with a maximum credit of $2,000 per tax return.

"Having multiple individuals in college does not get you additional credits," says Tracie Miller, a CPA and professor at Franklin University. Eligible expenses include tuition and required fees for yourself, your spouse or a dependent you claim on your tax return.

The income limits are the same as they are for the American opportunity credit – to claim the full credit for tax year 2023, your MAGI must be $80,000 or less if you're filing as single or head of household, or $160,000 or less for joint filers. You can claim a partial credit if your MAGI is between $80,000 and $90,000 as a single or head of household filer – or $160,000 to $180,000 as a married person filing jointly.

There's no limit to the number of years you can claim the lifetime learning credit, and its education requirements are much broader than the American opportunity credit.

You can take the lifetime learning credit for graduate or undergraduate expenses, and you don't have to be enrolled at least half time or working toward a degree. You can also claim the credit for continuing education, certificate programs or separate classes you take to acquire or improve job skills, and it's available for an unlimited number of tax years.

The key is that the class must be offered by an eligible educational institution, including any college, university, vocational school or other postsecondary educational institution eligible to participate in a U.S. Department of Education student aid program.

This credit can also be valuable for people who lost their jobs and took classes to improve their job prospects.

"Courses to acquire new skills may be especially relevant right now," says Melody Thornton, a CPA and tax manager at Fitzgerald and Company in San Diego.

You should receive Form 1098-T from the eligible institution reporting the qualified expenses you paid. To claim the credit, complete IRS Form 8863.

Deduction for Student Loan Interest

If you're paying back student loans, you may be able to deduct up to $2,500 in interest. Payments restarted on federal student loans, and interest began accruing, on September 1, 2023. Many borrowers who didn’t pay any student loan interest during the pandemic will be able to start claiming this tax break again, Kantrowitz says.

“The student loan interest deduction allows a deduction for interest you pay on certain student loans for you, your spouse or a dependent. The interest deduction goes to the person legally obligated to pay the interest," says Timothy M. Todd, a law professor at Liberty University School of Law in Lynchburg, Virginia.

"So, if a parent takes out the loan for his or her dependent child and the parent makes the interest payments, the parent gets the deduction. However, if a student takes out the loan and the parent pays the interest, it is treated as though the parent transferred the money to the student who then makes the payment,” he adds.

The student can't get the break, however, if their parents claim them as a dependent.

To qualify for the deduction in 2023, your MAGI must be less than $90,000 if you're filing as single or head of household – or $185,000 if you're married and filing jointly. The size of the deduction starts to phase out if your MAGI is more than $75,000 if single or head of household – or $155,000 for married, fjoint filers.

There is a $2,500 cap on the deduction per return, which means that a married couple gets a maximum deduction of $2,500 even though they could each deduct up to $2,500 if they were single, Todd says. You don't have to itemize to claim the student loan interest deduction.

Maximizing 529 Tax Breaks for Education at All Ages

You can withdraw money tax-free from a 529 savings plan for college tuition, fees and equipment such as a computer or printer. You can also withdraw money tax-free for room and board if you're enrolled at least half time, even if you don't live on campus.

Eligible expenses for off-campus housing are generally limited to room and board costs that the college reports for financial aid purposes (look for the number on your financial aid reward page or ask the aid office).

"For example, if the room and board cost reported by the school is $15,000 but it costs $30,000 for the student living off campus, then only $15,000 is a valid 529 expense," Thornton says.

You can also withdraw money tax-free for a computer, whether you attend school on campus or virtually. Computer-program costs are also eligible expenses.

"As long as the student is using it for 529-related coursework, then you can use the 529 for those expenses," says Mary Morris, CEO of Virginia529.

There's no age limit for using the money, and you don't need to be working toward a degree.

"One of the really important things we see are adults going back to school – maybe they lost their job and are taking classes or a certificate program that puts them on a road to a new career," Morris says.

You can withdraw money tax-free from a 529 for those expenses as long as you're taking the classes from an eligible educational institution. You'll get the biggest tax benefits if you can keep the money growing for years in the tax-advantaged account.

It's Not Too Late to Start a 529 Plan

If you don't already have a 529, it might still be worthwhile to open one and make the most of any tax breaks you get for contributions, even if you plan to use the money soon for education expenses.

“For parents thinking of starting a 529 plan, it’s important to realize that although many states offer a state income tax break for contributions to such plans, states typically require that the contributions be made to the 529 plan sponsored by that state,” Todd says.

Visit the Saving For College website for details about each state's plans and tax rules, and the College Savings Plans Network website for information and links to each state program’s website.

You can also withdraw up to $10,000 per year, per beneficiary, from a 529 to pay tuition for kindergarten through 12th grade and avoid paying taxes.

If your child doesn't use the money for educational expenses, you can switch the beneficiary to another eligible family member. If you take withdrawals that aren't for eligible education expenses, the earnings are taxable and subject to a 10% penalty, although the penalty is waived in some circumstances.

"If a child receives a scholarship, a distribution for up to the amount of the scholarship can be made without being subject to the 10% penalty," Miller says. "The taxpayer must, though, still pay tax on the earnings of this distribution."

Even if your child qualifies for a scholarship, you may still have other eligible expenses that qualify for tax-free withdrawals, such as room and board, fees, books and equipment.

New 529 Options in 2024

The Secure 2.0 tax law expanded the options for unused 529 money. Starting in 2024, families saving for education in 529 plans can roll over unused funds from those accounts into Roth IRAs without tax penalties. The 529 plan beneficiary must own the Roth but you can change the beneficiary, Kantrowitz says.

You can roll over only up to the annual Roth IRA contribution limit each year – $7,000 for people under age 50 in 2024 – with a $35,000 lifetime limit per beneficiary. The 529 plan must have been in existence for at least 15 years, and only funds that have been in it for at least five years are eligible for a rollover, he says.

“Financial professionals agree that although there are limitations to the rollovers, it will provide a new option for individuals who find themselves with leftover or unused money in their 529 account but who don’t want to incur the tax penalties that come with taking a nonqualified withdrawal,” Morris says.

Coordinating Tax Credits for Education With Tax-Free 529 Withdrawals

You can qualify for the American opportunity credit or lifetime learning credit and take tax-free 529 withdrawals in the same year, but you need to be careful.

"To optimize the tax benefits, you can’t use 529 distributions for the same expenses,” Todd says.

"In short, you can't 'double dip.' If you end up taking out more from the 529 plan than qualified education expenses (after accounting for the expenses used for an education credit), part of the 529 distribution may be taxable,” he says.

For example, if you claim the full American opportunity credit, the $4,000 in tuition and fees you claim is not considered a qualified education expense for your 529, and part of the distribution may be taxable.

If you claim the full lifetime learning credit, you can't take tax-free 529 withdrawals for the first $10,000 in tuition expenses you claimed for the credit but you can withdraw money tax-free from the 529 for additional expenses.

"If you withdraw money from the 529 plan and are possibly eligible to claim a credit, make sure to keep receipts for all costs so that they maximize the benefits between the 529 and the credit," Thornton says.

Answers to 15 Common Tax Questions

Kimberly Lankford April 20, 2023

The Best Financial Tools for You

Credit Cards

Find the Best Loan for You

Popular Stories

Saving and Budgeting

Family Finance

Personal Loans

Comparative assessments and other editorial opinions are those of U.S. News and have not been previously reviewed, approved or endorsed by any other entities, such as banks, credit card issuers or travel companies. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

Your Money Decisions

Advice on credit, loans, budgeting, taxes, retirement and other money matters.

You May Also Like

What is zero-based budgeting.

Erica Lamberg April 1, 2024

Tax Credits vs. Tax Deductions

Kimberly Lankford March 29, 2024

Am I Middle Class?

Jessica Walrack March 29, 2024

How to Get Home Energy Tax Credits

Kimberly Lankford March 28, 2024

Do You Owe the IRS? How to Find Out

Ask a Pro: Do I Need an Estate Plan?

Brandon Renfro March 27, 2024

Why Are Eggs So Expensive Right Now?

Geoff Williams March 27, 2024

How Are Unemployment Benefits Taxed?

Kimberly Lankford March 26, 2024

Tax Time Can Compromise Mental Health

Erica Sandberg March 26, 2024

Painful Tax Bill: Forgiven Debt

Got Kids? Here's Six Tax Breaks

Geoff Williams March 25, 2024

How to Find a Reputable Tax Preparer

Liz Knueven March 25, 2024

5 Best Free Budgeting Apps

Erica Sandberg March 22, 2024

Don't Let Food Eat up Your Budget

Jessica Walrack March 22, 2024

10 Cheapest Grocery Stores in the U.S.

Jessica Walrack March 21, 2024

What Is a 1099 Form?

Kimberly Lankford March 20, 2024

What Happens if You Don't Pay Taxes?

Geoff Williams March 18, 2024

Alternatives to Tax Accountants

Erica Lamberg March 15, 2024

Filing Last Minute: Pros and Cons

Erica Sandberg March 15, 2024

10 Small Business Tax Deductions

Jessica Walrack March 15, 2024

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

American Opportunity Tax Credit and Other Education Tax Credits for 2023

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The American Opportunity Tax Credit and the Lifetime Learning Credit are federal tax credits that can lower your upcoming tax bill if you paid for college in 2023.

You can claim these education tax credits as a student if you're not claimed as a dependent on anyone else's tax return. Parents can claim the credit for a student who is a dependent. Spouses can claim the credit if they use the married filing jointly status .

Here's what you need to know about the American Opportunity Tax Credit, Lifetime Learning Credit and education tax forms.

» MORE: NerdWallet's guide to the best tax software

Simple tax filing with a $50 flat fee for every scenario

With NerdWallet Taxes powered by Column Tax, registered NerdWallet members pay one fee, regardless of your tax situation. Plus, you'll get free support from tax experts. Sign up for access today.

for a NerdWallet account

Transparent pricing

Maximum refund guaranteed

Faster filing

*guaranteed by Column Tax

What is the American Opportunity Tax Credit?

The American Opportunity Tax Credit is a federal tax credit that allows you to lower your tax bill by up to $2,500 if you paid that much in undergraduate education expenses last year.

How the American Opportunity Tax Credit works

The American Opportunity Tax Credit lets you claim all of the first $2,000 you spend on eligible education expenses, plus 25% of the next $2,000, for a total of $2,500. Qualified expenses include:

Mandatory school fees.

Books and supplies.

You may not claim living expenses or transportation costs.

Who can claim the American Opportunity Tax Credit?

The American Opportunity Tax Credit is for undergraduate college students only. To qualify, students must meet the following criteria, according to the IRS:

Be pursuing a degree or other recognized education credential.

Be enrolled at least half time for at least one academic period beginning in the tax year.

Not have finished the first four years of higher education at the beginning of the tax year.

Not have claimed the American Opportunity Tax Credit for more than four tax years.

Not have a felony drug conviction at the end of the tax year.

As a student, you can claim the credit on your taxes for a maximum of four years as long as no one else, like your parents, claims you as a dependent on their tax returns. Parents will claim the credit, instead of the student, if they paid for the student's education expenses and have the student listed as a dependent on their return.

Your 2023 modified adjusted gross income, or MAGI, determines how much of the American Opportunity Tax Credit you can claim:

What the American Opportunity Credit is worth

The American Opportunity Tax Credit lowers the amount of taxes you pay. For example, if you owe $3,000 in taxes and get the full $2,500 credit, you’ll only have to pay $500 to the IRS.

Is the American Opportunity Tax Credit refundable?

Yes, it's refundable. You can still receive 40% of the American Opportunity Tax Credit's value — up to $1,000 — even if you earned no income last year or owe no tax. For example, if you qualified for a refund, this credit could increase the amount you'd receive by up to $1,000. That's why the American Opportunity Tax Credit is typically the best education tax break for students and their families.

» MORE: Guide to filing taxes with student loans

What is the Lifetime Learning Credit?

The Lifetime Learning Credit is a a federal tax credit that can reduce your taxable income by up to $2,000 if you're pursuing an undergraduate, graduate, vocational or non-degree program. Unlike the American Opportunity Tax Credit, there's no limit to the number of tax years in which you can claim this credit.

How the Lifetime Learning Credit works

You can claim 20% of the first $10,000 you paid toward 2023 tuition and fees, for a maximum of $2,000 each year.

Course supplies, living expenses and transportation costs are not qualified expenses for the Lifetime Learning Credit.

Who can claim the Lifetime Learning Credit?

The Lifetime Learning Credit is ideal for graduate students or anyone taking classes to develop new skills, even if you already claimed the American Opportunity Tax Credit on your taxes in the past.

Students can claim the Lifetime Learning Credit for themselves if they file their own taxes. Parents of dependent students can also claim the credit.

To qualify for the Lifetime Learning Credit, you must meet the following criteria, according to the IRS:

Be enrolled or taking courses at an eligible educational institution.

Be taking higher education courses to get a degree or other recognized education credential or to get or improve job skills.

Be enrolled for at least one academic period beginning in the tax year.

Your 2023 modified adjusted gross income, or MAGI, determines how much of the Lifetime Learning Credit you can claim:

Is the Lifetime Learning Credit refundable?

No, the Lifetime Learning Credit is not refundable. You can use the credit to pay any tax you owe, but you won't receive the money back as a refund, even if you earned no income or owe no tax.

» MORE: The difference between tax credits and tax deductions

American Opportunity Tax Credit vs. Lifetime Learning Credit

The American Tax Opportunity Credit is generally more valuable that the Lifetime Learning Credit, if you qualify. You can't claim both the American Opportunity Tax Credit and the Lifetime Learning Credit for the same student or the same qualified expenses.

Here are the key differences between these two education tax credits:

Education tax forms

In January your school will send you Form 1098-T, a tuition statement that shows the education expenses you paid for the year. You’ll use that form to enter the corresponding amounts on your tax return to claim an education tax credit or deduction.

If you also paid student loans , you may be able to deduct student loan interest from your taxable income. If you paid more than $600 in interest, your servicer will automatically send you Form 1098-E. You can still deduct interest if you paid less than $600, but you’ll have to ask your servicer for the form.

If your company provided funds for educational assistance — like tuition reimbursement or employer student loan repayment — up to $5,250 can be excluded from your taxable income.

On a similar note...

- Search Search Please fill out this field.

What Is an Education Tax Credit?

- How It Works

- Requirements

- American Opportunity Tax Credit

Lifetime Learning Credit

- Deductions & Credits

- Tax Credits

Education Tax Credit: Meaning, Requirements

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

Lea Uradu, J.D. is a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, and Tax Writer.

:max_bytes(150000):strip_icc():format(webp)/lea_uradu_updated_hs_121119-LeaUradu-7c54e49efe814a048e41278182ba02f8.jpg)

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

Education tax credits are available for taxpayers who pay qualified higher education expenses for an eligible student to an eligible educational institution, such as a college or university. The two types of education tax credits are the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC).

Key Takeaways

- The American Opportunity Tax Credit (AOTC) is for eligible students who have not yet completed their first four years of higher education.

- The Lifetime Learning Credit can be used to offset costs related to undergraduate, graduate, or professional degrees.

- You cannot claim both the AOTC and the lifetime learning credit for the same student in the same tax year.

How Education Tax Credits Work

Education tax credits may be claimed by those who incur qualifying educational expenses, such as tuition and fees. Parents who pay these expenses for their children may be able to claim this type of credit on their tax returns , subject to certain income restrictions.

There are two types of education tax credits: the American Opportunity Tax Credit (AOTC) and the lifetime learning credit. The AOTC applies to the first four years of postsecondary education, with certain restrictions. The Lifetime Learning Credit applies to all students at the undergraduate, graduate, and professional levels. You cannot claim both the AOTC and the Lifetime Learning Credit for the same student in the same tax year.

Requirements for the Education Tax Credit

Both credits also have their own eligibility rules, but a taxpayer must meet all three of these requirements for both:

- You, your dependent, or a third party must pay qualified higher education expenses .

- You, your spouse, or a dependent listed on your tax return qualify as an eligible student.

- The eligible student (above) must be enrolled at an eligible educational institution.

American Opportunity Tax Credit (AOTC)

The American Opportunity Tax Credit (AOTC) is for eligible students who have not yet completed their first four years of higher education. They must not have claimed the AOTC or former Hope credit for more than four tax years. The student must be enrolled at least half time for one academic period, as determined by the school, during the tax year. Additionally, they must not have a felony drug conviction as of the end of the tax year.

There are income limits for claiming the AOTC. The credit begins to phase out at a modified adjusted gross income (MAGI) of $80,000 for single filers and $160,000 for married taxpayers filing jointly for full credit. Single taxpayers with a MAGI of more than $90,000, or MFJs with a MAGI over $180,000, cannot claim the credit. Income in between these brackets allows for claiming a reduced credit.

Eligible students can claim 100% of the first $2,000 spent on school expenses and another 25% of the next $2,000. The maximum amount that an eligible student can claim is, therefore, $2,500: (100% × $2,000) + (25% × $2,000). In other words, the maximum $2,500 AOTC can offset $4,000 spent on qualified higher educational expenses.

The AOTC is a partially refundable tax credit. This means that if the credit reduces your tax burden to less than zero, then the Internal Revenue Service (IRS) will send you a check for up to 40% of the remaining credit. The maximum refundable portion of the credit is, therefore, $1,000 (40% × $2,500).

The Lifetime Learning Credit has broader eligibility requirements than the AOTC, as it is intended for taxpayers at all education levels. The Lifetime Learning Credit can be used for a wide range of schools, including vocational training or professional degree courses, as well as for tuition at more traditional four-year undergraduate and graduate schools.

To be eligible for the Lifetime Learning Credit, a student must be enrolled in a course to earn education credits or improve job skills at an eligible educational institution for at least one academic period, as determined by the school. The student will receive a Form 1098-T, Tuition Statement, from the educational institution if it is an eligible school as defined by the IRS.

After Dec. 31, 2020, the MAGI used by joint filers for the Lifetime Learning Credit is not adjusted for inflation. The credit is phased out for taxpayers with a MAGI between $80,000 and $90,000 for single filers and $160,000 and $180,000 for joint returns.

Eligible students can claim 20% of the first $10,000 of qualified education expenses. The maximum amount that an eligible student can claim is, therefore, $2,000 (20% × $10,000). The Lifetime Learning Credit is not refundable. This means that the credit can reduce your tax liability to zero, but it cannot be refunded to you beyond that point.

Criticisms of Education Tax Credits

Critics of subsidies for higher education have long argued that education tax credits are one reason that the cost of higher education has been rising many times faster than inflation . According to these critics, education tax credits simply raise the overall cost of college without an actual increase in access to it. Tax credits make more money available for spending on education, but they do nothing to increase the supply or quality of schooling.

What Are the Major Differences Between the AOTC and the Lifetime Learning Credit?

The AOTC has a maximum of $2,500, and the Lifetime Learning Credit maximum is $2,000. Both credits cannot be claimed in the same tax year for the same student.

The AOTC can only be used for undergraduate expenses, while the Lifetime Learning Credit is more flexible. The AOTC can only be claimed for four tax years; the Lifetime Learning Credit can be claimed an unlimited number of times.

The AOTC requires the student to be enrolled at least half time for an academic period, while the Lifetime Learning Credit is available to students enrolled in at least one course for an academic period.

Students cannot have a felony drug conviction and claim the AOTC. This is not a requirement for the Lifetime Learning Credit.

Is My Vocational School an Eligible Educational Institution for the Lifetime Learning Credit?

Yes, your vocational school may count as an eligible educational institution for the Lifetime Learning Credit. If your school is eligible, you will receive a Form 1098-T from your school in the mail before you file your taxes.

What If I Don’t Receive a Form 1098-T From My School?

If you do not receive a Form 1098-T, contact your school. Similarly, if you believe that the amount listed on your 1098-T is incorrect, contact your school.

Internal Revenue Service. “ Education Credits—AOTC and LLC .”

Internal Revenue Service. “ American Opportunity Tax Credit .”

Internal Revenue Service. “ Lifetime Learning Credit .”

Internal Revenue Service. “ Education Benefits — No Double Benefits Allowed .”

Internal Revenue Service. “ What Is an Eligible Educational Institution? ”

Internal Revenue Service. " IRS Provides Tax Inflation Adjustments for Tax Year 2023 ."

Internal Revenue Service. “ Compare Education Credits .”

Internal Revenue Service. " About Form 1098-T, Tuition Statement ."

:max_bytes(150000):strip_icc():format(webp)/AOTC-af112f206ca742fb8ec5c62beb19c1d5.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Teaching and Teacher Leadership

Contact Information

Connect with program staff.

If you have program-specific questions, please contact the TTL Program Staff .

- Connect with Admissions

If you have admissions-related questions, please email [email protected] .

Admissions Information

- Application Requirements

- Tuition and Costs

- International Applicants

- Recorded Webinars

- Download Brochure

A groundbreaking approach to teacher education — for people seeking to learn to teach, for experienced teachers building their leadership, and for all educators seeking to enhance their practice and create transformative learning opportunities.

Teachers change lives — and at the Harvard Graduate School of Education, you can be part of the change. The Teaching and Teacher Leadership (TTL) Program at HGSE will prepare you with the skills, knowledge, support, and professional network you need to design and lead transformative learning experiences, advance equity and social justice, and generate the best outcomes for students in U.S. schools.

The program’s innovative approach is intentionally designed to serve both individuals seeking to learn to teach and experienced teachers who are deepening their craft as teachers or developing their leadership to advance teaching and learning in classrooms, schools, and districts.

And through the Harvard Fellowship for Teaching , HGSE offers significant financial support to qualified candidates to reduce the burden of loan debt for teachers.

Applicants will choose between two strands:

- Do you want to become a licensed teacher? The Teaching Licensure strand lets novice and early-career teachers pursue Massachusetts initial licensure in secondary education, which is transferrable to all 50 states and Washington, D.C. Licensure candidates have two possible pathways — you can select a preference for either the residency fieldwork model or the internship fieldwork model . The residency model is for people ready to make an immediate impact as a teacher; the internship model offers a more gradual path.

- Do you want to focus on the art of teaching, without licensure? The Teaching and Leading strand will enable you to enhance your own teaching practice or to lead others in transforming learning in classrooms, schools, and other settings. Candidates can pursue a curriculum tailored toward an exploration of teaching practice or toward teacher leadership.

Note: Ideal candidates will come with the intention to work in U.S. schools.

“At the heart of TTL is helping teachers reach all students. Whether you are preparing for the classroom yourself or are an experienced teacher preparing to improve teaching and learning on a wider scale, our goal is to provide you with the knowledge and skills to lead others in learning.” Heather Hill Faculty Co-Chair

After completing the Teaching and Teacher Leadership Program, you will be able to:

- Leverage your knowledge and skills to lead others in joyful, equitable, rigorous, and transformative learning.

- Analyze instruction for the purpose of improving it.

- Foster productive inquiry and discussion.

- Identify, understand, and counteract systemic inequities within educational institutions.

The Harvard Fellowship for Teaching

HGSE is committed to investing in the future of the teaching profession — and minimizing the student debt that teachers carry. We offer a signature fellowship — the Harvard Fellowship for Teaching — to qualified candidates. The fellowship package covers 80 percent of tuition and provides for a $10,000 living stipend.

This prestigious fellowship is prioritized for admitted students pursuing the Teaching Licensure Residency model. Additional fellowships may be awarded to qualified candidates admitted to the Teaching Licensure Internship model and the Teaching and Leading strand. Fellowship decisions are determined during the admissions process. Fellowship recipients must be enrolled as full-time students. HGSE offers a range of other financial aid and fellowship opportunities to provide greater access and affordability to our students.

Curriculum Information

The TTL Program is designed to help you gain the knowledge and practice the skills essential to leading others in learning — and will create pathways to success that will allow you to thrive as an expert practitioner and mentor in your community. A minimum of 42 credits are required to graduate with an Ed.M. degree from HGSE.

The main elements of the curriculum are:

- Commence your Foundations studies with How People Learn, an immersive online course that runs June–July and requires a time commitment of 10–15 hours per week.

- You will continue Foundations with Leading Change, Evidence, and Equity and Opportunity on campus in August.

- Your Equity and Opportunity Foundations experience culminates in an elected course, which will take place during terms when electives are available.

To fulfill the program requirement, students must take a minimum of 12 credits specific to TTL.

- The TTL Program Core Experience (4 credits), is a full year course where all students come together to observe, analyze, and practice high-quality teaching.

- Teaching methods courses (10 credits) in the chosen content area, which begin in June.

- A Summer Field-Based Experience (4 credits), held on site in Cambridge in July, allows you to begin to hone your teaching practice.

- Two courses focused on inclusivity and diversity in the classroom (6 credits).

- Field experiences , where students in the Teacher Licensure strand will intern or teach directly in Boston-area schools.

- Individuals interested in enhancing their own teaching practice can engage in coursework focused on new pedagogies, how to best serve diverse student populations, and special topics related to classrooms and teaching.

- Experienced teachers may wish to enroll in HGSE’s Teacher Leadership Methods course, designed to provide cohort-based experience with skills and techniques used to drive adult learning and improve teaching.

- Candidates can take elective coursework based on interests or career goals, which includes the opportunity to specialize in an HGSE Concentration .

Advancing Research on Effective Teacher Preparation

As a student in the TTL Program, you will have the opportunity to contribute to HGSE’s research on what makes effective teacher preparation. This research seeks to build an evidence base that contributes to the field’s understanding of effective approaches to teacher training, including how to support high-quality instruction, successful models of coaching and mentorship, and effective approaches to addressing the range of challenges facing our students.

TTL students will be able to participate in research studies as part of their courses, and some will also serve as research assistants, gaining knowledge of what works, as well as a doctoral-type experience at a major research university.

Explore our course catalog . (All information and courses are subject to change.)

Note: The TTL Program trains educators to work in U.S. classrooms. Required coursework focuses on U.S. examples and contexts.

Teaching Licensure Strand

Students who want to earn certification to teach at the middle school and high school levels in U.S. schools should select the Teaching Licensure strand. TTL provides coursework and fieldwork that can lead to licensure in grades 5–8 in English, general science, history, and mathematics, as well as grades 8–12 in biology, chemistry, English, history, mathematics, and physics. In the Teaching Licensure strand, you will apply to one of two fieldwork models:

- The residency model – our innovative classroom immersion model, with significant funding available, in which students assume teaching responsibilities in the September following acceptance to the program.

- The internship model – which ramps up teaching responsibility more gradually.

In both models, you will be supported by Harvard faculty and school-based mentors — as well as by peers in the TTL Program, with additional opportunities for network-building with HGSE alumni. Both models require applicants to have an existing familiarity with U.S. schools to be successful. Learn more about the differences between the residency and internship models.

Summer Experience for Teaching Licensure Candidates

All students in the Teaching Licensure strand will participate in the Summer Experience supporting the Cambridge-Harvard Summer Academy (CHSA), which takes place in Cambridge in July 2023. Through your work at CHSA, you will help middle and high school students in the Cambridge Public Schools with credit recovery, academic enrichment, and preparation for high school. Students in the Teaching Licensure strand will teach students directly as part of the teaching team. This is an opportunity for you to immediately immerse yourself in a school environment and begin to practice the skills necessary to advance your career.

Teaching and Leading Strand

The Teaching and Leading strand is designed for applicants who want to enhance their knowledge of the craft of teaching or assume roles as teacher leaders. Candidates for the Teaching and Leading strand will share a common interest in exploring and advancing the practice of effective teaching, with the goal of understanding how to improve learning experiences for all students. The program will be valuable for three types of applicant:

- Individuals interested in teaching, but who do not require formal licensure to teach. This includes applicants who might seek employment in independent schools or in informal educational sectors such as arts education, after-school programs, tutoring, and youth organizations.

- Experienced teachers who wish to deepen their practice by learning new pedagogies and developing new capacities to help students thrive.

- Experienced teachers who seek leadership roles — from organizing school-based initiatives to more formal roles like coaching and professional development.

As a candidate in the Teaching and Leading strand, your own interests will guide your journey. If you are seeking a teacher leader role, TTL faculty will guide you to courses that focus on growing your skills as a reflective leader, preparing you to facilitate adult learning, helping you understand how to disrupt inequity, and teaching you how to engage in best practices around coaching, mentoring, and data analysis. If you are seeking to learn about the craft of teaching, our faculty will similarly direct you to recommended courses and opportunities that will meet your goals.

Students in this strand can also take on internships within the TTL Program (e.g., program supervisor, early career coach) or the HGSE community, and at surrounding schools or organizations. And you can customize your learning experience by pursuing one of HGSE's six Concentrations .

Note: Applicants in the Teaching and Leading strand should expect a focus on leadership within U.S. schools.

Program Faculty

Students will work closely with faculty associated with their area of study, but students can also work with and take courses with faculty throughout HGSE and Harvard. View our faculty directory for a full list of HGSE faculty.

Faculty Co-Chairs

Heather C. Hill

Heather Hill studies policies and programs to improve teaching quality. Research interests include teacher professional development and instructional coaching.

Victor Pereira, Jr.

Victor Pereira's focus is on teacher preparation, developing new teachers, and improving science teaching and learning in middle and high school classrooms.

Rosette Cirillo

Sarah Edith Fiarman

Noah Heller

Eric Soto-Shed

Career Pathways

The TTL Program prepares you for a variety of career pathways, including:

Teaching Licensure Strand:

- Licensed middle or high school teacher in English, science, math, and history

Teaching and Leading Strand:

- Classroom teachers

- Curriculum designers

- Department heads and grade-level team leaders

- District-based instructional leadership team members

- Instructional and curriculum leadership team members

- Out-of-school educators; teachers in youth organizations or after-school programs

- Professional developers and content specialists

- School improvement facilitators

- School-based instructional coaches and mentor teachers

- Teachers of English as a second language

- International educators seeking to understand and advance a career in U.S. education

Cohort & Community

The TTL Program prioritizes the development of ongoing teacher communities that provide continued support, learning, and collaboration. Our cohort-based approach is designed to encourage and allow aspiring teachers and leaders to build relationships with one another, as well as with instructors and mentors — ultimately building a strong, dynamic network.

As a TTL student, you will build a community around a shared commitment to teaching and teacher development. You will learn from and with colleagues from diverse backgrounds, levels of expertise, and instructional settings. To further connections with the field, you are invited to attend “meet the researcher” chats, engage in learning through affinity groups, and interact with teaching-focused colleagues across the larger university, by taking courses and participating in activities both at HGSE and at other Harvard schools.

Introduce Yourself

Tell us about yourself so that we can tailor our communication to best fit your interests and provide you with relevant information about our programs, events, and other opportunities to connect with us.

Program Highlights

Explore examples of the Teaching and Teacher Leadership experience and the impact its community is making on the field:

Donors Invest in Teachers, Reaching Key Milestone

The $10 million Challenge Match for Teachers, now complete, will expand scholarships for students in Teaching and Teacher Leadership

HGSE Honors Master's Students with Intellectual Contribution Award

Degrees and Programs

Residential Master's in Education

Immersive campus experience for aspiring and established educators, leaders, and innovators, with five distinct programs to choose from.

Online Master's in Education

Part-time, career-embedded program, delivered online, for experienced educators looking to advance their leadership in higher education or pre-K–12.

Doctor of Education Leadership

Preparing transformative leaders to have the capacity to guide complex organizations, navigate political environments, and create systemic change in the field of education.

Doctor of Philosophy in Education

Training cutting-edge researchers who work across disciplines, generate knowledge, and translate discoveries into transformative policy and practice.

- Undergraduate

Print Options

- Graduate School Academic Catalog

- Programs of Study

Education (EDUC)

https://cola.unh.edu/education

Degrees Offered: Ph.D., Ed.S., M.Ed., M.A.T., Graduate Certificate

Programs are offered in Durham, Manchester, and online.

The Education Department offers a variety of programs leading to the master's degree, the doctor of philosophy degree, and the education specialist degree. The department also offers graduate certificate programs.

The master of arts in teaching is offered in secondary education. The master of education is offered in early childhood education (including an option in special needs), elementary education, secondary education, and special education.

The M.Ed. in Educational Studies does not lead to certification and can be completed fully online.

The education specialist degrees are offered in educational administration and supervision.

The doctor of philosophy is offered in education.

Graduate certificates are offered in Curriculum and Instructional Leadership, Trauma Informed Policy & Practice (TIPP), and Special Education Administration.

Admission Requirements

In addition to the materials required by the Graduate School, individual programs within the department may have additional admissions requirements. Applicants should refer to specific program descriptions. Consultation with a program faculty member is recommended. In all cases, the applicant's relevant experience, references, and professional goals will be considered in the admission process.

Action on applications to Education Department programs varies by individual program. Applicants to this program must refer to the online Programs of Study listing for additional application instructions. This can be done by referring to the Graduate School's Admissions web page and then Application Requirements . The additional application instructions can be found under Requirements and Supplemental Documents.

- Education (Ph.D.)

- Early Childhood Education (M.Ed.)

- Early Childhood Education: Special Needs (M.Ed.)

- Educational Administration & Supervision (Ed.S.)

- Educational Studies (M.Ed.)

- Elementary Education (M.Ed.)

- Secondary Education (M.A.T.)

- Secondary Education (M.Ed.)

- Special Education (M.Ed.)

- Autism Spectrum Disorder (Graduate Certificate)

- Curriculum and Instructional Leadership (Graduate Certificate)

- Special Education Administration (Graduate Certificate)

- Trauma Informed Policy and Practice (Graduate Certificate)

Education (EDUC)

Educ #800 - educational structure and change.

Grade Mode: Letter Grading

EDUC 801 - Human Development & Learning: Cultural Perspectives

Special Fee: Yes

EDUC 803C - Classroom Management: Creating Positive Learning Environments

Educ 803d - social studies methods for middle and high school teachers, educ 803f - teaching elementary school science, educ 803m - teaching elementary social studies, educ #805 - contemporary educational perspectives, educ 806 - teaching & learning literacy in the elementary classroom, educ 807 - teaching reading through the content areas, educ 808 - literacy assessment for elementary classroom teachers.

Co-requisite: EDUC 900

Prerequisite(s): EDUC 806 with a minimum grade of D-.

EDUC 809 - Supporting Readers in Elementary Classrooms

Co-requisite: EDUC 901

Prerequisite(s): EDUC 806 with a minimum grade of D- and EDUC 808 with a minimum grade of D-.

EDUC 810 - Navigating Difficult Dialogue

Educ 812 - teaching multilingual learners, educ 818 - critical social justice in and beyond education, educ 820 - educational technology, educ 833 - teaching writing in the elementary grades, educ 834 - critical perspectives on children's literature, educ 839 - equitable assessment and individualized educational planning: building access and agency.

Prerequisite(s): EDUC 850 with a minimum grade of D- and EDUC 851 with a minimum grade of D-.

Equivalent(s): EDUC 939

EDUC 840 - Advanced Methods for Inclusive Curricular Design and Teaching: Building Access and Agency, Part II

Prerequisite(s): EDUC 839 with a minimum grade of D-.

Equivalent(s): EDUC 940

EDUC 841 - Exploring Mathematics with Young Children

Prerequisite(s): MATH 601 with a minimum grade of D- or MATH 801 with a minimum grade of D-.

EDUC 845 - Math with Technology in Early Education

Educ 850 - introduction to disability in inclusive schools and communities, educ 851a - inclusive elementary education: literacies and learning for diverse learners, educ 851b - methods of inclusive secondary education: literacies, learning, and transitions, educ 856 - advocating for diverse and inclusive family-school-community partnerships, educ 860 - introduction to young children with special needs, educ 861 - designing curriculum for inclusive, equitable settings for young children (birth-8), educ 862 - curriculum for young children with special needs: evaluation and program design.

Equivalent(s): EDUC 947

EDUC #867 - Students, Teachers, and the Law

Equivalent(s): JUST 867

EDUC #868 - Students and Higher Education Law

Educ #869 - faculty and higher education law, educ 881 - introduction to statistics: inquiry, analysis, and decision making, educ 882 - introduction to research methods, educ 884 - educators as researchers.

Equivalent(s): EDUC 984

EDUC 885 - Introduction to Assessment

Educ 886 - issues in assessment: historical contexts, perennial dilemmas, current trends, educ 897 - special topics in education.

Credits: 1-4

EDUC #899 - Master's Thesis

Credits: 1-10

Repeat Rule: May be repeated for a maximum of 10 credits.

Grade Mode: Graduate Credit/Fail grading

EDUC 900A - Internship and Seminar in Teaching

Credits: 2-6

EDUC 900B - Internship and Seminar in Early Childhood Education

Credits: 3 or 4

EDUC 900C - Internship and Seminar in Special Education

Credits: 3 or 6

EDUC 901A - Internship and Seminar in Teaching

Educ 901b - internship and seminar in early childhood education, educ 901c - internship and seminar in special education, educ 902 - doctoral pro-seminar, educ 904 - qualitative inquiry in research, educ 905 - critical inquiry in education, educ 906 - the literature review in educational research: interdisciplinary perspectives, educ 935a - seminar and practicum in teaching, educ #942 - socio-cultural perspectives on teaching and learning, educ #948 - leadership and advocacy in early childhood education, educ 950 - understanding culture in research on learning and development, educ 956 - developing positive behavior supports to ensure success for all learners, educ #957 - collaborative models of teaching, learning, and leading, educ 958 - analysis of teaching and learning, educ 959 - issues in education, educ 960 - curriculum development, educ 962 - educational finance and business management, educ 964 - human resources in education, educ 965 - educational supervision and evaluation, educ 967 - school law, educ 968 - collective bargaining in public education, educ 970 - foundations for leadership in higher education, educ 972 - introduction to educational evaluation, educ 973 - policy, politics, and planning in education, educ 974 - educational administrative internship, educ 975 - advanced education field project, educ 976 - policy and governance in higher education, educ 977 - leadership: the district level administrator, educ 978 - applied regression analysis in educational research.

Prerequisite(s): EDUC 881 with a minimum grade of D-.

EDUC 979 - Applied Multilevel Modeling

Prerequisite(s): EDUC 978 with a minimum grade of D-.

EDUC 981 - Quantitative Inquiry: Methods and Techniques of Educational Research

Educ 982 - qualitative fieldwork & data analysis.

Prerequisite(s): EDUC 904 with a minimum grade of D-.

EDUC 986 - Philosophy of Education

Educ 991 - curriculum theory i, educ #992 - curriculum theory ii, educ 995 - independent study.

Repeat Rule: May be repeated for a maximum of 8 credits.

EDUC 998 - Special Topics

Repeat Rule: May be repeated up to unlimited times.

EDUC 999 - Doctoral Research

See https://cola.unh.edu/education/faculty-staff-directory for faculty.

Send Page to Printer

Print this page.

Download Page (PDF)

The PDF will include all information unique to this page.

2023-2024 Undergraduate Catalog

A PDF of the entire 2023-2024 undergraduate catalog.

2023-2024 Graduate Catalog

A PDF of the entire 2023-2024 graduate catalog.

2023-2024 Law Catalog

A PDF of the entire 2023-2024 law catalog.

Students Rights, Rules and Responsibilies PDF

2023-2024 students rights, rules, and responsibilities PDF.

- Publications

Toggle navigation

The ACE National Guide

Filter results:

- Apprenticeship

- Organization

Untitled

Meet ace’s 2022 students of the year.

Congratulations to Amberlin Dupre and Joel Riley, the recipients of the 2022 ACE/Sophia Learning Student of the Year Award! This annual award recognizes the outstanding achievements of learners who have utilized ACE credit recommendations to pursue a postsecondary credential or advance their career. Learn more about their accomplishments .

ACE Military Guide Milestone

There are now over 1,000 registered colleges and universities that are using the ACE Military Guide's enhanced tools to make awarding credit for military learning easier! Is your higher education institution interested in establishing an Institution Account? Visit the ACE Military Guide page to learn more.

New Enhancements for the National Guide

Based on your feedback, ACE Learning Evaluations is excited to launch some enhancements for searching and browsing the ACE National Guide. These updates, which improve the display of search results and enable you to sort options, are designed to make it easier to find the information you need.

Apprenticeship Program Evaluations Now Available

ACE's Learning Evaluations is now accepting applications and conducting reviews for Apprenticeship programs! Leverage the ACE Apprenticeship evaluation process to validate your program and present a unique edge that sets you apart from the rest. Get started on the Apprenticeships Pathways page .

Want to learn what's new with the National Guide?

Ohio State navigation bar

- BuckeyeLink

- Search Ohio State

Traditional Master of Science

The College of Optometry offers a two-year post baccalaureate course of study in Vision Science to obtain a traditional Master of Science degree.

The Vision Science graduate program does not provide any fee waivers for the application, so you will need to pay this fee to apply to our program.

The only instances by which these application components are waived is listed on this webpage.

All interested applicants should apply to the program first rather than contacting individual faculty to seek a position in their lab. Placement with advisors is conducted after an offer of admission is made.

Yes. The Ohio State University Graduate School requires transcripts from every institution where you received college credit, whether or not you graduated. We must have stand-alone transcripts for each university where credit was earned.

We consider all applicants for potential funding, so there is no separate application. If funding is available, you will be notified at the time an offer of admission is made.

Prerequisites

- All students must have a cumulative GPA equivalent of at least 3.0 on a 4.0 scale in all prior undergraduate and graduate work.

- Earned baccalaureate or professional degree from an accredited college or university by the expected date of entry.

Application Procedures

- Must apply to the graduate school .

- Must have application and all documentation submitted by February 1st for admission in autumn semester. Off cycle applications will be considered on a case-by-case basis.

Application Requirements

Statement of purpose (sop).

A brief statement describing the applicant’s educational and professional objectives. The SOP must include information on your area of research interest.

Curriculum vitae (CV)

A written overview of academic, research, and work experiences and other qualifications.

Graduate Record Examination (GRE)

Must have testing agency report GRE test scores to The Ohio State University (ETS institution code #1592).

- There is no minimum GRE score requirement for admission. However, your scores will be used to assess your competitiveness relative to other applicants.

- All GRE scores must be received by February 1st.

- To be valid, the GRE test must have been taken in the past five years.

- Applicants who have earned, or will earn, a doctoral degree from a US or Canadian based institution prior to matriculation do not need to submit GRE scores.

Letters of Recommendation (LOR)

You must provide three letters of recommendation. These should be written by close colleagues, instructors, or others who are familiar with your work, classroom performance, and/or research experience.

- Letters of Recommendation will not be accepted from family or friends.

- The applicant cannot submit the LORs.

English proficiency testing

The Graduate School requires any applicant whose native language is not English, and who has been educated primarily outside of the U.S., to submit official scores from TOEFL, IELTS, or DUOLINGO.

- To be valid, the test must have been taken in the past two years.

- Paper version at least 550

- Internet version at least 79

- At least 7.0

- At least 120

Exemptions to English proficiency:

Applicants who are citizens of, or who have received a bachelor’s degree or higher by the time of matriculation from, one of the following countries or territories are exempt from the English proficiency requirement:

American Samoa, Anguilla, Antigua and Barbuda, Australia, Bahamas, Barbados, Belize, Bermuda, British Indian Ocean Territory, Canada (except Quebec), Cayman Islands, Christmas Island, Cook Islands, Dominica, England, Falkland Islands (Malvinas), Ghana, Gibraltar, Grenada, Guam, Guernsey, Guyana, Isle of Man, Jamaica, Jersey, Liberia, Montserrat, Netherland Antilles, New Zealand, Nigeria, Niue, Norfolk Island, Northern Ireland, Northern Mariana Islands, Pitcairn Island, Puerto Rico, Republic of Ireland, St. Vincent and the Grenadines, Saint Helena, Saint Kitts and Nevis, Saint Lucia, Saint Martin, Scotland, Singapore, Tokelau, Trinidad and Tobago, Turks and Caicos Islands, United States, Virgin Islands (U.S and British), Wales.

Official Transcripts

Official transcripts are those submitted directly from one institution to another. These are required for all institutions attended where college credit was earned, including community college and college credit earned while in high school. An official transcript must be submitted to GP admissions.

- Institutions should send transcripts to OSU electronically (preferred) at [email protected] .

- If an institution cannot send these electronically, they can be sent by US Mail to: The Ohio State University Graduate/Professional Admissions PO Box 182004 Columbus, OH 43218-2004

- Transcripts from international or express mail should be sent to: The Ohio State University Graduate/Professional Admissions 281 W. Lane Avenue Columbus, OH 43210-1132

- If you are admitted to the program you would need to submit official transcripts.

- Do not mail any application documents directly to the Vision Science program.

Degree Requirements

In consultation with their advisor, students select coursework according to their interests. However, coursework must include:

- No more than 10 credit hours of Vision Science 7999 (research credits) count toward the degree

- VS 8001 (Anatomy and Physiology of the Eye)

- VS 8002 (Ocular Motility and Binocular Vision)

- VS 8003 (Visual Sensory Processes)

- VS 8004 (Optics of the Eye and Specification of the Visual Stimulus)

- VS 7101 (Basics of Graduate Work)

- Vision Science 7960 (Ethics in Biomedical Research)

- Vision Science 7980 (Statistics for Clinical Research)

- Completion of an independent research project and thesis is required.

How to Decide if an MBA Is Worth it

Understand your financial and career goals before enrolling in an MBA program.

Getty Images

A master's degree in business administration can be a great asset when looking for jobs but applicants should weigh the commitment of this opportunity.

Key Takeaways

- Earning an MBA is always a significant time investment.

- Consider career goals and costs before enrolling in an MBA program.

- An MBA may lead to salary, promotion or job market benefits.

An MBA is a game changer for many professionals – a way to build specialized skills, make salary gains and valuable professional connections, or even change careers.

But it's not the right fit for everyone. Before committing to graduate business school to pursue a master of business administration degree, it's important to consider the time commitment, costs, potential return on investment and your personal career goals, experts say.

"You don't do it because you don't have anything else to do," says Sue Oldham, associate dean of MBA operations at Vanderbilt University's Owen Graduate School of Management in Tennessee. "You are doing it because you really want this career pivot and you want to be doing something different."

What to Consider Before Applying to an MBA Program

Time commitment.

A full-time MBA program typically takes two years, although accelerated full-time programs can take a single year. Executive and part-time MBA programs, designed for professionals who are attending school while working a full-time job, vary in length depending on how many credits a student takes each semester. Online and hybrid programs are also options, but every pathway to an MBA is a significant time investment.

Students should consider whether it's the right "season of life" to commit to an MBA program, Oldham says.

"Are you at a place in your life where you can step out of the workforce for two years (for a full-time MBA) and invest in yourself like that?" she says. "I think that's why part-time MBA programs are a much better option for people that are like, 'Listen, I can't take two years off. I've got to work. I've got a family. I've got a mortgage.'"

Academic Needs

Before applying, build a list of schools that meet your educational requirements, such as location, class size and academic tracks that align with your career goals.

"Unless you are definitely bound and determined and headed toward one of the very few slots available at the Ivys , the world is at your disposal for what you need and want," says Jeanne Allen, founder and CEO of the Washington, D.C.-based Center for Education Reform, which focuses on expanding educational opportunities.

Allen says some non-Ivy League colleges and newer MBA programs may offer "a better service – they are better priced; they are accelerated in terms of graduating; they are personalized to your needs; they are often competency-based. And that's going to get you your best education."

Experts advise visiting prospective programs virtually or in person , especially while classes are in session.

"Spend some time getting to know the students, the alumni and the staff at the various schools, because I always think culture really matters and each school has its own unique culture," Oldham says. "You have to figure out what that school's culture is and say, 'Does this mesh with who I am, the way I learn and the way I want to work?'"

Return on Investment

According to the 2023 Corporate Recruiters Survey by the Graduate Management Admission Council, the organization that designs and administers the GMAT, MBA graduates had the highest median earning potential in the U.S. among business school graduates, with an estimated median starting salary of $125,000 in 2023. Hiring is expected to remain stable over the next five years.

To decide whether an MBA program offers good return on investment , consider tuition costs and potential starting salaries – which most schools track – and calculate the salary-to-debt ratio. The return on investment is calculated by dividing the average salary and signing bonus of recent grads by the average student debt of those who borrowed.

Per GMAC's 2023 Enrolled Students report – which surveyed more than 660 enrolled business graduate students or recent graduates in 36 countries – 90% of respondents rated the overall value of their graduate business degree as "good," "excellent" or "outstanding." In addition, median total compensation increased by one-third after graduate business training, with greater increases for full-time MBA students, according to the study.

The question is, "do you see the degree helping to advance your salary, your work experiences and your opportunities to make a difference, in the sense of being able to pay that (debt) down so that's not some overwhelming burden?" says Sean Schrader, an MBA student in his final year at the University of South Florida's Muma College of Business and president of the National Association of Graduate-Professional Students.

Postgraduation, he plans to study abroad before pursuing more graduate education in law school . Schrader's ultimate goal is to work in public and government service.

"A lot of people would say, 'Why would you want to get an MBA if you're more interested in government?'" he says. "That can be a fair point. But I think that the MBA gives you a lot of skills that are very relevant in almost any environment."

Benefits of an MBA

Skill and career development.

The best MBA programs help you develop entrepreneurial habits, Allen says. "They build your ability to move, develop and manage programs in more innovative ways. It's not so much about what skills (you gain), it's about what kind of learning is going to best set you up for an increasingly complex, technologically sophisticated society, where just about anybody can start a business, manage or create a product."

Andrew Walker, director of research analysis and communications at GMAC, says MBA candidates want to graduate with problem-solving, communication, data interpretation and leadership skills, among others.

"Employers say things like patience, data analytics and strategy are the most important skills that graduate management education alumni can have and bring to their organizations," he says. "And these skills are only going to grow in importance in the next five years or so. There is a lot of alignment with the type of skills that candidates are looking for out of business school and what employers are looking for, which to us (means) a lot of business schools really are on the right track with what they are teaching alumni to be successful."

With full-time programs in particular, students graduate "better prepared to work in a culturally diverse organization," Oldham says.

Even more valuable is that MBA programs also teach certain hard skills, says Daniel Snow, director of MBA programs at Brigham Young University's Marriott School of Business in Utah.

"I think that a lot of people out there think that an MBA program is about ticking boxes on a series of skills," he says. "And while our program and other top programs do give you those skills, the really important differentiator is when you come out of an MBA program with managerial judgment. You can look at a messy situation that hasn't been contemplated in your textbooks, find the core of the problem and then you can go after that problem leading an organization."

An MBA may bring salary, promotion or job market benefits. But "if you think you're going to get an MBA and it's automatically catapult you into a CEO job, that's a bad reason to get an MBA," Allen says. "It can't necessarily do that and doesn't. It all depends on who you are."

Success with an MBA "really is (about) what you put into it and whether or not it helps you advance things that you already can do, but you want to take it to another level completely," she says. "It doesn't teach you business. It builds a mindset and an understanding of business culture and exposure to what's happening in the world of business that you don't necessarily get just by reading on your own."

A New Professional Network

Experts say an MBA also helps students expand their professional networks and build new connections that may broaden their opportunities and advance their career goals .

Networks vary by school, and experts recommend considering that in your research. Some MBA programs have alumni living around the world, for instance, while others are more localized.

"It's not just quality, but where do you want to go live your career geographically?" Snow says. "The quality of the people that you are going to be around is related to the network. ... You don't want to just be some place where you are not going to be pushed. You want to be around people who are going to really push you, that are excellent, that are striving to do the same things that you are doing."

Searching for a business school? Get our complete rankings of Best Business Schools.

Grad Degree Jobs With $100K+ Salaries

Tags: colleges , MBAs , business school , education , graduate schools , students

Applying By Program

Top Business Schools

Top Law Schools

Top Medical Schools

You May Also Like

Choosing a major for med school.

Andrew Bauld March 26, 2024

Handling a Law School Rejection Letter

Gabriel Kuris March 25, 2024

College Majors and MBA Admissions

Anthony Todd Carlisle March 20, 2024

Tips While Awaiting Med School Decision

Zach Grimmett March 19, 2024

2024 Best Grad Schools Rankings Coming

Robert Morse and Eric Brooks March 19, 2024

Tips for Aspiring Lawyers in High School

Gabriel Kuris March 18, 2024

4 Surprising MBA Application Mistakes

Andrew Warner March 18, 2024

Types of Doctors Premeds Can Become

Jarek Rutz March 14, 2024

Applying to Law School as a Minority

Sammy Allen March 14, 2024

Law School Websites: What to Look for

Gabriel Kuris March 12, 2024

How To Become a Biomedical Engineer

Industry Advice Engineering

Modern advances in medical technology have drastically improved the quality of care doctors are able to provide to patients. From diagnosis to treatment, biomedical devices continue to play a critical role in improving human health. Much of the credit for the development of these advanced technologies goes to biomedical engineers.

Here’s an overview of what a biomedical engineer does, how to become one, and why it’s an excellent career choice.

What Is Biomedical Engineering?

Biomedical engineering is a multidisciplinary field that applies engineering principles and techniques to biology and healthcare. It requires an in-depth understanding of life-science subjects such as biology, chemistry, and physics, as well as engineering knowledge in mathematics and design.

What Do Biomedical Engineers Do?

Biomedical engineers are tasked with a wide range of responsibilities depending on their industry. Common roles include:

- Designing medical devices: Developing medical imaging devices like MRIs, sonograms, ultrasound devices, and other medical technology

- Developing new innovations: Researching and contributing to the development of innovative medical advancements such as artificial organs, or replacement of body parts

- Collaborating with medical staff: Training other professionals on safety and the proper use of biomedical equipment, helping maintain medical devices, and troubleshooting medical equipment when necessary

- Research: Conducting statistical analysis, writing research papers, and offering valuable contributions to the overall scientific community on biomedical engineering methods and results

Biomedical engineers typically work behind the scenes and don’t have much interaction with patients. However, their work plays a critical role in patient recovery or improved quality of life. For this reason, many individuals are motivated to pursue a career as a biomedical engineer.

How to Become a Biomedical Engineer

For individuals interested in biological sciences, mathematics, engineering, and other related sub-disciplines, a position in biotechnology is the perfect career path. The steps to become a biomedical engineer are:

- Fulfill the educational requirements

- Obtain relevant experience

- Develop in-demand skills

- Obtain relevant qualifications, if required by employers

Educational Requirements

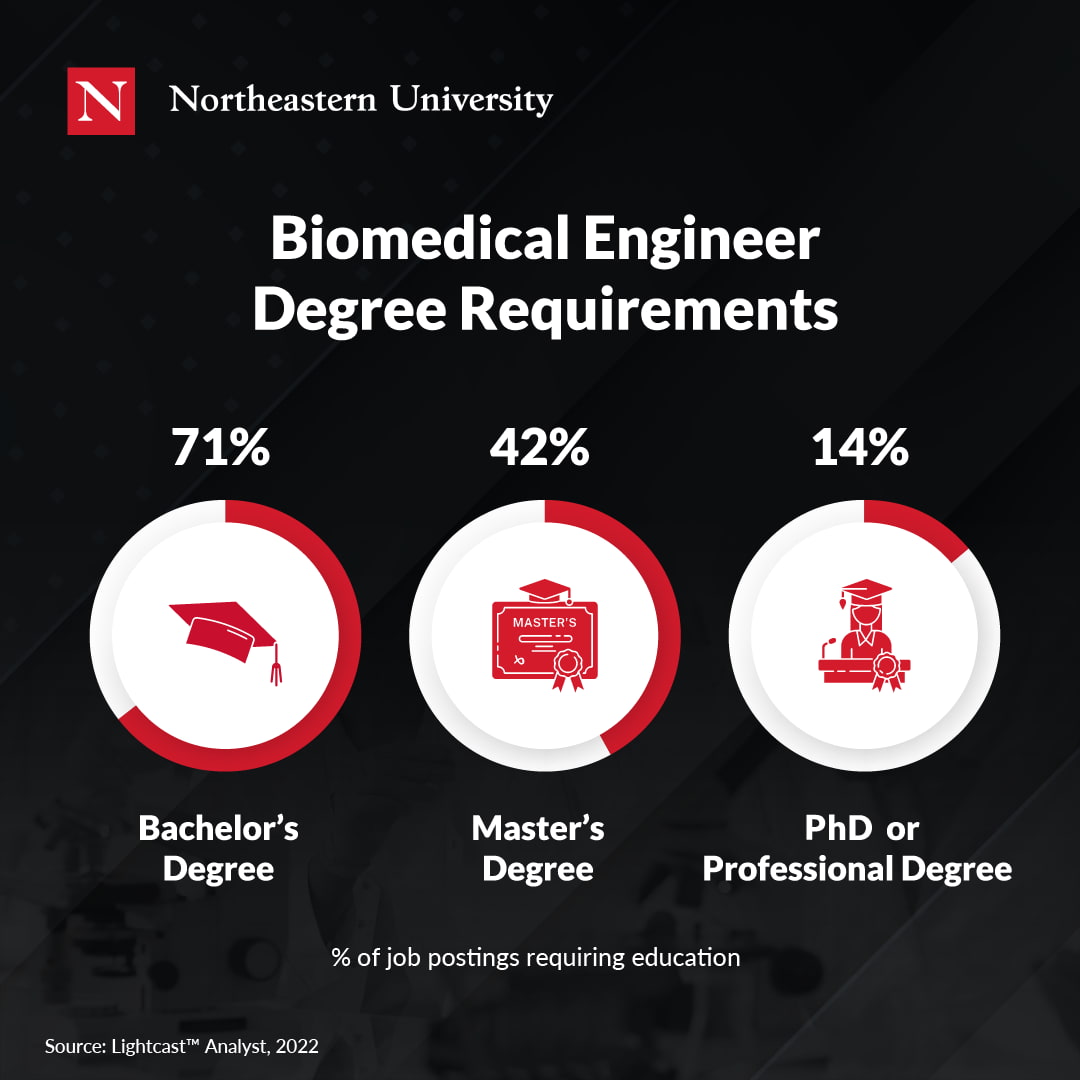

The first step to becoming a biomedical engineer is fulfilling the educational requirements of the role. Biomedical engineers typically need at least a bachelor’s in life sciences, biotechnology, or engineering. Many, however, continue their education by pursuing a graduate or doctoral degree as well. According to government data, almost 71 percent of biomedical engineers have a bachelor’s degree; of those, 42 percent also hold a master’s, and 14 percent earned a doctoral or professional degree.

Background Experience

Experience is an important aspect of any professional job posting. Many times employers want to know if applicants have been successful performing job responsibilities in other settings. According to government data, the largest percentage of experience requirements for biomedical engineer job postings is between four and six years of prior experience, comprising 31 percent of job postings. Only 18 percent of postings require one year of experience or less.

Since this industry values prior work experience, prospective biomedical engineers hoping to obtain relevant, hands-on experience, can greatly benefit from a program like the Master of Science in Biotechnology . These programs are designed specifically to prepare students for the workforce, presenting them with opportunities to collaborate with industry professionals and work with real-world projects.

In-Demand Skills

In addition to the experience and educational requirements, prospective biomedical engineers can set themselves apart from competing applicants by developing in-demand skills employers frequently look for.

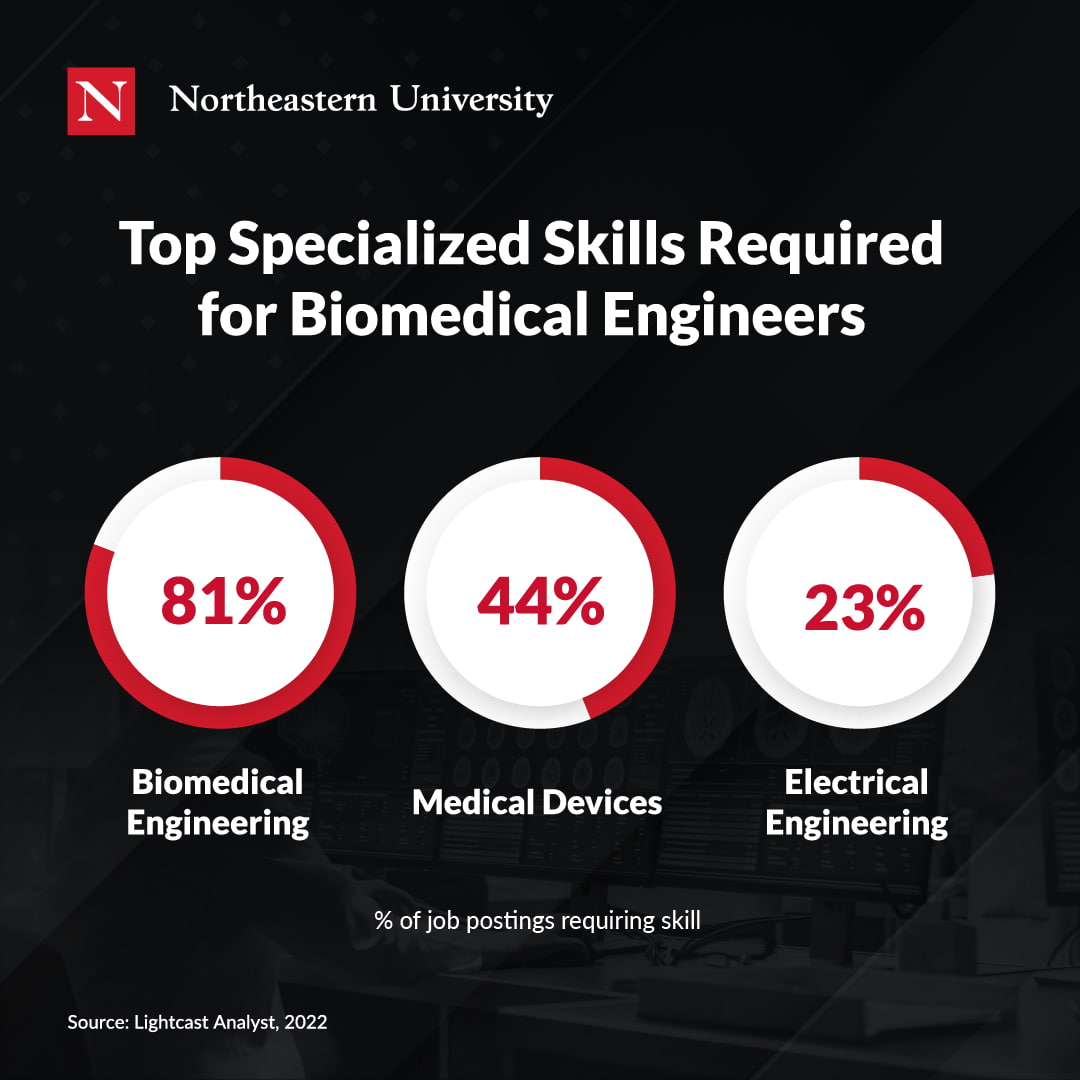

Specialized Skills

Specialized, or “hard” skills, refer to job-specific skills required to achieve success in a biomedical engineering position. The top hard skills employers list on biomedical engineering job postings are:

- Biomedical Engineering

- Medical Devices

- Electrical Engineering

Common Skills

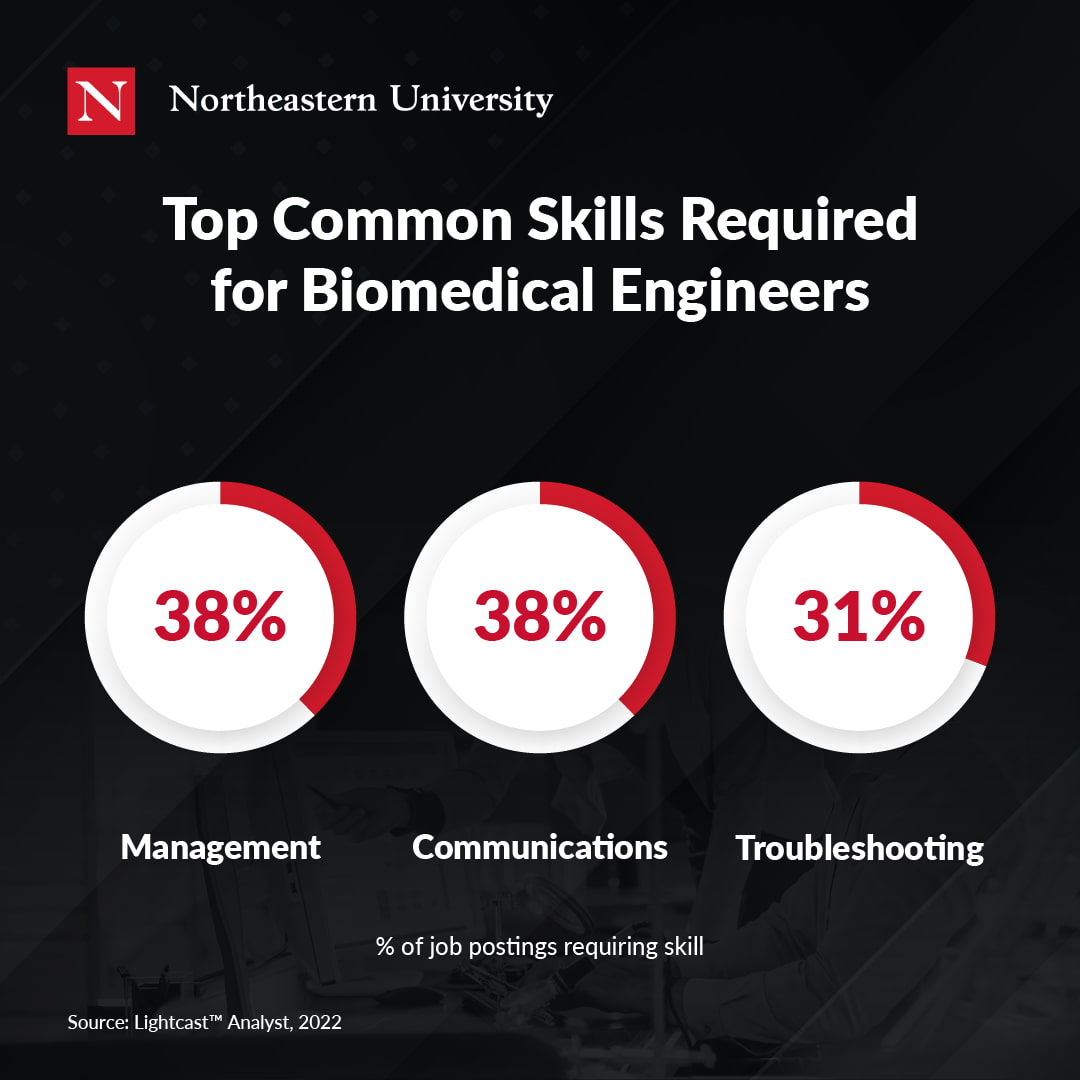

Common, or “soft” skills, are the personal attributes required for biomedical engineers to succeed in their position. These skills aren’t job-specific, but often promote success in interpersonal interactions with team members, or in rare cases, patients. The most commonly listed soft skills in job postings are:

- Communications

- Troubleshooting (Problem Solving)

Top Qualifications

On top of any specialized skills specific to the industry, some biomedical engineering positions require certain credentials and certifications. Many of these certifications are job or industry specific, so you don’t need to pursue them unless you know they’re necessary. Nevertheless, it’s good to be aware that some jobs may require these credentials. According to a government report, some of the credentials listed in biomedical engineering job postings include: